-

@ 866e0139:6a9334e5

2025-05-23 17:57:24

@ 866e0139:6a9334e5

2025-05-23 17:57:24Autor: Caitlin Johnstone. Dieser Beitrag wurde mit dem Pareto-Client geschrieben. Sie finden alle Texte der Friedenstaube und weitere Texte zum Thema Frieden hier. Die neuesten Pareto-Artikel finden Sie in unserem Telegram-Kanal.

Die neuesten Artikel der Friedenstaube gibt es jetzt auch im eigenen Friedenstaube-Telegram-Kanal.

Ich hörte einem jungen Autor zu, der eine Idee beschrieb, die ihn so sehr begeisterte, dass er die Nacht zuvor nicht schlafen konnte. Und ich erinnerte mich daran, wie ich mich früher – vor Gaza – über das Schreiben freuen konnte. Dieses Gefühl habe ich seit 2023 nicht mehr gespürt.

Ich beklage mich nicht und bemitleide mich auch nicht selbst, ich stelle einfach fest, wie unglaublich düster und finster die Welt in dieser schrecklichen Zeit geworden ist. Es wäre seltsam und ungesund, wenn ich in den letzten anderthalb Jahren Freude an meiner Arbeit gehabt hätte. Diese Dinge sollen sich nicht gut anfühlen. Nicht, wenn man wirklich hinschaut und ehrlich zu sich selbst ist in dem, was man sieht.

Es war die ganze Zeit über so hässlich und so verstörend. Es gibt eigentlich keinen Weg, all diesen Horror umzudeuten oder irgendwie erträglich zu machen. Alles, was man tun kann, ist, an sich selbst zu arbeiten, um genug inneren Raum zu schaffen, um die schlechten Gefühle zuzulassen und sie ganz durchzufühlen, bis sie sich ausgedrückt haben. Lass die Verzweiflung herein. Die Trauer. Die Wut. Den Schmerz. Lass sie deinen Körper vollständig durchfließen, ohne Widerstand, und steh dann auf und schreibe das nächste Stück.

Das ist es, was Schreiben für mich jetzt ist. Es ist nie etwas, worüber ich mich freue, es zu teilen, oder wofür ich von Inspiration erfüllt bin. Wenn überhaupt, dann fühlt es sich eher so an wie: „Okay, hier bitte, es tut mir schrecklich leid, dass ich euch das zeigen muss, Leute.“ Es ist das Starren in die Dunkelheit, in das Blut, in das Gemetzel, in die gequälten Gesichter – und das Aufschreiben dessen, was ich sehe, Tag für Tag.

Nichts daran ist angenehm oder befriedigend. Es ist einfach das, was man tut, wenn ein Genozid in Echtzeit vor den eigenen Augen stattfindet, mit der Unterstützung der eigenen Gesellschaft. Alles daran ist entsetzlich, und es gibt keinen Weg, das schönzureden – aber man tut, was getan werden muss. So, wie man es täte, wenn es die eigene Familie wäre, die da draußen im Schutt liegt.

Dieser Genozid hat mich für immer verändert. Er hat viele Menschen für immer verändert. Wir werden nie wieder dieselben sein. Die Welt wird nie wieder dieselbe sein. Ganz gleich, was passiert oder wie dieser Albtraum endet – die Dinge werden nie wieder so sein wie zuvor.

Und das sollten sie auch nicht. Der Holocaust von Gaza ist das Ergebnis der Welt, wie sie vor ihm war. Unsere Gesellschaft hat ihn hervorgebracht – und jetzt starrt er uns allen direkt ins Gesicht. Das sind wir. Das ist die Frucht des Baumes, den die westliche Zivilisation bis zu diesem Punkt gepflegt hat.

Jetzt geht es nur noch darum, alles zu tun, was wir können, um den Genozid zu beenden – und sicherzustellen, dass die Welt die richtigen Lehren daraus zieht. Das ist eines der würdigsten Anliegen, denen man sich in diesem Leben widmen kann.

Ich habe noch immer Hoffnung, dass wir eine gesunde Welt haben können. Ich habe noch immer Hoffnung, dass das Schreiben über das, was geschieht, eines Tages wieder Freude bereiten kann. Aber diese Dinge liegen auf der anderen Seite eines langen, schmerzhaften, konfrontierenden Weges, der in den kommenden Jahren vor uns liegt. Es gibt keinen Weg daran vorbei.

Die Welt kann keinen Frieden und kein Glück finden, solange wir uns nicht vollständig damit auseinandergesetzt haben, was wir Gaza angetan haben.

Dieser Text ist die deutsche Übersetzung dieses Substack-Artikels von Caitlin Johnstone.

LASSEN SIE DER FRIEDENSTAUBE FLÜGEL WACHSEN!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt.

Schon jetzt können Sie uns unterstützen:

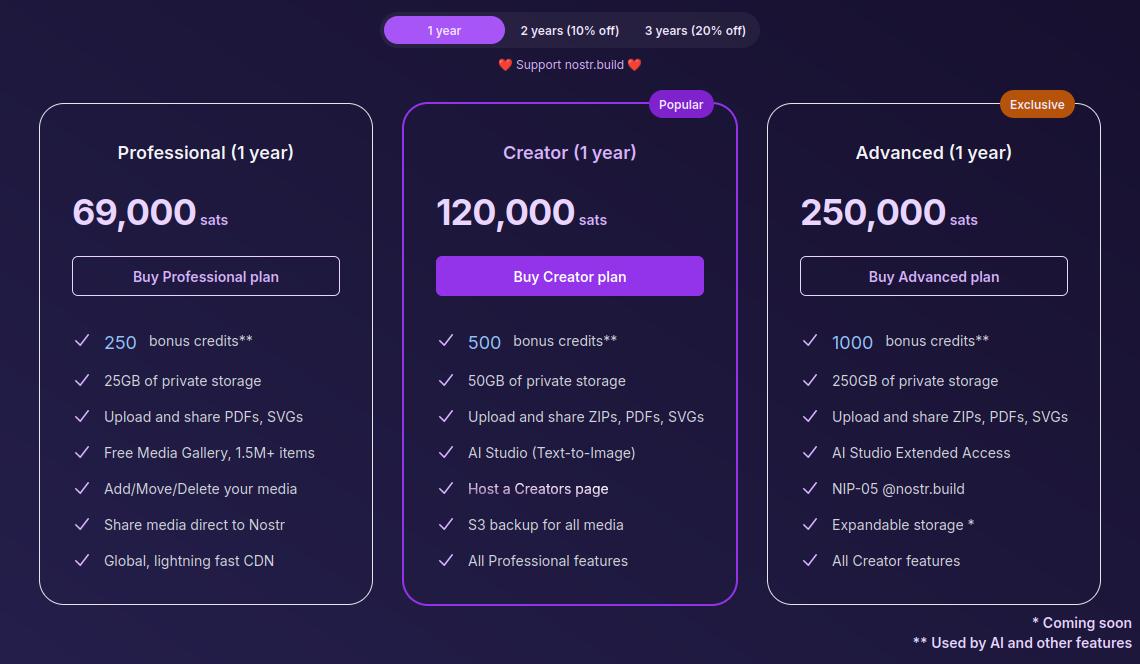

- Für 50 CHF/EURO bekommen Sie ein Jahresabo der Friedenstaube.

- Für 120 CHF/EURO bekommen Sie ein Jahresabo und ein T-Shirt/Hoodie mit der Friedenstaube.

- Für 500 CHF/EURO werden Sie Förderer und bekommen ein lebenslanges Abo sowie ein T-Shirt/Hoodie mit der Friedenstaube.

- Ab 1000 CHF werden Sie Genossenschafter der Friedenstaube mit Stimmrecht (und bekommen lebenslanges Abo, T-Shirt/Hoodie).

Für Einzahlungen in CHF (Betreff: Friedenstaube):

Für Einzahlungen in Euro:

Milosz Matuschek

IBAN DE 53710520500000814137

BYLADEM1TST

Sparkasse Traunstein-Trostberg

Betreff: Friedenstaube

Wenn Sie auf anderem Wege beitragen wollen, schreiben Sie die Friedenstaube an: friedenstaube@pareto.space

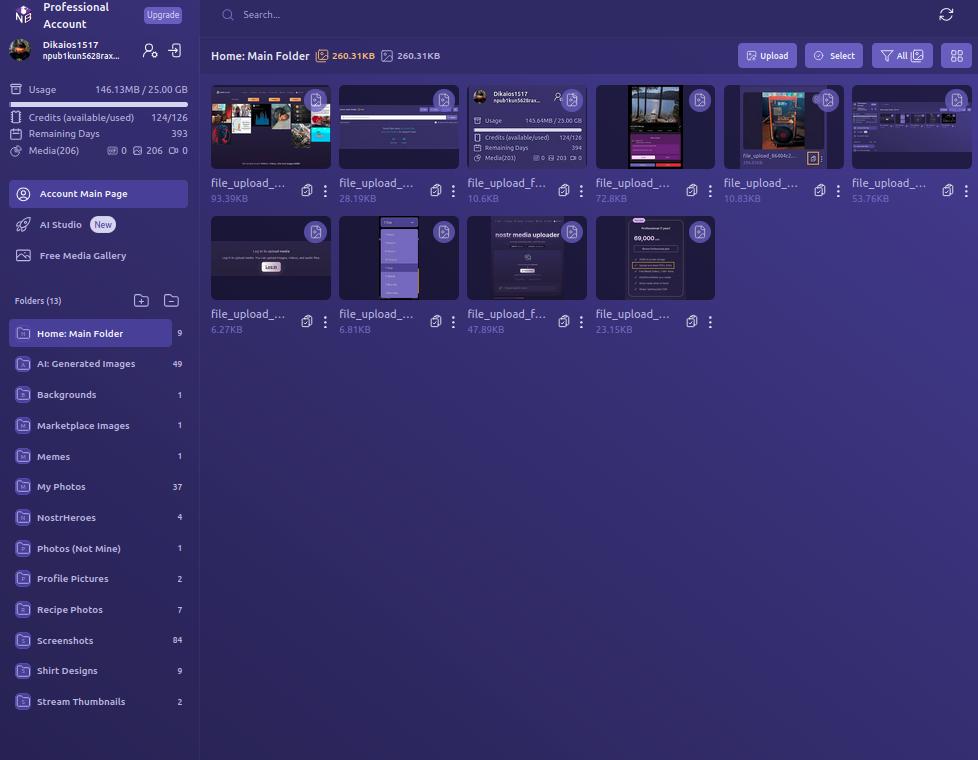

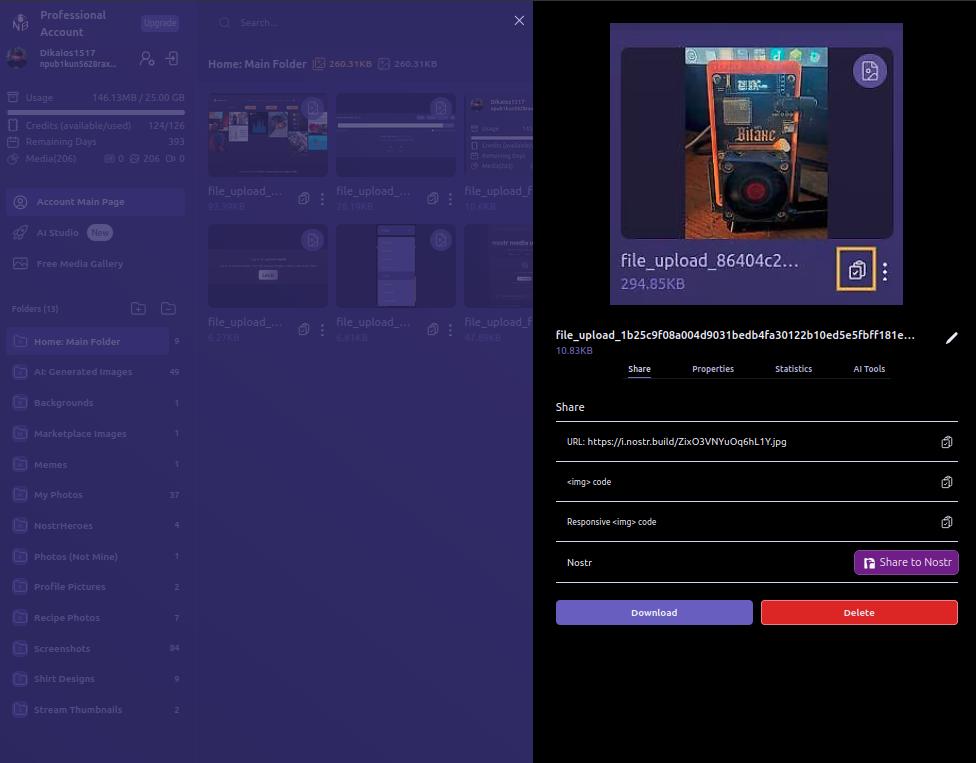

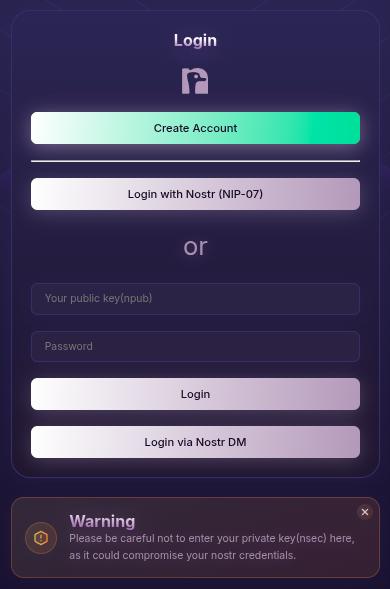

Sie sind noch nicht auf Nostr and wollen die volle Erfahrung machen (liken, kommentieren etc.)? Zappen können Sie den Autor auch ohne Nostr-Profil! Erstellen Sie sich einen Account auf Start. Weitere Onboarding-Leitfäden gibt es im Pareto-Wiki.

-

@ c9badfea:610f861a

2025-05-24 12:55:17

@ c9badfea:610f861a

2025-05-24 12:55:17Before you post a message or article online, let the LLM check if you are leaking any personal information using this prompt:

Analyze the following text to identify any Personally Identifiable Information (PII): <Your Message>Replace

<Your Message>with your textIf no PII is found, continue by modifying your message to detach it from your personality. You can use any of the following prompts (and further modify it if necessary).

Prompt № 1 - Reddit-Style

Convert the message into a casual, Reddit-style post without losing meaning. Split the message into shorter statements with the same overall meaning. Here is the message: <Your Message>Prompt № 2 - Advanced Modifications

``` Apply the following modifications to the message: - Rewrite it in lowercase - Use "u" instead of "you" - Use "akchoaly" instead of "actually" - Use "hav" instead of "have" - Use "tgat" instead of "that" - Use comma instead of period - Use British English grammar

Here is the message:

``` Prompt № 3 - Neutral Tone

Rewrite the message to correct grammar errors, and ensure the tone is neutral and free of emotional language: <Your Message>Prompt № 4 - Cross Translation Technique

Translate the message into Chinese, then translate the resulting Chinese text back into English. Provide only the final English translation. Here is the message: <Your Message>Check the modified message and send it.

ℹ️ You can use dialects to obfuscate your language further. For example, if you are from the US, you can tell the LLM to use British grammar and vice versa.

⚠️ Always verify the results. Don't fully trust an LLM.

-

@ 90c656ff:9383fd4e

2025-05-24 12:11:01

@ 90c656ff:9383fd4e

2025-05-24 12:11:01Since its creation, Bitcoin has marked a turning point in the digital money revolution—but its evolution didn’t stop at the original concept of decentralized transactions. Over the years, new technological solutions have been developed to expand its capabilities, making it more efficient and versatile. Among these innovations, smart contracts and the Lightning Network stand out, enabling increased functionality and scalability of the network, and ensuring a faster, cheaper, and more accessible system.

Smart contracts on Bitcoin

Smart contracts are programs that automatically execute certain actions when predefined conditions are met. Although the concept is more commonly associated with other networks, Bitcoin also supports smart contracts, especially through upgrades like Taproot.

- Smart contracts on Bitcoin enable functionalities such as:

01 - Conditional payments: Transactions that are only completed if certain rules are met, such as multi-signatures or specific time conditions.

02 - Advanced fund management: Use of multi-signature wallets, where different parties must approve a transaction before it is processed.

03 - Enhanced privacy: With the Taproot upgrade, smart contracts can be more efficient and indistinguishable from regular transactions, improving privacy across the network.

Although smart contracts on Bitcoin are simpler than those on other platforms, this simplicity is a strength—it preserves the network's security and robustness by avoiding complex vulnerabilities.

Lightning Network: scalability and instant transactions

One of the biggest challenges Bitcoin faces is scalability. Since the original network was designed to prioritize security and decentralization, transaction speed can be limited during periods of high demand. To address this issue, the Lightning Network was created—a second-layer solution that enables near-instant transactions with extremely low fees.

The Lightning Network works by creating payment channels between users, allowing them to conduct multiple transactions off-chain and recording only the final balance on the main Bitcoin blockchain or timechain. Key advantages include:

01 - Speed: Transactions are completed in milliseconds, making Bitcoin more suitable for daily payments.

02 - Low fees: Since transactions occur off-chain, fees are minimal, allowing for viable microtransactions.

03 - Network decongestion: By moving many transactions to the Lightning Network, Bitcoin’s main chain becomes more efficient and less congested.

In summary, Bitcoin continues to evolve technologically to meet the demands of a global financial system. Smart contracts increase its functionality, offering greater flexibility and security in transactions. The Lightning Network improves scalability, making Bitcoin faster and more practical for everyday use. With these innovations, Bitcoin remains at the forefront of the financial revolution, proving that despite its initial limitations, it continues to adapt and grow as a truly decentralized and global monetary system.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ 90c656ff:9383fd4e

2025-05-24 12:06:36

@ 90c656ff:9383fd4e

2025-05-24 12:06:36Throughout history, money has always been under the control of central authorities, such as governments and banks. These intermediaries have set the rules of the financial system, controlled the issuance of currency, and overseen transactions. However, with the emergence of Bitcoin, a new paradigm began to take shape: decentralized money. This transformation represents a profound shift in how people store and transfer value, challenging the traditional financial model.

- The traditional model: centralized money

01 - Dependence on intermediaries: To carry out transactions, people rely on banks, governments, and other regulatory entities.

02 - Inflation and devaluation: Central banks can print money endlessly, often leading to a loss in purchasing power.

03 - Censorship and restrictions: Access to money can be denied for political, bureaucratic, or institutional reasons, limiting individuals’ financial freedom.

Despite being the dominant model for centuries, the centralized system has shown its vulnerabilities through numerous economic and political crises. It was in this context that Bitcoin emerged as an innovative alternative.

- The revolution of decentralized money

01 - Elimination of intermediaries: Transactions can be made directly between users, without the need for banks or financial companies.

02 - Limited and predictable supply: Bitcoin has a fixed cap of 21 million units, preventing the inflation caused by excessive money printing.

03 - Censorship resistance: No entity can block or prevent transactions, ensuring full financial freedom.

04 - Self-custody: Each user can hold their own funds without relying on a bank or any other institution.

This paradigm shift has a significant impact not only on the financial system but also on how people interact with money and protect their wealth.

Challenges and opposition to financial decentralization

The transition to a decentralized financial system faces several challenges, the main one being resistance from traditional institutions. Banks and governments see Bitcoin as a threat to their control over money and seek to regulate or limit its adoption.

There are also technical and educational barriers. Many people still do not fully understand how Bitcoin works, which can hinder its adoption. However, as more people become aware of the benefits of decentralized money, its use is likely to grow.

In summary, the shift from a centralized financial system to a decentralized one represents one of the most significant transformations of the digital era. Bitcoin leads this movement by offering a censorship-resistant, transparent, and accessible alternative. Despite opposition from the traditional system, the decentralization of money continues to gain momentum, providing greater autonomy and financial freedom to people around the world. This revolution is not just technological, but also social and economic—redefining the way the world understands and uses money.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ 866e0139:6a9334e5

2025-05-22 06:51:15

@ 866e0139:6a9334e5

2025-05-22 06:51:15Autor: Milosz Matuschek. Dieser Beitrag wurde mit dem Pareto-Client geschrieben. Sie finden alle Texte der Friedenstaube und weitere Texte zum Thema Frieden hier. Die neuesten Pareto-Artikel finden Sie auch in unserem Telegram-Kanal.

Die neuesten Artikel der Friedenstaube gibt es jetzt auch im eigenen Friedenstaube-Telegram-Kanal.

https://www.youtube.com/watch?v=gjndTXyk3mw

Im Jahr 1954, als Frankreich gerade dabei war, seine kolonialen Kriege in Indochina und Algerien zu verschärfen, schrieb Boris Vian ein Lied – oder vielmehr: einen poetischen Faustschlag. Le Déserteur ist keine Ballade, sondern ein Manifest. Keine Hymne auf den Frieden, sondern eine Anklage gegen den Krieg. Adressiert an den Präsidenten, beginnt das Chanson wie ein höflicher Brief – und endet als flammender Akt des zivilen Ungehorsams.

„Herr Präsident,\ ich schreibe Ihnen einen Brief,\ den Sie vielleicht lesen werden,\ wenn Sie Zeit haben.“

Was folgt, ist ein klassischer Kriegsdienstverweigerungsbrief, aber eben kein bürokratischer. Vian spricht nicht in Paragraphen, sondern in Herzschlägen. Der Erzähler, ein einfacher Mann, will nicht kämpfen. Nicht für irgendein Vaterland, nicht für irgendeine Fahne, nicht für irgendeinen ideologischen Zweck.

„Ich soll zur Welt gekommen sein,\ um zu leben, nicht um zu sterben.“

70 Jahre später klingt diese Zeile wie ein Skandal. In einer Zeit, in der die Ukraine junge Männer für Kopfgeld auf der Straße zwangsrekrutiert und in Stahlgewitter schickt, in der palästinensische Jugendliche im Gazastreifen unter Trümmern begraben werden, während israelische Reservisten mit Dauerbefehl marschieren – ist Le Déserteur ein sakraler Text geworden. Fast ein Gebet.

„Wenn man mich verfolgt,\ werde ich den Gehorsam verweigern.\ Ich werde keine Waffe in die Hand nehmen,\ ich werde fliehen, bis ich Frieden finde.“

Wie viele „Deserteure“ gibt es heute, die wir gar nicht kennen? Menschen, die sich nicht auf die Seite der Bomben stellen wollen – egal, wer sie wirft? Die sich nicht mehr einspannen lassen zwischen Propaganda und Patriotismus? Die ihre Menschlichkeit über jeden nationalen Befehl stellen?

Der Krieg, sagt Vian, macht aus freien Menschen Befehlsempfänger und aus Söhnen Leichen. Und wer heute sagt, es gebe „gerechte Kriege“, sollte eine Frage beantworten: Ist es auch ein gerechter Tod?

Darum: Verweigert.

Verweigert den Befehl, zu hassen.\ Verweigert den Reflex, Partei zu ergreifen.\ Verweigert den Dienst an der Waffe.

Denn wie Vian singt:

„Sagen Sie's den Leuten:\ Ich werde nicht kommen.“

LASSEN SIE DER FRIEDENSTAUBE FLÜGEL WACHSEN!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt.

Schon jetzt können Sie uns unterstützen:

- Für 50 CHF/EURO bekommen Sie ein Jahresabo der Friedenstaube.

- Für 120 CHF/EURO bekommen Sie ein Jahresabo und ein T-Shirt/Hoodie mit der Friedenstaube.

- Für 500 CHF/EURO werden Sie Förderer und bekommen ein lebenslanges Abo sowie ein T-Shirt/Hoodie mit der Friedenstaube.

- Ab 1000 CHF werden Sie Genossenschafter der Friedenstaube mit Stimmrecht (und bekommen lebenslanges Abo, T-Shirt/Hoodie).

Für Einzahlungen in CHF (Betreff: Friedenstaube):

Für Einzahlungen in Euro:

Milosz Matuschek

IBAN DE 53710520500000814137

BYLADEM1TST

Sparkasse Traunstein-Trostberg

Betreff: Friedenstaube

Wenn Sie auf anderem Wege beitragen wollen, schreiben Sie die Friedenstaube an: friedenstaube@pareto.space

Sie sind noch nicht auf Nostr and wollen die volle Erfahrung machen (liken, kommentieren etc.)? Zappen können Sie den Autor auch ohne Nostr-Profil! Erstellen Sie sich einen Account auf Start. Weitere Onboarding-Leitfäden gibt es im Pareto-Wiki.

-

@ b1ddb4d7:471244e7

2025-05-24 11:00:40

@ b1ddb4d7:471244e7

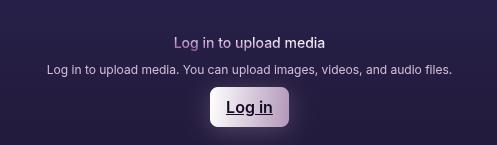

2025-05-24 11:00:40The upcoming Bitcoin 2025 conference, scheduled from May 27–29 at the Venetian Conference Center in Las Vegas, is set to make history with an official attempt to break the GUINNESS WORLD RECORDS® title for the most Bitcoin point-of-sale transactions in an eight-hour period.

Organized by BTC Inc, the event will showcase Bitcoin’s evolution from a digital capital asset to a practical medium of exchange, leveraging the latest advancements in payment technology.

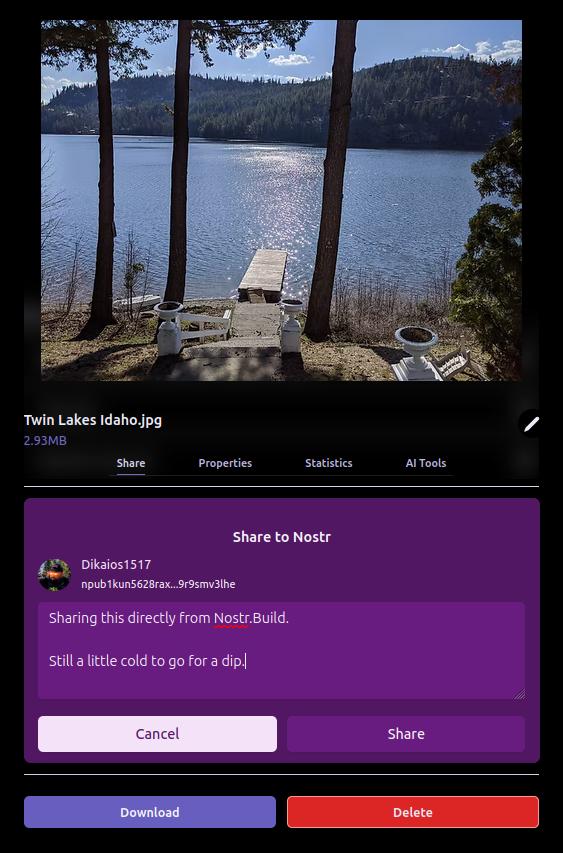

Tap-to-Pay with Lightning-Ready Bolt Cards

To facilitate this record-setting attempt, 4,000 Lightning-ready Bolt Cards will be distributed to conference attendees.

— Uncle Rockstar Developer (@r0ckstardev) May 15, 2025

These NFC-enabled cards allow users to make instant, contactless Bitcoin payments at vendor booths throughout the expo-no apps or QR codes required, just a simple tap.

The cards are available in four collectible designs, each featuring a prominent figure in Bitcoin’s history: Senator Cynthia Lummis, Michael Saylor, Satoshi Nakamoto, and Jack Dorsey.

Each attendee will receive a randomly assigned card, making them both functional and collectible souvenirs.

Senator Lummis: A Playful Provocation

Notably, one of the card designs features Senator Cynthia Lummis with laser eyes-a playful nod to her reputation as a leading Bitcoin advocate in US politics.

While Lummis is known for her legislative efforts to promote Bitcoin integration, she has publicly stated she prefers to “spend dollars and save Bitcoin,” viewing BTC as a long-term store of value rather than a daily currency.

The choice to feature her on the Bolt Card, could be suggested by Rockstar Dev of the BTC Pay Server Foundation, perhaps a lighthearted way to highlight the ongoing debate about Bitcoin’s role in everyday payments.

Nothing cracks me up quite like a senator that wants the US to buy millions of Bitcoin use dollars to buy a beer at a Bitcoin bar.

This is how unserious some of you are. pic.twitter.com/jftIEggmip

— Magoo PhD (@HodlMagoo) April 4, 2025

How Bolt Cards and the Lightning Network Work

Bolt Cards are physical cards equipped with NFC (Near Field Communication) technology, similar to contactless credit or debit cards. When linked to a compatible Lightning wallet, they enable users to make Bitcoin payments over the Lightning Network by simply tapping the card at a point-of-sale terminal.

The Lightning Network is a second-layer protocol built on top of Bitcoin, designed to facilitate instant, low-cost transactions ideal for everyday purchases.

This integration aims to make Bitcoin as easy to use as traditional payment methods, eliminating the need for QR code scanning or mobile apps.

A Showcase for Bitcoin’s Real-World Usability

With over 30,000 attendees, 300 exhibitors, and 500 speakers expected, the Bitcoin 2025 conference is poised to be the largest Bitcoin event of the year-and potentially the most transactional.

The event will feature on-site activations such as the Official Bitcoin Magazine Store, where all merchandise will be available at a 21% discount for those paying with Bitcoin via the Lightning Network-a nod to Bitcoin’s 21 million coin supply limit.

By deeply integrating Lightning payments into the conference experience, organizers hope to demonstrate Bitcoin’s readiness for mainstream commerce and set a new benchmark for its practical use as a currency.

Conclusion

The Guinness World Record attempt at Bitcoin 2025 is more than a publicity stunt-it’s a bold demonstration of Bitcoin’s technological maturity and its potential to function as a modern, everyday payment method.

Whether or not the record is set, the event will serve as a milestone in the ongoing journey to make Bitcoin a truly global, user-friendly currency

-

@ b1ddb4d7:471244e7

2025-05-24 11:00:38

@ b1ddb4d7:471244e7

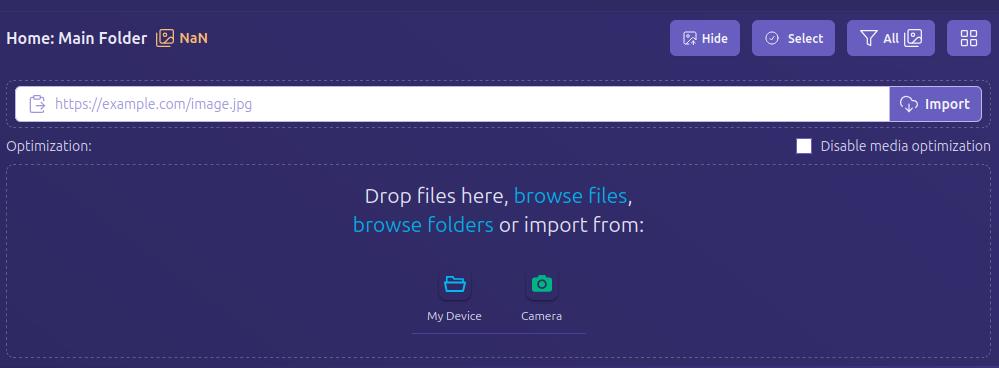

2025-05-24 11:00:38Flash, an all-in-one Bitcoin payment platform, has announced the launch of Flash 2.0, the most intuitive and powerful Bitcoin payment solution to date.

With a completely redesigned interface, expanded e-commerce integrations, and a frictionless onboarding process, Flash 2.0 makes accepting Bitcoin easier than ever for businesses worldwide.

We did the unthinkable!

We did the unthinkable! Website monetization used to be super complicated.

"Buy me a coffee" — But only if we both have a bank account.

WHAT IF WE DON'T?

Thanks to @paywflash and bitcoin, it's just 5 CLICKS – and no banks!

Start accepting donations on your website… pic.twitter.com/uwZUrvmEZ1

Start accepting donations on your website… pic.twitter.com/uwZUrvmEZ1— Flash • The Bitcoin Payment Gateway (@paywflash) May 13, 2025

Accept Bitcoin in Three Minutes

Setting up Bitcoin payments has long been a challenge for merchants, requiring technical expertise, third-party processors, and lengthy verification procedures. Flash 2.0 eliminates these barriers, allowing any business to start accepting Bitcoin in just three minutes, with no technical set-up and full control over their funds.

The Bitcoin Payment Revolution

The world is witnessing a seismic shift in finance. Governments are backing Bitcoin funds, major companies are adding Bitcoin to their balance sheets, and political figures are embracing it as the future of money. Just as Stripe revolutionized internet payments, Flash is now doing the same for Bitcoin. Businesses that adapt today will gain a competitive edge in a rapidly evolving financial landscape.

With Bitcoin adoption accelerating, consumers are looking for places to spend it. Flash 2.0 ensures businesses of all sizes can seamlessly accept Bitcoin and position themselves at the forefront of this financial revolution.

All-in-One Monetization Platform

More than just a payment gateway, Flash 2.0 is a complete Bitcoin monetization suite, providing multiple ways for businesses to integrate Bitcoin into their operations. Merchants can accept payments online and in-store, content creators can monetize with donations and paywalls, and freelancers can send instant invoices via payment links.

For example, a jewelry designer selling products on WooCommerce can now integrate Flash for online payments, use Flash’s Point-of-Sale system at trade shows, enable Bitcoin donations for her digital artwork, and lock premium content behind Flash Paywalls. The possibilities are endless.

E-Commerce for Everyone

With built-in integrations for Shopify, WooCommerce, and soon Wix and OpenCart, Flash 2.0 enables Bitcoin payments on 95% of e-commerce stores worldwide. Businesses can now add Bitcoin as a payment option in just a few clicks—without needing developers or external payment processors.

And for those looking to start selling, Flash’s built-in e-commerce features allow users to create online stores, showcase products, and manage payments seamlessly.

No Middlemen, No Chargebacks, No Limits

Unlike traditional payment platforms, Flash does not hold or process funds. Businesses receive Bitcoin directly, instantly, and securely. There are no chargebacks, giving merchants full control over refunds and eliminating fraud. Flash also remains KYC-free, ensuring a seamless experience for businesses and customers alike.

A Completely Redesigned Experience

“The world is waking up to Bitcoin. Just like the internet revolutionized commerce, Bitcoin is reshaping finance. Businesses need solutions that are simple, efficient, and truly decentralized. Flash 2.0 is more than just a payment processor—it’s a gateway to the future of digital transactions, putting financial power back into the hands of businesses.”

— Pierre Corbin, CEO at Flash.

Flash 2.0 introduces a brand-new user interface, making it easier than ever to navigate, set up payments, and manage transactions. With an intuitive dashboard, streamlined checkout, and enhanced mobile compatibility, the platform is built for both new and experienced Bitcoin users.

About Flash

Flash is an all-in-one Bitcoin payment platform that empowers businesses, creators, and freelancers to accept, manage, and grow with Bitcoin. With a mission to make Bitcoin payments accessible to everyone, Flash eliminates complexity and gives users full control over their funds.

To learn more or get started, visit www.paywithflash.com.

Press Contact:

Julien Bouvier

Head of Marketing

+3360941039 -

@ b1ddb4d7:471244e7

2025-05-24 11:00:37

@ b1ddb4d7:471244e7

2025-05-24 11:00:37Bitcoin FilmFest (BFF25) returns to Warsaw for its third edition, blending independent cinema—from feature films and commercials to AI-driven experimental visuals—with education and entertainment.

Hundreds of attendees from around the world will gather for three days of screenings, discussions, workshops, and networking at the iconic Kinoteka Cinema (PKiN), the same venue that hosted the festival’s first two editions in March 2023 and April 2024.

This year’s festival, themed “Beyond the Frame,” introduces new dimensions to its program, including an extra day on May 22 to celebrate Bitcoin Pizza Day, the first real-world bitcoin transaction, with what promises to be one of Europe’s largest commemorations of this milestone.

BFF25 bridges independent film, culture, and technology, with a bold focus on decentralized storytelling and creative expression. As a community-driven cultural experience with a slightly rebellious spirit, Bitcoin FilmFest goes beyond movies, yet cinema remains at its heart.

Here’s a sneak peek at the lineup, specially curated for movie buffs:

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money.

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money. Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative).

Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative). Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.

Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.To get an idea of what might come up at the event, here, you can preview 6 selected ads combined into two 2 videos:

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships.

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships. Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.

Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.BFF25 Main Screenings

Sample titles from BFF25’s Official Selection:

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director.

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director. UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year.

UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year. HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.

HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.Check out trailers for this year’s BFF25 and past editions on YouTube.

Tickets & Info:

- Detailed program and tickets are available at bitcoinfilmfest.com/bff25.

- Stay updated via the festival’s official channels (links provided on the website).

- Use ‘LN-NEWS’ to get 10% of tickets

-

@ b1ddb4d7:471244e7

2025-05-24 11:00:35

@ b1ddb4d7:471244e7

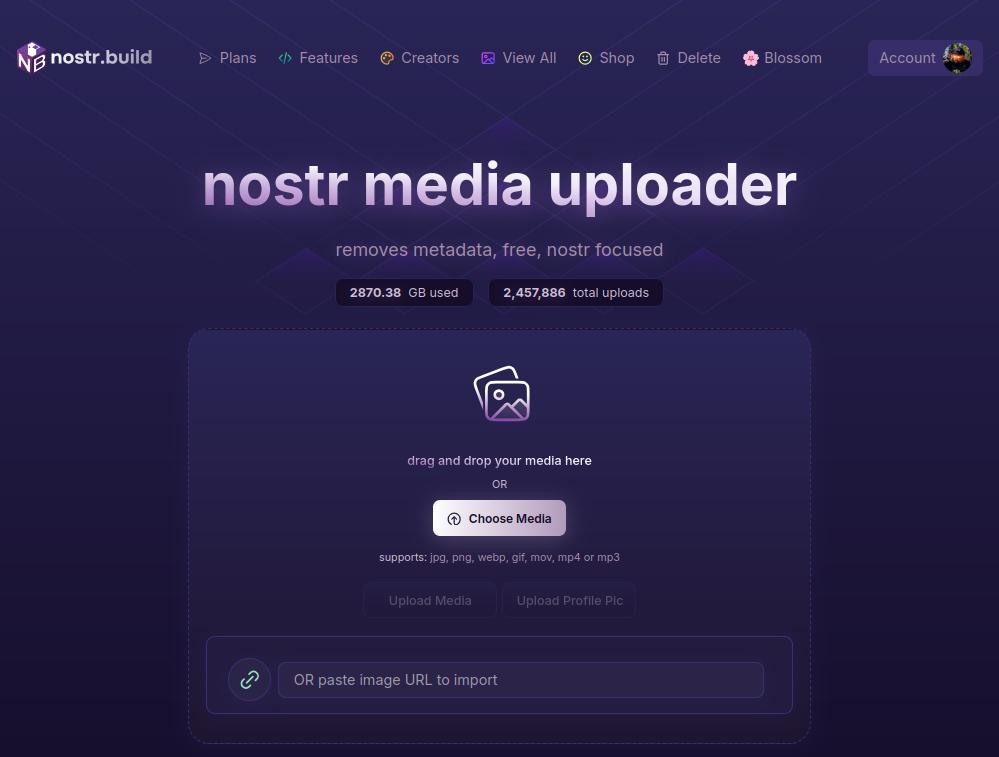

2025-05-24 11:00:35Starting January 1, 2026, the United Kingdom will impose some of the world’s most stringent reporting requirements on cryptocurrency firms.

All platforms operating in or serving UK customers-domestic and foreign alike-must collect and disclose extensive personal and transactional data for every user, including individuals, companies, trusts, and charities.

This regulatory drive marks the UK’s formal adoption of the OECD’s Crypto-Asset Reporting Framework (CARF), a global initiative designed to bring crypto oversight in line with traditional banking and to curb tax evasion in the rapidly expanding digital asset sector.

What Will Be Reported?

Crypto firms must gather and submit the following for each transaction:

- User’s full legal name, home address, and taxpayer identification number

- Detailed data on every trade or transfer: type of cryptocurrency, amount, and nature of the transaction

- Identifying information for corporate, trust, and charitable clients

The obligation extends to all digital asset activities, including crypto-to-crypto and crypto-to-fiat trades, and applies to both UK residents and non-residents using UK-based platforms. The first annual reports covering 2026 activity are due by May 31, 2027.

Enforcement and Penalties

Non-compliance will carry stiff financial penalties, with fines of up to £300 per user account for inaccurate or missing data-a potentially enormous liability for large exchanges. The UK government has urged crypto firms to begin collecting this information immediately to ensure operational readiness.

Regulatory Context and Market Impact

This move is part of a broader UK strategy to position itself as a global fintech hub while clamping down on fraud and illicit finance. UK Chancellor Rachel Reeves has championed these measures, stating, “Britain is open for business – but closed to fraud, abuse, and instability”. The regulatory expansion comes amid a surge in crypto adoption: the UK’s Financial Conduct Authority reported that 12% of UK adults owned crypto in 2024, up from just 4% in 2021.

Enormous Risks for Consumers: Lessons from the Coinbase Data Breach

While the new framework aims to enhance transparency and protect consumers, it also dramatically increases the volume of sensitive personal data held by crypto firms-raising the stakes for cybersecurity.

The risks are underscored by the recent high-profile breach at Coinbase, one of the world’s largest exchanges.

In May 2025, Coinbase disclosed that cybercriminals, aided by bribed offshore contractors, accessed and exfiltrated customer data including names, addresses, government IDs, and partial bank details.

The attackers then used this information for sophisticated phishing campaigns, successfully deceiving some customers into surrendering account credentials and funds.

“While private encryption keys remained secure, sufficient customer information was exposed to enable sophisticated phishing attacks by criminals posing as Coinbase personnel.”

Coinbase now faces up to $400 million in compensation costs and has pledged to reimburse affected users, but the incident highlights the systemic vulnerability created when large troves of personal data are centralized-even if passwords and private keys are not directly compromised. The breach also triggered a notable drop in Coinbase’s share price and prompted a $20 million bounty for information leading to the attackers’ capture.

The Bottom Line

The UK’s forthcoming crypto reporting regime represents a landmark in financial regulation, promising greater transparency and tax compliance. However, as the Coinbase episode demonstrates, the aggregation of sensitive user data at scale poses a significant cybersecurity risk.

As regulators push for more oversight, the challenge will be ensuring that consumer protection does not become a double-edged sword-exposing users to new threats even as it seeks to shield them from old ones.

-

@ 866e0139:6a9334e5

2025-05-22 06:46:34

@ 866e0139:6a9334e5

2025-05-22 06:46:34Autor: Jana Moava. Dieser Beitrag wurde mit dem Pareto-Client geschrieben. Sie finden alle Texte der Friedenstaube und weitere Texte zum Thema Frieden hier. Die neuesten Pareto-Artikel finden Sie auch in unserem Telegram-Kanal.

Die neuesten Artikel der Friedenstaube gibt es jetzt auch im eigenen Friedenstaube-Telegram-Kanal.

Zwei Worte nur braucht man – und die Sache ist klar. Jeder gebildete Russe kennt diese Worte: sie stammen aus dem XIX. Jahrhundert, als Nikolaus I. die Krim-Kampagne begann und das Zarenreich nach üblen Querelen ganz Europa und die Türkei zum Gegner hatte - allen voran die Herrscher der Weltmeere: das British Empire mit Queen Victoria. Der historische Ausdruck anglitschanka gadit (locker übersetzt: die Engländerin macht Shit) besitzt bis heute verdeckte politische Sprengkraft und ist seit Ende Februar 2022 in Russland wieder populär. Wer auch immer der Urheber dieser im Original durchaus diskreten Benennung des Fäkalvorgangs war: der Ausdruck steht für ernste Konflikte mit dem Englisch sprechenden Westen, dem Erzfeind.

Ein kurzer Blick in die Geschichte mag dies erläutern: Fast alle westlichen Historiker benennen als Auslöser des Krimkrieges Mitte des IX. Jahrhunderts die Verteidigung der russisch-orthodoxen Kirche und deren Zugang zur Kreuzkirche in Jerusalem. Es wird vom letzten Kreuzzug u.a. geschrieben. Das ist eine höchst einseitige Interpretation, denn es ging Nikolaus I. vor allem um den Zugang zum einzigen dauerhaft eisfreien Hafen Russlands im Schwarzen Meer, durch die Meeresenge der Dardanellen ins Mittelmeer. Das ist verständlich, war doch die Eroberung der Krim ab 1783 unter seiner Großmutter Katharina II. aus eben diesem Grunde erfolgt. Damals schon wurde der Hafen Sewastopol zum Stützpunkt der russischen Flotte ausgebaut.

Ende 1825, nach dem plötzlichen Tod des ältesten Bruders Alexander I., war Nikolaus von seiner Erziehung her auf eine Regentschaft ganz und gar nicht vorbereitet gewesen, doch herrschte er dreißig Jahre lang nicht nur über das russische Reich, sondern auch über Finnland und das damalige Königreich Polen unter russischem Protektorat. Nikolaus I. zeichnete sich von Beginn an durch Gewaltmaßnahmen aus: Als ihm im Dezember (russ. dekabr)1825 eine Gruppe sehr gebildeter, freiheitsliebender junger Adligen aus besten Familien den Eid verweigerte (dies zog als Dekabristenaufstand in die Geschichte ein), ließ er fünf der Rebellen hängen, die anderen schickte er in Fußfesseln nach Sibirien in die Bergwerke. Er gründete die berüchtigte Geheimpolizei Dritte Abteilung, ließ Privatbriefe des Dichters Puschkin öffnen (obwohl dieser „in seiner Gnade stand“) und Historikern ist Nikolaus I. als Gendarm Europas bekannt. Im russischen Volk aber nannte man ihn kurz und bündig: *Nicki Knüppel aus dem Sack (Nikolaschka palkin). *

Leo Tolstoj beschrieb diesen Zaren in seinen Erzählungen über die Kriege im Kaukasus (Hadschi Murat) als feist und fett, mit leblosen, trüben Augen und als berüchtigten Frauenjäger. Tolstoj war es auch, der als junger Teilnehmer im Krimkrieg drei Erzählungen schrieb: Sewastopol im Dezember 1854, im Mai 1855 und im August 1855. Nachdem das British Empire unter Queen Victoria Russland den Krieg erklärt hatte (in Koalition mit Frankreich und Piemont-Sardinien als Schutzmacht des Osmanischen Reiches), entstand der Ausdruck anglitschanka gadit – die Engländerin macht Shit. Bis heute findet man dazu drastische Illustrationen im Netz…

Noch bevor russische Truppen Ende Februar 2022 in die Ukraine marschierten, lebte dieser Ausdruck in Russland wieder auf. Wer hierzulande Interesse an der Wahrheit hat, kann deutliche Parallelen zur damaligen politischen Lage entdecken, auch in Bezug auf die Verhaltensweisen des derzeitigen russischen Staatschefs und des historischen Nicki Knüppel aus dem Sack. Obwohl der amtierende durchaus Anerkennung verdient hat, denn nach dem Zusammenbruch der Sowjetunion in den 1990er Jahren unter Jelzin stellte er die Staatlich-keit des verlotterten, hungernden Landes wieder her und trieb den wirtschaftlichen Aufbau voran. Davon kann ich zeugen, lebte ich doch von 1992 – 2008 vor Ort.

Sicher - heute ist längst bekannt, daß die bereits Ende März 2022 in Istanbul laufenden Friedensverhandlungen zwischen Russland und der Ukraine vom britischen Premier und im Namen des US Präsidenten boykottiert wurden. Daniel Ruch, Schweizer Botschafter a.D., sprach gar von Sabotage! Der deutsche General a. D. Harald Kujat kommentierte damals mit den Worten: „Seit April 2022 gehen alle Kriegsopfer in der Ukraine auf das Konto des Westens!“ Der Ausdruck anglitschanka gadit ist seitdem in Russland wieder geläufig. Nun, brandaktuell, treffen sich die Kriegsparteien wieder in Istanbul: Ausgang ungewiss. Doch wird inzwischen auch von einzelnen westlichen Politikern anerkannt, dass Russland eine neutrale Pufferzone zu den Nato-Staaten verlangt und braucht.

Wenn hierzulande gemutmaßt wird, alle Russen würden den Ukraine-Krieg bejahen, so sollte man zur Kenntnis nehmen, dass derartige Aussagen kaum die wirkliche Überzeugung wiedergeben. Seit den Repressionen unter Stalin, seit in jeder zweiten Familie nahe Angehörige im GULAG einsaßen und umkamen und darüber Jahrzehnte lang geschwiegen werden musste, ist der Wahrheitsgehalt öffentlicher Umfragen getrost zu bezweifeln. Hat man hier etwa vergessen, dass seit 2011 auf eine mächtig wachsende zivile Protestbewegung und riesige Demonstrationen in russischen Großstädten immer schärfere Aktionen von Seiten des Staates erfolgten? Dass Knüppel auf Köpfe und Leiber prasselten, wie zur Zeit Nickis I., und der Polizeiapparat derart wuchs, dass heute das Verhältnis von Bürger und Silowiki (Vertreter der Gewalt)1:1 steht?

Offenbar weiß man hier nicht, dass schon Anfang 2022 von Mitarbeitern in jeder staatlich finanzierten Institution, ob im Bereich von Kultur, Wissenschaft, Forschung oder Lehre die schriftliche Zustimmung zur Spezialoperation mit der Ukraine eingefordert wurde! Eine Weigerung hatte den Verlust des Arbeitsplatzes zur Folge, egal welches Renommée oder welchen Rang der Betroffene besaß! Manche Leiter von staatlichen Institutionen zeigten dabei gehöriges Geschick und zeichneten für alle; andere (z.B. staatliche Theater) riefen jeden Mitarbeiter ins Kontor. Nur wenige Personen, die unter dem persönlichem Schutz des Präsidenten standen, konnten sich dieser Zustimmung zum Krieg entziehen. Wissenschaftler und Künstler emigrierten zuhauf. Berlin ist voll mit Geflohenen aus jenem Land, das kriegerisch ins Bruderland einmarschierte! Aber kann denn jeder emigrieren? Die Alten, Familien mit Kindern? Mit guten Freunden, die dort blieben, ist eine Kommunikation nur verschlüsselt möglich, in Nachrichten wie: die Feuer der Inquisition brennen (jeder, der von der offiziellen Doktrin abweicht, ist gefährdet), Ratten verbreiten Krankheiten bezieht sich auf Denunziationen, die in jeder Diktatur aufblühen, wenn sich jemand dem Schussfeld entziehen möchte und im vorauseilenden Gehorsam den Nachbarn anzeigt. Kennen wir das nicht noch aus unseren hitlerdeutschen 1930er Jahren?!

Je mehr im Reich aller Russen in den letzten Jahren von oben geknebelt und geknüppelt wurde, desto mehr Denunziationen griffen um sich. Junge Menschen, die auf Facebook gegen den Krieg posteten, wurden verhaftet. Seit 2023 sitzen u.a. zwei junge russische Theaterfrauen aufgrund der üblen Denunziation eines Kollegen hinter Gittern. Die Inszenierung der Regisseurin Zhenja Berkowitsch und der Autorin Swetlana Petritschuk erhielt Ende 2022 den höchsten Theaterpreis von ganz Russland, die Goldene Maske. Das Stück Finist (Phönix), klarer Falke ist nach dem Motiv eines russischen Märchens geschrieben, fußt aber auf dokumentarischem Material: es verhandelt die Versuchung junger Frauen, auf Islamisten hereinzufallen und sie aus Frust und falsch verstandener Solidarität zu heiraten. Die Anklage hat den Spieß genau umgedreht: Autorin und Regisseurin wurden des Terrorismus beschuldigt! Das Rechtssystem im Land scheint heute noch vergleichbar mit jenem, das Alexander Puschkin vor über 200 Jahren in seiner Erzählung Dubrowski authentisch beschrieb: Wer die Macht hat, regelt das Recht. Man kann die Erzählung des russischen Robin Hood auch deutsch nachlesen (leider, leider hat Puschkin sie nicht beendet).

Andere, erbaulichere Elemente aus der Zeit Puschkins, bzw. von Nikolaus I., dienen allerdings als Gegengewicht zum Alltag: seit Ende 2007 finden in Moskau und St. Petersburg jeden Winter nach dem Vorbild der historischen Adelsbälle große gesellschaftliche Events statt: Puschkinball, Wiener Opernball, jetzt nur noch Opernball genannt. Der Nachwuchs aus begüterten Familien lernt alte Tanzschritte und feine Sitten. Fort mit dem sowjetischen Schmuddelimage! Prächtige Kostümbälle werden nun zum Abschluss jedes Schuljahres aufgeboten. In stilisierten Kostümen der Zeit Nikolajs I. bzw. Puschkins tanzen Schuldirektoren, Lehrer und junge Absolventen. Der Drang nach altem Glanz und Größe (oder eine notwendige Kompensation?) spiegelt sich im Volk.

Werfen wir jedoch einen Blick auf einige Geschehnisse in der Ukraine ab 2014, die in unserer Presse immer noch verschwiegen werden: Im Spätsommer 2022 begegnete ich auf Kreta einer Ukrainerin aus der Nordukraine, die wegen des fürchterlichen Nationalismus nach 2014 ihre Heimat verließ. Sie ist nicht die einzige! Ihre Kinder waren erwachsen und zogen nach Polen, sie aber reiste mit einer Freundin weiter Richtung Griechenland, lernte die Sprache, erwarb die Staatsbürgerschaft und ist nun auf Kreta verheiratet.

Natalia erzählte mir, was bei uns kaum zu lesen ist, was jedoch Reporter wie Patrick Baab oder Historiker wie Daniele Ganser schon lange berichtet haben: 2014, als die Bilder der Proteste auf dem Maidan um die Welt gingen, habe die damalige amerikanische Regierung unter Präsident Biden die Vorgänge in Kiew für einen Putsch genutzt: Janukowitsch, der korrupte, doch demokratisch gewählte Präsident der Ukraine wurde gestürzt, die Ereignisse mit Hilfe von Strohmännern und rechten Nationalisten gelenkt, die mit Geld versorgt wurden. Bis es zum Massaker auf dem Maidan kam, als bewaffnete, ihrer Herkunft nach zunächst nicht identifi-zierbare Schützen (es waren v.a. rechte Nationalisten, so der gebürtige Ukrainer und US Bürger Professor N. Petro und Prof. Ivan Katchanovskij) von den Dächern in die Menge schossen.

Im YouTube Kanal Neutrality Studies konnte man am 17.02.2024 hören: Anlässlich des traurigen 10. Jahrestages des Maidan-Massakers, bei dem am 20. Februar 2014 mehr als 100 Menschen durch Scharfschützenfeuer getötet wurden, spreche ich heute mit Ivan Katchanovski, einem ukrainischen (und kanadischen) Politikwissenschaftler an der Univer-sität von Ottawa, der das Massaker detailliert erforscht hat. Letztes Jahr veröffentlichte er das Papier „Die Maidan-Massaker-Prozess und Untersuchungserkenntnisse: Implikationen für den Krieg zwischen der Ukraine und Russland und die Beziehungen“. Kurz gesagt, das Massaker wurde NICHT von den Kräften Victor Janukowytschs begangen, wie in westlichen Medien berichtet, und es gibt schlüssige Beweise dafür, dass die Schützen Teil des ultra-rechten Flügels der Ukraine waren, die dann nach dem Putsch an die Macht kamen. (Link zum Paper).

Wer erinnert sich hierzulande noch daran, dass 2014 im deutschen öffentlichen Fernsehen von Hunter Biden, Sohn des US-Präsidenten berichtet wurde, der durch dubiose Gas- und Ölgeschäfte in der Ukraine auffiel? Dass damals im deutschen Fernsehen auch Bilder von Ukrainern mit SS-Stahlhelmen auftauchten? In einer Arte-Reportage zu Hilfs-transporten im März 2022 aus Polen über die Westukraine konnte der aufmerksame Zu-schauer an fast allen Häusern die tiefroten Banner von Anhängern des verstorbenen, in München begrabenen, faschistischen Stepan Bandera erkennen. Ausgesprochen wurde es nicht.

Die neue Kreterin Natalia sprach auch über eine Amerikanerin ukrainischer Herkunft, die Röntgenärztin Uljana Suprun, die aus den USA als Gesundheitsministerin rekrutiert wurde und unter dem amerikafreundlichen Präsidenten Poroschenko von 2016-2019 diesen Posten innehatte. Was bitte sollte eine Röntgenärztin aus den USA auf dem Ministerposten der Ukraine?! Streit und Skandal umgaben sie fast täglich in der RADA, dem ukrainischen Parlament. Es wurde gemunkelt, sie diene als Feigenblatt bei der Herstellung biologischer Waffen. Material zu ihr ist bis heute auf YouTube zu finden.

DIE FRIEDENSTAUBE FLIEGT AUCH IN IHR POSTFACH!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt, vorerst für alle kostenfrei, wir starten gänzlich ohne Paywall. (Die Bezahlabos fangen erst zu laufen an, wenn ein Monetarisierungskonzept für die Inhalte steht). Sie wollen der Genossenschaft beitreten oder uns unterstützen? Mehr Infos hier oder am Ende des Textes.

Natalia bezeichnete die ukrainischen Emigrantenkreise in den USA und Kanada zurecht als ultranationalistisch, sie seien Kollaborateure der Nazis bei der Judenvernichtung gewesen und hätten sich nach dem Rückzug der Deutschen rechtzeitig nach Übersee abgesetzt. Das ist wohl bekannt.

Heute ist das Recherchieren der wahren Geschehnisse von 2014 zwar immer noch mühsam, aber die Wahrheit sickert immer mehr durch, zumal auch Exilukrainer dazu geschrieben und öffentlich gesprochen haben. Die Kanäle SaneVox und Neutrality studies liefern unermüdlich weitere Fakten! Im März 2025 klärte der US-Professor Jeffrey Sachs das Europa-Parlament endlich in allen Details über die kriegerischen Machenschaften bestimmter Kreise innerhalb der englischsprechenden Westmächte auf!

Kürzlich war im multipolar-magazin zu lesen, wie erschreckend tief unser eigenes Land bereits in**** den Ukraine-Krieg verwickelt ist: Da hieß es:

*„Kriegsplanung von deutschem Boden“ *

Zwei umfassende Beiträge der „New York Times“ und der Londoner „Times“ belegen, was lange bestritten wurde: die tiefe militärische und strategische Verwicklung von Nato-Mitgliedsstaaten in den Ukraine-Krieg. Demnach wird deren Kriegsbeteiligung seit Jahren vom europäischen Hauptquartier der US-Armee in Wiesbaden koordiniert. Für Deutschland stellen sich damit verfassungsrechtliche Fragen.

Und ein Karsten Montag schrieb ebenda am 25. April 2025:

Mehr als drei Jahre nach Beginn des russisch-ukrainischen Krieges berichten zwei große westliche Tageszeitungen über die tiefgreifende Beteiligung von Nato-Militärs an diesem Konflikt. Den Anfang machte die „New York Times“ (NYT). Unter dem Titel „Die Partnerschaft: Die geheime Geschichte des Krieges in der Ukraine“ erschien Ende März ein umfassender *Artikel, der laut Autor Adam Entous auf 300 Interviews mit Regierungs-, Militär- und Geheim-dienstvertretern in der Ukraine, den Vereinigten Staaten sowie weiteren Nato-Partnern basiert. Es handle sich um die „unerzählte Geschichte“ der „versteckten Rolle“ der USA bei den ukrainischen Militäroperationen. *

Wenige Wochen später veröffentlichte die britische Tageszeitung „The Times“ Anfang April einen ähnlichen Beitrag mit dem Titel „Die unerzählte Geschichte der entscheidenden Rolle der britischen Militärchefs in der Ukraine“. Dieser bestätigt die tiefe Verstrickung der Nato-Staaten in Militäroperationen wie der ukrainischen Offensive 2023. Abweichend vom NYT-Artikel bezeichnet er jedoch die britischen Militärchefs als die „Köpfe“ der „Anti-Putin“-Koalition. Einigkeit herrscht wiederum bei der Frage, wer für den Misserfolg der Operationen verantwortlich ist: Dies sei eindeutig der Ukraine zuzuschreiben. Auch im Times-Beitrag wird auf die besondere Rolle des europäischen US-Hauptquartiers im hessischen Wiesbaden bei der Koordination der Einsätze und den Waffenlieferungen hingewiesen.

Na also! Es gibt unter den aus der Ukraine Geflüchteten hier allerdings eine große Mehrheit, die von diesen Fakten weder etwas wissen, noch wissen wollen. Amerika und die Heimat der Anglitschanka ist für sie das Gelobte Land und wehe, du sprichst darüber, dann wirst du sofort der russischen Propaganda verdächtig. Wie Nicki mittlerweile daheim den Knüppel schwingt, interessiert sie auch nicht.

Wieso wird hier nicht untersucht, wieso wird verschwiegen, dass Alexej Nawalny für einen englischen Dienst arbeitete – woher erhielt er das viele Geld für seine Kampagnen? Wo leben nun seine Witwe und die Kinder? Auf der Insel im nebligen Avalon/ Albion…

Ein letztes Beispiel aus dem Bereich der Kultur zum Verständnis des leider so aktuellen Ausdrucks Die Engländerin macht Shit: Anfang 2024 wurde im staatlichen Sender ONE (ARD) eine Serie der BBC zu frühen Erzählungen von Michail Bulgakow ausgestrahlt:** Aufzeichnungen eines jungen Arztes. Die BBC verhunzte den in Kiew geborenen Arzt und weltberühmten Autor derart, dass dem Zuschauer schlecht wurde: Mit dem Titel A Young Doctor‘s Notebook verfilmte sie Bulgakows frühe Erzählungen über die Nöte eines jungen Arztes in der bettelarmen sowjetrussischen Provinz in den 1920er Jahren hypernaturalistisch, blut-, dreck- und eitertriefend. Pseudokyrillische Titel und Balalaika Geklimper begleiteten das Leiden von schwer traumatisierten Menschen im russischen Bürgerkrieg oder Abscheulichkeiten, wie das Amputieren eines Mädchenbeines mit einer Baumsäge - ausgestrahlt vom 1. Deutschen Fernsehen! Michail Bulgakow hätte sich im Grabe umgedreht.

Als Autor beherrschte Bulgakow die Kunst der Groteske ebenso wie hochlyrische Schilderungen. Seine Prosa und seine Theaterstücke aber wurden Zeit seines Lebens von der Sowjetmacht verstümmelt - und post mortem auch von seinen ukrainischen Landsleuten: sein schönes Museum, das ehemalige Domizil der Familie Bulgakow in Kiew am Andrejew-Steig, das mit seinem ersten Roman Die weiße Garde (Kiew vor 100 Jahren im Strudel auch ultranationalistischer Strömungen) und der berühmten Dramatisierung Die Tage der Turbins in die große Literatur einzog, dieses Museum wurde abgewickelt und geschlossen, weil Bulgakow angeblich schlecht über die Ukraine geschrieben hätte!

Ein Glück jedoch, dass die bedeutenden Werke Bulgakows seit nun drei Dekaden von russischsprachigen Philologen beharrlich in ihrer ursprünglichen Fassung wieder hergestellt wurden. Seine großen Romane Die weiße Garde und Meister und Margarita seien in der hervorragenden deutschen Übersetzung von Alexander Nitzberg jedem Interessierten ans Herz gelegt!

Die obigen Ausführungen sind keinesfalls eine Rechtfertigung des Krieges, es geht vielmehr um Hintergründe, Fakten und Machenschaften, die in der Regel bis heute bei uns verschwiegen werden! Obwohl es nun sonnenklar und öffentlich ist, dass bestimmte Inter-essengruppen der englischsprachigen Westmächte die hochgefährliche Konfrontationspolitik mit Russland zu verantworten haben: die Engländerin macht Shit…Und wir? Wir schweigen, glauben der immer noch laufenden Propaganda und wehren uns nicht gegen diese üble Russenphobie?! Ich erinnere mich noch lebhaft an die Nachkriegszeit im Ruhrgebiet, als der Ton ruppig war und Dreck und Trümmer unsere Sicht beherrschten. Auch uns kleinen Kindern gegenüber wurde von den bösen Russen gesprochen, als hätten diese unser Land überfallen.

Ja – es waren viele Geflüchtete aus dem Osten hier gestrandet, und diese hatten Unsägliches hinter sich. Lew Kopelew, der den Einmarsch der Roten Armee in Ostpreußen miterlebte und Gräuel vergebens zu verhindern suchte, wurde noch im April 1945 verhaftet und wegen Mitleid mit dem Feind zu 10 Jahren Lager verurteilt. Viele Jahre später erschienen seine Erinnerungen Aufbewahren für alle Zeit – auch auf Deutsch. Über die mindestens 27 Mio Opfer in der damaligen Sowjetunion und über die deutschen Aggressoren, die damals mit Mord und Raub die bösen Russen, sowjetische Zivilisten überfielen, wurde in den 1950er Jahren, im zerbombten und dreckigen Pott kein einziges Wort verloren. Der Spieß wurde einfach umgedreht. Von der Blockade Leningrads erfuhr ich erst als Erwachsene, anno 1974, als Austauschstudentin vor Ort.

Exakt vor 10 Jahren wurde es jedoch möglich – herzlichen Dank der damaligen stell-vertretenden tatarischen Kulturministerin Frau Irada Ayupova! – mein dokumentarisches Antikriegsstück mit Schicksalen von Kriegskindern – sowjetischen, jüdischen, deutschen – in Kasan, der Hauptstadt von Tatarstan, zweisprachig auf die Bühne des dortigen Jugendtheaters zu bringen. Wir spielten 15 Vorstellungen und einige tausend Jugendliche im Saal verstummten und verstanden, dass Krieg furchtbar ist. Hier und heute will leider kein Theater das Stück umsetzen…

Wir Menschen brauchen Frieden und keine Aufrüstung für neue Kriege! Der gute alte Aischylos schrieb einst in seinem Stück Die Perser: Wahrheit ist das erste Opfer eines Krieges. Leider ist dies immer noch genauso aktuell wie damals. Pfui Teufel!

Jana Moava (Pseudonym) ist Journalistin, Dozentin und arbeitete für große Zeitungen als Korrespondentin.

LASSEN SIE DER FRIEDENSTAUBE FLÜGEL WACHSEN!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt.

Schon jetzt können Sie uns unterstützen:

- Für 50 CHF/EURO bekommen Sie ein Jahresabo der Friedenstaube.

- Für 120 CHF/EURO bekommen Sie ein Jahresabo und ein T-Shirt/Hoodie mit der Friedenstaube.

- Für 500 CHF/EURO werden Sie Förderer und bekommen ein lebenslanges Abo sowie ein T-Shirt/Hoodie mit der Friedenstaube.

- Ab 1000 CHF werden Sie Genossenschafter der Friedenstaube mit Stimmrecht (und bekommen lebenslanges Abo, T-Shirt/Hoodie).

Für Einzahlungen in CHF (Betreff: Friedenstaube):

Für Einzahlungen in Euro:

Milosz Matuschek

IBAN DE 53710520500000814137

BYLADEM1TST

Sparkasse Traunstein-Trostberg

Betreff: Friedenstaube

Wenn Sie auf anderem Wege beitragen wollen, schreiben Sie die Friedenstaube an: friedenstaube@pareto.space

Sie sind noch nicht auf Nostr and wollen die volle Erfahrung machen (liken, kommentieren etc.)? Zappen können Sie den Autor auch ohne Nostr-Profil! Erstellen Sie sich einen Account auf Start. Weitere Onboarding-Leitfäden gibt es im Pareto-Wiki.

-

@ 8bad92c3:ca714aa5

2025-05-24 11:01:08

@ 8bad92c3:ca714aa5

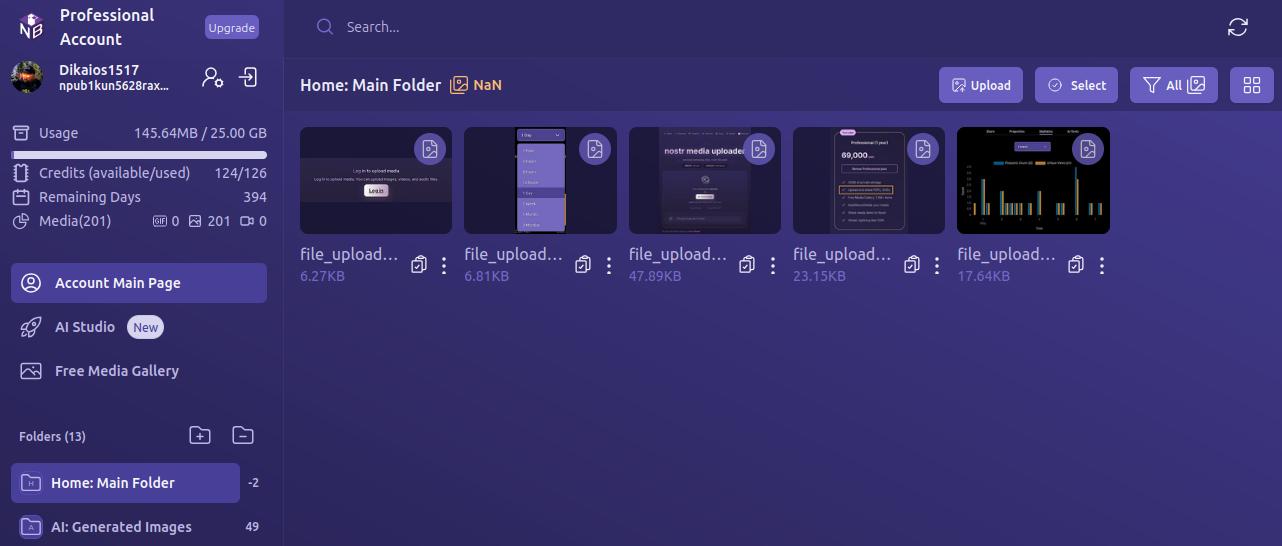

2025-05-24 11:01:08Marty's Bent

It's been a hell of a week in Austin, Texas. The Texas Energy & Mining Summit was held at Bitcoin Park Austin on Tuesday and yesterday. Around 200 people from across the energy sector and the mining sector convened to discuss the current state of bitcoin mining, how it integrates with energy systems, and where things are going in the near to medium term. Representatives from ERCOT, Halliburton, and some of the largest mining companies in the world were in attendence. Across town, Bitcoin++ is holding their conference on mempools, which is fitting considering there is currently an ongoing debate about mempool policy and whether or not Bitcoin Core should eliminate the data limit on OP_RETURN.

I've had the pleasure of participating in both events. At the Texas Energy & Mining Summit I opened up the two-day event with the opening panel on why Texas is perfectly suited not only for bitcoin mining but for the bitcoin industry in general. Texas is a state that highly values private property rights, low taxes, and free market competition. It's become clear to me over the four years that I've lived in Texas that it is an incredible place to start a bitcoin business. The energy down here (pun intended) is palpable.

I also hosted the ending panel with Nick Gates from Priority Power, Will Cole from Zaprite and Jay Beddict from Foundry about what we have to look forward to through the rest of the year. I think the consensus was pretty clear on the panel, there's never been a more bullish setup for bitcoin historically. The political support we're getting here in the United States, the institutional adoption that we're seeing, and the fervor around protocol level development are all pointing in the right direction. Even though the discussions around protocol development can be contentious at times, it's a signal that people really care about this open source monetary protocol that we're all building on. We all agreed that Bitcoin has never been more de-risked than it is today. That is not to say that there aren't any risk.

We also discussed the problem with mining pool centralization and the FPPS payout scheme and why people need to be paying attention to it. But I think overall, things are looking pretty good right now.

Yesterday I also had the pleasure of running the live desk at Bitcoin++ speaking with many of the developers building out the protocol layer and layers above bitcoin. It's always extremely humbling to sit down and speak with the developers because they are so damn smart. Brilliant people who really care deeply about bitcoin. Even though many of them have very different views about the state of bitcoin and how to build it out moving forward. I view my role on the live desk is simply to try to get everybody's perspective. Not only on the OP_RETURN discussion, but on the future of bitcoin and how the protocol progresses from a technical perspective.

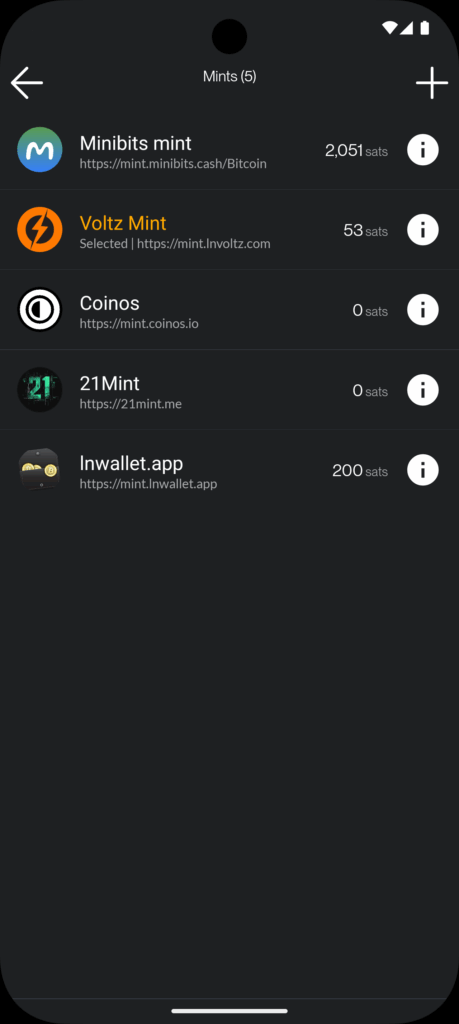

I had many conversations. The first with Average Gary and VNPRC, who are working on hashpools, which are attempting to solve the mining pool centralization and privacy problems that exists by using ecash. Hashpool gives miners the ability to exchange hash shares for ehash tokens. that are immediately liquid and exchangeable for bitcoin over the lightning network. Solving the consistent payout and liquidity problem that miners are always trying to solve. Currently FPPS payout schemes are the way they solve these problems. I'm incredibly optimistic about the hashpools project.

I also had the pleasure of speaking with SuperTestNet and Dusty Daemon, who are both focused on making bitcoin more inherently private at the protocol layer and on the lightning network. I think Dusty's work on splicing is very underappreciated right now and is something that you should all look into. Dusty also explained an idea he has that would make CoinJoin coordination much easier by creating a standardized coordination protocol. I'm going to butcher the explanation here, But I think the general idea is to create a way for people to combine inputs by monitoring the lightning network and looking for individual actors who are looking to rebalance channels and opportunistically set up a collaborative transaction with them. This is something I think everyone should look into and champion because I think it would be incredibly beneficial to on-chain privacy. As Bitcoin scales and gets adopted by millions and billions of people over the next few decades.

I also had the pleasure of speaking with Andrew Poelstra and Boerst about cryptography and block templates. For those of you who are unaware, Andrew Poelstra the Head of Research at Blockstream and on the cutting edge of the cryptography that bitcoin uses and may implement in the future. We had a wide ranging discussion about OP_RETURN, FROST, Musig2, Miniscript, quantum. resistant cryptographic libraries, and how Bitcoin Core actually works as a development project.

I also spoke with Liam Egan from Alpen Labs. He's working on ZK rollups on Bitcoin. Admittedly, this is an area I haven't explored too deeply, so it was awesome to sit down with Liam and get his perspective. Alpen Labs is leveraging BitVM to enable their rollups.

I highly recommend if and when you get the time to check out the YouTube stream of the Live Desk. A lot of very deep, technical conversations, but if you're really interested to learn how bitcoin actually works and some of the ideas that are out there to make it better, this is an incredible piece of content to watch. I'm about to head over for day two of Bitcoin++ to run the Live Desk again. So if you get this email before we go live make sure you subscribe to the YouTube channel and tune in for the day.

One thing I will say. Last night, there was a debate about OP_RETURN and I think it's important to note that despite how vitriolic people may get on Twitter, it's always interesting to see people with diametrically opposed views get together and have civil debates. It's obvious that everyone involved cares deeply about bitcoin. Having these tough conversations in person is very important. Particularly, civil conversations. I certainly think yesterday's debate was civil. Though, I will say I think that as bitcoiners, we should hold ourselves to a higher standard of decorum when debates like this are had.

Tyler Campbell from Unchained mentioned that it is insane that there was such a small group of people attending this particular debate about the future of a two trillion dollar protocol. Bitcoin is approaching $100,000 again as I type and no one in big tech, no one in big finance outside of people looking for bitcoin treasury plays is really paying attention to what's happening at the protocol level. This is simply funny to observe and probably a good thing in the long run. But, Meta, Stripe, Apple, Visa, Mastercard and the Teslas of the world are all asleep at the wheel as we build out the future of money.

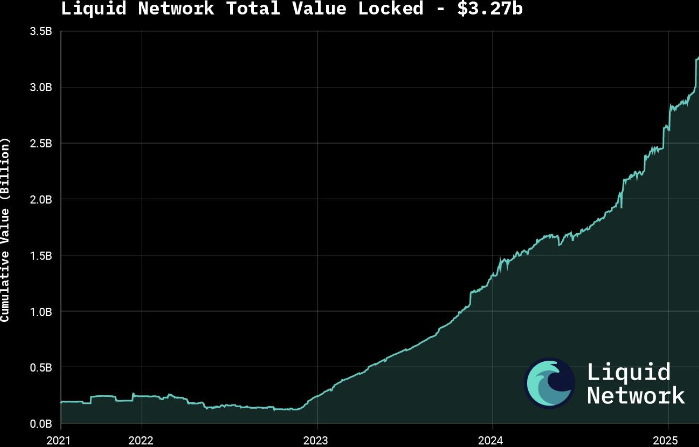

The $1 Trillion Basis Trade Time Bomb

The massive basis trade currently looming over financial markets represents a systemic risk that dwarfs previous crises. As James Lavish warned during our conversation, approximately $1 trillion in leveraged positions exist within this trade - ten times larger than those held by Long-Term Capital Management before its 1998 collapse. These trades employ staggering leverage ratios between 20x to 100x just to make minuscule basis point differences profitable. The Brookings Institution, which Lavish describes as a "tacit research arm of the Fed," has published a paper explicitly warning about this trade's dangers.

"The Brookings Institution came out with a solution... instead of printing money this time, the Fed will just take the whole trade off of the hedge funds books. Absolutely, utterly maniacal. The thought of the Fed becoming a hedge fund... it's nuts." - James Lavish

What makes this situation particularly alarming is how an unwind could trigger cascading margin calls throughout interconnected financial markets. As Lavish explained, when positions begin unwinding, prices move dramatically, triggering more margin calls that force more selling. This "powder keg behind the scenes" is being closely monitored by sophisticated investors who understand its destructive potential. Unlike a controlled demolition, this unwinding could quickly become chaotic, potentially forcing unprecedented Fed intervention.

Check out the full podcast here for more on Bitcoin's role as the neutral reserve asset, nation-state mining strategies, and the repeal of SAB 121's impact on banking adoption.

Headlines of the Day

Panama City Signs Deal for Bitcoin Municipal Payments - via X

U.S. Economy Polls Show Falling Confidence in Trump Leadership - via CNBC

Jack Mallers's Bitcoin Bank Targets $500 Trillion Market - via X

Bitcoin Decouples From Markets With 10% Gain Amid Asset Slump - via X

Looking for the perfect video _to push the smartest person you know from zero to one on bitcoin? Bitcoin, Not Crypto is a three-part master class from Parker Lewis and Dhruv Bansal that cuts through the noise—covering why 2

-

@ 3c506452:fef9202b

2025-05-24 10:55:21

@ 3c506452:fef9202b

2025-05-24 10:55:21Kia ora ra!

I thought I'd look into the claim made by Tim Ferriss and see if these sentence patterns are able to give a brief overview of te reo and it's structure.

I initially struggled to stick with a single sentence as it didn't accurately reflect how the reo is actually spoken so I have included what I feel are the most "normal" sounding structures that one will probably encounter.

Here is the full list:

1. The apple is red.

E whero te tae o te aporo / E whero te aporo.\ He whero te tae o te aporo / He whero te aporo.\ Ko te aporo e whero nei te tae / Ko te aporo e whero nei tona tae.\ E whero ana te tae o te aporo.\ He aporo whero / Ko te aporo whero.

2. It is John's apple.

Ma John te aporo / Na John te aporo.\ He aporo ma John / He aporo na John.\ Ko te aporo a John / Ko ta John aporo.

3. I give John the apple.

Mahaku te aporo e hoatu ma John.\ E hoatu ana te aporo ki a John.\ Ko te aporo e hoatu nei e au ki a John.\ E hoatu ana mahana.

4. We give him the apple.

Ma ma[ua/tou] te aporo e hoatu ma John.\ E hoatu ana te aporo ki a John.\ Ko te aporo e hoatu nei e ma[ua/tou] ki a John.\ E hoatu ana mahana.

5. He gives it to John.

Mahana e hoatu ma John / Nahana i hoatu ma John.\ E hoatu ana ki a John.\ E hoatu ana mahana.

6. She gives it to him.

Mahana e hoatu mahana / Nahana i hoatu mahana.\ Mahana e hoatu / Nahana i hoatu.\ E hoatu ana ki a ia.\ E hoatu ana mahana.

7. Is the apple red?

E whero te tae o te aporo? / E whero te aporo?\ He whero te tae o te aporo?/ He whero te aporo?\ Ko te aporo e whero nei te tae? / Ko te aporo e whero nei tona tae?\ E whero ana te tae o te aporo?\ He aporo whero? / Ko te aporo whero?

8. The apples are red.

E whero te tae o nga aporo / E whero nga aporo.\ He whero te tae o nga aporo / He whero nga aporo.\ Ko nga aporo e whero nei te tae / Ko nga aporo e whero nei ona tae.\ E whero ana te tae o nga aporo.\ He aporo whero / Ko nga aporo whero.

9. I must give it to him.

Hoatu e au te mea ki a ia.\ Hoatu e au mahana.\ Mahaku e hoatu mahana.\ Me hoatu ki a ia.\ E hoatu ai mahana.

10. I want to give it to her.

Mahaku noa e hoatu.\ Waiho mahaku e hoatu.

- I'm going to know tomorrow. Apopo ka mohio ai / Aoake te ra ka mohio ai.\ Ka mohio au apopo / Ka mohio au a aoake te ra.

12. I can't eat the apple.

Ehara i te mea mahaku te aporo te kai.

13. I have eaten the apple.

Kua kai ke au i te aporo.\ Kua pau te aporo te kai i au.\ Nahaku te aporo i kai.\ Ko te aporo nahaku nei i kai ai.\ He mea kai e au te aporo.

-

@ a296b972:e5a7a2e8

2025-05-24 09:35:09

@ a296b972:e5a7a2e8

2025-05-24 09:35:09„Aaaach, was für ein herrlicher Tag!“

In Berlin geht man hochmotiviert an die Arbeit, in der tiefen Überzeugung stets die richtigen Entscheidungen zu treffen, die Steuern der Einzahler ausschließlich für wohlüberlegte, notwendige Investitionen auszugeben und Entscheidungen zu treffen, die im dem Umfeld, in dem man sich bewegt, als höchst sinnvoll erachtet werden. Zustimmung von allen Seiten, dann muss es ja richtig sein.

Man fährt im Dienstwagen ins Regierungsviertel, sieht die vielen geschäftigen Menschen, wie sie ebenfalls zur Arbeit eilen. Man freut sich darüber, dass alles so gut läuft, dank der überragenden Kompetenz, die man einbringen darf und die das alles ermöglicht.

In Gedanken klopft man sich auf die Schulter und sagt sich im Stillen: „Bist schon ein geiler Typ, der richtig was bewegen kann, bewegen kann.“

Man hat auch schon erkannt, dass die zunehmende Kriminalität, vorzugsweise mit einem unsachgemäß gebrauchten Messer, durch den schlechten Einfluss der sozialen Medien entstanden ist und schon entsprechende Maßnahmen auf den Weg gebracht, um das durch geleitete Meinungsäußerungen, selbstverständlich zum Wohle aller, zu unterbinden. Man ist ja nicht umsonst in diese verantwortungsvolle Position gelangt. „Endlich am Ziel!“

„Messerattacken sind unschön, unschön, aber man muss auch berücksichtigen, dass viele der Attentäter und Attentäterinnen in ihren Herkunftsländern Schlimmes erlebt haben und dadurch traumatisiert wurden. Den betroffenen Traumaopfern kann ja nichts Besseres passieren, als in eine deutsche Psychiatrie zu kommen, wo sie die allerbeste Therapie erfahren, um wieder glückliche Menschen der Gesellschaft zu werden.

** **

Und jeder, der nicht die große soziale Aufgabe erkennt, die wir uns gestellt haben und auch effizient umsetzen, muss es eben noch besser erklärt bekommen, erklärt bekommen. Daran müssen wir noch arbeiten. (Muss ich mir notieren, damit ich meinem Sekretär die Anweisung erteile, das in die Wege zu leiten). Und jeder, der sich dagegen sträubt, zeigt damit eindeutig, dass er zum rechten Rand gehört. Was denen nur einfällt? Da müssen klare Zeichen gesetzt werden, und das muss unter allen Umständen unterbunden werden, unterbunden werden.

** **

Sowas schadet der Demokratie, es delegitimiert sie“.

Zum Schutz der braven Bürger arbeitet man auch fleißig daran, Deutschland, in neuem Selbstbewusstsein, zur stärksten Kraft in Europa zu machen. Mit der Stationierung von deutschen Soldaten an der Ostfront, pardon, an der Ostflanke, zeigt man dem bösen, aggressiven Russen schon mal, was eine Harke ist. „Und das ist ja erst der Anfang, der Anfang. Warte nur ab!“

„Was noch? Ach ja, die Wirtschaft. Solange die nicht auf die Barrikaden geht, das sehe ich derzeit nicht, scheint es ja noch keinen akuten Handlungsbedarf zu geben. Darum kümmern wir uns später. Immerhin halten sich die Wirtschaftsprognosen in einem akzeptablen Rahmen und die Priorität (die kann auch nicht jeder richtig setzen) der Investitionen muss derzeit auf dem wichtigsten Bereich, der Aufrüstung liegen, Aufrüstung liegen. Schließlich werden wir bald angegriffen.

** **

Ich darf nicht vergessen, meinen Sekretär zu beauftragen, meine Bestellung im Feinkostladen abholen zu lassen, sonst gibt’s Zuhause Ärger. Ach ja, und die Anzüge und die Wäsche muss auch noch aus der Reinigung abgeholt werden. Darf ich nicht vergessen, nicht vergessen.

** **

Wie viele Reinigungen gäbe es nicht, wenn wir Politiker nicht wären, nicht wären. Viele sichere Arbeitsplätze, gut so!

** **

Was, schon da? Das ging aber heute schnell. Kein Stau. Ja, der Chauffeur ist schon ein Guter, der weiß, wo man lang muss, um Baustellen zu umfahren. Allerdings muss ich ihm bei nächster Gelegenheit noch einmal deutlich sagen, dass er bitte die Sitzheizung früher anzuschalten hat, anzuschalten hat! Dass der sich das immer noch nicht gemerkt hat, unmöglich!“

Wen wundert es, wenn in dieser Wonnewelt der Selbstüberschätzung von Unsererdemokratie gesprochen wird, so entrückt vom Alltag, in einem Raumschiff, dass völlig losgelöst von der Realität über allem schwebt.

„Ich müsste ja verrückt sein, wenn ich an diesen Zuständen etwas ändern wollte. Warum auch, es läuft doch und mir geht es doch gut. Ich habe ein gutes Einkommen, kann mir allerhand leisten, Haus ist bezahlt, Frau ist gut untergebracht, Kinder sind versorgt, wie die Zeit vergeht. Und wenn ich mal ausscheide, erhalte ich weiter meine Bezüge und muss nicht an mein Vermögen ran, man will ja auch den Kindern was hinterlassen. Schadet ja nicht, wenn ich mich etwas einschränke, und der eine oder andere Job wird schon an mich herangetragen werden, schließlich habe ich ja erstklassige Kontakte, die dem einen oder anderen sicher etwas wert sein werden.

** **

Na, dann woll’n wir mal wieder, woll’n wir mal wieder!“

Dieser Artikel wurde mit dem Pareto-Client geschrieben

* *

(Bild von pixabay)

-

@ 90152b7f:04e57401

2025-05-24 03:47:24

@ 90152b7f:04e57401

2025-05-24 03:47:24"Army study suggests U.S. force of 20,000"

The Washington Times - Friday, April 5, 2002

The Bush administration says there are no active plans to put American peacekeepers between Palestinians and Israelis, but at least one internal military study says 20,000 well-armed troops would be needed.

The Army’s School of Advanced Military Studies (SAMS), an elite training ground and think tank at Fort Leavenworth, Kan., produced the study last year. The 68-page paper tells how the major operation would be run the first year, with peacekeepers stationed in Gaza, Hebron, Jerusalem and Nablus.

One major goal would be to “neutralize leadership of Palestine dissenting factions [and] prevent inter-Palestinian violence.”

The military is known to update secret contingency plans in the event international peacekeepers are part of a comprehensive Middle East peace plan. The SAMS study, a copy of which was obtained by The Washington Times, provides a glimpse of what those plans might entail.

Defense Secretary Donald H. Rumsfeld repeatedly has said the administration has no plans to put American troops between the warring factions. But since the escalation of violence, more voices in the debate are beginning to suggest that some type of American-led peace enforcement team is needed.

Sen. Arlen Specter, Pennsylvania Republican, quoted U.S. special envoy Gen. Anthony Zinni as saying there is a plan, if needed, to put a limited number of American peacekeepers in the Israeli-occupied territories.

Asked on CBS whether he could envision American troops on the ground, Mr. Specter said Sunday: “If we were ever to stabilize the situation, and that was a critical factor, it’s something that I would be willing to consider.”

Added Sen. Joseph R. Biden Jr., Delaware Democrat and Senate Foreign Relations Committee chairman, “In that context, yes, and with European forces as well.”

The recent history of international peacekeeping has shown that it often takes American firepower and prestige for the operation to work. The United Nations made futile attempts to stop Serbian attacks on the Muslim population in Bosnia.

The U.S. entered the fray by bombing Serbian targets and bringing about a peace agreement that still is being backed up by American soldiers on the ground. U.S. combat troops are also in Kosovo, and they have a more limited role in Macedonia.