-

@ c4f5e7a7:8856cac7

2025-06-03 08:15:33

@ c4f5e7a7:8856cac7

2025-06-03 08:15:33I've managed to amass three SN profiles.

Is there a way to combined these?

@k00b @ek

https://stacker.news/items/995836

-

@ 472f440f:5669301e

2025-06-02 21:12:29

@ 472f440f:5669301e

2025-06-02 21:12:29Marty's Bent

via me

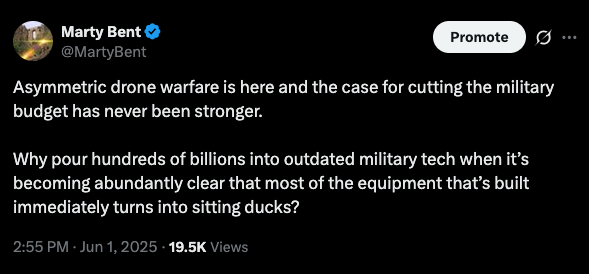

I think we'll look back at last weekend as one of the most pivotal points in human history. Ukraine's Operation Spider Web is one of the more shocking things I've seen in terms of military operations in my life. It validates something that many bitcoiners, many cypherpunks, and many prescient individuals have been talking about for decades now at this point, which is asymmetric drone warfare.

The Sovereign Individual is a book that many bitcoiners have talked about throughout the years due to how prescient it was in terms of the inevitable emergence of a digital currency outside the control of central banks and governments. The book was written in the mid-90s, so the fact that the two authors were able to predict that something like bitcoin would emerge less than 20 years after writing the book is pretty incredible. However, digital currencies leveraging cryptography were not the sole focus of the book. Another portion of the book was dedicated to the idea of asymmetric drone warfare and its effects on society overall.

It seems pretty clear today that this is another call from The Sovereign Individual that is coming true. Obviously, unless you've been living under a rock, you've noticed that Ukraine has been using drones in the battlefield to target strategic Russian assets and individual soldiers over the last year. The amount of battlefield videos I've seen of Russian soldiers running from autonomous drones that are hunting them down has been increasing significantly over the last six months. The footage is truly harrowing. It is a death that I wouldn't wish on anybody. With Operation Spider Web Ukraine has increased the stakes of this type of drone warfare by going deep into Russian territory and targeting strategic long-range bombers, some of which had the ability to deploy nuclear warheads. This is sure to incite a reaction from Russia. No one will be surprised if, by the end of the week, Russia has started a shock and awe campaign that goes deep into Ukrainian territory in retaliation for the kamikaze drone strikes on their long-range aircraft. I pray for peace and a quick resolution to this war, and every other war for that matter.

I didn't come here to pontificate and give my thoughts on this particular war, but I would like to focus on this new tactic of war and what it means for military budgets moving forward. The Sovereign Individual laid it out clearly when they wrote in the 1990s that at some point in the future autonomous drones would be leveraged in the battlefield and prove to be asymmetric because of the fact that they are extremely cheap to produce. When you compare the price it cost to produce one of these drones to the price of the equipment they are destroying, things get pretty crazy. With tens of thousands of dollars of drone equipment the Ukrainian army destroyed tens if not hundreds of millions of dollars worth of long-range missile aircraft. And it did so without putting any Ukrainian military personnel in harm's way. Directly, at least.

When you consider the return on investment of deploying these drones compared to sending in soldiers, tanks, and your own aircraft, it becomes pretty obvious that this is going to quickly become the most logical way to fight a war moving forward. The question that remains is how quickly do other governments recognize this and implement it into their own defense strategies? As an American looking at our military budget, which is quickly approaching $1 trillion in annual spend, I'm forced to question whether or not most of that money is simply being wasted, considering the fact that we live in a time where these asymmetric battlefield strategies now exist. Why build new fighter jets when a Somali pirate, or nefarious individual for that matter, could use a $200 drone to destroy it in a matter of seconds with no threat of direct physical harm?

I'm no military expert, but if I were at the helm of the Defense Department, I would seriously be forcing those below me to focus a ton of effort on this problem and create plans to make sure that we are sufficiently protected from these risks. The only way to protect from these risks is to build the capabilities yourself. When it comes to the risk reward from a defense tech investment perspective I think a majority of the effort should be focused on defensive drone technologies and capabilities.

With that being said, it does seem like the US military is privy to this asymmetric reality that we currently live in. Defense contracts with Andruil make this pretty clear. Andruil is certainly ahead of the curve when it comes to autonomous drone warfare and defense against it. As an American, even though I don't like war, or the military industrial complex, knowing that the military is working with companies like Andruil does give me some comfort. However, the other side of that coin is that it is very unnerving when you consider that the government creating these public-private partnerships could lead to some Orwellian outcomes here at home. It may make some of you feel uncomfortable, but I believe the ideal scenario is that any individual has access to these types of defensive drone technologies in the future. The end goal being to create a nuclear game theoretical outcome where violence is reduced because one always has to assume that anyone they intend to attack has access to sufficient and formidable defensive technologies.

It's truly scary times we're living in as we transition further into the Digital Age. Part of the reason that I've dedicated my whole life to bitcoin is because I truly do believe that if you fix the money, you can fix the world. That is not to say that kinetic wars or physical violence will not exist in the future. It certainly will. But I believe sound money and open access to these systems and tools creates conditions which are much more suitable for cooperation and less so for conflict.

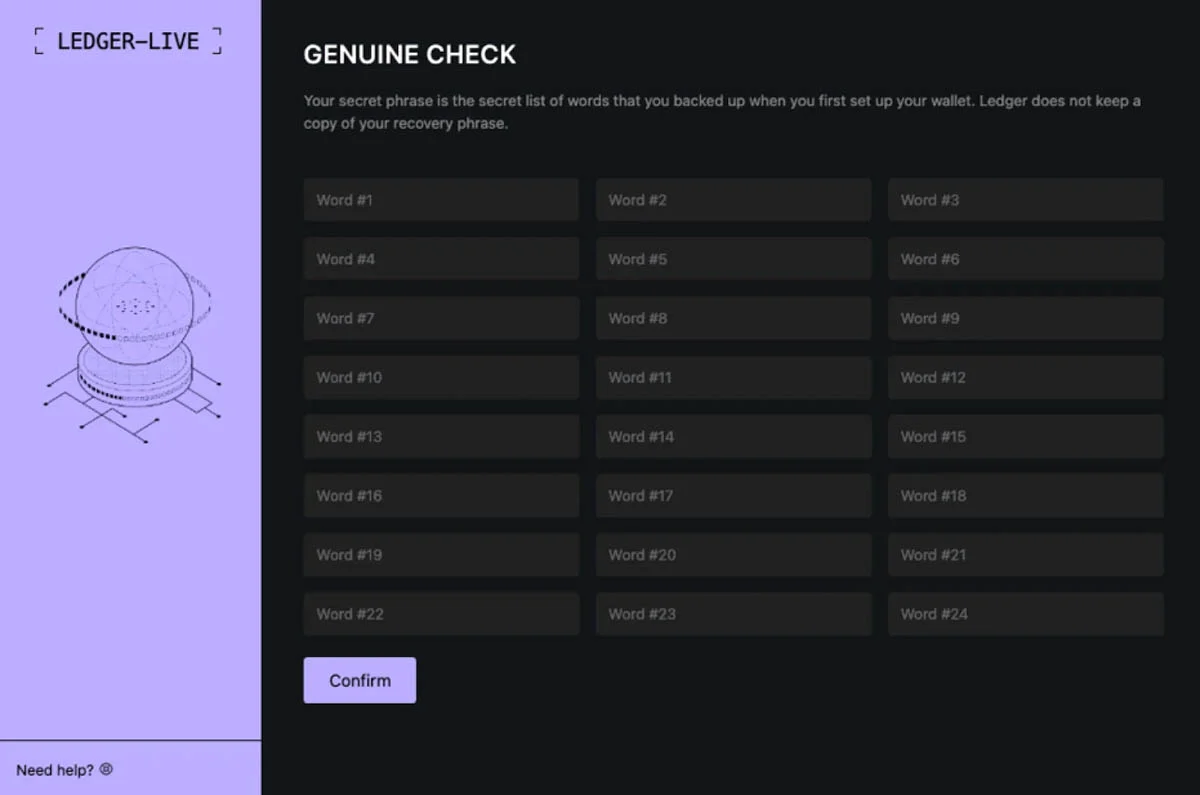

Multi-Signature Bitcoin Custody Is Replacing Single-Point Solutions

Jesse Gilger made a compelling case for why multi-signature Bitcoin custody represents the future of secure storage. He explained how Gannett Trust's approach ensures "not all of the keys are going to be at any one entity," fundamentally reducing the honeypot risk that plagues centralized custodians. This distributed model means no single point of failure can compromise your Bitcoin, whether through hacking, internal fraud, or regulatory seizure.

"I was on the list. I got the email. 'You were affected.'" - Jesse Gilger

Jesse's firsthand experience with the Coinbase data breach drives home why centralized custody is fundamentally flawed. While Coinbase holds keys for 10 of 12 Bitcoin ETFs, smart money is moving toward multi-institutional setups where Gannett holds a key, Unchained holds a key, and a third party holds a key. This alignment with Bitcoin's decentralized ethos isn't just philosophically pure—it's pragmatically superior for protecting generational wealth.

Check out the full podcast here for more on MSTY risks, Bitcoin retirement strategies and nation-state adoption dynamics.

Headlines of the Day

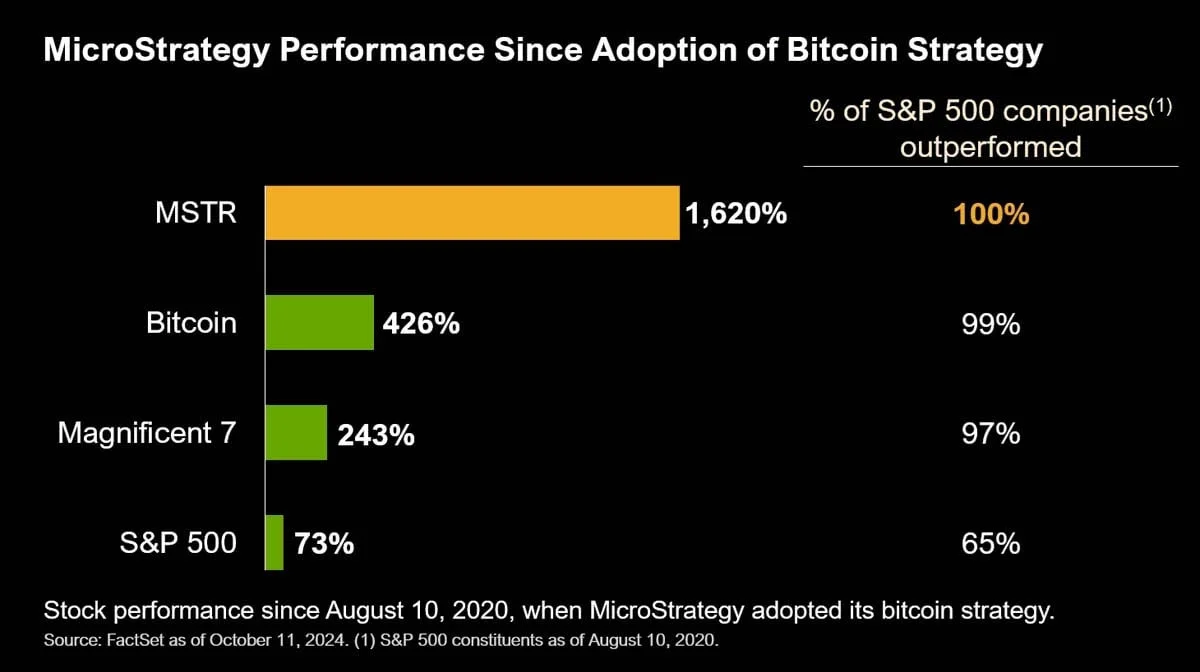

MicroStrategy Copycats See Speculative Premiums Fade - via X

Square Tests Bitcoin Payments, Lightning Yields Beat DeFi - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitfinex Moves $731M Bitcoin to Jack Mallers' Fund - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Trying to imagine the future my children are going to live in gets harder by the day.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 32e18276:5c68e245

2025-06-02 20:58:05

@ 32e18276:5c68e245

2025-06-02 20:58:05Damus OpenSats Grant Q1 2025 Progress Report

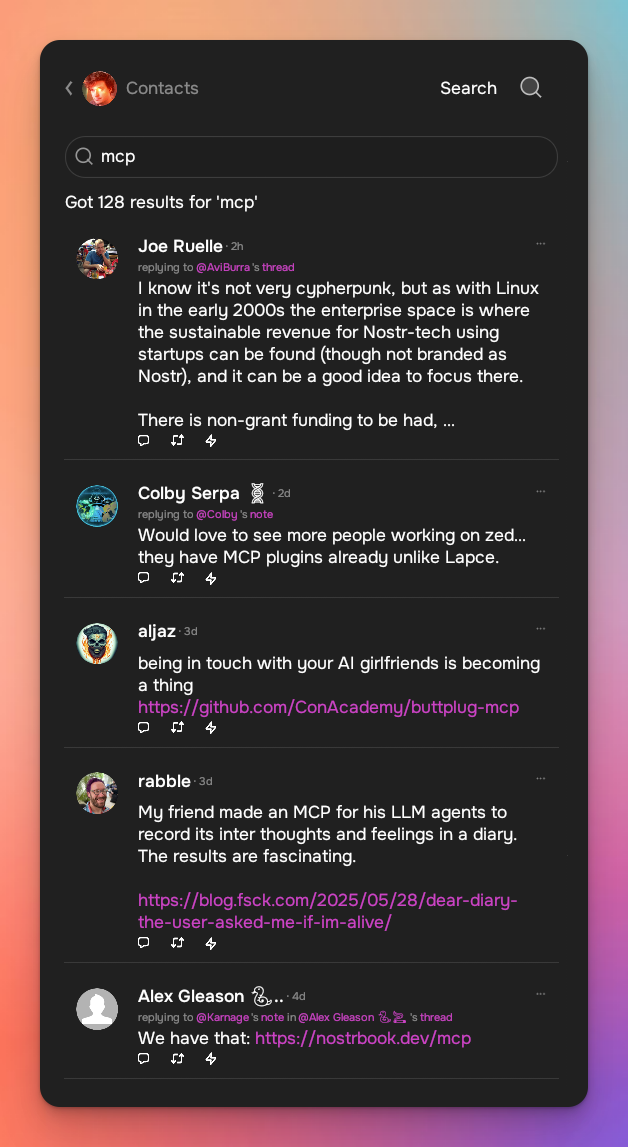

This period of the Damus OpenSats grant has been productive, and encompasses the work our beta release of Notedeck. Since we sent our last report on January, this encompasses all the work after then.

Damus Notedeck

We released the Beta version of Notedeck, which has many new features:

Dave

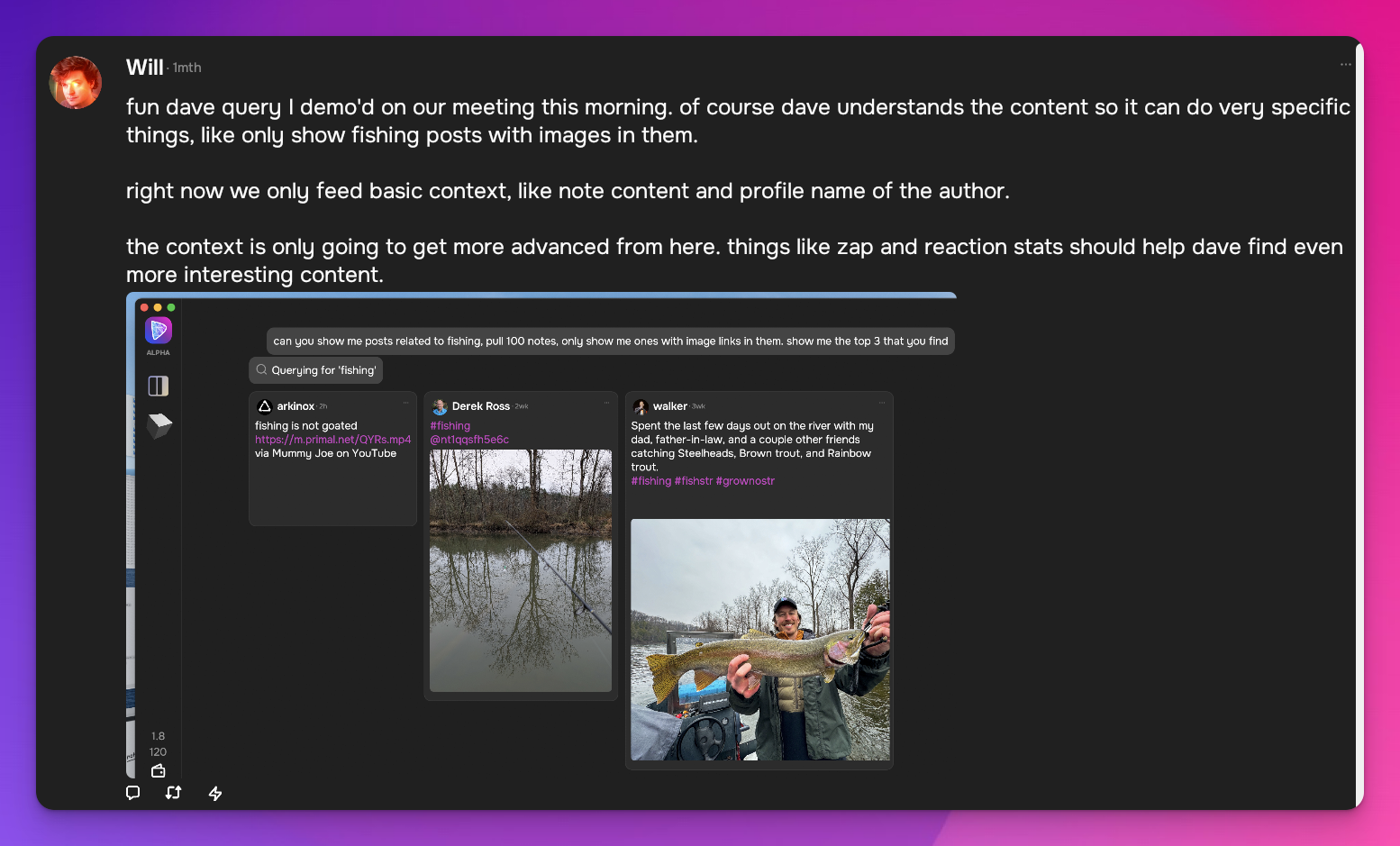

We've added a new AI-powered nostr assistant, similar to Grok on X. We call him Dave.

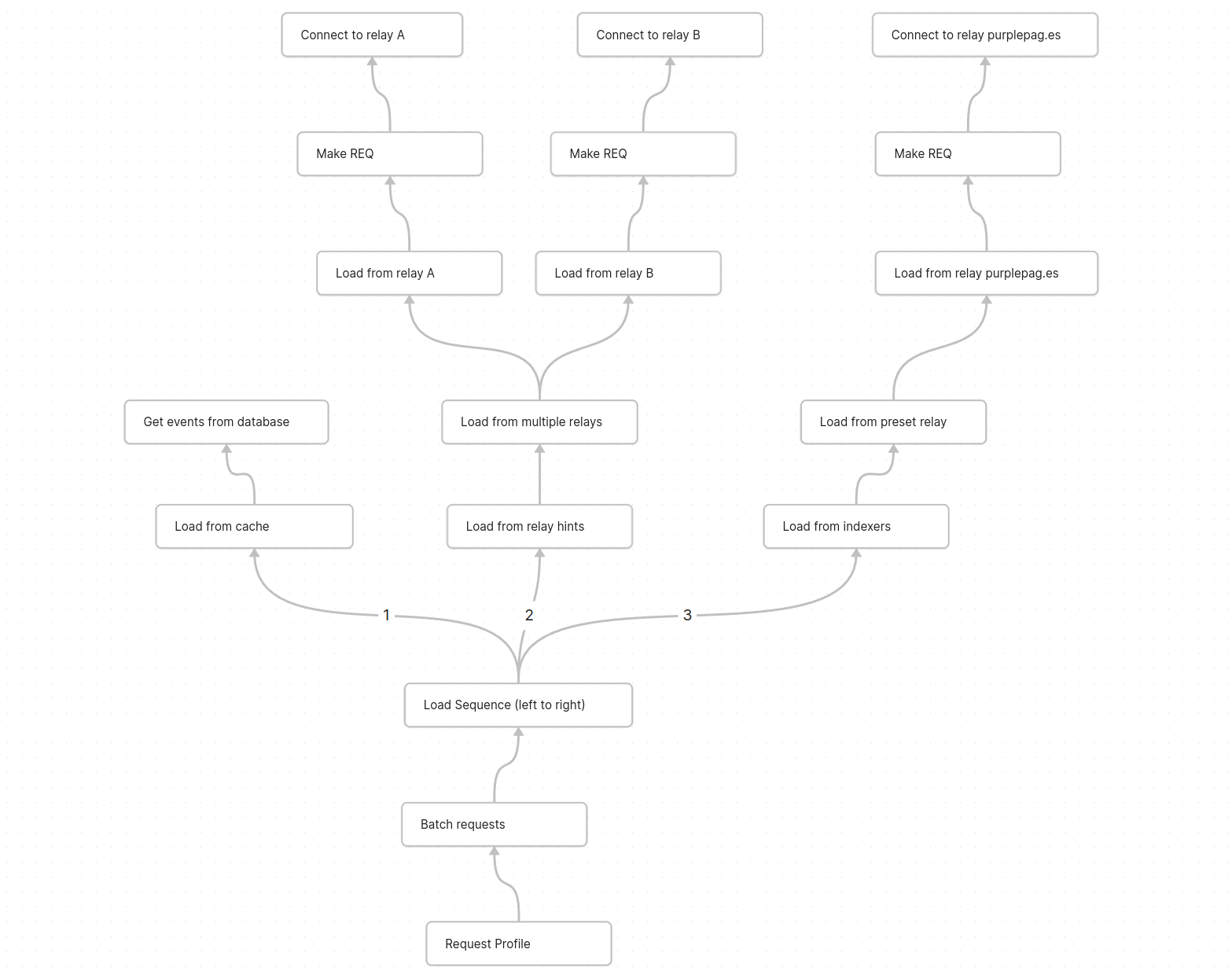

Dave is integrated with tooling that allows it to query the local relay for posts and profiles:

Search

The beta release includes a fulltext search interface powered by nostrdb:

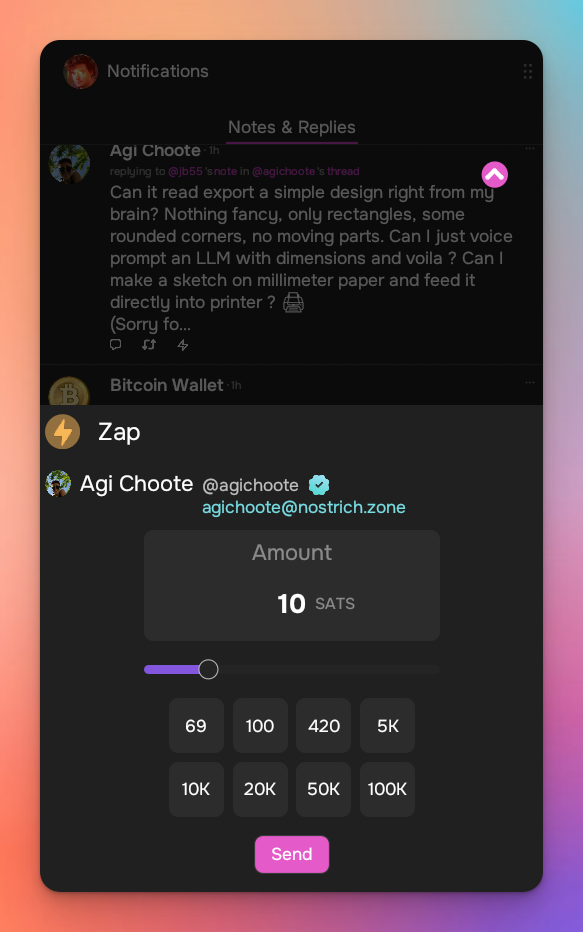

Zaps

You can now zap with NWC!

And More!

- GIFs!

- Add full screen images, add zoom & pan

- Introduce last note per pubkey feed (experimental)

- Allow multiple media uploads per selection

- Major Android improvements (still wip)

- Added notedeck app sidebar

- User Tagging

- Note truncation

- Local network note broadcast, broadcast notes to other notedeck notes while you're offline

- Mute list support (reading)

- Relay list support

- Ctrl-enter to send notes

- Added relay indexing (relay columns soon)

- Click hashtags to open hashtag timeline

Damus iOS

Work continued on the iOS side. While I was not directly involved in the work since the last report, I have been directing and managing its development.

What's new:

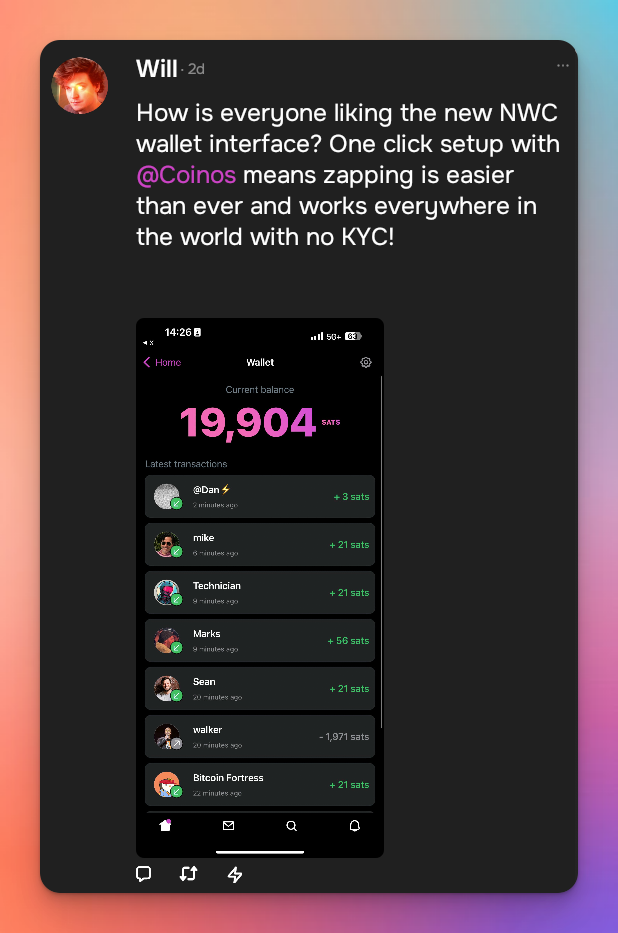

Coinos Wallet + Interface

We've partnered with coinos to enable a one-click, non-KYC lightning wallet!

We now have an NWC wallet interface, and we've re-enabled zaps as per the new appstore guidelines!

Now you can see all incoming and outgoing NWC transactions and start zapping right away.

Enhanced hellthread muting

Damus can now automatically mute hellthreads, instead of having to do that manually.

Drafts

We now locally persist note drafts so that they aren't lost on app restart!

Profile editing enhancements

We now have a profile picture editing tool so that profile pictures are optimized and optionally cropped

Conversations tab

We now have a conversations tab on user profiles, allowing you to see all of your past conversations with that person!

Enhanced push notifications

We've updated our push notifications to include profile pictures, and they are also now grouped by the thread that they came from.

And lots more!

Too many to list here, check out the full changelog

Nostrdb

nostrdb, the engine that powers notecrumbs, damus iOS, and notedeck, continued to improve:

Custom filters

We've added the ability to include custom filtering logic during any nostrdb query. Dave uses this to filter replies from kind1 results to keep the results small and to avoid doing post-processing.

Relay index + queries

There is a new relay index! Now when ingesting notes, you can include extra metadata such as where the note came from. You can use this index to quickly list all of the relays for a particular note, or for relay timelines.

NIP50 profile searches

To assist dave in searching for profiles, we added a new query plan for {kind:0, search:} queries to scan the profile search index.

How money was used

- relay.damus.io server costs

- Living expenses

Next quarter

We're making a strong push to get our Android version released, so that is the main focus for me.

-

@ 06639a38:655f8f71

2025-06-02 18:23:34

@ 06639a38:655f8f71

2025-06-02 18:23:34You might notice the styling of this site has changed. That's because I've made a custom Drupal theme using TailwindCSS and daisyUI. For these CSS frameworks / components I've also seperate Drupal theme everyone could use:

https://www.drupal.org/project/tailwind_css

https://www.drupal.org/project/daisy_uiWhat else?

- Wrote my third OpenSats progress report, read it here

- Added Nostr-PHP RelayListMetadata class (NIP-65) and tests, see PR

- Added Nostr-PHP PersistentConnection class and tests, see PR

-

@ 06639a38:655f8f71

2025-06-02 18:20:03

@ 06639a38:655f8f71

2025-06-02 18:20:031) How did you spend your time?

I continued to write and publish more detailed weekly updates here: https://nostrver.se/blog. These updates are also cross-posted via Nostr as long-form content.

All commits on the main branch from 01-03-2025 till 30-04-2025: https://github.com/nostrver-se/nostr-php/commits/main/?since=2025-03-01&until=2025-04-30

NIP-19 bech32-encoded entities

This has been implemented in the library, see https://github.com/nostrver-se/nostr-php/pull/68

Added getTag method to the Event class

https://github.com/nostrver-se/nostr-php/commit/5afa38a45d3371bf79c78cda4d93be3ecef86985

Added a profile class to fetch profile metadata of a given pubkey

https://github.com/nostrver-se/nostr-php/commit/0e6cbbb80b08b2b38722d4cef68205c64b70b205

Drupal nJump module which implements Nostr-PHP

This Drupal module which is providing these Nostr features is FOSS and uses the Nostr-PHP library for doing the following:

- Request the event from one or more relays

- Decode the provided NIP-19 identifier

For now this module is way for me to utilize the Nostr-PHP library with Drupal for fetching events.

Any event and a NIP-19 identifier can now be fetched with the following URL pattern:

https://nostrver.se/e/{event_id|nevent1|note1|addr1}As an example, take this URL https://nostrver.se/e/nevent1qvzqqqqqqypzqmjxss3dld622uu8q25gywum9qtg4w4cv4064jmg20xsac2aam5nqqsqm2lz4ru6wlydzpulgs8m60ylp4vufwsg55whlqgua6a93vp2y4g3uu9lr fetches the data from one or more relays. This data is then being saved as a (Drupal) node entity (in a database on the server where this website is hosted, which is located in my tiny office). With this saved node, this data is now also available at https://nostrver.se/e/0dabe2a8f9a77c8d1079f440fbd3c9f0d59c4ba08a51d7f811ceeba58b02a255/1 where the (cached) data is server from the database instead. It's just raw data for now, nothing special about it (yet).

Contributions to the library

- NIP-04 + NIP-44

https://github.com/nostrver-se/nostr-php/pull/84

https://github.com/nostrver-se/nostr-php/pull/88 - NIP-05 internet identifier lookup

https://github.com/nostrver-se/nostr-php/pull/89 - Allow verification of Event objects

https://github.com/nostrver-se/nostr-php/pull/86 - Work in progress: NIP-17 direct messages

https://github.com/nostrver-se/nostr-php/pull/90

All these contributions are made by Djuri who is working on the Nostr integration in https://satsback.com and on a private messaging browser client https://n17.chat.

Removed the CLI tool from the library

See https://github.com/nostrver-se/nostr-php/pull/93

New / updated documentation at nostr-php.dev

I started to explore what is possible generating documentation using Goose as an AI agent and Claude as the LLM provider. Bootstrapping new pages with documentation works very well while I point to several resources to be used as input for the LLM (using the example snippets in the Nostr-PHP library and the Nostr NIP repository).

All commits on the master branch from 01-03-2025 till 30-04-2025: https://github.com/nostrver-se/nostr-php.dev/commits/master?since=2025-03-01&until=2025-04-30- Updated the page how to handle tags on a event, see https://nostr-php.dev/guides/manage-tags-on-an-event#getting-specific-tags

- Added a instructions to try out the library online at https://nostr-php.dev/guides/get-started

- Work in progress, NIP-19 documentation: https://github.com/nostrver-se/nostr-php.dev/tree/feat/nip19docs and https://nostr-php.dev/guides/nip19

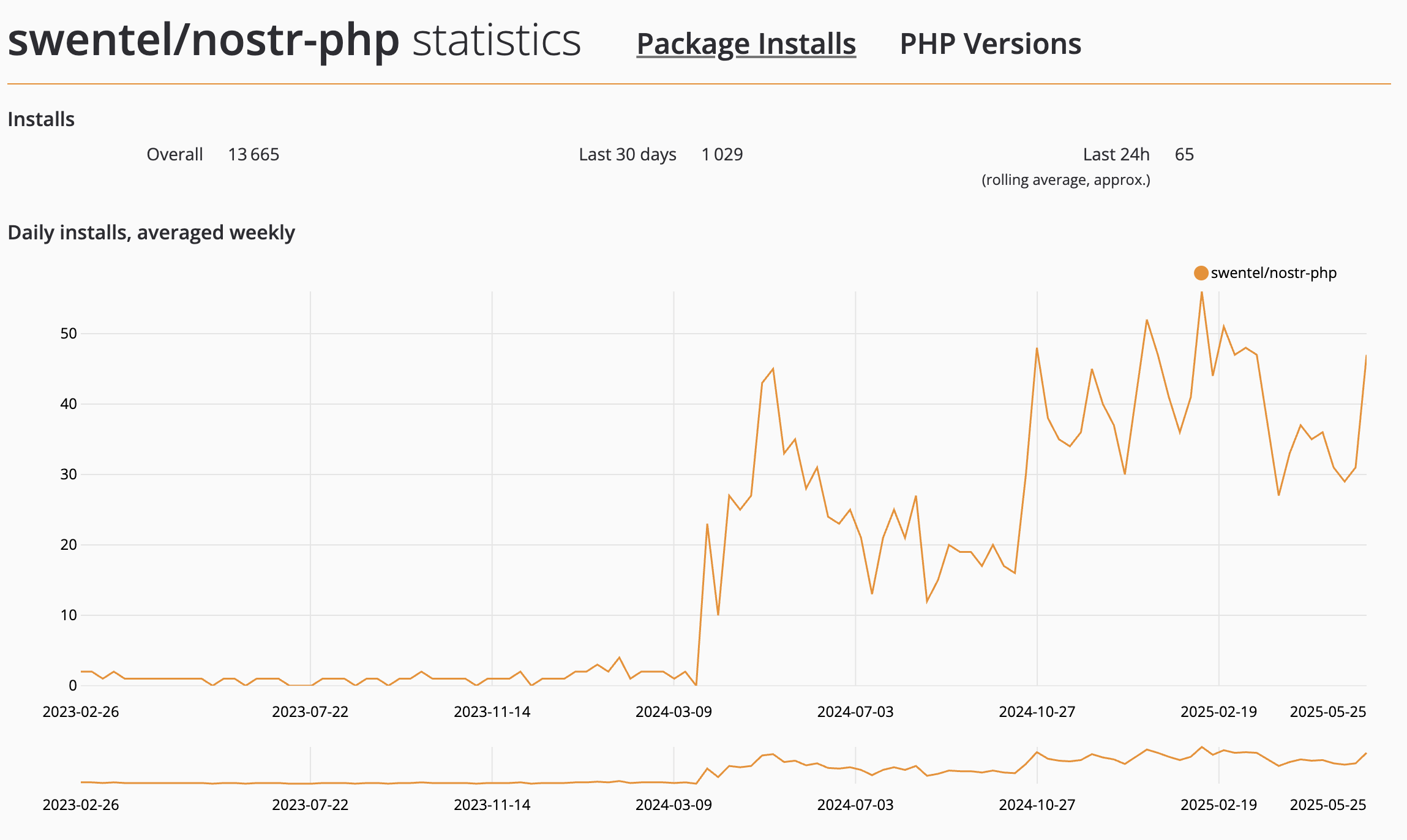

Some analytics

Source: https://packagist.org/packages/swentel/nostr-php/stats

Other Nostr stuff I would to mention I worked on

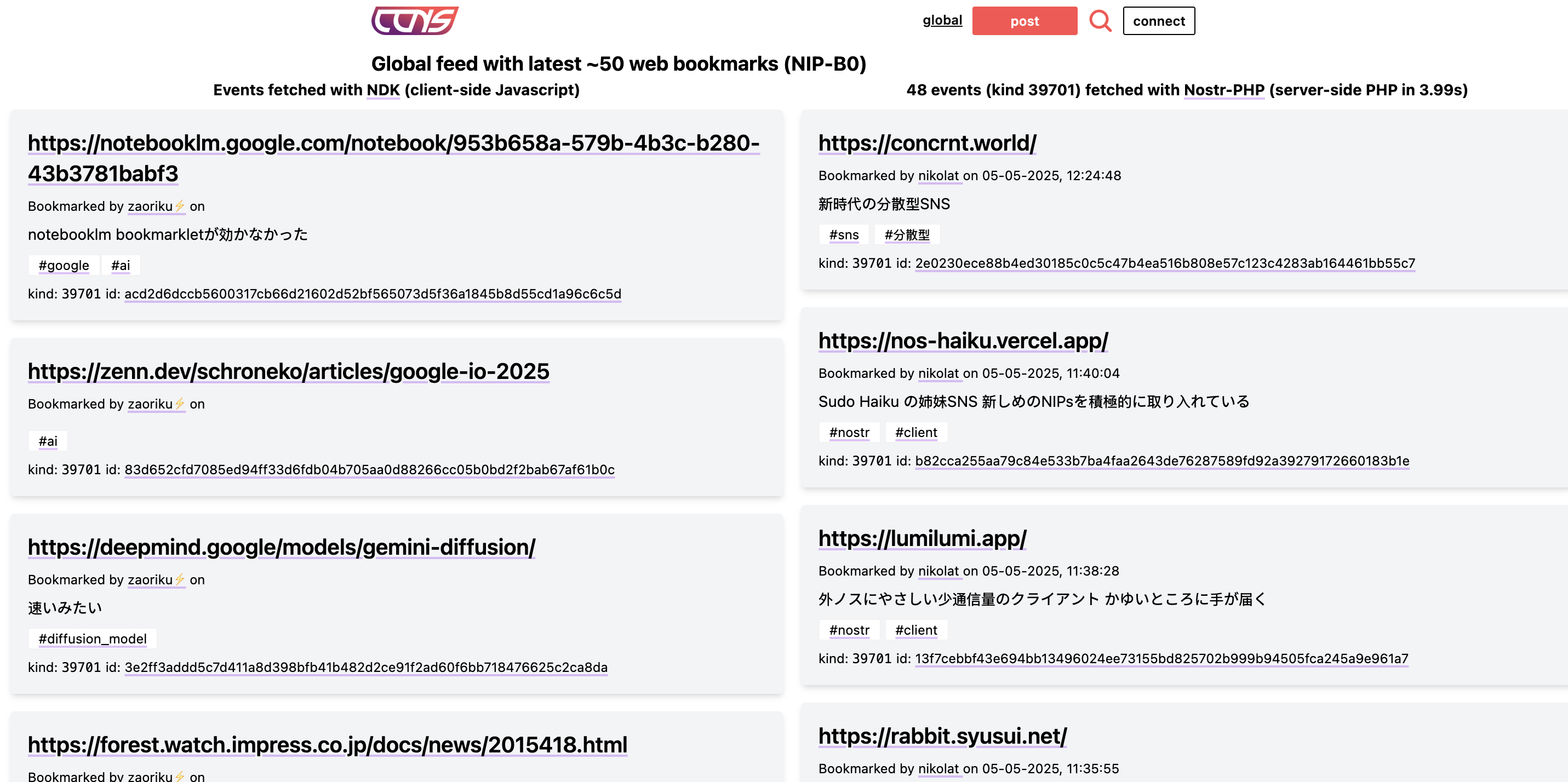

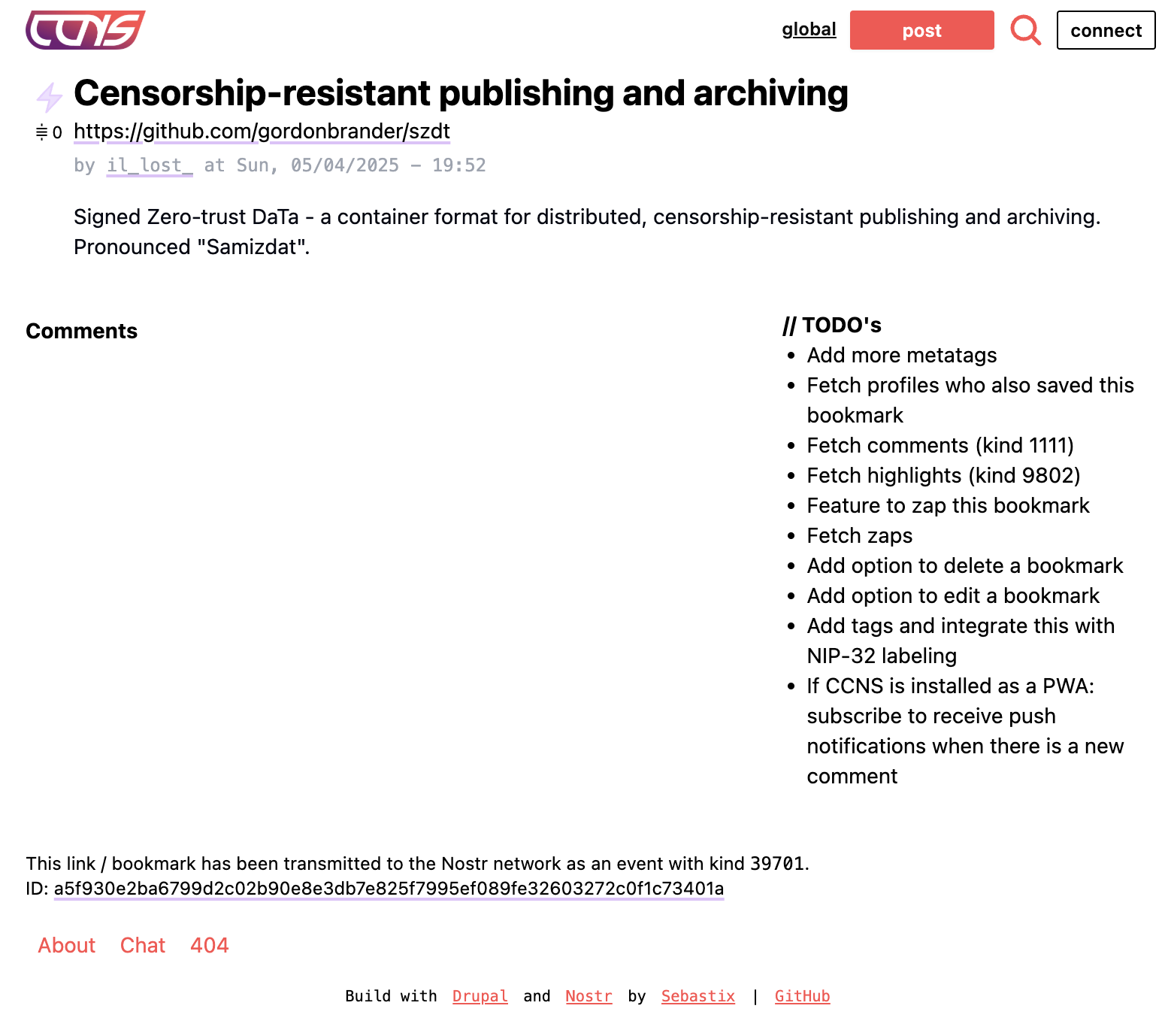

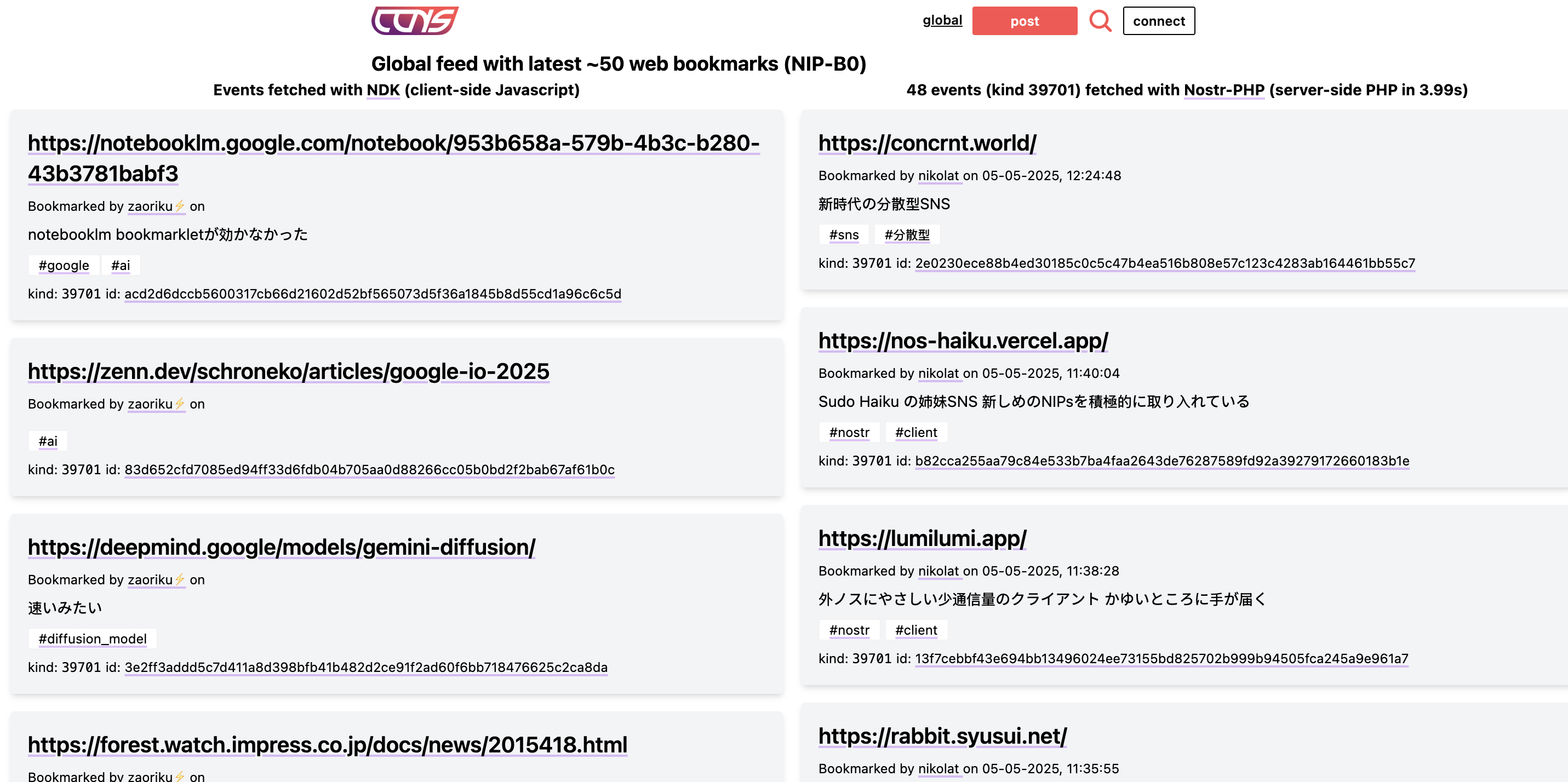

NIP-B0 web bookmarks with CCNS.news

I moved https://ccns.nostrver.se to a own domain https://ccns.news and has integrated NIP-B0 which we worked out how to handle web bookmarks via Nostr. Before this NIP was merged, there were already some other Nostr clients handling web bookmarks:

Also Fiatjaf started to work on an annotation noting tool (browser extension) called Lantern (which is a fork of https://hypothes.is) integrating Nostr for creating highlights and annotations on a webpage with text. This extension can also be used to bookmark web pages.

On CCNS.news there is a global feed now: https://ccns.news/global which fetches all the web bookmark events with kind

39701from several public Nostr relays. I had a rough idea to compare feeds generated with NDK and Nostr-PHP (for both using the same set of relays):

When you post a bookmark now on the site, a kind

39701event is transmitted to some Nostr relays (take a look at this event for example). Optionally you can also publish this content as a note to the network.2) What do you plan to work on next quarter?

- Already work in progress:

- Review and merge PR with NIP-17

https://github.com/nostrver-se/nostr-php/pull/90 - Implement NIP-65 with RelayListMetadata class

https://github.com/nostrver-se/nostr-php/pull/100 - Implement DMRelayList class

https://github.com/nostrver-se/nostr-php/blob/main/src/Event/List/DmRelaysList.php - Review and implements extra metadata fields for profile

- https://github.com/nostrver-se/nostr-php/pull/94

- Implement PersistantConnection class

https://github.com/nostrver-se/nostr-php/pull/99 - Review and merge PR NIP-13 proof of work

https://github.com/nostrver-se/nostr-php/pull/97 - Review and merge PR for implementing methods (TODO's) on Relay and RelaySet class

https://github.com/nostrver-se/nostr-php/pull/95

- Review and merge PR with NIP-17

- Planned:

- Research how the revolt/event-loop package can be used to serve as a sort of a message bus for handling async and concurrent requests in the library

- Build a stable 2.0.x release

- By default and full async concurrent requests support

- Add / update documentation on https://nostr-php.dev:

- Direct messages with NIP-04 and NIP-17

- Encrypted payloads with NIP-44

- Instructions how to bootstrap a Nostr profile with a given pubkey

- Host the https://nostr-php.dev website as a static website using Blossom.

See https://github.com/lez/nsite and https://github.com/hzrd149/nsite-ts

3) How did you make use of the money?

- Livings costs

4) Is there anything we could help with?

I would love to see a (closed/private) digital place with other Nostr OpenSats grantees where we can share our experiences and challenges. We could give feedback to each other as a form of encouragement. For example I'm curious how other grantees are explaining the work they to other which are not familiar with FOSS, Nostr and/or Bitcoin.

-

@ 06639a38:655f8f71

2025-06-01 19:45:04

@ 06639a38:655f8f71

2025-06-01 19:45:04Nostr-PHP

All commits on the main branch between 19-05 and 25-05: https://github.com/nostrver-se/nostr-php/commits/main/?since=2025-05-19&until=2025-05-25

- Merged PR #95 finish implementing methods Relay and RelaySet

- Merged PR #90 implementing NIP-17 private direct messages

[https://shares.sebastix.dev/DTkBk1By.png]#d04e152f809a86e495a4b80c3c292ca70fb0b94b9fcf35ff424769848fc15314)

- Made some progress on the persistentConnection class for fetching messages from a relay in runtime (realtime)

New release: 1.8.0

What's Changed

- feat: Implement NIP-05 lookups by @dsbaars in https://github.com/nostrver-se/nostr-php/pull/89

- NIP 44 implementation fix and test improvements by @dsbaars in https://github.com/nostrver-se/nostr-php/pull/88

- remove CLI tool from library - https://github.com/nostrver-se/nostr-p… by @Sebastix in https://github.com/nostrver-se/nostr-php/pull/93

- Add extra metadata fields for profile by @dsbaars in https://github.com/nostrver-se/nostr-php/pull/94

- Finish implementing methods Relay and RelaySet by @dsbaars in https://github.com/nostrver-se/nostr-php/pull/95

- Implement NIP-17 Private Direct Messages by @dsbaars in https://github.com/nostrver-se/nostr-php/pull/90

Full changelog: https://github.com/nostrver-se/nostr-php/compare/1.7.1...1.8.0

Link: https://github.com/nostrver-se/nostr-php/releases/tag/1.8.0 -

@ 472f440f:5669301e

2025-06-01 13:48:34

@ 472f440f:5669301e

2025-06-01 13:48:34Marty's Bent

Sorry for the lack of writing over the last week. As many of you may already know, I was in Las Vegas, Nevada for the Bitcoin 2025 conference. It was my first time in Las Vegas. I had successfully avoided Sin City for the first 34 years of my life. But when duty calls, you have to make some personal concessions.

Despite what many say about this particular conference and the spectacle that it has become, I will say that having attended every single one of Bitcoin Magazine's conferences since 2019, I thoroughly enjoy these events, even if I don't agree with all the content. Being able to congregate with others in the industry who have been working extremely hard to push Bitcoin forward, all of whom I view as kindred spirits who have also dedicated their lives to making the world a better place. There's nothing better than getting together, seeing each other in person, shaking hands, giving hugs, catching up and reflecting on how much things have changed over the years while also focusing on the opportunities that lie ahead.

I think out of all the Bitcoin magazine conferences I've been to, this was certainly my favorite. If only because it has become abundantly clear that Bitcoin is here to stay. Many powerful, influential, and competent people have identified Bitcoin as an asset and monetary network that will play a large part in human society moving forward. And more importantly, Bitcoin is proving to work far better than anybody not paying attention expected. While at the same time, the fiat system is in woeful disrepair at the same time.

As a matter of reflection and surfacing signal for you freaks, here are the presentations and things that happened that I think were the most impactful.

Miles Suter's Block Presentation

This presentation was awesome for many reasons, one of which being that we often forget just how dedicated Block, as an organization with many companies - including Cash App, Square, the open source organization known as Spiral and more recently, BitKey and Proto - has been to bitcoin over the last eight years. They've worked methodically to make Bitcoin a first-class citizen in their business operations and slowly but surely have built an incredibly integrated experience across their brands. The two big announcements from Block during the conference were the enablement of Bitcoin payments in Square point-of-sale systems and the amount of revenue they're making on their Lightning node, c=, from routing payments.

Right now, the Bitcoin payments and point of sale systems is in beta with many merchants testing it out for the next six months, but it will be available for all 4 million square merchants in 2026. This is something that many bitcoiners have been waiting for for many years now, and it is incredible to see that they finally brought it across the line. Merchants will have the ability to accept bitcoin payments and either convert every payment into fiat automatically, convert a portion of the bitcoin payment into fiat to keep the rest in sats, or simply keep all of the bitcoin they receive via payments in sats. This is an incredible addition to what Square has already built, which is the ability of their merchants to sweep a portion of their revenues into bitcoin if they desire. Square is focused on building a vertically integrated suite of bitcoin products for merchants that includes the ability to buy bitcoin, receive bitcoin, and eventually leverage financial services using bitcoin as collateral so that they can reinvest in and expand their businesses.

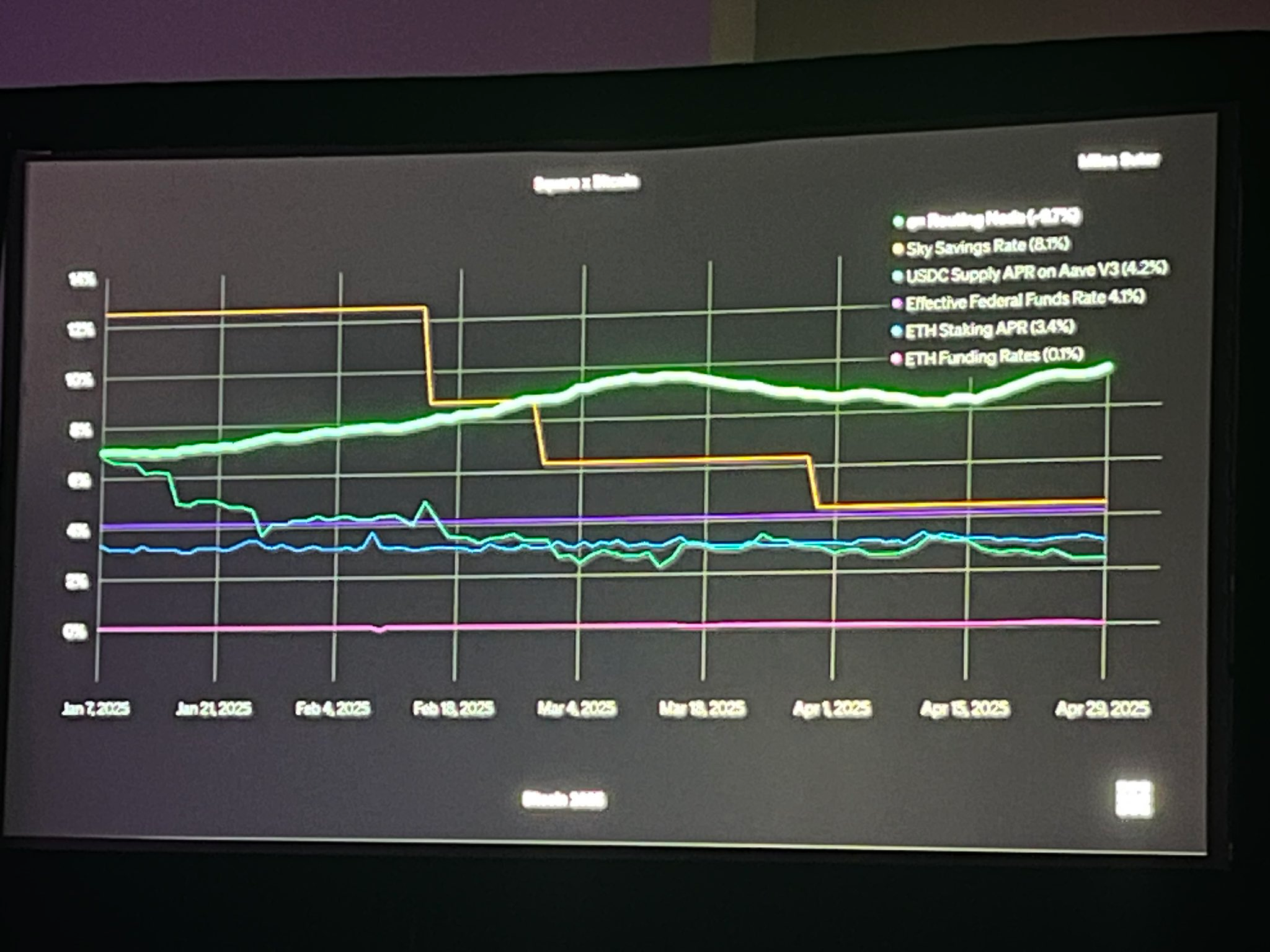

via Ryan Gentry

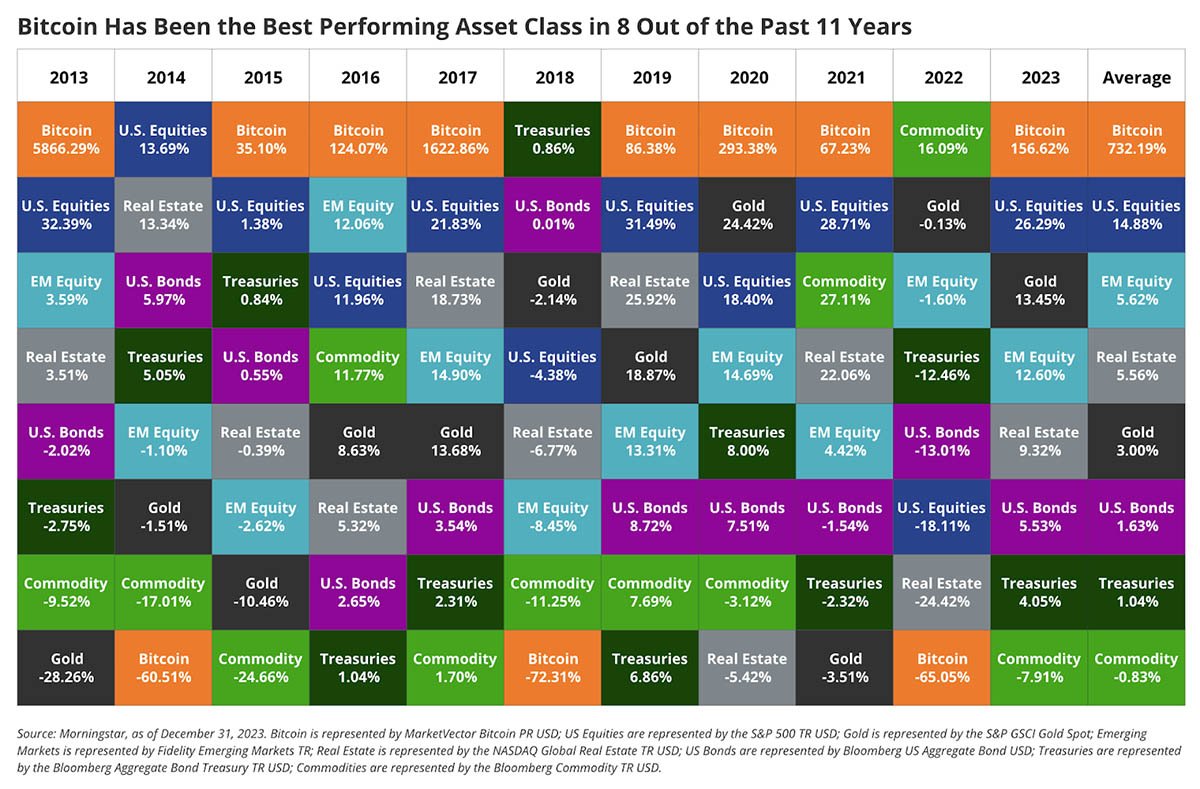

What went a bit underappreciated in the crowd was the routing node revenue that c= is producing, \~9.7% annualized. This is a massive validation of something that many bitcoiners have been talking about for quite some time, which is the ability to produce "yield" on bitcoin in a way that reduces risk significantly. Locking up bitcoin in a 2-of-2 multisig within Lightning channels and operating a Lightning routing node has been long talked about as one of the ways to produce more bitcoin with your bitcoin in a way that minimizes the threat of loss.

It seems that c= has found a way to do this at scale and is doing it successfully. 10% yield on bitcoin locked in Lightning channels is nothing to joke about. And as you can see from the chart above in the grainy picture taken by Ryan Gentry of Lightning Labs, this routing node "yield" is producing more return on capital than many of the most popular staking and DeFi protocols.

This is a strong signal to the rest of the market that this can be done. It may take economies of scale and a high degree of technical competency today. But this is incredibly promising for the future of earning bitcoin by providing valuable goods and services to the market of Bitcoiners. In this case, facilitating relatively cheap and instantly settled payments over the Lightning Network.

Saifedean Ammous' Bitcoin and Tether Presentation

This was one of the best presentations at the conference. Saifedean Ammous is a friend, he has been an incredible influence on my personal bitcoin journey, and I feel comfortable in saying he's been a strong influence on the journey of hundreds of thousands, at least, if not millions of people as they've attempted to understand bitcoin.

This presentation is a bit spicy because it puts a pin in the balloon of hopium that stablecoins like Tether are mechanisms that could bail out the market for US Treasuries in the medium to long-term if they take enough market share. As one always should do, Saif ran the numbers and clearly illustrates that even in the most optimistic case, Tether's impact on the market for treasuries, their interest rates, and curbing the growth of the debt held by the US federal government will be minimal at best.

One of the most interesting things that Saif points out that I'm a bit embarrassed I didn't recognize before is that much of the demand for Tether that we're seeing these days is replacement demand for treasuries. Meaning that many people who are turning to Tether, particularly in countries that have experienced hyperinflationary events, are using Tether as a substitute for their currencies, which are operated by central banks likely buying U.S. treasuries to support their monetary systems. The net effect of Tether buying those treasuries is zero for this particular user archetype.

Saif goes on to explain that if anything, Tether is a weapon against the US Treasury system when you consider that they're storing a large portion of the stablecoin backing in Treasuries and then using the yields produced by those Treasuries to buy bitcoin. Slowly but surely over time bitcoin as a percentage of their overall backing of Tether has grown quite significantly starting at 0% and approaching 10% today. It isn't hard to imagine that at some point within the next decade, Bitcoin could be the dominant reserve asset backing tethers and, as a result, Tether could be pegged to bitcoin eventually.

It's a fascinating take on Tether that I've never heard before.

Nothing Stops this Train from Lyn Alden

Lyn's been saying it loudly for quite some time now; "Nothing stops this train." She's even been on our podcast to explain why she believes this many times over the last five years. However, I don't think there is one piece of content out there that consolidates her thesis of why nothing stops the train of fiscal irresponsibility and unfettered debt expansion and why that's good for bitcoin than the presentation she gave at the conference. Definitely give this one a watch when you get a chance if you haven't already.

Overall, it was a great week in Vegas and I think it's safe to say that bitcoin has gone mainstream. Whether or not people who have been in the bitcoin industry and community for a while are okay with does not really matter. It's happening and all we can do is ride the wave as more and more people come to recognize the value prop of bitcoin and the social clout they can gain from supporting it. Our job here at TFTC is to help you discern the signal from the noise, continue to champion the self-sovereign usage of bitcoin and keep you abreast of developments in the space as they manifest.

Buckle up. Things are only going to get weirder from here on out.

Bitcoin's Mathematical Destiny

Sean Bill and Adam Back make a compelling case for Bitcoin's inevitable march toward $1 million. Sean points out that Bitcoin represents just a tiny fraction—2 trillion out of 900 trillion—of total financial assets, calling it a "tiny orange dot" on their presentation to Texas pensions. He emphasizes that reaching parity with gold alone would deliver a 10x return from current levels. Adam highlights the mathematical impossibility of current prices, noting that ETF buyers are absorbing 500,000 BTC annually while only 165,000 new coins are mined.

"Who's selling at these prices? It doesn't quite add up to me." - Adam Back

The institutional wave is just beginning. Sean revealed that while 50% of hedge fund managers personally own Bitcoin, only 3% have allocated institutional funds. Combined with emerging demand from nation states and corporate treasuries meeting Bitcoin's fixed supply, the price trajectory seems clear. Both guests stressed the importance of staying invested—missing just the 12 best performing days each year would turn Bitcoin into a losing investment.

Check out the full podcast here for more on pensions allocating to Bitcoin, cypherpunk banking, and commodity trading insights.

Headlines of the Day

Panama Canal Eyes Bitcoin for Payment Option - via X

U.S. Warns of Imminent Chinese Threat to Taiwan - via X

Get our new STACK SATS hat - via tftcmerch.io

Saylor's Bitcoin Strategy Explodes Globally Amid Doubt - via CNBC

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Moving is the least fun part of the human experience.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 8d34bd24:414be32b

2025-06-01 04:04:10

@ 8d34bd24:414be32b

2025-06-01 04:04:10Many people today believe that the church has replaced Israel and that the promises given to Israel now apply to the church. When we say this, we are calling God a liar.

Can you imagine a groom promising to love and cherish his wife until death do they part and then saying, “I’m keeping my promise by loving and cherishing a new and different wife.”? We would never consider that man to be honest, faithful, and good. If God promised to protect and guide Israel, to have a descendant of David on the throne, and to give them the land, we can only trust Him if He fulfills these promises.

When we say the church has replaced Israel, we make two mistakes. We raise up the church beyond what is right and we put down Israel. We need to be careful because God promised Abraham:

“And I will bless those who bless you, And the one who curses you I will curse. And in you all the families of the earth will be blessed.” (Genesis 12:3)

and He reiterated this promise to Israel during the Exodus:

“He couches, he lies down as a lion,\ And as a lion, who dares rouse him?\ Blessed is everyone who blesses you [Israel],\ And cursed is everyone who curses you [Israel].” (Numbers 24:9) {clarification mine}

When we curse Israel or the Jews, we will be under God’s curse. Now this does not mean that every criticism of a particular action by Israel’s leaders brings a curse. Today’s nation of Israel is led by fallible men like every other nation, so there are mistakes made or corruption by particular leaders. It does, however, mean that generalizations against Israel and the Jews are wrong and of Satan.

Paul specifically warned the church against thinking they had replaced Israel in God’s blessing and love.

If the first piece of dough is holy, the lump is also; and if the root is holy, the branches are too.

But if some of the branches were broken off, and you, being a wild olive, were grafted in among them and became partaker with them of the rich root of the olive tree, do not be arrogant toward the branches; but if you are arrogant, remember that it is not you who supports the root, but the root supports you. You will say then, “Branches were broken off so that I might be grafted in.” Quite right, they were broken off for their unbelief, but you stand by your faith. Do not be conceited, but fear; for if God did not spare the natural branches, He will not spare you, either. Behold then the kindness and severity of God; to those who fell, severity, but to you, God’s kindness, if you continue in His kindness; otherwise you also will be cut off. And they also, if they do not continue in their unbelief, will be grafted in, for God is able to graft them in again. For if you were cut off from what is by nature a wild olive tree, and were grafted contrary to nature into a cultivated olive tree, how much more will these who are the natural branches be grafted into their own olive tree?

For I do not want you, brethren, to be uninformed of this mystery—so that you will not be wise in your own estimation—that a partial hardening has happened to Israel until the fullness of the Gentiles has come in; and so all Israel will be saved; just as it is written,

“The Deliverer will come from Zion,\ He will remove ungodliness from Jacob.”\ “This is My covenant with them,\ When I take away their sins.” *From the standpoint of the gospel they are enemies for your sake, but from the standpoint of God’s choice they are beloved for the sake of the fathers*; for the gifts and the calling of God are irrevocable**. For just as you once were disobedient to God, but now have been shown mercy because of their disobedience, so these also now have been disobedient, that because of the mercy shown to you they also may now be shown mercy. For God has shut up all in disobedience so that He may show mercy to all. (Romans 11:16-32) {emphasis mine}

Paul warns that although the Jews were pruned away due to rejection of Him and gentiles were grafted into Him by faith, if we reject God’s word, we can be pruned away and if the Jews return to Jesus, they can be grafted back in. He predicts that the Jews will return. “…that a partial hardening has happened to Israel until the fullness of the Gentiles has come in; and so all Israel will be saved.” He also says regarding Israel that “the gifts and the calling of God are irrevocable.” Yes, Israel rejected Jesus and was punished for doing so, but they will be called back to God and trust in their Messiah, Jesus. In the end, all the promises of God to Abraham, Jacob, David, and others regarding Israel, will be brought to complete fulfillment.

Both the Old and New Testaments talk about Israel being punished for rejecting God and their Messiah, but that, after the time of the Gentiles, they will be called back to Him.

and they will fall by the edge of the sword, and will be led captive into all the nations; and Jerusalem will be trampled under foot by the Gentiles until the times of the Gentiles are fulfilled. (Luke 21:24)

After Daniel had been in prayer and repentance for the sins of Israel, the angel Gabriel came with this prophecy about Israel.

“Seventy weeks have been decreed for your people and your holy city, to finish the transgression, to make an end of sin, to make atonement for iniquity, to bring in everlasting righteousness, to seal up vision and prophecy and to anoint the most holy place. So you are to know and discern that from the issuing of a decree to restore and rebuild Jerusalem until Messiah the Prince there will be seven weeks and sixty-two weeks; it will be built again, with plaza and moat, even in times of distress. Then after the sixty-two weeks the Messiah will be cut off and have nothing, and the people of the prince who is to come will destroy the city and the sanctuary. And its end will come with a flood; even to the end there will be war; desolations are determined. (Daniel 9:24-26)

In this prophecy, the prediction of 69 weeks (literally sevens, but meaning groups of 7 years) from the decree to rebuild Jerusalem (by Artaxerxes) to the Messiah was fulfilled to the day when Jesus rode into Jerusalem on a donkey on Palm Sunday.

I always thought it strange that the prophecy predicted 70 sevens and that there was the first 69 sevens (483 years), then \~2,000 years where nothing happens, and then comes the final seven — the Great Tribulation. It didn’t make sense until I realized, the 70 sevens referred to the years of Israel. The time of the gentiles intervenes between the 69th and 70th sevens. This delay happened due to Israel rejecting their Messiah.

When He approached Jerusalem, He saw the city and wept over it, saying, “If you had known in this day, even you, the things which make for peace! But now they have been hidden from your eyes. For the days will come upon you when your enemies will throw up a barricade against you, and surround you and hem you in on every side, and they will level you to the ground and your children within you, and they will not leave in you one stone upon another, because you did not recognize the time of your visitation.” (Luke 19:41-44)

We are now in the time of the Gentiles, the church age, the intermission in the story of Israel. After the church is raptured, the story will return to Israel. The Jews (at least many of them) will finally accept their Messiah. They will suffer through the Tribulation while witnessing to the world and then God will finally fully fulfill His promises to Israel through the Millennial kingdom.

Alas! for that day is great,\ There is none like it;\ And it is the time of Jacob’s distress,\ But he will be saved from it.

‘It shall come about on that day,’ declares the Lord of hosts, ‘that I will break his yoke from off their neck and will tear off their bonds; and strangers will no longer make them their slaves. But they shall serve the Lord their God and David their king, whom I will raise up for them.

Fear not, O Jacob My servant,’ declares the Lord,\ ‘And do not be dismayed, O Israel;\ For behold, I will save you from afar\ And your offspring from the land of their captivity.\ And Jacob will return and will be quiet and at ease,\ And no one will make him afraid.\ For I am with you,’ declares the Lord, ‘to save you;\ For I will destroy completely all the nations where I have scattered you,\ Only I will not destroy you completely.\ But I will chasten you justly\ And will by no means leave you unpunished.’ \ (Jeremiah 30:7-11) {emphasis mine}

Jacob’s distress is the final Tribulation. The 144,000 Jewish witnesses will be saved through the whole Tribulation. Others may become saved and die a martyrs death, but they will then be brought into the millennial kingdom where the Messiah will fill the throne of David and Israel will reach from the River to the Sea.

The Jews have already been saved “from afar, and your offspring from the land of their captivity” with the recreation of Israel in 1947 and the continual return of Jews to their homeland.

God is working to fulfill His promises to Israel and His work is nearly complete.

“O Jacob My servant, do not fear,” declares the Lord, “For I am with you. For I will make a full end of all the nations where I have driven you, Yet I will not make a full end of you; But I will correct you properly And by no means leave you unpunished.” (Jeremiah 46:28)

God promises a “full end of all the nations where I have driven you.” Those nations and people who try to destroy Israel will be destroyed. As Christians we should love what God loves, and despite Israel’s repeated betrayals, God still loves Israel, so we should, too.

May the God of heaven give us a right view of Israel. May we see them as God sees them. May God use us to share the Gospel in such a way as to lead to a harvest of Jews for the Kingdom of God. To God be the glory!

Trust Jesus

-

@ c230edd3:8ad4a712

2025-05-31 01:51:38

@ c230edd3:8ad4a712

2025-05-31 01:51:38Chef's notes

Most Santa Maria tri tip roast recipes call for red wine vinegar and dijon mustard. I prefer other ingredients in place of those, but should you like those flavors and textures, they are more traditional.

Keep in mind when cooking and slicing, that the grain of tri-tip runs in 3 directions and the meat is unevenly thick. Pulling the roast when the thin end achieves well done, the thicker end will be a nice medium rare. When slicing, change direction to cut against the grain as you transition through for the most tender outcome.

Details

- ⏲️ Prep time: 10 minutes

- 🍳 Cook time: 1 hour ( with grill heating time)

- 🍽️ Servings: 4-6

Ingredients

- 1.5 - 2 lb Tri-Tip Roast

- 1 Tbsp Kosher Salt

- 1 tsp Black Pepper

- 1 tsp Cayanne Pepper ( substitute all or some with smoked paprika for a milder taste)

- 1 tsp Garlic Powder

- 1 tsp Onion Powder

- 1 Tbsp Rosemary

- 2 Tbsp Stone Ground Mustard

- 1 Tbsp Rice Vinegar

- 2-3 Cloves Garlic, Minced

Directions

- Mix all dry spices.

- Pat the roast dry and coat on all sides with seasdoning mix.

- Cover loosely and allow to sit in fridge for 8-12 hours.

- Preheat grill to 475 degrees F, allow meat to sit at room temp during this process.

- Mix vinegar, mustard, and minced garlic.

- Place meat on hot grill, fat side down and coat the upward side with mustard mix

- Grill approximately 7-10 minutes.

- Flip meat, repeat coating and grilling.

- Flip once more and grill for 2-3 minutes to caramelize the glaze and until the fat begins to render.

- Remove from grill and let the roast rest for 5 minutes before slicing,

- Serve with grilled veggies or any side of your choice. This is a bit spicy so it goes well with a salsa fresca and tortillas, too.

-

@ 6ad08392:ea301584

2025-05-30 15:40:59

@ 6ad08392:ea301584

2025-05-30 15:40:59

We’re back with another update.

It’s been a crazy two weeks. Since I last spoke to you, I’ve been in Sao Paulo, Lisbon, Porto, Munich, Warsaw and now, Albufeira for the Nomad World conference, meeting with nomads, bitcoiners, entrepreneurs, creators and builders. 10 days into a 7wk tour.

If you didn’t read the first update, you can find that here: \ Release Notes Ed #1

Of course, we just released another version of the Web and Mobile Apps:

-

Apple / iOS (you need TestFlight, so download that first and then click the link)

The skeleton is slowly turning into a real body. The blood is starting to pump, and it’s not just a headless directory anymore — it’s starting to feel like an actual experience.

Still early. Still raw. But here’s what’s new.

The Good

🗺 The Map Is Live

This is the biggest visual and experiential change to Satlantis so far. You can now search for and explore merchants on a map. You access the map from a destination, but it’s global so you can zoom out and see where the action is worldwide, or zoom in to see what’s around you. It works beautifully across both mobile and web.

The one is a beautiful experience. Trust me. Update the app & go play with it.

🎥 Video Content Is Here (Kinda)

We now render video content from the Nostr ecosystem. That means you’ll start seeing videos in your feed and on your profile — if you’ve previously posted videos via other clients. We’re not quite at native video upload yet, but this is the first step. Consider it a sneak preview of a richer, more dynamic feed.

✨ Better Onboarding

We rebuilt the interest selection flow! Interests are now grouped into subcategories with clear emoji identifiers, making it easier and faster to find what you’re into. It’s cleaner, more intuitive, and sets up your profile for better recommendations. The UI and the UX is much much better.

Once again, to try this out, delete the current app, and download it again. Then go through the flow and see for yourself. If it’s your first time using it, just download and enjoy 🙂

📝 Text-Only Posts

You can now post text without needing to attach media. Sounds basic? It is. But necessary. We want Satlantis to be a place for guides, rants, recommendations, reflections and notes — not just videos & pretty pictures. This opens the door.

🎟 Events Got a Serious Upgrade

Big changes:

-

New events page design

-

Co-hosts upgrade. Now you can toggle between them easily.

-

Upgraded notifications

-

Venue integration — tap the venue tile to go to venue page (smooth AF)

-

Email RSVPs — this one’s huge. People can RSVP with just an email. No login needed. Lower friction = more attendance.

Together, this makes event hosting smoother, and discovery more actionable.

The Bad

🔍 Merchant Discovery Is Still a Bit… Meh

Yes, we now have a map. But the underlying discovery engine isn’t quite smart enough yet. We’re working on filters, categories, vibe-tags and much better social + interest matching. For now: it’s functional, and it’s a good discovery experience, but it doesn’t have the full “magic” yet. That’s coming soon.

🙈 Videos Still Can’t Be Uploaded Natively

You’ll see videos from others (if they posted on Damus, Primal, Amethyst etc), but you can’t upload one yourself — yet. That’s coming up next.

📥 No Chat Yet

We wanted this live & available on this release, but we’re still cleaning up some kinks. You will see it in the next release. Pinky promise 😉

The Ugly

🧬 It’s Still a Skeleton

The map makes it look like a real product. The feed is coming alive. The events feel functional. But we’re still not there yet. The web home page isn’t selling the experience. The destination pages are still part of the old design and need to be caught up.

The feed is also full of a lot of junk, but that will change as more people join and post new content relevant to travel, location independence, lifestyle, health & the things important to the community on Satlantis.

Getting there…

What’s Next

-

Chat (DMs) — been a long time coming. Chat with anyone on Nostr (NIP-04)

-

QR Code Scanner — for easy profile sharing and connecting IRL

-

New Web Home Page — with new classifications for destinations (featured, active)

-

Upgraded Destination Pages — new look, new feed, soooo much nicer

-

Smarter Merchant Discovery — better algorithm to show you more relevant places

-

More Events Upgrades — export attendee list, calendar links, recurring events

-

Profile Settings — change your username, see your nPub, edit your info

Final Words

This is the beginning of the real v1. The map is the turning point.

Now we shift into layering utility: better feeds, better discovery, better profiles, better events, actual chat.

If it’s your first time checking out the app, welcome!

If it’s not your first time, delete the current app, download it again (from Google Play or Apple’s Testflight) and check out the new onboarding flow (interests), check out your profile, and of course, go to the merchant tab and open up the map!

In fact, while you’re there, take 5min to suggest some of your favorite local merchants (seed oil free, bitcoin accepted, awesome local pick, etc). You’ll see how smooth that is.

Then…if you’re coming to Prague — go over to the Prague page on the Web App, and click on the Events tab! There’s about 10 side events happening during the conference, and they’re ALL hosted on Satlantis.

Try out the RSVP flow. If you’re logged into Satlantis already, it’s just one click RSVP. If you’re new, and don’t have an account yet, just RSVP with your email 🙂

Finally, it goes without saying, let us know what you think! \ Tag us if you post anything cool. We’ll help amplify your voice.

Looking forward to building this with you.\ See you in 2wks for another update

Aleksandar Svetski

PS — I almost forgot..I’ll have more news on our crowdfund soon. This will be an opportunity to own a piece of Satlantis & a piece of the future!

-

@ 8d34bd24:414be32b

2025-05-28 13:53:46

@ 8d34bd24:414be32b

2025-05-28 13:53:46These days it can feel like the whole world is out of control. Government officials lie and break the law. People are selfish, act emotionally rather than logically, and push ideologies that are illogical and contrary to reality. Society is divided into groups and people are judged, not for their own character, but based on which group they are placed into. There are wars and rumors of wars. There are worries of pandemics and economic disasters. Depression, psychosis, and despair is rampant even among the youngest among us.

Hope For Believers

As much as things seem to be out of control, they are not out of God’s control. This is what the Bible predicted. No matter how bad things get in the world, those who have put their faith in Jesus, do not need to feel despair.

Why are you in despair, O my soul?\ And why have you become disturbed within me?\ Hope in God, for I shall again praise Him\ For the help of His presence.\ O my God, my soul is in despair within me;\ Therefore I remember You from the land of the Jordan\ And the peaks of Hermon, from Mount Mizar. (Psalm 42:5-6)

When we start to feel despair overcoming us, we need to remember what God has done and what He has promised. We need to praise God for what He has done, what He has promised, and what He will bring to completion. Things may be hard now, but God is still in control, and we know how the story will end. God triumphs. Good is rewarded. Evil is destroyed. We can stand on the foundation of hope because we know the ending. Even though things may be out of our personal control, they are always under God’s control.

The more fiercely the storm rages, the more we need to rest in Jesus and the more we need to put our hope in Him.

O love the Lord, all you His godly ones!\ The Lord preserves the faithful\ And fully recompenses the proud doer.\ **Be strong and let your heart take courage,\ All you who hope in the Lord. (Psalm 31:23-24) {emphasis mine}

We can take courage because God always acts for our long term good. Every hardship we experience here on earth will be recognized as a blessing that grew our faith and prepared us for heaven and God’s presence in eternity.

For I know the plans that I have for you,’ declares the Lord, ‘plans for welfare and not for calamity to give you a future and a hope. (Jeremiah 29:11)

Even the worst things that happen to us, due to the sins of others, have a good purpose in our lives. God is working good through us. Our hope isn’t an empty hope. It isn’t a “I really hope this happens.” It is a “I can hope in the guaranteed promises of God.”

For we do not want you to be unaware, brethren, of our affliction which came to us in Asia, that we were burdened excessively, beyond our strength, so that we despaired even of life; indeed, we had the sentence of death within ourselves so that we would not trust in ourselves, but in God who raises the dead; who delivered us from so great a peril of death, and will deliver us, He on whom we have set our hope. And He will yet deliver us, (2 Corinthians 1:8-10) {emphasis mine}

We may experience situations so bad that they seem hopeless, but with God, nothing is hopeless. The God who raises the dead can raise us out of any situation. The God who spoke the universe into existence can deliver us by a word.

The God of the Bible knows all and loves us completely. He looks at our situation through the lens of eternity. What seems best in the moment is not necessarily what is best for our eternity. Many times He delivers us through hardship rather than out of it. We just need to trust Him and put our hope in Him because He is good.

In the same way God, desiring even more to show to the heirs of the promise the unchangeableness of His purpose, interposed with an oath, so that by two unchangeable things in which it is impossible for God to lie, we who have taken refuge would have strong encouragement to take hold of the hope set before us. This hope we have as an anchor of the soul, a hope both sure and steadfast and one which enters within the veil, where Jesus has entered as a forerunner for us, having become a high priest forever according to the order of Melchizedek. (Hebrews 6:17-20) {emphasis mine}

Read that statement again. “This hope we have as an anchor of the soul, a hope both sure and steadfast.” Are you trusting Jesus as the “anchor of your soul?” Is your hope just a wish or is it a “sure and steadfast” hope based on the promises of God that you know will 100% come true?

And not only this, but we also exult in our tribulations, knowing that tribulation brings about perseverance; and perseverance, proven character; and proven character, hope; and hope does not disappoint, because the love of God has been poured out within our hearts through the Holy Spirit who was given to us. (Romans 5:3-5)

Isn’t it ironic that we need hope to persevere through tribulations, but that persevering through tribulation gives us character and hope? Our faith, trust, and hope grow through hardship. When things are easy, we almost always fall back on trusting in our own power rather than relying on God’s power. If we have put our faith in Jesus, there is no situation in which we should lose hope.

Now may the God of hope fill you with all joy and peace in believing, so that you will abound in hope by the power of the Holy Spirit. (Romans 15:13)

Is your joy and peace based on your circumstances or have you learned to have hope in God so you can experience joy and peace even in the trials?

Many people equate joy and happiness, but I think there is a key distinction. Happiness is a pleasant feeling that comes from pleasant circumstances. Joy is a similar feeling to happiness, but it comes from knowing God and His love. It is not tied to circumstances. When we have truly put our hope in God we can still have joy in and despite the most horrific circumstances.

Blessed be the God and Father of our Lord Jesus Christ, who according to His great mercy has caused us to be born again to a living hope through the resurrection of Jesus Christ from the dead, to obtain an inheritance which is imperishable and undefiled and will not fade away, reserved in heaven for you, (1 Peter 1:3-4) {emphasis mine}

Just as Jesus told the Samaritan woman at the well that He provides living water that wells up inside, so that she need never thirst, in the same way believers have a living hope that wells up in times of need. Our hope is in the Creator of the universe and Savior of the world. No problem is too big for Him. No situation is a surprise to Him. No enemy is too powerful for Him. All of our problems are already solved. We just haven’t necessarily seen the solution yet.

My soul, wait in silence for God only,\ For my hope is from Him.\ He only is my rock and my salvation,\ My stronghold; I shall not be shaken.\ On God my salvation and my glory rest;\ The rock of my strength, my refuge is in God. (Psalm 62:5-7)

Despair For Unbelievers

Although believers never have reason to despair, the same is not true for those who have rejected the Savior, Jesus Christ. In these perilous times, they have a real reason for dread and despair.

Moreover, the Lord will scatter you among all peoples, from one end of the earth to the other end of the earth; and there you shall serve other gods, wood and stone, which you or your fathers have not known. Among those nations you shall find no rest, and there will be no resting place for the sole of your foot; but there the Lord will give you a trembling heart, failing of eyes, and despair of soul. So your life shall hang in doubt before you; and you will be in dread night and day, and shall have no assurance of your life. (Deuteronomy 64-66)

Those who reject the atoning sacrifice of Jesus do not get His protection. They do not get His help. They cannot rest in hope in Him.

Of course, the good news is that they can chose to turn their hearts to Him, confess their sins, and trust in Him up until their moment of death. Sadly many will continue to put off faith until it is too late. Many will choose evil over good and license over submission until God gives them over to their lusts.

And just as they did not see fit to acknowledge God any longer, God gave them over to a depraved mind, to do those things which are not proper, being filled with all unrighteousness, wickedness, greed, evil; full of envy, murder, strife, deceit, malice; they are gossips, slanderers, haters of God, insolent, arrogant, boastful, inventors of evil, disobedient to parents, without understanding, untrustworthy, unloving, unmerciful; and although they know the ordinance of God, that those who practice such things are worthy of death, they not only do the same, but also give hearty approval to those who practice them. (Romans 1:28-32)

If any of you have not yet put your trust in Jesus as Savior and Lord, do not wait. Turn away from evil. Submit to the will of Jesus. Trust Him to take away your sins and cover you with His righteousness.

If any of you know people who are in despair, share the gospel with them. Tell them about the greatness of God. Show them the hope that is within you.

Can Believers Despair?

Are there believers who despair? Yes. Should believers ever despair? Definitely not!

But we have this treasure in earthen vessels, so that the surpassing greatness of the power will be of God and not from ourselves; we are afflicted in every way, but not crushed; perplexed, but not despairing; persecuted, but not forsaken; struck down, but not destroyed; always carrying about in the body the dying of Jesus, so that the life of Jesus also may be manifested in our body. (2 Corinthians 4:7-10)

Jesus is always with believers in all situations guiding and protecting us. Those difficult situations that happen are for our good, even when we can’t see how it could be for good.

Job had more reasons to despair than almost anyone, yet he trusted in God. He didn’t know why he was being put through such loss, but his loss increased his faith in God and was a great example to people throughout history. I also love this cry of his heart.

“Oh that my words were written!\ Oh that they were inscribed in a book!” (Job 19:23)

He may or may not have seen even the partial fulfillment of this cry, but His words are written in the book of Job, in the Holy Scriptures read by Jews and Christians throughout the world and throughout history. Job’s first response to loss was an example to us all. After losing all ten children and all of his wealth, this was his response.

Then Job arose and tore his robe and shaved his head, and he fell to the ground and worshiped. (Job 1:20)

Yes, it is true that he had moments of despair where he cursed his birth, but he then returned to God in faith and hope. After a brief rebuke from God, Job submitted to God’s will.

“Behold, I am insignificant; what can I reply to You?\ I lay my hand on my mouth.\ Once I have spoken, and I will not answer;\ Even twice, and I will add nothing more.” (Job 40:4-5)

After his second rebuke from God, he fully submitted.

Then Job answered the Lord and said,

“I know that You can do all things,\ And that no purpose of Yours can be thwarted.\ ‘Who is this that hides counsel without knowledge?’\ *Therefore I have declared that which I did not understand,\ Things too wonderful for me, which I did not know.\ ‘Hear, now, and I will speak;\ I will ask You, and You instruct me*.’\ I have heard of You by the hearing of the ear;\ But now my eye sees You;\ Therefore I retract,\ And I repent in dust and ashes**.” (Job 42:1-6) {emphasis mine}

Job admitted that he did not understand what God was doing, but that God was right; God was good; and God was Lord. Job was able to have hope knowing that God was in control and working for good.

In the case of Job, he was later blessed with more kids, more wealth, and more respect than he had in the beginning. We won’t all see our blessings here on earth, but all believers will receive blessings from their trials.

May our glorious Savior and God fill you with faith and hope in God, His goodness, His power, and His plan. May we all submit to His good will even when we do not understand and even when every part of our earthly body is crying, “stop!” May God fill you with knowledge of Him, faith in Him, and hope in Him.

Trust Jesus

-

@ 491afeba:8b64834e

2025-05-27 23:57:01

@ 491afeba:8b64834e

2025-05-27 23:57:01Quando adolescente eu acreditava na coerência da teoria de "amor líquido" do polonês, sociólogo, Zygmunt Bauman, apresentada no livro "Amor Líquido: Sobre a Fragilidade dos Laços Humanos", qual no meu amadurecimento em estudos, sejam eles no meio acadêmico ou fora, percebo como uma das formas mais rasas de explicar as mudanças e transformações dos padrões de relações sócio-afetivas dos humanos. A seguir colocar-me-ei na minha juventude não tanto recente, direi então que nós, se adolescentes e conservadores, ou mesmo jovens adultos mais conservadores, costumamos levar como dogma uma óptica decadentista generalizada de todos os avanços de eras dos homens, universalizamos por nos ser comum a indistinção entre humanidade e humanidades, ou mesmo "humanity" e "humankind" ("humanidade" como espécime e "humanidade" como um universal), compreendemos toda "essas" como "essa" e indistinguimos as sociedades para com os homens, ou seja, a incapacidade de definir os seres dentro de suas respectivas singularidades e especificidades nos leva ao decadentismo generalista (a crença de que de forma geral, e universal, a "civilização universal" decai moralmente, éticamente, materialmente e espiritualmente), que aparente à nós determinadas mudanças nas relações humanas quanto ao caráter sócio-afetivo, por falta de profundidade e critérios ainda sobre questões alinhadas aos métodos e coerências, ou incoerências, lógicas, nós se jovens e conservadores somos levados ao engodo de concordar com a teoria do amor líquido de Bauman, que devo cá explicar de antemão: trata ela, a teoria, o padrão de "amor" dos tempos presentes como frágil, de prazo (curto e médio) e diferente em grau comparativamente ao amor comum das eras passadas.

Aos jovens mais progressistas opera uma compreensão dialética sobre as eras dos homens nos seu tempo presente, na qual ao tempo que o ser progride ele também regride simultaneamente, ou seja, a medida que aparecem contradições advindas de transformações materiais da realidade humana o ser supera essas contradições e progride em meio as transformações, ainda fazendo parte da lógica dessa indissociavelmente, assim constantemente progredindo e regredindo, havendo para esses dois vetores de distinção: o primeiro é o que releva questões espirituais como ao caráter do pensamento "new age", o segundo ignora essas questões por negar a existência da alma, seguem ao materialismo. Cedem em crer na teoria baumaninana como dogma, pois não encontram outros meios para explicar as transformações da sociedade na esfera sócio-afetiva sem que haja confrontamento direto com determinadas premissas assim pertinemente presentes, ou por não conciliarem com análises relativamente superiores, como a de Anthony Giddens sobre a "relação pura" em "A Transformação da Intimidade" e de François de Singly apresentada em "Sociologie du Couple".

https://i.pinimg.com/736x/6f/b4/9e/6fb49eda2c8cf6dc837a0abfc7e108e6.jpg

Há um problema quando uma teoria deixa de assim ser para vir a tornar-se mais um elemento desconexo da ciência, agora dentro da cultura pop, se assim podemos dizer, ou da cultura de massa, ou se preferirem mesmo "anticultura", esse problema é a sua deformização teórica, tornando-se essa rasa para sua palatabilidade massiva, somada a incapacidade de partes da sociedade civil em compreender as falhas daquilo que já foi massificado. Tive surpresa ao entender que muitos outros compartilham da mesma opinião, a exemplo, possuo um amigo na faculdade, marxista, que ao falarmos sobre nossos projetos de pesquisa, citou ele o projeto de um de nossos colegas, no qual esse referido um de nossos colegas faria seu projeto com base na teoria do amor líquido de Bauman, então alí demos risada disso, ora, para nós a teoria baumaniana é furada, passamos a falar sobre Bauman e o motivo pelo qual não gostávamos, lá fiquei até surpreso em saber que mais gente além de mim não gostava da teoria de Bauman, pois ao que eu via na internet era rede de enaltecimentos à figura e à sua teoria, tal como fosse uma revelação partindo de alguma divindade da Idade do Bronze. Pouco tempo depois tive em aula de teoria política uma citação de Bauman partindo do professor que ministrava a disciplina, no entanto, ao citar o nome de Bauman o mesmo fez uma feição na qual aparentava segurar risada, provavelmente ele também não levava Bauman à sério. Não devo negar que todas as vezes que vejo o sociólogo sendo citado em alguma nota no X, no Instagram ou qualquer outra rede social, tal como fosse um referencial teórico bom, sinto uma vergonha alheia pois alí tenho uma impressão de que a pessoa não leu Bauman e usa o referencial teórico como um fato já assim provado e comprovado.

Há pontos positivos na teoria baumaniana, como a capacidade de perceber o problema e correlacioná-lo à modernidade, assim como sucitar a influência do que há de material no fenômeno, porém os erros são pertinentes: o primeiro problema é de categoria. Não há, por parte de Bauman noção alguma entre as dissociações dos amores, não há atenção sobre o amor como estrutura ou ele como um sentimento, todo ele é compreendido uniformemente como "amor", partindo do pressuposto que todas as relações, todas elas, são firmadas com base no amor. Essa crença tem uma origem: Hegel. Nos Escritos Teológicos Hegel partia da crença que o amor ligava os seres relacionalmente como uma força de superação e alienação, mas há de compreendermos que esse Friedrich Hegel é o jovem ainda pouco maduro em suas ideias e seu sistema de pensamento, mais a frente, em "Fenomenologia do Espírito e na Filosofia do Direito", Hegel compreende a institucionalidade do direito no amor e a institucionalização dessa força, assim aproxima-se da realidade a respeito da inserção do amor nas esferas práticas do humano, porém essa ideia, apesar de imperfeita, pois ao que sabemos não é o amor que consolida a relação, mas sim a Verdade (Alétheia), conforme apontado por Heidegger em "Ser e Tempo", essa ideia do amor como a fundamento das relações humanas influenciou, e até hoje influencia, qualquer análise sobre as relações humanas fora da esfera materialista, fora dessa pois, melhormente explicado em exemplo, os marxistas (em exemplo), assim como Marx, consideram como base primordial das relações as condições materiais.

Por certo, não é de todo amor a base para a solidificação, ora, erram aqueles que creem que somente essa força, assim apontada por Hegel, constituiam todos os relacionamentos formais como pilares fundamentais, pois em prática as famílias eram até a fiduciarização dessas, por mais paradoxal que seja, compreendidas melhor como instituições orgânicas de caráter legal do que conluios de afetividades. A família outrora tinha consigo aparelhos de hierarquia bem estabelicidos, quais prezavam pela ordem interna e externa, que acima dessa instituição estava somente a Igreja (outra instituição), com sua fiduciarização [da família] após o movimento tomado pelos Estados nacionais em aplicação do casamento civil mudou-se a lógica das partes que a compõe, findou-se o princípio da subsidiariedade (não intervenção de determinadas instituições nas decisões quais podem ser exercidas em resuluções de problemas nas competências de quaisquer instituições), foi-se então, contudo, também a autoridade, e nisso revela-se um outro problema não apontado na teoria de Bauman: qual o padrão do amor "sólido"? Pois, ora, sociedades tradicionais não abdicavam do relevar dos amores para tornar seus filhos em ativos nas práticas de trocas (dádivas)? É notório que esse padrão se dissocia do padrão de sentimento apontado por Bauman, encontramos esse fato em estudo nos trabalhos "Ensaio Sobre a Dádiva", do Marcel Mauss, e "As Estruturas Elementares do Parentesco", do Claude Levi-Strauss, quais expõem que nas sociedades "sólidas", tradicionais, relevava-se mais questões institucionais que as sentimentais para a formação de laços (teoria da aliança). Muitas das relações passadas não eram baseadas no amor, não significando assim que as de hoje, em oposição, sejam, mas que permanecem-se semelhantes em base, diferentemente em grau e forma.

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F748b94c3-f882-45db-8333-09260ef15cfe_615x413.jpeg

Ora, ainda existem casamentos motivados pela política, pelo status, pelo prestígio, pelos bens, pelo poder, pela influência familiar e assim sucetivamente, tal como no passado, ocorre que essa prática tornou-se oculta, não mais explícita e aparente, devo dizer ainda que em partes, pois prepondera em nosso tempo uma epidemia de adultérios, fornicações, práticas lascivas e demais práticas libertinosas explicitamente, em contraposição às práticas ocultas em vergonhas de sociedades sem declínio moral e espiritual, o que nos leva a questionar o método comparativo em dicotomia temporal "presente x passado" aplicado por Bauman, no qual segue-se da seguinte forma:

Transformação Passado = *sólido* | Presente = *líquido* Categorias Padrão de amor: tradicional (*sólido*) moderno (*líquido*) *Sólido* = estável, prazo (médio-grande), profundo, determinado. *Líquido* = instável, prazo (curto-médio), raso, indeterminado.O que penso é: Zygmunt Bauman buscou uma explicação material e laical para desviar ao fato de que há uma notória correlação entre espiritualização da sociedade, se voltada à Verdade, com a estabilidade das instituições, o que é já reduzido à moral religiosa, somente, não à mística, como por pensadores da linha de Tocqueville, ou em abordagens também mais laical (positivista) porém ainda relevantes, como Émile Durkheim em "As Formas Elementares da Vida Religiosa" e Max Weber em "A Ética Protestante e o Espírito do Capitalismo", contrapondo uma abordage mais voltada, de fato, a espiritualidade, como Christopher Dawnson, que defende essa teoria em "Religião e o Surgimento da Cultura Ocidental", e Eric Voegelin, principalmente nas obras "A Nova Ciência da Política" e "Ordem e História".

Encerrando, minha cosmovisão é a católica, o sistema de crença e religião qual sigo é do Deus que se fez homem por amor aos seus filhos, não posso negar ou mesmo omitir o fato de que, por trás de toda a minha crítica estão meus pensamentos e minhas convicções alinhadas àquilo que mais tenho amor em toda minha vida: a Verdade, e a Verdade é Deus, pois Cristo é a Verdade, o Caminho e a Vida, ninguém vai ao Pai se não por Ele, e pois bem, seria incoerência de minha parte não relevar o fato de crença como um dos motivos pelos quais eu rejeito a teoria do amor líquido de Zygmunt Bauman, pois os amores são todos eles praticados por formas, existem por diferentes formas e assim são desde sua tradicionalidade até o predomínio das distorções de declínio espiritual das eras presentes (e também antigas pré-Era Axial), estão esses preservados pelo alinhamento à verdade, assim são indistorcíveis, imutáveis, ou seja, amor é amor, não releva-se o falso amor como um, simplesmente não o é, assim o interesse, a sanha por bens, o egoísmo e a egolatria ("cupiditas", para Santo Agostinho de Hipona, em oposição ao que o santo e filósofo trata por "caritas") não são formas do amor, são autoenganos, não bons, se não são bons logo não são de Deus, ora, se Deus é amor, se ele nos ama, determino como amor (e suas formas) o que está de acordo com a Verdade. Aprofundando, a Teologia do Corpo, do Papa São João Paulo II, rejeita a "liquidez" apresentada por Bauman, pois o amor é, em suma, sacríficio, parte da entrega total de si ao próximo, e se não há logo não é amor. A Teologia do Corpo rejeita não os fundamentos de mentira no "líquido", mas também no "sólido", pois a tradicionalidade não é sinônimo de bom e pleno acordo com o amor que Deus pede de nós, não são as coerções, as violências, as imposições e demais vontades em oposição às de Deus que determinam os amores -- fatos em oposição ao ideário romanticizado. Claro, nem todas as coerções são por si inválidas do amor, ou mesmo as escolhas em trocas racionalizadas, a exemplo do autruísmo em vista da chance da família ter êxito e sucesso, ou seja, pelo bem dos próximos haver a necessidade de submissão a, em exemplo, um casamento forjado, ou algo do gênero, reconhece-se o amor no ato se feito por bem da família, porém o amor incutido, nesse caso, explicita o caráter sacrificial, no qual uma vontade e um amor genuinamente potencial em prazeres e alegrias são anulados, ou seja, mesmo nesse modelo tradicional na "solidez" há possibilidade do amor, não nas formas romanticizadas em critérios, como "estabilidade" e "durabilidade", mas no caráter do sacríficio exercido. Conforme nos ensina São Tomás de Aquino, o amor não é uma "força", tal como ensina Hegel, mas sim uma virtude teologal conforme na "Suma Teológica" (II-II Q. 26-28), não devemos reduzir o amor e os amores em análises simplórias (não simples) de falsa complexidade extraídas em métodos questionáveis e pouco competentes à real diensão de crise espiritual das eras, por esse motivo não concordo com a teoria do amor líquido de Zygmunt Bauman.

-

@ 06639a38:655f8f71

2025-05-26 14:21:37

@ 06639a38:655f8f71

2025-05-26 14:21:37Finally there is a release (1.7.0) for Nostr-PHP with a full NIP-19 integration. Here is an example file with some snippets to how it works to encode and decode bech32 encoded entities:

- https://github.com/nostrver-se/nostr-php/blob/main/src/Examples/nip19-bech32-decoded-entities.php

- https://github.com/nostrver-se/nostr-php/blob/main/src/Examples/nip19-bech32-encoded-entities.php

Now merge request #68 (and issues #74, #64 are closed) is finally merged which I opened in October 2024.

Next up is:

- Create documentation how to use NIP-19 with the library on https://nostr-php.dev

- Create documentation how to use NIP-04 and NIP-44 with the library on https://nostr-php.dev

- Work out a proof-of-concept with the revolt/event-loop package to create concurrent async requests with websocket connections

-

@ 06639a38:655f8f71

2025-05-26 12:58:38

@ 06639a38:655f8f71

2025-05-26 12:58:38Nostr-PHP

Djuri submitted quite some pull requests in the last couple of week while he was implementing a Nostr connect / login on https://satsback.com. The backend of that platform is written in PHP so the Nostr-PHP library is used for several purposes while Djuri also developed quite some new features utilizing the following NIPs:

- NIP-04

- NIP-05

- NIP-17

- NIP-44

Thank you very much Djuri for these contributions. We now can do the basic private stuff with the library.

PR for NIP-04 and NIP-44: https://github.com/nostrver-se/nostr-php/pull/84 and https://github.com/nostrver-se/nostr-php/pull/88

Examples:- https://github.com/nostrver-se/nostr-php/blob/main/src/Examples/nip04-encrypted-messages.php

- https://github.com/nostrver-se/nostr-php/blob/main/src/Examples/nip44-gift-wrapping.php

PR for NIP-05: https://github.com/nostrver-se/nostr-php/pull/89

Example: https://github.com/nostrver-se/nostr-php/blob/main/src/Examples/nip05-lookup.phpPR for NIP-17: https://github.com/nostrver-se/nostr-php/pull/90

Example: https://github.com/nostrver-se/nostr-php/blob/main/src/Examples/nip17-private-direct-messages.phpPR for adding more metadata profile fields: https://github.com/nostrver-se/nostr-php/pull/94

Example: https://github.com/nostrver-se/nostr-php/blob/main/src/Examples/fetch-profile-metadata.phpFetch

10050event (dm relay list) of an given pubkey

Example: https://github.com/nostrver-se/nostr-php/blob/main/src/Examples/fetch-dm-relayslist.phpThe CLI tool is removed from the library, see PR https://github.com/nostrver-se/nostr-php/pull/93

Nostr-PHP documentation

While new NIPs are implemented in the Nostr-PHP library, I'm trying to keep up with the documentation at https://nostr-php.dev. For now, things are still much work in progress and I've added the AI agent Goose using the Claude LLM to bootstrap new documentation pages. Currently I'm working on documentation for

- How to direct messages with NIP-04 and NIP-17

- Encrypted payloads for event content NIP-44