-

@ f85b9c2c:d190bcff

2025-05-26 01:00:24

@ f85b9c2c:d190bcff

2025-05-26 01:00:24

We've all heard the advice to "trust your gut," but what if I told you that your first instinct might not always be your best guide? In a world where decisions can have long-lasting impacts, relying solely on our initial reactions could be a significant misstep. Here's why you should often look beyond that immediate gut feeling. First off, let's consider the science of decision-making. Psychologists and behavioral economists have long studied how our initial reactions can be influenced by biases, fears, or even the most recent information we've encountered. Daniel Kahneman, a Nobel laureate in economics, distinguishes between two systems of thought:

System 1, which is fast, automatic, and emotional (our first instinct), and System 2, which is slower, more deliberate, and logical.

From my own life, I've learned that acting on my first instinct often leads to outcomes I later regret. There was a time when I almost turned down a job offer because my initial reaction was fear of change. Thankfully, I gave myself time to think it over, discussed it with mentors, and realized it was an opportunity not to be missed. That job turned out to be one of the most rewarding experiences of my career. Moreover, the concept of "sleeping on it" has a scientific basis. Sleep helps in memory consolidation and emotional regulation, which can lead to a clearer perspective when you revisit the decision. This isn't a sign of indecision but rather of wisdom in understanding the complexity of human judgment. While there’s merit in intuition, the second thought, when you’ve had time to reflect, gather more information, or consult with others, often proves more reliable.

My personal advice? When faced with a decision, resist the urge to act immediately based on your first instinct. Give yourself time to think, reflect, research, and maybe even discuss with those you trust. Remember, [5/26, 1:35 AM] eihto: in the rush of life, the second thought can be the one that truly guides you to the right path. Trust it; it’s often right.

-

@ f85b9c2c:d190bcff

2025-05-26 00:52:41

@ f85b9c2c:d190bcff

2025-05-26 00:52:41

Where do conversations go after they’ve already been had? Is there some sort of cosmic repository of conversation where every sound that’s ever been uttered has been recorded?

If parallel and alternate realities exist, then it makes sense that once you utter the words in one reality, they become imprinted in the universal narrative and live on forever.

Every word you’ve ever uttered is familiar to you. If you really think about it, nothing you say feels surprising. You know what you’re going to say because you’ve said it all before. You cannot put your finger on why you feel it, but you always have.

This is deja vu.

And because worlds are parallel you can also experience your future while in your present (imagination), or your past while in the future (memory).

-

@ f85b9c2c:d190bcff

2025-05-26 00:46:51

@ f85b9c2c:d190bcff

2025-05-26 00:46:51

I despise money. It is probably because of its constant lack of existence within our household. Even with its possession, I would still loathe its entitlement to everything. I wish it was not a necessity. Would I carry a different tune if I was able to help provide more of a steady income for our family? No, I would not. I have been on the other side as well. With more money, came more responsibility, longer working hours, and less time with those I loved. Financial stress is the unwanted guest within our home. In all of our financial ups and downs, we found our family and love for one another never changed. I am truly grateful for that. I hope others can reciprocate. Of course, we want more but we are blessed with the basics shelter, love, and NeverEnding support.

Do not let the stress of everyday life and finances tear you or your family apart. When times are hard, fall to your knees and talk to the lord. Find your quiet place in this chaotic world and ask for the Lord to provide. If you believe he will, you will be okay. God always finds a way. Trust in him!

-

@ c9badfea:610f861a

2025-05-25 22:36:12

@ c9badfea:610f861a

2025-05-25 22:36:12- Install Notally (it's free and open source)

- Open the app, tap ≡, and select Settings

- Tap View and switch to Grid

- Return to the main screen

- Tap ☑ to create a task list and ✏️ to create a note

- Enjoy!

ℹ️ You can also add pictures and set reminders for notes and task lists

ℹ️ Add labels to the notes (e.g. "Diary", "Snippet" or "Knowledge")

ℹ️ Use emojis to enhance titles (e.g. "🛒 Purchases" and "🔗️ Links")

-

@ cefb08d1:f419beff

2025-05-25 22:14:48

@ cefb08d1:f419beff

2025-05-25 22:14:48Source: https://stacker.news/items/986794

https://stacker.news/items/989164

-

@ 4d4fb5ff:1e821f47

2025-05-25 22:14:22

@ 4d4fb5ff:1e821f47

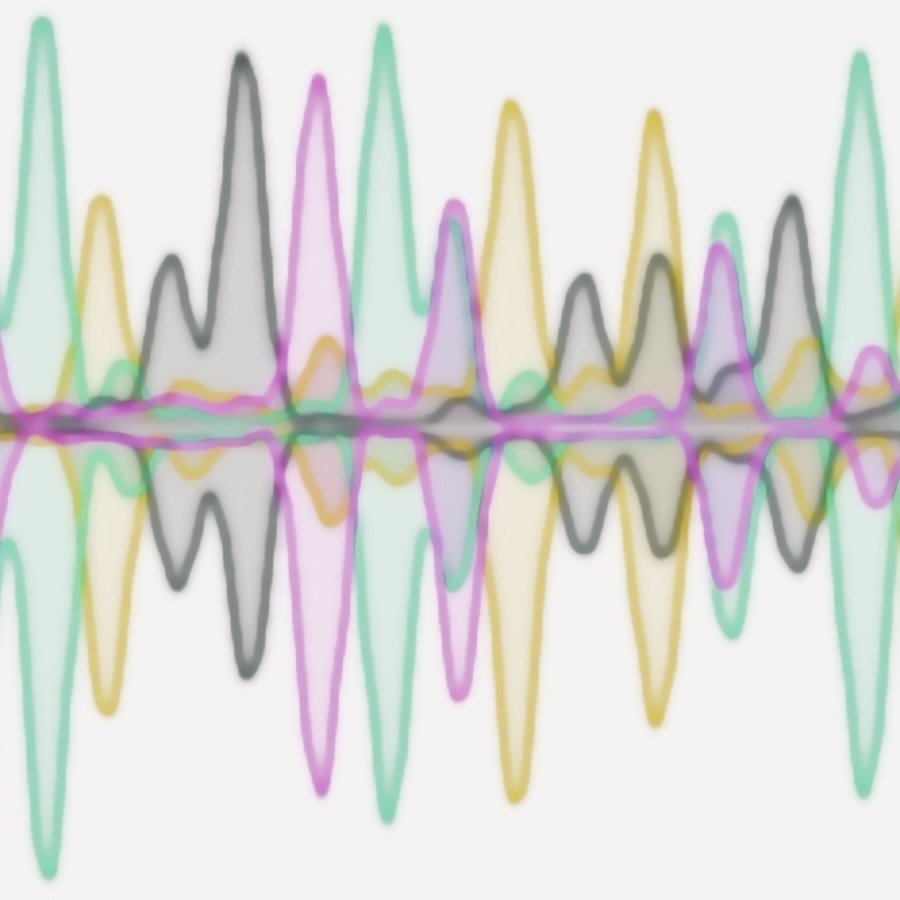

2025-05-25 22:14:22Sanger sequencing traces. I extracted DNA directly from my cells and determined a short genetic sequence, which is visualized by the bottom trace. In a second sample, I mutated my DNA enzymatically and used to same process to determine the sequence, shown in the top trace. Each peak and color represents a unique DNA base (A, T, C or G) in part of a gene with 13 bases shown here in total. This biogenerative process resulted in the center base changing from T to C, resulting in a slightly different, mixed peak by comparison. To further separate this work from being purely scientific, I did not record specific details about the experimental process.

https://ordiscan.com/inscription/96817755

-

@ 4d41a7cb:7d3633cc

2025-04-08 01:17:39

@ 4d41a7cb:7d3633cc

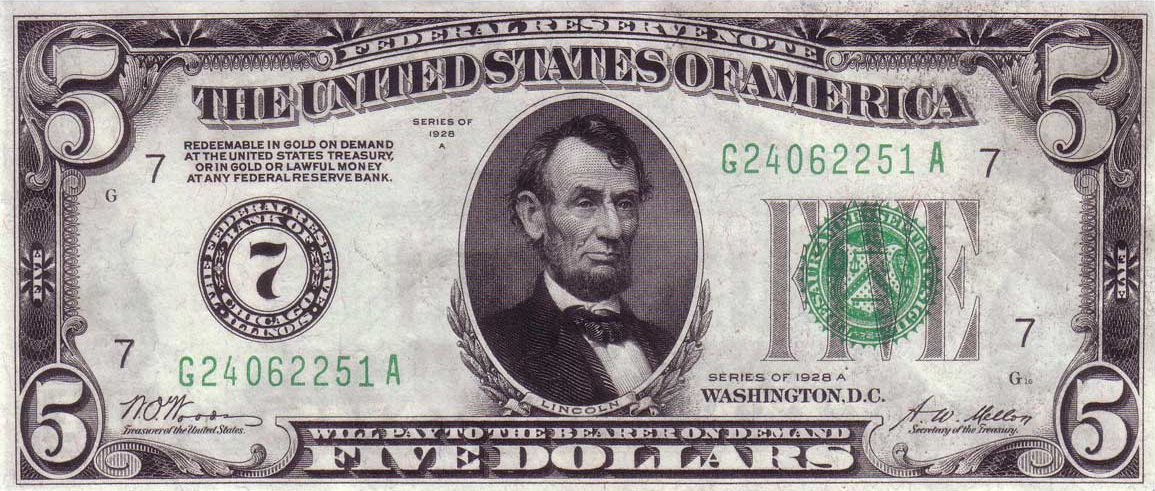

2025-04-08 01:17:39Satoshi Nakamoto, the pseudonymous creator of Bitcoin, registered his birthday as April 5, 1975, on his P2P Foundation profile. Many think that he chose this date because on that same day in 1933, the United States government confiscated the gold of the American people. Whether this was on purpose or not, what happened in this day is very important to understand how do we ended up here.

In 1933, as expressed in Roosevelt’s Executive Orders 6073, 6102, and 6260, the United States first declared bankruptcy. The bankrupt U.S. went into receivership in 1933. America was turned over via receivership and reorganization in favor of its creditors. These creditors, the International Bankers, from the beginning stated their intent, which was to plunder, bankrupt, conquer and enslave America and return it to its colonial status.1

As one of his first acts as President, Franklin Delano Roosevelt declared a “Banking Emergency” to bail out the Federal Reserve Bank, which had embezzled this country’s gold supply. The Congress gave the President dictatorial powers under the “War Powers Act of 1917” (amended 1933), written, by the way, by the Board of Governors of the Federal Reserve Bank of New York.2

This day marked the official abandonment of the American Constitution, law and real money. Today, 92 years after this event, most of the people living today have never had any real money or paid for anything using real money; unless they used Bitcoin...

There could be no bankruptcy if there was not a private central bank lending paper currency to the government at interest, so we must start from 1913, when the Federal Reserve was created: a non-federal private bank with no reserves and the monopoly of issuing debt based paper currency in unlimited amounts and lending it to the government at interest by buying treasury bills. The fact that this currency is lent into existence at interest makes the debt mathematically impossible to be repaid; it can only be refinanced or defaulted.

Between 1929 and 1933, the Federal Reserve Bank reduced the currency supply by 33%, thereby creating the Great Depression, bankrupting the US government, stealing the Americans’ gold supply, and officially ending the gold standard. Since then the US dollar (money) was replaced with Federal Reserve Notes (debt). This was also the end of the Republican form of government and the beginning of a socialist mob rule democracy (Fascism).

“Fascism should more properly be called corporatism because it is the merger of state and corporate power.” — Benito Mussolini

The United States government has been bankrupt since 1933, since it defaulted on its gold bonds. This type of bond existed until 1933, when the U.S. monetary system abandoned the gold standard. 3 From this year the government has been totally controlled by the International bankers and used as a tool to spread and maintain their power worldwide.

Many people think that the gold standard was abandoned in 1971, but this is not true; in fact, this happened in 1933 when the US dollar was replaced by Federal Reserve Notes that are 100% debt-based fiat paper currency.

The year 1933 in the United States marked:

- The end of the Republican form of government and the beginning of American Fascism

- The end of the United States dollar and its replacement by Federal Reserve Notes

- The abandonment of common law and replacement with military admiralty law

- The takeover of the United States government by International bankers

- A massive gold theft and the end of the US gold standard

- The exchange of rights with privileges and licenses

- The United States government bankruptcy

The next shameful event in our history which still plagues us to this day was the “War Powers Act of 1933.” This Act permitted President Roosevelt to make law in the form of Executive Order, bypass Congress and create his socialist state. We (citizens of this country) were ever after to be considered enemies of the United States who must be licensed to engage in any commercial activity. With the aid of the Federal Reserve (the same people who created the Depression), the President confiscated our gold and silver coin and replaced it with worthless pieces of paper and a debt system that will eventually destroy this great country. Our land and our labor were pledged to the Federal Reserve Bank, Inc., as collateral for a debt system that could never be paid.4

“Emergency Powers” means any form of military style government, martial law, or martial rule. Martial law and martial rule are not the same.

United States Congressional Record March 17, 1993 Vol. #33, page H- 1303, Congressman James Traficant, Jr. (Ohio) addressing the House:

“Mr. Speaker, we are here now in chapter 11. Members of Congress are official trustees presiding over the greatest reorganization of any Bankrupt entity in world history, the U.S. Government. We are setting forth, hopefully, a blueprint for our future”

“There are some who say it is a coroner’s report that will lead to our demise. It is an established fact that the United States Federal Government has been dissolved by the Emergency Banking Act, March 9, 1933, 48 Stat. 1, Public Law 89-719; dered by President Roosevelt, being bankrupt and insolvent. H.J.R. 192, 73rd Congress in session June 5, 1933 – Joint Resolution To Suspend The Gold Standard and Abrogate the Gold Clause dissolved the Sovereign Authority of the United States and the official capacities of all United States Governmental Offices, Officers, and Departments and is further evidence that the United States Federal Government exists today in name only” **“The receivers of the United States Bankruptcy are the International Bankers, via the United Nations, the World Bank and the International Monetary Fund”

“All United States Offices, Officials, and Departments are now operating within a de facto status in name only under Emergency War Powers. With the Constitutional Republican form of Government now dissolved, the receivers of the Bankruptcy have adopted a new form of government for the United States. This new form of government is known as a Democracy, being an established Socialist/Communist order under a new governor for America. This act was instituted and established by transferring and/or placing the Office of the Secretary of Treasury to that of the Governor of the International Monetary Fund. Public Law 94-564, page 8, Section H.R. 13955 read in part:”

“The U.S. Secretary of Treasury receives no compensation for representing the United States.”

The American Spirit

The intention of the founding fathers of the United States was to create a constitutional republic to protect natural human rights and escape from the tyrannical English monarchy and its usurious Bank of England's monetary system. They created an honest monetary system based on gold and silver (United State Dollar) and got rid of nobility titles, creating equality under the law.

Section 10 of the American Constitution says:

No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make anything but gold and silver Coin a tender in payment of debts; pass any bill of attainder, ex post facto law, or law impairing the obligation of contracts; or grant any title of nobility.

The United States Dollar (1792-1933)

A dollar is a measure of weight defined by the Coinage Act of 1792 and 1900, which specifies a certain quantity—24.8 grains of gold or 371.25 grains of silver (from 1792 to 1900) when the American dollar was based on a bimetallic standard.

The Gold Standard Act of 1900 formally placed the United States on the gold standard, setting the value of one dollar at 25.8 grams of 90% pure gold, which fixed the price of gold at $20.67 per troy ounce. This standard was totally abandoned in 1933.

Gold and silver were such powerful money during the founding of the United States of America that the founding fathers declared that only gold or silver coins could be “money” in America.

But since the greedy bankers cannot profit from honest money they cannot print, they replaced the money with paper debt instruments. And by doing this, they have effectively enslaved the American people until today. My definition of modern slavery is working for a currency that someone else can create at no cost or effort. What's worse is that they even demand to be paid back and with interest!

Federal Reserve Notes (1913-present)

Federal Reserve Notes are not real money. Money that has metallic or other intrinsic value, as distinguished from paper currency, checks, and drafts.

Federal Reserve Notes (FRNs) are a legal fiction. An assumption that something is true even though it may be untrue. 5 The assumption that they are money, when in fact they are the opposite of money: debt or paper currency.

Paper money. Paper documents that circulate as currency; bills drawn by a government against its own credit. 6 Like Goldsmiths' notes. Hist. Bankers' cash notes: promissory notes given by bankers to customers as acknowledgments of the receipt of money. • This term derives from the London banking business, which originally was transacted by goldsmiths.7

These notes were scientifically designed to bankrupt the government and slave the American people, as Alfred Owen Crozier warned one year before the bill for the creation of the FED was passed through Congress (1912):

If Congress yields and authorizes a private central bank as proposed by the pending bill, the end when the bubble bursts will be universal ruin and national bankruptcy.

Unfortunately, the bill was passed in 1913, and this private bank started printing a new currency different from the US dollar creating the great depression and effectible bankrupting the government like Alfred warned 20 years before.

Alfred also warned:

Thus the way is opened for an unlimited inflation of corporate paper currency issued by a mere private corporation with relatively small net assets and no government guarantee, every dollar supposed to be redeemable in gold, but with not a single dollar of gold necessarily held in the reserves of such corporation to accomplish such redemption.

Differently from what's commonly believed Federal Reserve Notes (FRNs) were never really “backed” by gold; they were never supposed to be hard currency. Currency backed by reserves, esp. gold and silver reserves.

The United States government defaulted on its gold clauses, calling for payment in gold. This marked the end of the gold standard. A monetary system in which currency is convertible into its legal equivalent in gold or gold coin.

Since then we have been under a paper standard, where we use fake money as tender for payments. Paper standard. A monetary system based entirely on paper; a system of currency that is not convertible into gold or other precious metal.

People traded their coupons as money or “currency.” Currency is not money but a money substitute. Redeemable currency must promise to pay a dollar equivalent in gold or silver money. Federal Reserve Notes (FRNs) make no such promises and are not “money.” A Federal Reserve Note is a debt obligation of the federal United States government, not “money.” The federal United States government and the U.S. Congress were not and have never been authorized by the Constitution of the United States of America to issue currency of any kind, but only lawful money—gold and silver coin.8

A bona fide note can be used in a financial transaction to discharge the debt only because it is an unconditional promise to pay by the issuer to the bearer. Is a Federal Reserve Note a contract note, an unconditional promise to pay? At one time the Federal Reserve issued bona fide contractual notes and certificates, redeemable in gold and silver coin. Most people never saw or comprehended the contract. It went largely unread because the Federal Reserve very cunningly hid the contract on the face of the note by breaking it up into five separate lines of text with a significantly different typeface for each line and placing the president’s picture right in the middle of it. They even used the old attorney’s ruse of obscuring the most important text in fine print! Over time, the terms and conditions of the contract were diluted until eventually they literally became an I.O.U. for nothing.

FEDERAL RESERVE NOTE

-

THIS NOTE IS LEGAL TENDER FOR ALL DEBT, PUBLIC AND PRIVATE, AND IT IS REDEEMABLE IN LAWFUL MONEY AT THE UNITED STATES TREASURY OR ANY FEDERAL RESERVE BANK.

-

DATE: SERIES OF 1934

-

WILL PAY TO THE BEARER ON DEMAND: ONE HUNDRED DOLLARS

-

TREASURER OF THE UNITED STATES SIGNATURE

-

SECRETARY OF THE TREASURY SIGNATURE

Nowadays FRNs say "This note is legal tender for all debts public and private" it tender debt but it does not pay the bearer on demand. It value was stolen by a counterfeiting technique commonly know as inflation.

One hundred dollars (SERIES OF 1934) will be 2480 grains of gold, or 159.4 grams, or 5.1249 troy ounces. Today one troy ounce is priced around $3,000 federal reserve notes. 5.1249 X 3,000 = $15,375 actual FRNs.

A $100 FRN bill today will buy 0.65% of a real gold $100 dollar certificate. That’s a -99.35% loss of purchasing power in the last 91 years.

FRNs savers have been rugged pulled!

Gold bugs where the winners...

But Bitcoin is even better...

Happy birthday Satoshi! April 5 will be forever remembered.

Satoshi... The man, the myth, the Legend...

-

@ 4d4fb5ff:1e821f47

2025-05-25 22:12:14

@ 4d4fb5ff:1e821f47

2025-05-25 22:12:14Numerical heatmap derived from biologically-sourced data. I reversed the process of scientific discovery by stripping away the context of data collected in four of my published experiments, leaving only single digits. This makes the table appear to include only unrelated, random numbers. However, since the numbers come from real world data, there remains meaningful hidden structure in the grid. This invites the viewer to participate in parsing signal from noise.

https://ordiscan.com/inscription/96817034

-

@ 4d4fb5ff:1e821f47

2025-05-25 22:11:07

@ 4d4fb5ff:1e821f47

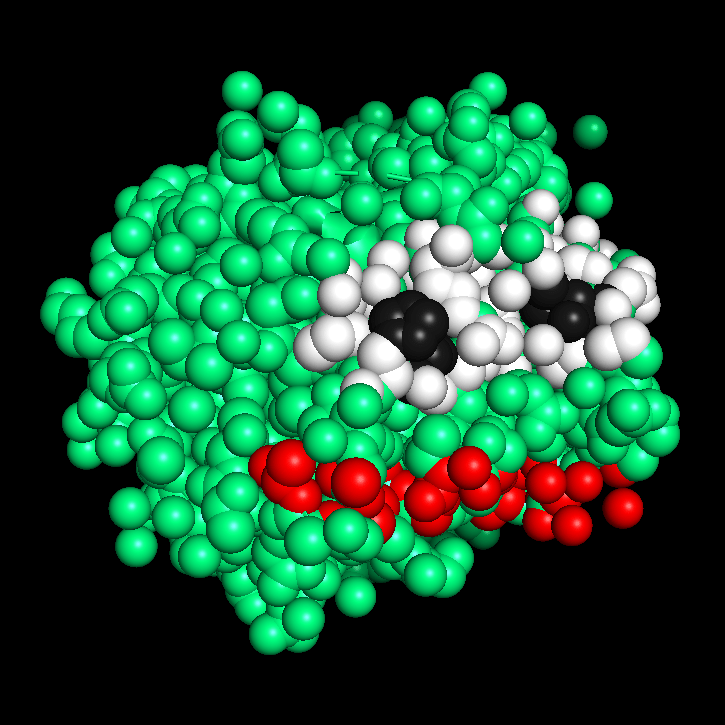

2025-05-25 22:11:07Snapshot of a 3D molecular structure. In bacteria, the enzyme Peptidase E (PepE) is encoded by the gene PEPE. PEPEDASE is an atomic view of PepE enzyme’s spatial architecture based on publicly available scientific data, visually arranged to pay homage to Pepe the Frog. I made this piece in support of Matt Furie’s #SavePepe movement.

https://ordiscan.com/inscription/96817644

-

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57

@ 52b4a076:e7fad8bd

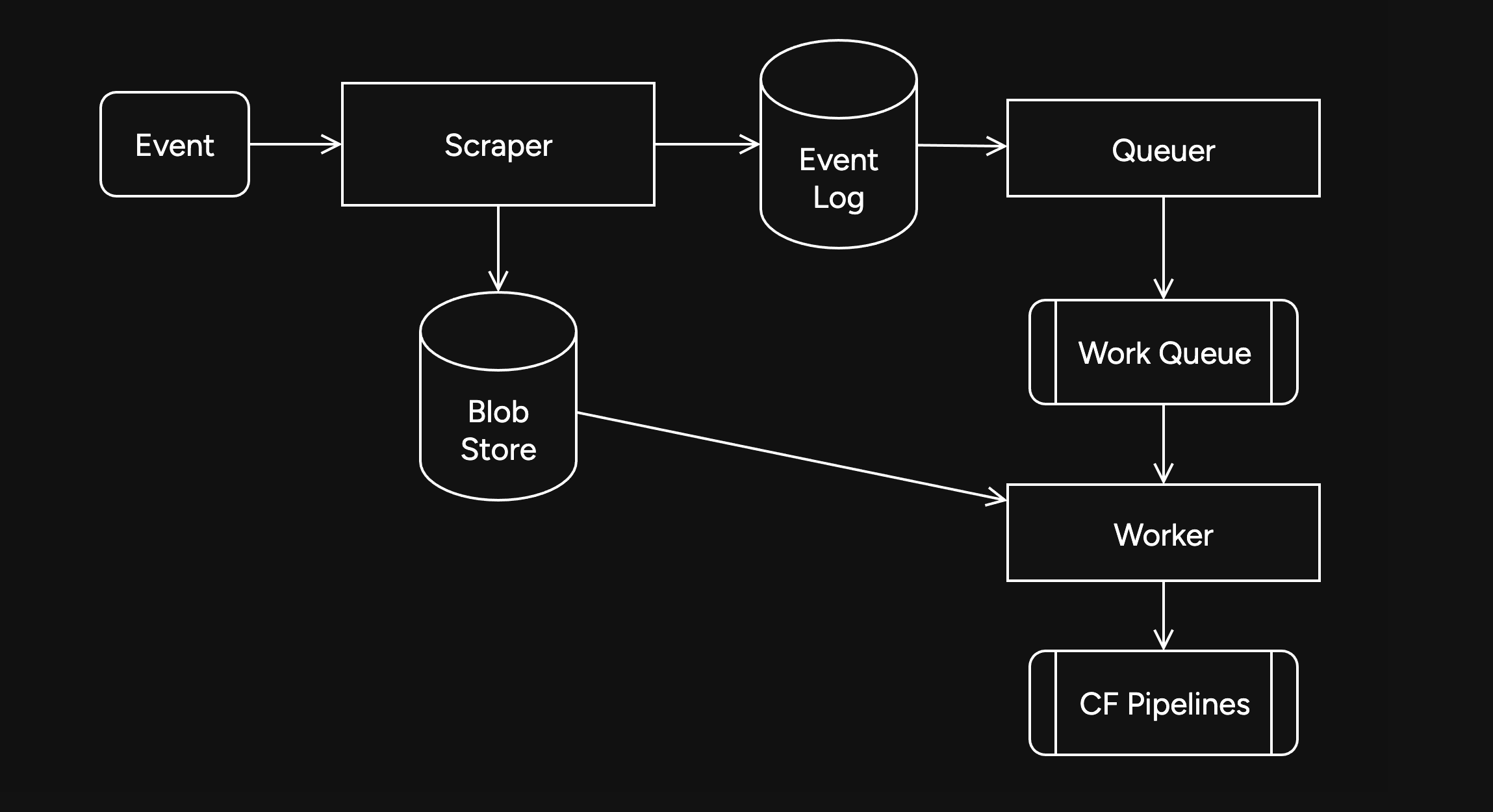

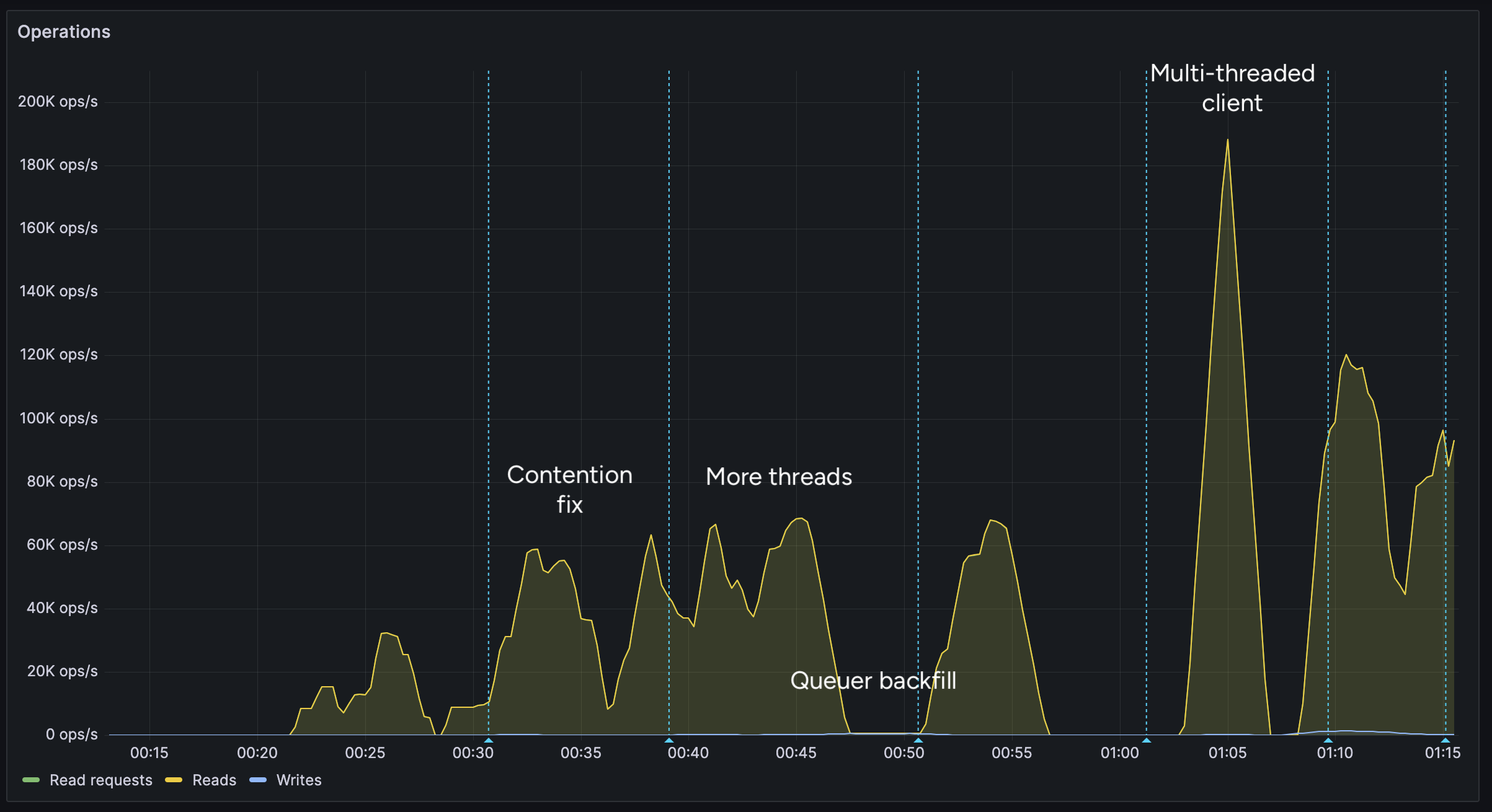

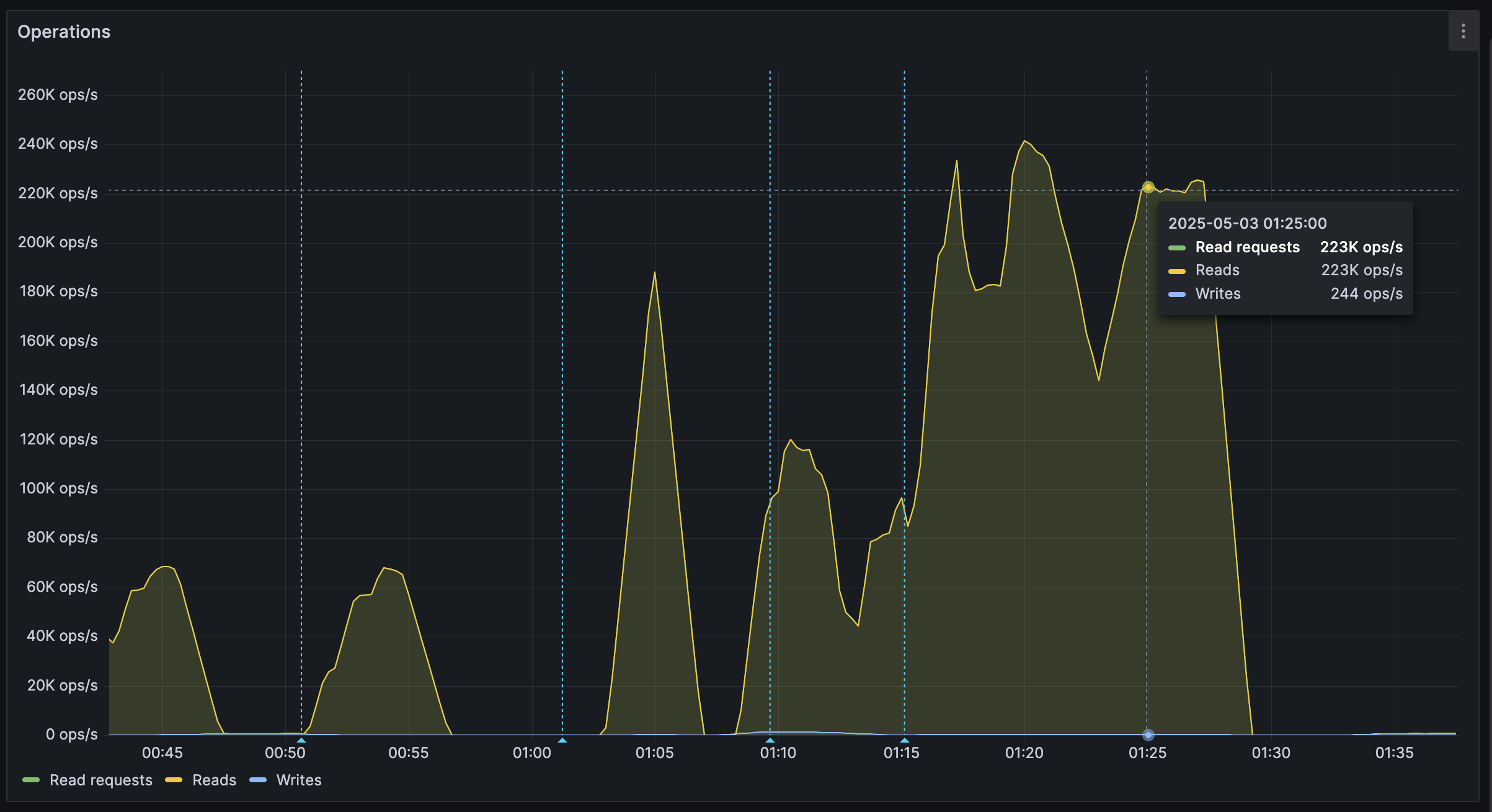

2025-04-28 00:48:57I have been recently building NFDB, a new relay DB. This post is meant as a short overview.

Regular relays have challenges

Current relay software have significant challenges, which I have experienced when hosting Nostr.land: - Scalability is only supported by adding full replicas, which does not scale to large relays. - Most relays use slow databases and are not optimized for large scale usage. - Search is near-impossible to implement on standard relays. - Privacy features such as NIP-42 are lacking. - Regular DB maintenance tasks on normal relays require extended downtime. - Fault-tolerance is implemented, if any, using a load balancer, which is limited. - Personalization and advanced filtering is not possible. - Local caching is not supported.

NFDB: A scalable database for large relays

NFDB is a new database meant for medium-large scale relays, built on FoundationDB that provides: - Near-unlimited scalability - Extended fault tolerance - Instant loading - Better search - Better personalization - and more.

Search

NFDB has extended search capabilities including: - Semantic search: Search for meaning, not words. - Interest-based search: Highlight content you care about. - Multi-faceted queries: Easily filter by topic, author group, keywords, and more at the same time. - Wide support for event kinds, including users, articles, etc.

Personalization

NFDB allows significant personalization: - Customized algorithms: Be your own algorithm. - Spam filtering: Filter content to your WoT, and use advanced spam filters. - Topic mutes: Mute topics, not keywords. - Media filtering: With Nostr.build, you will be able to filter NSFW and other content - Low data mode: Block notes that use high amounts of cellular data. - and more

Other

NFDB has support for many other features such as: - NIP-42: Protect your privacy with private drafts and DMs - Microrelays: Easily deploy your own personal microrelay - Containers: Dedicated, fast storage for discoverability events such as relay lists

Calcite: A local microrelay database

Calcite is a lightweight, local version of NFDB that is meant for microrelays and caching, meant for thousands of personal microrelays.

Calcite HA is an additional layer that allows live migration and relay failover in under 30 seconds, providing higher availability compared to current relays with greater simplicity. Calcite HA is enabled in all Calcite deployments.

For zero-downtime, NFDB is recommended.

Noswhere SmartCache

Relays are fixed in one location, but users can be anywhere.

Noswhere SmartCache is a CDN for relays that dynamically caches data on edge servers closest to you, allowing: - Multiple regions around the world - Improved throughput and performance - Faster loading times

routerd

routerdis a custom load-balancer optimized for Nostr relays, integrated with SmartCache.routerdis specifically integrated with NFDB and Calcite HA to provide fast failover and high performance.Ending notes

NFDB is planned to be deployed to Nostr.land in the coming weeks.

A lot more is to come. 👀️️️️️️

-

@ c9badfea:610f861a

2025-05-25 21:03:23

@ c9badfea:610f861a

2025-05-25 21:03:23- Install AnkiDroid (it's free and open source)

- Launch the app, tap Get Started, then tap ≡ and select Settings

- Select Sync and disable Display Synchronization Status

- Return to the main screen

- Create and download flashcard decks (see links below)

- Tap ⁝, then Import, then Deck Package (.apkg), select the file and tap Add

- Select Import

- Wait for the import to finish and start learning!

Some Flashcard Deck Sources

ℹ️ On GrapheneOS, you may need to enable the Network (used for localhost access) and Read And Write To The AnkiDroid Database permissions.

ℹ️ Also check this article on formulating knowledge

-

@ eb0157af:77ab6c55

2025-05-25 21:01:28

@ eb0157af:77ab6c55

2025-05-25 21:01:28Vivek Ramaswamy’s company bets on distressed bitcoin claims as its Bitcoin treasury strategy moves forward.

Strive Enterprises, an asset management firm co-founded by Vivek Ramaswamy, is exploring the acquisition of distressed bitcoin claims, with particular interest in around 75,000 BTC tied to the Mt. Gox bankruptcy estate. This move is part of the company’s broader strategy to build a Bitcoin treasury ahead of its planned merger with Asset Entities.

According to a document filed on May 20 with the Securities and Exchange Commission, Strive has partnered with 117 Castell Advisory Group to “identify and evaluate” distressed Bitcoin claims with confirmed legal judgments. Among these are approximately 75,000 BTC connected to Mt. Gox, with an estimated market value of $8 billion at current prices.

Essentially, Strive aims to acquire rights to bitcoins currently tied up in legal disputes, which can be purchased at a discount by those willing to take on the risk and wait for eventual recovery.

In a post on X, Strive’s CFO, Ben Pham, stated:

“Strive intends to use all available mechanisms, including novel financial strategies not used by other Bitcoin treasury companies, to maximize its exposure to the asset.”

The company also plans to buy cash at a discount by merging with publicly traded companies holding more cash than their stock value, using the excess funds to purchase additional Bitcoin.

Mt. Gox, the exchange that collapsed in 2014, is currently in the process of repaying creditors, with a deadline set for October 31, 2025.

In its SEC filing, Strive declared:

“This strategy is intended to allow Strive the opportunity to purchase Bitcoin exposure at a discount to market price, enhancing Bitcoin per share and supporting its goal of outperforming Bitcoin over the long run.”

At the beginning of May, Strive announced its merger plan with Asset Entities, a deal that would create the first publicly listed asset management firm focused on Bitcoin. The resulting company aims to join the growing number of firms adopting a Bitcoin treasury strategy.

The corporate treasury trend

Strive’s initiative to accumulate bitcoin mirrors that of other companies like Strategy and Japan’s Metaplanet. On May 19, Strategy, led by Michael Saylor, announced the purchase of an additional 7,390 BTC for $764.9 million, raising its total holdings to 576,230 BTC. On the same day, Metaplanet revealed it had acquired another 1,004 BTC, increasing its total to 7,800 BTC.

The post Bitcoin in Strive’s sights: 75,000 BTC from Mt. Gox among its targets appeared first on Atlas21.

-

@ fd208ee8:0fd927c1

2024-12-26 07:02:59

@ fd208ee8:0fd927c1

2024-12-26 07:02:59I just read this, and found it enlightening.

Jung... notes that intelligence can be seen as problem solving at an everyday level..., whereas creativity may represent problem solving for less common issues

Other studies have used metaphor creation as a creativity measure instead of divergent thinking and a spectrum of CHC components instead of just g and have found much higher relationships between creativity and intelligence than past studies

https://www.mdpi.com/2079-3200/3/3/59

I'm unusually intelligent (Who isn't?), but I'm much more creative, than intelligent, and I think that confuses people. The ability to apply intelligence, to solve completely novel problems, on the fly, is something IQ tests don't even claim to measure. They just claim a correlation.

Creativity requires taking wild, mental leaps out into nothingness; simply trusting that your brain will land you safely. And this is why I've been at the forefront of massive innovation, over and over, but never got rich off of it.

I'm a starving autist.

Zaps are the first time I've ever made money directly, for solving novel problems. Companies don't do this because there is a span of time between providing a solution and the solution being implemented, and the person building the implementation (or their boss) receives all the credit for the existence of the solution. At best, you can hope to get pawned off with a small bonus.

Nobody can remember who came up with the solution, originally, and that person might not even be there, anymore, and probably never filed a patent, and may have no idea that their idea has even been built. They just run across it, later, in a tech magazine or museum, and say, "Well, will you look at that! Someone actually went and built it! Isn't that nice!"

Universities at least had the idea of cementing novel solutions in academic papers, but that: 1) only works if you're an academic, and at a university, 2) is an incredibly slow process, not appropriate for a truly innovative field, 3) leads to manifestations of perverse incentives and biased research frameworks, coming from 'publish or perish' policies.

But I think long-form notes and zaps solve for this problem. #Alexandria, especially, is being built to cater to this long-suffering class of chronic underachievers. It leaves a written, public, time-stamped record of Clever Ideas We Have Had.

Because they are clever, the ideas. And we have had them.

-

@ eb0157af:77ab6c55

2025-05-25 21:01:20

@ eb0157af:77ab6c55

2025-05-25 21:01:20Banking giants JPMorgan, Bank of America, Citigroup, and Wells Fargo are in talks to develop a unified stablecoin solution.

According to the Wall Street Journal on May 22, some of the largest financial institutions in the United States are exploring the possibility of joining forces to launch a stablecoin.

Subsidiaries of JPMorgan, Bank of America, Citigroup, and Wells Fargo have initiated preliminary discussions for a joint stablecoin issuance, according to sources close to the matter cited by the WSJ. Also at the negotiating table are Early Warning Services, the parent company of the digital payments network Zelle, and the payment network Clearing House.

The talks are reportedly still in the early stages, and any final decision could change depending on regulatory developments and market demand for stablecoins.

Stablecoin regulation

On May 20, the US Senate voted 66 to 32 to advance discussion of the Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act), a specific law to regulate stablecoins. The bill outlines a regulatory framework for stablecoin collateralization and mandates compliance with anti-money laundering rules.

David Sacks, White House crypto advisor, expressed optimism about the bill’s bipartisan approval. However, senior Democratic Party officials intend to amend the bill to include a clause preventing former President Donald Trump and other US officials from profiting from stablecoins.

Demand for stablecoins has increased, with total market capitalization rising to $245 billion from $205 billion at the beginning of the year, a 20% increase.

The post Major US banks consider launching a joint stablecoin appeared first on Atlas21.

-

@ 8671a6e5:f88194d1

2025-05-25 20:38:25

@ 8671a6e5:f88194d1

2025-05-25 20:38:25#### Dit is een reactie op dit artikel Dit is een reactie op dit artikel\ --\ Geachte redactie van De Tijd,

Met teleurstelling las ik uw recente artikel waarin Bitcoin onterecht wordt omschreven als een "hot wallet", en waarin de meldplicht voor de fiscus onnauwkeurig wordt voorgesteld.\ Maar wat vooral schrijnend is (naast het gebrek aan kennis inzake Bitcoin) is de lichte zweem van "onbehagen" die er omheen werd geweven.

Bitcoin is geen hot wallet, maar een gedecentraliseerd netwerk met bewezen digitale schaarste – hard money. Een "hot wallet" is eenvoudig gezegd een internet-verbonden opslagmethode voor bitcoin, zoals een app op een smartphone, terwijl een cold wallet offline private sleutels bewaart. Dit onderscheid is essentieel voor correcte berichtgeving, maar werd helaas onvoldoende uitgelegd aan uw lezers.

Daarnaast schetst het artikel een misleidend beeld van de meldplicht. \ Volgens de Belgische wetgeving moeten Belgische belastingplichtigen buitenlandse rekeningen melden bij het CAP en jaarlijks in hun belastingaangifte. De juridische status van zulke exchange in de EU-"junta" zone, is daarbij van belang. Dat werd in het artikel gewoon onder de mat geveegd zonder enige nuance.\ \ De Belgische fiscus biedt na zestien jaar trouwens nog steeds geen adequate manier om bitcoin bezit correct aan te geven, zoals een veld voor xpub- of zpub-sleutels (mensen die dit correct willen aangeven worden geconfronteerd met een gebrek aan kennis die overal in België op eenzelfde bedroevend laag niveau zit,... hier hebben we al vaker voorbeelden van gezien).\ \ Vertrouwen op zulke instanties om je cold-storage holdings te melden, is vragen om problemen. Toch meldt uw krant dat je dat maar beter WEL doet.\ Er is echter GEEN verplichting om non-custodial wallets aan te tegen. Het gaat hier voor alle duidelijkheid over bitcoin UTXO's waar de houder zelf in het bezit is van de eigen sleutels, ... echte bitcoin dus:)... \ Zulk hard money spontaan melden bij een instantie die daar niet klaar voor is, kan onnodige administratieve lasten opleggen zonder juridische basis en bovendien ook andere problemen veroorzaken. \ Dit advies van De Tijd, lijkt eerder ingegeven door overdreven voorzichtigheid, dan dan door een wettelijke verplichting. Maar vooral moet het een sfeertje scheppen alsof alle bitcoin houders die NIET via een gecapteerde derde partij werken (een exchange of een service) blijkbaar "louche" zijn. \ Dan kunnen we meteen ook iedereen die een waardevol schilderij in de privé woning heeft hangen "louche" noemen, om maar te zwijgen over fake-NGO's en dure wijn collecties niet?

Uw artikel schept naast het etaleren van een gebrek aan kennis inzake bitcoin, bovendien een sfeer van criminalisering, waarbij uw artikel gewag maakt van het oude refrein: “Wie niets te verbergen heeft...” \ Komaan, dit argument is intussen doorzichtig en dient enkel om mensen bang te maken en totalitaire controle als ‘normaal’ te doen aanvaarden. \ Net zoals de wildgroei aan flitspalen en de in oktober uit te rollen CBDC "Digitale Euro", die in essentie een programmeerbare, makkelijk uitschakelbare nep-euro zal zijn (een slechtere vorm van een kermis-jeton).

Het blijft vreemd dat er in De Tijd – net als bij andere mainstream media – zelden of nooit ruimte is voor een kritische stem hierover... het zal niet in de kraam passen.\ Net zoals het niet in de kraam past om de lamentabele BEL20 performantie of de laakbare promotie van rommel-aandelen op TV aan de kaak te stellen, of de huizenmarkt-zwendel eens een welverdiende kritiek te geven. Kritiek of nuances hierover zijn ook ... uit den boze.\ Neen, bij De Tijd gaan we het altijd op veilig spelen, en de paar mensen die de krant nog betalend lezen vooral niet wijzer maken?\ \ Er was nochtans goede hoop op meer en betere berichtgeven over bitcoin. Maar die hoop smelt zienderogen weg.

Het artikel plaatst bitcoin gebruikers impliciet in het kamp van potentiële overtreders, wat bijdraagt aan een negatieve en onterechte criminalisering. \ Dit patroon, ook zichtbaar in media zoals De Morgen en De Standaard, vertroebelt elementaire kennis en benadeelt uw betalende abonnees door hen foutieve en onvolledige informatie te verstrekken over het best presterende activum van het afgelopen decennium – en over de unieke rol van bitcoin als alternatief voor de steeds verder wegsmeltende koopkracht en waarde van fiat-munten van oude staten en unies.

Ik hoop dat u uw verantwoordelijkheid opneemt om abonnees objectief en feitelijk correct te informeren, zodat zij de échte opportunity cost van hun keuzes kunnen inschatten – een kost die, ironisch genoeg, met elk jaarabonnement verder oploopt.

Wie sinds 2015 maandelijks €50 aan bitcoin had gekocht in plaats van een abonnement op De Tijd te nemen, heeft zich alvast niet laten misleiden door uw doemverhalen en onjuiste informatie over dit activum. En het verschil in rendement is, op z’n zachtst gezegd, significant.

Jammer maar helaas, "De Tijd" lijkt anno 2025 nog steeds niet in staat om systematisch correct te berichten over "de" Bitcoin.\ \ Een paar Anonieme Bitcoiners

-

@ 3c559080:a053153e

2025-05-25 20:26:43

@ 3c559080:a053153e

2025-05-25 20:26:43So firstly you should find an emulator for whatever you want to play on. There are many for desktop and mobile devices. Checkhere for a list of all the available consoles and their various emulators.

Next what game do you want to play? This is the like the homepage for a shit ton of roms.

Some of the more popular roms are there and other various list like Sony Nintendo

After narrowing down your selection you will end up on myrient i assume this is just some dope person hosting all these so if you get some use out of it, think of donating they even take corn, but other shitcoins too (but thats not the focus here)

Once you download the Rom of the game you want, you will get a compressed (zip) folder, unzip it and within it will be the rom, most systems will identify your emulator and use it open the game. If not, launch the emulator and within it should be an option to open a file, open the file in the unzipped folder.

Enjoy So you want to Mod?

So every Mod, is a mod for a specific game [ex. Pokemon Blue, Pokemon FireRed, Super Mario Bros.] so it requires you to get the Rom for that base game, the mod itself, and a tool to patch it.

There is an online tool to easily patch the mod to the ROM. IMPORTANT, this will not change any naming, Id recommend having a folder with the base game roms, and a folder for the mods, and lastly a folder for the newly modded roms. Make sure to name or just save the game in modded roms folder after the patch.

There is an online tool to easily patch the mod to the ROM. IMPORTANT, this will not change any naming, Id recommend having a folder with the base game roms, and a folder for the mods, and lastly a folder for the newly modded roms. Make sure to name or just save the game in modded roms folder after the patch. Below are a few resource to find various Pokemon Rom mods(sometimes called hacks)

Personally, Pokemon Unbound is considered the best most polished hack. it runs on Pokemon Fire Red.

Pokemon Emerald Rouge is a cool take on the popular Rougelite genre. This runs on base game Pokemon Emerald

-

@ bf47c19e:c3d2573b

2025-05-25 19:44:15

@ bf47c19e:c3d2573b

2025-05-25 19:44:15Originalni tekst na graduallythensuddenly.xyz

Autor: Parker Lewis

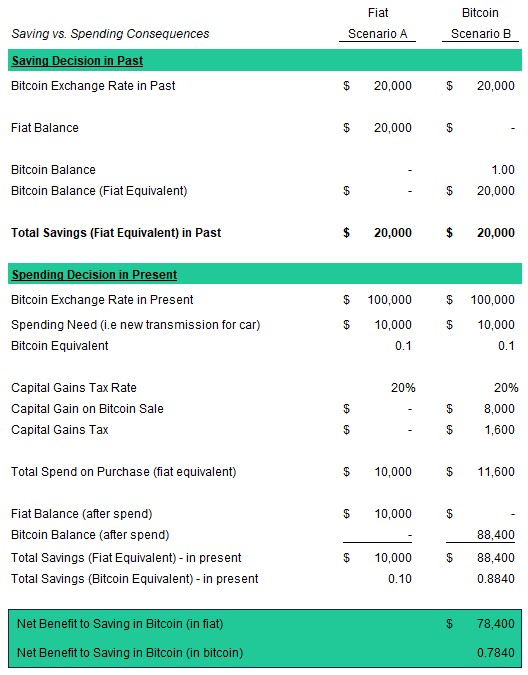

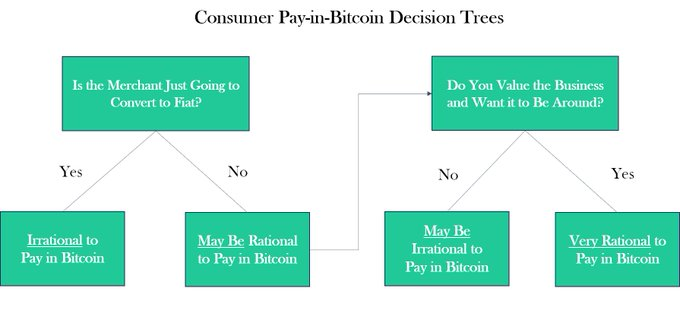

Bitkoin raste zauvek i kupovina stvari Bitkoinom je savršeno logična. Ove dve tvrdnje nisu suprotstavljene. Ovo je važno zato što mnogo ljudi (možda i većina) misli da je trošenje Bitkoina iracionalno. Zašto oni misle tako? Postoji kombinacija razloga:

- Ukoliko Bitkoin raste, zašto biste ikada želeli da se rastanete od njega? Ako cena raste i vi ga potrošite, ostajete bez budućih "dobitaka".

- Postoje poreske posledice kada kupujete Bitkoinom. Kada kupite nešto za Bitkoin, postoji porez na kapitalnu dobit zato što se to tretira kao da ste ga prodali, iz poreskih razloga (tako da tada plaćate više).

Ništa od ovoga nije racionalni razlog da ne potrošite Bitkoin. Zašto?

-

Prvi zaključak je iracionalan zato što se radi o drugačijoj dilemi od one na koju mislite. Ona se zapravo odnosi na svaku odluku u vezi sa potrošnjom ili štednjom, bez obzira da li trošite Bitkoin ili fiat novac. Na primer, ukoliko trošite fiat, mogli ste da se odreknete te potrošnje i umesto toga uštedite taj iznos u Bitkoinu. Vaša ekonomska računica je posve drugačija kada ste suočeni sa dilemom da li da potrošite novac fiksne količine u odnosu na novac koji konstantno gubi vrednost. Tačno je da se, bez obzira da li se odlučite (ili ne) da potrošite Bitkoin, radi o boljem testu potrošnje od štednje ili trošenja fiata. Ali svi moramo da svakodnevno trošimo novac.

-

Drugi zaključak je iracionalan zato što kapitalni dobitak ostvarujete samo u slučaju kada vaš novac dobije na vrednosti. Drugim rečima, kapitalni dobitak ste ostvarili samo ako vaš novac nije izgubio kupovnu moć. Da, bilo bi bolje kada bi promena politike dovela do ukidanja poreza na kapitalnu dobit na sve Bitkoin transakcije, ali to što plaćate porez na kapitalnu dobit ne znači da je stvar koju kupujete skuplja. Kako je to moguće? Zato što vi sada zapravo imate više novca nego u slučaju da ste izabrali put štednje u fiatu. Skuplje je štedeti u fiatu i trošiti u fiatu. Matematika je ubedljiva, a samim tim i logika.

Osnova rešavanja ove logičke dileme: ako mislite da je trošenje Bitkoina iracionalno, onda verovatno imate previše fiat novca. I pre nego što odemo dalje, volatilnost jeste stvarna. Njome morate upravljati. Ako je vaše razumevanje Bitkoina ograničeno, vaša sposobnost tolerancije prema volatilnosti Bitkoina je neminovno manja od nekoga ko je godinama štedeo u Bitkoinu i ko ima mnogo iskustva u upravljanju volatilnošću (i poseduje veće znanje o Bitkoinu od vas). Tako da ono što ću pokušati da objasnim, iako je 100% logično, ne odnosi se na svakoga zato što svačije znanje o Bitkoinu nije jednako, kao što nije jednaka ni svačija sposobnost da se toleriše volatilnost.

Sada možemo razmotriti nekoliko uporednih primera. Ukoliko imate 99% svoje štednje u fiatu (obliku novca koji gubi na vrednosti zato što se može sa lakoćom štampati) i 1% u Bitkoinu (obliku novca ograničene količine koji se ne može štampati), jeste veoma logično da štedite u Bitkoinu i trošite vaš fiat novac. Imate mnogo više fiata nego što imate Bitkoina. Ali ako imate 99% štednje u Bitkoinu i samo 1% u fiatu, bićete voljni da trošite Bitkoin. Pošto ste štedeli svoj novac u Bitkoinu koji čuva vrednost tokom vremena, nalazite se u boljoj poziciji od osobe koja je štedela u fiat novcu.

Hajmo da odemo u još veću krajnost da bismo izveli logičan zaključak, pre svega u vezi sa dve lažne ekonomske dileme. Pretpostavimo da imate 100% vaše štednje u Bitkoinu i 0 % u fiatu. Vi po definiciji morate da trošite tako da ste prinuđeni da trošite Bitkoin. Morate ga trošiti, bilo da kupujete proizvode i usluge direktno za Bitkoin, bilo da prodajete Bitkoin za fiat kojim ćete onda kupovati proizvode i usluge. Prva dilema je poništena. Ne radi se o tome da li treba da trošite Bitkoin. Radi se o tome da li uopšte treba da trošite (npr. da li je ono na šta trošite novac dobra potrošačka odluka).

Svi imamo i potrebe I želje. I jedno i drugo je validno. Život je kratak. Nikada ne trošiti novac je visoka vremenska preferencija. Ali nisu sve potrošačke odluke dobre odluke. U nekim slučajevima bi trebalo da štedite. Ali u oba slučaja, ako se radi o dobroj potrošačkoj odluci (o čemu samo vi odlučujete), dilema u vezi sa budućim rastom cene Bitkoina je poništena. Na primer, gotovo celokupna moja štednja je u Bitkoinu. Bila mi je neophodna popravka menjača na automobilu. Oko toga nije postojala dilema. Morao sam da popravim menjač i, s obzirom na to koliko malo fiat novca držim, bio sam prinuđen da potrošim Bitkoin. Nije mi bilo bitno da li će Bitkoin "rasti" u budućnosti. Bio mi je potreban moj automobil. U ovom konkretnom slučaju, prodao sam Bitkoin za fiat novac, zatim potrošio fiat, pa sam nabavio novi menjač kako ne bih morao svuda da pešačim.

Ovo nas sada vraća na drugu lažnu ekonomsku dilemu broj 2: kapitalne dobitke. Ukoliko pratite logiku, posledica kapitalnog dobitka je istovremeno i stvarna i nevažeća za dilemu rastanka sa Bitkoinom. Da bih ovo pokazao, zapravo ću proći kroz ekonomsku matematiku. Ovde dolazi do izražaja onaj zaključak da imate previše fiat novca ukoliko mislite da je trošenje Bitkoina iracionalno. Scenario A: tokom vremena štedite više u fiat novu i trošite fiat. Scenario B: tokom vremena štedite u Bitkoinu i trošite Bitkoin. Ovaj primer pretpostavlja ekstremne slučajeve da bi se naglasio ekonomski argument. 100% ušteđevine u fiatu naspram 100% ušteđevine u Bitkoinu:

Ekonomija štednje i trošenja u fiat novcu naspram štednje i trošenja u Bitkoinu

Tako da ono što ste smatrali dilemom o trošenju Bitkoina je zapravo dilema o štednji fiat novca. Štednja i potrošnja su suštinski povezane i, bez obzira na krajnosti (ili alokaciju), ekonomske posledice (izbora štednje u novcu koja gubi na vrednosti naspram štednje u novcu koji čuva kupovnu moć) se ne menjaju. U praktičnijem primeru, cene proizvoda i usluga "rastu" od sadašnjosti prema budućnosti kada su izražene u fiat valuti (fiat inflacija) tako da vam je potreban novac koji čuva kupovnu moć da biste se odbranili od obezvređivanja fiat novca. Ali štaviše, vaša dilema o trošenju je zapravo dilema o štednji i u stvarnom svetu ste ostvarili kapitalni dobitak koji treba da platite samo ako je vaša fiat štednja izgubila na vrednosti.

Sada mnogi od vas možda misle, "zašto jednostavno ne založite Bitkoin i pozajmite dolare koje ćete trošiti". Ovde se radi o potpuno drugačijoj ekonomskoj računici koja ne menja ništa u vezi sa matematikom ili ekonomskom logikom trošenja Bitkoina. To je samo dodavanje još jednog sloja na vrh. Da li možete potencijalno finansijski osmisliti bolji ishod preuzimanjem leveridža i duga i tako zakomplikovati svoj život? Možda. Ali to ne menja I) dilemu o potrošnji naspram štednje, II) posledice budućeg rasta Bitkoina (zato što ste mogli i da kupite Bitkoin sa leveridžom), ili III) posledice kapitalnog dobitka (koje su samo vremenski pomerene iz sadašnjosti u budućnost).

Suština je da je ekonomski pogled da je trošenje Bitkoina iracionalno - matematički nedosledan. Zapravo se radi o dilemi o štednji i vi jednostavno držite previše fiat novca. Ovde postoje i drugi logični razlozi za trošenje Bitkoina koje ću izložiti ali ih neću detaljnije objašnjavati (to ću učiniti u budućem članku).

- Ako niko ne troši Bitkoin, neće postojati ni alati za trošenje Bitkoina i kada fiat novac propadne, svima će biti potrebni ti alati zato što će Bitkoin biti jedina valuta koja funkcioniše.

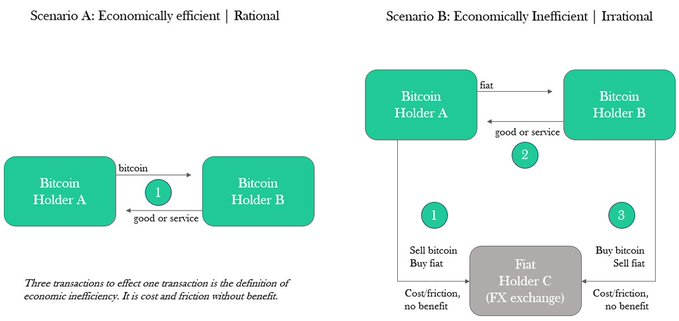

- Ukoliko neki biznis želi da bude isplaćen u Bitkoinu, kupac poseduje Bitkoin za trošenje, trošenje fiat novca donosi nepotreban transakcioni trošak što dovodi do ekonomske neefikasnosti (veći trošak bez benefita)

Efikasnost Bitkoin transakcije između korisnika

- Ako cenite neki biznis (tj. proizvode i usluge koje vam omogućava) i želite da taj biznis opstane (da bi vam i dalje isporučivao proizvode i usluge), ako taj biznis želi da bude isplaćivan u Bitkoinu i ako vi razumete Bitkoin - u vašem je interesu da trošite Bitkoin zato što znate da će i taj biznis napredovati ako to učinite, a to omogućava i vaš napredak jer cenite proizvode i usluge tog biznisa.

Zaključak je da je trošenje Bitkoina lažna dilema. To je zapravo dilema o štednji. Matematika to i dokazuje. Ako se držite ove iracionalne pozicije (koja je iracionalna samo ako razumete Bitkoin zato što je volatilnost stvarna), onda verovatno imate previše fiat novca. Ipak, moram da naglasim da ovo nije molba da potrošite svoj Bitkoin. Ne postoji moralni imperativ za trošenje Bitkoina. Svaki Bitkoin (i satoši) je dragocen. Kada god trošite (ili investirate), potrudite se da trošite mudro jer je to ono što je zaista važno.

Do sledećeg puta. Srdačan pozdrav, Parker

-

@ c9badfea:610f861a

2025-05-25 19:40:48

@ c9badfea:610f861a

2025-05-25 19:40:48- Install Currencies (it's free and open source)

- Launch the app, tap ⋮ and select Settings

- Enable the Foreign Transaction Fee to factor in conversion fees if necessary

- Tap Data Provider and choose another provider if necessary

- Enjoy ad-free conversion rates

ℹ️ Tap 📈 to open the exchange rate chart

-

@ 28ca019b:93fcb2cc

2025-05-25 19:25:17

@ 28ca019b:93fcb2cc

2025-05-25 19:25:17Introduction

“There is nothing more powerful than an idea whose time has come.” -Victor Hugo

Early 1950’s America. Harry S. Truman is in office. The economy is booming and the middle class are comfortable. Shiny new television sets invite the first scenes of Hollywood into people’s homes. The Weavers, Tony Bennett, Vera Lynn and Perry Como play on the radio.

But on the fringes, in dance halls and late night clubs, a cultural revolution is brewing… A new musical fusion with influences from blues, R\&B, jazz, rockabilly, country and gospel music is about to give birth to not only a new genre, but a whole new way of life that will change society and culture, forever.

Rock & Roll

It becomes a symbol of freedom, a means of expression, and a catalyst for social change. It brings into existence a new type of counter-culture, filled with individuals who are driven to rebel against norms and authority. They don’t ask for permission. They push for change.

I believe we are witnessing such a shift now. And like rock & roll, the movement I’m speaking of is also ground up, grass roots, punk rock and will not look to authority to seek permission. The catalyst for this new social change, I believe, is Bitcoin. With its innate properties, it empowers and enables the individual like never before to achieve their fullest potential, expressed through an unprecedented freedom technology. It is an idea, like a song everyone can sing in their own way, that nobody can silence.

Revolution

"You say you got a real solution / Well you know / we’d all love to see the plan" -John Lennon

The rock & roll era helped bring about meaningful societal change through art, music, and film. It created a new social narrative. Today, the Bitcoin network is providing people with a different set of tools and ideas to build a better future in a much more practical and pragmatic way. Instead of trying to reshape social consensus and cultural norms through art forms, fashion, or lifestyle, bitcoin is achieving this through open source code.

For the first time, this technology gives individuals financial sovereignty and personal control over their own destiny, with the ability to self custody their own money that no corporation, government, dictator or king can tamper with. The individual has an opportunity to finally be freed from economic tyranny. And societies have the potential to avoid endless wars funded with printed government money. John Lennon said ‘give peace a chance’. If he were still here today and understood how bitcoin could subvert the military industrial complex would he not exclaim, ‘give bitcoin a chance’?

Natural Rights, Civil Rights, Digital Rights

"The times they are a-Changin’" -Bob Dylan

The civil rights movement was tightly interwoven with the history of rock & roll. The march on Washington, August 28th 1963, marked a seminal moment in American history for the advancement of equal rights before the law. Bob Dylan, along with Joan Baez, stood with over two hundred thousand other Americans and listened to Martin Luther King’s now immortal speech.

People with the same values peacefully gathered in numbers to make a statement powerful enough to change the conversation. This is analogous to the same freedom-minded people today gathering in cyberspace and voting not in the traditional sense, but voting with their money – peacefully exiting and transferring their economic energy into a system where they can’t be expropriated.

The question of whether individual rights are granted or have to be secured by each individual remains a contested area of philosophy to this day. To outline each in a very crude and simplistic way, natural rights (sometimes referred to as inalienable rights) are derived from the belief that every person owns their own body, therefore their own labor, time, and energy. Civil rights, on the other hand, are granted by the state and are therefore not universal. The fact that they are rights granted to humans by other humans means they always have the potential to be revoked or withdrawn.

Digital rights granted by the power of asymmetric cryptography are based in the laws of mathematics. Combined with proof of work, based in the law of thermodynamics, this makes digital rights that bitcoin provides more akin to natural rights than civil rights, as no one person or group can unilaterally revoke those rights or confiscate your property through violence. No amount of fire power, tanks, fighter jets or nuclear weapons can break a bitcoin private key or rewrite the sunken cost of proof of work embedded into bitcoin’s timechain. This idea of securing rights without asking permission is, in itself, a revolution and achievable now in an egalitarian way. This implies a potentially huge shift in power from those with a monopoly on violence, to peaceful individuals who want to be treated fairly and with dignity.

Cypher Punk-Rock

Songwriters write songs. Cypherpunks write code.

To tie things back and look at a very narrow, but potentially huge use case of bitcoin, let’s examine the current broken incentives of the music industry, particularly recorded music. It is becoming increasingly apparent that an option other than a subscription model could find demand from content consumers and producers alike.

There is now a way, with Bitcoin and Lightning Network, for a music fan to pay artists directly and for any amount – dollars, cents or even fractions of cents. This model has positive outcomes for the music producer and fan who are the main two parties engaged in the transaction. The artist keeps all of what is sent and the listener can pay what they want. The listener can pay as they listen, rather than be locked into a rolling subscription that isn’t based on usage. This concept, called ‘value for value’, is finding its way into new music platforms such as Wavlake and Fountain. I believe this model will become the de-facto way of monetizing digital content in the coming years. This could bring an economic signal back to music that has been lost and cannot be achieved by streams alone. This will hopefully create a more meritocratic music system and shake up the entrenched streaming monoliths.

Art can shine a light on a certain truth. It can also make people look at things in a completely new way. Maybe then, Satoshi was the greatest artist who ever lived. Bitcoin smashed the conventional wisdom and theories of the most basic and prevalent thing everyone takes for granted: money. Using money as a lens to view the world can lead to distortions in your perception if the lens is warped. Removing the glasses makes you reevaluate economics, politics, religion, philosophy, morality, beauty, and almost every other aspect of life. The beauty of the Sistine Chapel, the Egyptian pyramids, the Mona Lisa, Beethoven’s 5th Symphony, Bohemian Rhapsody all intrinsically imply a certain degree of proof of work. The art, you could say, speaks for itself.

The Long and Winding Road Ahead

As a musician, I have found a new hope. The value for value movement gives me that hope. If this is truly a superior model of music distribution and consumption it will win out over time on the market.

Another point to touch on would be the possibility of this technology ushering in an artistic renaissance. I can honestly say my favorite music, the songs that have moved me the most, normally comes from a place of truth, honesty and sheer talent. Maybe I’m out of touch, but I feel popular music of late is devoid of soul, meaning and the biggest mainstream artists want to conform to the man (giant corporations/governments) instead of stick it to the man! Probably because there is nowhere else to turn now that streaming and social media platforms own their speech and art. We need to investigate and embrace new ways to own our speech and art, to make art interesting again. The powers that be, need to let it be, and leave alone individuals who wish to use this technology for their own interests if they do so in a peaceful way.

I want to leave you with a Frank Zappa quote that seems more relevant than ever:

“I’d say that today, dishonesty is the rule, and honesty the exception. It could be, statistically, that more people are honest than dishonest, but the few that really control things are not honest, and that tips the balance…”

My charitable view is that the majority of people in power aren’t corrupt, it’s rather just a case of ‘no one is better than their incentives’. But when incentives are misaligned bad outcomes will inevitably result. With bitcoin and its incorruptible incentive structure, we have a chance to peacefully opt-out of a rigged game. I urge you to not trust, but verify with your own research that bitcoin is the answer to many of society’s current problems.

I think it’s fair to say, we all need to question ourselves and authority a little more than we’re comfortable doing, to hold truth as an ideal worth striving for, and live a little more rock & roll!

Link to original article**

-

@ 58537364:705b4b85

2025-05-25 16:31:56

@ 58537364:705b4b85

2025-05-25 16:31:56People often only realize the value of something in two situations: First, before they have it. Second, after they’ve lost it.

This is a tragedy that happens to many. People may have good things in their lives, but they don’t see their worth— because they’re always looking outward, focusing on what they don’t have, wishing for something else.

It’s similar to Aesop’s fable about the dog and the piece of meat. We probably remember it from childhood: A dog had a big piece of meat in its mouth. Delighted, it ran to a quiet place where it could enjoy the meat in peace.

At one point, it had to cross a bridge. Looking down into the stream below, it saw its reflection— but mistook it for another dog with an even bigger piece of meat. It wanted that bigger piece badly, so it opened its mouth to snatch it— and the meat in its own mouth fell into the water. The reflection disappeared too.

In the end, it lost both.

So, if we learn to value what we already have, happiness comes easily. It might not be possessions or people— it might simply be our health.

It could be as simple as our breath, the ability to breathe normally, to walk around freely, to see, to hear.

Many people already have these things but don’t recognize their value. They don’t feel lucky. Instead, they focus on what they still lack— no house, no car, no money— and feel miserable.

They ask, “Why is life so hard for me?” Even though they have so many good things already— health, normalcy, freedom of movement— they fail to see it, because their minds are lost in chasing what they don’t yet have, which belongs to the future.

If we turn back and learn to value what we already possess, and stop obsessing over what we don’t, we can find happiness more easily.

This is one of the meanings of “Doing your best in the present.”

…

Doing Your Best in the Present by Phra Paisal Visalo

-

@ 9223d2fa:b57e3de7

2025-05-25 16:09:51

@ 9223d2fa:b57e3de7

2025-05-25 16:09:512,143 steps

-

@ 58537364:705b4b85

2025-05-25 15:38:04

@ 58537364:705b4b85

2025-05-25 15:38:04พระอาจารย์ไพศาล วิสาโล วัดป่าสุคะโต แสดงธรรมเย็นวันที่ 28 กันยายน 2565

ที่ประเทศจีนเมื่อสัก 100 - 200 ปีก่อน ชายคนหนึ่งตาบอด แต่ก็สามารถใช้ชีวิตได้ตามปกติ วันหนึ่งก็เดินไปเยี่ยมเพื่อน ซึ่งอยู่ในเมืองเดียวกัน แต่ก็เดินไกลสักหน่อย แล้วชายตาบอดคนนี้ก็เดินได้โดยที่ไม่ต้องใช้ไม้เท้า ถึงบ้านเพื่อนก็สนทนากับเพื่อนหลายเรื่องหลายราว คุยกันถูกคอ จนกระทั่งค่ำ ก็ได้เวลาที่ชายตาบอดจะกลับบ้าน แต่ก่อนที่แกจะเดินออกจากบ้าน เพื่อนก็ยื่นโคมให้ โคมนี่เป็นคนที่จุดไฟให้แสงสว่างในเวลากลางคืน

ชายตาบอดก็บอกว่าฉันไม่ต้องใช้โคมหรอก เดินได้โดยที่ไม่เห็นอะไร ไม่ต้องใช้แสงสว่างก็เดินได้ ทางเส้นนี้ฉันก็คุ้นแล้ว เพื่อนก็บอกว่าที่ให้โคมนี่ ก็เพื่อเวลาคุณเดินกลับบ้านตามตรอกซอกซอย มันจะได้ให้แสงสว่าง คนที่เขาเดินสวนคุณมา เขาเห็นทาง เขาก็จะได้ไม่เดินชนคุณไงล่ะ เหตุผลนี้ก็ทำให้ชายตาบอดถือโคมกลับบ้าน ทั้งๆ ที่ตัวเองไม่จำเป็นต้องใช้โคมนั้นเลย

ระหว่างที่เดินกลับบ้านก็มีคนหลายคนเดินสวน เพราะมันเป็นตรอกซอกซอยที่มีคนเดินผ่านไปผ่านมาอยู่ แต่ว่าพอเดินมาพักหนึ่ง ปรากฏว่ามีผู้ชายคนหนึ่งเดินชนชายตาบอดอย่างแรงเลย จนล้มเลย ชายตาบอดก็โกรธมาก ก็พูดขึ้นมาว่าแกตาบอดหรือไง แกไม่เห็นหรือโคมที่ฉันถือนี่ ชายคนที่เดินชนชายตาบอดก็บอกว่าขอโทษครับ ขอโทษจริงๆ แต่โคมที่พี่จุดนี่มันดับไปนานแล้วนะ เรื่องก็จบเท่านี้นะ ฟังแล้วเราได้แง่คิดอะไรไหม

เรื่องนี้อาจจะเป็นนิทานนะ แต่มันไม่ใช่นิทานประเภทว่าสอน บอกเราในตอนท้ายว่านิทานเรื่องนี้สอนอะไร แต่ว่ามันจบลงโดยให้เราคิดเอง ฟังเรื่องนี้แล้วเราได้แง่คิดอะไร

แง่คิดอย่างหนึ่งก็คือว่าในการดำเนินชีวิตของคนเรา เราควรจะคิดถึงคนอื่นด้วย ของบางอย่างเราไม่จำเป็น แต่ว่ามันมีประโยชน์กับคนอื่น ถ้าเรานึกถึงคนอื่น มันก็ไม่ใช่ประโยชน์กับคนอื่นอย่างเดียว มันเป็นประโยชน์กับเราด้วย อย่างชายตาบอด เขาไม่จำเป็นต้องใช้โคมเลย ในการเดินกลับบ้านยามค่ำคืน แต่เพื่อนคะยั้นคะยอให้ถือโคมเพื่ออะไร ก็เพื่อประโยชน์ของคนอื่นที่เขาตาดี แล้วเขาต้องใช้แสงสว่างในการเดินสัญจร

การที่ชายตาบอดถือโคม ไม่ได้เพื่อประโยชน์ของตัวเอง แต่เพื่อประโยชน์ของคนอื่น แต่สุดท้ายมันก็เป็นประโยชน์กับตัวเอง เพราะถ้าหากว่าคนที่เขาเดินสวนมา เขาเห็นชายตาบอดถือโคม เขาก็ไม่เดินชน ฉะนั้นทีแรกชายตาบอดก็เดินได้สะดวกสบาย ไม่มีใครชน ก็เพราะว่าคนอื่นเขาเห็นแสงสว่างจากโคมนั้น

อันนี้เขาสอนว่าคนเราควรจะนึกถึงผู้อื่น ของบางอย่างแม้เราไม่จำเป็น แต่ว่ามันเป็นประโยชน์กับผู้อื่นก็ควรทำ หรือบางอย่างอาจจะไม่สะดวกกับเรา แต่ว่ามันช่วยคนอื่นได้ อย่างเช่นการถือโคม มันคงไม่สะดวกสบายเท่ากับเดินตัวเปล่า แต่ว่าเมื่อเดินถือโคมแล้ว มันก็เป็นประโยชน์กับคนที่เดินสวนมาด้วย แต่สุดท้ายมันก็กลับมาเป็นประโยชน์กับชายตาบอดนั่นเอง อย่างที่พูดไปแล้ว ไม่มีใครมาเดินชน

ในชีวิตของคนเรา เราควรจะคิดถึงคนอื่น ฉะนั้นการที่สังคมหรือบ้านเมืองมันน่าอยู่ ก็เพราะผู้คนไม่ได้คิดถึงแต่ตัวเองอย่างเดียว การกระทำบางอย่าง เราทำเพื่อประโยชน์ของส่วนรวม เพื่อผู้อื่น ยกตัวอย่างง่ายๆ เวลาเรากินอะไร มันมีขยะอยู่ในมือ จะเป็นถุงพลาสติก จะเป็นนมกล่อง หรือจะเป็นขวด ขวดน้ำที่กลายเป็นขยะเรียบร้อยแล้ว ทำไมเราควรจะถือขยะนั้นไว้กับตัว จนกว่าจะเห็นถังขยะจึงหย่อนลงถังขยะ

ที่จริงถ้าเรานึกถึงแต่ตัวเอง เราก็แค่โยนมันทิ้งขยะนั้นข้างทาง สบายดีนะ หลายคนก็ทำอย่างนั้น คนเราถ้าคิดถึงแต่ตัวเอง เราไม่เก็บมันไว้กับตัว แล้วก็รอจนกว่าจะเดินเห็นถังขยะ แต่คนจำนวนมากเขาก็เก็บขยะเอาไว้ เพื่อที่จะไปทิ้งลงในถังขยะ

อันนี้เพราะอะไร เพราะนึกถึงผู้อื่น นึกถึงคนที่เก็บขยะบ้าง หรือนึกถึงสังคมส่วนรวม ว่าถ้าเราทิ้งขยะไม่เป็นที่ มันก็จะเลอะเทอะ ไม่น่าดู บางคนก็คิดถึงพนักงานเก็บขยะ หรือคิดถึงพนักงานทำความสะอาด ก็เลยช่วยเขาด้วยการทิ้งขยะเป็นที่ ทั้งที่ถ้าทิ้งข้างทาง กินเสร็จ ดื่มน้ำเสร็จ ดูดนมกล่องเสร็จ ทิ้งไปเลยนี่มันสบายกว่า แต่เป็นเพราะเราคิดถึงคนอื่น เราจึงเอาไปทิ้งเป็นที่

หรือการปิดไฟ บางทีเราก็เห็นไฟเปิดอยู่ที่ห้องน้ำ หรือที่ห้องที่โล่ง เราก็อุตส่าห์เดินไป แทนที่เราจะกลับบ้านเลย เราก็เดินไปที่ห้องน้ำเพื่อที่จะปิดสวิตช์ไฟ เรายอมเสียเวลาเพื่ออะไร ก็เพื่อส่วนรวม หรืออาจจะเป็นเพราะว่าเราอยากจะช่วยพนักงานที่เขาดูแลสถานที่นั้น ไม่ต้องเหนื่อยกับการวิ่งการเดินตามปิดไฟ ที่วัดเราเป็นระเบียบ ก็เพราะผู้คนจำนวนมากคิดถึงผู้อื่นด้วย ไม่ได้คิดถึงแต่ตัวเอง และสุดท้ายมันก็เป็นประโยชน์กับตัวเรา เพราะว่าพอสถานที่มันสะอาดหมดจด มันก็สบายหูสบายตา น่าอยู่

แต่ว่านิทานเรื่องนี้เขาสอนมากกว่านั้น ในการดำเนินชีวิตประจำวัน เราควรจะคิดถึงผู้อื่น มองไปที่ประโยชน์ของคนอื่นก่อนตัวเอง แต่เวลามีปัญหาขึ้นมา ก่อนที่จะไปโทษคนอื่น ต้องกลับมามองที่ตัวเองก่อน ไม่เหมือนกันนะ ยามปกติเรามองไปที่คนอื่นก่อน นึกถึงประโยชน์ของคนอื่นก่อน ประโยชน์ของตัวเองเอาไว้ทีหลัง แต่ว่าเวลามีปัญหา เราควรมองที่ตัวเองก่อนที่จะไปโทษคนอื่น

อย่างชายตาบอดนี่ พอมีคนมาชน แกก็ว่าชายคนนั้นเลยทีเดียว ว่าตาบอดหรือไง มาชนเขา แต่เขาไม่รู้ว่าที่เขาถูกชน เป็นเพราะว่าโคมของเขามันดับไปแล้ว ชายคนนั้นก็เลยมองไม่เห็น แต่ชายตาบอดจะรู้ได้อย่างไร ว่าโคมของตัวเองนี่ดับไปแล้ว อันนี้เหมือนกับสอนเป็นนัยว่าคนที่โทษคนอื่น แทนที่จะมองมาที่ตัวเอง จะว่าไปก็เหมือนกับคนตาบอด คือมองไม่เห็นความบกพร่อง ความผิดพลาดของตัวเอง อันนี้ก็รวมถึงคนตาดีด้วยนะ คนตาดีถ้าเกิดปัญหาขึ้นมาแล้ว ไปโทษคนอื่น แต่มองไม่เห็นความบกพร่อง ความผิดพลาดของตัวเอง ก็ไม่ต่างจากคนตาบอดเหมือนกัน

อันนี้ก็เป็นข้อคิดที่ดีมากเลย ในยามปกติเราควรนึกถึงผู้อื่น มองไปที่คนอื่นก่อน แต่เวลามีปัญหาควรจะกลับมามองที่ตัวเอง ก่อนที่จะไปโทษคนอื่น อันนี้จะเรียกว่าเป็นวิสัยของนักปฏิบัติธรรมก็ได้ จะเรียกว่าเป็นวิสัยของผู้ใฝ่ธรรม ซึ่งต่างจากวิสัยของชาวโลกทั่วๆ ไป ชาวโลกทั่วไปเขามองตัวเองก่อน เขามองถึงประโยชน์ตัวเองก่อน คิดถึงตัวเองก่อน ส่วนคนอื่น ประโยชน์ของคนอื่นเอาไว้ทีหลัง แต่เวลามีปัญหาขึ้นมา ก็โทษคนอื่นก่อนเลย แทนที่จะกลับมามองที่ตัวเอง

บ่อยครั้งเวลางานมีปัญหา เราจะเห็นคนก็จะไปโทษคนโน้นคนนี้ ว่าเป็นเหตุทำให้งานมีปัญหา ทำให้งานตัวเองมีปัญหา เจ้านายไม่ดี เพื่อนร่วมงานไม่ได้เรื่อง บางทีก็โทษดินฟ้าอากาศ แต่ว่าสิ่งที่ไม่ได้มองคือความผิดพลาดของตัวเอง เวลานัดเพื่อน เพื่อนไม่มาตามนัดตามเวลา ก็โกรธเพื่อน พอเจอเพื่อนก็ไปด่าเพื่อนเลย ว่าทำไมนัด 4 โมงเย็น ทำไมไม่มา อุตส่าห์รอ

เพื่อนบอกอ้าวจะไปรู้เหรอ นึกว่านัด 4 โมงเช้า ผมก็อุตส่าห์ไปรอตั้งแต่ 4 โมงเช้า คือ 10 โมง ปรากฏว่าคนนัดบอกเวลาไม่ละเอียด แทนที่จะบอก 4 โมงเย็น ก็ไปพูดว่า 4 โมง เพื่อนก็เลยนึกว่า 4 โมงเช้า เป็นความผิดพลาดของคนนัดแท้ๆ แต่ว่าก็ไปด่าเพื่อนเสียแล้ว ตัวเองพูดไม่ละเอียด ก็ไปโทษเพื่อน ว่าเพื่อนไม่รับผิดชอบ เพื่อนไม่เอาใจใส่

อันนี้เรียกว่าไปโทษคนอื่นก่อนที่จะมามองที่ตัวเอง ถ้าจะให้ดีก็ควรจะถามเขาก่อนว่าทำไมถึงไม่มาตามนัด พอรู้คำอธิบายของเพื่อน ก็อาจจะพบว่าเป็นเพราะเราผิดเองนะ เราพูดไม่รัดกุมเพียงพอ ที่จริงมันไม่ใช่เฉพาะเวลามีความผิดพลาด หรือเวลามีปัญหาในงานการ เวลามีความทุกข์ก็เหมือนกัน เวลามีความทุกข์ก่อนที่จะไปโทษใคร ต้องกลับมามองที่ตัวเองก่อน แต่คนส่วนใหญ่เวลามีความทุกข์ ไปโทษข้างนอก ไปโทษเสียงดังจากข้างนอก ไปโทษการกระทำของคนนั้นคนนี้ แต่ลืมหรือไม่ได้กลับมามองที่ตัวเอง ว่าเป็นที่เราหรือเปล่า

เวลามีความทุกข์ใจ สาเหตุหลักๆ มันล้วนแล้วแต่อยู่ที่ตัวเองทั้งนั้นแหละ ไม่ได้อยู่ที่คนอื่น ทุกข์กายอาจจะเป็นเพราะของแหลมมาแทง อาจจะเป็นเพราะเชื้อโรค เพราะอาหารเป็นพิษ หรือเพราะมีคนมาทำร้าย แต่ถ้าทุกข์ใจแล้วนี่ มันน่าจะเกิดจากตัวเอง หรือใจของตัวเองเป็นหลักเลยทีเดียว

เมื่อสัก 40 กว่าปีก่อน หลวงพ่อชาท่านได้รับนิมนต์ให้มาแสดงธรรมที่ประเทศอังกฤษ ตอนนั้นท่านก็มากับลูกศิษย์ที่เป็นพระฝรั่ง เช่นหลวงพ่อสุเมโธ ซึ่งตอนนั้นยังไม่ได้สร้างวัดอมราวดีที่อังกฤษ เจ้าภาพก็ให้หลวงพ่อชากับลูกศิษย์พักที่วิหารกลางกรุงลอนดอน ย่านนั้นมีสถานบันเทิง เช่น ผับ บาร์ กลางคืนก็จะมีเสียงดนตรี

สมัยนั้นดิสโก้ก็เริ่มเป็นที่นิยมแล้ว เพราะฉะนั้นเสียงดังก็จะกระหึ่มเลยตอนกลางคืน มาถึงวิหารแฮมสเตทที่หลวงพ่อชาและลูกศิษย์พัก ซึ่งก็พอดีเป็นช่วงที่ท่านพาคนนั่งสมาธิ พระและโยมหลายคนนั่งสมาธิไม่เป็นสุขเลย เพราะเสียงดนตรีมันดัง

แต่หลวงพ่อชาท่านนั่งสมาธิอย่างสงบ เหมือนกับไม่ได้ยินอะไรเลย จนกระทั่งนั่งสมาธิเสร็จ ก็มีโยมซึ่งเป็นฝรั่ง เป็นเจ้าภาพ ก็มาหาท่านแล้วก็บอกขอโทษ ที่เสียดนตรีรบกวนการนั่งสมาธิ หลวงพ่อชาท่านฟังแล้วก็ยิ้ม แล้วท่านก็พูดว่าโยมอย่าไปคิดว่าเสียงดนตรีรบกวนเรา ที่จริงเราต่างหากที่ไปรบกวนเสียงดนตรี

บางคนฟังแล้วก็งงนะ แต่ที่จริงที่ท่านพูดนี่มันเป็นสัจธรรมเลยนะ ที่คนมีความทุกข์ หงุดหงิด เมื่อเสียงมากระทบหู มันไม่ใช่เพราะเสียง แต่เป็นเพราะใจมันไปทะเลาะกับเสียงนั้น ใจมันไปต่อสู้ ไปทะเลาะเบาะแว้งกับเสียงนั้น มันไปผลักไสเสียงนั้น ถ้าเพียงแต่ยอมรับเสียงนั้น มันก็ไม่หงุดหงิด แต่พอใจมันทะเลาะกับเสียง เพราะว่ามีความรู้สึกเป็นลบต่อเสียงนั้น ว่าเป็นเสียงดัง เสียงรบกวน พอใจรู้สึกเป็นลบ มันหงุดหงิดขึ้นมาเลย ความหงุดหงิดจนนั่งสมาธิไม่เป็นสุข เป็นเพราะใจของคนฟัง ที่วางใจไม่ถูกต้องต่อเสียง ถ้าหากว่าเพียงแต่รู้สึกเป็นกลางๆ มันก็ไม่ทุกข์

มีนักปฏิบัติธรรมคนหนึ่ง แกก็มาปฏิบัติอยู่ที่สำนักหรือวัดแห่งหนึ่ง ก็ค้างคืนอยู่ประมาณ 2-3 คืน คืนแรกเลย พักเสร็จตื่นเช้าขึ้นมา เจ้าอาวาสก็ถามว่า เป็นยังไง หลับดีไหม ชายคนนั้นก็บอกว่าหลับไม่ค่อยดี โดยเฉพาะช่วงแรกๆ เพราะว่าเสียงห่านมันดัง

เสียงห่านมันดัง ตอนกลางคืนนอนไม่ค่อยหลับเลยช่วงแรก แต่ว่านึกขึ้นมาได้ว่าตัวเองพกโทรศัพท์มือถือมา แล้วในโทรศัพท์มือถือก็มีการอัดเทปคำบรรยายธรรมะของครูบาอาจารย์หลายท่าน ก็เลยเอาหูฟังใส่ไว้ในหู แล้วก็ฟัง เปิดเทปธรรมะ เปิดคำบรรยายของครูบาอาจารย์ จนกระทั่งหลับได้ กระทั่งเช้าก็เป็นอันว่าได้พัก ได้หลับดีหน่อยช่วงครึ่งหลัง

สิ่งที่น่าสนใจคือว่า ระหว่างเสียงห่านกับเสียงบรรยาย อะไรดังกว่ากัน ชายคนนั้นบอกว่าหลับไม่ได้ เพราะว่าเสียงห่านมันดัง แต่เสียงบรรยายที่ฟังมันไม่ดังหรือ ที่จริงมันดังกว่าเสียงห่าน เพราะว่าเอาหูฟังใส่เข้าไปในรูหู อย่างไรมันดังกว่าเสียงห่านอยู่แล้วล่ะ แต่ทำไมหลับ ก็เพราะใจมันยอมรับเสียงบรรยายธรรมะ หรือว่ารู้สึกดีกับเสียงนั้น ขณะที่เสียงห่านนี่ ใจมองว่าเป็นเสียงรบกวน การที่ใจไปตีค่าว่าเสียงห่านเป็นเสียงรบกวน ก็ทำให้เกิดอาการต่อสู้ผลักไสกับเสียงนั้น

เหมือนอย่างที่หลวงพ่อชาท่านว่าไปทะเลาะกับเสียง ส่วนเสียงบรรยายธรรมะที่ฟังทางโทรศัพท์มือถือ ใจมันยอมรับ ใจมันรู้สึกเป็นบวก เลยไม่รู้สึกว่าดัง ทั้งที่ถ้าพูดถึงเดซิเบลแล้ว มันดังกว่าเสียงห่านอยู่แล้วแต่ก็เป็นอันหลับได้ ฉะนั้นที่หลับไม่ได้ ไม่ใช่เพราะเสียงดัง ไม่ใช่เพราะเสียงห่าน แต่เพราะใจมันไปทะเลาะกับเสียงห่าน ในขณะที่เสียงบรรยายใจไม่ได้ทะเลาะ ใจไปเคลิ้มคล้อยกับเสียงบรรยายธรรมเลยหลับ

นี่เป็นตัวอย่างง่ายๆ ในชีวิตของคนเรา เวลามีความทุกข์ ทุกข์ใจ เรามักโทษข้างนอก โทษเสียงดนตรี โทษเสียงห่าน โทษคนนั้นคนนี้ แต่นั่นเป็นเพราะเราไม่ได้กลับมาดูใจของเรา ไม่ได้กลับมาสังเกตปฎิกริยาของใจเรา ฉะนั้นถ้าเรากลับมาสังเกต ก็จะพบว่ามันเป็นเพราะใจของเราต่างหาก ที่เป็นตัวการทำให้เกิดทุกข์

ฉะนั้นถ้าเกิดว่าเรามีทุกข์ หรือมีปัญหาขึ้นมาในใจ แล้วเราไปมองออกนอกตัว ไม่กลับมามองที่ตัว ก็ไม่ต่างจากชายตาบอด ที่ไปต่อว่าคนที่มาชนตัวเอง ทั้งที่โคมที่ตัวเองถือ ไฟมันดับไปนานแล้ว แต่มองไม่เห็น วิถีธรรมกับวิถีโลกมันต่างกัน วิถีโลก มีปัญหาอะไรก็โทษคนอื่น แต่เวลาสบายก็คิดถึงแต่ตัวเอง ส่วนวิถีธรรม เวลาสบายๆ เวลาปกติก็นึกถึงคนอื่น แต่เวลามีปัญหาก็กลับมองที่ตัวเองก่อน

แล้วที่จริงถ้าเราดู มันสะท้อนให้เห็นว่า วิถีโลกเขาเน้นในเรื่องการเปลี่ยนแปลง จัดการกับภายนอก แต่ว่าวิถีธรรมหรือวิถีของผู้ใฝ่ธรรม จะเน้นที่การเปลี่ยนแปลงที่ตัวเอง โดยเฉพาะการปรับเปลี่ยนใจของตัว เวลามีความทุกข์ก็ลองปรับเปลี่ยนใจ

เหมือนมีผู้ชายคนหนึ่งที่เขานั่งสมาธิทุกเช้าเป็นประจำ แล้วเขาก็นั่งได้ดีด้วย แต่วันหนึ่งปรากฏว่าพอนั่งไปได้สักครู่หนึ่ง ก็มีเสียงค้อนดัง ทีแรกก็เสียงค้อน ตอนหลังก็เสียงเลื่อยยนต์ เพราะมีการก่อสร้างใกล้ๆ ตอนที่เสียงค้อน เสียงเลื่อยยนต์มากระทบหู ใจนี่ก็กระเพื่อมเลย แต่เขามีสติเห็น สติรู้ทัน พอมีสติรู้ทัน ใจก็สงบ แต่พอเผลอ ใจก็กระเพื่อม ทุกครั้งที่เสียงเลื่อยยนต์ดังกระทบหู แล้วมันก็สงบลงพอมีสติรู้ทัน เป็นอย่างนี้พักหนึ่ง

เขาก็เลยลองไปพิจารณาที่เสียงเลื่อยยนต์ พอพิจารณาไปก็สังเกตว่าบางครั้งมันก็กระชากกระชั้น บางครั้งมันก็ลากยาว บางครั้งเสียงสูง บางครั้งเสียงต่ำ บางครั้งเสียงดัง บางครั้งเสียงเบา ดูๆไปแล้วมันเหมือนกับเสียงเพลงเลยนะ เพลงประเภท heavy metal พอทันทีที่มองว่ามันเป็นเสียงเพลง ใจก็สงบเลย สงบประเภทที่ว่าเพลินเลย

ที่จริงเพลินก็ไม่ดี แต่เขาก็อดฉุกคิดไม่ได้ เอ๊ะ เมื่อกี้ใจยังกระเพื่อมขึ้นกระเพื่อมลง แถมมีความหงุดหงิดด้วย ตอนนี้ทำไมใจมันสงบ มีบางช่วงเสียงเลื่อยยนต์มันหายไป เขาอยากให้เสียงมันดังกลับมาใหม่ เขาก็เลยแปลกใจ ทีแรกเราอยากให้เสียงมันดับไปหายไป แต่ทำไมตอนนี้อยากให้เสียงมันดังใหม่ เสียงมันก็ยังดังเหมือนเดิม แต่ทำไมความรู้สึกเปลี่ยนไป

ที่ความรู้สึกเปลี่ยนไปเพราะอะไร เพราะว่าไม่ได้มองว่ามันเป็นเสียงดังอีกต่อไป แต่มองว่ามันเป็นเสียงเพลง พอมองว่าเป็นเสียงเพลง ความรู้สึกมันเป็นความรู้สึกในทางบวก ใจก็สงบเลย อันนี้มันก็ชี้ให้เห็นว่าความสงบมันอยู่ที่ใจ มากกว่าอยู่ที่สิ่งภายนอก และที่หงุดหงิด ที่ไม่สงบ มันไม่ใช่เพราะสิ่งภายนอก แต่เป็นเพราะใจ ใจรู้สึกลบกับเสียง มันก็กระเพื่อม มันก็หงุดหงิด ไม่สงบ ไม่เป็นสุข แต่พอใจรู้สึกเป็นบวก ความรู้สึกก็เปลี่ยนเป็นตรงกันข้าม

ฉะนั้นแทนที่จะไปตะโกนโวกเวกว่าให้หยุดส่งเสียง ให้เลิกตอกตะปู ให้เลิกใช้เลื่อยยนต์ มันจะดีกว่าหรือเปล่า ถ้ากลับมาดูที่ใจของเรา กลับมาสังเกตที่ใจของเรา หรือกลับมาปรับใจของเรา ใจของเรานี่อาจจะเป็นปัญหา

อันนี้คล้ายๆ กับเมื่อ 2-3 วันก่อน มีพระรูปหนึ่งเล่าให้ฟัง ได้ยินเสียงตอนเช้าๆ ที่วัด ตอนสายๆ วันกรรมกร มันมีเสียงเครื่องยนต์ดัง ตอนนั้นก็คิดว่าเป็นเสียงมอเตอร์ไซค์ ทันทีที่คิดว่าเป็นเสียงมอเตอร์ไซค์ ไม่พอใจขึ้นมาทันทีเลย มันมาขี่มอเตอร์ไซค์อะไรกันตรงนี้ ในวัด

แต่สักประเดี๋ยวเดียวฉุกขึ้นมาว่าเอ๊ะ มันอาจจะไม่ใช่เสียงมอเตอร์ไซค์ก็ได้ อาจจะเป็นเสียงเลื่อย เลื่อยที่เขากำลังตัดไม้ที่โค่น เพราะว่าก่อนหน้านั้นมีไม้โค่น ทันทีที่นึกว่าเป็นเสียงเลื่อย ที่ใช้ตัดไม้ที่ล้มลง ใจมันสงบเลย กลับอนุโมทนาด้วย เขามาช่วยกันทำงาน เสียงก็เสียงเดิม แต่ทำไมทีแรกหงุดหงิด เพราะไปคิดว่าเสียงมอเตอร์ไซค์ และคิดต่อไปว่ามันมาขี่อะไรแถวนี้ ในวัด แต่พอมองว่าเป็นเสียงเลื่อยที่ใช้เลื่อยไม้ที่ล้ม ความรู้สึกมันเปลี่ยนไป เพราะเกิดความรู้สึกว่าเขากำลังทำหน้าที่ของเขา

ฉะนั้นสุขหรือทุกข์อยู่ที่ใจแท้ๆ เลย หงุดหงิดหรือว่าสงบ อยู่ที่ใจ ไม่ใช่อยู่ที่เสียง อยู่ที่ว่าเราจะมองมันอย่างไร ฉะนั้นถ้าเราเข้าใจตรงนี้ สังเกตใจของเรา เราจะพบว่าจะไปแก้ทุกข์ก็ต้องแก้ที่ใจนั่นแหละ ไม่ต้องไปแก้ที่คนอื่น เป็นเพราะใจเราวางไว้ผิด มันจึงทุกข์ มันจึงเกิดความหงุดหงิด เกิดความรำคาญ แต่พอเราปรับใจ เปลี่ยนมุมมอง ความรู้สึกก็เปลี่ยนไป

zen sukato บันทึกเสียง Nun & oi ถอดเสียง nok edit

-

@ cae03c48:2a7d6671

2025-05-25 15:00:49

@ cae03c48:2a7d6671

2025-05-25 15:00:49Bitcoin Magazine

Nigel Farage To Speak At Bitcoin 2025 ConferenceWe are pleased to announce that Nigel Farage will join the speaker lineup at the Bitcoin Conference 2025 in Las Vegas. A defining figure in modern European politics, Farage led the Brexit movement that took the United Kingdom out of the EU, reshaping global conversations around national sovereignty. He is the founder and current leader of Reform UK, a rising political force now polling competitively, positioning him as a serious contender for to be the next UK Prime Minister.

A former Member of the European Parliament for over 20 years, Farage built his reputation challenging supranational institutions and unelected power—values that resonate deeply with the Bitcoin community. He also hosts GB News, where he critiques monetary policy, CBDCs, and digital surveillance. An outspoken advocate for financial sovereignty and free speech, Farage previously appeared at Bitcoin Amsterdam 2023 in a conversation with Peter McCormack. In 2025, he returns for a fireside with Bitcoin Magazine’s Frank Corva, whose sharp political interviews are helping shape Bitcoin’s place in global affairs.

About Bitcoin 2025

The excitement is building as the world’s largest Bitcoin conference approaches, Bitcoin 2025. Set to take place in Las Vegas from May 27-29, this premier event is anticipated to draw Bitcoin enthusiasts, industry leaders, and innovators from all over the globe.

Be part of the revolution! Come experience the cultural movement that’s the Bitcoin Conference – a landmark event with wealth of opportunities for networking and learning. In 2025, Bitcoin takes over Las Vegas, uniting builders, leaders, and believers in the world’s most resilient monetary network.

New in 2025: Code & Country launches on Industry Day, bringing together policymakers, technologists, and industry leaders for a full day of focused collaboration.

The aim: strengthen Bitcoin’s role in national strategy, regulatory clarity, and technological sovereignty. This marks a new era where Bitcoin’s protocol and geopolitical potential intersect more directly than ever before.

Highlights Include

- Keynote Speakers: Renowned experts and visionaries will share their insights and predictions for the future of digital currency.

- Workshops and Panels: Attendees can participate in hands-on workshops and panel discussions covering a wide array of topics, from technical details to practical applications in various industries.

- Exhibition Hall: The exhibition will showcase art, cutting-edge products and services from top companies in the bitcoin ecosystem.

- Networking Opportunities: With thousands of attendees expected, Bitcoin 2025 offers unparalleled opportunities for networking with peers, potential partners, and thought leaders.

Keynote Speakers

The conference is set to feature an impressive lineup of speakers, including leading Bitcoin developers, experts, as well as influential figures from the financial sector. Topics range from the latest advancements to regulatory updates and investment strategies.

- JD Vance, Vice President Vance will become the first sitting vice president in the history of the United States to publicly voice his support for Bitcoin as he addresses the audience in Las Vegas.

- Ross Ulbricht, Freedom Advocate – Founder of the Silk Road marketplace, recently released by President Donald Trump from serving a double life sentence. His story has become emblematic of the clash between personal liberty, Bitcoin, and the state.

- Eric Trump & Donald Trump Jr, Both figures bring a bold voice to the conversation around Capitalism, Bitcoin, freedom, and economic sovereignty.

- Cameron & Tyler Winklevoss, Co-Founders of Gemini – Early Bitcoin adopters and founders of the regulated exchange Gemini.

- David Sacks, White House AI & Crypto Czar – Former PayPal COO and venture capitalist, now serving as the White House’s senior advisor on AI and cryptocurrency policy, leading national efforts on stablecoin legislation and digital asset strategy.

- Bryan Johnson, Founder of Project Blueprint – Tech entrepreneur and longevity researcher known for reversing his biological age and challenging fiat-era assumptions about health, time, and human potential.

Past Conferences in the USA

– 2021 Miami: Where President Nayib Bukele revealed plans for El Salvador to adopt Bitcoin as legal tender, making history live on stage. Attendance: 11,000

– 2022 Miami: Where Michael Saylor delivered a landmark address on corporate Bitcoin strategy and announced additional MicroStrategy purchases. Attendance: 26,000

– 2023 Miami: Where Secretary Robert F. Kennedy Jr. became the first U.S. presidential candidate to speak at a Bitcoin conference, addressing financial freedom and civil liberties. Attendance: 15,000

– 2024 Nashville: Highlights include President Donald J. Trump’s appearance, where he voiced support for Bitcoin mining and national monetary sovereignty. Attendance: 22,000Join Us in Las Vegas

- Date: May 27-29, 2025

- Venue: The Venetian, Las Vegas, NV, USA

- Tickets: https://b.tc/conference/2025

- Get a free General Admission ticket when you deposit $200 on eToro – while supplies last!

This post Nigel Farage To Speak At Bitcoin 2025 Conference first appeared on Bitcoin Magazine and is written by Conor Mulcahy.

-

@ 26769dac:498e333b

2025-05-25 12:51:09

@ 26769dac:498e333b

2025-05-25 12:51:09Here's to the ones who can\ Feel there cause\ Surrender\ Change their ways\ But keep their fire\ And never give up

We will transform this world\ Restructuring\ One belief at a time

-

@ 26769dac:498e333b

2025-05-25 12:24:47

@ 26769dac:498e333b

2025-05-25 12:24:47Here's to the ones who can\ Feel there cause\ Surrender\ Change their ways\ But keep their fire\ And never give up

We will transform this world\ Restructuring\ One belief at a time

-

@ 47259076:570c98c4

2025-05-25 21:55:28