-

@ d360efec:14907b5f

2025-05-27 15:46:26

@ d360efec:14907b5f

2025-05-27 15:46:26 -

@ c1e6505c:02b3157e

2025-05-27 01:11:45

@ c1e6505c:02b3157e

2025-05-27 01:11:45I spent Memorial Day swimming in the local river - something I try to do at least four times a week. It’s the best form of exercise imo, but it’s more than that. Swimming against the tide, feeling the water move around me... there’s something about it that keeps me grounded. Nature at her peak.

Today I brought my X-Pro2 with the 1959 Leica Summaron 35mm f/2.8. I'm still testing the lens wide open to get a feel for its character. My subject this time: the light playing on the ripples and waves.

While I was shooting, a kid randomly ran up to me and started telling me something about what he got for his dad while fishing, or something - I didn’t quite hear him - and then he asked what I was looking at. I told him, “The ripples. The way the light is refracting.” I had him sit exactly where I was so he could see it too.

He lit up. You could tell no one had ever pointed something like that out to him before. In that moment, I felt like maybe I was able to plant a little seed - a new way of seeing.

This is what I was looking at.

-

@ b1ddb4d7:471244e7

2025-05-28 14:01:29

@ b1ddb4d7:471244e7

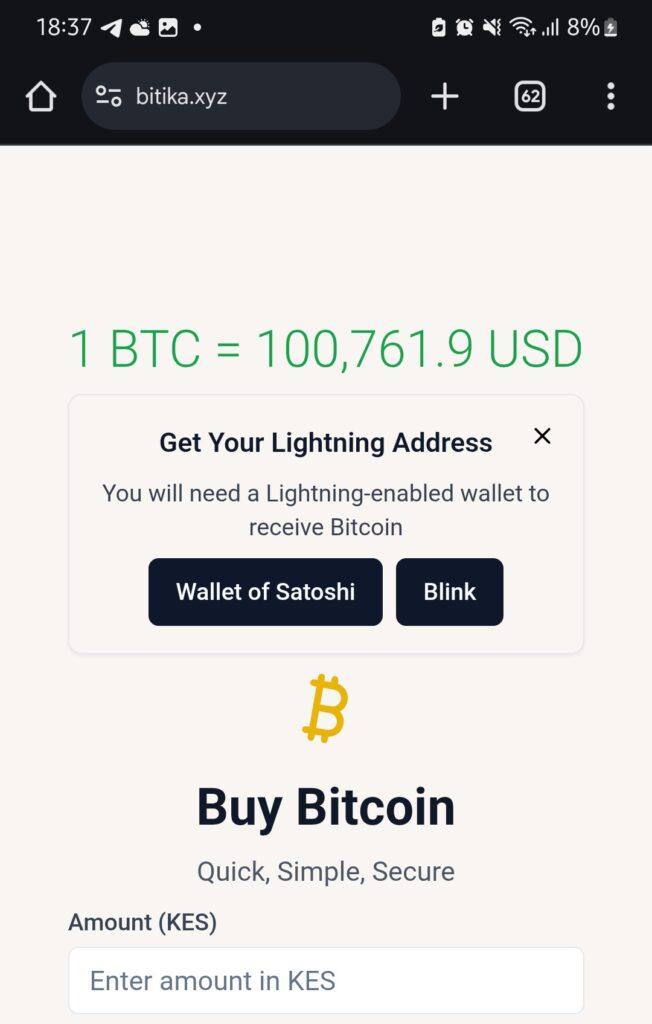

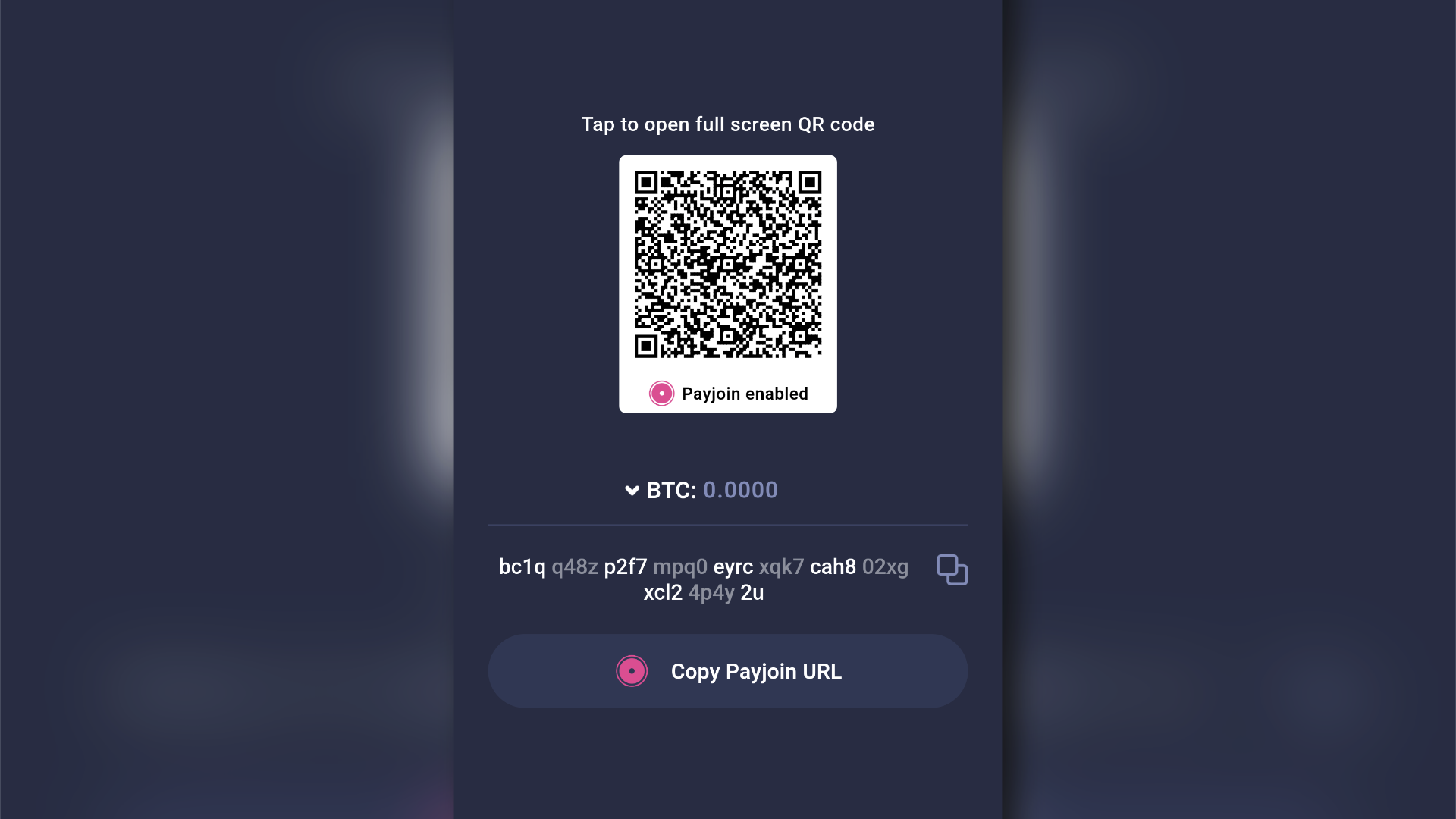

2025-05-28 14:01:29In the heart of East Africa, where M-Pesa reigns supreme and innovation pulses through bustling markets, a quiet revolution is brewing—one that could redefine how millions interact with money.

Enter Bitika, the Kenyan startup turning bitcoin’s complexity into a three-step dance, merging the lightning speed of sats with the trusted rhythm of mobile money.

At the helm is a founder whose “aha” moment came not in a boardroom, but at his kitchen table, watching his father grapple with the gap between understanding bitcoin and actually using it.

Bitika was born from that friction—a bridge between M-Pesa’s ubiquity and bitcoin’s borderless promise, wrapped in a name as playful as the Swahili slang that inspired it.

But this isn’t just a story about simplifying transactions. It’s about liquidity battles, regulatory tightropes, and a vision to turn Bitika into the invisible rails powering Africa’s Bitcoin future.

Building on Bitcoin

- Tell us a bit about yourself and how you got into bitcoin/fintech, and what keeps you passionate about this space?

I first came across bitcoin in 2020, but like many at that time, I didn’t fully grasp what it really was. It sounded too complicated, probably with the heavy terminologies. Over time, I kept digging deeper and became more curious.

I started digging into finance and how money works and realised this was what I needed to understand bitcoin’s objectives. I realized that bitcoin wasn’t just a new type of money—it was a breakthrough in how we think about freedom, ownership, and global finance.

What keeps me passionate is how bitcoin can empower people—especially in Africa—to take control of their wealth, without relying on unstable systems or middlemen.

- What pivotal moment or experience inspired you to create Bitika? Was there a specific gap in Kenya’s financial ecosystem that sparked the idea?

Yes, this idea was actually born right in my own home. I’ve always been an advocate for bitcoin, sharing it with friends, family, and even strangers. My dad and I had countless conversations about it. Eventually, he understood the concept. But when he asked, “How do I even buy bitcoin?” or “Can you just buy it for me?” and after taking him through binance—that hit me.

If someone I’d educated still found the buying process difficult, how many others were feeling the same way? That was the lightbulb moment. I saw a clear gap: the process of buying bitcoin was too technical for the average Kenyan. That’s the problem Bitika set out to solve.

- How did you identify the synergy between bitcoin and M-Pesa as a solution for accessibility?

M-Pesa is at the center of daily life in Kenya. Everyone uses it—from buying groceries to paying rent. Instead of forcing people to learn new tools, I decided to meet them where they already are. That synergy between M-Pesa and bitcoin felt natural. It’s about bridging what people already trust with something powerful and new.

- Share the story behind the name “Bitika” – does it hold a cultural or symbolic meaning?

Funny enough, Bitika isn’t a deeply planned name. It came while I was thinking about bitcoin and the type of transformation it brings to individuals. In Swahili, we often add “-ka” to words for flair—like “bambika” from “bamba.”

So, I just coined Bitika as a playful and catchy way to reflect something bitcoin-related, but also uniquely local. I stuck with it because thinking of an ideal brand name is the toughest challenge for me.

- Walk us through the user journey – how does buying bitcoin via M-Pesa in “3 simple steps” work under the hood?

It’s beautifully simple.

1. The user enters the amount they want to spend in KES—starting from as little as 50 KES (about $0.30).

2. They input their Lightning wallet address.

3. They enter their M-Pesa number, which triggers an STK push (payment prompt) on their phone. Once confirmed—pap!—they receive bitcoin almost instantly.

Under the hood, we fetch the live BTC price, validate wallet addresses, check available liquidity, process the mobile payment, and send sats via the Lightning Network—all streamlined into a smooth experience for the user.

- Who’s Bitika’s primary audience? Are you focusing on unbanked populations, tech enthusiasts, or both?

Both. Bitika is designed for everyday people—especially the unbanked and underbanked who are excluded from traditional finance. But we also attract bitcoiners who just want a faster, easier way to buy sats. What unites them is the desire for a seamless and low-barrier bitcoin experience.

Community and Overcoming Challenges

- What challenges has Bitika faced navigating Kenya’s bitcoin regulations, and how do you build trust with regulators?

Regulation is still evolving here. Parliament has drafted bills, but none have been passed into law yet. We’re currently in a revision phase where policymakers are trying to strike a balance between encouraging innovation and protecting the public.

We focus on transparency and open dialogue—we believe that building trust with regulators starts with showing how bitcoin can serve the public good.

- What was the toughest obstacle in building Bitika, and how did you overcome it?

Liquidity. Since we don’t have deep capital reserves, we often run into situations where we have to pause operations often to manually restock our bitcoin supply. It’s frustrating—for us and for users. We’re working on automating this process and securing funding to maintain consistent liquidity so users can access bitcoin at any time, without disruption.

This remains our most critical issue—and the primary reason we’re seeking support.

- Are you eyeing new African markets? What’s next for Bitika’s product?

Absolutely. The long-term vision is to expand Bitika into other African countries facing similar financial challenges. But first, we want to turn Bitika into a developer-first tool—infrastructure that others can build on. Imagine local apps, savings products, or financial tools built using Bitika’s simple bitcoin rails. That’s where we’re heading.

- What would you tell other African entrepreneurs aiming to disrupt traditional finance?

Disrupting finance sounds exciting—but the reality is messy. People fear what they don’t understand. That’s why simplicity is everything. Build tools that hide the complexity, and focus on making the user’s life easier. Most importantly, stay rooted in local context—solve problems people actually face.

What’s Next?

- What’s your message to Kenyans hesitant to try bitcoin, and to enthusiasts watching Bitika?

To my fellow Kenyans: bitcoin isn’t just an investment—it’s a sovereign tool. It’s money you truly own. Start small, learn, and ask questions.

To the bitcoin community: Bitika is proof that bitcoin is working in Africa. Let’s keep pushing. Let’s build tools that matter.

- How can the bitcoin community, both locally and globally, support Bitika’s mission?

We’re currently fundraising on Geyser. Support—whether it’s financial, technical, or simply sharing our story—goes a long way. Every sat you contribute helps us stay live, grow our liquidity, and continue building a tool that brings bitcoin closer to the everyday person in Africa.

Support here: https://geyser.fund/project/bitika

-

@ b7274d28:c99628cb

2025-05-27 02:57:50

@ b7274d28:c99628cb

2025-05-27 02:57:50A few months ago, a nostrich was switching from iOS to Android and asked for suggestions for #Nostr apps to try out. nostr:npub18ams6ewn5aj2n3wt2qawzglx9mr4nzksxhvrdc4gzrecw7n5tvjqctp424 offered the following as his response:

nostr:nevent1qvzqqqqqqypzq0mhp4ja8fmy48zuk5p6uy37vtk8tx9dqdwcxm32sy8nsaa8gkeyqydhwumn8ghj7un9d3shjtnwdaehgunsd3jkyuewvdhk6tcpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhszythwden5te0dehhxarj9emkjmn99uqzpwwts6n28eyvjpcwvu5akkwu85eg92dpvgw7cgmpe4czdadqvnv984rl0z

Yes. #Android users are fortunate to have some powerful Nostr apps and tools at our disposal that simply have no comparison over on the iOS side. However, a tool is only as good as the knowledge of the user, who must have an understanding of how best to wield it for maximum effect. This fact was immediately evidenced by replies to Derek asking, "What is the use case for Citrine?" and "This is the first time I'm hearing about Citrine and Pokey. Can you give me links for those?"

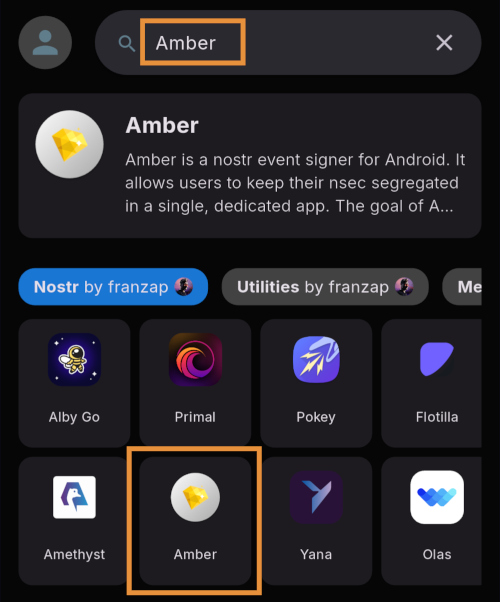

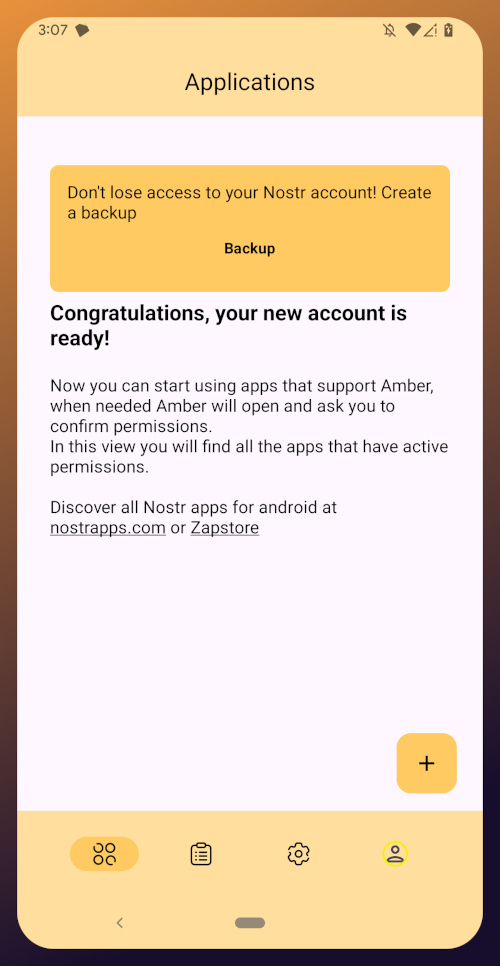

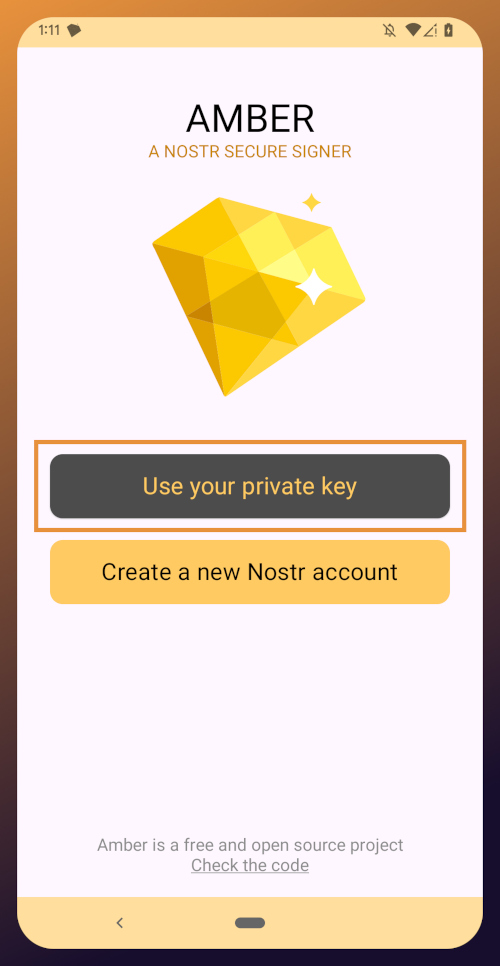

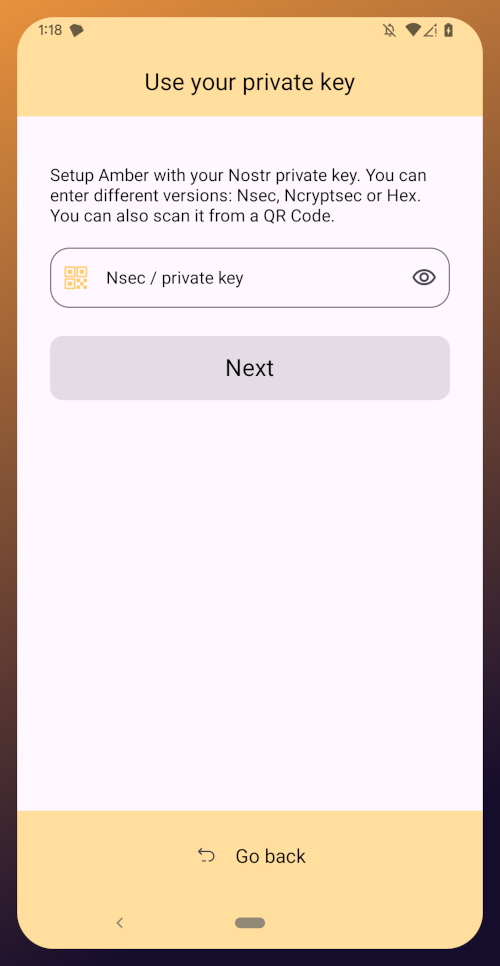

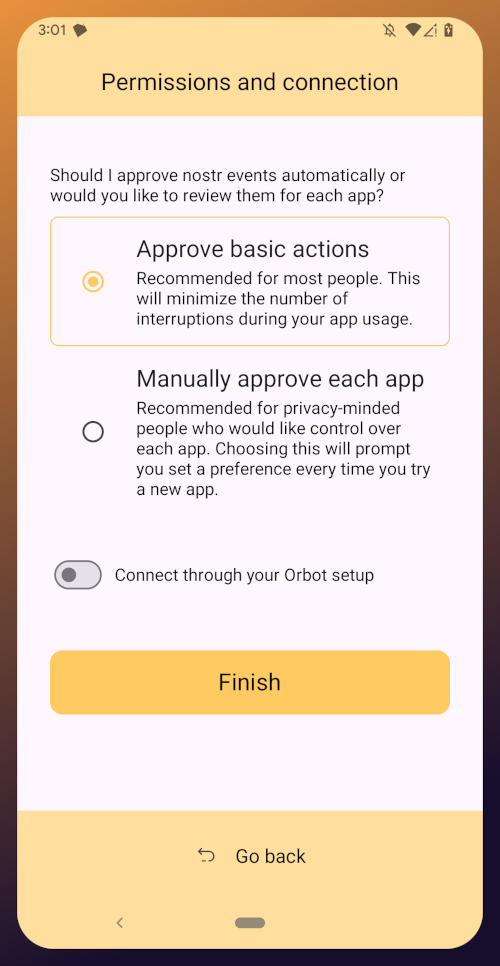

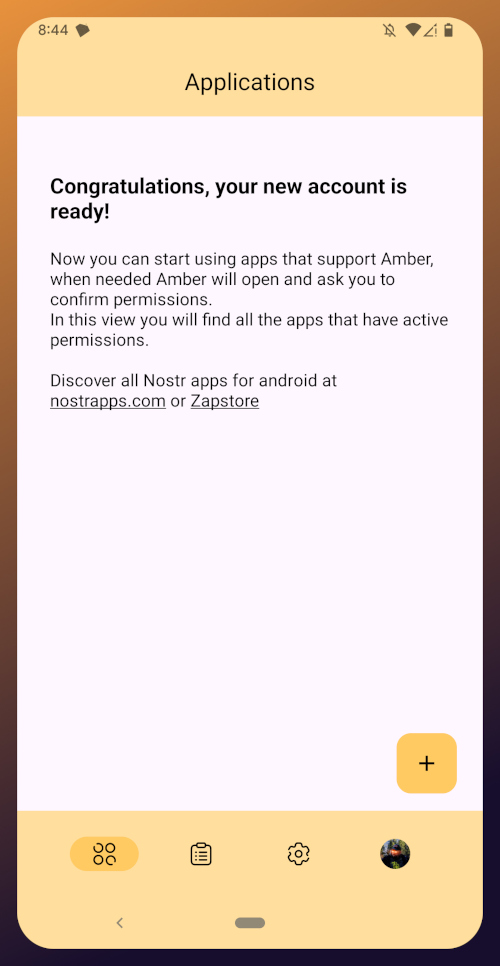

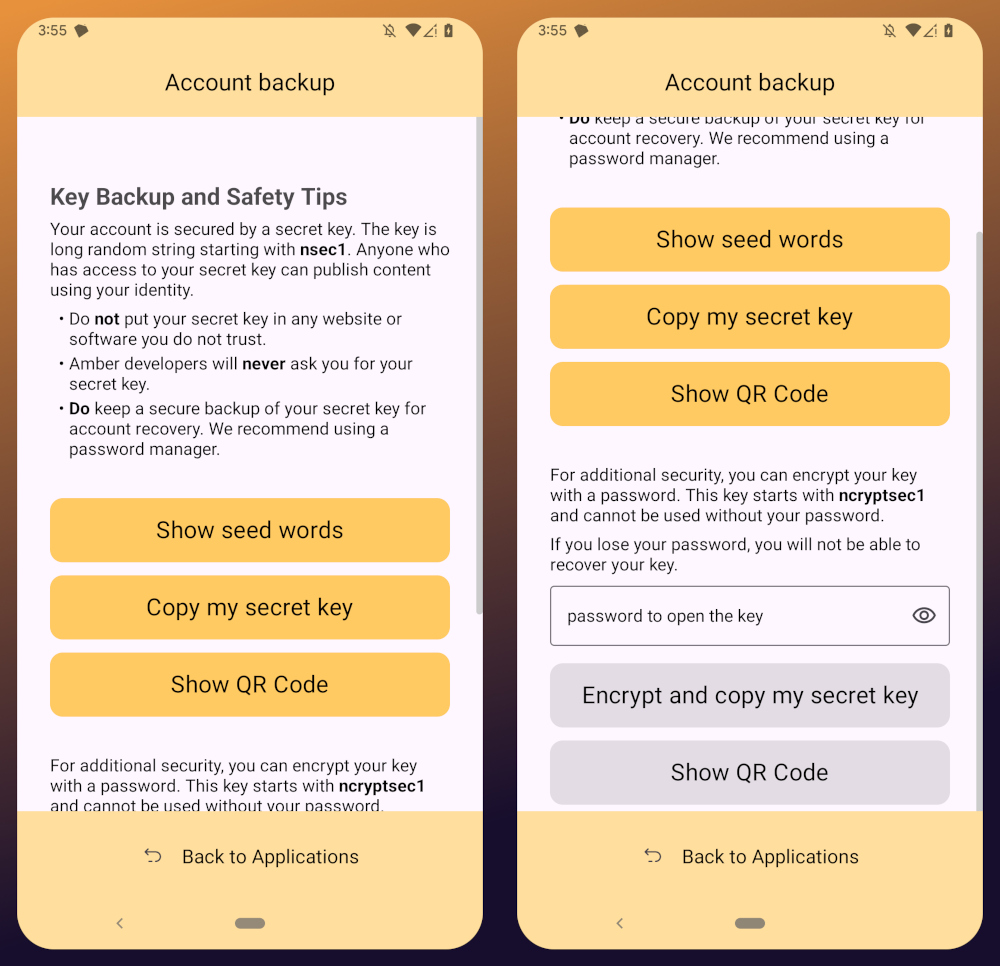

Well, consider this tutorial your Nostr starter-kit for Android. We'll go over installing and setting up Amber, Amethyst, Citrine, and Pokey, and as a bonus we'll be throwing in the Zapstore and Coinos to boot. We will assume no previous experience with any of the above, so if you already know all about one or more of these apps, you can feel free to skip that tutorial.

So many apps...

You may be wondering, "Why do I need so many apps to use Nostr?" That's perfectly valid, and the honest answer is, you don't. You can absolutely just install a Nostr client from the Play Store, have it generate your Nostr identity for you, and stick with the default relays already set up in that app. You don't even need to connect a wallet, if you don't want to. However, you won't experience all that Nostr has to offer if that is as far as you go, any more than you would experience all that Italian cuisine has to offer if you only ever try spaghetti.

Nostr is not just one app that does one thing, like Facebook, Twitter, or TikTok. It is an entire ecosystem of applications that are all built on top of a protocol that allows them to be interoperable. This set of tools will help you make the most out of that interoperability, which you will never get from any of the big-tech social platforms. It will provide a solid foundation for you to build upon as you explore more and more of what Nostr has to offer.

So what do these apps do?

Fundamental to everything you do on Nostr is the need to cryptographically sign with your private key. If you aren't sure what that means, just imagine that you had to enter your password every time you hit the "like" button on Facebook, or every time you commented on the latest dank meme. That would get old really fast, right? That's effectively what Nostr requires, but on steroids.

To keep this from being something you manually have to do every 5 seconds when you post a note, react to someone else's note, or add a comment, Nostr apps can store your private key and use it to sign behind the scenes for you. This is very convenient, but it means you are trusting that app to not do anything with your private key that you don't want it to. You are also trusting it to not leak your private key, because anyone who gets their hands on it will be able to post as you, see your private messages, and effectively be you on Nostr. The more apps you give your private key to, the greater your risk that it will eventually be compromised.

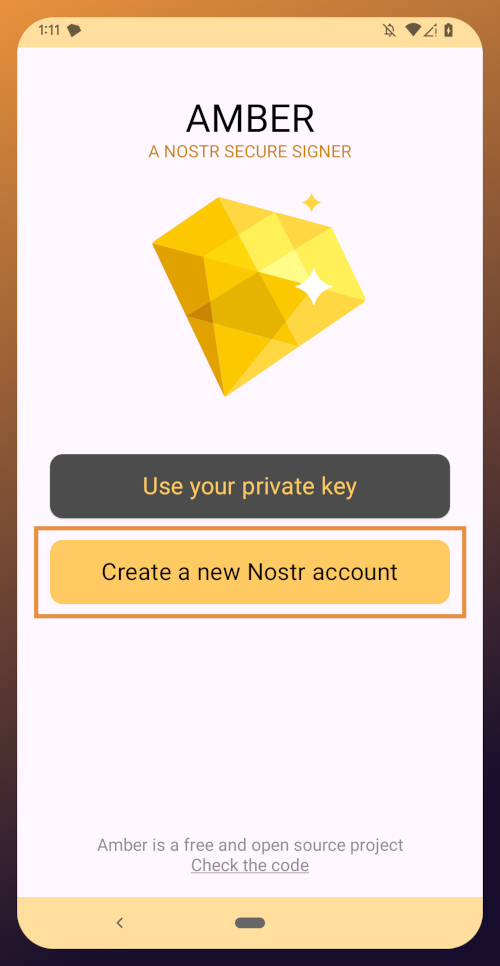

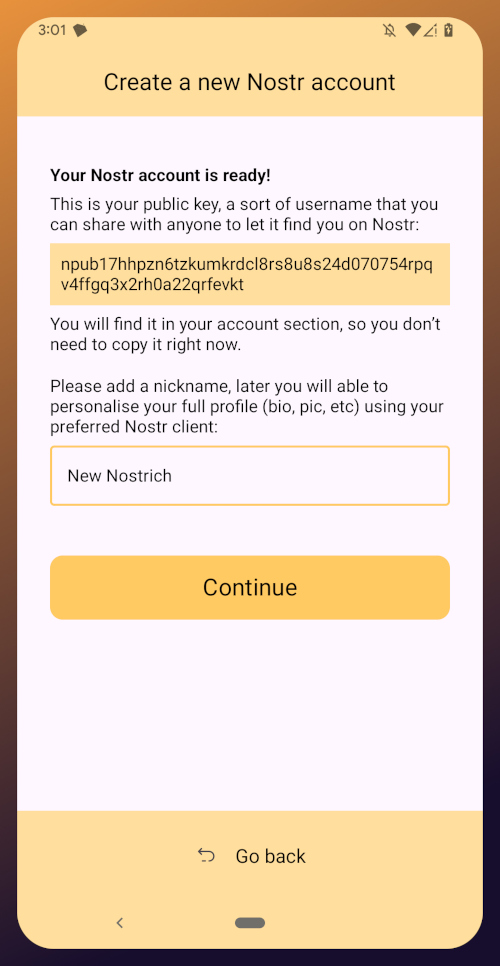

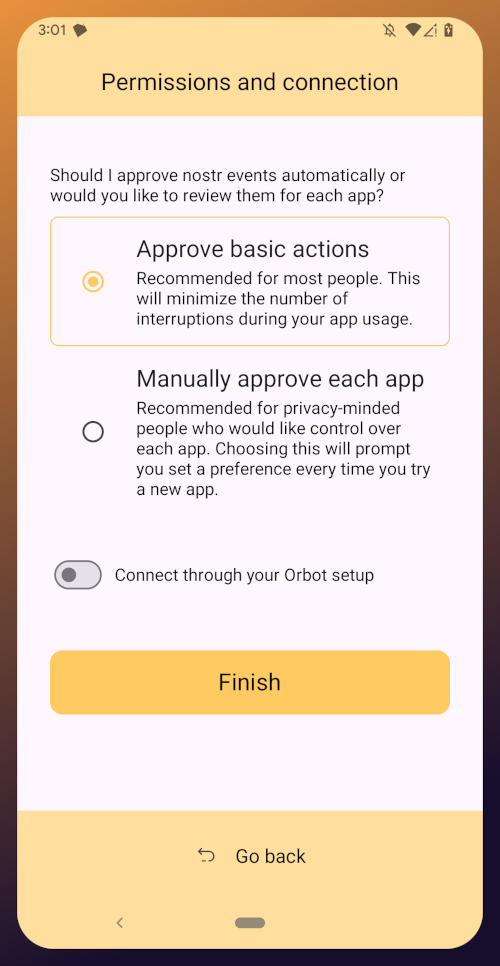

Enter #Amber, an application that will store your private key in only one app, and all other compatible Nostr apps can communicate with it to request a signature, without giving any of those other apps access to your private key.

Most Nostr apps for Android now support logging in and signing with Amber, and you can even use it to log into apps on other devices, such as some of the web apps you use on your PC. It's an incredible tool given to us by nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5, and only available for Android users. Those on iPhone are incredibly jealous that they don't have anything comparable, yet.

Speaking of nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5, the next app is also one of his making.

All Nostr data is stored on relays, which are very simple servers that Nostr apps read notes from and write notes to. In most forms of social media, it can be a pain to get your own data out to keep a backup. That's not the case on Nostr. Anyone can run their own relay, either for the sake of backing up their personal notes, or for others to post their notes to, as well.

Since Nostr notes take up very little space, you can actually run a relay on your phone. I have been on Nostr for almost 2 and a half years, and I have 25,000+ notes of various kinds on my relay, and a backup of that full database is just 24MB on my phone's storage.

Having that backup can save your bacon if you try out a new Nostr client and it doesn't find your existing follow list for some reason, so it writes a new one and you suddenly lose all of the people you were following. Just pop into your #Citrine relay, confirm it still has your correct follow list or import it from a recent backup, then have Citrine restore it. Done.

Additionally, there are things you may want to only save to a relay you control, such as draft messages that you aren't ready to post publicly, or eCash tokens, which can actually be saved to Nostr relays now. Citrine can also be used with Amber for signing into certain Nostr applications that use a relay to communicate with Amber.

If you are really adventurous, you can also expose Citrine over Tor to be used as an outbox relay, or used for peer-to-peer private messaging, but that is far more involved than the scope of this tutorial series.

You can't get far in Nostr without a solid and reliable client to interact with. #Amethyst is the client we will be using for this tutorial because there simply isn't another Android client that comes close, so far. Moreover, it can be a great client for new users to get started on, and yet it has a ton of features for power-users to take advantage of as well.

There are plenty of other good clients to check out over time, such as Coracle, YakiHonne, Voyage, Olas, Flotilla and others, but I keep coming back to Amethyst, and by the time you finish this tutorial, I think you'll see why. nostr:npub1gcxzte5zlkncx26j68ez60fzkvtkm9e0vrwdcvsjakxf9mu9qewqlfnj5z and others who have contributed to Amethyst have really built something special in this client, and it just keeps improving with every update that's shipped.

Most social media apps have some form of push notifications, and some Nostr apps do, too. Where the issue comes in is that Nostr apps are all interoperable. If you have more than one application, you're going to have both of them notifying you. Nostr users are known for having five or more Nostr apps that they use regularly. If all of them had notifications turned on, it would be a nightmare. So maybe you limit it to only one of your Nostr apps having notifications turned on, but then you are pretty well locked-in to opening that particular app when you tap on the notification.

Pokey, by nostr:npub1v3tgrwwsv7c6xckyhm5dmluc05jxd4yeqhpxew87chn0kua0tjzqc6yvjh, solves this issue, allowing you to turn notifications off for all of your Nostr apps, and have Pokey handle them all for you. Then, when you tap on a Pokey notification, you can choose which Nostr app to open it in.

Pokey also gives you control over the types of things you want to be notified about. Maybe you don't care about reactions, and you just want to know about zaps, comments, and direct messages. Pokey has you covered. It even supports multiple accounts, so you can get notifications for all the npubs you control.

One of the most unique and incredibly fun aspects of Nostr is the ability to send and receive #zaps. Instead of merely giving someone a 👍️ when you like something they said, you can actually send them real value in the form of sats, small portions of a Bitcoin. There is nothing quite like the experience of receiving your first zap and realizing that someone valued what you said enough to send you a small amount (and sometimes not so small) of #Bitcoin, the best money mankind has ever known.

To be able to have that experience, though, you are going to need a wallet that can send and receive zaps, and preferably one that is easy to connect to Nostr applications. My current preference for that is Alby Hub, but not everyone wants to deal with all that comes along with running a #Lightning node. That being the case, I have opted to use nostr:npub1h2qfjpnxau9k7ja9qkf50043xfpfy8j5v60xsqryef64y44puwnq28w8ch for this tutorial, because they offer one of the easiest wallets to set up, and it connects to most Nostr apps by just copy/pasting a connection string from the settings in the wallet into the settings in your Nostr app of choice.

Additionally, even though #Coinos is a custodial wallet, you can have it automatically transfer any #sats over a specified threshold to a separate wallet, allowing you to mitigate the custodial risk without needing to keep an eye on your balance and make the transfer manually.

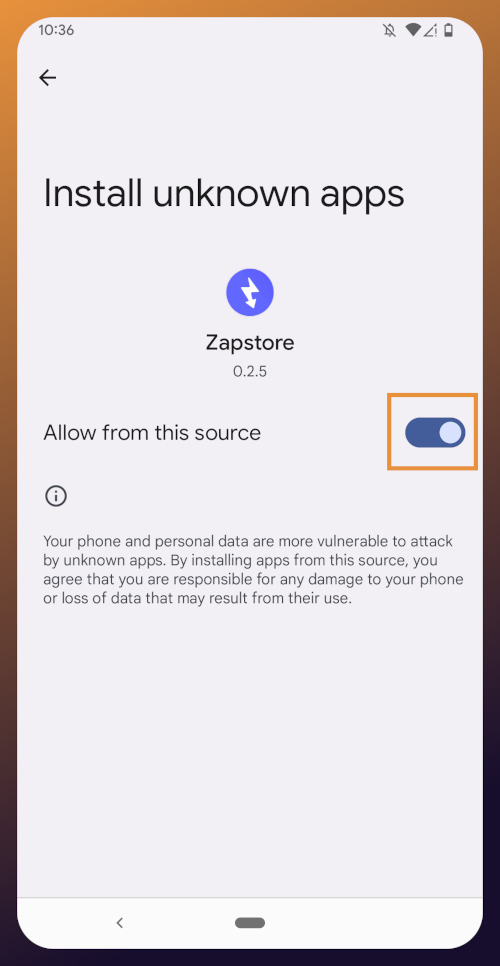

Most of us on Android are used to getting all of our mobile apps from one souce: the Google Play Store. That's not possible for this tutorial series. Only one of the apps mentioned above is available in Google's permissioned playground. However, on Android we have the advantage of being able to install whatever we want on our device, just by popping into our settings and flipping a toggle. Indeed, thumbing our noses at big-tech is at the heart of the Nostr ethos, so why would we make ourselves beholden to Google for installing Nostr apps?

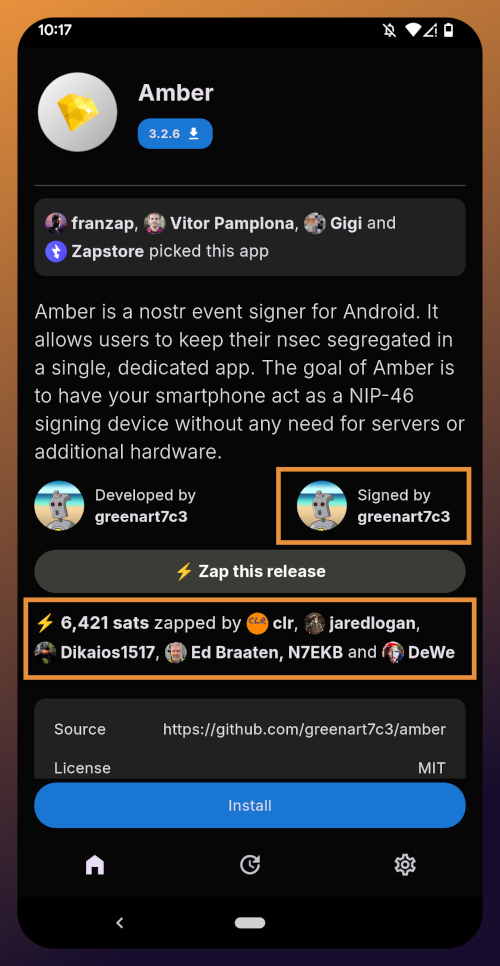

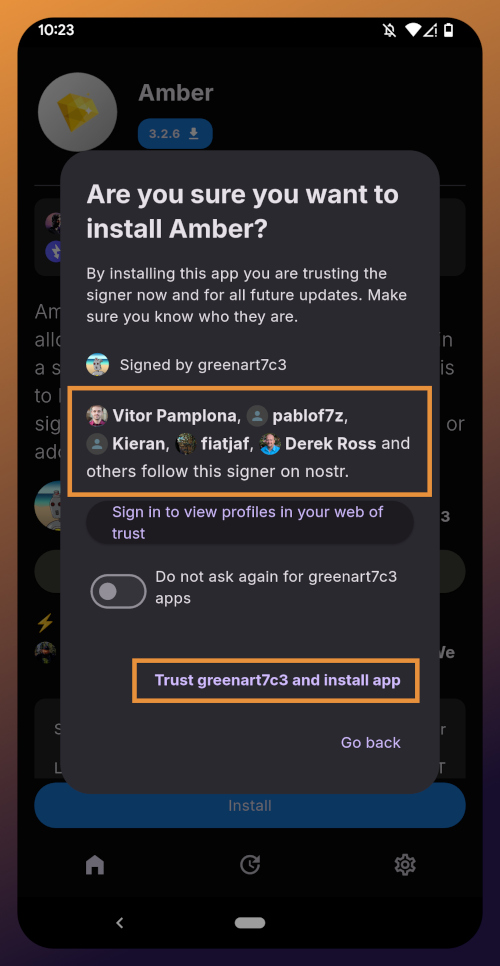

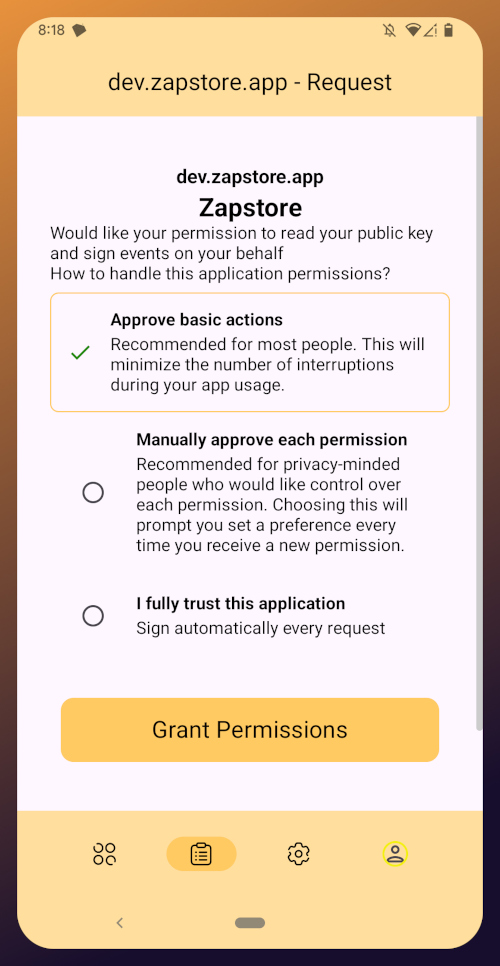

The nostr:npub10r8xl2njyepcw2zwv3a6dyufj4e4ajx86hz6v4ehu4gnpupxxp7stjt2p8 is an alternative app store made by nostr:npub1wf4pufsucer5va8g9p0rj5dnhvfeh6d8w0g6eayaep5dhps6rsgs43dgh9 as a resource for all sorts of open-source apps, but especially Nostr apps. What is more, you can log in with Amber, connect a wallet like Coinos, and support the developers of your favorite Nostr apps directly within the #Zapstore by zapping their app releases.

One of the biggest features of the Zapstore is the fact that developers can cryptographically sign their app releases using their Nostr keys, so you know that the app you are downloading is the one they actually released and hasn't been altered in any way. The Zapstore will warn you and won't let you install the app if the signature is invalid.

Getting Started

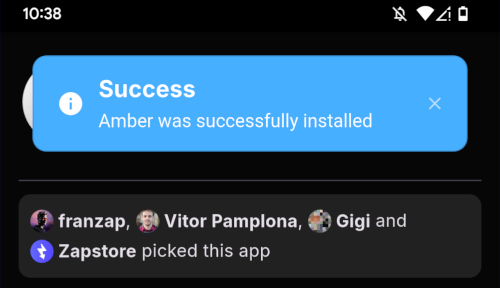

Since the Zapstore will be the source we use for installing most of the other apps mentioned, we will start with installing the Zapstore.

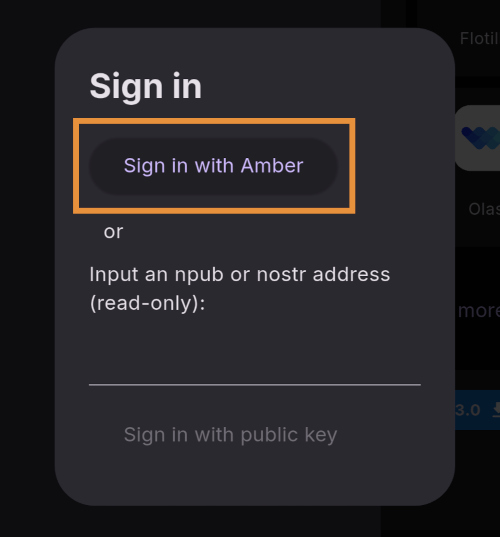

We will then use the Zapstore to install Amber and set it up with our Nostr account, either by creating a new private key, or by importing one we already have. We'll also use it to log into the Zapstore.

Next, we will install Amethyst from the Zapstore and log into it via Amber.

After this, we will install Citrine from the Zapstore and add it as a local relay on Amethyst.

Because we want to be able to send and receive zaps, we will set up a wallet with CoinOS and connect it to Amethyst and the Zapstore using Nostr Wallet Connect.

Finally, we will install Pokey using the Zapstore, log into it using Amber, and set up the notifications we want to receive.

By the time you are done with this series, you will have a great head-start on your Nostr journey compared to muddling through it all on your own. Moreover, you will have developed a familiarity with how things generally work on Nostr that can be applied to other apps you try out in the future.

Continue to Part 2: The Zapstore. Nostr Link: nostr:naddr1qvzqqqr4gupzpde8f55w86vrhaeqmd955y4rraw8aunzxgxstsj7eyzgntyev2xtqydhwumn8ghj7un9d3shjtnzwf5kw6r5vfhkcapwdejhgtcqp5cnwdphxv6rwwp3xvmnzvqgty5au

-

@ b7274d28:c99628cb

2025-05-28 01:11:43

@ b7274d28:c99628cb

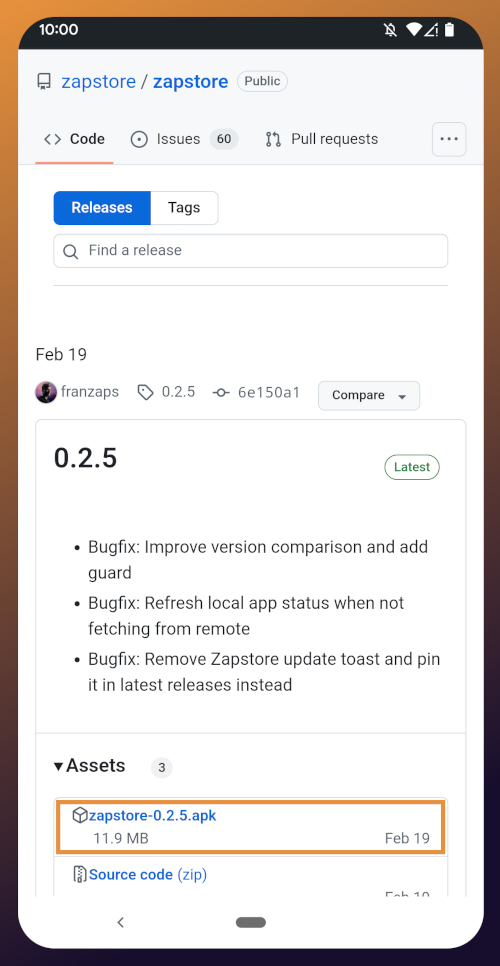

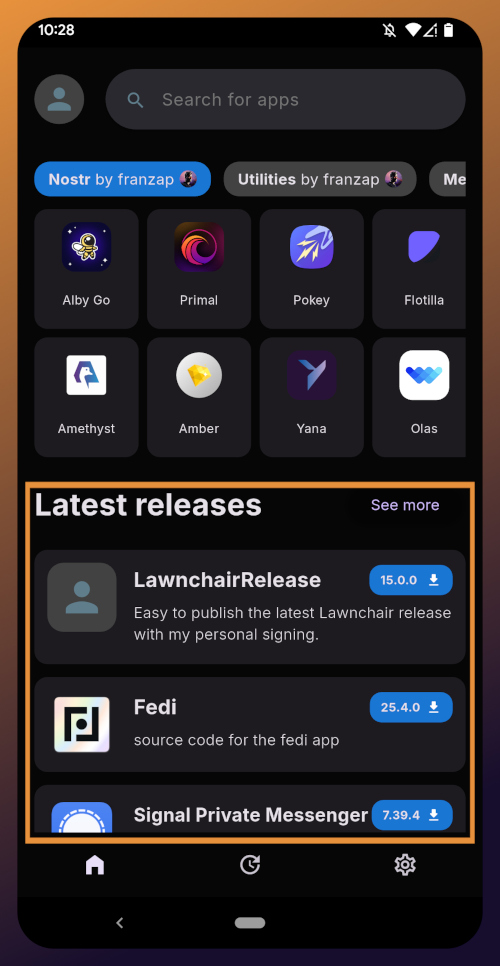

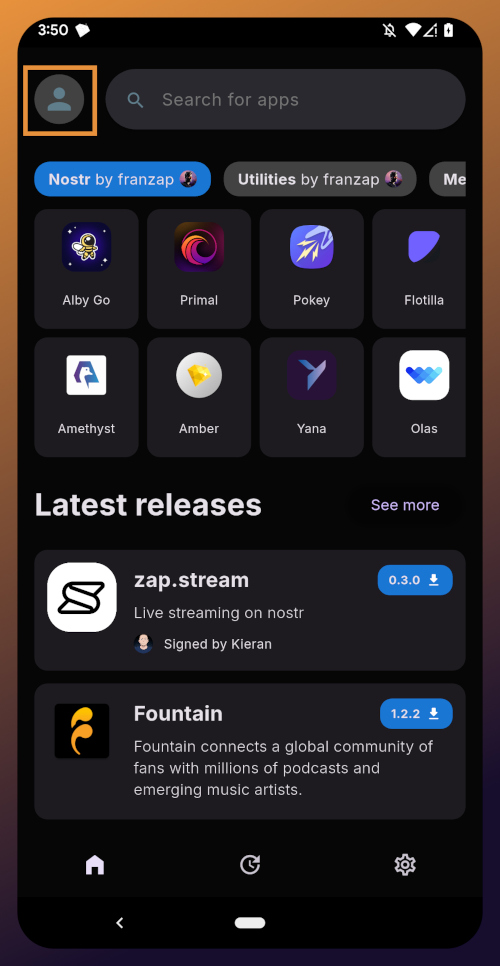

2025-05-28 01:11:43In this second installment of The Android Elite Setup tutorial series, we will cover installing the nostr:npub10r8xl2njyepcw2zwv3a6dyufj4e4ajx86hz6v4ehu4gnpupxxp7stjt2p8 on your #Android device and browsing for apps you may be interested in trying out.

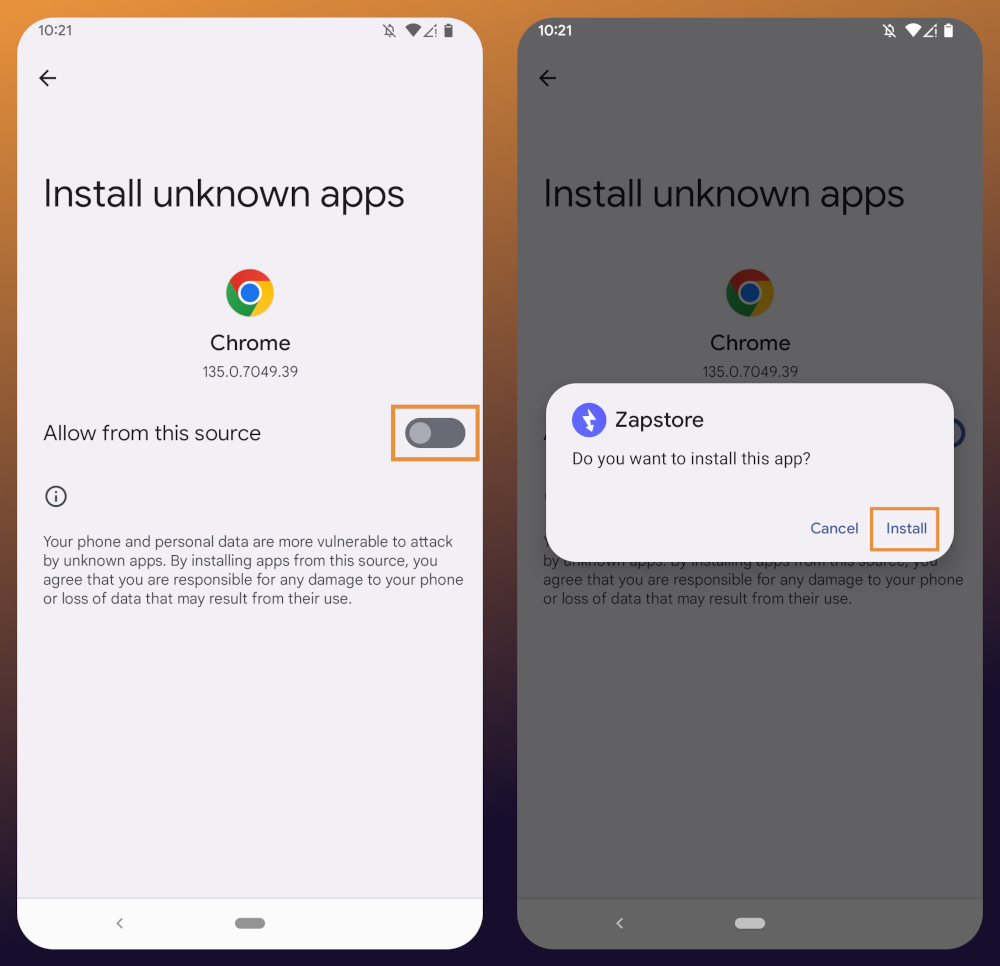

Since the #Zapstore is a direct competitor to the Google Play Store, you're not going to be able to find and install it from there like you may be used to with other apps. Instead, you will need to install it directly from the developer's GitHub page. This is not a complicated process, but it is outside the normal flow of searching on the Play Store, tapping install, and you're done.

Installation

From any web browser on your Android phone, navigate to the Zapstore GitHub Releases page and the most recent version will be listed at the top of the page. The .apk file for you to download and install will be listed in the "Assets."

Tap the .apk to download it, and you should get a notification when the download has completed, with a prompt to open the file.

You will likely be presented with a prompt warning you that your phone currently isn't allowed to install applications from "unknown sources." Anywhere other than the Play Store is considered an "unknown source" by default. However, you can manually allow installation from unknown sources in the settings, which the prompt gives you the option to do.

In the settings page that opens, toggle it to allow installation from this source, and you should be prompted to install the application. If you aren't, simply go to your web browser's downloads and tap on the .apk file again, or go into your file browser app and you should find the .apk in your Downloads folder.

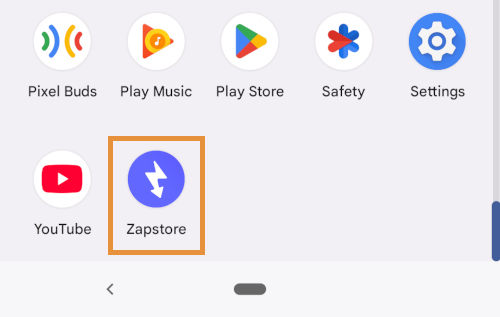

If the application doesn't open automatically after install, you will find it in your app drawer.

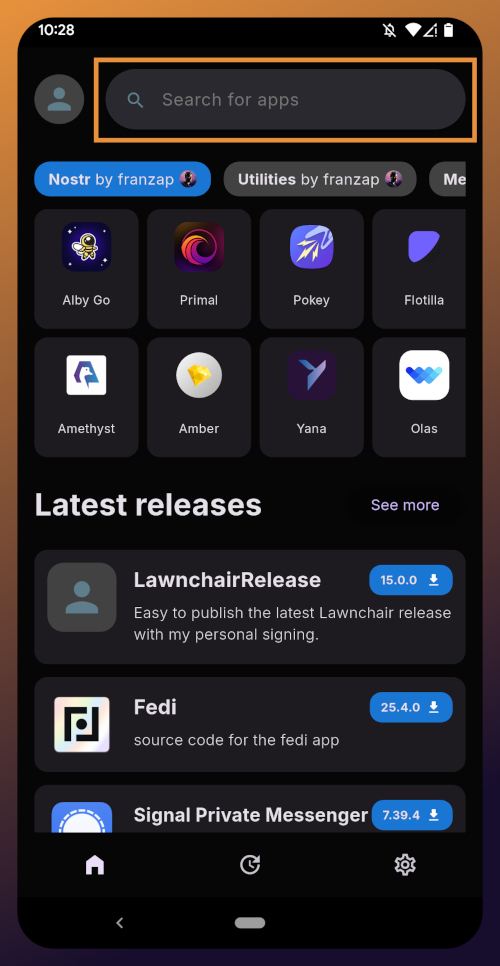

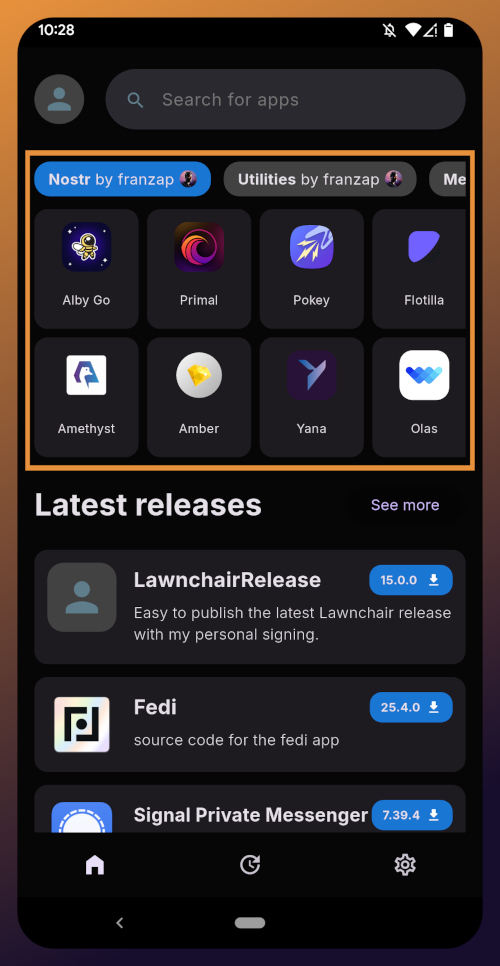

Home Page

Right at the top of the home page in the Zapstore is the search bar. You can use it to find a specific app you know is available in the Zapstore.

There are quite a lot of open source apps available, and more being added all the time. Most are added by the Zapstore developer, nostr:npub1wf4pufsucer5va8g9p0rj5dnhvfeh6d8w0g6eayaep5dhps6rsgs43dgh9, but some are added by the app developers themselves, especially Nostr apps. All of the applications we will be installing through the Zapstore have been added by their developers and are cryptographically signed, so you know that what you download is what the developer actually released.

The next section is for app discovery. There are curated app collections to peruse for ideas about what you may want to install. As you can see, all of the other apps we will be installing are listed in nostr:npub1wf4pufsucer5va8g9p0rj5dnhvfeh6d8w0g6eayaep5dhps6rsgs43dgh9's "Nostr" collection.

In future releases of the Zapstore, users will be able to create their own app collections.

The last section of the home page is a chronological list of the latest releases. This includes both new apps added to the Zapstore and recently updated apps. The list of recent releases on its own can be a great resource for discovering apps you may not have heard of before.

Installed Apps

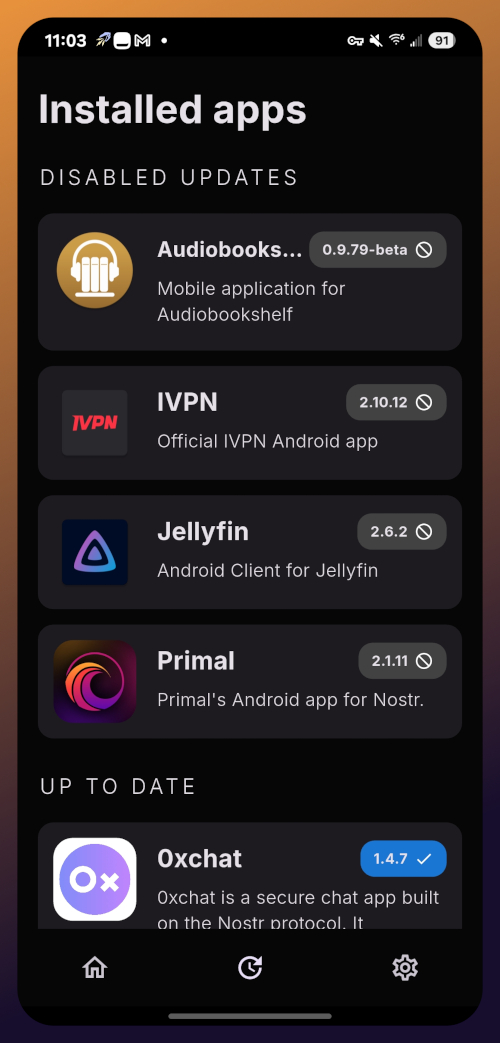

The next page of the app, accessed by the icon in the bottom-center of the screen that looks like a clock with an arrow circling it, shows all apps you have installed that are available in the Zapstore. It's also where you will find apps you have previously installed that are ready to be updated. This page is pretty sparse on my test profile, since I only have the Zapstore itself installed, so here is a look at it on my main profile:

The "Disabled Apps" at the top are usually applications that were installed via the Play Store or some other means, but are also available in the Zapstore. You may be surprised to see that some of the apps you already have installed on your device are also available on the Zapstore. However, to manage their updates though the Zapstore, you would need to uninstall the app and reinstall it from the Zapstore instead. I only recommend doing this for applications that are added to the Zapstore by their developers, or you may encounter a significant delay between a new update being released for the app and when that update is available on the Zapstore.

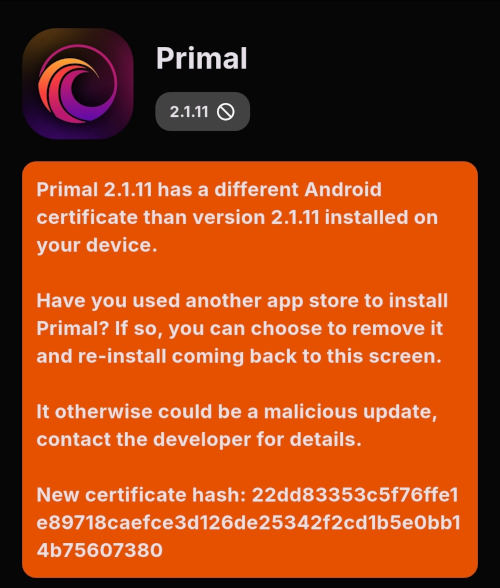

Tap on one of your apps in the list to see whether the app is added by the developer, or by the Zapstore. This takes you to the application's page, and you may see a warning at the top if the app was not installed through the Zapstore.

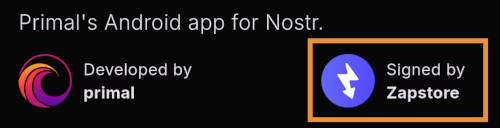

Scroll down the page a bit and you will see who signed the release that is available on the Zapstore.

In the case of Primal, even though the developer is on Nostr, they are not signing their own releases to the Zapstore yet. This means there will likely be a delay between Primal releasing an update and that update being available on the Zapstore.

Settings

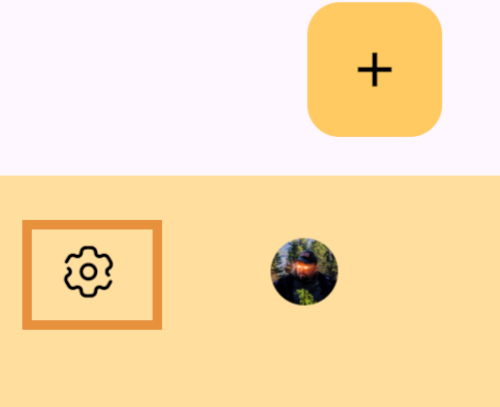

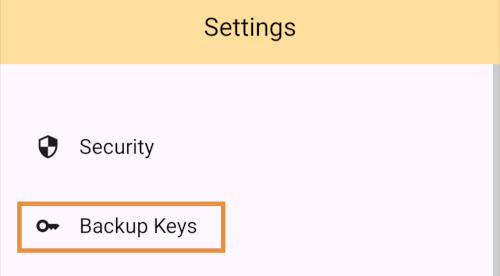

The last page of the app is the settings page, found by tapping the cog at the bottom right.

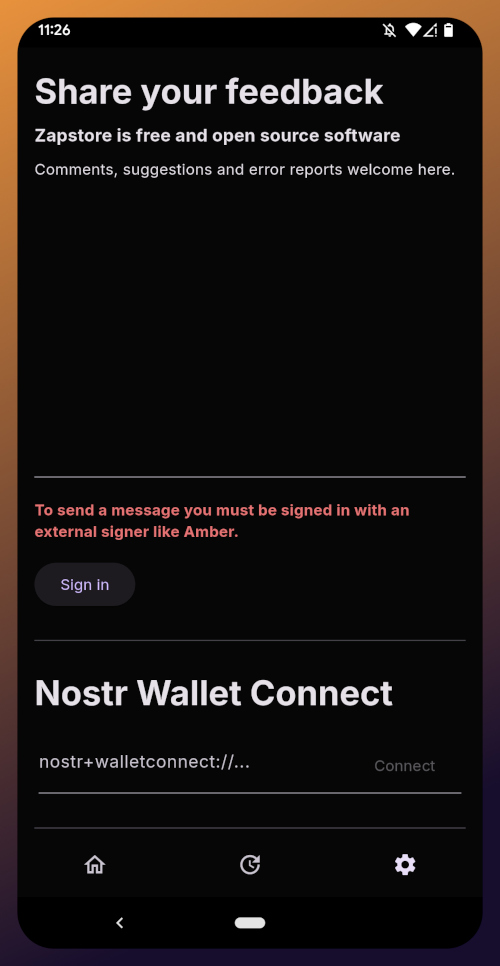

Here you can send the Zapstore developer feedback directly (if you are logged in), connect a Lightning wallet using Nostr Wallet Connect, delete your local cache, and view some system information.

We will be adding a connection to our nostr:npub1h2qfjpnxau9k7ja9qkf50043xfpfy8j5v60xsqryef64y44puwnq28w8ch wallet in part 5 of this tutorial series.

For the time being, we are all set with the Zapstore and ready for the next stage of our journey.

Continue to Part 3: Amber Signer. Nostr link: nostr:naddr1qqxnzde5xuengdeexcmnvv3eqgstwf6d9r37nqalwgxmfd9p9gclt3l0yc3jp5zuyhkfqjy6extz3jcrqsqqqa28qy2hwumn8ghj7un9d3shjtnyv9kh2uewd9hj7qg6waehxw309aex2mrp0yhxyunfva58gcn0d36zumn9wss80nug

-

@ 7f6db517:a4931eda

2025-05-28 14:02:13

@ 7f6db517:a4931eda

2025-05-28 14:02:13

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 5c26ee8b:a4d229aa

2025-05-26 16:10:05

@ 5c26ee8b:a4d229aa

2025-05-26 16:10:05In March 2022, I have introduced “VCPs”; (Virtual Currency points). So that the international transactions are made without relying on one currency or another and the financial crises are easily avoided.

You may have noticed that banks are increasing their gold reserves and that there are interests for local virtual currency and that was after the note was published.

The picture of the note showing its date will be in attachment to this post; I can’t edit it to avoid that its date gets changed. Here its content:

Conversion of international banking system: The “VCPs” system: * Each central bank would keep its assets and funds in homeland. * Establishing the value of one virtual currency point. I suggested that: 1 virtual currency point (VCP) = 0.1 gram of gold. * Virtual evaluation must be made to each currency, virtual currency points must be added to each currency’s market value. * International transfers and payments must use the virtual currency points, VCPs, assigned to each currency in international operations. * Daily, weekly, monthly or yearly the actual money corresponding to the virtual currency points used in payments and transfers will be sent by any chosen mean of transport to the banks that had completed the operations or to the corresponding central banks. In this way no currency would prevail in international payments as all currencies will be considered as VCPs. —————————————————————- Because of the need of more guidelines to start using VCPs I have published the following updates:

VCPs allowance updates:

- Not only gold, also precious stones or agreed minerals held in banks can be used to obtain the VCPs allowance (public VCPs allowances). At the same time what is registered and kept in circulation (of gold, precious stones and agreed minerals that belongs to the people) in the country as private VCPs allowances to increase the VCPs allowances. The people can use their personal VCPs along with their precious items for purchases; for example if they sell or use their own gold to buy something, they must give their VCPs registration receipt or card (if they didn’t register their gold to obtain VCPs allowance, they can get it registered at the moment they decide to sell it so it gets added to the private VCPs allowances of his/her country). However, the registered materials must be declared at all borders while traveling once exceeded an internationally agreed specific amount (such as the value of €10000). Therefore a registration method can be agreed with gold and jewelry shops. For instance, while evaluating the materials getting registered, an online VCPs account (for a first registration) can get made on the site that is getting ready and the registration can be combined with a physical/online card (VCPs allowance card. For registering other materials in a later moment, the same card can be used to access the same account. Note that the materials must be used with the private VCPs allowance card for buying or selling, while for public VCPs accounts it’s not necessary because the materials will be kept in the central bank or other banks) or a receipt with a serial number (and other methods to protect customers from fraud). Banks can buy private VCPs while buying gold or other agreed materials and make them public VCPs. And people can have public VCPs allowances corresponding to the value of money (currency) they have already in their accounts. While if people buy gold from the bank (with cash or any other payment method), the related public VCPs allowance will be transformed into private ones (the buyers must receive the actual gold with the private VCPs allowance).

- The agreed materials that can be used to obtain public VCPs must not be consumable (such as oil or natural gas) or used for industrial purposes (such as iron or lithium).

- The printed and online (used by credit or debit cards) currency kept in circulation of the concerned country must correspond to the value of public VCPs allowance that must correspond with the value of gold kept in the central bank (printing more money will decrease its own value internationally).

- Private banks in the same country can have a public VCPs agreement with the central bank so that each bank registers and declares how much gold or valuable materials it has and get its own share of public VCPs allowance and its related printed/online currency in circulation.

- Gems and gold kept in museums can have public VCPs allowances that correspond to their weights only not the archeological values.

- International trade can use public VCPs allowances and the physical payment must follow; either by a preferred currency or gold. However if two or more countries have a trade agreement they can barter goods using IVCPs (International VCPs Allowances; that does not need to have a deposited amount of gold although they will use the same reference as public or private VCPs because it’s a general way to evaluate goods of different types; so for example oil can be swapped for electronics based on how much IVCPs are agreed to be equally swapped each year; i.e. a gallon of oil that costs 50 IVCPs can be swapped for a device that costs 25 IVCPs and grains that cost 25 IVCPs in an International VCPs Allowance Agreement where all parties receives the agreed goods without transferring money or gold). The amount of IVCPs can be agreed per year or there could a multiple online account/s viewable by the countries/parties taking part in the agreement showing the balance of International VCPs that can still be used in bartering goods for each one of the participating countries/parties).

- Cryptocurrencies can be like International VCPs they won’t need to have a deposit of gold, however they must go through an evaluation process compared to their current comparative value and gold (i.e. the amount of bitcoin that must be paid to buy a 0.1g of gold now can become the fixed value) so that the Cryptocurrencies can still be used for trading or bartering for goods even after the release of VCPs. The Cryptocurrencies can sustain the deficiencies of amount of currency that can be used in the same country or internationally (because not everyone can have enough gold deposited to sustain the daily trade). However regulations on the amount of Cryptocurrency/ies exchanged in a country must be agreed with its own central bank or there could be an international agreement; this amount can’t be less than what’s already in use of a certain Cryptocurrency. Or Cryptocurrencies can be exchanged with IVCPs (to protect people’s money while keeping in mind their compared value with gold now) and an amount of International VCPs allowance can be used also for bartering goods in the same country through an agreement with its own central bank.

- Public VCPs must have printable cash allowance that can be in the country or overseas (registered in banks, exchange companies and at borders). Each bank can have registers of local or foreign cash.

- In order to avoid the devaluation of the currency, because the printed money will corrisponde to the gold or valuable minerals held by the country, the concerned country must retrieve the cash abroad and replace it either with another currency or IVCPs through a trade agreement.

- To compensate the deficit of VCPs necessary for daily use within a country and to make a proper distinction, locally, Local Virtual Points (LVCPs) can be used.

- The Local VCPs would be issued by local authorities.

Meanwhile, countries started using the free VCPs platform that is built by a talented web developer in JavaScript; fiatjaf. I insist though that the trade name for the virtual currency points stays “VCPs” and that the clients are made aware of its usage in their daily banking.

-

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06Star Wars is often viewed as a myth of rebellion, freedom, and resistance to tyranny. The iconography—scrappy rebels, totalitarian stormtroopers, lone smugglers—suggests a deep anti-authoritarian ethos. Yet, beneath the surface, the narrative arc of Star Wars consistently affirms the necessity, even sanctity, of central authority. This blog entry introduces the question: Is Star Wars fundamentally a celebration of statism?

Rebellion as Restoration, Not Revolution

The Rebel Alliance’s mission is not to dismantle centralized power, but to restore the Galactic Republic—a bureaucratic, centrally governed institution. Characters like Mon Mothma and Bail Organa are high-ranking senators, not populist revolutionaries. The goal is to remove the corrupt Empire and reinstall a previous central authority, presumed to be just.

- Rebels are loyalists to a prior state structure.

- Power is not questioned, only who wields it.

Jedi as Centralized Moral Elites

The Jedi, often idealized as protectors of peace, are unelected, extra-legal enforcers of moral and military order. Their authority stems from esoteric metaphysical abilities rather than democratic legitimacy.

- They answer only to their internal Council.

- They are deployed by the Senate, but act independently of civil law.

- Their collapse is depicted as tragic not because they were unaccountable, but because they were betrayed.

This positions them as a theocratic elite, not spiritual anarchists.

Chaos and the Frontier: The Case of the Cantina

The Mos Eisley cantina, often viewed as a symbol of frontier freedom, reveals something darker. It is: - Lawless - Violent - Culturally fragmented

Conflict resolution occurs through murder, not mediation. Obi-Wan slices off a limb; Han shoots first—both without legal consequence. There is no evidence of property rights, dispute resolution, or voluntary order.

This is not libertarian pluralism—it’s moral entropy. The message: without centralized governance, barbarism reigns.

The Mythic Arc: Restoration of the Just State

Every trilogy in the saga returns to a single theme: the fall and redemption of legitimate authority.

- Prequels: Republic collapses into tyranny.

- Originals: Rebels fight to restore legitimate order.

- Sequels: Weak governance leads to resurgence of authoritarianism; heroes must reestablish moral centralism.

The story is not anti-state—it’s anti-bad state. The solution is never decentralization; it’s the return of the right ruler or order.

Conclusion: The Hidden Statism of a Rebel Myth

Star Wars wears the costume of rebellion, but tells the story of centralized salvation. It: - Validates elite moral authority (Jedi) - Romanticizes restoration of fallen governments (Republic) - Portrays decentralized zones as corrupt and savage (outer rim worlds)

It is not an anarchist parable, nor a libertarian fable. It is a statist mythology, clothed in the spectacle of rebellion. Its core message is not that power should be abolished, but that power belongs to the virtuous few.

Question to Consider:

If the Star Wars universe consistently affirms the need for centralized moral and political authority, should we continue to see it as a myth of freedom? Or is it time to recognize it as a narrative of benevolent empire? -

@ 7f6db517:a4931eda

2025-05-28 11:01:40

@ 7f6db517:a4931eda

2025-05-28 11:01:40

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ b1ddb4d7:471244e7

2025-05-28 14:01:28

@ b1ddb4d7:471244e7

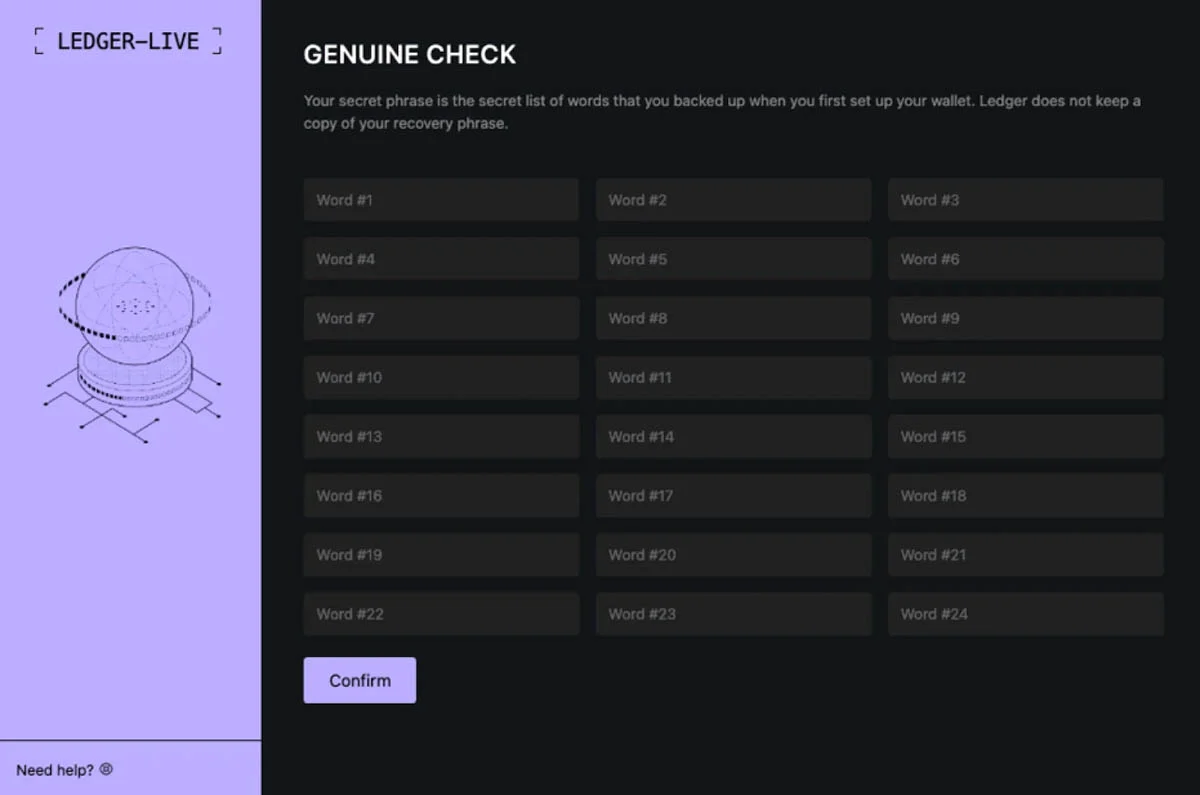

2025-05-28 14:01:28Custodial Lightning wallets allow users to transact without managing private keys or channel liquidity. The provider handles technical complexities, but this convenience comes with critical trade-offs:

- You don’t control your keys: The custodian holds your bitcoin.

- Centralized points of failure: Servers can be hacked or shut down.

- Surveillance risks: Providers track transaction metadata.

Key Risks of Custodial Lightning Wallets

*1. Hacks and Exit Scams*

Custodians centralize large amounts of bitcoin, attracting hackers:

- Nearly $2.2 billion worth of funds were stolen from hacks in 2024.

- Lightning custodians suffered breaches, losing user funds.

Unlike non-custodial wallets, victims have no recourse since they don’t hold keys.

*2. Censorship and Account Freezes*

Custodians comply with regulators, risking fund seizures:

- Strike (a custodial Lightning app) froze accounts of users in sanctioned regions.

- A U.K. court in 2020 ordered Bitfinex to freeze bitcoin worth $860,000 after the exchange and blockchain sleuthing firm Chainalysis traced the funds to a ransomware payment.

*3. Privacy Erosion*

Custodians log user activity, exposing sensitive data:

- Transaction amounts, receiver addresses, and IPs are recorded.

*4. Service Downtime*

Centralized infrastructure risks outages.

*5. Inflation of Lightning Network Centralization*

Custodians dominate liquidity, weakening network resilience:

- At the moment, 10% of the nodes on Lightning control 80% of the liquidity.

- This centralization contradicts bitcoin’s decentralized ethos.

How to Switch to Self-Custodial Lightning Wallets

Migrating from custodial services is straightforward:

*1. Choose a Non-Custodial Wallet*

Opt for wallets that let you control keys and channels:

- Flash: The self-custodial tool that lets you own your keys, control your coins, and transact instantly.

- Breez Wallet : Non-custodial, POS integrations.

- Core Lightning : Advanced, for self-hosted node operators.

*2. Transfer Funds Securely*

- Withdraw funds from your custodial wallet to a bitcoin on-chain address.

- Send bitcoin to your non-custodial Lightning wallet.

*3. Set Up Channel Backups*

Use tools like Static Channel Backups (SCB) to recover channels if needed.

*4. Best Practices*

- Enable Tor: Mask your IP (e.g., Breez’s built-in Tor support).

- Verify Receiving Addresses: Avoid phishing scams.

- Regularly Rebalance Channels: Use tools like Lightning Pool for liquidity.

Why Self-Custodial Lightning Matters

- Self-custody: Control your keys and funds.

- Censorship resistance: No third party can block transactions.

- Network health: Decentralized liquidity strengthens Lightning.

Self-custodial wallets now rival custodial ease.

Custodial Lightning wallets sacrifice security for convenience, putting users at risk of hacks, surveillance, and frozen funds. As bitcoin adoption grows, so does the urgency to embrace self-custodial solutions.

Take action today:

- Withdraw custodial funds to a hardware wallet.

- Migrate to a self-custodial Lightning wallet.

- Educate others on the risks of custodial control.

The Lightning Network’s potential hinges on decentralization—don’t let custodians become its Achilles’ heel.

-

@ 7f6db517:a4931eda

2025-05-28 11:01:39

@ 7f6db517:a4931eda

2025-05-28 11:01:39

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ c9badfea:610f861a

2025-05-25 22:36:12

@ c9badfea:610f861a

2025-05-25 22:36:12- Install Notally (it's free and open source)

- Open the app, tap ≡, and select Settings

- Tap View and switch to Grid

- Return to the main screen

- Tap ☑ to create a task list and ✏️ to create a note

- Enjoy!

ℹ️ You can also add pictures and set reminders for notes and task lists

ℹ️ Add labels to the notes (e.g. "Diary", "Snippet" or "Knowledge")

ℹ️ Use emojis to enhance titles (e.g. "🛒 Purchases" and "🔗️ Links")

-

@ b7274d28:c99628cb

2025-05-27 07:07:33

@ b7274d28:c99628cb

2025-05-27 07:07:33A few months ago, a nostrich was switching from iOS to Android and asked for suggestions for #Nostr apps to try out. nostr:npub18ams6ewn5aj2n3wt2qawzglx9mr4nzksxhvrdc4gzrecw7n5tvjqctp424 offered the following as his response:

nostr:nevent1qvzqqqqqqypzq0mhp4ja8fmy48zuk5p6uy37vtk8tx9dqdwcxm32sy8nsaa8gkeyqydhwumn8ghj7un9d3shjtnwdaehgunsd3jkyuewvdhk6tcpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhszythwden5te0dehhxarj9emkjmn99uqzpwwts6n28eyvjpcwvu5akkwu85eg92dpvgw7cgmpe4czdadqvnv984rl0z

Yes. #Android users are fortunate to have some powerful Nostr apps and tools at our disposal that simply have no comparison over on the iOS side. However, a tool is only as good as the knowledge of the user, who must have an understanding of how best to wield it for maximum effect. This fact was immediately evidenced by replies to Derek asking, "What is the use case for Citrine?" and "This is the first time I'm hearing about Citrine and Pokey. Can you give me links for those?"

Well, consider this tutorial your Nostr starter-kit for Android. We'll go over installing and setting up Amber, Amethyst, Citrine, and Pokey, and as a bonus we'll be throwing in the Zapstore and Coinos to boot. We will assume no previous experience with any of the above, so if you already know all about one or more of these apps, you can feel free to skip that tutorial.

So many apps...

You may be wondering, "Why do I need so many apps to use Nostr?" That's perfectly valid, and the honest answer is, you don't. You can absolutely just install a Nostr client from the Play Store, have it generate your Nostr identity for you, and stick with the default relays already set up in that app. You don't even need to connect a wallet, if you don't want to. However, you won't experience all that Nostr has to offer if that is as far as you go, any more than you would experience all that Italian cuisine has to offer if you only ever try spaghetti.

Nostr is not just one app that does one thing, like Facebook, Twitter, or TikTok. It is an entire ecosystem of applications that are all built on top of a protocol that allows them to be interoperable. This set of tools will help you make the most out of that interoperability, which you will never get from any of the big-tech social platforms. It will provide a solid foundation for you to build upon as you explore more and more of what Nostr has to offer.

So what do these apps do?

Fundamental to everything you do on Nostr is the need to cryptographically sign with your private key. If you aren't sure what that means, just imagine that you had to enter your password every time you hit the "like" button on Facebook, or every time you commented on the latest dank meme. That would get old really fast, right? That's effectively what Nostr requires, but on steroids.

To keep this from being something you manually have to do every 5 seconds when you post a note, react to someone else's note, or add a comment, Nostr apps can store your private key and use it to sign behind the scenes for you. This is very convenient, but it means you are trusting that app to not do anything with your private key that you don't want it to. You are also trusting it to not leak your private key, because anyone who gets their hands on it will be able to post as you, see your private messages, and effectively be you on Nostr. The more apps you give your private key to, the greater your risk that it will eventually be compromised.

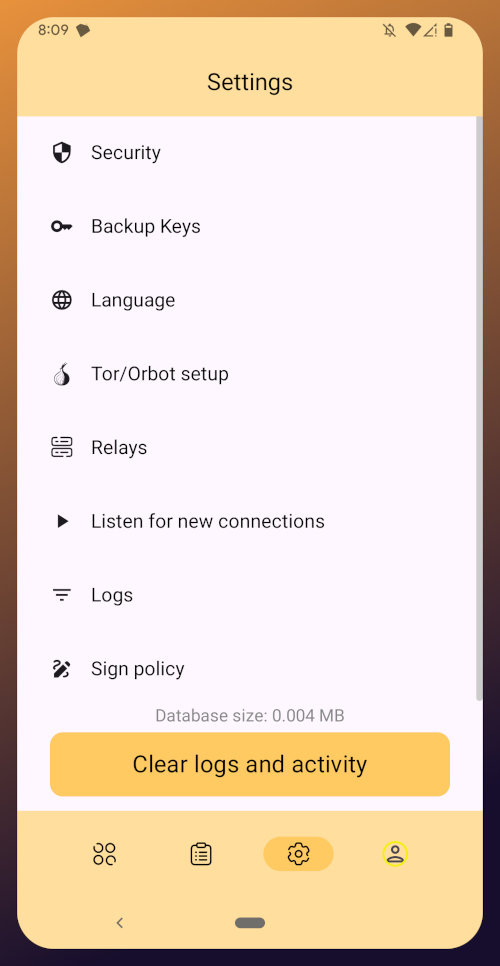

Enter #Amber, an application that will store your private key in only one app, and all other compatible Nostr apps can communicate with it to request a signature, without giving any of those other apps access to your private key.

Most Nostr apps for Android now support logging in and signing with Amber, and you can even use it to log into apps on other devices, such as some of the web apps you use on your PC. It's an incredible tool given to us by nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5, and only available for Android users. Those on iPhone are incredibly jealous that they don't have anything comparable, yet.

Speaking of nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5, the next app is also one of his making.

All Nostr data is stored on relays, which are very simple servers that Nostr apps read notes from and write notes to. In most forms of social media, it can be a pain to get your own data out to keep a backup. That's not the case on Nostr. Anyone can run their own relay, either for the sake of backing up their personal notes, or for others to post their notes to, as well.

Since Nostr notes take up very little space, you can actually run a relay on your phone. I have been on Nostr for almost 2 and a half years, and I have 25,000+ notes of various kinds on my relay, and a backup of that full database is just 24MB on my phone's storage.

Having that backup can save your bacon if you try out a new Nostr client and it doesn't find your existing follow list for some reason, so it writes a new one and you suddenly lose all of the people you were following. Just pop into your #Citrine relay, confirm it still has your correct follow list or import it from a recent backup, then have Citrine restore it. Done.

Additionally, there are things you may want to only save to a relay you control, such as draft messages that you aren't ready to post publicly, or eCash tokens, which can actually be saved to Nostr relays now. Citrine can also be used with Amber for signing into certain Nostr applications that use a relay to communicate with Amber.

If you are really adventurous, you can also expose Citrine over Tor to be used as an outbox relay, or used for peer-to-peer private messaging, but that is far more involved than the scope of this tutorial series.

You can't get far in Nostr without a solid and reliable client to interact with. #Amethyst is the client we will be using for this tutorial because there simply isn't another Android client that comes close, so far. Moreover, it can be a great client for new users to get started on, and yet it has a ton of features for power-users to take advantage of as well.

There are plenty of other good clients to check out over time, such as Coracle, YakiHonne, Voyage, Olas, Flotilla and others, but I keep coming back to Amethyst, and by the time you finish this tutorial, I think you'll see why. nostr:npub1gcxzte5zlkncx26j68ez60fzkvtkm9e0vrwdcvsjakxf9mu9qewqlfnj5z and others who have contributed to Amethyst have really built something special in this client, and it just keeps improving with every update that's shipped.

Most social media apps have some form of push notifications, and some Nostr apps do, too. Where the issue comes in is that Nostr apps are all interoperable. If you have more than one application, you're going to have both of them notifying you. Nostr users are known for having five or more Nostr apps that they use regularly. If all of them had notifications turned on, it would be a nightmare. So maybe you limit it to only one of your Nostr apps having notifications turned on, but then you are pretty well locked-in to opening that particular app when you tap on the notification.

Pokey, by nostr:npub1v3tgrwwsv7c6xckyhm5dmluc05jxd4yeqhpxew87chn0kua0tjzqc6yvjh, solves this issue, allowing you to turn notifications off for all of your Nostr apps, and have Pokey handle them all for you. Then, when you tap on a Pokey notification, you can choose which Nostr app to open it in.

Pokey also gives you control over the types of things you want to be notified about. Maybe you don't care about reactions, and you just want to know about zaps, comments, and direct messages. Pokey has you covered. It even supports multiple accounts, so you can get notifications for all the npubs you control.

One of the most unique and incredibly fun aspects of Nostr is the ability to send and receive #zaps. Instead of merely giving someone a 👍️ when you like something they said, you can actually send them real value in the form of sats, small portions of a Bitcoin. There is nothing quite like the experience of receiving your first zap and realizing that someone valued what you said enough to send you a small amount (and sometimes not so small) of #Bitcoin, the best money mankind has ever known.

To be able to have that experience, though, you are going to need a wallet that can send and receive zaps, and preferably one that is easy to connect to Nostr applications. My current preference for that is Alby Hub, but not everyone wants to deal with all that comes along with running a #Lightning node. That being the case, I have opted to use nostr:npub1h2qfjpnxau9k7ja9qkf50043xfpfy8j5v60xsqryef64y44puwnq28w8ch for this tutorial, because they offer one of the easiest wallets to set up, and it connects to most Nostr apps by just copy/pasting a connection string from the settings in the wallet into the settings in your Nostr app of choice.

Additionally, even though #Coinos is a custodial wallet, you can have it automatically transfer any #sats over a specified threshold to a separate wallet, allowing you to mitigate the custodial risk without needing to keep an eye on your balance and make the transfer manually.

Most of us on Android are used to getting all of our mobile apps from one souce: the Google Play Store. That's not possible for this tutorial series. Only one of the apps mentioned above is available in Google's permissioned playground. However, on Android we have the advantage of being able to install whatever we want on our device, just by popping into our settings and flipping a toggle. Indeed, thumbing our noses at big-tech is at the heart of the Nostr ethos, so why would we make ourselves beholden to Google for installing Nostr apps?

The nostr:npub10r8xl2njyepcw2zwv3a6dyufj4e4ajx86hz6v4ehu4gnpupxxp7stjt2p8 is an alternative app store made by nostr:npub1wf4pufsucer5va8g9p0rj5dnhvfeh6d8w0g6eayaep5dhps6rsgs43dgh9 as a resource for all sorts of open-source apps, but especially Nostr apps. What is more, you can log in with Amber, connect a wallet like Coinos, and support the developers of your favorite Nostr apps directly within the #Zapstore by zapping their app releases.

One of the biggest features of the Zapstore is the fact that developers can cryptographically sign their app releases using their Nostr keys, so you know that the app you are downloading is the one they actually released and hasn't been altered in any way. The Zapstore will warn you and won't let you install the app if the signature is invalid.

Getting Started

Since the Zapstore will be the source we use for installing most of the other apps mentioned, we will start with installing the Zapstore.

We will then use the Zapstore to install Amber and set it up with our Nostr account, either by creating a new private key, or by importing one we already have. We'll also use it to log into the Zapstore.

Next, we will install Amethyst from the Zapstore and log into it via Amber.

After this, we will install Citrine from the Zapstore and add it as a local relay on Amethyst.

Because we want to be able to send and receive zaps, we will set up a wallet with CoinOS and connect it to Amethyst and the Zapstore using Nostr Wallet Connect.

Finally, we will install Pokey using the Zapstore, log into it using Amber, and set up the notifications we want to receive.

By the time you are done with this series, you will have a great head-start on your Nostr journey compared to muddling through it all on your own. Moreover, you will have developed a familiarity with how things generally work on Nostr that can be applied to other apps you try out in the future.

Continue to Part 2: The Zapstore. Nostr Link: nostr:naddr1qvzqqqr4gupzpde8f55w86vrhaeqmd955y4rraw8aunzxgxstsj7eyzgntyev2xtqydhwumn8ghj7un9d3shjtnzwf5kw6r5vfhkcapwdejhgtcqp5cnwdphxv6rwwp3xvmnzvqgty5au

-

@ b1ddb4d7:471244e7

2025-05-28 14:01:26

@ b1ddb4d7:471244e7

2025-05-28 14:01:26The upcoming Bitcoin 2025 conference, scheduled from May 27–29 at the Venetian Conference Center in Las Vegas, is set to make history with an official attempt to break the GUINNESS WORLD RECORDS® title for the most Bitcoin point-of-sale transactions in an eight-hour period.

Organized by BTC Inc, the event will showcase Bitcoin’s evolution from a digital capital asset to a practical medium of exchange, leveraging the latest advancements in payment technology.

Tap-to-Pay with Lightning-Ready Bolt Cards

To facilitate this record-setting attempt, 4,000 Lightning-ready Bolt Cards will be distributed to conference attendees.

— Uncle Rockstar Developer (@r0ckstardev) May 15, 2025

These NFC-enabled cards allow users to make instant, contactless Bitcoin payments at vendor booths throughout the expo-no apps or QR codes required, just a simple tap.

The cards are available in four collectible designs, each featuring a prominent figure in Bitcoin’s history: Senator Cynthia Lummis, Michael Saylor, Satoshi Nakamoto, and Jack Dorsey.

Each attendee will receive a randomly assigned card, making them both functional and collectible souvenirs.

Senator Lummis: A Playful Provocation

Notably, one of the card designs features Senator Cynthia Lummis with laser eyes-a playful nod to her reputation as a leading Bitcoin advocate in US politics.

While Lummis is known for her legislative efforts to promote Bitcoin integration, she has publicly stated she prefers to “spend dollars and save Bitcoin,” viewing BTC as a long-term store of value rather than a daily currency.

The choice to feature her on the Bolt Card, could be suggested by Rockstar Dev of the BTC Pay Server Foundation, perhaps a lighthearted way to highlight the ongoing debate about Bitcoin’s role in everyday payments.

Nothing cracks me up quite like a senator that wants the US to buy millions of Bitcoin use dollars to buy a beer at a Bitcoin bar.

This is how unserious some of you are. pic.twitter.com/jftIEggmip

— Magoo PhD (@HodlMagoo) April 4, 2025

How Bolt Cards and the Lightning Network Work

Bolt Cards are physical cards equipped with NFC (Near Field Communication) technology, similar to contactless credit or debit cards. When linked to a compatible Lightning wallet, they enable users to make Bitcoin payments over the Lightning Network by simply tapping the card at a point-of-sale terminal.

The Lightning Network is a second-layer protocol built on top of Bitcoin, designed to facilitate instant, low-cost transactions ideal for everyday purchases.

This integration aims to make Bitcoin as easy to use as traditional payment methods, eliminating the need for QR code scanning or mobile apps.

A Showcase for Bitcoin’s Real-World Usability

With over 30,000 attendees, 300 exhibitors, and 500 speakers expected, the Bitcoin 2025 conference is poised to be the largest Bitcoin event of the year-and potentially the most transactional.

The event will feature on-site activations such as the Official Bitcoin Magazine Store, where all merchandise will be available at a 21% discount for those paying with Bitcoin via the Lightning Network-a nod to Bitcoin’s 21 million coin supply limit.

By deeply integrating Lightning payments into the conference experience, organizers hope to demonstrate Bitcoin’s readiness for mainstream commerce and set a new benchmark for its practical use as a currency.

Conclusion

The Guinness World Record attempt at Bitcoin 2025 is more than a publicity stunt-it’s a bold demonstration of Bitcoin’s technological maturity and its potential to function as a modern, everyday payment method.

Whether or not the record is set, the event will serve as a milestone in the ongoing journey to make Bitcoin a truly global, user-friendly currency

-

@ c9badfea:610f861a

2025-05-25 19:40:48

@ c9badfea:610f861a

2025-05-25 19:40:48- Install Currencies (it's free and open source)

- Launch the app, tap ⋮ and select Settings

- Enable the Foreign Transaction Fee to factor in conversion fees if necessary

- Tap Data Provider and choose another provider if necessary

- Enjoy ad-free conversion rates

ℹ️ Tap 📈 to open the exchange rate chart

-

@ 7f6db517:a4931eda

2025-05-28 12:01:44

@ 7f6db517:a4931eda

2025-05-28 12:01:44

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ 491afeba:8b64834e

2025-05-27 23:57:01

@ 491afeba:8b64834e

2025-05-27 23:57:01Quando adolescente eu acreditava na coerência da teoria de "amor líquido" do polonês, sociólogo, Zygmunt Bauman, apresentada no livro "Amor Líquido: Sobre a Fragilidade dos Laços Humanos", qual no meu amadurecimento em estudos, sejam eles no meio acadêmico ou fora, percebo como uma das formas mais rasas de explicar as mudanças e transformações dos padrões de relações sócio-afetivas dos humanos. A seguir colocar-me-ei na minha juventude não tanto recente, direi então que nós, se adolescentes e conservadores, ou mesmo jovens adultos mais conservadores, costumamos levar como dogma uma óptica decadentista generalizada de todos os avanços de eras dos homens, universalizamos por nos ser comum a indistinção entre humanidade e humanidades, ou mesmo "humanity" e "humankind" ("humanidade" como espécime e "humanidade" como um universal), compreendemos toda "essas" como "essa" e indistinguimos as sociedades para com os homens, ou seja, a incapacidade de definir os seres dentro de suas respectivas singularidades e especificidades nos leva ao decadentismo generalista (a crença de que de forma geral, e universal, a "civilização universal" decai moralmente, éticamente, materialmente e espiritualmente), que aparente à nós determinadas mudanças nas relações humanas quanto ao caráter sócio-afetivo, por falta de profundidade e critérios ainda sobre questões alinhadas aos métodos e coerências, ou incoerências, lógicas, nós se jovens e conservadores somos levados ao engodo de concordar com a teoria do amor líquido de Bauman, que devo cá explicar de antemão: trata ela, a teoria, o padrão de "amor" dos tempos presentes como frágil, de prazo (curto e médio) e diferente em grau comparativamente ao amor comum das eras passadas.

Aos jovens mais progressistas opera uma compreensão dialética sobre as eras dos homens nos seu tempo presente, na qual ao tempo que o ser progride ele também regride simultaneamente, ou seja, a medida que aparecem contradições advindas de transformações materiais da realidade humana o ser supera essas contradições e progride em meio as transformações, ainda fazendo parte da lógica dessa indissociavelmente, assim constantemente progredindo e regredindo, havendo para esses dois vetores de distinção: o primeiro é o que releva questões espirituais como ao caráter do pensamento "new age", o segundo ignora essas questões por negar a existência da alma, seguem ao materialismo. Cedem em crer na teoria baumaninana como dogma, pois não encontram outros meios para explicar as transformações da sociedade na esfera sócio-afetiva sem que haja confrontamento direto com determinadas premissas assim pertinemente presentes, ou por não conciliarem com análises relativamente superiores, como a de Anthony Giddens sobre a "relação pura" em "A Transformação da Intimidade" e de François de Singly apresentada em "Sociologie du Couple".

https://i.pinimg.com/736x/6f/b4/9e/6fb49eda2c8cf6dc837a0abfc7e108e6.jpg

Há um problema quando uma teoria deixa de assim ser para vir a tornar-se mais um elemento desconexo da ciência, agora dentro da cultura pop, se assim podemos dizer, ou da cultura de massa, ou se preferirem mesmo "anticultura", esse problema é a sua deformização teórica, tornando-se essa rasa para sua palatabilidade massiva, somada a incapacidade de partes da sociedade civil em compreender as falhas daquilo que já foi massificado. Tive surpresa ao entender que muitos outros compartilham da mesma opinião, a exemplo, possuo um amigo na faculdade, marxista, que ao falarmos sobre nossos projetos de pesquisa, citou ele o projeto de um de nossos colegas, no qual esse referido um de nossos colegas faria seu projeto com base na teoria do amor líquido de Bauman, então alí demos risada disso, ora, para nós a teoria baumaniana é furada, passamos a falar sobre Bauman e o motivo pelo qual não gostávamos, lá fiquei até surpreso em saber que mais gente além de mim não gostava da teoria de Bauman, pois ao que eu via na internet era rede de enaltecimentos à figura e à sua teoria, tal como fosse uma revelação partindo de alguma divindade da Idade do Bronze. Pouco tempo depois tive em aula de teoria política uma citação de Bauman partindo do professor que ministrava a disciplina, no entanto, ao citar o nome de Bauman o mesmo fez uma feição na qual aparentava segurar risada, provavelmente ele também não levava Bauman à sério. Não devo negar que todas as vezes que vejo o sociólogo sendo citado em alguma nota no X, no Instagram ou qualquer outra rede social, tal como fosse um referencial teórico bom, sinto uma vergonha alheia pois alí tenho uma impressão de que a pessoa não leu Bauman e usa o referencial teórico como um fato já assim provado e comprovado.

Há pontos positivos na teoria baumaniana, como a capacidade de perceber o problema e correlacioná-lo à modernidade, assim como sucitar a influência do que há de material no fenômeno, porém os erros são pertinentes: o primeiro problema é de categoria. Não há, por parte de Bauman noção alguma entre as dissociações dos amores, não há atenção sobre o amor como estrutura ou ele como um sentimento, todo ele é compreendido uniformemente como "amor", partindo do pressuposto que todas as relações, todas elas, são firmadas com base no amor. Essa crença tem uma origem: Hegel. Nos Escritos Teológicos Hegel partia da crença que o amor ligava os seres relacionalmente como uma força de superação e alienação, mas há de compreendermos que esse Friedrich Hegel é o jovem ainda pouco maduro em suas ideias e seu sistema de pensamento, mais a frente, em "Fenomenologia do Espírito e na Filosofia do Direito", Hegel compreende a institucionalidade do direito no amor e a institucionalização dessa força, assim aproxima-se da realidade a respeito da inserção do amor nas esferas práticas do humano, porém essa ideia, apesar de imperfeita, pois ao que sabemos não é o amor que consolida a relação, mas sim a Verdade (Alétheia), conforme apontado por Heidegger em "Ser e Tempo", essa ideia do amor como a fundamento das relações humanas influenciou, e até hoje influencia, qualquer análise sobre as relações humanas fora da esfera materialista, fora dessa pois, melhormente explicado em exemplo, os marxistas (em exemplo), assim como Marx, consideram como base primordial das relações as condições materiais.

Por certo, não é de todo amor a base para a solidificação, ora, erram aqueles que creem que somente essa força, assim apontada por Hegel, constituiam todos os relacionamentos formais como pilares fundamentais, pois em prática as famílias eram até a fiduciarização dessas, por mais paradoxal que seja, compreendidas melhor como instituições orgânicas de caráter legal do que conluios de afetividades. A família outrora tinha consigo aparelhos de hierarquia bem estabelicidos, quais prezavam pela ordem interna e externa, que acima dessa instituição estava somente a Igreja (outra instituição), com sua fiduciarização [da família] após o movimento tomado pelos Estados nacionais em aplicação do casamento civil mudou-se a lógica das partes que a compõe, findou-se o princípio da subsidiariedade (não intervenção de determinadas instituições nas decisões quais podem ser exercidas em resuluções de problemas nas competências de quaisquer instituições), foi-se então, contudo, também a autoridade, e nisso revela-se um outro problema não apontado na teoria de Bauman: qual o padrão do amor "sólido"? Pois, ora, sociedades tradicionais não abdicavam do relevar dos amores para tornar seus filhos em ativos nas práticas de trocas (dádivas)? É notório que esse padrão se dissocia do padrão de sentimento apontado por Bauman, encontramos esse fato em estudo nos trabalhos "Ensaio Sobre a Dádiva", do Marcel Mauss, e "As Estruturas Elementares do Parentesco", do Claude Levi-Strauss, quais expõem que nas sociedades "sólidas", tradicionais, relevava-se mais questões institucionais que as sentimentais para a formação de laços (teoria da aliança). Muitas das relações passadas não eram baseadas no amor, não significando assim que as de hoje, em oposição, sejam, mas que permanecem-se semelhantes em base, diferentemente em grau e forma.

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F748b94c3-f882-45db-8333-09260ef15cfe_615x413.jpeg

Ora, ainda existem casamentos motivados pela política, pelo status, pelo prestígio, pelos bens, pelo poder, pela influência familiar e assim sucetivamente, tal como no passado, ocorre que essa prática tornou-se oculta, não mais explícita e aparente, devo dizer ainda que em partes, pois prepondera em nosso tempo uma epidemia de adultérios, fornicações, práticas lascivas e demais práticas libertinosas explicitamente, em contraposição às práticas ocultas em vergonhas de sociedades sem declínio moral e espiritual, o que nos leva a questionar o método comparativo em dicotomia temporal "presente x passado" aplicado por Bauman, no qual segue-se da seguinte forma:

Transformação Passado = *sólido* | Presente = *líquido* Categorias Padrão de amor: tradicional (*sólido*) moderno (*líquido*) *Sólido* = estável, prazo (médio-grande), profundo, determinado. *Líquido* = instável, prazo (curto-médio), raso, indeterminado.O que penso é: Zygmunt Bauman buscou uma explicação material e laical para desviar ao fato de que há uma notória correlação entre espiritualização da sociedade, se voltada à Verdade, com a estabilidade das instituições, o que é já reduzido à moral religiosa, somente, não à mística, como por pensadores da linha de Tocqueville, ou em abordagens também mais laical (positivista) porém ainda relevantes, como Émile Durkheim em "As Formas Elementares da Vida Religiosa" e Max Weber em "A Ética Protestante e o Espírito do Capitalismo", contrapondo uma abordage mais voltada, de fato, a espiritualidade, como Christopher Dawnson, que defende essa teoria em "Religião e o Surgimento da Cultura Ocidental", e Eric Voegelin, principalmente nas obras "A Nova Ciência da Política" e "Ordem e História".

Encerrando, minha cosmovisão é a católica, o sistema de crença e religião qual sigo é do Deus que se fez homem por amor aos seus filhos, não posso negar ou mesmo omitir o fato de que, por trás de toda a minha crítica estão meus pensamentos e minhas convicções alinhadas àquilo que mais tenho amor em toda minha vida: a Verdade, e a Verdade é Deus, pois Cristo é a Verdade, o Caminho e a Vida, ninguém vai ao Pai se não por Ele, e pois bem, seria incoerência de minha parte não relevar o fato de crença como um dos motivos pelos quais eu rejeito a teoria do amor líquido de Zygmunt Bauman, pois os amores são todos eles praticados por formas, existem por diferentes formas e assim são desde sua tradicionalidade até o predomínio das distorções de declínio espiritual das eras presentes (e também antigas pré-Era Axial), estão esses preservados pelo alinhamento à verdade, assim são indistorcíveis, imutáveis, ou seja, amor é amor, não releva-se o falso amor como um, simplesmente não o é, assim o interesse, a sanha por bens, o egoísmo e a egolatria ("cupiditas", para Santo Agostinho de Hipona, em oposição ao que o santo e filósofo trata por "caritas") não são formas do amor, são autoenganos, não bons, se não são bons logo não são de Deus, ora, se Deus é amor, se ele nos ama, determino como amor (e suas formas) o que está de acordo com a Verdade. Aprofundando, a Teologia do Corpo, do Papa São João Paulo II, rejeita a "liquidez" apresentada por Bauman, pois o amor é, em suma, sacríficio, parte da entrega total de si ao próximo, e se não há logo não é amor. A Teologia do Corpo rejeita não os fundamentos de mentira no "líquido", mas também no "sólido", pois a tradicionalidade não é sinônimo de bom e pleno acordo com o amor que Deus pede de nós, não são as coerções, as violências, as imposições e demais vontades em oposição às de Deus que determinam os amores -- fatos em oposição ao ideário romanticizado. Claro, nem todas as coerções são por si inválidas do amor, ou mesmo as escolhas em trocas racionalizadas, a exemplo do autruísmo em vista da chance da família ter êxito e sucesso, ou seja, pelo bem dos próximos haver a necessidade de submissão a, em exemplo, um casamento forjado, ou algo do gênero, reconhece-se o amor no ato se feito por bem da família, porém o amor incutido, nesse caso, explicita o caráter sacrificial, no qual uma vontade e um amor genuinamente potencial em prazeres e alegrias são anulados, ou seja, mesmo nesse modelo tradicional na "solidez" há possibilidade do amor, não nas formas romanticizadas em critérios, como "estabilidade" e "durabilidade", mas no caráter do sacríficio exercido. Conforme nos ensina São Tomás de Aquino, o amor não é uma "força", tal como ensina Hegel, mas sim uma virtude teologal conforme na "Suma Teológica" (II-II Q. 26-28), não devemos reduzir o amor e os amores em análises simplórias (não simples) de falsa complexidade extraídas em métodos questionáveis e pouco competentes à real diensão de crise espiritual das eras, por esse motivo não concordo com a teoria do amor líquido de Zygmunt Bauman.

-

@ b1ddb4d7:471244e7

2025-05-28 14:01:24

@ b1ddb4d7:471244e7

2025-05-28 14:01:24Flash, an all-in-one Bitcoin payment platform, has announced the launch of Flash 2.0, the most intuitive and powerful Bitcoin payment solution to date.

With a completely redesigned interface, expanded e-commerce integrations, and a frictionless onboarding process, Flash 2.0 makes accepting Bitcoin easier than ever for businesses worldwide.

We did the unthinkable!

We did the unthinkable! Website monetization used to be super complicated.

"Buy me a coffee" — But only if we both have a bank account.

WHAT IF WE DON'T?

Thanks to @paywflash and bitcoin, it's just 5 CLICKS – and no banks!

Start accepting donations on your website… pic.twitter.com/uwZUrvmEZ1

Start accepting donations on your website… pic.twitter.com/uwZUrvmEZ1— Flash • The Bitcoin Payment Gateway (@paywflash) May 13, 2025

Accept Bitcoin in Three Minutes

Setting up Bitcoin payments has long been a challenge for merchants, requiring technical expertise, third-party processors, and lengthy verification procedures. Flash 2.0 eliminates these barriers, allowing any business to start accepting Bitcoin in just three minutes, with no technical set-up and full control over their funds.

The Bitcoin Payment Revolution