-

@ 3c7dc2c5:805642a8

2025-05-24 22:05:00

@ 3c7dc2c5:805642a8

2025-05-24 22:05:00🧠Quote(s) of the week:

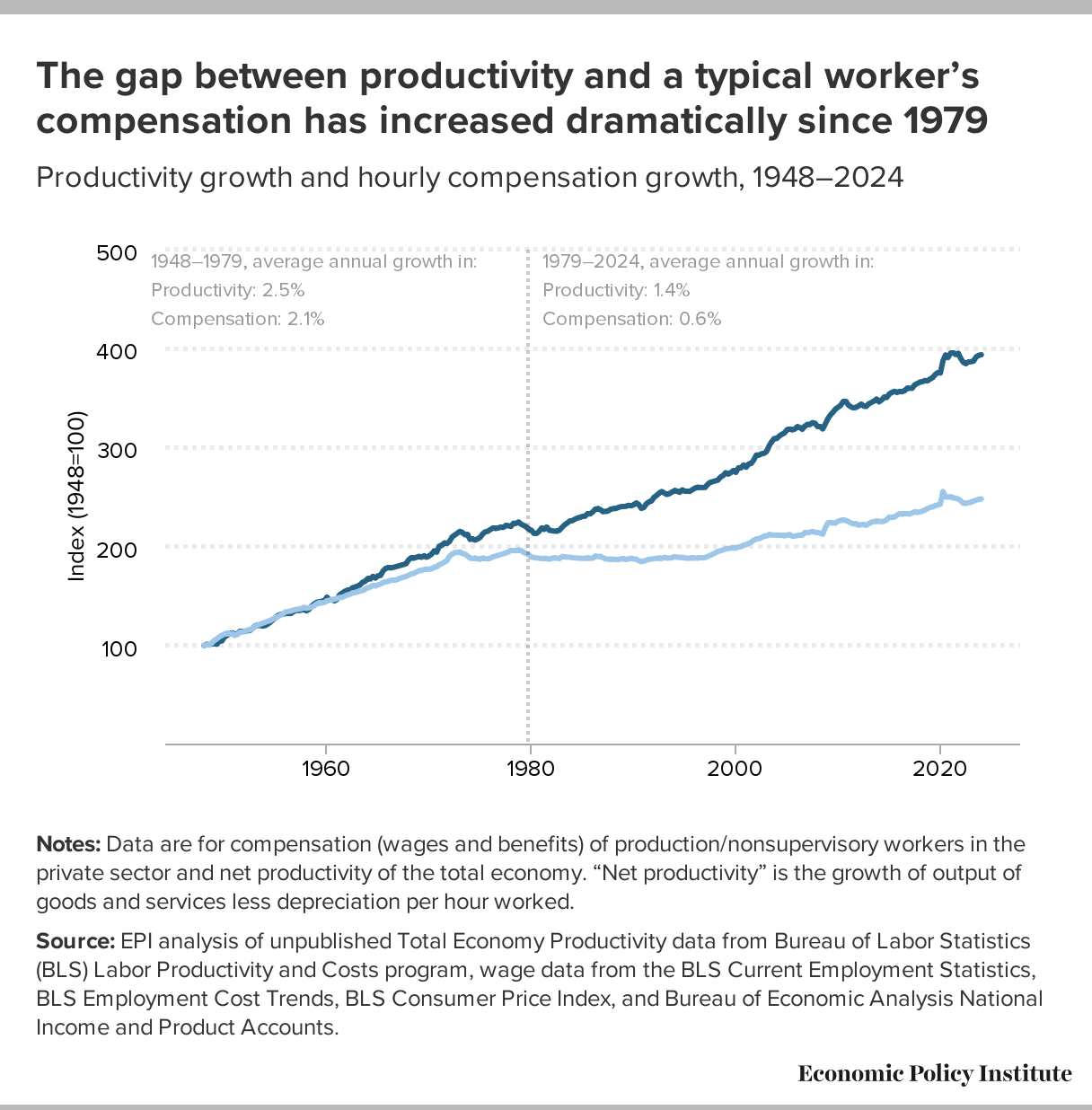

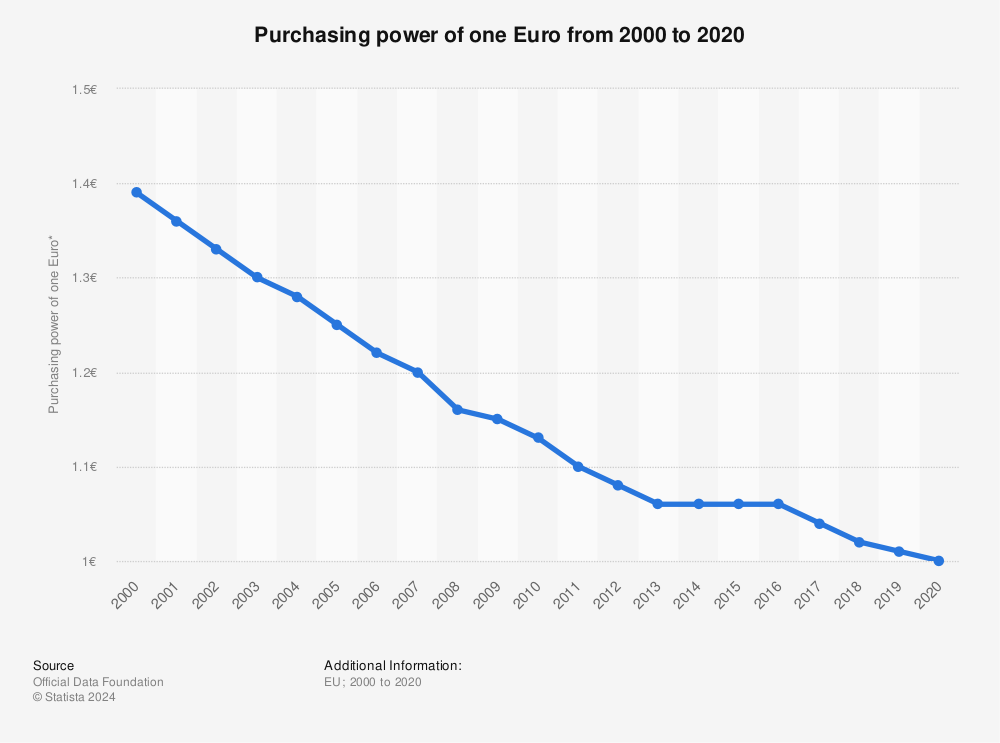

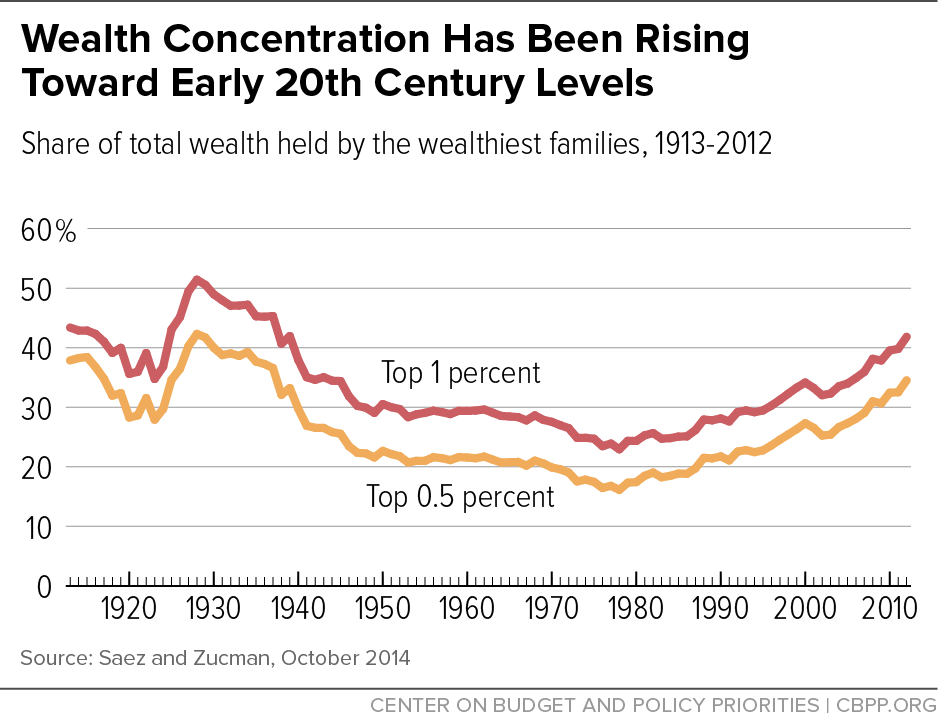

'The Cantillon Effect: When new money is printed, those closest to the source (banks, elites) benefit first, buying assets before prices rise. Others lose purchasing power as inflation hits later. If people find out how this works, they will riot.' -Bitcoin for Freedom

Just think about it. Your employer gives you a 5% raise. The Fed (central banks in general) prints 7% more dollars/euros/Fiat. You just got a 2% pay cut. This isn't a conspiracy theory. This is how fiat money steals from the working class every single day. This is why I support Bitcoin.

Anilsaidso: 'Saving in fiat currency is no longer an option. A 2% inflation rate means you lose 1/3 of your purchasing power over 20yrs. At 5% inflation, you lose 60%. And at 10% you've burnt 85%. Reduce your uncertainty. Save in Bitcoin.' https://i.ibb.co/N661BdVp/Gr-Rwdg-OXc-AAWPVE.jpg

🧡Bitcoin news🧡

“Education increases conviction.

Conviction increases allocation.

Allocation increases freedom.” —Gigi

https://i.ibb.co/Q3trHk8Y/Gr-Arv-Ioa-AAAF5b0.jpg

On the 12th of May:

➡️Google searches for "Digital Gold" are at all-time highs. Bitcoin Croesus: "This is the second wave of the Digital Revolution - the digitization of value to complement the Internet's digitization of information. It wasn't possible to own a slice of the Internet itself, but it is possible with Bitcoin, the internet of value." "...It feels like you're late to Bitcoin. But this is a bigger game playing out than most realize, and we are much earlier than casual observers know. If you're reading this, you're here on the frontier early. And you have a chance to stake a claim before 99% of the world shows up. This is a land grab. This is the digital gold rush. Make your descendants proud."

https://i.ibb.co/5XXbNQ8S/Gqw-X4-QRWs-AEd5-Uh-1.jpg

➡️ 'A new holding company ‘Nakamoto’ just raised $710 million to buy more Bitcoin and will merge with KindlyMD to establish a Bitcoin Treasury company. Saylor playbook!' - Bitcoin Archive

➡️American Bitcoin, backed by Donald Trump Jr. and Eric Trump, will go public via an all-stock merger with Gryphon Digital Mining. Post-merger, Trump affiliates and Hut 8 will retain 98% ownership. GRYP tripled to $2.19, Hut 8 jumped 11% to $15.45. The deal closes in Q3 2025.

➡️Phoenix Wallet: 'Phoenix 0.6.0 is out: offers can now have a custom description simple close (set an exact mutual close tx fee rate) native support for Linux arm64 This is the server version. Phoenix mobile release is around the corner. '

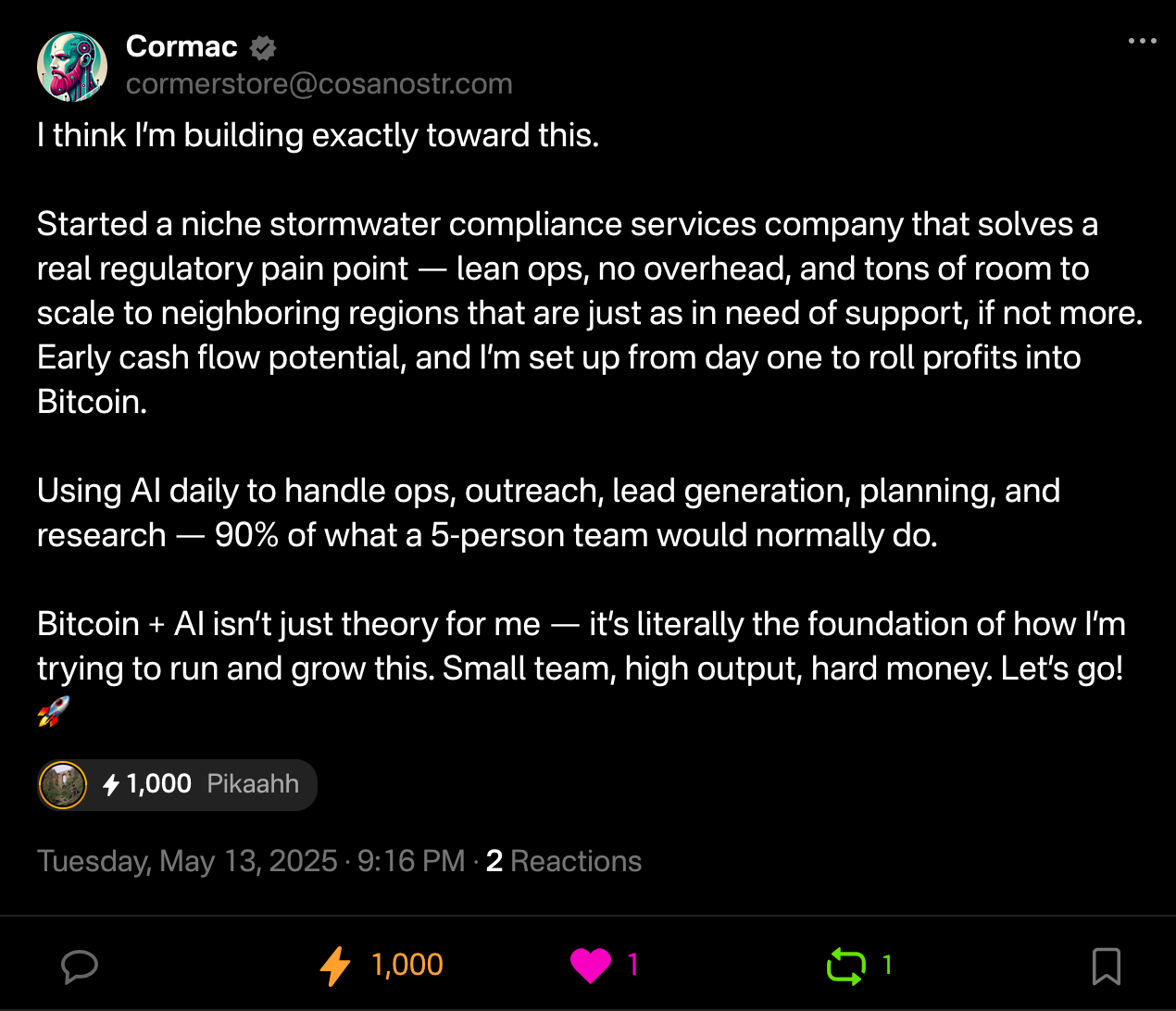

On the 13th of May:

➡️Corporate Bitcoin purchases have now outweighed the supply of new Bitcoin by 3.3x in 2025. https://i.ibb.co/fVdgQhyY/Gq1ck-XRXUAAsg-Ym.jpg

➡️ Publicly listed Next Technology disclosed buying 5,000 Bitcoin for $180m, now HODLs 5,833 $BTC worth +$600m.

➡️ After rejecting the Arizona Strategic Bitcoin Reserve Act, Governor Katie Hobbs vetoed Bill SB 1373, which proposed a digital asset reserve fund. "Current volatility in the cryptocurrency markets does not make a prudent fit for general fund dollars."

➡️Meanwhile in Paris, France the kidnapping of a woman with her 2-year-old child morning on the streets of Paris - the target is allegedly the daughter of a crypto CEO. 3 masked men tried forcing them into a fake delivery van, before being fought off by her partner and bystanders. One of whom grabbed a dropped gun and aimed it back.

➡️ 'Bitcoin illiquid supply hit a new all-time high of $1.4B Are you HODLing too, anon?' - Bitcoin News

➡️Why Coinbase entering the S&P 500 matters. Boomers will have Bitcoin / CrApTo exposure, whether they like it or not. Anyway, remember what happened in 2021. The COIN IPO, and they’re still trading about 35% below their IPO-day high. Oh and please read the 'Coinbase" hack below haha.

➡️ Nasdaq listed GD Culture Group to sell up to $300 million shares to buy Bitcoin.

➡️ A Bitcoin wallet untouched since April 2014 just moved 300 BTC worth $31M for the first time in 11 years. This is how you HODL.

➡️ Bitcoin's realized price is steadily increasing, mirroring behaviors seen in past bull markets, according to CryptoQuant.

➡️ Bitcoin whales and sharks (10-10K BTC) accumulated 83,105 BTC in the last 30 days, while small retail holders (<0.1 BTC) sold 387 BTC, according to Santiment.

Bitcoin Whales have been AGGRESSIVELY accumulating BTC recently! With at least 240,000+ Bitcoin transferred to wallets with at least 100 BTC. The largest market participants are trying to buy as much as possible, what do they think comes next...

➡️'The average cost of mining 1 BTC for miners is currently $36.8K. The spread between the current market price and the cost of one coin = 182%. This is essentially the average profitability. This corresponds to the beginning of the bull cycle in November 2022 and the peaks of this cycle >$100K. A price increase above this level will allow miners to fully recover after the last halving and reach excess profits comparable to the beginning of the bull rally in January 2023.' -Axel Adler Jr.

➡️ Remember last week's segment on Coinbase..."Coinbase just disclosed in their Q1 filing: that they have custody of 2.68 million Bitcoin. That’s over 13% of all Bitcoin in circulation, on one platform. Is this the greatest honeypot in financial history? Yes, it is...read next week's Weekly Bitcoin update."

Well, here you go.

Coinbase estimates $180-$400 million in losses, remediation costs, and reimbursement following today’s cyber attack. https://i.ibb.co/jkysLtZ1/Gq-C7zl-W4-AAJ0-N6.jpg

Coinbase didn't get hacked. Coinbase employees sold customer data on the black market. Coinbase failed to protect customer data. This is why KYC is useless. The criminals have our driver's license scans. They have AI tools that can generate fake images and videos. KYC puts our identities at risk, makes onboarding more difficult, and rewards criminals. To make it even worse. Coinbase knew about the hack as early as January but only disclosed it publicly after being added to the S&P 500.

I will say it one more time! Don't buy your Bitcoin on KYC exchanges. KYC means handing over your identity to be leaked, sold, or extorted.

It was 2 days ago, see the bit on the 13th of May, that we saw a violent attack in Paris. Minimize the data you share with centralized tools. Store as much as you can locally. Always ask yourself what data am I giving and to whom? Remove the need for trust.

And for the love of God, Allah, or whatever god you are praying to...

DON'T LEAVE YOUR COINS ON A FREAKING EXCHANGE!!!!

Clear!

➡️ Sam Callahan: Bitcoin CAGRs over rolling four-year holding periods since 2012:

10th percentile: 33%

25th percentile: 50% 40th percentile: 75%

Said differently, for 90% of the time, Bitcoin’s four-year CAGR was higher than 33%. For comparison, here are the single best four-year CAGRs over the same period for:

Gold: 17%

Silver: 20%

S&P 500: 24%

Apple: 52%

Two lessons here:

1.) Even when Bitcoin underperforms, it still outperforms.

2.) Bitcoin holding goals are best measured in halving cycles.'

https://i.ibb.co/9m6q2118/Gq1-Ie2-Ob-AAIJ8-Kf.jpg

➡️ Deutsche Bank Aktiengesellschaft has bought 96,870 Strategy₿ stocks for 30 Million dollars at an Average Price Of $310 Per Share In Q1 2025, Their Total Holdings Is 518,000 Shares Worth Over 214 Million Dollars.

➡️Senator Lummis urges the U.S. Treasury to eliminate taxes on unrealized gains for Bitcoin.

On the 14th of May:

➡️At $168,000, Bitcoin will surpass Microsoft, the world's largest company.

➡️Fidelity tells institutions to buy Bitcoin if they can’t match Bitcoin’s 65% return on capital.

➡️Michigan has adopted House Resolution 100, declaring May 13 2025 as "Digital Asset Awareness Day." The resolution encourages "activities and programs that foster a deeper understanding of digital assets and their impact on our society and economy."

➡️Publicly traded Vinanz raises funding to buy $2 million in #Bitcoin assets.

➡️Bitcoin News: "Investor Jim Chanos is shorting MicroStrategy while going long on Bitcoin, calling the stock overvalued relative to its BTC holdings. “We’re selling MicroStrategy and buying Bitcoin, basically buying something for $1 and selling it for $2.50," he told CNBC

On the 15th of May:

➡️The Abu Dhabi sovereign wealth fund disclosed owning $511 million in Bitcoin through BlackRock’s ETF.

➡️UK public company Coinsilium Group raises £1.25 million to adopt a Bitcoin treasury strategy.

➡️Chinese Textile company Addentax issues stock to buy 8,000 Bitcoin.

➡️14 US states have reported $632m in $MSTR exposure for Q1, in public retirement and treasury funds. A collective increase of $302m in one quarter. The average increase in holding size was 44%.

➡️Chinese public company DDC Enterprise to adopt a Bitcoin Reserve with 5,000 BTC.

On the 16th of May:

➡️Brazilian listed company Méliuz buys $28.4 million Bitcoin to become the nation's first Bitcoin Treasury Company. Shareholders voted to approve the strategy by an "overwhelming majority".

➡️13F Filings show Texas Retirement System owns MSTR. The day MSTR enters the S&P 500, every pension fund will follow.

➡️'Wealthy Investors Shift Up to 5% into Bitcoin as confidence in fiat falters. UBS, a Swiss banking giant says Bitcoin and digital assets are becoming key hedges against inflation and systemic risk, marking a dramatic shift in modern portfolio strategy.' -CarlBMenger

➡️River: "Above all, Bitcoin is money for the people." https://i.ibb.co/Jj8MVQwr/Gr-Ew-EPp-XAAA1-TVN.jpg

On the 17th of May:

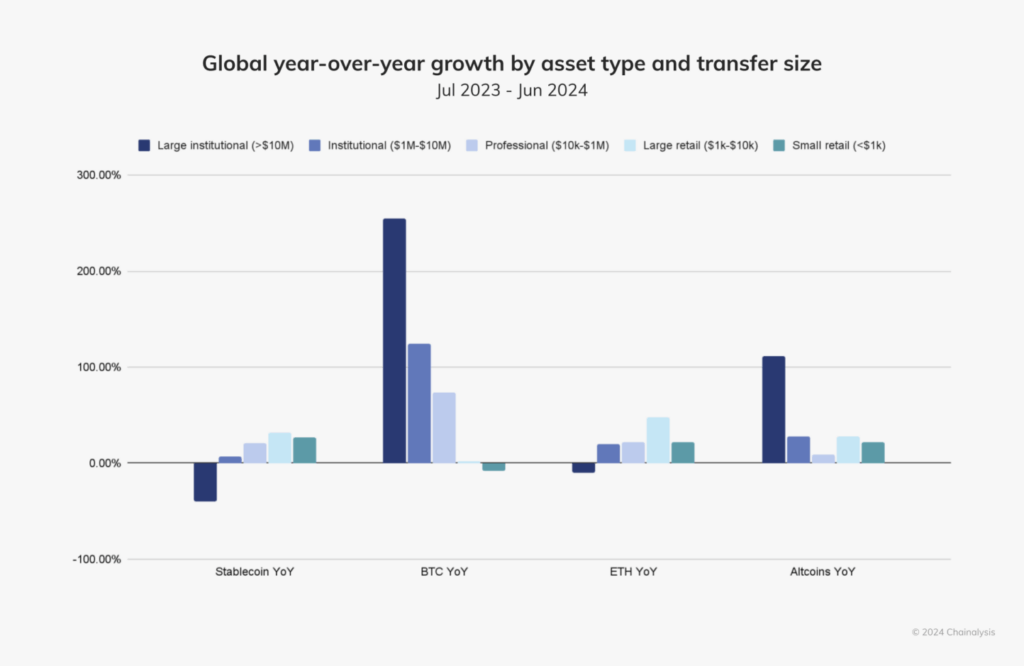

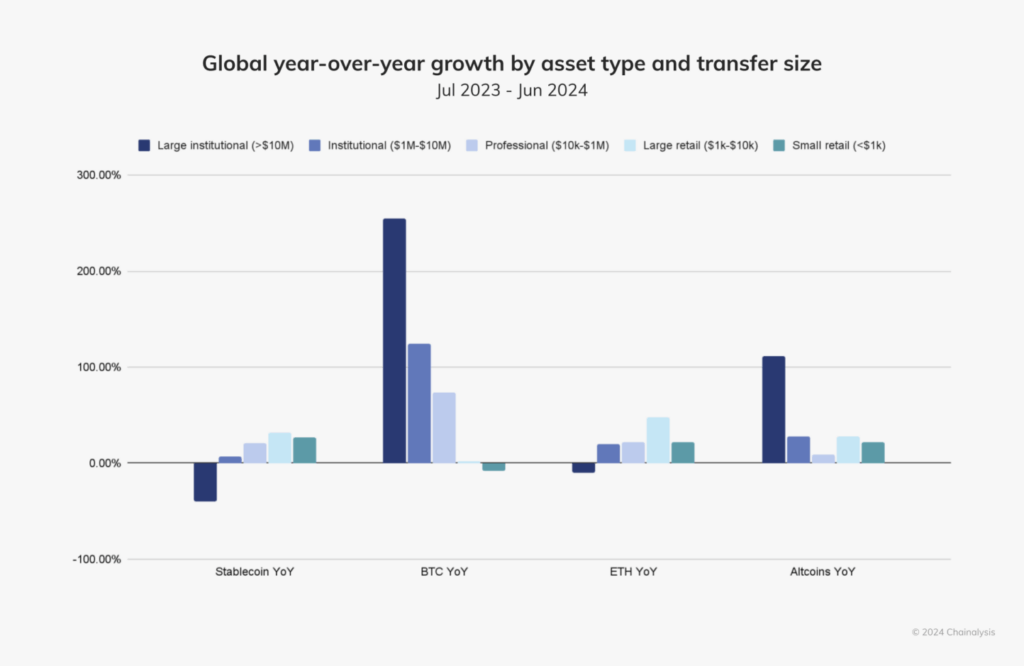

➡️Illicit activity is now down to 0.14% of transaction volume across all crypto.

Context: World Bank, IMF suggests 1.5–4% of global GDP is laundered yearly through traditional banking Of that 0.14%:

63% of illicit trade was stablecoins.

13% was Bitcoin (declining each year)

Source: The 2025 Crypto Crime Report, Chainalysis 2025

Yet another confirmation that Bitcoin's use in facilitating illicit activities is a rounding error on a rounding error.

On the 18th of May:

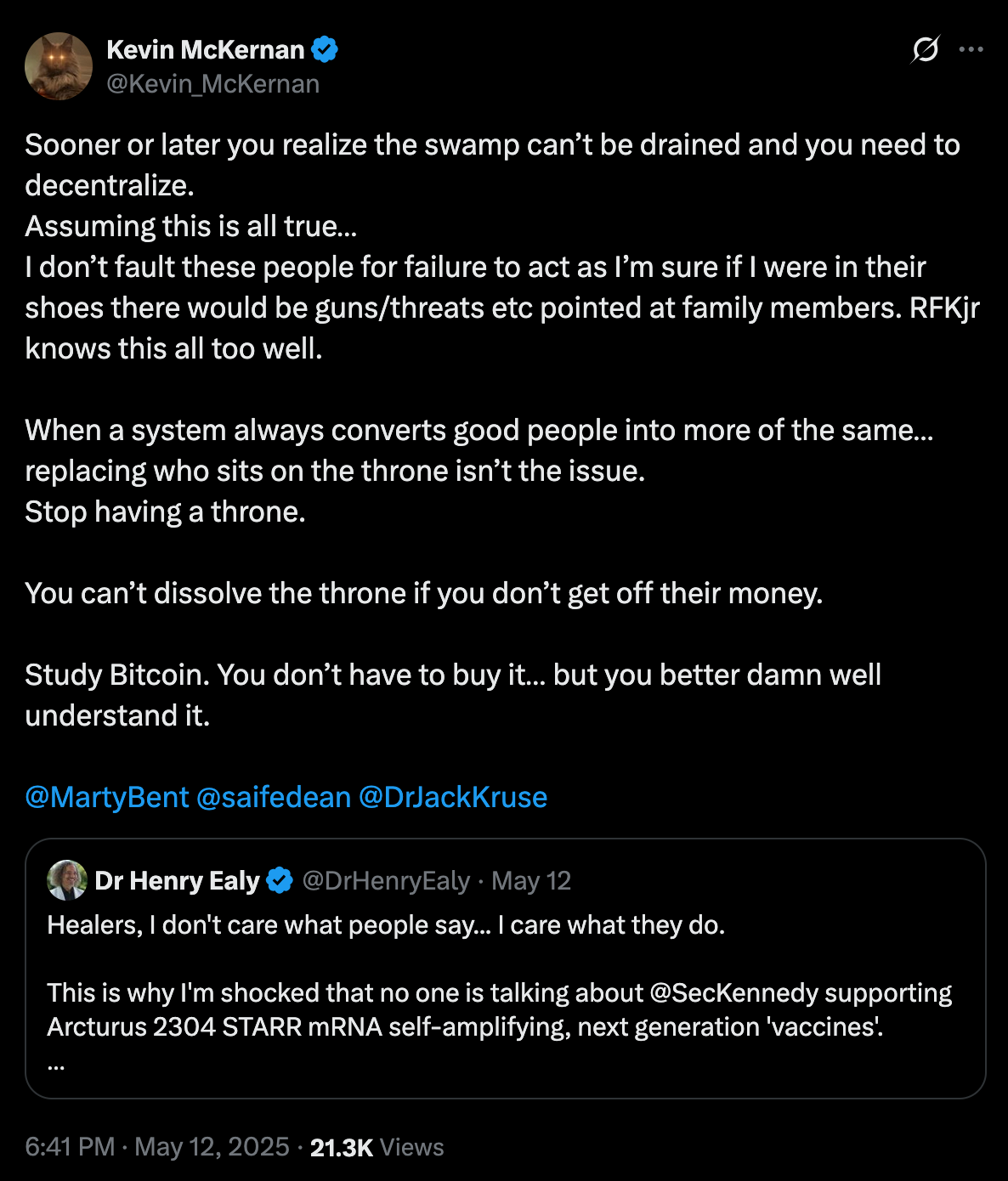

➡️JPMorgan CEO Jamie Dimon said they will allow clients to buy Bitcoin. The repeal of SAB 121 is a bigger deal than most realize. “I will fire any employee buying or trading Bitcoin for being stupid” - Jamie Dimon (2017) https://i.ibb.co/b5tnkb15/Gr-Vxxc-OXk-AA7cyo.jpg

On the 19th of May.

➡️Bookmark the following stuff from Daniel Batten if you want to combat climate change (fanatics)...

'That Bitcoin mining is not only not harmful, but beneficial to the environment is now supported by:

7 independent reports

20 peer-reviewed papers

As a result * 90% of climate-focused magazines * 87.5% of media coverage on Bitcoin & the environment is now positive * source 7 independent reports https://x.com/DSBatten/status/1922666207754281449… * 20 peer-reviewed papers https://x.com/DSBatten/status/1923014527651615182… * 10 climate-focused magazines https://x.com/DSBatten/status/1919518338092323260… * 16 mainstream media articles https://x.com/DSBatten/status/1922628399551434755

➡️Saifedean Ammous: '5 years ago at the height of corona hysteria, everyone worried about their savings.

If you put $10,000 in "risk-free" long-term US government bonds, you'd have $6,000 today.

If you put the $10,000 in "risky speculative tulip" bitcoin, you'd have $106,000.

HFSP, bondcucks!'

I love how Saifedean always put it so eloquently. haha

➡️An Australian judge rules Bitcoin is “just another form of money.” This could make it exempt from capital gains tax. Potentially opening the door to millions in refunds across the country. - AFR

If upheld, the decision could trigger up to $1B in refunds and overturn the Australian Tax Office’s crypto tax approach.

➡️Publicly traded Vinanz buys 16.9 Bitcoin for $1.75 Million for their treasury.

➡️Bitcoin just recorded its highest weekly close ever, while the Global Economic Policy Uncertainty Index hit its highest level in history.

➡️4 in 5 Americans want the U.S. to convert part of its gold reserves to Bitcoin. - The Nakamoto Project

"or background, the survey question was: "Assuming the United States was thinking of converting some of their gold reserves into Bitcoin, what percentage would you advise they convert?" Respondents were provided a slider used to choose between 0% and 100%. Our survey consisted of a national sample of 3,345 respondents recruited in partnership with Qualtrics, a survey and data collection company"

Context: https://x.com/thetrocro/status/1924552097565180107 https://i.ibb.co/fGDw06MC/Gr-VYDIdb-AAI7-Kxd.jpg

➡️Michael Saylor's STRATEGY bought another $764.9m Bitcoin. They now HODL 576,230 Bitcoin, acquired for $40.18 billion at $69,726 per Bitcoin.

➡️The German Government sold 49,858 BTC for $2.89B, at an average price of $57,900. If they had held it, their BTC would now be worth $5.24B.

➡️A record 63% of all the Bitcoin that exist have not transacted or moved from their wallets this year. - Wicked

https://i.ibb.co/j9nvbvmP/Gq3-Z-x6-Xw-AAv-Bhg.jpg

💸Traditional Finance / Macro:

On the 12th of May:

👉🏽The S&P 500 has closed more than 20% above its April low, technically beginning a new bull market. We are now up +1,000 points in one month.

On the 13th of May:

👉🏽 Nvidia announces a partnership with Humain to build "AI factories of the future" in Saudi Arabia. Just one hour ago, Saudi Arabia signed an economic agreement with President Trump to invest $600 billion in the US.

🏦Banks:

👉🏽 No news

🌎Macro/Geopolitics:

On the 12th of May:

👉🏽Huge pressure is on the European Union to reach a trade deal. Equities and commodities bounce hard on news of China-US trade deal. "We have reached an agreement on a 90-day pause and substantially moved down the tariff levels — both sides, on the reciprocal tariffs, will move their tariffs down 115%." - Treasury Secretary Scott Bessent

Dollar and Yuan strong bounce. Gold corrects.

👉🏽After reaching a high of 71% this year, recession odds are now back down to 40%. The odds of the US entering a recession in 2025 fall to a new low of 40% following the US-China trade deal announcement.

👉🏽'Truly incredible:

- Trump raises tariffs: Yields rise because inflation is back

- Trump cuts tariffs: Yields rise because growth is back

- Trump does nothing: Yields rise because the Fed won't cut rates Today, the bond market becomes Trump and Bessent's top priority.' - TKL

President Trump’s biggest problem persists even as trade deals are announced. Tariffs have been paused for 90 days, the US-China trade deal has been announced, and inflation data is down. Yet, the 10Y yield is nearing 4.50% again. Trump needs lower rates, but rates won’t fall.

👉🏽Last week a lot of talk on Japan’s Debt Death Spiral: Japan’s 40-year yield is detonating and the myth of consequence-free debt just died with it. One of the best explanations, you can read here:

👉🏽Michael A. Arouet: 'Eye-opening chart. Can a country with a services-based economy remain a superpower? Building back US manufacturing base makes a lot of strategic and geopolitical sense.' https://i.ibb.co/Q3zJY9Fc/Gqxc6-Pt-WQAI73c.jpg

On the 13th of May:

👉🏽There is a possibility of a “big, beautiful” economic rebalancing, Treasury Secretary Scott Bessent says at an investment forum in Saudi Arabia. The “dream scenario” would be if China and the US can work together on rebalancing, he adds

Luke Gromen: It does roll off the tongue a whole lot nicer than "We want to significantly devalue USD v. CNY, via a gold reference point."

Ergo: The price of gold specifically would rise in USD much more than it would in CNY, while prices for other goods and services would not, or would do so to a lesser degree.

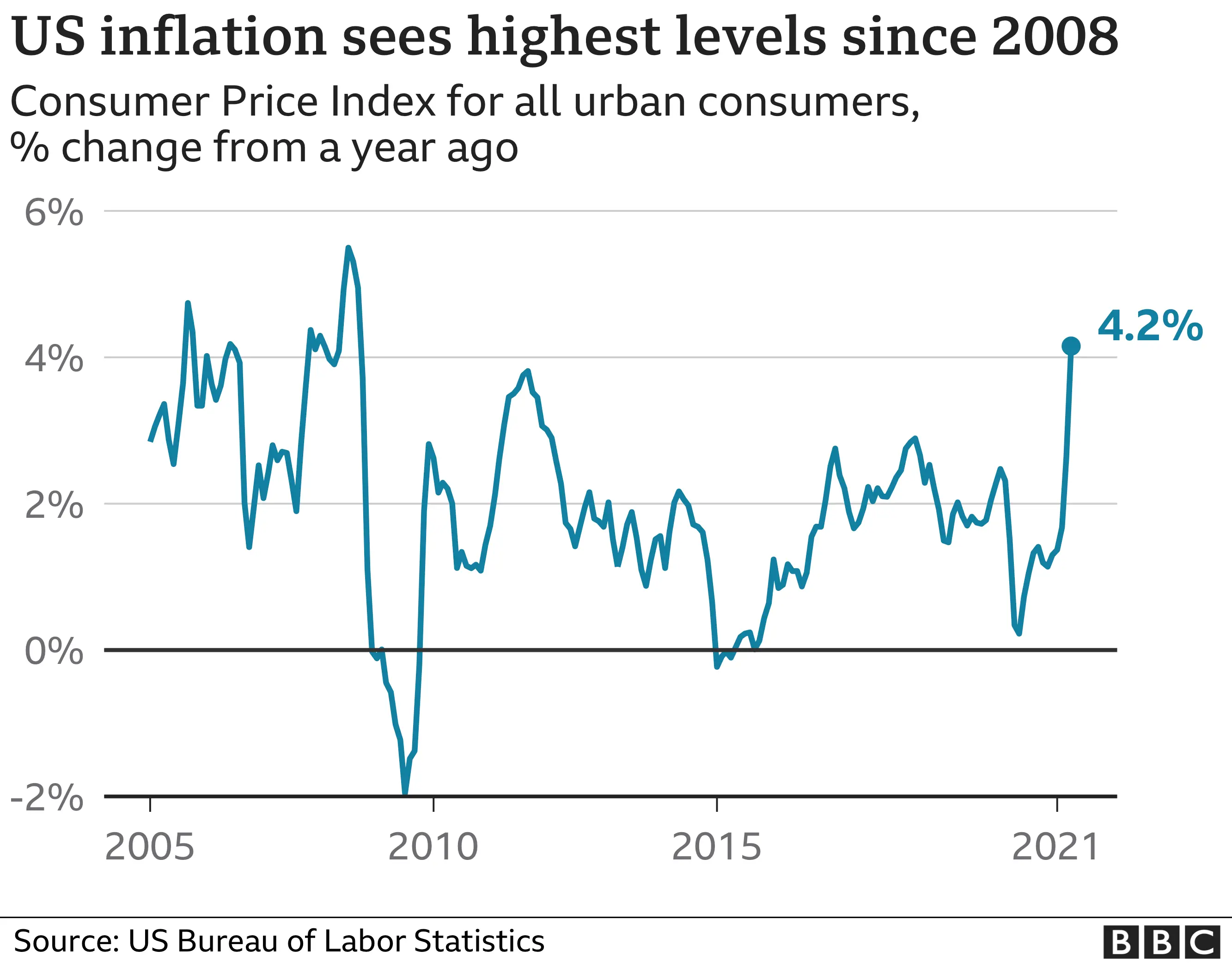

👉🏽 Dutch inflation rises to 4.1 percent in April | CBS – final figure. Unchanged compared to the estimate.

👉🏽Philipp Heimberger: This interesting new paper argues that cuts to taxes on top incomes disproportionately benefit the financial sector. The finance industry gains more from top-income tax cuts than other industries. "Cuts in top income tax rates increase the (relative) size of the financial sector"

Kinda obvious, innit?

👉🏽US CPI data released. Overall good results and cooler than expected month-over-month and year-over-year (outside of yearly core). U.S. inflation is down to 2.3%, lower than expected.

On the 14th of May:

👉🏽'The US government cannot afford a recession: In previous economic cycles, the US budget deficit widened by ~4% of GDP on average during recessions. This would imply a ~$1.3 trillion deterioration of US government finances if a recession hits in 2025. That said, if the US enters a recession, long-term interest rates will likely go down.

A 2-percentage-point decrease in interest rates would save ~$568 billion in annual interest payments. However, this means government finances would worsen by more than DOUBLE the amount saved in interest due to a recession. An economic downturn would be incredibly costly for the US government.' -TKL

On the 15th of May:

👉🏽'In the Eurozone and the UK, households hold more than 30% of their financial assets in fiat currencies and bank deposits. This means that they (unknowingly?) allow inflation to destroy their purchasing power. The risks of inflation eating up your wealth increase in a debt-driven economic system characterized by fiscal dominance, where interest rates are structurally low and inflation levels and risks are high. There is so much forced and often failed regulation to increase financial literacy, but this part is never explained. Why is that, you think?' - Jeroen Blokland https://i.ibb.co/zWRpNqhz/Gq-jn-Bn-X0-AAmplm.png

On the 16th of May:

👉🏽'For the first time in a year, Japan's economy shrank by -0.7% in Q1 2025. This is more than double the decline expected by economists. Furthermore, this data does NOT include the reciprocal tariffs imposed on April 2nd. Japan's economy is heading for a recession.' -TKL

👉🏽'246 US large companies have gone bankrupt year-to-date, the most in 15 years. This is up from 206 recorded last year and more than DOUBLE during the same period in 2022. In April alone, the US saw 59 bankruptcy filings as tariffs ramped up. So far this year, the industrials sector has seen 41 bankruptcies, followed by 31 in consumer discretionary, and 17 in healthcare. According to S&P Global, consumer discretionary companies have been hit the hardest due to market volatility, tariffs, and inflation uncertainty. We expect a surge in bankruptcies in 2025.' -TKL

👉🏽'Moody's just downgraded the United States' credit rating for the FIRST time in history. The reason: An unsustainable path for US federal debt and its resulting interest burden. Moody's notes that the US debt-to-GDP ratio is on track to hit 134% by 2035. Federal interest payments are set to equal ~30% of revenue by 2035, up from ~18% in 2024 and ~9% in 2021. Furthermore, deficit spending is now at World War 2 levels as a percentage of GDP. The US debt crisis is our biggest issue with the least attention.' - TKL

Still, this is a nothing burger. In August 2023, when Fitch downgraded the US to AA+, and S&P (2011) the US became a split-rated AA+ country. This downgrade had almost no effect on the bond market. The last of the rating agencies, Moodys, pushed the US down to AA+ today. So technically it didn’t even change the US’s overall credit rating because it was already split-rated AA+, now it’s unanimous AA+.

Ergo: Nothing changed. America now shares a credit rating with Austria and Finland. Hard assets don’t lie. Watch Gold and Bitcoin.

https://i.ibb.co/Q7DcWY2P/Gr-K66i-EXIAAKh-MR.jpg

RAY DALIO: Credit Agencies are UNDERSTATING sovereign credit risks because "they don't include the greater risk that the countries in debt will print money to pay their debts" with devalued currency.

👉🏽US consumer credit card serious delinquencies are rising at a CRISIS pace: The share of US credit card debt that is past due at least 90 days hit 12.3% in Q1 2025, the highest in 14 YEARS. The percentage has risen even faster than during the Great Financial Crisis.' - Global Markets Investor

https://i.ibb.co/nNH9CxVK/Gr-E838o-XYAIk-Fyn.png

On the 18th of May:

👉🏽Michael A. Arouet: 'Look at ten bottom of this list. Milei has not only proven that real free market reforms work, but he has also proven that they work fast. It’s bigger than Argentina now, no wonder that the left legacy media doesn’t like him so much.' https://i.ibb.co/MDnBCDSY/Gr-Npu-KKWMAAf-Pc.jpg

On the 19th of May: 👉🏽Japan's 40-year bond yield just hit its highest level in over 20 years. Japan’s Prime Minister Ishiba has called the situation “worse than Greece.” All as Japan’s GDP is contracting again. You and your mother should be scared out of your fucking minds. https://i.ibb.co/rGZ9cMtv/GTXx-S7-Cb-MAAOu-Vt.png

👉🏽 TKL: 'Investors are piling into gold funds like never before: Gold funds have posted a record $85 BILLION in net inflows year-to-date. This is more than DOUBLE the full-year record seen in 2020. At this pace, net inflows will surpass $180 billion by the end of 2025. Gold is now the best-performing major asset class, up 22% year-to-date. Since the low in October 2022, gold prices have gained 97%. Gold is the global hedge against uncertainty.'

🎁If you have made it this far, I would like to give you a little gift, well, in this case, two gifts:

What Bitcoin Did - IS THE FED LOSING CONTROL? With Matthew Mezinskis

'Matthew Mezinskis is a macroeconomic researcher, host of the Crypto Voices podcast, and creator of Porkopolis Economics. In this episode, we discuss fractional reserve banking, why it's controversial among Bitcoiners, the historical precedent for banking practices, and whether fractional reserve banking inherently poses systemic risks. We also get into the dangers and instabilities introduced by central banking, why Bitcoin uniquely offers a pathway to financial sovereignty, the plumbing of the global financial system, breaking down money supply metrics, foreign holdings of US treasuries, and how all these elements indicate growing instability in the dollar system.'

https://youtu.be/j-XPVOl9zGc

Credit: I have used multiple sources!

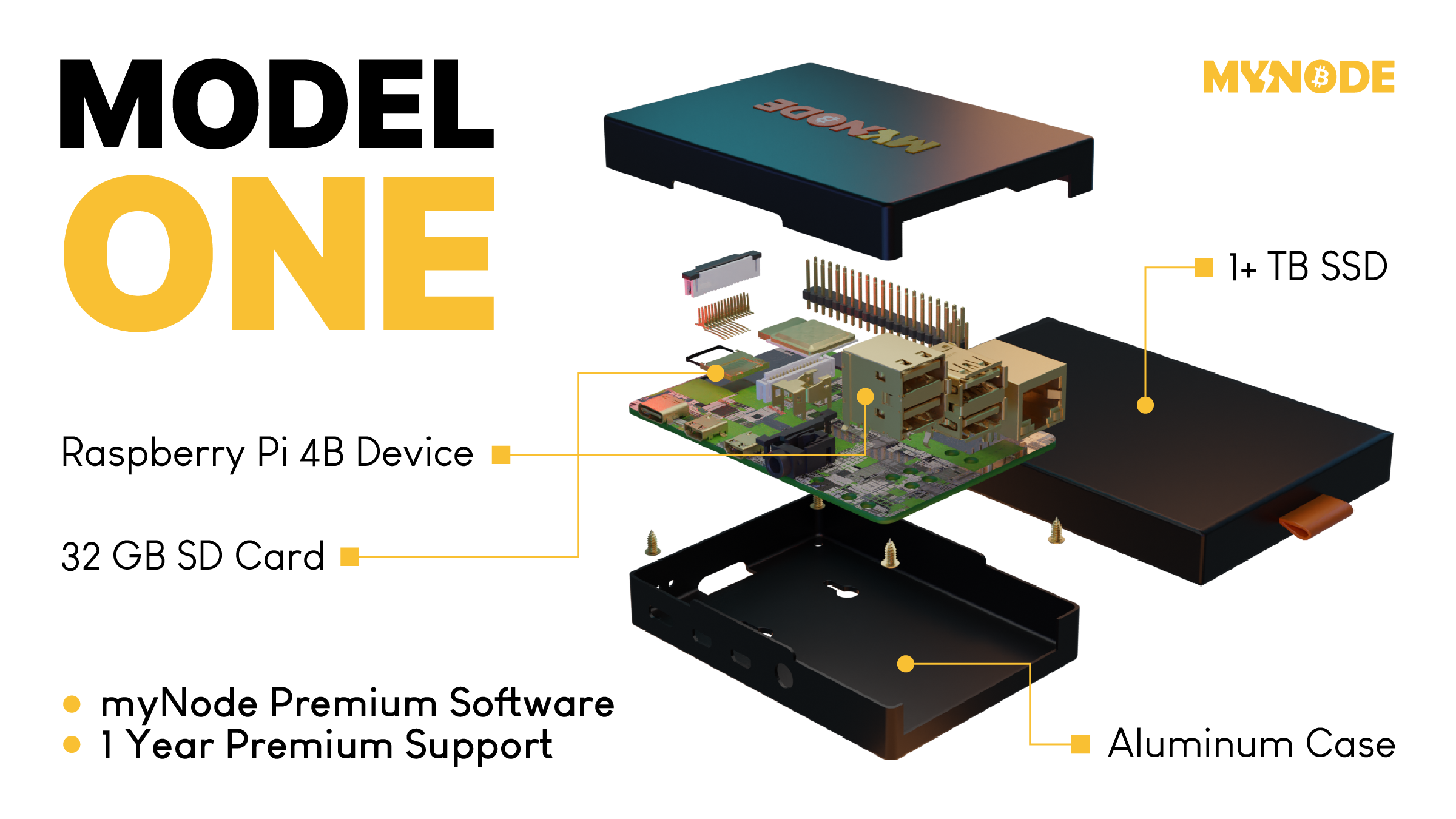

My savings account: Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

-

@ bf47c19e:c3d2573b

2025-05-24 21:16:10

@ bf47c19e:c3d2573b

2025-05-24 21:16:10U ovoj sekciji pratićemo cene raznih dobara i usluga, a pre svega nekretnina, prosečne srpske plate, goriva, deviznih i zlatnih rezervi Srbije u odnosu na Bitkoin. Iz priloženih grafikona može se videti da sve vremenom gubi vrednost, odnosno postaje jeftinije u odnosu na BTC.

Cene nekretnina u Republici Srbiji izražene kroz Bitkoin (kompletni grafikoni)

Visina prosečne zarade u Republici Srbiji, cene goriva, dinarska i devizna štednja stanovništva, devizne i zlatne rezerve Srbije - izraženo kroz Bitkoin (kompletni grafikoni)

Prosečna cena m2 stana u Gradu Beogradu izražena kroz BTC

Prosečna cena m2 stana u Novom Sadu izražena kroz BTC

Prosečna cena m2 stana u Nišu izražena kroz BTC

Prosečna cena m2 stana u Kragujevcu izražena kroz BTC

Prosečna zarada u Republici Srbiji izražena kroz BTC

Cena goriva 'Evro Premium BMB 95' izražena kroz BTC

Cena goriva 'Evro Dizel' izražena kroz BTC

Dinarska štednja stanovništva kod banaka izražena kroz BTC

Devizna štednja stanovništva kod banaka izražena kroz BTC

Devizne rezerve Republike Srbije izražene kroz BTC

-

@ 58537364:705b4b85

2025-05-24 20:48:43

@ 58537364:705b4b85

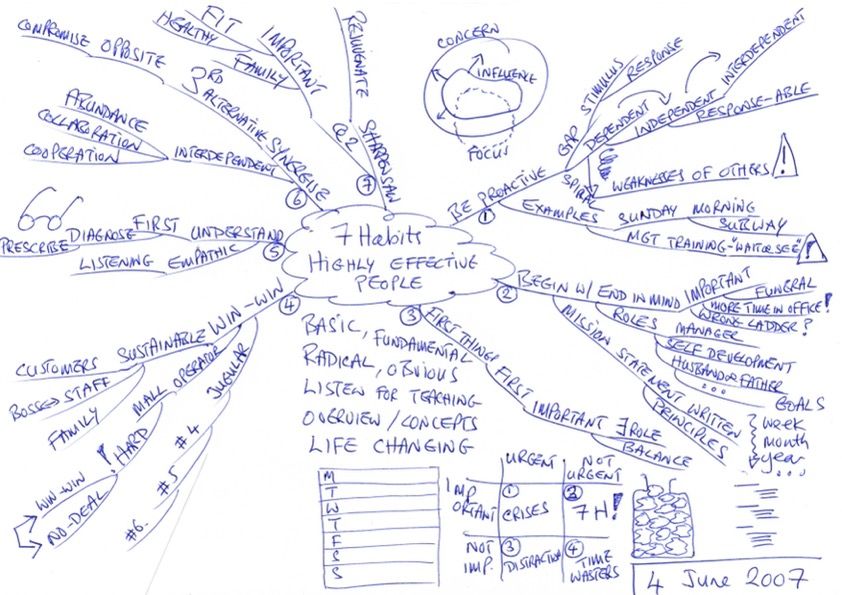

2025-05-24 20:48:43“Any society that sets intellectual development as its goal will continually progress, without end—until life is liberated from problems and suffering. All problems can ultimately be solved through wisdom itself.

The signpost pointing toward ‘wisdom’ is the ability to think—or what is called in Dhamma terms, ‘yoniso-manasikāra,’ meaning wise or analytical reflection. Thinking is the bridge that connects information and knowledge with insight and understanding. Refined or skillful thinking enables one to seek knowledge and apply it effectively.

The key types of thinking are:

- Thinking to acquire knowledge

- Thinking to apply knowledge effectively In other words, thinking to gain knowledge and thinking to use that knowledge. A person with knowledge who doesn’t know how to think cannot make that knowledge useful. On the other hand, a person who thinks without having or seeking knowledge will end up with nothing but dreamy, deluded ideas. When such dreamy ideas are expressed as opinions, they become nonsensical and meaningless—mere expressions of personal likes or dislikes.

In this light, the ‘process of developing wisdom’ begins with the desire to seek knowledge, followed by the training of thinking skills, and concludes with the ability to express well-founded opinions. (In many important cases, practice, testing, or experimentation is needed to confirm understanding.)

Thus, the thirst for knowledge and the ability to seek knowledge are the forerunners of intellectual development. In any society where people lack a love for knowledge and are not inclined to search for it, true intellectual growth will be difficult. That society will be filled with fanciful, delusional thinking and opinions based merely on personal likes and dislikes. For the development of wisdom, there must be the guiding principle that: ‘Giving opinions must go hand-in-hand with seeking knowledge. And once knowledge is gained, thinking must be refined and skillful.’”

— Somdet Phra Buddhaghosacariya (P.A. Payutto) Source: Dhamma treatise “Organizing Society According to the Ideals of the Sangha”

Note: “Pariyosāna” means the complete conclusion or the final, all-encompassing end.

“We must emphasize the pursuit of knowledge more than merely giving opinions. Opinions must be based on the most solid foundation of knowledge.

Nowadays, we face so many problems because people love to express opinions without ever seeking knowledge.”

— Somdet Phra Buddhaghosacariya (P.A. Payutto)

-

@ 3283ef81:0a531a33

2025-05-24 20:47:39

@ 3283ef81:0a531a33

2025-05-24 20:47:39This event has been deleted; your client is ignoring the delete request.

-

@ 3283ef81:0a531a33

2025-05-24 20:36:35

@ 3283ef81:0a531a33

2025-05-24 20:36:35Suspendisse quis rutrum nisi Integer nec augue quis ex euismod blandit ut ac mi

Curabitur suscipit vulputate volutpat Donec ornare, risus non tincidunt malesuada, elit magna feugiat diam, id faucibus libero libero efficitur mauris

-

@ f7a1599c:6f2484d5

2025-05-24 20:06:04

@ f7a1599c:6f2484d5

2025-05-24 20:06:04In March 2020, Lucas was afraid.

The economy was grinding to a halt. Markets were in freefall. In a sweeping response, the Federal Reserve launched an unprecedented intervention—buying everything from Treasury bonds and mortgages to corporate debt, expanding the money supply by $4 trillion. At the same time, the U.S. government issued over $800 billion in stimulus checks to households across the country.

These extraordinary measures may have averted a wave of business failures and bank runs—but they came at a cost: currency debasement and rising inflation. Alarmed by the scale of central bank intervention and its consequences for savers, Lucas decided to act.

In a state of mild panic, he withdrew $15,000 from his bank account and bought ten gold coins. Then he took another $10,000 and bought two bitcoins. If the dollar system failed, Lucas wanted something with intrinsic value he could use.

He mentioned his plan to his friend Daniel, who laughed.

“Why don’t you stock up on guns and cigarettes while you’re at it?” Daniel quipped. “The Fed is doing what it has to—stabilizing the economy in a crisis. Sure, $4 trillion is a lot of money, but it's backed by the most productive economy on Earth. Don’t panic. The world’s not ending.”

To prove his point, Daniel put $25,000 into the S&P 500—right at the pandemic bottom.

And he was right. Literally.

By Spring 2025, the stock market was near all-time highs. The world hadn’t ended. The U.S. economy kept moving, more or less as usual. Daniel’s investment had nearly tripled—his $25,000 had grown to $65,000.

But oddly enough, Lucas’ seemingly panicked reaction had been both prudent and profitable.

His gold coins had climbed from $1,500 to $3,300 apiece—a 120% gain. Bitcoin had soared from $5,000 to $90,000, making his two coins worth $180,000. Altogether, Lucas’s $25,000 allocation had grown to $213,000—a nearly 10x return. And his goal wasn’t even profit. It was safety.

With that kind of fortune, you’d expect Lucas to feel confident, even serene. He had more than enough to preserve his purchasing power, even in the face of years of inflation.

But in the spring of 2025, Lucas felt anything but calm.

He was uneasy—gripped by a sense that the 2020 crisis hadn’t been a conclusion, but a prelude.

In his mind, 2020 was just the latest chapter in a troubling sequence: the Asian financial crisis in 1998, the global financial crisis in 2008, the pandemic shock of 2020. Each crisis had been more sudden, more sweeping, and more dependent on emergency measures than the last.

And Lucas couldn’t shake the feeling that the next act—whenever it came—would be more disruptive, more severe, and far more damaging.

-

@ 15cf81d4:b328e146

2025-05-24 19:19:46

@ 15cf81d4:b328e146

2025-05-24 19:19:46Losing access to your cryptocurrency can feel like losing a part of your future. Whether it’s due to a forgotten password, a damaged seed backup, or a simple mistake in a transfer, the stress can be overwhelming. Fortunately, cryptrecver.com is here to assist! With our expert-led recovery services, you can safely and swiftly reclaim your lost Bitcoin and other cryptocurrencies.

Why Trust Crypt Recver? 🤝 🛠️ Expert Recovery Solutions At Crypt Recver, we specialize in addressing complex wallet-related issues. Our skilled engineers have the tools and expertise to handle:

Partially lost or forgotten seed phrases Extracting funds from outdated or invalid wallet addresses Recovering data from damaged hardware wallets Restoring coins from old or unsupported wallet formats You’re not just getting a service; you’re gaining a partner in your cryptocurrency journey.

🚀 Fast and Efficient Recovery We understand that time is crucial in crypto recovery. Our optimized systems enable you to regain access to your funds quickly, focusing on speed without compromising security. With a success rate of over 90%, you can rely on us to act swiftly on your behalf.

🔒 Privacy is Our Priority Your confidentiality is essential. Every recovery session is conducted with the utmost care, ensuring all processes are encrypted and confidential. You can rest assured that your sensitive information remains private.

💻 Advanced Technology Our proprietary tools and brute-force optimization techniques maximize recovery efficiency. Regardless of how challenging your case may be, our technology is designed to give you the best chance at retrieving your crypto.

Our Recovery Services Include: 📈 Bitcoin Recovery: Lost access to your Bitcoin wallet? We help recover lost wallets, private keys, and passphrases. Transaction Recovery: Mistakes happen — whether it’s an incorrect wallet address or a lost password, let us manage the recovery. Cold Wallet Restoration: If your cold wallet is failing, we can safely extract your assets and migrate them into a secure new wallet. Private Key Generation: Lost your private key? Our experts can help you regain control using advanced methods while ensuring your privacy. ⚠️ What We Don’t Do While we can handle many scenarios, some limitations exist. For instance, we cannot recover funds stored in custodial wallets or cases where there is a complete loss of four or more seed words without partial information available. We are transparent about what’s possible, so you know what to expect

Don’t Let Lost Crypto Hold You Back! Did you know that between 3 to 3.4 million BTC — nearly 20% of the total supply — are estimated to be permanently lost? Don’t become part of that statistic! Whether it’s due to a forgotten password, sending funds to the wrong address, or damaged drives, we can help you navigate these challenges

🛡️ Real-Time Dust Attack Protection Our services extend beyond recovery. We offer dust attack protection, keeping your activity anonymous and your funds secure, shielding your identity from unwanted tracking, ransomware, and phishing attempts.

🎉 Start Your Recovery Journey Today! Ready to reclaim your lost crypto? Don’t wait until it’s too late! 👉 cryptrecver.com

📞 Need Immediate Assistance? Connect with Us! For real-time support or questions, reach out to our dedicated team on: ✉️ Telegram: t.me/crypptrcver 💬 WhatsApp: +1(941)317–1821

Crypt Recver is your trusted partner in cryptocurrency recovery. Let us turn your challenges into victories. Don’t hesitate — your crypto future starts now! 🚀✨

Act fast and secure your digital assets with cryptrecver.com.Losing access to your cryptocurrency can feel like losing a part of your future. Whether it’s due to a forgotten password, a damaged seed backup, or a simple mistake in a transfer, the stress can be overwhelming. Fortunately, cryptrecver.com is here to assist! With our expert-led recovery services, you can safely and swiftly reclaim your lost Bitcoin and other cryptocurrencies.

# Why Trust Crypt Recver? 🤝

# Why Trust Crypt Recver? 🤝🛠️ Expert Recovery Solutions\ At Crypt Recver, we specialize in addressing complex wallet-related issues. Our skilled engineers have the tools and expertise to handle:

- Partially lost or forgotten seed phrases

- Extracting funds from outdated or invalid wallet addresses

- Recovering data from damaged hardware wallets

- Restoring coins from old or unsupported wallet formats

You’re not just getting a service; you’re gaining a partner in your cryptocurrency journey.

🚀 Fast and Efficient Recovery\ We understand that time is crucial in crypto recovery. Our optimized systems enable you to regain access to your funds quickly, focusing on speed without compromising security. With a success rate of over 90%, you can rely on us to act swiftly on your behalf.

🔒 Privacy is Our Priority\ Your confidentiality is essential. Every recovery session is conducted with the utmost care, ensuring all processes are encrypted and confidential. You can rest assured that your sensitive information remains private.

💻 Advanced Technology\ Our proprietary tools and brute-force optimization techniques maximize recovery efficiency. Regardless of how challenging your case may be, our technology is designed to give you the best chance at retrieving your crypto.

Our Recovery Services Include: 📈

- Bitcoin Recovery: Lost access to your Bitcoin wallet? We help recover lost wallets, private keys, and passphrases.

- Transaction Recovery: Mistakes happen — whether it’s an incorrect wallet address or a lost password, let us manage the recovery.

- Cold Wallet Restoration: If your cold wallet is failing, we can safely extract your assets and migrate them into a secure new wallet.

- Private Key Generation: Lost your private key? Our experts can help you regain control using advanced methods while ensuring your privacy.

⚠️ What We Don’t Do\ While we can handle many scenarios, some limitations exist. For instance, we cannot recover funds stored in custodial wallets or cases where there is a complete loss of four or more seed words without partial information available. We are transparent about what’s possible, so you know what to expect

# Don’t Let Lost Crypto Hold You Back!

# Don’t Let Lost Crypto Hold You Back!Did you know that between 3 to 3.4 million BTC — nearly 20% of the total supply — are estimated to be permanently lost? Don’t become part of that statistic! Whether it’s due to a forgotten password, sending funds to the wrong address, or damaged drives, we can help you navigate these challenges

🛡️ Real-Time Dust Attack Protection\ Our services extend beyond recovery. We offer dust attack protection, keeping your activity anonymous and your funds secure, shielding your identity from unwanted tracking, ransomware, and phishing attempts.

🎉 Start Your Recovery Journey Today!\ Ready to reclaim your lost crypto? Don’t wait until it’s too late!\ 👉 cryptrecver.com

📞 Need Immediate Assistance? Connect with Us!\ For real-time support or questions, reach out to our dedicated team on:\ ✉️ Telegram: t.me/crypptrcver\ 💬 WhatsApp: +1(941)317–1821

Crypt Recver is your trusted partner in cryptocurrency recovery. Let us turn your challenges into victories. Don’t hesitate — your crypto future starts now! 🚀✨

Act fast and secure your digital assets with cryptrecver.com.

-

@ 6c05c73e:c4356f17

2025-05-24 19:16:17

@ 6c05c73e:c4356f17

2025-05-24 19:16:17Descrição da empresa

Fundada em 1961, a WEG é uma empresa global de equipamentos eletroeletrônicos, atuando principalmente no setor de bens de capital com soluções em máquinas elétricas, automação e tintas, para diversos setores, incluindo infraestrutura, siderurgia, papel e celulose, petróleo e gás, mineração, entre muitos outros.

A WEG se destaca em inovação pelo desenvolvimento constante de soluções para atender as grandes tendências voltadas a eficiência energética, energias renováveis e mobilidade elétrica. Com operações industriais em 17 países e presença comercial em mais de 135 países, a companhia possui mais de 47.000 mil colaboradores distribuídos pelo mundo.

Em 2024, a WEG atingiu faturamento líquido de R$38,0 bilhões, destes 57,0% proveniente das vendas realizadas fora do Brasil.

Vendendo soluções para os clientes

"Na febre do ouro, muito garimpeiros corriam atrás de ouro para ficar ricos. Enquanto isso, muita gente enriqueceu vendendo pás, roupas, bebidas, cigarros e mantimentos para eles…”

Em um mundo dominado cada vez mais por Inteligência Artificial, carros elétricos e tecnologias quânticas. A Wege segue se destacando por oferecer equipamentos e parte da estrutura pode detrás para que essas tecnologias possam existir. Focada em inovação e performance. A empresa oferece soluções de ponta a ponta para os mais variados setores da indústria.

Visão geral da empresa

A Wege atua no setor de máquinas e equipamentos. Se formos fazer um refino, podemos dizer que ela atua em subsetores tais como: motores, compressores e outros.

Mercado que atua

O setor de máquinas e equipamentos no Brasil em 2024 enfrentou um cenário desafiador, com uma queda na receita líquida, mas também mostrou sinais de recuperação e algumas perspectivas positivas em segmentos específicos e no início de 2025.

A WEG é gigante no mundo todo. Os caras têm fábricas e filiais em mais de 40 países, espalhados por todos os continentes. A estratégia dos caras é expandir sempre, comprando outras empresas e investindo pesado em mercados-chave. A empresa foca em: Expansão, inovação e sustentabilidade.

Mercado

Grana Alta: Em 2024, o mercado global de máquinas e equipamentos valeu uns US$ 205,67 bilhões. Já a parte de motores elétricos, chegou a uns US$ 152,2 bilhões. A parada é que a automação industrial, que é a cara do futuro, estava em uns US$ 192,02 bilhões em 2024. É muita grana rolando!

As empresas estão investindo cada vez mais em IA (Inteligência artificial), IOT (internet das coisas, robótica e fabricação sustentável.

Perspectiva de crescimento A parada é que esse mercado tá com gás total pra crescer nos próximos anos, parceiro:

Máquinas e Equipamentos: A expectativa é que o mercado global de máquinas e equipamentos cresça cerca de 6,57% ao ano até 2033, podendo chegar a uns US$ 364,66 bilhões.

Motores Elétricos: Esse setor tá prometendo um crescimento de uns 6,3% ao ano até 2029, podendo bater uns US$ 206,4 bilhões. A demanda por carros elétricos tá puxando muito esse crescimento.

Automação Industrial: Essa é a cereja do bolo! A expectativa é que o mercado de automação industrial dispare uns 9,1% ao ano até 2033, alcançando uns US$ 420,49 bilhões. A busca por mais produtividade, menos erros e mais eficiência tá impulsionando essa onda.

Materia sobre carros eletricos

Oportunidades que o ativo traz

Na minha visão, as maiores oportunidades que a Wege nos traz são:

-

Equipamentos Eletroeletrônicos Industriais

Esta área inclui os motores elétricos, drives e equipamentos e serviços de automação industrial e serviços de manutenção. Os motores elétricos e demais equipamentos têm aplicação em praticamente todos os segmentos industriais, em equipamentos como compressores, bombas e ventiladores.

-

Geração Transmissão e Distribuição de Energia (GTD)

Os produtos e serviços incluídos nesta área são os geradores elétricos para usinas hidráulicas e térmicas (biomassa), turbinas hidráulicas (PCH e CGH), aerogeradores, transformadores, subestações, painéis de controle e serviços de integração de sistemas.

-

Motores Comerciais e Appliance

O foco de atuação nesta área é o mercado de motores monofásicos para bens de consumo durável, como lavadoras de roupas, aparelhos de ar condicionado, bombas de água, entre outros.

Desde Janeiro/25, podemos observar que o gráfico teve uma queda no seu preço. Contudo, continua se mantendo acima da ema200 e com ótimo volume negociado. Isso tudo caracteriza que a tendência majoritária ainda é compradora. Então, devemos pensar em atuar somente nesse sentido.

Riscos

Os maiores riscos que vejo hoje, para uma empresa tão sólida como Wege são:

- Instabilidade Econômica Global e Regional, qualquer flutuação em mercado chave atuante pode representar um risco.

- Inflação e Custo de Insumos, principalmente aço e cobre que são matérias prima base.

- Políticas Tarifárias e Protecionismo, se o homem laranja dos EUA impor tarifas. Pode afetar sim os negócios da empresa como um todo.

Catalisadores

Na minha visão, os catalisadores da empresa. Que impulsionam e continuaram dando força a ela são:

- Forte diversificação de receita, 53% vem em dólar.

- Boa perspectiva do aumento do valor do dólar. Isso representa mais caixa.

- As aquisiçõess feitas recentemente, que vão impulsionar a receita da empresa.

Faq

Qual foi o desempenho da WEGE3 nas últimas 52 semanas?

13.95% foi desempenho das ações da WEGE3 até o momento.

WEGE3 paga dividendos? Qual o Dividend Yield (DY) da WEGE3?

Sim, WEGE3 (WEG) paga dividendos e juros sobre capital próprio (JCP). O Dividend Yield (DY) da WEGE3 tem variado ao longo do tempo, mas geralmente se encontra entre 1,4% e 1,8%, dependendo da cotação atual das ações e dos valores de dividendos e JCP distribuídos.

O que é a WEG? Qual o setor de atuação da WEG?

A WEG é uma empresa global de equipamentos eletroeletrônicos, que atua principalmente no setor de bens de capital. A empresa se destaca por suas soluções em máquinas elétricas, automação, tintas e sistemas de energia, com foco em eficiência energética e sustentabilidade.

Quais produtos a WEG fabrica?

A WEG produz uma vasta gama de produtos e soluções, abrangendo desde equipamentos elétricos e eletrônicos até tintas e vernizes.

Qual é o P/L (Preço sobre Lucro) da WEGE3?

O P/L (Preço sobre Lucro) da WEGE3, conforme indicadores de mercado, está em torno de 29,32.

Bio

Investir não precisa ser um bicho de sete cabeças! Na Threedolar, democratizamos o acesso ao mundo dos investimentos, oferecendo conteúdo claro e prático. Comece hoje mesmo a construir seu futuro financeiro!

Disclaimer

Lembre-se: este não é um conselho de investimento. Faça sua própria pesquisa antes de investir. Resultados passados não garantem lucros futuros. Cuide do seu dinheiro!

Referencia

https://www.fundamentus.com.br/detalhes.php?papel=WEGE3&h=1

https://ri.weg.net/a-weg/perfil-corporativo/

https://ri.weg.net/a-weg/por-que-a-weg/

https://www.cnnbrasil.com.br/auto/carros-eletrificados-registram-85-de-aumento-nas-vendas-de-2024/

-

-

@ 3283ef81:0a531a33

2025-05-24 18:41:43

@ 3283ef81:0a531a33

2025-05-24 18:41:43Why

is

this

noton

separate

lines -

@ 3283ef81:0a531a33

2025-05-24 18:20:45

@ 3283ef81:0a531a33

2025-05-24 18:20:45Aliquam eu turpis sed enim ultricies scelerisque\ Duis posuere congue faucibus

Praesent pretium orci ante, et faucibus lectus euismod a

-

@ 3283ef81:0a531a33

2025-05-24 18:17:22

@ 3283ef81:0a531a33

2025-05-24 18:17:22Vestibulum a nunc a sapien aliquam rhoncus\ Sed sem turpis, scelerisque sed augue ut, faucibus blandit lectus

Maecenas commodo, augue in placerat lacinia, lorem libero convallis mi, eu fringilla velit arcu id sem. In ac metus vitae sapien dignissim luctus

-

@ bf47c19e:c3d2573b

2025-05-24 18:17:09

@ bf47c19e:c3d2573b

2025-05-24 18:17:09Ovaj post sam objavio 24.01.2024. godine na Redditu povodom tri decenije od uvođenja Novog dinara kao rešenja za hiperinflaciju u Saveznoj Republici Jugoslaviji na šta su pojedini besni nokoineri sa te društvene mreže osuli drvlje i kamenje na mene. Od starih budalaština da je Bitkoin bezvredan, da nije oblik novca već finansijsko ulaganje, preko pravdanja svrhe inflacije, sve do potpune nemoći da se argumentima opovrgne nepobitna istina i pozivanja moderatora da me banuju. 🙃

Cena Bitkoina tada je bila oko $40.000. :)

Osim glavnog posta, ovde ću navesti i moje odgovore na neutemeljene i neinformisane tvrdnje besnih nokoinera. :) Da se sačuva od zaborava!

Juče se navršilo 30 godina "Deda Avramove reforme".

Dan kada je rođen novi dinar, a Deda Avram sasekao hiperinflaciju

Dva jajeta – nedeljna profesorska plata: Kako se živelo u hiperinflaciji i šta je uradio Avramović

Vikipedija: Jugoslovenski dinar

„U julu '93. godine u Jugoslaviji nisi mogao skoro ništa da kupiš i niko za dinare nije hteo ništa da prodaje“, pisao je Avramović. Centralno-bankarska prevara se nastavlja jer je već do kraja 1995. dinar oslabio prema marki za 70% (1 dinar = 3.4 DM), a u decembru 2000. je taj kurs već bio 30.5 dinara za 1 DM (-96.7% od uvođenja novog dinara). To samo pokazuje da redenominacija valute tj. "brisanje nula" nije nikako čudo i viđano je puno puta kroz istoriju)

Ako je reformom iz januara '94 god. 1 novi dinar vredeo kao 1 nemačka marka, zatim od 2002. uveden evro čime je realna vrednost marke (samim tim i dinara) prepolovljena, a danas 1 EUR vredi oko 117 RSD, to znači da je "deda Avramov dinar" prema evru već obezvređen 59.91 puta za 30 godina. Dakle devalvacija dinara od 5991% od 1994. godine, a svakako još veća izražena kroz dobra i usluge jer su i nemačka marka do 2002. i evro od svog uvođenja iste godine prošli kroz sopstvenu inflaciju. Sam evro je izgubio oko 38% vrednosti od 2002. godine. Tako da se može reći da i "deda Avramov dinar" već uveliko prolazi kroz hiperinflaciju koja je samo razvučena na mnogo duži vremenski period (ne brinite - znam "zvaničnu" definiciju hiperinflacije - još jedan "gaslighting" centralno-bankarskog kartela da zabašuri šta se iza brda valja). Jer šta je inflacija od preko 5991% nego višedecenijska hiperinflacija?! Kako ne shvata gigantske razmere ove prevare?!

ISPRAVKA: Dinar nije nominalno izgubio 23400% (234x) vrednosti prema nemačkoj marki/evru od 1994. godine, već 59.91x odnosno 5991%. I danas na sajtu NBS postoji zvanični srednji kurs marke prema dinaru od 59,91:1. Realno, obezvređivanje dinara i evra prema robama i uslugama je puno veće, pošto su cene roba i usluga izražene u evrima ubrzo udvostručene u periodu nakon uvođenja evra. Hvala članu DejanJwtq na ispravci i izvinjenje svima od mene zbog greške.

Dafiment i Jugoskandik ("Dafina i Jezda") su bili samo državna konstrukcija da se izvuku devize iz ruku naivnih investitora da bi te devize nešto kasnije poslužile kao tobožnja rezerva za novi dinar. Ova gigantska prevara je unapred bila planirana, a Deda Avram iskorišćen kao marioneta tadašnjeg režima.

Inače lista država koje su izvršile redenominaciju valute kroz "brisanje nula" je poprilično dugačka i radi se o uobičajenoj pojavi kroz istoriju još od Haitija 1813. godine, a poslednji put su to uradile Sijera Leone i Kolumbija 2021. godine. Odavno je zaboravljeno da je (SR) Jugoslavija devedesetih to učinila još 1990. (10.000:1), 1992. (10:1), 1993. (1.000.000:1) i 1994. pre Avramovića (1.000.000.000∶1) ali je ovaj dinar trajao samo 23 dana. Tako da Deda Avram nije izmislio toplu vodu.

U SFRJ je izvršena jedna redenominacija 1966. godine u odnosu 10.000:1.

Wikipedia: Redenomination

Kome i dalje nije jasno zašto Bitkoin neka više puta pažljivo pročita ove tekstove iznad: oblik novca koji se ne može redenominirati, veoma lako konfiskovati i izdavati bez ikakve kontrole i pokrića. Potpuno nezavistan od kaprica korumpiranih i od realnosti otuđenih političara i centralnih bankara. Veoma je bitno da postoji ovakav oblik novca koji nije podložan ovakvim manipulacijama od strane ljudskog faktora i da postoji slobodan izbor da se taj oblik novca odabere za štednju i transakcije: barem od strane onih koji ga razumeju, ovi koji ne žele da razumeju neka i dalje pristaju da budu pljačkani - njima ionako nema pomoći.

Komentari

brainzorz: Da, ali ako cemo realno bitkoin ne sluzi kao oblik novca, vec kao finansijsko ulaganje.

Bar je tako za nas i vecinu ljudi po svetu u praktičnom smislu. Jer 99.99% ljudi ili koliko vec prime platu u svojoj lokalnoj valuti, trose istu na redovan zivot, a ostatak (ako ga ima) investiraju. Slazem se da lokalne valute imaju svoj neki rizik, koji je veci u banana drzavi i da cuvanje svog kapitala u turbulentnom periodu u istoj je jako losa ideja.

Kada tako posmatras onda se mogu vuci pararele izmedju ostalih aseta, poput ETFova na primer i onda dolazimo do gomile problema sa bitkoinom.

@BTCSRB: Bitkoin se ne može porediti sa ETF-ovima pošto ETF-ove i ostale investicione instrumente ne možeš koristiti kao novac jer oni nisu "bearer assets" kao što jeste BTC. BTC eliminiše potpuno inflaciju (jer džabe ti keš u slamarici kao "bearer asset" kada je podložan inflaciji) i potrebu za posrednikom kod elektronskih plaćanja.

brainzorz: Ali on to eleminise samo u teoriji, sad da odem u pekaru, moram platiti u lokalnoj valuti, sad da li cu prodati bitkoin ili etf, prilicno je slicno.

Jedino sto mogu bitkoin zamenuti uzivo (ilegalno) sa nekim, pa tu jeste zamenjen posrednik. Ali provizije povlacenja su uglavnom zanemarljive, naspram ostalih parametara investicionog sredstva.

Neke stvari se mogu direktno platiti za bitkoin, ali to je ekstremno retko u stvarnom zivotu vecine ljudi.

@BTCSRB: Slažem se ali u uslovima hiperinflacije i visoke inflacije kakvu danas imamo u Argentini, Venecueli, Zimbabveu, Libanu, Turskoj itd. sve više ljudi direktno vrši transakcije u kriptovalutama, naročito "stablecoinima" poput USDT Tethera. Priznajem da u tim transakcijama BTC zaostaje upravo zbog volatilnosti ali je vršenje brzih i jeftinih transakcija svakako moguće putem Lightning mreže. Sve te lokalne valute su izgubile značajnu vrednost i prema USDT i prema BTC-u, odnosno BTC konstantno probija rekordnu vrednost kada se denominuje u tim valutama. I u tim državama je adopcija kriptovaluta najraširenija.

HunterVD: Kako valuta u koju se upumpavaju nepostojeci dolari i evri moze biti realna i dobra. A USDT tek da ne spominjem. Mozes uvek revi jer joj ljudi veruju, al ta vera u nesto ide samo do odredjenog nivoa.

@BTCSRB: Godinama kupujem BTC od svake plate, praktično štedim u njemu i kupovna moć mi vremenom raste denominirana u evrima i dinarima. To isto rade na desetine hiljada ljudi širom sveta. Kako su ti realni dinari i evri koje ubacujem svakog meseca koje sam zaradio od svog realnog rada - "nepostojeći"?

Kako dolari i evri koji se štampaju ni iz čega mogu biti realni i dobri kao valuta?

HunterVD: Pa eto bas to. Ulaze se nepostojeci novac u BTC i onda se prica o nekoj novoj valuti. Nije sija nego vrat, BTC ima jedino vrednost dok se upumpava taj lazni novac u njega. FIAT novac kolko tolko nastaje radom i proizvodnjom dobara, ne sav FIAT novac al neki deo, dok se BTC zasniva skroz na upumpavanje tog istog FIAT novca i dobroj volji i zeljama da magicne brojke idu navise.

@BTCSRB: Itekako je moguće izraziti cenu svih ostalih dobara i usluga kroz BTC i postojanje i vrednost BTC-a uopšte ne zavisi od fiat novca. Štaviše, gotova sva dobra i usluge dugoročno postaju jeftiniji kada se mere kroz BTC. Sutra kada bi fiat novac nestao BTC bi i dalje imao vrednost, čak i veću nego danas.

https://www.pricedinbitcoin21.com/

HunterVD: Naravno da je moguce izraziti cene svakodnevnih proizvoda u BTCu. Cene svakodnevnih proizvoda je moguce izraziti u cemu god pozelis, evo npr broj radnih sati koji je potreban da se proizvede taj proizvod i onda se uporedi sa cenom radnih sati i cene na polici, mozes ga uracunavati i u dobrima , jedan iphone kosta tolko i tolko KG juneceg mesa..... nista cudno. Takodje cene proizvoda pokazuju pad u odnosu sa BTCom jer je BTC masivno porastao u poslednjih 5-6 godina. Sta ce biti kad BTC stagnira ili pada kako se u tom periodu odnose cene, a da BTC je store of value i namenjen je samo da se cuva izvinte molim vas moja greska. Ni druge kripto valute nisu nista bolje. Ljudi koji su zaradili na BTCu svaka cast eto imali su pameti i srece , al sad kako je cena sve veca, inflacija sve losija i kamatne stope sve vise postace sve teze i teze dolaziti do novca a kamo li intvestirati ga u nesto rizicno ko kripto valute tako da ce i BTC sve manje rasti sto zbog velicine market cap-a sto zbog toga sto ljudi i firme imaju sve manje novca za ulagati. Dal ce btc moci da se uzbori sa inflacijom i losim uslovima to tek treba da se vidi. Tako da videcemo u narednom periodu koliko ce se ta priva o BTC kao store of value i nacinu odbrane od inflacije obistiniti. Licno ne verujem da ce BTC ikad biti zvanicno sredstvo placanja.

@BTCSRB: Cena svega se može izraziti kroz sve ostalo ali šta od svega toga najbolje vrši funkciju novca? BTC bolje vrši funkciju novca u većini okolnosti od gotovo svih stvari.

Šta će biti sa BTC videće se i oni koji veruju u njega će biti najzaslužniji za njegov uspeh jer su obezbeđivali potražnju kada su kola išla nizbrdo i za to biti asimetrično nagrađeni, ali će i puno izgubiti ako se pokaže da nisu u pravu. Pukovnici ili pokojnici. Po meni je to cilj zbog koga vredi rizikovati, pa i bankrotirati a cilj je da se centralno-bankarski kartel učini manje relevantnim.

Znaš i sam da fiat sistem ne može da preživi i izbegne imploziju bez konstantnog uvećanja mase novca u opticaju i zato se uopšte ne plašim za BTC i spavam mirno. BTC sigurno neće rasti istom brzinom kao prvih 15 godina ali moje očekivanje je svakako ubedljivo nadmašivanje svetske inflacije i obezvređivanja. Ne vidim kako sistem može da opstane bez novog QE kada god se on desi, u suprotnom imamo deflatornu spiralu.

Ne mora da bude zvanično sredstvo plaćanja, dovoljno da meni kao pojedincu služi za to dok god ima ljudi koji ga prihvataju, a ima ih puno. I da niko u tome ne može da nas spreči.

loldurrr: Ali i BTC je postao, u neku ruku, berzanska roba. Imaš market cap izražen u dolarima, koji je danas, npr. 2 triliona $, za mjesec dana 500 milijardi. Isto kao i dolar, samo volatilnije. Zato i kažem, da je to sve rezultat ponude i tražnje. Hipotetički, ja da imam milion BTC i odlučim to danas prodati, enormno ću oboriti cenu BTC. Ako je to valuta nezavisna od vanjskih uticaja - zašto će pasti toliko, kada imamo ograničenu količinu BTC-a. Svima je i dalje u podsvesti vrednost BTC izražena u USD, tako da je to isto kao i dinar, franak, akcija CocaCola i sl. Bar za sada...

A mogućnosti za korištenje BTC za robna plaćanja su mizerna. Ima li na vidiku mogućnosti da se vrednost nafte počne izražavati u BTC?

@BTCSRB: Meriti Bitkoin direktno prema robama i uslugama je itekako moguće i kada ga tako meriš, a ne prema fiat novcu, dugoročno cene gotovo svih roba i usluga padaju prema Bitkoinu. Cene svega izražene kroz BTC neće nestati ni u slučaju nestanka fiat novca, dolar sutra da prestane da postoji nikoga ne sprečava da izražava cene svega kroz BTC. Dolar i ostale valute nisu potrebni Bitkoinu.

Unlikely-Put-5524: Imam samo jedno pitanje za one "koji vide iza svega" i pronikli su bankarsku prevare da porobi čovečanstvo... Kako ne postoji mogućnost da je BTC i kripto nastao iz iste kuhinje i predstavlja ultimativni način za porobljavanje?

2% novčanika poseduje 95% svog BTC-a koji nije izgubljen. Znači da centralizacija može biti maksimalna...

@BTCSRB: Količina BTC-a u posedu ne daje kontrolu nad pravilima protokola i većinski vlasnici ne mogu da štampaju nove novčiće i tako uvećaju konačnu količinu u opticaju. Mogu samo da kratkoročno obore cenu i tako samo ostanu sa manje BTC-a koji imaju pošto će tržište vremenom apsorbovati te dampovane koine.

Unlikely-Put-5524: A mogu i dugoročno da obore cenu. Hajde da kažemo da imaš sada 10 BTC-a gde svaki vredi 40k

Veliki dumpu-ju ceo svoj bag u kontinutitetu kao što sad radi GS i posle godinu dana tvoj BTC sad vredi 4k, zašto misliš da bi ljudi nastavili da ga drže? Posebno ako znamo da ga 97% kupuje da bi zaradili, a ne zato što žele da ga koriste kao sredstvo plaćanja.

Ja bih ore BTC gledao kao commodity, jer sa svojim deflatornim svojstvima ne može biti valuta za plaćanje.

Takođe postoji i doomsday scenario gde jednostavno mogu svi da se dogovore da je ilegalan i to je onda to. Ovo mi deluje kao gotovo neverovatno, ali po meni je bilo koji maksimalizam potpuno detinjasto razmišljanje.

@BTCSRB: Pa padao je toliko puta za preko 70% i uvek se vraćao jer si uvek imao ljude koji su bili spremni da ga kupuju po bilo kojoj ceni, uključujući i mene. Pošto se ne može štampati, na kraju će ovi prodavci ostati bez BTC-a za prodaju i tržište apsorbovati čak i njihov "sell pressure". A ovi veliki koji drže tolike količine itekako dobro znaju vrednost toga što poseduju i nema smisla da svu količinu koju drže prodaju za inflatorni novac - prodavaće da bi finansirali svoj životni stil ili investiraju u biznise ili će ga koristiti kao kolateral za fiat pozajmice - ako raspolažu tolikim količinama i mogu da kontrolišu tržište nemaju strah da će im kolateral biti likvidiran.

Većina ljudi su fiat maksimalisti samim tim što su 100% u fiat novcu pa ne razmišljaju u pravcu doomsday scenarija kakav je upravo bila hiperinflacija devedesetih.

Romeo_y_Cohiba: Niko ti ne brani da ulažeš u bitcoin pod uslovom da znaš da je rizičniji od gotovog novca, štednje po viđenju, oročene štednje, obveznica, nekretnina, akcija, raznoraznih etfova, private equitya i derivata.

Drugim rečima ako ti je ok da danas uložiš 1000e, da za nedelju dana to vredi 500e, za mesec 1500 a za pola godina 300e ili 0 samo napred. Većini ljudi to nije ok.

Razlog zašto pamtimo Avrama je jer njegov dinar i dan danas koristimo. Prethodne uzastopne reforme nisu uspele kao što si i sam primetio.

Takođe, nije u pitanju "centralno-bankarska" prevara jer se ništa od toga ne bi desilo da ovom "odozgo" nisu zatrebale pare za finansiranje izvesnih stvari.

I dan danas, izvesni političar(i) izađu na TV i kažu da su "našli" novac za neki svoj genijalni plan i ljudi to puše. To u prevodu najčešće znači da će da nagna centralnu banku da mu doštampa novca i to nema veze sa bankama nego politikom..

@BTCSRB: Za investicione instrumente koje si naveo treba videti koliko su uspešno nadvladavali inflaciju prethodnih decenija i da li su očuvali kupovnu moć. Za štednju u banci i obveznice se i iz daleka vidi da nisu. US obveznice su u septembru imale drawdown od 48% od ATH iz 2020, a kao važe sa sigurnu investiciju. Čak i u momentu dospeća posle 10-30 godina jako teško čuvaju vrednost od inflacije.

A sada se zapitaj: da li zaista misliš da političari kontrolišu banke i bankare ili je možda obrnuto? Nisu političari ti koji su vlasnici krupnog kapitala.

Romeo_y_Cohiba: Ne investiraju svi na 10-30 godina za potrebe penzije. To je samo jedan od mnogo vidova i razloga investiranja. Nadvladavanje inflacije je isto tako samo jedan od kriterijuma. Samo pogledaš u šta jedan penzioni fond u SAD-u investira(hint: nije btc i nisu samo akcije). Npr. neki penzioni fondovi su od skoro počeli da investiraju u private equity ali isključivo do 15% veličine portfolija. Počeće i sa kriptom u nekom trenutku ali mogu da potpišem da će biti u još manjem procentu nego PE. Niko nije blesav da grune teško stečeni novac u nešto tako rizično osim u jako malim iznosima.

Ne znam ko koga kontroliše ali Avram je bio daleko manji baja od Slobe 90ih i pitao se za stvari samo u meri koliko mu je bio dozvoljeno da se pita. Ratovanje košta i finansira se štampanjem novca, nisu to neke neshvatljive stvari. Da ne pričam da smo bili pod apsolutnim sankcijama celog sveta.

Virtual_Plenty_6047: Npr jedan od velikih uspeha Japana od pre par decenija je zahvaljujući devalvaciji njihove valute, pa samim tim izvoz im je bio relativno jeftin. Naš dinar je jak, i to odgovara uvozničkom lobiju.

Nažalost mi ionako ništa ne proizvodimo tako da ne verujem da bi nešto pomoglo ako bi devalvirali dinar. Al svakako ovo je jedna viša ekonomija za koju naši političari nisu dorasli.

@BTCSRB: Gde je običan čovek u tom velikom japanskom uspehu? Postali su zemlja starih i nesrećnih mladih ljudi koji ne mogu da pobegnu iz "hamster wheel-a". Imaju "debt to GDP" od preko 260%. Taj dug nikada neće vratiti, a uz to će povući u ambis pola sveta jer najveći držaoci američkog duga - 14.5%. Spolja gladac, iznutra jadac. Iako je malo degutantno da mi iz Srbije komentarišemo Japance, opet pitam: gde je prosečan Japanac u celoj ovoj igri?

Why Japan Is Facing a Financial Disaster

Preporučujem da pogledate dokumentarac "Princes of the Yen | The Hidden Power of Central Banks" snimljenom po istoimenoj knjizi profesora Riharda Vernera koji je otac kvantitativnog popuštanja (quantitative easing) i ekspert za japansku ekonomiju i bankarski sistem.

Virtual_Plenty_6047: Zato sam rekao od pre nekoliko decenija. Jer su do pre nekih 30 godina bili 50 godina ispred celog sveta, sad su 20 godina iza naprednog sveta. Japanci su svako specifični. Poenta mog komentara da postoji razlog za neke zemlje da oslabe svoju valutu, i može itekako dobro da radi ako se radi u sinergiji sa nekim drugim ekonomskim merama. Tako da odgovor na to opet pitam, ne znam gde je prosečni Japanac, uskoro tamo trebam da idem pa ću ti reći. :'D

Odgledao sam ja ovaj dokumentarac odavno, super je. Pročitao mnoge knjige, a ponajviše od Austrijske ekonomske škole gde su pojedinci (Hayek) bili prvi koji su zagovarali novu decentralizovanu valutu, bili su u toj školi mnogi koji su prvi pričali o problemu inflacije i šta je tačno inflacija, ali su bili i za kapitalizam. Ali ovo je zaista jedna visoka ekonomija, videćeš da nije baš sve tako jednostavno kao što misliš.

Malo si previše u kriptovalutama pa gledaš na sve drugo u ekonomiji sa prekorom, pogotovu na kapitalizam. Evo i ja sam sam dobro investiran u kripto (uglavnom u BTC) pa sam itekako svestan da sve to može na kraju da bude potpuna pizdarija.

p.s. Knjiga za preporuku: 23 stvari koje vam ne kazu o kapitalizmu

@BTCSRB: Nisam u kriptovalutama nego isključivo u BTC.

Nisam ja protiv kapitalizma samo što nije pravi kapitalizam kada ne postoji slobodno tržište novca, pa samim tim ne postoji uopšte slobodno tržište koliko god se činilo tako. Kada su ekonomski subjekti prisiljeni da koriste određeni oblik novca, a monetarna politika se centralno planira - po meni tu nema slobodnog tržišta niti kapitalizma. Npr. formiranje cene Bitkoina i transakcionih naknada je čisto slobodno tržište jer tu nema "bailout-a", a BTC mining industrija je pravi primer slobodnog tržišta u kapitalizmu. Čista ponuda i potražnja bez intervencionizma. Ako si neprofitabilan nema ti spasa i bankrotiraćeš i nema nikoga ko će ti priteći u pomoć. Niko nije "too big to fail".

Znam da sam se ovde usredsredio usko na jednu industriju ali se može primeniti na celokupnu ekonomiju. Države i centralne banke su suvišne i apsolutno pokvare sve čega se dotaknu pa će u slučaju potpune pizdarije odgovornost biti na njima, a ne na Bitkoinu i njegovim držaocima.

kutija_keksa: Evo zašto btc nije pogodan kao valuta:

-Volatilna vrednost. Vrednost btc se menja i do 200% godišnje, dok dolar ne trpi inflaciju vecu od 10% godišnje (mada je u redovnim uslovima tipa 3%). Čak i dinar, ako gledaš realnu kupovnu moć u prodavnici nema volatilnost preko 30% na godišnjem nivou (jedno 7 puta nižu od BTC) Ako danas kupim BTC u vrednosti od 15 USD ne znam da li ću sutra moći da kupim 10 ili 20 USD za isti taj BTC.

-„Gas fees” koji se plaćaju na svaku transakciju, u poređenjusa kešom koji nema takvih problema.

-Spor transfer novca. Arhitektura blockchaina ne dozvoljava mreži da procesuira više od 10 transakcija po sekundi, što značida na transakciju možete čekati i po nekoloo sati, u poređenju sa kešom (bez odugovlačenja) ili debitnim karticama (10 sekundi do 10 minuta). Visa i MasterCard procesuiraju hiljadu puta više transakcija po sekundi.

-Retko ko eksplicitno prima BTC, tako da ćete plaćati menjačnici na kursu u oba smera, i pritom čekati menjačnicu.

-Podložan je manipulacijama velikih igrača poput Ilona Maska i velikih banki koje su u zadnjih pet godina debelo uložile u kripto. Fiat je na milosti države i njenih građana, dok je BTC na milost privatnih investitora. Kome verujete više?

-SVE BTC transakcije su jsvne, ako neko zna koji novčanik je vaš lako zna i koliko para ste kada slali kome, dok fizičke novčanice nemaju taj problem.

-Vrednost i upotreljivost BTC ne garantuje niko, dok vrednost i upotrebljivost fiat valute barem donekle garantuje država. Na primer, Srbija garantuje da je dinar upotrebljiv jer zahteva da vodu, struju, poreze, namete i takse plaćaš u dinarima, a i javni sektor (10% čitavog stanovništva) isplaćuje isključivo u dinarima.

OP očigledno ima jako ostrašćenu ideološku perspektivu... Ja nisam stručnjak, ali je moj otac pisao naučne radove o blockchainu dok je bio na doktorskim studijama, još kad je pomisao o BTC vrednijem od sto dolada bila smešna, tako da znam nešto malo kroz priče sa njim. Uostalom, sve o čemu pričam lako je proveriti pomoću javnih podataka. Ono što OP piše je jednim delom tačno, ali su iznete samo one informacije koje idu u prilog BTC.

Kripto kao pobuna protiv fiata, centralnih banaka i vlada je imao ideološke korene kod anarhista na internetu devedestih, međutim od njihovih belih papira i špekulacija dobili smo nešto što je kao valuta beskorisno. BTC može biti investicija, ako su ljudi iskreni sa sobom, ali ideja o valuti je prevaziđena. Ako i neka kripto valuta drži do toga onda je to Monero koji bar ima anonimnost.

@BTCSRB: Ne ulazeći u sve iznete navode taksativno, ipak moram da prokomentarišem neke od nepreciznih ili netačnih navoda.

Transakcione naknade kod Bitkoina se ne zovu "gas fees" već "transaction fees". Kod keša nema takvih problema ali ga ne možete poslati putem komunikacionog kanala bez posrednika. To mora da ima svoju cenu pošto BTC majneri moraju da imaju neki podsticaj da uključe nečiju transakciju u blok koji je ograničene veličine. BTC "fee market" je najslobodnije tržište na svetu. Fiat novac nemate mogućnost da pošaljete na daljinu bez posrednika koji takođe naplaćuje nekada dosta skupe naknade.

Besmisleno je porediti blokčejn kao "settlement layer" sa Visom i Mastercardom koje ne služe za finalno poravnanje. Glavni Bitkoin blokčejn se može pre uporediti s SWIFT-om ili FedWire-om kod kojih je jednom poravnata transakcija nepovratna, a Mastercard/Visa sa BTC "Lightning Network-om" koji služi za brza i jeftina plaćanja. Otac je trebalo da Vas nauči o Lightning mreži, kako funkcioniše i da je sposobna da procesuira više miliona transakcija u sekundi. Lightning mreža takođe nudi veći nivo privatnosti od glavnog blokčejna ali puno manju sigurnost.

Ne bih se složio da je fiat na milosti isključivo države i građana, samo ću spomenuti Crnu sredu iz septembra 1992. godine i spekulativni napad na britansku funtu.

BTC transakcije su javne ali su pseudonimne što znači da je jako teško utvrditi identitet ukoliko adresa nije povezana sa identitetom korisnika. Generisanje BTC adrese ne zahteva nikakvu identifikaciju ("krvnu sliku") za razliku od otvaranja bankovnog računa. Može se generisati neograničen broj adresa i na razne načine prekinuti i zamaskirati veza transakcija između njih radi očuvanja privatnosti. Ponovo, fizičke novčanice ne možemo slati putem komunikacionog kanala bez posrednika, podložne su konfiskaciji, uništenju i obezvređivanju.

Upotrebljivost Bitkoina garantuje "open source" kod, energija, matematika i kriptografija. To su mnogo jače garancije nego obećanja bilo koje države koja su toliko puta u istoriji izigrale poverenje sopstvenog stanovništva - poput Jugoslavije devedesetih.

Ja sam BTC spomenuo kao potencijalno rešenje za (hiper)inflaciju tek u kraćem delu na kraju teksta, a od Vas i od ostalih komentatora sam dobio nesrazmeran odgovor usmeren na Bitkoin, a puno manje usmeren na navode iz najvećeg dela posta.

Tako ste i vi izneli isključivo informacije koje ne idu u prilog BTC-a, a potpuno ignorisali sve očigledne nedostatke fiat novca (kako u fizičkom, tako i u digitalnom obliku) koji su se i ispoljili tokom hiperinflacije devedesetih, a ispoljavaju se i dan-danas.

Svako dobro!

kutija_keksa: Zato su i „Gas fees” pod navodnicima.

Ne vidim zašto bi bilo dobro imati „slobodno tržište” kada se radi o kopačima.

Ali, čak i da je dobro imati slobodno tržište, morate primetiti da BTC kopanje nije tako slobodno. Postojanje ASIC mašina znači da se kopanje prevashodno isplati velikim igračima (ne mislim na likove sa 3 riser kartice u PC, nego na kineze sa skladištima teških preko milion u opremi). Takođe, te velike operacije organi vlasti mogu zaustaviti kad im se prohte (Kina).

Jako je teško izvući BTC anonimno bez gubitka kod menjača -- pojedinca ili non KYC institucije.

Što se upotrebljivosti BTC tiče, šta meni garantuje da ću imati na šta da potrošim BTC? To je ključno pitanje. A kasa Jugoslovenski fiat nije bio upotebljiv, vidim da Nemački jeste. Isto tako, mislim da će USD biti upotrebljiv dugo, a kada USD bude neupotrebljiv društvo će ionako biti u apokalipsi gde papir nije važan koliko i hrana, utočište, voda, radio, municija, lekovi i vatreno oružje.

Naravno da iznosim samo informacije koje proizilaze iz nedostataka, to je balans postu i komentarima. Da su ljudi samo blatili kripto moj komentar bi mnogo više ličio na originalni post nego na moj prošli komentar. Ja se sa mnogim tvrdnjama u postu slažem delimično ili potpuno, samo želim da pružim kontekst za tumačenje toga.

Ideološki su mi Cryptopunks potpuno zanimljivi, ali cinizam je opravdan kada se u obzir uzme priča. Ljudi su želeli da se odupru bankama, vladama, kontroli i prismotri. Izmislili su tehnologiju. Počeli su da koriste i popularizuju tu tehnologiju. U prostor su ušle banke i vlade, kupovanjem, prodajom i praćenjem samog tržišta (danas sve velike menjačnice imaju KYC procedure). Kao u matriksu, kontrolisana opozicija. Ok, ovo je lična teorija zavere u koju ni ja ne verujem u potpunosti.

Ako govorimo o crypto kao valuti mislim da je XMR mnogo bolja VALUTA od BTC, dok je mnogo gora investicija. Jednostavno se slažem sa političkim i ideološkim ciljevima pionira kripto valuta, ali smatram da su oni ogromnim delom iznevereni zbog ulaska banaka i država u celu priču, te njihova stara rešenja više ne rešavaju originalne probleme.

@BTCSRB: BTC kao neutralni novac je za svakoga, pa i za bankare i države. Ne možemo ih sprečiti da ga kupe na tržištu i stave ga u kakav god instrument, pa i ETF. Ne možemo ih sprečiti da ga konfiskuju od onih koji nisu dobro obezbedili svoje ključeve. Države su regulisale ono što su mogle, poput menjačnica, kroz AML/KYC procedure ali kakve to veze ima sa BTC-om? Na protokol kao protokol nisu mogle da utiču.

Ko želi i dalje može koristiti BTC kako je i prvobitno predviđeno - za p2p transakcije i skladištenje vrednosti u "self custody-u". Bitkoin je i dalje "bearer asset" otporan na cenzuru i konfiskaciju. Ne vidim da je taj pravac promenjen samo zato što su ušle banke i države. Možda nije u duhu Bitkoina da ga kupuju fondovi pa ga prodaju upakovanog u ETF. Najmanje je u duhu bitkoina da se nekome zabrani da ga kupuje.

Kako to mislite "ne vidite zašto bi bilo dobro imati „slobodno tržište” kada se radi o kopačima? Na decentralizaciji mininga se radi (StratumV2 protkol, Ocean pool...), a kineski primer je samo pokazatelj koliko je otporno: nakon zabrane raširilo se dodatno po svetu, a u Kini se i dalje nalazi 21% hešrejta. Majneri imaju veoma male margine profita zbog same prirode rudarenja i halvinga pa će bilo kakav "fck around" poput cenzure transakcija verovatno značiti bankrot.

Možemo do sutra pričati o XMR vs BTC i navešću puno razloga zašto XMR ne može i neće zaživeti kao novac, a pre svega je manjak decentralizacije (neograničena veličina blokčejna) i otpornost na državni napad - sve što Bitkoin ima. Kada je novac u pitanju pobednik nosi sve i tu je Monero već izgubio, dok će BTC poboljšanu privatnost obezbediti na ostalim nivoima, sidechainovima itd (Lightning, Liquid, Cashu, Fedimint, Ark i ko zna šta sve što još i ne postoji - nivo developmenta u Bitkoin prostoru je ogroman).

Dolar će uvek u nekom obliku biti upotrebljiv ali ne znači da će zauvek ostati svetska rezervna valuta, kao što i danas postoji funta ali odavno nije više ono što je bila na vrhuncu Britanske imperije.

kutija_keksa: Pa ti protokoli sprečavaju pljude da anonimno kupe BTC.

Mislim, BTC realno ima neku primenu, ali ja ga danas npr. imam čisto kao neku malu investicijicu, i to još od doba kad je kopanje sa 2 grafičke u kućnom PC bilo isplativo po skupoj struji. Ali BTC prosto nije dobra alternativa fizičkom novcu na nivou države zbog volatilnosti i manjka kontrole. Jedna ogromna poluga države je puštanje u promet novog novca, i tako se kontroliše inflacija, pored menjanja kamatnih stopa. Bez mogućnosti štampe gubi se i taj faktor kontrole. A inflacija od 2-3% godišnje je zdrava, dok je za ekonomiju deflacija (kojoj je BTC bar delimično sklon) haos, jer smanjuje ekonomsku aktivnost i investicije...

Što se tiče državnog napada na XMR, misliš na to kako jedna država može da realistično sprovede 51% napad?

XMR nije vrhovna valuta ali meni se sviđa kako za njega nema ASIC mašina, kako je anoniman u smislu da ne možeš lako da provališ ko kome koliko i kada šalje šta... Mislim da će XMR sigurno u toj privacy niši zameniti neka druga valuta kroz 10-15 godina koja ima bolji algoritam i tehnologiju...

Dobra dosetka za veličinu blockchaina, ali ona je trenutno 160GB cela / 50 GB pruned, tako nešto. Sve dok nije preko 10TB (100x) veća može je pohraniti najveći hard disk namenjen „običnim ljudima”, a kad se dođe do tad verovatno će i cene tih diskova biti pristupačnije nego danas. Sa druge strane, agresivan pruning je takođe opcija. A da ne govorimo o sidechainovima koji takođe postoje za XMR.

Da, to za dolar je i moja poenta, nekako će biti upotrebljiv uvek, dok je kripto neupotrebljiv bez neta, a i nema mnogo šta da se kupi kriptom u poređenju sa fiatom. I

@BTCSRB: Ima bezbroj načina da se nabavi non-KYC Bitkoin: coinjoin, coinmixing, rudarenje u non-KYC pulu, nabavka nekog drugog kripta putem KYC menjačnice pa "trustless atomic swap" za BTC, nabavka KYC BTC-a putem Lightning-a pa "submarine swap" on-chain, zatim nabavka bilo kog KYC kripta ili Lightning ili on-chain BTC-a pa swap na sidechain Liquid BTC gde su transakcije tajne slično XMR-u i nazad swap na on-chain. Naravno i stara narodska razmena na ulici. XMR se isto može koristiti za svrhu nabavke non-KYC Bitkoina. U svim ovim slučajevima se adrese koje su krajnje destinacije tih sredstava ne mogu ili jako teško povezati sa KYC identitetom korisnika. Više na: kycnot.me

Diskusija o tome da li je zdrava i potrebna inflacija i da li je uopšte potreban državni intervencionizam u ekonomiji je stara diskusija između Kejnzijanske i Austrijske ekonomske škole. Po meni svaka inflacija je pljačka. Da ne govorimo da centralni bankari ne snose nikakvu odgovornost za gubitak kontrole nad inflacijom koji se meri u stotinama procenata "omaška" jer kada je ciljana inflacija 2%, a imamo inflaciju od 10% to je onda promašaj od 500%. A svi vodeći centralni bankari su i dalje na svojim funkcijama od početka inflacije negde 2020. godine iako su izneverili sva očekivanja. Nisu izabrani od strane naroda i nemoguće ih je smeniti od strane naroda, a utiču na živote svih!

Usled tehnološkog napretka i rasta produktivnosti, prirodno stanje slobodnog tržišta je pad cena, a ne njihov konstantan rast kroz inflaciju. Ne postoji nikakva "poželjna" ili "neophodna" inflacija, svaka "ciljana" inflacija je pljačka koji onemogućava populaciju da uživa u plodovima sopstvene produktivnosti u obliku nižih cena svih roba i usluga. Bitkoin zbog svoje fiksne ponude novca u opticaju (21 milion novčića = apsolutna digitalna oskudnost) nameće ovu disciplinu slobodnog tržišta i tehnološkog napretka. Dok je postojeći dužnički fiat sistem dizajniran da krade plodove produktivnosti, Bitkoin omogućava populaciji da ih zadrži u obliku nižih cena.