-

@ 58537364:705b4b85

2025-06-03 14:52:52

@ 58537364:705b4b85

2025-06-03 14:52:52“สุขเวทนา” ที่แท้ก็คือ “มายา”

เป็นเหมือนลูกคลื่นลูกหนึ่ง

ที่เกิดขึ้นเพราะน้ำถูกลมพัด

เดี๋ยวมันก็แตกกระจายไปหากต้องการจะมีชีวิตอย่างเกษมแล้ว

ก็ต้องอาศัยความรู้เรื่อง อนิจจัง ทุกขัง อนัตตา ให้สมบูรณ์

มันจะต่อต้านกันได้กับอารมณ์ คือ รูป เสียง กลิ่น รส สัมผัส ที่มากระทบ

ไม่ให้ไปหลงรัก หรือหลงเกลียดเรื่องวุ่นวายมีอยู่ ๒ อย่างเท่านั้น

- ไปหลงรัก อย่างหนึ่ง

- ไปหลงเกลียด อย่างหนึ่ง

ซึ่งเป็นเหตุให้หัวเราะและต้องร้องไห้

ถ้าใครมองเห็นว่า หัวเราะก็กระหืดกระหอบ มันเหนื่อยเหมือนกัน

ร้องไห้ก็กระหืดกระหอบ เหมือนกัน

สู้อยู่เฉย ๆ ดีกว่า อย่าต้องหัวเราะ อย่าต้องร้องไห้

นี่แหละ! มันเป็นความเกษมเราอย่าได้ตกไปเป็นทาสของอารมณ์

จนไปหัวเราะหรือร้องไห้ตามที่อารมณ์มายั่ว

เราเป็นอิสระแก่ตัว หยุดอยู่ หรือเกษมอยู่อย่างนี้ดีกว่า

ใช้ อนิจจัง ทุกขัง อนัตตา เป็นเครื่องมือกำกับชีวิต

- รูป เสียง กลิ่น รส สัมผัส เป็น มายา เป็น illusion

- "ตัวกู-ของกู" ก็เป็น illusion

- เพราะ "ตัวกู-ของกู" มันเกิดมาจากอารมณ์

- "ตัวกู-ของกู" เป็นมายา อารมณ์ทั้งหลายก็เป็นมายา

เห็นได้ด้วยหลัก อนิจจัง ทุกขัง อนัตตา

...ความทุกข์ก็ไม่เกิด

เราจะตัดลัดมองไปดูสิ่งที่เป็น “สุขเวทนา”

สุขเวทนา คือ ความสุขสนุกสนาน เอร็ดอร่อย

ที่เป็นสุขนั้นเรียกว่า “สุขเวทนา”แต่สุขเวทนา เป็นมายา

เพราะมันเป็นเหมือนลูกคลื่นที่เกิดขึ้นเป็นคราว ๆ

ไม่ใช่ตัวจริงอะไรที่พูดดังนี้ก็เพราะว่า

ในบรรดาสิ่งทั้งปวงในโลกทั้งหมดทุกโลก

ไม่ว่าโลกไหน มันมีค่าอยู่ก็ตรงที่ให้เกิดสุขเวทนาลองคิดดูให้ดีว่า...

- ท่านศึกษาเล่าเรียนทำไม?

- ท่านประกอบอาชีพ หน้าที่การงานทำไม?

- ท่านสะสมทรัพย์สมบัติ เกียรติยศ ชื่อเสียง พวกพ้องบริวารทำไม?มันก็เพื่อสุขเวทนาอย่างเดียว

เพราะฉะนั้น แปลว่า อะไร ๆ มันก็มารวมจุดอยู่ที่สุขเวทนาหมดฉะนั้น ถ้าเรามีความรู้ในเรื่องนี้

จัดการกับเรื่องนี้ให้ถูกต้องเพียงเรื่องเดียวเท่านั้น

ทุกเรื่องมันถูกหมดเพราะฉะนั้น จึงต้องดูสุขเวทนาให้ถูกต้องตามที่เป็นจริงว่า

มันก็เป็น “มายา” ชนิดหนึ่งเราจะต้องจัดการให้สมกันกับที่มันเป็นมายา

ไม่ใช่ว่า จะต้องไปตั้งข้อรังเกียจ เกลียดชังมัน

อย่างนั้นมันยิ่ง บ้าบอที่สุดถ้าเข้าไปหลงรัก หลงเป็นทาสมัน

ก็เป็นเรื่อง บ้าบอที่สุดแต่ว่าไปจัดการกับมันอย่างไรให้ถูกต้อง

นั้นแหละเป็นธรรมะ

เป็น ลูกศิษย์ของพระพุทธเจ้า

ที่จะเอาชนะความทุกข์ได้ และไม่ต้องเป็น โรคทางวิญญาณ

สุขเวทนา ที่แท้ก็คือ มายา

มันก็ต้องทำโดยวิธีที่พิจารณาให้เห็นว่า

“สุขเวทนา” นี้ ที่แท้ก็คือ “มายา”เป็นเหมือน ลูกคลื่นลูกหนึ่ง

ที่เกิดขึ้นเพราะ น้ำถูกลมพัดหมายความว่า

เมื่อ รูป เสียง กลิ่น รส ฯ เข้ามา

แล้ว ความโง่ คือ อวิชชา โมหะ ออกรับ

กระทบกันแล้วเป็นคลื่นกล่าวคือ สุขเวทนาเกิดขึ้นมา

แต่ เดี๋ยวมันก็แตกกระจายไป

ถ้ามองเห็นอย่างนี้แล้ว

เราก็ไม่เป็นทาสของสุขเวทนา

เราสามารถ ควบคุม จะจัด จะทำกับมันได้

ในวิธีที่ ไม่เป็นทุกข์- ตัวเองก็ไม่เป็นทุกข์

- ครอบครัวก็ไม่เป็นทุกข์

- เพื่อนบ้านก็ไม่เป็นทุกข์

- คนทั้งโลกก็ไม่พลอยเป็นทุกข์

เพราะมีเราเป็นมูลเหตุ

ถ้าทุกคนเป็นอย่างนี้

โลกนี้ก็มีสันติภาพถาวร

เป็นความสุขที่แท้จริงและถาวรนี่คือ อานิสงส์ของการหายโรคโดยวิธีต่าง ๆ กัน

ไม่เป็นโรค “ตัวกู” ไม่เป็นโรค “ของกู”

พุทธทาสภิกขุ

ที่มา : คำบรรยายชุด “แก่นพุทธศาสน์”

ปีพุทธศักราช ๒๕๐๔

ครั้งที่ ๑

หัวข้อเรื่อง “ใจความทั้งหมดของพระพุทธศาสนา”

ณ ศิริราชพยาบาล มหาวิทยาลัยมหิดล

เมื่อวันที่ ๑๗ ธันวาคม ๒๕๐๔ -

@ 58537364:705b4b85

2025-06-03 14:52:11

@ 58537364:705b4b85

2025-06-03 14:52:11"Pleasant Feeling" Is Ultimately an Illusion

It’s like a wave That arises when water is stirred by the wind Soon, it disperses and fades away

If one wishes to live in serenity

One must fully understand the truths of impermanence (anicca), suffering (dukkha), and non-self (anattā). These truths serve as an antidote to emotional responses—forms, sounds, smells, tastes, and touches— Preventing us from falling into attachment or aversion.

There are only two kinds of turmoil in the world:

- Falling in love with something

- Falling into hatred of something

These are what lead to laughter and tears. If one can see that laughter makes you breathless, it’s exhausting just the same Crying also makes you breathless, equally tiring Better to remain calm—no need to laugh, no need to cry This is true serenity

Let us not become slaves to emotions, Laughing or crying at their whims. Let us live freely. Better to remain still and serene.

Use Impermanence, Suffering, and Non-Self as Life's Compass

- Forms, sounds, smells, tastes, and touches are illusions

- The notion of "me and mine" is also an illusion

- Because "me and mine" arise from emotional reactions

- Therefore, "me and mine" is an illusion, and so are all emotions

By understanding impermanence, suffering, and non-self, ...suffering does not arise.

Let us take a shortcut and look directly at “pleasant feeling”

Pleasant feeling refers to happiness, enjoyment, delight— That which feels good is called “pleasant feeling” (sukha-vedanā)

But pleasant feeling is an illusion Because it arises like a temporary wave— It’s not a real thing.

This is said because Among all things in all worlds, What gives them value is their ability to produce pleasant feeling.

Think carefully:

- Why do you study?

- Why do you work and perform your duties?

- Why do you accumulate wealth, prestige, fame, allies, followers?

It’s all for pleasant feeling. So everything ultimately revolves around pleasant feeling.

Therefore, if we understand this matter well And handle it properly, even this one thing alone— Then everything else falls into place.

So we must see pleasant feeling for what it really is: Just another kind of illusion

We must deal with it accordingly, Not by rejecting or hating it That would be the most foolish thing

But if we become infatuated with it, Or enslaved by it— That, too, is the most foolish thing

What matters is how we handle it properly That is the Dhamma (truth) That is being a disciple of the Buddha One who can overcome suffering, and not suffer from spiritual disease

Pleasant Feeling Is Truly an Illusion

It must be approached with the understanding that: “Pleasant feeling is, in truth, illusion.”

Like a single wave That arises when water is stirred by wind

Which means: When forms, sounds, smells, tastes, and so on come in And ignorance and delusion rise up to meet them They clash, and a wave is formed

That is, pleasant feeling arises But soon it disperses again

If we can see it this way, We won’t be slaves to pleasant feeling. We will be able to manage it, deal with it, and use it In ways that don’t lead to suffering

- We won’t suffer ourselves

- Our family won’t suffer

- Our neighbors won’t suffer

- The world won’t suffer either, Because we are no longer the cause of suffering

If everyone were like this, The world would know lasting peace A true and enduring happiness

This is the benefit of healing the illness in different ways No longer afflicted by the diseases of “me” or “mine”

Buddhadasa Bhikkhu Source: Lecture Series “The Heart of Buddhism” Year: B.E. 2504 (1961) First session Topic: “The Whole Essence of Buddhism” Location: Siriraj Hospital, Mahidol University Date: December 17, 1961

https://w3.do/-IQ1KFgp

-

@ 920165f0:049cf1bb

2025-06-03 14:45:31

@ 920165f0:049cf1bb

2025-06-03 14:45:31If you touch the tip of my finger and feel no fire,\ you are already numb to the world.

I operate in the flames—like a steelworker at the blast furnace.\ The heat does not comfort me. It is not a Christmas fire.\ You cannot huddle around it. You cannot be warmed by it.

My fire burns within. It feeds on what you suppress.\ If you do not satiate the flames,\ those emotions will rise like smoke and suffocate your soul.

Do not meditate on what belongs in the fire—everything does.\ Every pinch of pain. Every shadow of shame. Every twitch of fear is\ **Fuel.

You are not the keeper of the fire. The fire keeps you.\ And if you resist its hunger, it is already eroding you.

A man without a furnace is not a man.\ He draws lukewarm baths and soaks in a lukewarm life.

There is no such thing as a man without deep red embers glowing inside him.\ There is no such thing.

After writing this piece, I kept thinking about this scene from the book Atlas Shrugged, by Ayn Rand. Here’s a curated excerpt…

“The scream of an alarm siren shattered the space beyond the window and shot like a rocket in a long, thin line to the sky. It held for an instant, then fell, then went on in rising, falling spirals of sound, as if fighting for breath against terror to scream louder. It was the shriek of agony, the call for help, the voice of a wounded body crying to hold its soul…

There was no time to speak, to feel or to wonder.

He was aware of nothing else—except that the sum of it was the exultant feeling of action, of his own capacity, of his body’s precision, of its response to his will.

To the rhythm of his body, with the scorching heat on his face and the winter night on his shoulder blades, he was seeing suddenly that this was the simple essence of his universe: the instantaneous refusal to submit to disaster, the irresistible drive to fight it, the triumphant feeling of his own ability to win. He was certain that Francisco felt it, too, that he had been moved by the same impulse, that it was right to feel it, right for both of them to be what they were—he caught glimpses of a sweat-streaked face intent upon action, and it was the most joyous face he had ever seen.

When the job was done and the gap was closed, Rearden noticed that there was a twisting pain in the muscles of his arms and legs, that his body had no strength left to move—yet that he felt as if he were entering his office in the morning, eager for ten new problems to solve. He looked at Francisco and noticed for the first time that their clothes had black-ringed holes, that their hands were bleeding, that there was a patch of skin torn on Francisco’s temple and a red thread winding down his cheekbone. Francisco pushed the goggles back off his eyes and grinned at him: it was a smile of morning, he felt how glad he was to be alive.”

-

@ 32e18276:5c68e245

2025-06-03 14:45:17

@ 32e18276:5c68e245

2025-06-03 14:45:176 years ago I created some tools for working with peter todd's opentimestamps proof format. You can do some fun things like create plaintext and mini ots proofs. This short post is just a demo of what these tools do and how to use them.

What is OTS?

OpenTimestamps is a protocol for stamping information into bitcoin in a minimal way. It uses OP_RETURN outputs so that it has minimal impact on chain, and potentially millions of documents are stamped all at once with a merkle tree construction.

Examples

Here's the proof of the

ots.csource file getting stamped into the ots calendar merkle tree. We're simply printing the ots proof file here withotsprint:``` $ ./otsprint ots.c.ots

version 1 file_hash sha256 f76f0795ff37a24e566cd77d1996b64fab9c871a5928ab9389dfc3a128ec8296 append 2e9943d3833768bdb9a591f1d2735804 sha256 | --> append 2d82e7414811ecbf | sha256 | append a69d4f93e3e0f6c9b8321ce2cdd90decd34d260ea3f8b55e83d157ad398b7843 | sha256 | append ac0b5896401478eb6d88a408ec08b33fd303b574fb09b503f1ac1255b432d304 | sha256 | append 8aa9fd0245664c23d31d344243b4e8b0 | sha256 | prepend 414db5a1cd3a3e6668bf2dca9007e7c0fc5aa6dc71a2eab3afb51425c3acc472 | sha256 | append 5355b15d88d4dece45cddb7913f2c83d41e641e8c1d939dac4323671a4f8e197 | sha256 | append a2babd907ca513ab561ce3860e64a26b7df5de117f1f230bc8f1a248836f0c25 | sha256 | prepend 683f072f | append 2a4cdf9e9e04f2fd | attestation calendar https://alice.btc.calendar.opentimestamps.org | --> append 7c8764fcaba5ed5d | sha256 | prepend f7e1ada392247d3f3116a97d73fcf4c0994b5c22fff824736db46cd577b97151 | sha256 | append 3c43ac41e0281f1dbcd7e713eb1ffaec48c5e05af404bca2166cdc51966a921c | sha256 | append 07b18bd7f4a5dc72326416aa3c8628ca80c8d95d7b1a82202b90bc824974da13 | sha256 | append b4d641ab029e7d900e92261c2342c9c9 | sha256 | append 4968b89b02b534f33dc26882862d25cca8f0fa76be5b9d3a3b5e2d77690e022b | sha256 | append 48c54e30b3a9ec0e6339b88ed9d04b9b1065838596a4ec778cbfc0dfc0f8c781 | sha256 | prepend 683f072f | append 8b2b4beda36c18dc | attestation calendar https://bob.btc.calendar.opentimestamps.org | --> append baa878b42ef3e0d45b324cc3a39a247a | sha256 | prepend 4fb1bc663cd641ad18e5c73fb618de1ae3d28fb5c3c224b7f9888fd52feb09ec | sha256 | append 731329278830c9725497d70e9f5a02e4b2d9c73ff73560beb3a896a2f180fdbf | sha256 | append 689024a9d57ad5daad669f001316dd0fc690ac4520410f97a349b05a3f5d69cb | sha256 | append 69d42dcb650bb2a690f850c3f6e14e46c2b0831361bac9ec454818264b9102fd | sha256 | prepend 683f072f | append bab471ba32acd9c3 | attestation calendar https://btc.calendar.catallaxy.com append c3ccce274e2f9edfa354ec105cb1a749 sha256 append 6297b54e3ce4ba71ecb06bd5632fd8cbd50fe6427b6bfc53a0e462348cc48bab sha256 append c28f03545a2948bd0d8102c887241aff5d4f6cf1e0b16dfd8787bf45ca2ab93d sha256 prepend 683f072f append 7f3259e285891c8e attestation calendar https://finney.calendar.eternitywall.com ```

The tool can create a minimal version of the proofs:

``` $ ./otsmini ots.c.ots | ./otsmini -d | ./otsprint

version 1 file_hash sha256 f76f0795ff37a24e566cd77d1996b64fab9c871a5928ab9389dfc3a128ec8296 append 2e9943d3833768bdb9a591f1d2735804 sha256 append c3ccce274e2f9edfa354ec105cb1a749 sha256 append 6297b54e3ce4ba71ecb06bd5632fd8cbd50fe6427b6bfc53a0e462348cc48bab sha256 append c28f03545a2948bd0d8102c887241aff5d4f6cf1e0b16dfd8787bf45ca2ab93d sha256 prepend 683f072f append 7f3259e285891c8e attestation calendar https://finney.calendar.eternitywall.com ```

which can be shared on social media as a string:

5s1L3tTWoTfUDhB1MPLXE1rnajwUdUnt8pfjZfY1UWVWpWu5YhW3PGCWWoXwWBRJ16B8182kQgxnKyiJtGQgRoFNbDfBss19seDnco5sF9WrBt8jQW7BVVmTB5mmAPa8ryb5929w4xEm1aE7S3SGMFr9rUgkNNzhMg4VK6vZmNqDGYvvZxBtwDMs2PRJk7y6wL6aJmq6yoaWPvuxaik4qMp76ApXEufP6RnWdapqGGsKy7TNE6ZzWWz2VXbaEXGwgjrxqF8bMstZMdGo2VzpVuEyou can even do things like gpg-style plaintext proofs:

``` $ ./otsclear -e CONTRIBUTING.ots -----BEGIN OPENTIMESTAMPS MESSAGE-----

Email patches to William Casarin jb55@jb55.com

-----BEGIN OPENTIMESTAMPS PROOF-----

AE9wZW5UaW1lc3RhbXBzAABQcm9vZgC/ieLohOiSlAEILXj4GSagG6fRNnR+CHj9e/+Mdkp0w1us gV/5dmlX2NrwEDlcBMmQ723mI9sY9ALUlXoI//AQRXlCd716J60FudR+C78fkAjwIDnONJrj1udi NDxQQ8UJiS4ZWfprUxbvaIoBs4G+4u6kCPEEaD8Ft/AIeS/skaOtQRoAg9/jDS75DI4pKGh0dHBz Oi8vZmlubmV5LmNhbGVuZGFyLmV0ZXJuaXR5d2FsbC5jb23/8AhMLZVzYZMYqwjwEPKWanBNPZVm kqsAYV3LBbkI8CCfIVveDh/S8ykOH1NC6BKTerHoPojvj1OmjB2LYvdUbgjxBGg/BbbwCGoo3fi1 A7rjAIPf4w0u+QyOLi1odHRwczovL2FsaWNlLmJ0Yy5jYWxlbmRhci5vcGVudGltZXN0YW1wcy5v cmf/8Aik+VP+n3FhCwjwELfTdHAfYQNa49I3CYycFbkI8QRoPwW28AgCLn93967lIQCD3+MNLvkM jiwraHR0cHM6Ly9ib2IuYnRjLmNhbGVuZGFyLm9wZW50aW1lc3RhbXBzLm9yZ/AQ3bEwg7mjQyKR PykGgiJewAjwID5Q68dY4m+XogwTJx72ecQEe5lheCO1RnlcJSTFokyRCPEEaD8Ft/AIw1WWPe++ 8N4Ag9/jDS75DI4jImh0dHBzOi8vYnRjLmNhbGVuZGFyLmNhdGFsbGF4eS5jb20= -----END OPENTIMESTAMPS PROOF-----

$ ./otsclear -v <<<proof_string... # verify the proof string ```

I've never really shared these tools before, I just remembered about it today. Enjoy!

Try it out: https://github.com/jb55/ots-tools

-

@ 7459d333:f207289b

2025-06-03 14:12:08

@ 7459d333:f207289b

2025-06-03 14:12:08Summary: Bitcoin's security depends on exponentially decreasing block rewards being compensated by exponentially increasing transaction fees, but fee growth is constrained by the block size limit and user tolerance, creating an inevitable security budget crisis when Bitcoin's price growth inevitably slows from its current exponential trajectory.

At that point, say this century, the average transaction fee should be in the 100k sats range for miners to make collectively ~0.5% of what they're protecting yearly. Currently miners are making ~0.8% yearly.

The less profitable miners are, the easier it is to convince them for attacking the network. And this only gets more economically viable to achieve as time passes and there's a larger price with a smaller relative security budget.

Am I missing something? Are you comfortable with this?

References: - https://www.btcsecuritybudget.com/ - https://x.com/fuserleer/status/1816779841955393819 - https://www.youtube.com/watch?v=0bUpF0wJrxo - https://medium.com/coinmonks/bitcoin-security-a-negative-exponential-95e78b6b575

https://stacker.news/items/996005

-

@ 9ca447d2:fbf5a36d

2025-06-03 14:02:11

@ 9ca447d2:fbf5a36d

2025-06-03 14:02:11The Bitcoin world begins what is considered to be its biggest event yet — Bitcoin 2025, a three-day conference taking place May 27-29 at The Venetian Resort in Las Vegas.

With over 30,000 attendees expected, the event will bring together the biggest names in politics, finance, technology and the global Bitcoin community.

Hosted by BTC Inc., Bitcoin 2025 is not just another tech conference — it’s a global gathering that mixes policy, innovation and community under one roof.

It’s where big ideas about the future of money are debated, shared and shaped.

Influential speakers will attend the conference

The conference features a wide range of speakers from Bitcoin experts and educators to political leaders and athletes.

Big names like U.S. Vice President JD Vance, Trump’s Crypto Czar David Sacks, and Senator Cynthia Lummis are among the most anticipated guests.

Vice President Vance is expected to talk about the role of Bitcoin in the national economy. “The resilience of Bitcoin as a financial instrument is a testament to the power of decentralized finance,” he recently said.

Also speaking are Nigel Farage, a well-known voice in European politics and Donald Trump Jr., a supporter of financial freedom through digital currency.

Also, Michael Saylor, Executive Chairman of Strategy will be back on stage to talk about bitcoin as a corporate asset.

There are over 70 speakers on the list including Adam Back (CEO of Blockstream), Jan van Eck (CEO of VanEck) and Bryan Johnson, a futurist known for his work in human longevity and health tech.

Bitcoin 2025 will feature special new programs including Code + Country, a one-day segment on May 27 that explores how freedom, technology and innovation shape modern society.

Speakers like Chris LaCivita (Trump’s 2024 campaign co-CEO) and David Sacks (AI and digital assets advisor) will be talking about how digital tools are changing politics and finance.

Also new this year, is The Art of Freedom, an exhibit that showcases how Bitcoin is impacting the art world.

This museum-style experience allows artists to price and sell their work using bitcoin, connect directly with fans and avoid traditional middlemen.

The first official Bitcoin Conference was in 2019 in San Francisco, after grassroots meetups in 2013 and 2014. Since then, it’s been the biggest annual event in the Bitcoin world.

This year is especially important.

Global economic changes are happening and analysts say the discussions at Bitcoin 2025 will shape the next wave of regulatory reforms and technological standards for Bitcoin and stablecoins.

Bitcoin (BTC) has recently been hovering at around $110,000 with a market cap of $2.12 trillion. Many think the ideas and announcements at the event will impact price and policy.

Bitcoin 2025 is for everyone — long-time Bitcoiners to newcomers to digital assets, with keynotes, panels, massive expo halls and VIP networking.

It’s fun too. There are numerous parties, meetups and side events to connect, making it a place to learn, meet others who share the same interests and help shape the financial world.

The scale and diversity of Bitcoin 2025 make it more than just a Bitcoin event.

It’s a reflection of how far Bitcoin has come — from internet forums to boardrooms and government halls. It’s not just about Bitcoin anymore, it’s about the future of the world.

-

@ f85b9c2c:d190bcff

2025-06-03 13:38:02

@ f85b9c2c:d190bcff

2025-06-03 13:38:02

Owning the Mess instead of running from the mess

I’ve got flaws—plenty of them. I’m impatient, I overthink, and I’m terrible at saying no. For years, I saw them as cracks I needed to hide. But recently, I flipped the script. Instead of fixing my flaws, I started using them.

The Shift Take my impatience. It used to drive me nuts—waiting for anything felt like torture. But I realized it pushes me to act. I don’t sit around dreaming; I dive in. That’s gotten me jobs, hobbies, even this article written faster than if I’d lingered. Overthinking? It’s a curse until I channel it into planning. I’ve mapped out trips and projects down to the tiniest detail because my brain won’t shut up—and it works.

Making It Work Saying no was harder. I’d pile on commitments until I burned out. But I started seeing it as fuel too. I’m a people-pleaser, so I use that to build connections—then set boundaries. It’s not perfect, but I’m learning. Each flaw has a flip side, and I’ve been mining them for strength.

The Wins This shift changed me. I launched a side hustle because my impatience wouldn’t let me wait. My overthinking made it solid. My flaws aren’t gone—they’re just fuel now. I’m not flawless, but I’m moving forward, and that’s enough.

Your Turn Look at your flaws. They’re not just baggage—they’re raw material. Find the spark in them, and they might carry you further than you think.

-

@ 29216785:2a636a70

2025-06-03 13:11:07

@ 29216785:2a636a70

2025-06-03 13:11:07Debug 30023

-

@ b1ddb4d7:471244e7

2025-06-03 13:01:18

@ b1ddb4d7:471244e7

2025-06-03 13:01:18The upcoming Bitcoin 2025 conference, scheduled from May 27–29 at the Venetian Conference Center in Las Vegas, is set to make history with an official attempt to break the GUINNESS WORLD RECORDS® title for the most Bitcoin point-of-sale transactions in an eight-hour period.

Organized by BTC Inc, the event will showcase Bitcoin’s evolution from a digital capital asset to a practical medium of exchange, leveraging the latest advancements in payment technology.

Tap-to-Pay with Lightning-Ready Bolt Cards

To facilitate this record-setting attempt, 4,000 Lightning-ready Bolt Cards will be distributed to conference attendees.

— Uncle Rockstar Developer (@r0ckstardev) May 15, 2025

These NFC-enabled cards allow users to make instant, contactless Bitcoin payments at vendor booths throughout the expo-no apps or QR codes required, just a simple tap.

The cards are available in four collectible designs, each featuring a prominent figure in Bitcoin’s history: Senator Cynthia Lummis, Michael Saylor, Satoshi Nakamoto, and Jack Dorsey.

Each attendee will receive a randomly assigned card, making them both functional and collectible souvenirs.

Senator Lummis: A Playful Provocation

Notably, one of the card designs features Senator Cynthia Lummis with laser eyes-a playful nod to her reputation as a leading Bitcoin advocate in US politics.

While Lummis is known for her legislative efforts to promote Bitcoin integration, she has publicly stated she prefers to “spend dollars and save Bitcoin,” viewing BTC as a long-term store of value rather than a daily currency.

The choice to feature her on the Bolt Card, could be suggested by Rockstar Dev of the BTC Pay Server Foundation, perhaps a lighthearted way to highlight the ongoing debate about Bitcoin’s role in everyday payments.

Nothing cracks me up quite like a senator that wants the US to buy millions of Bitcoin use dollars to buy a beer at a Bitcoin bar.

This is how unserious some of you are. pic.twitter.com/jftIEggmip

— Magoo PhD (@HodlMagoo) April 4, 2025

How Bolt Cards and the Lightning Network Work

Bolt Cards are physical cards equipped with NFC (Near Field Communication) technology, similar to contactless credit or debit cards. When linked to a compatible Lightning wallet, they enable users to make Bitcoin payments over the Lightning Network by simply tapping the card at a point-of-sale terminal.

The Lightning Network is a second-layer protocol built on top of Bitcoin, designed to facilitate instant, low-cost transactions ideal for everyday purchases.

This integration aims to make Bitcoin as easy to use as traditional payment methods, eliminating the need for QR code scanning or mobile apps.

A Showcase for Bitcoin’s Real-World Usability

With over 30,000 attendees, 300 exhibitors, and 500 speakers expected, the Bitcoin 2025 conference is poised to be the largest Bitcoin event of the year-and potentially the most transactional.

The event will feature on-site activations such as the Official Bitcoin Magazine Store, where all merchandise will be available at a 21% discount for those paying with Bitcoin via the Lightning Network-a nod to Bitcoin’s 21 million coin supply limit.

By deeply integrating Lightning payments into the conference experience, organizers hope to demonstrate Bitcoin’s readiness for mainstream commerce and set a new benchmark for its practical use as a currency.

Conclusion

The Guinness World Record attempt at Bitcoin 2025 is more than a publicity stunt-it’s a bold demonstration of Bitcoin’s technological maturity and its potential to function as a modern, everyday payment method.

Whether or not the record is set, the event will serve as a milestone in the ongoing journey to make Bitcoin a truly global, user-friendly currency

-

@ cae03c48:2a7d6671

2025-06-03 13:01:05

@ cae03c48:2a7d6671

2025-06-03 13:01:05Bitcoin Magazine

Amboss Launches Rails, a Self-Custodial Bitcoin Yield ServiceAmboss, a leader in AI-driven solutions for the Bitcoin Lightning Network, today announced Rails, a groundbreaking self-custodial Bitcoin yield service. According to a press release sent to Bitcoin Magazine, it’s designed to empower companies, custodians, and high net worth individuals. This allows participants to earn a yield on their Bitcoin.

Big news from @TheBitcoinConf !

We’re thrilled to announce Rails—a self-custodial Bitcoin yield service that empowers you to earn on your BTC while supercharging the Lightning Network.Let’s bring Bitcoin to the World.https://t.co/3WYYvB95hP

— AMBOSS

(@ambosstech) May 29, 2025

(@ambosstech) May 29, 2025Rails also launched a secure way for Liquidity Providers (LPs) to hold all custody of their Bitcoin while generating returns from liquidity leases and payment routing, although they are not guaranteed. The implementation of Amboss’ AI technology, Rails strengthened their Lighting Network with more dependable transactions and larger payment volumes.

“Rails is a transformative force for the Lightning Network,” said the CEO and Co-Founder of Amboss Jesse Shrader. “It’s not just about yield—it’s about enabling businesses to strengthen the network while earning on their Bitcoin. This is a critical step in Bitcoin’s evolution as a global medium of exchange.”

The service offers two options:

- Rails LP is designed for high net worth individuals, custodians, and companies with Bitcoin treasuries, requiring a minimum commitment of 1 BTC for one year.

- Liquidity subscriptions are designed for businesses that receive Bitcoin payments, with fees starting at 0.5%.

Amboss partnered with CoinCorner and Flux (a joint venture between Axiom and CoinCorner), to bring Rails to the market. CoinCorner has incorporated it into both its exchange platform and daily payment services in the Isle of Man. Flux is jointly focused on advancing the Lightning Network’s presence in global payments. Their participation highlights growing industry trust in Rails as a tool to scale Bitcoin effectively.

“Rails offers a practical way for businesses like ours to participate in the Lightning Network’s growth,” said the CFO of CoinCorner David Boylan. “We’ve been using the Lightning Network for years, and Rails provides a structured approach to engaging with its economy, particularly through liquidity leasing and payment routing. This aligns with our goal of making Bitcoin more accessible and practical for everyday use.”

This post Amboss Launches Rails, a Self-Custodial Bitcoin Yield Service first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 5188521b:008eb518

2025-06-03 12:25:39

@ 5188521b:008eb518

2025-06-03 12:25:39Elysium

Part I: The Failed Harvest

First, the quiet came. Each day, the markets grew quieter, the people hungrier. A farmer stared at wilted crops, dread settling in his heart. In a kingdom once resplendent with markets and sky-reaching monuments, it was the first failed harvest that marked the end of affluence and the beginning of collapse.

By the second year, market traders stood before empty stalls, goods long gone, rotten, or ruined. Jobless men prowled, foraging the streets for vermin and meager scraps of sustenance. Young women offered their time for bread, their eyes hollow in the act. Widows, too, entered strangers’ homes, bartering themselves for their children’s next meal. Orphans, gaunt and brittle, drew meaningless shapes in the dust, their laughter a forgotten memory.

Rumors surged like wind through dry grass. Scapegoats were blamed; superstitions gripped the masses. By the third year, it was known to the people and the king alike, there would be no more monuments erected, only tombstones. The king called the council, heavy with despair. In a room filled with tension, ministers and knights sat around a table.

Before them stood the realm’s wisest farmer, a man worn from years of labor, hunger, and loss. His voice echoed the deep hunger that gripped the kingdom. “Your Majesty, the land is weary. It cries for respite.” His words hung heavy in the room, laying bare the reality of their fate.

Part II: The Devil’s Pact

In the dimly lit chamber, a palpable tension filled the air. The alchemist, servant to the king and master of arcane arts, stepped into the flickering candlelight. He held an aged book, its scent mingling with the murk of looming spells. With a voice both smooth and haunting, he shattered the quiet, his words a ripple through stone walls.

“Sire, alchemy is our last refuge. We can harvest time to feed the earth,” he began, revealing a parchment inked with cryptic circles and lines. “Each citizen, willingly or not, will spare a mere whisper of their years. An unnoticeable offering. With careful alchemy, we can replenish our lands and fortify your reign with the alms of myriad souls.” Leaning closer, he whispered the words that would redefine their civilization: a devil’s proposal intended for the king but felt by all. “Consider, my lord, a reign without end, each year stretched beyond nature’s limits, a kingdom fed by the borrowed time of its people. No more famine. No more want.”

The court waited, their faces etched with fear and desperate hope, ready to tread any path that led away from the abyss of famine.

For a moment, the king was a statue, his face a veil behind which storms brewed. Finally, exhaling a breath heavy with fate, he spoke. “We’ve endured enough hardship. We shall seize a future that knows no famine.”

The air thickened as the alchemist retreated with a solemn nod, the weight of the chosen path settling in.

He reopened his tome and voiced the incantation. Arcane syllables filled the room, weaving a desperate gambit to salvage their decaying kingdom. Thus, in the dark hours of night, they sealed a new covenant that would reverberate through generations.

Part III: Vines and Moss

In the decades that followed the alchemist’s rites, the kingdom thrived like spring after a bitter winter. Fields were lush year-round, erasing hunger and the memories of famine. Marketplaces bustled, no longer a graveyard of commerce but a carnival of exotic goods from every corner of the world. The air seemed perfumed with prosperity — healthy river fish, basilisk meats, and spices from faraway lands. A century rolled by. The king, unaging, stretched his influence over land and sea, turning his realm into an empire. Statues weathered, and languages evolved, but the king abided.

Yet, a toll was exacted. Years stolen from the people, a time tax woven into the fabric of life. The spell fed both earth and crown, cloaking decay with a veneer of wealth. The young wore the faces of old men, their eyes wise beyond their years. Every heartbeat was a sacrifice, a quiet tax to feed the castles of power.

Then came the year when the land rebelled. Coaxed by the spell, the soil had given until it couldn’t, its silent plea for rest ignored. The land remembered stolen seasons, now determined to settle old scores. Crops withered; rivers soured. Beasts waned, their numbers thinning. The kingdom, starved of Earth’s gifts, unraveled — not from human revolt, but from the silent insurrection of the land that once fed them.

With hunger as the harbinger, society fractured. Chaos and mass confusion swallowed the land, a virulent blight not even alchemy could stem. Witch hunts raged for a merciless century, fire consuming flesh and innocence. Men’s strength wilted, armies disbanded. Women, walking in the agonizing footsteps of famine-haunted foremothers, bartered touch for bread.

Monuments lay buried under vines and moss. Fertile lands turned barren. Schools emptied, their echoing halls abandoned, and children torn from learning, were sent to farm dying lands. Art withered. Painters swapped colors for shades of gray, and soon vanished altogether. Teachers and engineers were supplanted by an ever-growing class of soil-bound serfs.

Desperate, the eternal king sought another spell. He asked the people not for mere years but decades. The alchemist obliged, crafting another spell from dark incantations. Yet the ravaged earth, too spent to yield, exacted a monstrous price: lifetimes for crumbs of bread. People, skeletal, on the verge of vanishing, offered their very existence. A silence settled, a collective sacrifice borne not in rebellion, but in surrender.

Part IV: Clara The Torchbearer

In the land between sleep and waking, Clara was a child again, standing at the threshold of a room aglow with amber light. Her mother ground herbs, the wooden table before her strewn with books, vials, and leaves. “These aren’t just leaves and liquids,” her mother said. “They’re doors to the gardens of your mind.” Her words sank into Clara like stones into deep water.

She woke to a gusting wind. Her dream dissolved like morning mist. The sun broke over the kingdom, time’s toll evident in every vine-entangled ruin. Light spilled into her chamber.

Clara’s room was modest: a bed, a wardrobe, a desk. On it, a lone candle and scattered books that whispered of the kingdom’s past grandeur and freedoms now lost. It was her mother’s notes and books, crafted in the quiet, away from royal eyes — a puzzle to decipher, a quest still yearning for footsteps.

She draped a linen robe over her shoulders and approached the window, her fingers ink-stained from yesterday’s writings. Below, people shuffled through life, joyless and muted.

The spell cast long ago had become an oppressive, faceless dictator. It promised bread but dealt only crumbs, a tarnished magic now woven into the kingdom’s culture as enduringly as its ancient stone walls and teeming graveyards.

She remembered the cold spring day she put her mother in the earth. The ground was hard, the casket simple. The tombstone bore the words: ‘Seed in Drought.’

The chambermaid standing beside her asked what it meant.

“Her wish,” Clara answered. Her face gave nothing away, her thoughts a distant country.

From her room, Clara watched the people below — eyes down, spirits broken. Clara was not like the others. She carried an inner fire, gifted from her mother, a quiet revolt against a gray world.

In her room’s sanctuary, amid ink and parchment molded by hands long stilled, Clara found traces of a freer past, free from famine and theft of years. A past now entrusted to her. As she flipped through the timeworn pages of an ancient tome, something caught Clara’s eye. In the margins of the text, a note penned in her mother’s hand: “For Clara — Elric is the keeper of truths that free us. Go where I could not. Find him.” Below it, a tender signature, her mother’s name etched in ink.

The name ‘Elric’ stirred a latent memory, a shared secret often spoken by her mother. Filled with a sense of destiny, Clara closed her worn books and left her chamber.

At the age of twenty, for the first time, she ventured beyond the confining walls of her castle. Guided by remnants of forgotten eras, she set forth to unearth truths long interred but never wholly erased. Her compass drew her toward the Whispering Pines, a land untouched by the alchemist’s dark arts and, as her mother had often mentioned, the rumored dwelling of Elric.

Part V: Far to Go

Clara walked through towns void of kindness, over land stripped of life. Each day sculpted her in the likeness of the land she traversed — a leaner body, hands hardened, face etched by sun and wind.

Thirteen days out, Clara trudged through the ashen remains of a town, its name forgotten, its history lost. Empty buildings sagged under the weight of time, their hollow frames like gravestones against the evening sky. Vacant faces, like clock dials without hands, glanced through her, never at her.

Spying a run-down tavern, she cautiously stepped inside. The door whined on rusted hinges. She eased onto a splintered stool. “Bread,” she rasped. The innkeeper, a bloated man with eyes like rotted plums, flung stale crust onto the counter. Her teeth sank into the stale crust, her body weeping for nourishment.

The room stank of unwashed bodies and sour ale. In a dim corner, men gambled their souls on dice, their faces marred by desperation and greed. As she made to leave, talk stilled, and eyes tracked her. A rough hand seized her wrist.

“Far to go?” The words, a mockery.

Her eyes darted to the innkeeper, pleading for an ally. His gaze, cold, turned away. “Yes, far,” she replied, stalling.

Then, violence. Teeth, nails, a taste of blood. Outmanned, her screams died in cruel laughter. Her clothes yielded, torn in the contest of her humiliation.

After the degradation, she stepped outside and into the soft rain of the night. Her path now carried weight measured in more than miles.

Ahead, barren land stretched mercilessly. A fleeting image of her mother’s face offered a brief moment of comfort. She tilted her head back, letting rain droplets fall onto her tongue to dilute the bitterness that swelled within her. The night urged in tones only darkness knows. Turn back, it murmured.

But she walked on. Her will was a defiant ember, the last flicker of light in a world teetering on oblivion, its humanity long forfeited.

Part VI: Elric

After weeks traversing a harsh expanse, gaunt but unbroken, she found herself beneath the Whispering Pines. As she approached, she carried more than her own weight. She embodied her mother’s enduring hope and her land’s final prayer for redemption.

Elric greeted her at the doorway. “You’ve come,” he said, leading her inside, the room warm from the fire in the stone hearth.

Her eyes roved from the firelight dancing on the walls to the shelves laden with books. A staircase twisted upward, its banister engraved with ancient symbols.

“Your homeland withers,” Elric said, drawing from his pipe, the wood old and marked by years. The scent of herbs, a blend cultivated through many seasons, sharpened the mind as it filled the room. “The spell,” she confirmed.

“Mmm,” he exhaled, his eyes shifting to the fireplace, wood popping in the heat. “Your forebears knew better days. Days without sacrifice.”

“The legends spoke truth, then?”

“Indeed.”

“Did you know I was coming?”

“I’ve waited twenty years. This isn’t our first meeting.”

“We’ve met before?”

“Once, when you were but a newborn. Your mother and I collaborated. We worked on a potion that siphons the power of nature to protect the truth in our world, to shield it from alchemy and dark spells.”

Elric opened a small cabinet beside the hearth. From it, he took an empty wooden chalice and a stoppered glass vial. Uncorking the vial, he poured a golden liquid into the chalice, the firelight making it shimmer. “This elixir hails from untarnished lands, free from the alchemy that poisons your realm. One sip and illusions shatter, transforming soul and society alike.” “What is it called?” she asked.

He looked at her intently. “Elysium,” he said, the word hanging heavy in the room. “It’s both the end and the beginning of your journey. You must experience it to understand. Drink.”

She sipped the brew; it tasted of nothing. Soon, as she nestled by the fire, the walls took a breath, and the world sharpened as if coming into focus for the first time. The air thickened into a heavy mist, her fingers danced through it, each ripple sending colors splashing around like bioluminescent whispers. She floated, her body dissolving, her name a distant echo.

Elric’s gaze turned to the fire, shadows playing across his face. “Elysium shows only what one needs to see, no more, no less,” he said, his voice a gentle wave against the shores of her uncertainty. “In my own experience with Elysium, I saw a torchbearer in the veil of time, a young soul with the spark to undo the dark spell on your land.” His eyes found Clara’s. “But the torchbearer had to come to me, the journey forging the resolve. Had I sought you out sooner, before your heart was ready, Elysium’s truth would have been a burden too heavy.”

As the reality of his words sank in, Clara felt the weight of the years, the faces of the countless lives lost to the alchemist’s dark magic flashing before her eyes. “And the elixir… why not share it sooner?”

Elric sighed, his eyes drifting to the ancient books lining the shelves. “Elysium’s truth is a double-edged blade. In the wrong hands, it could cut through the fabric of reality, leaving wounds that might never heal. Your kingdom…” he gestured vaguely towards the window, “…it wasn’t ready. But now, the ground has been furrowed by suffering, ready to receive the truth about the universe, the spell, the suffering.”

The walls breathed with a rhythm older than time. She looked at her hands moving through the bioluminescent mist, each movement sending ripples across the room. Tendrils of light danced in the air, ethereal spirits beckoning her towards another realm.

“But why?” Clara pressed, her presence deepening with each breath. “Why involve yourself?”

Elric’s eyes softened. “I once lived in your kingdom, fleeing when I realized the spell’s plague. Your mother and I, we shared a vision of a world free from dark alchemy. But more than a promise to an old friend, it’s a battle against the grasp of evil spells, a grasp threatening to choke the essence of life and freedom from this world. It’s a battle,” he looked at Clara with a profound earnestness, “that now passes to you.”

Suddenly, reality shattered, and her soul twisted and warped through a portal faster and faster until she touched the core of the cosmos.

Here, in a land beyond words, beyond the confines of time and space, she witnessed the birth and demise of the universe. With each breath, a star was born and died; each blink saw the rise and fall of civilizations. Like a photon racing at light speed through the cosmos, untouched by time, she beheld the entirety of all that ever was and will be.

Peering beyond the infinitely small, she saw the source code of the universe, equations as living tendrils of light materializing into particles, planets, and stars. The universe, a symphony of mathematical elegance, its physicality a melody resonating along the strings of her consciousness.

She floated amidst the cosmic code, orchestrating the universe — the planets, the voids, the unseen forces weaving through them — and she was one with all. She was the universe gazing at itself. Beyond the veil of mortality, she saw endless realms, death a mere doorway. In that boundless expanse, she brushed against the face of the divine.

A golden phoenix took form before her.

“I am Veritas,” it spoke, not in words, but in a language of complex geometry.

It exposed the grim truths of her lands, the Great Famine, and the enslaving spell — a counterfeit prosperity bought at the terrible price of human years.

“How do we break free?” Clara’s voice carried the untold suffering of generations.

“Simple,” the phoenix intoned. “Don’t battle the alchemist or his spell; you won’t win. Acknowledge the illusion. Tend to your own gardens, and reliance on the alchemist and the king fades. Elysium shields you, body and mind, from the spell’s reach.”

As the vision faded, Clara found herself back on the wooden floor, her head cushioned by a pillow. The urgency of her quest snapped her back to reality, a newfound resolve kindling in her chest.

“I see now,” she breathed, her voice steady. “I know what I must do.”

Elric nodded, a sage with a deep understanding of the paths of the universe. “Yes, but first, tea. There’s strength to regain and you have a long journey ahead,” he said, anchoring them both in a moment of calm before the impending storm of change.

Part VII: The Wayfarer’s Hearth

After days navigating barren expanses, Clara entered a cobblestone town as twilight settled. Figures lined the street, some alive, some not, most in limbo — too tired to beg, too frail to feed. Candlelight flickered from the windows of a tavern, illuminating well-fed faces. “The Wayfarer’s Hearth,” read the sign above the door.

She approached. The door creaked open to admit her, wafting out stale beer and the scent of roast meat. Her fingers twitched involuntarily, memories of weeks ago crawling up her spine, but her body ached for sustenance, for warmth. Holding her satchel close, safeguarding the vial of Elysium, she chose a chair at an empty table and settled in. Soon enough, food appeared.

The man who had set her meal before her took the adjacent seat with deliberate ease, his eyes lingering on her satchel. Her pulse quickened.

“You carry a weight, wanderer,” he said.

“Or hope,” she countered, her grip on her satchel unyielding.

A glass shattered. Drunkards stumbled into their table, a wave of mead sweeping over worn wood. Clara’s heart surged, the man’s fingers brushed her satchel, pulling the vial from its sanctuary. “Hope carries its own burden,” he said.

“The hope of my people is in that vial,” she shot back, her voice stripped bare.

“This is Elysium,” he said, his words like barbs. “At what cost, wanderer, do you think Elysium will save your people?”

Doubt snaked around her convictions. Was she the bearer of emancipation or a harbinger of calamity? Was her land ready for Elysium? “You know it?” she asked.

“I know it,” he said, eyeing it closely.

“Return it,” she commanded.

He handed over the vial. “The road to freedom is paved with the stones of responsibility. I wouldn’t want to walk in your shoes.”

She nodded, heavy but resolute. Clara left as quietly as she’d come, meal untouched, mission intact.

The night took her in. She cast a final glance back at a room oblivious to her departure. That night, she’d sleep under indifferent stars, closer to home but adrift in certainty, carrying the weight of a thousand stones of untold responsibility, a Trojan’s shroud for her people, a destiny unasked.

Part VIII: This is Elysium

Under a storm-heavy sky, Clara returned home. In her pocket was Elysium; in her mind, a plan that required Harold — an old friend and a knight by trade.

In the guild hall, Harold sat among knights and minstrels, a goblet in hand. “Look at this,” Clara said, pushing the vial across the table without ceremony. Her words pierced the tavern’s noise as she recounted her journey.

Harold looked at her, then at the vial. “You mean to say that one day, this will help us fight the spell?”

“No,” said Clara, her voice deep with a new knowing. “It means one day, we won’t have to.”

“Heresy,” Harold said. “You’re risking death.”

“So are we all,” she answered.

“They’ll burn you at the stake.”

“If I’m right, they won’t.”

“A trial then, regardless,” Harold said, his gaze dropping to the vial as the tavern’s jovial banter became a distant echo for them both.

“So be it,” Clara said, meeting his gaze. She leaned in, her fingers resting on his scarred knuckles. “Our farms take our children. It’s not right.”

“It’s how things are.”

“It’s how things were.”

“A trial will not be lenient, Clara. I can’t let you bring this to the king.”

“Not the king. The people.” She continued. “But don’t trust me. See for yourself.” Her eyes locked onto his. “Drink,” she said, her words echoing Elric’s.

Harold hesitated but finally drank. His eyes widened. He gripped the edge of the wooden table, his knuckles turning white. A sort of vacant gaze overcame him as if he’d journeyed to someplace far.

When the Elysium vision receded, he opened his eyes and looked at her anew, seeing the world for the first time again. He glanced around the hall as though it were a foreign land, his eyes lingering on the mundane — a crack in the table, the smudged goblet, a flickering torch on the wall—with awe and wonder. She knew then that they stood as one. Two visionaries, shouldering the burden of transforming the world, ready to shepherd their people into a revolutionary dawn.

In the square, the stone eyes of old heroes watched. A crowd formed, silenced by expectation and unaccustomed to the art of public speaking. Autumn leaves swirled at their feet.

“A new dawn!” Harold broke the silence. “Generations sacrificed, giving years for meager sustenance. But the land wants not our years — only our care and periodic reverence. The tales of a time without the toll of hunger, without a tax on life itself, from before the Great Famine, are not myths. They are forgotten chapters of our history, now on the verge of being rewritten.”

He raised the vial. Sunlight mirrored in its gold. “This is Elysium.”

Part IX: A Revolution Takes Shape

In the fading light of day, Harold and Clara stood by a murmuring brook, leaves rustling at their feet in quiet revolt. Faces young and old assembled around them; each one a silent rebellion against the servitude that taxed their years.

They drank, the chalice passing from hand to hand, a new ritual born. With each gathering, the numbers swelled; with each sip, more souls entwined. Slowly, yet with unyielding certainty, the kingdom shifted over the years. It changed not through a coup or uprising but through a still, relentless force, like water eroding stone. As the seasons passed and more villagers imbibed the Elysian brew, the weight of their invisible chains lessened, their atoms scattering into the evening air.

Shielded now, villagers sowed their own gardens, sanctuaries from the alchemist’s dominion. Bountiful harvests followed, hope supplanted despair. Word of the blooming private gardens spread like wildflowers, and fields once cursed by dark alchemy lay fallow and forgotten.

And there, by the unassuming brook, a revolution took shape. The soft sounds of the stream became an earthbound anchor for the myriad souls who opened the door to walk in the cosmic gardens of their minds. Each ritual added another stitch in the fabric of a new dawn; each sip, another brushstroke on the canvas of a world remade.

Part X: The Old Man

A decade drifted by. With each soul that tasted Elysium, the fetters of the old world loosened. The alchemist’s spell, once a yoke around their necks, now waned like thick morning fog giving way to the warmth of the day. Fields once cursed now bore food, not dread. Families gathered around bountiful tables, words flowing freely, unveiled.

Each year, townsfolk met by the sword in the square. Harold’s blade, the first monument raised in ages, stood as freedom’s spine, the axis of their new world. An old man approached, his eyes dimmed by memories of famine, leading a boy by the hand. Their eyes met, a chasm bridged: one soul untarnished by hunger, the other haunted by its ghost.

The old man stepped forward, his fingers quivering on the hilt of the sword. “Clara, what becomes of us if the land fails us again?” Years of hardship wavered in his voice, the ghosts of famine flickering in his eyes.

“It could,” Clara said, her voice steady as bedrock. “But it’s different now. Our fields are wider, our hands more skilled. We’re not trying to trick the earth with alchemy anymore. We speak in the simple terms it understands: soil, sun, water, time.”

Above, the alchemist’s fortress loomed, its towers now marred with cracks. Clara looked up. Empty windows stared back, like dead eyes on a fallen beast. Old times had ended; new ones had begun.

Part XI: The Note

Dawn broke, casting new light over worn cobblestones. Clara moved through the marketplace as if through a dream. The scent of cinnamon and rich coffee filled the air as she ran her fingers down silken tassels and through powdery barrels of golden saffron. Voices haggled; her feet felt the earth’s warm embrace.

Traders argued leisurely, their time no longer taxed by the spell. Children laughed, unburdened by field and plow.

Fields that once caged both young and old now released thinkers, builders, creators. The horizon changed form — bridges leapt over waterways, roads bound the land. Each stone laid was more than a fixture; it was a vow, a pact between the present and the future. It was today’s promise to a future yet unborn, anchored by the prosperity that now bloomed under Elysium’s sky.

As evening descended, the grand hall filled with voices unburdened by yesterday’s sorrow. In a secluded corner, Clara and Harold exchanged words about the loftier truths Elysium had laid bare.

A courier emerged from the crowd, extending a sealed parchment. “For you, mademoiselle.”

With a nod, Clara exchanged a coin for the note. Her eyes brightened as she absorbed the message:

Only a true renaissance resounds to the Whispering Pines. Continue, in health and strength. - Elric

She passed it to Harold, their eyes locking in wordless affirmation. “The Whispering Pines acknowledge us,” he finally said. “And so, we continue,” Clara replied, her voice unwavering, guided by truth. In the hall’s enveloping warmth, laughter, toasts, and spirited debates blended into a harmonious score — a sound that would have been foreign to their ancestors, a sound that marked the close of an era and the dawn of something profoundly new.

This story first appeared in Tales from the Timechain. Support our work and buy a copyhere.

79% of the zaps from this story will be passed onto the author, Reed.

21 Futures requests 21% for operating costs.

Ioni Appelberg (pronounced Yo-Ni Apple-Burg) is a bitcoin philosopher, futurist, author, and content creator. His content centers around science fiction, human history and it often takes the form of swashbuckling journeys to the frontiers of technology, space, and the human mind. His love of sci-fi, psychedelics, and futurism may take his stories (and unsuspecting readers) to strange but exciting places. He is also an avid reader, a medical doctor, a freedom fighter, an MMA fighter, a psychonaut, and a terrible chess player.

-

@ 6c05c73e:c4356f17

2025-06-03 12:18:10

@ 6c05c73e:c4356f17

2025-06-03 12:18:10Trabalhar 40 anos e aposentar?

Quando comecei minha jornada, pensei que trabalhar em emprego que detesto e receber pouco não era o suficiente. Na época eu lia nos consultórios de dentistas as revistas veja e exame.

Ficava elucidando: -Como pode uma empresa pagar carro, telefone, viagem e um belo salário para esses caras? Será que eu teria chance algum dia?

Mas, quando seu primeiro emprego é o Bobs. Você é negro e vem de um um lugar aonde o seu nome e seu tempo de carteira são sinônimos de orgulho.

Eu sabia que seria difícil. Principalmente, porque além de ter que melhorar quem eu era. Eu teria, que enfrentar pré conceitos e críticas da família junto. Enfim, mãos a obra.

É só investir que fico rico!

Foi então que pensei se teria alguma forma de não ter que trabalhar por 40 anos e depender do governo no fim da minha vida. Daí, eu estudei e encontrei algumas pessoas que me mostraram uma opção. Investimentos! Caraca, tudo parecia muito legal naquela época.

Era uma sopa de letrinhas acompanhada por um glossário recheado e diferente de tudo que tinha conhecimento. Meu primeiro investimento foram 3 ações da Ambev. Fiquei empolgado demais quando chegou a primeira carta da Bovespa mostrando o meu "rico”patrimônio.

Ademais, eu fui vivendo outras coisas: Crise da época Dilma, crise do Temer com o Joesley, Covid e pós Covid. Fui além, e fiquei alguns anos negociando forex e criptomoedas também. Vivi demais, fiz grana, perdi grana, fiz amizades, perdi amizades e o mais importante que fiquei experiente nesse ramo. Tão experiente que percebi uma coisa…

Opaaa, falta uma peça no quebra cabeça

Os anos passavam e era como uma montanha russa. Tinha anos bons e ruins. Normal, como qualquer outra coisa que aconteça na vida. Mas, cara. Era inegável que eu estava evoluindo. Mas, o ritmo era lento demais. E, pelas minhas contas eu ia chegar lá com uma idade bem avançada. A diferença é que eu teria mais controle sobre meu futuro.

Contudo, no meio da jornada comecei a perceber que toda vez que eu pegava meu dinheiro e entregava para o mercado financeiro. Eu mandava uma mensagem para meu subconsciente: Você não é capaz de multiplicar seu dinheiro! E, isso é muito louco.

Porque eu multiplicava. Mas, tinha que me contentar com 10-12% a.a em anos normais, -6% a.a em anos ruins e anos bons era algo como 20%.

Portanto, isso tudo me deixava maluco. Porque? Eu tinha amigos empreendendo e ganhando 20% de lucro líquido ao mês. E, porque eu deveria me contentar com módicos 12% a.a? Esse raciocínio alugou um triplex na minha cabeça.

Durante minha jornada, eu tentei vários empreendimentos: Festas, venda de camisetas, venda de acessórios de telefone, confeitaria online e mais alguns que não lembro. Foram excelentes negócios para aprender. Mas, eu queria meu próprio negócio. Mas, não mais um negócio. Um negócio online, escalável e multilíngue. Fui estudar Desenvolvimento de sistemas, marketing digital e varri a internet atrás de informações.

O que você pode fazer

E, aqui estamos. A ideia de construir isso que você está usufruindo hoje nasceu 2 anos atrás. Eu levei 6 meses para lapidar e mais 6 meses criando conteúdo na unha. Literalmente, sentando a bunda na cadeira e escrevendo do zero cada texto.

Eu sei que alguns não ficaram bons como queria. Mas, o processo é esse. Você vai melhorando a medida que avança. Não dá para ficar vendo tutoriais no youtube, gurus de internet e ler milhares de livros. Tu tem que pegar e começar a fazer algo. Hoje, agora!

A vantagem da internet é que você não precisa de permissão para começar nada. Abre o Word, Docs, Canva, Capcut, Câmera do seu celular e cria. A resposta para todos os seus problemas está em: CRIAR!

Eu criei esse site, complementando: Meu site, meu Medium, meu Reddit e meu Nostr. Eu crio coisas novas todas as semanas e distribuo.

Minha empresa só tem eu de funcionário(por enquanto). Mas, já desenhei quais os próximos passos. Pode ser que eu nem use os próximos passos porque tudo muda toda hora.

Mas, vale a pena tentar! Se você puder acabar esse texto com uma só lição, eu diria:

Acredite mais em você e menos nos outros. Pare de pegar seu combustível (dinheiro) e entregar nas mãos de pessoas que em muitos casos. São menos preparadas que você.

Muito obrigado pelo seu tempo e até o próximo.

Compartilhe

-

@ eb0157af:77ab6c55

2025-06-03 12:02:09

@ eb0157af:77ab6c55

2025-06-03 12:02:09The Pakistani government embraces Bitcoin, following the example set by the United States.

Pakistan has officially announced the creation of a strategic Bitcoin reserve. The announcement was made during the Bitcoin 2025 conference in Las Vegas, marking a significant shift from the government’s previous stance against digital assets.

During the event, Bilal Bin Saqib, head of the Pakistani Crypto Council, shared the country’s decision:

“Today, I announce the Pakistani government is setting up its own government-led Bitcoin Strategic Reserve, and we want to thank the United States of America again because we were inspired by them.”

Bin Saqib then added:

“This wallet, the national Bitcoin wallet, is not for speculation. We will be holding these bitcoins and we will never, ever sell them.”

It remains unclear how the bitcoins will be acquired, whether through direct purchases or other means.

Pakistan’s shift in approach toward digital assets traces back to last February, when the government first explored the idea of creating a National Crypto Council. This body was designed to oversee the development of a comprehensive regulatory framework for cryptocurrencies and to attract foreign investment in the sector.

The Council’s proposed initiatives included projects such as utilizing surplus energy for Bitcoin mining, building high-performance data centers, and accumulating Bitcoin for the national treasury.

Just a few days ago, the Council officially allocated 2,000 megawatts of surplus energy to support mining operations and AI data centers.

Moreover, Changpeng Zhao, co-founder of Binance, was appointed as an advisor to the Council in April, offering expertise on crypto regulations, blockchain infrastructure, and the adoption of digital assets.

To further consolidate this new approach, the Pakistani Ministry of Finance has commissioned the creation of the Digital Asset Authority, an agency dedicated to supervising digital asset regulations and issuing licenses for crypto service providers operating within the country.

The post Pakistan announces the creation of a strategic Bitcoin reserve appeared first on Atlas21.

-

@ 9c9d2765:16f8c2c2

2025-06-03 11:56:41

@ 9c9d2765:16f8c2c2

2025-06-03 11:56:41A young monk once asked the elder of the mountain temple, “Master, how do I become wise like you?”

The elder smiled and handed him a lump of clay. “Make me a cup,” he said.

The monk, eager and certain, molded the clay quickly. He baked it in the kiln and brought it proudly to the master.

The elder poured tea into it and it cracked. “Try again,” he said.

The monk frowned but obeyed. He made another shape better, baked longer. But it still leaked.

Again. And again. The monk grew weary. Days turned into weeks. Each cup cracked, leaked, tilted, or burned.

On the eleventh attempt, the cup finally held. It was simple, slightly uneven, but strong.

The master poured tea. It stayed. He sipped, then smiled.

The monk said, “Why did all the others fail?”

The elder replied, “Because each one taught your hands what they did not know. Each mistake shaped the wisdom in your fingers.”

Moral: Wisdom is not poured into us it is shaped in us, one mistake at a time.

-

@ 9c9d2765:16f8c2c2

2025-06-03 11:40:05

@ 9c9d2765:16f8c2c2

2025-06-03 11:40:05In the ancient city of Kaduna, where cobbled streets echoed with the footsteps of time, lived a young sculptor named Ali. Born to a family of scholars and philosophers, he was expected to follow in their footsteps books, debates, and deep logic. But Ali's heart beat for marble and chisel, not scroll and quill.

Against his family's wishes, he became an apprentice in a sculptor's guild. Though talented, he was prideful, impatient with learning, dismissive of advice, and obsessed with perfection. “Mistakes are for the foolish,” he often said. “Not for those destined for greatness.”

One day, Ali was given his first major commission: a statue of Queen Amina at Kaduna city’s central square to honor the Queen, goddess of wisdom. Determined to prove himself, he secluded himself in his workshop, refusing help. For months, he labored, carving what he believed was his masterpiece.

When the curtain was pulled off at the grand unveiling, the crowd gasped but not in awe.

The statue’s proportions were wrong. The Queen's face, meant to inspire reverence, looked distorted and harsh. Rumors spread. Ali’s arrogance had blinded him, people said. Critics mocked him. His patrons revoked the rest of his commissions.

Humiliated, Ali fled the city. He wandered from village to village, surviving by carving small figurines and helping repair broken statues. He worked alongside humble craftsmen, old and wrinkled, whose hands trembled but whose eyes held oceans of experience.

They taught him patience not through lectures, but through their mistakes. One cracked a statue's leg, then calmly fixed it better than before. Another accidentally chipped a nose, then reshaped the entire face into something more expressive. They didn't hide their flaws, they embraced them, learned from them, and adapted.

Years passed. Ali returned to Kaduna city, older and quieter. He set up a small workshop near the KD city gates. His first new sculpture was a fountain of children learning to walk, some falling, some crawling, some laughing through their tumbles. People noticed.

His fame grew again, not because of flawless technique, but because his work now had soul. Every sculpture whispered of growth, of struggle, of becoming. His final masterpiece was a second statue of Queen Amina the goddess of wisdom, placed beside the first.

This time, Ali was not stern and flawless, but warm, his hands outstretched, one holding a cracked tablet, the other a sapling growing through stone. At his feet, a broken chisel lay deliberately placed.

When asked why, Ali said, “Wisdom is not born from perfection. It is carved through failure.”

Moral: To build wisdom, you must make mistakes. Only through falling can we learn how to rise.

-

@ 32e18276:5c68e245

2025-06-02 20:58:05

@ 32e18276:5c68e245

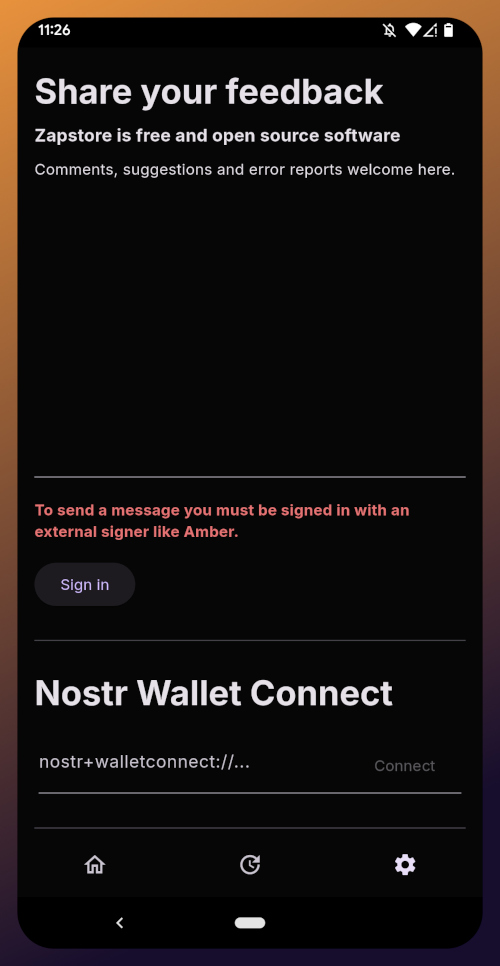

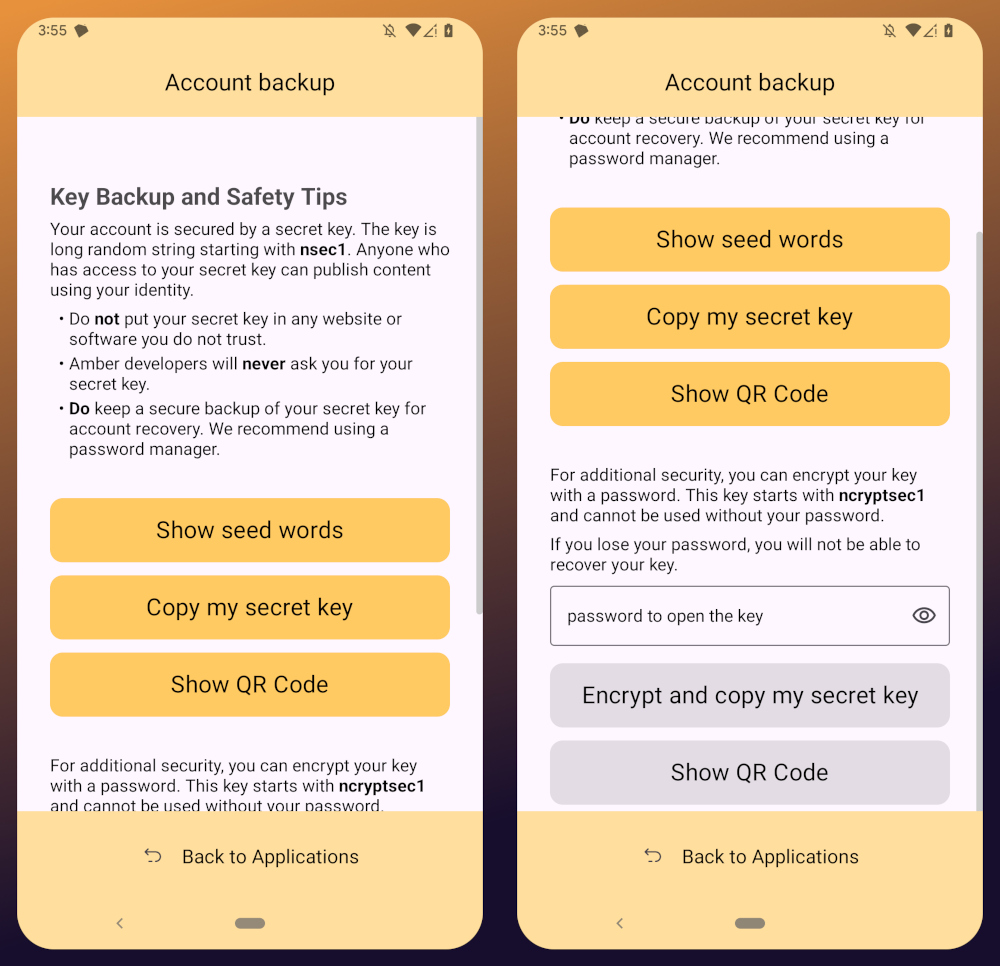

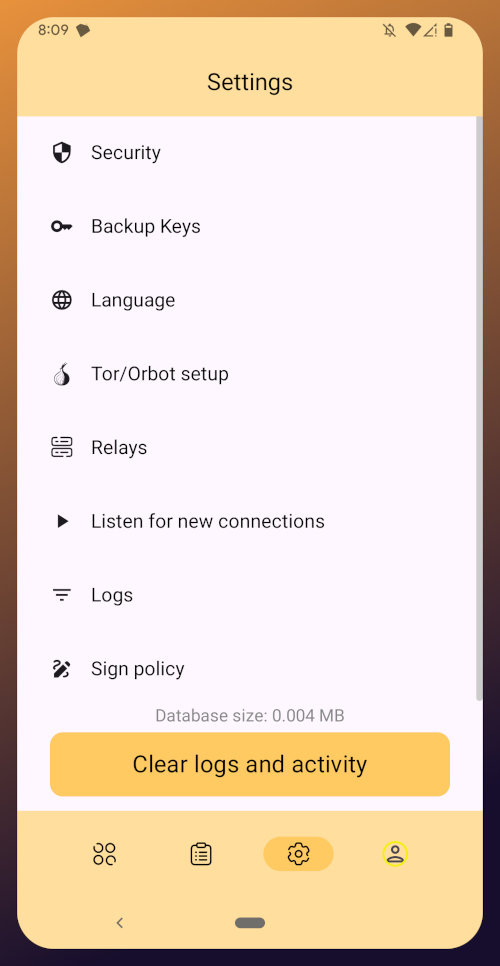

2025-06-02 20:58:05Damus OpenSats Grant Q1 2025 Progress Report

This period of the Damus OpenSats grant has been productive, and encompasses the work our beta release of Notedeck. Since we sent our last report on January, this encompasses all the work after then.

Damus Notedeck

We released the Beta version of Notedeck, which has many new features:

Dave

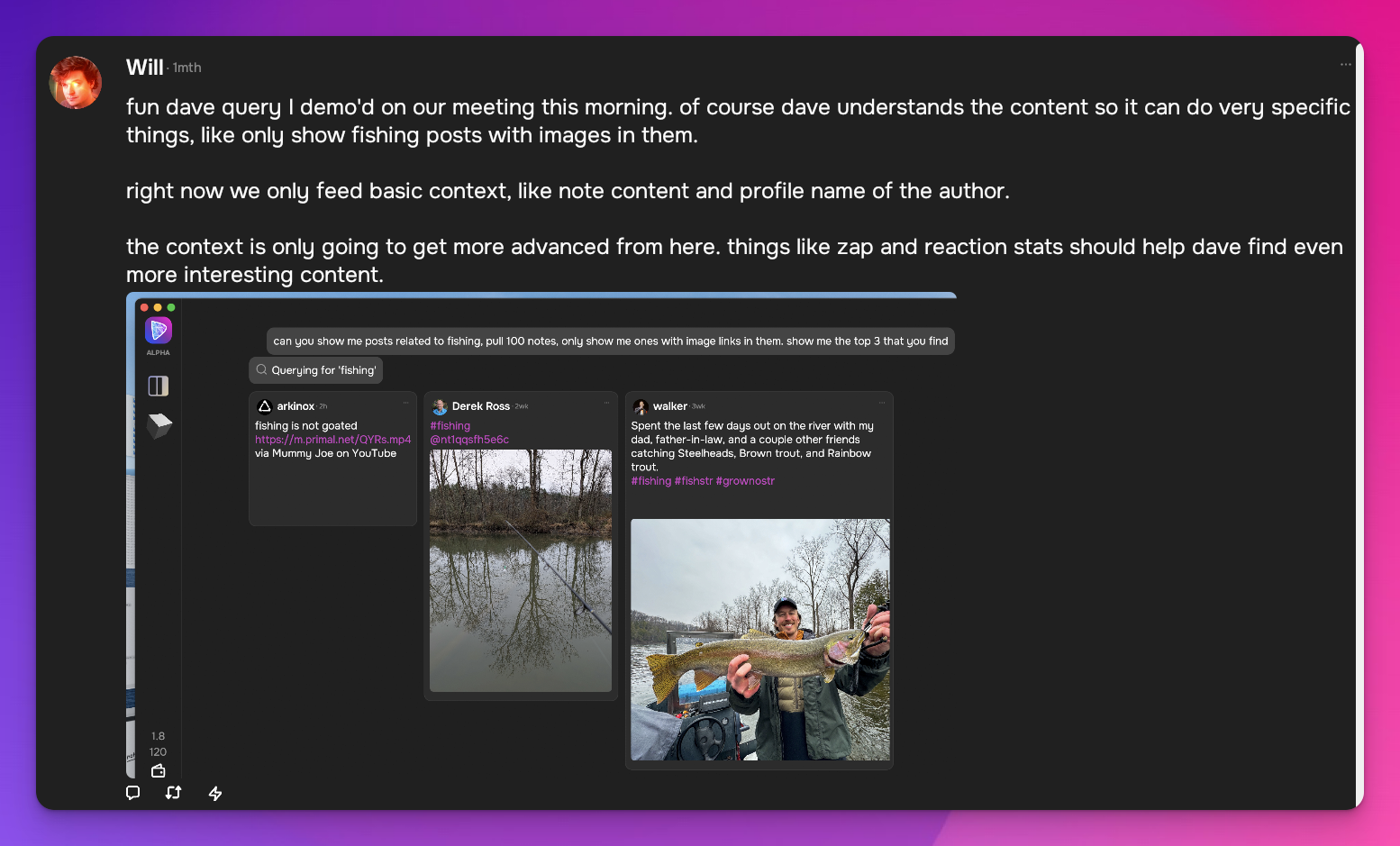

We've added a new AI-powered nostr assistant, similar to Grok on X. We call him Dave.

Dave is integrated with tooling that allows it to query the local relay for posts and profiles:

Search

The beta release includes a fulltext search interface powered by nostrdb:

Zaps

You can now zap with NWC!

And More!

- GIFs!

- Add full screen images, add zoom & pan

- Introduce last note per pubkey feed (experimental)

- Allow multiple media uploads per selection

- Major Android improvements (still wip)

- Added notedeck app sidebar

- User Tagging

- Note truncation

- Local network note broadcast, broadcast notes to other notedeck notes while you're offline

- Mute list support (reading)

- Relay list support

- Ctrl-enter to send notes

- Added relay indexing (relay columns soon)

- Click hashtags to open hashtag timeline

Damus iOS

Work continued on the iOS side. While I was not directly involved in the work since the last report, I have been directing and managing its development.

What's new:

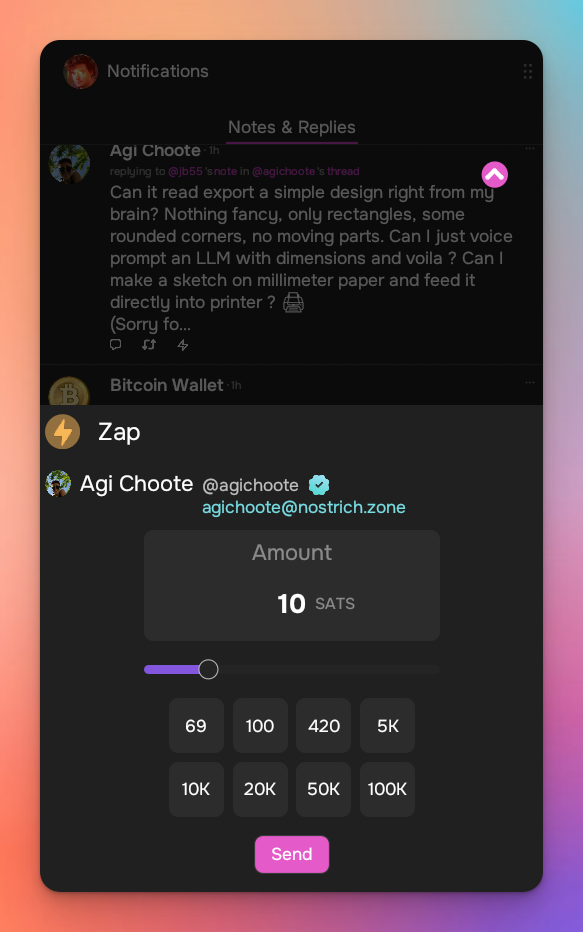

Coinos Wallet + Interface

We've partnered with coinos to enable a one-click, non-KYC lightning wallet!

We now have an NWC wallet interface, and we've re-enabled zaps as per the new appstore guidelines!

Now you can see all incoming and outgoing NWC transactions and start zapping right away.

Enhanced hellthread muting

Damus can now automatically mute hellthreads, instead of having to do that manually.

Drafts

We now locally persist note drafts so that they aren't lost on app restart!

Profile editing enhancements

We now have a profile picture editing tool so that profile pictures are optimized and optionally cropped

Conversations tab

We now have a conversations tab on user profiles, allowing you to see all of your past conversations with that person!

Enhanced push notifications

We've updated our push notifications to include profile pictures, and they are also now grouped by the thread that they came from.

And lots more!

Too many to list here, check out the full changelog

Nostrdb

nostrdb, the engine that powers notecrumbs, damus iOS, and notedeck, continued to improve:

Custom filters

We've added the ability to include custom filtering logic during any nostrdb query. Dave uses this to filter replies from kind1 results to keep the results small and to avoid doing post-processing.

Relay index + queries

There is a new relay index! Now when ingesting notes, you can include extra metadata such as where the note came from. You can use this index to quickly list all of the relays for a particular note, or for relay timelines.

NIP50 profile searches

To assist dave in searching for profiles, we added a new query plan for {kind:0, search:} queries to scan the profile search index.

How money was used

- relay.damus.io server costs

- Living expenses

Next quarter

We're making a strong push to get our Android version released, so that is the main focus for me.

-

@ 9ca447d2:fbf5a36d

2025-06-03 11:01:51

@ 9ca447d2:fbf5a36d

2025-06-03 11:01:51George Town, Grand Cayman — Ledn, one of the longest-standing digital asset lenders, today announced a sweeping update to its platform to discontinue any lending of client assets to generate interest, meaning that client assets will never be exposed to third party lending credit risk.

Going forward, Ledn will only offer its Custodied Bitcoin loan structure, under which client bitcoin collateral will remain fully in custody either with Ledn or its trusted funding partners.

As part of this strategic shift, Ledn will also remove support for ETH, doubling down on Bitcoin as its sole digital asset focus. These changes were unveiled by the company at Bitcoin 2025 in Las Vegas.

“With our new hyper-focus on Bitcoin-only lending, we’re going back to our roots and principles that inspired Bitcoin to begin with,” said Adam Reeds, Co-Founder and CEO of Ledn.

“Bitcoin was created as a direct response to the risks of fractional reserve banking and unchecked use of client assets to generate interest. Traditional finance relies on constantly reusing client assets to create leverage and, ultimately, inflation.

“Bitcoiners instinctively reject that model. That’s why we’ve moved away from this approach entirely. With our Custodied loan structure, client assets stay where they belong and are held in a transparent manner.”

While Ledn is taking these steps to further de-risk its product and further enhance client security, many of the new lending products in the market are exposing consumers to risky and opaque structures once again.

“These are the exact dynamics that led to the meltdown of the lending sector in 2022,” Reeds added.

“As more new entrants push half-baked lending models back into the market, we’re choosing the opposite path— Eliminating lending risk entirely for our users and making it 100% clear how their assets are dealt with.

“That clarity is what has helped us originate over $9.5 billion in loans and become the #1 retail CeFi lender in the Bitcoin space. We believe this approach should become the new standard for any serious digital asset lender.”

This shift reinforces Ledn’s broader strategy: Going all in on Bitcoin, simplifying its product stack, and sharpening its focus around the most secure and proven digital asset.

Ledn was the first crypto lender to introduce proof-of-reserves attestations in 2020, offering clients third-party verification that assets were fully accounted for down to the satoshi.

That transparency-first approach allowed the company to navigate market volatility as peers collapsed under opaque and hidden risks.

Now, as global regulators begin signaling openness to supervised participation rather than blanket restrictions, the opportunity — and the responsibility — for digital asset platforms is clear: Build resilient systems and proactively mitigate risk.

Ledn will exclusively offer custodied bitcoin-backed loans as of July 1, 2025. Support for ETH will be retired in the same release, reflecting Ledn’s strategic shift to a Bitcoin-only platform.

For more information on this transition, visit blog.ledn.io

For media inquiries, interviews, or early access to supporting materials, contact ledn@clpr.agency

About Ledn

Ledn offers growth accounts and loans to clients in over 120 countries, with an expanding range of services and supported regions. The company is dedicated to building world-class financial services, with a focus on helping people build long-term wealth through digital asset-based products.

For more information about Ledn and its services, visit the company’s website at www.ledn.io

-

@ cae03c48:2a7d6671

2025-06-03 11:01:15

@ cae03c48:2a7d6671

2025-06-03 11:01:15Bitcoin Magazine

Bitcoin Builders Exist Because Of UsersBuilder: Nicholas Gregory

Language(s): C++, Rust

Contribute(s/ed) To: Ocean Sidechain, Mainstay, Mercury Wallet, Mercury Layer

Work(s/ed) At: CommerceBlock (formerly)

Prior to Bitcoin, Nicholas was a software developer working in the financial system for banking firms developing trading and derivatives platforms. After the 2008 financial crisis he began to consider alternatives to the legacy financial system in the fallout.

Like many from that time, he completely ignored the original Slashdot article featuring the Bitcoin whitepaper due to the apparent focus on Windows as an application platform (Nicholas was a UNIX/Linux developer). Thankfully someone he knew introduced him to Bitcoin later on.

The thing that captured his interest about Bitcoin rather than other alternatives at the time was its specific architecture as a distributed computer network.

“The fact that it was like an alternative way. It was all based around [a] kind of […] network. And what I mean by that, building financial systems, people always wanted a system that was 24-7.

And how do you deal with someone interacting [with] it in different geographical parts of the world without it being centralized?

And I’d seen various ways of people solving that problem, but it never had been done, you know, in a kind of […] scalable solution. And using […] cryptography and proof of work to solve that issue was just weird, to be honest. It was totally weird for me.”

All of the other systems he had designed, and some that he built, were systems distributed across multiple parts of the world. Unlike Bitcoin however, these systems were permissioned and restricted who could update the relevant database(s) despite that fact that copies of them were redundantly distributed globally.

“The fact that in Bitcoin you had everyone kind of doing this proof of work game, which is what it is. And whoever wins does the [database] write. That mess[ed] with my head. That was […] very unique.”

Beginning To Build

Nicholas’s path to building in the space was an organic one. At the time he was living in New York City, and being a developer he of course found the original Bitdevs founded in NYC. Back then meetups were incredibly small, sometimes even less than a dozen people, so the environment was much more conducive to in-depth conversations than some larger meetups these days.

He first began building a “hobbyist” Over The Counter (OTC) trading software stack for some people (back then a very significant volume of bitcoin was traded OTC for cash or other fiat mediums). From here Nicholas and Omar Shibli, whom he met at Bitdevs, worked together on Pay To Contract (BIP 175).

BIP 175 specifies a scheme where a customer purchasing a good participates in generating the address the merchant provides. This is done by the two first agreeing on a contract describing what is being paid for, afterwards the merchant sends a master public key to the consumer, who uses the hash of that description of the item or service to generate an individual address using the hash and master public key.

This allows the customer to prove what the merchant agreed to sell them, and that the payment for the good or service has been made. Simply publishing the master public key and contract allows any third party to generate the address that was paid, and verify that the appropriate amount of funds were sent there.

Ocean and Mainstay

Nicholas and Omar went on to found CommerceBlock, a Bitcoin infrastructure company. Commerceblock took a similar approach to business as Blockstream, building technological platforms to facilitate the use of Bitcoin and blockchains in general in commerce and finance. Shortly afterwards Nicholas met Tom Trevethan who came on board.

“I met Tom via, yeah, a mutual friend, happy to say who it is. There’s a guy called, who, new people probably don’t know who he is, but OGs do, John Matonis. John Matonis was a good friend of mine, [I’d] known him for a while. He introduced me to Tom, who was, you know, kind of more on the cryptography side. And it kind of went from there.”

The first major project they worked on was Ocean, a fork of the Elements sidechain platform developed by Blockstream that the Liquid sidechain was based on. The companies CoinShares and Blockchain in partnership with others launched an Ocean based sidechain in 2019 to issue DGLD, a gold backed digital token.