-

@ 3283ef81:0a531a33

2025-05-24 18:41:43

@ 3283ef81:0a531a33

2025-05-24 18:41:43Why

is

this

noton

separate

lines -

@ 3283ef81:0a531a33

2025-05-24 18:17:22

@ 3283ef81:0a531a33

2025-05-24 18:17:22Vestibulum a nunc a sapien aliquam rhoncus\ Sed sem turpis, scelerisque sed augue ut, faucibus blandit lectus

Maecenas commodo, augue in placerat lacinia, lorem libero convallis mi, eu fringilla velit arcu id sem. In ac metus vitae sapien dignissim luctus

-

@ bf47c19e:c3d2573b

2025-05-24 18:17:09

@ bf47c19e:c3d2573b

2025-05-24 18:17:09Ovaj post sam objavio 24.01.2024. godine na Redditu povodom tri decenije od uvođenja Novog dinara kao rešenja za hiperinflaciju u Saveznoj Republici Jugoslaviji na šta su pojedini besni nokoineri sa te društvene mreže osuli drvlje i kamenje na mene. Od starih budalaština da je Bitkoin bezvredan, da nije oblik novca već finansijsko ulaganje, preko pravdanja svrhe inflacije, sve do potpune nemoći da se argumentima opovrgne nepobitna istina i pozivanja moderatora da me banuju. 🙃

Cena Bitkoina tada je bila oko $40.000. :)

Osim glavnog posta, ovde ću navesti i moje odgovore na neutemeljene i neinformisane tvrdnje besnih nokoinera. :) Da se sačuva od zaborava!

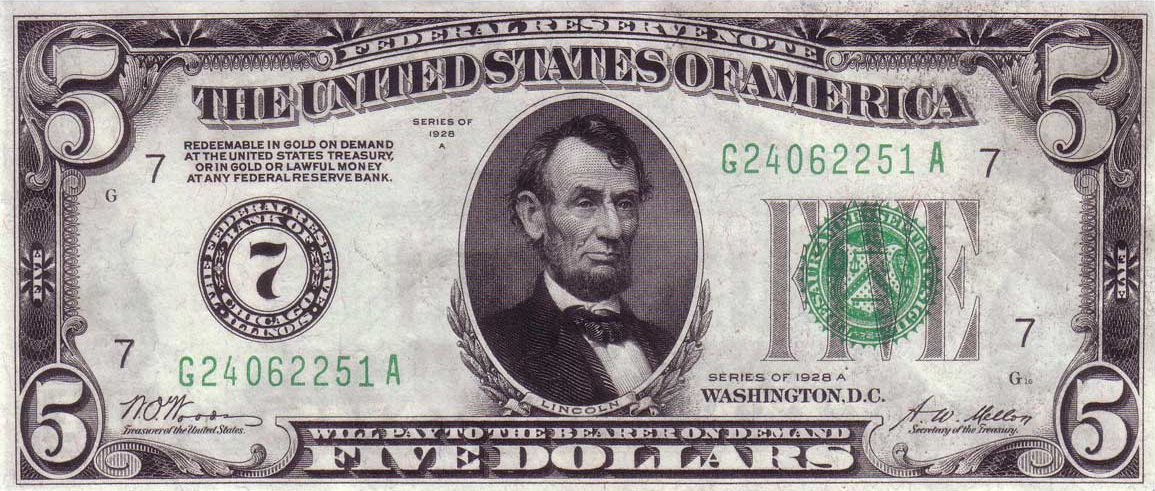

Juče se navršilo 30 godina "Deda Avramove reforme".

Dan kada je rođen novi dinar, a Deda Avram sasekao hiperinflaciju

Dva jajeta – nedeljna profesorska plata: Kako se živelo u hiperinflaciji i šta je uradio Avramović

Vikipedija: Jugoslovenski dinar

„U julu '93. godine u Jugoslaviji nisi mogao skoro ništa da kupiš i niko za dinare nije hteo ništa da prodaje“, pisao je Avramović. Centralno-bankarska prevara se nastavlja jer je već do kraja 1995. dinar oslabio prema marki za 70% (1 dinar = 3.4 DM), a u decembru 2000. je taj kurs već bio 30.5 dinara za 1 DM (-96.7% od uvođenja novog dinara). To samo pokazuje da redenominacija valute tj. "brisanje nula" nije nikako čudo i viđano je puno puta kroz istoriju)

Ako je reformom iz januara '94 god. 1 novi dinar vredeo kao 1 nemačka marka, zatim od 2002. uveden evro čime je realna vrednost marke (samim tim i dinara) prepolovljena, a danas 1 EUR vredi oko 117 RSD, to znači da je "deda Avramov dinar" prema evru već obezvređen 59.91 puta za 30 godina. Dakle devalvacija dinara od 5991% od 1994. godine, a svakako još veća izražena kroz dobra i usluge jer su i nemačka marka do 2002. i evro od svog uvođenja iste godine prošli kroz sopstvenu inflaciju. Sam evro je izgubio oko 38% vrednosti od 2002. godine. Tako da se može reći da i "deda Avramov dinar" već uveliko prolazi kroz hiperinflaciju koja je samo razvučena na mnogo duži vremenski period (ne brinite - znam "zvaničnu" definiciju hiperinflacije - još jedan "gaslighting" centralno-bankarskog kartela da zabašuri šta se iza brda valja). Jer šta je inflacija od preko 5991% nego višedecenijska hiperinflacija?! Kako ne shvata gigantske razmere ove prevare?!

ISPRAVKA: Dinar nije nominalno izgubio 23400% (234x) vrednosti prema nemačkoj marki/evru od 1994. godine, već 59.91x odnosno 5991%. I danas na sajtu NBS postoji zvanični srednji kurs marke prema dinaru od 59,91:1. Realno, obezvređivanje dinara i evra prema robama i uslugama je puno veće, pošto su cene roba i usluga izražene u evrima ubrzo udvostručene u periodu nakon uvođenja evra. Hvala članu DejanJwtq na ispravci i izvinjenje svima od mene zbog greške.

Dafiment i Jugoskandik ("Dafina i Jezda") su bili samo državna konstrukcija da se izvuku devize iz ruku naivnih investitora da bi te devize nešto kasnije poslužile kao tobožnja rezerva za novi dinar. Ova gigantska prevara je unapred bila planirana, a Deda Avram iskorišćen kao marioneta tadašnjeg režima.

Inače lista država koje su izvršile redenominaciju valute kroz "brisanje nula" je poprilično dugačka i radi se o uobičajenoj pojavi kroz istoriju još od Haitija 1813. godine, a poslednji put su to uradile Sijera Leone i Kolumbija 2021. godine. Odavno je zaboravljeno da je (SR) Jugoslavija devedesetih to učinila još 1990. (10.000:1), 1992. (10:1), 1993. (1.000.000:1) i 1994. pre Avramovića (1.000.000.000∶1) ali je ovaj dinar trajao samo 23 dana. Tako da Deda Avram nije izmislio toplu vodu.

U SFRJ je izvršena jedna redenominacija 1966. godine u odnosu 10.000:1.

Wikipedia: Redenomination

Kome i dalje nije jasno zašto Bitkoin neka više puta pažljivo pročita ove tekstove iznad: oblik novca koji se ne može redenominirati, veoma lako konfiskovati i izdavati bez ikakve kontrole i pokrića. Potpuno nezavistan od kaprica korumpiranih i od realnosti otuđenih političara i centralnih bankara. Veoma je bitno da postoji ovakav oblik novca koji nije podložan ovakvim manipulacijama od strane ljudskog faktora i da postoji slobodan izbor da se taj oblik novca odabere za štednju i transakcije: barem od strane onih koji ga razumeju, ovi koji ne žele da razumeju neka i dalje pristaju da budu pljačkani - njima ionako nema pomoći.

Komentari

brainzorz: Da, ali ako cemo realno bitkoin ne sluzi kao oblik novca, vec kao finansijsko ulaganje.

Bar je tako za nas i vecinu ljudi po svetu u praktičnom smislu. Jer 99.99% ljudi ili koliko vec prime platu u svojoj lokalnoj valuti, trose istu na redovan zivot, a ostatak (ako ga ima) investiraju. Slazem se da lokalne valute imaju svoj neki rizik, koji je veci u banana drzavi i da cuvanje svog kapitala u turbulentnom periodu u istoj je jako losa ideja.

Kada tako posmatras onda se mogu vuci pararele izmedju ostalih aseta, poput ETFova na primer i onda dolazimo do gomile problema sa bitkoinom.

@BTCSRB: Bitkoin se ne može porediti sa ETF-ovima pošto ETF-ove i ostale investicione instrumente ne možeš koristiti kao novac jer oni nisu "bearer assets" kao što jeste BTC. BTC eliminiše potpuno inflaciju (jer džabe ti keš u slamarici kao "bearer asset" kada je podložan inflaciji) i potrebu za posrednikom kod elektronskih plaćanja.

brainzorz: Ali on to eleminise samo u teoriji, sad da odem u pekaru, moram platiti u lokalnoj valuti, sad da li cu prodati bitkoin ili etf, prilicno je slicno.

Jedino sto mogu bitkoin zamenuti uzivo (ilegalno) sa nekim, pa tu jeste zamenjen posrednik. Ali provizije povlacenja su uglavnom zanemarljive, naspram ostalih parametara investicionog sredstva.

Neke stvari se mogu direktno platiti za bitkoin, ali to je ekstremno retko u stvarnom zivotu vecine ljudi.

@BTCSRB: Slažem se ali u uslovima hiperinflacije i visoke inflacije kakvu danas imamo u Argentini, Venecueli, Zimbabveu, Libanu, Turskoj itd. sve više ljudi direktno vrši transakcije u kriptovalutama, naročito "stablecoinima" poput USDT Tethera. Priznajem da u tim transakcijama BTC zaostaje upravo zbog volatilnosti ali je vršenje brzih i jeftinih transakcija svakako moguće putem Lightning mreže. Sve te lokalne valute su izgubile značajnu vrednost i prema USDT i prema BTC-u, odnosno BTC konstantno probija rekordnu vrednost kada se denominuje u tim valutama. I u tim državama je adopcija kriptovaluta najraširenija.

HunterVD: Kako valuta u koju se upumpavaju nepostojeci dolari i evri moze biti realna i dobra. A USDT tek da ne spominjem. Mozes uvek revi jer joj ljudi veruju, al ta vera u nesto ide samo do odredjenog nivoa.

@BTCSRB: Godinama kupujem BTC od svake plate, praktično štedim u njemu i kupovna moć mi vremenom raste denominirana u evrima i dinarima. To isto rade na desetine hiljada ljudi širom sveta. Kako su ti realni dinari i evri koje ubacujem svakog meseca koje sam zaradio od svog realnog rada - "nepostojeći"?

Kako dolari i evri koji se štampaju ni iz čega mogu biti realni i dobri kao valuta?

HunterVD: Pa eto bas to. Ulaze se nepostojeci novac u BTC i onda se prica o nekoj novoj valuti. Nije sija nego vrat, BTC ima jedino vrednost dok se upumpava taj lazni novac u njega. FIAT novac kolko tolko nastaje radom i proizvodnjom dobara, ne sav FIAT novac al neki deo, dok se BTC zasniva skroz na upumpavanje tog istog FIAT novca i dobroj volji i zeljama da magicne brojke idu navise.

@BTCSRB: Itekako je moguće izraziti cenu svih ostalih dobara i usluga kroz BTC i postojanje i vrednost BTC-a uopšte ne zavisi od fiat novca. Štaviše, gotova sva dobra i usluge dugoročno postaju jeftiniji kada se mere kroz BTC. Sutra kada bi fiat novac nestao BTC bi i dalje imao vrednost, čak i veću nego danas.

https://www.pricedinbitcoin21.com/

HunterVD: Naravno da je moguce izraziti cene svakodnevnih proizvoda u BTCu. Cene svakodnevnih proizvoda je moguce izraziti u cemu god pozelis, evo npr broj radnih sati koji je potreban da se proizvede taj proizvod i onda se uporedi sa cenom radnih sati i cene na polici, mozes ga uracunavati i u dobrima , jedan iphone kosta tolko i tolko KG juneceg mesa..... nista cudno. Takodje cene proizvoda pokazuju pad u odnosu sa BTCom jer je BTC masivno porastao u poslednjih 5-6 godina. Sta ce biti kad BTC stagnira ili pada kako se u tom periodu odnose cene, a da BTC je store of value i namenjen je samo da se cuva izvinte molim vas moja greska. Ni druge kripto valute nisu nista bolje. Ljudi koji su zaradili na BTCu svaka cast eto imali su pameti i srece , al sad kako je cena sve veca, inflacija sve losija i kamatne stope sve vise postace sve teze i teze dolaziti do novca a kamo li intvestirati ga u nesto rizicno ko kripto valute tako da ce i BTC sve manje rasti sto zbog velicine market cap-a sto zbog toga sto ljudi i firme imaju sve manje novca za ulagati. Dal ce btc moci da se uzbori sa inflacijom i losim uslovima to tek treba da se vidi. Tako da videcemo u narednom periodu koliko ce se ta priva o BTC kao store of value i nacinu odbrane od inflacije obistiniti. Licno ne verujem da ce BTC ikad biti zvanicno sredstvo placanja.

@BTCSRB: Cena svega se može izraziti kroz sve ostalo ali šta od svega toga najbolje vrši funkciju novca? BTC bolje vrši funkciju novca u većini okolnosti od gotovo svih stvari.

Šta će biti sa BTC videće se i oni koji veruju u njega će biti najzaslužniji za njegov uspeh jer su obezbeđivali potražnju kada su kola išla nizbrdo i za to biti asimetrično nagrađeni, ali će i puno izgubiti ako se pokaže da nisu u pravu. Pukovnici ili pokojnici. Po meni je to cilj zbog koga vredi rizikovati, pa i bankrotirati a cilj je da se centralno-bankarski kartel učini manje relevantnim.

Znaš i sam da fiat sistem ne može da preživi i izbegne imploziju bez konstantnog uvećanja mase novca u opticaju i zato se uopšte ne plašim za BTC i spavam mirno. BTC sigurno neće rasti istom brzinom kao prvih 15 godina ali moje očekivanje je svakako ubedljivo nadmašivanje svetske inflacije i obezvređivanja. Ne vidim kako sistem može da opstane bez novog QE kada god se on desi, u suprotnom imamo deflatornu spiralu.

Ne mora da bude zvanično sredstvo plaćanja, dovoljno da meni kao pojedincu služi za to dok god ima ljudi koji ga prihvataju, a ima ih puno. I da niko u tome ne može da nas spreči.

loldurrr: Ali i BTC je postao, u neku ruku, berzanska roba. Imaš market cap izražen u dolarima, koji je danas, npr. 2 triliona $, za mjesec dana 500 milijardi. Isto kao i dolar, samo volatilnije. Zato i kažem, da je to sve rezultat ponude i tražnje. Hipotetički, ja da imam milion BTC i odlučim to danas prodati, enormno ću oboriti cenu BTC. Ako je to valuta nezavisna od vanjskih uticaja - zašto će pasti toliko, kada imamo ograničenu količinu BTC-a. Svima je i dalje u podsvesti vrednost BTC izražena u USD, tako da je to isto kao i dinar, franak, akcija CocaCola i sl. Bar za sada...

A mogućnosti za korištenje BTC za robna plaćanja su mizerna. Ima li na vidiku mogućnosti da se vrednost nafte počne izražavati u BTC?

@BTCSRB: Meriti Bitkoin direktno prema robama i uslugama je itekako moguće i kada ga tako meriš, a ne prema fiat novcu, dugoročno cene gotovo svih roba i usluga padaju prema Bitkoinu. Cene svega izražene kroz BTC neće nestati ni u slučaju nestanka fiat novca, dolar sutra da prestane da postoji nikoga ne sprečava da izražava cene svega kroz BTC. Dolar i ostale valute nisu potrebni Bitkoinu.

Unlikely-Put-5524: Imam samo jedno pitanje za one "koji vide iza svega" i pronikli su bankarsku prevare da porobi čovečanstvo... Kako ne postoji mogućnost da je BTC i kripto nastao iz iste kuhinje i predstavlja ultimativni način za porobljavanje?

2% novčanika poseduje 95% svog BTC-a koji nije izgubljen. Znači da centralizacija može biti maksimalna...

@BTCSRB: Količina BTC-a u posedu ne daje kontrolu nad pravilima protokola i većinski vlasnici ne mogu da štampaju nove novčiće i tako uvećaju konačnu količinu u opticaju. Mogu samo da kratkoročno obore cenu i tako samo ostanu sa manje BTC-a koji imaju pošto će tržište vremenom apsorbovati te dampovane koine.

Unlikely-Put-5524: A mogu i dugoročno da obore cenu. Hajde da kažemo da imaš sada 10 BTC-a gde svaki vredi 40k

Veliki dumpu-ju ceo svoj bag u kontinutitetu kao što sad radi GS i posle godinu dana tvoj BTC sad vredi 4k, zašto misliš da bi ljudi nastavili da ga drže? Posebno ako znamo da ga 97% kupuje da bi zaradili, a ne zato što žele da ga koriste kao sredstvo plaćanja.

Ja bih ore BTC gledao kao commodity, jer sa svojim deflatornim svojstvima ne može biti valuta za plaćanje.

Takođe postoji i doomsday scenario gde jednostavno mogu svi da se dogovore da je ilegalan i to je onda to. Ovo mi deluje kao gotovo neverovatno, ali po meni je bilo koji maksimalizam potpuno detinjasto razmišljanje.

@BTCSRB: Pa padao je toliko puta za preko 70% i uvek se vraćao jer si uvek imao ljude koji su bili spremni da ga kupuju po bilo kojoj ceni, uključujući i mene. Pošto se ne može štampati, na kraju će ovi prodavci ostati bez BTC-a za prodaju i tržište apsorbovati čak i njihov "sell pressure". A ovi veliki koji drže tolike količine itekako dobro znaju vrednost toga što poseduju i nema smisla da svu količinu koju drže prodaju za inflatorni novac - prodavaće da bi finansirali svoj životni stil ili investiraju u biznise ili će ga koristiti kao kolateral za fiat pozajmice - ako raspolažu tolikim količinama i mogu da kontrolišu tržište nemaju strah da će im kolateral biti likvidiran.

Većina ljudi su fiat maksimalisti samim tim što su 100% u fiat novcu pa ne razmišljaju u pravcu doomsday scenarija kakav je upravo bila hiperinflacija devedesetih.

Romeo_y_Cohiba: Niko ti ne brani da ulažeš u bitcoin pod uslovom da znaš da je rizičniji od gotovog novca, štednje po viđenju, oročene štednje, obveznica, nekretnina, akcija, raznoraznih etfova, private equitya i derivata.

Drugim rečima ako ti je ok da danas uložiš 1000e, da za nedelju dana to vredi 500e, za mesec 1500 a za pola godina 300e ili 0 samo napred. Većini ljudi to nije ok.

Razlog zašto pamtimo Avrama je jer njegov dinar i dan danas koristimo. Prethodne uzastopne reforme nisu uspele kao što si i sam primetio.

Takođe, nije u pitanju "centralno-bankarska" prevara jer se ništa od toga ne bi desilo da ovom "odozgo" nisu zatrebale pare za finansiranje izvesnih stvari.

I dan danas, izvesni političar(i) izađu na TV i kažu da su "našli" novac za neki svoj genijalni plan i ljudi to puše. To u prevodu najčešće znači da će da nagna centralnu banku da mu doštampa novca i to nema veze sa bankama nego politikom..

@BTCSRB: Za investicione instrumente koje si naveo treba videti koliko su uspešno nadvladavali inflaciju prethodnih decenija i da li su očuvali kupovnu moć. Za štednju u banci i obveznice se i iz daleka vidi da nisu. US obveznice su u septembru imale drawdown od 48% od ATH iz 2020, a kao važe sa sigurnu investiciju. Čak i u momentu dospeća posle 10-30 godina jako teško čuvaju vrednost od inflacije.

A sada se zapitaj: da li zaista misliš da političari kontrolišu banke i bankare ili je možda obrnuto? Nisu političari ti koji su vlasnici krupnog kapitala.

Romeo_y_Cohiba: Ne investiraju svi na 10-30 godina za potrebe penzije. To je samo jedan od mnogo vidova i razloga investiranja. Nadvladavanje inflacije je isto tako samo jedan od kriterijuma. Samo pogledaš u šta jedan penzioni fond u SAD-u investira(hint: nije btc i nisu samo akcije). Npr. neki penzioni fondovi su od skoro počeli da investiraju u private equity ali isključivo do 15% veličine portfolija. Počeće i sa kriptom u nekom trenutku ali mogu da potpišem da će biti u još manjem procentu nego PE. Niko nije blesav da grune teško stečeni novac u nešto tako rizično osim u jako malim iznosima.

Ne znam ko koga kontroliše ali Avram je bio daleko manji baja od Slobe 90ih i pitao se za stvari samo u meri koliko mu je bio dozvoljeno da se pita. Ratovanje košta i finansira se štampanjem novca, nisu to neke neshvatljive stvari. Da ne pričam da smo bili pod apsolutnim sankcijama celog sveta.

Virtual_Plenty_6047: Npr jedan od velikih uspeha Japana od pre par decenija je zahvaljujući devalvaciji njihove valute, pa samim tim izvoz im je bio relativno jeftin. Naš dinar je jak, i to odgovara uvozničkom lobiju.

Nažalost mi ionako ništa ne proizvodimo tako da ne verujem da bi nešto pomoglo ako bi devalvirali dinar. Al svakako ovo je jedna viša ekonomija za koju naši političari nisu dorasli.

@BTCSRB: Gde je običan čovek u tom velikom japanskom uspehu? Postali su zemlja starih i nesrećnih mladih ljudi koji ne mogu da pobegnu iz "hamster wheel-a". Imaju "debt to GDP" od preko 260%. Taj dug nikada neće vratiti, a uz to će povući u ambis pola sveta jer najveći držaoci američkog duga - 14.5%. Spolja gladac, iznutra jadac. Iako je malo degutantno da mi iz Srbije komentarišemo Japance, opet pitam: gde je prosečan Japanac u celoj ovoj igri?

Why Japan Is Facing a Financial Disaster

Preporučujem da pogledate dokumentarac "Princes of the Yen | The Hidden Power of Central Banks" snimljenom po istoimenoj knjizi profesora Riharda Vernera koji je otac kvantitativnog popuštanja (quantitative easing) i ekspert za japansku ekonomiju i bankarski sistem.

Virtual_Plenty_6047: Zato sam rekao od pre nekoliko decenija. Jer su do pre nekih 30 godina bili 50 godina ispred celog sveta, sad su 20 godina iza naprednog sveta. Japanci su svako specifični. Poenta mog komentara da postoji razlog za neke zemlje da oslabe svoju valutu, i može itekako dobro da radi ako se radi u sinergiji sa nekim drugim ekonomskim merama. Tako da odgovor na to opet pitam, ne znam gde je prosečni Japanac, uskoro tamo trebam da idem pa ću ti reći. :'D

Odgledao sam ja ovaj dokumentarac odavno, super je. Pročitao mnoge knjige, a ponajviše od Austrijske ekonomske škole gde su pojedinci (Hayek) bili prvi koji su zagovarali novu decentralizovanu valutu, bili su u toj školi mnogi koji su prvi pričali o problemu inflacije i šta je tačno inflacija, ali su bili i za kapitalizam. Ali ovo je zaista jedna visoka ekonomija, videćeš da nije baš sve tako jednostavno kao što misliš.

Malo si previše u kriptovalutama pa gledaš na sve drugo u ekonomiji sa prekorom, pogotovu na kapitalizam. Evo i ja sam sam dobro investiran u kripto (uglavnom u BTC) pa sam itekako svestan da sve to može na kraju da bude potpuna pizdarija.

p.s. Knjiga za preporuku: 23 stvari koje vam ne kazu o kapitalizmu

@BTCSRB: Nisam u kriptovalutama nego isključivo u BTC.

Nisam ja protiv kapitalizma samo što nije pravi kapitalizam kada ne postoji slobodno tržište novca, pa samim tim ne postoji uopšte slobodno tržište koliko god se činilo tako. Kada su ekonomski subjekti prisiljeni da koriste određeni oblik novca, a monetarna politika se centralno planira - po meni tu nema slobodnog tržišta niti kapitalizma. Npr. formiranje cene Bitkoina i transakcionih naknada je čisto slobodno tržište jer tu nema "bailout-a", a BTC mining industrija je pravi primer slobodnog tržišta u kapitalizmu. Čista ponuda i potražnja bez intervencionizma. Ako si neprofitabilan nema ti spasa i bankrotiraćeš i nema nikoga ko će ti priteći u pomoć. Niko nije "too big to fail".

Znam da sam se ovde usredsredio usko na jednu industriju ali se može primeniti na celokupnu ekonomiju. Države i centralne banke su suvišne i apsolutno pokvare sve čega se dotaknu pa će u slučaju potpune pizdarije odgovornost biti na njima, a ne na Bitkoinu i njegovim držaocima.

kutija_keksa: Evo zašto btc nije pogodan kao valuta:

-Volatilna vrednost. Vrednost btc se menja i do 200% godišnje, dok dolar ne trpi inflaciju vecu od 10% godišnje (mada je u redovnim uslovima tipa 3%). Čak i dinar, ako gledaš realnu kupovnu moć u prodavnici nema volatilnost preko 30% na godišnjem nivou (jedno 7 puta nižu od BTC) Ako danas kupim BTC u vrednosti od 15 USD ne znam da li ću sutra moći da kupim 10 ili 20 USD za isti taj BTC.

-„Gas fees” koji se plaćaju na svaku transakciju, u poređenjusa kešom koji nema takvih problema.

-Spor transfer novca. Arhitektura blockchaina ne dozvoljava mreži da procesuira više od 10 transakcija po sekundi, što značida na transakciju možete čekati i po nekoloo sati, u poređenju sa kešom (bez odugovlačenja) ili debitnim karticama (10 sekundi do 10 minuta). Visa i MasterCard procesuiraju hiljadu puta više transakcija po sekundi.

-Retko ko eksplicitno prima BTC, tako da ćete plaćati menjačnici na kursu u oba smera, i pritom čekati menjačnicu.

-Podložan je manipulacijama velikih igrača poput Ilona Maska i velikih banki koje su u zadnjih pet godina debelo uložile u kripto. Fiat je na milosti države i njenih građana, dok je BTC na milost privatnih investitora. Kome verujete više?

-SVE BTC transakcije su jsvne, ako neko zna koji novčanik je vaš lako zna i koliko para ste kada slali kome, dok fizičke novčanice nemaju taj problem.

-Vrednost i upotreljivost BTC ne garantuje niko, dok vrednost i upotrebljivost fiat valute barem donekle garantuje država. Na primer, Srbija garantuje da je dinar upotrebljiv jer zahteva da vodu, struju, poreze, namete i takse plaćaš u dinarima, a i javni sektor (10% čitavog stanovništva) isplaćuje isključivo u dinarima.

OP očigledno ima jako ostrašćenu ideološku perspektivu... Ja nisam stručnjak, ali je moj otac pisao naučne radove o blockchainu dok je bio na doktorskim studijama, još kad je pomisao o BTC vrednijem od sto dolada bila smešna, tako da znam nešto malo kroz priče sa njim. Uostalom, sve o čemu pričam lako je proveriti pomoću javnih podataka. Ono što OP piše je jednim delom tačno, ali su iznete samo one informacije koje idu u prilog BTC.

Kripto kao pobuna protiv fiata, centralnih banaka i vlada je imao ideološke korene kod anarhista na internetu devedestih, međutim od njihovih belih papira i špekulacija dobili smo nešto što je kao valuta beskorisno. BTC može biti investicija, ako su ljudi iskreni sa sobom, ali ideja o valuti je prevaziđena. Ako i neka kripto valuta drži do toga onda je to Monero koji bar ima anonimnost.

@BTCSRB: Ne ulazeći u sve iznete navode taksativno, ipak moram da prokomentarišem neke od nepreciznih ili netačnih navoda.

Transakcione naknade kod Bitkoina se ne zovu "gas fees" već "transaction fees". Kod keša nema takvih problema ali ga ne možete poslati putem komunikacionog kanala bez posrednika. To mora da ima svoju cenu pošto BTC majneri moraju da imaju neki podsticaj da uključe nečiju transakciju u blok koji je ograničene veličine. BTC "fee market" je najslobodnije tržište na svetu. Fiat novac nemate mogućnost da pošaljete na daljinu bez posrednika koji takođe naplaćuje nekada dosta skupe naknade.

Besmisleno je porediti blokčejn kao "settlement layer" sa Visom i Mastercardom koje ne služe za finalno poravnanje. Glavni Bitkoin blokčejn se može pre uporediti s SWIFT-om ili FedWire-om kod kojih je jednom poravnata transakcija nepovratna, a Mastercard/Visa sa BTC "Lightning Network-om" koji služi za brza i jeftina plaćanja. Otac je trebalo da Vas nauči o Lightning mreži, kako funkcioniše i da je sposobna da procesuira više miliona transakcija u sekundi. Lightning mreža takođe nudi veći nivo privatnosti od glavnog blokčejna ali puno manju sigurnost.

Ne bih se složio da je fiat na milosti isključivo države i građana, samo ću spomenuti Crnu sredu iz septembra 1992. godine i spekulativni napad na britansku funtu.

BTC transakcije su javne ali su pseudonimne što znači da je jako teško utvrditi identitet ukoliko adresa nije povezana sa identitetom korisnika. Generisanje BTC adrese ne zahteva nikakvu identifikaciju ("krvnu sliku") za razliku od otvaranja bankovnog računa. Može se generisati neograničen broj adresa i na razne načine prekinuti i zamaskirati veza transakcija između njih radi očuvanja privatnosti. Ponovo, fizičke novčanice ne možemo slati putem komunikacionog kanala bez posrednika, podložne su konfiskaciji, uništenju i obezvređivanju.

Upotrebljivost Bitkoina garantuje "open source" kod, energija, matematika i kriptografija. To su mnogo jače garancije nego obećanja bilo koje države koja su toliko puta u istoriji izigrale poverenje sopstvenog stanovništva - poput Jugoslavije devedesetih.

Ja sam BTC spomenuo kao potencijalno rešenje za (hiper)inflaciju tek u kraćem delu na kraju teksta, a od Vas i od ostalih komentatora sam dobio nesrazmeran odgovor usmeren na Bitkoin, a puno manje usmeren na navode iz najvećeg dela posta.

Tako ste i vi izneli isključivo informacije koje ne idu u prilog BTC-a, a potpuno ignorisali sve očigledne nedostatke fiat novca (kako u fizičkom, tako i u digitalnom obliku) koji su se i ispoljili tokom hiperinflacije devedesetih, a ispoljavaju se i dan-danas.

Svako dobro!

kutija_keksa: Zato su i „Gas fees” pod navodnicima.

Ne vidim zašto bi bilo dobro imati „slobodno tržište” kada se radi o kopačima.

Ali, čak i da je dobro imati slobodno tržište, morate primetiti da BTC kopanje nije tako slobodno. Postojanje ASIC mašina znači da se kopanje prevashodno isplati velikim igračima (ne mislim na likove sa 3 riser kartice u PC, nego na kineze sa skladištima teških preko milion u opremi). Takođe, te velike operacije organi vlasti mogu zaustaviti kad im se prohte (Kina).

Jako je teško izvući BTC anonimno bez gubitka kod menjača -- pojedinca ili non KYC institucije.

Što se upotrebljivosti BTC tiče, šta meni garantuje da ću imati na šta da potrošim BTC? To je ključno pitanje. A kasa Jugoslovenski fiat nije bio upotebljiv, vidim da Nemački jeste. Isto tako, mislim da će USD biti upotrebljiv dugo, a kada USD bude neupotrebljiv društvo će ionako biti u apokalipsi gde papir nije važan koliko i hrana, utočište, voda, radio, municija, lekovi i vatreno oružje.

Naravno da iznosim samo informacije koje proizilaze iz nedostataka, to je balans postu i komentarima. Da su ljudi samo blatili kripto moj komentar bi mnogo više ličio na originalni post nego na moj prošli komentar. Ja se sa mnogim tvrdnjama u postu slažem delimično ili potpuno, samo želim da pružim kontekst za tumačenje toga.

Ideološki su mi Cryptopunks potpuno zanimljivi, ali cinizam je opravdan kada se u obzir uzme priča. Ljudi su želeli da se odupru bankama, vladama, kontroli i prismotri. Izmislili su tehnologiju. Počeli su da koriste i popularizuju tu tehnologiju. U prostor su ušle banke i vlade, kupovanjem, prodajom i praćenjem samog tržišta (danas sve velike menjačnice imaju KYC procedure). Kao u matriksu, kontrolisana opozicija. Ok, ovo je lična teorija zavere u koju ni ja ne verujem u potpunosti.

Ako govorimo o crypto kao valuti mislim da je XMR mnogo bolja VALUTA od BTC, dok je mnogo gora investicija. Jednostavno se slažem sa političkim i ideološkim ciljevima pionira kripto valuta, ali smatram da su oni ogromnim delom iznevereni zbog ulaska banaka i država u celu priču, te njihova stara rešenja više ne rešavaju originalne probleme.

@BTCSRB: BTC kao neutralni novac je za svakoga, pa i za bankare i države. Ne možemo ih sprečiti da ga kupe na tržištu i stave ga u kakav god instrument, pa i ETF. Ne možemo ih sprečiti da ga konfiskuju od onih koji nisu dobro obezbedili svoje ključeve. Države su regulisale ono što su mogle, poput menjačnica, kroz AML/KYC procedure ali kakve to veze ima sa BTC-om? Na protokol kao protokol nisu mogle da utiču.

Ko želi i dalje može koristiti BTC kako je i prvobitno predviđeno - za p2p transakcije i skladištenje vrednosti u "self custody-u". Bitkoin je i dalje "bearer asset" otporan na cenzuru i konfiskaciju. Ne vidim da je taj pravac promenjen samo zato što su ušle banke i države. Možda nije u duhu Bitkoina da ga kupuju fondovi pa ga prodaju upakovanog u ETF. Najmanje je u duhu bitkoina da se nekome zabrani da ga kupuje.

Kako to mislite "ne vidite zašto bi bilo dobro imati „slobodno tržište” kada se radi o kopačima? Na decentralizaciji mininga se radi (StratumV2 protkol, Ocean pool...), a kineski primer je samo pokazatelj koliko je otporno: nakon zabrane raširilo se dodatno po svetu, a u Kini se i dalje nalazi 21% hešrejta. Majneri imaju veoma male margine profita zbog same prirode rudarenja i halvinga pa će bilo kakav "fck around" poput cenzure transakcija verovatno značiti bankrot.

Možemo do sutra pričati o XMR vs BTC i navešću puno razloga zašto XMR ne može i neće zaživeti kao novac, a pre svega je manjak decentralizacije (neograničena veličina blokčejna) i otpornost na državni napad - sve što Bitkoin ima. Kada je novac u pitanju pobednik nosi sve i tu je Monero već izgubio, dok će BTC poboljšanu privatnost obezbediti na ostalim nivoima, sidechainovima itd (Lightning, Liquid, Cashu, Fedimint, Ark i ko zna šta sve što još i ne postoji - nivo developmenta u Bitkoin prostoru je ogroman).

Dolar će uvek u nekom obliku biti upotrebljiv ali ne znači da će zauvek ostati svetska rezervna valuta, kao što i danas postoji funta ali odavno nije više ono što je bila na vrhuncu Britanske imperije.

kutija_keksa: Pa ti protokoli sprečavaju pljude da anonimno kupe BTC.

Mislim, BTC realno ima neku primenu, ali ja ga danas npr. imam čisto kao neku malu investicijicu, i to još od doba kad je kopanje sa 2 grafičke u kućnom PC bilo isplativo po skupoj struji. Ali BTC prosto nije dobra alternativa fizičkom novcu na nivou države zbog volatilnosti i manjka kontrole. Jedna ogromna poluga države je puštanje u promet novog novca, i tako se kontroliše inflacija, pored menjanja kamatnih stopa. Bez mogućnosti štampe gubi se i taj faktor kontrole. A inflacija od 2-3% godišnje je zdrava, dok je za ekonomiju deflacija (kojoj je BTC bar delimično sklon) haos, jer smanjuje ekonomsku aktivnost i investicije...

Što se tiče državnog napada na XMR, misliš na to kako jedna država može da realistično sprovede 51% napad?

XMR nije vrhovna valuta ali meni se sviđa kako za njega nema ASIC mašina, kako je anoniman u smislu da ne možeš lako da provališ ko kome koliko i kada šalje šta... Mislim da će XMR sigurno u toj privacy niši zameniti neka druga valuta kroz 10-15 godina koja ima bolji algoritam i tehnologiju...

Dobra dosetka za veličinu blockchaina, ali ona je trenutno 160GB cela / 50 GB pruned, tako nešto. Sve dok nije preko 10TB (100x) veća može je pohraniti najveći hard disk namenjen „običnim ljudima”, a kad se dođe do tad verovatno će i cene tih diskova biti pristupačnije nego danas. Sa druge strane, agresivan pruning je takođe opcija. A da ne govorimo o sidechainovima koji takođe postoje za XMR.

Da, to za dolar je i moja poenta, nekako će biti upotrebljiv uvek, dok je kripto neupotrebljiv bez neta, a i nema mnogo šta da se kupi kriptom u poređenju sa fiatom. I

@BTCSRB: Ima bezbroj načina da se nabavi non-KYC Bitkoin: coinjoin, coinmixing, rudarenje u non-KYC pulu, nabavka nekog drugog kripta putem KYC menjačnice pa "trustless atomic swap" za BTC, nabavka KYC BTC-a putem Lightning-a pa "submarine swap" on-chain, zatim nabavka bilo kog KYC kripta ili Lightning ili on-chain BTC-a pa swap na sidechain Liquid BTC gde su transakcije tajne slično XMR-u i nazad swap na on-chain. Naravno i stara narodska razmena na ulici. XMR se isto može koristiti za svrhu nabavke non-KYC Bitkoina. U svim ovim slučajevima se adrese koje su krajnje destinacije tih sredstava ne mogu ili jako teško povezati sa KYC identitetom korisnika. Više na: kycnot.me

Diskusija o tome da li je zdrava i potrebna inflacija i da li je uopšte potreban državni intervencionizam u ekonomiji je stara diskusija između Kejnzijanske i Austrijske ekonomske škole. Po meni svaka inflacija je pljačka. Da ne govorimo da centralni bankari ne snose nikakvu odgovornost za gubitak kontrole nad inflacijom koji se meri u stotinama procenata "omaška" jer kada je ciljana inflacija 2%, a imamo inflaciju od 10% to je onda promašaj od 500%. A svi vodeći centralni bankari su i dalje na svojim funkcijama od početka inflacije negde 2020. godine iako su izneverili sva očekivanja. Nisu izabrani od strane naroda i nemoguće ih je smeniti od strane naroda, a utiču na živote svih!

Usled tehnološkog napretka i rasta produktivnosti, prirodno stanje slobodnog tržišta je pad cena, a ne njihov konstantan rast kroz inflaciju. Ne postoji nikakva "poželjna" ili "neophodna" inflacija, svaka "ciljana" inflacija je pljačka koji onemogućava populaciju da uživa u plodovima sopstvene produktivnosti u obliku nižih cena svih roba i usluga. Bitkoin zbog svoje fiksne ponude novca u opticaju (21 milion novčića = apsolutna digitalna oskudnost) nameće ovu disciplinu slobodnog tržišta i tehnološkog napretka. Dok je postojeći dužnički fiat sistem dizajniran da krade plodove produktivnosti, Bitkoin omogućava populaciji da ih zadrži u obliku nižih cena.

Kada nema rasta cena, inflacija je 0% i cene su stabilne. Krađa i tada postoji, jer cene prirodno padaju zbog povećanja efikasnosti proizvodnje/usluga, gde bi se tada veca količina robe/usluga, takmičila za istu (fiksnu) količinu novča od 21M BTC-a.

Kakav je ishod ove diskusije nije bitno, bitno je da sada svako ima slobodu izbora kakav novac želi da koristi a ne da bude prisiljen da koristi isključivo inflatorni novac. Ako se neko ne slaže sa modernom monetarnom teorijom, sada ima alternativu koju nekada nije imao (zlato je odavno izgubilo bitku sa MMT) pre postojanja Bitkoina.

kutija_keksa: Neki od ovih non kyc nacina su mi vec bili poznati, neki nisu, ovo je bas informativan komentar.

A što je inflacija pljačka? Bez obzira na inflaciju, broj novčanica u novčaniku ostaje isti, to što se one sada mogu zameniti za manje robe je druga priča. Da li je onda i zlato pljačka, jer neko kupi, na primer, 100g zlata danas, a sutra na tržištu cena zlata padne? Da li je onda pljačka i BTC, jer i danas i kad je BTC bio na vrhuncu cene imam isti broj satoshija, samo je danas njihova vrednost manja?

Ne vidim zašto bi centralni bankari snosili odgovornost zbog inflacije. Oni ugrobo imaju dve poluge za kontrolu inflacije: kamatne stope i štampanje novca. U realnosti na inflaciju utiče mnogo faktora na koje centralna banka nema uticaj, niti koje može da predvidi: pandemije, ratovi, državni budžeti i zaduživanja, trgovina u datoj valuti (i izvoz i uvoz), porast i pad produktivnosti... Oni imaju donekle uticaj, ali nisu svemoćni.

Što se tiče izbora, ovo već zalazi u politiku a ne u finansije, ali ni direktor pošte, ni direktor EPS, ni direktor vodovoda nisu birani na izborima na kojima glasaju svi, a utiču na živote svih!

Ne verujem u kripto kao spasioce kapitalizma ili pojedinca. Ovo je sada više politički, ali zaista mislim da u kapitalizmu prosečna osoba nema slobode, a da je kripto u najbolju ruku jedna mala stavka koja omogućava skladištenje stečenog kapitala (ovo se dobija ako prihvatimo sve kripto pozitivne teze), ali ne rešava problem radnika koji čine 95% društva i doprinose 99% vrednosti a kapitala kontrolišu višestruko manje.

Otkud znam, ono, da rezimiram: kripto je koristan alat koji još nije dostigao svoj vrhunac, ali neće nešto mnogo promeniti svet. To je neko moje viđenje.

@BTCSRB: Kako nije pljačka? Broj novčanica u novčaniku ostaje isti ali ukupan broj novca u opticaju se uvećava i tako obezvređuje tvoje novčanice. Inače, znaš vrlo dobro da fizički keš čini manje od 10% ukupnog novca u opticaju, a ostalo je digitalno. Dakle "money supply" se uvećava pritiskom na dugme tastature računara u FED/ECB/NBS... Neko stvara novac ni iz čega za koji svi moramo da radimo trošeći svoje dragoceno i ograničeno vreme na ovom svetu. Tako nam efektivno krade vreme pošto tvoj radni sat iz prošlosti konstantno može da kupi manje roba i usluga u budućnosti, a zbog tehnološkog napretka i rasta produktivnosti bi realno cene trebaju da budu niže vremenom

Kako možeš da porediš fiat, zlato i BTC u tom smislu? Vrednost fiata prevashodno smanjuje ljudska manipulacija sa strane ponude koja se uvek uvećava, dok je potražnja permanentno rastuća zbog zakona o "legal tenderu" i rasta privrede i broja stanovnika. Ovo sa BTC je strana potražnje koju reguliše slobodno tržište dok ukupna ponuda nije podložna ljudskoj manipulaciji. Dugoročno, vrednost zlata i BTC raste sa rastućom potražnjom jer nema manipulacije ponude.

Centralni bankari će optužiti sve druge faktore da bi skrenuli pažnju sa svoje odgovornosti za inflaciju, a za ratove se može reći da su čak i saučesnici pošto tokovi novca mogu utvrditi veoma zanimljivu vezu između njih i vojno-industrijskog kompleksa. Na stranu to, dolarska monetarna masa je samo između februara i aprila 2020. uvećana za 1.39 biliona/triliona što je više nego ukupna monetarna masa iz 2008-09 krize. U krizi 2008-09 su od septembra 2008. do januara 2009. naštampali 803 milijarde i tako uvećali monetarnu masu za 88% sa 909 milijardi na 1712 milijardi - to znači da su 4 meseca naštampali skoro isto novca kao tokom celih 95 prethodnig godina sopstvenog postojanja Federalnih rezervi. Te 2020. su i potpuno ukinuli obavezne rezerve u komercijalnim bankama.

ECB je naštampala 1T evra "zbog kovida". A kao naštampali su jer je bila zatvorena celokupna privreda, pa što ste tako agresivno zatvarali privredu - trebalo je da pustite ljude da rade a ne da se igrate Mao Ce Tunga. I uprkos nezapamćenom štampanju ti isti centralni bankari su nazivali inflaciju "prolaznom" - dakle ni zrnce odgovornosti.

Ako u kapitalizmu prosečna osoba nema slobode, šta reći za komunizam gde ne da nema slobode nego nema ni života pošto su komunistički režimi pobili na desetine miliona ljudi?

Na hipotetičkom BTC standardu zbog fiksne količine novca u opticaju bi se popravio položaj radnika jer kapitalisti ne mogu da beskonačno uvećavaju svoj BTC kapital i kupovna moć i radnika i kapitalista bi procentualno podjednako rasla i običan radnik bi imao mnogo bolje šanse da i sam postane kapitalista nego danas. Imao bi mogućnost da štedi od svoje plate jer mu novac ne bi gubio vrednost i u nekom trenutku bi iz svoje štednje finansirao neki biznis, a ne zaduživanjem. Tako bi se ravnomernije rasporedilo društveno bogatstvo ali ne centralnim planiranjem nego kroz slobodno tržište.

-

@ 3283ef81:0a531a33

2025-05-24 18:12:47

@ 3283ef81:0a531a33

2025-05-24 18:12:47Lorem ipsum dolor sit amet, consectetur adipiscing elit\ enean magna lorem, dignissim et nisl a, iaculis eleifend dolor

uspendisse potenti

-

@ 0e9491aa:ef2adadf

2025-05-24 18:01:14

@ 0e9491aa:ef2adadf

2025-05-24 18:01:14

Humanity's Natural State Is Chaos

Without order there is chaos. Humans competing with each other for scarce resources naturally leads to conflict until one group achieves significant power and instates a "monopoly on violence."Power Brings Stability

Power has always been the key means to achieve stability in societies. Centralized power can be incredibly effective in addressing issues such as crime, poverty, and social unrest efficiently. Unfortunately this power is often abused and corrupted.Centralized Power Breeds Tyranny

Centralized power often leads to tyrannical rule. When a select few individuals hold control over a society, they tend to become corrupted. Centralized power structures often lack accountability and transparency, and rely too heavily on trust.Distributed Power Cultivates Freedom

New technology that empowers individuals provide us the ability to rebuild societies from the bottom up. Strong individuals that can defend and provide for themselves will help build strong local communities on a similar foundation. The result is power being distributed throughout society rather than held by a select few.In the short term, relying on trust and centralized power is an easy answer to mitigating chaos, but freedom tech tools provide us the ability to build on top of much stronger distributed foundations that provide stability while also cultivating individual freedom.

The solution starts with us. Empower yourself. Empower others. A grassroots freedom tech movement scaling one person at a time.

If you found this post helpful support my work with bitcoin.

-

@ 8bad92c3:ca714aa5

2025-05-24 18:01:02

@ 8bad92c3:ca714aa5

2025-05-24 18:01:02Key Takeaways

Lyn Alden unpacks the complex interplay of global trade imbalances, the dollar’s entrenched reserve currency status, and America’s eroded industrial base, arguing that aggressive tariffs under Trump have backfired by hurting U.S. businesses without reversing decades of offshoring. She illustrates how China has rapidly ascended the value chain, dominating key industries and making it nearly impossible for the U.S. to build a trade coalition against them. Despite the U.S.’s massive debt and persistent global demand for dollars, cracks are forming in the system as nations explore alternative payment systems and neutral reserve assets like gold and Bitcoin. Lyn emphasizes that Bitcoin’s most effective path to integration is through grassroots and corporate adoption, not government-led initiatives, and warns that unless the U.S. urgently scales its energy and industrial capacity, it risks falling further behind China’s unmatched pace of growth and infrastructure dominance.

Best Quotes

- "The trade deficit is often described as us sending out pieces of paper and getting goods and services, which sounds like a really good deal."

- "It's better to correct these imbalances from a position of strength, not weakness."

- "All that debt creates inflexible demand for dollars. There’s literally way more demand than dollars in the system."

- "China became the largest auto exporter in the world in just four years."

- "Bitcoin isn’t changing to fit into the global financial system. The global financial system is changing to fit Bitcoin."

- "Individuals, small businesses, corporations—these are the real drivers of Bitcoin adoption. Not governments."

Conclusion

This episode offers a sobering look at America’s trade and currency dilemmas, with Lyn Alden explaining why quick policy fixes like tariffs can’t reverse decades of deindustrialization tied to the dollar’s reserve status. She highlights the rise of neutral reserve assets like gold and Bitcoin as important hedges, stressing that grassroots and corporate adoption will be more effective than government-led efforts. Lyn also warns that without a major push to expand energy production, the U.S. risks falling behind in an AI-driven, hardware-centric world, urging strategic humility and innovation to navigate the shifting global order.

Timestamps

0:00 - Intro

0:31 - Triffin's dilemma

8:10 - Debt leverage

11:04 - Fold & Bitkey

12:41 - Trump's goals and tariff policy

19:54 - Unchained

20:24 - China is not weak

30:07 - Energy

37:15 - AI/robots

41:11 - SBR

48:47 - Bitcoin credit products

52:40 - Eventful week for bitcoinTranscript

(00:00) They ramped up tariffs super high, super quickly. In many cases, were so high that they hurt us as much as some of our trade adversaries. China has ramped up to like unfathomable degrees. Nuclear, solar, pretty much everything that they can throw money at they're building. The trade is often described as us sending out pieces of paper and getting goods and services, which sounds like a really good deal.

(00:19) They take those slips of paper and then they buy our stocks. They buy our corporate bonds and government bonds. And so they end up owning a larger and larger share of corporate America. got the headphone hair. I'm all out of whack, Lynn. It's been a long week here in Austin. Yeah, I can imagine. It's been a long time since we've talked on the show. It's been two years.

(00:41) I was checking, which is a astonishing to me. But no better time than now. Uh I think quite literally based off of all the conversations we've had uh over the years. I mean, your famous saying, nothing stops this train. I think we're coming to a juncture where that's becoming abundantly clear. and you wrote uh a newsletter earlier this week, I believe you sent it out Sunday, that basically highlighted the crux of the problem, which is the dollar reserve status and the almost impossible task that Trump would like to accomplish, but

(01:21) likely isn't the case, which is sort of solving Triffin's dilemma of reshoring manufacturing while keeping US dollar dominance. So I think diving into this from first principles would be great. Sure. Yeah. And that's that's the um I can imagine the administration's challenge of trying to communicate this because uh the intricacies of how trade deficits and the reserve currency kind of pair together is very wonkish.

(01:46) It it kind of has this like academic quality to it that doesn't go over well uh in kind of political oriented speeches. Um like I would I would be terrible at a political rally for example when I try to explain any of this. Um and so we kind of have this situation where um and this was outlined back during the Breton Wood system by Triffin as you mentioned uh which is that having the reserve currency does come with a bunch of benefits um you know historically called a extraordin uh exorbitant privilege um but then it has certain costs to

(02:15) maintain it and those costs can vary a bit depending on how the system structure. So for example back in the Bretton Woods era the cost was that we kept draining our gold reserves. uh we basically had to kind of keep paying out our go gold gold reserves to maintain that part of the system and in the current formation uh instead we kind of pay for it with our industrial base.

(02:36) We keep kind of sending out little parts of our industrial base over time to maintain the the global reserve currency status. And there's a few reasons for that. One is that um because unlike every other fiat currency, the dollar has all these extra demands for it by countries all around the world. um all these different purposes.

(02:55) um there's this extra demand for dollars which sounds good on the surface and as for Americans for example we have tons of import power when we go on vacations to the rest of the world it's you know we have pretty strong purchasing power compared to when they come to the US um these things seem good on the surface but it also means that it's pretty expensive to manufacture lower margin things here at home uh and so we have this kind of situation where our imports are very strong our exports uh especially lower margin stuff is less uh

(03:22) competitive whereas we can still be competitive competitive on really high margin stuff, you know, technology, finance, healthcare, that kind of thing. Um, and then the other aspect is that even if you could somehow solve that, there's the more fundamental problem, which is that the whole world needs dollars uh for the you know, global reserve currency status to use it for international contract pricing, crossber financing, one side of every trade pair that they do, all these different purposes as a reserve asset. Um uh and

(03:51) when you step back and say, "Well, how do they get all those dollars if they're all using dollars? How did all those dollars get out there?" And the answer is trade deficits. Um basically that overvalued aspect forces open the US trade deficit. And every year we send out hundreds of billions or sometimes a trillion dollars in net outflows.

(04:10) And over years and decades, these have accumulated out there. And so, uh, kind of the way it works is that if you want to fix the trade deficit, which I've been I've been writing about since 2019, I think that's a I think that's a valid mandate to do. Um, unfortunately does come with trade-offs.

(04:26) Uh, some of the some of the benefits that that you know that we enjoy at the cost of the trade deficit. Um, if you do want to kind of fix that imbalance, it comes up, you know, with with basically giving away at least some of those benefits and prioritizing that that industrial base a bit more. And one of the dynamics that you highlighted in your newsletter, which makes sense, but wasn't very clear to me before, is that via these deficits, we flood international markets with dollars because we're sending parts of our industrial base over there. But then

(05:00) it's like cyclical. They take those dollars and then reinvest them in US financial assets. So it has this sort of flow where it goes out but then it comes back in into the financialized economy via equities and real estate and other such assets and that is good for asset owners here in the United States.

(05:19) But again I think that's is part of the bag of mandate is that sort of cycle has led to this large wealth gap in the United States that they're trying to fix. Yeah. Exactly. Um and so basically the opposite side of a current account deficit which is basically so the trade deficit plus things like interest and dividends.

(05:39) Um so we run a structural current account deficit and the opposite side of that is a capital account surplus. Um which is that funds flow in the rest of the world and buy our financial assets. Uh and so it's the the trade deficit is often described as us sending out pieces of paper and getting goods and services which sounds like a really good deal.

(05:57) Um but then the extra step of that that you mentioned is that they take those slips of paper or really those electronic digits that they have and then they buy our stocks, they buy our real estate, they buy our private equity, they they buy our corporate bonds and government bonds and so they end up owning a larger and larger share of corporate America as part of their kind of accumulated uh trade surpluses uh and reserve assets and uh international private assets.

(06:22) Um, and the kind of the consequence of this, if you kind of like view the foreign sector as an intermediary, we're basically constantly kind of taking economic vibrancy out of, you know, Michigan and Ohio and, uh, you know, rural Pennsylvania where the steel m -

@ bf47c19e:c3d2573b

2025-05-24 17:11:28

@ bf47c19e:c3d2573b

2025-05-24 17:11:28Originalni tekst na bitcoin-balkan.com.

Pregled sadržaja

- Odakle Potiče Bitcoin?

- Koje Probleme Rešava Bitcoin?

- Kako se Bitcoin razvijao u poslednjoj deceniji?

Bitcoin je peer to peer elektronski keš, novi oblik digitalnog novca koji se može prenositi između ljudi ili računara, bez potrebe za učestvovanjem pouzdanog posrednika (kao što je banka) i čije izdavanje nije pod kontrolom nijedne stranke.

Zamislite papirni dolar ili metalni novčić. Kad taj novac date drugoj osobi, ona ne mora da zna ko ste vi.

On samo treba da veruju da novac koji dobiju od vas nije falsifikat. Obično, proveravanje falsifikata „fizičkog“ novca, ljudi rade koristeći samo oči i prste ili koristeći specijalnu opremu za testiranje ukoliko se radi o značajnijoj sumi novca.

Većina plaćanja u našem digitalnom društvu vrši se putem Interneta korišćenjem neke posredničke usluge: kompanije za izdavanje kreditnih kartica poput Visa, snabdevača digitalnih plaćanja kao što je PayPal ili Apple Pay ili mrežne platforme poput WeChat u Kini.

Kretanje ka digitalnom plaćanju sa sobom donosi oslanjanje na nekog centralnog aktera koji mora odobriti i verifikovati svaku uplatu.

Priroda novca se promenila od fizičkog predmeta koji možete da nosite, prenesete i autentifikujete do digitalnih bitova koje mora da čuva i verifikuje treća strana koja kontroliše njihov prenos.

Odricanjem od gotovine u korist „udobnih“ digitalnih plaćanja, mi takođe stvaramo sistem u kome dajemo ogromna ovlašćenja onima koji bi poželeli da nas tlače.

Platforme za digitalno plaćanje postale su osnova distopijskih autoritarnih metoda kontrole, poput onih koje kineska vlada koristi za nadgledanje disidenata i sprečava građane, čije ponašanje im se ne svidja, da kupuju robu i plaćaju usluge.

Bitcoin nudi alternativu centralno kontrolisanom digitalnom novcu sa sistemom koji nam vraća prirodu korišćenja keša – čovek čoveku, ali u digitalnom obliku.

Bitcoin je digitalno sredstvo koje se izdaje i prenosi preko mreže međusobno povezanih računara, od koji svaki od njih samostalno potvrđuje da svi ostali igraju po pravilima.

Bitcoin Mreža

Odakle Potiče Bitcoin?

Bitcoin je izumela osoba ili grupa poznata pod pseudonimom Satoshi Nakamoto, oko 2008. godine.

Niko ne zna Satoshijev identitet, a koliko znamo, oni su nestali i o njima se godinama ništa nije čulo.

11.februara 2009. godine, Satoshi je pisao o ranoj verziji Bitcoin-a na mrežnom forumu za cypherpunkere, ljude koji rade na tehnologiji kriptografije i koji su zabrinuti za privatnost i slobodu pojedinca.

Iako ovo nije prvo zvanično objavljivanje Bitcoin-a, sadrži dobar rezime Satoshi-jevih motiva.

Razvio sam novi P2P sistem e-keša otvorenog koda pod nazivom Bitcoin. Potpuno je decentralizovan, bez centralnog servera ili pouzdanih stranki, jer se sve zasniva na kripto dokazima umesto na poverenju. […]

Osnovni problem konvencionalne valute je potpuno poverenje koje je potrebno za njeno funkcionisanje. Centralnoj banci se mora verovati da neće devalvirati valutu, ali istorija tradicionalnih valuta je puna primera kršenja tog poverenja. Bankama se mora verovati da drže naš novac i prenose ga elektronskim putem, ali one ga daju u talasima kreditnih balona sa delićem rezerve. Moramo im verovati sa našom privatnošću, verovati im da neće dozvoliti da kradljivci identiteta pokradu naše račune. Njihovi ogromni režijski troškovi onemogućavaju mikro plaćanja.

Generaciju ranije, višekorisnički time-sharing računarski sistemi imali su sličan problem. Pre pojave jake enkripcije, korisnici su morali da imaju pouzdanje u zaštitu lozinkom kako bi zaštitili svoje fajlove […]

Tada je jaka enkripcija postala dostupna širokim masama i više nije bilo potrebno poverenje. Podaci bi se mogli osigurati na način koji je fizički bio nemoguć za pristup drugima, bez obzira iz kog razloga, bez obzira koliko je dobar izgovor, bez obzira na sve.

Vreme je da imamo istu stvar za novac. Uz e-valutu zasnovanu na kriptografskom dokazu, bez potrebe da verujete posredniku treće strane, novac može biti siguran i transakcije mogu biti izvršene bez napora. […]

Rešenje Bitcoin-a je korišćenje peer-to-peer mreže za proveru dvostruke potrošnje. Ukratko, mreža radi poput distribuiranog servera vremenskih žigova, obeležavajući prvu transakciju koja je potrošila novčić. Potrebna je prednost prirode informacije koju je lako širiti, ali je teško ugušiti. Za detalje o tome kako to funkcioniše, pogledajte članak o dizajnu na bitcoin.org

Satoshi Nakamoto

Koje Probleme Rešava Bitcoin?

Razdvojimo neke od Satoshi-jevih postova kako bismo uvideli razloge njegove motivacije.

„Razvio sam novi P2P sistem e-keša otvorenog koda.“

P2P je skraćenica za peer to peer i ukazuje na sistem u kojem jedna osoba može da komunicira sa drugom bez ikoga u sredini, kao medjusobno jednaki.

Možete se setiti P2P tehnologija za razmenu datoteka poput Napster-a, Kazaa-e i BitTorrrent-a, koje su prve omogućile ljudima da dele muziku i filmove bez posrednika.

Satoshi je dizajnirao Bitcoin kako bi omogućio ljudima da razmenjuju e-keš, elektronski keš, bez prolaska preko posrednika na približno isti način.

Softver je otvorenog koda, što znači da svako može videti kako funkcioniše i doprineti tome.

Ne treba da verujemo ni u šta što je Satoshi napisao u svom postu o tome kako softver radi.

Možemo pogledati kod i sami proveriti kako to funkcioniše. Štaviše, možemo promeniti funkcionalnost sistema promenom koda.

„Potpuno je decentralizovan, bez centralnog servera ili pouzdanih stranki …“

Satoshi napominje da je sistem decentralizovan kako bi se razlikovao od sistema koji imaju centralnu kontrolu.

Prethodne pokušaje stvaranja digitalne gotovine poput DigiCash-a od strane Davida Chaum-a podržavao je centralni server, računar ili skup računara koji je bio odgovoran za izdavanje i verifikaciju plaćanja pod kontrolom jedne korporacije.

Takve, centralno kontrolisane privatne šeme novca, bile su osuđene na propast; ljudi se ne mogu osloniti na novac koji može nestati kada kompanija prestane sa poslovanjem, bude hakovana, pretrpi pad servera ili je zatvori vlada.

Bitcoin održava mreža pojedinaca i kompanija širom sveta.

Da bi se Bitcoin isključio, bilo bi potrebno isključiti desetine do stotine hiljada računara širom sveta u isto vreme, zauvek, od kojih su mnogi na nepoznatim lokacijama.

Bila bi to beznadežna igra, jer bi svaki napad ove prirode jednostavno podstakao stvaranje novih Bitcoin čvorova ili računara na mreži.

„… sve se zasniva na kripto dokazima umesto na poverenju“

Internet, a u stvari i većina savremenih računarskih sistema, izgrađeni su na kriptografiji, metodi prikrivanja informacija, tako da je može dekodirati samo primalac informacije.

Kako se Bitcoin oslobađa potrebe za poverenjem? Umesto da verujemo nekome ko kaže „Ja sam Alisa“ ili „Imam 10 $ na računu“, možemo koristiti kriptografsku matematiku da bismo izneli iste činjenice na način koji je vrlo lako verifikovati od strane primaoca dokaza ali ga je nemoguće falsifikovati.

Bitcoin u svom dizajnu koristi kriptografsku matematiku kako bi učesnicima omogućio da provere ponašanje svih ostalih učesnika, bez poverenja u bilo koju centralnu stranku.

„Moramo im verovati [bankama] sa našom privatnošću, verovati im da neće dozvoliti da kradljivci identiteta pokradu naše račune“

Za razliku od korišćenja vašeg bankovnog računa, sistema digitalnog plaćanja ili kreditne kartice, Bitcoin omogućava dvema stranama da obavljaju transakcije bez davanje bilo kakvih ličnih podataka.

Centralizovana skladišta potrošačkih podataka koji se čuvaju u bankama, kompanijama sa kreditnim karticama, procesorima plaćanja i vladama, predstavljaju pravu poslasticu za hakere.

Kao dokaz Satoshi-jeve poente služi primer iz 2017. godine kada je Equifax masovono kompromitovan, kada su hakeri ukrali identifikacione i finansijske podatke za više od 140 miliona ljudi.

Bitcoin odvaja finansijske transakcije od stvarnih identiteta.

Na kraju krajeva, kada nekome damo fizički novac, on nema potrebu da zna ko smo, niti treba da brinemo da će nakon naše razmene moći da iskoristi neke informacije koje smo mu dali da ukrade još našeg novca.

Zašto ne bismo očekivali isto, ili čak i bolje, od digitalnog novca?

„Centralnoj banci se mora verovati da neće devalvirati valutu, ali istorija tradicionalnih valuta je puna primera kršenja tog poverenja.“

Pojam tradicionalna valuta, odnosi se na valutu izdatu od strane vlade i centralne banke, koju vlada proglašava zakonskim sredstvom plaćanja.

Istorijski, novac je nastao od stvari koje je bilo teško proizvesti, koje su bile lake za proveravanje i transport, poput školjki, staklenih perli, srebra i zlata.

Kad god bi se nešto koristilo kao novac, postojalo je iskušenje da se stvori više toga.

Ako bi neko pronašao vrhunsku tehnologiju za brzo stvaranje velike količine nečega, ta stvar bi izgubila vrednost.

Evropski naseljenici uspeli su da liše afrički kontinent bogatstva trgujući staklenim perlicama koje su se lako proizvodile za ljudske robove.

Isto se dogodilo sa američkim indijancima, kada su kolonisti otkrili način brze proizvodnje vampum školjki, koje su starosedeoci smatrali retkim.

Vremenom, širom sveta ljudi su shvatili da je samo zlato dovoljno retko da deluje kao novac, bez straha da bi neko drugi mogao da ga stvori u velikim količinama.

Polako smo prešli sa svetske ekonomije koja je koristila zlato kao novac na onu gde su banke izdavale papirne sertifikate kao dokaz posedovanja tog zlata.

Nixon je okončao međunarodnu konvertibilnost američkog dolara u zlato 1971. godine, privremenim rešenjem, koje je ubrzo postalo trajno.

Kraj zlatnog standarda omogućio je vladama i centralnim bankama da imaju punu dozvolu da povećavaju novčanu masu po svojoj volji, razredjujući vrednost svake novčanice u opticaju, poznatije kao umanjenje vrednosti.

Iako je izdata od strane vlade, suštinska tradicionalna valuta je novac koji svi znamo i svakodnevno koristimo, ipak je relativno novo iskustvo u opsegu svetske istorije.

Moramo verovati našim vladama da ne zloupotrebljavaju njegovo štamparije, i ne treba nam puno muke da nadjemo primere kršenja tog poverenja.

U autokratskim i centralno planiranim režimima gde vlada ima prst direktno na mašini za novac, kao što je Venecuela, valuta je postala gotovo bezvredna.

Venecuelanski Bolivar prešao je sa 2 bolivara za 1 američki dolar, koliko je vredeo 2009. godine, na 250.000 bolivara za 1 američki dolar 2019. godine.

Pogledajte koliko novčanica je bilo potrebno za kupovinu piletine u Venecueli posle hiperinflacije.

Satoshi je želeo da ponudi alternativu tradicionalnoj valuti čija se ponuda uvek nepredvidivo širi.

Da bi sprečilo umanjenje vrednosti, Satoshi je dizajnirao novčani sistem gde je zaliha bila fiksna i izdavana po predvidljivoj i nepromenjivoj stopi.

Postojaće samo 21 milion Bitcoin-a.

Međutim, svaki Bitcoin se može podeliti na 100 miliona jedinica koje se sada nazivaju satoshis (sats-ovi), što će činiti ukupno 2,1 kvadriliona satoshi-a u opticaju oko 2140. godine.

Pre Bitcoin-a nije bilo moguće sprečiti beskrajnu reprodukciju digitalnih sredstava.

Kopirati digitalnu knjigu, audio datoteku ili video zapis i poslati ga prijatelju, je jeftino i lako.

Jedini izuzeci od toga su digitalna sredstva koja kontrolišu posrednici.

Na primer, kada iznajmite film sa iTunes-a, možete ga gledati na vašem uređaju samo zato što iTunes kontroliše distribuciju tog filma i može ga zaustaviti nakon perioda njegovog iznajmljivanja.

Slično tome, vaša banka kontroliše vaš digitalni novac. Zadatak banke je da vodi evidenciju koliko novca imate.

Ako ga prenesete nekom drugom, oni će odobriti ili odbiti takav prenos.

Bitcoin je prvi digitalni sistem koji sprovodi oskudicu bez posrednika i prvo je sredstvo poznato čovečanstvu čija je nepromenljiva ponuda i raspored izdavanja poznat unapred.

Ni plemeniti metali poput zlata nemaju ovo svojstvo, jer uvek možemo iskopati sve više i više zlata ukoliko je to isplativo.

Zamislite da otkrijemo asteroid koji sadrži deset puta više zlata nego što ga imamo na zemlji.

Šta bi se dogodilo sa cenom zlata uzimajući u obzir tako obilnu ponudu? Bitcoin je imun na takva otkrića i manipulisanje nabavkom.

Jednostavno je nemoguće proizvesti više od toga (21 miliona).

„Podaci bi se mogli osigurati na način koji je fizički bio nemoguć za pristup drugima, bez obzira iz kog razloga, bez obzira koliko je dobar izgovor, bez obzira na sve. […] Vreme je da imamo istu stvar za novac “

Naše trenutne metode obezbeđivanja novca, poput stavljanja u banku, oslanjaju se na poverenje nekome drugom da će obaviti taj posao.

Poverenje u takvog posrednika ne zahteva samo sigurnost da on neće učiniti nešto zlonamerno ili glupo, već i da vlada neće zapleniti ili zamrznuti vaša sredstva vršeći pritisak na ovog posrednika.

Međutim, videli smo bezbroj puta da vlade mogu, i zaista uskraćuju pristup novcu kada se osećaju ugroženo.

Nekom ko živi u Sjedinjenim Državama ili nekoj drugoj visoko regulisanoj ekonomiji možda zvuči glupo da razmišlja da se probudi sa oduzetim novcem, ali to se događa stalno.

PayPal mi je zamrzao sredstva jednostavno zato par meseci nisam koristio svoj račun.

Trebalo mi je više od nedelju dana da vratim pristup „svom“ novcu.

Srećan sam što živim u Europi, gde bih se bar mogao nadati da ću potražiti neko pravno rešenje ako mi PayPal zamrzne sredstva i gde imam osnovno poverenje da moja vlada i banka neće ukrasti moj novac.

Mnogo gore stvari su se dogodile, i trenutno se dešavaju, u zemljama sa manje slobode.

Banke su se zatvorile tokom kolapsa valuta u Grčkoj.

Banke na Kipru su koristile kaucije da konfiskuju sredstva od svojih klijenata.

Indijska vlada je proglasila određene novčanice bezvrednim.

Bivši SSSR, u kojem sam odrastao, imao je ekonomiju pod kontrolom vlade što je dovelo do ogromnih nestašica robe.

Bilo je nezakonito posedovati strane valute kao što je američki dolar.

Kada smo poželeli da odemo, mojoj porodici je bilo dozvoljeno da zameni samo ograničenu količinu novca po osobi za američke dolare po zvaničnom kursu koji je bio u velikoj meri različit od pravog kursa slobodnog tržišta.

U stvari, vlada nam je oduzela ono malo bogatstva koje smo imali koristeći gvozdeni stisak na ekonomiji i kretanju kapitala.

Autokratske zemlje imaju tendenciju da sprovode strogu ekonomsku kontrolu, sprečavajući ljude da na slobodnom tržištu povuku svoj novac iz banaka, iznesu ga iz zemlje ili da ga razmene u ne još uvek bezvredne valute poput američkog dolara.

To omogućava vladinoj slobodnoj vladavini da primeni sulude ekonomske eksperimente poput socijalističkog sistema SSSR-a.

Bitcoin se ne oslanja na poverenje u treću stranu da bi osigurao vaš novac.

Umesto toga, Bitcoin onemogućava drugima pristup vašim novčićima bez jedinstvenog ključa koji imate samo vi, bez obzira iz kog razloga, bez obzira koliko je dobar izgovor, bez obzira na sve.

Držeći Bitcoin, držite ključeve sopstvene finansijske slobode. Bitcoin razdvaja novac i državu

„Rešenje Bitcoin-a je korišćenje peer-to-peer mreže za proveru dvostruke potrošnje […] poput distribuiranog servera vremenskih žigova, obeležavajući prvu transakciju koja je potrošila novčić“

Mreža se odnosi na ideju da je gomila računara povezana i da mogu međusobno slati poruke.

Reč distribuirano znači da ne postoji centralna stranka koja kontroliše, već da svi učesnici koordiniraju medjusobno kako bi mreža bila uspešna.

U sistemu bez centralne kontrole, bitno je znati da niko ne vara. Ideja dvostruke potrošnje odnosi se na mogućnost trošenja istog novca dva puta.

Fizički novac odlazi iz vaše ruke kad ga potrošite. Međutim, digitalne transakcije se mogu kopirati baš kao muzika ili filmovi.

Kada novac šaljete preko banke, oni se pobrinu da isti novac ne možete da prebacujete dva puta.

U sistemu bez centralne kontrole potreban nam je način da sprečimo ovu vrstu dvostruke potrošnje, koja je u suštini ista kao i falsifikovanje novca.

Satoshi opisuje da učesnici u Bitcoin mreži rade zajedno kako bi vremenski označili (doveli u red) transakcije kako bismo znali šta je bilo prvo.

Zbog toga možemo odbiti sve buduće pokušaje trošenja istog novca.

Satoshi se uhvatio u koštac sa nekoliko zanimljivih tehničkih problema kako bi rešio probleme privatnosti, uništavanja vrednosti i centralne kontrole u trenutnim monetarnim sistemima.

Na kraju je stvorio peer to peer mrežu kojoj se svako mogao pridružiti bez otkrivanja svog identiteta ili potrebe da veruje bilo kom drugom učesniku.

Kako se Bitcoin razvijao u poslednjoj deceniji?

Doprinosi izvornom kodu Bitcoina

Kada je Bitcoin pokrenut, samo nekolicina ljudi ga je koristila i pokrenula Bitcoin softver na svojim računarima za napajanje Bitcoin mreže.

Većina ljudi u to vreme mislila je da je to šala ili da će se otkriti ozbiljni nedostaci u dizajnu sistema koji će ga učiniti neizvodljivim.

Vremenom se mreži pridružilo sve više ljudi koji su pomoću svojih računara dodali sigurnost mreži.

Ljudi su počeli da menjaju Bitcoin-e za robu i usluge, dajući mu stvarnu vrednost. Pojavile su se menjačnice valuta koje su menjale Bitcoin-e za gotovo sve tradicionalne valute na svetu.

Deset godina nakon izuma, Bitcoin koriste milioni ljudi sa desetinama do stotinama hiljada čvorova koji pokreću besplatni Bitcoin softver, koji se razvija od strane stotina dobrovoljaca i kompanija širom sveta.

Bitcoin mreža je porasla kako bi obezbedila vrednost veću od stotine biliona dolara.

Računari koji učestvuju u zaštiti Bitcoin mreže poznati su kao rudari/majneri.

Oni rade u industrijskim operacijama širom sveta, ulažući milione dolara u specijalni rudarski hardver koji radi samo jedno: pobrinuti se da je Bitcoin najsigurnija mreža na planeti.

Rudari troše električnu energiju kako bi transakcije Bitcoin-a učinile sigurnim od modifikacija. Budući da se rudari međusobno takmiče za oskudan broj Bitcoin-a proizvedenih dnevno, oni uvek moraju da pronalaze najjeftinije izvore energije na planeti da bi ostali profitabilni.

Rudari rade na različitim mestima, od hidroelektrana u dalekim krajevima Kine do vetroparkova u Teksasu, do kanadskih naftnih polja koja proizvode gas koji bi u suprotnom bio odzračen ili spaljen u atmosferi.

Iako je Bitcoin popularna tema i o njemu se često raspravlja u medijima, procenjujemo da je samo nekoliko miliona ljudi na svetu počelo da redovno štedi Bitcoin.

Za mnoge ljude, posebno za one koji nikada nisu živeli pod represivnim režimima, ovaj izum novog oblika digitalnog novca izvan kontrole vlade može biti veoma izazovan za razumevanje i prihvatanje.

Zato sam ja ovde. Želim da vam pomognem da razumete Bitcoin i budete gospodar svoje budućnosti!

-

@ 58937958:545e6994

2025-05-22 12:25:49

@ 58937958:545e6994

2025-05-22 12:25:49Since it's Bitcoin Pizza Day, I made a Bitcoin pizza!

To give it a Japanese twist, I made it a mentaiko pizza (※ mentaiko = spicy cod roe, a popular Japanese ingredient often used in pasta or rice dishes). For the Bitcoin logo, I used a salmon terrine.

Salmon Terrine

I cut out the "B" logo using hanpen (※ hanpen = a soft, white Japanese fish cake made from fish paste and yam). Tip: You can also cut a colored plastic folder into the "B" shape and place it on top as a stencil — makes it easier!

I blended salmon, hanpen, milk, egg, and a bit of salt in a food processor, poured it into a container, and baked it in a water bath.

Pizza Dough

I mixed bread flour, dry yeast, salt, olive oil, and water, then kneaded it with determination! Let it rise for about an hour until fluffy.

Mentaiko Mayo Topping

I mixed mentaiko, mayonnaise, and soy sauce.

I spread out the dough, added the mentaiko mayo, cheese, and corn, then baked it. Halfway through, I added thin slices of mochi (rice cake). After baking, I topped it with seaweed and the salmon terrine to finish!

Lots to reflect on

About the Terrine

In the video, you’ll see I divided the terrine into two portions. I was worried that the salmon and hanpen parts might end up looking too similar in color, making the “B” logo hard to see.

So for one half, I added ketchup, thinking: “Maybe this will make the red more vibrant?” But even with the ketchup, it didn’t change much.

The Mochi

I accidentally bought thinly sliced mochi, but I realized it might burn too easily as a pizza topping. Regular mochi with standard thickness is probably better.

I added the mochi halfway through baking, opening the oven once, but now I’m thinking that might have lowered the oven temp too much.

Lessons Learned

This was my first and only attempt—no test run beforehand— so I ended up with a long list of lessons learned. In the future, I should definitely do a trial version first… But you know… salmon and mentaiko are expensive! (excuses, excuses)

Cheese

I wanted to do that Instagram-worthy cheese pull moment, but nope. No stretch. None at all. I think that kind of thing needs a totally different kind of cheese or prep. Will have to experiment more.

Taste Test

Actually really good. I usually don’t eat mentaiko mayo myself, and I’m a Margherita pizza fan at heart. But this was surprisingly nice. A little rich in flavor—made me crave a bowl of rice. Next time, I might skip the soy sauce to tone it down a bit.

nostr:nevent1qqsrhularycewltxz88e9wrwutkqu5pkylh3vxrmys2e0nuh7c2h06qgqp9zc

-

@ 58937958:545e6994

2025-05-22 11:50:08

@ 58937958:545e6994

2025-05-22 11:50:08ビットコインピザデーということで ビットコインピザを作りました せっかくなので日本っぽい明太ピザにして ビットコインロゴは鮭のテリーヌにしました

鮭のテリーヌ

はんぺんでBのマークを気合で切ります 色付きクリアファイルをBマークに切って乗せると楽です 鮭とはんぺんと牛乳と卵と塩をフードプロセッサーにかけます 容器に流して蒸し焼きします

生地作り

強力粉・ドライイースト・塩・オリーブオイル・水を混ぜます

気合でこねます

1時間くらい発酵させるとふっくらします

強力粉・ドライイースト・塩・オリーブオイル・水を混ぜます

気合でこねます

1時間くらい発酵させるとふっくらしますトッピングの明太マヨ

明太子とマヨネーズとしょうゆを混ぜます

のばした生地に

明太マヨ・チーズ・コーンを乗せて焼きます

途中で薄いおもちを乗せます

焼けたらのりとテリーヌを乗せてできあがり

のばした生地に

明太マヨ・チーズ・コーンを乗せて焼きます

途中で薄いおもちを乗せます

焼けたらのりとテリーヌを乗せてできあがり反省点いろいろ

今回一番くやしいのは明太マヨに色がつきすぎたこと 明太ピザってピンク色の感じが独特な気がするし もしかしたら日本だけかもと思ったから作ったのに 焼けたらトマトソースみたいな色になっちゃった なんてことだ 生地に焼き色がつかないな~白いな~もうちょっと焼くか~とか思ってたら 明太さんが焦げてました むねん

ちなみに製作動画の中でテリーヌを2つに分けているのは 鮭とはんぺんの部分が同じ色っぽくなってBが目立たなかったらどうしようと思って 片方はケチャップを足して 赤色濃くなるかな~大失敗したらいやだな~とか思ってたんですけど ケチャップ入れても何も変わらなかった むねん

薄いおもち(しゃぶしゃぶもちというらしい)を買ってしまったんだけど これはピザのトッピングにするには焦げそうだから 普通の厚みのもちの方がよさそう 今回は途中で一度オーブン開けておもちを乗せたけど オーブンの温度が下がるのが微妙かも

あと今回は練習無しのぶっつけ本番で作ったので ちょっと自分の中で反省点が多かったな~と やっぱり一度試作した方がいいですね いや鮭とか明太子とか高くて(言い訳

あ~あとチーズ 溶け溶けチーズがのびーるインスタ映え的なやつをやりたかったんですけど 全然むりでした のびないのびない ああいうのは別で工夫が必要そうなので要検討

味はおいしかったです 明太マヨって自分ではあんまり食べないしピザはマルゲリータ派なんですけど結構いいですね ちょっと味が濃くてご飯食べたくなっちゃった 次作る時はしょうゆ入れないようにしよう

nostr:nevent1qqsrhularycewltxz88e9wrwutkqu5pkylh3vxrmys2e0nuh7c2h06qgqp9zc

-

@ 0e9491aa:ef2adadf

2025-05-24 17:01:16

@ 0e9491aa:ef2adadf

2025-05-24 17:01:16

For years American bitcoin miners have argued for more efficient and free energy markets. It benefits everyone if our energy infrastructure is as efficient and robust as possible. Unfortunately, broken incentives have led to increased regulation throughout the sector, incentivizing less efficient energy sources such as solar and wind at the detriment of more efficient alternatives.

The result has been less reliable energy infrastructure for all Americans and increased energy costs across the board. This naturally has a direct impact on bitcoin miners: increased energy costs make them less competitive globally.

Bitcoin mining represents a global energy market that does not require permission to participate. Anyone can plug a mining computer into power and internet to get paid the current dynamic market price for their work in bitcoin. Using cellphone or satellite internet, these mines can be located anywhere in the world, sourcing the cheapest power available.

Absent of regulation, bitcoin mining naturally incentivizes the build out of highly efficient and robust energy infrastructure. Unfortunately that world does not exist and burdensome regulations remain the biggest threat for US based mining businesses. Jurisdictional arbitrage gives miners the option of moving to a friendlier country but that naturally comes with its own costs.

Enter AI. With the rapid development and release of AI tools comes the requirement of running massive datacenters for their models. Major tech companies are scrambling to secure machines, rack space, and cheap energy to run full suites of AI enabled tools and services. The most valuable and powerful tech companies in America have stumbled into an accidental alliance with bitcoin miners: THE NEED FOR CHEAP AND RELIABLE ENERGY.

Our government is corrupt. Money talks. These companies will push for energy freedom and it will greatly benefit us all.

Microsoft Cloud hiring to "implement global small modular reactor and microreactor" strategy to power data centers: https://www.datacenterdynamics.com/en/news/microsoft-cloud-hiring-to-implement-global-small-modular-reactor-and-microreactor-strategy-to-power-data-centers/

If you found this post helpful support my work with bitcoin.

-

@ a19caaa8:88985eaf

2025-05-20 10:34:53

@ a19caaa8:88985eaf

2025-05-20 10:34:53-

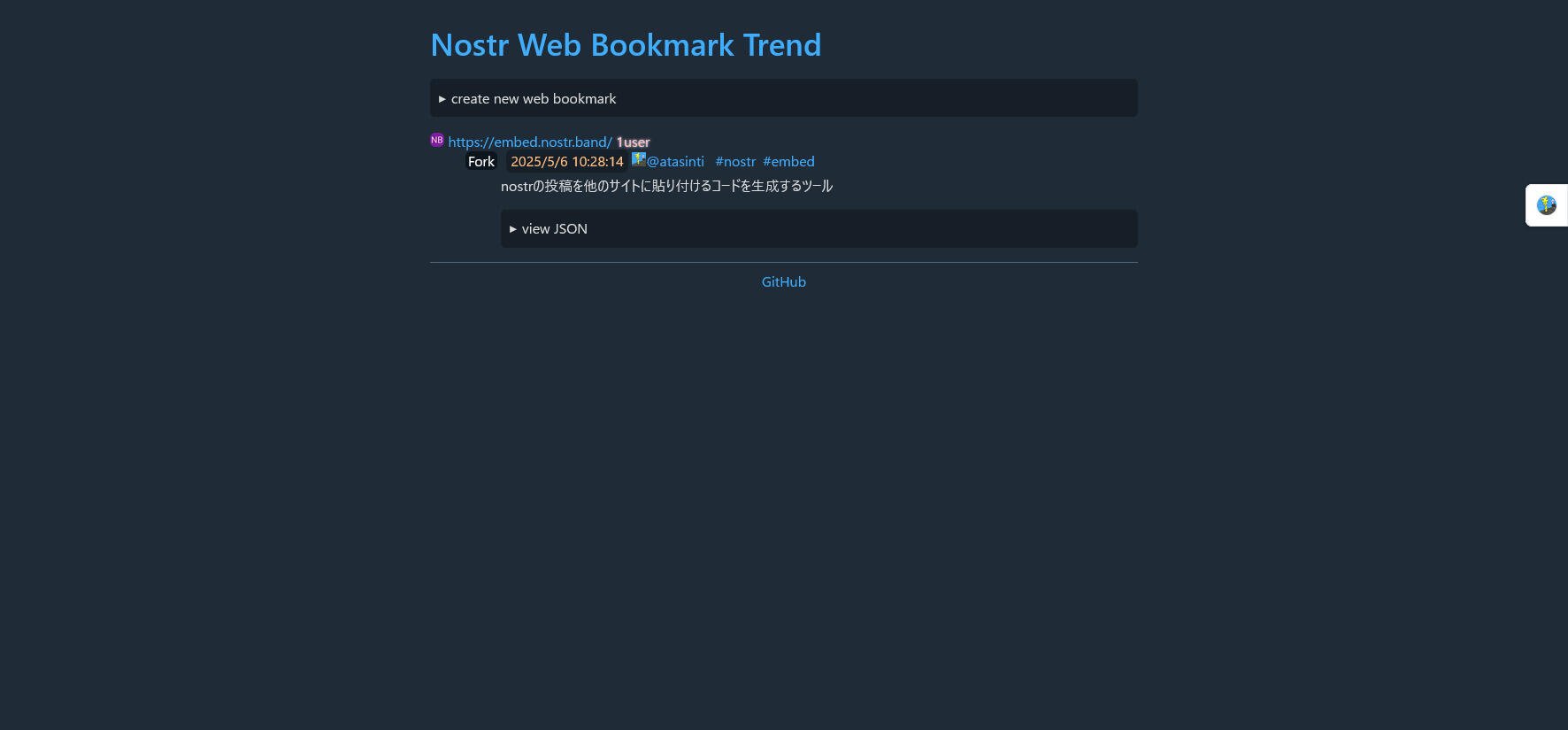

拡張機能を使わない状態で使用した所感!

-

makimono:全部できる。nip21にも対応してる。kind10002にデータが無いときは勝手にどっかに流される。kind5が流せない。nsec.appで署名できる。

-

flycat:新規作成できるけど、流すだけで読み取りはしないっぽい。上書き(置き換え)はできるけど、編集はできない。すぐnos.lolに流そうとしてくる。kind5が流せない。他クライアント(lumilumiなど)から流したkind5は自動で反映されず、flycat内「設定」の「重複イベントの削除」をやれば反映される。nip21非対応。秘密鍵でログインできる。

-

habla:秘密鍵ログインできない、nsec.appもなんか入れない(読み込みから進まない)。公開鍵ログインからの表示確認用。nip21には対応してる。

-

yakihonnne:秘密鍵ログインできる。編集ができない(読み込みから進まない)。nip21は試してない。まだ全然見れてない。

-

ほか:

| クライアント | 編集 | 秘密鍵ログイン | nip21対応 | kind5流せるか | その他 | | -------------- | -------------------- | ------- | ------- | --------- | ------------------------------------------- | | makimono | 新規作成、編集可 | 不可 | 対応 | 流せない | kind10002にデータが無いときは自動で他に流される、nsec.appで署名可能 | | flycat | 新規作成、上書き(置き換え)可 | 可 | 非対応 | 流せない | 送信先要確認、他クライアントから流したkind5は重複イベント削除で反映 | | habla | 未確認 | 不可 | 対応 | 未確認 | nsec.app読み込み不可、公開鍵ログインのみ、表示確認用? | | yakihonnne | 編集不可(読み込みで止まる) | 可 | 未確認 | 未確認 | もっとちゃんと確認したい |

-

-

@ 6b0a60cf:b952e7d4

2025-05-19 22:33:33

@ 6b0a60cf:b952e7d4

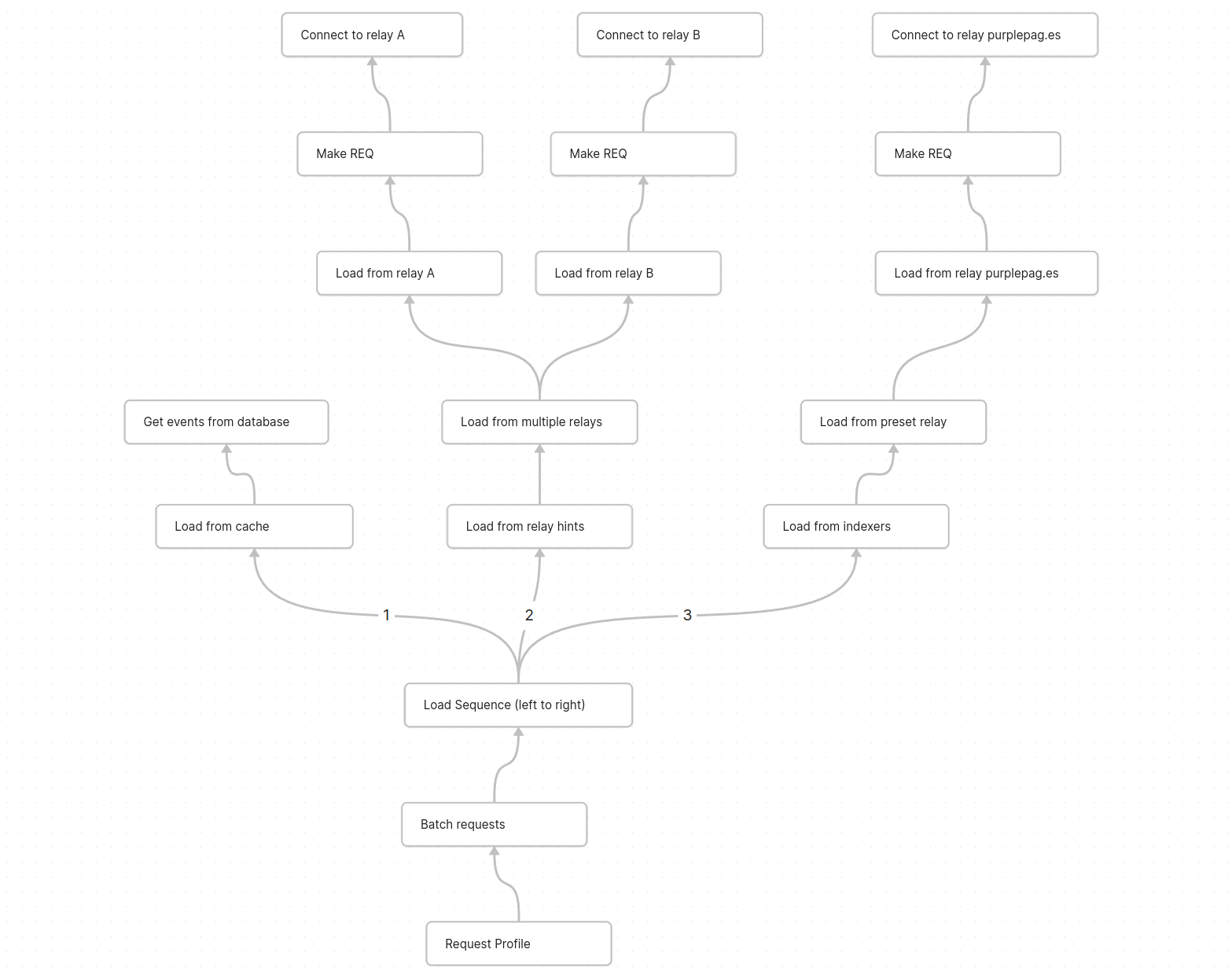

2025-05-19 22:33:33タイトルは釣りです。そんなこと微塵も思っていません。 本稿はアウトボックスモデルの実装に関してうだうだ考えるコーナーです。 ダムスに関して何か言いたいわけではないので先にタイトル回収しておきます。

- NIP-65を守る気なんかさらさら無いのにNIP-65に書いてあるkind:10002のReadリレーの意味を知っていながら全然違う使い方をしているのは一部の和製クライアントの方だよね

- NIP-65を守る気が無いならkind:10002を使うべきではなく、独自仕様でリレーを保存するべきだよね

- アウトボックスモデルを採用しているクライアントからすれば仕様と異なる実装をしてしまっているクライアントが迷惑だと思われても仕方ないよね

- と考えればダムスの方が潔いよね

- とはいえkind:3のcontentは空にしろって言われてんだからやっぱダムスはゴミだわ

- やるとしたらRabbitみたいにローカルに保存するか、別デバイス間で同期したいならkind:30078を使うべきだよね

アウトボックスモデルはなぜ人気がないのか

言ってることはとてもいいと思うんですよ。 欠点があるとすれば、

- 末端のユーザーからすればreadリレーとwriteリレーと書かれると直感的にイメージされるものとかけ離れている

- 正しく設定してもらうには相当の説明が必要

- フォローTLを表示しようとすれば非常にたくさんのリレーと接続することになり現実的ではない

- なるほど完璧な作戦っスねーっ 不可能だという点に目をつぶればよぉ~

余談ですが昔irisでログインした時に localhost のリレーに繋ごうとしてiris壊れたって思ったけど今思えばアウトボックスモデルを忠実に実装してたんじゃないかな…。

現実的に実装する方法は無いのか

これでReadすべきリレーをシミュレーションできる。 https://nikolat.github.io/nostr-relay-trend/ フォローイーのWriteリレーを全部購読しようとすると100個近いリレー数になるので現実的ではありません。 しかしフォローイーのWriteリレーのうち1個だけでよい、とする条件を仮に追加すると一気にハードルが下がります。私の場合はReadリレー含めて7個のリレーに収まりました。 Nos Haikuはとりあえずこの方針でいくことにしました。

今後どうしていきたいのか

エンドユーザーとしての自分の志向としては、自分が指定したリレーだけを購読してほしい、勝手に余計なリレーを読みに行かないでほしい、という気持ちがあり、現状の和製クライアントの仕様を気に入っています。 仮にNos Haikuでアウトボックスモデルを採用しつつ自分の決めたリレーに接続するハイブリッド実装を考えるとすれば、

あなたの購読するリレーはこれですよー - Read(inbox) Relays (あなたへのメンションが届くリレー) - wss://relay1.example.com/ - wss://relay2.example.com/ - wss://relay3.example.com/ - Followee's Write Relays (フォローイーが書き込んでいるリレー) - wss://relay4.example.com/ - wss://relay5.example.com/ - wss://relay6.example.com/って出して、チェックボックス付けてON/OFFできるようにして最終的に購読するリレーをユーザーに決めてもらう感じかな……って漠然と考えています。よほど時間を持て余したときがあればやってみるかも。