-

@ 05e6367c:6ba9be85

2023-04-03 11:10:15

@ 05e6367c:6ba9be85

2023-04-03 11:10:15Last week, DAOhaus was featured on The Defiant: A Big Test for DAOs: Honing New Compensation and Contribution Practices, sharing a template for how DAOs can create a flexible compensation plan for contributors. Today, we’d like to go deeper into how we’re implementing that template for our own compensation plan - the principles, how it works, and how you can follow our progress.

With the rise of DAOs, we’ve seen more ‘workers’ transition to becoming DAO contributors, embracing more flexibility and control in how they spend their time. This is a win for both contributors and DAOs, vastly expanding the talent pool to anyone willing to show up and contribute.

📖 Background

At DAOhaus, this is no different. The DAOhaus platform is managed by Warcamp DAO, to which UberHaus has delegated responsibility for building, maintaining, and stewarding the platform. Warcamp current is a team of 20 (and growing) core contributors with different skill sets, time zones, and bandwidth availability. Each contributor is a member of one or more Circles, or functional working groups, underneath the Warcamp umbrella.

Contributors are currently compensated retroactively. Contributors informally request payment at the end of each month from their respective Circles according to the self-assessed value they created. Once the Circle verifies contributor requests, Circle leads then make a proposal requesting Circle funds for that month from the Warcamp DAO. Individual contributors then make formal proposals against their Circle to get paid.

As an MVP, this has been effective in bootstrapping compensation and getting a small group of contributors started. However, as we look to expand our team and accelerate our work towards our long term vision, we find there is room for improvement in the following areas:

-

Compensation clarity for contributor recruitment: While retroactive compensation is flexible, it is hard to attract contributors who want more clarity and certainty on their compensation before committing their time and effort.

-

Contributor retention & focus: Context-switching is common in DAOs for good reason, but it comes with attentional drawbacks. How can we better incentivise contributors who want more focus? Can we give contributors tools to manage their own workflows?

-

Contributor evaluation & growth: As more DAO members join, how can we help contributors evaluate their personal growth & development? How can the DAO effectively align compensation and value created within a non-hierarchical context?

-

Contributor ownership: As contributors add value, how can we give them greater ownership and governance power? This is especially important for new contributors, as we want to avoid entrenching power among only early contributors.

To solve these issues, we wanted to create a plan with the following principles in mind (these are the same principles the OpEd advocated for):

-

Contributors should have flexibility in how they engage with the DAO

-

Contributors should have flexibility in how they are compensated by the DAO

-

Contributor engagement and compensation models should be interoperable with that of other DAOs

-

Contributor value should be assessed in a bottom-up fashion

✨ Our new Compensation Plan

After many rounds of research, discussion and alignment, our new compensation plan consists of three pillars: base compensation, bonus compensation, and governance power.

🛠 Base Compensation

Our Base Compensation is very similar to what the Defiant OpEd outlined. In the spirit of Principles 1 and 2, , we’ve created two tracks. Contributors can now choose to be compensated for their contributions as part of either the Retroactive or the Commitment tracks.

**Retroactive Track **

The Retroactive Track is tailored to contributors wanting more flexibility or testing the waters before committing more substantially to Warcamp. This works the same as our previous compensation approach; contributors can start contributing whenever they want, however they want, and wherever they want. At the end of each month, they request compensation retroactively for their contributions, based on how much value they deem they’ve provided within their Circle.

Commitment Track

The Commitment Track is designed for contributors wanting to make more substantial commitments to DAOhaus and have more certainty about their compensation.

We’ve just over a month into this new approach, but in the spirit of building in public, we’re sharing how we are running this experiment beginning with two-month cycles; Starting in November, Warcamp contributors could select the Commitment Track if they wished.

Commitment Track Process

To uphold the ethos of decentralization and transparency, the processes for establishing base compensation are designed in a bottom-up and open manner. With that in mind, we start with a self-assessment phase where contributors indicate their Commitment and Value Levels.

Commitment Levels are expressed in percentages, referring to how much of their total time – or effort, or prioritization, or focus; contributors are free to use the measure that’s most relevant for them – a contributor desires to commit to DAOhaus. For example, someone using time as their measurement and selecting a level of 100% would be committing to spend roughly 35 hours a week, whereas someone selecting 15% spends 5-10hrs weekly with DAOhaus.

You’ll notice that these time estimates don’t line up with traditional “full time” hours. This is intentional. In the DAO space, there is a lot of value in forging connections across projects, so we encourage all Warcamp contributors to spend roughly 10% of their committed time contributing to web3 projects or DAOs. This is also yet another reason why we want to give contributors lots of options for how they engage with DAOhaus.

Value Levels are graded from 1 to 5, referring to the contributor’s expected value created during the compensation cycle. Measuring expected value is challenging and subjective, so once again contributors are free to use the measure that’s most relevant for them: DAOhaus experience, domain-specific knowledge, skill-specific talent, etc. For example, a contributor may justifiably grade themselves as an L5 contributor based on their high quality experience in Web3 or DAOs, recognition as a leader in their space, deep knowledge about DAOhaus, or any combination of those three. Conversely, L1 contributors tend to be new to Web3, with some experience in their area of interest and are just beginning to learn about DAOhaus.

While we begin with self-assessment, the DAO collectively has final say over which value levels each contributor is assigned. We’re still actively working on how best to do this in a way that balances DAO budget constraints and needs with our desire to drive compensation in a bottom-up manner (Principle 4)

How to determine Base Compensation

Based on each contributor’s Value and Commitment Levels, we pro-rate the compensation for each contributor from a fair value of a Level 5 contributor committing 100% (i.e. $12,000). From this topline dollar value, each contributor then selects the percentage they wish to receive in DAOhaus’ native $HAUS token vs. the DAI stablecoin. Thus far, most contributors have selected to receive roughly 25% of their compensation in $HAUS.

For instance, a Level 5 Contributor committing 100% of his or her time receives $12,000 a month, whereas a Level 3 Contributor committing 50% earns $3,500 a month. To incentivise longer-term alignment with DAOhaus, contributors can also choose to receive a portion of their compensation in $HAUS token instead of the DAI stablecoin.

Once all selections have been made and informally approved by the DAO, a Contributor Compensation Ratification Proposal is submitted and Warcamp DAO members vote to pass the proposal. You can view our first cycle’s Value and Commitment Levels for each contributor on the Commitment track, together with their monthly DAI and $HAUS payment, in this forum post. And here is the on-chain proposal ratifying these elections.

Through bottom-up assessments, ratification proposals and open discussion, this process helps create openness and transparency in determining compensation, unlike traditional human resources departments, which are opaque and more prone to bias.

Furthermore, in the spirit of Principle 3, using Commitment percentages helps contributors segment their bandwidth and signal availability to contribute to other DAOs. Our hope is that this helps contributors better manage their bandwidth and reduce burnout, as well as help DAOs better estimate and communicate the commitment they want from contributors. As this approach gets more widely adopted, this should create a more sustainable way for greater cross-pollination of contributors among DAOs.

💰 Bonus Compensation

Earlier this year, Warcamp began using Coordinape to distribute $HAUS tokens to contributors on a monthly basis. In our new Bonus Compensation program, we continue using Coordinape but have increased the Bonus allocation to 600 total $HAUS across all contributors, regardless of whether they are on the Commitment or Retroactive tracks.

In addition to putting $HAUS in contributors’ hands (see the next section for more), determining bonuses via intersubjective evaluation (i.e. Coordinape), is a bottom-up and decentralized approach to a couple other important areas of contributor “management”:

-

Holding each contributor accountable to their Value and Commitment Levels as the Compensation Cycles progress

-

Creating a framework to help contributors assess themselves and peers in terms of personal growth and development

For instance, if an L3 contributor on the Commitment Track has received more giveHAUS than their L3 peers, this could be a signal that they’ve been over-delivering and should be leveled up to L4. Conversely, If someone on a Commitment Track received fewer giveHAUS than their peers, this could be a signal for us to help them better hit their Value Level or review the right Compensation track for them.

As we go through more Compensation Cycles, we are looking to experiment with different amounts of giveHAUS per person, perhaps in proportion to their commitment % (for Commitment track) or the previous month’s received giveHAUS (for Retroactive track).

Our goal is to create a system that accurately and fairly evaluates the contributions and capabilities of Warcamp contributors in a non-hierarchical setting, informing contributors’ Bonus Compensation in the short term as well the evolution of their Base Compensation over the long term.

🗳 Governance Power

We believe that distributing governance power among all contributors is crucial to everything a DAO does. When contributors have actual power to determine the direction of DAOhaus, they approach their contributions as an owner or entrepreneur would, because that’s exactly what they are!

To distribute governance power over Warcamp to those that best know how to exercise it, we have a voluntary program for contributors to stake $HAUS received each month as Bonus Compensation for additional shares in the Warcamp DAO. The additional shares a contributor can receive is determined by intersubjective evaluation from their peers (as part of the Coordinape process).

Since their newly-minted governance power is a result of peer evaluation, we stay true to ensuring that our processes are bottom-up and transparent. Furthermore, as staking is voluntary, contributors have flexibility on whether they want to participate and how much they want to stake.

We’ve been thrilled that most Warcamp contributors have been staking almost 100% of their $HAUS received for additional Warcamp shares. This is a strong signal that Warcamp contributors are aligned with the long term direction and value of DAOhaus.

🔮 Moving Forward

As mentioned, we are beginning with 2 month Compensation Cycles so we can review and adapt as we go, and we plan to use Coordinape results to continuously evaluate performance and calibrate compensation. We will likely be experimenting with longer commitment periods and/or Cycle lengths as well as $HAUS token lock-ups and multipliers to further deepen long-term alignment between contributors and DAOhaus.

To us, creating effective and flexible compensation models is only step one towards creating a better contributor experience. As we look towards our next steps, we’d like to improve the qualitative and human aspects of being a Contributor, such as providing peer-support and feedback (through a buddy system) and ameliorating contributor burnout.

👇 Conclusion

DAOhaus is creating a new compensation plan to address the following problems commonly faced by DAOs.

-

Increase compensation clarity for contributor recruitment 💰

-

Increase contributor retention & focus 🎯

-

Create a foundation for contributor evaluation & growth 📈

-

Give contributors greater ownership & governance 🤝

The new compensation plan we are experimenting with consists of 3 core pillars:

- 🛠 Base Compensation: Our Retroactive and Commitment Track create clear compensation for flexible and focused contributors respectively.

2.💰 Bonus Compensation: Contributors give $HAUS bonus (as kudos) to each other, helping to evaluate performance & guide contributor development.

- 🗳 Governance Power: Contributors can stake their $HAUS bonus for Warcamp DAO shares, giving them more stake and alignment with DAOhaus.

We are running the experiment in cycles of 2 months and will update the community on the progress, results and learning. Meanwhile, if you’re interested in reading more, you can check out some of the discussion related to this new program in the original forum post and proposal.

Acknowledgement

Original author: arentweall Original link: https://daohaus.substack.com/p/-experiment-in-the-haus-a-new-contributor

This article was translated into Chinese on January, 2022. Appreciate the support and assistance of the DAOrayaki community. Chinese translation link:

https://daorayaki.org/daorayakirangers/posts/edit/63ea24c6481af1bc756c973c -

-

@ 05e6367c:6ba9be85

2023-04-03 11:05:44

@ 05e6367c:6ba9be85

2023-04-03 11:05:44A Synthesis Toward Equitable Group Decision Making

This is the first half of a longer article that I split to allow a more thorough explanation of the topics in each. The cover art was generated using content from the full article. Special thanks to Seth Benton for feedback and review.

Summary

Below are the main points I will attempt to outline a conceptual framework for in part 1. In part 2, I explore the potential implications of this framework for DAO governance.

- The power of an individual in an organization is equivalent to their reputation;

2.Reputation is equivalent to contributions;

-

Contributions can be enumerated, measured, and quantified;

-

A holistic quantification of contributions to a DAO enables a fully transparent, trustless, and equitable governance system.

Reputation is Multi-Dimensional

Each person’s reputation is composed of a variety of factors. Which factors we choose to observe and how we choose to measure them can have a dramatic impact on the decisions we make regarding a person. We also need to be wary of subjective measurements involving moral and ethical considerations. Subjective measurements such as peer-reward circles (e.g. Coordinape) can capture contributions that aren’t fully enumerated, while also incentivizing emergent growth through new efforts. However, I’ll do my best to stick with objective measurements in this article and approach questions from logical first principles.

If a new hire at an organization already has a reputation; then, it’s because of contributions they made elsewhere - either in their personal or professional lives. Those contributions conferred them a transferable reputation. One that’s difficult to quantify and even more difficult to verify.

In the world of web3 where pseudonymity, privacy, censorship resistance, trustlessness, and permissionless systems rightly reign supreme we often have little more than reputation to rely on when evaluating a new org or person. Therefore, reputation is extremely important when determining how much power someone has in an organization. Good thing we can track actions, and therefore contributions, on-chain.

DAO contributors can build a reputation through participating in chats, forums, polls, writing proposals, voting, attending meetings, completing bounties, and myriad other methods. These actions can be quantified in various ways and rewarded using tokens. Non-transferrable NFTs, aka “soulbound” tokens (SBTs), have become popularized over the last year as the gold-standard for issuing reputation credentials on-chain. However, this approach is inadequate to sufficiently represent the complexity of human reputation, particularly in a digital environment.

Some of the approaches to creating digital representations of human reputation do incorporate a diverse set of input data sources. Reputation models can be based on contributions drawn from a variety of data sources, both on-chain and off-chain, then aggregated or compared to calculate a given metric and eligibility for a credential (a “merit badge”). A couple of examples of this are the Gitcoin Passport and Orange Protocol’s reputation NFTs.

Using models allows a decision maker to fine-tune their choice of inputs. At one end of the spectrum is a complete lack of authentication and at the other end is a comprehensive evaluation of all enumerated variables. Compared to the singular qualitative data point provided by SBTs, a quantitative model of reputation can be much more meaningful.

Honesty

Why Organizations Use KPIs

KPIs are a means to measure performance toward a goal. Improving KPIs should not be the primary goal of any initiative. That’s like a dog chasing its tail. Optimizing for KPIs does not solve the original problem and results in “training the model” on an irrelevant dataset. Humans are inherently biased and subjective. Humans lie not just to others, but to ourselves, often unintentionally. The only way to keep ourselves in check is with objective data & analysis.

What Are Contributions?

Proof of work with infinite design space. A contribution consists of an:

● An action (work)

● An outcome (value)

● Documentation (proof of work)

The Four Contribution Types

-

Governance: number of polls, proposals, votes, operations, moderation

-

Financial: investments, grant acquisition

-

Effort: merit and deliverable-based activities, time spent in meetings, and tracked working on projects

4.Social: chat and forum ideation, feedback, meetings, promotion

Contribution Scores

By tracking and quantifying contributions in a variety of ways, it’s possible to create an algorithmic and holistic system that’s robust to fraud as well as more representative, equitable, and inclusive than with fewer inputs.

Discrete levels of authentication (credentials), and rules for acquiring them, need to be established to distinguish between individual contributors and the community. Each individual action needs to be enumerated. This can seem like a daunting task until we impose some structure on the process.

Individual contributions can be normalized using transformation functions, then time-filtered to adjust their relative weight. The weight of any particular contribution can then be aggregated according to a meta-function that scales the categories of contribution types according to a distribution specific to each community (described further below). The end result is to generate a single summary value we describe as a “contribution score”.

Conversion Functions: Data Transformation

Linear

X = n

”A function whose graph is a straight line, that is, a polynomial function of degree zero or one.”

Quadratic

X = 2^n

”A polynomial function with one or more variables in which the highest-degree term is of the second degree.”

Logarithmic

X = log2(n)

The inverse function to exponentiation.”\ ” the exponent to which another fixed number […] must be raised”

Time Filters

Each input can be adjusted to focus on a relevant timeframe, or weighted timeframe, to determine which contributions are included in the count sent to the conversion function. This section and concept were initially inspired by the model used in SourceCred grain distributions.

SourceCred has three policies for how a project distributes rewards (“grain”) for contributions - recent, immediate and balanced. The model presented here extends this to include conviction - a strategy to increase the weight of input(s) over a given period of time.

The concept of time filters can be applied to calculating contribution scores at any given snapshot in time.

1. Immediate

“This splits rewards evenly based on contributions from each participant over the last week. (This policy ignores all contributions from previous weeks, and is intended to give fast rewards to active participants).”

2. Balanced

“This splits rewards based both on lifetime contributions and on lifetime rewards earnings. A balanced time filter tries to ensure that everyone in the project receives a total rewards payment which is consistent with their total contributions over the entire duration of their participation.

For example, suppose that a contributor used to have a low number of contributions, and as such received a small amount of rewards. However, the community recently changed its weights, or added a new plugin, such that the contributor now has a larger amount of contributions recorded.

The balanced policy sees that this contributor is underpaid, so it will pay them extra to ‘catch them up’ to others in the project. Conversely, contributors might be ‘overpaid’ and they'll receive less rewards until the payouts have been equalized.”

3. Recent

“This splits rewards based on recent contributions using an exponential decay to prioritize more recent cred. The “recentWeeklyDecayRate parameter determines to what degree you want to focus on recent contributions. If recentWeeklyDecayRate is set to 0.5 (i.e. 50% discount), as in the above example, the policy will count 100% of the contributions generated in the last week, 50% of the contributions generated in the week before, 25% from the week before that, 12.5% from the week before that, and so on.”

4. Conviction

There’s a fourth possible modality popularized as a modifier for governance that is applicable as a temporal contribution filter. Conviction Voting incorporates the concept of increasing decision commitment continuously over time. The same concept can be extended to calculate contribution scores based on weights that decay continuously over time instead of a fixed period.

Feature Scaling & Data Normalization

Well-defined data processing methods can be used to combine any chosen set of random variables to make them comparable.

Conversion functions account for bias in the metric itself. For example, quadratic funding accounts for bias toward donors who give large amounts.

The time filter is self-explanatory, it corrects for a subjective time bias but makes it objective by codifying the process into a transparent formula.

However, neither of these operations makes our various metrics numerically comparable in any logical sense. Each metric still needs to be scaled so that they exist relative to a constant minimum and maximum. Each input metric should be scaled & normalized after the conversion function and time filter have been applied.

**Outputs ** The dependent variables result from passing an input variable through the appropriate time-filtered conversion function. Table 1 (shown in two parts) illustrates an example list of inputs (X) and pairs each with a hypothetical means to calculate an output value (Y).

Table 1. Input sources, categories, descriptions, conversion functions, and calculated outputs are shown for a hypothetical contribution score model.

Table 1A. Model components for inputs including off-chain KPIs, peer compensation groups (Coordinape), and SourceCred. Table 1A. Model components for inputs including off-chain KPIs, peer compensation groups (Coordinape), and SourceCred.

Table 1B. Model components for inputs including SourceCred, Bounties (Dework), Donations (Gitcoin), meeting attendance (POAP) and social media. Table 1B. Model components for inputs including SourceCred, Bounties (Dework), Donations (Gitcoin), meeting attendance (POAP) and social media.

Meta Functions

A meta function is defined here as a composite function made up of set functions. One property of a set function is to reduce the dimensional output of the computation relative to a set of input functions. Meta-functions can be used to calculate a standardized contribution score that reasonably approximates reputation-based participation in a community. There are three steps required to calculate a standardized contribution score from a set of output values (Y) that represent scaled and normalized quantifications for each individual contribution’s input source.

- Determine the weight of each contribution type.

Governance: XX% Financial: XX% Effort: XX% Social: XX% Note: If contributions are assigned to multiple types they must be calculated separately.

- Determine which conversion functions to use for combining contribution types.

(A) + (b) + (c) + (d) = Total Weight Note: It may be simpler to use linear conversions for all meta-functions and avoid superfluous data transformations. Finer control can be gained by transforming each individual input with an appropriate conversion function.

- Normalize the final contribution score by taking the average of the total weight.

Total Weight/# of Contribution Types = Normalized Contribution Score

Acknowledgement

Original author: Elijah Spina Original link: https://mirror.xyz/elijahspina.eth/1ll79DEikQuPkMvjBXVg2XQn4IVtbkGrUUk4SygHlho

-

@ 05e6367c:6ba9be85

2023-04-03 10:00:45

@ 05e6367c:6ba9be85

2023-04-03 10:00:45基础的应用程序:

假设一个基础的 "社交网络 "应用就像Twitter一样。在twitter上,人们有3个page。

*主页动态:显示你关注的每个人的动态。

*个人Profile:个人资料视图,显示该用户的所有动态。

*回复:显示对某一特定动态的所有回复。

一些Nostr客户端可能还想提供另一种体验,即显示所有人posts的全局流(Global Feed)。

**中继(Relays)的简单分类: ** 假设现有的中继可以分为三类:

*充满垃圾邮件的中继:任何人都可以发布任何类型的内容,没有过滤;

*安全中继:存在一些进入障碍,例如需要付费或需要一些繁琐的用户注册过程,垃圾邮件发送者或发布不良内容的人被禁止 - 但这仍然是一个基本上对任何人开放的中继;

*封闭式中继:只有特定类型的人才能进入,例如,一群朋友或封闭式在线社区的成员。

如何关注和查找特定人资料中的帖子:

当一个用户开始关注某人时,可以通过4种不同的方式进行。

*从应用程序中看到这个人

*使用nprofile URI

*使用一个NIP-05地址

*使用一个bear pubkey('npub')

情况1 :可以通过以下情况

发生在你或其他人的帖子的回复中 全局feed帖子中 *从其他人引用或重新发布的笔记中看到该人

当这种情况发生时,预计引用(在e和p标签中)包含中继的URL,以便在第一次接触时将该人与一个中继URL联系起来。

情况2和3:

在情况 2 和 3 中,nprofile 和 NIP-05 地址都应该包含该人的首选中继列表,因此我们可以基于此为该人引导中继列表。

情况4:

在情况 4 中没有中继列表,因此要么通过弹出窗口或其他方式提示用户,要么尝试在已知的中继之一中搜索该公钥。 这仍然是备选方案。

一旦有了给定配置文件的中继 URL,就可以使用这些中继从该公钥查询注释。 随着时间的推移,该用户可能会迁移到其他中继,或者可能会知道该用户也正在向其他中继发帖。 为了确保发现这些东西,我们必须注意在任何地方看到的所有事件的标签中发送的提示 - 来自任何人 - 以及类型 2 和 3 的事件,并相应地升级我们拥有配置文件和中继之间关系知识的本地数据库。

实现应用视图:

根据我们目前收集到的信息,我们可以轻松呈现主页和个人资料视图。 为此,它仅使用有关配置文件和中继之间关系的本地信息并获取注释:

对于主页,来自我们关注的所有人 对于个人资料视图,仅来自该特定个人资料

由于我们要从中继获取非常具体的数据,我们并不关心是否安全的,因为我们可以选择过滤垃圾邮件的中继。

现在,每当用户点击一条动态时,我们都希望显示回复状态。 在这种情况下,我们将只查询安全和关闭的中继,否则垃圾邮件可能会注入到应用程序中。 相同的原则适用于全局feed。

其他启发和极端情况:

本文并没有涵盖许多极端情况。 这只是为了描述一种对于去中心化的 Nostr 来说足够稳健的方式。

例如,如何显示某人引用的笔记? 如果它有中继提示,我们查询该中继。 如果没有,我们可以尝试与刚刚提到它的人相关联的中继,或者我们刚刚看到提到它的注释的同一个中继——因为,当提到它时,有人可能直接将它发布到自己的中继——等等。

最后的想法:

比所有这些更重要的是,我们必须牢记,Nostr只是一组非常松散的服务器,它们之间基本上没有任何联系,没有任何保证,而与他人保持联系和寻找内容的过程必须通过许多不同的Hackers尝试来解决。要编写Nostr应用程序和使用Nostr,就必须接受现在的混乱。

致谢:

感谢DAOrayaki社区的反馈,本文编译Nostr官网报道。 原文:A vision for content discovery and relay usage for basic social-networking in Nostr

-

@ 05e6367c:6ba9be85

2023-04-03 09:54:07

@ 05e6367c:6ba9be85

2023-04-03 09:54:07这两天在网络上又有一个东西火了,Twitter 的创始人 @jack 新的社交 iOS App Damus 上苹果商店(第二天就因为违反中国法律在中国区下架了),这个软件是一个去中心化的 Twitter,使用到的是 nostr – Notes and Other Stuff Transmitted by Relays 的协议(协议简介,协议细节),协议简介中有很大的篇幅是在批评Twitter和其相类似的中心化的产品,如:Mastodon 和 Secure Scuttlebutt 。我顺着去看了一下这个协议,发现这个协议真是非常的简单,简单到几句话就可以讲清楚了。

通讯过程

● 这个协议中有两个东西,一个是 client,一个是 relay,client 就是用户社交的客户端,relay 就是转发服务器。 ● 用户不需要注册,用户只需要有一个密钥对(公钥+私钥)就好了,然后把要发的信息做签名,发给一组 relays ● 然后你的 Follower 就可以从这些 relays 上订阅到你的信息。

技术细节摘要

• 技术实现上,nostr 使用 websocket + JSON 的方式。其中主要是下面这么几个指令 • Client 到 Relay主要是下面这几个指令: •EVENT。发出事件,可以扩展出很多很多的动作来,比如:发信息,删信息,迁移信息,建 Channel ……扩展性很好。 • REQ。用于请求事件和订阅更新。收到REQ消息后,relay 会查询其内部数据库并返回与过滤器匹配的• • 事件,然后存储该过滤器,并将其接收的所有未来事件再次发送到同一websocket,直到websocket关闭。 • CLOSE。用于停止被 REQ 请求的订阅。 • Relay 到 Client 主要是下面几个指令: • EVENT。用于发送客户端请求的事件。 • NOTICE。用于向客户端发送人类可读的错误消息或其他信息

• 关于 EVENT 下面是几个常用的基本事件: • 0: set_metadata:比如,用户名,用户头像,用户简介等这样的信息。 • 1: text_note:用户要发的信息内容 • 2: recommend_server:用户想要推荐给关注者的Relay的URL(例如wss://somerelay.com)

如何对抗网络审查

那么,这个协议是如何对抗网络审查的?

• 识别你的身份是通过你的签名,所以,只要你的私钥还在,你是不会被删号的 • 任何人都可以运行一个或多个relay,所以,就很难有人控制所有的relay • 你还可以很方便的告诉其中的 relay 把你发的信息迁到另一个 relay 上 • 你的信息是一次发给多个relay的,所以,只要不是所有的热门realy封了你,你就可以发出信息 • 每个relay的运营者都可以自己制定规则,会审查哪些类型内容。用户据此选择即可。基本不会有一个全局的规则。 • 如果你被全部的relay封了,你还是可以自建你的relay,然后,你可以通过各种方式告诉你身边的人你的relay服务器是什么?这样,他们把这个relay服务器加到他们的client列表中,你又可以从社死中复活了。

嗯,听起来很简单,整个网络是构建在一种 “社区式”的松散结构,完全可能会出现若干个 relay zone。这种架构就像是互联网的架构,没有中心化,比如 DNS服务器和Email服务器一样,只要你愿意,你完全可以发展出自己圈子里的“私服”。

其实,电子邮件是很难被封禁和审查的。我记得2003年中国非典的时候,我当时在北京,当时的卫生部部长说已经控制住了,才12个人感染,当局也在控制舆论和删除互联网上所有的真实信息。但是,大家都在用电子邮件传播信息,当时基本没有什么社交软件,大家分享信息都是通过邮件,尤其是外企工作的圈子,当时每天都要收很多的非典的群发邮件,大家还都是用公司的邮件服务器发……这种松散的,点对点的架构,让审查是基本不可能的。其实,我觉得 nostr 就是另外一个变种或是升级版的 email 的形式。

如何对抗Spam和骗子

但是问题来了,如果不能删号封人的话,那么如何对抗那些制造Spam,骗子或是反人类的信息呢?nostr目前的解决方案是通过比特币闪电网络。比如有些客户端实现了如果对方没有follow 你,如果给他发私信,需要支付一点点btc ,或是relay要求你给btc才给你发信息(注:我不认为这是一个好的方法,因为:1)因为少数的坏人让大多数正常人也要跟着付出成本,这是个糟糕的治理方式,2)不鼓励那些生产内容的人,那么平台就没有任何价值了)。

不过,我觉得也有可以有下面的这些思路:

• 用户主动拉黑,但很明显这个效率不高,而且体验不好 • 社区或是同盟维护一个黑名单,relay定期更新(如同email中防垃圾邮件也是这样搞的),这其实也是审查。 • 防Spam的算法过滤垃圾信息(如同email中干的),自动化审查。 • 增加发Spam的成本,如: PoW 工作量证明(比特币的挖矿,最早也是用于Email),发信息要花钱(这个对正常用户伤害太大了)等。 • ……

总之,还是有相应的方法的,但是一定没有完美解,email对抗了这么多年,你还是可以收到大量的垃圾邮件和钓鱼邮件,所以,我觉得 nostr 也不可能做到……

怎么理解审查

最后,我们要明白的是,无论你用什么方法,审查是肯定需要的,所以,我觉得要完全干掉审查,最终的结果就是一个到处都垃圾内容的地方!

我理解的审查不应该是为权力或是个体服务的,而是为大众和人民服务的,所以,审查必然是要有一个开放和共同决策的流程,而不是独断的。

这点可以参考开源软件基金会的运作模式。

• 最底端的是用户(User)参与开源社区的使用并提供问题和反馈。 • 用户在使用过程中了解项目情况后贡献代码和文档就可以晋升为贡献者(Contributors), • 当贡献者提交一定数量贡献之后就可以晋升为提交者(Committers),此时你将拥有你参与仓库的代码读写权限。 • 当提交者Committers在社区得到认可后,由项目管理委员会(PMC)选举并产生PMC成员(类似于议员),PMC成员拥有社区相关事务的投票、提名和共同决策权利和义务。

注意下面几点

• 整个社区的决策者,是要通过自己贡献来挣到被选举权的。 • 社区所有的工作和决定都是要公开的。 • 社区的方向和决策都是要投票的,PMC成员有binding的票权,大众也有non-binding的投票权供参考。 • 如果出现了价值观的不同,那么,直接分裂社区就好了,不同价值观的人加入到不同的社区就好了。

如果审查是在这个框架下运作的话,虽然不完美,但至少会在一种公允的基础下运作,是透明公开的,也是集体决策的。

开源软件社区是一个很成功的示范,所以,我觉得只有技术而没有一个良性的可持续运作的社区,是不可能解决问题的,干净整齐的环境是一定要有人打扫和整理的。

致谢

感谢原文作者 陈皓

-

@ 05e6367c:6ba9be85

2023-04-03 09:48:06

@ 05e6367c:6ba9be85

2023-04-03 09:48:06Nostr 出现的原因——爆火的导火索

经历了反垄断之年的互联网群众们,即痛恨于中心化机构对数据的滥用与侵犯,又无力脱离优秀的应用体验以及并无选择性的市场,归根究底在于社交产品背后是公司为机构在运营,是公司就有接受监管与审查的义务,他所有负责的对像是股东以及注册地政 府,本质上追求的是商业上的成功,而不是言 论 自 由的理想。

此外,目前的社交软体都或多或少存在着一些问题:

1、Twitter 的问题 Twitter 有广告;Twitter 使用奇怪的技巧让你上瘾;Twitter 不会显示你关注的人的真实历史动态;Twitter 会禁止某些人的帐户;Twitter 会使用影子禁令(Shadowbans).Twitter 有很多垃圾资讯;

2、Mastodon 和类似应用的问题 用户身份附加在第三方控制的域名上;伺服器所有者可以像Twitter 一样禁止你,伺服器所有者也可以阻止其他伺服器;伺服器之间的迁移是事后才考虑的,只有在伺服器协作的情况下才能完成。它在对抗环境中不起作用(所有追随者都会丢失);运行伺服器没有明确的动机,因此它们往往由爱好者以及希望将自己的名字附加到一个很酷的域名上的人来运行的。然后,用户受制于一个人的专 制,这往往比Twitter 这样的大公司还要糟糕,他们无法迁移出去;由于伺服器往往是业余的,它们经常在一段时间后被抛弃—— 这实际上等同于禁止所有人;如果每台伺服器的更新都必须痛苦地推送(和保存!) 到大量其他伺服器,那么拥有大量伺服器就没有意义了;这一点由于伺服器数量庞大而加剧,因此更多的数据必须更频繁地传递到更多的地方;对于影片共享的具体范例,ActivityPub 爱好者意识到完全不可能像文本注解那样在伺服器之间传输影片;

3、SSB(Secure Scuttlebutt)的问题 它没有太多问题,我认为这很棒。事实上,我打算以此为基础,但是它的协议太复杂了,因为它根本就没有被认为是一个开放的协议。它只是用JavaScript 编写的,可能是一种快速解决特定问题的方法,因此它有奇怪和不必要的怪癖,比如签署一个JSON 字符串,其必须严格遵守ECMA-262 第6 版规则;它坚持从单个用户那获得一连串的更新,这对我来说是不必要的,而且会增加内容的臃肿和僵化程度—— 每个伺服器/ 用户都需要存储所有的Post 链,以确保新的Post 是有效的。为什么要这么做?(也许他们有很好的理由);它不像Nostr 那样简单,因为它主要是为P2P 同步而设计的;不过,可能值得考虑使用SSB 而不是这种自定义协议,并仅使其适应客户端中继伺服器模型,因为重用标准总是比尝试让人们使用新标准更好。

4、其他要求运行伺服器方案的问题 他们要求每个人都运行自己的伺服器;有时人们仍然会在这些方面受到审查,因为域名可能会受到审查。

而反垄断的终局古往今来更多是屠龙勇士终成恶龙,既然中心机构做不到,也没有立场去做,那么对自由的向往便催生出使用代码来保障自由的去中心化协议:Nostr。

Nostr 协议是什么?——真正的去中心化社交

最近大火的Damus,是建立在Nostr 协议的一个应用,主要是以去中心化的社交场景(你把它理解为去中心化的Twitter)即可。

Nostr全称是Notes and Other Stuff Transmitted by Relays,是一个于2020年启动的去中心化社交网络开源协议。项目创始人fiatjaf也是比特币和闪电网络的开发者。目前项目没有公开融资,推特创始人Jack Dorsey对该项目进行了14BTC的捐助。

透过nostr 协议,你可以建立很多东西,这个协议相对轻量级的、简单但可扩展的开放协议,在它上面可以建立真正去中心化的社交媒体平台。

Nostr 协议的运行原理

Nostr协议中由两部分组成,一个是客户端Client,另一个是中继端Relay。客户端用于签名、验证信息,由用户运行。中继端可以抓取、存储任何与它链接的客户端的信息,并且转发给其他客户端。

任何人都可以运行中继端,但中继端和中继端之间互不通信,这一点与区块链节点有着本质区别。

另外,客户端允许用户与他们想要的任何数量中继端相连,用户还可以选择是否想要从自己所连接的中继端中读取、写入信息等等。这就意味着,我们可以连接某个中继端来检索内容,但是可以选择不在那里进行事件发布,或者反过来也成立。

如何在nostr 上创建帐号?

在nostr 中,我们不需要通过使用个人数据来注册一个帐户(这就是它的优势)。

像比特币一样,我们只需要一套钥匙,也就是两把钥匙。

一个公钥(Public Key)作为你的用户名,这个密钥可以共享,并对所有人公开(就像你的微博帐号、微信ID、银行帐户一样,别人通过这个找到你)。一个私钥(Private Key)。这把钥匙像你的密码,需要对它进行保密,通过这个密钥,你可以在任何由nostr 支持的平台上 访问你的帐户。只需要选择一个nostr 协议的客户端,如anigma、coracle 或astral,它就会为你生成,这里,为了增加安全性,建议使用外部签名程序,如Alby 浏览器扩展或nos2x 扩展等等,也可以用Rana 等工俱生成一个独立的私钥。

注意保存私钥,因为它是将来恢复和重新登录你的帐户的唯一途径。

Nostr 协议的特点

Nostr 协议主要有以下5 个特点:

1、简单易注册 任何用户都可以创建一对公私钥,无需通过域名或社交帐号注册。Nostr的签名和验签算法不是常用的ECDSA,而是schnorr signature算法,这意味着,如果用户已经拥有比特币以太坊的私钥,那么是可以用于Nostr网络的,但因为编码形式的不同,私钥在不同网络的显示形式可能有所不同,这个需要做一次转换。

2、信息传递存储去中心化 不依赖于任何可信任的中心化服务器,且客户端发布信息可选择存储至多个中继端,因而对单一中继端依赖更小,也更具有迅速恢复性。

3、降低信任风险 讯息都有公钥标识,而讯息的验证由客户端验证完成,中继端只负责存储、传输,用户无需信任中继端,这进一步降低了通过Web3钱包进行签名带来的信任风险。

4、处理应对垃圾信息 果在Nostr网络中不能删 号封人的话如何对抗那些不良信息呢?Nostr中继端可以要求用户为发布付费或其他形式的身份验证,并将这些在内部与公钥相关联,以对抗垃圾信息。如果一个中继端被用作垃圾信息载体,它很容易会被用户丢弃,客户端可以继续从其他中继端获取更新。

5、 与闪电网络的结合: Nostr的开发者fiatjaf同时也是比特币和闪电网络的开发者,因而Nostr原生支援闪电网络。闪电网络速度非常快,性能非常强,能够承载Nostr上的高并发应用。基于Nostr的客户端Damus内置比特币闪电网络功能,可以直接调用第三方闪电网络钱包支付。2023年2月3日,Damus表示将通过比特币闪电网络随机向用户发放小额比特币。

Nostr 协议如何进行操作?

Nostr 的NIP 是一个雷同于以太坊EIP 提案的机制,而NIP-01 即说明了每个讯息的内容。

从用户客户端的视角出发,可以进行下列操作:

操作1、签名发布信息:EVENT

用户想要发布信息时,则是用自己本地客户端存储的私钥,对一串内容content做签名,最终生成如下的json类型数据

{

“id”:<结构化数据的哈希值>

“pubkey”: <事件创建者的公钥>,

“created_at”:

, “kind”:<种类,可理解为频道>,

“tags”:[

[“e”, <另一个事件的id>, <推荐的中继器URL>],

[“p”, <推荐的中继器URL>],

… // 未来可能会包含其他类型的标签

],

“content”:<任意字符串,如hello world>,

“sig”: <序列化事件数据的sha256 哈希的64 字节签名,与”id”字段相同>

}

这里的id 其实是基于当前内容[pubkey,created_at,kind,tags,content]组合后用哈希计算得出的,因为有时间戳的参与,所以正常情况下id 是不会重复的。

操作2、订阅目标事件:REQ

作为信息传输,有来就有回,指令REQ 需要向中继器发送一个随机ID 作为订阅ID,以及一个过滤器信息。目前协议可支持的设定如下,

{

“ids”: <事件ID 的列表>,

“authors”: <公钥列表,必选项一>,

“kind”:<种类列表,可理解为频道>,

“#e”:<“e”标签中引用的事件的ID 列表>,

“#p”:<“p”标签中引用的公钥列表>,

“since”: <时间戳,筛选此时间之后的>,

“until”: <时间戳,筛选此时间之前的>,

“limit”: <要返回的最大事件数>

}

从筛选条件来看,基本等同于关注这个功能,既不需要对方许可也能拉取到对方发布的信息(事实上本质都是公开的),而过滤器也只是更好的定义,是谁在什么时间段,发布的那一条

当然出于中继器这样的设计,有可能部分中继器并没有存储目标用户的信息,那么用户需要尝试从不同的中继器去拉取,一旦中继器挂了,甚至全部相关联的中继器都挂了,那这块信息也就损失了。

操作3、结束订阅:CLOSE

最后一种客户端能对中继器发起的信息便是close 指令,即关闭订阅,那客户端便不会持续持续获取到最新的事件信息了。

从技术角度看,此协议使用了订阅ID 的模式这意味着中继器会建立起持续的websocket链接,一旦此中继器收到被关注用户的信息,就会主动向订阅方的客户端发起请求来同步,这种模式虽然对中继器而言负载更高,但同时也能得到实时被关注数这样的数据,是一种能激励用户发布更有价值信息的方式。

并且协议出现多个「e」、「p」,这类信息虽然并不是必选项,但他能让各个中继地址在客户端之间裂变,传播,是提升抗审查性的关键。

Nostr 协议的表现如何?

1、Nostr 的数据表现 根据nostr.io的数据显示,截止至2023年2月5日,Nostr的公钥数量为500,463,拥有的中继端为289个,事件(event)超过121万。Nostr在最初的NIP 01中定义了三种不同的事件类型:

0:发送有关用户的元数据,例如用户名、图片、简介等;1:发送短信和基本内容;2:推荐中继服务器供关注事件创建者的人连结。

2.Nostr 的生态应用 去中心化的推特是Nostr当前最大的用例,然而其运用远不止社交产品这么简单。现在基于Nostr建立起了类似Telegram的Anigma.io、Reddit的替代品novote、端到端加密文本共享工具Sendtr、在线下棋小游戏Jeste等等。

Nostr 的野心:不止替代Twitter

那么,Nostr 仅仅就是想做个去中心化的Twitter 吗?

1、替代Twitter 为达到替代Twitter 的目的,客户端利用了第1 类的事件,即纯文本笔记。一些客户端包括:coracle, astral, nostr.ch, branle, damus, alphaama.com, Nostros 等等

比如Damus, 就是替代Twitter 的创造

2、替代Telegram 通过使用4X(X 是0 到9 之间的数字),可以实现像Telegram 那样的公共频道,比如上面主页的Anigma.io 是实现Telegram 克隆的网络应用。你可以创建公共频道,任何人都可以加入并聊天。在anigma 中,可以向用户发送私人的端到端加密讯息。

3、替代Reddit Nostr 也可以作为Reddit 的替代品,可以发布帖子,用户可以对这些帖子投票,比如上面网站大图的nvote。

4、 在线游戏 nostr 的另一个有趣的用途是创建简单的多人在线游戏,比如Jeste,在这个平台上,你可以通过Nostr 与其他用户在线下棋。

5、文本共享 Sendstr 是一个在线工具,你可以通过nostr 协议在两个设备之间分享端到端的加密文本数据。

Nostr 协议目前存在哪些问题?

1、中继端激励问题 虽然任何人都可以建立中继端,但目前全球只有200+公开的中继端,因为搭建是存在门槛的,需要较好的处理性能和网络,同时也需要一定的技术和运维能力,但是中继端缺乏收益,因而如何吸引更多的中继端加入是个问题,如果基础设施建立在脆弱的「自愿主义」基础上,则难以壮大为一个强大的社交网络。

然而,如果有激励,则会面临着,大部分激励将逐渐掌握在少数人手里,无法形成有效激励,且容易受到攻击的困境。针对运行中继器激励的问题,开发者认为,首先不应假设中继器的运营者会无偿服务,即便没有所谓的「激励」,p2p网络中的DHT节点仍然在持续运营。

2、社交隐私问题 目前的Nostr 中继器只是简单JSON 数据的转储。客户端通过过滤器获取。这使得nostr 成为客户端之间的通用数据共享平台,那对于有隐私信息传递需求的场景而言,如何解决呢?毕竟即使是推特这样的社交广场也会有私信的需求存在。

目前较优的解决方案是,DH 算法(迪菲- 赫尔曼密钥交换),这套1976 年问世的算法。它是第一个实用的在非保护信道中创建共享密钥方法。只要得到共享密钥,使用Nostr 的双方均可以发布加密后的信息,从而实现点对点的隐私通信。由于隐私常有阅后即焚的诉求,所以其中的服务器存储成本还能进一步降低。

3、抗DOS 问题 会受到攻击的是中继器这一层,目前Nostr 协议并不直接指导和确定如何让中继器抗击DOS 攻击和垃圾信息,因此也是众多中继器实现的重点。

4、Nostr 的存储问题 目前数据主要存储在中继端上,但这并不是永久存储,用户一旦更换客户端,信息就清除了。中继端用于缺乏激励,没有足够的动力来为用户数据进行存储,因而也存在着中继端主动或者被动删除数据的可能。未来Nostr或可以针对存储功能提供激励,在确保去中心化和易用性的同时,使得数据更加具有可得性。

Nostr 协议的发展展望

总体来说,Nostr是一个非常简单且具有高度互操作性的协议,其呈现了去中心化社交协议与自由的价值传递交织后涌现的可能性。客户端和中继端的组合,使得信息的发布和传递更加具有抗审查性,这与比特币倡导的精神内核相吻合。

Nostr算是为去中心化社交新打开了一扇窗,自此之后,相信大规模的协议以及应用会迎来新的突破。

-

@ 3bf0c63f:aefa459d

2023-04-03 09:42:48

@ 3bf0c63f:aefa459d

2023-04-03 09:42:48We need a bunch of JSON files with test vectors inside.

For starters, would be nice to have just a bunch of kind:1 events to see if they are valid and have a valid signature. We need vectors for events that should fail (for example, if they have an invalid signature or if they are missing some property or have something that isn't a string inside a tag array, stuff like that).

And also tests for parsing event filters and if a given filter matches a given event.

I don't know what is the best format for the JSON, but it should be something that library implementors can easily load -- for example, directly from GitHub -- and plug into their test file to test everything in a single loop.

-

@ a6e3fee8:a1e557ee

2023-04-03 08:08:57

@ a6e3fee8:a1e557ee

2023-04-03 08:08:571BTC = 1BTC suona bene. Ma che significa?

1BTC = 1BTC significa che 1 BTC dell'offerta totale rimarrà invariato nel tempo, per sempre.

L'offerta totale è limitata a 21.000.000 di BTC. Non ce ne saranno mai di più. Si tratta di una regola scritta nel codice, applicata dalla rete e da ogni singolo nodo. Se si possiede 1 BTC, si possiederà sempre 1/21.000.000 dell'offerta totale. Chi possiede 100.000 Satoshi, possiederà sempre 0,001/21.000.000 dell'offerta totale.

Poiché Bitcoin non è inflazionabile nell'offerta monetaria, questo rimarrà vero per sempre. Fino al singolo #sats

Esplorando questo concetto con un semplice esercizio di pensiero e alcune immagini, si può fare un confronto con il dollaro USA.

L'USD non ha le stesse regole: l'offerta monetaria può cambiare nel tempo ed è già successo in passato. Questo fenomeno è noto come inflazione dell'offerta monetaria. Il problema dell'inflazione si fa sentire nel tempo, influisce negativamente sul proprio conto di risparmio, come diminuizione del potere d'acquisto.

E poiché l'offerta monetaria del dollaro USA cambia nel tempo, diciamo:

1USD ≠ 1USD

Una semplice visualizzazione dovrebbe aiutare a spiegare questo concetto.

Nello schema interattivo creato da @mrldotsh, c'è un semplice diagramma. Una parte rappresenta il conto di risparmio. L'altra parte rappresenta il resto dell'offerta totale. Insieme, costituiscono l'offerta totale di USD e bitcoin.

Sotto il diagramma si trovano alcuni elementi di controllo. È possibile modificare la dimensione del proprio conto di risparmio, la dimensione totale del mercato e l'attuale offerta totale di dollari USA disponibili.

(i risparmi con una certa inflazione dell'offerta monetaria)

Cosa succede all'aumento dell'inflazione?

(gli stessi risparmi, se aumenta l'offerta monetaria, aka l'inflazione)

Troviamo il tool a questo link

1BTC = 1BTC

Proviamo a farlo con bitcoin, il mostro energivoro che inquina e usa tutta la vostra energia da normies?

Non si può. Perché nessuno può farlo!

Riflessioni sull'inflazione

L'ex boss della federal reserve, Ben Bernanke, una volta ha detto:

«Un'inflazione bassa e stabile in molti paesi è un risultato importante che continuerà a portare benefici significativi»

La verità è che l'inflazione «è un modo per sottrarre ai cittadini la loro ricchezza senza dover aumentare apertamente le tasse. L'inflazione è la tassa più universale di tutte» - Thomas Sowell

«L'inflazione è quando si pagano quindici dollari per un taglio di capelli da dieci dollari che si otteneva per cinque dollari quando si avevano i capelli» - Sam Ewing

«L'inflazione è violenta come uno scippatore, spaventosa come un rapinatore a mano armata e letale come un sicario» - Ronald Regan

«È giusto affermare che la gente della nazione non capisce il sistema bancario e monetario perché, se lo capisse, credo che ci sarebbe una rivoluzione prima di domani mattina» - Henry Ford

Se ti è piaciuto il tool creato da @mrldotsh puoi zappargli qualche #sats al suo LNAddress: mrldotsh@getalby.com

Se ti è piaciuta la traduzione, puoi scambiare V4V a questo LNAddress: milanotrustless@getalby.com

-

@ 45c41f21:c5446b7a

2023-04-03 05:16:33

@ 45c41f21:c5446b7a

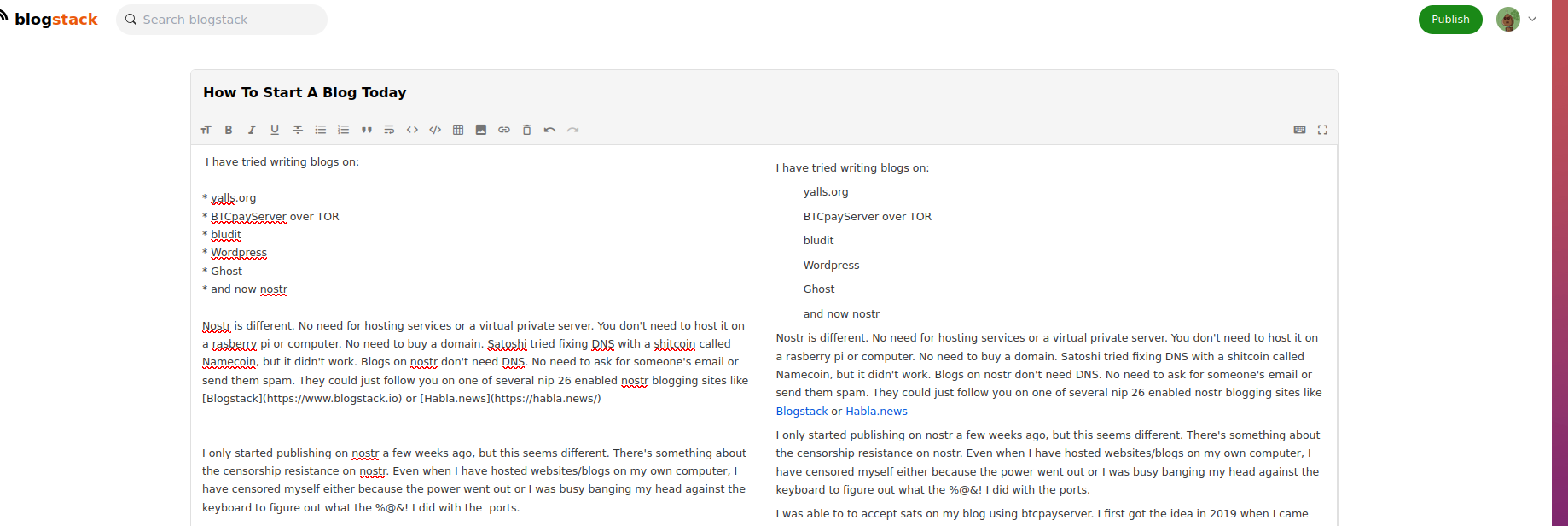

2023-04-03 05:16:33hello Monday! Today we refactored the writing experience on flycat.club, now you can save local draft posts when blogging on flycat.

We also adjusted the layout of the editor page so you get less distracted in writing.

some meta datas will be displaying and required you filling only when you try publishing the post.

you can find your drafts on

myBlogpage (https://flycat.club/blog/and continue editing it until you are comfortable to publish it.

As always, we appreciate your feedback. Please don't hesitate to tell me what you think about the updates~

-

@ 00000000:6a5fcbfa

2023-04-03 02:42:39

@ 00000000:6a5fcbfa

2023-04-03 02:42:39Amo volver a escribir. Y que volver a escribir sea parte de NOSTR. I'm back bitches! Ya lo verán. Quizá en este perfil o quizá en otro, pero la adrenalina y felicidad de volver escribir.

-

@ dace63b0:f1ce8491

2023-04-02 22:58:26

@ dace63b0:f1ce8491

2023-04-02 22:58:26[3]

[4]

[5]

[6]

[7]

[8]

[9]

[10]

[11]

[12]

[13]

[14]

[15]

[16]

[17]

[18]

[19]

[20]

-

@ 75bf2353:e1bfa895

2023-04-02 22:11:19

@ 75bf2353:e1bfa895

2023-04-02 22:11:19So if stocks are not safe, banks are crashing, house prices are dropping…I would put all my cash under the floorboards but there’s also inflation. Sooo do we buy Bonds?

— Louis KC (@NotlouisCk) March 13, 2023

PS if you say bitcoin in the comments, I’ll Twitter slap you.Dear Louis CK,

I don't know much about stocks. I don't really know why unprofitable companies go up in value. I don't know why so many people bought bonds that pay 1.5% when the goal of the Federal Reserve is to keep inflation at 2%. I don't know why these investments are considered safe. I sure as hell don't know why banks only keep a fraction of the money on reserve. I also can't predict what the Federal Reserve will set the interest rates to. I don't know how the USA will pay off the national debt.

I just know we have a peer to peer electronic cash system named bitcoin.

Ducks Twitter Slap by using nostr

We use the lightning network to pay for coffee. Here is a video of Alex Gladstein buying a cup of coffee in El Salvador. Bitcoin is legal tender in that country. Alex works for the Human Rights Foundation.

Flawless experience using @MuunWallet here in El Zonte to buy all sorts of things with Bitcoin 👌

— Alex Gladstein 🌋 ⚡ (@gladstein) September 2, 2021

If you visit, make sure to stop by for a coffee with Karla, an excellent barista.

You can tip her instantly from anywhere in the world with Lightning here:https://t.co/qFWYI0bt4e pic.twitter.com/ruyBLWrRy7Zaps On Nostr

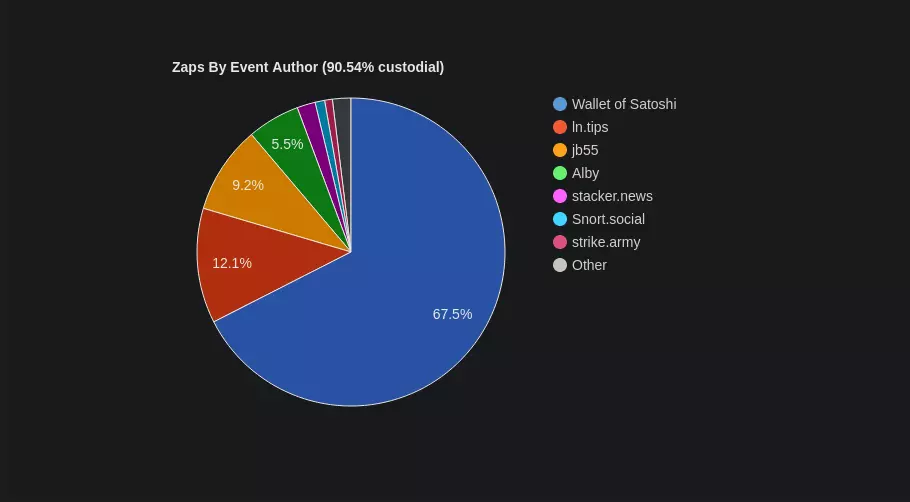

We use the lightning network to send zaps on nostr. A zap is a bitcoin payment sent over the lightning network. It takes seconds and zaps can be made to anyone with a nostr account and a lightning address, and Internet connection, no matter where they are in the world.

We Tip With Bitcoin

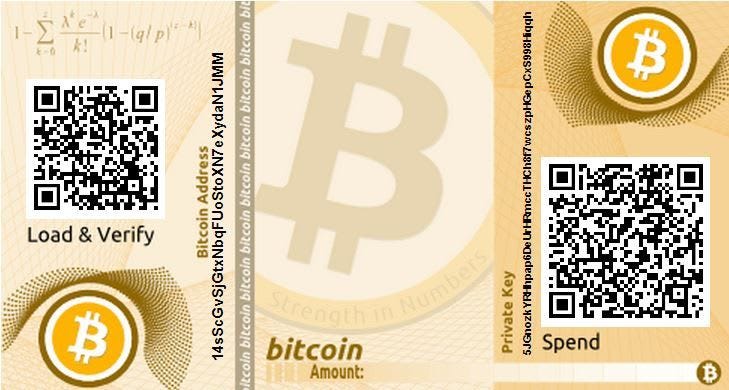

We don't know what the value as compared to dollars will be on any given day. Nor do we know how many dollars exist. We do know how many bitcoin will exist. We also know the last satoshi will be mined somewhere around the year 2139.

Bitcoin is information crypto graphically proven to be true. It does not need FDIC insurance. Math does not lie. People lie. If a $100 bond is worth $80, the central bank says, "No... the price the free market gives this bond is wrong. A bond that pays 1.5% interest in and 8% interest world is worth $100." They lie.

When Bernie Madoff stole billions of dollars and did not invest any of it. His clients did not lose money because of the great financial crisis. His clients panicked like everyone else at the time so demanded their money. He just didn't have it because he already spent it paying Peter after robbing Paul. People lost their life savings because they trusted Bernie, one of the founders of the Nasdaq. Before his Ponzi Scheme collapsed, this guy named, Harry Markopolos noticed Bernie "would have had to buy more options on the Chicago Board Options Exchange than actually existed." He caught onto Bernie's Ponzi Scheme in the late 90's. He did not just trust Bernie Madoff. He verified the Madoff's math, but the numbers did not add up. He tried to tell the SEC. launching an investigation of Madoff's business. The regulators came up empty handed because they were bamboozled by the Nasdaq founder. Essentially, nobody listened to Harry Markopolis, but he was right.

Bitcoin did not exist back then. Bitcoin has a Timechain that audits the entire network every ten minutes on average. We can calculate how much bitcoin has been made in minutes. We don't need to be a math wizard like Harry Markopolos because of this. We don't need to trust SEC regulators. We just run a single command.

bitcoin-cli gettxoutsetinfoThis Is Not Investment Advice

Bitcoin is not an investment. Bitcoin is a peer-to-peer electronic cash system. If you have 100% faith in the US dollar and banking system, congratulations, you don't need any bitcoin. Maybe you have a financial advisor like Bernie Madoff. If you mistrust the fiat US dollar and banking system just 99%, maybe you should put 1% of your assets in bitcoin just in case. If you trust your financial advisor 100%--I guess you will not need any bitcoin either. How valuable is bitcoin? It changes from day to day. Sometimes it drops especially when a lot of people start trusting people like Sam Bankman-Fried to hold their bitcoin and casino coins like people trusted Bernie Madoff to invest their life savings.

If bitcoin goes to zero, yo0u probably won't be able to buy a cup of coffee with it anymore. At least you only lost 1% of your assets. You can probably handle a 1% loss, but if bitcoin fails the banking system better make it. What are we going to do otherwise? Go back to trusting the banks have gold in the vaults? Use salt again? Invest "risk free" like Madoff's clients thought they were doing?

One thing is sure. Bitcoin properly secured in your own wallet does not require trust. It does not require the esteemed qualifications like those of Bernie Madoff. It just requires thousands of nodes verifying the math 144 times per day. We can verify that bitcoin is there even though we do not know how much people will value that mathematical trust of the system in fiat terms. This doesn't matter because when money dies again, bitcoin will be there. Hopefully the world will be ready to use it before then.

Don't Trust, Verify

Blogging Bitcoin 783,671

-

@ e2d7d2ea:a8cfe665

2023-04-02 01:57:42

@ e2d7d2ea:a8cfe665

2023-04-02 01:57:42I've spent years attributing genuine malice to the actions of plutocrats, governmental leader types and general societal elites. I've watched current events unfold, studied abuse of power in the past and seen the seemingly endless cycle of fealty leading to "loyalty" transmuting to law abiding and in all cases reinforced by threat of pain if a contrite obedience wasn't observed by most.

I think I was wrong about this simple one sided, relatively flat, dominance described above. Don't get me wrong, there's certainly an observable concentration of sociopaths at the top of the economic ladder. Monster Magnet said it best, "if I don't get my bath I take it out on the slaves" but, I've come to suspect that there are significantly fewer true psychopaths at the top and, rather, a very thick and stodgy maelstrom of power imposters, middle managers, toadies if you will, who've not really been given any power, but are compensated mightily and allowed to associate with the truly powerful, for the one simple task of ++communicating and enforcing policy++ that has been developed by others.

In this series of posts I'll attempt to find out if this hypothesis is classically defensible. I'll look for support and also find untenable this claim of a massive and largely inept management class scurrying around, attempt to satiate their leaders. I'll further attempt to define who these leaders are and do so in as un-conspiratorial a fashion as possible.

The History is going to begin with 1000 AD, break the entire world down into continental Asia, The Islamic World including expansion into Africa, Europe (or Christendom) and cover what can be verifies concerning the Americas, both North and South.

It seems important to understand how far we've come from vassals of perpetually warring states, all in the name of expansion, and then outline how, even in this modern age, truly right on the edge of a functioning AGI, that we still fall into these almost pre-ordained class systems.

Maybe if we understand it better, we can move past it. Just maybe.

-

@ 75bf2353:e1bfa895

2023-04-01 13:25:55

@ 75bf2353:e1bfa895

2023-04-01 13:25:55[3]

[4]

[5]

[6]

[7]

[8]

[9]

[10]

[11]

-

@ 75bf2353:e1bfa895

2023-04-01 02:43:18

@ 75bf2353:e1bfa895

2023-04-01 02:43:18According to Jack Mallers Bitcoin 2022 announcement, Bitcoiner's will be able to spend bitcoin at normie stores in a matter of weeks. This officially makes bitcoin:

- A Store of Value

- A Medium of Exchange

- A technology capable of disrupting SWIFT and Credit Cards

Unit of Account is the final boss. Many of us already think in sats, but when we truly get hyperbitcoinization, we will all think in sats.. When we all think in sats, we'll get paid in bitcoin.

To help make this a reality, I think it is important to support businesses and creators that are already accepting bitcoin. I shop at stores that accept bitcoin. I eat at restaurants that accept bitcoin. I'm excited to buy everything I need using bitcoin.

I also support podcasters with bitcoin using the Fountain App. This allows me to support my favorite podcasters like Matt Odell on Citadel Dispatch. I especially like how his podcast is 100% listener supported. This is how the Internet should be, instead of corporations acting like sharks and treating us like chum. , Mr. Odell says the add based model pays way more than listener contributions. It shouldn't be that way.

Matt Odell has 160,000 followers I suppose many of these followers are nyms, so maybe the actual audience is 80K. Suppose 20% of these people donate 250 sats to Matt Odell by boosting him 250 sats per episode or perhaps streaming 5 sats per minute(which is about 250 sats per hour) 250 sats is only ten cents on the fiat standard. You might not even pick up a dime if you found it on the ground. You might pay 10 cents more per gallon of gas because because it's easier to use a credit card than making a trip to the ATM. You might pay 1600 times that on a Spotify subscription that would give Matt Odell an income that is the equivalent of $1,600 per week or $83,200 per year.

How much do you think Spotify pays podcasters when subscribers listen to them on Spotify? Does some of that $16.00 per month get to podcasters other than people with the name, Joe Rogan? My guess is zero. You could pay 50 content creators $0.10 for $5.00. Bitcoin over the lightning network lets us cut out the middle man?

What About Capital Gains Tax?

If you spend $60.00 a year worth of bitcoin on supporing podcasters, you may owe capital gains tax. In the United States, long term capital gains tax is 15%. So you should send a $9.00 to the IRS to avoid tax evasion. Is $9.00 a year really going to change your lifestyle all that much? If it is, you should consider tax evasion. The government probably won't find out, but I would just pay the taxes to avoid the IRS. I understand the tax protest movement has a long tradition in the U.S. and I'm sympathetic to this movement, but for me...it's just not worth the risk. If a draconian government raised capital gains to 80% I would reconsider my position.

Spend At Least A Small Amount Of Bitcoin

I'm not saying sell all your bitcoin and buy a lambo. I'm saying get comfortable paying in bitcoin. Support Businesses that accept bitcoin. You can spend and replace or use Strike if you are lucky enough to live in the US. Are there privacy implications of this? Yes. Am I better off buying Bitcoin with cash I earn under the table on Bisq, coin-joining on Samourai and sending it to Muun to make lightning payments? Also yes. Most people are not going to do that, but that's the goal.

Ideally, you want to make your living by selling goods and services for bitcoin. Then spend bitcoin on everything you need. You'll be surprised how your spending habits change when using peer-to-peer electronic cash as your money. To be honest, even cuck bucks seem to make you spend less money because it takes away the convenience of a credit card. I would say this is the main drawback of using something like Strike for your payments. Yeah... I know...KYC, but if you only spend fiat with Strike, the KYC is not as big of a deal until you get banned from using the app for making protests or selling tit pics. This negates most of the benefits of a peer-to-peer network. When dealing with a company, the relationship is no longer peer-to-peer, but rather master, slave. The ability to spend your money is entrusted with a third party.

Of course, most people would probably use Strike to stack too, since there are virtually no fees. Ideally, you would want to use bitcoin in a completely peer-to-peer way, but that's probably not going to happen. Most people will probably choose convenience. I suggest you use Bisq, but I understand it's not a perfect world. If you want to pay my paywall using Strike, I'm not going to stop you.

Brutus Bond Block Height: 732,708

Reverse Paywall(I had this idea of creating a reverse paywall, but it's silly now that we have zaps.

Value 4 Value

This blog has no ads and is reader supported. It uses the Value 4 Value model instead. If you don't know what that is, please click the button bellow.

-

@ 75bf2353:e1bfa895

2023-04-01 02:01:31

@ 75bf2353:e1bfa895

2023-04-01 02:01:31This was my first blog post on Ghost. Before this I wrote under this nym on wordsmith. have decided to re-post all my blogs on nostr. to be honest, many of them suck, but I want to post them here anyway To remind myself how much I have learned and how much I still need to work on my craft.

At first, I used the image of a real person on pixelfed. I regret this decision. I also later changed my nym to Blogging Bitcoin. I still use BrutusBondBTC on Github because they won't give me permission to use BloggingBitoin.

My Nym Is Brutus Bond

My nym is Brutus Bond. You won't find this name on my driver's licence . I started writing a blog about bitcoin because I've been obsessed with it since 2014. I want a way to explore my ideas about bitcoin and teach people how to use it. I'm using a pseudonym for the following reasons:

- Anonymous writing has a long tradition in the US. I chose Brutus becuase it was the nym chosen by the person who wrote my favorite Anti-Federalist Paper

- Satoshi was a nym and showed that it was possible to have a completely peer-to-peer cash system that allows world-wide commerce without an identity attached.

- I was inspired by Rockstar Developer's appearance on Citadel Dispatch.

My goal is to become a soverign individual by building a small audience willing to pay me 250 sats per week or 13000 sats per year. I will also donate 10% of everything I make to opensats.org. I realize making a living off donations worth 10 cents is a longshot, but it's something I want to try. I believe the Internet is better if we can avoid the surviellence capatalism that preys upon us all, making us spend more money than we should on things we don't really need.

The idea is to write about bitcoin everyday and ask for donations. I'm trying something I like to call a reverse paywall to do this. Normallly, a writer provides a small sample of thier article before asking you to pay 50-500 per year to read the rest.

250 Sats Per Week

I decided to present my article first and then ask for a small donation at the end of the article. The paywall comes at the end instead of the begining. You are only asked to pay 250 sats at the end of the article. If you can't afford it, you still get to read the article.

Skip to main content Posts Published

This is not a picture of my actual face, but it does have my PGP ID

My nym is Brutus Bond. You won't find this name on my driver's licence . I started writing a blog about bitcoin because I've been obsessed with it since 2014. I want a way to explore my ideas about bitcoin and teach people how to use it. I'm using a pseudonym for the following reasons:

-

Anonymous writing has a long tradition in the US. I chose Brutus becuase it was the nym chosen by the person who wrote my favorite Anti-Federalist Paper.

- Satoshi was a nym and showed that it was possible to have a completely peer-to-peer cash system that allows world-wide commerce without an identity attached.

-

I was inspired by Rockstar Developer's appearance on Citadel Dispatch.

My goal is to become a soverign individual by building a small audience willing to pay me 250 sats per week or 13000 sats per year. I will also donate 10% of everything I make to opensats.org. I realize making a living off donations worth 10 cents is a longshot, but it's something I want to try. I believe the Internet is better if we can avoid the surviellence capatalism that preys upon us all, making us spend more money than we should on things we don't really need.

The idea is to write about bitcoin everyday and ask for donations. I'm trying something I like to call a reverse paywall to do this. Normallly, a writer provides a small sample of thier article before asking you to pay 50-500 per year to read the rest. 250 Sats Per Week

I decided to present my article first and then ask for a small donation at the end of the article. The paywall comes at the end instead of the begining. You are only asked to pay 250 sats at the end of the article. If you can't afford it, you still get to read the article.

I hope you enjoy it. I started writing this blog on wordsmith. It's like a rough draft, but I'll leave it here in case you want to read more of my writing.

Photo by Choong Deng Xiang / Unsplash

Brutus Bond Block Height: 732,562 Donate 250 sats

Brutus Bond Block Height: 732,562 Donate 250 sats

376 words

-

@ 75bf2353:e1bfa895

2023-04-01 01:39:46

@ 75bf2353:e1bfa895

2023-04-01 01:39:46Crypto Means Cryptography

My nym should probably be blogging crypto, but it sounds like such a dirty word in the aftermath of ICO's like dentacoin, Non-scarce JPEG's marketed as NFT's, and Elon Musk pumping DogeShitCoin. The e is silent.

Remember the decentralized storage coins? Oh yeah, and who can forget about the decentralized exchange tokens like Komode or something like that? Who cares? Today, we have decentralized exchanges like RoboSats, Bisq, and Peach. We could probably encrypt our stuff and put it on Keet for decentralized storage.

Before nostr, Dan Larimer tried to create a social media using a shitcoin. It didn't work, so what did he do? He created another casino coin to create another decentralized social media.

Oh yeah and I really lost some sats on nano. It made payments fast and cheap...You know.. Like the lightning network does today.

Why do I know these things? Because 270,000 blocks ago I had no idea what the hell I was doing. I was an idiot gambling my sats away on DumbAss coin and Dumber Coin because I thought "crypto" would change the world. Back then, I didn't understand cryptography was actually a form of mathematics like trigonometry.

Bitcoin changed the world, but cryptocurrencies do not change anything. Bitcoin is the invention of the wheel. All the other casino coins are like Hot Wheels. Sure, some people collect them I would buy one that looked like the Bitcoin Formula One car myself, but alternative coins use cryptography like Hot Wheels use the wheel. Nobody with all their marbles thinks Hot Wheels are more valuable than the invention of the wheel!

Ethereum, the biggest number 2 of them all, is a convoluted central bank that uses cryptography. The monetary policy of this crypto central bank is to just allow anyone with a keyboard and an asshole to create new money whenever the hell they feel like it, create a pre-mine, and dump it onto unsuspecting suckers. Except they also can create non fungible tokens for non scarce JPEGS. I'm no fan of the Fed, but Eth delirium's monetary supply is what would happen if every member of the Federal Reserve was selected from an insane asylum.

Cryptograophy Can Change The World

Even though I no longer trade casino coins, I still think public key cryptography is a useful tool that can change the world. I just happen to think that money created out of an absolutely scarce decentralized ledger using real world energy(proof-of-work) is already solved and can only be solved once. That being said, I find cryptographic tools like PGP and Nostr useful. Public Key cryptography is fun. We should take the word crypto back from the scammers. We will not argue with them on Twitter. We will use crypto like a slap in the face of shitcoiners. Nostr is a gob-of-spit in the face of Web3 and there is no token to buy but it has created bitcoin businesses on the Internet. How amazing is that?

We don't need your ICO's.

We don't need your NFT's

We don't need your tokens.

We don't need your blockchain technology

We don't need banana coins.

We don't need your Web 3.

We don't need the next coin that takes a picture of your iris,

We don't need your affinity scam coin.

We don't need butt plug coins or whatever your next new bullshit narrative is for your next rug pull.

We Need Freedom On The Internet.

I believe public key cryptography is our best chance of obtaining that freedom.

In 1776, some liberty loving young people started a revolution in the United States. Their goal was to obtain freedom for themselves and for their Posterity. Their Posterity lost those freedoms.

We will use cryptography to get that freedom back.

Crypto means cryptography.

We already fixed the money. Now we fix the world.

Blogging Bitcoin

783,400

This blog has no ads and is reader supported. It uses the Value 4 Value model instead. If you don't know what that is, please click the button bellow.

-

@ 26bd32c6:cfdb0158

2023-03-31 21:40:04

@ 26bd32c6:cfdb0158

2023-03-31 21:40:04San José, Costa Rica - March 28th 2023

After weeks of planning and days of running around, the nostr:npub1nstrcu63lzpjkz94djajuz2evrgu2psd66cwgc0gz0c0qazezx0q9urg5l unconference has ended, and I think everyone's perspective on the future and present of nostr has evolved.

Communication is one of the growth factors that continuously marks human evolution. Each time humans need to expand their reach, new ways of sharing messages emerge. And nostr is a clear example of that.

The need for a censorship-resistant protocol that gives us back control of our data and thoughts is now giving birth to a safe place where content creators can freely share their art without becoming some big corporation's product. A grassroots V4V approach became more apparent to me during Nostrica.

Understanding the ins and outs of this protocol seemed like an alien thought. Still, after listening to many brilliant players, I am very bullish on the individual value proposition each of us holds.

How lucky I was to meet so many of these bright characters. Therefore this special Nostr Report highlights the work of one of the content creators who give nostr real-life use cases.

Photographers📸 have a way of seeing the mundane turn into art, which is what nostr:npub1fv9u4drq4hdrr7k45vn0krqy7mkgy8ajf059m0wq8szvcrsjlsrs8tdz3p did with this series of #Nostrica pictures. Now that calm has reached my corner, these pictures fill my heart with good nostalgia and a boost to create more spaces for others to meet and people like Nela to create art.

If you did not have the chance to be at Nostrica, let me tell you that the calmness and joy these pictures transmit were precisely what we all felt during those three days.

Hommage to Awake: nostr:note1ge70mmvfwhxfxfhpr9ywk479vm7e8rsz36h8juky54fyregzlzdqxj3cq9

Beautiful Iranian content creator nostr:npub1csamkk8zu67zl9z4wkp90a462v53q775aqn5q6xzjdkxnkvcpd7srtz4x9 : nostr:note1vhyyu9vnsz40550ekv8g3jhfyayyuenvrrss4r3hwhkddhg3cnkq5f7ptg

This #Bitcoin and Nostr queen👑 needs no introduction nostr:npub1hu3hdctm5nkzd8gslnyedfr5ddz3z547jqcl5j88g4fame2jd08qh6h8nh : nostr:note1q6nrrjlrm6vlzht7xxespnagrv38fe9mqrs6sxtrx9ah5ypfdlgsu0qj5s

Some of the magicians behind nostr:npub14f26g7dddy6dpltc70da3pg4e5w2p4apzzqjuugnsr2ema6e3y6s2xv7lu : nostr:note1kwvjpstt0mj6jslj3dnvqnrarwh942j50k7w09q9dncfnc3h7mzqcr5kas

Jack 🤙, McShane, and Rockstar: nostr:note1rss3ef04ae5fjznca9ujqwzyyw9vmewmtmfkrwepqlc57daccqesa4azt2

All the hope vibes Nostr, Nostrica, Bitcoin Jungle, and Awake, summed up in one beautiful mother💗: nostr:note1tke9gsfm3sz50gwfn9thykqe2ykgrm4mcrzphf4rmh3dw9fk644srqxl9q

One of the magicians behind the scenes, AV team member Rob: nostr:note19dn9fldjwjtln853rwzeu8su36zxekv42qlt7g248qlx3j7u2l9qe256fs

Spring Equinox in Playa Hermosa: nostr:note16d43wwamcgn8jyv6c9gxpj0wwj8reksvu543dax7f333fd86ph0q9c9en7

Costa Rica: nostr:note1rec78cwn6j44a6dmyy5kw6r6f6jcesx5xgvdl5ffyye39ketflns83km4h

kombuchaman:

nostr:note160858w42ty8pw2spw4t7t7zluwmq96kmac5jdmkzm327r3x38ayqrrgnww

Kindness in one human being nostr:npub148ut8u4vr8xqd4gefhg6eyc5636p5zthw3zfse2njfkezegczers59ty0w: nostr:note1mvasv38scx9hhg63lw8r8xppdp0u4d9sz35e703h2ctcfp52qphsqg7027

BitcoinJungle/Organizer/Magician/#HombreTodoTerreno nostr:npub1taycl7qfuqk9dp0rhkse8lxhz3az9eanjug8j4ympwehvslnetxqkujg5y: nostr:note1h4hq0l0dkyjva9578a7ysg7876p72xfn7f7yjzzhegtwwqar98zq6585ea

nostr:npub1y67n93njx27lzmg9ua37ce7csvq4awvl6ynfqffzfssvdn7mq9vqlhq62h admiring nostr:npub1rpes5hhk6mxun5ddt5kecxfm8y3xdr0h5jwal32mc6mxafr48hxsaj2et2 brilliantness: nostr:note1k43ggzgjfs2yw3ka9wx5azd99axs9k6vfja496vn8hzlkzv6l0ks6adwms

Jack and zaps⚡! nostr:note1t80q7389jw7ear89g6km9xp35mgfsf548dqk77ym3afgsa3j5wwsngww2e

Uvita talent: nostr:note1pqr9qu9fcf9dmp0325zny65ux4cdfzqsp036d4e9ya0u0n8pucvsfuvky2

nostr:npub1lelkh3hhxw9hdwlcpk6q9t0xt9f7yze0y0nxazvzqjmre3p98x3sthkvyz, film and laughter maker 🎥: nostr:note1sgr9u3rlxrxe7kuzs8n4d6vhedh4nv8zql4alr93q2rfftr2ue6sqvwsh9

nostr:npub19vvkfwy9mcluhvehw7r56p4stsj5lmx4v9g3vgkwsm3arpgef8aqsrt562 & nostr:npub1papldckxytp2m8met6hyeh37m0cn6e32j03srl6thy4gq3tqrz3srq8t4n behind the scenes masters: nostr:note12cayrwy9ftq5sdawqf5hterhgukxqgq56kxemtz72y8ymxkwvkvs68dtdh

ExFrog The best for real: nostr:note1newc0xm52m4g6u363jpae2te5n9njfdkgwln4qjy8l47lvva5aks8unt0z

Beauty: nostr:note1e0z44cws3v5k7exf3svymar67ssweq6fshtgf8k63jkxl424ft4s2x0jqp

Kindness: nostr:note1jzxksgauyt0y0q3dha45remcrdw9f3zmdp3l7m6rvnn0g2jzhr6qhvaq5y

Some of my favorite people! nostr:note12ktn97jqn3k73asan9960jda028mlfxkxtm0wzs4y72a7n65lfuskgp0jp

McShane's energy is contagious in real life too: nostr:note1e5nttw79qeza28e7atu2kr9tra2nrq4586qpr6jdg82hv4t95tws4099gs

Drew: nostr:note130rv7enpj0e5gz42ct8uvnvwr68um72mt4fv9da78wwwatgjwraqfttrj5

The best part of this unconference is all the puppies <3: nostr:note1l0ndgkhzdaqne93m23vz6nxfmltya0zk6f9yhnp6tsakpss8nevqe04s79

More beauty: nostr:note1alf0vrg2uf89k3kh653dux50u0d7wx6dlt2d59n7y5f66sv8jgtq2m8pn4

Jungle nostr:npub1hte85nxymfyez0nlmmxf287nh9cujfuetxhk9vptwcdqg0pn8pxqxasw3d is still my favorite Tatum: nostr:note196gx6j26aqdm0evm4t0tcxuemw7xdsuznspprnvrm9upcjt2x6gspshhqn

Thanks 🙏: nostr:note1px594sy5xkhff2x4yzt5gsjm53u0pn6h6pxgghlt9upawlvtclvskk4284

Awake gifts: nostr:note1mzcupr0nw08avquv8t2uew3gsgnclwnhfjpvwahl5zy084d38aes2st8en

Kind souls who are doing wonders for Bitcoin: nostr:note18gw5vutqza3er55fya8ct6feu293drlwmn87ps5vkanwm69zu3jsae624y

Nela, seriously! You even make socks 🧦 be art: nostr:note1yq8e4zhfwqjn5w7kuv5mc5yrxye3gu7hajjn55l5vh6ze6483fxq88jpvg nostr:note10ldtsun5y3e73v7r8m4ylss3gcl6un67rxmzyfh2awuk3h6ksutsfqaya4

nostr:npub1nxy56ame2gfnfj6fjylzxwq7r94phvgwt037mmvwr60qsqlaseksswlnxl : nostr:note1qk9mlcxw6cy88nwtf8hnyqnnt9vkphtmc7t8xl3vt28x0ryqyavqj9dqp2

Meat🥩 Chefs = Bitcoiners Happiness Creators nostr:note15zyvn02uv83gxq43f684rlzefsrzgtu3ty96nvyq70rh6vhv535q3xlenk

Sitting nostr:npub1cj8znuztfqkvq89pl8hceph0svvvqk0qay6nydgk9uyq7fhpfsgsqwrz4u : nostr:note1pn6a09x2cs807aex9pkyc8y6nwl7q2scuw5p66mrq2r9q6pu67xs6jeygk

If energy was a person nostr:npub1v67clmf4jrezn8hsz28434nc0y5fu65e5esws04djnl2kasxl5tskjmjjk: nostr:note149j249xlul8j8ktdxt7ng2g473csq9aajth4e3q6nhtccannrzcq8xjdty

NIPs IRL: nostr:note1xguq007m8yyf2lpxr5d62xl9jsf4g5ulh76a2u4ceng6lxrnqkhsj0k3g3

This picture 100% shares the beauty Alex's soul transmits: nostr:note1sa68r3k024cru8qnxtt7jytj47yvhq9yqwc8caj0v70j5hknlr4sg7qff0

Closing day Q&A: nostr:note1ama6z3fnrhd8m4r4q73sd6p9ggl3w6chec9h2est98w5k4634vzqtmg2mh

Bullish on nostr:npub1t289s8ck5qfwynf2vsq49t2kypvvkpj7rhegayrur0ag9s2sezaqgunkzs and all he is creating for Costa Rica: nostr:note1cvvyw9t4eznqj49d9dlnsq5xkmfdn0q2zn2ykmjvhla2w2xqd8wsg0xp54

Nostriches: nostr:note199pngnvaxult7lf0p5lz2u2j4v9uplpwvzklj95jxcau2rk9ef0q6zn7qa nostr:note1numu5gvmvrjlhz36sx4h4ewz3z2l0uy6n6lwacrxst8rq8wyxwjsz8yujn nostr:note1nnmtm4m48w0q6ntll659q6nv4zqq6pnxrdajzzm0rkq4y3kxaweswy3dyv nostr:note1nw93qul0xq5796ed4cqe36p3vkl3tkz4tagmaw86avzza6l2ud5slaryd5

Jack🤙: nostr:note1rpet22d37hmnp4td397hynzem7f5ln9yf3fck0c8qlgsdtr88y6s2feawf

Nela, thanks for the opportunity to share your creations. Never stop. You are magic🧝🏾♀️. Can't wait to spend time together again! To everyone reading, please make sure to give her a follow and some zaps ⚡️.

-

@ f8838597:7ad3e77a

2023-03-31 14:06:32

@ f8838597:7ad3e77a

2023-03-31 14:06:32将来的に見失わないようにメモ

https://nostr.build/i/nostr.build_fabdb45fffe5499738572bf03f482aaed9993e0ab4f97777a7a42424c6dfd708.jpg

https://nostr.build/i/nostr.build_70e391103f75c9ebdaac5b786a8c5a2892ab42f8be0768fcd9c2d28736765ea2.jpg

https://nostr.build/i/nostr.build_edfc33e7fbf20c41e47e569f7a3a916b96bd834e11bc6287d8eaa530154e4358.jpg

https://nostr.build/i/nostr.build_658295acf79765a7d5edee76a82954d82bbdc664dc7efe9accda34689f63c328.jpg

https://nostr.build/i/nostr.build_64d83ff2fc2e2a7053fa4d57f59b73fa1aefa0e32488f6585da7b57b5c5692b3.jpg

https://nostr.build/i/nostr.build_2e1e39ebbe00b52627b449b1fecb0d2fec96e1a7d6d37c2df4e5691450c5d910.jpg

https://nostr.build/i/nostr.build_139ada396e81ec159aab620336c021177aaaf0e4c1f46554346272120fa90798.jpg

https://nostr.build/i/nostr.build_4611af28662d86b211d0ed4d731683cf2c26374394c5f7c5718402986ff824a2.webp

https://nostr.build/i/nostr.build_be07ecea47ad60b8bbf00802c4f62e027014d38b67433dc178d8d7be4badd369.jpg

https://nostr.build/i/nostr.build_14fda45e0240365461f653b22ec586aa4d027ee839565bf96c2436e8a955fa77.jpeg

https://nostr.build/i/nostr.build_1ae37276b6cc13b28c852b1d9b438c0245b37ea1135c70bbaf4488430b22b3c8.jpeg

https://nostr.build/i/nostr.build_4a3535e194cedbd9e24860ec87e8976b12483cc237df67427ecd1a4240db3b1f.jpeg

https://nostr.build/i/nostr.build_00c335feb7850bd93fd8e54ce88e83ed7406beb1b1af62e13aec22782f56a3a9.jpeg

https://nostr.build/i/nostr.build_df40e04056a4032bce5c431044253fed1914f748715207f689655bcf0c08c843.jpeg

https://nostr.build/i/nostr.build_a0f86414c512c9350f57d3702efa7b8ba33ce8eefa615228fae64bdd7c7d6fff.jpeg

https://nostr.build/i/nostr.build_095b1bc9524846c40c645b48b1a4b5aa44932edd75de69735fa0b6a582f17083.jpeg

https://nostr.build/i/nostr.build_4503d6ec0900427778783287224a9a6e6ff89d3e36466f31a59b49aac6b70569.jpeg

https://nostr.build/i/nostr.build_ee24b7197db41043ab0971efa3dc9282728063008d5f1e2bd993d63b18002ef0.webp

https://nostr.build/i/nostr.build_869e3ea8a9a92e1f41a1dee2f1f62b811148687c76536d671ca22fa385078ffe.jpg

https://nostr.build/i/nostr.build_28b4d26f6725064dd5de4449f47aa5e4fde9666ee7c6a93e70ab4e53fbd8a459.webp

https://nostr.build/i/nostr.build_3e15710084c33365256c793fcd9933bacf55d2537eb46404af2d86bff9b4d515.webp

https://nostr.build/av/nostr.build_fc335a12024522c38f9f978c865c892ed148ca05e9276aa347d50d7aba84c161.mp4

https://nostr.build/av/nostr.build_e5a3e4b0006d314cf63bc2a4255b465bf68e9385a0916e62866189d548b4b02a.mp4 https://nostr.build/i/nostr.build_5736ffa235ea49869e7be569c3332031b0077bf501cbca0adef7712c8ef64709.webp

https://nostr.build/i/nostr.build_831e4c6f9e40aa106acb45b3d29251add9a7f10966961b3d4805e508098aa0fb.webp

https://s3.arkjp.net/misskey/09b8125f-d530-4d65-a11a-a87458156013.jpg

https://nostr.build/i/nostr.build_597f18e5dd42e11e4bf6713530573b6ae03d9b675be9ae1016d55af9814a0094.jpg

https://nostr.build/i/nostr.build_fea927158f4e6689463ea15fd19be8f5c313c5849d126f53a94e778b37b248b3.png

https://nostr.build/i/nostr.build_bffdcd571ece89d8deebec32da5654f89533f4d4e9dd3349d36575dc5410a75e.jpg

-

@ b3b1d580:27db0aa8

2023-03-31 10:56:59

@ b3b1d580:27db0aa8

2023-03-31 10:56:59A memer on twitter has been sending these fire memes to Libby who runs our social accounts https://twitter.com/LoveIsBitcoin21 instead of posting them directly. Maybe it’s hesitation because they’re saucy?

Maybe not.

Either way, they’re pure fire.

Enjoy them.

This one was a hit.

This one was a hit.Follow him on twitter for more banger tweets and memes. https://twitter.com/TheBTCTherapist

Originally published at https://loveisbitcoin.com/we-got-a-meme-guy-now/

-

@ f0ff87e7:deeeff58

2023-03-30 09:43:23

@ f0ff87e7:deeeff58

2023-03-30 09:43:23Testy test.

-

@ 75bf2353:e1bfa895

2023-03-29 22:12:26

@ 75bf2353:e1bfa895

2023-03-29 22:12:26#I made the code better. If you think it is better edit the original hello.py. We need a way to easily revert to the original code and do a bunch of other stuff.print('Hello nostr world!')

-

@ 75bf2353:e1bfa895

2023-03-29 22:07:52

@ 75bf2353:e1bfa895

2023-03-29 22:07:52print("Hello world!")

-

@ 75bf2353:e1bfa895

2023-03-29 22:04:12

@ 75bf2353:e1bfa895

2023-03-29 22:04:12README

This is just a single line of code written in Python.

-

@ 75bf2353:e1bfa895

2023-03-29 22:00:38

@ 75bf2353:e1bfa895

2023-03-29 22:00:38WriteCodeOnNostr(repository name)

Repository Desription: This "repository" is just a single line of code written in Python. It's not very good. If you can improve it please submit a pull request.

-

@ 97c70a44:ad98e322

2023-03-29 19:56:16

@ 97c70a44:ad98e322

2023-03-29 19:56:16Proof-of-work (POW) is not new to Nostr. Because the protocol is "Bitcoin-adjacent", there is a general familiarity with one of the precursor technologies to Bitcoin, Hashcash, invented by Adam Back in 1997. Some users have mined keys with a certain number of leading zeroes, or with the first few letters of their handle in order to demonstrate skin-in-the-game, and there have even been some nips merged which take advantage of proof-of-work.

This blog post won't be new to people who have given much thought to the merits of Hashcash and proof of work, but I only recently discovered the benefits of POW against micropayments in some situations, and thought would be interesting to try to articulate.

POW vs Micropayments

The basic idea behind using proof-of-work in a social protocol is that having work embedded in pubkeys (or event ids) demonstrates that the person publishing the information has spent a certain amount of processing power mining the information, and therefore has invested more into producing the content that would otherwise be evident.

There is, however, another way to prove your work: micropayments. Bitcoin, being the best money, is directly based on proof of work, and so payments made using Bitcoin are a way of borrowing the proof of work already invested in minting the coins. But any token that has recognized value will also work (with less fidelity) to store your labor for later use; that's just how money works.

It's exchange of value all the way down