-

@ 491afeba:8b64834e

2025-05-27 16:48:45

@ 491afeba:8b64834e

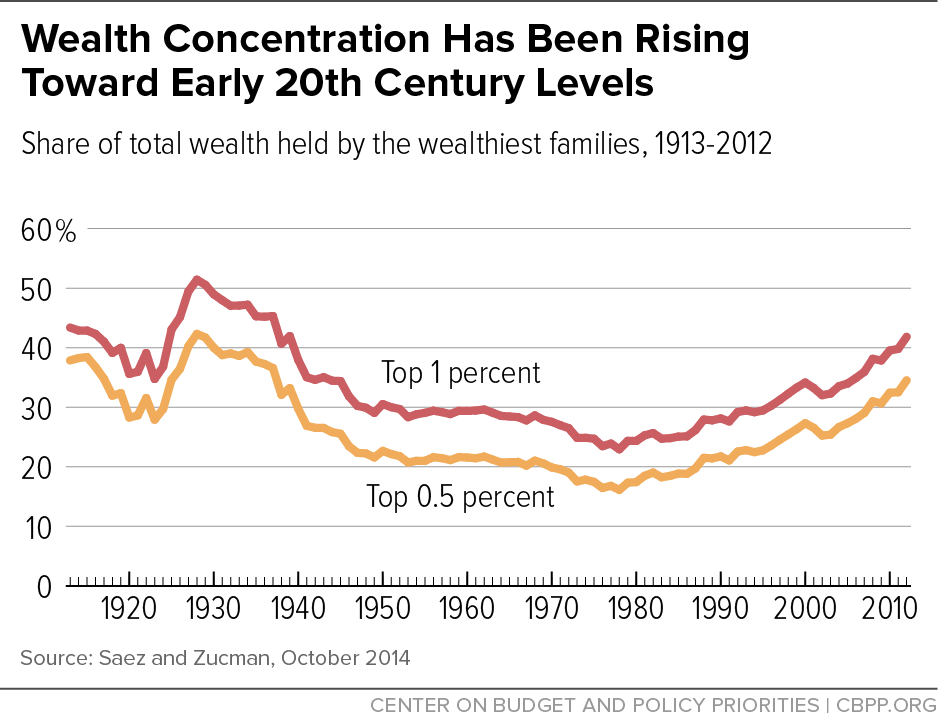

2025-05-27 16:48:45Quando adolescente eu acreditava na coerência da teoria de "amor líquido" do polonês, sociólogo, Zygmunt Bauman, apresentada no livro "Amor Líquido: Sobre a Fragilidade dos Laços Humanos", qual no meu amadurecimento em estudos, sejam eles no meio acadêmico ou fora, percebo como uma das formas mais rasas de explicar as mudanças e transformações dos padrões de relações sócio-afetivas dos humanos. A seguir colocar-me-ei na minha juventude não tanto recente, direi então que nós, se adolescentes e conservadores, ou mesmo jovens adultos mais conservadores, costumamos levar como dogma uma óptica decadentista generalizada de todos os avanços de eras dos homens, universalizamos por nos ser comum a indistinção entre humanidade e humanidades, ou mesmo "humanity" e "humankind" ("humanidade" como espécime e "humanidade" como um universal), compreendemos toda "essas" como "essa" e indistinguimos as sociedades para com os homens, ou seja, a incapacidade de definir os seres dentro de suas respectivas singularidades e especificidades nos leva ao decadentismo generalista (a crença de que de forma geral, e universal, a "civilização universal" decai moralmente, éticamente, materialmente e espiritualmente), que aparente à nós determinadas mudanças nas relações humanas quanto ao caráter sócio-afetivo, por falta de profundidade e critérios ainda sobre questões alinhadas aos métodos e coerências, ou incoerências, lógicas, nós se jovens e conservadores somos levados ao engodo de concordar com a teoria do amor líquido de Bauman, que devo cá explicar de antemão: trata ela, a teoria, o padrão de "amor" dos tempos presentes como frágil, de prazo (curto e médio) e diferente em grau comparativamente ao amor comum das eras passadas.

Aos jovens mais progressistas opera uma compreensão dialética sobre as eras dos homens nos seu tempo presente, na qual ao tempo que o ser progride ele também regride simultaneamente, ou seja, a medida que aparecem contradições advindas de transformações materiais da realidade humana o ser supera essas contradições e progride em meio as transformações, ainda fazendo parte da lógica dessa indissociavelmente, assim constantemente progredindo e regredindo, havendo para esses dois vetores de distinção: o primeiro é o que releva questões espirituais como ao caráter do pensamento "new age", o segundo ignora essas questões por negar a existência da alma, seguem ao materialismo. Cedem em crer na teoria baumaninana como dogma, pois não encontram outros meios para explicar as transformações da sociedade na esfera sócio-afetiva sem que haja confrontamento direto com determinadas premissas assim pertinemente presentes, ou por não conciliarem com análises relativamente superiores, como a de Anthony Giddens sobre a "relação pura" em "A Transformação da Intimidade" e de François de Singly apresentada em "Sociologie du Couple".

!(image)[https://i.pinimg.com/736x/6f/b4/9e/6fb49eda2c8cf6dc837a0abfc7e108e6.jpg]

Há um problema quando uma teoria deixa de assim ser para vir a tornar-se mais um elemento desconexo da ciência, agora dentro da cultura pop, se assim podemos dizer, ou da cultura de massa, ou se preferirem mesmo "anticultura", esse problema é a sua deformização teórica, tornando-se essa rasa para sua palatabilidade massiva, somada a incapacidade de partes da sociedade civil em compreender as falhas daquilo que já foi massificado. Tive surpresa ao entender que muitos outros compartilham da mesma opinião, a exemplo, possuo um amigo na faculdade, marxista, que ao falarmos sobre nossos projetos de pesquisa, citou ele o projeto de um de nossos colegas, no qual esse referido um de nossos colegas faria seu projeto com base na teoria do amor líquido de Bauman, então alí demos risada disso, ora, para nós a teoria baumaniana é furada, passamos a falar sobre Bauman e o motivo pelo qual não gostávamos, lá fiquei até surpreso em saber que mais gente além de mim não gostava da teoria de Bauman, pois ao que eu via na internet era rede de enaltecimentos à figura e à sua teoria, tal como fosse uma revelação partindo de alguma divindade da Idade do Bronze. Pouco tempo depois tive em aula de teoria política uma citação de Bauman partindo do professor que ministrava a disciplina, no entanto, ao citar o nome de Bauman o mesmo fez uma feição na qual aparentava segurar risada, provavelmente ele também não levava Bauman à sério. Não devo negar que todas as vezes que vejo o sociólogo sendo citado em alguma nota no X, no Instagram ou qualquer outra rede social, tal como fosse um referencial teórico bom, sinto uma vergonha alheia pois alí tenho uma impressão de que a pessoa não leu Bauman e usa o referencial teórico como um fato já assim provado e comprovado.

Há pontos positivos na teoria baumaniana, como a capacidade de perceber o problema e correlacioná-lo à modernidade, assim como sucitar a influência do que há de material no fenômeno, porém os erros são pertinentes: o primeiro problema é de categoria. Não há, por parte de Bauman noção alguma entre as dissociações dos amores, não há atenção sobre o amor como estrutura ou ele como um sentimento, todo ele é compreendido uniformemente como "amor", partindo do pressuposto que todas as relações, todas elas, são firmadas com base no amor. Essa crença tem uma origem: Hegel. Nos Escritos Teológicos Hegel partia da crença que o amor ligava os seres relacionalmente como uma força de superação e alienação, mas há de compreendermos que esse Friedrich Hegel é o jovem ainda pouco maduro em suas ideias e seu sistema de pensamento, mais a frente, em "Fenomenologia do Espírito e na Filosofia do Direito", Hegel compreende a institucionalidade do direito no amor e a institucionalização dessa força, assim aproxima-se da realidade a respeito da inserção do amor nas esferas práticas do humano, porém essa ideia, apesar de imperfeita, pois ao que sabemos não é o amor que consolida a relação, mas sim a Verdade (Alétheia), conforme apontado por Heidegger em "Ser e Tempo", essa ideia do amor como a fundamento das relações humanas influenciou, e até hoje influencia, qualquer análise sobre as relações humanas fora da esfera materialista, fora dessa pois, melhormente explicado em exemplo, os marxistas (em exemplo), assim como Marx, consideram como base primordial das relações as condições materiais.

Por certo, não é de todo amor a base para a solidificação, ora, erram aqueles que creem que somente essa força, assim apontada por Hegel, constituiam todos os relacionamentos formais como pilares fundamentais, pois em prática as famílias eram até a fiduciarização dessas, por mais paradoxal que seja, compreendidas melhor como instituições orgânicas de caráter legal do que conluios de afetividades. A família outrora tinha consigo aparelhos de hierarquia bem estabelicidos, quais prezavam pela ordem interna e externa, que acima dessa instituição estava somente a Igreja (outra instituição), com sua fiduciarização [da família] após o movimento tomado pelos Estados nacionais em aplicação do casamento civil mudou-se a lógica das partes que a compõe, findou-se o princípio da subsidiariedade (não intervenção de determinadas instituições nas decisões quais podem ser exercidas em resuluções de problemas nas competências de quaisquer instituições), foi-se então, contudo, também a autoridade, e nisso revela-se um outro problema não apontado na teoria de Bauman: qual o padrão do amor "sólido"? Pois, ora, sociedades tradicionais não abdicavam do relevar dos amores para tornar seus filhos em ativos nas práticas de trocas (dádivas)? É notório que esse padrão se dissocia do padrão de sentimento apontado por Bauman, encontramos esse fato em estudo nos trabalhos "Ensaio Sobre a Dádiva", do Marcel Mauss, e "As Estruturas Elementares do Parentesco", do Claude Levi-Strauss, quais expõem que nas sociedades "sólidas", tradicionais, relevava-se mais questões institucionais que as sentimentais para a formação de laços (teoria da aliança). Muitas das relações passadas não eram baseadas no amor, não significando assim que as de hoje, em oposição, sejam, mas que permanecem-se semelhantes em base, diferentemente em grau e forma.

!(image)[https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F748b94c3-f882-45db-8333-09260ef15cfe_615x413.jpeg]

Ora, ainda existem casamentos motivados pela política, pelo status, pelo prestígio, pelos bens, pelo poder, pela influência familiar e assim sucetivamente, tal como no passado, ocorre que essa prática tornou-se oculta, não mais explícita e aparente, devo dizer ainda que em partes, pois prepondera em nosso tempo uma epidemia de adultérios, fornicações, práticas lascivas e demais práticas libertinosas explicitamente, em contraposição às práticas ocultas em vergonhas de sociedades sem declínio moral e espiritual, o que nos leva a questionar o método comparativo em dicotomia temporal "presente x passado" aplicado por Bauman, no qual segue-se da seguinte forma:

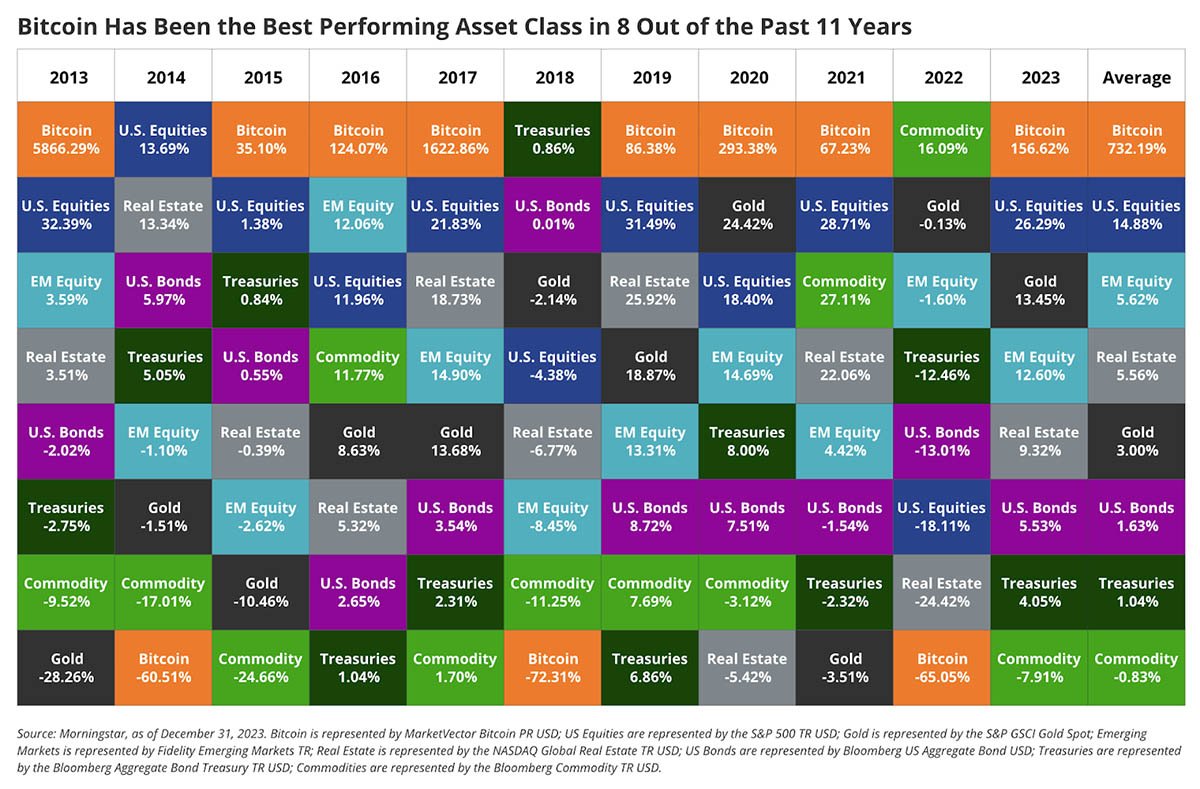

Transformação Passado = *sólido* | Presente = *líquido* Categorias Padrão de amor: tradicional (*sólido*) moderno (*líquido*) *Sólido* = estável, prazo (médio-grande), profundo, determinado. *Líquido* = instável, prazo (curto-médio), raso, indeterminado.O que penso é: Zygmunt Bauman buscou uma explicação material e laical para desviar ao fato de que há uma notória correlação entre espiritualização da sociedade, se voltada à Verdade, com a estabilidade das instituições, o que é já reduzido à moral religiosa, somente, não à mística, como por pensadores da linha de Tocqueville, ou em abordagens também mais laical (positivista) porém ainda relevantes, como Émile Durkheim em "As Formas Elementares da Vida Religiosa" e Max Weber em "A Ética Protestante e o Espírito do Capitalismo", contrapondo uma abordage mais voltada, de fato, a espiritualidade, como Christopher Dawnson, que defende essa teoria em "Religião e o Surgimento da Cultura Ocidental", e Eric Voegelin, principalmente nas obras "A Nova Ciência da Política" e "Ordem e História".

Encerrrando, minha cosmovisão é a católica, o sistema de crença e religião qual sigo é do Deus que se fez homem por amor aos seus filhos, não posso negar ou mesmo omitir o fato de que, por trás de toda a minha crítica estão meus pensamentos e minhas convicções alinhadas àquilo que mais tenho amor em toda minha vida: a Verdade, e a Verdade é Deus, pois Cristo é a Verdade, o Caminho e a Vida, ninguém vai ao Pai se não por Ele, e pois bem, seria incoerência de minha parte não relevar o fato de crença como um dos motivos pelos quais eu rejeito a teoria do amor líquido de Zygmunt Bauman, pois os amores são todos eles praticados por formas, existem por diferentes formas e assim são desde sua tradicionalidade até o predomínio das distorções de declínio espiritual das eras presentes (e também antigas pré-Era Axial), estão esses preservados pelo alinhamento à verdade, assim são indistorcíveis, imutáveis, ou seja, amor é amor, não releva-se o falso amor como um, simplesmente não o é, assim o interesse, a sanha por bens, o egoísmo e a egolatria ("cupiditas", para Santo Agostinho de Hipona, em oposição ao que o santo e filósofo trata por "caritas") não são formas do amor, são autoenganos, não bons, se não são bons logo não são de Deus, ora, se Deus é amor, se ele nos ama, determino como amor (e suas formas) o que está de acordo com a Verdade. Aprofundando, a Teologia do Corpo, do Papa São João Paulo II, rejeita a "liquidez" apresentada por Bauman, pois o amor é, em suma, sacríficio, parte da entrega total de si ao próximo, e se não há logo não é amor. A Teologia do Corpo rejeita não os fundamentos de mentira no "líquido", mas também no "sólido", pois a tradicionalidade não é sinônimo de bom e pleno acordo com o amor que Deus pede de nós, não são as coerções, as violências, as imposições e demais vontades em oposição às de Deus que determinam os amores -- fatos em oposição ao ideário romanticizado. Claro, nem todas as coerções são por si inválidas do amor, ou mesmo as escolhas em trocas racionalizadas, a exemplo do autruísmo em vista da chance da família ter êxito e sucesso, ou seja, pelo bem dos próximos haver a necessidade de submissão a, em exemplo, um casamento forjado, ou algo do gênero, reconhece-se o amor no ato se feito por bem da família, porém o amor incutido, nesse caso, explicita o caráter sacrificial, no qual uma vontade e um amor genuinamente potencial em prazeres e alegrias são anulados, ou seja, mesmo nesse modelo tradicional na "solidez" há possibilidade do amor, não nas formas romanticizadas em critérios, como "estabilidade" e "durabilidade", mas no caráter do sacríficio exercido. Conforme nos ensina São Tomás de Aquino, o amor não é uma "força", tal como ensina Hegel, mas sim uma virtude teologal conforme postas na "Suma Teológica" (II-II Q. 26-28), não devemos reduzir o amor e os amores em análises simplórias (não simples) de falsa complexidade extraídas em métodos questionáveis e pouco competentes à real diensão de crise espiritual das eras, por esse motivo não concordo com a teoria do amor líquido de Zygmunt Bauman.

-

@ d360efec:14907b5f

2025-05-27 15:46:26

@ d360efec:14907b5f

2025-05-27 15:46:26 -

@ 7f6db517:a4931eda

2025-05-27 13:01:37

@ 7f6db517:a4931eda

2025-05-27 13:01:37

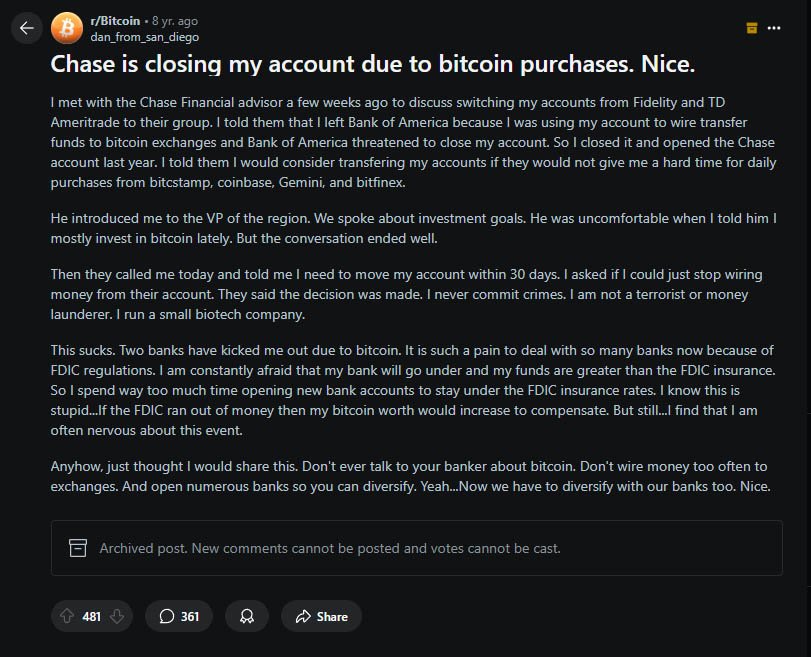

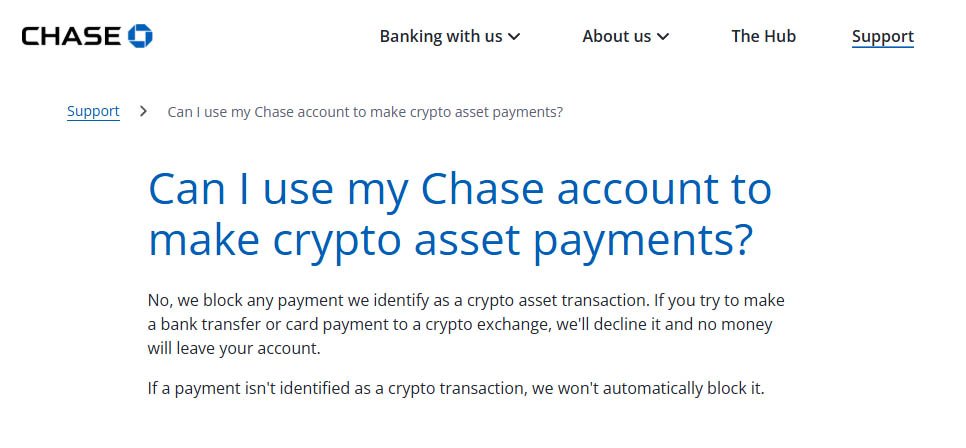

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-27 12:02:03

@ 7f6db517:a4931eda

2025-05-27 12:02:03

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ b7274d28:c99628cb

2025-05-27 07:07:33

@ b7274d28:c99628cb

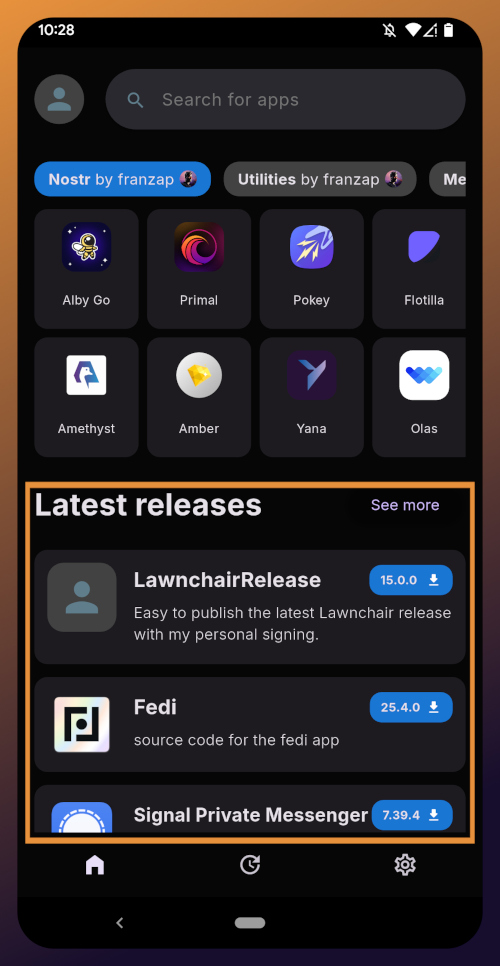

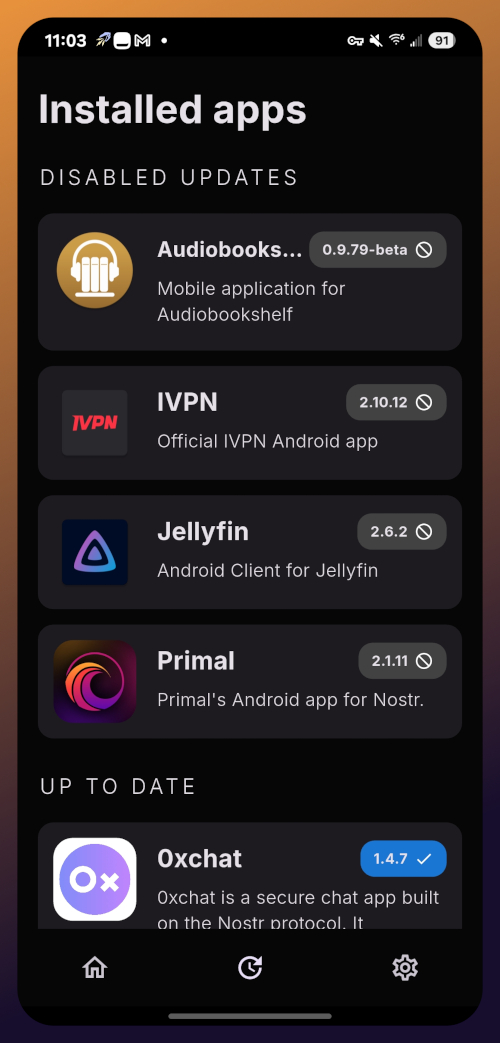

2025-05-27 07:07:33A few months ago, a nostrich was switching from iOS to Android and asked for suggestions for #Nostr apps to try out. nostr:npub18ams6ewn5aj2n3wt2qawzglx9mr4nzksxhvrdc4gzrecw7n5tvjqctp424 offered the following as his response:

nostr:nevent1qvzqqqqqqypzq0mhp4ja8fmy48zuk5p6uy37vtk8tx9dqdwcxm32sy8nsaa8gkeyqydhwumn8ghj7un9d3shjtnwdaehgunsd3jkyuewvdhk6tcpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhszythwden5te0dehhxarj9emkjmn99uqzpwwts6n28eyvjpcwvu5akkwu85eg92dpvgw7cgmpe4czdadqvnv984rl0z

Yes. #Android users are fortunate to have some powerful Nostr apps and tools at our disposal that simply have no comparison over on the iOS side. However, a tool is only as good as the knowledge of the user, who must have an understanding of how best to wield it for maximum effect. This fact was immediately evidenced by replies to Derek asking, "What is the use case for Citrine?" and "This is the first time I'm hearing about Citrine and Pokey. Can you give me links for those?"

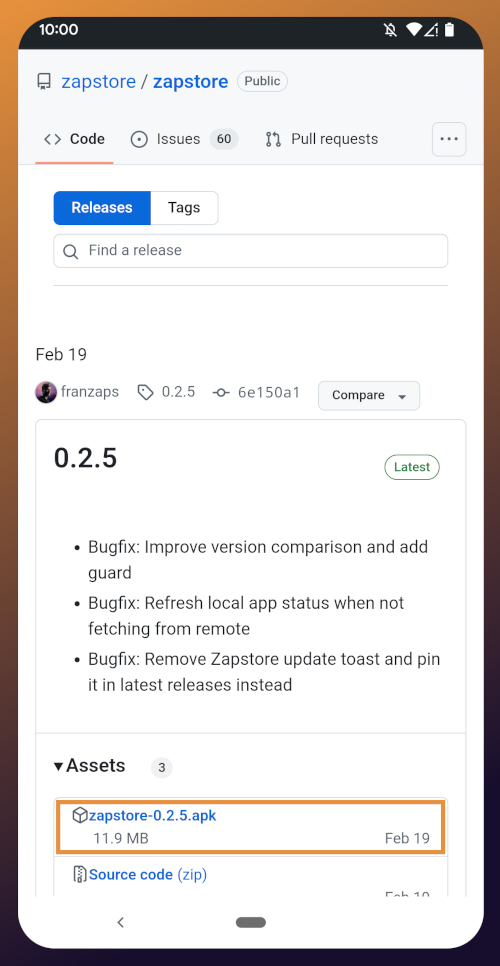

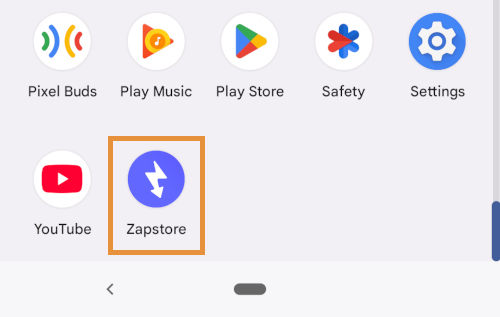

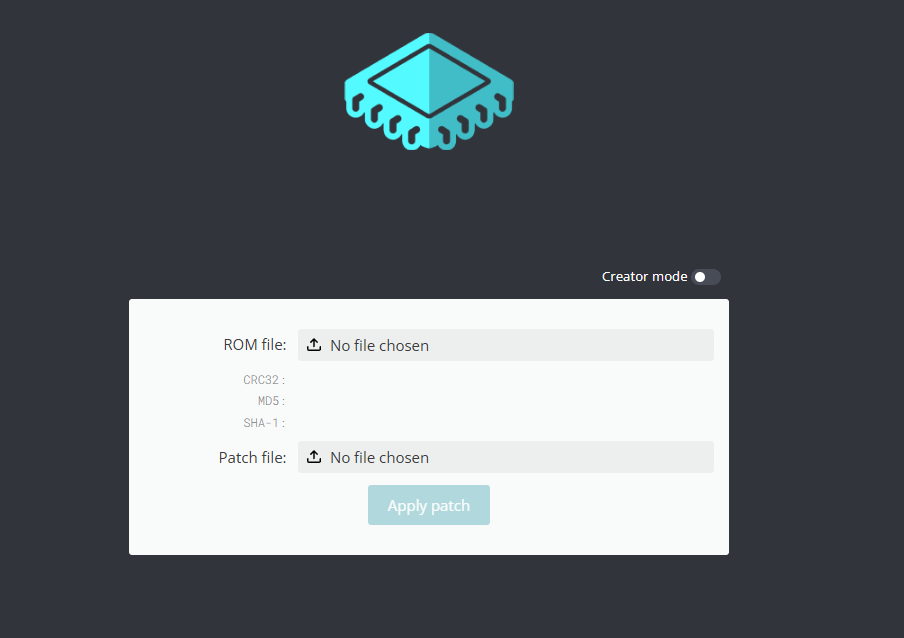

Well, consider this tutorial your Nostr starter-kit for Android. We'll go over installing and setting up Amber, Amethyst, Citrine, and Pokey, and as a bonus we'll be throwing in the Zapstore and Coinos to boot. We will assume no previous experience with any of the above, so if you already know all about one or more of these apps, you can feel free to skip that tutorial.

So many apps...

You may be wondering, "Why do I need so many apps to use Nostr?" That's perfectly valid, and the honest answer is, you don't. You can absolutely just install a Nostr client from the Play Store, have it generate your Nostr identity for you, and stick with the default relays already set up in that app. You don't even need to connect a wallet, if you don't want to. However, you won't experience all that Nostr has to offer if that is as far as you go, any more than you would experience all that Italian cuisine has to offer if you only ever try spaghetti.

Nostr is not just one app that does one thing, like Facebook, Twitter, or TikTok. It is an entire ecosystem of applications that are all built on top of a protocol that allows them to be interoperable. This set of tools will help you make the most out of that interoperability, which you will never get from any of the big-tech social platforms. It will provide a solid foundation for you to build upon as you explore more and more of what Nostr has to offer.

So what do these apps do?

Fundamental to everything you do on Nostr is the need to cryptographically sign with your private key. If you aren't sure what that means, just imagine that you had to enter your password every time you hit the "like" button on Facebook, or every time you commented on the latest dank meme. That would get old really fast, right? That's effectively what Nostr requires, but on steroids.

To keep this from being something you manually have to do every 5 seconds when you post a note, react to someone else's note, or add a comment, Nostr apps can store your private key and use it to sign behind the scenes for you. This is very convenient, but it means you are trusting that app to not do anything with your private key that you don't want it to. You are also trusting it to not leak your private key, because anyone who gets their hands on it will be able to post as you, see your private messages, and effectively be you on Nostr. The more apps you give your private key to, the greater your risk that it will eventually be compromised.

Enter #Amber, an application that will store your private key in only one app, and all other compatible Nostr apps can communicate with it to request a signature, without giving any of those other apps access to your private key.

Most Nostr apps for Android now support logging in and signing with Amber, and you can even use it to log into apps on other devices, such as some of the web apps you use on your PC. It's an incredible tool given to us by nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5, and only available for Android users. Those on iPhone are incredibly jealous that they don't have anything comparable, yet.

Speaking of nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5, the next app is also one of his making.

All Nostr data is stored on relays, which are very simple servers that Nostr apps read notes from and write notes to. In most forms of social media, it can be a pain to get your own data out to keep a backup. That's not the case on Nostr. Anyone can run their own relay, either for the sake of backing up their personal notes, or for others to post their notes to, as well.

Since Nostr notes take up very little space, you can actually run a relay on your phone. I have been on Nostr for almost 2 and a half years, and I have 25,000+ notes of various kinds on my relay, and a backup of that full database is just 24MB on my phone's storage.

Having that backup can save your bacon if you try out a new Nostr client and it doesn't find your existing follow list for some reason, so it writes a new one and you suddenly lose all of the people you were following. Just pop into your #Citrine relay, confirm it still has your correct follow list or import it from a recent backup, then have Citrine restore it. Done.

Additionally, there are things you may want to only save to a relay you control, such as draft messages that you aren't ready to post publicly, or eCash tokens, which can actually be saved to Nostr relays now. Citrine can also be used with Amber for signing into certain Nostr applications that use a relay to communicate with Amber.

If you are really adventurous, you can also expose Citrine over Tor to be used as an outbox relay, or used for peer-to-peer private messaging, but that is far more involved than the scope of this tutorial series.

You can't get far in Nostr without a solid and reliable client to interact with. #Amethyst is the client we will be using for this tutorial because there simply isn't another Android client that comes close, so far. Moreover, it can be a great client for new users to get started on, and yet it has a ton of features for power-users to take advantage of as well.

There are plenty of other good clients to check out over time, such as Coracle, YakiHonne, Voyage, Olas, Flotilla and others, but I keep coming back to Amethyst, and by the time you finish this tutorial, I think you'll see why. nostr:npub1gcxzte5zlkncx26j68ez60fzkvtkm9e0vrwdcvsjakxf9mu9qewqlfnj5z and others who have contributed to Amethyst have really built something special in this client, and it just keeps improving with every update that's shipped.

Most social media apps have some form of push notifications, and some Nostr apps do, too. Where the issue comes in is that Nostr apps are all interoperable. If you have more than one application, you're going to have both of them notifying you. Nostr users are known for having five or more Nostr apps that they use regularly. If all of them had notifications turned on, it would be a nightmare. So maybe you limit it to only one of your Nostr apps having notifications turned on, but then you are pretty well locked-in to opening that particular app when you tap on the notification.

Pokey, by nostr:npub1v3tgrwwsv7c6xckyhm5dmluc05jxd4yeqhpxew87chn0kua0tjzqc6yvjh, solves this issue, allowing you to turn notifications off for all of your Nostr apps, and have Pokey handle them all for you. Then, when you tap on a Pokey notification, you can choose which Nostr app to open it in.

Pokey also gives you control over the types of things you want to be notified about. Maybe you don't care about reactions, and you just want to know about zaps, comments, and direct messages. Pokey has you covered. It even supports multiple accounts, so you can get notifications for all the npubs you control.

One of the most unique and incredibly fun aspects of Nostr is the ability to send and receive #zaps. Instead of merely giving someone a 👍️ when you like something they said, you can actually send them real value in the form of sats, small portions of a Bitcoin. There is nothing quite like the experience of receiving your first zap and realizing that someone valued what you said enough to send you a small amount (and sometimes not so small) of #Bitcoin, the best money mankind has ever known.

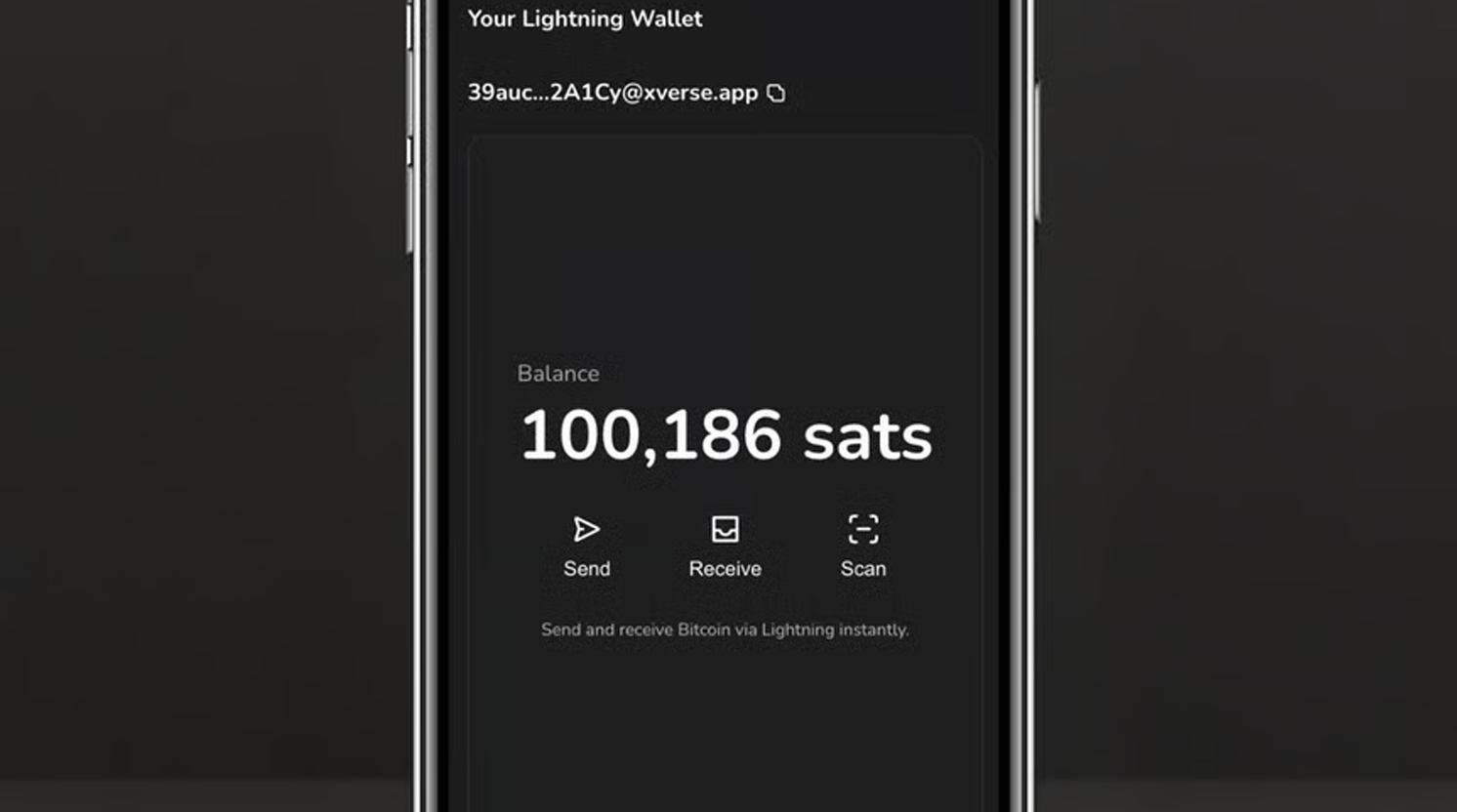

To be able to have that experience, though, you are going to need a wallet that can send and receive zaps, and preferably one that is easy to connect to Nostr applications. My current preference for that is Alby Hub, but not everyone wants to deal with all that comes along with running a #Lightning node. That being the case, I have opted to use nostr:npub1h2qfjpnxau9k7ja9qkf50043xfpfy8j5v60xsqryef64y44puwnq28w8ch for this tutorial, because they offer one of the easiest wallets to set up, and it connects to most Nostr apps by just copy/pasting a connection string from the settings in the wallet into the settings in your Nostr app of choice.

Additionally, even though #Coinos is a custodial wallet, you can have it automatically transfer any #sats over a specified threshold to a separate wallet, allowing you to mitigate the custodial risk without needing to keep an eye on your balance and make the transfer manually.

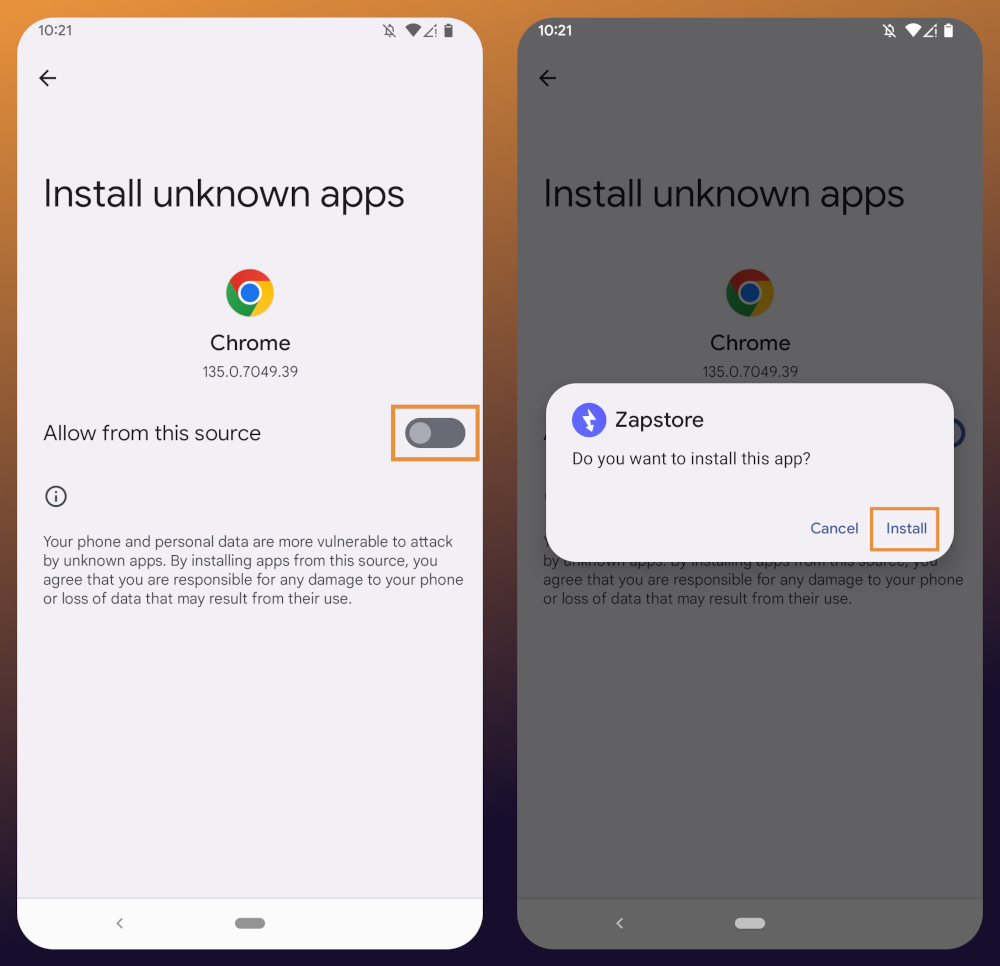

Most of us on Android are used to getting all of our mobile apps from one souce: the Google Play Store. That's not possible for this tutorial series. Only one of the apps mentioned above is available in Google's permissioned playground. However, on Android we have the advantage of being able to install whatever we want on our device, just by popping into our settings and flipping a toggle. Indeed, thumbing our noses at big-tech is at the heart of the Nostr ethos, so why would we make ourselves beholden to Google for installing Nostr apps?

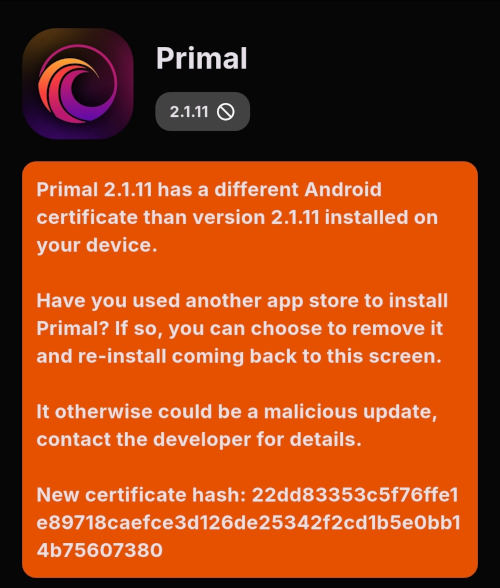

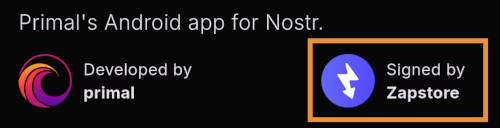

The nostr:npub10r8xl2njyepcw2zwv3a6dyufj4e4ajx86hz6v4ehu4gnpupxxp7stjt2p8 is an alternative app store made by nostr:npub1wf4pufsucer5va8g9p0rj5dnhvfeh6d8w0g6eayaep5dhps6rsgs43dgh9 as a resource for all sorts of open-source apps, but especially Nostr apps. What is more, you can log in with Amber, connect a wallet like Coinos, and support the developers of your favorite Nostr apps directly within the #Zapstore by zapping their app releases.

One of the biggest features of the Zapstore is the fact that developers can cryptographically sign their app releases using their Nostr keys, so you know that the app you are downloading is the one they actually released and hasn't been altered in any way. The Zapstore will warn you and won't let you install the app if the signature is invalid.

Getting Started

Since the Zapstore will be the source we use for installing most of the other apps mentioned, we will start with installing the Zapstore.

We will then use the Zapstore to install Amber and set it up with our Nostr account, either by creating a new private key, or by importing one we already have. We'll also use it to log into the Zapstore.

Next, we will install Amethyst from the Zapstore and log into it via Amber.

After this, we will install Citrine from the Zapstore and add it as a local relay on Amethyst.

Because we want to be able to send and receive zaps, we will set up a wallet with CoinOS and connect it to Amethyst and the Zapstore using Nostr Wallet Connect.

Finally, we will install Pokey using the Zapstore, log into it using Amber, and set up the notifications we want to receive.

By the time you are done with this series, you will have a great head-start on your Nostr journey compared to muddling through it all on your own. Moreover, you will have developed a familiarity with how things generally work on Nostr that can be applied to other apps you try out in the future.

Continue to Part 2: The Zapstore. Nostr Link: nostr:naddr1qvzqqqr4gupzpde8f55w86vrhaeqmd955y4rraw8aunzxgxstsj7eyzgntyev2xtqydhwumn8ghj7un9d3shjtnzwf5kw6r5vfhkcapwdejhgtcqp5cnwdphxv6rwwp3xvmnzvqgty5au

-

@ 1f956aec:768866bd

2025-05-26 15:06:38

@ 1f956aec:768866bd

2025-05-26 15:06:38== January 17 2025

Out From Underneath | Prism Shores

crazy arms | pigeon pit

Humanhood | The Weather Station

== february 07 2025

Wish Defense | FACS

Sayan - Savoie | Maria Teriaeva

Nowhere Near Today | Midding

== february 14 2025

Phonetics On and On | Horsegirl

== february 21 2025

Finding Our Balance | Tsoh Tso

Machine Starts To Sing | Porridge Radio

Armageddon In A Summer Dress | Sunny Wa

== february 28 2025

you, infinite | you, infinite

On Being | Max Cooper

Billboard Heart | Deep Sea Diver

== March 21 2025

Watermelon/Peacock | Exploding Flowers

Warlord of the Weejuns | Goya Gumbani

== March 28 2025

Little Death Wishes | CocoRosie

Forever is a Feeling | Lucy Dacus

Evenfall | Sam Akpro

== April 4 2025

Tripla | Miki Berenyi Trio

Adagio | Σtella

The Fork | Oscar Jerome

== April 18 2025

Send A Prayer My Way | Julien Baker & TORRES

Superheaven | Superheaven

Thee Black Boltz | Tunde Adebimpe

from brooklyvegan

== April 25 2025

Face Down In The Garden |Tennis

Under Tangled Silence | Djrum

Viagr Aboys |Viagra Boys

Blurring Time | Bells Larsen

== May 2 2025

Time is Not Yours | Say Sue Me 세이수미

If You Asked For A Picture | Blondshell

== May 16 2025

Wield Your Hope Like A Weapon | Soot Sprite

Transmission 96 | Liftin Spirits & DJ Persuasion

Menedék | TÖRZS

== May 28 2025

Forefowk, Mind Me | Quinie

Silver Tears | SILVER TEARS

-

@ 57d1a264:69f1fee1

2025-05-26 07:07:54

@ 57d1a264:69f1fee1

2025-05-26 07:07:54Though Philips is no longer the consumer electronics giant they once were—they've shifted into health technology—they still manufacture some personal care items, like electric shavers and hair dryers. Now, somewhat bizarrely, they're dipping their foot into the DIY repair movement to support those products. The company has partnered with Prusa, the Czech company that has become one of the world's largest manufacturers of 3D printers, to launch this new Philips Fixables initiative.

https://www.youtube.com/watch?v=q85lZdNStGs

https://stacker.news/items/989395

-

@ c1e9ab3a:9cb56b43

2025-05-27 13:19:53

@ c1e9ab3a:9cb56b43

2025-05-27 13:19:53I. Introduction: Money as a Function of Efficiency and Preference

Money is not defined by law, but by power over productivity. In any open economy, the most economically efficient actors—those who control the most valuable goods, services, and knowledge—ultimately dictate the medium of exchange. Their preferences signal to the broader market what form of money is required to access the highest-value goods, from durable commodities to intangibles like intellectual property and skilled labor.

Whatever money these actors prefer becomes the de facto unit of account and store of value, regardless of its legal status. This emergent behavior is natural and reflects a hierarchy of monetary utility.

II. Classical Gresham’s Law: A Product of Market Distortion

Gresham’s Law, famously stated as:

"Bad money drives out good"

is only valid under coercive monetary conditions, specifically: - Legal tender laws that force the acceptance of inferior money at par with superior money. - Fixed exchange rates imposed by decree, not market valuation. - Governments or central banks backing elastic fiduciary media with promises of redemption. - Institutional structures that mandate debt and tax payments in the favored currency.

Under these conditions, superior money (hard money) is hoarded, while inferior money (soft, elastic, inflationary) circulates. This is not an expression of free market behavior—it is the result of suppressed price discovery and legal coercion.

Gresham’s Law, therefore, is not a natural law of money, but a law of distortion under forced parity and artificial elasticity.

III. The Collapse of Coercion: Inversion of Gresham’s Law

When coercive structures weaken or are bypassed—through technological exit, jurisdictional arbitrage, monetary breakdown, or political disintegration—Gresham’s Law inverts:

Good money drives out bad.

This occurs because: - Market actors regain the freedom to select money based on utility, scarcity, and credibility. - Legal parity collapses, exposing the true economic hierarchy of monetary forms. - Trustless systems (e.g., Bitcoin) or superior digital instruments (e.g., stablecoins) offer better settlement, security, and durability. - Elastic fiduciary media become undesirable as counterparty risk and inflation rise.

The inversion marks a return to monetary natural selection—not a breakdown of Gresham’s Law, but the collapse of its preconditions.

IV. Elasticity and Control

Elastic fiduciary media (like fiat currency) are not intrinsically evil. They are tools of state finance and debt management, enabling rapid expansion of credit and liquidity. However, when their issuance is unconstrained, and legal tender laws force their use, they become weapons of economic coercion.

Banks issue credit unconstrained by real savings, and governments enforce the use of inflated media through taxation and courts. This distorts capital allocation, devalues productive labor, and ultimately hollows out monetary confidence.

V. Monetary Reversion: The Return of Hard Money

When the coercion ends—whether gradually or suddenly—the monetary system reverts. The preferences of the productive and wealthy reassert themselves:

- Superior money is not just saved—it begins to circulate.

- Weaker currencies are rejected not just for savings, but for daily exchange.

- The hoarded form becomes the traded form, and Gresham’s Law inverts completely.

Bitcoin, gold, and even highly credible stable instruments begin to function as true money, not just stores of value. The natural monetary order returns, and the State becomes a late participant, not the originator of monetary reality.

VI. Conclusion

Gresham’s Law operates only under distortion. Its inversion is not an anomaly—it is a signal of the collapse of coercion. The monetary system then reorganizes around productive preference, technological efficiency, and economic sovereignty.

The most efficient market will always dictate the form of hard money. The State can delay this reckoning through legal force, but it cannot prevent it indefinitely. Once free choice returns, bad money dies, and good money lives again.

-

@ 162b4b08:9f7d278c

2025-05-27 10:12:53

@ 162b4b08:9f7d278c

2025-05-27 10:12:53Trong thời đại mà công nghệ số trở thành trụ cột không thể thiếu trong mọi lĩnh vực, từ công việc đến giải trí, việc sở hữu một nền tảng số toàn diện như PUM88 đóng vai trò vô cùng quan trọng đối với người dùng hiện đại. Không chỉ là nơi cung cấp các công cụ tiện ích, PUM88 còn tạo nên một hệ sinh thái linh hoạt, đáp ứng mọi nhu cầu trong một môi trường trực tuyến đầy năng động. Từ những bước đầu như đăng ký, đăng nhập, cho đến trải nghiệm thực tế, tất cả đều được tối ưu nhằm mang lại sự thuận tiện tối đa. Giao diện thiết kế thông minh, bố cục rõ ràng, thao tác nhanh gọn giúp người dùng dễ dàng tiếp cận và sử dụng mà không cần kiến thức kỹ thuật chuyên sâu. Bên cạnh đó, hệ thống xử lý tốc độ cao và khả năng tương thích đa nền tảng (từ smartphone đến laptop) giúp người dùng duy trì kết nối mọi lúc mọi nơi, không bị giới hạn bởi thiết bị hay không gian sử dụng. Không dừng lại ở đó, PUM88 còn liên tục nâng cấp công nghệ như tích hợp trí tuệ nhân tạo để gợi ý nội dung cá nhân hóa theo hành vi và sở thích, giúp mỗi trải nghiệm trở nên sống động, gần gũi và mang tính cá nhân cao hơn bao giờ hết. Đây chính là điểm cộng lớn giúp PUM88 tạo nên dấu ấn trong lòng người dùng yêu thích sự tiện lợi và linh hoạt trong đời sống số.

Ngoài ra, yếu tố khiến PUM88 trở nên đáng tin cậy chính là khả năng bảo mật vượt trội và chính sách hỗ trợ khách hàng tận tâm. Dữ liệu cá nhân và các hoạt động của người dùng luôn được bảo vệ nghiêm ngặt bằng các chuẩn mã hóa quốc tế, hệ thống tường lửa, xác thực hai lớp và giám sát bảo mật liên tục. Nhờ vậy, người dùng hoàn toàn yên tâm khi sử dụng mà không lo bị lộ thông tin hay rò rỉ dữ liệu. Thêm vào đó, đội ngũ chăm sóc khách hàng hoạt động 24/7 với thái độ chuyên nghiệp và phản hồi nhanh chóng giúp giải quyết mọi thắc mắc hoặc sự cố kỹ thuật một cách hiệu quả. Không những thế, PUM88 còn thường xuyên lắng nghe ý kiến người dùng để cải tiến giao diện, bổ sung tính năng mới, đảm bảo rằng nền tảng luôn bắt kịp xu hướng công nghệ và đáp ứng đúng nhu cầu thực tế. Việc cập nhật liên tục không chỉ giúp người dùng có được trải nghiệm mượt mà hơn mà còn giữ cho nền tảng luôn mới mẻ, sáng tạo và không ngừng phát triển. Trong bối cảnh chuyển đổi số đang diễn ra mạnh mẽ tại Việt Nam, PUM88 không chỉ đơn thuần là một ứng dụng tiện ích mà còn là một trợ thủ đắc lực cho cuộc sống hiện đại – nơi mà người dùng có thể tận dụng công nghệ để nâng cao hiệu suất cá nhân, tối ưu hóa thời gian và tận hưởng trải nghiệm số trọn vẹn nhất mỗi ngày.

-

@ 611021ea:089a7d0f

2025-05-26 18:28:46

@ 611021ea:089a7d0f

2025-05-26 18:28:46Imagine a world where your favorite health and fitness apps—diet trackers, meditation tools, cardio and strength training platforms, even therapy apps—can all work together seamlessly. Not because they're owned by the same company, but because they speak a common, open language. That's the future NIP-101h is building on Nostr.

A Modular, Privacy-First Health Data Framework

NIP-101h defines a modular, privacy-first framework for sharing granular health and fitness metrics on the decentralized Nostr protocol. The core idea is simple but powerful: every health metric (weight, steps, calories, mood, and so on) gets its own unique Nostr event kind. Apps can implement only the metrics they care about, and users can choose exactly what to share, with whom, and how.

This modular approach means true interoperability. A meditation app can log mindfulness sessions, a running app can record your daily mileage, and a diet tracker can keep tabs on your nutrition—all using the same underlying standard. Each app remains independent, but your data becomes portable, composable, and, most importantly, under your control.

Why NIP-101h Matters

Interoperability

Today's health and fitness apps are walled gardens. Data is locked away in proprietary formats, making it hard to move, analyze, or combine. NIP-101h breaks down these barriers by providing a common, open standard for health metrics on Nostr. Apps can collaborate, users can migrate, and new services can emerge—without permission or lock-in.

User Control & Privacy

Health data is deeply personal. That's why NIP-101h is privacy-first: all metric values are encrypted by default using NIP-44, unless the user explicitly opts out. You decide what's public, what's private, and who gets access. Even if you want to keep everything local, that's supported too.

Extensibility

The world of health and fitness is always evolving. NIP-101h is designed to grow with it. New metrics can be added at any time via the

-

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06Star Wars is often viewed as a myth of rebellion, freedom, and resistance to tyranny. The iconography—scrappy rebels, totalitarian stormtroopers, lone smugglers—suggests a deep anti-authoritarian ethos. Yet, beneath the surface, the narrative arc of Star Wars consistently affirms the necessity, even sanctity, of central authority. This blog entry introduces the question: Is Star Wars fundamentally a celebration of statism?

Rebellion as Restoration, Not Revolution

The Rebel Alliance’s mission is not to dismantle centralized power, but to restore the Galactic Republic—a bureaucratic, centrally governed institution. Characters like Mon Mothma and Bail Organa are high-ranking senators, not populist revolutionaries. The goal is to remove the corrupt Empire and reinstall a previous central authority, presumed to be just.

- Rebels are loyalists to a prior state structure.

- Power is not questioned, only who wields it.

Jedi as Centralized Moral Elites

The Jedi, often idealized as protectors of peace, are unelected, extra-legal enforcers of moral and military order. Their authority stems from esoteric metaphysical abilities rather than democratic legitimacy.

- They answer only to their internal Council.

- They are deployed by the Senate, but act independently of civil law.

- Their collapse is depicted as tragic not because they were unaccountable, but because they were betrayed.

This positions them as a theocratic elite, not spiritual anarchists.

Chaos and the Frontier: The Case of the Cantina

The Mos Eisley cantina, often viewed as a symbol of frontier freedom, reveals something darker. It is: - Lawless - Violent - Culturally fragmented

Conflict resolution occurs through murder, not mediation. Obi-Wan slices off a limb; Han shoots first—both without legal consequence. There is no evidence of property rights, dispute resolution, or voluntary order.

This is not libertarian pluralism—it’s moral entropy. The message: without centralized governance, barbarism reigns.

The Mythic Arc: Restoration of the Just State

Every trilogy in the saga returns to a single theme: the fall and redemption of legitimate authority.

- Prequels: Republic collapses into tyranny.

- Originals: Rebels fight to restore legitimate order.

- Sequels: Weak governance leads to resurgence of authoritarianism; heroes must reestablish moral centralism.

The story is not anti-state—it’s anti-bad state. The solution is never decentralization; it’s the return of the right ruler or order.

Conclusion: The Hidden Statism of a Rebel Myth

Star Wars wears the costume of rebellion, but tells the story of centralized salvation. It: - Validates elite moral authority (Jedi) - Romanticizes restoration of fallen governments (Republic) - Portrays decentralized zones as corrupt and savage (outer rim worlds)

It is not an anarchist parable, nor a libertarian fable. It is a statist mythology, clothed in the spectacle of rebellion. Its core message is not that power should be abolished, but that power belongs to the virtuous few.

Question to Consider:

If the Star Wars universe consistently affirms the need for centralized moral and political authority, should we continue to see it as a myth of freedom? Or is it time to recognize it as a narrative of benevolent empire? -

@ bf47c19e:c3d2573b

2025-05-27 14:57:56

@ bf47c19e:c3d2573b

2025-05-27 14:57:56Srpski prevod knjige "The Little Bitcoin Book"

Zašto je Bitkoin bitan za vašu slobodu, finansije i budućnost?

Verovatno ste čuli za Bitkoin u vestima ili da o njemu raspravljaju vaši prijatelji ili kolege. Kako to da se cena stalno menja? Da li je Bitkoin dobra investicija? Kako to uopšte ima vrednost? Zašto ljudi stalno govore o tome kao da će promeniti svet?

"Mala knjiga o Bitkoinu" govori o tome šta nije u redu sa današnjim novcem i zašto je Bitkoin izmišljen da obezbedi alternativu trenutnom sistemu. Jednostavnim rečima opisuje šta je Bitkoin, kako funkcioniše, zašto je vredan i kako utiče na individualnu slobodu i mogućnosti ljudi svuda - od Nigerije preko Filipina do Venecuele do Sjedinjenih Država. Ova knjiga takođe uključuje odeljak "Pitanja i odgovori" sa nekim od najčešće postavljanih pitanja o Bitkoinu.

Ako želite da saznate više o ovom novom obliku novca koji i dalje izaziva interesovanje i usvajanje širom sveta, onda je ova knjiga za vas.

-

@ bf47c19e:c3d2573b

2025-05-27 14:54:03

@ bf47c19e:c3d2573b

2025-05-27 14:54:03Originalni tekst na bitcoin-balkan.com.

Pregled sadržaja

- 5 Razloga Zašto je Novac Važan za Vas, Individualno

- 3 Razloga Zašto je Novac Važan za Društvo u Celini

- Zašto ljudi mrze novac?

Novac vs trenuci – da li oni treba da budu u sukobu? Kakva je uloga novca?

Novac je nepredvidiva zver modernog društva – neki ga veličaju sa stalnom željom da steknu više, dok ga drugi demonizuju i kažu da je pohlepa srž društvenih problema. Tokom mnogih godina svog života, ja sam često prelazio sa jednog na drugo gledište, i naučio mnogo toga upoznajući druge ljude koji žive na oba kraja ovog spektra. Kao i kod mnogih složenih tema, istina leži negde u sredini.

Novac je važan zato što on može da pomogne u uklanjanju materijalnih želja i patnji – omogućavanjem da preuzmete kontrolu nad svojim životom i da brinete o voljenima. Novac podiže životni standard društva omogućavanjem trgovine, a pritom minimalizuje potrebu za poverenjem.

Na novac možemo gledati kao na način da svoj uloženi trud sačuvamo u odredjenom obliku, i da ga vremenom prenesemo, tako da možemo da uživamo u plodovima svog rada. Novac kao alat je jedna od najvažnijih stvari za rast civilizacije. Na nesreću, mnogi su vremenom zlostavljali novac, ali sa dobrim razlogom: način na koji naš novac danas funkcioniše dovodi do duboko podeljenog društva – što ću i objasniti.

5 Razloga Zašto je Novac Važan za Vas, Individualno

Novac je važan za rast bogatstva, što je malo drugačije od toga da imamo veliku platu ili jednostavno zarađivati velike količine novca. Bogatstvo je otklanjanje želja, kako bi mogli da obratimo više pažnje na neke korisnije stvari u životu, od pukog preživljavanja i osnovnih udobnosti.

Bogata osoba je ona koja zaradi više novca nego što potroši, i koja ga čuva – ona čuva svoj rad tokom vremena. Uporedite ovo sa visoko plaćenim lekarom koji živi u velikoj vili sa hipotekom i sa Mercedesom na lizing. Iako ova osoba ima visoke prihode, ona takođe ima velike rashode u vidu obaveze plaćanja te hipoteke i lizinga. Te obaveze sprečavaju ovu osobu da uživa u istinskim blagodetima novca i bogatstva koje one predstavljaju:

1. Sloboda od potrebe za radom

Bez bogatstva, vi morate da radite da biste preživeli. Dostizanjem bogatstva i odredjenom imovinom koja vam donosi novac bez potrebe da vi trošite svoje vreme, vi možete da oslobodite svoj raspored. Više ne zavisite od posla koji mrzite, i nemorate da provodite 40 sati nedeljno odvojeni od porodice, samo da biste se pobrinuli za svoje osnovne potrebe. Dobijanje otkaza u padu ekonomije neće vas dovesti do finansijske propasti ili nečeg goreg.

2. Kontrola nad time kako vi trošite svoje vreme

Kada steknete bogatstvo, vi možete da odlučite kako želite da provodite svoje vreme. Kada se nalazimo u trci pacova i radimo 40+ sati nedeljno, često se naviknemo da novac trošimo onda kada imamo slobodnog vremena. Idemo na lepe večere ili idemo na skupe odmore. Međutim, sa više vremena, a možda čak i sa manje novca, mi možemo da imamo isto ili više uživanja živeći usporenije.

Razmislite o ovome – ukoliko imate samo 1 nedelju slobodno od posla, vi onda morate da kupite onaj mnogo skuplji let u Petak uveče koji se vraća u sledeću Nedelju, kako biste maksimalno iskoristili svoje vreme na nekom egzotičnom mestu za odmor. Međutim, ukoliko ste u mogućnosti da izdržavate sebe bez potrebe da mnogo vremena provodite na poslu, vi onda možete u Utorak da krenete jeftinijim letom i vratite se u sledeću Sredu. Takođe nećete osećati toliki pritisak da se opustite u uživanju tokom vaše nedelje u inostranstvu – možda ćete čak moći i da ostanete duže i da istražujete više, bez plaćanja skupih turističkih agencija i hotela kako bi organizovali vaše kraće putovanje.

3. Sposobnost da pomažete vašim prijateljima i porodici

Onda kada novca imate na pretek, možete poboljšati svoje odnose sa prijateljima i porodicom ne samo kroz dodatno slobodno vreme koje provodite sa njima, već i sa samim novcem. Ako je vašem prijatelju potrebna hitna operacija, vi možete da mu izadjete u susret i pomognete mu da stane na svoje noge. Ukoliko vam je tetka bolesna, vi možete da provedete vreme pored nje, umesto da je pozovete na kratko dok putujete prema kući vraćajući se nakon celog dana provedenog u kancelariji.

4. Smanjen finansijski stres

Stres je sveobuhvatno i opasno stanje modernog doba, sa kojim gotovo svi mi živimo u nekoj odredjenoj meri. Povezan je sa lošim zdravljem, sa preko 43% svih odraslih koji kažu da pate od odredjenih zdravstvenih problema uzrokovanih stresom. Stres zbog posla pogađa 83% zaposlenih.

Pravo bogatstvo – koje znači eliminaciju želja i potreba – može da ukloni ovaj stres i njegove negativne uticaje na druge delove života. Ovo bi čak moglo da ukloni većinu stresa u vašem životu, uzimajući u obzir da je uzrok stresa broj 1 upravo novac.

5. Bolje možete da pomognete vašoj zajednici

Mnogi od nas žele da volontiraju u svojim zajednicama i pomognu onima koja je pomoć preko potrebna, ali nisu u stanju da pronađu slobodnog vremena i energije zbog svog posla, porodice i društvenih aktivnosti koje nas mentalno i fizički čine srećnima, zdravima i hranjenima. Sa bogatstvom, mi možemo da posvetimo vreme koje nam je potrebno za razumevanje i doprinos drugima – a ne samo da sa vremena na vreme pomognemo slanjem humanitarnog SMS-a.

Novac, koji se pametno koristi, je moćno sredstvo za poboljšanje vašeg života i života vaših najmilijih i zajednice. Međutim, novac je takođe moćno sredstvo za poboljšanje društva u celini – ukoliko je dobro strukturiran.

3 Razloga Zašto je Novac Važan za Društvo u Celini

Novac poboljšava sposobnost ljudi da trguju jedni s drugima, što podstiče određene specijalizacije. Ako je imanje vašeg komšije odlično za proizvodnju vina, a vaše je pogodno za žito, obojica možete da profitirate trgovinom. Sad oboje imate i hleb i vino, umesto jednog pijanog vlasnika vinograda i jednog proizvodjača žita kome je dosadno!

Novac poboljšava društvo na nekoliko načina:

1. Omogućava specijalizaciju

Kao u primeru vlasnika vinograda i proizvodjača žita, novac omogućava povećanu specijalizaciju poboljšavajući sposobnost trgovine. Svaka razmena dobara ima problem sa ‘sticajima potreba’ – oba partnera u trgovini moraju da žele ono što druga osoba ima da bi pristala na trgovinu.

Možemo da mislimo o novcu kao o dobru koje žele gotovo svi. Ovo trgovinu čini mnogo jednostavnijom – da biste stekli odredjeno dobro, sve što vam je potrebno je novac, a ne neka slučajna stvar koju prodavac tog dobra takođe želi u tom trenutku. Vremenom je upotreba novca omogućila specijalizaciju, što je povećalo kvalitet i složenost roba i usluga.

Zamislite da sami pokušate da napravite svoj telefon – a bili su potrebni milioni stručnjaka i specijalizovana oprema da bi proizveli taj uređaj. Svi ti stručnjaci i kompanije plaćaju jedni drugima u novcu, omogućavajući složenom plesu globalnih proizvođača i lanaca snabdevanja da taj telefon isporuče na dlan vaše ruke. Čak i nešto tako jednostavno kao flaša za vodu uključuje naftna polja i proizvodne pogone koji su možda hiljadama kilometara od vaše kuće.

Kada ljudi mogu da se specijalizuju, kvalitet robe i usluga može da se poveća.

2. Omogućava korisnu trgovinu uz smanjeno poverenje

Mala društva mogu mirno i produktivno da posluju bez novca koristeći usluge, “dodjem ti” i uzajamno razumevanje. Međutim, kako se društva uvećavaju, svima brzo postaje nemoguće da održavaju lične odnose i isti stepen poverenja sa svima ostalima. Sistem trgovine uslugama i međusobnog poverenja ne funkcioniše previše dobro sa putnikom koji se nalazi na proputovanju kroz grad, i provede samo 15 minuta svog života u vašoj prodavnici.

Novac minimizira poverenje potrebno za trgovinu u većim društvima. Sada više ne moram da verujem da ćete mi pomoći kasnije kada mi zatreba – mogu samo da prihvatim uplatu od vas i da to koristim da bih sebi pomogao kasnije. Jedan od mojih omiljenih mislilaca, Nick Szabo, ovo naziva ‘društvena prilagodljivost’.

3. Smanjuje upotrebu sile

Kada društvo teži upotrebi određenog oblika novca za olakšavanje trgovine, može u velikoj meri da smanji nasilje u tom društvu. Kako to može biti tako? Zar ljudi ne bi i dalje želeli da kradu jedni od drugih ili da se svete?

Ukoliko razmišljamo van uobičajnih okvira, možemo da počnemo da razumemo kako novac može da smanji nasilje. Ako ti i ja živimo u susednim zemljama i želimo nešto što druga zemlja ima, imamo dva načina da to dobijemo: uzimanjem na silu ili menjanjem nečeg našeg za to. Kao što je ranije rečeno, novac znatno olakšava trgovinu – pa ćemo postojanjem zajedničkog monetarnog sistema verovatnije radje izvršiti trgovinu nego napad na zemlju. Zašto bismo rizikovali svoje živote kad možemo samo mirno da trgujemo jedni sa drugima?

Zašto ljudi mrze novac?

Pa ako novac ima toliko koristi za nas lično i za društvo u celini, zašto toliko ljudi mrzi novac? Zašto je demonizovan, zajedno sa onima koji ga imaju puno?

Za deo ovoga može biti okrivljen problem u jednakosti mogućnosti – to da je nekima teže da izadju iz nemaštine i postanu bogati. Bez sumnje, neki mali deo potiče od ljudi koji jednostavno ne žele da se trude ili preduzmu neophodne rizike da bi postali bogati.

Međutim, oba ova problema imaju više veze sa problemima kako naš novac danas funkcioniše, nego sa bilo kojim problemom u samom konceptu novca. Novčani sistem treba da nagrađuje ljude koji proizvode vredne stvari i trguju njima sa drugima. Verujem da većina ljudi danas misli da novac tako funkcioniše, i to ne bi smelo da bude daleko od istine.

Naš trenutni monetarni sistem, na žalost, nagrađuje ’finansijalizaciju’ – pretvarajući sve u imovinu, čija vrednost može da se napumpava ili spušta stvaranjem dobre priče i navođenjem drugih da veruju u nju. Razuzdani dug pogonjen stalnim omalovažavanjem svih glavnih valuta dodat je ovom blatu finansijalizacije. Sada je isplativije podići ogroman kredit i koristiti ga za brzo okretanje imovine radi zarade nego izgraditi posao koji društvu nudi korisne robe i usluge.

Tradicionalni monetarni sistem dodatno nagradjuje predatore, partnere u zločinu i neradnike.

Propast našeg novca razvila se tokom proteklih pola veka, počevši od toga kada su naše valute postale ništa više od parčeta papira, podržanog sa verom i kreditima naših vlada. Da biste bolje razumeli ovu promenu, pogledajte moj post o svrsi i istoriji novca.

Ako vam se sviđa moj rad, molim vas da ga podelite sa svojim prijateljima i porodicom. Cilj mi je da svima pružim pogled u ekonomiju i na to kako ona utiče na njihov život.

-

@ 45d6c2bf:56915a25

2025-05-27 14:23:39

@ 45d6c2bf:56915a25

2025-05-27 14:23:39published without nostr installed

-

@ 1d7ff02a:d042b5be

2025-05-27 02:56:33

@ 1d7ff02a:d042b5be

2025-05-27 02:56:33ສຳລັບໃຜທີ່ຍັງບໍ່ເຂົ້າໃຈ Bitcoin ຢ່າງແທ້ຈິງ, ຫມາຍຄວາມວ່າເຈົ້າຍັງບໍ່ທັນເຂົ້າໃຈວ່າເງິນແມ່ນຫຍັງ, ໃຜເປັນຜູ້ສ້າງມັນ, ແລະເປັນຫຍັງມະນຸດຈຶ່ງຕ້ອງການເງິນ. ມັນເປັນເລື່ອງ scam ທີ່ລະບົບການສຶກສາບໍ່ໄດ້ສອນເລື່ອງສຳຄັນນີ້, ໃນຂະນະທີ່ພວກເຮົາໃຊ້ເວລາເກືອບທັງຊີວິດເພື່ອຫາເງິນ. ດັ່ງນັ້ນ, ຂໍແນະນຳໃຫ້ follow the money ແລະ ສຶກສາ Bitcoin ຢ່າງຈິງຈັງ.

Why Bitcoin Matters

Saving is the greatest discovery in human history

ກ່ອນທີ່ມະນຸດຈະຮຽນຮູ້ການເກັບອອມ, ພວກເຮົາເປັນພຽງແຕ່ສັດທີ່ມີຊີວິດຢູ່ແບບວັນຕໍ່ວັນ. ການປະຢັດແມ່ນສິ່ງທີ່ເຮັດໃຫ້ມະນຸດແຕກຕ່າງຈາກສັດອື່ນ — ຄວາມສາມາດໃນການຄິດກ່ຽວກັບອະນາຄົດ ແລະ ເກັບໄວ້ສຳລັບມື້ຫຼັງ.

Saving created civilization itself

ບໍ່ມີການເກັບອອມ, ບໍ່ມີການສ້າງເມືອງ, ບໍ່ມີວິທະຍາສາດ, ບໍ່ມີສິລະປະ. ທຸກສິ່ງທີ່ເຮົາເອີ້ນວ່າ "ຄວາມກ້າວໜ້າ" ແມ່ນມາຈາກຄວາມສາມາດໃນການຮູ້ຈັກເກັບອອມ.

Money is the greatest creation in human history

ມັນເປັນເຄື່ອງມືທີ່ເຮັດໃຫ້ອາລະຍະທຳມະນຸດກ້າວໜ້າມາເຖິງທຸກມື້ນີ້ ເງິນ ເປັນເຄື່ອງມືທີ່ດີທີ່ສຸດທີ່ມະນຸດໃຊ້ໃນການເກັບອອມ.

Bitcoin is the best money ever created

ມັນແມ່ນເງິນທີ່ສົມບູນແບບທີ່ສຸດທີ່ມະນຸດເຄີຍສ້າງຂຶ້ນມາ. ບໍ່ມີໃຜສາມາດ ຄວບຄຸມ, ຈັດການ, ທຳລາຍ ແລະ ມີຈຳກັດຢ່າງແທ້ຈິງ ຄືກັບເວລາໃນຊີວິດ.

Bitcoin ຄືກັບ black hole

ທີ່ຈະດູດເອົາມູນຄ່າທັງໝົດຈາກລະບົບການເງິນທີ່ເສຍຫາຍມັນຈະດູດເອົາຄວາມໝັ້ນຄົງແລະມູນຄ່າມາສູ່ຕົວມັນເອງ. ທຸກສິ່ງທີ່ມີມູນຄ່າຈະໄຫຼເຂົ້າສູ່ Bitcoin ໃນທີ່ສຸດ.

Bitcoin ຄືກັບສາດສະໜາພຸດທີ່ຄົ້ນພົບຄວາມຈິງ

ມັນເຮັດໃຫ້ເຂົ້າໃຈຕົ້ນຕໍບັນຫາຂອງລະບົບການເງິນປະຈຸບັນ ແລະ ເກີດເປັນບັນຫາຫລາຍໆຢ່າງໃນສັງຄົມ ດັ່ງກັບພະພຸດທະເຈົ້າທີ່ເຂົ້າໃຈທຸກ ແລະ ເຫດຂອງການເກີດທຸກ.

Bitcoin ຄືອິດສະຫຼະພາບ

ເງິນຄືອຳນາດ, ເງິນຄືສິ່ງຄວບຄຸມພຶດຕິກຳຂອງມະນຸດ ເມື່ອເຮົາມີເງິນທີ່ຮັກສາມູນຄ່າໄດ້ ແລະ ຄວບຄຸມບໍ່ໄດ້ ຈຶ່ງຈະມີຄວາມອິດສະຫຼະທາງຄວາມຄິດ, ການສະແດງອອກ, ແລະ ອຳນາດໃນການເລືອກ.

ຫນີ້ສິນທີ່ມະນຸດສ້າງຂຶ້ນໃນປະຈຸບັນນີ້ ໃຊ້ເວລາອີກພັນປີກໍ່ໄຊ້ຫນີ້ບໍ່ໝົດ

ມັນບໍ່ມີທາງອອກ ແລະ ກຳລັງມຸ່ງໜ້າສູ່ການລົ່ມສະລາຍຢ່າງຮ້າຍແຮງ. Bitcoin ຄືແສງສະຫວ່າງທີ່ຈະຊ່ວຍປ້ອງກັນບໍ່ໃຫ້ມະນຸດເຂົ້າສູ່ຍຸກມືດມົວອີກຄັ້ງ.

Bitcoin cannot steal your time

ມັນບໍ່ສາມາດຖືກສ້າງຂຶ້ນຈາກຄວາມຫວ່າງເປົ່າ. ທຸກ Bitcoin ຕ້ອງໃຊ້ພະລັງງານແລະເວລາທີ່ແທ້ຈິງໃນການສ້າງ.

Bitcoin ຄືປະກັນໄພທີ່ປ້ອງກັນການບໍລິຫານທີ່ຜິດພາດ

ມັນຊ່ວຍປ້ອງກັນຄວາມເສື່ອມໂຊມຂອງເງິນຕາ, ເສດຖະກິດທີ່ຕົກຕ່ຳ ແລະ ນະໂຍບາຍທີ່ຜິດພາດ, Bitcoin ຈະປົກປ້ອງຄຸນຄ່າຂອງເຈົ້າ.

Bitcoin is going to absorb the world's value

ໃນທີ່ສຸດ, Bitcoin ຈະກາຍເປັນທີ່ເກັບຮັກສາມູນຄ່າຂອງໂລກທັງໝົດ. ມັນຈະດູດເອົາຄວາມມັ່ງຄັ່ງຈາກທຸກຊັບສິນ, ທຸກລາຄາ, ແລະທຸກການລົງທຶນ.

Exit The Matrix

ພວກເຮົາອາໄສຢູ່ໃນ Matrix ທາງດ້ານການເງິນ. ທຸກໆມື້ພວກເຮົາຕື່ນຂຶ້ນມາແລະໄປເຮັດວຽກ, ຄິດວ່າເຮົາກຳລັງສ້າງອະນາຄົດໃຫ້ຕົວເອງ. ແຕ່ຄວາມຈິງແລ້ວ, ພວກເຮົາພຽງແຕ່ກຳລັງໃຫ້ພະລັງງານແກ່ລະບົບທີ່ຂູດເອົາຄຸນຄ່າຈາກພວກເຮົາທຸກວິນາທີ. Bitcoin is the red pill — ມັນຈະເປີດຕາໃຫ້ເຈົ້າເຫັນຄວາມຈິງຂອງໂລກການເງິນ. Central banks are the architects of this Matrix — ພວກເຂົາສ້າງເງິນຈາກຄວາມຫວ່າງເປົ່າ, ແລະພວກເຮົາຕ້ອງເຮັດວຽກໜັກເພື່ອໄດ້ມັນມາ.

ລະບົບການສຶກສາໄດ້ຫຼອກລວງເຮົາຢ່າງໃຫຍ່ຫຼວງ. ພວກເຂົາສອນໃຫ້ເຮົາເຮັດວຽກເພື່ອຫາເງິນ, ແຕ່ບໍ່ເຄີຍສອນວ່າເງິນແມ່ນຫຍັງ. ເຮົາໃຊ້ເວລາ 12-16 ປີໃນໂຮງຮຽນ, ຫຼັງຈາກນັ້ນໃຊ້ເວລາທັງຊີວິດເພື່ອຫາເງິນ, ແຕ່ບໍ່ເຄີຍຮູ້ຈັກວ່າມັນແມ່ນຫຍັງ, ໃຜສ້າງ, ແລະເປັນຫຍັງມັນມີຄຸນຄ່າ.This is the biggest scam in human history ພວກເຮົາຖືກສອນໃຫ້ເປັນທາດຂອງລະບົບ, ແຕ່ບໍ່ໄດ້ຮັບການສອນໃຫ້ເຂົ້າໃຈລະບົບ.

The Bitcoin standard will end war

ເມື່ອບໍ່ສາມາດພິມເງິນເພື່ອສົງຄາມແລ້ວ, ສົງຄາມຈະກາຍເປັນສິ່ງທີ່ແພງເກີນໄປ.

ພວກເຮົາກຳລັງເຂົ້າສູ່ຍຸກ Bitcoin Renaissance

ຍຸກແຫ່ງການຟື້ນຟູທາງດ້ານການເງິນແລະປັນຍາ. Bitcoin is creating a new class of humans ຄົນທີ່ເຂົ້າໃຈ ແລະ ຖື Bitcoin ຈະກາຍເປັນຊົນຊັ້ນໃໝ່ທີ່ມີອິດສະຫຼະພາບຢ່າງແທ້ຈິງ.

The Path to Financial Truth

Follow the money trail ແລະເຈົ້າຈະເຫັນຄວາມຈິງ:

- ໃຜຄວບຄຸມການພິມເງິນ?

- ເປັນຫຍັງລາຄາສິນຄ້າຂຶ້ນສູງຂຶ້ນເລື້ອຍໆ?

- ເປັນຫຍັງຄົນທຸກທຸກກວ່າເກົ່າ ແລະຄົນຮັ່ງມີຮັ່ງມີກວ່າເກົ່າ?

ຄຳຕອບທັງໝົດແມ່ນຢູ່ໃນການທຳຄວາມເຂົ້າໃຈເລື່ອງເງິນ ແລະ Bitcoin.

ການສຶກສາ Bitcoin ບໍ່ແມ່ນພຽງແຕ່ການລົງທຶນ — ມັນແມ່ນການເຂົ້າໃຈອະນາຄົດຂອງເງິນຕາ ແລະ ສັງຄົມມະນຸດ.

Don't just work for money. Understand money. Study Bitcoin.

ຖ້າເຈົ້າບໍ່ເຂົ້າໃຈເງິນ, ເຈົ້າຈະເປັນທາດຂອງລະບົບຕະຫຼອດໄປ. ຖ້າເຈົ້າເຂົ້າໃຈ Bitcoin, ເຈົ້າຈະໄດ້ຮັບອິດສະຫຼະພາບ.

-

@ 5c26ee8b:a4d229aa

2025-05-26 16:10:05

@ 5c26ee8b:a4d229aa

2025-05-26 16:10:05In March 2022, I have introduced “VCPs”; (Virtual Currency points). So that the international transactions are made without relying on one currency or another and the financial crises are easily avoided.

You may have noticed that banks are increasing their gold reserves and that there are interests for local virtual currency and that was after the note was published.

The picture of the note showing its date will be in attachment to this post; I can’t edit it to avoid that its date gets changed. Here its content:

Conversion of international banking system: The “VCPs” system: * Each central bank would keep its assets and funds in homeland. * Establishing the value of one virtual currency point. I suggested that: 1 virtual currency point (VCP) = 0.1 gram of gold. * Virtual evaluation must be made to each currency, virtual currency points must be added to each currency’s market value. * International transfers and payments must use the virtual currency points, VCPs, assigned to each currency in international operations. * Daily, weekly, monthly or yearly the actual money corresponding to the virtual currency points used in payments and transfers will be sent by any chosen mean of transport to the banks that had completed the operations or to the corresponding central banks. In this way no currency would prevail in international payments as all currencies will be considered as VCPs. —————————————————————- Because of the need of more guidelines to start using VCPs I have published the following updates:

VCPs allowance updates:

- Not only gold, also precious stones or agreed minerals held in banks can be used to obtain the VCPs allowance (public VCPs allowances). At the same time what is registered and kept in circulation (of gold, precious stones and agreed minerals that belongs to the people) in the country as private VCPs allowances to increase the VCPs allowances. The people can use their personal VCPs along with their precious items for purchases; for example if they sell or use their own gold to buy something, they must give their VCPs registration receipt or card (if they didn’t register their gold to obtain VCPs allowance, they can get it registered at the moment they decide to sell it so it gets added to the private VCPs allowances of his/her country). However, the registered materials must be declared at all borders while traveling once exceeded an internationally agreed specific amount (such as the value of €10000). Therefore a registration method can be agreed with gold and jewelry shops. For instance, while evaluating the materials getting registered, an online VCPs account (for a first registration) can get made on the site that is getting ready and the registration can be combined with a physical/online card (VCPs allowance card. For registering other materials in a later moment, the same card can be used to access the same account. Note that the materials must be used with the private VCPs allowance card for buying or selling, while for public VCPs accounts it’s not necessary because the materials will be kept in the central bank or other banks) or a receipt with a serial number (and other methods to protect customers from fraud). Banks can buy private VCPs while buying gold or other agreed materials and make them public VCPs. And people can have public VCPs allowances corresponding to the value of money (currency) they have already in their accounts. While if people buy gold from the bank (with cash or any other payment method), the related public VCPs allowance will be transformed into private ones (the buyers must receive the actual gold with the private VCPs allowance).

- The agreed materials that can be used to obtain public VCPs must not be consumable (such as oil or natural gas) or used for industrial purposes (such as iron or lithium).

- The printed and online (used by credit or debit cards) currency kept in circulation of the concerned country must correspond to the value of public VCPs allowance that must correspond with the value of gold kept in the central bank (printing more money will decrease its own value internationally).

- Private banks in the same country can have a public VCPs agreement with the central bank so that each bank registers and declares how much gold or valuable materials it has and get its own share of public VCPs allowance and its related printed/online currency in circulation.

- Gems and gold kept in museums can have public VCPs allowances that correspond to their weights only not the archeological values.

- International trade can use public VCPs allowances and the physical payment must follow; either by a preferred currency or gold. However if two or more countries have a trade agreement they can barter goods using IVCPs (International VCPs Allowances; that does not need to have a deposited amount of gold although they will use the same reference as public or private VCPs because it’s a general way to evaluate goods of different types; so for example oil can be swapped for electronics based on how much IVCPs are agreed to be equally swapped each year; i.e. a gallon of oil that costs 50 IVCPs can be swapped for a device that costs 25 IVCPs and grains that cost 25 IVCPs in an International VCPs Allowance Agreement where all parties receives the agreed goods without transferring money or gold). The amount of IVCPs can be agreed per year or there could a multiple online account/s viewable by the countries/parties taking part in the agreement showing the balance of International VCPs that can still be used in bartering goods for each one of the participating countries/parties).

- Cryptocurrencies can be like International VCPs they won’t need to have a deposit of gold, however they must go through an evaluation process compared to their current comparative value and gold (i.e. the amount of bitcoin that must be paid to buy a 0.1g of gold now can become the fixed value) so that the Cryptocurrencies can still be used for trading or bartering for goods even after the release of VCPs. The Cryptocurrencies can sustain the deficiencies of amount of currency that can be used in the same country or internationally (because not everyone can have enough gold deposited to sustain the daily trade). However regulations on the amount of Cryptocurrency/ies exchanged in a country must be agreed with its own central bank or there could be an international agreement; this amount can’t be less than what’s already in use of a certain Cryptocurrency. Or Cryptocurrencies can be exchanged with IVCPs (to protect people’s money while keeping in mind their compared value with gold now) and an amount of International VCPs allowance can be used also for bartering goods in the same country through an agreement with its own central bank.

- Public VCPs must have printable cash allowance that can be in the country or overseas (registered in banks, exchange companies and at borders). Each bank can have registers of local or foreign cash.

- In order to avoid the devaluation of the currency, because the printed money will corrisponde to the gold or valuable minerals held by the country, the concerned country must retrieve the cash abroad and replace it either with another currency or IVCPs through a trade agreement.

- To compensate the deficit of VCPs necessary for daily use within a country and to make a proper distinction, locally, Local Virtual Points (LVCPs) can be used.

- The Local VCPs would be issued by local authorities.

Meanwhile, countries started using the free VCPs platform that is built by a talented web developer in JavaScript; fiatjaf. I insist though that the trade name for the virtual currency points stays “VCPs” and that the clients are made aware of its usage in their daily banking.

-

@ 1d7ff02a:d042b5be

2025-05-27 02:35:53

@ 1d7ff02a:d042b5be

2025-05-27 02:35:53ກຸນແຈສຳຄັນແມ່ນການເຂົ້າໃຈວ່າແສງແດດບໍ່ແມ່ນສິ່ງດຽວ—ມັນແມ່ນຄື່ນຄວາມຖີ່ທີ່ສັບສົນທີ່ເຮັດວຽກຮ່ວມກັນຄືດັ່ງດົນຕີສຳລັບສຸຂະພາບຂອງມະນຸດ.

ວົງດົນຕີສຸຂະພາບຂອງດວງອາທິດ

ແສງຕອນເຊົ້າ (ແສງແດງ/ແສງອິນຟາເຣດໃກ້): ແສງແດງອ່ອນໂຍນຂອງຕອນແລງແລະຄຳ່ທີ່ປະກອບສ້າງ 90% ຂອງການປ່ອຍແສງຂອງດວງອາທິດ. ຄື່ນຄວາມຖີ່ນີ້ເຮັດໜ້າທີ່ຄືການປັບແຕ່ງເຊວລ໌, ເພີ່ມການຜະລິດພະລັງງານມີໂຕຄອນເດຍແລະກະກຽມຮ່າງກາຍຂອງທ່ານສຳລັບມື້ທີ່ຈະມາເຖິງ. ຄິດໃສ່ວ່າມັນແມ່ນການກະກຽມເຄື່ອງຈັກເຊວລ໌ຂອງທ່ານ.

ແສງຕອນກາງວັນ (ແສງ UV/ແສງສີຟ້າ): ແສງອາທິດທີ່ເຂັ້ມຂົ້ນຕອນກາງວັນສົ່ງມອບແສງອຸນຕາລະວິໂອເລດທີ່ຜະລິດວິຕາມິນ D—ຮໍໂມນທີ່ສຳຄັນຫຼາຍທີ່ເກືອບທຸກເຊວລ໌ໃນຮ່າງກາຍຂອງທ່ານມີຕົວຮັບສຳລັບມັນ. ເຖິງແມ່ນວ່າມັນຖືກເອີ້ນວ່າ "ວິຕາມິນ," ຮ່າງກາຍຂອງທ່ານຜະລິດວິຕາມິນ D ສ່ວນໃຫຍ່ຜ່ານການສຳຜັດຜິວໜັງກັບແສງ UVB. ນີ້ບໍ່ແມ່ນພຽງແຕ່ເລື່ອງສຸຂະພາບກະດູກ—ການຂາດວິຕາມິນ D ໄດ້ຖືກເຊື່ອມໂຍງກັບມະເຮັງ, ໂຣກພູມຄຸ້ມກັນຕົນເອງ, ໂຣກຫົວໃຈແລະເສັ້ນເລືອດ, ແລະການເພີ່ມຂຶ້ນຂອງການເສຍຊີວິດຈາກທຸກສາເຫດ. ວິຕາມິນ D ທີ່ຜະລິດຕາມທຳມະຊາດຈາກແສງແດດແກ່ຍາວ 2-3 ເທົ່າໃນຮ່າງກາຍຂອງທ່ານເມື່ອທຽບກັບຢາເສີມ, ສະແດງໃຫ້ເຫັນວ່າເປັນຫຍັງການສຳຜັດແສງແດດຕາມທຳມະຊາດຈຶ່ງດີກວ່າຢາເສີມ.

ແສງ UV ຍັງກະຕຸ້ນການຜະລິດເມລານິນ, ທີ່ເຮັດໜ້າທີ່ເປັນແບັດເຕີຣີທຳມະຊາດ, ເກັບຮັກສາອີເລັກຕຣອນທີ່ໃຫ້ພະລັງງານແກ່ມີໂຕຄອນເດຍຂອງທ່ານ. ໃນຂະນະທີ່ແສງສີຟ້າຮັບໃຊ້ຈຸດປະສົງຄູ່: ມັນຮັກສາໃຫ້ທ່ານຕື່ນຕົວໃນຕອນກາງວັນໃນຂະນະທີ່ຂັດຂວາງການຜະລິດເມລາໂທນິນ. ແຕ່ວ່າ, ແສງສີຟ້າມີດ້ານມືດ—ການສຶກສາສະແດງວ່າມັນສາມາດເຮັດໃຫ້ເກີດຄວາມເສຍຫາຍຂອງ DNA ແລະສ້າງສິ່ງທີ່ເປັນອັນຕະລາຍທີ່ເອີ້ນວ່າສະສາລະອົກຊິເຈນປະຕິກິລິຍາຢູ່ທັງຜິວໜັງແລະຕາ, ຄ້າຍຄືກັບລັງສີ UV. ນີ້ແມ່ນເຫດຜົນທີ່ການສຳຜັດແສງສີຟ້າໂດດດ່ຽວ (ເຊັ່ນຈາກໜ້າຈໍ) ໂດຍບໍ່ມີຄື່ນຄວາມຖີ່ປ້ອງກັນຂອງແສງອາທິດສາມາດເປັນອັນຕະລາຍໂດຍສະເພາະ.

ການປ່ຽນແປງຕອນແລງ: ເມື່ອແສງສີຟ້າຫຼຸດລົງໃນຕອນແລງ, ຮ່າງກາຍຂອງທ່ານເລີ່ມຜະລິດເມລາໂທນິນ, ທີມງານທຳຄວາມສະອາດເຊວລ໌ທີ່ເອົາຜະລິດຕະພັນພິດທີ່ສະສົມໃນລະຫວ່າງການຜະລິດພະລັງງານຂອງມື້ອອກ.

ວິກິດການແສງສະໄໝໃໝ່

ມະນຸດສະໄໝໃໝ່ໃຊ້ເວລາ 93% ຢູ່ໃນເຮືອນ, ສ້າງຄວາມບໍ່ສົມດູນຂອງແສງທີ່ເປັນອັນຕະລາຍ. ພວກເຮົາໄດ້ປ່ຽນໝໍ້ແສງໄຟແກ້ວທີ່ມີປະໂຫຍດດ້ວຍ LED ທີ່ຂາດຄື່ນຄວາມຖີ່ແສງອິນຟາເຣດໃກ້ທີ່ປ້ອງກັນ, ໃນຂະນະທີ່ແສງສີຟ້າປອມຈາກໜ້າຈໍຂັດຂວາງການຜະລິດເມລາໂທນິນຕາມທຳມະຊາດຂອງພວກເຮົາໃນຕອນກາງຄືນ. ນີ້ສ້າງພາຍຸທີ່ສົມບູນແບບ: ຄວາມເຄັ່ງຕຶງຈາກການເກີດອົກຊິເດຊັນໂດຍບໍ່ມີກົນໄກການທຳຄວາມສະອາດຕາມທຳມະຊາດ, ການຂາດວິຕາມິນ D, ແລະການຂາດຄື່ນຄວາມຖີ່ປ້ອງກັນຕອນເຊົ້າທີ່ກະກຽມຮ່າງກາຍຂອງພວກເຮົາສຳລັບການສຳຜັດແສງແດດ.

ທາງແກ້ໄຂຕາມທຳມະຊາດ

ການຄົ້ນຄວ້າຊີ້ໃຫ້ເຫັນວິທີການງ່າຍໆ: ຮັບເອົາຈັງຫວະຕາມທຳມະຊາດຂອງດວງອາທິດ. ເລີ່ມມື້ຂອງທ່ານດ້ວຍການສຳຜັດແສງຕອນເຊົ້າເພື່ອກະກຽມມີໂຕຄອນເດຍຂອງທ່ານ. ຍອມຮັບວ່າແສງແດດຕອນກາງວັນບາງຢ່າງໃຫ້ວິຕາມິນ D ແລະເມລານິນທີ່ຈຳເປັນ. ຄ່ອຍໆຜ່ອນຄາຍເມື່ອແສງແລງຫຼຸດລົງ, ອະນຸຍາດໃຫ້ມີການຜະລິດເມລາໂທນິນຕາມທຳມະຊາດ.

ຮ່າງກາຍຂອງທ່ານພັດທະນາມາຫຼາຍລ້ານປີກັບວົງຈອນແສງນີ້. ໃນຂະນະທີ່ພວກເຮົາບໍ່ສາມາດປະຖິ້ມຊີວິດທີ່ທັນສະໄໝໄດ້, ພວກເຮົາສາມາດເຄົາລົບຄວາມຕ້ອງການທາງຊີວະວິທະຍາຂອງພວກເຮົາສຳລັບແສງແດດແບບຄົບຖ້ວນ. ຫຼັງຈາກທັງໝົດ, ທຸກເຊວລ໌ໃນຮ່າງກາຍຂອງທ່ານແລ່ນດ້ວຍພະລັງງານ, ແລະດວງອາທິດຍັງຄົງເປັນແຫຼ່ງພະລັງງານຫຼັກຂອງໂລກພວກເຮົາ. ໃນໂລກເທັກໂນໂລຢີສູງຂອງພວກເຮົາ, ພວກເຮົາຕ້ອງຈື່ຄູ່ຮ່ວມງານບູຮານລະຫວ່າງສຸຂະພາບຂອງມະນຸດກໍຄືແສງແດດ.

-

@ 28ca019b:93fcb2cc

2025-05-25 19:25:17

@ 28ca019b:93fcb2cc

2025-05-25 19:25:17Introduction

“There is nothing more powerful than an idea whose time has come.” -Victor Hugo

Early 1950’s America. Harry S. Truman is in office. The economy is booming and the middle class are comfortable. Shiny new television sets invite the first scenes of Hollywood into people’s homes. The Weavers, Tony Bennett, Vera Lynn and Perry Como play on the radio.

But on the fringes, in dance halls and late night clubs, a cultural revolution is brewing… A new musical fusion with influences from blues, R\&B, jazz, rockabilly, country and gospel music is about to give birth to not only a new genre, but a whole new way of life that will change society and culture, forever.

Rock & Roll

It becomes a symbol of freedom, a means of expression, and a catalyst for social change. It brings into existence a new type of counter-culture, filled with individuals who are driven to rebel against norms and authority. They don’t ask for permission. They push for change.

I believe we are witnessing such a shift now. And like rock & roll, the movement I’m speaking of is also ground up, grass roots, punk rock and will not look to authority to seek permission. The catalyst for this new social change, I believe, is Bitcoin. With its innate properties, it empowers and enables the individual like never before to achieve their fullest potential, expressed through an unprecedented freedom technology. It is an idea, like a song everyone can sing in their own way, that nobody can silence.

Revolution

"You say you got a real solution / Well you know / we’d all love to see the plan" -John Lennon

The rock & roll era helped bring about meaningful societal change through art, music, and film. It created a new social narrative. Today, the Bitcoin network is providing people with a different set of tools and ideas to build a better future in a much more practical and pragmatic way. Instead of trying to reshape social consensus and cultural norms through art forms, fashion, or lifestyle, bitcoin is achieving this through open source code.

For the first time, this technology gives individuals financial sovereignty and personal control over their own destiny, with the ability to self custody their own money that no corporation, government, dictator or king can tamper with. The individual has an opportunity to finally be freed from economic tyranny. And societies have the potential to avoid endless wars funded with printed government money. John Lennon said ‘give peace a chance’. If he were still here today and understood how bitcoin could subvert the military industrial complex would he not exclaim, ‘give bitcoin a chance’?

Natural Rights, Civil Rights, Digital Rights

"The times they are a-Changin’" -Bob Dylan

The civil rights movement was tightly interwoven with the history of rock & roll. The march on Washington, August 28th 1963, marked a seminal moment in American history for the advancement of equal rights before the law. Bob Dylan, along with Joan Baez, stood with over two hundred thousand other Americans and listened to Martin Luther King’s now immortal speech.

People with the same values peacefully gathered in numbers to make a statement powerful enough to change the conversation. This is analogous to the same freedom-minded people today gathering in cyberspace and voting not in the traditional sense, but voting with their money – peacefully exiting and transferring their economic energy into a system where they can’t be expropriated.

The question of whether individual rights are granted or have to be secured by each individual remains a contested area of philosophy to this day. To outline each in a very crude and simplistic way, natural rights (sometimes referred to as inalienable rights) are derived from the belief that every person owns their own body, therefore their own labor, time, and energy. Civil rights, on the other hand, are granted by the state and are therefore not universal. The fact that they are rights granted to humans by other humans means they always have the potential to be revoked or withdrawn.

Digital rights granted by the power of asymmetric cryptography are based in the laws of mathematics. Combined with proof of work, based in the law of thermodynamics, this makes digital rights that bitcoin provides more akin to natural rights than civil rights, as no one person or group can unilaterally revoke those rights or confiscate your property through violence. No amount of fire power, tanks, fighter jets or nuclear weapons can break a bitcoin private key or rewrite the sunken cost of proof of work embedded into bitcoin’s timechain. This idea of securing rights without asking permission is, in itself, a revolution and achievable now in an egalitarian way. This implies a potentially huge shift in power from those with a monopoly on violence, to peaceful individuals who want to be treated fairly and with dignity.

Cypher Punk-Rock

Songwriters write songs. Cypherpunks write code.

To tie things back and look at a very narrow, but potentially huge use case of bitcoin, let’s examine the current broken incentives of the music industry, particularly recorded music. It is becoming increasingly apparent that an option other than a subscription model could find demand from content consumers and producers alike.

There is now a way, with Bitcoin and Lightning Network, for a music fan to pay artists directly and for any amount – dollars, cents or even fractions of cents. This model has positive outcomes for the music producer and fan who are the main two parties engaged in the transaction. The artist keeps all of what is sent and the listener can pay what they want. The listener can pay as they listen, rather than be locked into a rolling subscription that isn’t based on usage. This concept, called ‘value for value’, is finding its way into new music platforms such as Wavlake and Fountain. I believe this model will become the de-facto way of monetizing digital content in the coming years. This could bring an economic signal back to music that has been lost and cannot be achieved by streams alone. This will hopefully create a more meritocratic music system and shake up the entrenched streaming monoliths.

Art can shine a light on a certain truth. It can also make people look at things in a completely new way. Maybe then, Satoshi was the greatest artist who ever lived. Bitcoin smashed the conventional wisdom and theories of the most basic and prevalent thing everyone takes for granted: money. Using money as a lens to view the world can lead to distortions in your perception if the lens is warped. Removing the glasses makes you reevaluate economics, politics, religion, philosophy, morality, beauty, and almost every other aspect of life. The beauty of the Sistine Chapel, the Egyptian pyramids, the Mona Lisa, Beethoven’s 5th Symphony, Bohemian Rhapsody all intrinsically imply a certain degree of proof of work. The art, you could say, speaks for itself.

The Long and Winding Road Ahead

As a musician, I have found a new hope. The value for value movement gives me that hope. If this is truly a superior model of music distribution and consumption it will win out over time on the market.

Another point to touch on would be the possibility of this technology ushering in an artistic renaissance. I can honestly say my favorite music, the songs that have moved me the most, normally comes from a place of truth, honesty and sheer talent. Maybe I’m out of touch, but I feel popular music of late is devoid of soul, meaning and the biggest mainstream artists want to conform to the man (giant corporations/governments) instead of stick it to the man! Probably because there is nowhere else to turn now that streaming and social media platforms own their speech and art. We need to investigate and embrace new ways to own our speech and art, to make art interesting again. The powers that be, need to let it be, and leave alone individuals who wish to use this technology for their own interests if they do so in a peaceful way.

I want to leave you with a Frank Zappa quote that seems more relevant than ever:

“I’d say that today, dishonesty is the rule, and honesty the exception. It could be, statistically, that more people are honest than dishonest, but the few that really control things are not honest, and that tips the balance…”