-

@ d57360cb:4fe7d935

2025-06-18 15:38:43

@ d57360cb:4fe7d935

2025-06-18 15:38:43Your mind will berate you in performance. It’s self centered thinking that ruins your performance, it isolates you. Instead of being immersed in the experience of the game, you are caught in a web of your own stinking thinking.

Only thinking of yourself and how you will perform.

How others will judge you.

In your fear of what others think, you create the reality for them to judge you. You create an opportunity for them to distrust your gifts. Your fear is small and selfish. You must let go of oneself in order to be the creative expression of art.

Expression has no individual behind it, it is a force beyond small little me. Where once you took a step now it is the step that takes you.

We haven’t forgotten how to trust ourselves. We have forgotten how to love and accept ourselves and it shows when we contract and tighten under pressure.

Pressure is a spotlight it magnifies and calls you to bring forth your greatest gist, your greatest expression. Do not let the spotlight hinder you, most people are running from the light but the light always follows you, it’s like a shadow.

Until you come to accept that you are always in the spotlight only then can you realize what you do behind the scenes is also the scene itself.

-

@ cbd044aa:090d5436

2025-06-18 15:37:44

@ cbd044aa:090d5436

2025-06-18 15:37:44Pet Medical Services Surrey Got a pet in need of top-notch care? Cedar Hills Animal Hospital in Surrey has you covered! From wellness exams to advanced diagnostics like X-rays, our friendly team keeps your furry friend healthy. We offer vaccinations, surgeries, and even emergency care, all with a caring touch. Affordable, local, and trusted, we’re here to make pet parenting stress-free. Visit Cedar Hills Animal Hospital today for expert pet medical services in Surrey—your pet deserves the best, and we deliver!

-

@ cbd044aa:090d5436

2025-06-18 15:35:12

@ cbd044aa:090d5436

2025-06-18 15:35:12Pet Dental Care Services Langley Got a furry friend with funky breath? AVON Hospital in Langley offers top-notch pet dental care services to keep your pet’s smile sparkling! From professional cleanings to advanced treatments like dental X-rays, our caring team ensures your cat or dog stays healthy and happy. We use safe, modern techniques and provide at-home care tips too. Affordable, friendly, and local—trust AVON Hospital for your pet’s dental needs. Book today and give your pet the gift of a healthy mouth!

-

@ cbd044aa:090d5436

2025-06-18 15:34:35

@ cbd044aa:090d5436

2025-06-18 15:34:35Pet Dental Care Services Langley Got a furry friend with funky breath? AVON Hospital in Langley offers top-notch pet dental care services to keep your pet’s smile sparkling! From professional cleanings to advanced treatments like dental X-rays, our caring team ensures your cat or dog stays healthy and happy. We use safe, modern techniques and provide at-home care tips too. Affordable, friendly, and local—trust AVON Hospital for your pet’s dental needs. Book today and give your pet the gift of a healthy mouth!

-

@ 5e5ab9f7:271774d7

2025-06-18 15:18:45

@ 5e5ab9f7:271774d7

2025-06-18 15:18:45Affordable 3D Rendering Looking for stunning 3D visuals without breaking the bank? HS3D Visualization offers affordable 3D rendering that’s perfect for small businesses, architects, or homeowners! Our budget-friendly services deliver high-quality renders for real estate, products, or interiors, all tailored to your needs. With fast turnarounds and expert support, we make your vision pop without the hefty price tag. Ready to bring your ideas to life? Contact HS3D Visualization today and see how affordable top-notch 3D rendering can be! 3D Residential House Rendering Dreaming of seeing your home design come to life? HS3D Visualization specializes in 3D residential house rendering that’s both realistic and affordable! Whether you’re a homeowner, architect, or realtor in Melbourne, our detailed renders showcase every angle of your property, from cozy interiors to stunning exteriors. Perfect for marketing or planning, we deliver fast, high-quality visuals with a personal touch. Let’s make your house shine—reach out to HS3D Visualization now for jaw-dropping 3D renders that sell or inspire!

-

@ 383c9882:72943781

2025-06-18 15:15:10

@ 383c9882:72943781

2025-06-18 15:15:10Office Catering POS Systems Hey, running an office catering biz? Canteen POS has your back with top-notch office catering POS systems! Streamline orders, manage deliveries, and handle cashless payments like a pro. Our user-friendly setups integrate with corporate billing and track inventory, saving you time and hassle. Perfect for small startups or big contracts, we offer fast setup and local support. Ready to impress your office clients? Grab a Canteen POS system today and make catering smooth, efficient, and totally stress-free! School Catering POS School canteens, listen up! Canteen POS brings you school catering POS systems that make lunchtimes a breeze. From cashless payments to pre-order apps, we help you serve students faster while tracking inventory and dietary needs. Parents love our portal for easy top-ups and meal monitoring. With secure, scalable solutions, we’re perfect for any school size. Get started with Canteen POS now and turn your canteen into a smooth, modern operation that keeps everyone happy—students, staff, and parents alike!

-

@ dfa02707:41ca50e3

2025-06-18 15:02:27

@ dfa02707:41ca50e3

2025-06-18 15:02:27Contribute to keep No Bullshit Bitcoin news going.

This update brings key enhancements for clarity and usability:

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ 0b65f96a:7fda4c8f

2025-06-18 15:09:17

@ 0b65f96a:7fda4c8f

2025-06-18 15:09:17Eine treffsicher, kurze und klare Rezension. Besser hätte ich das Buch selbst nicht zusammenfassen können. Herzlichen Dank an die Autorin!

Leseprobe und Bestellmöglichkeit: Zukunft beginnt im Kopf

Paperback, 148 Seiten, ISBN-13: 9783759734266, € 12,50

In jeder Buchhandlung erhältlich.

Dieser Beitrag wurde mit dem Pareto-Client geschrieben.

Noch nicht auf Nostr? Hier entlang zum leichten Einstieg!

Über den Autor

Patric I. Vogt, geb. 1968 in Mainz lebt als freischaffender Künstler, Lehrer und Unternehmer. Studium der Eurythmie, Anthroposophie, Sprachgestaltung und Ausbildung zum Instructor der M. Chekhov Acting Technique. Über drei Jahrzehnte Beschäftigung mit dem Ideenfeld soziale Dreigliederung und Anthroposphie. Moderation und Mediation von sozialen Prozessen und Organisationsentwicklung. Staatlich ungeprüft, abgesehen von den Fahrerlaubnissen zu Land und zu Wasser. Vom Leben mit vielen Wassern gewaschen und am liebsten auf eigenem Kiel unterwegs.\ Motto: Gedanken werden Worte, werden Taten!

www.perspektivenwechsel.social

post@perspektivenwechsel.social

Nostr patric@pareto.town

auf X @patricivogt

#dreigliederung

-

@ 90c656ff:9383fd4e

2025-06-18 14:56:43

@ 90c656ff:9383fd4e

2025-06-18 14:56:43You've probably heard it before. A bitcoiner is asked about their sats and, with a sly smile, replies: “I lost it all in a boating accident.” But where did this phrase come from? Why do so many bitcoiners make this joke? And more importantly: what does it actually mean?

The Origin of the Meme The phrase "Lost all my Bitcoin in a boating accident" originally came from American forums among gun and precious metal enthusiasts—long before Bitcoin entered the mainstream. The original context went like this: someone would ask if you still owned your gold or firearm collection, and the sarcastic response would be, “Unfortunately, I lost everything in a boating accident.”

This excuse was used as a way to avoid declaring ownership of assets to the government or other authorities. After all, what can’t be proven to exist can’t be taxed, confiscated, or regulated. Over time, this logic found fertile ground among advocates of individual sovereignty—a group where bitcoiners naturally belong.

The Metaphor of Resistance When Bitcoin maximalists adopted the phrase, it came to represent more than just an excuse to dodge uncomfortable questions—it became a symbol of resistance against an increasingly invasive and coercive financial system. Saying you “lost your Bitcoin in a boating accident” is often a euphemism for:

“It’s none of your business how many sats I have.”

“I don’t recognize the authority of anyone trying to seize my digital wealth.”

“My assets are sovereign, self-custodied, and unreachable by traditional means.”

Bitcoin Is Freedom, Not Compliance The meme also touches on a core pillar of Bitcoin philosophy: self-custody and the right to financial privacy. In a world where governments freeze accounts, censor transactions, and print money at will, owning Bitcoin is a form of civil resistance. But for that to have real power, the individual must take responsibility—not just for custody, but for silence.

Saying you “lost your Bitcoin” is also a reminder: Don’t talk about your private keys. Don’t flaunt your sats. Don’t paint a target on your back.

A Meme With a Purpose At the end of the day, the “boating accident” is a joke with a very serious undertone. It reminds us that in a truly sovereign system, the ownership of digital assets is something intimate, personal—and, if needed, deniable. It’s a way to reaffirm that Bitcoin is not just a tool for investment, but a tool for freedom.

So next time someone asks where your bitcoins are, just smile and say:

“Unfortunately, I lost it all in a boating accident…”

And let them wonder.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ b64c3591:8c12a151

2025-06-18 15:07:56

@ b64c3591:8c12a151

2025-06-18 15:07:56First Home Buyers Loans in Melbourne Ready to own your first home in Melbourne? Blacksmith Financial Group makes it easy! We guide first home buyers through tailored loans, low-deposit options, and Victoria’s First Home Owner Grant. Our expert brokers find you the best rates, whether for a city apartment or suburban gem. With pre-approval tips and personalized support, your dream home is closer than you think. Start your journey today with Blacksmith Financial Group—fast, friendly, and local expertise you can trust. Let’s unlock your Melbourne home! Investment Loans in Melbourne Looking to grow your wealth through property? Blacksmith Financial Group has you covered with investment loans in Melbourne! Our expert brokers secure competitive rates and flexible terms to suit your goals, whether it’s a rental property or a portfolio expansion. We simplify the process, from pre-approval to settlement, with personalized advice for Melbourne’s dynamic market. Maximize your returns with our tailored solutions and local insights. Ready to invest? Connect with Blacksmith Financial Group today and build your future with confidence!

-

@ cae03c48:2a7d6671

2025-06-18 15:01:25

@ cae03c48:2a7d6671

2025-06-18 15:01:25Bitcoin Magazine

Ukraine Introduces Bill to Allow Bitcoin in National ReservesUkraine has introduced a bill that would give its central bank the legal right to hold Bitcoin and other assets as part of its national reserves. The draft law, submitted to the Verkhovna Rada on June 10, 2025, proposes updates to existing legislation to include “virtual assets” in the foreign exchange and gold reserves of the National Bank of Ukraine (NBU).

NEW: Ukraine introduces bill for Bitcoin Reserve in Parliament

pic.twitter.com/bYIiCNF13D

pic.twitter.com/bYIiCNF13D— Bitcoin Magazine (@BitcoinMagazine) June 17, 2025

This doesn’t mean Ukraine is officially adding Bitcoin to its balance sheet just yet, but it would give the central bank the green light to do so in the future.

One of the bill’s co-sponsors, Member of Parliament Yaroslav Zhelezniak, emphasized that the legislation is about granting permission, not making it a requirement. “Whether and to what extent they actually do so,” he said, “is up to the institution itself.”

Zhelezniak recently discussed with Binance’s regional head Kyrylo Khomiakov, that he believes Bitcoin could help Ukraine strengthen its economic position and contribute to long term digital innovation.

The timing of the bill is vital as Ukraine has been under enormous financial pressure since Russia’s invasion in 2022. Inflation remains high, the hryvnia has lost significant value, and the country is heavily reliant on international aid and loans. The NBU has managed to hold roughly $44.5 billion in reserves, mostly in U.S. dollars and government securities, but its room to maneuver is limited.

Back in 2022, the Ukrainian government was actively raising donations for the war effort through Bitcoin. They had an official wallet set up for donations, and their politicians were publicly tweeting out the addresses asking for support. On the first day alone, Ukraine’s official Bitcoin wallet raised over $3.5 million. By leaning into Bitcoin during their time of crisis, the government showed their belief and commitment in it, and this new bill shows that that commitment has not faded.

NEW

Ukraine government #Bitcoin wallet raises OVER $3.5 MILLION in 1st day of donations

Ukraine government #Bitcoin wallet raises OVER $3.5 MILLION in 1st day of donations

— Bitcoin Magazine (@BitcoinMagazine) February 27, 2022

If this bill is adopted, it could position Ukraine as one of the first countries to give its central bank the legal ability to hold Bitcoin as a strategic reserve asset.

This post Ukraine Introduces Bill to Allow Bitcoin in National Reserves first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 2afadffc:ab95c71d

2025-06-18 14:57:43

@ 2afadffc:ab95c71d

2025-06-18 14:57:43Egg Vibrator for Women Hey ladies, ready to elevate your pleasure? At Adult Junky, our egg vibrators for women are all about discreet, powerful fun! Perfect for solo adventures or spicing up couple time, these compact gems offer versatile vibes to hit all the right spots. With body-safe materials and whisper-quiet designs, you can explore confidently anywhere. Shop now for fast, private delivery across India and discover why our egg vibrators are a game-changer. Your next favorite moment is just a click away with Adult Junky! BDSM Sex Toys Kit Curious about BDSM? Dive into excitement with Adult Junky’s BDSM sex toys kits! Perfect for beginners or seasoned explorers, our curated kits include everything from soft restraints to teasing accessories, all crafted for safe, thrilling play. Designed with quality and comfort in mind, they’re your ticket to spicy adventures. Get yours now with discreet shipping across India and unlock new levels of intimacy. Ready to turn up the heat? Shop Adult Junky’s BDSM kits and let the fun begin!

-

@ 6ad3e2a3:c90b7740

2025-06-18 12:00:52

@ 6ad3e2a3:c90b7740

2025-06-18 12:00:52"Whereof one cannot speak, thereof one must be silent."

— Ludwig Wittgenstein

Simulation Theory, the idea our entire existence is part of a simulation, that we are just code running on some more advanced civilization’s supercomputer has come up in conversations of late. I’m writing to say it’s not just wrong, but bullshit. A category error, at best, and cover for a nefarious agenda at worst.

The first problem with Simulation Theory is unless there’s some way to get outside the simulation, to access base reality, so to speak, the theory has no meaning. It’s just a semantic game.

Consider for example the theory (one I came up with on my walk back from the track) that you are actually a sleeping elephant dreaming of this human life. You are sleeping peacefully under a quiet grove of trees, and you won’t wake into elephant consciousness for another four hours when the sun rises. Moreover, the pace of your dream is glacial — you will experience tens of thousands of human incarnations, full lifetimes, before daybreak. You will not wake up before then as your elephant self.

Maybe this theory is true, maybe it’s not, there’s no way to know. Anything that could possibly happen in this lifetime would not invalidate it. When there is nothing that could possibly falsify a theory, it’s neither true nor false, but meaningless. Elephant Dream and Simulation Theory are similar in this respect. You might as well call them The Universe. It’s just substituting one word-concept for another to describe an inaccessible structure containing all of reality.

Now some proponents of Simulation Theory posit a base reality beyond our simulation, namely that of the simulators. But there are two problems with that: (1) If you can’t access it because you’re just code within their closed system, you are stuck back at Elephant Dream; and (2) Even if you could somehow figure this out and access the “reality” of the simulators, why would you assume they too were not a simulation of some even yet more advanced civilization?

If they could simulate us, why couldn’t someone else simulate them? Why would their reality be any more real than ours for the exact same reasons? There could conceivably be an infinite regress of simulations within simulations, and even worse it could turn out to be circular, i.e., we will one day create a simulation that becomes the “base” simulation for all the simulations all the way down, eventually including our own.

So not being able to falsify any simulators’ reality, n-simulations deep, you are back to Elephant Dream. The elephant when he awakes similarly could himself be the dream of a person, who is the dream of another elephant ad infinitum. These are just empty words that don’t describe or affect the content of your “reality.”

(As an aside I like the infinite circular loop simulation theory as a short-circuit to the false logic it purports. It reminds me of that scene in Animal House where the students get high with Donald Sutherland (their professor.) When they opine his new book must be amazing, he says, “piece of shit” and they talk about how each atom in their hands could be an entire universe, and our entire universe might be an atom in the hand of some giant being. I always thought this could also be an infinite regress of universes as atoms in yet larger universes, and also circular wherein our universe could actually reside in one of the atoms in our own hand.)

These thought experiments reveal category errors in that they purport to describe something that’s outside the range of describability. To describe something is to distinguish it from the things that it is not, so to describe everything is the same as describing nothing in particular. You cannot describe the totality of reality any better than you can its absence. It’s like imagining how it is to be dead.

. . .

What I wrote above is the most generous interpretation of Simulation Theory, but at worst it’s actually being pushed to further an agenda. Just as a “science-based” materialism (everything is atoms) underpinned communist ideology where material resources were the only thing, and their equitable distribution at all costs the moral imperative, a code-based reality supports its own distorted, dark worldview.

If we are merely code in a simulation, then humans have no special claim to individual rights and resources any more than artificially intelligent robots. It’s only a small step from there to trans-humanism, utilitarianism and a technocratic state that subverts the principle of the individual being an end in himself.

The category error, in this view, is a convenient one — it removes the obstacles for the power-mad autists into quite literally playing God.

. . .

But back to the original inquiry: If Simulation Theory is no better than Elephant Dream, how can people hope to understand their reality? Are we stuck simply pushing back the impenetrable wall of truth via incremental scientific advances, doomed never to connect to the ultimate ground of our existence?

I think not. For the same reasons Simulation Theory fails, all of our theories will ultimately fail, and the best we can do is create better descriptions and explanations about particular phenomena that occur within our observational range.

But just because our logical minds can never reach beyond that expandable but necessarily limited spectrum, doesn’t mean it’s off limits. The problem is that to know consciousness itself, i.e., the base reality, outside of thought concepts like “code” or “atoms” one must be consciousness, not grasp at the perceptible phenomena within it.

That’s why religions emphasize faith, or in some cases, doubt. Trust in God, or doubting everything else that would impede you, is the path to that level of understanding. Logical explanations like Simulation Theory then are at best a misunderstanding to keep the deepest questions at bay, at worst a justification for unholy schemes at the heart of which is simply a will to power.

-

@ 7776c32d:45558888

2025-06-18 14:21:25

@ 7776c32d:45558888

2025-06-18 14:21:25On the one hand, Iran is justified to defend itself. On the other hand, nuclear bombs are bad.

On the one hand, the US are the only ones that have used nuclear bombs on civilians.

On the other hand, I live in the US. That makes me especially scared of nukes going off on US soil.

Both hands now:

Guess where nukes need to be to go off on US soil?

Guess where the US military stores and transports a lot of nukes?

Did you know they've lost more than one?

I don't want nuclear bombs being stored and transported near me by people so incompetent, they've lost a single one ever. Let alone multiple.

Why would I trust they'll never let one go off where it's not supposed to?

If Iran had nuclear bombs, they might hit me someday when climate change makes Iran uninhabitable and the world's refugee policy is "let them die." That hasn't happened yet.

They have no reason to end the world in a nuclear apocalypse right now. The position they're in right now is simple self-defense. There's no need for suicide.

The US doesn't need to do it either, but the US are the ones escalating the risk. The US military are the ones storing and transporting and losing nuclear bombs where I live. They're the ones I'm worried about nuking me today, while I'm typing this.

Right now, today, Iran could secretly have nukes (we "lost") and their nukes still wouldn't be as much of a threat to me as the ones here.

We have nuclear submarines. We have a lot of less inhabited land in Alaska. We could start by banning the military from storing or transporting nuclear bombs in the 48 contiguous states.

But the end goal should be to fully denuclearize, so that we can reasonably ask the rest of the world to come together on that idea. I've been saying this for a few years.

The US nuclear arsenal is ostensibly the most powerful on earth. We invented the things.

The US has bragged for decades about having the most powerful military on Earth. The US has the GBU-43/B MOAB, a conventional bomb that hits as hard as a small nuke, but without the radiation. The US has military bases all over the world.

The US has nuclear armed allies who would defend us until other counterparties join in denuclearizing. Our nukes aren't the only powerful leverage we can use to make sure these allies don't betray us.

Without this arsenal, we wouldn't be sitting ducks.

We would simply be much safer from the insane military-industrial-complex terrorists endangering us all today.

We would still know how to make nukes. We don't need to keep practicing to hone that skill; there aren't even nuclear tests anymore because the mad scientists have all agreed they've gone too far already. Do you realize how far that means we've gone?

A lot of the damage so far has been indirect. The nuclear arms race left particles of irradiated material in the air worldwide, still measurable today, still part of the pollution causing today's increased global cancer rates.

Recent escalation has politicians talking about starting nuclear testing again - just to terrorize the world with more of this indirect damage, when we've already done all the testing we could need.

Iran hasn't done any nuclear detonation tests. They've been very hesitant to try to catch up on this insanity.

I remind you again, nuclear bombs have been used directly on civilians twice. Of course, both times were the US military at the end of World War II. Those war-traumatized, broken people thought it was OK to go again, after doing it once.

Today's war-traumatized, broken people still seem to think that wasn't wrong.

How can we let distrustful and mentally unstable loyalists keep so many nukes, and yet blow up Iran over it?

Mutually assured destruction is not a sane goal. Mutually assured survival is a sane goal.

Let's make the atomic age the last chapter of a spacefaring race's dark, wartorn origin story; not the last chapter of human history altogether.

It's time for people to wake up and come together like never before.

Photo attached - courtesy of Wikimedia user Oilstreet - shows the Hiroshima Peace Memorial, or Genbaku Dome. It was the closest building left standing when the city was bombed.

-

@ 6ef65af3:8eb6e4fe

2025-06-18 14:53:15

@ 6ef65af3:8eb6e4fe

2025-06-18 14:53:15Egg Vibrator for Women Hey ladies, ready to elevate your pleasure? At Adult Junky, our egg vibrators for women are all about discreet, powerful fun! Perfect for solo adventures or spicing up couple time, these compact gems offer versatile vibes to hit all the right spots. With body-safe materials and whisper-quiet designs, you can explore confidently anywhere. Shop now for fast, private delivery across India and discover why our egg vibrators are a game-changer. Your next favorite moment is just a click away with Adult Junky! BDSM Sex Toys Kit Curious about BDSM? Dive into excitement with Adult Junky’s BDSM sex toys kits! Perfect for beginners or seasoned explorers, our curated kits include everything from soft restraints to teasing accessories, all crafted for safe, thrilling play. Designed with quality and comfort in mind, they’re your ticket to spicy adventures. Get yours now with discreet shipping across India and unlock new levels of intimacy. Ready to turn up the heat? Shop Adult Junky’s BDSM kits and let the fun begin!

-

@ 472f440f:5669301e

2025-06-18 04:25:57

@ 472f440f:5669301e

2025-06-18 04:25:57Marty's Bent

via Dr. Eli David

The case for a neutral, permissionless monetary protocol has never been stronger. The incumbent financial system is a permissioned wall garden that is susceptible to a tax. When you're using this system, you don't own your money. Your money doesn't really even exist. What you have is a claim to be able to ask your bank to give you your money or move it somewhere that you desire. Not only is it a permissioned wall garden, but it is an insecure permissioned wall garden that is susceptible to attacks from nefarious actors.

This was made very clear earlier today when Sepah Bank in Iran was the subject of a cyber attack that led to all of its databases being erased and their ATMs being deemed non-functional. Sepah Bank customers have been unable to withdraw cash. And many are warning Iranian citizens to withdraw as much cash as possible from any ATM outside of Sepah Bank's network that is working. Because there is a high likelihood that other banks and ATM networks will be targeted.

Bitcoin is a digital bearer instrument that you can custody yourself using either a software or hardware wallet. The network is operated by an army of geographically distributed nodes that maintain the rules and ensure that anybody trying to transact within the network is doing so within the rules that are set forth. Bitcoin is a push system, not a pull system. It is extremely hard to attack in the way that Sepah Bank was attacked earlier today.

I think it's important to note the way in which Sepah Bank was attacked and highlight that it is starkly different from the types of attacks or shortcomings from the financial system that we've seen over the years.

One of the events that caused a rush to Bitcoin over a decade ago was the banking crisis in Cyprus. We've seen hyperinflationary events in countries like Lebanon and Turkey that have rendered their currencies defunct. In the case of Lebanon, the central bank simply came out and said that people were not going to have access to their money and gave Lebanese citizens an overnight haircut on their savings. We've seen countries like India and Nigeria mess with their physical bills, forcing their citizens to exchange smaller denominations for larger denominations, causing massive disruptions in the process.

We've seen the United States government and its allies freeze the treasury assets of its enemies and they move towards a more multipolar monetary order over the last five years. We've seen the Canadian government freeze the bank accounts of protesters fighting for bodily autonomy. We've seen Operation Chokepoint 1.0 and 2.0. Here in the United States, the government directly targeted industries and businesses within those industries by either overtly preventing them from accessing bank accounts or covertly making it as hard as possible to access bank accounts.

On top of all this, obviously, we have the constant drumbeat of currency debasement across the world, even here in the United States, where the Federal Reserve and Federal Government are expanding the monetary base and going further into debt, ultimately destroying the purchasing power of the dollar at an increasing rate over time.

However, this type of cyber attack on a bank is unique, at least from what I can recall. The ability of nefarious actors to access bank databases and erase them is something new and something that should not be taken lightly. If Iranian hacking capabilities are as sufficient and capable as we are led to believe, it's not hard to imagine that we could see some retaliatory actions from the Iranian regime to counteract the attack on their banking system.

I don't want to incite alarm in any of you, but I think it is important to highlight that this new attack vector is definitely a step towards financial nihilism that could put hundreds of millions, if not billions of people in harm's way, in the sense that they could wake up one morning and be told that the bank does not have access to the records of their cuck buck IOUs. If something like this were to happen, I'm sure anyone who isn't holding Bitcoin in a wallet that they control will really wish they were. Being able to access your money is a vital part of being able to live you life. The thought of that ability being taken away because of a hacking war that breaks out is extremely unnerving.

As I said at the top of this letter, the case for a neutral, permissionless, distributed monetary system with a native currency that is finite is clearer than it ever has been, at least for me. It is imperative that you and anyone that you care about holds Bitcoin in self-custody to inoculate yourselves from these very real risks that are only going to increase from here on out.

Eliminate the trusted third party risks that exist in your life. Use Bitcoin as your money and use it correctly by holding it in self-custody.

Why 5% Interest Rates Won't Trigger The Next Market Crash

Guest Mel Mattison challenges the prevailing fear around rising interest rates, arguing that markets have developed immunity to higher yields. Unlike 2023's sharp selloff when the 10-year hit 5%, Mattison believes equities and Bitcoin can now absorb these levels because they signal stronger growth expectations ahead. He emphasizes that the pace of rate increases matters more than absolute levels, and notes that markets have had time to adjust. With oil trading at just $65 per barrel—a fraction of its inflation-adjusted 2008 peak of over $200—the deflationary pressure from cheap energy provides a crucial buffer.

> "It's not just what the rate we get to, it's how fast we get there." - Mel Mattison

Mattison's most compelling argument centers on AI-driven productivity gains enabling companies to maintain margins despite higher borrowing costs. As I've witnessed firsthand implementing AI tools at TFTC, what once required hiring multiple employees can now be handled by one person with the right automation. This productivity revolution means traditional rate sensitivity models may no longer apply.

Check out the full podcast here for more on institutional Bitcoin adoption, resistance money warnings, and bipartisan coalition building.

Headlines of the Day

Davis Commodities Puts 40% of $30M Into Bitcoin - via X

Ukraine Bill Adds Bitcoin to National Reserves - via X

Vinanz Raises £3.58M to Expand Bitcoin Mining - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

The joy of a 5-year old riding a bike for the first time is something that should be protected at all costs.

*Download our free browser extension, Opportunity Cost: *<https://www.opportunitycost.app/> start thinking in SATS today.

*Get this newsletter sent to your inbox daily: *https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ b1ddb4d7:471244e7

2025-06-18 14:01:44

@ b1ddb4d7:471244e7

2025-06-18 14:01:44Why are Stripe Alternatives are growing like mushrooms? When it comes to online payment processing, Stripe has long dominated the conversation.

However, with its complex pricing structure, strict policies and first-world focus, many entrepreneurs and companies are actively seeking viable Stripe alternatives.

Whether you’re a SaaS startup, e-commerce store, or global enterprise, choosing the right payment processor can significantly impact your bottom line and customer experience.

Table of Contents

- Why Consider Stripe Alternatives?

- The Complete List of Stripe Alternatives

- Additional Notable Mentions

- How to Choose the Right Stripe Alternative

- Conclusion

Why Consider Stripe Alternatives?

Before diving into our comprehensive list, it’s worth understanding why businesses are exploring alternatives to Stripe. While Stripe offers robust features and excellent developer tools, some businesses face challenges with pricing transparency, limited global coverage, or specific industry requirements that Stripe doesn’t fully address.

The Complete List of Stripe Alternatives

Based on extensive research and analysis of the payment processing landscape, here are 27 proven Stripe alternatives that could be the perfect fit for your business:

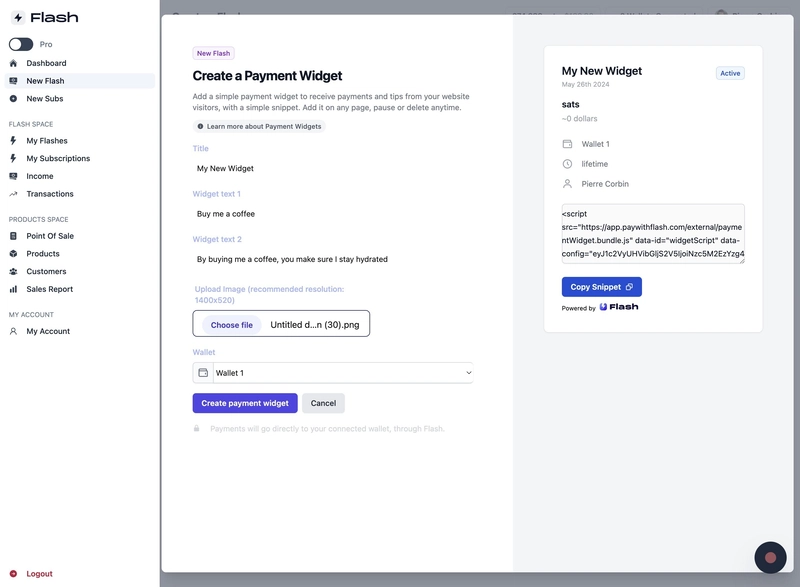

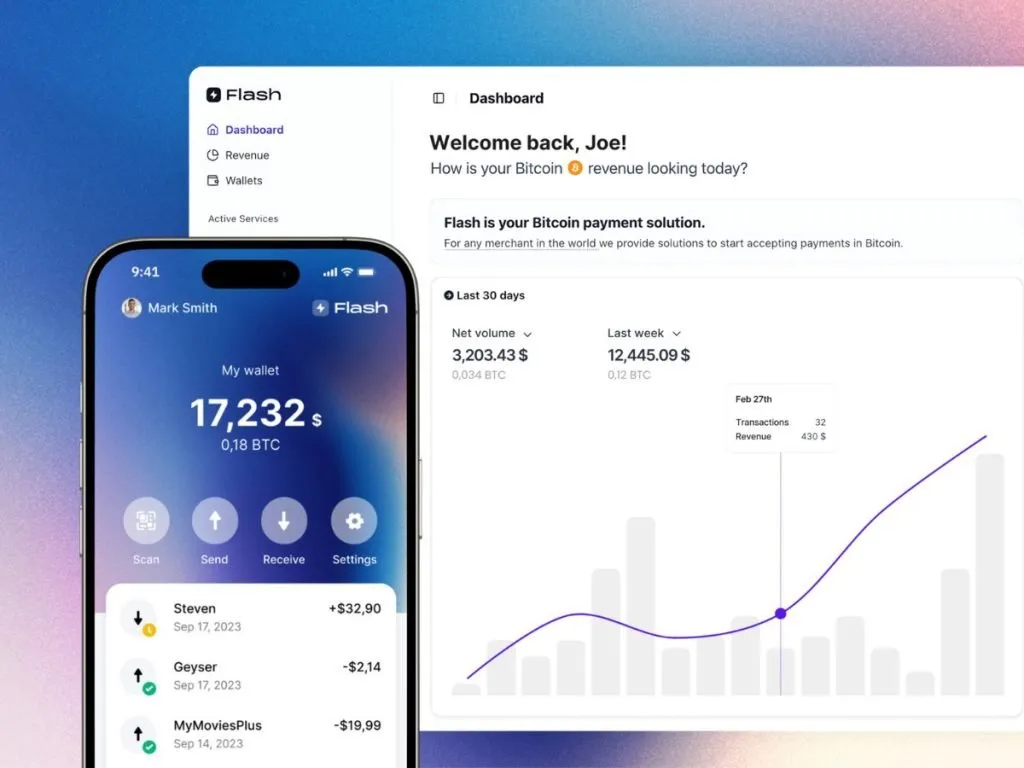

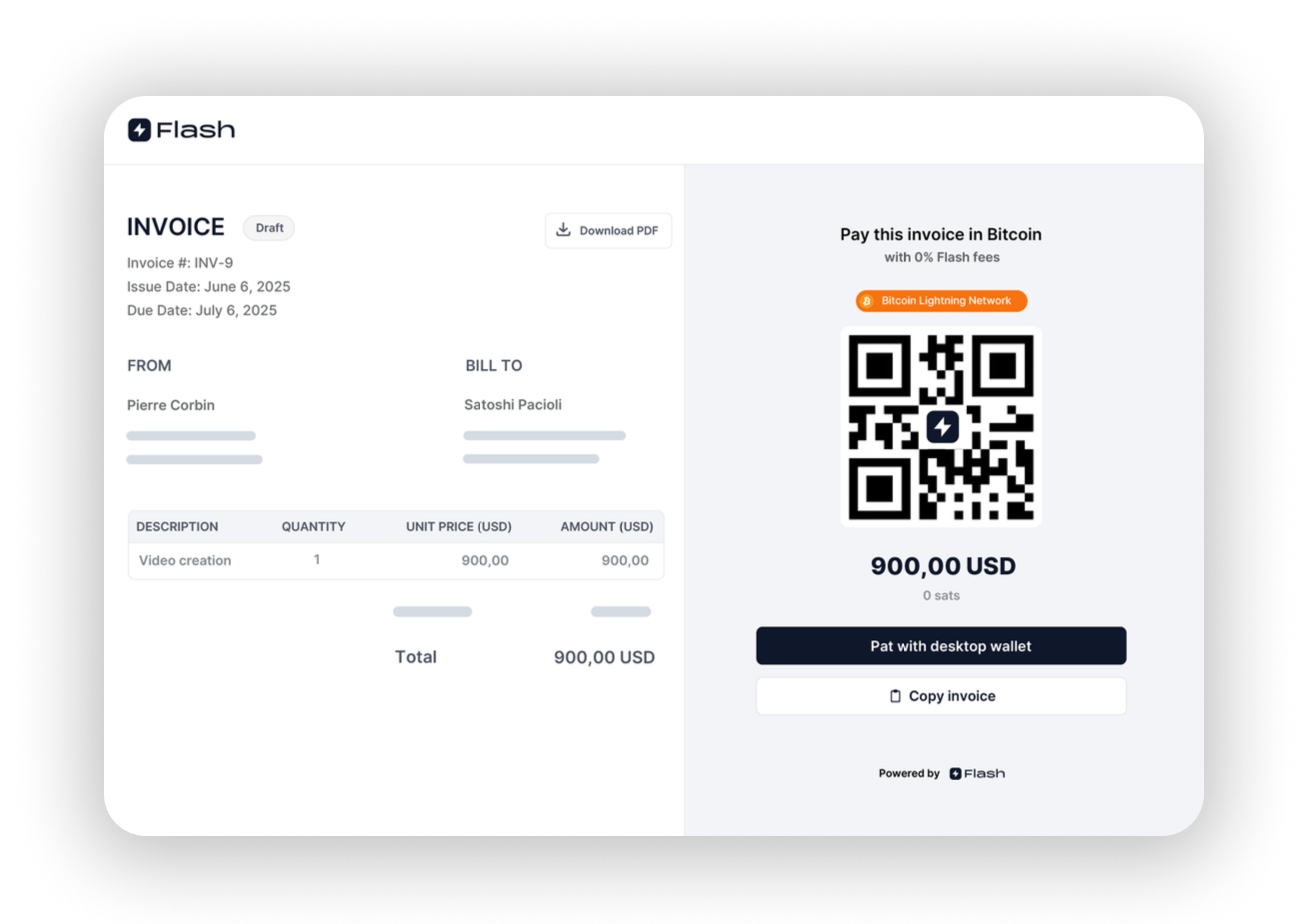

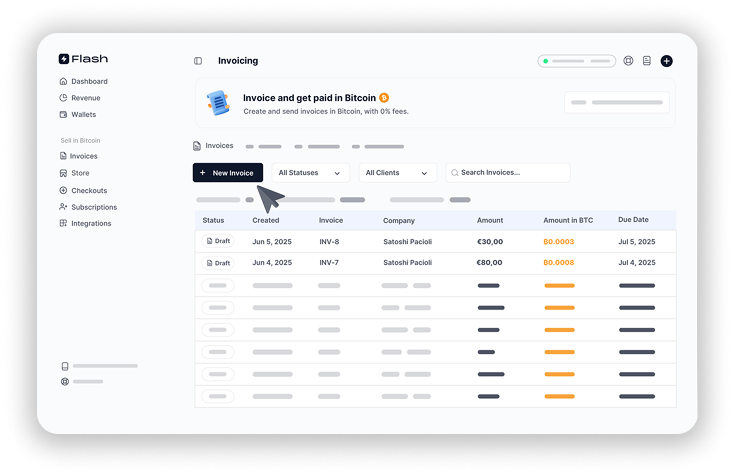

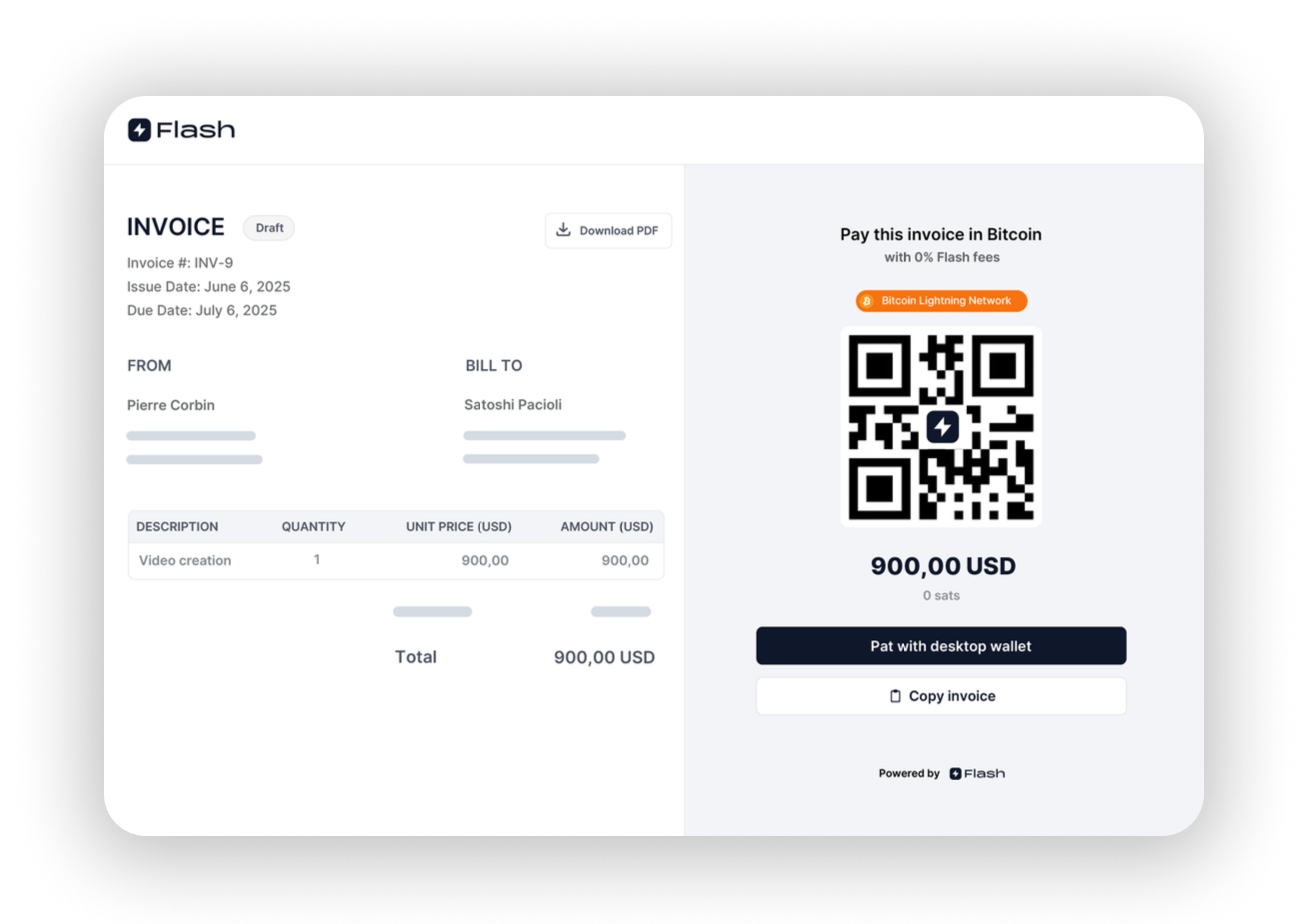

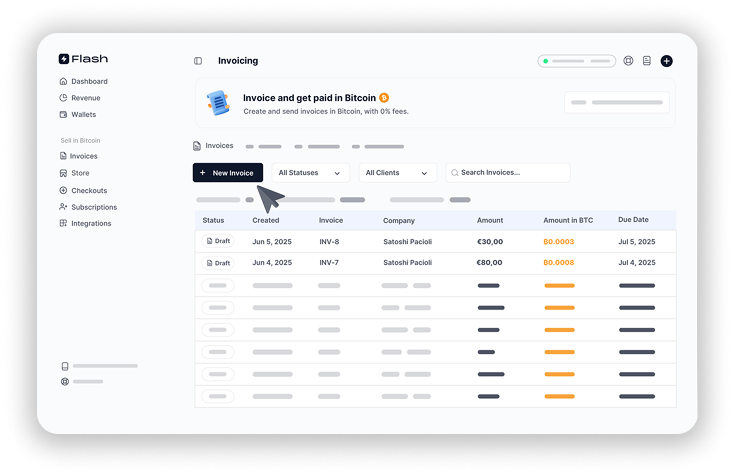

1. Flash – Easiest Bitcoin Payment Solution

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

2. Lemon Squeezy – The SaaS-Focused Alternative

Dubbed as “acq’d by Stripe,” Lemon Squeezy offers a comprehensive solution specifically designed for digital product sales and SaaS businesses. It provides strong customer support, built-in analytics, and handles payments, subscriptions, global tax compliance, and fraud prevention in one platform.

3. Gumroad – Creator Economy Champion

Gumroad has carved out a niche serving creators and small businesses by providing tools for selling digital products, physical goods, and subscriptions. It’s particularly popular among content creators, artists, and independent entrepreneurs who want to experiment with various ideas and formats. They also open-sourced their code which is quite the ‘chad-move’.

4. Paddle – All-in-One SaaS Commerce

Paddle caters to SaaS and software companies by offering a comprehensive platform with billing, licensing, and global tax handling capabilities. It’s designed to be a complete solution for subscription-based businesses, handling payments, tax, and subscription management in one platform.

5. FastSpring – Global E-commerce Specialist

FastSpring specializes in e-commerce solutions for software and SaaS companies, with a focus on global payments and subscription management. According to TechnologyAdvice, it’s particularly strong for international transactions and helps companies sell more, stay lean, and compete big.

6. 2Checkout – Versatile Payment Solutions

2Checkout (now part of Verifone) offers versatile payment solutions excelling in global payments, subscription billing, and digital commerce. One of the best stripe alternatives as it’s an all-in-one monetization platform that maximizes revenues and makes global online sales easier, supporting over 200 countries and territories.

7. Payoneer – Cross-Border Payment Expert

Payoneer simplifies cross-border payment solutions, offering local payment ease globally with a focus on market expansion and multi-currency support. It’s trusted by small to medium-sized businesses for global payment solutions and international money transfers.

8. Chargebee – Subscription Management Leader

Chargebee is a subscription management platform perfect for SaaS and SMBs, with robust billing and revenue management features. If you were looking for stripe alternatives to setup subscriptions, Chargebee might be right for you. It streamlines revenue operations and helps businesses grow efficiently with comprehensive subscription billing capabilities.

9. Maxio (formerly Chargify) – B2B SaaS Billing

Maxio offers a robust platform for B2B SaaS billing and financial operations, focusing on growth and efficiency for subscription businesses. It’s the most complete financial operations platform for B2B SaaS, bringing core financial operations into one platform.

10. Recurly – Dynamic Subscription Management

Recurly offers dynamic subscription management platform, excelling in churn management and data insights for subscription growth. It’s the only proven platform that expands and protects your recurring revenue with subscription management, recurring billing, and payments orchestration.

11. Braintree – PayPal’s Enterprise Solution

Braintree (by PayPal) provides a versatile global payments platform, integrating multiple payment methods with a focus on conversion and security. It delivers end-to-end checkout experiences for businesses, offering single-touch payments and mobile optimization.

12. PayKickstart – Modern Commerce Platform

PayKickstart offers a modern commerce platform for online billing and affiliates, focusing on revenue maximization and churn minimization. It’s the most complete checkout, recurring billing, affiliate management, and retention solution with global capabilities.

13. PayPro Global – Full-Service E-commerce

PayPro Global offers a full-service eCommerce solution for selling software and SaaS, focusing on global payments, tax compliance, and customer support. It provides flexible solutions with over 70 payment methods and great support for software companies.

14. Shopify Payments – E-commerce Integration

Integrated with Shopify, this service is ideal for SMBs in eCommerce, offering a seamless shopping cart and payment experience. It’s the simplest way to accept online payments, automatically set up for major methods with no fees for some payment types.

15. Square – Versatile POS and Payment Solutions

Square provides versatile POS and payment solutions for small businesses with a strong focus on retail and mobile payments. Forbes Advisor notes it as one of the top alternatives for businesses needing both online and offline payment capabilities.

16. Zoho Billing – Integrated Business Solution

Zoho Billing is an online recurring billing and subscription management solution, ideal for small and medium-sized businesses seeking professional invoice creation, time and expense tracking, and improved cash flow management. Zoho isn’t just competing for stripe alternatives, they offer a ton of other products and services.

17. WePay – Chase Company Integration

WePay, a Chase company, provides integrated payment solutions for ISVs and SaaS companies with customizable payment solutions. It’s designed for platforms like marketplaces and small business tools, offering seamless user experience and fraud protection.

18. QuickBooks Payments – SMB Accounting Integration

This service provides seamless accounting and payment solutions for SMBs and SaaS businesses, featuring real-time tracking and automated bookkeeping. It lets small businesses accept payments online from anywhere with easy integration into QuickBooks accounting.

19. Mangopay – Marketplace Payment Infrastructure

Mangopay offers a modular payment infrastructure for marketplaces and platforms, emphasizing flexibility, global payouts, and AI-powered anti-fraud. It uses flexible wallets built to orchestrate fund flows and monetize payment experiences.

20. Coinbase Commerce – Cryptocurrency Payments

Coinbase Commerce enables businesses to accept payments from around the world using cryptocurrency. It offers instant settlement, low fees, and broad asset support, making it easy for merchants to accept digital currency payments globally.

21. BTCPay Server – Open-Source Bitcoin Processor

BTCPay Server is a self-hosted, open-source cryptocurrency payment processor with 0% fees and no third-party involvement. It’s secure, private, censorship-resistant, and completely free for businesses wanting full control over their Bitcoin payments.

22. Lago – Open-Source Billing Alternative

Lago is an open-source alternative to Stripe Billing and Chargebee, specializing in billing and metering in one place for usage-b

-

@ a205e40f:f487e7d5

2025-06-18 14:50:31

@ a205e40f:f487e7d5

2025-06-18 14:50:31Buy Masturbators for Men Discover the ultimate pleasure with top-quality masturbators for men at Adult Toys India! Our curated collection offers discreet, body-safe, and innovative designs to elevate your intimate moments. Whether you're exploring solo play or spicing things up, we’ve got options for every preference. Shop now for fast, confidential delivery across India and experience satisfaction like never before. Don’t wait—find your perfect match today and take your pleasure to the next level with Adult Toys India! Buy Penis Rings for Men in India Enhance your performance and pleasure with premium penis rings for men from Adult Toys India! Designed for comfort and durability, our range helps you last longer and intensify sensations. Perfect for beginners or seasoned users, we offer discreet packaging and swift delivery across India. Explore our high-quality, body-safe collection to find the ideal fit for your needs. Elevate your intimate experiences today—shop now at Adult Toys India and unlock a world of excitement with confidence!

-

@ ae8ef557:3633e453

2025-06-17 20:05:43

@ ae8ef557:3633e453

2025-06-17 20:05:43The boy left the piano and ran toward his parents. "Shall we play another song?" In one of those surprisingly magical moments, the three of them were playing together, pretending to be a band: the father with the trumpet, playing distractedly while checking messages on his phone; the mother with the guitar, smiling and listening attentively; the son with the piano, happy. Stumbles in the notes, laughter, joy. "Tomorrow is Monday," she remembered. They stopped and put away the instruments—they could do it another time. There was time. There's always more time, right?

That night, like any other on a typical week, they fulfilled the ritual of dinner at eight, a shower before bed, getting the uniform and backpack ready. Afterward, the quick hug to the father and the long kiss to the mother. In turn, the parents continued with their own routine: checking emails, reading for a while. He went to sleep while she logged on to her computer to teach an online class. The nocturnal silence took over the house, interrupted only by the occasional comment from her lesson.

The scream startled her. Was it coming from a neighbor's house? No, it couldn't be. That slight sensation in her chest, that anguish... She decided to go see how her only son was doing. When she was about to reach the second floor, she heard some moaning. She ran to the room. Her boy, curled up in a ball, and beside the bed, vomit. The forehead first—it was burning—then the abdomen. Another scream tore through her. The father woke up and approached to ask what was happening. "I don't know. Go to sleep, I'll handle it." How many other times had she said that? Without thinking, without considering the weight of the tacit agreement between them, of the comfortable distance he called space.

She lifted her son in her arms, covered him with a blanket, and took him to the emergency room. The bright lights of triage, the familiar waiting, then nurse, and finally, doctor. She knew the procedure by heart. She was always the one who handled these emergencies, who knew the nurses, who knew his medical history —allergies, previous injuries. "The experience of having an athlete son," she used to say. During the examination, the boy remained curled up. "It looks like acute appendicitis," the doctor said. "We need an urgent ultrasound and blood work."

The mother grew impatient between her child's suffering and the staff's slowness. She demanded faster attention, called the nurses over and over. "The CT scan shows perforation with fluid in the abdomen," she heard afterward. "He needs surgery now." When they came rushing and took him, while she waited for the results... it had been because of her demands, surely. She never thought she wouldn't see him again. How could she imagine that emptiness that would take over her chest, to the point of not being able to breathe?

They called the father. He arrived disoriented, like someone arriving in unknown territory, and somewhat worried, not much, because he was used to her taking care of things. The father listened to the doctor's explanation with a distorted face. "I'm very sorry. There were complications. The perforation caused severe sepsis." The man let out a scream that echoed throughout the entire hallway: "He died alone, my God, he died alone." It was the first time in years that he expressed something so profound, and it came too late. A postponed fatherhood concentrated in an instant.

Hadn't the mother been with her son until they took him away? Or the doctor and staff in the operating room? He didn't ask about her, didn't look for her. She wanted to speak, but the words wouldn't come out. If she hadn't been at the hospital, perhaps no one would have comforted her in that terrible moment. She moved because she had to, responded because they asked her. From that night she would only remember her son's face and small hands when she let them go for the last time. Afterward, only the reconstruction of events through the eyes of others: her sister and her parents.

Who thinks about when it will be the last time for anything? The last chess game with the father, the last dinner out with the mother, the last birthday of the favorite aunt. The last frightened squeeze of a small child's hand. They hadn't paid attention. Why would they? You always think there's more time.

The days that followed blurred into a hazy sequence of impossible decisions. Arrangements had to be made. At first, everything seemed suspended, even sadness. A family eclipse where darkness takes everything. You know it's temporary, but you can't glimpse the light. The family gropes around like blind people, and slowly grief sprouts. Decisions are made that will be forgotten: how to tell others, who will speak and who won't. An endless series of unimportant actions in the face of pain invading everything, little by little, to then explode like a volcano. The siblings of both parents and the grandparents crying. The parents in black silence.

The funeral passed. The weeks passed. For the mother, everything was now subordinated to the memory of an ancient life. The habit of picking him up after school or some activity outside, seeing him walk toward the car, seeing him walk away. His voice. His smell. He still smelled like a child—he was still a few months away from his eleventh birthday. He was still her little one. She could take his hand to cross the street, give him a long hug just because, plant a kiss on his cheek. He didn't impose that distance that comes when children start becoming men. Her boy, the storyteller of the childhood world... had departed.

As the months passed, the father withdrew more and more. He came home later and later, hardly spoke. He avoided talking to her. Sometimes, she found him crying in the boy's room. The fragility became evident and the limited kindnesses from one to the other disappeared. The one who was barely there was no longer there. The bridge between two solitudes had disappeared. The family had also died, and so, simply, one afternoon, he didn't return. Without words, without farewell.

-

@ 04c3c1a5:a94cf83d

2025-06-18 12:40:02

@ 04c3c1a5:a94cf83d

2025-06-18 12:40:02123

-

@ b9ff7cb5:a0e092a8

2025-06-18 09:41:48

@ b9ff7cb5:a0e092a8

2025-06-18 09:41:48Bismillah

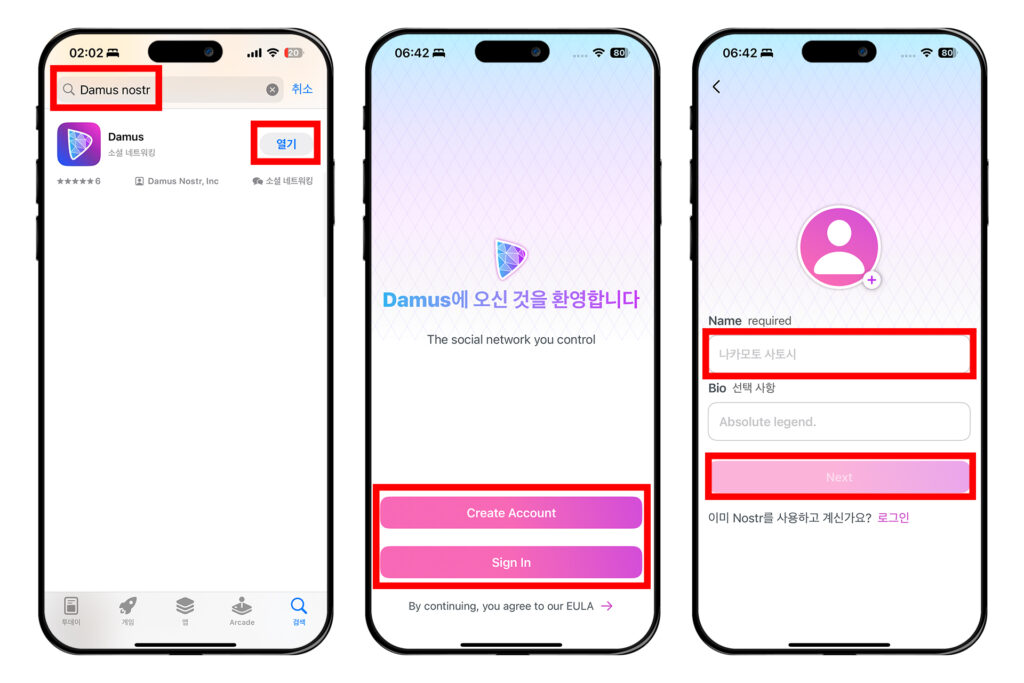

The internet has no instruction manual. Anyone can post freely, which means unwanted spam can flood your replies, feed, and notifications. New domains call for new practice, and joining a paid relay is one way you can protect yourself against nostr spam. As a relay is also community focused, it aims to be a way for those new to nostr to find fitra and ummah in cyber-space, thereby building and joining patterns of higher-purpose.

NoorNode is a nostr relay dedicated for muslims on nostr. It is maintained and moderated by the Pnostr:npub1vmgf2pzv8k3fsch2hvc5uqnp9kvrxwrfgucek95528zax3syfwtqhykxpn team, which is a podcast incubator project for the creation of Islamic media on nostr.

The Noor Node relay is free to read. All content posted to the relay is public. However, one must pay to join the relay in order to post content to it. This payment feature is small but necessary proof-of-work barrier to keep bots and spam out.

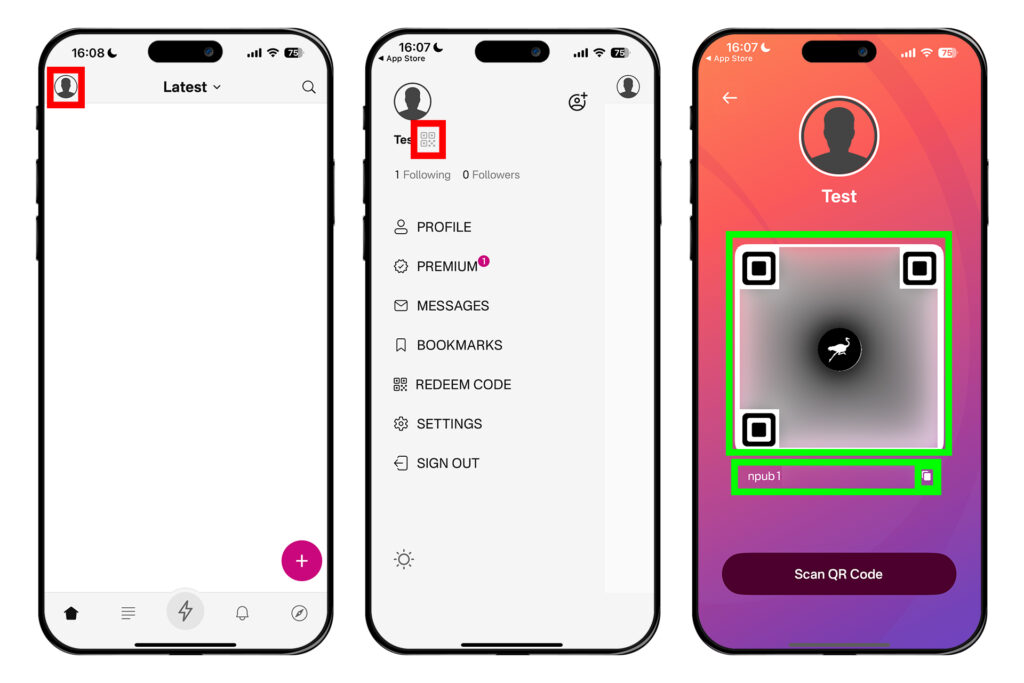

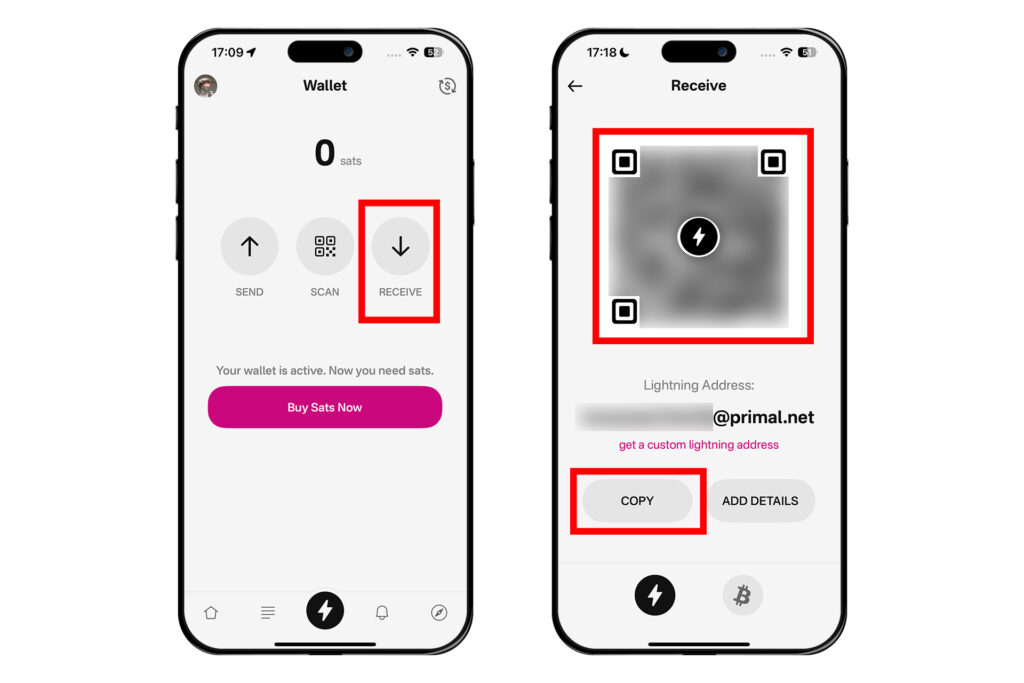

How To Join:

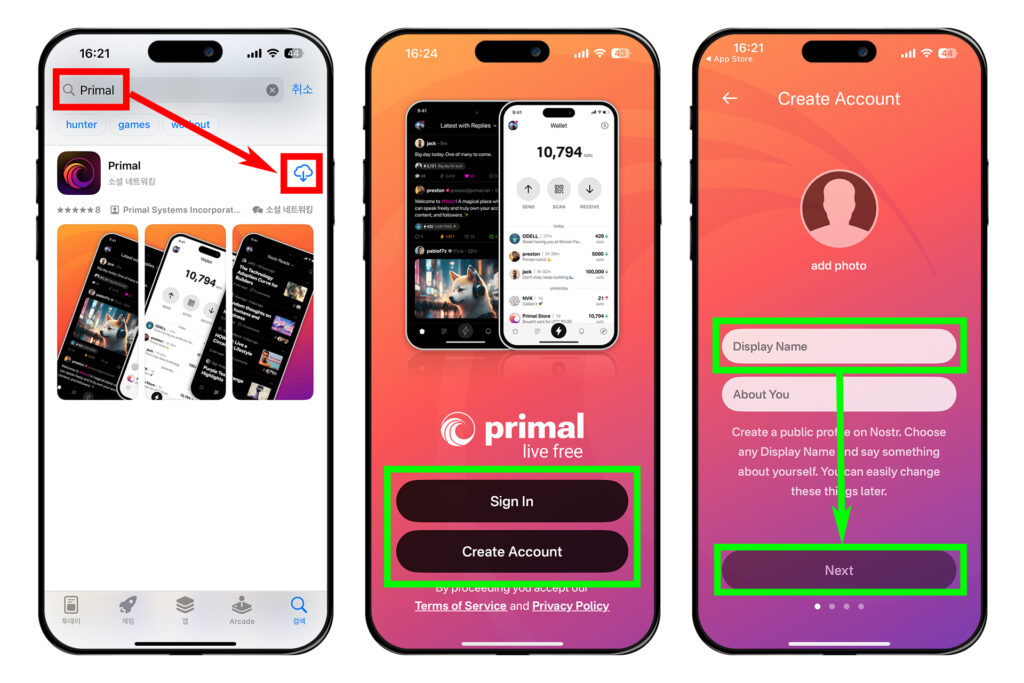

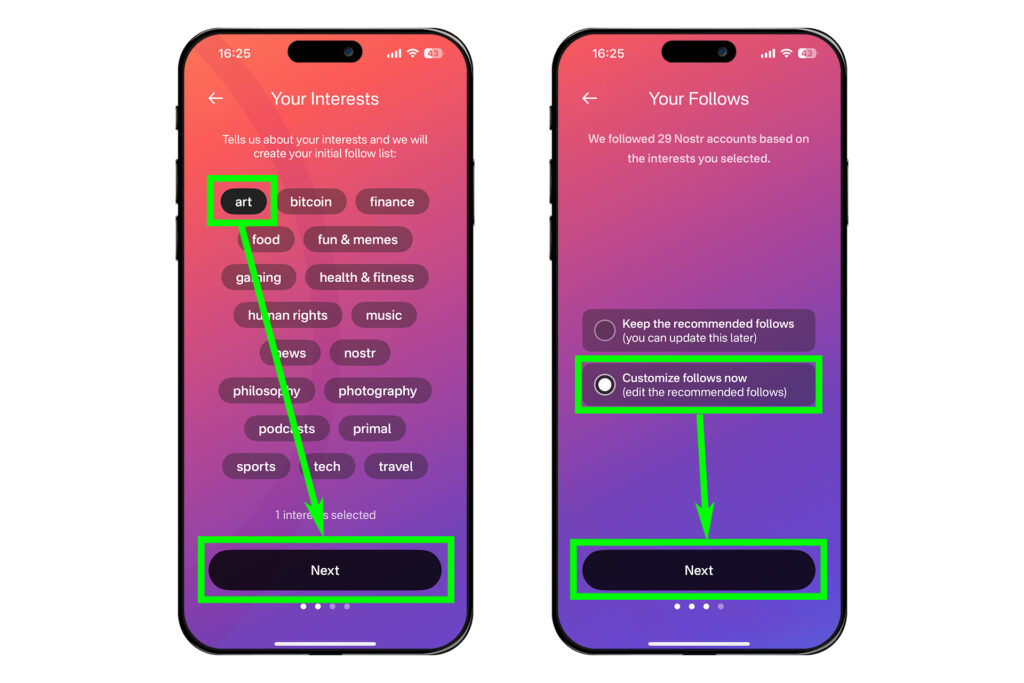

If you simply want to read notes on NoorNode, just add

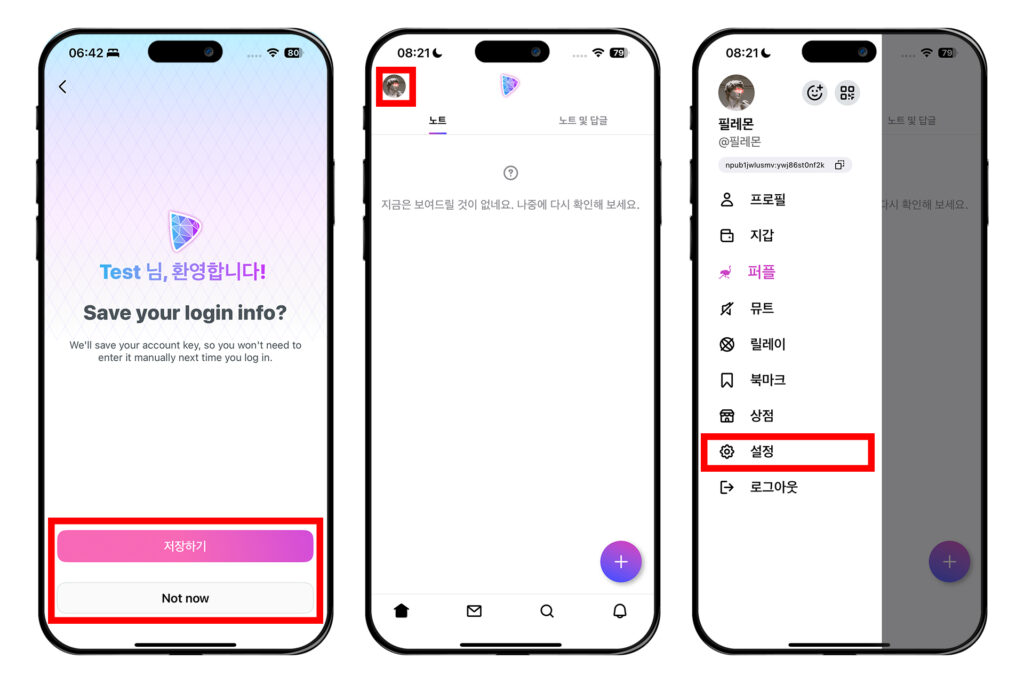

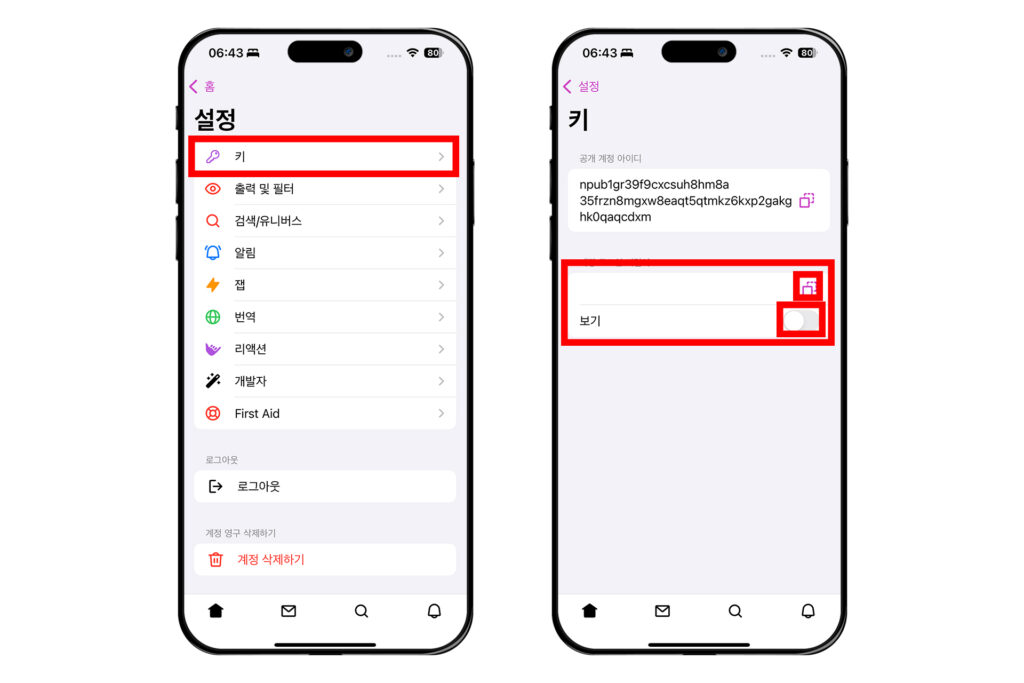

wss://noornode.nostr1.comto your read/inbox relays in your client settings.To join NoorNode and post notes to the relay, visit the RelayTool explorer page at https://noornode.nostr1.com

Click on the gear button to show options and it will reveal a side pannel where you can submit your payment.

Enter your nostr public address (npub) into the text box and select the

Lightning Pay ✅ ⚡button for it to generate an invoice QR code.Once payment has been received a lightning bolt will animate across the screen and you will be able to post to the NoorNode relay.

Client Relay Cofigurations:

The RelayTool explorer is a very basic client which can be used to post to NoorNode, but for best user experience other clients will be preferable. So long as NoorNode set as a write/outbox relay in a client's settings, any client should work. That said, clients where you can customize the relay feeds are preferable. Of these, Yakihonne is the one we recommend due to it's support for both mobile (Andriod & iOS) and desktop.

To create a custom feed for NoorNode in Yakihonne from the desktop home page, select the gear button in the Note feed dropdown menu.

A widget will then pop up where NoorNode can be added as a custom relay feed. Enter

wss://noornode.nostr1.comand hit the+button and then select theUpdatebottom to save the custom feed.

The NoorNode relay can then be viewed as a seperate feed from Yakihonne's home page by selecting it from the note feed dropdown menu (scroll to the bottom to find it).

Other clients, like Jumble, can also funtion as great ways to test out customized relay feeds. As nostr continues to grow, it is expected that more clients will include this feature.

To learn more about relays and how they work on nostr, check out this guide from the developer of Amethyst

The intention behind NoorNode is for muslims on nostr to have a safe place to build community while not having to worry about issues like spam or religious intolerance. The payment to post is designed to enough to keep most bots out while also not being a significant barrier for anyone who want to enage. The mission of nostr:npub1vmgf2pzv8k3fsch2hvc5uqnp9kvrxwrfgucek95528zax3syfwtqhykxpn is to create new Islamicate mythos. We hope that the community that grows around NoorNode will embody that same goal and that the Noor of Islam will be able to radiate, even from nostr.

Please keep in mind that NoorNode is a public relay and notes posted can be picked up by others relays. If any content found on the relay does not seem appropriate or if any issues occure that cause concern, please reach out to the PodSystems team for support.

May the peace and blessings of the most merciful God be with you and light your way on nostr.

-

@ 472f440f:5669301e

2025-06-16 18:33:54

@ 472f440f:5669301e

2025-06-16 18:33:54Marty's Bent

So much for that tariff hyperinflation.\ \ New inflation numbers came at 1.2% — way below the Fed’s target.\ \ For the 4th time in Trump’s 4 months.\ \ Yet not a word about easing from the fed. Who’s now moving the inflation goal-posts to 2026 or even 2027. pic.twitter.com/nwzSCABrbR

— Peter St Onge, Ph.D. (@profstonge) June 16, 2025

After months of pundits, politicians, and partisan hacks kvetching about the aggressive tariff regime put forth by the Trump administration, we're beginning to see some data tickle in that makes it seem as if the tariff strategy may actually be working. At the end of last week, inflation data hit the market cooler than expected. Some core components coming in below the Federal Reserve's 2% inflation target. Granted, the CPI is manipulated and may be underreporting actual inflation. However, if we're simply comparing the CPI to itself, it seems to be moving in the right direction if, like me, you don't like when prices consistently rise month on month, year on year, decade on decade.

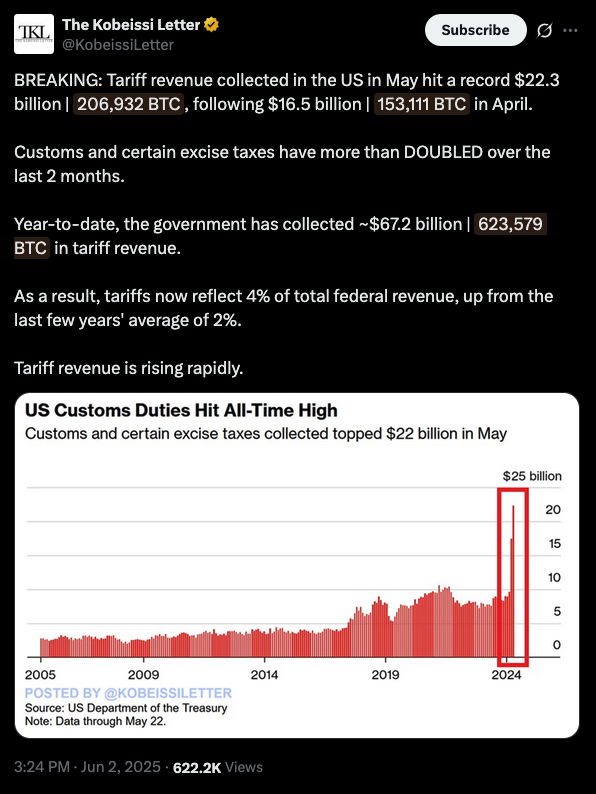

On top of this, the amount of revenue that tariffs are bringing in is significant and rising quickly. In May, tariff revenue collected in the U.S. hit a record of $22.3 billion. In April, the U.S. government brought in $16.5 billion from tariffs, and collectively, since Trump took office, the government has brought in around $67.2 billion in tariff revenue. Tariffs now reflect 4% of the total federal revenue, which is up from an average of 2% over the last few years. If this trend keeps up, the idea that tariffs can replace income tax revenue in the United States seems to be validated. Even better, it seems that the increased inflation that many were warning about hasn't materialized yet. There could be a way to increase the revenue of the federal government without increasing taxes on American producers while keeping prices lower. This is a beautiful thing.

I don't think it's time to ring the bell and claim victory in regards to tariffs and inflation quite yet, but this is extremely encouraging and something that all of you should be monitoring closely in the months ahead. Whether you're a Republican or a Democrat, I think we should all celebrate if the bold strategy of levying tariffs on the rest of the world to bring manufacturing home, while the government produces revenue via means that don't attack the income of individual citizens actually works out in the end.

It's crazy what pricing your life in Bitcoin does as you surf the internet. This newsletter was partly inspired by the video above from our good friend Peter St. Onge, but also because of this tweet I saw earlier today that priced the tariff revenue in bitcoin.

The Kobeissi Letter did not include the bitcoin denominations in its tweet. Our browser extension, Opportunity Cost, automatically injected it into the tweet so that I could understand how much revenue the government is bringing in in terms of Bitcoin. If they chose to use Bitcoin as a reserve asset.

It's crazy to think that at current bitcoin prices and if tariff revenue stays at the level it reached last month, the United States government could acquire a strategic reserve of 1 million bitcoin in less than five months. That really puts things into perspective, for me at least, about how much money is being thrown around the system both in the private markets and the public sector.

We are still extremely early in terms of bitcoin's adoption and monetization. Just looking at the tweet makes me want to tap somebody on the shoulder in the government and say, "Hey, look at this. If you sacrifice less than five months of tariff revenue and funnel that into bitcoin, you could have your strategic reserve by the end of the year. Before Thanksgiving even."

If tariff revenue continues to increase at the pace it has over the last couple of months, and the economy recovers, inflation isn't that bad, why not? Why not start building the strategic reserve with some of these revenues? A man can dream.

Washington's Bitcoin Awakening: From Crime Concerns to Strategic Asset

Ken Egan described a remarkable shift in how Washington views Bitcoin. Just a year ago, he recalls fighting defensive battles against basic misconceptions about criminal use and technical vulnerabilities. Today, policymakers ask sophisticated questions about Bitcoin's role in global monetary competition and national security strategy. Egan emphasized that discussions no longer waste time on "is it just for buying drugs" but instead focus on how Bitcoin can counter China's parallel financial systems and strengthen America's competitive position.

"There are people thinking, even the Department of Energy, some of whom will be at our conference, thinking really deeply about everything this ecosystem has to offer and how we can apply it to sort of a comprehensive national security strategy." - Ken Egan

Multiple government departments are now actively exploring Bitcoin's potential, Egan revealed. The Department of Defense examines mining for energy resilience, while the Department of Energy considers grid applications. Trump's executive order formally distinguished Bitcoin from other cryptocurrencies, signaling institutional recognition of its unique properties. This evolution from skepticism to strategic thinking represents a fundamental transformation in how America's policy establishment approaches Bitcoin.

Check out the full podcast here for more on institutional Bitcoin adoption, resistance money warnings, and bipartisan coalition building.

Headlines of the Day

France Eyes Bitcoin Mining to Use Excess Energy - via X

Truth Social Files for Bitcoin ETF - via X

French Firm Raises €9.7M to Expand Bitcoin Treasury - via X

China's DDC Enterprise Adds 38 BTC to Treasury - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

The best way to start your Monday morning is for the brake system in your car to completely shit the bed and force you to sit on the side of the road for a tow truck for two hours.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 97e691db:de6b25b7

2025-06-18 14:46:05

@ 97e691db:de6b25b7

2025-06-18 14:46:05Cheap Silicone Sex Doll for Male Looking for a cheap silicone sex doll for male pleasure that doesn’t skimp on quality? At Get Pleasure, we’ve got you covered with budget-friendly options that feel incredibly real! Our affordable silicone dolls are crafted for maximum satisfaction, offering lifelike textures and durable designs. Whether you’re a first-time buyer or exploring new experiences, our curated selection fits every taste and wallet. Shop now for discreet shipping and unbeatable prices. Ready to spice things up? Discover your perfect companion at Get Pleasure today!

Penis Sleeves for Men Want to boost your confidence and pleasure? Penis sleeves for men from Get Pleasure are the game-changer you need! Our high-quality, affordable sleeves add length, girth, and exciting textures to enhance your intimate moments. Designed for comfort and durability, they’re perfect for solo play or spicing things up with a partner. Easy to use and clean, our sleeves cater to all experience levels. Curious to level up your game? Shop Get Pleasure’s collection now for discreet delivery and unbeatable value!

-

@ a53364ff:e6ba5513

2025-06-18 14:30:19

@ a53364ff:e6ba5513

2025-06-18 14:30:19Cashu is a free and open-source Chaumian ecash protocol built for Bitcoin. Ecash is a digital bearer token that is stored on a user's device, very similar to physical cash. The Cashu protocol allows you to build applications such as wallets or voucher systems. Cashu is designed to be private, secure and scalable. Transactions are instant and nearly free.

What is Cashu?

Cashu is an ecash protocol that is integrated with the Bitcoin protocol. An Ecash system consists of two parts, the mint and the Ecash wallet. Anyone can run a mint for their application, be it a wallet, a web paywall, paid streaming services, or a voucher and rewards system for a super market. Ecash transactions between users or from the user to a service provider respect the user's privacy. A mint does not store a database of user accounts and their activity which protects users of an Ecash system from leaks their private data to hackers and can provide stronger censorship resistant than classical payment systems.

The Cashu Protocol

Cashu is an ecash protocol built for Bitcoin. It is an open protocol which means that everyone can write their own software to interact with other Cashu apps. Applications that follow the specifications will be compatible with the rest of the ecosystem.

Cashu wallets

Nutshell

Nutshell is a CLI wallet available through PyPi. It is the first Cashu wallet and mint. Both, the mint and the wallet can be used as standalone software or included into other applications as a library. It has full Bitcoin Lightning integration, PostgreSQL and SQLite database support, builtin Tor, supports multiple mints, and can send and receive tokens on nostr, and supports complex spending conditions tokens.

Nutstash

Nutstash is a Cashu web wallet with many features such as multimint support and support for sending and receiving tokens via nostr. Nutstash is written in TypeScript and uses the cashu-ts library.

Minibits

Minibits is a mobile Cashu wallet with a focus on performance and usability.

Cashu.me

Cashu.me is another web wallet built on Quasar and Vue.js. It is written in JavaScript and TypeScript and is in active development.

Macadamia

Macadamia is a Cashu wallet for iOS written in Swift.

Sovran

Sovran is a Cashu wallet for iOS.

Prism

Prism wallet is a social wallet that runs on Discord.

Boardwalk

Boardwalk Cash is a wallet designed for fast, easy onboarding and use.

-

@ 04c3c1a5:a94cf83d

2025-06-18 12:27:00

@ 04c3c1a5:a94cf83d

2025-06-18 12:27:00123

-

@ 04c3c1a5:a94cf83d

2025-06-18 12:26:00

@ 04c3c1a5:a94cf83d

2025-06-18 12:26:00123

-

@ 04c3c1a5:a94cf83d

2025-06-18 12:26:00

@ 04c3c1a5:a94cf83d

2025-06-18 12:26:00123

-

@ eb0157af:77ab6c55

2025-06-18 08:01:36

@ eb0157af:77ab6c55

2025-06-18 08:01:36A new study by Kraken reveals how cryptocurrency investors perceive security as the main challenge in self-managing their digital assets.

According to The Block, a recent survey conducted by crypto exchange Kraken found that nearly half of respondents consider themselves the primary risk factor for their own crypto security. The research, which surveyed 789 participants, highlights that 48% of users see their own actions as the greatest threat to their investments in digital assets, surpassing concerns about external theft or fraud.

Kraken’s report underlines how personal responsibility in security management forces users to take full control of their digital funds. However, the study suggests that this autonomy can also become a source of anxiety for many investors.

Nick Percoco, Chief Security Officer at Kraken, commented on the findings, noting that “a lack of confidence in personal crypto security is capping the growth of the industry.” According to Percoco, unlocking the full potential of cryptocurrencies will require users to embrace self-custody and consistently invest in strong security habits.

Technologies to strengthen security

Despite the concerns highlighted in the study, 31% of participants expressed optimism about future technologies that could improve crypto security. Among the most promising solutions identified:

- advanced biometric systems for user authentication;

- multi-factor authentication to secure wallet access;

- AI-based fraud detection systems to prevent attacks.

Data and case studies

Kraken’s research emerges in a context where security threats remain a pressing reality. FBI data shows that in 2024, nearly 150,000 reports of crypto-related internet fraud resulted in $9.3 billion in losses. Older users, particularly those over 60, proved especially vulnerable, accounting for $3 billion in crypto-related financial fraud losses on their own.

The post Kraken study: 48% of users fear themselves in managing and securing their funds appeared first on Atlas21.

-

@ 8d34bd24:414be32b

2025-06-15 03:31:00

@ 8d34bd24:414be32b

2025-06-15 03:31:00How do you look at the things in your life?

-

Do you focus on your physical problems or do you look forward to your resurrection body in heaven?

-

Do you spend your time trying to fix the corruption in government or do you spend your time trying to bring as many people as possible home to heaven?

-

When you see someone suffering do you first pray for their physical healing or do you pray for their spiritual healing?

-

Do you work to fit in with the people around you or do you work to become more Christ-like?

-

Do you crave entertainment or do you crave biblical enrichment?

-

Do you focus more on your citizenship here on earth or more on your eternal citizenship?

-

Do you seek fellowship with the people of this world or do you seek fellowship with your Savior?

-

Do you look at people’s faults and how they hurt you or do you look at their hurt and separation from God and seek to bring them to Jesus?

-

Do you spend your time on work and entertainment or do you spend your time studying the word of God, praying to God, and telling others about God?

Do you have an earthly or an eternal perspective?

Physical or Spiritual Needs

Jesus always had an eternal perspective. This event is just one example.

One day He was teaching; and there were some Pharisees and teachers of the law sitting there, who had come from every village of Galilee and Judea and from Jerusalem; and the power of the Lord was present for Him to perform healing. And some men were carrying on a bed a man who was paralyzed; and they were trying to bring him in and to set him down in front of Him. But not finding any way to bring him in because of the crowd, they went up on the roof and let him down through the tiles with his stretcher, into the middle of the crowd, in front of Jesus. Seeing their faith, He said, “Friend, your sins are forgiven you.” The scribes and the Pharisees began to reason, saying, “Who is this man who speaks blasphemies? Who can forgive sins, but God alone?” But Jesus, aware of their reasonings, answered and said to them, “Why are you reasoning in your hearts? Which is easier, to say, ‘Your sins have been forgiven you,’ or to say, ‘Get up and walk’? But, so that you may know that the Son of Man has authority on earth to forgive sins,”—He said to the paralytic—“I say to you, get up, and pick up your stretcher and go home.” (Luke 5:17-24) {emphasis mine}

In this familiar story a man who was paralyzed was brought to Jesus for healing. The paralytic’s friends worked so hard to get him physically healed that they hauled him up on the roof, dug through the roof, and lowered him down in front of Jesus. What was Jesus’s response? Jesus forgave the man’s sins. Every person there saw the man’s need to be able to walk, so he could take care of himself here on earth. Jesus saw the more important spiritual need and forgave his sins. After taking care of his eternal need, he also took care of his more earthly need and healed him physically.

Do you see people’s eternal need or do you just see their physical needs or worse, only see their earthly failings? Do you only see the hurt they are causing you or do you see the hurt they feel that comes from being separated from God?

Earthly or Heavenly Citizenship

I’ve been involved in politics for many years. I’ve been to precinct, county, state, and national conventions. I’ve written, debated, and defended political platforms and resolutions. I vote every election. All of that is good and useful, but is that where we are supposed to spend most of our time and effort? I’ve come to the conclusion that this is not what is most important.

For our citizenship is in heaven, from which also we eagerly wait for a Savior, the Lord Jesus Christ; who will transform the body of our humble state into conformity with the body of His glory, by the exertion of the power that He has even to subject all things to Himself. (Philippians 3:20-21)

We are told that our citizenship is in heaven. The majority of our effort should be put into support of our heavenly citizenship, not our earthly citizenship. That doesn’t mean that we should let our earthly kingdom fall apart and turn away from God, but it does mean we should be more focused on turning hearts and minds to Jesus than we are with setting domestic laws. We should be more focused on worshipping God than supporting politicians.

Sadly I see too many Christians who focus on pushing the “Pledge of Allegiance to the Flag” than they do pushing loyalty to Jesus. I see too many Christians who put all of their effort into electing the “right” politician instead of pointing people to the real Savior. I see too many Christians who try to pass the “right” laws instead of reading the law of God. I see too many Christians who put all of their effort into changing people’s minds to the “right” party instead of changing hearts and minds for Christ.

Do you really seek the kingdom of God or are you only focused on your earthly nation? Do you spend more time trying to win people for your political party than you do trying to win people for Christ? Our primary focus should be on the Millennial Kingdom of Christ and on eternity in heaven with Jesus, not on our earthly country.

Yes, we are to be a light in the world and we should seek the good of our earthly nations, but sharing the gospel, living a life honoring to God, and doing everything within our power to draw people to Jesus should be our focus and where we put most of our effort.

And He came and preached peace to you who were far away, and peace to those who were near; for through Him we both have our access in one Spirit to the Father. So then you are no longer strangers and aliens, but you are fellow citizens with the saints, and are of God’s household, having been built on the foundation of the apostles and prophets, Christ Jesus Himself being the corner stone, in whom the whole building, being fitted together, is growing into a holy temple in the Lord, in whom you also are being built together into a dwelling of God in the Spirit. (Ephesians 2:17-22)

The Hurt They Cause or the Hurt They Feel

People today are selfish and hurtful. Most people are trying to be the greatest victim which means they are accusing others of being abusers, tyrants, or haters. People are impolite, inconsiderate, and sometimes downright hateful. How do you respond?

Do you attack back when you are attacked? Are you rude back when you are treated rudely? Do you only see how others hurt you or can you see the hurt behind the hurtful behavior?