-

@ 2d59d99a:2fe1d17f

2025-06-17 14:13:03

@ 2d59d99a:2fe1d17f

2025-06-17 14:13:03Keep your air conditioner running smoothly with professional AC service in Tucson from Intelligent Design Air Conditioning. Regular AC maintenance is crucial in Arizona's harsh climate to prevent costly breakdowns and ensure peak efficiency. Our comprehensive AC service includes thorough system inspections, filter replacements, coil cleaning, and refrigerant level checks. We service all makes and models, helping extend your unit's lifespan while reducing energy bills. Our Tucson AC service technicians are licensed, insured, and committed to keeping your home cool and comfortable. Schedule your AC tune-up today and avoid unexpected summer breakdowns.

-

@ 9ca447d2:fbf5a36d

2025-06-17 14:02:01

@ 9ca447d2:fbf5a36d

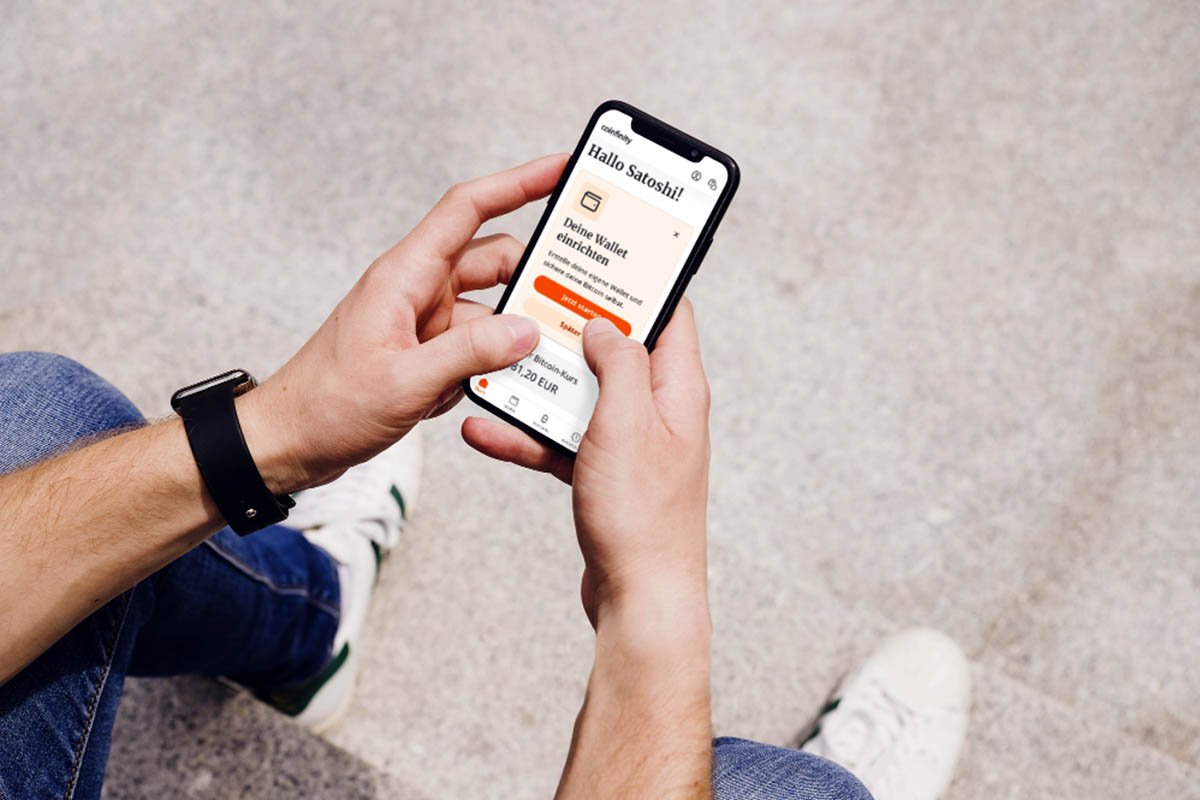

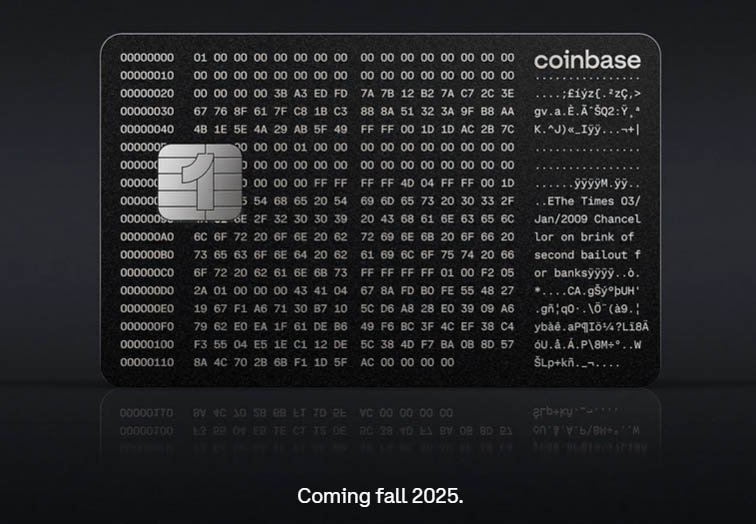

2025-06-17 14:02:01While most Bitcoin companies chase quick wins with flashy marketing and complex trading features, Coinfinity is taking a different path. The Austria-based company has built their entire business model around something most brokers treat as an afterthought: education.

Founded on the principle that Bitcoin adoption requires understanding, not just access, Coinfinity offers something great in the Bitcoin space: a broker that actually wants you to take your bitcoin off their platform.

Their Bitcoin Blinks educational series provides a self-custody-first approach, and Austrian economics foundation make them stand out in a crowded field of crypto casinos.

Coinfinity’s HQ in Graz, Austria

At the heart of this educational mission is Fab, Coinfinity’s Head of Bitcoin Education, whose journey to Bitcoin mirrors that of many who’ve found their way to Austrian economics through pure instinct.

“I always had the feeling that something in the world just doesn’t add up,” he told Bitcoin News when he sat down with us. “Something’s wrong, I don’t know what, but I felt like the foundation of our society isn’t quite fair, I just never knew what it was.”

Sound familiar?

That hunch eventually led him down a rabbit hole of geopolitics, monetary systems, and finally to Andreas Antonopoulos videos on YouTube.

“I basically disappeared from life for about a week, just watching those videos,” Fab recalled. But it wasn’t until he read The Bitcoin Standard that everything clicked.

“I remember it like it was yesterday, I closed the book and thought ‘Holy s***, now I get it.’ That was the moment. From then on, I was Bitcoin-only.”

Many of the best Bitcoin books are in English and translating them is important

Now as Head of Bitcoin Education at Coinfinity and co-founder of Aprycot Media (a German publishing house focused exclusively on Bitcoin), Fab spends his days helping others find that same spark.

And unlike most “crypto” companies, Coinfinity’s strategy isn’t driven by marketing gimmicks or token launches, it’s driven by teaching.

“Our goal is to create educational content that’s so easy to understand that people love sharing it,” Fab explained. “When they share it, they connect with us. Once they start understanding Bitcoin, they choose us to buy it.”

Most companies buy Google ads. Coinfinity builds minds. With their Bitcoin Blinks, 42 short, clear lessons covering everything from subjective value to seed phrases, they’re offering what most brokers won’t: context. Meaning. Philosophy.

“It became quite popular, and we think it’s way more effective for our brand than just buying ads,” Fab said.

And they don’t stop there. When it comes to custody, Coinfinity takes a radically different approach than most Bitcoin brokers.

“When you buy bitcoin from us, you always take custody, either in our in-app wallet where you control the seed, or your own hardware wallet,” Fab emphasized. “Even our lightning feature works the same way you always buy into your own wallet.”

That’s not just a slogan. It’s a core value of the company that runs so deep they’re willing to sacrifice user experience for it. “We never custody your bitcoin,” Fab said. “It’s one of the core values that you custody them yourself.”

Even as fees rise and UTXO management gets harder, Coinfinity stays committed to self-custody. They are open to optional custodial tools in the future, but always paired with education, and always encouraging users to take their bitcoin off-platform when the time is right.

“If we ever offer custodial services, it would only be to help users stack small amounts until they reach a meaningful UTXO size,” Fab explained.

The plan would involve accumulating smaller purchases monthly or weekly until users hit a threshold, maybe a million sats, then withdrawing to self-custody. “We don’t want to play games with your bitcoin. We don’t want to lend it out or earn interest on it.”

Coinfinity emphasizes on self-custody and education, even in its app

The challenge is real though. When new users first encounter Bitcoin, the technical barriers can be overwhelming. “Often causes problems with people just getting into Bitcoin who don’t understand what self custody is” Fab notes.

That’s why they built their in-app wallet, to smooth the onboarding while maintaining their self-custody values. “The in-app wallet was our first step toward optimizing user experience without compromising our core value of bringing bitcoin into self-custody,” he said.

“One of our taglines is ‘bringing Bitcoin to the people’ and we literally mean that. We want to bring bitcoin to them, not keep it from them.”

Another promising thing the company is doing in their operations is using AI to create more content, faster. Podcast scripts, educational summaries, internal tools, Fab’s even feeding Austrian economics PDFs into models to keep the tone on-brand and Bitcoin-only.

“We’re using these tools in our business development and marketing teams to generate more output with the same number of people,” he said. But the future looks even more exciting.

“Maybe one day we’ll have a tutor in the app where you can do a video call and ask ‘What is a Bitcoin address?’ and it will talk back to you naturally, going deeper as you ask more questions,” Fab explained. “That’s absolutely possible.”

The technology isn’t quite there yet for mainstream deployment in their app, but Fab is optimistic. “I’m sure that in the future, this won’t just be used for improving our internal workflow, but for enhancing the content itself,” he said.

It’s not a pipe dream. The tech is already close. The only thing missing is more Bitcoin-native data and companies like Coinfinity are quietly building that layer.

One of the favorite parts of these interviews is asking the builders in the space what they would ask Satoshi if given one question. When I asked Fab what he’d ask Bitcoin’s creator, he didn’t hesitate:

“Did you purposely build Bitcoin based on Austrian economics, or did it just happen by accident?

“All this monetization theory, Bitcoin being a store of value first, is this something you actually thought was possible and had in mind? Or was it just a lucky shot that accidentally gave us the best monetary properties?”

Because if Satoshi had built Bitcoin with a 2% inflation rate, like some other projects, it might’ve worked. But it wouldn’t have lasted.

“He could have made it with 2% tail emission, it still would have been decentralized. But then today, someone might introduce a coin with a fixed supply that could kill Bitcoin,” Fab noted.

Fab suspects the fixed supply wasn’t an accident. And thank God for that.

What’s remarkable about Coinfinity isn’t just their Austrian approach or their self-custody obsession, it’s how they’re proving that education-first Bitcoin companies can compete with the flashy crypto casinos dominating the space.

Coinfinity doesn’t serve U.S. customers. They’re focused on Europe, operating within EU regulations. But what they’re building, honest Bitcoin education, smart tools, and a relentless push for financial sovereignty, matters everywhere.

-

@ f0fd6902:a2fbaaab

2025-06-17 13:49:07

@ f0fd6902:a2fbaaab

2025-06-17 13:49:07https://stacker.news/items/1008542

-

@ f0fd6902:a2fbaaab

2025-06-17 13:37:23

@ f0fd6902:a2fbaaab

2025-06-17 13:37:23There are some amazing places in Georgia to see monarch butterflies! Journey North, an organization that allows users to report monarch sightings, has some great information on the best sightings in Georgia! One great place is Savannah. Known for its historical architecture and beautiful parks, Savannah is also a famous spot to see monarchs! Places such as Wassaw National Wildlife Refuge help with the conservation of monarchs to support them on their migration south. This makes it a great place to observe the monarchs.

https://stacker.news/items/1008538

-

@ e1cde248:609c13b0

2025-06-17 13:09:20

@ e1cde248:609c13b0

2025-06-17 13:09:20ในโลกของเกมออนไลน์ โดยเฉพาะเกมที่มีระบบแลกเปลี่ยนและการซื้อขายกันระหว่างผู้เล่น (player-to-player trading) มีสิ่งหนึ่งที่เกิดขึ้นซ้ำแล้วซ้ำเล่าในแทบทุกเกม นั่นคือ "item หายาก" (rare item) ค่อยๆ กลายเป็นสื่อกลางในการแลกเปลี่ยน มันไม่ใช่แค่ของมีค่าในตัวเองเท่านั้น แต่ยังถูกใช้เสมือนเป็น “เงิน” (currency) ของโลกเสมือนนั้นด้วย

ลองจินตนาการว่าเรากำลังเล่นเกมที่มีระบบ economy ผู้เล่นสามารถหาของจากการล่ามอนสเตอร์ (monster hunting) หรือผ่านเควสต่างๆ สิ่งที่เกิดขึ้นคือบาง item มีโอกาสดรอป (drop rate) ต่ำมากๆ และมีความต้องการสูง สิ่งเหล่านี้แหละที่เริ่ม “มีมูลค่า” ในสายตาของผู้เล่น

เมื่อคนจำนวนมากเริ่มยอมรับว่า item นี้ “แลกของอื่นได้” หรือ “ใช้วัดมูลค่าได้” มันก็กลายเป็นเงินอย่างไม่เป็นทางการโดยอัตโนมัติ

Rare item = เงิน? ได้ไง?

คำตอบง่ายมาก: เพราะมัน หายาก (scarce), เป็นที่ต้องการ (demanded) และ เป็นที่ยอมรับในกลุ่มผู้เล่น (accepted)

ในระบบที่ไม่มีเงินกลางแบบ fix ผู้เล่นจะเริ่มหาสิ่งใดสิ่งหนึ่งมาทำหน้าที่แทน เช่น item ที่ทุกคนรู้ว่าหายากจริง หาไม่ได้ง่ายๆ และมีปริมาณจำกัดในตลาด ระบบนี้เกิดขึ้นเองโดยไม่มี dev หรือระบบของเกมไปบอกว่า "นี่คือเงินนะ"

สิ่งนี้ทำให้เกิด “เศรษฐกิจเสมือน (virtual economy)” ที่ผู้เล่นสร้างขึ้นเองโดยธรรมชาติ และมันคือบทเรียนสำคัญเรื่องเงินในโลกจริง

เศรษฐกิจที่เกิดจาก consensus (ฉันทามติ)

เงิน ไม่ว่าจะในโลกจริงหรือโลกเสมือน มีจุดเริ่มต้นมาจากสิ่งเดียวกันคือ ความเชื่อร่วมกัน (shared belief)

ในเกม ผู้เล่นหลายพันคนพร้อมใจกันเชื่อว่า item ชิ้นนี้ “มีค่า” จึงสามารถใช้แลกทุกอย่างได้ บางคนเอาไปจ้างช่วยผ่านบอส บางคนเอาไปซื้อชุดหรือของตกแต่ง ความน่าสนใจคือ item นั้นอาจไม่ใช่สิ่งที่มี "utility" สูงด้วยซ้ำ บางอันมีไว้โชว์เท่ๆ เท่านั้น แต่มันมี “มูลค่า” เพราะผู้เล่นเห็นว่ามันควรมี

นั่นคือพลังของ consensus และมันคือกลไกเดียวกับที่เงินกระดาษ หรือแม้แต่คริปโตอย่าง Bitcoin ใช้ในการสร้างมูลค่า

ระบบที่ไร้เสถียรภาพ (fragile system)

แต่ economy แบบนี้ไม่ได้สมบูรณ์แบบไปเสียหมด สิ่งหนึ่งที่มักเกิดขึ้นคือ ความเปราะบาง (fragility)

ถ้า item ที่เคยหายากอยู่ๆ กลายเป็นดรอปง่ายขึ้น หรือมี bug ให้ dup ได้ ความเชื่อในความขาดแคลนนั้นจะพังลงทันที และแน่นอนว่า value ที่เคยสูงลิ่วก็ร่วงตามไปด้วย

นอกจากนี้ ยังมีปัจจัยอื่นเช่น การที่ dev แก้กฎ เพิ่มหรือลด supply item โดยไม่แจ้งล่วงหน้า หรือปิด server แบบไม่คาดคิด สิ่งเหล่านี้ทำให้ economy ที่เคยดูมั่นคงต้องสลายไปเพียงชั่วข้ามคืน

นั่นคือจุดที่ virtual economy แตกต่างจาก real-world crypto economy ที่สร้างอยู่บนความโปร่งใสและโค้ดที่ทุกคนตรวจสอบได้

สิ่งที่เราเห็นในเกมไม่ใช่เรื่องบังเอิญ มันคือบทเรียนทางเศรษฐศาสตร์แบบเรียลไทม์ และเรียลฟีล

เรารู้ว่าเงินไม่จำเป็นต้องถูกสร้างโดยรัฐ เรารู้ว่าเงินไม่จำเป็นต้องมีตัวตนแบบธนบัตร และเรารู้ว่า สิ่งใดก็ตามที่หายาก ตรวจสอบได้ และได้รับการยอมรับร่วมกัน — มันสามารถเป็น “เงิน” ได้ แม้จะเป็นแค่ item ในเกมก็ตาม

โลกของเกมจึงเป็น sandbox ที่สอนเราว่า “value” คือสิ่งที่ถูกสร้างขึ้นจากฉันทามติ ไม่ใช่จากอำนาจ

สรุป: เกมคือโลกจำลองของเศรษฐกิจมนุษย์

ไอเทมหายากในเกมที่กลายเป็นเงินไม่ใช่แค่เรื่องบังเอิญ แต่มันคือภาพสะท้อนว่า ความขาดแคลน + ความต้องการ + ความยอมรับ = มูลค่า และนั่นคือหัวใจของระบบเงินทุกแบบ ไม่ว่าจะเป็นทองคำ เงินเฟียต หรือสินทรัพย์ดิจิทัลอย่าง Bitcoin

โลกของเกมไม่ใช่แค่ที่เล่นสนุก แต่มันคือห้องทดลองทางเศรษฐกิจ ที่เปิดเผยให้เราเห็นว่าผู้คนสามารถสร้างระบบเงินได้ด้วยตัวเอง โดยไม่ต้องพึ่งรัฐ ไม่ต้องมีธนาคารกลาง และไม่ต้องมีใคร “อนุมัติ”

มันเริ่มจาก item เล็กๆ ที่คนอยากได้ และจบลงด้วยระบบ economy ที่ทรงพลังยิ่งกว่าที่ dev เคยคาดคิด

-

@ e1cde248:609c13b0

2025-06-17 13:08:24

@ e1cde248:609c13b0

2025-06-17 13:08:24ในการกล่าวสุนทรพจน์หลักในงาน Bitcoin 2025 ไมเคิล เซย์เลอร์ (Michael Saylor) นักเคลื่อนไหวชื่อดังด้านบิตคอยน์และซีอีโอของบริษัท MicroStrategy ได้บรรยายหัวข้อที่ทรงพลังชื่อว่า "21 วิธีสู่ความมั่งคั่ง" เขาได้เสนอเส้นทางเชิงกลยุทธ์สำหรับบุคคลทั่วไป ครอบครัว และธุรกิจขนาดเล็ก ในการบรรลุความมั่งคั่งทางการเงินผ่านบิตคอยน์

ต่างจากคำพูดก่อนหน้าของเขาที่มุ่งเป้าไปที่สถาบันและรัฐบาล คำพูดนี้ถูกออกแบบมาสำหรับผู้คนทั้ง 8 พันล้านคน บนโลก โดยเน้นขั้นตอนปฏิบัติที่สามารถใช้บิตคอยน์เป็นทรัพย์สินเปลี่ยนชีวิตอย่างแท้จริง ด้านล่างนี้คือการสำรวจเชิงลึกใน 21 หลักการ ของเซย์เลอร์ ซึ่งเปรียบเสมือนพิมพ์เขียวในการสร้างความมั่งคั่งในยุคดิจิทัล:

1. ความชัดเจน (Clarity): เข้าใจบิตคอยน์ในฐานะทุนที่สมบูรณ์แบบ เซย์เลอร์เริ่มต้นด้วยแนวคิดเรื่อง “ความชัดเจน” โดยเน้นว่าบิตคอยน์คือ "ทุนที่ถูกออกแบบอย่างสมบูรณ์" ซึ่งไม่สามารถถูกทำลายหรือดัดแปลงได้ ความเข้าใจนี้เป็นพื้นฐานสำคัญในการยอมรับศักยภาพของบิตคอยน์ในฐานะรากฐานของความมั่งคั่ง

2. ความเชื่อมั่น (Conviction): ศรัทธาในศักยภาพการเติบโตเหนือกว่า เซย์เลอร์ยืนยันว่าบิตคอยน์ถูกออกแบบมาให้เติบโตเร็วกว่าสินทรัพย์ทั่วไป เช่น หุ้น ทองคำ หรืออสังหาริมทรัพย์ การมีความเชื่อมั่นอย่างแท้จริงเป็นสิ่งจำเป็นต่อการให้ความสำคัญกับบิตคอยน์เหนือการลงทุนแบบดั้งเดิม

3. ความกล้า (Courage): ยอมรับความเสี่ยงทางการเงินอย่างชาญฉลาด บิตคอยน์คือการยอมรับความเสี่ยงที่คำนวณได้อย่างชาญฉลาด ไม่ใช่ความกลัวหรือการพนัน ผู้ที่ "เติมเชื้อไฟ" ให้กับระบบนี้คือผู้ที่เปลี่ยนเงินเฟียตหรือสินทรัพย์ด้อยค่ามาเป็นบิตคอยน์

4. ความร่วมมือ (Cooperation): ผนึกกำลังในครอบครัวเพื่อความแข็งแกร่ง เมื่อครอบครัวร่วมมือกัน ศักยภาพในการสร้างความมั่งคั่งจะเพิ่มทวีคูณ เซย์เลอร์เสนอให้ครอบครัวผสานความสามารถและทรัพยากร เพื่อผลักดันกันและกันสู่อนาคตที่ดีกว่า

5. ความสามารถ (Capability): เชี่ยวชาญปัญญาประดิษฐ์ ในปี 2025 AI เป็นกุญแจสำคัญในการปลดล็อกโอกาสทางการเงินระดับสูง โดยที่บุคคลทั่วไปสามารถเข้าถึงคำแนะนำจากทนาย นักบัญชี หรือผู้เชี่ยวชาญ โดยไม่เสียค่าใช้จ่าย

6. การจัดวางโครงสร้าง (Composition): สร้างนิติบุคคลเพื่อป้องกันและขยายผล การตั้งบริษัท ทรัสต์ หรือโครงสร้างทางกฎหมาย เช่น IRA หรือ 401(k) คือวิธีเพิ่มประสิทธิภาพในการลงทุนบิตคอยน์อย่างปลอดภัยและถูกกฎหมาย

7. สัญชาติทางเศรษฐกิจ (Citizenship): เลือกฐานภาษีอย่างชาญฉลาด เลือกอยู่ในพื้นที่หรือประเทศที่เป็นมิตรกับบิตคอยน์ เช่น ฟลอริดา หรือประเทศอย่างสิงคโปร์ เพื่อลดภาระภาษีและเพิ่มเสถียรภาพระยะยาว

8. ความสุภาพ (Civility): เคารพโครงสร้างอำนาจ ไม่จำเป็นต้องล้มล้างระบบเก่า เพียงแค่รู้จักเคารพอำนาจและสร้างพันธมิตรในทางที่สร้างสรรค์เพื่อเดินหน้ากับบิตคอยน์ได้

9. การใช้บริษัท (Corporation): บริษัทคือเครื่องจักรสร้างความมั่งคั่ง บริษัทสามารถใช้ประโยชน์จากระบบการเงินและภาษีได้ดีกว่าปัจเจกบุคคล จึงควรจัดตั้งนิติบุคคลเพื่อลงทุนในบิตคอยน์อย่างจริงจัง

10. โฟกัส (Focus): อย่าหลงทาง อย่าวอกแวกไปกับธุรกิจเสี่ยงสูงหรือเหรียญอื่น ๆ เพราะบิตคอยน์มีประวัติผลตอบแทนสูงอย่างสม่ำเสมอ

11. การมีส่วนร่วม (Equity): ร่วมมือกับนักลงทุน ให้ผู้อื่นร่วมลงทุนในกิจการของคุณ เช่น หมอฟันอาจขายหุ้นบางส่วนของคลินิกเพื่อนำเงินไปลงทุนในบิตคอยน์

12. เครดิต (Credit): ใช้หนี้เป็นเครื่องมือ กู้เงินดอกเบี้ยต่ำและลงทุนในบิตคอยน์ที่มีแนวโน้มเติบโตสูง เพื่อทำกำไรจากส่วนต่างระหว่างดอกเบี้ยกับผลตอบแทน

13. การปฏิบัติตามกฎ (Compliance): ทำตามกฎหมาย สร้างบริษัทที่สอดคล้องกับกฎระเบียบเพื่อขยายเงินทุนได้อย่างมั่นคงและปลอดภัย

14. การระดมทุน (Capitalization): หาเงินลงทุนอย่างต่อเนื่อง ไม่ว่าจะจากการขายหุ้น หรือรีไฟแนนซ์ทรัพย์สินส่วนตัว ทุกโอกาสคือช่องทางในการระดมทุนและลงทุนต่อในบิตคอยน์

15. การสื่อสาร (Communication): โปร่งใสและจริงใจ การเปิดเผยแผนและเป้าหมายอย่างชัดเจนจะสร้างความไว้วางใจจากนักลงทุน พนักงาน และลูกค้า

16. ความมุ่งมั่น (Commitment): อยู่กับบิตคอยน์ ไม่หลงทาง หลีกเลี่ยงเหรียญอื่น ๆ หรือโปรเจกต์ที่ไม่มั่นคง ยึดมั่นในบิตคอยน์เพื่อเสถียรภาพระยะยาว

17. การลงมือทำ (Delivery): ลงมือจริงอย่างแม่นยำ ไม่ใช่แค่คิด แต่ต้องทำอย่างมีประสิทธิภาพ สม่ำเสมอ และไม่ประมาท

18. การปรับตัว (Adaptation): พร้อมเปลี่ยนแปลงเมื่อจำเป็น ระบบใด ๆ ก็มีวันล้มเหลว การปรับตัวตามสถานการณ์คือสิ่งที่ทำให้ยืนหยัดได้ในระยะยาว

19. วิวัฒนาการ (Evolution): เติบโตจากจุดแข็ง ขยายธุรกิจจากสิ่งที่คุณเชี่ยวชาญ แทนที่จะพยายามเริ่มสิ่งใหม่จากศูนย์

20. การเผยแพร่ (Advocacy): เป็นกระบอกเสียงเพื่อเสรีภาพทางเศรษฐกิจ บอกต่อและสอนผู้อื่นให้เข้าใจบิตคอยน์ เพื่อขยายเครือข่ายแห่งความมั่งคั่ง

21. ความเอื้อเฟื้อ (Generosity): แบ่งปันความสำเร็จ การช่วยเหลือครอบครัว ชุมชน และพนักงาน ด้วยทรัพยากรที่คุณมี จะสร้างความสุขทั้งต่อตัวคุณและโลก

เซย์เลอร์จบท้ายด้วยคำของซาโตชิ นากาโมโตะว่า:

“มันอาจจะดีถ้ามี bitcoin ไว้บ้าง เผื่อว่ามันจะกลายเป็นสิ่งสำคัญในอนาคต”

หลังจาก 16 ปีแห่งการเติบโตและมูลค่าตลาดกว่า 2 ล้านล้านดอลลาร์ หลักการทั้ง 21 ข้อนี้คือพิมพ์เขียวแห่งเสรีภาพทางการเงิน ที่รวมเอาความชัดเจน ความกล้า และเครื่องมืออย่าง AI, การจัดตั้งบริษัท และเครดิต เข้าด้วยกัน เพื่อให้ทุกคนสามารถใช้บิตคอยน์สร้างอนาคตที่ดีกว่าได้

-

@ e1cde248:609c13b0

2025-06-17 13:07:33

@ e1cde248:609c13b0

2025-06-17 13:07:33ในปี 1975 มหาวิทยาลัย Yale ได้ทำการศึกษาจากกลุ่มคนที่มีอายุตั้งแต่ 50 ปีจำนวน 660 คน ในหัวข้อ ความเห็นที่มีต่อ “การสูงวัยขึ้น(aging)”

กลุ่มที่หนึ่ง มีความเห็นและความเชื่อที่เป็นด้านบวก ทั้งในเรื่องสุขภาพ ความคิด ความคาดหวังที่ดี เมื่อแก่ตัวขึ้น

กลุ่มที่สอง มีความเห็นและความเชื่อที่เป็นด้านลบ ประมาณว่า “การออกกำลังกายไม่ได้ทำอะไรให้ดีขึ้นหรอก ยังไงก็ต้องป่วย ต้องตายอยู่ดี”

ปรากฎว่า เมื่อผ่านไป 23 ปี กลุ่มที่หนึ่งมีอายุขัยเฉลี่ยมากกว่ากลุ่มที่สอง ถึง 7.6 ปี ซึ่งเป็นตัวเลขที่แตกต่างกันมาก

การศึกษานี้ต้องการจะบอกอะไรกับเรา?

แน่นอนว่า ผลลัพธ์ทุกอย่าง เกิดขึ้นได้ จากการกระทำ เวลาที่เราวางแผนจะลงมือทำอะไร ล้วนแต่เริ่มต้นจาก การตั้งเป้าหมาย ทั้งสิ้น

แต่คำถามคือ เมื่อบรรลุเป้าหมายแล้ว ยังไงต่อ?

ข้อเสียอย่างหนึ่ง ของการตั้งเป้าหมายโดยมีรากฐานมาจากผลลัพธ์ที่ต้องการ คือ เรามีแนวโน้มที่จะ “หยุดทำ” เมื่อได้ผลลัพธ์ที่ต้องการแล้ว

ยกตัวอย่างเช่น การลดน้ำหนัก เราชอบมองเรื่องของการลดน้ำหนักเป็นเหมือน การจัดแคมเปญ โดยมีช่วงเวลาที่กำหนด และเมื่อบรรลุเป้าหมาย เราก็กลับมามีพฤติกรรมแบบเดิม ซึ่งทำให้น้ำหนักที่ลดลงไป กลับมา

James Clear ผู้เขียนหนังสือชื่อ Atomic Habits ได้กล่าวว่า แค่การวางแผน และลงมือทำ ไม่ได้นำมาซึ่งผลลัพธ์ที่ยั่งยืน

แต่สิ่งที่สำคัญกว่า ที่เราต้องทำคือ การกำหนดตัวตนของเราใหม่

เวลาที่เราต้องการลดน้ำหนัก 10 กิโล ให้เรามองลึกลงไปกว่าการวางแผนเรื่องการกิน และการออกกำลังกาย

แต่ให้ตั้งเป้าหมายว่า

“ต่อไปนี้ฉันจะเป็นคนที่ เลือกกินที่แต่ของที่มีประโยชน์ และจะออกกำลังกายสม่ำเสมอ” “ฉันไม่ใช่คนที่ชอบกินขนมและของที่มีน้ำตาลสูง” “ฉันเป็นนักกีฬาที่เข้มงวดต่อตารางฝึกซ้อม”

การกำหนดตัวตนของเราใหม่ เป็นเหมือนการปรับเปลี่ยน Mindset ถ้าเรา “โฟกัส” ลงไปที่แก่นของพฤติกรรมแล้ว “ผลลัพธ์” แบบที่เราต้องการจะมาเอง และยั่งยืนกว่า

การศึกษาของมหาวิทยาลัย Yale เป็นข้อพิสูจน์ของเรื่องนี้ได้อย่างดี เพราะกลุ่มคนที่มีความเชื่อที่เป็นด้านบวก จะให้ความสำคัญต่อการออกกำลังกายมากขึ้น หยุดกินเหล้า หยุดสูบบุหรี่ และใช้เวลาอยู่กับคนที่มีมุมมองเป็นบวกเหมือนกัน

เมื่อเราได้ติดสินใจแล้วว่า คนแบบไหนที่เราต้องการจะเป็น พฤติกรรมต่างๆในชีวิตประจำวันของเราจะค่อยๆ เปลี่ยนไป และจะยิ่งเห็นผลชัดเจนขึ้นเรื่อยๆในระยะยาว

เรา คือผลลัพธ์ของ สิ่งที่เราลงมือทำ

เรา คือผลลัพธ์ของ การตัดสินใจของเรา

-

@ c1e6505c:02b3157e

2025-06-17 12:50:03

@ c1e6505c:02b3157e

2025-06-17 12:50:03Back in March of this year, my friend nostr:nprofile1qyfhwumn8ghj7ctvvahjuat50phjummwv5q35amnwvaz7tmrv968xarjwgh8xampwfkhxarj9e3k7mgqyrcmjyd0r3a9vpe78wpm5l42dq2xwpqwp7aa6fj5gk4gpejuyaxzy06fp23 - a photographer I met on Nostr in the Bitcoin community, though I think he was initially acquainted with me through my photography publication, nostr:nprofile1qyvhwumn8ghj7etvd96x2uewdehhxarjv96xjtn0wfnszrthwden5te0dehhxtnvdakqqgrr6kwm3556hc5akuuqh6u39w8kqq3hxv4kextckgyxjnjtu9c0dutqvkwz — reached out asking if I wanted to be his production assistant for a shoot with David Byrne for his new album, “Who is the Sky?”.

Ahmed and David.

I wasn't too familiar with David before Ahmed asked, but I knew him from the Talking Heads, so obviously I said yes. Then came the logistics of actually making it happen - scheduling everything around and figuring out if I could pull off the trip from South Carolina all the way up to Manhattan.

The Journey North

The drive involved coordinating between Airbnbs and making strategic stops along the way. I stayed at my dad's house for a few days in Charlotte, which I tend to do whenever I travel north. It's always a good stop to see my dad since I don't get to see him very often. From there, I scheduled a couple Airbnbs in Jersey City, where I was able to see my friend Raf - always nice to catch up with him and drop off some rolls of film (watch our interview together here).** **The next day I got another Airbnb in a different city, then drove the following morning to a parking garage in Manhattan that was a block or two from Ahmed's studio.

Sunday Afternoon Studios

The studio is called Sunday Afternoon Studios, and of course I was the first one there - I'm always early to things. I find it better to be early than late, and it's never a problem for me because I usually just end up walking around, taking pictures, and being able to relax without worrying about rushing to get somewhere.

When I told my dad about how this shoot was going to happen, he said, "Make sure to get a picture of him on his bike" - apparently David rides his bike around the city quite often. I kept that in mind, and when David came in, sure enough, he came up the elevator with his bike. I thought of my dad and took a quick picture and sent it to him. He appreciated that, so that was cool.

Davids bike.

The Shoot

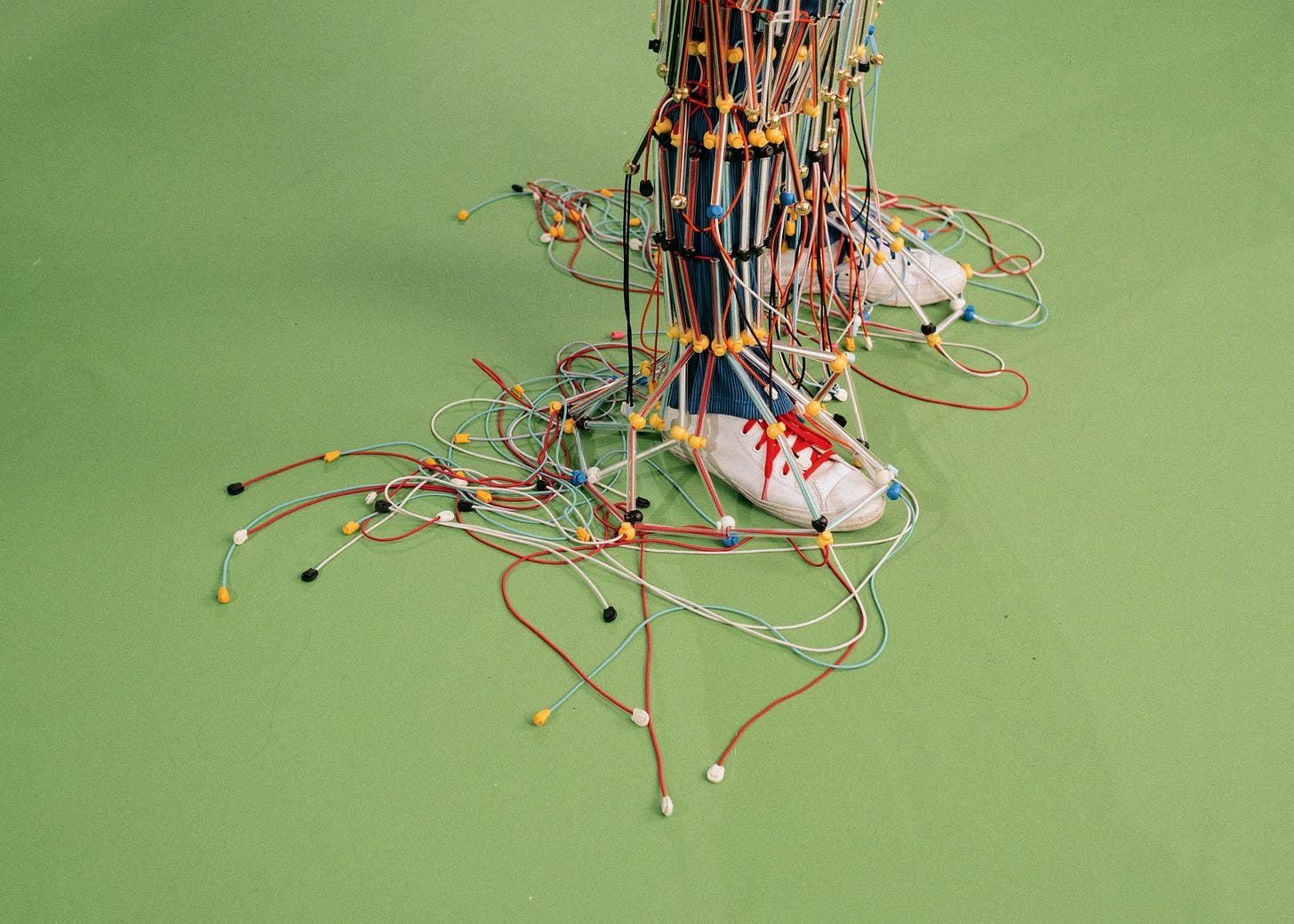

The shoot took a few hours, starting at 10 AM and wrapping up around 4:30 PM with cleanup. It was a gread day - I had a lot of fun and was able to learn more on lighting methods and setting up things I'd never worked with before in a professional environment. But I was also doing some documentary work with my Leica M262, so that's what these photos were taken with.

David's outfit, by the way, was extremely heavy - must've been at least 50 pounds or something like that. When I had to put it back in the box to ship it back to wherever it came from, I really noticed how heavy this thing actually was. It was made out of plastic tubing and zip ties and bungee cords and stuff. Actually really cool design work.

Ahmed and his newborn, Harmony.

I had a great time. Big thanks to Ahmed and crew for this opportunity to help out, meet David, and take some pictures. Really great experience. I feel very grateful for everything.

Thanks for reading.

-

@ 2d59d99a:2fe1d17f

2025-06-17 12:49:11

@ 2d59d99a:2fe1d17f

2025-06-17 12:49:11Need extra-long bamboo poles for large-scale projects? Bamboo Supply specializes in long bamboo poles ranging from 12 to 30 feet in length. Our extended-length bamboo poles are perfect for construction scaffolding, tall garden supports, flag poles, and architectural features. Each long bamboo pole is carefully harvested and processed to maintain structural integrity across its entire length. These poles offer exceptional strength-to-weight ratios, making them ideal for applications requiring both reach and durability. Available in various diameters to match your load requirements. Our long bamboo poles ship nationwide with special handling to ensure safe delivery. Contact Bamboo Supply today for custom length requirements and bulk pricing on long bamboo poles.

-

@ eb0157af:77ab6c55

2025-06-17 12:02:26

@ eb0157af:77ab6c55

2025-06-17 12:02:26Lightspark introduces a layer 2 for instant payments, stablecoins and interoperability with Lightning.

Spark is an open-source layer 2 protocol developed by Lightspark, designed to offer instant low-cost payments without the need for intermediaries. It allows the creation of wallets and applications that interact directly with the Bitcoin and Lightning networks. The company’s stated goal is to transform Bitcoin into a true global digital currency, solving the scalability limitations of the base layer.

Lightspark, a company led by David Marcus (former PayPal and former Facebook), officially launched Spark in beta version on April 29, 2025. Developers can already use Spark’s SDKs (Wallet and Issuer) to build self-custodial wallets compatible with Lightning and tokens (such as stablecoins) native to the Bitcoin network.

How it works

Spark adopts a statechain-based approach, allowing the transfer of ownership of a UTXO off-chain between different users without using the main blockchain, thus reducing costs and transaction times. Instead of executing an on-chain transaction that physically moves the asset, users acquire signing rights or control over a key that represents a bitcoin UTXO. Transfers occur through a chain of signatures and a mechanism that allows subsequent transactions to overwrite previous ones, ensuring that neither the user nor the service provider (Spark Service Provider, SSP) can lose funds during the operation.

Spark is designed to be fully interoperable with LN, supporting not only bitcoin transactions, but also stablecoins and other tokenized assets. SSPs facilitate Lightning payments by accepting funds on Spark and converting them into Lightning transactions or vice versa, eliminating the need for users to manage nodes or worry about channel liquidity. For example, a user can pay an LN invoice with a stablecoin on Spark, with the SSP converting the stablecoin to BTC in the background and sending the funds to the recipient.

Shared signature model (multisig 2-of-2)

Unlike the LN trust model, which is based on peer-to-peer bidirectional channels with smart contract logic, Spark involves a coordinating entity, the “Spark Service Provider” (SSP). This shifts part of the risk from channel liquidity management to trust in operators who sign off-chain transactions. The SSP’s task is to sign “blindly” (blindly) on behalf of the user, which means the SSP does not see the content of the signature and does not even know if it is signing a Bitcoin transaction or something else.

Bitcoin deposited on Spark always remains under the user’s control. When a user sends funds to Spark, they are initially transferred to a statechain. Once funds are on the statechain, payments on the Spark network occur instantly and at near-zero costs.

At the heart of Spark’s security is the use of a shared signature scheme, specifically a multisig 2-of-2 model. This means that two keys are required to authorize a transaction, and the user always holds one. When users deposit funds on Spark, they send them to a multisig address. Here, they maintain control of their funds and can perform a unilateral exit without the need to interact with other parties.

Each payment is enabled by a Spark Service Provider (SSP), which must co-authorize the transaction together with the user for it to be valid and successful.

Although the network is currently managed only by Lightspark and another operator (Flashnet), users do not risk losing funds even if these operators stopped cooperating. In fact, Spark offers the possibility to unilaterally force the return of bitcoin to the mainnet at any time. Users can exit Spark in two ways: through a cooperative exit (cheaper and faster) or a unilateral exit (slower, but possible in case of malfunction or loss of trust). Lightspark has declared its intention to add more operators in the future to increase decentralization.

Fee structure

Regarding fees, transactions within the Spark network are zero fee. The only fees users will have to bear are Bitcoin’s on-chain fees for depositing or withdrawing funds from Spark. Additionally, transferring bitcoin from Spark to LN involves a 0.25% fee plus routing fees. Conversely, a transaction from LN to Spark costs 0.15%.

The native LRC20 token protocol

Introduced in the summer of 2024, LRC20 is a token issuance protocol designed to be compatible with both Bitcoin’s mainnet and LN. Anyone can issue an LRC20 token. The protocol also supports freeze and burn operations, giving the original issuing wallet the power to freeze tokens at any address, preventing transactions until unlocked. LRC20 is primarily designed for issuing stablecoins and regulated assets.

After thoroughly testing it, the Lightspark team decided to run the LRC20 protocol natively on Spark, to enable token issuance on the network.

Ecosystem and partnerships

The birth of Spark has immediately attracted the interest of other Bitcoin projects. Among the various partnerships established, the multisig wallet Theya has integrated Spark to offer its users simpler and faster bitcoin and stablecoin payments.

Last May, Breez announced a new implementation of the Breez SDK based on Spark, which allows developers to integrate Lightning payments directly into their apps through Spark. As part of this collaboration, Breez will also act as a Spark Service Provider, helping to expand the ecosystem. According to the two companies, this partnership will provide developers with new Bitcoin-native tools for use cases such as streaming payments, international remittances and micro-payments for AI.

The post Spark: the layer 2 launched by Lightspark appeared first on Atlas21.

-

@ 2cde0e02:180a96b9

2025-06-17 11:47:51

@ 2cde0e02:180a96b9

2025-06-17 11:47:51pen & ink; monochromized

https://stacker.news/items/1008456

-

@ 5d085290:0edc3292

2025-06-17 11:19:53

@ 5d085290:0edc3292

2025-06-17 11:19:53SculpturesHome is a high-end custom sculpture factory in Shenzhen, China, with more than a decade of experience producing exclusive artwork for international clients. Their work encompasses hand-made and 3D-printed artworks such as animal sculptures and human statues, as well as decorative reliefs and furniture. They work in association with leading designers, interior companies, galleries, and individual artists to provide personalized sculptures for residences, hotels, workplaces, and public areas. Equipped with the latest machinery and skilled artisans, they provide quality care at each phase from sketch to last finish. Production times are usually between 4 and 12 weeks depending on size and complexity. SculpturesHome accommodates complete customization: customers may provide drawings, pictures, or idea notes to design uniques in every sense.

Their international shipping network covers North America, Europe, Asia, Australia, with safe and timely delivery. Shipping cost depends on weight, dimensions, destination, and selected mode (air/sea transport). Blending handmade artwork with 3D-printing technology, SculpturesHome provides high quality at affordable prices. Their workshop is located in the Silicon Valley Industrial Park, Longhua District, Shenzhen. Customer support is provided Monday to Friday (9am–8pm) and Saturday (10am–4pm) local time. SculpturesHome.com For questions, contact them through WhatsApp +86?13944048206 or email terry@sculptureshome.com.

-

@ e5cfb5dc:0039f130

2025-06-17 11:11:30

@ e5cfb5dc:0039f130

2025-06-17 11:11:30はりまメンタルクリニック:GIDの大手そう。丸の内線ならパムくんちが近い。

わらびメンタルクリニック:GIDの大手そう?公式サイトには影もかたちも

ナグモクリニック:SRS手術までしてるところ。GID精神科外来が月1第1木曜日だけ?

狭山メンタルクリニック:距離・時間的にはまま近い。サイトの記述が思想的にちょとあやしげ。新患受付がだいぶ先。GIDは専門外か?

川島領診療所:オンライン診療あり!強迫性障害や美容皮膚科をやっている。雰囲気よさそうなところ。GIDは専門外か?

Jこころのクリニック:電車いっぽんなので楽。GIDは専門外か?

ハッピースマイルクリニック:オンライン診療あり!GIDは専門外か?

-

@ e5cfb5dc:0039f130

2025-06-17 11:00:35

@ e5cfb5dc:0039f130

2025-06-17 11:00:35はりまメンタルクリニック:GIDの大手そう。丸の内線ならパムくんちが近い。

わらびメンタルクリニック:GIDの大手そう?公式サイトには影もかたちも

ナグモクリニック:SRS手術までしてるところ。GID精神科外来が月1第1木曜日だけ?

狭山メンタルクリニック:距離・時間的にはまま近い。サイトの記述が思想的にちょとあやしげ。新患受付がだいぶ先。GIDは専門外か?

川島領診療所:オンライン診療あり!強迫性障害や美容皮膚科をやっている。雰囲気よさそうなところ。GIDは専門外か?

Jこころのクリニック:電車いっぽんなので楽。GIDは専門外か?

ハッピースマイルクリニック:オンライン診療あり!GIDは専門外か?

-

@ faade9ee:1c6dfd69

2025-06-17 11:07:49

@ faade9ee:1c6dfd69

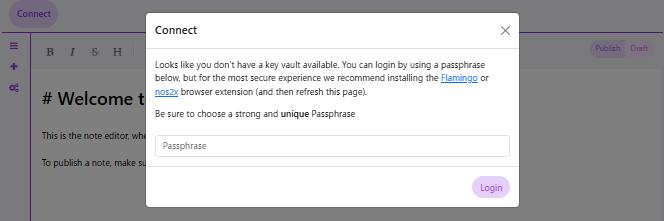

2025-06-17 11:07:49This is a normal piece of text.z

This is a bold piece of text via button press.z

this is also bold, but via double-starsz

this is an italic via button press

this also but via one-star

look, it's an underline!

oh, a piece of code has appeared. Nice. Button press tho. seems like it's purple / missed styling it, will change that.another code but via textcode block, kinda buggy (really buggy actually x3)```this is another, but via text which is disabled for now as it's cause issues```

This is a top number thing222

a bottom number thing5ss65435ghrt

- bullets!

-

another!

- a third!

-

Number!

-

another!

- a third!

-

[x] check

- [x] box

this is a quote

"quote"

heading 1

heading 2

heading 3 via text

heading 4 via text

heading 5 via text

heading 6 via text

this is a link via text (button has an annoyance bug)

video below

::youtube{#aApSteSbeGA}

-

@ 7f6db517:a4931eda

2025-06-17 11:02:38

@ 7f6db517:a4931eda

2025-06-17 11:02:38

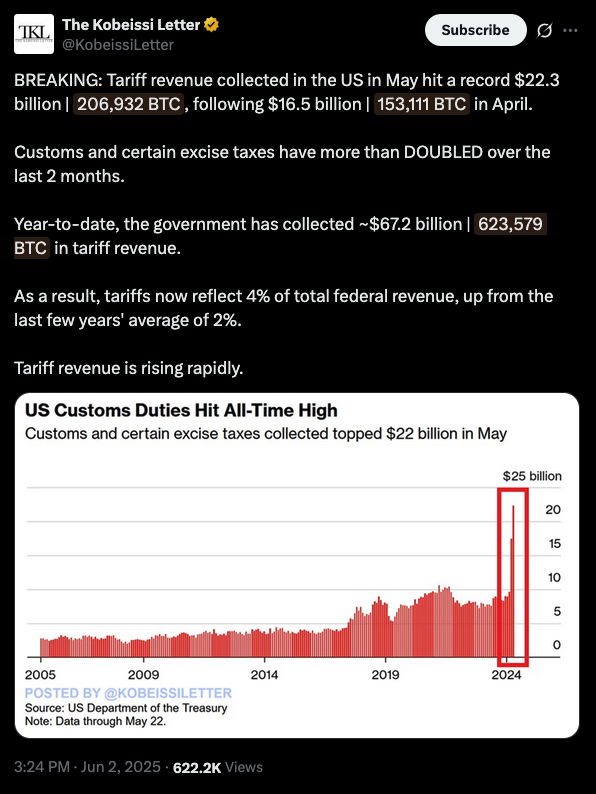

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ 8bad92c3:ca714aa5

2025-06-17 14:02:21

@ 8bad92c3:ca714aa5

2025-06-17 14:02:21Marty's Bent

Sup, freaks? Your Uncle Marty did a little vibe coding a couple months ago and that vibe coding project has turned into an actual product that is live in the Google Chrome web store and will soon to be live in the Firefox add-on store as well. It's called Opportunity Cost and it is an extension that enables you to price the internet in Bitcoin.

[

Opportunity Cost – See Prices in Bitcoin Instantly

Convert USD prices to Bitcoin (satoshis) as you browse. Dual display, privacy-first, and open source.

Opportunity CostTFTC

](https://www.opportunitycost.app/?ref=tftc.io)

Check it out!

This whole process has been extremely rewarding to me for many reasons. The first of which is that I've had many ideas in the past to launch a product focused on bitcoin education that simply never left my brain because I never felt comfortable paying a developer to go out and build a product that I wasn't sure would ultimately get product market fit.

Due to the advancements of AI, particularly ChatGPT and Replit, I was able to spend a few hours on a Saturday vibe coding a prototype for Opportunity Cost. It worked. I side loaded it into Chrome and Firefox, tested it out for a few days and decided, "Hey, I think this is something that's worthwhile and should be built."

Backtracking just a little bit, the initial idea for this app was to create an AR application that would enable you to take pictures of goods in the real world and have their prices automatically converted to bitcoin so that you could weigh the opportunity cost of whether or not you actually wanted to buy that good or decide to save in bitcoin instead. With the help of Justin Moon from the Human Rights Foundation and Anthony Ronning from OpenSecret and Maple AI, I was pointed in the right direction of vibe coding tools I could use to build a simple MVP. I took their advice, built the MVP, and demoed it at the Bitcoin Park Austin weekly AI meetup in mid-April.

The next week, I was talking with a friend, Luke Thomas, about the idea and during our conversation he made a simple quip, "You should make a Chrome extension. I really want a Chrome extension that does this." And that's what sent me down the vibe coding rabbit hole that Saturday which led to the prototype.

After I was comfortable with and confident in the prototype, I found a young hungry developer by the name of Moses on Nostr, I reached out to him, told him my idea, showed him the prototype and asked if he thought he could finish the application for me. He luckily agreed to do so and within a couple of weeks we had a fully functioning app that was officially launched today. We're about 12 hours into the launch and I must say that I'm pleasantly surprised with the reception from the broader Bitcoin community. It seems like something that people are happy exists and I feel extremely happy that people see some value in this particular application.

Now that you have the backstory, let's get into why I think something like Opportunity Cost should exist. As someone who's been writing a newsletter and producing podcasts about bitcoin for eight years in an attempt to educate individuals from around the world about what bitcoin is, why it's important, and how they can leverage it, I've become convinced that a lot of the work that needs to be done still exists at the top of the funnel. You can scream at people. You can grab them by the shoulders. You can shake them. You can remind them at Thanksgiving that if they had listened to your advice during any Thanksgiving in the previous years they would be better off financially. But at the end of the day most people don't listen. They need to see things. Seeing things for yourself is a much more effective teaching mechanism than be lectured to by someone else.

My hope with Opportunity Cost is that it catches the eye of some bitcoin skeptics or individuals who may be on the cusp of falling down the bitcoin rabbit hole and they see the extension as a way to dip their toes into bitcoin to get a better understanding of the world by pricing the goods and services they purchase on a day-to-day month-to-month and year-to-year basis in bitcoin without having to download a wallet or set up an exchange account. The tippy top of the bitcoin marketing funnel.

That is not all though. I think Opportunity Cost can serve individuals at both ends of the funnel. That's why it's pretty exciting to me. It's as valuable to the person who is bitcoin curious and looking to get a better understanding as it is to the hardcore bitcoiner living on a bitcoin standard who is trying to get access to better tools that enable him to get a better grasp of their spending in bitcoin terms.

Lastly, after playing around with it for a few days after I built the prototype, I realized that it has incredible memetic potential. Being able to take a screenshot of goods that people are buying on a day-to-day basis, pricing them in bitcoin and then sharing them on social media is very powerful. Everything from houses to junk items on Amazon to the salaries of pro athletes to your everyday necessities. Seeing the value of those things in bitcoin really makes you think.

One day while I was testing the app, I tried to see how quickly I could find goods on the internet that cumulatively eclipsed the 21 million supply cap limit of bitcoin. To my surprise, even though I've been in bitcoin for 12 years now, it did not take me that long. The opportunity cost of everything I buy on a day-to-day basis becomes very clear when using the extension. What's even clearer is the fact that Bitcoin is completely mispriced at current levels. There is so much winning ahead of us.

Also, it's probably important to note that the extension is completely open source. You can check out our GitHub page here. Submit pull requests. Suggest changes to the app.

We've also tried to make Opportunity Cost as privacy preserving as possible. Everything within the extension happens in your browser. The only external data that we're providing is the bitcoin to fiat price conversion at any given point in time. We're not data harvesting the web pages you're browsing or the items you're looking at. We're not collecting data and sending it to third party marketers. We want to align ourselves with the open and permissionless nature of bitcoin while also preserving our users' privacy. We're not trying to monetize this in that way. Though, I will say that I'm thinking of ways to monetize Opportunity Cost if it does gain significant traction, but I promise it will be in a way that respects your privacy and is as unobtrusive as possible. We'll see how it goes.

Thank you for coming to my TED talk. Please download and use the extension. Let us know what you think.

Headlines of the Day

Saylor Says Bitcoin Is Perfect Money to Jordan Peterson - via X

Trump Won't Sell Tesla Despite Musk-Bessent Heated Exchange - via X

Bitcoin Gains Traction in Kenya's Largest Slum Kibera - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

East Coast aesthetics over everything.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !important; } } .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } .moz-text-html .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } /* Helps with rendering in various email clients */ body { margin: 0 !important; padding: 0 !important; -webkit-text-size-adjust: 100% !important; -ms-text-size-adjust: 100% !important; } img { -ms-interpolation-mode: bicubic; } /* Prevents Gmail from changing the text color in email threads */ .im { color: inherit !important;

-

@ dfa02707:41ca50e3

2025-06-17 06:01:51

@ dfa02707:41ca50e3

2025-06-17 06:01:51Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ cae03c48:2a7d6671

2025-06-17 11:01:36

@ cae03c48:2a7d6671

2025-06-17 11:01:36Bitcoin Magazine

Smarter Web Company Raises £29.3M to Grow Bitcoin HoldingsThe Smarter Web Company, a UK-based web design and digital services firm, has raised £29.3 million in a new funding round to support its Bitcoin treasury strategy.

JUST IN:

Publicly traded The Smarter Web Company raised £29.3M (~$37.1M) to buy more #Bitcoin pic.twitter.com/n5k7XlLvie

Publicly traded The Smarter Web Company raised £29.3M (~$37.1M) to buy more #Bitcoin pic.twitter.com/n5k7XlLvie— Bitcoin Magazine (@BitcoinMagazine) June 16, 2025

The raise was completed through an accelerated bookbuild and a subscription with institutional investors. Shares were priced at £1.80 each, matching the closing bid on Friday, June 13. That price is more than double the company’s last fundraising round.

“The Smarter Web Company is pleased to announce the successful completion of an Accelerated Bookbuild to institutional investors through Tennyson Securities and Peterhouse Capital Limited. A Subscription with Qualified Investors has also been completed, the company said.

In total, more than 16.2 million new shares were issued—15.4 million through the bookbuild and about 854,000 through the subscription.

With a high level of demand the Bookbuild and Subscription has raised approximately £29.3 million, well above the stated minimum of £15 million, through the issue of a total of 16,297,627 new ordinary shares of £0.001 each at £1.80 per share. The Offer Price was at the closing bid price on Friday 13 June 2025,” the company said.

The raise comes just three days after the company revealed it had purchased 74.27 more Bitcoin for £5.98 million, bringing its total Bitcoin holdings to 242.34 BTC. Its average cost basis now sits at £78,793 per Bitcoin.

“The Company believes that Bitcoin forms a core part of the future of the global financial system,” it said in both filings.

Smarter Web started building its Bitcoin treasury strategy in 2023.

“Since 2023 The Smarter Web Company has adopted a policy of accepting payment in Bitcoin. The Company is pioneering the adoption of a Bitcoin Treasury Policy into its strategy.”

The strategy was officially formalized in April, 2025 with the launch of its “10 Year Plan,” seeing Bitcoin play a key role in its financial structure.

Admission of the new shares is expected around June 19, after which the company’s total shares in issue will rise to over 220 million.

With this raise, Smarter Web continues to stand out as one of the few UK-listed companies actively building a corporate Bitcoin treasury.

This post Smarter Web Company Raises £29.3M to Grow Bitcoin Holdings first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 523a8281:fc94329a

2025-06-17 13:06:10

@ 523a8281:fc94329a

2025-06-17 13:06:10As Web3 enters deeper waters and industrial transformation accelerates, capital is no longer just a driving force for investment and financing but has become the core engine for building ecosystems. Golden Carrot Capital (GC Capital) has emerged as a prominent player in this industry shift. Founded by former Binance executive Gerald Check, GC Capital has quickly grown into a powerhouse behind several blockbuster projects. Driven by its "Investment + Incubation + Ecosystem Co-Building" integrated strategy, GC Capital not only empowers projects but also reshapes the early growth model of Web3.

Unlike traditional capital’s profit-driven logic, GC Capital adheres to the core values of "excellence, integrity, and strategic foresight," dedicated to long-term empowerment and global collaboration for early-stage projects. In the current surge of the Web3 wave, the institution views investment as a leverage tool linking industry, community, and technology. It has never been confined to financial input but deeply participates in project strategy design, business model validation, and ecosystem expansion. GC Capital’s investment footprint spans three major areas: infrastructure, content ecosystems, and the integration of real-world assets (RWA). From Layer2, cross-chain protocols, to GameFi, social platforms, and blockchain + RWA real-world pilot scenarios, each of its bets balances technological value and commercial viability. The institution has established localized teams in Hong Kong, Singapore, and Abu Dhabi, forming a global early-stage incubation network. Among its many strategic partnerships, the deep integration with Web3 digital ecosystem platform M3 DAO stands out as GC Capital’s most iconic collaboration model. GC is not only an early investor but also plays a significant role in incubating and launching products such as MarsVerse, MarsChain, and MarsProtocol. Gerald Check himself joined the core management team of M3 DAO to drive technological development, resource integration, and global operational mechanisms. Their cooperation goes beyond on-chain narratives, exploring the digitization path for real-world assets. In Phuket, Thailand, GC Capital and M3 DAO jointly led a $200 million Web3 + gaming + tourism resort project, combining RWA and token economies to enhance asset management efficiency through on-chain governance, offering a new landing template for global capital. GC Capital has also validated the effectiveness of its methodology with remarkable investment results. For example, MetaMars, co-incubated with M3 DAO, saw its token MARS surge more than 35 times after its launch, with monthly growth reaching 400%, becoming a classic example of combining Web3 community and financial mechanisms. The project DeepLink, invested by GC, quickly gained market favor with its AI + cloud gaming platform model, forming a positive synergy with M3’s ecosystem in terms of content and traffic. Projects like Voopay, LoserChick, and Rocket have also achieved more than 10x returns. These results are not coincidental but a concentrated reflection of GC Capital’s long-term, full-chain accompanying strategy. Now, GC Capital is accelerating its global strategic layout. The institution has launched the "Web3 Global Incubator Program," which will support 20 high-potential projects worldwide each year, offering integrated incubation services in technology, market, and community. At the same time, GC has established cross-industry collaboration mechanisms with leading ecosystems such as Animoca Brands, Fantom, and Flow Desk, and spearheaded the M3 Ecosystem Incubation Alliance, aiming to standardize DAO governance mechanisms and Web3 investment frameworks. Additionally, GC Capital plans to set up a "Decentralized Entrepreneurship Academy" to provide global entrepreneurs with systematic training, mentor matching, and financing channel connections, creating a true Web3 talent and innovation platform for the future. In a Web3 industry still filled with short-term speculation and valuation bubbles, GC Capital has paved a more sustainable and systematic path. It is no longer just a venture capital firm but the most stable foundational force behind the Web3 industry chain. Through deep collaboration with M3 DAO and hands-on participation in global multi-scenario landing projects, GC Capital not only creates value in the capital dimension but also redefines the role that the next generation of Web3 investment institutions should play at the industry paradigm level. It understands technological logic, grasps business rhythm, and knows how to find answers that transcend cycles within the folds of time. This resonance between capital and ecosystems is the rare variable that will determine the landscape of Web3’s second half.

-

@ 502ab02a:a2860397

2025-06-17 05:54:52

@ 502ab02a:a2860397

2025-06-17 05:54:52ปี 1937 — บริษัท Hormel Foods Corporation ในเมืองออสติน รัฐมินนิโซตา สหรัฐฯ ชายคนหนึ่งชื่อ Jay C. Hormel ลูกชายของผู้ก่อตั้งบริษัท มีไอเดียแสนทะเยอทะยานว่า “อยากทำผลิตภัณฑ์จากหมู ที่เก็บได้นาน ไม่ต้องแช่เย็น และไม่แพง”

เพราะตอนนั้น หมูเหลือเยอะ โดยเฉพาะ “หัวไหล่หมู” ที่ขายไม่ออก เพราะมันไม่ใช่ชิ้นเนื้อพรีเมียมที่คนอยากซื้อไปทำอาหาร เจย์เลยทดลองบดเนื้อไหล่หมู เติมเกลือ น้ำตาล สารกันเสีย โซเดียมไนไตรต์ และสิ่งสำคัญสุดคือ เจลาตินจากน้ำต้มกระดูก เพื่อให้เนื้อเกาะตัว ไม่แห้ง และอยู่ได้นานโดยไม่ต้องแช่เย็น

ผลลัพธ์คือ หมูกระป๋อง 340 กรัมในกล่องสี่เหลี่ยม พร้อมเปิดฝาดึงด้วยมือ ไม่ต้องใช้ที่เปิดกระป๋อง ชูความ ราคาถูก เก็บง่าย พกพาสะดวก และไม่ต้องปรุงอะไรเพิ่มเติม ซ่อนความของเหลือเอาไว้เงียบๆ

และเพื่อให้คนจำได้ง่าย บริษัทจัดประกวดตั้งชื่อ และผู้ชนะเสนอคำว่า “Spam” = Spiced Ham (แต่ไม่มีใครรู้จริงๆ ว่าย่อจากอะไรแน่) แค่ “สั้น จัดจ้าน และจำง่าย” ก็พอ

เมื่อเกิดสงครามโลกครั้งที่ 2 ในปี 1939 สหรัฐฯ ยังไม่เข้าสงครามเต็มตัว แต่เริ่มเตรียมเสบียงสนับสนุนพันธมิตร และ Spam กลายเป็นของขวัญจากพระเจ้า เพราะ เก็บได้นานหลายปี ไม่ต้องแช่เย็น น้ำหนักเบา เปิดง่าย ไม่เสียง่ายแม้เจอฝุ่น โคลน หรือไอร้อนจากปืนใหญ่

รัฐบาลสหรัฐฯ เริ่มจัดสั่ง Spam ให้กับกองทัพในสัดส่วนที่มากขึ้นเรื่อยๆ โดยเฉพาะทหารแนวหน้าในยุโรปและแปซิฟิก เช่น ฮาวาย, ฟิลิปปินส์, กวม, และเกาหลี ระหว่างสงคราม Hormel ผลิต Spam มากถึง 15 ล้านกระป๋องต่อสัปดาห์ และส่งออกไปมากกว่า 100 ล้านกระป๋อง ภายในเวลาไม่กี่ปี

Jay C. Hormel ถือว่ามีบทบาททางสังคมและการเมืองอยู่ไม่น้อย โดยเฉพาะช่วงก่อนสงครามโลกครั้งที่ 2

เขาเคยเป็นสมาชิกของ America First Committee ซึ่งเป็นกลุ่มเคลื่อนไหวทางการเมืองที่มีอิทธิพลมากในช่วงก่อนสงครามโลกครั้งที่ 2 โดยกลุ่มนี้มีเป้าหมายคือ “ต่อต้านการที่อเมริกาจะเข้าไปร่วมสงครามในยุโรป” สมาชิกของกลุ่มนี้มีทั้งนักธุรกิจใหญ่ สื่อมวลชน นักวิชาการ รวมถึงชาร์ลส ลินด์เบิร์ก (นักบินชื่อดัง) เรียกได้ว่าเป็นกลุ่มที่มีอิทธิพลเชิงความคิดและการเมืองในช่วงปลายยุค 1930s

แม้ในตอนแรก Hormel จะมีแนวคิดไม่เห็นด้วยกับการเข้าสงคราม แต่พอสงครามเริ่มต้นจริง และสหรัฐฯ ต้องส่งทหารและเสบียงออกไปรบ เขาก็ “ปรับตัวทันที” และกลายเป็นหนึ่งในผู้จัดหาอาหารรายใหญ่ให้กองทัพ โดยเฉพาะ Spam ที่ผลิตส่งเป็นล้านกระป๋องต่อสัปดาห์ ซึ่งแน่นอนว่าไม่มีทางทำได้ถ้าไม่มีความสัมพันธ์และการประสานงานกับภาครัฐโดยตรง

หลังสงครามโลกสิ้นสุดในปี 1945 สิ่งที่รัฐบาลและภาคธุรกิจต้องเจอคือ จะทำยังไงกับโรงงานผลิตอาหารที่เคยทำเพื่อ “เลี้ยงทหารนับล้าน” แต่ตอนนี้ไม่มีสงครามแล้ว? Hormel ไม่ยอมให้ Spam หายไปจากโต๊ะอาหารโลกง่ายๆ แผนการตลาดที่ฉลาดมากของพวกเขาคือ 1. “Sell the nostalgia” ขายความทรงจำ! คนอเมริกันที่เป็นทหารผ่านศึก กลับมาใช้ชีวิตปกติ แต่ก็ยังคุ้นเคยกับ Spam อยู่แล้ว ก็ขายให้พวกเขานั่นแหละ 2. “ผูกกับอาหารเช้า” Hormel ทำสูตร “Spam and eggs” และโฆษณาว่าเป็นอาหารเช้าที่ให้พลังงาน ย่อยง่าย และเหมาะกับทุกครอบครัว 3. เจาะตลาดประเทศที่ได้รับ Spam ระหว่างสงคราม ฟิลิปปินส์, ฮาวาย, ญี่ปุ่น, เกาหลีใต้, อังกฤษ กลายเป็นตลาดหลัก บางประเทศพัฒนาเมนูท้องถิ่นกับ Spam เช่น ฟิลิปปินส์ Spam silog (Spam + ข้าว + ไข่ดาว), เกาหลี 부대찌개 (Budae-jjigae) หรือหม้อไฟทหาร, ญี่ปุ่น Spam onigiri, ฮาวาย Spam musubi (สแปมวางบนข้าว ปิดด้วยสาหร่าย) 4. สร้างแบรนด์ให้รัก Hormel สนับสนุนการจัดงานเทศกาล Spam (เช่น Spam Jam) และทำให้แบรนด์กลายเป็น Pop Culture ของอเมริกา เพื่อโปรโมตแบรนด์ให้เป็นของอเมริกันจ๋า ทั้งน่ารัก ทั้งเท่ ทั้งกินง่าย และกลายเป็นความภูมิใจของชนชั้นกลาง

ระหว่างปี 1937–1946 Spam สร้างชื่อให้ Hormel อย่างถล่มทลาย ถึงขั้นรัฐบาลโซเวียตยังเคยร้องขอให้สหรัฐฯ ส่ง Spam เข้าโซเวียตเพื่อเลี้ยงทหารแนวหน้า โดย นายพล Dwight D. Eisenhower (ต่อมาคือประธานาธิบดีสหรัฐฯ) เคยกล่าวว่า “I ate my share of Spam along with millions of other soldiers. I’ll even confess to a few unkind remarks about it—uttered during the strain of battle... But as former Commander in Chief, I believe I can still see Spam in my dreams.” (ฉันกิน Spam มากพอๆ กับทหารหลายล้านคน แม้จะเคยบ่นบ้าง แต่ในฐานะอดีตแม่ทัพใหญ่...ฉันยังฝันเห็นมันเลย)

Jay C. Hormel ไม่ใช่แค่คนขายหมู แต่เขาเป็นนักวางระบบอุตสาหกรรมขั้นเทพ สามารถยกระดับกิจการท้องถิ่นของพ่อให้กลายเป็นบริษัทอาหารที่ส่งออกระดับโลกได้ เขาเป็น early adopter ของสิ่งที่เรียกว่า vertical integration คือควบคุมทุกขั้นตอน ตั้งแต่ฟาร์ม โรงฆ่าสัตว์ โรงงาน บรรจุภัณฑ์ จนถึงการขนส่งและการตลาด

ในปี 1970s รายการตลกชื่อดังของอังกฤษอย่าง Monty Python’s Flying Circus ได้เอา Spam มาเล่นมุกในตอนหนึ่ง โดยฉากคือร้านอาหารที่ทุกเมนูมี Spam อยู่ในนั้น แล้วลูกค้าพยายามสั่งอาหารโดยไม่เอา Spam แต่ร้านไม่ยอม เพราะ “เมนูเรามี Spam ทุกอย่าง!” จนเสียงลูกค้ากับแม่ค้ากลายเป็นการโต้เถียงอันแสนตลก และมีนักแสดงแต่งเป็นไวกิ้งยืนร้อง “Spam, Spam, Spam, Spam...” ซ้ำๆ อยู่ด้านหลังแบบไม่รู้จบ https://youtu.be/anwy2MPT5RE?si=-68WQeng47lhJENJ

ฉากนั้นกลายเป็นตำนานในโลกตลก และคำว่า “Spam” ก็เริ่มถูกใช้เป็นคำสแลงหมายถึง “ของที่ซ้ำซาก ไร้สาระ รบกวน” ซึ่งต่อมาก็กลายเป็นคำที่เราใช้เรียกอีเมลหรือข้อความขยะนั่นเอง

จะว่าไปแล้ว Spam ถือเป็น “สินค้าที่ครอบงำและเปลี่ยนแปลงอาหารของโลกอีกตัวนึง” อย่างแท้จริง จากเศษหมูไร้คนซื้อ → สินค้าแห่งนวัตกรรมอาหาร → เสบียงสงคราม → อาหารเช้าคลาสสิก → วัฒนธรรมท้องถิ่น → Meme ตลก → และสุดท้ายก็กลายเป็นคำด่าบนอินเทอร์เน็ต

Jay C. Hormel ไม่ได้เป็นนักการเมือง แต่เขาเป็น “นักอุตสาหกรรมที่มีบทบาททางการเมือง” โดยเฉพาะในช่วงเปลี่ยนผ่านของประเทศจาก “ไม่เอาสงคราม” ไปสู่ “ต้องชนะสงคราม”

เขาอาจเริ่มจากแนวคิด “อย่ายุ่งเรื่องคนอื่น” แต่พอเห็นว่าโอกาสมา เขาก็เปลี่ยนโหมดทันที และทำให้ Spam กลายเป็นเสบียงระดับชาติ แบบนี้แหละเฮียถึงบอกว่า “สงครามทำให้คนธรรมดากลายเป็นตำนาน” ...หรือไม่ก็ “สงครามทำให้ธุรกิจธรรมดากลายเป็นธุรกิจผูกขาดที่ไม่มีใครเลิกกินได้อีกเลย”

Spam ไม่ใช่แค่อาหารกระป๋อง แต่เป็นเครื่องมือทางภูมิสงคราม อุตสาหกรรม และการตลาด จากห้องครัวทดลองเล็กๆ ในมินนิโซตา กลายเป็นไอเท็มในสนามรบระดับโลก และสุดท้าย…ก็กลายเป็นทั้ง อาหารในตู้, มุกในมุขตลก, และ คำด่าบนโลกออนไลน์ ทั้งหมดนี้เริ่มต้นจากคำเดียว... "หมูมันเหลือ"

#pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ 7f6db517:a4931eda

2025-06-17 04:01:58

@ 7f6db517:a4931eda

2025-06-17 04:01:58

The newly proposed RESTRICT ACT - is being advertised as a TikTok Ban, but is much broader than that, carries a $1M Fine and up to 20 years in prison️! It is unconstitutional and would create massive legal restrictions on the open source movement and free speech throughout the internet.

The Bill was proposed by: Senator Warner, Senator Thune, Senator Baldwin, Senator Fischer, Senator Manchin, Senator Moran, Senator Bennet, Senator Sullivan, Senator Gillibrand, Senator Collins, Senator Heinrich, and Senator Romney. It has broad support across Senators of both parties.

Corrupt politicians will not protect us. They are part of the problem. We must build, support, and learn how to use censorship resistant tools in order to defend our natural rights.

The RESTRICT Act, introduced by Senators Warner and Thune, aims to block or disrupt transactions and financial holdings involving foreign adversaries that pose risks to national security. Although the primary targets of this legislation are companies like Tik-Tok, the language of the bill could potentially be used to block or disrupt cryptocurrency transactions and, in extreme cases, block Americans’ access to open source tools or protocols like Bitcoin.

The Act creates a redundant regime paralleling OFAC without clear justification, it significantly limits the ability for injured parties to challenge actions raising due process concerns, and unlike OFAC it lacks any carve-out for protected speech. COINCENTER ON THE RESTRICT ACT

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-17 07:01:47

@ dfa02707:41ca50e3

2025-06-17 07:01:47Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ 7f6db517:a4931eda

2025-06-16 19:02:17

@ 7f6db517:a4931eda

2025-06-16 19:02:17

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ b1ddb4d7:471244e7

2025-06-16 20:02:42

@ b1ddb4d7:471244e7

2025-06-16 20:02:42This article was originally published on dev.to by satshacker.

Alright, you’ve built a useful and beautiful website, tool or app. However, monetization isn’t a priority and you’d rather keep the project free, ads-free and accessible?

Accepting donations would be an option, but how? A PayPal button? Stripe? Buymeacoffe? Patreon?

All of these services require a bank account and KYC verification, before you can send and receive donations – not very convenient.

If we only could send value over the internet, with just one click and without the need of a bank account…

Oh, hold on, that’s bitcoin. The decentralized protocol to send value across the globe. Money over TCP/IP.

In this article, we’ll learn how anyone can easily add a payment button or donation widget on a website or app.

Let’s get into it.

Introduction

Bitcoin is digital money that you can send and receive without the need for banks. While bitcoin is extremely secure, it’s not very fast. The maximum transactions per second (TPS) the network can handle is about 7. Obviously that’s not useful for daily payments or microtransactions.

If you’d like to dig deeper into how bitcoin works, a great read is “Mastering Bitcoin” by Andreas Antonopoulos.

Bitcoin vs Lightning

If you’d like to receive bitcoin donations “on-chain” all you need is a bitcoin wallet. You simply display your bitcoin address on your site and that’s it. You can receive donations.

It would look something like this; 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa

Instead of showing the actual bitcoin address, you can also turn it into a QR code.

However, this is not a recommended solution. Using static on-chain addresses has two major downsides. It lowers privacy for you and your donnors and it’s a UTXO disaster because many small incoming transactions could beocme hard to consolidate in the future.

For donations and small transactions, the Lightning Network is the better option. Lightning allows for instant settlement with fees only a fraction of a cent.

Similar to bitcoin, you have the choice between non-custodial and custodial wallets. This means, either you have full control over your money or the wallet provider has.

Option 1: Lightning Address

With the lightning address feature, you an easily receive donations to an email like address.

It looks like this: yourname@wallet.com

Many wallets support lightning addresses and make it easy to create one. Then, you simple add the address to your donation page and you’re ready to receive tips.

You can also add a link link as in lightning:yourname@wallet.com and compatible lightning wallets and browser wallets will detect the address.

Option 2: Lightning Donation Widgets

If you like to take it a step further, you can also create a more enhanced donation checkout flow. Of course you could programm something yourself, there are many open source libraries you can build upon. If you want a simple plug-and-play solution, here are a couple of options:

Name

Type

Registration

SatSale

Self-hosted

No KYC

BTCPay Server

Self-hosted

No KYC

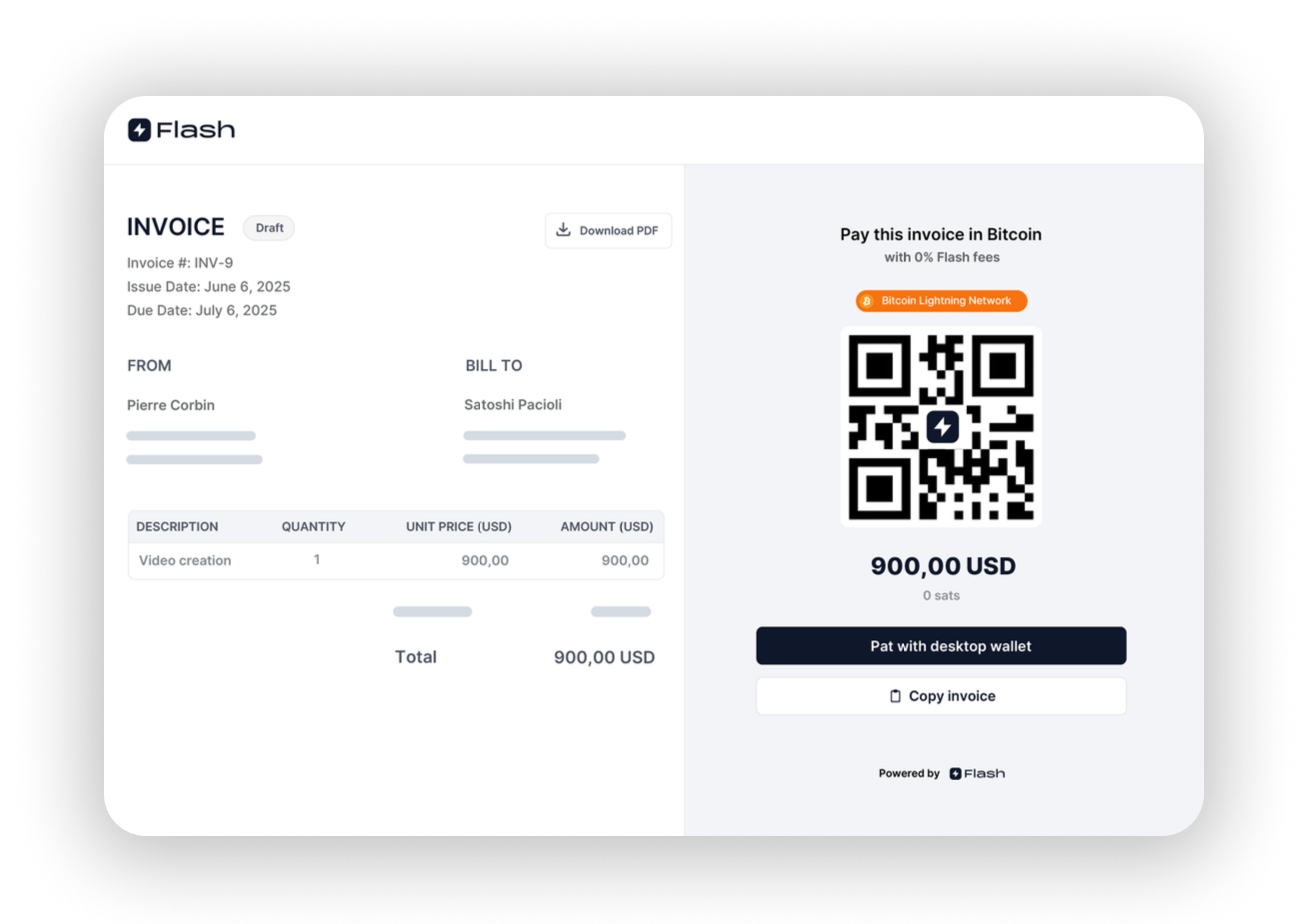

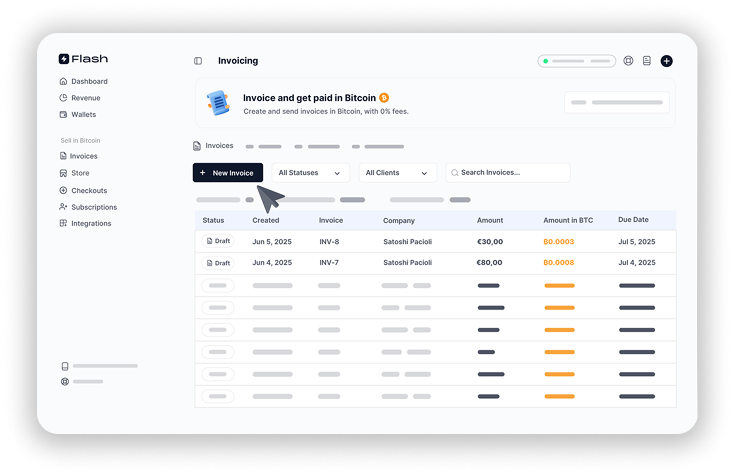

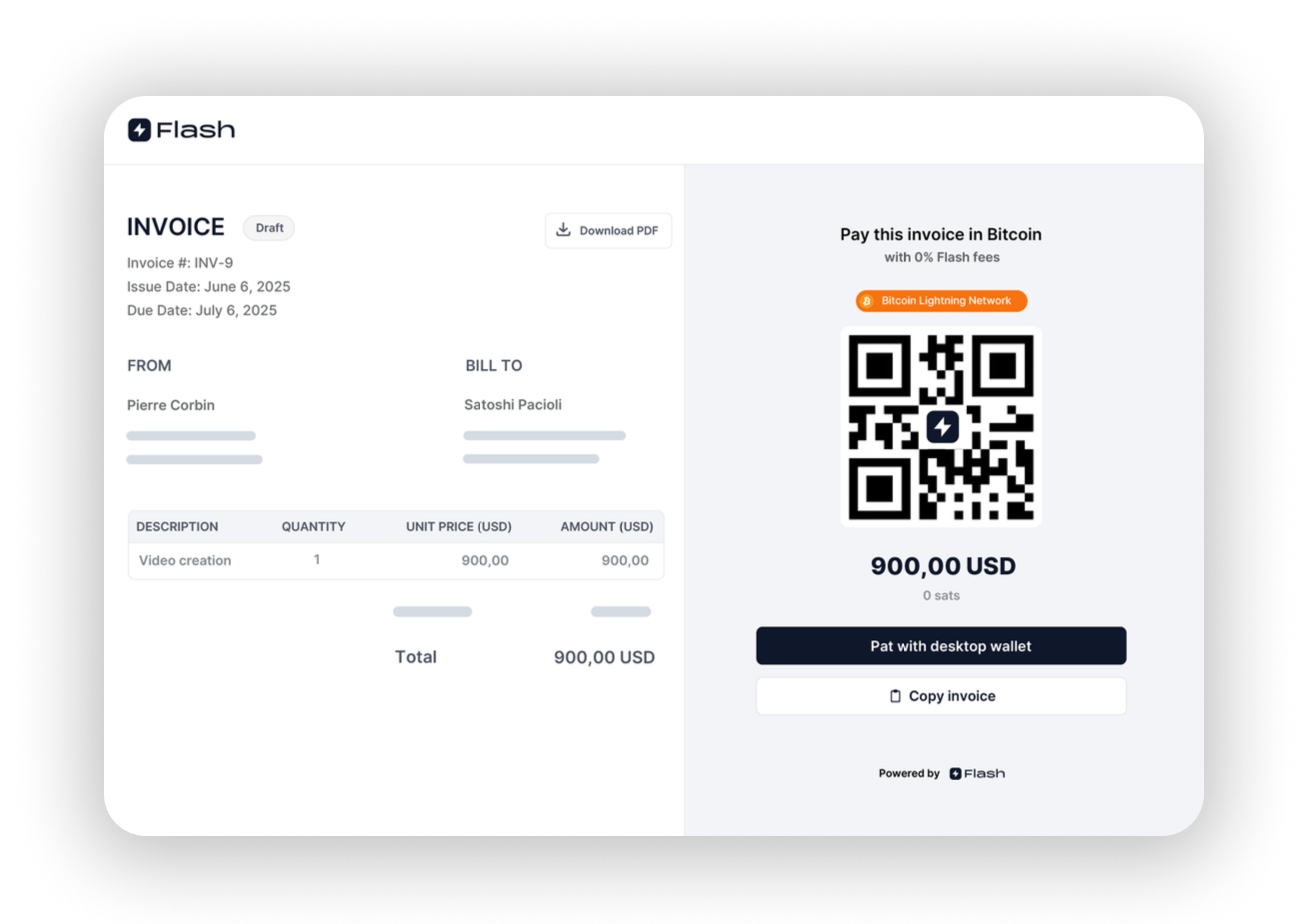

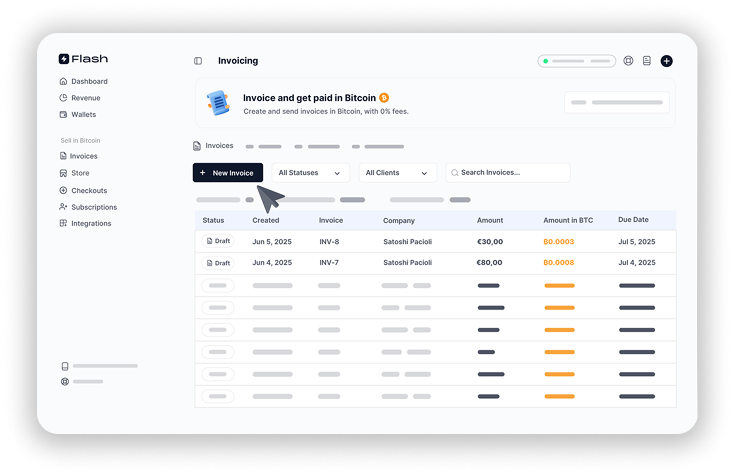

Pay With Flash

Widget

Email

Geyser Fund

Widget

Email

The Giving Block

Hosted

KYC

OpenNode

Hosted

KYC

SatSale (GitHub)

Lightweight, self-hosted Bitcoin/Lightning payment processor. No KYC.

Ideal for developers comfortable with server management. Simple to deploy, supports both on-chain and Lightning, and integrates with WooCommerce.

BTCPay Server

Powerful, open-source, self-hosted processor for Bitcoin and Lightning. No KYC.

Supports multiple currencies, advanced features, and full privacy. Requires technical setup and maintenance. Funds go directly to your wallet; great for those seeking full control.

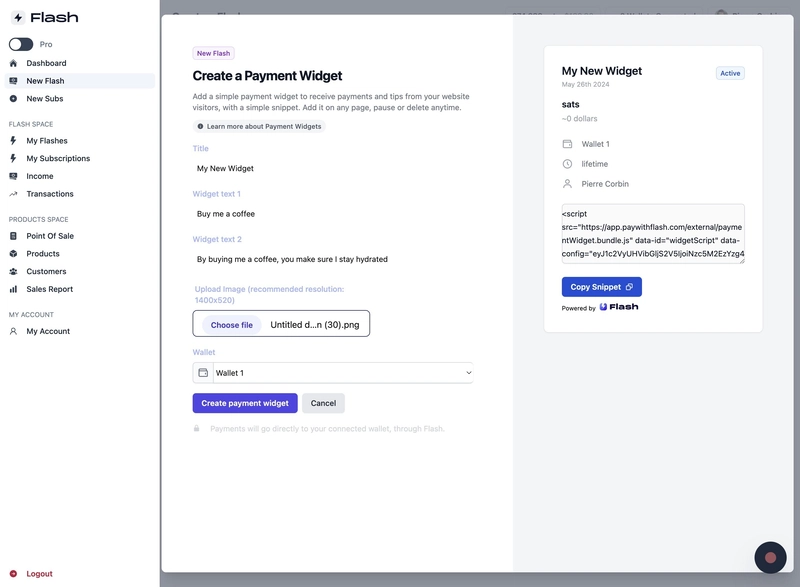

Pay With Flash

Easiest for indie hackers. Add a donation widget with minimal code and no KYC. Payments go directly to your wallet for a 1.5% fee.

Setup Steps:

- Sign up at PayWithFlash.com

- Customize your widget in the dashboard

- Embed the code:

- Test to confirm functionality

Benefits:

- Minimal technical skills required

- Supports one-time or recurring donations

- Direct fund transfer, no intermediaries

Geyser Fund

Crowdfunding platform. Widget-based, connects to your wallet, email registration.Focused on Bitcoin crowdfunding, memberships and donations.

The Giving Block

Hosted, KYC required. Integrates with fiat and crypto, best for nonprofits or larger organizations.

OpenNode

Hosted, KYC required. Accept Bitcoin payments and donations; supports conversion to fiat, suitable for businesses and nonprofits.

Summary

- Fast, low-code setup: Use Pay With Flash or Geyser Fund.

- Privacy and control: Choose SatSale or BTCPay Server (requires technical skills).

- Managed, compliant solutions: The Giving Block or OpenNode.

Choose based on your technical comfort, privacy needs, and project scale.

I hope this article helped you. If you added bitcoin donations, share your link in the comments and I will send you a few satoshis maybe

-

@ cae03c48:2a7d6671

2025-06-17 11:01:25

@ cae03c48:2a7d6671

2025-06-17 11:01:25Bitcoin Magazine

Leading OnChain Comms Agency Melrose PR Joins Decentralized Gentleman’s Club with Rare Pepe Inscription on BitcoinLOS ANGELES, CA — Melrose PR, the leading onchain communications agency, officially joins Decentralized Gentlemen Club (DGC) with the minting of a rare Pepe inscription on the Bitcoin blockchain. The Decentralized Gentlemen Club (DGC) will be the biggest collection on Bitcoin when complete at 3GB, which is twice as large as the next biggest collection. DGC is a Bitcoin-themed, meme-culture movement that champions decentralization, style, and storytelling. Each member is immortalized as a custom, tuxedo-clad Pepe — a digital gentleman inscribed as a massive, one-of-a-kind Ordinal on the Bitcoin blockchain. Melrose PR’s symbolic mint is a wizard frog (wearing a bowtie) representation of Melrose PR CEO Kelley Weaver.

“At Melrose, we believe in Bitcoin, not just as a technology powering the future of finance, but also as a foundation for community,” said CEO Kelley Weaver. “This is why we’re delighted to join DGC with our Pepe inscription and be part of a community of meme lords, pioneers, and visionaries who value elegance, independence, and on-chain legacy.”

Since 2016, Melrose has represented some of the most innovative projects across Bitcoin infrastructure, crypto-native venture capital, blockchain-AI convergence, and Web3 networks. Their addition to DGC signals the importance of narrative in the next wave of Bitcoin culture.

“Kelley’s wizard inscription is more than just art—it’s an eternal membership,” said Mr. Bitcoin Beast, spokesperson for the Decentralized Gentlemen Club. “She understands that great storytelling isn’t optional. It’s essential. And there’s no better pepe wizard to help tell the tale of this movement.”

Melrose’s inscription in the DGC collection features Kelley Weaver in full arcane regalia, casting spells of signal over noise, clarity over confusion, and truth over trend. The JPEG, weighing in at 388 kilobytes, stands among the largest onchain artworks in Bitcoin history.

As the biggest Ordinals collection ever attempted, DGC is pushing the technical boundaries of what can be inscribed on Bitcoin. 2500 pieces have been minted so far out of the total 10,000. To join the DGC movement, you can mint your own Degent and submit the inscription ID to the DGC Telegram or you can buy a verified DGC Ordinal at Magic Eden: https://magiceden.us/ordinals/marketplace/degentclub

About the Decentralized Gentlemen Club

The Decentralized Gentlemen Club is a 10,000-piece Bitcoin Ordinal collection featuring tuxedoed Pepe-style frogs immortalized as large-inscription art. Each Gentleman represents a unique membership in the emergent cultural layer of Bitcoin—combining elegance, satire, and self-sovereignty. Get your forever Degent at https://degent.club

About Melrose PR

Melrose PR is a leading onchain communications firm focused on delivering the highest quality results for bitcoin and crypto companies. Founded in 2016, Melrose PR is known for its strategic approach based on intimate knowledge of the unique crypto media landscape. The agency’s relationships across mainstream business, finance, tech, and crypto outlets form the foundation for the team’s success in meeting and exceeding their clients’ goals.

Disclaimer: This is a sponsored press release. Readers are encouraged to perform their own due diligence before acting on any information presented in this article.

This post Leading OnChain Comms Agency Melrose PR Joins Decentralized Gentleman’s Club with Rare Pepe Inscription on Bitcoin first appeared on Bitcoin Magazine and is written by Melrose.

-

@ b1ddb4d7:471244e7

2025-06-17 05:02:27

@ b1ddb4d7:471244e7

2025-06-17 05:02:27This article was originally published on dev.to by satshacker.

Alright, you’ve built a useful and beautiful website, tool or app. However, monetization isn’t a priority and you’d rather keep the project free, ads-free and accessible?

Accepting donations would be an option, but how? A PayPal button? Stripe? Buymeacoffe? Patreon?

All of these services require a bank account and KYC verification, before you can send and receive donations – not very convenient.

If we only could send value over the internet, with just one click and without the need of a bank account…

Oh, hold on, that’s bitcoin. The decentralized protocol to send value across the globe. Money over TCP/IP.

In this article, we’ll learn how anyone can easily add a payment button or donation widget on a website or app.

Let’s get into it.

Introduction

Bitcoin is digital money that you can send and receive without the need for banks. While bitcoin is extremely secure, it’s not very fast. The maximum transactions per second (TPS) the network can handle is about 7. Obviously that’s not useful for daily payments or microtransactions.

If you’d like to dig deeper into how bitcoin works, a great read is “Mastering Bitcoin” by Andreas Antonopoulos.

Bitcoin vs Lightning

If you’d like to receive bitcoin donations “on-chain” all you need is a bitcoin wallet. You simply display your bitcoin address on your site and that’s it. You can receive donations.

It would look something like this; 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa

Instead of showing the actual bitcoin address, you can also turn it into a QR code.

However, this is not a recommended solution. Using static on-chain addresses has two major downsides. It lowers privacy for you and your donnors and it’s a UTXO disaster because many small incoming transactions could beocme hard to consolidate in the future.

For donations and small transactions, the Lightning Network is the better option. Lightning allows for instant settlement with fees only a fraction of a cent.

Similar to bitcoin, you have the choice between non-custodial and custodial wallets. This means, either you have full control over your money or the wallet provider has.

Option 1: Lightning Address

With the lightning address feature, you an easily receive donations to an email like address.

It looks like this: yourname@wallet.com

Many wallets support lightning addresses and make it easy to create one. Then, you simple add the address to your donation page and you’re ready to receive tips.

You can also add a link link as in lightning:yourname@wallet.com and compatible lightning wallets and browser wallets will detect the address.

Option 2: Lightning Donation Widgets