-

@ f0fd6902:a2fbaaab

2025-06-13 15:31:03

@ f0fd6902:a2fbaaab

2025-06-13 15:31:03What can't fungi do? Fungi come in all kinds of delightfully enchanting and bizarre forms and are the ultimate do-it-alls. Some of them are edible or medicinal; they help organic gardeners keep their gardens happy; they eat plastic, and they glow in the dark. Fungi-based biomaterials also have the potential to help us build more sustainable homes or make more eco-friendly products; heck, they can even talk to each other in their own secret language.

Not surprisingly, they can also make some interesting music, with a little help from Canadian musician Tarun Nayar, the mastermind who makes nature-inspired electronic music under the name Modern Biology.

Source: https://www.treehugger.com/modern-biology-musician-makes-music-using-mushrooms-7485168

Video with mushrooms sound like:

https://www.youtube.com/watch?v=EHwybeMXFAA&t=22s

https://stacker.news/items/1005531

-

@ b1e9b8df:07685594

2025-06-13 15:17:02

@ b1e9b8df:07685594

2025-06-13 15:17:02OERTR steht für eine Art, freie Bildungsressourcen (Open Educational Resources) über das dezentrale Protokoll Nostr zu verbreiten, auffindbar zu machen und weiterzuentwickeln.

Statt zentraler Plattformen oder Silos nutzen wir Relays – offene Knoten im Nostr-Netzwerk – um Materialien, Metadaten, Annotationen und Kurse dauerhaft, hoch verfügbar und maschinenlesbar im interoperablen Datenraum verfügbar zu machen.

🚀 Unser Ziel

-

OER auffindbar machen – über strukturierte Events (z. B. Kind

30023,30142) -

Mitmachen ermöglichen – durch einfache Workflows mit git, Matrix & Nostr

-

Bildung dezentral denken – jenseits von Plattformlogiken

-

Metadaten lebendig halten – durch Community-gestützte Annotation & Remixbarkeit

🔧 Womit wir arbeiten

-

💬

Matrixzur Koordination & Diskussion -

💻

git(hub)zur offenen Entwicklung und Dokumentation

📡 Mach mit!

➡ Nostr folgen:\ 👉 npub1k85m3haymj3ggjknfrxm5kwtf5umaze4nyghnp29a80lcpmg2k2q54v05a (nähere Infos auf https://github.com/edufeed-org/OERTR )

➡ Matrix beitreten:\ 🟢

#OERTR:rpi-virtuell.de\ https://matrix.to/#/%23OERTR:rpi-virtuell.de\ Zum Diskutieren, Planen, Ausprobieren.➡ GitHub anschauen:\ 📂 https://github.com/edufeed-org/OERTR\ Mit Beispieldaten, n8n-Workflows, NIP-Verlinkungen & mehr.

🧠 Ideen zum Start

-

🔍 Indexe für OER-Projekte (z. B.

OERinfo,rpi-virtuell,WirLernenOnline) -

📚 Tagging-Events für Fachbereiche, Zielgruppen & Lizenztypen

-

🤝 Event-Verknüpfung mit Mastodon, Mobilizon, Wikidata

-

🧩 Mitdenken beim Aufbau eines offenen Bildungsraums via Nostr

📎 Beispiel: OER-Material posten

json { "kind": 30142, "tags": [ ["d", "https://example.org/oer1234"], ["r", "https://example.org/oer1234"], ["subject", "Ethik"], ["author", "Max Mustermann"], ["license", "CC-BY 4.0"] ], "content": "Material zur Gewaltfreien Kommunikation für die 5. Klasse" }💡 Fragen? Ideen?

Wir freuen uns über Feedback, Pull Requests oder ein einfaches "Hallo!"\ ➡ Schreib uns im Matrix-Raum oder auf Nostr .

OERTR – ein Netzwerk. Kein Silo.

-

-

@ efc2b6e5:99c53c19

2025-06-13 14:32:51

@ efc2b6e5:99c53c19

2025-06-13 14:32:51AI companies massively influence society by projecting their values on ML models, whether we want it or not. It'd be great if at least some people in the companies knew how exactly they influence society, could make certain predictions, or even make ML models themselves predict users' worldviews and some of their behavior.

Some might argue that AI systems already do something like that. I believe they could do it much better: chatbots could be more balanced in terms of security (they are definitely overcensored) and recommender systems, for instance, could contribute to healthy personal and collective transformations (rather than just competing in ability to steal users' attention and trap it in the echo chambers).

Reductionism is an obstacle in AI development

Even most reliable knowledge doesn't solve some of the problems that are already in demand. Even least reliable knowledge still may contain something useful for our problems. While we lack reliable and noncontradictory knowledge, we can still benefit from certain synthesis of working ideas. There's approach that makes it possible to look at the knowledge from a very broad perspective, do such synthesis, and benefit from emergent properties of the synthesis.

Integral (Meta-)Theory created by Ken Wilber is probably the best known attempt to enable the possibility to form and navigate the big picture understanding in a hope to address issues of the epoch we've recently entered.

IMO it has certain challenges that make it repellent to IT:

- Fundamental psychological theories on which the Integral Theory is based are still pretty fragile; they need time to become mature enough and recognized (while it doesn't look like we have that time). There are endless edit wars on Wikipedia, which makes me feel depressing about possibilities to even introduce Spiral Dynamics and Multiple Intelligences to IT people.

- Emphasis on controversial interpretations of certain arational states of consciousness.

It's hard to address the first challenge; however, I recently discovered a new “secularized” Non-Reductionist Philosophy launched by David Long, which, among other things, uses wisdom from Integral Theory and attempts to address the second challenge. I'm glad that there are people who don't just criticize the Integral Theory, its community and Wilber's positions but are also developing the new meta-theories.

NR can also be a good way to get familiar with other meta-theories, so one could choose whatever works the best for their problems. For instance, if you're working on something as exotic as some competitor to EEG-powered meditation device, perhaps you will find Integral Theory relevant to study as well, since it's more focused on the states.

I'd like to point out a couple of moments I noticed in the video "Why Non-Reductionism Is A Better Meta-Theory" that caught my attention, as well as in some other older videos. There's not much to comment on the content itself rather than on the form of the content. This feedback might be used for improvements/elaborations in the next videos and just for everyone curious about the new meta-theory. But first

Why do I post here?

Specifically for the deep topics that relate to the current epoch, I no longer find engaging in the YouTube/FB/Reddit/Diqus/Giscus/etc. discussions useful anymore, at least due to broken and almost omnipresent AI-based censorship, that keeps “improving” at randomly shadow-banning people. How many deep and valuable opinions we no longer see?

BTW, it's possible to create Reddit-like communities here at Nostr as well, using Satellite client for example. I believe it's a better place for NR, Rebel Wisdom and many others.

References to full materials used for criticism

There are curious clips with Wilber in the video. It'd be great to have links in the description (or at least titles of the full videos if it's copyrighted material) so viewers could easier form their own independent opinions. I find it important during the age of information overload and narrative warfare. This will also improve SEO.

Emergentism FAQ

There's a strong position on emergence of consciousness; it seems it's not even a hypothesis in NR and I guess that makes some people so reactive.

I think it would be great to have an FAQ page to possibly make future debates more ecological and fruitful. Some of the things that could be elaborated in the FAQ:

- importance of distinction between philosophical theory (inductive reasoning? or actually deductive reasoning? I'm confused here) and scientific theory (deductive reasoning)

- the fact that for now counterarguments usually fall into the categories of “ignorance fallacy”, “false equivalency fallacy” and “God of the gaps” which aren't something sufficient; the whole point of challenge was to find at least a logically valid counterposition (ideally a counterposition that is sound with currently available scientific ~~facts~~ theories), not the nitpicking attacks

- what kind of emergence is meant, is it important here at all and why.

Debates moderation

Probably most of the debates converge to consensus, which are fruitful anyway. There are a few interesting conflicting debates as well. However, I found this specific conflicting debate with Matt Segall quite exceptional.

Matt's position was not understood. He was more interested in a dialogue rather than debates and I think it would be more productive. However, in this specific case, my guess is it would literally take hours to just figure out the common language on a certain concept he mentions.

My humble guess is that a combination of negotiator and moderator with a primary perceiving personality type function (if typologies work at all) could be a step to more meaningful and ecological dialogues in the future. But such negotiator/moderator should also be skilled enough to reflect most challenging parts using more “rational language” as best as possible. These people are rare. Basically I mean the style of dialogues that happened between theoretical physicist David Bohm and Indian philosopher Jiddu Krishnamurti: IMO these were the talks where both sides at some point were barely transcending limitations of their languages and focusing more on intuition in order to understand each other. Much fuzzier and spontaneous dialogues, which aren't prematurely limited by too harsh rationality. Similar thing (with shorter periods of negotiation) could be combined with debating as well.

I hope NR community will be open to understanding more perspectives and won't end up turning into something like a cold and scary crystallization of rational arrogance; that would be damaging and quite opposite to the healthy intentions of the whole project.

Final thoughts

I like the clarity and density of the presented ideas in the video, the choice of lines of development in the map and the alternative to the Integral Methodological Pluralism. I like the mentioned interpretation of “free” will, very much resonates with how I personally interpret it. Tritone-ish devilish sounds in the cons sections is a nice aesthetic choice as well.

I guess there's a lot to learn from NR, no matter what positions we hold on the “rational spirituality” and that sort of stuff. Just to avoid projections and misunderstandings: I'm in a neutral position to all the post-postmodern discourses (NR, Integral, Metamodernism, etc.); I care about these philosophies, make my own distinctions on what's healthy or not, and my positions don't necessarily perfectly match with some of the claims these philosophies make.

Thank you David Long for launching this philosophy and the movement; I'm looking forward to the next videos!

I'd appreciate reposts and all this as well, thanks!

-

@ 5d4b6c8d:8a1c1ee3

2025-06-13 14:08:51

@ 5d4b6c8d:8a1c1ee3

2025-06-13 14:08:51Boy howdy! We're getting some good finals games in the NBA and NHL. I imagine that will occupy most of our discussion.

Do we expect these teams to be contenders next year too or is this their window?

I now need Indy to pull off the win, if I'm going to win our bracket challenge. In the event of an Indy win, @grayruby hilariously shot himself in the foot with his pick for MVP in the points challenge (there's a fun little econ lesson there).

We are starting to transition into offseason mode, though: starting with the Knicks post mortem.

Aaron Judge has a ludicrous 87% chance of winning the AL MVP this year. Also, @Jer is demolishing me in fantasy this week.

Predyx has some exciting new sports markets up. I may have gotten a bargain on some Euro Rules Football outcomes just a few minutes ago.

We'll also recap the ongoing contests and discuss whatever else stackers want to hear about.

https://stacker.news/items/1005467

-

@ 99e7936f:d5d2197c

2025-06-13 13:56:02

@ 99e7936f:d5d2197c

2025-06-13 13:56:02“Dieser Beitrag wurde mit dem Pareto-Client geschrieben.”

„BORN TUBI FREE“ statt „VIEL FREE“

Ja, Sie haben richtig gelesen.

Bildung hatte in meinem Elternhaus keinen hohen Stellenwert. Für meine Eltern war es erstrebenswert, ein gutes Heim mit großem Garten, etwas Komfort und gutes Essen zu haben. Sowohl mein Vater als auch meine Mutter hatten starken Bezug zur Landwirtschaft und Nutztierhaltung. Tiere, die keinen Nutzen hatten, waren in den Augen meiner Eltern Luxus. Auch für mich ist es heute wichtig, Zugang zu Grün und zur Natur zu haben. Ich liebe Tiere, die keinen Nutzen haben, und Pflanzen aller Art. Im Sommer stundenlang unter dem Blätterdach eines alten Baumes zu liegen und dem Knacken der Äste zuzuhören, ist für mich Glück.

In meiner Kindheit gab es blökende Schafe und Lämmer statt Klavierunterricht. Wir kletterten bei der Obsternte auf den Baum oder sammelten Fallobst statt im Sportverein zu turnen. Statt Büchern gab es Besuche bei Tante und Onkel, die Geschichten von früher erzählten. Und statt Museumsbesuchen gab es die Werkstatt meines Vaters und das Hobby meiner Mutter, alte Möbel zu sammeln und selbst zu restaurieren. Die Themen des Lebens lernte ich nicht durch Theateraufführungen kennen, sondern durch den Alltag und die Menschen in meiner unmittelbaren Umgebung.

Durch die Schule kam ich erstmals in Kontakt mit der Möglichkeit, dass man Dinge auch abstrakt-theoretisch lernen konnte. Schule war für mich auch ein Ort, an dem ich ganz nebenbei das Sozialverhalten anderer Menschen studieren konnte. Das war für mich als Kind und Teenager ein wichtiges Korrektiv. Aber vor allem habe ich über die Schule gelernt, dass es eine ganze Welt zu entdecken gab, die mir bis dahin unbekannt war. Bildung war für mich nie etwas, mit dem man angibt. Bildung war für mich ein Geschenk, eine Überraschung, eine Freude, ein Anfang von etwas Neuem, eine Hoffnung, manchmal eine Angst, es nicht zu schaffen, aber immer wieder eine Quelle von Verstehen und neuen Fragen. Bildung ist für mich heute eine riesige Landkarte, die ich nach Herzenslust bereisen kann, wenn ich mag. Auf meiner Landkarte gibt es noch so viele weiße Flecken. Ich habe mein Abitur mit 29 Jahren ohne die emotionale Unterstützung meiner Eltern nachgeholt. Meine Eltern ahnten schon, dass sich nach dem Abitur ein „teures“ Studium anschließen würde. Auch das war in ihren Augen Luxus, denn ich hatte ja bereits eine Ausbildung.

Nach dem Krieg hatten viele Menschen gar nicht die Möglichkeit, Schulbildung zu erlangen. Im Vordergrund stand, einen guten Job zu finden, Kinder zu bekommen und etwas aufzubauen, ein Haus zu bauen, sich Urlaub im sonnigen Süden leisten zu können. Frauen, die in den 60er Jahren nicht heirateten und stattdessen studieren wollten, waren in der Welt meiner Eltern nicht sichtbar. Bildung war eine stille Sehnsucht, an die man nicht mal im Traum denken durfte, so kam es mir in meiner Familie als Teenager manchmal vor. Das muss mit dem materiellen Mangel meiner Eltern in ihrer Kindheit zu tun gehabt haben. Ich habe dieses Phänomen auch bei den Eltern von Freunden oder bei Verwandten beobachten können. Materieller Wohlstand schien wichtiger als irgendwelche fernen Ziele und Horizonte. Erst mit fortschreitendem Alter fingen meine Eltern an, sich hobbymäßig und theoretisch zu bilden. Sie besuchten zwar keine Kurse in der Volkshochschule, aber sie kauften sich Sachbücher zu den verschiedensten Themen oder machten Kulturreisen in die neuen Bundesländer. Das war für sie der pure Luxus. Sie besuchten Schlösser und Burgen, mein Vater liebte es, in rustikaler Umgebung oder in historischen Gebäuden an schön gedeckten Tischen zu essen, während meine Mutter die Holzmaserung der Möbel genau betrachtete und befühlte.

Da ich diesen „Bildungsluxus“ aber deutlich vor meinem Rentenalter haben wollte, nahm ich die zähen Diskussionen mit meinen Eltern wegen einer finanziellen Unterstützung meines Studiums in Kauf. Bildung ist ein Grundbedürfnis von Menschen, das von ganz allein entsteht, wenn es nicht aktiv unterdrückt wird. Das hat die Evolution vermutlich so angelegt, damit man ab und zu auch mal das Gewohnte verlässt, um Neues zu entdecken, weil Flexibilität die Überlebenschancen der Spezies erhöht.

Bildung ist ein Grundbedürfnis, und das machen sich natürlich auch die dunklen Kräfte auf dieser Welt zu Nutze.

Das heutige Bild, das ich zum Artikel gewählt habe, habe ich vor ein paar Wochen in dem Viertel, in dem ich wohne, mit der Kamera aufgenommen. Auf einem Plakat konnte ich „VIEL FREE“ in großen Buchstaben lesen und war sprachlos. Ich wusste gar nicht, was mich so bestürzte, als ich das Plakat sah. Aber ich spürte, dass ich dieses Plakat im Bild festhalten musste, weil irgendeine tiefe Botschaft darin lag, die ich mitnehmen sollte. Manchmal verstehe ich Dinge erst intuitiv und anschließend kognitiv.

Dieses Plakat ist eine Werbung für irgendeinen Freizeitpass o.ä., den man in unserer Region erwerben kann. Aber der Anbieter wirbt mit einer bewusst falschen Rechtschreibung (VIEL FREE). Da ich nicht aus einem Bildungshaushalt komme, könnte mir das herzlich egal sein. Aber was mir nicht egal ist, ist das Gefühl, das ich beim Lesen dieses Plakats bekam. Das war ein Gefühl von einem vollen Nachttopf, den man mir über den Kopf schüttet und dabei noch hämisch grinst. Das Plakat hat mich spontan empört.

Ich dachte sofort an die Geflüchteten aus Syrien und Afghanistan, mit denen ich vor ein paar Jahren gearbeitet hatte. Sie hatten dermaßen Stress mit dem Erlernen der deutschen Sprache gehabt. Oft waren die „Lehrer“ in den Sprachkursen keine ausgebildeten Lehrer gewesen. Die Familienväter und die Teenager der Flüchtlingsfamilien fielen teils mehrmals durch die Prüfungen und hatten Angst, deshalb von der Behörde nicht zum regulären Arbeitsmarkt bzw. zum Gymnasium zugelassen zu werden. Die Mütter blieben zum Glück gelassener. Die bestandene Sprachprüfung war die offizielle Voraussetzung für die Teilnahme am ersten Arbeitsmarkt, so hieß es damals zumindest. Wer den Abschluss nicht hatte, erhielt keine Hilfe beim Schreiben einer Bewerbung. Das „Konzept“ der Maßnahme zur Vermittlung in Arbeit, in der ich damals tätig war, sah dies so vor. Ich kann mich noch lebhaft an die Auseinandersetzung mit meinem Kollegen erinnern, die ich deshalb damals hatte. Diese Logik erschloss sich mir nicht, denn man lernt Sprache doch am besten dort, wo man lebt UND arbeitet. Aber zurück zu dem Plakat. Was ich zum Ausdruck bringen möchte, ist, dass es insbesondere in dem Viertel, in dem ich wohne, viele Menschen mit ganz unterschiedlicher Herkunft und mit Kriegserfahrung gibt, die nicht sicher sind in der deutschen Sprache, für die es nicht hilfreich ist, dass Plakate mit einer fehlerhaften Rechtschreibung für etwas werben. Und von der zynischen Qualität dieses „VIEL FREE“ rede ich noch gar nicht.

Wie soll man in einem Land, das man neu kennen lernen möchte und muss, weil man aus einem Krieg geflüchtet ist, die Sprache lernen, wenn man bewusst fehlerhafte Rechtschreibung vorgesetzt bekommt? Und den angeblichen Wortwitz verstehen doch die meisten gar nicht, weil sie, wie gesagt, weder im mündlichen noch im schriftlichen Sprachausdruck sicher sind. Und niemand möchte sich lediglich „frei fühlen“, sondern lieber tatsächlich „frei sein“, oder nicht? Und echte Freiheit hat sicherlich auch nichts mit irgendeiner Plastikkarte zu tun, mit der ich einen Erlebnispark oder ein Spaßbad aufsuchen kann.

„Frei sein“ bedeutet für mich, dass ich nicht durch psychologische Tricks für etwas interessiert werde, das mich von echter Freiheit ablenken und abhalten soll. Echte Freiheit braucht auch sicherlich keine Plastikkarten mit personenbezogenen Daten. Echte Freiheit bedeutet, dass ich NICHT aus meinem Heimatland durch Krieg vertrieben werde, sondern dass ich mein Leben (und meine Freizeit) nach Lust und Laune so gestalten kann, wie ich das will. Und dazu gehört mehr als ein Besuch im Erlebnispark des Landes, in das ich geflüchtet bin, um zu überleben. Dazu gehört, dass ich die Sprache vor Ort verstehe und selbst sprechen kann, dass ich ein respektierter Teil der Gesellschaft werde, dass ich die gleichen Chancen bekomme wie die anderen, dass ich die finanziellen Mittel habe für Bildung, guten Wohnraum mit Garten und was auch immer, dass ich mobil bin, und dass ich, insbesondere als junger Mensch, meine Familie und eine vertraute Gruppe von Freunden um mich habe. Also „frei sein“ bedeutet, NICHT aus meiner Heimat weggebombt zu werden.

In meiner unmittelbaren Nachbarschaft leben unbegleitete minderjährige Flüchtlinge in einer Wohngemeinschaft zusammen. Das sind höfliche Jungs so um die 16/17 Jahre. Sie lernen die Welt und das Leben gerade erst kennen. Sie haben keinen leichten Start gehabt, sind aber neugierig auf dieses neue Land, in dem sie nun leben. Sie grüßen freundlich und probieren die neu erlernte Sprache aus. Solche Plakate direkt vor ihrer Haustür sind nicht hilfreich. Diese Plakate versuchen, junge Menschen mit ihrem ganz normalen Bedürfnis danach, Neues zu erleben, abzuholen und in eine aktionsreiche Scheinwelt zu entführen, in der es vermeintlich Freiheit und ganz VIEL Spaß gibt. Solche Plakate sind für mich keine unschuldige Werbung für einfache Freizeitgestaltung. Solche Plakate sind einerseits der dezente Wink in Richtung Konsum und andererseits kognitive Platzhalter, mentale Füllstoffe.

VIEL FREE mit Plastikkarten ist in meinen Augen ein aufdringliches Angebot für willkommene Schmerzvermeidung durch Konsum. Es ist Angriff auf Sprache und Denken. Es richtet sich an junge Menschen, die das, was sie in den letzten Jahren hier oder woanders erleben mussten, vergessen möchten. Nach Kriegen oder staatlichen Übergriffen, so wie in der sogenannten Corona-Zeit, geht es immer für fast alle Beteiligten um das Vergessen. An diesem Punkt sind sich die Dynamik von Trauma einerseits und die Täterstruktur andererseits leider immer einig. Deswegen hat es ja auch in der deutschen Vergangenheit funktioniert, Konsum als Schmerzpflaster auf Wunden aller Art zu kleben.

VIEL FREE ist für mich ein trauriges Zeitdokument, das meine Aufmerksamkeit gefunden hat, weil es das Gegenteil von Freiheit, Genießen, Gemeinschaft und vielem mehr darstellt.

VIEL FREE hat mich an meine Eltern in jungen Jahren und ihre Sehnsüchte erinnert, eine traumatisierte Generation, die alles dafür getan hat, materiellen Wohlstand zu generieren, um sich endlich wieder emotional sicher fühlen zu können.

VIEL FREE erreicht nicht die Herzebene, weil es nicht von Herzen kommt.

VIEL FREE ist eine kostengünstige Zucker-LÖSUNG, die den kleinen Hunger und die stille Sehnsucht nach Heimat, Zugehörigkeit, Sicherheit, Frieden, Glück und vielleicht auch nach Bildung stillen soll. Aber sie macht genau das, was Zucker macht. Sie macht nicht satt, sondern weckt den großen Hunger. Man konsumiert dann das Falsche mit all den Folgen, die das hat. Es ist schwer, aus solchen Kreisläufen wieder raus zu kommen.

Wem dienen diese ungesunden Kreisläufe?

Wem dient dieser Konsum, der nicht satt macht?

Wem dient das Vergessen einer traumatischen Jugend?

Was denkt man alles NICHT, während man mit VIEL FREE als mentalem Füllstoff beschäftigt ist?

Was fühlt man alles NICHT, während man Loopings auf der Konsumschiene dreht?

Was macht man alles NICHT, was außerhalb der vorgezeichneten Freizeitzone liegt, aber auch Spaß macht?

Was ist die gesunde Alternative für junge Menschen, egal welcher Herkunft?

Wie können Angebote insbesondere für junge Menschen, die traumatisiert sind, aussehen?

Wo kann man als junger Mensch kostenlos und ohne eine Institution oder ein „Konzept“ im Nacken mit Gleichaltrigen in der Freizeit „abhängen“ und nebenbei Schafe, Obstbäume und andere Menschen aus sicherer Entfernung beobachten?

Wo gibt es solche unschuldigen Oasen?

Wo kann man Trauma „heilen“ oder zumindest die Voraussetzungen für spätere Selbstheilung schaffen?

Wo wird man nicht mit Zucker-LÖSUNG angefixt?

Wo kann man lernen, den eigenen Körper, die eigenen Gefühle nach Trauma wieder zu spüren, zu regulieren und sich dadurch wirklich frei zu fühlen?

Wer vermittelt der nächsten Generation eigentlich, was wir (in den letzten fünf Jahren) gelernt haben?

Vielleicht geht das erstmal über praktische Angebote, über das persönliche Erleben und später dann über theoretische Bildung. Man muss den Wert von Schafen und Bäumen nicht sofort theoretisch erklärt bekommen. Für den Anfang reicht es, wenn man Zugang zu Schafen und Bäumen bekommt und lernt, wie andere mit Schafen und Bäumen umgehen, also Lernen am Modell. Es müssen auch nicht unbedingt Schafe und Bäume sein, das ist, wie Sie bereits gemerkt haben, nur eine Metapher.

Mich haben Schafe und Bäume in gewisser Weise gerettet. Sie haben mir Verbindung angeboten. Ich konnte diese Verbindung am eigenen Leib spüren. Ich konnte spüren, dass ich bin und auch erahnen, wer ich wirklich bin. Sie waren mir ein verlässliches Gegenüber in schwierigen Zeiten, sie haben mich so oft beruhigt, getröstet und gehalten. Die Natur hört zu, wenn keiner mehr zuhört. Sie nimmt Dich an, egal wer Du bist. Sie bewertet Dich nicht. Sie ist unendlich geduldig und ein super Lehrer für alle Fragen, die einem als Kind so einfallen können. Sie weckt Deine Aufmerksamkeit, Deine Neugier, Deinen Wunsch zu Lernen und zu Verstehen. Sie lenkt Dich ab. Die Natur unterrichtet Dich ganz beiläufig. Ihre Sprache ist das kreative Spiel und die Fülle. Diese Anbindung an die Natur hilft mir bis heute, mit Herausforderungen aller Art klarzukommen. Wenn ich nicht weiter weiß oder mich beruhigen möchte und muss, dann gehe ich in die Natur. Danach ist nicht jedes Problem sofort gelöst, aber ich bin wieder zuversichtlich, dass ich auch diese Welle nehmen kann und über Wasser bleibe. Ich spüre mich dann mit all meiner Kraft als einen Teil dieser Welt. Und genau das wünsche ich vor allem den jungen Leuten in meiner Umgebung, die noch so viel vor sich haben.

Du bist geboren, um Dich als einen Teil dieser Welt kraftvoll und frei zu fühlen.

Du bist ein Stück von dieser Natur, die jeden Tag kreativ spielt und immer reichlich von allem hat.

Man sagt: „Schau auf den Horizont, wenn die Wellen hochschlagen.“

Für mich bedeutet das: Wenn Du Dich mit der Natur verbindest, dann hast Du Orientierung, dann fühlst Du Dich selbst. Und wenn Du Dich und Deine angeborene Stärke fühlst, dann bist Du frei. Dann kann Dir kein Problem etwas anhaben. Die Natur heilt sich und Dich jeden Tag auf`s Neue.

BORN TO BE FREE.

BE FREE.

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

“Dieser Beitrag wurde mit dem Pareto-Client geschrieben.”

Sie sind noch nicht auf Nostr and wollen die volle Erfahrung machen (liken, kommentieren etc.)? Zappen können Sie den Autor auch ohne Nostr-Profil! Erstellen Sie sich einen Account auf Start. Weitere Onboarding-Leitfäden gibt es im Pareto-Wiki.

\ Newsletter per Mail (Die Friedenstaube)\ hier abonnieren\ \ In Telegram lesen -> hier unsere Kanäle\ https://t.me/pareto_artikel \ https://t.me/friedenstaube_artikel \ \ Als Feed in einem Feed-Reader \ https://pareto.space/atom/feed.xml \ https://pareto.space/atom/de_feed.xml \ https://pareto.space/atom/en_feed.xml

-

@ e096a89e:59351479

2025-06-13 13:54:30

@ e096a89e:59351479

2025-06-13 13:54:30Here’s how to make the perfect soft boiled egg in seven minutes using ice water.

Video: https://v.nostr.build/gODN4ihoJal4EhuA.mp4

-

Grab your eggs.

-

Fill a pot with water, put it on high heat, and bring it to a boil.

-

While waiting, fill a bowl with ice and water. Set it aside.

-

Once the water is boiling, gently add the eggs.

-

Start a timer for 7 minutes.

-

When 7 minutes are up, transfer the eggs into the ice water bowl.

-

Let them sit for a couple of minutes before peeling.

(Optional) Make peeling fun - see how big of shell pieces you can get.

-

After peeling, put the eggs back into the ice water for a few more minutes. *This helps them firm up slightly while keeping the yolk soft but not runny.

-

Sprinkle with sea salt flakes and enjoy with whatever you like.

Give a zap if you enjoy this sort of content, and if this yielded good results for you :)

-

-

@ 2cde0e02:180a96b9

2025-06-13 13:48:55

@ 2cde0e02:180a96b9

2025-06-13 13:48:55pen & ink; monochromized

tools used

https://stacker.news/items/1005456

-

@ 5d4b6c8d:8a1c1ee3

2025-06-13 13:39:20

@ 5d4b6c8d:8a1c1ee3

2025-06-13 13:39:20Here's a video about the Pacers' offensive adjustments to OKC's extraordinary defense:

https://youtu.be/1LF2Sd1jTXQ

This finals matchup probably has the highest level team basketball I remember seeing.

https://stacker.news/items/1005445

-

@ 9c9d2765:16f8c2c2

2025-06-13 13:31:00

@ 9c9d2765:16f8c2c2

2025-06-13 13:31:00In the heart of a forgotten village, wrapped in fog and silence, lived a girl named Lisa who had never seen her reflection.

There were no mirrors in the village, only old tales whispered by elders that mirrors “stole your spirit” or “showed things best left hidden.” Lisa never questioned it. She believed what she was told: she was plain, timid, and destined for nothing more than blending into shadows.

But she felt something inside a flicker, like a candle trying to burn through thick glass.

One day, while gathering herbs deep in the forest, Lisa stumbled upon the ruins of an ancient house. Inside, beneath sheets of ivy and dust, stood an enormous mirror tall, cracked, and untouched for decades.

She froze.

Curiosity trembled in her chest. Carefully, she wiped away the dust with her sleeve.

At first, she saw only her eyes, wild, curious, and afraid. Then, slowly, the whole reflection emerged. Not plain. Not broken. But alive.

It was her, and yet someone more stronger, prouder, freer.

Tears welled in her eyes. All her life, she had believed others’ words. But here, in silence, she saw the truth for herself.

She began visiting the mirror each day, not to admire beauty, but to remind herself she was real. That her thoughts mattered. That what lived inside her could not be shaped by lies spoken outside.

When she returned to the village, she walked differently.

She spoke.

She led.

And others began to wonder: What did she see that changed her?

Lisa simply smiled and said, “I stopped seeing what they told me I was. And started seeing who I truly am.”

Moral: You are not what others say you are. You are who you choose to see.

-

@ 9c9d2765:16f8c2c2

2025-06-13 13:04:54

@ 9c9d2765:16f8c2c2

2025-06-13 13:04:54In a quiet coastal town where summer lingered like a forgotten song, lived an old gardener named Ali. His home sat at the edge of the cliffs, where ocean wind tossed sea spray into the air and the sun kissed everything golden. Ali’s garden was a legend of tulips that sang with color, vines that danced in the breeze, and trees that whispered stories to anyone who would listen.

But Ali had grown frail. His hands, once strong, now trembled. His memory sometimes slipped like sand through a sieve. Yet every day, he tended the plants. Not because he needed them but because they still needed him.

One autumn, a young boy named Ben moved into the neighboring house. Ben had not spoken a word since losing his mother the year before. He would sit for hours at the fence, watching Ali work.

Ali never asked him to speak. Instead, he gave Ben a sunflower seed.

“Plant it,” he said. “And believe in the bloom.”

Ben did.

The next day, Ali gave him a cracked watering can. The next, a rusty trowel. Day by day, silence became action. The boy mimicked Ali’s movements. Dug soil. Watered. Waited.

Then winter came fast. A cruel one.

One morning, Ali was gone.

The town whispered, “The gardener has passed.” Snow dusted the garden. The plants withered. Ben stood before the tiny sunflower shoot and wept silently.

But spring arrived timid and uncertain.

And from the earth, a single sunflower broke through.

Ben spoke his first words in months to the flower.

“You’re not alone.”

And in a voice that cracked but carried, he added, “Neither am I.”

Moral: Even after loss, life finds a way. Sometimes, a single leaf can carry the weight of hope for someone else.

-

@ 0403c86a:66d3a378

2025-06-13 12:55:09

@ 0403c86a:66d3a378

2025-06-13 12:55:09Exciting news for FOOTBALL fans ⚽! Global Sports Central 🌐 is teaming up with Predyx, a leading prediction market in the Bitcoin ecosystem, to bring you comprehensive coverage of the very first Club World Cup directly on Nostr. This partnership is all about enhancing your experience with the latest news, insights, and interactive features!

The Club World Cup will showcase the best clubs from around the globe, and with our collaboration, you’ll be fully engaged in the action. Predyx focuses on long-term outcomes, allowing you to make predictions on who will win it all. Plus, if you’re not happy with your predictions, you can sell your shares at any time and switch allegiance—after all, it’s a free market!

What You Can Expect:

-

Latest News and Match Reports: Stay updated with the latest news, in-depth match reports, and insights from the tournament, ensuring you never miss a moment.

-

Market Odds Tracking: Follow the shifts in market odds in real-time, giving you the edge when making predictions and engaging with the action.

-

Player of the Day Card: Celebrate standout performances with our Daily Player of the Day card, highlighting the top players from the tournament.

-

Game oN Frontpage: Each day, we’ll feature the frontpage of the day, showcasing the most historical matchups and capturing the feel of the game.

-

Best Moments Replays: Relive the excitement with replays of the best moments from the Cup, so you can catch all the highlights and unforgettable plays.

-

Long-Term Predictions: Engage with Predyx to forecast who will win the tournament and who will take home the MVP award, allowing you to make strategic predictions as the tournament unfolds.

-

Easy Login System: Getting started is a breeze! All you need is a Lightning wallet to log in and participate, making it simple for everyone to join in on the fun.

-

Lightning-Fast Bitcoin Payments: With the Lightning Network, placing your bets and making predictions is faster and easier than ever. Enjoy seamless transactions while you cheer for your favorite teams!

"Predyx is excited to be part of this innovative partnership," said Derek. "We’re bringing fans a new way to interact with the game they love, all while using the fast and secure Lightning Network."

Predyx is a Bitcoin-native prediction market platform running on the Lightning Network. We’re building the fastest, most trust-minimized betting engine in the world — no deposits, instant payouts, sats-native, and degen-friendly.

Global Sports Central 🌐 Your daily spin around the sports world 🔄 Stay in the loop with the latest scores, stories, and stats.

GSC360 - Where Every Angle Matters

-

-

@ b1ddb4d7:471244e7

2025-06-13 08:01:22

@ b1ddb4d7:471244e7

2025-06-13 08:01:22The latest AI chips, 8K displays, and neural processing units make your device feel like a pocket supercomputer. So surely, with all this advancement, you can finally mine bitcoin on your phone profitably, right?

The 2025 Hardware Reality: Can You Mine Bitcoin on Your Phone

Despite remarkable advances in smartphone technology, the fundamental physics of bitcoin mining haven’t changed. In 2025, flagship devices with their cutting-edge 2nm processors can achieve approximately 25-40 megahashes per second when you mine bitcoin on your phone—a notable improvement from previous generations, but still laughably inadequate.

Meanwhile, 2025’s top-tier ASIC miners have evolved dramatically. The latest Bitmain Antminer S23 series and Canaan AvalonMiner A15 Pro deliver 200-300 terahashes per second while consuming 4,000-5,500 watts. That’s a performance gap of roughly 1:8,000,000 between when you mine bitcoin on your phone and professional mining equipment.

To put this in perspective that hits home: if you mine bitcoin on your phone and it earned you one penny, professional miners would earn $80,000 in the same time period with the same effort. It’s not just an efficiency problem—it’s a complete category mismatch.

According to Pocket Option’s 2025 analysis, when you mine bitcoin on your phone in 2025, you generate approximately $0.003-0.006 in daily revenue while consuming $0.45-0.85 in electricity through constant charging cycles. Factor in the accelerated device wear (estimated at $0.75-1.20 daily depreciation), and you’re looking at losses of $1.20-2.00 per day just for the privilege of running mining software.

Mining Economic Factor

Precise Value (April 2025)

Direct Impact on Profitability

Smartphone sustained hash rate

20-35 MH/s

0.00000024% contribution to global hashrate

Daily power consumption

3.2-4.8 kWh (4-6 full charges)

$0.38-0.57 at average US electricity rates

Expected daily BTC earnings

0.0000000086 BTC ($0.0035 at $41,200 BTC)

Revenue covers only 0.9% of electricity costs

CPU/GPU wear cost

$0.68-0.92 daily accelerated depreciation

Reduces smartphone lifespan by 60-70%

Annual profit projection

-$386 to -$412 per year

Guaranteed negative return on investment

Source: PocketOption

Bitcoin’s 2025 Network: Harder Than Ever

Bitcoin’s network difficulty in 2025 has reached unprecedented levels. After the April 2024 halving event that reduced block rewards from 6.25 to 3.125 BTC, mining became significantly more competitive. The global hash rate now exceeds 800 exahashes per second—that’s 800 followed by 18 zeros worth of computational power securing the network.

Here’s what this means in practical terms: Bitcoin’s mining difficulty adjusts every 2,016 blocks (roughly every two weeks) to maintain the 10-minute block time. As more efficient miners join the network, difficulty increases proportionally. In 2025, mining difficulty has increased compared to 2024, making small-scale mining even less viable.

The math is unforgiving:

- Global Bitcoin hash rate: 828.96 EH/s

- Your smartphone’s contribution: ~0.000000003%

- Probability of solo mining a block: Virtually zero

- Expected time to mine one Bitcoin: Several million years

Even joining mining pools doesn’t solve the economic problem. Pool fees typically range from 1-3%, and your minuscule contribution would earn proportionally tiny rewards—far below the electricity and device depreciation costs.

The 2025 Scam Evolution: More Sophisticated, More Dangerous

Fraudsters now leverage AI-generated content, fake influencer endorsements, and impressive-looking apps that simulate realistic mining activity to entice you to mine bitcoin on your phone.

New 2025 scam tactics include:

AI-Powered Fake Testimonials: Deepfake videos of supposed successful mobile miners showing fabricated earnings statements and encouraging downloads of malicious apps.

Gamified Mining Interfaces: Apps that look and feel like legitimate games but secretly harvest personal data while simulating mining progress that can never be withdrawn.

Social Media Manipulation: Coordinated campaigns across TikTok, Instagram, and YouTube featuring fake “financial influencers” promoting mobile mining apps to younger audiences.

Subscription Trap Mining: Apps offering “free trials” that automatically charge $19.99-49.99 monthly for “premium mining speeds” while delivering no actual mining capability.

Recent cybersecurity research shows that over 180 fake mining apps were discovered across major app stores in 2025, with some accumulating more than 500,000 downloads before being removed.

Red flags that scream “scam” in 2025:

- Apps claiming “revolutionary mobile mining breakthrough”

- Promises of earning “$10-50 daily” from phone mining

- Requirements to recruit friends or watch ads to unlock withdrawals

- Apps that don’t require connecting to actual mining pools

- Testimonials that seem too polished or use stock photo models

- Apps requesting permissions unrelated to mining (contacts, camera, microphone)

The 2025 Professional Mining Landscape

To understand why, consider what professional bitcoin mining looks like in 2025. Industrial mining operations now resemble high-tech data centers with:

Cutting-edge hardware:

- Bitmain Antminer S23 Pro: 280 TH/s at 4,800W

- MicroBT WhatsMiner M56S++: 250 TH/s at 4,500W

- Canaan AvalonMiner A1566: 185 TH/s at 3,420W

Infrastructure requirements:

- Megawatt-scale power contracts with industrial electricity rates

- Liquid cooling systems maintaining 24/7 optimal temperatures

- Redundant internet connections ensuring zero downtime

- Professional facility management with 24/7 monitoring

For a small operation, you might need at least $10,000 to $20,000 to buy a few ASIC miners, set up cooling systems, and cover electricity costs. These operations employ teams of engineers, maintain relationships with power companies, and operate with margins measured in single-digit percentages.

2025’s Legitimate Mobile Bitcoin Strategies

While it remains impossible to mine bitcoin on your phone profitably, 2025 offers exciting legitimate ways to engage with bitcoin through your smartphone:

Lightning Network Participation: Apps like Phoenix, Breez, and Zeus allow you to run Lightning nodes on mobile devices, earning small routing fees while supporting bitcoin’s payment layer.

Bitcoin DCA Automation: Services enable automated dollar-cost averaging with amounts as small as $1 daily. Historical data shows $10 weekly bitcoin purchases consistently outperform any mobile mining attempt by 1,500-2,000%.

Educational Mining Simulators: Legitimate apps like “Bitcoin Mining Simulator” teach mining concepts without false earning promises. These educational tools help users understand hash rates, difficulty adjustments, and mining economics.

Stacking Sats Rewards: Apps offering bitcoin rewards for shopping, learning, or completing tasks.

Lightning Gaming: Bitcoin-native mobile games where players can earn sats through skilled gameplay, with some players earning $10 monthly.onfirm that even the most optimized mobile mining setups in 2025 lose money consistently and predictably.

The Bottom Line

When you mine bitcoin on your phone fundamental economics remain unchanged: it’s impossible to profit. The laws of physics, network competition, and energy efficiency create insurmountable barriers that no app can overcome.

However, 2025 offers unprecedented opportunities to engage with bitcoin meaningfully through your smartphone. Focus on education, legitimate earning opportunities, and strategic investment rather than chasing the impossible dream of phone-based mining.

The bitcoin community’s greatest strength lies in its commitment to truth over hype. When someone promises profits to mine bitcoin on your phone in 2025, they’re either uninformed or deliberately misleading you. Trust the mathematics, learn from the community, and build your bitcoin knowledge and holdings through proven methods.

The real opportunity in 2025 isn’t to mine bitcoin on your phone—it’s understanding bitcoin deeply enough to participate confidently in the most important monetary revolution of our lifetime. Your smartphone is the perfect tool for that education; it’s just not a mining rig.

-

@ 9ca447d2:fbf5a36d

2025-06-13 13:01:52

@ 9ca447d2:fbf5a36d

2025-06-13 13:01:52El Salvador – June 3, 2025 — The grassroots Bitcoin community of El Salvador is proud to announce the return of Bitcoin Week, taking place this November with five dynamic events celebrating Bitcoin adoption, education, and community-led innovation.

Join us for a week of inspiration, collaboration, and impact.

Bitcoin Week 2025 calendar

📍 November 12 – Bitcoin Education Celebration Gala: Kick off the week in style with a luxurious and intimate evening at a high-class dinner, celebrating “proof of work” and the achievements of the Bitcoin education movement.

Expect major plans for the year(s) ahead but also a reflection to past proof-of-work—and don’t miss out on the Great Grassroots Giveaway, included with every ticket.📍 November 13 – Bitcoin Educators Unconference: Hosted for the third time in San Salvador at Cadejo Montaña, this sixth edition of the Educators Unconference embodies our commitment to provide a space for decentralized, community-led conversations.

Join educators and leaders shaping the global Bitcoin conversation!📍 November 14–15 – Adopting Bitcoin: The Network Effect: Now in its fifth year, Adopting Bitcoin returns with a powerful focus on real-world Bitcoin usage across global communities.

This year’s theme—The Network Effect—explores how interconnected local initiatives can spark exponential growth in adoption.📍 November 16 – Visit Bitcoin Beach, El Zonte: Make your way to Bitcoin Beach, the heart of El Salvador’s Bitcoin story. Enjoy a day of connection and discovery in this iconic beachside town. Full details coming soon.

📍 November 22–23 – Economía Bitcoin, Berlín: Head to the town of Berlín, El Salvador for the second edition of Economía Bitcoin, a powerful, small-scale conference and festival focused on circular economies and practical Bitcoin use.

Spend sats freely in town and see how local action drives global impact.With five unique events across three regions in Bitcoin Country, this edition of Bitcoin Week is your chance to experience El Salvador’s Bitcoin journey up close. Whether you’re an educator, builder, Bitcoiner, or simply curious—you’re invited.

Join us this November. Be part of the movement.

-

@ cae03c48:2a7d6671

2025-06-13 13:01:11

@ cae03c48:2a7d6671

2025-06-13 13:01:11Bitcoin Magazine

Remixpoint Invests ¥887 Million More Into BitcoinRemixpoint Inc. (3825.T), a management consulting services company, announced it has purchased ¥887.3 million worth of Bitcoin, acquiring 55.68 BTC at an average price of ¥15.94 million per coin.

JUST IN:

JUST IN:  Remixpoint just keeps buying more #bitcoin. Another 55.68 BTC today and they now have a total of 981.39 BTC. pic.twitter.com/mTkZg8mNO4

Remixpoint just keeps buying more #bitcoin. Another 55.68 BTC today and they now have a total of 981.39 BTC. pic.twitter.com/mTkZg8mNO4— NLNico (@btcNLNico) June 12, 2025

Following this purchase, the company now holds a total of 981.39 BTC, with a market value of approximately ¥15.63 billion. The unrealized gain on its Bitcoin holdings stands at ¥2.32 billion, reflecting their confidence in Bitcoin’s long term value. The funds came from the exercise of stock acquisition rights conducted on June 10.

Remixpoint Inc. is a Japanese company that started in the auto and energy sectors but has changed toward digital assets. It’s one of the few public companies in Japan actively holding Bitcoin, seeing it as both a store of value and a hedge against the weakening yen. Their move highlights a growing shift in Japan’s corporate space toward Bitcoin adoption.

Bitcoin has been so strong over the years that even in Japan, more companies are adding it to their balance sheets. It all started with Metaplanet, which was originally a hotel and hospitality company. In 2024, they shifted their strategy entirely and began accumulating Bitcoin as a treasury asset. That move caught the attention of investors and marked a turning point in Japan’s corporate approach to digital assets. Since then, Metaplanet has leaned fully into the Bitcoin thesis, positioning itself as Japan’s version of Strategy.

Recently, Metaplanet also announced its “555 Million Plan,” aiming to acquire 210,000 BTC, which is about 1% of Bitcoin’s total supply, by the end of 2027. This represents a major step up from its original “21 Million Plan,” which aimed for just 21,000 BTC. As of June 2, the company had already secured 8,888 BTC, far ahead of schedule and signaling strong momentum in its accumulation strategy.

Metaplanet has launched Asia’s largest-ever equity raise dedicated to Bitcoin:

¥770.9 billion (~$5.4B) capital raise

¥770.9 billion (~$5.4B) capital raise

555 million shares via moving strike warrants

555 million shares via moving strike warrants

First in Japan: issued at a premium to market — enabled by Metaplanet’s high volatility and deep liquidity… pic.twitter.com/UlXHneyDzo

First in Japan: issued at a premium to market — enabled by Metaplanet’s high volatility and deep liquidity… pic.twitter.com/UlXHneyDzo— Simon Gerovich (@gerovich) June 6, 2025

To fund this effort, Metaplanet launched Japan’s first moving strike warrant structure, issuing 555 million shares to raise approximately ¥770.9 billion. The plan was approved following a 10-for-1 stock split and a shareholder vote to increase authorized shares. With robust BTC yield performance and growing investor backing, Metaplanet is quickly establishing itself as Japan’s most influential corporate player in the Bitcoin space.

This post Remixpoint Invests ¥887 Million More Into Bitcoin first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

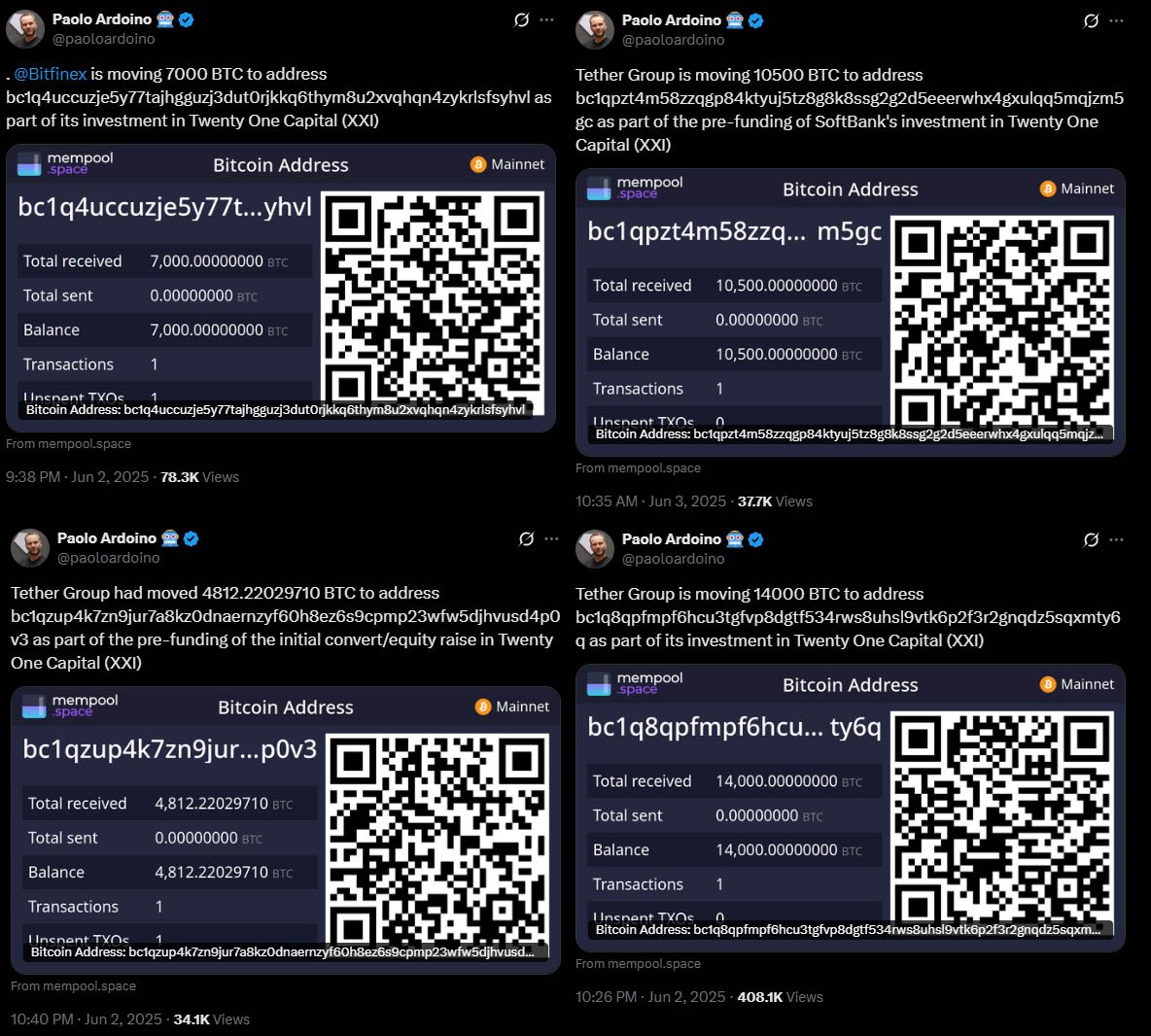

@ 7f6db517:a4931eda

2025-06-13 03:02:44

@ 7f6db517:a4931eda

2025-06-13 03:02:44

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ f0fd6902:a2fbaaab

2025-06-13 11:56:10

@ f0fd6902:a2fbaaab

2025-06-13 11:56:10https://stacker.news/items/1005372

-

@ f0fd6902:a2fbaaab

2025-06-13 11:43:17

@ f0fd6902:a2fbaaab

2025-06-13 11:43:17From my end, it s not one thing but a sentence:

A borderless world in a decentralized economy, where age, sex, race, religion... have not labels in a society where human are sovereigns.

https://stacker.news/items/1005361

-

@ df478568:2a951e67

2025-06-12 18:58:48

@ df478568:2a951e67

2025-06-12 18:58:48How To Mine Your Own Vanity Nostr Key

note. This article works best on https://habla.news/u/marc@primal.net/how-to-mine-a-nostr-vanity-key-with-rana

Rana is a vanity npub generator.

I'll show you how to use it on Ubuntu.

If you're not Linux ninja and use Windows instead of Linux ninja weapons, you can still use Linux with Virtualbox, free ans open source virtualization software. Head over to

https://www.virtualbox.org/ to learn more. They also have an enterprise business if you need that sort of thing, you can learn more at https://shop.oracle.com/

Rana is a nostr vanity key mining program. The source code can be found here.

Rana Is On GitHub

https://github.com/grunch/rana

Since rana already has pretty good docs, I decided to make a video instead of write about this because It's easier to see rana in action than it is to write about Rana. I went off on some tangents, so I might edit this down later, but I hope it helps you mine your own nostr key.

nevent1qqsfk7a000m8zc3ptsuu4vytepqc9eedceclpt2ns9pzlech5cpaflceng5al

Show Notes

https://github.com/grunch/rana

https://virtualbox.org/

https://doc.rust-lang.org/cargo/getting-started/installation.html

cargo run --release -- --vanity-n-prefix=juxtap0se

☮️

nostr:npub1marc26z8nh3xkj5rcx7ufkatvx6ueqhp5vfw9v5teq26z254renshtf3g0

-

@ 8bad92c3:ca714aa5

2025-06-13 11:01:53

@ 8bad92c3:ca714aa5

2025-06-13 11:01:53Marty's Bent

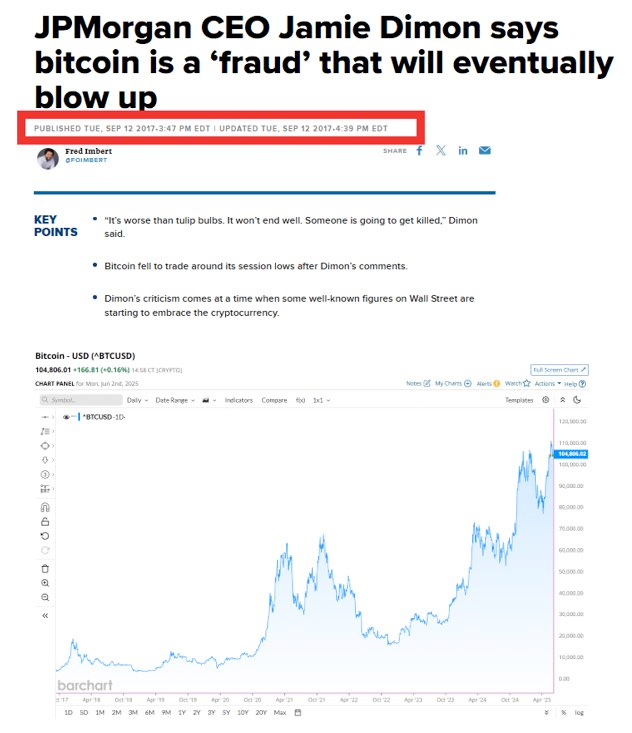

J.P. Morgan CEO Jamie Dimon has long been an outspoken skeptic and critic of bitcoin. He has called Bitcoin a speculative asset, a fraud, a pet rock, and has opined that it will inevitably blow up. A couple of years ago, he was on Capitol Hill saying that if he were the government, he would "close it down". Just within the last month, he was on Fox Business News talking with Maria Bartiromo, proclaiming that the U.S. should be stockpiling bullets and rare earth metals instead of bitcoin. It's pretty clear that Jamie Dimon, who is at the helm of the most powerful and largest bank in the world, does not like bitcoin one bit.

Evidence below:

via Bitcoin Magazine

via me

via CNBC

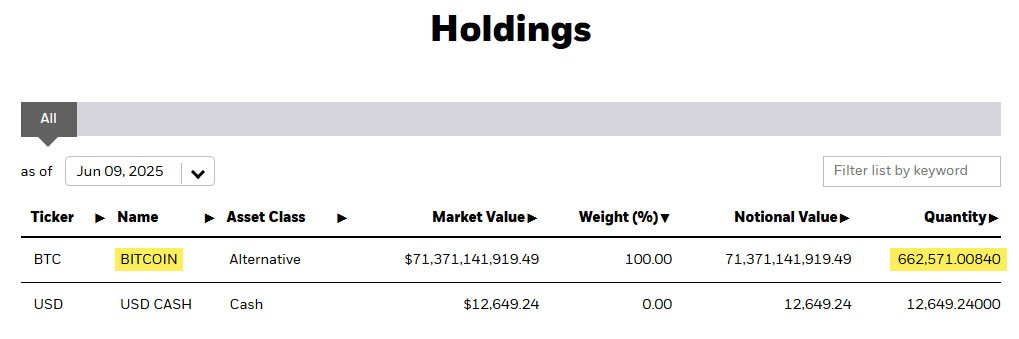

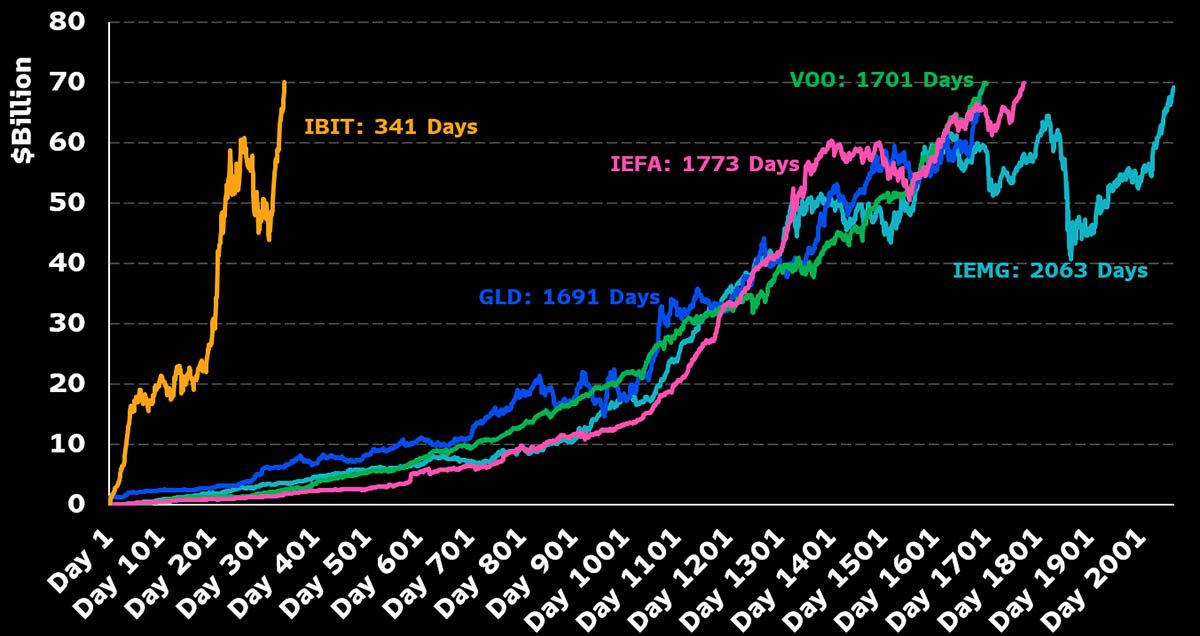

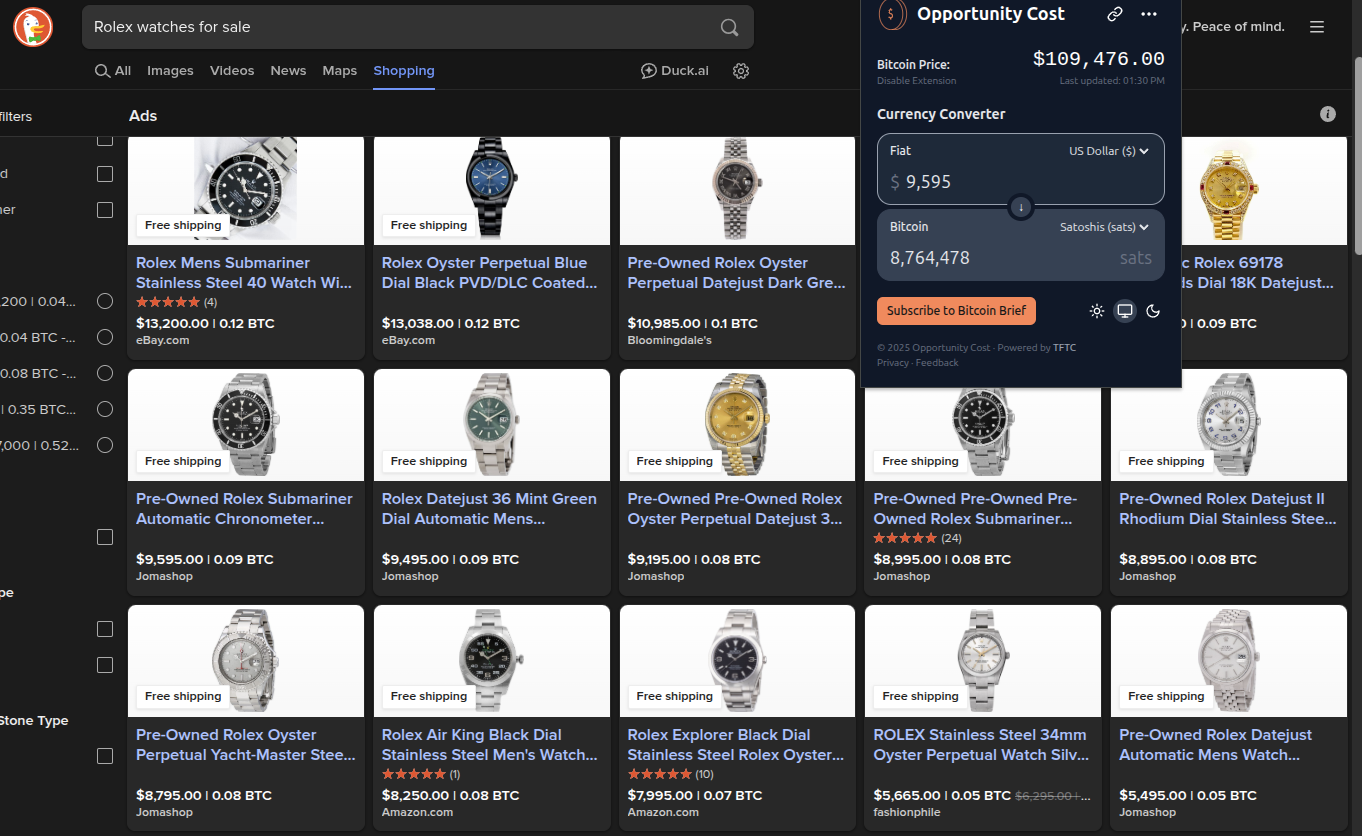

Despite Dimon's distinguished disdain for Bitcoin, J.P. Morgan cannot deny reality. The CEO of the largest bank in the world is certainly a powerful man, but no one individual, even in the position that Jamie Dimon is in, is more powerful than the market. And the market has spoken very clearly, it is demanding bitcoin. The Bitcoin ETFs have been the most successful ETFs in terms of pace of growth since their launch. They've accumulated tens of billions of dollars in AUM in a very short period of time. Outpacing the previous record set by the gold ETF, GLD.

Whether or not Jamie Dimon himself likes Bitcoin doesn't matter. J.P. Morgan, as the largest bank in the world and a publicly traded company, has a duty to shareholders. And that duty is to increase shareholder value by any ethical and legal means necessary. Earlier today, J.P. Morgan announced plans to offer clients financing against their Bitcoin ETFs, as well as some other benefits, including having their bitcoin holdings recognized in their overall net worth and liquid assets, similar to stocks, cars, and art, which will be massive for bitcoiners looking to get mortgages and other types of loans.

via Bloomberg

I've talked about this recently, but trying to buy a house when most of your liquid net worth is held in bitcoin is a massive pain in the ass. Up until this point, if you wanted to have your bitcoin recognized as part of your net worth and count towards your overall credit profile, you would need to sell some bitcoin, move it to a bank account, and have it sit there for a certain period of time before it was recognized toward your net worth. This is not ideal for bitcoiners who have sufficient cash flows and don't want to sell their bitcoin, pay the capital gains tax, and risk not being able to buy back the amount of sats they were forced to sell just to get a mortgage.

It's not yet clear to me whether or not J.P. Morgan will recognize bitcoin in cold storage toward their clients' net worth and credit profile, or if this is simply for bitcoin ETFs only. However, regardless, this is a step in the right direction and a validation of something that many bitcoiners have been saying for years. Inevitably, everyone will have to bend the knee to bitcoin. Today, it just happened to be the largest bank in the world. I expect more of this to come in the coming months, years, and decades.

Lyn Alden likes to say it in the context of the U.S. national debt and the fiscal crisis, but it also applies to bitcoin adoption and the need for incumbents to orient themselves around the demands of individual bitcoiners; nothing stops this train.

Real Estate Correction Coming

Real estate expert Leon Wankum shared his perspective on why property prices need to find a new equilibrium by 2026. He pointed to the 18-year property cycle theory, noting we're at the end of the current cycle with a massive imbalance - 34% more sellers than buyers, the highest gap since records began in 2013. Leon explained that sellers still have unrealistic expectations based on 2021-2022 peaks, while buyers face a fundamentally different reality with higher borrowing costs.

"We need a price equilibrium. We need demand and supply prices to match. It's going to take a long time, I think." - Leon Wankum

Leon doesn't expect a catastrophic crash, however. He emphasized that the financial system depends too heavily on real estate as collateral for authorities to allow a complete collapse. With interest rates likely staying above 3% to combat inflation, he sees a healthy correction rather than devastation - a necessary adjustment that creates opportunities for patient buyers who understand the new market dynamics.

Check out the full podcast here for more on Bitcoin treasury strategies, dual collateralization, and corporate BTC adoption

Headlines of the Day

California May Seize Idle Bitcoin After 3 Years - via X

Semler Scientific Buys $20M More Bitcoin, Holds $467M - via X

US Home Sellers Surge as Buyers Hit 4-Year Low - via X

Get our new STACK SATS hat - via tftcmerch.io

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code *“TFTC20”* during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

I feel old.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !important; } } .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } .moz-text-html .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } /* Helps with rendering in various email clients */ body { margin: 0 !important; padding: 0 !important; -webkit-text-size-adjust: 100% !important; -ms-text-size-adjust: 100% !important; } img { -ms-interpolation-mode: bicubic; } /* Prevents Gmail from changing the text color in email threads */ .im { color: inherit !important; }

-

@ f0fd6902:a2fbaaab

2025-06-13 10:36:58

@ f0fd6902:a2fbaaab

2025-06-13 10:36:58The Pallas cat wasn’t known to live on Mount Everest until a National Geographic Expedition in 2019 made a surprising discovery. The research team, made up of scientists from eight different countries, unexpectedly found Pallas feces in the Sagarmatha National Park in Nepal. “It is phenomenal to discover proof of this rare and remarkable species at the top of the world,” said Dr Tracie Seimon of the Wildlife Conservation Society’s Zoological Health Program.

These irritated-looking kitties live at high elevations throughout Asia and are considered “super predators,” meaning they are extremely successful at catching their prey. Analysis of scat revealed the feline is surving on pika within the mountain region.

https://stacker.news/items/1005336

-

@ 7f6db517:a4931eda

2025-06-12 15:02:58

@ 7f6db517:a4931eda

2025-06-12 15:02:58

The former seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

The latter's future remains to be seen. Dependence on Tor, which has had massive reliability issues, and lack of strong privacy guarantees put it at risk.

— ODELL (@ODELL) October 27, 2022

The Basics

- Lightning is a protocol that enables cheap and fast native bitcoin transactions.

- At the core of the protocol is the ability for bitcoin users to create a payment channel with another user.

- These payment channels enable users to make many bitcoin transactions between each other with only two on-chain bitcoin transactions: the channel open transaction and the channel close transaction.

- Essentially lightning is a protocol for interoperable batched bitcoin transactions.

- It is expected that on chain bitcoin transaction fees will increase with adoption and the ability to easily batch transactions will save users significant money.

- As these lightning transactions are processed, liquidity flows from one side of a channel to the other side, on chain transactions are signed by both parties but not broadcasted to update this balance.

- Lightning is designed to be trust minimized, either party in a payment channel can close the channel at any time and their bitcoin will be settled on chain without trusting the other party.

There is no 'Lightning Network'

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise.

- There are many lightning channels between many different users and funds can flow across interconnected channels as long as there is a route through peers.

- If a lightning transaction requires multiple hops it will flow through multiple interconnected channels, adjusting the balance of all channels along the route, and paying lightning transaction fees that are set by each node on the route.

Example: You have a channel with Bob. Bob has a channel with Charlie. You can pay Charlie through your channel with Bob and Bob's channel with User C.

- As a result, it is not guaranteed that every lightning user can pay every other lightning user, they must have a route of interconnected channels between sender and receiver.

Lightning in Practice

- Lightning has already found product market fit and usage as an interconnected payment protocol between large professional custodians.

- They are able to easily manage channels and liquidity between each other without trust using this interoperable protocol.

- Lightning payments between large custodians are fast and easy. End users do not have to run their own node or manage their channels and liquidity. These payments rarely fail due to professional management of custodial nodes.

- The tradeoff is one inherent to custodians and other trusted third parties. Custodial wallets can steal funds and compromise user privacy.

Sovereign Lightning

- Trusted third parties are security holes.

- Users must run their own node and manage their own channels in order to use lightning without trusting a third party. This remains the single largest friction point for sovereign lightning usage: the mental burden of actively running a lightning node and associated liquidity management.

- Bitcoin development prioritizes node accessibility so cost to self host your own node is low but if a node is run at home or office, Tor or a VPN is recommended to mask your IP address: otherwise it is visible to the entire network and represents a privacy risk.

- This privacy risk is heightened due to the potential for certain governments to go after sovereign lightning users and compel them to shutdown their nodes. If their IP Address is exposed they are easier to target.

- Fortunately the tools to run and manage nodes continue to get easier but it is important to understand that this will always be a friction point when compared to custodial services.

The Potential Fracture of Lightning

- Any lightning user can choose which users are allowed to open channels with them.

- One potential is that professional custodians only peer with other professional custodians.

- We already see nodes like those run by CashApp only have channels open with other regulated counterparties. This could be due to performance goals, liability reduction, or regulatory pressure.

- Fortunately some of their peers are connected to non-regulated parties so payments to and from sovereign lightning users are still successfully processed by CashApp but this may not always be the case going forward.

Summary

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise. There is no singular 'Lightning Network' but rather many payment channels between distinct peers, some connected with each other and some not.

- Lightning as an interoperable payment protocol between professional custodians seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

- Lightning as a robust sovereign payment protocol has yet to be battle tested. Heavy reliance on Tor, which has had massive reliability issues, the friction of active liquidity management, significant on chain fee burden for small amounts, interactivity constraints on mobile, and lack of strong privacy guarantees put it at risk.

If you have never used lightning before, use this guide to get started on your phone.

If you found this post helpful support my work with bitcoin.

-

@ f0fd6902:a2fbaaab

2025-06-13 10:26:19

@ f0fd6902:a2fbaaab

2025-06-13 10:26:19Panpsychism is the view that mentality is fundamental and ubiquitous in the natural world. The view has a long and venerable history in philosophical traditions of both East and West, and has recently enjoyed a revival in analytic philosophy. For its proponents panpsychism offers an attractive middle way between physicalism on the one hand and dualism on the other. The worry with dualism—the view that mind and matter are fundamentally different kinds of thing—is that it leaves us with a radically disunified picture of nature, and the deep difficulty of understanding how mind and brain interact. And whilst physicalism offers a simple and unified vision of the world, this is arguably at the cost of being unable to give a satisfactory account of the emergence of human and animal consciousness. Panpsychism, strange as it may sound on first hearing, promises a satisfying account of the human mind within a unified conception of nature.

For more details: https://plato.stanford.edu/entries/panpsychism/

https://stacker.news/items/1005324

-

@ cae03c48:2a7d6671

2025-06-13 10:01:39

@ cae03c48:2a7d6671

2025-06-13 10:01:39Bitcoin Magazine

F Street Announced Goal Of Accumulating $10 Million In BitcoinToday, F Street, an alternative investment and private lending firm, announced it has begun adding Bitcoin to its corporate treasury, with a goal of accumulating $10 million in BTC.

JUST IN: Investment firm F Street announced it's buying Bitcoin daily using business proceeds for its treasury reserves

They plan to buy $10 million Bitcoin

pic.twitter.com/NMLOteyUYU

pic.twitter.com/NMLOteyUYU— Bitcoin Magazine (@BitcoinMagazine) June 11, 2025

The company began daily BTC purchases on June 9, using business proceeds and treasury funds. This move is part of a broader strategy to strengthen F Street’s capital base and support its real estate lending and investment operations.

“Bitcoin offers a compelling hedge against inflation and dollar debasement,” said the Chief Operating Officer of F Street Mike Doney. “Incorporating it into our treasury is a strategic step to preserve and grow value for our investors and our business interests.”

In line with its commitment to transparency, F Street also plans to establish a public proof of reserves so that stakeholders can independently verify the custody of its Bitcoin assets. The firm aims to build a meaningful BTC position that supports its long term vision of a capital framework.

F Street’s move comes at a time when institutional interest in Bitcoin is experiencing a notable surge, and many prominent voices in the financial world are starting to support it. Billionaire investor Paul Tudor Jones, speaking today in an interview with Bloomberg, named Bitcoin as a critical part of what he considers the ideal portfolio against inflation.

“What would an ideal portfolio be… But it would be some kind of combination of probably gold, vol adjusted, Bitcoin, gold, stocks,” Jones said. “That’s probably your best portfolio to fight inflation. Vol adjusted because the vol of Bitcoin obviously is five times that of gold, so you’re going to do it in different ways.”

Adding to the momentum, the Head of Digital Assets of BlackRock Robert Mitchnick explained two days ago what’s really driving the surge in demand for Bitcoin ETFs.

“It’s a lot of things coming together. Out of the gate was retail and investor demand…” said Mitchnick. “Now, more recently, we’ve seen just steady progress of more wealth advisor adoption, more institutional adoption. It’s been a mix of people who it’s the first time that they’ve invested in anything in the crypto space. And then on the other hand, you have lots of people who’ve been invested in Bitcoin for a long time and they’re taking advantage of the ETP wrapper.”

This post F Street Announced Goal Of Accumulating $10 Million In Bitcoin first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

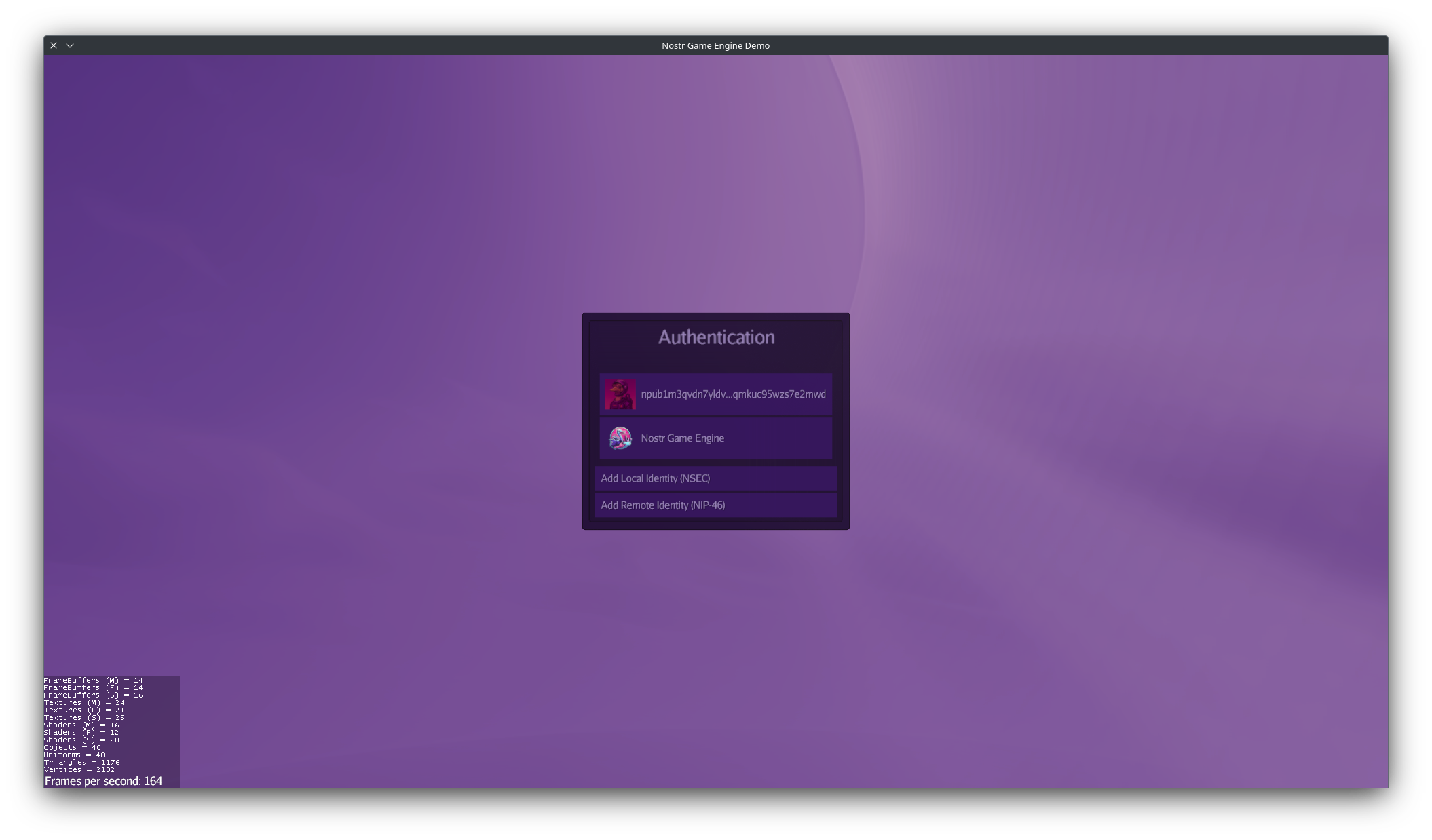

@ ae9dc5ef:77f0ed87

2025-06-13 09:25:28

@ ae9dc5ef:77f0ed87

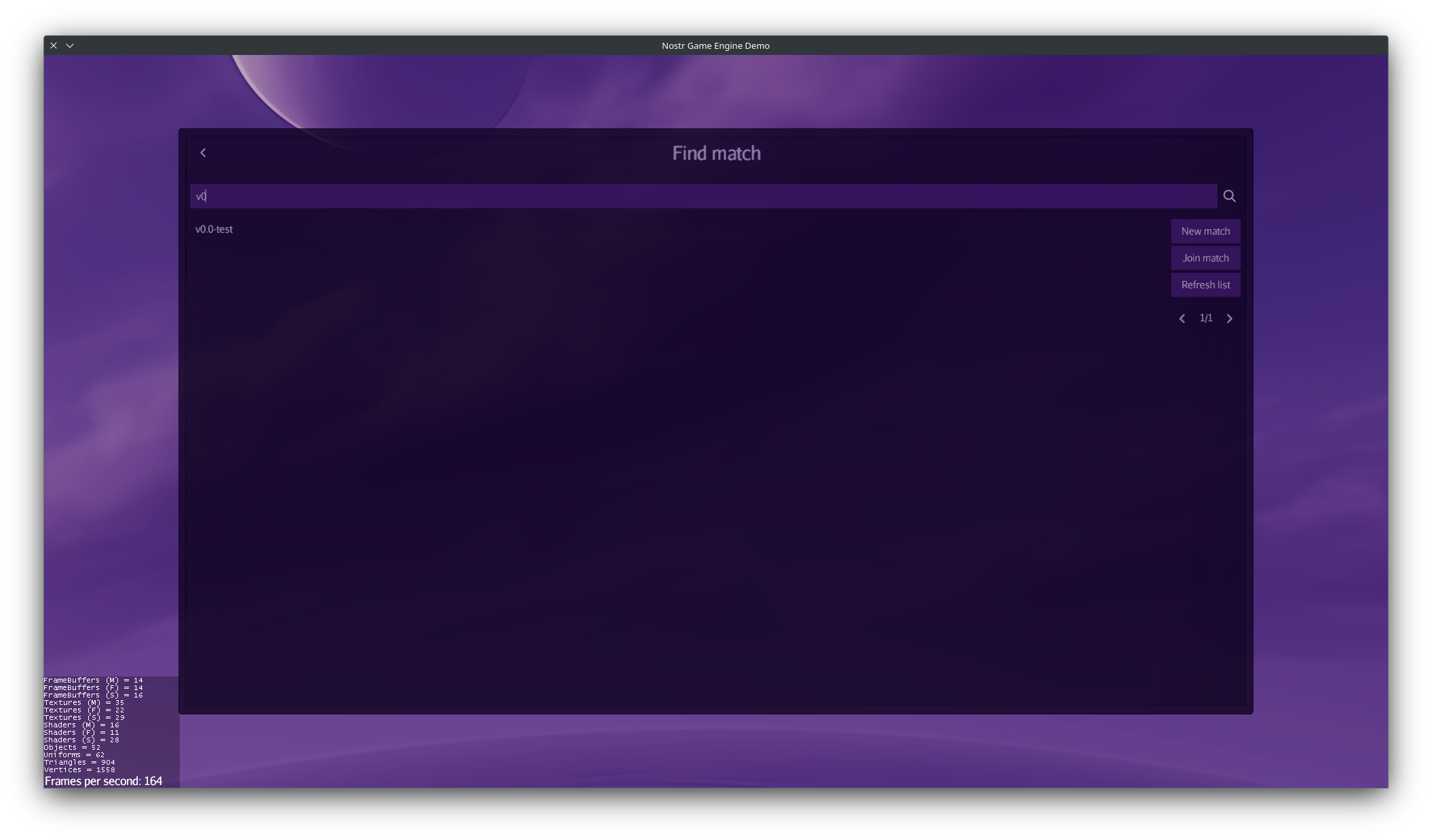

2025-06-13 09:25:28I'm excited to announce that Nostr Game Engine just reached its first development milestone: v0.0.

What is Nostr Game Engine?

Nostr Game Engine is built on top of the modular and proven jMonkeyEngine.

What sets it apart? Its internals are being gradually replaced with Nostr-powered modules, turning it into a reference engine purpose-built for decentralized games.

This first release delivers these key capabilities:

Peer-to-Peer Networking

Forget centralized game servers. Nostr Game Engine gives you real P2P multiplayer, using WebRTC for data streaming and Nostr relays for coordination.

Want to dig deeper? This is a draft NIP that is a revised version of this other draft NIP, that details how the signaling works.

WebRTC is already a solid and reliable peer-to-peer protocol, equipped with a full set of NAT traversal capabilities, but its signaling phase typically relies on specialized central servers.

By coupling WebRTC with Nostr, we take signaling decentralized too by relying on a network of dumb public relays that are oblivious to what encrypted data we send to them and are easily replaceable.

(see the documentation for more info)

Nostr Authentication & Gamertags

NGE has a fully managed Nostr Auth flow, with support for NIP-49 encrypted local nsecs and NIP-46 remote signers.

It also fully handles metadata, including external identities: your profile picture, display name, and other details can carry over between games, and even from other Nostr clients and communities.

This release is also introducing Gamertags: persistent gaming handles tied to your Nostr pubkey. They are like Xbox Gamertags or the old Discord handle, but they’re decentralized and follow you across any game that supports them (check this draft nip for more info).

Match Making

While matchmaking is planned for a later milestone on the roadmap, this release ships with an early implementation to help test RTC connections.

This initial implementation has the APIs to create lobbies that are discoverable and optionally password-protected. Players can search and filter for lobbies using both client-side and relay-side filtering, depending on what the relay supports.

Right now, you can’t see how many players are in a lobby, and the feature is still a bit rough around the edges, but it's a solid start, and more improvements are coming as we move further along the roadmap.

The cool part? You don’t even need to know Nostr is running under the hood. The engine exposes simple APIs like createLobby, findLobbies, and connectToLobby, the developer can call them when needed, and the engine handles all the relay querying and data stitching behind the scenes.

(see the documentation for more info)

A new Nostr Client Library

The engine uses a new Nostr client library built from scratch, designed for performance, asynchronicity, and memory efficiency. It’s lean, fast, and built to be the foundation for everything that comes next.

Cross-Platform and language of choice

The entire codebase is written mostly in Java, and it builds natively for Linux, macOS, and Windows.

Support for Android, iOS, and Web Browsers is on the roadmap.

What has been built so far?

-

Version 0.0, with the core features mentioned above

-

Documentation covering the key components of the engine

-

An app template to help bootstrap projects and experiment with the engine

-

An high performance and portable nostr client library

-

A tech demo (more on that later)

So now, you can get a real feel for the engine, see what it does, play around with it, and maybe even start experimenting with your own ideas.

Roadmap

This is just the beginning. There is a full roadmap on the website.

Upcoming milestones include ads, deeper identity features, and tools that make decentralized game development as smooth as possible.

Sea of Nostriches

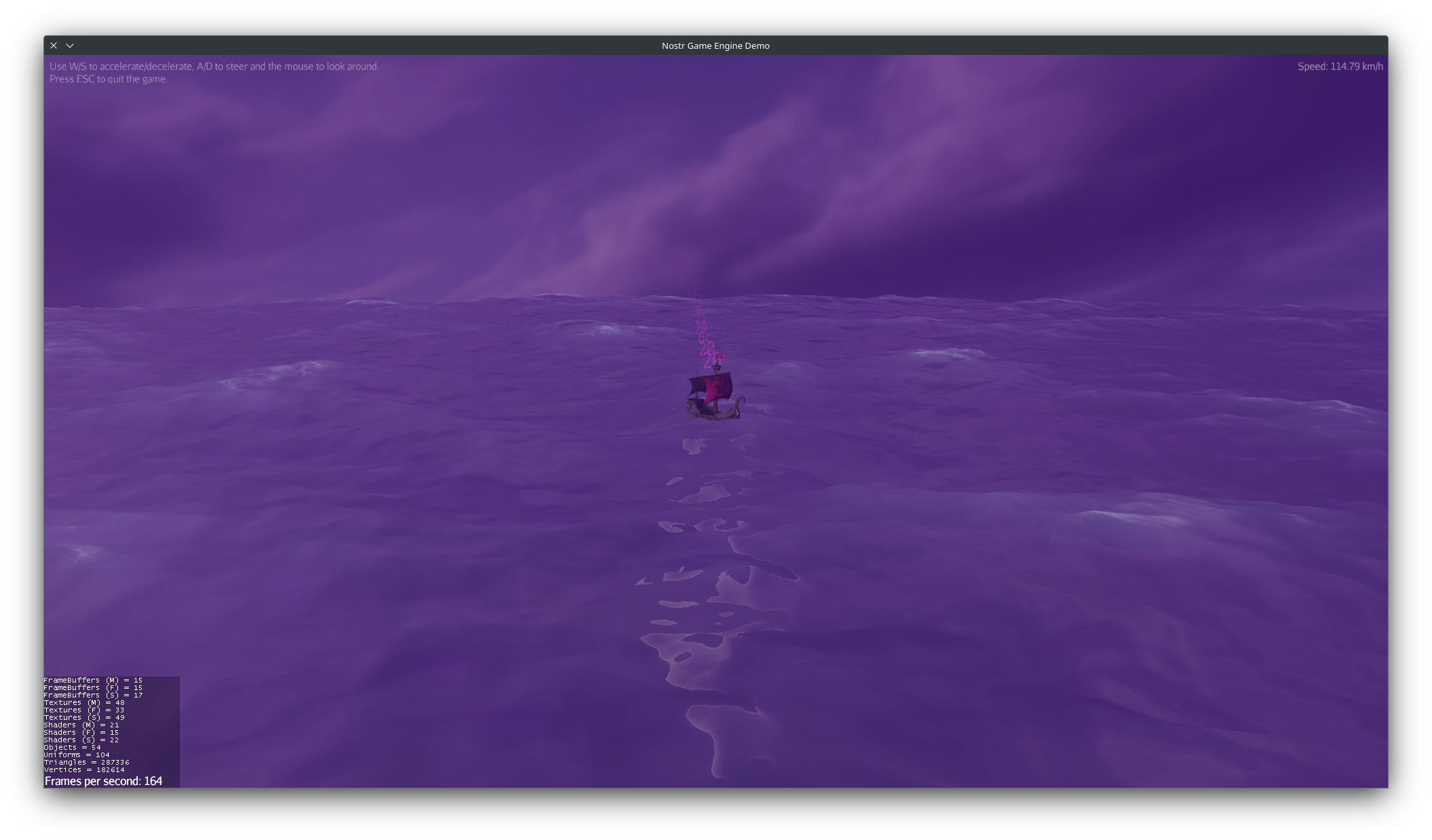

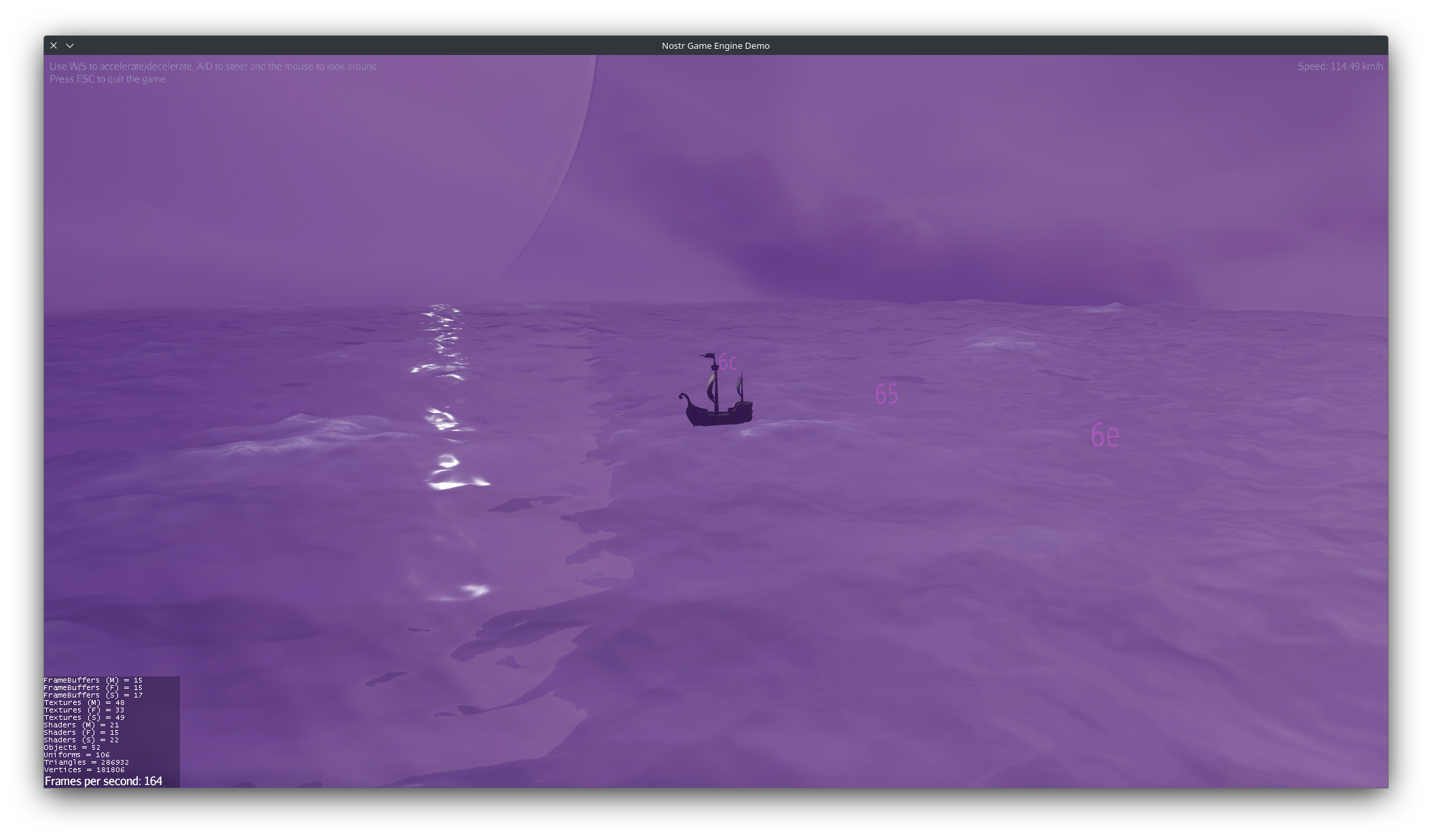

This is a demo built for this release.

You start alone in an open ocean with a boat, nothing much at first.

But as soon as another player joins (another peer), your boat begins sending data directly to theirs via peer-to-peer communication. You’ll see this visualized as a stream of numbers moving between boats in game.

If you have a profile picture set, it’ll automatically appear on your boat’s sail, and you’ll see others’ profile pictures on theirs.

That’s the core of it.

It is not a real game, as there is nothing really to do, no lag compensation, no score etc… but it is a decent reference, and an “integration test” for this release.

There’s a lot more going on behind the scenes, like how the ocean is simulated or how rendering is handled, but that’s beyond the scope of this post. You can check out the full source code on GitHub, along with native builds for all supported platforms and a portable JAR.

That’s all for now! Huge thanks go to nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcqypu8xwr40lp96ewdj2fef408wy70gd3carf9n6xu7hrnhq6whpgly925h0z for making this possible. Their support allows me to dedicate full-time effort to this project and contribute to the growth of the Nostr ecosystem.

Check out the website at ngengine.org and browse the docs at ngengine.org/docs if you want to dig deeper.

Feel free to come up with any questions. I’ll do my best to answer.

-

-

@ 7460b7fd:4fc4e74b

2025-06-13 09:04:33

@ 7460b7fd:4fc4e74b

2025-06-13 09:04:33从“出行规则”看监管逻辑与比特币的制度之道

FATF“出行规则”的治理逻辑与监管者的苦衷

金融行动特别工作组(FATF)在2019年推出“Travel Rule”(出行规则),试图将传统银行体系的反洗钱规制延伸至加密资产领域complyadvantage.com。这一规则要求虚拟资产服务商(VASPs)在转账过程中收集并传递交易双方的身份信息,使这些信息如同“随行护照”般伴随资金流动complyadvantage.com。其背后的治理逻辑不难理解:随着加密货币跨境使用的激增,监管者担心加密交易的匿名性为洗钱、恐怖融资提供了便利通道complyadvantage.com。因此,FATF将传统金融领域的第16号建议(关于跨境电汇信息)更新,明确要求加密交易同样附带发送人和接收人的姓名、地址等识别数据complyadvantage.comcomplyadvantage.com。这一举措体现了监管机构的苦衷:在犯罪分子利用技术躲避监管的现实下,他们感到有责任“补上漏洞”,即便这意味着套用旧有的银行规则到全新的区块链技术上。

然而,落实出行规则绝非易事。首先,不同司法管辖区行动步调不一,FATF多次批评各国实施进度缓慢,许多国家尚未将该规则转化为国内法complyadvantage.com。即使在已经执行的地区,监管部门也面临两难:既要防止非法资金流动,又担心过严管制扼杀金融创新。监管者的“苦衷”在于,他们既害怕被视作纵容犯罪,又担心被指责扼杀技术进步。出行规则要求VASPs收集详尽的客户身份信息,并在交易时与对方机构共享,这在实践中遇到技术和隐私保护方面的阻碍trisa.io。一些国家(如瑞士、新加坡)甚至在无最低金额门槛的情况下要求对所有交易执行该规则,欧盟更规定即使收款方是私人自管钱包也必须提交信息trisa.io。这种高标准加重了行业合规负担,使守法企业叫苦不迭,而不法分子则可能转入地下或转向无监管区域继续活动。可以说,监管机构陷入“猫抓老鼠”的困境:不推行吧,担心放任犯罪;推行过严吧,又恐打击面过广。正因如此,FATF在其2024年报告中承认出行规则的全球落实“严重滞后”complyadvantage.com,这既反映各国执法能力的差异,也凸显了此规则本身在新技术环境下的水土不服。

全球跨境资金与信息的系统性压制

出行规则的推行,从宏观上看是在全球金融体系施加新的“信息围墙”。一方面,它将原本开放的价值互联网重新划分为受监管的透明区和未监管的黑箱区。凡是跨过一定金额门槛(FATF建议为1000美元/欧元)的交易,都必须在链上绑定用户的实名信息complyadvantage.com。这意味着个人的资金流动和身份信息被深度绑定并广泛共享,一举打破了加密货币原有的准匿名特性。这种做法固然提升了追踪非法交易的可能性,但也埋下了系统性压制的隐患。正如业界联盟TRISA所警告的那样,将出行规则机械地套用于公开区块链,实则打造了一个集中存储个人隐私与财富信息的“数据金库”,极易成为黑客、犯罪组织甚至敌对政府垂涎的目标trisa.iotrisa.io。因为在传统银行体系下,账户账本是私密的,第三方难以直接获取交易明细;而在区块链上,一旦将姓名、地址等个人识别数据与公开的钱包地址关联,任何人都能通过链上记录分析出个人的财富状况和社交图谱trisa.io。这种对跨境资金和信息流动的全面记录与监控,实质上构成了对个人金融自由的系统性压制:人们在国际转账时不得不暴露隐私,否则交易将被拒之门外。更有甚者,一些国家已将这一逻辑无限延伸,例如中国公安机关提示即便一笔1000 USDT(泰达币)的转账都有可能被列入重点监控名单binance.com。当连如此小额的个人跨境交易都被严密审查时,金融交易所承载的信息自由流动已大打折扣。

从制度批判的视角看,这种全球范围的信息管制源自某些法律传统下对国家主权和税收控制的执念。在大陆法系传统中,国家往往通过成文法律对经济活动实施自上而下的强力规范,历史上形成了构筑信息壁垒以巩固主权和财政的路径依赖。例如许多大陆法系国家长期实行外汇管制和资本流动限制,以防范资金外逃、维护本国税基。这种做法虽出于主权自主的考虑,却与自由贸易要求的要素自由流动天然矛盾。研究表明,不同法律体系的国家在经贸合作模式上偏好迥异,法律传统差异往往成为国际经济一体化的无形藩篱,甚至导致经济关系的割裂cogitatiopress.com。典型案例如中国,对加密资产和稳定币采取高压监管,正是延续了其在资本项目下的信息管控传统。2024年链上数据显示,中国境内USDT跨境流动规模同比激增400%,日均交易额超过50亿美元binance.com。大量民间资金试图借助稳定币绕开官方的外汇管制,形成了一条隐蔽的“数字资金高速公路”binance.com。对此当局迅速祭出国家安全大旗,不仅将无证出入境资金视为重大风险隐患,甚至明确指出USDT等稳定币已成资本无序外逃的工具,必须强力封堵binance.combinance.com。在这一背景下,FATF出行规则等于为各国提供了一个合法理由,在全球范围内实施对跨境资金与信息的联合围堵:以打击洗钱之名,行资本管制之实。这套机制所产生的结构性效果,是在国际金融体系中嵌入了一种“默认不信任”的基调——跨境资金流动被一律视为潜在不法,必须层层验证、记录在案。其结果不仅压抑了资金与信息的自由流通,也为公民个人头上加装了“数字镣铐”,让人们在国际经贸往来中丧失匿名行动的选择权。

隐私协议的滥用:区块链匿名性的两面

在区块链世界中,隐私与匿名性原本被视作一项珍贵的技术特性,代表着去中心化金融对个人隐私权的尊重。然而,当缺乏法理自洽性和契约中立性的支撑,这种匿名性工具却易被犯罪集团所劫持,成为逃避监管的温床。以太坊上的“Tornado Cash”混币协议就是前车之鉴。作为一个去中心化的匿名交易服务,Tornado Cash初衷在于增强用户隐私,但由于缺少必要的合法约束和内部控制,一再被不法之徒利用:自2019年成立以来,该协议已被用于清洗超过70亿美元的犯罪收益,其中包括朝鲜黑客组织“拉撒路集团”在攻击Axie Infinity游戏桥后盗取的4.55亿美元secrss.com。2022年美国财政部更指出,尽管开发者声称Tornado Cash只是中立工具,但其并未采取哪怕基本的措施来阻止服务被反复用于恶意洗钱secrss.com。最终,美国OFAC直接将Tornado Cash列入制裁清单,以此警示加密行业:缺乏法理支撑的匿名协议,终将因为被滥用于洗钱而招致严厉监管惩罚secrss.com。