-

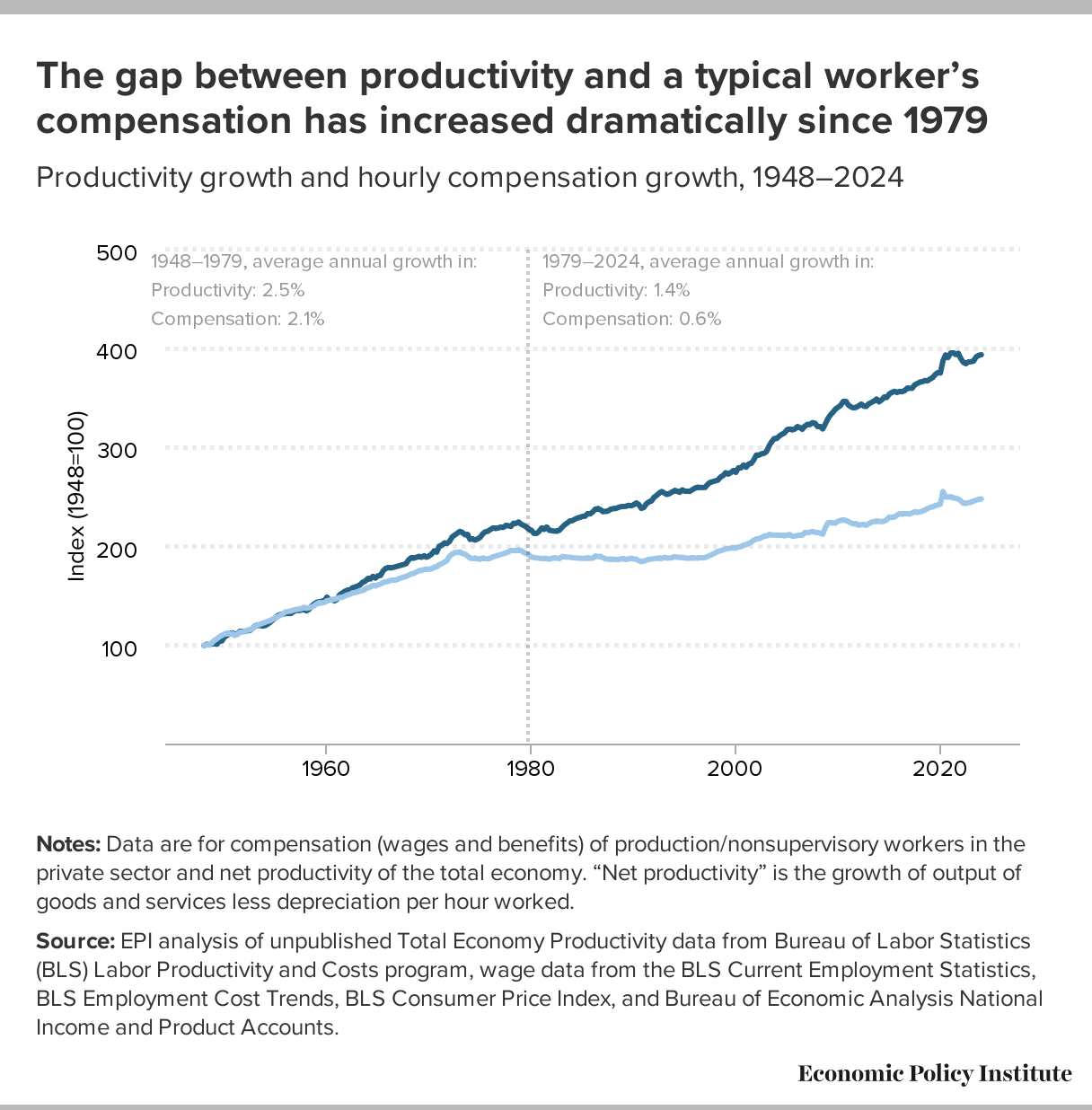

@ 84b0c46a:417782f5

2025-05-27 08:19:49

@ 84b0c46a:417782f5

2025-05-27 08:19:49Simple Long Form Content Editor (NIP-23)

機能

-

nostr:npub1sjcvg64knxkrt6ev52rywzu9uzqakgy8ehhk8yezxmpewsthst6sw3jqcw や、 nostr:nevent1qvzqqqqqqypzq4jsz7zew5j7jr4pdfxh483nwq9vyw9ph6wm706sjwrzj2we58nqqyxhwumn8ghj77tpvf6jumt9qys8wumn8ghj7un9d3shjtt2wqhxummnw3ezuamfwfjkgmn9wshx5uqpr4mhxue69uhhyetvv9ujumn0wd68ytnhd9ex2erwv46zu6nsqyxhwumn8ghj7mn0wvhxcmmvqqsgcn99jyn5tevxz5zxsrkd7h0sx8fwnqztula423xh83j9wau7cms3vg9c7 のようにnostr:要素を挿入できる (メニューのNアイコンから挿入またはnostr:note~~のように手動で入力)

-

:monoice:のようにカスタム絵文字を挿入できる(メニューの🙂アイコンから)

:monopaca_kao:

:kubipaca_karada:

- 新規記事作成と、既存記事の修正ができる

やることやったこと

-

[x] nostr:を投稿するときにtagにいれる

-

[x] 画像をアップロードできるようにする(NIP-96)

できる

できる - [x] 投稿しましたログとかをトースト的なやつでだすようにする

- [ ] レイアウトを整える

- [ ] あとなんか

-

-

@ 84b0c46a:417782f5

2025-05-27 07:04:13

@ 84b0c46a:417782f5

2025-05-27 07:04:13 -

@ 84b0c46a:417782f5

2025-05-18 12:22:32

@ 84b0c46a:417782f5

2025-05-18 12:22:32- Lumilumi The Nostr Web Client.

Lightweight modes are available, such as not displaying icon images, not loading images automatically, etc.

-

MAKIMONO A lightweight Long Form Content Editor with editing functionality for your articles. It supports embedding Nostr IDs via NIP-19 and custom emoji integration.

-

Nostr Share Component Demo A simple web component for sharing content to Nostr. Create customizable share buttons that let users easily post to Nostr clients with pre-filled content. Perfect for blogs, websites, or any content you want shared on the Nostr network. Try the interactive demo to see how seamlessly it integrates with your website.

Only clients that support receiving shared text via URL parameters can be added to the client list. If your preferred client meets this requirement, feel free to submit a pull request.

-

Nostr Follow Organizer A practical tool for managing your Nostr follows(kind3) with ease.

-

NAKE NAKE is a powerful utility for Nostr developers and users that simplifies working with NIP-19 and NIP-49 formats. This versatile tool allows you to easily encode and decode Nostr identifiers and encrypted data according to these protocol specifications.

- chrome extension

- firefox add-on

-

Nostviewstr A versatile Nostr tool that specializes in creating and editing addressable or replaceable events on the Nostr network. This comprehensive editor allows you to manage various types of lists and structured content within the Nostr ecosystem.

-

Luminostr Luminostr is a recovery tool for Nostr that helps you retrieve and restore Addressable or Replaceable events (such as kind: 0, 3, 10002, 10000, etc.) from relays. It allows you to search for these events across multiple relays and optionally re-publish them to ensure their persistence.

-

Nostr Bookmark Recovery Tool Nostr Bookmark Recovery Tool is a utility for retrieving and re-publishing past bookmark events ( kind:10003,30001,30003 ) from public relays. Rather than automatically selecting the latest version, it allows users to pick any previous version and overwrite the current one with it. This is useful for restoring a preferred snapshot of your bookmark list.

-

Profile Editor Profile Editor is a simple tool for editing and publishing your Nostr profile (kind: 0 event). It allows you to update fields such as name, display name, picture, and about text, and then publish the updated profile to selected relays.

-

Nostr bookmark viewer Nostr Bookmark Viewer is a tool for viewing and editing Nostr bookmark events (kind: 10003, 30001, 30003). It allows users to load bookmark data from relays, browse saved posts, and optionally edit and publish their own bookmark lists.

-

Nostr Note Duplicater Nostr Note Duplicater is a tool that rebroadcasts an existing Nostr event from a relay to other selected relays.

-

@ 84b0c46a:417782f5

2025-05-18 12:18:41

@ 84b0c46a:417782f5

2025-05-18 12:18:41-

バーガーキング

-

バーミヤン 台湾カステラ

-

焼肉ライク

-

本屋でギータの練習本探してみるとか

-

シードしぐなーの材料 → 普通にHWW買ったほうがいい説

- https://github.com/SeedSigner/seedsigner/releases

- Raspberry Pi Zero v1.3 ← v1.3はヘッダピンを自分でつけないといけないからWHにしてWi-FiBluetoothを外すのがよい

- Raspberry Pi Zero W ← Wi-Fi外すのが少し面倒

- Raspberry Pi Zero WH ¥3500

- WaveShare 1.3inch LCD HAT【14972】1.3インチ 240×240 IPS LCDディスプレイHAT for RaspberryPi ¥1980

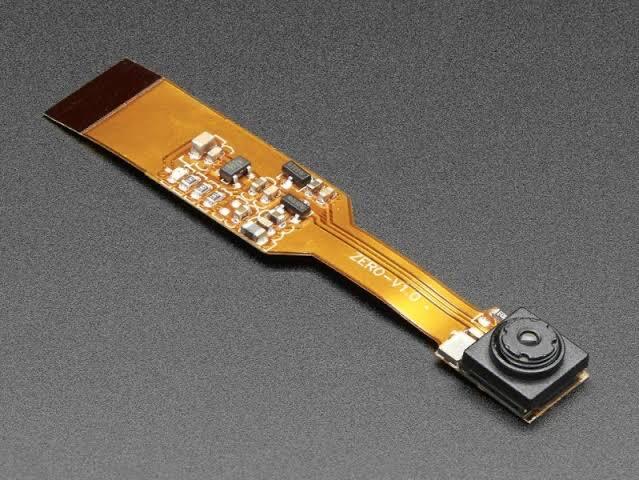

- Raspberry Pi Zero用スパイカメラ ¥3310

リボンの長さが色々ある seedsignerのケースによるけど多分短いやつでいける

↑こういうやつでいい

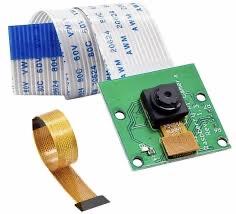

↑こういうやつでいい

↑ケースによってはこういうのがいい場合もある

↑ケースによってはこういうのがいい場合もある - https://github.com/SeedSigner/seedsigner/releases

-

-

@ 84b0c46a:417782f5

2025-05-16 13:09:31

@ 84b0c46a:417782f5

2025-05-16 13:09:31₍ ・ᴗ・ ₎ ₍ ・ᴗ・ ₎₍ ・ᴗ・ ₎

-

@ f85b9c2c:d190bcff

2025-05-28 00:43:46

@ f85b9c2c:d190bcff

2025-05-28 00:43:46

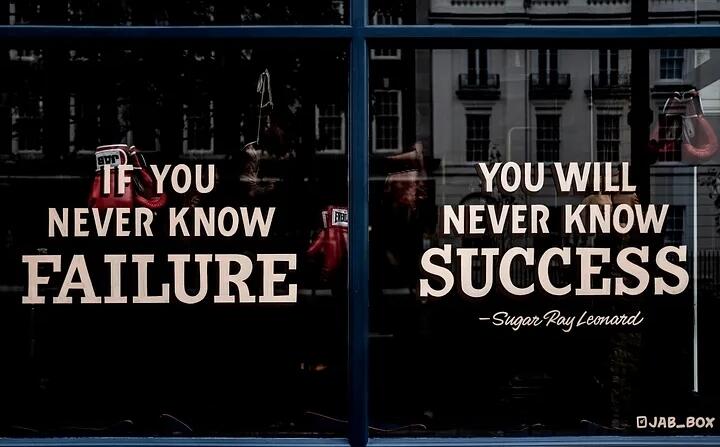

Growing up, we’re often taught that failure is something to avoid at all costs. The educational system, in particular, has ingrained in us the notion that failure is not just undesirable but downright bad. But what if I told you that this perspective might be the very thing holding us back from achieving true success?

But Schools Taught Us "Failure is Bad". From our earliest school days, we learned that mistakes on tests, failing a grade, or not meeting expectations could lead to disappointment or even punishment. This conditioning often translates into a fear of failure that persists into adulthood. But let’s reflect on some wisdom from those who’ve walked this path before us: 1.Thomas Edison once famously remarked, "I have not failed. I’ve just found 10,000 ways that won’t work." This statement reflects the essence of seeing failure not as a dead-end but as part of the journey to innovation.

2.Oprah Winfrey shares a perspective that resonates deeply with me, saying, "The more you praise and celebrate your life, the more there is in life to celebrate." This celebrates the process, including the failures, as part of the life’s journey, not just the successes.

- J.K. Rowling, before becoming one of the world’s most beloved authors, faced rejection after rejection. She once said, "It is impossible to live without failing at something, unless you live so cautiously that you might as well not have lived at all." Her words remind us that living fully means embracing failure as part of the adventure.

I remember vividly my first real brush with failure. It was during my college years when I decided to launch a small business selling eco-friendly products. The business flopped spectacularly. I was devastated, thinking that all my efforts had been for naught. But looking back, that failure was one of the best teachers I ever had. It taught me about market research, resilience, and the importance of adaptability - lessons I carried into every subsequent endeavor. Here are some life lessons I've gleaned from my own failures: Failure Teaches Resilience: Each time you fail, you’re not just knocked down; you’re being trained to get back up stronger. Resilience is not about never falling but about how quickly you recover. Innovation Often Comes from Failure: Many of the products we take for granted today were born from numerous failed attempts. Failure forces us to think differently, to innovate. Failure Clarifies Your Path: Sometimes, it’s only through failing that you realize what you truly want or what doesn’t work for you. It can redirect you towards your true calling or passion. Failure Humanizes Us: It keeps us grounded, humble, and connected to others who are also on their journey of trial and error. So, if you’re reading this and feeling discouraged by a recent setback, remember that failure isn’t a sign of defeat. It’s an invitation to grow, learn, and eventually succeed in ways you might not have imagined. Let’s reframe our understanding of failure, not as the end, but as one of many steps on the path to success. After all, every master was once a beginner who made mistakes, learned from them, and kept moving forward. So whenever you fail at something, learn a lesson from it and get back up. Never stay down.

-

@ a19caaa8:88985eaf

2025-05-27 22:36:15

@ a19caaa8:88985eaf

2025-05-27 22:36:15インターネット、だいすき!

レスバって?

- たのしさ(ちゃぴにきく)

ちがい

- タイプもきく?それはダルい?

さけるには

- ちゃぴにきく

“思い遣る”のと“邪推する”のは違う

- でもそう捉えたんだから仕方ないじゃん(自分の気持ちも大事にする)(バランス)(またあ?)

- 「意見単体」として見ているか、「そのひとから発された言葉」として見ているかの違い?

-

自分の理想をひとに押し付けない

-

それはそれとして、社会に疲れて深く潜りにきて、同じように深いとこに居るひとと手を振り合ったり、そのあり方を見て吸収したりしたいのに、バトルに巻き込まれるの、不憫すぎる

- インスタくんはえらいなあ、「このひとにストーリーズを表示しない」ができて

- 自分はそんなつもり無くても、始まってしまった以上、責任がある気がしてしまって、相手がどうして欲しいかを考え始めてしまい、消耗する

- 社会じゃん

- EなのにEしづらい環境のひとたちの捌け口になる必要は無い

- 海は広い

-

@ f85b9c2c:d190bcff

2025-05-28 00:37:00

@ f85b9c2c:d190bcff

2025-05-28 00:37:00

Staking and mining are both “consensus mechanisms.” They are used to confirm that transactions are legitimate and that nobody is for example trying to spend the same coins more than once.

What is staking? Staking is a way of earning interest on your cryptocurrency by depositing it for a fixed period of time. The term staking refers to the Proof of Stake or “PoS” protocol, in which deposited coins are used to verify transactions on the blockchain.

What is mining? Mining functions under a Proof of Work protocol, where miners compete to solve cryptographic puzzles. However, mining uses a lot of computing power and a lot of energy.

Conclusion The staking process has a lot to offer for both those involved in the world of crypto and those outside of it. Stakers can earn interest on their cryptocurrency holdings, potentially increase the value of their coins, and contribute to a healthy crypto community. They may enjoy faster transaction times relative to those offered by Proof of Work cryptocurrencies. For those who choose to stake on their own, the cost of setting up and running a staking node is far less than what you would need to spend on a mining rig. In other words, staking is profitable, efficient, and good for the environment. Sounds good, right? All that’s left is to get started.

-

@ f85b9c2c:d190bcff

2025-05-28 00:24:10

@ f85b9c2c:d190bcff

2025-05-28 00:24:10 This article is meant to give some tips on trading crypto but does not mean you should take any mentions of currencies as advice to buy or sell. I am writing this guide to help people navigate the many currencies, exchanges, and resources to find a coin to trade.

This article is meant to give some tips on trading crypto but does not mean you should take any mentions of currencies as advice to buy or sell. I am writing this guide to help people navigate the many currencies, exchanges, and resources to find a coin to trade.Getting the big picture (or your first stop) Before you go sign up for an exchange to trade on, first it’s always a good idea to get an idea of what’s happening in the market. To do this, I use a couple of resources but they all come from one place: Coin Market Cap.

What’s better than opinions and articles about a particular coin? Data. Coin Market Cap (CMC) provides data on all coins available, if a coin isn’t listed on here, you’re probably looking at something not available to trade or something that’s been long dead. When you first load up CMC, you’ll see a list of the top 100 coins right now. From here, you can navigate to check out a lot of different things.

The website is one of the most important things to look at, it’s the place where you will find the utility of a coin.The other links below the website link are informative but another important one is the Source Code link. A good indicator to look for is recent activity and to see if the coin has people working on it at least in the past month or so. Here, if a coin hasn’t had any activity for the past year or so, it’s as good as dead. Some coins won’t have a source code and that usually is a bad sign, the only exception is Bitcoin

Another thing you will want to look at along with website and source code is if there are any links to Twitter, Reddit, or any other social platform and how active the coin and its development team are around the web. This important to look at because you’re getting to know the people behind the coin you’re putting your money into. If you can’t find people responsible for the coin, the coin might be disappear.

I advise to look at some other coins on Coin Market Cap and learn about them so you have an idea of what their websites look like

Trading coins To buy or sell your coins, there’s a couple of basics we need to get figured out first. You’ll need a Coinbase account to buy Bitcoin, Ethereum, Bitcoin Cash, or Litecoin using dollars. The first problem you’ll notice with that previous sentence is that, there’s not many choices to buy. Of course, that gives you four currencies to buy but you’ll want to trade other currencies and that’s where things get a little messy. I decided to only list these but if you do a search for “crypto exchanges”, you’ll find alot of them. My top recommendations is Binance, it’s relatively easy to use and they have a lot of coins to choose from.

Transfer and Transaction fees I think the biggest cost that will come early on is fees for purchasing from USD to a currency and transferring to another exchange. A typical purchase using USD on Coinbase is calculated as 1% of the amount you’re purchasing, regardless of which coin. After you purchase using your Coinbase, you’ll want to transfer to another exchange, and at this point, you’ll be paying to transfer out. Trading on an exchange After you’ve done some research into a coin, bought a coin to transfer on Coinbase, and then transferred it over to an exchange, you’re ready to trade. There’s not much to trading, you put in an order and within minutes, it should be filled. It’s always best to do a limit order and set your price so you know beforehand what you’ll be paying and what you’ll be getting.

Final thoughts Trading coins means you’ll be dealing with real money and it’s your own money but I urge you to do as much research as possible before buying one. Looking at data on Coin Market Cap will give you insights but looking at the charts will give you some fear, uncertainty, and doubt but please you should be investing instead of day trading if you expect to grow your investments in the long run

-

@ 491afeba:8b64834e

2025-05-27 23:57:01

@ 491afeba:8b64834e

2025-05-27 23:57:01Quando adolescente eu acreditava na coerência da teoria de "amor líquido" do polonês, sociólogo, Zygmunt Bauman, apresentada no livro "Amor Líquido: Sobre a Fragilidade dos Laços Humanos", qual no meu amadurecimento em estudos, sejam eles no meio acadêmico ou fora, percebo como uma das formas mais rasas de explicar as mudanças e transformações dos padrões de relações sócio-afetivas dos humanos. A seguir colocar-me-ei na minha juventude não tanto recente, direi então que nós, se adolescentes e conservadores, ou mesmo jovens adultos mais conservadores, costumamos levar como dogma uma óptica decadentista generalizada de todos os avanços de eras dos homens, universalizamos por nos ser comum a indistinção entre humanidade e humanidades, ou mesmo "humanity" e "humankind" ("humanidade" como espécime e "humanidade" como um universal), compreendemos toda "essas" como "essa" e indistinguimos as sociedades para com os homens, ou seja, a incapacidade de definir os seres dentro de suas respectivas singularidades e especificidades nos leva ao decadentismo generalista (a crença de que de forma geral, e universal, a "civilização universal" decai moralmente, éticamente, materialmente e espiritualmente), que aparente à nós determinadas mudanças nas relações humanas quanto ao caráter sócio-afetivo, por falta de profundidade e critérios ainda sobre questões alinhadas aos métodos e coerências, ou incoerências, lógicas, nós se jovens e conservadores somos levados ao engodo de concordar com a teoria do amor líquido de Bauman, que devo cá explicar de antemão: trata ela, a teoria, o padrão de "amor" dos tempos presentes como frágil, de prazo (curto e médio) e diferente em grau comparativamente ao amor comum das eras passadas.

Aos jovens mais progressistas opera uma compreensão dialética sobre as eras dos homens nos seu tempo presente, na qual ao tempo que o ser progride ele também regride simultaneamente, ou seja, a medida que aparecem contradições advindas de transformações materiais da realidade humana o ser supera essas contradições e progride em meio as transformações, ainda fazendo parte da lógica dessa indissociavelmente, assim constantemente progredindo e regredindo, havendo para esses dois vetores de distinção: o primeiro é o que releva questões espirituais como ao caráter do pensamento "new age", o segundo ignora essas questões por negar a existência da alma, seguem ao materialismo. Cedem em crer na teoria baumaninana como dogma, pois não encontram outros meios para explicar as transformações da sociedade na esfera sócio-afetiva sem que haja confrontamento direto com determinadas premissas assim pertinemente presentes, ou por não conciliarem com análises relativamente superiores, como a de Anthony Giddens sobre a "relação pura" em "A Transformação da Intimidade" e de François de Singly apresentada em "Sociologie du Couple".

https://i.pinimg.com/736x/6f/b4/9e/6fb49eda2c8cf6dc837a0abfc7e108e6.jpg

Há um problema quando uma teoria deixa de assim ser para vir a tornar-se mais um elemento desconexo da ciência, agora dentro da cultura pop, se assim podemos dizer, ou da cultura de massa, ou se preferirem mesmo "anticultura", esse problema é a sua deformização teórica, tornando-se essa rasa para sua palatabilidade massiva, somada a incapacidade de partes da sociedade civil em compreender as falhas daquilo que já foi massificado. Tive surpresa ao entender que muitos outros compartilham da mesma opinião, a exemplo, possuo um amigo na faculdade, marxista, que ao falarmos sobre nossos projetos de pesquisa, citou ele o projeto de um de nossos colegas, no qual esse referido um de nossos colegas faria seu projeto com base na teoria do amor líquido de Bauman, então alí demos risada disso, ora, para nós a teoria baumaniana é furada, passamos a falar sobre Bauman e o motivo pelo qual não gostávamos, lá fiquei até surpreso em saber que mais gente além de mim não gostava da teoria de Bauman, pois ao que eu via na internet era rede de enaltecimentos à figura e à sua teoria, tal como fosse uma revelação partindo de alguma divindade da Idade do Bronze. Pouco tempo depois tive em aula de teoria política uma citação de Bauman partindo do professor que ministrava a disciplina, no entanto, ao citar o nome de Bauman o mesmo fez uma feição na qual aparentava segurar risada, provavelmente ele também não levava Bauman à sério. Não devo negar que todas as vezes que vejo o sociólogo sendo citado em alguma nota no X, no Instagram ou qualquer outra rede social, tal como fosse um referencial teórico bom, sinto uma vergonha alheia pois alí tenho uma impressão de que a pessoa não leu Bauman e usa o referencial teórico como um fato já assim provado e comprovado.

Há pontos positivos na teoria baumaniana, como a capacidade de perceber o problema e correlacioná-lo à modernidade, assim como sucitar a influência do que há de material no fenômeno, porém os erros são pertinentes: o primeiro problema é de categoria. Não há, por parte de Bauman noção alguma entre as dissociações dos amores, não há atenção sobre o amor como estrutura ou ele como um sentimento, todo ele é compreendido uniformemente como "amor", partindo do pressuposto que todas as relações, todas elas, são firmadas com base no amor. Essa crença tem uma origem: Hegel. Nos Escritos Teológicos Hegel partia da crença que o amor ligava os seres relacionalmente como uma força de superação e alienação, mas há de compreendermos que esse Friedrich Hegel é o jovem ainda pouco maduro em suas ideias e seu sistema de pensamento, mais a frente, em "Fenomenologia do Espírito e na Filosofia do Direito", Hegel compreende a institucionalidade do direito no amor e a institucionalização dessa força, assim aproxima-se da realidade a respeito da inserção do amor nas esferas práticas do humano, porém essa ideia, apesar de imperfeita, pois ao que sabemos não é o amor que consolida a relação, mas sim a Verdade (Alétheia), conforme apontado por Heidegger em "Ser e Tempo", essa ideia do amor como a fundamento das relações humanas influenciou, e até hoje influencia, qualquer análise sobre as relações humanas fora da esfera materialista, fora dessa pois, melhormente explicado em exemplo, os marxistas (em exemplo), assim como Marx, consideram como base primordial das relações as condições materiais.

Por certo, não é de todo amor a base para a solidificação, ora, erram aqueles que creem que somente essa força, assim apontada por Hegel, constituiam todos os relacionamentos formais como pilares fundamentais, pois em prática as famílias eram até a fiduciarização dessas, por mais paradoxal que seja, compreendidas melhor como instituições orgânicas de caráter legal do que conluios de afetividades. A família outrora tinha consigo aparelhos de hierarquia bem estabelicidos, quais prezavam pela ordem interna e externa, que acima dessa instituição estava somente a Igreja (outra instituição), com sua fiduciarização [da família] após o movimento tomado pelos Estados nacionais em aplicação do casamento civil mudou-se a lógica das partes que a compõe, findou-se o princípio da subsidiariedade (não intervenção de determinadas instituições nas decisões quais podem ser exercidas em resuluções de problemas nas competências de quaisquer instituições), foi-se então, contudo, também a autoridade, e nisso revela-se um outro problema não apontado na teoria de Bauman: qual o padrão do amor "sólido"? Pois, ora, sociedades tradicionais não abdicavam do relevar dos amores para tornar seus filhos em ativos nas práticas de trocas (dádivas)? É notório que esse padrão se dissocia do padrão de sentimento apontado por Bauman, encontramos esse fato em estudo nos trabalhos "Ensaio Sobre a Dádiva", do Marcel Mauss, e "As Estruturas Elementares do Parentesco", do Claude Levi-Strauss, quais expõem que nas sociedades "sólidas", tradicionais, relevava-se mais questões institucionais que as sentimentais para a formação de laços (teoria da aliança). Muitas das relações passadas não eram baseadas no amor, não significando assim que as de hoje, em oposição, sejam, mas que permanecem-se semelhantes em base, diferentemente em grau e forma.

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F748b94c3-f882-45db-8333-09260ef15cfe_615x413.jpeg

Ora, ainda existem casamentos motivados pela política, pelo status, pelo prestígio, pelos bens, pelo poder, pela influência familiar e assim sucetivamente, tal como no passado, ocorre que essa prática tornou-se oculta, não mais explícita e aparente, devo dizer ainda que em partes, pois prepondera em nosso tempo uma epidemia de adultérios, fornicações, práticas lascivas e demais práticas libertinosas explicitamente, em contraposição às práticas ocultas em vergonhas de sociedades sem declínio moral e espiritual, o que nos leva a questionar o método comparativo em dicotomia temporal "presente x passado" aplicado por Bauman, no qual segue-se da seguinte forma:

Transformação Passado = *sólido* | Presente = *líquido* Categorias Padrão de amor: tradicional (*sólido*) moderno (*líquido*) *Sólido* = estável, prazo (médio-grande), profundo, determinado. *Líquido* = instável, prazo (curto-médio), raso, indeterminado.O que penso é: Zygmunt Bauman buscou uma explicação material e laical para desviar ao fato de que há uma notória correlação entre espiritualização da sociedade, se voltada à Verdade, com a estabilidade das instituições, o que é já reduzido à moral religiosa, somente, não à mística, como por pensadores da linha de Tocqueville, ou em abordagens também mais laical (positivista) porém ainda relevantes, como Émile Durkheim em "As Formas Elementares da Vida Religiosa" e Max Weber em "A Ética Protestante e o Espírito do Capitalismo", contrapondo uma abordage mais voltada, de fato, a espiritualidade, como Christopher Dawnson, que defende essa teoria em "Religião e o Surgimento da Cultura Ocidental", e Eric Voegelin, principalmente nas obras "A Nova Ciência da Política" e "Ordem e História".

Encerrando, minha cosmovisão é a católica, o sistema de crença e religião qual sigo é do Deus que se fez homem por amor aos seus filhos, não posso negar ou mesmo omitir o fato de que, por trás de toda a minha crítica estão meus pensamentos e minhas convicções alinhadas àquilo que mais tenho amor em toda minha vida: a Verdade, e a Verdade é Deus, pois Cristo é a Verdade, o Caminho e a Vida, ninguém vai ao Pai se não por Ele, e pois bem, seria incoerência de minha parte não relevar o fato de crença como um dos motivos pelos quais eu rejeito a teoria do amor líquido de Zygmunt Bauman, pois os amores são todos eles praticados por formas, existem por diferentes formas e assim são desde sua tradicionalidade até o predomínio das distorções de declínio espiritual das eras presentes (e também antigas pré-Era Axial), estão esses preservados pelo alinhamento à verdade, assim são indistorcíveis, imutáveis, ou seja, amor é amor, não releva-se o falso amor como um, simplesmente não o é, assim o interesse, a sanha por bens, o egoísmo e a egolatria ("cupiditas", para Santo Agostinho de Hipona, em oposição ao que o santo e filósofo trata por "caritas") não são formas do amor, são autoenganos, não bons, se não são bons logo não são de Deus, ora, se Deus é amor, se ele nos ama, determino como amor (e suas formas) o que está de acordo com a Verdade. Aprofundando, a Teologia do Corpo, do Papa São João Paulo II, rejeita a "liquidez" apresentada por Bauman, pois o amor é, em suma, sacríficio, parte da entrega total de si ao próximo, e se não há logo não é amor. A Teologia do Corpo rejeita não os fundamentos de mentira no "líquido", mas também no "sólido", pois a tradicionalidade não é sinônimo de bom e pleno acordo com o amor que Deus pede de nós, não são as coerções, as violências, as imposições e demais vontades em oposição às de Deus que determinam os amores -- fatos em oposição ao ideário romanticizado. Claro, nem todas as coerções são por si inválidas do amor, ou mesmo as escolhas em trocas racionalizadas, a exemplo do autruísmo em vista da chance da família ter êxito e sucesso, ou seja, pelo bem dos próximos haver a necessidade de submissão a, em exemplo, um casamento forjado, ou algo do gênero, reconhece-se o amor no ato se feito por bem da família, porém o amor incutido, nesse caso, explicita o caráter sacrificial, no qual uma vontade e um amor genuinamente potencial em prazeres e alegrias são anulados, ou seja, mesmo nesse modelo tradicional na "solidez" há possibilidade do amor, não nas formas romanticizadas em critérios, como "estabilidade" e "durabilidade", mas no caráter do sacríficio exercido. Conforme nos ensina São Tomás de Aquino, o amor não é uma "força", tal como ensina Hegel, mas sim uma virtude teologal conforme na "Suma Teológica" (II-II Q. 26-28), não devemos reduzir o amor e os amores em análises simplórias (não simples) de falsa complexidade extraídas em métodos questionáveis e pouco competentes à real diensão de crise espiritual das eras, por esse motivo não concordo com a teoria do amor líquido de Zygmunt Bauman.

-

@ b7274d28:c99628cb

2025-05-28 00:59:49

@ b7274d28:c99628cb

2025-05-28 00:59:49Your identity is important to you, right? While impersonation can be seen in some senses as a form of flattery, we all would prefer to be the only person capable of representing ourselves online, unless we intentionally delegate that privilege to someone else and maintain the ability to revoke it.

Amber does all of that for you in the context of #Nostr. It minimizes the possibility of your private key being compromized by acting as the only app with access to it, while all other Nostr apps send requests to Amber when they need something signed. This even allows you to give someone temporary authority to post as you without giving them your private key, and you retain the authority to revoke their permissions at any time.

nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5 has provided Android users with an incredibly powerful tool in Amber, and he continues to improve its functionality and ease of use. Indeed, there is not currently a comparative app available for iOS users. For the time being, this superpower is exclusive to Android.

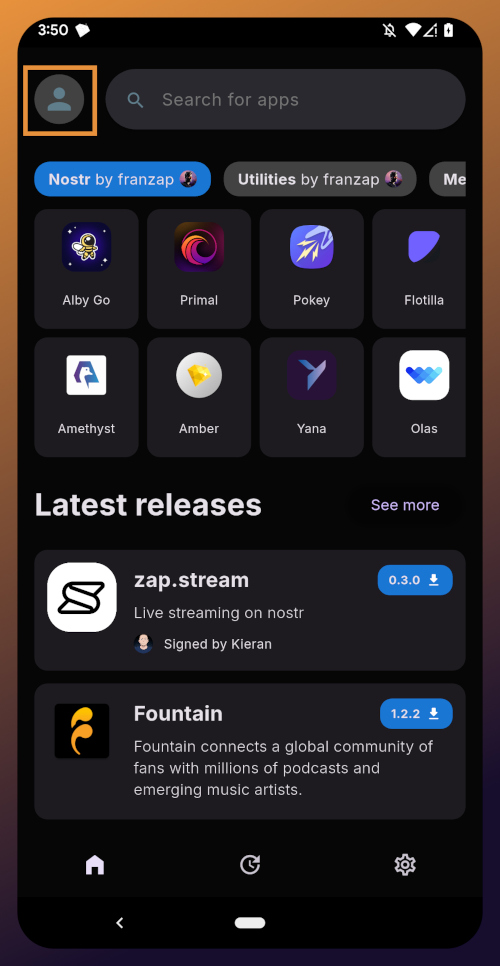

Installation

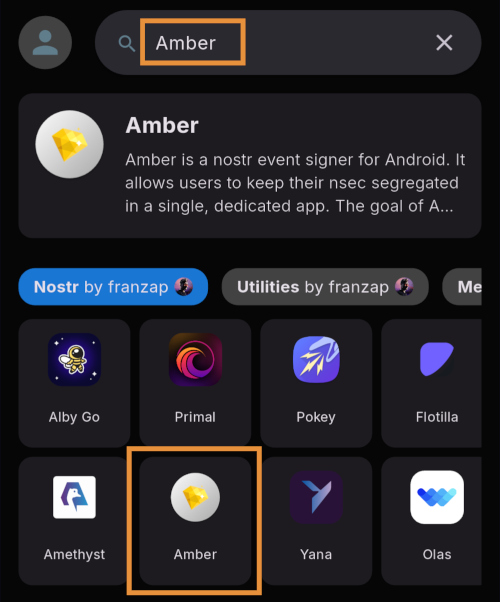

Open up the Zapstore app that you installed in the previous stage of this tutorial series.

Very likely, Amber will be listed in the app collection section of the home page. If it is not, just search for "Amber" in the search bar.

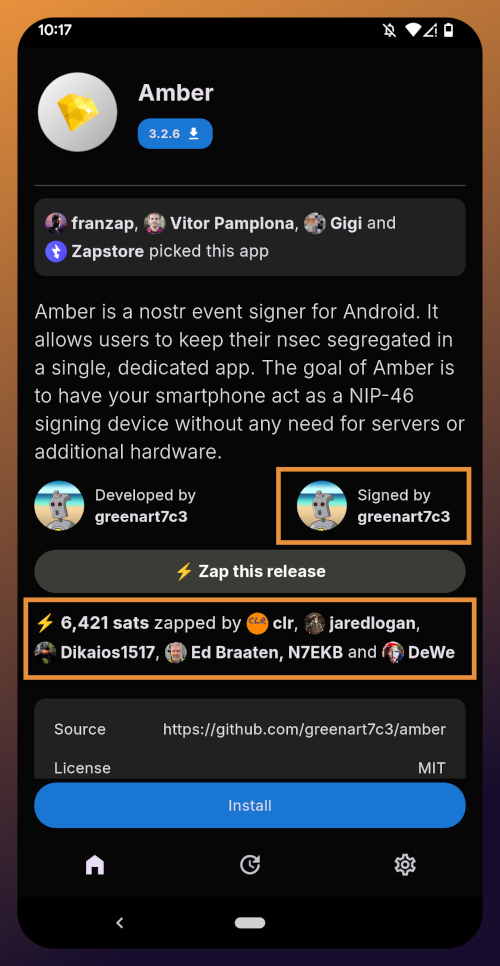

Opening the app's page in the Zapstore shows that the release is signed by the developer. You can also see who has added this app to one of their collections and who has supported this app with sats by zapping the release.

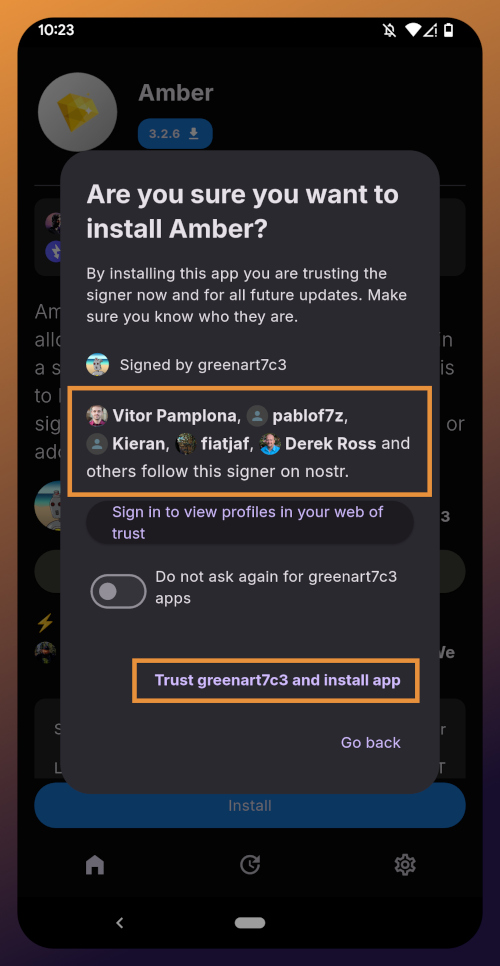

Tap "Install" and you will be prompted to confirm you are sure you want to install Amber.

Helpfully, you are informed that several other users follow this developer on Nostr. If you have been on Nostr a while, you will likely recognize these gentlemen as other Nostr developers, one of them being the original creator of the protocol.

You can choose to never have Zapstore ask for confirmation again with apps developed by nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5, and since we have another of his apps to install later in this tutorial series, I recommend you toggle this on. Then tap on "Trust greenart7c3 and install app."

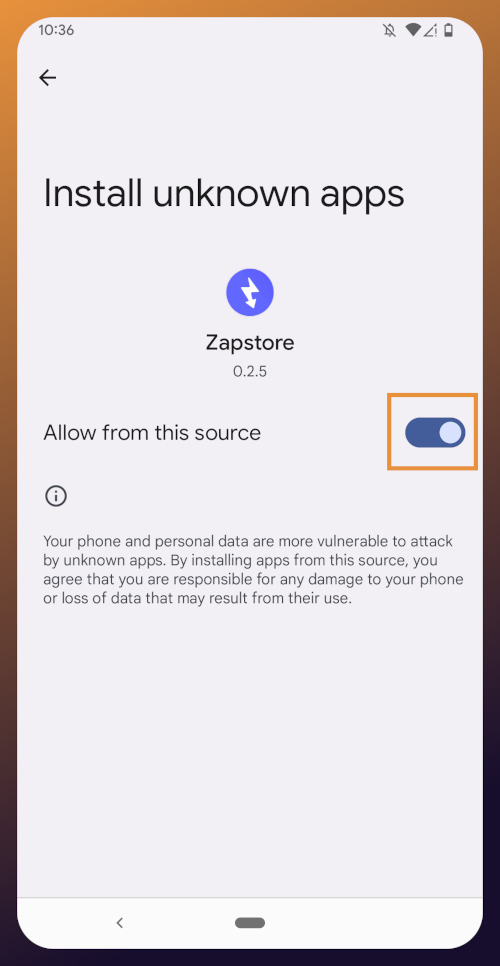

Just like when you installed the Zapstore from their GitHub, you will be prompted to allow the Zapstore to install apps, since Android considers it an "unknown source."

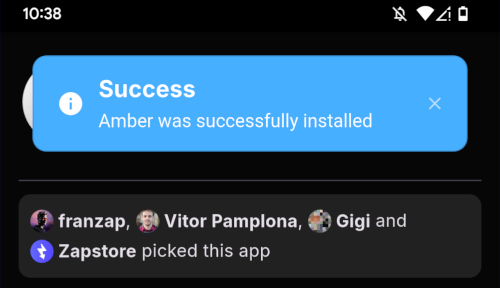

Once you toggle this on and use the back button to get back to the Zapstore, Amber will begin downloading and then present a prompt to install the app. Once installed, you will see a prompt that installation was a success and you can now open the app.

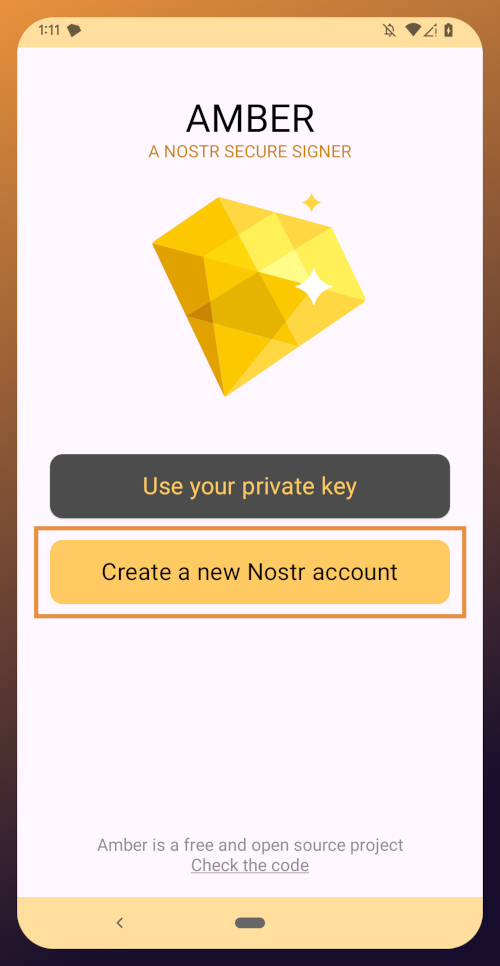

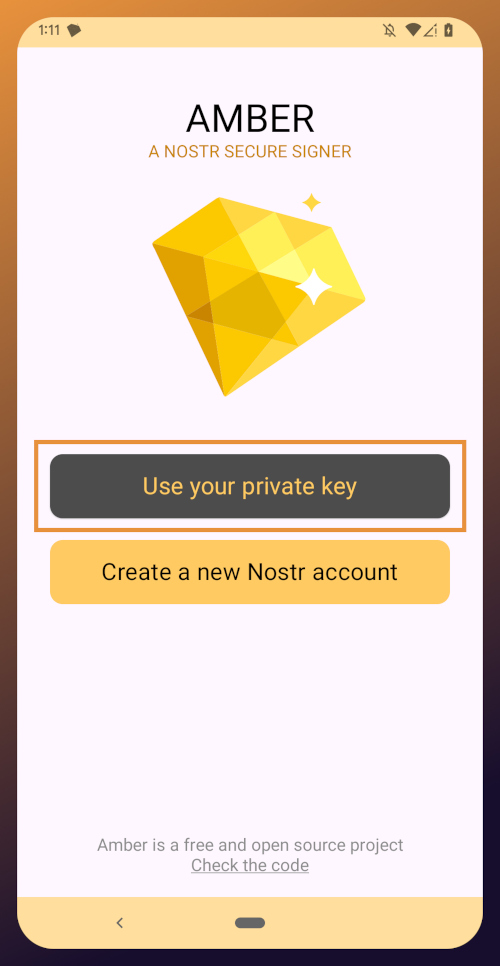

From here, how you proceed will depend on whether you need to set up a new Nostr identity or use Amber with an existing private key you already have set up. The next section will cover setting up a new Nostr identity with Amber. Skip to the section titled "Existing Nostrich" if you already have an nsec that you would like to use with Amber.

New Nostrich

Upon opening the application, you will be presented with the option to use an existing private key or create a new Nostr account. Nostr doesn't really have "accounts" in the traditional sense of the term. Accounts are a relic of permissioned systems. What you have on Nostr are keys, but Amber uses the "account" term because it is a more familiar concept, though it is technically inaccurate.

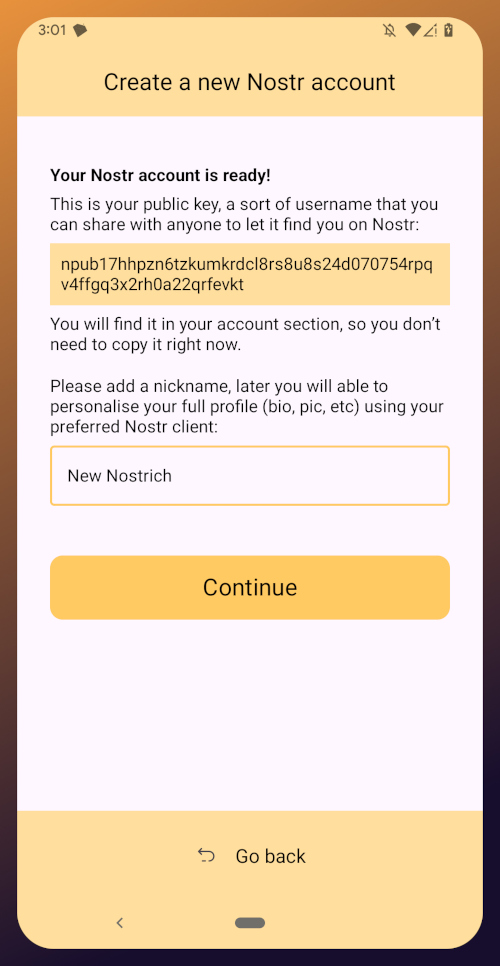

Choose "Create a new Nostr account" and you will be presented with a screen telling you that your Nostr account is ready. Yes, it was really that easy. No email, no real name, no date of birth, and no annoying capcha. Just "Create a new account" and you're done.

The app presents you with your public key. This is like an address that can be used to find your posts on Nostr. It is 100% unique to you, and no one else can post a note that lists this npub as the author, because they won't have the corresponding private key. You don't need to remember your npub, though. You'll be able to readily copy it from any Nostr app you use whenever you need it.

You will also be prompted to add a nickname. This is just for use within Amber, since you can set up multiple profiles within the app. You can use anything you want here, as it is just so you can tell which profile is which when switching between them in Amber.

Once you've set your nickname, tap on "Continue."

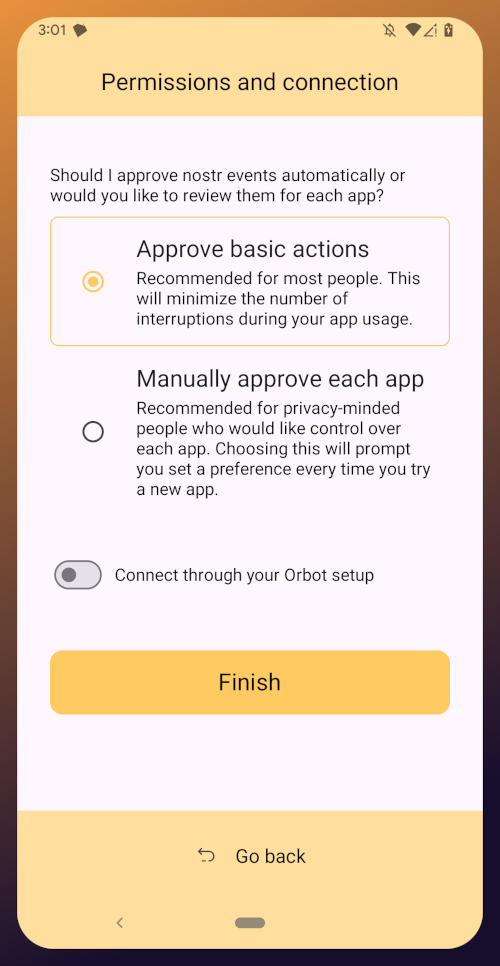

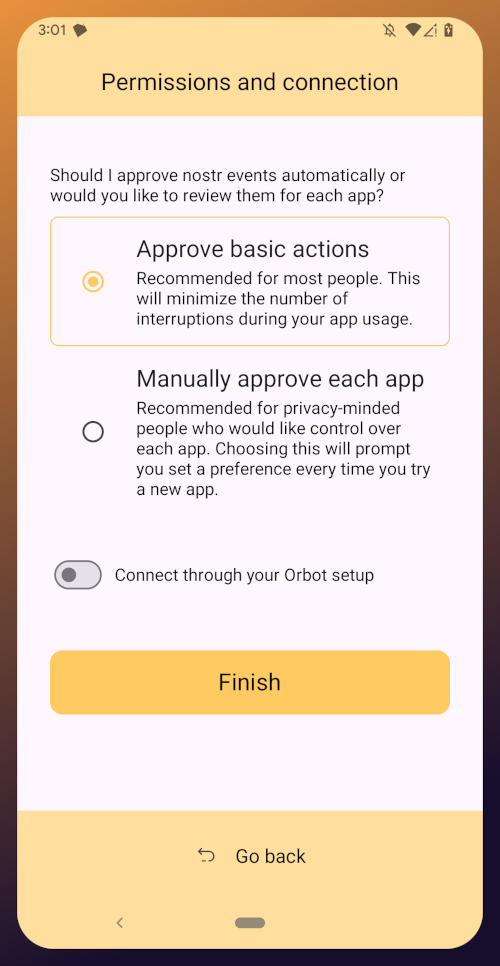

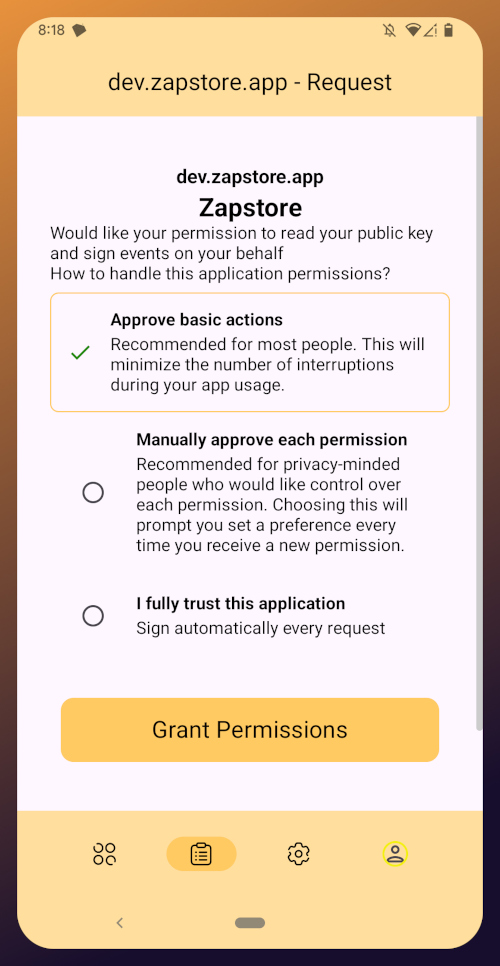

The next screen will ask you what Amber's default signing policy should be.

The default is to approve basic actions, referring to things that are common for Nostr clients to request a signature for, like following another user, liking a post, making a new post, or replying. If you are more concerned about what Amber might be signing for on your behalf, you can tell it to require manual approval for each app.

Once you've made your decision, tap "Finish." You will also be able to change this selection in the app settings at any time.

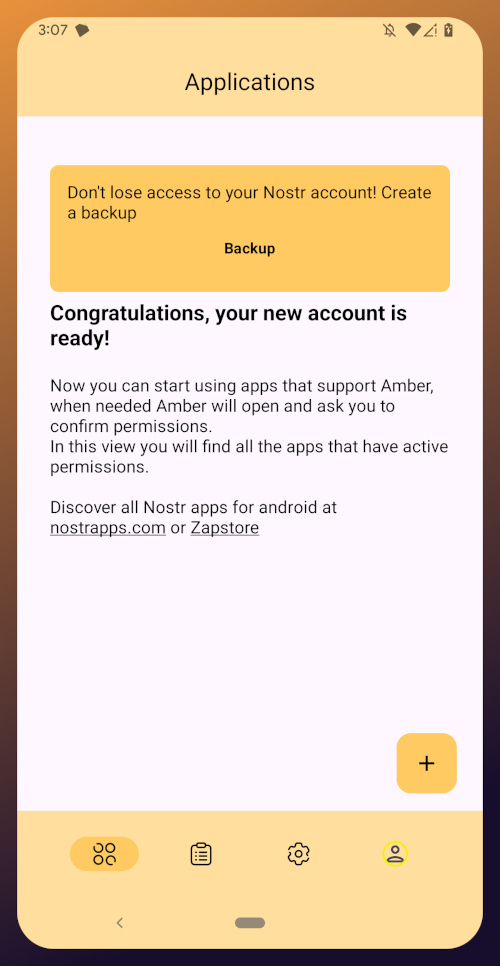

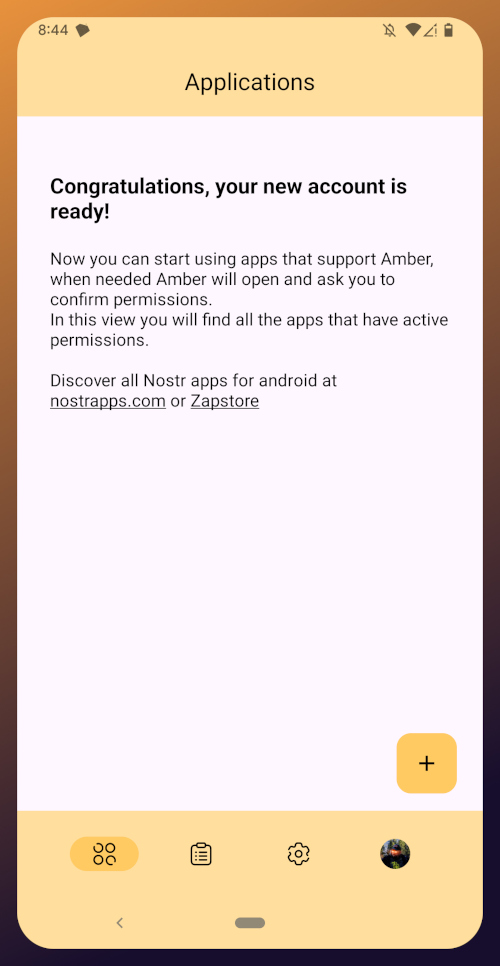

With this setup out of the way, you are now presented with the main "Applications" page of the app.

At the top, you have a notification encouraging you to create a backup. Let's get that taken care of now by tapping on the notification and skipping down to the heading titled "Backing Up Your Identity" in this tutorial.

Existing Nostrich

Upon opening the application, you will be presented with the option to use your private key or create a new Nostr account. Choose the former.

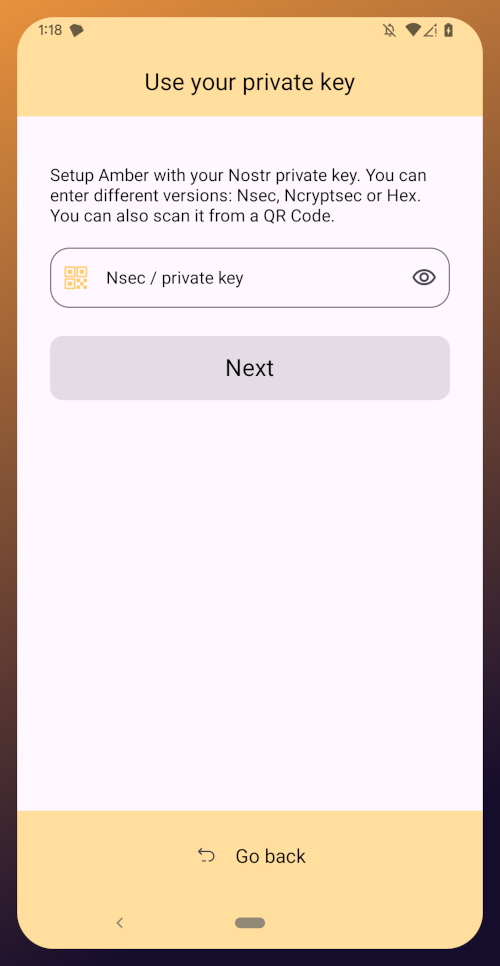

The next screen will require you to paste your private key.

You will need to obtain this from whatever Nostr app you used to create your profile, or any other Nostr app that you pasted your nsec into in the past. Typically you can find it in the app settings and there will be a section mentioning your keys where you can copy your nsec. For instance, in Primal go to Settings > Keys > Copy private key, and on Amethyst open the side panel by tapping on your profile picture in the top-left, then Backup Keys > Copy my secret key.

After pasting your nsec into Amber, tap "Next."

Amber will give you a couple options for a default signing policy. The default is to approve basic actions, referring to things that are common for Nostr clients to request a signature for, like following another user, liking a post, making a new post, or replying. If you are more concerned about what Amber might be signing for on your behalf, you can tell it to require manual approval for each app.

Once you've made your decision, tap "Finish." You will also be able to change this selection in the app settings at any time.

With this setup out of the way, you are now presented with the main "Applications" page of the app. You have nothing here yet, since you haven't used Amber to log into any Nostr apps, but this will be where all of the apps you have connected with Amber will be listed, in the order of the most recently used at the top.

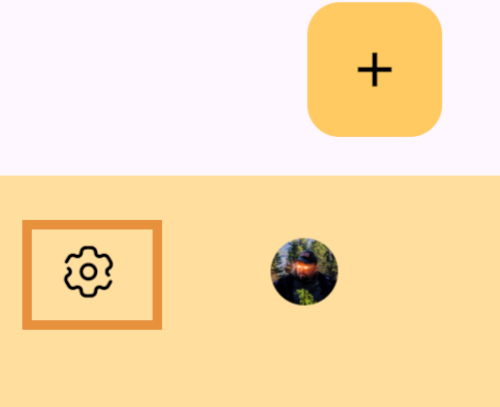

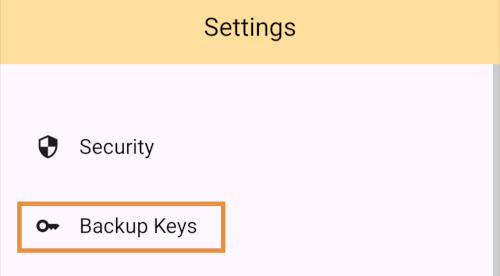

Before we go and use Amber to log into an app, though, let's make sure we've created a backup of our private key. You pasted your nsec into Amber, so you could just save that somewhere safe, but Amber gives you a few other options as well. To find them, you'll need to tap the cog icon at the bottom of the screen to access the settings, then select "Backup Keys."

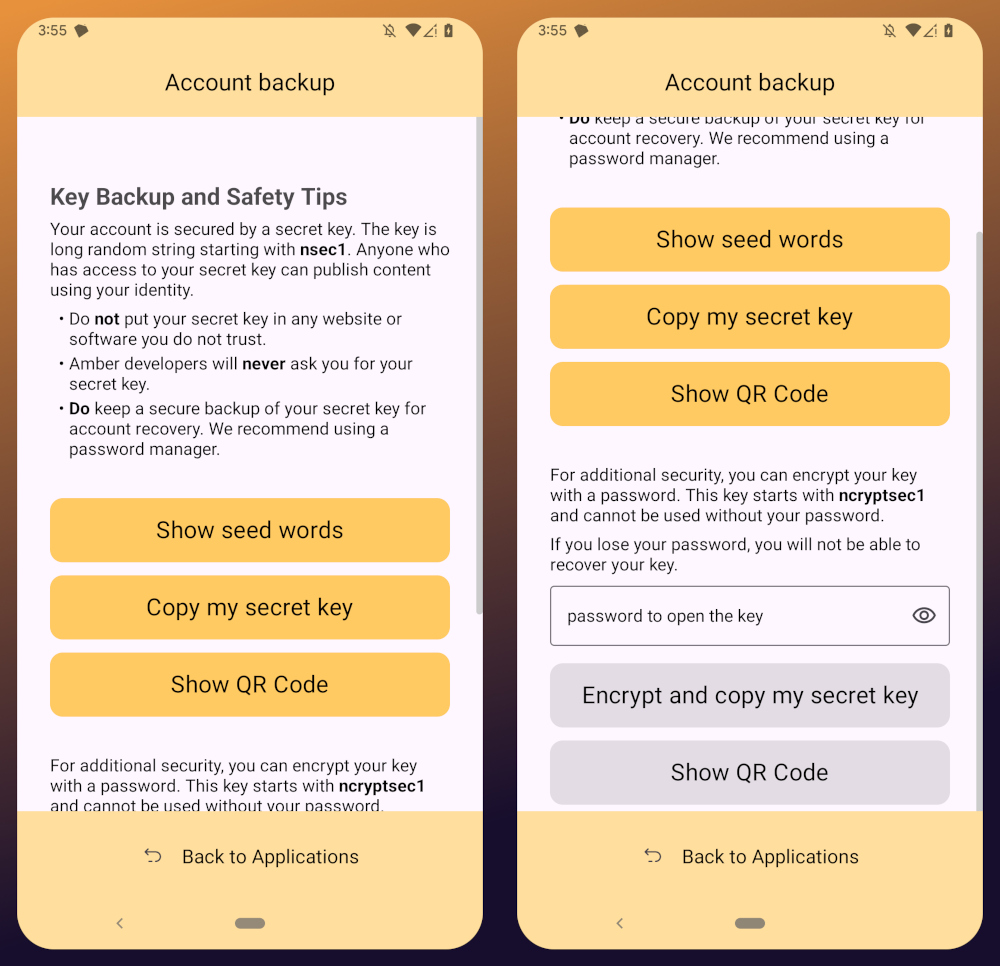

Backing Up Your Identity

You'll notice that Amber has a few different options for backing up your private key that it can generate.

First, it can give you seed words, just like a Bitcoin seed. If you choose that option, you'll be presented with 12 words you can record somewhere safe. To recover your Nostr private key, you just have to type those words into a compatible application, such as Amber.

The next option is to just copy the secret/private key in its standard form as an "nsec." This is the least secure way to store it, but is also the most convenient, since it is simple to paste into another signer application. If you want to be able to log in on a desktop web app, the browser extension Nostr signers won't necessarily support entering your 12 word seed phrase, but they absolutely will support pasting in your nsec.

You can also display a QR code of your private key. This can be scanned by Amber signer on another device for easily transferring your private key to other devices you want to use it on. Say you have an Android tablet in addition to your phone, for instance. Just make sure you only use this function where you can be certain that no one will be able to get a photograph of that QR code. Once someone else has your nsec, there is no way to recover it. You have to start all over on Nostr. Not a big deal at this point in your journey if you just created a Nostr account, but if you have been using Nostr for a while and have built up a decent amount of reputation, it could be much more costly to start over again.

The next options are a bit more secure, because they require a password that will be used to encrypt your private key. This has some distinct advantages, and a couple disadvantages to be aware of. Using a password to encrypt your private key will give you what is called an ncryptsec, and if this is leaked somehow, whoever has it will not necessarily have access to post as you on Nostr, the way they would if your nsec had been leaked. At least, not so long as they don't also have your password. This means you can store your ncryptsec in multiple locations without much fear that it will be compromised, so long as the password you used to encrypt it was a strong and unique one, and it isn't stored in the same location. Some Nostr apps support an ncryptsec for login directly, meaning that you have the option to paste in your ncryptsec and then just log in with the password you used to encrypt it from there on out. However, now you will need to keep track of both your ncryptsec and your password, storing both of them safely and separately. Additionally, most Nostr clients and signer applications do not support using an ncryptsec, so you will need to convert it back to a standard nsec (or copy the nsec from Amber) to use those apps.

The QR option using an ncryptsec is actually quite useful, though, and I would go this route when trying to set up Amber on additional devices, since anyone possibly getting a picture of the QR code is still not going to be able to do anything with it, unless they also get the password you used to encrypt it.

All of the above options will require you to enter the PIN you set up for your device, or biometric authentication, just as an additional precaution before displaying your private key to you.

As for what "store it in a safe place" looks like, I highly recommend a self-hosted password manager, such as Vaultwarden+Bitwarden or KeePass. If you really want to get wild, you can store it on a hardware signing device, or on a steel seed plate.

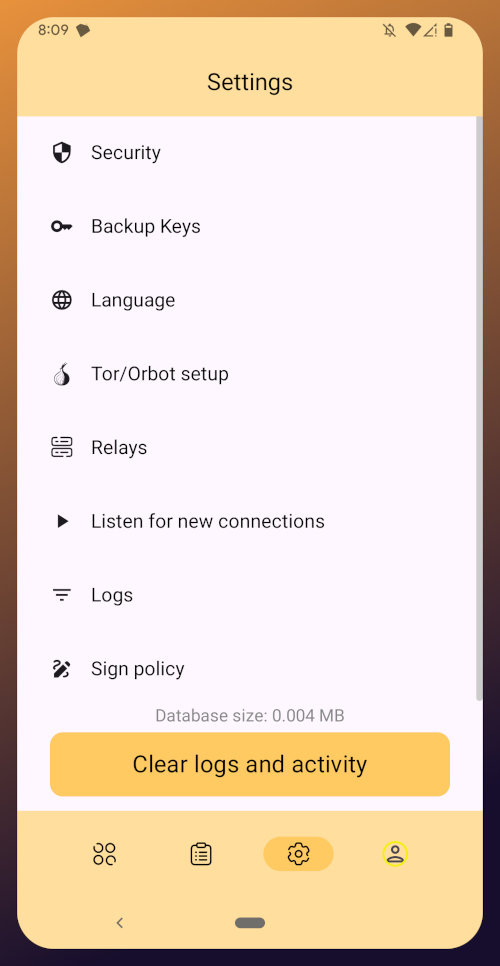

Additional Settings

Amber has some additional settings you may want to take advantage of. First off, if you don't want just anyone who has access to your phone to be able to approve signing requests, you can go into the Security settings add a PIN or enable biometrics for signing requests. If you enable the PIN, it will be separate from the PIN you use to access your phone, so you can let someone else use your phone, like your child who is always begging to play a mobile game you have installed, without worrying that they might have access to your Nostr key to post on Amethyst.

Amber also has some relay settings. First are the "Active relays" which are used for signing requests sent to Amber remotely from Nostr web apps. This is what enables you to use Amber on your phone to log into Nostr applications on your desktop web browser, such as Jumble.social, Coracle.social, or Nostrudel.ninja, eliminating your need to use any other application to store your nsec whatsoever. You can leave this relay as the default, or you can add other relays you want to use for signing requests. Just be aware, not all relays will accept the notes that are used for Nostr signing requests, so make sure that the relay you want to use does so. In fact, Amber will make sure of this for you when you type in the relay address.

The next type of relays that you can configure in Amber are the "Default profile relays." These are used for reading your profile information. If you already had a Nostr identity that you imported to Amber, you probably noticed it loaded your profile picture and display name, setting the latter as your nickname in Amber. These relays are where Amber got that information from. The defaults are relay.nostr.band and purplepag.es. The reason for this is because they are aggregators that look for Nostr profiles that have been saved to other relays on the network and pull them in. Therefore, no matter what other relay you may save your profile to, Amber will likely be able to find it on one of those two relays as well. If you have a relay you know you will be saving your Nostr profiles to, you may want to add it to this list.

You can also set up Amber to be paired with Orbot for signing over Tor using relays that are only accessible via the Tor network. That is an advanced feature, though, and well beyond the scope of this tutorial.

Finally, you can update the default signing policy. Maybe after using Amber for a while, you've decided that the choice you made before was too strict or too lenient. You can change it to suit your needs.

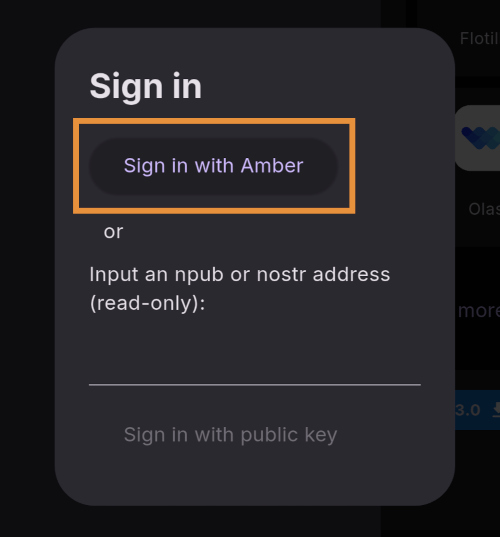

Zapstore Login

Now that you are all set up with Amber, let's get you signed into your first Nostr app by going back to the Zapstore.

From the app's home screen, tap on the user icon in the upper left of the screen. This will open a side panel with not much on it except the option to "sign in." Go ahead and tap on it.

You will be presented with the option to either sign in with Amber, or to paste your npub. However, if you do the latter, you will only have read access, meaning you cannot zap any of the app releases. There are other features planned for the Zapstore that may also require you to be signed in with write access, so go ahead and choose to log in with Amber.

Your phone should automatically switch to Amber to approve the sign-in request.

You can choose to only approve basic actions for Zapstore, require it to manually approve every time, or you can tell it that you "fully trust this application." Only choose the latter option with apps you have used for a while and they have never asked you to sign for anything suspicious. For the time being, I suggest you use the "Approve basic actions" option and tap "Grant Permissions."

Your phone will switch back to the Zapstore and will show that you are now signed in. Congratulations! From here on out, logging into most Nostr applications will be as easy as tapping on "Log in with Amber" and approving the request.

If you set up a new profile, it will just show a truncated version of your npub rather than the nickname you set up earlier. That's fine. You'll have an opportunity to update your Nostr profile in the next tutorial in this series and ensure that it is spread far and wide in the network, so the Zapstore will easily find it.

That concludes the tutorial for Amber. While we have not covered using Amber to log into Nostr web apps, that is outside the scope of this series, and I will cover it in an upcoming tutorial regarding using Amber's remote signer options in detail.

Since you're already hanging out in the Zapstore, you may as well stick around, because we will be using it right out the gate in the next part of this series: Amethyst Installation and Setup. (Coming Soon)

-

@ 84b0c46a:417782f5

2025-05-08 06:28:42

@ 84b0c46a:417782f5

2025-05-08 06:28:42至高の油淋鶏の動画 https://youtu.be/Ur2tYVZppBU のレシピ書き起こし

材料(2人分)

- 鶏モモ肉…300g

- A[しょうゆ…小さじ1 塩…小さじ1/3 酒…大さじ1と1/2 おろしショウガ…5g 片栗粉…大さじ1]

- 長ネギ(みじん切り)…1/2本(50g)

- ショウガ(みじん切り)…10g

- B[しょうゆ…大さじ2 砂糖…小さじ4 酢…大さじ1 ゴマ油…小さじ1 味の素…4ふり 赤唐辛子(小口切り)…1本分]

- 赤唐辛子、花椒(各好みで)…各適量

手順

- 肉を切る

皮を上にして適当に八等分くらい

- 肉を肉入ってたトレーかなんか適当な入れ物に入れてそこに 醤油こさじ1、塩こさじ1/3、酒おおさじ1と1/2 と ショウガ*5グラムすりおろして入れて軽く混ぜる

- そこに、片栗粉おおさじ1入れて混ぜる(漬ける段階にも片栗粉を入れることで厚衣になりやすい)

- 常温で15分くらい置く

- その間にたれを作る

-

長ネギ50gを細かいみじん切りにしてボウルに入れる(白いとこも青いとこも)

(端っこを残して縦に切り込みを入れて横に切るとよい) 2. ショウガ10gを細かいみじん切りにして同じボウルにいれる 3. 鷹の爪1本分入れる(任意) 4. 醤油おおさじ2、砂糖小さじ4、酢(穀物酢)おおさじ1を入れる 5. 味の素4振りいれてよく混ぜる 6. 小さなフライパン(油が少なくて済むので)に底に浸るくらいの油を入れ、中火で温める 7. 肉に片栗粉をたっぷりつけて揚げる 8. 揚がったらキッチンペーパーを敷いたなにかしらとかに上げる 9. もりつけてタレをかけて完成

-

-

@ 78b3c1ed:5033eea9

2025-05-07 08:23:24

@ 78b3c1ed:5033eea9

2025-05-07 08:23:24各ノードにポリシーがある理由 → ノードの資源(CPU、帯域、メモリ)を守り、無駄な処理を避けるため

なぜポリシーがコンセンサスルールより厳しいか 1.資源の節約 コンセンサスルールは「最終的に有効かどうか」の基準だが、全トランザクションをいちいち検証して中継すると資源が枯渇する。 ポリシーで「最初から弾く」仕組みが必要。

-

ネットワーク健全性の維持 手数料が低い、複雑すぎる、標準でないスクリプトのトランザクションが大量に流れると、全体のネットワークが重くなる。 これを防ぐためにノードは独自のポリシーで中継制限。

-

開発の柔軟性 ポリシーはソフトウェアアップデートで柔軟に変えられるが、コンセンサスルールは変えるとハードフォークの危険がある。 ポリシーを厳しくすることで、安全に新しい制限を試すことができる。

標準ポリシーの意味は何か? ノードオペレーターは自分でbitcoindの設定やコードを書き換えて独自のポリシーを使える。 理論上ポリシーは「任意」で、標準ポリシー(Bitcoin Coreが提供するポリシー)は単なるデフォルト値。 ただし、標準ポリシーには以下の大事な意味がある。

-

ネットワークの互換性を保つ基準 みんなが全く自由なポリシーを使うとトランザクションの伝播効率が落ちる。 標準ポリシーは「大多数のノードに中継される最小基準」を提供し、それを守ればネットワークに流せるという共通の期待値になる。

-

開発・サービスの指針 ウォレット開発者やサービス提供者(取引所・支払いサービスなど)は、「標準ポリシーに準拠したトランザクションを作れば十分」という前提で開発できる。 もし標準がなければ全ノードの個別ポリシーを調査しないと流れるトランザクションを作れなくなる。

-

コミュニティの合意形成の場 標準ポリシーはBitcoin Coreの開発・議論で決まる。ここで新しい制限や緩和を入れれば、まずポリシーレベルで試せる。 問題がなければ、将来のコンセンサスルールに昇格させる議論の土台になる。

つまりデフォルトだけど重要。 確かに標準ポリシーは技術的には「デフォルト値」にすぎないが、実際にはネットワークの安定・互換性・開発指針の柱として重要な役割を果たす。

ビットコインノードにおける「無駄な処理」というのは、主に次のようなものを指す。 1. 承認される見込みのないトランザクションの検証 例: 手数料が極端に低く、マイナーが絶対にブロックに入れないようなトランザクション → これをいちいち署名検証したり、メモリプールに載せるのはCPU・RAMの無駄。

-

明らかに標準外のスクリプトや形式の検証 例: 極端に複雑・非標準なスクリプト(non-standard script) → コンセンサス的には有効だが、ネットワークの他ノードが中継しないため、無駄な伝播になる。

-

スパム的な大量トランザクションの処理 例: 攻撃者が極小手数料のトランザクションを大量に送り、メモリプールを膨張させる場合 → メモリやディスクI/O、帯域の消費が無駄になる。

-

明らかに無効なブロックの詳細検証 例: サイズが大きすぎるブロック、難易度条件を満たさないブロック → 早期に弾かないと、全トランザクション検証や署名検証で計算資源を浪費する。

これらの無駄な処理は、ノードの CPU時間・メモリ・ディスクI/O・帯域 を消耗させ、最悪の場合は DoS攻撃(サービス妨害攻撃) に悪用される。 そこでポリシーによって、最初の受信段階、または中継段階でそもそも検証・保存・転送しないように制限する。 まとめると、「無駄な処理」とはネットワークの大勢に受け入れられず、ブロックに取り込まれないトランザクションやブロックにノード資源を使うこと。

無駄な処理かどうかは、単に「ポリシーで禁止されているか」で決まるわけではない。

本質的には次の2つで判断される 1. ノードの資源(CPU、メモリ、帯域、ディスク)を過剰に使うか 2. 他のノード・ネットワーク・マイナーに受け入れられる見込みがあるか

将来のBitcoin CoreのバージョンでOP_RETURNの出力数制限やデータサイズ制限が撤廃されたとする。 この場合標準ポリシー的には通るので、中継・保存されやすくなる。 しかし、他のノードやマイナーが追随しなければ意味がない。大量に流せばやはりDoS・スパム扱いされ、無駄な資源消費になる。

最終的には、ネットワーク全体の運用実態。 標準ポリシーの撤廃だけでは、「無駄な処理ではない」とは断定できない。 実質的な「無駄な処理」の判定は、技術的制約+経済的・運用的現実のセットで決まる。

-

-

@ a19caaa8:88985eaf

2025-05-06 00:14:49

@ a19caaa8:88985eaf

2025-05-06 00:14:49これって更新したらタイムラインに流れちゃう?それはいやかも テスト

-

@ 39cc53c9:27168656

2025-05-27 09:21:37

@ 39cc53c9:27168656

2025-05-27 09:21:37After almost 3 months of work, we've completed the redesign of kycnot.me. More modern and with many new features.

Privacy remains the foundation - everything still works with JavaScript disabled. If you enable JS, you will get some nice-to-have features like lazy loading and smoother page transitions, but nothing essential requires it.

User Accounts

We've introduced user accounts that require zero personal information:

- Secret user tokens - no email, no phone number, no personal data

- Randomly generated usernames for default privacy and fairness

- Karma system that rewards contributions and unlocks features: custom display names, profile pictures, and more.

Reviews and Community Discussions

On the previous sites, I was using third party open source tools for the comments and discussions. This time, I've built my own from scratch, fully integrated into the site, without JavaScript requirements.

Everyone can share their experiences and help others make informed decisions:

- Ratings: Comments can have a 1-5 star rating attached. You can have one rating per service and it will affect the overall user score.

- Discussions: These are normal comments, you can add them on any listed service.

Comment Moderation

I was strugling to keep up with moderation on the old site. For this, we've implemented an AI-powered moderation system that:

- Auto-approves legitimate comments instantly

- Flags suspicious content for human review

- Keeps discussions valuable by minimizing spam

The AI still can mark comments for human review, but most comments will get approved automatically by this system. The AI also makes summaries of the comments to help you understand the overall sentiment of the community.

Powerful Search & Filtering

Finding exactly what you need is now easier:

- Advanced filtering system with many parameters. You can even filter by attributes to pinpoint services with specific features.

The results are dynamic and shuffle services with identical scores for fairness.

See all listings

Listings are now added as 'Community Contributed' by default. This means that you can still find them in the search results, but they will be clearly marked as such.

Updated Scoring System

New dual-score approach provides more nuanced service evaluations:

- Privacy Score: Measures how well a service protects your personal information and data

-

Trust Score: Assesses reliability, security, and overall reputation

-

Combined into a weighted Overall Score for quick comparisons

- Completely transparent and open source calculation algorithm. No manual tweaking or hidden factors.

AI-Powered Terms of Service Analysis

Basically, a TLDR summary for Terms of Service:

- Automated system extracts the most important points from complex ToS documents

- Clear summaries

- Updated monthly to catch any changes

The ToS document is hashed and only will be updated if there are any changes.

Service Events and Timelines

Track the complete history of any service, on each service page you can see the timeline of events. There are two types of events:

- Automatic events: Created by the system whenever something about a service changes, like its description, supported currencies, attributes, verification status…

- Manual events: Added by admins when there’s important news, such as a service going offline, being hacked, acquired, shut down, or other major updates.

There is also a global timeline view available at /events

Notification System

Since we now have user accounts, we built a notifiaction system so you can stay informed about anything:

- Notifications for comment replies and status changes

- Watch any comment to get notified for new replies.

- Subscribe to services to monitor events and updates

- Notification customization.

Coming soon: Third-party privacy-preserving notifications integration with Telegram, Ntfy.sh, webhooks...

Service Suggestions

Anyone with an account can suggest a new service via the suggestion form. After submitting, you'll receive a tracking page where you can follow the status of your suggestion and communicate directly with admins.

All new suggestions start as "unlisted" — they won't appear in search results until reviewed. Our team checks each submission to ensure it's not spam or inappropriate. If similar services already exist, you'll be shown possible duplicates and can choose to submit your suggestion as an edit instead.

You can always check the progress of your suggestion, respond to moderator questions, and see when it goes live, everything will also be notified to your account. This process ensures high-quality listings and a collaborative approach to building the directory.

These are some of the main features we already have, but there are many more small changes and improvements that you will find when using the site.

What's Next?

This is just the beginning. We will be constantly working to improve KYCnot.me and add more features that help you preserve your privacy.

Remember: True financial freedom requires the right to privacy. Stay KYC-free!

-

@ 84b0c46a:417782f5

2025-05-04 09:49:45

@ 84b0c46a:417782f5

2025-05-04 09:49:45- 1:nan:

- 2

- 2irorio絵文字

- 1nostr:npub1sjcvg64knxkrt6ev52rywzu9uzqakgy8ehhk8yezxmpewsthst6sw3jqcw

- 2

- 2

- 3

- 3

- 2

- 1

|1|2| |:--|:--| |test| :nan: |

---

---:nan: :nan:

- 1

- 2

- tet

- tes

- 3

- 1

-

2

t

te

test

-

19^th^

- H~2~O

本サイトはfirefoxのみサポートしています うにょ :wayo: This text will bounce wss://catstrr.swarmstr.com/

うにょうにょてすと

-

@ f11e91c5:59a0b04a

2025-04-30 07:52:21

@ f11e91c5:59a0b04a

2025-04-30 07:52:21!!!2022-07-07に書かれた記事です。

暗号通貨とかでお弁当売ってます 11:30〜14:00ぐらいでやってます

◆住所 木曜日・東京都渋谷区宇田川町41 (アベマタワーの下らへん)

◆お値段

Monacoin 3.9mona

Bitzeny 390zny

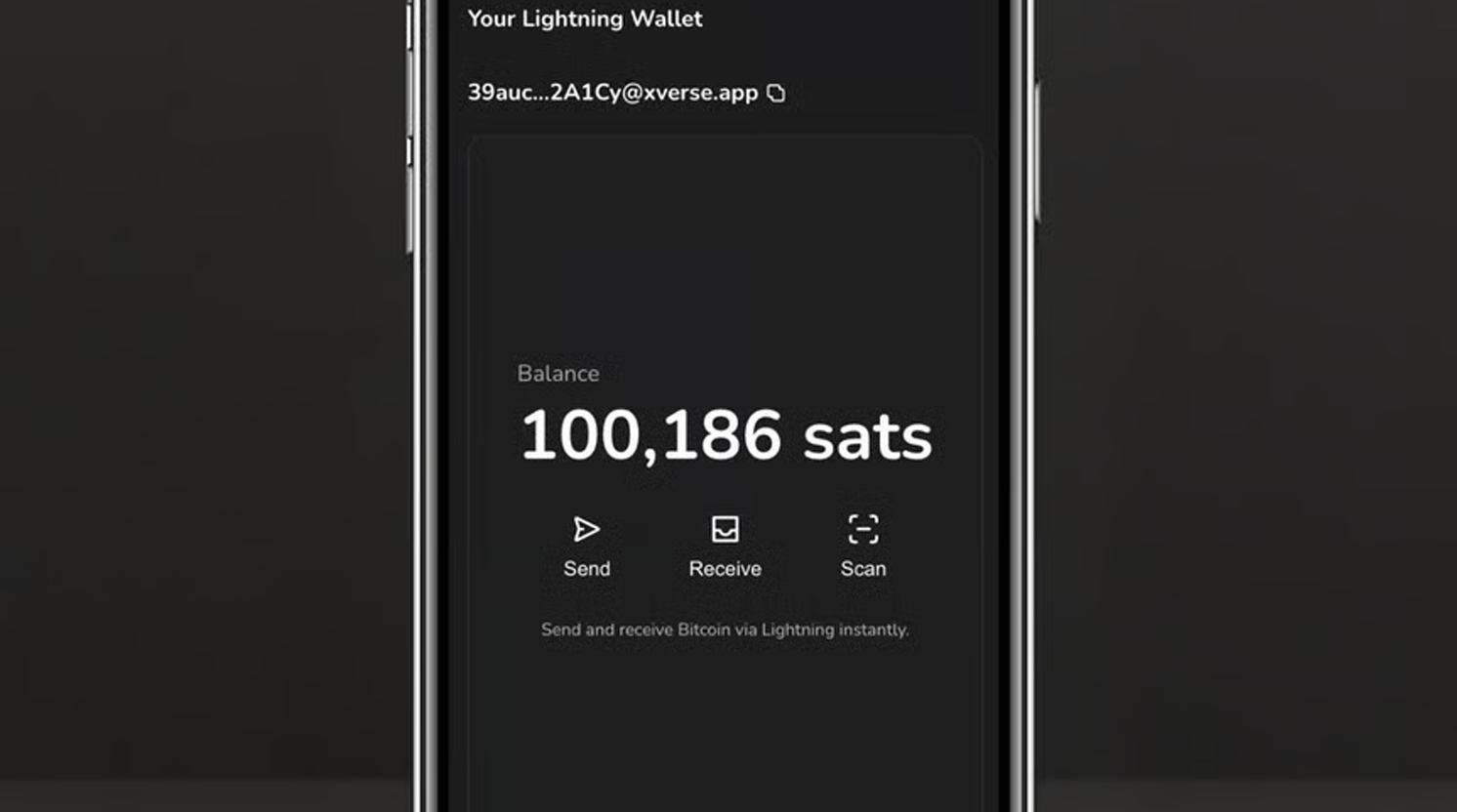

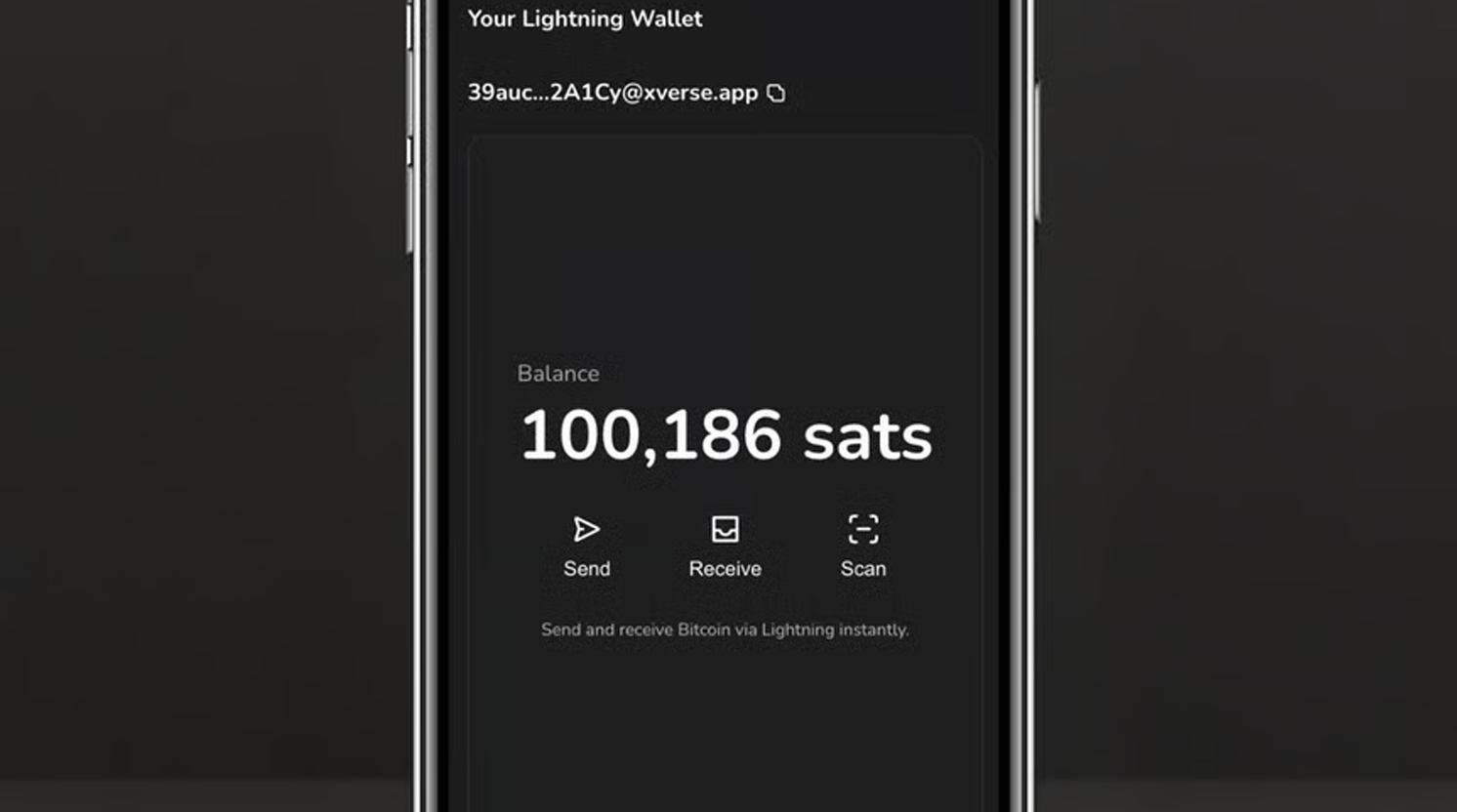

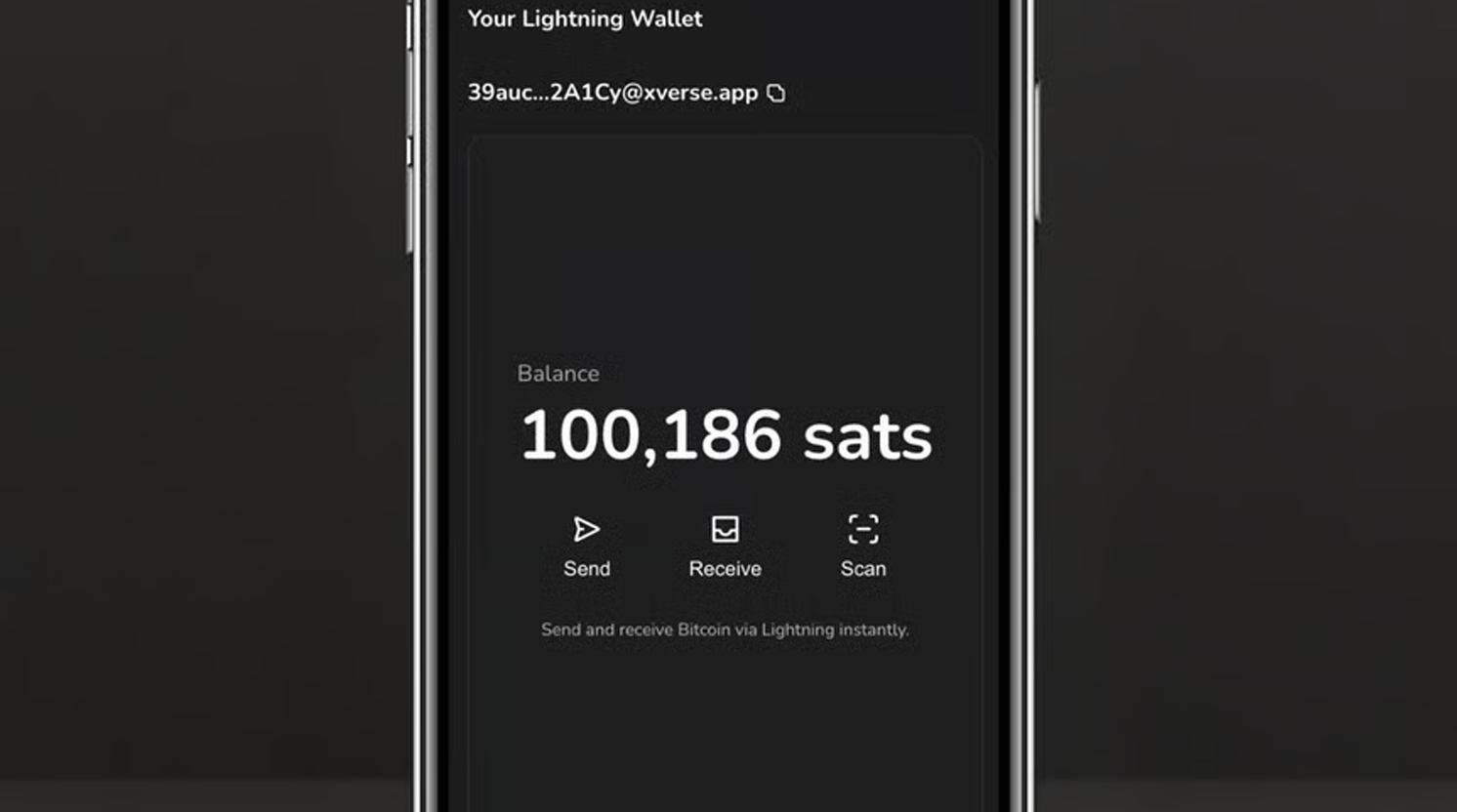

Bitcoin 3900sats (#lightningNetwork)

Ethereum 0.0039Ether(#zkSync)

39=thank you. (円を基準にしてません)

最近は週に一回になりました。 他の日はキッチンカーの現場を探したり色々してます。 東京都内で平日ランチ出店出来そうな場所があればぜひご連絡を!

写真はNFCタグです。

スマホにウォレットがあればタッチして3900satsで決済出来ます。

正直こんな怪しい手書きのNFCタグなんて絶対にビットコイナーは触りたくも無いだろうなと思いますが、これでも良いんだぜというメッセージです。

写真はNFCタグです。

スマホにウォレットがあればタッチして3900satsで決済出来ます。

正直こんな怪しい手書きのNFCタグなんて絶対にビットコイナーは触りたくも無いだろうなと思いますが、これでも良いんだぜというメッセージです。今までbtcpayのposでしたが速度を追求してこれに変更しました。 たまに上手くいかないですがそしたら渋々POS出すので温かい目でよろしくお願いします。

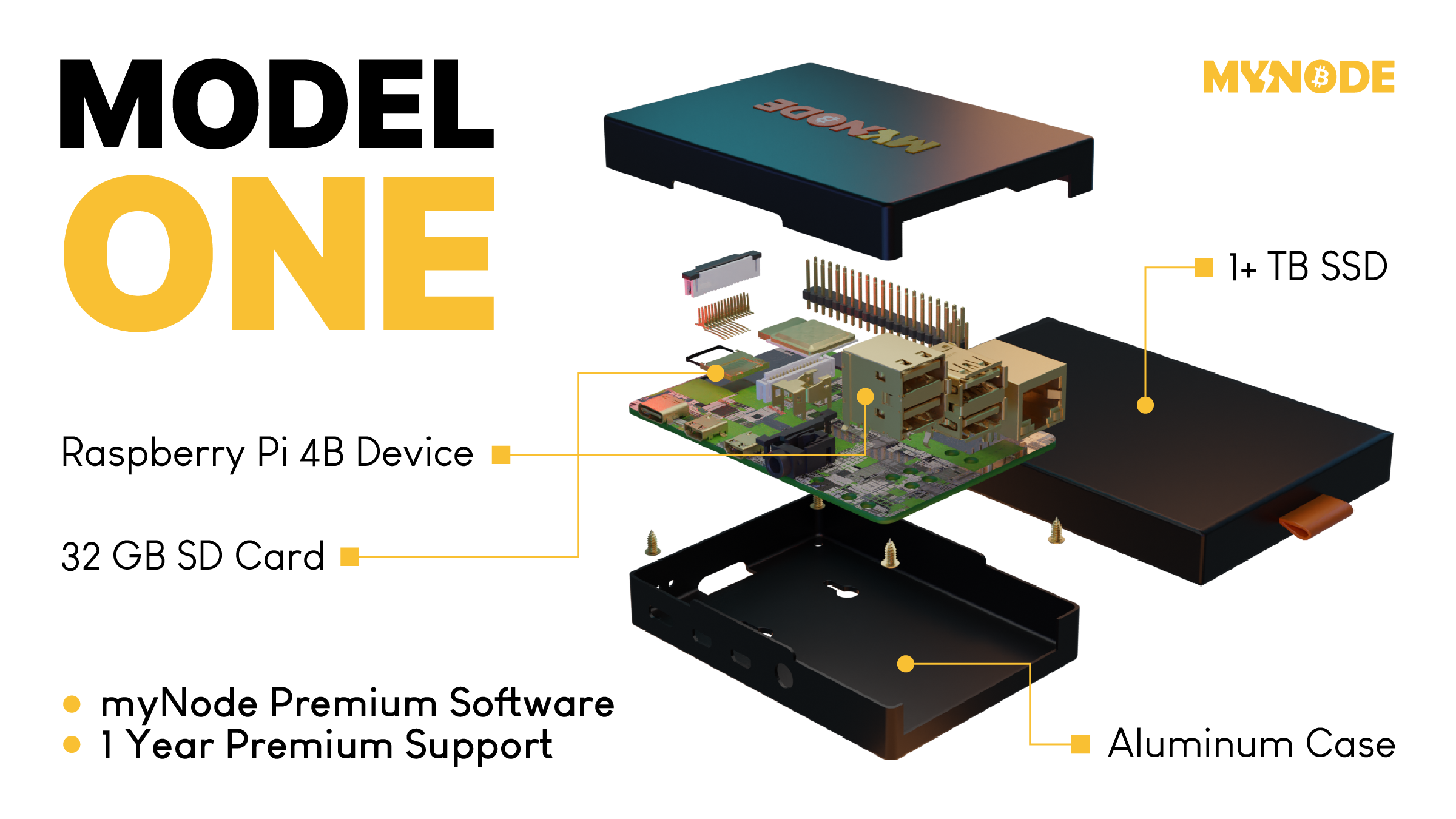

ノードを建てたり決済したりで1年経ちました。 最近も少しずつノードを建てる方が増えてるみたいで本当凄いですねUmbrel 大体の人がルーティングに果敢に挑むのを見つつ 奥さんに土下座しながら費用を捻出する弱小の私は決済の利便性を全開で振り切るしか無いので応援よろしくお願いします。

あえて あえて言うのであれば、ルーティングも楽しいですけど やはり本当の意味での即時決済や相手を選んでチャネルを繋げる楽しさもあるよとお伝えしたいっ!! 決済を受け入れないと分からない所ですが 承認がいらない時点で画期的です。

QRでもタッチでも金額指定でも入力でも もうやりようには出来てしまうし進化が恐ろしく早いので1番利用の多いpaypayの手数料(事業者側のね)を考えたらビットコイン凄いじゃない!と叫びたくなる。 が、やはり税制面や価格の変動(うちはBTC固定だけども)ウォレットの操作や普及率を考えるとまぁ難しい所もあるんですかね。

それでも継続的に沢山の人が色んな活動をしてるので私も何か出来ることがあれば 今後も奥さんに土下座しながら頑張って行きたいと思います。

(Originally posted 2022-07-07)

I sell bento lunches for cryptocurrency. We’re open roughly 11:30 a.m. – 2:00 p.m. Address Thursdays – 41 Udagawa-chō, Shibuya-ku, Tokyo (around the base of Abema Tower)

Prices Coin Price Note Monacoin 3.9 MONA

Bitzeny 390 ZNY Bitcoin 3,900 sats (Lightning Network)

Ethereum 0.0039 ETH (zkSync) “39” sounds like “thank you” in Japanese. Prices aren’t pegged to yen.These days I’m open only once a week. On other days I’m out scouting new spots for the kitchen-car. If you know weekday-lunch locations inside Tokyo where I could set up, please let me know!

The photo shows an NFC tag. If your phone has a Lightning wallet, just tap and pay 3,900 sats. I admit this hand-written NFC tag looks shady—any self-respecting Bitcoiner probably wouldn’t want to tap it—but the point is: even this works!

I used to run a BTCPay POS, but I switched to this setup for speed. Sometimes the tap payment fails; if that happens I reluctantly pull out the old POS. Thanks for your patience.

It’s been one year since I spun up a node and started accepting Lightning payments. So many people are now running their own nodes—Umbrel really is amazing. While the big players bravely chase routing fees, I’m a tiny operator scraping together funds while begging my wife for forgiveness, so I’m all-in on maximising payment convenience. Your support means a lot!

If I may add: routing is fun, but instant, trust-minimised payments and the thrill of choosing whom to open channels with are just as exciting. You’ll only understand once you start accepting payments yourself—zero-confirmation settlement really is revolutionary.

QR codes, NFC taps, fixed amounts, manual entry… the possibilities keep multiplying, and the pace of innovation is scary fast. When I compare it to the merchant fees on Japan’s most-used service, PayPay, I want to shout: “Bitcoin is incredible!” Sure, taxes, price volatility (my shop is BTC-denominated, though), wallet UX, and adoption hurdles are still pain points.

Even so, lots of people keep building cool stuff, so I’ll keep doing what I can—still on my knees to my wife, but moving forward!

-

@ 9e9085e9:2056af17

2025-05-27 17:16:22

@ 9e9085e9:2056af17

2025-05-27 17:16:22Market Overview

As of May 27, 2025, Bitcoin (BTC) is trading at approximately $110,387, reflecting a modest 0.8% daily gain.

24-Hour Range: $108,291 – $110,415

Recent High: $111,970

Support Level to Watch: $105,700

Bullish Target: $135,000 (based on analyst projections)

The market remains optimistic ahead of the Bitcoin 2025 Conference in Las Vegas, sparking renewed interest and speculation.

Impact on Decentralized Social Media

Bitcoin’s strong performance is influencing decentralized social platforms in multiple ways:

- Increased Engagement

Platforms like Nostr, Mastodon, and others are seeing a spike in activity. Users are sharing price charts, engaging in Bitcoin discourse, and posting market-related content.

- Monetization Opportunities

Creators on decentralized networks are leveraging Bitcoin-based tipping, NFT-based publishing, and tokenized rewards to monetize content more effectively.

- Community Growth

Positive sentiment is drawing in new users and developers, contributing to the growth of decentralized ecosystems and innovation in peer-to-peer social tech.

Strategic Highlights

Trump Media & Technology Group aims to raise $2.5 billion to build a Bitcoin treasury, signaling strong institutional interest.

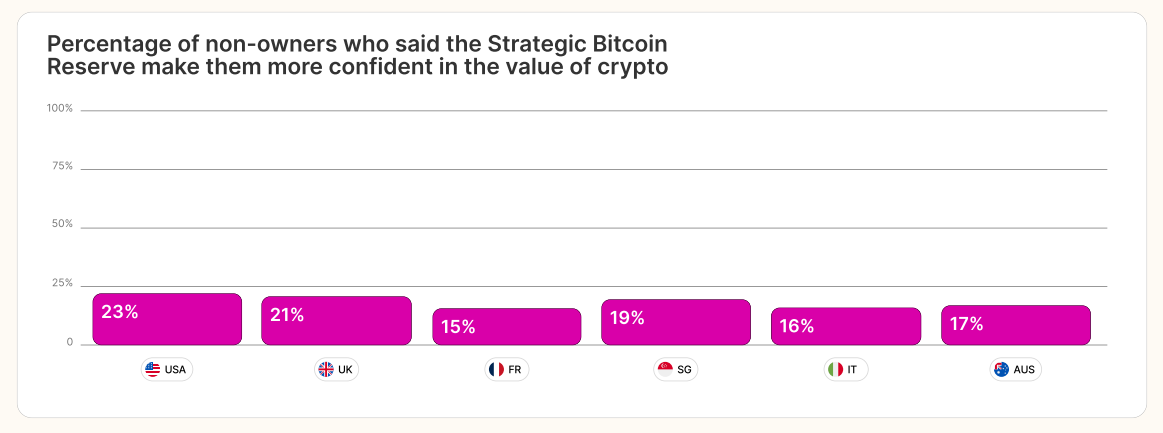

The U.S. is reportedly establishing a Strategic Bitcoin Reserve, underscoring digital currency’s growing relevance at the national level.

#Bitcoin #BTC #CryptoNews #Web3 #DecentralizedSocialMedia #Nostr #Yakihonne #CryptoCommunity #BitcoinUpdate #BTC2025 #DigitalFreedom #ContentCuration #Hackathon #SocialFi

-

@ 9e9085e9:2056af17

2025-05-27 16:58:28

@ 9e9085e9:2056af17

2025-05-27 16:58:28Part 2: Community Impact & Key Milestones

How Yakihonne Benefits the Community

Yakihonne is more than an app—it's a platform for freedom and self-expression. Here’s how it empowers its users and community:

Censorship-Resistant Communication Say what matters without fear of shadowbans or takedowns.

Privacy and Data Control You own your data—no tracking, no selling, no manipulation.

Peer-to-Peer Support for Creators With Bitcoin Lightning tipping, fans can directly support creators without needing middlemen.

Open Participation Developers, artists, and builders can all contribute to the network through the open Nostr protocol.

Milestones (You can update these with exact dates later)

Platform Launch: [Insert Date]

1,000+ Users Joined: [Insert Date]

Key Feature Rollouts (Chats, Groups, Tips): [Insert Date]

Yakihonne #Yakihonne #Yakihonne #Nostr #Nostr #YoungDfx

-

@ a4992688:88fd660f

2025-05-28 00:58:09

@ a4992688:88fd660f

2025-05-28 00:58:09Retail Isn't Coming Back

(and they might be gone for good)

Written by nostr:nprofile1qqs2fxfx3z6yns4a6mafcwdgsrtluf747h37nl2vglt9mqj93r7kvrcwm69jy

It's been just a matter of days since Bitcoin has broken a new all-time high in US dollars and yet, things are extremely quiet on the ground level... Your friends aren't texting to find out if now is a good time to buy, the normies at work haven't brought it up to you, and Coinbase isn't even in the top 100 overall apps in the Google Play App Store. As of now, it sits at #164.

In fact, according to Google search trends, worldwide interest in Bitcoin is lower today while setting new all-time highs above $110,000 than it was at the pits of the 2022 bear market when FTX was blowing up and Bitcoin crashed to below $16,000.

the mempool also paints a quiet picture. It’s mostly empty. Just a few blocks’ worth of transactions waiting to confirm, most paying 1–4 sats/vB. In fact, over the last 144 blocks (about 24 hours), the average fee per transaction has hovered below 1,500 sats, roughly $1.50.

This is far from the behavior found on-chain during previous all-time highs. It reflects an underutilized network predominantly being used by its original power users. Meanwhile, the hash rate climbs relentlessly, month after month, setting record after record. Miners are expending more energy than ever, but fee pressure is nowhere to be found.

🕵️♂️ Is Retail In The Room with Us Now?

The typical signs of retail investor enthusiasm, such as increased Google searches, higher Coinbase app downloads, and a congested mempool all remain subdued. This raises the question: Is the current rally predominantly driven by institutional investors, with retail participation lagging behind?

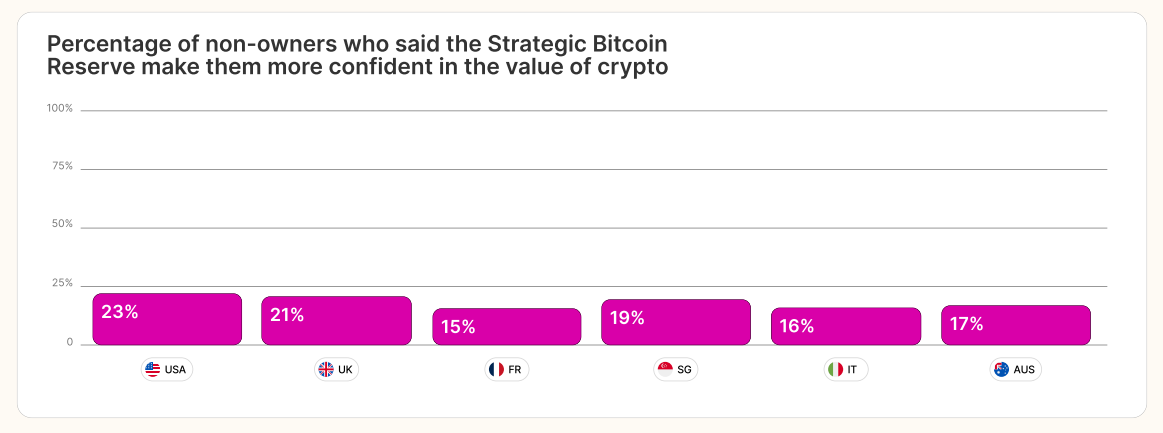

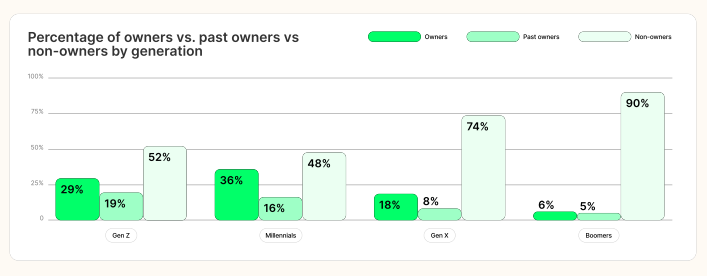

Since the approval of spot Bitcoin ETFs in January 2024, these financial instruments have accumulated nearly 1.21 million bitcoin, with total assets under management exceeding $132 billion (or, 5.75%+ of 21M total BTC). Initially, retail investors were the primary contributors to these inflows, accounting for approximately 80% of the total assets under management as of October 2024. However, more recent trends indicate a shift, with institutional investors, including hedge funds and asset managers, increasing their stakes in Bitcoin ETFs.

Institutional exposure more than doubled from Q3 to Q4 of 2024 according to SEC 13-F filings, whereas assets under management for all non-institutional ETF holders grew by 62%. While retail is responsible for approximately 73.7% of AUM in the ETFs, a small number of institutions represent more than a 26% of the ETF inflows as of the end of 2024.

🥴 PTSD - Portfolio Trauma & Speculative Disillusionment

For many retail investors, the scars from the 2021–2022 crypto cycle run deep. They bought into the hype near Bitcoin's previous all-time high of $69,000, only to watch their investments plummet to $15,000. The collapse of major platforms like Terra, Celsius, and FTX didn't just erase wealth—it shattered trust.

This collective trauma has left many retail investors wary. They've seen the cycle before: rapid gains followed by devastating losses. The excitement that once drew them into the market has been replaced by caution and skepticism. Even as Bitcoin reaches new heights, the enthusiasm that characterized previous bull runs is noticeably absent.

By all measurable metrics, retail investors appear increasingly reluctant to step outside the comfort of traditional financial rails to gain Bitcoin exposure. In response to past losses and a heightened desire for security, many are now turning to regulated investment vehicles like spot Bitcoin ETFs, offered by institutions such as BlackRock and Fidelity. These products provide a familiar, low-friction on-ramp by eliminating the need for self-custody, avoiding the risks of phishing and exchange hacks, and sidestepping the complexities of managing wallets or navigating volatile crypto platforms. This behavioral shift helps explain why we’re not seeing a surge in mempool congestion, on-chain activity, or crypto exchange downloads. Retail isn’t gone per se... they are however predominantly choosing to interact with Bitcoin from a "safe" distance, inside the walled garden of TradFi.

🧙♂️ Pay No Attention to the Custodian Behind the Curtain

Retail might look like it's back, but it isn't. Not really. They've been rerouted. Herded away from the open network and into the controlled comfort of traditional finance, where Bitcoin is boxed up, regulated, and sold as a familiar financial product.

Spot ETFs from firms like BlackRock offer the illusion of exposure without any of the responsibility or freedom that comes with actually owning Bitcoin. There are no private keys, no ability to withdraw, no direct access to the asset. Most of the Bitcoin that backs those shares sits in Coinbase Custody, inaccessible from the investor’s point of view. Retail can watch the price move, but they can't move a single sat.

They can't send it to family. They can't use Lightning. They can't participate in a fork or vote with their coins. Their holdings are locked inside a financial product, subject to tax surveillance and government oversight, with none of the borderless, censorship-resistant qualities that make Bitcoin what it is.

This isn’t Bitcoin as a tool for sovereignty. It’s Bitcoin as a stock proxy, tucked neatly into retirement accounts and brokerage dashboards. Retail hasn't returned to Bitcoin. They've returned to a synthetic version of it. One that looks clean, feels safe, and doesn’t ask them to think too hard.

The crowd is back, but not on the chain. They've returned to price, not protocol.

🔍Missing: Retail. Last Seen 2021.

If this bull run feels quieter than the last one, it’s because it is. Retail investors, once the lifeblood of Bitcoin mania, are largely absent from the on-chain activity. Their presence isn’t being felt where it used to be.

The reasons are stacking up. Regulatory pressure has increased globally, with new tax reporting rules, stricter KYC requirements, and fewer accessible exchanges making direct participation more frustrating than exciting. At the same time, the opportunity cost has shifted. T-bills are yielding 5 percent, and the stock market is deep in an AI-driven rally that feels new and full of upside. Compared to that, Bitcoin’s core narratives like digital gold or inflation protection no longer feel urgent or unique.

Institutions are now leading through ETFs and futures, smoothing out volatility and removing many of the sudden moves that once drew in retail traders. On-chain user experience still falls behind modern apps, Lightning remains niche, and energy concerns continue to shape public perception. More importantly, the cost of everyday life has gone up. Rent is up. Groceries are expensive. People are stretched thin. Student loans have resumed and homeownership is out of reach for many.

Until those conditions shift, retail is unlikely to return in any meaningful way. It is not that they have given up on Bitcoin. They are simply trying to keep up with everything else.

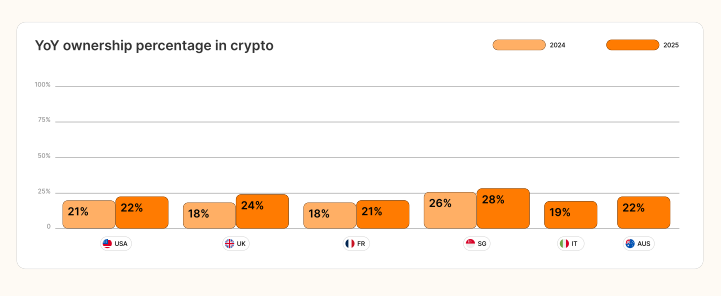

The chart below illustrates that the number of active Bitcoin addresses has declined by approximately 42% since its peak in 2021.

🧲 What Pulls Them Back In?

Retail hasn’t disappeared. It’s just not on-chain. They’re watching the charts, buying the proxies, and dipping into Bitcoin exposure through familiar vehicles like ETFs and high-beta stocks. MSTR, MSTY, SQ, MARA, and RIOT have become stand-ins for the real thing. For many, that feels close enough. They haven’t sworn off Bitcoin entirely, but they also haven’t found a reason to return to the protocol itself. Price alone isn’t doing it. If Bitcoin is going to recapture retail attention on-chain, it needs more than speculation. It needs to be usable, intuitive, and culturally relevant. Until then, the crowd will stay inside the walled garden, content with price exposure. The question now is what pulls them back into the open network.

🛠️ Make it Frictionless, or Forget it

Retail won’t return until exploring Bitcoin feels rewarding, not risky. Right now, engaging directly with the network still feels technical, intimidating, and easy to get wrong. The average person doesn’t want to learn about seed phrases, fee markets, or signing messages. They just want it to work, and ideally in one tap.

Self-custody, while powerful, still comes with a learning curve that scares most users off. One typo can lose everything. One phishing link can wipe a life’s savings. When compared to the ease of buying a Bitcoin ETF inside a brokerage app, it becomes obvious why most people choose comfort over control.

Lightning wallets have improved, but mainstream usability is still far off. Many users struggle with basic concepts like payment channels and inbound liquidity. App store reviews often reflect confusion and frustration. More importantly, Lightning still raises serious questions in a high-fee environment. Opening or closing a channel can become expensive when the base layer gets congested. This undermines Lightning’s value as a low-cost, instant settlement layer. If fees are unpredictable, it becomes harder to trust that Lightning will be there when users actually need it.

Apps like Nostr are beginning to pave the way with native Lightning features like zaps, where users can send sats as tips or signals within a social feed. It’s the kind of simple, purpose-driven interaction that could eventually normalize Lightning in everyday use. But for now, it remains niche, with limited reach beyond early adopters and Bitcoin-native circles. The pieces are falling into place, but mainstream readiness is still a long way off.

To pull retail back in, Bitcoin has to compete on usability, not just principle. That means seedless recovery. Wallets that back up automatically. Tap-to-pay Lightning. Default privacy. Smarter fee estimation. The average user should not have to study Bitcoin to use it, just like they don’t need to understand TCP/IP to send an email.

Until the experience becomes effortless, Bitcoin on-chain will remain the domain of power users and diehards. Everyone else will keep choosing exposure over participation, because for now, the friction outweighs the freedom.

🔥 Give Them a Reason to Care Again

Speculation brought retail in. Survival might bring them back. But between those extremes, there needs to be a reason to engage that feels meaningful in everyday life. For most people, Bitcoin still doesn’t offer that. It’s not woven into anything they do. It’s not a tool they reach for. It’s just a number in a ticker—or now, in an ETF.

The core narratives that once drove adoption have lost their urgency. “Digital gold” sounds more like a sales pitch than a breakthrough. “Inflation hedge” didn’t hold up during inflation. “Opt out of the banking system” is hard to relate to when your paycheck hits a checking account and your bills are on autopay. These messages worked when people were curious or scared. But in a world focused on AI, passive income, and stable yields, Bitcoin feels like a cold, hard asset with no warm story.

Retail doesn’t just need new slogans. They need a new reason. A killer app. A cultural hook. Something that connects the protocol to their daily life. That could come from anywhere—remittances, peer-to-peer media, AI payments, creator tools, censorship resistance, even gaming. We’re starting to see glimpses. Nostr’s Lightning zaps, for example, show how sats could flow through social interactions. It's lightweight, casual, and fits into habits people already have. But even that is still early and relatively isolated from the mainstream.

Of course, it’s possible that price alone brings them back. A violent move toward $200,000 or higher could generate headlines, social buzz, and another wave of opportunistic buying. But even in that scenario, most people still won't touch the protocol. They’ll chase exposure, not interaction. They’ll buy tickers, not UTXOs.

Retail will come back when Bitcoin stops being an idea they watch and starts being a tool they use. Until then, attention might spike, but engagement will remain shallow.

🏠 Bitcoin Needs a Homebase

Bitcoin is everywhere, but it feels like it’s nowhere. There's no single place where the culture lives. No town square. No digital front porch where holders, builders, speculators, artists, and newcomers all cross paths. And that absence is being felt.

In past cycles, Twitter served as a kind of home for Bitcoin discussion. But now the conversation is fractured. Memes, developer talk, Lightning experiments, and exchange drama are scattered across Telegram groups, Nostr relays, GitHub repos, Reddit threads, and gated newsletters. There’s no central venue that brings it all together. What once felt like a movement now feels more like a loose network of subcultures.

This isn’t just a cultural gap. It’s a usability gap. Without a shared space or interface, discovering Bitcoin's tools, communities, or use cases becomes a fragmented and overwhelming experience. For newcomers especially, it turns exploration into a scavenger hunt. There’s no hub where someone can casually browse peer-to-peer markets, tip someone over Lightning, try a game, test a wallet, or ask basic questions without feeling out of place.

Importantly, this homebase shouldn’t be a corporate platform or single point of failure. It should reflect the values of the network itself—open, decentralized, secure, and resistant to censorship. A sovereign space, not another walled garden. Something that anyone can plug into, build on top of, or access freely without needing permission or credentials. Not a headquarters, but a commons.

Bitcoin doesn’t need a leader, but it could use a center of gravity. A place where its many threads can be visible, accessible, and in conversation with each other. Until it feels like something you can step into, most people won’t feel like they’re truly part of it.

🧵 Final Thoughts

Retail didn’t disappear. It checked out. After wild volatility, failed platforms, and busted narratives, most people aren't rushing back into the Bitcoin Network as we know it. They’ve opted for safety. For simplicity. For familiar rails like ETFs, proxy stocks, and apps that feel intuitive and risk-free.

Bitcoin, meanwhile, has matured in price but not necessarily in presence. The protocol is stronger than ever, but the culture feels scattered. The use cases feel theoretical. The experience still feels fragile. And for most, that's just not enough.

Maybe retail comes back with the next crisis. Maybe it takes a breakout product. Or maybe it doesn’t happen for years. No one knows what the catalyst will be, or if there even has to be one. But what’s clear is that Bitcoin’s next chapter won’t be won by price alone. It will be shaped by the tools we build, the stories we tell, and the places we create for people to show up.

One thing I know for sure: if retail returns, it won’t be for long unless we’ve built something that gives them a real reason to stay.

-

@ 78b3c1ed:5033eea9

2025-04-29 04:04:19

@ 78b3c1ed:5033eea9

2025-04-29 04:04:19Umbrel Core-lightning(以下CLNと略す)を運用するにあたり役に立ちそうなノウハウやメモを随時投稿します。

・configファイルを用意する Umbrelのアプリとして必要な設定はdocker-compose.ymlで指定されている。 それ以外の設定をしたい場合configファイルに入れると便利。 configファイルの置き場所は /home/umbrel/umbrel/app-data/core-lightning/data/lightningd ここにtouch configとでもやってファイルをつくる。

cd /home/umbrel/umbrel/app-data/core-lightning/data/lightningd touch config以下内容をひな型として使ってみてください。 行頭に#があるとコメント行になります。つまり.iniフォーマット。 /home/umbrel/umbrel/app-data/core-lightning/data/lightningd/config ```[General options]

[Bitcoin control options]

[Lightning daemon options]

[Lightning node customization options]

[Lightning channel and HTLC options]

[Payment control options]

[Networking options]

[Lightning Plugins]

[Experimental Options]

``` configに設定できる内容は以下を参照 https://lightning.readthedocs.io/lightningd-config.5.html セクションを意味する[]があるけれどもこれは私(tanakei)が意図的に見やすく区別しやすくするために付けただけ。これら行の#は外さない。

・configの設定をCLNに反映させる appスクリプトでCLNを再起動すると反映することができる。 configを書き換えただけでは反映されない。

cd /home/umbrel/umbrel/scripts ./app restart core-lightning・ログをファイルに出力させる

以下の場所でtouch log.txtとしてlog.txtファイルを作る。 /home/umbrel/umbrel/app-data/core-lightning/data/lightningd

cd /home/umbrel/umbrel/app-data/core-lightning/data/lightningd touch log.txt次にconfigの[Lightning daemon options]セクションにlog-fileを追加する。 ```[Lightning daemon options]

log-file=/data/.lightning/log.txt ``` ※Dockerによって/home/umbrel/umbrel/app-data/core-lightning/data/lightningd は /data/.lightning として使われている。

・addrとbind-addrの違い どちらも着信用のインターフェースとポートの設定。addrは指定したホストIPアドレス:ポート番号をノードURIに含めて公開する(node_announcementのuris)。bind-addrは公開しない。

・実験的機能のLN Offerを有効にする configの[Experimental Options]セクションに以下を追加する。 ```

[Experimental Options]

experimental-onion-messages experimental-offers ``` ※ v24.08でexperimental-onion-messageは廃止されデフォルト有効であり、上記設定の追加は不要になりました。 ※ v21.11.1 では experimental-offersは廃止されデフォルト有効であり、上記設定の追加は不要になりました。 もう実験扱いじゃなくなったのね...

・完全にTorでの発信オンリーにする UmbrelはなぜかCLNの発信をClearnetとTorのハイブリッドを許している。それは always-use-proxy=true の設定がないから。(LNDは発着信Torのみなのに) なのでこの設定をconfigに追加してCLNも発着進Torのみにする。 ```

[Networking options]

always-use-proxy=true ```

・任意のニーモニックからhsm_secretを作る CLNのhsm_secretはLNDのwallet.dbのようなもの。ノードで使う様々な鍵のマスター鍵となる。Umbrel CLNはこのhsm_secretファイルを自動生成したものを使い、これをバックアップするためのニーモニックを表示するとかそういう機能はない。自分で作って控えてあるニーモニックでhsm_secretを作ってしまえばこのファイルが壊れてもオンチェーン資金は復旧はできる。

1.CLNインストール後、dockerコンテナに入る

docker exec -it core-lightning_lightningd_1 bash2.lightning-hsmtoolコマンドを使って独自hsm_secretを作る ``` cd data/.lightning/bitcoin lightning-hsmtool generatehsm my-hsm_secret・上記コマンドを実行するとニーモニックの言語、ニーモニック、パスフレーズの入力を催促される。 Select your language: 0) English (en) 1) Spanish (es) 2) French (fr) 3) Italian (it) 4) Japanese (jp) 5) Chinese Simplified (zhs) 6) Chinese Traditional (zht) Select [0-7]: 0 ※定番の英単語なら0を入力 Introduce your BIP39 word list separated by space (at least 12 words): <ニーモニックを入力する> Warning: remember that different passphrases yield different bitcoin wallets. If left empty, no password is used (echo is disabled). Enter your passphrase: <パスフレーズを入力する> ※パスフレーズ不要ならそのままエンターキーを押す。 New hsm_secret file created at my-hsm_secret Use the

encryptcommand to encrypt the BIP32 seed if neededコンテナから抜ける exit

3.appスクリプトでCLNを止めて、独自hsm_secret以外を削除 ※【重要】いままで使っていたhsm_secretを削除する。もしチャネル残高、ウォレット残高があるならチャネルを閉じて資金を退避すること。自己責任!cd ~/umbrel/scripts/ ./app stop core-lightningcd ~/umbrel/app-data/core-lightning/data/lightningd/bitcoin rm gossip_store hsm_secret lightningd.sqlite3 lightning-rpc mv my-hsm_secret hsm_secret

4.appスクリプトでCLNを再開するcd ~/umbrel/scripts/ ./app start core-lightning ```【補記】 hsm_secret作成につかうニーモニックはBIP39で、LNDのAezeedと違って自分が作成されたブロック高さというものを含んでいない。新規でなくて復元して使う場合は作成されたブロック高さからブロックチェーンをrescanする必要がある。 configの1行目にrescanオプションを付けてCLNをリスタートする。 ``` // 特定のブロック高さを指定する場合はマイナス記号をつける rescan=-756000

// 現在のブロック高さから指定ブロック分さかのぼった高さからrescanする rescan=10000 ※現在の高さが760,000なら10000指定だと750,000からrescan ```

・clnrestについて core-lightningでREST APIを利用したい場合、別途c-lightning-restを用意する必要があった。v23.8から標準でclnrestというプラグインがついてくる。pythonで書かれていて、ソースからビルドした場合はビルド完了後にpip installでインストールする。elementsproject/lightningdのDockerイメージではインストール済みになっている。 (v25.02からgithubからバイナリをダウンロードしてきた場合はpip install不要になったようだ) このclnrestを使うにはcreaterunesコマンドでruneというLNDのマカロンのようなものを作成する必要がある。アプリ側でこのruneとREST APIを叩いてcore-lightningへアクセスすることになる。 自分が良く使っているLNbitsやスマホアプリZeus walletはclnrestを使う。まだclnrestに対応していないアプリもあるので留意されたし。

・Emergency recoverについて LNDのSCBのようなもの。ファイル名はemergency.recover チャネルを開くと更新される。 hsm_secretとこのファイルだけを置いてCLNを開始すると自動でこのファイルから強制クローズするための情報が読み出されてDLPで相手から強制クローズするような仕組み。この機能はv0.12から使える。

動作確認してみた所、LNDのSCBに比べるとかなり使いづらい。 1. CLNがTor発信だとチャネルパートナーと接続できない。 Clearnet発信できても相手がTorのみノードならTor発信せざるを得ない。 相手と通信できなければ資金回収できない。 2. 相手がLNDだとなぜか強制クローズされない。相手がCLNならできる。