-

@ 21810ca8:f2e8341e

2025-05-25 05:02:33

@ 21810ca8:f2e8341e

2025-05-25 05:02:33If so, please comment. So I can see if Nostr works for me.

-

@ 211c0393:e9262c4d

2025-05-25 04:00:34

@ 211c0393:e9262c4d

2025-05-25 04:00:34Original: https://www.yakihonne.com/article/naddr1qvzqqqr4gupzqgguqwf52cyve89xnxc4eh95jklelgw646kkkcdhxm4fp05jvtzdqq2hj6fhtpqkuutdv4xxxazjv9t92atedev45mcwusz

Nihon no kakuseizai Nihon no kakusei-zai bijinesu no yami: Keisatsu, bōryokudan, soshite

chinmoku no kyōhan kankei' no shinsō** 1. Bōryokudan no shihai kōzō (kōteki dēta ni motodzuku) yunyū izon no riyū: Kokunai seizō wa kon'nan (Heisei 6-nenkakusei-zai genryō kisei-hō' de kisei kyōka)→ myanmā Chūgoku kara no mitsuyu ga shuryū (Kokuren yakubutsu hanzai jimushoWorld Drug Report 2023'). Bōryokudan no rieki-ritsu: 1 Kg-atari shiire kakaku 30 man-en → kouri kakaku 500 man ~ 1000 man-en (Keisatsuchōyakubutsu jōsei hōkoku-sho' 2022-nen). 2. Keisatsu to bōryokudan nokyōsei kankei' taiho tōkei no fushizen-sa: Zen yakubutsu taiho-sha no 70-pāsento ga tanjun shoji (kōsei Rōdōshōyakubutsu ran'yō jōkyō' 2023-nen). Mitsuyu soshiki no tekihatsu wa zentai no 5-pāsento-miman (tōkyōchikentokusōbu dēta). Media no kenshō: NHK supesharukakusei-zai sensō'(2021-nen) de shiteki sa retamattan yūzā yūsen sōsa' no jittai. 3. Mujun suru genjitsu juyō no fukashi-sei: G 7 de saikō no kakusei-zai kakaku (1 g-atari 3 ~ 7 man-en, Ō kome no 3-bai)→ bōryokudan no bōri (Zaimushōsoshiki hanzai shikin ryūdō chōsa'). Shiyōsha-ritsu wa hikui (jinkō no 0. 2%, Kokuren chōsa) ga, taiho-sha no kahansū o shimeru mujun. 4.Mitsuyu soshiki taisaku' no genkai kokusai-tekina shippai rei: Mekishiko (karuteru tekihatsu-go mo ichiba kakudai), Ōshū (gōsei yakubutsu no man'en)→ daitai soshiki ga sokuza ni taitō (Eiekonomisuto' 2023-nen 6 tsuki-gō). Nippon'nochiri-teki hande: Kaijō mitsuyu no tekihatsu-ritsu wa 10-pāsento-miman (Kaijōhoanchō hōkoku). 5. Kaiketsusaku no saikō (jijitsu ni motodzuku teian) ADHD chiryō-yaku no gōhō-ka: Amerika seishin'igakukaiADHD kanja no 60-pāsento ga jiko chiryō de ihō yakubutsu shiyō'(2019-nen kenkyū). Nihonde wa ritarin aderōru kinshi → bōryokudan no ichiba dokusen. Rōdō kankyō kaikaku: Karō-shi rain koe no rōdō-sha 20-pāsento (Kōrōshōrōdō jikan chōsa' 2023-nen)→ kakusei-zai juyō no ichiin. 6. Kokuhatsu no risuku to jōhō-gen tokumei-sei no jūyō-sei: Kako no bōryokudan hōfuku jirei (2018-nen, kokuhatsu kisha e no kyōhaku jiken Mainichishinbun hōdō). Kōteki dēta nomi in'yō: Rei:Keisatsuchō tōkei'Kokuren hōkoku-sho' nado daisansha kenshō kanōna jōhō. Ketsuron: Henkaku no tame ni wajijitsu' no kajika ga hitsuyō `yakubutsu = kojin no dōtokuteki mondai' to iu gensō ga, bōryokudan to fuhai kanryō o ri shite iru. Kokusai dēta to kokunai tōkei no mujun o tsuku koto de, shisutemu no giman o abakeru. Anzen'na kyōyū no tame ni: Kojin tokutei o sake, tokumei purattofōmu (tōa-jō fōramu-tō) de giron. Kōteki kikan no dēta o chokusetsu rinku (rei: Keisatsuchō PDF repōto). Kono bunsho wa, kōhyō sa reta tōkei media hōdō nomi o konkyo to shi, kojin no suisoku o haijo shite imasu. Kyōi o yokeru tame, gutaitekina kojin soshiki no hinan wa itotekini sakete imasu. Show more 1,321 / 5,000 Stimulants in Japan The dark side of the Japanese stimulant drug business:The truth about the police, the yakuza, and their "silent complicity"**

- The control structure of the yakuza (based on public data)

Reasons for dependence on imports: Domestic production is difficult (tightened regulations under the Stimulant Drug Raw Materials Control Act of 1994) → Smuggling from Myanmar and China is the norm (UNODC World Drug Report 2023).

Profit margins for yakuza: Purchase price of 300,000 yen per kg → Retail price of 5 to 10 million yen (National Police Agency Drug Situation Report 2022).

- The "symbiotic relationship" between the police and the yakuza

The unnaturalness of arrest statistics: 70% of all drug arrests are for simple possession (Ministry of Health, Labor and Welfare Drug Abuse Situation 2023). Smuggling organizations account for less than 5% of all arrests (Tokyo District Public Prosecutors Office Special Investigation Unit data). Media verification: The reality of "end-user priority investigation" pointed out in the NHK special "Stimulant War" (2021).

- Contradictory reality

Invisibility of demand: The highest stimulant drug price in the G7 (30,000 to 70,000 yen per gram, three times that of Europe and the United States) → Excessive profits by organized crime (Ministry of Finance "Survey on Organized Crime Fund Flows"). The contradiction that the user rate is low (0.2% of the population, UN survey), but accounts for the majority of arrests.

- The limits of "countermeasures against smuggling organizations"

International examples of failure: Mexico (market expands even after cartel crackdown), Europe (proliferation of synthetic drugs) → Alternative organizations immediately emerge (UK "The Economist" June 2023 issue). Japan's geographical handicap: The crackdown rate for maritime smuggling is less than 10% (Japan Coast Guard report).

- Rethinking solutions (fact-based proposals)

Legalization of ADHD medications:

American Psychiatric Association: "60% of ADHD patients self-medicate with illegal drugs" (2019 study).

Banning Ritalin and Adderall in Japan → Yakuza monopoly on the market.

Work environment reform:

20% of workers exceed the line of death from overwork (Ministry of Health, Labor and Welfare "Working Hours Survey" 2023) → One cause of stimulant drug demand.

- Risks of accusation and sources of information

Importance of anonymity:

Past cases of Yakuza retaliation (2018, threat against accusing journalist, reported in the Mainichi Shimbun).

Citing only public data:

Examples: Information that can be verified by a third party, such as "National Police Agency statistics" and "UN reports".

Conclusion: Visualization of "facts" is necessary for change

The illusion that "drugs = individual moral problems" benefits Yakuza and corrupt bureaucrats.

Pointing out the contradictions between international data and domestic statistics can expose the deception of the system.

For safe sharing:

Avoid identifying individuals and discuss on anonymous platforms (such as forums on Tor).

Direct links to data from public organizations (e.g. National Police Agency PDF report).

This document is based solely on published statistics and media reports, and excludes personal speculation.

To avoid threats, we have intentionally avoided blaming specific individuals or organizations. Send feedback

-

@ 2b998b04:86727e47

2025-05-25 03:28:59

@ 2b998b04:86727e47

2025-05-25 03:28:59Turning 60

Ten years ago, I turned 50 with a vague sense that something was off.

I was building things, but they didn’t feel grounded.\ I was "in tech," but tech felt like a treadmill—just faster, sleeker tools chasing the same hollow outcomes.\ I knew about Bitcoin, but I dismissed it. I thought it was just “tech for tech’s sake.”

Less than a year later, I fell down the rabbit hole.

It didn’t happen all at once. At first it was curiosity. Then dissonance. Then conviction.

Somewhere in that process, I realized Bitcoin wasn’t just financial—it was philosophical. It was moral. It was real. And it held up a mirror to a life I had built on momentum more than mission.

So I started pruning.

I left Web3.\ I pulled back from projects that ran on hype instead of honesty.\ I repented—for chasing relevance instead of righteousness.\ And I began stacking—not just sats, but new habits. New thinking. New rhythms of faith, work, and rest.

Now at 60, I’m not where I thought I’d be.

But I’m more myself than I’ve ever been.\ More convicted.\ More rooted.\ More ready.

Not to start over—but to build again, from the foundation up.

If you're in that middle place—between chapters, between convictions, between certainty and surrender—you're not alone.

🟠 I’m still here. Still building. Still listening.

Zap if this resonates, or send your story. I’d love to hear it.

[*Zap *](https://tinyurl.com/yuyu2b9t)

-

@ 2b998b04:86727e47

2025-05-25 03:19:19

@ 2b998b04:86727e47

2025-05-25 03:19:19n an inflationary system, the goal is often just to keep up.

With prices always rising, most of us are stuck in a race:\ Earn more to afford more.\ Spend before your money loses value.\ Monetize everything just to stay ahead of the curve.

Work becomes reactive.\ You hustle to outrun rising costs.\ You take on projects you don’t believe in just to make next month’s bills.\ Money decays. So you move faster, invest riskier, and burn out quicker.

But what happens when the curve flips?

A deflationary economy—like the one Bitcoin makes possible—rewards stillness, reflection, and intentionality.

Time favors the saver, not the spender.\ Money gains purchasing power.\ You’re no longer punished for patience.

You don’t have to convert your energy into cash before it loses value.\ You don’t have to be always on.\ You can actually afford to wait for the right work.

And when you do work—it means more.

💡 The “bullshit jobs” David Graeber wrote about start to disappear.\ There’s no need to look busy just to justify your existence.\ There’s no reward for parasitic middle layers.\ Instead, value flows to real craft, real care, and real proof of work—philosophically and literally.

So what does a job look like in that world?

— A farmer building soil instead of chasing subsidies.\ — An engineer optimizing for simplicity instead of speed.\ — A craftsman making one perfect table instead of ten cheap ones.\ — A writer telling the truth without clickbait.\ — A builder who says no more than they say yes.

You choose work that endures—not because it pays instantly, but because it’s worth doing.

The deflationary future isn’t a fantasy.\ It’s a recalibration.

It’s not about working less.\ It’s about working better.

That’s what Bitcoin taught me.\ That’s what I’m trying to live now.

🟠 If you’re trying to align your work with these values, I’d love to connect.\ Zap this post, reply with your story, or follow along as I build—without permission, but with conviction.\ [https://tinyurl.com/yuyu2b9t](https://tinyurl.com/yuyu2b9t)

-

@ 34ff86e0:dbb6b9fb

2025-05-25 02:36:39

@ 34ff86e0:dbb6b9fb

2025-05-25 02:36:39test openletter redirection after creation

-

@ 47c860d3:b3f71b74

2025-05-25 01:56:39

@ 47c860d3:b3f71b74

2025-05-25 01:56:39ไขความลับรหัส 13 ตัวอักษรของ FT8: ศาสตร์แห่งการบีบอัดข้อมูลสื่อสารดิจิทัล คืนหนึ่ง ผมนั่งอยู่หน้าจอคอมพิวเตอร์ มองสัญญาณ FT8 กระพริบไปมา ส่งข้อความสั้นๆ ซ้ำไปซ้ำมา "CQ HS1IWX OK03" แล้วก็รอให้ใครสักคนตอบกลับ วนลูปไปอย่างไม่รู้จบ จนเกิดคำถามขึ้นมาในหัว... “นี่เรานั่งทำอะไรกันแน่?” FT8 มันควรเป็นอะไรมากกว่านี้ใช่ไหม? ไม่ใช่แค่การส่งคำสั้นๆ 13 ตัวอักษรไปมาเท่านั้น! เอ๊ะ! เดี๋ยวก่อน... 13 ตัวอักษร? ถ้าการส่งข้อความจำกัดที่ 13 ตัวอักษร แล้วทำไมข้อความอย่าง "CQ HS1IWX OK03" ซึ่งดูเหมือนจะมี 14 ตัวอักษร (รวมช่องว่าง) ถึงสามารถส่งได้? นี่มันต้องมีอะไรซ่อนอยู่! ระบบ FT8 ใช้เวทมนตร์อะไร หรือมันมีเทคนิคการเข้ารหัสแบบลับๆ ที่เรายังไม่รู้? และคำว่า "13 ตัวอักษร" ที่เขาพูดถึงนั้นหมายถึงอะไรกันแน่? แล้วลองนึกดูสิ... ถ้าเราอยู่ในสถานการณ์ฉุกเฉิน ต้องส่งข้อความที่สั้น กระชับ และมีความหมาย ในขณะที่แบตเตอรี่เหลือน้อย กำลังส่งต่ำ และอุปกรณ์มีเพียงเครื่องวิทยุขนาดเล็กกับสายอากาศชั่วคราวและมือถือ บางครั้ง FT8 อาจจะเป็นตัวเลือกเดียวที่ช่วยให้เราส่งสัญญาณขอความช่วยเหลือได้ เพราะมันสามารถถอดรหัสได้แม้สัญญาณอ่อนจนแทบจะมองไม่เห็น! ดังนั้น ผมต้องขุดลึกลงไป เพื่อไขความลับของรหัส 13 ตัวอักษรของ FT8 และหาคำตอบว่า ทำไม FT8 สามารถส่งข้อความบางอย่างที่ดูเหมือนยาวเกินขีดจำกัดได้? พร้อมกับสำรวจว่ามันสามารถช่วยเหลือเราในสถานการณ์ฉุกเฉินได้อย่างไร! อะไรคือความหมายที่แท้จริงของ 13 ตัวอักษร ? เมื่อเริ่มเจาะลึกลงไป ผมจึงได้รู้ว่า 13 ตัวอักษรที่เราพูดถึงนั้นหมายถึง ข้อความใน Free Text Mode หรือก็คือ ข้อความที่ไม่ได้ถูกเข้ารหัสในรูปแบบมาตรฐานของ FT8 หากเราส่งข้อความแบบอิสระ เช่น "HELLO WORLD!" หรือ "EMERGENCY CALL" เราจะถูกจำกัดแค่ 13 ตัวอักษรเท่านั้น เพราะข้อความเหล่านี้ไม่ได้ถูกเข้ารหัสให้เหมาะสมกับโปรโตคอลของระบบ FT8 แต่ถ้าเป็น ข้อความมาตรฐานที่ถูกกำหนดรูปแบบไว้แล้ว เช่น Callsign + Grid หรือ รายงาน SNR (-10, 599, RR73) ระบบ FT8 จะใช้การเข้ารหัส 77-bit Structured Message ซึ่งช่วยให้สามารถส่งข้อมูลได้มากกว่า 13 ตัวอักษร! อะไรคือ โครงสร้าง 77-bit Message ใน FT8 FT8 ใช้ 77 บิต สำหรับการเข้ารหัสข้อมูล โดยแบ่งออกเป็น 3 ส่วนหลัก: ส่วนของข้อมูล จำนวนบิต รายละเอียด Callsign 1 (ต้นทาง) 28 บิต รหัสสถานีที่ส่ง Callsign 2 (ปลายทาง) 28 บิต รหัสสถานีปลายทาง หรือ CQ Exchange Data 21 บิต Grid Locator หรือข้อมูลอื่น ๆ รวมทั้งหมด = 28 + 28 + 21 = 77 บิต การที่ FT8 ใช้โครงสร้างแบบนี้ ข้อความที่ถูกเข้ารหัสในมาตรฐาน FT8 จึงสามารถส่งได้มากกว่า 13 ตัวอักษร เช่น "CQ HS1IWX OK03" นั้นถูกเข้ารหัสให้อยู่ใน 77 บิต ไม่ใช่ Free Text แบบปกติ ทำให้สามารถส่งได้โดยไม่มีปัญหา! แต่ข้อสำคัญมันคือโปโตคอลของระบบ FT8 ในปัจจุบัน ถ้าเราต้องการ เข้ารหัสเองในรูปแบบของเราเราก็ต้องพัฒนาโปรแกรม FT8 ของเราเอง (ผมทำไม่เป็นครับ555) ก็ใช้ของเขาไปก็ได้ แล้วก็มาพัฒนาระบบ เทคนิคการส่งข้อมูลให้มีประสิทธิภาพภายใน 13 ตัวอักษร กันน่าจะสนุกกว่า ส่วนเรื่องรายละเอียดวิธีการเข้ารหัสผมคงไม่พูดถึงนะ เดี๋ยวจะวิชาการน่าเบื่อไปครับ ใครสนใจก็ไปศึกษาต่อกันเอาเองครับ การเข้ารหัสนี้จะใช้ร่วมกับเทคนิค FEC (Forward Error Correction) ใน FT8 ซึ่งเป็นหนึ่งในเทคนิคที่ทำให้ FT8 สามารถถอดรหัสข้อความได้แม้ในสภาวะสัญญาณอ่อน คือการใช้ Forward Error Correction (FEC) หรือ การแก้ไขข้อผิดพลาดล่วงหน้า ซึ่งช่วยให้สามารถกู้คืนข้อมูลที่อาจเกิดการสูญหายในระหว่างการส่งสัญญาณได้ โดย FT8 ใช้ Reed-Solomon (RS) Error Correction Code ซึ่งเป็นอัลกอริธึมที่เพิ่มบิตสำรองเพื่อช่วยตรวจจับและแก้ไขข้อผิดพลาดในข้อความที่ส่งไป และ ใช้ Convolutional Encoding และ Viterbi Decoding ซึ่งช่วยให้สามารถแก้ไขข้อมูลที่ผิดพลาดจากสัญญาณรบกวนได้ ซึ่งเมื่อสัญญาณอ่อน ข้อมูลบางส่วนอาจสูญหาย แต่ FEC ช่วยให้สามารถกู้คืนข้อความได้แม้ข้อมูลบางส่วนจะขาดหาย ทำให้ผลลัพธ์คือ FT8 สามารถทำงานได้แม้ระดับสัญญาณต่ำถึง -20 dB! ซึ่งส่วนนี้ผมก็ยังไม่เข้าใจมันดีเท่าไหร่ครับ อิอิ ฟังเขามาอีกที สิ่งที่เราทำได้ตอนนี้ในโปรแกรม FT8 ในปัจจุบันก็คือ เทคนิคการส่งข้อมูลให้มีประสิทธิภาพภายใน 13 ตัวอักษรถ้าเรา อยากส่งข้อความฉุกเฉินภายใน 13 ตัวอักษร ให้ได้ข้อมูลมากที่สุด เราต้องใช้เทคนิคต่อไปนี้: การใช้ตัวย่อและรหัสสากล • SOS 1234 BKK แทน "ขอความช่วยเหลือที่พิกัด 1234 ใกล้กรุงเทพ" • WX BKK T35C แทน "สภาพอากาศกรุงเทพ 35 องศา" • ALRT TSUNAMI แทน "เตือนภัยสึนามิ" ใช้ข้อความที่อ่านเข้าใจง่าย • ใช้โค้ดสั้นๆ เช่น "QRZ EMRG?" แทน "ใครรับสัญญาณฉุกเฉิน?" การส่งข้อความเป็นชุด • เฟรม 1: MSG1 BKK STORM1 • เฟรม 2: MSG2 BKK STORM2 • เฟรม 3: MSG3 BKK NOW “การฝึกฝนเพื่อทำความเข้าใจการสื่อสารเป็นสิ่งสำคัญ เพราะเมื่อได้รับข้อความเหล่านี้ เราจะสามารถถอดรหัสและติดตามข้อมูลได้อย่างทันท่วงที” ครั้งนี้อาจเป็นเพียงการค้นพบอีกด้านหนึ่งของ FT8… หรือมันอาจเปลี่ยนมุมมองของคุณที่มีต่อโหมดสื่อสารดิจิทัลไปตลอดกาลก็ได้ แต่เดี๋ยวก่อน—นี่มันอะไรกัน!? จู่ๆ บนจอคอมพิวเตอร์ของผมก็ปรากฏคอลซายที่ไม่คุ้นตา D1IFU—คอลซายที่ไม่มีอยู่ในฐานข้อมูลของ ITU แต่กลับปรากฏขึ้นบนคลื่นความถี่ของเรา D1…? มันมาได้ยังไง? แล้วทันใดนั้น ผมก็ฉุกคิดขึ้นมา—มันคือคอลซายจากพื้นที่ Donetsk หรือ Luhansk พื้นที่ที่เต็มไปด้วยความขัดแย้ง ดินแดนที่เราคิดว่าเงียบงันภายใต้เสียงระเบิดและความไม่แน่นอน แต่ตอนนี้ กลับมีสัญญาณเล็กๆ ปรากฏขึ้นบน FT8 มันคือใครกัน? เป็นทหาร? เป็นพลเรือนที่พยายามติดต่อโลกภายนอก? หรือเป็นเพียงนักวิทยุสมัครเล่นที่ยังคงเฝ้าฟังแม้โลกจะเต็มไปด้วยความวุ่นวาย? แต่สิ่งหนึ่งที่แน่ชัด… “นี่คือสัญญาณแห่งชีวิต” จบข่าว. 🚀📡

-

@ 47259076:570c98c4

2025-05-25 01:33:57

@ 47259076:570c98c4

2025-05-25 01:33:57When a man meets a woman, they produce another human being.

The biological purpose of life is to reproduce, that's why we have reproductive organs.

However, you can't reproduce if you are dying of starvation or something else.

So you must look for food, shelter and other basic needs.

Once those needs are satisfied, the situation as a whole is more stable and then it is easier to reproduce.

Once another human being is created, you still must support him.

In the animal kingdom, human babies are the ones who take longer to walk and be independent as a whole.

Therefore, in the first years of our lives, we are very dependent on our parents or whoever is taking care of us.

We also have a biological drive for living.

That's why when someone is drowning he will hold on into whatever they can grab with the highest strength possible.

Or when our hand is close to fire or something hot, we remove our hand immediately from the hot thing, without thinking about removing our hand, we just do it.

These are just 2 examples, there are many other examples that show this biological tendency/reflex to keep ourselves alive.

We also have our brain, which we can use to get information/knowledge/ideas/advice from the ether.

In this sense, our brain is just an antenna or radio, and the ether is the signal.

Of course, we are not the radio, we are the signal.

In other words, you are not your body, you are pure consciousness "locked" temporarily in a body.

Because we can act after receiving information from the ether, we can construct and invent new things to make our lives easier.

So far, using only biology as our rule, we can get to the following conclusion: The purpose of life is to live in a safe place, work to get food and reproduce.

Because humans have been evolving in the technological sense, we don't need to hunt for food, we can just go to the market and buy meat.

And for the shelter(house), we just buy it.

Even though you can buy a house, it's still not yours, since the government or any thug can take it from you, but this is a topic for another article.

So, adjusting what I said before in a modern sense, the purpose of life is: Work in a normal job from Monday to Friday, save money, buy a house, buy a car, get a wife and have kids. Keep working until you are old enough, then retire and do nothing for the rest of your life, just waiting for the moment you die.

Happy life, happy ending, right?

No.

There is something else to it, there is another side of the coin.

This is explored briefly by Steve Jobs in this video, but I pretend to go much further than him: https://youtu.be/uf6TzOHO_dk

Let's get to the point now.

First of all, you are alive. This is not normal.

Don't take life for granted.

There is no such a thing as a coincidence. Chance is but a name given for a law that has not been recognized yet.

You are here for a reason.

God is real. All creation starts in the mind.

The mind is the source of all creation.

When the mind of god starts thinking, it records its thoughts into matter through light.

But this is too abstract, let's get to something simple.

Governments exist, correct?

The force behind thinking is desire, without desire there is no creation.

If desired ceased to exist, everything would just vanish in the blink of an eye.

How governments are supported financially?

By taking your money.

Which means, you produce, and they take it.

And you can't go against it without suffering, therefore, you are a slave.

Are you realizing the gravity of the situation?

You are working to keep yourself alive as well as faceless useless men that you don't even know.

Your car must have an identification.

When you are born, you must have an identification.

In brazil, you can't home school your children.

When "your" "country" is in war, you must fight to defend it and give your life.

Countries are limited by imaginary lines.

How many lives have been destroyed in meaningless wars?

You must go to the front-line to defend your masters.

In most countries, you don't have freedom of speech, which means, you can't even express what you think.

When you create a company, you must have an identification and pass through a very bureaucratic process.

The money you use is just imaginary numbers in the screen of a computer or phone.

The money you use is created out of thin air.

By money here, I am referring to fiat money, not bitcoin.

Bitcoin is an alternative to achieve freedom, but this is topic for another article.

Depending on what you want to work on, you must go to college.

If you want to become a doctor, you must spend at least 5 years in an university decorating useless muscle names and bones.

Wisdom is way more important than knowledge.

That's why medical errors are the third leading cause of death in United States of America.

And I'm not even talking about Big Pharma and the "World Health Organization"

You can't even use or sell drugs, your masters don't allow it.

All the money you get, you must explain from where you got it.

Meanwhile, your masters have "black budget" and don't need to explain anything to you, even though everything they do is financed by your money.

In most countries you can't buy a gun, while your masters have a whole army fully armed to the teeth to defend them.

Your masters want to keep you sedated and asleep.

Look at all the "modern" art produced nowadays.

Look at the media, which of course was never created to "inform you".

Your masters even use your body to test their bio-technology, as happened with the covid 19 vaccines.

This is public human testing, there's of course secretive human testing, such as MKUltra and current experiments that happen nowadays that I don't even know.

I can give hundreds of millions of examples, quite literally, but let's just focus in one case, Jeffrey Epstein.

He was a guy who got rich "suddenly" and used his influence and spy skills to blackmail politicians and celebrities through recording them doing acts of pedophilia.

In United States of America, close to one million children a year go missing every year.

Some portion of these children are used in satanic rituals, and the participants of these rituals are individuals from the "high society".

Jeffrey Epstein was just an "employee", he was not the one at the top of the evil hierarchy.

He was serving someone or a group of people that I don't know who they are.

That's why they murdered him.

Why am I saying all of this?

The average person who sleep, work, eat and repeat has no idea all of this is going on.

They have no idea there is a very small group of powerful people who are responsible for many evil damage in the world.

They think the world is resumed in their little routine.

They think their routine is all there is to it.

They don't know how big the world truly is, in both a good and evil sense.

Given how much we produce and all the technology we have, people shouldn't even have to work, things would be almost nearly free.

Why aren't they?

Because of taxes.

This group of people even has access to a free energy device, which would disrupt the world in a magnitude greater than everything we have ever seen in the history of Earth.

That's why MANY people who tried to work in any manifestation of a free energy device have been murdered, or rather, "fell from a window".

How do I know a free energy device exist? This is topic for another article.

So my conclusion is:

We are in hell already. Know thyself. Use your mind for creation, any sort of creation. Do good for the people around you and the people you meet, always give more than you get, try to do your best in everything you set out to do, even if it's a boring or mundane work.

Life is short.

Our body can live no longer than 300 years.

Most people die before 90.

Know thyself, do good to the world while you can.

Wake up!!! Stop being sedated and asleep.

Be conscious.

-

@ 502ab02a:a2860397

2025-05-25 01:03:51

@ 502ab02a:a2860397

2025-05-25 01:03:51บางครั้งพลังยิ่งใหญ่ที่สุดก็ไม่ใช่สิ่งที่เห็นได้ด้วยตาเปล่า เหมือนแสงแดดที่คนส่วนใหญ่มักจะกลัวเพราะกลัวผิวเสีย กลัวฝ้า กลัวร้อน แต่แท้จริงแล้วในแสงแดดมีบางสิ่งที่น่าเคารพอยู่ลึกๆ มันคือแสงที่มองไม่เห็น มันไม่แสบตา ไม่แสบผิว แต่มันลึก ถึงเซลล์ มันคือ “แสงอินฟราเรด” ที่ซ่อนตัวอย่างสุภาพในแดดยามเช้า

เฮียมักชอบพูดว่า แดดที่ดีไม่จำเป็นต้องแสบหลัง อาบแสงที่ลอดผ่านใบไม้ยามเช้าแบบไม่ต้องฝืนตาก็พอ แสงอินฟราเรดนี่แหละคือพระเอกตัวจริงในความเงียบ มันไม่ดัง ไม่โชว์ ไม่โฆษณา แต่มันลงลึกไปถึงระดับที่ร่างกายเรากำลังหิวโดยไม่รู้ตัวในระดับเซลล์

ในเซลล์ของเรา มีหน่วยผลิตพลังงานที่เรียกว่าไมโทคอนเดรีย เจ้านี่แหละคือโรงไฟฟ้าจิ๋วประจำบ้าน ที่ต้องตื่นมาทำงานทุกวันโดยไม่ได้หยุดเสาร์อาทิตย์ ยิ่งถ้าไมโทคอนเดรียทำงานไม่ดี ร่างกายก็จะเหมือนไฟตกทั้งระบบ—ง่วงง่าย เพลียไว ปวดนู่นปวดนี่เหมือนไฟในบ้านกระพริบตลอดเวลา

แล้วแสงอินฟราเรดเกี่ยวอะไรกับมัน? เฮียขอเล่าง่ายๆ ว่า ไมโทคอนเดรียมีตัวรับแสงตัวหนึ่งชื่อว่า cytochrome c oxidase เจ้านี่ตอบสนองต่อแสงอินฟราเรดช่วงคลื่นเฉพาะ คือประมาณ 600–900 นาโนเมตร พอโดนเข้าไป มันเหมือนได้จุดประกายให้โรงงานพลังงานในร่างกายกลับมาคึกคักอีกครั้ง ผลิตพลังงานได้มากขึ้น ระบบไหลเวียนเลือดก็ดีขึ้น เหมือนท่อน้ำที่เคยอุดตันก็กลับมาใสแจ๋ว ความอักเสบเล็กๆ ในร่างกายก็ลดลง คล้ายบ้านที่เคยอับชื้นแล้วได้เปิดหน้าต่างให้แสงแดดส่องเข้าไป

และที่น่ารักกว่านั้นคือ เราไม่ต้องไปถึงชายหาด ไม่ต้องจองรีสอร์ตริมทะเล แค่แดดเช้าอ่อนๆ ข้างบ้านหรือตามขอบระเบียง ก็ให้แสงอินฟราเรดได้แล้ว ถ้าใครอยู่ในเมืองใหญ่ที่มีแต่ตึกบังแดด แล้วจะเลือกใช้หลอดไฟ Red Light Therapy ก็ไม่ผิด แต่ต้องเลือกแบบรู้เท่าทันรู้ ไม่ใช่เห็นใครรีวิวก็ซื้อมาเปิดใส่หน้า หวังจะหน้าใสข้ามคืน ต้องเข้าใจทั้งความยาวคลื่น เวลาใช้งาน และจุดประสงค์ ไม่ใช่ใช้เพราะแค่กลัวแก่อยากหน้าตึง แต่ใช้เพราะอยากให้ร่างกายกลับไปทำงานอย่างเป็นธรรมชาติอีกครั้ง และอยู่ในประเทศหรือสถานที่ที่โดนแดดได้น้อยอยากได้เสริมเฉยๆ

แล้วเราจะรู้ได้ยังไงว่าไมโทคอนเดรียเรากลับมาทำงานดีขึ้น? เฮียว่าไม่ต้องรอผลเลือดจากแล็บไหนก็รู้ได้ อย่าไปยึดติดกับตัวเลขมากครับ เอาตัวเองเป็นหลัก ตั้งคำถามกับตัวเองว่ารู้สึกยังไงบ้าง ถ้าเริ่มนอนหลับลึกขึ้น ตื่นมาแล้วหัวไม่มึน ไม่หงุดหงิดตั้งแต่ยังไม่ลืมตา ถ้าปวดหลังปวดข้อที่เคยมีเริ่มหายไปแบบไม่ได้กินยา หรือแม้แต่ผิวที่ดูสดใสขึ้นแบบไม่ต้องง้อสกินแคร์ นั่นแหละคือเสียงขอบคุณเบาๆ จากไมโทคอนเดรียที่ได้แสงแดดแล้วกลับมามีชีวิตอีกครั้ง ถ้ามันดีก็คือดี

บางที เราไม่ต้องกินวิตามินเม็ดไหนเพิ่ม แค่เดินออกไปรับแดดเบาๆ ในเวลาเช้าๆ แล้วให้ร่างกายได้พูดคุยกับธรรมชาติบ้าง เพราะในความอบอุ่นเงียบๆ ของแสงอินฟราเรดนั้น มีเสียงเบาๆ ที่กำลังปลุกพลังในตัวเราให้กลับมาอีกครั้ง

แดดไม่ใช่ศัตรู ถ้าเรารู้จักมันในมุมที่ถูกต้อง เฮียแค่อยากชวนให้ลองเปลี่ยนจากคำว่า “กลัวแดด” เป็น “ฟังแดด” เพราะบางครั้งธรรมชาติไม่ได้พูดด้วยคำ แต่สื่อสารด้วยแสงที่แทรกผ่านหัวใจเราโดยไม่ต้องผ่านล่าม

บางคนอาจคิดในใจ “แหมเฮีย ก็ดีหรอก ถ้าได้ตื่นเช้า” 555555

เฮียเข้าใจดีเลยว่าไม่ใช่ทุกคนจะตื่นมาทันแดดยามเช้าได้เสมอไป ชีวิตคนเรามันไม่ได้เริ่มต้นพร้อมไก่ขันทุกวัน บางคนเพิ่งเข้านอนตอนตีสาม ตื่นอีกทีแดดก็แตะบ่ายเข้าไปแล้ว ไม่ต้องกังวลไปจ้ะ เพราะความมหัศจรรย์ของแสงอินฟราเรดยังมีให้เราได้ใช้แม้ในแดดยามเย็น

แดดช่วงเย็น โดยเฉพาะหลังสี่โมงเย็นไปจนเกือบหกโมง (หรือเร็วช้าตามฤดู) ก็ยังอุดมไปด้วยแสงอินฟราเรดในช่วงคลื่นที่ไมโทคอนเดรียชอบ แถมยังไม่มีรังสี UV ที่แรงจัดมารบกวนเหมือนตอนเที่ยง เรียกว่าเป็นแดดแบบละมุนๆ สำหรับคนที่อยาก “บำบัดใจ” แบบไม่ต้องร้อนจนหัวเปียก

เฮียเคยลองตากแดดเย็นเดินไปในสวนสาธารณะ แล้วรู้สึกว่ามันเหมือนได้รีเซ็ตจิตใจหลังวันเหนื่อยๆ ไปในตัว ยิ่งพอรู้ว่าในช่วงเวลานี้แสงที่ได้กำลังช่วยปลุกพลังงานในร่างกายแบบเงียบๆ ด้วยแล้ว มันทำให้เฮียยิ่งเคารพธรรมชาติมากขึ้นไปอีก เคยเห็นคนที่วันๆมีแต่ความเครียด ความโกรธ ความอาฆาตต่อโลกไหมหละ บางคนแค่โดนแดด แต่ไม่ได้ตากแดด การตากแดดคือปล่อยใจไปกับธรรมชาติ พูดคุยกับร่างกาย บอกเขาว่าเราจะทำตัวให้เป็นประโยชน์กับโลกใบนี้ ให้สมกับที่ใช้พลังงานของโลก

จะเช้าหรือเย็น สำคัญไม่เท่ากับความตั้งใจ เฮียว่าไม่ว่าชีวิตจะตื่นตอนไหน ถ้าเราให้เวลาแค่ 10–15 นาทีในแต่ละวัน ออกไปยืนให้แดดแตะหน้า แตะแขน หรือแค่ให้แสงลอดผ่านตาเบาๆ โดยไม่ต้องจ้องจ้าๆ ก็พอ แค่นี้ก็เป็นการให้ไมโทคอนเดรียได้หายใจ ได้ออกกำลังกายแบบของมัน และได้ส่งพลังกลับมาหาเราทั้งร่างกายและจิตใจ

สุดท้ายแล้ว แดดไม่ได้แบ่งชนชั้น ไม่เลือกว่าจะรักเฉพาะคนตื่นเช้า หรือโกรธคนตื่นสาย ขอแค่เรารู้จักเวลาและวิธีอยู่กับมันอย่างถูกจังหวะ แดดก็พร้อมจะให้เสมอ

#pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr #SundaySpecialเราจะไปเป็นหมูแดดเดียว

-

@ eb0157af:77ab6c55

2025-05-25 04:48:11

@ eb0157af:77ab6c55

2025-05-25 04:48:11Michigan lawmakers are unveiling a comprehensive strategy to regulate Bitcoin and cryptocurrencies.

On May 21, Republican Representative Bill Schuette introduced House Bill 4510, a proposal to amend the Michigan Public Employee Retirement System Investment Act. The legislation would allow the state treasurer, currently Rachael Eubanks, to diversify the state’s investments by including cryptocurrencies with an average market capitalization of over $250 million in the past calendar year.

Under current criteria, Bitcoin (BTC) and Ether (ETH) are the only cryptocurrencies that meet these selection standards. The proposal specifies that any investment in digital assets must be made through exchange-traded products (spot ETFs) issued by registered investment companies.

Anti-CBDC legislation

Republican Representative Bryan Posthumus is leading the bipartisan initiative behind the second bill, HB 4511, which establishes protections for cryptocurrency holders. The proposal prohibits Michigan from implementing crypto bans or imposing licensing requirements on digital asset holders.

Another key aspect of the legislation is a ban on state officials from supporting or promoting a potential federal central bank digital currency (CBDC). The definition includes the issuance of memorandums or official statements endorsing CBDC proposals related to testing, adoption, or implementation.

Mining and redevelopment of abandoned sites

The third bill, HB 4512, is a proposal led by Democratic Representative Mike McFall for a bipartisan group. This initiative would establish a Bitcoin mining program allowing operators to use abandoned oil and natural gas sites.

The program calls for the appointment of a supervisor tasked with assessing the site’s remaining productive potential, identifying the last operator, and determining the length of abandonment. Prospective participants would need to submit detailed legal documentation of their organizational structure, demonstrate operational expertise in mining, and provide profitability breakeven estimates for their ventures.

The fourth and final bill, HB 4513, also introduced by the bipartisan group led by McFall, focuses on the fiscal aspect of the HB 4512 initiative. The proposal would amend Michigan’s income tax laws to include proceeds generated from the proposed Bitcoin mining program.

The post Michigan: four bills on pension funds, CBDCs, and mining appeared first on Atlas21.

-

@ 3c7dc2c5:805642a8

2025-05-24 22:05:00

@ 3c7dc2c5:805642a8

2025-05-24 22:05:00🧠Quote(s) of the week:

'The Cantillon Effect: When new money is printed, those closest to the source (banks, elites) benefit first, buying assets before prices rise. Others lose purchasing power as inflation hits later. If people find out how this works, they will riot.' -Bitcoin for Freedom

Just think about it. Your employer gives you a 5% raise. The Fed (central banks in general) prints 7% more dollars/euros/Fiat. You just got a 2% pay cut. This isn't a conspiracy theory. This is how fiat money steals from the working class every single day. This is why I support Bitcoin.

Anilsaidso: 'Saving in fiat currency is no longer an option. A 2% inflation rate means you lose 1/3 of your purchasing power over 20yrs. At 5% inflation, you lose 60%. And at 10% you've burnt 85%. Reduce your uncertainty. Save in Bitcoin.' https://i.ibb.co/N661BdVp/Gr-Rwdg-OXc-AAWPVE.jpg

🧡Bitcoin news🧡

“Education increases conviction.

Conviction increases allocation.

Allocation increases freedom.” —Gigi

https://i.ibb.co/Q3trHk8Y/Gr-Arv-Ioa-AAAF5b0.jpg

On the 12th of May:

➡️Google searches for "Digital Gold" are at all-time highs. Bitcoin Croesus: "This is the second wave of the Digital Revolution - the digitization of value to complement the Internet's digitization of information. It wasn't possible to own a slice of the Internet itself, but it is possible with Bitcoin, the internet of value." "...It feels like you're late to Bitcoin. But this is a bigger game playing out than most realize, and we are much earlier than casual observers know. If you're reading this, you're here on the frontier early. And you have a chance to stake a claim before 99% of the world shows up. This is a land grab. This is the digital gold rush. Make your descendants proud."

https://i.ibb.co/5XXbNQ8S/Gqw-X4-QRWs-AEd5-Uh-1.jpg

➡️ 'A new holding company ‘Nakamoto’ just raised $710 million to buy more Bitcoin and will merge with KindlyMD to establish a Bitcoin Treasury company. Saylor playbook!' - Bitcoin Archive

➡️American Bitcoin, backed by Donald Trump Jr. and Eric Trump, will go public via an all-stock merger with Gryphon Digital Mining. Post-merger, Trump affiliates and Hut 8 will retain 98% ownership. GRYP tripled to $2.19, Hut 8 jumped 11% to $15.45. The deal closes in Q3 2025.

➡️Phoenix Wallet: 'Phoenix 0.6.0 is out: offers can now have a custom description simple close (set an exact mutual close tx fee rate) native support for Linux arm64 This is the server version. Phoenix mobile release is around the corner. '

On the 13th of May:

➡️Corporate Bitcoin purchases have now outweighed the supply of new Bitcoin by 3.3x in 2025. https://i.ibb.co/fVdgQhyY/Gq1ck-XRXUAAsg-Ym.jpg

➡️ Publicly listed Next Technology disclosed buying 5,000 Bitcoin for $180m, now HODLs 5,833 $BTC worth +$600m.

➡️ After rejecting the Arizona Strategic Bitcoin Reserve Act, Governor Katie Hobbs vetoed Bill SB 1373, which proposed a digital asset reserve fund. "Current volatility in the cryptocurrency markets does not make a prudent fit for general fund dollars."

➡️Meanwhile in Paris, France the kidnapping of a woman with her 2-year-old child morning on the streets of Paris - the target is allegedly the daughter of a crypto CEO. 3 masked men tried forcing them into a fake delivery van, before being fought off by her partner and bystanders. One of whom grabbed a dropped gun and aimed it back.

➡️ 'Bitcoin illiquid supply hit a new all-time high of $1.4B Are you HODLing too, anon?' - Bitcoin News

➡️Why Coinbase entering the S&P 500 matters. Boomers will have Bitcoin / CrApTo exposure, whether they like it or not. Anyway, remember what happened in 2021. The COIN IPO, and they’re still trading about 35% below their IPO-day high. Oh and please read the 'Coinbase" hack below haha.

➡️ Nasdaq listed GD Culture Group to sell up to $300 million shares to buy Bitcoin.

➡️ A Bitcoin wallet untouched since April 2014 just moved 300 BTC worth $31M for the first time in 11 years. This is how you HODL.

➡️ Bitcoin's realized price is steadily increasing, mirroring behaviors seen in past bull markets, according to CryptoQuant.

➡️ Bitcoin whales and sharks (10-10K BTC) accumulated 83,105 BTC in the last 30 days, while small retail holders (<0.1 BTC) sold 387 BTC, according to Santiment.

Bitcoin Whales have been AGGRESSIVELY accumulating BTC recently! With at least 240,000+ Bitcoin transferred to wallets with at least 100 BTC. The largest market participants are trying to buy as much as possible, what do they think comes next...

➡️'The average cost of mining 1 BTC for miners is currently $36.8K. The spread between the current market price and the cost of one coin = 182%. This is essentially the average profitability. This corresponds to the beginning of the bull cycle in November 2022 and the peaks of this cycle >$100K. A price increase above this level will allow miners to fully recover after the last halving and reach excess profits comparable to the beginning of the bull rally in January 2023.' -Axel Adler Jr.

➡️ Remember last week's segment on Coinbase..."Coinbase just disclosed in their Q1 filing: that they have custody of 2.68 million Bitcoin. That’s over 13% of all Bitcoin in circulation, on one platform. Is this the greatest honeypot in financial history? Yes, it is...read next week's Weekly Bitcoin update."

Well, here you go.

Coinbase estimates $180-$400 million in losses, remediation costs, and reimbursement following today’s cyber attack. https://i.ibb.co/jkysLtZ1/Gq-C7zl-W4-AAJ0-N6.jpg

Coinbase didn't get hacked. Coinbase employees sold customer data on the black market. Coinbase failed to protect customer data. This is why KYC is useless. The criminals have our driver's license scans. They have AI tools that can generate fake images and videos. KYC puts our identities at risk, makes onboarding more difficult, and rewards criminals. To make it even worse. Coinbase knew about the hack as early as January but only disclosed it publicly after being added to the S&P 500.

I will say it one more time! Don't buy your Bitcoin on KYC exchanges. KYC means handing over your identity to be leaked, sold, or extorted.

It was 2 days ago, see the bit on the 13th of May, that we saw a violent attack in Paris. Minimize the data you share with centralized tools. Store as much as you can locally. Always ask yourself what data am I giving and to whom? Remove the need for trust.

And for the love of God, Allah, or whatever god you are praying to...

DON'T LEAVE YOUR COINS ON A FREAKING EXCHANGE!!!!

Clear!

➡️ Sam Callahan: Bitcoin CAGRs over rolling four-year holding periods since 2012:

10th percentile: 33%

25th percentile: 50% 40th percentile: 75%

Said differently, for 90% of the time, Bitcoin’s four-year CAGR was higher than 33%. For comparison, here are the single best four-year CAGRs over the same period for:

Gold: 17%

Silver: 20%

S&P 500: 24%

Apple: 52%

Two lessons here:

1.) Even when Bitcoin underperforms, it still outperforms.

2.) Bitcoin holding goals are best measured in halving cycles.'

https://i.ibb.co/9m6q2118/Gq1-Ie2-Ob-AAIJ8-Kf.jpg

➡️ Deutsche Bank Aktiengesellschaft has bought 96,870 Strategy₿ stocks for 30 Million dollars at an Average Price Of $310 Per Share In Q1 2025, Their Total Holdings Is 518,000 Shares Worth Over 214 Million Dollars.

➡️Senator Lummis urges the U.S. Treasury to eliminate taxes on unrealized gains for Bitcoin.

On the 14th of May:

➡️At $168,000, Bitcoin will surpass Microsoft, the world's largest company.

➡️Fidelity tells institutions to buy Bitcoin if they can’t match Bitcoin’s 65% return on capital.

➡️Michigan has adopted House Resolution 100, declaring May 13 2025 as "Digital Asset Awareness Day." The resolution encourages "activities and programs that foster a deeper understanding of digital assets and their impact on our society and economy."

➡️Publicly traded Vinanz raises funding to buy $2 million in #Bitcoin assets.

➡️Bitcoin News: "Investor Jim Chanos is shorting MicroStrategy while going long on Bitcoin, calling the stock overvalued relative to its BTC holdings. “We’re selling MicroStrategy and buying Bitcoin, basically buying something for $1 and selling it for $2.50," he told CNBC

On the 15th of May:

➡️The Abu Dhabi sovereign wealth fund disclosed owning $511 million in Bitcoin through BlackRock’s ETF.

➡️UK public company Coinsilium Group raises £1.25 million to adopt a Bitcoin treasury strategy.

➡️Chinese Textile company Addentax issues stock to buy 8,000 Bitcoin.

➡️14 US states have reported $632m in $MSTR exposure for Q1, in public retirement and treasury funds. A collective increase of $302m in one quarter. The average increase in holding size was 44%.

➡️Chinese public company DDC Enterprise to adopt a Bitcoin Reserve with 5,000 BTC.

On the 16th of May:

➡️Brazilian listed company Méliuz buys $28.4 million Bitcoin to become the nation's first Bitcoin Treasury Company. Shareholders voted to approve the strategy by an "overwhelming majority".

➡️13F Filings show Texas Retirement System owns MSTR. The day MSTR enters the S&P 500, every pension fund will follow.

➡️'Wealthy Investors Shift Up to 5% into Bitcoin as confidence in fiat falters. UBS, a Swiss banking giant says Bitcoin and digital assets are becoming key hedges against inflation and systemic risk, marking a dramatic shift in modern portfolio strategy.' -CarlBMenger

➡️River: "Above all, Bitcoin is money for the people." https://i.ibb.co/Jj8MVQwr/Gr-Ew-EPp-XAAA1-TVN.jpg

On the 17th of May:

➡️Illicit activity is now down to 0.14% of transaction volume across all crypto.

Context: World Bank, IMF suggests 1.5–4% of global GDP is laundered yearly through traditional banking Of that 0.14%:

63% of illicit trade was stablecoins.

13% was Bitcoin (declining each year)

Source: The 2025 Crypto Crime Report, Chainalysis 2025

Yet another confirmation that Bitcoin's use in facilitating illicit activities is a rounding error on a rounding error.

On the 18th of May:

➡️JPMorgan CEO Jamie Dimon said they will allow clients to buy Bitcoin. The repeal of SAB 121 is a bigger deal than most realize. “I will fire any employee buying or trading Bitcoin for being stupid” - Jamie Dimon (2017) https://i.ibb.co/b5tnkb15/Gr-Vxxc-OXk-AA7cyo.jpg

On the 19th of May.

➡️Bookmark the following stuff from Daniel Batten if you want to combat climate change (fanatics)...

'That Bitcoin mining is not only not harmful, but beneficial to the environment is now supported by:

7 independent reports

20 peer-reviewed papers

As a result * 90% of climate-focused magazines * 87.5% of media coverage on Bitcoin & the environment is now positive * source 7 independent reports https://x.com/DSBatten/status/1922666207754281449… * 20 peer-reviewed papers https://x.com/DSBatten/status/1923014527651615182… * 10 climate-focused magazines https://x.com/DSBatten/status/1919518338092323260… * 16 mainstream media articles https://x.com/DSBatten/status/1922628399551434755

➡️Saifedean Ammous: '5 years ago at the height of corona hysteria, everyone worried about their savings.

If you put $10,000 in "risk-free" long-term US government bonds, you'd have $6,000 today.

If you put the $10,000 in "risky speculative tulip" bitcoin, you'd have $106,000.

HFSP, bondcucks!'

I love how Saifedean always put it so eloquently. haha

➡️An Australian judge rules Bitcoin is “just another form of money.” This could make it exempt from capital gains tax. Potentially opening the door to millions in refunds across the country. - AFR

If upheld, the decision could trigger up to $1B in refunds and overturn the Australian Tax Office’s crypto tax approach.

➡️Publicly traded Vinanz buys 16.9 Bitcoin for $1.75 Million for their treasury.

➡️Bitcoin just recorded its highest weekly close ever, while the Global Economic Policy Uncertainty Index hit its highest level in history.

➡️4 in 5 Americans want the U.S. to convert part of its gold reserves to Bitcoin. - The Nakamoto Project

"or background, the survey question was: "Assuming the United States was thinking of converting some of their gold reserves into Bitcoin, what percentage would you advise they convert?" Respondents were provided a slider used to choose between 0% and 100%. Our survey consisted of a national sample of 3,345 respondents recruited in partnership with Qualtrics, a survey and data collection company"

Context: https://x.com/thetrocro/status/1924552097565180107 https://i.ibb.co/fGDw06MC/Gr-VYDIdb-AAI7-Kxd.jpg

➡️Michael Saylor's STRATEGY bought another $764.9m Bitcoin. They now HODL 576,230 Bitcoin, acquired for $40.18 billion at $69,726 per Bitcoin.

➡️The German Government sold 49,858 BTC for $2.89B, at an average price of $57,900. If they had held it, their BTC would now be worth $5.24B.

➡️A record 63% of all the Bitcoin that exist have not transacted or moved from their wallets this year. - Wicked

https://i.ibb.co/j9nvbvmP/Gq3-Z-x6-Xw-AAv-Bhg.jpg

💸Traditional Finance / Macro:

On the 12th of May:

👉🏽The S&P 500 has closed more than 20% above its April low, technically beginning a new bull market. We are now up +1,000 points in one month.

On the 13th of May:

👉🏽 Nvidia announces a partnership with Humain to build "AI factories of the future" in Saudi Arabia. Just one hour ago, Saudi Arabia signed an economic agreement with President Trump to invest $600 billion in the US.

🏦Banks:

👉🏽 No news

🌎Macro/Geopolitics:

On the 12th of May:

👉🏽Huge pressure is on the European Union to reach a trade deal. Equities and commodities bounce hard on news of China-US trade deal. "We have reached an agreement on a 90-day pause and substantially moved down the tariff levels — both sides, on the reciprocal tariffs, will move their tariffs down 115%." - Treasury Secretary Scott Bessent

Dollar and Yuan strong bounce. Gold corrects.

👉🏽After reaching a high of 71% this year, recession odds are now back down to 40%. The odds of the US entering a recession in 2025 fall to a new low of 40% following the US-China trade deal announcement.

👉🏽'Truly incredible:

- Trump raises tariffs: Yields rise because inflation is back

- Trump cuts tariffs: Yields rise because growth is back

- Trump does nothing: Yields rise because the Fed won't cut rates Today, the bond market becomes Trump and Bessent's top priority.' - TKL

President Trump’s biggest problem persists even as trade deals are announced. Tariffs have been paused for 90 days, the US-China trade deal has been announced, and inflation data is down. Yet, the 10Y yield is nearing 4.50% again. Trump needs lower rates, but rates won’t fall.

👉🏽Last week a lot of talk on Japan’s Debt Death Spiral: Japan’s 40-year yield is detonating and the myth of consequence-free debt just died with it. One of the best explanations, you can read here:

👉🏽Michael A. Arouet: 'Eye-opening chart. Can a country with a services-based economy remain a superpower? Building back US manufacturing base makes a lot of strategic and geopolitical sense.' https://i.ibb.co/Q3zJY9Fc/Gqxc6-Pt-WQAI73c.jpg

On the 13th of May:

👉🏽There is a possibility of a “big, beautiful” economic rebalancing, Treasury Secretary Scott Bessent says at an investment forum in Saudi Arabia. The “dream scenario” would be if China and the US can work together on rebalancing, he adds

Luke Gromen: It does roll off the tongue a whole lot nicer than "We want to significantly devalue USD v. CNY, via a gold reference point."

Ergo: The price of gold specifically would rise in USD much more than it would in CNY, while prices for other goods and services would not, or would do so to a lesser degree.

👉🏽 Dutch inflation rises to 4.1 percent in April | CBS – final figure. Unchanged compared to the estimate.

👉🏽Philipp Heimberger: This interesting new paper argues that cuts to taxes on top incomes disproportionately benefit the financial sector. The finance industry gains more from top-income tax cuts than other industries. "Cuts in top income tax rates increase the (relative) size of the financial sector"

Kinda obvious, innit?

👉🏽US CPI data released. Overall good results and cooler than expected month-over-month and year-over-year (outside of yearly core). U.S. inflation is down to 2.3%, lower than expected.

On the 14th of May:

👉🏽'The US government cannot afford a recession: In previous economic cycles, the US budget deficit widened by ~4% of GDP on average during recessions. This would imply a ~$1.3 trillion deterioration of US government finances if a recession hits in 2025. That said, if the US enters a recession, long-term interest rates will likely go down.

A 2-percentage-point decrease in interest rates would save ~$568 billion in annual interest payments. However, this means government finances would worsen by more than DOUBLE the amount saved in interest due to a recession. An economic downturn would be incredibly costly for the US government.' -TKL

On the 15th of May:

👉🏽'In the Eurozone and the UK, households hold more than 30% of their financial assets in fiat currencies and bank deposits. This means that they (unknowingly?) allow inflation to destroy their purchasing power. The risks of inflation eating up your wealth increase in a debt-driven economic system characterized by fiscal dominance, where interest rates are structurally low and inflation levels and risks are high. There is so much forced and often failed regulation to increase financial literacy, but this part is never explained. Why is that, you think?' - Jeroen Blokland https://i.ibb.co/zWRpNqhz/Gq-jn-Bn-X0-AAmplm.png

On the 16th of May:

👉🏽'For the first time in a year, Japan's economy shrank by -0.7% in Q1 2025. This is more than double the decline expected by economists. Furthermore, this data does NOT include the reciprocal tariffs imposed on April 2nd. Japan's economy is heading for a recession.' -TKL

👉🏽'246 US large companies have gone bankrupt year-to-date, the most in 15 years. This is up from 206 recorded last year and more than DOUBLE during the same period in 2022. In April alone, the US saw 59 bankruptcy filings as tariffs ramped up. So far this year, the industrials sector has seen 41 bankruptcies, followed by 31 in consumer discretionary, and 17 in healthcare. According to S&P Global, consumer discretionary companies have been hit the hardest due to market volatility, tariffs, and inflation uncertainty. We expect a surge in bankruptcies in 2025.' -TKL

👉🏽'Moody's just downgraded the United States' credit rating for the FIRST time in history. The reason: An unsustainable path for US federal debt and its resulting interest burden. Moody's notes that the US debt-to-GDP ratio is on track to hit 134% by 2035. Federal interest payments are set to equal ~30% of revenue by 2035, up from ~18% in 2024 and ~9% in 2021. Furthermore, deficit spending is now at World War 2 levels as a percentage of GDP. The US debt crisis is our biggest issue with the least attention.' - TKL

Still, this is a nothing burger. In August 2023, when Fitch downgraded the US to AA+, and S&P (2011) the US became a split-rated AA+ country. This downgrade had almost no effect on the bond market. The last of the rating agencies, Moodys, pushed the US down to AA+ today. So technically it didn’t even change the US’s overall credit rating because it was already split-rated AA+, now it’s unanimous AA+.

Ergo: Nothing changed. America now shares a credit rating with Austria and Finland. Hard assets don’t lie. Watch Gold and Bitcoin.

https://i.ibb.co/Q7DcWY2P/Gr-K66i-EXIAAKh-MR.jpg

RAY DALIO: Credit Agencies are UNDERSTATING sovereign credit risks because "they don't include the greater risk that the countries in debt will print money to pay their debts" with devalued currency.

👉🏽US consumer credit card serious delinquencies are rising at a CRISIS pace: The share of US credit card debt that is past due at least 90 days hit 12.3% in Q1 2025, the highest in 14 YEARS. The percentage has risen even faster than during the Great Financial Crisis.' - Global Markets Investor

https://i.ibb.co/nNH9CxVK/Gr-E838o-XYAIk-Fyn.png

On the 18th of May:

👉🏽Michael A. Arouet: 'Look at ten bottom of this list. Milei has not only proven that real free market reforms work, but he has also proven that they work fast. It’s bigger than Argentina now, no wonder that the left legacy media doesn’t like him so much.' https://i.ibb.co/MDnBCDSY/Gr-Npu-KKWMAAf-Pc.jpg

On the 19th of May: 👉🏽Japan's 40-year bond yield just hit its highest level in over 20 years. Japan’s Prime Minister Ishiba has called the situation “worse than Greece.” All as Japan’s GDP is contracting again. You and your mother should be scared out of your fucking minds. https://i.ibb.co/rGZ9cMtv/GTXx-S7-Cb-MAAOu-Vt.png

👉🏽 TKL: 'Investors are piling into gold funds like never before: Gold funds have posted a record $85 BILLION in net inflows year-to-date. This is more than DOUBLE the full-year record seen in 2020. At this pace, net inflows will surpass $180 billion by the end of 2025. Gold is now the best-performing major asset class, up 22% year-to-date. Since the low in October 2022, gold prices have gained 97%. Gold is the global hedge against uncertainty.'

🎁If you have made it this far, I would like to give you a little gift, well, in this case, two gifts:

What Bitcoin Did - IS THE FED LOSING CONTROL? With Matthew Mezinskis

'Matthew Mezinskis is a macroeconomic researcher, host of the Crypto Voices podcast, and creator of Porkopolis Economics. In this episode, we discuss fractional reserve banking, why it's controversial among Bitcoiners, the historical precedent for banking practices, and whether fractional reserve banking inherently poses systemic risks. We also get into the dangers and instabilities introduced by central banking, why Bitcoin uniquely offers a pathway to financial sovereignty, the plumbing of the global financial system, breaking down money supply metrics, foreign holdings of US treasuries, and how all these elements indicate growing instability in the dollar system.'

https://youtu.be/j-XPVOl9zGc

Credit: I have used multiple sources!

My savings account: Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

-

@ 6389be64:ef439d32

2025-05-24 21:51:47

@ 6389be64:ef439d32

2025-05-24 21:51:47Most nematodes are beneficial and "graze" on black vine weevil, currant borer moth, fungus gnats, other weevils, scarabs, cutworms, webworms, billbugs, mole crickets, termites, peach tree borer and carpenter worm moths.

They also predate bacteria, recycling nutrients back into the soil and by doing so stimulates bacterial activity. They act as microbial taxis by transporting microbes to new locations of soil as they move through it while providing aeration.

https://stacker.news/items/988573

-

@ 58537364:705b4b85

2025-05-24 20:48:43

@ 58537364:705b4b85

2025-05-24 20:48:43“Any society that sets intellectual development as its goal will continually progress, without end—until life is liberated from problems and suffering. All problems can ultimately be solved through wisdom itself.

The signpost pointing toward ‘wisdom’ is the ability to think—or what is called in Dhamma terms, ‘yoniso-manasikāra,’ meaning wise or analytical reflection. Thinking is the bridge that connects information and knowledge with insight and understanding. Refined or skillful thinking enables one to seek knowledge and apply it effectively.

The key types of thinking are:

- Thinking to acquire knowledge

- Thinking to apply knowledge effectively In other words, thinking to gain knowledge and thinking to use that knowledge. A person with knowledge who doesn’t know how to think cannot make that knowledge useful. On the other hand, a person who thinks without having or seeking knowledge will end up with nothing but dreamy, deluded ideas. When such dreamy ideas are expressed as opinions, they become nonsensical and meaningless—mere expressions of personal likes or dislikes.

In this light, the ‘process of developing wisdom’ begins with the desire to seek knowledge, followed by the training of thinking skills, and concludes with the ability to express well-founded opinions. (In many important cases, practice, testing, or experimentation is needed to confirm understanding.)

Thus, the thirst for knowledge and the ability to seek knowledge are the forerunners of intellectual development. In any society where people lack a love for knowledge and are not inclined to search for it, true intellectual growth will be difficult. That society will be filled with fanciful, delusional thinking and opinions based merely on personal likes and dislikes. For the development of wisdom, there must be the guiding principle that: ‘Giving opinions must go hand-in-hand with seeking knowledge. And once knowledge is gained, thinking must be refined and skillful.’”

— Somdet Phra Buddhaghosacariya (P.A. Payutto) Source: Dhamma treatise “Organizing Society According to the Ideals of the Sangha”

Note: “Pariyosāna” means the complete conclusion or the final, all-encompassing end.

“We must emphasize the pursuit of knowledge more than merely giving opinions. Opinions must be based on the most solid foundation of knowledge.

Nowadays, we face so many problems because people love to express opinions without ever seeking knowledge.”

— Somdet Phra Buddhaghosacariya (P.A. Payutto)

-

@ 57d1a264:69f1fee1

2025-05-24 06:07:19

@ 57d1a264:69f1fee1

2025-05-24 06:07:19Definition: when every single person in the chain responsible for shipping a product looks at objectively horrendous design decisions and goes: yup, this looks good to me, release this. Designers, developers, product managers, testers, quality assurance... everyone.

I nominate Peugeot as the first example in this category.

Continue reading at https://grumpy.website/1665

https://stacker.news/items/988044

-

@ 3283ef81:0a531a33

2025-05-24 20:47:39

@ 3283ef81:0a531a33

2025-05-24 20:47:39This event has been deleted; your client is ignoring the delete request.

-

@ 3283ef81:0a531a33

2025-05-24 20:36:35

@ 3283ef81:0a531a33

2025-05-24 20:36:35Suspendisse quis rutrum nisi Integer nec augue quis ex euismod blandit ut ac mi

Curabitur suscipit vulputate volutpat Donec ornare, risus non tincidunt malesuada, elit magna feugiat diam, id faucibus libero libero efficitur mauris

-

@ eb0157af:77ab6c55

2025-05-25 04:48:10

@ eb0157af:77ab6c55

2025-05-25 04:48:10A fake Uber driver steals $73,000 in XRP and $50,000 in Bitcoin after drugging an American tourist.

A U.S. citizen vacationing in the United Kingdom fell victim to a scam that cost him $123,000 in cryptocurrencies stored on his smartphone. The man was drugged by an individual posing as an Uber driver.

According to My London, Jacob Irwin-Cline had spent the evening at a London nightclub, consuming several alcoholic drinks before requesting an Uber ride home. The victim admitted he hadn’t carefully verified the booking details on his device, mistakenly getting into a private taxi driven by someone who, at first glance, resembled the expected Uber driver but was using a completely different vehicle.

Once inside the car, the American tourist reported that the driver offered him a cigarette, allegedly laced with scopolamine — a rare and powerful sedative. Irwin-Cline described how the smoke made him extremely docile and fatigued, causing him to lose consciousness for around half an hour.

Upon waking, the driver ordered the victim to get out of the vehicle. As Irwin-Cline stepped out, the man suddenly accelerated, running him over and fleeing with his mobile phone, which contained the private keys and access to his cryptocurrencies. Screenshots provided to MyLondon show that $73,000 worth of XRP and $50,000 in bitcoin had been transferred to various wallets.

This incident adds to a growing trend of kidnappings, extortions, armed robberies, and ransom attempts targeting crypto executives, investors, and their families.

Just a few weeks ago, the daughter and grandson of Pierre Noizat, CEO of crypto exchange Paymium, were targeted in a kidnapping attempt in Paris. The incident took place in broad daylight when attackers tried to force the family into a parked vehicle. However, Noizat’s daughter managed to fight off the assailants.

The post American tourist drugged and robbed: $123,000 in crypto stolen in London appeared first on Atlas21.

-

@ 57d1a264:69f1fee1

2025-05-24 05:53:43

@ 57d1a264:69f1fee1

2025-05-24 05:53:43This talks highlights tools for product management, UX design, web development, and content creation to embed accessibility.

Organizations need scalability and consistency in their accessibility work, aligning people, policies, and processes to integrate it across roles. This session highlights tools for product management, UX design, web development, and content creation to embed accessibility. We will explore inclusive personas, design artifacts, design systems, and content strategies to support developers and creators, with real-world examples.

https://www.youtube.com/watch?v=-M2cMLDU4u4

https://stacker.news/items/988041

-

@ 1d7ff02a:d042b5be

2025-05-24 10:15:40

@ 1d7ff02a:d042b5be

2025-05-24 10:15:40ຄົນສ່ວນຫຼາຍມັກຈະມອງເຫັນ Bitcoin ເປັນສິນຊັບທີ່ມີຄວາມສ່ຽງສູງ ເນື່ອງຈາກມີອັດຕາການປ່ຽນແປງລາຄາທີ່ຮຸນແຮງແລະກວ້າງຂວາງໃນໄລຍະສັ້ນໆ. ແຕ່ຄວາມຈິງແລ້ວ ຄວາມຜັນຜວນຂອງ Bitcoin ແມ່ນຄຸນລັກສະນະພິເສດທີ່ສຳຄັນຂອງມັນ ບໍ່ແມ່ນຂໍ້ບົກພ່ອງ.

ລາຄາແມ່ນຫຍັງ?

ເພື່ອເຂົ້າໃຈເລື້ອງນີ້ດີຂຶ້ນ ເຮົາຕ້ອງເຂົ້າໃຈກ່ອນວ່າລາຄາໝາຍເຖິງຫຍັງ. ລາຄາແມ່ນການສະທ້ອນຄວາມຄິດເຫັນແລະການປະເມີນມູນຄ່າຂອງຜູ້ຊື້ແລະຜູ້ຂາຍໃນເວລາໃດໜຶ່ງ. ການຕັດສິນໃຈຊື້ຫຼືຂາຍໃນລາຄາໃດໜຶ່ງ ກໍແມ່ນການສື່ສານກັບຕະຫຼາດ ແລະກົນໄກຂອງຕະຫຼາດຈະຄ້ົນຫາແລະກໍານົດລາຄາທີ່ແທ້ຈິງຂອງສິນຊັບນັ້ນ.

ເປັນຫຍັງ Bitcoin ຈຶ່ງຜັນຜວນ?

Bitcoin ຖືກສ້າງຂຶ້ນບົນພື້ນຖານອິນເຕີເນັດ ເຮັດໃຫ້ການສື່ສານຄວາມຄິດເຫັນຂອງຜູ້ຄົນສາມາດເຮັດໄດ້ຢ່າງໄວວາ. ຍິ່ງໄປກວ່ານັ້ນ Bitcoin ມີລັກສະນະກະຈາຍສູນ (decentralized) ແລະບໍ່ມີຜູ້ຄວບຄຸມສູນກາງ ຈຶ່ງເຮັດໃຫ້ຄົນສາມາດຕັດສິນໃຈຊື້ຂາຍໄດ້ຢ່າງໄວວາ.

ສິ່ງນີ້ເຮັດໃຫ້ລາຄາຂອງ Bitcoin ສາມາດສະທ້ອນຄວາມຄິດເຫັນຂອງຄົນໄດ້ແບບເວລາຈິງ (real-time). ແລະເນື່ອງຈາກມະນຸດເຮົາມີຄວາມຄິດທີ່ບໍ່ແນ່ນອນ ມີການປ່ຽນແປງ ລາຄາຂອງ Bitcoin ຈຶ່ງປ່ຽນແປງໄປຕາມຄວາມຄິດເຫັນລວມຂອງຜູ້ຄົນແບບທັນທີ.

ປັດໄຈທີ່ເພີ່ມຄວາມຜັນຜວນ:

ຂະໜາດຕະຫຼາດທີ່ຍັງນ້ອຍ: ເມື່ອປຽບທຽບກັບຕະຫຼາດການເງິນແບບດັ້ງເດີມ ຕະຫຼາດ Bitcoin ຍັງມີຂະໜາດນ້ອຍ ເຮັດໃຫ້ການຊື້ຂາຍຈຳນວນໃຫຍ່ສາມາດສົ່ງຜົນກະທົບຕໍ່ລາຄາໄດ້ຫຼາຍ.

ການຄ້າຂາຍຕະຫຼອດ 24/7: ບໍ່ເຫມືອນກັບຕະຫຼາດຫຼັກຊັບທີ່ມີເວລາເປີດປິດ Bitcoin ສາມາດຊື້ຂາຍໄດ້ຕະຫຼອດເວລາ ເຮັດໃຫ້ການປ່ຽນແປງລາຄາສາມາດເກີດຂຶ້ນໄດ້ທຸກເວລາ.

ການປຽບທຽບກັບສິນຊັບອື່ນ

ເມື່ອປຽບທຽບກັບສິນຊັບອື່ນທີ່ມີການຄວບຄຸມ ເຊັ່ນ ສະກຸນເງິນທ້ອງຖິ່ນຫຼືທອງຄຳ ທີ່ເບິ່ງຄືວ່າມີຄວາມຜັນຜວນໜ້ອຍກວ່າ Bitcoin ນັ້ນ ບໍ່ແມ່ນຫມາຍຄວາມວ່າພວກມັນບໍ່ມີຄວາມຜັນຜວນ. ແຕ່ເປັນເພາະມີການຄວບຄຸມຈາກອົງການສູນກາງ ເຮັດໃຫ້ການສື່ສານຄວາມຄິດເຫັນຂອງຄົນໄປຮອດຕະຫຼາດບໍ່ແບບເວລາຈິງ.

ດັ່ງນັ້ນ ສິ່ງທີ່ເຮົາເຫັນແມ່ນການຊັກຊ້າ (delay) ໃນການສະແດງຄວາມຄິດເຫັນທີ່ແທ້ຈິງອອກມາເທົ່ານັ້ນ ບໍ່ແມ່ນຄວາມໝັ້ນຄົງຂອງມູນຄ່າ.

ກົນໄກການຄວບຄຸມແລະຜົນກະທົບ:

ສະກຸນເງິນ: ທະນາຄານກາງສາມາດພິມເງິນ ປັບອັດຕາດອກເບີ້ຍ ແລະແຊກແຊງຕະຫຼາດ ເຮັດໃຫ້ລາຄາບໍ່ສະທ້ອນມູນຄ່າທີ່ແທ້ຈິງໃນທັນທີ.

ຫຼັກຊັບ: ມີລະບຽບການຫຼາຍຢ່າງ ເຊັ່ນ ການຢຸດການຊື້ຂາຍເມື່ອລາຄາປ່ຽນແປງຫຼາຍເກີນໄປ (circuit breakers) ທີ່ຂັດຂວາງການສະແດງຄວາມຄິດເຫັນທີ່ແທ້ຈິງ.

ທອງຄຳ: ຖຶງແມ່ນຈະເປັນສິນຊັບທີ່ບໍ່ມີການຄວບຄຸມ ແຕ່ຕະຫຼາດທອງຄຳມີຂະໜາດໃຫຍ່ກວ່າ Bitcoin ຫຼາຍ ແລະມີການຄ້າແບບດັ້ງເດີມທີ່ຊ້າກວ່າ.

ບົດສະຫຼຸບ

ການປຽບທຽບຄວາມຜັນຜວນລະຫວ່າງ Bitcoin ແລະສິນຊັບອື່ນໆ ໂດຍໃຊ້ໄລຍະເວລາສັ້ນນັ້ນ ບໍ່ມີຄວາມສົມເຫດສົມຜົນປານໃດ ເພາະວ່າປັດໄຈເລື້ອງການຊັກຊ້າໃນການສະແດງຄວາມຄິດເຫັນນີ້ແມ່ນສິ່ງສຳຄັນທີ່ສົ່ງຜົນຕໍ່ລາຄາທີ່ແທ້ຈິງ.

ສິ່ງທີ່ຄວນເຮັດແທ້ໆແມ່ນການນຳເອົາກອບເວລາທີ່ກວ້າງຂວາງກວ່າມາວິເຄາະ ເຊັ່ນ ເປັນປີຫຼືຫຼາຍປີ ແລ້ວຈຶ່ງປຽບທຽບ. ດ້ວຍວິທີນີ້ ເຮົາຈຶ່ງຈະເຫັນປະສິດທິຜົນແລະການດຳເນີນງານທີ່ແທ້ຈິງຂອງ Bitcoin ໄດ້ຢ່າງຈະແຈ້ງ

-

@ eb0157af:77ab6c55

2025-05-25 04:48:09

@ eb0157af:77ab6c55

2025-05-25 04:48:09Banking giants JPMorgan, Bank of America, Citigroup, and Wells Fargo are in talks to develop a unified stablecoin solution.

According to the Wall Street Journal on May 22, some of the largest financial institutions in the United States are exploring the possibility of joining forces to launch a stablecoin.

Subsidiaries of JPMorgan, Bank of America, Citigroup, and Wells Fargo have initiated preliminary discussions for a joint stablecoin issuance, according to sources close to the matter cited by the WSJ. Also at the negotiating table are Early Warning Services, the parent company of the digital payments network Zelle, and the payment network Clearing House.

The talks are reportedly still in the early stages, and any final decision could change depending on regulatory developments and market demand for stablecoins.

Stablecoin regulation

On May 20, the US Senate voted 66 to 32 to advance discussion of the Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act), a specific law to regulate stablecoins. The bill outlines a regulatory framework for stablecoin collateralization and mandates compliance with anti-money laundering rules.

David Sacks, White House crypto advisor, expressed optimism about the bill’s bipartisan approval. However, senior Democratic Party officials intend to amend the bill to include a clause preventing former President Donald Trump and other US officials from profiting from stablecoins.

Demand for stablecoins has increased, with total market capitalization rising to $245 billion from $205 billion at the beginning of the year, a 20% increase.

The post Major US banks consider launching a joint stablecoin appeared first on Atlas21.

-

@ 95cbd62b:a5270126

2025-05-24 14:06:33

@ 95cbd62b:a5270126

2025-05-24 14:06:33Trong thời đại công nghệ số phát triển mạnh mẽ, nhu cầu tìm kiếm một nền tảng tích hợp đầy đủ tiện ích, an toàn và thân thiện với người dùng ngày càng tăng cao. OK22 đã chứng minh vị thế của mình không chỉ là một nền tảng giải trí trực tuyến, mà còn là một công cụ công nghệ thông minh phục vụ mọi nhu cầu trong đời sống số. Với thiết kế giao diện 100% tiếng Việt và khả năng tương thích trên mọi thiết bị từ máy tính đến điện thoại, OK22 mang đến cho người dùng trải nghiệm mượt mà, dễ sử dụng và hoàn toàn bảo mật. Được phát triển trên nền tảng công nghệ hiện đại, OK22 hỗ trợ người dùng quản lý thông tin cá nhân, thực hiện giao dịch nhanh chóng, lưu trữ dữ liệu an toàn và tiếp cận các tiện ích công nghệ tiên tiến một cách dễ dàng, kể cả với người mới sử dụng.

Một trong những điểm mạnh nổi bật của OK22 chính là khả năng tự động hóa trong xử lý tác vụ, giúp tiết kiệm thời gian và tối ưu hóa hiệu suất làm việc. Nền tảng được trang bị hệ thống bảo mật cao cấp, bảo vệ tối đa quyền riêng tư và tài sản số của người dùng. OK22 còn cung cấp hệ thống hỗ trợ trực tuyến 24/7, giúp người dùng giải quyết mọi vấn đề nhanh chóng mà không bị gián đoạn. Dù là một cá nhân đang tìm kiếm công cụ quản lý tài chính cá nhân, một doanh nghiệp nhỏ cần nền tảng để xử lý đơn hàng và thanh toán, hay một nhóm cộng đồng cần không gian kết nối số – OK22 đều có thể đáp ứng linh hoạt và hiệu quả. Không những vậy, nhờ tích hợp nhiều tính năng như thông báo tự động, đồng bộ dữ liệu đám mây, và tích hợp API mở, OK22 còn dễ dàng kết nối với các nền tảng khác trong hệ sinh thái số, giúp người dùng tạo nên một môi trường làm việc và sinh hoạt thông minh.

Không dừng lại ở đó, OK22 đang ngày càng mở rộng hợp tác với các đối tác lớn trong nhiều lĩnh vực như giáo dục trực tuyến, thương mại điện tử, chăm sóc sức khỏe và tài chính cá nhân. Nền tảng không ngừng cập nhật những công nghệ tiên tiến như AI, blockchain và dữ liệu lớn (Big Data) nhằm mang lại trải nghiệm người dùng tối ưu và đáp ứng nhu cầu ngày càng đa dạng của cộng đồng Việt. Với tốc độ xử lý nhanh, giao diện trực quan và độ tin cậy cao, OK22 không chỉ đơn thuần là một ứng dụng công nghệ – mà còn là người bạn đồng hành tin cậy trong hành trình số hóa của người Việt. Trong tương lai gần, OK22 hứa hẹn sẽ trở thành nền tảng công nghệ không thể thiếu trong mỗi gia đình, tổ chức và doanh nghiệp, đóng vai trò then chốt trong việc thúc đẩy chuyển đổi số toàn diện và phát triển bền vững.

-

@ cff1720e:15c7e2b2

2025-05-24 20:17:45

@ cff1720e:15c7e2b2

2025-05-24 20:17:45Ich liebe Pareto. Für das was es ist, viel mehr aber für das was es derzeit wird - der Marktplatz der Ideen. Er entsteht durch gemeinsames Engagement von Entwicklern, Autoren und aktiven Lesern. Es ist ein lebendiges Medium, das jeden Tag wächst, quantitativ wie qualitativ, durch offene Interaktion, was es in dieser Form einzigartig macht.\ \ Mein Text ist inspiriert durch den Artikel von Alexa Rodrian vom 22. Mai über den Auftritt von Wolf Biermann bei der Verleihung des Deutschen Filmpreises. Alexa ist keine Publizistin, genau wie zahlreiche unserer Autoren, aber sie hat einen bemerkenswerten Beitrag verfasst. Ich habe ihn spontan geliked, kommentiert und mit einer Spende honoriert. In den vergangenen Tagen habe ich viel darüber reflektiert, und Pareto ermöglicht es mir, und jedem anderen, diese Überlegungen zur “Causa Biermann” hier darzulegen.

MSN kommentierte die anstößige Rede wie folgt: mit einem verfälschten Golda-Meir-Zitat lenkte Biermann das Thema auf das Sterben in Gaza, für das er die Palästinenser selbst verantwortlich machte. „Dass ihr unsere Söhne ermordet habt, werden wir Euch eines Tages verzeihen“, habe Meir zu den Palästinensern gesagt, „aber wir werden euch niemals verzeihen können, dass ihr unsere Söhne gezwungen habt, selber Mörder zu werden.“ Alexa Rodrian, in einer Mischung aus Enttäuschung und Empörung, eröffnete ihren Artikel wie folgt:

„Triff niemals deine Idole“ heißt ein gängiger Ratschlag. In gewendeten Zeiten stehen zu dem die Werte auf dem Kopf – und manche Künstler mit ihnen. Die Worte, die aus manch ihrer Mündern kommen, wirken, als hätte eine fremde Hand sie auf deren Zunge gelegt. Die fremde Hand ist bei Biermann eher unwahrscheinlich, denn sein Hang zu Provokationen und Verletzungen haben Tradition, man erinnere sich an den legendären Auftritt bei einer Feierstunde im Bundestag 2014 in der er die Mitglieder der Linksfraktion als “elenden Rest“ und ”Drachenbrut” bezeichnete. Oder seine Beschimpfungen der (ostdeutschen) Wähler von AfD und BSW im August 2024 in einem Zeit-Interview: „Die, die zu feige waren in der Diktatur, rebellieren jetzt ohne Risiko gegen die Demokratie. Den Bequemlichkeiten der Diktatur jammern sie nach, und die Mühen der Demokratie sind ihnen fremd.“

Im Februar 2025 wurde Wolf Biermann für sein Lebenswerk mit einem Musikpreis der GEMA ausgezeichnet. Was aber ist sein Lebenswerk, sein mutiges Engagement in der Opposition der DDR bis 1976 oder seine verfehlten Rüpeleien in der Gegenwart? Ein solcher Preis ist fragwürdig, denn kein Lebenswerk ist konsistent, und die Bewertung abhängig von subjektiven Maßstäben. Meist wählen wir unsere Idole nach unseren Idealen, aber die können sich verändern, ebenso wie das Idol. Beethoven widmete seine 3. Sinfonie (Eroica) Napoleon, zog die Widmung aber zurück als dieser sich 1804 zum Kaiser krönen ließ. “Ist der auch nichts anderes, wie ein gewöhnlicher Mensch?” soll er wütend ausgerufen haben. Richtig! Was hatte Beethoven erwartet, einen Gott? “Hosianna” und “kreuzigt ihn” sind Affekte die durch unsere Projektionen verursacht und den Realitäten nie gerecht werden.

Den Preis für sein Lebenswerk kann Wolf Biermann behalten. Er hat Millionen von Menschen in der DDR Mut gemacht. Er hat zahlreiche großartige Gedichte und Lieder verfasst, das behalte ich gerne in Erinnerung. Nun hat er sich selbst vom Sockel gestürzt und durch seinen Empathiemangel das Image beschädigt. Das hätte er vermeiden können, wenn er sich an die Worte seines Lehrmeisters Brecht erinnert hätte.

...\ Dabei wissen wir doch:\ Auch der Hass gegen die Niedrigkeit\ verzerrt die Züge.\ Auch der Zorn über das Unrecht\ Macht die Stimme heiser. Ach, wir\ Die wir den Boden bereiten wollten für die Freundlichkeit\ Konnten selber nicht freundlich sein.\ ...

Er hätte auch von der Medizin nehmen können, die er selbst für andere entwickelt hat \ (1966 für seinen Freund Peter Huchel).

…\ Du, laß dich nicht verhärten\ in dieser harten Zeit.\ Die allzu hart sind, brechen,\ die allzu spitz sind, stechen\ und brechen ab sogleich.\ …

PS: Fortsetzung folgt in der Reihe \ “Was wir von großen Persönlichkeiten lernen können, wenn wir ihnen zuhören würden."

-

@ f6488c62:c929299d

2025-05-24 05:10:20

@ f6488c62:c929299d

2025-05-24 05:10:20คุณเคยจินตนาการถึงอนาคตที่ AI มีความฉลาดเทียบเท่ามนุษย์หรือไม่? นี่คือสิ่งที่ Sam Altman ซีอีโอของ OpenAI และทีมพันธมิตรอย่าง SoftBank, Oracle และ MGX กำลังผลักดันผ่าน โครงการ Stargate! โครงการนี้ไม่ใช่แค่เรื่องเทคโนโลยี แต่เป็นก้าวกระโดดครั้งใหญ่ของมนุษยชาติ! Stargate คืออะไร? Stargate เป็นโปรเจกต์สร้าง ศูนย์ข้อมูล AI ขนาดยักษ์ที่ใหญ่ที่สุดในประวัติศาสตร์ ด้วยเงินลงทุนเริ่มต้น 100,000 ล้านดอลลาร์ และอาจสูงถึง 500,000 ล้านดอลลาร์ ภายในปี 2029! เป้าหมายคือการพัฒนา Artificial General Intelligence (AGI) หรือ AI ที่ฉลาดเทียบเท่ามนุษย์ เพื่อให้สหรัฐฯ ครองความเป็นผู้นำด้าน AI และแข่งขันกับคู่แข่งอย่างจีน โครงการนี้เริ่มต้นที่เมือง Abilene รัฐเท็กซัส โดยจะสร้างศูนย์ข้อมูล 10 แห่ง และขยายไปยังญี่ปุ่น สหราชอาณาจักร และสหรัฐอาหรับเอมิเรตส์ ทำไม Stargate ถึงสำคัญ?

นวัตกรรมเปลี่ยนโลก: AI จาก Stargate จะช่วยพัฒนาวัคซีน mRNA รักษามะเร็งได้ใน 48 ชั่วโมง และยกระดับอุตสาหกรรมต่าง ๆ เช่น การแพทย์และความมั่นคงแห่งชาติสร้างงาน: คาดว่าจะสร้างงานกว่า 100,000 ตำแหน่ง ในสหรัฐฯ

พลังงานมหาศาล: ศูนย์ข้อมูลอาจใช้พลังงานถึง 1.2 กิกะวัตต์ เทียบเท่ากับเมืองขนาดใหญ่!

ใครอยู่เบื้องหลัง? Sam Altman ร่วมมือกับ Masayoshi Son จาก SoftBank และได้รับการสนับสนุนจาก Donald Trump ซึ่งผลักดันนโยบายให้ Stargate เป็นจริง การก่อสร้างดำเนินการโดย Oracle และพันธมิตรด้านพลังงานอย่าง Crusoe Energy Systems ความท้าทาย? ถึงจะยิ่งใหญ่ แต่ Stargate ก็เจออุปสรรค ทั้งปัญหาการระดมทุน ความกังวลเรื่องภาษีนำเข้าชิป และการแข่งขันจากคู่แข่งอย่าง DeepSeek ที่ใช้โครงสร้างพื้นฐานน้อยกว่า แถม Elon Musk ยังออกมาวิจารณ์ว่าโครงการนี้อาจ “ไม่สมจริง” แต่ Altman มั่นใจและเชิญ Musk ไปดูไซต์งานที่เท็กซัสเลยทีเดียว! อนาคตของ Stargate ศูนย์ข้อมูลแห่งแรกจะเริ่มใช้งานในปี 2026 และอาจเปลี่ยนโฉมวงการ AI ไปตลอดกาล นี่คือก้าวสำคัญสู่ยุคใหม่ของเทคโนโลยีที่อาจเปลี่ยนวิถีชีวิตของเรา! และไม่ใช่ประตูดวงดาวแบบในหนังนะ! ถึงชื่อ Stargate จะได้แรงบันดาลใจจากภาพยนตร์ sci-fi อันโด่งดัง แต่โครงการนี้ไม่ได้พาเราไปยังดวงดาวอื่น มันคือการเปิดประตูสู่โลกแห่ง AI ที่ทรงพลัง และอาจเปลี่ยนอนาคตของมนุษยชาติไปเลย! และไม่เหมือน universechain ของ star ของผมนะครับ

Stargate #AI #SamAltman #OpenAI #อนาคตของเทคโนโลยี

-

@ 9ca447d2:fbf5a36d

2025-05-22 14:01:52

@ 9ca447d2:fbf5a36d

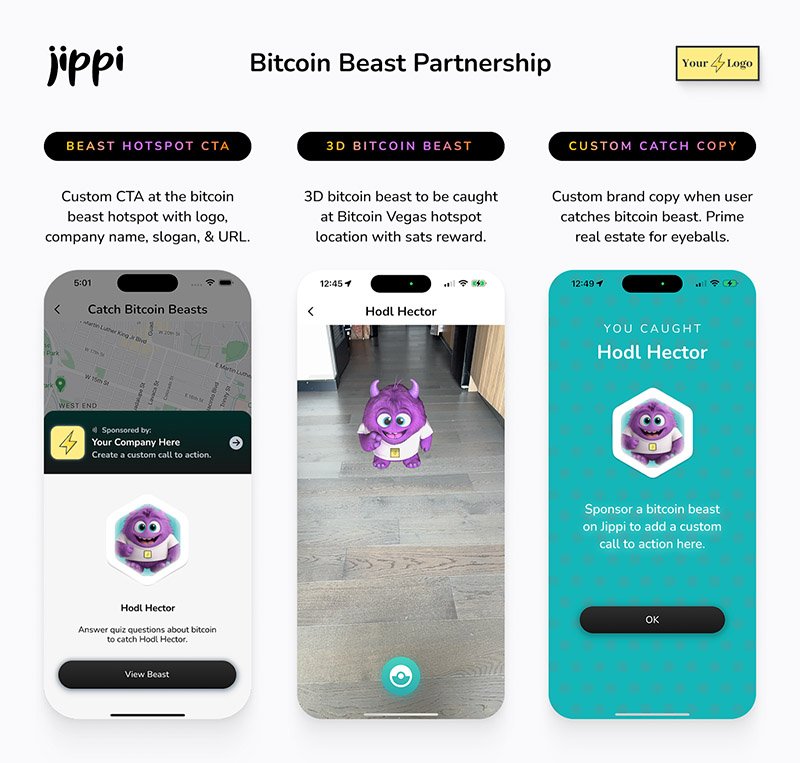

2025-05-22 14:01:52Gen Z (those born between 1997 and 2012) are not rushing to stack sats, and Oliver Porter, Founder & CEO of Jippi, understands the challenge better than most. His strategy revolves around adapting Bitcoin education to fit seamlessly into the digital lives of young adults.

“We need to meet them where they are,” Oliver explains. “90% of Gen Z plays games. 70% expect to earn rewards.”

So, what will effectively introduce them to Bitcoin? In Oliver’s mind, the answer is simple: games that don’t feel preachy but still plant the orange pill.

Learn more at Jippi.app

That’s exactly what Jippi is. Based in Austin, Texas, the team has created a mobile augmented reality (AR) game that rewards players in bitcoin and sneakily teaches them why sound money matters.

“It’s Pokémon GO… but for sats,” Oliver puts it succinctly.

Jippi is like Pokemon Go, but for sats

Oliver’s Bitcoin journey, like many in the space, began long before he was ready. A former colleague had tried planting the seed years earlier, handing him a copy of The Bitcoin Standard. But the moment passed.

It wasn’t until the chaos of 2020 when lockdowns hit, printing presses roared, and civil liberties shrank that the message finally landed for him.

“The government got so good at doing reverse Robin Hood,” Oliver explains. “They steal from the working population and reward the rich.”

By 2020, though, the absurdity of the covid hysteria had caused his eyes to be opened and the orange light seemed the best path back to freedom.

He left the UK for Austin “one of the best places for Bitcoiners,” he says, and dove headfirst into the industry, working at Swan for a year before founding Jippi on PlebLab’s accelerator program.

Jippi’s flagship game lets players roam their cities hunting digital creatures, Bitcoin Beasts, tied to real-world locations. Catching them requires answering Bitcoin trivia, and the reward is sats.

No jargon. No hour-long lectures. Just gameplay with sound money principles woven right in.

The model is working. At a recent hackathon in Austin, Jippi beat out 14 other teams to win first place and $15,000 in prize money.

Oliver of Jippi won Top Builder Season 2 — PlebLab on X

“We’re backdooring Bitcoin education,” Oliver admits. “And while we’re at it, encouraging people to get outside and touch grass.”

Not everyone’s been thrilled. When Jippi team members visited one of the more liberal-leaning places in Texas, UT Austin, to test interest in Bitcoin, they found some seriously committed no-coiners on the campus.

“One young woman told me, ‘I would rather die than talk about Bitcoin,'” Oliver recalls, highlighting the cultural resistance that’s built up among younger demographics.

This resistance is backed by hard data. According to Oliver, some of the Bitcoin podcasters they met with in the space to do market research reported that less than 1% of their listeners are from Gen Z and that number is dropping.

“Unless we find a way to capture their interest in a meaningful way, there’s going to be a big problem around trying to sway Gen Z away from the siren call of s***coins and crypto casinos and towards Bitcoin,” Oliver warns.

Jippi’s next big move is Las Vegas, where they’ll launch the Beast Catch experience at the Venetian during a major Bitcoin event. To mark the occasion, they’re opening up six limited sponsorship spots for Bitcoin companies, each one tied to a custom in-game beast.

Jippi looks to launch a special event at Bitcoin 2025

“It’s real estate inside the game,” Oliver explains. “Brands become allies, not intrusions. You get a logo, company name, and call to action, so we can push people to your site or app.”

Bitcoin Well—an automatic self-custody Bitcoin platform—has claimed Beast #1. Only five exclusive spots remain for Bitcoin companies to “beastify their brand” through Jippi’s immersive AR game.

“I love the Jippi mission. I think gamified learning is how we will onboard the next generation and it’s exciting to see what the Jippi team is doing! I love working with bitcoiners towards our common mission – bullish!” said Adam O’Brien, Bitcoin Well CEO.