-

@ 6b0a60cf:b952e7d4

2025-05-19 22:33:33

@ 6b0a60cf:b952e7d4

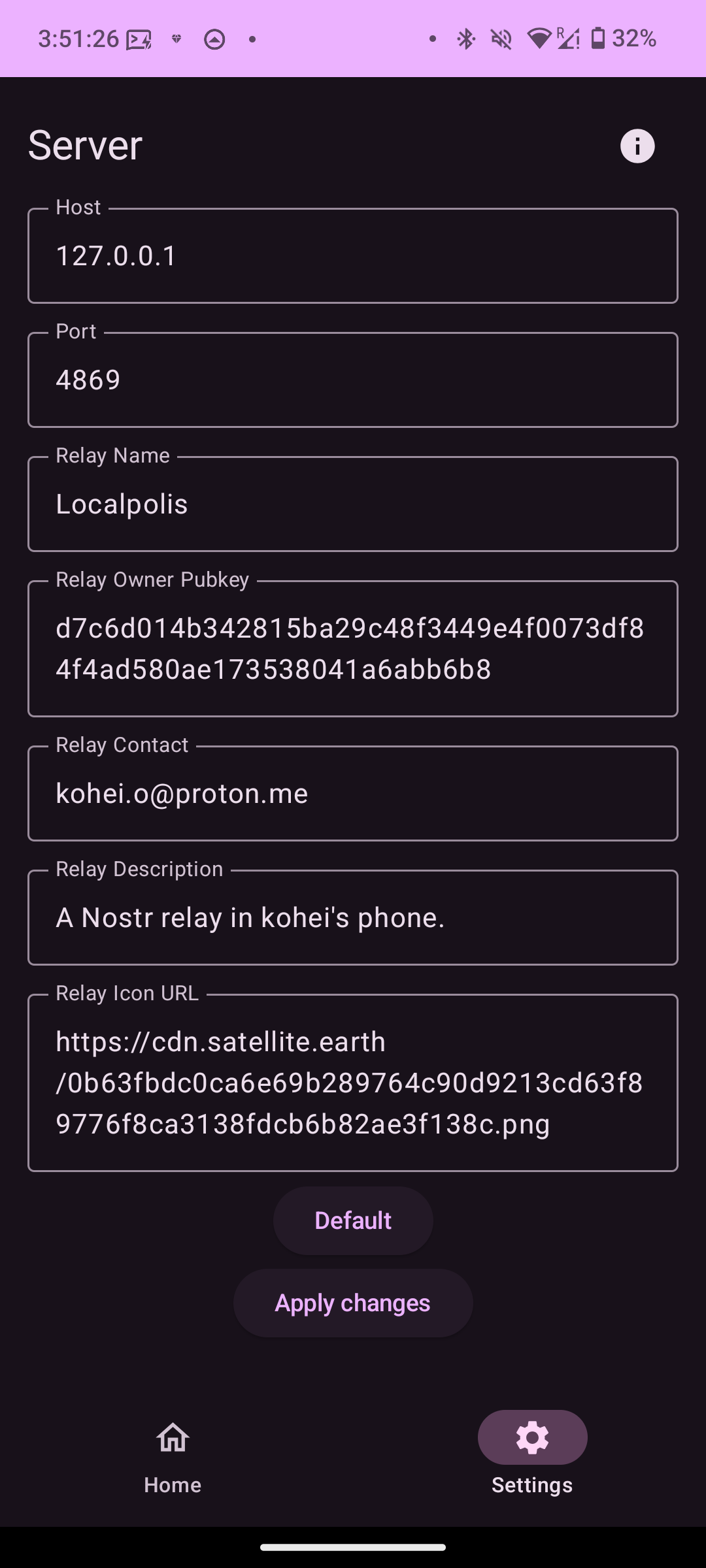

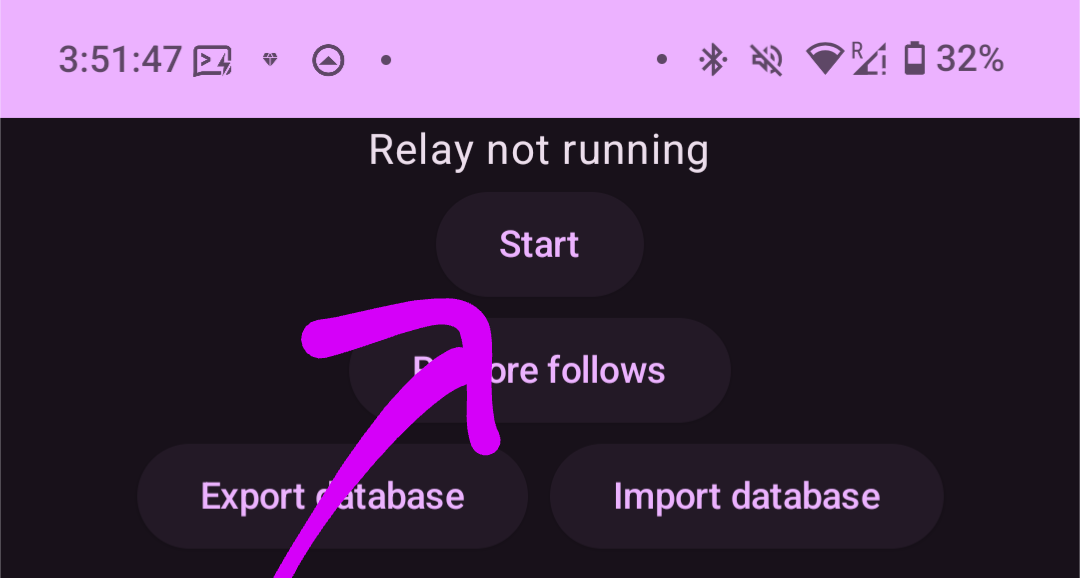

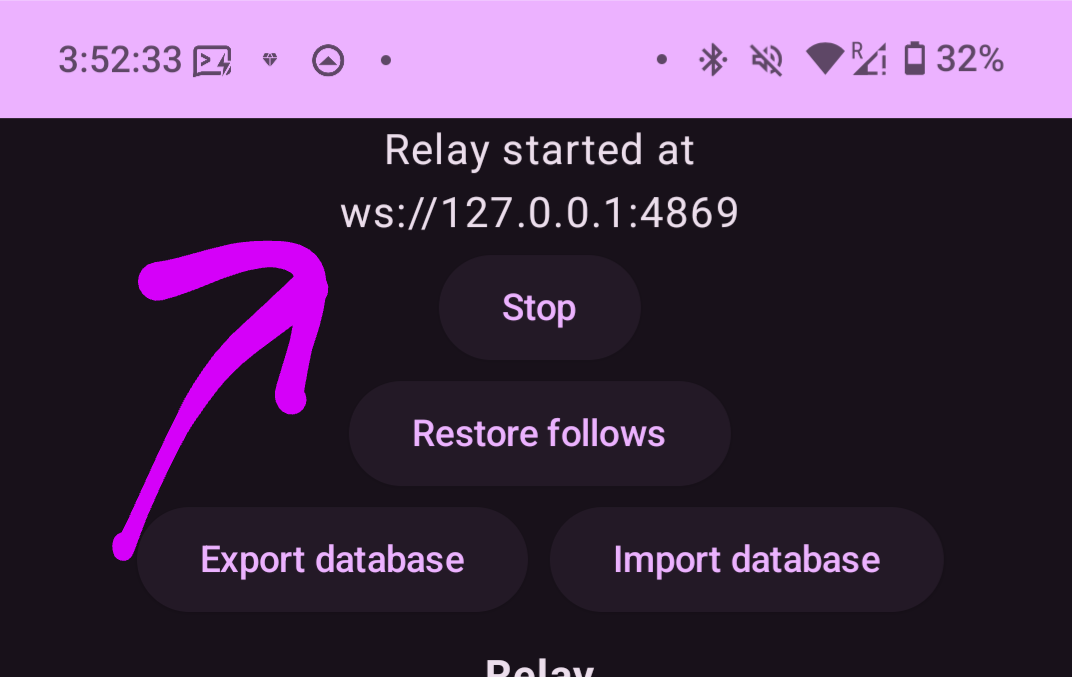

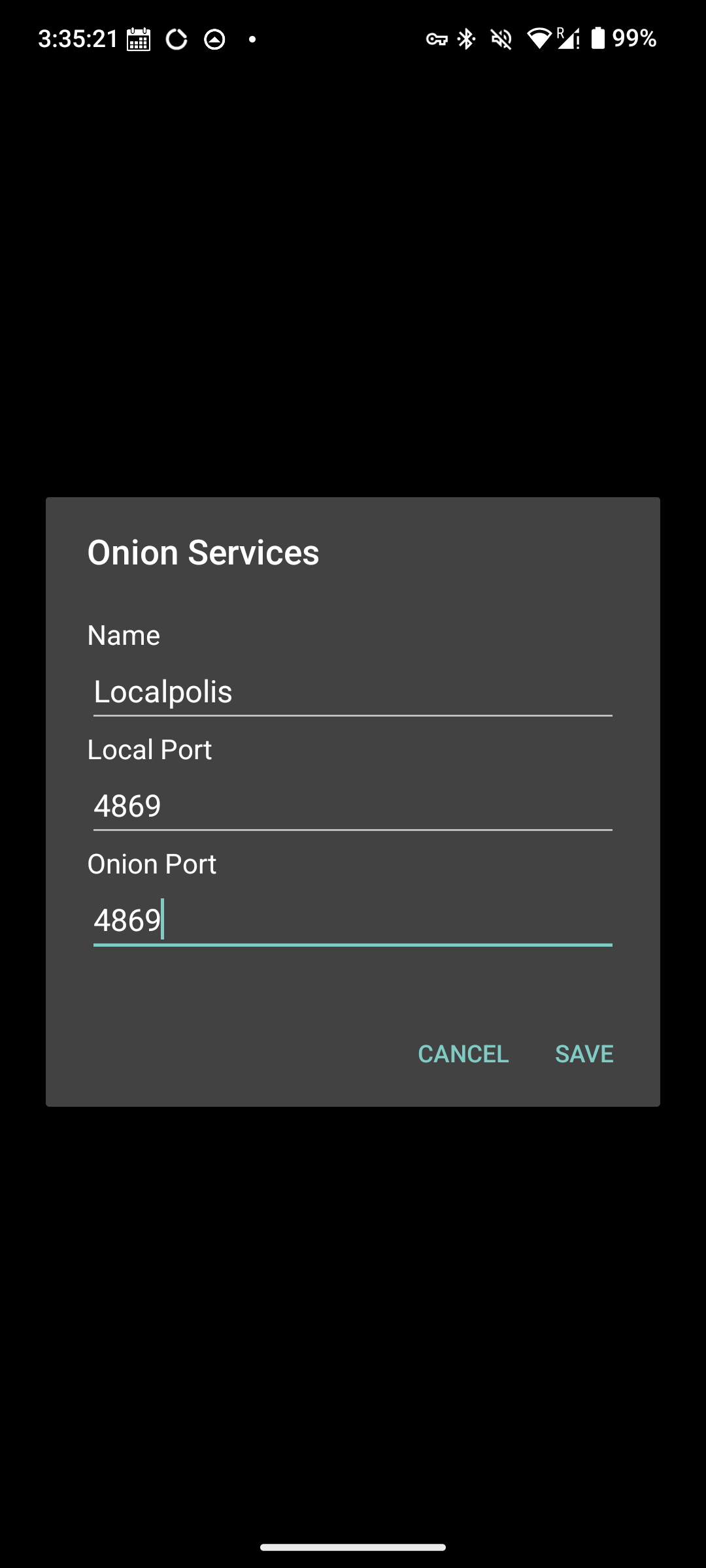

2025-05-19 22:33:33タイトルは釣りです。そんなこと微塵も思っていません。 本稿はアウトボックスモデルの実装に関してうだうだ考えるコーナーです。 ダムスに関して何か言いたいわけではないので先にタイトル回収しておきます。

- NIP-65を守る気なんかさらさら無いのにNIP-65に書いてあるkind:10002のReadリレーの意味を知っていながら全然違う使い方をしているのは一部の和製クライアントの方だよね

- NIP-65を守る気が無いならkind:10002を使うべきではなく、独自仕様でリレーを保存するべきだよね

- アウトボックスモデルを採用しているクライアントからすれば仕様と異なる実装をしてしまっているクライアントが迷惑だと思われても仕方ないよね

- と考えればダムスの方が潔いよね

- とはいえkind:3のcontentは空にしろって言われてんだからやっぱダムスはゴミだわ

- やるとしたらRabbitみたいにローカルに保存するか、別デバイス間で同期したいならkind:30078を使うべきだよね

アウトボックスモデルはなぜ人気がないのか

言ってることはとてもいいと思うんですよ。 欠点があるとすれば、

- 末端のユーザーからすればreadリレーとwriteリレーと書かれると直感的にイメージされるものとかけ離れている

- 正しく設定してもらうには相当の説明が必要

- フォローTLを表示しようとすれば非常にたくさんのリレーと接続することになり現実的ではない

- なるほど完璧な作戦っスねーっ 不可能だという点に目をつぶればよぉ~

余談ですが昔irisでログインした時に localhost のリレーに繋ごうとしてiris壊れたって思ったけど今思えばアウトボックスモデルを忠実に実装してたんじゃないかな…。

現実的に実装する方法は無いのか

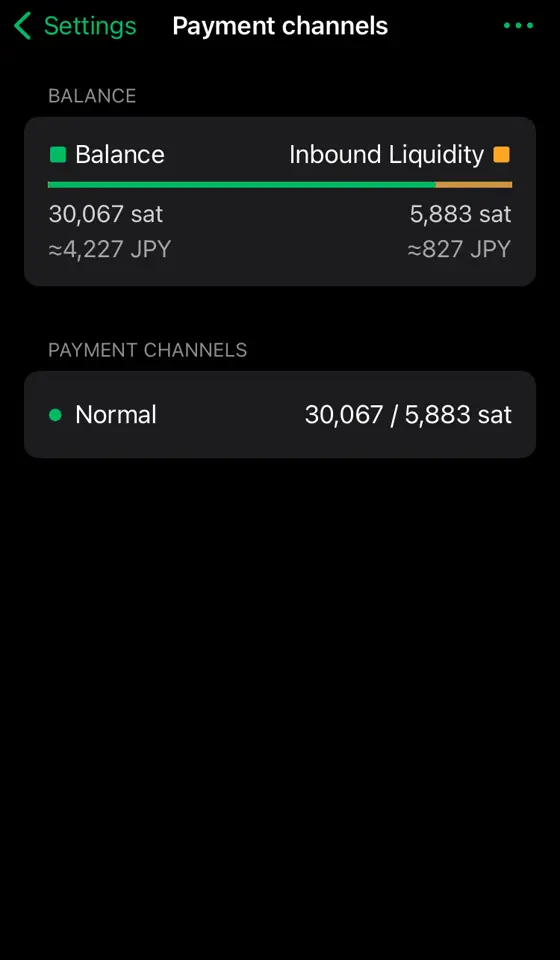

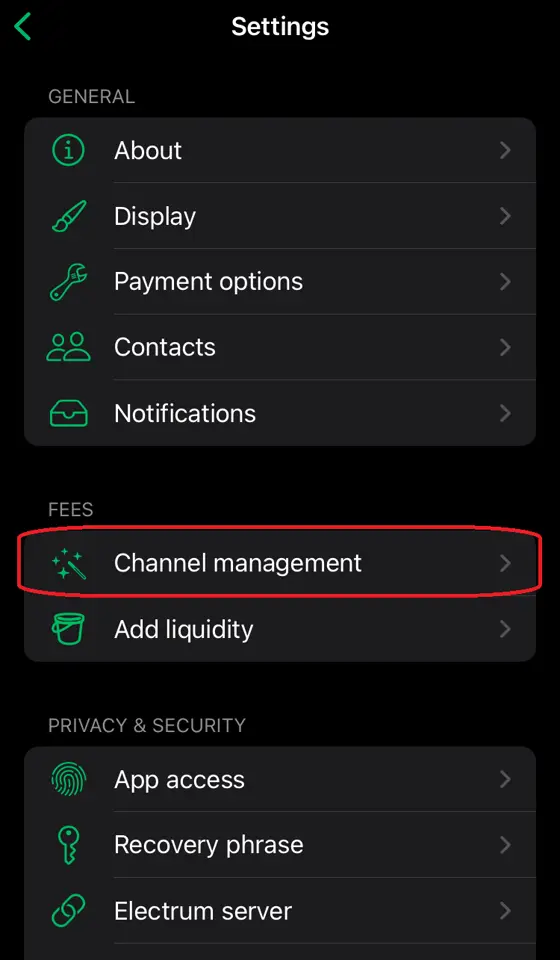

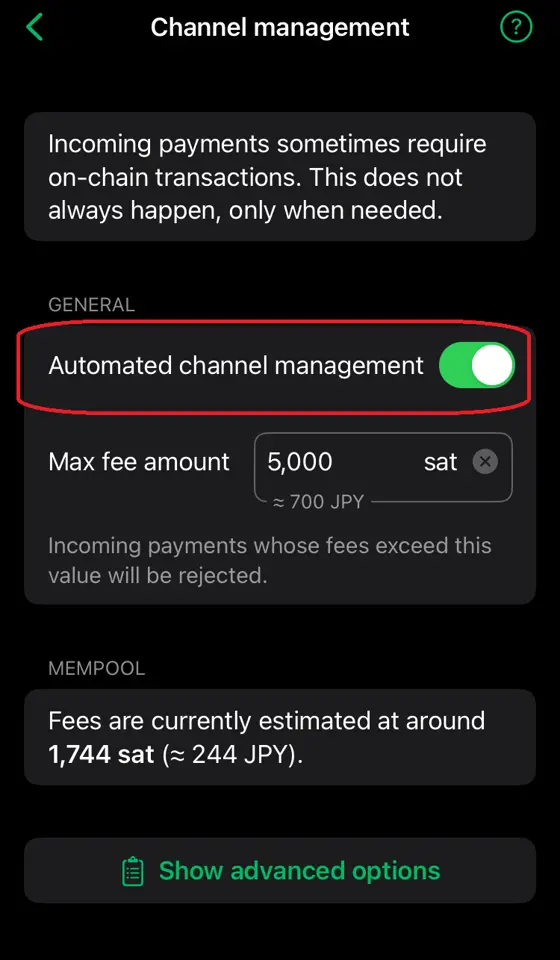

これでReadすべきリレーをシミュレーションできる。 https://nikolat.github.io/nostr-relay-trend/ フォローイーのWriteリレーを全部購読しようとすると100個近いリレー数になるので現実的ではありません。 しかしフォローイーのWriteリレーのうち1個だけでよい、とする条件を仮に追加すると一気にハードルが下がります。私の場合はReadリレー含めて7個のリレーに収まりました。 Nos Haikuはとりあえずこの方針でいくことにしました。

今後どうしていきたいのか

エンドユーザーとしての自分の志向としては、自分が指定したリレーだけを購読してほしい、勝手に余計なリレーを読みに行かないでほしい、という気持ちがあり、現状の和製クライアントの仕様を気に入っています。 仮にNos Haikuでアウトボックスモデルを採用しつつ自分の決めたリレーに接続するハイブリッド実装を考えるとすれば、

あなたの購読するリレーはこれですよー - Read(inbox) Relays (あなたへのメンションが届くリレー) - wss://relay1.example.com/ - wss://relay2.example.com/ - wss://relay3.example.com/ - Followee's Write Relays (フォローイーが書き込んでいるリレー) - wss://relay4.example.com/ - wss://relay5.example.com/ - wss://relay6.example.com/って出して、チェックボックス付けてON/OFFできるようにして最終的に購読するリレーをユーザーに決めてもらう感じかな……って漠然と考えています。よほど時間を持て余したときがあればやってみるかも。

あとリレーを数は仕方ないとしてリレーごとにフォローイーの投稿だけを取得するようにした方が理にかなってるよね。全部のリレーから全部のフォローイーの投稿を取得しようとしたら(実装はシンプルで楽だけど)通信量が大変だよね。 rx-nostr の Forward Strategy ってリレーごとにREQかえて一度に購読できるっけ?

常にひとつ以下の REQ サブスクリプションを保持します。

って書いてあるから無理なのかな? あとReadリレーは純粋に自分へのメンション(pタグ付き)イベントのみを購読するようにした方がいい気がする。スパム対策としてかなり有効だと思うので。スパムはNIP-65に準拠したりはしていないでしょうし。 まぁ、NIP-65に準拠していないクライアントからのメンションは届かなくなってしまうわけですが。

-

@ 84b0c46a:417782f5

2025-05-18 12:22:32

@ 84b0c46a:417782f5

2025-05-18 12:22:32- Lumilumi The Nostr Web Client.

Lightweight modes are available, such as not displaying icon images, not loading images automatically, etc.

-

MAKIMONO A lightweight Long Form Content Editor with editing functionality for your articles. It supports embedding Nostr IDs via NIP-19 and custom emoji integration.

-

Nostr Share Component Demo A simple web component for sharing content to Nostr. Create customizable share buttons that let users easily post to Nostr clients with pre-filled content. Perfect for blogs, websites, or any content you want shared on the Nostr network. Try the interactive demo to see how seamlessly it integrates with your website.

Only clients that support receiving shared text via URL parameters can be added to the client list. If your preferred client meets this requirement, feel free to submit a pull request.

-

Nostr Follow Organizer A practical tool for managing your Nostr follows(kind3) with ease.

-

NAKE NAKE is a powerful utility for Nostr developers and users that simplifies working with NIP-19 and NIP-49 formats. This versatile tool allows you to easily encode and decode Nostr identifiers and encrypted data according to these protocol specifications.

- chrome extension

- firefox add-on

-

Nostviewstr A versatile Nostr tool that specializes in creating and editing addressable or replaceable events on the Nostr network. This comprehensive editor allows you to manage various types of lists and structured content within the Nostr ecosystem.

-

Luminostr Luminostr is a recovery tool for Nostr that helps you retrieve and restore Addressable or Replaceable events (such as kind: 0, 3, 10002, 10000, etc.) from relays. It allows you to search for these events across multiple relays and optionally re-publish them to ensure their persistence.

-

Nostr Bookmark Recovery Tool Nostr Bookmark Recovery Tool is a utility for retrieving and re-publishing past bookmark events ( kind:10003,30001,30003 ) from public relays. Rather than automatically selecting the latest version, it allows users to pick any previous version and overwrite the current one with it. This is useful for restoring a preferred snapshot of your bookmark list.

-

Profile Editor Profile Editor is a simple tool for editing and publishing your Nostr profile (kind: 0 event). It allows you to update fields such as name, display name, picture, and about text, and then publish the updated profile to selected relays.

-

Nostr bookmark viewer Nostr Bookmark Viewer is a tool for viewing and editing Nostr bookmark events (kind: 10003, 30001, 30003). It allows users to load bookmark data from relays, browse saved posts, and optionally edit and publish their own bookmark lists.

-

Nostr Note Duplicater Nostr Note Duplicater is a tool that rebroadcasts an existing Nostr event from a relay to other selected relays.

-

@ e0a8cbd7:f642d154

2025-05-06 03:29:12

@ e0a8cbd7:f642d154

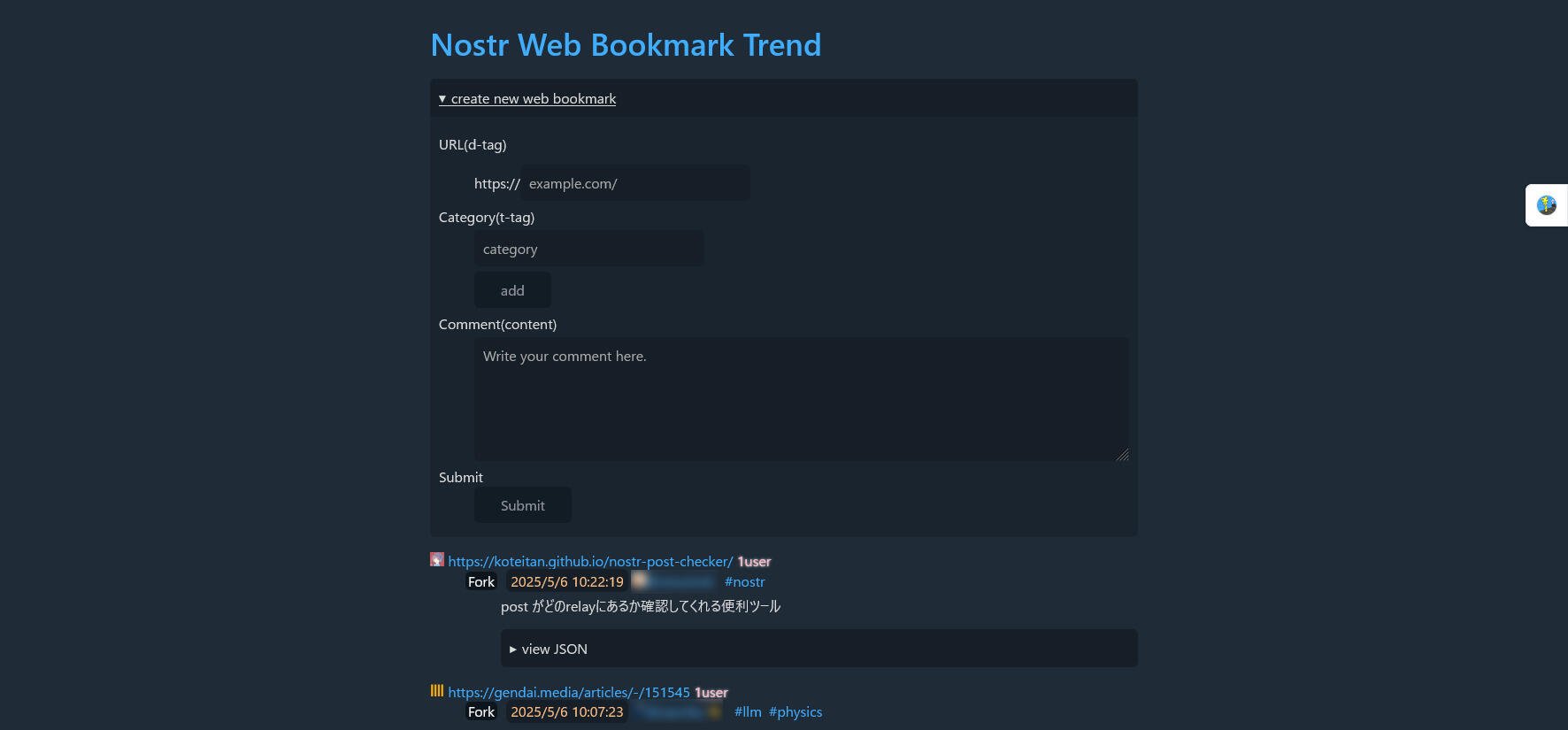

2025-05-06 03:29:12分散型プロトコルNostr上でWeb bookmarkを見たり書いたりする「Nostr Web Bookmark Trend」を試してみました。

NostrのWeb Bookmarkingは「nip-B0 Web Bookmarking· nostr-protocol/nips · GitHub」で定義されています。

WEBブラウザの拡張による認証(NIP-07)でログインしました。

create new web bookmark(新規ブックマーク作成)を開くとこんな感じ。

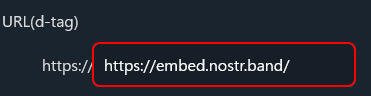

URL入力部分において、https:// が外に出ているので、URLのhttps:// 部分を消して入力しないといけないのがちょっと面倒。 ↓

↓

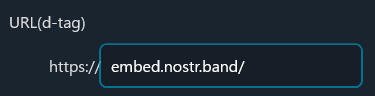

1個、投稿してみました。

アカウント名をクリックするとそのユーザが登録したbookmark一覧が表示されます。

以上、Nostr Web Bookmark Trendについてでした。

なお、本記事は「Nostr NIP-23 マークダウンエディタ」のテストのため、「NostrでWeb bookmark - あたしンちのおとうさんの独り言」と同じ内容を投稿したものです。 -

@ c631e267:c2b78d3e

2025-05-16 18:40:18

@ c631e267:c2b78d3e

2025-05-16 18:40:18Die zwei mächtigsten Krieger sind Geduld und Zeit. \ Leo Tolstoi

Zum Wohle unserer Gesundheit, unserer Leistungsfähigkeit und letztlich unseres Glücks ist es wichtig, die eigene Energie bewusst zu pflegen. Das gilt umso mehr für an gesellschaftlichen Themen interessierte, selbstbewusste und kritisch denkende Menschen. Denn für deren Wahrnehmung und Wohlbefinden waren und sind die rasanten, krisen- und propagandagefüllten letzten Jahre in Absurdistan eine harte Probe.

Nur wer regelmäßig Kraft tankt und Wege findet, mit den Herausforderungen umzugehen, kann eine solche Tortur überstehen, emotionale Erschöpfung vermeiden und trotz allem zufrieden sein. Dazu müssen wir erkunden, was uns Energie gibt und was sie uns raubt. Durch Selbstreflexion und Achtsamkeit finden wir sicher Dinge, die uns erfreuen und inspirieren, und andere, die uns eher stressen und belasten.

Die eigene Energie ist eng mit unserer körperlichen und mentalen Gesundheit verbunden. Methoden zur Förderung der körperlichen Gesundheit sind gut bekannt: eine ausgewogene Ernährung, regelmäßige Bewegung sowie ausreichend Schlaf und Erholung. Bei der nicht minder wichtigen emotionalen Balance wird es schon etwas komplizierter. Stress abzubauen, die eigenen Grenzen zu kennen oder solche zum Schutz zu setzen sowie die Konzentration auf Positives und Sinnvolles wären Ansätze.

Der emotionale ist auch der Bereich, über den «Energie-Räuber» bevorzugt attackieren. Das sind zum Beispiel Dinge wie Überforderung, Perfektionismus oder mangelhafte Kommunikation. Social Media gehören ganz sicher auch dazu. Sie stehlen uns nicht nur Zeit, sondern sind höchst manipulativ und erhöhen laut einer aktuellen Studie das Risiko für psychische Probleme wie Angstzustände und Depressionen.

Geben wir negativen oder gar bösen Menschen keine Macht über uns. Das Dauerfeuer der letzten Jahre mit Krisen, Konflikten und Gefahren sollte man zwar kennen, darf sich aber davon nicht runterziehen lassen. Das Ziel derartiger konzertierter Aktionen ist vor allem, unsere innere Stabilität zu zerstören, denn dann sind wir leichter zu steuern. Aber Geduld: Selbst vermeintliche «Sonnenköniginnen» wie EU-Kommissionspräsidentin von der Leyen fallen, wenn die Zeit reif ist.

Es ist wichtig, dass wir unsere ganz eigenen Bedürfnisse und Werte erkennen. Unsere Energiequellen müssen wir identifizieren und aktiv nutzen. Dazu gehören soziale Kontakte genauso wie zum Beispiel Hobbys und Leidenschaften. Umgeben wir uns mit Sinnhaftigkeit und lassen wir uns nicht die Energie rauben!

Mein Wahlspruch ist schon lange: «Was die Menschen wirklich bewegt, ist die Kultur.» Jetzt im Frühjahr beginnt hier in Andalusien die Zeit der «Ferias», jener traditionellen Volksfeste, die vor Lebensfreude sprudeln. Konzentrieren wir uns auf die schönen Dinge und auf unsere eigenen Talente – soziale Verbundenheit wird helfen, unsere innere Kraft zu stärken und zu bewahren.

[Titelbild: Pixabay]

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ 6b0a60cf:b952e7d4

2025-03-20 07:36:17

@ 6b0a60cf:b952e7d4

2025-03-20 07:36:17このイベント自身をnaddr形式で参照する nostr:naddr1qvzqqqr4gupzq6c2vr8l8m9952e9qhxt8acn8kzzypzuhm6q70fvvxylkzu49e75qydhwumn8ghj7mnjv4kxz7fwvvkhxar9d3kxzu3wdejhgtcqp5cnwdpjxs6n2de3xyenxwql6rq76

-

@ eb0157af:77ab6c55

2025-05-25 04:48:11

@ eb0157af:77ab6c55

2025-05-25 04:48:11Michigan lawmakers are unveiling a comprehensive strategy to regulate Bitcoin and cryptocurrencies.

On May 21, Republican Representative Bill Schuette introduced House Bill 4510, a proposal to amend the Michigan Public Employee Retirement System Investment Act. The legislation would allow the state treasurer, currently Rachael Eubanks, to diversify the state’s investments by including cryptocurrencies with an average market capitalization of over $250 million in the past calendar year.

Under current criteria, Bitcoin (BTC) and Ether (ETH) are the only cryptocurrencies that meet these selection standards. The proposal specifies that any investment in digital assets must be made through exchange-traded products (spot ETFs) issued by registered investment companies.

Anti-CBDC legislation

Republican Representative Bryan Posthumus is leading the bipartisan initiative behind the second bill, HB 4511, which establishes protections for cryptocurrency holders. The proposal prohibits Michigan from implementing crypto bans or imposing licensing requirements on digital asset holders.

Another key aspect of the legislation is a ban on state officials from supporting or promoting a potential federal central bank digital currency (CBDC). The definition includes the issuance of memorandums or official statements endorsing CBDC proposals related to testing, adoption, or implementation.

Mining and redevelopment of abandoned sites

The third bill, HB 4512, is a proposal led by Democratic Representative Mike McFall for a bipartisan group. This initiative would establish a Bitcoin mining program allowing operators to use abandoned oil and natural gas sites.

The program calls for the appointment of a supervisor tasked with assessing the site’s remaining productive potential, identifying the last operator, and determining the length of abandonment. Prospective participants would need to submit detailed legal documentation of their organizational structure, demonstrate operational expertise in mining, and provide profitability breakeven estimates for their ventures.

The fourth and final bill, HB 4513, also introduced by the bipartisan group led by McFall, focuses on the fiscal aspect of the HB 4512 initiative. The proposal would amend Michigan’s income tax laws to include proceeds generated from the proposed Bitcoin mining program.

The post Michigan: four bills on pension funds, CBDCs, and mining appeared first on Atlas21.

-

@ c631e267:c2b78d3e

2025-05-10 09:50:45

@ c631e267:c2b78d3e

2025-05-10 09:50:45Information ohne Reflexion ist geistiger Flugsand. \ Ernst Reinhardt

Der lateinische Ausdruck «Quo vadis» als Frage nach einer Entwicklung oder Ausrichtung hat biblische Wurzeln. Er wird aber auch in unserer Alltagssprache verwendet, laut Duden meist als Ausdruck von Besorgnis oder Skepsis im Sinne von: «Wohin wird das führen?»

Der Sinn und Zweck von so mancher politischen Entscheidung erschließt sich heutzutage nicht mehr so leicht, und viele Trends können uns Sorge bereiten. Das sind einerseits sehr konkrete Themen wie die zunehmende Militarisierung und die geschichtsvergessene Kriegstreiberei in Europa, deren Feindbildpflege aktuell beim Gedenken an das Ende des Zweiten Weltkriegs beschämende Formen annimmt.

Auch das hohe Gut der Schweizer Neutralität scheint immer mehr in Gefahr. Die schleichende Bewegung der Eidgenossenschaft in Richtung NATO und damit weg von einer Vermittlerposition erhält auch durch den neuen Verteidigungsminister Anschub. Martin Pfister möchte eine stärkere Einbindung in die europäische Verteidigungsarchitektur, verwechselt bei der Argumentation jedoch Ursache und Wirkung.

Das Thema Gesundheit ist als Zugpferd für Geschäfte und Kontrolle offenbar schon zuverlässig etabliert. Die hauptsächlich privat finanzierte Weltgesundheitsorganisation (WHO) ist dabei durch ein Netzwerk von sogenannten «Collaborating Centres» sogar so weit in nationale Einrichtungen eingedrungen, dass man sich fragen kann, ob diese nicht von Genf aus gesteuert werden.

Das Schweizer Bundesamt für Gesundheit (BAG) übernimmt in dieser Funktion ebenso von der WHO definierte Aufgaben und Pflichten wie das deutsche Robert Koch-Institut (RKI). Gegen die Covid-«Impfung» für Schwangere, die das BAG empfiehlt, obwohl es fehlende wissenschaftliche Belege für deren Schutzwirkung einräumt, formiert sich im Tessin gerade Widerstand.

Unter dem Stichwort «Gesundheitssicherheit» werden uns die Bestrebungen verkauft, essenzielle Dienste mit einer biometrischen digitalen ID zu verknüpfen. Das dient dem Profit mit unseren Daten und führt im Ergebnis zum Verlust unserer demokratischen Freiheiten. Die deutsche elektronische Patientenakte (ePA) ist ein Element mit solchem Potenzial. Die Schweizer Bürger haben gerade ein Referendum gegen das revidierte E-ID-Gesetz erzwungen. In Thailand ist seit Anfang Mai für die Einreise eine «Digital Arrival Card» notwendig, die mit ihrer Gesundheitserklärung einen Impfpass «durch die Hintertür» befürchten lässt.

Der massive Blackout auf der iberischen Halbinsel hat vermehrt Fragen dazu aufgeworfen, wohin uns Klimawandel-Hysterie und «grüne» Energiepolitik führen werden. Meine Kollegin Wiltrud Schwetje ist dem nachgegangen und hat in mehreren Beiträgen darüber berichtet. Wenig überraschend führen interessante Spuren mal wieder zu internationalen Großbanken, Globalisten und zur EU-Kommission.

Zunehmend bedenklich ist aber ganz allgemein auch die manifestierte Spaltung unserer Gesellschaften. Angesichts der tiefen und sorgsam gepflegten Gräben fällt es inzwischen schwer, eine zukunftsfähige Perspektive zu erkennen. Umso begrüßenswerter sind Initiativen wie die Kölner Veranstaltungsreihe «Neue Visionen für die Zukunft». Diese möchte die Diskussionskultur reanimieren und dazu beitragen, dass Menschen wieder ohne Angst und ergebnisoffen über kontroverse Themen der Zeit sprechen.

Quo vadis – Wohin gehen wir also? Die Suche nach Orientierung in diesem vermeintlichen Chaos führt auch zur Reflexion über den eigenen Lebensweg. Das ist positiv insofern, als wir daraus Kraft schöpfen können. Ob derweil der neue Papst, dessen «Vorgänger» Petrus unsere Ausgangsfrage durch die christliche Legende zugeschrieben wird, dabei eine Rolle spielt, muss jede/r selbst wissen. Mir persönlich ist allein schon ein Führungsanspruch wie der des Petrusprimats der römisch-katholischen Kirche eher suspekt.

[Titelbild: Pixabay]

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ eb0157af:77ab6c55

2025-05-25 04:48:10

@ eb0157af:77ab6c55

2025-05-25 04:48:10A fake Uber driver steals $73,000 in XRP and $50,000 in Bitcoin after drugging an American tourist.

A U.S. citizen vacationing in the United Kingdom fell victim to a scam that cost him $123,000 in cryptocurrencies stored on his smartphone. The man was drugged by an individual posing as an Uber driver.

According to My London, Jacob Irwin-Cline had spent the evening at a London nightclub, consuming several alcoholic drinks before requesting an Uber ride home. The victim admitted he hadn’t carefully verified the booking details on his device, mistakenly getting into a private taxi driven by someone who, at first glance, resembled the expected Uber driver but was using a completely different vehicle.

Once inside the car, the American tourist reported that the driver offered him a cigarette, allegedly laced with scopolamine — a rare and powerful sedative. Irwin-Cline described how the smoke made him extremely docile and fatigued, causing him to lose consciousness for around half an hour.

Upon waking, the driver ordered the victim to get out of the vehicle. As Irwin-Cline stepped out, the man suddenly accelerated, running him over and fleeing with his mobile phone, which contained the private keys and access to his cryptocurrencies. Screenshots provided to MyLondon show that $73,000 worth of XRP and $50,000 in bitcoin had been transferred to various wallets.

This incident adds to a growing trend of kidnappings, extortions, armed robberies, and ransom attempts targeting crypto executives, investors, and their families.

Just a few weeks ago, the daughter and grandson of Pierre Noizat, CEO of crypto exchange Paymium, were targeted in a kidnapping attempt in Paris. The incident took place in broad daylight when attackers tried to force the family into a parked vehicle. However, Noizat’s daughter managed to fight off the assailants.

The post American tourist drugged and robbed: $123,000 in crypto stolen in London appeared first on Atlas21.

-

@ 34ff86e0:dbb6b9fb

2025-05-25 02:36:39

@ 34ff86e0:dbb6b9fb

2025-05-25 02:36:39test openletter redirection after creation

-

@ 8fb140b4:f948000c

2025-03-20 01:29:06

@ 8fb140b4:f948000c

2025-03-20 01:29:06As many of you know, https://nostr.build has recently launched a new compatibility layer for the Blossom protocol blossom.band. You can find all the details about what it supports and its limitations by visiting the URL.

I wanted to cover some of the technical details about how it works here. One key difference you may notice is that the service acts as a linker, redirecting requests for the media hash to the actual source of the media—specifically, the nostr.build URL. This allows us to maintain a unified CDN cache and ensure that your media is served as quickly as possible.

Another difference is that each uploaded media/blob is served under its own subdomain (e.g.,

npub1[...].blossom.band), ensuring that your association with the blob is controlled by you. If you decide to delete the media for any reason, we ensure that the link is broken, even if someone else has duplicated it using the same hash.To comply with the Blossom protocol, we also link the same hash under the main (apex) domain (blossom.band) and collect all associations under it. This ensures that Blossom clients can fetch media based on users’ Blossom server settings. If you are the sole owner of the hash and there are no duplicates, deleting the media removes the link from the main domain as well.

Lastly, in line with our mission to protect users’ privacy, we reject any media that contains private metadata (such as GPS coordinates, user comments, or camera serial numbers) or strip it if you use the

/media/endpoint for upload.As always, your feedback is welcome and appreciated. Thank you!

-

@ 82b30d30:40c6c003

2025-03-17 15:26:29

@ 82b30d30:40c6c003

2025-03-17 15:26:29[3]

[4]

[5]

[6]

[7]

[8]

[9]

[10]

[11]

[12]

[13]

[14]

[15]

[16]

[17]

[18]

[19]

[20]

[21]

[22]

[23]

[24]

[25]

[26]

[27]

[28]

[29]

[30]

[31]

[32]

[33]

-

@ c631e267:c2b78d3e

2025-05-02 20:05:22

@ c631e267:c2b78d3e

2025-05-02 20:05:22Du bist recht appetitlich oben anzuschauen, \ doch unten hin die Bestie macht mir Grauen. \ Johann Wolfgang von Goethe

Wie wenig bekömmlich sogenannte «Ultra-Processed Foods» wie Fertiggerichte, abgepackte Snacks oder Softdrinks sind, hat kürzlich eine neue Studie untersucht. Derweil kann Fleisch auch wegen des Einsatzes antimikrobieller Mittel in der Massentierhaltung ein Problem darstellen. Internationale Bemühungen, diesen Gebrauch zu reduzieren, um die Antibiotikaresistenz bei Menschen einzudämmen, sind nun möglicherweise gefährdet.

Leider ist Politik oft mindestens genauso unappetitlich und ungesund wie diverse Lebensmittel. Die «Corona-Zeit» und ihre Auswirkungen sind ein beredtes Beispiel. Der Thüringer Landtag diskutiert gerade den Entwurf eines «Coronamaßnahmen-Unrechtsbereinigungsgesetzes» und das kanadische Gesundheitsministerium versucht, tausende Entschädigungsanträge wegen Impfnebenwirkungen mit dem Budget von 75 Millionen Dollar unter einen Hut zu bekommen. In den USA soll die Zulassung von Covid-«Impfstoffen» überdacht werden, während man sich mit China um die Herkunft des Virus streitet.

Wo Corona-Verbrecher von Medien und Justiz gedeckt werden, verfolgt man Aufklärer und Aufdecker mit aller Härte. Der Anwalt und Mitbegründer des Corona-Ausschusses Reiner Fuellmich, der seit Oktober 2023 in Untersuchungshaft sitzt, wurde letzte Woche zu drei Jahren und neun Monaten verurteilt – wegen Veruntreuung. Am Mittwoch teilte der von vielen Impfschadensprozessen bekannte Anwalt Tobias Ulbrich mit, dass er vom Staatsschutz verfolgt wird und sich daher künftig nicht mehr öffentlich äußern werde.

Von der kommenden deutschen Bundesregierung aus Wählerbetrügern, Transatlantikern, Corona-Hardlinern und Russenhassern kann unmöglich eine Verbesserung erwartet werden. Nina Warken beispielsweise, die das Ressort Gesundheit übernehmen soll, diffamierte Maßnahmenkritiker als «Coronaleugner» und forderte eine Impfpflicht, da die wundersamen Injektionen angeblich «nachweislich helfen». Laut dem designierten Außenminister Johann Wadephul wird Russland «für uns immer der Feind» bleiben. Deswegen will er die Ukraine «nicht verlieren lassen» und sieht die Bevölkerung hinter sich, solange nicht deutsche Soldaten dort sterben könnten.

Eine wichtige Personalie ist auch die des künftigen Regierungssprechers. Wenngleich Hebestreit an Arroganz schwer zu überbieten sein wird, dürfte sich die Art der Kommunikation mit Stefan Kornelius in der Sache kaum ändern. Der Politikchef der Süddeutschen Zeitung «prägte den Meinungsjournalismus der SZ» und schrieb «in dieser Rolle auch für die Titel der Tamedia». Allerdings ist, anders als noch vor zehn Jahren, die Einbindung von Journalisten in Thinktanks wie die Deutsche Atlantische Gesellschaft (DAG) ja heute eher eine Empfehlung als ein Problem.

Ungesund ist definitiv auch die totale Digitalisierung, nicht nur im Gesundheitswesen. Lauterbachs Abschiedsgeschenk, die «abgesicherte» elektronische Patientenakte (ePA) ist völlig überraschenderweise direkt nach dem Bundesstart erneut gehackt worden. Norbert Häring kommentiert angesichts der Datenlecks, wer die ePA nicht abwähle, könne seine Gesundheitsdaten ebensogut auf Facebook posten.

Dass die staatlichen Kontrolleure so wenig auf freie Software und dezentrale Lösungen setzen, verdeutlicht die eigentlichen Intentionen hinter der Digitalisierungswut. Um Sicherheit und Souveränität geht es ihnen jedenfalls nicht – sonst gäbe es zum Beispiel mehr Unterstützung für Bitcoin und für Initiativen wie die der Spar-Supermärkte in der Schweiz.

[Titelbild: Pixabay]

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ 6b0a60cf:b952e7d4

2025-03-17 11:03:41

@ 6b0a60cf:b952e7d4

2025-03-17 11:03:41ものさんに説明する用

CreateEntry.svelte で

previewEvent = $bindable()として受け取っているのがプレビュー用のイベント。

ここでごちゃごちゃ変更して呼び出し元に変更を反映させる。

呼び出し元は Page.svelte と Entry.svelte の2つ。

前者が投稿欄、後者が返信欄のプレビューをそれぞれこんな感じでリアクティブで定義している。let previewEvent: UnsignedEvent | undefined = $state();CreateEntry.svelte では受け取った previewEvent を $derived.by() や $effect() を使って他の変数に依存して勝手に変わるようにしている。

特に contentToSend に依存して変わるので、入力の度に勝手に変わる。

contentToSend は textarea で bind:value しているので onChange とか onKeyPress とかはまったく使わない。勝手に変わってくれる。 ```makeEvent() っていうのが入力された色々を突っ込むとプレビュー用の UnsignedEvent を返してくれるやつ。 1文字入力されてcontentToSendが変わる度にこれが処理される。うわー。 このイベントには付与すべきpタグも含まれている。 これをpubkeysMentioningToとして定義する。const pubkeysMentioningTo = $derived( previewEvent?.tags.filter((tag) => tag.length >= 2 && tag[0] === 'p').map((tag) => tag[1]) ?? [] );あとは除外したいpタグリストpubkeysExcludedを定義して、let pubkeysExcluded: string[] = $state([]); ``` pubkeysMentioningToの中からユーザーに選んでもらう。

実際に送信するイベントはpubkeysExcludedも考慮して署名する。

送信する際もmakeEvent()を呼んでるけど、こっちは引数にpubkeysExcludedが入ってる。プレビューの方には入ってない。 -

@ c631e267:c2b78d3e

2025-04-25 20:06:24

@ c631e267:c2b78d3e

2025-04-25 20:06:24Die Wahrheit verletzt tiefer als jede Beleidigung. \ Marquis de Sade

Sagen Sie niemals «Terroristin B.», «Schwachkopf H.», «korrupter Drecksack S.» oder «Meinungsfreiheitshasserin F.» und verkneifen Sie sich Memes, denn so etwas könnte Ihnen als Beleidigung oder Verleumdung ausgelegt werden und rechtliche Konsequenzen haben. Auch mit einer Frau M.-A. S.-Z. ist in dieser Beziehung nicht zu spaßen, sie gehört zu den Top-Anzeigenstellern.

«Politikerbeleidigung» als Straftatbestand wurde 2021 im Kampf gegen «Rechtsextremismus und Hasskriminalität» in Deutschland eingeführt, damals noch unter der Regierung Merkel. Im Gesetz nicht festgehalten ist die Unterscheidung zwischen schlechter Hetze und guter Hetze – trotzdem ist das gängige Praxis, wie der Titel fast schon nahelegt.

So dürfen Sie als Politikerin heute den Tesla als «Nazi-Auto» bezeichnen und dies ausdrücklich auf den Firmengründer Elon Musk und dessen «rechtsextreme Positionen» beziehen, welche Sie nicht einmal belegen müssen. [1] Vielleicht ernten Sie Proteste, jedoch vorrangig wegen der «gut bezahlten, unbefristeten Arbeitsplätze» in Brandenburg. Ihren Tweet hat die Berliner Senatorin Cansel Kiziltepe inzwischen offenbar dennoch gelöscht.

Dass es um die Meinungs- und Pressefreiheit in der Bundesrepublik nicht mehr allzu gut bestellt ist, befürchtet man inzwischen auch schon im Ausland. Der Fall des Journalisten David Bendels, der kürzlich wegen eines Faeser-Memes zu sieben Monaten Haft auf Bewährung verurteilt wurde, führte in diversen Medien zu Empörung. Die Welt versteckte ihre Kritik mit dem Titel «Ein Urteil wie aus einer Diktatur» hinter einer Bezahlschranke.

Unschöne, heutzutage vielleicht strafbare Kommentare würden mir auch zu einigen anderen Themen und Akteuren einfallen. Ein Kandidat wäre der deutsche Bundesgesundheitsminister (ja, er ist es tatsächlich immer noch). Während sich in den USA auf dem Gebiet etwas bewegt und zum Beispiel Robert F. Kennedy Jr. will, dass die Gesundheitsbehörde (CDC) keine Covid-Impfungen für Kinder mehr empfiehlt, möchte Karl Lauterbach vor allem das Corona-Lügengebäude vor dem Einsturz bewahren.

«Ich habe nie geglaubt, dass die Impfungen nebenwirkungsfrei sind», sagte Lauterbach jüngst der ZDF-Journalistin Sarah Tacke. Das steht in krassem Widerspruch zu seiner früher verbreiteten Behauptung, die Gen-Injektionen hätten keine Nebenwirkungen. Damit entlarvt er sich selbst als Lügner. Die Bezeichnung ist absolut berechtigt, dieser Mann dürfte keinerlei politische Verantwortung tragen und das Verhalten verlangt nach einer rechtlichen Überprüfung. Leider ist ja die Justiz anderweitig beschäftigt und hat außerdem selbst keine weiße Weste.

Obendrein kämpfte der Herr Minister für eine allgemeine Impfpflicht. Er beschwor dabei das Schließen einer «Impflücke», wie es die Weltgesundheitsorganisation – die «wegen Trump» in finanziellen Schwierigkeiten steckt – bis heute tut. Die WHO lässt aktuell ihre «Europäische Impfwoche» propagieren, bei der interessanterweise von Covid nicht mehr groß die Rede ist.

Einen «Klima-Leugner» würden manche wohl Nir Shaviv nennen, das ist ja nicht strafbar. Der Astrophysiker weist nämlich die Behauptung von einer Klimakrise zurück. Gemäß seiner Forschung ist mindestens die Hälfte der Erderwärmung nicht auf menschliche Emissionen, sondern auf Veränderungen im Sonnenverhalten zurückzuführen.

Das passt vielleicht auch den «Klima-Hysterikern» der britischen Regierung ins Konzept, die gerade Experimente zur Verdunkelung der Sonne angekündigt haben. Produzenten von Kunstfleisch oder Betreiber von Insektenfarmen würden dagegen vermutlich die Geschichte vom fatalen CO2 bevorzugen. Ihnen würde es besser passen, wenn der verantwortungsvolle Erdenbürger sein Verhalten gründlich ändern müsste.

In unserer völlig verkehrten Welt, in der praktisch jede Verlautbarung außerhalb der abgesegneten Narrative potenziell strafbar sein kann, gehört fast schon Mut dazu, Dinge offen anzusprechen. Im «besten Deutschland aller Zeiten» glaubten letztes Jahr nur noch 40 Prozent der Menschen, ihre Meinung frei äußern zu können. Das ist ein Armutszeugnis, und es sieht nicht gerade nach Besserung aus. Umso wichtiger ist es, dagegen anzugehen.

[Titelbild: Pixabay]

--- Quellen: ---

[1] Zur Orientierung wenigstens ein paar Hinweise zur NS-Vergangenheit deutscher Automobilhersteller:

- Volkswagen

- Porsche

- Daimler-Benz

- BMW

- Audi

- Opel

- Heute: «Auto-Werke für die Rüstung? Rheinmetall prüft Übernahmen»

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ eb0157af:77ab6c55

2025-05-25 04:48:09

@ eb0157af:77ab6c55

2025-05-25 04:48:09Banking giants JPMorgan, Bank of America, Citigroup, and Wells Fargo are in talks to develop a unified stablecoin solution.

According to the Wall Street Journal on May 22, some of the largest financial institutions in the United States are exploring the possibility of joining forces to launch a stablecoin.

Subsidiaries of JPMorgan, Bank of America, Citigroup, and Wells Fargo have initiated preliminary discussions for a joint stablecoin issuance, according to sources close to the matter cited by the WSJ. Also at the negotiating table are Early Warning Services, the parent company of the digital payments network Zelle, and the payment network Clearing House.

The talks are reportedly still in the early stages, and any final decision could change depending on regulatory developments and market demand for stablecoins.

Stablecoin regulation

On May 20, the US Senate voted 66 to 32 to advance discussion of the Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act), a specific law to regulate stablecoins. The bill outlines a regulatory framework for stablecoin collateralization and mandates compliance with anti-money laundering rules.

David Sacks, White House crypto advisor, expressed optimism about the bill’s bipartisan approval. However, senior Democratic Party officials intend to amend the bill to include a clause preventing former President Donald Trump and other US officials from profiting from stablecoins.

Demand for stablecoins has increased, with total market capitalization rising to $245 billion from $205 billion at the beginning of the year, a 20% increase.

The post Major US banks consider launching a joint stablecoin appeared first on Atlas21.

-

@ 6b0a60cf:b952e7d4

2025-03-06 02:45:45

@ 6b0a60cf:b952e7d4

2025-03-06 02:45:45とあるSNSで海外の相互さん(以降、Aさんと呼ぶ)からDMで相談されたことがあって、思ったことをつらつらと書いてみる。

非公開の場での相談なので多少ぼかしを入れるけど。事の経緯

発端は、Aさんの友人が作品に日本人作者の素材を使用しようとしていて、その利用規約を翻訳して読んだらうまく翻訳されなくて理解が正しいのかわからない、なので間違いが無いか確認してほしい、という相談だった。

あー、確かに日本語特有の回りくどい表現があるねー、と思いながらバシッと簡潔に意訳してお伝えしたところ、スッキリ理解していただけたらしく一件落着となった。独自ライセンス文化

しかしまあ、創作界隈における作品・素材の利用規約というものは総じて長くて細かい。

ジャンルによるのかもしれないけれど。

自分は絵や音を創ることは無いがプログラムのコードを書く趣味はあるのでプログラム向けのライセンスを利用している。MITとかGPLとかいうやつ。

創作向けであればCCライセンスが適しているだろう。しかしこれがなかなか広まらない。

杓子定規のライセンスでは表しきれないような特別な希望があるのだろう。

そして独自ライセンスが跋扈することとなる。NO MORE 映画泥棒

特に気になるのが、「泥棒をしてはいけません」レベルの注意書きが散見されるのだ。

わざわざライセンスに書くことではない。あなたが警告するまでもなく、違法な行為は処罰される。

でも、たぶん効果があるからこういうのが広まるのだろう。

「泥棒してはいけないって書いてないから泥棒しました」というレベルの利用者が存在するのだろう。

そういう人は書いてあっても読んでないか、理屈をこねて泥棒するんだろうと思うけれども。その術はオレに効く

で、そういう警告文が魔除けの札のごとくびっしり貼られていると、こちらにやましい心が無くても、ちょっとこの素材は利用しないほうがよさそうだな……と思って引き返してしまうことがある。

SNSで可愛い絵を見て、作者さんをフォローしようと思ったら「無断転載禁止」みたいなのがプロフにずらずら書いてあって「おっと……」みたいに引き返すことがあるが、それに似ている。

きっと過去によくない体験をしてしまって、そのようにプロフに書くことでそれが改善するという実体験があって、そうなっているのだろうと推測している。異文化の壁を超えて

冒頭で話したAさんはきわめて紳士的な方であり、日本文化に対してもよく理解しようと努めてくれるので、話が通じやすくて助かったし、件の素材についても臆すること無く使用することになりそうだった。

ただ魔除けの札が効かないような魑魅魍魎にはいくら札を貼っても意味がないし、実際の悪魔祓いの効果と善良な利用者をも祓ってしまう機会損失(?)を比べて合理的なのだろうか、と考えたりしたのでした。オチは無い。ライセンス

この文章は CC0 1.0 でライセンスします。

Nostrイベントとして公開する以上はNIPsに従う範囲内で自由に利用されることを望みます。

NIPsに違反したご利用は他のクライアントの利用者にご迷惑になるのでご遠慮いただくことを希望します。^1 -

@ 47259076:570c98c4

2025-05-25 01:33:57

@ 47259076:570c98c4

2025-05-25 01:33:57When a man meets a woman, they produce another human being.

The biological purpose of life is to reproduce, that's why we have reproductive organs.

However, you can't reproduce if you are dying of starvation or something else.

So you must look for food, shelter and other basic needs.

Once those needs are satisfied, the situation as a whole is more stable and then it is easier to reproduce.

Once another human being is created, you still must support him.

In the animal kingdom, human babies are the ones who take longer to walk and be independent as a whole.

Therefore, in the first years of our lives, we are very dependent on our parents or whoever is taking care of us.

We also have a biological drive for living.

That's why when someone is drowning he will hold on into whatever they can grab with the highest strength possible.

Or when our hand is close to fire or something hot, we remove our hand immediately from the hot thing, without thinking about removing our hand, we just do it.

These are just 2 examples, there are many other examples that show this biological tendency/reflex to keep ourselves alive.

We also have our brain, which we can use to get information/knowledge/ideas/advice from the ether.

In this sense, our brain is just an antenna or radio, and the ether is the signal.

Of course, we are not the radio, we are the signal.

In other words, you are not your body, you are pure consciousness "locked" temporarily in a body.

Because we can act after receiving information from the ether, we can construct and invent new things to make our lives easier.

So far, using only biology as our rule, we can get to the following conclusion: The purpose of life is to live in a safe place, work to get food and reproduce.

Because humans have been evolving in the technological sense, we don't need to hunt for food, we can just go to the market and buy meat.

And for the shelter(house), we just buy it.

Even though you can buy a house, it's still not yours, since the government or any thug can take it from you, but this is a topic for another article.

So, adjusting what I said before in a modern sense, the purpose of life is: Work in a normal job from Monday to Friday, save money, buy a house, buy a car, get a wife and have kids. Keep working until you are old enough, then retire and do nothing for the rest of your life, just waiting for the moment you die.

Happy life, happy ending, right?

No.

There is something else to it, there is another side of the coin.

This is explored briefly by Steve Jobs in this video, but I pretend to go much further than him: https://youtu.be/uf6TzOHO_dk

Let's get to the point now.

First of all, you are alive. This is not normal.

Don't take life for granted.

There is no such a thing as a coincidence. Chance is but a name given for a law that has not been recognized yet.

You are here for a reason.

God is real. All creation starts in the mind.

The mind is the source of all creation.

When the mind of god starts thinking, it records its thoughts into matter through light.

But this is too abstract, let's get to something simple.

Governments exist, correct?

The force behind thinking is desire, without desire there is no creation.

If desired ceased to exist, everything would just vanish in the blink of an eye.

How governments are supported financially?

By taking your money.

Which means, you produce, and they take it.

And you can't go against it without suffering, therefore, you are a slave.

Are you realizing the gravity of the situation?

You are working to keep yourself alive as well as faceless useless men that you don't even know.

Your car must have an identification.

When you are born, you must have an identification.

In brazil, you can't home school your children.

When "your" "country" is in war, you must fight to defend it and give your life.

Countries are limited by imaginary lines.

How many lives have been destroyed in meaningless wars?

You must go to the front-line to defend your masters.

In most countries, you don't have freedom of speech, which means, you can't even express what you think.

When you create a company, you must have an identification and pass through a very bureaucratic process.

The money you use is just imaginary numbers in the screen of a computer or phone.

The money you use is created out of thin air.

By money here, I am referring to fiat money, not bitcoin.

Bitcoin is an alternative to achieve freedom, but this is topic for another article.

Depending on what you want to work on, you must go to college.

If you want to become a doctor, you must spend at least 5 years in an university decorating useless muscle names and bones.

Wisdom is way more important than knowledge.

That's why medical errors are the third leading cause of death in United States of America.

And I'm not even talking about Big Pharma and the "World Health Organization"

You can't even use or sell drugs, your masters don't allow it.

All the money you get, you must explain from where you got it.

Meanwhile, your masters have "black budget" and don't need to explain anything to you, even though everything they do is financed by your money.

In most countries you can't buy a gun, while your masters have a whole army fully armed to the teeth to defend them.

Your masters want to keep you sedated and asleep.

Look at all the "modern" art produced nowadays.

Look at the media, which of course was never created to "inform you".

Your masters even use your body to test their bio-technology, as happened with the covid 19 vaccines.

This is public human testing, there's of course secretive human testing, such as MKUltra and current experiments that happen nowadays that I don't even know.

I can give hundreds of millions of examples, quite literally, but let's just focus in one case, Jeffrey Epstein.

He was a guy who got rich "suddenly" and used his influence and spy skills to blackmail politicians and celebrities through recording them doing acts of pedophilia.

In United States of America, close to one million children a year go missing every year.

Some portion of these children are used in satanic rituals, and the participants of these rituals are individuals from the "high society".

Jeffrey Epstein was just an "employee", he was not the one at the top of the evil hierarchy.

He was serving someone or a group of people that I don't know who they are.

That's why they murdered him.

Why am I saying all of this?

The average person who sleep, work, eat and repeat has no idea all of this is going on.

They have no idea there is a very small group of powerful people who are responsible for many evil damage in the world.

They think the world is resumed in their little routine.

They think their routine is all there is to it.

They don't know how big the world truly is, in both a good and evil sense.

Given how much we produce and all the technology we have, people shouldn't even have to work, things would be almost nearly free.

Why aren't they?

Because of taxes.

This group of people even has access to a free energy device, which would disrupt the world in a magnitude greater than everything we have ever seen in the history of Earth.

That's why MANY people who tried to work in any manifestation of a free energy device have been murdered, or rather, "fell from a window".

How do I know a free energy device exist? This is topic for another article.

So my conclusion is:

We are in hell already. Know thyself. Use your mind for creation, any sort of creation. Do good for the people around you and the people you meet, always give more than you get, try to do your best in everything you set out to do, even if it's a boring or mundane work.

Life is short.

Our body can live no longer than 300 years.

Most people die before 90.

Know thyself, do good to the world while you can.

Wake up!!! Stop being sedated and asleep.

Be conscious.

-

@ ec42c765:328c0600

2025-02-05 23:45:09

@ ec42c765:328c0600

2025-02-05 23:45:09test

test

-

@ c631e267:c2b78d3e

2025-04-20 19:54:32

@ c631e267:c2b78d3e

2025-04-20 19:54:32Es ist völlig unbestritten, dass der Angriff der russischen Armee auf die Ukraine im Februar 2022 strikt zu verurteilen ist. Ebenso unbestritten ist Russland unter Wladimir Putin keine brillante Demokratie. Aus diesen Tatsachen lässt sich jedoch nicht das finstere Bild des russischen Präsidenten – und erst recht nicht des Landes – begründen, das uns durchweg vorgesetzt wird und den Kern des aktuellen europäischen Bedrohungs-Szenarios darstellt. Da müssen wir schon etwas genauer hinschauen.

Der vorliegende Artikel versucht derweil nicht, den Einsatz von Gewalt oder die Verletzung von Menschenrechten zu rechtfertigen oder zu entschuldigen – ganz im Gegenteil. Dass jedoch der Verdacht des «Putinverstehers» sofort latent im Raume steht, verdeutlicht, was beim Thema «Russland» passiert: Meinungsmache und Manipulation.

Angesichts der mentalen Mobilmachung seitens Politik und Medien sowie des Bestrebens, einen bevorstehenden Krieg mit Russland geradezu herbeizureden, ist es notwendig, dieser fatalen Entwicklung entgegenzutreten. Wenn wir uns nur ein wenig von der herrschenden Schwarz-Weiß-Malerei freimachen, tauchen automatisch Fragen auf, die Risse im offiziellen Narrativ enthüllen. Grund genug, nachzuhaken.

Wer sich schon länger auch abseits der Staats- und sogenannten Leitmedien informiert, der wird in diesem Artikel vermutlich nicht viel Neues erfahren. Andere könnten hier ein paar unbekannte oder vergessene Aspekte entdecken. Möglicherweise klärt sich in diesem Kontext die Wahrnehmung der aktuellen (unserer eigenen!) Situation ein wenig.

Manipulation erkennen

Corona-«Pandemie», menschengemachter Klimawandel oder auch Ukraine-Krieg: Jede Menge Krisen, und für alle gibt es ein offizielles Narrativ, dessen Hinterfragung unerwünscht ist. Nun ist aber ein Narrativ einfach eine Erzählung, eine Geschichte (Latein: «narratio») und kein Tatsachenbericht. Und so wie ein Märchen soll auch das Narrativ eine Botschaft vermitteln.

Über die Methoden der Manipulation ist viel geschrieben worden, sowohl in Bezug auf das Individuum als auch auf die Massen. Sehr wertvolle Tipps dazu, wie man Manipulationen durchschauen kann, gibt ein Büchlein [1] von Albrecht Müller, dem Herausgeber der NachDenkSeiten.

Die Sprache selber eignet sich perfekt für die Manipulation. Beispielsweise kann die Wortwahl Bewertungen mitschwingen lassen, regelmäßiges Wiederholen (gerne auch von verschiedenen Seiten) lässt Dinge irgendwann «wahr» erscheinen, Übertreibungen fallen auf und hinterlassen wenigstens eine Spur im Gedächtnis, genauso wie Andeutungen. Belege spielen dabei keine Rolle.

Es gibt auffällig viele Sprachregelungen, die offenbar irgendwo getroffen und irgendwie koordiniert werden. Oder alle Redenschreiber und alle Medien kopieren sich neuerdings permanent gegenseitig. Welchen Zweck hat es wohl, wenn der Krieg in der Ukraine durchgängig und quasi wörtlich als «russischer Angriffskrieg auf die Ukraine» bezeichnet wird? Obwohl das in der Sache richtig ist, deutet die Art der Verwendung auf gezielte Beeinflussung hin und soll vor allem das Feindbild zementieren.

Sprachregelungen dienen oft der Absicherung einer einseitigen Darstellung. Das Gleiche gilt für das Verkürzen von Informationen bis hin zum hartnäckigen Verschweigen ganzer Themenbereiche. Auch hierfür gibt es rund um den Ukraine-Konflikt viele gute Beispiele.

Das gewünschte Ergebnis solcher Methoden ist eine Schwarz-Weiß-Malerei, bei der einer eindeutig als «der Böse» markiert ist und die anderen automatisch «die Guten» sind. Das ist praktisch und demonstriert gleichzeitig ein weiteres Manipulationswerkzeug: die Verwendung von Doppelstandards. Wenn man es schafft, bei wichtigen Themen regelmäßig mit zweierlei Maß zu messen, ohne dass das Publikum protestiert, dann hat man freie Bahn.

Experten zu bemühen, um bestimmte Sachverhalte zu erläutern, ist sicher sinnvoll, kann aber ebenso missbraucht werden, schon allein durch die Auswahl der jeweiligen Spezialisten. Seit «Corona» werden viele erfahrene und ehemals hoch angesehene Fachleute wegen der «falschen Meinung» diffamiert und gecancelt. [2] Das ist nicht nur ein brutaler Umgang mit Menschen, sondern auch eine extreme Form, die öffentliche Meinung zu steuern.

Wann immer wir also erkennen (weil wir aufmerksam waren), dass wir bei einem bestimmten Thema manipuliert werden, dann sind zwei logische und notwendige Fragen: Warum? Und was ist denn richtig? In unserem Russland-Kontext haben die Antworten darauf viel mit Geopolitik und Geschichte zu tun.

Ist Russland aggressiv und expansiv?

Angeblich plant Russland, europäische NATO-Staaten anzugreifen, nach dem Motto: «Zuerst die Ukraine, dann den Rest». In Deutschland weiß man dafür sogar das Datum: «Wir müssen bis 2029 kriegstüchtig sein», versichert Verteidigungsminister Pistorius.

Historisch gesehen ist es allerdings eher umgekehrt: Russland, bzw. die Sowjetunion, ist bereits dreimal von Westeuropa aus militärisch angegriffen worden. Die Feldzüge Napoleons, des deutschen Kaiserreichs und Nazi-Deutschlands haben Millionen Menschen das Leben gekostet. Bei dem ausdrücklichen Vernichtungskrieg ab 1941 kam es außerdem zu Brutalitäten wie der zweieinhalbjährigen Belagerung Leningrads (heute St. Petersburg) durch Hitlers Wehrmacht. Deren Ziel, die Bevölkerung auszuhungern, wurde erreicht: über eine Million tote Zivilisten.

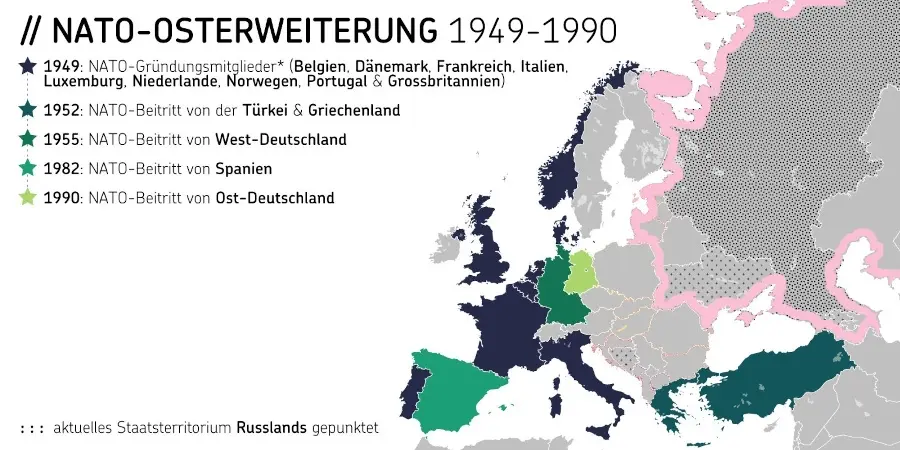

Trotz dieser Erfahrungen stimmte Michail Gorbatschow 1990 der deutschen Wiedervereinigung zu und die Sowjetunion zog ihre Truppen aus Osteuropa zurück (vgl. Abb. 1). Der Warschauer Pakt wurde aufgelöst, der Kalte Krieg formell beendet. Die Sowjets erhielten damals von führenden westlichen Politikern die Zusicherung, dass sich die NATO «keinen Zentimeter ostwärts» ausdehnen würde, das ist dokumentiert. [3]

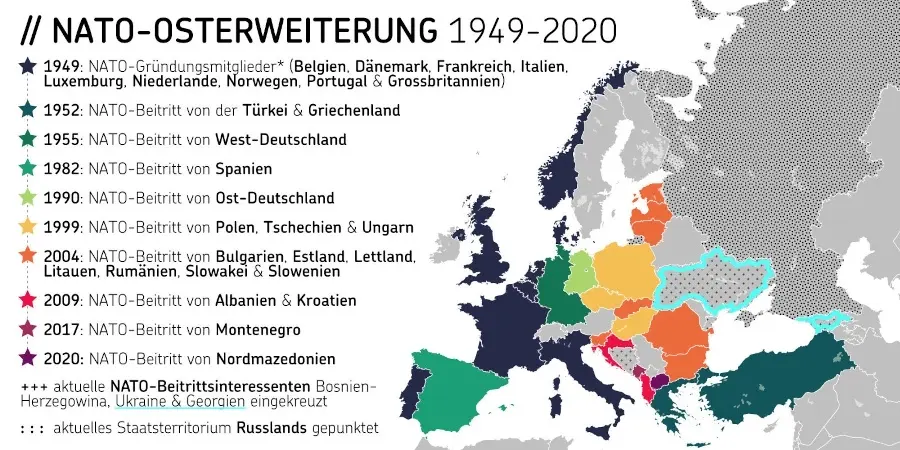

Expandiert ist die NATO trotzdem, und zwar bis an Russlands Grenzen (vgl. Abb. 2). Laut dem Politikberater Jeffrey Sachs handelt es sich dabei um ein langfristiges US-Projekt, das von Anfang an die Ukraine und Georgien mit einschloss. Offiziell wurde der Beitritt beiden Staaten 2008 angeboten. In jedem Fall könnte die massive Ost-Erweiterung seit 1999 aus russischer Sicht nicht nur als Vertrauensbruch, sondern durchaus auch als aggressiv betrachtet werden.

Russland hat den europäischen Staaten mehrfach die Hand ausgestreckt [4] für ein friedliches Zusammenleben und den «Aufbau des europäischen Hauses». Präsident Putin sei «in seiner ersten Amtszeit eine Chance für Europa» gewesen, urteilt die Journalistin und langjährige Russland-Korrespondentin der ARD, Gabriele Krone-Schmalz. Er habe damals viele positive Signale Richtung Westen gesendet.

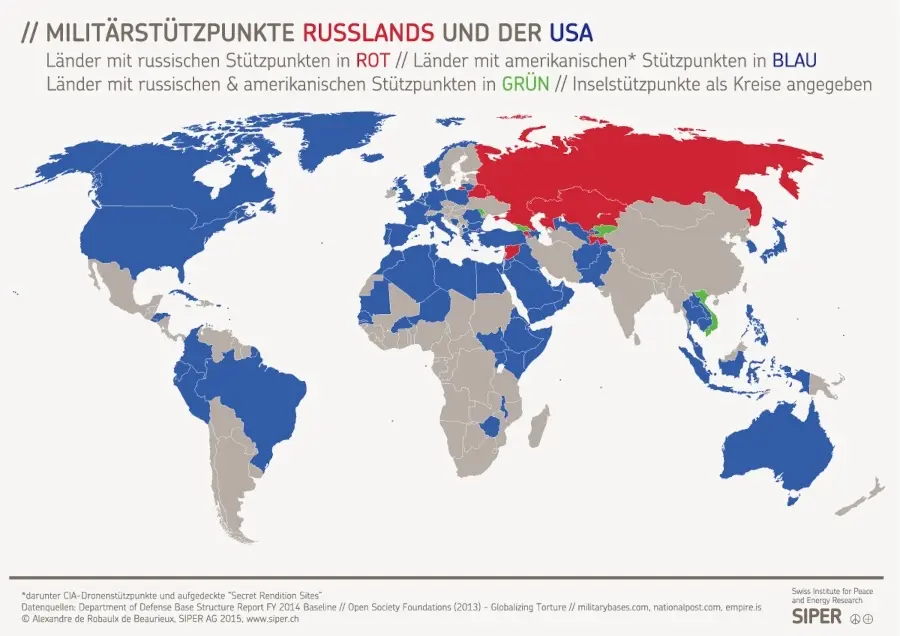

Die Europäer jedoch waren scheinbar an einer Partnerschaft mit dem kontinentalen Nachbarn weniger interessiert als an der mit dem transatlantischen Hegemon. Sie verkennen bis heute, dass eine gedeihliche Zusammenarbeit in Eurasien eine Gefahr für die USA und deren bekundetes Bestreben ist, die «einzige Weltmacht» zu sein – «Full Spectrum Dominance» [5] nannte das Pentagon das. Statt einem neuen Kalten Krieg entgegenzuarbeiten, ließen sich europäische Staaten selber in völkerrechtswidrige «US-dominierte Angriffskriege» [6] verwickeln, wie in Serbien, Afghanistan, dem Irak, Libyen oder Syrien. Diese werden aber selten so benannt.

Speziell den Deutschen stünde außer einer Portion Realismus auch etwas mehr Dankbarkeit gut zu Gesicht. Das Geschichtsbewusstsein der Mehrheit scheint doch recht selektiv und das Selbstbewusstsein einiger etwas desorientiert zu sein. Bekanntermaßen waren es die Soldaten der sowjetischen Roten Armee, die unter hohen Opfern 1945 Deutschland «vom Faschismus befreit» haben. Bei den Gedenkfeiern zu 80 Jahren Kriegsende will jedoch das Auswärtige Amt – noch unter der Diplomatie-Expertin Baerbock, die sich schon länger offiziell im Krieg mit Russland wähnt, – nun keine Russen sehen: Sie sollen notfalls rausgeschmissen werden.

«Die Grundsatzfrage lautet: Geht es Russland um einen angemessenen Platz in einer globalen Sicherheitsarchitektur, oder ist Moskau schon seit langem auf einem imperialistischen Trip, der befürchten lassen muss, dass die Russen in fünf Jahren in Berlin stehen?»

So bringt Gabriele Krone-Schmalz [7] die eigentliche Frage auf den Punkt, die zur Einschätzung der Situation letztlich auch jeder für sich beantworten muss.

Was ist los in der Ukraine?

In der internationalen Politik geht es nie um Demokratie oder Menschenrechte, sondern immer um Interessen von Staaten. Diese These stammt von Egon Bahr, einem der Architekten der deutschen Ostpolitik des «Wandels durch Annäherung» aus den 1960er und 70er Jahren. Sie trifft auch auf den Ukraine-Konflikt zu, den handfeste geostrategische und wirtschaftliche Interessen beherrschen, obwohl dort angeblich «unsere Demokratie» verteidigt wird.

Es ist ein wesentliches Element des Ukraine-Narrativs und Teil der Manipulation, die Vorgeschichte des Krieges wegzulassen – mindestens die vor der russischen «Annexion» der Halbinsel Krim im März 2014, aber oft sogar komplett diejenige vor der Invasion Ende Februar 2022. Das Thema ist komplex, aber einige Aspekte, die für eine Beurteilung nicht unwichtig sind, will ich wenigstens kurz skizzieren. [8]

Das Gebiet der heutigen Ukraine und Russlands – die übrigens in der «Kiewer Rus» gemeinsame Wurzeln haben – hat der britische Geostratege Halford Mackinder bereits 1904 als eurasisches «Heartland» bezeichnet, dessen Kontrolle er eine große Bedeutung für die imperiale Strategie Großbritanniens zumaß. Für den ehemaligen Sicherheits- und außenpolitischen Berater mehrerer US-amerikanischer Präsidenten und Mitgründer der Trilateralen Kommission, Zbigniew Brzezinski, war die Ukraine nach der Auflösung der Sowjetunion ein wichtiger Spielstein auf dem «eurasischen Schachbrett», wegen seiner Nähe zu Russland, seiner Bodenschätze und seines Zugangs zum Schwarzen Meer.

Die Ukraine ist seit langem ein gespaltenes Land. Historisch zerrissen als Spielball externer Interessen und geprägt von ethnischen, kulturellen, religiösen und geografischen Unterschieden existiert bis heute, grob gesagt, eine Ost-West-Spaltung, welche die Suche nach einer nationalen Identität stark erschwert.

Insbesondere im Zuge der beiden Weltkriege sowie der Russischen Revolution entstanden tiefe Risse in der Bevölkerung. Ukrainer kämpften gegen Ukrainer, zum Beispiel die einen auf der Seite von Hitlers faschistischer Nazi-Armee und die anderen auf der von Stalins kommunistischer Roter Armee. Die Verbrechen auf beiden Seiten sind nicht vergessen. Dass nach der Unabhängigkeit 1991 versucht wurde, Figuren wie den radikalen Nationalisten Symon Petljura oder den Faschisten und Nazi-Kollaborateur Stepan Bandera als «Nationalhelden» zu installieren, verbessert die Sache nicht.

Während die USA und EU-Staaten zunehmend «ausländische Einmischung» (speziell russische) in «ihre Demokratien» wittern, betreiben sie genau dies seit Jahrzehnten in vielen Ländern der Welt. Die seit den 2000er Jahren bekannten «Farbrevolutionen» in Osteuropa werden oft als Methode des Regierungsumsturzes durch von außen gesteuerte «demokratische» Volksaufstände beschrieben. Diese Strategie geht auf Analysen zum «Schwarmverhalten» [9] seit den 1960er Jahren zurück (Studentenproteste), wo es um die potenzielle Wirksamkeit einer «rebellischen Hysterie» von Jugendlichen bei postmodernen Staatsstreichen geht. Heute nennt sich dieses gezielte Kanalisieren der Massen zur Beseitigung unkooperativer Regierungen «Soft-Power».

In der Ukraine gab es mit der «Orangen Revolution» 2004 und dem «Euromaidan» 2014 gleich zwei solcher «Aufstände». Der erste erzwang wegen angeblicher Unregelmäßigkeiten eine Wiederholung der Wahlen, was mit Wiktor Juschtschenko als neuem Präsidenten endete. Dieser war ehemaliger Direktor der Nationalbank und Befürworter einer Annäherung an EU und NATO. Seine Frau, die First Lady, ist US-amerikanische «Philanthropin» und war Beamtin im Weißen Haus in der Reagan- und der Bush-Administration.

Im Gegensatz zu diesem ersten Event endete der sogenannte Euromaidan unfriedlich und blutig. Die mehrwöchigen Proteste gegen Präsident Wiktor Janukowitsch, in Teilen wegen des nicht unterzeichneten Assoziierungsabkommens mit der EU, wurden zunehmend gewalttätiger und von Nationalisten und Faschisten des «Rechten Sektors» dominiert. Sie mündeten Ende Februar 2014 auf dem Kiewer Unabhängigkeitsplatz (Maidan) in einem Massaker durch Scharfschützen. Dass deren Herkunft und die genauen Umstände nicht geklärt wurden, störte die Medien nur wenig. [10]

Janukowitsch musste fliehen, er trat nicht zurück. Vielmehr handelte es sich um einen gewaltsamen, allem Anschein nach vom Westen inszenierten Putsch. Laut Jeffrey Sachs war das kein Geheimnis, außer vielleicht für die Bürger. Die USA unterstützten die Post-Maidan-Regierung nicht nur, sie beeinflussten auch ihre Bildung. Das geht unter anderem aus dem berühmten «Fuck the EU»-Telefonat der US-Chefdiplomatin für die Ukraine, Victoria Nuland, mit Botschafter Geoffrey Pyatt hervor.

Dieser Bruch der demokratischen Verfassung war letztlich der Auslöser für die anschließenden Krisen auf der Krim und im Donbass (Ostukraine). Angesichts der ukrainischen Geschichte mussten die nationalistischen Tendenzen und die Beteiligung der rechten Gruppen an dem Umsturz bei der russigsprachigen Bevölkerung im Osten ungute Gefühle auslösen. Es gab Kritik an der Übergangsregierung, Befürworter einer Abspaltung und auch für einen Anschluss an Russland.

Ebenso konnte Wladimir Putin in dieser Situation durchaus Bedenken wegen des Status der russischen Militärbasis für seine Schwarzmeerflotte in Sewastopol auf der Krim haben, für die es einen langfristigen Pachtvertrag mit der Ukraine gab. Was im März 2014 auf der Krim stattfand, sei keine Annexion, sondern eine Abspaltung (Sezession) nach einem Referendum gewesen, also keine gewaltsame Aneignung, urteilte der Rechtswissenschaftler Reinhard Merkel in der FAZ sehr detailliert begründet. Übrigens hatte die Krim bereits zu Zeiten der Sowjetunion den Status einer autonomen Republik innerhalb der Ukrainischen SSR.

Anfang April 2014 wurden in der Ostukraine die «Volksrepubliken» Donezk und Lugansk ausgerufen. Die Kiewer Übergangsregierung ging unter der Bezeichnung «Anti-Terror-Operation» (ATO) militärisch gegen diesen, auch von Russland instrumentalisierten Widerstand vor. Zufällig war kurz zuvor CIA-Chef John Brennan in Kiew. Die Maßnahmen gingen unter dem seit Mai neuen ukrainischen Präsidenten, dem Milliardär Petro Poroschenko, weiter. Auch Wolodymyr Selenskyj beendete den Bürgerkrieg nicht, als er 2019 vom Präsidenten-Schauspieler, der Oligarchen entmachtet, zum Präsidenten wurde. Er fuhr fort, die eigene Bevölkerung zu bombardieren.

Mit dem Einmarsch russischer Truppen in die Ostukraine am 24. Februar 2022 begann die zweite Phase des Krieges. Die Wochen und Monate davor waren intensiv. Im November hatte die Ukraine mit den USA ein Abkommen über eine «strategische Partnerschaft» unterzeichnet. Darin sagten die Amerikaner ihre Unterstützung der EU- und NATO-Perspektive der Ukraine sowie quasi für die Rückeroberung der Krim zu. Dagegen ließ Putin der NATO und den USA im Dezember 2021 einen Vertragsentwurf über beiderseitige verbindliche Sicherheitsgarantien zukommen, den die NATO im Januar ablehnte. Im Februar eskalierte laut OSZE die Gewalt im Donbass.

Bereits wenige Wochen nach der Invasion, Ende März 2022, kam es in Istanbul zu Friedensverhandlungen, die fast zu einer Lösung geführt hätten. Dass der Krieg nicht damals bereits beendet wurde, lag daran, dass der Westen dies nicht wollte. Man war der Meinung, Russland durch die Ukraine in diesem Stellvertreterkrieg auf Dauer militärisch schwächen zu können. Angesichts von Hunderttausenden Toten, Verletzten und Traumatisierten, die als Folge seitdem zu beklagen sind, sowie dem Ausmaß der Zerstörung, fehlen einem die Worte.

Hasst der Westen die Russen?

Diese Frage drängt sich auf, wenn man das oft unerträglich feindselige Gebaren beobachtet, das beileibe nicht neu ist und vor Doppelmoral trieft. Russland und speziell die Person Wladimir Putins werden regelrecht dämonisiert, was gleichzeitig scheinbar jede Form von Diplomatie ausschließt.

Russlands militärische Stärke, seine geografische Lage, sein Rohstoffreichtum oder seine unabhängige diplomatische Tradition sind sicher Störfaktoren für das US-amerikanische Bestreben, der Boss in einer unipolaren Welt zu sein. Ein womöglich funktionierender eurasischer Kontinent, insbesondere gute Beziehungen zwischen Russland und Deutschland, war indes schon vor dem Ersten Weltkrieg eine Sorge des britischen Imperiums.

Ein «Vergehen» von Präsident Putin könnte gewesen sein, dass er die neoliberale Schocktherapie à la IWF und den Ausverkauf des Landes (auch an US-Konzerne) beendete, der unter seinem Vorgänger herrschte. Dabei zeigte er sich als Führungspersönlichkeit und als nicht so formbar wie Jelzin. Diese Aspekte allein sind aber heute vermutlich keine ausreichende Erklärung für ein derart gepflegtes Feindbild.

Der Historiker und Philosoph Hauke Ritz erweitert den Fokus der Fragestellung zu: «Warum hasst der Westen die Russen so sehr?», was er zum Beispiel mit dem Medienforscher Michael Meyen und mit der Politikwissenschaftlerin Ulrike Guérot bespricht. Ritz stellt die interessante These [11] auf, dass Russland eine Provokation für den Westen sei, welcher vor allem dessen kulturelles und intellektuelles Potenzial fürchte.

Die Russen sind Europäer aber anders, sagt Ritz. Diese «Fremdheit in der Ähnlichkeit» erzeuge vielleicht tiefe Ablehnungsgefühle. Obwohl Russlands Identität in der europäischen Kultur verwurzelt ist, verbinde es sich immer mit der Opposition in Europa. Als Beispiele nennt er die Kritik an der katholischen Kirche oder die Verbindung mit der Arbeiterbewegung. Christen, aber orthodox; Sozialismus statt Liberalismus. Das mache das Land zum Antagonisten des Westens und zu einer Bedrohung der Machtstrukturen in Europa.

Fazit

Selbstverständlich kann man Geschichte, Ereignisse und Entwicklungen immer auf verschiedene Arten lesen. Dieser Artikel, obwohl viel zu lang, konnte nur einige Aspekte der Ukraine-Tragödie anreißen, die in den offiziellen Darstellungen in der Regel nicht vorkommen. Mindestens dürfte damit jedoch klar geworden sein, dass die Russische Föderation bzw. Wladimir Putin nicht der alleinige Aggressor in diesem Konflikt ist. Das ist ein Stellvertreterkrieg zwischen USA/NATO (gut) und Russland (böse); die Ukraine (edel) wird dabei schlicht verheizt.

Das ist insofern von Bedeutung, als die gesamte europäische Kriegshysterie auf sorgsam kultivierten Freund-Feind-Bildern beruht. Nur so kann Konfrontation und Eskalation betrieben werden, denn damit werden die wahren Hintergründe und Motive verschleiert. Angst und Propaganda sind notwendig, damit die Menschen den Wahnsinn mitmachen. Sie werden belogen, um sie zuerst zu schröpfen und anschließend auf die Schlachtbank zu schicken. Das kann niemand wollen, außer den stets gleichen Profiteuren: die Rüstungs-Lobby und die großen Investoren, die schon immer an Zerstörung und Wiederaufbau verdient haben.

Apropos Investoren: Zu den Top-Verdienern und somit Hauptinteressenten an einer Fortführung des Krieges zählt BlackRock, einer der weltgrößten Vermögensverwalter. Der deutsche Bundeskanzler in spe, Friedrich Merz, der gerne «Taurus»-Marschflugkörper an die Ukraine liefern und die Krim-Brücke zerstören möchte, war von 2016 bis 2020 Aufsichtsratsvorsitzender von BlackRock in Deutschland. Aber das hat natürlich nichts zu sagen, der Mann macht nur seinen Job.

Es ist ein Spiel der Kräfte, es geht um Macht und strategische Kontrolle, um Geheimdienste und die Kontrolle der öffentlichen Meinung, um Bodenschätze, Rohstoffe, Pipelines und Märkte. Das klingt aber nicht sexy, «Demokratie und Menschenrechte» hört sich besser und einfacher an. Dabei wäre eine für alle Seiten förderliche Politik auch nicht so kompliziert; das Handwerkszeug dazu nennt sich Diplomatie. Noch einmal Gabriele Krone-Schmalz:

«Friedliche Politik ist nichts anderes als funktionierender Interessenausgleich. Da geht’s nicht um Moral.»

Die Situation in der Ukraine ist sicher komplex, vor allem wegen der inneren Zerrissenheit. Es dürfte nicht leicht sein, eine friedliche Lösung für das Zusammenleben zu finden, aber die Beteiligten müssen es vor allem wollen. Unter den gegebenen Umständen könnte eine sinnvolle Perspektive mit Neutralität und föderalen Strukturen zu tun haben.

Allen, die sich bis hierher durch die Lektüre gearbeitet (oder auch einfach nur runtergescrollt) haben, wünsche ich frohe Oster-Friedenstage!

[Titelbild: Pixabay; Abb. 1 und 2: nach Ganser/SIPER; Abb. 3: SIPER]

--- Quellen: ---

[1] Albrecht Müller, «Glaube wenig. Hinterfrage alles. Denke selbst.», Westend 2019

[2] Zwei nette Beispiele:

- ARD-faktenfinder (sic), «Viel Aufmerksamkeit für fragwürdige Experten», 03/2023

- Neue Zürcher Zeitung, «Aufstieg und Fall einer Russlandversteherin – die ehemalige ARD-Korrespondentin Gabriele Krone-Schmalz rechtfertigt seit Jahren Putins Politik», 12/2022

[3] George Washington University, «NATO Expansion: What Gorbachev Heard – Declassified documents show security assurances against NATO expansion to Soviet leaders from Baker, Bush, Genscher, Kohl, Gates, Mitterrand, Thatcher, Hurd, Major, and Woerner», 12/2017

[4] Beispielsweise Wladimir Putin bei seiner Rede im Deutschen Bundestag, 25/09/2001

[5] William Engdahl, «Full Spectrum Dominance, Totalitarian Democracy In The New World Order», edition.engdahl 2009

[6] Daniele Ganser, «Illegale Kriege – Wie die NATO-Länder die UNO sabotieren. Eine Chronik von Kuba bis Syrien», Orell Füssli 2016

[7] Gabriele Krone-Schmalz, «Mit Friedensjournalismus gegen ‘Kriegstüchtigkeit’», Vortrag und Diskussion an der Universität Hamburg, veranstaltet von engagierten Studenten, 16/01/2025\ → Hier ist ein ähnlicher Vortrag von ihr (Video), den ich mit spanischer Übersetzung gefunden habe.

[8] Für mehr Hintergrund und Details empfehlen sich z.B. folgende Bücher:

- Mathias Bröckers, Paul Schreyer, «Wir sind immer die Guten», Westend 2019

- Gabriele Krone-Schmalz, «Russland verstehen? Der Kampf um die Ukraine und die Arroganz des Westens», Westend 2023

- Patrik Baab, «Auf beiden Seiten der Front – Meine Reisen in die Ukraine», Fiftyfifty 2023

[9] vgl. Jonathan Mowat, «Washington's New World Order "Democratization" Template», 02/2005 und RAND Corporation, «Swarming and the Future of Conflict», 2000

[10] Bemerkenswert einige Beiträge, von denen man später nichts mehr wissen wollte:

- ARD Monitor, «Todesschüsse in Kiew: Wer ist für das Blutbad vom Maidan verantwortlich», 10/04/2014, Transkript hier

- Telepolis, «Blutbad am Maidan: Wer waren die Todesschützen?», 12/04/2014

- Telepolis, «Scharfschützenmorde in Kiew», 14/12/2014

- Deutschlandfunk, «Gefahr einer Spirale nach unten», Interview mit Günter Verheugen, 18/03/2014

- NDR Panorama, «Putsch in Kiew: Welche Rolle spielen die Faschisten?», 06/03/2014

[11] Hauke Ritz, «Vom Niedergang des Westens zur Neuerfindung Europas», 2024

Dieser Beitrag wurde mit dem Pareto-Client geschrieben.

-

@ ec42c765:328c0600

2025-02-05 23:43:35

@ ec42c765:328c0600

2025-02-05 23:43:35test

-

@ c631e267:c2b78d3e

2025-04-18 15:53:07

@ c631e267:c2b78d3e

2025-04-18 15:53:07Verstand ohne Gefühl ist unmenschlich; \ Gefühl ohne Verstand ist Dummheit. \ Egon Bahr

Seit Jahren werden wir darauf getrimmt, dass Fakten eigentlich gefühlt seien. Aber nicht alles ist relativ und nicht alles ist nach Belieben interpretierbar. Diese Schokoladenhasen beispielsweise, die an Ostern in unseren Gefilden typisch sind, «ostern» zwar nicht, sondern sie sitzen in der Regel, trotzdem verwandelt sie das nicht in «Sitzhasen».

Nichts soll mehr gelten, außer den immer invasiveren Gesetzen. Die eigenen Traditionen und Wurzeln sind potenziell «pfui», um andere Menschen nicht auszuschließen, aber wir mögen uns toleranterweise an die fremden Symbole und Rituale gewöhnen. Dabei ist es mir prinzipiell völlig egal, ob und wann jemand ein Fastenbrechen feiert, am Karsamstag oder jedem anderen Tag oder nie – aber bitte freiwillig.

Und vor allem: Lasst die Finger von den Kindern! In Bern setzten kürzlich Demonstranten ein Zeichen gegen die zunehmende Verbreitung woker Ideologie im Bildungssystem und forderten ein Ende der sexuellen Indoktrination von Schulkindern.

Wenn es nicht wegen des heiklen Themas Migration oder wegen des Regenbogens ist, dann wegen des Klimas. Im Rahmen der «Netto Null»-Agenda zum Kampf gegen das angeblich teuflische CO2 sollen die Menschen ihre Ernährungsgewohnheiten komplett ändern. Nach dem Willen von Produzenten synthetischer Lebensmittel, wie Bill Gates, sollen wir baldmöglichst praktisch auf Fleisch und alle Milchprodukte wie Milch und Käse verzichten. Ein lukratives Geschäftsmodell, das neben der EU aktuell auch von einem britischen Lobby-Konsortium unterstützt wird.

Sollten alle ideologischen Stricke zu reißen drohen, ist da immer noch «der Putin». Die Unions-Europäer offenbaren sich dabei ständig mehr als Vertreter der Rüstungsindustrie. Allen voran zündelt Deutschland an der Kriegslunte, angeführt von einem scheinbar todesmutigen Kanzlerkandidaten Friedrich Merz. Nach dessen erneuter Aussage, «Taurus»-Marschflugkörper an Kiew liefern zu wollen, hat Russland eindeutig klargestellt, dass man dies als direkte Kriegsbeteiligung werten würde – «mit allen sich daraus ergebenden Konsequenzen für Deutschland».

Wohltuend sind Nachrichten über Aktivitäten, die sich der allgemeinen Kriegstreiberei entgegenstellen oder diese öffentlich hinterfragen. Dazu zählt auch ein Kongress kritischer Psychologen und Psychotherapeuten, der letzte Woche in Berlin stattfand. Die vielen Vorträge im Kontext von «Krieg und Frieden» deckten ein breites Themenspektrum ab, darunter Friedensarbeit oder die Notwendigkeit einer «Pädagogik der Kriegsuntüchtigkeit».

Der heutige «stille Freitag», an dem Christen des Leidens und Sterbens von Jesus gedenken, ist vielleicht unabhängig von jeder religiösen oder spirituellen Prägung eine passende Einladung zur Reflexion. In der Ruhe liegt die Kraft. In diesem Sinne wünsche ich Ihnen frohe Ostertage!

[Titelbild: Pixabay]

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ ec42c765:328c0600

2025-02-05 23:38:12

@ ec42c765:328c0600

2025-02-05 23:38:12カスタム絵文字とは

任意のオリジナル画像を絵文字のように文中に挿入できる機能です。

また、リアクション(Twitterの いいね のような機能)にもカスタム絵文字を使えます。

カスタム絵文字の対応状況(2025/02/06)

カスタム絵文字を使うためにはカスタム絵文字に対応したクライアントを使う必要があります。

※表は一例です。クライアントは他にもたくさんあります。

使っているクライアントが対応していない場合は、クライアントを変更する、対応するまで待つ、開発者に要望を送る(または自分で実装する)などしましょう。

対応クライアント

ここではnostterを使って説明していきます。

準備

カスタム絵文字を使うための準備です。

- Nostrエクステンション(NIP-07)を導入する

- 使いたいカスタム絵文字をリストに登録する

Nostrエクステンション(NIP-07)を導入する

Nostrエクステンションは使いたいカスタム絵文字を登録する時に必要になります。

また、環境(パソコン、iPhone、androidなど)によって導入方法が違います。

Nostrエクステンションを導入する端末は、実際にNostrを閲覧する端末と違っても構いません(リスト登録はPC、Nostr閲覧はiPhoneなど)。

Nostrエクステンション(NIP-07)の導入方法は以下のページを参照してください。

ログイン拡張機能 (NIP-07)を使ってみよう | Welcome to Nostr! ~ Nostrをはじめよう! ~

少し面倒ですが、これを導入しておくとNostr上の様々な場面で役立つのでより快適になります。

使いたいカスタム絵文字をリストに登録する

以下のサイトで行います。

右上のGet startedからNostrエクステンションでログインしてください。

例として以下のカスタム絵文字を導入してみます。

実際より絵文字が少なく表示されることがありますが、古い状態のデータを取得してしまっているためです。その場合はブラウザの更新ボタンを押してください。

- 右側のOptionsからBookmarkを選択

これでカスタム絵文字を使用するためのリストに登録できます。

カスタム絵文字を使用する

例としてブラウザから使えるクライアント nostter から使用してみます。

nostterにNostrエクステンションでログイン、もしくは秘密鍵を入れてログインしてください。

文章中に使用

- 投稿ボタンを押して投稿ウィンドウを表示

- 顔😀のボタンを押し、絵文字ウィンドウを表示

- *タブを押し、カスタム絵文字一覧を表示

- カスタム絵文字を選択

- : 記号に挟まれたアルファベットのショートコードとして挿入される

この状態で投稿するとカスタム絵文字として表示されます。

カスタム絵文字対応クライアントを使っている他ユーザーにもカスタム絵文字として表示されます。

対応していないクライアントの場合、ショートコードのまま表示されます。

ショートコードを直接入力することでカスタム絵文字の候補が表示されるのでそこから選択することもできます。

リアクションに使用

- 任意の投稿の顔😀のボタンを押し、絵文字ウィンドウを表示

- *タブを押し、カスタム絵文字一覧を表示

- カスタム絵文字を選択

カスタム絵文字リアクションを送ることができます。

カスタム絵文字を探す

先述したemojitoからカスタム絵文字を探せます。

例えば任意のユーザーのページ emojito ロクヨウ から探したり、 emojito Browse all からnostr全体で最近作成、更新された絵文字を見たりできます。

また、以下のリンクは日本語圏ユーザーが作ったカスタム絵文字を集めたリストです(2025/02/06)

※漏れがあるかもしれません

各絵文字セットにあるOpen in emojitoのリンクからemojitoに飛び、使用リストに追加できます。

以上です。

次:Nostrのカスタム絵文字の作り方

Yakihonneリンク Nostrのカスタム絵文字の作り方

Nostrリンク nostr:naddr1qqxnzdesxuunzv358ycrgveeqgswcsk8v4qck0deepdtluag3a9rh0jh2d0wh0w9g53qg8a9x2xqvqqrqsqqqa28r5psx3

仕様

-

@ c631e267:c2b78d3e

2025-04-04 18:47:27

@ c631e267:c2b78d3e

2025-04-04 18:47:27Zwei mal drei macht vier, \ widewidewitt und drei macht neune, \ ich mach mir die Welt, \ widewide wie sie mir gefällt. \ Pippi Langstrumpf

Egal, ob Koalitionsverhandlungen oder politischer Alltag: Die Kontroversen zwischen theoretisch verschiedenen Parteien verschwinden, wenn es um den Kampf gegen politische Gegner mit Rückenwind geht. Wer den Alteingesessenen die Pfründe ernsthaft streitig machen könnte, gegen den werden nicht nur «Brandmauern» errichtet, sondern der wird notfalls auch strafrechtlich verfolgt. Doppelstandards sind dabei selbstverständlich inklusive.

In Frankreich ist diese Woche Marine Le Pen wegen der Veruntreuung von EU-Geldern von einem Gericht verurteilt worden. Als Teil der Strafe wurde sie für fünf Jahre vom passiven Wahlrecht ausgeschlossen. Obwohl das Urteil nicht rechtskräftig ist – Le Pen kann in Berufung gehen –, haben die Richter das Verbot, bei Wahlen anzutreten, mit sofortiger Wirkung verhängt. Die Vorsitzende des rechtsnationalen Rassemblement National (RN) galt als aussichtsreiche Kandidatin für die Präsidentschaftswahl 2027.

Das ist in diesem Jahr bereits der zweite gravierende Fall von Wahlbeeinflussung durch die Justiz in einem EU-Staat. In Rumänien hatte Călin Georgescu im November die erste Runde der Präsidentenwahl überraschend gewonnen. Das Ergebnis wurde später annulliert, die behauptete «russische Wahlmanipulation» konnte jedoch nicht bewiesen werden. Die Kandidatur für die Wahlwiederholung im Mai wurde Georgescu kürzlich durch das Verfassungsgericht untersagt.

Die Veruntreuung öffentlicher Gelder muss untersucht und geahndet werden, das steht außer Frage. Diese Anforderung darf nicht selektiv angewendet werden. Hingegen mussten wir in der Vergangenheit bei ungleich schwerwiegenderen Fällen von (mutmaßlichem) Missbrauch ganz andere Vorgehensweisen erleben, etwa im Fall der heutigen EZB-Chefin Christine Lagarde oder im «Pfizergate»-Skandal um die Präsidentin der EU-Kommission Ursula von der Leyen.

Wenngleich derartige Angelegenheiten formal auf einer rechtsstaatlichen Grundlage beruhen mögen, so bleibt ein bitterer Beigeschmack. Es stellt sich die Frage, ob und inwieweit die Justiz politisch instrumentalisiert wird. Dies ist umso interessanter, als die Gewaltenteilung einen essenziellen Teil jeder demokratischen Ordnung darstellt, während die Bekämpfung des politischen Gegners mit juristischen Mitteln gerade bei den am lautesten rufenden Verteidigern «unserer Demokratie» populär zu sein scheint.

Die Delegationen von CDU/CSU und SPD haben bei ihren Verhandlungen über eine Regierungskoalition genau solche Maßnahmen diskutiert. «Im Namen der Wahrheit und der Demokratie» möchte man noch härter gegen «Desinformation» vorgehen und dafür zum Beispiel den Digital Services Act der EU erweitern. Auch soll der Tatbestand der Volksverhetzung verschärft werden – und im Entzug des passiven Wahlrechts münden können. Auf europäischer Ebene würde Friedrich Merz wohl gerne Ungarn das Stimmrecht entziehen.

Der Pegel an Unzufriedenheit und Frustration wächst in großen Teilen der Bevölkerung kontinuierlich. Arroganz, Machtmissbrauch und immer abstrusere Ausreden für offensichtlich willkürliche Maßnahmen werden kaum verhindern, dass den etablierten Parteien die Unterstützung entschwindet. In Deutschland sind die Umfrageergebnisse der AfD ein guter Gradmesser dafür.

[Vorlage Titelbild: Pixabay]

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ 211c0393:e9262c4d

2025-05-25 04:00:34

@ 211c0393:e9262c4d

2025-05-25 04:00:34Original: https://www.yakihonne.com/article/naddr1qvzqqqr4gupzqgguqwf52cyve89xnxc4eh95jklelgw646kkkcdhxm4fp05jvtzdqq2hj6fhtpqkuutdv4xxxazjv9t92atedev45mcwusz

Nihon no kakuseizai Nihon no kakusei-zai bijinesu no yami: Keisatsu, bōryokudan, soshite

chinmoku no kyōhan kankei' no shinsō** 1. Bōryokudan no shihai kōzō (kōteki dēta ni motodzuku) yunyū izon no riyū: Kokunai seizō wa kon'nan (Heisei 6-nenkakusei-zai genryō kisei-hō' de kisei kyōka)→ myanmā Chūgoku kara no mitsuyu ga shuryū (Kokuren yakubutsu hanzai jimushoWorld Drug Report 2023'). Bōryokudan no rieki-ritsu: 1 Kg-atari shiire kakaku 30 man-en → kouri kakaku 500 man ~ 1000 man-en (Keisatsuchōyakubutsu jōsei hōkoku-sho' 2022-nen). 2. Keisatsu to bōryokudan nokyōsei kankei' taiho tōkei no fushizen-sa: Zen yakubutsu taiho-sha no 70-pāsento ga tanjun shoji (kōsei Rōdōshōyakubutsu ran'yō jōkyō' 2023-nen). Mitsuyu soshiki no tekihatsu wa zentai no 5-pāsento-miman (tōkyōchikentokusōbu dēta). Media no kenshō: NHK supesharukakusei-zai sensō'(2021-nen) de shiteki sa retamattan yūzā yūsen sōsa' no jittai. 3. Mujun suru genjitsu juyō no fukashi-sei: G 7 de saikō no kakusei-zai kakaku (1 g-atari 3 ~ 7 man-en, Ō kome no 3-bai)→ bōryokudan no bōri (Zaimushōsoshiki hanzai shikin ryūdō chōsa'). Shiyōsha-ritsu wa hikui (jinkō no 0. 2%, Kokuren chōsa) ga, taiho-sha no kahansū o shimeru mujun. 4.Mitsuyu soshiki taisaku' no genkai kokusai-tekina shippai rei: Mekishiko (karuteru tekihatsu-go mo ichiba kakudai), Ōshū (gōsei yakubutsu no man'en)→ daitai soshiki ga sokuza ni taitō (Eiekonomisuto' 2023-nen 6 tsuki-gō). Nippon'nochiri-teki hande: Kaijō mitsuyu no tekihatsu-ritsu wa 10-pāsento-miman (Kaijōhoanchō hōkoku). 5. Kaiketsusaku no saikō (jijitsu ni motodzuku teian) ADHD chiryō-yaku no gōhō-ka: Amerika seishin'igakukaiADHD kanja no 60-pāsento ga jiko chiryō de ihō yakubutsu shiyō'(2019-nen kenkyū). Nihonde wa ritarin aderōru kinshi → bōryokudan no ichiba dokusen. Rōdō kankyō kaikaku: Karō-shi rain koe no rōdō-sha 20-pāsento (Kōrōshōrōdō jikan chōsa' 2023-nen)→ kakusei-zai juyō no ichiin. 6. Kokuhatsu no risuku to jōhō-gen tokumei-sei no jūyō-sei: Kako no bōryokudan hōfuku jirei (2018-nen, kokuhatsu kisha e no kyōhaku jiken Mainichishinbun hōdō). Kōteki dēta nomi in'yō: Rei:Keisatsuchō tōkei'Kokuren hōkoku-sho' nado daisansha kenshō kanōna jōhō. Ketsuron: Henkaku no tame ni wajijitsu' no kajika ga hitsuyō `yakubutsu = kojin no dōtokuteki mondai' to iu gensō ga, bōryokudan to fuhai kanryō o ri shite iru. Kokusai dēta to kokunai tōkei no mujun o tsuku koto de, shisutemu no giman o abakeru. Anzen'na kyōyū no tame ni: Kojin tokutei o sake, tokumei purattofōmu (tōa-jō fōramu-tō) de giron. Kōteki kikan no dēta o chokusetsu rinku (rei: Keisatsuchō PDF repōto). Kono bunsho wa, kōhyō sa reta tōkei media hōdō nomi o konkyo to shi, kojin no suisoku o haijo shite imasu. Kyōi o yokeru tame, gutaitekina kojin soshiki no hinan wa itotekini sakete imasu. Show more 1,321 / 5,000 Stimulants in Japan The dark side of the Japanese stimulant drug business:The truth about the police, the yakuza, and their "silent complicity"**

- The control structure of the yakuza (based on public data)

Reasons for dependence on imports: Domestic production is difficult (tightened regulations under the Stimulant Drug Raw Materials Control Act of 1994) → Smuggling from Myanmar and China is the norm (UNODC World Drug Report 2023).

Profit margins for yakuza: Purchase price of 300,000 yen per kg → Retail price of 5 to 10 million yen (National Police Agency Drug Situation Report 2022).

- The "symbiotic relationship" between the police and the yakuza

The unnaturalness of arrest statistics: 70% of all drug arrests are for simple possession (Ministry of Health, Labor and Welfare Drug Abuse Situation 2023). Smuggling organizations account for less than 5% of all arrests (Tokyo District Public Prosecutors Office Special Investigation Unit data). Media verification: The reality of "end-user priority investigation" pointed out in the NHK special "Stimulant War" (2021).

- Contradictory reality

Invisibility of demand: The highest stimulant drug price in the G7 (30,000 to 70,000 yen per gram, three times that of Europe and the United States) → Excessive profits by organized crime (Ministry of Finance "Survey on Organized Crime Fund Flows"). The contradiction that the user rate is low (0.2% of the population, UN survey), but accounts for the majority of arrests.

- The limits of "countermeasures against smuggling organizations"