-

@ 63d59db8:be170f6f

2025-05-23 12:53:00

@ 63d59db8:be170f6f

2025-05-23 12:53:00In a world overwhelmed by contradictions—climate change, inequality, political instability, and social disconnection—absurdity becomes an unavoidable lens through which to view the human condition. Inspired by Albert Camus' philosophy, this project explores the tension between life’s inherent meaninglessness and our persistent search for purpose.\ \ The individuals in these images embody a quiet defiance, navigating chaos with a sense of irony and authenticity. Through the act of revolt—against despair, against resignation—they find agency and resilience. These photographs invite reflection, not on solutions, but on our capacity to live meaningfully within absurdity.

Visit Katerina's website here.

Submit your work to the NOICE Visual Expression Awards for a chance to win a few thousand extra sats:

-

@ bf47c19e:c3d2573b

2025-05-24 16:29:55

@ bf47c19e:c3d2573b

2025-05-24 16:29:55Originalni tekst na bitcoin-balkan.com.

Pregled sadržaja

- Šta je Bitcoin?

- Šta Bitcoin može da učini za vas?

- Zašto ljudi kupuju Bitcoin?

- Da li je vaš novac siguran u dolarima, kućama, akcijama ili zlatu?

- Šta je bolje za štednju od dolara, kuća i akcija?

- Po čemu se Bitcoin razlikuje od ostalih valuta?

- kako Bitcoin spašava svet?

- Kako mogu da saznam više o Bitcoin-u?

Bitcoin čini da štednja novca bude kul – i praktična – ponovo. Ovaj članak objašnjava kako i zašto.

Šta je Bitcoin?

Bitcoin se naziva digitalno zlato, mašina za istinu, blockchain, peer to peer mreža čvorova, energetski ponor i još mnogo toga. Bitcoin je, u stvari, sve ovo. Međutim, ova objašnjenja su često toliko tehnička i suvoparna, da bi većina ljudi radije gledala kako trava raste. Što je najvažnije, ova objašnjenja ne pokazuju kako Bitcoin ima bilo kakve koristi za vas.

iPod nije postao kulturološka senzacija jer ga je Apple nazvao „prenosnim digitalnim medijskim uređajem“. Postao je senzacija jer su ga zvali “1,000 pesama u vašem džepu.”

Ne zanima vas šta je Bitcoin. Vas zanima šta on može da učini za vas.

Baš kao i Internet, vaš auto, vaš telefon, kao i mnogi drugi uređaji i sistemi koje svakodnevno koristite, vi ne treba da znate šta je Bitcoin ili kako to funkcioniše da biste razumeli šta on može da učini za vas.

Šta Bitcoin može da učini za vas?

Bitcoin može da sačuva vaš teško zarađeni novac.

Bitcoin je stekao veliku pažnju u 2017. i 2018. godini zbog svoje spekulativne upotrebe. Mnogi ljudi su ga kupili nadajući se da će se obogatiti. Cena je naglo porasla, a zatim se srušila. Ovo nije bio prvi put da je Bitcoin uradio to. Međutim, niko nikada nije izgubio novac držeći bitcoin duže od 3,5 godine – ćak i ako je kupio na apsolutnim vrhovima.

Zašto Bitcoin konstantno raste? Ljudi počinju da shvataju koliko je Bitcoin moćan, kao način uštede novca u svetu u kojem je ’novac’ poput dolara, eura i drugih nacionalnih valuta dizajniran da gubi vrednost.

Ovo čini Bitcoin odličnom opcijom za štednju novca na nekoliko godina ili više. Bitcoin je bolji od štednje novca u dolarima, akcijama, nekretninama, pa čak i u zlatu.

Zato pokušajte da zaboravite na trenutak na razumevanje blockchaina, digitalne valute, kriptografije, seed fraza, novčanika, rudarstva i svih ostalih nerazumljivih termina. Za sada, razgovarajmo o tome zašto ljudi kupuju Bitcoin: razlog je prostiji nego što vi mislite.

Zašto ljudi kupuju Bitcoin?

Naravno, svako ima svoj razlog za kupovinu Bitcoin-a. Jedan od razloga, koji verovatno često čujete, je taj što mu vrednost raste. Ljudi žele da se obogate. Uskoče kao spekulanti, krenu u vožnju i najverovatnije ih prodaju ubrzo nakon kupovine.

Međutim, čak i kada cena krene naglo prema gore i strmoglavo padne nazad, mnogi ljudi ostanu i nakon tog pada. Otkud mi to znamo? Broj aktivnih novčanika dnevno, koji je otprilike sličan broju korisnika Bitcoin-a, nastavlja da raste. Takođe, nakon svakog balona u istoriji Bitcoin-a, cena se nikada ne vraća na svoju cenu pre balona. Uvek ostane malo višlja. Bitcoin se penje, a svaka masovna spekulativna serija dovodi sve više i više ljudi.

Broj aktivnih Bitcoin novčanika neprekidno raste

„Aktivna adresa“ znači da je neko tog dana poslao Bitcoin transakciju. Donji grafikon je na logaritamskoj skali.

Izvor: Glassnode

Izvor: GlassnodeCena Bitcoina se neprestano penje

Kroz istoriju Bitcoin-a možemo videti divlje kolebanje cena, ali nakon svakog balona, cena se ostaje višlja nego pre. Ovo je cena Bitcoin-a na logaritamskoj skali.

Izvor: Glassnode

Izvor: GlassnodeTo pokazuje da se ljudi zadržavaju: potražnja za Bitcoin-om se povećava. Da je svaki masovni rast cena bio samo balon koji su iscenirali prevaranti koji žele brzo da se obogate, cena bi se vratila na nivo pre balona. To se dogodilo sa lalama, ali ne i sa Bitcoin-om.

I zašto se onda cena Bitcoin-a stalno povećava? Sve veći broj ljudi čuva Bitcoin dugoročno – oni razumeju šta Bitcoin može učiniti za njihovu štednju.

Zašto ljudi štede svoj novac u Bitcoin-u umesto na štednim računima, kućama, deonicama ili zlatu? Hajde da pogledajmo sve te metode štednje, i zatim da ih uporedimo sa Bitcoin-om.

Da li je vaš novac siguran u dolarima, kućama, akcijama ili zlatu?

Tokom mnogo godina, to su bile pristojne opcije za štednju. Međutim, sistem koji podržava vrednost svega ovoga je u krizi.

Dolari, Euri, Dinari

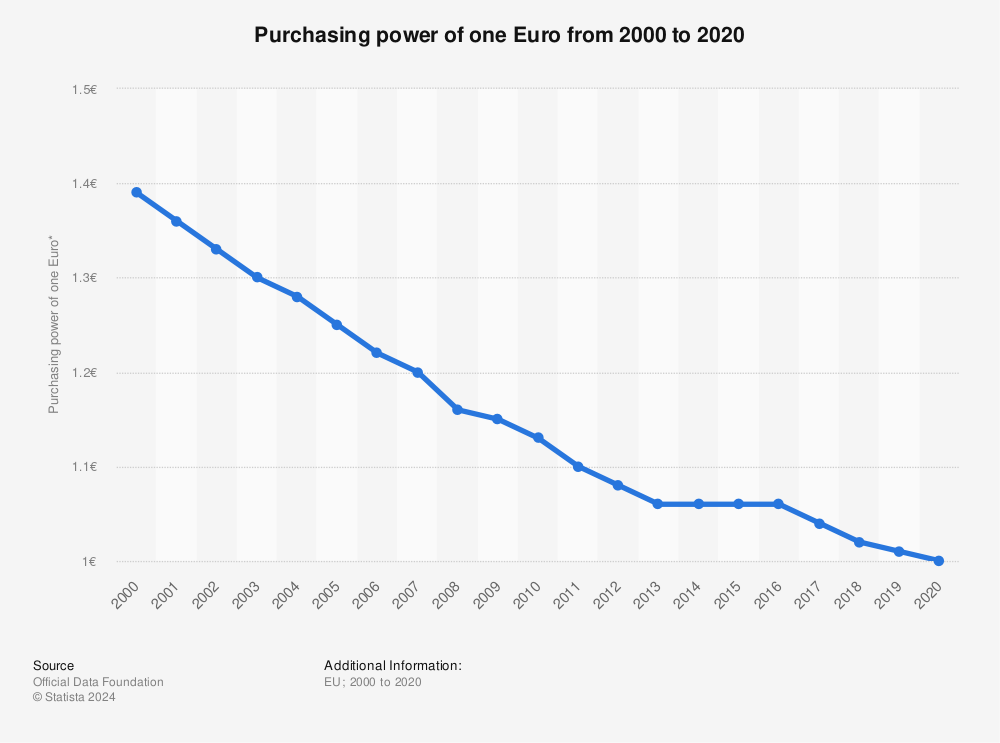

Dolari i sve ostale „tradicionalne“ valute koje proizvode vlade, stvorene su da izgube vrednost kroz inflaciju. Banke i tradicionalni monetarni sistem uzrokuju inflaciju stalnim stvaranjem i distribucijom novog novca. Kada Američke Federalne Rezerve objave ciljanu stopu od 2% inflacije, to znači da žele da vaš novac svake godine izgubi 2% od svoje vrednosti. Čak i sa inflacijom od samo 2%, vaša štednja u dolarima izgubiće polovinu vrednosti tokom 40-godišnjeg radnog veka.

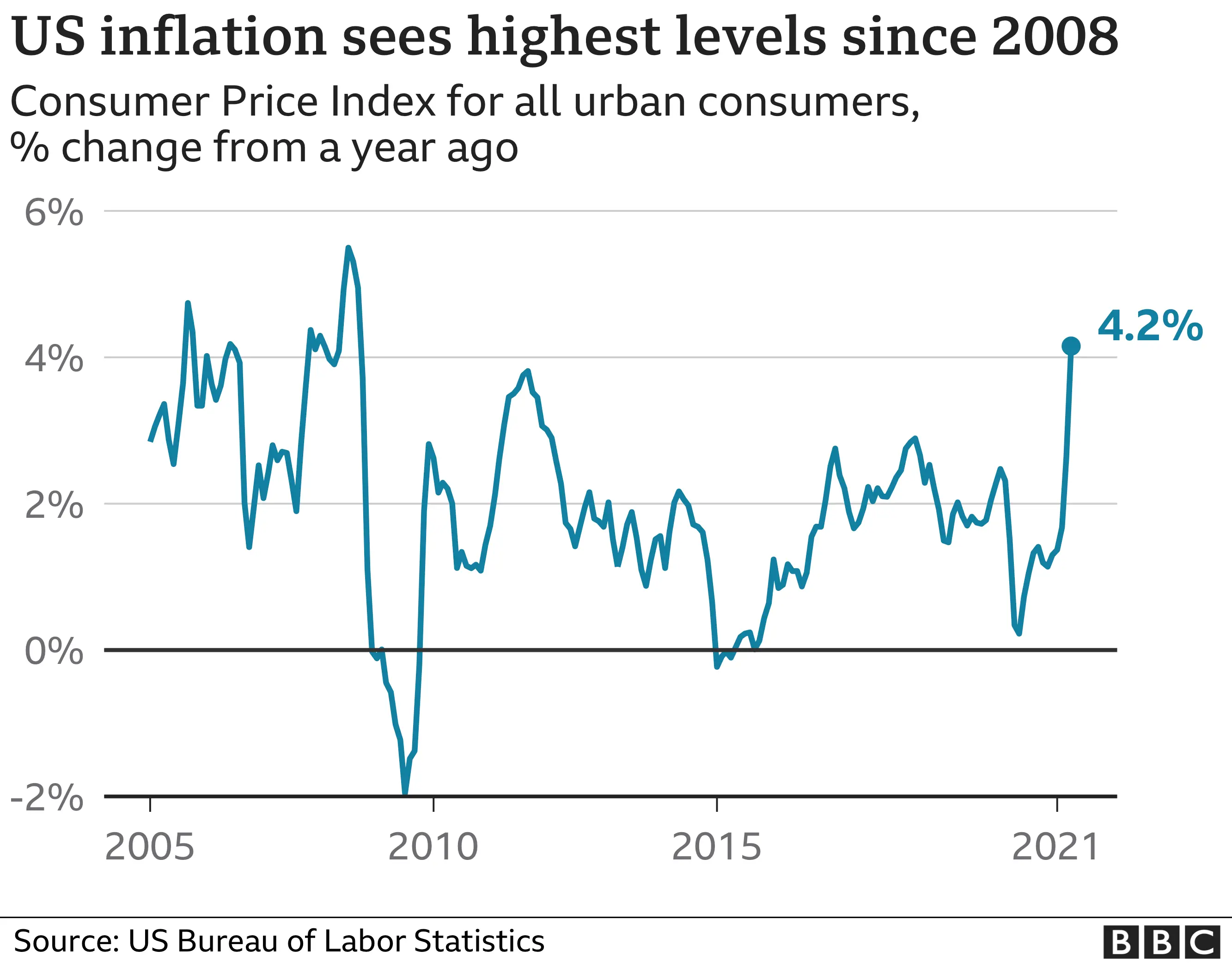

Izveštena inflacija se danas opasno povečava, uprkos rastućem „buretu sa barutom“ koji bi mogao da explodira i dovede do masivne hiperinflacije. Što je više valute u opticaju, to je više baruta u buretu.

Naše vlade su ekonomiju napunile valutama da bankarski sistem ne bi propao nakon finansijske krize koja se dogodila 2008. godine. Od tada je većina glavnih centralnih banaka postavila vrlo niske kamatne stope, što pojedincima i korporacijama omogućava dobijanje jeftinijih kredita. To znači da mnogi pojedinci i korporacije podižu ogromne kredite i koriste ih za kupovinu druge imovine poput deonica, umetničkih dela i nekretnina. Sve ovo pozajmljivanje znači da stvaramo tone novog novca i stavljamo ga u opticaj.

Računi za podsticaje (stimulus bills) COVID-19 za 2020. godinu unose trilione u sistem. Ovoliko stvaranje valuta na kraju dovodi do inflacije – velikog gubitka u vrednosti valute.

Količina američkog dolara u opticaju gotovo se udvostručila od marta 2020. godine. Izvor

Količina američkog dolara u opticaju gotovo se udvostručila od marta 2020. godine. IzvorRačuni za podsticaje su bez presedana, toliko da je neko izmislio meme da opiše ovu situaciju.

Resurs koji vlade mogu da naprave u većem broju da bi platile svoje račune? Ne zvuči kao dobro mesto za štednju novca.

Kuće

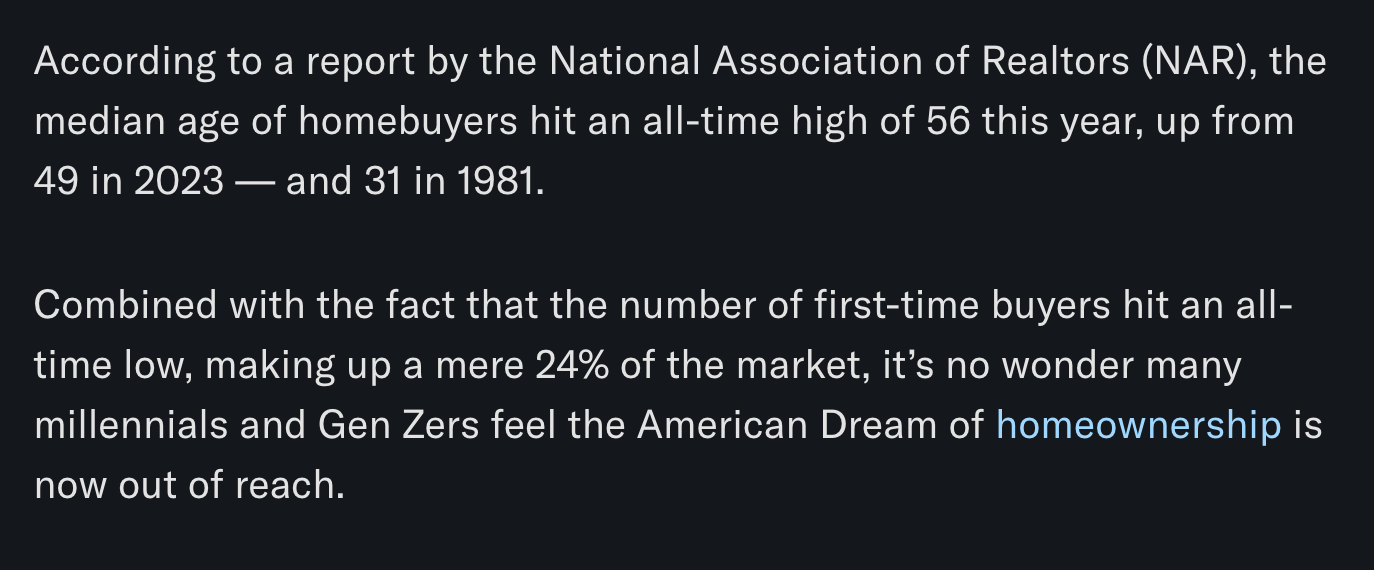

Kuće su tokom prošlog veka bile pristojan način štednje novca. Međutim, pad cena nekretnina 2007. godine doveo je do toga da su mnogi vlasnici kuća izgubili svu ušteđevinu.

Danas su kuće gotovo nepristupačne za prosečnog čoveka. Jedan od načina da se ovo izmeri je koliko godišnjih zarada treba prosečnom čoveku da zaradi ekvivalent vrednosti prosečne kuće. Prema CityLab-u, publikaciji Bloomberg-a koja pokriva gradove, porodica može da priuštiti određenu kuću ako košta manje od 2,6 godišnjih prihoda domaćinstva te porodice.

Međutim, prema RZS (Republički zavod za statistiku) prosečan prihod porodičnog domaćinstva u Srbiji iznosi oko 570 EUR mesečno ili otprilike 7.000 EUR godišnje. Nažalost, samo najjeftinija područja van gradova imaju srednje cene kuća od oko 2,6 prosečnih godišnjih prihoda domaćinstva. U većim gradovima poput Beograda i Novog Sada srednja cena kuće je veća od 10 prosečnih godišnjih prihoda jednog domaćinstva.

Ako nekako možete sebi da priuštite kuću, ona bi mogla biti pristojna zaliha vrednosti. Dokle god ne doživimo još jedan krah i izvršitelji zaplene ovu imovinu mnogim vlasnicima kuća.

Akcije

Berza je u prošlosti takođe dobro poslovala. Međutim, sporo i stabilno povećanje tržišta događa se u dosadnom, predvidljivom svetu. Svakog dana vidimo sve manje toga. Nakon ubrzanja korona virusa, videli smo smo najbrži pad američke berze u istoriji od 25% – brži od Velike depresije.

Neki se odlučuju za ulaganje u obveznice i drugu finansijsku imovinu, ali ’prinosi’ za tu imovinu – procenat kamate zarađene na imovinu iz godine u godinu – stalno opada. Sve veći broj odredjenih imovina ima čak i negativne prinose, što znači da posedovanje te imovine košta! Ovo je veliki problem za sve koji se oslanjaju na penziju. Plus, s obzirom na to da su akcije denominovane u tradicionalnim valutama poput dolara i evra, inflacija pojede prinos koji investitor dobije.

Najgore od svega je to što ti isti ekonomski krahovi koji uzrokuju masovna otpuštanja i teško tržište rada takođe znače i nagli pad cena akcija. Čuvanje ušteđevine u akcijama može značiti i gubitak štednje i gubitak posla zbog recesije. Teška vremena mogu da vas prisile da svoje akcije prodate po vrlo malim cenama samo da biste platili svoje račune.

A to nije baš siguran način štednje novca.

Zlato

Vrednost zlata neprekidno se povećavala tokom 5000 godina, obično padajući onda kada berza obećava jače prinose.

Evidencija vrednosti zlata je solidna. Međutim, zlato nosi i druge rizike. Većina ljudi poseduje zlato na papiru. Oni fizički ne poseduju zlato, već ga njihova banka čuva za njih. Zbog toga je zlato veoma podložno konfiskaciji od strane vlade.

Zašto bi vlada konfiskovala nečije zlato, a kamoli u demokratskoj zemlji u „slobodnom svetu“? Ali to se dešavalo i ranije. 1933. godine Izvršnom Naredbom 6102, predsednik Roosevelt naredio je svim Amerikancima da prodaju svoje zlato vladi u zamenu za papirne dolare. Vlada je iskoristila pretnju zatvorom za prikupljanje zlata u fizičkom obliku. Znali su da se zlato više poštuje kao zaliha vrednosti širom sveta od papirnih dolara.

Ako posedujete svoje zlato na nekoj od aplikacija za trgovanje akcijama, možete se kladiti da će vam ga država oduzeti ako joj zatreba. Čak i ako posedujete fizičko zlato, onda ga izlažete mogućnosti krađe – od strane kriminalca ili vaše vlade.

Vaša uštedjevina nije bezbedna.

Rast cena svih gore navedenih sredstava zavisi od našeg trenutnog političkog i ekonomskog sistema koji se nastavlja kao i tokom proteklih 100 godina. Međutim, danas vidimo ogromne pukotine u ovom sistemu.

Sistem ne funkcioniše dobro za većinu ljudi.

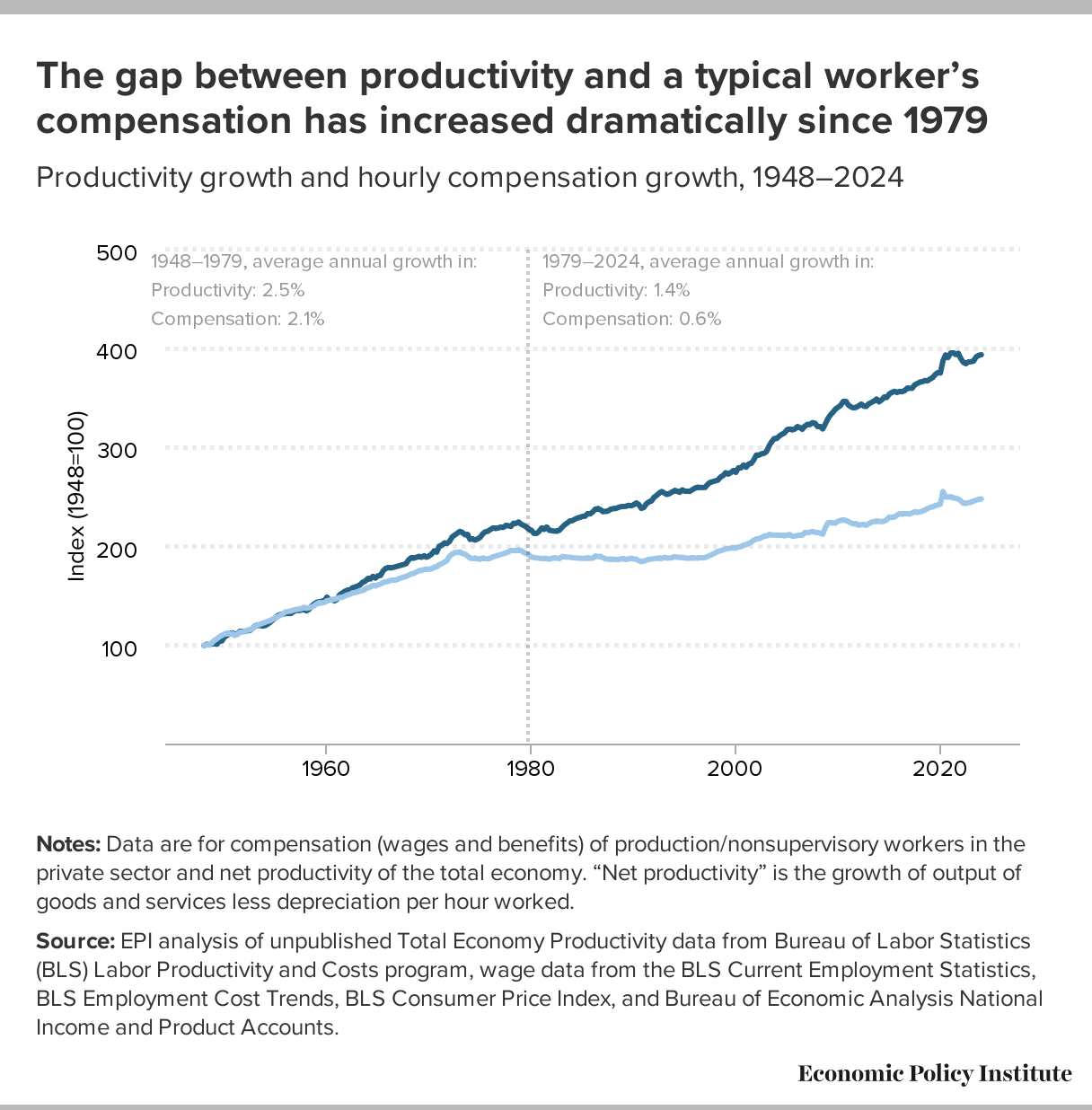

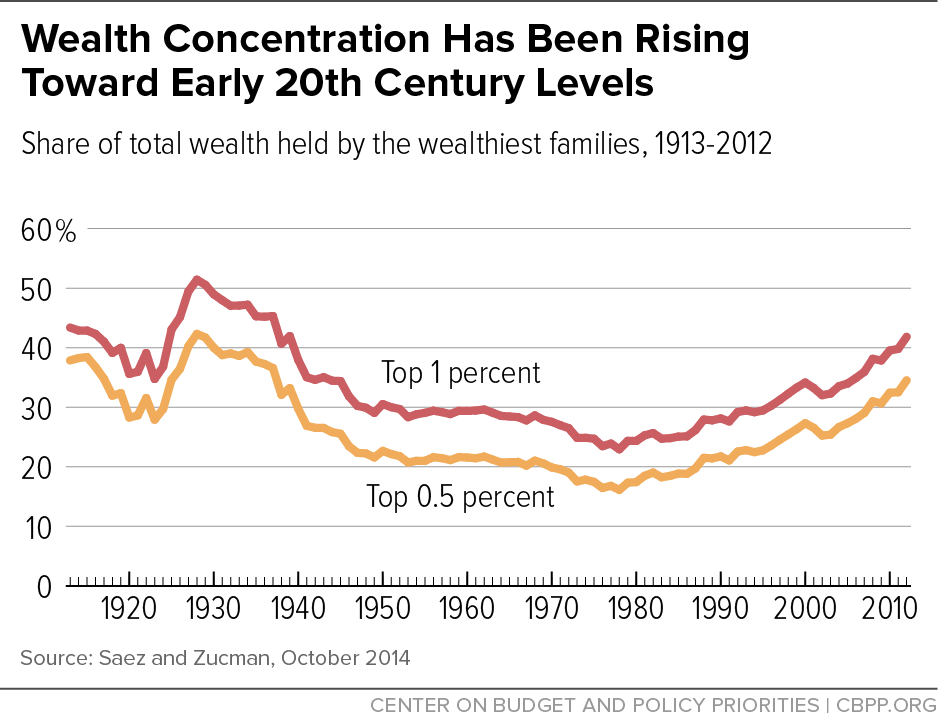

Od 1971. plate većine američkih radnika nisu rasle. S druge strane, bogatstvo koje imaju najbogatiji u društvu nalazi se na nivoima koji nisu viđeni više od 80 godina. U međuvremenu, ljudi sve manje i manje veruju institucijama poput banaka i vlada.

CBPP Nejednakost Bogatstva Tokom Vremena

CBPP Nejednakost Bogatstva Tokom VremenaŠirom sveta možemo videti dokaze o slamanju sistema kroz politički ekstremizam: izbor Trampa i drugih ekstremističkih desničarskih kandidata, Bregzit, pokret Occupy, popularizacija koncepta univerzalnog osnovnog dohotka, povratak pojma „socijalizam“ nazad u modu. Ljudi na svim delovima političkog i društvenog spektra osećaju problematična vremena i posežu za sve radikalnijim rešenjima.

Šta je bolje za štednju od dolara, kuća i akcija?

Pa kako ljudi mogu da štede novac u ovim teškim vremenima? Ili ne koriste tradicionalne valute, ili kupuju sredstva koja će zadržati vrednost u teškim vremenima.

Bitcoin ima najviše potencijala da zadrži vrednost kroz politička i ekonomska previranja od bilo koje druge imovine. Na tom putu će biti rupa na kojima će se rušiti ili pumpati, međutim, njegova svojstva čine ga takvim da će verovatno preživeti previranja kada druga imovina ne bude to mogla.

Šta Bitcoin čini drugačijim?

Bitcoini su retki.

Proces ‘rudarenja’ bitcoin-a, proizvodnju bitcoin-a čini veoma skupom, a Bitcoin protokol ograničava ukupan broj bitcoin-a na 21 milion novčića. To čini Bitcoin imunim na nagle poraste ponude. Ovo se veoma razlikuje od tradicionalnih valuta, koje vlade mogu da štampaju sve više kad god one to požele. Zapamtite, povećanje ponude vrši veliki pritisak na vrednost valute.

Bitcoini nemaju drugu ugovornu stranu.

Bitcoin se takođe razlikuje od imovine kao što su obveznice, akcije i kuće, jer mu nedostaje druga ugovorna strana. Druge ugovorne strane su drugi subjekti uključeni u vrednost sredstva, koji to sredstvo mogu obezvrediti ili vam ga uzeti. Ako imate hipoteku na svojoj kući, banka je druga ugovorna strana. Kada sledeći put dođe do velikog finansijskog kraha, banka vam može oduzeti kuću. Kompanije su kvazi-ugovorne strane akcijama i obveznicama, jer mogu da počnu da donose loše odluke koje utiču na njihovu cenu akcija ili na „neizvršenje“ duga (da ga ne vraćaju vama ili drugim poveriocima). Bitcoin nema ovih problema.

Bitcoin je pristupačan.

Svako sa 5 eura i mobilnim telefonom može da kupi i poseduje mali deo bitcoin-a. Važno je da znate da ne morate da kupite ceo bitcoin. Bitcoin-i su deljivi do 100-milionite jedinice, tako da možete da kupite Bitcoin u vrednosti od samo nekoliko eura. Neuporedivo lakše nego kupovina kuće, zlata ili akcija!

Bitcoin se ne može konfiskovati.

Banke drže većinu vaših eura, zlata i akcija za vas. Većina ljudi u razvijenom svetu veruje bankama, jer većina ljudi koji žive u današnje vreme nikada nije doživela konfiskaciju imovine ili ’šišanje’ od strane banaka ili vlada. Nažalost, postoji presedan za konfiskaciju imovine čak i u demokratskim zemljama sa snažnom vladavinom prava.

Kada vlada konfiskuje imovinu, ona obično ubedi javnost da će je menjati za imovinu jednake vrednosti. U SAD-u 1930-ih, vlada je davala dolare vlasnicima zlata. Vlada je znala da uvek može da odštampa još više dolara, ali da ne može da napravi više zlata. Na Kipru 2012. godine, jedna propala banka je svojim klijentima dala deonice banke da pokrije dolare klijenata koje je banka trebala da ima. I dolari i deonice su strmoglavo opali u odnosu na imovinu koja je uzeta od ovih ljudi.

Doći do bitcoin-a koji ljudi poseduju, biće mnogo teže jer se bitcoin-i mogu čuvati u novčaniku koji ne poseduje neka treća strana, a vi možete čak i da zapamtite privatne ključeve do vašeg bitcoin-a u glavi.

Bitcoin je za štednju.

Bitcoin se polako pokazuje kao najbolja opcija za dugoročnu štednju novca, posebno s obzirom na današnju ekonomsku klimu. Posedovanje čak i malog dela, je polisa osiguranja koja se isplati ako svet i dalje nastavi da ludi. Cena Bitcoin-a u dolarima može divlje da varira u roku od godinu ili dve, ali tokom 3+ godine skoro svi vide slične ili više cene od trenutka kada su ga kupili. U stvari, doslovno niko nije izgubio novac čuvajući Bitcoin duže od 3,5 godine – čak i ako je kupio BTC na apsolutnim vrhovima tržišta.

Imajte na umu da nakon ove tačke ti ljudi više nikada nisu videli rizik od gubitka. Cena se nikada nije smanjila niže od najviše cene u prethodnom ciklusu.

Po čemu se Bitcoin razlikuje od ostalih valuta?

Bitcoin funkcioniše tako dobro kao način štednje zbog svog neobičnog dizajna, koji ga čini drugačijim od bilo kog drugog oblika novca koji je postojao pre njega. Bitcoin je digitalna valuta, prvi i verovatno jedini primer valute koja ima ograničenu ponudu dok radi na otvorenom, decentralizovanom sistemu. Vlade strogo kontrolišu valute koje danas koristimo, poput dolara i eura, i proizvode ih za finansiranje ratova i dugova. Korisnici Bitcoin-a – poput vas – kontrolišu Bitcoin protokol.

Evo šta Bitcoin razlikuje od dolara, eura i drugih valuta:

Bitcoin je otvoren sistem.

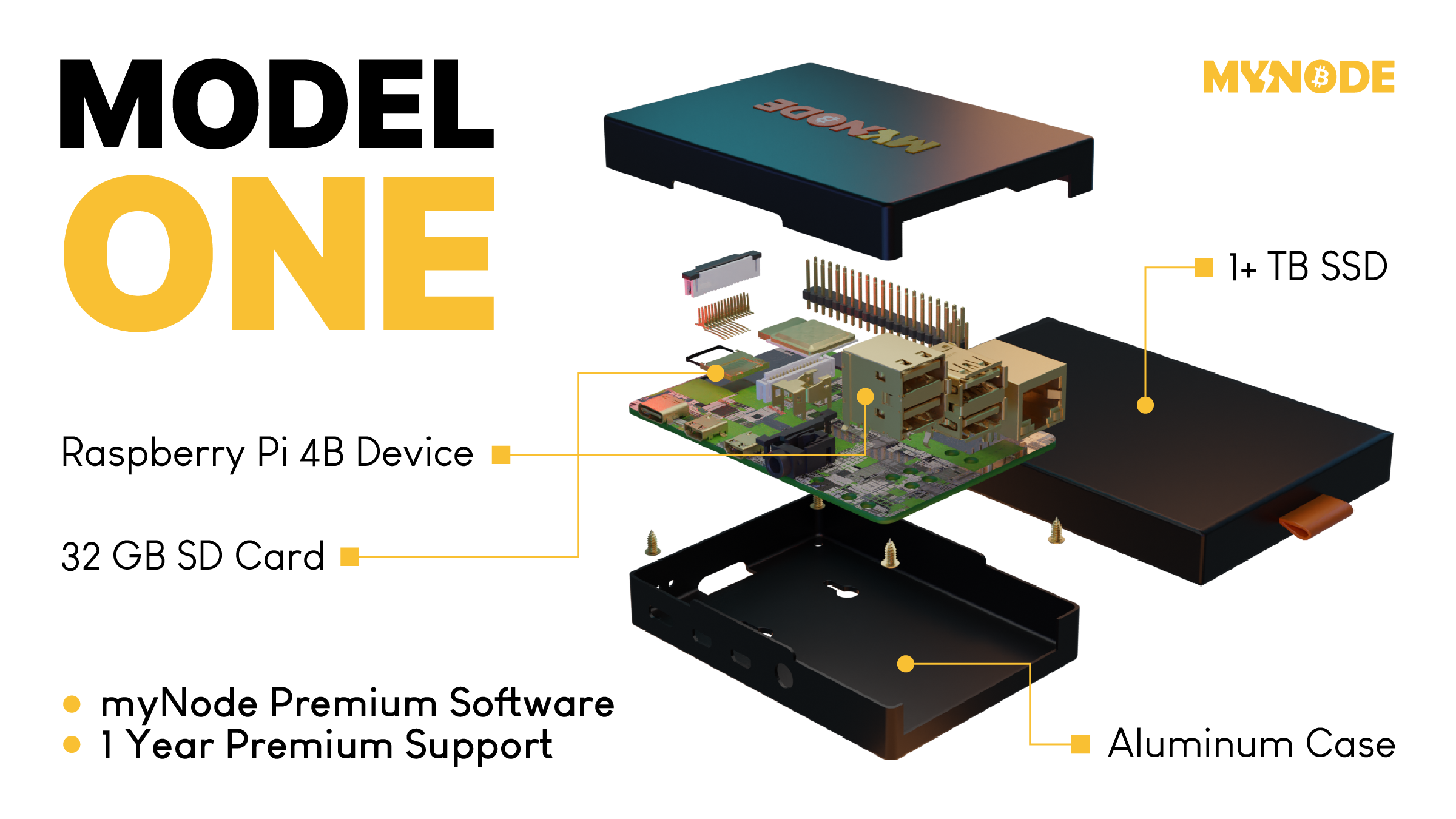

Svako može da odluči da se pridruži Bitcoin mreži i primeni pravila softverskog protokola, što je dovelo do vrlo decentralizovanog sistema u kojem nijedan pojedinac ili entitet ne može da blokira transakciju, zamrzne sredstva ili da ukrade od druge osobe.Današnji savremeni bankarski sistem se uveliko razlikuje. Nekoliko banaka je dobilo poverenje da gotovo sve valute, akcije i druge vredne predmete čuvaju na “sigurnom” za svoje klijente. Da biste postali banka, potrebni su vam milioni dolara i neverovatne količine političkog uticaja. Da biste pokrenuli Bitcoin čvor i postali „svoja banka“, potrebno vam je nekoliko stotina dolara i jedno slobodno popodne.

Tako izgleda Bitcoin čvor – Node

MyNode čvor vam omogućava da postanete svoja banka za samo nekoliko minuta.

Tako izgleda Bitcoin čvor – Node

MyNode čvor vam omogućava da postanete svoja banka za samo nekoliko minuta.Bitcoin ima ograničenu ponudu.

Softverski protokol otvorenog koda koji upravlja Bitcoin sistemom ograničava broj novih bitcoin-a koji se mogu stvoriti tokom vremena, sa ograničenjem od ukupno 21.000.000 bitcoin-a. S druge strane, valute koje danas koristimo imaju neograničenu ponudu. Istorija i sadašnje odluke centralnih banaka govore nam da će vlade uvek štampati sve više i više valuta, sve dok valuta ne bude bezvredna. Sve ovo štampanje uzrokuje inflaciju, što pravi štetu običnim radnim ljudima i štedišama.

Tradicionalne valute su dizajnirane tako da opadaju vremenom. Svaki put kada centralna banka kaže da cilja određenu stopu inflacije, oni ustvari kažu da žele da vaš novac svake godine izgubi određeni procenat svoje vrednosti.

Bitcoin-ova ograničena ponuda znači da je on tako dizajniran da raste vremenom kako se potražnja za njim povećava.

Bitcoin putuje oko sveta za nekoliko minuta.

Svako može da pošalje bitcoin-e za nekoliko minuta širom sveta, bez obzira na granice, banke i vlade. Potrebno je manje od minuta da se transakcija pojavi na novčaniku primaoca i oko 60 minuta da se transakcija u potpunosti „obračuna“, tako da primaoc može da bude siguran da su primljeni bitcoin-i sada njegovi (6 konfirmacija bloka). Slanje drugih valuta širom sveta traje danima ili čak mesecima ako se šalju milionski iznosi, a podrazumeva i visoke naknade.

Neke vlade i novinari tvrde da ova sloboda putovanja koju pruža Bitcoin pomaže kriminalcima i teroristima. Međutim, transakciju Bitcoin-a je lakše pratiti nego većinu transakcija u dolarima ili eurima.

Bitcoin se može čuvati na “USB-u”.

Dizajn Bitcoin-a je takav da vam treba samo da čuvate privatni ključ do svojih ‘bitcoin’ adresa (poput lozinke do bankovnih računa) da biste pristupili svojim bitcoin-ima odakle god poželite. Ovaj privatni ključ možete da sačuvate na disku ili na papiru u obliku 12 ili 24 reči na engleskom jeziku. Kao rezultat toga, možete da držite Bitcoin-e vredne milione dolara u svojoj šaci.

Sve ostale valute danas možete ili da strpate u svoj dušek ili da ih poverite banci na čuvanje. Za većinu ljudi koji žive u razvijenom svetu, i koji ne osporavaju autoritet i poverenje u banku, ovo deluje sasvim dobro. Međutim, oni kojima je potrebno da pobegnu od ugnjetavačke vlade ili koji naljute pogrešne ljude, ne mogu verovati bankama. Za njih je sposobnost da nose svoju ušteđevinu bez potrebe za ogromnim koferom neprocenjiva. Čak i ako ne živite na mestu poput ovog, cena Bitcoin-a se i dalje povećava kada ih neko kome oni trebaju kupi.

Kako Bitcoin spašava svet?

Bitcoin, kao ultimativni način štednje, je cakum pakum, ali da li on pomaže u poboljšanju sveta u celini?

Kao što ćete početi da shvatate, ulazeći sve dublje i u druge sadržaje na ovoj stranici, mnogi temeljni delovi našeg današnjeg monetarnog sistema i ekonomije su duboko slomljeni. Međutim, oni koji upravljaju imaju korist od ovakvih sistema, pa se on verovatno neće promeniti bez revolucije ili mirnog svrgavanja od strane naroda. Bitcoin predstavlja novi sistem, sa nekoliko glavnih prednosti:

- Bitcoin popravlja novac, koji je milenijumima služio kao važan alat za rast i poboljšanje društva.

- Bitcoin vraća zdrav razum pozajmljivanju, uklanjanjem apsurdnih situacija poput negativnih kamatnih stopa (gde zajmitelj plaća da bi se zadužio).

- Bitcoin pokreće ulaganja u obnovljive izvore energije i poboljšava energetsku efikasnost u mreži, služeći kao „krajnji kupac“ za sve vrste energije.

Kako mogu da saznam više o Bitcoin-u?

Ovaj članak vam je dao osnovno razumevanje zašto biste trebali razmišljati o Bitcoin-u. Ako želite da saznate više, preporučujem ove resurse:

- Film "Bitcoin: Kraj Novca Kakav Poznajemo"

- Još uvek je rano za Bitcoin

- Zasto baš Bitcoin?

- Šta je to Bitcoin?

- The Bitcoin Whitepaper ← objavljen 2008. godine, ovo je izložio dizajn za Bitcoin.

-

@ 5c26ee8b:a4d229aa

2025-05-23 08:47:45

@ 5c26ee8b:a4d229aa

2025-05-23 08:47:45Generally mentioning God, Allah, by reciting/reading the Quran or performing Salat (compulsory prayer), for instance, brings tranquility to the heart of the believer. The Salat, other than being the first deed a Muslim would be questioned about on Judgement Day, it keeps the person away from the forbidden wrong deeds too. The Salat is sufficient for obtaining God’s provision as he decrees the means for it to reach the person. Wasting or missing performing the Salat or mentioning God (Allah) by reciting/reading the Quran or Tasbieh, can lead to following the desires only and a depressed life as well as punishment in the Thereafter.

13:28 Ar-Ra'd

الَّذِينَ آمَنُوا وَتَطْمَئِنُّ قُلُوبُهُمْ بِذِكْرِ اللَّهِ ۗ أَلَا بِذِكْرِ اللَّهِ تَطْمَئِنُّ الْقُلُوبُ

Those who have believed and whose hearts are assured (tranquillised) by the remembrance of Allah. Unquestionably, by the remembrance of Allah hearts are assured (tranquillised)."

29:45 Al-Ankaboot

اتْلُ مَا أُوحِيَ إِلَيْكَ مِنَ الْكِتَابِ وَأَقِمِ الصَّلَاةَ ۖ إِنَّ الصَّلَاةَ تَنْهَىٰ عَنِ الْفَحْشَاءِ وَالْمُنْكَرِ ۗ وَلَذِكْرُ اللَّهِ أَكْبَرُ ۗ وَاللَّهُ يَعْلَمُ مَا تَصْنَعُونَ

Recite, [O Muhammad], what has been revealed to you of the Book and establish prayer. Indeed, prayer prohibits immorality and wrongdoing, and the remembrance of Allah is greater. And Allah knows that which you do.

11:114 Hud

وَأَقِمِ الصَّلَاةَ طَرَفَيِ النَّهَارِ وَزُلَفًا مِنَ اللَّيْلِ ۚ إِنَّ الْحَسَنَاتِ يُذْهِبْنَ السَّيِّئَاتِ ۚ ذَٰلِكَ ذِكْرَىٰ لِلذَّاكِرِينَ

And establish prayer at the two ends of the day and at the approach of the night. Indeed, good deeds do away with misdeeds. That is a reminder for those who remember.

20:132 Taa-Haa

وَأْمُرْ أَهْلَكَ بِالصَّلَاةِ وَاصْطَبِرْ عَلَيْهَا ۖ لَا نَسْأَلُكَ رِزْقًا ۖ نَحْنُ نَرْزُقُكَ ۗ وَالْعَاقِبَةُ لِلتَّقْوَىٰ

And enjoin prayer upon your family [and people] and be steadfast therein. We ask you not for provision; We provide for you, and the [best] outcome is for [those of] righteousness.

20:124 Taa-Haa

وَمَنْ أَعْرَضَ عَنْ ذِكْرِي فَإِنَّ لَهُ مَعِيشَةً ضَنْكًا وَنَحْشُرُهُ يَوْمَ الْقِيَامَةِ أَعْمَىٰ

And whoever turns away from My remembrance - indeed, he will have a depressed life, and We will gather him on the Day of Resurrection blind."

20:125 Taa-Haa

قَالَ رَبِّ لِمَ حَشَرْتَنِي أَعْمَىٰ وَقَدْ كُنْتُ بَصِيرًا

He will say, "My Lord, why have you raised me blind while I was [once] seeing?"

20:126 Taa-Haa

قَالَ كَذَٰلِكَ أَتَتْكَ آيَاتُنَا فَنَسِيتَهَا ۖ وَكَذَٰلِكَ الْيَوْمَ تُنْسَىٰ

[Allah] will say, "Thus did Our signs come to you, and you forgot them; and thus will you this Day be forgotten."

20:127 Taa-Haa

وَكَذَٰلِكَ نَجْزِي مَنْ أَسْرَفَ وَلَمْ يُؤْمِنْ بِآيَاتِ رَبِّهِ ۚ وَلَعَذَابُ الْآخِرَةِ أَشَدُّ وَأَبْقَىٰ

And thus do We recompense he who transgressed and did not believe in the signs of his Lord. And the punishment of the Hereafter is more severe and more enduring.

20:128 Taa-Haa

أَفَلَمْ يَهْدِ لَهُمْ كَمْ أَهْلَكْنَا قَبْلَهُمْ مِنَ الْقُرُونِ يَمْشُونَ فِي مَسَاكِنِهِمْ ۗ إِنَّ فِي ذَٰلِكَ لَآيَاتٍ لِأُولِي النُّهَىٰ

Then, has it not become clear to them how many generations We destroyed before them as they walk among their dwellings? Indeed in that are signs for those of intelligence.

49:17 Al-Hujuraat

يَمُنُّونَ عَلَيْكَ أَنْ أَسْلَمُوا ۖ قُلْ لَا تَمُنُّوا عَلَيَّ إِسْلَامَكُمْ ۖ بَلِ اللَّهُ يَمُنُّ عَلَيْكُمْ أَنْ هَدَاكُمْ لِلْإِيمَانِ إِنْ كُنْتُمْ صَادِقِينَ

They consider it a favor to you that they have accepted Islam. Say, "Do not consider your Islam a favor to me. Rather, Allah has conferred favor upon you that He has guided you to the faith, if you should be truthful."

53:29 An-Najm

فَأَعْرِضْ عَنْ مَنْ تَوَلَّىٰ عَنْ ذِكْرِنَا وَلَمْ يُرِدْ إِلَّا الْحَيَاةَ الدُّنْيَا

So turn away from whoever turns his back on Our message and desires not except the worldly life.

53:30 An-Najm

ذَٰلِكَ مَبْلَغُهُمْ مِنَ الْعِلْمِ ۚ إِنَّ رَبَّكَ هُوَ أَعْلَمُ بِمَنْ ضَلَّ عَنْ سَبِيلِهِ وَهُوَ أَعْلَمُ بِمَنِ اهْتَدَىٰ

That is their sum of knowledge. Indeed, your Lord is most knowing of who strays from His way, and He is most knowing of who is guided.

53:62 An-Najm

فَاسْجُدُوا لِلَّهِ وَاعْبُدُوا ۩

So prostrate to Allah and worship [Him].

-

@ 975e4ad5:8d4847ce

2025-05-23 08:47:08

@ 975e4ad5:8d4847ce

2025-05-23 08:47:08Bitcoin Is Not Just an Asset

When Satoshi Nakamoto introduced Bitcoin in 2009, the vision was clear: a decentralized currency for everyday transactions, from buying coffee to paying bills. It was designed to bypass banks and governments, empowering individuals with financial freedom. But when Bitcoin is treated as “digital gold” and locked away in wallets, it fails to fulfill this vision. Instead of replacing fiat currencies, it becomes just another investment, leaving people reliant on dollars, euros, or other traditional currencies for their daily needs.

The Problem with HODLing and Loans

Some Bitcoin enthusiasts advocate holding their coins indefinitely and taking loans against them rather than spending. This approach may seem financially savvy—Bitcoin’s value often rises over time, and loans provide liquidity without selling. But this prioritizes personal gain over the broader goal of financial revolution. Someone who holds Bitcoin while spending fiat isn’t supporting Bitcoin’s mission; they’re merely using it to stay wealthy within the existing system. This undermines the dream of a decentralized financial future.

Lightning Network: Fast and Cheap Transactions

One common argument against using Bitcoin for daily purchases is the high fees and slow transaction times on the main blockchain. Enter the Lightning Network, a second-layer solution that enables near-instant transactions with minimal fees. Imagine paying for groceries or ordering a pizza with Bitcoin, quickly and cheaply. This technology makes Bitcoin practical for everyday use, paving the way for widespread adoption.

Why Using Bitcoin Matters

If Bitcoin is only hoarded and not spent, it will remain a niche asset that shields against inflation but doesn’t challenge the fiat system. For Bitcoin to become a true alternative currency, it must be used everywhere—in stores, online platforms, and peer-to-peer exchanges. The more people and businesses accept Bitcoin, the closer we get to a world where decentralized currency is the norm. This isn’t just an investment; it’s a movement for financial freedom.\ \ Bitcoin wasn’t created to sit idly in wallets or serve as collateral for loans. It’s a tool for change that demands active use. If we want a world where individuals control their finances, we must start using Bitcoin—not just to avoid poverty, but to build a new financial reality.

-

@ 975e4ad5:8d4847ce

2025-05-22 14:30:53

@ 975e4ad5:8d4847ce

2025-05-22 14:30:53The Risks of Offline Storage

Keeping your seed phrase offline – on paper, in a safe, or on a USB drive – seems secure, but it comes with significant risks:

-

Fire or Flood: A disaster could destroy your home, along with the paper or device storing your seed phrase.

-

Theft: Someone could find your seed phrase in your safe or a hidden spot at home.

-

Natural Disasters or War: If you’re forced to leave your home, you might lose access to your seed phrase, effectively locking you out of your assets.

-

Human Error: You could accidentally lose, damage, or misplace the paper or device holding your seed phrase.

These vulnerabilities make offline storage less reliable, especially if you don’t have backups or can’t access them in an emergency.

The Benefits of Online Storage

When done right, online storage addresses these issues. The primary advantage is accessibility: you can retrieve your seed phrase from anywhere in the world as long as you have an internet connection and the necessary credentials. This is invaluable if you’re away from home or in a crisis.

The key to making online storage safe? Encryption.

How to Store Your Seed Phrase Online Securely

-

Choose a Secure Platform\ Upload your encrypted seed phrase to a reputable cloud storage service like Google Drive, Dropbox, or Proton Drive, which offers built-in encryption. Ensure you use a strong password and enable two-factor authentication (2FA) for your account.

-

Encrypt Your Seed Phrase\ Before uploading, encrypt your seed phrase using a tool with strong encryption, such as AES-256. Here are some easy options:

-

VeraCrypt: A free tool that lets you create an encrypted file or container. Save your seed phrase in a text file, add it to an encrypted container, and set a password only you know.

-

GPG (GnuPG): This tool allows you to encrypt text files using public and private keys. Generate a key pair and store the private key securely (e.g., on an offline USB drive).

-

7-Zip: A popular compression tool that supports AES-256 encryption. Create an encrypted archive with your seed phrase and set a strong password.

-

Keep the Decryption Key in Your Head\ The password or decryption key should be something only you know. Avoid writing it down to prevent unauthorized access.

-

Disguise the File\ Even if someone sees your encrypted file, they shouldn’t suspect what it contains. Name the file something generic, like “family_recipes.txt,” instead of “seed_phrase.txt.”

Why Encryption Matters

Encryption ensures that even if someone gains access to your file, they can’t read your seed phrase without the decryption key. AES-256, for example, is an industry-standard encryption method considered virtually unbreakable with a strong password. This means that even if a hacker accesses your cloud storage, they can’t use your seed phrase.

Practical Tips for Maximum Security

-

Split Your Seed Phrase: For added protection, divide your seed phrase into multiple parts and store them in separate encrypted files on different platforms.

-

Test Your Access: Periodically check that you can log into your cloud storage and decrypt your file to avoid surprises.

-

Use a Strong Password: Choose a password longer than 12 characters, combining letters, numbers, and special characters.

-

Create Backups: Store multiple encrypted copies on different platforms for extra redundancy.

Conclusion

Storing your seed phrase online isn’t reckless if you do it right. With proper encryption and a secure platform, you can combine the convenience of global access with a high level of protection. Offline methods have their risks, but secure online storage ensures your assets are safe and accessible, no matter where you are.

-

-

@ 06830f6c:34da40c5

2025-05-24 04:21:03

@ 06830f6c:34da40c5

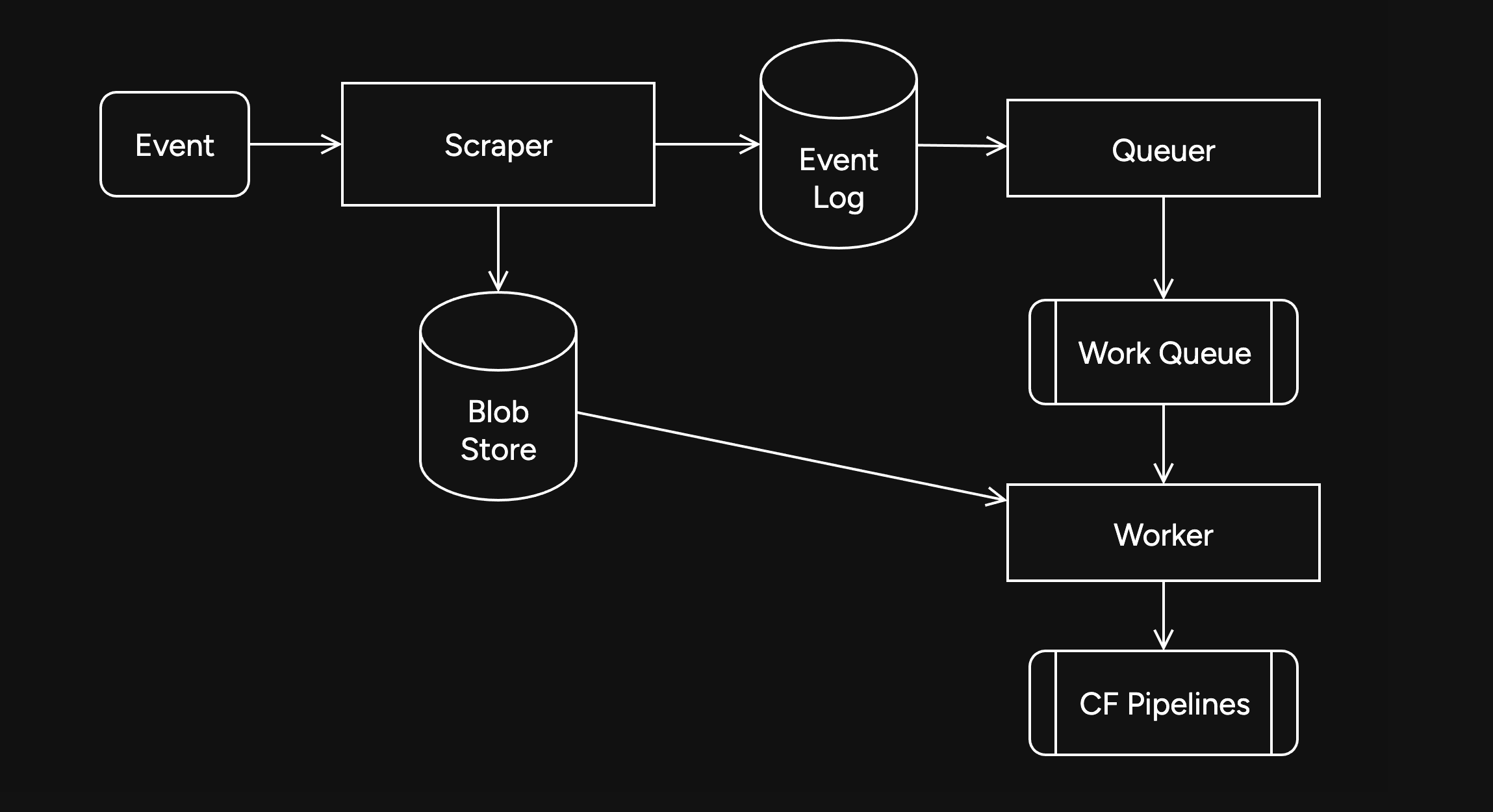

2025-05-24 04:21:03The evolution of development environments is incredibly rich and complex and reflects a continuous drive towards greater efficiency, consistency, isolation, and collaboration. It's a story of abstracting away complexity and standardizing workflows.

Phase 1: The Bare Metal & Manual Era (Early 1970s - Late 1990s)

-

Direct OS Interaction / Bare Metal Development:

- Description: Developers worked directly on the operating system's command line or a basic text editor. Installation of compilers, interpreters, and libraries was a manual, often arcane process involving downloading archives, compiling from source, and setting environment variables. "Configuration drift" (differences between developer machines) was the norm.

- Tools: Text editors (Vi, Emacs), command-line compilers (GCC), Makefiles.

- Challenges: Extremely high setup time, dependency hell, "works on my machine" syndrome, difficult onboarding for new developers, lack of reproducibility. Version control was primitive (e.g., RCS, SCCS).

-

Integrated Development Environments (IDEs) - Initial Emergence:

- Description: Early IDEs (like Turbo Pascal, Microsoft Visual Basic) began to integrate editors, compilers, debuggers, and sometimes GUI builders into a single application. This was a massive leap in developer convenience.

- Tools: Turbo Pascal, Visual Basic, early Visual Studio versions.

- Advancement: Improved developer productivity, streamlined common tasks. Still relied on local system dependencies.

Phase 2: Towards Dependency Management & Local Reproducibility (Late 1990s - Mid-2000s)

-

Basic Build Tools & Dependency Resolvers (Pre-Package Managers):

- Description: As projects grew, manual dependency tracking became impossible. Tools like Ant (Java) and early versions of

autoconf/makefor C/C++ helped automate the compilation and linking process, managing some dependencies. - Tools: Apache Ant, GNU Autotools.

- Advancement: Automated build processes, rudimentary dependency linking. Still not comprehensive environment management.

- Description: As projects grew, manual dependency tracking became impossible. Tools like Ant (Java) and early versions of

-

Language-Specific Package Managers:

- Description: A significant leap was the emergence of language-specific package managers that could fetch, install, and manage libraries and frameworks declared in a project's manifest file. Examples include Maven (Java), npm (Node.js), pip (Python), RubyGems (Ruby), Composer (PHP).

- Tools: Maven, npm, pip, RubyGems, Composer.

- Advancement: Dramatically simplified dependency resolution, improved intra-project reproducibility.

- Limitation: Managed language-level dependencies, but not system-level dependencies or the underlying OS environment. Conflicts between projects on the same machine (e.g., Project A needs Python 2.7, Project B needs Python 3.9) were common.

Phase 3: Environment Isolation & Portability (Mid-2000s - Early 2010s)

-

Virtual Machines (VMs) for Development:

- Description: To address the "it works on my machine" problem stemming from OS-level and system-level differences, developers started using VMs. Tools like VMware Workstation, VirtualBox, and later Vagrant (which automated VM provisioning) allowed developers to encapsulate an entire OS and its dependencies for a project.

- Tools: VMware, VirtualBox, Vagrant.

- Advancement: Achieved strong isolation and environment reproducibility (a true "single environment" for a project).

- Limitations: Resource-heavy (each VM consumed significant CPU, RAM, disk space), slow to provision and boot, difficult to share large VM images.

-

Early Automation & Provisioning Tools:

- Description: Alongside VMs, configuration management tools started being used to automate environment setup within VMs or on servers. This helped define environments as code, making them more consistent.

- Tools: Chef, Puppet, Ansible.

- Advancement: Automated provisioning, leading to more consistent environments, often used in conjunction with VMs.

Phase 4: The Container Revolution & Orchestration (Early 2010s - Present)

-

Containerization (Docker):

- Description: Docker popularized Linux Containers (LXC), offering a lightweight, portable, and efficient alternative to VMs. Containers package an application and all its dependencies into a self-contained unit that shares the host OS kernel. This drastically reduced resource overhead and startup times compared to VMs.

- Tools: Docker.

- Advancement: Unprecedented consistency from development to production (Dev/Prod Parity), rapid provisioning, highly efficient resource use. Became the de-facto standard for packaging applications.

-

Container Orchestration:

- Description: As microservices and container adoption grew, managing hundreds or thousands of containers became a new challenge. Orchestration platforms automated the deployment, scaling, healing, and networking of containers across clusters of machines.

- Tools: Kubernetes, Docker Swarm, Apache Mesos.

- Advancement: Enabled scalable, resilient, and complex distributed systems development and deployment. The "environment" started encompassing the entire cluster.

Phase 5: Cloud-Native, Serverless & Intelligent Environments (Present - Future)

-

Cloud-Native Development:

- Description: Leveraging cloud services (managed databases, message queues, serverless functions) directly within the development workflow. Developers focus on application logic, offloading infrastructure management to cloud providers. Containers become a key deployment unit in this paradigm.

- Tools: AWS Lambda, Azure Functions, Google Cloud Run, cloud-managed databases.

- Advancement: Reduced operational overhead, increased focus on business logic, highly scalable deployments.

-

Remote Development & Cloud-Based IDEs:

- Description: The full development environment (editor, terminal, debugger, code) can now reside in the cloud, accessed via a thin client or web browser. This means developers can work from any device, anywhere, with powerful cloud resources backing their environment.

- Tools: GitHub Codespaces, Gitpod, AWS Cloud9, VS Code Remote Development.

- Advancement: Instant onboarding, consistent remote environments, access to high-spec machines regardless of local hardware, enhanced security.

-

Declarative & AI-Assisted Environments (The Near Future):

- Description: Development environments will become even more declarative, where developers specify what they need, and AI/automation tools provision and maintain it. AI will proactively identify dependency issues, optimize resource usage, suggest code snippets, and perform automated testing within the environment.

- Tools: Next-gen dev container specifications, AI agents integrated into IDEs and CI/CD pipelines.

- Prediction: Near-zero environment setup time, self-healing environments, proactive problem identification, truly seamless collaboration.

web3 #computing #cloud #devstr

-

-

@ bf47c19e:c3d2573b

2025-05-24 16:21:56

@ bf47c19e:c3d2573b

2025-05-24 16:21:56Originalni tekst na bitcoin-balkan.com.

Pregled sadržaja

- Šta uzrokuje Inflaciju?

- Da li nam je infacija potrebna?

- Kako se meri inflacija?

- Da li inflacija pokreće ekonomski rast?

- Da li inflacija pokreće ili umanjuje nejednakost bogatstva?

- Gde se danas javlja inflacija?

- Šta je deflacija?

- Kakav uticaj inflacija ima na društvo?

Inflacija može da bude uznemirujuća tema, jer uključuje amorfni koncept novca. Međutim, inflacija je zapravo jednostavna tema koja je napravljena da bude složena razdvajanjem novca i drugih dobara. U ovom članku razlažemo inflaciju i njene uzroke.

Najjednostavnija definicija inflacije je rast cena dobara i usluga. Kada cene rastu, to takođe znači da vrednost jedinice novca – poput dolara – opada. Uzmimo primer McDonald’s hamburgera: 1955. ovaj skromni hamburger se prodavao za samo 15 centi. U 2018. godini se prodavao za 1,09 USD. U 2021. godini prodaje se za 2,49 USD – ogroman rast cene od 1650%.

To znači da je dolar izgubio dosta svoje vrednosti. 1955. godine mogli ste da kupite gotovo 7 hamburgera za novčanicu od jednog dolara. 2021. godine taj dolar vam ne bi kupio ni jedan hamburger. Zašto se čini da cene uvek rastu tokom vremena? I šta možete da učinite povodom toga? Ovaj članak ima za cilj da odgovori na ta pitanja.

Ekonomisti pokušavaju da sumiraju rast cena mnogih dobara i usluga kao jedan prosečan broj. Ovaj broj predstavlja promenu ukupnih troškova u godišnjim troškovima prosečnog potrošača, kao što su stanarina, hrana i gorivo.

U Sjedinjenim Državama ovaj broj je poznat kao Indeks Potrošačkih Cena, eng. Consumer Price Index (CPI). Kada se CPI poveća tokom određenog vremenskog perioda, ekonomisti kažu da imamo inflaciju. Kada se smanji, to se naziva deflacija.

Šta uzrokuje Inflaciju?

Mnogi izvori kažu da je stalna inflacija koju danas doživljavamo ili uzrokovana povećanjem potražnje (eng. demand-pull) ili smanjenjem ponude usled povećanih proizvodnih troškova (eng. cost-push).

Ovi razlozi nisu tačni – hajde da pogledamo zašto.

Da bismo razumeli pravi razlog inflacije, moramo da sagledamo dve vrste inflacije:

- Inflacija Cena: Cene vremenom rastu.

- Monetarna Inflacija: Količina valute u opticaju raste sa vremenom.

Prva, inflacija cena, retko se javlja tokom dužih perioda (decenije, vekovi) zbog povećane potražnje ili povećanih troškova. Zašto? Tržišta teže da se uravnoteže. Tokom istorije smo više puta videli da povećana potražnja za dobrom povećava njegovu cenu, što podstiče proizvođače da proizvode više tog dobra. Kada se ponuda poveća, cene se smanjuju.

Ovaj ciklus može da potraje nekoliko godina, i javlja se kod gotovo svake robe i „konačnog dobra“ (automobili, televizori, hrana itd.) na Zemlji. Izuzetak su retki metali poput zlata i srebra. Dokazi o tome su prikazani u nastavku.

Kada se poveća trošak za proizvodnju dobra, cena tog dobra često raste da bi pokrila te troškove. Ovaj rast cene dovodi do toga da potrošači tog dobra traže alternativu ili smanjuju potrošnju tog dobra, što dovodi do pada cena na prethodni nivo.

Tržište se prirodno uravnotežava, a cene se smanjuju ili povećanjem ponude ili smanjenjem potražnje.

Da li imamo dokaze da tržišta vremenom uravnotežuju ponudu i potražnju?

Podaci o cenama robe tokom vremena mogu nam dati bolje razumevanje da li tržišta zaista efikasno uravnotežuju ponudu i potražnju. Međutim, cene ne možemo da posmatramo u smislu nacionalnih valuta, jer naše vlade uvek štampaju više svojih nacionalnih valuta.

Oni sprovode monetarnu inflaciju, koja može da izazove inflaciju cena. Posmatranje tržišnih cena u smislu nacionalnih valuta, poput američkog dolara, je poput merenja visine lenjirom koji se neprestano smanjuje. Vaša visina u broju biće sve veća i veća, ali stvarna visina se ne menja.

Mi možemo da znamo da li tržišta uravnotežuju ponudu i potražnju gledajući cene dobara u smislu monetarnog dobra koje ima vrlo konzistentnu ponudu tokom vremena.

Vremenom se pokazalo da zlato ima najmanju monetarnu inflaciju od svih postojećih valuta i dobara. To čini zlato odličnim ‘lenjirom’ za merenje da li tržišta vremenom uravnotežuju ponudu i potražnju. Da bismo bolje razumeli inflaciju cena tokom vremena, pitaćemo koliko unci zlata nešto košta tokom vremena.

Cene u zlatu pokazuju nam da se tržišta vremenom uravnotežuju

Ako cene dobara posmatramo u obliku zlata, vidimo da cene robe prate srednje tačke tokom dužih vremenskih perioda.

Nafta, na primer, je vrlo nestabilna, ali ima tendenciju da se kreće oko 2,5 grama zlata po barelu.

WTI Sirova Nafta u gramima Zlata po Barelu

WTI Sirova Nafta u gramima Zlata po BareluCena nafte je promenljiva, ali tokom decenija ima tendenciju da se kreće po strani.

Cene kuća tokom proteklih 10 godina takođe su prilično stabilne, iako imamo fiksnu količinu zemlje na planeti. Vidimo da cene kuća u pogledu zlata imaju tendenciju da variraju oko indeksne cene od oko 80, prikazane na grafikonu.

Shiller-ov US indeks cena kuća u USD i zlatu

Shiller-ov US indeks cena kuća u USD i zlatuOvaj grafikon je na logaritamskoj skali, što nam omogućava da vizualizujemo zapanjujuća povećanja u zelenoj liniji, koja predstavlja domove u dolarima.

Grafički izražene u američkim dolarima, cene ovih dobara uvek rastu – baš kao i McDonald’s hamburger. Da su povećana potražnja ili povećani troškovi odgovorni za konstantnu inflaciju cena, takođe bismo videli kako se cena ove robe povećava u smislu zlata. Podaci iznad pokazuju da su cene konstantne.

Moraju da postoje i drugi razlozi za upornu inflaciju cena koju smo videli u dolarskim iznosima tokom proteklog veka.

Evo šta znamo o tome šta dugoročno utiče na cene, kao u periodu od 1955. do 2018. godine:

- Rast produktivnosti uzrokovan inovacijama, što dovodi do pada cena tokom vremena

- Monetarna inflacija – štampanje velikih količina valute – koja uzrokuje porast cena denominovanih u toj valuti tokom vremena

Znamo da cene izražene u dolarima, eurima i ostalim valutama neprestano rastu. Ako ne mislimo da naša produktivnost kao društva ide unazad, postoji samo jedan jednostavan razlog za inflaciju cena: štampanje većih količina valute, iliti monetarna inflacija.

Naše vlade i banke su zapravo prilično iskrene u pogledu zapanjujućih količina valute koje štampaju. Oni nam svakodnevno govore da oni uzrokuju monetarnu inflaciju.

Da li nam je infacija potrebna?

Bez uporne monetarne inflacije (koja uzrokuje inflaciju cena), naša celokupna savremena ekonomija bi se srušila.

Dozvolite da vam objasnim. Sledeći odeljak može da bude šokantan, i ohrabrujem vas da i sami istražite ukoliko mislite da nisam u pravu.

Kada centralne banke i komercijalne banke daju zajmove, one stvaraju novu valutu.

Kada centralne banke daju zajmove vladama “kupujući državni dug”, one stvaraju novu valutu kada to urade. To omogućava vladama da vode budžetski deficit trošeći više nego što uzimaju od poreza. U tom procesu državni dug se nagomilava.

Komercijalne banke stvaraju novu valutu kada daju zajmove fizičkim licima i preduzećima. Jedino ograničenje koliko novog novca mogu da stvore je zakonski zahtev da banka ima na raspolaganju određeni procenat od ukupnog iznosa novca koji su ljudi deponovali. Zbog toga je naš bankarski sistem poznat kao delimična rezerva – banke pri ruci moraju da imaju samo deo vašeg novca.

Stvaranje valute je neophodno da bi održalo sistem u životu

Budući da se svi zajmovi uglavnom sastoje od novostvorene valute, mora se stvoriti još više valute da bi se taj dug otplatio. A evo i zašto:

Recimo da su prošle godine sve svetske kreditne aktivnosti dovele do stvaranja 100 milijardi dolara. Svih tih 100 milijardi dolara je novostvoreno, i one se duguju bankama sa nekom dodatnom vrednošću za kamate. Odakle dolazi ova dodatna valuta za plaćanje kamata? Budući da ovde govorimo o celokupnoj svetskoj ekonomiji, to plaćanje kamata mora da dodje iz nove količine novostvorene valute.

Sve jedinice današnjih valuta nastale su pozajmljivanjem, a isplata kamate na te zajmove znači da moramo stalno da stvaramo još više nove valute. To dovodi do beskrajne monetarne inflacije. Kada nova valuta cirkuliše kroz ekonomiju, to dovodi do porasta cena: inflacije cena.

Previše monetarne inflacije može dovesti do hiperinflacije cena. U Venecueli je krajem 2018. godine piletina koštala preko 14 miliona Bolivara. Izvor: NBC News

Previše monetarne inflacije može dovesti do hiperinflacije cena. U Venecueli je krajem 2018. godine piletina koštala preko 14 miliona Bolivara. Izvor: NBC NewsMonetarni sistem se raspada ako se ova monetarna inflacija zaustavi, jer bi to značilo da veliki broj onih koji su uzeli zajam širom sveta ne bi mogao da vrati novac koji su pozajmili – oni ne bi izmirili svoje dugove.

Banke ili zajmodavci koji drže dug tada bi imali bezvrednu imovinu. Budući da vrednost duga podupire vrednost valute, vrednost valute bi strmoglavo padala zajedno sa dugom.

Kada ljudi izgube poverenje u ’tradicionalnu’ valutu, ona brzo postane bezvredna. To se dogodilo u Nemačkoj nakon Prvog svetskog rata, u Peruu devedesetih, Jugoslaviji 1994. ,Zimbabveu, Venecueli i sa još bezbroj drugih tradicionalnih valuta. Da bi odložile ovaj neizbežni ishod dokle god mogu, centralne banke jačaju poverenje u sistem nastavljajući da štampaju valutu stabilnim kursom.

Ovo osigurava da većina ljudi koju su uzeli zajam ima valutu za otplatu svojih kredita. Upravo to se dešava kada vlada izvrši „spas“ kao 2008. ili 2020. – oni osiguravaju da svi imaju dovoljno novca za plaćanje dugova, tako da laž može da se nastavi.

Inflacija ne dolazi iz povećanja potražnje

Sa više valute u opticaju, monetarna inflacija može da izgleda kao povećanje potražnje. Međutim, ekonomisti koji kažu da povećana potražnja pokreće stabilnu inflaciju tokom decenija propuštaju suptilnu poentu: iako monetarna inflacija može da prouzrokuje veću potrošnju, to nije zato što su ljudi zaista bogatiji, već zato što veruju da su bogatiji.

Kada se puno novca ubrizga u ekonomiju, cene jednostavno rastu jer više valute pokriva istu količinu robe. Rast cena znači pad vrednosti valute, tako da nema realnog povećanja stvarnog bogatstva, iako ljudi možda “troše više” u nominalnom iznosu valute.

Uzmimo ovaj primer: vi mesečno zarađujete 1.500 EUR, i prema svom trenutnom načinu života vi mesečno trošite oko 1.500 EUR. Dolazi vlada i počinje da vam daje dodatnih 500 EUR svakog meseca – vi se osećate poprilično dobro, zar ne? Sada možete da izlazite češće u restoran.

Međutim, vlada daje svima po 500 EUR mesečno, i svi ostali takođe troše taj novac. Ekonomista u vladinoj kancelariji, vidi da sada svi troše tih dodatnih 500 EUR mesečno i zaključuje da je vlada ‘stimulisala ekonomiju’.

Ipak, kako sav taj dodatni novac kruži ekonomijom, cene prirodno rastu. Sada vam je potrebno 2.000 EUR da biste održali svoj trenutni način života.

Da li si nešto bogatiji?

Vi možda imate više eura na vašem bankovnom računu, ali svaki od njih vam kupuje manje. Sada trošite 2.000 EUR mesečno da biste živeli životnim stilom koji vas je nekada koštao samo 1.500 EUR mesečno.

Ovo je ono što monetarna inflacija radi, i zašto je toliko pametnih ekonomista zavarano da misle da povećana potražnja, radije nego štampanje novca, pokreće trajnu inflaciju cena.

Da li smo uvek imali inflaciju?

Stalna inflacija cena relativno je nedavna pojava u modernim ekonomijama i započela je u vreme kada su Sjedinjene Države počele da konstantno štampaju valutu. Ako bi promene ponude i potražnje zaista dugoročno uzrokovale inflaciju cena, videli bismo inflaciju cena tokom istorije. Podaci govore drugačiju priču.

Indeks potrošačkih cena, koji se povećava kada imamo inflaciju cena, bio je prilično konstantan pre početka našeg trenutnog tradicionalnog ’fiat’ monetarnog sistema.

Taj sistem je započeo Bretton Woods-ovim sporazumom iz 1945. godine, a ubrzao se kada je Nixon 1971. okončao svetski zlatni standard.

Indeks potrošačkih cena, Sjedinjene Države, 1790-2015

Indeks potrošačkih cena, Sjedinjene Države, 1790-2015Kako se meri inflacija?

Inflacija cena se često prikazuje kao promena indeksa potrošačkih cena (CPI). CPI je prosek cena raznih dobara koje ljudi kupuju u svakodnevnom životu: hrane, goriva, stanovanja itd. U Sjedinjenim Državama, vladin odsek pod nazivom Biro za statistiku rada (BLS) meri promene cena. To rade tako što posećuju maloprodajne radnje, beleže cene, računaju prosek i izveštavaju godišnju inflaciju kao promenu u odnosu na prošlu godinu.

Stopa inflacije koja se izveštava, je važna svima jer se koristi za određivanje povećanja troškova života i socijalnih davanja, poput plaćanja socijalnog osiguranja. Kada se CPI prilagodi naniže, isplate zarada i naknada su manje nego što bi trebalo da budu.

Efekti su se vremenom sjedinili: osoba koja u svojoj prvoj godini rada zaradi 40.000 USD zarađivaće samo 52.000 USD u svojoj desetoj godini staža, sa povećanim troškovima života od 3% da bi se plata podudarala sa inflacijom. Ako bi vlada umesto toga prijavila inflaciju od 6%, ta osoba bi u svojoj desetoj godini zarađivala 67.500 USD – tj. oko 30% više. Način na koji izračunavamo i prijavljujemo inflaciju ima ogroman uticaj na zaradu većine zaposlenih i građana.

Ovo je inflacija (procentualna promena u CPI) izmerena u poslednjih 20 godina u Sjedinjenim Državama:

Prvobitno je BLS jednostavno beležio cenu korpe robe široke potrošnje svake godine. Međutim, istraživanje Boskinove Komisije 1996. godine dovelo je do novih alata koji Birou za statistiku rada omogućavaju prilagođavanje cena u CPI. Dva najvažnija alata su geometrijsko ponderisanje i hedonika.

Geometrijsko Ponderisanje

Geometrijsko ponderisanje znači da kupovne navike sada mogu da utiču na to koliko promena cene pojedinog dobra utiče na CPI. Ako potrošači kupe manje robe, ona ima manju težinu kada se ubaci u presek indeksa potrošačkih cena. Boskinova Komisija je tvrdila da bi ova promena pomogla da se promene sklonosti potrošača. Međutim, ne postoji način da se utvrdi da li ljudi menjaju svoje kupovne navike jer zapravo žele da kupuju različite stvari. Vrlo je moguće da ljudi kupuju manje određenog dobra jer ono raste u ceni. Stoga geometrijsko ponderisanje uzrokuje da roba sa velikim rastom cena ima manje uticaja na CPI, što dovodi do niže prijavljene inflacije.

Hedonika

Hedonika omogućava Birou za statistiku rada da menja cenu dobra na osnovu njegovog opaženog povećanja ‘korisnosti’ tokom vremena. Evo primera: recimo da se televizor sa rezolucijom od 720p 2009. godine prodavao za 200 USD. U 2010. godini isti model televizora sada ima rezoluciju od 1080p i prodaje se po istoj ceni: 200 USD. Međutim, pošto se tehnologija u televizoru poboljšala, zaposleni u Birou za statistiku rada mogu da izmisle ‘korisni’ broj i pomoću njega oduzmu deo vrednosti od cene televizora. Kao rezultat, BLS može da kaže da TV košta 180 USD u 2010. godini – iako je njegova cena 200 USD. Ovo dovodi do pada prijavljene inflacije.

Oba ova prilagođavanja smanjuju prijavljenu stopu inflacije, što smanjuje povećanje troškova života i isplate naknada za socijalno osiguranje. Koliko ta prilagođavanja inflacije pogađaju radničku klasu i penzionere? Neke procene, poput procena ekonomiste John Williams-a, sa koledža u Darmouthu, stavljaju stvarnu inflaciju u SAD na u proseku 3% – 6% više nego što je izveštavano od strane Bira za statistiku rada. To bi inflaciju u 2020 dovelo do 5% – 8%, umesto na prijavljenih 2%.

U 2021. godini prijavljena inflacija je 5.4%, u prvom kvartalu.

Da li inflacija pokreće ekonomski rast?

Mnogi ljudi veruju da stabilna inflacija pokreće ekonomski rast podstičući investicije i potrošnju umesto štednje. Međutim, osnovni ekonomski podaci pobijaju ovu uobičajenu tvrdnju.

Ako za primer uzmemo Sjedinjene Države, nacija je imala samo kratke periode inflacije od 1775. do oko 1950. godine, kao što pokazuje indeks potrošačkih cena koji je ostao nepromenjen. Inflacija dobija zamah tek nakon 1971. godine, pa bi bilo za očekivati da će i stopa rasta bruto domaćeg proizvoda (BDP) Sjedinjenih Država porasti nakon 1971. godine.

Indeks potrošačkih cena, Sjedinjene Države, 1790-2015

Indeks potrošačkih cena, Sjedinjene Države, 1790-2015Međutim, vidimo da se bruto domaći proizvod (BDP) po stanovniku u Sjedinjenim Državama, uobičajena mera ekonomske snage, neprekidno povećavao od 1820. godine do danas po stopi od oko 1,85% godišnje. Ne postoji porast oko 1971. godine, uprkos rastućoj inflaciji koja je započela u to vreme.

Ovo je logaritamski grafikon, koji nam omogućava da bolje vizualizujemo rast tokom vremena: što više logaritamski grafikon podseća na pravu liniju, to je stopa promene konzistentnija. Za više detalja, ovde pogledajte naslov: Rast na tehnološkoj granici i rast dostizanja.

To pokazuje da inflacija ne pokreće ekonomski rast.

Nažalost, imamo dokaze da inflacija ima i druge neželjene posledice, poput nejednakosti bogatstva. Koncentracija bogatstva u top 1%, počela je da raste krajem 1970-ih, nekoliko godina nakon što su Sjedinjene Države skinule svet sa zlatnog standarda i pretvorile se u monetarni sistem zasnovan na dugovima koji zahteva monetarnu inflaciju, a time i inflaciju cena, da bi preživeo.

Za potpunu istoriju tranzicije novca sa robnog sistema na dužni sistem, pročitajte naš članak o novcu.

Da li inflacija pokreće ili umanjuje nejednakost bogatstva?

Veza između inflacije i nejednakosti bogatstva postaje jasna kada pogledamo kako novostvorena valuta ulazi u ekonomiju. Vlade, komercijalne banke, velike korporacije i bogati često koriste kredite da bi iskoristili prednosti svojih moći. Kada podignu kredite, oni novonastalu valutu dobijaju ranije od svih ostalih. Oni imaju koristi od inflacije trošenjem nove valute pre nego što cene počnu da rastu kao rezultat te nove valute koja kruži u ekonomiji. Veliki i bogati subjekti često mogu da dobiju kredite po nižim troškovima od prosečnog građanina ili malog preduzeća. To znači da mogu da povećaju svoje poslovanje i bogatstvo brže od manjih firmi.

Bogati mogu da dobiju jeftine zajmove, zahvaljujući Federalnim Rezervama koje zadržavaju niske kamatne stope. To im omogućava da koriste ovo prednost za ostvarivanje ogromne dobiti.

Inflacija pogadja one koji rade za platu i ne mogu da ulože veći deo svog prihoda. Zarade se polako menjaju, ponekad se uskladjuju samo jednom godišnje. Kao rezultat, cene osnovnih dobara i usluga često rastu mnogo pre nego što zarade porastu. Cena potrošačke korpe takođe se smanjuje sa manipulacijama indeksom potrošačkih cena (CPI) koji skriva rast inflacije.

Gde se danas javlja inflacija?

Rekordno visoka inflacija javlja se u zemljama kao što su Venecuela, Zimbabve, Turska, Iran, Kuba, Južna Afrika i Argentina. To dovodi do sloma trgovine i političke nestabilnosti.

U razvijenom svetu vlade izveštavaju o niskoj inflaciji cena. Međutim, globalni bankarski sistem stvara nove valute u tonama – u toku je velika monetarna inflacija. Centralne banke dovode do sve većeg stvaranja valuta snižavanjem kamatnih stopa. To dovodi do toga da korporacije i pojedinci mogu da uzimaju jeftinije kredite, a svaki kredit znači stvaranje nove valute. Od 2008. godine, gotovo sve glavne centralne banke postavile su kamatne stope blizu nule.

Mnoge centralne banke takođe su pozajmljivale ogromne iznose vladama i bankama koje su propale nakon finansijske krize 2008. godine. Za samo nekoliko meseci, ovo je udvostručilo (ponekad utrostručilo ili učetvorostručilo) novčanu masu mnogih nacija. Oni su ovo nazvali „kvantitativno ublažavanje“.

Ako banke koriste toliku monetarnu inflaciju, zašto onda mi ne vidimo inflaciju cena?

Jednostavno rečeno, većina nove valute nije dospela u ruke običnih ljudi. Kada obični ljudi budu mogli da potroše novoštampanu valutu na svoje svakodnevne potrebe, tada ćemo videti rast CPI i inflacije.

Danas većina valuta ulazi u svet putem bankarskih zajmova, pa banke igraju veliku ulogu u tome gde se dešava inflacija. Banke prvenstveno pozajmljuju vrlo ‘sigurnim’ klijentima poput bogatih pojedinaca, vlada i velikih korporacija. Ovi subjekti kupuju luksuznu robu, umetnička dela, finansijsku imovinu i državne obveznice.

Cene ovih vrsta imovine nisu uključene u CPI, tako da je prijavljena inflacija niska. Kao rezultat, povećanje plata i isplate socijalnog osiguranja su takođe na niskom nivou.

Bogati su uživali u periodu od 2008. do 2021. godine, kada je njihova imovina upumpavana sa velikom količinom novog novca proizvedenog od bankarskih kredita!

Bogati su uživali u periodu od 2008. do 2021. godine, kada je njihova imovina upumpavana sa velikom količinom novog novca proizvedenog od bankarskih kredita!Šta se dešava kada nova valuta dodje u ruke običnih ljudi?

Nažalost, jednog dana će sva ova nova valuta da uđe u normalnu ekonomiju i time će se povećati cene svakodnevne robe. To je poćelo da se dešava 2021. godine kao rezultat stimulativnih programa COVID-19 u Sjedinjenim Državama, koji su ljudima distribuirali trilione dolara. Iako je ovo zasigurno poželjnije od spašavanja korporacija, svaka vrsta spašavanja koja uključuje štampanje novca ima gadne dugoročne efekte.

Ovo što sada doživljavamo dogodilo se u Nemačkoj tokom i posle Prvog svetskog rata. Cene u Nemačkoj su zapravo pale tokom Prvog svetskog rata uprkos velikom stvaranju valute od strane Nemačke centralne banke. Nisko poverenje u ekonomiju sprečavalo je nemački narod da troši novac. Međutim, kad se rat završio i kada su ljudi ponovo počeli da ga troše, cene su vrlo naglo skočile i valuta je postala bezvredna. To bi moglo da se dogodi 2020-ih u Sjedinjenim Državama, sa obzirom na predložene programe podsticaja.

Politike poput Univerzalnog Osnovnog Dohotka, eng. Universal Basic Income (UBI), koje izgledaju pogodne za njihova obećanja da će “spasiti ljude”, takođe mogu da pokrenu hiperinflaciju. Obični ljudi bi se osećali imućnije, trošili bi svoju novoštampanu valutu i doveli do brzog rasta cena. Ovo bi u suštini poništilo pozitivan uticaj građana koji dobijaju “besplatan novac” svakog meseca.

Pa kako onda vi možete da zaštitite svoju ušteđevinu od inflacije? Kupujte imovinu koja je retka, potcenjena i koju vlade teško mogu da prigrabe. Ova imovina su plemeniti metali poput zlata, i Bitcoin.

Šta je deflacija?

Deflacija znači pad cena tokom vremena. Mnogi ekonomisti kažu da će ovo dovesti do toga da ljudi gomilaju valutu i da će dovesti do ekonomskog kolapsa, jer ljudi prestaju da kupuju robu i ulažu u preduzeća. To jednostavno nije tačno, jer ljudi uvek imaju potrebe i želje zbog kojih kupuju odredjenu robu. Stalni pad cena tokom vremena jednostavno bi promenio psihologiju potrošačke kulture u kojoj živimo.

Potrošačka kultura potiče od inflacije

Kako je to istina? Pogledajmo na sledećem primeru. Recimo da želite novi auto i da imate dovoljno novca da ga kupite. Poznato je da u našem svetu zbog stalne inflacije vaš novac vremenom postaje sve manje i manje vredan. U paralelnom svemiru u kojem se javlja stalna deflacija, vaš novac vremenom postaje sve vredniji.

- Uz konstantnu inflaciju, auto će koštati nešto više sledeće godine, i nešto više naredne godine. Niste sigurni gde da uložite novac da biste sa vremenom sigurno očuvali njegovu kupovnu moć. Ako niste sigurni da li ćete da kupite auto, ima više finansijskog smisla da ga kupite odmah, da biste dobili najbolju ponudu.

- Uz konstantnu deflaciju, auto će koštati nešto manje sledeće, i još manje naredne godine. Ako samo čuvate vaš novac, sledeće godine ćete dobiti bolju ponudu za auto. Ako niste sigurni da li ćete da kupite auto, ima više finansijskog smisla da sačekate malo duže da biste dobili bolju ponudu.

Sada razmislite o ta dva scenarija, pomnožena bilionima ljudi i proizvoda. Uz konstantnu inflaciju, svako ima malo više razloga da kupuje stvari upravo sada. Uz konstantnu deflaciju, svi sada imaju malo manje razloga da kupuju. Upravo na taj način inflacija je u osnovi naše materijalističke, potrošačke kulture. Deflacija bi mogla da bude lek.

Inflacija uzrokuje loše investicije

Vaš novac godišnje gubi “2%” svoje vrednosti zbog inflacije. Sada, recimo da vas Stefan pita da investirate u njegov Fast food. Nakon uvida u brojeve, verujete da ćete ovom investicijom izgubiti 1% od vrednosti svog novca. Gubitak od 1% u Stefanovom poslu bolji je od gubitka od 2% zbog inflacije, pa se vi odlučujete da uložite. Ovo je loša investicija, eng. malinvestment – investirajući vi ćete da izgubite deo vrednosti. Međutim, čuvanje valute je još gore, zato ulažete.

Mnogi investitori, poput penzijskih fondova, danas su prisiljeni da investiraju u neprofitabilne biznise zbog investicionih mandata i same veličine njihove ‘imovine pod upravljanjem’.

Pristalice konstantno niske inflacije veruju da bi deflacija smanjila investicije. Međutim, to bi samo smanjilo ulaganje u preduzeća sa negativnim očekivanim prinosom poput Stefanovog Fast food-a. Na primer, recimo da je deflacija u proseku oko 2% godišnje. Na ovom tržištu investitori bi jednostavno prestali da ulažu u projekte za koje misle da će im zaraditi manje od 2% godišnjeg povrata ulaganja.

Neznatno deflaciona valuta obeshrabriće ulaganja u lažna i loša preduzeća i podstaći ulaganje u solidna preduzeća koja svetu dodaju vrednost.

Kakav uticaj inflacija ima na društvo?

Inflacija pokreće povećanu potrošnju, smanjenu štednju i povećani dug. Sve ove stvari dovode do toga da većina ljudi mora da radi više sati i duže u starosti. Iako inflacija kažnjava one koji rade za platu, ona obogaćuje vlasnike bilo koje imovine koja dobija na ceni kada nova valuta uđe u sistem. Ova imovina uključuje akcije, umetnička dela, nekretnine i drugu imovinu koju bogataši koriste za čuvanje svog bogatstva.

Vremenom ljudi i firme izmišljaju nove načine za jeftinije stvaranje dobara i usluga višeg kvaliteta. Ovo je poznato kao ‘rast produktivnosti’ i trebalo bi da uzrokuje da cene tokom vremena konstantno padaju, a ne da rastu. Samo konstantno stvaranje valute koje je neophodno zbog monetarnog sistema zasnovanog na dugu naše vlade uzrokuje stalnu inflaciju i njene loše efekte.

Ako vam se sviđa moj rad, molim vas da ga podelite sa svojim prijateljima i porodicom. Cilj mi je da svima pružim pogled u ekonomiju i na to kako ona utiče na njihov život.

-

@ 554ab6fe:c6cbc27e

2025-04-10 18:48:57

@ 554ab6fe:c6cbc27e

2025-04-10 18:48:57What is consciousness, and can it be changed or enhanced? This is a question that humans have struggled with for a very long time. The question of consciousness alone is daunting. Some even argue that humans will never be able to find the answer. Regardless, the quest for knowledge is not always about the answer, rather it is the journey that is revealing. This is true not only for our society, but the individual as well. The search for the truth often leads one down a path of self-reflection, and can lead to conclusions previously thought to be ludicrous. Here, I will argue that consciousness can be interpreted as an interpretation of reality, where the interpretation may become clearer and more accurate through practices such as meditation.

Consciousness

To articulate this idea, the concept of consciousness must firstly be discussed. There is an incredibly interesting TED talk given by Anil Seth, where he describes consciousness as an illusion. He explains how the brain receives signals from both the internal and external environment of the body, makes an interpretation of those signals, which creates our conscious experience. In his scientific writing, he claims that the brain can be viewed as a prediction machine1. He argues that the brain is constantly making predictions and error correcting in order to gain understanding of the signals it is receiving. He is not alone in this theory, and many other researchers concur that the constant comparison of internal predictions and external stimuli is what generates the brain’s sensations of causal forces2. There are plenty of reasons to believe this is true. Imagine, the brain is receiving all kinds of neuronal signals both from external stimuli sensors and sensors for our internal systems. These signals all shoot up the spinal cord to the brain. It is unclear that these neuronal signals are stamped with an identifier of where they came from, so the brain has to make a predictive model for not only where the signal came from, but also why the signal came at all. The latter is important for survival: the use of our senses to accurately predict our environment would be a critical reason why consciousness developed in the first place. Imagine you are an ancient hominid walking in the wild: you see a tangled cord like thing around a branch on the tree. You need to process that information, determine if it is more branch or a snake and act accordingly. This is a potential biological reason for the manifestation of thought and problem solving. This is a very meta-cognitive example of our brain receiving information and then using previous knowledge to generate a predictive conclusion on the external reality.

There are also examples of this outside of the more obvious meta-cognitive examples. A good example is the famous rubber hand experiment. The first rubber hand experiment was conducted in 1998 by Botvinick and Cohen3. In this experiment, a subject places their hand on a table with a screen blocking their view of their own hand. A rubber hand is then placed on the other side of the screen where it is visible. The experimenter rubs both the rubber hand and real hand with a paint brush. By the end of the experiment, subjects begin to feel as if the rubber hand is their own limb3. The brain, using the visual senses, detects that a hand is being stroked with a brush while sensory neurons send signals that the hand is experiencing the touch of a paint brush. These two signals cause the predicting brain to think that the rubber hand is our hand. This experiment has been repeated many times in different ways. It has been observed that participants begin to react defensively to the threat of pain or damage to the rubber hand4. This illustrates the powerful extent at which the brain processes and reacts to information that it interprets from reality. Amazingly, some research suggests that the touch aspect of the experiment isn’t even necessary to produce the illusion5. Others have recreated this experience using virtual reality, citing that when the virtual hand changed color in response to the subject’s heartbeat, a significant sense of body ownership was generated6. Body ownership, and our sense of reality is arguably determined by our brain’s interpretation of both internal and external stimuli.

The Neuroscience and Meditation

It is hypothesized that the anterior insular cortex (AIC) is involved in the comparison of the stimuli to the predicted model1. Interestingly, the same brain region is associated with the anticipation of pain7. For those unaware, there is some research to suggest that much of the pain we experience is not due to the actual noxious stimuli (physical pain sensation), but from the anticipation of that pain. Evidence for this can be found in studies such as Al-Obaidi et al. from 2005, that concluded that the pain experienced in patients with chronic low back pain could not be solely attributed to the sensor signals, but from the anticipation of the pain8. Additionally, the anticipation of pain relief is the primary contributor to placebo analgesia (placebo pain killers)9. Furthermore, a large body of research has been conducted showing that meditators show a decreased anticipatory attitude towards pain, subsequently experiencing less unpleasant pain 7,10,11. For example, chronic pain in multiple areas such as the low back, neck, shoulder, and arms have been shown to reduce after meditation practice12. Finally, an extreme case study worth noting is of a yogi master who claimed to not experience pain at all13. When this master was brought into the lab, not only did he not experience pain, but his thalamus showed no additional activation following painful stimuli13. What is fascinating about this is that the thalamus is the main relay station for all incoming somatosensory information14, and some argue that this is a candidate for the location of consciousness15. To not have strong activation here after painful stimuli is to suggest a radical change in how the brain receives incoming stimuli, and perhaps is indicative in a dramatic shift in how this individual’s conscious experiences the world. Though this is but one small example, the previous studies outline a strong case for meditation’s ability to alter the way the brain processes information. Given meditation involves the active practice of generating an open and non-judgmental attitude towards all incoming stimuli, perhaps this alters the processing of incoming stimuli, thereby changing the predictive model. On a similar note, perhaps it relates to neuroplastic changes that occur within the brain. It has been noted that the AIC is activated during times of awareness of mind wandering16. This suggests that the AIC is in use frequently during meditation practices. Perhaps it is strengthened then by meditation, thereby also allowing for greater prediction model generation. Imagine the mind as a pond. If the pond is calm and still, one single rain drop rippling in the pond is clearly identifiable. One would easily know information about the droplet, because the ripple could be easily analyzed. Now imagine a pond during a rain storm, where an uncountable amount of rain drops is hitting the pond and there are ripples everywhere. One could not adequately make out where each ripple came from, because there would be too much overlap in the ripples. This may be how the brain functions as well. When the signals are low, and no extraneous thoughts and interpretations are created from signals, then the brain’s prediction model can easily determine where and why a signal it received came from. If, however, the mind is chaotic and full of internal noise, then the brain has a harder time creating an accurate understanding of incoming stimuli and generating a correct model.

Enlightenment

Enlightenment, from a scientific point of view, has been defined as a form of awareness where a person feels that s/he has gained a new understanding of reality 17. In this sense, it bears a striking relationship to the topic of consciousness. If consciousness can be defined as our interpretation of the external and internal environment through our mental prediction model, then experiences of enlightenment are defined by moments where our interpretation is completely changed in a profound way. The experiences are often characterized by the loss of individuality and consequent identification of being part of a greater oneness 18,19. As an interesting side note, this same experience is common amongst subjects, who in a double-blinded study, take psilocybin (the active ingredient in magic mushrooms)20,21. The neuroscience of enlightenment is particularly interesting. The temporo-parietal junction of the brain is involved with self-location and body ownership22. Unsurprisingly, this area is highly involved in the illusion of the rubber hand experiment23. This is the same brain area that is hypothesized to be related to these enlightened experiences of oneness 17. If this brain area, which handles the interpretation of where and what the body is, was to decrease in activation, then the brain would generate a more ambiguous interpretation that the self and the external environment are less distinct than previously thought. This is a possible explanation to why enlightenment experiences involve a feeling of oneness with everything. To bring this all home, meditation has been shown to decrease parietal lobe activation 4,24. Suggesting that meditation can be a method of adjusting the brain’s interpretation of stimuli to generate an outlook that is unifying in perceptive.

Closing Remarks

The evidence that meditation may lead to an altered conscious living has deep philosophical implications. Meditation is a practice that, in part, involves an open awareness to all incoming stimuli alongside the absence of any meta-cognitive interpretation or processing of said stimuli. This generation of a still mind may generate a more accurate prediction model of incoming stimuli, void of any corruption on the part of our thoughts. Given the observation that meditation, both scientifically and culturally, can lead to an understanding and experience of a greater oneness amongst all suggests that this interpretation of incoming stimuli is the more accurate interpretation. It is hard to imagine that anyone would not advocate the beauty and usefulness of this perspective. If more people had this perspective, we would have a much more peaceful, happy and unified society and planet. Ironically, our culture often aims to arrive to this philosophical perspective through analytical thought. However, given the evidence in this post, perhaps it is the absence of analytical thought, and the stillness of the mind that truly grants this perspective.