-

@ 472f440f:5669301e

2025-05-20 13:01:09

@ 472f440f:5669301e

2025-05-20 13:01:09Marty's Bent

via me

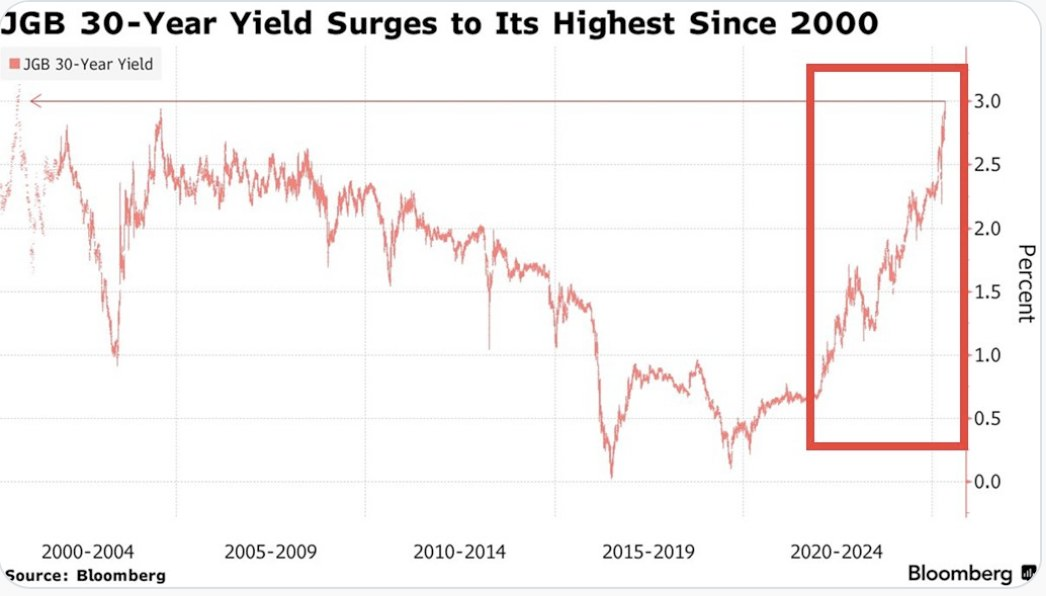

Don't sleep on what's happening in Japan right now. We've been covering the country and the fact that they've lost control of their yield curve since late last year. After many years of making it a top priority from a monetary policy perspective, last year the Bank of Japan decided to give up on yield curve control in an attempt to reel inflation. This has sent yields for the 30-year and 40-year Japanese government bonds to levels not seen since the early 2000s in the case of the 30-year and levels never before seen for the 40-year, which was launched in 2007. With a debt to GDP ratio that has surpassed 250% and a population that is aging out with an insufficient amount of births to replace the aging workforce, it's hard to see how Japan can get out of this conundrum without some sort of economic collapse.

This puts the United States in a tough position considering the fact that Japan is one of the largest holders of U.S. Treasury bonds with more than 1,135 sats | $1.20 trillion in exposure. If things get too out of control in Japan and the yield curve continues to drift higher and inflation continues to creep higher Japan can find itself in a situation where it's a forced seller of US Treasuries as they attempt to strengthen the yen. Another aspect to consider is the fact that investors may see the higher yields on Japanese government bonds and decide to purchase them instead of US Treasuries. This is something to keep an eye on in the weeks to come. Particularly if higher rates drive a higher cost of capital, which leads to even more inflation. As producers are forced to increase their prices to ensure that they can manage their debt repayments.

It's never a good sign when the Japanese Prime Minister is coming out to proclaim that his country's financial situation is worse than Greece's, which has been a laughing stock of Europe for the better part of three decades. Japan is a very proud nation, and the fact that its Prime Minister made a statement like this should not be underappreciated.

As we noted last week, the 10-year and 30-year U.S. Treasury bonds are drifting higher as well. Earlier today, the 30-year bond yield surpassed 5%, which has been a psychological level that many have been pointed to as a critical tipping point. When you take a step back and look around the world it seems pretty clear that bond markets are sending a very strong signal. And that signal is that something is not well in the back end of the financial system.

This is even made clear when you look at the private sector, particularly at consumer debt. In late March, we warned of the growing trend of buy now, pay later schemes drifting down market as major credit card companies released charge-off data which showed charge-off rates reaching levels not seen since the 2008 great financial crisis. At the time, we could only surmise that Klarna was experiencing similar charge-off rates on the bigger-ticket items they financed and started doing deals with companies like DoorDash to finance burrito deliveries in an attempt to move down market to finance smaller ticket items with a higher potential of getting paid back. It seems like that inclination was correct as Klarna released data earlier today showing more losses on their book as consumers find it extremely hard to pay back their debts.

via NewsWire

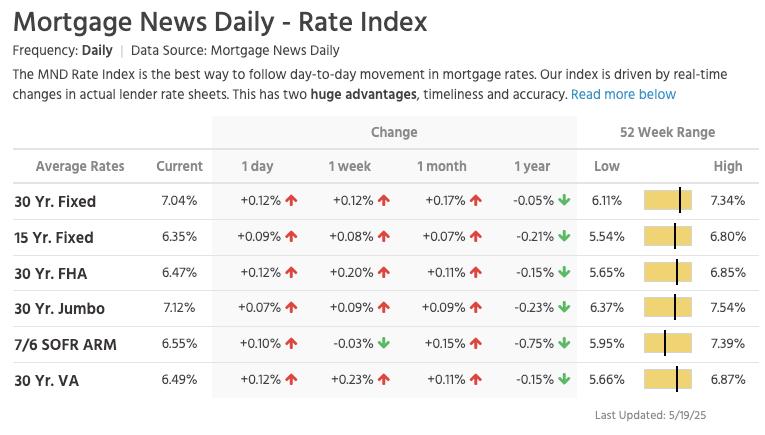

This news hit the markets on the same day as the average rate of the 30-year mortgage in the United States rose to 7.04%. I'm not sure if you've checked lately, but real estate prices are still relatively elevated outside of a few big cities who expanded supply significantly during the COVID era as people flooded out of blue states towards red states. It's hard to imagine that many people can afford a house based off of sticker price alone, but with a 7% 30-year mortgage rate it's becoming clear that the ability of the Common Man to buy a house is simply becoming impossible.

via Lance Lambert

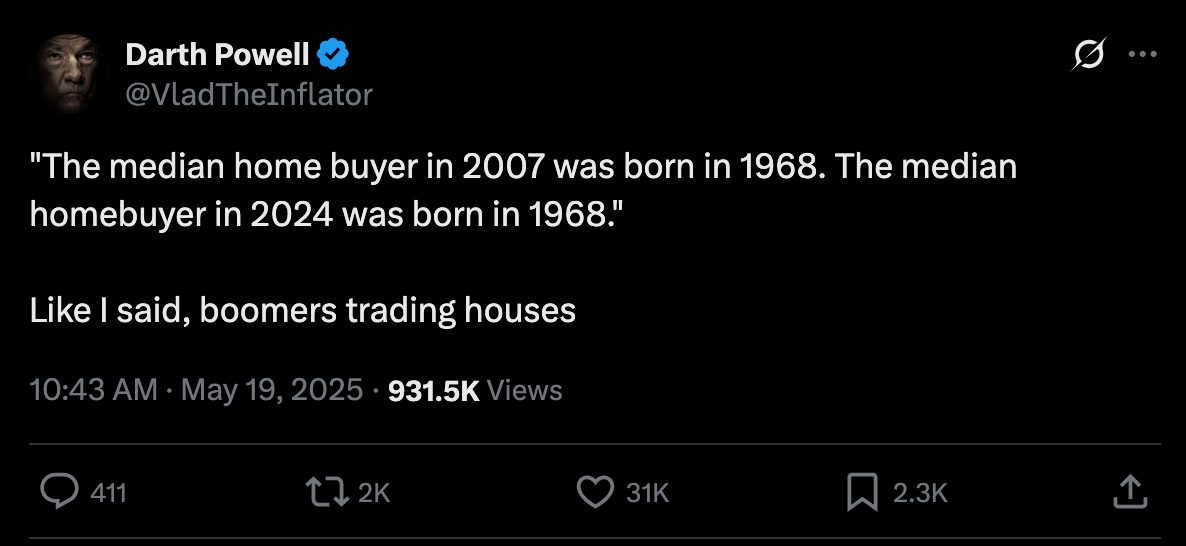

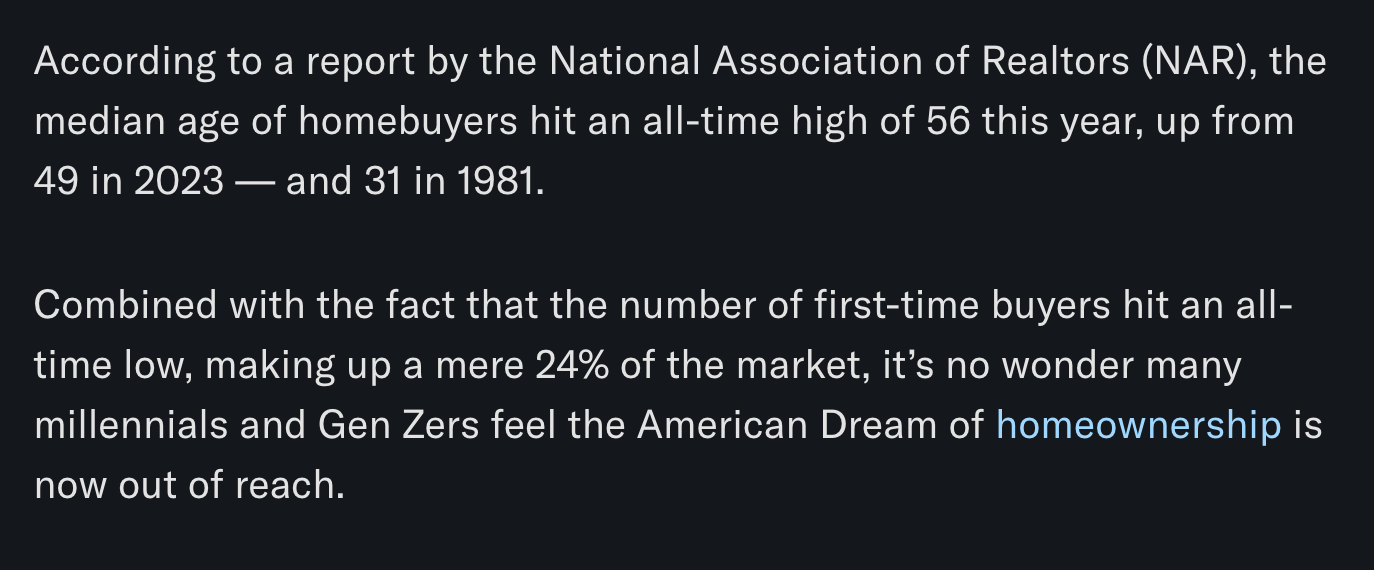

The mortgage rate data is not the only thing you need to look at to understand that it's becoming impossible for the Common Man of working age to buy a house. New data has recently been released that highlights That the median home buyer in 2007 was born in 1968, and the median home buyer in 2024 was born in 1968. Truly wild when you think of it. As our friend Darth Powell cheekily highlights below, we find ourselves in a situation where boomers are simply trading houses and the younger generations are becoming indentured slaves. Forever destined to rent because of the complete inability to afford to buy a house.

via Darth Powell

via Yahoo Finance

Meanwhile, Bitcoin re-approached all-time highs late this evening and looks primed for another breakout to the upside. This makes sense if you're paying attention. The high-velocity trash economy running on an obscene amount of debt in both the public and private sectors seems to be breaking at the seams. All the alarm bells are signaling that another big print is coming. And if you hope to preserve your purchasing power or, ideally, increase it as the big print approaches, the only thing that makes sense is to funnel your money into the hardest asset in the world, which is Bitcoin.

via Bitbo

Buckle up, freaks. It's gonna be a bumpy ride. Stay humble, Stack Sats.

Trump's Middle East Peace Strategy: Redefining U.S. Foreign Policy

In his recent Middle East tour, President Trump signaled what our guest Dr. Anas Alhajji calls "a major change in US policy." Trump explicitly rejected the nation-building strategies of his predecessors, contrasting the devastation in Afghanistan and Iraq with the prosperity of countries like Saudi Arabia and UAE. This marks a profound shift from both Republican and Democratic foreign policy orthodoxy. As Alhajji noted, Trump's willingness to meet with Syrian President Assad follows a historical pattern where former adversaries eventually become diplomatic partners.

"This is really one of the most important shifts in US foreign policy to say, look, sorry, we destroyed those countries because we tried to rebuild them and it was a big mistake." - Dr. Anas Alhajji

The administration's new approach emphasizes negotiation over intervention. Rather than military solutions, Trump is engaging with groups previously considered off-limits, including the Houthis, Hamas, and Iran. This pragmatic stance prioritizes economic cooperation and regional stability over ideological confrontation. The focus on trade deals and investment rather than regime change represents a fundamental reimagining of America's role in the Middle East.

Check out the full podcast here for more on the Iran nuclear situation, energy market predictions, and why AI development could create power grid challenges. Only on TFTC Studio.

Headlines of the Day

Bitcoin Soars to 100,217 sats | $106.00K While Bonds Lose 40% Since 2020 - via X

US Senate Advances Stablecoin Bill As America Embraces Bitcoin - via X

Get our new STACK SATS hat - via tftcmerch.io

Texas House Debates Bill For State-Run Bitcoin Reserve - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Don't let the noise consume you. Focus on making your life 1% better every day.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ c9badfea:610f861a

2025-05-24 12:55:17

@ c9badfea:610f861a

2025-05-24 12:55:17Before you post a message or article online, let the LLM check if you are leaking any personal information using this prompt:

Analyze the following text to identify any Personally Identifiable Information (PII): <Your Message>Replace

<Your Message>with your textIf no PII is found, continue by modifying your message to detach it from your personality. You can use any of the following prompts (and further modify it if necessary).

Prompt № 1 - Reddit-Style

Convert the message into a casual, Reddit-style post without losing meaning. Split the message into shorter statements with the same overall meaning. Here is the message: <Your Message>Prompt № 2 - Advanced Modifications

``` Apply the following modifications to the message: - Rewrite it in lowercase - Use "u" instead of "you" - Use "akchoaly" instead of "actually" - Use "hav" instead of "have" - Use "tgat" instead of "that" - Use comma instead of period - Use British English grammar

Here is the message:

``` Prompt № 3 - Neutral Tone

Rewrite the message to correct grammar errors, and ensure the tone is neutral and free of emotional language: <Your Message>Prompt № 4 - Cross Translation Technique

Translate the message into Chinese, then translate the resulting Chinese text back into English. Provide only the final English translation. Here is the message: <Your Message>Check the modified message and send it.

ℹ️ You can use dialects to obfuscate your language further. For example, if you are from the US, you can tell the LLM to use British grammar and vice versa.

⚠️ Always verify the results. Don't fully trust an LLM.

-

@ 90c656ff:9383fd4e

2025-05-24 12:11:01

@ 90c656ff:9383fd4e

2025-05-24 12:11:01Since its creation, Bitcoin has marked a turning point in the digital money revolution—but its evolution didn’t stop at the original concept of decentralized transactions. Over the years, new technological solutions have been developed to expand its capabilities, making it more efficient and versatile. Among these innovations, smart contracts and the Lightning Network stand out, enabling increased functionality and scalability of the network, and ensuring a faster, cheaper, and more accessible system.

Smart contracts on Bitcoin

Smart contracts are programs that automatically execute certain actions when predefined conditions are met. Although the concept is more commonly associated with other networks, Bitcoin also supports smart contracts, especially through upgrades like Taproot.

- Smart contracts on Bitcoin enable functionalities such as:

01 - Conditional payments: Transactions that are only completed if certain rules are met, such as multi-signatures or specific time conditions.

02 - Advanced fund management: Use of multi-signature wallets, where different parties must approve a transaction before it is processed.

03 - Enhanced privacy: With the Taproot upgrade, smart contracts can be more efficient and indistinguishable from regular transactions, improving privacy across the network.

Although smart contracts on Bitcoin are simpler than those on other platforms, this simplicity is a strength—it preserves the network's security and robustness by avoiding complex vulnerabilities.

Lightning Network: scalability and instant transactions

One of the biggest challenges Bitcoin faces is scalability. Since the original network was designed to prioritize security and decentralization, transaction speed can be limited during periods of high demand. To address this issue, the Lightning Network was created—a second-layer solution that enables near-instant transactions with extremely low fees.

The Lightning Network works by creating payment channels between users, allowing them to conduct multiple transactions off-chain and recording only the final balance on the main Bitcoin blockchain or timechain. Key advantages include:

01 - Speed: Transactions are completed in milliseconds, making Bitcoin more suitable for daily payments.

02 - Low fees: Since transactions occur off-chain, fees are minimal, allowing for viable microtransactions.

03 - Network decongestion: By moving many transactions to the Lightning Network, Bitcoin’s main chain becomes more efficient and less congested.

In summary, Bitcoin continues to evolve technologically to meet the demands of a global financial system. Smart contracts increase its functionality, offering greater flexibility and security in transactions. The Lightning Network improves scalability, making Bitcoin faster and more practical for everyday use. With these innovations, Bitcoin remains at the forefront of the financial revolution, proving that despite its initial limitations, it continues to adapt and grow as a truly decentralized and global monetary system.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ 90c656ff:9383fd4e

2025-05-24 12:06:36

@ 90c656ff:9383fd4e

2025-05-24 12:06:36Throughout history, money has always been under the control of central authorities, such as governments and banks. These intermediaries have set the rules of the financial system, controlled the issuance of currency, and overseen transactions. However, with the emergence of Bitcoin, a new paradigm began to take shape: decentralized money. This transformation represents a profound shift in how people store and transfer value, challenging the traditional financial model.

- The traditional model: centralized money

01 - Dependence on intermediaries: To carry out transactions, people rely on banks, governments, and other regulatory entities.

02 - Inflation and devaluation: Central banks can print money endlessly, often leading to a loss in purchasing power.

03 - Censorship and restrictions: Access to money can be denied for political, bureaucratic, or institutional reasons, limiting individuals’ financial freedom.

Despite being the dominant model for centuries, the centralized system has shown its vulnerabilities through numerous economic and political crises. It was in this context that Bitcoin emerged as an innovative alternative.

- The revolution of decentralized money

01 - Elimination of intermediaries: Transactions can be made directly between users, without the need for banks or financial companies.

02 - Limited and predictable supply: Bitcoin has a fixed cap of 21 million units, preventing the inflation caused by excessive money printing.

03 - Censorship resistance: No entity can block or prevent transactions, ensuring full financial freedom.

04 - Self-custody: Each user can hold their own funds without relying on a bank or any other institution.

This paradigm shift has a significant impact not only on the financial system but also on how people interact with money and protect their wealth.

Challenges and opposition to financial decentralization

The transition to a decentralized financial system faces several challenges, the main one being resistance from traditional institutions. Banks and governments see Bitcoin as a threat to their control over money and seek to regulate or limit its adoption.

There are also technical and educational barriers. Many people still do not fully understand how Bitcoin works, which can hinder its adoption. However, as more people become aware of the benefits of decentralized money, its use is likely to grow.

In summary, the shift from a centralized financial system to a decentralized one represents one of the most significant transformations of the digital era. Bitcoin leads this movement by offering a censorship-resistant, transparent, and accessible alternative. Despite opposition from the traditional system, the decentralization of money continues to gain momentum, providing greater autonomy and financial freedom to people around the world. This revolution is not just technological, but also social and economic—redefining the way the world understands and uses money.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ 57d1a264:69f1fee1

2025-05-24 06:07:19

@ 57d1a264:69f1fee1

2025-05-24 06:07:19Definition: when every single person in the chain responsible for shipping a product looks at objectively horrendous design decisions and goes: yup, this looks good to me, release this. Designers, developers, product managers, testers, quality assurance... everyone.

I nominate Peugeot as the first example in this category.

Continue reading at https://grumpy.website/1665

https://stacker.news/items/988044

-

@ 472f440f:5669301e

2025-05-20 02:00:54

@ 472f440f:5669301e

2025-05-20 02:00:54Marty's Bent

https://www.youtube.com/watch?v=p0Sj1sG05VQ

Here's a great presentation from our good friend nostr:nprofile1qyx8wumn8ghj7cnjvghxjmcpp4mhxue69uhkummn9ekx7mqqyz2hj3zg2g3pqwxuhg69zgjhke4pcmjmmdpnndnefqndgqjt8exwj6ee8v7 , President of The Nakamoto Institute titled Hodl for Good. He gave it earlier this year at the BitBlockBoom Conference, and I think it's something everyone reading this should take 25 minutes to watch. Especially if you find yourself wondering whether or not it's a good idea to spend bitcoin at any given point in time. Michael gives an incredible Austrian Economics 101 lesson on the importance of lowering one's time preference and fully understanding the importance of hodling bitcoin. For the uninitiated, it may seem that the hodl meme is nothing more than a call to hoard bitcoins in hopes of getting rich eventually. However, as Michael points out, there's layers to the hodl meme and the good that hodling can bring individuals and the economy overall.

The first thing one needs to do to better understand the hodl meme is to completely flip the framing that is typically thrust on bitcoiners who encourage others to hodl. Instead of ceding that hodling is a greedy or selfish action, remind people that hodling, or better known as saving, is the foundation of capital formation, from which all productive and efficient economic activity stems. Number go up technology is great and it really matters. It matters because it enables anybody leveraging that technology to accumulate capital that can then be allocated toward productive endeavors that bring value to the individual who creates them and the individual who buys them.

When one internalizes this, it enables them to turn to personal praxis and focus on minimizing present consumption while thinking of ways to maximize long-term value creation. Live below your means, stack sats, and use the time that you're buying to think about things that you want in the future. By lowering your time preference and saving in a harder money you will have the luxury of demanding higher quality goods in the future. Another way of saying this is that you will be able to reshape production by voting with your sats. Initially when you hold them off the market by saving them - signaling that the market doesn't have goods worthy of your sats - and ultimately by redeploying them into the market when you find higher quality goods that meet the standards desire.

The first part of this equation is extremely important because it sends a signal to producers that they need to increase the quality of their work. As more and more individuals decide to use bitcoin as their savings technology, the signal gets stronger. And over many cycles we should begin to see low quality cheap goods exit the market in favor of higher quality goods that provide more value and lasts longer and, therefore, make it easier for an individual to depart with their hard-earned and hard-saved sats. This is only but one aspect that Michael tries to imbue throughout his presentation.

The other is the ability to buy yourself leisure time when you lower your time preference and save more than you spend. When your savings hit a critical tipping point that gives you the luxury to sit back and experience true leisure, which Michael explains is not idleness, but the contemplative space to study, create art, refine taste, and to find what "better goods" actually are. Those who can experience true leisure while reaping the benefits of saving in a hard asset that is increasing in purchasing power significantly over the long term are those who build truly great things. Things that outlast those who build them. Great art, great monuments, great institutions were all built by men who were afforded the time to experience leisure. Partly because they were leveraging hard money as their savings and the place they stored the profits reaped from their entrepreneurial endeavors.

If you squint and look into the future a couple of decades, it isn't hard to see a reality like this manifesting. As more people begin to save in Bitcoin, the forces of supply and demand will continue to come into play. There will only ever be 21 million bitcoin, there are around 8 billion people on this planet, and as more of those 8 billion individuals decide that bitcoin is the best savings vehicle, the price of bitcoin will rise.

When the price of bitcoin rises, it makes all other goods cheaper in bitcoin terms and, again, expands the entrepreneurial opportunity. The best part about this feedback loop is that even non-holders of bitcoin benefit through higher real wages and faster tech diffusion. The individuals and business owners who decide to hodl bitcoin will bring these benefits to the world whether you decide to use bitcoin or not.

This is why it is virtuous to hodl bitcoin. The potential for good things to manifest throughout the world increase when more individuals decide to hodl bitcoin. And as Michael very eloquently points out, this does not mean that people will not spend their bitcoin. It simply means that they have standards for the things that they will spend their bitcoin on. And those standards are higher than most who are fully engrossed in the high velocity trash economy have today.

In my opinion, one of those higher causes worthy of a sats donation is nostr:nprofile1qyfhwumn8ghj7enjv4jhyetvv9uju7re0gq3uamnwvaz7tmfdemxjmrvv9nk2tt0w468v6tvd3skwefwvdhk6qpqwzc9lz2f40azl98shkjewx3pywg5e5alwqxg09ew2mdyeey0c2rqcfecft . Consider donating so they can preserve and disseminate vital information about bitcoin and its foundations.

The Shell Game: How Health Narratives May Distract from Vaccine Risks

In our recent podcast, Dr. Jack Kruse presented a concerning theory about public health messaging. He argues that figures like Casey and Callie Means are promoting food and exercise narratives as a deliberate distraction from urgent vaccine issues. While no one disputes healthy eating matters, Dr. Kruse insists that focusing on "Froot Loops and Red Dye" diverts attention from what he sees as immediate dangers of mRNA vaccines, particularly for children.

"It's gonna take you 50 years to die from processed food. But the messenger jab can drop you like Damar Hamlin." - Dr Jack Kruse

Dr. Kruse emphasized that approximately 25,000 children per month are still receiving COVID vaccines despite concerns, with 3 million doses administered since Trump's election. This "shell game," as he describes it, allows vaccines to remain on childhood schedules while public attention fixates on less immediate health threats. As host, I believe this pattern deserves our heightened scrutiny given the potential stakes for our children's wellbeing.

Check out the full podcast here for more on Big Pharma's alleged bioweapons program, the "Time Bank Account" concept, and how Bitcoin principles apply to health sovereignty.

Headlines of the Day

Aussie Judge: Bitcoin is Money, Possibly CGT-Exempt - via X

JPMorgan to Let Clients Buy Bitcoin Without Direct Custody - via X

Get our new STACK SATS hat - via tftcmerch.io

Mubadala Acquires 384,239 sats | $408.50M Stake in BlackRock Bitcoin ETF - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

I've been walking from my house around Town Lake in Austin in the mornings and taking calls on the walk. Big fan of a walking call.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 57d1a264:69f1fee1

2025-05-24 05:53:43

@ 57d1a264:69f1fee1

2025-05-24 05:53:43This talks highlights tools for product management, UX design, web development, and content creation to embed accessibility.

Organizations need scalability and consistency in their accessibility work, aligning people, policies, and processes to integrate it across roles. This session highlights tools for product management, UX design, web development, and content creation to embed accessibility. We will explore inclusive personas, design artifacts, design systems, and content strategies to support developers and creators, with real-world examples.

https://www.youtube.com/watch?v=-M2cMLDU4u4

https://stacker.news/items/988041

-

@ 1d7ff02a:d042b5be

2025-05-24 10:15:40

@ 1d7ff02a:d042b5be

2025-05-24 10:15:40ຄົນສ່ວນຫຼາຍມັກຈະມອງເຫັນ Bitcoin ເປັນສິນຊັບທີ່ມີຄວາມສ່ຽງສູງ ເນື່ອງຈາກມີອັດຕາການປ່ຽນແປງລາຄາທີ່ຮຸນແຮງແລະກວ້າງຂວາງໃນໄລຍະສັ້ນໆ. ແຕ່ຄວາມຈິງແລ້ວ ຄວາມຜັນຜວນຂອງ Bitcoin ແມ່ນຄຸນລັກສະນະພິເສດທີ່ສຳຄັນຂອງມັນ ບໍ່ແມ່ນຂໍ້ບົກພ່ອງ.

ລາຄາແມ່ນຫຍັງ?

ເພື່ອເຂົ້າໃຈເລື້ອງນີ້ດີຂຶ້ນ ເຮົາຕ້ອງເຂົ້າໃຈກ່ອນວ່າລາຄາໝາຍເຖິງຫຍັງ. ລາຄາແມ່ນການສະທ້ອນຄວາມຄິດເຫັນແລະການປະເມີນມູນຄ່າຂອງຜູ້ຊື້ແລະຜູ້ຂາຍໃນເວລາໃດໜຶ່ງ. ການຕັດສິນໃຈຊື້ຫຼືຂາຍໃນລາຄາໃດໜຶ່ງ ກໍແມ່ນການສື່ສານກັບຕະຫຼາດ ແລະກົນໄກຂອງຕະຫຼາດຈະຄ້ົນຫາແລະກໍານົດລາຄາທີ່ແທ້ຈິງຂອງສິນຊັບນັ້ນ.

ເປັນຫຍັງ Bitcoin ຈຶ່ງຜັນຜວນ?

Bitcoin ຖືກສ້າງຂຶ້ນບົນພື້ນຖານອິນເຕີເນັດ ເຮັດໃຫ້ການສື່ສານຄວາມຄິດເຫັນຂອງຜູ້ຄົນສາມາດເຮັດໄດ້ຢ່າງໄວວາ. ຍິ່ງໄປກວ່ານັ້ນ Bitcoin ມີລັກສະນະກະຈາຍສູນ (decentralized) ແລະບໍ່ມີຜູ້ຄວບຄຸມສູນກາງ ຈຶ່ງເຮັດໃຫ້ຄົນສາມາດຕັດສິນໃຈຊື້ຂາຍໄດ້ຢ່າງໄວວາ.

ສິ່ງນີ້ເຮັດໃຫ້ລາຄາຂອງ Bitcoin ສາມາດສະທ້ອນຄວາມຄິດເຫັນຂອງຄົນໄດ້ແບບເວລາຈິງ (real-time). ແລະເນື່ອງຈາກມະນຸດເຮົາມີຄວາມຄິດທີ່ບໍ່ແນ່ນອນ ມີການປ່ຽນແປງ ລາຄາຂອງ Bitcoin ຈຶ່ງປ່ຽນແປງໄປຕາມຄວາມຄິດເຫັນລວມຂອງຜູ້ຄົນແບບທັນທີ.

ປັດໄຈທີ່ເພີ່ມຄວາມຜັນຜວນ:

ຂະໜາດຕະຫຼາດທີ່ຍັງນ້ອຍ: ເມື່ອປຽບທຽບກັບຕະຫຼາດການເງິນແບບດັ້ງເດີມ ຕະຫຼາດ Bitcoin ຍັງມີຂະໜາດນ້ອຍ ເຮັດໃຫ້ການຊື້ຂາຍຈຳນວນໃຫຍ່ສາມາດສົ່ງຜົນກະທົບຕໍ່ລາຄາໄດ້ຫຼາຍ.

ການຄ້າຂາຍຕະຫຼອດ 24/7: ບໍ່ເຫມືອນກັບຕະຫຼາດຫຼັກຊັບທີ່ມີເວລາເປີດປິດ Bitcoin ສາມາດຊື້ຂາຍໄດ້ຕະຫຼອດເວລາ ເຮັດໃຫ້ການປ່ຽນແປງລາຄາສາມາດເກີດຂຶ້ນໄດ້ທຸກເວລາ.

ການປຽບທຽບກັບສິນຊັບອື່ນ

ເມື່ອປຽບທຽບກັບສິນຊັບອື່ນທີ່ມີການຄວບຄຸມ ເຊັ່ນ ສະກຸນເງິນທ້ອງຖິ່ນຫຼືທອງຄຳ ທີ່ເບິ່ງຄືວ່າມີຄວາມຜັນຜວນໜ້ອຍກວ່າ Bitcoin ນັ້ນ ບໍ່ແມ່ນຫມາຍຄວາມວ່າພວກມັນບໍ່ມີຄວາມຜັນຜວນ. ແຕ່ເປັນເພາະມີການຄວບຄຸມຈາກອົງການສູນກາງ ເຮັດໃຫ້ການສື່ສານຄວາມຄິດເຫັນຂອງຄົນໄປຮອດຕະຫຼາດບໍ່ແບບເວລາຈິງ.

ດັ່ງນັ້ນ ສິ່ງທີ່ເຮົາເຫັນແມ່ນການຊັກຊ້າ (delay) ໃນການສະແດງຄວາມຄິດເຫັນທີ່ແທ້ຈິງອອກມາເທົ່ານັ້ນ ບໍ່ແມ່ນຄວາມໝັ້ນຄົງຂອງມູນຄ່າ.

ກົນໄກການຄວບຄຸມແລະຜົນກະທົບ:

ສະກຸນເງິນ: ທະນາຄານກາງສາມາດພິມເງິນ ປັບອັດຕາດອກເບີ້ຍ ແລະແຊກແຊງຕະຫຼາດ ເຮັດໃຫ້ລາຄາບໍ່ສະທ້ອນມູນຄ່າທີ່ແທ້ຈິງໃນທັນທີ.

ຫຼັກຊັບ: ມີລະບຽບການຫຼາຍຢ່າງ ເຊັ່ນ ການຢຸດການຊື້ຂາຍເມື່ອລາຄາປ່ຽນແປງຫຼາຍເກີນໄປ (circuit breakers) ທີ່ຂັດຂວາງການສະແດງຄວາມຄິດເຫັນທີ່ແທ້ຈິງ.

ທອງຄຳ: ຖຶງແມ່ນຈະເປັນສິນຊັບທີ່ບໍ່ມີການຄວບຄຸມ ແຕ່ຕະຫຼາດທອງຄຳມີຂະໜາດໃຫຍ່ກວ່າ Bitcoin ຫຼາຍ ແລະມີການຄ້າແບບດັ້ງເດີມທີ່ຊ້າກວ່າ.

ບົດສະຫຼຸບ

ການປຽບທຽບຄວາມຜັນຜວນລະຫວ່າງ Bitcoin ແລະສິນຊັບອື່ນໆ ໂດຍໃຊ້ໄລຍະເວລາສັ້ນນັ້ນ ບໍ່ມີຄວາມສົມເຫດສົມຜົນປານໃດ ເພາະວ່າປັດໄຈເລື້ອງການຊັກຊ້າໃນການສະແດງຄວາມຄິດເຫັນນີ້ແມ່ນສິ່ງສຳຄັນທີ່ສົ່ງຜົນຕໍ່ລາຄາທີ່ແທ້ຈິງ.

ສິ່ງທີ່ຄວນເຮັດແທ້ໆແມ່ນການນຳເອົາກອບເວລາທີ່ກວ້າງຂວາງກວ່າມາວິເຄາະ ເຊັ່ນ ເປັນປີຫຼືຫຼາຍປີ ແລ້ວຈຶ່ງປຽບທຽບ. ດ້ວຍວິທີນີ້ ເຮົາຈຶ່ງຈະເຫັນປະສິດທິຜົນແລະການດຳເນີນງານທີ່ແທ້ຈິງຂອງ Bitcoin ໄດ້ຢ່າງຈະແຈ້ງ

-

@ 472f440f:5669301e

2025-05-16 00:18:45

@ 472f440f:5669301e

2025-05-16 00:18:45Marty's Bent

It's been a pretty historic week for the United States as it pertains to geopolitical relations in the Middle East. President Trump and many members of his administration, including AI and Crypto Czar David Sacks and Treasury Secretary Scott Bessent, traveled across the Middle East making deals with countries like Qatar, Saudi Arabia, the United Arab Emirates, Syria, and others. Many are speculating that Iran may be included in some behind the scenes deal as well. This trip to the Middle East makes sense considering the fact that China is also vying for favorable relationships with those countries. The Middle East is a power player in the world, and it seems pretty clear that Donald Trump is dead set on ensuring that they choose the United States over China as the world moves towards a more multi-polar reality.

Many are calling the events of this week the Riyadh Accords. There were many deals that were struck in relation to artificial intelligence, defense, energy and direct investments in the United States. A truly prolific power play and demonstration of deal-making ability of Donald Trump, if you ask me. Though I will admit some of the numbers that were thrown out by some of the countries were a bit egregious. We shall see how everything plays out in the coming years. It will be interesting to see how China reacts to this power move by the United States.

While all this was going on, there was something happening back in the United States that many people outside of fringe corners of FinTwit are not talking about, which is the fact that the 10-year and 30-year U.S. Treasury bond yields are back on the rise. Yesterday, they surpassed the levels of mid-April that caused a market panic and are hovering back around levels that have not been seen since right before Donald Trump's inauguration.

I imagine that there isn't as much of an uproar right now because I'm pretty confident the media freakouts we were experiencing in mid-April were driven by the fact that many large hedge funds found themselves off sides of large levered basis trades. I wouldn't be surprised if those funds have decreased their leverage in those trades and bond yields being back to mid-April levels is not affecting those funds as much as they were last month. But the point stands, the 10-year and 30-year yields are significantly elevated with the 30-year approaching 5%. Regardless of the deals that are currently being made in the Middle East, the Treasury has a big problem on its hands. It still has to roll over many trillions worth of debt over over the next few years and doing so at these rates is going to be massively detrimental to fiscal deficits over the next decade. The interest expense on the debt is set to explode in the coming years.

On that note, data from the first quarter of 2025 has been released by the government and despite all the posturing by the Trump administration around DOGE and how tariffs are going to be beneficial for the U.S. economy, deficits are continuing to explode while the interest expense on the debt has definitively surpassed our annual defense budget.

via Charlie Bilello

via Mohamed Al-Erian

To make matters worse, as things are deteriorating on the fiscal side of things, the U.S. consumer is getting crushed by credit. The 90-plus day delinquency rates for credit card and auto loans are screaming higher right now.

via TXMC

One has to wonder how long all this can continue without some sort of liquidity crunch. Even though equities markets have recovered from their post-Liberation Day month long bear market, I would not be surprised if what we're witnessing is a dead cat bounce that can only be continued if the money printers are turned back on. Something's got to give, both on the fiscal side and in the private markets where the Common Man is getting crushed because he's been forced to take on insane amounts of debt to stay afloat after years of elevated levels of inflation. Add on the fact that AI has reached a state of maturity that will enable companies to replace their current meat suit workers with an army of cheap, efficient and fast digital workers and it isn't hard to see that some sort of employment crisis could be on the horizon as well.

Now is not the time to get complacent. While I do believe that the deals that are currently being made in the Middle East are probably in the best interest of the United States as the world, again, moves toward a more multi-polar reality, we are facing problems that one cannot simply wish away. They will need to be confronted. And as we've seen throughout the 21st century, the problems are usually met head-on with a money printer.

I take no pleasure in saying this because it is a bit uncouth to be gleeful to benefit from the strife of others, but it is pretty clear to me that all signs are pointing to bitcoin benefiting massively from everything that is going on. The shift towards a more multi-polar world, the runaway debt situation here in the United States, the increasing deficits, the AI job replacements and the consumer credit crisis that is currently unfolding, All will need to be "solved" by turning on the money printers to levels they've never been pushed to before.

Weird times we're living in.

China's Manufacturing Dominance: Why It Matters for the U.S.

In my recent conversation with Lyn Alden, she highlighted how China has rapidly ascended the manufacturing value chain. As Lyn pointed out, China transformed from making "sneakers and plastic trinkets" to becoming the world's largest auto exporter in just four years. This dramatic shift represents more than economic success—it's a strategic power play. China now dominates solar panel production with greater market control than OPEC has over oil and maintains near-monopoly control of rare earth elements crucial for modern technology.

"China makes like 10 times more steel than the United States does... which is relevant in ship making. It's relevant in all sorts of stuff." - Lyn Alden

Perhaps most concerning, as Lyn emphasized, is China's financial leverage. They hold substantial U.S. assets that could be strategically sold to disrupt U.S. treasury market functioning. This combination of manufacturing dominance, resource control, and financial leverage gives China significant negotiating power in any trade disputes, making our attempts to reshoring manufacturing all the more challenging.

Check out the full podcast here for more on Triffin's dilemma, Bitcoin's role in monetary transition, and the energy requirements for rebuilding America's industrial base.

Headlines of the Day

Financial Times Under Fire Over MicroStrategy Bitcoin Coverage - via X

Trump in Qatar: Historic Boeing Deal Signed - via X

Get our new STACK SATS hat - via tftcmerch.io

Johnson Backs Stock Trading Ban; Passage Chances Slim - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Building things of value is satisfying.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 472f440f:5669301e

2025-05-14 13:17:04

@ 472f440f:5669301e

2025-05-14 13:17:04Marty's Bent

via me

It seems like every other day there's another company announced that is going public with the intent of competing with Strategy by leveraging capital markets to create financial instruments to acquire Bitcoin in a way that is accretive for shareholders. This is certainly a very interesting trend, very bullish for bitcoin in the short-term, and undoubtedly making it so bitcoin is top of mind in the mainstream. I won't pretend to know whether or not these strategies will ultimately be successful or fail in the short, medium or long term. However, one thing I do know is that the themes that interest me, both here at TFTC and in my role as Managing Partner at Ten31, are companies that are building good businesses that are efficient, have product-market-fit, generate revenues and profits and roll those profits into bitcoin.

While it seems pretty clear that Strategy has tapped into an arbitrage that exists in capital markets, it's not really that exciting. From a business perspective, it's actually pretty straightforward and simple; find where potential arbitrage opportunities exists between pools of capital looking for exposure to spot bitcoin or bitcoin's volatility but can't buy the actual asset, and provide them with products that give them access to exposure while simultaneously creating a cult-like retail following. Rinse and repeat. To the extent that this strategy is repeatable is yet to be seen. I imagine it can expand pretty rapidly. Particularly if we have a speculative fervor around companies that do this. But in the long run, I think the signal is falling back to first principles, looking for businesses that are actually providing goods and services to the broader economy - not focused on the hyper-financialized part of the economy - to provide value and create efficiencies that enable higher margins and profitability.

With this in mind, I think it's important to highlight the combined leverage that entrepreneurs have by utilizing bitcoin treasuries and AI tools that are emerging and becoming more advanced by the week. As I said in the tweet above, there's never been a better time to start a business that finds product-market fit and cash flows quickly with a team of two to three people. If you've been reading this rag over the last few weeks, you know that I've been experimenting with these AI tools and using them to make our business processes more efficient here at TFTC. I've also been using them at Ten31 to do deep research and analysis.

It has become abundantly clear to me that any founder or entrepreneur that is not utilizing the AI tools that are emerging is going to get left behind. As it stands today, all anyone has to do to get an idea from a thought in your head to the prototype stage to a minimum viable product is to hop into something like Claude or ChatGPT, have a brief conversation with an AI model that can do deep research about a particular niche that you want to provide a good service to and begin building.

Later this week, I will launch an app called Opportunity Cost in the Chrome and Firefox stores. It took me a few hours of work over the span of a week to ideate and iterate on the concept to the point where I had a working prototype that I handed off to a developer who is solving the last mile problem I have as an "idea guy" of getting the product to market. Only six months ago, accomplishing something like this would have been impossible for me. I've never written a line of code that's actually worked outside of the modded MySpace page I made back in middle school. I've always had a lot of ideas but have never been able to effectively communicate them to developers who can actually build them. With a combination of ChatGPT-03 and Replit, I was able to build an actual product that works. I'm using it in my browser today. It's pretty insane.

There are thousands of people coming to the same realization at the same time right now and going out there and building niche products very cheaply, with small teams, they are getting to market very quickly, and are amassing five figures, six figures, sometimes seven figures of MRR with extremely high profit margins. What most of these entrepreneurs have not really caught on to yet is that they should be cycling a portion - in my opinion, a large portion - of those profits into bitcoin. The combination of building a company utilizing these AI tools, getting it to market, getting revenue and profits, and turning those profits into bitcoin cannot be understated. You're going to begin seeing teams of one to ten people building businesses worth billions of dollars and they're going to need to store the value they create, any money that cannot be debased.

nostr:nprofile1qyx8wumn8ghj7cnjvghxjmcpz4mhxue69uhk2er9dchxummnw3ezumrpdejqqgy8fkmd9kmm8yp4lea2cx0g8fyz27g4ud7572j4edx2v6lz6aa23qmp5dth , one of the co-founders of Ten31, wrote about this in early 2024, bitcoin being the fourth lever of equity value growth for companies.

Bitcoin Treasury - The Fourth Lever to Equity Value Growth

We already see this theme playing out at Ten31 with some of our portfolio companies, most notably nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgdwaehxw309ahx7uewd3hkcqpqex7mdykw786qxvmtuls208uyxmn0hse95rfwsarvfde5yg6wy7jqjrm2qp , which recently released some of their financials, highlighting the fact that they're extremely profitable with high margins and a relatively small team (\~75). This is extremely impressive, especially when you consider the fact that they're a global company competing with the likes of Coinbase and Block, which have each thousands of employees.

Even those who are paying attention to the developments in the AI space and how the tools can enable entrepreneurs to build faster aren't really grasping the gravity of what's at play here. Many are simply thinking of consumer apps that can be built and distributed quickly to market, but the ways in which AI can be implemented extend far beyond the digital world. Here's a great example of a company a fellow freak is building with the mindset of keeping the team small, utilizing AI tools to automate processes and quickly push profits into bitcoin.

via Cormac

Again, this is where the exciting things are happening in my mind. People leveraging new tools to solve real problems to drive real value that ultimately produce profits for entrepreneurs. The entrepreneurs who decide to save those profits in bitcoin will find that the equity value growth of their companies accelerates exponentially as they provide more value, gain more traction, and increase their profits while also riding the bitcoin as it continues on its monetization phase. The compounded leverage of building a company that leverages AI tools and sweeps profits into bitcoin is going to be one of the biggest asymmetric plays of the next decade. Personally, I also see it as something that's much more fulfilling than the pure play bitcoin treasury companies that are coming to market because consumers and entrepreneurs are able to recive and provide a ton of value in the real economy.

If you're looking to stay on top of the developments in the AI space and how you can apply the tools to help build your business or create a new business, I highly recommend you follow somebody like Greg Isenberg, whose Startup Ideas Podcast has been incredibly valuable for me as I attempt to get a lay of the land of how to implement AI into my businesses.

America's Two Economies

In my recent podcast with Lyn Alden, she outlined how our trade deficits create a cycle that's reshaping America's economic geography. As Alden explained, US trade deficits pump dollars into international markets, but these dollars don't disappear - they return as investments in US financial assets. This cycle gradually depletes industrial heartlands while enriching financial centers on the coasts, creating what amounts to two separate American economies.

"We're basically constantly taking economic vibrancy out of Michigan and Ohio and rural Pennsylvania where the steel mills were... and stuffing it back into financial assets in New York and Silicon Valley." - nostr:nprofile1qy2hwumn8ghj7mn0wd68ytndv9kxjm3wdahxcqg5waehxw309ahx7um5wfekzarkvyhxuet5qqsw4v882mfjhq9u63j08kzyhqzqxqc8tgf740p4nxnk9jdv02u37ncdhu7e3

This pattern has persisted for over four decades, accelerating significantly since the early 1980s. Alden emphasized that while economists may argue there's still room before reaching a crisis point, the political consequences are already here. The growing divide between these two Americas has fueled populist sentiment as voters who feel left behind seek economic rebalancing, even if they can't articulate the exact mechanisms causing their hardship.

Check out the full podcast here for more on China's manufacturing dominance, Trump's tariff strategy, and the future of Bitcoin as a global reserve asset. All discussed in under 60 minutes.

Headlines of the Day

Trump's Saudi Summit: Peace and Economic Ties - via X

MSTR Edges Closer To S\&P 500 With Just 89 Trading Days Left - via X

Get our new STACK SATS hat - via tftcmerch.io

Individuals Shed 247K Bitcoin As Businesses Gain 157K - via X

Looking for the perfect video to push the smartest person you know from zero to one on bitcoin? Bitcoin, Not Crypto is a three-part master class from Parker Lewis and Dhruv Bansal that cuts through the noise—covering why 21 million was the key technical simplification that made bitcoin possible, why blockchains don’t create decentralization, and why everything else will be built on bitcoin.

Ten31, the largest bitcoin-focused investor, has deployed 144,229 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

My boys have started a game in the car where we count how many Waymos we see on the road while driving around town. Pretty crazy how innately stoked they are about that particular car.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 5ea46480:450da5bd

2025-05-24 09:57:37

@ 5ea46480:450da5bd

2025-05-24 09:57:37Decentralization refers to control/power, and relates to censorship resistance. That is it, it is not more complicated then that. Resilience is a function of redundancy; a centralized censored system can have a redundant set-up and therefor be resilient.

Take Bitcoin; the blockchain is a central database, it is resilient because it has many redundant copies among a lot of different nodes. The message (txs and blocks) propagation is decentralized due to existence of a p2p network among these nodes, making the data distribution censorship resistant (hello op_return debate). But onchain transactions themselves are NOT p2p, they require a middlemen (a miner) because it is a central database, as opposed to something like lightning which is p2p. Peer to Peer says something about relative architectural hierarchical position/relation. P2P provides censorship resistance because it entails equal power relations, provided becoming a peer is permissionless. What makes onchain transactions censorship resistant is that mining is permissionless, and involves this open power struggle/game where competition results in a power distribution among players, meaning (hopefully) decentralization. The fact users rely on these middlemen is mitigated by this decentralization on the one hand, and temper-proofing via cryptographic signatures on the other, resulting in what we call trustlessness (or trust minimization for the autists in the room); we only rely on a miner to perform a job (including your tx into a block), but we don’t trust the miner to perform the job correctly, this we can verify ourselves.

This leads us to Nostr, because that last part is exactly what Nostr does as well. It uses cryptography to get tamper-proof messaging, which then allows you to use middle-men in a trust minimized way. The result is decentralization because in general terms, any middle man is as good as any other (same as with miners), and becoming such a middleman is permissionless(somewhat, mostly); which in turn leads to censorship resistance. It also allows for resilience because you are free to make things as redundant as you'd like.

Ergo, the crux is putting the cryptography central, making it the starting point of the system; decentralization then becomes an option due to trust minimization. The difference between Bitcoin an Nostr, is that Bitcoin maintains a global state/central ledger and needs this PoW/Nakamoto consensus fanfare; Nostr rests itself with local perspectives on 'the network'.

The problem with the Fediverse, is that it does not provide trust minimization in relation to the middlemen. Sure, there are a lot different servers, but you rely on a particular one (and the idea you could switch never really seemed to have materialized in a meaningful way). It also fails in permisionlessness because you rely on the association between servers, i.e. federation, to have meaningful access to the rest of the network. In other words, it is more a requirement of association than freedom of association; you have the freedom to be excommunicated.

The problem with ATproto is that is basically does not solve this dynamic; it only complicates it by pulling apart the components; identity and data, distribution and perspective are now separated, and supposedly you don’t rely on any particular one of these sub-component providers in the stack; but you do rely on all these different sub-component providers in the stack to play nice with each other. And this ‘playing nice’ is just the same old ‘requirement of association’ and ‘freedom of excommunication’ that looms at the horizon.

Yes, splitting up the responsibilities of identity, hosting and indexing is what is required to safe us from the platform hellscape which at this stage takes care of all three. But as it turns out, it was not a matter cutting those up into various (on paper) interchangeable middlemen. All that is required is putting cryptographic keys in the hands of the user; the tamperproofing takes care of the rest, simply by trust minimizing the middlemen we use. All the sudden it does not matter which middlemen we use, and no one is required to play nice; we lost the requirement of association, and gained freedom of association, which was the purpose of censorship resistance and therefor decentralization, to begin with.

-

@ 6a6be47b:3e74e3e1

2025-05-24 08:21:35

@ 6a6be47b:3e74e3e1

2025-05-24 08:21:35Hi, frens!

🥳 This is my first post over here, yaaay! I’m very excited to start this journey. I have lots of posts on my website https://samhainsam.art/ , but I decided to give you a short introduction to me and my artwork. Shall we?

But first, how’s your weekend going? Already dreading Monday, or just enjoying the moment? I hope it’s the latter, but if not, that’s okay too. Everything passes, and while that might not be the most comforting thought, knowing that it will eventually pass—and, most importantly, that we get to decide how to respond—makes a big difference. Either way, we’re all going to die, so take it as you wish! 😅

Anyway, I wanted to share a little something. If you’ve visited my shop on Ko-fi https://ko-fi.com/samhainsam/shop , you might have wondered why it seems a bit all over the place. Or maybe you haven’t noticed or don’t care—but either way, I thought I’d clarify.

🖼️ I’m a self-taught artist who loves everything related to religion, occultism, paganism, animals, and esotericism—and how all these themes intertwine in our lives. I paint and illustrate inspired by these ideas.

Most of my recent paintings come with a blog post explaining their background. Even before, I always researched the subjects I painted, but lately, I’ve been diving much deeper.

🎨 My “Wheel of the Year” series has completely fascinated me. I’ve been learning so many nuggets of wisdom, and discovering how Christianity borrowed or even erased many symbols and traditions to create new narratives. For example, Imbolc was rebranded as Candlemas, and my blog post about the Spanish Inquisition touches on some of these symbols and their impact on both past and present society.

🐦 I also have some paintings just about birds—I'm a bit of a sucker for them! Shoebills and cassowaries are among my favorites, and I might end up painting them again soon. But you get the picture! If not, why not take a peek at my blog? https://samhainsam.art/blog/

🖋️ You can read something fun and interesting while enjoying my artwork.

Come on over, and let’s have some cool and healthy fun.

Enjoy your weekend, my friends!

Godspeed ⚡

https://stacker.news/items/988069

-

@ 9ca447d2:fbf5a36d

2025-05-22 14:01:52

@ 9ca447d2:fbf5a36d

2025-05-22 14:01:52Gen Z (those born between 1997 and 2012) are not rushing to stack sats, and Oliver Porter, Founder & CEO of Jippi, understands the challenge better than most. His strategy revolves around adapting Bitcoin education to fit seamlessly into the digital lives of young adults.

“We need to meet them where they are,” Oliver explains. “90% of Gen Z plays games. 70% expect to earn rewards.”

So, what will effectively introduce them to Bitcoin? In Oliver’s mind, the answer is simple: games that don’t feel preachy but still plant the orange pill.

Learn more at Jippi.app

That’s exactly what Jippi is. Based in Austin, Texas, the team has created a mobile augmented reality (AR) game that rewards players in bitcoin and sneakily teaches them why sound money matters.

“It’s Pokémon GO… but for sats,” Oliver puts it succinctly.

Jippi is like Pokemon Go, but for sats

Oliver’s Bitcoin journey, like many in the space, began long before he was ready. A former colleague had tried planting the seed years earlier, handing him a copy of The Bitcoin Standard. But the moment passed.

It wasn’t until the chaos of 2020 when lockdowns hit, printing presses roared, and civil liberties shrank that the message finally landed for him.

“The government got so good at doing reverse Robin Hood,” Oliver explains. “They steal from the working population and reward the rich.”

By 2020, though, the absurdity of the covid hysteria had caused his eyes to be opened and the orange light seemed the best path back to freedom.

He left the UK for Austin “one of the best places for Bitcoiners,” he says, and dove headfirst into the industry, working at Swan for a year before founding Jippi on PlebLab’s accelerator program.

Jippi’s flagship game lets players roam their cities hunting digital creatures, Bitcoin Beasts, tied to real-world locations. Catching them requires answering Bitcoin trivia, and the reward is sats.

No jargon. No hour-long lectures. Just gameplay with sound money principles woven right in.

The model is working. At a recent hackathon in Austin, Jippi beat out 14 other teams to win first place and $15,000 in prize money.

Oliver of Jippi won Top Builder Season 2 — PlebLab on X

“We’re backdooring Bitcoin education,” Oliver admits. “And while we’re at it, encouraging people to get outside and touch grass.”

Not everyone’s been thrilled. When Jippi team members visited one of the more liberal-leaning places in Texas, UT Austin, to test interest in Bitcoin, they found some seriously committed no-coiners on the campus.

“One young woman told me, ‘I would rather die than talk about Bitcoin,'” Oliver recalls, highlighting the cultural resistance that’s built up among younger demographics.

This resistance is backed by hard data. According to Oliver, some of the Bitcoin podcasters they met with in the space to do market research reported that less than 1% of their listeners are from Gen Z and that number is dropping.

“Unless we find a way to capture their interest in a meaningful way, there’s going to be a big problem around trying to sway Gen Z away from the siren call of s***coins and crypto casinos and towards Bitcoin,” Oliver warns.

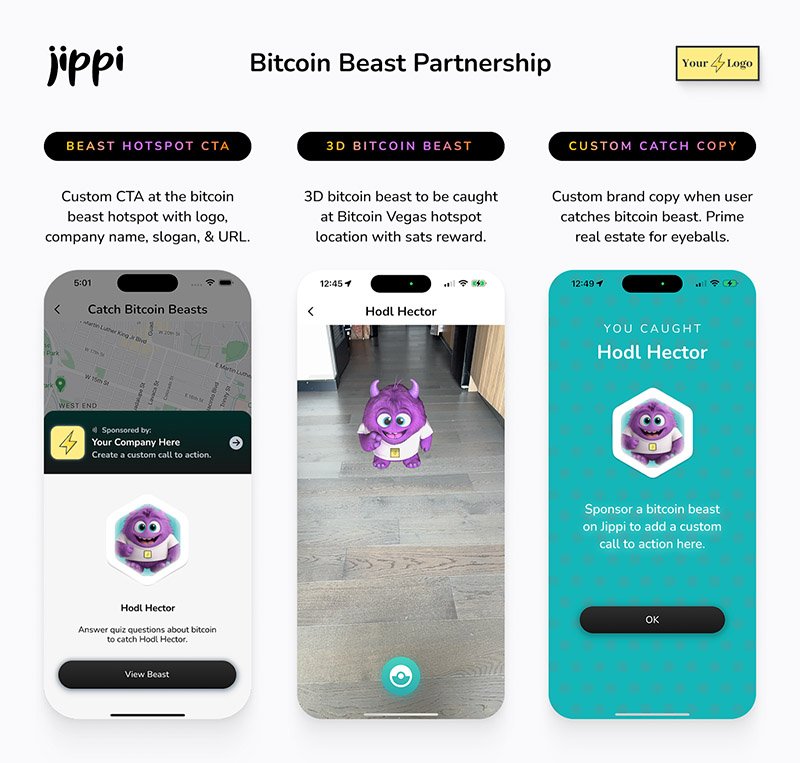

Jippi’s next big move is Las Vegas, where they’ll launch the Beast Catch experience at the Venetian during a major Bitcoin event. To mark the occasion, they’re opening up six limited sponsorship spots for Bitcoin companies, each one tied to a custom in-game beast.

Jippi looks to launch a special event at Bitcoin 2025

“It’s real estate inside the game,” Oliver explains. “Brands become allies, not intrusions. You get a logo, company name, and call to action, so we can push people to your site or app.”

Bitcoin Well—an automatic self-custody Bitcoin platform—has claimed Beast #1. Only five exclusive spots remain for Bitcoin companies to “beastify their brand” through Jippi’s immersive AR game.

“I love the Jippi mission. I think gamified learning is how we will onboard the next generation and it’s exciting to see what the Jippi team is doing! I love working with bitcoiners towards our common mission – bullish!” said Adam O’Brien, Bitcoin Well CEO.

Jippi’s sponsorship model is simple: align incentives, respect users, and support builders. Instead of throwing ad money at tech giants, Bitcoin companies can connect with new users naturally while they’re having fun and earning sats in the process.

For Bitcoin companies looking to reach a younger demographic, this represents a unique opportunity to showcase their brand to up to 30,000 potential customers at the Vegas event.

Jippi Bitcoin Beast partnership

While Jippi’s current focus is simple, get the game into more cities, Oliver sees a future where AR glasses and AI help personalize Bitcoin education even further.

“The magic is going to really happen when Apple releases the glasses form factor,” he says, describing how augmented reality could enhance real-world connections rather than isolate users.

In the longer term, Jippi aims to evolve from a free-to-play model toward a pay-to-play version with higher stakes. Users would form “tribes” with friends to compete for substantial bitcoin prizes, creating social connections along with financial education.

Unlike VC-backed startups, Jippi is raising funds pleb style via Timestamp, an open investment platform for Bitcoin companies.

“You don’t have to be an accredited investor,” Oliver explains. “You’re directly supporting the parallel Bitcoin economy by investing in Bitcoin companies for equity.”

Anyone can invest as little as $100. Perks include early access, exclusive game content, and even creating your own beast design with your name/pseudonym and unique game lore. Each investment comes with direct ownership of an early-stage Bitcoin company like Jippi.

For Oliver, this is more than just a business. It’s about future-proofing Bitcoin adoption and ensuring Satoshi’s vision lives on, especially as many people are lured by altcoins, NFTs, and social media dopamine.

“We’re on the right side of history,” he says firmly. “I want my grandkids to know that early on in the Bitcoin revolution, games like Jippi helped make it stick.”

In a world increasingly absorbed by screens and short attention spans, Jippi’s combination of outdoor play, sats rewards, and Bitcoin education might be exactly the bridge Gen Z needs.

Interested in sponsoring a Beast or investing in Jippi? Reach out to Jippi directly by heading to their partnerships page on their website or visit their Timestamp page to invest in Jippi today.

-

@ 472f440f:5669301e

2025-05-14 01:15:12

@ 472f440f:5669301e

2025-05-14 01:15:12Marty's Bent

via Kevin McKernan

There's been a lot of discussion this week about Casey Means being nominated for Surgeon General of the United States and a broader overarching conversation about the effectiveness of MAHA since the inauguration and how effective it may or may not be moving forward. Many would say that President Trump won re-election due to Robert F. Kennedy Jr. and Nicole Shanahan deciding to reach across the aisle and join the Trump ticket, bringing with them the MAHA Moms, who are very focused on reorienting the healthcare system in the United States with a strong focus on the childhood vaccine schedule.

I'm not going to lie, this is something I'm passionate about as well, particularly after having many conversations over the years with doctors like Kevin McKernan, Dr. Jack Kruse, Dr. Mary Talley Bowden, Dr. Brooke Miller, Dr. Peter McCullough and others about the dangers of the COVID mRNA vaccines. As it stands today, I think this is the biggest elephant in the room in the world of healthcare. If you look at the data, particularly disability claims, life insurance claims, life expectancy, miscarriage rates, fertility issues and rates of turbo cancer around the world since the COVID vaccine was introduced in 2021, it seems pretty clear that there is harm being done to many of the people who have taken them.

The risk-reward ratio of the vaccines seems to be incredibly skewed towards risk over reward and children - who have proven to be least susceptible to COVID - are expected to get three COVID shots in the first year of their life if their parents follow the vaccine schedule. For some reason or another it seems that Robert F. Kennedy Jr. has shied away from this topic after becoming the head of Health and Human Services within the Trump administration. This is after a multi-year campaign during which getting the vaccines removed from the market war a core part of his platform messaging.

I'm still holding out hope that sanity will prevail. The COVID mRNA vaccines will be taken off the market in a serious conversation about the crimes against humanity that unfolded during the COVID years will take place. However, we cannot depend on that outcome. We must build with the assumption in mind that that outcome may never materialize. This leads to identifying where the incentives within the system are misconstrued. One area where I think it's pretty safe to say that the incentives are misaligned is the fact that 95% of doctors work for and answer to a corporation driven by their bottom line. Instead of listening to their patients and truly caring about the outcome of each individual, doctors forced to think about the monetary outcome of the corporation they work for first.

The most pernicious way in which these misaligned incentives emerge is the way in which the hospital systems and physicians are monetarily incentivized by big pharma companies to push the COVID vaccine and other vaccines on their patients. It is important to acknowledge that we cannot be dependent on a system designed in this way to change from within. Instead, we must build a new incentive system and market structure. And obviously, if you're reading this newsletter, you know that I believe that bitcoin will play a pivotal role in realigning incentives across every industry. Healthcare just being one of them.

Bitcoiners who have identified the need to become sovereign in our monetary matters, it probably makes sense to become sovereign when it comes to our healthcare as well. This means finding doctors who operate outside the corporate controlled system and are able to offer services that align incentives with the end patient. My family utilizes a combination of CrowdHealth and a private care physician to align incentives. We've even utilized a private care physician who allowed us to pay in Bitcoin for her services for a number of years. I think this is the model. Doctors accepting hard censorship resistant money for the healthcare and advice they provide. Instead of working for a corporation looking to push pharmaceutical products on their patients so they can bolster their bottom line, work directly with patients who will pay in bitcoin, which will appreciate in value over time.

I had a lengthy discussion with Dr. Jack Kruse on the podcast earlier today discussing these topic and more. It will be released on Thursday and I highly recommend you freaks check it out once it is published. Make sure you subscribe so you don't miss it.

How the "Exorbitant Privilege" of the Dollar is Undermining Our Manufacturing Base

In my conversation with Lyn Alden, we explored America's fundamental economic contradiction. As Lyn expertly explained, maintaining the dollar's reserve currency status while attempting to reshore manufacturing presents a near-impossible challenge - what economists call Triffin's Dilemma. The world's appetite for dollars gives Americans tremendous purchasing power but simultaneously hollows out our industrial base. The overvalued dollar makes our exports less competitive, especially for lower-margin manufacturing, while our imports remain artificially strong.

"Having the reserve currency does come with a bunch of benefits, historically called an exorbitant privilege, but then it has certain costs to maintain it." - Lyn Alden

This dilemma forces America to run persistent trade deficits, as this is how dollars flow to the world. For over four decades, these deficits have accumulated, creating massive economic imbalances that can't be quickly reversed. The Trump administration's attempts to address this through tariffs showcase how difficult rebalancing has become. As Lyn warned, even if we successfully pivot toward reshoring manufacturing, we'll face difficult trade-offs: potentially giving up some reserve currency benefits to rebuild our industrial foundation. This isn't just economic theory - it's the restructuring challenge that will define America's economic future.

Check out the full podcast here for more on China's manufacturing dominance, the role of Bitcoin in monetary transitions, and energy production as the foundation for future industrial power.

Headlines of the Day

Coinbase to replace Discover in S\&P 500 on May 19 - via X

Mallers promises no rehypothecation in Strike Bitcoin loans - via X

Get our new STACK SATS hat - via tftcmerch.io

Missouri passes HB 594, eliminates Bitcoin capital gains tax - via X

The 2025 Bitcoin Policy Summit is set for June 25th—and it couldn’t come at a more important time. The Bitcoin industry is at a pivotal moment in Washington, with initiatives like the Strategic Bitcoin Reserve gaining rapid traction. Whether you’re a builder, advocate, academic, or policymaker—we want you at the table. Join us in DC to help define the future of freedom, money & innovation in the 21st century.

Ten31, the largest bitcoin-focused investor, has deployed 144,264 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

The 100+ degree days have returned to Austin, TX. Not mad about it... yet.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 57d1a264:69f1fee1

2025-05-22 13:13:36

@ 57d1a264:69f1fee1

2025-05-22 13:13:36Graphics materials for Bitcoin Knots https://github.com/bitcoinknots branding. See below guide image for reference, a bit cleaner and scalable:

Font family "Aileron" is provided free for personal and commercial use, and can be found here: https://www.1001fonts.com/aileron-font.html

Source: https://github.com/Blissmode/bitcoinknots-gfx/tree/main

https://stacker.news/items/986624

-

@ 57d1a264:69f1fee1

2025-05-22 12:36:20

@ 57d1a264:69f1fee1

2025-05-22 12:36:20Graphics materials for Bitcoin Knots https://github.com/bitcoinknots branding. See below guide image for reference, a bit cleaner and scalable:

Font family "Aileron" is provided free for personal and commercial use, and can be found here: https://www.1001fonts.com/aileron-font.html

Source: https://github.com/Blissmode/bitcoinknots-gfx/tree/main

https://stacker.news/items/986587

-

@ 57d1a264:69f1fee1

2025-05-22 06:21:22

@ 57d1a264:69f1fee1

2025-05-22 06:21:22You’ve probably seen it before.

You open an agency’s website or a freelancer’s portfolio. At the very top of the homepage, it says:

We design for startups.

You wait 3 seconds. The last word fades out and a new one fades in:

We design for agencies.

Wait 3 more seconds:

We design for founders.

I call this design pattern The Wheel of Nothing: a rotating list of audience segments meant to impress through inclusion and draw attention through motion… for absolutely no reason.

Revered brand studio Pentagram recently launched a new website. To my surprise, the homepage features the Wheel of Nothing front and center, boldly claiming:

We design Everything for Everyone…before cycling through more specific combinations every few seconds.

Dan Mall, a husband, dad, teacher, creative director, designer, founder, and entrepreneur from Philly. I share as much as I can to create better opportunities for those who wouldn’t have them otherwise. Most recently, I ran design system consultancy SuperFriendly for over a decade.

Read more at Dans' website https://danmall.com/posts/the-wheel-of-nothing/

https://stacker.news/items/986392

-

@ 21335073:a244b1ad

2025-05-21 16:58:36

@ 21335073:a244b1ad

2025-05-21 16:58:36The other day, I had the privilege of sitting down with one of my favorite living artists. Our conversation was so captivating that I felt compelled to share it. I’m leaving his name out for privacy.

Since our last meeting, I’d watched a documentary about his life, one he’d helped create. I told him how much I admired his openness in it. There’s something strange about knowing intimate details of someone’s life when they know so little about yours—it’s almost like I knew him too well for the kind of relationship we have.

He paused, then said quietly, with a shy grin, that watching the documentary made him realize how “odd and eccentric” he is. I laughed and told him he’s probably the sanest person I know. Because he’s lived fully, chasing love, passion, and purpose with hardly any regrets. He’s truly lived.

Today, I turn 44, and I’ll admit I’m a bit eccentric myself. I think I came into the world this way. I’ve made mistakes along the way, but I carry few regrets. Every misstep taught me something. And as I age, I’m not interested in blending in with the world—I’ll probably just lean further into my own brand of “weird.” I want to live life to the brim. The older I get, the more I see that the “normal” folks often seem less grounded than the eccentric artists who dare to live boldly. Life’s too short to just exist, actually live.

I’m not saying to be strange just for the sake of it. But I’ve seen what the crowd celebrates, and I’m not impressed. Forge your own path, even if it feels lonely or unpopular at times.

It’s easy to scroll through the news and feel discouraged. But actually, this is one of the most incredible times to be alive! I wake up every day grateful to be here, now. The future is bursting with possibility—I can feel it.

So, to my fellow weirdos on nostr: stay bold. Keep dreaming, keep pushing, no matter what’s trending. Stay wild enough to believe in a free internet for all. Freedom is radical—hold it tight. Live with the soul of an artist and the grit of a fighter. Thanks for inspiring me and so many others to keep hoping. Thank you all for making the last year of my life so special.

-

@ 472f440f:5669301e

2025-05-12 23:29:50

@ 472f440f:5669301e

2025-05-12 23:29:50Marty's Bent

Last week we covered the bombshell developments in the Samourai Wallet case. For those who didn't read that, last Monday the world was made aware of the fact that the SDNY was explicitly told by FinCEN that the federal regulator did not believe that Samourai Wallet was a money services business six months before arresting the co-founders of Samourai Wallet for conspiracy to launder money and illegally operating a money services business. This was an obvious overstep by the SDNY that many believed would be quickly alleviated, especially considering the fact that the Trump administration via the Department of Justice has made it clear that they do not intend to rule via prosecution.

It seems that this is not the case as the SDNY responded to a letter sent from the defense to dismiss the case by stating that they fully plan to move forward. Stating that they only sought the recommendations of FinCEN employees and did not believe that those employees' comments were indicative of FinCEN's overall views on this particular case. It's a pretty egregious abuse of power by the SDNY. I'm not sure if the particular lawyers and judges within the Southern District of New York are very passionate about preventing the use of self-custody bitcoin and products that enable bitcoiners to transact privately, or if they're simply participating in a broader meta war with the Trump administration - who has made it clear to federal judges across the country that last Fall's election will have consequences, mainly that the Executive Branch will try to effectuate the policies that President Trump campaigned on by any legal means necessary - and Samouari Wallet is simply in the middle of that meta war.

However, one thing is pretty clear to me, this is an egregious overstep of power. The interpretation of that law, as has been laid out and confirmed by FinCEN over the last decade, is pretty clear; you cannot be a money services business if you do not control the funds that people are sending to each other, which is definitely the case with Samourai Wallet. People downloaded Samourai Wallet, spun up their own private-public key pairs and initiated transactions themselves. Samourai never custodied funds or initiated transactions on behalf of their users. This is very cut and dry. Straight to the point. It should be something that anyone with more than two brain cells is able to discern pretty quickly.

It is imperative that anybody in the industry who cares about being able to hold bitcoin in self-custody, to mine bitcoin, and to send bitcoin in a peer-to-peer fashion makes some noise around this case. None of the current administration's attempts to foster innovation around bitcoin in the United States will matter if the wrong precedent is set in this case. If the SDNY is successful in prosecuting Samourai Wallet, it will mean that anybody holding Bitcoin in self-custody, running a bitcoin fold node or mining bitcoin will have to KYC all of their users and counterparts lest they be labeled a money services business that is breaking laws stemming from the Bank Secrecy Act. This will effectively make building a self-custody bitcoin wallet, running a node, or mining bitcoin in tillegal in the United States. The ability to comply with the rules that would be unleashed if this Samourai case goes the wrong way, are such that it will effectively destroy the industry overnight.

It is yet to be seen whether or not the Department of Justice will step in to publicly flog the SDNY and force them to stop pursuing this case. This is the only likely way that the case will go away at this point, so it is very important that bitcoiners who care about being able to self-custody bitcoin, mine bitcoin, or send bitcoin in a peer-to-peer fashion in the United States make it clear to the current administration and any local politicians that this is an issue that you care deeply about. If we are too complacent, there is a chance that the SDNY could completely annihilate the bitcoin industry in America despite of all of the positive momentum we're seeing from all angles at the moment.

Make some noise!

Bitcoin Adoption by Power Companies: The Next Frontier

In my recent conversation with Andrew Myers from Satoshi Energy, he shared their ambitious mission to "enable every electric power company to use bitcoin by block 1,050,000" – roughly three years from now. This strategic imperative isn't just about creating new Bitcoin users; it's about sovereignty. Andrew emphasized that getting Bitcoin into the hands of energy companies who value self-sovereignty creates a more balanced future economic landscape. The excitement was palpable as he described how several energy companies are already moving beyond simply selling power to Bitcoin miners and are beginning to invest in mining operations themselves.

"You have global commodity companies being like, 'Oh, this is another commodity – we want to invest in this, we want to own this,'" - Andrew Myers

Perhaps most fascinating was Andrew's revelation about major energy companies in Texas developing Bitcoin collateral products for power contracts – a practical application that could revolutionize how energy transactions are settled. As energy companies continue embracing Bitcoin for both operations and collateral, we're witnessing the early stages of a profound shift in how critical infrastructure interfaces with sound money. The implications for both sectors could be transformative.

Check out the full podcast here for more on remote viewing, Nikola Tesla's predictions, and the convergence of Bitcoin and AI technology. We cover everything from humanoid robots to the energy demands of next-generation computing.

Headlines of the Day

Steak n Shake to Accept Bitcoin at All Locations May 16 - via X

Facebook Plans Crypto Wallets for 3B Users, Bitcoin Impact Looms - via X

Trump Urges Americans to Buy Stocks for Economic Boom - via X

UK Drops Tariffs, U.S. Farmers Set to Reap Major Benefits - via X

Looking for the perfect video to push the smartest person you know from zero to one on bitcoin? Bitcoin, Not Crypto is a three-part master class from Parker Lewis and Dhruv Bansal that cuts through the noise—covering why 21 million was the key technical simplification that made bitcoin possible, why blockchains don’t create decentralization, and why everything else will be built on bitcoin.