-

@ 91bea5cd:1df4451c

2025-05-23 17:04:49

@ 91bea5cd:1df4451c

2025-05-23 17:04:49Em nota, a prefeitura justificou que essas alterações visam ampliar a segurança das praias, conforto e organização, para os frequentadores e trabalhadores dos locais. No entanto, Orla Rio, concessionária responsável pelos espaços, e o SindRio, sindicato de bares e restaurantes, ficou insatisfeita com as medidas e reforçou que a música ao vivo aumenta em mais de 10% o ticket médio dos estabelecimentos e contribui para manter os empregos, especialmente na baixa temporada.

De acordo com Paes, as medidas visam impedir práticas ilegais para que a orla carioca continue sendo um espaço ativo econômico da cidade: “Certas práticas são inaceitáveis, especialmente por quem tem autorização municipal. Vamos ser mais restritivos e duros. A orla é de todos”.

Saiba quais serão as 16 proibições nas praias do Rio de Janeiro

- Utilização de caixas de som, instrumentos musicais, grupos ou qualquer equipamento sonoro, em qualquer horário. Apenas eventos autorizados terão permissão.

- Venda ou distribuição de bebidas em garrafas de vidro em qualquer ponto da areia ou do calçadão.

- Estruturas comerciais ambulantes sem autorização, como carrocinhas, trailers, food trucks e barracas.

- Comércio ambulante sem permissão, incluindo alimentos em palitos, churrasqueiras, isopores ou bandejas térmicas improvisadas.

- Circulação de ciclomotores e patinetes motorizados no calçadão.

- Escolinhas de esportes ou recreações não autorizadas pelo poder público municipal.

- Ocupação de área pública com estruturas fixas ou móveis de grandes proporções sem autorização.

- Instalação de acampamentos improvisados em qualquer trecho da orla.

- Práticas de comércio abusivo ou enganosas, incluindo abordagens insistentes. Quiosques e barracas devem exibir cardápio, preços e taxas de forma clara.

- Uso de animais para entretenimento, transporte ou comércio.

- Hasteamento ou exibição de bandeiras em mastros ou suportes.

- Fixação de objetos ou amarras em árvores ou vegetação.

- Cercadinhos feitos por ambulantes ou quiosques, que impeçam a livre circulação de pessoas.

- Permanência de carrinhos de transporte de mercadorias ou equipamentos fora dos momentos de carga e descarga.

- Armazenamento de produtos, barracas ou equipamentos enterrados na areia ou depositados na vegetação de restinga.

- Uso de nomes, marcas, logotipos ou slogans em barracas. Apenas a numeração sequencial da prefeitura será permitida.

-

@ 5144fe88:9587d5af

2025-05-23 17:01:37

@ 5144fe88:9587d5af

2025-05-23 17:01:37The recent anomalies in the financial market and the frequent occurrence of world trade wars and hot wars have caused the world's political and economic landscape to fluctuate violently. It always feels like the financial crisis is getting closer and closer.

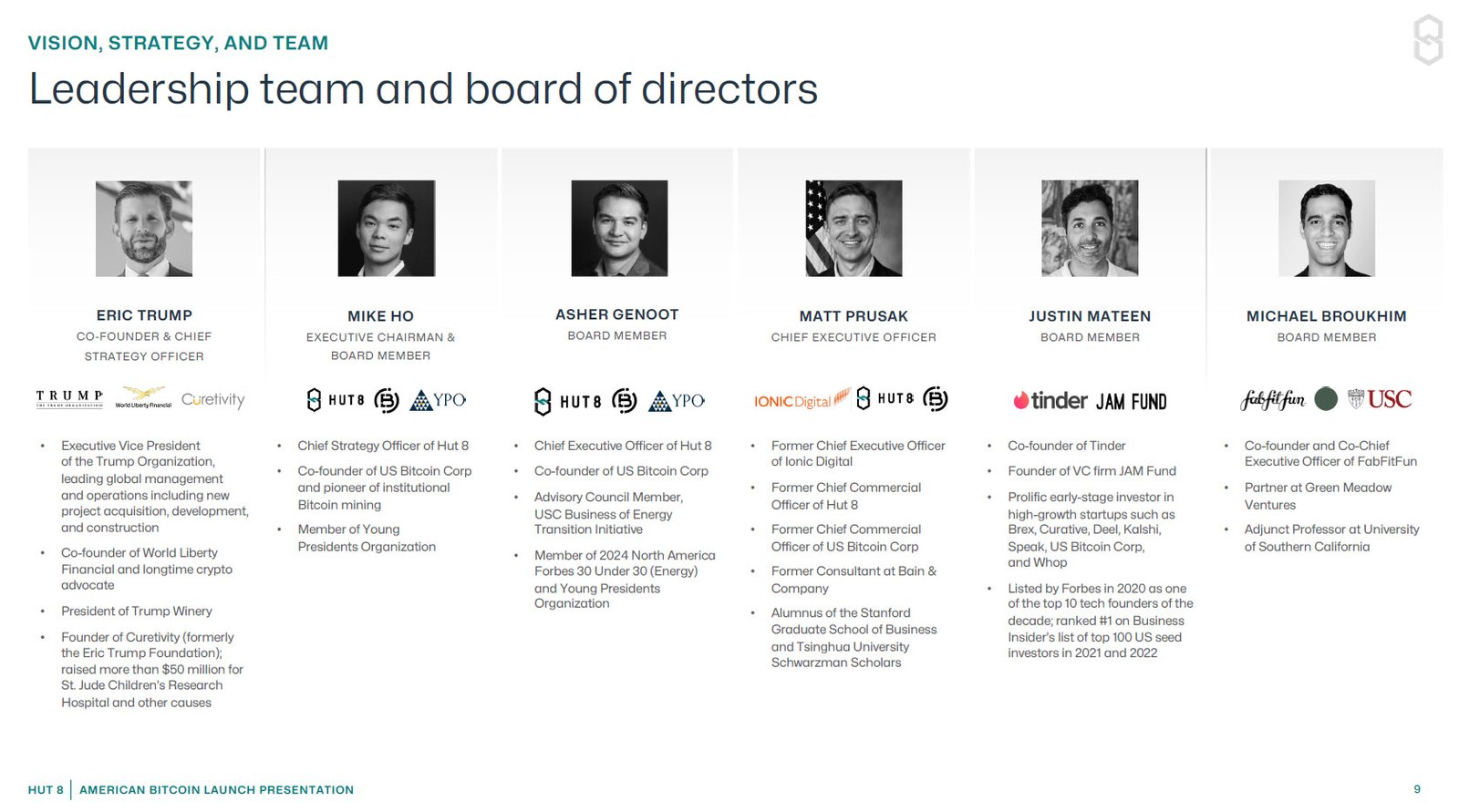

This is a systematic analysis of the possibility of the current global financial crisis by Manus based on Ray Dalio's latest views, US and Japanese economic and financial data, Buffett's investment behavior, and historical financial crises.

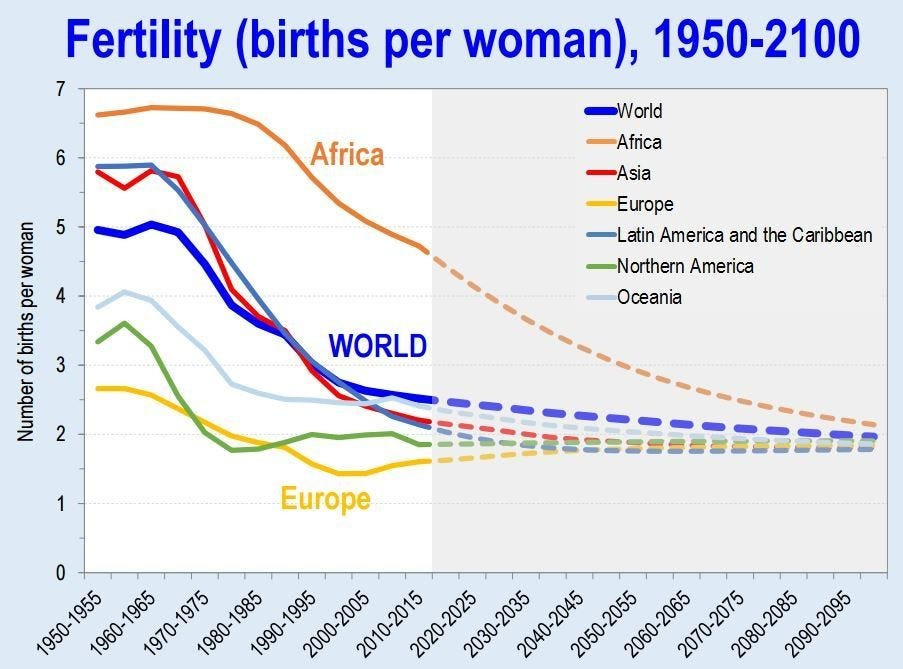

Research shows that the current financial system has many preconditions for a crisis, especially debt levels, market valuations, and investor behavior, which show obvious crisis signals. The probability of a financial crisis in the short term (within 6-12 months) is 30%-40%,

in the medium term (within 1-2 years) is 50%-60%,

in the long term (within 2-3 years) is 60%-70%.

Japan's role as the world's largest holder of overseas assets and the largest creditor of the United States is particularly critical. The sharp appreciation of the yen may be a signal of the return of global safe-haven funds, which will become an important precursor to the outbreak of a financial crisis.

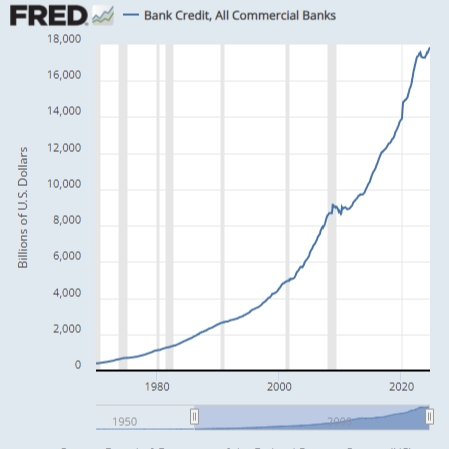

Potential conditions for triggering a financial crisis Conditions that have been met 1. High debt levels: The debt-to-GDP ratio of the United States and Japan has reached a record high. 2. Market overvaluation: The ratio of stock market to GDP hits a record high 3. Abnormal investor behavior: Buffett's cash holdings hit a record high, with net selling for 10 consecutive quarters 4. Monetary policy shift: Japan ends negative interest rates, and the Fed ends the rate hike cycle 5. Market concentration is too high: a few technology stocks dominate market performance

Potential trigger points 1. The Bank of Japan further tightens monetary policy, leading to a sharp appreciation of the yen and the return of overseas funds 2. The US debt crisis worsens, and the proportion of interest expenses continues to rise to unsustainable levels 3. The bursting of the technology bubble leads to a collapse in market confidence 4. The trade war further escalates, disrupting global supply chains and economic growth 5. Japan, as the largest creditor of the United States, reduces its holdings of US debt, causing US debt yields to soar

Analysis of the similarities and differences between the current economic environment and the historical financial crisis Debt level comparison Current debt situation • US government debt to GDP ratio: 124.0% (December 2024) • Japanese government debt to GDP ratio: 216.2% (December 2024), historical high 225.8% (March 2021) • US total debt: 36.21 trillion US dollars (May 2025) • Japanese debt/GDP ratio: more than 250%-263% (Japanese Prime Minister’s statement)

Before the 2008 financial crisis • US government debt to GDP ratio: about 64% (2007) • Japanese government debt to GDP ratio: about 175% (2007)

Before the Internet bubble in 2000 • US government debt to GDP ratio: about 55% (1999) • Japanese government debt to GDP ratio: about 130% (1999)

Key differences • The current US debt-to-GDP ratio is nearly twice that before the 2008 crisis • The current Japanese debt-to-GDP ratio is more than 1.2 times that before the 2008 crisis • Global debt levels are generally higher than historical pre-crisis levels • US interest payments are expected to devour 30% of fiscal revenue (Moody's warning)

Monetary policy and interest rate environment

Current situation • US 10-year Treasury yield: about 4.6% (May 2025) • Bank of Japan policy: end negative interest rates and start a rate hike cycle • Bank of Japan's holdings of government bonds: 52%, plans to reduce purchases to 3 trillion yen per month by January-March 2026 • Fed policy: end the rate hike cycle and prepare to cut interest rates

Before the 2008 financial crisis • US 10-year Treasury yield: about 4.5%-5% (2007) • Fed policy: continuous rate hikes from 2004 to 2006, and rate cuts began in 2007 • Bank of Japan policy: maintain ultra-low interest rates

Key differences • Current US interest rates are similar to those before the 2008 crisis, but debt levels are much higher than then • Japan is in the early stages of ending its loose monetary policy, unlike before historical crises • The size of global central bank balance sheets is far greater than at any time in history

Market valuations and investor behavior Current situation • The ratio of stock market value to the size of the US economy: a record high • Buffett's cash holdings: $347 billion (28% of assets), a record high • Market concentration: US stock growth mainly relies on a few technology giants • Investor sentiment: Technology stocks are enthusiastic, but institutional investors are beginning to be cautious

Before the 2008 financial crisis • Buffett's cash holdings: 25% of assets (2005) • Market concentration: Financial and real estate-related stocks performed strongly • Investor sentiment: The real estate market was overheated and subprime products were widely popular

Before the 2000 Internet bubble • Buffett's cash holdings: increased from 1% to 13% (1998) • Market concentration: Internet stocks were extremely highly valued • Investor sentiment: Tech stocks are in a frenzy

Key differences • Buffett's current cash holdings exceed any pre-crisis level in history • Market valuation indicators have reached a record high, exceeding the levels before the 2000 bubble and the 2008 crisis • The current market concentration is higher than any period in history, and a few technology stocks dominate market performance

Safe-haven fund flows and international relations Current situation • The status of the yen: As a safe-haven currency, the appreciation of the yen may indicate a rise in global risk aversion • Trade relations: The United States has imposed tariffs on Japan, which is expected to reduce Japan's GDP growth by 0.3 percentage points in fiscal 2025 • International debt: Japan is one of the largest creditors of the United States

Before historical crises • Before the 2008 crisis: International capital flows to US real estate and financial products • Before the 2000 bubble: International capital flows to US technology stocks

Key differences • Current trade frictions have intensified and the trend of globalization has weakened • Japan's role as the world's largest holder of overseas assets has become more prominent • International debt dependence is higher than any period in history

-

@ da8b7de1:c0164aee

2025-05-23 16:08:53

@ da8b7de1:c0164aee

2025-05-23 16:08:53Amerikai Nukleáris Fordulat és Pénzügyi hatások

Donald Trump elnök bejelentette, hogy végrehajtási rendeleteket ír alá a nukleáris energia fellendítésére . Ezek célja az új reaktorok engedélyezési folyamatának egyszerűsítése, az üzemanyag-ellátási láncok megerősítése, valamint a hazai ipar támogatása az orosz és kínai nyersanyagfüggőség csökkentése érdekében. A hír hatására az amerikai és globális nukleáris részvények jelentős emelkedést mutattak: az Uránium Energy 11%, a Centrus Energy 19,6%, az Oklo 16%, a Nano Nuclear 15%, a Nu Power 14,1%, a Global X Uranium ETF pedig 9%-kal erősödött . A növekvő energiaigény, különösen a mesterséges intelligencia által hajtott adatközpontok miatt, tovább növeli a nukleáris energia stratégiai szerepét az USA-ban .

Európai és Nemzetközi Nukleáris Fejlemények

Svédország parlamentje elfogadta az új állami támogatási keretrendszert, amely akár 5 000 MW új nukleáris kapacitás beruházását ösztönzi . Az intézkedés célja az áramárak stabilizálása, az ellátásbiztonság növelése és a zöld átmenet támogatása. A program keveri az állami hiteleket és a piaci árgaranciákat (CfD), a projektek finanszírozásában pedig a magántőke is részt vesz. A törvény 2025. augusztus 1-jén lép hatályba, a végrehajtás azonban még EU-jóváhagyásra vár .

Nukleáris Ellátási Lánc és Iparági Konferencia

Május 20–21-én Varsóban rendezték meg az első World Nuclear Supply Chain Conference-t, amelynek célja a globális nukleáris ellátási lánc megerősítése és bővítése . A konferencián elhangzottak szerint az iparág előtt álló kihívás a kapacitás gyors növelése, hiszen a cél a globális nukleáris kapacitás megháromszorozása 2050-ig. A World Nuclear Association legfrissebb elemzése szerint a következő 15 évben akár 2 billió dollár értékű beruházási lehetőség nyílhat a nemzetközi ellátási láncban . A rendezvényen kiemelték az innováció, a lokalizáció és az iparági együttműködés fontosságát, valamint a szállítási és geopolitikai kihívásokat is.

Új Projektek, Technológiai és Piaci Hírek

Az Egyesült Államokban a Tennessee Valley Authority (TVA) benyújtotta az első hivatalos engedélykérelmet egy BWRX-300 típusú kis moduláris reaktor (SMR) építésére a Clinch River telephelyen . Indiában a nukleáris hatóság jóváhagyta a Mahi Banswara Rajasthan Atomerőmű négy új blokkjának helyszínét . Kínában befejeződött a Haiyang 3 atomerőmű gőzturbinájának fő egységeinek telepítése . Belgiumban és Dániában is újraértékelik a nukleáris energia szerepét, míg Brazília Oroszországgal közös SMR-projektet tervez .

Iparági Trendek és Kilátások

A World Nuclear Association és az International Energy Agency (IEA) szerint a globális nukleáris energiatermelés 2025-ben minden korábbinál magasabb szintet érhet el, köszönhetően az új reaktorok üzembe helyezésének és a stabil, alacsony kibocsátású energiaforrások iránti növekvő igénynek . A nukleáris üzemanyag-ellátási lánc megerősítése, az uránbányászat, az átalakítás és a dúsítás bővítése, valamint a szállítási kapacitás fejlesztése mind kulcsfontosságú tényezők lesznek a következő években .

Hivatkozások

reuters.com

investopedia.com

nucnet.org

world-nuclear-news.org

world-nuclear.org -

@ 0e9491aa:ef2adadf

2025-05-23 16:01:28

@ 0e9491aa:ef2adadf

2025-05-23 16:01:28

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ 90152b7f:04e57401

2025-05-23 15:48:58

@ 90152b7f:04e57401

2025-05-23 15:48:58U.S. troops would enforce peace under Army study

The Washington Times - September 10, 2001

by Rowan Scarborough

https://www.ord.io/70787305 (image) https://www.ord.io/74522515 (text)

An elite U.S. Army study center has devised a plan for enforcing a major Israeli-Palestinian peace accord that would require about 20,000 well-armed troops stationed throughout Israel and a newly created Palestinian state. There are no plans by the Bush administration to put American soldiers into the Middle East to police an agreement forged by the longtime warring parties. In fact, Defense Secretary Donald H. Rumsfeld is searching for ways to reduce U.S. peacekeeping efforts abroad, rather than increasing such missions. But a 68-page paper by the Army School of Advanced Military Studies (SAMS) does provide a look at the daunting task any international peacekeeping force would face if the United Nations authorized it, and Israel and the Palestinians ever reached a peace agreement.

Located at Fort Leavenworth, Kan., the School for Advanced Military Studies is both a training ground and a think tank for some of the Army’s brightest officers. Officials say the Army chief of staff, and sometimes the Joint Chiefs of Staff, ask SAMS to develop contingency plans for future military operations. During the 1991 Persian Gulf war, SAMS personnel helped plan the coalition ground attack that avoided a strike up the middle of Iraqi positions and instead executed a “left hook” that routed the enemy in 100 hours.

The cover page for the recent SAMS project said it was done for the Joint Chiefs of Staff. But Maj. Chris Garver, a Fort Leavenworth spokesman, said the study was not requested by Washington. “This was just an academic exercise,” said Maj. Garver. “They were trying to take a current situation and get some training out of it.” The exercise was done by 60 officers dubbed “Jedi Knights,” as all second-year SAMS students are nicknamed.

The SAMS paper attempts to predict events in the first year of a peace-enforcement operation, and sees possible dangers for U.S. troops from both sides. It calls Israel’s armed forces a “500-pound gorilla in Israel. Well armed and trained. Operates in both Gaza . Known to disregard international law to accomplish mission. Very unlikely to fire on American forces. Fratricide a concern especially in air space management.”

Of the Mossad, the Israeli intelligence service, the SAMS officers say: “Wildcard. Ruthless and cunning. Has capability to target U.S. forces and make it look like a Palestinian/Arab act.”

On the Palestinian side, the paper describes their youth as “loose cannons; under no control, sometimes violent.” The study lists five Arab terrorist groups that could target American troops for assassination and hostage-taking. The study recommends “neutrality in word and deed” as one way to protect U.S. soldiers from any attack. It also says Syria, Egypt and Jordan must be warned “we will act decisively in response to external attack.”

It is unlikely either of the three would mount an attack. Of Syria’s military, the report says: “Syrian army quantitatively larger than Israeli Defense Forces, but largely seen as qualitatively inferior. More likely, however, Syrians would provide financial and political support to the Palestinians, as well as increase covert support to terrorism acts through Lebanon.” Of Egypt’s military, the paper says, “Egyptians also maintain a large army but have little to gain by attacking Israel.”

The plan does not specify a full order of battle. An Army source who reviewed the SAMS work said each of a possible three brigades would require about 100 Bradley fighting vehicles, 25 tanks, 12 self-propelled howitzers, Apache attack helicopters, Kiowa Warrior reconnaissance helicopters and Predator spy drones. The report predicts that nonlethal weapons would be used to quell unrest. U.S. European Command, which is headed by NATO’s supreme allied commander, would oversee the peacekeeping operation. Commanders would maintain areas of operation, or AOs, around Nablus, Jerusalem, Hebron and the Gaza strip. The study sets out a list of goals for U.S. troops to accomplish in the first 30 days. They include: “create conditions for development of Palestinian State and security of “; ensure “equal distribution of contract value or equivalent aid” that would help legitimize the peacekeeping force and stimulate economic growth; “promote U.S. investment in Palestine”; “encourage reconciliation between entities based on acceptance of new national identities”; and “build lasting relationship based on new legal borders and not religious-territorial claims.”

Maj. Garver said the officers who completed the exercise will hold major planning jobs once they graduate. “There is an application process” for students, he said. “They screen their records, and there are several tests they go through before they are accepted by the program. The bright planners of the future come out of this program.”

James Phillips, a Middle East analyst at the Heritage Foundation, said it would be a mistake to put peacekeepers in Israel, given the “poor record of previous monitors.” “In general, the Bush administration policy is to discourage a large American presence,” he said. “But it has been rumored that one of the possibilities might be an expanded CIA role.” “It would be a very different environment than Bosnia,” said Mr. Phillips, referring to America’s six-year peacekeeping role in Bosnia-Herzegovina. “The Palestinian Authority is pushing for this as part of its strategy to internationalize the conflict. Bring in the Europeans and Russia and China. But such monitors or peacekeeping forces are not going to be able to bring peace. Only a decision by the Palestinians to stop the violence and restart talks could possibly do that.”

<<https://www.ord.io/70787305>>

<<<https://www.ord.io/74522515>>>

-

@ 87e98bb6:8d6616f4

2025-05-23 15:36:32

@ 87e98bb6:8d6616f4

2025-05-23 15:36:32Use this guide if you want to keep your NixOS on the stable branch, but enable unstable application packages. It took me a while to figure out how to do this, so I wanted to share because it ended up being far easier than most of the vague explanations online made it seem.

I put a sample configuration.nix file at the very bottom to help it make more sense for new users. Remember to keep a backup of your config file, just in case!

If there are any errors please let me know. I am currently running NixOS 24.11.

Steps listed in this guide: 1. Add the unstable channel to NixOS as a secondary channel. 2. Edit the configuration.nix to enable unstable applications. 3. Add "unstable." in front of the application names in the config file (example: unstable.program). This enables the install of unstable versions during the build. 4. Rebuild.

Step 1:

- Open the console. (If you want to see which channels you currently have, type: sudo nix-channel --list)

- Add the unstable channel, type: sudo nix-channel --add https://channels.nixos.org/nixpkgs-unstable unstable

- To update the channels (bring in the possible apps), type: sudo nix-channel --update

More info here: https://nixos.wiki/wiki/Nix_channels

Step 2:

Edit your configuration.nix and add the following around your current config:

``` { config, pkgs, lib, ... }:

let unstable = import

{ config = { allowUnfree = true; }; }; in { #insert normal configuration text here } #remember to close the bracket!```

At this point it would be good to save your config and try a rebuild to make sure there are no errors. If you have errors, make sure your brackets are in the right places and/or not missing. This step will make for less troubleshooting later on if something happens to be in the wrong spot!

Step 3:

Add "unstable." to the start of each application you want to use the unstable version. (Example: unstable.brave)

Step 4:

Rebuild your config, type: sudo nixos-rebuild switch

Example configuration.nix file:

```

Config file for NixOS

{ config, pkgs, lib, ... }:

Enable unstable apps from Nix repository.

let unstable = import

{ config = { allowUnfree = true; }; }; in { #Put your normal config entries here in between the tags. Below is what your applications list needs to look like.

environment.systemPackages = with pkgs; [ appimage-run blender unstable.brave #Just add unstable. before the application name to enable the unstable version. chirp discord ];

} # Don't forget to close bracket at the end of the config file!

``` That should be all. Hope it helps.

-

@ 10f7c7f7:f5683da9

2025-05-23 15:26:17

@ 10f7c7f7:f5683da9

2025-05-23 15:26:17While I’m going to stand by what I said in my previous piece, minimise capital gains payments, don’t fund the government, get a loan against your bitcoin, but the wheels in my left curve brain have continued to turn, well that, and a few more of my 40PW insights. I mentioned about paying attention to the risks involved in terms of borrowing against your bitcoin, and hopefully ending up paying less in bitcoin at the end of the loan, even if you ultimately sold bitcoin to pay off the loan. However, the idea of losing control of the bitcoin I have spent a good deal of time and effort accumulating being out of my control has led me to reconsider. I also realised I didn’t fully flesh out some other topics that I think are relevant, not least time preference, specifically in relation to what you’re buying. The idea of realising a lump some of capital to live your dreams, buy a house or a cool car may be important, but it may be worth taking a step back and looking at what you’re purchasing. Are you only purchasing those things because you had been able to get this new money “tax free”? If that is the case, and the fiat is burning a hold in your pocket, maybe you’ve just found yourself with the same fiat brained mentality you have been working so hard to escape from while you have sacrificed and saved to stack sats.

While it may no longer be necessary to ask yourself whether a particular product or service is worth selling your bitcoin for because you’ve taken out a loan, it may still be worth asking yourself whether a particular loan fuelled purchase is worth forfeiting control of your keys for? Unlike the foolish 18 year-old, released into a world with their newly preapproved credit card, you need to take a moment and ask yourself:

Is the risk worth it?

Is the purchase worth it?

But also take a moment to consider a number of other things, are there fiat options?

Where in the cycle might you be?

Or if I’m thinking carefully about this, will whatever I’m buying hold its value (experiences may be more difficult to run the numbers on)?

The reason for asking these things, is that if you still have a foot in the fiat world, dealing with a fiat bank account, fiat institutions may still be very willing to provide you with a loan at a lower rate than a bitcoin backed loan. Particularly if you’re planning on using that money to buy a house; if you can qualify for a mortgage, get a mortgage, but if you need cash for a deposit, maybe that is where the bitcoin backed loan may come in. Then, it may be worth thinking about where are you in the bitcoin cycle? No one can answer this, but with the historic data we have, it appears logical that after some type of run up, prices may retrace (Dan Held’s supercycle withstanding).

Matteo Pellegrini with Daniel Prince provided a new perspective on this for me. Rather the riding the bull market gains all the way through to the bear market bottom, what happens if I chose to buy an asset that didn’t lose quite as much fiat value as bitcoin, for example, a Swiss Watch, or a tasteful, more mature sports car? If that was the purchase of choice, they suggested that you could enjoy the car, “the experience” for a year or two, then realise the four door estate was likely always the better option, sell it and be able to buy back as many, if not slightly more bitcoin that you originally sold (not financial, classic car or price prediction advice, I’m not accredited to advise pretty much anything). Having said that, it is a scenario I think worth thinking about when the bitcoin denominated dream car begins to make financial sense.

Then, as we begin to look forward to the near inevitable bear market (they are good for both stacking and grinding), if we’ve decided to take out a loan rather than sell, we then may ultimately need to increase our collateral to maintain loan to value requirements, as well as sell more bitcoin to cover repayments (if that’s the route we’re taking). This then moves us back into the domain of saying, well in actual fact we should just sell our bitcoin when we can get most dollar for it (or the coolest car), with a little extra to cover future taxes, it is probably better to sell near a top than a bottom. The balance between these two rather extreme positions could be to take out a fiat loan to buy the item and maybe sell sufficient bitcoin so you’re able to cover the loan for a period of time (less taxable events to keep track of and also deals with future uncertainty of bitcoin price). In this case, if the loan timeframe is longer than the amount of loan your sale can cover, by the time you need to sell anymore, the price should have recovered from a cycle bottom.

In this scenario, apart from the smaller portion of bitcoin you have had to sell, the majority of your stack can remain in cold storage, the loan you took out will be unsecured (particularly against your bitcoin), but even if it isn’t, the value of what you purchase maintains its value, you can in theory exit the loan at any point by selling the luxury item. Then within this scenario, if you had sold near a top, realised the car gave you a bad back or made you realise you staying humble is more important, sold it, paid off the loan, there may even be a chance you could buy back more bitcoin with the money you had left over from selling your bitcoin to fund the loan.

I have no idea of this could actually work, but to be honest, I’m looking forward to trying it out in the next 6-12 months, although I may keep my daily driver outside of my bitcoin strategy (kids still need a taxi service). Having said that, I think there are some important points to consider in addition to not paying capital gains tax (legally), as well as the opportunities of bitcoin loans. They are still very young products and to quote every trad-fi news outlet, “bitcoin is still a volatile asset”, these thought experiments are still worth working through. To push back on the Uber fiat journalist, Katie Martin, “Bitcoin has no obvious use case”, it does, it can be a store of value to hold or sell, it can be liquid and flexible collateral, but also an asset that moves independently of other assets to balance against fiat liabilities. The idea of being able to release some capital, enjoy the benefits of the capital for a period, before returning that capital to store value feels like a compelling one.

The important thing to remember is that there are a variety of options, whether selling for cash, taking out a bitcoin backed loan, taking out a fiat loan or some combination of each. Saying that, what I would think remains an important question to ask irrespective of the option you go for:

Is what I’m planning on buying, worth selling bitcoin for?

If it cannot pass this first question, maybe it isn’t worth purchasing to start with.

-

@ 348e7eb2:3b0b9790

2025-05-23 15:15:45

@ 348e7eb2:3b0b9790

2025-05-23 15:15:45Nostr-Konto erstellen - funktioniert

Was der Button macht

Der folgende Code fügt einen Button hinzu, der per Klick einen Nostr-Anmeldedialog öffnet. Alle Schritte sind im Code selbst ausführlich kommentiert.

Erläuterungen:

- Dynamisches Nachladen: Das Script

modal.jswird nur bei Klick nachgeladen, um Fehlermeldungen beim Initial-Load zu vermeiden. -

Parameter im Überblick:

-

baseUrl: Quelle für API und Assets. an: App-Name für den Modal-Header.aa: Farbakzent ( als Hex).al: Sprache des Interfaces.am: Licht- oder Dunkelmodus.s: Empfohlene Nostr-Accountsafb/asb: Bunker-Modi für erhöhten Datenschutz.aan/aac: Steuerung der Rückgabe privater Schlüssel.arr/awr: Primal Relay als Lese- und Schreib-Relay.- Callbacks:

onComplete: Schließt das Modal, zeigt eine Bestätigung und bietet die Weiterleitung zu Primal an.onCancel: Schließt das Modal und protokolliert den Abbruch.

Damit ist der gesamte Code sichtbar, kommentiert und erklärt.

- Dynamisches Nachladen: Das Script

-

@ 348e7eb2:3b0b9790

2025-05-23 14:27:03

@ 348e7eb2:3b0b9790

2025-05-23 14:27:03Nostr-Konto erstellen

Was der Button macht

Der folgende Code fügt einen Button hinzu, der per Klick einen Nostr-Anmeldedialog öffnet. Alle Schritte sind im Code selbst ausführlich kommentiert.

```html

```

Erläuterungen:

- Dynamisches Nachladen: Das Script

modal.jswird nur bei Klick nachgeladen, um Fehlermeldungen beim Initial-Load zu vermeiden. -

Parameter im Überblick:

-

baseUrl: Quelle für API und Assets. an: App-Name für den Modal-Header.aa: Farbakzent (Foerbico-Farbe als Hex).al: Sprache des Interfaces.am: Licht- oder Dunkelmodus.afb/asb: Bunker-Modi für erhöhten Datenschutz.aan/aac: Steuerung der Rückgabe privater Schlüssel.arr/awr: Primal Relay als Lese- und Schreib-Relay.-

Callbacks:

-

onComplete: Schließt das Modal, zeigt eine Bestätigung und bietet die Weiterleitung zu Primal an. onCancel: Schließt das Modal und protokolliert den Abbruch.

Damit ist der gesamte Code sichtbar, kommentiert und erklärt.

Accounts

as: [ 'npub1f7jar3qnu269uyx5p0e4v24hqxjnxysxudvujza2ur5ehltvdeqsly2fx9', 'npub1ak7mtjnyha96rjqjdaav7tkjjulcmx7vgmcd6map82vsags8dhtsmecgtd', 'npub1cmvrxn8k50ljamtqlcd3eqznqlnz50zpyp2q45dh0p5gcvyg84ksxezqps', 'npub14c3ffunyuzpl69y526dcknn785t35zvq6y63pvxvmfvghfj6dewqc0v55d', ],

## funzt#️⃣ https://nstart.me/de?an=MeineApp&at=popup&am=light&aa=203a8f&asb=yes&s=npub1f7jar3qnu269uyx5p0e4v24hqxjnxysxudvujza2ur5ehltvdeqsly2fx9,npub1ak7mtjnyha96rjqjdaav7tkjjulcmx7vgmcd6map82vsags8dhtsmecgtd - Dynamisches Nachladen: Das Script

-

@ 0e9491aa:ef2adadf

2025-05-23 14:01:33

@ 0e9491aa:ef2adadf

2025-05-23 14:01:33

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 0e9491aa:ef2adadf

2025-05-23 14:01:32

@ 0e9491aa:ef2adadf

2025-05-23 14:01:32

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ 0e9491aa:ef2adadf

2025-05-23 14:01:32

@ 0e9491aa:ef2adadf

2025-05-23 14:01:32

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

The four main banks of bitcoin and “crypto” are Signature, Prime Trust, Silvergate, and Silicon Valley Bank. Prime Trust does not custody funds themselves but rather maintains deposit accounts at BMO Harris Bank, Cross River, Lexicon Bank, MVB Bank, and Signature Bank. Silvergate and Silicon Valley Bank have already stopped withdrawals. More banks will go down before the chaos stops. None of them have sufficient reserves to meet withdrawals.

Bitcoin gives us all the ability to opt out of a system that has massive layers of counterparty risk built in, years of cheap money and broken incentives have layered risk on top of risk throughout the entire global economy. If you thought the FTX bank run was painful to watch, I have bad news for you: every major bank in the world is fractional reserve. Bitcoin held in self custody is unique in its lack of counterparty risk, as global market chaos unwinds this will become much more obvious.

The rules of bitcoin are extremely hard to change by design. Anyone can access the network directly without a trusted third party by using their own node. Owning more bitcoin does not give you more control over the network with all participants on equal footing.

Bitcoin is:

- money that is not controlled by a company or government

- money that can be spent or saved without permission

- money that is provably scarce and should increase in purchasing power with adoptionBitcoin is money without trust. Whether you are a nation state, corporation, or an individual, you can use bitcoin to spend or save without permission. Social media will accelerate the already deteriorating trust in our institutions and as this trust continues to crumble the value of trust minimized money will become obvious. As adoption increases so should the purchasing power of bitcoin.

A quick note on "stablecoins," such as USDC - it is important to remember that they rely on trusted custodians. They have the same risk as funds held directly in bank accounts with additional counterparty risk on top. The trusted custodians can be pressured by gov, exit scam, or caught up in fraud. Funds can and will be frozen at will. This is a distinctly different trust model than bitcoin, which is a native bearer token that does not rely on any centralized entity or custodian.

Most bitcoin exchanges have exposure to these failing banks. Expect more chaos and confusion as this all unwinds. Withdraw any bitcoin to your own wallet ASAP.

Simple Self Custody Guide: https://werunbtc.com/muun

More Secure Cold Storage Guide: https://werunbtc.com/coldcard

If you found this post helpful support my work with bitcoin.

-

@ 0e9491aa:ef2adadf

2025-05-23 14:01:32

@ 0e9491aa:ef2adadf

2025-05-23 14:01:32

The former seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

The latter's future remains to be seen. Dependence on Tor, which has had massive reliability issues, and lack of strong privacy guarantees put it at risk.

— ODELL (@ODELL) October 27, 2022

The Basics

- Lightning is a protocol that enables cheap and fast native bitcoin transactions.

- At the core of the protocol is the ability for bitcoin users to create a payment channel with another user.

- These payment channels enable users to make many bitcoin transactions between each other with only two on-chain bitcoin transactions: the channel open transaction and the channel close transaction.

- Essentially lightning is a protocol for interoperable batched bitcoin transactions.

- It is expected that on chain bitcoin transaction fees will increase with adoption and the ability to easily batch transactions will save users significant money.

- As these lightning transactions are processed, liquidity flows from one side of a channel to the other side, on chain transactions are signed by both parties but not broadcasted to update this balance.

- Lightning is designed to be trust minimized, either party in a payment channel can close the channel at any time and their bitcoin will be settled on chain without trusting the other party.

There is no 'Lightning Network'

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise.

- There are many lightning channels between many different users and funds can flow across interconnected channels as long as there is a route through peers.

- If a lightning transaction requires multiple hops it will flow through multiple interconnected channels, adjusting the balance of all channels along the route, and paying lightning transaction fees that are set by each node on the route.

Example: You have a channel with Bob. Bob has a channel with Charlie. You can pay Charlie through your channel with Bob and Bob's channel with User C.

- As a result, it is not guaranteed that every lightning user can pay every other lightning user, they must have a route of interconnected channels between sender and receiver.

Lightning in Practice

- Lightning has already found product market fit and usage as an interconnected payment protocol between large professional custodians.

- They are able to easily manage channels and liquidity between each other without trust using this interoperable protocol.

- Lightning payments between large custodians are fast and easy. End users do not have to run their own node or manage their channels and liquidity. These payments rarely fail due to professional management of custodial nodes.

- The tradeoff is one inherent to custodians and other trusted third parties. Custodial wallets can steal funds and compromise user privacy.

Sovereign Lightning

- Trusted third parties are security holes.

- Users must run their own node and manage their own channels in order to use lightning without trusting a third party. This remains the single largest friction point for sovereign lightning usage: the mental burden of actively running a lightning node and associated liquidity management.

- Bitcoin development prioritizes node accessibility so cost to self host your own node is low but if a node is run at home or office, Tor or a VPN is recommended to mask your IP address: otherwise it is visible to the entire network and represents a privacy risk.

- This privacy risk is heightened due to the potential for certain governments to go after sovereign lightning users and compel them to shutdown their nodes. If their IP Address is exposed they are easier to target.

- Fortunately the tools to run and manage nodes continue to get easier but it is important to understand that this will always be a friction point when compared to custodial services.

The Potential Fracture of Lightning

- Any lightning user can choose which users are allowed to open channels with them.

- One potential is that professional custodians only peer with other professional custodians.

- We already see nodes like those run by CashApp only have channels open with other regulated counterparties. This could be due to performance goals, liability reduction, or regulatory pressure.

- Fortunately some of their peers are connected to non-regulated parties so payments to and from sovereign lightning users are still successfully processed by CashApp but this may not always be the case going forward.

Summary

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise. There is no singular 'Lightning Network' but rather many payment channels between distinct peers, some connected with each other and some not.

- Lightning as an interoperable payment protocol between professional custodians seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

- Lightning as a robust sovereign payment protocol has yet to be battle tested. Heavy reliance on Tor, which has had massive reliability issues, the friction of active liquidity management, significant on chain fee burden for small amounts, interactivity constraints on mobile, and lack of strong privacy guarantees put it at risk.

If you have never used lightning before, use this guide to get started on your phone.

If you found this post helpful support my work with bitcoin.

-

@ c1e9ab3a:9cb56b43

2025-05-18 04:14:48

@ c1e9ab3a:9cb56b43

2025-05-18 04:14:48Abstract

This document proposes a novel architecture that decouples the peer-to-peer (P2P) communication layer from the Bitcoin protocol and replaces or augments it with the Nostr protocol. The goal is to improve censorship resistance, performance, modularity, and maintainability by migrating transaction propagation and block distribution to the Nostr relay network.

Introduction

Bitcoin’s current architecture relies heavily on its P2P network to propagate transactions and blocks. While robust, it has limitations in terms of flexibility, scalability, and censorship resistance in certain environments. Nostr, a decentralized event-publishing protocol, offers a multi-star topology and a censorship-resistant infrastructure for message relay.

This proposal outlines how Bitcoin communication could be ported to Nostr while maintaining consensus and verification through standard Bitcoin clients.

Motivation

- Enhanced Censorship Resistance: Nostr’s architecture enables better relay redundancy and obfuscation of transaction origin.

- Simplified Lightweight Nodes: Removing the full P2P stack allows for lightweight nodes that only verify blockchain data and communicate over Nostr.

- Architectural Modularity: Clean separation between validation and communication enables easier auditing, upgrades, and parallel innovation.

- Faster Propagation: Nostr’s multi-star network may provide faster propagation of transactions and blocks compared to the mesh-like Bitcoin P2P network.

Architecture Overview

Components

-

Bitcoin Minimal Node (BMN):

- Verifies blockchain and block validity.

- Maintains UTXO set and handles mempool logic.

- Connects to Nostr relays instead of P2P Bitcoin peers.

-

Bridge Node:

- Bridges Bitcoin P2P traffic to and from Nostr relays.

- Posts new transactions and blocks to Nostr.

- Downloads mempool content and block headers from Nostr.

-

Nostr Relays:

- Accept Bitcoin-specific event kinds (transactions and blocks).

- Store mempool entries and block messages.

- Optionally broadcast fee estimation summaries and tipsets.

Event Format

Proposed reserved Nostr

kindnumbers for Bitcoin content (NIP/BIP TBD):| Nostr Kind | Purpose | |------------|------------------------| | 210000 | Bitcoin Transaction | | 210001 | Bitcoin Block Header | | 210002 | Bitcoin Block | | 210003 | Mempool Fee Estimates | | 210004 | Filter/UTXO summary |

Transaction Lifecycle

- Wallet creates a Bitcoin transaction.

- Wallet sends it to a set of configured Nostr relays.

- Relays accept and cache the transaction (based on fee policies).

- Mining nodes or bridge nodes fetch mempool contents from Nostr.

- Once mined, a block is submitted over Nostr.

- Nodes confirm inclusion and update their UTXO set.

Security Considerations

- Sybil Resistance: Consensus remains based on proof-of-work. The communication path (Nostr) is not involved in consensus.

- Relay Discoverability: Optionally bootstrap via DNS, Bitcoin P2P, or signed relay lists.

- Spam Protection: Relay-side policy, rate limiting, proof-of-work challenges, or Lightning payments.

- Block Authenticity: Nodes must verify all received blocks and reject invalid chains.

Compatibility and Migration

- Fully compatible with current Bitcoin consensus rules.

- Bridge nodes preserve interoperability with legacy full nodes.

- Nodes can run in hybrid mode, fetching from both P2P and Nostr.

Future Work

- Integration with watch-only wallets and SPV clients using verified headers via Nostr.

- Use of Nostr’s social graph for partial trust assumptions and relay reputation.

- Dynamic relay discovery using Nostr itself (relay list events).

Conclusion

This proposal lays out a new architecture for Bitcoin communication using Nostr to replace or augment the P2P network. This improves decentralization, censorship resistance, modularity, and speed, while preserving consensus integrity. It encourages innovation by enabling smaller, purpose-built Bitcoin nodes and offloading networking complexity.

This document may become both a Bitcoin Improvement Proposal (BIP-XXX) and a Nostr Improvement Proposal (NIP-XXX). Event kind range reserved: 210000–219999.

-

@ 5d4b6c8d:8a1c1ee3

2025-05-23 13:46:21

@ 5d4b6c8d:8a1c1ee3

2025-05-23 13:46:21You'd think I'd be most excited to talk about that awesome Pacers game, but, no. What I'm most excited about this week is that @grayruby wants to continue Beefing with Cowherd.

Still, I am excited to talk about Tyrese Haliburton becoming a legendary Knicks antagonist. Unfortunately, the Western Conference Finals are not as exciting. Also, why was the MVP announcement so dumb?

The T20k cricket contest is tightening up, as we head towards the finish. Can @Coinsreporter hold on to his vanishing lead?

@Carresan has launched Football Madness. Let's see if we understand whatever the hell this is any better than we did last week.

On this week's Blok'd Shots, we'll ridicule Canada for their disgraceful loss in the World Championships and talk about the very dominant American Florida Panthers, who are favorites to win the Stanley Cup.

Are the Colorado the worst team in MLB history?

The Tush Push has survived another season. Will the NFL eventually ban it or will teams adjust?

Plus, whatever else Stackers want to talk about.

https://stacker.news/items/987399

-

@ 0e9491aa:ef2adadf

2025-05-23 14:01:31

@ 0e9491aa:ef2adadf

2025-05-23 14:01:31

There must be a limit to how much data is transferred across the bitcoin network in order to keep the ability to run and use your own node accessible. A node is required to interact with the global bitcoin network - if you do not use your own node then you must trust someone else's node. If nodes become inaccessible to run then the network will centralize around the remaining entities that operate them - threatening the censorship resistance at the core of bitcoin's value prop. The bitcoin protocol uses three main mechanisms to keep node operation costs low - a fixed limit on the amount of data in each block, an automatic difficulty adjustment that regulates how many blocks are produced based on current mining hash rate, and a robust dynamic transaction fee market.

Bitcoin transaction fees limit network abuse by making usage expensive. There is a cost to every transaction, set by a dynamic free market based on demand for scarce block space. It is an incredibly robust way to prevent spam without relying on centralized entities that can be corrupted or pressured.

After the 2017 bitcoin fee spike we had six years of relative quiet to build tools that would be robust in a sustained high fee market. Fortunately our tools are significantly better now but many still need improvement. Most of the pain points we see today will be mitigated.

The reality is we were never going to be fully prepared - pressure is needed to show the pain points and provide strong incentives to mitigate them.

It will be incredibly interesting to watch how projects adapt under pressure. Optimistic we see great innovation here.

_If you are willing to wait for your transaction to confirm you can pay significantly lower fees. Learn best practices for reducing your fee burden here.

My guide for running and using your own bitcoin node can be found here._

If you found this post helpful support my work with bitcoin.

-

@ 1c5ff3ca:efe9c0f6

2025-05-23 10:13:57

@ 1c5ff3ca:efe9c0f6

2025-05-23 10:13:57Auto-Deployment on a VPS with GitHub Actions

Introduction

This tutorial describes how you can deploy an application on a VPS using GitHub Actions. This way, changes in your GitHub repository are automatically deployed to your VPS.

Prerequisites

- GitHub Account

- GitHub Repository

- Server + SSH access to the server

Step 1 - SSH Login to Server

Open a terminal and log in via SSH. Then navigate to the

.sshdirectoryssh user@hostname cd ~/.sshStep 2 - Create an SSH Key

Now create a new SSH key that we will use for auto-deployment. In the following dialog, simply press "Enter" repeatedly until the key is created.

ssh-keygen -t ed25519 -C "service-name-deploy-github"Step 3 - Add the Key to the

authorized_keysFilecat id_ed25519.pub >> authorized_keys(If you named the key file differently, change this accordingly)

Step 4 - GitHub Secrets

In order for the GitHub Action to perform the deployment later, some secrets must be stored in the repository. Open the repository on GitHub. Navigate to "Settings" -> "Secrets And Variables" -> "Actions". Add the following variables:

HOST: Hostname or IP address of the serverUSERNAME: Username you use to log in via SSHSSHKEY: The private key (copy the content fromcat ~/.ssh/id_ed25519)PORT: 22

Step 5 - Create the GitHub Action

Now create the GitHub Action for auto-deployment. The following GitHub Action will be used: https://github.com/appleboy/scp-action In your local repository, create the file

.github/workflows/deploy.yml:```yaml name: Deploy on: [push] jobs: build: runs-on: ubuntu-latest steps: - uses: actions/checkout@v1 - name: Copy repository content via scp uses: appleboy/scp-action@master with: host: ${{ secrets.HOST }} username: ${{ secrets.USERNAME }} port: ${{ secrets.PORT }} key: ${{ secrets.SSHKEY }} source: "." target: "/your-target-directory"

- name: Executing a remote command uses: appleboy/ssh-action@master with: host: ${{ secrets.HOST }} username: ${{ secrets.USERNAME }} port: ${{ secrets.PORT }} key: ${{ secrets.SSHKEY }} script: | ls```

This action copies the repository files to your server using

scp. Afterwards, thelscommand is executed. Here you can add appropriate commands that rebuild your service or similar. To rebuild and start a docker service you could use something like this or similar:docker compose -f target-dir/docker-compose.yml up --build -dNow commit this file and in the "Actions" tab of your repository, the newly created action should now be visible and executed. With every future change, the git repository will now be automatically copied to your server.Sources

I read this when trying out, but it did not work and I adapted the

deploy.ymlfile: https://dev.to/knowbee/how-to-setup-continuous-deployment-of-a-website-on-a-vps-using-github-actions-54im -

@ 2b468756:7930dd9c

2025-05-23 12:17:09

@ 2b468756:7930dd9c

2025-05-23 12:17:09Agorisme is libertarisme in de praktijk: op legale wijze maximale economische en persoonlijke vrijheid. Samen ontdekken en delen we wat er allemaal mogelijk is. We doen dit door: - organiseren jaarlijks agorismefestival - organiseren meerdere themadagen / excursies per jaar - bundelen praktische kennis op Agorisme Wiki - online uitwisselen via (thema)appgroepen

Op deze site worden activiteiten aangekondigd en kun je je opgeven.

Binnenkort: - cursussen metselen, stucen en vloeren - reis naar libertarisch dorp Walden Woods en Liberstad in Noorwegen - introductie Krav Maga zelfverdediging

We zijn gelieerd aan de libertarische partij.

Graag tot ziens!

-

@ cae03c48:2a7d6671

2025-05-23 14:01:05

@ cae03c48:2a7d6671

2025-05-23 14:01:05Bitcoin Magazine

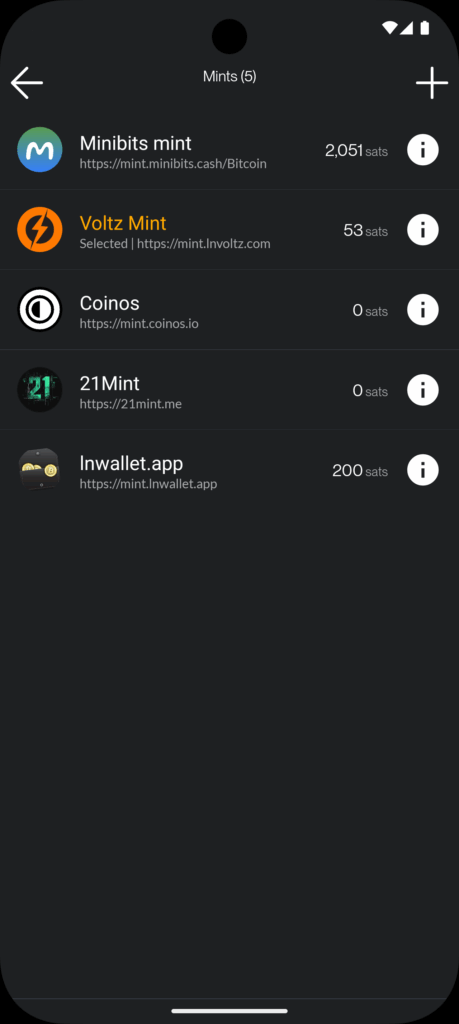

How Zeus is Redefining Bitcoin with Cashu Ecash IntegrationThe U.S.-based Bitcoin and Lightning mobile wallet Zeus recently announced an alpha-release integration of Cashu. The move marks the first integration of ecash into a popular Bitcoin wallet, breaking new ground for potential user adoption to Bitcoin.

Cashu is a hot new implementation of Chaumian ecash, a form of digital cash invented by David Chaum in the ’90s that has incredible privacy and scalability properties, with the trade-off of being fundamentally centralized, requiring a significant amount of trust in the issuer.

In a counterintuitive move for Zeus, known as the go-to tool for advanced Lightning users seeking to connect to their home nodes, the integration of Cashu acknowledges a “last mile” challenge Lightning wallets face when delivering Bitcoin to the masses.

“We basically started off as the cypherpunk wallet, right? You got to set up your own Lightning node and connect to it with Zeus. The last two years, we put the node in the phone with one click, you can run it all in a standalone app without a remote node,” Evan Kaloudis, founder and CEO of Zeus, told Bitcoin Magazine.

“Cashu addresses uneconomical self-custody for small bitcoin amounts. On-chain, the dust limit is 546 satoshis, and Layer Two systems like Lightning have costs for channel setup or unilateral exits that aren’t widely discussed,” Evan explained, highlighting a major point of friction in noncustodial Lightning wallets: the need for liquidity and channel management. While these esoteric aspects of the Lightning Network have been mostly abstracted away since its invention in 2016, these fundamental trade-offs continue to manifest even in the most sophisticated and user-friendly wallets.

In the case of both Phoenix and Zeus, two of the most popular noncustodial options in the market, users must pay up to 10,000 sats upfront to gain spending capacity. These fees are necessary to cover the on-chain fees spent to open a channel for the user against the wallet’s liquidity service provider, unlocking a noncustodial experience.

The required up-front fee is difficult to explain and represents a painful onboarding experience for new users who are used to fiat apps giving them money to join instead. The result is the proliferation of custodial Lightning wallets like Wallet of Satoshi (WOS), which gained massive adoption early on by leveraging the global, near-instant settlement power of Bitcoin combined with the excellent user experience centralized wallets can create.

Major developments have been made over seven years after the Lightning Network’s inception, however, and Zeus is pushing the boundaries.

“With Ecash, we make it so easy that anyone can set up a wallet and start participating in our ecosystem, which I really think is going to become more and more prevalent,” Evan explained.

Today, at roughly $100,000 per bitcoin, 1,000 satoshis are equivalent to $1. Transactions of these sizes are known as microtransactions — a popular example are Nostr social media tips known as Zaps. But finding the right tool for this use case is not simple. Self custodied wallets like Phoenix charge transaction fees in the hundreds of satoshis, even with open channels, and on-chain fees often cost the same and are slower to settle. As a result, there’s an entire category of spending that is only served by cheaper alternatives such as custodial lightning wallets like WOS or Blink, but result in significant privacy tradeoffs, often requiring phone numbers from users and in some cases more advanced KYC and IP tracking. Cashu hopes to serve this market with lower privacy costs, the same ease of use, speed and competitive fees.

Digging deeper into the Cashu integration, Evan explained that “for users this means being able to pick and switch between custodians in a single app. For developers this means being able to defer custodial responsibilities to third parties and not have to wire up a new integration when your current custodian halts operations.”

Zaps are satoshi-denominated rewards delivered as “likes” or micro-tips for content in the Nostr social media ecosystem. A Zap can be as small as one satoshi, the smallest amount of bitcoin that can be technically transferred, equivalent today to about a tenth of a penny. “But I think if we look at Nostr and you’re seeing how many people are Zapping and how big a part of that ecosystem it is. It’s like, people are willing to do it,” Evan explained.

“Cashu, while custodial, lets users accumulate small amounts — say, via Nostr Zaps — without needing 6,000 satoshis to open a Lightning channel. Zeus prompts users to upgrade to self-custody as their balance grows,” he concluded, explaining that the wallet will effectively annoy users into self custody, one of several design choices made to mitigate the risks introduced by Cashu.

Ecash

The trade-offs introduced by Cashu challenge the common understanding of custody as an either-or in Bitcoin. Historically you were either a centralized — custodial — exchange, or you were a noncustodial Bitcoin wallet. In the former, you entrust the coins to a third party; in the latter you take personal responsibility for those coins and their corresponding private keys. Cashu changes this paradigm by introducing bitcoin-denominated ecash notes or “nuts,” which are bearer instruments that should be backed by a full bitcoin reserve and Lightning interoperability for instant withdraw.

Similar to fiat cash, you must take control and responsibility over these notes, but there’s also counterparty risk. In the case of Cashu, there are certain things the issuing mint can theoretically do to exploit their users — akin to how a bank can run on a fractional reserve.

The big difference between Cashu or custodial Bitcoin exchanges and fiat currency is that Cashu is open source, is designed around user privacy, and scales very well. It makes the cost of running a mint lower than either alternative, a feature that makes mint competition easier, in theory countering the centralizing network effects of specific mints.

Finally, the user experience of storing Cashu tokens has been attached to known forms of Bitcoin self custody such as the download of 12-words seeds via various mechanisms, though implementations still vary from wallet to wallet and the whole ecosystem is in its early stages.

To further mitigate the custodial risk of Chaumian-style ecash in Bitcoin, the Cashu community has developed various methods for automatically managing custody risk.

“Users can split risk by using multiple mints, switching between them in the user interface. Soon, ZEUS will guide users to select five or six reputable mints, automatically balancing funds to minimize exposure,” Evan explained, referring to a particular approach called automated bank runs. The idea is that as some Cashu mints may hold more of your funds, Zeus de-ranks them and rotates value out to minimize risk.

“I think the idea is going to be that we guide users to pick five or six reputable mints… And from there, users will be able to have the wallet automatically switch between those mints and determine which mint should be receiving the balance depending on the balance of all the mints presently. So you’ll be like, OK. MiniBits has way too much money. Let’s switch the default to one of the mints that doesn’t have a lot. So that way you can sort of mitigate or rather distribute the rug risk there,” Evan explained, adding, “Our Discover Mint feature pulls reviews from bitcoinmints.com, showing vouch counts and user feedback, like mint reliability or longevity,” describing the reputation layer stacked on top of the various other risk management mechanisms.

There is no known way to use Chaumian-style ecash in an entirely noncustodial way. So as long as the custody risk can be minimized, the scaling and privacy upside becomes remarkable.

Microtransactions

One of the opportunities that ecash unlocks is microtransactions, the most popular example of which are Nostr Zaps often in single dollar ranges of value transferred, though it applies to small Lightning transactions as well. This use case triggers an important technical question that predates Bitcoin, do microtransactions actually make economic sense?

There’s a long-standing argu

-

@ 662f9bff:8960f6b2

2025-05-23 07:38:51

@ 662f9bff:8960f6b2

2025-05-23 07:38:51I have been really busy this week with work - albeit back in Madeira - so I had little time to read or do much other than work. In the coming weeks I should have more time - I am taking a few weeks off work and have quite a list of things to do.

First thing is to relax a bit and enjoy the pleasant weather here in Funchal for a few days. With 1st May tomorrow it does seem that there will be quite a bit to do..

Some food for thought for you. Who takes and makes your decisions? Do you make them yourself based on information that you have and know to be true or do you allow other people to take and make decisions for you? For example - do you allow governments or unaccountable beaureaucrats and others to decide for you and even to compell you?

In theory Governments should respect Consent of the Governed and the 1948 Universal Declaration of Human Rights states that "The will of the people shall be the basis of the authority of government". For you to decide if and to what extent governments today are acting in line with these principles. If not, what can you do about it? I dive into this below and do refer back to letter 9 - section: So What can you do about it.

First, a few things to read, watch and listen to

-

I Finance the Current Thing by Allen Farrington - when money is political, everything is political...

-

Prediction for 2030 (the Great Reset). Sorelle explains things pretty clearly if you care to watch and listen...

-

The Global Pandemic Treaty: What You Need to Know . James Corbett is pretty clear too... is this being done with your support? Did you miss something?

-

Why the Past 10 Years of American Life Have Been Uniquely Stupid - fascinating thinking on how quite a few recent things came about...

And a few classics - you ought to know these already and the important messages in them should be much more obvious now...

-

1984 by George Orwell - look for the perpetual war & conflict, ubiquitous surveillance and censorship not to mention Room 101

-

Animal farm - also by George Orwell - note how the pigs end up living in the farmhouse exceeding all the worst behaviour of the farmer and how the constitution on the wall changes. Things did not end well for loyal Boxer.

-

Brave New World by Aldous Huxley- A World State, inhabited by genetically modified citizens and an intelligence-based social hierarchy - the novel anticipates large scale psychological manipulation and classical conditioning that are combined to make a dystopian society which is challenged by only a single individual who does not take the Soma.

For more - refer to the References and Reading List

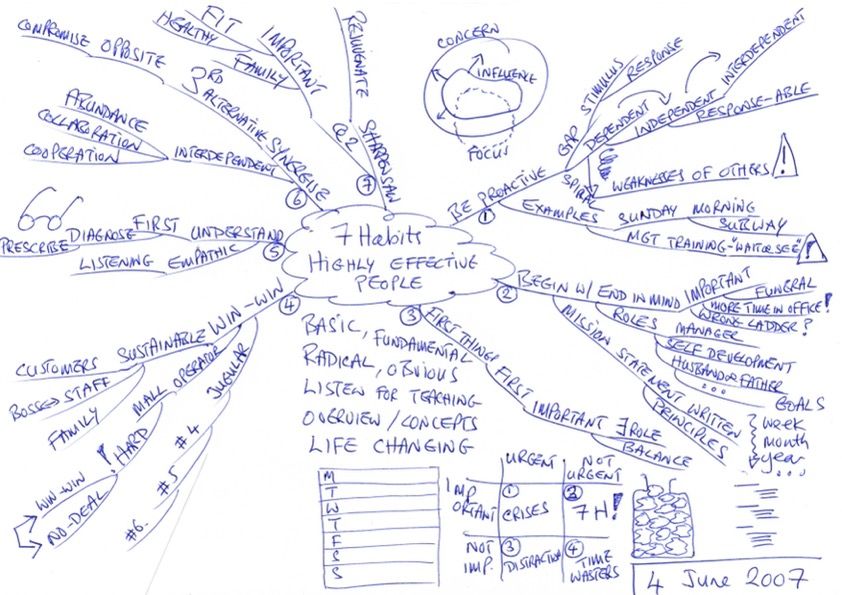

The 7 Habits of Highly Effective People

One of the most transformative books that I ever read was 7 Habits of Highly Effective People by Steven Covey. Over many years and from researching hstorical literature he found seven traits that successful people typically display. By default everyone does the opposite of each of these! Check how you do - be honest...

-

Habits 1-3 are habits of Self - they determine how you behave and feel

-

Habits 4-6 are habits of interpersonal behaviour - they determine how you deal with and interact with others

-

Habit 7 is about regeneration and self care - foundation for happy and healthy life and success

One: Be proactive

Choose your responses to all situations and provocations - your reaction to a situation determines how you feel about it.

By default people will be reactive and this controls their emotions

Two: Begin with the end in mind

When you start to work on something, have a clear view of the goal to be achieved; it should be something substantial that you need and will value.

By default people will begin with what is in front of them or work on details that they can do or progress without having a clear view on the end result to be achieved

Three: Put First things First

Be clear on, and begin with, the Big Rocks- the most important things. If you do not put the Big Rocks into your planning daily activities, your days will be full of sand and gravel! All things can be categorised as Urgent or Not-Urgent and Important or Not-Important.

By Default people will focus on Urgent regardless of importance - all of the results come from focusing on Important Non-Urgent things. All of the 7 Habits are in this category!

Four: Seek Win-Win in all dealings with people and in all negotiations

This is the only sustainable outcome; if you cannot achieve Win-Win then no-deal is the sustainable alternative.

By default people will seek Win-Loose - this leads to failed relationships

Five: Seek first to understand - only then to be understood.

Once you visibly understand the needs and expectations of your counterpart they will be open to listening to your point of view and suggestions/requests - not before!

By default people will expound their point of view or desired result causing their counterpart to want to do the same - this ends in "the dialogue of the deaf"

Six: Synergise - Seek the 3rd alternative in all problems and challenges

Work together to find a proposal that is better than what each of you had in mind

By default people will focus on their own desired results and items, regardless of what the other party could bring to help/facilitate or make available

Seven: Sharpen the saw

Take time to re-invigorate and to be healthy - do nothing to excess. Do not be the forrester who persists in cutting the tree with a blunt saw bcause sharpening it is inconvenient or would "take too much time"!

By default people tend to persist on activities and avoid taking time to reflect, prepare and recover

Mindaps - a technique by Tony Buzan

Many years ago I summarised this in a Mind Map (another technique that was transformative for me - a topic for another Letter from around the world!) see below. Let me know if this interests you - happy to do an explainer video on this!

That's it!

No one can be told what The Matrix is.\ You have to see it for yourself.**

Do share this newsletter with any of your friends and family who might be interested.

You can also email me at: LetterFrom@rogerprice.me

💡Enjoy the newsletters in your own language : Dutch, French, German, Serbian, Chinese Traditional & Simplified, Thai and Burmese.

-

-

@ eed7ca5d:191de8eb

2025-05-23 13:58:46

@ eed7ca5d:191de8eb

2025-05-23 13:58:46Growing up, we were told that in order to build wealth, we need to save little by little. By living below your means, you are providing more for your future.

It is a simple formula that will help you build up the capital necessary to buy a car, a house or start a business… You prioritize long-term benefits and delayed gratification over immediate rewards.

This is called having a low-time preference. In contrast, high-time preference individuals prioritize today over tomorrow, seeking immediate gratification.

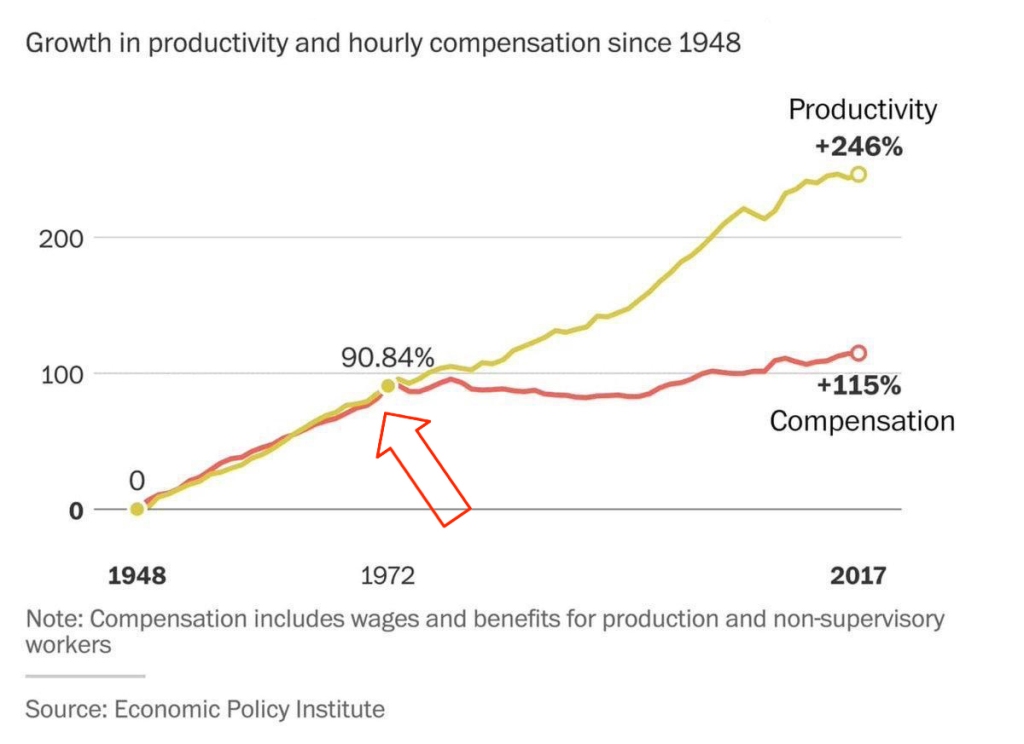

Austrian economists explain that civilization growth is driven by low-time preference societies. Groups of individuals who prioritize long-term planning are able to innovate and develop new tools for a better future. Over time, this behavior leads to technological inventions like the light bulb and artistic masterpieces like the Notre Dame cathedral.

***What happens when you realize that the money you save is losing value over time? ***

There is less incentive to save for the future, because in the future your savings will be worth less. You might as well spend it now and enjoy life today.

When the money you save loses its value, you are facing one of two choices:

-

Spend it today and reap the rewards of your hard work;

-

Invest it (stocks, real estate, etc.) with the hope to reap higher rewards later, bearing the risk of losing it all if the investment does not pay off.

There is a distinct difference between saving and investing as the latter approach is riskier than the former. By investing, you are betting on the upside while bearing the downside risk. Saving, in contrast, comes without downside risk. That difference becomes blurry when the money you save is losing value. In fact, saving becomes inherently a losing approach. Logically, you will be forced to place a speculative bet with the hope to outperform the guaranteed loss of value. You are required to find a way to hedge your bet…

Humans over time have always sought out a medium to save their economic energy for a better future. That used to be beads and seashells, and evolved to precious metals like gold and silver.

Money is a tool that we use to save our economic energy over time, and exchange value with each other.

I spend time fishing, you spend time farming, the neighbor spends time building homes, and society rewards us with money for the time and energy we spent being productive

Today, the tool that we use to save our economic energy is clearly losing value over time. The nominal value remains the same, but the purchasing power is decreasing. In other words, the value of our time today will be worth less in the future.

That explains why everyone around us is looking for the next best investment opportunity. We are all needing to become investment experts, speculators, on top of our respective professions. Speculation became necessary, and some of us are forced into a high-time preference lifestyle.

Earn now and spend it all now before you lose it.

This should not be the case…

Time is Money

Our time is the only scarce resource we all have. We use it to be productive and generate economic value, then store that value in the form of money in order to reap the rewards in the future.

Money is the abstract representation of our time. Hence, time is money.

In January 2009, at the height of the global financial crisis, a software protocol called Bitcoin was released pseudonymously by Satoshi Nakamoto. This individual (or group) released a whitepaper a few months prior named “Bitcoin: A Peer-to-Peer Electronic Cash System” outlining how the system enables secure, peer-to-peer transactions without relying on a central authority. (https://bitcoin.org/bitcoin.pdf)

Although there are more technical concepts involved, the bitcoin protocol can be thought of as a language for communicating value. The same way we respect the rules of the English language to communicate ideas with one another, bitcoin users adhere to the network’s consensus rules to communicate value with each other in a peer-to-peer fashion.

There are no physical or digital coins in the bitcoin network. Rather, it is a collection of transactions transferring value from sender to recipient. Transactions are validated and propagated by nodes across the network, before being recorded into the blockchain. The Bitcoin blockchain is a global public ledger of all transactions that cannot be altered.

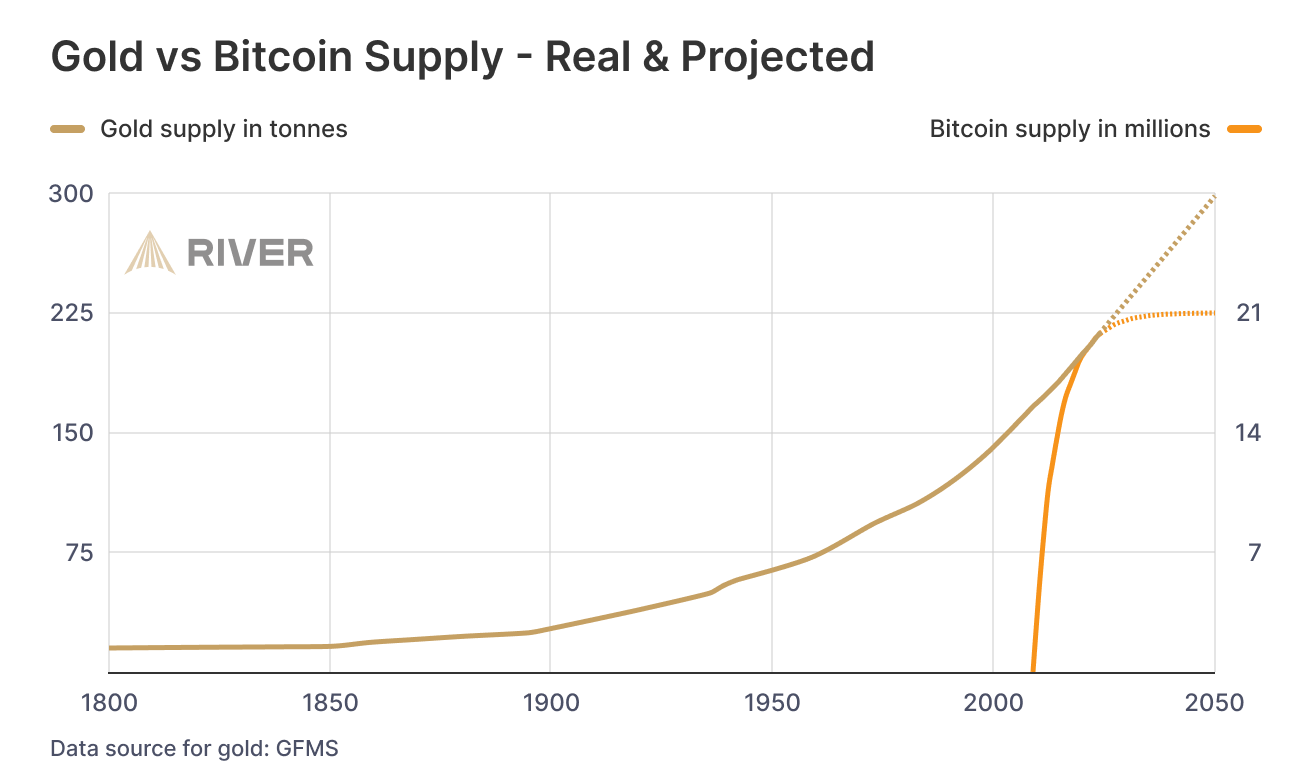

More importantly, Bitcoin is money that does not lose value overtime.

-

Its supply is capped at 21 million coins.

-

Its scarcity increases over time due to the predictable issuance rate, which halves roughly every 4 years.

-

Its decentralized nature puts the power in the hands of its users.

-

There is no governing body that can devalue or alter it.

It is a tool that we can use to save our economic energy over time, and be able to use it later.

It is the scarcest verifiable commodity: we cannot make more of it no matter how high its demand grows. That cannot be said for any other commodity in the world today.

A savings tool in disguise

See, most people tend to view bitcoin as another speculative investment. They presume they have missed out on another investment opportunity, and it’s now too late to get in.

Meanwhile, it is quite the opposite. Bitcoin’s value will keep growing over time due to its deflationary nature.

With bitcoin, we can save for a better future, for a rainy day, and spend more time with our loved ones or focusing on our craft to build better tools or artistic masterpieces. It takes away the burden of having to speculate on which stock will perform best, or which real estate market will grow the fastest, all while working one or multiple jobs

Bitcoin is not another investment opportunity you missed out on. It is the best savings tool humans have invented (or discovered), while everything else is the speculative bet. Bitcoin is the hedge against the guaranteed devaluation of money, without any counterparty risk.