-

@ 220522c2:61e18cb4

2025-05-04 23:55:32{"wss://relay.chrisatmachine.com":{"read":true,"write":true},"wss://relay.damus.io":{"write":true,"read":true}}

@ 220522c2:61e18cb4

2025-05-04 23:55:32{"wss://relay.chrisatmachine.com":{"read":true,"write":true},"wss://relay.damus.io":{"write":true,"read":true}} -

@ 220522c2:61e18cb4

2025-05-04 23:54:38Here are a couple reasons off the top of my head: - moderation i don't want to moderate kind 1's, but i want it to be public - resources i can run this relay on a very cheap server since it won't have to scale past the niche use case of code snippets (which could actually get pretty difficult if MCP servers start using this relay for agents, but at least i will only need to deal with increasing resources in that case)

@ 220522c2:61e18cb4

2025-05-04 23:54:38Here are a couple reasons off the top of my head: - moderation i don't want to moderate kind 1's, but i want it to be public - resources i can run this relay on a very cheap server since it won't have to scale past the niche use case of code snippets (which could actually get pretty difficult if MCP servers start using this relay for agents, but at least i will only need to deal with increasing resources in that case) -

@ 220522c2:61e18cb4

2025-05-04 22:29:35Running a new relay for just kind 1337 code snippets at relay.notebin.io. #grownostr

@ 220522c2:61e18cb4

2025-05-04 22:29:35Running a new relay for just kind 1337 code snippets at relay.notebin.io. #grownostr -

@ 220522c2:61e18cb4

2025-04-27 10:39:32We're planning to change the recommended hosting provider on relayrunner.org soon, currently planning to use https://1984.hosting . Any other suggestions?

@ 220522c2:61e18cb4

2025-04-27 10:39:32We're planning to change the recommended hosting provider on relayrunner.org soon, currently planning to use https://1984.hosting . Any other suggestions? -

@ 220522c2:61e18cb4

2025-04-27 10:23:08You probably shouldn’t be running a public relay if you don’t have the time to moderate it.

@ 220522c2:61e18cb4

2025-04-27 10:23:08You probably shouldn’t be running a public relay if you don’t have the time to moderate it. -

@ 220522c2:61e18cb4

2025-04-14 04:54:27Ok I think i understand now after finding these: https://github.com/nostr-protocol/data-vending-machines/tree/master/kinds I'll adapt this nip to a job request.

@ 220522c2:61e18cb4

2025-04-14 04:54:27Ok I think i understand now after finding these: https://github.com/nostr-protocol/data-vending-machines/tree/master/kinds I'll adapt this nip to a job request. -

@ 220522c2:61e18cb4

2025-04-14 04:42:20If I understand DVMs correctly I would have to pay a relay for this data though right?

@ 220522c2:61e18cb4

2025-04-14 04:42:20If I understand DVMs correctly I would have to pay a relay for this data though right? -

@ 220522c2:61e18cb4

2025-04-14 04:21:33Zap Reducer NIP: https://github.com/nostr-protocol/nips/pull/1877/files It's like NIP-45 Counts but allows you to reduce filtered zap amounts to based on some function like: - sum - avg - min - max - count relays that implement this nip will allow the client to just ask for the sum of all zaps rather than streaming all of the zaps and summing on the client. #grownostr

@ 220522c2:61e18cb4

2025-04-14 04:21:33Zap Reducer NIP: https://github.com/nostr-protocol/nips/pull/1877/files It's like NIP-45 Counts but allows you to reduce filtered zap amounts to based on some function like: - sum - avg - min - max - count relays that implement this nip will allow the client to just ask for the sum of all zaps rather than streaming all of the zaps and summing on the client. #grownostr -

@ 220522c2:61e18cb4

2025-04-10 00:46:36{"id":"f294c3da5a6c3fb4fcd4d0dd808b672eac8e4c0bc177d744dff2d48647923546","pubkey":"e1aec115450c09710c745a274b2636dcc11705f30089d131d051f009723c918e","created_at":1744214633,"kind":1,"tags":[["e","5359c2ca207343603768d18752bc74a8bfd41c4cd079325f2deef608a6b0143d","wss://aegis.utxo.one/","root"],["p","460c25e682fda7832b52d1f22d3d22b3176d972f60dcdc3212ed8c92ef85065c","","mention"],["p","3f770d65d3a764a9c5cb503ae123e62ec7598ad035d836e2a810f3877a745b24","","mention"]],"content":"We should fork PebbleOS since it’s open source now and create our own wearables. That would be rad. ","sig":"3604132cc1a1715994bcd4f559bb7f3a640eea79ebcb92db502813059ee18e8d62820f2d678f605fbde0ea2f8a9871c8d48b9b0882bbcbd68a3b7570c95f180e"}

@ 220522c2:61e18cb4

2025-04-10 00:46:36{"id":"f294c3da5a6c3fb4fcd4d0dd808b672eac8e4c0bc177d744dff2d48647923546","pubkey":"e1aec115450c09710c745a274b2636dcc11705f30089d131d051f009723c918e","created_at":1744214633,"kind":1,"tags":[["e","5359c2ca207343603768d18752bc74a8bfd41c4cd079325f2deef608a6b0143d","wss://aegis.utxo.one/","root"],["p","460c25e682fda7832b52d1f22d3d22b3176d972f60dcdc3212ed8c92ef85065c","","mention"],["p","3f770d65d3a764a9c5cb503ae123e62ec7598ad035d836e2a810f3877a745b24","","mention"]],"content":"We should fork PebbleOS since it’s open source now and create our own wearables. That would be rad. ","sig":"3604132cc1a1715994bcd4f559bb7f3a640eea79ebcb92db502813059ee18e8d62820f2d678f605fbde0ea2f8a9871c8d48b9b0882bbcbd68a3b7570c95f180e"} -

@ 220522c2:61e18cb4

2025-04-09 23:20:22it should already publish to all of your NIP-65 write relays, assuming it can find your 10002. I'm not sure about drafts yet.

@ 220522c2:61e18cb4

2025-04-09 23:20:22it should already publish to all of your NIP-65 write relays, assuming it can find your 10002. I'm not sure about drafts yet. -

@ 220522c2:61e18cb4

2025-04-09 23:08:17How do you think relays should be handled on https://notebin.io?

@ 220522c2:61e18cb4

2025-04-09 23:08:17How do you think relays should be handled on https://notebin.io? -

@ 87e98bb6:8d6616f4

2025-05-23 15:36:32

@ 87e98bb6:8d6616f4

2025-05-23 15:36:32Use this guide if you want to keep your NixOS on the stable branch, but enable unstable application packages. It took me a while to figure out how to do this, so I wanted to share because it ended up being far easier than most of the vague explanations online made it seem.

I put a sample configuration.nix file at the very bottom to help it make more sense for new users. Remember to keep a backup of your config file, just in case!

If there are any errors please let me know. I am currently running NixOS 24.11.

Steps listed in this guide: 1. Add the unstable channel to NixOS as a secondary channel. 2. Edit the configuration.nix to enable unstable applications. 3. Add "unstable." in front of the application names in the config file (example: unstable.program). This enables the install of unstable versions during the build. 4. Rebuild.

Step 1:

- Open the console. (If you want to see which channels you currently have, type: sudo nix-channel --list)

- Add the unstable channel, type: sudo nix-channel --add https://channels.nixos.org/nixpkgs-unstable unstable

- To update the channels (bring in the possible apps), type: sudo nix-channel --update

More info here: https://nixos.wiki/wiki/Nix_channels

Step 2:

Edit your configuration.nix and add the following around your current config:

``` { config, pkgs, lib, ... }:

let unstable = import

{ config = { allowUnfree = true; }; }; in { #insert normal configuration text here } #remember to close the bracket!```

At this point it would be good to save your config and try a rebuild to make sure there are no errors. If you have errors, make sure your brackets are in the right places and/or not missing. This step will make for less troubleshooting later on if something happens to be in the wrong spot!

Step 3:

Add "unstable." to the start of each application you want to use the unstable version. (Example: unstable.brave)

Step 4:

Rebuild your config, type: sudo nixos-rebuild switch

Example configuration.nix file:

```

Config file for NixOS

{ config, pkgs, lib, ... }:

Enable unstable apps from Nix repository.

let unstable = import

{ config = { allowUnfree = true; }; }; in { #Put your normal config entries here in between the tags. Below is what your applications list needs to look like.

environment.systemPackages = with pkgs; [ appimage-run blender unstable.brave #Just add unstable. before the application name to enable the unstable version. chirp discord ];

} # Don't forget to close bracket at the end of the config file!

``` That should be all. Hope it helps.

-

@ 10f7c7f7:f5683da9

2025-05-23 15:26:17

@ 10f7c7f7:f5683da9

2025-05-23 15:26:17While I’m going to stand by what I said in my previous piece, minimise capital gains payments, don’t fund the government, get a loan against your bitcoin, but the wheels in my left curve brain have continued to turn, well that, and a few more of my 40PW insights. I mentioned about paying attention to the risks involved in terms of borrowing against your bitcoin, and hopefully ending up paying less in bitcoin at the end of the loan, even if you ultimately sold bitcoin to pay off the loan. However, the idea of losing control of the bitcoin I have spent a good deal of time and effort accumulating being out of my control has led me to reconsider. I also realised I didn’t fully flesh out some other topics that I think are relevant, not least time preference, specifically in relation to what you’re buying. The idea of realising a lump some of capital to live your dreams, buy a house or a cool car may be important, but it may be worth taking a step back and looking at what you’re purchasing. Are you only purchasing those things because you had been able to get this new money “tax free”? If that is the case, and the fiat is burning a hold in your pocket, maybe you’ve just found yourself with the same fiat brained mentality you have been working so hard to escape from while you have sacrificed and saved to stack sats.

While it may no longer be necessary to ask yourself whether a particular product or service is worth selling your bitcoin for because you’ve taken out a loan, it may still be worth asking yourself whether a particular loan fuelled purchase is worth forfeiting control of your keys for? Unlike the foolish 18 year-old, released into a world with their newly preapproved credit card, you need to take a moment and ask yourself:

Is the risk worth it?

Is the purchase worth it?

But also take a moment to consider a number of other things, are there fiat options?

Where in the cycle might you be?

Or if I’m thinking carefully about this, will whatever I’m buying hold its value (experiences may be more difficult to run the numbers on)?

The reason for asking these things, is that if you still have a foot in the fiat world, dealing with a fiat bank account, fiat institutions may still be very willing to provide you with a loan at a lower rate than a bitcoin backed loan. Particularly if you’re planning on using that money to buy a house; if you can qualify for a mortgage, get a mortgage, but if you need cash for a deposit, maybe that is where the bitcoin backed loan may come in. Then, it may be worth thinking about where are you in the bitcoin cycle? No one can answer this, but with the historic data we have, it appears logical that after some type of run up, prices may retrace (Dan Held’s supercycle withstanding).

Matteo Pellegrini with Daniel Prince provided a new perspective on this for me. Rather the riding the bull market gains all the way through to the bear market bottom, what happens if I chose to buy an asset that didn’t lose quite as much fiat value as bitcoin, for example, a Swiss Watch, or a tasteful, more mature sports car? If that was the purchase of choice, they suggested that you could enjoy the car, “the experience” for a year or two, then realise the four door estate was likely always the better option, sell it and be able to buy back as many, if not slightly more bitcoin that you originally sold (not financial, classic car or price prediction advice, I’m not accredited to advise pretty much anything). Having said that, it is a scenario I think worth thinking about when the bitcoin denominated dream car begins to make financial sense.

Then, as we begin to look forward to the near inevitable bear market (they are good for both stacking and grinding), if we’ve decided to take out a loan rather than sell, we then may ultimately need to increase our collateral to maintain loan to value requirements, as well as sell more bitcoin to cover repayments (if that’s the route we’re taking). This then moves us back into the domain of saying, well in actual fact we should just sell our bitcoin when we can get most dollar for it (or the coolest car), with a little extra to cover future taxes, it is probably better to sell near a top than a bottom. The balance between these two rather extreme positions could be to take out a fiat loan to buy the item and maybe sell sufficient bitcoin so you’re able to cover the loan for a period of time (less taxable events to keep track of and also deals with future uncertainty of bitcoin price). In this case, if the loan timeframe is longer than the amount of loan your sale can cover, by the time you need to sell anymore, the price should have recovered from a cycle bottom.

In this scenario, apart from the smaller portion of bitcoin you have had to sell, the majority of your stack can remain in cold storage, the loan you took out will be unsecured (particularly against your bitcoin), but even if it isn’t, the value of what you purchase maintains its value, you can in theory exit the loan at any point by selling the luxury item. Then within this scenario, if you had sold near a top, realised the car gave you a bad back or made you realise you staying humble is more important, sold it, paid off the loan, there may even be a chance you could buy back more bitcoin with the money you had left over from selling your bitcoin to fund the loan.

I have no idea of this could actually work, but to be honest, I’m looking forward to trying it out in the next 6-12 months, although I may keep my daily driver outside of my bitcoin strategy (kids still need a taxi service). Having said that, I think there are some important points to consider in addition to not paying capital gains tax (legally), as well as the opportunities of bitcoin loans. They are still very young products and to quote every trad-fi news outlet, “bitcoin is still a volatile asset”, these thought experiments are still worth working through. To push back on the Uber fiat journalist, Katie Martin, “Bitcoin has no obvious use case”, it does, it can be a store of value to hold or sell, it can be liquid and flexible collateral, but also an asset that moves independently of other assets to balance against fiat liabilities. The idea of being able to release some capital, enjoy the benefits of the capital for a period, before returning that capital to store value feels like a compelling one.

The important thing to remember is that there are a variety of options, whether selling for cash, taking out a bitcoin backed loan, taking out a fiat loan or some combination of each. Saying that, what I would think remains an important question to ask irrespective of the option you go for:

Is what I’m planning on buying, worth selling bitcoin for?

If it cannot pass this first question, maybe it isn’t worth purchasing to start with.

-

@ 220522c2:61e18cb4

2025-04-09 02:58:39yes, the hardest part was finding a good rich text editor to integrate well with react native but with dom components this editor should translate pretty nicely to mobile. i'll work on a mobile client once cross platform encrypted sync is implemented on the desktop.

@ 220522c2:61e18cb4

2025-04-09 02:58:39yes, the hardest part was finding a good rich text editor to integrate well with react native but with dom components this editor should translate pretty nicely to mobile. i'll work on a mobile client once cross platform encrypted sync is implemented on the desktop. -

@ 220522c2:61e18cb4

2025-04-08 23:54:34fair point

@ 220522c2:61e18cb4

2025-04-08 23:54:34fair point -

@ 220522c2:61e18cb4

2025-04-08 23:50:40An information junkie that buys ram so he doesn't have to close any tabs. I still see this as an experimental project overall, one of my biggest issues has been trying to decide what to do with relays, with multiple columns you can just have the user decide what relays they want to read from per column.

@ 220522c2:61e18cb4

2025-04-08 23:50:40An information junkie that buys ram so he doesn't have to close any tabs. I still see this as an experimental project overall, one of my biggest issues has been trying to decide what to do with relays, with multiple columns you can just have the user decide what relays they want to read from per column. -

@ 220522c2:61e18cb4

2025-04-08 23:19:21yea but there are already mobile clients with single feeds that are doing that task well.

@ 220522c2:61e18cb4

2025-04-08 23:19:21yea but there are already mobile clients with single feeds that are doing that task well. -

@ 220522c2:61e18cb4

2025-04-08 23:09:56it seems like a good fit for nostr, you can mix and match all kinds of feeds

@ 220522c2:61e18cb4

2025-04-08 23:09:56it seems like a good fit for nostr, you can mix and match all kinds of feeds -

@ 220522c2:61e18cb4

2025-04-08 23:02:36ok i'm just realizing now that this is based on tweetdeck/xpro which i've never seen until now. Maybe i should take notestack in this direction 🤔

@ 220522c2:61e18cb4

2025-04-08 23:02:36ok i'm just realizing now that this is based on tweetdeck/xpro which i've never seen until now. Maybe i should take notestack in this direction 🤔 -

@ 220522c2:61e18cb4

2025-04-08 22:54:53Are clients with multiple column feeds the future?

@ 220522c2:61e18cb4

2025-04-08 22:54:53Are clients with multiple column feeds the future? -

@ 220522c2:61e18cb4

2025-04-08 15:08:57{"id":"7dc4c9e28c1d409aaeae78a2e04335c27b0a68ed52bcd539595e57ff4daa00be","pubkey":"fa984bd7dbb282f07e16e7ae87b26a2a7b9b90b7246a44771f0cf5ae58018f52","created_at":1744066777,"kind":1,"tags":[["p","6e468422dfb74a5738702a8823b9b28168abab8655faacb6853cd0ee15deee93","wss://nostr.oxtr.dev/","mention"]],"content":"I just vibelined a vertex DVM search app without touching a single key.\n\nLiterally only recorded a voice memo and saved it on my phone.\nWhich went to my old laptop via syncthing\n\nnostr:nprofile1qqsxu35yyt0mwjjh8pcz4zprhxegz69t4wr9t74vk6zne58wzh0waycpz4mhxue69uhkummnw3ezummcw3ezuer9wchszxthwden5te0v3jhyemfva5jumn0wd68yvfwvdhk6tc4839wp ‘s vibeline picked it up from there: whisper to transcribe locally, qwen2.5 via Ollama to understand what I wanted, saw that I was talking about building an app so it called my new build_app plugin which transformed my text into an app spec and then kicked-off my vibeline tools with mcp, checking my nostr code snippets to one-shot build a CLI DVM-capable WoT username search tool\n\n😂😂😂 wiiiiild times\n\nVoice-memo in, app out","sig":"f3ab2543de65bca976bfa40066c1af6803f663a82a30b0856b457dbf75f35db2338dbdc944981eca93ded6204971e8b81275d5c0f7ac6f16cad0faddafec5722"}

@ 220522c2:61e18cb4

2025-04-08 15:08:57{"id":"7dc4c9e28c1d409aaeae78a2e04335c27b0a68ed52bcd539595e57ff4daa00be","pubkey":"fa984bd7dbb282f07e16e7ae87b26a2a7b9b90b7246a44771f0cf5ae58018f52","created_at":1744066777,"kind":1,"tags":[["p","6e468422dfb74a5738702a8823b9b28168abab8655faacb6853cd0ee15deee93","wss://nostr.oxtr.dev/","mention"]],"content":"I just vibelined a vertex DVM search app without touching a single key.\n\nLiterally only recorded a voice memo and saved it on my phone.\nWhich went to my old laptop via syncthing\n\nnostr:nprofile1qqsxu35yyt0mwjjh8pcz4zprhxegz69t4wr9t74vk6zne58wzh0waycpz4mhxue69uhkummnw3ezummcw3ezuer9wchszxthwden5te0v3jhyemfva5jumn0wd68yvfwvdhk6tc4839wp ‘s vibeline picked it up from there: whisper to transcribe locally, qwen2.5 via Ollama to understand what I wanted, saw that I was talking about building an app so it called my new build_app plugin which transformed my text into an app spec and then kicked-off my vibeline tools with mcp, checking my nostr code snippets to one-shot build a CLI DVM-capable WoT username search tool\n\n😂😂😂 wiiiiild times\n\nVoice-memo in, app out","sig":"f3ab2543de65bca976bfa40066c1af6803f663a82a30b0856b457dbf75f35db2338dbdc944981eca93ded6204971e8b81275d5c0f7ac6f16cad0faddafec5722"} -

@ 220522c2:61e18cb4

2025-04-08 08:21:15{"picture":"https://chrisatmachine.com/images/me.jpg","about":"Working on nostr stuff\n\n- comet.md\n- notebin.io\n- notestack.com\n- relayrunner.org\n- relaywizard.com\n\nNIP-C0 author","website":"https://chrisatmachine.com","lud16":"chrisatmachine@strike.me","name":"Chris","nip05":"chris@nostrings.news","display_name":""}

@ 220522c2:61e18cb4

2025-04-08 08:21:15{"picture":"https://chrisatmachine.com/images/me.jpg","about":"Working on nostr stuff\n\n- comet.md\n- notebin.io\n- notestack.com\n- relayrunner.org\n- relaywizard.com\n\nNIP-C0 author","website":"https://chrisatmachine.com","lud16":"chrisatmachine@strike.me","name":"Chris","nip05":"chris@nostrings.news","display_name":""} -

@ 220522c2:61e18cb4

2025-04-08 08:05:22Never heard of freenet tbh

@ 220522c2:61e18cb4

2025-04-08 08:05:22Never heard of freenet tbh -

@ 220522c2:61e18cb4

2025-04-08 08:04:24I haven’t thought about dms but I do plan to build in encrypted sync cross platform for your notes.

@ 220522c2:61e18cb4

2025-04-08 08:04:24I haven’t thought about dms but I do plan to build in encrypted sync cross platform for your notes. -

@ 220522c2:61e18cb4

2025-04-08 08:01:59🤝 A simple desktop note taking app that allows you to write markdown in rich text and publish articles to nostr. Still in alpha tho so if you test it make sure to save your notes outside of the app until 1.0.

@ 220522c2:61e18cb4

2025-04-08 08:01:59🤝 A simple desktop note taking app that allows you to write markdown in rich text and publish articles to nostr. Still in alpha tho so if you test it make sure to save your notes outside of the app until 1.0. -

@ 220522c2:61e18cb4

2025-04-08 07:58:38I’ll consider it out of alpha once encrypted sync is working, and when that’s done I should be able to put together a mobile client but that’s a little further out. In the meantime let me know what features you’d like to see!

@ 220522c2:61e18cb4

2025-04-08 07:58:38I’ll consider it out of alpha once encrypted sync is working, and when that’s done I should be able to put together a mobile client but that’s a little further out. In the meantime let me know what features you’d like to see! -

@ 220522c2:61e18cb4

2025-04-08 07:53:25I’ll give it a shot for the next release.

@ 220522c2:61e18cb4

2025-04-08 07:53:25I’ll give it a shot for the next release. -

@ 220522c2:61e18cb4

2025-04-08 07:11:07yea it's a desktop note taking app you can use to publish long form content. I'm planning to add regular notes and code snippets soon. It's still in alpha so if you test it out make sure to back up the notes somewhere else until 1.0. you can download it at https://comet.md

@ 220522c2:61e18cb4

2025-04-08 07:11:07yea it's a desktop note taking app you can use to publish long form content. I'm planning to add regular notes and code snippets soon. It's still in alpha so if you test it out make sure to back up the notes somewhere else until 1.0. you can download it at https://comet.md -

@ 220522c2:61e18cb4

2025-04-08 05:36:45You can now sort by last edited, created at and title in Comet. Title is particularly useful if you're writing a book or course where you can number the titles. Each notebook should have it's own sort state. https://v.nostr.build/UYI1ZMXp3FfKlwsL.mp4

@ 220522c2:61e18cb4

2025-04-08 05:36:45You can now sort by last edited, created at and title in Comet. Title is particularly useful if you're writing a book or course where you can number the titles. Each notebook should have it's own sort state. https://v.nostr.build/UYI1ZMXp3FfKlwsL.mp4 -

@ 220522c2:61e18cb4

2025-04-08 04:58:06You can now tag your code snippets on notebin.io, this will allow for enhanced lookup with MCP serviers: https://v.nostr.build/aQ0sJT93wQh6HCZx.mp4

@ 220522c2:61e18cb4

2025-04-08 04:58:06You can now tag your code snippets on notebin.io, this will allow for enhanced lookup with MCP serviers: https://v.nostr.build/aQ0sJT93wQh6HCZx.mp4 -

@ 220522c2:61e18cb4

2025-04-08 00:28:41I refactored the code snippet MCP code to use typescript and be simpler to understand, if you're just learning how to integrate nostr with MCP I recommend checking out the tools directory: https://github.com/nodetec/nostr-code-snippet-mcp/tree/master/src/tools

@ 220522c2:61e18cb4

2025-04-08 00:28:41I refactored the code snippet MCP code to use typescript and be simpler to understand, if you're just learning how to integrate nostr with MCP I recommend checking out the tools directory: https://github.com/nodetec/nostr-code-snippet-mcp/tree/master/src/tools -

@ 220522c2:61e18cb4

2025-04-07 17:49:37It’s back.

@ 220522c2:61e18cb4

2025-04-07 17:49:37It’s back. -

@ 220522c2:61e18cb4

2025-04-07 17:34:33The domain for Tauri (the rust desktop application framework) has expired. Reminder that if you have a good domain to put it on auto-renew. Hopefully they’re able to get it back. https://tauri.app

@ 220522c2:61e18cb4

2025-04-07 17:34:33The domain for Tauri (the rust desktop application framework) has expired. Reminder that if you have a good domain to put it on auto-renew. Hopefully they’re able to get it back. https://tauri.app -

@ 220522c2:61e18cb4

2025-04-07 09:19:00NIP-C0 supported landed in rust-nostr: https://github.com/rust-nostr/nostr/pull/830 #grownostr

@ 220522c2:61e18cb4

2025-04-07 09:19:00NIP-C0 supported landed in rust-nostr: https://github.com/rust-nostr/nostr/pull/830 #grownostr -

@ 220522c2:61e18cb4

2025-04-07 06:29:34If anyone is looking to: - show x results per page (not infinite scroll feed) - save paginated state when navigating to a post and back - reduce number of calls that need to be made to relays checkout how I'm doing pagination for notebin snippets: https://notebin.io/archive I think this is about as good as you can do when you only have the created_at timestamp to work with.

@ 220522c2:61e18cb4

2025-04-07 06:29:34If anyone is looking to: - show x results per page (not infinite scroll feed) - save paginated state when navigating to a post and back - reduce number of calls that need to be made to relays checkout how I'm doing pagination for notebin snippets: https://notebin.io/archive I think this is about as good as you can do when you only have the created_at timestamp to work with. -

@ 220522c2:61e18cb4

2025-04-06 20:44:29MCP and UDS signer code: https://github.com/nodetec/nostr-code-snippet-mcp (make sure to spin up the UDS signer first if you wanna test publishing)

@ 220522c2:61e18cb4

2025-04-06 20:44:29MCP and UDS signer code: https://github.com/nodetec/nostr-code-snippet-mcp (make sure to spin up the UDS signer first if you wanna test publishing) -

@ 220522c2:61e18cb4

2025-04-06 20:27:57{"id":"35ac687ae7fa33107b91897e0022c76eac0d8cca994ae9edc72988dd43e05e27","sig":"5fcab4535239bd6671bccd918021125f59a79b4417a344900e114d96a10d9bed2148225092db117ff8fcf02b49069c36000769760ba10fdb18cb412add206f85","kind":1,"tags":[["e","30095879987f7c8c3215f23096facaed124d065494df7a060ba137eaf54e794d","","mention"]],"pubkey":"82341f882b6eabcd2ba7f1ef90aad961cf074af15b9ef44a09f9d2a8fbfbe6a2","content":"this is excellent \n\nnostr:nevent1qvzqqqqqqypzp75cf0tahv5z7plpdeaws7ex52nmnwgtwfr2g3m37r844evqrr6jqqsrqz2c0xv87lyvxg2lyvyklt9w6yjdqe2ffhm6qc96zdl27488jngy2xs4c ","created_at":1743966717}

@ 220522c2:61e18cb4

2025-04-06 20:27:57{"id":"35ac687ae7fa33107b91897e0022c76eac0d8cca994ae9edc72988dd43e05e27","sig":"5fcab4535239bd6671bccd918021125f59a79b4417a344900e114d96a10d9bed2148225092db117ff8fcf02b49069c36000769760ba10fdb18cb412add206f85","kind":1,"tags":[["e","30095879987f7c8c3215f23096facaed124d065494df7a060ba137eaf54e794d","","mention"]],"pubkey":"82341f882b6eabcd2ba7f1ef90aad961cf074af15b9ef44a09f9d2a8fbfbe6a2","content":"this is excellent \n\nnostr:nevent1qvzqqqqqqypzp75cf0tahv5z7plpdeaws7ex52nmnwgtwfr2g3m37r844evqrr6jqqsrqz2c0xv87lyvxg2lyvyklt9w6yjdqe2ffhm6qc96zdl27488jngy2xs4c ","created_at":1743966717} -

@ 220522c2:61e18cb4

2025-04-06 20:26:35also just realized I put and @ and not a # 🤦♂️

@ 220522c2:61e18cb4

2025-04-06 20:26:35also just realized I put and @ and not a # 🤦♂️ -

@ 220522c2:61e18cb4

2025-04-06 20:24:57Here is the nip to sign via Unix Domain Sockets: https://github.com/nostr-protocol/nips/pull/1862

@ 220522c2:61e18cb4

2025-04-06 20:24:57Here is the nip to sign via Unix Domain Sockets: https://github.com/nostr-protocol/nips/pull/1862 -

@ 220522c2:61e18cb4

2025-04-06 20:22:10In this demo we ask Claude to post a simple python code snippet. The MCP server reaches out via unix domain socket to have the event signed so Claude nor the MCP server needs to know the private key. This will allow you to have Claude post code snippets that you like on your behalf without needed to expose your private key/nsec. @grownostr https://v.nostr.build/VyJH6QCH6Q5RgAV8.mp4

@ 220522c2:61e18cb4

2025-04-06 20:22:10In this demo we ask Claude to post a simple python code snippet. The MCP server reaches out via unix domain socket to have the event signed so Claude nor the MCP server needs to know the private key. This will allow you to have Claude post code snippets that you like on your behalf without needed to expose your private key/nsec. @grownostr https://v.nostr.build/VyJH6QCH6Q5RgAV8.mp4 -

@ 0e9491aa:ef2adadf

2025-05-23 14:01:33

@ 0e9491aa:ef2adadf

2025-05-23 14:01:33

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ eed7ca5d:191de8eb

2025-05-23 13:58:46

@ eed7ca5d:191de8eb

2025-05-23 13:58:46Growing up, we were told that in order to build wealth, we need to save little by little. By living below your means, you are providing more for your future.

It is a simple formula that will help you build up the capital necessary to buy a car, a house or start a business… You prioritize long-term benefits and delayed gratification over immediate rewards.

This is called having a low-time preference. In contrast, high-time preference individuals prioritize today over tomorrow, seeking immediate gratification.

Austrian economists explain that civilization growth is driven by low-time preference societies. Groups of individuals who prioritize long-term planning are able to innovate and develop new tools for a better future. Over time, this behavior leads to technological inventions like the light bulb and artistic masterpieces like the Notre Dame cathedral.

***What happens when you realize that the money you save is losing value over time? ***

There is less incentive to save for the future, because in the future your savings will be worth less. You might as well spend it now and enjoy life today.

When the money you save loses its value, you are facing one of two choices:

-

Spend it today and reap the rewards of your hard work;

-

Invest it (stocks, real estate, etc.) with the hope to reap higher rewards later, bearing the risk of losing it all if the investment does not pay off.

There is a distinct difference between saving and investing as the latter approach is riskier than the former. By investing, you are betting on the upside while bearing the downside risk. Saving, in contrast, comes without downside risk. That difference becomes blurry when the money you save is losing value. In fact, saving becomes inherently a losing approach. Logically, you will be forced to place a speculative bet with the hope to outperform the guaranteed loss of value. You are required to find a way to hedge your bet…

Humans over time have always sought out a medium to save their economic energy for a better future. That used to be beads and seashells, and evolved to precious metals like gold and silver.

Money is a tool that we use to save our economic energy over time, and exchange value with each other.

I spend time fishing, you spend time farming, the neighbor spends time building homes, and society rewards us with money for the time and energy we spent being productive

Today, the tool that we use to save our economic energy is clearly losing value over time. The nominal value remains the same, but the purchasing power is decreasing. In other words, the value of our time today will be worth less in the future.

That explains why everyone around us is looking for the next best investment opportunity. We are all needing to become investment experts, speculators, on top of our respective professions. Speculation became necessary, and some of us are forced into a high-time preference lifestyle.

Earn now and spend it all now before you lose it.

This should not be the case…

Time is Money

Our time is the only scarce resource we all have. We use it to be productive and generate economic value, then store that value in the form of money in order to reap the rewards in the future.

Money is the abstract representation of our time. Hence, time is money.

In January 2009, at the height of the global financial crisis, a software protocol called Bitcoin was released pseudonymously by Satoshi Nakamoto. This individual (or group) released a whitepaper a few months prior named “Bitcoin: A Peer-to-Peer Electronic Cash System” outlining how the system enables secure, peer-to-peer transactions without relying on a central authority. (https://bitcoin.org/bitcoin.pdf)

Although there are more technical concepts involved, the bitcoin protocol can be thought of as a language for communicating value. The same way we respect the rules of the English language to communicate ideas with one another, bitcoin users adhere to the network’s consensus rules to communicate value with each other in a peer-to-peer fashion.

There are no physical or digital coins in the bitcoin network. Rather, it is a collection of transactions transferring value from sender to recipient. Transactions are validated and propagated by nodes across the network, before being recorded into the blockchain. The Bitcoin blockchain is a global public ledger of all transactions that cannot be altered.

More importantly, Bitcoin is money that does not lose value overtime.

-

Its supply is capped at 21 million coins.

-

Its scarcity increases over time due to the predictable issuance rate, which halves roughly every 4 years.

-

Its decentralized nature puts the power in the hands of its users.

-

There is no governing body that can devalue or alter it.

It is a tool that we can use to save our economic energy over time, and be able to use it later.

It is the scarcest verifiable commodity: we cannot make more of it no matter how high its demand grows. That cannot be said for any other commodity in the world today.

A savings tool in disguise

See, most people tend to view bitcoin as another speculative investment. They presume they have missed out on another investment opportunity, and it’s now too late to get in.

Meanwhile, it is quite the opposite. Bitcoin’s value will keep growing over time due to its deflationary nature.

With bitcoin, we can save for a better future, for a rainy day, and spend more time with our loved ones or focusing on our craft to build better tools or artistic masterpieces. It takes away the burden of having to speculate on which stock will perform best, or which real estate market will grow the fastest, all while working one or multiple jobs

Bitcoin is not another investment opportunity you missed out on. It is the best savings tool humans have invented (or discovered), while everything else is the speculative bet. Bitcoin is the hedge against the guaranteed devaluation of money, without any counterparty risk.

What we were taught as children is true. With the right tool, the idea that saving will help you build wealth overtime stands true. Bitcoin might seem like an investment today given the volatility during its adoption phase. In reality, it is the perfect way to store your time and economic energy and grow your wealth. Whether you make $1/hour or $1M/hour, you can start saving in the best money humans have invented.

My goal is to help people around me understand this technology and break the stigma around it.

Bitcoin is not the next best investment.

It is the best tool we have found to store our economic energy across time and exchange value with each other.

Bitcoin is Money.

-

-

@ 5d4b6c8d:8a1c1ee3

2025-05-23 13:46:21

@ 5d4b6c8d:8a1c1ee3

2025-05-23 13:46:21You'd think I'd be most excited to talk about that awesome Pacers game, but, no. What I'm most excited about this week is that @grayruby wants to continue Beefing with Cowherd.

Still, I am excited to talk about Tyrese Haliburton becoming a legendary Knicks antagonist. Unfortunately, the Western Conference Finals are not as exciting. Also, why was the MVP announcement so dumb?

The T20k cricket contest is tightening up, as we head towards the finish. Can @Coinsreporter hold on to his vanishing lead?

@Carresan has launched Football Madness. Let's see if we understand whatever the hell this is any better than we did last week.

On this week's Blok'd Shots, we'll ridicule Canada for their disgraceful loss in the World Championships and talk about the very dominant American Florida Panthers, who are favorites to win the Stanley Cup.

Are the Colorado the worst team in MLB history?

The Tush Push has survived another season. Will the NFL eventually ban it or will teams adjust?

Plus, whatever else Stackers want to talk about.

https://stacker.news/items/987399

-

@ 450102fc:539757ac

2025-05-23 13:43:58

@ 450102fc:539757ac

2025-05-23 13:43:58With Nostr, Jack is well ahead of what Elon and Zuck have learned about censorship

Mark Zuckerberg’s announcement that he is dropping censorship in the U.S. for Facebook and Instagram was accompanied by a comment that he is going to work with the U.S. government to encourage other countries to not censor content. Upon acquiring Twitter, Elon Musk dropped censorship and soon learned that government mandates from across the world censor content.

In 2024, Brazil blocked Twitter until it complied with censorship demands, France arrested Telegram’s CEO Pavel Durov, the EU censored additional Russian outlets and wrote letters to Twitter mandating more content moderation, and Australia announced it will fine platforms for misinformation.

The current U.S. administration had a heavy censorship hand and had threatened to revoke Section 230 which protects Internet sites from liability about their users’ content. Zuck indicated in his announcement and a letter to Congress in November that Meta felt coerced to comply. Twitter under Jack Dorsey was also coerced to censor, as disclosed in the Twitter Files and Alex Berenson’s amended censorship lawsuit with new insider materials from Twitter.

Western governments did not typically engage in government guidance or mandates on content until after the Brexit and Trump elections in 2016 followed by the Russia-Ukraine war in 2022. Once Western governments realized that they had lost narrative control, they started playing catch up with China, which was well aware from the start of the power of social networks to both disrupt and control narratives.

Due to the secretive nature of government guidance and mandates, Elon and those outside social media organizations had only witnessed basic content moderation. Jack and Zuck had already experienced years of coercive government guidance threatening Section 230 revocation as well as numerous explicit censorship mandates from Western governments.

Zuck’s response was to downrank and de-emphasize political content in early 2021 after the bruising 2020 U.S. election cycle. This was a difficult decision since Facebook made a lot of money from political arguments, as I pointed out in a 2019 article for VentureBeat. Zuck sidestepped government pressure and continued to grow his properties. Correspondingly, despite the volumes of racist and homophobic content on Instagram, there is not much pressure for content moderation from groups like Media Matters and GARM that have targeted X/Twitter.

Jack’s response was to fund Bluesky to shift Twitter to an open protocol like email’s SMTP and the web’s HTTP. Governments can of course censor at the protocol level with firewalls like they currently do for email and web, but by separating the application and protocol layers, Jack recognized that social networks could operate like any other Internet infrastructure that is content neutral. Jack departed Bluesky when the company started massively moderating accounts and content. Jack then discovered Nostr (Notes and Other Stuff Transmitted by Relays), a decentralized messaging protocol initially created by an anonymous developer FiatJeff, much like an anonymous developer Satoshi Nakamoto created Bitcoin.

Nostr is reminiscent of FidoNet, a popular store-and-forward messaging protocol for Bulletin Board Systems (BBS) in the 1980s. Each BBS was fully independent, and each could choose which forum messages to store-and-forward, whether to moderate content, and how long to keep the messages. In addition, FidoNet could store-and-forward private messages between users. UseNet also operated in a similar store-and-forward manner for Internet forums, but did not operate private messages since the Internet already had SMTP.

Nostr developers offer an active ecosystem of both clients and servers offering an interface familiar to social network users, as well as micro apps offering new functionality on top of the protocol. Nostr is decentralized with no central control point and transmits messages across independently operated relays. Just like with current email systems and Nostr predecessors FidoNet and UseNet the independence of the relays create inefficiency. Different users may not see each others’ replies chronologically until the messages transmission has caught up, and not all relays transmit all messages. FidoNet and UseNet were inefficient due to resource constraints such as long distance charges and intermittent connectivity. Nostr and Bitcoin use inefficiency to engineer resilience into the protocol.

A Nostr account can never be “revoked,” however relays are not obligated to carry an account’s messages. Users can easily switch relays or even operate their own. As part of the new generation of decentralized crypto software, Nostr uses a public/private key combination for identity, and you can optionally publish your profile name, e-mail address, and lightning wallet associated with the key. Nostr clients sign messages with your private key when you post, and users know it’s you by your public key. A note of caution: just like with crypto, if your private key gets compromised or lost, it’s like losing or having your Bitcoin private key stolen.

A new administration could easily coerce social media companies. This time, Elon stood in the face of a government onslaught. Zuck followed when the coast was clear. Jack has laid the foundation for the future. https://npub1g5qs9.layer3.press/articles/cd5020b0-08ad-409d-b792-81387bb4f060

-

@ d12614be:8ed99bc6

2025-05-23 13:35:09

@ d12614be:8ed99bc6

2025-05-23 13:35:09Test article 23.05.2025 2

https://drewdru.layer3.press/articles/ddd70871-69c2-41af-ae56-13fea76050e0

-

@ cae03c48:2a7d6671

2025-05-23 13:00:58

@ cae03c48:2a7d6671

2025-05-23 13:00:58Bitcoin Magazine

Bitcoin Pizza Day: 15 Years Since 10,000 BTC Bought Two Pizzas and Changed EverythingOn May 22, 2010, Bitcoin became more than just an idea—it became real money. Laszlo Hanyecz, a developer and early contributor to Bitcoin’s codebase, posted a casual offer: “I’ll pay 10,000 bitcoins for a couple of pizzas.” Five days later, someone took him up on it. Two Papa John’s pizzas were delivered. A screenshot was posted. Bitcoin had entered the real world.

15 years ago, Laszlo Hanyecz spent 10,000 #bitcoin worth $30 on two Papa John's pizzas.

Today, 10,000 $BTC is worth over $1,100,000,000.

What a legend!

pic.twitter.com/EbxQAsixhZ

pic.twitter.com/EbxQAsixhZ— Bitcoin Magazine (@BitcoinMagazine) May 22, 2025

That 10,000 Bitcoin, worth about $41 at the time, is now valued at over $1.1 billion. And with Bitcoin hitting a new all-time high of $111,999 on the 15th anniversary of the transaction, the story of the “Bitcoin Pizza” carries more weight than ever.

15 years ago, someone paid 10,000 #Bitcoin for 2 pizzas. That’s worth over $1,000,000,000 today!

It wasn’t just about the pizza. This was the moment Bitcoin proved itself as a functioning currency. Until then, it had lived mostly in theory and code—talked about by cryptographers and mined by hobbyists. Hanyecz’s post, and the trade that followed, transformed the idea into action. “This transaction made Bitcoin real in my eyes,” he said in a 2019 interview. “It wasn’t worth much at the time. I wouldn’t have spent $100 million on pizza, right? But if I hadn’t done that, maybe Bitcoin wouldn’t have become so popular.”

Over the summer of 2010, Hanyecz continued using Bitcoin to buy pizzas, eventually spending more than 79,000 BTC—now worth nearly $8.7 billion. While some have joked at his expense, the truth is this: without those early real-world transactions, Bitcoin might never have proven its use case. Hanyecz helped move Bitcoin from the fringe into functionality.

That legacy still shapes us today. Bitcoin Pizza Day has become a cultural milestone in the crypto world, with meetups, pizza parties, and educational events held globally each May 22. The day serves as a reminder of how far the technology has come—and the importance of everyday actions and the impact they have.

Smiles, joy, and shared moments, this is what today looked like.#Bitcoin Pizza Day at His Grace School was more than a visit. It was connection, care, and community. A heartfelt thank you to everyone who donated and supported #BitcoinGhana #BitcoinPizzaDay #BTC #Bitfiasi pic.twitter.com/xRMv1rpife

— Bitfiasi Initiative (@bitfiasi) May 22, 2025

Just this week, fast food chain Steak ‘n Shake began accepting Bitcoin via the Lightning Network, signaling a growing wave of mainstream adoption. What once felt experimental is now becoming part of everyday commerce.

Bitcoin Pizza Day is about recognition. One simple transaction proved that Bitcoin could work—and 15 years later, the world is still building on that first bite.

This post Bitcoin Pizza Day: 15 Years Since 10,000 BTC Bought Two Pizzas and Changed Everything first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 9ca447d2:fbf5a36d

2025-05-22 14:01:52

@ 9ca447d2:fbf5a36d

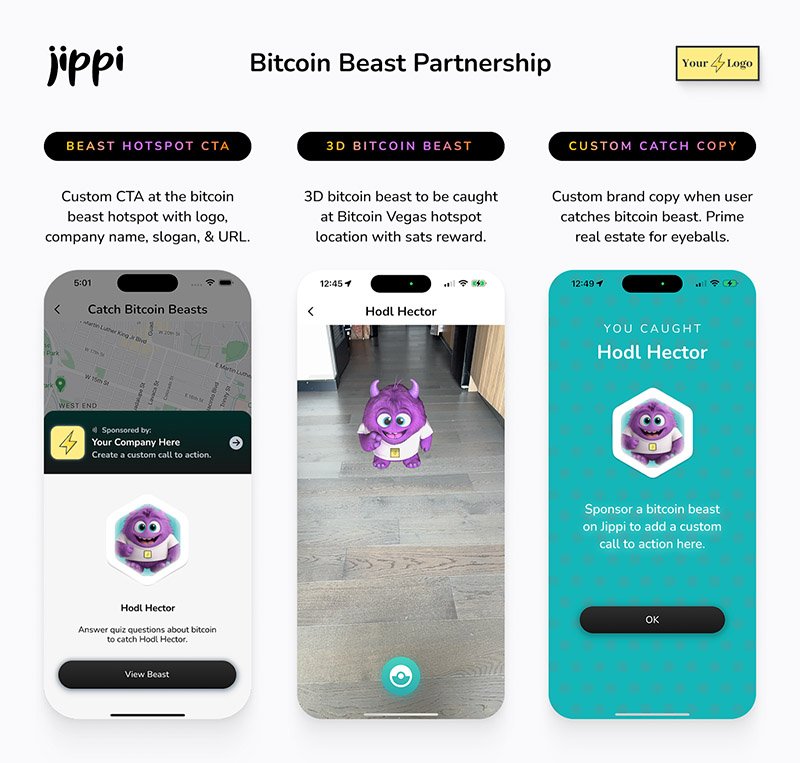

2025-05-22 14:01:52Gen Z (those born between 1997 and 2012) are not rushing to stack sats, and Oliver Porter, Founder & CEO of Jippi, understands the challenge better than most. His strategy revolves around adapting Bitcoin education to fit seamlessly into the digital lives of young adults.

“We need to meet them where they are,” Oliver explains. “90% of Gen Z plays games. 70% expect to earn rewards.”

So, what will effectively introduce them to Bitcoin? In Oliver’s mind, the answer is simple: games that don’t feel preachy but still plant the orange pill.

Learn more at Jippi.app

That’s exactly what Jippi is. Based in Austin, Texas, the team has created a mobile augmented reality (AR) game that rewards players in bitcoin and sneakily teaches them why sound money matters.

“It’s Pokémon GO… but for sats,” Oliver puts it succinctly.

Jippi is like Pokemon Go, but for sats

Oliver’s Bitcoin journey, like many in the space, began long before he was ready. A former colleague had tried planting the seed years earlier, handing him a copy of The Bitcoin Standard. But the moment passed.

It wasn’t until the chaos of 2020 when lockdowns hit, printing presses roared, and civil liberties shrank that the message finally landed for him.

“The government got so good at doing reverse Robin Hood,” Oliver explains. “They steal from the working population and reward the rich.”

By 2020, though, the absurdity of the covid hysteria had caused his eyes to be opened and the orange light seemed the best path back to freedom.

He left the UK for Austin “one of the best places for Bitcoiners,” he says, and dove headfirst into the industry, working at Swan for a year before founding Jippi on PlebLab’s accelerator program.

Jippi’s flagship game lets players roam their cities hunting digital creatures, Bitcoin Beasts, tied to real-world locations. Catching them requires answering Bitcoin trivia, and the reward is sats.

No jargon. No hour-long lectures. Just gameplay with sound money principles woven right in.

The model is working. At a recent hackathon in Austin, Jippi beat out 14 other teams to win first place and $15,000 in prize money.

Oliver of Jippi won Top Builder Season 2 — PlebLab on X

“We’re backdooring Bitcoin education,” Oliver admits. “And while we’re at it, encouraging people to get outside and touch grass.”

Not everyone’s been thrilled. When Jippi team members visited one of the more liberal-leaning places in Texas, UT Austin, to test interest in Bitcoin, they found some seriously committed no-coiners on the campus.

“One young woman told me, ‘I would rather die than talk about Bitcoin,'” Oliver recalls, highlighting the cultural resistance that’s built up among younger demographics.

This resistance is backed by hard data. According to Oliver, some of the Bitcoin podcasters they met with in the space to do market research reported that less than 1% of their listeners are from Gen Z and that number is dropping.

“Unless we find a way to capture their interest in a meaningful way, there’s going to be a big problem around trying to sway Gen Z away from the siren call of s***coins and crypto casinos and towards Bitcoin,” Oliver warns.

Jippi’s next big move is Las Vegas, where they’ll launch the Beast Catch experience at the Venetian during a major Bitcoin event. To mark the occasion, they’re opening up six limited sponsorship spots for Bitcoin companies, each one tied to a custom in-game beast.

Jippi looks to launch a special event at Bitcoin 2025

“It’s real estate inside the game,” Oliver explains. “Brands become allies, not intrusions. You get a logo, company name, and call to action, so we can push people to your site or app.”

Bitcoin Well—an automatic self-custody Bitcoin platform—has claimed Beast #1. Only five exclusive spots remain for Bitcoin companies to “beastify their brand” through Jippi’s immersive AR game.

“I love the Jippi mission. I think gamified learning is how we will onboard the next generation and it’s exciting to see what the Jippi team is doing! I love working with bitcoiners towards our common mission – bullish!” said Adam O’Brien, Bitcoin Well CEO.

Jippi’s sponsorship model is simple: align incentives, respect users, and support builders. Instead of throwing ad money at tech giants, Bitcoin companies can connect with new users naturally while they’re having fun and earning sats in the process.

For Bitcoin companies looking to reach a younger demographic, this represents a unique opportunity to showcase their brand to up to 30,000 potential customers at the Vegas event.

Jippi Bitcoin Beast partnership

While Jippi’s current focus is simple, get the game into more cities, Oliver sees a future where AR glasses and AI help personalize Bitcoin education even further.

“The magic is going to really happen when Apple releases the glasses form factor,” he says, describing how augmented reality could enhance real-world connections rather than isolate users.

In the longer term, Jippi aims to evolve from a free-to-play model toward a pay-to-play version with higher stakes. Users would form “tribes” with friends to compete for substantial bitcoin prizes, creating social connections along with financial education.

Unlike VC-backed startups, Jippi is raising funds pleb style via Timestamp, an open investment platform for Bitcoin companies.

“You don’t have to be an accredited investor,” Oliver explains. “You’re directly supporting the parallel Bitcoin economy by investing in Bitcoin companies for equity.”

Anyone can invest as little as $100. Perks include early access, exclusive game content, and even creating your own beast design with your name/pseudonym and unique game lore. Each investment comes with direct ownership of an early-stage Bitcoin company like Jippi.

For Oliver, this is more than just a business. It’s about future-proofing Bitcoin adoption and ensuring Satoshi’s vision lives on, especially as many people are lured by altcoins, NFTs, and social media dopamine.

“We’re on the right side of history,” he says firmly. “I want my grandkids to know that early on in the Bitcoin revolution, games like Jippi helped make it stick.”

In a world increasingly absorbed by screens and short attention spans, Jippi’s combination of outdoor play, sats rewards, and Bitcoin education might be exactly the bridge Gen Z needs.

Interested in sponsoring a Beast or investing in Jippi? Reach out to Jippi directly by heading to their partnerships page on their website or visit their Timestamp page to invest in Jippi today.

-

@ 57d1a264:69f1fee1

2025-05-22 13:13:36

@ 57d1a264:69f1fee1

2025-05-22 13:13:36Graphics materials for Bitcoin Knots https://github.com/bitcoinknots branding. See below guide image for reference, a bit cleaner and scalable:

Font family "Aileron" is provided free for personal and commercial use, and can be found here: https://www.1001fonts.com/aileron-font.html

Source: https://github.com/Blissmode/bitcoinknots-gfx/tree/main

https://stacker.news/items/986624

-

@ 57d1a264:69f1fee1

2025-05-22 12:36:20

@ 57d1a264:69f1fee1

2025-05-22 12:36:20Graphics materials for Bitcoin Knots https://github.com/bitcoinknots branding. See below guide image for reference, a bit cleaner and scalable:

Font family "Aileron" is provided free for personal and commercial use, and can be found here: https://www.1001fonts.com/aileron-font.html

Source: https://github.com/Blissmode/bitcoinknots-gfx/tree/main

https://stacker.news/items/986587

-

@ 57d1a264:69f1fee1

2025-05-22 06:21:22

@ 57d1a264:69f1fee1

2025-05-22 06:21:22You’ve probably seen it before.

You open an agency’s website or a freelancer’s portfolio. At the very top of the homepage, it says:

We design for startups.

You wait 3 seconds. The last word fades out and a new one fades in:

We design for agencies.

Wait 3 more seconds:

We design for founders.

I call this design pattern The Wheel of Nothing: a rotating list of audience segments meant to impress through inclusion and draw attention through motion… for absolutely no reason.

Revered brand studio Pentagram recently launched a new website. To my surprise, the homepage features the Wheel of Nothing front and center, boldly claiming:

We design Everything for Everyone…before cycling through more specific combinations every few seconds.

Dan Mall, a husband, dad, teacher, creative director, designer, founder, and entrepreneur from Philly. I share as much as I can to create better opportunities for those who wouldn’t have them otherwise. Most recently, I ran design system consultancy SuperFriendly for over a decade.

Read more at Dans' website https://danmall.com/posts/the-wheel-of-nothing/

https://stacker.news/items/986392

-

@ 21335073:a244b1ad

2025-05-21 16:58:36

@ 21335073:a244b1ad

2025-05-21 16:58:36The other day, I had the privilege of sitting down with one of my favorite living artists. Our conversation was so captivating that I felt compelled to share it. I’m leaving his name out for privacy.

Since our last meeting, I’d watched a documentary about his life, one he’d helped create. I told him how much I admired his openness in it. There’s something strange about knowing intimate details of someone’s life when they know so little about yours—it’s almost like I knew him too well for the kind of relationship we have.

He paused, then said quietly, with a shy grin, that watching the documentary made him realize how “odd and eccentric” he is. I laughed and told him he’s probably the sanest person I know. Because he’s lived fully, chasing love, passion, and purpose with hardly any regrets. He’s truly lived.

Today, I turn 44, and I’ll admit I’m a bit eccentric myself. I think I came into the world this way. I’ve made mistakes along the way, but I carry few regrets. Every misstep taught me something. And as I age, I’m not interested in blending in with the world—I’ll probably just lean further into my own brand of “weird.” I want to live life to the brim. The older I get, the more I see that the “normal” folks often seem less grounded than the eccentric artists who dare to live boldly. Life’s too short to just exist, actually live.

I’m not saying to be strange just for the sake of it. But I’ve seen what the crowd celebrates, and I’m not impressed. Forge your own path, even if it feels lonely or unpopular at times.

It’s easy to scroll through the news and feel discouraged. But actually, this is one of the most incredible times to be alive! I wake up every day grateful to be here, now. The future is bursting with possibility—I can feel it.

So, to my fellow weirdos on nostr: stay bold. Keep dreaming, keep pushing, no matter what’s trending. Stay wild enough to believe in a free internet for all. Freedom is radical—hold it tight. Live with the soul of an artist and the grit of a fighter. Thanks for inspiring me and so many others to keep hoping. Thank you all for making the last year of my life so special.

-

@ a296b972:e5a7a2e8

2025-05-23 12:42:10

@ a296b972:e5a7a2e8

2025-05-23 12:42:10Was Rudolf Steiner vor gut 110 Jahren an Informationen zusammengetragen und kommentiert hat, liest sich in großen Abschnitten so, als ob es in der heutigen Zeit geschrieben worden wäre. Man trifft auf eine ganze Reihe von „guten, alten Bekannten“, die auch heute noch maßgeblich an den Strippen ziehen. Deutlich wird, dass ein Krieg nicht aus heiterem Himmel ausbricht, sondern das im Vorfeld schon Kräfte wirken, die auf einen Krieg hinarbeiten. Wie jetzt wieder im Ukraine-Krieg wird diese Vorgeschichte gerne versucht unter den Teppich zu kehren und hochkompetente, sauber recherchierende, akribisch Quellen angebende Journalisten, wie z. B. Frau Gabriele Krone-Schmalz oder Herr Patrik Baab, der sich auf eigene Kosten einen Eindruck von vor Ort verschafft hat, werden versucht mundtot zu machen und mittlerweile gar nicht mehr zu Gesprächen im öffentlich-rechtlichen Rundfunk eingeladen, weil sie die fortlaufende Gehirnwäsche des Ministeriums für Wahrheit und Narrative mit ihren Aussagen gefährden. Andere kommen auf die Sanktionsliste.

Auch heute ist von den „Guten“ und den „Bösen“ die Rede, was darauf schließen lässt, dass man durchaus eingesteht, dass hier geistige Kräfte am Werk sind. Rudolf Steiner kommt auf diese immer wieder zu sprechen. Aus der von ihm gegebenen anthroposophischen Geisteswissenschaft heraus, beleuchtet er die Vorgänge innerhalb der gesamten Menschheitsentwicklung. Mancher stört sich hier an Begriffen, die man heute so nicht mehr verwenden würde. Dabei ist immer zu berücksichtigen, zu welcher Zeit die Vorträge gehalten wurden. Die Anthroposophie von Rudolf Steiner gilt heute bei vielen auch als „umstritten“, aber was ist das heute nicht? Fast könnte man es schon als Auszeichnung sehen, wenn etwas „umstritten“ ist, denn das ist mittlerweile ein Beweis dafür, dass es Ansichten, Meinungen und Einschätzungen gibt, die in einer gesunden Demokratie innerhalb einer Kontroverse zu einem Dialog und Austausch beitragen können, der jedoch leider derzeit weder gewünscht ist, noch gepflegt wird, was an der „Spaltung“ deutlich zu sehen ist. Und auch unter den Anthroposophen hat die „Spaltung“ Einzug gehalten.

Um das aktuelle, viele Bereiche umschließende, gigantische Lügenkonstrukt aufrecht zu erhalten, ist mittlerweile jedes Mittel recht, von der Deutungshoheit der Wahrheit durch systemkonforme Begutachter, bis hin zu infantil-kleingeistigen Kindergartenspielchen, um gegenläufige Meinungen oder Oppositionelle in ihrem Wirken zu behindern.

Der gesunde Hausverstand wird ausgetrocknet, und der Garten des Wahnsinns wird durch immer neue Ideen kranker Geister weiter gegossen, gehegt und gepflegt.

Die Zeitgeschichtlichen Betrachtungen von Rudolf Steiner bestehen aus 3 Bänden aus der GA (Gesamtausgabe):

GA 173 a – Wege zu einer objektiven Urteilsbildung

GA 173 b – Das Karma der Unwahrhaftigkeit

GA 173 c – Die Wirklichkeit okkulter Impulse

Sie bestehen aus niedergeschriebenen Vorträgen und einem sehr umfangreichen Anhang mit näheren Erläuterungen und einer Schilderung der Entstehung dieser drei Bände.

Es bedarf einiger Eingewöhnung in die zur damaligen Zeit verwendete Sprache Rudolf Steiners, der ein Meister im Bilden von Schachtelsätzen war. Der Inhalt jedoch, und auf den kommt es ja an, berührt immer wieder den in allen Menschen vorhandenen Wahrheitssinn.

Hier nur eine kleine Kostprobe, die vielleicht das Interesse wecken kann, sich mit diesem derzeit besonders aktuellen Werk näher zu beschäftigen.

GA 173a, 6. Vortrag, Seite 205 und Seite 206, Dornach, 17. Dezember 1916:

„Viel intimer, viel verborgener liegen die Dinge bei der englischen Politik, die ja ganz beeinflußt ist von dem, was in solcher Weise hinter ihr steckt. Da handelt es sich darum, daß man die Wege findet, um die entsprechenden Menschen an die richtigen Plätze zu befördern. Okkultistische Menschen, im Hintergrunde stehend, sind oftmals – na, verzeihen Sie – Einser, bloße Einser, und bedeuten für sich nichts Besonderes; sie brauchen noch etwas anderes – sie brauchen Nullen. Nullen sind ja nicht Einser, aber (fügt man eine Null zu einer Eins), dann wird gleich eine Zehn daraus. Und wenn man noch mehr Nullen hinzufügt – jede Null ist nur eine Null, aber wenn die Eins irgendwo steckt, dann ist gar mancherlei da, zum Beispiel die Tausend, und wenn man die Eins zudeckt, dann sind (scheinbar) nur die Nullen da; die Nullen brauchen aber nur in der entsprechenden Weise mit den Einsern kombiniert zu sein, und sie brauchen nicht einmal viel zu wissen von der Art, wie sie mit den Einsern kombiniert sind.“

Schildert diese 108 Jahre alte Beschreibung nicht genau das, was sich heute vor unseren Augen abspielt?

Dieser Artikel wurde mit dem Pareto-Client geschrieben

* *

(Bild von pixabay)

-

@ 1c5ff3ca:efe9c0f6

2025-05-23 10:13:57

@ 1c5ff3ca:efe9c0f6

2025-05-23 10:13:57Auto-Deployment on a VPS with GitHub Actions

Introduction

This tutorial describes how you can deploy an application on a VPS using GitHub Actions. This way, changes in your GitHub repository are automatically deployed to your VPS.

Prerequisites

- GitHub Account

- GitHub Repository

- Server + SSH access to the server

Step 1 - SSH Login to Server

Open a terminal and log in via SSH. Then navigate to the

.sshdirectoryssh user@hostname cd ~/.sshStep 2 - Create an SSH Key

Now create a new SSH key that we will use for auto-deployment. In the following dialog, simply press "Enter" repeatedly until the key is created.

ssh-keygen -t ed25519 -C "service-name-deploy-github"Step 3 - Add the Key to the

authorized_keysFilecat id_ed25519.pub >> authorized_keys(If you named the key file differently, change this accordingly)

Step 4 - GitHub Secrets

In order for the GitHub Action to perform the deployment later, some secrets must be stored in the repository. Open the repository on GitHub. Navigate to "Settings" -> "Secrets And Variables" -> "Actions". Add the following variables:

HOST: Hostname or IP address of the serverUSERNAME: Username you use to log in via SSHSSHKEY: The private key (copy the content fromcat ~/.ssh/id_ed25519)PORT: 22

Step 5 - Create the GitHub Action

Now create the GitHub Action for auto-deployment. The following GitHub Action will be used: https://github.com/appleboy/scp-action In your local repository, create the file

.github/workflows/deploy.yml:```yaml name: Deploy on: [push] jobs: build: runs-on: ubuntu-latest steps: - uses: actions/checkout@v1 - name: Copy repository content via scp uses: appleboy/scp-action@master with: host: ${{ secrets.HOST }} username: ${{ secrets.USERNAME }} port: ${{ secrets.PORT }} key: ${{ secrets.SSHKEY }} source: "." target: "/your-target-directory"

- name: Executing a remote command uses: appleboy/ssh-action@master with: host: ${{ secrets.HOST }} username: ${{ secrets.USERNAME }} port: ${{ secrets.PORT }} key: ${{ secrets.SSHKEY }} script: | ls```

This action copies the repository files to your server using

scp. Afterwards, thelscommand is executed. Here you can add appropriate commands that rebuild your service or similar. To rebuild and start a docker service you could use something like this or similar:docker compose -f target-dir/docker-compose.yml up --build -dNow commit this file and in the "Actions" tab of your repository, the newly created action should now be visible and executed. With every future change, the git repository will now be automatically copied to your server.Sources

I read this when trying out, but it did not work and I adapted the

deploy.ymlfile: https://dev.to/knowbee/how-to-setup-continuous-deployment-of-a-website-on-a-vps-using-github-actions-54im -

@ cae03c48:2a7d6671

2025-05-23 10:00:57

@ cae03c48:2a7d6671

2025-05-23 10:00:57Bitcoin Magazine

H100 Group Became The First Publicly Listed Bitcoin Treasury Company In SwedenH100 Group AB has announced it has become Sweden’s first publicly listed health technology company to adopt Bitcoin as a treasury reserve asset, announcing the purchase of 4.39 BTC for 5 million NOK (approximately $475,000) as part of its long-term Bitcoin Treasury Strategy.

The Stockholm-based company, which provides AI-powered automation and digital solutions for healthcare providers, joins a growing roster of public companies adding Bitcoin to their balance sheets in 2025. The purchase was executed at an average price of 1,138,737 NOK per Bitcoin (roughly $108,200).

JUST IN:

H100 Group buys 4.39 BTC and becomes Sweden's first publicly listed #Bitcoin treasury company. pic.twitter.com/pNXe9XT2a7

H100 Group buys 4.39 BTC and becomes Sweden's first publicly listed #Bitcoin treasury company. pic.twitter.com/pNXe9XT2a7— Bitcoin Magazine (@BitcoinMagazine) May 22, 2025

“This addition to H100’s Bitcoin Treasury Strategy follows an increasing number of tech-oriented growth companies holding Bitcoin on their balance sheet,” said CEO Sander Andersen. “And I believe the values of individual sovereignty highly present in the Bitcoin community aligns well with, and will appeal to, the customers and communities we are building the H100 platform for.”

The move comes amid a surge in corporate Bitcoin adoption, with many public companies announcing Bitcoin treasury programs in the first five months of 2025. Notable recent entrants include Twenty One Capital, Strive and several others.

H100 Group emphasized that the Bitcoin purchase does not affect its core operations in the health and longevity industry. The company views the investment as a strategic deployment of excess liquidity to strengthen its financial position while aligning with its values of individual sovereignty.

The announcement reflects a broader shift in corporate treasury management, as companies seek to diversify their holdings beyond traditional cash reserves.

At press time, Bitcoin trades at $111,108, up 1.28% over the past 24 hours, as institutional adoption continues to drive market momentum. H100 Group’s shares closed up 1.37% at 0.89 SEK on the NGM Nordic SME exchange following the announcement.

This post H100 Group Became The First Publicly Listed Bitcoin Treasury Company In Sweden first appeared on Bitcoin Magazine and is written by Vivek Sen.

-

@ dfc7c785:4c3c6174

2025-05-23 09:42:37

@ dfc7c785:4c3c6174

2025-05-23 09:42:37Where do I even start? Sometimes it's best to just begin writing whatever comes into your head. What do I do for a living? It used to be easy to explain, I write JavaScript, I build front-end code, in order to build apps. I am more than that though. Over the past eight years, I moved from writing Angular, to React and then to Vue. However my background was originally in writing full-stack projects, using technologies such as .NET and PHP. The thing is - the various jobs I've had recently have pigeon-holed me as front-end developer but nowadays I am starting to feel distracted by a multitude of other interesting, pivotal technologies both in my "day job" and across my wider experience as a Technologist; a phrase I prefer to use in order to describe who I am, more gernerally.

I have used untype.app to write this today, it looks great.

More to come...

-

@ cae03c48:2a7d6671

2025-05-23 09:00:54

@ cae03c48:2a7d6671

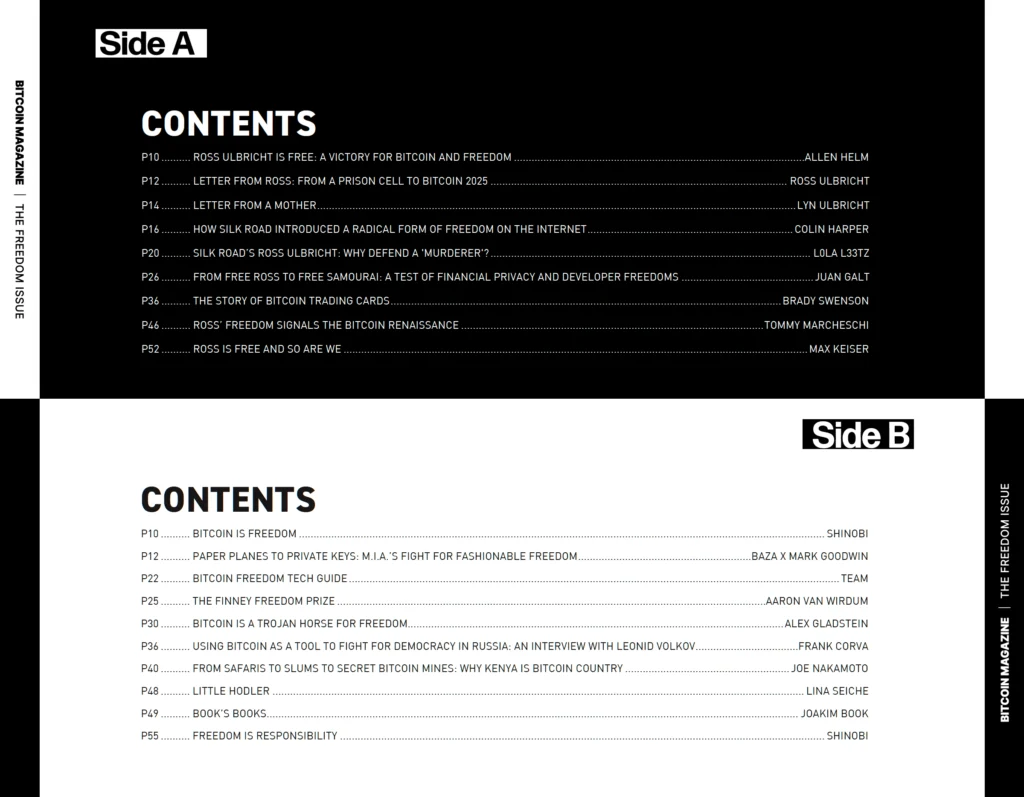

2025-05-23 09:00:54Bitcoin Magazine

The Freedom Issue: Letter From the EditorBitcoin is freedom money, a censorship-resistant form of digital cash allowing anyone with an internet connection to send money to anyone else, regardless of nationality, borders, or other arbitrary restrictions.

I personally first heard about Bitcoin in early 2013, through friends who were buying… stuff from Silk Road, the darknet marketplace helmed by the mysterious Dread Pirate Roberts. Although Silk Road was controversial (the “stuff” most people bought and sold was, of course, illegal drugs), it represented a radical example of the form of freedom that Bitcoin provides.

Later in 2013, Silk Road was shut down by the FBI, and Ross Ulbricht was revealed as the market’s founder and the true identity behind the Dread Pirate Roberts pseudonym — although he claims several people operated the account. Ulbricht was sentenced to two life sentences plus forty years in prison without the possibility of parole.

In my view — and that of many Bitcoiners — it was excessive. Even if you believe Ulbricht was guilty of everything he was convicted of (all nonviolent crimes), he was made an example of, and didn’t actually deserve to be locked up for the rest of his days.

Fortunately, Ulbricht was granted a full and unconditional pardon from President Trump in January of this year. The founder of Silk Road, in a very literal sense, has regained his freedom.

This edition of Bitcoin Magazine celebrates and highlights the freedom aspect of Bitcoin with a range of articles and artwork focusing on the people and projects that use bitcoin to advance liberty, and those who make this possible… with a special focus on Ulbricht and Silk Road.

For other stories about bitcoin as freedom money, flip the magazine around!

Welcome to The Freedom Issue.

Aaron van Wirdum

Don’t miss your chance to own The Freedom Issue—featuring never-before-seen letters from Ross Ulbricht and his mother, Lyn. Limited run. Only available while supplies last.

This piece is the Letter from the Editor featured in the latest print edition of Bitcoin Magazine, The Freedom Issue. We’re sharing it here as an early look at the ideas explored throughout the full issue.

This post The Freedom Issue: Letter From the Editor first appeared on Bitcoin Magazine and is written by Aaron Van Wirdum.

-

@ 5c26ee8b:a4d229aa

2025-05-23 08:47:45

@ 5c26ee8b:a4d229aa

2025-05-23 08:47:45Generally mentioning God, Allah, by reciting/reading the Quran or performing Salat (compulsory prayer), for instance, brings tranquility to the heart of the believer. The Salat, other than being the first deed a Muslim would be questioned about on Judgement Day, it keeps the person away from the forbidden wrong deeds too. The Salat is sufficient for obtaining God’s provision as he decrees the means for it to reach the person. Wasting or missing performing the Salat or mentioning God (Allah) by reciting/reading the Quran or Tasbieh, can lead to following the desires only and a depressed life as well as punishment in the Thereafter.

13:28 Ar-Ra'd

الَّذِينَ آمَنُوا وَتَطْمَئِنُّ قُلُوبُهُمْ بِذِكْرِ اللَّهِ ۗ أَلَا بِذِكْرِ اللَّهِ تَطْمَئِنُّ الْقُلُوبُ

Those who have believed and whose hearts are assured (tranquillised) by the remembrance of Allah. Unquestionably, by the remembrance of Allah hearts are assured (tranquillised)."

29:45 Al-Ankaboot

اتْلُ مَا أُوحِيَ إِلَيْكَ مِنَ الْكِتَابِ وَأَقِمِ الصَّلَاةَ ۖ إِنَّ الصَّلَاةَ تَنْهَىٰ عَنِ الْفَحْشَاءِ وَالْمُنْكَرِ ۗ وَلَذِكْرُ اللَّهِ أَكْبَرُ ۗ وَاللَّهُ يَعْلَمُ مَا تَصْنَعُونَ

Recite, [O Muhammad], what has been revealed to you of the Book and establish prayer. Indeed, prayer prohibits immorality and wrongdoing, and the remembrance of Allah is greater. And Allah knows that which you do.

11:114 Hud

وَأَقِمِ الصَّلَاةَ طَرَفَيِ النَّهَارِ وَزُلَفًا مِنَ اللَّيْلِ ۚ إِنَّ الْحَسَنَاتِ يُذْهِبْنَ السَّيِّئَاتِ ۚ ذَٰلِكَ ذِكْرَىٰ لِلذَّاكِرِينَ

And establish prayer at the two ends of the day and at the approach of the night. Indeed, good deeds do away with misdeeds. That is a reminder for those who remember.

20:132 Taa-Haa

وَأْمُرْ أَهْلَكَ بِالصَّلَاةِ وَاصْطَبِرْ عَلَيْهَا ۖ لَا نَسْأَلُكَ رِزْقًا ۖ نَحْنُ نَرْزُقُكَ ۗ وَالْعَاقِبَةُ لِلتَّقْوَىٰ

And enjoin prayer upon your family [and people] and be steadfast therein. We ask you not for provision; We provide for you, and the [best] outcome is for [those of] righteousness.

20:124 Taa-Haa

وَمَنْ أَعْرَضَ عَنْ ذِكْرِي فَإِنَّ لَهُ مَعِيشَةً ضَنْكًا وَنَحْشُرُهُ يَوْمَ الْقِيَامَةِ أَعْمَىٰ

And whoever turns away from My remembrance - indeed, he will have a depressed life, and We will gather him on the Day of Resurrection blind."

20:125 Taa-Haa

قَالَ رَبِّ لِمَ حَشَرْتَنِي أَعْمَىٰ وَقَدْ كُنْتُ بَصِيرًا

He will say, "My Lord, why have you raised me blind while I was [once] seeing?"

20:126 Taa-Haa

قَالَ كَذَٰلِكَ أَتَتْكَ آيَاتُنَا فَنَسِيتَهَا ۖ وَكَذَٰلِكَ الْيَوْمَ تُنْسَىٰ

[Allah] will say, "Thus did Our signs come to you, and you forgot them; and thus will you this Day be forgotten."

20:127 Taa-Haa

وَكَذَٰلِكَ نَجْزِي مَنْ أَسْرَفَ وَلَمْ يُؤْمِنْ بِآيَاتِ رَبِّهِ ۚ وَلَعَذَابُ الْآخِرَةِ أَشَدُّ وَأَبْقَىٰ

And thus do We recompense he who transgressed and did not believe in the signs of his Lord. And the punishment of the Hereafter is more severe and more enduring.

20:128 Taa-Haa

أَفَلَمْ يَهْدِ لَهُمْ كَمْ أَهْلَكْنَا قَبْلَهُمْ مِنَ الْقُرُونِ يَمْشُونَ فِي مَسَاكِنِهِمْ ۗ إِنَّ فِي ذَٰلِكَ لَآيَاتٍ لِأُولِي النُّهَىٰ

Then, has it not become clear to them how many generations We destroyed before them as they walk among their dwellings? Indeed in that are signs for those of intelligence.

49:17 Al-Hujuraat