-

@ c1e6505c:02b3157e

2025-05-13 00:58:11

@ c1e6505c:02b3157e

2025-05-13 00:58:11I rarely make black and white photographs. I usually find color more interesting. But sometimes, it’s wise to strip it away.

Color can be distracting. It can pull attention from what matters. Beauty, I believe, should be simple - something that’s felt, not overthought.

Removing the excessive, the superfluous, can do a lot. It reduces noise. It reveals what’s often hidden. What’s elusive becomes clear.

-

@ d360efec:14907b5f

2025-05-13 00:39:56

@ d360efec:14907b5f

2025-05-13 00:39:56🚀📉 #BTC วิเคราะห์ H2! พุ่งชน 105K แล้วเจอแรงขาย... จับตา FVG 100.5K เป็นจุดวัดใจ! 👀📊

จากากรวิเคราะห์ทางเทคนิคสำหรับ #Bitcoin ในกรอบเวลา H2:

สัปดาห์ที่แล้ว #BTC ได้เบรคและพุ่งขึ้นอย่างแข็งแกร่งค่ะ 📈⚡ แต่เมื่อวันจันทร์ที่ผ่านมา ราคาได้ขึ้นไปชนแนวต้านบริเวณ 105,000 ดอลลาร์ แล้วเจอแรงขายย่อตัวลงมาตลอดทั้งวันค่ะ 🧱📉

ตอนนี้ ระดับที่น่าจับตาอย่างยิ่งคือโซน H4 FVG (Fair Value Gap ในกราฟ 4 ชั่วโมง) ที่ 100,500 ดอลลาร์ ค่ะ 🎯 (FVG คือโซนที่ราคาวิ่งผ่านไปเร็วๆ และมักเป็นบริเวณที่ราคามีโอกาสกลับมาทดสอบ/เติมเต็ม)

👇 โซน FVG ที่ 100.5K นี้ ยังคงเป็น Area of Interest ที่น่าสนใจสำหรับมองหาจังหวะ Long เพื่อลุ้นการขึ้นในคลื่นลูกถัดไปค่ะ!

🤔💡 อย่างไรก็ตาม การตัดสินใจเข้า Long หรือเทรดที่บริเวณนี้ ขึ้นอยู่กับว่าราคา แสดงปฏิกิริยาอย่างไรเมื่อมาถึงโซน 100.5K นี้ เพื่อยืนยันสัญญาณสำหรับการเคลื่อนไหวที่จะขึ้นสูงกว่าเดิมค่ะ!

เฝ้าดู Price Action ที่ระดับนี้อย่างใกล้ชิดนะคะ! 📍

BTC #Bitcoin #Crypto #คริปโต #TechnicalAnalysis #Trading #FVG #FairValueGap #PriceAction #MarketAnalysis #ลงทุนคริปโต #วิเคราะห์กราฟ #TradeSetup #ข่าวคริปโต #ตลาดคริปโต

-

@ 68768a6c:0eaf07e9

2025-05-12 23:58:56

@ 68768a6c:0eaf07e9

2025-05-12 23:58:56What Is Bitcoin? Bitcoin is the world’s first decentralized digital currency—created in 2009 by an anonymous person (or group) under the name Satoshi Nakamoto. Unlike regular money, it’s not printed or controlled by any government or bank. Instead, it runs on a global network of computers using a technology called blockchain. Why Is Bitcoin Valuable? Bitcoin is often called “digital gold” because it’s limited in supply—only 21 million bitcoins will ever exist. This scarcity, combined with increasing demand and global adoption, makes it valuable. Many people invest in Bitcoin as a hedge against inflation or unstable currencies. How Can You Use Bitcoin? Today, Bitcoin can be used for: Online shopping (some stores accept it) Transferring money across borders Investing for long-term growth You can store it in a digital wallet and send it anywhere in the world in minutes—with low fees. The Risks and Rewards Bitcoin prices can go up or down quickly—it’s very volatile. But many investors believe it will grow in value as the world becomes more digital. Tip for Beginners: Never invest more than you can afford to lose. Start small, learn as you go, and stay updated. Final Thoughts Bitcoin is more than just internet money—it’s a revolution in how we think about value, privacy, and freedom. Whether you’re a curious beginner or a savvy investor, understanding Bitcoin could be your first step toward financial innovation.

-

@ 9c9d2765:16f8c2c2

2025-05-12 23:52:29

@ 9c9d2765:16f8c2c2

2025-05-12 23:52:29CHAPTER SEVENTEEN

"I don't get it... How is James still in charge?" Tracy murmured, her brows furrowed as she stared at her screen. She sat in her office, fingers nervously drumming against her desk.

Across from her, Mark stood with arms folded, pacing slowly. "You mean after all that evidence? After the blacklist, the embezzlement records nothing happened?"

Tracy shook her head. "Nothing. I checked again this morning. He’s still listed as President of JP Enterprises. It’s like the files we found didn’t even exist."

Helen, who had been silent until now, hissed through clenched teeth. "This is ridiculous. Are you sure the information got to the right hands?"

"It did," Tracy insisted. "I sent it directly to the Prime Minister's inbox using a confidential channel. I even received a delivery confirmation. Someone higher up must’ve swept it under the rug or maybe James covered his tracks faster than we imagined."

Mark slumped into the chair, clearly defeated. "He’s not just lucky he’s smart. Smarter than we gave him credit for."

For the first time since they began scheming, their confidence had begun to falter. They had dug into James’s past, unearthed the most damning of records, and yet… nothing. He remained untouched. Unshaken.

James continued to lead JP Enterprises with iron resolve, his status not just preserved, but strengthened. Whatever scandal they tried to ignite had fizzled out before it could burn.

The silence from JP's top board members was loud. No statements. No investigations. Not even a whisper of an internal review. To the outside world, James remained the unshakable President who had pulled a crumbling empire back from the edge.

Mark clenched his jaw. "He must have allies who are protecting him."

Helen nodded slowly. "We underestimated him. That was our biggest mistake."

Tracy remained quiet, her eyes still fixed on the screen as if trying to decipher what had gone wrong. She had risked everything, accessed confidential files, and violated protocols, expecting James to crumble.

Instead, he was thriving.

"Have you heard?" Robert leaned over his desk, eyes wide with interest. "JP Enterprises is about to celebrate their sixteenth anniversary. It’s going to be the biggest corporate event of the year."

Christopher looked up from the documents he was reviewing. "I heard. Mr. and Mrs. JP are returning for it. The entire business world is going to be there including us."

Robert nodded. "Every major company in and out of the city has received an invitation. It’s not just a celebration, it's a power show. A way for JP Enterprises to remind everyone who’s at the top."

Indeed, the buzz around the sixteenth anniversary of JP Enterprises was like nothing the city had seen in years. Massive banners were already being hoisted across the city skyline. High-end hotels were fully booked. Fashion designers, chefs, tech specialists, and media crews from around the world were preparing for the grand occasion. It was more than a business event, it was a spectacle.

At the heart of the preparations was James, the young and surprisingly unshakable President of JP Enterprises. Under his leadership, the company had grown in power and reach, and the anniversary was both a celebration of its legacy and a testament to its transformation.

Meanwhile, at Ray Enterprises, tension brewed behind the scenes. Though they were invited, the Ray family carried mixed feelings about attending the event. Memories of humiliation and disbelief still lingered the day James had revealed himself as the President was still fresh in their minds.

"We have no choice but to attend," Helen muttered in frustration during a board meeting. "If we stay away, we’ll seem petty and afraid. But going there means bowing our heads to him again."

Sarah, the secretary, tried to mask her discomfort. "It’s a corporate event, ma’am. It might be best to appear neutral… diplomatic."

Rita, now reinstated as General Manager, remained quiet but observant. She knew better than anyone how unpredictable James could be when it came to public appearances. She had no idea what to expect from him at the anniversary.

Back at JP Enterprises, preparations continued in full force. The guest list included billionaires, global CEOs, high-ranking politicians, and the most influential figures across industries. Red carpets would roll out, cameras would flash, and speeches would echo through the grand hall like music from an orchestra.

The city, already buzzing with excitement, awaited the grand event.

"I can’t believe it," the young woman muttered as she stared at her phone, her hands trembling with excitement. "James… the same James who used to sleep in front of Mr. Kola’s grocery store? He’s the President of JP Enterprises now?"

Her name was Evelyn. Sharp-tongued, impatient, and fueled by bitter memories, she had known James during his hardest days on the streets, days when survival meant fighting for leftovers and sleeping on cold sidewalks. To her, his rise wasn’t a success story to be admired. It was a jackpot she felt entitled to.

Storming into the JP Enterprises headquarters during working hours, Evelyn ignored the receptionist's polite inquiries and pushed her way toward the executive wing.

"I want to see James!" she shouted, causing heads to turn in the busy lobby. "I know he’s here. Tell him Evelyn from the street is here!"

Security was alerted immediately, but by then, Evelyn had already reached the waiting area outside the President’s office.

James, who was in a brief meeting with department heads, heard the commotion and stepped out with a composed expression. As soon as his eyes met Evelyn’s, something shifted. He recognized her instantly.

"Evelyn?" he said, frowning slightly. "What are you doing here?"

"Don’t act like you don’t know me, James," she snapped, crossing her arms. "You owe me. We suffered together. I was there when you were nothing. Now you’re swimming in wealth and you think you can forget the people who once mattered!"

James’s expression hardened.

"This is not the place for this kind of talk. You’re disrupting my company’s operations. If you need help, there are proper channels"

"To hell with proper channels!" she yelled. "I came to get what’s mine!"

That was enough. James turned to the nearby security officer. "Escort her out. And make sure she doesn’t return without a valid appointment."

The security guards moved quickly, but Evelyn didn’t go quietly. She shouted all the way to the exit, throwing insults, struggling, and drawing even more attention.

Among those who witnessed the scene was Tracy. At first, she thought it was just a random case of disturbance by some unruly visitor trying to make trouble. But as she watched James’s calm yet stern expression, and the woman’s emotional outburst, something clicked in her cunning mind.

This is gold, she thought, quickly pulling out her phone and snapping a series of pictures from the hallway James arguing with a ragged woman, the woman being dragged out, and James watching in silence. What a perfect way to ruin his reputation.

Tracy, ever the opportunist, reviewed the photos and smirked.

This is it… this will shake him up.

Without hesitation, she sent the pictures to Helen and Mark, attaching a voice note.

-

@ 472f440f:5669301e

2025-05-12 23:29:50

@ 472f440f:5669301e

2025-05-12 23:29:50Marty's Bent

Last week we covered the bombshell developments in the Samourai Wallet case. For those who didn't read that, last Monday the world was made aware of the fact that the SDNY was explicitly told by FinCEN that the federal regulator did not believe that Samourai Wallet was a money services business six months before arresting the co-founders of Samourai Wallet for conspiracy to launder money and illegally operating a money services business. This was an obvious overstep by the SDNY that many believed would be quickly alleviated, especially considering the fact that the Trump administration via the Department of Justice has made it clear that they do not intend to rule via prosecution.

It seems that this is not the case as the SDNY responded to a letter sent from the defense to dismiss the case by stating that they fully plan to move forward. Stating that they only sought the recommendations of FinCEN employees and did not believe that those employees' comments were indicative of FinCEN's overall views on this particular case. It's a pretty egregious abuse of power by the SDNY. I'm not sure if the particular lawyers and judges within the Southern District of New York are very passionate about preventing the use of self-custody bitcoin and products that enable bitcoiners to transact privately, or if they're simply participating in a broader meta war with the Trump administration - who has made it clear to federal judges across the country that last Fall's election will have consequences, mainly that the Executive Branch will try to effectuate the policies that President Trump campaigned on by any legal means necessary - and Samouari Wallet is simply in the middle of that meta war.

However, one thing is pretty clear to me, this is an egregious overstep of power. The interpretation of that law, as has been laid out and confirmed by FinCEN over the last decade, is pretty clear; you cannot be a money services business if you do not control the funds that people are sending to each other, which is definitely the case with Samourai Wallet. People downloaded Samourai Wallet, spun up their own private-public key pairs and initiated transactions themselves. Samourai never custodied funds or initiated transactions on behalf of their users. This is very cut and dry. Straight to the point. It should be something that anyone with more than two brain cells is able to discern pretty quickly.

It is imperative that anybody in the industry who cares about being able to hold bitcoin in self-custody, to mine bitcoin, and to send bitcoin in a peer-to-peer fashion makes some noise around this case. None of the current administration's attempts to foster innovation around bitcoin in the United States will matter if the wrong precedent is set in this case. If the SDNY is successful in prosecuting Samourai Wallet, it will mean that anybody holding Bitcoin in self-custody, running a bitcoin fold node or mining bitcoin will have to KYC all of their users and counterparts lest they be labeled a money services business that is breaking laws stemming from the Bank Secrecy Act. This will effectively make building a self-custody bitcoin wallet, running a node, or mining bitcoin in tillegal in the United States. The ability to comply with the rules that would be unleashed if this Samourai case goes the wrong way, are such that it will effectively destroy the industry overnight.

It is yet to be seen whether or not the Department of Justice will step in to publicly flog the SDNY and force them to stop pursuing this case. This is the only likely way that the case will go away at this point, so it is very important that bitcoiners who care about being able to self-custody bitcoin, mine bitcoin, or send bitcoin in a peer-to-peer fashion in the United States make it clear to the current administration and any local politicians that this is an issue that you care deeply about. If we are too complacent, there is a chance that the SDNY could completely annihilate the bitcoin industry in America despite of all of the positive momentum we're seeing from all angles at the moment.

Make some noise!

Bitcoin Adoption by Power Companies: The Next Frontier

In my recent conversation with Andrew Myers from Satoshi Energy, he shared their ambitious mission to "enable every electric power company to use bitcoin by block 1,050,000" – roughly three years from now. This strategic imperative isn't just about creating new Bitcoin users; it's about sovereignty. Andrew emphasized that getting Bitcoin into the hands of energy companies who value self-sovereignty creates a more balanced future economic landscape. The excitement was palpable as he described how several energy companies are already moving beyond simply selling power to Bitcoin miners and are beginning to invest in mining operations themselves.

"You have global commodity companies being like, 'Oh, this is another commodity – we want to invest in this, we want to own this,'" - Andrew Myers

Perhaps most fascinating was Andrew's revelation about major energy companies in Texas developing Bitcoin collateral products for power contracts – a practical application that could revolutionize how energy transactions are settled. As energy companies continue embracing Bitcoin for both operations and collateral, we're witnessing the early stages of a profound shift in how critical infrastructure interfaces with sound money. The implications for both sectors could be transformative.

Check out the full podcast here for more on remote viewing, Nikola Tesla's predictions, and the convergence of Bitcoin and AI technology. We cover everything from humanoid robots to the energy demands of next-generation computing.

Headlines of the Day

Steak n Shake to Accept Bitcoin at All Locations May 16 - via X

Facebook Plans Crypto Wallets for 3B Users, Bitcoin Impact Looms - via X

Trump Urges Americans to Buy Stocks for Economic Boom - via X

UK Drops Tariffs, U.S. Farmers Set to Reap Major Benefits - via X

Looking for the perfect video to push the smartest person you know from zero to one on bitcoin? Bitcoin, Not Crypto is a three-part master class from Parker Lewis and Dhruv Bansal that cuts through the noise—covering why 21 million was the key technical simplification that made bitcoin possible, why blockchains don’t create decentralization, and why everything else will be built on bitcoin.

Ten31, the largest bitcoin-focused investor, has deployed 145,630 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Happy belated Mother's Day to all the moms out there.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 472f440f:5669301e

2025-05-12 23:29:19

@ 472f440f:5669301e

2025-05-12 23:29:19Marty's Bent

Last week we covered the bombshell developments in the Samourai Wallet case. For those who didn't read that, last Monday the world was made aware of the fact that the SDNY was explicitly told by FinCEN that the federal regulator did not believe that Samourai Wallet was a money services business six months before arresting the co-founders of Samourai Wallet for conspiracy to launder money and illegally operating a money services business. This was an obvious overstep by the SDNY that many believed would be quickly alleviated, especially considering the fact that the Trump administration via the Department of Justice has made it clear that they do not intend to rule via prosecution.

It seems that this is not the case as the SDNY responded to a letter sent from the defense to dismiss the case by stating that they fully plan to move forward. Stating that they only sought the recommendations of FinCEN employees and did not believe that those employees' comments were indicative of FinCEN's overall views on this particular case. It's a pretty egregious abuse of power by the SDNY. I'm not sure if the particular lawyers and judges within the Southern District of New York are very passionate about preventing the use of self-custody bitcoin and products that enable bitcoiners to transact privately, or if they're simply participating in a broader meta war with the Trump administration - who has made it clear to federal judges across the country that last Fall's election will have consequences, mainly that the Executive Branch will try to effectuate the policies that President Trump campaigned on by any legal means necessary - and Samouari Wallet is simply in the middle of that meta war.

However, one thing is pretty clear to me, this is an egregious overstep of power. The interpretation of that law, as has been laid out and confirmed by FinCEN over the last decade, is pretty clear; you cannot be a money services business if you do not control the funds that people are sending to each other, which is definitely the case with Samourai Wallet. People downloaded Samourai Wallet, spun up their own private-public key pairs and initiated transactions themselves. Samourai never custodied funds or initiated transactions on behalf of their users. This is very cut and dry. Straight to the point. It should be something that anyone with more than two brain cells is able to discern pretty quickly.

It is imperative that anybody in the industry who cares about being able to hold bitcoin in self-custody, to mine bitcoin, and to send bitcoin in a peer-to-peer fashion makes some noise around this case. None of the current administration's attempts to foster innovation around bitcoin in the United States will matter if the wrong precedent is set in this case. If the SDNY is successful in prosecuting Samourai Wallet, it will mean that anybody holding Bitcoin in self-custody, running a bitcoin fold node or mining bitcoin will have to KYC all of their users and counterparts lest they be labeled a money services business that is breaking laws stemming from the Bank Secrecy Act. This will effectively make building a self-custody bitcoin wallet, running a node, or mining bitcoin in tillegal in the United States. The ability to comply with the rules that would be unleashed if this Samourai case goes the wrong way, are such that it will effectively destroy the industry overnight.

It is yet to be seen whether or not the Department of Justice will step in to publicly flog the SDNY and force them to stop pursuing this case. This is the only likely way that the case will go away at this point, so it is very important that bitcoiners who care about being able to self-custody bitcoin, mine bitcoin, or send bitcoin in a peer-to-peer fashion in the United States make it clear to the current administration and any local politicians that this is an issue that you care deeply about. If we are too complacent, there is a chance that the SDNY could completely annihilate the bitcoin industry in America despite of all of the positive momentum we're seeing from all angles at the moment.

Make some noise!

Bitcoin Adoption by Power Companies: The Next Frontier

In my recent conversation with Andrew Myers from Satoshi Energy, he shared their ambitious mission to "enable every electric power company to use bitcoin by block 1,050,000" – roughly three years from now. This strategic imperative isn't just about creating new Bitcoin users; it's about sovereignty. Andrew emphasized that getting Bitcoin into the hands of energy companies who value self-sovereignty creates a more balanced future economic landscape. The excitement was palpable as he described how several energy companies are already moving beyond simply selling power to Bitcoin miners and are beginning to invest in mining operations themselves.

"You have global commodity companies being like, 'Oh, this is another commodity – we want to invest in this, we want to own this,'" - Andrew Myers

Perhaps most fascinating was Andrew's revelation about major energy companies in Texas developing Bitcoin collateral products for power contracts – a practical application that could revolutionize how energy transactions are settled. As energy companies continue embracing Bitcoin for both operations and collateral, we're witnessing the early stages of a profound shift in how critical infrastructure interfaces with sound money. The implications for both sectors could be transformative.

Check out the full podcast here for more on remote viewing, Nikola Tesla's predictions, and the convergence of Bitcoin and AI technology. We cover everything from humanoid robots to the energy demands of next-generation computing.

Headlines of the Day

Steak n Shake to Accept Bitcoin at All Locations May 16 - via X

Facebook Plans Crypto Wallets for 3B Users, Bitcoin Impact Looms - via X

Trump Urges Americans to Buy Stocks for Economic Boom - via X

UK Drops Tariffs, U.S. Farmers Set to Reap Major Benefits - via X

Looking for the perfect video to push the smartest person you know from zero to one on bitcoin? Bitcoin, Not Crypto is a three-part master class from Parker Lewis and Dhruv Bansal that cuts through the noise—covering why 21 million was the key technical simplification that made bitcoin possible, why blockchains don’t create decentralization, and why everything else will be built on bitcoin.

Ten31, the largest bitcoin-focused investor, has deployed 145,630 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Happy belated Mother's Day to all the moms out there.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ bf47c19e:c3d2573b

2025-05-12 21:45:41

@ bf47c19e:c3d2573b

2025-05-12 21:45:41Originalni tekst na bitcoin-balkan.com.

Pregled sadržaja

- Definisanje novca

- Šta je sredstvo razmene?

- Šta je obračunska jedinica?

- Šta je zaliha vrednosti?

- Zašto su važne funkcije novca?

- Novac Gubi Funkciju: Alhemičar iz Njutonije

- Eksploatacija pomoću Novca: Agri Perle

- Novac Gubi Funkciju 2. Deo: Kejnslandski Bankar

- Da li nas novac danas eksploatiše?

- Šta je novac, i zašto trebate da brinete?

- Efikasnija Ušteda Novca

- Zasluge

- Molim vas da šerujete!

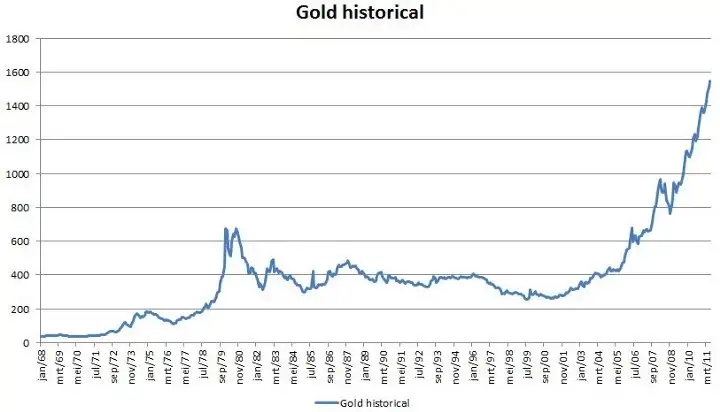

Google izveštava o stalnom povećanju interesa u svetu za pitanje „Šta je novac?“ koji se postavlja iz godine u godinu, od 2004. do 2021., a sa naglim porastom nakon finansijske krize 2008. godine.

I izgleda se da niko nema dobar odgovor za to.

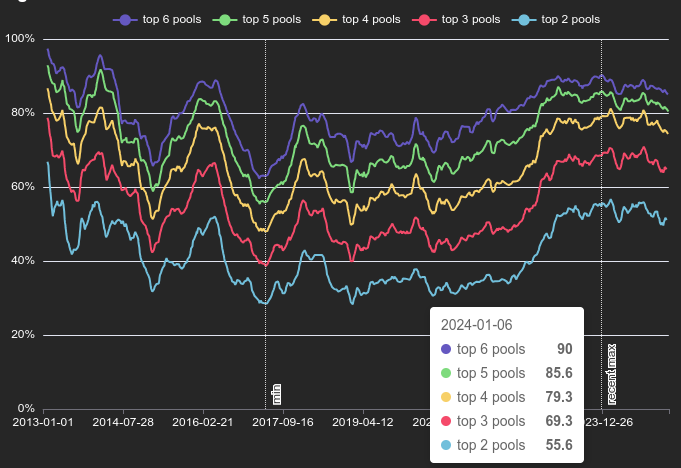

Godišnji proseci mesečnih interesa za pretragu. 100 predstavlja najveći interes za pretragu tokom čitavog perioda, koji se dogodio u decembru 2019. Podaci sa Google Trends-a.

Godišnji proseci mesečnih interesa za pretragu. 100 predstavlja najveći interes za pretragu tokom čitavog perioda, koji se dogodio u decembru 2019. Podaci sa Google Trends-a.Međutim, odgovaranje na ovo naizgled jednostavno pitanje pomoći će vam da razjasnite ulogu novca u vašem životu. Jednom kada shvatite kako novac funkcioniše, tačno ćete videti i zašto svet danas ludi – i šta učiniti povodom toga. Zato hajde da se udubimo u to.

Na pitanje šta je novac, većina ljudi otvori svoje novčanike i pokaže nekoliko novčanica – “evo, ovo je novac!”

Ali po čemu se ove novčanice razlikuju od stranica vaše omiljene knjige? Pa, naravno, zavod za izradu novčanica te zemlje je odštampao te novčanice iz vašeg novčanika kako bi se oduprla falsifikovanju, i svi ih koriste da bi kupili odredjene stvari.

Međutim, Nemačka Marka imala je sva ova svojstva u prošlosti – ali preduzeća danas ne prihvataju te novčanice. Zapravo, građani Nemačke su početkom dvadesetih godina prošlog veka spaljivali papirne Marke kako bi grejali svoje domove. Marka je imala veću vrednost kao papir za potpalu nego kao novac!

1923. nemačka valuta poznata kao Marka bila je jeftinija od uglja i drveta!

Pa šta to čini novac, novcem?

Ispostavilo se da ovo nije pitanje na koje je lako dati odgovor.

Definisanje novca

Novac nije fizička stvar poput novčanice dolara. Novac je društveni sistem koji koristimo da bismo olakšali trgovinu robom i uslugama. Međutim, tokom istorije fizička monetarna dobra igrala su ključnu ulogu u društvenom sistemu novca, često kao znakovi koji predstavljaju vrednost u monetarnom sistemu. Ovaj sistem ima tri funkcije: 1) Sredstvo Razmene, 2) Obračunsku Jedinicu i 3) Zalihu Vrednosti.

Odakle dolaze ove funkcije, i zašto su one vredne?

Šta je sredstvo razmene?

Sredstvo razmene je neko dobro koje se obično razmenjuje za drugo dobro. Najčešće objašnjenje za to kako su se pojavila sredstva razmene glasi otprilike ovako: Boris ima ječam i želeo bi da kupi ovcu od Marka. Marko ima ovce, ali želi samo piliće. Ana ima piliće, ali ona ne želi ječam ili ovce.

To se naziva problem sticaja potreba: dve strane moraju da žele ono što druga ima da bi mogle da trguju. Ako se želje dve osobe ne podudaraju, oni moraju da pronađu druge ljude sa kojima će trgovati dok svi ne pronađu dobro koje žele.

Ljudi koji trguju robom i uslugama moraju da imaju potrebe koje se podudaraju.

Ljudi koji trguju robom i uslugama moraju da imaju potrebe koje se podudaraju.Vremenom, veoma je verovatno da će se određena vrsta robe, poput pšenice, pojaviti kao sredstvo razmene jer su je mnogi ljudi želeli. Uzimajući pšenicu kao primer: pšenica je rešila “sticaje potreba” u mnogim zanatima, jer čak i ako onaj koji prima pšenicu a nije želeo da je koristi za sebe, znao je da će je neko drugi želeti.

Ovo nazivamo prodajnost imovine.

Pšenica je dobar primer dobra za prodaju jer svi moraju da jedu, a od pšenice se pravi hleb. Pšenica ima vrednost kao sastojak hleba i kao dobro koje olakšava trgovinu rešavanjem problema „sticaja potreba“.

Razmislite o svojoj želji da dobijete više novčanica u eurima ili drugoj valuti. Ne možete da jedete novčanice da biste preživeli, a i ne bi vam bile od velike koristi ako poželite da ih koristite kao građevinski materijal za vašu kuću. Međutim, znate da sa tim novčanicama možete da kupite hranu i kuću.

Stvarne fizičke novčanice su beskorisne za vas. Novčanice su vam dragocene samo zato što će ih drugi prihvatiti za stvari koje su vama korisne.

Tokom dugog perioda istorije, novac je evoluirao do te mere da monetarno dobro može imati vrednost, a da to dobro ne služi za bilo koju drugu ‘suštinsku’ upotrebu, poput hrane ili energije. Umesto toga, njegova upotreba je zaliha vrednosti i jednostavna zamena za drugu robu u bilo kom trenutku koji poželite.

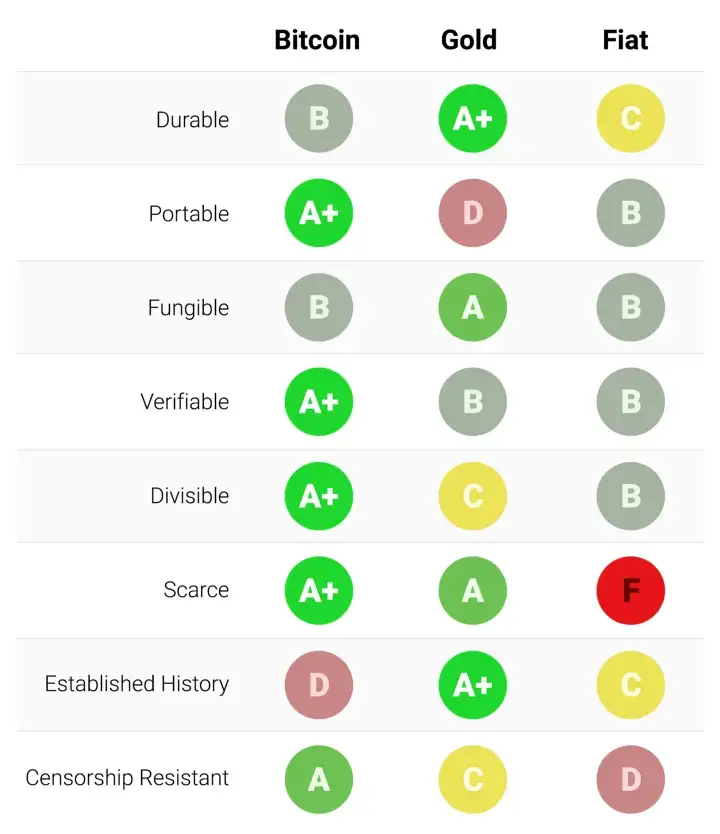

Šta jedno dobro čini poželjnijim i prodajnijim od drugog dobra?

Deljivost

Definicija: Sposobnost podele dobra na manje količine.

Loš Primer: Dijamante je teško podeliti na manje komade. Za zajednicu od hiljada ljudi koji dnevno izvrše milione transakcija, dijamanti čine loše sredstvo razmene. Previše su retki i nedeljivi da bi se koristili za mnoge transakcije.

Potrebno je puno obuke da bi izrezali dijamant.

Potrebno je puno obuke da bi izrezali dijamant.Ujednačenost

Definicija: Sličnost pojedinačnih jedinica odredjenog dobra.

Loš Primer: Krave nisu ujednačene – neke su veće, neke manje, neke bolesne, neke zdrave. Sa druge strane, unca čistog zlata je jednolična – jedna unca je potpuno ista kao sledeća. Ovo svojstvo se takođe često naziva zamenljivost.

Svaka je jedinstvena na svoj način.

Svaka je jedinstvena na svoj način.Prenosivost

Definicija: Lakoća transporta dobra.

Loš Primer: Krava nije baš prenosiva. Zlatnici su prilično prenosivi. Papirne novčanice su još prenošljivije. Knjiga u kojoj se jednostavno beleži vlasništvo nad tim vrednostima (poput Rai kamenog sistema ili digitalnog bankovnog računa) je neverovatno prenosiva, jer nema fizičkog dobra koje treba nositi sa sobom za kupovinu. Postoji samo sistem za evidentiranje vlasništva nad tim vrednostima u nematerijalnom obliku.

Novac star 5000 godina VS novac star 13 godina

Novac star 5000 godina VS novac star 13 godinaKako dobro postaje sredstvo razmene?

Dobra postaju, i ostaju sredstva razmene zbog svoje univerzalne potražnje, takođe poznate kao njihova prodajnost, čemu pomažu svojstva koja su gore nabrojana.

Mnogo različitih dobara mogu u različitoj meri delovati kao sredstva razmene u ekonomiji. Danas, naša globalna ekonomija koristi valute koje izdaju države, zlato, pa čak i robu poput nafte kao sredstvo razmene.

Šta je obračunska jedinica?

Stvari se komplikuju kada u ekonomiji postoji mnogo robe koja se prodaje. Čak i sa samo 5 dobara, postoji 10 “kurseva razmene” između svake robe kojih svi u ekonomiji moraju da se sete: 1 svinja se menja za 15 pilića, 1 pile se menja za 15 litara mleka, desetak jaja se menja za 15 litara mleka, i tako dalje. Ako ekonomija ima 50 dobara, među njima postoji 1.225 “kurseva razmene”!

Sredstvo za merenje vrednosti

Zamislite obračunsku jedinicu kao sredstvo za merenje vrednosti. Umesto da se sećamo vrednosti svakog dobra u poredjenju sa drugim dobrima, mi samo treba da se setimo vrednosti svakog dobra u poredjenju sa jednim dobrom – obračunskom jedinicom.

Umesto da se setimo 1.225 kurseva razmene kada imamo 50 proizvoda na tržištu, mi treba da zapamtimo samo 50 cena.

Na primer, ne treba da se sećamo da litar mleka vredi 1/15 piletine ili desetak jaja, možemo da se samo setimo da litar mleka košta 1USD.

Mnogo opcija, sve u istoj obračunskoj jedinici.

Mnogo opcija, sve u istoj obračunskoj jedinici.Poređenje dobara je lakše sa obračunskom jedinicom

Obračunska jedinica takođe olakšava upoređivanje vrednosti i donošenje odluka. Zamislite da pokušavate da kupite par Nike Air Jordan patika kada ih jedan prodavac prodaje za jedno pile, a drugi za 50 klipova kukuruza.

Šta je zaliha vrednosti?

Do sada smo gledali samo primere transakcija koje se odvijaju u određenom trenutku u vremenu.

Međutim, ljudi vrše transakcije tokom vremena – oni štede novac i troše ga kasnije. Da bi odredjeno dobro moglo da funkcioniše pravilno kao monetarno dobro, ono treba da održi vrednost tokom vremena.

Novac koji vremenom dobro drži vrednost daje njegovom imaocu više izbora kada će taj novac da potroši.

To znači da prodajnost dobra uključuje njegovu sposobnost da održi vrednost tokom vremena.

Šta jedno dobro čini boljom zalihom vrednosti od drugog dobra?

Trajnost

Definicija: Sposobnost dobra da vremenom zadrži svoj oblik.

Loš Primer: Jagode čine lošu zalihu vrednosti jer se lako oštete i brzo trunu.

Odluka je daleko lakša ako jedan prodavac naplaćuje 150 USD, a drugi 200 USD – odmah je očigledno koja je bolja ponuda jer su vrednosti izražene u istoj jedinici.

Nije sjajna forma novca.

Nije sjajna forma novca.Teške za Proizvodnju

Definicija: Teškoće koje ljudi imaju u proizvodnji veće količine dobra.

Loš Primer: Papirne novčanice predstavljaju lošu zalihu vrednosti jer banke i vlade mogu jeftino da ih naprave.

Sa zlatom je suprotno – u ponudi se nalazi ograničena količina uprkos velikoj potražnji za njim, jednostavno zato što ga je vrlo teško iskopati iz zemlje. Ova ograničena ponuda osigurava da svaka jedinica zlata održi vrednost tokom vremena.

Traženje zlata je spora i teška aktivnost. Obično se ne pronađe puno!

Traženje zlata je spora i teška aktivnost. Obično se ne pronađe puno!Kako dobra postaju zalihe vrednosti?

Dobro postaje zaliha vrednosti ako se vremenom pokaže trajnim i teškim za proizvodnju.

Samo će vreme pokazati da li je neko dobro zaista trajno i da li ga je teško proizvesti. Zbog toga neki oblici novca su postojali vekovima pre nego što je neko otkrio način da ih proizvede više, i na kraju se to dobro više nije koristilo kao novac.

Ovo je priča o školjkama, Rai kamenju i mnogim drugim oblicima novca tokom istorije.

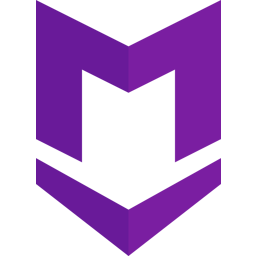

Zlato je primer dobra koje je hiljadama godina služilo kao dobra zaliha vrednosti. Zlato se ne razgrađuje tokom vremena i još uvek ga je teško proizvesti. Hiljadama godina alhemičari su bezuspešno pokušavali da sintetišu zlato iz jeftinih materijala.

Čak i sa današnjim naprednim rudarskim tehnikama, svake godine svi svetski rudnici zlata zajedno mogu da proizvedu samo 2% od ukupne ponude zlata u prometu.

Teškoće u proizvodnji zlata daju izuzetno visok odnos “zaliha i protoka”: zaliha je broj postojećih jedinica, a protok su nove jedinice stvorene tokom određenog vremenskog perioda. Svake godine se stvori vrlo malo novih jedinica zlata, iako je potražnja za zlatom obično vrlo velika.

Kombinujući ovo sa deljivošću, ujednačenošću i prenosivošću zlata, nije ni čudo što je zlato čovečanstvu služilo kao monetarno dobro tokom poslednjih 5.000 godina. Pošto je zlato teško proizvesti, možemo ga nazvati teškim novcem (hard money).

Kao rezultat toga, svoju vrednost je u velikoj meri zadržao kroz milenijume. Cena većine dobara i usluga u pogledu zlata zapravo se vremenom smanjivala kao rezultat tehnoloških inovacija, koje sve proizvode čine jeftinijim.

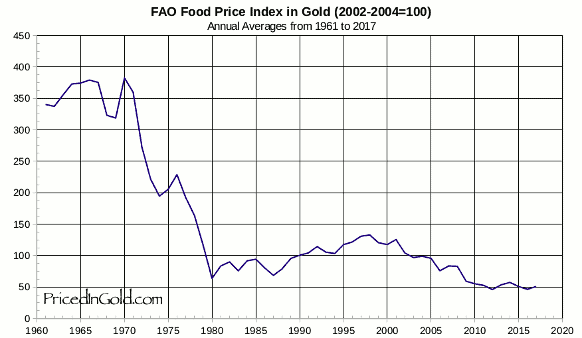

Uzmimo na primer cene hrane prema praćenju Kancelarije za hranu i poljoprivredu UN-a: sa obzirom na skokove u poljoprivrednoj tehnologiji tokom poslednjih 60 godina, cene hrane drastično su pale kada se procenjuju u zlatu. To čak i važi uprkos činjenici da obični ljudi retko koriste zlato za kupovinu stvari.

Cene hrane su padale u pogledu zlata tokom proteklih 60 godina, i mnogo pre toga (FAO Indeks Cena Hrane u Zlatu)

Cene hrane su padale u pogledu zlata tokom proteklih 60 godina, i mnogo pre toga (FAO Indeks Cena Hrane u Zlatu)Zaliha vrednosti omogućava ljudima da uštede novac kako bi mogli da ga ulažu u pokretanje preduzeća i obrazovanje, povećavajući produktivnost društva.

Monetarna dobra koja dobro čuvaju vrednost takođe podstiču dugoročniji pogled na život, ili kratke vremenske preference. Pojedinac može da radi 10 godina, uštedi odredjeno monetarno dobro koje je dobra zaliha vrednosti, i nema potrebe da se plaši da će njegova ušteđevina biti izbrisana krahom tržišta ili povećanjem ponude tog dobra.

Zašto su važne funkcije novca?

Kada neki oblik novca izgubi bilo koju od svojih važnih funkcija kao što su sredstvo razmene, obračunska jedinica i zaliha vrednosti, celokupna ekonomija i društvo mogu da se rastrgnu.

Tokom istorije često vidimo grupe ljudi koje eksploatišu druge iskorišćavajući nesporazume o novcu i važnosti njegovih funkcija.

Sledeće, proći ću kroz istoriju novca, prvo hipotetički da bih ilustrovao poentu, a zatim ću preći na stvarne istorijske primere. Kroz ove primere videćemo štetne efekte na društva u slučajevima kada se izgubi samo jedna od tih ključnih funkcija novca.

Novac Gubi Funkciju: Alhemičar iz Njutonije

Kroz istoriju, mnoga dobra su dolazila i odlazila kao oblici novca. Na žalost, kada se neki oblik novca ukine, ponekad postoji grupa ljudi koja eksploatiše drugi oblik manipulišući tim novcem.

Hajde da pogledamo hipotetičko selo zvano Njutonija da bismo razumeli kako dolazi do ove eksploatacije.

Zelene perle postaju Novac

Tokom stotina godina ribolova u obližnjoj reci, stanovnici Njutonije sakupljali su zelene perle iz vode. Zrnca su mala, lagana, izdržljiva, jednolična i retko se pojavljuju u reci. Ljudi prvo priželjkuju perle zbog svoje lepote. Na kraju, seljani shvataju da svi drugi žele perle – one se vrlo lako mogu prodati. Zrnca uskoro postaju sredstvo razmene i obračunska jedinica u selu: pile je 5 zrna, vreća jabuka 2 zrna, krava 80 zrna.

Ukupna ponuda perli je prilično konstantna i cene se vremenom ne menjaju mnogo. Seoski starešina je uveren da može da se opustiti u poslednjim danima živeći od svoje velike zalihe perli.

Alhemičar stvara više perli

Seoski alhemičar je poželeo da bude bogat čovek, ali nije voleo da vredno radi na tome. Umesto da traži perle u reci ili da prodaje vrednu robu drugim seljanima, on sedeo je u svojoj laboratoriji. Na kraju je otkrio kako da lako stvori stotine perli sa malo peska i vatre.

Seljani koji su tragali za perlama u reci bili su srećni ako bi svaki dan pronašli po 1 zrno. Alhemičar je mogao da proizvede stotine uz malo napora.

Alhemičar troši svoje perle

Budući da je bio prilično zao, alhemičar nije svoj metod pravljenja zrna delio ni sa kim drugim. Stvorio je sebi još više perli i počeo da ih troši za dobra na tržištu u Njutoniji. Tokom sledećih meseci, alhemičar je kupio farmu pilića, nekoliko krava, finu svilu, posteljine i ogromno imanje. On je imao priliku da kupi ova dobra po normalnim cenama na tržištu.

Alhemičarevo trošenje ostavljalo je seljanima mnogo perli, ali malo njihove vredne robe.

Svi seljani su se osećali bogatima – imali su tone perli! Međutim, polako su primetili da i svi ostali takodje imaju tone.

Cene počinju da rastu

Uzgajivač pilića primetio je da sva roba koju je trebalo da kupi na pijaci poskupela. Džak jabuka sada se prodaje za 100 perli – 50 puta više od njihove cene pre nekoliko meseci!

Iako je sada imao hiljade perli, uskoro bi mogao da ostane bez njih zbog ovih cena. Pitao se – da li zaista može sebi da priušti da prodaje svoje piliće za samo 5 perli po komadu? Morao je i on da podigne svoje cene.

Jednostavno rečeno, kao rezultat alhemičarevog trošenja njegovih novostvorenih perli, bilo je previše perli koje su jurile premalo dobara – pa su cene porasle.

Kupci robe bili su spremni da potroše više perli da bi kupili potrebna dobra. Prodavci robe su trebali da naplate više da bi bili sigurni da su zaradili dovoljno da kupe potrebna dobra za sebe.

Budući da su cene svih dobara porasle, možemo reći da se vrednost svake perle smanjila.

Nejednakost bogatstva raste

Seoski starešina, koji je vredno radio da sačuva hiljade perli, sada se našao osiromašenim i gladnim. U međuvremenu, alhemičar je udobno sedeo na svom velikom imanju sa kravama, pilićima i slugama koji su se brinuli za svaki njegov hir.

Alhemičar je efikasno ukrao bogatstvo celog sela, tako što je jeftino proizvodio perle i koristio ih za kupovinu vredne robe.

Ono što je najvažnije, kupio je robu pre nego što je tržište shvatilo da je više perli u opticaju i da ima manje robe, što je dovelo do rasta cena. Ova dodatna proizvodnja perli nije dodala korisnu robu ili usluge selu. Kroz istoriju, mnoga dobra su dolazila i odlazila kao oblici novca. Na žalost, kada se neki oblik novca ukine, ponekad postoji grupa ljudi koja eksploatiše drugi oblik manipulišući tim novcem.

Hajde da pogledamo hipotetičko selo zvano Njutonija da bismo razumeli kako dolazi do ove eksploatacije.

Zelene perle postaju Novac

Tokom stotina godina ribolova u obližnjoj reci, stanovnici Njutonije sakupljali su zelene perle iz vode. Zrnca su mala, lagana, izdržljiva, jednolična i retko se pojavljuju u reci. Ljudi prvo priželjkuju perle zbog svoje lepote. Na kraju, seljani shvataju da svi drugi žele perle – one se vrlo lako mogu prodati. Zrnca uskoro postaju sredstvo razmene i obračunska jedinica u selu: pile je 5 zrna, vreća jabuka 2 zrna, krava 80 zrna.

Ukupna ponuda perli je prilično konstantna i cene se vremenom ne menjaju mnogo. Seoski starešina je uveren da može da se opustiti u poslednjim danima živeći od svoje velike zalihe perli.

Alhemičar stvara više perli

Seoski alhemičar je poželeo da bude bogat čovek, ali nije voleo da vredno radi na tome. Umesto da traži perle u reci ili da prodaje vrednu robu drugim seljanima, on sedeo je u svojoj laboratoriji. Na kraju je otkrio kako da lako stvori stotine perli sa malo peska i vatre.

Seljani koji su tragali za perlama u reci bili su srećni ako bi svaki dan pronašli po 1 zrno. Alhemičar je mogao da proizvede stotine uz malo napora.

Alhemičar troši svoje perle

Budući da je bio prilično zao, alhemičar nije svoj metod pravljenja zrna delio ni sa kim drugim. Stvorio je sebi još više perli i počeo da ih troši za dobra na tržištu u Njutoniji. Tokom sledećih meseci, alhemičar je kupio farmu pilića, nekoliko krava, finu svilu, posteljine i ogromno imanje. On je imao priliku da kupi ova dobra po normalnim cenama na tržištu.

Alhemičarevo trošenje ostavljalo je seljanima mnogo perli, ali malo njihove vredne robe.

Svi seljani su se osećali bogatima – imali su tone perli! Međutim, polako su primetili da i svi ostali takodje imaju tone.

Cene počinju da rastu

Uzgajivač pilića primetio je da sva roba koju je trebalo da kupi na pijaci poskupela. Džak jabuka sada se prodaje za 100 perli – 50 puta više od njihove cene pre nekoliko meseci!

Iako je sada imao hiljade perli, uskoro bi mogao da ostane bez njih zbog ovih cena. Pitao se – da li zaista može sebi da priušti da prodaje svoje piliće za samo 5 perli po komadu? Morao je i on da podigne svoje cene.

Jednostavno rečeno, kao rezultat alhemičarevog trošenja njegovih novostvorenih perli, bilo je previše perli koje su jurile premalo dobara – pa su cene porasle.

Kupci robe bili su spremni da potroše više perli da bi kupili potrebna dobra. Prodavci robe su trebali da naplate više da bi bili sigurni da su zaradili dovoljno da kupe potrebna dobra za sebe.

Budući da su cene svih dobara porasle, možemo reći da se vrednost svake perle smanjila.

Nejednakost bogatstva raste

Seoski starešina, koji je vredno radio da sačuva hiljade perli, sada se našao osiromašenim i gladnim. U međuvremenu, alhemičar je udobno sedeo na svom velikom imanju sa kravama, pilićima i slugama koji su se brinuli za svaki njegov hir.

Alhemičar je efikasno ukrao bogatstvo celog sela, tako što je jeftino proizvodio perle i koristio ih za kupovinu vredne robe.

Ono što je najvažnije, kupio je robu pre nego što je tržište shvatilo da je više perli u opticaju i da ima manje robe, što je dovelo do rasta cena. Ova dodatna proizvodnja perli nije dodala korisnu robu ili usluge selu.

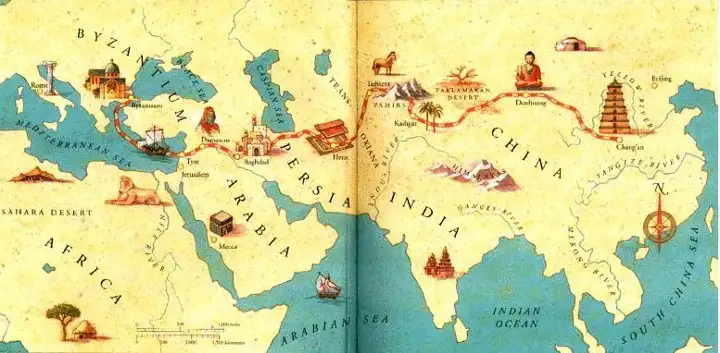

Eksploatacija pomoću Novca: Agri Perle

Nažalost, priča o alhemičaru iz Njutonije nije u potpunosti hipotetička. Ovaj prenos bogatstva kroz stvaranje novca ima istorijske i moderne presedane.

Na primer, afrička plemena su nekada koristila staklene perle, poznate kao “agri perle”, kao sredstvo razmene. U to vreme plemenskim ljudima je bilo veoma teško da prave staklene perle, i one su predstavljale težak novac unutar njihovog plemenskog društva.

Niko nije mogao jeftino da proizvede perle i koristiti ih za kupovinu skupe, vredne robe poput kuća, hrane i odeće.

Eksploatacija pomoću Novca: Agri Perle

Nažalost, priča o alhemičaru iz Njutonije nije u potpunosti hipotetička. Ovaj prenos bogatstva kroz stvaranje novca ima istorijske i moderne presedane.

Na primer, afrička plemena su nekada koristila staklene perle, poznate kao “agri perle”, kao sredstvo razmene. U to vreme plemenskim ljudima je bilo veoma teško da prave staklene perle, i one su predstavljale težak novac unutar njihovog plemenskog društva.

Niko nije mogao jeftino da proizvede perle i koristiti ih za kupovinu skupe, vredne robe poput kuća, hrane i odeće.

Perle proizvedene u Gani

Perle proizvedene u GaniSve se promenilo kada su stigli Evropljani, i primetili upotrebu staklenih perli kao novca.

U to vreme, Evropljani su mogli jeftino da stvaraju staklo u velikim količinama. Kao rezultat toga, Evropljani su počeli tajno da uvoze perle i koriste ih za kupovinu dobara, usluga i robova od Afrikanaca.

Peć za izradu stakla u Muranu, Italija. Ovo ostrvo izvan Venecije proizvodi staklo od 15. veka.

Peć za izradu stakla u Muranu, Italija. Ovo ostrvo izvan Venecije proizvodi staklo od 15. veka.Vremenom se iz Afrike izvlačila vredna roba i ljudi, dok je plemenima ostajalo mnogo perli i malo robe.

Perle su izgubile veći deo vrednosti zbog inflacije uzrokovane snabdevanjem od strane Evropljana.

Rezultat je bio osiromašenje afričkih plemena i bogaćenje Evropljana, kako to ovde objašnjava monetarni istoričar Bezant Denier.

Dragocena roba je kupljena jeftino proizvedenim monetarnim dobrom.

Profitiranje na proizvodnji novca: Emisiona dobit

Ova priča ilustruje kako se bogatstvo prenosi kada jedna grupa može jeftino da proizvodi monetarno dobro.

Razlika između troškova proizvodnje monetarnog dobra i vrednosti tog monetarnog dobra poznata je kao emisiona dobit, eng. seignorage.

Kada je monetarno dobro mnogo vrednije od troškova proizvodnje, ljudi će proizvesti više od monetarnog dobra da bi uhvatili profit od emisione dobiti.

Na kraju će ova povećana ponuda dovesti do pada vrednosti monetarnog dobra. To je zbog zakona ponude i potražnje: kada se ponuda povećava, cena (poznata i kao vrednost) dobra opada.

Novac Gubi Funkciju 2. Deo: Kejnslandski Bankar

U priči o Njutoniji, alhemičar je otkrio način da se od malo peska jeftino stvori više zelenih perli. To se u stvarnosti odigralo kroz trgovinu između Evropljana i Afrikanaca, pričom o agri perlama. Međutim, ove priče su pomalo zastarele – mi više ne trgujemo robom za perle.

Da bismo nas doveli do modernog doba, hajde da promenimo neka imena u našoj priči:

- Selo Njutonija postaje država koja se zove Kejnsland

- Alhemičar postaje bankar

- Seoski starešina postaje penzioner

- Zelene perle postaju zlato, koje niko ne može jeftinije da stvori – čak ni bankar.

Bankar Menja Papirne Novčanice za Zlato

Kao i u stvarnosti, bankar u ovoj priči nema formulu ili trik da stvori više zlata. Međutim, bankar bezbedno čuva zlato u vlasništvu svakog građanina Kejnslanda. Bankar daje svakom građaninu po jednu potvrdu za svaku uncu zlata koje ima u svom trezoru.

Te potvrde se mogu iskoristiti u bilo koje vreme za stvarno zlato. Papirne potvrde ili novčanice su mnogo pogodnije za plaćanje nego nošenje zlata kroz supermarket.

Građani su srećni – oni imaju prikladno sredstvo plaćanja u vidu bankarevih novčanica, i znaju da niko ne može da ukrade njihovo bogatstvo falsifikujući više zlata.

Građani na kraju počinju da plaćaju u potpunosti papirnim novčanicama, ne trudeći se nikad da zamene svoje novčanice za zlato. Na kraju, novčanice postaju “dobre kao i zlato” – svaka predstavlja fiksnu količinu zlata u bankarevom trezoru.

Ukupno kruži 1.000.000 novčanica, od kojih je svaka otkupljiva za jednu uncu zlata. 1.000.000 unci zlata sedi u bankarevom trezoru. Svaka novčanica je u potpunosti podržana u zlatu.

Starešina koji je sačuvao sve svoje perle u priči o Njutoniji sada je penzioner u Kejnslandu, koji svoje zlato drži u banci i planira da ugodno živi od novčanica koje je dobio zauzvrat.

Hajde da u ovu priču dodamo i novi lik: premijera Kejnslanda. Premijer naplaćuje porez od građana i koristi ga za plaćanje javnih usluga poput policije i vojske. Premijer takođe drži vladino zlato kod bankara.

Bankar Menja Papirne Novčanice za Dug

Premijer želi da osigura da nacionalno zlato ostane na sigurnom, pa banku štiti policijom. Bankar i premijer se zbog toga zbližavaju, pa premijer traži uslugu. Traži od bankara da kreira 200.000 novčanica za premijera, uz obećanje da će mu premijer vratiti za pet godina. Premijeru su novčanice potrebne za finansiranje rata. Građani Kejnslanda borili su se protiv većih poreza zbog finansiranja rata, pa je morao da se obrati bankaru.

Bankar se slaže da izradi novčanice, ali pod jednim uslovom: bankar uzima deo od 10.000 novčanica za sebe. Premijer prihvata posao kojim bankar ’kupuje državni dug’. Sada je u opticaju 1.200.000 novčanica, potpomognutih kombinacijom 1.000.000 unci zlata i ugovorom o dugu sa vladom za 200.000 novčanica.

Premijer troši svoje nove novčanice na bombe kupujući ih od dobavljača iz domaće vojne industrije, a bankar sebi kupuje veliki luksuzni stan.

Dobavljač iz vojne industrije koristi sve nove novčanice koje je dobio od premijera da kupi amonijum nitrat (đubrivo koje se koristi u bombama) za proizvodnju bombi. Sve njegove kupovine povećavaju cenu đubriva za uzgajivače pšenice u Kejnslandu, pa oni podižu cenu pšenice.

Kao uzrok toga, pekar koji kupuje pšenicu treba da podigne cenu svog hleba da bi ostao u poslu. Na taj način cene u Kejnslandu počinju da rastu, baš kao što su to činile u Njutoniji kada su nove perle ušle u opticaj.

Papirne Novčanice Više Ne Predstavljaju Zlato

Penzioner nailazi na finansijski časopis u kojem se pominje premijerov dogovor da se zaduži za finansiranje rata. Obzirom da je mudar, on zna da bombe loše vraćaju ulaganje i sumnja da će premijer ikada da vrati svoj dug.

Ako on ‘podmiri’ svoj dug, to bi ostavilo 1.200.000 novčanica u opticaju sa samo 1.000.000 unci zlata da bi ih podržalo, obezvređujući njegovu ušteđevinu. Već oseća stisak u džepu zbog porasta cena, i on odlučuje da se uputi u lokalnu banku i preda svoje novčanice i zameni ih za zlato, koje niko ne može da napravi u većoj količini.

Kada penzioner stigne u banku, on zatiče i mnoge druge okupljene oko banke. Svi oni se nadaju da će uzeti zlato koje predstavljaju njihove novčanice. Građani Kejnslanda sa pravom se plaše da njihove novčanice gube na vrednosti – oni to već osećaju zbog porasta cena.

Vrata su zaključana, sa obaveštenjem bankara na njima:

Po nalogu premijera, onom koji se plaši za stabilnost ove bankarske institucije, ova banka više neće podržavati konvertibilnost papirnih novčanica u zlato. Hvala vam!

Gomila se razilazi, ostavljena sa jednim izborom: da zadrže svoje novčanice, koje sada vrede manje od 1 unce zlata. Građani sa dovoljno finansijske stabilnosti odlučuju da ulože svoje novčanice u kupovinu akcija banke i kompanija vojne industrije, koje dobro posluju jer mogu da kupuju stvari pre nego što se povećaju tržišne cene.

Mnogi ljudi nisu u mogućnosti da investiraju – oni moraju da gledaju kako njihove zarade stagniraju i kako njihova ušteđevina polako ali sigurno gubi vrednost.

Penzioner, koji se nadao da će živeti od novčanica koje je zaradio tokom svojih 40 radnih godina, sada 40 sati nedeljno provodi iza kase u lokalnoj prodavnici, pitajući se gde je sve pošlo po zlu.

Dug Nikada Nije Otplaćen

Prošlo je nekoliko godina, a premijerov dug prema banci dolazi na naplatu. Budući da je potrošio svih 200.000 novčanica na bombe, koje nemaju baš dobar povraćaj ulaganja, on nema novčanice koje može da vrati banci. Plus, premijer želi da kupi još bombi za svoj rat.

Bankar uverava premijera da je sve u redu. Bankar će napraviti novi ugovor o dugu za 600.000 novčanica, koji bi trebao da stigne na naplatu u narednih 5 godina. Premijer može da iskoristi 200.000 od tih novih 600.000 novčanica da vrati svoj prvobitni dug prema banci, zadrži još 300.000 da kupi još bombi i da 100.000 bankaru da bi mu platio njegove usluge.

To nastavlja da se dešava – svaki put kada dug dospeva na naplatu, bankar stvara više novčanica za vraćanje starijih dugova i daje premijeru još više novca za trošenje. Ovaj ciklus se nastavlja.

Šta se dešava u Kejnslandu?

- Oni koji prvi dobiju nove novčanice, gledaju kako se njihovo bogatstvo povećava

- To uključuje bankara, premijera, vladu i sve one koji mogu da pristupe mogućnostima za investiranje u preduzeća koja prva dobiju nove novčanice (finansijske, vojne itd.).

- Cene roba rastu

- Cene se ne povećavaju ravnomerno – one se povećavaju gde god nove novčanice prvo uđu u ekonomiju i od tog trenutka imaju efekat talasa na tržišta. U našem primeru prvo raste cena amonijum nitrata, zatim cena pšenice, pa cena hleba. A tek na kraju zarade običnih ljudi.

- Štednja i životni standard opšte populacije se smanjuju

- Najviše pate oni koji žive od plate do plate i ne mogu da ulažu. Čak i oni koji su u mogućnosti da investiraju podložni su hirovima tržišta. Mnogi su prisiljeni da prodaju svoje investicije po niskim cenama tokom pada tržišta samo da bi platili svoje dnevne potrebe.

- Razlika u prihodima i bogatstvu između bogatih i siromašnih se povećava

- Bogatstvo opšte populacije se smanjuje, dok se bogatstvo onih koji su blizu mesta gde se troše nove novčanice povećava. Rezultat je disparitet koji se vremenom samo proširuje.

Da li nas novac danas eksploatiše?

Priča o Njutoniji i stvarna priča o agri perlama u Africi deluju pomalo zastarelo. Priča o Kejnslandu, međutim, deluje neobično poznato. U našem svetu cene robe uvek rastu, i vidimo rekordne nivoe nejednakosti u bogatstvu.

U poslednjem odeljku ovog našeg članka Šta je novac, proći ću kroz nastanak bankarstva i korake koji su bili potrebni da se dođe do današnjeg sistema, gde banke i vlade sarađuju u kontroli ekonomije i samog novca.

Šta su banke, i odakle su one došle?

Pojava bankarstva verovatno se dogodila da bi olakšala poljoprivrednu trgovinu i da bi povećala pogodnosti. Iako su se mnoga društva na kraju konvergirala ka upotrebi zlata i srebra kao novca, ovi metali su bili teški i opasni za nošenje kao tovar. Međutim, u mnogim slučajevima ih nije ni trebalo prevoziti. Uzmite ovaj primer:

Grad treba da plati poljoprivrednicima na selu za žito, a poljoprivrednici gradskoj vojsci za zaštitu od varvara. U ovom dogovoru zlato se kreće u oba smera: prema poljoprivrednicima u selu kako bi im se platilo žito, i nazad u grad da bi se platila vojska. Da bi olakšali ove transakcije, preduzetnici su stvorili koncept banke. Banka je zlato čuvala u sigurnom trezoru i izdavala novčanice od papira. Svaka priznanica je predstavljala potvrdu da njen imaoc poseduje određenu količinu zlata u banci. Imaoc novčanice je u svako doba mogao da uzme svoje zlato nazad vraćanjem te novčanice banci.

Korisnici banke mogli su lakše da trguju sa novčanicama od papira, i onaj koji poseduje novčanice mogao je da preuzme njihovo fizičko zlato u bilo kom trenutku. To je te novčanice učinilo “dobrim kao i zlato”.

Banke su izdržavale svoje poslovanje naplaćujući od kupaca naknadu za skladištenje zlata ili pozajmljivanjem dela zlata i zaračunavanjem kamata na njega. Trgovina na ovaj način je mogla da se odvija sa laganim novčanicama od papira umesto sa teškim vrećama zlatnika.

Ovakva praksa sa transakcijama, korišćenjem papirne valute potpomognute monetarnim dobrima, verovatno je započela u Kini u 7. veku.

Na kraju se proširila Evropom 1600-ih, a svoj zalet dobila je u Holandiji sa bankama poput Amsterdamske Wisselbanke. Novčanice Wisselbank-e često su vredele više od zlata koje ih je podržavalo, zbog dodane vrednosti njihovih pogodnosti.

Uspon nacionalnih ‘centralnih banaka’

Tokom vekova, zlato je počelo da se sakuplja u trezorima banaka, jer su ljudi više voleli pogodnosti transakcija sa novčanicama.

Na kraju, nacionalne banke u vlasništvu vlada preuzele su ulogu čuvanja zlata od privatnih banaka koje su započeli preduzetnici.

Nacionalne papirne valute potpomognute zlatnim rezervama u nacionalnim bankama zamenile su novčanice iz privatnih banaka. Sve nacionalne valute bile su jednostavno potvrde za zlato koje se nalazilo u trezoru nacionalne banke.

Ovaj sistem je poznat kao zlatni standard – sve valute su jednostavno predstavljale različite težine zlata.

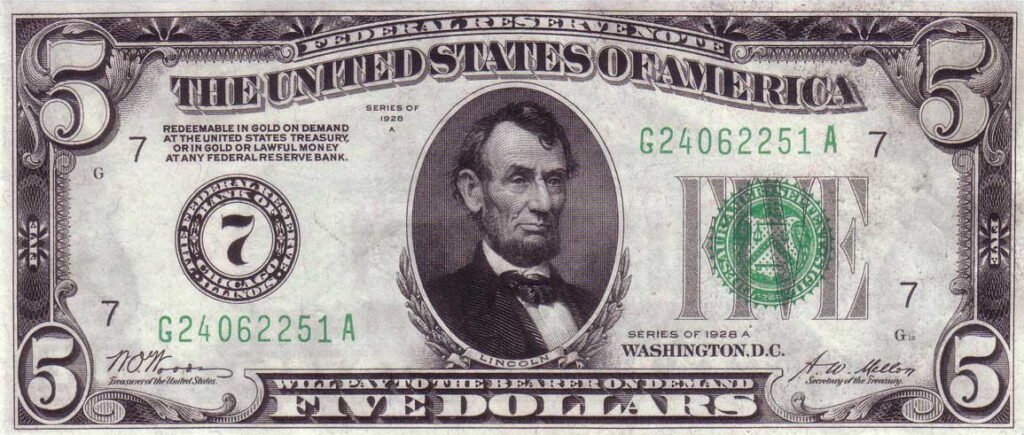

U gornjem levom uglu novčanice možete videti da piše da je novčanica “zamenljiva za zlato”. Savremeni dolari nemaju ovaj natpis, ali inače izgledaju vrlo slično. Izvor

U gornjem levom uglu novčanice možete videti da piše da je novčanica “zamenljiva za zlato”. Savremeni dolari nemaju ovaj natpis, ali inače izgledaju vrlo slično. IzvorZlatni sistem je postojao veći deo vremena, sve do Prvog svetskog rata. Vladama je bilo teško da prikupe novac za ovaj rat putem poreza, pa su morale da budu kreativne.

Kada vlade troše više nego što zarađuju na porezima, to se naziva deficitna potrošnja.

Kako vlade mogu ovo da urade? Vlade to rade tako što pozajmljuju novac prodavajući svoj dug.

Tokom Prvog svetskog rata, vlade su građanima i preduzećima prodavale vrstu duga koja se naziva ratna obveznica. Kada građanin kupi ratnu obveznicu, on preda svoj novac vladi i dobije papir u kojem je stajalo vladino obećanje da će vlasniku obveznice vratiti novac, plus kamate, za nekoliko godina.

Plakat koji obaveštava građane, tražeći od njih da kupe ratne obveznice – što predstavlja zajam vladi. Izvor

Plakat koji obaveštava građane, tražeći od njih da kupe ratne obveznice – što predstavlja zajam vladi. IzvorCentralne banke ‘monetizuju’ državni dug

Međutim, građani i preduzeća nisu bili voljni da kupe dovoljno ratnih obveznica za finansiranje Prvog svetskog rata.

Vlade se nisu predale – pa su zatražile od svojih nacionalnih ‘centralnih banaka’ da one kupe ove obveznice. Centralne banke su otkupile obveznice, ali ih nisu platile valutom potpomognutom postojećim zlatnim rezervama, kao što su to činili građani i banke prilikom kupovine obveznica.

Centralne banke su umesto toga davale vladi novu, sveže štampanu papirnu valutu potpomognutu samo obveznicom. Ovu valutu podržalo je samo obećanje da će im vlada vratiti dugove. Ovo je poznato kao monetizacija duga.

Budući da su ratne obveznice i valuta samo komadi papira, one su lake i jeftine za proizvodnju i mogu se napraviti u ogromnim količinama. Ono što ograničava proizvodnju i jednog i drugog je poverenje.

Ima smisla da se neko rastane od svog teško stečenog novca da kupi državnu obveznicu, samo ako veruje da će vlada da vrati svoj dug, plus kamate. Centralna banka je “krajnji kupac”, što znači da će ona da kupi državne obveznice kada to niko drugi neće da uradi.

Zapamtite, centralnu banku gotovo da ništa ne košta da kupi državne obveznice, jer oni sami štampaju valutu da bi ih kupili.

Zamislite da pridjete najskupljem automobilu u autosalonu – koji košta 100.000 USD. Mislite da je automobil lep, ali taj novac biste radije potrošili na lepši stan – tako da ste spremni da platite samo 40.000 USD za taj auto.

Sada, hajde da zamislimo da imate štampač za novac i da vas košta samo 50 USD za mastilo i papir da bi ištampali 1.000.000 USD. Vi biste odmah kupili auto, čak i ako biste morali da se cenkate sa drugim čovekom, i da ga na kraju platite 150.000 USD!

Ista stvar se dešava kada centralna banka kupuje obveznice (dugove) od vlade. Centralna banka može da stvori valutu toliko jeftino, da su spremni da plate i više nego što bi drugi platili ove obveznice i nastaviće da ih kupuju čak i kada niko drugi ne bude želeo.

Monetizacija duga uzrokuje inflaciju

Kada centralne banke monetizuju državni dug, funkcija novca kao zalihe vrednosti počinje da se nagriza. Vlada troši novi novac koji je dobila od svoje centralne banke na ratnu robu, obroke i još mnogo toga.

Cene roba rastu od ove novoštampane valute koja kruži kroz ekonomiju. Kada se cene povećavaju, to znači da se vrednost svake jedinice valute smanjuje. Svi koji drže valutu sada imaju manje vrednosti. Danas to nazivamo sporim gubitkom funkcije zalihe vrednosti u novčanoj inflaciji.

Za Nemačku nakon Prvog svetskog rata monetizacija duga izazvala je totalni slom Nemačke ekonomije i stvorila uslove za rast fašizma.

Kao deo sporazuma o prekidu vatre koji je okončao Prvi svetski rat, Nemačka je pobednicima morala da plati ogroman novac. Nemačkoj vladi je bio preko potreban novac, pa su prodale obveznice (dug) Rajhsbanci, nemačkoj centralnoj banci.

Ovaj postupak doveo je do toga da je vlada štampala toliko maraka (tadašnja nemačka valuta) da je tempo inflacije u Nemačkoj ubrzan u hiperinflaciju početkom 1920-ih. Cena vekne hleba za samo 4 godine popela se sa 1,2 marke na 428 biliona maraka.

Tokom i posle Prvog svetskog rata, SAD, Britanija, Francuska i mnoge druge vlade pratile su Nemačku u štampanju valute potpomognute državnim dugom.

To je dovelo do toga da su građani želeli da svoju papirnu valutu zamene za zlato, baš kao i penzioner iz priče o Kejnslandu.

Međutim, mnoge vlade su suspendovale konvertibilnost svojih valuta u zlato. Ovim potezom vlade su primorale svoje građane da drže nacionalnu papirnu valutu i gledaju kako se njihova ušteda smanjuje u vrednosti.

Da bi mogle da nastave da štampaju novac i da bi ga trošile na nepopularne programe za koje nisu mogle da skupljaju poreze za finansiranje – poput ratova.

Bretton Woods: Novi monetarni sistem

Nakon razaranja koja su donela dva svetska rata, vlade su uspostavile novi globalni monetarni sistem prema Bretton Woods-ovom sporazumu iz 1944. godine.

Prema ovom sporazumu, valuta svake države konvertovala se po fiksnom kursu sa američkim dolarom. Američki dolar je zauzvrat predstavljao zlato po stopi od 35 USD za jednu trojsku uncu zlata*.

Sve globalne valute su stoga još uvek bile jednostavna reprezentacija zlata, putem američkih dolara kao posrednika. Redovni građani više nisu mogli da otkupljuju svoje valute za zlato iz Sjedinjenih Država. Međutim, strane centralne banke mogle bi da dođu u Sjedinjene Države da bi zamenile dolare za zlato po stopi od 35 USD za jednu uncu zlata.

Međutim, vlada Sjedinjenih Država nije uvek držala dovoljno zlata da podrži sve dolare u opticaju. Američka vlada nastavila je da finansira proširene socijalne i vojne programe prodajom državnog duga svojoj centralnoj banci, Federalnim rezervama, koja je povećala ponudu dolara bez povećanja ponude zlata koja podupire te dolare.

*Trojna unca je standardna mera čistog zlata i ima malo veću težinu od normalne unce.

Propast Bretton Woods-a

Tokom 1970-ih, sve veći troškovi rata u Vijetnamu i stranih vlada koje su otkupljivale svoje dolare za zlato, stvorili su pritisak na Trezor Sjedinjenih Država.

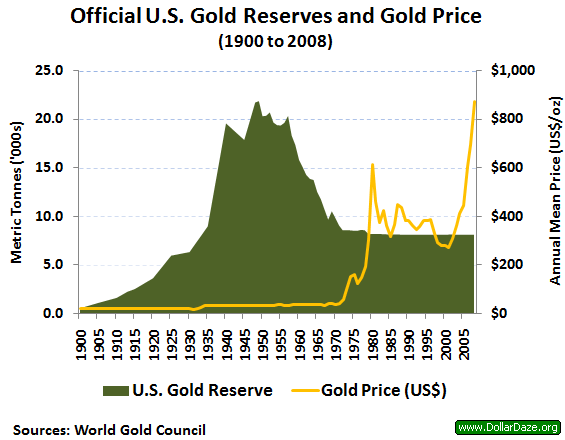

Ponuda dolara je porasla, dok je zlato u posedu Sjedinjenih Država opalo. Od 1950. pa do početka 1970-ih, rezerve zlata koje je držala vlada Sjedinjenih Država smanjile su se za više od 50%, sa 20 metričkih tona na samo 8 metričkih tona.

Godine 1970. država je imala zlata u vrednosti od samo 12 biliona dolara po zvaničnom kursu od 35 dolara za trojsku uncu zlata. Tokom ovog istog vremenskog perioda, ukupna ponuda američkih dolara otišla je sa oko 32 biliona USD na skoro 70 biliona USD.

Zvanične rezerve zlata u SAD-u su naglo padale od 1950. do 1970. godine, dok su se dolari u opticaju povećavali. Izvor: Wikipedia, DollarDaze.org

Zvanične rezerve zlata u SAD-u su naglo padale od 1950. do 1970. godine, dok su se dolari u opticaju povećavali. Izvor: Wikipedia, DollarDaze.orgAmerička vlada nije bila u stanju da potkrepi dolare zlatom od 35 dolara po trojnoj unci, što dovelo do rizika za čitav globalni monetarni sistem.

Početkom sedamdesetih godina, trojna unca zlata trebala je da vredi 200 USD da bi u potpunosti podržala sve američke dolare u opticaju. Rečeno na drugi način, Sjedinjene Države su pokušavale da kažu svetu da jedan dolar vredi 1/35 trojne unce zlata, ali u stvarnosti dolar je vredeo samo 1/200 trojne unce.

Kad su strane vlade trebale da pribave dolare za međunarodnu trgovinu i rezerve, bile su opelješene. Francuska vlada je to shvatila šezdesetih godina prošlog veka i počela je da prodaje svoje američke dolare za zlato po zvaničnom kursu od 35 dolara za trojsku uncu zlata.

Zemlje su počinjale da se bude iz šeme američke vlade. SAD su krale bogatstvo putem emisione dobiti, prodajući dolare za 1/35 trojne unce zlata, kada su vredeli samo 1/200 trojske unce.

Nixonov Šok ulazi u ’tradicionalni’ novac

Da bi kuća od karata mogla da ostane na mestu, predsednik Nixon je 1971. najavio da će američka vlada privremeno da obustavi konvertibilnost dolara u zlato.

Strane vlade više nisu mogle da polažu pravo na zlato svojim papirnim dolarima, a dolar više nije bio “poduprt” zlatom. Nixon je tvrdio da će ovo stabilizovati dolar.

50 godina kasnije, kristalno je jasno da je ovo samo pomoglo dolaru da izgubi vrednost i da ovaj “privremeni” program još uvek traje.

Pre 1971. godine, sve globalne valute bile su vezane za američki dolar putem Bretton Woods-ovog sporazuma. Kada je Nixon promenio američki dolar iz dolara podržanog u zlatu u dolar podržan dugom, ovim je promenio i svaku drugu valutu na Zemlji.

Sam je učinio da se celokupna svetska ekonomija zasniva na dugovima. Valute više nisu predstavljale zlato, već su predstavljale vrednost državnog duga.

Zlatni Standard se nikada nije vratio

Konvertibilnost američkih dolara u zlato – zlatni standard – nikada se nije vratio.

Od 1971. godine, čitav globalni monetarni sistem pokreće se tradicionalnim “fiat” valutama: poverenjem u vladine institucije da održavaju valutni sistem.

Većina valuta podržana je kombinacijom duga njihove vlade i drugih tradicionalnih valuta poput dolara i evra. Papirne valute više nisu podržane zlatom, imovinom koja je više od 5000 godina služila kao težak novac.

Danas vas vlade prisiljavaju da plaćate porez u njihovoj valuti i manipulišu saznanjima oko novca kako bi osigurale da potražnja za njihovom valutom ostane velika.

To im omogućava da neprestano štampaju više valuta, da bi je potrošili na vladine projekte, uzrokujući inflaciju cena koja jede i smanjuje bogatstvo i plate.

Američka vlada sada prodaje državne obveznice (dugove), poznate kao obveznice Trezora SAD, eng. US Treasuries, komercijalnim bankama u zamenu za američke dolare.

Vlada koristi te dolare za finansiranje svog budžetskog deficita. Komercijalne banke prodaju mnoge obveznice Trezora SAD, koje su kupile, američkoj centralnoj banci, Federalnim Rezervama.

Federalne rezerve plaćaju komercijalnim bankama sveže štampanim novcem “pomoću računara i upisivanjem količine na račun”, kako je rekao bivši predsednik Fed-a Ben Bernanke.

Ove komercijalne banke često zarađuju samo kupujući obveznice Trezora SAD od države i prodajući ih centralnoj banci. Kupujte nisko, prodajte visoko.

Centralne banke ovaj proces kupovine državnog duga – odnosno pozajmljivanja novca državi – nazivaju operacijama otvorenog tržišta.

Kada centralna banka odjednom kupi velike iznose duga, oni to nazivaju kvantitativnim ublažavanjem. Centralne banke javno najavljuju kupovinu državnog duga, ali vrlo malo ljudi razume šta to zapravo znači.

Euro, jen i svaka druga valuta koja se danas koristi funkcionišu slično kao američki dolar.

Da li će SAD ikada vratiti svoj nacionalni dug? Neobična stvar u vezi sa državnim dugom SAD-a je ta što vlada poseduje štampariju potrebnu za njegovu otplatu.

Kao rezultat toga, kada vlada duguje novac, oni samo pozajme još više novca da bi otplatile taj dug, povećavajući nacionalni dug.

Ako vam ovo zvuči kao Ponzijeva piramidalna šema, to je zato što ona to i jeste – najveća Ponzijeva šema u istoriji. Kao i svaka Ponzijeva šema, nastaviće se sve dok su ljudi koji kupuju Ponzijevu šemu budu uvereni da će im biti plaćeno nazad.

Ako ljudi i nacije prestanu da se zadužuju i koriste američke dolare jer nemaju poverenja u američku vladu ili vide da cena robe raste (tj. dolar postaje sve manje vredan), potražnja za dolarom će opadati, što će izazvati začaranu spiralu.

Ova spirala često završi u hiperinflaciji, kao što smo videli u novijoj istoriji sa Jugoslavijom, Venecuelom, Argentinom, Zimbabveom i mnogim drugim državama.

Ovo je način kako funkcioniše novac na vašem bankovnom računu. Novac svake nacije na svetu pati od istih problema kao i perle i novčanice u pričama o Njutoniji i Kejnslandu.

Kako banke i vlade kradu tvoj novac?

Tokom vekova, stigli smo do monetarnog sistema u kojem banke i vlade mogu da štampaju novu valutu za finansiranje svojih operacija i svojih prijatelja u zločinu, dok kradu bogatstvo svojih građana.

Šta će se desiti sa svetom kada novac bude mogao da štampa svaki narod na planeti?

- Bogatstvo onih koji su blizu pravljenja nove valute se povećava

- Vlada i politički povlašćena klasa ljudi, imaju pristup novoštampanom novcu pre svih ostalih, pa mogu da ga potroše pre nego što cene porastu. Na ovaj efekat pokazao je ekonomista Richard Cantillon sredinom 1700-ih i poznat je kao Cantillonov Efekat.

- Cena robe raste (poznato kao inflacija)

- Ne raste sve roba istovremeno u ceni. Roba blizu mesta gde se proizvodi nova valuta – finansijski sektor i vlada – prva raste, i odatle uzrokuje efekt talasa na cene.

- Inflacija se često predstavlja kao promena cene potrošačke korpe, poznata kao Indeks Potrošačkih Cena, eng. Consumer Price Index (CPI). Vlada ima alate za manipulisanje ovim brojem kako bi osigurala da se ona čini niskom i stabilnom, kao što je objašnjeno u našem članku o inflaciji.

- Finansijska imovina često primećuje ogromnu inflaciju, ali bankari to ne nazivaju inflacijom – oni kažu da naša ekonomija cveta! Nakon što su američke Federalne rezerve učetvorostručile ponudu američkih dolara u šest godina nakon finansijske krize 2008. godine, banke koje su dobile te nove dolare, kupile su akcije i obveznice, stvarajući ogroman balon u cenama ove imovine.

- Štednja i životni standard stanovništva se smanjuju

- Plate su jedna od poslednjih “cena” u ekonomiji koja se prilagođava, jer se često povećavaju samo jednom godišnje. U međuvremenu, cene dnevnih potrepština te osobe koja zaradjuje platu neprestano rastu kako novi novac kruži ekonomijom.

- Najviše su pogođeni oni koji žive od plate do plate – a to je 70% Amerikanaca.

- Razlike u prihodima između bogatih i siromašnih se povećavaju, kao što se vidi na grafikonu ispod.

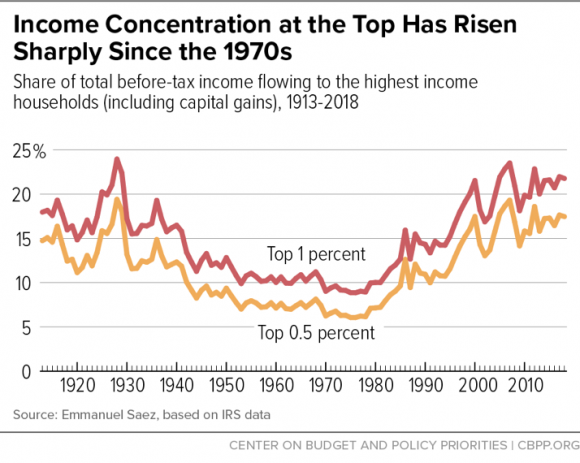

Koncentracija Dohotka na Vrhu Naglo je Porasla od 1970-ih

(Udeo u ukupnom prihodu pre oporezivanja u domaćinstvima sa najvišim dohotkom (uključujući kapitalne dobitke), 1913-2018)

Koncentracija Dohotka na Vrhu Naglo je Porasla od 1970-ih

(Udeo u ukupnom prihodu pre oporezivanja u domaćinstvima sa najvišim dohotkom (uključujući kapitalne dobitke), 1913-2018)Zašto i dalje imamo isti monetarni sistem?

Ako ovaj sistem bogate još više obogaćuje, a siromašne još više osiromašuje, dovodeći do političke nestabilnosti, zašto ga onda ne bismo promenili?

Najveći razlog zašto se ništa ne menja je verovatno to što puno toga ne znamo o samom sistemu. Svi svakodnevno koristimo valute svojih vlada, ali većina nas ne razume kako sistem funkcioniše i šta on čini našim društvima.

Obrazovni sistem, mediji i finansijski stručnjaci neprestano nam govore da je monetarni sistem previše komplikovan da bi ga normalni ljudi razumeli. Mnogi od nas se zato i ne trude da pokušaju.

Još nekoliko razloga zašto ovaj sistem nastavlja da opstaje:

- Mnogo je ljudi koji imaju direktnu korist od štampanja novog novca.

- Ti ljudi ne žele nikakve promene i bore se da zadrže tu moć.

- Nacionalne valute su često pogodne

- Kreditne kartice, online bankarstvo i još mnogo toga čine upravljanje nacionalnim valutama i njihovo trošenje lakim i jednostavnim.

- Građani moraju da plaćaju porez u svojoj nacionalnoj valuti

- To stvara potražnju za tom valutom od svih građana, povećavajući njenu vrednost.

- Glavna međunarodna tržišta, poput nafte, denominirana su u dolarima.

- Nafta je potrebna svakoj zemlji na planeti, ali pošto mnogi ne mogu da je proizvode, moraju da je kupuju na međunarodnim berzama. Od 1970-ih na ovim berzama gotovo sva nafta se prodaje za dolare, što stvara potražnju za dolarima. Da bi se odmaknule od ovog sistema, zemlje bi trebale da pronađu novu valutu ili robu za trgovinu naftom, što zahteva vreme i rizike.

- Nije postojala dobra alternativa

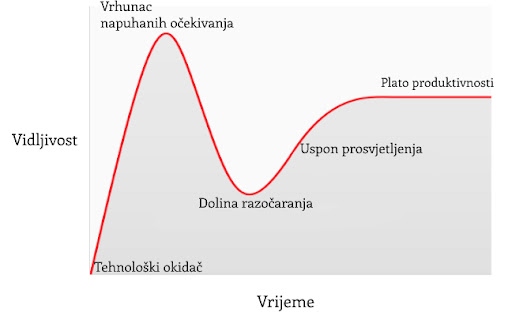

- Uz globalnu ekonomiju u realnom vremenu, naš sistem digitalnog bankarstva koji koristi nacionalne valute je pogodan. Transakcija u tvrdom novcu poput zlata bila bi previše nezgrapna za današnji svet. Digitalna valuta pod nazivom Bitcoin, predstavljena 2009. godine, je rastuća alternativa koja nudi čvrst novac koji se kreće brzinom interneta.

Šta je novac, i zašto trebate da brinete?

Novac je alat koji olakšava razmenu dobara. Kao i svako drugo dobro, novac se pridržava zakona ponude i potražnje – povećanje potražnje povećaće njegovu vrednost, a povećanje ponude smanjiće njegovu vrednost.

Na ovaj način novac se ne razlikuje od kuće ili piletine. Međutim, velika prodajnost novca znači da je potražnja za njim uvek velika. Kao rezultat, novac mora biti težak za proizvodnju (a samim tim i ograničen u ponudi) ili će ga onaj ko ga može napraviti, stvoriti toliko, da vremenom više neće služiti kao zaliha vrednosti. Uskoro će izgubiti svoje funkcije kao sredstvo razmene i obračunske jedinice.

Najbolji novac u datoj ekonomiji je onaj koji se najslobodnije kreće – svi ga žele, lako je obaviti transakcije sa njim i koji sa vremenom dobro drži svoju vrednost. Nijedan novac nije savršen u svemu ovome, a neki ističu jednu funkciju novca na štetu drugih.

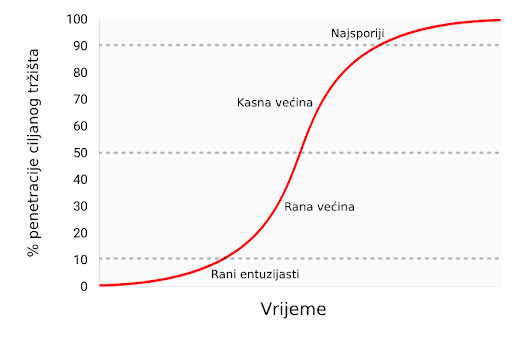

Iako se istorija ne ponavlja, ona se rimuje, a usponi i padovi monetarnih sistema imaju jasne ritmove. Uspon i pad monetarnog sistema često sledi opšti obrazac koji smo videli u pričama o agri perlama i Kejnslandu: pojavljuje se odredjenji oblik novca koji pomaže ljudima da efikasnije trguju i štede, ali na kraju gubi na vrednosti kada neko shvati kako da ga jeftino stvori u velikoj količini. Međutim, tokom dugog perioda vremena, monetarni sistemi su se poboljšali u sve tri funkcije novca.

Na primer, zlato je tokom vremena dobro služilo kao zaliha vrednosti. Međutim, naša međusobno povezana ekonomija ne bi mogla efikasno da funkcioniše ako bi trebalo da fizičko zlato zamenimo robom i uslugama. Mnogo je lakše kretati se na papirnom i digitalnom novcu, ali istorija nam govori da su vlade i bankari iskoristili ove oblike novca za krađu bogatstva putem inflacije.

Današnji globalni monetarni sistem je vrlo zgodan, a digitalna plaćanja i kreditne kartice olakšavaju trošenje novca. Ovo skriva stalnu inflaciju koja nagriza vrednost svake jedinice novca i dovodi do sve većeg jaza u bogatstvu.

Nadam se da je ovaj članak proširio vaše razumevanje novca i njegove uloge u društvu. Ovo je samo početak svega što treba istražiti o novcu: za kasnije su sačuvane teme o inflaciji, kamatnim stopama, pozajmljivanju, poslovnim ciklusima i još mnogo toga.

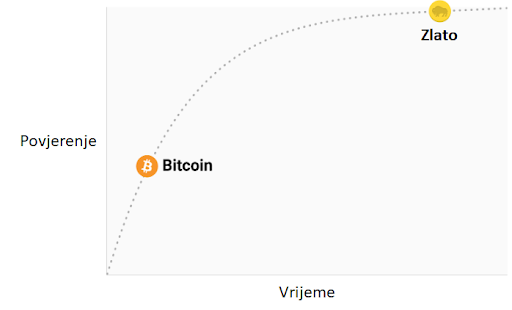

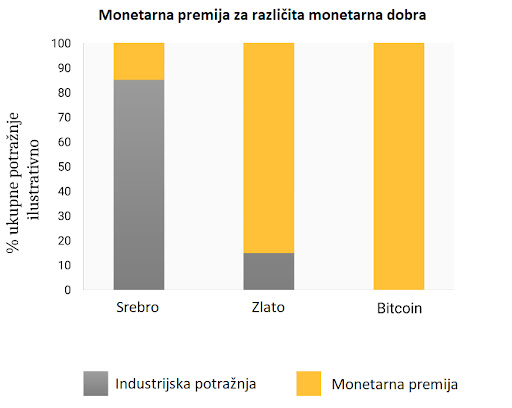

Efikasnija Ušteda Novca

Možda se pitate kako zaštititi svoju štednju kada svaki oblik često korišćenog novca i investicija pati od inflacije ponude – koja umanjuje vrednost i prenosi bogatstvo onima koji mogu da stvore novac ili investiciju. Možda se čini da se ništa na planeti danas ne može kvalifikovati kao ‘težak’ novac, ali dve stvari ipak ostaju: zlato i njegov noviji rođak Bitcoin. Obe ove stvari je neverovatno teško proizvesti, a jedna od njih se kreće brzinom interneta i može se čuvati u vašem mozgu.

Ako želite da saznate više o Bitcoin-u kao sredstvu za zaštitu vaše ušteđevine, pročitajte ovde. Ako ste već spremni za kupovinu Bitcoin-a, pogledajte moj vodič za kupovinu Bitcoin-a. Možete početi sa investiranjem sa samo 5 ili 10 €.

Zasluge

Hvala svima koji su pomogli u izradi i uređivanju ove serije o novcu: @ck_SNARKS, @CryptoRothbard, Neil Woodfine, Emil Sandstedt, Taylor Pearson, Parker Lewis, Jason Choi, mojoj porodici i mnogim drugima.

Hvala svima koji su ovo inspirisali i razvili ključne ideje koje su ovde primenjene: Friedrich Hayek, Carl Menger, Ludwig Von Mises, Murray Rothbard, Saifedean Ammous, Dan Held, Pierre Rochard, Stephan Livera, Michael Goldstein, i mnogi drugi.

Molim vas da šerujete! Ako vam je ovaj članak otvorio oči o tome kako funkcioniše naš novac i finansijski sistem, kontaktirajte me ili ostavite komentar!

Ako vam se sviđa moj rad, molim vas da ga podelite sa svojim prijateljima i porodicom. Cilj mi je da svima pružim pogled u ekonomiju i na to kako ona utiče na njihov život.

-

@ 472f440f:5669301e

2025-05-12 23:29:25

@ 472f440f:5669301e

2025-05-12 23:29:25Marty's Bent