-

@ eb0157af:77ab6c55

2025-06-17 12:02:26

@ eb0157af:77ab6c55

2025-06-17 12:02:26Lightspark introduces a layer 2 for instant payments, stablecoins and interoperability with Lightning.

Spark is an open-source layer 2 protocol developed by Lightspark, designed to offer instant low-cost payments without the need for intermediaries. It allows the creation of wallets and applications that interact directly with the Bitcoin and Lightning networks. The company’s stated goal is to transform Bitcoin into a true global digital currency, solving the scalability limitations of the base layer.

Lightspark, a company led by David Marcus (former PayPal and former Facebook), officially launched Spark in beta version on April 29, 2025. Developers can already use Spark’s SDKs (Wallet and Issuer) to build self-custodial wallets compatible with Lightning and tokens (such as stablecoins) native to the Bitcoin network.

How it works

Spark adopts a statechain-based approach, allowing the transfer of ownership of a UTXO off-chain between different users without using the main blockchain, thus reducing costs and transaction times. Instead of executing an on-chain transaction that physically moves the asset, users acquire signing rights or control over a key that represents a bitcoin UTXO. Transfers occur through a chain of signatures and a mechanism that allows subsequent transactions to overwrite previous ones, ensuring that neither the user nor the service provider (Spark Service Provider, SSP) can lose funds during the operation.

Spark is designed to be fully interoperable with LN, supporting not only bitcoin transactions, but also stablecoins and other tokenized assets. SSPs facilitate Lightning payments by accepting funds on Spark and converting them into Lightning transactions or vice versa, eliminating the need for users to manage nodes or worry about channel liquidity. For example, a user can pay an LN invoice with a stablecoin on Spark, with the SSP converting the stablecoin to BTC in the background and sending the funds to the recipient.

Shared signature model (multisig 2-of-2)

Unlike the LN trust model, which is based on peer-to-peer bidirectional channels with smart contract logic, Spark involves a coordinating entity, the “Spark Service Provider” (SSP). This shifts part of the risk from channel liquidity management to trust in operators who sign off-chain transactions. The SSP’s task is to sign “blindly” (blindly) on behalf of the user, which means the SSP does not see the content of the signature and does not even know if it is signing a Bitcoin transaction or something else.

Bitcoin deposited on Spark always remains under the user’s control. When a user sends funds to Spark, they are initially transferred to a statechain. Once funds are on the statechain, payments on the Spark network occur instantly and at near-zero costs.

At the heart of Spark’s security is the use of a shared signature scheme, specifically a multisig 2-of-2 model. This means that two keys are required to authorize a transaction, and the user always holds one. When users deposit funds on Spark, they send them to a multisig address. Here, they maintain control of their funds and can perform a unilateral exit without the need to interact with other parties.

Each payment is enabled by a Spark Service Provider (SSP), which must co-authorize the transaction together with the user for it to be valid and successful.

Although the network is currently managed only by Lightspark and another operator (Flashnet), users do not risk losing funds even if these operators stopped cooperating. In fact, Spark offers the possibility to unilaterally force the return of bitcoin to the mainnet at any time. Users can exit Spark in two ways: through a cooperative exit (cheaper and faster) or a unilateral exit (slower, but possible in case of malfunction or loss of trust). Lightspark has declared its intention to add more operators in the future to increase decentralization.

Fee structure

Regarding fees, transactions within the Spark network are zero fee. The only fees users will have to bear are Bitcoin’s on-chain fees for depositing or withdrawing funds from Spark. Additionally, transferring bitcoin from Spark to LN involves a 0.25% fee plus routing fees. Conversely, a transaction from LN to Spark costs 0.15%.

The native LRC20 token protocol

Introduced in the summer of 2024, LRC20 is a token issuance protocol designed to be compatible with both Bitcoin’s mainnet and LN. Anyone can issue an LRC20 token. The protocol also supports freeze and burn operations, giving the original issuing wallet the power to freeze tokens at any address, preventing transactions until unlocked. LRC20 is primarily designed for issuing stablecoins and regulated assets.

After thoroughly testing it, the Lightspark team decided to run the LRC20 protocol natively on Spark, to enable token issuance on the network.

Ecosystem and partnerships

The birth of Spark has immediately attracted the interest of other Bitcoin projects. Among the various partnerships established, the multisig wallet Theya has integrated Spark to offer its users simpler and faster bitcoin and stablecoin payments.

Last May, Breez announced a new implementation of the Breez SDK based on Spark, which allows developers to integrate Lightning payments directly into their apps through Spark. As part of this collaboration, Breez will also act as a Spark Service Provider, helping to expand the ecosystem. According to the two companies, this partnership will provide developers with new Bitcoin-native tools for use cases such as streaming payments, international remittances and micro-payments for AI.

The post Spark: the layer 2 launched by Lightspark appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-06-17 12:02:24

@ eb0157af:77ab6c55

2025-06-17 12:02:24The new communication protocol aims to improve the industry with measurable advantages in terms of efficiency and security.

A new study conducted by Hashlabs, in collaboration with the SRI (Stratum V2 Reference Implementation) team and figures like Matt Corallo, Alejandro De La Torre and others reveals how the Stratum V2 protocol can increase miner profitability compared to the current Stratum V1 standard, used for over a decade.

Speaking to Atlas21, Gabriele Vernetti, Stratum V2 maintainer, declared:

“This first case study demonstrates how much Stratum V2 can help miners as well, securing and increasing their profits, in addition to the rest of the network. It’s just a first study aimed at demonstrating how decentralization can be aligned with the profit dynamics typical of the mining sector.

In the future we will also focus on the benefits for mining pool operators, who can benefit from the protocol’s efficiency to lower their operating costs (such as those for bandwidth used by their servers).

The feedback has been very positive: this first study was a joint work with various market players, including miners and mining pool operators. As SRI we want to continue working together with the entire community as done in this case, becoming a reference point for all actors interested in innovating the Bitcoin mining field”.

The research, based on controlled tests with two identical ASIC S19k Pro, with stock firmware, demonstrates that Stratum V2 can increase net profits by up to 7.4%. For an industry that often operates with 10% margins, this could represent a substantial competitive advantage.

The V2 protocol reduces various inefficiencies that plague the current system. The latency in block switching, that is the waiting time created when a miner must change block template after a new block has been mined on the network, goes from 325 milliseconds to just 1.42 milliseconds, a speed 228 times higher. This translates to about 4.9 hours of completely wasted hash power less per year.

Another problem of modern mining concerns “stale shares” – proofs of work that arrive too late to be remunerated, often due to network latency or inefficient communication. However, not all stale shares depend on inefficiency problems. On average, about 2% are rejected for expected reasons, such as when the share doesn’t reach the minimum difficulty required by the pool. This value is considered normal in the sector. The remaining 98%, instead, is caused by avoidable delays. With Stratum V1, miners lose between 0.1% and 0.2% of their computing power this way. Stratum V2 with Job Declaration completely eliminates this waste, provided that the miner and the pool node have the same level of connectivity. This step could translate into a net profit increase of up to 2% by fully adopting Stratum V2 with Job Declaration.

In the Stratum V2 protocol, the Job Declaration Client (JDC) is software that allows miners to receive mining jobs directly from their local Bitcoin node, that is the block templates to work on. The JDC communicates directly with the miner’s local node, receiving updated data for new block construction and immediately sending them to the mining software via Stratum V2. This allows miners to receive jobs in real time from their own node, without having to wait for them from the pool, reducing latency and the risk of working on obsolete jobs. Furthermore, if the pool allows it, miners can build custom templates choosing which transactions to include in the block.

The research also highlights an often overlooked aspect: the loss of transaction fees. With the Stratum V1 protocol, miners lose about 0.75% of potential fees for each block due to the delay in receiving new jobs. Considering that about 52,560 blocks are mined each year, this loss per block adds up to a total of about 74 bitcoins per year, equivalent to over $8 million at current prices.

Beyond economic advantages, Stratum V2 solves a critical vulnerability of the current system: hashrate hijacking. The V1 protocol doesn’t encrypt communications, allowing attackers to intercept and steal up to 2% of computing power without the miner noticing. The new protocol eliminates this risk through end-to-end encryption and authentication.

According to the study, by reducing latency, optimizing share sending and improving security, Stratum V2 enables a potential net profit increase of 7.4%, derived exclusively from technical improvements.

The post Stratum V2 increases profits by 7.4%: “The study shows that profit and decentralization can coexist”, says Vernetti, SV2 maintainer appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-06-17 12:02:24

@ eb0157af:77ab6c55

2025-06-17 12:02:24Carl Rickertsen completely exits his position in Strategy as insiders sell $864 million worth of stock.

As reported by Protos, Carl Rickertsen, a member of Strategy’s board of directors, has fully liquidated his entire shareholding for over $10 million.

Rickertsen’s decision to completely exit his Strategy position marks a sharp shift from his previous investment stance. In 2022, the executive had shown confidence in the company by investing $700,000 in MSTR shares.

On June 13, 2022, Rickertsen purchased $608,000 worth of MSTR stock at $152 per share. Since then, the stock has rallied 152%. However, by 2023, the director had already sold half of his 4,000-share position.

Rickertsen’s approach to managing his holdings has become increasingly aggressive in recent years. Since joining the board in 2019, he has adopted a strategy of immediately liquidating any stock options received.

One example of this tactic occurred on June 2, when he acquired and sold 26,390 MSTR shares on the same day.

As of June 5 this year, Rickertsen reported zero vested Strategy shares, marking the end of his equity involvement with the company.

Rickertsen’s situation is not an isolated case within Strategy. Data from the Securities and Exchange Commission (SEC) reveals a controversial picture. According to information gathered by secform4.com, over the past five years, total insider sales have exceeded purchases by $864 million. This imbalance in insider transactions could raise questions about executives’ confidence in the company’s future.

The post Strategy director liquidates all his MSTR shares appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-06-17 12:02:23

@ eb0157af:77ab6c55

2025-06-17 12:02:23French lawmakers are proposing Bitcoin mining as a solution to optimize the national electricity system and make use of surplus energy.

A group of French parliamentarians has introduced an amendment that could turn the country into a European hub for Bitcoin mining, strategically leveraging its energy production capacity.

The legislative proposal aims to assess how mining could be integrated into the French energy system — the largest in Europe — to optimize the management of electricity produced by nuclear power plants.

The amendment to the law on “National Programming and Regulatory Simplification in the Energy Sector” calls on the government to conduct a thorough evaluation of the potential of Bitcoin mining. The initiative represents a pragmatic approach to addressing the issue of excess energy, a key topic for France’s nuclear industry.

France’s energy system, powered by nuclear for over 70% of its needs, often generates electricity surpluses that require efficient management. The proponents of the proposal see mining as an ideal solution to absorb this excess, transforming a potential waste into an economic resource.

The operational flexibility of mining farms offers a unique competitive advantage: machines can be quickly turned on and off based on production and consumption peaks, dynamically adapting to the needs of the electrical grid. This feature makes them particularly suitable for installation near power plants, even in the most remote areas of the country.

The parliamentary proposal highlights how mining could contribute to the revitalization of abandoned industrial sites, creating new opportunities for economic development under the supervision of public authorities.

Lawmakers emphasize the various benefits of this strategy: reducing negative pricing in wholesale markets, relieving the workload on nuclear plants by avoiding frequent modulation cycles that accelerate equipment wear, and absorbing surplus energy that would otherwise go to waste.

The French Association for the Development of Digital Assets (ADAN) collaborated in drafting the amendment, contributing technical expertise and industrial insight to the project. The organization emphasized how low-carbon Bitcoin mining could help strengthen the resilience of the national electricity grid.

The parliamentary report notes that mining in France could represent “an activity tailored to the constraints of the electrical system, absorbing surplus energy and reducing environmental impact” by using power that would otherwise be lost.

The post France considers Bitcoin mining: parliamentary proposal for managing nuclear energy appeared first on Atlas21.

-

@ e5cfb5dc:0039f130

2025-06-17 11:11:30

@ e5cfb5dc:0039f130

2025-06-17 11:11:30はりまメンタルクリニック:GIDの大手そう。丸の内線ならパムくんちが近い。

わらびメンタルクリニック:GIDの大手そう?公式サイトには影もかたちも

ナグモクリニック:SRS手術までしてるところ。GID精神科外来が月1第1木曜日だけ?

狭山メンタルクリニック:距離・時間的にはまま近い。サイトの記述が思想的にちょとあやしげ。新患受付がだいぶ先。GIDは専門外か?

川島領診療所:オンライン診療あり!強迫性障害や美容皮膚科をやっている。雰囲気よさそうなところ。GIDは専門外か?

Jこころのクリニック:電車いっぽんなので楽。GIDは専門外か?

ハッピースマイルクリニック:オンライン診療あり!GIDは専門外か?

-

@ eb0157af:77ab6c55

2025-06-17 12:02:22

@ eb0157af:77ab6c55

2025-06-17 12:02:22Russian authorities uncover 95 Bitcoin mining machines hidden inside a truck stealing electricity from a village.

Law enforcement in the Republic of Buryatia has uncovered an illegal Bitcoin mining operation concealed inside a KamAZ truck. The clandestine facility was siphoning off electricity meant for the local population.

According to the national news agency TASS, the discovery was made during a routine inspection of power lines in the Pribaikalsky district, where inspectors identified an unauthorized connection to a 10-kilovolt line — enough to power an entire village. The criminal operation showed a high level of organization, with sophisticated equipment hidden inside an apparently innocuous transport vehicle.

Source: Babr Mash

Inside the commercial truck, authorities found a fully operational mining center equipped with 95 machines and a portable transformer station. The technical setup suggested careful planning, designed to maximize bitcoin production while minimizing the risk of detection.

Two individuals suspected of involvement in the illegal activity managed to escape in an SUV before law enforcement arrived.

Impact of illegal mining on the local power grid

Buryatenergo, a regional unit of Rosseti Siberia, stressed how unauthorized connections severely compromise the stability of the local power grid. Consequences include voltage drops, overloads, and potential blackouts that disproportionately affect rural communities, already vulnerable in terms of energy access.

The illegal siphoning of electricity for mining creates a domino effect across the entire electrical infrastructure, causing service disruptions for legitimate users and increasing maintenance costs for grid operators.

Government restrictions on mining

The Russian government has implemented various restrictions on cryptocurrency mining in several regions of the country. In Buryatia, mining is banned from November 15 to March 15 due to seasonal energy shortages. Only companies registered in specific districts such as Severo-Baikalsky and Muisky are allowed to operate outside this period.

Federal restrictions were further tightened in December 2024, when Russia announced a ban on mining during peak energy months in multiple regions, including Dagestan, Chechnya, and parts of eastern Ukraine under Russian control. Since April, a total ban has been in effect in the southern region of Irkutsk.

Despite these restrictions, some Russian companies continue to operate legally in the sector. BitRiver, one of the country’s leading operators, takes advantage of the region’s low-cost energy, having launched its first and largest facility in 2019 in the city of Bratsk.

The post Illegal mining: clandestine operation discovered in a KamAZ truck in Russia appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-06-17 12:02:21

@ eb0157af:77ab6c55

2025-06-17 12:02:21The Brazilian government has abolished the Bitcoin tax exemption for small investors and introduced a flat 17.5% tax rate on all crypto capital gains.

Brazil has officially ended the tax-free period for small digital asset investors, introducing a flat 17.5% rate on all profits from cryptocurrency sales. The decision was formalized through Provisional Measure 1303, part of the government’s strategy to increase tax revenues from financial markets.

Until now, Brazilian residents selling up to 35,000 Brazilian reais (around $6,300) in cryptocurrencies per month were completely exempt from income tax. Profits exceeding this threshold were subject to progressive taxation, starting at 15% and reaching up to 22.5% for amounts over 30 million reais.

The new flat rate, which took effect on June 12, removes all exemptions and applies uniformly to every investor, regardless of the size of their transactions, according to local outlet Portal do Bitcoin.

While small-scale investors will now face a higher tax burden, high-net-worth individuals might actually benefit. Under the previous system, large transactions were taxed between 17.5% and 22.5%. With the new flat 17.5% rate, many high-profile investors will see their effective tax liability reduced.

Under the new rules, taxes will be calculated quarterly, with investors allowed to offset losses from the previous five quarters. However, starting in 2026, the time frame for claiming losses will be shortened.

Last March, Brazilian lawmakers also proposed a bill allowing employers to partially pay workers in cryptocurrency. According to the draft, crypto payments could not exceed 50% of an employee’s salary.

Full payment in cryptocurrencies would only be allowed for foreign workers or contractors, and only under specific conditions set by the Brazilian Central Bank. The bill prohibits full crypto payment for standard employees.

The post Brazil scraps crypto tax exemption: new 17.5% flat tax appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-06-17 12:02:19

@ eb0157af:77ab6c55

2025-06-17 12:02:19VanEck analyst Matthew Sigel warns of growing risks for Bitcoin treasury companies as their stock prices approach NAV.

Matthew Sigel, Head of Digital Assets Research at VanEck, has sounded the alarm for companies that have adopted Bitcoin-based treasury strategies.

No public BTC treasury company has traded below its Bitcoin NAV for a sustained period.

But at least one is now approaching parity.

As some of these companies raise capital through large at-the-market (ATM) programs to buy BTC, a risk is emerging: If the stock trades at or near…

— matthew sigel, recovering CFA (@matthew_sigel) June 16, 2025

In a post on X, Sigel highlighted an emerging issue in the sector of companies holding Bitcoin treasuries. Until now, no public company with a Bitcoin treasury has ever traded below its own Net Asset Value (NAV) for extended periods. The NAV represents the net value of a company’s assets (such as bitcoin and cash) minus its liabilities, divided by the number of outstanding shares — essentially indicating the real value of each share based on the company’s holdings. However, at least one of these companies (Semler Scientific) is now dangerously approaching breakeven.

The core of the issue lies in the capital-raising mechanism. Many of these companies rely on large-scale at-the-market (ATM) programs to acquire bitcoin, but when the stock price nears the NAV, this strategy can shift from creating value to destroying it.

The risk for shareholders

Under normal market conditions, companies like Semler Scientific and Strategy trade at a premium to the value of the bitcoin they hold. This means investors are willing to pay more for the company’s stock than the simple value of its bitcoin treasury.

However, when a company’s stock price approaches or falls below its NAV, the situation becomes problematic, according to Sigel. Issuing new shares at these levels not only dilutes the value for existing shareholders but can also become extractive, as management continues to raise capital while benefiting more than shareholders.

Proposed solutions

Sigel suggested several measures for companies pursuing Bitcoin treasury strategies. His recommendations include implementing preventive safeguards while stock premiums still exist. Notably, he proposes announcing a pause in ATM issuances if the stock trades below 0.95 times NAV for ten or more consecutive trading days. Additionally, Sigel advises prioritizing buybacks when bitcoin appreciates but the company’s equity does not reflect that increase.

Lessons from Bitcoin miners’ past

The VanEck analyst pointed out that similar situations have occurred in the Bitcoin mining sector, marked by persistent equity issuances and disproportionate executive compensation. To avoid repeating those mistakes, Sigel suggests that executive pay should be tied to growth in NAV per share, not the size of the Bitcoin position or the total number of outstanding shares.

Sigel concluded:

“Once you are trading at NAV, shareholder dilution is no longer strategic. It is extractive. Boards and shareholders should act with discipline now, while they still have the benefit of optionality.”

The post Bitcoin treasury: VanEck sounds the alarm for companies in the danger zone appeared first on Atlas21.

-

@ 9ca447d2:fbf5a36d

2025-06-17 12:02:05

@ 9ca447d2:fbf5a36d

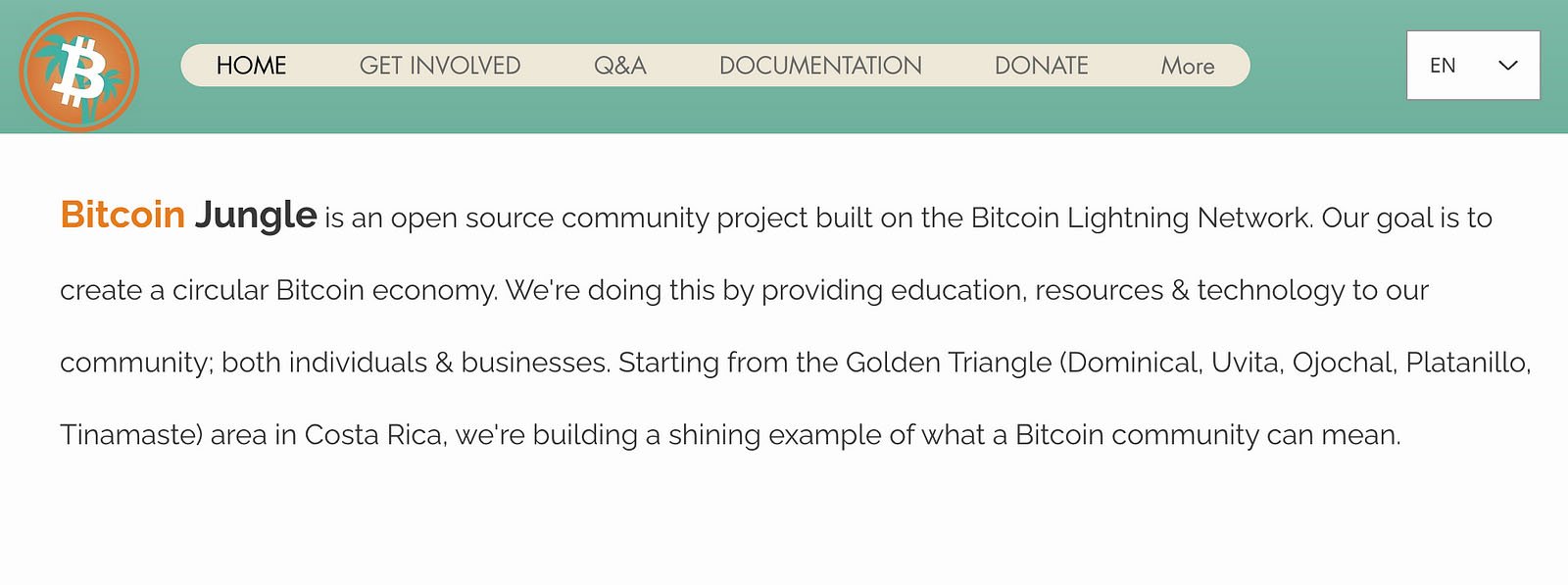

2025-06-17 12:02:05When Richard Scotford moved to Costa Rica in 2018, he had no idea he would become a key figure in a thriving Bitcoin economy.

A longtime Bitcoin holder who initially saw it through the lens of speculation, Scotford’s journey led him to embrace Bitcoin’s deeper purpose and spearhead Bitcoin Jungle — a grassroots movement bringing real-world Bitcoin adoption to Costa Rica.

Bitcoin circular economies create holistic value for Bitcoiners

Bitcoin Jungle is inspired by Bitcoin Beach in El Salvador but uniquely adapted to Costa Rica’s economic landscape. Unlike El Salvador, where Bitcoin was positioned as a tool for financial inclusion, Costa Rica already has a fairly stable banking system.

The real issue? The friction of moving money. Expats, business owners, and tourists struggle with high fees, banking red tape, and slow transactions. Bitcoin helped solve a lot of these problems.

The Birth of Bitcoin Jungle

Scotford and his team launched Bitcoin Jungle in late 2021 with a simple goal: get bitcoin into people’s hands and make it usable. However, there was one challenge — he had no technical background.

Determined to create a circular bitcoin economy, Scotford networked aggressively. He attended the first Adopting Bitcoin conference in El Salvador, approaching strangers with his vision:

“I was just walking around trying to find people who could help me make this economy, going up to random people saying ‘Hey, what can you do? We’re trying to make a circular economy in Costa Rica, can you help us?’ They all thought I was crazy.”

The breakthrough came when he turned to Bitcoin Twitter. Nicolas Burtey from Galoy encouraged him to create a wallet, and developer Lee Salminen forked the Bitcoin Beach wallet for their project.

“Within two weeks of Adopting Bitcoin, Lee forked the Galoy Bitcoin Beach wallet, which took Galoy by surprise. Even though they made their wallet to be forked if necessary, I don’t think they were expecting people to do it so fast and, I’d like to say, so well. They were like, ‘Okay, cool, who are these guys doing this?’”

Finally Bitcoin Jungle had its own working wallet, surprising even the Galoy team with the speed of execution.

Grassroots Adoption: One Vendor at a Time

How do you build a bitcoin economy from scratch? Scotford’s answer was simple: start at the farmers’ markets.

“We were like, okay, we’re going to get all the bespoke niche market sellers who are in this area. We have all these beautiful farmers markets, and we decided to approach these people first,” Scotford explained.

His team took a strategic approach, targeting market gatekeepers first.

“If you want to talk to every individual person, it’s really difficult. But if you can talk to the person who is the owner of the market, and then they can introduce you to their market stores, you’re already halfway there.”

Going stall by stall, they pitched Bitcoin’s advantages — no bank fees and better payment options. But adoption didn’t happen overnight, so Bitcoin Jungle initially offered a safety net — vendors could cash out at the end of the day.

“We would say to the vendors, ‘Look, accept bitcoin, and at the end of the day, if you don’t want to keep the bitcoin, we’ll buy it off you,’” Scotford recalled.

“When we first started, maybe 30–40% of the vendors were cashing up every day or at the weekends. Lee would be walking around with big fistfuls of money, cashing out vendors.”

But over time, something shifted — they started keeping their bitcoin.

“Eventually, the vendors started to learn themselves that, ‘Oh, actually it’s better to keep it.’ They would then pay for their tables in the markets using bitcoin. They thought, ‘Well, I don’t want to keep this bitcoin, I don’t really know what to do with it, but I can pay for my table.’ So there, the circular economy starts to happen.”

Today, Bitcoin Jungle runs with minimal intervention, and Scotford takes pride in their reliability.

“When you come here to Costa Rica, what we really pride ourselves on is that if someone says they accept bitcoin, 99% of the time, they will. And if they’re part of Bitcoin Jungle, they will 100% accept bitcoin and you will have a fluid experience with it.”

By mid-summer 2024 over 380 locations in Costa Rica accepted bitcoin

The Bitcoin Jungle Wallet and Real Usage

Bitcoin Jungle is an open-source community project built on the Bitcoin Lightning Network.

Acting as a community bank, the project processes a large number of transactions daily. To encourage proper security practices, Scotford’s team alerts their peers, reminding users to move their bitcoin to cold storage.

“If you’ve got too much bitcoin on your wallet, we send you a message telling you to move it to cold storage,” he explained. For larger businesses, they even offer hands-on assistance to secure funds properly.

Unlike the HODL-only philosophy that many Bitcoiners advocate, Bitcoin Jungle encourages spending.

“Michael Saylor says don’t spend your bitcoin. We say the opposite,” Scotford laughed. “We’re the antithesis of that. You need to spend it.”

Bitcoin Jungle’s Unique Approach to Costa Rica

Bitcoin Jungle isn’t just another Bitcoin adoption effort; it’s tailored to Costa Rica’s economy. The wallet operates in Costa Rican colónes, making transactions feel familiar to residents while ensuring tourists and expats can still interact easily.

The team has also introduced low-fee bitcoin ATMs, point-of-sale integrations, and partnerships that allow users to pay in bitcoin while the recipient receives local currency.

A major breakthrough came when Francis Pouliot from Bull Bitcoin joined forces with Bitcoin Jungle, bringing his expertise in banking infrastructure to the project.

This collaboration enabled seamless bitcoin payments that integrate directly with Costa Rica’s financial system, allowing users to pay anyone, even businesses that don’t directly accept bitcoin, while the recipient receives funds in colónes or dollars.

“I can go to a hardware store, order steel for my new basketball court, pay in bitcoin, and the store gets dollars,” Scotford said. “For a non-tech guy like me, it’s magical.”

Why Aren’t There More Bitcoin Jungles?

Scotford sees an opportunity for more localized bitcoin economies.

“There should be a Bitcoin Harbor, a Bitcoin Mountain, a Bitcoin Driveway,” he joked. “But instead of waiting for permission or corporate funding, people need to take action themselves.”

He emphasizes that building a circular bitcoin economy doesn’t require deep pockets. “I probably gave away $600 worth of bitcoin when we started — just $3 here, $4 there — to get people using it.”

The Future of Bitcoin Jungle

Bitcoin Jungle continues to grow, recently hosting events like the Bitcoin Freedom Festival and integrating bitcoin into community projects, including a school where tuition can be paid in bitcoin.

“The institutions have come in, but the grassroots projects haven’t caught up,” Scotford observed. “It’s time for people to stop sitting on their hands and start building.”

Bitcoin is permissionless, no one has to wait for approval to start using it. Bitcoin Jungle proves that with vision and persistence, anyone can build a thriving Bitcoin economy, one market stall at a time.

Get the latest from Bitcoin Jungle: follow them on X

-

@ b1ddb4d7:471244e7

2025-06-17 12:01:44

@ b1ddb4d7:471244e7

2025-06-17 12:01:44Years ago, I flew a microlight aircraft for the first time and felt what it meant to leave the ground. Recently, I bought a gigabyte of storage for 5 cents via Lightning, and something similar happened. This is about that moment—when you stop believing something works and start knowing it does.

Every now and then (if you’re lucky) you have one of those “eureka” moments where the full implications of something hit you for the first time. My biggest experience of that was years ago when I got a microlight aircraft. They’d just come out, so there were no regulations, and anyone could buy one and just fly.

People who should never be flying were going all over the place, and—having no navigation training—they were following motorways instead. Some were even landing at the service stops to get more fuel. How could I resist?

The price included training at an old airfield that was now not busy at all. After a lot of taxiing along the runways, it came time to try a takeoff. Nothing can prepare you for that. It’s not like a Cessna or any of those “proper” aircraft; it’s just an aluminum frame, and you hang off the center of the main pole, the center of gravity. There was a twin motor behind me, totaling 250 cc. I could feel where the wind was on the wings, which side, and even how far along. It was an insight into what birds must feel. I’d trade wings for a big brain any day!

I hit the gas on full, and we accelerated. I had been told that this thing could fly. and had seen my teacher fly in it many times. I thought I understood that it could fly, but as I left the ground and the drag on the wheels was suddenly gone, the whole thing lurched up into the air fast, at a really steep angle, and before I could think, I was already higher than a house. That was when I understood that this thing could fly. Belief is not knowledge, and knowledge only comes from experience.

So it is with many things. So it is with Bitcoin and the Lightning Network. I believed that Lightning could “transform the economic landscape.” I had read about how bitcoin can “revolutionize the financial system.” What hadn’t happened yet was that I had not actually experienced it. That take-off moment came when someone sent me a file link on a CDN. I downloaded the PDF (300 MB or so) and then cut the end off the URL to have a look at the service provider.

To my surprise, they were offering storage space on the CDN at 5c per gigabyte per month. with “unlimited” data transfer. So I decided to try it out. Within a few seconds I had ordered, paid for, and received my credit, and the service was available. 5 cents! That was when I realized how simple everything else in the world can be with Bitcoin and the Lightning Network.

Who cares about how many stupid dollars you can get with bitcoin? Look at what you can do with it! In the new world that may be opening up for us, we can rid ourselves of the parasites who have held us back for so long. “When moon?” takes on a whole different meaning. Nothing is beyond our reach.

There was no bitcoin back in the Spanish Civil War when Durruti was doing his thing, but something of the same awakening must have stirred in him to inspire these words: “We should not be in the least afraid of ruins. They may blast and lay bare this world before they go, but we carry a new world here in our hearts, and this world is growing as we speak.”

https://satellite.earth is the site. It’s not just a storage provider; it’s a Nostr node you can use like any other node, and it has communities set up, among other things. It’s well worth a look. No, I’m not getting paid; they don’t even know me. And I’m not sure, but it looks like because I haven’t used the whole 1 GB yet, they are using my 5c to extend the time I have. In other words, it’s 5c per gigabyte-month, not per gigabyte per month.

-

@ cae03c48:2a7d6671

2025-06-17 12:01:22

@ cae03c48:2a7d6671

2025-06-17 12:01:22Bitcoin Magazine

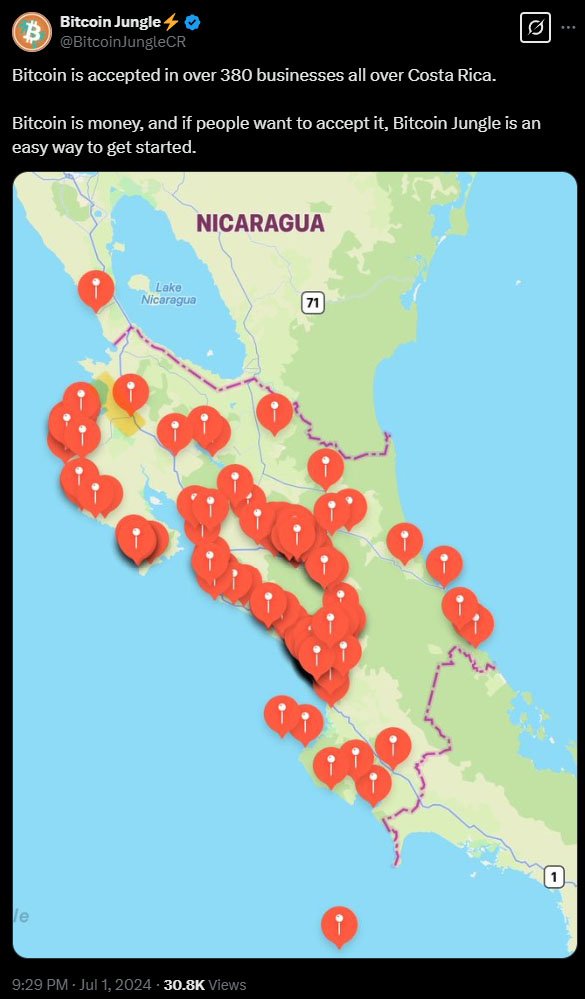

Strategy Acquires 10,100 BTC, Surpasses 592,000 Bitcoin in HoldingsMichael Saylor’s Strategy announces it has purchased an additional 10,100 BTC for approximately $1.05 billion, raising its total holdings to 592,100 BTC acquired at an average cost of $70,666 per Bitcoin.

BREAKING:

STRATEGY BUYS ANOTHER 10,100 #BITCOIN pic.twitter.com/TZ6nosWenr

STRATEGY BUYS ANOTHER 10,100 #BITCOIN pic.twitter.com/TZ6nosWenr— Bitcoin Magazine (@BitcoinMagazine) June 16, 2025

Strategy added another 10,100 Bitcoin to its treasury between June 9 and June 15, 2025, according to a Form 8-K filed Monday with the SEC. The company spent approximately $1.05 billion on the latest allocation, paying an average price of $104,080 per Bitcoin, inclusive of fees and expenses.

This brings Strategy’s total holdings to 592,100 BTC, acquired at a cumulative cost of $41.84 billion, or an average price of $70,666 per Bitcoin, solidifying its status as the world’s largest corporate holder of Bitcoin.

The recent allocation was financed through multiple capital raises. Strategy tapped its STRK and STRF at-the-market offerings, and completed a $979.7 million public offering of STRD, its 10.00% Series A Perpetual Stride Preferred Stock, on June 10.

“The Bitcoin purchases were made using proceeds from the STRK ATM, STRF ATM, and STRD Offering,” the company stated.

In addition to the purchase, Strategy reported a 19.1% BTC yield year-to-date in 2025, reflecting the strength of its long-term bitcoin investment thesis.

This latest acquisition follows a series of steady purchases throughout 2024 and early 2025. Strategy has continued to scale its position quarter over quarter, using capital market tools to accumulate Bitcoin as part of its strategy.

“Strategy continues to execute on its commitment to the Bitcoin standard,” the company stated in its filing.

The company continues to emphasize transparency around its holdings. Its website, strategy.com, hosts a Bitcoin Dashboard that is regularly updated with BTC purchase details, securities activity, and performance metrics in compliance with Regulation FD.

Strategy’s move comes during increasing institutional adoption of Bitcoin in 2025. The company’s acquisition strategy and consistent messaging have made it a leader for corporate engagement with the digital asset.

With its most recent buy, Strategy now holds over 592,000 Bitcoin, a significant portion of the asset’s fixed 21 million supply—showing its view of Bitcoin not just as an investment, but as a core component of its financial strategy.

This post Strategy Acquires 10,100 BTC, Surpasses 592,000 Bitcoin in Holdings first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-17 12:01:17

@ cae03c48:2a7d6671

2025-06-17 12:01:17Bitcoin Magazine

Senator Hagerty’s Vision Beyond The GENIUS Act: Make Tennessee A Hub For Bitcoin MiningSenator Bill Hagerty (R-TN) has been in the headlines as of late as the GENIUS Act (S. 1582), a bill for which he was the primary sponsor, moves closer to passing in the U.S. Senate.

The GENIUS Act is a bill that, if enacted into law, would create a federal regulatory framework for stablecoins so that the technology can be more widely adopted. (While some Bitcoin enthusiasts may not like this, they should still pay attention to the language in the bill, as it could have an impact on U.S. citizens’ ability to use Bitcoin wallets privately.)

However, stablecoins aren’t the only thing on Senator Hagerty’s mind.

He’s also thinking about how to best produce and harness energy in Tennessee to use it for Bitcoin mining and AI compute.

He shared his vision on this topic with me in an interview I conducted with him at Bitcoin 2025:

Tennessee As A Hub For Bitcoin Mining and AI Compute

“We have an opportunity before us to be in the very lead,” Senator Hagerty told Bitcoin Magazine in regard to building nuclear facilities that can be used to produce energy for Bitcoin mining and AI processing.

“The largest utility in the world is the Tennessee Valley Authority — certainly the largest one in America — and I think we’ve got a unique opportunity here to move forward and become the energy hub of America,” he added.

“[We should] see more and more not only mining operations, but if you think about what Elon Musk is doing in Memphis with xAI, the data centers, the opportunities with artificial intelligence — there are many, many things that are going to happen in Tennessee.”

The Senator added that he believes the state can also strike partnerships with Oak Ridge National Laboratory, Vanderbilt University, the University of Tennessee and Tennessee Tech as it works to become a more friendly destination for Bitcoin miners and data centers.

“We’ve got great opportunities [from] Memphis all the way across the state,” said Senator Hagerty.

Hagerty’s Call For Bipartisanship

Whether it’s working toward stablecoin legislation or crafting regulation that will enable industries like Bitcoin mining and data centers to thrive in the United States, Senator Hagerty believes these efforts should be inherently bipartisan.

“[These are] bipartisan — or nonpartisan issue[s] — frankly,” said the Senator.

“If you care about the competitiveness of America — if you want to see innovation happen on our shores rather than being pushed overseas — then you’re going to support what we’re trying to do in terms of putting a regulatory framework in place that will deliver certainty, that will create an ecosystem here in America that will allow these companies to thrive,” he added.

“It’s not just the stablecoin legislation I’m putting forward or what may happen with Bitcoin or other technologies like that. It’s the overall blockchain technology that’s going to help advance America beyond the 21st century. We need to stay in the lead. We can stay in the lead.”

This post Senator Hagerty’s Vision Beyond The GENIUS Act: Make Tennessee A Hub For Bitcoin Mining first appeared on Bitcoin Magazine and is written by Frank Corva.

-

@ cae03c48:2a7d6671

2025-06-17 12:01:15

@ cae03c48:2a7d6671

2025-06-17 12:01:15Bitcoin Magazine

Michael Saylor and Pakistan’s Crypto Minister Bilal Talk Bitcoin and Global InvestmentPakistan’s Finance Minister Muhammad Aurangzeb and State Minister of Crypto Bilal Bin Saqib, held a conversation recently with the Executive Chairman and CEO of Strategy, Michael Saylor, about Bitcoin and its potential role in Pakistan’s economy.

BREAKING:

Pakistan’s Finance Minister and State Minister on Crypto Bilal just talked with Michael Saylor about #Bitcoin

Pakistan’s Finance Minister and State Minister on Crypto Bilal just talked with Michael Saylor about #Bitcoin Nation States are here

pic.twitter.com/aa5tM5kKbY

pic.twitter.com/aa5tM5kKbY— Bitcoin Magazine (@BitcoinMagazine) June 15, 2025

Saylor highlighted the critical role of trust and leadership in attracting global capital, citing his own journey of turning a $400 million investment into a $40 billion market backed position through Bitcoin.

“Today, I will stay in touch with Bilal,” he said. “Pakistan has many brilliant people and a lot of people to do business with you. My company had less than $400 million to invest, but the markets gave me $40 billion because they trust us. And so the most important thing is leadership, intellectual leadership and that they trust you.”

Saylor further emphasized that trust and clarity of vision are what drive global capital flows.

“If the world trusts you and they hear your words, and you speak particularly, the capital and the capability will flow to Pakistan,” said Saylor. “It’s there, it wants to find a home and that’s what happened with our company. Our success is because we were clear and committed. And once the market decides who the leader is. They get behind the leader and they send their money to you. And I think they’d do it to Pakistan too. You have the most important thing, which is you have a commitment and a will and clarity here. So, I look forward to working with you.”

The new stance is a stark change for Pakistan, which had previously banned Bitcoin trading in 2018. On March 20, Bilal Bin Saqib told Bloomberg that Pakistan was planning to legalize Bitcoin and try to implement a regulatory framework to attract investors.

“Pakistan is done sitting on the sidelines,” said Saqib. “We want to attract international investment because Pakistan is a low-cost, high-growth market with 60% of the population under 30… Trump is making crypto a national priority, and every country, including Pakistan, will have to follow suit.”

During the 2025 Bitcoin Conference in Las Vegas, Saqib announced that Pakistan was creating a strategic Bitcoin reserve.

“Today, I will announce that the Pakistan government is setting up their own government led Bitcoin strategic reserve… and this wallet, the national Bitcoin wallet,” said Saqib. “It’s not for speculation or hype. We will be holding this Bitcoin and we will never ever sell them.”

This post Michael Saylor and Pakistan’s Crypto Minister Bilal Talk Bitcoin and Global Investment first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 502ab02a:a2860397

2025-06-17 05:54:52

@ 502ab02a:a2860397

2025-06-17 05:54:52ปี 1937 — บริษัท Hormel Foods Corporation ในเมืองออสติน รัฐมินนิโซตา สหรัฐฯ ชายคนหนึ่งชื่อ Jay C. Hormel ลูกชายของผู้ก่อตั้งบริษัท มีไอเดียแสนทะเยอทะยานว่า “อยากทำผลิตภัณฑ์จากหมู ที่เก็บได้นาน ไม่ต้องแช่เย็น และไม่แพง”

เพราะตอนนั้น หมูเหลือเยอะ โดยเฉพาะ “หัวไหล่หมู” ที่ขายไม่ออก เพราะมันไม่ใช่ชิ้นเนื้อพรีเมียมที่คนอยากซื้อไปทำอาหาร เจย์เลยทดลองบดเนื้อไหล่หมู เติมเกลือ น้ำตาล สารกันเสีย โซเดียมไนไตรต์ และสิ่งสำคัญสุดคือ เจลาตินจากน้ำต้มกระดูก เพื่อให้เนื้อเกาะตัว ไม่แห้ง และอยู่ได้นานโดยไม่ต้องแช่เย็น

ผลลัพธ์คือ หมูกระป๋อง 340 กรัมในกล่องสี่เหลี่ยม พร้อมเปิดฝาดึงด้วยมือ ไม่ต้องใช้ที่เปิดกระป๋อง ชูความ ราคาถูก เก็บง่าย พกพาสะดวก และไม่ต้องปรุงอะไรเพิ่มเติม ซ่อนความของเหลือเอาไว้เงียบๆ

และเพื่อให้คนจำได้ง่าย บริษัทจัดประกวดตั้งชื่อ และผู้ชนะเสนอคำว่า “Spam” = Spiced Ham (แต่ไม่มีใครรู้จริงๆ ว่าย่อจากอะไรแน่) แค่ “สั้น จัดจ้าน และจำง่าย” ก็พอ

เมื่อเกิดสงครามโลกครั้งที่ 2 ในปี 1939 สหรัฐฯ ยังไม่เข้าสงครามเต็มตัว แต่เริ่มเตรียมเสบียงสนับสนุนพันธมิตร และ Spam กลายเป็นของขวัญจากพระเจ้า เพราะ เก็บได้นานหลายปี ไม่ต้องแช่เย็น น้ำหนักเบา เปิดง่าย ไม่เสียง่ายแม้เจอฝุ่น โคลน หรือไอร้อนจากปืนใหญ่

รัฐบาลสหรัฐฯ เริ่มจัดสั่ง Spam ให้กับกองทัพในสัดส่วนที่มากขึ้นเรื่อยๆ โดยเฉพาะทหารแนวหน้าในยุโรปและแปซิฟิก เช่น ฮาวาย, ฟิลิปปินส์, กวม, และเกาหลี ระหว่างสงคราม Hormel ผลิต Spam มากถึง 15 ล้านกระป๋องต่อสัปดาห์ และส่งออกไปมากกว่า 100 ล้านกระป๋อง ภายในเวลาไม่กี่ปี

Jay C. Hormel ถือว่ามีบทบาททางสังคมและการเมืองอยู่ไม่น้อย โดยเฉพาะช่วงก่อนสงครามโลกครั้งที่ 2

เขาเคยเป็นสมาชิกของ America First Committee ซึ่งเป็นกลุ่มเคลื่อนไหวทางการเมืองที่มีอิทธิพลมากในช่วงก่อนสงครามโลกครั้งที่ 2 โดยกลุ่มนี้มีเป้าหมายคือ “ต่อต้านการที่อเมริกาจะเข้าไปร่วมสงครามในยุโรป” สมาชิกของกลุ่มนี้มีทั้งนักธุรกิจใหญ่ สื่อมวลชน นักวิชาการ รวมถึงชาร์ลส ลินด์เบิร์ก (นักบินชื่อดัง) เรียกได้ว่าเป็นกลุ่มที่มีอิทธิพลเชิงความคิดและการเมืองในช่วงปลายยุค 1930s

แม้ในตอนแรก Hormel จะมีแนวคิดไม่เห็นด้วยกับการเข้าสงคราม แต่พอสงครามเริ่มต้นจริง และสหรัฐฯ ต้องส่งทหารและเสบียงออกไปรบ เขาก็ “ปรับตัวทันที” และกลายเป็นหนึ่งในผู้จัดหาอาหารรายใหญ่ให้กองทัพ โดยเฉพาะ Spam ที่ผลิตส่งเป็นล้านกระป๋องต่อสัปดาห์ ซึ่งแน่นอนว่าไม่มีทางทำได้ถ้าไม่มีความสัมพันธ์และการประสานงานกับภาครัฐโดยตรง

หลังสงครามโลกสิ้นสุดในปี 1945 สิ่งที่รัฐบาลและภาคธุรกิจต้องเจอคือ จะทำยังไงกับโรงงานผลิตอาหารที่เคยทำเพื่อ “เลี้ยงทหารนับล้าน” แต่ตอนนี้ไม่มีสงครามแล้ว? Hormel ไม่ยอมให้ Spam หายไปจากโต๊ะอาหารโลกง่ายๆ แผนการตลาดที่ฉลาดมากของพวกเขาคือ 1. “Sell the nostalgia” ขายความทรงจำ! คนอเมริกันที่เป็นทหารผ่านศึก กลับมาใช้ชีวิตปกติ แต่ก็ยังคุ้นเคยกับ Spam อยู่แล้ว ก็ขายให้พวกเขานั่นแหละ 2. “ผูกกับอาหารเช้า” Hormel ทำสูตร “Spam and eggs” และโฆษณาว่าเป็นอาหารเช้าที่ให้พลังงาน ย่อยง่าย และเหมาะกับทุกครอบครัว 3. เจาะตลาดประเทศที่ได้รับ Spam ระหว่างสงคราม ฟิลิปปินส์, ฮาวาย, ญี่ปุ่น, เกาหลีใต้, อังกฤษ กลายเป็นตลาดหลัก บางประเทศพัฒนาเมนูท้องถิ่นกับ Spam เช่น ฟิลิปปินส์ Spam silog (Spam + ข้าว + ไข่ดาว), เกาหลี 부대찌개 (Budae-jjigae) หรือหม้อไฟทหาร, ญี่ปุ่น Spam onigiri, ฮาวาย Spam musubi (สแปมวางบนข้าว ปิดด้วยสาหร่าย) 4. สร้างแบรนด์ให้รัก Hormel สนับสนุนการจัดงานเทศกาล Spam (เช่น Spam Jam) และทำให้แบรนด์กลายเป็น Pop Culture ของอเมริกา เพื่อโปรโมตแบรนด์ให้เป็นของอเมริกันจ๋า ทั้งน่ารัก ทั้งเท่ ทั้งกินง่าย และกลายเป็นความภูมิใจของชนชั้นกลาง

ระหว่างปี 1937–1946 Spam สร้างชื่อให้ Hormel อย่างถล่มทลาย ถึงขั้นรัฐบาลโซเวียตยังเคยร้องขอให้สหรัฐฯ ส่ง Spam เข้าโซเวียตเพื่อเลี้ยงทหารแนวหน้า โดย นายพล Dwight D. Eisenhower (ต่อมาคือประธานาธิบดีสหรัฐฯ) เคยกล่าวว่า “I ate my share of Spam along with millions of other soldiers. I’ll even confess to a few unkind remarks about it—uttered during the strain of battle... But as former Commander in Chief, I believe I can still see Spam in my dreams.” (ฉันกิน Spam มากพอๆ กับทหารหลายล้านคน แม้จะเคยบ่นบ้าง แต่ในฐานะอดีตแม่ทัพใหญ่...ฉันยังฝันเห็นมันเลย)

Jay C. Hormel ไม่ใช่แค่คนขายหมู แต่เขาเป็นนักวางระบบอุตสาหกรรมขั้นเทพ สามารถยกระดับกิจการท้องถิ่นของพ่อให้กลายเป็นบริษัทอาหารที่ส่งออกระดับโลกได้ เขาเป็น early adopter ของสิ่งที่เรียกว่า vertical integration คือควบคุมทุกขั้นตอน ตั้งแต่ฟาร์ม โรงฆ่าสัตว์ โรงงาน บรรจุภัณฑ์ จนถึงการขนส่งและการตลาด

ในปี 1970s รายการตลกชื่อดังของอังกฤษอย่าง Monty Python’s Flying Circus ได้เอา Spam มาเล่นมุกในตอนหนึ่ง โดยฉากคือร้านอาหารที่ทุกเมนูมี Spam อยู่ในนั้น แล้วลูกค้าพยายามสั่งอาหารโดยไม่เอา Spam แต่ร้านไม่ยอม เพราะ “เมนูเรามี Spam ทุกอย่าง!” จนเสียงลูกค้ากับแม่ค้ากลายเป็นการโต้เถียงอันแสนตลก และมีนักแสดงแต่งเป็นไวกิ้งยืนร้อง “Spam, Spam, Spam, Spam...” ซ้ำๆ อยู่ด้านหลังแบบไม่รู้จบ https://youtu.be/anwy2MPT5RE?si=-68WQeng47lhJENJ

ฉากนั้นกลายเป็นตำนานในโลกตลก และคำว่า “Spam” ก็เริ่มถูกใช้เป็นคำสแลงหมายถึง “ของที่ซ้ำซาก ไร้สาระ รบกวน” ซึ่งต่อมาก็กลายเป็นคำที่เราใช้เรียกอีเมลหรือข้อความขยะนั่นเอง

จะว่าไปแล้ว Spam ถือเป็น “สินค้าที่ครอบงำและเปลี่ยนแปลงอาหารของโลกอีกตัวนึง” อย่างแท้จริง จากเศษหมูไร้คนซื้อ → สินค้าแห่งนวัตกรรมอาหาร → เสบียงสงคราม → อาหารเช้าคลาสสิก → วัฒนธรรมท้องถิ่น → Meme ตลก → และสุดท้ายก็กลายเป็นคำด่าบนอินเทอร์เน็ต

Jay C. Hormel ไม่ได้เป็นนักการเมือง แต่เขาเป็น “นักอุตสาหกรรมที่มีบทบาททางการเมือง” โดยเฉพาะในช่วงเปลี่ยนผ่านของประเทศจาก “ไม่เอาสงคราม” ไปสู่ “ต้องชนะสงคราม”

เขาอาจเริ่มจากแนวคิด “อย่ายุ่งเรื่องคนอื่น” แต่พอเห็นว่าโอกาสมา เขาก็เปลี่ยนโหมดทันที และทำให้ Spam กลายเป็นเสบียงระดับชาติ แบบนี้แหละเฮียถึงบอกว่า “สงครามทำให้คนธรรมดากลายเป็นตำนาน” ...หรือไม่ก็ “สงครามทำให้ธุรกิจธรรมดากลายเป็นธุรกิจผูกขาดที่ไม่มีใครเลิกกินได้อีกเลย”

Spam ไม่ใช่แค่อาหารกระป๋อง แต่เป็นเครื่องมือทางภูมิสงคราม อุตสาหกรรม และการตลาด จากห้องครัวทดลองเล็กๆ ในมินนิโซตา กลายเป็นไอเท็มในสนามรบระดับโลก และสุดท้าย…ก็กลายเป็นทั้ง อาหารในตู้, มุกในมุขตลก, และ คำด่าบนโลกออนไลน์ ทั้งหมดนี้เริ่มต้นจากคำเดียว... "หมูมันเหลือ"

#pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ eb0157af:77ab6c55

2025-06-17 12:02:18

@ eb0157af:77ab6c55

2025-06-17 12:02:18The banking giant is exploring an expansion of its blockchain services, focusing on digital payments and currencies.

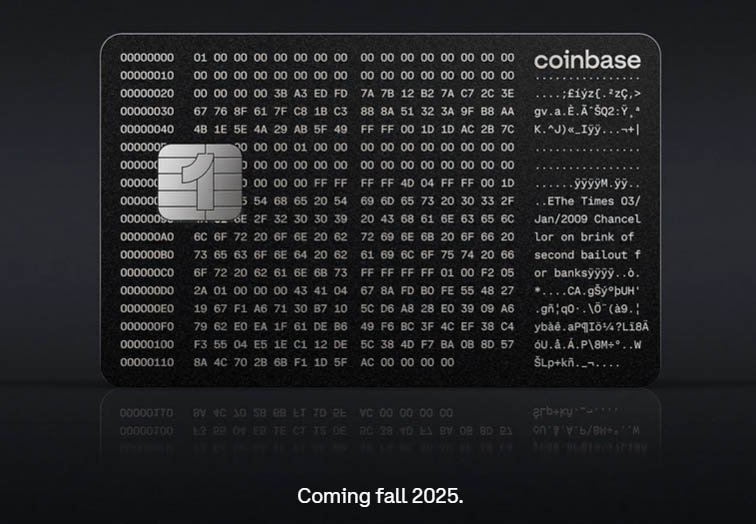

JPMorgan Chase has filed a new trademark application for the name “JPMD.” The filing was submitted on June 15 to the United States Patent and Trademark Office (USPTO).

The application, filed by JPMorgan Chase Bank, N.A., covers a broad range of services related to digital assets and blockchain technology. These include the issuance of digital currencies, electronic payment processing, and financial custody services — all of which suggest a possible new stablecoin initiative for JPMorgan.

Experience with JPM Coin

This move wouldn’t be JPMorgan’s first foray into blockchain-based finance. The bank already operates JPM Coin, a dollar-pegged stablecoin used to enable instant transactions between institutional clients. The token runs on Quorum, a private blockchain network developed in-house by JPMorgan and based on Ethereum’s technology.

The registration of the JPMD trademark comes as JPMorgan and other major U.S. banks are considering a collaborative stablecoin project through their jointly owned entities: Early Warning Services and The Clearing House.

Similarly, corporations like Walmart and Amazon are mulling the creation of their own stablecoins.

The post JPMorgan files trademark for ‘JPMD’: a new stablecoin on the horizon for the American bank appeared first on Atlas21.

-

@ b1ddb4d7:471244e7

2025-06-17 05:02:27

@ b1ddb4d7:471244e7

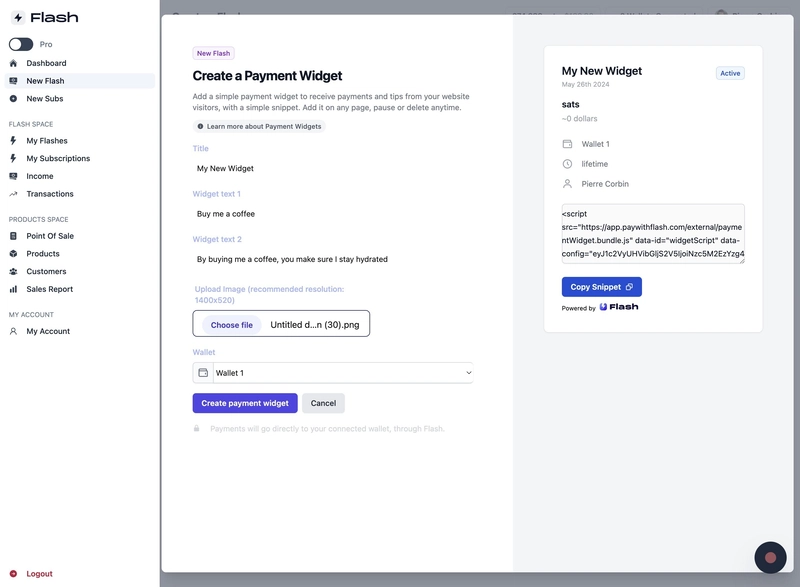

2025-06-17 05:02:27This article was originally published on dev.to by satshacker.

Alright, you’ve built a useful and beautiful website, tool or app. However, monetization isn’t a priority and you’d rather keep the project free, ads-free and accessible?

Accepting donations would be an option, but how? A PayPal button? Stripe? Buymeacoffe? Patreon?

All of these services require a bank account and KYC verification, before you can send and receive donations – not very convenient.

If we only could send value over the internet, with just one click and without the need of a bank account…

Oh, hold on, that’s bitcoin. The decentralized protocol to send value across the globe. Money over TCP/IP.

In this article, we’ll learn how anyone can easily add a payment button or donation widget on a website or app.

Let’s get into it.

Introduction

Bitcoin is digital money that you can send and receive without the need for banks. While bitcoin is extremely secure, it’s not very fast. The maximum transactions per second (TPS) the network can handle is about 7. Obviously that’s not useful for daily payments or microtransactions.

If you’d like to dig deeper into how bitcoin works, a great read is “Mastering Bitcoin” by Andreas Antonopoulos.

Bitcoin vs Lightning

If you’d like to receive bitcoin donations “on-chain” all you need is a bitcoin wallet. You simply display your bitcoin address on your site and that’s it. You can receive donations.

It would look something like this; 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa

Instead of showing the actual bitcoin address, you can also turn it into a QR code.

However, this is not a recommended solution. Using static on-chain addresses has two major downsides. It lowers privacy for you and your donnors and it’s a UTXO disaster because many small incoming transactions could beocme hard to consolidate in the future.

For donations and small transactions, the Lightning Network is the better option. Lightning allows for instant settlement with fees only a fraction of a cent.

Similar to bitcoin, you have the choice between non-custodial and custodial wallets. This means, either you have full control over your money or the wallet provider has.

Option 1: Lightning Address

With the lightning address feature, you an easily receive donations to an email like address.

It looks like this: yourname@wallet.com

Many wallets support lightning addresses and make it easy to create one. Then, you simple add the address to your donation page and you’re ready to receive tips.

You can also add a link link as in lightning:yourname@wallet.com and compatible lightning wallets and browser wallets will detect the address.

Option 2: Lightning Donation Widgets

If you like to take it a step further, you can also create a more enhanced donation checkout flow. Of course you could programm something yourself, there are many open source libraries you can build upon. If you want a simple plug-and-play solution, here are a couple of options:

Name

Type

Registration

SatSale

Self-hosted

No KYC

BTCPay Server

Self-hosted

No KYC

Pay With Flash

Widget

Email

Geyser Fund

Widget

Email

The Giving Block

Hosted

KYC

OpenNode

Hosted

KYC

SatSale (GitHub)

Lightweight, self-hosted Bitcoin/Lightning payment processor. No KYC.

Ideal for developers comfortable with server management. Simple to deploy, supports both on-chain and Lightning, and integrates with WooCommerce.

BTCPay Server

Powerful, open-source, self-hosted processor for Bitcoin and Lightning. No KYC.

Supports multiple currencies, advanced features, and full privacy. Requires technical setup and maintenance. Funds go directly to your wallet; great for those seeking full control.

Pay With Flash

Easiest for indie hackers. Add a donation widget with minimal code and no KYC. Payments go directly to your wallet for a 1.5% fee.

Setup Steps:

- Sign up at PayWithFlash.com

- Customize your widget in the dashboard

- Embed the code:

- Test to confirm functionality

Benefits:

- Minimal technical skills required

- Supports one-time or recurring donations

- Direct fund transfer, no intermediaries

Geyser Fund

Crowdfunding platform. Widget-based, connects to your wallet, email registration.Focused on Bitcoin crowdfunding, memberships and donations.

The Giving Block

Hosted, KYC required. Integrates with fiat and crypto, best for nonprofits or larger organizations.

OpenNode

Hosted, KYC required. Accept Bitcoin payments and donations; supports conversion to fiat, suitable for businesses and nonprofits.

Summary

- Fast, low-code setup: Use Pay With Flash or Geyser Fund.

- Privacy and control: Choose SatSale or BTCPay Server (requires technical skills).

- Managed, compliant solutions: The Giving Block or OpenNode.

Choose based on your technical comfort, privacy needs, and project scale.

I hope this article helped you. If you added bitcoin donations, share your link in the comments and I will send you a few satoshis maybe

-

@ df478568:2a951e67

2025-06-16 20:09:29

@ df478568:2a951e67

2025-06-16 20:09:29 -

@ cae03c48:2a7d6671

2025-06-17 12:01:10

@ cae03c48:2a7d6671

2025-06-17 12:01:10Bitcoin Magazine

Trump Media Files to Launch Bitcoin and Ethereum ETFTrump Media & Technology Group has filed a registration statement with the U.S. Securities and Exchange Commission to launch the Truth Social Bitcoin and Ethereum ETF, B.T.

The ETF will directly hold Bitcoin and Ether, with an initial allocation of 75% Bitcoin and 25% Ether. Shares of the fund will be offered to investors to track the performance of these assets and are expected to trade on NYSE Arca once approved.

JUST IN:

Registration statement for Trump Media's Bitcoin Treasury deal was declared effective by the SEC

Registration statement for Trump Media's Bitcoin Treasury deal was declared effective by the SEC  pic.twitter.com/PFyy44qXxH

pic.twitter.com/PFyy44qXxH— Bitcoin Magazine (@BitcoinMagazine) June 13, 2025

Crypto.com has been selected as the exclusive custodian, prime execution agent, staking, and liquidity provider for the ETF. Yorkville America Digital, LLC is the sponsor of the fund.

According to the company’s announcement, “The launch of the Truth Social Bitcoin and Ethereum ETF is pending effectiveness of the Registration Statement as well as approval of a Form 19b-4 filing with the SEC.”

The fund is structured as a Nevada business trust. Shares will be issued and redeemed in blocks of 10,000 by authorized participants, with cash used for creation and redemption. The ETF may offer in-kind transactions in the future, pending additional regulatory approval.

Trump Media acknowledged, “A registration statement relating to the Shares has been filed with the SEC but has not yet become effective. The Shares may not be sold, nor may offers to buy be accepted, prior to the time the registration statement becomes effective.”

The ETF is not registered under the Investment Company Act of 1940, which typically governs mutual funds and traditional ETFs by imposing rules on investor protections, disclosures, and fund operations. Because the ETF holds Bitcoin and Ether directly rather than securities, it qualifies as a grantor trust and is exempt from these requirements.

The ETF filing also reflects Trump Media’s strategy to establish a presence in the digital asset space beyond social media and streaming. With the development of its financial services arm, Truth.Fi, the company is clearly positioning itself to compete in the growing digital asset space.

If approved, the Truth Social ETF would give investors a direct, regulated path into both Bitcoin and Ether through one fund. As Trump Media expands its presence in financial services, the move signals a clear intention to compete in the space.

This post Trump Media Files to Launch Bitcoin and Ethereum ETF first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 7f6db517:a4931eda

2025-06-16 19:02:17

@ 7f6db517:a4931eda

2025-06-16 19:02:17

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 19:02:16

@ 7f6db517:a4931eda

2025-06-16 19:02:16

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ e5cfb5dc:0039f130

2025-06-17 11:00:35

@ e5cfb5dc:0039f130

2025-06-17 11:00:35はりまメンタルクリニック:GIDの大手そう。丸の内線ならパムくんちが近い。

わらびメンタルクリニック:GIDの大手そう?公式サイトには影もかたちも

ナグモクリニック:SRS手術までしてるところ。GID精神科外来が月1第1木曜日だけ?

狭山メンタルクリニック:距離・時間的にはまま近い。サイトの記述が思想的にちょとあやしげ。新患受付がだいぶ先。GIDは専門外か?

川島領診療所:オンライン診療あり!強迫性障害や美容皮膚科をやっている。雰囲気よさそうなところ。GIDは専門外か?

Jこころのクリニック:電車いっぽんなので楽。GIDは専門外か?

ハッピースマイルクリニック:オンライン診療あり!GIDは専門外か?

-

@ cae03c48:2a7d6671

2025-06-17 12:01:03

@ cae03c48:2a7d6671

2025-06-17 12:01:03Bitcoin Magazine

H100 Group Receives 144.8 BTC in Convertible Loan DealH100 Group, Swedish health-tech firm, has received 144.8 BTC as part of a settlement tied to its convertible loan agreement, according to a company press release issued Monday. With this latest transaction, the Stockholm-based firm now holds a total of 169.2 BTC on its balance sheet.

H100 Group Receives 144.8 BTC as Partial Settlement Under Convertible Loan Framework. Now holds 169.2 BTC. pic.twitter.com/MAW044iXkG

— H100 (@H100Group) June 16, 2025

The 144.8 BTC was transferred as a part of the first four segments of H100’s loan agreement, which has been well received by investors thus far. H100 said in the release, “H100 Group AB (‘H100 Group’ or the ‘Company’) has today received 144.8 BTC as part of the proceeds from Tranches 1 through 4 under its previously announced convertible loan agreements.”

This follows recent reporting that Blockstream CEO Adam Back committed to lead a 750 million kronor (~$79 million) funding initiative for H100, anchored by a 150 million-krona injection in Tranche 6. The loan, structured for speed and cost-efficiency, was priced at 6.38 kronor per share—a 33% premium to market—showing investor confidence.

The loan structure includes settlement flexibility—either in cash or Bitcoin—which allows counterparties to opt for BTC delivery, reducing fiat friction and lining up with the firm’s long-term treasury outlook.

“Unexpectedly, given the strong reception, Tranches 1-4 became in-the-money rapidly,” Back told CoinDesk. “I was expecting [H100] would convert them over time as they reached in-the-money status.”

This funding approach allows H100 to bypass traditional rights issues while onboarding capital in a flexible manner. Tranches 7 and 8 are on deck, with room for size increases depending on market appetite.

This also reflects H100’s evolving financial strategy. While the company’s core operations remain focused on AI-driven health and longevity services, its growing Bitcoin position is reshaping how capital is raised, stored, and deployed. As of now, the company’s BTC holdings stand at 169.2 BTC—up from just 24.41 BTC prior to this latest tranche execution.

H100’s stock jumped 22% on Monday in response to the developments.

As the firm continues negotiations for future tranches and explores adoption of BTC as a financial backbone, it positions itself uniquely at the intersection of health tech and decentralized finance.

This post H100 Group Receives 144.8 BTC in Convertible Loan Deal first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-17 12:00:57

@ cae03c48:2a7d6671

2025-06-17 12:00:57Bitcoin Magazine

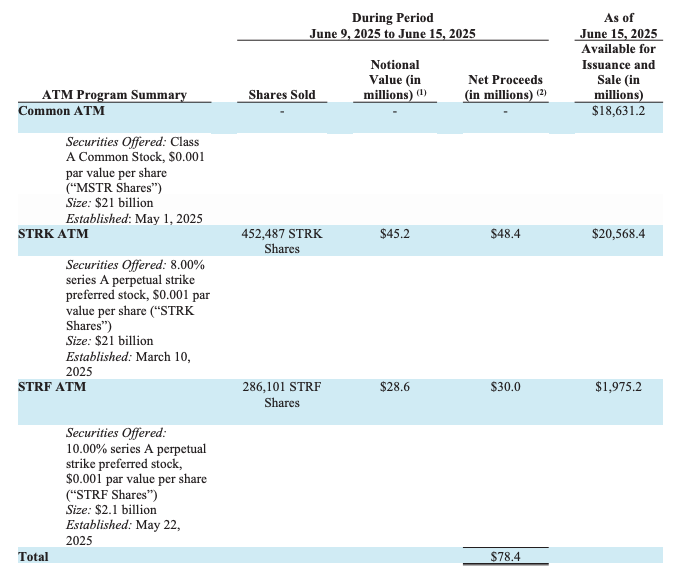

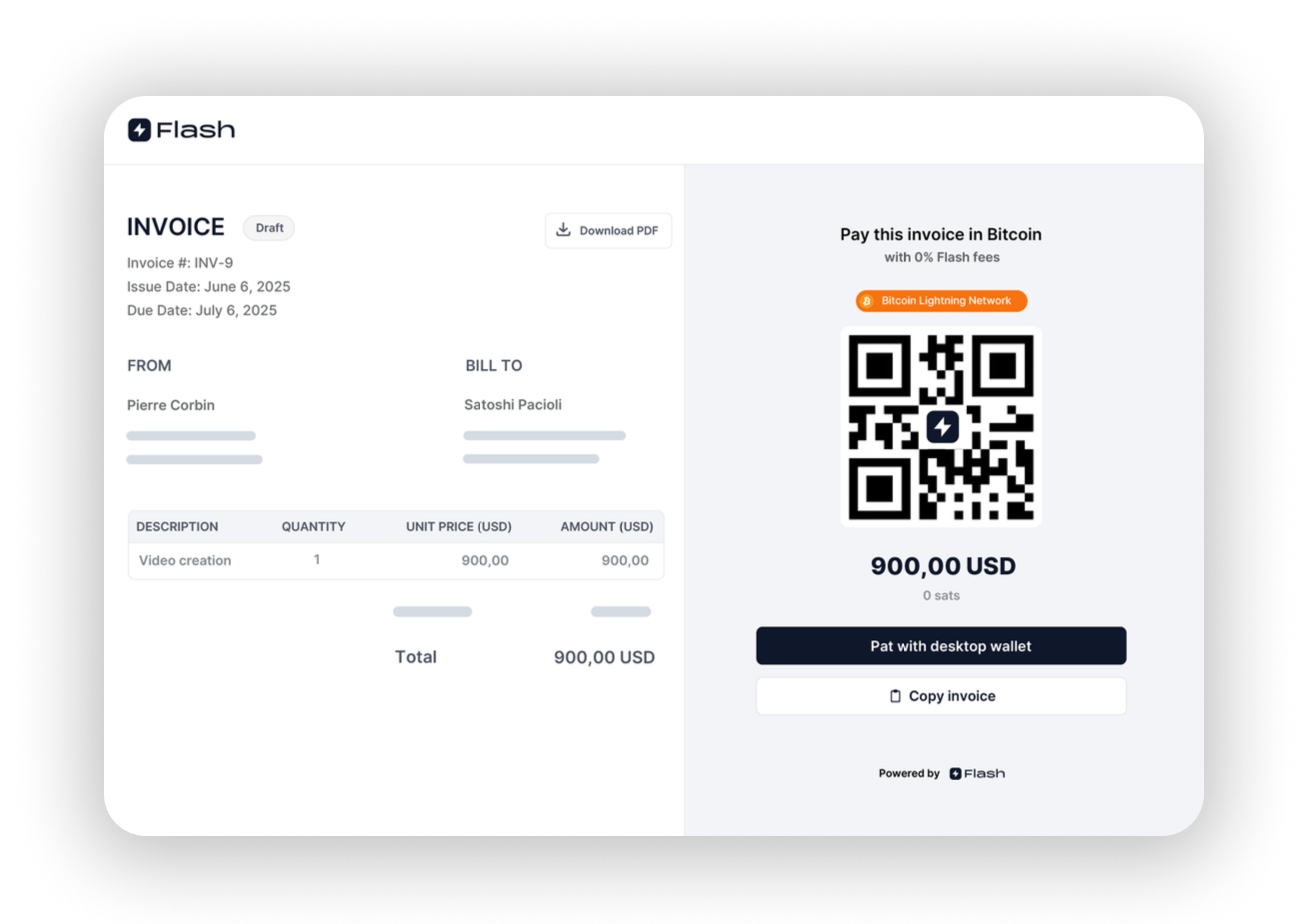

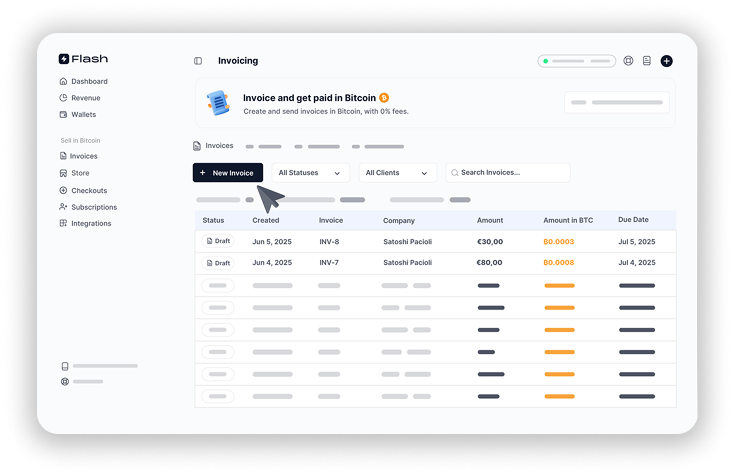

Flash Releases Free Bitcoin Invoicing Tool with No Fees, KYC, or CustodyFlash, a Bitcoin payment platform, just announced it has launched Flash Invoicing, a completely free, non-custodial, and KYC-free Bitcoin invoicing tool. Designed for freelancers, the platform allows users to send professional invoices without platform fees, identity checks, or third party custody.

According to Deel, a crypto payments company for freelancers, Bitcoin is the most used cryptocurrency in the world for payments. Despite this growth, many freelancers continue to use basic methods such as pasting Bitcoin addresses into PDFs or emails. Some rely on custodial platforms that deduct fees or require identity verification, which can affect both earnings and data privacy.

“We’ve seen too many people paste BTC addresses into documents and call it invoicing,” said the CEO of Flash Pierre Corbin. “It’s messy. It’s risky. And it’s time for something better.”

Flash Invoicing Features:

- 0% platform fees: no subscriptions or commission

- Non-custodial: Bitcoin goes straight to the user’s wallet

- No KYC: users maintain full privacy

- Professional output: branded PDFs and secure payment links

- Integrated dashboard: manage payments, clients, and revenue

- Works with Flash ecosystem: including Stores, Donations, Paywalls, and POS

Many Bitcoin invoicing tools charge a percentage per transaction or require a subscription. As a result, freelancers often lose part of their income simply to issue an invoice and receive payment. Flash is aiming to solve this issue.

“Freelancers work hard enough. The last thing they need is a platform skimming off their earnings,” said Corbin. “That’s why we dropped our fee from 1.5% to 0% — and launched the first invoicing tool that’s truly free, without compromising on privacy or control.”

Flash Invoicing allows users to accept Bitcoin payments without relinquishing control, privacy, or revenue. It is integrated with the broader Flash suite, enabling users to manage invoicing alongside features such as setting up stores, receiving donations, or gating premium content.

“As a freelancer myself, I love using the Flash invoicing feature,” stated a freelancer & Flash user. ”It keeps all my clients in one place, allows me to easily edit invoices and track payments. Much more professional than sending a lightning address in the footer of a PDF invoice.”

This post Flash Releases Free Bitcoin Invoicing Tool with No Fees, KYC, or Custody first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ e1cde248:609c13b0

2025-06-17 11:53:50

@ e1cde248:609c13b0

2025-06-17 11:53:50Arthur Hayes ได้ฉายภาพหนึ่งในปัญหาใหญ่ที่สุดที่เศรษฐกิจโลกกำลังเผชิญ นั่นคือ "ศึกเงียบระหว่างคนรุ่นเก่าและรุ่นใหม่" ที่กำลังจะปะทุขึ้นจากการโอนถ่ายความมั่งคั่งขนาดมหาศาลจากรุ่น Baby Boomer ไปยัง Millennials และ Gen Z

ในอีกไม่กี่ปีข้างหน้า คนรุ่น Boomer ซึ่งเป็นกลุ่มที่ถือครองทรัพย์สินมากที่สุดในประวัติศาสตร์ กำลังเข้าสู่วัยเกษียณ และเริ่มขายสินทรัพย์อย่างหุ้น บ้าน และอสังหาริมทรัพย์ เพื่อเปลี่ยนเป็นเงินสดใช้ในบั้นปลายชีวิต

แต่ปัญหาคือ... ใครจะซื้อของเหล่านั้น?

คนรุ่นใหม่ไม่ได้มองบ้านหลังใหญ่ในชานเมืองหรือหุ้นบริษัทน้ำมันเป็นเป้าหมายชีวิตอีกต่อไป พวกเขาให้คุณค่ากับ "ประสบการณ์" มากกว่าสิ่งของ อีกทั้งยังสนใจ "สินทรัพย์ดิจิทัล" มากกว่าทรัพย์สินแบบดั้งเดิม และเชื่อในอิสระมากกว่าความมั่นคง

สิ่งนี้นำไปสู่คำถามสำคัญที่อาจเปลี่ยนทิศทางเศรษฐกิจโลก:

-

หากไม่มีใครอยากซื้อ สินทรัพย์จะราคาตกหรือไม่? ถ้าเกิดขึ้นจริง นั่นหมายถึงคนรุ่น Boomer จะต้องเกษียณด้วยสินทรัพย์ที่มีมูลค่าลดลง และอาจต้องพึ่งพารัฐบาลมากขึ้น

-

แล้วภาระจะตกกับใคร? หากรัฐบาลต้องอุ้มค่าใช้จ่ายผู้เกษียณ สิ่งที่ตามมาคือ "ภาษีที่เพิ่มขึ้น" ซึ่งจะตกอยู่กับคนรุ่นใหม่ที่แทบยังไม่มีอะไรในมือ

-

หรือสุดท้าย ทางออกเดียวจะคือการ “พิมพ์เงิน”? Hayes คาดว่ารัฐบาลจะหันไปใช้วิธีนี้ ซึ่งอาจช่วยได้ในระยะสั้น แต่จะกลายเป็นเชื้อเพลิงเงินเฟ้อในระยะยาว

และนั่นคือจุดที่ "ความไม่พอใจระหว่างรุ่น" อาจปะทุขึ้นอย่างรุนแรง

คนรุ่นใหม่จะถามว่า "ทำไมเราต้องจ่ายเพื่อความล้มเหลวของระบบที่เราไม่ได้สร้าง?" ขณะที่คนรุ่นเก่าอาจตอบว่า "เราเสียภาษีมาทั้งชีวิตเพื่อระบบนี้ แล้วใครจะดูแลเรา?"

นี่ไม่ใช่แค่ความต่างทางวัย แต่คือ ความขัดแย้งทางโครงสร้างเศรษฐกิจและคุณค่าของชีวิต ที่กำลังทวีความรุนแรงขึ้น

Hayes มองว่า ผลลัพธ์ของความขัดแย้งนี้ อาจมีตั้งแต่การปรับขึ้นภาษีรุนแรง การเปลี่ยนแปลงระบบบำนาญ ไปจนถึง ความไม่มั่นคงทางการเงินระดับชาติ ที่อาจเปลี่ยนวิธีที่โลกจัดการกับเงิน สินทรัพย์ และอนาคตของคนแต่ละรุ่นไปอย่างสิ้นเชิง

และในโลกแบบนี้ Hayes ถึงเชื่อว่า Bitcoin จะเป็นผู้ชนะ เพราะมันไม่สามารถพิมพ์เพิ่มได้ ซึ่งตรงข้ามกับเงินเฟ้อที่กำลังมาท่วมโลก

source: https://www.youtube.com/watch?v=AH7TIPRKGZw

-

-

@ 7f6db517:a4931eda

2025-06-16 19:02:16

@ 7f6db517:a4931eda

2025-06-16 19:02:16

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 2cde0e02:180a96b9

2025-06-17 11:47:51

@ 2cde0e02:180a96b9

2025-06-17 11:47:51pen & ink; monochromized

https://stacker.news/items/1008456

-

@ 7f6db517:a4931eda

2025-06-16 19:02:15

@ 7f6db517:a4931eda

2025-06-16 19:02:15Will not live in a pod.

Will not eat the bugs.

Will not get the chip.

Will not get a blue check.

Will not use CBDCs.Live Free or Die.

Why did Elon buy twitter for $44 Billion? What value does he see in it besides the greater influence that undoubtedly comes with controlling one of the largest social platforms in the world? We do not need to speculate - he made his intentions incredibly clear in his first meeting with twitter employees after his takeover - WeChat of the West.

To those that do not appreciate freedom, the value prop is clear - WeChat is incredibly powerful and successful in China.

To those that do appreciate freedom, the concern is clear - WeChat has essentially become required to live in China, has surveillance and censorship integrated at its core, and if you are banned from the app your entire livelihood is at risk. Employment, housing, payments, travel, communication, and more become extremely difficult if WeChat censors determine you have acted out of line.

The blue check is the first step in Elon's plan to bring the chinese social credit score system to the west. Users who verify their identity are rewarded with more reach and better tools than those that do not. Verified users are the main product of Elon's twitter - an extensive database of individuals and complete control of the tools he will slowly get them to rely on - it is easier to monetize cattle than free men.

If you cannot resist the temptation of the blue check in its current form you have already lost - what comes next will be much darker. If you realize the need to resist - freedom tech provides us options.

If you found this post helpful support my work with bitcoin.

-

@ 5d085290:0edc3292

2025-06-17 11:19:53

@ 5d085290:0edc3292

2025-06-17 11:19:53SculpturesHome is a high-end custom sculpture factory in Shenzhen, China, with more than a decade of experience producing exclusive artwork for international clients. Their work encompasses hand-made and 3D-printed artworks such as animal sculptures and human statues, as well as decorative reliefs and furniture. They work in association with leading designers, interior companies, galleries, and individual artists to provide personalized sculptures for residences, hotels, workplaces, and public areas. Equipped with the latest machinery and skilled artisans, they provide quality care at each phase from sketch to last finish. Production times are usually between 4 and 12 weeks depending on size and complexity. SculpturesHome accommodates complete customization: customers may provide drawings, pictures, or idea notes to design uniques in every sense.

Their international shipping network covers North America, Europe, Asia, Australia, with safe and timely delivery. Shipping cost depends on weight, dimensions, destination, and selected mode (air/sea transport). Blending handmade artwork with 3D-printing technology, SculpturesHome provides high quality at affordable prices. Their workshop is located in the Silicon Valley Industrial Park, Longhua District, Shenzhen. Customer support is provided Monday to Friday (9am–8pm) and Saturday (10am–4pm) local time. SculpturesHome.com For questions, contact them through WhatsApp +86?13944048206 or email terry@sculptureshome.com.

-

@ 7f6db517:a4931eda

2025-06-16 19:02:15

@ 7f6db517:a4931eda

2025-06-16 19:02:15

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda