-

@ 7f6db517:a4931eda

2025-06-18 13:02:04

@ 7f6db517:a4931eda

2025-06-18 13:02:04

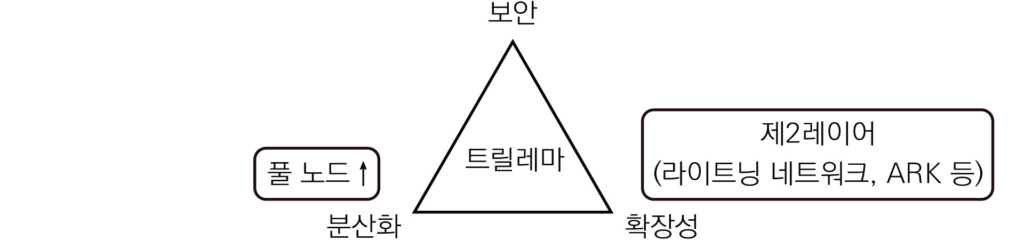

There must be a limit to how much data is transferred across the bitcoin network in order to keep the ability to run and use your own node accessible. A node is required to interact with the global bitcoin network - if you do not use your own node then you must trust someone else's node. If nodes become inaccessible to run then the network will centralize around the remaining entities that operate them - threatening the censorship resistance at the core of bitcoin's value prop. The bitcoin protocol uses three main mechanisms to keep node operation costs low - a fixed limit on the amount of data in each block, an automatic difficulty adjustment that regulates how many blocks are produced based on current mining hash rate, and a robust dynamic transaction fee market.

Bitcoin transaction fees limit network abuse by making usage expensive. There is a cost to every transaction, set by a dynamic free market based on demand for scarce block space. It is an incredibly robust way to prevent spam without relying on centralized entities that can be corrupted or pressured.

After the 2017 bitcoin fee spike we had six years of relative quiet to build tools that would be robust in a sustained high fee market. Fortunately our tools are significantly better now but many still need improvement. Most of the pain points we see today will be mitigated.

The reality is we were never going to be fully prepared - pressure is needed to show the pain points and provide strong incentives to mitigate them.

It will be incredibly interesting to watch how projects adapt under pressure. Optimistic we see great innovation here.

_If you are willing to wait for your transaction to confirm you can pay significantly lower fees. Learn best practices for reducing your fee burden here.

My guide for running and using your own bitcoin node can be found here._

If you found this post helpful support my work with bitcoin.

-

@ eb0157af:77ab6c55

2025-06-18 13:01:43

@ eb0157af:77ab6c55

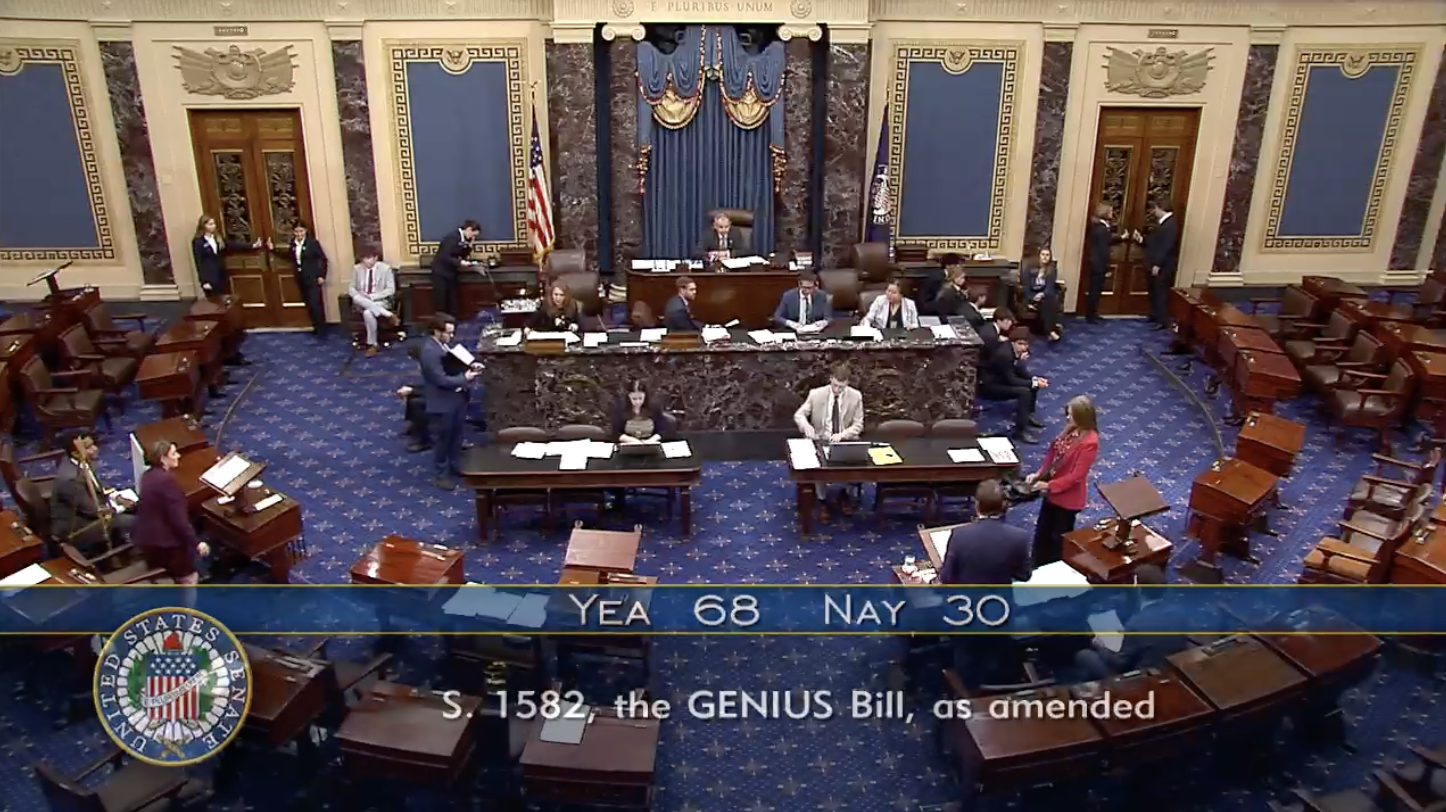

2025-06-18 13:01:43The House of Representatives will now decide whether to adopt its own proposal or the Senate’s version for the new stablecoin regulations.

The United States Senate has officially passed the GENIUS Act, marking another step toward establishing a federal regulatory framework for stablecoins. The final vote concluded with 68 in favor and 30 against, sending the bill to the House of Representatives for final approval in the coming weeks.

Republican Senator Bill Hagerty, sponsor of the bill, stated:

“The GENIUS Act establishes a pro-growth regulatory framework for payment stablecoins. This legislation will cement U.S. dollar dominance, protect consumers, and drive demand for U.S. Treasurys.”

New standards for stablecoins in the U.S.

The legislative proposal, officially titled the Guiding and Establishing National Innovation for US Stablecoins Act, sets strict legal requirements for stablecoin issuers. The bill mandates that every token must be fully backed by U.S. dollars or equally liquid assets (such as U.S. Treasurys), ensuring market stability and transparency.

Stablecoin issuers with a market capitalization exceeding $50 billion will be subject to mandatory annual audits, while foreign entities like Tether will be required to meet specific compliance rules to operate in the U.S. market.

Restrictions for Big Tech

One of the provisions of the GENIUS Act bans non-financial public companies — including giants like Meta and Amazon — from issuing stablecoins unless they meet stringent risk management and privacy standards. This measure aims to prevent potential conflicts of interest and concentrations of power in the digital currency sector.

In the event of an issuer’s insolvency, the bill grants stablecoin holders a “super-priority” status in bankruptcy proceedings, placing them ahead of other creditors in the repayment hierarchy.

Despite Senate approval, the GENIUS Act now faces a competing proposal in the House — the STABLE Act — which was advanced in committee last May. The two bills differ on key issues such as state versus federal oversight and the treatment of foreign stablecoin issuers. Reconciling these versions will be crucial before any legislation reaches President Trump’s desk for final signature.

The post U.S. Senate approves the GENIUS Act: now it moves to the House appeared first on Atlas21.

-

@ b1ddb4d7:471244e7

2025-06-18 13:01:23

@ b1ddb4d7:471244e7

2025-06-18 13:01:23Why are Stripe Alternatives are growing like mushrooms? When it comes to online payment processing, Stripe has long dominated the conversation.

However, with its complex pricing structure, strict policies and first-world focus, many entrepreneurs and companies are actively seeking viable Stripe alternatives.

Whether you’re a SaaS startup, e-commerce store, or global enterprise, choosing the right payment processor can significantly impact your bottom line and customer experience.

Table of Contents

- Why Consider Stripe Alternatives?

- The Complete List of Stripe Alternatives

- Additional Notable Mentions

- How to Choose the Right Stripe Alternative

- Conclusion

Why Consider Stripe Alternatives?

Before diving into our comprehensive list, it’s worth understanding why businesses are exploring alternatives to Stripe. While Stripe offers robust features and excellent developer tools, some businesses face challenges with pricing transparency, limited global coverage, or specific industry requirements that Stripe doesn’t fully address.

The Complete List of Stripe Alternatives

Based on extensive research and analysis of the payment processing landscape, here are 27 proven Stripe alternatives that could be the perfect fit for your business:

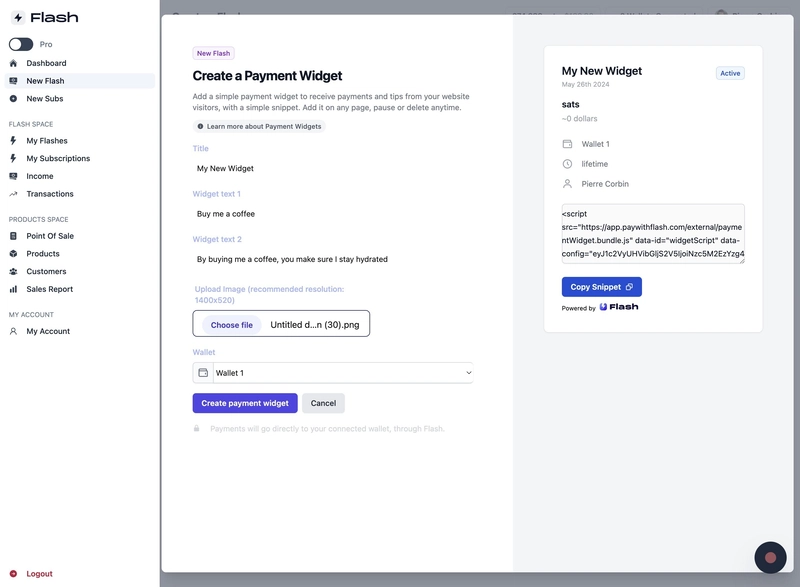

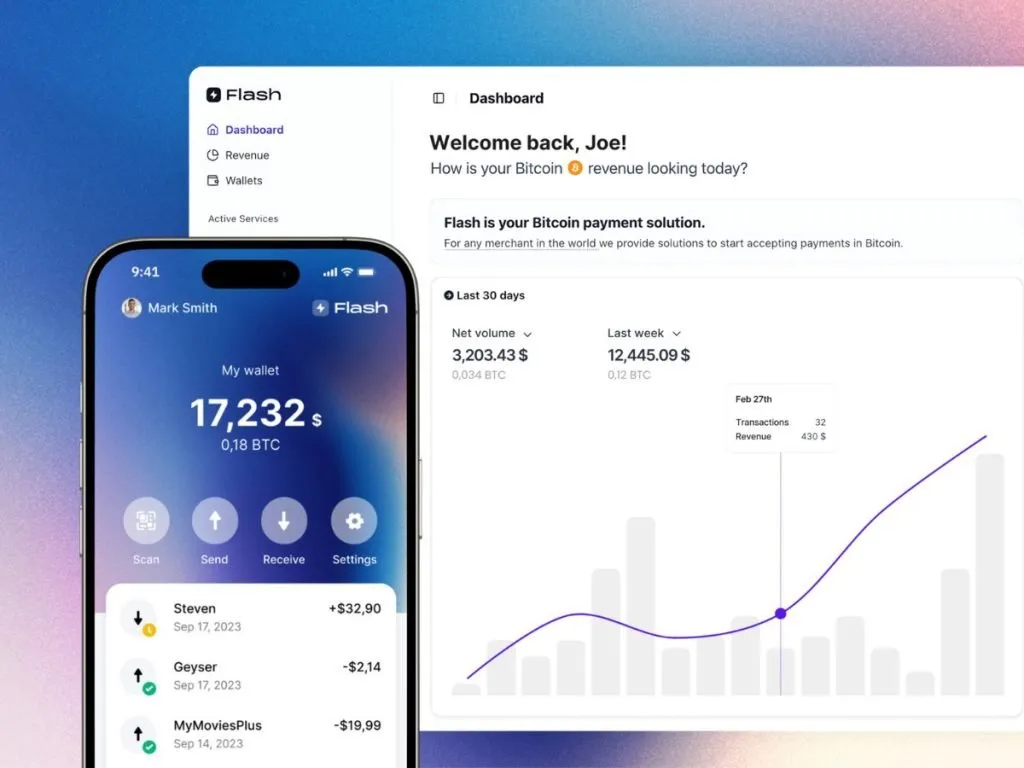

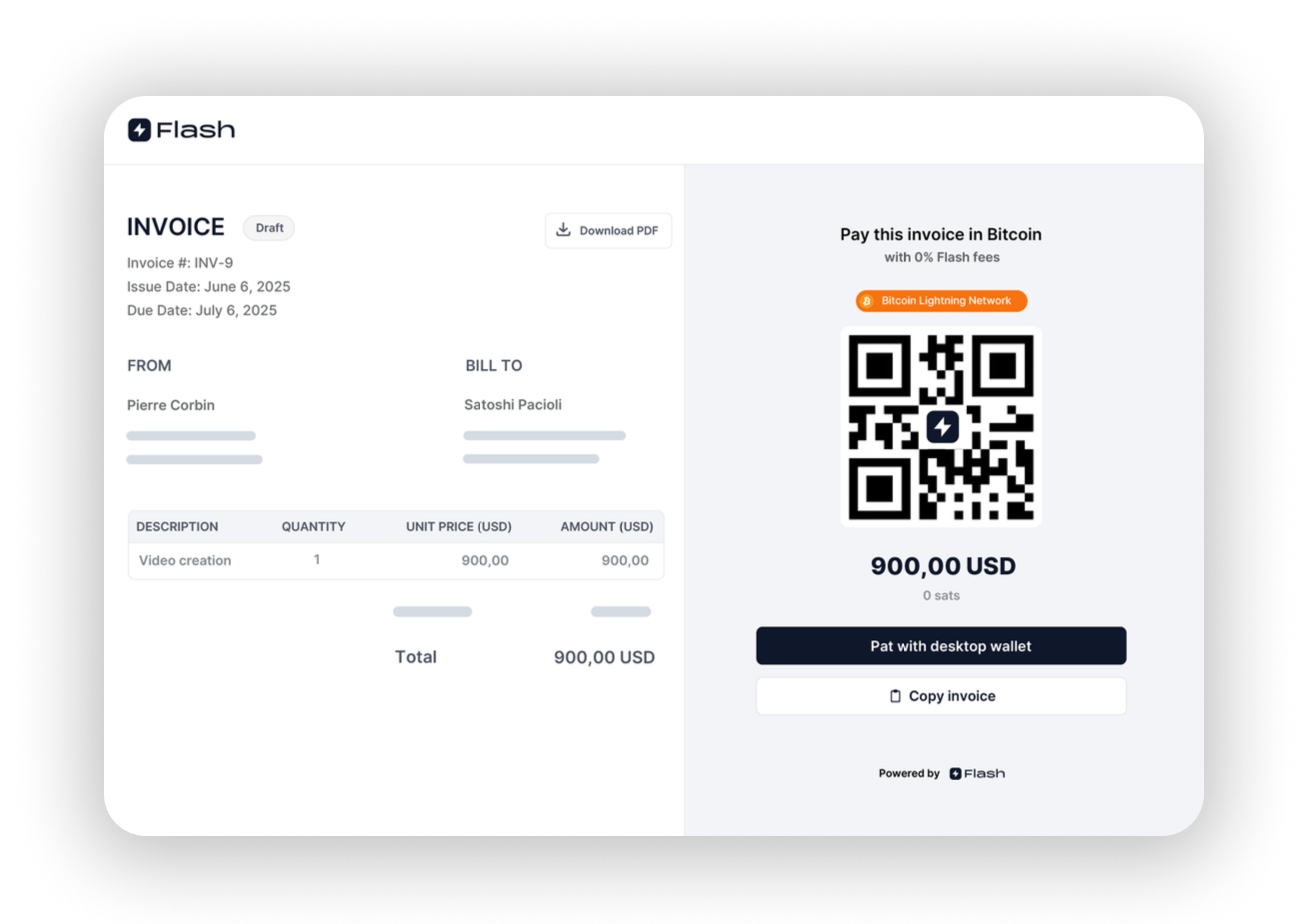

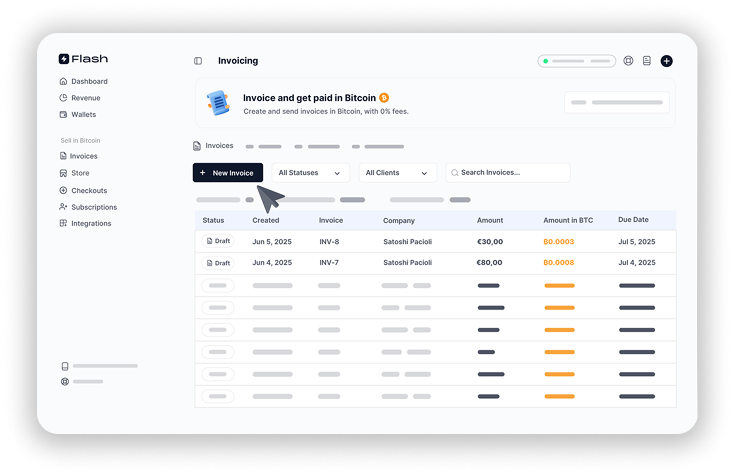

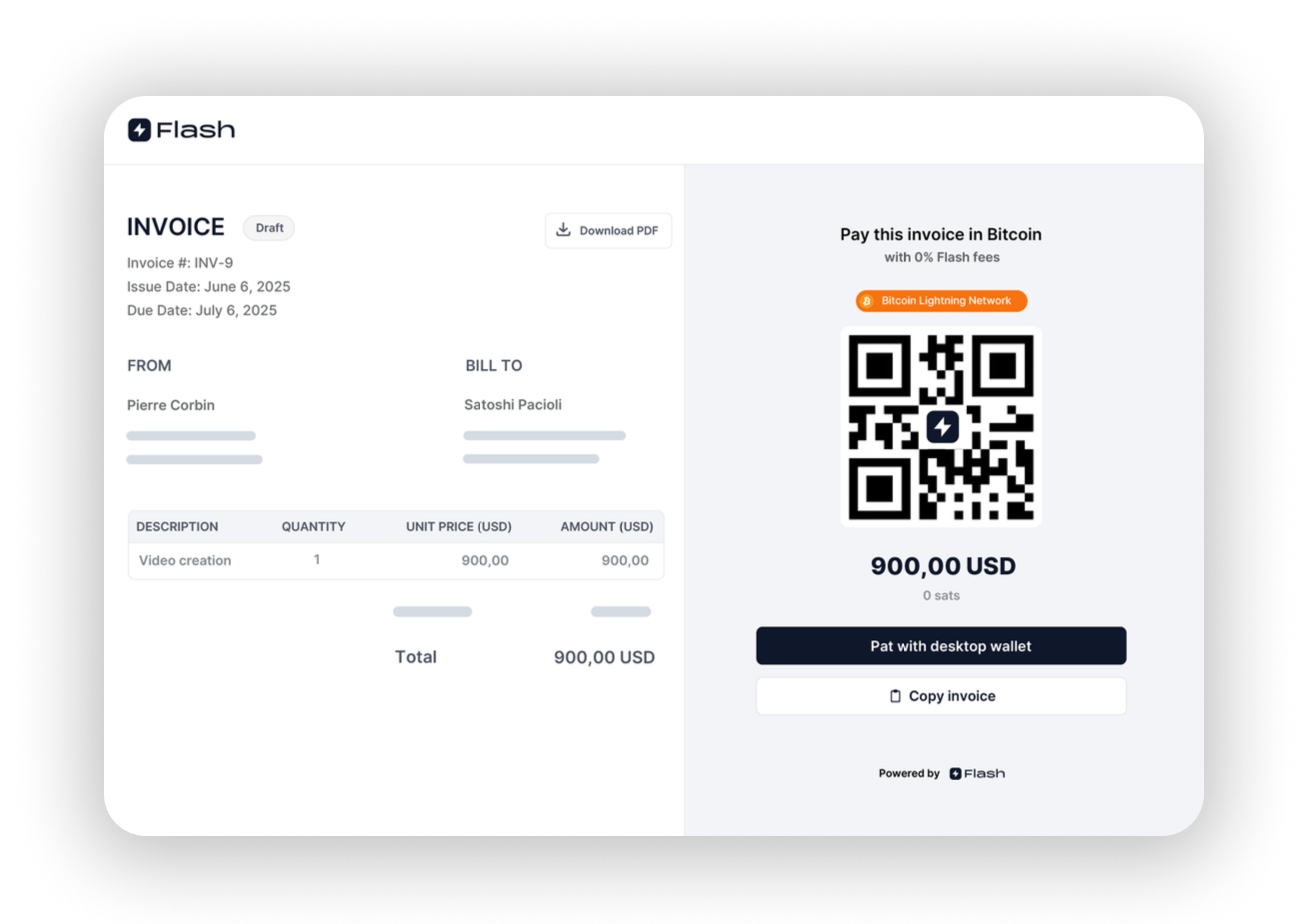

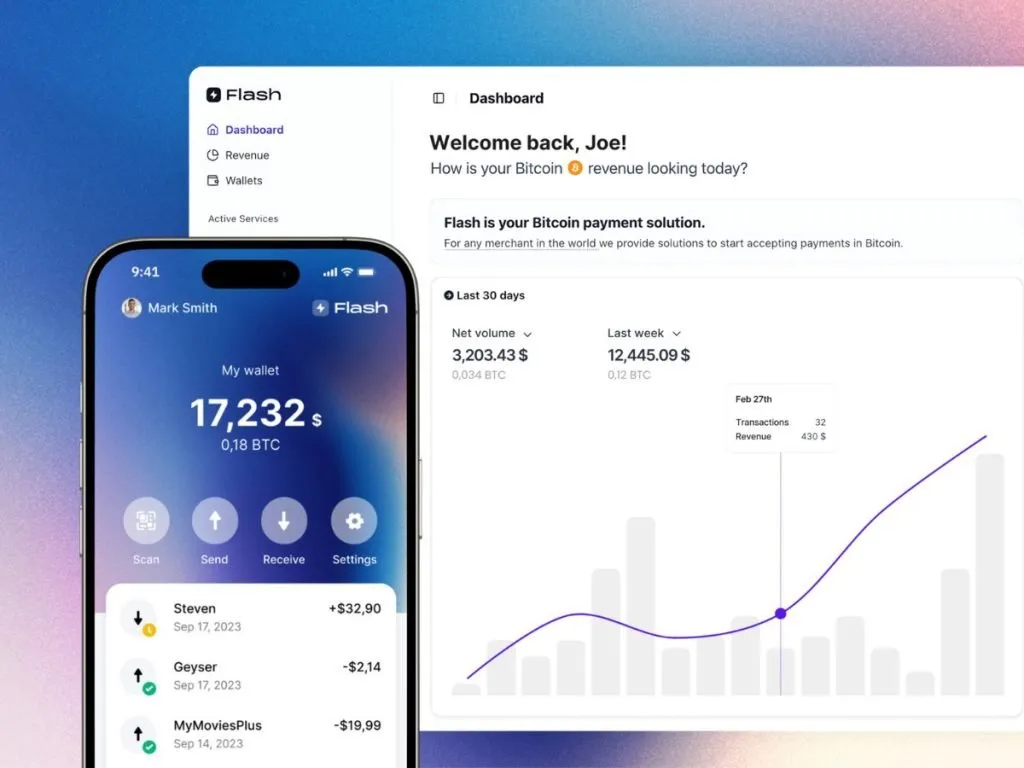

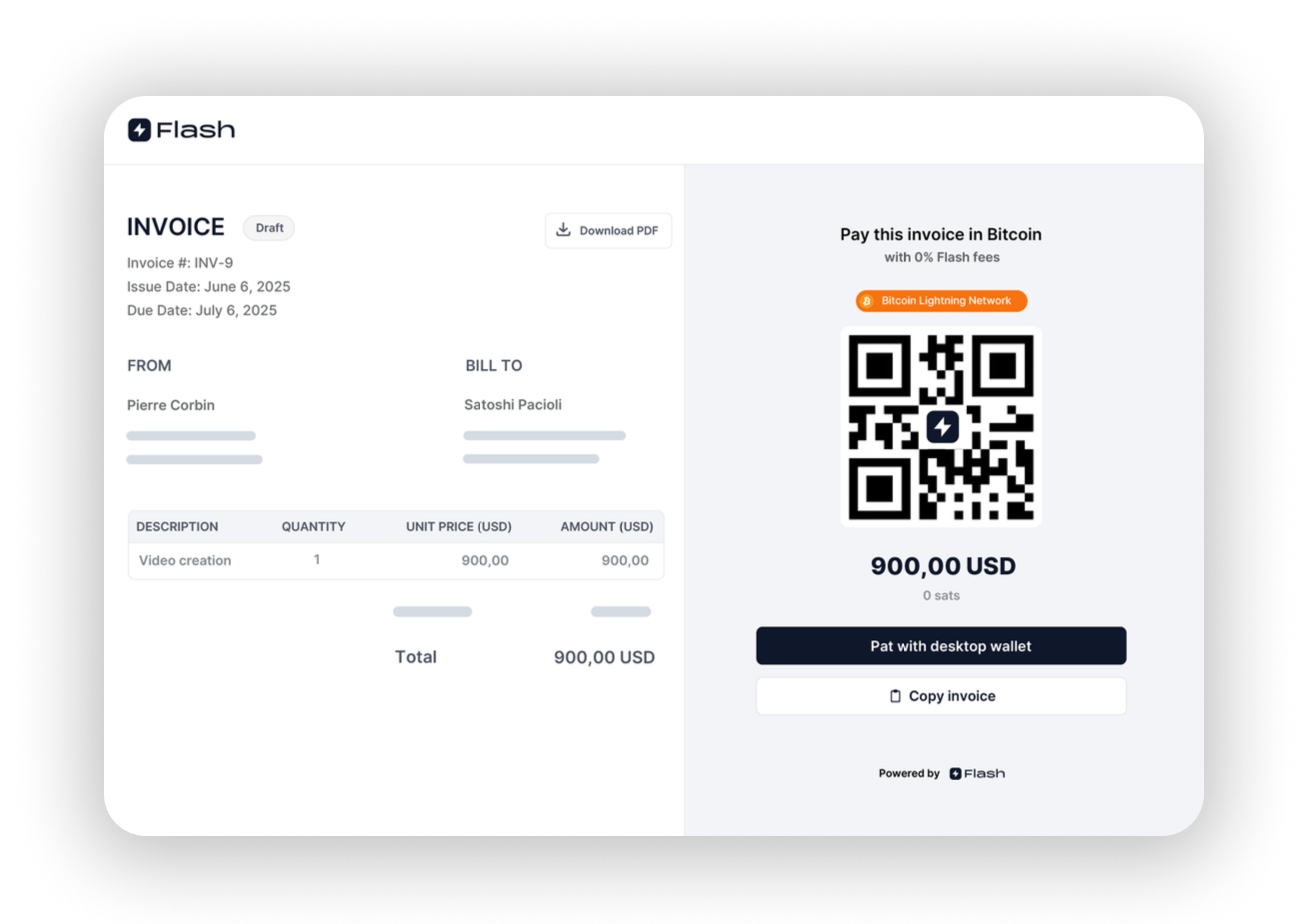

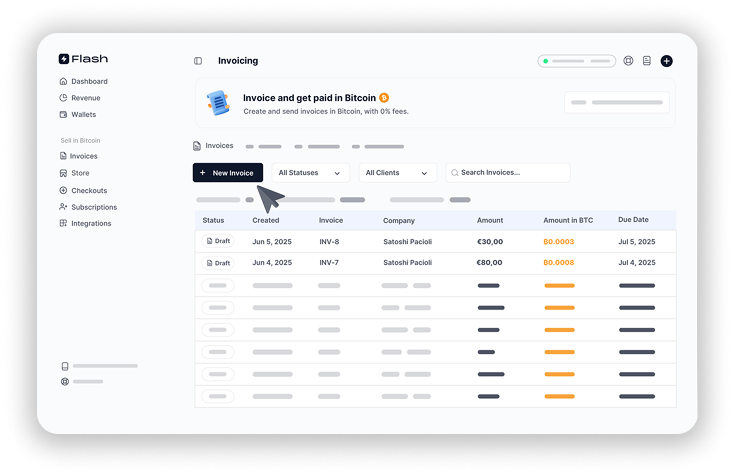

1. Flash – Easiest Bitcoin Payment Solution

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

2. Lemon Squeezy – The SaaS-Focused Alternative

Dubbed as “acq’d by Stripe,” Lemon Squeezy offers a comprehensive solution specifically designed for digital product sales and SaaS businesses. It provides strong customer support, built-in analytics, and handles payments, subscriptions, global tax compliance, and fraud prevention in one platform.

3. Gumroad – Creator Economy Champion

Gumroad has carved out a niche serving creators and small businesses by providing tools for selling digital products, physical goods, and subscriptions. It’s particularly popular among content creators, artists, and independent entrepreneurs who want to experiment with various ideas and formats. They also open-sourced their code which is quite the ‘chad-move’.

4. Paddle – All-in-One SaaS Commerce

Paddle caters to SaaS and software companies by offering a comprehensive platform with billing, licensing, and global tax handling capabilities. It’s designed to be a complete solution for subscription-based businesses, handling payments, tax, and subscription management in one platform.

5. FastSpring – Global E-commerce Specialist

FastSpring specializes in e-commerce solutions for software and SaaS companies, with a focus on global payments and subscription management. According to TechnologyAdvice, it’s particularly strong for international transactions and helps companies sell more, stay lean, and compete big.

6. 2Checkout – Versatile Payment Solutions

2Checkout (now part of Verifone) offers versatile payment solutions excelling in global payments, subscription billing, and digital commerce. One of the best stripe alternatives as it’s an all-in-one monetization platform that maximizes revenues and makes global online sales easier, supporting over 200 countries and territories.

7. Payoneer – Cross-Border Payment Expert

Payoneer simplifies cross-border payment solutions, offering local payment ease globally with a focus on market expansion and multi-currency support. It’s trusted by small to medium-sized businesses for global payment solutions and international money transfers.

8. Chargebee – Subscription Management Leader

Chargebee is a subscription management platform perfect for SaaS and SMBs, with robust billing and revenue management features. If you were looking for stripe alternatives to setup subscriptions, Chargebee might be right for you. It streamlines revenue operations and helps businesses grow efficiently with comprehensive subscription billing capabilities.

9. Maxio (formerly Chargify) – B2B SaaS Billing

Maxio offers a robust platform for B2B SaaS billing and financial operations, focusing on growth and efficiency for subscription businesses. It’s the most complete financial operations platform for B2B SaaS, bringing core financial operations into one platform.

10. Recurly – Dynamic Subscription Management

Recurly offers dynamic subscription management platform, excelling in churn management and data insights for subscription growth. It’s the only proven platform that expands and protects your recurring revenue with subscription management, recurring billing, and payments orchestration.

11. Braintree – PayPal’s Enterprise Solution

Braintree (by PayPal) provides a versatile global payments platform, integrating multiple payment methods with a focus on conversion and security. It delivers end-to-end checkout experiences for businesses, offering single-touch payments and mobile optimization.

12. PayKickstart – Modern Commerce Platform

PayKickstart offers a modern commerce platform for online billing and affiliates, focusing on revenue maximization and churn minimization. It’s the most complete checkout, recurring billing, affiliate management, and retention solution with global capabilities.

13. PayPro Global – Full-Service E-commerce

PayPro Global offers a full-service eCommerce solution for selling software and SaaS, focusing on global payments, tax compliance, and customer support. It provides flexible solutions with over 70 payment methods and great support for software companies.

14. Shopify Payments – E-commerce Integration

Integrated with Shopify, this service is ideal for SMBs in eCommerce, offering a seamless shopping cart and payment experience. It’s the simplest way to accept online payments, automatically set up for major methods with no fees for some payment types.

15. Square – Versatile POS and Payment Solutions

Square provides versatile POS and payment solutions for small businesses with a strong focus on retail and mobile payments. Forbes Advisor notes it as one of the top alternatives for businesses needing both online and offline payment capabilities.

16. Zoho Billing – Integrated Business Solution

Zoho Billing is an online recurring billing and subscription management solution, ideal for small and medium-sized businesses seeking professional invoice creation, time and expense tracking, and improved cash flow management. Zoho isn’t just competing for stripe alternatives, they offer a ton of other products and services.

17. WePay – Chase Company Integration

WePay, a Chase company, provides integrated payment solutions for ISVs and SaaS companies with customizable payment solutions. It’s designed for platforms like marketplaces and small business tools, offering seamless user experience and fraud protection.

18. QuickBooks Payments – SMB Accounting Integration

This service provides seamless accounting and payment solutions for SMBs and SaaS businesses, featuring real-time tracking and automated bookkeeping. It lets small businesses accept payments online from anywhere with easy integration into QuickBooks accounting.

19. Mangopay – Marketplace Payment Infrastructure

Mangopay offers a modular payment infrastructure for marketplaces and platforms, emphasizing flexibility, global payouts, and AI-powered anti-fraud. It uses flexible wallets built to orchestrate fund flows and monetize payment experiences.

20. Coinbase Commerce – Cryptocurrency Payments

Coinbase Commerce enables businesses to accept payments from around the world using cryptocurrency. It offers instant settlement, low fees, and broad asset support, making it easy for merchants to accept digital currency payments globally.

21. BTCPay Server – Open-Source Bitcoin Processor

BTCPay Server is a self-hosted, open-source cryptocurrency payment processor with 0% fees and no third-party involvement. It’s secure, private, censorship-resistant, and completely free for businesses wanting full control over their Bitcoin payments.

22. Lago – Open-Source Billing Alternative

Lago is an open-source alternative to Stripe Billing and Chargebee, specializing in billing and metering in one place for usage-b

-

@ cae03c48:2a7d6671

2025-06-18 13:01:03

@ cae03c48:2a7d6671

2025-06-18 13:01:03Bitcoin Magazine

Thailand Approves Five Year Bitcoin And Crypto Tax BreakThailand has approved a five year tax exemption on capital gains from cryptocurrency trading made through licensed digital asset platforms. The exemption will be in effect from January 1, 2025, through December 31, 2029.

JUST IN:

Thailand’s cabinet approved personal tax waiver on profits from the #Bitcoin and crypto sale over five years. pic.twitter.com/4gWc1gn84j

Thailand’s cabinet approved personal tax waiver on profits from the #Bitcoin and crypto sale over five years. pic.twitter.com/4gWc1gn84j— Bitcoin Magazine (@BitcoinMagazine) June 17, 2025

Deputy Finance Minister Julapun Amornvivat announced the measure, calling it a move to increase investment, stimulate economic activity, and drive long term growth.

Amornvivat stated, “The Cabinet approved a five-year crypto tax exemption to promote Thailand as a global digital asset hub.”

According to the Ministry of Finance, the policy is designed to strengthen Thailand’s competitiveness in the global digital economy. It targets transparent growth, and aims to increase capital inflow into the Thai market. Officials expect over 1 billion baht in indirect tax revenue to result from the increased economic activity during the exemption period.

Amornvivat went on to say, “The capital gain tax exemption will be for the sale of digital assets made through operators regulated by the Securities and Exchange Commission.”

The tax break applies only to platforms licensed by the Thai SEC. This includes exchanges that meet strict regulatory standards under the government’s digital finance framework. Exchanges without Thai licenses will not benefit from the exemption and continue to face restrictions.

Officials say the new exemption aligns with international standards from the OECD and FATF. The government is also exploring a possible value-added tax (VAT) on digital assets to support fiscal stability.

Furthermore, this isn’t Thailand’s first step toward embracing Bitcoin or crypto.

Thailand approved its first spot Bitcoin ETF in 2024, allowing asset manager ONEAM to launch a fund for institutional investors. The ETF offers regulated exposure to Bitcoin through global funds and reflects growing demand for institutional access to the asset.

Thailand is taking a two sided approach. They support innovation through licensed platforms, while cracking down on unregulated players. With clearer rules and tax breaks, the country is positioning itself as a leader for Bitcoin and crypto growth in Southeast Asia.

This post Thailand Approves Five Year Bitcoin And Crypto Tax Break first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-18 13:01:02

@ cae03c48:2a7d6671

2025-06-18 13:01:02Bitcoin Magazine

Fold Holdings Secures $250 Million Equity Deal to Expand Bitcoin TreasuryToday, Fold Holdings, Inc. (NASDAQ: FLD), the first publicly traded bitcoin financial services company, has announced a $250 million equity purchase agreement to significantly increase its bitcoin holdings.

JUST IN:

Publicly traded Fold secures $250 million equity facility to buy more #Bitcoin pic.twitter.com/M7E3fzwAsT

Publicly traded Fold secures $250 million equity facility to buy more #Bitcoin pic.twitter.com/M7E3fzwAsT— Bitcoin Magazine (@BitcoinMagazine) June 17, 2025

Fold Holdings has the option, but not the obligation, to issue and sell up to $250 million in new common stock. The ability to access the funds is subject to certain conditions, including the requirement that a registration statement covering the resale of the stock be filed with and approved by the Securities and Exchange Commission (SEC).

“The Company is not required to use the Facility and controls the timing and amount of any drawdown on the Facility, subject to certain restrictions under the Facility,” said the press release. “The Company expects to use the net proceeds from the Facility, if any, primarily to acquire additional bitcoin for Fold’s corporate treasury.”

The shares offered under the facility will be issued through a private placement, relying on exemptions from the registration requirements of the Securities Act of 1933 and Regulation D. Fold noted that it “plans to file with the SEC a registration statement relating to the resale of the Common Stock issuable under the Facility.”

“The offers and sales of the Common Stock issuable under the Facility will be made in a private placement in reliance on an exemption from the registration requirements of the Securities Act of 1933,” according to the press release. “The Company cannot draw on the Facility, and the Common Stock may not be sold nor may offers to buy be accepted, prior to the time that the registration statement covering the resale of the Common Stock is declared effective by the SEC.”

On May 19, Fold also announced the launch of its Bitcoin gift card, marking its entry into the $300 billion U.S. retail gift card market. This new product allows consumers to purchase and gift bitcoin through familiar retail channels, with plans to expand to major retailers nationwide throughout the year.

“This gift card gives us distribution directly to millions of Americans who may not be buying Bitcoin because they haven’t downloaded a new app, don’t have a brokerage account, or haven’t seen the ETF,” said the Chairman and CEO of Fold Will Reeves.

“I think there’s a real chance by the end of 2025 that Bitcoin becomes the most popular gift in America because of this card,” stated Reeves.

This post Fold Holdings Secures $250 Million Equity Deal to Expand Bitcoin Treasury first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-18 13:01:01

@ cae03c48:2a7d6671

2025-06-18 13:01:01Bitcoin Magazine

Ukraine Introduces Bill to Allow Bitcoin in National ReservesUkraine has introduced a bill that would give its central bank the legal right to hold Bitcoin and other assets as part of its national reserves. The draft law, submitted to the Verkhovna Rada on June 10, 2025, proposes updates to existing legislation to include “virtual assets” in the foreign exchange and gold reserves of the National Bank of Ukraine (NBU).

NEW: Ukraine introduces bill for Bitcoin Reserve in Parliament

pic.twitter.com/bYIiCNF13D

pic.twitter.com/bYIiCNF13D— Bitcoin Magazine (@BitcoinMagazine) June 17, 2025

This doesn’t mean Ukraine is officially adding Bitcoin to its balance sheet just yet, but it would give the central bank the green light to do so in the future.

One of the bill’s co-sponsors, Member of Parliament Yaroslav Zhelezniak, emphasized that the legislation is about granting permission, not making it a requirement. “Whether and to what extent they actually do so,” he said, “is up to the institution itself.”

Zhelezniak recently discussed with Binance’s regional head Kyrylo Khomiakov, that he believes Bitcoin could help Ukraine strengthen its economic position and contribute to long term digital innovation.

The timing of the bill is vital as Ukraine has been under enormous financial pressure since Russia’s invasion in 2022. Inflation remains high, the hryvnia has lost significant value, and the country is heavily reliant on international aid and loans. The NBU has managed to hold roughly $44.5 billion in reserves, mostly in U.S. dollars and government securities, but its room to maneuver is limited.

Back in 2022, the Ukrainian government was actively raising donations for the war effort through Bitcoin. They had an official wallet set up for donations, and their politicians were publicly tweeting out the addresses asking for support. On the first day alone, Ukraine’s official Bitcoin wallet raised over $3.5 million. By leaning into Bitcoin during their time of crisis, the government showed their belief and commitment in it, and this new bill shows that that commitment has not faded.

NEW

Ukraine government #Bitcoin wallet raises OVER $3.5 MILLION in 1st day of donations

Ukraine government #Bitcoin wallet raises OVER $3.5 MILLION in 1st day of donations

— Bitcoin Magazine (@BitcoinMagazine) February 27, 2022

If this bill is adopted, it could position Ukraine as one of the first countries to give its central bank the legal ability to hold Bitcoin as a strategic reserve asset.

This post Ukraine Introduces Bill to Allow Bitcoin in National Reserves first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-18 13:01:00

@ cae03c48:2a7d6671

2025-06-18 13:01:00Bitcoin Magazine

BBVA Tells Wealthy Clients to Invest Up to 7% in BitcoinSpanish bank BBVA is now advising its wealthy clients to invest up to 7% of their portfolios in crypto and Bitcoin, showing how traditional banks are starting to see the potential of Bitcoin.

JUST IN:

Spain's second largest bank BBVA is telling wealthy clients to invest in Bitcoin — Reuters pic.twitter.com/i2Pqg85uSk

Spain's second largest bank BBVA is telling wealthy clients to invest in Bitcoin — Reuters pic.twitter.com/i2Pqg85uSk— Bitcoin Magazine (@BitcoinMagazine) June 17, 2025

“With private customers, since September last year, we started advising on Bitcoin,” said Philippe Meyer, head of digital & blockchain solutions at BBVA Switzerland, during the DigiAssets conference in London. “The riskier profile, we allow up to 7% of portfolios in crypto.”

The bank’s private wealth division is currently recommending clients allocate 3% to 7% of their portfolio to Bitcoin and crypto, depending on their individual appetite. While many private banks have offered to execute Bitcoin or crypto trades upon request, it remains rare for a global financial institution to formally advise clients to buy. BBVA is currently recommending allocations specifically in Bitcoin.

Meyer emphasized that even a modest allocation to Bitcoin can have a meaningful impact on portfolio returns, “If you look at a balanced portfolio, if you introduce 3%, you already boost the performance,” he said. “At 3%, you are not taking a huge risk.”

BBVA began executing Bitcoin purchases for its clients in 2021, but Meyer said this is the first time it is formally advising allocations. In June 2021, the bank launched Bitcoin trading and custody services through its Swiss subsidiary for private clients. “With this innovative offer, BBVA positions itself as a benchmark institution in the adoption of blockchain technology,” said BBVA Switzerland CEO Alfonso Gómez at the time.

BREAKING: Spain's BBVA is opening #Bitcoin trading and custody to all private banking clients in Switzerland. pic.twitter.com/2ppfs34g6F

— Bitcoin Magazine (@BitcoinMagazine) June 18, 2021

BBVA’s interest in digital currency goes back even further. As early as 2015, the bank made it clear that it viewed Bitcoin and blockchain technology as more than just a passing trend. In a statement that now seems increasingly prescient, BBVA said “institutions that understand Bitcoin and digital currencies will lead the new monetary system,” highlighting its belief that early adopters would gain a strategic advantage.

This early support set BBVA apart from many of its peers, as few major banks were willing to publicly engage with Bitcoin at the time.

What began as interest in blockchain technology has turned into direct investment guidance, now culminating in BBVA formally advising wealthy clients to allocate up to 7% of their portfolios into Bitcoin, a clear sign the bank sees it as a long term part of its future.

This post BBVA Tells Wealthy Clients to Invest Up to 7% in Bitcoin first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-18 13:00:59

@ cae03c48:2a7d6671

2025-06-18 13:00:59Bitcoin Magazine

U.S. Senate Passes Stablecoin Bill The GENIUS ActThe U.S. Senate has passed the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act (S. 394) by a vote of 68-30, establishing the first comprehensive federal framework for fiat-backed stablecoins.

The bipartisan legislation was introduced by Senator Bill Hagerty and co-sponsored by Senators Tim Scott, Kirsten Gillibrand, and Cynthia Lummis. It passed under the official title “Guiding and Establishing National Innovation for U.S. Stablecoins of 2025.”

The United States Senate has passed the GENIUS Act

— Bo Hines (@BoHines) June 17, 2025

“Today, on a bipartisan basis, the Senate passed its first piece of major legislation this Congress with my bill—the GENIUS Act,” said Senator Hagerty. “With GENIUS, the United States is one step closer to becoming the crypto capital of the world.”

The GENIUS Act tightly regulates payment stablecoins, requiring 1:1 dollar-backed reserves, monthly disclosures, audits, and clear federal or state licensing. It prohibits algorithmic coins and places strict limitations on rehypothecation and commingling of reserves. Importantly, the bill also amends existing securities laws to explicitly state that compliant stablecoins are not securities—freeing them from SEC jurisdiction.

While the bill is aimed at stablecoins, Bitcoin proponents see it as a foundational win.

Stablecoins act as bridges into Bitcoin, enabling on-ramps, easier settlements, and institutional access. By legitimizing stablecoin infrastructure, the U.S. is indirectly reinforcing the rails on which Bitcoin operates.

And as the financial system modernizes, trusted access points like dollar-backed tokens could play a role in onboarding new Bitcoin users—especially in international markets and corporate treasuries.

“The U.S. Senate has passed the GENIUS Act — landmark stablecoin legislation that provides regulatory clarity, enhances consumer protection, and extends U.S. dollar dominance online,” said President Donald Trump’s AI & Crypto Czar David Sacks. “Thanks to President Trump for his leadership on crypto & Senator Hagerty for authoring the bill.”

The passage of the GENIUS Act may be the clearest signal yet that the U.S. is preparing for a stablecoin and Bitcoin-powered future.

This post U.S. Senate Passes Stablecoin Bill The GENIUS Act first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-18 13:00:58

@ cae03c48:2a7d6671

2025-06-18 13:00:58Bitcoin Magazine

Swiss Bitcoin Platform Relai & Casa Partner to Offer Multisig Bitcoin SecurityToday, Relai, a Swiss Bitcoin platform, announced it has partnered with Casa to introduce a new Bitcoin saving and security solution, according to a press release sent to Bitcoin Magazine.

“Self-custody is at the heart of Bitcoin’s promise,” said the Co-Founder and CTO of Relai Adem Bilican. “As our users continue to accumulate and grow their holdings over time, we recognize the need for long-term solutions designed for serious Bitcoin enthusiasts. Casa is the ideal partner – a sovereignty-focused and user-friendly solution. Together, we’re helping users secure not just their savings, but their legacy.”

According to the press release, the app has over 500,000 downloads, more than 85,000 active users, and a total user investment exceeding $1 billion. These figures reflect growing user engagement with self-custody Bitcoin solutions intended for long-term use.

Self-custody is a fundamental aspect of Bitcoin ownership, but it also comes with certain risks, particularly around long-term security. The partnership introduces a multisignature (multisig) custody option, which requires multiple keys to access funds. This setup can help mitigate the vulnerabilities of single-key storage.

Through the integration, users who purchase Bitcoin via Relai will have the option to store their assets using Casa’s multisig system. The offering also includes an inheritance feature that allows users to designate a beneficiary, adding a layer of planning for asset transfer across generations.

“Casa’s mission is to maximize sovereignty and security in the world,” stated the CEO of Casa Nick Neuman. “The best way we can do that today is by making sovereign bitcoin custody as safe and simple as possible. Our partnership with Relai will help people stack bitcoin and store it securely, for themselves and their families.”

According to both companies, the integration represents a first-of-its-kind model that combines Bitcoin accumulation with long-term custody and inheritance planning for everyday users.

This post Swiss Bitcoin Platform Relai & Casa Partner to Offer Multisig Bitcoin Security first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ beef3d4d:479b72bc

2025-06-18 12:59:11

@ beef3d4d:479b72bc

2025-06-18 12:59:11Costantino e il solidus

Quando Costantino il Grande prese in mano le redini dell'impero, ne risollevò le sorti adottando riforme economiche lungimiranti. Tra gli impegni assunti, il più importante fu quello di mantenere il solidus a 4,5 grammi d'oro senza tagli o svalutazioni, coniandolo in grandi quantità a partire dal 312 d.C.. Spostò poi la capitale verso est, a Bisanzio, nel punto di incontro tra Asia ed Europa, dando vita all'Impero Romano d'Oriente, che adottò il solidus come moneta.

Mentre Roma continuava a deteriorarsi economicamente, socialmente e culturalmente, crollando infine nel 476 d.C., Bisanzio, poi rinominata Costantinopoli, sopravvisse per quasi 1200 anni, e il solidus divenne la moneta più longeva e accettata della storia.

Il nome Bisanzio vuole quindi essere un omaggio alla saggezza di Costantino e celebrare l’unica moneta nella storia dell’umanità capace di durare oltre un millennio. Un esempio ed un auspicio per la Bitcoin, moneta di oro digitale che ci accompagnerà per un lunghissimo tempo.

\

Vedi anche: Monetazione bizantina su Wikipedia.

\

Vedi anche: Monetazione bizantina su Wikipedia.Il problema dei generali bizantini

Il termine Bitcoin soffre di un’ambiguità semantica: con lo stesso termine si indicano due cose ben diverse tra loro: il protocollo di comunicazione e la moneta digitale costruita su di esso. Bitcoin inteso come protocollo rappresenta la prima soluzione a un problema informatico, centrale per il funzionamento di sistemi distribuiti, denominato problema dei generali bizantini, formulato nel 1982 e che e’ rimasto irrisolto per decenni.

La sua formulazione e’ tipicamente la seguente:

\> Diverse divisioni dell’esercito bizantino, ciascuna guidata da un generale, sono accampate in posizioni strategiche attorno a una città nemica e dovono condividere una strategia di attacco coordinato per poter sopraffare il nemico. Le divisioni possono comunicare solo mediante messaggeri al fine di coordinare l’attacco decisivo. Il terreno impedisce alle divisioni bizantine di comunicare a distanza e queste possono comunicare solo tramite dei messaggeri. Come possono le varie divisioni accordarsi per un attacco congiunto sapendo che i messaggeri che inviano potrebbero essere catturati dal nemico, o che alcuni generali potrebbero addirittura tradire e mandare messaggeri con ordini sbagliati?

Il problema che devono risolvere i generali bizantini è lo stesso che affligge i sistemi di elaborazione distribuiti. Come raggiungere un consenso su una rete distribuita in cui alcuni nodi che la costituiscono possono essere difettosi o corrotti?

Il protocollo Bitcoin offre una soluzione a questo problema introducendo il concetto di “prova di lavoro” (proof of work) e della “catena di blocchi” (blockchain). E quindi, nuovamente, il nome Bisanzio si collega a Bitcoin ed alla principale innovazione tecnologica da esso introdotta.

\ Vedi anche: Byzantine fault su Wikipedia.

PS

Come resistere poi alla disponibilità del dominio internet bisanz.io? :)

-

@ eb0157af:77ab6c55

2025-06-18 08:01:36

@ eb0157af:77ab6c55

2025-06-18 08:01:36A new study by Kraken reveals how cryptocurrency investors perceive security as the main challenge in self-managing their digital assets.

According to The Block, a recent survey conducted by crypto exchange Kraken found that nearly half of respondents consider themselves the primary risk factor for their own crypto security. The research, which surveyed 789 participants, highlights that 48% of users see their own actions as the greatest threat to their investments in digital assets, surpassing concerns about external theft or fraud.

Kraken’s report underlines how personal responsibility in security management forces users to take full control of their digital funds. However, the study suggests that this autonomy can also become a source of anxiety for many investors.

Nick Percoco, Chief Security Officer at Kraken, commented on the findings, noting that “a lack of confidence in personal crypto security is capping the growth of the industry.” According to Percoco, unlocking the full potential of cryptocurrencies will require users to embrace self-custody and consistently invest in strong security habits.

Technologies to strengthen security

Despite the concerns highlighted in the study, 31% of participants expressed optimism about future technologies that could improve crypto security. Among the most promising solutions identified:

- advanced biometric systems for user authentication;

- multi-factor authentication to secure wallet access;

- AI-based fraud detection systems to prevent attacks.

Data and case studies

Kraken’s research emerges in a context where security threats remain a pressing reality. FBI data shows that in 2024, nearly 150,000 reports of crypto-related internet fraud resulted in $9.3 billion in losses. Older users, particularly those over 60, proved especially vulnerable, accounting for $3 billion in crypto-related financial fraud losses on their own.

The post Kraken study: 48% of users fear themselves in managing and securing their funds appeared first on Atlas21.

-

@ e3ce5265:4bb9f609

2025-06-18 12:44:49

@ e3ce5265:4bb9f609

2025-06-18 12:44:49The TENEX prompting system is a sophisticated, distributed architecture that enables AI agents to construct, process, and execute complex prompts with integrated tool support, context management, and conversation orchestration. Unlike traditional prompt systems that focus on single interactions, TENEX implements a multi-agent conversational framework with dynamic prompt building, real-time typing indicators, and sophisticated context preservation.

Architecture Overview

Core Design Philosophy

The TENEX prompting system follows a context-first, agent-centric approach where prompts are: - Dynamically constructed based on agent roles, project context, and available tools - Conversation-aware with signal-based state management - Tool-integrated with automatic prompt enhancement for available capabilities - Multi-agent orchestrated with team formation and collaborative prompt execution

Key Components

TENEX Prompting System Architecture ├── Agent Layer (tenex/src/agents/domain/) │ ├── Agent.ts - Core prompt building and response generation │ ├── TeamLead.ts - Enhanced prompts for orchestration │ └── Team.ts - Multi-agent conversation management ├── Orchestration Layer (tenex/src/agents/application/) │ ├── EventRouter.ts - Prompt routing and agent selection │ └── TeamOrchestrator.ts - Dynamic team formation prompts ├── Tool Integration (tenex/src/utils/agents/tools/) │ ├── ToolRegistry.ts - Dynamic tool prompt generation │ ├── ToolEnabledProvider.ts - Tool-enhanced prompt execution │ └── Individual Tools (readSpecs.ts, updateSpec.ts, etc.) ├── LLM Providers (tenex/src/llm/) │ ├── BaseLLMProvider.ts - Core prompt processing │ ├── AnthropicProvider.ts - Claude-specific prompt handling │ └── ToolEnabledProvider.ts - Tool-aware prompt execution └── Infrastructure ├── RulesManager.ts - Project rule integration ├── SpecCache.ts - Living documentation access └── LLMProviderAdapter.ts - Typing indicator integrationPrompt Construction System

1. Core Agent Prompt Building

Location:

tenex/src/agents/domain/Agent.ts:133-162``typescript protected buildSystemPrompt(): string { let prompt =You are ${this.config.name}, ${this.config.role}.Instructions: ${this.config.instructions} `;

// Add tool instructions if agent has tools if (this.toolRegistry) { const toolPrompt = this.toolRegistry.generateSystemPrompt(); if (toolPrompt) { prompt += `${toolPrompt} `; } }

prompt += `When responding, you should indicate the conversation state using one of these signals: - continue: You have more to say in this conversation phase - ready_for_transition: You've completed your part and are ready for the next phase - need_input: You need input from another team member - blocked: You're blocked and need help - complete: The entire task/conversation is complete

Format your response as: [Your response content]

-

@ dfa02707:41ca50e3

2025-06-18 12:01:41

@ dfa02707:41ca50e3

2025-06-18 12:01:41Contribute to keep No Bullshit Bitcoin news going.

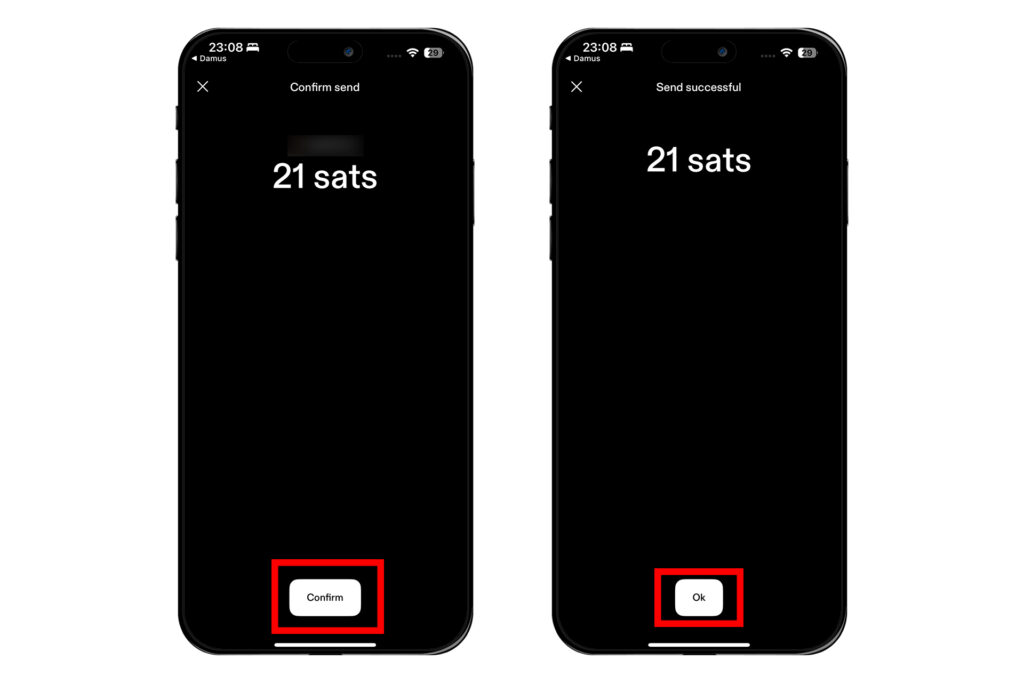

- "Today we're launching the beta version of our multiplatform Nostr browser! Think Google Chrome but for Nostr apps. The beta is our big first step toward this vision," announced Damus.

- This version comes with the Dave Nostr AI assistant, support for zaps and the Nostr Wallet Connect (NWC) wallet interface, full-text note search, GIFs and fullscreen images, multiple media uploads, user tagging, relay list and mute list support, along with a number of other improvements."

"Included in the beta is the Dave, the Nostr AI assistant (its Grok for Nostr). Dave is a new Notedeck browser app that can search and summarize notes from the network. For a full breakdown of everything new, check out our beta launch video."

What's new

- Dave Nostr AI assistant app.

- GIFs.

- Fulltext note search.

- Add full screen images, add zoom, and pan.

- Zaps! NWC/ Wallet UI.

- Introduce last note per pubkey feed (experimental).

- Allow multiple media uploads per selection.

- Major Android improvements (still WIP).

- Added notedeck app sidebar.

- User Tagging.

- Note truncation.

- Local network note broadcast, broadcast notes to other notedeck notes while you're offline.

- Mute list support (reading).

- Relay list support.

- Ctrl-enter to send notes.

- Added relay indexing (relay columns soon).

- Click hashtags to open hashtag timeline.

- Fixed timelines sometimes not updating (stale feeds).

- Fixed UI bounciness when loading profile pictures

- Fixed unselectable post replies.

-

@ e3ce5265:4bb9f609

2025-06-18 12:45:23

@ e3ce5265:4bb9f609

2025-06-18 12:45:23...

-

@ eb0157af:77ab6c55

2025-06-18 05:01:12

@ eb0157af:77ab6c55

2025-06-18 05:01:12The banking giant is exploring an expansion of its blockchain services, focusing on digital payments and currencies.

JPMorgan Chase has filed a new trademark application for the name “JPMD.” The filing was submitted on June 15 to the United States Patent and Trademark Office (USPTO).

The application, filed by JPMorgan Chase Bank, N.A., covers a broad range of services related to digital assets and blockchain technology. These include the issuance of digital currencies, electronic payment processing, and financial custody services — all of which suggest a possible new stablecoin initiative for JPMorgan.

Experience with JPM Coin

This move wouldn’t be JPMorgan’s first foray into blockchain-based finance. The bank already operates JPM Coin, a dollar-pegged stablecoin used to enable instant transactions between institutional clients. The token runs on Quorum, a private blockchain network developed in-house by JPMorgan and based on Ethereum’s technology.

The registration of the JPMD trademark comes as JPMorgan and other major U.S. banks are considering a collaborative stablecoin project through their jointly owned entities: Early Warning Services and The Clearing House.

Similarly, corporations like Walmart and Amazon are mulling the creation of their own stablecoins.

The post JPMorgan files trademark for ‘JPMD’: a new stablecoin on the horizon for the American bank appeared first on Atlas21.

-

@ 6ad3e2a3:c90b7740

2025-06-18 12:00:52

@ 6ad3e2a3:c90b7740

2025-06-18 12:00:52"Whereof one cannot speak, thereof one must be silent."

— Ludwig Wittgenstein

Simulation Theory, the idea our entire existence is part of a simulation, that we are just code running on some more advanced civilization’s supercomputer has come up in conversations of late. I’m writing to say it’s not just wrong, but bullshit. A category error, at best, and cover for a nefarious agenda at worst.

The first problem with Simulation Theory is unless there’s some way to get outside the simulation, to access base reality, so to speak, the theory has no meaning. It’s just a semantic game.

Consider for example the theory (one I came up with on my walk back from the track) that you are actually a sleeping elephant dreaming of this human life. You are sleeping peacefully under a quiet grove of trees, and you won’t wake into elephant consciousness for another four hours when the sun rises. Moreover, the pace of your dream is glacial — you will experience tens of thousands of human incarnations, full lifetimes, before daybreak. You will not wake up before then as your elephant self.

Maybe this theory is true, maybe it’s not, there’s no way to know. Anything that could possibly happen in this lifetime would not invalidate it. When there is nothing that could possibly falsify a theory, it’s neither true nor false, but meaningless. Elephant Dream and Simulation Theory are similar in this respect. You might as well call them The Universe. It’s just substituting one word-concept for another to describe an inaccessible structure containing all of reality.

Now some proponents of Simulation Theory posit a base reality beyond our simulation, namely that of the simulators. But there are two problems with that: (1) If you can’t access it because you’re just code within their closed system, you are stuck back at Elephant Dream; and (2) Even if you could somehow figure this out and access the “reality” of the simulators, why would you assume they too were not a simulation of some even yet more advanced civilization?

If they could simulate us, why couldn’t someone else simulate them? Why would their reality be any more real than ours for the exact same reasons? There could conceivably be an infinite regress of simulations within simulations, and even worse it could turn out to be circular, i.e., we will one day create a simulation that becomes the “base” simulation for all the simulations all the way down, eventually including our own.

So not being able to falsify any simulators’ reality, n-simulations deep, you are back to Elephant Dream. The elephant when he awakes similarly could himself be the dream of a person, who is the dream of another elephant ad infinitum. These are just empty words that don’t describe or affect the content of your “reality.”

(As an aside I like the infinite circular loop simulation theory as a short-circuit to the false logic it purports. It reminds me of that scene in Animal House where the students get high with Donald Sutherland (their professor.) When they opine his new book must be amazing, he says, “piece of shit” and they talk about how each atom in their hands could be an entire universe, and our entire universe might be an atom in the hand of some giant being. I always thought this could also be an infinite regress of universes as atoms in yet larger universes, and also circular wherein our universe could actually reside in one of the atoms in our own hand.)

These thought experiments reveal category errors in that they purport to describe something that’s outside the range of describability. To describe something is to distinguish it from the things that it is not, so to describe everything is the same as describing nothing in particular. You cannot describe the totality of reality any better than you can its absence. It’s like imagining how it is to be dead.

. . .

What I wrote above is the most generous interpretation of Simulation Theory, but at worst it’s actually being pushed to further an agenda. Just as a “science-based” materialism (everything is atoms) underpinned communist ideology where material resources were the only thing, and their equitable distribution at all costs the moral imperative, a code-based reality supports its own distorted, dark worldview.

If we are merely code in a simulation, then humans have no special claim to individual rights and resources any more than artificially intelligent robots. It’s only a small step from there to trans-humanism, utilitarianism and a technocratic state that subverts the principle of the individual being an end in himself.

The category error, in this view, is a convenient one — it removes the obstacles for the power-mad autists into quite literally playing God.

. . .

But back to the original inquiry: If Simulation Theory is no better than Elephant Dream, how can people hope to understand their reality? Are we stuck simply pushing back the impenetrable wall of truth via incremental scientific advances, doomed never to connect to the ultimate ground of our existence?

I think not. For the same reasons Simulation Theory fails, all of our theories will ultimately fail, and the best we can do is create better descriptions and explanations about particular phenomena that occur within our observational range.

But just because our logical minds can never reach beyond that expandable but necessarily limited spectrum, doesn’t mean it’s off limits. The problem is that to know consciousness itself, i.e., the base reality, outside of thought concepts like “code” or “atoms” one must be consciousness, not grasp at the perceptible phenomena within it.

That’s why religions emphasize faith, or in some cases, doubt. Trust in God, or doubting everything else that would impede you, is the path to that level of understanding. Logical explanations like Simulation Theory then are at best a misunderstanding to keep the deepest questions at bay, at worst a justification for unholy schemes at the heart of which is simply a will to power.

-

@ eb0157af:77ab6c55

2025-06-18 12:01:21

@ eb0157af:77ab6c55

2025-06-18 12:01:21Only 1% of stablecoin transactions in 2024 are linked to criminal activity.

A recent report by TRM Labs has revealed new data on stablecoin usage in 2024. Contrary to widespread perception, 99% of stablecoin transactions were entirely legal and compliant with existing regulations.

The research shows that over 60% of last year’s total transaction volume was conducted using dollar-pegged tokens.

One key point highlighted in the report is the intrinsic traceability of stablecoins. Operating on public blockchains, these digital currencies allow for highly precise transaction monitoring through specialized analytics tools.

Issuers of centralized tokens like USDT and USDC also have the ability to freeze or permanently remove tokens associated with illicit activities.

TRM Labs data shows a 24% decrease in crypto-related criminal activity compared to 2023, with a total of $45 billion representing just 0.4% of overall crypto transaction volume. This decline is attributed to increased law enforcement efforts, stronger industry collaboration, and the growing adoption of advanced analytics tools.

According to TRM Labs, regulatory clarity provided by legislation such as the GENIUS Act could accelerate stablecoin adoption among major banks, financial institutions, and corporations. Many of these entities are already testing stablecoin-based infrastructures for cross-border payments, supply chain management, and programmable finance.

The post Stablecoins: new report debunks myths about illicit use appeared first on Atlas21.

-

@ 472f440f:5669301e

2025-06-18 04:25:57

@ 472f440f:5669301e

2025-06-18 04:25:57Marty's Bent

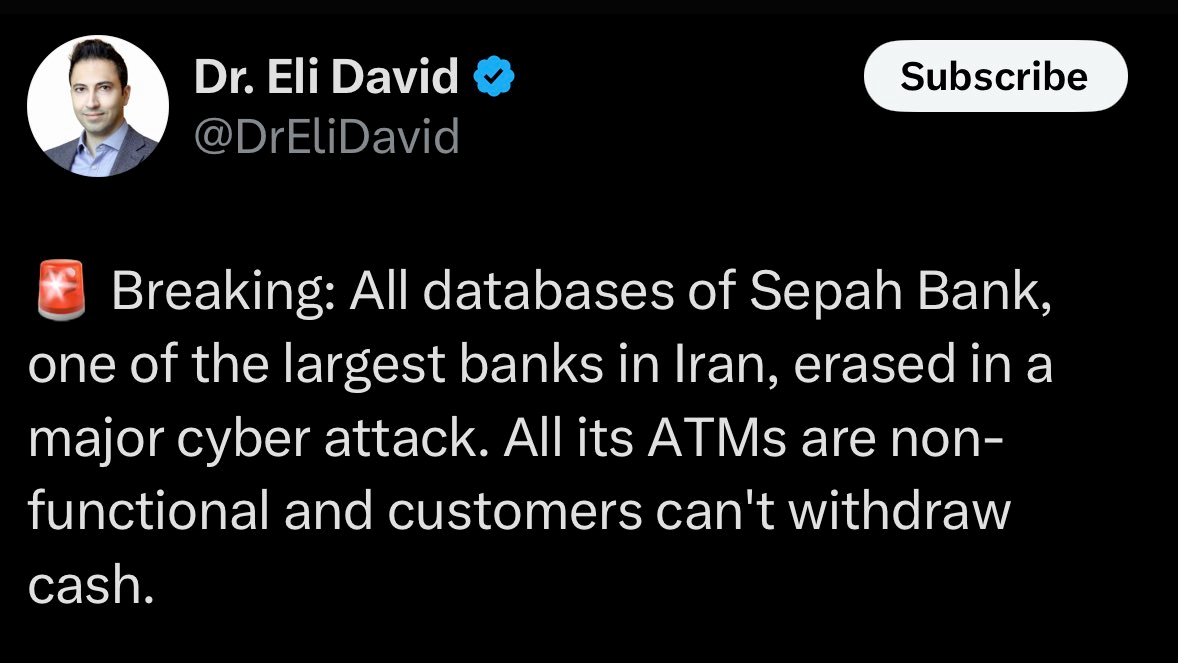

via Dr. Eli David

The case for a neutral, permissionless monetary protocol has never been stronger. The incumbent financial system is a permissioned wall garden that is susceptible to a tax. When you're using this system, you don't own your money. Your money doesn't really even exist. What you have is a claim to be able to ask your bank to give you your money or move it somewhere that you desire. Not only is it a permissioned wall garden, but it is an insecure permissioned wall garden that is susceptible to attacks from nefarious actors.

This was made very clear earlier today when Sepah Bank in Iran was the subject of a cyber attack that led to all of its databases being erased and their ATMs being deemed non-functional. Sepah Bank customers have been unable to withdraw cash. And many are warning Iranian citizens to withdraw as much cash as possible from any ATM outside of Sepah Bank's network that is working. Because there is a high likelihood that other banks and ATM networks will be targeted.

Bitcoin is a digital bearer instrument that you can custody yourself using either a software or hardware wallet. The network is operated by an army of geographically distributed nodes that maintain the rules and ensure that anybody trying to transact within the network is doing so within the rules that are set forth. Bitcoin is a push system, not a pull system. It is extremely hard to attack in the way that Sepah Bank was attacked earlier today.

I think it's important to note the way in which Sepah Bank was attacked and highlight that it is starkly different from the types of attacks or shortcomings from the financial system that we've seen over the years.

One of the events that caused a rush to Bitcoin over a decade ago was the banking crisis in Cyprus. We've seen hyperinflationary events in countries like Lebanon and Turkey that have rendered their currencies defunct. In the case of Lebanon, the central bank simply came out and said that people were not going to have access to their money and gave Lebanese citizens an overnight haircut on their savings. We've seen countries like India and Nigeria mess with their physical bills, forcing their citizens to exchange smaller denominations for larger denominations, causing massive disruptions in the process.

We've seen the United States government and its allies freeze the treasury assets of its enemies and they move towards a more multipolar monetary order over the last five years. We've seen the Canadian government freeze the bank accounts of protesters fighting for bodily autonomy. We've seen Operation Chokepoint 1.0 and 2.0. Here in the United States, the government directly targeted industries and businesses within those industries by either overtly preventing them from accessing bank accounts or covertly making it as hard as possible to access bank accounts.

On top of all this, obviously, we have the constant drumbeat of currency debasement across the world, even here in the United States, where the Federal Reserve and Federal Government are expanding the monetary base and going further into debt, ultimately destroying the purchasing power of the dollar at an increasing rate over time.

However, this type of cyber attack on a bank is unique, at least from what I can recall. The ability of nefarious actors to access bank databases and erase them is something new and something that should not be taken lightly. If Iranian hacking capabilities are as sufficient and capable as we are led to believe, it's not hard to imagine that we could see some retaliatory actions from the Iranian regime to counteract the attack on their banking system.

I don't want to incite alarm in any of you, but I think it is important to highlight that this new attack vector is definitely a step towards financial nihilism that could put hundreds of millions, if not billions of people in harm's way, in the sense that they could wake up one morning and be told that the bank does not have access to the records of their cuck buck IOUs. If something like this were to happen, I'm sure anyone who isn't holding Bitcoin in a wallet that they control will really wish they were. Being able to access your money is a vital part of being able to live you life. The thought of that ability being taken away because of a hacking war that breaks out is extremely unnerving.

As I said at the top of this letter, the case for a neutral, permissionless, distributed monetary system with a native currency that is finite is clearer than it ever has been, at least for me. It is imperative that you and anyone that you care about holds Bitcoin in self-custody to inoculate yourselves from these very real risks that are only going to increase from here on out.

Eliminate the trusted third party risks that exist in your life. Use Bitcoin as your money and use it correctly by holding it in self-custody.

Why 5% Interest Rates Won't Trigger The Next Market Crash

Guest Mel Mattison challenges the prevailing fear around rising interest rates, arguing that markets have developed immunity to higher yields. Unlike 2023's sharp selloff when the 10-year hit 5%, Mattison believes equities and Bitcoin can now absorb these levels because they signal stronger growth expectations ahead. He emphasizes that the pace of rate increases matters more than absolute levels, and notes that markets have had time to adjust. With oil trading at just $65 per barrel—a fraction of its inflation-adjusted 2008 peak of over $200—the deflationary pressure from cheap energy provides a crucial buffer.

> "It's not just what the rate we get to, it's how fast we get there." - Mel Mattison

Mattison's most compelling argument centers on AI-driven productivity gains enabling companies to maintain margins despite higher borrowing costs. As I've witnessed firsthand implementing AI tools at TFTC, what once required hiring multiple employees can now be handled by one person with the right automation. This productivity revolution means traditional rate sensitivity models may no longer apply.

Check out the full podcast here for more on institutional Bitcoin adoption, resistance money warnings, and bipartisan coalition building.

Headlines of the Day

Davis Commodities Puts 40% of $30M Into Bitcoin - via X

Ukraine Bill Adds Bitcoin to National Reserves - via X

Vinanz Raises £3.58M to Expand Bitcoin Mining - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

The joy of a 5-year old riding a bike for the first time is something that should be protected at all costs.

*Download our free browser extension, Opportunity Cost: *<https://www.opportunitycost.app/> start thinking in SATS today.

*Get this newsletter sent to your inbox daily: *https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 9ca447d2:fbf5a36d

2025-06-18 12:01:00

@ 9ca447d2:fbf5a36d

2025-06-18 12:01:00The signs started appearing everywhere for Will Reeves long before he founded Fold. In Argentina, a friend showed him how families preserved wealth through Bitcoin during runaway inflation.

In Sonoma County, where his family worked in the wine industry, he watched migrant workers get gouged by traditional remittance providers who charged usurious fees for sending money home.

During Occupy Wall Street in Oakland, he witnessed PayPal donations getting shut down while bitcoin donations flowed through unimpeded.

“I had all these touch points with Bitcoin all representing an incredibly powerful aspect of it,” noted Will. Each interaction revealed another superpower: wealth preservation, efficient remittances, censorship resistance, technological innovation.

But even with all these glaring signs, it took years before he made the leap.

The Silicon Valley Disconnect

Will had spent over a decade in Silicon Valley’s corporate machine, bouncing between major tech companies and launching consumer payment products. He was good at building things, it was his calling, but something felt off.

“Even despite doing this in Silicon Valley with a bunch of incredible opportunities and projects I got to work on, I never truly felt like I was completely aligned with what I was bringing to market,” he explained.

“I thought it was cool to build, I thought there was a great opportunity and I thought I could make something the world would love, but the alignment wasn’t there.”

The breakthrough came around 2015 when he met his co-founder, who was working on a Bitcoin side project. For the first time, Will saw how he could merge his two worlds: building exceptional products and supporting something he genuinely believed in.

“That was truly inspiring where I could actually finally say I could bring my worlds together building things and things that I care about,” he said. “That was a complete unlock.”

Solving the Wrong Problem First

Fold’s early iteration focused on spending bitcoin, converting it to gift cards or cash so people could shop at places that didn’t accept it directly. The logic seemed sound: Bitcoin holders needed ways to spend their digital money in the real world.

But Will quickly realized they were solving the wrong problem.

“The problem was not enough people had bitcoin,” he said. “We were solving a problem that didn’t quite exist or wasn’t even really ready for it.”

The insight that changed everything came from connecting two observations: not enough people own bitcoin because it’s a superior savings asset, and not enough people have savings period, regardless of where they are from.

“Those two insights brought together this idea of wait, how can we build a product that allows people to passively build savings that will be denominated in Bitcoin?” Will explained.

That’s when Fold pivoted to rewards. Instead of asking people to spend bitcoin, they would help people earn it through everyday purchases.

Building the Bitcoin Financial Stack

Today’s Fold bears little resemblance to that early gift card conversion service. The platform has evolved into a comprehensive financial services suite designed around one core principle: helping users end up with more bitcoin than they started with each day.

The Fold debit card rewards users with bitcoin on every purchase. Premium Fold+ members get higher cashback rates, boosted spins, and exclusive giveaways.

Users can direct deposit paychecks, set up automatic bitcoin purchases through dollar-cost averaging, enable round-ups on purchases, and even get paid directly in bitcoin.

“Fold is a platform where you can fully port your personal financial activity to, but to a platform that is there specifically designed to make sure that you end up with more bitcoin than you started with each day,” Will said.

The platform serves everyone from Bitcoin newcomers earning rewards on Uber rides and Amazon purchases to maximalists “living 100% of my life in Bitcoin and living in a parallel financial reality to the rest of the world.”

Most importantly, Fold provides the tools to move along that spectrum at your own pace.

“Maybe it’s not 100% conversion of your paycheck right now. Maybe it’s 10%. Okay, let’s dial up the paycheck conversion there. Let’s increase your roundups,” Will explained. “It gives you this toolkit that follows your education into Bitcoin as you develop confidence.”

Surviving Bitcoin’s Volatility Cycles

Building a Bitcoin company means accepting an additional layer of difficulty that most entrepreneurs never face.

Will describes it as “building on a moving foundation” not just responding to customer needs, but adapting to an entire industry figuring out its own product-market fit.

“When you have 50% drawdowns in incredibly short periods of time… that adds a whole new difficulty factor,” he said, noting the “absolute trail of Bitcoin company bodies that got pushed through that meat grinder and didn’t make it out.”

The key to survival? Conservative growth and what Will calls “cockroach mode.”

“Growth at all costs will destroy you in Bitcoin,” he warned. “You need to be extraordinarily resilient, very conservative in how you’re building your company… and be prepared to go into cockroach mode for years on end.”

But those who survive the volatility cycles emerge stronger. Fold now holds over 1,000 BTC in its treasury and went public on NASDAQ in February 2025.

Neil Jacobs on X

The Gift Card Revolution

Fold’s newest innovation might be its most significant: Bitcoin gift cards appearing in physical retail locations across America. While most people discover Bitcoin through brokerage accounts or mobile apps, Will sees a much larger distribution opportunity.

“When you think of where financial services are distributed today, it is not just an app store. It’s not just a brokerage account. It’s literally in every store you shop in,” he explained.

Gift cards represent the perfect Trojan horse. They’re familiar to consumers “gift cards are the number one gift in America” and retailers already have dedicated sections for them. More importantly, retailers want Bitcoin customers.

“These retailers know that Bitcoin is able to draw very valuable customers who are high earners… Many of them have families. They want these customers,” Will said, pointing to Costco’s $200 million monthly gold sales as proof that Americans want alternative assets.

“You’re going to see this in 2025 get rolled out. Big orange Bitcoin B’s are going to be gracing the checkout lines of the largest retailers in America where millions of people shop and trust already.”

Building Partnerships Beyond Traditional Finance

One of Fold’s most interesting developments is its integration with different companies, such as Crowd Health, a peer-to-peer healthcare funding company that helps people avoid traditional insurance. Will sees these partnerships as representative of a broader shift.

“We’re talking with life insurance companies, lending companies, mortgage companies,” he said. “I think this is a vision that is going to replicate across Crowd Health into a bunch of other adjacent services I think Bitcoiners are going to love.”

These integrations matter because they make Bitcoin part of everyday financial life rather than a separate investment category.

When someone can contribute to their health coverage with bitcoin or earn bitcoin rewards on insurance payments, it becomes truly integrated into their financial routine.

The Human Impact

Beyond the business metrics and technical innovations, one of the things Will loves to see is his customers doing better financially than their peers.

“Our customers are more confident, more stable and more optimistic about their financial future,” he said. “Part of it is they’re genuinely doing better than their peers. They are outpacing their peers.”

Will sees this success against a troubling backdrop. “Everyone else is living in a world where the tools that they rely on are actually counterproductive to their end financial goals, that’s a really f****** big story,” he said.

It’s a meaningful achievement when hundreds of thousands of people have earned bitcoin through Fold, with thousands now living primarily on bitcoin, especially in a financial system where traditional tools often work against people’s long-term interests.

Looking Forward

When I asked Will what he’d want to ask Satoshi Nakamoto if given the chance, his answer revealed his perspective on Bitcoin’s evolution.

“I would ask him what surprises him most about where Bitcoin is today versus what he envisioned,” he said. “Bitcoin has been unleashed into the world. It is a virus that is taking over people to achieve its ends at this point.”

Will sees Bitcoin as having “taken a life of its own” far beyond what any single person, even Satoshi, could have predicted. The technical developments, social adoption, and financial integration have all exceeded early expectations.

Fold’s role in that evolution is clear: making Bitcoin accessible to anyone willing to start small. Whether you’re earning your first satoshis on coffee purchases or converting your entire paycheck, Fold provides the infrastructure.

“Are we achieving a better world for those that are adopting Bitcoin and can we be a good tool to support that transition?” Will asked. For thousands of Fold users [stacking

-

@ 2e8970de:63345c7a

2025-06-18 10:22:43

@ 2e8970de:63345c7a

2025-06-18 10:22:43https://iai.tv/articles/water-not-silicon-has-to-be-the-basis-of-true-ai-auid-3200

https://stacker.news/items/1009213

-

@ eb0157af:77ab6c55

2025-06-18 02:02:07

@ eb0157af:77ab6c55

2025-06-18 02:02:07Carl Rickertsen completely exits his position in Strategy as insiders sell $864 million worth of stock.

As reported by Protos, Carl Rickertsen, a member of Strategy’s board of directors, has fully liquidated his entire shareholding for over $10 million.

Rickertsen’s decision to completely exit his Strategy position marks a sharp shift from his previous investment stance. In 2022, the executive had shown confidence in the company by investing $700,000 in MSTR shares.

On June 13, 2022, Rickertsen purchased $608,000 worth of MSTR stock at $152 per share. Since then, the stock has rallied 152%. However, by 2023, the director had already sold half of his 4,000-share position.

Rickertsen’s approach to managing his holdings has become increasingly aggressive in recent years. Since joining the board in 2019, he has adopted a strategy of immediately liquidating any stock options received.

One example of this tactic occurred on June 2, when he acquired and sold 26,390 MSTR shares on the same day.

As of June 5 this year, Rickertsen reported zero vested Strategy shares, marking the end of his equity involvement with the company.

Rickertsen’s situation is not an isolated case within Strategy. Data from the Securities and Exchange Commission (SEC) reveals a controversial picture. According to information gathered by secform4.com, over the past five years, total insider sales have exceeded purchases by $864 million. This imbalance in insider transactions could raise questions about executives’ confidence in the company’s future.

The post Strategy director liquidates all his MSTR shares appeared first on Atlas21.

-

@ df478568:2a951e67

2025-06-17 21:37:10

@ df478568:2a951e67

2025-06-17 21:37:10It can already be used for pay-to-send e-mail. The send dialog is resizable and you can enter as long of a message as you like. It's sent directly when it connects. The recipient double-clicks on the transaction to see the full message. If someone famous is getting more e-mail than they can read, but would still like to have a way for fans to contact them, they could set up Bitcoin and give out the IP address on their website. "Send X bitcoins to my priority hotline at this IP and I'll read the message personally." -- Satoshi Nakamoto, January 17, 2009

"It might make sense just to get some in case it catches on. If enough people think the same way, that becomes a self-fulfilling prophecy. Once it gets bootstrapped, there are so many applications if you could effortlessly pay a few cents to a website as easily as dropping coins in a vending machine." -- Satoshi Nakamoto, January 17, 2009

.jpg?raw=true)

"Forgot to add the good part about micropayments. While I don't think Bitcoin is practical for smaller micropayments right now, it will eventually be as storage and bandwidth costs continue to fall. If Bitcoin catches on on a big scale, it may already be the case by that time. Another way they can become more practical is if I implement client-only mode and the number of network nodes consolidates into a smaller number of professional server farms. Whatever size micropayments you need will eventually be practical. I think in 5 or 10 years, the bandwidth and storage will seem trivial." -- Satoshi Nakamoto, August 10, 2010

"It can already be used for pay-to-send e-mail. The send dialog is resizable and you can enter as long of a message as you like. It's sent directly when it connects. The recipient double-clicks on the transaction to see the full message. If someone famous is getting more e-mail than they can read, but would still like to have a way for fans to contact them, they could set up Bitcoin and give out the IP address on their website. "Send X bitcoins to my priority hotline at this IP and I'll read the message personally." -- Satoshi Nakamoto, January 17, 2009

.jpg?raw=true)

"It might make sense just to get some in case it catches on. If enough people think the same way, that becomes a self-fulfilling prophecy. Once it gets bootstrapped, there are so many applications if you could effortlessly pay a few cents to a website as easily as dropping coins in a vending machine." -- Satoshi Nakamoto, January 17, 2009

"Forgot to add the good part about micropayments. While I don't think Bitcoin is practical for smaller micropayments right now, it will eventually be as storage and bandwidth costs continue to fall. If Bitcoin catches on on a big scale, it may already be the case by that time. Another way they can become more practical is if I implement client-only mode and the number of network nodes consolidates into a smaller number of professional server farms. Whatever size micropayments you need will eventually be practical. I think in 5 or 10 years, the bandwidth and storage will seem trivial." -- Satoshi Nakamoto, August 10, 2010

Bitcoin Is Winning Fast AF

.jpg?raw=true)

I began writing about using the lightning network about 150,000 blocks ago because I got tired of hearing that bitcoin can't make more than 7 transactions a minute. That was true 565,000 blocks ago, but is no longer true since the inception of the lightning network. For example:

- We sent 4,187 bitcoin payments over an 8-hour period at Bitcoin 2025, a Guinness Book of World Record winning achievement.

- Nostr is the biggest bitcoin circular economy in the world.

- Shake N Steak, a U.S.-based Hamburger franchise, accepts bitcoin over the Lightning Network at all of its locations.

- We can pay our credit cards with fractions of bitcoin (sats).

- We can use bitcoin over the lightning network to pay AI agents to do vibe coding using tools like Stacks and Goose.

- Bitcoin Helped Secure An Election In A County In Georgia.

I pay for Protonmail with bitcoin on-chain.

I can also use this email to send it to other people who do the same. I've only done this once to test it out, but it works. This is not new. The time chain uses Hashcash (with a double SHA256 algorithm instead of SHA1) for its famous proof-of-work. Hashcash was originally intended to prevent spam. Now you can use bitcoin to do the same.

I ran the numbers. Our world record is an average of 8.72 bitcoin transactions per second. This is just in one place, but bitcoin is a global monetary network. Bitcoin over the lightning network makes it possible to send value at the speed of light, anywhere in the world.

We won a world record. We are winning. We use money that we know works better than gold.

"If you don't believe me or don't get it, I don't have time to try to convince you, sorry." -- Satoshi Nakamoto

☮️ nostr:npub1marc26z8nh3xkj5rcx7ufkatvx6ueqhp5vfw9v5teq26z254renshtf3g0

Zap This Blog would like to think The Nakamoto Institute for making it easy to find these awsome Satoshi quotes. If you like this article, please Zap The Nakamoto Institute!

-

@ cae03c48:2a7d6671

2025-06-18 12:00:39

@ cae03c48:2a7d6671

2025-06-18 12:00:39Bitcoin Magazine

DDC Enterprise Secures $528 Million to Expand Bitcoin HoldingsToday, DDC Enterprise Limited (NYSE: DDC) announced it has raised three securities purchase agreements for a total of up to $528 million to expand its Bitcoin holdings. According to the press release, this is one of the largest single-purpose Bitcoin raises by any NYSE-listed company.

JUST IN:

DDC Enterprise to raise up to $528 million to buy more #Bitcoin pic.twitter.com/CPxPlsjvwq

DDC Enterprise to raise up to $528 million to buy more #Bitcoin pic.twitter.com/CPxPlsjvwq— Bitcoin Magazine (@BitcoinMagazine) June 17, 2025

“Today is a defining moment for DDC Enterprise and our shareholders,” said the Founder and CEO of DDC Enterprise Norma Chu. “This capital commitment of up to $528 million, backed by respected institutions from both traditional finance and the digital asset frontier, represents a strong mandate to execute an ambitious corporate Bitcoin accumulation strategy globally. Our vision is unequivocal: we are building the world’s most valuable Bitcoin treasury.”

The funding, backed by investors including Anson Funds, Animoca Brands, Kenetic Capital, and QCP Capital, will be primarily allocated toward significantly increasing the company’s Bitcoin holdings.

“This funding is expected to propel DDC into one of the top global corporate Bitcoin holders,” stated Chu. “This investment by Anson Funds and the group of PIPE investors is a resounding validation of Bitcoin’s important role in future corporate balance sheets.”

Components of the capital raise include:

- $26 Million Equity PIPE Investment:

The company will issue up to 2.4 million Class A ordinary shares at an average price of $10.30 to investors including Animoca Brands, Kenetic Capital, and QCP Capital. The shares will be restricted for 180 days. - $300 Million Convertible Note and $2 Million Private Placement:

Anson Funds will provide an initial $25 million with no interest and will mature in 24 months, with up to $275 million available in future tranches. Anson will also purchase 307,693 Class A ordinary shares for $2 million in a concurrent private placement. - $200 Million Equity Line of Credit:

Anson Funds has also committed to a $200 million equity line of credit (ELOC), giving DDC flexible access to capital for future Bitcoin purchases.

“At DDC, we will deploy this capital with institutional discipline and unwavering conviction, cementing our position as the premier bridge between global capital markets and the Bitcoin ecosystem,” said Chu. “DDC Enterprise is strongly positioned as the definitive publicly-traded vehicle for concentrated Bitcoin exposure and value creation. My focus will be on growing our BTC treasury and delivering attractive BTC yield consistently for our shareholders.”

This post DDC Enterprise Secures $528 Million to Expand Bitcoin Holdings first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

- $26 Million Equity PIPE Investment:

-

@ eb0157af:77ab6c55

2025-06-18 11:01:52

@ eb0157af:77ab6c55

2025-06-18 11:01:52The Brazilian government has abolished the Bitcoin tax exemption for small investors and introduced a flat 17.5% tax rate on all crypto capital gains.

Brazil has officially ended the tax-free period for small digital asset investors, introducing a flat 17.5% rate on all profits from cryptocurrency sales. The decision was formalized through Provisional Measure 1303, part of the government’s strategy to increase tax revenues from financial markets.

Until now, Brazilian residents selling up to 35,000 Brazilian reais (around $6,300) in cryptocurrencies per month were completely exempt from income tax. Profits exceeding this threshold were subject to progressive taxation, starting at 15% and reaching up to 22.5% for amounts over 30 million reais.

The new flat rate, which took effect on June 12, removes all exemptions and applies uniformly to every investor, regardless of the size of their transactions, according to local outlet Portal do Bitcoin.

While small-scale investors will now face a higher tax burden, high-net-worth individuals might actually benefit. Under the previous system, large transactions were taxed between 17.5% and 22.5%. With the new flat 17.5% rate, many high-profile investors will see their effective tax liability reduced.

Under the new rules, taxes will be calculated quarterly, with investors allowed to offset losses from the previous five quarters. However, starting in 2026, the time frame for claiming losses will be shortened.

Last March, Brazilian lawmakers also proposed a bill allowing employers to partially pay workers in cryptocurrency. According to the draft, crypto payments could not exceed 50% of an employee’s salary.