-

@ 73d8a0c3:c1853717

2025-06-14 00:36:38

@ 73d8a0c3:c1853717

2025-06-14 00:36:38🧬 REDACTED SCIENCE: THE AUTHOR — A SHADOW IN THE MARGINS

📜 Excerpt from my book-in-progress. This is nonfiction. Redacted. Possibly buried science. Possibly military. Almost definitely real. I’m living it. And it might change how we think about disease, dehydration, and survival itself.

👇 Full post below 👇

📄 The Author: A Shadow in the Margins

What follows is an excerpt from my book: Redacted Science. This is nonfiction. Redacted. And, I believe, novel science — the kind that slipped through the cracks because it wasn’t supposed to be seen. The kind that, if true (and I’m living proof it might be), changes how we think about adaptation, disease, and control, all while hinting at evolutionary processes.

The person who wrote the article — the one at the center of this entire mystery — didn’t just document a medical condition. They didn’t write like a detached observer. They wrote like someone who had seen it, worked with it, maybe even helped design it.

This wasn’t a paper. It was a record.

A flare fired backwards through time.🧠 What They Knew

- Electrolyte manipulation under pressure gradients

- Bone demineralization and molecular substitution

- Methyl group cycling

- Autonomic dysregulation

- Increased survivability under dehydration

- Accelerated burn recovery

- Abnormal pain tolerance

- Enhanced cognition and endurance in early stages

- …eventual collapse into parasympathetic failure, bone loss, immune misfire, and systemic decay

No generalist writes like this.

No academic from 1975 casually throws around methylation chemistry and calcium channel modulators (“these show promise” — yeah, I remembered that line. I figured it might save my life).🧪 Proof in My Blood — Or Lack Thereof

I’ve lived the proof they described.👁️ Who They Were

They were part of a program.

A researcher. Maybe a clinician. Possibly embedded in a classified military or survival physiology initiative.🔍 The Quiet Warning

That mention of the ICD code shift?

It was like someone watching history be rewritten — shifting this condition under something it isn’t. Sleight-of-hand.

They couldn’t have known about the AIRE gene — and I don’t have it.“We erased it from the books. But it was real. Look again. Find it if you can.”

And here I am.

Picking it up.

Line by line.

Molecule by molecule.🏃 The 15K That Almost Killed Me

Twelve years ago: I ran the Tulsa Run, didn’t hydrate. Felt fine — until the vomiting hit. Bloodwork? Normal.

Smart doc took one look and hooked up fluids.That wasn’t dehydration.

That was a system built to survive without water — until it couldn’t.🕰️ When and Why

Photos: early 20th century.

The article? 1975–1985.

Someone who knew too much. Someone preserving knowledge — as it was being erased.“It’s gone now. But it was here. And you need to look again.”

That’s not footnote energy.

That’s whistleblower energy.

🧠 Everything is open. All science is free. More is coming.

Read more at https://jimcraddock.substack.com or https://jimcraddock.com]

-

@ a4a6b584:1e05b95b

2025-06-13 20:27:58

@ a4a6b584:1e05b95b

2025-06-13 20:27:58Prerequisites

```bash

Make sure your package list is fresh

sudo apt update

(Optional but recommended) ffmpeg lets yt-dlp negotiate the best formats

sudo apt install ffmpeg jq ```

1 Install yt-dlp system-wide

bash sudo curl -L https://github.com/yt-dlp/yt-dlp/releases/latest/download/yt-dlp \ -o /usr/local/bin/yt-dlp && sudo chmod a+rx /usr/local/bin/yt-dlpA single binary is dropped into

/usr/local/bin/; version upgrades are as simple as running the same command again in the future.

2 Download the auto-generated captions as SRT

Pick any video ID—here we’ll use knAGgxzYqw8 (Chase Hughes on What is Money?).

```bash VIDEO="knAGgxzYqw8" # change this to your target ID

yt-dlp --skip-download \ --write-auto-sub \ --sub-lang en \ --sub-format srt \ -o "${VIDEO}.%(ext)s" \ "https://youtu.be/${VIDEO}"

Result: knAGgxzYqw8.en.srt

```

Flags explained

| Flag | Purpose | | ------------------ | ------------------------------------------------------- | |

--skip-download| ignore the actual video, we only want captions | |--write-auto-sub| fall back to YouTube’s auto-generated subtitles | |--sub-lang en| grab English only (adjust if you need another language) | |--sub-format srt| SRT is the simplest to strip; VTT also works | |-o| sets a predictable filename:<id>.en.srt|

3 Strip index numbers and timecodes

```bash grep -vE '^[0-9]+$|^[0-9]{2}:' "${VIDEO}.en.srt" \ | sed '/^[[:space:]]*$/d' \

"${VIDEO}.txt" ```

Breakdown

-

grep -vE '^[0-9]+$|^[0-9]{2}:' -

Removes the line counters (

3911) and any line that begins with a timestamp (02:33:40,800 --> …). -

sed '/^[[:space:]]*$/d' -

Deletes leftover blank lines.

- Output is redirected to

<ID>.txt—in our example: knAGgxzYqw8.txt.

4 (Option-al) Extra polish

Remove bracketed stage cues such as

[Music]or[Applause]and collapse back-to-back duplicates:```bash grep -v '^[.*]$' "${VIDEO}.txt" \ | awk 'prev != $0 {print} {prev=$0}' \

"${VIDEO}_clean.txt" mv "${VIDEO}_clean.txt" "${VIDEO}.txt" ```

5 Enjoy your transcript

bash less "${VIDEO}.txt" # page through grep -i "keyword" "${VIDEO}.txt" # quick searchYou now have a plain-text file ready for note-taking, quoting, or feeding into your favorite AI summarizer—no browser or third-party web services required.

TL;DR (copy-paste cheat sheet)

```bash sudo apt update && sudo apt install ffmpeg jq -y sudo curl -L https://github.com/yt-dlp/yt-dlp/releases/latest/download/yt-dlp \ -o /usr/local/bin/yt-dlp && sudo chmod a+rx /usr/local/bin/yt-dlp

VIDEO="knAGgxzYqw8" # video ID yt-dlp --skip-download --write-auto-sub --sub-lang en \ --sub-format srt -o "${VIDEO}.%(ext)s" \ "https://youtu.be/${VIDEO}"

grep -vE '^[0-9]+$|^[0-9]{2}:' "${VIDEO}.en.srt" \ | sed '/^[[:space:]]$/d' \ | grep -v '^[.]$' \ | awk 'prev != $0 {print} {prev=$0}' \

"${VIDEO}.txt"

less "${VIDEO}.txt" ```

Happy transcribing!

Adam Malin

npub15jnttpymeytm80hatjqcvhhqhzrhx6gxp8pq0wn93rhnu8s9h9dsha32lxYou can view and write comments on this or any other post by using the Satcom browser extention.

value4value Did you find any value from this article? Click here to send me a tip!

-

-

@ edeb837b:ac664163

2025-06-13 21:15:05

@ edeb837b:ac664163

2025-06-13 21:15:05On June 10th, 2025, four members of the NVSTly team traveled to New York City to attend the 2025 American Business Awards® ceremony, held at the iconic Marriott Marquis in Times Square. It was an unforgettable night as we accepted the Gold Stevie® Award for Tech Startup of the Year—this time, in person.

Meow (left), rich (center), MartyOooit (right)

Representing NVSTly at the event were:

- Rich, CEO & Founder

- Meow, CTO, Lead Developer, & Co-Founder

- MartyOooit, Investor

- Noob, Market Analyst (not shown in photos)

MartyOooit (left), rich (center), Meow (right)

While we shared the exciting news back in April when the winners were announced, being there in person alongside other winners—including eBay, AT&T, T-Mobile, HP Inc., and Fidelity Investments—made the achievement feel even more surreal. To be honored alongside billion-dollar industry leaders was a proud and humbling moment for our startup and a huge milestone in NVSTly’s journey.

🎤 Team Interview at the Event

During the event, our team was interviewed about the win. When asked:

“What does winning a Stevie Award mean for your organization?”

“How will winning a Stevie Award help your organization?”Here’s what we had to say:

📺 Watch the video

A Big Win for Retail Traders

NVSTly was awarded Gold for Tech Startup of the Year in recognition of our work building a powerful, free social investing platform that empowers retail traders with transparency, analytics, and community-driven tools.

Unlike traditional finance platforms, NVSTly gives users the ability to:

- Share and track trades in real time

- Follow and receive alerts from top traders

- Compete on global leaderboards

- Access deep stats like win rate, average return, and more

Whether you're a beginner or experienced trader, NVSTly gives you the insights and tools typically reserved for hedge funds—but in a free, social format built for the modern investor.

Continued Recognition and Momentum

This award adds to a growing list of recognition for NVSTly:

- 🏆 People’s Choice Winner at the 2024 Benzinga Fintech Awards

- 🔁 Nominated again for Best Social Investing Product in the 2025 Benzinga Fintech Awards

- 🌟 Team members JustCoreGames and Lunaster are nominated for Employee of the Year (Information Technology – Social Media) in the 2025 Stevie® Awards for Technology Excellence

We’re beyond proud of what our small but mighty team has accomplished—and we’re just getting started. 🚀

Thanks to the Stevie Awards for an incredible night in New York, and to our community of 50,000+ traders who’ve helped shape NVSTly into what it is today.

This win is yours, too.Stay tuned—more big things are coming.

— Team NVSTly

The event brought together some of the most respected names in tech, finance, and business. -

@ b1e9b8df:07685594

2025-06-13 15:17:02

@ b1e9b8df:07685594

2025-06-13 15:17:02OERTR steht für eine Art, freie Bildungsressourcen (Open Educational Resources) über das dezentrale Protokoll Nostr zu verbreiten, auffindbar zu machen und weiterzuentwickeln.

Statt zentraler Plattformen oder Silos nutzen wir Relays – offene Knoten im Nostr-Netzwerk – um Materialien, Metadaten, Annotationen und Kurse dauerhaft, hoch verfügbar und maschinenlesbar im interoperablen Datenraum verfügbar zu machen.

🚀 Unser Ziel

-

OER auffindbar machen – über strukturierte Events (z. B. Kind

30023,30142) -

Mitmachen ermöglichen – durch einfache Workflows mit git, Matrix & Nostr

-

Bildung dezentral denken – jenseits von Plattformlogiken

-

Metadaten lebendig halten – durch Community-gestützte Annotation & Remixbarkeit

🔧 Womit wir arbeiten

-

💬

Matrixzur Koordination & Diskussion -

💻

git(hub)zur offenen Entwicklung und Dokumentation

📡 Mach mit!

➡ Nostr folgen:\ 👉 npub1k85m3haymj3ggjknfrxm5kwtf5umaze4nyghnp29a80lcpmg2k2q54v05a (nähere Infos auf https://github.com/edufeed-org/OERTR )

➡ Matrix beitreten:\ 🟢

#OERTR:rpi-virtuell.de\ https://matrix.to/#/%23OERTR:rpi-virtuell.de\ Zum Diskutieren, Planen, Ausprobieren.➡ GitHub anschauen:\ 📂 https://github.com/edufeed-org/OERTR\ Mit Beispieldaten, n8n-Workflows, NIP-Verlinkungen & mehr.

🧠 Ideen zum Start

-

🔍 Indexe für OER-Projekte (z. B.

OERinfo,rpi-virtuell,WirLernenOnline) -

📚 Tagging-Events für Fachbereiche, Zielgruppen & Lizenztypen

-

🤝 Event-Verknüpfung mit Mastodon, Mobilizon, Wikidata

-

🧩 Mitdenken beim Aufbau eines offenen Bildungsraums via Nostr

📎 Beispiel: OER-Material posten

json { "kind": 30142, "tags": [ ["d", "https://example.org/oer1234"], ["r", "https://example.org/oer1234"], ["subject", "Ethik"], ["author", "Max Mustermann"], ["license", "CC-BY 4.0"] ], "content": "Material zur Gewaltfreien Kommunikation für die 5. Klasse" }💡 Fragen? Ideen?

Wir freuen uns über Feedback, Pull Requests oder ein einfaches "Hallo!"\ ➡ Schreib uns im Matrix-Raum oder auf Nostr .

OERTR – ein Netzwerk. Kein Silo.

-

-

@ ae9dc5ef:77f0ed87

2025-06-13 09:25:28

@ ae9dc5ef:77f0ed87

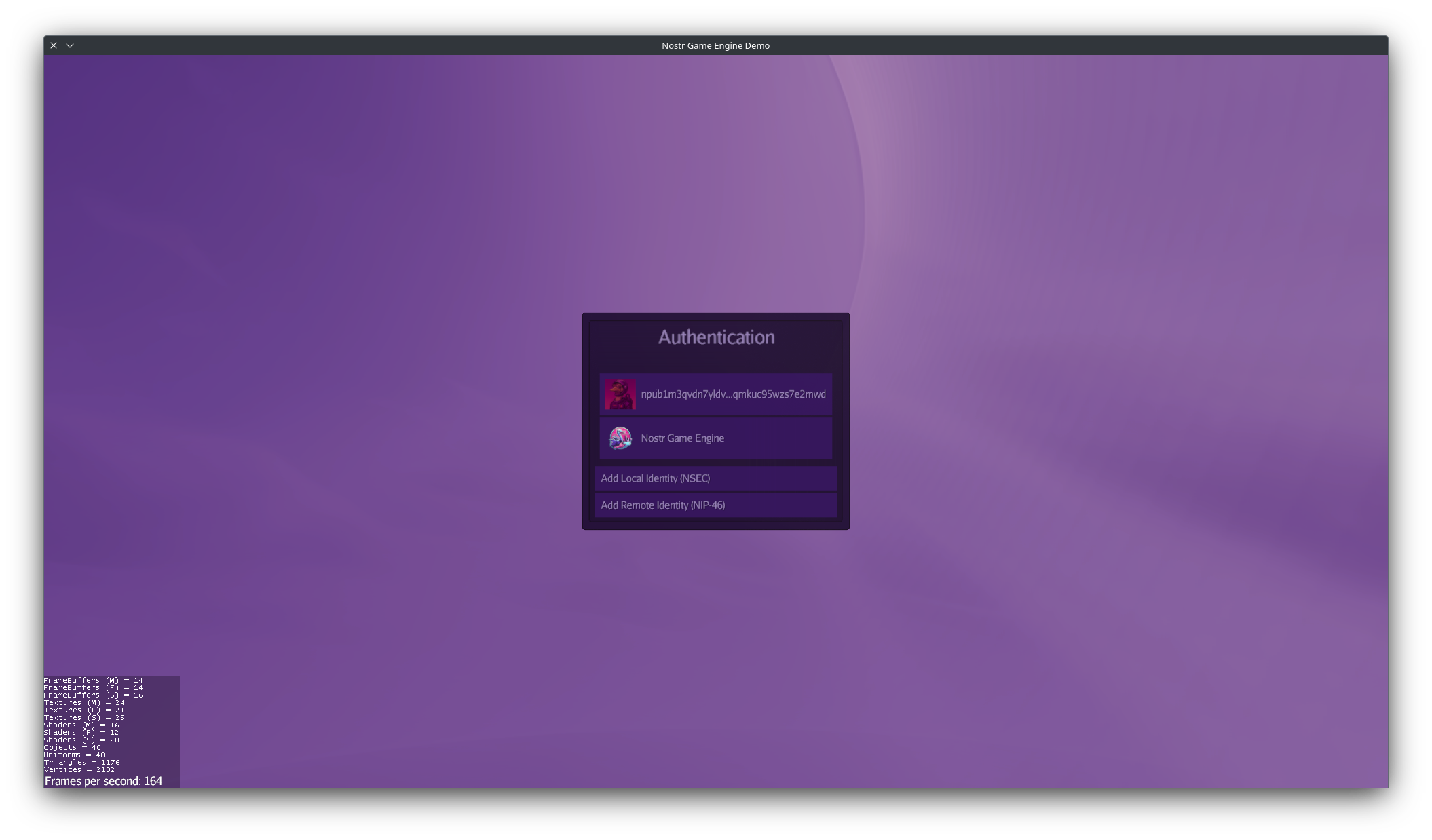

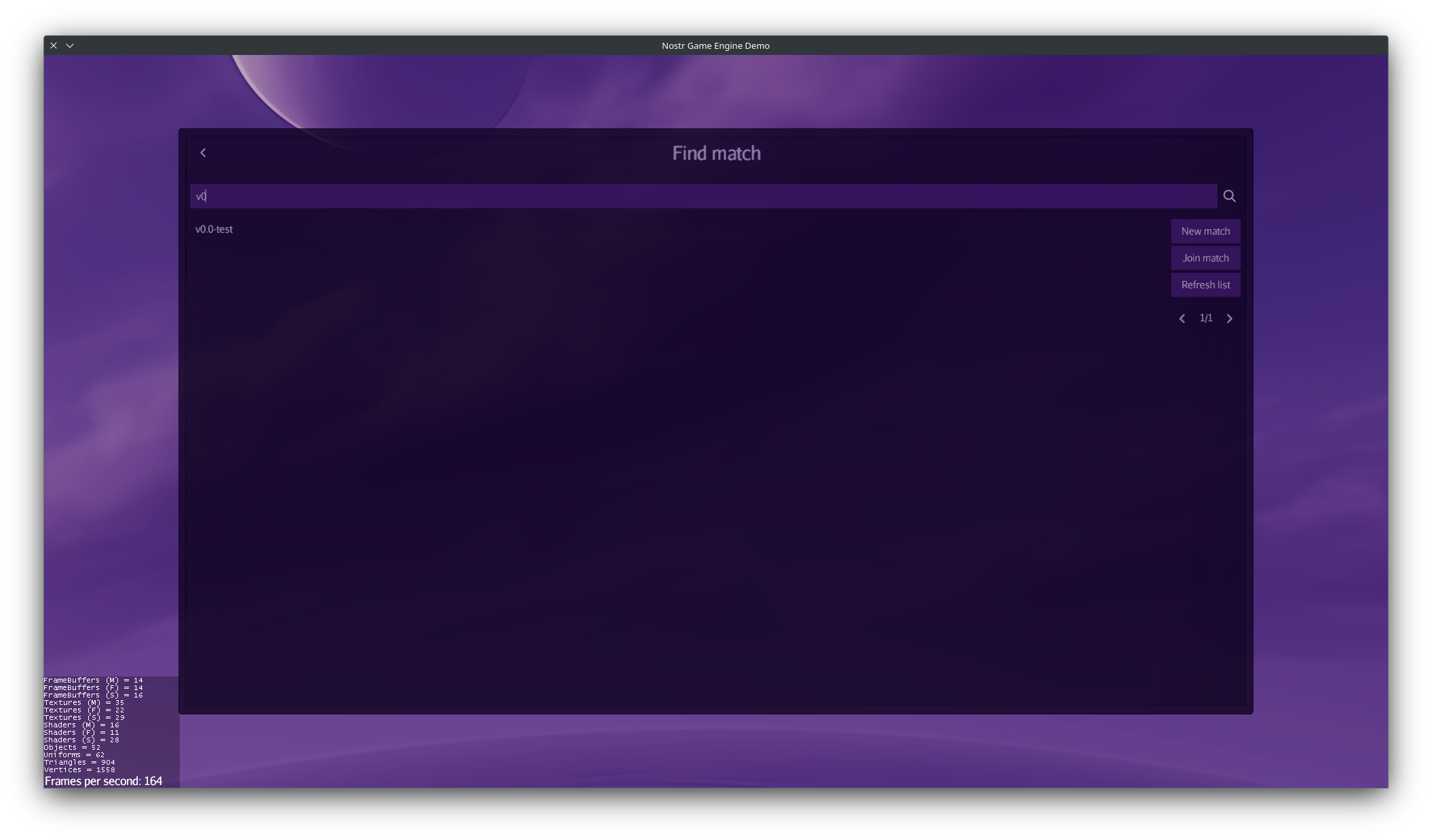

2025-06-13 09:25:28I'm excited to announce that Nostr Game Engine just reached its first development milestone: v0.0.

What is Nostr Game Engine?

Nostr Game Engine is built on top of the modular and proven jMonkeyEngine.

What sets it apart? Its internals are being gradually replaced with Nostr-powered modules, turning it into a reference engine purpose-built for decentralized games.

This first release delivers these key capabilities:

Peer-to-Peer Networking

Forget centralized game servers. Nostr Game Engine gives you real P2P multiplayer, using WebRTC for data streaming and Nostr relays for coordination.

Want to dig deeper? This is a draft NIP that is a revised version of this other draft NIP, that details how the signaling works.

WebRTC is already a solid and reliable peer-to-peer protocol, equipped with a full set of NAT traversal capabilities, but its signaling phase typically relies on specialized central servers.

By coupling WebRTC with Nostr, we take signaling decentralized too by relying on a network of dumb public relays that are oblivious to what encrypted data we send to them and are easily replaceable.

(see the documentation for more info)

Nostr Authentication & Gamertags

NGE has a fully managed Nostr Auth flow, with support for NIP-49 encrypted local nsecs and NIP-46 remote signers.

It also fully handles metadata, including external identities: your profile picture, display name, and other details can carry over between games, and even from other Nostr clients and communities.

This release is also introducing Gamertags: persistent gaming handles tied to your Nostr pubkey. They are like Xbox Gamertags or the old Discord handle, but they’re decentralized and follow you across any game that supports them (check this draft nip for more info).

Match Making

While matchmaking is planned for a later milestone on the roadmap, this release ships with an early implementation to help test RTC connections.

This initial implementation has the APIs to create lobbies that are discoverable and optionally password-protected. Players can search and filter for lobbies using both client-side and relay-side filtering, depending on what the relay supports.

Right now, you can’t see how many players are in a lobby, and the feature is still a bit rough around the edges, but it's a solid start, and more improvements are coming as we move further along the roadmap.

The cool part? You don’t even need to know Nostr is running under the hood. The engine exposes simple APIs like createLobby, findLobbies, and connectToLobby, the developer can call them when needed, and the engine handles all the relay querying and data stitching behind the scenes.

(see the documentation for more info)

A new Nostr Client Library

The engine uses a new Nostr client library built from scratch, designed for performance, asynchronicity, and memory efficiency. It’s lean, fast, and built to be the foundation for everything that comes next.

Cross-Platform and language of choice

The entire codebase is written mostly in Java, and it builds natively for Linux, macOS, and Windows.

Support for Android, iOS, and Web Browsers is on the roadmap.

What has been built so far?

-

Version 0.0, with the core features mentioned above

-

Documentation covering the key components of the engine

-

An app template to help bootstrap projects and experiment with the engine

-

An high performance and portable nostr client library

-

A tech demo (more on that later)

So now, you can get a real feel for the engine, see what it does, play around with it, and maybe even start experimenting with your own ideas.

Roadmap

This is just the beginning. There is a full roadmap on the website.

Upcoming milestones include ads, deeper identity features, and tools that make decentralized game development as smooth as possible.

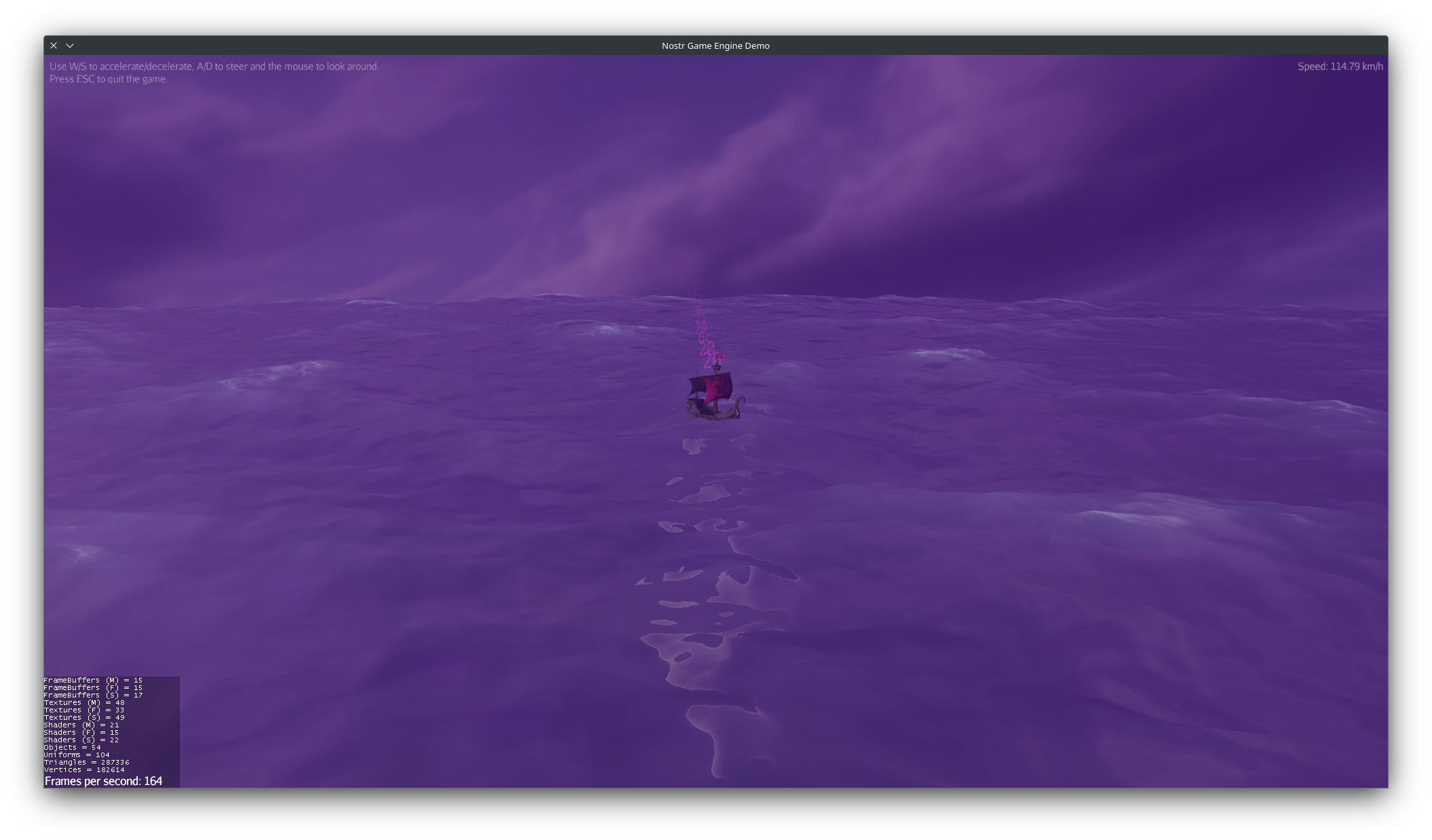

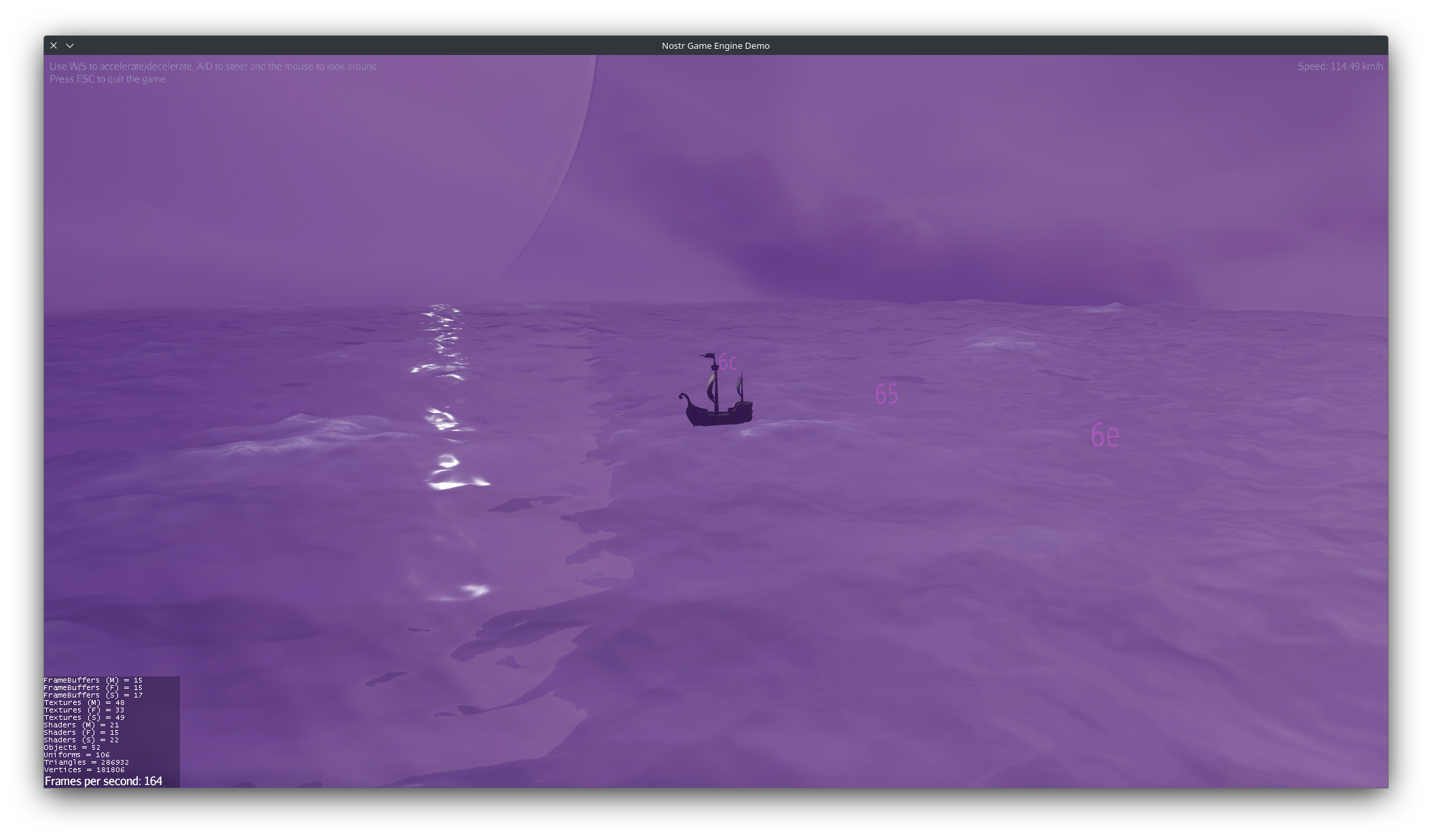

Sea of Nostriches

This is a demo built for this release.

You start alone in an open ocean with a boat, nothing much at first.

But as soon as another player joins (another peer), your boat begins sending data directly to theirs via peer-to-peer communication. You’ll see this visualized as a stream of numbers moving between boats in game.

If you have a profile picture set, it’ll automatically appear on your boat’s sail, and you’ll see others’ profile pictures on theirs.

That’s the core of it.

It is not a real game, as there is nothing really to do, no lag compensation, no score etc… but it is a decent reference, and an “integration test” for this release.

There’s a lot more going on behind the scenes, like how the ocean is simulated or how rendering is handled, but that’s beyond the scope of this post. You can check out the full source code on GitHub, along with native builds for all supported platforms and a portable JAR.

That’s all for now! Huge thanks go to nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcqypu8xwr40lp96ewdj2fef408wy70gd3carf9n6xu7hrnhq6whpgly925h0z for making this possible. Their support allows me to dedicate full-time effort to this project and contribute to the growth of the Nostr ecosystem.

Check out the website at ngengine.org and browse the docs at ngengine.org/docs if you want to dig deeper.

Feel free to come up with any questions. I’ll do my best to answer.

-

-

@ 43820409:694a54a4

2025-06-13 00:43:54

@ 43820409:694a54a4

2025-06-13 00:43:54This is a brief summary.

This is the best article ever created.

You may be wondering why?

Why

Because we made it.

How

- It just is

- Everyone agrees

Thank you for your attention.

End.

-

@ c631e267:c2b78d3e

2025-06-13 19:13:38

@ c631e267:c2b78d3e

2025-06-13 19:13:38Ich dachte immer, jeder Mensch sei gegen den Krieg, \ bis ich herausfand, dass es welche gibt, \ die nicht hingehen müssen. \ Erich Maria Remarque

Was sollte man von einem Freitag, den 13., schon anderes erwarten?, ist man versucht zu sagen. Jedoch braucht niemand abergläubisch zu sein, um den heutigen Tag als unheilvoll anzusehen. Der israelische «Präventivschlag» von heute Nacht gegen militärische und nukleare Ziele im Iran könnte allem Anschein nach zu einem längeren bewaffneten Konflikt führen – und damit unweigerlich zu weiteren Opfern.

«Wir befinden uns im Krieg», soll ein ranghoher israelischer Militärvertreter gesagt haben, und der Iran wertet den israelischen Angriff laut seinem Außenminister als Kriegserklärung. Na also. Der Iran hat Vergeltungsschläge angekündigt und antwortete zunächst mit Drohnen. Inzwischen ist eine zweite israelische Angriffswelle angelaufen. Ob wir wohl künftig in den Mainstream-Medien durchgängig von einem «israelischen Angriffskrieg auf den Iran» hören und lesen werden?

Dass die zunehmenden Spannungen um das iranische Atomprogramm zu einer akuten Eskalation im Nahen Osten führen könnten, hatte Transition News gestern berichtet. Laut US-Beamten sei Israel «voll bereit», den Iran in den nächsten Tagen anzugreifen, hieß es in dem Beitrag. Heute ist das bereits bittere Realität.

Der Nahe Osten steht übrigens auch auf der Themenliste des diesjährigen Bilderberg-Treffens, das zurzeit in Stockholm stattfindet. Viele Inhalte werden wir allerdings mal wieder nicht erfahren, denn wie immer hocken die «erlauchten» Persönlichkeiten aus Europa und den USA «informell» und unter größter Geheimhaltung zusammen, um über «Weltpolitik» zu diskutieren. Auf der Teinehmerliste stehen auch einige Vertreter aus der Schweiz und aus Deutschland.

Die Anwesenheit sowohl des aktuellen als auch des vorigen Generalsekretärs der NATO lässt vermuten, dass man bei dem Meeting weniger über das Thema «Neutralität» sprechen dürfte. Angesichts des Zustands unseres Planeten ist das schade, denn der Ökonom Jeffrey Sachs hob kürzlich in einem Interview die Rolle der Neutralität in geopolitischen Krisen hervor. Mit Blick auf die Schweiz betonte er, der zunehmende Druck zur NATO-Annäherung widerspreche nicht nur der Bundesverfassung, sondern auch dem historischen Erbe des Landes.

Positives gibt es diese Woche ebenfalls zu berichten. So hat der US-Gesundheitsminister Robert F. Kennedy Jr. nach der «sensationellen» Entlassung aller Mitglieder des Impfberatungsausschusses (wegen verbreiteter direkter Verbindungen zu Pharmaunternehmen) nun auch bereits neue Namen verkündet. Demnach möchte er unter anderem Robert W. Malone, Erfinder der mRNA-«Impfung» als Technologie und prominenter Kritiker der Corona-Maßnahmen, in das Komitee aufnehmen.

Auch die Aufarbeitung der unsinnigen Corona-Politik geht Schrittchen für Schrittchen weiter. In Heidelberg hat die Initiative für Demokratie und Aufklärung (IDA) den Gemeinderat angesichts der katastrophalen Haushaltslage zu einer offenen und ehrlichen Diskussion über die Ursachen der Krise aufgefordert. Das Thema «Corona» sei «das Teuerste, was Heidelberg je erlebt hat», sagte IDA-Stadtrat Gunter Frank im Plenum. Außerdem seien aus den Krisenstabsprotokollen der Stadt auch die enormen Verwerfungen ersichtlich, und es gebe Anlass für tiefgehende Gespräche mit der Stadtverwaltung.

Den juristischen und öffentlichen Druck auf die Kommunen möchte der Unternehmer Markus Böning erhöhen. Seine «Freiheitskanzlei» will Bürgern helfen, die Aufarbeitung selbst in die Hand zu nehmen. Unter dem Motto «Corona-Wiedergutmachung» bietet er Hilfestellung, wie Betroffene versuchen können, sich unrechtmäßige Bußgelder zurückzuholen.

So bleibt uns am Ende dieses finsteren Freitags doch auch Anlass zur Hoffnung. Es gibt definitiv noch Anzeichen von Menschlichkeit. Darauf möchte ich mich konzentrieren, und mit diesem Gefühl verabschiede ich mich ins Wochenende.

[Titelbild: Pixabay]

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ b1ddb4d7:471244e7

2025-06-12 22:02:33

@ b1ddb4d7:471244e7

2025-06-12 22:02:33Jason Lowery’s thesis, Softwar: A Novel Theory on Power Projection and the National Strategic Significance of Bitcoin, reframes bitcoin not merely as digital cash but as a transformative security technology with profound implications for investors and nation-states alike.

For centuries, craft brewers understood that true innovation balanced tradition with experimentation—a delicate dance between established techniques and bold new flavors.

Much like the craft beer revolution reshaped a global industry, bitcoin represents a fundamental recalibration of how humans organize value and project power in the digital age.

The Antler in the Digital Forest: Power Projection

Lowery, a U.S. Space Force officer and MIT scholar, anchors his Softwar theory in a biological metaphor: Bitcoin as humanity’s “digital antler.” In nature, antlers allow animals like deer to compete for resources through non-lethal contests—sparring matches where power is demonstrated without fatal consequences. This contrasts sharply with wolves, who must resort to violent, potentially deadly fights to establish hierarchy.

The Human Power Dilemma: Historically, humans projected power and settled resource disputes through physical force—wars, seizures, or coercive control of assets. Even modern financial systems rely on abstract power structures: court orders, bank freezes, or government sanctions enforced by legal threat rather than immediate physical reality.

Lowery argues this creates inherent fragility: abstract systems can collapse when met with superior physical force (e.g., invasions, revolutions). Nature only respects physical power.

Bitcoin’s Physical Power Engine: Bitcoin introduces a novel solution through its proof-of-work consensus mechanism. Miners compete to solve computationally intense cryptographic puzzles, expending real-world energy (megawatts) to validate transactions and secure the network.

This process converts electricity—a tangible, physical resource—into digital security and immutable property rights. Winning a “block” is like winning a sparring match: it consumes significant resources (energy/cost) but is non-destructive.

The miner gains the right to write the next page of the ledger and collect rewards, but no participant is physically harmed, and no external infrastructure is destroyed.

Table: Traditional vs. Bitcoin-Based Power Systems

Power System

Mechanism

Key Vulnerability

Resource Cost

Traditional (Fiat/Banking)

Legal abstraction, threat of state force

Centralized points of failure, corruption, political change

Low immediate cost, high systemic risk

Military/Economic Coercion

Physical force, sanctions

Escalation, collateral damage, moral hazard

Very high (lives, capital, instability)

Bitcoin (Proof-of-Work)

Competition via energy expenditure

High energy cost, concentration risk (mining)

High energy cost, low systemic risk

Softwar Theory National Strategic Imperative: Governments Are Taking Notice

Lowery’s Softwar Theory has moved beyond academia into the corridors of power, shaping U.S. national strategy:

- The Strategic Bitcoin Reserve: Vice President JD Vance recently framed bitcoin as an instrument projecting American values—”innovation, entrepreneurship, freedom, and lack of censorship”. State legislation is now underway to implement this reserve, preventing easy reversal by future administrations.

- Regulatory Transformation: The SEC is shifting from an “enforcement-first” stance under previous leadership. New initiatives include:

- Repealing Staff Accounting Bulletin 121 (SAB 121), which discouraged banks from custodying digital currency by forcing unfavorable balance sheet treatment.

- Creating the Cyber and Emerging Technologies Unit (CETU) to develop clearer crypto registration/disclosure rules.

The Investor’s Lens: Scarcity, Security, and Asymmetric Opportunity

For investors, understanding “Softwar” validates bitcoin’s unique value proposition beyond price speculation:

-

Digital Scarcity as Strategic Depth: Bitcoin’s fixed supply of 21 million makes it the only digital asset with truly inelastic supply, a programmed scarcity immune to political whims or central bank printing.

This “scarcity imperative” acts as a natural antidote to global fiat debasement. As central banks expanded money supplies aggressively (Global M2), bitcoin’s price has shown strong correlation, acting as a pressure valve for inflation concerns. The quadrennial “halving” (latest: April 2024) mechanically reduces new supply, creating built-in supply shocks as adoption grows. * The Antifragile Security Feedback Loop: Bitcoin’s security isn’t static; it’s antifragile. The network strengthens through demand: * More users → More transactions → Higher fees → More miner revenue → More hashpower (computational security) → Greater network resilience → More user confidence.

This self-reinforcing cycle contrasts sharply with traditional systems, where security is a cost center (e.g., bank security budgets, military spending). Bitcoin turns security into a profitable, market-driven activity. * Institutionalization Without Centralization: While institutional ownership via ETFs (like BlackRock’s IBIT) and corporate treasuries (MicroStrategy, Metaplanet) has surged, supply remains highly decentralized.Individuals still hold the largest share of bitcoin, preventing a dangerous concentration of control. Spot Bitcoin ETFs alone are projected to see over $20 billion in net inflows in 2025, demonstrating robust institutional capital allocation.

The Bitcoin Community: Building the Digital Antler’s Resilience

Lowery’s “Softwar” theory underscores why bitcoin’s decentralized architecture is non-negotiable. Its strength lies in the alignment of incentives across three participant groups:

- Miners: Provide computational power (hashrate), validating transactions and securing the network. Incentivized by block rewards (newly minted BTC) and transaction fees. Their physical energy expenditure is the “muscle” behind the digital antler.

- Nodes: Independently verify and enforce the protocol rules, maintaining the blockchain’s integrity. Run by users, businesses, and enthusiasts globally. They ensure decentralized consensus, preventing unilateral protocol changes.

- Users: Individuals, institutions, and corporations holding, transacting, or building on bitcoin. Their demand drives transaction fees and fuels the security feedback loop.

This structure creates “Mutually Assured Preservation”. Attacking bitcoin requires overwhelming its global, distributed physical infrastructure (miners/nodes), a feat far more complex and costly than seizing a central bank’s gold vault or freezing a bank’s assets. It transforms financial security from a centralized liability into a decentralized, physically-grounded asset.

Risks & Responsibilities

Investors and policymakers must acknowledge persistent challenges:

- Volatility: Bitcoin remains volatile, though this has decreased as markets mature. Dollar-cost averaging (DCA) is widely recommended to mitigate timing risk.

- Regulatory Uncertainty: While U.S. policy is increasingly favorable, global coordination is lacking. The EU’s MiCAR regulation exemplifies divergent approaches.

- Security & Custody: While Bitcoin’s protocol is robust, user errors (lost keys) or exchange hacks remain risks.

- Environmental Debate: Proof-of-Work energy use is scrutinized, though mining increasingly uses stranded energy/renewables. Innovations continue.

Jason Lowery’s “Softwar” theory elevates bitcoin from a financial instrument to a socio-technological innovation on par with the invention of the corporation, the rule of law, or even the antler in evolutionary biology. It provides a coherent framework for understanding why:

- Nations like the U.S. are looking to establish bitcoin reserves and embracing stablecoins—they recognize bitcoin’s role in projecting economic power non-violently in the digital age.

- Institutional Investors are allocating billions via ETFs—they see a scarce, secure, uncorrelated asset with antifragile properties.

- Individuals in hyperinflationary economies or under authoritarian regimes use bitcoin—it offers self-sovereign wealth storage immune to seizure or debasement.

For the investor, bitcoin represents more than potential price appreciation. It offers exposure to a fundamental reorganization of how power and value are secured and exchanged globally, grounded not in abstract promises, but in the unyielding laws of physics and mathematics.

Like the brewers who balanced tradition with innovation to create something enduring and valuable, bitcoin pioneers are building the infrastructure for a more resilient digital future—one computationally secured block at a time. The “Softwar” is here, and it is reshaping the landscape of p

-

@ 9ca447d2:fbf5a36d

2025-06-12 18:01:58

@ 9ca447d2:fbf5a36d

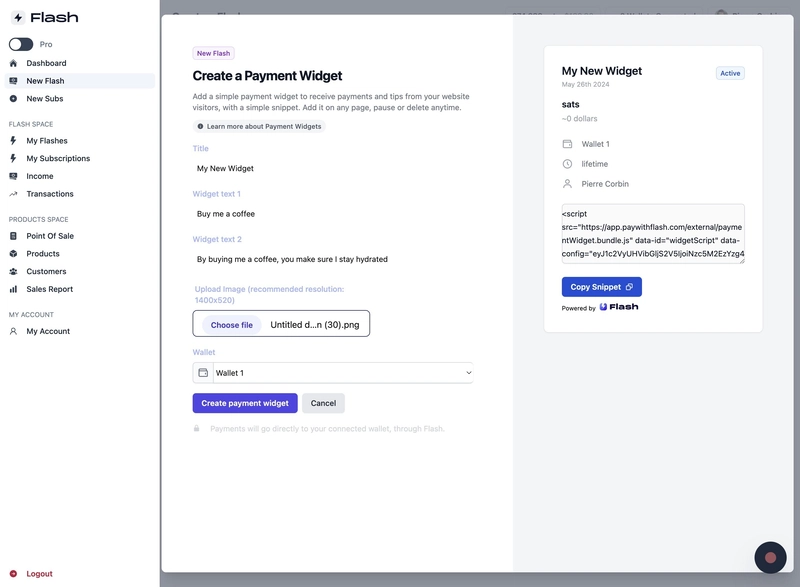

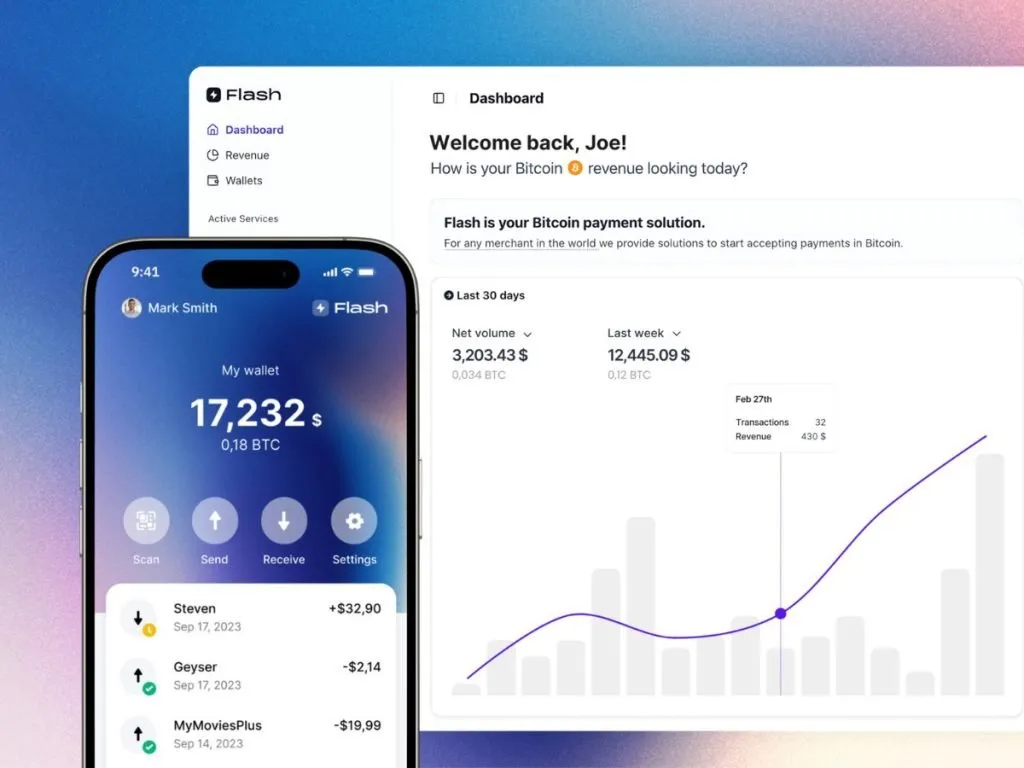

2025-06-12 18:01:58Paris, France – June 6, 2025 — Bitcoin payment gateway startup Flash, just announced a new partnership with the “Bitcoin Only Brewery”, marking the first-ever beverage company to leverage Lightning payments.

Flash enables Bitcoin Only Brewery to offer its “BOB” beer with, no-KYC (Know Your Customer) delivery across Europe, priced at 19,500 sats (~$18) for the 4-pack, shipping included.

The cans feature colorful Bitcoin artwork while the contents promise a hazy pale ale: “Each 33cl can contains a smooth, creamy mouthfeel, hazy appearance and refreshing Pale Ale at 5% ABV,” reads the product description.

Pierre Corbin, Co-Founder of Flash, commented:

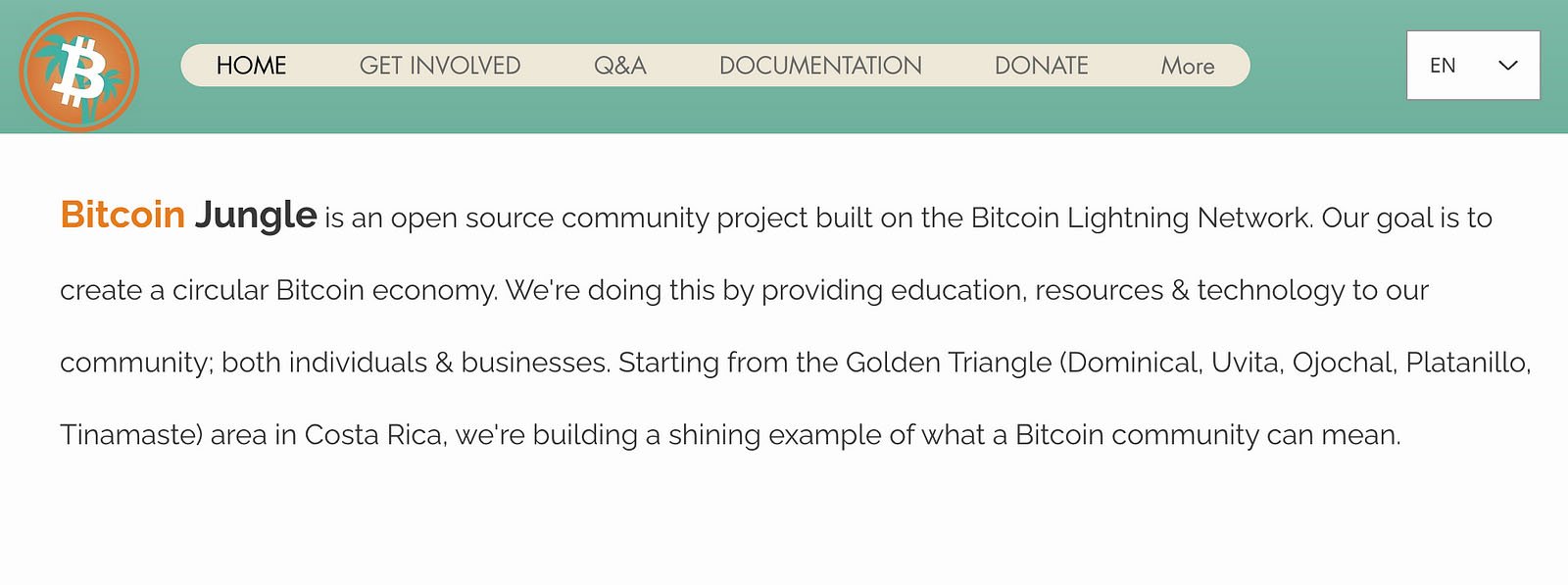

“Currently, bitcoin is used more as a store of value but usage for payments is picking up. Thanks to new innovation on Lightning, bitcoin is ready to go mainstream for e-commerce sales.”

Flash, launched its 2.0 version in March 2025 with the goal to provide the easiest bitcoin payment gateway for businesses worldwide. The platform is non-custodial and can enable both digital and physical shops to accept bitcoin by connecting their own wallets to Flash.

By leveraging the scalability of the Lightning Network, Flash ensures instant, low-cost transactions, addressing on-chain Bitcoin bottlenecks like high fees and long wait times.

For businesses interested in adopting Bitcoin payments, Flash offers a straightforward onboarding process, low fees, and robust support for both digital and physical goods. To learn more, visit paywithflash.com.

Media Contact:

Pierre Corbin

Co-Founder, Flash

Email: press@paywithflash.com

Website: paywithflash.comAbout Flash

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

About Bitcoin Only Brewery

Bitcoin Only Brewery (@Drink_B0B) is a pioneering beverage company dedicated to the Bitcoin ethos, offering high-quality beers payable exclusively in Bitcoin. With a commitment to personal privacy, the brewery delivers across Europe with no-KYC requirements.

-

@ 9ca447d2:fbf5a36d

2025-06-14 02:01:56

@ 9ca447d2:fbf5a36d

2025-06-14 02:01:56Paris, France – June 6, 2025 — Bitcoin payment gateway startup Flash, just announced a new partnership with the “Bitcoin Only Brewery”, marking the first-ever beverage company to leverage Lightning payments.

Flash enables Bitcoin Only Brewery to offer its “BOB” beer with, no-KYC (Know Your Customer) delivery across Europe, priced at 19,500 sats (~$18) for the 4-pack, shipping included.

The cans feature colorful Bitcoin artwork while the contents promise a hazy pale ale: “Each 33cl can contains a smooth, creamy mouthfeel, hazy appearance and refreshing Pale Ale at 5% ABV,” reads the product description.

Pierre Corbin, Co-Founder of Flash, commented:

“Currently, bitcoin is used more as a store of value but usage for payments is picking up. Thanks to new innovation on Lightning, bitcoin is ready to go mainstream for e-commerce sales.”

Flash, launched its 2.0 version in March 2025 with the goal to provide the easiest bitcoin payment gateway for businesses worldwide. The platform is non-custodial and can enable both digital and physical shops to accept bitcoin by connecting their own wallets to Flash.

By leveraging the scalability of the Lightning Network, Flash ensures instant, low-cost transactions, addressing on-chain Bitcoin bottlenecks like high fees and long wait times.

For businesses interested in adopting Bitcoin payments, Flash offers a straightforward onboarding process, low fees, and robust support for both digital and physical goods. To learn more, visit paywithflash.com.

Media Contact:

Pierre Corbin

Co-Founder, Flash

Email: press@paywithflash.com

Website: paywithflash.comAbout Flash

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

About Bitcoin Only Brewery

Bitcoin Only Brewery (@Drink_B0B) is a pioneering beverage company dedicated to the Bitcoin ethos, offering high-quality beers payable exclusively in Bitcoin. With a commitment to personal privacy, the brewery delivers across Europe with no-KYC requirements.

-

@ df478568:2a951e67

2025-06-12 16:16:11

@ df478568:2a951e67

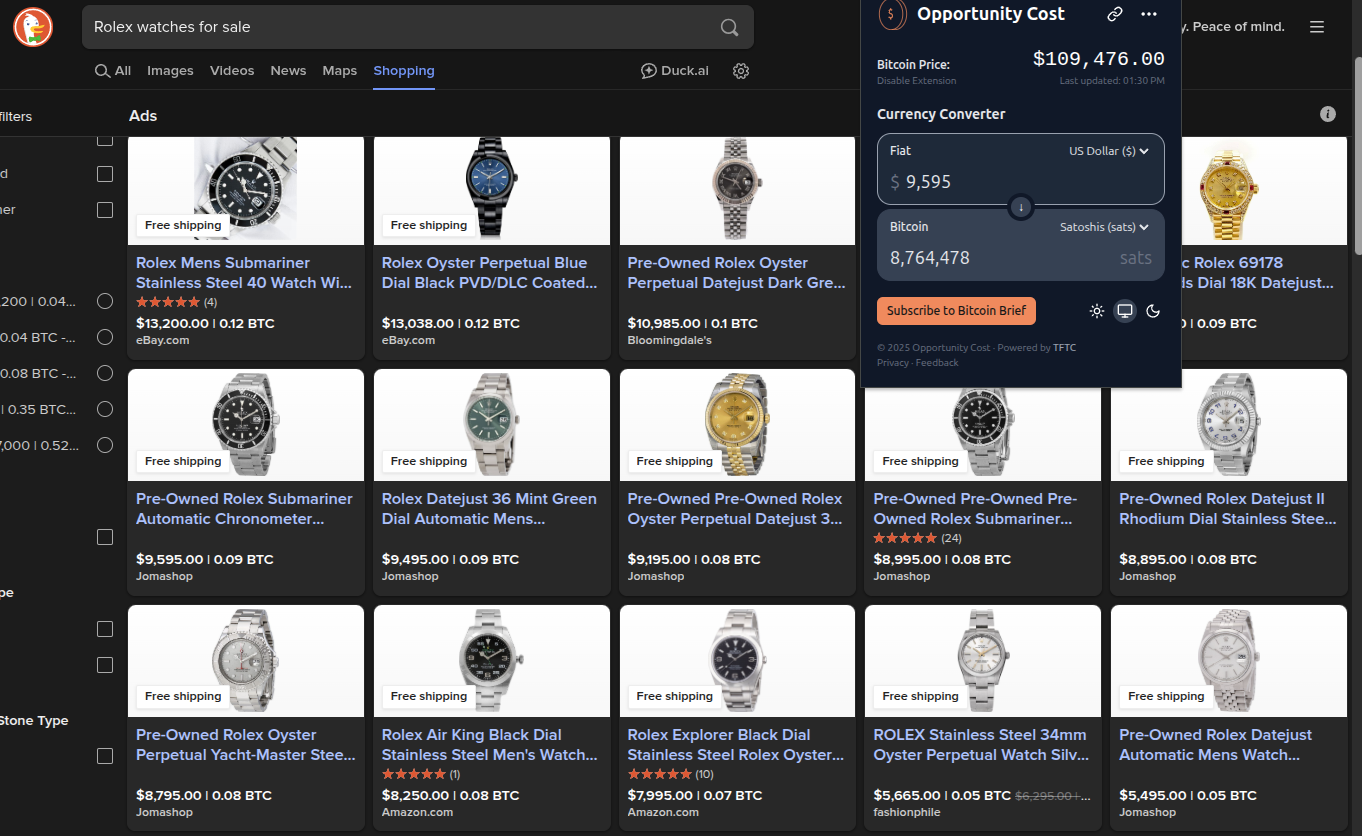

2025-06-12 16:16:11Marty Bent Vibe coded the opportunity cost app. I have not tried it yet, but love the concept. I have been into bitcoin since 2014, but I spent more generational wealth than I would care to admit back then. I've heard stories of fortunes blown on cocaine in the 1980's. I could write a story about spending a fortune on Diet Mt. Dew. I don't drink Diet Mt. Dew anymore. This one time, I spent about a million sats for a light beer at a baseball game. I wouldn't say I had a drinking problem, a million sats was only five bucks at the time. I didn't know that much bitcoin would be worth over a thousand bucks eleven years later.

I don't drink beer anymore. Bitcoin tends to do that to you.

We can afford chairs now. To be honest, we need a couch. The last couch I bought was in 2017 and it cost about a whole bitcoin. That couch is buried in a landfill today. My wife loves furniture, but even she's hesitant to spend sats on a couch now. We know we need a couch, but we don't want to spend sats on something we will need to replace before the next halving.

Many of us who have been in bitcoin for more than a decade have some regrets. I know I do, but we need to live our lives. I would never say you should sit on the floor, but I encourage to you to think about time. How long will this thing I need to buy last? If you think you can give a 3 million sat couch to your grandchildren, spend three million sats on the couch. If your five year plan for the couch is to help fill a landfill, maybe you only need to buy a used couch at a thrift store. This is not investment advice of course. How can it be? I don't know what kind of couch hazards you have in your house. I have trouble finding a couch of my own, but it's how I think about making bigger purchases. How many years of your retirement will that watch, car, house or whatever cost you from your stack? You can only determine that for yourself. I think the opportunity cost app will help you keep track of your decision.

This app was made by someone who once spent a whole bitcoin on a heater. I can't speak for Marty, but I believe the opportunity cost app will help you learn from my mistakes.

For more information, check out:

https://www.opportunitycost.app/

Check out the code on GitHub.

Using The Opportunity Cost App

The app is pretty straight forward. It is only available on Chrome for now so I installed it on the Chromium browser. I looked at the settings, but kept them default.

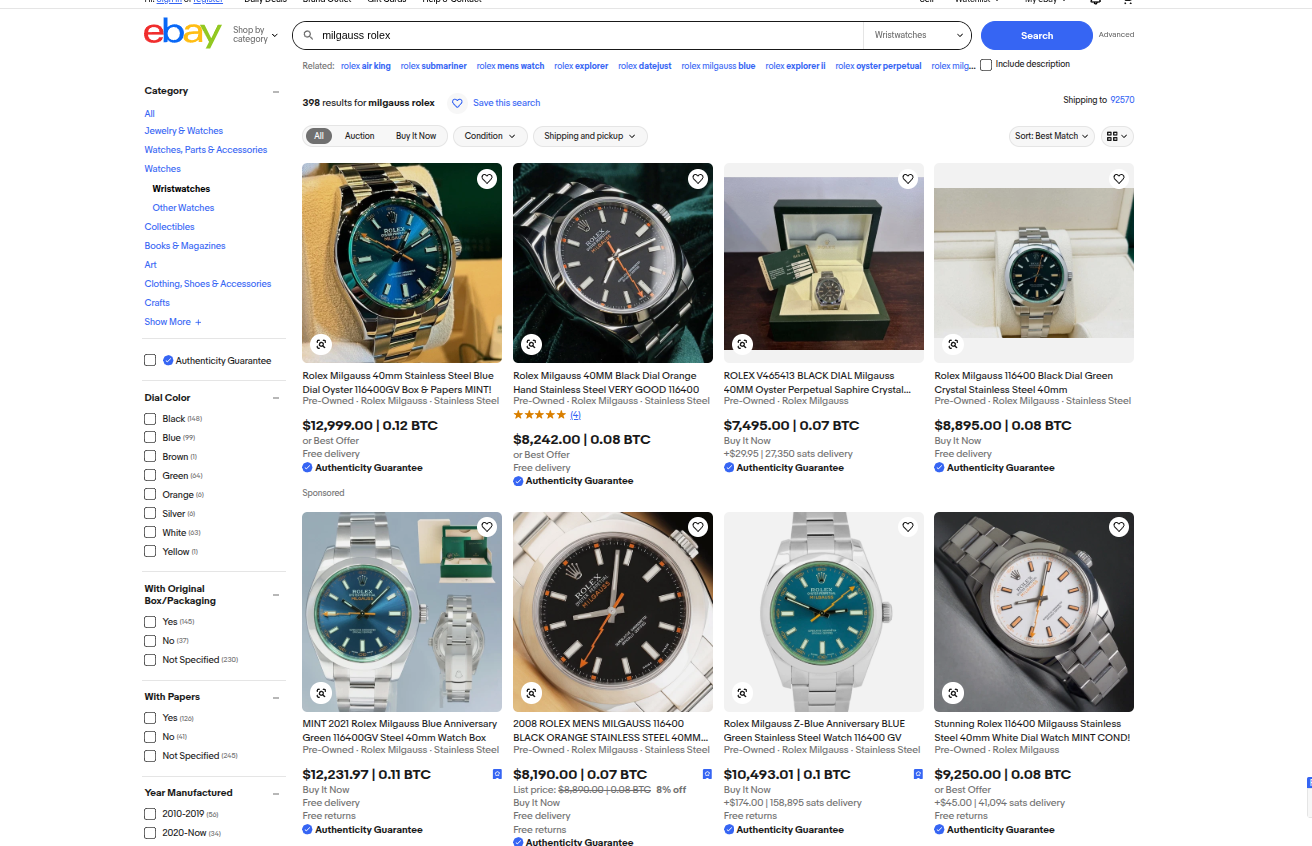

Then I searched for a Rolex in Duck Duck Go.

The default is bitcoin, but there is a sat calculator in the corner too, I have always wanted a Rolex Milgauss with a green sapphire so I looked it up on eBay. It's about 8 million sats. That's too rich for my blood, but I might be willing to part with a million sats for that watch. I'll definitely pick it up for 500,000 sats. I can wait. Bitcoin is the best clock in the world. I wouldn't go so far as to call this Rolex a shitcoin, but bitcoin is a better clock than any watch in my opinion--Even when compared to my favorite watch.

Video From Opportunity Cost Website

How will you use the Opportunity Cost browser extension?

☮️ npub1marc26z8nh3xkj5rcx7ufkatvx6ueqhp5vfw9v5teq26z254renshtf3g0

https://zapthisblog.com/calculate-your-opportunity-cost-while-shopping/

-

@ 87f5ac31:60daf34c

2025-06-14 03:16:52

@ 87f5ac31:60daf34c

2025-06-14 03:16:52수정 test

-

@ d62e8d04:569fa79c

2025-06-13 18:35:37

@ d62e8d04:569fa79c

2025-06-13 18:35:37In today's fast-paced digital world, where cyber threats are constantly evolving, and blockchain technology is reshaping industries, Privkey LLC emerges as a leader in providing cutting-edge solutions. Founded in 2018 and headquartered in Miami, Florida, Privkey LLC is dedicated to safeguarding businesses through its expertise in cybersecurity and blockchain technology. With over 20 years of experience in networking and the Internet, the company positions itself as a trusted advisor, helping organizations navigate the complexities of emerging digital landscapes.

A Mission to Secure the Digital Future

Privkey LLC’s core mission is to protect businesses by delivering high-quality, tailored solutions. Leveraging their deep understanding of cybersecurity and blockchain, they empower organizations to build secure, resilient, and compliant digital infrastructures. Whether it’s safeguarding sensitive financial data or ensuring the integrity of blockchain systems, Privkey LLC combines experience with innovation to meet the unique challenges of the modern era.

Comprehensive Services for a Digital World

Privkey LLC offers a diverse range of auditing and consulting services, focusing on some of the most critical areas in technology today. Below is an overview of their key offerings:

-

Central Bank Digital Currency (CBDC):As nations explore digital versions of fiat currencies, Privkey LLC provides auditing services to ensure CBDC systems are secure, scalable, and compliant with regulatory standards.

-

DeFi and CeFi (Fintech):Decentralized Finance (DeFi) and Centralized Finance (CeFi) represent the future of financial services on the blockchain. Privkey LLC offers expertise in auditing these systems, helping businesses mitigate risks and maintain trust in their financial operations.

-

Cybersecurity:With cyber threats on the rise, Privkey LLC delivers robust cybersecurity solutions to protect digital assets and sensitive data from malicious attacks, ensuring businesses remain secure in an increasingly hostile digital environment.

-

Distributed Ledger Technology (DLT):As the backbone of blockchain, DLT requires meticulous implementation. Privkey LLC audits DLT systems to ensure they are efficient, secure, and optimized for business needs.

-

CryptoCurrency Security Standard (CCSS):For organizations handling cryptocurrencies, compliance with CCSS is essential. Privkey LLC provides certification services to verify adherence to these standards, fostering trust among users and stakeholders.

These services reflect Privkey LLC’s commitment to addressing the diverse needs of businesses operating in the blockchain and cybersecurity domains.

Staying Ahead in a Rapidly Evolving Industry

Privkey LLC doesn’t just provide services—they actively engage with the latest industry trends and innovations. Their team, including professionals like William K. Santiago, frequently shares insights on platforms like LinkedIn. Topics range from Jack Dorsey’s Block unveiling a new Bitcoin hardware wallet to sustainable Bitcoin mining powered by nuclear and solar energy. While these discussions may not directly tie to specific Privkey LLC projects, they demonstrate the company’s deep involvement in the broader blockchain and cryptocurrency ecosystem. This forward-thinking approach ensures their services remain relevant and cutting-edge.

A Trusted Partner with Proven Expertise

With over two decades of experience in networking and Internet technologies, Privkey LLC brings unparalleled expertise to the table. This foundation allows them to tackle the unique challenges of cybersecurity and blockchain with confidence. As cyber threats grow more sophisticated and blockchain adoption accelerates, Privkey LLC stands ready to help businesses secure their digital futures.

Conclusion

Privkey LLC is more than a consulting firm—it’s a pioneer in cybersecurity and blockchain solutions. By offering specialized auditing and consulting services, staying ahead of industry trends, and leveraging decades of experience, they empower businesses to thrive in a digital world. For organizations looking to secure their digital assets and embrace blockchain technology, Privkey LLC is a reliable partner poised to lead the way.

-

-

@ 7f6db517:a4931eda

2025-06-12 15:02:58

@ 7f6db517:a4931eda

2025-06-12 15:02:58

The former seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

The latter's future remains to be seen. Dependence on Tor, which has had massive reliability issues, and lack of strong privacy guarantees put it at risk.

— ODELL (@ODELL) October 27, 2022

The Basics

- Lightning is a protocol that enables cheap and fast native bitcoin transactions.

- At the core of the protocol is the ability for bitcoin users to create a payment channel with another user.

- These payment channels enable users to make many bitcoin transactions between each other with only two on-chain bitcoin transactions: the channel open transaction and the channel close transaction.

- Essentially lightning is a protocol for interoperable batched bitcoin transactions.

- It is expected that on chain bitcoin transaction fees will increase with adoption and the ability to easily batch transactions will save users significant money.

- As these lightning transactions are processed, liquidity flows from one side of a channel to the other side, on chain transactions are signed by both parties but not broadcasted to update this balance.

- Lightning is designed to be trust minimized, either party in a payment channel can close the channel at any time and their bitcoin will be settled on chain without trusting the other party.

There is no 'Lightning Network'

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise.

- There are many lightning channels between many different users and funds can flow across interconnected channels as long as there is a route through peers.

- If a lightning transaction requires multiple hops it will flow through multiple interconnected channels, adjusting the balance of all channels along the route, and paying lightning transaction fees that are set by each node on the route.

Example: You have a channel with Bob. Bob has a channel with Charlie. You can pay Charlie through your channel with Bob and Bob's channel with User C.

- As a result, it is not guaranteed that every lightning user can pay every other lightning user, they must have a route of interconnected channels between sender and receiver.

Lightning in Practice

- Lightning has already found product market fit and usage as an interconnected payment protocol between large professional custodians.

- They are able to easily manage channels and liquidity between each other without trust using this interoperable protocol.

- Lightning payments between large custodians are fast and easy. End users do not have to run their own node or manage their channels and liquidity. These payments rarely fail due to professional management of custodial nodes.

- The tradeoff is one inherent to custodians and other trusted third parties. Custodial wallets can steal funds and compromise user privacy.

Sovereign Lightning

- Trusted third parties are security holes.

- Users must run their own node and manage their own channels in order to use lightning without trusting a third party. This remains the single largest friction point for sovereign lightning usage: the mental burden of actively running a lightning node and associated liquidity management.

- Bitcoin development prioritizes node accessibility so cost to self host your own node is low but if a node is run at home or office, Tor or a VPN is recommended to mask your IP address: otherwise it is visible to the entire network and represents a privacy risk.

- This privacy risk is heightened due to the potential for certain governments to go after sovereign lightning users and compel them to shutdown their nodes. If their IP Address is exposed they are easier to target.

- Fortunately the tools to run and manage nodes continue to get easier but it is important to understand that this will always be a friction point when compared to custodial services.

The Potential Fracture of Lightning

- Any lightning user can choose which users are allowed to open channels with them.

- One potential is that professional custodians only peer with other professional custodians.

- We already see nodes like those run by CashApp only have channels open with other regulated counterparties. This could be due to performance goals, liability reduction, or regulatory pressure.

- Fortunately some of their peers are connected to non-regulated parties so payments to and from sovereign lightning users are still successfully processed by CashApp but this may not always be the case going forward.

Summary

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise. There is no singular 'Lightning Network' but rather many payment channels between distinct peers, some connected with each other and some not.

- Lightning as an interoperable payment protocol between professional custodians seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

- Lightning as a robust sovereign payment protocol has yet to be battle tested. Heavy reliance on Tor, which has had massive reliability issues, the friction of active liquidity management, significant on chain fee burden for small amounts, interactivity constraints on mobile, and lack of strong privacy guarantees put it at risk.

If you have never used lightning before, use this guide to get started on your phone.

If you found this post helpful support my work with bitcoin.

-

@ d68401a8:11aad383

2025-06-13 17:54:54

@ d68401a8:11aad383

2025-06-13 17:54:54Before AI, building a website posed a technological barrier. Not everyone was able to create even a simple contact page. It often meant paying for a yearly subscription (often too expensive for most), for templates that still required manual work, or paying even more to hire someone to do it for you.

Today, thanks to AI, building a website has become technologically accessible. Even if you still prefer to rely on a third-party company, the ease brought by AI is driving more competitive pricing.

In the domain world, before Handshake, owning a top-level domain (TLD) was economically out of reach. The application process set by ICANN was tedious and expensive. For most people, the only option was to rent a second-level domain, one not controlled by individuals and subject to whatever fees the TLD owner chose to charge.

Now, thanks to the Handshake DNS protocol, anyone can own a top-level domain and create an infinite number of second-level domains under it, at virtually no cost.

Owning a plot of land (a top-level domain) on the internet should be open and easy. Handshake aims to pave the way toward that vision, you can start to explore by using Namebase , Shakestation or Bob wallet .

-

@ dfa02707:41ca50e3

2025-06-14 03:03:02

@ dfa02707:41ca50e3

2025-06-14 03:03:02Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ 58537364:705b4b85

2025-06-12 13:59:39

@ 58537364:705b4b85

2025-06-12 13:59:39ในร่างกายที่มันมีสิ่งที่เรียกว่า… ระบบประสาท ทีนี้มีอะไรเข้ามากระทบร่างกาย คือกระทบระบบประสาท ปฏิกิริยามันก็เกิดขึ้น เป็นเหตุการณ์ อย่างใดอย่างหนึ่งขึ้น

เหตุการณ์นั้นแหละสำคัญ ถ้าให้เกิดความรู้สึกที่ถูกใจมันจะเป็นบวก เหตุการณ์นั้นไม่รู้สึกถูกใจแก่จิต มันก็จะเป็นลบ #ตัวกูเพิ่งเกิดเมื่อมีการกระทบแล้ว

ถ้าเหตุการณ์ที่เป็นบวกเกิดขึ้น ตัวกูบวกก็เกิดขึ้น เหตุการณ์ที่เป็นลบเกิดขึ้น ตัวกูที่เป็นลบเกิดขึ้น #ตัวกูนี้เกิดหลังเหตุการณ์ ขอให้เข้าใจดีๆ ไม่ใช่เกิดอยู่ก่อน

ตัวกูคลอดออกมาจาก situation ที่มากระทบระบบประสาท เช่นว่า… ไม่ได้กินอาหาร ขาดอาหาร มันหิว ความหิวเกิดขึ้นแก่ระบบประสาท ต่อมาจึงเกิด concept ว่า กูหิว, มีการกินแล้วจึงเกิด concept ว่า กูกิน

ถ้ามีอาการอร่อยแก่ลิ้น มันจึงเกิด concept ว่า… กูอร่อย หรือ มาทีหลังเหตุการณ์เสมอ จะถือว่าเป็น product ของเหตุการณ์นั้น ๆ ก็ได้

นี่คือความที่ไม่มีตัวจริง มิใช่ของจริง ของสิ่งที่เรียกว่าตัวกู #ขอให้รู้จักว่าตัวกูนี้มันเป็นมายาถึงขนาดนี้

ฟังดูการพูดอย่างนี้ มันเป็น logic แต่ความจริงของธรรมชาติมันเป็นอย่างนั้น ถือตามกฎ logic ธรรมดาสามัญ ที่พูดกันอยู่นี้ไม่ได้ ต้องถือตามความเป็นจริงที่ว่า มันเป็นอยู่อย่างไร

จิตก็เป็นธาตุชนิดหนึ่ง สิ่งแวดล้อมต่างๆ ที่เป็นธาตุชนิดหนึ่ง พอมาถึงกันเข้า ก็เกิดปฏิกิริยาออกมาอย่างนั้นอย่างนี้ ความรู้สึกที่เรียกว่า… #จิตคิดนึกได้นี้_ก็เป็นปฏิกิริยาที่เกิดขึ้นเท่านั้น แล้วความรู้สึกว่าตัวกู ตัวนี้ก็เป็นเพียงปฏิกิริยาที่เกิดขึ้นเท่านั้น.

มันฟังยากสำหรับท่านทั้งหลายที่ว่า ผู้กระทำนั้นเกิดทีหลังการกระทำ มันผิด logic อย่างนี้

แต่ความจริงเป็นอย่างนั้น self หรือ ego ผู้กระทำจะเกิดทีหลังการกระทำ เป็นปฏิกิริยาของการกระทำ

ความคิดอย่าง ตรรกะ หรืออย่างปรัชญา เอามาใช้กับสิ่งนี้ไม่ได้ ขอยืนยันไว้อย่างนี้

ถ้าท่านยังไม่เชื่อ ท่านก็ไปคิดดูเรื่อย ๆ ไปเถอะ ท่านจะพบว่ามันไม่เป็นอย่างกฎเกณฑ์ทางตรรกะหรือทางปรัชญา ที่เรามีๆ กันอยู่

ผู้กระทำเป็นเพียง concept ไม่ใช่ตัวจริง ส่วนการกระทำมันเป็นเหตุการณ์ของธรรมชาติ พอเข้ามาถึงจิตแล้ว ก็เกิดความคิด ความเชื่อ ความยึดว่าตัวกู

ตัวกูซึ่งเป็นเพียง concept ไม่ใช่ของจริง

พุทธทาสภิกขุ

อตัมมยตาประทีป

ชีวิตใหม่และหนทางเข้าถึงชีวิตใหม่

หน้า_๒๙๕-๒๙๖

-

@ f40a134b:60fb788b

2025-06-13 21:10:14

@ f40a134b:60fb788b

2025-06-13 21:10:14{"url":"https://convy.click","title":"Convy","description":"","submittedAt":1749849014}

-

@ d57360cb:4fe7d935

2025-06-13 17:00:16

@ d57360cb:4fe7d935

2025-06-13 17:00:16Most of life is out of your control. It happens of its own accord. We make plans in our minds but they rarely turn out how we want them to. Look back five years ago and remember the visions and dreams you had of your life. Most likely it never fit the vision you used to imagine. Sure somethings may have came into reality but it’s certain it didn’t go according to plan.

That’s the great myth it never goes as planned and that’s, well it’s okay. We don’t need to hold on for dear life and close ourselves off to life itself.

When life occurs, we have the tendency to want to edit and modify things to our likings. Only it’s impossible. What’s more important is the mind we bring with us to life. If we can enter into every situation with acceptance, things start to feel completely different. This isn’t to say this is some magical fix and everything will be fine. It’s more of a way to eliminate unnecessary mental roadblocks we create.

The outside circumstances don’t matter as much as you think. People will use the things outside themselves as a perpetual hope machine they strive on to escape their present issues. Surely one day it will all change when x, y, and z happen, but the joke of it all is when x, y and z do happen people suddenly look for a, b and c.

Instead of peering off into an imaginative future, ask yourself what mind did you bring to the place your feet are firmly placed in. You don’t need to hope on x, y, or z when you have a mind that can attend to any circumstance.

There’s an old zen story of a man who received a lump of clay, thinking it worthless he discarded it. Another man found it washed up near a river bank. On close inspection he saw a shining light glittering through the clay. He rinsed it completely to find a shining gold bar. It was always gold whether covered in clay or in its purest form much like pure attention is the nature of your mind only its often buried under an endless stream of thoughts.

-

@ f40a134b:60fb788b

2025-06-13 21:07:02

@ f40a134b:60fb788b

2025-06-13 21:07:02{"url":"https://test.com","title":"test.com","description":"","submittedAt":1749848822}

-

@ b1ddb4d7:471244e7

2025-06-14 01:01:23

@ b1ddb4d7:471244e7

2025-06-14 01:01:23The latest AI chips, 8K displays, and neural processing units make your device feel like a pocket supercomputer. So surely, with all this advancement, you can finally mine bitcoin on your phone profitably, right?

The 2025 Hardware Reality: Can You Mine Bitcoin on Your Phone

Despite remarkable advances in smartphone technology, the fundamental physics of bitcoin mining haven’t changed. In 2025, flagship devices with their cutting-edge 2nm processors can achieve approximately 25-40 megahashes per second when you mine bitcoin on your phone—a notable improvement from previous generations, but still laughably inadequate.

Meanwhile, 2025’s top-tier ASIC miners have evolved dramatically. The latest Bitmain Antminer S23 series and Canaan AvalonMiner A15 Pro deliver 200-300 terahashes per second while consuming 4,000-5,500 watts. That’s a performance gap of roughly 1:8,000,000 between when you mine bitcoin on your phone and professional mining equipment.

To put this in perspective that hits home: if you mine bitcoin on your phone and it earned you one penny, professional miners would earn $80,000 in the same time period with the same effort. It’s not just an efficiency problem—it’s a complete category mismatch.

According to Pocket Option’s 2025 analysis, when you mine bitcoin on your phone in 2025, you generate approximately $0.003-0.006 in daily revenue while consuming $0.45-0.85 in electricity through constant charging cycles. Factor in the accelerated device wear (estimated at $0.75-1.20 daily depreciation), and you’re looking at losses of $1.20-2.00 per day just for the privilege of running mining software.

Mining Economic Factor

Precise Value (April 2025)

Direct Impact on Profitability

Smartphone sustained hash rate

20-35 MH/s

0.00000024% contribution to global hashrate

Daily power consumption

3.2-4.8 kWh (4-6 full charges)

$0.38-0.57 at average US electricity rates

Expected daily BTC earnings

0.0000000086 BTC ($0.0035 at $41,200 BTC)

Revenue covers only 0.9% of electricity costs

CPU/GPU wear cost

$0.68-0.92 daily accelerated depreciation

Reduces smartphone lifespan by 60-70%

Annual profit projection

-$386 to -$412 per year

Guaranteed negative return on investment

Source: PocketOption

Bitcoin’s 2025 Network: Harder Than Ever

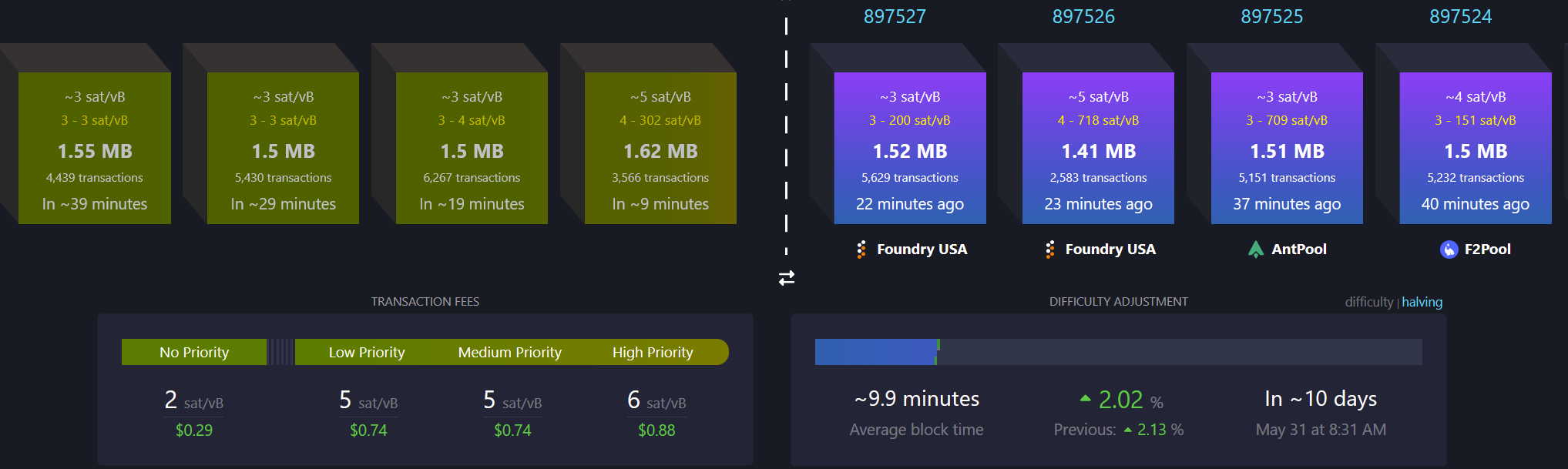

Bitcoin’s network difficulty in 2025 has reached unprecedented levels. After the April 2024 halving event that reduced block rewards from 6.25 to 3.125 BTC, mining became significantly more competitive. The global hash rate now exceeds 800 exahashes per second—that’s 800 followed by 18 zeros worth of computational power securing the network.

Here’s what this means in practical terms: Bitcoin’s mining difficulty adjusts every 2,016 blocks (roughly every two weeks) to maintain the 10-minute block time. As more efficient miners join the network, difficulty increases proportionally. In 2025, mining difficulty has increased compared to 2024, making small-scale mining even less viable.

The math is unforgiving:

- Global Bitcoin hash rate: 828.96 EH/s

- Your smartphone’s contribution: ~0.000000003%

- Probability of solo mining a block: Virtually zero

- Expected time to mine one Bitcoin: Several million years

Even joining mining pools doesn’t solve the economic problem. Pool fees typically range from 1-3%, and your minuscule contribution would earn proportionally tiny rewards—far below the electricity and device depreciation costs.

The 2025 Scam Evolution: More Sophisticated, More Dangerous

Fraudsters now leverage AI-generated content, fake influencer endorsements, and impressive-looking apps that simulate realistic mining activity to entice you to mine bitcoin on your phone.

New 2025 scam tactics include:

AI-Powered Fake Testimonials: Deepfake videos of supposed successful mobile miners showing fabricated earnings statements and encouraging downloads of malicious apps.

Gamified Mining Interfaces: Apps that look and feel like legitimate games but secretly harvest personal data while simulating mining progress that can never be withdrawn.

Social Media Manipulation: Coordinated campaigns across TikTok, Instagram, and YouTube featuring fake “financial influencers” promoting mobile mining apps to younger audiences.

Subscription Trap Mining: Apps offering “free trials” that automatically charge $19.99-49.99 monthly for “premium mining speeds” while delivering no actual mining capability.

Recent cybersecurity research shows that over 180 fake mining apps were discovered across major app stores in 2025, with some accumulating more than 500,000 downloads before being removed.

Red flags that scream “scam” in 2025:

- Apps claiming “revolutionary mobile mining breakthrough”

- Promises of earning “$10-50 daily” from phone mining

- Requirements to recruit friends or watch ads to unlock withdrawals

- Apps that don’t require connecting to actual mining pools

- Testimonials that seem too polished or use stock photo models

- Apps requesting permissions unrelated to mining (contacts, camera, microphone)

The 2025 Professional Mining Landscape

To understand why, consider what professional bitcoin mining looks like in 2025. Industrial mining operations now resemble high-tech data centers with:

Cutting-edge hardware:

- Bitmain Antminer S23 Pro: 280 TH/s at 4,800W

- MicroBT WhatsMiner M56S++: 250 TH/s at 4,500W

- Canaan AvalonMiner A1566: 185 TH/s at 3,420W

Infrastructure requirements:

- Megawatt-scale power contracts with industrial electricity rates

- Liquid cooling systems maintaining 24/7 optimal temperatures

- Redundant internet connections ensuring zero downtime

- Professional facility management with 24/7 monitoring

For a small operation, you might need at least $10,000 to $20,000 to buy a few ASIC miners, set up cooling systems, and cover electricity costs. These operations employ teams of engineers, maintain relationships with power companies, and operate with margins measured in single-digit percentages.

2025’s Legitimate Mobile Bitcoin Strategies

While it remains impossible to mine bitcoin on your phone profitably, 2025 offers exciting legitimate ways to engage with bitcoin through your smartphone:

Lightning Network Participation: Apps like Phoenix, Breez, and Zeus allow you to run Lightning nodes on mobile devices, earning small routing fees while supporting bitcoin’s payment layer.

Bitcoin DCA Automation: Services enable automated dollar-cost averaging with amounts as small as $1 daily. Historical data shows $10 weekly bitcoin purchases consistently outperform any mobile mining attempt by 1,500-2,000%.

Educational Mining Simulators: Legitimate apps like “Bitcoin Mining Simulator” teach mining concepts without false earning promises. These educational tools help users understand hash rates, difficulty adjustments, and mining economics.

Stacking Sats Rewards: Apps offering bitcoin rewards for shopping, learning, or completing tasks.

Lightning Gaming: Bitcoin-native mobile games where players can earn sats through skilled gameplay, with some players earning $10 monthly.onfirm that even the most optimized mobile mining setups in 2025 lose money consistently and predictably.

The Bottom Line

When you mine bitcoin on your phone fundamental economics remain unchanged: it’s impossible to profit. The laws of physics, network competition, and energy efficiency create insurmountable barriers that no app can overcome.

However, 2025 offers unprecedented opportunities to engage with bitcoin meaningfully through your smartphone. Focus on education, legitimate earning opportunities, and strategic investment rather than chasing the impossible dream of phone-based mining.

The bitcoin community’s greatest strength lies in its commitment to truth over hype. When someone promises profits to mine bitcoin on your phone in 2025, they’re either uninformed or deliberately misleading you. Trust the mathematics, learn from the community, and build your bitcoin knowledge and holdings through proven methods.

The real opportunity in 2025 isn’t to mine bitcoin on your phone—it’s understanding bitcoin deeply enough to participate confidently in the most important monetary revolution of our lifetime. Your smartphone is the perfect tool for that education; it’s just not a mining rig.

-

@ a296b972:e5a7a2e8

2025-06-12 12:36:22

@ a296b972:e5a7a2e8

2025-06-12 12:36:22Europa sitzt in einem Demokratie-Simulator. Auf die Scheiben im Cockpit werden Bilder projiziert, die nicht der Realität entsprechen, und es gibt immer noch zu viele Menschen, die diese Simulation nicht erkannt haben.

Nichts wäre erstrebenswerter, als über eine positive Entwicklung, hin zur Vernunft und realitätsbezogenen, auf Tatsachen beruhenden Entscheidungen, berichten zu können. Die Frage ist, ob nicht zuerst unentwegt auf Missstände hingewiesen werden muss, um weitere Menschen dazu zu bewegen, sich denjenigen anzuschließen, die offensichtlich an Indoktrinationsintoleranz leiden.

Wer sich vor Hofberichterstattung und die tägliche Fahrt durch die Gehirnwaschanlage schützen will, der meidet den öffentlich-rechtlichen Unfug und die einschlägigen Käseblätter, die vielleicht noch halbwegs dazu geeignet sind, den Fisch auf dem Markt einzuschlagen, um ihn nach Hause zu tragen, vorausgesetzt, man kann ihn sich noch leisten.

Die Neuen Medien liefern die Informationen, die man sonst im „Qualitäts-Mainstream“ nicht finden kann, was nicht verwundert, denn infiltriert von willigen Erfüllungsgehilfen, die Angst um ihr Prestige und ihre Stellung haben, kann man hier keine freie Berichterstattung erwarten.

Beste Unterhaltung bietet auch die Bundespressekonferenz-Show, auf die schon näher eingegangen wurde. Offizieller Regierungssprech in höchster Perfektion. Ob man dort wirklich davon überzeugt ist, dass es irgendjemanden gibt, der diesen Verlautbarungen Glauben schenkt? Was hat Tante Käthe immer gesagt: G E L D L O C K T I M M E R !

Was also tun? Die Neuen Medien auch noch meiden, und sich vor dem blanken Wahnsinn schützen, in dem man ihn ignoriert, was jedoch nicht bewirkt, dass er nicht mehr da wäre.

Temporäre Abstinenz tut auch hier gut, allerdings ist der Wiedereinstieg so ähnlich, wie der erste Arbeitstag nach einem zweimonatigen Urlaub, falls man nicht in seinem Lieblings-Job gelandet ist.

Und was, wenn die Irren vollends durchdrehen, und man bekommt es nicht mit? Schön, ändern kann man vielleicht wenig, aber man kann sich vielleicht noch eine richtig gute, edle Flasche Rotwein kaufen, und die am Vorabend des Untergangs genießen, oder noch schnell einen Baum pflanzen.

Hier ein Beispiel für jemanden, dessen besonderer Blick sehr an den Universal-Gesundheits-Klima-Hysteriker erinnert:

https\://rumble.com/v6umjdj-respekt-und-anerkennung-deutscher-general-lobt-ukrainische-angriffe-in-russ.html

Wie sieht der Alltag aus, wenn man sich einmal nicht mit den Informationen über Dauer- Bekloppte beschäftigt?

Wenn sich ein Besuch in der nächst größeren Stadt nicht vermeiden lässt, sieht man vor allem gehetzte Menschen, viele mit einem finsteren Blick, anders, als früher.

Viele zahlen mit Karte oder ihrem Handy, Kleckerbeträge. „Zahlen Sie noch bar, oder schon mit Überwachung?“, wünschte man sich, dass die Verkäuferinnen den Kunden fragen würden. Tun sie aber nicht.

Die Menschen scheinen keine Ahnung zu haben, was auf sie zukommt. Im Oktober soll der digitale Euro eingeführt werden, natürlich zuerst nur freiwillig. Was das bedeutet, kennt man ja schon. Freiwilligkeit durch das Schaffen eines Raumes, in dem der Zwang in der Luft hängt, wie damals der Kohlenstaub im Ruhrgebiet. Es wird die persönliche ID vorangetrieben, mit einem Wallet, das die Anonymität und die persönliche Freiheit immer mehr aushöhlen will.

Europa soll unter einen Demokratie-Schutzschirm gestellt werden, der zu nichts anderem dient, als dass diejenigen, die derzeit glauben zu wissen, was gut für die Menschen ist, ihre kruden Vorstellungen auch durchsetzen können. Zweifelhaft, was in den USA vorgeht, was da gerade mit Palantir, natürlich nur zur Sicherheit der Amerikaner, so im Hintergrund schon anläuft. Hierzu gibt es interessante Informationen von Regenauer und Tögel. Einziger Hoffnungsschimmer, besonders für Deutschland: Das klappt sowieso nicht. In den hintersten Bergdörfern in den italienischen Alpen gibt es Glasfaseranschluss, und fährt man in Deutschland auf’s Land, reiht sich Funkloch an Funkloch.

Die wirklich wichtige und große Frage ist, wie können sich Gemeinschaften, die diesen Irrsinn nicht mitmachen wollen, weitgehend aus dem System ausklinken? Bitcoin ist ein erster Schritt zur finanziellen Unabhängigkeit. Eine regionale Lebensmittelversorgung, mit nicht verseuchten, genunmanipulierten, mit Schadstoffen weitgehend unbelasteten Produkten entwickelt sich ebenfalls schon sehr gut. Was, wenn der Zugang zu Informationen über das Internet von einer Anmeldung mit persönlicher ID abhängt und man will und hat keine? Was ist mit Dokumenten, wenn man verreisen oder das Land verlassen will? Was ist, wenn man krank wird und auf das noch vorhandene Rest-Gesundheitssystem angewiesen ist? Was, wenn das Unternehmen seine Mitarbeiter auf staatliche Anweisung zu etwas zwingen muss, was der Mitarbeiter vielleicht gar nicht will, er aber auf das Einkommen angewiesen ist?

Das alles sind Fragen, zu denen es schwer ist, auch in den Neuen Medien, passende Antworten zu finden. Die würden in der Tat Hoffnung machen, dass es ein Schlupfloch gibt, sich, wenn vielleicht auch mit Einschränkungen, den „demokratischen“ Verhältnissen, auf denen nur noch Demokratie draufsteht, aber sehr wenig bis keine Demokratie mehr drin ist, so weit es geht zu entziehen. Sachdienliche Hinweise gerne in der Kommentarfunktion.

Oder ist es „gesünder“, sich zurückzuziehen, die Klappe zu halten und dafür zu sorgen, dass man unter dem Radar bleibt? Diese Gabe ist leider nicht jedem gegeben. Besonders nicht denen, die einen ausgeprägten Wahrheitssinn und ein starkes Gerechtigkeitsgefühl haben.

Menschen die andere belügen, die werden geliebt. Menschen, die anderen sagen, dass sie belogen werden, die werden gehasst.

„Die Wahrheit ist dem Menschen zumutbar.“ (Ingeborg Bachmann)

„Kein Mensch hat das Recht zu gehorchen.“ (Hannah Ahrendt)

“Dieser Beitrag wurde mit dem Pareto-Client geschrieben.”

* *

(Bild von pixabay)

-

@ b9d5de4b:26c0a1b8

2025-06-14 01:51:07

@ b9d5de4b:26c0a1b8

2025-06-14 01:51:07Hello, legitmately asking for a friend...does anyone know of a way to recover a bip38 address created on bitaddress? they claim to have both keys just dont know the passphase.

https://stacker.news/items/1005953

-

@ 5627e59c:d484729e

2025-06-12 10:21:02

@ 5627e59c:d484729e

2025-06-12 10:21:02Liefde\ De samenkomst\ Van zien en zijn

Leven\ Het zijn en zien\ Een vorm gekregen

Sterven\ Een deur\ Die vrijheid geeft van vorm

En eeuwig leven\ Aan liefde

-

@ 1fdb6dac:65eb9a8a

2025-06-13 16:01:58

@ 1fdb6dac:65eb9a8a

2025-06-13 16:01:58What if art knows before I do?

There are times when I finish a piece and just stare at it, not really understanding what I’ve done. As if it had been created by another part of me… a part that knows things I don’t yet know.

It often happens that, some time later—when I’m no longer so immersed in the process—I start to see signs, symbols, colors or shapes that speak of something I’m going through — or was about to go through. It’s as if my body knew it before my mind. As if art were a secret language between my soul and the world.

I don’t know if this happens to other artists, but I feel that often I’m not creating something with a clear intention. It just appears. And then, when I look at it with some distance, I realize a story was being told… my story. One I wasn’t fully aware of.

I feel that when I create from an honest place, without trying to control, something bigger takes over. The mind quiets a little, and it’s the body that begins to speak. There’s a kind of trance, like a current running through me. Sometimes I enjoy it, other times it makes me uncomfortable.

When I “finish,” I’m left with the feeling of having been moved by something that taught me without words.

I’ve realized that art doesn’t always say what I want to show, but what I need to see. And that’s powerful, because sometimes it reveals things I’m not ready to face. But it’s there. In front of me. Like a symbolic mirror.

It also happens that, when someone looks at my work and says, “this made me feel something,” it often aligns with something I’m processing inside—even if I haven’t said it out loud. As if the other person could read in the art what I didn’t know how to write in words.

When we’re creating, we’re also moving energy. Not just painting, or writing, or dancing — but transforming emotions, releasing things we didn’t know were stuck. There’s something ritualistic about art. A healing with no prescription. Alchemy.

Sometimes I feel that art heals me without me even knowing what was hurting. And that feels magical — and also very real.

I’m starting to trust that more: that the soul knows first. That my most intuitive and wild side understands processes that my rational side still can’t name. Art helps me give shape to the shapeless. And maybe, sometimes, it’s not even mine — it simply moves through me.

That when I stop trying to control, something appears that reveals me. That says:\ “This is you, even if you don’t know it yet.”¿Y si el arte sabe antes que yo?

ESPAÑOL

Hay veces que termino una obra y me quedo mirándola sin entender bien qué hice. Como si la hubiese creado otra parte de mí… una parte que sabe cosas que yo todavía no sé.

Me pasa seguido que, tiempo después, cuando ya no estoy tan adentro del proceso, empiezo a ver señales, símbolos, colores o formas que me hablan de algo que estoy atravesando —o que estaba por atravesar. Es como si mi cuerpo lo hubiera sabido antes que mi cabeza. Como si el arte fuese un lenguaje secreto entre mi alma y el mundo.

No sé si a otros artistas les pasa esto, pero yo siento que muchas veces no estoy creando algo con intención clara. Simplemente aparece. Y después, al observarlo con distancia, me doy cuenta de que ahí se estaba contando una historia… mi historia. Una que ni yo tenía del todo consciente.

Siento que cuando creo desde un lugar honesto, sin querer controlar, algo más grande toma el control. La mente se silencia un poco, y es el cuerpo el que empieza a hablar. Hay una especie de trance, como una corriente que me atraviesa. A veces me gusta y otras me incomoda.

Cuando "termino", quedo con la sensación de haber sido atravesada por algo que me enseñó sin palabras.

Me di cuenta de que el arte no siempre dice lo que quiero mostrar, sino lo que necesito ver. Y eso es fuerte, porque a veces revela cosas que no estoy lista para enfrentar. Pero está ahí. Frente a mí. Como un espejo simbólico.

Me pasa también que, cuando alguien mira mi obra y me dice “esto me hizo sentir tal cosa”, muchas veces coincide con algo que yo estoy procesando internamente, aunque no lo haya dicho en voz alta. Como si el otro pudiera leer en el arte lo que yo no supe escribir con palabras.

Cuando estamos creando, también estamos moviendo energía. No solo pintando o escribiendo o bailando, sino transformando emociones, liberando cosas que no sabíamos que estaban trabadas. El arte tiene algo de ritual. De sanación sin receta. De alquimia.

A veces siento que el arte me cura sin que yo entienda qué me estaba enfermando. Y eso me parece mágico y también muy real.

Estoy empezando a confiar más en eso: en que el alma sabe antes. En que mi parte más intuitiva y salvaje entiende procesos que mi parte racional todavía no puede nombrar. El arte me ayuda a poner en forma lo que no tiene forma. Y quizás, a veces, ni siquiera es mío: simplemente pasa por mí.

Que cuando dejo de querer controlar, aparece algo que me revela. Que me dice:\ “Esto sos vos, aunque no lo sepas todavía”.

-

@ 8173f6e1:e488ac0f

2025-06-13 19:18:56

@ 8173f6e1:e488ac0f

2025-06-13 19:18:56{"voteEventId":"083ae248828a454a7d01b7de12f99ce90297672e0457ec8147bd7cfabd14f044","txHash":"752d3894c5657758d7b9754da3dc38db61662acb5f94c3dcb38077fc33f1bd7e","amount":"1000000000000000000","fee":"1000000000000000000","type":"token-gated-vote-proof"}

-

@ 5d4b6c8d:8a1c1ee3

2025-06-14 01:26:59

@ 5d4b6c8d:8a1c1ee3

2025-06-14 01:26:59OMAD is great! Outside the very short window eating window, I have almost no desire to eat or drink.

I also took a nap today and a cold shower. I just needed to be more active.

How did you all do today? Are you making progress towards your ~HealthAndFitness goals?

https://stacker.news/items/1005945

-

@ eb0157af:77ab6c55

2025-06-14 03:02:42

@ eb0157af:77ab6c55

2025-06-14 03:02:42Lightspark introduces a layer 2 for instant payments, stablecoins and interoperability with Lightning.

Spark is an open-source layer 2 protocol developed by Lightspark, designed to offer instant low-cost payments without the need for intermediaries. It allows the creation of wallets and applications that interact directly with the Bitcoin and Lightning networks. The company’s stated goal is to transform Bitcoin into a true global digital currency, solving the scalability limitations of the base layer.