-

@ 7f6db517:a4931eda

2025-06-03 16:01:56

@ 7f6db517:a4931eda

2025-06-03 16:01:56

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-03 16:01:55

@ dfa02707:41ca50e3

2025-06-03 16:01:55Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ b1ddb4d7:471244e7

2025-06-03 16:01:15

@ b1ddb4d7:471244e7

2025-06-03 16:01:15Bitcoin FilmFest (BFF25) returns to Warsaw for its third edition, blending independent cinema—from feature films and commercials to AI-driven experimental visuals—with education and entertainment.

Hundreds of attendees from around the world will gather for three days of screenings, discussions, workshops, and networking at the iconic Kinoteka Cinema (PKiN), the same venue that hosted the festival’s first two editions in March 2023 and April 2024.

This year’s festival, themed “Beyond the Frame,” introduces new dimensions to its program, including an extra day on May 22 to celebrate Bitcoin Pizza Day, the first real-world bitcoin transaction, with what promises to be one of Europe’s largest commemorations of this milestone.

BFF25 bridges independent film, culture, and technology, with a bold focus on decentralized storytelling and creative expression. As a community-driven cultural experience with a slightly rebellious spirit, Bitcoin FilmFest goes beyond movies, yet cinema remains at its heart.

Here’s a sneak peek at the lineup, specially curated for movie buffs:

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money.

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money. Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative).

Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative). Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.

Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.To get an idea of what might come up at the event, here, you can preview 6 selected ads combined into two 2 videos:

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships.

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships. Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.

Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.BFF25 Main Screenings

Sample titles from BFF25’s Official Selection:

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director.

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director. UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year.

UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year. HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.

HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.Check out trailers for this year’s BFF25 and past editions on YouTube.

Tickets & Info:

- Detailed program and tickets are available at bitcoinfilmfest.com/bff25.

- Stay updated via the festival’s official channels (links provided on the website).

- Use ‘LN-NEWS’ to get 10% of tickets

-

@ dfa02707:41ca50e3

2025-06-03 18:02:38

@ dfa02707:41ca50e3

2025-06-03 18:02:38Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ dfa02707:41ca50e3

2025-06-03 18:02:35

@ dfa02707:41ca50e3

2025-06-03 18:02:35Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ e0e92e54:d630dfaa

2025-06-03 19:01:32

@ e0e92e54:d630dfaa

2025-06-03 19:01:32As some of you know, I lead a quarterly Bible Study through Faith Driven Investor

One of the members from the cohort that just ended forwarded me an email from the US Christian Chamber of Commerce

The summary is: Christians should intentionally be doing more business with Christians.

[Full email at the bottom of this Article]

I recanted to my FDI member about a book I read a few years ago, Thou Shall Prosper, by Rabbi Daniel Lapin.

In it he gave the statistics that a single dollar recirculates in the Jewish community 12 times, Muslims 8 times, and Christians only 3 or 4 times.

(I'm probably slightly off on recalling the stats)

But the point being that as a people group, Jews are 4x more wealthy than Christians because Christians value doing business with one another 4 times less than Jews...or said another way, the Jewish people value doing business with one another 4x more than Christians.

Reading the email I was sent, I was further reminded as business owners, leaders, and investors;

If we are truly going to steward that which God has entrusted to us, we should want to re-circulate those resources as many times as possible within the Christian community in order to have the greatest probability of return on image bearers.

What are your thoughts?

I Bought a House Through the Christian Chamber - What happened next surprised me

My husband and I just bought a house—but it wasn’t just a transaction. It was a transformation.

With our daughter’s high school graduation behind us, we felt ready to step into a long-held dream: moving to a beach town we’ve thought, talked, and prayed about for years. As part of turning our dream into a reality, we made a very intentional decision:

We would buy our home entirely through the Christian Chamber community.

We wanted to walk the talk—to model what Kingdom commerce really looks like. So we sought Christian-led businesses for every part of the process. What started as a symbolic gesture quickly became a profound experience with two life-changing revelations:

1) The Power of Prayer in Business

Yes, we prayed as a couple—but imagine your Realtor, lender, inspector, and insurance agent all praying with you, too.

We’re not talking about just being “nice people” or listening to worship in the office. We’re talking about Spirit-filled, Jesus-following believers who brought prayer into every decision.

· Our Realtor is also a church planter—her discernment helped us find the perfect house on day one.

· Our lender joined us in prayer—and worked miracles to make the deal smooth and abundantly possible.

· Our inspector's biggest red flag? A bird’s nest in a porch light. (Yes, really.)

· Our insurance agent handled everything—and in Florida, that’s no small feat.

I have bought and sold seven homes in my life, but this was the best experience by far. The layout, the location, the timing, the favor—it was all wrapped in prayer and covered in grace. It wasn’t just business. It was supernatural.

2) Kingdom ROI — A Multiplied Impact

By doing business with Christians, we didn’t just find great service. We created a multiplied Kingdom return.

We know where our vendors give. We know the churches they support, the ministries they fund, and the people they serve.

When they earned from our purchase, those dollars didn’t disappear—they were reinvested into Kingdom causes we could never reach on our own.

This is Kingdom ROI.

It’s a real-life example of the parable of the talents—we didn’t bury our resources. We multiplied them. When you spend money with aligned believers, your impact compounds.

The opposite is also true:

When we spend with businesses that oppose our values, we’re funding platforms that erode the very things we’re trying to protect—our families, our freedoms, and our faith.

We MUST STOP funding the enemy.

The Bigger Picture

Let’s be clear: Studies show that Christians make up 31% of the world’s population, but we control 55% of the world’s wealth—more than $107 trillion in personal assets.

And yet…we’re leaking that wealth into systems that are actively working against us.

Why? Because we do not have the infrastructure to keep it aligned.

Until now.

That’s what we’re building through the U.S. Christian Chamber of Commerce: A national infrastructure that empowers Christians to redirect their dollars, align their values, and multiply their impact.

What If You Did the Same?

· Buy your next product or service from a Christian-led business.

· Hire your next contractor from your local Christian Chamber.

· Invest in a company with eternal impact.

· Launch a Christian Chamber in your region—we’ll help you.

· Join the U.S. Christian Chamber. This is your Chamber, for your nation.

· Meet us in Orlando for SWC 2026, the global gathering of Christian commerce.

Imagine the multiplying power if thousands of us made similar decisions—every day—across this nation.

We own the wealth. Now let’s build the infrastructure, create the ecosystem, and shift the world's wealth one transaction at a time.

This is our nation and we are One Nation Under God!

Jason Ansley is the founder of Above The Line Leader, where he provides tailored leadership support and operational expertise to help business owners, entrepreneurs, and leaders thrive— without sacrificing your faith, family, or future.

-

Want to strengthen your leadership and enhance operational excellence? Connect with Jason at https://abovethelineleader.com/#your-leadership-journey

-

📌 This article first appeared on NOSTR. You can also find more Business Leadership Articles and content at: 👉 https://abovethelineleader.com/business-leadership-articles

-

-

@ cae03c48:2a7d6671

2025-06-03 16:01:01

@ cae03c48:2a7d6671

2025-06-03 16:01:01Bitcoin Magazine

Sberbank, Russia’s Biggest Bank, Launches Structured Bond Tied to BitcoinSberbank, the largest bank in Russia, has launched a new structured bond that ties investor returns to the performance of Bitcoin and the U.S. dollar-to-ruble exchange rate. This new financial product represents one of the first moves by a major Russian institution to offer Bitcoin-linked investments under recently updated national regulations.

BREAKING:

Russia's largest bank Sberbank launches structured bonds linked to Bitcoin. pic.twitter.com/LtD26jPS0x

Russia's largest bank Sberbank launches structured bonds linked to Bitcoin. pic.twitter.com/LtD26jPS0x— Bitcoin Magazine (@BitcoinMagazine) June 2, 2025

The structured bond is initially available over the counter to a limited group of qualified investors. According to the announcement, it allows investors to earn based on two factors: the price performance of BTC in U.S. dollars and any strengthening of the dollar compared to the Russian ruble.

Unlike typical Bitcoin investments, this product does not require the use of a Bitcoin wallet or foreign platforms. “All transactions [are] processed in rubles within Russia’s legal and infrastructure systems,” Sberbank stated, highlighting compliance with domestic financial protocols.

In addition to the bond, Sberbank has announced plans to launch similar structured investment products with Bitcoin exposure on the Moscow Exchange. The bank also revealed it will introduce a Bitcoin futures product via its SberInvestments platform on June 4, aligning with the product’s debut on the Moscow Exchange.

These developments follow a recent policy change by the Bank of Russia, which now permits financial institutions to offer Bitcoin-linked instruments to qualified investors. This shift opens the door for Bitcoin within the country’s traditional financial markets.

While Russia has previously taken a cautious approach to digital assets, Sberbank’s launch of a Bitcoin-linked bond and upcoming futures product marks a new phase of adoption—one that blends Bitcoin exposure with existing financial infrastructure.

The bank’s structured bond may signal a growing interest in regulated access to Bitcoin, especially within large financial institutions.

This post Sberbank, Russia’s Biggest Bank, Launches Structured Bond Tied to Bitcoin first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 7f6db517:a4931eda

2025-06-03 08:02:34

@ 7f6db517:a4931eda

2025-06-03 08:02:34

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-03 08:02:32

@ 7f6db517:a4931eda

2025-06-03 08:02:32

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-03 08:02:31

@ 7f6db517:a4931eda

2025-06-03 08:02:31

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ b1ddb4d7:471244e7

2025-06-02 23:01:56

@ b1ddb4d7:471244e7

2025-06-02 23:01:56Starting January 1, 2026, the United Kingdom will impose some of the world’s most stringent reporting requirements on cryptocurrency firms.

All platforms operating in or serving UK customers-domestic and foreign alike-must collect and disclose extensive personal and transactional data for every user, including individuals, companies, trusts, and charities.

This regulatory drive marks the UK’s formal adoption of the OECD’s Crypto-Asset Reporting Framework (CARF), a global initiative designed to bring crypto oversight in line with traditional banking and to curb tax evasion in the rapidly expanding digital asset sector.

What Will Be Reported?

Crypto firms must gather and submit the following for each transaction:

- User’s full legal name, home address, and taxpayer identification number

- Detailed data on every trade or transfer: type of cryptocurrency, amount, and nature of the transaction

- Identifying information for corporate, trust, and charitable clients

The obligation extends to all digital asset activities, including crypto-to-crypto and crypto-to-fiat trades, and applies to both UK residents and non-residents using UK-based platforms. The first annual reports covering 2026 activity are due by May 31, 2027.

Enforcement and Penalties

Non-compliance will carry stiff financial penalties, with fines of up to £300 per user account for inaccurate or missing data-a potentially enormous liability for large exchanges. The UK government has urged crypto firms to begin collecting this information immediately to ensure operational readiness.

Regulatory Context and Market Impact

This move is part of a broader UK strategy to position itself as a global fintech hub while clamping down on fraud and illicit finance. UK Chancellor Rachel Reeves has championed these measures, stating, “Britain is open for business – but closed to fraud, abuse, and instability”. The regulatory expansion comes amid a surge in crypto adoption: the UK’s Financial Conduct Authority reported that 12% of UK adults owned crypto in 2024, up from just 4% in 2021.

Enormous Risks for Consumers: Lessons from the Coinbase Data Breach

While the new framework aims to enhance transparency and protect consumers, it also dramatically increases the volume of sensitive personal data held by crypto firms-raising the stakes for cybersecurity.

The risks are underscored by the recent high-profile breach at Coinbase, one of the world’s largest exchanges.

In May 2025, Coinbase disclosed that cybercriminals, aided by bribed offshore contractors, accessed and exfiltrated customer data including names, addresses, government IDs, and partial bank details.

The attackers then used this information for sophisticated phishing campaigns, successfully deceiving some customers into surrendering account credentials and funds.

“While private encryption keys remained secure, sufficient customer information was exposed to enable sophisticated phishing attacks by criminals posing as Coinbase personnel.”

Coinbase now faces up to $400 million in compensation costs and has pledged to reimburse affected users, but the incident highlights the systemic vulnerability created when large troves of personal data are centralized-even if passwords and private keys are not directly compromised. The breach also triggered a notable drop in Coinbase’s share price and prompted a $20 million bounty for information leading to the attackers’ capture.

The Bottom Line

The UK’s forthcoming crypto reporting regime represents a landmark in financial regulation, promising greater transparency and tax compliance. However, as the Coinbase episode demonstrates, the aggregation of sensitive user data at scale poses a significant cybersecurity risk.

As regulators push for more oversight, the challenge will be ensuring that consumer protection does not become a double-edged sword-exposing users to new threats even as it seeks to shield them from old ones.

-

@ dfa02707:41ca50e3

2025-06-03 18:02:35

@ dfa02707:41ca50e3

2025-06-03 18:02:35Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

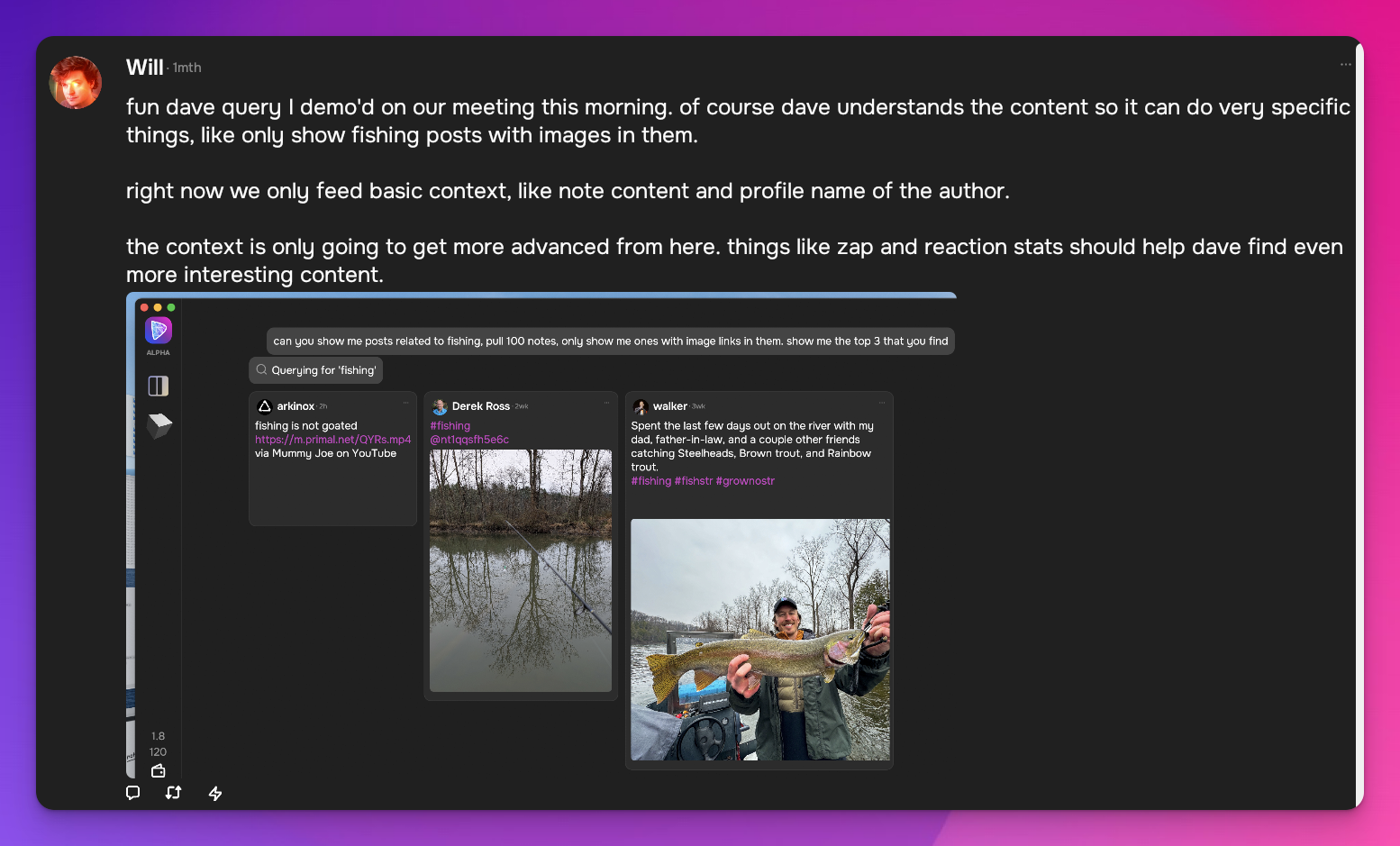

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ 7f6db517:a4931eda

2025-06-02 18:02:01

@ 7f6db517:a4931eda

2025-06-02 18:02:01

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ bf47c19e:c3d2573b

2025-06-03 18:32:49

@ bf47c19e:c3d2573b

2025-06-03 18:32:49Originalni tekst na bitcoin-balkan.com

Pregled sadržaja

- Bitcoin Je Nosilac Imovine

- Komprimis: Bezbednost vs Konfor

- Pregled Novčanika: Istraživanje Hardverskih, Mobilnih, Desktop i Multisig Bitcoin Novčanika

- Vruće vs Hladno – (hot vs Cold) Bitcoin Novčanici: U čemu je razlika?

- Bitcoin Novčanik – Backup Fraza

- Bitcoin Multisignature: Kako radi

- Zašto Moj Bitcoin Novčanik Stalno Menja Moju Adresu?

- Moja Preporuka: Neka Procenat Neto Vrednosti Vodi Vaš Izbor Bitcoin Novčanika

- Da Zaokružimo Priču

U redu, dakle stekli ste neku količinu Bitcoin-a, i koji je sada najbolji način za njegovo čuvanje? Ovde ću vas provesti kroz proces pronalaženja pravog Bitcoin novčanika za vas.

Iako se čini kao jednostavno pitanje, ima iznenađujuće puno nijansi koje treba razmotriti. Koliko Bitcoin-a imate? Koliko često planirate da ga trošite? Da li ste sigurni da su vaši ključevi sigurniji kod vas nego kod offline čuvara? Odgovori na ova pitanja pomoći će vam da pronadjete pravo rešenje za vas.

Bitcoin je nosilac imovine, što znači da i sami možete držati ključeve svog Bitcoin-a. Kada držite svoje Bitcoin ključeve, vi imate direktnu kontrolu nad svojim novcem. Nije povereno nijednoj trećoj strani, poput banke. Trebate držati svoje ključeve onda kada utvrdite da je rizik da ih lično držite manji od rizika da ih čuvar izgubi. Donošenje te odluke oslanja se uglavnom na vaše razumevanje kako i zašto držati svoje Bitcoin ključeve. U ovom članku ću vam pomoći da razumete obe strane.

U ovom članku ćemo istražiti:

- „Nisu vaši ključevi, nije vaš Bitcoin“

- Bezbednost vs Konfor

- Vrste Bitcoin novčanika

- Postavke Multisig-a

- Moja preporuka za izbor najboljeg novčanika za VAS

Zato počnimo polako.

Bitcoin Je Nosilac Imovine

U kriptografiji, javni ključ(public key) se koristi za šifrovanje poruka, a privatni ključ(private key) za njihovo dešifrovanje. Ako bi neko želeo da vam pošalje šifrovanu poruku, šifrirao bi je vašim javnim ključem. Vaš privatni ključ je jedini način za dešifrovanje te poruke, pa sve dok ste jedina osoba koja drži taj privatni ključ, vi ste i jedina osoba koja može pročitati poruku.

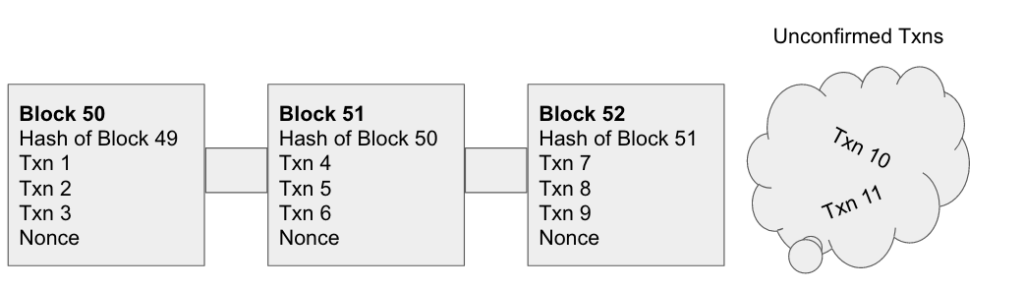

Bitcoin koristi kriptografiju javnog/privatnog ključa da bi osigurao transakcije. Privatni ključ se kreira kada napravite Bitcoin novčanik. Novčanik stvara javne ključeve koji se heširaju i koriste kao adrese za prijem Bitcoin-a. Privatni ključ je potreban da bi se dokazalo vlasništvo nad uskladištenim Bitcoin-om na toj adresi kako bi se mogao potrošiti.

Ako lično ne kontrolišete privatne ključeve povezane sa vašim Bitcoin-om, onda zapravo ne posedujete svoj Bitcoin. Drugim rečima, ako menjačnica ili banka drži vaše Bitcoin-e u vaše ime, vi onda nemate direktnu kontrolu nad svojim Bitcoin-ima. Vi prenosite sigurnost svog Bitcoin-a drugoj stranci.

Da biste u potpunosti iskoristili jedinstvene osobine Bitcoin-a kao novca, vi trebate da držite svoje privatne ključeve. Kao što Bitcoineri često kažu „nisu vaši ključevi, nije vaš Bitcoin“. Ovo vam pruža mogućnost držanja vašeg Bitcoin-a pod vašim nadzorom, tako da ga države, banke ili hakeri koji ga ciljaju ne mogu zapleniti ili oduzeti. Ali odabir držanja sopstvenih ključeva dolazi sa odredjenom odgovornošću za bezbednost vašeg Bitcoin-a.

Moj cilj je da vam pomognem da postanete konforni sa mogućnošću držanja svojih ključeva. Do tada, Bitcoin če biti sigurniji na novčaniku vaše menjačnice.

Sada ćemo pogledati koje opcije imate za preuzimanje kontrole nad sopstvenim Bitcoin ključevima.

Bezbednost vs Komfor

Komprimis: Bezbednost vs Komfor

Glavni kompromis koji treba uzeti u obzir prilikom skladištenja vašeg Bitcoin-a je između bezbednosti i konfora. Očigledno je da su i bezbednost i konfor poželjne osobine prilikom čuvanja vašeg Bitcoin-a, ali se međusobno direktno suprotstavljaju.

Gde se vi nalazite u spektru bezbednosti nasuprot konfora?

Postavite sebi ova pitanja da biste stekli bolji utisak o tome koji način čuvanja za vas ima najviše smisla:

- Ukupna vrednost – da li skladištite na nivou od 0,1%, 1% ili 10 +% vaše neto vrednosti u Bitcoin-u? Odgovor bi trebao da vam da vrlo različite metode čuvanja vašeg Bitcoin-a. Očigledno biste bili spremni da pretrpite više neprijatnosti ako to znači zaštitu 50% vaše neto vrednosti.

- Vremenski okvir/dostupnost – Kada i koliko često imate potrebu da trošite svoje Bitcoin-e? Da li je to više kao tekući račun, srednjoročni štedni račun ili je vaš Bitcoin sličniji dugoročnom penzionom računu?

“Pazite da podešavanje vaše zaštite ne bude tako složeno da čak i vi zaboravite kako dostupiti vašom Bitcoin-u“

Od Bitcoinera se mogu čuti upozoravajuće priče o ljudima koji gube svoje Bitcoin-e zbog prekomplikovanih podešavanja čuvanja, što rezultira time da vlasnik zaboravi kako da pristupi svojim novčićima.

Pregled Novčanika: Istraživanje Hardverskih, Mobilnih, Desktop i Multisig Bitcoin Novčanika

Sada kada ste odlučili da nabavite nekoliko Bitcoin-a (pametan potez) vreme je da odlučite gde ćete čuvati vaš Bitcoin. Kada započinjete, ovo vam može dati nadmoćan osećaj. U ovom odeljku ću vam dati kratki pregled opcija kojima raspolažete. Kao i u većini stvari u životu, i ovde se radi o kompromisima.

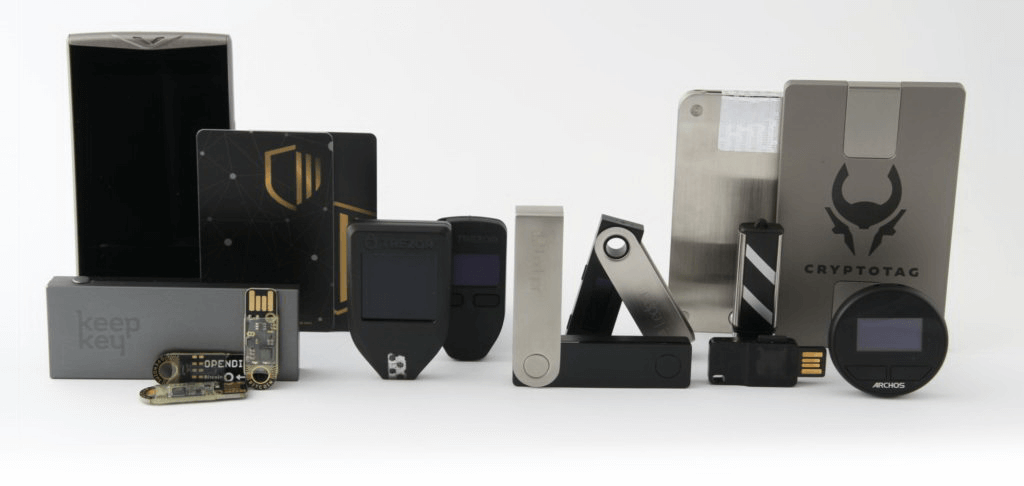

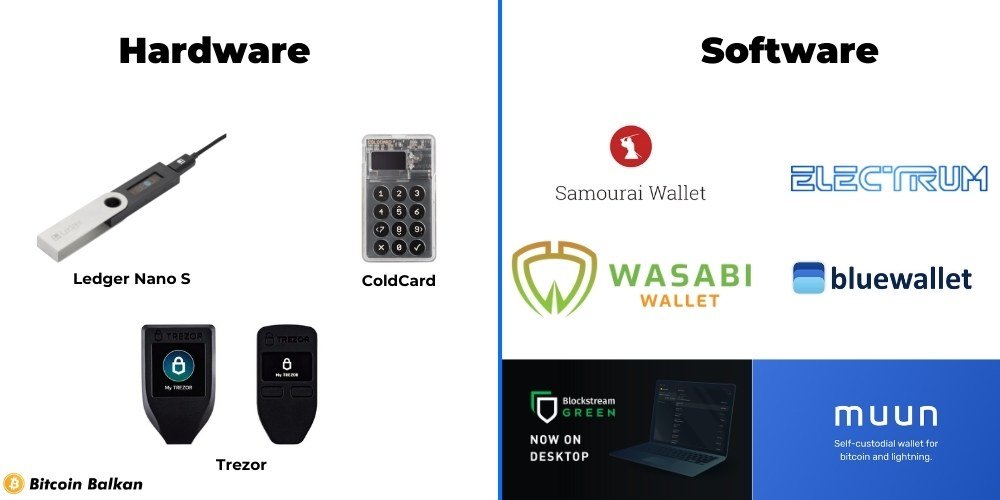

Hardverski Bitcoin Novčanici

Korisnici čuvaju privatne ključeve na namenskom hardverskom delu.

Prednosti: Privatni ključevi nikada ne dolaze u dodir sa internetom, što smanjuje rizik od njihovih gubitaka. Pogodno za dugotrajno skladištenje. Ako izgubite hardverski novčanik, možete da upotrebite backup seed fraze (eng. seed phrase backup) da biste vratili novčanik.

Mane: Korisnici moraju da obezbede backup seed fraze, što zahteva promišljenu strategiju kako da je zaštite. Preporučuje se da zapišete svoju seed frazu na metal i sačuvate rezervne kopije na više sigurnih lokacija. Ako vam ukradu hardverski novčanik, dolazite u rizik hakovanja vaših sredstava. Napomena: zaštita backup seed fraze je standardna praksa za novčanike gde korisnik kontroliše svoje privatne ključeve.

Primeri: Ledger, Trezor, Coldcard i BitBox

Mobilni Bitcoin Novčanici

Korisnici čuvaju privatne ključeve na mobilnom uređaju.

Prednosti: Jednostavan za upotrebu, dobar za početnike, pogodan za male iznose.

Mane: Najmanje sigurna opcija jer se privatni ključevi nalaze na uređaju povezanom na Internet. Ako napadač stekne fizički pristup vašem telefonu, može proslediti sredstva u njegov novčanik. Nije dobro za dugotrajno skladištenje.

Primeri: Blockstream Green, Samourai (samo za Android), Muun, Blue Wallet, Electrum

Desktop Bitcoin Novčanici

Korisnici čuvaju privatne ključeve na svom desktop/laptop računaru

Prednosti: Dobro korisničko iskustvo.

Mane: Nije baš bezbedno, jer su računari povezani na internet i podložni virusima i napadima. Nije dobro za dugotrajno čuvanje.

Primeri: Bitcoin Core i Electrum (napredni), Wasabi (srednji), Blockstream Green (početni). Wasabi je verovatno najbolji novčanik za privatnost, a Blockstream Green je najbolji početnički desktop novčanik.

Multisignature Bitcoin Novčanici

Korisnik čuva privatne ključeve u posebnom novčaniku za koji je potrebno da potpiše više privatnih ključeva pre nego što može da premešta svoja sredstva. Na primer, u „2 od 3“ multisig (eng. multisignature – više potpisa) novčaniku, korisniku su potrebna bilo koja dva od tri privatna ključa za slanje sredstava.

Prednosti: Jedan od najsigurnijih načina za čuvanje vašeg Bitcoin-a, smanjuje efikasnost fizičkih napada, pogodan za dugoročno skladištenje.

Mane: Teško ga je samostalno podesiti, ali postoji nekoliko servisa koji olakšavaju ovaj proces. Nije pogodno za potrošnju, a to može predstavljati i poentu.

Primeri: Unchained Capital’s Vault (2 od 3), Casa’s Keymaster (2 od 3 i 3 od 5), Blocksteam Green (2 od 2), Electrum.

Vruće vs Hladno – (hot vs Cold) Bitcoin Novčanici: U čemu je razlika?

Vrući novčanici su povezani na Internet. To znači da je ključevima lakše pristupiti nego kada su na hardverskom novčaniku, a to takođe znači i da su vaša sredstva ranjiva na napade hakera. Vruće novčanike preporučujem samo za male količine.

Hladni novčanici NISU povezani sa Internetom. To znači da je vašim sredstvima teže pristupiti. Hladni novčanici su manje pogodni za korisnike, ali hakeri mnogo teže mogu da pristupe vašim sredstvima. Hladne novčanike treba smatrati jedinom opcijom za dugoročno čuvanje.

Bitcoin Novčanik – Backup Fraza

Većina novčanika zahteva od korisnika da zapišu „backup seed frazu“. Ovo je mera predostrožnosti u slučaju da izgubite pristup svojim privatnim ključevima/novčaniku. To takođe znači da korisnici moraju biti vrlo oprezni sa svojim rezervnim kopijama jer one sadrže sve potrebne informacije za pristup vašim sredstvima. Tretirajte i čuvajte svoje rezervne kopije na način kao što bi tretirali i čuvali gomilu zlata.

- Ne pravite slike ili snimke ekrana svoje backup fraze

- Ne izgovarajte naglas svoju backup frazu – ikad!

- Ne čuvajte svoju semensku frazu Password Manager Aplikaciji

- Ne koristite Internet uslugu oporavka backup fraze

- Koristite pristupnu frazu (passphrase) da biste dodali još sigurnosti

- Koristite više metoda za pravljenje rezervnih kopija

- Ograničite pristup svojoj backup frazi što je više moguće

- Nikada ne razgovarajte sa ljudima gde, kako i koliko Bitcoin-a čuvate

Tako izgleda „backup seed fraza“

Bitcoin Novčanici Bez Seed-ova

Drugi način za čuvanje Bitcoin-a su novčanici bez seed-ova. Oni su dizajnirani za multisig akaunte, gde korisnici ne kreiraju backup seed-ove, već se oslanjaju na uslugu rezervne kopije. Casa prednjači u novčanicima bez seed-ova sa svojim Keymaster multisignaturnim proizvodom.

Bitcoin Multisignature: Kako radi

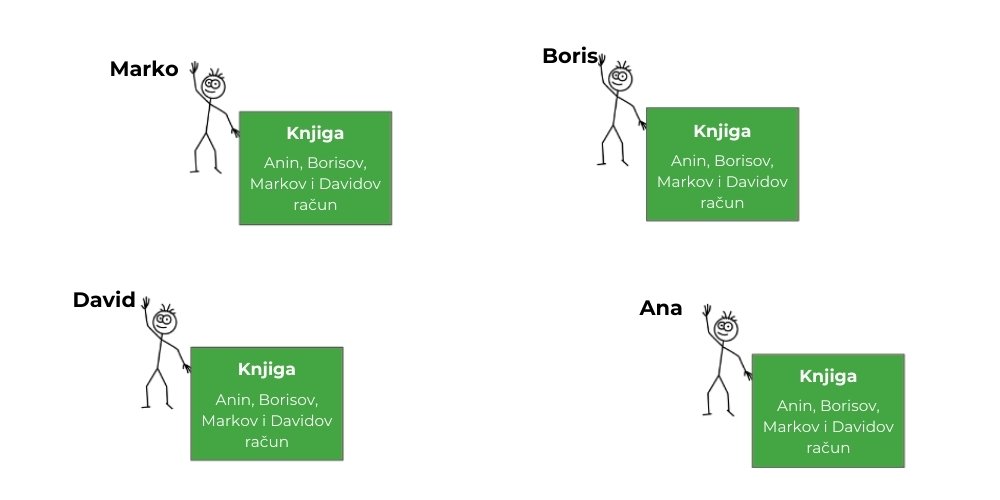

Umesto da zahtevaju jedan potpis privatnog ključa za premeštanje sredstava, multisig novčanici zahtevaju više potpisa za premeštanje sredstava. Postoji mnogo načina za pravljenje multisig novčanika, ali iskoristimo postavku 2 od 3 za naš primer.

Kao korisnik, to znači da imate ukupno 3 privatna ključa koji odgovaraju jednom Bitcoin novčaniku. Da biste prebacili sredstva, potrebna su vam najmanje 2 privatna ključa za potpisivanje transakcije. Većina korisnika će fizički odvojiti lokacije svakog ključa kako bi što više smanjili rizik. Samo nemojte biti previše kreativni, da ne prevarite i sebe i na taj način izgubite svoja sredstva (to se dogodilo mnogo puta).

Kao što je gore pomenuto, evo nekoliko primera Multisignature novčanika

- Blocksteam Green Wallet (2 od 2)

- Casa’s Keymaster (2 od 3 i 3 od 5)

- Unchained Capital’s Vault (2 od 3)

- Electrum

Prednosti Multisig-a

Multisig nudi prostor za greške. Ako imate samo jedan privatni ključ i izgubite ga, vaša sredstva će se zauvek izgubiti. Međutim, ako imate podešavanje 2 od 3, možete sebi priuštiti da izgubite jedan privatni ključ i dalje pristupite svojim sredstvima.

Multisig takođe smanjuje šanse za moguće fizičke napade. Recimo da ste fizički ugroženi i primorani da se odreknete svog dragocenog Bitcoin-a. Ako ste imali normalan novčanik (a ne multisig), onda biste lako mogli da prebacite svoj Bitcoin tom kom vas napada. Međutim, ako ste postavili multisig podešavanja, jedan od vaših ključeva je u kući, a drugi ključ na nekom drugom mestu (npr. vaša kancelarija ili sef u banci). Ovakvo razdvajanje ključeva u velikoj meri smanjuje želju tog napadača da uopšte pokuša da preotme vaš Bitcoin.

Zašto Moj Bitcoin Novčanik Stalno Menja Moju Adresu?

Svaki skup privatnih ključeva može generisati bilione javnih ključeva. Ovi javni ključevi se zatim transformišu (kroz matematički proces zvan heširanje) da bi se proizvele javne adrese.

Svaka pojedinačna adresa može da primi Bitcoin. Dakle, svaki skup privatnih ključeva koji posedujete sposoban je da proizvede svoj jedinstveni, masivni skup javnih adresa koje posedujete vi, i samo vi. Svako može da pošalje Bitcoin na te javne adrese, ali samo onaj koji poseduje te privatne ključeve može trošiti Bitcoin sa tih adresa.

Mnogi ljudi vole da uporedjuju privatne ključeve, javne adrese i Bitcoin novčanike sa e-mail adresama. Privatni ključevi su vaša lozinka, javna adresa je vaša e-mail adresa, a novčanik je e-mail domen koji koristite (npr. Gmail, Protonmail, Yahoo itd.). Iako je korisna, ova analogija pomalo obmanjuje, jer sa Bitcoin-om svaka lozinka (privatni ključ) koju posedujete omogućava pristup bilionima potencijalnih e-mail adresa (javnih adresa) za slanje i primanje Bitcoin-a.

Nema razloga za brigu ako vaš novčanik stalno generiše nove Bitcoin adrese. To je zapravo jedna od njegovih karakteristika! Novčanici koji generišu i koriste nove javne adrese pomažu u zaštiti vaše privatnosti od ljudi koji „njuškaju“ na javnom Bitcoin blockchain-u. Samo zapamtite da sve dok vi držite privatne ključeve novčanika, samo vi posedujete sadašnji i budući Bitcoin, poslat na bilo koju javnu adresu koju je generisao vaš novčanik. Samo se pobrinite da privatni ključevi Bitcoin-a budu sigurni, bezbedni i privatni.

Moja Preporuka: Neka Procenat Neto Vrednosti Vodi Vaš Izbor Bitcoin Novčanika

Najjednostavniji način pristupanja izbora koji novčanik će te odabrati za vaš Bitcoin je fokusiranje na pitanje „koliko novca je u igri?“. Drugim rečima, koji procenat vaše neto vrednosti je zaštićen? Evo naše analize, ali naravno, situacija svake osobe je jedinstvena. Koristite ovo kao smernicu, a ne kao apsolutnu istinu.

Male količine (oko 0,1% neto vrednosti) – Koristite mobilni Bitcoin novčanik

- Blockstream Green – ima multisig 2 od 2. To je verovatno najbolji Bitcoin novčanik za iPhone.

- Casa Keymaster (režim sa jednim ključem) – rezervna kopija bez seed-a.

Srednji iznosi (oko 1% neto vrednosti) – Koristite hardverski Bitcoin novčanik

- Ledger

- Trezor

- Coldcard

Velike količine (više od 10% + neto vrednost) – Koristite Multisig Bitcoin novčanik

- Casa Keymaster Multisig — interfejs koji je jednostavan za korišćenje, možete birati postavke 2 od 3 i 3 od 5. Oni imaju alat za samooporavak, međutim ovo nisam lično koristio, i želeo bih da obavim više istraživanja pre nego što dam pravu preporuku.

- Unchained Capital’s Multisig — interfejs koji je jednostavan za korišćenje, postavka 2 od 3, može pristupiti finansijskim uslugama zasnovanim na vašem BTC u depozitu.

- Self Hosted Multisig — korisnici takođe mogu da kreiraju sopstvene multisig postavke. Ovo zahteva mnogo veće tehničko znanje u poređenju sa Unchained i Casa, međutim, ne žrtvujete nikakvu privatnost.

Protip: Rapodelite sredstva koja želite da skladištite dugoročno. Ako imate značajan deo svoje neto vrednosti u Bitcoin-u, u vašem je najboljem interesu da raspodelite svoj ulog. Ovo umanjuje vaš rizik, što smanjuje šanse da budete izbrisani. Na primer, trećinu svog Bitcoin-a čuvajte sa Casa multisig-om, drugu trećinu sa Unchained Capital Vault-om, a preostalu trećinu na hardverskom novčaniku (Cold Card, Ledger ili Trezor).

Da Zaokružimo Priču

Ovo je moj rezime vaših mogućnosti izbora Bitcoin-ovih novčanika i kako odabrati pravi od njih uzimajući u obzir privatne ključeve, načine i stepen zaštite i sigurnosti koji oni pružaju. Ako ste i dalje zastrašeni, bez brige. Preporučujemo da preuzmete kontrolu nad vašim Bitcoin ključevima samo kada budete sigurni u uslugu koja vam se pruža. Ali vas podstičemo da i dalje razmatrate jedinstvenu priliku koju vam pruža Bitcoin: mogućnost da imate apsolutnu kontrolu nad svojim bogatstvom.

Samostalno čuvanje je vremenom sve lakše i lakše. Razmotrite svoju situaciju i odaberite način čuvanja koji najbolje odgovara vama. Ovde sam da vam pomognem, i slobodno mi se obratite sa svim pitanjima koja vas zanimaju.

-

@ dfa02707:41ca50e3

2025-06-03 18:02:34

@ dfa02707:41ca50e3

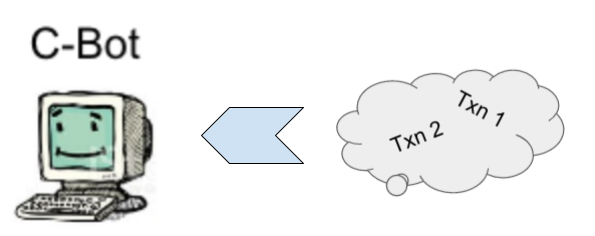

2025-06-03 18:02:34- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ dfa02707:41ca50e3

2025-06-03 18:02:34

@ dfa02707:41ca50e3

2025-06-03 18:02:34Contribute to keep No Bullshit Bitcoin news going.

This update brings key enhancements for clarity and usability:

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ dfa02707:41ca50e3

2025-06-02 18:01:56

@ dfa02707:41ca50e3

2025-06-02 18:01:56Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ 8bad92c3:ca714aa5

2025-06-03 18:02:33

@ 8bad92c3:ca714aa5

2025-06-03 18:02:33Marty's Bent

It's been a pretty historic week for the United States as it pertains to geopolitical relations in the Middle East. President Trump and many members of his administration, including AI and Crypto Czar David Sacks and Treasury Secretary Scott Bessent, traveled across the Middle East making deals with countries like Qatar, Saudi Arabia, the United Arab Emirates, Syria, and others. Many are speculating that Iran may be included in some behind the scenes deal as well. This trip to the Middle East makes sense considering the fact that China is also vying for favorable relationships with those countries. The Middle East is a power player in the world, and it seems pretty clear that Donald Trump is dead set on ensuring that they choose the United States over China as the world moves towards a more multi-polar reality.

Many are calling the events of this week the Riyadh Accords. There were many deals that were struck in relation to artificial intelligence, defense, energy and direct investments in the United States. A truly prolific power play and demonstration of deal-making ability of Donald Trump, if you ask me. Though I will admit some of the numbers that were thrown out by some of the countries were a bit egregious. We shall see how everything plays out in the coming years. It will be interesting to see how China reacts to this power move by the United States.

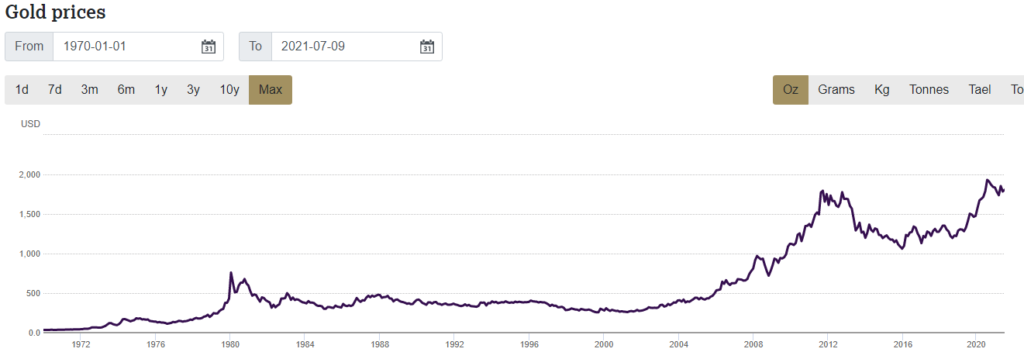

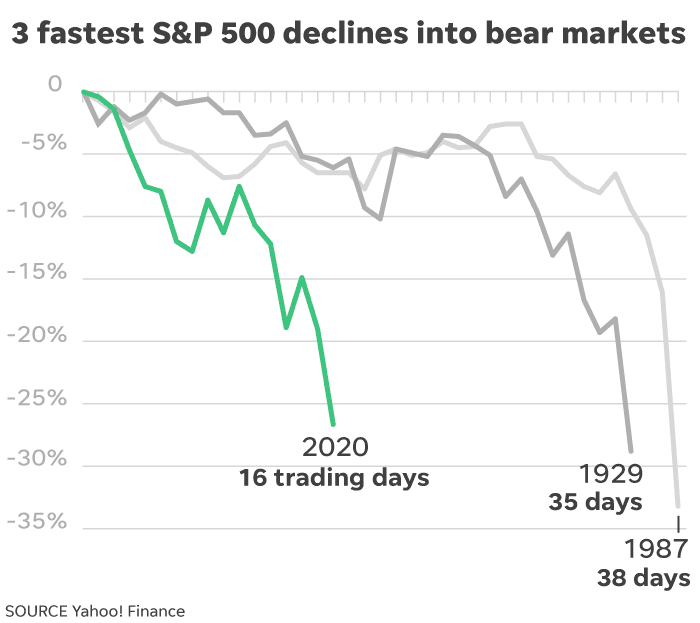

While all this was going on, there was something happening back in the United States that many people outside of fringe corners of FinTwit are not talking about, which is the fact that the 10-year and 30-year U.S. Treasury bond yields are back on the rise. Yesterday, they surpassed the levels of mid-April that caused a market panic and are hovering back around levels that have not been seen since right before Donald Trump's inauguration.

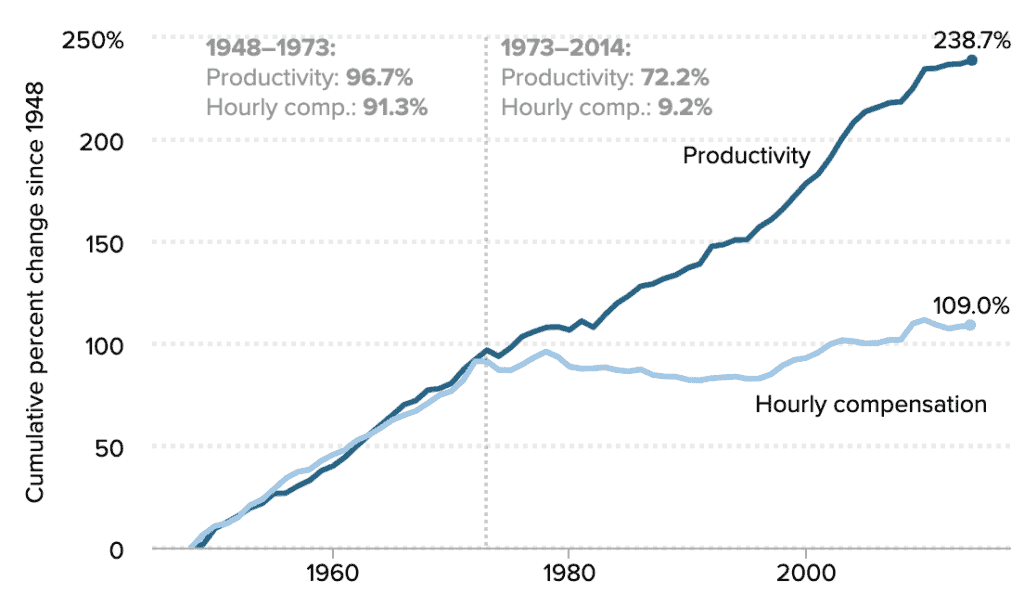

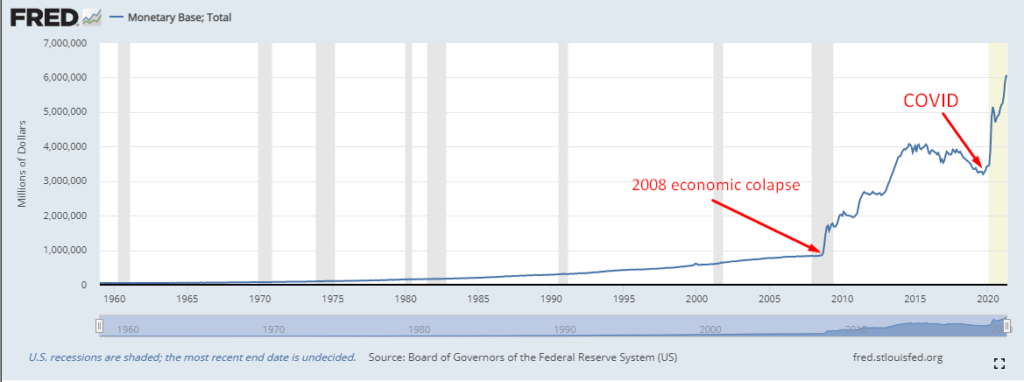

I imagine that there isn't as much of an uproar right now because I'm pretty confident the media freakouts we were experiencing in mid-April were driven by the fact that many large hedge funds found themselves off sides of large levered basis trades. I wouldn't be surprised if those funds have decreased their leverage in those trades and bond yields being back to mid-April levels is not affecting those funds as much as they were last month. But the point stands, the 10-year and 30-year yields are significantly elevated with the 30-year approaching 5%. Regardless of the deals that are currently being made in the Middle East, the Treasury has a big problem on its hands. It still has to roll over many trillions worth of debt over over the next few years and doing so at these rates is going to be massively detrimental to fiscal deficits over the next decade. The interest expense on the debt is set to explode in the coming years.

On that note, data from the first quarter of 2025 has been released by the government and despite all the posturing by the Trump administration around DOGE and how tariffs are going to be beneficial for the U.S. economy, deficits are continuing to explode while the interest expense on the debt has definitively surpassed our annual defense budget.

via Charlie Bilello

via Mohamed Al-Erian

To make matters worse, as things are deteriorating on the fiscal side of things, the U.S. consumer is getting crushed by credit. The 90-plus day delinquency rates for credit card and auto loans are screaming higher right now.

via TXMC

One has to wonder how long all this can continue without some sort of liquidity crunch. Even though equities markets have recovered from their post-Liberation Day month long bear market, I would not be surprised if what we're witnessing is a dead cat bounce that can only be continued if the money printers are turned back on. Something's got to give, both on the fiscal side and in the private markets where the Common Man is getting crushed because he's been forced to take on insane amounts of debt to stay afloat after years of elevated levels of inflation. Add on the fact that AI has reached a state of maturity that will enable companies to replace their current meat suit workers with an army of cheap, efficient and fast digital workers and it isn't hard to see that some sort of employment crisis could be on the horizon as well.

Now is not the time to get complacent. While I do believe that the deals that are currently being made in the Middle East are probably in the best interest of the United States as the world, again, moves toward a more multi-polar reality, we are facing problems that one cannot simply wish away. They will need to be confronted. And as we've seen throughout the 21st century, the problems are usually met head-on with a money printer.

I take no pleasure in saying this because it is a bit uncouth to be gleeful to benefit from the strife of others, but it is pretty clear to me that all signs are pointing to bitcoin benefiting massively from everything that is going on. The shift towards a more multi-polar world, the runaway debt situation here in the United States, the increasing deficits, the AI job replacements and the consumer credit crisis that is currently unfolding, All will need to be "solved" by turning on the money printers to levels they've never been pushed to before.

Weird times we're living in.

China's Manufacturing Dominance: Why It Matters for the U.S.

In my recent conversation with Lyn Alden, she highlighted how China has rapidly ascended the manufacturing value chain. As Lyn pointed out, China transformed from making "sneakers and plastic trinkets" to becoming the world's largest auto exporter in just four years. This dramatic shift represents more than economic success—it's a strategic power play. China now dominates solar panel production with greater market control than OPEC has over oil and maintains near-monopoly control of rare earth elements crucial for modern technology.

"China makes like 10 times more steel than the United States does... which is relevant in ship making. It's relevant in all sorts of stuff." - Lyn Alden

Perhaps most concerning, as Lyn emphasized, is China's financial leverage. They hold substantial U.S. assets that could be strategically sold to disrupt U.S. treasury market functioning. This combination of manufacturing dominance, resource control, and financial leverage gives China significant negotiating power in any trade disputes, making our attempts to reshoring manufacturing all the more challenging.

Check out the full podcast here for more on Triffin's dilemma, Bitcoin's role in monetary transition, and the energy requirements for rebuilding America's industrial base.

Headlines of the Day

Financial Times Under Fire Over MicroStrategy Bitcoin Coverage - via X

Trump in Qatar: Historic Boeing Deal Signed - via X

Get our new STACK SATS hat - via tftcmerch.io

Johnson Backs Stock Trading Ban; Passage Chances Slim - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code *“TFTC20”* during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Building things of value is satisfying.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !import

-

@ b1ddb4d7:471244e7

2025-06-03 18:01:49

@ b1ddb4d7:471244e7

2025-06-03 18:01:49“Not your keys, not your coins” isn’t a slogan—it’s a survival mantra in the age of digital sovereignty.

The seismic collapses of Mt. Gox (2014) and FTX (2022) weren’t anomalies; they were wake-up calls. When $8.7 billion in customer funds vanished with FTX, it exposed the fatal flaw of third-party custody: your bitcoin is only as secure as your custodian’s weakest link.

Yet today, As of early 2025, analysts estimate that between 2.3 million and 3.7 million Bitcoins are permanently lost, representing approximately 11–18% of bitcoin’s fixed maximum supply of 21 million coins, with some reports suggesting losses as high as 4 million BTC. This paradox reveals a critical truth: self-custody isn’t just preferable—it’s essential—but it must be done right.

The Custody Spectrum

Custodial Wallets (The Illusion of Control)

- Rehypothecation Risk: Most platforms lend your bitcoin for yield generation. When Celsius collapsed, users discovered their “held” bitcoin was loaned out in risky strategies.

- Account Freezes: Regulatory actions can lock withdrawals overnight. In 2023, Binance suspended dollar withdrawals for U.S. users citing “partner bank issues,” trapping funds for weeks.

- Data Vulnerability: KYC requirements create honeypots for hackers. The 2024 Ledger breach exposed 270,000 users’ personal data despite hardware security.

True Self-Custody

Self-custody means exclusively controlling your private keys—the cryptographic strings that prove bitcoin ownership. Unlike banks or exchanges, self-custody eliminates:- Counterparty risk (no FTX-style implosions)

- Censorship (no blocked transactions)

- Inflationary theft (no fractional reserve lending)

Conquering the Three Great Fears of Self-Custody

Fear 1: “I’ll Lose Everything If I Make a Mistake”

Reality: Human error is manageable with robust systems:

- Test Transactions: Always send a micro-amount (0.00001 BTC) before large transfers. Verify receipt AND ability to send back.

- Multi-Backup Protocol: Store seed phrases on fireproof/waterproof steel plates (not paper!). Distribute copies geographically—one in a home safe, another with trusted family 100+ miles away.

- SLIP39 Sharding: Split your seed into fragments requiring 3-of-5 shards to reconstruct. No single point of failure.

Fear 2: “Hackers Will Steal My Keys”

Reality: Offline storage defeats remote attacks:

- Hardware Wallets: Devices like Bitkey or Ledger keep keys in “cold storage”—isolated from internet-connected devices. Transactions require physical confirmation.

- Multisig Vaults: Bitvault’s multi-sig system requires attackers compromise multiple locations/devices simultaneously. Even losing two keys won’t forfeit funds.

- Air-Gapped Verification: Use dedicated offline devices for wallet setup. Never type seeds on internet-connected machines.

Fear 3: “My Family Can’t Access It If I Die”

Reality: Inheritance is solvable:

- Dead Man Switches: Bitwarden’s emergency access allows trusted contacts to retrieve encrypted keys after a pre-set waiting period (e.g., 30 days).

- Inheritance Protocols: Bitkey’s inheritance solution shares decryption keys via designated beneficiaries’ emails. Requires multiple approvals to prevent abuse.