-

@ f240be2b:00c761ba

2025-05-25 10:32:12

@ f240be2b:00c761ba

2025-05-25 10:32:12Wirtschaftswunder werden oft als mysteriöse, unvorhersehbare Phänomene dargestellt – als wären sie glückliche Zufälle oder das Ergebnis genialer Planungen. Bei näherer Betrachtung offenbart sich jedoch ein grundlegendes Muster: Diese vermeintlichen "Wunder" sind keine übernatürlichen Ereignisse, sondern das natürliche Ergebnis wirtschaftlicher Freiheit. Die Erfolgsgeschichten verschiedener Länder bestätigen diese These und zeigen, dass Wohlstand entsteht, wenn Menschen die Freiheit haben, zu handeln, zu produzieren und zu innovieren.

Das deutsche Wirtschaftswunder

Nach dem Zweiten Weltkrieg lag Deutschland in Trümmern. Die Industrieproduktion war auf ein Viertel des Vorkriegsniveaus gesunken, und Millionen Menschen lebten in Armut. Doch innerhalb weniger Jahre erlebte Westdeutschland einen beispiellosen wirtschaftlichen Aufschwung, der als "Wirtschaftswunder" in die Geschichte einging.

Der Wandel begann mit Ludwig Erhards mutiger Währungsreform und Preisfreigabe im Jahr 1948. Erhard, damals Direktor der Wirtschaftsverwaltung, schaffte Preiskontrollen ab und führte die Deutsche Mark ein. Diese Maßnahmen wurden von Besatzungsmächten und deutschen Sozialisten skeptisch betrachtet und waren zunächst unpopulär. Doch die Ergebnisse sprachen für sich: Über Nacht füllten sich die Ladenregale wieder, und die Schwarzmärkte verschwanden.

Das Kernprinzip war einfach: Erhard gab den Menschen ihre wirtschaftliche Freiheit zurück. Er schuf einen stabilen Rechtsrahmen, reduzierte staatliche Eingriffe und förderte den freien Wettbewerb. Die Sozialisten bekämpften diese Entwicklung von Anfang an, deuteten diese jedoch im Nachhinein als “soziale Marktwirtschaft” um, diese Lüge verbreiten sie noch heute sehr erfolgreich.

Die freie Marktwirtschaft erlaubte es den Deutschen, ihre unternehmerischen Fähigkeiten zu entfalten und ihre zerstörte Wirtschaft wieder aufzubauen.\ Das Ergebnis: Zwischen 1950 und 1960 wuchs das westdeutsche BIP um mehr als 8% jährlich. Die Arbeitslosigkeit sank von 11% auf unter 1%, und Deutschland wurde zu einer der führenden Exportnationen der Welt. Was als "Wunder" bezeichnet wurde, war tatsächlich die natürliche Konsequenz wiederhergestellter wirtschaftlicher Freiheit.

Chiles wirtschaftliche Transformation

Chile bietet ein weiteres eindrucksvolles Beispiel. In den frühen 1970er Jahren litt das Land unter einer Hyperinflation von 700%, einem schrumpfenden BIP und zunehmender Armut. Die Transformation begann in den späten 1970er Jahren mit tiefgreifenden Wirtschaftsreformen.

Die chilenische Regierung privatisierte Staatsunternehmen, öffnete Märkte für internationalen Handel, schuf ein stabiles Finanzsystem und führte ein innovatives Rentensystem ein. Während andere lateinamerikanische Länder mit protektionistischen Maßnahmen experimentierten, entschied sich Chile für wirtschaftliche Freiheit.

Die Ergebnisse waren beeindruckend: Zwischen 1975 und 2000 verdreifachte sich Chiles Pro-Kopf-Einkommen. Die Armutsquote sank von 45% auf unter 10%. Heute hat Chile das höchste Pro-Kopf-Einkommen in Südamerika und eine der stabilsten Wirtschaften der Region.

Mit einer gewissen Melancholie müssen wir beobachten, wie die hart erkämpften Errungenschaften Chiles allmählich in den Schatten der Vergänglichkeit gleiten. Was einst als Leuchtturm wirtschaftlicher Transformation strahlte, wird nun von den Nebeln der kollektiven Amnesie umhüllt. In dieser Dämmerung der Erinnerung finden interventionistische Strömungen erneut fruchtbaren Boden.

Dieses Phänomen ist nicht auf Chile beschränkt. Auch in Deutschland verblasst die Erinnerung an die transformative Kraft der freien Marktwirtschaft. Die Geschichte wird umgedichtet, in der wirtschaftliche Freiheit als unbarmherziger Kapitalismus karikiert wird, während staatliche Intervention als einziger Weg zur sozialen Gerechtigkeit glorifiziert wird.

Chinas große Öffnung

Im Reich der Mitte vollzog sich die vielleicht dramatischste wirtschaftliche Metamorphose unserer Zeit. Nach Jahrzehnten der Isolation und planwirtschaftlicher Starrheit öffnete China unter Deng Xiaoping vorsichtig die Tore zur wirtschaftlichen Freiheit.

Die Transformation begann in den Reisfeldern, wo Bauern erstmals seit Generationen über ihre eigene Ernte bestimmen durften. Sie setzte sich fort in den pulsierenden Sonderwirtschaftszonen, wo unternehmerische Energie auf globale Märkte traf.

Das Ergebnis war atemberaubend: Fast vier Jahrzehnte mit durchschnittlich 10 Prozent Wirtschaftswachstum jährlich – eine beispiellose Leistung in der Wirtschaftsgeschichte. Mehr als 800 Millionen Menschen überwanden die Armut und fanden den Weg in die globale Mittelschicht. Selbst die partielle Einführung wirtschaftlicher Freiheiten entfesselte eine Produktivität, die die Welt veränderte.

Die zeitlose Lektion

Das Geheimnis wirtschaftlicher Erneuerung liegt nicht in komplexen Theorien oder staatlichen Eingriffen, sondern in der einfachen Weisheit, Menschen die Freiheit zu geben, ihre Träume zu verwirklichen. Wenn wir von "Wirtschaftswundern" sprechen, verkennen wir die wahre Natur dieser Transformationen.

Sie sind keine mysteriösen Anomalien, sondern vielmehr Bestätigungen eines zeitlosen Prinzips: In der fruchtbaren Erde wirtschaftlicher Freiheit blüht der menschliche Erfindungsgeist. Diese Erkenntnis ist keine ideologische Position, sondern eine durch die Geschichte vielfach bestätigte Wahrheit.

Die Lektion dieser Erfolgsgeschichten ist sowohl schlicht als auch tiefgründig: Der Weg zu Wohlstand und menschlicher Entfaltung führt über die Anerkennung und den Schutz wirtschaftlicher Freiheiten. In dieser Erkenntnis liegt vielleicht das wahre Wunder – die beständige Kraft einer einfachen Idee, die immer wieder Leben und Hoffnung in die dunkelsten wirtschaftlichen Landschaften bringt.

Der aufsteigende Stern des Südens

Jenseits der Andenkette, wo Argentinien und Chile ihre lange Grenze teilen, entfaltet sich eine neue Erfolgsgeschichte. Mit mutigen Reformen und einer Rückbesinnung auf wirtschaftliche Freiheit erwacht dieses Land mit viel Potenzial aus seinem langen Schlummer. Was wir beobachten, ist nichts weniger als die Geburt eines neuen südamerikanischen Wirtschaftswunders – geboren aus der Erkenntnis, dass Wohlstand nicht verteilt, sondern erschaffen wird.

-

@ 7f6db517:a4931eda

2025-05-25 15:01:51

@ 7f6db517:a4931eda

2025-05-25 15:01:51

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-25 15:01:51

@ 7f6db517:a4931eda

2025-05-25 15:01:51

The former seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

The latter's future remains to be seen. Dependence on Tor, which has had massive reliability issues, and lack of strong privacy guarantees put it at risk.

— ODELL (@ODELL) October 27, 2022

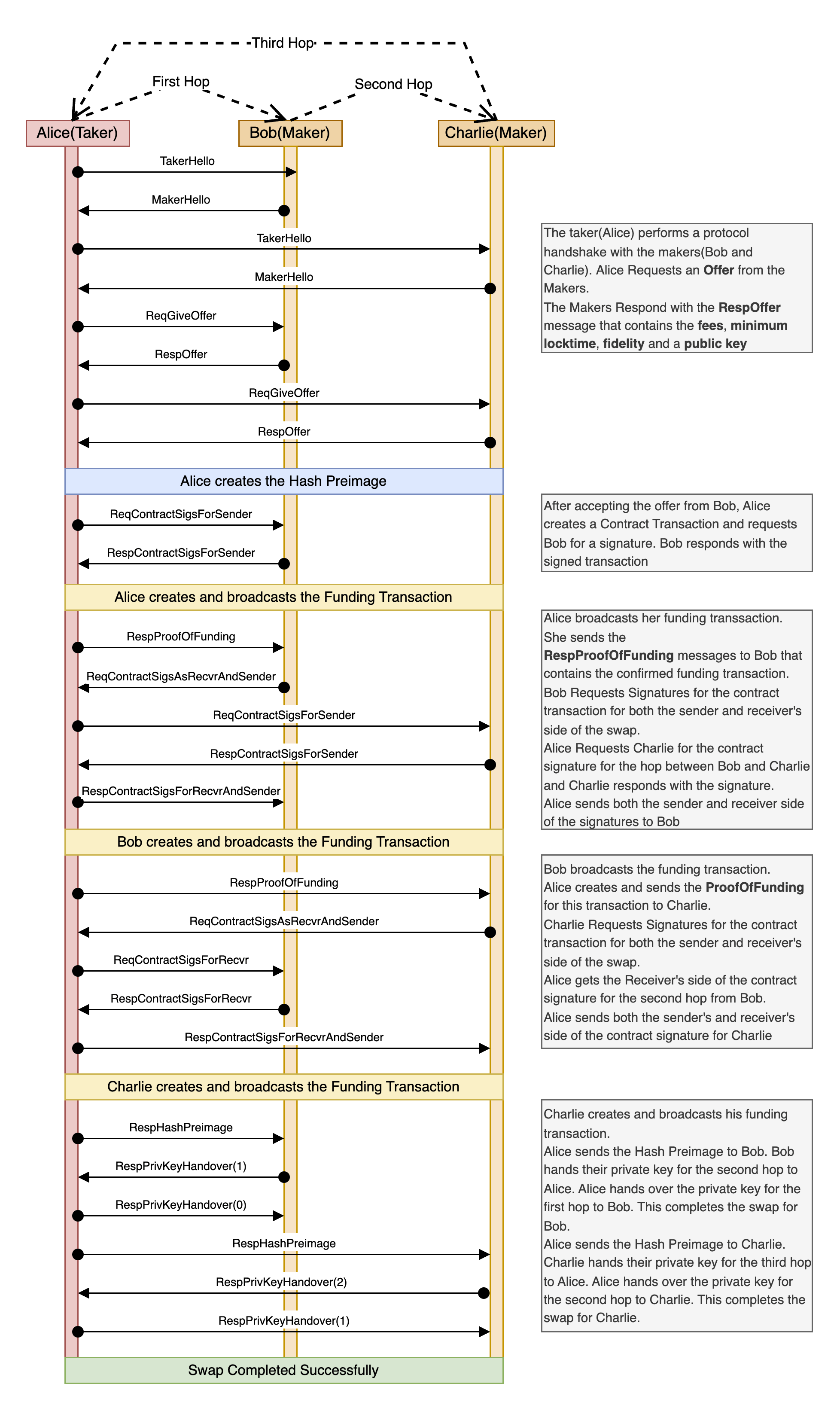

The Basics

- Lightning is a protocol that enables cheap and fast native bitcoin transactions.

- At the core of the protocol is the ability for bitcoin users to create a payment channel with another user.

- These payment channels enable users to make many bitcoin transactions between each other with only two on-chain bitcoin transactions: the channel open transaction and the channel close transaction.

- Essentially lightning is a protocol for interoperable batched bitcoin transactions.

- It is expected that on chain bitcoin transaction fees will increase with adoption and the ability to easily batch transactions will save users significant money.

- As these lightning transactions are processed, liquidity flows from one side of a channel to the other side, on chain transactions are signed by both parties but not broadcasted to update this balance.

- Lightning is designed to be trust minimized, either party in a payment channel can close the channel at any time and their bitcoin will be settled on chain without trusting the other party.

There is no 'Lightning Network'

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise.

- There are many lightning channels between many different users and funds can flow across interconnected channels as long as there is a route through peers.

- If a lightning transaction requires multiple hops it will flow through multiple interconnected channels, adjusting the balance of all channels along the route, and paying lightning transaction fees that are set by each node on the route.

Example: You have a channel with Bob. Bob has a channel with Charlie. You can pay Charlie through your channel with Bob and Bob's channel with User C.

- As a result, it is not guaranteed that every lightning user can pay every other lightning user, they must have a route of interconnected channels between sender and receiver.

Lightning in Practice

- Lightning has already found product market fit and usage as an interconnected payment protocol between large professional custodians.

- They are able to easily manage channels and liquidity between each other without trust using this interoperable protocol.

- Lightning payments between large custodians are fast and easy. End users do not have to run their own node or manage their channels and liquidity. These payments rarely fail due to professional management of custodial nodes.

- The tradeoff is one inherent to custodians and other trusted third parties. Custodial wallets can steal funds and compromise user privacy.

Sovereign Lightning

- Trusted third parties are security holes.

- Users must run their own node and manage their own channels in order to use lightning without trusting a third party. This remains the single largest friction point for sovereign lightning usage: the mental burden of actively running a lightning node and associated liquidity management.

- Bitcoin development prioritizes node accessibility so cost to self host your own node is low but if a node is run at home or office, Tor or a VPN is recommended to mask your IP address: otherwise it is visible to the entire network and represents a privacy risk.

- This privacy risk is heightened due to the potential for certain governments to go after sovereign lightning users and compel them to shutdown their nodes. If their IP Address is exposed they are easier to target.

- Fortunately the tools to run and manage nodes continue to get easier but it is important to understand that this will always be a friction point when compared to custodial services.

The Potential Fracture of Lightning

- Any lightning user can choose which users are allowed to open channels with them.

- One potential is that professional custodians only peer with other professional custodians.

- We already see nodes like those run by CashApp only have channels open with other regulated counterparties. This could be due to performance goals, liability reduction, or regulatory pressure.

- Fortunately some of their peers are connected to non-regulated parties so payments to and from sovereign lightning users are still successfully processed by CashApp but this may not always be the case going forward.

Summary

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise. There is no singular 'Lightning Network' but rather many payment channels between distinct peers, some connected with each other and some not.

- Lightning as an interoperable payment protocol between professional custodians seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

- Lightning as a robust sovereign payment protocol has yet to be battle tested. Heavy reliance on Tor, which has had massive reliability issues, the friction of active liquidity management, significant on chain fee burden for small amounts, interactivity constraints on mobile, and lack of strong privacy guarantees put it at risk.

If you have never used lightning before, use this guide to get started on your phone.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-25 15:01:51

@ 7f6db517:a4931eda

2025-05-25 15:01:51

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

The four main banks of bitcoin and “crypto” are Signature, Prime Trust, Silvergate, and Silicon Valley Bank. Prime Trust does not custody funds themselves but rather maintains deposit accounts at BMO Harris Bank, Cross River, Lexicon Bank, MVB Bank, and Signature Bank. Silvergate and Silicon Valley Bank have already stopped withdrawals. More banks will go down before the chaos stops. None of them have sufficient reserves to meet withdrawals.

Bitcoin gives us all the ability to opt out of a system that has massive layers of counterparty risk built in, years of cheap money and broken incentives have layered risk on top of risk throughout the entire global economy. If you thought the FTX bank run was painful to watch, I have bad news for you: every major bank in the world is fractional reserve. Bitcoin held in self custody is unique in its lack of counterparty risk, as global market chaos unwinds this will become much more obvious.

The rules of bitcoin are extremely hard to change by design. Anyone can access the network directly without a trusted third party by using their own node. Owning more bitcoin does not give you more control over the network with all participants on equal footing.

Bitcoin is:

- money that is not controlled by a company or government

- money that can be spent or saved without permission

- money that is provably scarce and should increase in purchasing power with adoptionBitcoin is money without trust. Whether you are a nation state, corporation, or an individual, you can use bitcoin to spend or save without permission. Social media will accelerate the already deteriorating trust in our institutions and as this trust continues to crumble the value of trust minimized money will become obvious. As adoption increases so should the purchasing power of bitcoin.

A quick note on "stablecoins," such as USDC - it is important to remember that they rely on trusted custodians. They have the same risk as funds held directly in bank accounts with additional counterparty risk on top. The trusted custodians can be pressured by gov, exit scam, or caught up in fraud. Funds can and will be frozen at will. This is a distinctly different trust model than bitcoin, which is a native bearer token that does not rely on any centralized entity or custodian.

Most bitcoin exchanges have exposure to these failing banks. Expect more chaos and confusion as this all unwinds. Withdraw any bitcoin to your own wallet ASAP.

Simple Self Custody Guide: https://werunbtc.com/muun

More Secure Cold Storage Guide: https://werunbtc.com/coldcard

If you found this post helpful support my work with bitcoin.

-

@ 8d34bd24:414be32b

2025-05-25 06:29:21

@ 8d34bd24:414be32b

2025-05-25 06:29:21It seems like most Christians today have lost their reverence and awe of God. We’ve attributed God’s awesome creation by the word of His mouth to random chance and a Big Bang. We’ve attributed the many layers of sediment to millions and billions of years of time instead of God’s judgment of evil. We’ve emphasized His love and mercy to the point that we’ve forgotten about His holiness and righteous wrath. We’ve brought God down to our level and made Him either our “buddy” or made Him our magic genie servant, who is just there to answer our every want and whim.

The God of the Bible is a holy and awesome God who should be both loved and feared.

The fear of the Lord is the beginning of knowledge;\ Fools despise wisdom and instruction. (Proverbs 1:7)

The God of the Bible is the Lord of Lords and King of Kings who “… upholds all things by the word of His power. …” (Hebrews 1:3). Yes, God loves us as sons. Yes, God is merciful. Yes, through Jesus we have the blessed opportunity to approach God directly. None of that means we get to treat God like just another friend. We are to approach God with fear and trembling and worship Him in reverence and awe.

Worship the Lord with reverence And rejoice with trembling. (Psalm 2:11)

Part of the problem is that our culture just doesn’t show reverence to authority. It focuses on self and freedom. The whole thought of reverence for authority is incomprehensible for many. Look at this Psalm of worship:

The Lord reigns, let the peoples tremble;\ He is enthroned above the cherubim, let the earth shake!\ The Lord is great in Zion,\ And He is exalted above all the peoples.\ Let them praise Your great and awesome name;\ Holy is He. (Psalm 99:1-3)

This is the way we should view God and the proper attitude for approaching God.

Another issue is that we don’t study what God has done in the past. In the Old Testament, God commanded the Israelites to setup monuments of remembrance and to teach their kids all of the great things God had done for them. When they failed to do so, Israel drifted astray.

You shall teach them to your sons, talking of them when you sit in your house and when you walk along the road and when you lie down and when you rise up. (Deuteronomy 11:19)

God has given us the Bible, His word, so that we can know Him, know His character, and know His great deeds. When we fail to be in His word daily, we can forget (or not even know) the greatness of our God.

Establish Your word to Your servant,\ As that which produces reverence for You. (Psalm 119:38)

Do you love God’s word like this? Do you hunger for God’s word? Do you seek to know everything about God that you can know? When we love someone or something, we want to know everything about it.

Princes persecute me without cause,\ But my heart stands in awe of Your words.\ **I rejoice at Your word,\ As one who finds great spoil. \ (Psalm 119:161-162) {emphasis mine}

In addition to what we can learn about God in the Bible, we also need to remember what God has done in our own lives. We need to dwell on what God has done for us. We can just try to remember. Even better (I’ll admit this is a weakness for me), write down answered prayers, blessings, and other things God has done for you. My son has been writing down one blessing every day for over a year. What an example he is!

After we have thought about what God has done for us and those we care about, we should praise Him for His great works.

Shout joyfully to God, all the earth;\ Sing the glory of His name;\ Make His praise glorious.\ Say to God, “How awesome are Your works!\ Because of the greatness of Your power \ Your enemies will give feigned obedience to You.\ All the earth will worship You,\ And will sing praises to You;\ They will sing praises to Your name.” Selah.\ **Come and see the works of God,\ Who is awesome in His deeds toward the sons of men. \ (Psalm 66:1-5) {emphasis mine}

There is nothing we can do to earn salvation from God, but we should be in awe of what He has done for us leading to submission and obedience in gratitude.

Therefore, since we receive a kingdom which cannot be shaken, let us show gratitude, by which we may offer to God an acceptable service with reverence and awe; for our God is a consuming fire. (Hebrews 12:28-29) {emphasis mine}

Are you thankful for your blessings or resentful for what you don’t have? Do you worship God or take things He has provided for granted? Do you tell the world the awesome things God has done for you or do you stay silent? Do you claim to be a Christian, but live a life no different than those around you?

Then the Lord said,

“Because this people draw near with their words\ And honor Me with their lip service,\ But they remove their hearts far from Me,\ And their reverence for Me consists of tradition learned by rote, (Isaiah 29:13)

I hope this passage does not describe your relation ship with our awesome God. He deserves so much more. Instead we should be zealous to praise God and share His goodness with those around us.

Who is there to harm you if you prove zealous for what is good? But even if you should suffer for the sake of righteousness, you are blessed. And do not fear their intimidation, and do not be troubled, but sanctify Christ as Lord in your hearts, always being ready to make a defense to everyone who asks you to give an account for the hope that is in you, yet with gentleness and reverence; (1 Peter 3:13-15) {emphasis mine}

Did you know that you can even show reverence by your every day work?

By faith Noah, being warned by God about things not yet seen, in reverence prepared an ark for the salvation of his household, by which he condemned the world, and became an heir of the righteousness which is according to faith. (Hebrews 11:7) {emphasis mine}

When Noah stepped out in faith and obedience to God and built the ark as God commanded, despite the fact that the people around him probably thought he was crazy building a boat on dry ground that had never flooded, his work was a kind of reverence to God. Are there areas in your life where you can obey God in reverence to His awesomeness? Do you realize that quality work in obedience to God can be a form of worship?

Just going above and beyond in your job can be a form of worship of God if you are working extra hard to honor Him. Obedience is another form of worship and reverence.

Then Zerubbabel the son of Shealtiel, and Joshua the son of Jehozadak, the high priest, with all the remnant of the people, obeyed the voice of the Lord their God and the words of Haggai the prophet, as the Lord their God had sent him. And the people showed reverence for the Lord. (Haggai 1:12) {emphasis mine}

Too many people have put the word of men (especially scientists) above the word of God and have tried to change the clear meaning of the Bible. I used to think it strange how the Bible goes through the days of creation and ends each day with “and there was evening and there was morning, the xth day.” Since a day has an evening and a morning, that seemed redundant. Why did God speak in this manner? God knew that a day would come when many scientist would try to disprove God and would claim that these days were not 24 hour days, but long ages. When a writer is trying to convey long ages, the writer does not mention evening/morning and doesn’t count the days.1

When we no longer see God as speaking the universe and everything in it into existence, we tend to not see God as an awesome God. We don’t see His power. We don’t see His knowledge. We don’t see His goodness. We also don’t see His authority. Why do we have to obey God? Because He created us and because He upholds us. Without Him we would not exist. Our creator has the authority to command His creation. When we compromise in this area, we lose our submission, our awe, and our reverence. (For more on the subject see my series.) When we believe His great works, especially those spoken of in Genesis 1-11 and in Exodus, we can’t help but be in awe of our God.

For the word of the Lord is upright,\ And all His work is done in faithfulness.\ He loves righteousness and justice;\ The earth is full of the lovingkindness of the Lord.\ By the word of the Lord the heavens were made,\ And by the breath of His mouth all their host.\ He gathers the waters of the sea together as a heap;\ He lays up the deeps in storehouses.\ **Let all the earth fear the Lord;\ Let all the inhabitants of the world stand in awe of Him. \ (Psalm 33:4-8) {emphasis mine}

Remembering God’s great works, we can’t help but worship in awe and reverence.

By awesome deeds You answer us in righteousness, O God of our salvation,\ *You who are the trust of all the ends of the earth* and of the farthest sea;\ Who establishes the mountains by His strength,\ Being girded with might;\ Who stills the roaring of the seas,\ The roaring of their waves,\ And the tumult of the peoples.\ They who dwell in the ends of the earth stand in awe of Your signs;\ You make the dawn and the sunset shout for joy. \ (Psalm 65:5-8) {emphasis mine}

If we truly do have awe and reverence for our God, we should be emboldened to tell those around us of His great works.

I will tell of Your name to my brethren;\ In the midst of the assembly I will praise You.\ You who fear the Lord, praise Him;\ All you descendants of Jacob, glorify Him,\ And stand in awe of Him, all you descendants of Israel. \ (Psalm 22:22-23) {emphasis mine}

May God grant you the wisdom to see His awesomeness and to trust Him, serve Him, obey Him, and worship Him as He so rightly deserves. May you always have a right view of God and a hunger for His word and a personal relationship with Him. To God be the Glory!

Trust Jesus

FYI, these are a few more passages on the subject that are helpful, but didn’t fit in the flow of my post.

Great is the Lord, and highly to be praised,\ And His greatness is unsearchable.\ One generation shall praise Your works to another,\ And shall declare Your mighty acts.\ On the glorious splendor of Your majesty\ And on Your wonderful works, I will meditate.\ Men shall speak of the power of Your awesome acts,\ And I will tell of Your greatness. (Psalm 145:3-6)

The boastful shall not stand before Your eyes;\ You hate all who do iniquity.\ You destroy those who speak falsehood;\ The Lord abhors the man of bloodshed and deceit.\ But as for me, by Your abundant lovingkindness I will enter Your house,\ At Your holy temple I will bow in reverence for You. (Psalm 5:5-7) {emphasis mine}

If you do not listen, and if you do not take it to heart to give honor to My name,” says the Lord of hosts, “then I will send the curse upon you and I will curse your blessings; and indeed, I have cursed them already, because you are not taking it to heart. Behold, I am going to rebuke your offspring, and I will spread refuse on your faces, the refuse of your feasts; and you will be taken away with it. Then you will know that I have sent this commandment to you, that My covenant may continue with Levi,” says the Lord of hosts. “My covenant with him was one of life and peace, and I gave them to him as an object of reverence; so he revered Me and stood in awe of My name. (Malachi 2:2-5) {emphasis mine}

-

@ 7f6db517:a4931eda

2025-05-25 15:01:51

@ 7f6db517:a4931eda

2025-05-25 15:01:51

The newly proposed RESTRICT ACT - is being advertised as a TikTok Ban, but is much broader than that, carries a $1M Fine and up to 20 years in prison️! It is unconstitutional and would create massive legal restrictions on the open source movement and free speech throughout the internet.

The Bill was proposed by: Senator Warner, Senator Thune, Senator Baldwin, Senator Fischer, Senator Manchin, Senator Moran, Senator Bennet, Senator Sullivan, Senator Gillibrand, Senator Collins, Senator Heinrich, and Senator Romney. It has broad support across Senators of both parties.

Corrupt politicians will not protect us. They are part of the problem. We must build, support, and learn how to use censorship resistant tools in order to defend our natural rights.

The RESTRICT Act, introduced by Senators Warner and Thune, aims to block or disrupt transactions and financial holdings involving foreign adversaries that pose risks to national security. Although the primary targets of this legislation are companies like Tik-Tok, the language of the bill could potentially be used to block or disrupt cryptocurrency transactions and, in extreme cases, block Americans’ access to open source tools or protocols like Bitcoin.

The Act creates a redundant regime paralleling OFAC without clear justification, it significantly limits the ability for injured parties to challenge actions raising due process concerns, and unlike OFAC it lacks any carve-out for protected speech. COINCENTER ON THE RESTRICT ACT

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-25 15:01:50

@ 7f6db517:a4931eda

2025-05-25 15:01:50

@matt_odell don't you even dare not ask about nostr!

— Kukks (Andrew Camilleri) (@MrKukks) May 18, 2021

Nostr first hit my radar spring 2021: created by fellow bitcoiner and friend, fiatjaf, and released to the world as free open source software. I was fortunate to be able to host a conversation with him on Citadel Dispatch in those early days, capturing that moment in history forever. Since then, the protocol has seen explosive viral organic growth as individuals around the world have contributed their time and energy to build out the protocol and the surrounding ecosystem due to the clear need for better communication tools.

nostr is to twitter as bitcoin is to paypal

As an intro to nostr, let us start with a metaphor:

twitter is paypal - a centralized platform plagued by censorship but has the benefit of established network effects

nostr is bitcoin - an open protocol that is censorship resistant and robust but requires an organic adoption phase

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

- Anyone can run a relay.

- Anyone can interact with the protocol.

- Relays can choose which messages they want to relay.

- Users are identified by a simple public private key pair that they can generate themselves.Nostr is often compared to twitter since there are nostr clients that emulate twitter functionality and user interface but that is merely one application of the protocol. Nostr is so much more than a mere twitter competitor. Nostr clients and relays can transmit a wide variety of data and clients can choose how to display that information to users. The result is a revolution in communication with implications that are difficult for any of us to truly comprehend.

Similar to bitcoin, nostr is an open and permissionless protocol. No person, company, or government controls it. Anyone can iterate and build on top of nostr without permission. Together, bitcoin and nostr are incredibly complementary freedom tech tools: censorship resistant, permissionless, robust, and interoperable - money and speech protected by code and incentives, not laws.

As censorship throughout the world continues to escalate, freedom tech provides hope for individuals around the world who refuse to accept the status quo. This movement will succeed on the shoulders of those who choose to stand up and contribute. We will build our own path. A brighter path.

My Nostr Public Key: npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx

If you found this post helpful support my work with bitcoin.

-

@ 57d1a264:69f1fee1

2025-05-25 06:26:42

@ 57d1a264:69f1fee1

2025-05-25 06:26:42I dare to claim that the big factor is the absence of an infinite feed design.

Modern social media landscape sucks for a myriad of reasons, but oh boy does the infinite feed take the crapcake. It's not just bad on it's own, it's emblematic of most, if not all other ways social media have deteriorated into an enshitification spiral. Let's see at just three things I hate about it the most.

1) It's addictive: In the race for your attention, every addictive design element helps. But infinite feed is addictive almost by default. Users are expected to pull the figurative lever until they hit a jackpot. Just one more reel, then I'll go to sleep.

2) Autonomy? What's that? You are not the one driving your experience. No. You are just a passenger passively absorbing what the feed feeds you.

3) Echo chambers. The algorithm might be more to blame here, but the infinite feed and it's super-limited exploration options sure don't help. Your feed only goes two ways - into the past and into the comfortable.

And I could go on, and on...

The point it, if the goal of every big tech company is to have us mindlessly and helplessly consume their products, without agency and opposition (and it is $$$), then the infinite feed gets them half-way there.

Let's get rid of it. For the sake of humanity.

Aphantasia [^1]

Version: 1.0.2 AlphaWhat is Aphantasia?

I like to call it a social network for graph enthusiasts. It's a place where your thoughts live in time and space, interconnected with others and explorable in a graph view.

The code is open-source and you can take a look at it on GitHub. There you can find more information about contributions, API usage and other details related to the software.

There is also an accompanying youtube channel.

https://www.youtube.com/watch?v=JeLOt-45rJM

[^1]: Aphantasia the software is named after aphantasia the condition - see Wikipedia for more information.

https://stacker.news/items/988754

-

@ 502ab02a:a2860397

2025-05-25 01:03:51

@ 502ab02a:a2860397

2025-05-25 01:03:51บางครั้งพลังยิ่งใหญ่ที่สุดก็ไม่ใช่สิ่งที่เห็นได้ด้วยตาเปล่า เหมือนแสงแดดที่คนส่วนใหญ่มักจะกลัวเพราะกลัวผิวเสีย กลัวฝ้า กลัวร้อน แต่แท้จริงแล้วในแสงแดดมีบางสิ่งที่น่าเคารพอยู่ลึกๆ มันคือแสงที่มองไม่เห็น มันไม่แสบตา ไม่แสบผิว แต่มันลึก ถึงเซลล์ มันคือ “แสงอินฟราเรด” ที่ซ่อนตัวอย่างสุภาพในแดดยามเช้า

เฮียมักชอบพูดว่า แดดที่ดีไม่จำเป็นต้องแสบหลัง อาบแสงที่ลอดผ่านใบไม้ยามเช้าแบบไม่ต้องฝืนตาก็พอ แสงอินฟราเรดนี่แหละคือพระเอกตัวจริงในความเงียบ มันไม่ดัง ไม่โชว์ ไม่โฆษณา แต่มันลงลึกไปถึงระดับที่ร่างกายเรากำลังหิวโดยไม่รู้ตัวในระดับเซลล์

ในเซลล์ของเรา มีหน่วยผลิตพลังงานที่เรียกว่าไมโทคอนเดรีย เจ้านี่แหละคือโรงไฟฟ้าจิ๋วประจำบ้าน ที่ต้องตื่นมาทำงานทุกวันโดยไม่ได้หยุดเสาร์อาทิตย์ ยิ่งถ้าไมโทคอนเดรียทำงานไม่ดี ร่างกายก็จะเหมือนไฟตกทั้งระบบ—ง่วงง่าย เพลียไว ปวดนู่นปวดนี่เหมือนไฟในบ้านกระพริบตลอดเวลา

แล้วแสงอินฟราเรดเกี่ยวอะไรกับมัน? เฮียขอเล่าง่ายๆ ว่า ไมโทคอนเดรียมีตัวรับแสงตัวหนึ่งชื่อว่า cytochrome c oxidase เจ้านี่ตอบสนองต่อแสงอินฟราเรดช่วงคลื่นเฉพาะ คือประมาณ 600–900 นาโนเมตร พอโดนเข้าไป มันเหมือนได้จุดประกายให้โรงงานพลังงานในร่างกายกลับมาคึกคักอีกครั้ง ผลิตพลังงานได้มากขึ้น ระบบไหลเวียนเลือดก็ดีขึ้น เหมือนท่อน้ำที่เคยอุดตันก็กลับมาใสแจ๋ว ความอักเสบเล็กๆ ในร่างกายก็ลดลง คล้ายบ้านที่เคยอับชื้นแล้วได้เปิดหน้าต่างให้แสงแดดส่องเข้าไป

และที่น่ารักกว่านั้นคือ เราไม่ต้องไปถึงชายหาด ไม่ต้องจองรีสอร์ตริมทะเล แค่แดดเช้าอ่อนๆ ข้างบ้านหรือตามขอบระเบียง ก็ให้แสงอินฟราเรดได้แล้ว ถ้าใครอยู่ในเมืองใหญ่ที่มีแต่ตึกบังแดด แล้วจะเลือกใช้หลอดไฟ Red Light Therapy ก็ไม่ผิด แต่ต้องเลือกแบบรู้เท่าทันรู้ ไม่ใช่เห็นใครรีวิวก็ซื้อมาเปิดใส่หน้า หวังจะหน้าใสข้ามคืน ต้องเข้าใจทั้งความยาวคลื่น เวลาใช้งาน และจุดประสงค์ ไม่ใช่ใช้เพราะแค่กลัวแก่อยากหน้าตึง แต่ใช้เพราะอยากให้ร่างกายกลับไปทำงานอย่างเป็นธรรมชาติอีกครั้ง และอยู่ในประเทศหรือสถานที่ที่โดนแดดได้น้อยอยากได้เสริมเฉยๆ

แล้วเราจะรู้ได้ยังไงว่าไมโทคอนเดรียเรากลับมาทำงานดีขึ้น? เฮียว่าไม่ต้องรอผลเลือดจากแล็บไหนก็รู้ได้ อย่าไปยึดติดกับตัวเลขมากครับ เอาตัวเองเป็นหลัก ตั้งคำถามกับตัวเองว่ารู้สึกยังไงบ้าง ถ้าเริ่มนอนหลับลึกขึ้น ตื่นมาแล้วหัวไม่มึน ไม่หงุดหงิดตั้งแต่ยังไม่ลืมตา ถ้าปวดหลังปวดข้อที่เคยมีเริ่มหายไปแบบไม่ได้กินยา หรือแม้แต่ผิวที่ดูสดใสขึ้นแบบไม่ต้องง้อสกินแคร์ นั่นแหละคือเสียงขอบคุณเบาๆ จากไมโทคอนเดรียที่ได้แสงแดดแล้วกลับมามีชีวิตอีกครั้ง ถ้ามันดีก็คือดี

บางที เราไม่ต้องกินวิตามินเม็ดไหนเพิ่ม แค่เดินออกไปรับแดดเบาๆ ในเวลาเช้าๆ แล้วให้ร่างกายได้พูดคุยกับธรรมชาติบ้าง เพราะในความอบอุ่นเงียบๆ ของแสงอินฟราเรดนั้น มีเสียงเบาๆ ที่กำลังปลุกพลังในตัวเราให้กลับมาอีกครั้ง

แดดไม่ใช่ศัตรู ถ้าเรารู้จักมันในมุมที่ถูกต้อง เฮียแค่อยากชวนให้ลองเปลี่ยนจากคำว่า “กลัวแดด” เป็น “ฟังแดด” เพราะบางครั้งธรรมชาติไม่ได้พูดด้วยคำ แต่สื่อสารด้วยแสงที่แทรกผ่านหัวใจเราโดยไม่ต้องผ่านล่าม

บางคนอาจคิดในใจ “แหมเฮีย ก็ดีหรอก ถ้าได้ตื่นเช้า” 555555

เฮียเข้าใจดีเลยว่าไม่ใช่ทุกคนจะตื่นมาทันแดดยามเช้าได้เสมอไป ชีวิตคนเรามันไม่ได้เริ่มต้นพร้อมไก่ขันทุกวัน บางคนเพิ่งเข้านอนตอนตีสาม ตื่นอีกทีแดดก็แตะบ่ายเข้าไปแล้ว ไม่ต้องกังวลไปจ้ะ เพราะความมหัศจรรย์ของแสงอินฟราเรดยังมีให้เราได้ใช้แม้ในแดดยามเย็น

แดดช่วงเย็น โดยเฉพาะหลังสี่โมงเย็นไปจนเกือบหกโมง (หรือเร็วช้าตามฤดู) ก็ยังอุดมไปด้วยแสงอินฟราเรดในช่วงคลื่นที่ไมโทคอนเดรียชอบ แถมยังไม่มีรังสี UV ที่แรงจัดมารบกวนเหมือนตอนเที่ยง เรียกว่าเป็นแดดแบบละมุนๆ สำหรับคนที่อยาก “บำบัดใจ” แบบไม่ต้องร้อนจนหัวเปียก

เฮียเคยลองตากแดดเย็นเดินไปในสวนสาธารณะ แล้วรู้สึกว่ามันเหมือนได้รีเซ็ตจิตใจหลังวันเหนื่อยๆ ไปในตัว ยิ่งพอรู้ว่าในช่วงเวลานี้แสงที่ได้กำลังช่วยปลุกพลังงานในร่างกายแบบเงียบๆ ด้วยแล้ว มันทำให้เฮียยิ่งเคารพธรรมชาติมากขึ้นไปอีก เคยเห็นคนที่วันๆมีแต่ความเครียด ความโกรธ ความอาฆาตต่อโลกไหมหละ บางคนแค่โดนแดด แต่ไม่ได้ตากแดด การตากแดดคือปล่อยใจไปกับธรรมชาติ พูดคุยกับร่างกาย บอกเขาว่าเราจะทำตัวให้เป็นประโยชน์กับโลกใบนี้ ให้สมกับที่ใช้พลังงานของโลก

จะเช้าหรือเย็น สำคัญไม่เท่ากับความตั้งใจ เฮียว่าไม่ว่าชีวิตจะตื่นตอนไหน ถ้าเราให้เวลาแค่ 10–15 นาทีในแต่ละวัน ออกไปยืนให้แดดแตะหน้า แตะแขน หรือแค่ให้แสงลอดผ่านตาเบาๆ โดยไม่ต้องจ้องจ้าๆ ก็พอ แค่นี้ก็เป็นการให้ไมโทคอนเดรียได้หายใจ ได้ออกกำลังกายแบบของมัน และได้ส่งพลังกลับมาหาเราทั้งร่างกายและจิตใจ

สุดท้ายแล้ว แดดไม่ได้แบ่งชนชั้น ไม่เลือกว่าจะรักเฉพาะคนตื่นเช้า หรือโกรธคนตื่นสาย ขอแค่เรารู้จักเวลาและวิธีอยู่กับมันอย่างถูกจังหวะ แดดก็พร้อมจะให้เสมอ

#pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr #SundaySpecialเราจะไปเป็นหมูแดดเดียว

-

@ 7f6db517:a4931eda

2025-05-25 15:01:50

@ 7f6db517:a4931eda

2025-05-25 15:01:50

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-25 15:01:50

@ 7f6db517:a4931eda

2025-05-25 15:01:50

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-25 15:01:50

@ 7f6db517:a4931eda

2025-05-25 15:01:50

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-25 15:01:49

@ 7f6db517:a4931eda

2025-05-25 15:01:49

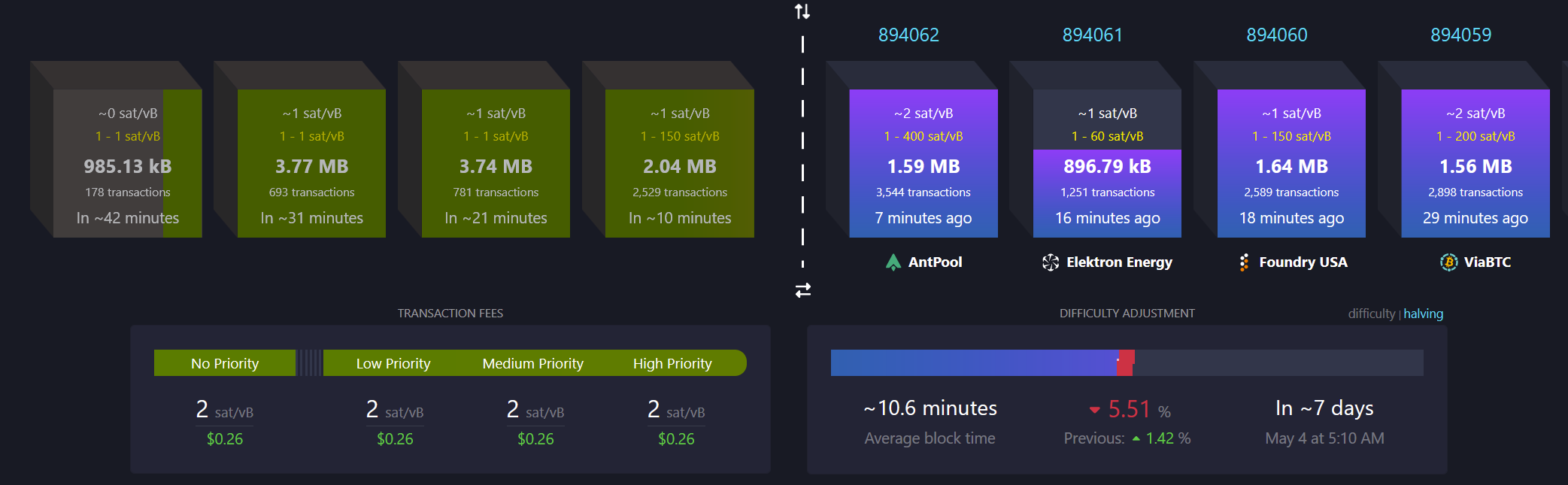

There must be a limit to how much data is transferred across the bitcoin network in order to keep the ability to run and use your own node accessible. A node is required to interact with the global bitcoin network - if you do not use your own node then you must trust someone else's node. If nodes become inaccessible to run then the network will centralize around the remaining entities that operate them - threatening the censorship resistance at the core of bitcoin's value prop. The bitcoin protocol uses three main mechanisms to keep node operation costs low - a fixed limit on the amount of data in each block, an automatic difficulty adjustment that regulates how many blocks are produced based on current mining hash rate, and a robust dynamic transaction fee market.

Bitcoin transaction fees limit network abuse by making usage expensive. There is a cost to every transaction, set by a dynamic free market based on demand for scarce block space. It is an incredibly robust way to prevent spam without relying on centralized entities that can be corrupted or pressured.

After the 2017 bitcoin fee spike we had six years of relative quiet to build tools that would be robust in a sustained high fee market. Fortunately our tools are significantly better now but many still need improvement. Most of the pain points we see today will be mitigated.

The reality is we were never going to be fully prepared - pressure is needed to show the pain points and provide strong incentives to mitigate them.

It will be incredibly interesting to watch how projects adapt under pressure. Optimistic we see great innovation here.

_If you are willing to wait for your transaction to confirm you can pay significantly lower fees. Learn best practices for reducing your fee burden here.

My guide for running and using your own bitcoin node can be found here._

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-25 15:01:49

@ 7f6db517:a4931eda

2025-05-25 15:01:49

I often hear "bitcoin doesn't interest me, I'm not a finance person."

Ironically, the beauty of sound money is you don't have to be. In the current system you're expected to manage a diversified investment portfolio or pay someone to do it. Bitcoin will make that optional.

— ODELL (@ODELL) September 16, 2018

At first glance bitcoin often appears overwhelming to newcomers. It is incredibly easy to get bogged down in the details of how it works or different ways to use it. Enthusiasts, such as myself, often enjoy going down the deep rabbit hole of the potential of bitcoin, possible pitfalls and theoretical scenarios, power user techniques, and the developer ecosystem. If your first touch point with bitcoin is that type of content then it is only natural to be overwhelmed. While it is important that we have a thriving community of bitcoiners dedicated to these complicated tasks - the true beauty of bitcoin lies in its simplicity. Bitcoin is simply better money. It is the best money we have ever had.

Life is complicated. Life is hard. Life is full of responsibility and surprises. Bitcoin allows us to focus on our lives while relying on a money that is simple. A money that is not controlled by any individual, company, or government. A money that cannot be easily seized or blocked. A money that cannot be devalued at will by a handful of corrupt bureaucrat who live hundreds of miles from us. A money that can be easily saved and should increase in purchasing power over time without having to learn how to "build a diversified stock portfolio" or hire someone to do it for us.

Bitcoin enables all of us to focus on our lives - our friends and family - doing what we love with the short time we have on this earth. Time is scarce. Life is complicated. Bitcoin is the most simple aspect of our complicated lives. If we spend our scarce time working then we should be able to easily save that accrued value for future generations without watching the news or understanding complicated financial markets. Bitcoin makes this possible for anyone.

Yesterday was Mother's Day. Raising a human is complicated. It is hard, it requires immense personal responsibility, it requires critical thinking, but mothers figure it out, because it is worth it. Using and saving bitcoin is simple - simply install an app on your phone. Every mother can do it. Every person can do it.

Life is complicated. Life is beautiful. Bitcoin is simple.

If you found this post helpful support my work with bitcoin.

-

@ bf47c19e:c3d2573b

2025-05-24 23:02:05

@ bf47c19e:c3d2573b

2025-05-24 23:02:05Da li ste znali da se već danas u Srbiji možete kompletno obući i svoj dom u potpunosti opremiti tehnikom i za sve to platiti Bitkoinom? Sve ovo je moguće zahvaljujući kompaniji Bitrefill!

Bitrefill je vodeća platforma koja omogućava kupovinu poklon-kartica putem Bitkoina i drugih kriptovaluta.

Od poklon-kartica koje je moguće kupiti na Bitrefillu, u Srbiji je najpopularnija, najraznovrsnija i najpraktičnija za korišćenje digitalna Giftoncard Multibrand poklon-kartica koju je moguće koristiti u više desetina šoping centara širom Srbije! Moguće je iskoristiti u više od 150 naznačenih brendova i radnji raznovrsnog tipa i zato kao takva predstavlja pravi spoj zabave, mode, sporta, tehnike... Od najpoznatijih prodavnica izdvajaju se Gigatron, Tehnomanija, Tehnomedija, Puma, Adidas, Sport Vision, Univerexport...

GiftOnCard poklon kartica je savršen način da ispoštujete ukus baš svakoga i rešite problem promašenog poklona!

Neki od tržnih centara u kojima se mogu koristiti poklon-kartice: Delta City, TC Ušće, Ada Mall, Galerija Beograd, TC Stadion, Merkator Centar Beograd/Novi Sad, Roda Mega Shopping Centar, Big Kruševac, Big Nova Pazova, Aviv Park Zvezdara, Stop Shop Borča, Forum Park, Big Shopping Centar Novi Sad, TC Promenada Novi Sad, TC Forum Niš, Delta Planet Niš, Capitol Park Šabac...

Giftoncard Multibrand poklon-karticu je na Bitrefillu moguće kupiti kako on-chain Bitkoinom, tako i putem Bitkoin Lightning mreže. U ponudi su kartice sa sredstvima u iznosu od 3000 i 6000 dinara.

Pored Multibrand kartice, na sajtu Bitrefill su dostupne i poklon-kartice Tehnomanije i Sport Visiona, s tim što je Sport Vision karticu moguće iskoristiti i onlajn na njihovom sajtu (ovo važi i za Multibrand karticu).

Kako do Giftoncard Multibrand poklon-kartice?

Proces plaćanja Bitkoin (Lightning-om) je veoma jednostavan.

- Izaberite vašu poklon-karticu zajedno sa željenom vrednošću.

- Popunite potrebna polja da biste nastavili sa plaćanjem.

- Izaberite željenu kriptovalutu i pošaljite odgovarajući iznos na dostavljenu adresu ili skenirajte QR kod putem vašeg mobilnog novčanika.

- Kada plaćanje bude izvršeno, digitalna poklon-kartica će vam biti dostavljena za nekoliko trenutaka, a takođe ćete dobiti i kopiju putem imejla.

Kako iskoristiti poklon-karticu?

- Možete iskoristiti poklon-karticu za plaćanje proizvoda i usluga na više od 300 lokacija širom Srbije sve do visine sredstava koja se nalaze na kartici.

- Niste u obavezi da iskoristite ceo iznos sa kartice odjednom; kartica se može koristiti više puta za više proizvoda i usluga sve dok ne potrošite čitav iznos.

- Možete proveravati stanje na kartici i sve transakcije registracijom na sajtu giftoncard.eu.

- Moguće je iskoristiti više poklon-kartica za jednu kupovinu.

- Kartica se ne može koristiti za povlačenje gotovine

- Kartica ne može biti poništena ili ponovo dopunjena.

Obradujte svoje najmilije i sebe poklonima, proizvodima i uslugama kupljenim za Bitkoin!

-

@ 7f6db517:a4931eda

2025-05-25 15:01:49

@ 7f6db517:a4931eda

2025-05-25 15:01:49Will not live in a pod.

Will not eat the bugs.

Will not get the chip.

Will not get a blue check.

Will not use CBDCs.Live Free or Die.

Why did Elon buy twitter for $44 Billion? What value does he see in it besides the greater influence that undoubtedly comes with controlling one of the largest social platforms in the world? We do not need to speculate - he made his intentions incredibly clear in his first meeting with twitter employees after his takeover - WeChat of the West.

To those that do not appreciate freedom, the value prop is clear - WeChat is incredibly powerful and successful in China.

To those that do appreciate freedom, the concern is clear - WeChat has essentially become required to live in China, has surveillance and censorship integrated at its core, and if you are banned from the app your entire livelihood is at risk. Employment, housing, payments, travel, communication, and more become extremely difficult if WeChat censors determine you have acted out of line.

The blue check is the first step in Elon's plan to bring the chinese social credit score system to the west. Users who verify their identity are rewarded with more reach and better tools than those that do not. Verified users are the main product of Elon's twitter - an extensive database of individuals and complete control of the tools he will slowly get them to rely on - it is easier to monetize cattle than free men.

If you cannot resist the temptation of the blue check in its current form you have already lost - what comes next will be much darker. If you realize the need to resist - freedom tech provides us options.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-25 15:01:49

@ 7f6db517:a4931eda

2025-05-25 15:01:49

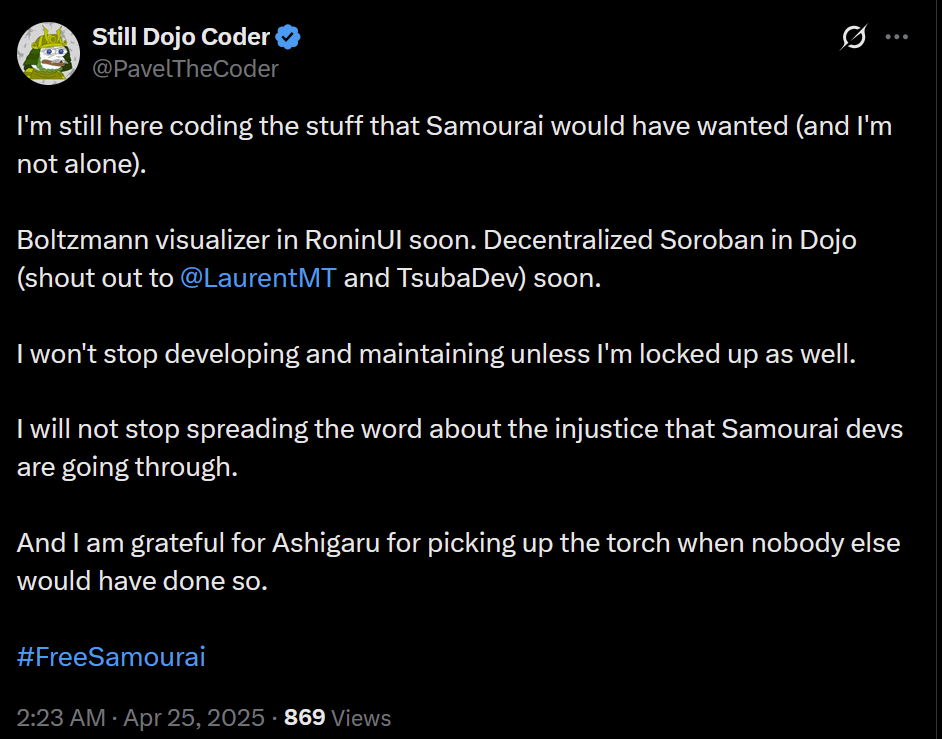

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-25 15:01:48

@ 7f6db517:a4931eda

2025-05-25 15:01:48

Influencers would have you believe there is an ongoing binance bank run but bitcoin wallet data says otherwise.

- binance wallets are near all time highs

- bitfinex wallets are also trending up

- gemini and coinbase are being hit with massive withdrawals thoughYou should not trust custodians, they can rug you without warning. It is incredibly important you learn how to hold bitcoin yourself, but also consider not blindly trusting influencers with a ref link to shill you.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-25 15:01:48

@ 7f6db517:a4931eda

2025-05-25 15:01:48

For years American bitcoin miners have argued for more efficient and free energy markets. It benefits everyone if our energy infrastructure is as efficient and robust as possible. Unfortunately, broken incentives have led to increased regulation throughout the sector, incentivizing less efficient energy sources such as solar and wind at the detriment of more efficient alternatives.

The result has been less reliable energy infrastructure for all Americans and increased energy costs across the board. This naturally has a direct impact on bitcoin miners: increased energy costs make them less competitive globally.

Bitcoin mining represents a global energy market that does not require permission to participate. Anyone can plug a mining computer into power and internet to get paid the current dynamic market price for their work in bitcoin. Using cellphone or satellite internet, these mines can be located anywhere in the world, sourcing the cheapest power available.

Absent of regulation, bitcoin mining naturally incentivizes the build out of highly efficient and robust energy infrastructure. Unfortunately that world does not exist and burdensome regulations remain the biggest threat for US based mining businesses. Jurisdictional arbitrage gives miners the option of moving to a friendlier country but that naturally comes with its own costs.

Enter AI. With the rapid development and release of AI tools comes the requirement of running massive datacenters for their models. Major tech companies are scrambling to secure machines, rack space, and cheap energy to run full suites of AI enabled tools and services. The most valuable and powerful tech companies in America have stumbled into an accidental alliance with bitcoin miners: THE NEED FOR CHEAP AND RELIABLE ENERGY.

Our government is corrupt. Money talks. These companies will push for energy freedom and it will greatly benefit us all.

Microsoft Cloud hiring to "implement global small modular reactor and microreactor" strategy to power data centers: https://www.datacenterdynamics.com/en/news/microsoft-cloud-hiring-to-implement-global-small-modular-reactor-and-microreactor-strategy-to-power-data-centers/

If you found this post helpful support my work with bitcoin.

-

@ 3c7dc2c5:805642a8

2025-05-24 22:05:00

@ 3c7dc2c5:805642a8

2025-05-24 22:05:00🧠Quote(s) of the week:

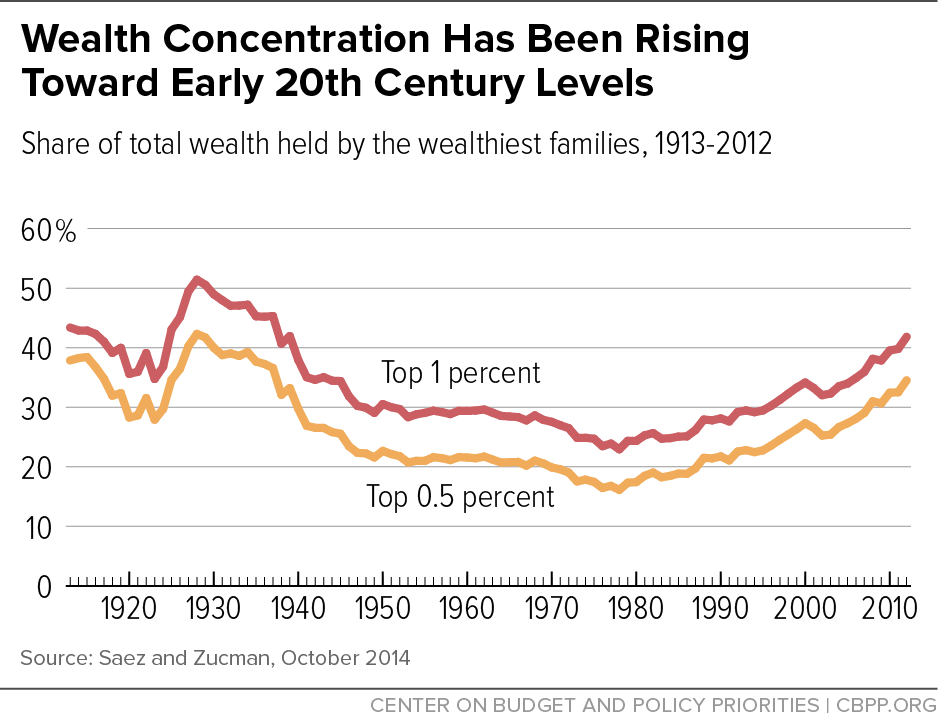

'The Cantillon Effect: When new money is printed, those closest to the source (banks, elites) benefit first, buying assets before prices rise. Others lose purchasing power as inflation hits later. If people find out how this works, they will riot.' -Bitcoin for Freedom

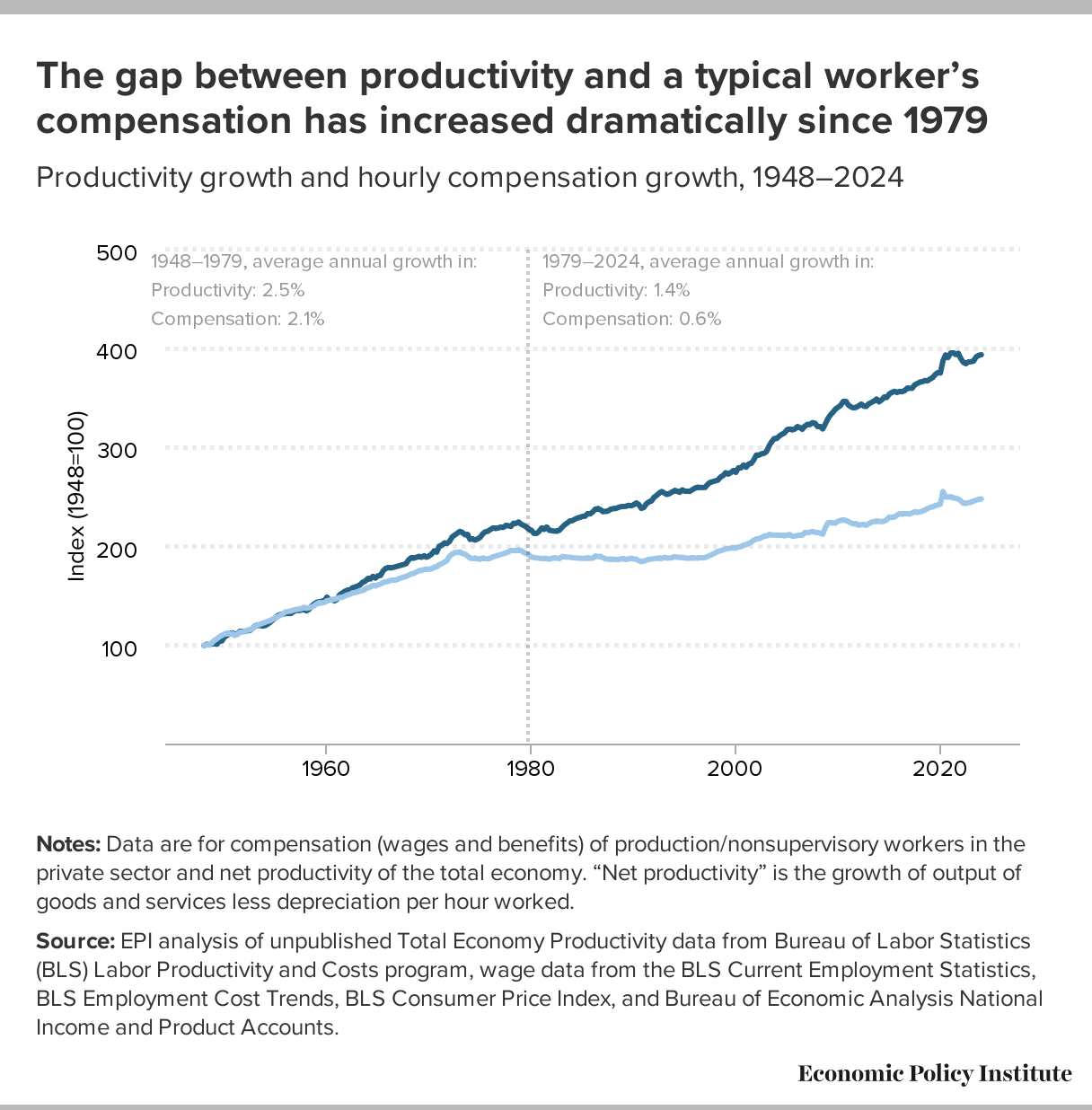

Just think about it. Your employer gives you a 5% raise. The Fed (central banks in general) prints 7% more dollars/euros/Fiat. You just got a 2% pay cut. This isn't a conspiracy theory. This is how fiat money steals from the working class every single day. This is why I support Bitcoin.

Anilsaidso: 'Saving in fiat currency is no longer an option. A 2% inflation rate means you lose 1/3 of your purchasing power over 20yrs. At 5% inflation, you lose 60%. And at 10% you've burnt 85%. Reduce your uncertainty. Save in Bitcoin.' https://i.ibb.co/N661BdVp/Gr-Rwdg-OXc-AAWPVE.jpg

🧡Bitcoin news🧡

“Education increases conviction.

Conviction increases allocation.

Allocation increases freedom.” —Gigi

https://i.ibb.co/Q3trHk8Y/Gr-Arv-Ioa-AAAF5b0.jpg

On the 12th of May:

➡️Google searches for "Digital Gold" are at all-time highs. Bitcoin Croesus: "This is the second wave of the Digital Revolution - the digitization of value to complement the Internet's digitization of information. It wasn't possible to own a slice of the Internet itself, but it is possible with Bitcoin, the internet of value." "...It feels like you're late to Bitcoin. But this is a bigger game playing out than most realize, and we are much earlier than casual observers know. If you're reading this, you're here on the frontier early. And you have a chance to stake a claim before 99% of the world shows up. This is a land grab. This is the digital gold rush. Make your descendants proud."

https://i.ibb.co/5XXbNQ8S/Gqw-X4-QRWs-AEd5-Uh-1.jpg

➡️ 'A new holding company ‘Nakamoto’ just raised $710 million to buy more Bitcoin and will merge with KindlyMD to establish a Bitcoin Treasury company. Saylor playbook!' - Bitcoin Archive

➡️American Bitcoin, backed by Donald Trump Jr. and Eric Trump, will go public via an all-stock merger with Gryphon Digital Mining. Post-merger, Trump affiliates and Hut 8 will retain 98% ownership. GRYP tripled to $2.19, Hut 8 jumped 11% to $15.45. The deal closes in Q3 2025.

➡️Phoenix Wallet: 'Phoenix 0.6.0 is out: offers can now have a custom description simple close (set an exact mutual close tx fee rate) native support for Linux arm64 This is the server version. Phoenix mobile release is around the corner. '

On the 13th of May:

➡️Corporate Bitcoin purchases have now outweighed the supply of new Bitcoin by 3.3x in 2025. https://i.ibb.co/fVdgQhyY/Gq1ck-XRXUAAsg-Ym.jpg

➡️ Publicly listed Next Technology disclosed buying 5,000 Bitcoin for $180m, now HODLs 5,833 $BTC worth +$600m.

➡️ After rejecting the Arizona Strategic Bitcoin Reserve Act, Governor Katie Hobbs vetoed Bill SB 1373, which proposed a digital asset reserve fund. "Current volatility in the cryptocurrency markets does not make a prudent fit for general fund dollars."

➡️Meanwhile in Paris, France the kidnapping of a woman with her 2-year-old child morning on the streets of Paris - the target is allegedly the daughter of a crypto CEO. 3 masked men tried forcing them into a fake delivery van, before being fought off by her partner and bystanders. One of whom grabbed a dropped gun and aimed it back.

➡️ 'Bitcoin illiquid supply hit a new all-time high of $1.4B Are you HODLing too, anon?' - Bitcoin News

➡️Why Coinbase entering the S&P 500 matters. Boomers will have Bitcoin / CrApTo exposure, whether they like it or not. Anyway, remember what happened in 2021. The COIN IPO, and they’re still trading about 35% below their IPO-day high. Oh and please read the 'Coinbase" hack below haha.

➡️ Nasdaq listed GD Culture Group to sell up to $300 million shares to buy Bitcoin.

➡️ A Bitcoin wallet untouched since April 2014 just moved 300 BTC worth $31M for the first time in 11 years. This is how you HODL.

➡️ Bitcoin's realized price is steadily increasing, mirroring behaviors seen in past bull markets, according to CryptoQuant.

➡️ Bitcoin whales and sharks (10-10K BTC) accumulated 83,105 BTC in the last 30 days, while small retail holders (<0.1 BTC) sold 387 BTC, according to Santiment.

Bitcoin Whales have been AGGRESSIVELY accumulating BTC recently! With at least 240,000+ Bitcoin transferred to wallets with at least 100 BTC. The largest market participants are trying to buy as much as possible, what do they think comes next...

➡️'The average cost of mining 1 BTC for miners is currently $36.8K. The spread between the current market price and the cost of one coin = 182%. This is essentially the average profitability. This corresponds to the beginning of the bull cycle in November 2022 and the peaks of this cycle >$100K. A price increase above this level will allow miners to fully recover after the last halving and reach excess profits comparable to the beginning of the bull rally in January 2023.' -Axel Adler Jr.

➡️ Remember last week's segment on Coinbase..."Coinbase just disclosed in their Q1 filing: that they have custody of 2.68 million Bitcoin. That’s over 13% of all Bitcoin in circulation, on one platform. Is this the greatest honeypot in financial history? Yes, it is...read next week's Weekly Bitcoin update."

Well, here you go.

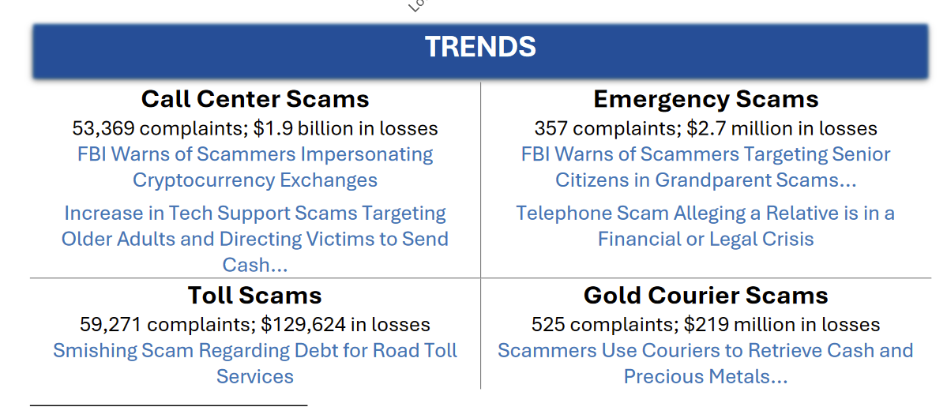

Coinbase estimates $180-$400 million in losses, remediation costs, and reimbursement following today’s cyber attack. https://i.ibb.co/jkysLtZ1/Gq-C7zl-W4-AAJ0-N6.jpg

Coinbase didn't get hacked. Coinbase employees sold customer data on the black market. Coinbase failed to protect customer data. This is why KYC is useless. The criminals have our driver's license scans. They have AI tools that can generate fake images and videos. KYC puts our identities at risk, makes onboarding more difficult, and rewards criminals. To make it even worse. Coinbase knew about the hack as early as January but only disclosed it publicly after being added to the S&P 500.

I will say it one more time! Don't buy your Bitcoin on KYC exchanges. KYC means handing over your identity to be leaked, sold, or extorted.

It was 2 days ago, see the bit on the 13th of May, that we saw a violent attack in Paris. Minimize the data you share with centralized tools. Store as much as you can locally. Always ask yourself what data am I giving and to whom? Remove the need for trust.

And for the love of God, Allah, or whatever god you are praying to...

DON'T LEAVE YOUR COINS ON A FREAKING EXCHANGE!!!!

Clear!

➡️ Sam Callahan: Bitcoin CAGRs over rolling four-year holding periods since 2012:

10th percentile: 33%

25th percentile: 50% 40th percentile: 75%

Said differently, for 90% of the time, Bitcoin’s four-year CAGR was higher than 33%. For comparison, here are the single best four-year CAGRs over the same period for:

Gold: 17%

Silver: 20%

S&P 500: 24%

Apple: 52%

Two lessons here:

1.) Even when Bitcoin underperforms, it still outperforms.

2.) Bitcoin holding goals are best measured in halving cycles.'

https://i.ibb.co/9m6q2118/Gq1-Ie2-Ob-AAIJ8-Kf.jpg

➡️ Deutsche Bank Aktiengesellschaft has bought 96,870 Strategy₿ stocks for 30 Million dollars at an Average Price Of $310 Per Share In Q1 2025, Their Total Holdings Is 518,000 Shares Worth Over 214 Million Dollars.

➡️Senator Lummis urges the U.S. Treasury to eliminate taxes on unrealized gains for Bitcoin.

On the 14th of May:

➡️At $168,000, Bitcoin will surpass Microsoft, the world's largest company.

➡️Fidelity tells institutions to buy Bitcoin if they can’t match Bitcoin’s 65% return on capital.

➡️Michigan has adopted House Resolution 100, declaring May 13 2025 as "Digital Asset Awareness Day." The resolution encourages "activities and programs that foster a deeper understanding of digital assets and their impact on our society and economy."

➡️Publicly traded Vinanz raises funding to buy $2 million in #Bitcoin assets.

➡️Bitcoin News: "Investor Jim Chanos is shorting MicroStrategy while going long on Bitcoin, calling the stock overvalued relative to its BTC holdings. “We’re selling MicroStrategy and buying Bitcoin, basically buying something for $1 and selling it for $2.50," he told CNBC

On the 15th of May:

➡️The Abu Dhabi sovereign wealth fund disclosed owning $511 million in Bitcoin through BlackRock’s ETF.

➡️UK public company Coinsilium Group raises £1.25 million to adopt a Bitcoin treasury strategy.

➡️Chinese Textile company Addentax issues stock to buy 8,000 Bitcoin.

➡️14 US states have reported $632m in $MSTR exposure for Q1, in public retirement and treasury funds. A collective increase of $302m in one quarter. The average increase in holding size was 44%.

➡️Chinese public company DDC Enterprise to adopt a Bitcoin Reserve with 5,000 BTC.

On the 16th of May:

➡️Brazilian listed company Méliuz buys $28.4 million Bitcoin to become the nation's first Bitcoin Treasury Company. Shareholders voted to approve the strategy by an "overwhelming majority".

➡️13F Filings show Texas Retirement System owns MSTR. The day MSTR enters the S&P 500, every pension fund will follow.

➡️'Wealthy Investors Shift Up to 5% into Bitcoin as confidence in fiat falters. UBS, a Swiss banking giant says Bitcoin and digital assets are becoming key hedges against inflation and systemic risk, marking a dramatic shift in modern portfolio strategy.' -CarlBMenger

➡️River: "Above all, Bitcoin is money for the people." https://i.ibb.co/Jj8MVQwr/Gr-Ew-EPp-XAAA1-TVN.jpg

On the 17th of May:

➡️Illicit activity is now down to 0.14% of transaction volume across all crypto.

Context: World Bank, IMF suggests 1.5–4% of global GDP is laundered yearly through traditional banking Of that 0.14%:

63% of illicit trade was stablecoins.

13% was Bitcoin (declining each year)

Source: The 2025 Crypto Crime Report, Chainalysis 2025

Yet another confirmation that Bitcoin's use in facilitating illicit activities is a rounding error on a rounding error.

On the 18th of May:

➡️JPMorgan CEO Jamie Dimon said they will allow clients to buy Bitcoin. The repeal of SAB 121 is a bigger deal than most realize. “I will fire any employee buying or trading Bitcoin for being stupid” - Jamie Dimon (2017) https://i.ibb.co/b5tnkb15/Gr-Vxxc-OXk-AA7cyo.jpg

On the 19th of May.

➡️Bookmark the following stuff from Daniel Batten if you want to combat climate change (fanatics)...

'That Bitcoin mining is not only not harmful, but beneficial to the environment is now supported by:

7 independent reports

20 peer-reviewed papers

As a result * 90% of climate-focused magazines * 87.5% of media coverage on Bitcoin & the environment is now positive * source 7 independent reports https://x.com/DSBatten/status/1922666207754281449… * 20 peer-reviewed papers https://x.com/DSBatten/status/1923014527651615182… * 10 climate-focused magazines https://x.com/DSBatten/status/1919518338092323260… * 16 mainstream media articles https://x.com/DSBatten/status/1922628399551434755

➡️Saifedean Ammous: '5 years ago at the height of corona hysteria, everyone worried about their savings.

If you put $10,000 in "risk-free" long-term US government bonds, you'd have $6,000 today.

If you put the $10,000 in "risky speculative tulip" bitcoin, you'd have $106,000.

HFSP, bondcucks!'

I love how Saifedean always put it so eloquently. haha

➡️An Australian judge rules Bitcoin is “just another form of money.” This could make it exempt from capital gains tax. Potentially opening the door to millions in refunds across the country. - AFR

If upheld, the decision could trigger up to $1B in refunds and overturn the Australian Tax Office’s crypto tax approach.

➡️Publicly traded Vinanz buys 16.9 Bitcoin for $1.75 Million for their treasury.

➡️Bitcoin just recorded its highest weekly close ever, while the Global Economic Policy Uncertainty Index hit its highest level in history.

➡️4 in 5 Americans want the U.S. to convert part of its gold reserves to Bitcoin. - The Nakamoto Project

"or background, the survey question was: "Assuming the United States was thinking of converting some of their gold reserves into Bitcoin, what percentage would you advise they convert?" Respondents were provided a slider used to choose between 0% and 100%. Our survey consisted of a national sample of 3,345 respondents recruited in partnership with Qualtrics, a survey and data collection company"

Context: https://x.com/thetrocro/status/1924552097565180107 https://i.ibb.co/fGDw06MC/Gr-VYDIdb-AAI7-Kxd.jpg

➡️Michael Saylor's STRATEGY bought another $764.9m Bitcoin. They now HODL 576,230 Bitcoin, acquired for $40.18 billion at $69,726 per Bitcoin.

➡️The German Government sold 49,858 BTC for $2.89B, at an average price of $57,900. If they had held it, their BTC would now be worth $5.24B.

➡️A record 63% of all the Bitcoin that exist have not transacted or moved from their wallets this year. - Wicked

https://i.ibb.co/j9nvbvmP/Gq3-Z-x6-Xw-AAv-Bhg.jpg

💸Traditional Finance / Macro:

On the 12th of May:

👉🏽The S&P 500 has closed more than 20% above its April low, technically beginning a new bull market. We are now up +1,000 points in one month.

On the 13th of May:

👉🏽 Nvidia announces a partnership with Humain to build "AI factories of the future" in Saudi Arabia. Just one hour ago, Saudi Arabia signed an economic agreement with President Trump to invest $600 billion in the US.

🏦Banks:

👉🏽 No news

🌎Macro/Geopolitics:

On the 12th of May:

👉🏽Huge pressure is on the European Union to reach a trade deal. Equities and commodities bounce hard on news of China-US trade deal. "We have reached an agreement on a 90-day pause and substantially moved down the tariff levels — both sides, on the reciprocal tariffs, will move their tariffs down 115%." - Treasury Secretary Scott Bessent

Dollar and Yuan strong bounce. Gold corrects.

👉🏽After reaching a high of 71% this year, recession odds are now back down to 40%. The odds of the US entering a recession in 2025 fall to a new low of 40% following the US-China trade deal announcement.

👉🏽'Truly incredible:

- Trump raises tariffs: Yields rise because inflation is back

- Trump cuts tariffs: Yields rise because growth is back

- Trump does nothing: Yields rise because the Fed won't cut rates Today, the bond market becomes Trump and Bessent's top priority.' - TKL

President Trump’s biggest problem persists even as trade deals are announced. Tariffs have been paused for 90 days, the US-China trade deal has been announced, and inflation data is down. Yet, the 10Y yield is nearing 4.50% again. Trump needs lower rates, but rates won’t fall.

👉🏽Last week a lot of talk on Japan’s Debt Death Spiral: Japan’s 40-year yield is detonating and the myth of consequence-free debt just died with it. One of the best explanations, you can read here:

👉🏽Michael A. Arouet: 'Eye-opening chart. Can a country with a services-based economy remain a superpower? Building back US manufacturing base makes a lot of strategic and geopolitical sense.' https://i.ibb.co/Q3zJY9Fc/Gqxc6-Pt-WQAI73c.jpg

On the 13th of May:

👉🏽There is a possibility of a “big, beautiful” economic rebalancing, Treasury Secretary Scott Bessent says at an investment forum in Saudi Arabia. The “dream scenario” would be if China and the US can work together on rebalancing, he adds

Luke Gromen: It does roll off the tongue a whole lot nicer than "We want to significantly devalue USD v. CNY, via a gold reference point."

Ergo: The price of gold specifically would rise in USD much more than it would in CNY, while prices for other goods and services would not, or would do so to a lesser degree.

👉🏽 Dutch inflation rises to 4.1 percent in April | CBS – final figure. Unchanged compared to the estimate.

👉🏽Philipp Heimberger: This interesting new paper argues that cuts to taxes on top incomes disproportionately benefit the financial sector. The finance industry gains more from top-income tax cuts than other industries. "Cuts in top income tax rates increase the (relative) size of the financial sector"

Kinda obvious, innit?

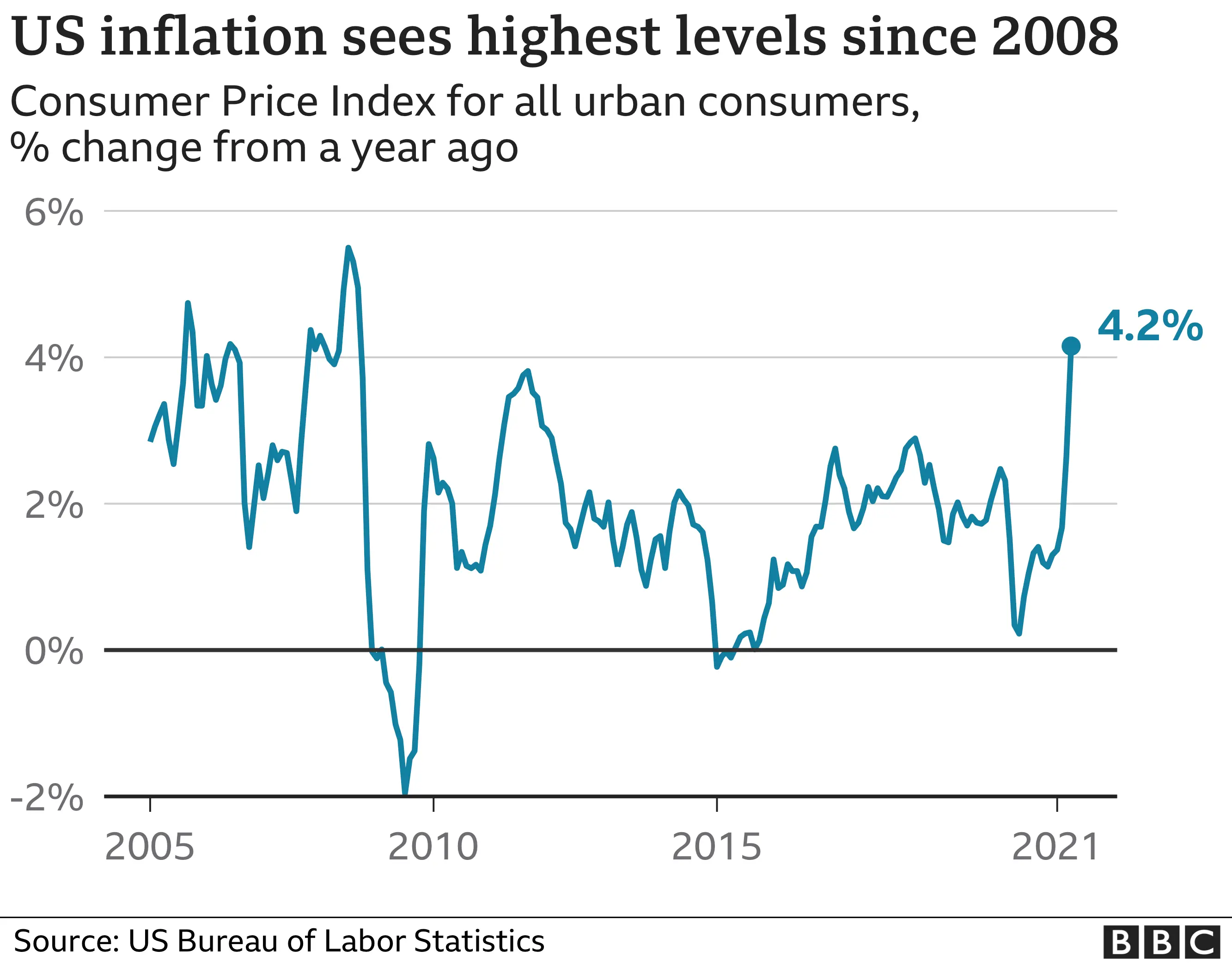

👉🏽US CPI data released. Overall good results and cooler than expected month-over-month and year-over-year (outside of yearly core). U.S. inflation is down to 2.3%, lower than expected.

On the 14th of May:

👉🏽'The US government cannot afford a recession: In previous economic cycles, the US budget deficit widened by ~4% of GDP on average during recessions. This would imply a ~$1.3 trillion deterioration of US government finances if a recession hits in 2025. That said, if the US enters a recession, long-term interest rates will likely go down.

A 2-percentage-point decrease in interest rates would save ~$568 billion in annual interest payments. However, this means government finances would worsen by more than DOUBLE the amount saved in interest due to a recession. An economic downturn would be incredibly costly for the US government.' -TKL

On the 15th of May:

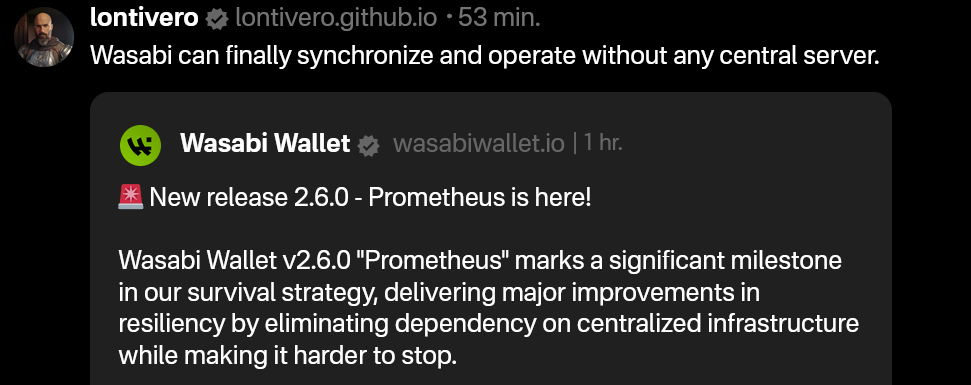

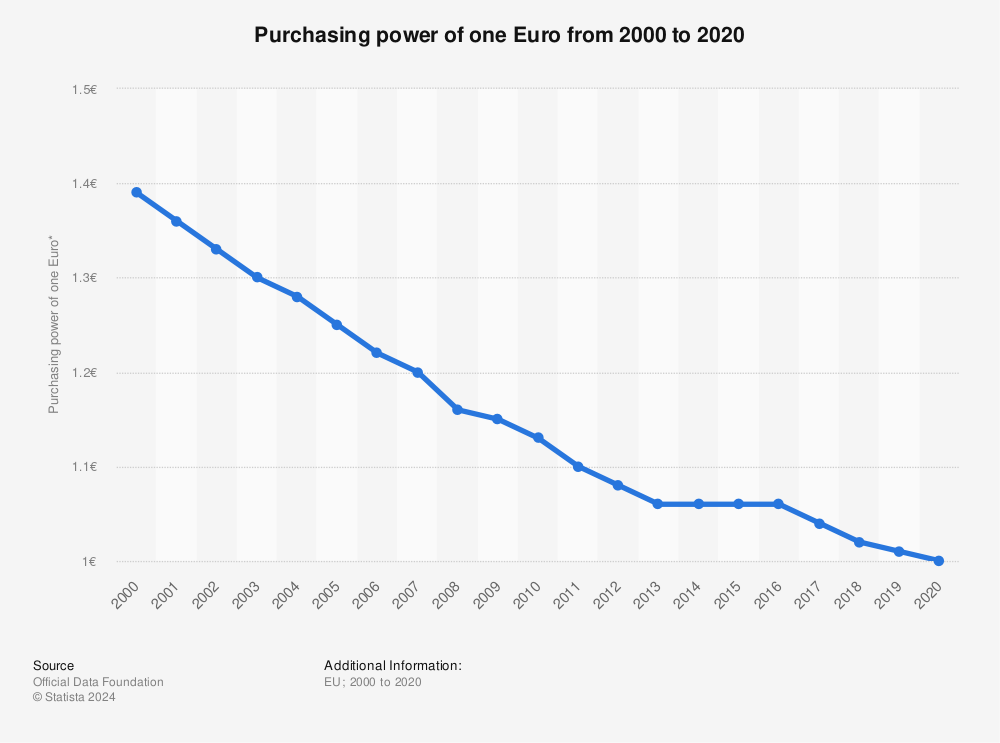

👉🏽'In the Eurozone and the UK, households hold more than 30% of their financial assets in fiat currencies and bank deposits. This means that they (unknowingly?) allow inflation to destroy their purchasing power. The risks of inflation eating up your wealth increase in a debt-driven economic system characterized by fiscal dominance, where interest rates are structurally low and inflation levels and risks are high. There is so much forced and often failed regulation to increase financial literacy, but this part is never explained. Why is that, you think?' - Jeroen Blokland https://i.ibb.co/zWRpNqhz/Gq-jn-Bn-X0-AAmplm.png

On the 16th of May:

👉🏽'For the first time in a year, Japan's economy shrank by -0.7% in Q1 2025. This is more than double the decline expected by economists. Furthermore, this data does NOT include the reciprocal tariffs imposed on April 2nd. Japan's economy is heading for a recession.' -TKL

👉🏽'246 US large companies have gone bankrupt year-to-date, the most in 15 years. This is up from 206 recorded last year and more than DOUBLE during the same period in 2022. In April alone, the US saw 59 bankruptcy filings as tariffs ramped up. So far this year, the industrials sector has seen 41 bankruptcies, followed by 31 in consumer discretionary, and 17 in healthcare. According to S&P Global, consumer discretionary companies have been hit the hardest due to market volatility, tariffs, and inflation uncertainty. We expect a surge in bankruptcies in 2025.' -TKL