-

@ 31a4605e:cf043959

2025-06-17 16:35:04

@ 31a4605e:cf043959

2025-06-17 16:35:04Bitcoin foi criado para oferecer uma alternativa segura e descentralizada ao dinheiro tradicional, permitindo transações financeiras sem a necessidade de intermediários. DeFi, por outro lado, surgiu como uma expansão deste conceito, propondo serviços financeiros descentralizados, como empréstimos, trocas e geração de rendimento. No entanto, apesar das promessas de inovação, DeFi apresenta inúmeros riscos, tornando-se uma aposta perigosa para quem valoriza a segurança do seu Bitcoin.

O que é DeFi?

DeFi refere-se a um conjunto de aplicações financeiras que funcionam sem a intermediação de bancos ou instituições tradicionais. Estas plataformas utilizam contratos inteligentes para automatizar transações, permitindo que qualquer pessoa aceda a serviços financeiros sem depender de terceiros. Na teoria, DeFi promete mais liberdade financeira, mas na prática está cheio de riscos, fraudes e vulnerabilidades técnicas que podem comprometer os fundos dos utilizadores.

Os riscos de DeFi para quem tem Bitcoin

Bitcoin é a moeda digital mais segura do mundo, protegida por uma rede descentralizada e resistente à censura. Ao contrário de DeFi, que ainda está em fase experimental e já sofreu inúmeros ataques, Bitcoin mantém-se sólido e confiável. Quando alguém coloca Bitcoin em plataformas DeFi, está a abrir mão da segurança da sua custódia direta e a confiar em sistemas mais frágeis. os principais riscos incluem:

Hackers e falhas de código: contratos inteligentes são escritos por programadores e podem conter falhas que permitem roubos massivos. ao longo dos anos, milhares de milhões de dólares já foram perdidos devido a vulnerabilidades em plataformas DeFi.

Riscos de liquidação: muitas aplicações DeFi funcionam com sistemas de colateralização, onde os utilizadores bloqueiam Bitcoin para obterem empréstimos. se o mercado se tornar volátil, esses Bitcoins podem ser liquidados a preços abaixo do esperado, causando perdas irreversíveis.

Fraudes e rug pulls: DeFi está repleto de projetos obscuros onde os criadores desaparecem com os fundos dos utilizadores. sem regulamentação e sem garantias, quem deposita Bitcoin nessas plataformas pode nunca mais recuperar os seus fundos.

Guardar Bitcoin em segurança é a melhor escolha

Bitcoin foi criado para ser auto-custodiado, ou seja, cada utilizador deve ter controlo direto sobre os seus fundos sem depender de terceiros. Ao enviar Bitcoin para plataformas DeFi, perde-se essa segurança e expõe-se o ativo a riscos desnecessários. A melhor forma de proteger Bitcoin é armazená-lo numa carteira segura, preferencialmente offline (cold storage), evitando qualquer tipo de exposição a contratos inteligentes ou sistemas vulneráveis.

Resumindo, DeFi pode parecer inovador, mas os riscos superam largamente os potenciais benefícios, especialmente para quem valoriza a segurança de Bitcoin. ao invés de arriscar perder fundos em plataformas inseguras, o mais sensato é manter Bitcoin armazenado de forma segura, garantindo a sua preservação a longo prazo. Enquanto Bitcoin continua a ser a melhor reserva de valor digital do mundo, DeFi ainda se revela um ambiente instável e perigoso, onde poucos saem ganhadores e muitos acabam por perder.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 39cc53c9:27168656

2025-06-17 16:40:16

@ 39cc53c9:27168656

2025-06-17 16:40:16“The future is there... staring back at us. Trying to make sense of the fiction we will have become.” — William Gibson.

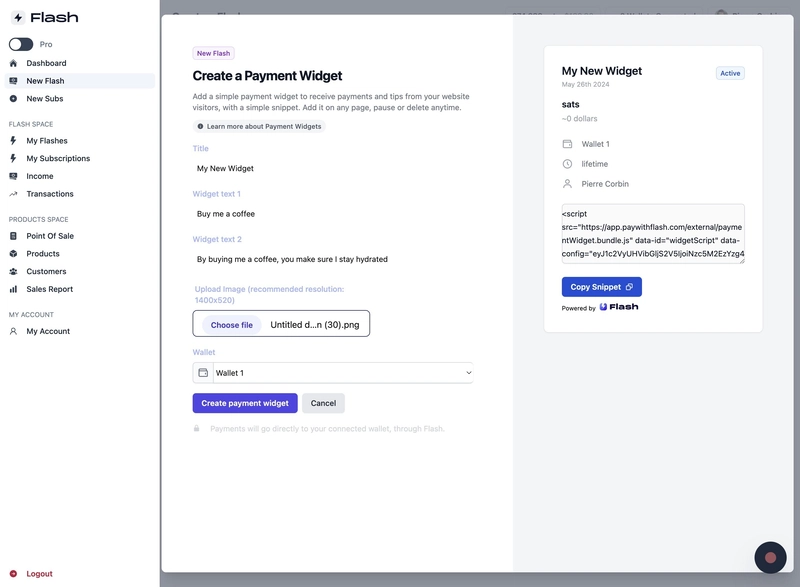

This month is the 4th anniversary of kycnot.me. Thank you for being here.

Fifteen years ago, Satoshi Nakamoto introduced Bitcoin, a peer-to-peer electronic cash system: a decentralized currency free from government and institutional control. Nakamoto's whitepaper showed a vision for a financial system based on trustless transactions, secured by cryptography. Some time forward and KYC (Know Your Customer), AML (Anti-Money Laundering), and CTF (Counter-Terrorism Financing) regulations started to come into play.

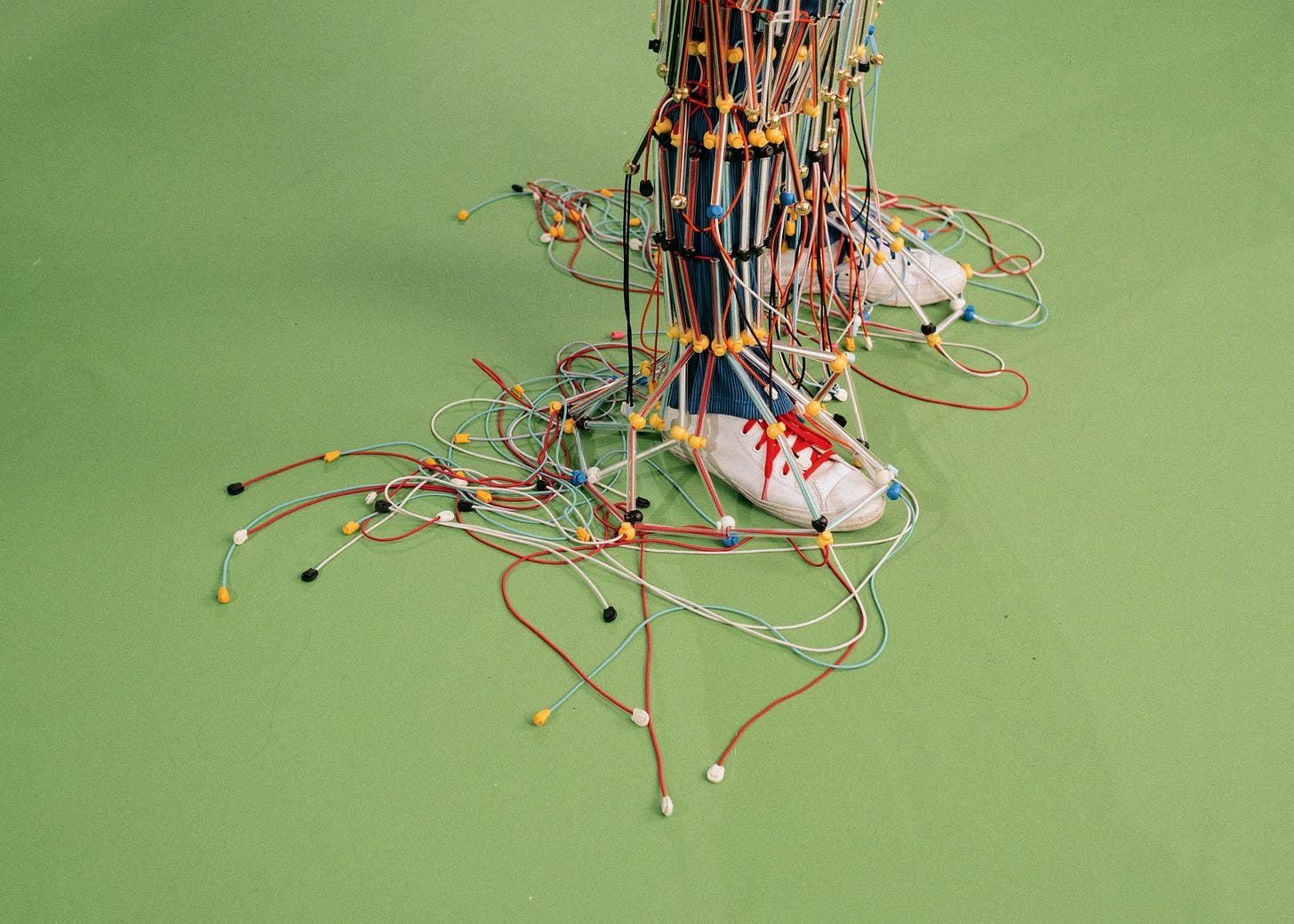

What a paradox: to engage with a system designed for decentralization, privacy, and independence, we are forced to give away our personal details. Using Bitcoin in the economy requires revealing your identity, not just to the party you interact with, but also to third parties who must track and report the interaction. You are forced to give sensitive data to entities you don't, can't, and shouldn't trust. Information can never be kept 100% safe; there's always a risk. Information is power, who knows about you has control over you.

Information asymmetry creates imbalances of power. When entities have detailed knowledge about individuals, they can manipulate, influence, or exploit this information to their advantage. The accumulation of personal data by corporations and governments enables extensive surveillances.

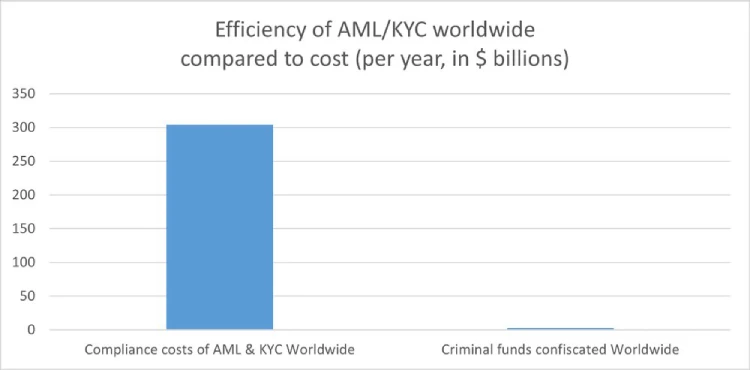

Such practices, moreover, exclude individuals from traditional economic systems if their documentation doesn't meet arbitrary standards, reinforcing a dystopian divide. Small businesses are similarly burdened by the costs of implementing these regulations, hindering free market competition^1:

How will they keep this information safe? Why do they need my identity? Why do they force businesses to enforce such regulations? It's always for your safety, to protect you from the "bad". Your life is perpetually in danger: terrorists, money launderers, villains... so the government steps in to save us.

‟Hush now, baby, baby, don't you cry Mamma's gonna make all of your nightmares come true Mamma's gonna put all of her fears into you Mamma's gonna keep you right here, under her wing She won't let you fly, but she might let you sing Mamma's gonna keep baby cosy and warm” — Mother, Pink Floyd

We must resist any attack on our privacy and freedom. To do this, we must collaborate.

If you have a service, refuse to ask for KYC; find a way. Accept cryptocurrencies like Bitcoin and Monero. Commit to circular economies. Remove the need to go through the FIAT system. People need fiat money to use most services, but we can change that.

If you're a user, donate to and prefer using services that accept such currencies. Encourage your friends to accept cryptocurrencies as well. Boycott FIAT system to the greatest extent you possibly can.

This may sound utopian, but it can be achieved. This movement can't be stopped. Go kick the hornet's nest.

“We must defend our own privacy if we expect to have any. We must come together and create systems which allow anonymous transactions to take place. People have been defending their own privacy for centuries with whispers, darkness, envelopes, closed doors, secret handshakes, and couriers. The technologies of the past did not allow for strong privacy, but electronic technologies do.” — Eric Hughes, A Cypherpunk's Manifesto

The anniversary

Four years ago, I began exploring ways to use crypto without KYC. I bookmarked a few favorite services and thought sharing them to the world might be useful. That was the first version of kycnot.me — a simple list of about 15 services. Since then, I've added services, rewritten it three times, and improved it to what it is now.

kycnot.me has remained 100% independent and 100% open source^2 all these years. I've received offers to buy the site, all of which I have declined and will continue to decline. It has been DDoS attacked many times, but we made it through. I have also rewritten the whole site almost once per year (three times in four years).

The code and scoring algorithm are open source (contributions are welcome) and I can't arbitrarly change a service's score without adding or removing attributes, making any arbitrary alterations obvious if they were fake. You can even see the score summary for any service's score.

I'm a one-person team, dedicating my free time to this project. I hope to keep doing so for many more years. Again, thank you for being part of this.

-

@ 31a4605e:cf043959

2025-06-17 16:31:03

@ 31a4605e:cf043959

2025-06-17 16:31:03O Bitcoin tem revolucionado a forma como as pessoas realizam transações financeiras em todo o mundo. Sendo uma moeda digital descentralizada, oferece novas oportunidades para pagamentos no comércio eletrónico e transferências internacionais de dinheiro. A sua rapidez, segurança e baixos custos tornam-no uma alternativa eficiente aos métodos tradicionais, eliminando intermediários e facilitando transações globais.

Bitcoin no comércio eletrónico

O comércio eletrónico tem crescido exponencialmente, e o Bitcoin surge como uma solução inovadora para pagamentos online. Grandes retalhistas e pequenas empresas estão a começar a aceitar Bitcoin como forma de pagamento, oferecendo benefícios tanto para os comerciantes como para os consumidores.

Vantagens do Bitcoin para o comércio eletrónico:

Baixas taxas de transação: ao contrário dos cartões de crédito e plataformas de pagamento que cobram taxas elevadas, as transações em Bitcoin apresentam, geralmente, custos mais reduzidos. Isto beneficia os comerciantes, que podem diminuir despesas e oferecer preços mais competitivos aos clientes.

Eliminação de chargebacks: no sistema tradicional, os chargebacks (reembolsos forçados pelos bancos ou operadoras de cartão) representam uma preocupação para os lojistas. Como as transações em Bitcoin são irreversíveis, os comerciantes evitam fraudes e disputas.

Acesso global: qualquer pessoa com acesso à Internet pode pagar com Bitcoin, independentemente da sua localização. Isto permite às empresas expandirem o seu mercado internacionalmente, sem depender de bancos ou sistemas de pagamento locais.

Privacidade e segurança: as transações em Bitcoin protegem a identidade do utilizador, oferecendo maior privacidade em comparação com pagamentos através de cartão de crédito ou transferências bancárias. Além disso, como não há necessidade de partilhar dados pessoais, o risco de roubo de informações é reduzido.

Desafios do Uso do Bitcoin no Comércio Eletrónico:

Volatilidade: o preço do Bitcoin pode oscilar rapidamente, o que dificulta a fixação de preços para produtos e serviços. No entanto, alguns comerciantes utilizam serviços de pagamento que convertem automaticamente Bitcoin em moeda fiduciária, minimizando esse risco.

Adoção limitada: apesar do crescimento, a aceitação do Bitcoin ainda não é universal. Muitas lojas e plataformas populares ainda não o adotaram, o que pode dificultar a sua utilização em compras diárias.

Tempo de confirmação: embora o Bitcoin seja mais rápido do que as transferências bancárias tradicionais, o tempo de confirmação pode variar consoante a taxa de rede paga. Algumas soluções, como a Lightning Network, estão a ser desenvolvidas para tornar os pagamentos instantâneos.

Bitcoin na remessa de dinheiro

O envio de dinheiro para o estrangeiro sempre foi um processo burocrático, dispendioso e demorado. Serviços tradicionais, como os bancos e empresas de transferência de dinheiro, cobram taxas elevadas e podem demorar dias a concluir uma transação. O Bitcoin, por outro lado, oferece uma alternativa eficiente para remessas globais, permitindo que qualquer pessoa envie e receba dinheiro de forma rápida e económica.

Benefícios do Bitcoin para remessas:

Custos reduzidos: enquanto os bancos e empresas como a Western Union cobram elevadas taxas para transferências internacionais, o Bitcoin permite o envio de dinheiro com custos mínimos, independentemente do montante ou do destino.

Velocidade nas transações: as transferências bancárias internacionais podem demorar vários dias a serem concluídas, especialmente em países com uma infraestrutura financeira limitada. Com o Bitcoin, o dinheiro pode ser enviado para qualquer parte do mundo em poucos minutos ou horas.

Acessibilidade global: em regiões onde o sistema bancário é restrito ou ineficiente, o Bitcoin possibilita que as pessoas recebam dinheiro sem depender de bancos. Isto é particularmente útil em países em desenvolvimento, onde as remessas internacionais são uma fonte essencial de rendimento.

Independência de intermediários: o Bitcoin opera de forma descentralizada, sem necessidade de recorrer a bancos ou empresas de transferência. Isto significa que as pessoas podem enviar dinheiro diretamente para amigos e familiares sem intermediários.

Desafios das remessas com Bitcoin:

Conversão para moeda local: apesar de o Bitcoin poder ser recebido instantaneamente, muitas pessoas ainda precisam de convertê-lo em moeda local para o utilizar. Isso pode envolver custos adicionais e depender da disponibilidade de serviços de câmbio.

Adoção e conhecimento: nem todos compreendem o funcionamento do Bitcoin, o que pode dificultar a sua adoção generalizada para remessas. No entanto, a crescente educação financeira sobre o tema pode ajudar a ultrapassar essa barreira.

Regulamentação e restrições: alguns governos impõem restrições ao uso do Bitcoin, tornando as remessas mais complicadas. A evolução das regulamentações pode afetar a facilidade de uso em determinados países.

Resumindo, o Bitcoin está a transformar o comércio eletrónico e as remessas de dinheiro em todo o mundo. A sua capacidade de eliminar intermediários, reduzir custos e oferecer pagamentos rápidos e seguros torna-o uma alternativa viável aos sistemas financeiros tradicionais.

No comércio eletrónico, proporciona benefícios para lojistas e consumidores, reduzindo taxas e melhorando a privacidade. No setor das remessas, facilita a transferência de dinheiro para qualquer parte do mundo, especialmente para aqueles que vivem em países com sistemas bancários pouco eficientes.

Apesar dos desafios, a adoção do Bitcoin continua a crescer, impulsionada por soluções inovadoras e pelo reconhecimento do seu potencial como meio de pagamento global. À medida que mais empresas e indivíduos aderirem a esta tecnologia, a sua presença no comércio eletrónico e nas remessas internacionais será cada vez mais relevante.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 31a4605e:cf043959

2025-06-17 16:00:48

@ 31a4605e:cf043959

2025-06-17 16:00:48As carteiras digitais são ferramentas importantes para guardar e manejar Bitcoin. Elas possibilitam que as pessoas mantenham suas chaves privadas, acessem seus fundos e façam transações de forma prática e segura. Contudo, com vários tipos de carteiras disponíveis e os riscos de uso errado, é essencial entender suas características e seguir boas práticas de segurança.

O que é uma carteira digital?

Uma carteira digital é um software ou aparelho que armazena as chaves privadas e públicas ligadas ao Bitcoin. De forma simples, ela não "armazena" o Bitcoin em si, mas oferece acesso seguro à rede para conferir e assinar transações.

As chaves privadas funcionam como uma senha secreta que permite gastar os Bitcoins, enquanto as chaves públicas são como números de conta que podem ser compartilhados para receber pagamentos. Manter a chave privada segura é muito importante, pois quem tem acesso a ela controla os fundos.

Tipos de carteiras digitais

Existem diferentes tipos de carteiras digitais, cada uma com características específicas que atendem a várias necessidades, seja para uso diário ou guardar por longo período.

1 - Carteiras Quentes (Hot Wallets)

Carteiras conectadas à internet, feitas para uso frequente.

Exemplos: Aplicativos para celulares, carteiras de desktop, carteiras online.

Vantagens:

Acessíveis e fáceis de usar.

Ideais para transações diárias e rápidas.

Desvantagens:

Mais expostas a ataques cibernéticos, como phishing ou hacking.

2 - Carteiras Frias (Cold Wallets)

Carteiras que mantêm as chaves privadas offline, aumentando a segurança.

Exemplos: Carteiras de hardware, carteiras em papel, dispositivos USB dedicados.

Vantagens:

Alta proteção contra hackers, pois não estão online.

Ideais para grandes quantidades de Bitcoin ou armazenamento prolongado.

Desvantagens:

Menos práticas para uso diário.

Podem ser danificadas fisicamente ou perdidas se não forem manuseadas com cuidado.

3 - Carteiras de Hardware

Dispositivos físicos, como Ledger ou Trezor, que guardam as chaves privadas offline.

Vantagens:

Interface fácil de usar e segura.

Resistentes a vírus e ataques online.

Desvantagens:

Custo inicial mais alto.

Requerem cuidado para evitar danos físicos.

4 - Carteiras de Papel

Envolvem imprimir ou escrever as chaves privadas e públicas em um pedaço de papel.

Vantagens:

Totalmente offline e imunes a ataques digitais.

Simples e de baixo custo.

Desvantagens:

Vulneráveis a danos físicos, como água, fogo ou perda.

Difíceis de recuperar se perdidas.

Segurança em carteiras digitais

Proteger uma carteira digital é essencial para salvaguardar seus Bitcoins de perdas ou roubos.

A seguir estão práticas importantes para aumentar a segurança:

Proteção da chave privada

Nunca compartilhe sua chave privada com ninguém.

Guarde cópias de segurança da chave privada ou frase de recuperação em lugares seguros.

Uso de frases de recuperação

A seed phrase é uma sequência de 12 a 24 palavras que ajuda a recuperar os fundos se a carteira for perdida.

Armazene a seed phrase offline e evite tirar fotos dela ou salvá-la em aparelhos conectados à internet.

Ativação de autenticação em dois fatores (2FA)

Quando possível, ligue o 2FA para proteger contas ligadas a carteiras online ou exchanges.

Isso acrescenta uma camada a mais de segurança, pedindo um segundo código para entrar.

Atualizações e manutenção

Tenha o software da carteira sempre atualizado para garantir proteção contra falhas.

Use apenas carteiras de criadores confiáveis e respeitáveis.

Escolha do tipo de carteira conforme a necessidade

Para transações frequentes, escolha carteiras quentes, mas mantenha apenas pequenas quantidades.

Para grandes valores, use carteiras frias, como carteiras de hardware ou papel, que são mais seguras.

Riscos e como evitá-los

Ataques de hackers

Risco: Acessos indevidos em carteiras quentes ligadas à internet.

Prevenção: Use carteiras frias para guardar grandes quantidades e evite clicar em links duvidosos.

Perda de acesso

Risco: Perda de chaves privadas ou da frase de recuperação, tornando os fundos irrecuperáveis.

Prevenção: Faça cópias de segurança regularmente e guarde as informações em lugares seguros.

Engenharia Social e Phishing

Risco: Hackers enganam as pessoas para obter suas chaves privadas ou informações pessoais.

Prevenção: Desconfie de mensagens ou sites que solicitam suas chaves privadas. Nunca compartilhe dados sensíveis.

Falhas físicas

Risco: Danos a dispositivos ou perda de carteiras de papel.

Prevenção: Guarde as cópias em locais que resistam à água, fogo e outras ameaças.

Resumindo, as carteiras digitais são essenciais para a segurança e uso do Bitcoin. Escolher a carteira certa e seguir boas práticas de segurança são passos chave para proteger seus bens.

Carteiras quentes oferecem facilidade para o uso diário, enquanto carteiras frias oferecem segurança forte para armazenamento a longo prazo. Independentemente do tipo que você escolher, cuidar das chaves privadas e da frase de recuperação é fundamental para garantir que seu Bitcoin fique sob seu controle.

Ao conhecer os tipos de carteiras e implementar medidas de segurança adequadas, os usuários podem aproveitar as vantagens do Bitcoin de forma segura e eficiente, maximizando os benefícios dessa revolução digital.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 31a4605e:cf043959

2025-06-17 15:58:20

@ 31a4605e:cf043959

2025-06-17 15:58:20O Bitcoin é uma nova forma de dinheiro digital, oferecendo liberdade financeira e acesso a uma economia global sem intermediários comuns. Para usar essa tecnologia, é importante saber como comprar, guardar e utilizá-la de forma segura e eficiente. Este guia cobre as principais etapas e práticas para incorporar o Bitcoin no dia a dia, ressaltando as melhores formas de proteger seus ativos e tirar o máximo proveito deles.

Comprar Bitcoin é o primeiro passo para participar da sua rede descentralizada. Existem várias maneiras de obter Bitcoin, dependendo das preferências e necessidades individuais.

Plataformas de corretoras (exchanges):

Funcionamento: as exchanges são plataformas online que permitem comprar Bitcoin usando moedas tradicionais, como dólar, euro ou real.

Processo: crie uma conta, complete a verificação de identidade (processo KYC) e deposite fundos para iniciar as negociações.

Dicas: escolha exchanges confiáveis, com boa reputação e segurança sólida.

Caixas eletrônicos de Bitcoin:

Funcionamento: alguns caixas eletrônicos permitem a compra de Bitcoin com dinheiro ou cartão de crédito.

Uso: insira o valor desejado, escaneie sua carteira digital e receba os Bitcoins imediatamente.

Compra Peer-to-Peer (P2P):

Funcionamento: plataformas P2P conectam compradores e vendedores diretamente, permitindo a negociação de termos específicos.

Dicas: confira a reputação do vendedor e utilize plataformas que oferecem garantias ou serviços de custódia.

A segurança é fundamental ao manusear Bitcoin. O armazenamento correto protege seus fundos contra perdas, hackers e acessos não autorizados.

Carteiras digitais:

Definição: uma carteira digital é um software ou dispositivo físico que guarda as chaves privadas necessárias para acessar seus Bitcoins.

Tipos de carteiras:

Carteiras quentes (hot wallets): conectadas à internet, são adequadas para uso frequente, mas mais suscetíveis a ataques. Exemplos são aplicativos móveis e carteiras online.

Carteiras frias (cold wallets): mantêm Bitcoin offline, sendo mais seguras para grandes quantidades. Exemplos incluem carteiras de hardware e de papel.

Carteiras de hardware:

Funcionamento: dispositivos físicos, como Ledger ou Trezor, que guardam suas chaves privadas offline.

Vantagens: segurança alta contra ataques digitais e fácil transporte.

Carteiras de papel:

Funcionamento: envolve imprimir ou anotar as chaves privadas em um pedaço de papel.

Cuidados: armazene em locais seguros, protegidos contra umidade, fogo e acessos não autorizados.

Backup e recuperação:

Boa prática: realize backups regulares de sua carteira e anote sua frase de recuperação (seed phrase) em um local seguro.

Atenção: nunca compartilhe sua frase de recuperação ou chave privada com ninguém.

O uso do Bitcoin vai além do investimento. Ele pode ser empregado para transações diárias, compras e transferência de valor de forma eficiente.

Transações:

Como enviar Bitcoin: informe o endereço do destinatário, o valor a ser enviado e confirme a transação em sua carteira.

Custos: as taxas de transação são pagas aos mineradores e podem mudar conforme a demanda da rede.

Compras de bens e serviços:

Comércios que aceitam Bitcoin: muitos negócios, tanto físicos quanto online, aceitam Bitcoin como forma de pagamento. Confira se o comerciante exibe o logotipo do Bitcoin ou consulte listas atualizadas de lugares que aceitam a moeda.

Uso prático: escaneie o código QR do vendedor e envie o pagamento diretamente da sua carteira.

Transferências internacionais: o Bitcoin permite transferências globais rápidas, com taxas geralmente menores do que as cobradas por bancos ou serviços de remessas comuns.

Pagamento de contas: em alguns países, já é possível pagar contas de serviços e impostos com Bitcoin, dependendo da infraestrutura local.

Dicas para usar Bitcoin com segurança

Escolha carteiras e serviços confiáveis:

Use apenas carteiras e exchanges renomadas e com boa reputação no mercado.

Ative a autenticação em dois fatores (2FA):

Sempre que possível, ligue o 2FA para proteger sua conta em exchanges e serviços online.

Evite deixar fundos em exchanges:

Após comprar Bitcoin em uma exchange, transfira o saldo para uma carteira sob seu controle. Isso diminui o risco de perdas por causa de hacks.

Eduque-se:

Entender os conceitos básicos de Bitcoin e segurança digital é fundamental para evitar erros e fraudes.

Resumindo, comprar, guardar e usar Bitcoin pode parecer complicado no começo, mas, com o tempo, passa a ser uma atividade simples e acessível. Ao seguir as melhores práticas de segurança e conhecer as funcionalidades básicas, qualquer um pode tirar proveito dessa tecnologia inovadora.

O Bitcoin não é apenas uma opção financeira; é uma ferramenta poderosa que favorece a liberdade econômica e o acesso a uma economia global. Com o conhecimento certo, você pode incorporar o Bitcoin à sua vida de maneira segura e eficiente.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 39cc53c9:27168656

2025-06-17 16:40:15

@ 39cc53c9:27168656

2025-06-17 16:40:15

Silent.link is an anonymous eSIM provider. They offer pay-as-you-go roaming in 160+ countries.

Pros

- Anonymous

- Private payment options

- High performance

- Global availability

Cons

- Need to select the right networks sometimes

- Latency

- Data and incoming SMS & call only

Rating

★★★★★

Service website

eSIMs replace traditional, physical SIM cards, if you have a fairly new phone, odds are it supports them. Since most people change their mobile carrier very rarely, the most common use case for these new eSIMs is their use in travel. Although their use as a piece of a larger OPSEC puzzle to improve privacy when using the internet from your phone is increasingly popular too.

Silent.link is not the only eSIM provider out there. Yet, they’re so unique that even Twitter’s (now X) founder Jack Dorsey recommends them.

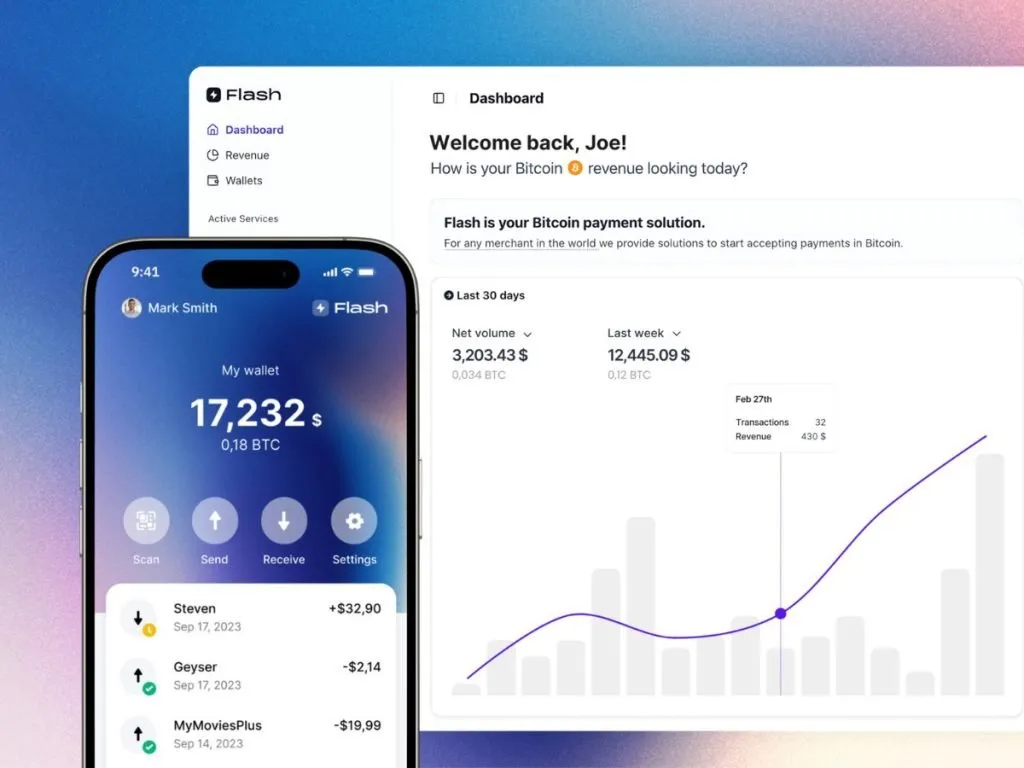

Let’s start off with a quick explanation of how Silent.link works and what pay-as-you-go means. Most other eSIM providers will sell you packages of GBs with an expiration date. For instance imagine you’re visiting France then going to the UK after a few months. With other providers you might buy a 10GB in France package valid for 7 days, then after some months a 10GB in the UK package also valid for 7 days. You likely won’t use up the full package in either country and the remaining capacity will be voided as the package expires.

Silent.link’s pay-as-you-go is different. There are no geographic packages. There are no expiration dates. You simply have a balance denominated in USD and are charged as you use up the data according to the pricing of whichever local carrier you’re connecting via.

Preparing for the same trips from the example above you’d simply top-up your Silent.link balance with $10. Then you’d use Silent.link in France paying $1.33/GB, you’d only be charged for the exact amount used, then you’d go to the UK and pay $1.54/GB from the balance you had left over from France. It doesn’t matter how much time passes between the trips, because Silent.link balances don’t expire. If you have a balance left over you can use it on a future trip, or simply use it up in your home country.

Pros

Anonymity

Silent.link is anonymous. Most other eSIM providers require some form of identification. This can be a traditional, full KYC, procedure involving your ID or passport numbers or, as seemingly innocent, as verifying your phone number with your main carrier. Regardless, a link between the eSIM you bought online and your identity is established.

In some countries you’ll be able to pick up a traditional SIM (or the new eSIM) from a local carrier without undergoing this verification. This can still be a hassle though. You’ll need to look up the laws before travelling, you’ll need to find a local store selling them, you’ll need to decide how you’ll pay privately, etc. And that’s the best case, that’s assuming the country you want to get the SIM in allows you to buy one anonymously.

Private payment methods

Silent.link only accepts cryptocurrency and according to their stats, most payments are made with Bitcoin (either onchain or using the Lightning Network) or with Monero. As such paying anonymously is not a problem. The use a self-hosted instance of BTCPay Server to process payments and operate their own LN node. The entire checkout process can be completed over Tor.

Cons

Network selection

Although you can skip the hassle of buying a new eSIM every time you travel it’s a good idea to look up the pricing of different mobile networks in the country you’re going to. The differences can be trivial, but can also be 100x. If a specific mobile network offers a much better deal, you’ll probably want to dive into your phone’s settings to make sure it only connects to that network.

High prices for some regions

Second issue can be that, especially for poorer countries, Silent.link might not have the best prices. For instance if you travel to Angola you’ll end up paying $155.44/GB. But if you search around for other providers you’ll find eSIM that offer much lower prices for that same country.

Data & incoming SMS & calls only

These eSIMs are either data-only or only offer data and inbound sms and calls. You can’t use Silent.link eSIMs to send texts or make phone calls.

Latency

For most use-cases this shouldn’t matter, but the way roaming works is that when you’re abroad your data is first sent to your home country then sent out into the internet from there. For instance if you’re a Brit on holiday in Spain wherever you open up a website your phone communicates with the Spanish network who forwards the request to your home network in the UK and only there does the request start going towards the website you’re trying to load. The response takes the same path in reverse.

The home network for the Silent.link eSIMs is Poland. To take an extreme (antipodal) example, if you’re in Chile loading a Chilean website your request will go to Poland then back from Poland to the website’s server in Chile, then the response will go from Chile to Poland to you (in Chile). All those trips add latency. In our testing, done during the recent OrangeFren.com meetup in Istanbul, the difference was an additional 73ms. The bandwidth, however, was exceptional, easily surpassing 100 Mbps.

This latency issue isn’t unique to Silent.link, other eSIM providers usually suffer from it too, though their home network may be better suited for your latency needs. If you need the best latency we recommend a SIM from a local provider (or WiFi).

This proxy behaviour isn’t all negative however. It may potentially allow you to circumvent censorship or geoblocking if you’re trying to access resources available from Poland, but unavailable elsewhere.

Besides Istanbul one of the countries we also tested Silent.link in was Northern Cyprus. This territory is mostly unrecognized. It’s a country that, depending on who you ask, is or isn’t real. Despite this unresolved geopolitical status Silent.link performed without any issues.

Installation

If you decide to give Silent.link a try, you'll need to select if you want a data-only plan or a plan with inbound SMS & calling, once you complete the payment simply scan the QR code on the order confirmation page with your phone. Make sure to save the url of that order confirmation page somewhere! You will need it to top up your eSIM and check your remaining balance.

Getting in touch

The preferred way of contacting Silent.link's support is using the website's built-in chat function. Alternative methods include X (formerly Twitter), Matrix and email.

Their support is online from 09:00 - 21:00 UTC although even when testing outside of those hours we got a reply within a minute.

NOTE: These reviews are sponsored, yet the sponsorship does not influence the outcome of the evaluations. Sponsored reviews are independent from the kycnot.me list, being only part of the blog. The reviews have no impact on the scores of the listings or their continued presence on the list. Should any issues arise, I will not hesitate to remove any listing.

-

@ 31a4605e:cf043959

2025-06-17 15:55:26

@ 31a4605e:cf043959

2025-06-17 15:55:26O Bitcoin tem se destacado como uma ferramenta econômica nova em economias em desenvolvimento. Essas nações muitas vezes enfrentam dificuldades como alta inflação, sistemas bancários frágeis e acesso restrito a serviços financeiros. Com suas características especiais, como descentralização, resistência à censura e oferta limitada, o Bitcoin aparece como uma solução alternativo para proteger patrimônio, facilitar transações internacionais e promover a inclusão financeira.

Desafios enfrentados por economias emergentes

Inflação e desvalorização da moeda:

Muitos países em desenvolvimento enfrentam políticas monetárias instáveis, levando à desvalorização de suas moedas.

A inflação diminui o poder de compra das pessoas, tornando difícil manter patrimônio e planejar finanças a longo prazo.

Acesso dimitado ao sistema bancário:

Em várias áreas, especialmente rurais, uma parte significativa da população não tem acesso a bancos ou serviços financeiros básicos.

Isso dificulta a guarda de dinheiro, a obtenção de crédito e a realização de transações seguras.

Remessas e transações internacionais caras:

Muitos cidadãos de economias em desenvolvimento dependem de remessas enviadas por familiares que trabalham no exterior.

As taxas cobradas por intermediários financeiros podem ser elevadas, diminuindo o valor recebido pelas famílias.

Como o Bitcoin beneficia economias emergentes

Proteção contra inflação:

Com sua oferta limitada a 21 milhões de unidades, o Bitcoin serve como um ativo deflacionário, permitindo que indivíduos protejam seu patrimônio contra a desvalorização da moeda local.

Em países como Venezuela e Argentina, onde as taxas de inflação são muito altas, o Bitcoin tem sido usado como uma reserva de valor.

Inclusão financeira:

O Bitcoin elimina a necessidade de intermediários financeiros, permitindo que qualquer pessoa com acesso à internet participe da economia global.

Indivíduos sem conta bancária podem usar carteiras digitais para guardar e transacionar valor, promovendo a inclusão financeira em larga escala.

Transações internacionais simplificadas:

O Bitcoin permite transferências de valor rápidas e baratas entre países, sem a necessidade de intermediários como bancos ou empresas de remessas.

Isso ajuda trabalhadores que enviam dinheiro para casa, garantindo que mais recursos cheguem aos destinatários finais.

Resistência à censura e controle governamental:

Em economias em desenvolvimento com governos autoritários ou instabilidade política, o Bitcoin permite que cidadãos mantenham controle sobre seu dinheiro, sem medo de confiscos ou restrições injustas.

Sua rede descentralizada impede que uma única autoridade controle ou manipule o sistema.

Casos reais de uso em economias emergentes

El Salvador:

Em 2021, El Salvador se tornou o primeiro país a tornar o Bitcoin uma moeda oficial. Essa escolha tinha o objetivo de diminuir os custos das remessas internacionais e aumentar a inclusão financeira.

A iniciativa também atraiu investimentos e turismo ligados ao Bitcoin, embora enfrente críticas e dificuldades de implementação.

Nigéria:

Na Nigéria, o uso do Bitcoin aumentou bastante devido à inflação e às restrições do governo sobre transações financeiras.

Jovens empreendedores e trabalhadores autônomos usam o Bitcoin para receber pagamentos internacionais e evitar limitações impostas por bancos locais.

Venezuela:

Com a crise econômica e a hiperinflação, o Bitcoin se tornou uma ferramenta importante para proteger a riqueza e fazer transações no país.

Muitas famílias venezuelanas dependem do Bitcoin para comprar produtos essenciais e enviar ou receber dinheiro do exterior.

Desafios do uso de Bitcoin em economias emergentes

Volatilidade:

A alta volatilidade no preço do Bitcoin pode fazer com que seu uso seja arriscado para pessoas que dependem dele como reserva de valor.

Essa instabilidade pode desestimular seu uso em transações do dia a dia.

Infraestrutura Limitada:

O uso do Bitcoin precisa de acesso à internet e dispositivos digitais, o que pode ser um impedimento em áreas com infraestrutura limitada.

Educação e Adaptação:

A adoção do Bitcoin requer um certo nível de conhecimento técnico, e a falta de educação financeira pode dificultar sua utilização em larga escala.

Muitas pessoas ainda preferem moedas tradicionais por falta de conhecimento ou desconfiança em relação ao Bitcoin.

O futuro do Bitcoin em economias emergentes

Desenvolvimento de infraestrutura:

Projetos que promovem o acesso à internet e a dispositivos digitais podem aumentar bastante a adoção do Bitcoin nessas áreas.

Estabilidade e confiança:

Conforme o mercado se desenvolve, a volatilidade do Bitcoin pode diminuir, tornando-o mais útil como meio de troca e reserva de valor.

Educação e capacitação:

Iniciativas de educação financeira podem ajudar as pessoas a entender e aproveitar os benefícios do Bitcoin, facilitando sua incorporação ao dia a dia.

Resumindo, o Bitcoin tem um papel transformador em economias emergentes, oferecendo uma alternativa forte aos sistemas financeiros tradicionais. Sua capacidade de proteger contra a inflação, promover a inclusão financeira e facilitar transações internacionais faz dele uma ferramenta essencial para milhões de pessoas.

Embora desafios como volatilidade e infraestrutura limitada precisem ser superados, o potencial do Bitcoin de empoderar indivíduos em economias emergentes é claro. Como um ativo digital descentralizado, ele representa não apenas uma inovação tecnológica, mas também uma esperança para um futuro econômico mais justo e acessível.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 31a4605e:cf043959

2025-06-17 15:52:20

@ 31a4605e:cf043959

2025-06-17 15:52:20As regulações têm um papel fundamental na evolução do mercado financeiro global, criando as bases para a estabilidade, segurança e confiança nas transações econômicas. Porém, em um mundo cada vez mais globalizado e digital, os desafios regulatórios se tornaram mais complicados, especialmente com o surgimento de inovações financeiras disruptivas, como o Bitcoin e as finanças descentralizadas. A interação entre a regulação e o mercado financeiro tem profundas consequências, tanto boas quanto ruins, moldando o futuro da economia global.

A importância das regulações no mercado financeiro:

Estabilidade econômica: leis e regulamentações financeiras ajudam a evitar práticas arriscadas, como empréstimos irresponsáveis e especulação excessiva.

Proteção ao consumidor: regulamentos garantem que consumidores e investidores tenham acesso a informações claras e precisas, evitando fraudes e abusos.

Combate à lavagem de dinheiro e financiamento ao terrorismo: políticas de “conheça seu cliente” (KYC) e combate à lavagem de dinheiro (AML) asseguram que recursos ilegais não ingressem no sistema financeiro.

Desafios regulatórios em um mercado globalizado:

Interconectividade dos mercados: o mercado financeiro global é interconectado, e crises em um país podem rapidamente se espalhar para outros. Isso requer uma coordenação internacional mais eficiente entre os reguladores.

Inovações tecnológicas: o surgimento de tecnologias disruptivas, como o blockchain ou timechain, desafiou os modelos regulatórios clássicos. Muitos governos ainda estão tentando equilibrar a promoção da inovação com a redução de riscos.

Compliance e custos: empresas financeiras enfrentam custos crescentes para atender regulamentações cada vez mais severas, o que pode afetar sua lucratividade e criar barreiras para novos entrantes.

Impacto das regulações no mercado financeiro global:

Impactos positivos: confiança do Investidor: Regras claras e aplicação eficaz aumentam a confiança dos investidores, promovendo o crescimento do mercado financeiro.

Resiliência econômica: regulamentações bem elaboradas tornam o sistema financeiro mais forte contra choques econômicos.

Atração de capital estrangeiro: jurisdições com boa governança regulatória atraem investimentos de países e empresas em busca de segurança.

Impactos negativos: excesso de burocracia: regras muito complicadas podem tornar difícil a inovação e o crescimento econômico, especialmente para pequenas empresas.

Fuga de capital: empresas podem mover suas operações para países com leis mais fáceis, prejudicando a economia de lugares com regras mais rígidas.

Ineficácia em contextos lobais: regras nacionais nem sempre funcionam bem em mercados globais. A falta de cooperação entre países pode criar oportunidades para pessoas mal-intencionadas.

O papel das instituições internacionais:

Padrões Internacionais: essas organizações trabalham para criar padrões globais, como os de capital mínimo para bancos (Acordos de Basileia).

Resolução de crises: instituições internacionais também funcionam como mediadoras e fornecedoras de ajuda financeira em crises globais, como visto durante a pandemia de 2020-2021.

Regulação e inovação (equilíbrio necessário):

Incentivo à Inovação: reguladores devem manter as tecnologias emergentes em crescimento, permitindo que soluções como o blockchain ou timechain se desenvolvam.

Riscos associados à falta de regulação: sem regras apropriadas, mercados inovadores podem atrair ações fraudulentas, prejudicando a confiança pública.

Resumindo, as regulamentações são essenciais para manter a integridade e a estabilidade do mercado financeiro global. Elas asseguram a proteção dos participantes, previnem crises e fomentam um ambiente confiável. Contudo, o mundo globalizado e a rápida mudança tecnológica desafiam os reguladores a se adaptarem continuamente.

O equilíbrio entre segurança e inovação é vital para o futuro do mercado financeiro. Regras eficazes devem ser adaptáveis o bastante para acompanhar as mudanças e suficientemente fortes para proteger os participantes. Assim, o mercado financeiro global pode continuar a se desenvolver, promovendo prosperidade econômica de forma sustentável e justa.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 39cc53c9:27168656

2025-06-17 16:40:13

@ 39cc53c9:27168656

2025-06-17 16:40:13After almost 3 months of work, we've completed the redesign of kycnot.me. More modern and with many new features.

Privacy remains the foundation - everything still works with JavaScript disabled. If you enable JS, you will get some nice-to-have features like lazy loading and smoother page transitions, but nothing essential requires it.

User Accounts

We've introduced user accounts that require zero personal information:

- Secret user tokens - no email, no phone number, no personal data

- Randomly generated usernames for default privacy and fairness

- Karma system that rewards contributions and unlocks features: custom display names, profile pictures, and more.

Reviews and Community Discussions

On the previous sites, I was using third party open source tools for the comments and discussions. This time, I've built my own from scratch, fully integrated into the site, without JavaScript requirements.

Everyone can share their experiences and help others make informed decisions:

- Ratings: Comments can have a 1-5 star rating attached. You can have one rating per service and it will affect the overall user score.

- Discussions: These are normal comments, you can add them on any listed service.

Comment Moderation

I was strugling to keep up with moderation on the old site. For this, we've implemented an AI-powered moderation system that:

- Auto-approves legitimate comments instantly

- Flags suspicious content for human review

- Keeps discussions valuable by minimizing spam

The AI still can mark comments for human review, but most comments will get approved automatically by this system. The AI also makes summaries of the comments to help you understand the overall sentiment of the community.

Powerful Search & Filtering

Finding exactly what you need is now easier:

- Advanced filtering system with many parameters. You can even filter by attributes to pinpoint services with specific features.

The results are dynamic and shuffle services with identical scores for fairness.

See all listings

Listings are now added as 'Community Contributed' by default. This means that you can still find them in the search results, but they will be clearly marked as such.

Updated Scoring System

New dual-score approach provides more nuanced service evaluations:

- Privacy Score: Measures how well a service protects your personal information and data

-

Trust Score: Assesses reliability, security, and overall reputation

-

Combined into a weighted Overall Score for quick comparisons

- Completely transparent and open source calculation algorithm. No manual tweaking or hidden factors.

AI-Powered Terms of Service Analysis

Basically, a TLDR summary for Terms of Service:

- Automated system extracts the most important points from complex ToS documents

- Clear summaries

- Updated monthly to catch any changes

The ToS document is hashed and only will be updated if there are any changes.

Service Events and Timelines

Track the complete history of any service, on each service page you can see the timeline of events. There are two types of events:

- Automatic events: Created by the system whenever something about a service changes, like its description, supported currencies, attributes, verification status…

- Manual events: Added by admins when there’s important news, such as a service going offline, being hacked, acquired, shut down, or other major updates.

There is also a global timeline view available at /events

Notification System

Since we now have user accounts, we built a notifiaction system so you can stay informed about anything:

- Notifications for comment replies and status changes

- Watch any comment to get notified for new replies.

- Subscribe to services to monitor events and updates

- Notification customization.

Coming soon: Third-party privacy-preserving notifications integration with Telegram, Ntfy.sh, webhooks...

Service Suggestions

Anyone with an account can suggest a new service via the suggestion form. After submitting, you'll receive a tracking page where you can follow the status of your suggestion and communicate directly with admins.

All new suggestions start as "unlisted" — they won't appear in search results until reviewed. Our team checks each submission to ensure it's not spam or inappropriate. If similar services already exist, you'll be shown possible duplicates and can choose to submit your suggestion as an edit instead.

You can always check the progress of your suggestion, respond to moderator questions, and see when it goes live, everything will also be notified to your account. This process ensures high-quality listings and a collaborative approach to building the directory.

These are some of the main features we already have, but there are many more small changes and improvements that you will find when using the site.

What's Next?

This is just the beginning. We will be constantly working to improve KYCnot.me and add more features that help you preserve your privacy.

Remember: True financial freedom requires the right to privacy. Stay KYC-free!

-

@ 31a4605e:cf043959

2025-06-17 15:49:45

@ 31a4605e:cf043959

2025-06-17 15:49:45O Bitcoin trouxe uma nova maneira de entender a economia monetária, rompendo com os modelos inflacionários das moedas tradicionais e apresentando uma estrutura deflacionária especial. Com uma oferta restrita e regras matemáticas claras, o Bitcoin proporciona previsibilidade, segurança e resistência a manipulações, características que atraem investidores e fãs ao redor do mundo.

Um dos aspectos mais importantes do Bitcoin é sua oferta limitada a 21 milhões de unidades, definida no código original por Satoshi Nakamoto. Essa característica separa o Bitcoin das moedas tradicionais, cuja oferta é ilimitada e muitas vezes aumentada por bancos centrais para atender a necessidades econômicas ou políticas.

A oferta limitada dá ao Bitcoin uma qualidade semelhante ao ouro, sendo frequentemente chamado de "ouro digital". Assim como o ouro, o Bitcoin é escasso e requer esforço para ser adquirido (por meio de mineração). A escassez programada cria uma dinâmica de oferta e demanda que tende a aumentar o valor do ativo à medida que a demanda cresce e a oferta se mantém constante.

A emissão de novos bitcoins acontece através da mineração, e as recompensas são reduzidas pela metade em eventos chamados halvings, que ocorrem aproximadamente a cada quatro anos. Essa diminuição gradual na emissão de novos bitcoins assegura que a quantidade total será alcançada por volta de 2140, tornando o Bitcoin previsível a longo prazo.

O modelo deflacionário do Bitcoin é definido pela diminuição na criação de novas unidades e pelo aumento potencial de seu valor com o tempo. Isso contrasta diretamente com o modelo inflacionário das moedas tradicionais, nas quais a oferta é constantemente aumentada, reduzindo seu poder de compra.

A deflação no Bitcoin acontece porque a oferta de novos bitcoins diminui enquanto a demanda global tende a aumentar. Em vez de perder poder de compra, como ocorre com moedas tradicionais, o Bitcoin tem potencial de valorização à medida que mais pessoas buscam guardá-lo como valor.

Economias que dependem de sistemas deflacionários enfrentam desafios, como a tendência dos consumidores de adiar gastos na expectativa de preços mais baixos. Contudo, no caso do Bitcoin, ele é visto principalmente como uma reserva de valor, diminuindo esse efeito negativo. Por outro lado, o modelo deflacionário estimula a poupança, protegendo a riqueza das pessoas contra desvalorizações arbitrárias.

O modelo inflacionário das moedas fiduciárias se baseia na ampliação da oferta monetária para impulsionar o crescimento econômico, o que, na prática, reduz o poder de compra das moedas ao longo do tempo.

Governos e bancos centrais frequentemente imprimem dinheiro para pagar dívidas ou estimular a economia, o que pode resultar em inflação descontrolada.

Esse aumento na quantidade de dinheiro diminui o valor do dinheiro já existente, prejudicando poupadores e pessoas com menos acesso a ativos que protejam contra a inflação.

Como o Bitcoin é descentralizado e funciona em uma rede pública, nenhuma entidade central pode mudar suas regras ou aumentar sua oferta.

Isso o torna um ativo confiável para quem quer proteger sua riqueza em economias instáveis ou inflacionárias.

De maneira resumida a economia do Bitcoin é principalmente movida pela interação entre oferta e demanda.

O aumento da aceitação global, tanto por investidores institucionais quanto por indivíduos, gerou maior demanda pelo Bitcoin.

Sua utilidade como reserva de valor e defesa contra inflação atrai pessoas de economias frágeis e investidores em busca de diversificação.

Cada halving reduz a criação de novos bitcoins, diminuindo a oferta no mercado. Historicamente, esses eventos têm sido seguidos por aumentos significativos no preço do Bitcoin, pois a oferta menor atende a uma demanda crescente.

Com a oferta limitada e um cronograma previsível de emissão, o Bitcoin funciona de maneira clara, evitando surpresas econômicas comuns em sistemas fiduciários manipulados por bancos centrais.

Com o tempo, o Bitcoin pode ter um papel cada vez mais importante na economia global. Seu modelo deflacionário é especialmente atraente em um contexto de crescente desconfiança em relação às moedas fiduciárias e aos sistemas financeiros tradicionais.

O Bitcoin está se estabelecendo como uma reserva de valor, parecido com o ouro, mas com vantagens em portabilidade e divisibilidade.

Em períodos de crise econômica, ele é visto como uma alternativa segura para proteger riquezas.

À medida que a recompensa pela mineração diminui, espera-se que as taxas de transação sustentem a rede, aumentando sua segurança sem afetar a economia dos usuários.

Resumindo, a economia do Bitcoin é uma inovação que desafia os conceitos estabelecidos pelas moedas fiduciárias. Com sua oferta limitada, modelo deflacionário e resistência à manipulação, ele oferece uma alternativa forte para proteger a riqueza contra os efeitos da inflação.

Apesar de enfrentar desafios, como volatilidade e aceitação global, o Bitcoin continua a se fortalecer como uma reserva de valor confiável e uma forma de dinheiro digital. Seu modelo econômico, baseado na escassez e na transparência, pode ter um impacto duradouro na forma como pessoas e instituições lidam com o armazenamento e a preservação de valor no século XXI.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 31a4605e:cf043959

2025-06-17 15:47:27

@ 31a4605e:cf043959

2025-06-17 15:47:27O Bitcoin é amplamente reconhecido como a primeira e mais importante inovação no campo das moedas digitais. Criado por Satoshi Nakamoto em 2009, ele estabeleceu as bases para um sistema financeiro descentralizado. Desde então, surgiram milhares de outras moedas digitais, muitas vezes referidas como criptomoedas ou até mesmo "shitcoins" por críticos que apontam sua volatilidade, falta de utilidade clara ou centralização. Essa comparação entre o Bitcoin e outras criptomoedas é essencial para entender os valores exclusivos que o Bitcoin representa.

O Bitcoin foi criado para ser uma alternativa ao sistema financeiro tradicional. Sua missão central é fornecer uma moeda descentralizada, resistente à censura e livre de intermediários como bancos ou governos.

Por outro lado, a maioria das outras criptomoedas/shitcoins surgiu com diferentes objetivos, que vão desde experimentos tecnológicos até planos de enriquecimento rápido. Muitas dessas moedas não têm a mesma descentralização e segurança do Bitcoin, sendo frequentemente geridas por equipes ou organizações centralizadas, o que as torna mais suscetíveis à manipulação e falhas de segurança.

Descentralização e segurança

Bitcoin: a rede Bitcoin é suportada por milhares de nós espalhados pelo mundo, garantindo verdadeira descentralização.

Seu algoritmo de consenso, Proof of Work (PoW), é amplamente testado e proporciona altos níveis de segurança contra ataques.

Não há controle centralizado, o que significa que nenhuma entidade pode alterar suas regras fundamentais.

Outras criptomoedas/shitcoins

Praticamente todas sacrificam descentralização em troca de velocidade ou funcionalidades adicionais.

Algumas utilizam mecanismos de consenso alternativos, como Proof of Stake (PoS), que, embora sejam mais eficientes em termos energéticos, são frequentemente criticados por favorecer a centralização e oferecer menor segurança.

Em muitos casos, há equipes de desenvolvimento centralizadas que podem modificar o código, criar mais unidades da moeda ou até encerrar o projeto, comprometendo a confiança dos usuários.

Oferta e escassez

Bitcoin: o Bitcoin tem uma quantidade limitada de 21 milhões de unidades, garantindo sua escassez.

Essa característica, junto com a crescente demanda, posiciona o Bitcoin como uma reserva de valor confiável, frequentemente comparado ao ouro digital.

Outras criptomoedas/shitcoins

Muitas não têm limites claros em sua oferta, resultando em inflação descontrolada.

Algumas “moedas” são intencionalmente inflacionárias, o que pode reduzir seu valor com o tempo.

Em muitos casos, essas “moedas” são pré-mineradas ou distribuídas de maneira desigual, favorecendo os criadores em detrimento da comunidade.

Finalidade e utilidade

Bitcoin: o Bitcoin é, acima de tudo, uma forma de dinheiro digital e reserva de valor.

Sua rede é confiável e simples, com o foco principal em ser um meio de troca e proteção contra a inflação.

Sua solidez o torna ideal para transações e armazenamento de valor a longo prazo.

Outras criptomoedas/shitcoins

Muitas shitcoins são apresentadas como soluções para casos específicos, como contratos inteligentes, jogos ou finanças descentralizadas.

Apesar de promessas ousadas, muitos falham em oferecer utilidade real ou em competir com soluções centralizadas já existentes.

Há um número considerável de projetos que não têm uma proposta clara e acabam sendo abandonados após um tempo de especulação.

Volatilidade e reputação

Bitcoin: embora o Bitcoin seja instável, ele é amplamente aceito como o padrão-ouro das moedas digitais.

Sua imagem foi construída ao longo de mais de dez anos de operação confiável e segurança comprovada.

Outras criptomoedas/shitcoins

Muitas shitcoins enfrentam alta volatilidade, frequentemente impulsionada por especulação ou manipulação de mercado.

A falta de clareza e as práticas duvidosas de alguns projetos prejudicam a imagem do setor como um todo.

Resistência à censura

Bitcoin: devido à sua descentralização e segurança, o Bitcoin é muito resistente à censura. Qualquer pessoa com acesso à internet pode participar da rede e fazer transações.

Outras criptomoedas/shitcoins

Muitas "shitcoins" dependem de estruturas centralizadas ou têm líderes identificáveis que podem ser pressionados por governos ou outros atores para censurar transações.

Resumindo, o Bitcoin continua sendo o líder indiscutível no mundo das moedas digitais devido à sua descentralização, segurança e escassez comprovada. Ele é um sistema feito para durar, oferecendo liberdade financeira e proteção contra a inflação.

Enquanto isso, muitas criptomoedas ou shitcoins não conseguem atingir os mesmos padrões de segurança e confiança, frequentemente priorizando velocidade, funções extras ou lucros especulativos rápidos. Para investidores e usuários, é importante distinguir entre o Bitcoin e os vários projetos alternativos, muitos dos quais podem não resistir ao teste do tempo.

O Bitcoin não só iniciou uma revolução financeira, mas continua sendo o padrão pelo qual todas as outras moedas digitais são medidas.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 31a4605e:cf043959

2025-06-17 15:44:41

@ 31a4605e:cf043959

2025-06-17 15:44:41O Bitcoin tem se destacado como uma opção moderna para reserva de valor, frequentemente comparado a bens tradicionais como o ouro. Sua habilidade de resistir à inflação, junto com características como escassez, descentralização e segurança, o coloca como uma ferramenta promissora para preservar riqueza em tempos de incerteza econômica.

Uma reserva de valor é um ativo que mantém seu poder de compra ao longo do tempo, protegendo o patrimônio contra desvalorização. Historicamente, ativos como ouro e imóveis desempenharam esse papel, pois são relativamente escassos e têm demanda constante.

No entanto, moedas fiduciárias têm se mostrado menos eficientes como reserva de valor devido à inflação. Governos e bancos centrais frequentemente aumentam a oferta de dinheiro, o que pode diminuir o poder de compra das moedas. É nesse cenário que o Bitcoin se destaca como uma alternativa.

Bitcoin: escassez programada

A principal característica que torna o Bitcoin uma possível reserva de valor é sua oferta limitada. Apenas 21 milhões de bitcoins serão criados, um teto estabelecido em seu código. Essa escassez programada contrasta com as moedas fiduciárias, que podem ser emitidas sem limites por governos, resultando em inflação.

O processo de criação do Bitcoin também é controlado por eventos conhecidos como halvings, que cortam pela metade a recompensa por bloco minerado aproximadamente a cada quatro anos. Isso faz com que o Bitcoin se torne cada vez mais raro ao longo do tempo, aumentando seu potencial de valorização.

O Bitcoin oferece uma solução para o problema da inflação, pois sua oferta fixa evita que governos ou instituições centralizadas manipulem sua quantidade.

Descentralização e imutabilidade: por operar em uma rede descentralizada, o Bitcoin é imune a decisões políticas ou intervenções de bancos centrais. Nenhuma autoridade pode mudar o protocolo para "imprimir" mais bitcoins.

Transparência no suprimento: todas as transações e criações de novos bitcoins estão registradas no blockchain ou timechain, garantindo total transparência.

Proteção de poder de compra: com a oferta limitada e a crescente demanda, o Bitcoin tem mostrado tendência de valorização ao longo dos anos, funcionando como um hedge (proteção) contra a inflação em várias economias.

O Bitcoin é frequentemente chamado de "ouro digital" devido a suas semelhanças com o metal precioso como reserva de valor: Escassez: O ouro é limitado na natureza, enquanto o Bitcoin tem um suprimento máximo programado de 21 milhões de unidades.

Portabilidade: o Bitcoin é mais fácil de transferir e armazenar do que o ouro, sendo acessível digitalmente em qualquer lugar do mundo.

Divisibilidade: cada bitcoin pode ser dividido em até 100 milhões de unidades chamadas satoshis, permitindo transações de qualquer valor.

Segurança: enquanto o ouro exige armazenamento físico e está sujeito a roubo, o Bitcoin pode ser guardado em carteiras digitais seguras.

Essas qualidades fazem do Bitcoin uma opção mais flexível e acessível como forma de guardar valor em um mundo cada vez mais digital.

Apesar de sua promessa, o Bitcoin ainda enfrenta barreiras para ser aceito amplamente como reserva de valor:

Volatilidade: o valor do Bitcoin historicamente tem apresentado grandes variações, o que pode desestimular investidores que desejam segurança. Contudo, muitos acreditam que, com o aumento da aceitação, a volatilidade tende a diminuir.

Regulação: alguns governos têm implementado ações para restringir ou regular o uso do Bitcoin, o que pode impactar sua aceitação como reserva de valor.

Adaptação cultural: como um ativo novo e digital, o Bitcoin ainda precisa ganhar a confiança de pessoas que estão acostumadas a formas de valor físicas, como o ouro.

O Bitcoin tem se destacado como uma opção de guarda de valor particularmente útil em economias que enfrentam crises financeiras ou hiperinflação. Países como Venezuela, Argentina e Zimbábue, que passaram por uma queda acentuada de suas moedas, viram um crescimento na adoção do Bitcoin como maneira de proteger o poder de compra.

Além disso, sua acessibilidade mundial permite que pessoas em países sem fácil acesso a mercados financeiros tradicionais utilizem o Bitcoin como uma alternativa.

Resumindo, o Bitcoin possui características distintas que o fazem um candidato promissor como reserva de valor em um mundo cada vez mais digital e afetado pela inflação das moedas comuns. Sua escassez programada, resistência à manipulação e acessibilidade global oferecem uma solução moderna para conservar riqueza.

Embora dificuldades como volatilidade e regulação ainda precisem ser superadas, o Bitcoin já se mostrou uma ferramenta eficaz para proteger ativos, especialmente em contextos de instabilidade econômica. Com o tempo e um aumento na aceitação, o Bitcoin pode se consolidar como um dos principais ativos de reserva de valor no século XXI.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 31a4605e:cf043959

2025-06-17 15:42:15

@ 31a4605e:cf043959

2025-06-17 15:42:15A rede Bitcoin foi feita para ser segura, descentralizada e resistente à censura. Contudo, à medida que seu uso cresce, surge um desafio importante: a escalabilidade. Esse termo se refere à habilidade da rede de gerenciar um número crescente de transações sem afetar o desempenho ou a segurança. Esse desafio provocou o dilema de velocidade, que envolve equilibrar a rapidez nas transações com a preservação da descentralização e da segurança que o blockchain ou timechain proporciona.

Escalabilidade é a habilidade de um sistema aumentar seu desempenho para atender a demandas maiores. No caso do Bitcoin, isso implica processar um maior número de transações por segundo (TPS) sem comprometer os princípios básicos da rede.

Atualmente, a rede Bitcoin processa cerca de 7 transações por segundo, um número visto como baixo em comparação com sistemas tradicionais, como redes de cartões de crédito, que podem processar milhares de transações por segundo. Esse limite decorre diretamente do tamanho fixo dos blocos (1 MB) e do tempo médio de 10 minutos para a criação de um novo bloco no blockchain ou timechain.

O dilema de velocidade surge da necessidade de equilibrar três elementos essenciais: descentralização, segurança e velocidade.

O trilema do blockchain ou timechain:

Descentralização: a rede Bitcoin é composta por milhares de nós independentes, que verificam e validam transações. Aumentar os blocos ou torná-los mais rápidos poderia elevar os requisitos computacionais, dificultando a participação de nós menores e afetando a descentralização.

Segurança: a segurança vem do processo de mineração e da validação dos blocos. Aumentar a velocidade das transações poderia comprometer a segurança, pois diminuiria o tempo necessário para certificar cada bloco, tornando a rede mais propensa a ataques.

Velocidade: a necessidade de confirmar transações rapidamente é crucial para que o Bitcoin seja utilizado como meio de pagamento no cotidiano. Porém, priorizar a velocidade pode afetar tanto a segurança quanto a descentralização.

Esse dilema exige soluções equilibradas para expandir a rede sem sacrificar suas características essenciais.

Soluções para o problema de escalabilidade

Várias soluções têm sido sugeridas para solucionar os desafios de escalabilidade e velocidade na rede Bitcoin.

Otimização on-chain

Segregated witness (SegWit): implementado em 2017, o SegWit separa os dados de assinatura das transações, permitindo uma utilização mais eficiente do espaço nos blocos e aumentando a capacidade sem modificar o tamanho do bloco.

Aumento do tamanho do bloco: algumas propostas sugeriram aumentar o tamanho dos blocos para permitir mais transações por bloco. Contudo, isso poderia tornar o sistema mais centralizado, pois exigiria maior poder computacional.

Soluções off-chain

Lightning Network: uma solução de segunda camada que permite transações rápidas e de baixo custo fora da blockchain ou timechain principal. Essas transações são liquidadas depois na rede principal, mantendo a segurança e a descentralização.

Canais de Pagamento: ermitem transações diretas entre dois usuários sem a necessidade de registrar cada ação na rede, diminuindo a congestão.

Sidechains (cadeias paralelas): propostas que criam redes paralelas ligadas ao blockchain ou timechain principal, permitindo mais flexibilidade e capacidade de processamento.

Embora essas soluções tragam melhorias significativas, elas também apresentam problemas. A Lightning Network, por exemplo, depende de canais de pagamento que precisam de liquidez inicial, limitando sua adoção geral. O aumento do tamanho dos blocos pode tornar o sistema mais suscetível à centralização, impactando a segurança da rede.

Além disso, soluções de segunda camada podem exigir confiança extra entre os participantes, o que pode enfraquecer os princípios de descentralização e resistência à censura defendidos pelo Bitcoin.

Outro ponto importante é a necessidade de adoção em larga escala. Mesmo com avanços tecnológicos, as soluções só serão eficazes se forem amplamente usadas e aceitas pelos usuários e desenvolvedores.

Resumindo, a escalabilidade e o dilema de velocidade representam um dos maiores desafios técnicos para a rede Bitcoin. Embora a segurança e a descentralização sejam essenciais para manter os princípios originais do sistema, a necessidade de transações rápidas e eficientes torna a escalabilidade um tema urgente.

Soluções como o SegWit e a Lightning Network têm mostrado avanços promissores, mas ainda enfrentam barreiras técnicas e de adoção. O equilíbrio entre velocidade, segurança e descentralização continua sendo um objetivo central para o futuro do Bitcoin.

Assim, a busca por inovação e melhoria constante é essencial para que o Bitcoin mantenha sua relevância como uma rede confiável e eficiente, capaz de sustentar o crescimento e a adoção global sem comprometer seus valores fundamentais.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 31a4605e:cf043959

2025-06-17 15:40:23

@ 31a4605e:cf043959

2025-06-17 15:40:23No sistema Bitcoin, a proteção e a posse dos fundos são asseguradas por um modelo criptográfico que usa chaves privadas e públicas. Esses componentes são fundamentais para a segurança digital, permitindo que os usuários administrem e protejam seus ativos de maneira descentralizada. Esse processo elimina a necessidade de intermediários, assegurando que somente o legítimo proprietário tenha acesso ao saldo vinculado a um endereço específico na blockchain ou timechain.

Chaves privadas e públicas são partes de um sistema de criptografia assimétrica, onde dois códigos distintos, mas matematicamente ligados, são utilizados para garantir a segurança e a veracidade das transações.

Chave Privada = É um código secreto, normalmente apresentado como uma longa sequência de números e letras.

Funciona como uma senha que dá ao proprietário o controle sobre os bitcoins ligados a um endereço específico.

Deve ser mantida em total sigilo, pois qualquer pessoa que a tenha pode movimentar os fundos correspondentes.

Chave Pública = É matematicamente derivada da chave privada, mas não permite que a chave privada seja descoberta.

Funciona como um endereço digital, semelhante a um número de conta bancária, podendo ser compartilhada livremente para receber pagamentos.

Serve para confirmar a autenticidade das assinaturas geradas com a chave privada.

Juntas, essas chaves asseguram que as transações sejam seguras e verificáveis, dispensando a necessidade de intermediários.

O funcionamento das chaves privadas e públicas baseia-se na criptografia de curva elíptica. Quando um usuário quer enviar bitcoins, ele usa sua chave privada para assinar digitalmente a transação. Essa assinatura é exclusiva para cada operação e demonstra que o remetente possui a chave privada relacionada ao endereço de envio.

Os nós da rede Bitcoin checam essa assinatura utilizando a chave pública correspondente, garantindo que:

A assinatura é válida.

A transação não foi alterada desde que foi assinada.

O remetente tem a propriedade legítima dos fundos.

Se a assinatura for aceita, a transação é registrada na blockchain ou timechain e se torna irreversível. Esse procedimento protege os fundos contra fraudes e gastos duplicados.

A segurança das chaves privadas é um dos pontos mais importantes do sistema Bitcoin. Perder essa chave significa perder permanentemente o acesso aos fundos, pois não há nenhuma autoridade central capaz de recuperá-la.

Boas práticas para proteger a chave privada incluem:

Armazenamento offline: longe de redes conectadas à internet, diminuindo o risco de ataques cibernéticos.

Carteiras de hardware: dispositivos físicos dedicados para armazenar chaves privadas de forma segura.

Backup e redundância: manter cópias de segurança em locais seguros e distintos.

Criptografia adicional: proteger arquivos digitais que contêm chaves privadas com senhas fortes e criptografia.

Ameaças comuns incluem:

Phishing e malware: ataques que tentam enganar os usuários para obter acesso às chaves.

Roubo físico: no caso de chaves guardadas em dispositivos físicos.

Perda de senhas e backups: que pode resultar na perda definitiva dos fundos.

O uso de chaves privadas e públicas dá ao proprietário controle total sobre seus fundos, eliminando intermediários como bancos ou governos. Esse modelo coloca a responsabilidade de proteção nas mãos do usuário, o que representa tanto liberdade quanto risco.

Diferente de sistemas financeiros tradicionais, onde instituições podem reverter transações ou congelar contas, no sistema Bitcoin, a posse da chave privada é a única prova de propriedade. Esse princípio é frequentemente resumido pela frase: "Not your keys, not your coins" (Se não são suas chaves, não são suas moedas).

Essa abordagem fortalece a soberania financeira, permitindo que indivíduos guardem e movam valor de maneira independente e sem censura.

Apesar de sua segurança, o sistema de chaves também apresenta riscos. Se uma chave privada for perdida ou esquecida, não existe como recuperar os fundos associados. Isso já levou à perda de milhões de bitcoins ao longo dos anos.

Para reduzir esse risco, muitos usuários utilizam frases-semente (seed phrases), que são uma lista de palavras usadas para restaurar carteiras e chaves privadas. Essas frases devem ser guardadas com o mesmo cuidado, pois também podem ser usadas para acessar os fundos.

Resumindo, as chaves privadas e públicas são a base da segurança e da propriedade no sistema Bitcoin. Elas asseguram que somente os verdadeiros proprietários possam mover seus fundos, promovendo um sistema financeiro descentralizado, seguro e resistente à censura.

No entanto, essa liberdade acarreta grandes responsabilidades, exigindo que os usuários adotem práticas severas para proteger suas chaves privadas. A perda ou comprometimento dessas chaves pode levar a consequências irreversíveis, ressaltando a importância de educação e preparação ao usar o sistema Bitcoin.

Assim, o modelo de chaves criptográficas não apenas melhora a segurança, mas também representa a essência da independência financeira proporcionada pelo Bitcoin.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 31a4605e:cf043959

2025-06-17 15:37:47

@ 31a4605e:cf043959

2025-06-17 15:37:47A rede Bitcoin é formada por uma infraestrutura descentralizada feita de dispositivos chamados nós. Esses nós têm um papel crucial na validação, verificação e manutenção do sistema, assegurando a segurança e a integridade do blockchain ou timechain. Ao contrário dos sistemas tradicionais, onde uma autoridade central controla as operações, a rede Bitcoin requer a colaboração de milhares de nós pelo mundo, promovendo descentralização e transparência.

Na rede Bitcoin, um nó é qualquer computador que está conectado ao sistema e participa do armazenamento, validação ou distribuição de informações. Esses dispositivos rodam o software do Bitcoin e podem operar em diferentes níveis de participação, desde tarefas básicas de transmissão de dados até a validação total de transações e blocos.

Existem dois tipos principais de nós:

Nós completos (full nodes):

Armazenam uma cópia total do blockchain ou timechain.

Validam e verificam todas as transações e blocos de acordo com as regras do protocolo.

Asseguram a segurança da rede ao rejeitar transações inválidas ou tentativas de fraude.

Nós leves (light nodes):

Armazenam somente partes do blockchain ou timechain, não a estrutura inteira.

Confiam em nós completos para obter dados sobre o histórico de transações.

São mais rápidos e menos exigentes em termos de recursos, mas dependem de terceiros para validação completa.

Os nós conferem se as transações enviadas seguem as regras do protocolo, como assinaturas digitais válidas e ausência de gastos duplos.

Somente transações válidas são enviadas para outros nós e incluídas no próximo bloco.

Os nós completos mantêm uma cópia atualizada de todo o histórico de transações da rede, garantindo integridade e transparência e se houver discrepâncias, os nós seguem a cadeia mais longa e válida, evitando manipulações.

Os nós transmitem informações de transações e blocos para outros nós na rede. Esse processo assegura que todos os participantes estejam sincronizados e atualizados.

Como a rede Bitcoin é composta por milhares de nós independentes, é quase impossível que um único agente controle ou modifique o sistema.

Os nós também protegem contra ataques ao validar informações e barrar tentativas de fraudes.

Os nós completos são muito importantes, pois atuam como auditores independentes. Eles não precisam de terceiros e podem verificar todo o histórico de transações diretamente.

Ao manterem uma cópia completa do blockchain ou timechain, esses nós permitem que qualquer pessoa valide transações sem depender de intermediários, promovendo clareza e liberdade financeira.

Além disso, os nós completos:

Reforçam a resistência à censura: Nenhum governo ou entidade pode excluir ou alterar dados registrados no sistema.

Preservam a descentralização: Quanto mais nós completos existirem, mais segura e forte será a rede.