-

@ cae03c48:2a7d6671

2025-06-17 15:00:39

@ cae03c48:2a7d6671

2025-06-17 15:00:39Bitcoin Magazine

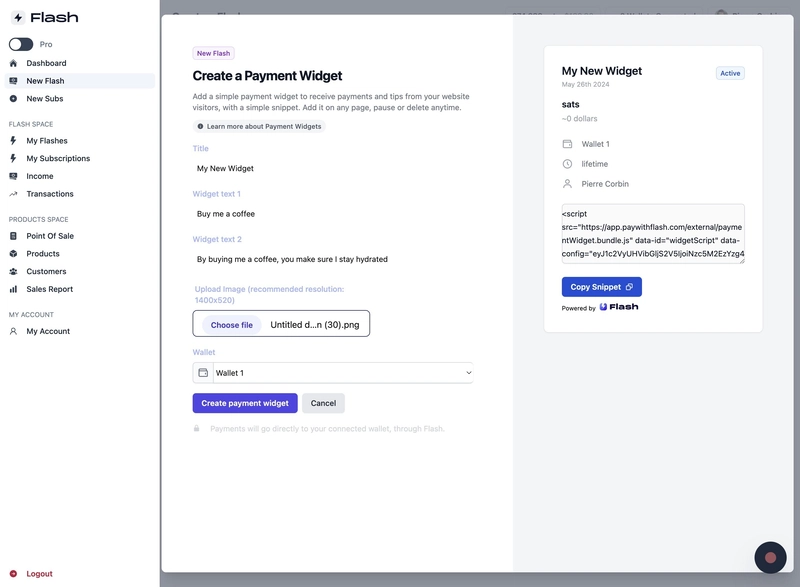

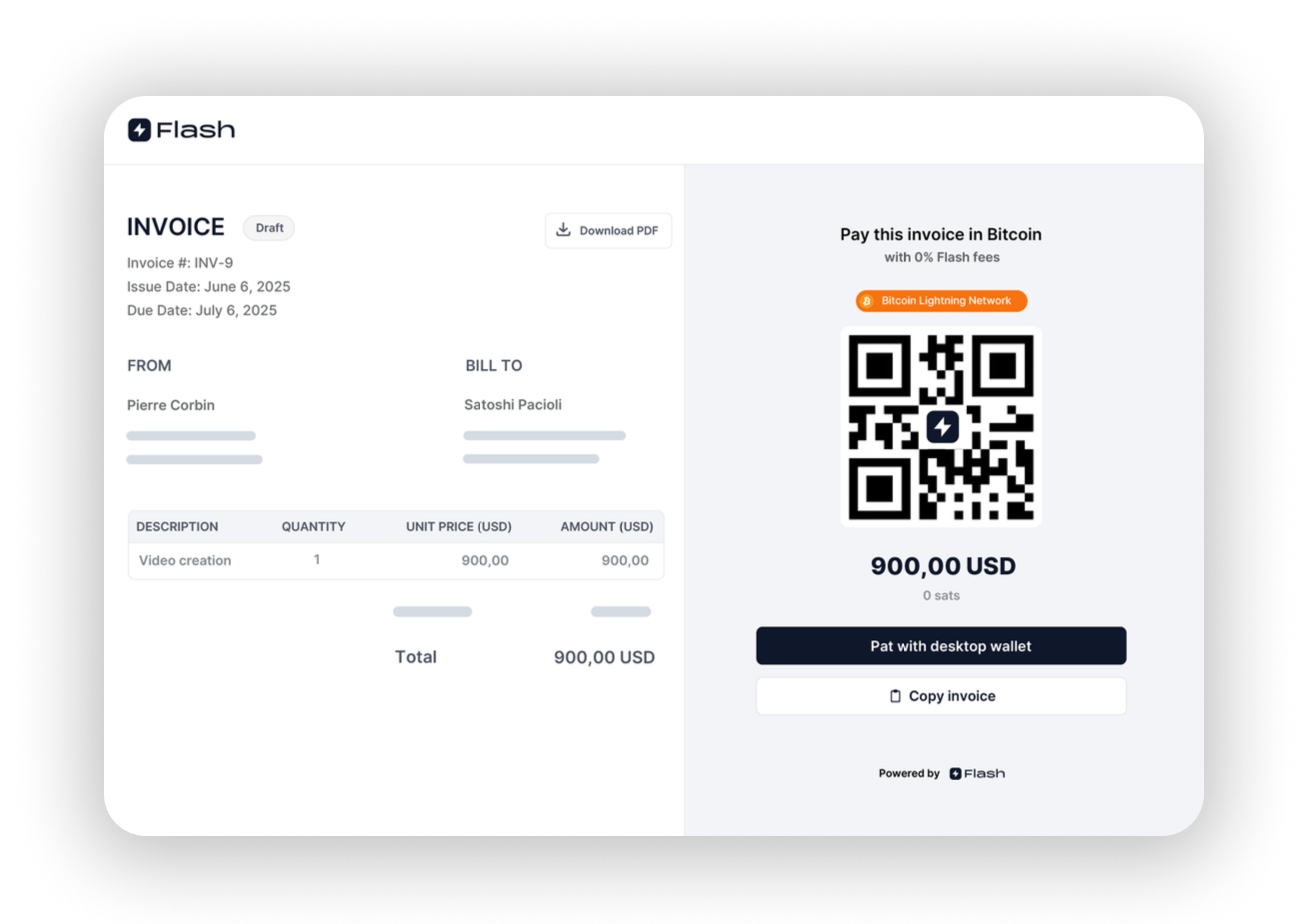

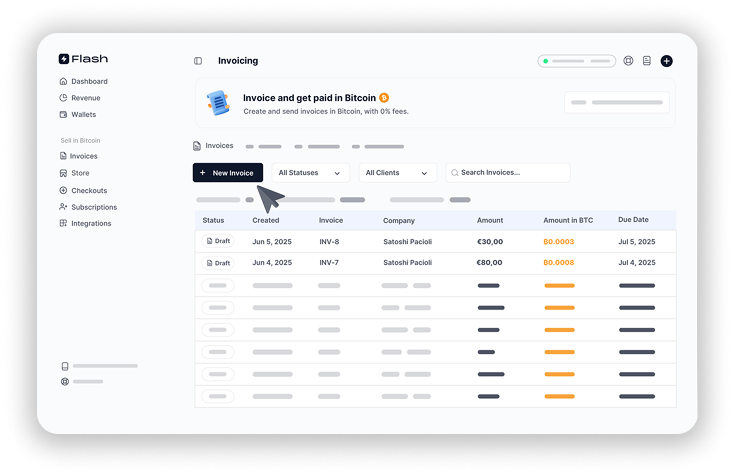

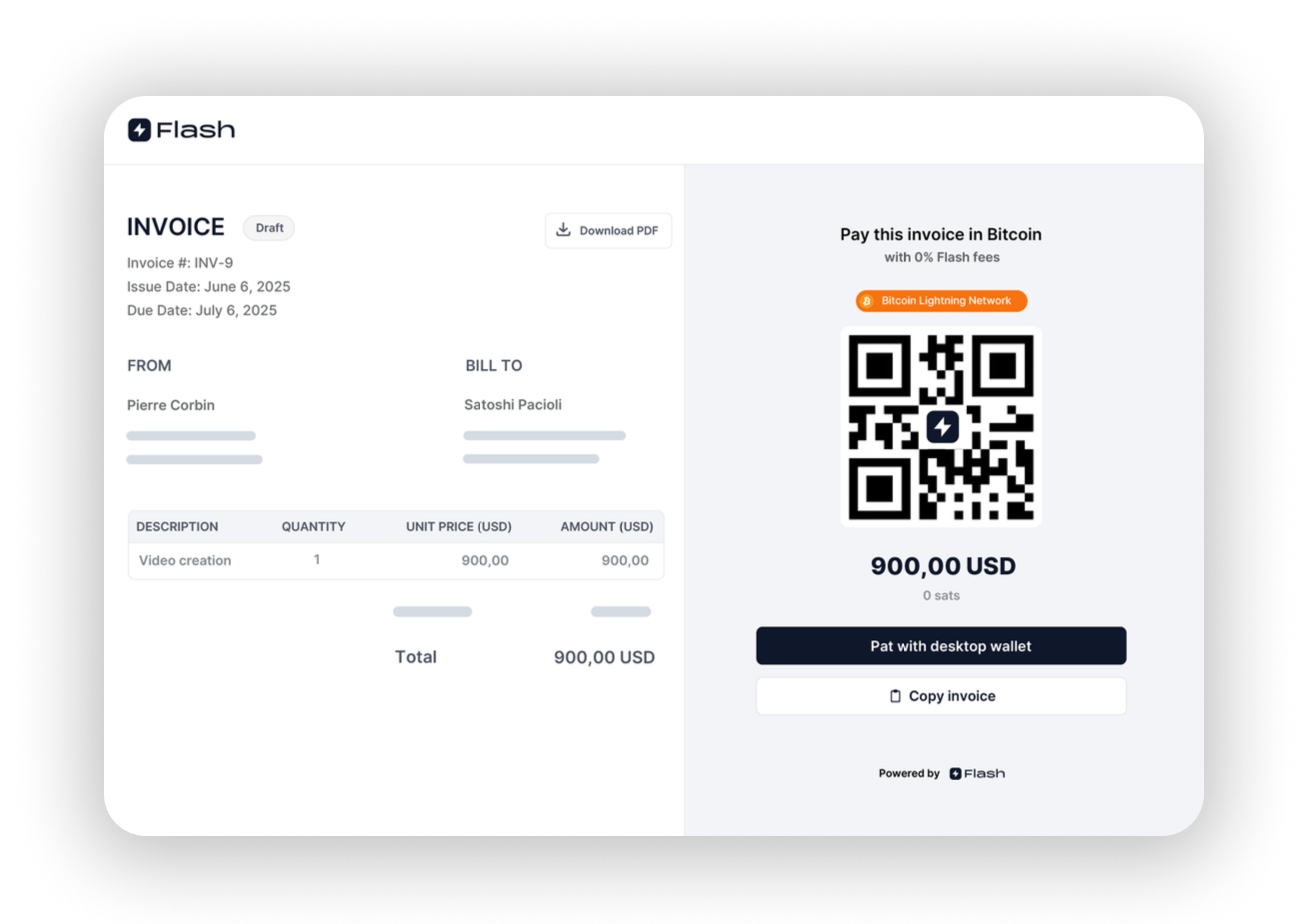

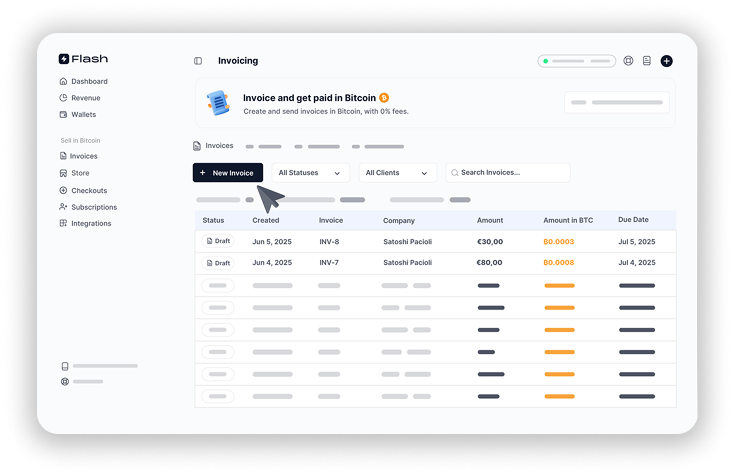

Flash Releases Free Bitcoin Invoicing Tool with No Fees, KYC, or CustodyFlash, a Bitcoin payment platform, just announced it has launched Flash Invoicing, a completely free, non-custodial, and KYC-free Bitcoin invoicing tool. Designed for freelancers, the platform allows users to send professional invoices without platform fees, identity checks, or third party custody.

According to Deel, a crypto payments company for freelancers, Bitcoin is the most used cryptocurrency in the world for payments. Despite this growth, many freelancers continue to use basic methods such as pasting Bitcoin addresses into PDFs or emails. Some rely on custodial platforms that deduct fees or require identity verification, which can affect both earnings and data privacy.

“We’ve seen too many people paste BTC addresses into documents and call it invoicing,” said the CEO of Flash Pierre Corbin. “It’s messy. It’s risky. And it’s time for something better.”

Flash Invoicing Features:

- 0% platform fees: no subscriptions or commission

- Non-custodial: Bitcoin goes straight to the user’s wallet

- No KYC: users maintain full privacy

- Professional output: branded PDFs and secure payment links

- Integrated dashboard: manage payments, clients, and revenue

- Works with Flash ecosystem: including Stores, Donations, Paywalls, and POS

Many Bitcoin invoicing tools charge a percentage per transaction or require a subscription. As a result, freelancers often lose part of their income simply to issue an invoice and receive payment. Flash is aiming to solve this issue.

“Freelancers work hard enough. The last thing they need is a platform skimming off their earnings,” said Corbin. “That’s why we dropped our fee from 1.5% to 0% — and launched the first invoicing tool that’s truly free, without compromising on privacy or control.”

Flash Invoicing allows users to accept Bitcoin payments without relinquishing control, privacy, or revenue. It is integrated with the broader Flash suite, enabling users to manage invoicing alongside features such as setting up stores, receiving donations, or gating premium content.

“As a freelancer myself, I love using the Flash invoicing feature,” stated a freelancer & Flash user. ”It keeps all my clients in one place, allows me to easily edit invoices and track payments. Much more professional than sending a lightning address in the footer of a PDF invoice.”

This post Flash Releases Free Bitcoin Invoicing Tool with No Fees, KYC, or Custody first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ e5cfb5dc:0039f130

2025-06-17 11:00:35

@ e5cfb5dc:0039f130

2025-06-17 11:00:35はりまメンタルクリニック:GIDの大手そう。丸の内線ならパムくんちが近い。

わらびメンタルクリニック:GIDの大手そう?公式サイトには影もかたちも

ナグモクリニック:SRS手術までしてるところ。GID精神科外来が月1第1木曜日だけ?

狭山メンタルクリニック:距離・時間的にはまま近い。サイトの記述が思想的にちょとあやしげ。新患受付がだいぶ先。GIDは専門外か?

川島領診療所:オンライン診療あり!強迫性障害や美容皮膚科をやっている。雰囲気よさそうなところ。GIDは専門外か?

Jこころのクリニック:電車いっぽんなので楽。GIDは専門外か?

ハッピースマイルクリニック:オンライン診療あり!GIDは専門外か?

-

@ 39cc53c9:27168656

2025-06-16 06:25:50

@ 39cc53c9:27168656

2025-06-16 06:25:50After almost 3 months of work, we've completed the redesign of kycnot.me. More modern and with many new features.

Privacy remains the foundation - everything still works with JavaScript disabled. If you enable JS, you will get some nice-to-have features like lazy loading and smoother page transitions, but nothing essential requires it.

User Accounts

We've introduced user accounts that require zero personal information:

- Secret user tokens - no email, no phone number, no personal data

- Randomly generated usernames for default privacy and fairness

- Karma system that rewards contributions and unlocks features: custom display names, profile pictures, and more.

Reviews and Community Discussions

On the previous sites, I was using third party open source tools for the comments and discussions. This time, I've built my own from scratch, fully integrated into the site, without JavaScript requirements.

Everyone can share their experiences and help others make informed decisions:

- Ratings: Comments can have a 1-5 star rating attached. You can have one rating per service and it will affect the overall user score.

- Discussions: These are normal comments, you can add them on any listed service.

Comment Moderation

I was strugling to keep up with moderation on the old site. For this, we've implemented an AI-powered moderation system that:

- Auto-approves legitimate comments instantly

- Flags suspicious content for human review

- Keeps discussions valuable by minimizing spam

The AI still can mark comments for human review, but most comments will get approved automatically by this system. The AI also makes summaries of the comments to help you understand the overall sentiment of the community.

Powerful Search & Filtering

Finding exactly what you need is now easier:

- Advanced filtering system with many parameters. You can even filter by attributes to pinpoint services with specific features.

The results are dynamic and shuffle services with identical scores for fairness.

See all listings

Listings are now added as 'Community Contributed' by default. This means that you can still find them in the search results, but they will be clearly marked as such.

Updated Scoring System

New dual-score approach provides more nuanced service evaluations:

- Privacy Score: Measures how well a service protects your personal information and data

-

Trust Score: Assesses reliability, security, and overall reputation

-

Combined into a weighted Overall Score for quick comparisons

- Completely transparent and open source calculation algorithm. No manual tweaking or hidden factors.

AI-Powered Terms of Service Analysis

Basically, a TLDR summary for Terms of Service:

- Automated system extracts the most important points from complex ToS documents

- Clear summaries

- Updated monthly to catch any changes

The ToS document is hashed and only will be updated if there are any changes.

Service Events and Timelines

Track the complete history of any service, on each service page you can see the timeline of events. There are two types of events:

- Automatic events: Created by the system whenever something about a service changes, like its description, supported currencies, attributes, verification status…

- Manual events: Added by admins when there’s important news, such as a service going offline, being hacked, acquired, shut down, or other major updates.

There is also a global timeline view available at /events

Notification System

Since we now have user accounts, we built a notifiaction system so you can stay informed about anything:

- Notifications for comment replies and status changes

- Watch any comment to get notified for new replies.

- Subscribe to services to monitor events and updates

- Notification customization.

Coming soon: Third-party privacy-preserving notifications integration with Telegram, Ntfy.sh, webhooks...

Service Suggestions

Anyone with an account can suggest a new service via the suggestion form. After submitting, you'll receive a tracking page where you can follow the status of your suggestion and communicate directly with admins.

All new suggestions start as "unlisted" — they won't appear in search results until reviewed. Our team checks each submission to ensure it's not spam or inappropriate. If similar services already exist, you'll be shown possible duplicates and can choose to submit your suggestion as an edit instead.

You can always check the progress of your suggestion, respond to moderator questions, and see when it goes live, everything will also be notified to your account. This process ensures high-quality listings and a collaborative approach to building the directory.

These are some of the main features we already have, but there are many more small changes and improvements that you will find when using the site.

What's Next?

This is just the beginning. We will be constantly working to improve KYCnot.me and add more features that help you preserve your privacy.

Remember: True financial freedom requires the right to privacy. Stay KYC-free!

-

@ 7f6db517:a4931eda

2025-06-16 17:02:07

@ 7f6db517:a4931eda

2025-06-16 17:02:07

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ 8bad92c3:ca714aa5

2025-06-16 14:02:15

@ 8bad92c3:ca714aa5

2025-06-16 14:02:15Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”

“We're not hodling just for the sake of hodling. There is a purpose to it.”

“Fiat money shortens your time horizon… you can never rest.”

“Savings precedes capital accumulation. You can’t build unless you’ve saved.”

“You're increasing the marginal value of everyone else’s Bitcoin.”

“True leisure is contemplation—the pursuit of the highest good.”

“What is Bitcoin for if not to make the conditions for magnificent acts of creation possible?”

“Bitcoin itself will last forever. Your stack might not. What will outlast your coins?”

“Only a whale can be magnificent.”

“The market will sell you all the crack you want. It’s up to you to demand beauty.”

Conclusion

This episode is a call to reimagine Bitcoin as more than a financial revolution—it’s a blueprint for civilizational renewal. Michael Goldstein reframes hodling as an act of moral stewardship, urging Bitcoiners to lower their time preference, build lasting institutions, and pursue truth, beauty, and legacy—not to escape the world, but to rebuild it on sound foundations.

Timestamps

00:00 - Intro

00:50 - Michael’s BBB presentation Hodl for Good

07:27 - Austrian principles on capital

15:40 - Fiat distorts the economic process

23:34 - Bitkey

24:29 - Hodl for Good triple entendre

29:52 - Bitcoin benefits everyone

39:05 - Unchained

40:14 - Leisure theory of value

52:15 - Heightening life

1:15:48 - Breaking from the chase makes room for magnificence

1:32:32 - Nakamoto Institute’s missionTranscript

(00:00) Fiat money is by its nature a disturbance. If money is being continually produced, especially at an uncertain rate, these uh policies are really just redistribution of wealth. Most are looking for number to go up post hyper bitcoinization. The rate of growth of bitcoin would be more reflective of the growth of the economy as a whole.

(00:23) Ultimately, capital requires knowledge because it requires knowing there is something that you can add to the structures of production to lengthen it in some way that will take time but allow you to have more in the future than you would today. Let Black Rockck buy the houses and you keep the sats, not the other way around.

(00:41) You wait until later for Larry Frink to try to sell you a [Music] mansion. And we're live just like that. Just like that. 3:30 on a Friday, Memorial Day weekend. It's a good good good way to end the week and start the holiday weekend. Yes, sir. Yes, sir. Thank you for having me here. Thank you for coming. I wore this hat specifically because I think it's I think it's very apppropo uh to the conversation we're going to have which is I hope an extension of the presentation you gave at Bitblock Boom Huddle for good. You were working on

(01:24) that for many weeks leading up to uh the conference and explaining how you were structuring it. I think it's a very important topic to discuss now as the Bitcoin price is hitting new all-time highs and people are trying to understand what am I doing with Bitcoin? Like you have you have the different sort of factions within Bitcoin.

(01:47) Uh get on a Bitcoin standard, get on zero, spend as much Bitcoin as possible. You have the sailors of the world are saying buy Bitcoin, never sell, die with your Bitcoin. And I think you do a really good job in that presentation. And I just think your understanding overall of Bitcoin is incredible to put everything into context. It's not either or.

(02:07) It really depends on what you want to accomplish. Yeah, it's definitely there there is no actual one-sizefits-all um for I mean nearly anything in this world. So um yeah, I mean first of all I mean there was it was the first conference talk I had given in maybe five years. I think the one prior to that uh was um bit block boom 2019 which was my meme talk which uh has uh become infamous and notorious.

(02:43) So uh there was also a lot of like high expectations uh you know rockstar dev uh has has treated that you know uh that that talk with a lot of reference. a lot of people have enjoyed it and he was expecting this one to be, you know, the greatest one ever, which is a little bit of a little bit of a uh a burden to live up to those kinds of standards.

(03:08) Um, but you know, because I don't give a lot of talks. Um, you know, I I I like to uh try to bring ideas that might even be ideas that are common. So, something like hodling, we all talk about it constantly. uh but try to bring it from a little bit of a different angle and try to give um a little bit of uh new light to it.

(03:31) I alsove I've I've always enjoyed kind of coming at things from a third angle. Um whenever there's, you know, there's there's all these little debates that we have in in Bitcoin and sometimes it's nice to try to uh step out of it and look at it a little more uh kind of objectively and find ways of understanding it that incorporate the truths of of all of them.

(03:58) uh you know cuz I think we should always be kind of as much as possible after ultimate truth. Um so with this one um yeah I was kind of finding that that sort of golden mean. So uh um yeah and I actually I think about that a lot is uh you know Aristotle has his his concept of the golden mean. So it's like any any virtue is sort of between two vices um because you can you can always you can always take something too far.

(04:27) So you're you're always trying to find that right balance. Um so someone who is uh courageous you know uh one of the vices uh on one side is being basically reckless. I I can't remember what word he would use. Uh but effectively being reckless and just wanting to put yourself in danger for no other reason than just you know the thrill of it.

(04:50) Um and then on the other side you would just have cowardice which is like you're unwilling to put yourself um at any risk at any time. Um, and courage is right there in the middle where it's understanding when is the right time uh to put your put yourself, you know, in in the face of danger um and take it on. And so um in some sense this this was kind of me uh in in some ways like I'm obviously a partisan of hodling.

(05:20) Um, I've for, you know, a long time now talked about the, um, why huddling is good, why people do it, why we should expect it. Um, but still trying to find that that sort of golden mean of like yes, huddle, but also what are we hodling for? And it's not we're we're not hodddling just merely for the sake of hodddling.

(05:45) There there is a a purpose to it. And we should think about that. And that would also help us think more about um what are the benefits of of spending, when should we spend, why should we spend, what should we spend on um to actually give light to that sort of side of the debate. Um so that was that was what I was kind of trying to trying to get into.

(06:09) Um, as well as also just uh at the same time despite all the talk of hodling, there's always this perennial uh there's always this perennial dislike of hodlers because we're treated as uh as if um we're just free riding the network or we're just greedy or you know any of these things. And I wanted to show how uh huddling does serve a real economic purpose.

(06:36) Um, and it does benefit the individual, but it also does uh it it has actual real social um benefits as well beyond merely the individual. Um, so I wanted to give that sort of defense of hodling as well to look at it from um a a broader position than just merely I'm trying to get rich. Um uh because even the person who uh that is all they want to do um just like you know your your pure number grow up go up moonboy even that behavior has positive ramifications on on the economy.

(07:14) And while we might look at them and have uh judgments about their particular choices for them as an individual, we shouldn't discount that uh their actions are having positive positive effects for the rest of the economy. Yeah. So, let's dive into that just not even in the context of Bitcoin because I think you did a great job of this in the presentation.

(07:36) just you've done a good job of this consistently throughout the years that I've known you. Just from like a first principles Austrian economics perspective, what is the idea around capital accumulation, low time preference and deployment of that capital like what what like getting getting into like the nitty-gritty and then applying it to Bitcoin? Yeah, it's it's a big question and um in many ways I mean I I even I barely scratched the surface.

(08:05) uh I I can't claim to have read uh all the volumes of Bombber works, you know, capital and interest and and stuff like that. Um but I think there's some some sort of basic concepts that we can look at that we can uh draw a lot out. Um the first uh I guess let's write that. So repeat so like capital time preference. Yeah. Well, I guess getting more broad like why sav -

@ 39cc53c9:27168656

2025-06-15 14:46:35

@ 39cc53c9:27168656

2025-06-15 14:46:35The new website is finally live! I put in a lot of hard work over the past months on it. I'm proud to say that it's out now and it looks pretty cool, at least to me!

Why rewrite it all?

The old kycnot.me site was built using Python with Flask about two years ago. Since then, I've gained a lot more experience with Golang and coding in general. Trying to update that old codebase, which had a lot of design flaws, would have been a bad idea. It would have been like building on an unstable foundation.

That's why I made the decision to rewrite the entire application. Initially, I chose to use SvelteKit with JavaScript. I did manage to create a stable site that looked similar to the new one, but it required Jav aScript to work. As I kept coding, I started feeling like I was repeating "the Python mistake". I was writing the app in a language I wasn't very familiar with (just like when I was learning Python at that mom ent), and I wasn't happy with the code. It felt like spaghetti code all the time.

So, I made a complete U-turn and started over, this time using Golang. While I'm not as proficient in Golang as I am in Python now, I find it to be a very enjoyable language to code with. Most aof my recent pr ojects have been written in Golang, and I'm getting the hang of it. I tried to make the best decisions I could and structure the code as well as possible. Of course, there's still room for improvement, which I'll address in future updates.

Now I have a more maintainable website that can scale much better. It uses a real database instead of a JSON file like the old site, and I can add many more features. Since I chose to go with Golang, I mad e the "tradeoff" of not using JavaScript at all, so all the rendering load falls on the server. But I believe it's a tradeoff that's worth it.

What's new

- UI/UX - I've designed a new logo and color palette for kycnot.me. I think it looks pretty cool and cypherpunk. I am not a graphic designer, but I think I did a decent work and I put a lot of thinking on it to make it pleasant!

- Point system - The new point system provides more detailed information about the listings, and can be expanded to cover additional features across all services. Anyone can request a new point!

- ToS Scrapper: I've implemented a powerful automated terms-of-service scrapper that collects all the ToS pages from the listings. It saves you from the hassle of reading the ToS by listing the lines that are suspiciously related to KYC/AML practices. This is still in development and it will improve for sure, but it works pretty fine right now!

- Search bar - The new search bar allows you to easily filter services. It performs a full-text search on the Title, Description, Category, and Tags of all the services. Looking for VPN services? Just search for "vpn"!

- Transparency - To be more transparent, all discussions about services now take place publicly on GitLab. I won't be answering any e-mails (an auto-reply will prompt to write to the corresponding Gitlab issue). This ensures that all service-related matters are publicly accessible and recorded. Additionally, there's a real-time audits page that displays database changes.

- Listing Requests - I have upgraded the request system. The new form allows you to directly request services or points without any extra steps. In the future, I plan to enable requests for specific changes to parts of the website.

- Lightweight and fast - The new site is lighter and faster than its predecessor!

- Tor and I2P - At last! kycnot.me is now officially on Tor and I2P!

How?

This rewrite has been a labor of love, in the end, I've been working on this for more than 3 months now. I don't have a team, so I work by myself on my free time, but I find great joy in helping people on their private journey with cryptocurrencies. Making it easier for individuals to use cryptocurrencies without KYC is a goal I am proud of!

If you appreciate my work, you can support me through the methods listed here. Alternatively, feel free to send me an email with a kind message!

Technical details

All the code is written in Golang, the website makes use of the chi router for the routing part. I also make use of BigCache for caching database requests. There is 0 JavaScript, so all the rendering load falls on the server, this means it needed to be efficient enough to not drawn with a few users since the old site was reporting about 2M requests per month on average (note that this are not unique users).

The database is running with mariadb, using gorm as the ORM. This is more than enough for this project. I started working with an

sqlitedatabase, but I ended up migrating to mariadb since it works better with JSON.The scraper is using chromedp combined with a series of keywords, regex and other logic. It runs every 24h and scraps all the services. You can find the scraper code here.

The frontend is written using Golang Templates for the HTML, and TailwindCSS plus DaisyUI for the CSS classes framework. I also use some plain CSS, but it's minimal.

The requests forms is the only part of the project that requires JavaScript to be enabled. It is needed for parsing some from fields that are a bit complex and for the "captcha", which is a simple Proof of Work that runs on your browser, destinated to avoid spam. For this, I use mCaptcha.

-

@ 39cc53c9:27168656

2025-06-15 14:13:58

@ 39cc53c9:27168656

2025-06-15 14:13:58Bitcoin enthusiasts frequently and correctly remark how much value it adds to Bitcoin not to have a face, a leader, or a central authority behind it. This particularity means there isn't a single person to exert control over, or a single human point of failure who could become corrupt or harmful to the project.

Because of this, it is said that no other coin can be equally valuable as Bitcoin in terms of decentralization and trustworthiness. Bitcoin is unique not just for being first, but also because of how the events behind its inception developed. This implies that, from Bitcoin onwards, any coin created would have been created by someone, consequently having an authority behind it. For this and some other reasons, some people refer to Bitcoin as "The Immaculate Conception".

While other coins may have their own unique features and advantages, they may not be able to replicate Bitcoin's community-driven nature. However, one other cryptocurrency shares a similar story of mystery behind its creation: Monero.

History of Monero

Bytecoin and CryptoNote

In March 2014, a Bitcointalk thread titled "Bytecoin. Secure, private, untraceable since 2012" was initiated by a user under the nickname "DStrange"^1^. DStrange presented Bytecoin (BCN) as a unique cryptocurrency, in operation since July 2012. Unlike Bitcoin, it employed a new algorithm known as CryptoNote.

DStrange apparently stumbled upon the Bytecoin website by chance while mining a dying bitcoin fork, and decided to create a thread on Bitcointalk^1^. This sparked curiosity among some users, who wondered how could Bytecoin remain unnoticed since its alleged launch in 2012 until then^2^.

Some time after, a user brought up the "CryptoNote v2.0" whitepaper for the first time, underlining its innovative features^4^. Authored by the pseudonymous Nicolas van Saberhagen in October 2013, the CryptoNote v2 whitepaper^5^ highlighted the traceability and privacy problems in Bitcoin. Saberhagen argued that these flaws could not be quickly fixed, suggesting it would be more efficient to start a new project rather than trying to patch the original^5^, an statement simmilar to the one from Satoshi Nakamoto^6^.

Checking with Saberhagen's digital signature, the release date of the whitepaper seemed correct, which would mean that Cryptonote (v1) was created in 2012^7^, although there's an important detail: "Signing time is from the clock on the signer's computer" ^9^.

Moreover, the whitepaper v1 contains a footnote link to a Bitcointalk post dated May 5, 2013^10^, making it impossible for the whitepaper to have been signed and released on December 12, 2012.

As the narrative developed, users discovered that a significant 80% portion of Bytecoin had been pre-mined^11^ and blockchain dates seemed to be faked to make it look like it had been operating since 2012, leading to controversy surrounding the project.

The origins of CryptoNote and Bytecoin remain mysterious, leaving suspicions of a possible scam attempt, although the whitepaper had a good amount of work and thought on it.

The fork

In April 2014, the Bitcointalk user

thankful_for_today, who had also participated in the Bytecoin thread^12^, announced plans to launch a Bytecoin fork named Bitmonero^13^.The primary motivation behind this fork was "Because there is a number of technical and marketing issues I wanted to do differently. And also because I like ideas and technology and I want it to succeed"^14^. This time Bitmonero did things different from Bytecoin: there was no premine or instamine, and no portion of the block reward went to development.

However, thankful_for_today proposed controversial changes that the community disagreed with. Johnny Mnemonic relates the events surrounding Bitmonero and thankful_for_today in a Bitcointalk comment^15^:

When thankful_for_today launched BitMonero [...] he ignored everything that was discussed and just did what he wanted. The block reward was considerably steeper than what everyone was expecting. He also moved forward with 1-minute block times despite everyone's concerns about the increase of orphan blocks. He also didn't address the tail emission concern that should've (in my opinion) been in the code at launch time. Basically, he messed everything up. Then, he disappeared.

After disappearing for a while, thankful_for_today returned to find that the community had taken over the project. Johnny Mnemonic continues:

I, and others, started working on new forks that were closer to what everyone else was hoping for. [...] it was decided that the BitMonero project should just be taken over. There were like 9 or 10 interested parties at the time if my memory is correct. We voted on IRC to drop the "bit" from BitMonero and move forward with the project. Thankful_for_today suddenly resurfaced, and wasn't happy to learn the community had assumed control of the coin. He attempted to maintain his own fork (still calling it "BitMonero") for a while, but that quickly fell into obscurity.

The unfolding of these events show us the roots of Monero. Much like Satoshi Nakamoto, the creators behind CryptoNote/Bytecoin and thankful_for_today remain a mystery^17^, having disappeared without a trace. This enigma only adds to Monero's value.

Since community took over development, believing in the project's potential and its ability to be guided in a better direction, Monero was given one of Bitcoin's most important qualities: a leaderless nature. With no single face or entity directing its path, Monero is safe from potential corruption or harm from a "central authority".

The community continued developing Monero until today. Since then, Monero has undergone a lot of technological improvements, migrations and achievements such as RingCT and RandomX. It also has developed its own Community Crowdfundinc System, conferences such as MoneroKon and Monerotopia are taking place every year, and has a very active community around it.

Monero continues to develop with goals of privacy and security first, ease of use and efficiency second. ^16^

This stands as a testament to the power of a dedicated community operating without a central figure of authority. This decentralized approach aligns with the original ethos of cryptocurrency, making Monero a prime example of community-driven innovation. For this, I thank all the people involved in Monero, that lead it to where it is today.

If you find any information that seems incorrect, unclear or any missing important events, please contact me and I will make the necessary changes.

Sources of interest

- https://forum.getmonero.org/20/general-discussion/211/history-of-monero

- https://monero.stackexchange.com/questions/852/what-is-the-origin-of-monero-and-its-relationship-to-bytecoin

- https://en.wikipedia.org/wiki/Monero

- https://bitcointalk.org/index.php?topic=583449.0

- https://bitcointalk.org/index.php?topic=563821.0

- https://bitcointalk.org/index.php?action=profile;u=233561

- https://bitcointalk.org/index.php?topic=512747.0

- https://bitcointalk.org/index.php?topic=740112.0

- https://monero.stackexchange.com/a/1024

- https://inspec2t-project.eu/cryptocurrency-with-a-focus-on-anonymity-these-facts-are-known-about-monero/

- https://medium.com/coin-story/coin-perspective-13-riccardo-spagni-69ef82907bd1

- https://www.getmonero.org/resources/about/

- https://www.wired.com/2017/01/monero-drug-dealers-cryptocurrency-choice-fire/

- https://www.monero.how/why-monero-vs-bitcoin

- https://old.reddit.com/r/Monero/comments/u8e5yr/satoshi_nakamoto_talked_about_privacy_features/

-

@ 3c7dc2c5:805642a8

2025-06-16 12:15:35

@ 3c7dc2c5:805642a8

2025-06-16 12:15:35🧠Quote(s) of the week:

"Bitcoin trades 168 hours a week. Every other asset trades 35 hours at best (and less on holidays). This is the most magical, transparent, and hard-working [asset] in history. I’m in awe watching Bitcoin trade at 9:30 pm on a Saturday. You could liquidate $100 million worth, any hour of any day, and maybe take a 3% haircut. This is extremely high-bandwidth price discovery." —Michael Saylor https://i.ibb.co/LXCm3Kp8/Gshl-Ixas-Awezk3.png

🧡Bitcoin news🧡

13 years ago the block subsidy was 50 BTC. 13 years from now it will be 0.39 BTC.

On the 2nd of June:

➡️Hong Kong’s Reitar Logitech files to acquire $1.5B in Bitcoin, becoming the latest firm to join the Bitcoin treasury trend. The logistics and real estate company says the move strengthens its financial foundation as it scales its global tech platform.

➡️Bitcoin's global hashrate has reached a new all-time high, with data from Hashrate Index showing a 7-day simple moving average peak of 943 EH/s. https://i.ibb.co/3yR2ZZ0w/Gsahm-VXMAA1m-Ol.png

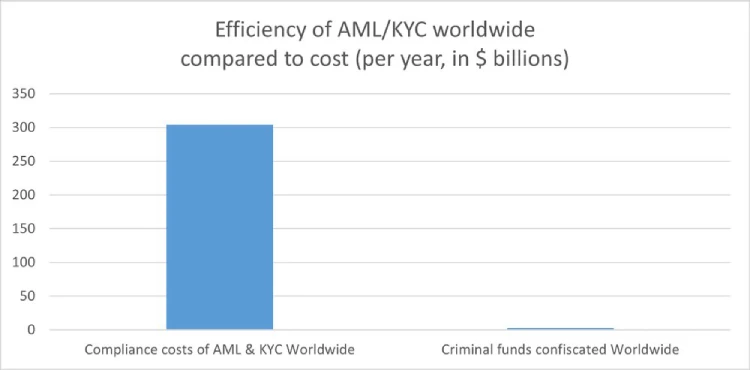

➡️(K)now (Y)our (C)ustomer is nothing but Stealth Mass Surveillance. What 95% of regulations cost versus return in one picture? https://i.ibb.co/Q3CLzF7j/Gsb20g-Pb-IAABy4-L.jpg

➡️Norwegian Block Exchange becomes the first publicly traded Bitcoin treasury company in Norway.' - Simply Bitcoin

➡️Poland just elected pro-Bitcoin Presidential candidate Karol Nawrocki. “Poland should be a birthplace of innovation rather than regulation.”

➡️NYC Mayor Eric Adams: “You all mocked me, ‘You’re taking your first 3 paychecks in #Bitcoin, what’s wrong with you?’ Now you wish you would have done.”

➡️Strategy plans to launch an IPO for 2.5M shares of its 10% Series A 'Stride' Preferred Stock (STRD), with proceeds going toward general corporate use and Bitcoin acquisition. Dividends are non-cumulative and paid only if declared.

Bit Paine: 'Remember: the entire fiat system is just various forms and layers of debt with different issuers all backed by an “asset,” (itself just a base layer of sovereign debt) that can and will be printed into oblivion. MSTR is just recapitulating this system but with a fixed supply underlying, meaning that in real terms anything it issues will benefit from the dilution of the fiat base layer and hence outperform (wildly) any fiat debt. No matter your institutional mandate, it makes no sense to hold debt whose base layer can be unilaterally demonetized when you can hold debt backed by a fixed supply underlying commodity that goes up forever.'

On the 3rd of June:

➡️Tether sends 37,229 Bitcoin worth almost $4 billion in total to Jack Maller's Twenty-One Capital

➡️El Salvador is running a full Bitcoin node!

➡️Canadian construction engineering company SolarBank adopts a Strategic Bitcoin Reserve "As the adoption of Bitcoin continues to grow, SolarBank believes that establishing a Bitcoin treasury strategy taps into a growing sector that is seeing increasing adoption."

➡️Willy Woo: "Who are the idiots who are selling when institutions and sovereigns are racing to buy billions in BTC?" This chart sheds light. The big whales >10k BTC have been selling since 2017. "They're stupid!" Most of those coins were bought between $0-$700 and held 8-16 years.' https://i.ibb.co/xKctV3Tf/Gsid236as-AAXPl-D.jpg

Selling at 20,000% profit is generally not a bad move.

➡️'South Korea just elected a pro-Bitcoin President who promised to legalize spot Bitcoin ETFs and scrap unfair regulation.' -Bitcoin Archive

➡️The average US investor owns 0.3% of their net worth in Bitcoin.

https://i.ibb.co/5WtFH9LM/Gsfoem-Tb0-AEfo-Ds.jpg

We are so damnn early.

➡️MARA mined 950 Bitcoin worth over $100 MILLION in May. They HODLed all of it.

➡️Bitcoin for Corporations: "Metaplanet just became Japan’s most traded stock — topping the charts in both value and volume:

➤ 170M shares traded

➤ ¥222B ($1.51B) value traded

This is what a Bitcoin strategy looks like in motion."

➡️'The Blockchain Group acquires 624 BTC for €60.2 million, nearly doubling their stack. They are now holding a total of 1,471 BTC with a BTC Yield of 1,097.6% YTD.' -Bitcoin News

➡️Publicly traded company K33 buys 10 Bitcoin for SEK 10 million for its balance sheet.

➡️California Assembly passes a bill to allow the state to receive payments in Bitcoin and digital currencies. It passed 68-0 and now heads to the Senate.

But hold up...

Bitcoin held on exchanges for +3 years will be transferred to the state of California under a law passed by the Assembly.

Not your keys…

➡️Adam Back invests $2.1 million into Swedish Bitcoin treasury company H100.

On the 4th of June:

➡️Daniel Batten: 'A large Bitcoin mining operation uses < 1/3 of the water of an average US family, and 0.0006% of the water a typical Gold mine uses.' https://i.ibb.co/TxNWSkHg/Gsn-VIjh-XQAEECOh.jpg

➡️And there it is: for JPMorgan, Bitcoin is now "safe collateral" JP Morgan will now offer loans backed by Bitcoin ETFs.

https://i.ibb.co/cXX0hKBK/Gsn-C5-B8-Wg-AA2e3i.png

Bent the knee. Wall Street realizes that Bitcoin is pristine collateral. Liquid 24/7/365 globally.

➡️Spanish coffee chain Vanadi Coffee to purchase $1.1 billion Bitcoin for its treasury reserve.

Disclaimer: This sounds great but it's not the whole story.

Pledditor: 'You mean a coffee shop chain founded just 4 years ago, only has 6 locations, and every year it has operated has suffered millions of dollars of net losses? They have 1975 Instagram followers. They have 149 Facebook followers. They have 48 X followers. But remember guys, you are investing in a "COFFEE GIANT"

So where does the $1.1B come from?

'The same way it came for Metaplanet (and all these other penny stocks) Get a bunch of high follower Bitcoin X accounts to hype your ticker (usually Bitcoin Magazine, Vivek, Pete Rizzo, etc), start up an "Irresponsibly Long ___" group, then dump a shitload of stock on the plebs.'

I have said it before...

Bitcoin treasury companies won't prevent another bear market; they’re the reason it’ll happen again this cycle.

➡️Public company Semler Scientific purchases an additional 185 Bitcoin for $20 million.

➡️Wicked: Imagine how rekt people would get if we went from $200k back down to $58k next bear market. The funny thing is that’d only be a 71% pullback, the smallest bear market pullback ever.

https://i.ibb.co/DfFtFZnP/Gsnr-U-3-Xo-AAJy-Kq.jpg

➡️Fidelty: An increasing number of institutions are leveraging Bitcoin as a strategic reserve asset. And as understanding of the asset deepens, interest continues to grow. See what may be driving the shift: Source: https://www.fidelitydigitalassets.com/research-and-insights/adding-bitcoin-corporate-treasury?ccsource=owned_social_btc_corp_treasury_june_x

➡️Solo Bitcoin miner solves block 899,826, earning 3.151 BTC ( $330K). A solo miner rented a massive amount of hashrate on @NiceHashMining and successfully mined a Bitcoin block solo on CKpool, claiming the full reward alone.

➡️Romania's national postal service, Poșta Română, launches a pilot program by installing its first Bitcoin ATM at a Tulcea branch, partnering with Bitcoin Romania (BTR Exchange), the country's leading cryptocurrency exchange.

On the 6th of June:

➡️Mononaut: 'With a weight of only 5723 units, block 899998 was the second lightest non-empty block of this halving epoch.'

➡️'UK-listed gold miner Bluebird Mining Ventures announces strategy to convert gold mining income into Bitcoin. A gold mining company will become the first UK-listed company to implement a Strategic Bitcoin Treasury' - Bitcoin News

➡️Phoenix Wallet: Phoenix 2.6.1 now supports NFC for sending and receiving. Works on Android and iOS. (NFC received on iOS is only due to Apple restrictions)

➡️Man from Germany fails to declare 24 words when crossing the border – nothing happens.

https://i.ibb.co/21W5qVks/Gswdghd-Xw-AA7-SH6.png

➡️Know Labs, Inc. to become a Bitcoin Treasury Strategy company starting with 1,000 BTC. Funny isn't it? Even former Ripple executive, Greg Kidd, is choosing to fill their company treasuries with bitcoin—not XRP.

➡️Bitcoin Successfully Mines the 900,000th Block! https://x.com/i/status/1930973314475815120

➡️Trump Media's latest S-3 filing officially adopts a Bitcoin treasury strategy. - Registers up to $12B in new securities to buy BTC - Adds to $2.44B already raised - Mentions “Bitcoin” 362 times (vs. once in prior S-3)

➡️Bitcoin News: Metaplanet just issued ¥855B ($5.4B) in moving-strike warrants to buy more Bitcoin, Japan’s largest equity issuance of its kind ever. It’s the first above-market pricing in Japan's history, defying the usual 8–10% discount.

➡️ Uber CEO tells Bloomberg Bitcoin is a proven store of value and that it is exploring crypto payments.

➡️Agricultural commodity trading company Davis Commodities will buy $4.5 million Bitcoin for their reserves, calling it "digital gold.

➡️Fidelity: As digital assets evolve, bitcoin’s potential as a store of value sets it apart from other cryptocurrencies. “Coin Report: Bitcoin” outlines why the asset’s design, scarcity, and decentralized nature help make it distinct—and where its future opportunities may lie. Read now: https://www.fidelitydigitalassets.com/research-and-insights/coin-report-bitcoin-btc?ccsource=owned_social_btc_report_june_x

➡️Japanese public company Remixpoint announces it bought 44.8 #Bitcoin worth $4.7 million

On the 8th of June:

➡️Wicked: Bitcoin has been running for 6,000 days and it’s already spent 60 of them, 1% of its life, closing above $100k. https://i.ibb.co/kVyrjR7v/Gs4uy-MIW8-AAOl-A.jpg

On the 9th of June:

➡️Australia’s ABC News reports on how Bitcoin adoption is bringing financial freedom and greater safety to Kibera, one of Africa’s largest slums in Kenya.

➡️ IBIT just blew through $70b and is now the fastest ETF to ever hit that mark in only 341 days, which is 5x faster than the old record held by GLD of 1,691 days. https://i.ibb.co/DfKbwhjG/Gt-Ar6-Eq-X0-AAzrl5.png

Credit chart JackiWang17 on X

➡️Japanese fashion brand ANAP plans to buy and hold over 1,000 Bitcoin by August 2025.

➡️South Korean President to introduce legislation this week to allow big banks to adopt Bitcoin.

➡️Wicked: Bitcoin's now 3x larger than the top 9 shitcoins combined. https://i.ibb.co/LDQKsGHM/Gt-AJy-D6-X0-AA7-PIY.jpg

💸Traditional Finance / Macro:

On the 3rd of May:

👉🏽'Hedge funds are still not buying the Magnificent 7: Hedge funds’ long/short ratio on Magnificent 7 stocks is now at its lowest level in 5 years, per Goldman Sachs. This is even lower than at the 2022 bear market bottom. Furthermore, their exposure to Magnificent 7 stocks is now down -50% over the last year. Meanwhile, hedge funds have bought US information technology stocks for 3 consecutive weeks. This occurred after the sector had been net sold in 10 of the previous 12 weeks. Retail has led the recent rebound.' -TKL

On the 6th of June:

👉🏽If you net out the Mag 7 from the S&P 500, the remaining 493 stocks have barely gone anywhere in over a decade (comparatively speaking). Chart: Goldman Sachs https://i.ibb.co/s9LmVBL8/Gsx53k6-W8-AAM2xr.jpg

🏦Banks:

On the 21st of May: 👉🏽No News

🌎Macro/Geopolitics:

'The reality is that the US soft defaults on its debt every day through structural inflation (the perpetual debasement of the US dollar). In other words, the Treasury pays you back dollars that are worth far less than what you lent to them. A soft default.' This is also valid for Europe.

On top of that, the richest man in the world is publicly arguing with the president of the United States about America’s solvency. Consider buying bitcoin.

So far regarding Trump: - didn't audit the Gold - didn't stop the wars - didn't reduce the deficit/debt/budget - didn't form a Bitcoin reserve - didn't release the Epstein files

Anyway, consider buying Bitcoin.

On the 2nd of June:

👉🏽'The Bank of Japan just racked up a record ¥28.6 trillion in bond losses That’s three times bigger than last year! This isn’t just Japan’s problem. It’s a screaming red alert for global markets.' - StockMarket News

TKL: " Japanese equity funds posted a record $11.8 billion in net outflows last week. This brought the 4-week moving average of outflows to $4.0 billion, an all-time high. Investors’ concerns over rapidly rising long-dated Japanese government bond yields were behind the outflows. Additionally, investors withdrew $5.1 billion from US stock funds. All while global equity funds saw $9.5 billion in net outflows, the most this year. Investors are taking profits after a sharp market recovery."

👉🏽The money printer is back on. US M2 just hit a new all-time high at $21.86T. Liquidity is flowing back into the system.

https://i.ibb.co/fGdx5kmt/Gsd-Jn-R9-XUAAUAO2.jpg

Recession odds have just dropped by 70% to 30% That’s the steepest decline in 65 years without a recession actually happening. Forget everything about a recession when M2 is moving up. Simple as that.

👉🏽$698 billion worth of homes are for sale in the United States, a new all-time high. Rajat Soni: 'The price of a house should be 0.01 BTC right now The housing market is way overpriced in terms of Bitcoin Interest rates or real estate prices will have to fall for these these homes actually to be sold.'

👉🏽The US Dollar is worth 8.9% less than it was at the beginning of the year.

👉🏽Argentina's economy grew 8% year-over-year in April 2025, the highest in the Western world!

On the 3rd of June:

👉🏽Trump's "Big Beautiful Bill" bans all 50 states from regulating AI for 10 years, centralizes control at the federal level, and integrates AI systems into key federal agencies. https://i.ibb.co/Q7t14q7M/Gse-V2f-YWUAAyb-Py.png

👉🏽 ZeroHedge: 'Total US debt is now $37.5 trillion (accrued). The $36.2 trillion actual is just the ceiling set by the debt limit which will be revised to $40 trillion in August/September.'

👉🏽A million seconds ago was May 23rd

A billion seconds ago was 1993

A trillion seconds ago was 30,000 B.C.

The US national debt is now rising by $1 Trillion every 180 days.

👉🏽NATO pushes European members to increase ground-based air defense systems five-fold — Bloomberg

👉🏽Global Markets Investor: 'This is incredible how European markets have outperformed the US this year. Poland, the Czech Republic, and Austria have grown their market capitalization by 44%, 36%, and 33%, respectively. Next are Hungary, Spain, Luxembourg, Greece, and Germany. The US has been flat.'

https://i.ibb.co/TMwrLnB0/Gsiu-KWYXEAAto-U1.jpg

This is one of the WORST years for the US stock market in history: The S&P 500 has UNDERperformed World stocks excluding the US by 12 percentage points year-to-date, the most in 32 YEARS. This is even worse than during the Great Financial Crisis.

👉🏽Bravos Research: 'M2 money supply is now expanding at 4.4% After reaching its deepest contraction in 65 years This is quite constructive for the stock market.' https://i.ibb.co/hFCRgFhr/Gsht-Kgk-Xw-AAy-PFq.jpg

On the 4th of June:

👉🏽“The $1.06 trillion unrealized loss in 2024 was ‘modestly higher’ than the $948.4 billion paper loss seen in 2023.” https://i.ibb.co/Pvm7zVWy/Gsj-9-OWs-AAvwp-F.jpg

Probably nothing. What’s a trillion between friends…

Currently, the US is spending $1,200 trillion per year on interest payments (dark line). If everything were financed at the current interest rate, the cost would exceed $1,500 trillion per year (green). https://i.ibb.co/mCpYtwVW/Gsm-H6-Mr-Xc-AAqd-F5.png

Note: The national debt is $36,9 trillion.

👉🏽Global debt is gigantic: Debt-to-GDP is above 100% in 6 of 7 G7 nations, and is still rising. Japan: ~250% Italy, the US, France, the UK, and Canada: all near or above 100%.

For 5 of 7 G7 economies, debt is set to surge further by 2030. Now debt is a problem but the main question would be...what will the productivity be in 2030?

On the 5th of June:

👉🏽 The United States Treasury just bought back $10 Billion of its own debt, the largest Treasury buyback in history.

Buying back your own debt with printed money. That's what happens just before fiat money goes to die (eventually). Eventually, nobody wants that worthless debt anymore, eventually!

Context by EndGame Macro:

💰 $10 Billion Buyback: The Treasury’s Silent Signal

On June 3, 2025, the U.S. Treasury quietly executed the largest debt buyback in American history, repurchasing $10 billion in short- and medium-term bonds. At first glance, it looked routine. But under the surface, this was a stealth intervention aimed at calming a system under increasing strain. This wasn’t just liquidity smoothing. It was strategic triage.

🧾 What Happened

Buyback Size: $10B (a record)

Debt Offered: $22.87B — more than double what was accepted

Target Maturities: July 2025 to May 2027

Issues Accepted: 22 of 40 eligible

Settlement: June 4, 2025

That huge offer volume isn’t just noise—it’s a warning sign that institutional players are under pressure.

🚨 What the Buyback Really Signaled

- A Quiet Circuit Breaker The buyback focused on maturities clustered around a $9 trillion rollover wall over the next 12 months. Without announcing it, the Treasury effectively tripped a circuit breaker to reduce near-term funding stress.

- QE Without the Label This wasn’t the Fed. No balance sheet expansion. But by retiring debt ahead of maturity and shrinking market float, the effect mirrored QE—without the political baggage.

- Institutions Are Feeling the Squeeze A staggering $22.87 billion in offers points to constraints at banks, funds, or foreign reserve desks. The Treasury didn’t save everyone—just enough to relieve pressure quietly.

🎯 Strategic Motivation

This wasn’t about boosting confidence. It was about managing two threats: Maturity Wall Risk: Avoiding auction failures as short-term debt piles up in 2025–2026. Yield Curve Stability: Preventing disorderly spikes by quietly absorbing supply. This move avoided triggering headlines—while containing the fire under the hood.

🧠 Echoes from History

This buyback fits into a lineage of quiet but powerful interventions: Operation Twist (1961) – Rebalancing maturity without QE branding. BoE Gilt Crisis (2022) – Targeted long-end intervention to save pensions. Belgium’s Shadow QE (2014) – U.S. debt absorbed off-balance-sheet during geopolitical tension. Each move relied on subtlety and intent—not optics.

🧩 What the Market Heard

Primary Dealers: Help exists—but it’s selective and discretionary.

Foreign Holders: Exit in order—or risk exclusion.

Money Markets: Relief, not resolution.

❗ Where the Logic Cracks

If this was routine: Why buy back below par? Why accept only 44% of the offered debt? Why deploy this now and not earlier? Each of these points to deeper stress than officials are openly admitting.

🔒 High-Conviction Takeaway

This buyback was a preemptive stabilization maneuver, not a stimulus. With over $9 trillion in short-term debt set to roll, foreign participation weakening, and institutional selling pressure rising, the Treasury acted before fractures became visible. The line wasn’t drawn to show strength. It was drawn behind the market—to stop a collapse.

🕵️♂️ Known Unknowns

Who were the biggest sellers—and what’s pressuring them? Was this coordinated with the Fed or global reserve desks? Is this a one-off event—or the start of a multi-phase liquidity campaign? The silence is strategic—but the signal is loud.

👉🏽Joe Consorti: 'Congress refuses to cut spending. So we must "grow our way out" of the deficit. That would take 39 years of 5% nominal GDP growth, or 22 years at 10%. In other words, 2-4 decades of explosive growth just to break even. We can't "grow our way out". We'll print our way out.'

👉🏽ZeroHedge: And just like that, the "climate crisis" is gone https://i.ibb.co/GQ76Z79P/Gsr3uus-XEAAjuv6.png

Don't get me wrong and with all respect to my environmentalist friends, but the “Crisis” never existed. A big part of the push has been marketing dollars/euros and media spin, let's face it.

Why do I think that? How do you think we will grow out of the Global Debt problem? One word: PRODUCTIVITY.

How can we manage that? They (Governments/Central Banks) need AI data farms. What do data farms need?

Electricity, water, energy.

Because Big Tech and AI need energy -- wherever they can find it -- climate change as a cause is finished. It was all virtue signaling. And remember the climate didn’t cool, it just stopped polling well. The scariest part of the “climate crisis” becoming out-of-vogue with the left is that it'll likely be replaced by something equally absurd and artificially manufactured.

On the 6th of June

👉🏽 'The US economy adds 139,000 jobs in May, above expectations of 126,000. The unemployment rate was 4.2%, in line with expectations of 4.2%. The April jobs number was revised down from 177,000 to 147,000. The headline numbers continue to exceed expectations.' - TKL

Surprise, surprise…

March jobs revised: 185K 120K (-65k)

April jobs revised: 177K 147K (-30k)

13 of the L16 have been revised lower.

Just to make it even worse, this is something I have shared multiple times in 2024. The number of year-over-year private job gains in 2024 was likely overstated by a MASSIVE 907,000 jobs, according to BLS data released Wednesday. This comes as the Quarterly Census of Employment and Wages (QCEW) data covering 97% of employers showed a private payroll growth rate of 0.6% for December 2024. This is 50% lower than the 1.2% growth rate initially reported in the monthly non-farm payroll (NFP) reports. To put this differently, there was a 907,000 gap between NFP data and QCEW data in 2024. This means jobs were likely overstated by an average of 75,583 PER MONTH in 2024.

👉🏽Opinion: Milei reduced government spending by 30% and achieved a surplus in only 1 month. His popularity didn't fall, it rose. Don't tell me fiscal discipline isn't popular with the general public. It's just unpopular to the powerful special interests that control DC or Brussels.

👉🏽'In the current fiscal year, the U.S. government already spent $4,159 billion. This is for the first 7 months and the fiscal year ends in September. The latest available data is as of April. The already accrued deficit amounts to over $1 trillion: $1,049 billion.

You can see in the chart how net interest expense has become the #2 largest spending category at $579 billion (for 7 months) after social security ($907 billion) and even exceeded national defense ($536 billion), health ($555 billion), and Medicare ($550 billion). The deficit is 34% of total receipts! (1049/3110) In other words: the U.S. government spent 34% more than it took in.

The last full fiscal year ended in September 2024. In that fiscal year, we spent $1.13 trillion on interest expenses. After only the first 7 months of fiscal year 2025 ending in September, they are already at $776 billion. This means we'll likely touch $1.3 trillion this fiscal year!' - AJ https://i.ibb.co/RTLTZPn1/Gsxv-Tso-Xc-AAZs-Zo.jpg

On the 7th of June:

👉🏽 The EU Commission paid climate "NGOs" for questionable lobbying with money from German taxpayers and wanted to keep it secret. https://i.ibb.co/zH6J41Zq/Gsz-Lu-F9-Xg-AAZttn.jpg Now read the above statement again and after that read the following bit:

👉🏽EU TRIES TO LECTURE EL SALVADOR - BUKELE BODYSLAMS BACK Source: https://www.eeas.europa.eu/eeas/el-salvador-statement-spokesperson-foreign-agents-law-and-recent-developments_en

The Diplomatic Service of the European: "El Salvador: The EU regrets the adoption of the Foreign Agents Law, which risks restricting civil society and runs counter to international obligations. Recent arrests of human rights defenders raise further concerns."

The EU’s sanctimonious finger-wagging at El Salvador reeks of hypocrisy. Brussels lectures sovereign nations on “civil society” while funneling billions into globalist NGOs that undermine national sovereignty. The institution that attacks liberty, freedom, democracy, and free speech in the name of a neosocialist woke ideology wants to lecture other countries on how they defend against their constant meddling and aggression. They are a bunch of unelected bureaucrats, accountable to no one, representing no one. Classic!

Supporting this further, let’s have a look how the EU is increasingly positioning itself as a technocratic regulator of personal freedom:

'The EU – the one that:

•wants to monitor every Bitcoin transaction through MiCA & DAC-8 •would love to ban non-custodial wallets

•is planning a chat control law that would make even China blush

•is considering a wealth register to digitally track every cent of your retirement savings

•restricts cash withdrawals in some member states •is testing CBDCs with expiration dates and spending limits

•and is preparing the digital euro as a full-blown control tool

…this EU is now complaining about human rights violations in El Salvador – a country whose government enjoys one of the highest approval ratings in the world. Over 85% support for President Bukele. Show me a single Western leader who even comes close to that.' - Bitcoin Hotel

Great reply by El Salvador's President Nayib Bukele: 'EU: El Salvador regrets that a bloc which is aging, overregulated, energy-dependent, tech-lagging, and led by unelected bureaucrats still insists on lecturing the rest of the world.'

👉🏽Sam Callahan: Alternative title: 73% of bonds in the world trading at less than the rate of debasement https://i.ibb.co/Y4qMvh0T/Gs7-Ry-WMAABf49.jpg

On the 8th of June:

👉🏽'US existing home sales dropped -3.1% year-over-year to an annualized 4.0 million in April, the lowest for any April since 2009. Month-over-month, home sales fell 0.5%, well below expectations of a +2.0% increase. The decline was driven by the West and Northeast regions. Sales in the South were flat, while in the Midwest improved slightly. Meanwhile, existing home inventory rose +21%, to 1.45 million, the most for any April since 2020, per ZeroHedge. Despite that, the median sales price increased +1.8% year-over-year to $414,000, a record for April. Homebuyer demand is weak and prices are still rising.' -TKL

On the 9th of June:

👉🏽Jeroen Blokland: '- China bought more gold in May. -China has been buying even more gold through ‘unofficial’ channels. - China's gold reserves today are low compared to those of the US and European countries -China is determined to move away from US dollar hegemony - China’s ambition to move away from the US dollar will only have strengthened because of the Trump tariff war - China has to acknowledge that few countries, companies, and households want to hold the Yuan So what will China be doing for years to come?'

No surprise central banks are avoiding sovereign debt and adding gold.

👉🏽TKL: Gold is on fire: Gold's share of global reserves reached 23% in Q2 2025, the highest level in 30 years. Over the last 6 years, the percentage has DOUBLED. At the same time, the US Dollar's share of international reserves has declined 10 percentage points, to 44%, the lowest since 1993. By comparison, the Euro's share has decreased 2 percentage points, to 16%, the lowest in 22 years. Gold is quickly replacing fiat currencies as a reserve currency.

🎁If you have made it this far, I would like to give you a little gift:

Lysander: "Lyn Alden gave one of the clearest breakdowns of why the U.S. is on an unstoppable fiscal path—and why Bitcoin matters more than ever because of it.

Lyn Alden walks through the numbers behind the federal deficit, interest expenses, Social Security, and the structural changes that happened post-2008. The short version? We’re in a new era. One where the government can’t slow down even if it wants to.

Her phrase: “Nothing stops this train.” Not because of ideology, but because of math—and human nature.

This isn’t hyperinflation doom-talk. It’s a sober look at what happens when a system built on ever-growing debt reaches its limits—and why Bitcoin, with its fixed supply and transparent rules, is the opposite of that system.

If you haven’t seen it, this is a must watch. Pure signal! https://www.youtube.com/watch?v=Giuzcd4oxIk

Credit: I have used multiple sources!

My savings account: Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

-

@ 39cc53c9:27168656

2025-06-15 13:49:52

@ 39cc53c9:27168656

2025-06-15 13:49:52Over the past few months, I've dedicated my time to a complete rewrite of the kycnot.me website. The technology stack remains unchanged; Golang paired with TailwindCSS. However, I've made some design choices in this iteration that I believe significantly enhance the site. Particularly to backend code.

UI Improvements

You'll notice a refreshed UI that retains the original concept but has some notable enhancements. The service list view is now more visually engaging, it displays additional information in a more aesthetically pleasing manner. Both filtering and searching functionalities have been optimized for speed and user experience.

Service pages have been also redesigned to highlight key information at the top, with the KYC Level box always accessible. The display of service attributes is now more visually intuitive.

The request form, especially the Captcha, has undergone substantial improvements. The new self-made Captcha is robust, addressing the reliability issues encountered with the previous version.

Terms of Service Summarizer

A significant upgrade is the Terms of Service summarizer/reviewer, now powered by AI (GPT-4-turbo). It efficiently condenses each service's ToS, extracting and presenting critical points, including any warnings. Summaries are updated monthly, processing over 40 ToS pages via the OpenAI API using a self-crafted and thoroughly tested prompt.

Nostr Comments

I've integrated a comment section for each service using Nostr. For guidance on using this feature, visit the dedicated how-to page.

Database

The backend database has transitioned to pocketbase, an open-source Golang backend that has been a pleasure to work with. I maintain an updated fork of the Golang SDK for pocketbase at pluja/pocketbase.

Scoring

The scoring algorithm has also been refined to be more fair. Despite I had considered its removal due to the complexity it adds (it is very difficult to design a fair scoring system), some users highlighted its value, so I kept it. The updated algorithm is available open source.

Listings

Each listing has been re-evaluated, and the ones that were no longer operational were removed. New additions are included, and the backlog of pending services will be addressed progressively, since I still have access to the old database.

API

The API now offers more comprehensive data. For more details, check here.

About Page

The About page has been restructured for brevity and clarity.

Other Changes

Extensive changes have been implemented in the server-side logic, since the whole code base was re-written from the ground up. I may discuss these in a future post, but for now, I consider the current version to be just a bit beyond beta, and additional updates are planned in the coming weeks.

-

@ dfa02707:41ca50e3

2025-06-16 00:02:32

@ dfa02707:41ca50e3

2025-06-16 00:02:32

Good morning (good night?)! The No Bullshit Bitcoin news feed is now available on Moody's Dashboard! A huge shoutout to sir Clark Moody for integrating our feed.

Headlines

- Spiral welcomes Ben Carman. The developer will work on the LDK server and a new SDK designed to simplify the onboarding process for new self-custodial Bitcoin users.

- The Bitcoin Dev Kit Foundation announced new corporate members for 2025, including AnchorWatch, CleanSpark, and Proton Foundation. The annual dues from these corporate members fund the small team of open-source developers responsible for maintaining the core BDK libraries and related free and open-source software (FOSS) projects.

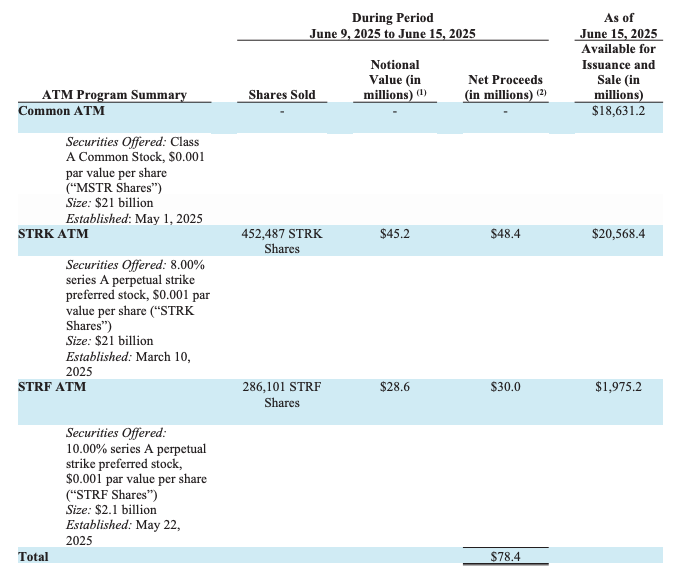

- Strategy increases Bitcoin holdings to 538,200 BTC. In the latest purchase, the company has spent more than $555M to buy 6,556 coins through proceeds of two at-the-market stock offering programs.

- Spar supermarket experiments with Bitcoin payments in Zug, Switzerland. The store has introduced a new payment method powered by the Lightning Network. The implementation was facilitated by DFX Swiss, a service that supports seamless conversions between bitcoin and legacy currencies.

- The Bank for International Settlements (BIS) wants to contain 'crypto' risks. A report titled "Cryptocurrencies and Decentralised Finance: Functions and Financial Stability Implications" calls for expanding research into "how new forms of central bank money, capital controls, and taxation policies can counter the risks of widespread crypto adoption while still fostering technological innovation."

- "Global Implications of Scam Centres, Underground Banking, and Illicit Online Marketplaces in Southeast Asia." According to the United Nations Office on Drugs and Crime (UNODC) report, criminal organizations from East and Southeast Asia are swiftly extending their global reach. These groups are moving beyond traditional scams and trafficking, creating sophisticated online networks that include unlicensed cryptocurrency exchanges, encrypted communication platforms, and stablecoins, fueling a massive fraud economy on an industrial scale.

- Slovenia is considering a 25% capital gains tax on Bitcoin profits for individuals. The Ministry of Finance has proposed legislation to impose this tax on gains from cryptocurrency transactions, though exchanging one cryptocurrency for another would remain exempt. At present, individual 'crypto' traders in Slovenia are not taxed.

- Circle, BitGo, Coinbase, and Paxos plan to apply for U.S. bank charters or licenses. According to a report in The Wall Street Journal, major crypto companies are planning to apply for U.S. bank charters or licenses. These firms are pursuing limited licenses that would permit them to issue stablecoins, as the U.S. Congress deliberates on legislation mandating licensing for stablecoin issuers.

"Established banks, like Bank of America, are hoping to amend the current drafts of [stablecoin] legislation in such a way that nonbanks are more heavily restricted from issuing stablecoins," people familiar with the matter told The Block.

- Charles Schwab to launch spot Bitcoin trading by 2026. The financial investment firm, managing over $10 trillion in assets, has revealed plans to introduce spot Bitcoin trading for its clients within the next year.

Use the tools

- Bitcoin Safe v1.2.3 expands QR SignMessage compatibility for all QR-UR-compatible hardware signers (SpecterDIY, KeyStone, Passport, Jade; already supported COLDCARD Q). It also adds the ability to import wallets via QR, ensuring compatibility with Keystone's latest firmware (2.0.6), alongside other improvements.

- Minibits v0.2.2-beta, an ecash wallet for Android devices, packages many changes to align the project with the planned iOS app release. New features and improvements include the ability to lock ecash to a receiver's pubkey, faster confirmations of ecash minting and payments thanks to WebSockets, UI-related fixes, and more.

- Zeus v0.11.0-alpha1 introduces Cashu wallets tied to embedded LND wallets. Navigate to Settings > Ecash to enable it. Other wallet types can still sweep funds from Cashu tokens. Zeus Pay now supports Cashu address types in Zaplocker, Cashu, and NWC modes.

- LNDg v1.10.0, an advanced web interface designed for analyzing Lightning Network Daemon (LND) data and automating node management tasks, introduces performance improvements, adds a new metrics page for unprofitable and stuck channels, and displays warnings for batch openings. The Profit and Loss Chart has been updated to include on-chain costs. Advanced settings have been added for users who would like their channel database size to be read remotely (the default remains local). Additionally, the AutoFees tool now uses aggregated pubkey metrics for multiple channels with the same peer.

- Nunchuk Desktop v1.9.45 release brings the latest bug fixes and improvements.

- Blockstream Green iOS v4.1.8 has renamed L-BTC to LBTC, and improves translations of notifications, login time, and background payments.

- Blockstream Green Android v4.1.8 has added language preference in App Settings and enables an Android data backup option for disaster recovery. Additionally, it fixes issues with Jade entry point PIN timeout and Trezor passphrase input.

- Torq v2.2.2, an advanced Lightning node management software designed to handle large nodes with over 1000 channels, fixes bugs that caused channel balance to not be updated in some cases and channel "peer total local balance" not getting updated.

- Stack Wallet v2.1.12, a multicoin wallet by Cypher Stack, fixes an issue with Xelis introduced in the latest release for Windows.

- ESP-Miner-NerdQAxePlus v1.0.29.1, a forked version from the NerdAxe miner that was modified for use on the NerdQAxe+, is now available.

- Zark enables sending sats to an npub using Bark.

- Erk is a novel variation of the Ark protocol that completely removes the need for user interactivity in rounds, addressing one of Ark's key limitations: the requirement for users to come online before their VTXOs expire.

- Aegis v0.1.1 is now available. It is a Nostr event signer app for iOS devices.

- Nostash is a NIP-07 Nostr signing extension for Safari. It is a fork of Nostore and is maintained by Terry Yiu. Available on iOS TestFlight.

- Amber v3.2.8, a Nostr event signer for Android, delivers the latest fixes and improvements.

- Nostur v1.20.0, a Nostr client for iOS, adds

-

@ 0403c86a:66d3a378

2025-06-13 12:55:09

@ 0403c86a:66d3a378

2025-06-13 12:55:09Exciting news for FOOTBALL fans ⚽! Global Sports Central 🌐 is teaming up with Predyx, a leading prediction market in the Bitcoin ecosystem, to bring you comprehensive coverage of the very first Club World Cup directly on Nostr. This partnership is all about enhancing your experience with the latest news, insights, and interactive features!

The Club World Cup will showcase the best clubs from around the globe, and with our collaboration, you’ll be fully engaged in the action. Predyx focuses on long-term outcomes, allowing you to make predictions on who will win it all. Plus, if you’re not happy with your predictions, you can sell your shares at any time and switch allegiance—after all, it’s a free market!

What You Can Expect:

-

Latest News and Match Reports: Stay updated with the latest news, in-depth match reports, and insights from the tournament, ensuring you never miss a moment.

-

Market Odds Tracking: Follow the shifts in market odds in real-time, giving you the edge when making predictions and engaging with the action.

-

Player of the Day Card: Celebrate standout performances with our Daily Player of the Day card, highlighting the top players from the tournament.

-

Game oN Frontpage: Each day, we’ll feature the frontpage of the day, showcasing the most historical matchups and capturing the feel of the game.

-

Best Moments Replays: Relive the excitement with replays of the best moments from the Cup, so you can catch all the highlights and unforgettable plays.

-

Long-Term Predictions: Engage with Predyx to forecast who will win the tournament and who will take home the MVP award, allowing you to make strategic predictions as the tournament unfolds.

-

Easy Login System: Getting started is a breeze! All you need is a Lightning wallet to log in and participate, making it simple for everyone to join in on the fun.

-

Lightning-Fast Bitcoin Payments: With the Lightning Network, placing your bets and making predictions is faster and easier than ever. Enjoy seamless transactions while you cheer for your favorite teams!

"Predyx is excited to be part of this innovative partnership," said Derek. "We’re bringing fans a new way to interact with the game they love, all while using the fast and secure Lightning Network."

Predyx is a Bitcoin-native prediction market platform running on the Lightning Network. We’re building the fastest, most trust-minimized betting engine in the world — no deposits, instant payouts, sats-native, and degen-friendly.

Global Sports Central 🌐 Your daily spin around the sports world 🔄 Stay in the loop with the latest scores, stories, and stats.

GSC360 - Where Every Angle Matters

-

-

@ 95543309:196c540e

2025-06-11 14:17:03

@ 95543309:196c540e

2025-06-11 14:17:03$$\int_{-\infty}^{\infty} e^{-x^2/2} \, dx = \sqrt{2\pi}$$$$\sum_{k=1}^n k^2 = \frac{n(n+1)(2n+1)}{6}$$$$\lim_{x \to \infty} \left(1 + \frac{1}{x}\right)^x = e$$$$\begin{vmatrix}a & b \\c & d\end{vmatrix} = ad - bc$$$$\frac{d}{dx}\left(\frac{x^2 + 1}{x - 1}\right)$$$$\iiint_V (\nabla \cdot \mathbf{F}) \, dV = \oint_{\partial V} \mathbf{F} \cdot d\mathbf{S}$$$$\binom{n}{k} = \frac{n!}{k!(n-k)!}$$$$\ln\left(\frac{f(x)}{g(x)}\right) = \ln f(x) - \ln g(x)$$$$\forall x \in \mathbb{R}, \exists y \in \mathbb{R} \text{ such that } x + y = 0$$$$\sqrt{\frac{x^2 + y^2}{x^2 - y^2}}$$$$\begin{array}{c|c}A & B \\hlineC & D\end{array}$$$$\sum_{i=1}^n \sum_{j=1}^n a_{ij}x_i x_j$$$$\mathcal{L}{f(t)}(s) = \int_0^\infty e^{-st}f(t)\,dt$$$$\frac{\partial^2 u}{\partial t^2} = c^2 \frac{\partial^2 u}{\partial x^2}$$$$\mathbf{A} = \begin{pmatrix}a_{11} & a_{12} \\a_{21} & a_{22}\end{pmatrix}, \quad\mathbf{B} = \begin{pmatrix}b_{11} & b_{12} \\b_{21} & b_{22}\end{pmatrix}$$$$\underbrace{a + b + \dots + z}{26}$$$$\left(\frac{a}{b}\right)^n = \frac{a^n}{b^n}$$$$\langle \psi | \phi \rangle = \int{-\infty}^{\infty} \psi^*(x)\phi(x) \, dx$$$$\oint_C \mathbf{F} \cdot d\mathbf{r} = \iint_S (\nabla \times \mathbf{F}) \cdot d\mathbf{S}$$$$\prod_{k=1}^n \left(1 + \frac{1}{k}\right) = \frac{(n+1)}{1}$$$$S(\omega)=1.466\, H_s^2 \frac{\omega_0^5}{\omega^6} \exp\Bigl[-3^{\frac{\omega}{\omega_0}}\Bigr]^2$$

-

@ 7f6db517:a4931eda

2025-06-15 20:01:52

@ 7f6db517:a4931eda

2025-06-15 20:01:52

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.