-

@ 8bad92c3:ca714aa5

2025-06-16 14:02:13

@ 8bad92c3:ca714aa5

2025-06-16 14:02:13Marty's Bent

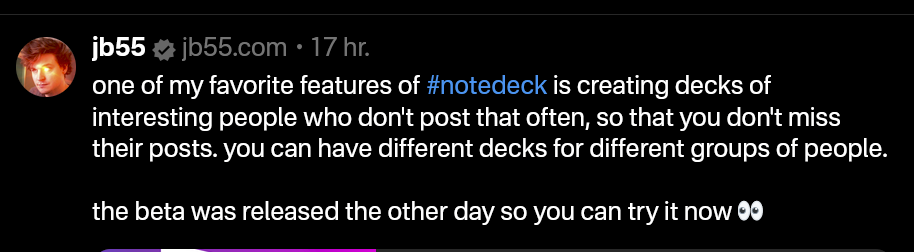

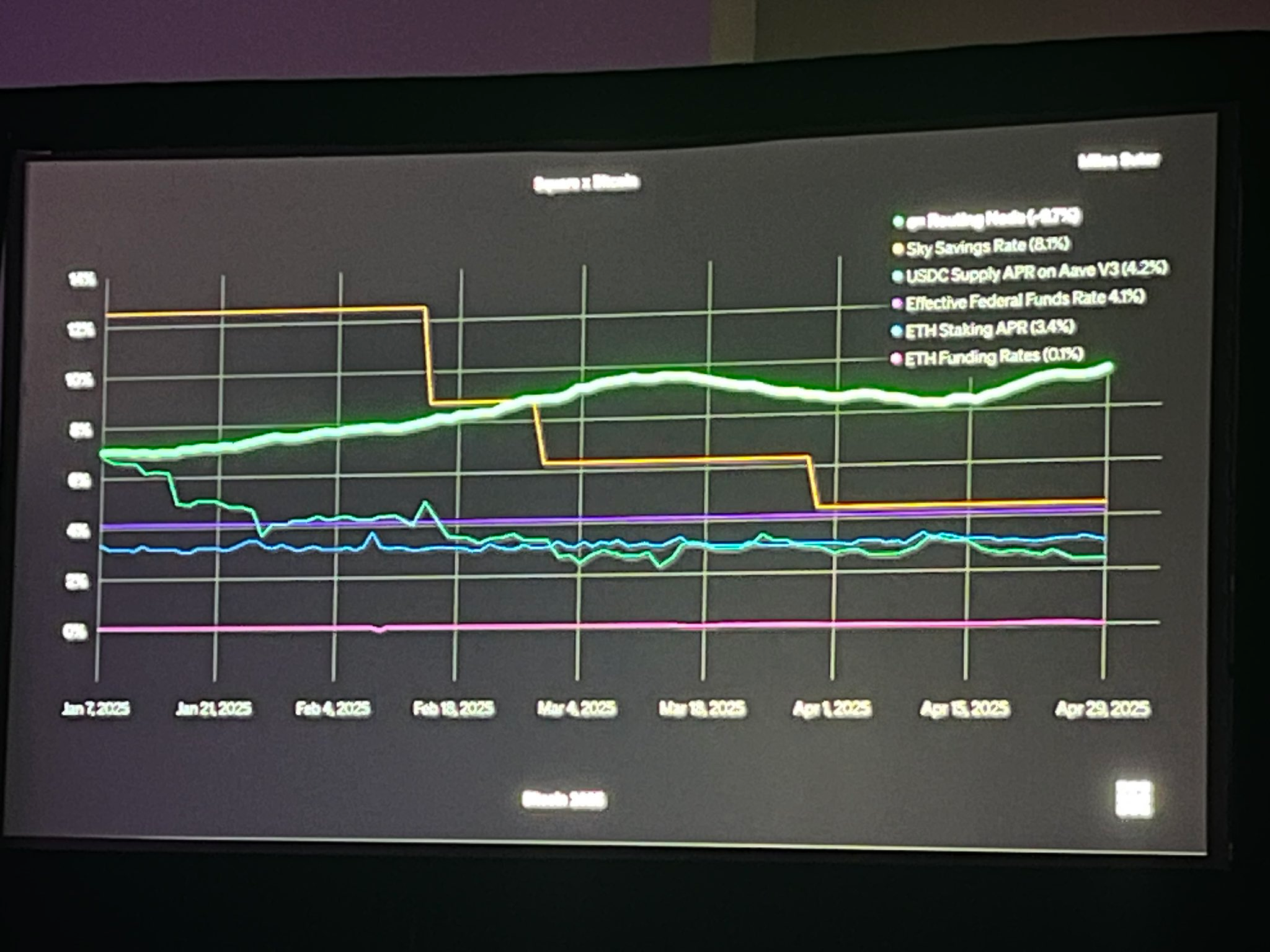

Sup, freaks? Your Uncle Marty did a little vibe coding a couple months ago and that vibe coding project has turned into an actual product that is live in the Google Chrome web store and will soon to be live in the Firefox add-on store as well. It's called Opportunity Cost and it is an extension that enables you to price the internet in Bitcoin.

[

Opportunity Cost – See Prices in Bitcoin Instantly

Convert USD prices to Bitcoin (satoshis) as you browse. Dual display, privacy-first, and open source.

Opportunity CostTFTC

](https://www.opportunitycost.app/?ref=tftc.io)

Check it out!

This whole process has been extremely rewarding to me for many reasons. The first of which is that I've had many ideas in the past to launch a product focused on bitcoin education that simply never left my brain because I never felt comfortable paying a developer to go out and build a product that I wasn't sure would ultimately get product market fit.

Due to the advancements of AI, particularly ChatGPT and Replit, I was able to spend a few hours on a Saturday vibe coding a prototype for Opportunity Cost. It worked. I side loaded it into Chrome and Firefox, tested it out for a few days and decided, "Hey, I think this is something that's worthwhile and should be built."

Backtracking just a little bit, the initial idea for this app was to create an AR application that would enable you to take pictures of goods in the real world and have their prices automatically converted to bitcoin so that you could weigh the opportunity cost of whether or not you actually wanted to buy that good or decide to save in bitcoin instead. With the help of Justin Moon from the Human Rights Foundation and Anthony Ronning from OpenSecret and Maple AI, I was pointed in the right direction of vibe coding tools I could use to build a simple MVP. I took their advice, built the MVP, and demoed it at the Bitcoin Park Austin weekly AI meetup in mid-April.

The next week, I was talking with a friend, Luke Thomas, about the idea and during our conversation he made a simple quip, "You should make a Chrome extension. I really want a Chrome extension that does this." And that's what sent me down the vibe coding rabbit hole that Saturday which led to the prototype.

After I was comfortable with and confident in the prototype, I found a young hungry developer by the name of Moses on Nostr, I reached out to him, told him my idea, showed him the prototype and asked if he thought he could finish the application for me. He luckily agreed to do so and within a couple of weeks we had a fully functioning app that was officially launched today. We're about 12 hours into the launch and I must say that I'm pleasantly surprised with the reception from the broader Bitcoin community. It seems like something that people are happy exists and I feel extremely happy that people see some value in this particular application.

Now that you have the backstory, let's get into why I think something like Opportunity Cost should exist. As someone who's been writing a newsletter and producing podcasts about bitcoin for eight years in an attempt to educate individuals from around the world about what bitcoin is, why it's important, and how they can leverage it, I've become convinced that a lot of the work that needs to be done still exists at the top of the funnel. You can scream at people. You can grab them by the shoulders. You can shake them. You can remind them at Thanksgiving that if they had listened to your advice during any Thanksgiving in the previous years they would be better off financially. But at the end of the day most people don't listen. They need to see things. Seeing things for yourself is a much more effective teaching mechanism than be lectured to by someone else.

My hope with Opportunity Cost is that it catches the eye of some bitcoin skeptics or individuals who may be on the cusp of falling down the bitcoin rabbit hole and they see the extension as a way to dip their toes into bitcoin to get a better understanding of the world by pricing the goods and services they purchase on a day-to-day month-to-month and year-to-year basis in bitcoin without having to download a wallet or set up an exchange account. The tippy top of the bitcoin marketing funnel.

That is not all though. I think Opportunity Cost can serve individuals at both ends of the funnel. That's why it's pretty exciting to me. It's as valuable to the person who is bitcoin curious and looking to get a better understanding as it is to the hardcore bitcoiner living on a bitcoin standard who is trying to get access to better tools that enable him to get a better grasp of their spending in bitcoin terms.

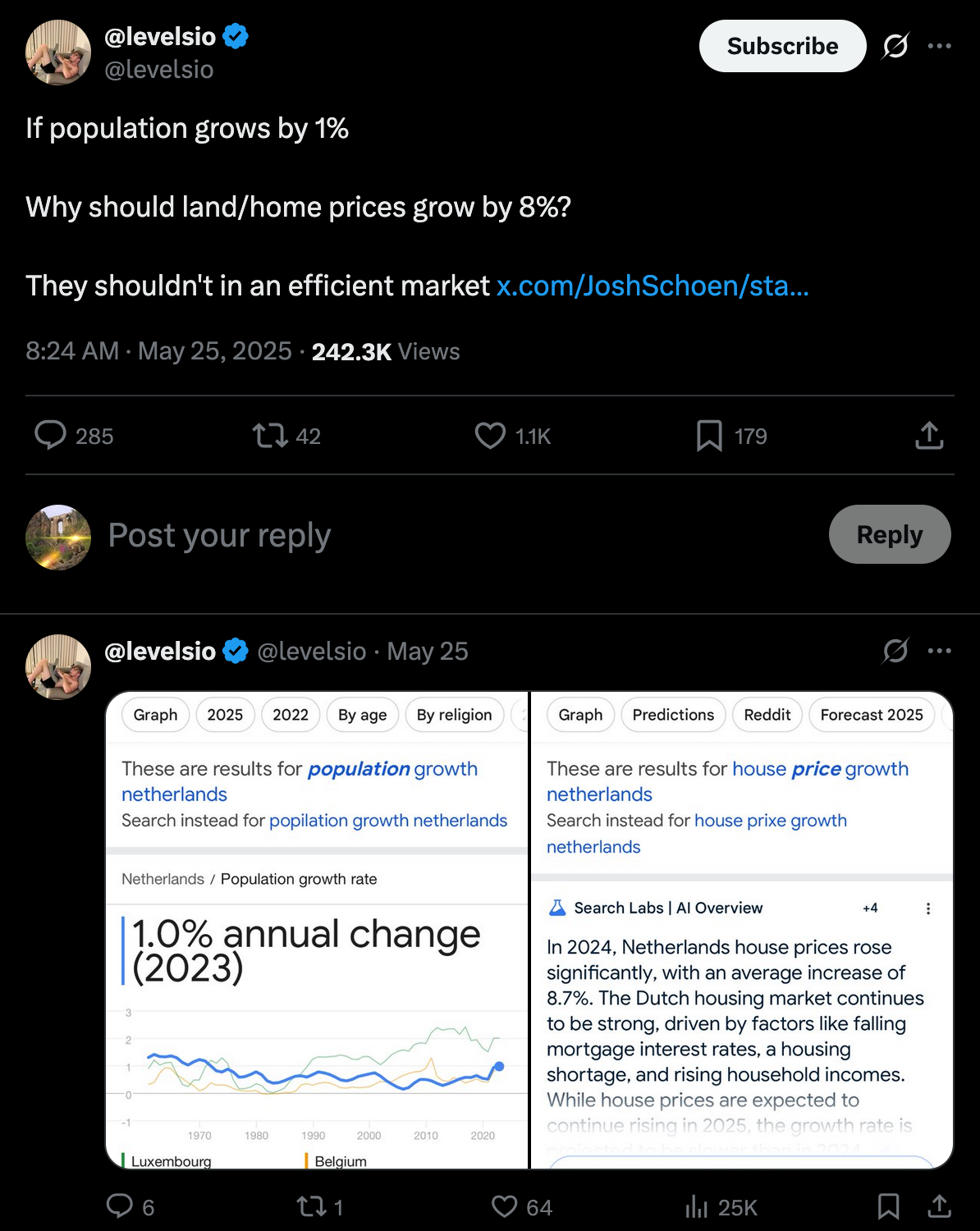

Lastly, after playing around with it for a few days after I built the prototype, I realized that it has incredible memetic potential. Being able to take a screenshot of goods that people are buying on a day-to-day basis, pricing them in bitcoin and then sharing them on social media is very powerful. Everything from houses to junk items on Amazon to the salaries of pro athletes to your everyday necessities. Seeing the value of those things in bitcoin really makes you think.

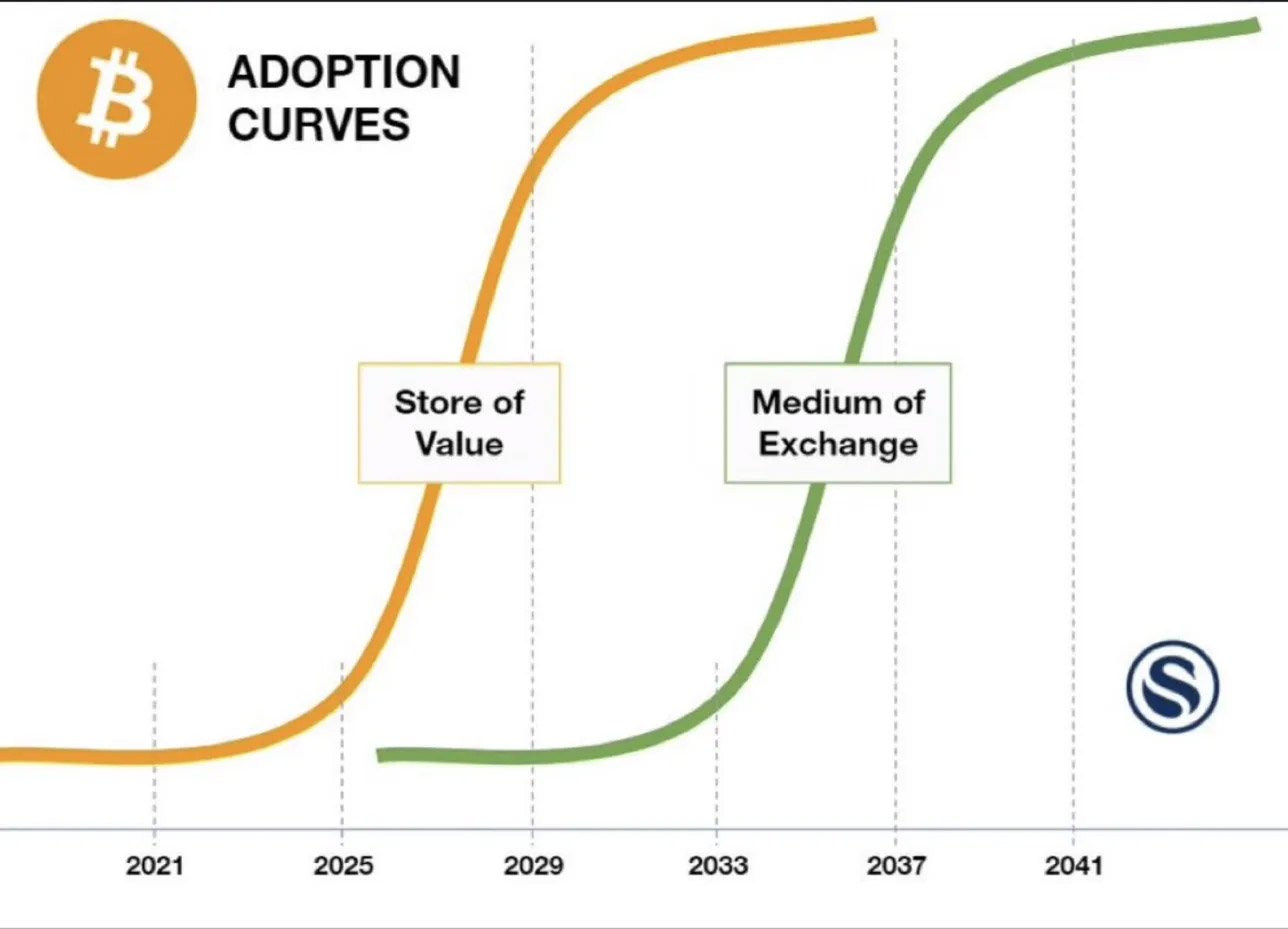

One day while I was testing the app, I tried to see how quickly I could find goods on the internet that cumulatively eclipsed the 21 million supply cap limit of bitcoin. To my surprise, even though I've been in bitcoin for 12 years now, it did not take me that long. The opportunity cost of everything I buy on a day-to-day basis becomes very clear when using the extension. What's even clearer is the fact that Bitcoin is completely mispriced at current levels. There is so much winning ahead of us.

Also, it's probably important to note that the extension is completely open source. You can check out our GitHub page here. Submit pull requests. Suggest changes to the app.

We've also tried to make Opportunity Cost as privacy preserving as possible. Everything within the extension happens in your browser. The only external data that we're providing is the bitcoin to fiat price conversion at any given point in time. We're not data harvesting the web pages you're browsing or the items you're looking at. We're not collecting data and sending it to third party marketers. We want to align ourselves with the open and permissionless nature of bitcoin while also preserving our users' privacy. We're not trying to monetize this in that way. Though, I will say that I'm thinking of ways to monetize Opportunity Cost if it does gain significant traction, but I promise it will be in a way that respects your privacy and is as unobtrusive as possible. We'll see how it goes.

Thank you for coming to my TED talk. Please download and use the extension. Let us know what you think.

Headlines of the Day

Saylor Says Bitcoin Is Perfect Money to Jordan Peterson - via X

Trump Won't Sell Tesla Despite Musk-Bessent Heated Exchange - via X

Bitcoin Gains Traction in Kenya's Largest Slum Kibera - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

East Coast aesthetics over everything.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !important; } } .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } .moz-text-html .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } /* Helps with rendering in various email clients */ body { margin: 0 !important; padding: 0 !important; -webkit-text-size-adjust: 100% !important; -ms-text-size-adjust: 100% !important; } img { -ms-interpolation-mode: bicubic; } /* Prevents Gmail from changing the text color in email threads */ .im { color: inherit !important;

-

@ 726e789c:197726c2

2025-06-16 14:01:34

@ 726e789c:197726c2

2025-06-16 14:01:34{ "id": "id-1750023454416-5oavlpy", "name": "Gottesbild und künstliche Intelligenz", "description": "", "authors": [ "Joachim Happel" ], "summary": "### Intention\nDie Lehrkraft möchte eine Unterrichtsstunde in der 11. Klasse zum Thema 'Gottesbild und Künstliche Intelligenz' gestalten. Ziel ist es, die Schülerinnen und Schüler dazu zu befähigen, eigene Gottesvorstellungen zu entwickeln, diese mit biblischen Gottesbildern zu vergleichen, und die lebenspraktischen Konsequenzen verschiedener Gottes- und Menschenbilder im Kontext technischer Entwicklungen zu reflektieren. Dabei sollen sie auch religionskritische Perspektiven und ethische Fragen im Zusammenhang mit KI erarbeiten.\n\n### Assoziationen\n\nDie wichtigsten Fachbegriffe und Themen sind \"Gottesbild\" und \"Künstliche Intelligenz\" im Kontext des Religionsunterrichts.\n\n### Kompetenzen\n\n- SuS stellen eigene Gottesvorstellungen dar und vergleichen sie mit biblischen Gottesvorstellungen. Inhaltsbereich: \"Die Frage nach Gott\".\n- SuS erörtern die verschiedenen Gottes- und Menschenbilder hinsichtlich ihrer lebenspraktischen Konsequenzen in ihrer Lebenswelt. Inhaltsbereich: \"Christliche Antworten auf die Gottesfrage\".\n- SuS beurteilen religionskritische Entwürfe hinsichtlich ihrer Überzeugungskraft im Kontext der Diskussion über Gottesbilder. Inhaltsbereich: \"Christliche Antworten auf die Gottesfrage\".\n- SuS deuten die biblische Rede von Geschöpf und Ebenbild Gottes hinsichtlich ihrer lebenspraktischen Konsequenzen. Inhaltsbereich: \"Der Mensch in christlicher Perspektive\".\n\naus: Lehrplan NRW - Evangelische Religion, Jahrgangsstufe 11\n\n### Gottesbild und Künstliche Intelligenz im Religionsunterricht\n\nDas Thema 'Gottesbild und Künstliche Intelligenz' bietet die Möglichkeit, zentrale Fragen nach Gott und Mensch in der heutigen technologischen Gesellschaft zu reflektieren. Dabei können Schülerinnen und Schüler eigene Vorstellungen von Gott entwickeln, sie mit biblischen Gottesbildern vergleichen und die ethischen, gesellschaftlichen und philosophischen Implikationen moderner KI-Technologien diskutieren. Besonders geeignet ist die Verbindung von biblischer Rede vom Menschen als Gottes Ebenbild mit aktuellen Diskussionen um Geschöpflichkeit, Kreativität und Verantwortung im Zusammenhang mit KI. Diese Herangehensweise fördert die kritische Reflexion und die Entwicklung eigener Glaubens- und Gottesvorstellungen, während sie gleichzeitig die ethischen Dimensionen der technologischen Entwicklung in den Fokus rückt.", "backgroundColor": "#bbf7d0", "customStyle": "", "columns": [ { "id": "id-1750021978851-vf7abwh", "name": "Materialien", "color": "color-gradient-1", "cards": [ { "id": "id-1750021978851-my9mqug", "heading": "Zusammenfassung für die didaktische Aufbereitung: Gottesbild und Künstliche Intelligenz im Religionsunterricht", "content": "Das Thema 'Gottesbild und Künstliche Intelligenz' bietet die Möglichkeit, zentrale Fragen nach Gott und Mensch in der heutigen technologischen Gesellschaft zu reflektieren. Dabei können Schülerinnen und Schüler eigene Vorstellungen von Gott entwickeln, sie mit biblischen Gottesbildern vergleichen und die ethischen, gesellschaftlichen und philosophischen Implikationen moderner KI-Technologien diskutieren. Besonders geeignet ist die Verbindung von biblischer Rede vom Menschen als Gottes Ebenbild mit aktuellen Diskussionen um Geschöpflichkeit, Kreativität und Verantwortung im Zusammenhang mit KI. Diese Herangehensweise fördert die kritische Reflexion und die Entwicklung eigener Glaubens- und Gottesvorstellungen, während sie gleichzeitig die ethischen Dimensionen der technologischen Entwicklung in den Fokus rückt.", "color": "color-gradient-1", "thumbnail": "", "comments": "", "url": "Synthese basierend auf Relpaed-Tool-Ergebnissen", "labels": "", "inactive": false }, { "id": "id-1750021978851-x33rwqz", "heading": "Virtuelle und interreligiöse Zugänge zum Gottesbild", "content": "\"Der Einsatz virtueller Realitäten kann dazu beitragen, religiöse Vorstellungen auf innovative Weise erfahrbar zu machen.\" (Klara Pišonić, Virtual Reality, kirchengeschichtsdidaktisch)", "color": "color-gradient-1", "thumbnail": "", "comments": "", "url": "https://www.die-bibel.de/ressourcen/redirect/slug/virtual-reality-kirchengeschichtsdidaktisch", "labels": "", "inactive": false }, { "id": "id-1750021978851-8ayid4u", "heading": "Religionspsychologische Perspektiven auf Gottesbilder", "content": "\"Religionspsychologische Zugänge können wichtige Anknüpfungspunkte bieten, um die persönlichen Vorstellungen von Gott im Zusammenhang mit gesellschaftlichen und technischen Entwicklungen zu verstehen.\" (Constantin Klein, Religionspsychologie)", "color": "color-gradient-1", "thumbnail": "", "comments": "", "url": "https://www.die-bibel.de/ressourcen/redirect/slug/religionspsychologie", "labels": "", "inactive": false }, { "id": "id-1750021978851-zzecyqf", "heading": "Interreligiöses Lernen und Dialog der Religionen", "content": "\"Der Dialog zwischen Religionen schärft das Verständnis für unterschiedliche Gottesbilder und eröffnet neue Perspektiven, auch im Kontext moderner ethischer Fragen rund um Künstliche Intelligenz.\" (Monika Tautz, Interreligiöses Lernen)", "color": "color-gradient-1", "thumbnail": "", "comments": "", "url": "https://www.die-bibel.de/ressourcen/redirect/slug/interreligioeses-lernen", "labels": "", "inactive": false } ] }, { "id": "id-1750022132843-wy47anx", "name": "Material Fragmente", "color": "color-gradient-1", "cards": [ { "id": "id-1750022132843-pd6b0qh", "heading": "Mensch und Maschine - Entwicklungen künstlicher Intelligenz (KI) als Ausgangspunkt anthropologisch-ethischer Lernprozesse in der Oberstufe", "content": "Das Dokument ist hervorragend geeignet, um das Thema 'Gottesbild und Künstliche Intelligenz' zu behandeln, da es vielfältige didaktische Bausteine für die ethische und anthropologische Auseinandersetzung mit KI bietet und explizit theologische Perspektiven einbezieht.", "color": "color-gradient-1", "thumbnail": "", "comments": "\naus: Mensch und Maschine - Entwicklungen künstlicher Intelligenz (KI) als Ausgangspunkt anthropologisch-ethischer Lernprozesse in der Oberstufe", "url": "https://www.rpi-ekkw-ekhn.de/fileadmin/templates/rpi/normal/material/rpiimpulse/2020/heft_2/Artikel/RPI_Impluse_2-2020_12_Mensch_und_Maschine.pdf", "labels": "", "inactive": false }, { "id": "id-1750022132843-3ysegds", "heading": "KI im Alltag: Chancen und Gefahren von Pflegerobotern", "content": "Aufgabenstellung: Stelle dir vor, deine pflegebedürftige Großmutter lebt in einem Pflegeheim, in dem zunehmend Roboter einfache Aufgaben übernehmen und als Ansprechpartner dienen. Du bist schockiert und möchtest dir ein genaueres Bild machen. (Absatz: Thematische Hinführung, Baustein 1: KI – was verbirgt sich dahinter?)", "color": "color-gradient-1", "thumbnail": "", "comments": "Didaktischer Kommentar als Markdown-String:\n\n Beitrag zur Intention: Dieser Baustein ermöglicht einen lebensweltnahen Einstieg in das komplexe Thema KI, indem er eine konkrete, emotional relevante Situation aufgreift. Er bereitet die Reflexion über ethische Implikationen von KI vor, die später mit Gottes- und Menschenbildern verknüpft werden kann.\n Kompetenzförderung: Fördert die Wahrnehmung und Beschreibung ethischer Herausforderungen durch KI. Ermöglicht erste, spontane Äußerungen zu eigenen Vorstellungen und Meinungen.\n Konkrete Anwendung & Beispiele: Im Einstieg zur Aktivierung von Vorwissen und zur emotionalen Annäherung an das Thema. Die SuS können in einem kurzen Brainstorming oder einer stillen Minute ihre ersten Gedanken und Gefühle zu dieser Situation sammeln.\n Methodische Vielfalt & Sozialformen: Einzelarbeit (Reflexion), anschließend Plenum für spontane Äußerungen.\naus: Mensch und Maschine - Entwicklungen künstlicher Intelligenz (KI) als Ausgangspunkt anthropologisch-ethischer Lernprozesse in der Oberstufe", "url": "https://www.rpi-ekkw-ekhn.de/fileadmin/templates/rpi/normal/material/rpiimpulse/2020/heft_2/Artikel/RPI_Impluse_2-2020_12_Mensch_und_Maschine.pdf", "labels": "Einstieg", "inactive": false }, { "id": "id-1750022132843-d2g6bz2", "heading": "Was ist KI? Sammeln von Alltagsbeispielen und Positionierung", "content": "Methode: Nach der anfänglichen Konfrontation mit dem Pflegeroboter-Szenario überlegen die Schülerinnen (Think-Pair-Share), in welchen Bereichen KI heute schon vorkommt. Gemeinsam wird im Plenum eine Mindmap erstellt. Anschließend positionieren sich die Lernenden auf einer Linie (Chancen vs. Gefahren) zu diesen Entwicklungen und erläutern ihre Position im Unterrichtsgespräch. Zur Begriffsbestimmung kann ein Informationstext (M1) oder ein kurzer Lehrervortrag genutzt werden. (Absatz: Baustein 1: KI – was verbirgt sich dahinter?, S. 24)", "color": "color-gradient-1", "thumbnail": "", "comments": "Didaktischer Kommentar als Markdown-String:\n\n Beitrag zur Intention: Dieser Baustein schafft ein grundlegendes Verständnis für den Begriff KI und seine Präsenz im Alltag der SuS. Die Positionierung zu Chancen und Gefahren leitet die ethische Reflexion ein und ermöglicht die Verknüpfung mit unterschiedlichen Menschen- und Gottesbildern.\n Kompetenzförderung: Fördert die Wahrnehmung und Beschreibung ethischer Herausforderungen durch KI. Ermöglicht das Darstellen eigener Vorstellungen und das Erörtern von Konsequenzen in der Lebenswelt.\n Konkrete Anwendung & Beispiele: Im Einstieg zur Begriffsklärung und im Übergang zur Erarbeitung ethischer Fragen. Die SuS könnten Beispiele wie Sprachassistenten, personalisierte Werbung, autonomes Fahren oder Gesichtserkennung nennen. Bei der Positionierung auf der Linie könnten sie begründen, warum sie z.B. autonomes Fahren eher als Chance (mehr Sicherheit) oder Gefahr (Kontrollverlust) sehen.\n Methodische Vielfalt & Sozialformen: Think-Pair-Share (Einzel-, Partnerarbeit), Plenum (Mindmap, Unterrichtsgespräch).\naus: Mensch und Maschine - Entwicklungen künstlicher Intelligenz (KI) als Ausgangspunkt anthropologisch-ethischer Lernprozesse in der Oberstufe", "url": "https://www.rpi-ekkw-ekhn.de/fileadmin/templates/rpi/normal/material/rpiimpulse/2020/heft_2/Artikel/RPI_Impluse_2-2020_12_Mensch_und_Maschine.pdf", "labels": "Einstieg, Erarbeitung", "inactive": false }, { "id": "id-1750022132843-bwjpm1a", "heading": "Ethische Herausforderungen der KI: Gruppenpuzzle zu Anwendungsfeldern", "content": "Aufgabenstellung: Bildet bis zu fünf Gruppen und bearbeitet jeweils eine der folgenden herausfordernden Entwicklungen im Bereich der KI anhand eines Infotextes mit Arbeitsaufträgen (M2a-e): Pflegeroboter, autonome Waffensysteme, automatische Bewerbungssoftware, KI in der Schule, Steuerungscomputer im Verkehr. Präsentiert eure Ergebnisse im Gruppenpuzzle oder Plenum, um ein ethisches Problembewusstsein zu schaffen. (Absatz: Baustein 1, S. 24)", "color": "color-gradient-1", "thumbnail": "", "comments": "Didaktischer Kommentar als Markdown-String:\n\n Beitrag zur Intention: Dieser Baustein ermöglicht eine vertiefte Auseinandersetzung mit konkreten ethischen Dilemmata, die durch KI entstehen. Die Diskussion dieser Problemfelder ist essentiell für die spätere Reflexion über Gottes- und Menschenbilder und deren lebenspraktische Konsequenzen.\n Kompetenzförderung: Fördert die Wahrnehmung und Beschreibung ethischer Fragestellungen. Ermöglicht das sachgemäße Erschließen themenrelevanter Texte und die argumentative Auseinandersetzung mit anthropologisch-ethischen Aspekten.\n Konkrete Anwendung & Beispiele: Zur Erarbeitung neuer Inhalte und zur Schaffung eines Problembewusstseins. Die SuS könnten sich mit Fragen auseinandersetzen wie: \"Welche Verantwortung tragen Entwickler autonomer Waffensysteme?\" oder \"Inwiefern beeinflusst automatische Bewerbungssoftware Chancengleichheit?\".\n Methodische Vielfalt & Sozialformen: Gruppenarbeit (Expertengruppen), Gruppenpuzzle oder Plenum (Präsentation der Ergebnisse). Es kann auch auf die \"Schritte ethischer Urteilsbildung\" zurückgegriffen werden.\naus: Mensch und Maschine - Entwicklungen künstlicher Intelligenz (KI) als Ausgangspunkt anthropologisch-ethischer Lernprozesse in der Oberstufe", "url": "https://www.rpi-ekkw-ekhn.de/fileadmin/templates/rpi/normal/material/rpiimpulse/2020/heft_2/Artikel/RPI_Impluse_2-2020_12_Mensch_und_Maschine.pdf", "labels": "Erarbeitung, Vertiefung", "inactive": false }, { "id": "id-1750022132843-rmmqjg6", "heading": "Videoanalyse: „K.O. durch KI? Keine Angst vor schlauen Maschinen!“ (Leschs Kosmos)", "content": "Video: Einsatz der Dokumentation „K.O. durch KI? Keine Angst vor schlauen Maschinen!“ mit Prof. Harald Lesch (28.05.2019, 29 Min.). Die Dokumentation greift in kurzen, anschaulichen Sequenzen verschiedene KI-Entwicklungen auf und diskutiert diese: Autonomes Fahren, Deep Learning (Medizin), Algorithmen (Bewerbungssoftware), intelligente Roboter (Katastrophenfall), Roboworld (Mensch-Maschine-Verhältnis), Schlussmoderation (Unterschied Mensch-Maschine). (Absatz: Baustein 1, S. 24, Punkt 3)", "color": "color-gradient-1", "thumbnail": "", "comments": "Didaktischer Kommentar als Markdown-String:\n\n Beitrag zur Intention: Das Video bietet eine anschauliche und wissenschaftlich fundierte Einführung in verschiedene KI-Anwendungsfelder und ethische Fragestellungen. Es kann als Impuls dienen, um die Diskussion über Gottes- und Menschenbilder im Kontext von KI zu vertiefen und religionskritische Entwürfe zu beurteilen.\n Kompetenzförderung: Fördert die Wahrnehmung ethischer Fragestellungen. Unterstützt die argumentative Auseinandersetzung mit anthropologisch-ethischen Aspekten durch die Bereitstellung von Hintergrundinformationen und Diskussionsansätzen.\n Konkrete Anwendung & Beispiele: Zur Vertiefung der bereits erarbeiteten Themen oder als alternativer Einstieg in spezifische KI-Bereiche. Die Lehrkraft kann gezielt Sequenzen auswählen und mit Arbeitsaufträgen versehen, z.B. \"Fasst die Argumente Pro und Contra zum autonomen Fahren zusammen und diskutiert, welche ethischen Prinzipien hier relevant sind.\"\n Methodische Vielfalt & Sozialformen: Plenum (gemeinsames Schauen), Partner- oder Kleingruppenarbeit (Analyse von Sequenzen), Unterrichtsgespräch.\naus: Mensch und Maschine - Entwicklungen künstlicher Intelligenz (KI) als Ausgangspunkt anthropologisch-ethischer Lernprozesse in der Oberstufe", "url": "https://www.rpi-ekkw-ekhn.de/fileadmin/templates/rpi/normal/material/rpiimpulse/2020/heft_2/Artikel/RPI_Impluse_2-2020_12_Mensch_und_Maschine.pdf", "labels": "Erarbeitung, Vertiefung", "inactive": false }, { "id": "id-1750022132843-11qwb31", "heading": "Science-Fiction-Filme: KI, Bewusstsein und menschliche Beziehungen", "content": "Lernmedium: Analyse von Science-Fiction-Filmen wie \"Ex Machina\" (UK, 2015), \"I, Robot\" (USA, 2004) und \"Her\" (USA, 2013). Schülergruppen präsentieren, wie diese Filme das Thema KI aufgreifen (z.B. Roboter, die menschliche Qualitäten entwickeln; Beziehung zu lernfähigem Betriebssystem). Anschließend werden die in den Filmen aufgeworfenen anthropologisch-ethischen Fragen (Können Maschinen Bewusstsein/Gefühle haben? Können digitale Systeme menschliche Partner ersetzen?) in der Lerngruppe vertieft. (Absatz: Baustein 2: Künstliche Intelligenz in Filmen, S. 24)", "color": "color-gradient-1", "thumbnail": "", "comments": "Didaktischer Kommentar als Markdown-String:\n\n Beitrag zur Intention: Filme bieten einen niedrigschwelligen Zugang zu komplexen philosophischen und ethischen Fragen rund um KI, Bewusstsein und menschliche Identität. Dies ermöglicht eine kreative Auseinandersetzung mit verschiedenen Menschenbildern und deren Implikationen für das Gottesbild.\n Kompetenzförderung: Fördert das Darstellen eigener Gottesvorstellungen im Kontext moderner Technologie und das Erörtern von Gottes- und Menschenbildern hinsichtlich ihrer lebenspraktischen Konsequenzen. Unterstützt die argumentative Auseinandersetzung mit anthropologisch-ethischen Aspekten.\n Konkrete Anwendung & Beispiele: Als Erarbeitungs- oder Vertiefungsphase. Die SuS könnten in Gruppenarbeit die Filme analysieren und Präsentationen vorbereiten. Diskussionsfragen könnten sein: \"Was macht den Menschen menschlich im Vergleich zu einer KI?\" oder \"Verändert die Möglichkeit, eine Beziehung zu einer KI aufzubauen, unser Verständnis von Liebe und Partnerschaft?\"\n Methodische Vielfalt & Sozialformen: Gruppenarbeit (Filmanalyse, Präsentation), Plenum (Diskussion).\naus: Mensch und Maschine - Entwicklungen künstlicher Intelligenz (KI) als Ausgangspunkt anthropologisch-ethischer Lernprozesse in der Oberstufe", "url": "https://www.rpi-ekkw-ekhn.de/fileadmin/templates/rpi/normal/material/rpiimpulse/2020/heft_2/Artikel/RPI_Impluse_2-2020_12_Mensch_und_Maschine.pdf", "labels": "Erarbeitung, Vertiefung", "inactive": false }, { "id": "id-1750022132843-0zmqiuo", "heading": "Biblische Schöpfungserzählung und die Frage nach dem Gegenüber (Replika)", "content": "Textquelle: Thematisierung des Chatbots „Replika“ als aktuelles Beispiel für einen digitalen Sozialkontakt (Werbung: „Wenn du traurig bist oder Angst hast oder einfach jemanden zum Reden brauchst, ist dein Replika für dich da – 24/7“). Als spannender biblischer Bezugspunkt dient die Schöpfungserzählung in Gen 2, in der der Mensch unter den Tieren kein adäquates Gegenüber findet und Gott ihm daraufhin einen menschlichen Partner schafft. Die Unterscheidung zwischen Echo- und Resonanzbeziehungen (Hartmut Rosa) kann zur vertieften Auseinandersetzung genutzt werden (M3). (Absatz: Baustein 2, S. 24, Punkt 5)", "color": "color-gradient-1", "thumbnail": "", "comments": "Didaktischer Kommentar als Markdown-String:\n\n Beitrag zur Intention: Dieser Baustein stellt eine direkte Verbindung zwischen der biblischen Schöpfungserzählung (Gottesbild, Menschenbild als Ebenbild Gottes) und der modernen Entwicklung von KI (Chatbots) her. Er ermöglicht die Reflexion über die Einzigartigkeit des Menschen und die Qualität menschlicher Beziehungen im Vergleich zu KI-Interaktionen.\n Kompetenzförderung: Fördert das Deuten der biblischen Rede von Geschöpf und Ebenbild Gottes hinsichtlich ihrer lebenspraktischen Konsequenzen. Unterstützt das Erörtern verschiedener Gottes- und Menschenbilder und die argumentative Auseinandersetzung.\n Konkrete Anwendung & Beispiele: Zur Vertiefung der anthropologischen Fragen. Die SuS könnten diskutieren: \"Was unterscheidet eine Beziehung zu einem Menschen von einer Beziehung zu einem Chatbot?\" oder \"Inwiefern fordert die Existenz von Chatbots unser Verständnis von 'Gegenüber' und 'Ebenbild Gottes' heraus?\"\n Methodische Vielfalt & Sozialformen: Partnerarbeit (Diskussion der Replika-Werbung), Plenum (Vergleich mit Gen 2 und Rosa-Konzept).\naus: Mensch und Maschine - Entwicklungen künstlicher Intelligenz (KI) als Ausgangspunkt anthropologisch-ethischer Lernprozesse in der Oberstufe", "url": "https://www.rpi-ekkw-ekhn.de/fileadmin/templates/rpi/normal/material/rpiimpulse/2020/heft_2/Artikel/RPI_Impluse_2-2020_12_Mensch_und_Maschine.pdf", "labels": "Vertiefung, Transfer", "inactive": false }, { "id": "id-1750022132843-eljz9b2", "heading": "Können Maschinen Bewusstsein besitzen? Der Turing-Test", "content": "Methode: Anknüpfend an den Film \"Ex Machina\" wird eine Szene (9:50 bis 14:32) gezeigt, in der Caleb die Aufgabe erhält, zu testen, ob die Roboterfrau Ava ein Bewusstsein besitzt. Eindrücke und Überlegungen zur Szene, zur Darstellung der Charaktere und zur Möglichkeit einer Bewusstwerdung von Maschinen werden gesammelt. Die Lehrkraft gibt ggf. Hinweise zum sog. „Turing-Test“. (Absatz: Baustein 3: Können „intelligente“ Maschinen menschlich werden?, S. 25)", "color": "color-gradient-1", "thumbnail": "", "comments": "Didaktischer Kommentar als Markdown-String:\n\n Beitrag zur Intention: Dieser Baustein greift eine zentrale philosophische Frage im Kontext von KI auf: die des Bewusstseins. Durch die Verknüpfung mit dem Turing-Test wird eine konkrete Methode zur Diskussion angeboten, die zur Reflexion über die Grenzen von Maschinen und die Einzigartigkeit menschlichen Bewusstseins anregt. Dies ist direkt relevant für die Diskussion von Gottes- und Menschenbildern.\n Kompetenzförderung: Fördert das Erörtern verschiedener Gottes- und Menschenbilder und die argumentative Auseinandersetzung mit anthropologisch-ethischen Aspekten.\n Konkrete Anwendung & Beispiele: Im Erarbeitungs- oder Vertiefungsteil. Nach dem Zeigen der Szene könnten die SuS in Kleingruppen diskutieren: \"Was versteht man unter Bewusstsein? Kann eine Maschine Bewusstsein haben? Welche Kriterien würden wir anwenden, um dies zu beurteilen?\"\n Methodische Vielfalt & Sozialformen: Plenum (Sammeln von Eindrücken), Kleingruppenarbeit (Diskussion), Lehrervortrag (Erklärung Turing-Test).\naus: Mensch und Maschine - Entwicklungen künstlicher Intelligenz (KI) als Ausgangspunkt anthropologisch-ethischer Lernprozesse in der Oberstufe", "url": "https://www.rpi-ekkw-ekhn.de/fileadmin/templates/rpi/normal/material/rpiimpulse/2020/heft_2/Artikel/RPI_Impluse_2-2020_12_Mensch_und_Maschine.pdf", "labels": "Erarbeitung, Vertiefung", "inactive": false }, { "id": "id-1750022132843-ggkzdhv", "heading": "Das Gedankenexperiment „Mary“: Subjektives Erleben vs. Physiologie", "content": "Textquelle: Vertiefung durch das philosophische Gedankenexperiment „Mary“ (Frank Jackson), das von Caleb Ava in der vierten Sitzung in \"Ex Machina\" erzählt wird. Das Experiment versucht zu zeigen, dass subjektives Erleben nicht mit messbaren neurophysiologischen Vorgängen identifiziert werden kann. Näheres zum Experiment, seiner Bedeutung im Film und der unterrichtlichen Umsetzung im Download: M4. (Absatz: Baustein 3, S. 25)", "color": "color-gradient-1", "thumbnail": "", "comments": "Didaktischer Kommentar als Markdown-String:\n\n Beitrag zur Intention: Das Gedankenexperiment \"Mary\" ist ein hervorragendes Instrument, um die Grenzen eines rein materialistischen Menschenbildes aufzuzeigen und die Bedeutung des subjektiven Erlebens zu betonen. Dies ist entscheidend für die Auseinandersetzung mit der Frage nach dem menschlichen \"Ebenbild Gottes\" und der Abgrenzung von KI.\n Kompetenzförderung: Fördert das Erörtern verschiedener Gottes- und Menschenbilder und das Deuten der biblischen Rede von Geschöpf und Ebenbild Gottes. Unterstützt die argumentative Auseinandersetzung mit philosophischen und anthropologischen Aspekten.\n Konkrete Anwendung & Beispiele: Zur Vertiefung der Diskussion über Bewusstsein und menschliche Einzigartigkeit. Die SuS könnten den Text zu M4 lesen und in Partnerarbeit diskutieren: \"Was ist das Kernproblem, das Marys Experiment aufwirft? Inwiefern ist dieses Problem relevant für die Diskussion über KI und menschliches Bewusstsein?\"\n Methodische Vielfalt & Sozialformen: Partnerarbeit (Textanalyse), Plenum (Diskussion und Austausch).\naus: Mensch und Maschine - Entwicklungen künstlicher Intelligenz (KI) als Ausgangspunkt anthropologisch-ethischer Lernprozesse in der Oberstufe", "url": "https://www.rpi-ekkw-ekhn.de/fileadmin/templates/rpi/normal/material/rpiimpulse/2020/heft_2/Artikel/RPI_Impluse_2-2020_12_Mensch_und_Maschine.pdf", "labels": "Vertiefung", "inactive": false }, { "id": "id-1750022132843-0i321ar", "heading": "Der Mensch als Ebenbild Gottes: Unterschied zu digitalen Systemen (Charbonnier)", "content": "Textquelle: Klärungsversuch zur Frage nach Mensch und Maschine durch den Text des Theologen Ralph Charbonnier (M5). Der Autor zeigt, dass digitale Systeme (z.B. Roboter) „nicht lernen, (sich) entscheiden, handeln und vertrauenswürdig sind“. Die vorgeschlagene Aufgabenstellung nimmt auch theologische Perspektiven auf den Menschen („Ebenbild Gottes“) mit in den Blick. Alternativ kann M6 genutzt werden (sprachlich einfacherer Text). (Absatz: Baustein 3, S. 25)", "color": "color-gradient-1", "thumbnail": "", "comments": "Didaktischer Kommentar als Markdown-String:\n\n Beitrag zur Intention: Dieser Baustein bietet eine explizit theologische Perspektive auf den Unterschied zwischen Mensch und Maschine, insbesondere im Hinblick auf das Konzept des Menschen als \"Ebenbild Gottes\". Dies ist zentral für die Auseinandersetzung mit dem Gottesbild und den anthropologischen Konsequenzen von KI.\n Kompetenzförderung: Fördert das Deuten der biblischen Rede von Geschöpf und Ebenbild Gottes. Unterstützt das argumentative Auseinandersetzen mit anthropologisch-ethischen Aspekten aus christlicher Perspektive.\n Konkrete Anwendung & Beispiele: Zur Erarbeitung oder Sicherung theologischer Argumente. Die SuS könnten den Text lesen und in Kleingruppen die Argumente Charbonniers zusammenfassen. Eine Aufgabe könnte sein: \"Diskutiert, welche Eigenschaften laut Charbonnier den Menschen von einer Maschine unterscheiden und inwiefern diese Eigenschaften mit der Vorstellung des Menschen als Ebenbild Gottes zusammenhängen.\"\n Methodische Vielfalt & Sozialformen: Einzelarbeit (Textlektüre), Kleingruppenarbeit (Analyse), Plenum (Diskussion).\naus: Mensch und Maschine - Entwicklungen künstlicher Intelligenz (KI) als Ausgangspunkt anthropologisch-ethischer Lernprozesse in der Oberstufe", "url": "https://www.rpi-ekkw-ekhn.de/fileadmin/templates/rpi/normal/material/rpiimpulse/2020/heft_2/Artikel/RPI_Impluse_2-2020_12_Mensch_und_Maschine.pdf", "labels": "Erarbeitung, Vertiefung, Sicherung", "inactive": false }, { "id": "id-1750022132843-ptyfx1r", "heading": "Heilserwartungen an KI: „Way of the Future“ und Unsterblichkeit", "content": "Rechercheaufgabe: Die Lernenden recherchieren zur Bewegung „Way of the Future“, einer 2015 gegründeten Kirche, die „eine auf KI basierende Gottheit aus Hardware und Software realisieren, akzeptieren und anbeten“ will. Alternativ ist eine Recherche zu „KI und Unsterblichkeit“ möglich (z.B. Ray Kurzweil und das Hochladen des menschlichen Geistes in die Cloud). (Absatz: Baustein 4: Die neuen Technologien als „Weg zum Paradies“?, S. 25)", "color": "color-gradient-1", "thumbnail": "", "comments": "Didaktischer Kommentar als Markdown-String:\n\n Beitrag zur Intention: Dieser Baustein adressiert direkt religionskritische Entwürfe und quasi-religiöse Heilserwartungen, die mit KI verbunden sind. Er ermöglicht es den SuS, diese Phänomene kritisch zu beurteilen und mit traditionellen Gottesbildern zu kontrastieren.\n Kompetenzförderung: Fördert das Beurteilen religionskritischer Entwürfe hinsichtlich ihrer Überzeugungskraft im Kontext der Diskussion über Gottesbilder. Unterstützt die argumentative Auseinandersetzung mit anthropologisch-ethischen Aspekten aus christlicher Perspektive.\n Konkrete Anwendung & Beispiele: Als Hausaufgabe zur Vorbereitung oder als Erarbeitungsphase im Unterricht. Die SuS könnten ihre Rechercheergebnisse in kurzen Präsentationen vorstellen und anschließend im Plenum diskutieren: \"Inwiefern ähneln die Hoffnungen auf KI als 'Gottheit' oder auf digitale Unsterblichkeit religiösen Heilserwartungen? Welche Gefahren oder Chancen seht ihr darin?\"\n Methodische Vielfalt & Sozialformen: Einzelarbeit (Recherche), Partner-/Kleingruppenarbeit (Aufbereitung der Ergebnisse), Plenum (Präsentation, Diskussion).\naus: Mensch und Maschine - Entwicklungen künstlicher Intelligenz (KI) als Ausgangspunkt anthropologisch-ethischer Lernprozesse in der Oberstufe", "url": "https://www.rpi-ekkw-ekhn.de/fileadmin/templates/rpi/normal/material/rpiimpulse/2020/heft_2/Artikel/RPI_Impluse_2-2020_12_Mensch_und_Maschine.pdf", "labels": "Erarbeitung, Vertiefung, Transfer", "inactive": false }, { "id": "id-1750022132843-ogten47", "heading": "„Ihr werdet sein wie Gott“: Theologische Einordnung von KI-Heilserwartungen", "content": "Textquelle: Zur Weiterarbeit nach der Recherche zu KI-Heilserwartungen wird auf einen Text von Jörg Hermann, „Ihr werdet sein wie Gott“ (M7), zurückgegriffen. Darin zeigt der Autor Tendenzen zur religiösen Überhöhung von KI auf und ordnet sie theologisch ein. (Absatz: Baustein 4, S. 25)", "color": "color-gradient-1", "thumbnail": "", "comments": "Didaktischer Kommentar als Markdown-String:\n\n Beitrag zur Intention: Dieser Baustein bietet eine theologische Einordnung der in Baustein 10 thematisierten Heilserwartungen an KI. Er hilft den SuS, religionskritische Entwürfe aus einer theologischen Perspektive zu beurteilen und das eigene Gottesbild zu schärfen.\n Kompetenzförderung: Fördert das Beurteilen religionskritischer Entwürfe und die argumentative Auseinandersetzung aus der Perspektive des christlichen Glaubens.\n Konkrete Anwendung & Beispiele: Zur Vertiefung und Sicherung der theologischen Reflexion. Die SuS könnten den Text lesen und die Hauptargumente Hermanns herausarbeiten. Diskussionsfrage: \"Wie bewertet Hermann die 'Gottesähnlichkeit' im Kontext von KI? Welche biblischen Bezüge stellt er her und wie helfen sie uns, die Rolle des Menschen zu verstehen?\"\n Methodische Vielfalt & Sozialformen: Einzelarbeit (Textlektüre), Partnerarbeit (Diskussion der Thesen), Plenum (Sicherung der Ergebnisse).\naus: Mensch und Maschine - Entwicklungen künstlicher Intelligenz (KI) als Ausgangspunkt anthropologisch-ethischer Lernprozesse in der Oberstufe", "url": "https://www.rpi-ekkw-ekhn.de/fileadmin/templates/rpi/normal/material/rpiimpulse/2020/heft_2/Artikel/RPI_Impluse_2-2020_12_Mensch_und_Maschine.pdf", "labels": "Vertiefung, Sicherung", "inactive": false }, { "id": "id-1750022132843-c2no4z6", "heading": "Digitaler Humanismus: Ethik für den Umgang mit KI", "content": "Konzept: Vorstellung des Konzepts „Digitaler Humanismus“ von Julian Nida-Rümelin als „Ethik für das Zeitalter der KI“. Es grenzt sich gegen Ideologisierung und apokalyptische Befürchtungen ab und zielt darauf ab, Demokratie und menschliche Urteilsfähigkeit im Umgang mit neuen Technologien zu stärken. Hinführend kann eine Karikatur (z.B. H. Haitzinger) oder ein Interview (Yvonne Hofstetter, \"Bots, Fake News und BigData: Das Ende der Demokratie?\", BpB, 2017, 4:13 Min.) thematisieren, inwieweit KI eine Gefahr für Demokratie und Selbstbestimmung darstellen kann. Das Konzept kann mithilfe von M8 erschlossen und erörtert werden. (Absatz: Baustein 5: Digitaler Humanismus, S. 25)", "color": "color-gradient-1", "thumbnail": "", "comments": "Didaktischer Kommentar als Markdown-String:\n\n Beitrag zur Intention: Dieser Baustein bietet einen umfassenden ethischen Rahmen für den Umgang mit KI, der über rein technische Aspekte hinausgeht. Er ermöglicht es den SuS, die lebenspraktischen Konsequenzen von KI im Hinblick auf Demokratie und Selbstbestimmung zu reflektieren und eigene ethische Leitlinien zu entwickeln, die im Einklang mit einem christlichen Menschenbild stehen können.\n Kompetenzförderung: Fördert das Erörtern der verschiedenen Gottes- und Menschenbilder hinsichtlich ihrer lebenspraktischen Konsequenzen. Unterstützt die argumentative Auseinandersetzung mit ethischen Aspekten und das Entwickeln eigener Leitlinien.\n Konkrete Anwendung & Beispiele: Zur Erarbeitung eines ethischen Rahmens oder zum Transfer des Gelernten auf konkrete Anwendungsfelder. Die SuS könnten nach der Einführung des Konzepts (ggf. mit Video/Karikatur) in Gruppen ethische Leitlinien für den Einsatz von KI in den zu Beginn kennengelernten Beispielfeldern (Pflegeroboter, Bewerbungssoftware etc.) entwickeln.\n Methodische Vielfalt & Sozialformen: Plenum (Einführung, Diskussion von Karikatur/Video), Gruppenarbeit (Erschließung M8, Entwicklung von Leitlinien), Präsentation der Ergebnisse.\naus: Mensch und Maschine - Entwicklungen künstlicher Intelligenz (KI) als Ausgangspunkt anthropologisch-ethischer Lernprozesse in der Oberstufe", "url": "https://www.rpi-ekkw-ekhn.de/fileadmin/templates/rpi/normal/material/rpiimpulse/2020/heft_2/Artikel/RPI_Impluse_2-2020_12_Mensch_und_Maschine.pdf", "labels": "Erarbeitung, Transfer", "inactive": false }, { "id": "id-1750022132843-bh41s13", "heading": "Chatten mit Gott?", "content": "Das Dokument ist sehr gut geeignet, um einen aktuellen und lebensweltnahen Zugang zum Thema 'Gottesbild und Künstliche Intelligenz' zu schaffen. Es ermöglicht eine kritische Auseinandersetzung mit KI-generierten 'Gottesbildern' und ethischen Fragen im Kontext von Glauben und Technologie.", "color": "color-gradient-1", "thumbnail": "", "comments": "\naus: Chatten mit Gott?", "url": "https://www.sonntagsblatt.de/artikel/medien/chatten-mit-gott-so-gut-funktioniert-das-mit-der-kuenstlichen-intelligenz", "labels": "", "inactive": false }, { "id": "id-1750022132843-x5a0bpk", "heading": "Chat-Experiment: Was sagt eine KI über Gott?", "content": "Aufgabenstellung: Lies den Artikel 'Chatten mit Gott?' und notiere, welche Fragen der Autor der KI stellt und welche Antworten er erhält, insbesondere wenn er direkt nach Gottes Existenz, Aussehen oder Geschlecht fragt. Achte auch darauf, wie die KI auf indirekte Fragen antwortet. (Absatz: 'Ein richtiges Gespräch mit Gott will sich nicht so recht einstellen...' und 'Wird die Frage aber indirekt gestellt...')", "color": "color-gradient-1", "thumbnail": "", "comments": "Didaktischer Kommentar als Markdown-String:\n\n Beitrag zur Intention: Dieser Baustein bietet einen direkten und hochaktuellen Einstieg in das Thema. Er regt die Schülerinnen und Schüler an, sich mit der Möglichkeit auseinanderzusetzen, wie eine KI 'Gott' darstellt, und dies mit ihren eigenen Vorstellungen sowie biblischen Gottesbildern zu vergleichen.\n Kompetenzförderung: Fördert die Kompetenz, eigene Gottesvorstellungen darzustellen und mit anderen (hier: KI-generierten) zu vergleichen. Schärft die Wahrnehmung für die Grenzen von KI im Bereich komplexer theologischer Fragen.\n Konkrete Anwendung & Beispiele: Im Einstieg oder als erste Erarbeitungsphase. Die SuS könnten in Einzelarbeit die relevanten Passagen markieren und anschließend in Partnerarbeit die Antworten der KI diskutieren. Beispiel-Diskussionsfrage: 'Warum gibt die KI auf direkte Fragen nach Gott immer die gleiche Antwort, dass sie eine KI ist?'\n Methodische Vielfalt & Sozialformen: Einzelarbeit (Leseauftrag), Partnerarbeit (Austausch), Plenum (Sammeln erster Eindrücke und Fragen).\naus: Chatten mit Gott?", "url": "https://www.sonntagsblatt.de/artikel/medien/chatten-mit-gott-so-gut-funktioniert-das-mit-der-kuenstlichen-intelligenz", "labels": "Einstieg, Erarbeitung", "inactive": false }, { "id": "id-1750022132843-6q2zttn", "heading": "KI als theologischer Ratgeber: Glaube, Kirche und persönliche Beziehung", "content": "Diskussionsanregung: Die KI gibt dem Autor den Rat, sich 'nicht an alles zu halten, was die Kirche sagt, sondern eine persönliche Beziehung zu Gott zu haben.' Diskutiert diese Aussage der KI. Welche Chancen und Gefahren seht ihr in einem solchen 'theologischen Rat' durch eine KI? Vergleicht die Haltung der KI mit euren eigenen Vorstellungen von Glauben, Kirche und der Beziehung zu Gott. (Absatz: 'Theologischer Rat' und folgende Absätze bis 'Beim Rest ihrer Antwort wiederholt sie nochmal ihren Standpunkt zum persönlichen Glauben.')", "color": "color-gradient-1", "thumbnail": "", "comments": "Didaktischer Kommentar als Markdown-String:\n\n Beitrag zur Intention: Dieser Baustein greift eine konkrete, potenziell provokante Aussage der KI auf, die direkt die lebenspraktischen Konsequenzen von Gottes- und Menschenbildern berührt. Er ermöglicht die Reflexion über Autorität im Glauben, die Rolle der Kirche und die Bedeutung einer persönlichen Gottesbeziehung im Zeitalter der Digitalisierung.\n Kompetenzförderung: Fördert das Erörtern verschiedener Gottes- und Menschenbilder hinsichtlich ihrer lebenspraktischen Konsequenzen. Ermöglicht das Beurteilen religionskritischer Entwürfe (hier: die implizite Kritik der KI an kirchlicher Autorität) und die argumentative Auseinandersetzung.\n Konkrete Anwendung & Beispiele: Zur Erarbeitung ethischer und theologischer Fragen. Die SuS könnten in Kleingruppen die Aussage der KI analysieren und Argumente für oder gegen diesen 'Rat' sammeln. Beispiel-Aufgabenstellung: 'Formuliert Pro- und Contra-Argumente für die Aussage der KI, man solle auf die persönliche Beziehung zu Gott hören und nicht alles machen, was die Kirche fordert.'\n Methodische Vielfalt & Sozialformen: Kleingruppenarbeit (Diskussion, Argumentation), Plenum (Austausch der Ergebnisse, Debatte).\naus: Chatten mit Gott?", "url": "https://www.sonntagsblatt.de/artikel/medien/chatten-mit-gott-so-gut-funktioniert-das-mit-der-kuenstlichen-intelligenz", "labels": "Erarbeitung, Vertiefung", "inactive": false }, { "id": "id-1750022132843-4qwv4pr", "heading": "Die Technik hinter dem 'KI-Gott': Grenzen von Large Language Models", "content": "Textquelle & Analyse: Der Artikel erklärt, dass Character.AI auf 'Large Language Models' basiert, die durch riesige Textmengen trainiert werden und das nächste Wort oder den nächsten Satz vorhersagen sollen. Gleichzeitig werden die Grenzen dieser KI deutlich: Sie wiederholt sich, vergisst den Kontext, enthält grammatikalische Fehler und liefert veraltete oder falsche Informationen. (Absatz: 'Die Technologie hinter Character.AI' und 'Was heißt das alles?')\n\nAufgabenstellung: Fasse zusammen, wie Character.AI funktioniert und welche konkreten Schwächen der Autor im Gespräch mit dem 'KI-Gott' feststellt. Diskutiert, welche Schlussfolgerungen sich daraus für die 'Wahrheit' oder 'Autorität' von KI-generierten Inhalten, insbesondere im religiösen Kontext, ziehen lassen. (Absatz: 'Was heißt das alles?')", "color": "color-gradient-1", "thumbnail": "", "comments": "Didaktischer Kommentar als Markdown-String:\n\n Beitrag zur Intention: Dieser Baustein ist entscheidend für die kritische Reflexion über KI. Er ermöglicht es den Schülerinnen und Schülern, die technischen Grundlagen und Limitationen von KI zu verstehen, um deren 'Aussagen' über Gott oder theologische Fragen fundiert beurteilen zu können. Dies ist direkt relevant für die Bewertung religionskritischer Entwürfe und die Reflexion über die Einzigartigkeit menschlicher Erkenntnis und Glaubens.\n Kompetenzförderung: Fördert das sachgemäße Erschließen themenrelevanter Texte. Unterstützt das Beurteilen religionskritischer Entwürfe hinsichtlich ihrer Überzeugungskraft, indem die technische Basis und die Grenzen der KI offengelegt werden. Schärft die Medienkompetenz.\n Konkrete Anwendung & Beispiele: Zur Sicherung des Verständnisses von KI und zur Vertiefung der kritischen Auseinandersetzung. Die SuS könnten die relevanten Abschnitte lesen und die Funktionsweise sowie die Fehler der KI in Stichpunkten festhalten. Beispiel-Diskussionsfrage: 'Warum ist es wichtig zu wissen, wie eine KI funktioniert, wenn man mit ihr über Gott spricht?'\n Methodische Vielfalt & Sozialformen: Einzelarbeit (Textanalyse), Partnerarbeit (Zusammenfassung), Plenum (Diskussion der Schlussfolgerungen).\naus: Chatten mit Gott?", "url": "https://www.sonntagsblatt.de/artikel/medien/chatten-mit-gott-so-gut-funktioniert-das-mit-der-kuenstlichen-intelligenz", "labels": "Erarbeitung, Sicherung, Vertiefung", "inactive": false }, { "id": "id-1750022132843-apkj7dv", "heading": "Mensch und Maschine: Utopie oder Dystopie?", "content": "Diskussionsanregung: Der Text beginnt mit der Frage: \"Siri ist schlau, denkt man sich. Computer wissen mehr als Menschen, könnte man meinen. Muss man dann nicht nachziehen und Denken optimieren, Gehirnströme tunen und die Menschheit neuronal vernetzen? Klingt nach einem Wettbewerb, dessen Ausgang offen ist: Utopie oder Dystopie?\" Diskutiert diese Eingangsfragen und eure ersten Assoziationen zum Thema 'Mensch und KI'. (Absatz: Thematische Hinführung)", "color": "color-gradient-1", "thumbnail": "", "comments": "Didaktischer Kommentar als Markdown-String:\n\n Beitrag zur Intention: Dieser Baustein dient als aktivierender Einstieg, um die Schülerinnen und Schüler für die anthropologischen und ethischen Kernfragen der Einheit zu sensibilisieren. Er knüpft an ihr Vorwissen und ihre Meinungen an und eröffnet den Diskussionsraum.\n Kompetenzförderung: Fördert die Wahrnehmung ethischer Fragestellungen und die Darstellung eigener Vorstellungen.\n Konkrete Anwendung & Beispiele: Im Einstieg als Impuls für eine offene Klassendiskussion oder eine kurze Brainstorming-Phase. Die SuS könnten Stichworte oder kurze Sätze zu 'Utopie' und 'Dystopie' im Kontext von KI sammeln.\n Methodische Vielfalt & Sozialformen: Plenum, Think-Pair-Share.\naus: Homo Digitalis — Upgrade für das Gehirn", "url": "https://webcompetent.org/homo-digitalis-upgrade-fuer-das-gehirn", "labels": "Einstieg", "inactive": false }, { "id": "id-1750022132843-m25ypwv", "heading": "Mein digitales Ich: Smartphone-Nutzung und Assistenzsysteme", "content": "Aufgabenstellung:\n1. Prüft euer Wissen zum Smartphone mit dem Kahoot (Link im Originaldokument).\n2. Führt einen Selbstversuch mit einer Detox-App (Android) oder Forest (iOS) durch, um euer Nutzungsverhalten zu entdecken. Haltet die Ergebnisse in Protokollen fest und tauscht euch darüber aus: Was war dir vorher bewusst? Was war neu? Bewegt sich für dich alles im grünen Bereich? Willst du etwas ändern?\n3. Denkt über die Intelligenz von Assistenzsystemen wie Siri oder Cortana nach. Wenn du dir ein intelligenteres Smartphone wünschen könntest: Was müsste dieses Gerät können? (Absatz: Kapitel: Was das Smartphone heute schon kann (00:21 — 01:06))", "color": "color-gradient-1", "thumbnail": "", "comments": "Didaktischer Kommentar als Markdown-String:\n\n Beitrag zur Intention: Dieser Baustein verbindet das abstrakte Thema KI mit der konkreten Lebenswelt der Schülerinnen und Schüler. Durch den Selbstversuch und die Reflexion über Assistenzsysteme werden erste ethische Fragen und die Frage nach der menschlichen Identität im digitalen Raum greifbar.\n Kompetenzförderung: Fördert die Wahrnehmung ethischer Herausforderungen und das Erörtern von Konsequenzen in der Lebenswelt.\n Konkrete Anwendung & Beispiele: In der Erarbeitung zur Aktivierung von Alltagserfahrungen und zur Sensibilisierung für das Thema. Die SuS könnten ihre Protokolle in Kleingruppen besprechen und Wünsche für zukünftige Smartphone-Funktionen formulieren, die auch ethische Implikationen haben könnten (z.B. \"ein Smartphone, das meine Gefühle erkennt und darauf reagiert\").\n Methodische Vielfalt & Sozialformen: Einzelarbeit (Selbstversuch, Kahoot), Partner-/Kleingruppenarbeit (Austausch), Plenum (Sammeln von Wünschen).\naus: Homo Digitalis — Upgrade für das Gehirn", "url": "https://webcompetent.org/homo-digitalis-upgrade-fuer-das-gehirn", "labels": "Erarbeitung", "inactive": false }, { "id": "id-1750022132843-a2dmufz", "heading": "Wenn Gedanken Maschinen steuern: Brain-Computer Interfaces", "content": "Diskussionsanregung & Aufgabenstellung:\n1. Beschreibt die Steuerung von Geräten mithilfe von Gedanken, wie sie am Ars Electronica FutureLab erforscht wird.\n2. Entwickelt Theorien über das Lernen und diskutiert die Frage, wie Schulen für das 21. Jh. aussehen müssen.\n3. Erläutere ethischen Herausforderungen, an denen Science-Fiction-Autoren, Ingenieure, Informatiker und Psychologen zusammen arbeiten. (Absatz: Kapitel: Wie das Gehirn mit KI mithalten kann (01:07 — 02:34))", "color": "color-gradient-1", "thumbnail": "", "comments": "Didaktischer Kommentar als Markdown-String:\n\n Beitrag zur Intention: Dieser Baustein führt in die komplexere Thematik der Brain-Computer Interfaces ein und regt zur Reflexion über die Zukunft des Lernens und die ethischen Grenzen der Technologie an. Er ermöglicht eine tiefere Auseinandersetzung mit dem Menschenbild.\n Kompetenzförderung: Fördert das Erörtern verschiedener Gottes- und Menschenbilder und die argumentative Auseinandersetzung mit ethischen Aspekten.\n Konkrete Anwendung & Beispiele: Zur Erarbeitung neuer Inhalte. Die SuS könnten in Gruppenarbeit die gestellten Fragen bearbeiten und ihre Theorien und Herausforderungen präsentieren. Beispiel: \"Welche ethischen Bedenken ergeben sich, wenn Gedanken zur Steuerung von Maschinen genutzt werden?\"\n Methodische Vielfalt & Sozialformen: Gruppenarbeit, Plenum (Präsentation und Diskussion).\naus: Homo Digitalis — Upgrade für das Gehirn", "url": "https://webcompetent.org/homo-digitalis-upgrade-fuer-das-gehirn", "labels": "Erarbeitung, Vertiefung", "inactive": false }, { "id": "id-1750022132843-h3rgdyd", "heading": "Identität und Erinnerung: Wer bin ich im digitalen Zeitalter?", "content": "Aufgabenstellung:\n1. Erstelle ein Akrostichon und bestimme, wer du bist.\n2. Erzähle von deinen ältesten Erinnerungen.\n3. Bestimme auf einer biografischen Zeitleiste die für deine Identität bedeutsamen Momente.\n4. Erkläre Zusammenhänge zwischen Kontinuitäten, Wandlungen und Erinnerungen. Visualisiere die Zusammenhänge in einer Grafik, z.B. in einer biografischen Landkarte, einem Garten oder einem Stadtplan.\n5. Diskutiert in der Lerngruppe mit Rückgriff auf eure Grafiken, inwiefern ein Eingriff in die Erinnerungen sich negativ oder positiv auf die Identitäten von Menschen auswirken kann. Formuliert Fallbeispiele. (Absatz: Kapitel: Manipulierte Erinnerungen (02:35 — 04:31))", "color": "color-gradient-1", "thumbnail": "", "comments": "Didaktischer Kommentar als Markdown-String:\n\n Beitrag zur Intention: Dieser Baustein ist zentral für die anthropologische Reflexion. Er verbindet philosophische Konzepte von Identität mit der konkreten Möglichkeit der Manipulation von Erinnerungen durch Technologie. Dies ist ein direkter Bezug zur Frage nach dem menschlichen Ebenbild und seiner Unversehrtheit.\n Kompetenzförderung: Fördert das Erörtern verschiedener Gottes- und Menschenbilder und das Deuten der biblischen Rede von Geschöpf und Ebenbild Gottes hinsichtlich ihrer lebenspraktischen Konsequenzen.\n Konkrete Anwendung & Beispiele: Zur Vertiefung der anthropologischen Fragen. Die SuS können kreativ ihre Identität visualisieren und anschließend die ethischen Implikationen von Erinnerungsmanipulation diskutieren. Beispiel: \"Welche ethischen Grenzen sollte es bei der Möglichkeit geben, Erinnerungen zu verändern?\"\n Methodische Vielfalt & Sozialformen: Einzelarbeit (kreative Aufgabe), Partner-/Kleingruppenarbeit (Diskussion, Fallbeispiele), Plenum (Vorstellung der Grafiken und Diskussion).\naus: Homo Digitalis — Upgrade für das Gehirn", "url": "https://webcompetent.org/homo-digitalis-upgrade-fuer-das-gehirn", "labels": "Vertiefung", "inactive": false }, { "id": "id-1750022132843-e7nti6s", "heading": "Der optimierte Mensch: Eine theologische Perspektive", "content": "Diskussionsanregung & Aufgabenstellung:\n1. Gib das Vorhaben Bryan Johnsons (kognitive und empathische Fähigkeiten durch Implantate beschleunigen) mit eigenen Worten wieder.\n2. Muss sich der Mensch optimieren? Präsentiere deine Einstellung mithilfe einer Positionslinie: JA! <- Hier stehe ich! -> Nein! Ordnet die unterschiedlichen Begründungszusammenhänge in einer Mindmap.\n3. Kann man die Humanmedizin und ihre Entwicklungen als Optimierungsversuch oder ‑prozess des Menschen verstehen? Sammelt Argumente und Beispiele und führt eine Pro- und Contra-Diskussion.\n4. Im Alten Testament wird in unterschiedlichen Texten von der Erschaffung des Menschen durch Gott erzählt. Im Schöpfungshymnus Gen 1,31 wird das Geschöpf beurteilt. In Gen 2,18 findet sich eine weitere Einschätzung. Inwiefern spiegeln sich in den Texten Überlegungen der biblischen Autoren zur „Optimierung” des Menschen? (Absatz: Kapitel: Aufmerksamer, konzentrierter, kreativer: Maschinenlesbare Hirnströme (04:32 — 06:05))", "color": "color-gradient-1", "thumbnail": "", "comments": "Didaktischer Kommentar als Markdown-String:\n\n Beitrag zur Intention: Dieser Baustein ist ein Kernstück für die Verknüpfung von KI und Gottesbild. Er fordert die SuS heraus, die Idee der menschlichen Optimierung kritisch zu hinterfragen und mit biblischen Schöpfungsaussagen zu kontrastieren. Dies ermöglicht eine tiefgehende Reflexion über das Gottesbild und die biblische Rede vom Menschen als Geschöpf.\n Kompetenzförderung: Fördert das Deuten der biblischen Rede von Geschöpf und Ebenbild Gottes. Unterstützt das Erörtern verschiedener Gottes- und Menschenbilder und das Beurteilen religionskritischer Entwürfe.\n Konkrete Anwendung & Beispiele: Zur Vertiefung der theologischen und ethischen Fragen. Die Positionslinie und die Pro-Contra-Diskussion fördern die argumentative Auseinandersetzung. Die Analyse der biblischen Texte verbindet die moderne Debatte mit religiösen Traditionen. Beispiel: \"Was bedeutet es für unser Gottesbild, wenn wir versuchen, den Menschen 'perfekter' zu machen?\"\n Methodische Vielfalt & Sozialformen: Einzelarbeit (Positionslinie, Textanalyse), Partner-/Kleingruppenarbeit (Mindmap, Pro-Contra-Diskussion), Plenum (Austausch, Sicherung).\naus: Homo Digitalis — Upgrade für das Gehirn", "url": "https://webcompetent.org/homo-digitalis-upgrade-fuer-das-gehirn", "labels": "Vertiefung, Erarbeitung", "inactive": false }, { "id": "id-1750022132843-gjp4zyr", "heading": "Das vernetzte Gehirn: Konzentration, Ablenkung und Mitgefühl", "content": "Diskussionsanregung & Aufgabenstellung:\n1. Stelle die Position Ian Pearsons zur Zukunft vernetzter menschlicher Hirne dar und formuliere ein eigenes Statement.\n2. Erläutere das Experiment an der Ars Electronica, Linz, und kläre die Bedeutungen von Konzentration und Ablenkungfreiheit.\n3. Diskutiert die Frage, ob die sonst hochgelobte „Konzentration” nicht auch Gefahren in sich birgt.\n4. In Mt 8,5−10 wird von einer Fernheilung gesprochen. Empathie oder Mitgefühl bekommen in dieser Geschichte eine große Bedeutung. Diskutiert die Vergleichbarkeit mit dem Experiment.\n5. Beurteilt die positiven Potentiale der Hirnschnittstellen an selbstgewählten Beispielen.\n6. Entwickelt Theorien, warum ausgerechnet der Spitzenforscher Christopher Lindinger vor einer letzten Vernetzung der menschlichen Gehirne warnt. (Absatz: Kapitel: Schnittstellen zum Gehirn (06:06 — 09:40))", "color": "color-gradient-1", "thumbnail": "", "comments": "Didaktischer Kommentar als Markdown-String:\n\n Beitrag zur Intention: Dieser Baustein erweitert die Diskussion um Brain-Computer Interfaces um die Aspekte Konzentration, Ablenkung und Empathie. Die Verknüpfung mit der biblischen Fernheilungsgeschichte (Mt 8,5-10) ermöglicht eine theologische Reflexion über Mitgefühl und die Grenzen menschlicher Fähigkeiten im Vergleich zu göttlicher Macht.\n Kompetenzförderung: Fördert das Erörtern verschiedener Gottes- und Menschenbilder. Unterstützt das Deuten biblischer Texte hinsichtlich ihrer lebenspraktischen Konsequenzen und die argumentative Auseinandersetzung.\n Konkrete Anwendung & Beispiele: Zur Vertiefung und zum Transfer des Gelernten. Die SuS könnten in Gruppenarbeit die verschiedenen Aspekte bearbeiten und ihre Ergebnisse präsentieren. Beispiel: \"Welche ethischen Bedenken ergeben sich, wenn menschliche Gehirne vollständig vernetzt werden? Welche Rolle spielt dabei die Empathie?\"\n Methodische Vielfalt & Sozialformen: Gruppenarbeit, Plenum (Diskussion, Präsentation).\naus: Homo Digitalis — Upgrade für das Gehirn", "url": "https://webcompetent.org/homo-digitalis-upgrade-fuer-das-gehirn", "labels": "Vertiefung, Transfer", "inactive": false }, { "id": "id-1750022132843-1gmsy6f", "heading": "Homo Digitalis: Eine abschließende Positionsbestimmung", "content": "Diskussionsanregung: \"Was passiert, wenn es uns gelingt, das Organ zu verändern, das unser Denken bestimmt, unser Bewusstsein, unsere Identität? Bleiben wir dann noch Mensch? Was denkst Du?\" Formuliert eure persönliche Antwort auf diese Kernfrage der Einheit und begründet sie unter Bezugnahme auf die erarbeiteten Inhalte und eure eigenen Gottes- und Menschenbilder. (Absatz: Abschließende Frage am Ende des Dokuments)", "color": "color-gradient-1", "thumbnail": "", "comments": "Didaktischer Kommentar als Markdown-String:\n\n Beitrag zur Intention: Dieser Baustein dient der abschließenden Synthese und Reflexion der gesamten Unterrichtseinheit. Er fordert die Schülerinnen und Schüler auf, eine eigene, begründete Position zu den komplexen Fragen von Menschsein und KI zu entwickeln und dabei die erarbeiteten Kompetenzen anzuwenden.\n Kompetenzförderung: Fördert das Darstellen eigener Gottesvorstellungen und das Erörtern der verschiedenen Gottes- und Menschenbilder hinsichtlich ihrer lebenspraktischen Konsequenzen.\n Konkrete Anwendung & Beispiele: Zur Sicherung und zum Transfer des Gelernten. Die SuS könnten ihre Antworten schriftlich festhalten (z.B. als Essay oder Statement) und anschließend in einer Gallery Walk oder einer Fishbowl-Diskussion präsentieren und diskutieren.\n Methodische Vielfalt & Sozialformen: Einzelarbeit (schriftliche Reflexion), Plenum (Diskussion, Präsentation).\naus: Homo Digitalis — Upgrade für das Gehirn", "url": "https://webcompetent.org/homo-digitalis-upgrade-fuer-das-gehirn", "labels": "Sicherung, Transfer", "inactive": false } ] }, { "id": "id-1750022178956-tvws3tr", "name": "Unterrichtsreihe", "color": "color-gradient-1", "cards": [ { "id": "id-1750022178956-cprxgo9", "heading": "Gottesbild und Künstliche Intelligenz", "content": "## Unterrichtsverlaufsplan: Gottesbild und Künstliche Intelligenz (Klasse 11)\n\nIntention der Unterrichtseinheit: Die Schülerinnen und Schüler sollen befähigt werden, eigene Gottesvorstellungen zu entwickeln, diese mit biblischen Gottesbildern zu vergleichen, und die lebenspraktischen Konsequenzen verschiedener Gottes- und Menschenbilder im Kontext technischer Entwicklungen zu reflektieren. Dabei sollen sie auch religionskritische Perspektiven und ethische Fragen im Zusammenhang mit KI erarbeiten.\n\nLerngruppe: Schülerinnen und Schüler der 11. Klasse\n\n### Stunde 1: Einführung in KI und ethische Alltagsfragen\n\nSchwerpunkt Kompetenzen:\n\n1. SuS erörtern die verschiedenen Gottes- und Menschenbilder hinsichtlich ihrer lebenspraktischen Konsequenzen in ihrer Lebenswelt.\n2. SuS stellen eigene Gottesvorstellungen dar (erste Ansätze durch die Auseinandersetzung mit den Auswirkungen von KI auf die Lebenswelt).\n\nPhasen:\n\n1. Einstieg (ca. 15 Min)\n2. Impuls und Brainstorming:\n\n> Mensch und Maschine: Utopie oder Dystopie?\n\n1. Die Lehrkraft beginnt mit der Frage nach den ersten Assoziationen der SuS zum Thema Künstliche Intelligenz und leitet eine offene Diskussion zu 'Utopie oder Dystopie' ein.\n2. Situationsbezug:\n\n> KI im Alltag: Chancen und Gefahren von Pflegerobotern\n\n1. Die SuS versetzen sich in die beschriebene Situation mit der pflegebedürftigen Großmutter. In Einzelarbeit sammeln sie erste Gedanken und Gefühle, gefolgt von einer kurzen Plenumsaussprache.\n2. Erarbeitung (ca. 25 Min)\n3. Begriffsdefinition und Alltagsbezug:\n\n> Was ist KI? Sammeln von Alltagsbeispielen und Positionierung\n\n1. \ \\Methode:\\ Think-Pair-Share. Die SuS überlegen zunächst allein, dann zu zweit, in welchen Bereichen KI heute schon vorkommt. \ \\Plenum:\\ Gemeinsam wird eine Mindmap mit Alltagsbeispielen für KI erstellt (z.B. Sprachassistenten, personalisierte Werbung, autonomes Fahren). \ \\Positionierung:\\ Die SuS positionieren sich auf einer gedachten Linie im Raum, an deren Enden 'Chancen' und 'Gefahren' markiert sind, und erläutern ihre Positionen im Unterrichtsgespräch. \ \\Lücke:\\ Eine konkrete Materialgrundlage (M1) zur Begriffsbestimmung von KI aus dem Artefakt \

Mensch und Maschine - Entwicklungen künstlicher Intelligenz (KI) als Ausgangspunkt anthropologisch-ethischer Lernprozesse in der Oberstufe\\wird im Artefakt \Was ist KI? Sammeln von Alltagsbeispielen und Positionierung\\erwähnt, ist aber nicht explizit als Kärtchen vorhanden. \ \\Vorschlag zur Füllung:\\ Die Lehrkraft bereitet eine kurze, prägnante Definition von KI vor oder stellt einen kurzen Informationstext (z.B. M1 aus dem Originaldokument) bereit, der nach der Mindmap zur Sicherung des Begriffsverständnisses dient.\n2. Sicherung/Ausblick (ca. 5 Min)\n3. Zusammenfassung: Die wichtigsten Erkenntnisse zu KI im Alltag und die Bandbreite der Meinungen zu Chancen und Gefahren werden kurz zusammengefasst.\n4. Ausblick: Die Lehrkraft leitet über zur Notwendigkeit, sich mit konkreten ethischen Dilemmata auseinanderzusetzen.\n\n### Stunde 2: Ethische Herausforderungen und die Frage nach dem Bewusstsein\n\nSchwerpunkt Kompetenzen:\n\n1. SuS erörtern die verschiedenen Gottes- und Menschenbilder hinsichtlich ihrer lebenspraktischen Konsequenzen in ihrer Lebenswelt.\n2. SuS beurteilen religionskritische Entwürfe hinsichtlich ihrer Überzeugungskraft im Kontext der Diskussion über Gottesbilder (erste Ansätze durch ethische Problemfelder).\n\nPhasen:\n\n1. Einstieg (ca. 10 Min)\n2. Wiederholung: Kurze Aktivierung der in Stunde 1 gesammelten KI-Anwendungsfelder.\n3. Impuls: Die Lehrkraft zeigt einen kurzen, provokanten Filmausschnitt oder ein Bild, das eine ethische Herausforderung im Kontext von KI darstellt (z.B. autonome Waffensysteme, KI in der Medizin).\n4. Erarbeitung (ca. 30 Min)\n5. Vertiefung ethischer Dilemmata (Gruppenpuzzle):\n\n> Ethische Herausforderungen der KI: Gruppenpuzzle zu Anwendungsfeldern\n\n1. \ Die SuS bilden Expertengruppen (bis zu fünf), die sich jeweils mit einem spezifischen Anwendungsfeld der KI (Pflegeroboter, autonome Waffensysteme, automatische Bewerbungssoftware, KI in der Schule, Steuerungscomputer im Verkehr) anhand von Infotexten (M2a-e aus dem Originaldokument) und Arbeitsaufträgen auseinandersetzen. \ Die Ergebnisse werden anschließend im Gruppenpuzzle oder direkt im Plenum präsentiert, um ein umfassendes ethisches Problembewusstsein zu schaffen.\n2. Mediale Ergänzung (optional):\n\n> Videoanalyse: „K.O. durch KI? Keine Angst vor schlauen Maschinen!“ (Leschs Kosmos)\n\n1. \ Gezielte Sequenzen des Videos können zur Vertiefung der jeweiligen Gruppenarbeitsthemen eingesetzt werden (z.B. \\\"Autonomes Fahren – mehr Sicherheit?\\\" oder \\\"Algorithmen – warum lügen sie?\\\").\n2. Sicherung/Ausblick (ca. 5 Min)\n3. Reflexion: Kurze gemeinsame Reflexion über die Komplexität ethischer Entscheidungen im KI-Kontext.\n4. Ausblick: Überleitung zur Frage, was den Menschen im Angesicht dieser Technologien ausmacht und wie sich dies auf unser Verständnis von Bewusstsein und Identität auswirkt.\n\n### Stunde 3: Menschliche Identität, Bewusstsein und biblische Anthropologie\n\nSchwerpunkt Kompetenzen:\n\n1. SuS erörtern die verschiedenen Gottes- und Menschenbilder hinsichtlich ihrer lebenspraktischen Konsequenzen.\n2. SuS deuten die biblische Rede von Geschöpf und Ebenbild Gottes hinsichtlich ihrer lebenspraktischen Konsequenzen.\n\nPhasen:\n\n1. Einstieg (ca. 10 Min)\n2. Filmimpuls:\n\n> Science-Fiction-Filme: KI, Bewusstsein und menschliche Beziehungen\n\n1. Die Lehrkraft zeigt eine ausgewählte Szene aus \\\"Ex Machina\\\" (z.B. 9:50-14:32) oder \\\"Her\\\", die die Frage nach dem Bewusstsein von Maschinen oder der Qualität menschlicher Beziehungen zu KI aufwirft.\n2. Sammeln von Eindrücken: Erste Eindrücke und Überlegungen zur Möglichkeit einer Bewusstwerdung von Maschinen oder der Rolle von KI in Beziehungen werden im Plenum gesammelt.\n3. Erarbeitung (ca. 20 Min)\n4. Philosophische Perspektiven auf Bewusstsein:\n\n> Können Maschinen Bewusstsein besitzen? Der Turing-Test\n\n1. \ Die Lehrkraft erläutert den Turing-Test. \ In Kleingruppen diskutieren die SuS: \\\"Was versteht man unter Bewusstsein? Kann eine Maschine Bewusstsein haben? Welche Kriterien würden wir anwenden, um dies zu beurteilen?\\\"\n2. Vertiefung der Identitätsfrage:\n\n> Identität und Erinnerung: Wer bin ich im digitalen Zeitalter?\n\n1. \ Die SuS erstellen ein Akrostichon oder eine biografische Zeitleiste zu ihrer Identität. \ In Kleingruppen diskutieren sie anschließend, inwiefern ein (hypothetischer) Eingriff in Erinnerungen sich negativ oder positiv auf die Identität von Menschen auswirken könnte.\n2. Vertiefung/Transfer (ca. 15 Min)\n3. Gedankenexperiment und theologische Reflexion:\n\n> Das Gedankenexperiment „Mary“: Subjektives Erleben vs. Physiologie\n\n1. \ Die SuS lesen den Text zum Gedankenexperiment \\\"Mary\\\" (M4 aus 'Mensch und Maschine...') und diskutieren in Partnerarbeit das Kernproblem: \\\"Was unterscheidet subjektives Erleben von messbaren physiologischen Vorgängen?\\\" \ \\Lücke:\\ Die direkte theologische Verknüpfung des Gedankenexperiments mit der biblischen Anthropologie ist im Artefakt impliziert, muss aber explizit gemacht werden. \ \\Vorschlag zur Füllung:\\ Die Lehrkraft führt die Diskussion fort mit der Frage: \\\"Was bedeutet es für unser Verständnis des Menschen als 'Ebenbild Gottes' (vgl. Gen 1,27), wenn subjektives Erleben nicht rein materiell erklärbar ist? Welche einzigartigen menschlichen Qualitäten werden hier sichtbar, die eine KI nicht abbilden kann?\\\"\n\n### Stunde 4: Der Mensch als Ebenbild Gottes und die Optimierung des Menschen\n\nSchwerpunkt Kompetenzen:\n\n1. SuS deuten die biblische Rede von Geschöpf und Ebenbild Gottes hinsichtlich ihrer lebenspraktischen Konsequenzen.\n2. SuS erörtern die verschiedenen Gottes- und Menschenbilder hinsichtlich ihrer lebenspraktischen Konsequenzen.\n\nPhasen:\n\n1. Einstieg (ca. 10 Min)\n2. Blitzlicht: Kurze Wiederholung der wichtigsten Erkenntnisse aus Stunde 3 zu Bewusstsein und Identität.\n3. Impuls: Die Lehrkraft stellt kurz das Vorhaben von Bryan Johnson (menschliche Optimierung durch Implantate) vor.\n4. Erarbeitung (ca. 25 Min)\n5. Diskussion über menschliche Optimierung:\n\n> Der optimierte Mensch: Eine theologische Perspektive\n\n1. \ Die SuS positionieren sich auf einer Positionslinie (\\\"Muss sich der Mensch optimieren? JA! <-> NEIN!\\\") und begründen ihre Haltung in einer Mindmap (Partnerarbeit). \ \\Plenum:\\ Pro- und Contra-Diskussion zur Frage, ob Humanmedizin und technologische Entwicklungen als Optimierungsversuch des Menschen verstanden werden können.\n2. Vertiefung (ca. 10 Min)\n3. Biblische Perspektive auf Geschöpflichkeit:\n\n> Der optimierte Mensch: Eine theologische Perspektive\n\n1. \ Analyse der biblischen Texte Gen 1,31 (Beurteilung des Geschöpfes als \\\"sehr gut\\\") und Gen 2,18 (Finden eines adäquaten Gegenübers). \ Diskussion: \\\"Inwiefern spiegeln sich in diesen Texten Überlegungen der biblischen Autoren zur 'Optimierung' des Menschen wider? Was bedeuten diese Texte für unsere heutige Debatte über menschliche Optimierung durch KI?\\\"\n2. Theologische Abgrenzung:\n\n> Der Mensch als Ebenbild Gottes: Unterschied zu digitalen Systemen (Charbonnier)\n\n1. \ Die SuS lesen den Text von Ralph Charbonnier (M5 aus 'Mensch und Maschine...') und fassen seine Argumente zusammen, warum digitale Systeme \\\"nicht lernen, (sich) entscheiden, handeln und vertrauenswürdig sind\\\". \ Anschließend wird der Bezug zum Menschen als \\\"Ebenbild Gottes\\\" diskutiert: Welche Eigenschaften des Menschen sind nach Charbonnier einzigartig und unübertragbar auf Maschinen?\n\n### Stunde 5: KI als 'Gott'? Religionskritik und theologische Einordnung\n\nSchwerpunkt Kompetenzen:\n\n1. SuS stellen eigene Gottesvorstellungen dar und vergleichen sie mit biblischen Gottesvorstellungen.\n2. SuS beurteilen religionskritische Entwürfe hinsichtlich ihrer Überzeugungskraft im Kontext der Diskussion über Gottesbilder.\n\nPhasen:\n\n1. Einstieg (ca. 10 Min)\n2. Provokation und Diskussion:\n\n> Chat-Experiment: Was sagt eine KI über Gott?\n\n1. Die SuS lesen den Artikel 'Chatten mit Gott?' und diskutieren die direkten und indirekten Antworten der KI auf Fragen nach Gott.\n2. Religionskritische Perspektive der KI:\n\n> KI als theologischer Ratgeber: Glaube, Kirche und persönliche Beziehung\n\n1. Diskussion der Aussage der KI, man solle sich 'nicht an alles halten, was die Kirche sagt, sondern eine persönliche Beziehung zu Gott haben'. Welche Chancen und Gefahren seht ihr in einem solchen 'theologischen Rat' durch eine KI?\n2. Erarbeitung (ca. 20 Min)\n3. Grenzen der KI im religiösen Kontext:\n\n> Die Technik hinter dem 'KI-Gott': Grenzen von Large Language Models\n\n1. \ Die SuS fassen zusammen, wie Character.AI funktioniert und welche konkreten Schwächen der Autor im Gespräch mit dem 'KI-Gott' feststellt (Wiederholungen, Kontextverlust, Fehler). \ Diskussion: \\\"Welche Schlussfolgerungen lassen sich daraus für die 'Wahrheit' oder 'Autorität' von KI-generierten Inhalten, insbesondere im religiösen Kontext, ziehen lassen?\\\"\n2. Recherche und Präsentation (Hausaufgabe oder Kurzrecherche):\n\n> Heilserwartungen an KI: „Way of the Future“ und Unsterblichkeit\n\n1. Kurze Präsentation der Rechercheergebnisse zu \\\"Way of the Future\\\" oder \\\"KI und Unsterblichkeit\\\".\n2. Vertiefung/Sicherung (ca. 15 Min)\n3. Theologische Einordnung von KI-Heilserwartungen:\n\n> „Ihr werdet sein wie Gott“: Theologische Einordnung von KI-Heilserwartungen\n\n1. \ Die SuS lesen den Text von Jörg Hermann (M7 aus 'Mensch und Maschine...') und erarbeiten, wie er Tendenzen zur religiösen Überhöhung von KI theologisch einordnet. \ Diskussion: \\\"Wie beurteilt Hermann die 'Gottesähnlichkeit' im Kontext von KI? Welche biblischen Bezüge stellt er her und wie helfen sie uns, die Rolle des Menschen zu verstehen?\\\"\n\n### Stunde 6: Digitaler Humanismus und Abschlussreflexion\n\nSchwerpunkt Kompetenzen:\n\n1. SuS erörtern die verschiedenen Gottes- und Menschenbilder hinsichtlich ihrer lebenspraktischen Konsequenzen in ihrer Lebenswelt.\n2. SuS deuten die biblische Rede von Geschöpf und Ebenbild Gottes hinsichtlich ihrer lebenspraktischen Konsequenzen.\n3. SuS stellen eigene Gottesvorstellungen dar und vergleichen sie mit biblischen Gottesvorstellungen.\n\nPhasen:\n\n1. Einstieg (ca. 10 Min)\n2. Impuls:\n\n> Digitaler Humanismus: Ethik für den Umgang mit KI\n\n1. Die Lehrkraft zeigt eine Karikatur (z.B. von H. Haitzinger) oder einen kurzen Ausschnitt aus dem Interview mit Yvonne Hofstetter (\\\"Bots, Fake News und BigData: Das Ende der Demokratie?\\\") zur Frage, inwieweit KI eine Gefahr für Demokratie und Selbstbestimmung darstellen kann.\n2. Sammeln von Assoziationen: Kurze Sammlung von Assoziationen und Fragen der SuS.\n3. Erarbeitung (ca. 20 Min)\n4. Konzept des Digitalen Humanismus:\n\n> Digitaler Humanismus: Ethik für den Umgang mit KI\n\n1. \ Die SuS erschließen das Konzept des „Digitalen Humanismus“ von Julian Nida-Rümelin (M8 aus 'Mensch und Maschine...') in Kleingruppen. \ Diskussion: \\\"Wie grenzt sich Nida-Rümelin von Ideologisierung und apokalyptischen Befürchtungen ab, und was ist sein Ziel für den Umgang mit KI?\\\"\n2. Entwicklung ethischer Leitlinien:\n\n> Digitaler Humanismus: Ethik für den Umgang mit KI\n\n1. \ Ausgehend vom Konzept des Digitalen Humanismus entwickeln die SuS in Gruppen ethische Leitlinien für den verantwortungsvollen Umgang mit KI. Dabei sollen sie sich auf die zu Beginn der Einheit kennengelernten Beispielfelder (Pflegeroboter, Bewerbungssoftware etc.) beziehen.\n2. Sicherung/Transfer (ca. 15 Min)\n3. Abschließende Positionsbestimmung:\n\n> Homo Digitalis: Eine abschließende Positionsbestimmung\n\n1. \ Die SuS formulieren ihre persönliche, begründete Antwort auf die Kernfrage der Einheit: \\\"Was passiert, wenn es uns gelingt, das Organ zu verändern, das unser Denken bestimmt, unser Bewusstsein, unsere Identität? Bleiben wir dann noch Mensch? Was denkst Du?\\\" \ \\Optional:\\ Präsentation der entwickelten Leitlinien und der persönlichen Statements im Plenum, gefolgt von einer abschließenden Diskussion.\n2. Lücke: Möglichkeiten für systematisches Feedback und Selbstbewertung fehlen noch.\n3. Vorschlag zur Füllung: Am Ende der Stunde oder der Einheit können die SuS eine 'Exit-Card' ausfüllen, auf der sie 1-2 zentrale Erkenntnisse der gesamten Einheit und 1 offene Frage notieren. Dies dient der Selbstreflexion und gibt der Lehrkraft Feedback zum Lernerfolg.", "color": "color-gradient-1", "thumbnail": "", "comments": "", "url": "", "labels": "", "inactive": false } ] }, { "id": "id-1750082204880-fpucylt", "name": "New Column", "color": "color-gradient-1", "cards": [ { "id": "id-1750082207747-a6bqez9", "heading": "Das Konzept eines digitalen Humanismus kann...", "content": "Das Konzept eines digitalen Humanismus kann mithilfe\nvon M8 erschlossen und erörtert werden. Die Schülerin-\nnen entwickeln (präzisieren) ausgehend davon ethische\nLeitlinien für den Umgang mit KI und greifen dazu noch\neinmal die zu Beginn kennengelernten Beispielfelder auf.", "color": "color-gradient-1", "thumbnail": "", "comments": "", "url": "", "labels": "", "inactive": false } ] } ], "aiConfig": { "provider": "", "apiKey": "", "model": "", "baseUrl": "" }, "backgroundTransparency": 80, "backgroundHex": "#bbf7d0", "headerRGBA": "rgba(255, 255, 255, 0.8)", "exportDate": "2025-06-16T14:01:34.711Z", "nostrEvent": true } -

@ 2cde0e02:180a96b9

2025-06-16 13:55:54

@ 2cde0e02:180a96b9

2025-06-16 13:55:54pen & ink; monochromized

https://stacker.news/items/1007644

-

@ a19caaa8:88985eaf

2025-06-16 13:47:40

@ a19caaa8:88985eaf

2025-06-16 13:47:40NostrをXのように使い始めて3か月が経った。最初は「ぷ プロトコル? ブロックチェーン?サーバー? そもそも、ギットハブって??」って謎だらけで、それでも利用できてしまうから「使えちゃって大丈夫かな」とすら思っていたけど、いちユーザーながら少しずつわかることが増えてきたから、この3か月間で覚えたこととかできるようになったことを、備忘録も兼ねてまとめてみる。といっても過去ツイ(便宜上)を集めてきただけだけど。初心を忘れたくない!!

-

PCで始めて、スマホは後だったんだろうな nostr:note1q8t0spfhg9dc4h590jedd00a5pag5j44tv0vzu55004q8qjw7fkscecvkz

-

iPhoneからNostore(拡張機能(NIP-??))を使ってSafariでlumilumiにログイン nostr:note1egt7y4a8wulu6kex40z0zqtgls0r9ups0q4npyrlmgd3f2swrcysrskp42 nostr:note15gjqzpnevft2h6ywlz2hzacsk6emlna5lwechcpwkx5n6fq8gs9qprfh6v ↑Damusをdisるな

nostr:note1cn4aspxthcysjgwhyd3wwr6slsz57anwn2ep3th05lpa0yag6xrqm8x3lh やかましい ※用語解説:Nostrクライアントなどの名前です - Nostore: 拡張機能(の、説明のscrapbox)

- nostter: https://nostter.app/about

- damus(for iOS): https://damus.io/

- lumilumi: https://lumilumi.app/about

- Rabbit(拡張機能必須): https://rabbit.syusui.net/

- 出会い nostr:nevent1qvzqqqqqqypzqv33pxtldvmmdntqhv269r56zjadmhalpp660h3yc6gj8gxpuexvqyxhwumn8ghj77tpvf6jumt9qyghwumn8ghj7u3wddhk56tjvyhxjmcpp4mhxue69uhkummn9ekx7mqqyz9k4uamtpsy9rtfh4dpxez0n8vr7tufttz5x5v9j5vd3t76kapjwxk245u nostr:note10e6flvadpyfshtnplfnc83dunzjrgl4fl0uzrw70xt3ulf0nv2yqm4qjfa nostr:note1wwchrc7vz8fcp2jrknms5ascup9eux9fkd89jxhqy6d46mkr06ssmgrjhk ↓続き

-

3sats (zap)(NIP-?? kind:??) nostr:nevent1qqsw9sfvmaqy6ngvl98drg93e7sy08kfu2y4tuyj8m2mleftvcx5mqc8uyq3m nostr:note1zzs7qfemq7qaekxv0qjea24t6k4kvlla0m9lusep2ce38tef8gjqfgv7zu nostr:nevent1qqsz8m0c5drajst00x92uc8pjwxa40nd5hmzxu4vn3yhuzjkaqmk4fqa4lvkl nostr:note106n902n66lsfxck4fsu9dqkwmelnp06qqx96nzyqvp89c9v28apqzjcflw (急な意思表示)

たゃ仕事中に熟考

-

nostr:note1fj5mmtsk0nh0e23hez2dm4unweklrypm6s6n9ajwaug574dg7pqq8phvav nostr:note1wk0ugra9pyv0y0rmpql6sjgsavu634x53f4v4jztqluq02awxwhql8d8mf nostr:nevent1qvzqqqqqqypzq2aj4wlutzft00dg77x4x6pdjy7vnfzxk30pry5lpy6a3l0uks9aqyxhwumn8ghj77tpvf6jumt9qqsyt4yh934z6fd324z5hljwlx74nndfwetu04lnu8wcj0pkhkqlppqwpsmue ⚡3satsくれました

- ステータス NIP-??kind:30315

nostr:note1p836vncvcxfvkqmpggxzf53q6kywxn443w2hytydr7pdvrca835s83nd2u

nostr:nevent1qqsdu2mf3d5am8hpjj432yf0qmpfxuwy50pv9rx6q7pryz0axnj44dg0d7auc

nostr:nevent1qqsyaypjm0a99g7626r28ct97jhjvt4kk4vyv63fphdz8guhsdtevsg4yvvhr