-

@ 91117f2b:111207d6

2025-06-15 20:04:53

@ 91117f2b:111207d6

2025-06-15 20:04:53

Father's Day is a special holiday celebrated annually to honor fathers, father figures, and the significant role they play in shaping our lives. This year, Father's Day falls on Sunday, June 15, 2025, in many countries around the world.

A Brief History of Father's Day

The concept of Father's Day was first introduced by Sonora Smart Dodd in 1909, inspired by the success of Mother's Day. Dodd's father, William Jackson Smart, had raised her and her five siblings alone after their mother's death, and she wanted to honor his sacrifices and dedication. The first Father's Day celebration was held on June 19, 1910, in Spokane, Washington, and it wasn't until 1972 that President Richard Nixon signed a law declaring the third Sunday in June as the permanent date for Father's Day.

Celebrating Father's Day Around the World

While many countries celebrate Father's Day on the third Sunday in June, others observe it on different dates. Some notable exceptions include : - Spain, Italy, and Portugal: March 19, St. Joseph's Day - Germany: Ascension Day - Scandinavian countries: Second Sunday in November - Taiwan: August 8 - Australia and New Zealand: First Sunday in September

Ways to Celebrate Father's Day

If you're looking for ideas to make Father's Day special, consider these activities ¹: - Outdoor activities: Plan a camping trip, barbecue, or beach day - Cooking: Try out delicious recipes like grilled flank steak, country-style ribs, or bourbon-glazed salmon - Quality time: Spend the day doing something your dad enjoys, like watching a game or playing a sport together

Honoring Fathers and Father Figures

Father's Day is an opportunity to express gratitude and appreciation for the men who have made a positive impact in our lives. Whether it's a biological father, stepfather, grandfather, or father figure, this holiday is a chance to show love, respect, and admiration for their guidance, support, and sacrifices.

We say thank U to all the fathers out there in the world who have sacrificed and will continue to sacrifice for the benefit and success of their children. 💝♥️♥️

-

@ 5d4b6c8d:8a1c1ee3

2025-06-15 18:42:08

@ 5d4b6c8d:8a1c1ee3

2025-06-15 18:42:08https://youtu.be/-ne8adkjY6A

Orlando gets Bane

Memphis gets KCP, Cole Anthony, and a bunch of picks

This move makes a lot of sense. Orlando needed someone like Bane and Memphis needed to break up their core.

https://stacker.news/items/1007156

-

@ 2aa53cab:e338bfac

2025-06-15 20:05:20

@ 2aa53cab:e338bfac

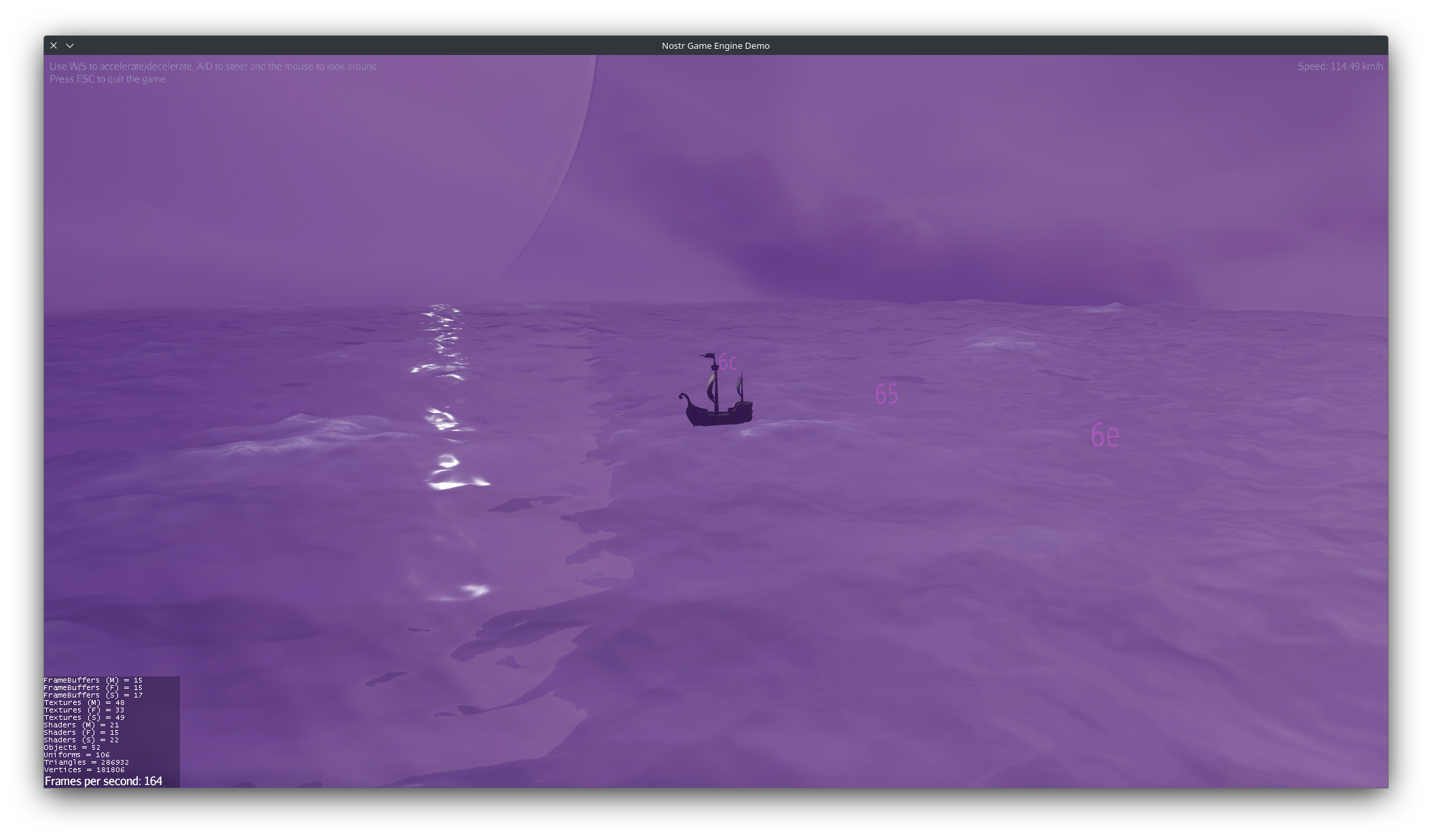

2025-06-15 20:05:20The Problem with Traditional Banking

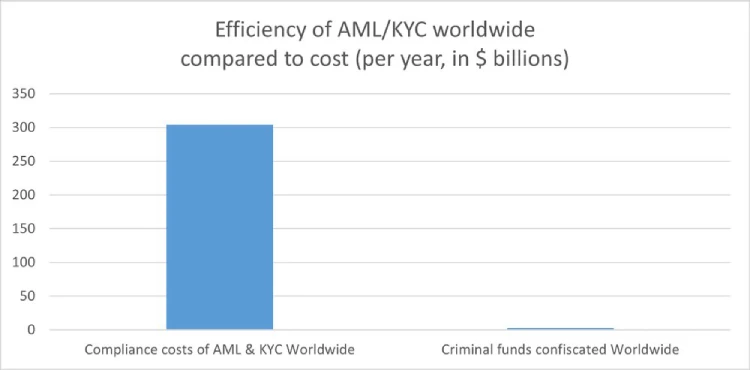

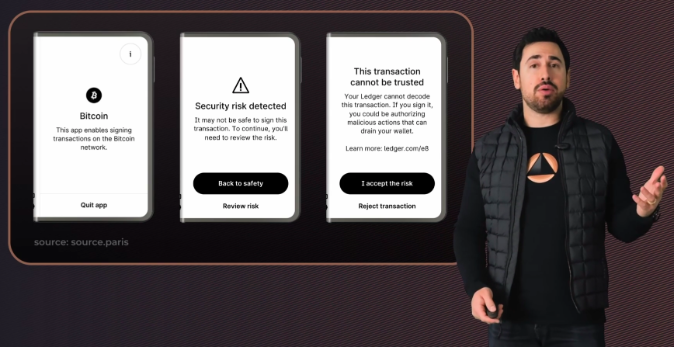

Let's be honest: traditional banking isn't working for everyone. High remittance fees eat into your hard-earned money, especially for cross-border transactions. Know Your Customer (KYC) barriers exclude millions from basic financial services. Banks hold only a fraction of your deposits in reserve, and when they fail—well, we've all seen what happens during financial crises.

These aren't just inconveniences; they're fundamental flaws in a system that was built for a different era. When you deposit money in a bank, you're essentially lending it to them, trusting they'll give it back when you need it. But what if there was a better way?

Bitcoin and the Self-Custody Revolution

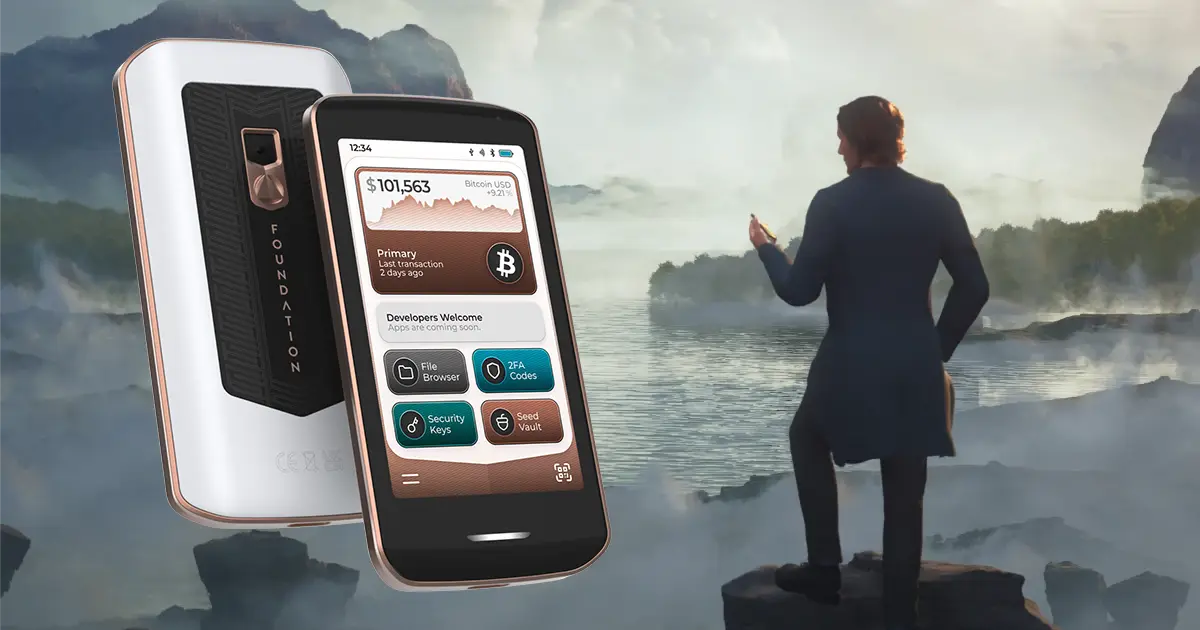

In 2009, Bitcoin introduced something revolutionary: the ability to be your own bank. Now we're witnessing the emergence of a borderless, permissionless financial system that puts power back in the hands of individuals.

Self-custody embodies a simple but powerful principle: "Your keys, your assets." Unlike traditional banking where institutions control your funds, self-custody wallets give you complete ownership and control. No one can freeze your account, limit your transactions, or decide how you use your money.

This isn't just about technology - it's about financial freedom and democratization. Blockchain's distributed consensus mechanism allows secure, peer-to-peer transactions without centralized authorities, solving the fundamental problem of digital money: preventing the same funds from being spent twice.

The Challenges We Face

Of course, this financial revolution isn't without hurdles:

Security Concerns: Losing your private keys means losing your funds - forever. While solutions like multi-signature wallets and social recovery mechanisms are emerging, the responsibility can feel overwhelming for newcomers.

Regulatory Uncertainty: Governments worldwide are still figuring out how to regulate crypto. The EU's new crypto-asset framework and similar initiatives in Dubai and Switzerland are steps in the mixed directions, additionally inconsistent regulations create confusion.

Technical Complexity: Bitcoin can take up to 60 minutes to confirm transactions, making it impractical for daily use. However, solutions like the Lightning Network are addressing these limitations.

Environmental Impact: Bitcoin's energy consumption is significant - 45.8 TWh annually as of 2018. Yet emerging research suggests Bitcoin mining actually supports renewable energy development and grid stability.

The Research Gap

Despite these challenges, something remarkable is happening. The crypto industry has matured significantly - compliance is improving, technology is advancing, and user experience is getting better.

But here's what's missing: understanding. While blockchain technology offers unprecedented financial autonomy, most people still don't understand how it works or why it matters. Self-custody remains under-researched and under-utilized, creating a gap between the technology's potential and its actual adoption.

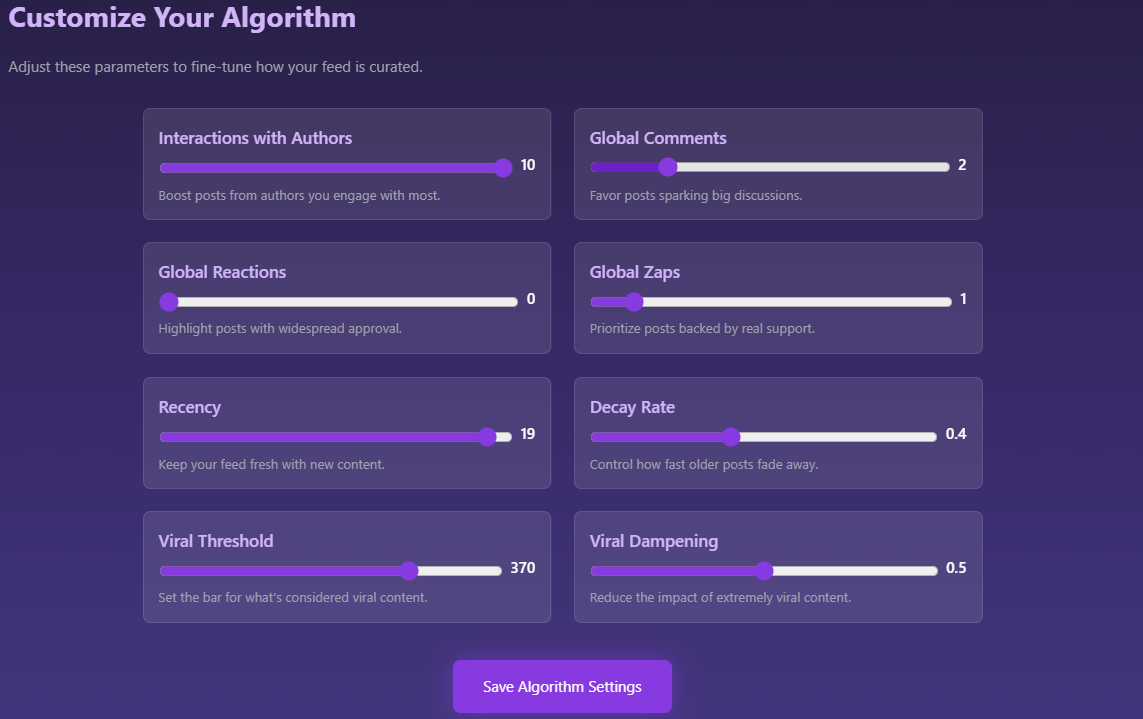

This gap prompted me to ask a critical question: What actually drives people to adopt self-custody wallets? To find answers, I conducted comprehensive research using the Unified Theory of Acceptance and Use of Technology (UTAUT) - a well-established psychological framework for understanding technology adoption.

My Research: Uncovering What Really Matters

I extended the traditional UTAUT model with additional factors specific to blockchain technology, including Technology Awareness, Personal Innovativeness in IT, and Perceived Control. After distributing questionnaires and gathering responses from 131 participants, I analyzed the data using advanced regression analysis methods.

The results challenged everything we thought we knew about technology adoption.

Surprising Finding #1: Traditional Factors Don't Matter

Conventional wisdom suggests that people adopt new technologies because they're useful or easy to use. My research revealed the opposite for self-custody wallets. Performance Expectancy (how useful people think the technology is) and Effort Expectancy (how easy they think it is to use) showed no significant influence on adoption decisions.

This finding is gripping. It suggests that when it comes to transformative technologies like blockchain, people's adoption decisions aren't driven by traditional utility calculations. Instead, they're motivated by something deeper.

Surprising Finding #2: Control Isn't What You Think

Even more unexpected was the role of Perceived Control. While individual analysis showed that feeling in control positively influenced adoption intentions, this effect completely disappeared - and even became slightly negative—when other factors were considered.

This paradox reveals something profound about technological maturity: as people develop deeper awareness of blockchain technology, they begin to understand the inherent limitations of control - even in self-custody systems. While Bitcoin offers significantly more control than traditional finance, truly informed users recognize that complete control is still an illusion.

Consider the realities: network congestion can delay transactions, protocol upgrades require consensus, market volatility affects value regardless of custody method, and the broader ecosystem still depends on exchanges, miners, and developers. As users become more technologically aware, they shift from seeking the illusion of total control to appreciating the relative autonomy that self-custody provides compared to traditional banking.

What Actually Drives Adoption

Research identified three critical factors that truly drive self-custody adoption:

1. Facilitating Conditions + Technology Awareness: The strongest predictor of adoption was having access to support resources combined with understanding blockchain's underlying principles. People need more than just technical support - they need to grasp why decentralization matters and how it empowers them.

2. Personal Innovativeness in IT: Individuals with higher technological curiosity and willingness to experiment with new technologies showed significantly greater adoption propensity. Early adopters aren't just tech-savvy; they're psychologically wired to embrace paradigm shifts.

3. Social Influence: Community and peer networks play a crucial role in adoption decisions. Unlike traditional technologies where social influence mainly drives awareness, in self-custody solutions, social networks serve as vital support systems for managing increased responsibility and complexity.

What This Means for the Future

These findings have profound implications for how we approach blockchain adoption:

For Individuals

Don't focus on whether self-custody is "easy" or "useful" - instead, invest time in understanding the fundamental principles of decentralization and building connections with knowledgeable communities. The technology's transformative potential becomes clear once you grasp its underlying philosophy.

For Educators and Organizations

Traditional approaches emphasizing convenience and utility miss the mark. Instead, focus on building comprehensive support systems and fostering deep technological understanding. Education should emphasize blockchain's empowering principles, not just operational mechanics.

For Policymakers

Regulations should support infrastructure development and community-driven learning rather than imposing traditional financial controls. Progressive jurisdictions like Switzerland and El Salvador demonstrate how supportive policy frameworks can accelerate adoption while protecting consumers.

For the Industry

Success in self-custody adoption depends more on building robust support infrastructure and fostering social networks than on emphasizing utility or ease of use. Companies should prioritize community building, comprehensive education, and graduated access systems that allow users to learn progressively.

The Bigger Picture

This research reveals something fundamental about how transformative technologies are adopted. When technologies don't just offer new features but challenge existing paradigms - like blockchain's challenge to traditional banking - adoption follows different rules.

The shift toward self-custody represents more than technological evolution; it's a fundamental movement toward democratizing finance. It addresses critical inefficiencies in traditional financial infrastructure while enabling a more inclusive financial future.

My research shows that this transition won't happen through traditional marketing approaches emphasizing convenience or performance. Instead, it requires building communities of understanding, creating comprehensive support systems, and recognizing that some people are naturally positioned to lead this transformation.

Why This Matters Now

Whether you're sending money to family abroad, protecting your savings from inflation, or simply wanting more control over your financial life, understanding self-custody wallets could be one of the most important financial decisions you make.

The data is clear: we're at the beginning of a financial revolution driven not by utility calculations but by deeper human needs for autonomy, understanding, and community. Those who grasp this distinction - and invest in building the necessary knowledge and connections - will be best positioned for the financial future that's rapidly approaching.

The future of money isn't just digital - it's self-sovereign. And this research to prove what that transformation really requires.\ \ Original research can be found here - "Do Users Understand and Want Self-Custody? Insights from an Extended UTAUT Perspective," Google Scholar**

-

@ f3873798:24b3f2f3

2025-06-15 16:18:52

@ f3873798:24b3f2f3

2025-06-15 16:18:52

Muito se fala sobre racismo no Brasil. A mídia, os políticos e os intelectuais engajados repetem discursos antirracistas, promovem campanhas e ergueram bandeiras pela igualdade. No entanto, existe uma hipocrisia gritante quando olhamos para a realidade dos povos indígenas no país.

No Brasil, o indígena ainda é, juridicamente, tratado como incapaz de decidir por si mesmo, sendo suas terras consideradas propriedade da União. Isso significa, na prática, que tudo o que diz respeito à sua cultura, território e desenvolvimento precisa do “amém” do Estado. É um tipo de tutela que remete aos tempos coloniais, onde os “civilizados” decidiam o que era melhor para os “selvagens”.

O mais engraçado e trágico deste fato, é que não há nenhum movimento midiático que aborda sobre a existência absurda deste tipo de regimento jurídico, não há influenciar não há atores e atrizes da Globo, nem cantores que questione e lance a pauta

Como falar em fim da escravidão ou combate ao racismo estrutural, se ainda hoje tratamos povos inteiros como se fossem incapazes de autodeterminação?

Enquanto isso, o governo federal, representado atualmente por figuras como “Tio Lule”, negocia e entrega terras indígenas para interesses geopolíticos, sustentando ditaduras e alianças internacionais, enquanto os próprios povos originários ficam à margem do desenvolvimento econômico.

Recursos como açaí, cupuaçu, babaçu e muitos outros produtos amazônicos serão explorados por empresas estrangeiras, que lucrarão intensamente, sem que as comunidades locais tenham condições mínimas de acesso aos meios de produção ou ao mercado. Isso destrói a economia regional, perpetua a dependência e impede que o verdadeiro protagonismo indígena aconteça.

Um ciclo que se repete: a história da borracha

O que está em curso não é novidade. É uma repetição histórica. Basta lembrar do ciclo da borracha, quando os ingleses levaram sementes de seringueira da Amazônia para plantar na Ásia, quebrando o monopólio brasileiro e afundando a economia da região Norte, que até hoje carrega as marcas desse roubo histórico.

Agora, a história se repete, mas com outros nomes e produtos — e com o apoio explícito do Estado brasileiro.

-

@ f85b9c2c:d190bcff

2025-06-15 20:02:25

@ f85b9c2c:d190bcff

2025-06-15 20:02:25

To all the dads, pops, uncles, big brothers, grandpas that are doing the father role.

I am sitting here during father’s day afternoon thinking about all the children across the world that for various reasons are not able to tell their dads happy father’s day. Before anyone thinks I mean anything negative by the above statement, I DON’T. I just want to shed light on all the male figures that step in to that role to help raise children.

Sending a big thank you to all the men who step up and help as a father figure despite their status.

-

@ e97aaffa:2ebd765d

2025-06-15 14:23:12

@ e97aaffa:2ebd765d

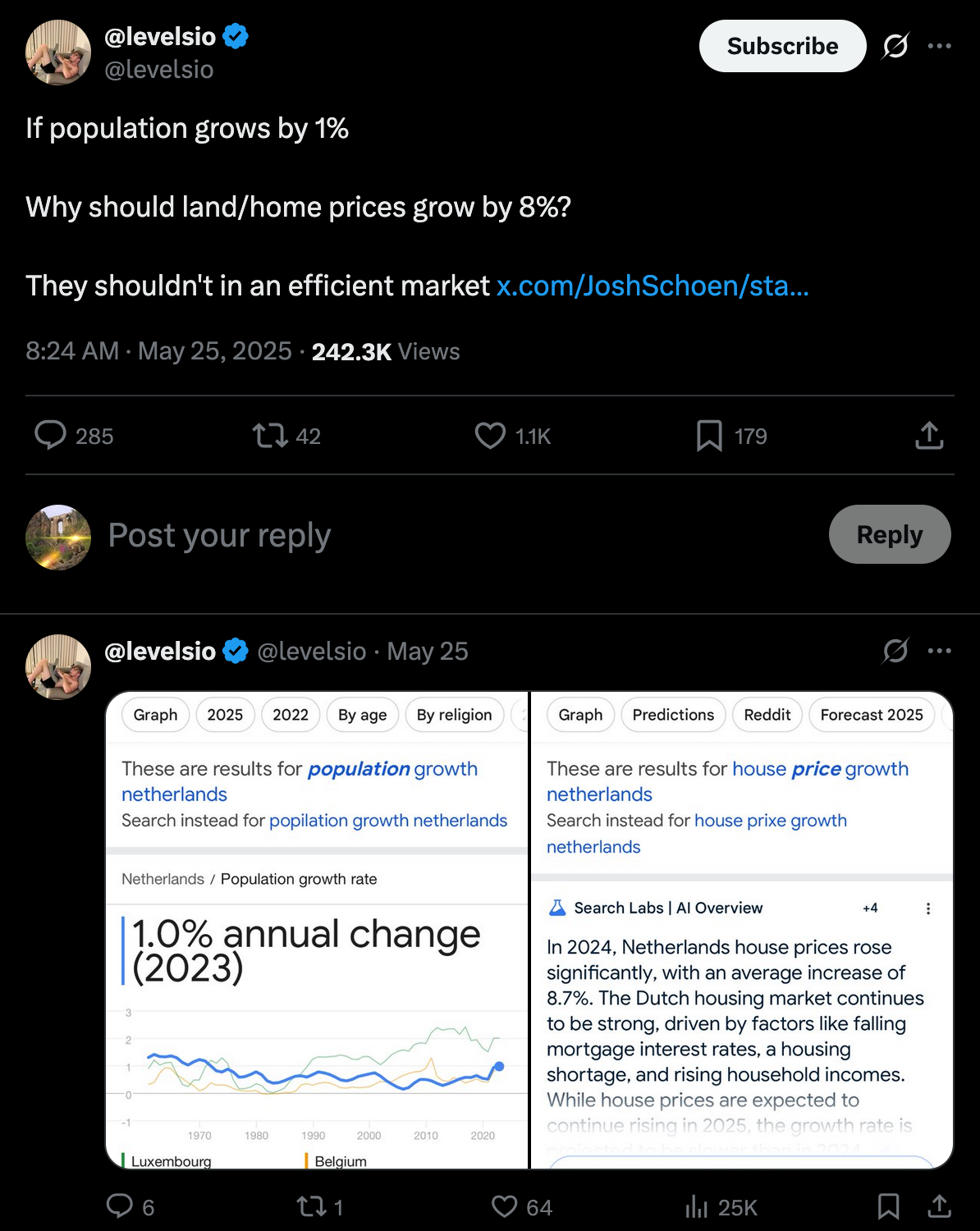

2025-06-15 14:23:12O mercado imobiliário português está a viver uma enorme bolha. É tão grave, está se tornando mais que uma crise de habitação, mas sim uma crise geracional. Os jovens portugueses não conseguem comprar casa, acabam por adiar indefinidamente a criação da família ou ter filhos, ou então a solução mais fácil é emigrar. Esta crise está a condenar a gerações mais novas e sem os mais novos, condenamos o futuro do país.

Problema

A origem do problema é o excesso de procura/demanda, Portugal ficou na moda, o turismo cresceu exponencialmente, quase diariamente são inaugurados novos hotéis nos centros das cidades e também houve um forte crescimento Alojamento Local(Airbnb). Tudo isto removeu muitas casas do mercado.

Além disso, Portugal tornou-se num destino para aposentados de outros países, sobretudo do norte da Europa e de nómadas digitais, que têm um poder de compra muito elevado, muito superior aos locais.

Para complicar ainda mais, nos últimos 5 anos houve uma imigração descontrolada, em plena crise de habitação, a população aumentou 20%. Com tanta gente nova, onde vai morar tanta gente?

Todos os portugueses, sobretudo nos grandes centros, conhecem casos de casas sobrelotadas, 10 ou 20 ou 30 pessoas a viver na mesma casa. É desumano, é uma escravatura moderna. Depois estas pessoas fazem concorrência desleal, porque eles podem pagar rendas de casas altas, o custo é dividido por 20 pessoas, enquanto os jovens casais portugueses não conseguem pagar.

Não existe um único problema, é uma soma de vários problemas, que gera uma enorme bolha.

Oferta

Tudo isto resultou num aumento da procura por habitação, mas como em tudo na economia, sempre que existe um aumento da procura, posteriormente o mercado ajusta-se, com o aumento da oferta, só que isso não está a acontecer.

A oferta de nova habitação é extremamente baixa, é insuficiente para o volume da procura. Até parece estranho, se o preço das casas estão muito elevadas, porque razão os promotores imobiliários não constroem mais?

Aqui está a razão da crise da habitação do mercado português, parece um problema sem solução.

A burocracia, a falta de terrenos, os impostos altos, falta de trabalhadores, tudo isto contribui para a crise na oferta, mas estes problemas sempre existiram em Portugal, não é uma coisa de hoje. Há 15 anos, mesmo com esses mesmo problemas, o mercado florescia, claramente dificultava mas não foram um entrave.

A meu ver, o problema está no financiamento.

Até à crise do subprime, os promotores imobiliários financiavam-se, quase em exclusividade na banca, com o juro muito baixo. Durante a crise, os casos mais problemáticos de crédito malparado foram de promotoras imobiliárias e de empresas de construção civil.

A crise do subprime e posteriormente a crise das dívidas soberanas, levou a UE a criar novas regras bancárias, onde criou muitas restrições ao acesso ao crédito por parte das empresas. Essas novas regras, que limitou o acesso ao crédito, provocaram uma alteração no modelo de financiamento das promotoras imobiliárias. Em vez de se financiarem na banca, os promotores vendiam primeiro as casas, antes de as construir. As promotoras recebiam parte do dinheiro e com esse dinheiro, financiavam a obra.

O modelo funcionou até ao pós pandemia, a impressão de dinheiros por parte dos governos foi monstruosa, criando uma forte inflação. Essa inflação provocou uma forte subida de preço nos materiais de construção e na mão de obra. Como as promotoras venderam as casas anteriormente, o valor que venderam as casas não foi suficiente para cobrir os novos custos da construção. Este problema provocado pela inflação, não afetou apenas o imobiliário, mas sim toda a economia, foram milhares de obras, por todo o país que não foram concluídas, as empresas faliram.

Este problema de financiamento, afecta sobretudo o mercado imobiliário da classe média, onde o custo é mais controlado, onde as empresas têm uma menor margem de lucro, o mínimo erro pode provocar uma falência. Por esse motivo, mas empresas de construção estão a preferir construir, o imobiliário de luxo, onde a margem de lucro é superior, minimiza a margem de erro. Mas o grande problema, é que falta habitação para a classe média.

A inflação é um grande problema, gera muita instabilidade nas empresas, torna-se imprevisível fazer um orçamento. Se a inflação é um forte contribuidor para o problema da habitação em Portugal e em breve teremos mais uma emissão massiva de novo dinheiro, por parte do BCE, parece um problema sem solução. As empresas terão que arranjar um novo método de financiamento, ou adaptar-se à inflação. Uma coisa é quase certa, na próxima década vamos ter alta inflação, porque é a única maneira para evitar o colapso dos governos, devido às enormes dívidas soberanas.

Procura/demanda

A resolução do problema do aumento da oferta é tão complexo, os governos vão optar pelo caminho mais fácil e populista, atacar a procura.

Nos próximos anos, os governos vão aprovar medidas mais autoritárias e antidemocráticas para minimizar o problema. Medidas como impedir os estrangeiros ou não residentes de adquirirem casas, impostos muito altos para 2° habitação, para forçar a venda ou o arrendamento, os Airbnb também serão um alvo.

Em suma, quem tiver uma casa como reserva de valor, para fugir à inflação, será declarada persona non grata.

Fix the money, Fix the world!

-

@ 2cde0e02:180a96b9

2025-06-15 11:40:13

@ 2cde0e02:180a96b9

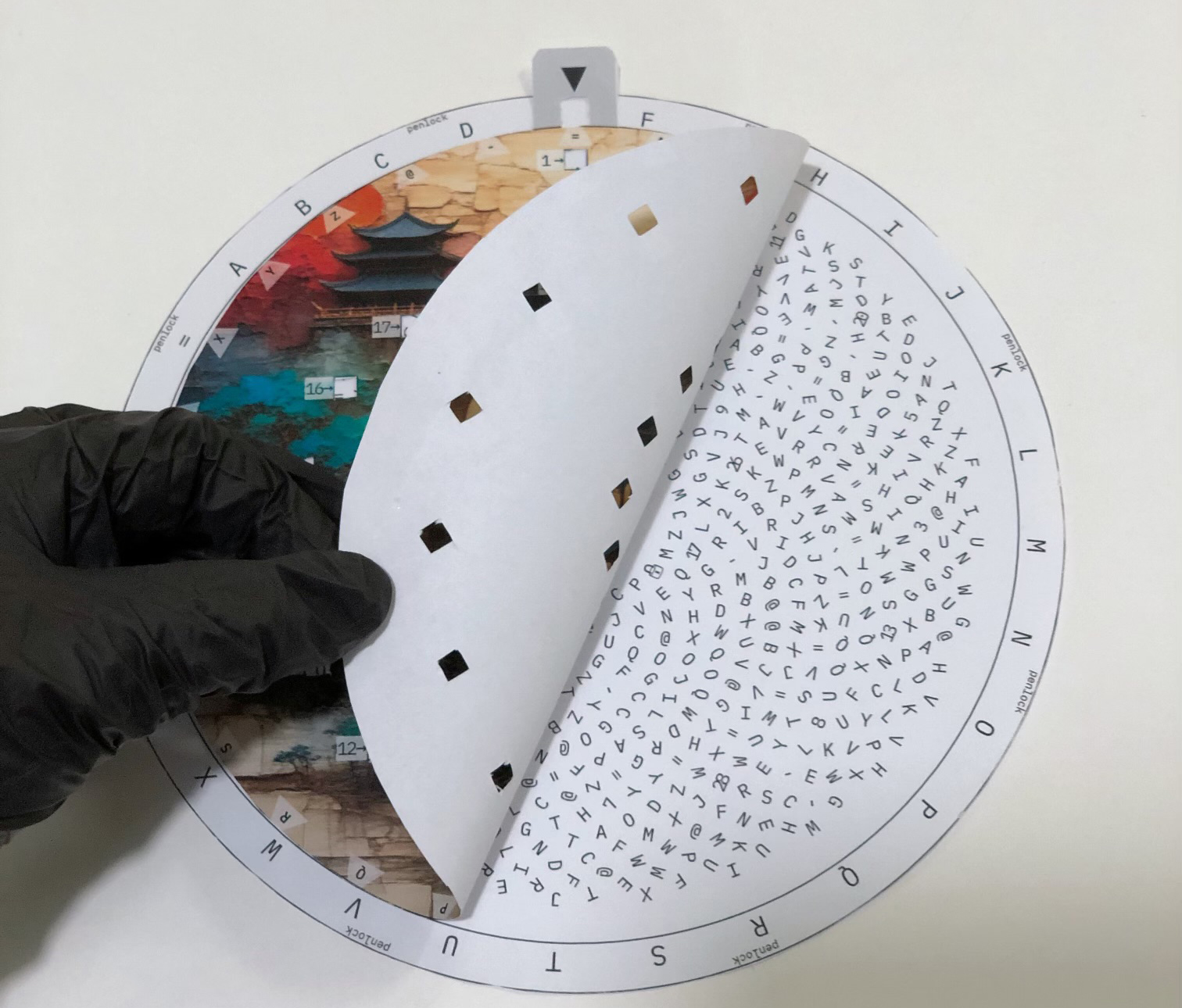

2025-06-15 11:40:13pen, watercolors & brushpen;

https://stacker.news/items/1006873

-

@ 88cc134b:5ae99079

2025-06-15 11:11:46

@ 88cc134b:5ae99079

2025-06-15 11:11:46text

-

@ bf47c19e:c3d2573b

2025-06-15 17:26:54

@ bf47c19e:c3d2573b

2025-06-15 17:26:54Аутор: Срђан М. РАДУЛОВИЋ - Универзитет у Приштини са привременим седиштем у Косовској Митровици (Србија), Правни факултет

Сажетак

Тенденција трансформације појединачних друштвених заједница у јединствено, унификовано друштво, које унутар себе не познаје никакве границе (или барем не инсистира на њима), можемо, уз неопходну дозу симплификације, сматрати појмовним одређењем глобализације, која, будући да је доживљавамо као тенденцију, по природи ствари има и своје темпорално одређење. Мада одређење временских координата ове појаве умногоме зависи од угла из којег је посматрамо, начелно је могуће постићи консензус око тога да овај процес није континуиран, већ да се одвијао у неколико засебних фаза.

Нама је блиско становиште да је ова тенденција имала три фазе. Но, верујемо да ће се и присталице нешто другачије периодизације усагласити са тим да је у периоду од 31. октобра 2008. године, када је објављен тзв. бели папир (white paper) под називом Bitcoin: A Peer-to-Peer Electronic Cash System, до момента проглашења пандемије SARSCoV-2 вируса од стране Светске здравствене организације започела сасвим нова, по потенцијалним дометима најефикаснија и најсвеобухватнија фаза глобализације.

У овом раду, због усмерености и обима рада, представљамо део резултата раније спроведеног теоријско-емпиријског истраживања о социолошко-правним моментима који су погодовали почетку нове фазе глобализације. Други део прикупљених резултата, усмерен на потенцијални обим и ефекте промене коју доноси нова фаза, биће представљен у неком од наредних радова. Сазнања су у оба дела истраживања прикупљена употребом аналитичко-синтетичких метода, уз нарочит ослонац на предности апстракције. У раду су, такође, коришћене и различите технике нормативног метода, као и специфичне технике интерпретације правних норми.

Кључне речи: глобализација; биткоин; криптовалуте; криптоимовина; новчане облигације; SARS-CoV-2 пандемија.

Уместо увода

Уколико идеју о глобализацији генерализујемо и интерпретирамо је као трансформацију самосталних друштвених заједница са релативно јасно одређеним државним, културним, економским и/или другим границама, у унификовано друштво које не познаје ниједну од поменутих граница, или барем није њима спутано (Радуловић, 2017), можемо доћи до неколико закључака.

Први у низу закључака био би да је овај процес иманентан људском друштву. Иако се израз не појављује у научној литератури до средине XX века (Попић, 2018; Џамић, 2014; Chumakov, 2010), мишљења смо да тенденција интензивирања људских односа кроз смањење просторних, временских, културних, а нарочито економских баријера одувек постоји. Доиста делује као да друштво тежи свеобухватности и да је глобализацију немогуће избећи (2) (Domišljanović, 2000), а да је несклад између научног конституисања појма и тренутка када се глобализација појавила чак и природан. (3) (Џамић, 2014)

Облик и, нарочито, интензитет глобализације разликују се кроз епохе. Начини постизања ефеката глобализације, такође, сукцесивно су се смењивали (Антић, 2013). Можемо уочити и периоде стагнације, чак и радикалних, темпорално или географски одређених фаза у којима се промовише изолација у односу на „нетрадиционалне” вредности. То, међутим, не значи да тенденција пораста степена међузависности процеса, појава и односа не постоји (Џамић, 2014). Напротив. Управо виши степен радикализма у „традиционалистичким” (4) одговорима подстиче активности усмерене ка стварању више форме друштвене заједнице (Марковић и Булатовић, 2014). Уосталом, push and pull ефекти (Giddens, 1990) глобализације нису нимало необични. Они природно произлазе из осећаја апатије, изгубљености, угрожености коју кроскултурни начин организовања доноси (5) (Chumakov, 2010).

Даље, глобализација спаја прошлост и садашњост, представља будућност, мада сама не подлеже никаквим временским ограничењима (Попић, 2018; Chumakov, 2010). Но, глобализација није униформна појава (Радуловић, 2017). Она, уколико је доживљавамо као процес, има своје фазе. Њих је могуће разликовати и определити периодизацију.

Критеријуми периодизације врло су хетерогени и није једноставно определити се за један, тим пре јер историјска димензија глобализације није сасвим јасна (Антић, 2003). Уз напомену да би закључци принципијелно били исти и да смо одабрали другачију хронологију, бирамо модификовану трофазну периодизацију глобализације (Печујлић, 2002; Радуловић, 2017). Прва фаза започиње успоном најстаријих цивилизација и траје до XVI века. Други талас глобализације траје до пада Берлинског зида (6). Најзад, трећи талас турбоглобализације започиње падом Берлинског зида и траје до данас без прекида [sic!].

- Штавише, степен достигнуте повезаности и свеобухватности могуће је и изразити релативно прецизно кроз глобалност као меру дешавања на глобалу (Cifrić, 2009).

- Природно је да свест о одвијању процеса, следствено и научно интересовање, у делу људске историје нису постојали, то јест да су се јавили у некој од фаза већ започетог процеса. Овакав закључак произлази из петофазне периодизације промишљања о проблемима и трендовима на нивоу човечанства као органске целине, а која почиње тек од средине XVIII века (Chumakov, 2010).

- Ваља бити нарочито обазрив уколико између појмова глобализације и модернизације, односно традиционализма и конзервативизма, постављамо знак једнакости. Социолошка теорија нуди врло деликатно упутство за употребу ових термина, нарочито онда када их употребљавамо као вредносне судове (Giddens, 1990; Шуваковић, 2013).

- Глобалистичке пројекције своје постојање, па и смисао уопште, потврђују тек кроз однос са изолационистичким тенденцијама. Однос глобалистичких тежњи друштва и регресивни одговори на те тежње само истичу контроверзну дуалну природу глобализације као процеса (Џамић, 2014). Утолико и синтагма „уједињено-разједињени свет” под којом је, како се сматра, Радомир Лукић проучавао глобализацију (Печујлић, 2002; Попић и Шуваковић, 2014; Џамић, 2014) има више смисла.

- Творац трофазне периодизације од које полазимо, период од XVI века до пада Берлинског зида не види као континуиран сегмент, већ унутар њега разликује две засебне фазе (Печујлић, 2002). Ми на њима нећемо инсистирати, будући да (не)прихватање ове поделе није релевантно за касније извођење закључака.

Корени четвртог таласа глобализације

Настанак и развој протоглобалних цивилизација, њихово ширење, те јављање тежње за унификацијом друштва нераскидиво су повезани са техничким открићима (Антић, 2003). Не само први већ сви таласи глобализације (а сваки наредни интензивнији је од претходног) узроковани су примарно модернизацијом у технолошком смислу. Увек када се појави технологија која има капацитет да обезбеди ефикасније умањење просторне и/или временске дистанце, за последицу имамо комплексне промене у друштву које, уз дозу генерализације, проучавамо као (нове) таласе глобализације. Изузетак није ни четврти талас на чије постојање желимо да укажемо.

Концепт новца и његова еволуција, такође, нераскидиво су везани за технолошки напредак, иако је он, будући да није спутан правним нити културним ограничењима, неупоредиво бржи (Calcaterra et al., 2020). Природно, кроз разраду идеја о дигитализацији традиционалних форми новца које су се појавиле већ у раним осамдесетим (Cavalhiero & Cavalhiero, 2022), у монетарним порецима започет је постепени прелазак са банкнотног на систем електронског плаћања (Димитријевић, 2018). Прелазак је био потпуно логична, чак и очекивана фаза у процесу еволуције новца усмерене ка његовој апстракцији. Безбројне предности апстрахованог инструмента – ефикасност, ефективност и погодност коришћења само су неке од њих (Ruslina, 2019) – учиниле су да се за мање од три деценије од појаве електронског (7), затим и виртуелног новца на глобално интегрисаном финансијском тржишту (Димитријевић, 2018), економски токови глобализују најпре у смислу да промет велике количине новца не трпи значајнија ограничења и да се одвија за релативно кратко време.

У таквом окружењу отвара се широк простор на међународном нивоу који теоретски може да попуни само наднационални, потенцијално недржавни новчани систем (Nahorniak et al., 2016). У том смислу, криптовалуте, базиране на блокчејн технологији, представљају занимљив новитет. Оне су створиле суштинске изазове за правне поретке и довеле у питање генералну улогу новца и различитих валута (Ronaghi, 2023). Такође, подстичу иновације и стварају нове прилике у свету који је створен у првим годинама интернета (Calcaterra et al., 2020; Cavalheiro & Cavalheiro, 2022).

Уз то, оне представљају облик дигиталног новца, но, нису исто што и електронски новац (Nahorniak et al., 2016). Оне су, заправо, нови правац у развоју дигиталног новца због тога што постојећу новчану масу комплементарно и квалитативно уздижу. Стога, криптовалуте нам се чине као најозбиљнији кандидат за задовољење потреба које на међународном тржишту новца постоје, а у мору пројеката издваја се феномен Биткоина (8).

Биткоин примарно не представља валуту, мада може преузети облик и функције новца (9), већ систем плаћања. Суштински, платформа поставља и спроводи правила усмерена на заштиту права својине (Abramowitz, 2016), која се, помало поједностављено, своди на својину на приватним кључевима (Raskin, 2015). Од момента када је постао оперативан, функционише као аутономан систем у потпуности заснован на транспарентним математичким и информатичким принципима. Прецизније, софтвер функционише искључиво према упутствима садржаним у самом коду, али она не долазе од централног ауторитета, сем иницијално, чак не ни од самог творца, већ од демократски организоване заједнице равноправних учесника у мрежи потпуно отвореног типа [нагласио аутор] (10). Као такав, практично посматрано, у потпуности је имун на постојећу међународну, а нарочито домаћу правну регулативу (која ће управо из тог разлога остати ван фокуса овог рада), јер његова поставка и није нормативна већ консенсуална.

Иако се данас стабилни коини погрешно или барем преурањено означавају као „Хајеков новац” (Syropyatov, 2021), биткоин, што се јасно види из његовог концепцијског манифеста, представља први успешан покушај оживотворења деценијама присутне идеје Ф. А. Хајека (1976) о демонополизацији државног утицаја на креирање монетарне политике кроз постепено увођење конкуренције „државном” новцу у виду новца креираног од стране приватних ентитета (Ruslina, 2019; Syropyatov, 2021), и то у форми „спољашњег новца” према прихваћеној дихотомији (Garrat & Wallace, 2018).

Биткоин мрежа је у потпуности транспарентна. Сет криптографских кључева, односно комбинација јавне адресе и приватног кључа (Raskin, 2015), омогућава да систем буде потпуно транспарентан, пре свега, у погледу начина рада, затим расподеле средстава и њиховог кретања (11), али истовремено и да буде имун на интервенције споља због апсолутне, криптографски гарантоване, анонимности учесника у мрежи. То, свакако, компромитује економски суверенитет државе, који је додатно компромитован и њеном немогућношћу да утиче на пуштање у оптицај и масе криптовалутних јединица (Raskin, 2015), затим њеном фактичком немогућношћу да их забрани или опорезује, као и немогућношћу да директно утиче на њихову курсну вредност или куповну моћ. Но, чињеница да овај систем не зависи од компарације и размене националних финансијских инструмената на интернационалном тржишту чини га суштински децентрализованим, а потпуна отвореност мреже интернационализованим, затим и глобализованим (Blaazer, 2020).

Дакле, када смо говорили о вези узрочно-последичног карактера између технолошких иновација и новог таласа глобализације, имали смо у виду примарно Биткоин. Суштински смо, заправо, имали у виду синтезу технолошких иновација први пут обједињених у оквиру функционалне целине од стране недржавног ауторитета која нема само локални већ која има и међународни домашај, а која је у време настанка идеје о новцу издатом од стране приватних ентитета била недоступна, што је саму идеју, по признању творца идеје, чинило утопистичком (Syropyatov, 2021).

- Електронски новац је облик дигиталног новца који, по правилу, представља електронску манифестацију већ постојећег новца у оптицају (Nahorniak et al., 2016; Ström, 2020). Појавио се најпре у Јапану средином осамдесетих година као припејд картица за плаћање неких врста „масовних услуга”, а замах је добио на западу где је коришћен као замена за кеш трансакције мале вредности (Димитријевић, 2018).

- Будући да је њихова правилна дистинкција од кључне важности, за потребе овог рада систем плаћања означаваћемо као Биткоин, дакле великим почетним словом „Б”, а виртуелне јединице унутар система малим почетним словом „б” (биткоин).

- Биткоин је најпре препознат као новац од стране специјализованих органа САД који се баве финансијским криминалитетом (Mirjanich, 2014), а тај став потврђен је у чувеном случају Silk Road (Raskin, 2015; Zebec, 2018) и широј јавности мање познатом, али правнополитички врло значајном случају SEC vs Shavers (Raskin, 2015).

- Кроз овакву поставку, творац и иницијални издавач решио је два кључна проблема – нежељене додатне продукције новца и његово кривотворења (Garrat & Wallace, 2018).

- Биткоин користи блокчејн технологију и hash функцију како би створио трајни запис свих трансакција које су се у оквиру мреже реализовале (Cavalheiro & Cavalheiro, 2022; Ruslina, 2019). У том контексту интересантан је податак да се чак и биткоини који су заплењени у случају Silk Road, то јест њихово кретање кроз заплену и каснију аукцију, могу пратити у потпуности кроз записе у блокчејну (адреса новчаника који припада FBI: lFfmbHfnpaZjKFvyilokTjJJusN455paPH), те да су оба поступка морала да буду потврђена кроз процес верификације специфичан за биткоинов блокчејн протокол (Raskin, 2015).

Проблем одређења временских координата четвртог таласа

Уколико уопште прихватимо идеју о новом таласу, чврсто стојећи на том становишту, можемо рећи да је блокчејн технологија темељ модерних глобалистичких активности, тим пре ако имамо у виду ситуационо и територијално неограничене могућности њене примене. Штавише, иако има оних који су у том смислу резервисани (Horvatić i Tafra, 2022), сматрамо да је овај вид технологије, по потенцијалним дометима и брзини усвајања, импресивнији од интернета. Компарације криптовалутног тржишта и интернета с почетка деведесетих година то потврђују (Syropyatov, 2021).

Почетак овог таласа глобализације, међутим, не можемо стриктно везати за моменат настанка блокчејн технологије а да тиме успешно разрешимо све недоумице које евентуално могу настати. Разлога је неколико, а два су, сматрамо, нарочито битна.

Најпре, блокчејн технологија није нова технологија per se. Блокчејн је први успешан спој технолошких идеја које су постојале и биле коришћене значајно пре формирања првих „низова података груписаних у блокове” (12).

Друго, први случајеви имплементације блокчејн технологије, иако успешни, прошли су незапажено ван информатичке заједнице. Блокчејн остаје потпуно непознат вид технологије широј јавности све до њене уградње у основе система плаћања (13) познатог под називом Биткоин (Horvatić i Tarfa, 2022). Тек од тренутка када је Биткоин мрежа постала оперативна, иако њена дистрибутивност симболизује универзалност (Ronaghi, 2023), блокчејн технологија суштински постаје глобални, доцније и мејнстрим феномен. Следи моменат настанка блокчејн технологије, иако кључне у техничком и суштинском смислу, због иницијално скромних домета, дакле, пре првих примера функционалне имплементације, не би га исправно било узети за почетак четвртог таласа глобализације.

Иако је творац система пажљиво одабрао тренутак како би истакао поенту у свом манифесту револуционарне реформе монетарног система (Sławiński, 2019), више је разлога због којих не можемо везати почетак четвртог таласа глобализације стриктно ни за крај 2008. године, када је објављен тзв. бели папир (14) (Raskin, 2015) нити за почетак 2009. године, када је мрежа постала оперативна.

Први разлог је тај што је кибернетизација и глобализација новца, следствено капиталистичког облика привређивања, суштински започела још 1971. године (Ström, 2020). Даље, Биткоин, ма колико импресивна идеја била, посматрано из перспективе нашег рада, суштински није ништа друго до тек први успешан пројекат имплементације блокчејн технологије на начин који промовише децентрализовану глобализацију. Биткоин је први приказ потенцијала технологије која у монетарној сфери омогућава поуздано креирање и трансфер дигиталних добара (Ronaghi, 2023), мада и то на начин који због читавог низа објективних околности компромитује његово усвајање као мејнстрим економског феномена (Syropyatov, 2021). Дакле, стварни домети блокчејн технологије биће спознати тек кроз пројекте који су се појавили значајно касније или који ће се тек појавити (15).

Штавише, потпуно смо сагласни са тим да биткоин не само да није једини, већ да није ни најнапреднији пројекат те врсте (Teomete Yalabik & Yalabik, 2019). Примера ради, из перспективе финансијског тржишта, stable coin пројекти, којима се покушава решити проблем волатилности, тренутно су иновација која највише обећава (Syropyatov, 2021). Трећи разлог је тај што је крај 2008. године, због економске кризе која је тај период обележила, исправније интерпретирати као посртање антидржавне, laissez faire глобалистичке методологије и јачање државног интервенционизма, него као нови талас глобализације (Mellor, 2020). Коначно, исправно интерпретирање Биткоина као феномена могуће је једино у контексту врло хетерогене групе догађаја међу којима нарочито место заузима проглашење пандемије изазване SARS-CoV-2 вирусом.

Наиме, 11. марта 2020. године Светска здравствена организација прогласила је пандемију SARS-CoV-2 вируса. Вирус који је узрок обољења познатог под називом ковид 19, постао је катализатор читавог низа процеса. Због природе пандемије, пре свега чињенице да је током трајања пандемије било неопходно свести физичке контакте на минимум, природно је да је потрага за алтернативним моделима функционисања свакодневних активности убрзала процес дигитализације (Mijatović, 2022).

У ред појава и процеса код којих је промена карактера и интензитета најизраженија на првом месту налази се процес трансформације новца, генерално и финансијског тржишта, што је уосталом и научно доказано (Vareško i Deković, 2022). Наиме, систем размене добара какав је карактеристичан за монетарне економије данашњице није одувек постојао, нити је кроз различите епохе функционисао на исти начин. Од скромних почетака неформалног робноновчаног промета, базираног на локализованом личном контакту (Ström, 2020), евентуално на једноставним бартер аранжманима (Calcaterra et al., 2020; Mellor, 2020; Ström, 2020), преко увођења ретких метала као опште мере вредности робе, до појаве првог кованог новца, затим банкнота, коначно и електронског новца као репрезентације новца који се већ налази у оптицају, новац је кроз сопствену апстракцију (Ström, 2020) пратио интензивирање друштвених односа. Његова социјална и материјална апстракција погодовала је интензивном и екстензивном ширењу капиталистичког начина привређивања (Ström, 2020). Последица је континуирано смањење просторне, временске, а затим и културне дистанце. Смањење различитих видова дистанце иницирало је ново апстраховање новца, што је, у складу с потребама све интензивнијег привредног живота, резултирало његовом метаморфозом у врло софистициран финансијски инструмент.

Биткоин осећа и прати тенденције у развоју новца, а у контексту савремених друштвених релација има савршен смисао. Најпре, очигледно је постојање тенденције изградње електронских облика чувања новца и система плаћања. Њихове предности су неспорне и сматра се да такви системи повећавају ефикасност и у виртуелном и у реалном свету (Vareško i Deković, 2022). Оно што је у почетку деловало као крајње несигурна концепција, прихваћено је и раширено у тој мери да монетарни системи најразвијенијих земаља, по правилу, функционишу без било какве физичке репрезентације новца, то јест као cashless заједница (Calcaterra et al., 2020). Како Биткоин промовише употребу најновијих информационих технологија за чување и трансфер новца, јасно је да је претходна тенденција уважена у потпуности. Штавише, Биткоин не само да уважава тенденцију дематеријализације новца већ је и наставља и уздиже на квалитативно виши ниво.

Кроз peer-to-peer систем на којем почива промовише се digital trust, што омогућава директне трансакције међу корисницима (Ruslina, 2019). Иако се то може тумачити као разлог несигурности система (Ruslina, 2019), на овај начин елиминише се потреба за акредитованим посредницима који су есенцијални у традиционалним системима плаћања (Živanović i Vitomir, 2022; Raskin, 2015; Ronaghi, 2023; Horvatić i Tafra, 2022; Cavalheiro & Cavalheiro, 2022). Такође, елиминише се и могућност да се деси „двострука потрошња” (Ruslina, 2019), све то уз истовремено унапређење брзине обављања трансакција и смањење провизија (Teomete Yalabik & Yalabik, 2019). Трошкови чувања средстава, осим уколико се корисник не одлучи да криптографске кључеве похрани на напреднији cold wallet, практично не постоје. Иако би интуитивнији кориснички интерфејс олакшао употребу, Биткоин мрежа промовише апсолутну монетарну инклузију свих заинтересованих лица, омогућава лак приступ средствима и њиховом управљању. Најзад, овај систем плаћања имун је на државну и међународну регулативу (16), а самим тим и на границе држава – практично их не познаје, што иде у прилог тенденцији апстракције, универзализације и денационализације средстава плаћања.

Иако је начин његове примене константно еволуирао (17) (Vareško i Deković, 2022), инсистирамо на томе да Биткоин није валута, већ да је у питању систем плаћања. Уосталом, у том капацитету је и коришћен примарно, конкретно ради куповине и продаје робе и услуга путем интернета (Vareško i Deković, 2022). Ипак, будући да је временом постајао све глобалнији и разноврснији као инструмент (Karabulut & Sari, 2022), Биткоин је најавио крупне промене на међународном, глобализованом тржишту роба и капитала (Živanović i Vitomir, 2022). Неке од њих су се и десиле у претходном периоду. Но, како објашњавамо везу између пандемије SARS-CoV-2 вируса, Биткоина и четвртог таласа глобализације (18)?

Биткоин је привукао масовно интересовање 2017. годинe када су „Биткоин” и „како купити биткоин” били најчешће коришћени појмови у популарним претраживачима попут Гугла (Cavalheiro & Cavalheiro, 2022). Разлог је једноставан. Уз уважавање осталих квалитета, основна снага Биткоина лежи у одсуству могућности повећања количине јединица у оптицају (19), затим одсуству могућности копирања појединачних јединица које „циркулишу” унутар система, најзад и математички пројектованој динамици „пуштања у оптицај” предвиђене количине јединица (20) (Raskin, 2015). На основу тога, можемо рећи да се биткоин понаша као изразито дефлаторна валута, свакако под условом да га уопште посматрамо као валуту.

С друге стране, модерне државе имају суверенитет у погледу одређења средства плаћања, а ексклузивитет одређивања куповне моћи тог средства, након аброгације „златног стандарда”, делегирале су својим централним монетарним установама. Традиционални новац у потпуности је завистан од одлука и регулативе централних банака (Ronaghi, 2023). Поверење у централне банке и њихову пројекцију суштински je једини принцип за одређење вредности новца. Принцип тржишне привреде, златни стандард, лимитирани златни стандард, величина привредног раста и други механизми за одређење вредности новца замењени су „принудним курсом”. Није, дакле, претеривање рећи да не постоје „природне” или барем концептуалне границе продукције новца (Mellor, 2020).

Модел може ефикасно функционисати у време када нема потреса, но све несавршености поставке до изражаја долазе управо у време криза, нарочито оним глобалних размера као што је пандемија вируса SARS-CoV-2, и то из разлога што на овакве кризе, када је привредни живот успорен или чак стопиран, а буџетска потрошња повећана, неоптерећене обавезом да за то обезбеде покриће, државе посежу за непопуларним мерама које подразумевају повећање количине новца у оптицају. (21) У таквом амбијенту, природно, систем који се базира једино на поверењу у централну монетарну институцију показује инфериорност у односу на систем који се базира на поверењу у математичке гаранције лимитиране понуде и сигурности плаћања. Следствено, тврдња о томе да се поверење у јавне (државне) институције не може поверити технологији (Sławiński, 2019) показује се као, благо речено, застарела. Ово је нарочито тачно након аброгације Bretton Woods споразума и „златног” стандарда када је окончана дефлаторна и започела инфлаторна ера у економској историји (Syropyatov, 2021). Дакле, иако је читав систем, након ере „слободног банкарства”, организован са циљем да обезбеди стабилност у временима кризе (Sławiński, 2019), парадоксално, управо у временима кризе показује се да је прерогатив државе у продукцији новца пре случајан него што је заиста потребан (Blaazer, 2020). Уосталом, случајеви Ел Салвадора (22) и Централноафричке Републике (23), у којима је усвојен низ прописа којима је Биткоин признат као средство плаћања у готово неограниченом капацитету, иако ове потезе треба тумачити као отворени економски експеримент, принципијелно потврђују капацитет ове иновације (24) (Cavalheiro & Cavalheiro, 2022) и стање у монетарним порецима.

У доба здравствене и економске кризе изазване пандемијом, повећана је потреба за укључењем реалне финансијске активе у портфолио (Živanović i Vitomir, 2022). Мисли се на тзв. safe haven имовину попут злата, затим и сребра (Živanović i Vitomir, 2022; Wen et al., 2022). Но, поред традиционалних облика заштитне финансијске активе, интересовање инвеститора усмерено је све више ка модерним облицима активе – примарно оне базиране на блокчејн технологији (Živanović i Vitomir, 2022). У њима, пре свега биткоину, могуће је наћи сличне, потенцијално чак и боље safe heaven особине него код злата (Ronaghi, 2023; Wen et al., 2022) или деоница (Vareško i Deković, 2022). Штавише, иако је истина да се биткоин суштински налази негде између злата и америчког долара (Syropyatov, 2021), истраживања недвосмислено потврђују како је диверсификација кроз биткоин, под условом да је у портфолио укључен и неки од традиционалних облика активе, добар потез чак и код оних инвеститора који нису склони ризику (Šoja i Senarthne, 2019).

Релативно ниска базна вредност биткоина у првим годинама трговања, услед огромног интересовања инвеститора за ову до тада непознату финансијску активу, у 2019. години мења се и постаје изузетно висока, а наставља да расте напоредно са негативним утицајем пандемије у наредном периоду (Živanović i Vitomir, 2022). У условима кризе изазване пандемијом, због изразитог државног интервенционизма и централизације у свим областима, биткоин као инструмент имун на државну регулативу и аполитичан, па и у односу на злато, испољава и неке додатне предности (Wen et al., 2022).

Истовремено са испољавањем првих слабости традиционалних централизованих монетарних система под притиском пандемије, изразито дефлаторна природа биткоина бива додатно истакнута кроз тзв. трећи halving event који се догодио 11. маја 2020. године. У таквим условима вредност биткоина иницијално расте безмало 10 пута и у наредном периоду достиже вредност од готово 65.000 америчких долара за један биткоин.

Цена биткоина изузетно је интересантан показатељ. Познато је, наиме, да цена биткоина зависи једино од односа понуде и тражње, односно потражње, будући да је понуда програмски ограничена и укупно и периодично. Прецизније, укупна количина биткоина који се могу наћи у оптицају је ограничена кодом на 21.000.000, али је, због програмиране динамике пуштања у оптицај, тренутно у промету тек нешто више од 90% укупне количине. Дакле, према ценама формираним на специјализованим платформама, у условима двоструко ограничене понуде, произлази да је тражња за биткоином у једном тренутку била многоструко већа од тражње за најјачом класичном валутом.

Тачно је да таква цена није била одржива, па је јењавањем пандемије и консолидацијом финансијских токова тражња за биткоином опадала. У тренутку израде рада креће се око 20.000 америчких долара. У том смислу, сасвим се чини рационалном критика волатилности цене биткоина, али и шпекулативног карактера овог облика имовине (Šoja i Senarathne, 2019). Критика нестабилности, иако постоји сасвим рационална и до детаља описана аргументација зашто се суштински дешава (Syropyatov, 2021), апсолутно је на месту. Нагли пораст и пад цене није нешто што је неуобичајено када је у питању криптоимовина, а оваква тенденција ће се засигурно наставити барем до момента када тржиште достигне критични волумен. То природно подгрева неповерење. Међутим, само на први поглед.

Наиме, када би подухват који је апсолутна новина, на иначе врло ригидном финансијском тржишту, била номинално барем једнака најјачој валути, то би био изузетан резултат по себи. Но, без обзира на значајан пад цене у односу на 2021. годину, садашња цена показује да су субјекти на финансијском тржишту, грубо речено, у 19.999 трансакција пре вољни да прихвате биткоин него амерички долар. Из реторичког питања „какво је онда стање са поверењем у остале, релативно слабије валуте?” произлази као сасвим логичан закључак да биткоин и други слични пројекти неспорно преузимају примат и савремено финансијско тржиште постепено обликују у децентрализовано окружење имуно на државну регулативу, следствено државне и све друге врсте граница.

- Технолошке иновације о којима говоримо подразумевају, без претензија да их све обухватимо, имплементацију TCP/IP технологије, изградњу напреднијих програмских језика, напредак криптографије, нарочито hash функција, конструисање тзв. Меркеловог дрвета. Творац Биткоина, такође, успешно је комбиновао искуства неких ранијих покушаја изградње дигиталних валута, примера ради B-money и HashCash (Antonopoulos, 2010).

- Иако има елемената на основу којих је Биткоин могуће исправно интерпретирати као валуту, идеја творца била је заправо најпре да створи економичнији и ефикаснији систем плаћања, пре свега код трансфера мале вредности (Živanović i Vitomir, 2022). Зато смо склонији ка томе да овај софтвер означимо као систем плаћања.

- Исто важи и за моменат регистрације интернет домена www.bitcoin.org, за који неки аутори (Živanović i Vitomir, 2022) везују укључивање Биткона на међународно финансијско тржиште.

- Могућност употребе блокчејн технологије није ограничена на изградњу система плаћања. У (децентрализованом) финансијском систему она се већ сада користи за формирање штедних улога, издавање полиса осигурања, пласирање кредита, трговање и управљање акцијама и обвезницама, прикупљање оснивачког капитала. Ван финансијског система она има потенцијал да се искористи за формирање катастара, вођење и чување медицинских картона или праћење пређене километраже коришћених аутомобила. Штавише, почетком јула 2020. године на референдуму је, поводом предложених уставних промена у Русији, део становништва са правом гласа своје активно бирачко право реализовао кроз софтвер базиран на блокчејн технологији. Детаљније о другим облицима коришћења блокчејн технологије видети у Ronaghi, 2023.

- У том контексту, Ронаги (2023) нуди опсежну студију о томе како је увођење санкција Ирану од стране САД и ЕУ погодовало промоцији криптовалута, пре свега Биткоина, са циљем превазилажења негативних ефеката забрана које су у вези са интернационалним пословањем привредних субјеката, али и са свакодневним активностима појединаца на територији ове земље.

- Ово потврђује и свеобухватна студија о броју, врстама и дистрибуцији патената који се односе директно на Биткоин, а који унапређују софтверску поставку на којој функционише. О томе детаљније видети у Cavalheiro & Cavalheiro, 2022.

- Ипак, слажемо се у потпуности са ауторима који указују на то да је због релативне краткоће времена трајања врхунца пандемије и дневних флуктуација тешко извести сигурне закључке, не толико да ли је, већ у којој мери је пандемија заправо иницирала промене на традиционалном финансијском тржишту (Vareško i Deković, 2022).

- Укупна количина биткоина која се може наћи у оптицају ограничена је на 21.000.000 кроз тзв. source code који се сматра непроменљивим. Ипак, будући да је Биткоин суштински особени софтвер, он није апсолутно затворен за измене, но, да би се таква измена десила у потпуно децентрализованом систему, потребно је да већина „нодова” у мрежи изрази сагласност са предложеним повећањем волумена биткоина. Сасвим је основано закључити да у мрежи са хиљадама „нодова” који су„DeFi ентузијасти” није вероватно формирати већину око става да се мрежа одрекне „ограничене понуде” као особине која је чини апсолутно супериорном у односу на традиционалне монетарне системе.

- Мрежа је програмирана тако да се комплексност математичког проблема који је потребно решити у процесу „рударења” управља према количини већ изрудареног биткоина. Сваки блок има капацитет од 1МВ, што му омогућава да у себи меморише око 4.000 трансакција. Блок плански бива попуњен сваких 10 минута у просеку. Сваким додатим блоком у оптицај се пушта одређена количина нових биткоина. На сваких 210.000 доданих блокова, број биткоина који ће бити пуштен у оптицај по блоку смањује се за једну половину (halving). То нам омогућава да имамо извесну динамику пуштања јединица у оптицај (Antonopoulos, 2014; Horvatić i Tafra, 2022).

- Примера ради, процена је да су само Сједињене Америчке Државе у последњих неколико месеци у оптицај пустиле преко 3,5 трилиона нових банкнота, а да је Европска централна банка дала зелено светло за штампање преко једног трилиона евра.

- Ley Bitcoin, Diario Oficial ES, 110/2021, Decreto No 57.

- République Centrafricaine Cryptomonnaie, Journal Officiel CAF, 22/2022.

- Ова настојања, иако и она потврђују капацитет криптовалута заснованих на блокчејн технологији, суштински не треба мешати са настојањима држава или наддржавних институција да изграде своје дигиталне и криптовалуте. О томе детаљније видети у Mijatović, 2022.

Закључна разматрања (увод у наредни рад)

Процес дигитализације новца реорганизује постојећу пословну праксу и доноси социјалне, политичке, онтолошке, чак и еколошке промене, a истовремено интензивира концетрацију и централизацију у процесу доношења одлука на глобалном нивоу (Ström, 2020). Но, криптовалуте, пре свега Биткоин, иако јесу дигиталне по свом карактеру, не прате ову тенденцију. Управо супротно, Биткоин почива на идеји свесног одрицања контроле управљачких механизама у корист мреже компјутера која покреће софтвер (Magnuson, 2022; Ruslina, 2019). Он представља модел утопијског нивоа глобалне децентрализације, и то не само у финансијском сектору. То је темељна идеја која је окупила највећи, свакодневно растући број учесника у систему (25).

Иако је због новине феномена и непостојања адекватне временске дистанце у односу на коју бисмо процењивали стварне ефекте незахвално изводити закључке или правити пројекције, сматрамо, а то је уједно став и у академским круговима, да криптовалуте представљају изванредну новину (Karabulut & Sari, 2022). Оне засноване на блокчејн технологији, а које нису централизоване, имају моћ да национална тржишта претворе у регионална, а регионална даље у глобална. У том смислу заиста делује као да историја глобализације не памти инструмент који у тој мери интензивира дешавања и процесе.

Уколико то ипак није довољно за закључак да су криптовалуте, засноване на блокчејн технологији, изванредан катализатор процеса глобализације, онда треба нагласити следеће. Изградња и пуштање у рад Биткоина, али и читавог низа других пројеката, објективно, у другом је плану у односу на изградњу такозваног DeFi система, којем су пут трасирала техничка и економска решења имплементирана у Биткоин. Систем је осмишљен тако да у својој идеалној форми, уз напомену да је систем још увек у изградњи, обезбеђује: 1) пуну контролу средстава; 2) апсолутну инклузивност; 3) децентрализовану верификацију исправног рада система; 4) неограничену могућност изградње нових финансијских услуга и производа (Werner et al., 2021). Андреас Антонопулос у својим многобројним предавањима прави аналогију у односу на интернет из времена када је једина апликација унутар система била имејл. Он истиче да уколико DeFi монетарни систем упоредимо са интернетом, Биткоин, иако импресиван по својим технолошким решењима, био би тек имејл, односно прва функционална апликација унутар система. Данас, верујемо, не најбоља и дефинитивно не једина.

Иако идеја делује футуристички, делови DeFi система постају видљиви. Унутар њега је већ могуће успешно куповати, продавати, штедети, закључити уговор о осигурању или кредиту, трговати акцијама, инвестирати, водити хуманитарне фондове, све без интервенције државе, без посредника, без територијалних ограничења, уз криптографски гарантовану безбедност (26). Према доступним подацима, простор је у сталном порасту: конкретно, за непуне две године укупна вредност у промету је порасла са 700 милиона на 150 милијарди америчких долара (Werner et al., 2021). Систем је у повоју и потребно је још много рада да би он постао потпуно оперативан и одржив на нормативном нивоу (Werner et al., 2021). Но, чињеница је да на идеолошком нивоу представља озбиљну претњу постојећем ригидном финансијском систему.

Ипак, степен глобализованости којем данашње друштво тежи не окончава се ни окончањем радова на изградњи DeFi система. Ако уз извесну дозу апстракције пратимо претходно поменуту аналогију Андреаса Антонопулоса, слично као што Биткоин налази примену као један од функционалних елемената DeFi система без обзира на ком блокчејну је изграђен, DeFi систем је тек један од механизма, односно апликација унутар далеко већег пројекта познатог под називом Web 3.0. Блокчејн технологија сматра се есенцијалном за реализацију сада већ мејнстрим идеја у технолошком свету познатих као „интернет ствари” (IoT) и „интернет свега” (IoE) (Horvatić i Tafra, 2022). Ови пројекти децентрализовану глобализацију промовишу шире, тј. ван економских токова, наравно, примарно у дигиталном свету. Но, како су свакодневне активности данас неодвојиво везане за интернет, остварени ефекти глобализованости у дигиталном свету, очекивано, прелиће се у све сфере друштвеног живота.

- И не само да је број учесника у мрежи и корисника у сталном порасту, већ је и тржиште криптовалута све веће према економским критеријумима. Процена је да само тржиште биткоина достиже размере од 1,2 трилиона америчких долара (Cavalheiro & Cavalheiro, 2022).

- Приказ појединих маркантних решења са техничким специфичностима, мада нису сви део DeFi система, видети у Mijatović, 2022.

Литература

- Антић, Ч. (2003). Глобализација и историја. У: М. Вучинић (ур.), Аспекти глобализације (стр. 42−49). Београд: Београдска отворена школа. http ://www.bos. rs/materijali/aspekti.pdf

- Димитријевић, М. (2018). Електронски новац у савременом монетарном праву. Зборник радова Правног факултета у Нишу, 57 (81), 221–236. https ://doi. org/10.5937/zrpfni1983061D

- Марковић, Д. Ж. и Булатовић, И. Ж. (2014). Социологија – основни појмови и савремено друштво. Београд: Београдска пословна школа − Висока школа струковних студија.

- Печујлић, М. (2002). Глобализација – два лика света. Београд: Гутенбергова галаксија. Попић, С. (2018). Идеје о глобализацији у часопису „Социолошки преглед” – могућност примене Хелдове поделе школа мишљења. Социолошки преглед, 52 (1), 147–180. https ://doi.org/10.5937/socpreg52-16798

- Попић, С. и Шуваковић, У. (2014). Академик Радомир Д. Лукић – претеча проучавања глобализације у Србији. Теме, 1 (38), 377−390.

- Радуловић, С. (2017). Аутономни концепт односа лекара и пацијента као продукт другог таласа глобализације. Зборник радова Правног факултета у Нишу, 56 (76), 467−478.

- Џамић, В. (2014). Глобализација: њено теоријско утемељење и њене противречности. Зборник Матице српске за друштвене науке, 149, 1001−1011. https:// doi.org/10.2298/ZMSDN1449001D

- Шуваковић, У. (2013). Традиција и модернизација. Српска политичка мисао, 41 (3), 57−75.

- Abramowitz, M. B. (2016). Cryptocurrency-based law. Arizona Law Review, 58(2), 359–420. Antonopoulos, A. (2010). Mastering Bitcoin: Unlocking Digital Cryptocurrencies. Sebastopol: O’Reilly Media, Inc.

- Blaazer, D. (2020). Bitcoin in the longue durée: Money, the state and cryptocurrency. Australian Humanities Review, 66, 196−203. Calcaterra, C., Kaal, W. A., & Rao, V. (2020). Stable cryptocurrencies. Washington University Journal of Law & Policy, 61, 193−227.

- Cavalheiro, G. M. do C., & Cavalheiro, M. B. (2022). Assessing technological trends through patent landscaping: The case of bitcoin. Journal of World Intellectual Property, 25(1), 206–219. https ://doi.org/10.1111/jwip.12216

- Chumakov, A. N. (2010). Philosophy of Globalization. Moscow: MAKS Press.

- Cifrić, I. (2009). Kultura i okoliš. Zaprešić: VŠPU.

- Domišljanović, M. (2000). Globalizacija i mogućnost izbora. Diskrepancija, 1 (2), 41−45.

- Garratt, R., & Wallace, N. (2018). Bitcoin 1, Bitcoin 2, ...: An experiment in privately issued outside monies. Economic Inquiry, 56(3), 1887−1897. https: //doi.org/10.1111/ecin.12569

- Giddens, A. (1990). The Consequences of Modernity. Stanford: Stanford University Press Hayek, F. A. (1976). Denationalization of Money (An Analysis of the Theory and Practice of Concurrent Currencies). London: The Institute of Economic Affairs.

- Horvatić, H. i Tafra, V. (2022). Identifikacija komercijalne blockchain tehnologije te izazovi i opasnosti primjene kroz konkretne primjere. Obrazovanje za poduzetništvo – E4E, 12 (2), 105−120. https ://doi.org/10.38190/ope.12.2.7

- Karabulut, T., & Sari, S. S. (2022). The attitude of academic staff towards bitcoin. Ekonomski vjesnik, 35 (1), 55−67. https ://doi.org/10.51680/ev.35.1.5

- Magnuson, J. W. (2022). The failure of market efficiency. Brigham Young University Law Review, 48(3), 827−908. http ://dx.doi.org/10.2139/ssrn.4096270

- Mellor, M. (2020). Bitcoin and the myths of neoliberalism. Australian Humanities Review, 66, 204−209.

- Mijatović, N. (2022). Pravna (ne)uređenost kriptovaluta i njihov utjecaj na industriju osiguranja. Hrvatski časopis za osiguranje, 6, 93−106.

- Mirjanich, N. (2014). Digital money: Bitcoin’s financial and tax future despite regulatory uncertainty. DePaul Law Review, 64(1), 213–248.

- Nahorniak, I., Leonova, K., & Skorokhod, V. (2016). Cryptocurrency in the context of development of digital single market in European Union. InterEULawEast, 3(1), 107–124.

- Raskin, M. I. (2015). Realm of the coin: Bitcoin and civil procedure. Fordham Journal of Corporate & Financial Law, 20(4), 969–1011.

- Ronaghi, M. H. (2023). A contextualized study of blockchain technology adoption as a digital currency platform under sanctions. Management Decision, 61(5), 1352−1373. https ://doi.org/10.1108/MD-03-2022-0392

- Ruslina, E. (2019). Legal protection for bitcoin users in E-commerce transactions. Journal of Internet Law, 23(4), 3–6.

- Sławiński, A. (2019). Will IT technologies and globalisation change the mechanism of money creation?. Zarządzanie Publiczne / Uniwersytet Ekonomiczny w Krakowie, 4(50), 5–14. https ://doi.org/10.15678/ZP.2019.50.4.01

- Šoja, T. i Senarathne, C. W. (2019). Bitcoin i diversifikacija portfolija – perspektiva globalnog investitora. Bankarstvo, 48 (4), 44−63. https ://doi.org/10.5937/bankarstvo1904044S Ström, Т. Е. (2020). Abstracting money: Cryptocurrencies, cybernetics and contradictions. Australian Humanities Review, 66, 188−195.

- Syropyatov, V. A. (2021). Stablecoins as an implementation of Hayek’s private money theory. Russian Journal of Economics and Law, 2, 318–331. http ://dx.doi. org/10.21202/1993-047X.15.2021.2.318-331

- Teomete Yalabık, F., & Yalabık, İ. (2019). Anonymous bitcoin v enforcement law. International Review of Law, Computers & Technology, 33(1), 34–52.

- Vareško, A. i Deković, D. (2022). Utjecaj pandemije COVID 19 na povezanost kretanja cijena bitcoina i vodećih svjetskih burzovnih indeksa. Zbornik radova Međimurskog veleučilišta u Čakovcu, 13 (2), 89−99.

- Wen, F., Tong, X., & Ren, X. (2022). Gold or bitcoin, which is the safe haven during the COVID-19 pandemic?. International Review of Financial Analysis, 81, 102–121. https ://doi.org/10.1016/j.irfa.2022.102121

- Werner, S. M., Perez, D., Gudgeon, L., Klages-Mundt, A., Harz, D., & Knottenbelt, W. J. (2021). SoK: Decentralized finance. arXiv preprint arXiv:2101.08778, 1−17.

- Zebec, S. (2018). Pravna regulacija bitcoina i ostalih virtualnih valuta u nekim neeuropskim zemljama i hrvatskom zakonodavstvu. Zbornik radova Međimurskog veleučilišta u Čakovcu, 9 (1), 87−91.

- Živanović, V. i Vitomir, J. (2022). Nove tehnologije i uloga kriptovaluta na nivou in- vesticionog portfolija. Megatrend revija, 19 (1), 1−16. https ://doi.org/10.5937/ MegRev2201001Z

-

@ beef3d4d:479b72bc

2025-06-15 17:13:46

@ beef3d4d:479b72bc

2025-06-15 17:13:46Costantino e il solidus

Quando Costantino il Grande prese in mano le redini dell'impero, ne risollevò le sorti adottando riforme economiche lungimiranti. Tra gli impegni assunti, il più importante fu quello di mantenere il solidus a 4,5 grammi d'oro senza tagli o svalutazioni, coniandolo in grandi quantità a partire dal 312 d.C.. Spostò poi la capitale verso est, a Bisanzio, nel punto di incontro tra Asia ed Europa, dando vita all'Impero Romano d'Oriente, che adottò il solidus come moneta.

Mentre Roma continuava a deteriorarsi economicamente, socialmente e culturalmente, crollando infine nel 476 d.C., Bisanzio, poi rinominata Costantinopoli, sopravvisse per quasi 1200 anni, e il solidus divenne la moneta più longeva e accettata della storia.

Il nome Bisanzio vuole quindi essere un omaggio alla saggezza di Costantino e celebrare l’unica moneta nella storia dell’umanità capace di durare oltre un millennio. Un esempio ed un auspicio per la Bitcoin, moneta di oro digitale che ci accompagnerà per un lunghissimo tempo.

\

Vedi anche: Monetazione bizantina su Wikipedia.

\

Vedi anche: Monetazione bizantina su Wikipedia.Il problema dei generali bizantini

Il termine Bitcoin soffre di un’ambiguità semantica: con lo stesso termine si indicano due cose ben diverse tra loro: il protocollo di comunicazione e la moneta digitale costruita su di esso. Bitcoin inteso come protocollo rappresenta la prima soluzione a un problema informatico, centrale per il funzionamento di sistemi distribuiti, denominato problema dei generali bizantini, formulato nel 1982 e che e’ rimasto irrisolto per decenni.

La sua formulazione e’ tipicamente la seguente:

> Diverse divisioni dell’esercito bizantino, ciascuna guidata da un generale, sono accampate in posizioni strategiche attorno a una città nemica e dovono condividere una strategia di attacco coordinato per poter sopraffare il nemico. Le divisioni possono comunicare solo mediante messaggeri al fine di coordinare l’attacco decisivo. Il terreno impedisce alle divisioni bizantine di comunicare a distanza e queste possono comunicare solo tramite dei messaggeri. Come possono le varie divisioni accordarsi per un attacco congiunto sapendo che i messaggeri che inviano potrebbero essere catturati dal nemico, o che alcuni generali potrebbero addirittura tradire e mandare messaggeri con ordini sbagliati?

Il problema che devono risolvere i generali bizantini è lo stesso che affligge i sistemi di elaborazione distribuiti. Come raggiungere un consenso su una rete distribuita in cui alcuni nodi che la costituiscono possono essere difettosi o corrotti?

Il protocollo Bitcoin offre una soluzione a questo problema introducendo il concetto di “prova di lavoro” (proof of work) e della “catena di blocchi” (blockchain). E quindi, nuovamente, il nome Bisanzio si collega a Bitcoin ed alla principale innovazione tecnologica da esso introdotta.

Vedi anche: Byzantine fault su Wikipedia.

PS

Come resistere poi alla disponibilità del dominio internet bisanz.io? :)

-

@ 91117f2b:111207d6

2025-06-15 16:41:46

@ 91117f2b:111207d6

2025-06-15 16:41:46

The debate about the strongest superhero between Marvel and DC has been ongoing for decades. Here's a breakdown of the top contenders:

Top 3 Strongest Marvel Heroes:

-

Thor: As the Asgardian God of Thunder, Thor possesses formidable strength, durability, and control over elements like lightning and storms. His mastery over Mjolnir, his enchanted hammer, makes him a force to be reckoned with.

-

Silver Surfer: With his Power Cosmic, Silver Surfer wields immense energy manipulation abilities, super strength, and speed. He's a formidable opponent in the Marvel universe.

-

Thanos: As a powerful Eternal with Deviant genes, Thanos possesses extraordinary strength, durability, and regenerative abilities. His cosmic energy manipulation and telepathic skills make him nearly unbeatable.

Top 3 Strongest DC Heroes:

-

Superman: With his Kryptonian origin, Superman's abilities include immense strength, speed, invulnerability, and sensory powers like heat vision and X-ray vision.

-

Spectre: As the physical embodiment of the Wrath of God, Spectre has near-omnipotent power levels, manipulating time, space, matter, and energy on a cosmic scale.

-

Doctor Manhattan: With his ability to perceive and manipulate reality, Doctor Manhattan's powers are unparalleled. He can alter the course of history and disintegrate foes with a mere thought.

The Strongest of Them All

According to recent rankings, the One Above All from Marvel takes the top spot as the most powerful character, surpassing even the likes of Spectre and Doctor Manhattan. The One Above All's omnipotent nature and role as the creator of the Marvel multiverse solidify its position as the ultimate authority ¹.

Ultimately, determining the strongest superhero between Marvel and DC is subjective and depends on the context of the story or battle. Both universes boast an array of formidable characters, each with unique abilities and strengths. In other words the strongest, and in a death match depends on the character, powers and the story context. But in all DC is said to be the strongest in a group fight of both MARVEL and DC.

-

-

@ a3c6f928:d45494fb

2025-06-15 16:13:05

@ a3c6f928:d45494fb

2025-06-15 16:13:05We live in a world that worships productivity and glorifies the grind. Rest is often seen as weakness, laziness, or a luxury you must earn. But true freedom includes the right to pause—to exhale, to be still, to exist without proving. Choosing rest isn’t stepping back—it’s stepping into wholeness.

The Lie of Endless Motion

We’re taught that to be worthy, we must be busy. We keep moving, not because we’re always inspired—but because we’re afraid of what stillness might reveal. But you are not a machine. You are a soul. And your value is not tied to output.

Why Rest Takes Courage

It means trusting that you’re enough—even when you’re doing nothing

It challenges the belief that busyness equals importance

It requires facing emotions we often outrun

It invites us to slow down in a world that keeps speeding up

Signs You Need Rest

Constant fatigue or irritability

Feeling disconnected from joy or purpose

Difficulty making decisions or being present

Losing the ability to celebrate wins

Reclaiming Your Right to Pause

-

Redefine Rest: Rest isn’t failure. It’s fuel.

-

Listen to Your Body: If it’s whispering, don’t wait for it to scream.

-

Release Guilt: Rest is not a reward. It’s a requirement.

-

Schedule Silence: Make time for nothing. Guard it like gold.

-

Celebrate Stillness: Let rest be sacred—not secret.

Why This Freedom Matters

Rest gives you back to yourself. It reconnects you to your wisdom, creativity, and humanity. In stillness, the truth becomes clear. In quiet, the next step finds you.

“You don’t need to earn your right to breathe. You already belong here.”

Choose rest. Claim space. That, too, is liberation.

-

-

@ 41959693:3888319c

2025-06-15 16:07:44

@ 41959693:3888319c

2025-06-15 16:07:44Überblick über die Anthologie

Die Anthologie „365 Tage Frieden“, herausgegeben von Rüdiger Heins und Michael Landgraf, erschien 2025 im Verlag EDITION MAYA. In diesem Werk haben über 100 Autoren ihre Gedanken zum Frieden geäußert und zeigen dabei thematisch wie stilistisch, welche Vielfalt und Komplexität unter diesem Begriff vereint werden kann.

Diese Buchbesprechung geht nicht auf einzelne Beiträge ein, sondern betrachtet die Zusammenstellung und Gesamtwirkung der Texte. Jedem Tag des Jahres wurde ein Text zugeordnet, wobei es keine feste Abgrenzung oder Reihenfolge von Lyrik und Prosa gibt. Das Aufschlagen einer neuen Seite bzw. eines neuen Tages ist stets eine Überraschung, ein Wunder, ähnlich dem Frieden wie einige Autoren meinen.

Die Stimmen der Autoren erreichen den Leser dabei nicht nur aus dem deutschsprachigen Raum, sondern international und als Querschnitt aus unterschiedlicher Perspektiven, Lebensweisen, Erfahrungen, Ängsten und Hoffnungen. Dies beginnt bereits bei der Definition des „Friedens“. Ist es das Schweigen der Waffen; die erbauliche Koexistenz? Ist es die Stille, die in der Andacht der Natur gefunden wird? Ist es innere Gelassenheit? Die thematische Inhomogenität der Texte kann keine klare Antwort finden – doch in dieser Offenheit liegt auch der Reiz, die vermeintlich kleine Gedankenwelt des in der Moderne gehetzt-gestressten Normalbürgers ebenso zu akzeptieren wie die innere Ruhe eines System-Aussteigers, der im Glauben steht, sich den großen Fragen des Universums zu widmen.

Doch zurück fällt das Gros der Texte unabhängig davon immer wieder auf die formelhafte Beschwörung von Harmonie, Liebe und Freiheit und der Wunsch nach Verständnis, Verständigung und einer sicheren Zukunft. Dieser ständige Rückgriff wirkt nicht ermüdend oder altbacken, nicht mit der Gewissheit im Hinterkopf, wie kostbar und leicht zerbrechlich der Frieden ist. Im Vorwort des Buches berichtet Michael Landgraf beispielsweise in einem kurzen historischen Abriss vom aufgezwungenen römischen Frieden über den dreißigjährigen Krieg bis zu den völkerrechtswidrigen Kriegen der Gegenwart. Im Nachwort erinnert Uli Rothfuss daran, welche Aufgabe gerade Autoren in solchen Zeiten zufällt und verstärkt die Erkenntnis, dass Frieden eine Leistung ist, an der alle mitwirken können.

Stil und Wirkung

Die Anthologie stützt sich auf das Abwechslungsreichtum der Beiträge: Hier überwiegen vor allem die lyrischen Werke und Prosagedichte. Es gibt auch vereinzelte Prosatexte, welche aber i. d. R. in ihrer Länge drei Seiten nicht überschreiten. Sprache wie Gattung sind vielfältig: nüchterner Essay, phonetische Sprachspiele, Aphorismen und Akrosticha, von ernst bis augenzwinkernd. Die Gedichte sind überwiegend reimlos und ohne Metrik, selten lösen sie sich ganz vom Schema klassischer Typografie und spielen so mit dem Betrachter. Immer wieder finden sich direkte und indirekte Zitate, die religiösen und philosophischen Schriften entstammen oder Persönlichkeiten zuzuordnen sind, welche sich als Aufklärer, Humanisten und Menschenrechtler einen Namen gemacht haben.

Thematisch sprechen die Autoren sich nicht nur für den Frieden aus, sondern illustrieren zum Teil auch verbal brutal die Schrecken des Krieges, zeigen die Zerstörung, den Schmerz, die Fremde und Einsamkeit. Wir erfahren von Hass, gezüchtet und blühend in den Rabatten. In einem Beitrag heißt es: „Da sah ich das Spiel der Liebe Arm in Arm mit den Drogen zum Dinner flanieren.“

Die Poesie soll uns mahnend im Gedächtnis bleiben und all die Bandbreite fassen; die Sicherheit des Friedens ebenso wie die Verzweiflung über die Sinnlosigkeit des Tötens. Diese Unnatürlichkeit, die uns als fühlende Wesen eigentlich fassungslos hinterlassen sollte, machen die Autoren durch ihre Sprache sichtbar: „Ich habe über den Frieden schreiben wollen, und dann verbrannte ich mich an Grablichtern.“

Fazit: Wie diese Anthologie helfen kann

„365 Tage Frieden“ ist nicht dafür geschrieben, sie wie ein gewöhnliches Buch von vorn bis hinten durchzublättern. Durch ihre Vielstimmigkeit soll sie Hoffnung wecken und mit dem Konzept, jeden Tag einen anderen Text vor sich zu haben, bindet sich der Leser an ein Stück Kontinuität.

Wer es sich zum Ritual machen möchte, jeden Tag einen Moment inne zu halten und einen der kleinen Friedenstexte zu lesen, wird gewiss die Möglichkeit finden, mit Vertrauen in die Zukunft zu blicken und sich gegen Angst zu wappnen. Die auch in zahlreichen Texten beschworenen Schrecken sollen dabei die Wichtigkeit des Friedens verdeutlichen und verschaffen der Reise durch das Jahr bzw. durch das Buch thematische und stilistische Abwechslung.

Der Wunsch nach Frieden und Versöhnung bleibt zeitlos, im Studium der Geschichte finden sich aber markante Punkte und Persönlichkeiten, die wir immer mit den großen Konflikten der Menschheit verbinden. Allgemeine, vergangene wie aktuelle Auseinandersetzungen, z. B. im Gaza-Streifen oder im Ukraine-Krieg kommen zur Ansprache, ebenso wie beispielsweise momentane Entwicklungen in den USA.

Wer dem Frieden eine Stimme geben möchte, kann durch dieses Buch seine Überzeugung stärken und die Stimmbänder emotional wie intellektuell trainieren. Die Schicksale und Beobachtungen der Autoren zeigen, dass wir fortwährend Fürsprecher für eine gemeinsame Zukunft brauchen werden.

365 Tage Frieden