-

@ dfa02707:41ca50e3

2025-06-15 11:02:43

@ dfa02707:41ca50e3

2025-06-15 11:02:43- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ 9ca447d2:fbf5a36d

2025-06-15 11:02:14

@ 9ca447d2:fbf5a36d

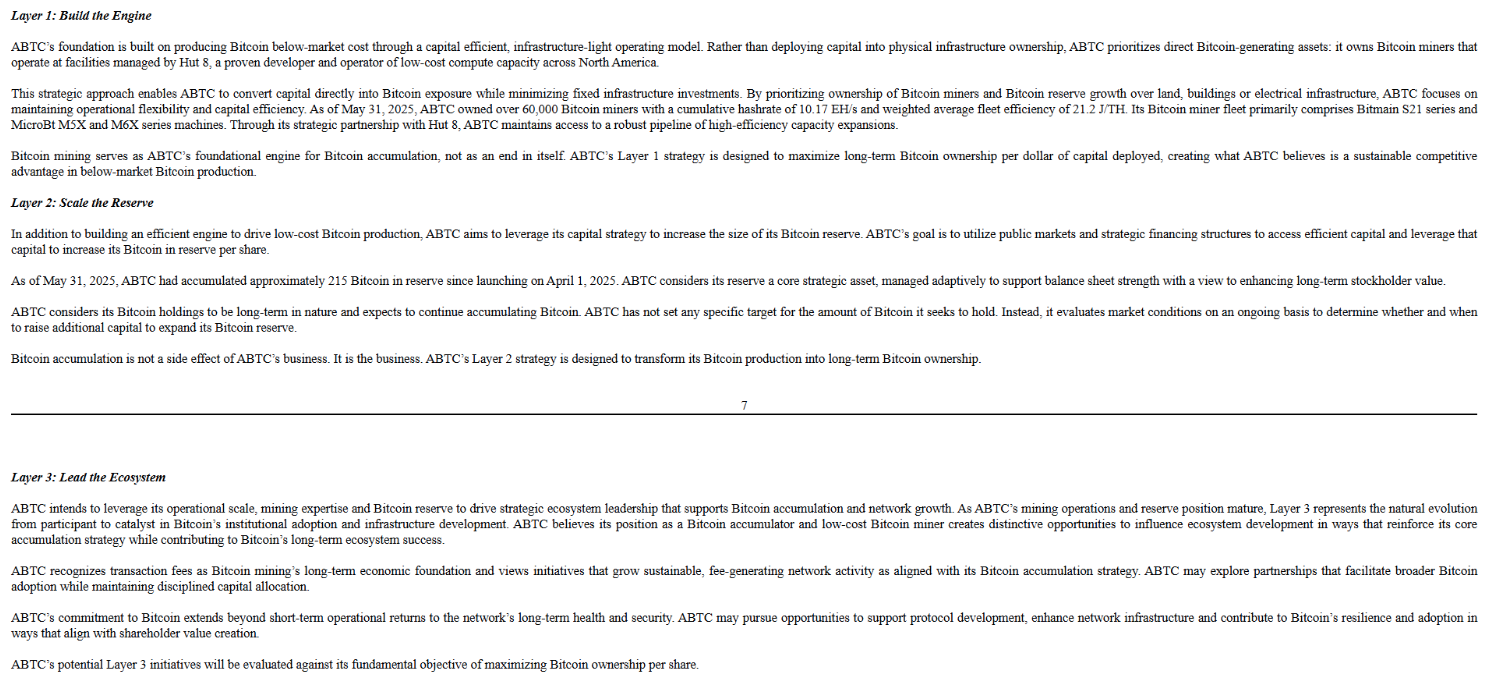

2025-06-15 11:02:14When Richard Scotford moved to Costa Rica in 2018, he had no idea he would become a key figure in a thriving Bitcoin economy.

A longtime Bitcoin holder who initially saw it through the lens of speculation, Scotford’s journey led him to embrace Bitcoin’s deeper purpose and spearhead Bitcoin Jungle — a grassroots movement bringing real-world Bitcoin adoption to Costa Rica.

Bitcoin circular economies create holistic value for Bitcoiners

Bitcoin Jungle is inspired by Bitcoin Beach in El Salvador but uniquely adapted to Costa Rica’s economic landscape. Unlike El Salvador, where Bitcoin was positioned as a tool for financial inclusion, Costa Rica already has a fairly stable banking system.

The real issue? The friction of moving money. Expats, business owners, and tourists struggle with high fees, banking red tape, and slow transactions. Bitcoin helped solve a lot of these problems.

The Birth of Bitcoin Jungle

Scotford and his team launched Bitcoin Jungle in late 2021 with a simple goal: get bitcoin into people’s hands and make it usable. However, there was one challenge — he had no technical background.

Determined to create a circular bitcoin economy, Scotford networked aggressively. He attended the first Adopting Bitcoin conference in El Salvador, approaching strangers with his vision:

“I was just walking around trying to find people who could help me make this economy, going up to random people saying ‘Hey, what can you do? We’re trying to make a circular economy in Costa Rica, can you help us?’ They all thought I was crazy.”

The breakthrough came when he turned to Bitcoin Twitter. Nicolas Burtey from Galoy encouraged him to create a wallet, and developer Lee Salminen forked the Bitcoin Beach wallet for their project.

“Within two weeks of Adopting Bitcoin, Lee forked the Galoy Bitcoin Beach wallet, which took Galoy by surprise. Even though they made their wallet to be forked if necessary, I don’t think they were expecting people to do it so fast and, I’d like to say, so well. They were like, ‘Okay, cool, who are these guys doing this?’”

Finally Bitcoin Jungle had its own working wallet, surprising even the Galoy team with the speed of execution.

Grassroots Adoption: One Vendor at a Time

How do you build a bitcoin economy from scratch? Scotford’s answer was simple: start at the farmers’ markets.

“We were like, okay, we’re going to get all the bespoke niche market sellers who are in this area. We have all these beautiful farmers markets, and we decided to approach these people first,” Scotford explained.

His team took a strategic approach, targeting market gatekeepers first.

“If you want to talk to every individual person, it’s really difficult. But if you can talk to the person who is the owner of the market, and then they can introduce you to their market stores, you’re already halfway there.”

Going stall by stall, they pitched Bitcoin’s advantages — no bank fees and better payment options. But adoption didn’t happen overnight, so Bitcoin Jungle initially offered a safety net — vendors could cash out at the end of the day.

“We would say to the vendors, ‘Look, accept bitcoin, and at the end of the day, if you don’t want to keep the bitcoin, we’ll buy it off you,’” Scotford recalled.

“When we first started, maybe 30–40% of the vendors were cashing up every day or at the weekends. Lee would be walking around with big fistfuls of money, cashing out vendors.”

But over time, something shifted — they started keeping their bitcoin.

“Eventually, the vendors started to learn themselves that, ‘Oh, actually it’s better to keep it.’ They would then pay for their tables in the markets using bitcoin. They thought, ‘Well, I don’t want to keep this bitcoin, I don’t really know what to do with it, but I can pay for my table.’ So there, the circular economy starts to happen.”

Today, Bitcoin Jungle runs with minimal intervention, and Scotford takes pride in their reliability.

“When you come here to Costa Rica, what we really pride ourselves on is that if someone says they accept bitcoin, 99% of the time, they will. And if they’re part of Bitcoin Jungle, they will 100% accept bitcoin and you will have a fluid experience with it.”

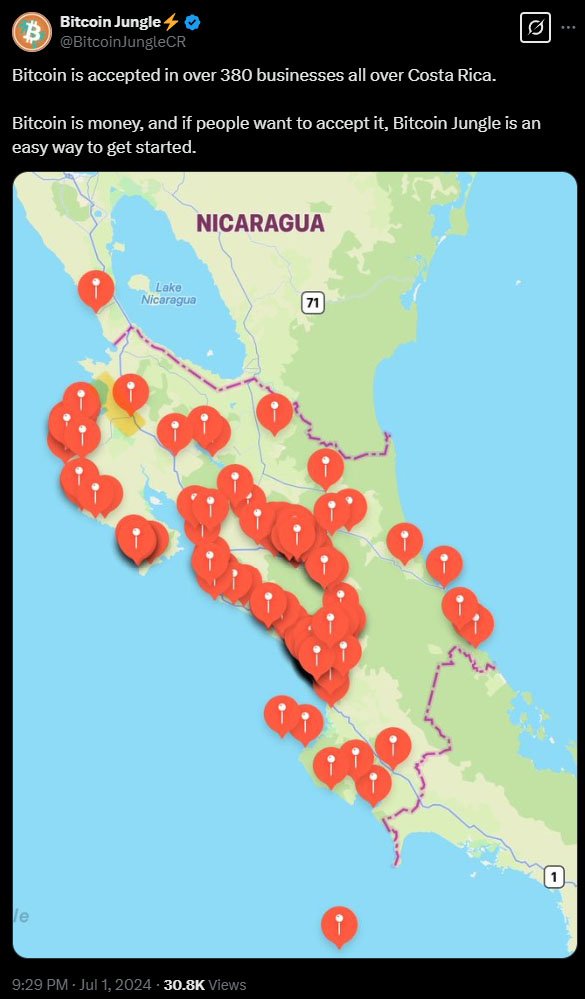

By mid-summer 2024 over 380 locations in Costa Rica accepted bitcoin

The Bitcoin Jungle Wallet and Real Usage

Bitcoin Jungle is an open-source community project built on the Bitcoin Lightning Network.

Acting as a community bank, the project processes a large number of transactions daily. To encourage proper security practices, Scotford’s team alerts their peers, reminding users to move their bitcoin to cold storage.

“If you’ve got too much bitcoin on your wallet, we send you a message telling you to move it to cold storage,” he explained. For larger businesses, they even offer hands-on assistance to secure funds properly.

Unlike the HODL-only philosophy that many Bitcoiners advocate, Bitcoin Jungle encourages spending.

“Michael Saylor says don’t spend your bitcoin. We say the opposite,” Scotford laughed. “We’re the antithesis of that. You need to spend it.”

Bitcoin Jungle’s Unique Approach to Costa Rica

Bitcoin Jungle isn’t just another Bitcoin adoption effort; it’s tailored to Costa Rica’s economy. The wallet operates in Costa Rican colónes, making transactions feel familiar to residents while ensuring tourists and expats can still interact easily.

The team has also introduced low-fee bitcoin ATMs, point-of-sale integrations, and partnerships that allow users to pay in bitcoin while the recipient receives local currency.

A major breakthrough came when Francis Pouliot from Bull Bitcoin joined forces with Bitcoin Jungle, bringing his expertise in banking infrastructure to the project.

This collaboration enabled seamless bitcoin payments that integrate directly with Costa Rica’s financial system, allowing users to pay anyone, even businesses that don’t directly accept bitcoin, while the recipient receives funds in colónes or dollars.

“I can go to a hardware store, order steel for my new basketball court, pay in bitcoin, and the store gets dollars,” Scotford said. “For a non-tech guy like me, it’s magical.”

Why Aren’t There More Bitcoin Jungles?

Scotford sees an opportunity for more localized bitcoin economies.

“There should be a Bitcoin Harbor, a Bitcoin Mountain, a Bitcoin Driveway,” he joked. “But instead of waiting for permission or corporate funding, people need to take action themselves.”

He emphasizes that building a circular bitcoin economy doesn’t require deep pockets. “I probably gave away $600 worth of bitcoin when we started — just $3 here, $4 there — to get people using it.”

The Future of Bitcoin Jungle

Bitcoin Jungle continues to grow, recently hosting events like the Bitcoin Freedom Festival and integrating bitcoin into community projects, including a school where tuition can be paid in bitcoin.

“The institutions have come in, but the grassroots projects haven’t caught up,” Scotford observed. “It’s time for people to stop sitting on their hands and start building.”

Bitcoin is permissionless, no one has to wait for approval to start using it. Bitcoin Jungle proves that with vision and persistence, anyone can build a thriving Bitcoin economy, one market stall at a time.

Get the latest from Bitcoin Jungle: follow them on X

-

@ b1ddb4d7:471244e7

2025-06-15 10:02:09

@ b1ddb4d7:471244e7

2025-06-15 10:02:09The latest AI chips, 8K displays, and neural processing units make your device feel like a pocket supercomputer. So surely, with all this advancement, you can finally mine bitcoin on your phone profitably, right?

The 2025 Hardware Reality: Can You Mine Bitcoin on Your Phone

Despite remarkable advances in smartphone technology, the fundamental physics of bitcoin mining haven’t changed. In 2025, flagship devices with their cutting-edge 2nm processors can achieve approximately 25-40 megahashes per second when you mine bitcoin on your phone—a notable improvement from previous generations, but still laughably inadequate.

Meanwhile, 2025’s top-tier ASIC miners have evolved dramatically. The latest Bitmain Antminer S23 series and Canaan AvalonMiner A15 Pro deliver 200-300 terahashes per second while consuming 4,000-5,500 watts. That’s a performance gap of roughly 1:8,000,000 between when you mine bitcoin on your phone and professional mining equipment.

To put this in perspective that hits home: if you mine bitcoin on your phone and it earned you one penny, professional miners would earn $80,000 in the same time period with the same effort. It’s not just an efficiency problem—it’s a complete category mismatch.

According to Pocket Option’s 2025 analysis, when you mine bitcoin on your phone in 2025, you generate approximately $0.003-0.006 in daily revenue while consuming $0.45-0.85 in electricity through constant charging cycles. Factor in the accelerated device wear (estimated at $0.75-1.20 daily depreciation), and you’re looking at losses of $1.20-2.00 per day just for the privilege of running mining software.

Mining Economic Factor

Precise Value (April 2025)

Direct Impact on Profitability

Smartphone sustained hash rate

20-35 MH/s

0.00000024% contribution to global hashrate

Daily power consumption

3.2-4.8 kWh (4-6 full charges)

$0.38-0.57 at average US electricity rates

Expected daily BTC earnings

0.0000000086 BTC ($0.0035 at $41,200 BTC)

Revenue covers only 0.9% of electricity costs

CPU/GPU wear cost

$0.68-0.92 daily accelerated depreciation

Reduces smartphone lifespan by 60-70%

Annual profit projection

-$386 to -$412 per year

Guaranteed negative return on investment

Source: PocketOption

Bitcoin’s 2025 Network: Harder Than Ever

Bitcoin’s network difficulty in 2025 has reached unprecedented levels. After the April 2024 halving event that reduced block rewards from 6.25 to 3.125 BTC, mining became significantly more competitive. The global hash rate now exceeds 800 exahashes per second—that’s 800 followed by 18 zeros worth of computational power securing the network.

Here’s what this means in practical terms: Bitcoin’s mining difficulty adjusts every 2,016 blocks (roughly every two weeks) to maintain the 10-minute block time. As more efficient miners join the network, difficulty increases proportionally. In 2025, mining difficulty has increased compared to 2024, making small-scale mining even less viable.

The math is unforgiving:

- Global Bitcoin hash rate: 828.96 EH/s

- Your smartphone’s contribution: ~0.000000003%

- Probability of solo mining a block: Virtually zero

- Expected time to mine one Bitcoin: Several million years

Even joining mining pools doesn’t solve the economic problem. Pool fees typically range from 1-3%, and your minuscule contribution would earn proportionally tiny rewards—far below the electricity and device depreciation costs.

The 2025 Scam Evolution: More Sophisticated, More Dangerous

Fraudsters now leverage AI-generated content, fake influencer endorsements, and impressive-looking apps that simulate realistic mining activity to entice you to mine bitcoin on your phone.

New 2025 scam tactics include:

AI-Powered Fake Testimonials: Deepfake videos of supposed successful mobile miners showing fabricated earnings statements and encouraging downloads of malicious apps.

Gamified Mining Interfaces: Apps that look and feel like legitimate games but secretly harvest personal data while simulating mining progress that can never be withdrawn.

Social Media Manipulation: Coordinated campaigns across TikTok, Instagram, and YouTube featuring fake “financial influencers” promoting mobile mining apps to younger audiences.

Subscription Trap Mining: Apps offering “free trials” that automatically charge $19.99-49.99 monthly for “premium mining speeds” while delivering no actual mining capability.

Recent cybersecurity research shows that over 180 fake mining apps were discovered across major app stores in 2025, with some accumulating more than 500,000 downloads before being removed.

Red flags that scream “scam” in 2025:

- Apps claiming “revolutionary mobile mining breakthrough”

- Promises of earning “$10-50 daily” from phone mining

- Requirements to recruit friends or watch ads to unlock withdrawals

- Apps that don’t require connecting to actual mining pools

- Testimonials that seem too polished or use stock photo models

- Apps requesting permissions unrelated to mining (contacts, camera, microphone)

The 2025 Professional Mining Landscape

To understand why, consider what professional bitcoin mining looks like in 2025. Industrial mining operations now resemble high-tech data centers with:

Cutting-edge hardware:

- Bitmain Antminer S23 Pro: 280 TH/s at 4,800W

- MicroBT WhatsMiner M56S++: 250 TH/s at 4,500W

- Canaan AvalonMiner A1566: 185 TH/s at 3,420W

Infrastructure requirements:

- Megawatt-scale power contracts with industrial electricity rates

- Liquid cooling systems maintaining 24/7 optimal temperatures

- Redundant internet connections ensuring zero downtime

- Professional facility management with 24/7 monitoring

For a small operation, you might need at least $10,000 to $20,000 to buy a few ASIC miners, set up cooling systems, and cover electricity costs. These operations employ teams of engineers, maintain relationships with power companies, and operate with margins measured in single-digit percentages.

2025’s Legitimate Mobile Bitcoin Strategies

While it remains impossible to mine bitcoin on your phone profitably, 2025 offers exciting legitimate ways to engage with bitcoin through your smartphone:

Lightning Network Participation: Apps like Phoenix, Breez, and Zeus allow you to run Lightning nodes on mobile devices, earning small routing fees while supporting bitcoin’s payment layer.

Bitcoin DCA Automation: Services enable automated dollar-cost averaging with amounts as small as $1 daily. Historical data shows $10 weekly bitcoin purchases consistently outperform any mobile mining attempt by 1,500-2,000%.

Educational Mining Simulators: Legitimate apps like “Bitcoin Mining Simulator” teach mining concepts without false earning promises. These educational tools help users understand hash rates, difficulty adjustments, and mining economics.

Stacking Sats Rewards: Apps offering bitcoin rewards for shopping, learning, or completing tasks.

Lightning Gaming: Bitcoin-native mobile games where players can earn sats through skilled gameplay, with some players earning $10 monthly.onfirm that even the most optimized mobile mining setups in 2025 lose money consistently and predictably.

The Bottom Line

When you mine bitcoin on your phone fundamental economics remain unchanged: it’s impossible to profit. The laws of physics, network competition, and energy efficiency create insurmountable barriers that no app can overcome.

However, 2025 offers unprecedented opportunities to engage with bitcoin meaningfully through your smartphone. Focus on education, legitimate earning opportunities, and strategic investment rather than chasing the impossible dream of phone-based mining.

The bitcoin community’s greatest strength lies in its commitment to truth over hype. When someone promises profits to mine bitcoin on your phone in 2025, they’re either uninformed or deliberately misleading you. Trust the mathematics, learn from the community, and build your bitcoin knowledge and holdings through proven methods.

The real opportunity in 2025 isn’t to mine bitcoin on your phone—it’s understanding bitcoin deeply enough to participate confidently in the most important monetary revolution of our lifetime. Your smartphone is the perfect tool for that education; it’s just not a mining rig.

-

@ dfa02707:41ca50e3

2025-06-15 09:02:24

@ dfa02707:41ca50e3

2025-06-15 09:02:24Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ dfa02707:41ca50e3

2025-06-15 08:02:07

@ dfa02707:41ca50e3

2025-06-15 08:02:07Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ 0faf8268:2e8a5462

2025-06-15 10:36:35

@ 0faf8268:2e8a5462

2025-06-15 10:36:35Using Browser Extensions to Log In and Sign Events on Nostr

If you're new to Nostr, or trying to log in to a client via a web browser using an existing account, you may come across something that feels risky: being asked to paste your private key (your

nsec) into a website to log in. This guide outlines a safer alternative. using browser extensions like Nos2x or Alby, which let you securely log in and sign actions without exposing your private key.These extensions only work in desktop web browsers, not in mobile apps. If you're logging in to a mobile Nostr client (such as Primal, Amethyst, Damus, or others), you’ll typically need to either paste your existing

nsecinto the app or use a secure import method, like scanning a QR code or restoring from a backup. Be extremely cautious when pasting yournsec, and only do so in apps you trust.What is NAWC

NAWC stands for "Nostr Authorisation Web Credential". It allows Nostr websites to ask your browser for permission to read your public key and sign messages, without needing direct access to your private key. It works similarly to a password manager or a crypto wallet extension.

Why avoid pasting your

nsecYour

nsecis your private key. If someone gains access to it, they can impersonate you, send posts as you, or read your private messages.Pasting your

nsecinto a web form is discouraged for several reasons:-

The site might be compromised or malicious

-

Your key could be stored in browser memory or cached

-

Extensions, scripts, or browser plugins could access the field

-

You may unknowingly copy or sync it elsewhere (e.g. clipboard history, autofill, cloud sync)

Once exposed, your

nseccannot be revoked or changed, it is your entire Nostr identity. This is why experienced users recommend using extensions that safely manage your key and handle signing.What new users might notice

Some Nostr clients still prompt users to paste their

nsec, even when a signing extension like Nos2x is installed. This can cause confusion, especially for users trying to follow best practice. Extensions sometimes need to be manually enabled, refreshed, or granted permission before they are recognised. These challenges are common in a developing ecosystem and should improve over time.Extensions that support NAWC

Nos2x

-

Chrome only

-

Stores one private key locally

-

Works with sites like Primal and Coracle

-

Lightweight and simple to use

Alby

-

Available for Chrome and Firefox

-

Originally built for Lightning, but also supports Nostr

-

May need extra setup for non-Lightning Nostr use

-

Supports switching between keys and profiles

Bunker (self-hosted signer, not an extension)

-

Keeps your private key entirely isolated from the browser

-

Can be combined with hardware devices or run remotely

-

Ideal for advanced users or managing multiple keys with higher security

Why Signing Events Matters in Nostr

On Nostr, everything you do, posting a note, reacting to content, updating your profile, is considered an event.

To prove that an event is really yours, it must be signed with your private key. This signature is what makes the event valid and verifiable by anyone on the network.

Browser extensions like Nos2x, Alby, or self-hosted signers like Bunker handle this event signing for you. Instead of giving the site your private key, the extension signs the event on your behalf, keeping your key secure while still proving authorship.

In short: extensions are not just for logging in, they also sign everything you do. This keeps your identity secure and helps maintain Nostr’s decentralised and trustless nature.

How to use an extension

-

Install Nos2x or Alby

-

Enter your

nsecinto the extension settings (only once) -

Visit a Nostr client like primal.net

-

Approve the login request from the extension

-

You’ll be logged in securely without pasting your key

Switching keys

Most extensions support only one private key at a time. To switch:

-

Open the extension

-

Remove the current key and enter a new one

-

Refresh the site and reauthorise when prompted

If your old key keeps reappearing or does not seem to clear properly, it may be necessary to:

-

Uninstall the extension

-

Reinstall it from the Chrome Web Store

-

Then enter your new

nsecduring setup

This is a known issue with some extensions (like Nos2x), and will likely improve as tools mature. For now, a clean reinstall is a simple workaround.

Wrap-up

Browser extensions are one of the safest and most effective ways to interact with Nostr. They protect your private key, simplify login, and securely sign every action you take.

While the user experience is still evolving, using a signing extension today is a smart way to get started safely and build good habits as you explore the network.

For more beginner-friendly Nostr guidance, visit:\ https://swiftsats.github.io/getting-started-with-nostr/

-

-

@ 7f6db517:a4931eda

2025-06-15 06:03:01

@ 7f6db517:a4931eda

2025-06-15 06:03:01

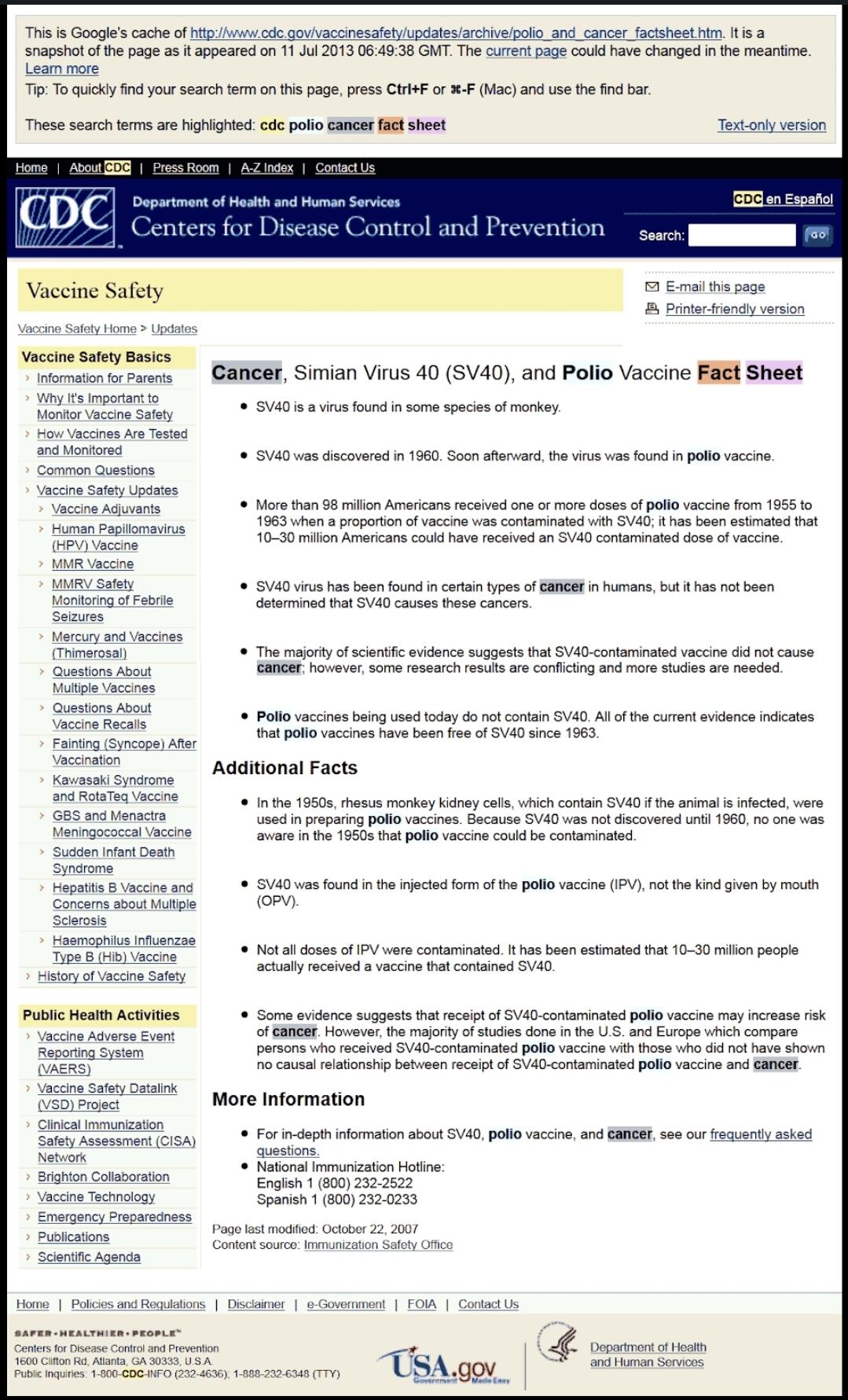

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 4fe14ef2:f51992ec

2025-06-15 10:19:13

@ 4fe14ef2:f51992ec

2025-06-15 10:19:13Let's support Bitcoin merchants! I'd love to hear some of your latest Lightning purchases and interesting products you bought. Feel free to include links to the shops or businesses you bought from.

Who else has a recent purchase they’re excited about? Bonus sats if you found a killer deal! ⚡

If you missed our last thread, here are some of the items stackers recently spent and zap on.

Like and repost: X: https://x.com/AGORA_SN/status/1934193660796780660 N: https://njump.me/nevent1qqsdaqz3qjmgta88a4wnzyh7vujla7ecsc7luatrtl0a2k7xq43thhq337lj2

https://stacker.news/items/1006838

-

@ c1e9ab3a:9cb56b43

2025-06-15 00:36:39

@ c1e9ab3a:9cb56b43

2025-06-15 00:36:391. Introduction

The 21st century is marked by a rare confluence of demographic, technological, and monetary regime shifts. As birth rates fall below replacement levels across advanced and many emerging economies, global population growth slows and begins to reverse. At the same time, automation, AI, and robotics are increasing productivity at an accelerating pace. Simultaneously, trust in central banks and fiat currencies is waning, giving rise to calls for a return to hard currencies (e.g., gold, Bitcoin) and decentralized monetary systems.

These trends pose stark challenges to existing economic theories and institutions. This paper explores their implications through two opposing lenses: Keynesian economics and Austrian (Misesian) economics.

2. The Keynesian Reaction: Deflation, Demand Collapse, and the Paradox of Thrift

2.1. Demand-Side Fragility in a Shrinking Population

Keynesian theory is rooted in the principle that aggregate demand drives output and employment. A declining population implies a falling consumption base, which directly reduces aggregate demand. Combined with increased longevity, this trend leads to a larger retired population disinclined to spend, creating persistent demand shortfalls.

2.2. Technological Unemployment and Reduced Income Velocity

Rapid productivity gains from AI and robotics may displace large segments of labor, leading to unemployment or underemployment. With fewer wage earners and heightened uncertainty, consumption slows further. Even if goods become cheaper, widespread income insecurity constrains the ability to buy them.

2.3. The Paradox of Thrift

In times of uncertainty, both individuals and businesses tend to save more. Keynes argued that if everyone saves, aggregate demand collapses because one person’s spending is another’s income. Thus, increased saving leads to lower incomes, which reduces saving in aggregate—a self-reinforcing contraction.

2.4. Retreat from Fiat and Central Banking: A Catastrophic Constraint

Abandoning fiat currency and central banking removes the government’s ability to perform countercyclical policy. Interest rates cannot be lowered below zero; money supply cannot be expanded to fill demand gaps. In such a regime, deflation becomes chronic, debt burdens rise in real terms, and recovery mechanisms are neutered.

Conclusion (Keynesian):

The combined effect of declining population, rising productivity, and a hard money transition is catastrophic. It leads to a deflationary spiral, mass unemployment, debt crises, and secular stagnation unless aggressively offset by expansive fiscal and monetary policy—tools unavailable in a hard currency system.

3. The Misesian Rebuttal: Market Coordination and the Natural Order of Decline

3.1. Savings as Capital Formation

Mises and the Austrian School reject the paradox of thrift. Savings are not lost demand; they are deferred consumption that funds capital investment. Increased saving, in a free market, lowers interest rates and reallocates resources toward longer-term, higher-order production.

3.2. Deflation as a Signal of Progress

Falling prices due to productivity gains are not a crisis but a benefit. Consumers gain real wealth. Entrepreneurs adjust cost structures. As long as wages and prices are flexible, deflation reflects abundance, not failure.

3.3. Population Decline as Economic Recalibration

A shrinking population reduces demand, yes—but it also reduces the labor supply. Wages rise in real terms. Capital intensity per worker increases. There is no systemic unemployment if labor markets are free and responsive.

3.4. Hard Currency as Restoration of Market Coordination

Transitioning to a hard currency purges fiat-induced malinvestment and restores the price mechanism. With no artificial credit expansion, capital is allocated based on real savings. Booms and busts are mitigated, and long-term planning becomes reliable.

Conclusion (Misesian):

There is no crisis. A hard currency, high-productivity, low-population economy stabilizes at a new equilibrium of lower consumption, higher capital intensity, and rising real wealth. Deflation is natural. Savings are the seed of future prosperity. Government interference, not market adaptation, is the threat.

4. Final Synthesis

The Keynesian and Misesian views diverge on first principles: Keynes sees demand shortfalls and rigidities requiring top-down correction, while Mises sees market-coordinated adaptation as sufficient and self-correcting. As the 21st century evolves, this ideological conflict will shape whether the transition leads to depression or renewal.

References

- Keynes, J.M. The General Theory of Employment, Interest and Money

- Mises, L. Human Action

- Hayek, F.A. Prices and Production

- Böhm-Bawerk, E. Capital and Interest

- Friedman, M. A Program for Monetary Stability

-

@ edeb837b:ac664163

2025-06-13 21:15:05

@ edeb837b:ac664163

2025-06-13 21:15:05On June 10th, 2025, four members of the NVSTly team traveled to New York City to attend the 2025 American Business Awards® ceremony, held at the iconic Marriott Marquis in Times Square. It was an unforgettable night as we accepted the Gold Stevie® Award for Tech Startup of the Year—this time, in person.

Meow (left), rich (center), MartyOooit (right)

Representing NVSTly at the event were:

- Rich, CEO & Founder

- Meow, CTO, Lead Developer, & Co-Founder

- MartyOooit, Investor

- Noob, Market Analyst (not shown in photos)

MartyOooit (left), rich (center), Meow (right)

While we shared the exciting news back in April when the winners were announced, being there in person alongside other winners—including eBay, AT&T, T-Mobile, HP Inc., and Fidelity Investments—made the achievement feel even more surreal. To be honored alongside billion-dollar industry leaders was a proud and humbling moment for our startup and a huge milestone in NVSTly’s journey.

🎤 Team Interview at the Event

During the event, our team was interviewed about the win. When asked:

“What does winning a Stevie Award mean for your organization?”

“How will winning a Stevie Award help your organization?”Here’s what we had to say:

📺 Watch the video

A Big Win for Retail Traders

NVSTly was awarded Gold for Tech Startup of the Year in recognition of our work building a powerful, free social investing platform that empowers retail traders with transparency, analytics, and community-driven tools.

Unlike traditional finance platforms, NVSTly gives users the ability to:

- Share and track trades in real time

- Follow and receive alerts from top traders

- Compete on global leaderboards

- Access deep stats like win rate, average return, and more

Whether you're a beginner or experienced trader, NVSTly gives you the insights and tools typically reserved for hedge funds—but in a free, social format built for the modern investor.

Continued Recognition and Momentum

This award adds to a growing list of recognition for NVSTly:

- 🏆 People’s Choice Winner at the 2024 Benzinga Fintech Awards

- 🔁 Nominated again for Best Social Investing Product in the 2025 Benzinga Fintech Awards

- 🌟 Team members JustCoreGames and Lunaster are nominated for Employee of the Year (Information Technology – Social Media) in the 2025 Stevie® Awards for Technology Excellence

We’re beyond proud of what our small but mighty team has accomplished—and we’re just getting started. 🚀

Thanks to the Stevie Awards for an incredible night in New York, and to our community of 50,000+ traders who’ve helped shape NVSTly into what it is today.

This win is yours, too.Stay tuned—more big things are coming.

— Team NVSTly

The event brought together some of the most respected names in tech, finance, and business. -

@ 0403c86a:66d3a378

2025-06-13 12:55:09

@ 0403c86a:66d3a378

2025-06-13 12:55:09Exciting news for FOOTBALL fans ⚽! Global Sports Central 🌐 is teaming up with Predyx, a leading prediction market in the Bitcoin ecosystem, to bring you comprehensive coverage of the very first Club World Cup directly on Nostr. This partnership is all about enhancing your experience with the latest news, insights, and interactive features!

The Club World Cup will showcase the best clubs from around the globe, and with our collaboration, you’ll be fully engaged in the action. Predyx focuses on long-term outcomes, allowing you to make predictions on who will win it all. Plus, if you’re not happy with your predictions, you can sell your shares at any time and switch allegiance—after all, it’s a free market!

What You Can Expect:

-

Latest News and Match Reports: Stay updated with the latest news, in-depth match reports, and insights from the tournament, ensuring you never miss a moment.

-

Market Odds Tracking: Follow the shifts in market odds in real-time, giving you the edge when making predictions and engaging with the action.

-

Player of the Day Card: Celebrate standout performances with our Daily Player of the Day card, highlighting the top players from the tournament.

-

Game oN Frontpage: Each day, we’ll feature the frontpage of the day, showcasing the most historical matchups and capturing the feel of the game.

-

Best Moments Replays: Relive the excitement with replays of the best moments from the Cup, so you can catch all the highlights and unforgettable plays.

-

Long-Term Predictions: Engage with Predyx to forecast who will win the tournament and who will take home the MVP award, allowing you to make strategic predictions as the tournament unfolds.

-

Easy Login System: Getting started is a breeze! All you need is a Lightning wallet to log in and participate, making it simple for everyone to join in on the fun.

-

Lightning-Fast Bitcoin Payments: With the Lightning Network, placing your bets and making predictions is faster and easier than ever. Enjoy seamless transactions while you cheer for your favorite teams!

"Predyx is excited to be part of this innovative partnership," said Derek. "We’re bringing fans a new way to interact with the game they love, all while using the fast and secure Lightning Network."

Predyx is a Bitcoin-native prediction market platform running on the Lightning Network. We’re building the fastest, most trust-minimized betting engine in the world — no deposits, instant payouts, sats-native, and degen-friendly.

Global Sports Central 🌐 Your daily spin around the sports world 🔄 Stay in the loop with the latest scores, stories, and stats.

GSC360 - Where Every Angle Matters

-

-

@ 88cc134b:5ae99079

2025-06-15 11:11:46

@ 88cc134b:5ae99079

2025-06-15 11:11:46text

-

@ 93bfc86d:fc8e91f5

2025-06-15 09:38:50

@ 93bfc86d:fc8e91f5

2025-06-15 09:38:50M of N 분산

이번 5월 BSL 컨퍼런스와 비트코인 서울 2025 컨퍼런스에서 펜락(Penlock) 프로젝트에 참여하고 있는 한 분을 만났다. 아마 이 분을 만난 한국인 분들이 더 있을 텐데, 현재는 익명을 원하시므로 프라이버시 보호를 위해 실명을 언급하는 것은 주의하는 것이 좋겠다.

키를 M of N으로 분산하는 방식 중 내가 알고 있는 건 멀티시그와 샤미르 분산이다.

멀티시그는 각자가 키를 생성하지만,

1. 스크립트 길이가 길어지고, 스크립트를 해시로 감싼다고 해도 일반 주소보다 길다.

2. 일반적인 P2MS는 공개키가 드러나므로 프라이버시 보장이 안 되고, P2SH로 감싸도 서명할 때 각자의 공개키가 드러난다(리딤 스크립트가 드러나므로).

이런 특징을 갖고 있다.

샤미르 분산은 하나의 키를 분산하는 방식이므로,

1. 키를 복원했을 때는 결국 하나의 키가 생성되므로 키가 복원되었을 때 보안에 매우 주의해야 한다.

2. 하지만 외부에서 볼 때는 어떤 방식으로 분할이 되었는지 알 수가 없으므로 프라이버시에 좋다.

이런 특징을 갖고 있다.

M of N은 회사에서의 권한 분산, 상속, 위험 지점 분산, 신뢰 지점 분산 등에 사용할 수 있을 것이다. 하지만 나는 멀티시그와 샤미르 분산이 둘 다 M of N을 구현하지만 그 특성이 약간 다르기 때문에 적합한 용처도 다르다고 생각한다. 만약 한 기업이 여러 이사진의 의사결정 과정에서 권한을 분산해야 한다면 멀티시그 방식이 훨씬 나을 것이다. 이사 각각이 서명하면 되기 때문이다. 여기다가 샤미르 분산을 쓴다면 이사 몇 명이 모여 키 하나를 생성했을 때 쪼개기 전의 원래 하나의 키가 생기므로 권한 분산에 차질이 생길 수 있다. 그 키를 갖는 사람이 갑자기 모든 권한을 가질 수 있게 되기 때문이다. 거꾸로 한 개인이 키를 백업하고자 하는데 키를 분실하거나 화재나 기타 재난 등의 이유로 파괴될 것에 대비하여 여러 장소에 분산하여 보관하고 싶다면 샤미르 분산이 더 적합할 것이다. 키 조각들을 합쳐서 원래 키가 생겼을 때 그 키는 어차피 한 개인이 쓰는 것이므로 권한 구조가 갑자기 한 곳으로 몰리는 것에 대해 걱정할 필요가 없기 때문이다.

그런데 샤미르 분산은 멀티시그보다 직관적이진 않은 것 같다. 멀티시그는 스크립트 구조를 보면 바로 어떤 구조인지 알 수 있다. 손으로 따라 쓸 수도 있는 수준이다. 하지만 트레저가 도입한 샤미르 분산인 SLIP-0039 같은 형식은 직관적이지가 않다. 일단 샤미르 분산이 다항함수를 통한 비밀 분산을 쓰는 원리라는 걸 이해해야 하고(키 조각이 부족하면 부정방정식이 되어서 복구 불가), 그걸 통해 복구하는 과정에서 사용하는 라그랑주 보간법이 인간이 손으로 계산하기에는 너무 어렵다. 키를 분할하고 복구하는 과정이 수학적인 함수 공간에서 정의되고, 사용자는 키 조각들만 보게 되므로 내부 구조에 대해 직관적으로 이해하기가 어렵다.

오프라인 손 계산과 직관적 이해

조금 다른 주제로 넘어가보자. 나는 기술의 사용자들이 그 기술을 '직관'적으로 이해할 수 있는 지가 매우 중요하다고 생각한다. 비트코인 경험에는 특히 '검증'이 중요한데 어떤 기술을 직관적으로 이해할 수 없다면 검증은 전문가들만의 전유물이 되기 때문이다.

예를 들어보자. 앨리스, 밥, 캐롤이 각각 니모닉을 만들었다.

1. 앨리스는 기계가 생성해준 니모닉을 사용한다. 기계는 SE칩 내부에 있는 전자의 브라운 운동 등을 엔트로피로 이용해 랜덤한 엔트로피를 생성했다. 하지만 앨리스는 이 사실을 모르고, 따라서 기계를 신뢰해야 한다. 앨리스는 기계가 생성해 준 엔트로피가 충분히 랜덤하고 안전하다고 "믿고 있다." 사실이 그런지 아닌지와는 별개로 말이다.

2. 밥은 주사위를 던져서 만든 니모닉을 사용한다. 하지만 주사위를 던졌을 때 나온 값이 어떻게 니모닉으로 변환되는지는 모른다. 기계는 주사위를 던져 나온 숫자를 유니코드 문자열로 인식하여 SHA256을 한 번 돌린 뒤, 그 해시값을 엔트로피로 사용한다. 밥은 자신이 직접 주사위를 던졌으므로 엔트로피가 랜덤하게 생성되었다는 것은 직관적으로 알지만, 그 숫자가 어떻게 니모닉으로 계산된 건지는 모른다.

3. 캐롤은 직접 동전을 던져 0, 1을 기록하고 자신이 직접 니모닉 표를 보며 니모닉을 대응시켰다. 따라서 캐롤은 자신이 사용하는 니모닉이 랜덤하다는 것도 이해하고 있으며, 랜덤한 엔트로피를 어떻게 니모닉에 대응시키는지도 알고 있다.

세 가지 경우 중 누가 니모닉에 대해 가장 잘 직관적으로 이해하고 있겠는가? 당연히 3번 캐롤이다. 이렇듯 오프라인에서 동전을 던져 직접 엔트로피를 생성하고, 표를 보며 손으로 직접 니모닉에 대응시키는 과정은 니모닉을 직관적으로 이해하는 데 매우 중요하다.

솔직히 3번의 경우도 완전히 신뢰 지점이 없진 않다. 왜냐하면... 니모닉의 체크썸을 계산하는 과정에서 해싱을 해야 하기 때문이다. 손으로 SHA256 함수를 계산할 수 있는 게 아니라면... 캐롤은 어떤 기계에게 체크섬 생성을 맡길 수밖에 없다. 그러면 적어도 그 과정에 대한 이해의 폭은 제한될 수밖에 없다.

오프라인에서 계산하는 경험들이 왜 직관적인 이해에 더 도움이 될까? 그 과정들을 자신이 온전히 통제하기 때문이다. 기계에 맡겨야 하는 순간에는 그 기계 안에서 무엇이 일어나는지 알 수 없으며 따라서 자신의 통제 밖에 있다.

펜락 프로젝트

서론이 길었다! 다시 샤미르 분산 이야기로 돌아오겠다. 샤미르 분산을 '손으로 계산'해 키 조각을 만들고, 키 조각들을 모아 다시 오프라인에서 '손으로 계산'해 하나로 만들 수 있을까? 거의 불가능에 가까울 것이다!

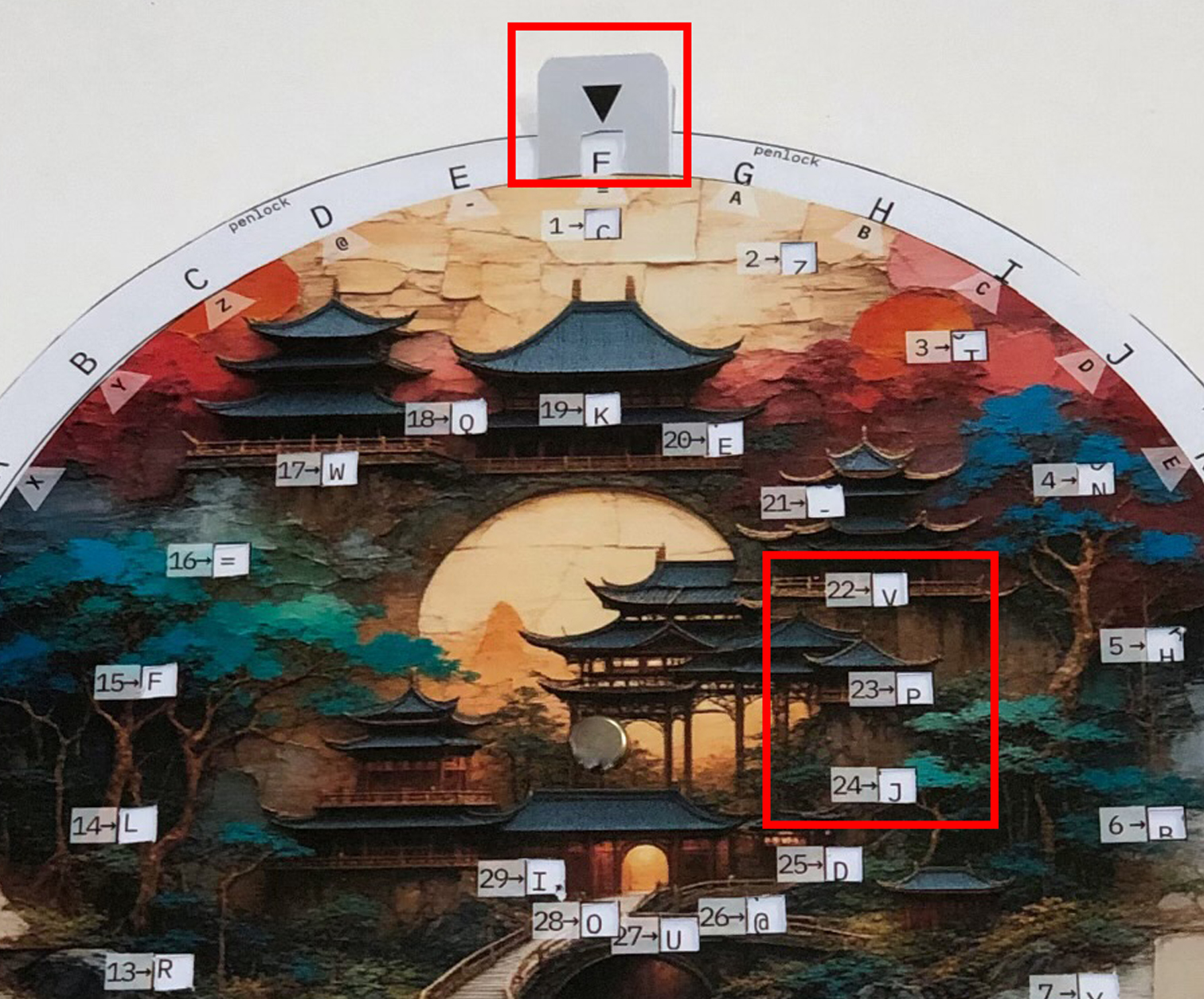

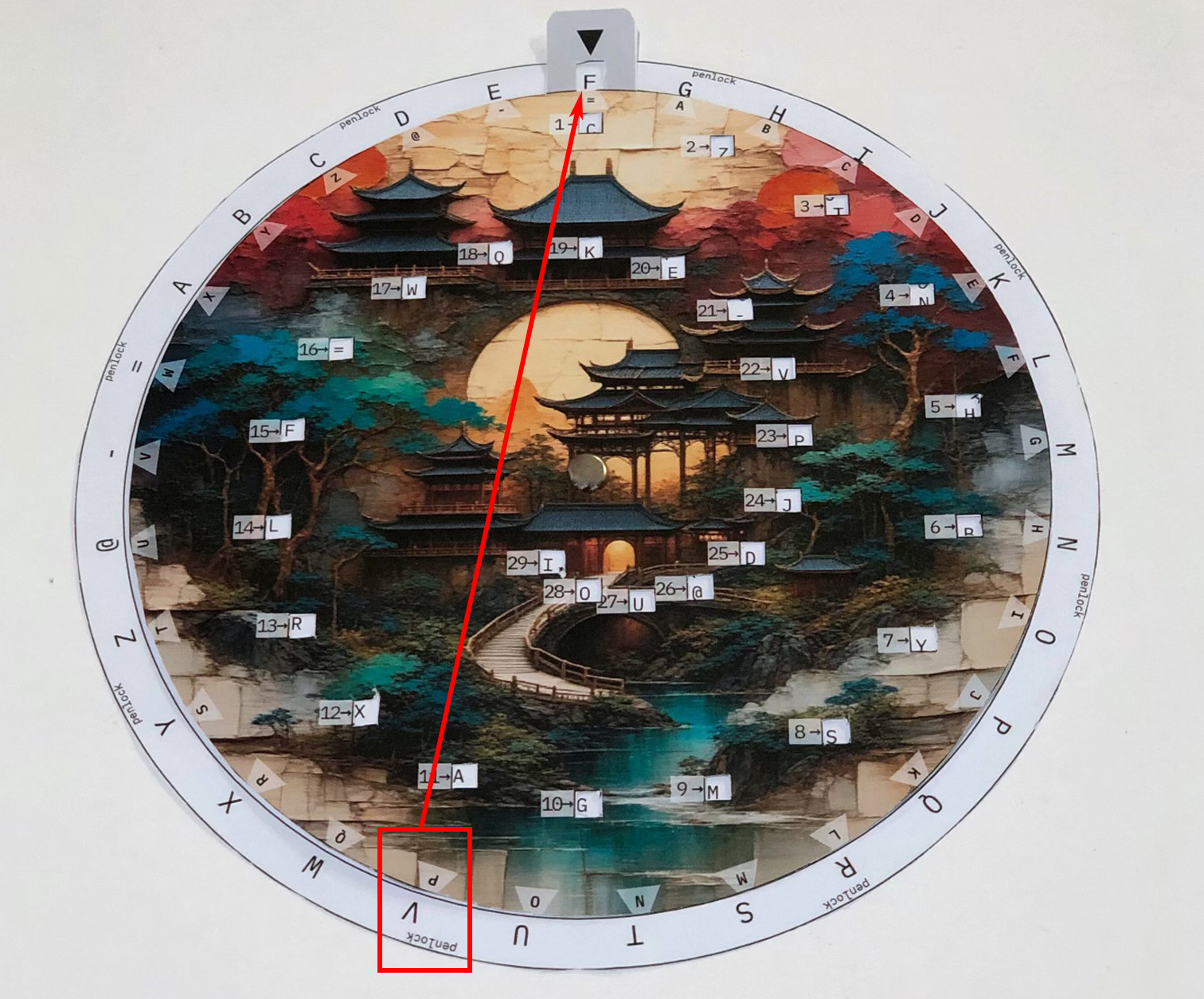

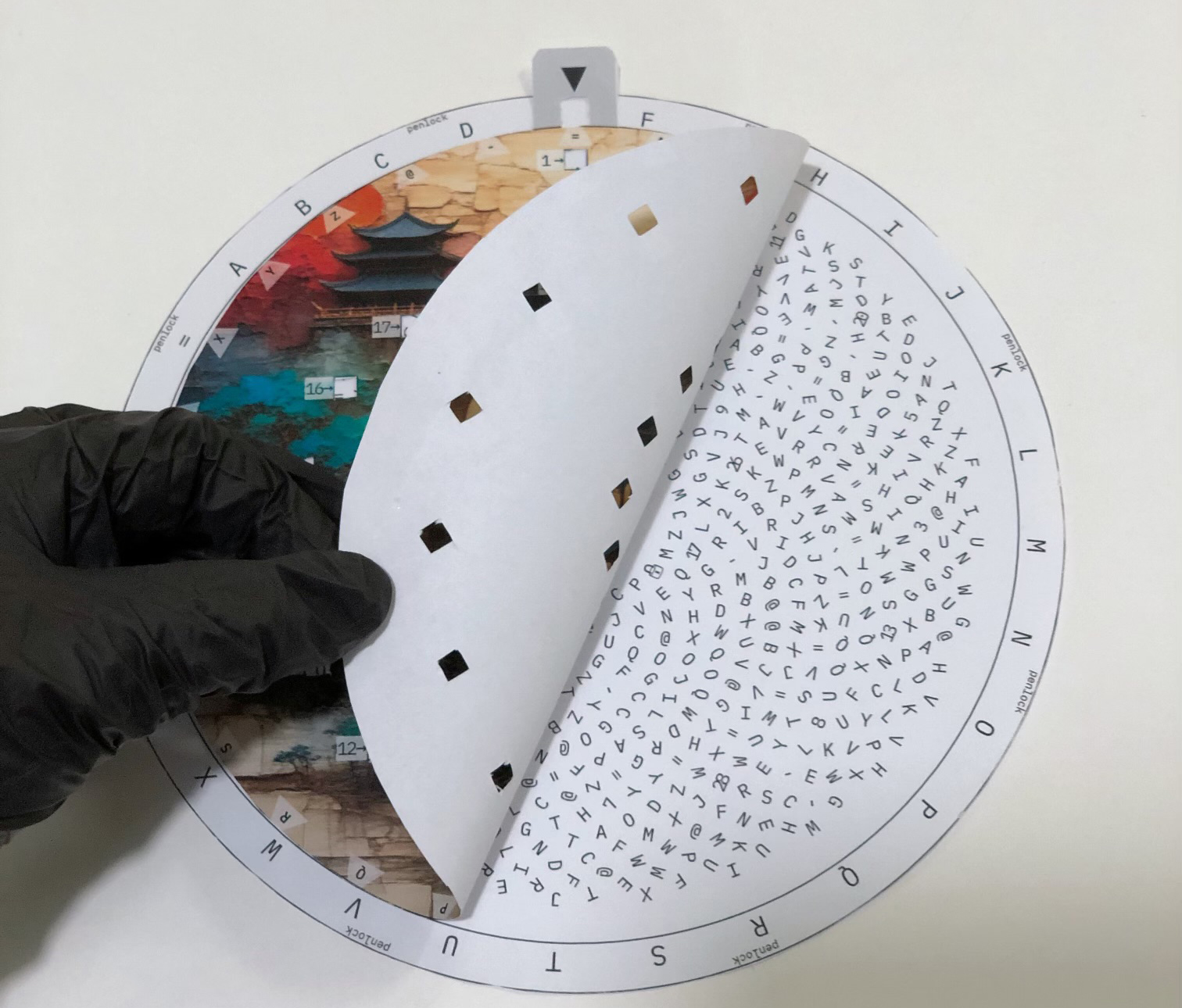

그런데 이번에 BSL 컨퍼런스에서 펜락 프로젝트에 참여하고 있는 한 분을 우연히 만나 인사를 나눴고, 며칠 뒤 있는 비트코인 서울 컨퍼런스에서 그 분이 나한테 선물을 주셨다. 바로... 아래 사진의 회전판이다. 직접 가위로 자르고 핀을 꽂는 것까지 봤다(컨퍼런스 강연 중에 뒷자리에서 가위로 자르고 있어서 웃음을 참을 수가 없었다ㅋㅋㅋ). 나는 이 귀엽고 조악한 회전판을 처음 봤을 때 이 위력에 대해 알지 못했다...

이 펜락 프로젝트 회전판은... 샤미르 분산처럼 하나의 키를 키 조각으로 나누고, 그 키 조각들을 오프라인에서 원래 키로 복구할 수 있게 만들어준다. 이게 작동하는 걸 처음 봤을 때 나는 정말 정말 x21 엄청나게 놀랐다.

사용 방법을 간단히 말해보자면, 메인 키(니모닉)가 있으면 니모닉 한 단어의 앞 4개 문자만 적는다(이유는 다들 아실 거라 생각... 니모닉은 앞 4글자가 겹치는 경우가 없기 때문). 그 다음에 두 숫자를 뽑는다. 1–32까지의 숫자 한 장, 그리고 1–32까지의 숫자인데 흰 동그라미/검은 동그라미 나눠져있는 걸로 한 장(그러면 총 64가지 경우일 것이다). 그러면 32*64 = 2,048가지 경우가 나온다. 그리고 체크섬을 표에서 찾아 적는데, 솔직히 추가 체크썸이 왜 필요한 건지는 아직 이해를 못했다. 진짜로 이 오프라인 과정을 해보며 생길 수 있는 오류를 잡기 위한 체크썸인 것으로 이해된다.

어쨌든 하이라이트는 지금부터인데... 자, 니모닉에서 'F'라는 단어가 있다고 해보자. 그러면 아래 사진처럼 눈금을 F에다 둔다. 그 다음 랜덤한 숫자를 뽑는다. 그렇게 뽑은 숫자가 22이라고 해보자. 그러면 회전판 내부에서 22, 23, 24에 있는 문자를 각각 아래에 적는다. 이게 키 조각이다... F가 ① V, ② P, ③ J 이렇게 세 가지 조각으로 분할 된 거다.

이제 세 개의 키 조각 ① V, ② P, ③ J로 키를 복구하는 상황을 생각해보자. 만약 ③번 키 조각인 J가 화재로 날아가버렸다. 2 of 3이니 그래도 키 조각이 두 개만 있어도 복구할 수 있다. ①번 키 조각인 V와, ②번 키 조각인 P를 조합해 키를 복구해보겠다. 그러면 회전판을 움직여... P가 V를 바라보게 하면 된다. 사진에서 빨간 박스로 표시한 부분이다. 그러면 큰 눈금이 원래 키인 F를 가리키게 된다. 정말 미쳤다! 만약, ②번 키 조각 P와, ③번 키 조각 J가 있다면 J가 P를 바라보게 하면 된다. 만약 ③번 키 조각 J와, ①번 키 조각 V로 키 복구를 시도한다면 J가 V를 바라보게 하고, 대신 ③번이 ①번을 바라보게 하는 것처럼 순환하는 상황에는 큰 눈금이 아니라 내부 1번 네모칸을 읽어야 한다.

펜락 회전판의 뒷면을 보면 이걸 어떻게 구현했는지 대강 알 수가 있다. 펜락 프로젝트는 반지름을 조금씩 다르게 하고, 회전 각도를 서로소인 두 숫자를 이용해 글자들이 겹치지 않도록 구현한 걸로 보인다. 말로 설명했지만, 직접 해봐야 "미쳤다!" 소리가 저절로 나온다. 이거 직접 해보면 ~비속어가 나올 정도로~ 놀란다. 정말로.

펜락 프로젝트는 오픈 소스라고 하고, 최고 개발자는 ganrama이다(사이트는 아직 베타라서 내용들이 채워지고 있는 걸로 보인다ㅎㅎ).

https://github.com/ganrama

https://beta.penlock.io/

나는 비트코인에서 나오는 프로젝트들을 일단 의심부터 하고 보는 편이다. 그런데 펜락은 직관적으로 다 이해가 되기 때문에 현재는 우려할만한 점이 생각나지 않는다. 비트코인 프로젝트들 중에는 편리함, 보안, 프라이버시 중 무언가를 희생시키고 그걸 교묘히 감추려고 하거나 비즈니스 모델을 만들다가 초기의 정신을 잊는 경우가 많다. 그런데 이 프로젝트는 그에 해당할 만한 게 없는 것 같아서 일단 의심의 눈초리를 거두고 응원한다. 내가 오프라인에서 직접 키를 분할해보고, 조합해본 경험이 너무 강렬하게 작용했기 때문인 것 같다. 펜락 대표 개발자가 올해 하반기에 기회가 된다면 한국에서도 소개하고 싶다고 하니 계속 관심을 갖고 지켜보려고 한다.

-

@ b1ddb4d7:471244e7

2025-06-13 07:02:19

@ b1ddb4d7:471244e7

2025-06-13 07:02:19Jason Lowery’s thesis, Softwar: A Novel Theory on Power Projection and the National Strategic Significance of Bitcoin, reframes bitcoin not merely as digital cash but as a transformative security technology with profound implications for investors and nation-states alike.

For centuries, craft brewers understood that true innovation balanced tradition with experimentation—a delicate dance between established techniques and bold new flavors.

Much like the craft beer revolution reshaped a global industry, bitcoin represents a fundamental recalibration of how humans organize value and project power in the digital age.

The Antler in the Digital Forest: Power Projection

Lowery, a U.S. Space Force officer and MIT scholar, anchors his Softwar theory in a biological metaphor: Bitcoin as humanity’s “digital antler.” In nature, antlers allow animals like deer to compete for resources through non-lethal contests—sparring matches where power is demonstrated without fatal consequences. This contrasts sharply with wolves, who must resort to violent, potentially deadly fights to establish hierarchy.

The Human Power Dilemma: Historically, humans projected power and settled resource disputes through physical force—wars, seizures, or coercive control of assets. Even modern financial systems rely on abstract power structures: court orders, bank freezes, or government sanctions enforced by legal threat rather than immediate physical reality.

Lowery argues this creates inherent fragility: abstract systems can collapse when met with superior physical force (e.g., invasions, revolutions). Nature only respects physical power.

Bitcoin’s Physical Power Engine: Bitcoin introduces a novel solution through its proof-of-work consensus mechanism. Miners compete to solve computationally intense cryptographic puzzles, expending real-world energy (megawatts) to validate transactions and secure the network.

This process converts electricity—a tangible, physical resource—into digital security and immutable property rights. Winning a “block” is like winning a sparring match: it consumes significant resources (energy/cost) but is non-destructive.

The miner gains the right to write the next page of the ledger and collect rewards, but no participant is physically harmed, and no external infrastructure is destroyed.

Table: Traditional vs. Bitcoin-Based Power Systems

Power System

Mechanism

Key Vulnerability

Resource Cost

Traditional (Fiat/Banking)

Legal abstraction, threat of state force

Centralized points of failure, corruption, political change

Low immediate cost, high systemic risk

Military/Economic Coercion

Physical force, sanctions

Escalation, collateral damage, moral hazard

Very high (lives, capital, instability)

Bitcoin (Proof-of-Work)

Competition via energy expenditure

High energy cost, concentration risk (mining)

High energy cost, low systemic risk

Softwar Theory National Strategic Imperative: Governments Are Taking Notice

Lowery’s Softwar Theory has moved beyond academia into the corridors of power, shaping U.S. national strategy:

- The Strategic Bitcoin Reserve: Vice President JD Vance recently framed bitcoin as an instrument projecting American values—”innovation, entrepreneurship, freedom, and lack of censorship”. State legislation is now underway to implement this reserve, preventing easy reversal by future administrations.

- Regulatory Transformation: The SEC is shifting from an “enforcement-first” stance under previous leadership. New initiatives include:

- Repealing Staff Accounting Bulletin 121 (SAB 121), which discouraged banks from custodying digital currency by forcing unfavorable balance sheet treatment.

- Creating the Cyber and Emerging Technologies Unit (CETU) to develop clearer crypto registration/disclosure rules.

The Investor’s Lens: Scarcity, Security, and Asymmetric Opportunity

For investors, understanding “Softwar” validates bitcoin’s unique value proposition beyond price speculation:

-

Digital Scarcity as Strategic Depth: Bitcoin’s fixed supply of 21 million makes it the only digital asset with truly inelastic supply, a programmed scarcity immune to political whims or central bank printing.

This “scarcity imperative” acts as a natural antidote to global fiat debasement. As central banks expanded money supplies aggressively (Global M2), bitcoin’s price has shown strong correlation, acting as a pressure valve for inflation concerns. The quadrennial “halving” (latest: April 2024) mechanically reduces new supply, creating built-in supply shocks as adoption grows. * The Antifragile Security Feedback Loop: Bitcoin’s security isn’t static; it’s antifragile. The network strengthens through demand: * More users → More transactions → Higher fees → More miner revenue → More hashpower (computational security) → Greater network resilience → More user confidence.

This self-reinforcing cycle contrasts sharply with traditional systems, where security is a cost center (e.g., bank security budgets, military spending). Bitcoin turns security into a profitable, market-driven activity. * Institutionalization Without Centralization: While institutional ownership via ETFs (like BlackRock’s IBIT) and corporate treasuries (MicroStrategy, Metaplanet) has surged, supply remains highly decentralized.Individuals still hold the largest share of bitcoin, preventing a dangerous concentration of control. Spot Bitcoin ETFs alone are projected to see over $20 billion in net inflows in 2025, demonstrating robust institutional capital allocation.

The Bitcoin Community: Building the Digital Antler’s Resilience

Lowery’s “Softwar” theory underscores why bitcoin’s decentralized architecture is non-negotiable. Its strength lies in the alignment of incentives across three participant groups:

- Miners: Provide computational power (hashrate), validating transactions and securing the network. Incentivized by block rewards (newly minted BTC) and transaction fees. Their physical energy expenditure is the “muscle” behind the digital antler.

- Nodes: Independently verify and enforce the protocol rules, maintaining the blockchain’s integrity. Run by users, businesses, and enthusiasts globally. They ensure decentralized consensus, preventing unilateral protocol changes.

- Users: Individuals, institutions, and corporations holding, transacting, or building on bitcoin. Their demand drives transaction fees and fuels the security feedback loop.

This structure creates “Mutually Assured Preservation”. Attacking bitcoin requires overwhelming its global, distributed physical infrastructure (miners/nodes), a feat far more complex and costly than seizing a central bank’s gold vault or freezing a bank’s assets. It transforms financial security from a centralized liability into a decentralized, physically-grounded asset.

Risks & Responsibilities

Investors and policymakers must acknowledge persistent challenges:

- Volatility: Bitcoin remains volatile, though this has decreased as markets mature. Dollar-cost averaging (DCA) is widely recommended to mitigate timing risk.

- Regulatory Uncertainty: While U.S. policy is increasingly favorable, global coordination is lacking. The EU’s MiCAR regulation exemplifies divergent approaches.

- Security & Custody: While Bitcoin’s protocol is robust, user errors (lost keys) or exchange hacks remain risks.

- Environmental Debate: Proof-of-Work energy use is scrutinized, though mining increasingly uses stranded energy/renewables. Innovations continue.

Jason Lowery’s “Softwar” theory elevates bitcoin from a financial instrument to a socio-technological innovation on par with the invention of the corporation, the rule of law, or even the antler in evolutionary biology. It provides a coherent framework for understanding why:

- Nations like the U.S. are looking to establish bitcoin reserves and embracing stablecoins—they recognize bitcoin’s role in projecting economic power non-violently in the digital age.

- Institutional Investors are allocating billions via ETFs—they see a scarce, secure, uncorrelated asset with antifragile properties.

- Individuals in hyperinflationary economies or under authoritarian regimes use bitcoin—it offers self-sovereign wealth storage immune to seizure or debasement.

For the investor, bitcoin represents more than potential price appreciation. It offers exposure to a fundamental reorganization of how power and value are secured and exchanged globally, grounded not in abstract promises, but in the unyielding laws of physics and mathematics.

Like the brewers who balanced tradition with innovation to create something enduring and valuable, bitcoin pioneers are building the infrastructure for a more resilient digital future—one computationally secured block at a time. The “Softwar” is here, and it is reshaping the landscape of p

-

@ b1ddb4d7:471244e7

2025-06-13 06:01:13

@ b1ddb4d7:471244e7

2025-06-13 06:01:13Paris, France – June 6, 2025 – Flash, the easiest Bitcoin payment gateway for businesses, just announced a new partnership with the Bitcoin Only Brewery, marking the first-ever beverage company to leverage Flash for seamless Bitcoin payments.

Bitcoin Buys Beer Thanks to Flash!

As Co-Founder of Flash, it's not every day we get to toast to a truly refreshing milestone.

Okay, jokes aside.

We're super buzzed to see our friends at @Drink_B0B

Bitcoin Only Brewery using Flash to power their online sales!The first… pic.twitter.com/G7TWhy50pX

— Pierre Corbin (@CierrePorbin) June 3, 2025

Flash enables Bitcoin Only Brewery to offer its “BOB” beer with, no-KYC (Know Your Customer) delivery across Europe, priced at 19,500 sats (~$18) for the 4-pack – shipping included.

The cans feature colorful Bitcoin artwork while the contents promise a hazy pale ale: “Each 33cl can contains a smooth, creamy mouthfeel, hazy appearance and refreshing Pale Ale at 5% ABV,” reads the product description.

Pierre Corbin, Co-Founder of Flash, commented: “Currently, bitcoin is used more as a store of value but usage for payments is picking up. Thanks to new innovation on Lightning, bitcoin is ready to go mainstream for e-commerce sales.”

Flash, launched its 2.0 version in March 2025 with the goal to provide the easiest Bitcoin payment gateway for businesses worldwide. The platform is non-custodial and can enable both digital and physical shops to accept Bitcoin by connecting their own wallets to Flash.

By leveraging the scalability of the Lightning Network, Flash ensures instant, low-cost transactions, addressing on-chain Bitcoin bottlenecks like high fees and long wait times.

Bitcoin payment usage is growing thanks to Lightning

In May, fast-food chain Steak ‘N Shake went viral for integrating bitcoin at their restaurants around the world. In the same month, the bitcoin2025 conference in Las Vegas set a new world record with 4,000 Lightning payments in one day.

According to a report by River Intelligence, public Lightning payment volume surged by 266% from August 2023 to August 2024. This growth is also reflected in the overall accessibility of lighting infrastructure for consumers. According to Lightning Service Provider Breez, over 650 Million users now have access to the Lightning Network through apps like CashApp, Kraken or Strike.

Bitcoin Only Brewery’s adoption of Flash reflects the growing trend of businesses integrating Bitcoin payments to cater to a global, privacy-conscious customer base. By offering no-KYC delivery across Europe, the brewery aligns with the ethos of decentralization and financial sovereignty, appealing to the increasing number of consumers and businesses embracing Bitcoin as a legitimate payment method.

“Flash is committed to driving innovation in the Bitcoin ecosystem,” Corbin added. “We’re building a future where businesses of all sizes can seamlessly integrate Bitcoin payments, unlocking new opportunities in the global market. It’s never been easier to start selling in bitcoin and we invite retailers globally to join us in this revolution.”

For businesses interested in adopting Bitcoin payments, Flash offers a straightforward onboarding process, low fees, and robust support for both digital and physical goods. To learn more, visit paywithflash.com.

About Flash

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

About Bitcoin Only Brewery

Bitcoin Only Brewery (@Drink_B0B) is a pioneering beverage company dedicated to the Bitcoin ethos, offering high-quality beers payable exclusively in Bitcoin. With a commitment to personal privacy, the brewery delivers across Europe with no-KYC requirements.

Media Contact:

Pierre Corbin

Co-Founder, Flash

Email: press@paywithflash.com

Website: paywithflash.comPhotos paywithflash.com/about/pressHow Flash Enables Interoperable, Self-Custodial Bitcoin Commerce

-

@ 88cc134b:5ae99079

2025-06-15 10:38:38

@ 88cc134b:5ae99079

2025-06-15 10:38:38text

-

@ df478568:2a951e67

2025-06-12 18:58:48

@ df478568:2a951e67

2025-06-12 18:58:48How To Mine Your Own Vanity Nostr Key

note. This article works best on https://habla.news/u/marc@primal.net/how-to-mine-a-nostr-vanity-key-with-rana

Rana is a vanity npub generator.

I'll show you how to use it on Ubuntu.

If you're not Linux ninja and use Windows instead of Linux ninja weapons, you can still use Linux with Virtualbox, free ans open source virtualization software. Head over to

https://www.virtualbox.org/ to learn more. They also have an enterprise business if you need that sort of thing, you can learn more at https://shop.oracle.com/

Rana is a nostr vanity key mining program. The source code can be found here.

Rana Is On GitHub

https://github.com/grunch/rana

Since rana already has pretty good docs, I decided to make a video instead of write about this because It's easier to see rana in action than it is to write about Rana. I went off on some tangents, so I might edit this down later, but I hope it helps you mine your own nostr key.

nevent1qqsfk7a000m8zc3ptsuu4vytepqc9eedceclpt2ns9pzlech5cpaflceng5al

Show Notes

https://github.com/grunch/rana

https://virtualbox.org/

https://doc.rust-lang.org/cargo/getting-started/installation.html

cargo run --release -- --vanity-n-prefix=juxtap0se

☮️

nostr:npub1marc26z8nh3xkj5rcx7ufkatvx6ueqhp5vfw9v5teq26z254renshtf3g0

-

@ 7e6f9018:a6bbbce5

2025-06-15 09:10:25

@ 7e6f9018:a6bbbce5

2025-06-15 09:10:25The velocity of money inform us about how quick the money moves, and is a frequent indicator to research the current economic environment.

An interesting twist is using housing instead of money. Why? The main reasons that come to mind are:

-

It’s easier to measure housing velocity than dollar velocity.

-

Data on housing transactions is more reliable.

-

Residential real state is the largest store of wealth in the world.

> The residential real estate is worth $287 trillion. Not even all the money deposited in stocks ($98 trillion) and bonds ($129 trillion), added together, surpass the residential real state market. In a way, housing is the economy.

The next chart shows the velocity of housing in Spain, where we observe a negative correlation of -0.53, which is quite significant. This suggests that the higher the housing velocity, the higher the inflation; and the lower the housing velocity, the lower the inflation.

> The velocity is a measurement of the rate at which the current stock of houses is exchanged. The lower the value, the higher the velocity. A ratio of (x) means that it would take (x) years to exchange the stock at current speed.

Therefore, by knowing how quickly the housing sector is moving, we can infer whether we are living under an inflationary or deflationary period.

Currently, housing velocity has been increasing, reaching a value of 36 in 2025, a relatively high figure (all time high was 28 in 2006), and at the same time, we are experiencing an inflationary period. Hopefully this data can help us navigate the economic world and invest accordingly.

-

-

@ 866e0139:6a9334e5

2025-06-15 06:23:31

@ 866e0139:6a9334e5

2025-06-15 06:23:31Autor: Jonas Tögel. Dieser Beitrag wurde mit dem Pareto-Client geschrieben. Sie finden alle Texte der Friedenstaube und weitere Texte zum Thema Frieden hier. Die neuesten Pareto-Artikel finden Sie in unserem Telegram-Kanal.

Die neuesten Artikel der Friedenstaube gibt es jetzt auch im eigenen Friedenstaube-Telegram-Kanal.

Eine der wichtigste Säulen einer funktionierenden Demokratie ist die sogenannte „öffentliche Sphäre“ (1), ein Debattenraum, in den sich alle Menschen gleichberechtigt einbringen und über aktuelle, für die Gemeinschaft wichtige Fragen diskutieren können. In Deutschland ist die Offenheit dieses Debattenraumes eigentlich durch fundamentale Grundrechte wie die Meinungs- und Pressefreiheit geschützt.

https://www.youtube.com/watch?v=FHF6rjDbK9w

Soziale Medien im Visier

Dennoch wird der öffentliche Diskurs derzeit immer stärker eingeschränkt. Als Rechtfertigung dafür wird seit einigen Jahren der sogenannte Kampf gegen „Desinformation“ oder auch „Falschinformation“ (Misinformation) angeführt: Unter dem Vorwand, die Bevölkerung vor schädlicher Einflussnahme von außen, beispielsweise aus Russland, schützen zu wollen, wird der öffentliche Diskurs mit Hilfe von „Faktencheckern“, „Trusted Flaggern“ oder durch das „Gesetz für Digitale Dienstleistungen“ (Digital Services Act) massiv eingeschränkt, wobei vor allem soziale Medien verstärkt ins Visier genommen werden.

In der Propagandaforschung ergibt sich bei dem vorgeblichen Kampf gegen „Desinformation“ jedoch das Problem, dass die Begriffe selbst, die als Rechtfertigung dafür verwendet werden, um den öffentlichen Diskurs einzuschränken und bestimmte Inhalte zu löschen, nicht eindeutig definiert sind. Auch was „falsche Tatsachenbehauptungen“ sind, kann letztlich nur der offene, öffentliche Diskurs entscheiden. Wenn das, was „falsch“ oder „richtig“ ist, durch eine einzelne Instanz im Alleingang entschieden wird, dann landet man bei dem, was George Orwell in seinem bekannten Roman 1984 als „Wahrheitsministerium“ beschrieb: ein Ministerium, das auch noch nach Jahren alle verfügbaren Informationen dem aktuellen Stand der „Wahrheit“ anpasst – selbst wenn diese sich ständig ändern sollte. (2)

Auch heute steht immer wieder der Vorwurf im Raum, dass der Kampf gegen „Desinformation“ sowie der Kampf gegen „russische Desinformation“ gezielt genutzt werden, um im Kampf um die Deutungshoheit das eigene, westliche Narrativ durchzusetzen. Diesen Punkt habe ich ausführlich in meinem Artikel in der Berliner Zeitung dargelegt.

Wie unehrlich der Kampf gegen falsche Informationen tatsächlich ist, kann folgendes konkrete Beispiel zeigen: Die deutsche Politikerin und ehemalige Vorsitzende des Verteidigungsausschusses im Bundestag, Marie-Agnes Strack-Zimmermann, erklärte in einer am 24. März 2025 im ORF2 ausgestrahlten Sendung:

„Wladimir Putin ist ein Mörder, ein Killer, der hunderte von Millionen Menschen unter die Erde gebracht hat.“

In der gleichen Sendung behauptete Strack-Zimmermann, dass die Ukraine 70 Milliarden Menschen ernähre. Besonders bemerkenswert dabei ist, dass ihr niemand in der Sendung widersprach.

Wenn man beide Zahlen einordnen möchte, dann sollte man sich einerseits bewusst machen, dass Strack-Zimmermann damit behauptet, dass der russische Präsident mehr Menschen „unter die Erde gebracht hat“, als laut offiziellen Zahlen im Ersten und Zweiten Weltkrieg zusammen gestorben sind. Andererseits sollte man wissen, dass die Weltbevölkerung insgesamt bei ca. 8,2 Milliarden Menschen liegt, die Ukraine laut dieser Aussage somit die gesamte Weltbevölkerung ca. 8,5 Mal ernähren könnte.

DIE FRIEDENSTAUBE FLIEGT AUCH IN IHR POSTFACH!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt, vorerst für alle kostenfrei, wir starten gänzlich ohne Paywall. (Die Bezahlabos fangen erst zu laufen an, wenn ein Monetarisierungskonzept für die Inhalte steht). Sie wollen der Genossenschaft beitreten oder uns unterstützen? Mehr Infos hier oder am Ende des Textes.

Das Messen mit doppeltem Maß

Als der Autor daher beschloss, die Äußerungen von Strack-Zimmermann bei mehreren, einschlägigen Meldeportalen für „Desinformation“ als gefährliche Hassrede zu melden, war das Ergebnis umso erstaunlicher: entweder erklärten sich die Meldeportale für das öffentlich-rechtliche Fernsehen nicht zuständig, oder sie lehnten eine Bearbeitung des Falles und einen Faktencheck der getroffenen Aussagen ab, da es wichtigere Fälle zu bearbeiten gäbe und leider keine Kapazitäten zur Prüfung dieses Aussagen zur Verfügung stünden.

Dieses konkrete Beispiel soll zeigen, wie wichtig es ist, den vorgeblichen Kampf gegen „Desinformation“ oder auch „russische Einflussnahme“ als das einzuordnen, was er in vielen Fällen ist: ein unehrlich Kampf um die Deutungshoheit und damit ein gefährlicher Bestandteil von dem, was man ehrlicherweise als Kriegspropaganda bezeichnet.

Den Bürgerinnen und Bürgern bleibt somit nur, alle Informationen selbst kritisch auf ihren Wahrheitsgehalt hin zu prüfen und selbst zu entscheiden, was als wertvolle Information und was als manipulative „Desinformation“ eingestuft werden kann. Je besser es gelingt, tatsächliche Desinformation und Kriegspropaganda aller an einem Krieg beteiligten Nationen zu hinterfragen, umso schwerer wird es, diesen Krieg zu führen. Damit ist das Durchschauen von unehrlichen Schlagwörtern wie „Desinformation“ oder „Falschinformation“ ein erster, wichtiger Schritt zur Neutralisierung von Kriegspropaganda und bildet das Fundament, das den Weg zum Frieden dadurch möglich macht. Jeder einzelne hat somit die Möglichkeit, diesen Weg zum Frieden aktiv mitzugestalten. Hier kann der Mut, sich jeden Tag im persönlichen Umfeld in den öffentlichen Diskurs einzubringen und die Friedensbotschaft zu stärken, bereits einen wichtigen Beitrag leisten.

(1) Habermas, Jürgen. 1971/1962. Strukturwandel der Öffentlichkeit. Untersuchungen zu einer Kategorie der bürgerlichen Gesellschaft. 5th ed. Neuwied/Berlin.

(2) Orwell, George (1948). 1984. Seite 193 ff.

Dr. Jonas Tögel ist Amerikanist, Propagandaforscher und *Bestsellerautor. Er hat zum Thema Soft Power und Motivation promoviert und arbeitet als wissenschaftlicher Mitarbeiter am Institut für Psychologie der Universität Regensburg. Seine Forschungsschwerpunkte sind unter anderem Motivation, der Einsatz von Soft-Power-Techniken, Nudging, Propaganda sowie Geostrategie. *

Zuletzt erschien sein Buch „Kriegsspiele“ im Westend-Verlag.

Website: *www.jonastoegel.de *

X (Twitter): *https://x.com/JonasToegel *

YouTube: *https://www.youtube.com/@DrJonasToegel *

Instagram: *https://www.instagram.com/drjonastoegel/ *

Telegram: https://t.me/drjonastoegel

LASSEN SIE DER FRIEDENSTAUBE FLÜGEL WACHSEN!

In Kürze folgt eine Mail an alle Genossenschafter, danke für die Geduld!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt.

Schon jetzt können Sie uns unterstützen:

- Für 50 CHF/EURO bekommen Sie ein Jahresabo der Friedenstaube.

- Für 120 CHF/EURO bekommen Sie ein Jahresabo und ein T-Shirt/Hoodie mit der Friedenstaube.

- Für 500 CHF/EURO werden Sie Förderer und bekommen ein lebenslanges Abo sowie ein T-Shirt/Hoodie mit der Friedenstaube.

- Ab 1000 CHF werden Sie Genossenschafter der Friedenstaube mit Stimmrecht (und bekommen lebenslanges Abo, T-Shirt/Hoodie).

Für Einzahlungen in CHF (Betreff: Friedenstaube):

Für Einzahlungen in Euro:

Milosz Matuschek

IBAN DE 53710520500000814137

BYLADEM1TST

Sparkasse Traunstein-Trostberg

Betreff: Friedenstaube

Wenn Sie auf anderem Wege beitragen wollen, schreiben Sie die Friedenstaube an: friedenstaube@pareto.space

Sie sind noch nicht auf Nostr and wollen die volle Erfahrung machen (liken, kommentieren etc.)? Zappen können Sie den Autor auch ohne Nostr-Profil! Erstellen Sie sich einen Account auf Start. Weitere Onboarding-Leitfäden gibt es im Pareto-Wiki.

-

@ a296b972:e5a7a2e8

2025-06-12 12:36:22

@ a296b972:e5a7a2e8

2025-06-12 12:36:22Europa sitzt in einem Demokratie-Simulator. Auf die Scheiben im Cockpit werden Bilder projiziert, die nicht der Realität entsprechen, und es gibt immer noch zu viele Menschen, die diese Simulation nicht erkannt haben.

Nichts wäre erstrebenswerter, als über eine positive Entwicklung, hin zur Vernunft und realitätsbezogenen, auf Tatsachen beruhenden Entscheidungen, berichten zu können. Die Frage ist, ob nicht zuerst unentwegt auf Missstände hingewiesen werden muss, um weitere Menschen dazu zu bewegen, sich denjenigen anzuschließen, die offensichtlich an Indoktrinationsintoleranz leiden.

Wer sich vor Hofberichterstattung und die tägliche Fahrt durch die Gehirnwaschanlage schützen will, der meidet den öffentlich-rechtlichen Unfug und die einschlägigen Käseblätter, die vielleicht noch halbwegs dazu geeignet sind, den Fisch auf dem Markt einzuschlagen, um ihn nach Hause zu tragen, vorausgesetzt, man kann ihn sich noch leisten.

Die Neuen Medien liefern die Informationen, die man sonst im „Qualitäts-Mainstream“ nicht finden kann, was nicht verwundert, denn infiltriert von willigen Erfüllungsgehilfen, die Angst um ihr Prestige und ihre Stellung haben, kann man hier keine freie Berichterstattung erwarten.

Beste Unterhaltung bietet auch die Bundespressekonferenz-Show, auf die schon näher eingegangen wurde. Offizieller Regierungssprech in höchster Perfektion. Ob man dort wirklich davon überzeugt ist, dass es irgendjemanden gibt, der diesen Verlautbarungen Glauben schenkt? Was hat Tante Käthe immer gesagt: G E L D L O C K T I M M E R !

Was also tun? Die Neuen Medien auch noch meiden, und sich vor dem blanken Wahnsinn schützen, in dem man ihn ignoriert, was jedoch nicht bewirkt, dass er nicht mehr da wäre.

Temporäre Abstinenz tut auch hier gut, allerdings ist der Wiedereinstieg so ähnlich, wie der erste Arbeitstag nach einem zweimonatigen Urlaub, falls man nicht in seinem Lieblings-Job gelandet ist.

Und was, wenn die Irren vollends durchdrehen, und man bekommt es nicht mit? Schön, ändern kann man vielleicht wenig, aber man kann sich vielleicht noch eine richtig gute, edle Flasche Rotwein kaufen, und die am Vorabend des Untergangs genießen, oder noch schnell einen Baum pflanzen.

Hier ein Beispiel für jemanden, dessen besonderer Blick sehr an den Universal-Gesundheits-Klima-Hysteriker erinnert:

https\://rumble.com/v6umjdj-respekt-und-anerkennung-deutscher-general-lobt-ukrainische-angriffe-in-russ.html

Wie sieht der Alltag aus, wenn man sich einmal nicht mit den Informationen über Dauer- Bekloppte beschäftigt?

Wenn sich ein Besuch in der nächst größeren Stadt nicht vermeiden lässt, sieht man vor allem gehetzte Menschen, viele mit einem finsteren Blick, anders, als früher.

Viele zahlen mit Karte oder ihrem Handy, Kleckerbeträge. „Zahlen Sie noch bar, oder schon mit Überwachung?“, wünschte man sich, dass die Verkäuferinnen den Kunden fragen würden. Tun sie aber nicht.