-

@ cae03c48:2a7d6671

2025-06-07 21:01:19

@ cae03c48:2a7d6671

2025-06-07 21:01:19Bitcoin Magazine

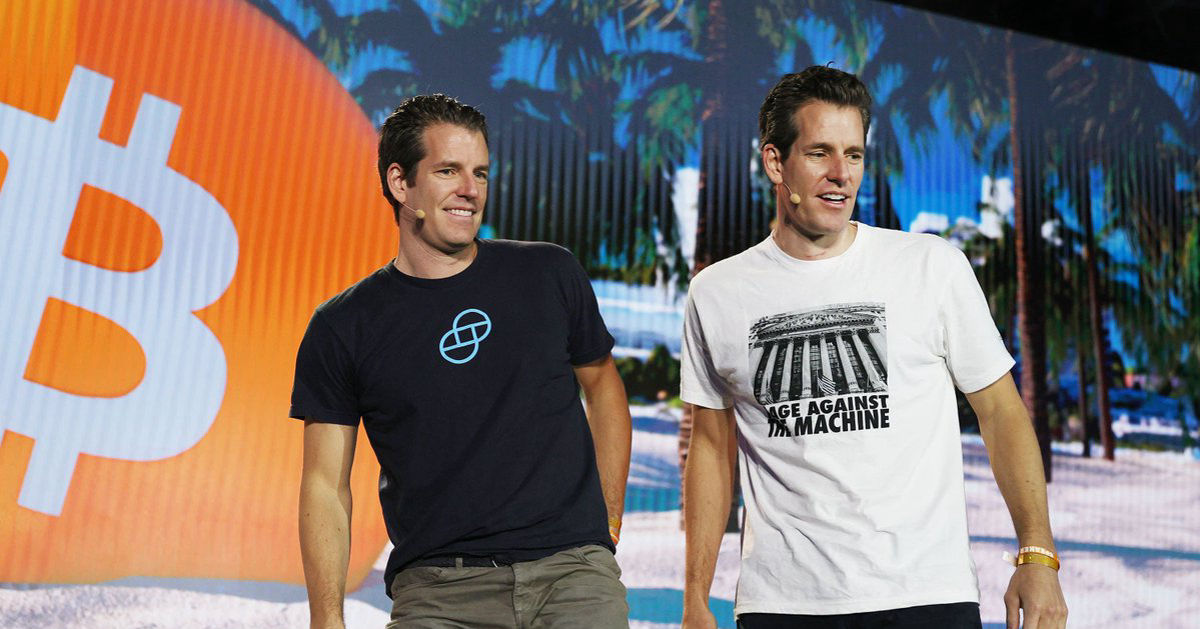

Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in BitcoinMeanwhile Insurance Bitcoin (Bermuda) Limited (“Meanwhile”) announced it has become the first company in the world to release externally audited financial statements denominated entirely in Bitcoin. According to the announcement, the company reported 220.4 BTC in assets and 25.29 BTC in net income for 2024, a 300% year over year increase.

Today marks a global first & historic event for us, along with the public release of our 2024 audited financial statements, covering our 1st year of sales.

As the 1st company in the world to have Bitcoin-denominated financial statements externally audited, we are excited to…

— meanwhile | Bitcoin Life Insurance (@meanwhilelife) June 5, 2025

“We’ve just made history as the first company in the world to have Bitcoin-denominated financial statements externally audited,” said Zac Townsend, CEO of Meanwhile. “This is an important, foundational step in reimagining the financial system based on a single, global, decentralized standard outside the control of any one government.”

The financial statements were audited by Harris & Trotter LLP and its digital asset division ht.digital. Meanwhile’s financials also comply with Bermuda’s Insurance Act 1978, noting that their BTC denominated financials were approved and comply with official guidelines. The firm, fully licensed by the Bermuda Monetary Authority (BMA), operates entirely in BTC and is prohibited from liquidating Bitcoin assets except through policyholder claims, positioning it as a long term holder.

“As the first regulated Bitcoin life insurance company, we view the BTC held by Meanwhile as inherently long-term in nature—primarily held to support the Company’s insurance liabilities over decades,” Townsend added. “This makes it significantly ‘stickier’ and resistant to market pressures compared to the BTC held by other companies as part of their treasury management strategies.”

Meanwhile’s 2024 financials also revealed 23.02 BTC in net premiums and 4.35 BTC in investment income, showing that its model not only preserves Bitcoin, but earns it. The company’s reserves (also held in BTC) were reviewed and approved by Willis Towers Watson (WTW).

Meanwhile also offers a Bitcoin Whole Life insurance product that allows policyholders to save, borrow, and build legacy wealth—entirely in BTC, and has plans to expand globally in 2025.

“We are incredibly proud of today’s news as it underscores how Meanwhile is at the forefront of the next phase of the convergence between Bitcoin and institutional financial markets,” said Tia Beckmann, CFO of Meanwhile. “Now having generated net income in BTC, we have demonstrated that we are earning it through a sustainable insurance business model designed for the long term.”

This post Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in Bitcoin first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 9ca447d2:fbf5a36d

2025-06-07 18:00:48

@ 9ca447d2:fbf5a36d

2025-06-07 18:00:48Paris, France – June 6, 2025 — Bitcoin payment gateway startup Flash, just announced a new partnership with the “Bitcoin Only Brewery”, marking the first-ever beverage company to leverage Lightning payments.

Flash enables Bitcoin Only Brewery to offer its “BOB” beer with, no-KYC (Know Your Customer) delivery across Europe, priced at 19,500 sats (~$18) for the 4-pack, shipping included.

The cans feature colorful Bitcoin artwork while the contents promise a hazy pale ale: “Each 33cl can contains a smooth, creamy mouthfeel, hazy appearance and refreshing Pale Ale at 5% ABV,” reads the product description.

Pierre Corbin, Co-Founder of Flash, commented:

“Currently, bitcoin is used more as a store of value but usage for payments is picking up. Thanks to new innovation on Lightning, bitcoin is ready to go mainstream for e-commerce sales.”

Flash, launched its 2.0 version in March 2025 with the goal to provide the easiest bitcoin payment gateway for businesses worldwide. The platform is non-custodial and can enable both digital and physical shops to accept bitcoin by connecting their own wallets to Flash.

By leveraging the scalability of the Lightning Network, Flash ensures instant, low-cost transactions, addressing on-chain Bitcoin bottlenecks like high fees and long wait times.

For businesses interested in adopting Bitcoin payments, Flash offers a straightforward onboarding process, low fees, and robust support for both digital and physical goods. To learn more, visit paywithflash.com.

Media Contact:

Pierre Corbin

Co-Founder, Flash

Email: press@paywithflash.com

Website: paywithflash.comAbout Flash

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

About Bitcoin Only Brewery

Bitcoin Only Brewery (@Drink_B0B) is a pioneering beverage company dedicated to the Bitcoin ethos, offering high-quality beers payable exclusively in Bitcoin. With a commitment to personal privacy, the brewery delivers across Europe with no-KYC requirements.

-

@ a296b972:e5a7a2e8

2025-06-07 16:39:43

@ a296b972:e5a7a2e8

2025-06-07 16:39:43Nur für‘s Protokoll. Hiermit erkläre ich, Georg Ohrweh, im tatsächlich vorhandenen vollen Besitz meiner geistigen Kräfte, dass Herr Lauterbach, gleich welche Position er in Zukunft noch bekleiden sollte, für mich nicht zuständig ist. Basta.

Ein Erguss dieses verhaltensoriginellen Über-alles-Bescheidwissers:

„Wir kommen jetzt in eine Phase hinein, wo der Ausnahmezustand die Normalität sein wird. Wir werden ab jetzt immer im Ausnahmezustand sein. Der Klimawandel wird zwangsläufig mehr Pandemien bringen.“

Wie kann es sein, dass solch eine Ausnahme-Gestalt, die schon rein äußerlich die Phantasie zu Vergleichen anregt, sich leider auch genauso verhält, wie die Gestalten, die in diesen Phantasien vorkommen, ungebremst auf der Panik-Klaviatur kakophonische Klänge erzeugen darf? Obwohl ein wenig Wahrheit ist auch enthalten: Wir sind tatsächlich immer im Ausnahmezustand, im Ausnahmezustand des fortgeschrittenen Wahnsinns.

Wie kann es sein, dass dieser Haaaarvardist seinen persönlich empfundenen Ausnahmezustand zum Allgemeingut erklären kann? Welche Verknüpfungs-Phantasien hat er sonst noch studiert? Er ist ja auch noch Vorsitzender im Raumfahrtausschuss. Was kommt als Nächstes? Eine Klima-Pandemie, verursacht durch außerirdische Viren, die die Temperaturen beeinflussen können? Im aktuellen Zeitgeist gibt es nichts, was nicht gedacht wird. Wem die besseren Absurditäten einfallen, der gewinnt. Man muss sich schon den gegebenen Denkstrukturen etwas anpassen, aber sich auch ein wenig Mühe geben.

Nach dem Wechsel der ehemaligen Außen-Dings zur UN (mit dem Ziel, aus den Vereinten Nationen die Feministischen Nationen zu gestalten) und des ehemaligen Wirtschafts-Dings in den Außenausschuss und als Gastdozent in Kalifornien (Thema: Wirtschaftsvernichtung unter Einbeziehung des gespannten Verhältnisses unter Geschwistern aufgrund ärmlicher Verhältnisse, am Beispiel des Märchens von Hänsel und Gretel) , jetzt auch noch der ehemalige Chef-Panikmacher zur WHO.

…und der Wahnsinn wurde hinausgetragen in die Welt, und es wurde dunkel, und es ward Nacht, und es wurde helle, und es ward Tag, der Wind blies oder auch nicht (was macht der Wind eigentlich, wenn er nicht weht?), und es ward Winter, und es wurde kälter, und es wurde wärmer, und es ward Sommer. Es regnete nicht mehr, die Wolken schwitzten. Und Putin verhinderte (wer auch sonst), dass das Eis in der Antarktis abnahm.

Wiederholte Bodentemperaturen in der Toskana von 50 Grad Celsius. Zu erwartende Wassertemperaturen während Ferragosto an der italienischen Adria von durchschnittlich 100 Grad Celsius. An Stellen mit wenig Strömung stiegen schon die ersten Kochblasen auf. Doch dann kam der durch Lachs gestählte, salzlose Super-Karl und rettete mit einem durch die WHO diktierten Klima-Logdown die gesamte Menschheit. Wer besser, als er konnte wissen, dass ein Klima-Logdown weitgehend nebenwirkungsfrei ist.

Was für ein Segen, dass Karl der Große, der uns so siegreich durch die Corona-Schlacht geführt hat, jetzt auch gegen das Klima in den Krieg zieht.

Wer kennt das nicht, Tage der Qual, in denen man zugeben muss: Ich hab‘ heute so schlimm Klima.

Viele Klimaexperten, die weltweit in der Qualitätspropaganda zitiert werden, zeichnen sich besonders dadurch aus, dass sie mit einer maximalen Abweichung von einem Grad Celsius ein Thermometer fehlerfrei ablesen können. Diese Ungenauigkeit wird der Erdverkochungsexperte sicher als erstes beheben.

In einer aufopfernden Studie während eines Urlaubs in 2023, in der um die damalige Zeit erstmals eisfreien Toskana, hat er den von ihm ausgetüftelten Klimaschutzplan ins Rheinische übersetzt. Titel: „Schützen Sie sisch, und, äh, andere!“ Weiter konnte er erforschen, dass die Bodentemperatur nicht immer mit der Temperatur des Erdkerns übereinstimmen muss.

Durch seine unermüdlichen Studien, können Hitzetote in Zukunft besser zugeordnet werden. Man weiß dann, ob jemand an hohen oder mit hohen Temperaturen gestorben ist. Der asymptomatische Klimawandel kann so in Zukunft viel besser bewertet werden. Man hat aus geringfügigen Fehlern gelernt und die Methoden erheblich verbessert.

Eine präzise Vorhersage der Jahreszeiten, vor allem die des Sommers, wird bald ebenfalls möglich sein. Es kann jetzt vor jahreszeitbedingten, teilweise sogar täglich schwankenden Temperaturveränderungen rechtzeitig gewarnt werden. Im Herbst können Heizempfehlungen für die ahnungslose Bevölkerung herausgegeben werden. Frieren war gestern, wissen wann es kalt wird, ist heute. Es wird an Farben geforscht, die noch roter sein sollen, als die, die jetzt in den Wetterkarten bei 21 Grad bereits verwendet werden.

Eine allgemeine Heizpflicht soll es europaweit zunächst nicht geben.

Weiter soll die Lichteinstrahlung der Sonne noch präziser bestimmt werden, damit den Europäern, in Ergänzung zur mitteleuropäischen Sommerzeit, jetzt auch noch genau mitgeteilt werden kann, wann es Tag und wann es Nacht ist.

Das Hinausschauen aus dem Fenster, zum Beispiel, ob es schon dunkel draußen ist, erübrigt sich. Die Tageszeit, in Ergänzung zur herkömmlichen Uhrzeit, wird demnächst automatisch mit dem Klima-Pass übermittelt werden. Zu Anfang natürlich erst einmal freiwillig.

Durch die persönliche ID können dann auch schnell und unkompliziert Sonderprämien überwiesen werden, sofern man sich klimakonform verhalten hat, damit man sich rechtzeitig vor Winterbeginn eine warme Jacke oder einen Mantel kaufen kann. Das Sparen von Bargeld auf eine bevorstehende größere Anschaffung von Winterkleidung wird somit überflüssig.

Ob es am Ende nun um Hitze oder Kälte geht, spielt eigentlich gar keine Rolle, denn wie wussten schon die Ahnen zu berichten: Was gut für die Kälte ist, ist auch gut für die Wärme.

Westliche Mächte unternehmen immer wieder Versuche, eskalierend auf den Ukraine-Konflikt einzuwirken, damit man atombetriebene Heizpilze aufstellen kann, an denen sich die Europäer im Winter auch im Freien wärmen können.

Wie praktisch, dass man nicht nur Gesundheit und Klima, sondern auch Klima und Krieg miteinander verbinden kann. Alles so, oder so ähnlich möglicherweise nachzulesen im genialen Hitzeschutzplan á la Lauterbach.

Besonders Deutschland braucht nicht nur lauterbachsche Hitzeschutzräume, nein es braucht atomsichere Hitzeschutzbunker, so schlägt man gleich zwei Fliegen mit einer Klappe.

Für die, die es sich leisten können, hier ein Vorschlag. Der K2000:

Für die weniger gut Betuchten reicht auch ein kühles Kellerloch, das man idealerweise im Februar beziehen und nicht vor November wieder verlassen sollte, so die Empfehlung auch von führenden Klima-Forschern, die es ja wissen müssen. Von Dezember bis Januar empfiehlt sich ein Besuch auf den Bahamas, besonders dann, wenn man eine leichte Erkältung verspürt.

Nur Verschwörungstheoretiker behaupten, dass die eigenartigen Anschlussverwendungen der Extrem-Kapazitäten, zu denen Lauterbach ohne Zweifel dazugehört, wie dicke rote Pfeile wirken, die auf Institutionen und Organisationen zeigen, um die man unter allen Umständen einen großen Bogen machen sollte, weil sie möglicherweise nichts Gutes im Schilde führen. Minimal sollen sie angeblich Unsinn verbreiten, maximal sollen sie gehörigen Schaden anrichten.

Man muss sich nur ein paar Gedanken machen, schon kann man feststellen, wie alles mit allem zusammenhängt.

“Dieser Beitrag wurde mit dem Pareto-Client geschrieben.”

* *

(Bild von pixabay)

-

@ 9ca447d2:fbf5a36d

2025-06-07 16:01:19

@ 9ca447d2:fbf5a36d

2025-06-07 16:01:19Wall Street is warming up to Bitcoin and getting closer and closer to it.

Cantor Fitzgerald, one of the oldest and most respected investment banks on Wall Street, has launched a $2 billion bitcoin-backed lending program.

They’ve reportedly already done their first deals, lending to two big digital asset companies: FalconX and Maple Finance.

This is a big step in connecting traditional finance to the fast-moving world of Bitcoin.

Cantor’s new service allows big investors, hedge funds and asset managers, to borrow money using bitcoin as collateral.

This is a game changer for institutions that hold bitcoin, as they can now access liquidity without having to sell their assets.

“Institutions holding bitcoin are looking to broaden their access to diverse funding sources,” said Christian Wall, co-CEO and global head of fixed income at Cantor Fitzgerald.

“And we are excited to support their liquidity needs to help them drive long term growth and success.”

The loans are not speculative or unsecured.

They are structured like traditional finance deals, backed by the borrower’s bitcoin. This reduces the risk for Cantor while giving bitcoin-holding companies new ways to grow and operate.

The first recipients of Cantor’s lending program are FalconX, a digital asset brokerage, and Maple Finance, a blockchain-based lending platform.

FalconX confirmed they secured a credit facility of over $100 million. Maple Finance also received the first tranche of their loan from Cantor.

This comes at a time when the bitcoin lending space is recovering after a tough period. Several big firms went under in 2022 and investor confidence was shaken.

Now with traditional finance on board, bitcoin-backed lending has returned. According to Galaxy Research the total size of the digital asset lending market grew to $36.5 billion in Q4 2024.

Cantor’s move into bitcoin-backed lending isn’t new. They announced their plans in July 2024 and have been building their presence in the Bitcoin space since then.

Earlier this year, they partnered with Tether, SoftBank and Bitfinex to launch Twenty One Capital, a $3.6 billion fund to buy over 42,000 bitcoin.

In May 2025 Cantor Equity Partners merged with Twenty One Capital and bought nearly $459 million worth of bitcoin.

They also own around $1.9 billion in shares of Strategy, a company that holds a lot of bitcoin. Clearly Cantor believes in bitcoin as a long-term asset.

Cantor is also a big player in the stablecoin space.

They manage U.S. Treasury reserves for Tether, the company behind the $142 billion USDT stablecoin. This adds another layer of trust and credibility to Cantor’s digital asset involvement.

To secure the bitcoin used as collateral, Cantor has partnered with digital asset custodians Anchorage Digital and Copper.co.

These companies are known for their robust security and institutional-grade infrastructure. Cantor hasn’t disclosed loan terms or interest rates but confirmed the lending will follow current regulations.

This also shows how traditional financial players are embracing DeFi.

Maple Finance for example allows undercollateralized lending using blockchain. By backing companies like Maple, Cantor is innovating while still having control and compliance.

For years, bitcoin-backed loans were only available through digital-asset-native companies like Genesis, BlockFi, and Ledn.

These loans were mostly for smaller clients and retail investors. But with Cantor’s entry, the scale and professionalism of bitcoin lending are expanding.

-

@ 9ca447d2:fbf5a36d

2025-06-07 14:01:00

@ 9ca447d2:fbf5a36d

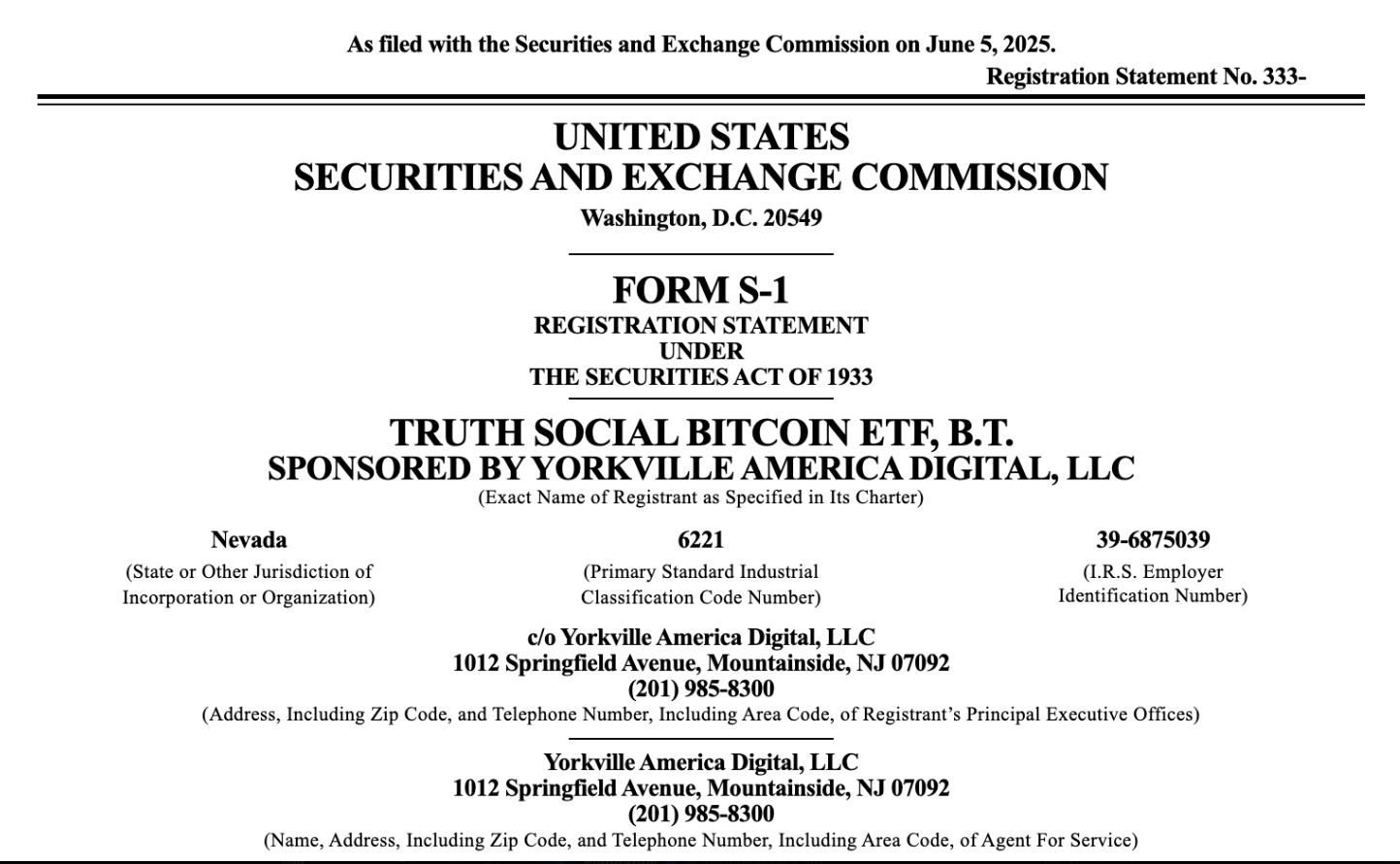

2025-06-07 14:01:00Trump Media & Technology Group (TMTG), the company behind Truth Social and other Trump-branded digital platforms, is planning to raise $2.5 billion to build one of the largest bitcoin treasuries among public companies.

The deal involves the sale of approximately $1.5 billion in common stock and $1.0 billion in convertible senior secured notes.

According to the company, the offering is expected to close by the end of May, pending standard closing conditions.

Devin Nunes, CEO of Trump Media, said the investment in bitcoin is a big part of the company’s long-term plan.

“We view Bitcoin as an apex instrument of financial freedom,” Nunes said.

“This investment will help defend our Company against harassment and discrimination by financial institutions, which plague many Americans and U.S. firms.”

He added that the bitcoin treasury will be used to create new synergies across the company’s platforms including Truth Social, Truth+, and the upcoming financial tech brand Truth.Fi.

“It’s a big step forward in the company’s plans to evolve into a holding company by acquiring additional profit-generating, crown jewel assets consistent with America First principles,” Nunes said.

The $2.5 billion raise will come from about 50 institutional investors. The $1 billion in convertible notes will have 0% interest and be convertible into shares at a 35% premium.

TMTG’s current liquid assets, including cash and short-term investments, are $759 million as of the end of the first quarter of 2025. With this new funding, the company’s liquid assets will be over $3 billion.

Custody of the bitcoin treasury will be handled by Crypto.com and Anchorage Digital. They will manage and store the digital assets.

Earlier this week The Financial Times reported Trump Media was planning to raise $3 billion for digital assets acquisitions.

The article said the funds would be used to buy bitcoin and other digital assets, and an announcement could come before a major related event in Las Vegas.

Related: Bitcoin 2025 Conference Kicks off in Las Vegas Today

Trump Media denied the FT report. In a statement, the company said, “Apparently the Financial Times has dumb writers listening to even dumber sources.”

There was no further comment. However, the official $2.5 billion figure, which was announced shortly after by Trump Media through a press release, aligns with its actual filing and investor communication.

Trump Media’s official announcement

This comes at a time when the Trump family and political allies are showing renewed interest in Bitcoin.

President Donald Trump who is now back in office since the 2025 election, has said he wants to make the U.S. the “crypto capital of the world.”

Trump Media is also working on retail bitcoin investment products including ETFs aligned with America First policies.

These products will make bitcoin more accessible to retail investors and support pro-Trump financial initiatives.

But not everyone is happy.

Democratic Senator Elizabeth Warren recently expressed concerns about Trump Media’s Bitcoin plans. She asked U.S. regulators to clarify their oversight of digital-asset ETFs, warning of investor risk.

Industry insiders are comparing Trump Media’s plans to Strategy (MSTR) which has built a multi-billion dollar bitcoin treasury over the last year. They used stock and bond sales to fund their bitcoin purchases.

-

@ 9ca447d2:fbf5a36d

2025-06-07 14:00:47

@ 9ca447d2:fbf5a36d

2025-06-07 14:00:47CANNES, FRANCE – May 2025 — Bitcoin mining made its mark at the world’s most prestigious film gathering this year as Puerto Rican director and producer Alana Mediavilla introduced her feature documentary Dirty Coin: The Bitcoin Mining Documentary at the Marché du Film during the Cannes Film Festival.

The film puts bitcoin mining at the center of a rising global conversation about energy, technology, and economic freedom.

Dirty Coin is the first feature-length documentary to explore bitcoin mining through immersive, on-the-ground case studies.

From rural towns in the United States to hydro-powered sites in Latin America and the Congo, the film follows miners and communities navigating what may be one of the most misunderstood technologies of our time.

The result is a human-centered look at how bitcoin mining is transforming local economies and energy infrastructure in real ways.

To mark its Cannes debut, Mediavilla and her team hosted a packed industry event that brought together leaders from both film and finance.

Dirty Coin debut ceremony at the Marché du Film

Sponsors Celestial Management, Sangha Renewables, Nordblock, and Paystand.org supported the program, which featured panels on mining, energy use, and decentralized infrastructure.

Attendees had the rare opportunity to engage directly with pioneers in the space. A special session in French led by Seb Gouspillou spotlighted mining efforts in the Congo’s Virunga region.

Dirty Coin builds on Mediavilla’s award-winning short film Stranded, which won over 20 international prizes, including Best Short Documentary at Cannes in 2024.

That success helped lay the foundation for the feature and positioned Mediavilla as one of the boldest new voices in global documentary filmmaking.

Alana Mediavilla speaks at the Marché du Film — Cannes Film Festival

“If we’ve found an industry that can unlock stranded energy and turn it into real power for people—especially in regions with energy poverty—why wouldn’t we look into it?” says Mediavilla. “Our privilege blinds us.

“The same thing we criticize could be the very thing that lifts the developing world to our standard of living. Ignoring that potential is a failure of imagination.”

Much like the decentralized network it explores, Dirty Coin is spreading globally through grassroots momentum.

Local leaders are hosting independent screenings around the world, from Roatán and Berlin to São Paulo and Madrid. Upcoming events include Toronto and Zurich, with more cities joining each month.

Mediavilla, who previously worked in creative leadership roles in the U.S. — including as a producer at Google — returned to Puerto Rico to found Campo Libre, a studio focused on high-caliber, globally relevant storytelling from the Caribbean.

She was also accepted into the Cannes Producers Network, a selective program open only to producers with box office releases in the past four years.

Mediavilla qualified after independently releasing Dirty Coin in theaters across Puerto Rico. Her participation in the network gave her direct access to meetings, insights, and connections with the most active distributors and producers working today.

The film’s next public screening will take place at the Anthem Film Festival in Palm Springs on Saturday, June 14 at 2 PM. Additional screenings and market appearances are planned throughout the year at Bitcoin events and international film platforms.

Dirty Coin at the Cannes Film Festival

Watch the Trailer + Access Press Materials

📂 EPK

🎬 Screener

🌍 Host a Screening

Follow the Movement

Instagram: https://www.instagram.com/dirty_coin_official/

Twitter: https://x.com/DirtyCoinDoc

Website: www.dirtycointhemovie.com -

@ 7f6db517:a4931eda

2025-06-07 13:01:52

@ 7f6db517:a4931eda

2025-06-07 13:01:52

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ 8bad92c3:ca714aa5

2025-06-07 13:01:40

@ 8bad92c3:ca714aa5

2025-06-07 13:01:40Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”

“We're not hodling just for the sake of hodling. There is a purpose to it.”

“Fiat money shortens your time horizon… you can never rest.”

“Savings precedes capital accumulation. You can’t build unless you’ve saved.”

“You're increasing the marginal value of everyone else’s Bitcoin.”

“True leisure is contemplation—the pursuit of the highest good.”

“What is Bitcoin for if not to make the conditions for magnificent acts of creation possible?”

“Bitcoin itself will last forever. Your stack might not. What will outlast your coins?”

“Only a whale can be magnificent.”

“The market will sell you all the crack you want. It’s up to you to demand beauty.”

Conclusion

This episode is a call to reimagine Bitcoin as more than a financial revolution—it’s a blueprint for civilizational renewal. Michael Goldstein reframes hodling as an act of moral stewardship, urging Bitcoiners to lower their time preference, build lasting institutions, and pursue truth, beauty, and legacy—not to escape the world, but to rebuild it on sound foundations.

Timestamps

00:00 - Intro

00:50 - Michael’s BBB presentation Hodl for Good

07:27 - Austrian principles on capital

15:40 - Fiat distorts the economic process

23:34 - Bitkey

24:29 - Hodl for Good triple entendre

29:52 - Bitcoin benefits everyone

39:05 - Unchained

40:14 - Leisure theory of value

52:15 - Heightening life

1:15:48 - Breaking from the chase makes room for magnificence

1:32:32 - Nakamoto Institute’s missionTranscript

(00:00) Fiat money is by its nature a disturbance. If money is being continually produced, especially at an uncertain rate, these uh policies are really just redistribution of wealth. Most are looking for number to go up post hyper bitcoinization. The rate of growth of bitcoin would be more reflective of the growth of the economy as a whole.

(00:23) Ultimately, capital requires knowledge because it requires knowing there is something that you can add to the structures of production to lengthen it in some way that will take time but allow you to have more in the future than you would today. Let Black Rockck buy the houses and you keep the sats, not the other way around.

(00:41) You wait until later for Larry Frink to try to sell you a [Music] mansion. And we're live just like that. Just like that. 3:30 on a Friday, Memorial Day weekend. It's a good good good way to end the week and start the holiday weekend. Yes, sir. Yes, sir. Thank you for having me here. Thank you for coming. I wore this hat specifically because I think it's I think it's very apppropo uh to the conversation we're going to have which is I hope an extension of the presentation you gave at Bitblock Boom Huddle for good. You were working on

(01:24) that for many weeks leading up to uh the conference and explaining how you were structuring it. I think it's a very important topic to discuss now as the Bitcoin price is hitting new all-time highs and people are trying to understand what am I doing with Bitcoin? Like you have you have the different sort of factions within Bitcoin.

(01:47) Uh get on a Bitcoin standard, get on zero, spend as much Bitcoin as possible. You have the sailors of the world are saying buy Bitcoin, never sell, die with your Bitcoin. And I think you do a really good job in that presentation. And I just think your understanding overall of Bitcoin is incredible to put everything into context. It's not either or.

(02:07) It really depends on what you want to accomplish. Yeah, it's definitely there there is no actual one-sizefits-all um for I mean nearly anything in this world. So um yeah, I mean first of all I mean there was it was the first conference talk I had given in maybe five years. I think the one prior to that uh was um bit block boom 2019 which was my meme talk which uh has uh become infamous and notorious.

(02:43) So uh there was also a lot of like high expectations uh you know rockstar dev uh has has treated that you know uh that that talk with a lot of reference. a lot of people have enjoyed it and he was expecting this one to be, you know, the greatest one ever, which is a little bit of a little bit of a uh a burden to live up to those kinds of standards.

(03:08) Um, but you know, because I don't give a lot of talks. Um, you know, I I I like to uh try to bring ideas that might even be ideas that are common. So, something like hodling, we all talk about it constantly. uh but try to bring it from a little bit of a different angle and try to give um a little bit of uh new light to it.

(03:31) I alsove I've I've always enjoyed kind of coming at things from a third angle. Um whenever there's, you know, there's there's all these little debates that we have in in Bitcoin and sometimes it's nice to try to uh step out of it and look at it a little more uh kind of objectively and find ways of understanding it that incorporate the truths of of all of them.

(03:58) uh you know cuz I think we should always be kind of as much as possible after ultimate truth. Um so with this one um yeah I was kind of finding that that sort of golden mean. So uh um yeah and I actually I think about that a lot is uh you know Aristotle has his his concept of the golden mean. So it's like any any virtue is sort of between two vices um because you can you can always you can always take something too far.

(04:27) So you're you're always trying to find that right balance. Um so someone who is uh courageous you know uh one of the vices uh on one side is being basically reckless. I I can't remember what word he would use. Uh but effectively being reckless and just wanting to put yourself in danger for no other reason than just you know the thrill of it.

(04:50) Um and then on the other side you would just have cowardice which is like you're unwilling to put yourself um at any risk at any time. Um, and courage is right there in the middle where it's understanding when is the right time uh to put your put yourself, you know, in in the face of danger um and take it on. And so um in some sense this this was kind of me uh in in some ways like I'm obviously a partisan of hodling.

(05:20) Um, I've for, you know, a long time now talked about the, um, why huddling is good, why people do it, why we should expect it. Um, but still trying to find that that sort of golden mean of like yes, huddle, but also what are we hodling for? And it's not we're we're not hodddling just merely for the sake of hodddling.

(05:45) There there is a a purpose to it. And we should think about that. And that would also help us think more about um what are the benefits of of spending, when should we spend, why should we spend, what should we spend on um to actually give light to that sort of side of the debate. Um so that was that was what I was kind of trying to trying to get into.

(06:09) Um, as well as also just uh at the same time despite all the talk of hodling, there's always this perennial uh there's always this perennial dislike of hodlers because we're treated as uh as if um we're just free riding the network or we're just greedy or you know any of these things. And I wanted to show how uh huddling does serve a real economic purpose.

(06:36) Um, and it does benefit the individual, but it also does uh it it has actual real social um benefits as well beyond merely the individual. Um, so I wanted to give that sort of defense of hodling as well to look at it from um a a broader position than just merely I'm trying to get rich. Um uh because even the person who uh that is all they want to do um just like you know your your pure number grow up go up moonboy even that behavior has positive ramifications on on the economy.

(07:14) And while we might look at them and have uh judgments about their particular choices for them as an individual, we shouldn't discount that uh their actions are having positive positive effects for the rest of the economy. Yeah. So, let's dive into that just not even in the context of Bitcoin because I think you did a great job of this in the presentation.

(07:36) just you've done a good job of this consistently throughout the years that I've known you. Just from like a first principles Austrian economics perspective, what is the idea around capital accumulation, low time preference and deployment of that capital like what what like getting getting into like the nitty-gritty and then applying it to Bitcoin? Yeah, it's it's a big question and um in many ways I mean I I even I barely scratched the surface.

(08:05) uh I I can't claim to have read uh all the volumes of Bombber works, you know, capital and interest and and stuff like that. Um but I think there's some some sort of basic concepts that we can look at that we can uh draw a lot out. Um the first uh I guess let's write that. So repeat so like capital time preference. Yeah. Well, I guess getting more broad like why sav -

@ dfa02707:41ca50e3

2025-06-07 11:01:54

@ dfa02707:41ca50e3

2025-06-07 11:01:54Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ dfa02707:41ca50e3

2025-06-07 11:01:52

@ dfa02707:41ca50e3

2025-06-07 11:01:52Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ dfa02707:41ca50e3

2025-06-07 10:02:22

@ dfa02707:41ca50e3

2025-06-07 10:02:22

Good morning (good night?)! The No Bullshit Bitcoin news feed is now available on Moody's Dashboard! A huge shoutout to sir Clark Moody for integrating our feed.

Headlines

- Spiral welcomes Ben Carman. The developer will work on the LDK server and a new SDK designed to simplify the onboarding process for new self-custodial Bitcoin users.

- The Bitcoin Dev Kit Foundation announced new corporate members for 2025, including AnchorWatch, CleanSpark, and Proton Foundation. The annual dues from these corporate members fund the small team of open-source developers responsible for maintaining the core BDK libraries and related free and open-source software (FOSS) projects.

- Strategy increases Bitcoin holdings to 538,200 BTC. In the latest purchase, the company has spent more than $555M to buy 6,556 coins through proceeds of two at-the-market stock offering programs.

- Spar supermarket experiments with Bitcoin payments in Zug, Switzerland. The store has introduced a new payment method powered by the Lightning Network. The implementation was facilitated by DFX Swiss, a service that supports seamless conversions between bitcoin and legacy currencies.

- The Bank for International Settlements (BIS) wants to contain 'crypto' risks. A report titled "Cryptocurrencies and Decentralised Finance: Functions and Financial Stability Implications" calls for expanding research into "how new forms of central bank money, capital controls, and taxation policies can counter the risks of widespread crypto adoption while still fostering technological innovation."

- "Global Implications of Scam Centres, Underground Banking, and Illicit Online Marketplaces in Southeast Asia." According to the United Nations Office on Drugs and Crime (UNODC) report, criminal organizations from East and Southeast Asia are swiftly extending their global reach. These groups are moving beyond traditional scams and trafficking, creating sophisticated online networks that include unlicensed cryptocurrency exchanges, encrypted communication platforms, and stablecoins, fueling a massive fraud economy on an industrial scale.

- Slovenia is considering a 25% capital gains tax on Bitcoin profits for individuals. The Ministry of Finance has proposed legislation to impose this tax on gains from cryptocurrency transactions, though exchanging one cryptocurrency for another would remain exempt. At present, individual 'crypto' traders in Slovenia are not taxed.

- Circle, BitGo, Coinbase, and Paxos plan to apply for U.S. bank charters or licenses. According to a report in The Wall Street Journal, major crypto companies are planning to apply for U.S. bank charters or licenses. These firms are pursuing limited licenses that would permit them to issue stablecoins, as the U.S. Congress deliberates on legislation mandating licensing for stablecoin issuers.

"Established banks, like Bank of America, are hoping to amend the current drafts of [stablecoin] legislation in such a way that nonbanks are more heavily restricted from issuing stablecoins," people familiar with the matter told The Block.

- Charles Schwab to launch spot Bitcoin trading by 2026. The financial investment firm, managing over $10 trillion in assets, has revealed plans to introduce spot Bitcoin trading for its clients within the next year.

Use the tools

- Bitcoin Safe v1.2.3 expands QR SignMessage compatibility for all QR-UR-compatible hardware signers (SpecterDIY, KeyStone, Passport, Jade; already supported COLDCARD Q). It also adds the ability to import wallets via QR, ensuring compatibility with Keystone's latest firmware (2.0.6), alongside other improvements.

- Minibits v0.2.2-beta, an ecash wallet for Android devices, packages many changes to align the project with the planned iOS app release. New features and improvements include the ability to lock ecash to a receiver's pubkey, faster confirmations of ecash minting and payments thanks to WebSockets, UI-related fixes, and more.

- Zeus v0.11.0-alpha1 introduces Cashu wallets tied to embedded LND wallets. Navigate to Settings > Ecash to enable it. Other wallet types can still sweep funds from Cashu tokens. Zeus Pay now supports Cashu address types in Zaplocker, Cashu, and NWC modes.

- LNDg v1.10.0, an advanced web interface designed for analyzing Lightning Network Daemon (LND) data and automating node management tasks, introduces performance improvements, adds a new metrics page for unprofitable and stuck channels, and displays warnings for batch openings. The Profit and Loss Chart has been updated to include on-chain costs. Advanced settings have been added for users who would like their channel database size to be read remotely (the default remains local). Additionally, the AutoFees tool now uses aggregated pubkey metrics for multiple channels with the same peer.

- Nunchuk Desktop v1.9.45 release brings the latest bug fixes and improvements.

- Blockstream Green iOS v4.1.8 has renamed L-BTC to LBTC, and improves translations of notifications, login time, and background payments.

- Blockstream Green Android v4.1.8 has added language preference in App Settings and enables an Android data backup option for disaster recovery. Additionally, it fixes issues with Jade entry point PIN timeout and Trezor passphrase input.

- Torq v2.2.2, an advanced Lightning node management software designed to handle large nodes with over 1000 channels, fixes bugs that caused channel balance to not be updated in some cases and channel "peer total local balance" not getting updated.

- Stack Wallet v2.1.12, a multicoin wallet by Cypher Stack, fixes an issue with Xelis introduced in the latest release for Windows.

- ESP-Miner-NerdQAxePlus v1.0.29.1, a forked version from the NerdAxe miner that was modified for use on the NerdQAxe+, is now available.

- Zark enables sending sats to an npub using Bark.

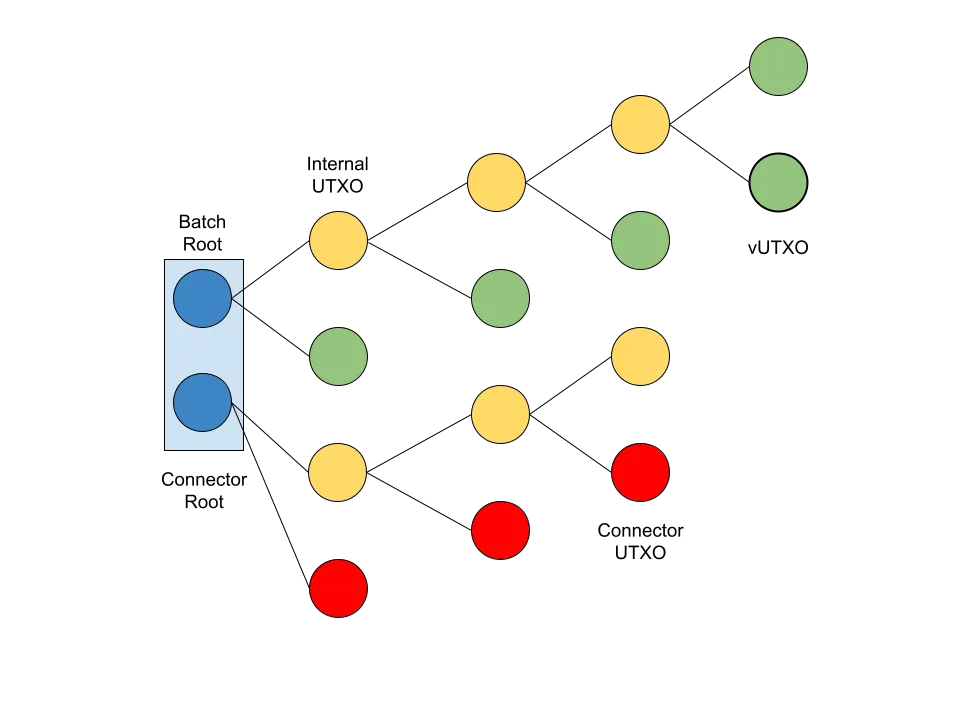

- Erk is a novel variation of the Ark protocol that completely removes the need for user interactivity in rounds, addressing one of Ark's key limitations: the requirement for users to come online before their VTXOs expire.

- Aegis v0.1.1 is now available. It is a Nostr event signer app for iOS devices.

- Nostash is a NIP-07 Nostr signing extension for Safari. It is a fork of Nostore and is maintained by Terry Yiu. Available on iOS TestFlight.

- Amber v3.2.8, a Nostr event signer for Android, delivers the latest fixes and improvements.

- Nostur v1.20.0, a Nostr client for iOS, adds

-

@ dfa02707:41ca50e3

2025-06-07 10:02:19

@ dfa02707:41ca50e3

2025-06-07 10:02:19Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ 0689c075:2936ee11

2025-06-09 21:54:26

@ 0689c075:2936ee11

2025-06-09 21:54:26{"layout":{"backgroundImage":null,"canvasSize":{"width":850,"height":1100}},"pages":[{"id":"page_1","name":"Main Page","objects":[]}],"objects":[],"texts":[]}

-

@ b1ddb4d7:471244e7

2025-06-07 10:01:38

@ b1ddb4d7:471244e7

2025-06-07 10:01:38When Sergei talks about bitcoin, he doesn’t sound like someone chasing profits or followers. He sounds like someone about to build a monastery in the ruins.

While the mainstream world chases headlines and hype, Sergei shows up in local meetups from Sacramento to Cleveland, mentors curious minds, and shares what he knows is true – hoping that, with the right spark, someone will light their own way forward.

We interviewed Sergei to trace his steps: where he started, what keeps him going, and why teaching bitcoin is far more than explaining how to set up a node – it’s about reaching the right minds before the noise consumes them. So we began where most journeys start: at the beginning.

First Steps

- So, where did it all begin for you and what made you stay curious?

I first heard about bitcoin from a friend’s book recommendation, American Kingpin, the book about Silk Road (online drug marketplace). He is still not a true bitcoiner, although I helped him secure private keys with some bitcoin.

I was really busy at the time – focused on my school curriculum, running a 7-bedroom Airbnb, and working for a standardized test prep company. Bitcoin seemed too technical for me to explore, and the pace of my work left no time for it.

After graduating, while pursuing more training, I started playing around with stocks and maximizing my savings. Passive income seemed like the path to early retirement, as per the promise of the FIRE movement (Financial Independence, Retire Early). I mostly followed the mainstream news and my mentor’s advice – he liked preferred stocks at the time.

I had some Coinbase IOUs and remember sending bitcoin within the Coinbase ledger to a couple friends. I also recall the 2018 crash; I actually saw the legendary price spike live but couldn’t benefit because my funds were stuck amidst the frenzy. I withdrew from that investment completely for some time. Thankfully, my mentor advised to keep en eye on bitcoin.

Around late 2019, I started DCA-ing cautiously. Additionally, my friend and I were discussing famous billionaires, and how there was no curriculum for becoming a billionaire. So, I typed “billionaires” into my podcast app, and landed on We Study Billionaires podcast.

That’s where I kept hearing Preston Pysh mention bitcoin, before splitting into his own podcast series, Bitcoin Fundamentals. I didn’t understand most of the terminology of stocks, bonds, etc, yet I kept listening and trying to absorb it thru repetition. Today, I realize all that financial talk was mostly noise.

When people ask me for a technical explanation of fiat, I say: it’s all made up, just like the fiat price of bitcoin! Starting in 2020, during the so-called pandemic, I dove deeper. I religiously read Bitcoin Magazine, scrolled thru Bitcoin Twitter, and joined Simply Bitcoin Telegram group back when DarthCoin was an admin.

DarthCoin was my favorite bitcoiner – experienced, knowledgeable, and unapologetic. Watching him shift from rage to kindness, from passion to despair, gave me a glimpse at what a true educator’s journey would look like.

The struggle isn’t about adoption at scale anymore. It’s about reaching the few who are willing to study, take risks, and stay out of fiat traps. The vast majority won’t follow that example – not yet at least… if I start telling others the requirements for true freedom and prosperity, they would certainly say “Hell no!”

- At what point did you start teaching others, and why?

After college, I helped teach at a standardized test preparation company, and mentored some students one-on-one. I even tried working at a kindergarten briefly, but left quickly; Babysitting is not teaching.

What I discovered is that those who will succeed don’t really need my help – they would succeed with or without me, because they already have the inner drive.

Once you realize your people are perishing for lack of knowledge, the only rational thing to do is help raise their level of knowledge and understanding. That’s the Great Work.

I sometimes imagine myself as a political prisoner. If that were to happen, I’d probably start teaching fellow prisoners, doctors, janitors, even guards. In a way we already live in an open-air prison, So what else is there to do but teach, organize, and conspire to dismantle the Matrix?

Building on Bitcoin

- You hosted some in-person meetups in Sacramento. What did you learn from those?

My first presentation was on MultiSig storage with SeedSigner, and submarine swaps through Boltz.exchange.

I realized quickly that I had overestimated the group’s technical background. Even the meetup organizer, a financial advisor, asked, “How is anyone supposed to follow these steps?” I responded that reading was required… He decided that Unchained is an easier way.

At a crypto meetup, I gave a much simpler talk, outlining how bitcoin will save the world, based on a DarthCoin’s guide. Only one person stuck around to ask questions – a man who seemed a little out there, and did not really seem to get the message beyond the strength of cryptographic security of bitcoin.

Again, I overestimated the audience’s readiness. That forced me to rethink my strategy. People are extremely early and reluctant to study.

- Now in Ohio, you hold sessions via the Orange Pill App. What’s changed?

My new motto is: educate the educators. The corollary is: don’t orange-pill stupid normies (as DarthCoin puts it).

I’ve shifted to small, technical sessions in order to raise a few solid guardians of this esoteric knowledge who really get it and can carry it forward.

The youngest attendee at one of my sessions is a newborn baby – he mostly sleeps, but maybe he still absorbs some of the educational vibes.

- How do local groups like Sactown and Cleveland Bitcoiners influence your work?

Every meetup reflects its local culture. Sacramento and Bay Area Bitcoiners, for example, do camping trips – once we camped through a desert storm, shielding our burgers from sand while others went to shoot guns.

Cleveland Bitcoiners are different. They amass large gatherings. They recently threw a 100k party. They do a bit more community outreach. Some are curious about the esoteric topics such as jurisdiction, spirituality, and healthful living.

I have no permanent allegiance to any state, race, or group. I go where I can teach and learn. I anticipate that in my next phase, I’ll meet Bitcoiners so advanced that I’ll have to give up my fiat job and focus full-time on serious projects where real health and wealth are on the line.

Hopefully, I’ll be ready. I believe the universe always challenges you exactly to your limit – no less, no more.

- What do people struggle with the most when it comes to technical education?

The biggest struggle isn’t technical – it’s a lack of deep curiosity. People ask “how” and “what” – how do I set up a node, what should one do with the lightning channels? But very few ask “why?”

Why does on-chain bitcoin not contribute to the circular economy? Why is it essential to run Lightning? Why did humanity fall into mental enslavement in the first place?

I’d rather teach two-year-olds who constantly ask “why” than adults who ask how to flip a profit. What worries me most is that most two-year-olds will grow up asking state-funded AI bots for answers and live according to its recommendations.

- One Cleveland Bitcoiner shows up at gold bug meetups. How valuable is face-to-face education?

I don’t think the older generation is going to reverse the current human condition. Most of them have been under mind control for too long, and they just don’t have the attention span to study and change their ways.

They’re better off stacking gold and helping fund their grandkids’ education. If I were to focus on a demographic, I’d go for teenagers – high school age – because by college, the indoctrination is usually too strong, and they’re chasing fiat mastery.

As for the gold bug meetup? Perhaps one day I will show up with a ukulele to sing some bitcoin-themed songs. Seniors love such entertainment.

- How do you choose what to focus on in your sessions, especially for different types of learners?

I don’t come in with a rigid agenda. I’ve collected a massive library of resources over the years and never stopped reading. My browser tab and folder count are exploding.

At the meetup, people share questions or topics they’re curious about, then I take that home, do my homework, and bring back a session based on those themes. I give them the key takeaways, plus where to dive deeper.

Most people won’t – or can’t – study the way I do, and I expect attendees to put in the work. I suspect that it’s more important to reach those who want to learn but don’t know how, the so-called nescient (not knowing), rather than the ignorant.

There are way too many ignorant bitcoiners, so my mission is to find those who are curious what’s beyond the facade of fake reality and superficial promises.

That naturally means that fewer people show up, and that’s fine. I’m not here for the crowds; I’m here to educate the educators. One bitcoiner who came decided to branch off into self-custody sessions and that’s awesome. Personally, I’m much more focused on Lightning.

I want to see broader adoption of tools like auth, sign-message, NWC, and LSPs. Next month, I’m going deep into eCash solutions, because let’s face it – most newcomers won’t be able to afford their own UTXO or open a lightning channel; additionally, it has to be fun and easy for them to transact sats, otherwise they won’t do it. Additionally, they’ll need to rely on

-

@ c5d54dd3:e4a3dfc6

2025-06-09 20:54:07

@ c5d54dd3:e4a3dfc6

2025-06-09 20:54:07I've been working on a few Python scripts to help automate and improve some Lightning node management tasks and wanted to share them with the community. I've bundled them into a GitHub repository called

Lightning-Python-Tools

You can find it here: https://github.com/TrezorHannes/Lightning-Python-Tools

Here's a quick rundown of a few scripts inside:

fee_adjuster.py: This script pulls data from your LNDg database and public fee market data from Amboss. It allows you to build your own custom heuristics for managing your outbound and inbound channel fees automatically.pocketmoney.py: Leveraging your LNBits instance, this tool can trigger regular, scheduled payments. It's perfect for things like sending pocket money to your children's wallets.peerswap-lndg_push.py: For those using Peerswap, this script makes your Peerswap-enabled channels visible in your LNDg dashboard and conveniently enters your past swap history as a note.boltz_swap-out.py: This is a command-line interface (CLI) tool for performing submarine swaps with Boltz. It intelligently suggests swaps based on your most outbound-heavy channels, again by feeding data from LNDg.Disclaimer & Call for Contributions This is an open-source project. Please use it at your own risk. I welcome everyone to fork the repository, create pull requests to make the scripts more robust and versatile, or open issues with suggestions.

I'm also very keen to get your feedback. What other tools could be built to make a node runner's life easier? Let me know your thoughts!

https://stacker.news/items/1002005

-

@ 623893fc:f8e3eaad

2025-06-09 22:32:00

@ 623893fc:f8e3eaad

2025-06-09 22:32:00testing something

-

@ b83a28b7:35919450

2025-06-09 21:14:19

@ b83a28b7:35919450

2025-06-09 21:14:19I posted on nostr last week that I had finally had enough of the fiat job and decided to take action:

nostr:nevent1qvzqqqqqqypzpwp69zm7fewjp0vkp306adnzt7249ytxhz7mq3w5yc629u6er9zsqythwumn8ghj7un9d3shjtnswf5k6ctv9ehx2ap0qyghwumn8ghj7mn0wd68ytnhd9hx2tcqyr604hwzr8vvluvp8y0s42gu4x0e725cetugnh7g293g9cggtpujww6vn8n

I'm going to document my journey from being in a well-established and well-paying fiat job into the unknown world of independent work in freedom tech in a series of articles. Will I end up finding something truly inspiring and fulfilling, while being able to support my family? We'll find out over the course of the next few weeks.

They say a watched pot never boils, but I’ve discovered a corollary: a watched lay-off never lands. It has now been ten full rotations of this curious planet since I politely asked my SVP to lay me off. The axe remains lodged somewhere in upper-management limbo, perhaps awaiting the proper ceremonial robe or a Procrustean bed that meets quarterly OKR standards.

While the paperwork drifts in the stratosphere, I’ve begun a quiet, delicious rebellion. My calendar, once a Tetris board stacked with 10–12 neon bricks of back-to-back calls, now resembles minimalist art: a single meeting block lounging at 11 a.m., sipping espresso and judging the empty white space around it. When unreasonable requests for road-maps, slide-decks, or seventeen-page AI vision statements arrive, I respond with the calm of a mountain lake: That timeline seems ambitious... shall we refine the scope? The sound you hear is the collective gasp of colleagues who thought the only acceptable answer was Yes, by yesterday.

With those reclaimed hours I’ve slipped into my mad-scientist lab (occasionally also known as sofa in the guest bedroom, or Orange Room) to experiment on MKStack. Imagine a Lego set for nostr clients, only the bricks are pure code and half the instructions are written in the margin of a philosophy book. I’m vibecoding away, torching roughly thirty thousand sats in compute every day as GPUs hum like distant Tibetan bowls. An accountant might call it reckless; I call it tuition for the University of Possibility.

The experiments are already bearing odd fruit. NosFabrica, the health-data-on-nostr project I started with nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgdwaehxw309ahx7uewd3hkcqpqt8pwzkkhhs94e9acgw9jwca9csyl7a4tnpdttu05039um5j7d6xskflc8d and nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq3qamnwvaz7tmwdaehgu3wd4hk6tcqyprqcf0xst760qet2tglytfay2e3wmvh9asdehpjztkceyh0s5r9cpvx58v is finally getting the attention it deserves. I've built out a simple prototype for a provider directory, that only lists providers with a "credential" issued by me. I'm polishing the app now, but hope to release it for testing in the next couple of weeks.

Most gratifying of all, I’ve traded status meetings for sideline cheers. My 14-yo son is sprinting toward his final exams and soccer playoffs simultaneously - Hegel might call it thesis and antithesis, I call it Tuesday. Instead of doom-scrolling Microsoft Teams during his matches, I’m barking out instructions to him to stay onside, while curbing my desire to manhandle the incompetent refs for not calling a penalty when he's clearly being roughhoused in the box by 190-lb defenders with neck beards and chest hair.

Here’s an unexpected twist: without the daily psychic smog of corporate urgency, the sky inside my skull has cleared. Ideas that once flickered like fireflies now glow with stadium lighting. I have sketched three chapters of the sequel to 24 (called July 18), and outlined a new creative project called A Muse Stochastic (coming soon). I don’t know which, if any, of these seedlings will grow, but the soil finally feels fertile again.

Do I worry about the math? Of course. The household budget once kept afloat by a predictable salary will soon meet the iceberg of reality. Yet the anxiety is strangely weightless, as though the fear itself got furloughed. Maybe it’s naïveté, maybe faith; either way, the net I cannot see is starting to feel palpable beneath my feet.

Ten days in, the lessons are already crystallizing:

-

Silence is space. Remove a dozen meetings and the mind blooms faster than AWS bills.

-

Pushback is a spiritual practice. Each gentle “no” to nonsense is a “yes” to sanity.

-

Compute credits are cheaper than regrets. I’ll trade a double espresso's worth of GPU time for a shot at building the future any day.

-

Presence compounds. One extra hour on the training pitch yields more familial ROI than a dozen performance reviews.

-

Uncertainty is a mirror. Stare into it long enough and you start seeing yourself, not your résumé.

Where does this road lead? I genuinely have no clue. The map dissolves about three steps ahead, like one of those old adventure games where the terrain renders just before you walk off a cliff. But every time I inch forward, the ground materializes. The net appears.

Next week, perhaps I’ll report that the corporate guillotine finally fell, or that I’ve secured my first contract, or that my son aced biology while scoring the winning goal. Whatever unfolds, I’ll keep threading these reflections into the loom of “The Net Appears.” After all, an abyss is just an invitation to practice flight.

Until then, may your own invisible nets breeze into view exactly when you need them, and may they be woven from stronger stuff than corporate lanyards.

-

-

@ 623893fc:f8e3eaad

2025-06-09 22:27:16

@ 623893fc:f8e3eaad

2025-06-09 22:27:16testing some top secret business

-

@ b1ddb4d7:471244e7

2025-06-07 10:01:33

@ b1ddb4d7:471244e7

2025-06-07 10:01:33“Not your keys, not your coins” isn’t a slogan—it’s a survival mantra in the age of digital sovereignty.

The seismic collapses of Mt. Gox (2014) and FTX (2022) weren’t anomalies; they were wake-up calls. When $8.7 billion in customer funds vanished with FTX, it exposed the fatal flaw of third-party custody: your bitcoin is only as secure as your custodian’s weakest link.

Yet today, As of early 2025, analysts estimate that between 2.3 million and 3.7 million Bitcoins are permanently lost, representing approximately 11–18% of bitcoin’s fixed maximum supply of 21 million coins, with some reports suggesting losses as high as 4 million BTC. This paradox reveals a critical truth: self-custody isn’t just preferable—it’s essential—but it must be done right.

The Custody Spectrum

Custodial Wallets (The Illusion of Control)

- Rehypothecation Risk: Most platforms lend your bitcoin for yield generation. When Celsius collapsed, users discovered their “held” bitcoin was loaned out in risky strategies.

- Account Freezes: Regulatory actions can lock withdrawals overnight. In 2023, Binance suspended dollar withdrawals for U.S. users citing “partner bank issues,” trapping funds for weeks.

- Data Vulnerability: KYC requirements create honeypots for hackers. The 2024 Ledger breach exposed 270,000 users’ personal data despite hardware security.

True Self-Custody

Self-custody means exclusively controlling your private keys—the cryptographic strings that prove bitcoin ownership. Unlike banks or exchanges, self-custody eliminates:- Counterparty risk (no FTX-style implosions)

- Censorship (no blocked transactions)

- Inflationary theft (no fractional reserve lending)

Conquering the Three Great Fears of Self-Custody

Fear 1: “I’ll Lose Everything If I Make a Mistake”

Reality: Human error is manageable with robust systems:

- Test Transactions: Always send a micro-amount (0.00001 BTC) before large transfers. Verify receipt AND ability to send back.

- Multi-Backup Protocol: Store seed phrases on fireproof/waterproof steel plates (not paper!). Distribute copies geographically—one in a home safe, another with trusted family 100+ miles away.

- SLIP39 Sharding: Split your seed into fragments requiring 3-of-5 shards to reconstruct. No single point of failure.

Fear 2: “Hackers Will Steal My Keys”

Reality: Offline storage defeats remote attacks:

- Hardware Wallets: Devices like Bitkey or Ledger keep keys in “cold storage”—isolated from internet-connected devices. Transactions require physical confirmation.

- Multisig Vaults: Bitvault’s multi-sig system requires attackers compromise multiple locations/devices simultaneously. Even losing two keys won’t forfeit funds.

- Air-Gapped Verification: Use dedicated offline devices for wallet setup. Never type seeds on internet-connected machines.

Fear 3: “My Family Can’t Access It If I Die”

Reality: Inheritance is solvable:

- Dead Man Switches: Bitwarden’s emergency access allows trusted contacts to retrieve encrypted keys after a pre-set waiting period (e.g., 30 days).

- Inheritance Protocols: Bitkey’s inheritance solution shares decryption keys via designated beneficiaries’ emails. Requires multiple approvals to prevent abuse.

- Public Key Registries: Share wallet XPUBs (not private keys!) with heirs. They can monitor balances but not spend, ensuring transparency without risk.

The Freedom Dividend

- Censorship Resistance: Send $10M BTC to a Wikileaks wallet without Visa/Mastercard blocking it.

- Privacy Preservation: Avoid KYC surveillance—non-custodial wallets like Flash require zero ID verification.

- Protocol Access: Participate in bitcoin-native innovations (Lightning Network, DLCs) only possible with self-custodied keys.

- Black Swan Immunity: When Cyprus-style bank bailins happen, your bitcoin remains untouched in your vault.

The Sovereign’s Checklist

- Withdraw from Exchanges: Move all BTC > $1,000 to self-custody immediately.

- Buy Hardware Wallet: Purchase DIRECTLY from manufacturer (no Amazon!) to avoid supply-chain tampering.

- Generate Seed OFFLINE: Use air-gapped device, write phrase on steel—never digitally.

- Test Recovery: Delete wallet, restore from seed before funding.

- Implement Multisig: For > $75k, use Bitvault for 2-of-3 multi-sig setup.

- Create Inheritance Plan: Share XPUBs/SLIP39 shards with heirs + legal documents.

“Self-custody isn’t about avoiding risk—it’s about transferring risk from opaque institutions to transparent, controllable systems you design.”

The Inevitable Evolution: Custody Without Compromise

Emerging solutions are erasing old tradeoffs:

- MPC Wallets: Services like Xapo Bank shatter keys into encrypted fragments distributed globally. No single device holds full keys, defeating physical theft.

- Social Recovery: Ethically designed networks (e.g., Bitkey) let trusted contacts restore access without custodial control.

- Biometric Assurance: Fingerprint reset protocols prevent lockouts from physical injuries.

Lost keys = lost bitcoin. But consider the alternative: entrusting your life savings to entities with proven 8% annual failure rates among exchanges. Self-custody shifts responsibility from hoping institutions won’t fail to knowing your system can’t fail without your consent.

Take action today: Move one coin. Test one recovery. Share one xpub. The path to unchained wealth begins with a single satoshi under your control.

-

@ cae03c48:2a7d6671

2025-06-07 10:01:07

@ cae03c48:2a7d6671

2025-06-07 10:01:07Bitcoin Magazine

Mapping Bitcoin’s Bull Cycle PotentialBitcoin’s Market Value to Realized Value, or MVRV ratio, remains one of the most reliable on-chain indicators for identifying local and macro tops and bottoms across every BTC cycle. By isolating data across different investor cohorts and adapting historical benchmarks to modern market conditions, we can generate more accurate insights into where Bitcoin may be headed next.

The Bitcoin MVRV Ratio

The MVRV Ratio compares Bitcoin’s market price to its realized price, essentially the average cost basis for all coins in the network. As of writing, BTC trades around $105,000 while the realized price floats near $47,000, putting the raw MVRV at 2.26. The Z-Score version of MVRV standardizes this ratio based on historical volatility, enabling clearer comparisons across different market cycles.

Figure 1: Historically, the MVRV Ratio and the MVRV Z-Score have accurately identified cycle peaks and bottoms. View Live Chart

Short-Term Holders

Short-term holders, defined as those holding Bitcoin for 155 days or less, currently have a realized price near $97,000. This metric often acts as dynamic support in bull markets and resistance in bear markets. Notably, when the Short Term Holder MVRV hits 1.33, local tops have historically occurred, as seen several times in both the 2017 and 2021 cycles. So far in the current cycle, this threshold has already been touched four times, each followed by modest retracements.

Figure 2: Short Term Holder MVRV reaching 1.33 in more recent cycles has aligned with local tops. View Live Chart

Long-Term Holders

Long-term holders, who’ve held BTC for more than 155 days, currently have an average cost basis of just $33,500, putting their MVRV at 3.11. Historically, Long Term Holder MVRV values have reached as high as 12 during major peaks. That said, we’re observing a trend of diminishing multiples each cycle.

Figure 3: Achieving a Long Term Holder MVRV value of 8 could extrapolate to a BTC price in excess of $300,000. View Live Chart

A key resistance band now sits between 7.5 and 8.5, a zone that has defined bull tops and pre-bear retracements in every cycle since 2011. If the current growth of the realized price ($40/day) continues for another 140–150 days, matching previous cycle lengths, we could see it reach somewhere in the region of $40,000. A peak MVRV of 8 would imply a price near $320,000.

A Smarter Market Compass

Unlike static all-time metrics, the 2-Year Rolling MVRV Z-Score adapts to evolving market dynamics. By recalculating average extremes over a rolling window, it smooths out Bitcoin’s natural volatility decay as it matures. Historically, this version has signaled overbought conditions when reaching levels above 3, and prime accumulation zones when dipping below -1. Currently sitting under 1, this metric suggests that substantial upside remains.

Figure 4: The current 2-Year Rolling MVRV Z-Score suggests more positive price action ahead. View Live Chart

Timing & Targets

A view of the BTC Growth Since Cycle Lows chart illustrates that BTC is now approximately 925 days removed from its last major cycle low. Historical comparisons to previous bull markets suggest we may be around 140 to 150 days away from a potential top, with both the 2017 and 2021 peaks occurring around 1,060 to 1,070 days after their respective lows. While not deterministic, this alignment reinforces the broader picture of where we are in the cycle. If realized price trends and MVRV thresholds continue on current trajectories, late Q3 to early Q4 2025 may bring final euphoric moves.

Figure 5: Will the current cycle continue to exhibit growth patterns similar to those of the previous two cycles? View Live Chart

Conclusion

The MVRV ratio and its derivatives remain essential tools for analyzing Bitcoin market behavior, providing clear markers for both accumulation and distribution. Whether observing short-term holders hovering near local top thresholds, long-term holders nearing historically significant resistance zones, or adaptive metrics like the 2-Year Rolling MVRV Z-Score signaling plenty of runway left, these data points should be used in confluence.

No single metric should be relied upon to predict tops or bottoms in isolation, but taken together, they offer a powerful lens through which to interpret the macro trend. As the market matures and volatility declines, adaptive metrics will become even more crucial in staying ahead of the curve.

For more deep-dive research, technical indicators, real-time market alerts, and access to a growing community of analysts, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post Mapping Bitcoin’s Bull Cycle Potential first appeared on Bitcoin Magazine and is written by Matt Crosby.

-

@ 4b3b215f:b091b1f9

2025-06-09 20:21:56

@ 4b3b215f:b091b1f9

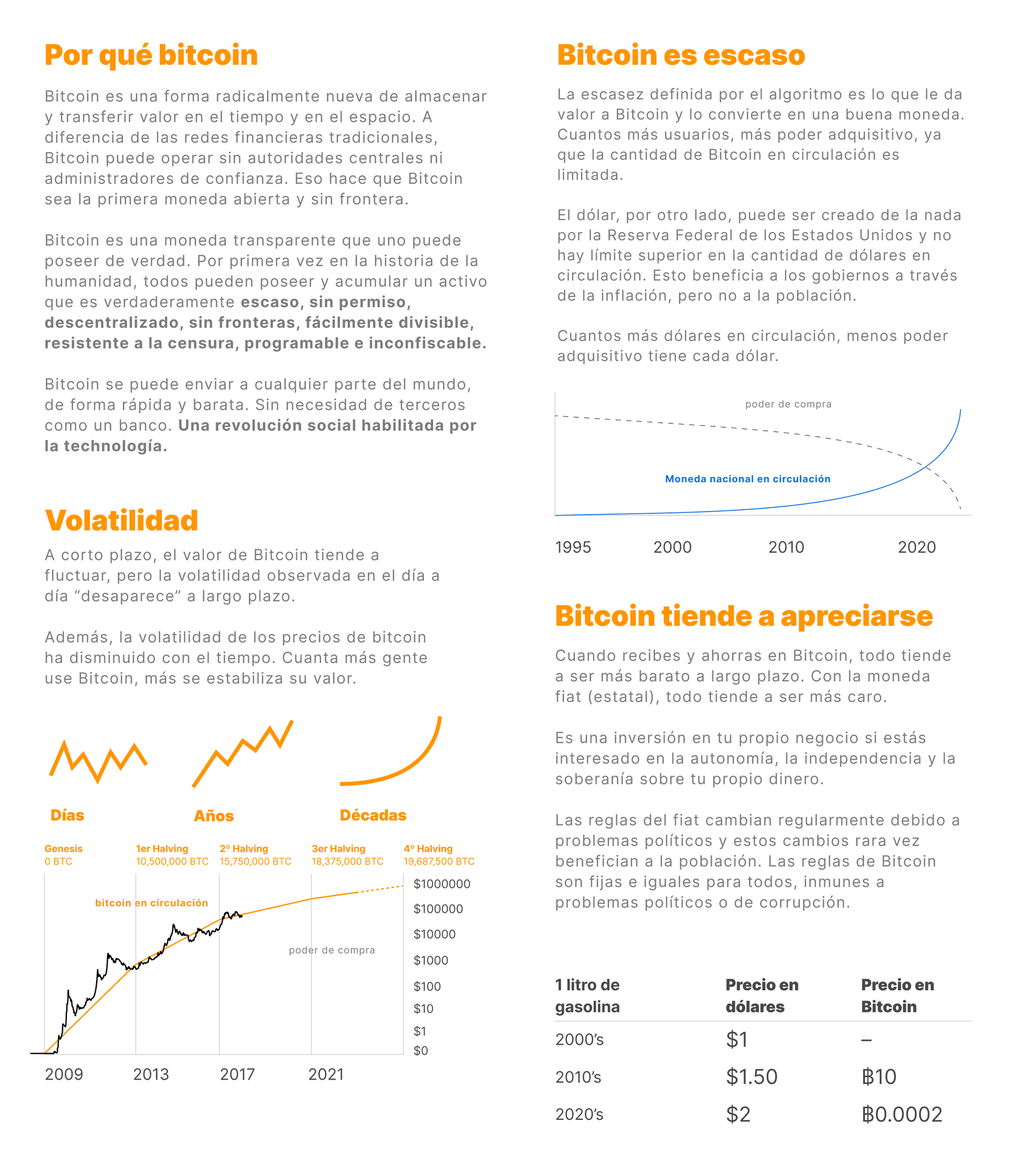

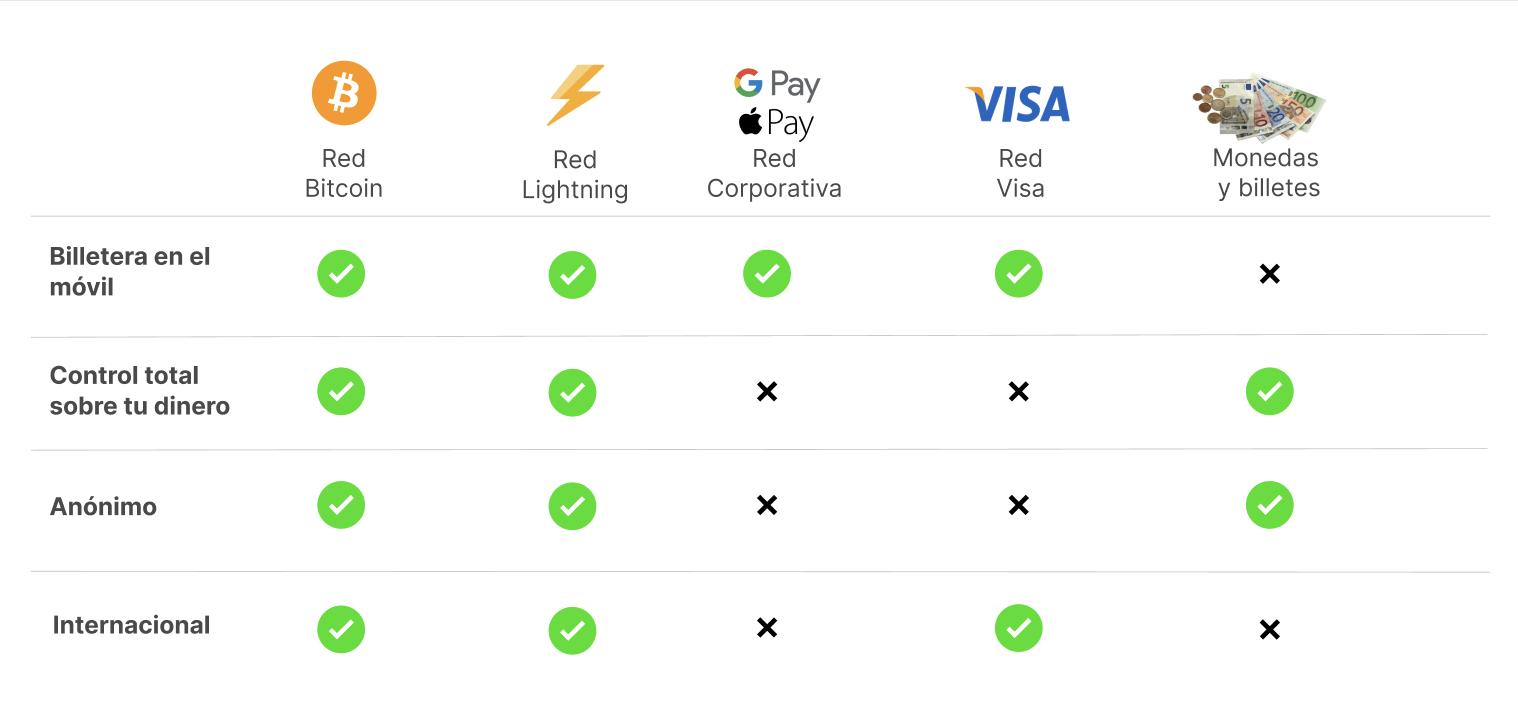

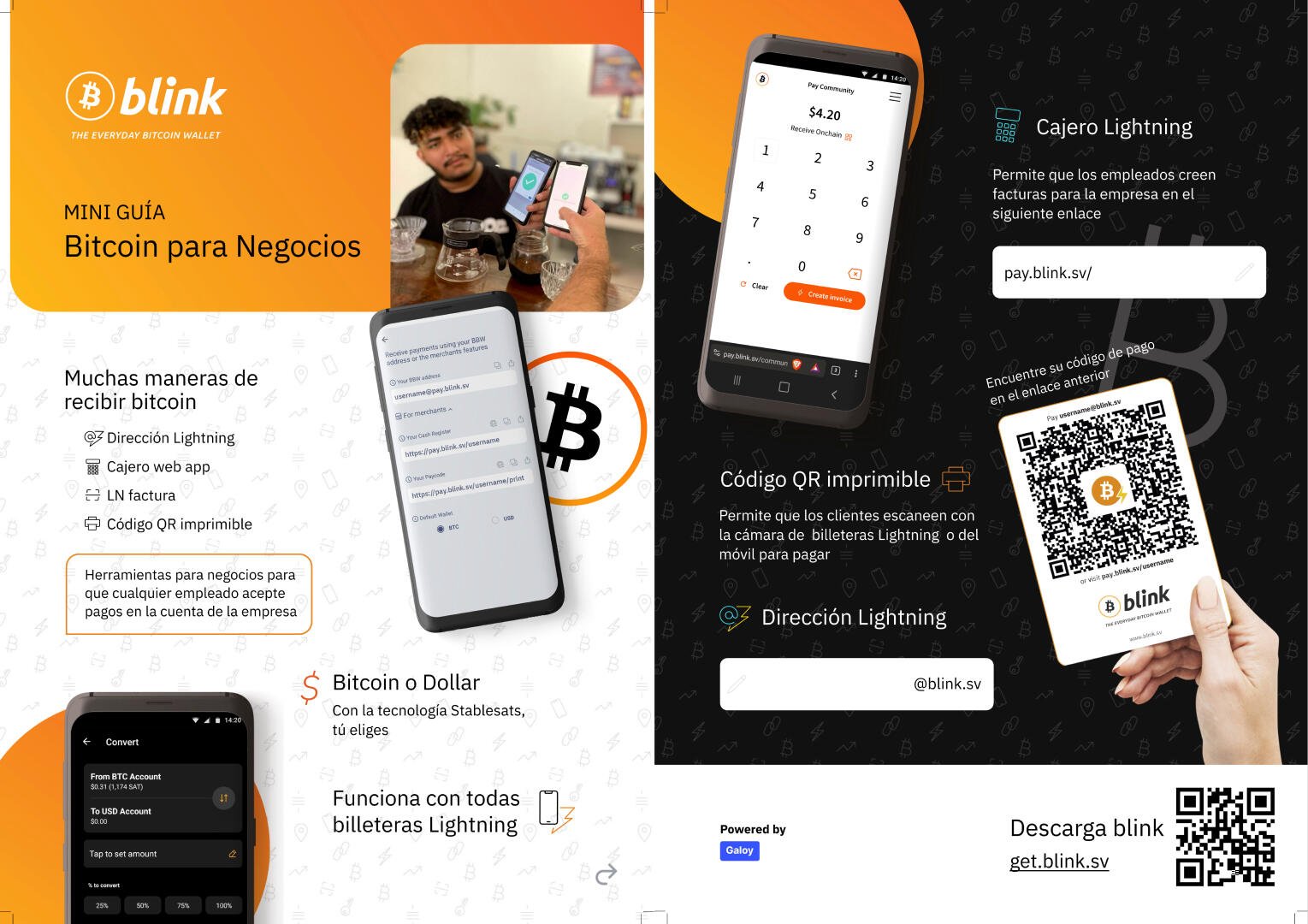

2025-06-09 20:21:56Actualizado: Agosto 10, 2024

⚠️ Advertencia: Esta guía tiene el objetivo de proporcionar información educativa sobre cómo empezar a aceptar Bitcoin en tu negocio. No se ofrece ni se vende ningún servicio relacionado con Bitcoin. Es esencial que sepas que NO DEBES confiar en terceros que te ofrezcan productos o servicios relacionados con Bitcoin, ya que el uso y la gestión de Bitcoin deben ser autónomos y soberanos.

Recuerda: ¡Bitcoin es tu camino hacia la libertad financiera! No confíes en terceros que te ofrezcan productos o servicios para aceptar o utilizar Bitcoin. Bitcoin es dinero, y no necesitas a nadie más para comenzar a usarlo.

¡No aceptes ni pagues por servicios de Bitcoin, tú puedes hacerlo por ti mismo!