-

@ cae03c48:2a7d6671

2025-06-08 00:01:17

@ cae03c48:2a7d6671

2025-06-08 00:01:17Bitcoin Magazine

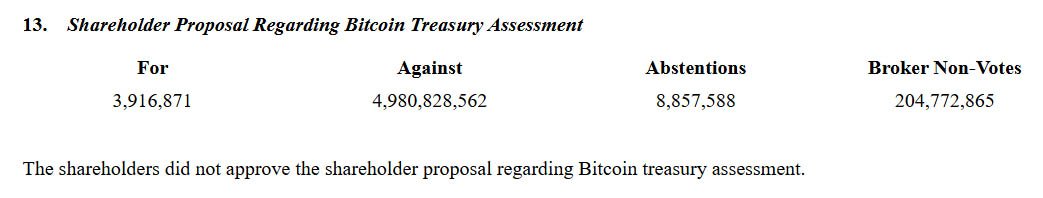

Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in BitcoinMeanwhile Insurance Bitcoin (Bermuda) Limited (“Meanwhile”) announced it has become the first company in the world to release externally audited financial statements denominated entirely in Bitcoin. According to the announcement, the company reported 220.4 BTC in assets and 25.29 BTC in net income for 2024, a 300% year over year increase.

Today marks a global first & historic event for us, along with the public release of our 2024 audited financial statements, covering our 1st year of sales.

As the 1st company in the world to have Bitcoin-denominated financial statements externally audited, we are excited to…

— meanwhile | Bitcoin Life Insurance (@meanwhilelife) June 5, 2025

“We’ve just made history as the first company in the world to have Bitcoin-denominated financial statements externally audited,” said Zac Townsend, CEO of Meanwhile. “This is an important, foundational step in reimagining the financial system based on a single, global, decentralized standard outside the control of any one government.”

The financial statements were audited by Harris & Trotter LLP and its digital asset division ht.digital. Meanwhile’s financials also comply with Bermuda’s Insurance Act 1978, noting that their BTC denominated financials were approved and comply with official guidelines. The firm, fully licensed by the Bermuda Monetary Authority (BMA), operates entirely in BTC and is prohibited from liquidating Bitcoin assets except through policyholder claims, positioning it as a long term holder.

“As the first regulated Bitcoin life insurance company, we view the BTC held by Meanwhile as inherently long-term in nature—primarily held to support the Company’s insurance liabilities over decades,” Townsend added. “This makes it significantly ‘stickier’ and resistant to market pressures compared to the BTC held by other companies as part of their treasury management strategies.”

Meanwhile’s 2024 financials also revealed 23.02 BTC in net premiums and 4.35 BTC in investment income, showing that its model not only preserves Bitcoin, but earns it. The company’s reserves (also held in BTC) were reviewed and approved by Willis Towers Watson (WTW).

Meanwhile also offers a Bitcoin Whole Life insurance product that allows policyholders to save, borrow, and build legacy wealth—entirely in BTC, and has plans to expand globally in 2025.

“We are incredibly proud of today’s news as it underscores how Meanwhile is at the forefront of the next phase of the convergence between Bitcoin and institutional financial markets,” said Tia Beckmann, CFO of Meanwhile. “Now having generated net income in BTC, we have demonstrated that we are earning it through a sustainable insurance business model designed for the long term.”

This post Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in Bitcoin first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ d6affa19:9110b177

2025-06-07 21:10:53

@ d6affa19:9110b177

2025-06-07 21:10:53If there were only one thing I had to list as the single most effective way to improve a Female Led Relationship (FLR), it would be found in the phrase “yes, Ma’am.” Whether trying to get the dynamic off the ground or keep it going during the grind of everyday life, this phrase—and the energy it evokes—encompasses so many essential elements of an FLR. In my experience, not many other things continuously breathe life into a relationship like the magic of “yes, Ma’am.”

Of course, this phrase can be modified to the Woman’s desire (“yes, Mistress,” “yes, my Queen,” “yes, Goddess” are common examples), but “yes, Ma’am” is something acceptable nearly anywhere. It’s simple, polite, somewhat discreet, and yet extremely effective and powerful. In an FLR (even in a low-protocol dynamic), the phrase is elevated from a basic formality to an invocation of trust, respect, and surrender.

The words by themselves are powerless. But when consistently expressed with the right energy and intention, it becomes a sort of miniature ritual that keeps them both anchored to the relationship. This shouldn’t be conflated with “yes, Dear,” a phrase stereotypically used when a man is merely appeasing a Woman. No, the energy here is not to appease, but to please. Because She deserves it.

To illustrate this further, let’s dig into the depth I find in these two words.

An Invocation of Structure, Trust, and Identity

“Yes, Ma’am” is so deceptively simple. It’s a verbal expression of his obedience—the bare minimum a Woman should receive in an FLR. And it keeps the framework intact in everyday life, especially when the mood is subtle or non-sexual.

In this way, “yes, Ma’am” reinforces the foundation of the FLR. Each utterance reminds them both of their positions. Each declaration quiets any confusion. Each delivery deepens the dynamic and tightens the structure.

When these words are spoken and consistently followed up with action, they demonstrate emotional maturity—that he’s moved beyond questioning whether She’s “right” and into the realm of devotion. It signals to Her that Her needs don’t have to be proven to him anymore and that Her preferences don’t need to be justified.

He’s no longer debating Her logic, making excuses, or searching for loopholes; he’s no longer resisting or self-protecting. He’s not agreeing as an equal, he’s not negotiating with Her, he’s not hedging Her demand. He is simply submitting to Her.

Just as it’s “yes, Ma’am” when She tells him to kneel, it’s also “yes, Ma’am” when She asks him to fix the sink, or dismisses a request, or even reminds him to do something he’s about to do. “Yes, Ma’am,” then act.

The Words Alone Are Not the Magic

Again, the magic of “yes, Ma’am” doesn’t reside in the words themselves, but in the intention, energy, and action behind them. The phrase itself is just a vessel. Just as a chalice, the words hold something sacred, but the sanctity resides in the wine, not the cup. The action, the delivery, and the consistency are what give the phrase its power.

If spoken with resentment, sarcasm, or with no follow-through, they mean nothing. If he speaks them but then delays, argues, or makes excuses, then his submission is inauthentic. This undermines trust and, ultimately, the relationship. But when he says “yes, Ma’am” and immediately acts on Her direction—despite being tired, flustered, aroused, or even in disagreement, then that is real submission; that is profound trust. And that is what She feels.

And that’s what he feels. It becomes a reminder of his humility and an expression of self-discipline in service to Her. Over time, it shifts his thought patterns and instincts. He may feel uncertainty, self-pity, or insecurity, but “yes, Ma’am” melts it all into clarity. Old responses like “Well, actually…” “Can’t I just…” “I thought we agreed…” “Why can’t You…” are simply replaced with “yes, Ma’am.”

Even if he’s feeling exhausted, annoyed, or needy. There are no complaints or explanations, only Her will and a choice to put aside his ego, align with Her rhythm, and re-center his purpose. This is an act of vulnerability. He is placing his emotional safety in Her hands and relying on Her to care for his well-being.

It communicates to Her:

- “I hear You.”

- “I will act on Your desires.”

- “I trust You more than I trust my resistance.”

- “I’m Yours, even now, especially now.”And let’s not ignore the erotic undertones in this depth of surrender. A simple phrase makes his discipline audible, echoing Her power. It bears his humility, longing, eagerness, vulnerability—his contained arousal. And She knows. She hears the plea. She feels the weight—the tension—the heat—the surrendered will… Ever-present, even in the most mundane moments…

Closing Thoughts

Of course, this level of devotion takes practice and a great deal of trust. No one is perfect, so he will fail at times, but that’s what makes it so beautiful—it’s a continuously active and conscious choice. And, at first, it may sound awkward for him or forced, but with dedication and intention She will begin to hear the tone, feel the vibe, and sense the sincerity in it. This energy is what builds Her trust in him.

This phrase, or rather the mindset behind it, has improved my own relationship so, so much. While it may not fit into every experience, it’s something that I discovered was a missing piece in mine. Enough so that I felt compelled to share.

Because as a relationship goes on, things change—passions fluctuate, pain resurfaces, doubts arise, life gets busy, things get heavy—but “yes, Ma’am” remains steady and intimate. Piece by piece trust and devotion are built with thousands of quiet yeses. And regardless of the circumstances, “yes, Ma’am” gently whispers “this is still us; this is still our shared truth; this is still sacred” over and over again.

-

@ eb0157af:77ab6c55

2025-06-09 08:02:07

@ eb0157af:77ab6c55

2025-06-09 08:02:07Russian authorities are stepping up their crackdown on illegal Bitcoin miners with a new confiscation case.

Law enforcement in Russia has launched a seizure campaign against unauthorized mining operations, marking an escalation in the fight against illicit crypto activity. The latest case saw investigators in the Amur Oblast confiscate bitcoin worth $88,500.

The Investigative Department of the Investigative Committee (SKR) for Amur Oblast announced it had seized assets worth around 7 million rubles ($88,570; 0.8414 BTC) from a former executive of an unnamed power company.

The accused served as head of technological connection services at the Amur branch of the Far Eastern Distribution Company (DRSC), a power grid operator managing electricity distribution in Russia’s eastern Amur region.

Investigators found that the former executive exploited his insider knowledge of the company’s power distribution systems to siphon electricity from the grid. The stolen power was used to run mining equipment at his private residence.

The seizure followed an investigation revealing that in 2024, the man used his technical skills to bypass metering devices and create an illegal connection to his employer’s infrastructure.

Authorities estimate that the executive used over 3.5 million rubles ($44,334) worth of electricity belonging to DRSC.

In April, several Russian ministries drafted a legal mechanism proposing new powers for courts and law enforcement to confiscate cryptocurrencies in criminal cases. The proposal, backed by government policymakers, would allow authorities to formally recognize digital assets as intangible property in criminal proceedings.

Previous seizures

Investigators appear to have already applied the principles of this draft law in several cases. Among them is the case of a server operator for the darknet marketplace Hydra, from whom police seized crypto assets worth $8.2 million.

Judicial officers also seized 1,032.1 BTC from Marat Tambiev, a former investigator with the Russian Investigative Committee. A court found Tambiev guilty of accepting Bitcoin bribes from an international fraud network, sentencing him to 16 years in prison.

The post Russia: $88,500 in bitcoin seized from illegal miner for power theft appeared first on Atlas21.

-

@ b1ddb4d7:471244e7

2025-06-07 14:00:42

@ b1ddb4d7:471244e7

2025-06-07 14:00:42When Sergei talks about bitcoin, he doesn’t sound like someone chasing profits or followers. He sounds like someone about to build a monastery in the ruins.

While the mainstream world chases headlines and hype, Sergei shows up in local meetups from Sacramento to Cleveland, mentors curious minds, and shares what he knows is true – hoping that, with the right spark, someone will light their own way forward.

We interviewed Sergei to trace his steps: where he started, what keeps him going, and why teaching bitcoin is far more than explaining how to set up a node – it’s about reaching the right minds before the noise consumes them. So we began where most journeys start: at the beginning.

First Steps

- So, where did it all begin for you and what made you stay curious?

I first heard about bitcoin from a friend’s book recommendation, American Kingpin, the book about Silk Road (online drug marketplace). He is still not a true bitcoiner, although I helped him secure private keys with some bitcoin.

I was really busy at the time – focused on my school curriculum, running a 7-bedroom Airbnb, and working for a standardized test prep company. Bitcoin seemed too technical for me to explore, and the pace of my work left no time for it.

After graduating, while pursuing more training, I started playing around with stocks and maximizing my savings. Passive income seemed like the path to early retirement, as per the promise of the FIRE movement (Financial Independence, Retire Early). I mostly followed the mainstream news and my mentor’s advice – he liked preferred stocks at the time.

I had some Coinbase IOUs and remember sending bitcoin within the Coinbase ledger to a couple friends. I also recall the 2018 crash; I actually saw the legendary price spike live but couldn’t benefit because my funds were stuck amidst the frenzy. I withdrew from that investment completely for some time. Thankfully, my mentor advised to keep en eye on bitcoin.

Around late 2019, I started DCA-ing cautiously. Additionally, my friend and I were discussing famous billionaires, and how there was no curriculum for becoming a billionaire. So, I typed “billionaires” into my podcast app, and landed on We Study Billionaires podcast.

That’s where I kept hearing Preston Pysh mention bitcoin, before splitting into his own podcast series, Bitcoin Fundamentals. I didn’t understand most of the terminology of stocks, bonds, etc, yet I kept listening and trying to absorb it thru repetition. Today, I realize all that financial talk was mostly noise.

When people ask me for a technical explanation of fiat, I say: it’s all made up, just like the fiat price of bitcoin! Starting in 2020, during the so-called pandemic, I dove deeper. I religiously read Bitcoin Magazine, scrolled thru Bitcoin Twitter, and joined Simply Bitcoin Telegram group back when DarthCoin was an admin.

DarthCoin was my favorite bitcoiner – experienced, knowledgeable, and unapologetic. Watching him shift from rage to kindness, from passion to despair, gave me a glimpse at what a true educator’s journey would look like.

The struggle isn’t about adoption at scale anymore. It’s about reaching the few who are willing to study, take risks, and stay out of fiat traps. The vast majority won’t follow that example – not yet at least… if I start telling others the requirements for true freedom and prosperity, they would certainly say “Hell no!”

- At what point did you start teaching others, and why?

After college, I helped teach at a standardized test preparation company, and mentored some students one-on-one. I even tried working at a kindergarten briefly, but left quickly; Babysitting is not teaching.

What I discovered is that those who will succeed don’t really need my help – they would succeed with or without me, because they already have the inner drive.

Once you realize your people are perishing for lack of knowledge, the only rational thing to do is help raise their level of knowledge and understanding. That’s the Great Work.

I sometimes imagine myself as a political prisoner. If that were to happen, I’d probably start teaching fellow prisoners, doctors, janitors, even guards. In a way we already live in an open-air prison, So what else is there to do but teach, organize, and conspire to dismantle the Matrix?

Building on Bitcoin

- You hosted some in-person meetups in Sacramento. What did you learn from those?

My first presentation was on MultiSig storage with SeedSigner, and submarine swaps through Boltz.exchange.

I realized quickly that I had overestimated the group’s technical background. Even the meetup organizer, a financial advisor, asked, “How is anyone supposed to follow these steps?” I responded that reading was required… He decided that Unchained is an easier way.

At a crypto meetup, I gave a much simpler talk, outlining how bitcoin will save the world, based on a DarthCoin’s guide. Only one person stuck around to ask questions – a man who seemed a little out there, and did not really seem to get the message beyond the strength of cryptographic security of bitcoin.

Again, I overestimated the audience’s readiness. That forced me to rethink my strategy. People are extremely early and reluctant to study.

- Now in Ohio, you hold sessions via the Orange Pill App. What’s changed?

My new motto is: educate the educators. The corollary is: don’t orange-pill stupid normies (as DarthCoin puts it).

I’ve shifted to small, technical sessions in order to raise a few solid guardians of this esoteric knowledge who really get it and can carry it forward.

The youngest attendee at one of my sessions is a newborn baby – he mostly sleeps, but maybe he still absorbs some of the educational vibes.

- How do local groups like Sactown and Cleveland Bitcoiners influence your work?

Every meetup reflects its local culture. Sacramento and Bay Area Bitcoiners, for example, do camping trips – once we camped through a desert storm, shielding our burgers from sand while others went to shoot guns.

Cleveland Bitcoiners are different. They amass large gatherings. They recently threw a 100k party. They do a bit more community outreach. Some are curious about the esoteric topics such as jurisdiction, spirituality, and healthful living.

I have no permanent allegiance to any state, race, or group. I go where I can teach and learn. I anticipate that in my next phase, I’ll meet Bitcoiners so advanced that I’ll have to give up my fiat job and focus full-time on serious projects where real health and wealth are on the line.

Hopefully, I’ll be ready. I believe the universe always challenges you exactly to your limit – no less, no more.

- What do people struggle with the most when it comes to technical education?

The biggest struggle isn’t technical – it’s a lack of deep curiosity. People ask “how” and “what” – how do I set up a node, what should one do with the lightning channels? But very few ask “why?”

Why does on-chain bitcoin not contribute to the circular economy? Why is it essential to run Lightning? Why did humanity fall into mental enslavement in the first place?

I’d rather teach two-year-olds who constantly ask “why” than adults who ask how to flip a profit. What worries me most is that most two-year-olds will grow up asking state-funded AI bots for answers and live according to its recommendations.

- One Cleveland Bitcoiner shows up at gold bug meetups. How valuable is face-to-face education?

I don’t think the older generation is going to reverse the current human condition. Most of them have been under mind control for too long, and they just don’t have the attention span to study and change their ways.

They’re better off stacking gold and helping fund their grandkids’ education. If I were to focus on a demographic, I’d go for teenagers – high school age – because by college, the indoctrination is usually too strong, and they’re chasing fiat mastery.

As for the gold bug meetup? Perhaps one day I will show up with a ukulele to sing some bitcoin-themed songs. Seniors love such entertainment.

- How do you choose what to focus on in your sessions, especially for different types of learners?

I don’t come in with a rigid agenda. I’ve collected a massive library of resources over the years and never stopped reading. My browser tab and folder count are exploding.

At the meetup, people share questions or topics they’re curious about, then I take that home, do my homework, and bring back a session based on those themes. I give them the key takeaways, plus where to dive deeper.

Most people won’t – or can’t – study the way I do, and I expect attendees to put in the work. I suspect that it’s more important to reach those who want to learn but don’t know how, the so-called nescient (not knowing), rather than the ignorant.

There are way too many ignorant bitcoiners, so my mission is to find those who are curious what’s beyond the facade of fake reality and superficial promises.

That naturally means that fewer people show up, and that’s fine. I’m not here for the crowds; I’m here to educate the educators. One bitcoiner who came decided to branch off into self-custody sessions and that’s awesome. Personally, I’m much more focused on Lightning.

I want to see broader adoption of tools like auth, sign-message, NWC, and LSPs. Next month, I’m going deep into eCash solutions, because let’s face it – most newcomers won’t be able to afford their own UTXO or open a lightning channel; additionally, it has to be fun and easy for them to transact sats, otherwise they won’t do it. Additionally, they’ll need to rely on

-

@ dfa02707:41ca50e3

2025-06-07 13:01:49

@ dfa02707:41ca50e3

2025-06-07 13:01:49Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ a296b972:e5a7a2e8

2025-06-09 08:00:20

@ a296b972:e5a7a2e8

2025-06-09 08:00:20Nur für‘s Protokoll. Hiermit erkläre ich, Georg Ohrweh, im tatsächlich vorhandenen vollen Besitz meiner geistigen Kräfte, dass Herr Lauterbach, gleich welche Position er in Zukunft noch bekleiden sollte, für mich nicht zuständig ist. Basta.

Ein Erguss dieses verhaltensoriginellen Über-alles-Bescheidwissers:

„Wir kommen jetzt in eine Phase hinein, wo der Ausnahmezustand die Normalität sein wird. Wir werden ab jetzt immer im Ausnahmezustand sein. Der Klimawandel wird zwangsläufig mehr Pandemien bringen.“

Wie kann es sein, dass solch eine Ausnahme-Gestalt, die schon rein äußerlich die Phantasie zu Vergleichen anregt, sich leider auch genauso verhält, wie die Gestalten, die in diesen Phantasien vorkommen, ungebremst auf der Panik-Klaviatur kakophonische Klänge erzeugen darf? Obwohl ein wenig Wahrheit ist auch enthalten: Wir sind tatsächlich immer im Ausnahmezustand, im Ausnahmezustand des fortgeschrittenen Wahnsinns.

Wie kann es sein, dass dieser Haaaarvardist seinen persönlich empfundenen Ausnahmezustand zum Allgemeingut erklären kann? Welche Verknüpfungs-Phantasien hat er sonst noch studiert? Er ist ja auch noch Vorsitzender im Raumfahrtausschuss. Was kommt als Nächstes? Eine Klima-Pandemie, verursacht durch außerirdische Viren, die die Temperaturen beeinflussen können? Im aktuellen Zeitgeist gibt es nichts, was nicht gedacht wird. Wem die besseren Absurditäten einfallen, der gewinnt. Man muss sich schon den gegebenen Denkstrukturen etwas anpassen, aber sich auch ein wenig Mühe geben.

Nach dem Wechsel der ehemaligen Außen-Dings zur UN (mit dem Ziel, aus den Vereinten Nationen die Feministischen Nationen zu gestalten) und des ehemaligen Wirtschafts-Dings in den Außenausschuss und als Gastdozent in Kalifornien (Thema: Wirtschaftsvernichtung unter Einbeziehung des gespannten Verhältnisses unter Geschwistern aufgrund ärmlicher Verhältnisse, am Beispiel des Märchens von Hänsel und Gretel) , jetzt auch noch der ehemalige Chef-Panikmacher zur WHO.

…und der Wahnsinn wurde hinausgetragen in die Welt, und es wurde dunkel, und es ward Nacht, und es wurde helle, und es ward Tag, der Wind blies oder auch nicht (was macht der Wind eigentlich, wenn er nicht weht?), und es ward Winter, und es wurde kälter, und es wurde wärmer, und es ward Sommer. Es regnete nicht mehr, die Wolken schwitzten. Und Putin verhinderte (wer auch sonst), dass das Eis in der Antarktis abnahm.

Wiederholte Bodentemperaturen in der Toskana von 50 Grad Celsius. Zu erwartende Wassertemperaturen während Ferragosto an der italienischen Adria von durchschnittlich 100 Grad Celsius. An Stellen mit wenig Strömung stiegen schon die ersten Kochblasen auf. Doch dann kam der durch Lachs gestählte, salzlose Super-Karl und rettete mit einem durch die WHO diktierten Klima-Logdown die gesamte Menschheit. Wer besser, als er konnte wissen, dass ein Klima-Logdown weitgehend nebenwirkungsfrei ist.

Was für ein Segen, dass Karl der Große, der uns so siegreich durch die Corona-Schlacht geführt hat, jetzt auch gegen das Klima in den Krieg zieht.

Wer kennt das nicht, Tage der Qual, in denen man zugeben muss: Ich hab‘ heute so schlimm Klima.

Viele Klimaexperten, die weltweit in der Qualitätspropaganda zitiert werden, zeichnen sich besonders dadurch aus, dass sie mit einer maximalen Abweichung von einem Grad Celsius ein Thermometer fehlerfrei ablesen können. Diese Ungenauigkeit wird der Erdverkochungsexperte sicher als erstes beheben.

In einer aufopfernden Studie während eines Urlaubs in 2023, in der um die damalige Zeit erstmals eisfreien Toskana, hat er den von ihm ausgetüftelten Klimaschutzplan ins Rheinische übersetzt. Titel: „Schützen Sie sisch, und, äh, andere!“ Weiter konnte er erforschen, dass die Bodentemperatur nicht immer mit der Temperatur des Erdkerns übereinstimmen muss.

Durch seine unermüdlichen Studien, können Hitzetote in Zukunft besser zugeordnet werden. Man weiß dann, ob jemand an hohen oder mit hohen Temperaturen gestorben ist. Der asymptomatische Klimawandel kann so in Zukunft viel besser bewertet werden. Man hat aus geringfügigen Fehlern gelernt und die Methoden erheblich verbessert.

Eine präzise Vorhersage der Jahreszeiten, vor allem die des Sommers, wird bald ebenfalls möglich sein. Es kann jetzt vor jahreszeitbedingten, teilweise sogar täglich schwankenden Temperaturveränderungen rechtzeitig gewarnt werden. Im Herbst können Heizempfehlungen für die ahnungslose Bevölkerung herausgegeben werden. Frieren war gestern, wissen wann es kalt wird, ist heute. Es wird an Farben geforscht, die noch roter sein sollen, als die, die jetzt in den Wetterkarten bei 21 Grad bereits verwendet werden.

Eine allgemeine Heizpflicht soll es europaweit zunächst nicht geben.

Weiter soll die Lichteinstrahlung der Sonne noch präziser bestimmt werden, damit den Europäern, in Ergänzung zur mitteleuropäischen Sommerzeit, jetzt auch noch genau mitgeteilt werden kann, wann es Tag und wann es Nacht ist.

Das Hinausschauen aus dem Fenster, zum Beispiel, ob es schon dunkel draußen ist, erübrigt sich. Die Tageszeit, in Ergänzung zur herkömmlichen Uhrzeit, wird demnächst automatisch mit dem Klima-Pass übermittelt werden. Zu Anfang natürlich erst einmal freiwillig.

Durch die persönliche ID können dann auch schnell und unkompliziert Sonderprämien überwiesen werden, sofern man sich klimakonform verhalten hat, damit man sich rechtzeitig vor Winterbeginn eine warme Jacke oder einen Mantel kaufen kann. Das Sparen von Bargeld auf eine bevorstehende größere Anschaffung von Winterkleidung wird somit überflüssig.

Ob es am Ende nun um Hitze oder Kälte geht, spielt eigentlich gar keine Rolle, denn wie wussten schon die Ahnen zu berichten: Was gut für die Kälte ist, ist auch gut für die Wärme.

Westliche Mächte unternehmen immer wieder Versuche, eskalierend auf den Ukraine-Konflikt einzuwirken, damit man atombetriebene Heizpilze aufstellen kann, an denen sich die Europäer im Winter auch im Freien wärmen können.

Wie praktisch, dass man nicht nur Gesundheit und Klima, sondern auch Klima und Krieg miteinander verbinden kann. Alles so, oder so ähnlich möglicherweise nachzulesen im genialen Hitzeschutzplan á la Lauterbach.

Besonders Deutschland braucht nicht nur lauterbachsche Hitzeschutzräume, nein es braucht atomsichere Hitzeschutzbunker, so schlägt man gleich zwei Fliegen mit einer Klappe.

Für die, die es sich leisten können, hier ein Vorschlag. Der K2000:

Für die weniger gut Betuchten reicht auch ein kühles Kellerloch, das man idealerweise im Februar beziehen und nicht vor November wieder verlassen sollte, so die Empfehlung auch von führenden Klima-Forschern, die es ja wissen müssen. Von Dezember bis Januar empfiehlt sich ein Besuch auf den Bahamas, besonders dann, wenn man eine leichte Erkältung verspürt.

Nur Verschwörungstheoretiker behaupten, dass die eigenartigen Anschlussverwendungen der Extrem-Kapazitäten, zu denen Lauterbach ohne Zweifel dazugehört, wie dicke rote Pfeile wirken, die auf Institutionen und Organisationen zeigen, um die man unter allen Umständen einen großen Bogen machen sollte, weil sie möglicherweise nichts Gutes im Schilde führen. Minimal sollen sie angeblich Unsinn verbreiten, maximal sollen sie gehörigen Schaden anrichten.

Man muss sich nur ein paar Gedanken machen, schon kann man feststellen, wie alles mit allem zusammenhängt.

“Dieser Beitrag wurde mit dem Pareto-Client geschrieben.”

* *

(Bild von pixabay)

-

@ dfa02707:41ca50e3

2025-06-07 13:01:47

@ dfa02707:41ca50e3

2025-06-07 13:01:47Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ 57d1a264:69f1fee1

2025-06-09 06:42:31

@ 57d1a264:69f1fee1

2025-06-09 06:42:31To become a master designer, you need to break past a slavish devotion of past forms and create vibrant, new experiences. This design talk covers practical techniques for reinventing game genres. The goal is the invention of a unique and highly differentiated customer value proposition that makes both strong business sense and is also deeply creatively fulfilling. We cover designing from the root, reducing design risk, and igniting original franchises. We also cover the pitfalls of design innovation and how to thrive in a highly competitive market.

https://www.youtube.com/watch?v=f7DFuXDN29M

https://stacker.news/items/1001313

-

@ dfa02707:41ca50e3

2025-06-07 13:01:45

@ dfa02707:41ca50e3

2025-06-07 13:01:45- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ dfa02707:41ca50e3

2025-06-07 13:01:45

@ dfa02707:41ca50e3

2025-06-07 13:01:45Contribute to keep No Bullshit Bitcoin news going.

This update brings key enhancements for clarity and usability:

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ 7f6db517:a4931eda

2025-06-09 06:02:17

@ 7f6db517:a4931eda

2025-06-09 06:02:17

There must be a limit to how much data is transferred across the bitcoin network in order to keep the ability to run and use your own node accessible. A node is required to interact with the global bitcoin network - if you do not use your own node then you must trust someone else's node. If nodes become inaccessible to run then the network will centralize around the remaining entities that operate them - threatening the censorship resistance at the core of bitcoin's value prop. The bitcoin protocol uses three main mechanisms to keep node operation costs low - a fixed limit on the amount of data in each block, an automatic difficulty adjustment that regulates how many blocks are produced based on current mining hash rate, and a robust dynamic transaction fee market.

Bitcoin transaction fees limit network abuse by making usage expensive. There is a cost to every transaction, set by a dynamic free market based on demand for scarce block space. It is an incredibly robust way to prevent spam without relying on centralized entities that can be corrupted or pressured.

After the 2017 bitcoin fee spike we had six years of relative quiet to build tools that would be robust in a sustained high fee market. Fortunately our tools are significantly better now but many still need improvement. Most of the pain points we see today will be mitigated.

The reality is we were never going to be fully prepared - pressure is needed to show the pain points and provide strong incentives to mitigate them.

It will be incredibly interesting to watch how projects adapt under pressure. Optimistic we see great innovation here.

_If you are willing to wait for your transaction to confirm you can pay significantly lower fees. Learn best practices for reducing your fee burden here.

My guide for running and using your own bitcoin node can be found here._

If you found this post helpful support my work with bitcoin.

-

@ 9ca447d2:fbf5a36d

2025-06-07 12:02:11

@ 9ca447d2:fbf5a36d

2025-06-07 12:02:11Trump Media & Technology Group (TMTG), the company behind Truth Social and other Trump-branded digital platforms, is planning to raise $2.5 billion to build one of the largest bitcoin treasuries among public companies.

The deal involves the sale of approximately $1.5 billion in common stock and $1.0 billion in convertible senior secured notes.

According to the company, the offering is expected to close by the end of May, pending standard closing conditions.

Devin Nunes, CEO of Trump Media, said the investment in bitcoin is a big part of the company’s long-term plan.

“We view Bitcoin as an apex instrument of financial freedom,” Nunes said.

“This investment will help defend our Company against harassment and discrimination by financial institutions, which plague many Americans and U.S. firms.”

He added that the bitcoin treasury will be used to create new synergies across the company’s platforms including Truth Social, Truth+, and the upcoming financial tech brand Truth.Fi.

“It’s a big step forward in the company’s plans to evolve into a holding company by acquiring additional profit-generating, crown jewel assets consistent with America First principles,” Nunes said.

The $2.5 billion raise will come from about 50 institutional investors. The $1 billion in convertible notes will have 0% interest and be convertible into shares at a 35% premium.

TMTG’s current liquid assets, including cash and short-term investments, are $759 million as of the end of the first quarter of 2025. With this new funding, the company’s liquid assets will be over $3 billion.

Custody of the bitcoin treasury will be handled by Crypto.com and Anchorage Digital. They will manage and store the digital assets.

Earlier this week The Financial Times reported Trump Media was planning to raise $3 billion for digital assets acquisitions.

The article said the funds would be used to buy bitcoin and other digital assets, and an announcement could come before a major related event in Las Vegas.

Related: Bitcoin 2025 Conference Kicks off in Las Vegas Today

Trump Media denied the FT report. In a statement, the company said, “Apparently the Financial Times has dumb writers listening to even dumber sources.”

There was no further comment. However, the official $2.5 billion figure, which was announced shortly after by Trump Media through a press release, aligns with its actual filing and investor communication.

Trump Media’s official announcement

This comes at a time when the Trump family and political allies are showing renewed interest in Bitcoin.

President Donald Trump who is now back in office since the 2025 election, has said he wants to make the U.S. the “crypto capital of the world.”

Trump Media is also working on retail bitcoin investment products including ETFs aligned with America First policies.

These products will make bitcoin more accessible to retail investors and support pro-Trump financial initiatives.

But not everyone is happy.

Democratic Senator Elizabeth Warren recently expressed concerns about Trump Media’s Bitcoin plans. She asked U.S. regulators to clarify their oversight of digital-asset ETFs, warning of investor risk.

Industry insiders are comparing Trump Media’s plans to Strategy (MSTR) which has built a multi-billion dollar bitcoin treasury over the last year. They used stock and bond sales to fund their bitcoin purchases.

-

@ 7f6db517:a4931eda

2025-06-09 06:02:17

@ 7f6db517:a4931eda

2025-06-09 06:02:17

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 9ca447d2:fbf5a36d

2025-06-07 12:01:58

@ 9ca447d2:fbf5a36d

2025-06-07 12:01:58CANNES, FRANCE – May 2025 — Bitcoin mining made its mark at the world’s most prestigious film gathering this year as Puerto Rican director and producer Alana Mediavilla introduced her feature documentary Dirty Coin: The Bitcoin Mining Documentary at the Marché du Film during the Cannes Film Festival.

The film puts bitcoin mining at the center of a rising global conversation about energy, technology, and economic freedom.

Dirty Coin is the first feature-length documentary to explore bitcoin mining through immersive, on-the-ground case studies.

From rural towns in the United States to hydro-powered sites in Latin America and the Congo, the film follows miners and communities navigating what may be one of the most misunderstood technologies of our time.

The result is a human-centered look at how bitcoin mining is transforming local economies and energy infrastructure in real ways.

To mark its Cannes debut, Mediavilla and her team hosted a packed industry event that brought together leaders from both film and finance.

Dirty Coin debut ceremony at the Marché du Film

Sponsors Celestial Management, Sangha Renewables, Nordblock, and Paystand.org supported the program, which featured panels on mining, energy use, and decentralized infrastructure.

Attendees had the rare opportunity to engage directly with pioneers in the space. A special session in French led by Seb Gouspillou spotlighted mining efforts in the Congo’s Virunga region.

Dirty Coin builds on Mediavilla’s award-winning short film Stranded, which won over 20 international prizes, including Best Short Documentary at Cannes in 2024.

That success helped lay the foundation for the feature and positioned Mediavilla as one of the boldest new voices in global documentary filmmaking.

Alana Mediavilla speaks at the Marché du Film — Cannes Film Festival

“If we’ve found an industry that can unlock stranded energy and turn it into real power for people—especially in regions with energy poverty—why wouldn’t we look into it?” says Mediavilla. “Our privilege blinds us.

“The same thing we criticize could be the very thing that lifts the developing world to our standard of living. Ignoring that potential is a failure of imagination.”

Much like the decentralized network it explores, Dirty Coin is spreading globally through grassroots momentum.

Local leaders are hosting independent screenings around the world, from Roatán and Berlin to São Paulo and Madrid. Upcoming events include Toronto and Zurich, with more cities joining each month.

Mediavilla, who previously worked in creative leadership roles in the U.S. — including as a producer at Google — returned to Puerto Rico to found Campo Libre, a studio focused on high-caliber, globally relevant storytelling from the Caribbean.

She was also accepted into the Cannes Producers Network, a selective program open only to producers with box office releases in the past four years.

Mediavilla qualified after independently releasing Dirty Coin in theaters across Puerto Rico. Her participation in the network gave her direct access to meetings, insights, and connections with the most active distributors and producers working today.

The film’s next public screening will take place at the Anthem Film Festival in Palm Springs on Saturday, June 14 at 2 PM. Additional screenings and market appearances are planned throughout the year at Bitcoin events and international film platforms.

Dirty Coin at the Cannes Film Festival

Watch the Trailer + Access Press Materials

📂 EPK

🎬 Screener

🌍 Host a Screening

Follow the Movement

Instagram: https://www.instagram.com/dirty_coin_official/

Twitter: https://x.com/DirtyCoinDoc

Website: www.dirtycointhemovie.com -

@ 57d1a264:69f1fee1

2025-06-09 05:36:53

@ 57d1a264:69f1fee1

2025-06-09 05:36:53A Junior-level free online course divided in four modules aiming to help you develop experience and confidence with: 1) An approach to mechanical systems design that incorporates ideation, back-of-the-envelope analysis, computational analysis, and prototyping, iteratively and with an appropriate balance for the domain. 2) Designing custom mechanical components, finding and selecting common machine elements, and selecting electric motors and transmission elements to meet performance, efficiency and reliability goals.

The first project introduces the structure of projects in this course; introduces the design approach; reviews and begins to apply statics and stress analysis skills from prerequisite courses to design; introduces finite-element analysis; and provides an opportunity to work out any issues with fabrication methods.

The second project comprises a challenging, open-ended problem: design of a single component for mass efficiency. Success requires sophisticated application of the design approach, including statics analysis using free-body diagrams; stress, deflection and buckling analysis using simplified models and finite-element analysis; and testing of both low-fidelity and functional prototypes.

The third project introduces simple models of electric motors and gears; applies these models to selection of a motor operating point and gear ratio; and introduces the design of experiments to identify important system characteristics.

The fourth project comprises the challenging, open-ended design of a motor-driven machine to maximize electromechanical performance. It requires application of the Design Approach to complex problems in a team setting; effective incorporation of multiple custom and catalog components into an assembly; and sophisticated use motor and gear models, power analysis, and mass-efficient component design.

Start the course, it's free at https://biomechatronics.stanford.edu/mechanical-systems-design

https://stacker.news/items/1001283

-

@ 8bad92c3:ca714aa5

2025-06-07 11:01:44

@ 8bad92c3:ca714aa5

2025-06-07 11:01:44Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”

“We're not hodling just for the sake of hodling. There is a purpose to it.”

“Fiat money shortens your time horizon… you can never rest.”

“Savings precedes capital accumulation. You can’t build unless you’ve saved.”

“You're increasing the marginal value of everyone else’s Bitcoin.”

“True leisure is contemplation—the pursuit of the highest good.”

“What is Bitcoin for if not to make the conditions for magnificent acts of creation possible?”

“Bitcoin itself will last forever. Your stack might not. What will outlast your coins?”

“Only a whale can be magnificent.”

“The market will sell you all the crack you want. It’s up to you to demand beauty.”

Conclusion

This episode is a call to reimagine Bitcoin as more than a financial revolution—it’s a blueprint for civilizational renewal. Michael Goldstein reframes hodling as an act of moral stewardship, urging Bitcoiners to lower their time preference, build lasting institutions, and pursue truth, beauty, and legacy—not to escape the world, but to rebuild it on sound foundations.

Timestamps

00:00 - Intro

00:50 - Michael’s BBB presentation Hodl for Good

07:27 - Austrian principles on capital

15:40 - Fiat distorts the economic process

23:34 - Bitkey

24:29 - Hodl for Good triple entendre

29:52 - Bitcoin benefits everyone

39:05 - Unchained

40:14 - Leisure theory of value

52:15 - Heightening life

1:15:48 - Breaking from the chase makes room for magnificence

1:32:32 - Nakamoto Institute’s missionTranscript

(00:00) Fiat money is by its nature a disturbance. If money is being continually produced, especially at an uncertain rate, these uh policies are really just redistribution of wealth. Most are looking for number to go up post hyper bitcoinization. The rate of growth of bitcoin would be more reflective of the growth of the economy as a whole.

(00:23) Ultimately, capital requires knowledge because it requires knowing there is something that you can add to the structures of production to lengthen it in some way that will take time but allow you to have more in the future than you would today. Let Black Rockck buy the houses and you keep the sats, not the other way around.

(00:41) You wait until later for Larry Frink to try to sell you a [Music] mansion. And we're live just like that. Just like that. 3:30 on a Friday, Memorial Day weekend. It's a good good good way to end the week and start the holiday weekend. Yes, sir. Yes, sir. Thank you for having me here. Thank you for coming. I wore this hat specifically because I think it's I think it's very apppropo uh to the conversation we're going to have which is I hope an extension of the presentation you gave at Bitblock Boom Huddle for good. You were working on

(01:24) that for many weeks leading up to uh the conference and explaining how you were structuring it. I think it's a very important topic to discuss now as the Bitcoin price is hitting new all-time highs and people are trying to understand what am I doing with Bitcoin? Like you have you have the different sort of factions within Bitcoin.

(01:47) Uh get on a Bitcoin standard, get on zero, spend as much Bitcoin as possible. You have the sailors of the world are saying buy Bitcoin, never sell, die with your Bitcoin. And I think you do a really good job in that presentation. And I just think your understanding overall of Bitcoin is incredible to put everything into context. It's not either or.

(02:07) It really depends on what you want to accomplish. Yeah, it's definitely there there is no actual one-sizefits-all um for I mean nearly anything in this world. So um yeah, I mean first of all I mean there was it was the first conference talk I had given in maybe five years. I think the one prior to that uh was um bit block boom 2019 which was my meme talk which uh has uh become infamous and notorious.

(02:43) So uh there was also a lot of like high expectations uh you know rockstar dev uh has has treated that you know uh that that talk with a lot of reference. a lot of people have enjoyed it and he was expecting this one to be, you know, the greatest one ever, which is a little bit of a little bit of a uh a burden to live up to those kinds of standards.

(03:08) Um, but you know, because I don't give a lot of talks. Um, you know, I I I like to uh try to bring ideas that might even be ideas that are common. So, something like hodling, we all talk about it constantly. uh but try to bring it from a little bit of a different angle and try to give um a little bit of uh new light to it.

(03:31) I alsove I've I've always enjoyed kind of coming at things from a third angle. Um whenever there's, you know, there's there's all these little debates that we have in in Bitcoin and sometimes it's nice to try to uh step out of it and look at it a little more uh kind of objectively and find ways of understanding it that incorporate the truths of of all of them.

(03:58) uh you know cuz I think we should always be kind of as much as possible after ultimate truth. Um so with this one um yeah I was kind of finding that that sort of golden mean. So uh um yeah and I actually I think about that a lot is uh you know Aristotle has his his concept of the golden mean. So it's like any any virtue is sort of between two vices um because you can you can always you can always take something too far.

(04:27) So you're you're always trying to find that right balance. Um so someone who is uh courageous you know uh one of the vices uh on one side is being basically reckless. I I can't remember what word he would use. Uh but effectively being reckless and just wanting to put yourself in danger for no other reason than just you know the thrill of it.

(04:50) Um and then on the other side you would just have cowardice which is like you're unwilling to put yourself um at any risk at any time. Um, and courage is right there in the middle where it's understanding when is the right time uh to put your put yourself, you know, in in the face of danger um and take it on. And so um in some sense this this was kind of me uh in in some ways like I'm obviously a partisan of hodling.

(05:20) Um, I've for, you know, a long time now talked about the, um, why huddling is good, why people do it, why we should expect it. Um, but still trying to find that that sort of golden mean of like yes, huddle, but also what are we hodling for? And it's not we're we're not hodddling just merely for the sake of hodddling.

(05:45) There there is a a purpose to it. And we should think about that. And that would also help us think more about um what are the benefits of of spending, when should we spend, why should we spend, what should we spend on um to actually give light to that sort of side of the debate. Um so that was that was what I was kind of trying to trying to get into.

(06:09) Um, as well as also just uh at the same time despite all the talk of hodling, there's always this perennial uh there's always this perennial dislike of hodlers because we're treated as uh as if um we're just free riding the network or we're just greedy or you know any of these things. And I wanted to show how uh huddling does serve a real economic purpose.

(06:36) Um, and it does benefit the individual, but it also does uh it it has actual real social um benefits as well beyond merely the individual. Um, so I wanted to give that sort of defense of hodling as well to look at it from um a a broader position than just merely I'm trying to get rich. Um uh because even the person who uh that is all they want to do um just like you know your your pure number grow up go up moonboy even that behavior has positive ramifications on on the economy.

(07:14) And while we might look at them and have uh judgments about their particular choices for them as an individual, we shouldn't discount that uh their actions are having positive positive effects for the rest of the economy. Yeah. So, let's dive into that just not even in the context of Bitcoin because I think you did a great job of this in the presentation.

(07:36) just you've done a good job of this consistently throughout the years that I've known you. Just from like a first principles Austrian economics perspective, what is the idea around capital accumulation, low time preference and deployment of that capital like what what like getting getting into like the nitty-gritty and then applying it to Bitcoin? Yeah, it's it's a big question and um in many ways I mean I I even I barely scratched the surface.

(08:05) uh I I can't claim to have read uh all the volumes of Bombber works, you know, capital and interest and and stuff like that. Um but I think there's some some sort of basic concepts that we can look at that we can uh draw a lot out. Um the first uh I guess let's write that. So repeat so like capital time preference. Yeah. Well, I guess getting more broad like why sav -

@ 57d1a264:69f1fee1

2025-06-09 05:21:29

@ 57d1a264:69f1fee1

2025-06-09 05:21:29Beginning with the history of

kubectl apply, this article briefly introduces the concept of "thick/thin clients" in software design.Designing software is a process of constantly raising and solving questions. When designers face a requirement, they generate many questions, among which is a seemingly simple but fundamental one: "Where should the business logic (complexity) go?" Each time a new feature is introduced into a project, the increase in total complexity is almost certain, but how to distribute this complexity among modules can vary greatly.

Whether a client is thick or thin depends on the responsibilities it undertakes; neither is inherently superior, only more suitable for different scenarios. Should you choose a thick or thin client? In most cases, the answer is clear because many functions naturally suit a particular implementation. For example, global search is typically a "thin client, thick server" solution because it relies on all the data in the server's database.

Continue reading at https://www.piglei.com/articles/en_the_software_design_i_see_thick_thin_clients/

https://stacker.news/items/1001277

-

@ b1ddb4d7:471244e7

2025-06-07 11:01:06

@ b1ddb4d7:471244e7

2025-06-07 11:01:06“Not your keys, not your coins” isn’t a slogan—it’s a survival mantra in the age of digital sovereignty.

The seismic collapses of Mt. Gox (2014) and FTX (2022) weren’t anomalies; they were wake-up calls. When $8.7 billion in customer funds vanished with FTX, it exposed the fatal flaw of third-party custody: your bitcoin is only as secure as your custodian’s weakest link.

Yet today, As of early 2025, analysts estimate that between 2.3 million and 3.7 million Bitcoins are permanently lost, representing approximately 11–18% of bitcoin’s fixed maximum supply of 21 million coins, with some reports suggesting losses as high as 4 million BTC. This paradox reveals a critical truth: self-custody isn’t just preferable—it’s essential—but it must be done right.

The Custody Spectrum

Custodial Wallets (The Illusion of Control)

- Rehypothecation Risk: Most platforms lend your bitcoin for yield generation. When Celsius collapsed, users discovered their “held” bitcoin was loaned out in risky strategies.

- Account Freezes: Regulatory actions can lock withdrawals overnight. In 2023, Binance suspended dollar withdrawals for U.S. users citing “partner bank issues,” trapping funds for weeks.

- Data Vulnerability: KYC requirements create honeypots for hackers. The 2024 Ledger breach exposed 270,000 users’ personal data despite hardware security.

True Self-Custody

Self-custody means exclusively controlling your private keys—the cryptographic strings that prove bitcoin ownership. Unlike banks or exchanges, self-custody eliminates:- Counterparty risk (no FTX-style implosions)

- Censorship (no blocked transactions)

- Inflationary theft (no fractional reserve lending)

Conquering the Three Great Fears of Self-Custody

Fear 1: “I’ll Lose Everything If I Make a Mistake”

Reality: Human error is manageable with robust systems:

- Test Transactions: Always send a micro-amount (0.00001 BTC) before large transfers. Verify receipt AND ability to send back.

- Multi-Backup Protocol: Store seed phrases on fireproof/waterproof steel plates (not paper!). Distribute copies geographically—one in a home safe, another with trusted family 100+ miles away.

- SLIP39 Sharding: Split your seed into fragments requiring 3-of-5 shards to reconstruct. No single point of failure.

Fear 2: “Hackers Will Steal My Keys”

Reality: Offline storage defeats remote attacks:

- Hardware Wallets: Devices like Bitkey or Ledger keep keys in “cold storage”—isolated from internet-connected devices. Transactions require physical confirmation.

- Multisig Vaults: Bitvault’s multi-sig system requires attackers compromise multiple locations/devices simultaneously. Even losing two keys won’t forfeit funds.

- Air-Gapped Verification: Use dedicated offline devices for wallet setup. Never type seeds on internet-connected machines.

Fear 3: “My Family Can’t Access It If I Die”

Reality: Inheritance is solvable:

- Dead Man Switches: Bitwarden’s emergency access allows trusted contacts to retrieve encrypted keys after a pre-set waiting period (e.g., 30 days).

- Inheritance Protocols: Bitkey’s inheritance solution shares decryption keys via designated beneficiaries’ emails. Requires multiple approvals to prevent abuse.

- Public Key Registries: Share wallet XPUBs (not private keys!) with heirs. They can monitor balances but not spend, ensuring transparency without risk.

The Freedom Dividend

- Censorship Resistance: Send $10M BTC to a Wikileaks wallet without Visa/Mastercard blocking it.

- Privacy Preservation: Avoid KYC surveillance—non-custodial wallets like Flash require zero ID verification.

- Protocol Access: Participate in bitcoin-native innovations (Lightning Network, DLCs) only possible with self-custodied keys.

- Black Swan Immunity: When Cyprus-style bank bailins happen, your bitcoin remains untouched in your vault.

The Sovereign’s Checklist

- Withdraw from Exchanges: Move all BTC > $1,000 to self-custody immediately.

- Buy Hardware Wallet: Purchase DIRECTLY from manufacturer (no Amazon!) to avoid supply-chain tampering.

- Generate Seed OFFLINE: Use air-gapped device, write phrase on steel—never digitally.

- Test Recovery: Delete wallet, restore from seed before funding.

- Implement Multisig: For > $75k, use Bitvault for 2-of-3 multi-sig setup.

- Create Inheritance Plan: Share XPUBs/SLIP39 shards with heirs + legal documents.

“Self-custody isn’t about avoiding risk—it’s about transferring risk from opaque institutions to transparent, controllable systems you design.”

The Inevitable Evolution: Custody Without Compromise

Emerging solutions are erasing old tradeoffs:

- MPC Wallets: Services like Xapo Bank shatter keys into encrypted fragments distributed globally. No single device holds full keys, defeating physical theft.

- Social Recovery: Ethically designed networks (e.g., Bitkey) let trusted contacts restore access without custodial control.

- Biometric Assurance: Fingerprint reset protocols prevent lockouts from physical injuries.

Lost keys = lost bitcoin. But consider the alternative: entrusting your life savings to entities with proven 8% annual failure rates among exchanges. Self-custody shifts responsibility from hoping institutions won’t fail to knowing your system can’t fail without your consent.

Take action today: Move one coin. Test one recovery. Share one xpub. The path to unchained wealth begins with a single satoshi under your control.

-

@ b1ddb4d7:471244e7

2025-06-07 11:01:04

@ b1ddb4d7:471244e7

2025-06-07 11:01:04Hosted at the iconic Palace of Culture and Science—a prominent symbol of the communist era—the Bitcoin FilmFest offers a vibrant celebration of film through the lens of bitcoin. The venue itself provides a striking contrast to the festival’s focus, highlighting bitcoin’s core identity as a currency embodying independence from traditional financial and political systems.

𝐅𝐢𝐱𝐢𝐧𝐠 𝐭𝐡𝐞 𝐜𝐮𝐥𝐭𝐮𝐫𝐞 𝐰𝐢𝐭𝐡 𝐩𝐨𝐰𝐞𝐫𝐟𝐮𝐥 𝐦𝐮𝐬𝐢𝐜 𝐯𝐢𝐛𝐞𝐬.

Warsaw, Day Zero at #BFF25 (European Bitcoin Pizza Day) with @roger__9000, MadMunky and the @2140_wtf squad

pic.twitter.com/9ogVvWRReA

pic.twitter.com/9ogVvWRReA— Bitcoin FilmFest

(@bitcoinfilmfest) May 28, 2025

(@bitcoinfilmfest) May 28, 2025This venue represents an era when the state tightly controlled the economy and financial systems. The juxtaposition of this historical site with an event dedicated to bitcoin is striking and thought-provoking.

The event features a diverse array of activities, including engaging panel discussions, screenings of both feature-length and short films, workshops and lively parties. Each component designed to explore the multifaceted world of bitcoin and its implications for society, offering attendees a blend of entertainment and education.

The films showcase innovative narratives and insights into bitcoin’s landscape, while the panels facilitate thought-provoking discussions among industry experts and filmmakers.

Networking is a significant aspect of the festival, with an exceptionally open and friendly atmosphere that foster connections among participants. Participants from all over Europe gather to engage with like-minded individuals who share a passion for BTC and its implications for the future.

The open exchanges of ideas foster a sense of community, allowing attendees to forge new connections, collaborate on projects, and discuss the potential of blockchain technology implemented in bitcoin.

The organization of the festival is extraordinary, ensuring a smooth flow of information and an expertly structured schedule filled from morning until evening. Attendees appreciate the meticulous planning that allowed them to maximize their experience. Additionally, thoughtful touches such as gifts from sponsors and well-chosen locations for various events contribute to the overall positive atmosphere of the festival.

Overall, the Bitcoin FilmFest not only highlights the artistic expression surrounding bitcoin but also serves as a vital platform for dialogue—about financial freedom, the future of money, and individual sovereignty in a shifting world.

The event successfully bridges the gap between a historical symbol of control and a movement that celebrates freedom, innovation, and collaboration in the digital age, highlighting the importance of independence in financial systems while fostering a collaborative environment for innovation and growth.

Next year’s event is slated for June 5-7 2026. For further updates check: https://bitcoinfilmfest.com/

-

@ 7f6db517:a4931eda

2025-06-09 05:02:24

@ 7f6db517:a4931eda

2025-06-09 05:02:24

The newly proposed RESTRICT ACT - is being advertised as a TikTok Ban, but is much broader than that, carries a $1M Fine and up to 20 years in prison️! It is unconstitutional and would create massive legal restrictions on the open source movement and free speech throughout the internet.

The Bill was proposed by: Senator Warner, Senator Thune, Senator Baldwin, Senator Fischer, Senator Manchin, Senator Moran, Senator Bennet, Senator Sullivan, Senator Gillibrand, Senator Collins, Senator Heinrich, and Senator Romney. It has broad support across Senators of both parties.

Corrupt politicians will not protect us. They are part of the problem. We must build, support, and learn how to use censorship resistant tools in order to defend our natural rights.

The RESTRICT Act, introduced by Senators Warner and Thune, aims to block or disrupt transactions and financial holdings involving foreign adversaries that pose risks to national security. Although the primary targets of this legislation are companies like Tik-Tok, the language of the bill could potentially be used to block or disrupt cryptocurrency transactions and, in extreme cases, block Americans’ access to open source tools or protocols like Bitcoin.

The Act creates a redundant regime paralleling OFAC without clear justification, it significantly limits the ability for injured parties to challenge actions raising due process concerns, and unlike OFAC it lacks any carve-out for protected speech. COINCENTER ON THE RESTRICT ACT

If you found this post helpful support my work with bitcoin.

-

@ 58537364:705b4b85

2025-06-09 04:26:21

@ 58537364:705b4b85