-

@ 81022b27:2b8d0644

2025-06-08 15:18:50

@ 81022b27:2b8d0644

2025-06-08 15:18:50I’ve always gravitated to ideas and topics that are not quite mainstream:

Well, like CHIROPRACTIC.

But even in chiropractic school, I went fringe. I heard about one of the technique clubs (Toftness) that showed you how you could detect a subluxation by just rubbing your thumb over a piece of plexiglass.

We were discussing that in a group, and most of my friends were saying:

“What a load of shit!”

And that made my ears perk up.

So I started going to the club meetings.

I walk in, and there’s a guy face down on a chiropractic table while another guy was holding what looked like some sort of cyberpunk lens. He started rubbing it and worked it down the guy's spine.

He pointed out areas that were subluxated:

“Here.”

And going further down:

“Here.”

And:

“Here.”

Wow.

Then he “adjusted” by touching the spine with his index finger.

My mind was blown.

So you mean I didn’t have to be adjusted the way Harvey Fish did?

Dr. Fish was a great guy and would adjust students for, I think, $10. You’d go in, wait to see if he had any “real patients.” In between patients, he would adjust the students. He was heavy-handed and sure as hell able to move a bone.

So now I’m intrigued and curious. I studied and practiced any chance I had. I had different friends that I studied different things with.

(Except for Dyslexic Dave - nobody wanted to study with that guy. Our group did once, and we all failed a test. His dyslexia was so powerful, it overcame all of us.)

I’d study all the weird stuff with my friend Victoria, and then we would go get our network chiropractic adjustment from Dr. Michael Scimeca.

I found out that it wasn’t the Toftness lens that had the super-powers. Instead, it was because when your hand detected a change in energy over the spinal segments, there's a “galvanic response” similar to that of a polygraph lie detector test. So it made the skin on my hand “sweat,” and that made the plexiglass squeak and stick.

So it wasn’t the equipment. It was me.

After a while, I realized that I could feel a warmth on my chest right before the lens squeaked. So, I ditched the lens and started working on people where I “felt” the subluxations were located.

Seemed to work well - I always double-checked my “regular” chiropractic findings with what I felt. We studied for exams, then practiced technique on each other.

One time at a seminar, the instructor demonstrated what to do and asked for volunteers - one to be the patient and the other to be the doctor. I watched this guy struggling with his patient. It looked like he had flippers instead of hands; the whole interaction was super awkward.

All of a sudden, I started feeling uncomfortable and just blurted out:

“For God’s sake, leave him alone! Can’t you tell he is super annoyed and angry?”

Oops.

The instructor said, “Yes, maybe we should take a break.”

The guy that was the patient came up to me and asked, “How did you know?”

“I don’t know, I just felt it,” I said.

After that I started trying to see if I could feel what others were feeling. So when I was bored in a class, I’d go down the rows and try to feel what the my fellow students felt and quickly move on.

Going down the row: nothing, nothing nothing. This guy is pissed off, next one: nothing, nothing, Ow! She has a headache.

Dammit! Now I have a headache!

So that turned into a problem: When I worked on someone that had pain or other symptoms, I would take those on for myself. And the person I worked on would leave feeling great.

My friend Juanita did what is called an "attunement," and I became a Reiki Master.

Reiki masters are supposed to move energy around, but I was afraid I’d pick up too much of someone’s vibe and it would make me uncomfortable.

Plus, I can’t be doing energy work if I’m a chiropractor now.

So I kept all that checked and on the "down low"; sometimes I would get a "feeling" about a client while I was working on them. Surprisingly, it was always correct and it helped my client to make progress.

At some point, I started feeling that I needed to be true to myself, and if I had these abilities and I was able to use them to help the people that came to see me, then that's what I was going to do.

I've embraced this side of my work. If my clients need some emotional work, that’s what we work on, if they need some energy work, then they get it.

I suppose some people don’t want a chiropractor that’s metaphysical, but really-that’s how it all started. There are plenty of “evidence-based” chiropractors out there that can’t adjust their way out of a paper bag.

If the power goes off, they couldn’t use their lasers or whatever machine the Chiropractic Physiotherapy Industrial Complex wants you to buy now.

While I appreciate all the fancy parties they throw for us at continuing education seminars, they are infiltrating the chiropractic schools and now we are pumping out new chiropractors that only think they will be successful if they have the latest and greatest shiny machine.

I’ve studied a bunch of different things, I’ve found what works for me and refined it.

I tell my clients :

“I’m a better chiropractor today than I was yesterday, and I was pretty good back then!”

So I guess my next step is teaching some of this information and hoping to pass it on before my time here is up.

And you know what? I will love every damn minute of it!

There's nothing quite like sharing the weird, the wonderful, and the downright strange ways we can help people heal.

So, let's get to it—I've got a lot of sharing and teaching to do—it's going to be exciting!

-

@ 9ca447d2:fbf5a36d

2025-06-08 16:02:03

@ 9ca447d2:fbf5a36d

2025-06-08 16:02:03Wall Street is warming up to Bitcoin and getting closer and closer to it.

Cantor Fitzgerald, one of the oldest and most respected investment banks on Wall Street, has launched a $2 billion bitcoin-backed lending program.

They’ve reportedly already done their first deals, lending to two big digital asset companies: FalconX and Maple Finance.

This is a big step in connecting traditional finance to the fast-moving world of Bitcoin.

Cantor’s new service allows big investors, hedge funds and asset managers, to borrow money using bitcoin as collateral.

This is a game changer for institutions that hold bitcoin, as they can now access liquidity without having to sell their assets.

“Institutions holding bitcoin are looking to broaden their access to diverse funding sources,” said Christian Wall, co-CEO and global head of fixed income at Cantor Fitzgerald.

“And we are excited to support their liquidity needs to help them drive long term growth and success.”

The loans are not speculative or unsecured.

They are structured like traditional finance deals, backed by the borrower’s bitcoin. This reduces the risk for Cantor while giving bitcoin-holding companies new ways to grow and operate.

The first recipients of Cantor’s lending program are FalconX, a digital asset brokerage, and Maple Finance, a blockchain-based lending platform.

FalconX confirmed they secured a credit facility of over $100 million. Maple Finance also received the first tranche of their loan from Cantor.

This comes at a time when the bitcoin lending space is recovering after a tough period. Several big firms went under in 2022 and investor confidence was shaken.

Now with traditional finance on board, bitcoin-backed lending has returned. According to Galaxy Research the total size of the digital asset lending market grew to $36.5 billion in Q4 2024.

Cantor’s move into bitcoin-backed lending isn’t new. They announced their plans in July 2024 and have been building their presence in the Bitcoin space since then.

Earlier this year, they partnered with Tether, SoftBank and Bitfinex to launch Twenty One Capital, a $3.6 billion fund to buy over 42,000 bitcoin.

In May 2025 Cantor Equity Partners merged with Twenty One Capital and bought nearly $459 million worth of bitcoin.

They also own around $1.9 billion in shares of Strategy, a company that holds a lot of bitcoin. Clearly Cantor believes in bitcoin as a long-term asset.

Cantor is also a big player in the stablecoin space.

They manage U.S. Treasury reserves for Tether, the company behind the $142 billion USDT stablecoin. This adds another layer of trust and credibility to Cantor’s digital asset involvement.

To secure the bitcoin used as collateral, Cantor has partnered with digital asset custodians Anchorage Digital and Copper.co.

These companies are known for their robust security and institutional-grade infrastructure. Cantor hasn’t disclosed loan terms or interest rates but confirmed the lending will follow current regulations.

This also shows how traditional financial players are embracing DeFi.

Maple Finance for example allows undercollateralized lending using blockchain. By backing companies like Maple, Cantor is innovating while still having control and compliance.

For years, bitcoin-backed loans were only available through digital-asset-native companies like Genesis, BlockFi, and Ledn.

These loans were mostly for smaller clients and retail investors. But with Cantor’s entry, the scale and professionalism of bitcoin lending are expanding.

-

@ cae03c48:2a7d6671

2025-06-08 12:01:59

@ cae03c48:2a7d6671

2025-06-08 12:01:59Bitcoin Magazine

Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in BitcoinMeanwhile Insurance Bitcoin (Bermuda) Limited (“Meanwhile”) announced it has become the first company in the world to release externally audited financial statements denominated entirely in Bitcoin. According to the announcement, the company reported 220.4 BTC in assets and 25.29 BTC in net income for 2024, a 300% year over year increase.

Today marks a global first & historic event for us, along with the public release of our 2024 audited financial statements, covering our 1st year of sales.

As the 1st company in the world to have Bitcoin-denominated financial statements externally audited, we are excited to…

— meanwhile | Bitcoin Life Insurance (@meanwhilelife) June 5, 2025

“We’ve just made history as the first company in the world to have Bitcoin-denominated financial statements externally audited,” said Zac Townsend, CEO of Meanwhile. “This is an important, foundational step in reimagining the financial system based on a single, global, decentralized standard outside the control of any one government.”

The financial statements were audited by Harris & Trotter LLP and its digital asset division ht.digital. Meanwhile’s financials also comply with Bermuda’s Insurance Act 1978, noting that their BTC denominated financials were approved and comply with official guidelines. The firm, fully licensed by the Bermuda Monetary Authority (BMA), operates entirely in BTC and is prohibited from liquidating Bitcoin assets except through policyholder claims, positioning it as a long term holder.

“As the first regulated Bitcoin life insurance company, we view the BTC held by Meanwhile as inherently long-term in nature—primarily held to support the Company’s insurance liabilities over decades,” Townsend added. “This makes it significantly ‘stickier’ and resistant to market pressures compared to the BTC held by other companies as part of their treasury management strategies.”

Meanwhile’s 2024 financials also revealed 23.02 BTC in net premiums and 4.35 BTC in investment income, showing that its model not only preserves Bitcoin, but earns it. The company’s reserves (also held in BTC) were reviewed and approved by Willis Towers Watson (WTW).

Meanwhile also offers a Bitcoin Whole Life insurance product that allows policyholders to save, borrow, and build legacy wealth—entirely in BTC, and has plans to expand globally in 2025.

“We are incredibly proud of today’s news as it underscores how Meanwhile is at the forefront of the next phase of the convergence between Bitcoin and institutional financial markets,” said Tia Beckmann, CFO of Meanwhile. “Now having generated net income in BTC, we have demonstrated that we are earning it through a sustainable insurance business model designed for the long term.”

This post Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in Bitcoin first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ dfa02707:41ca50e3

2025-06-08 03:01:34

@ dfa02707:41ca50e3

2025-06-08 03:01:34- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ b1ddb4d7:471244e7

2025-06-08 02:00:45

@ b1ddb4d7:471244e7

2025-06-08 02:00:45When Sergei talks about bitcoin, he doesn’t sound like someone chasing profits or followers. He sounds like someone about to build a monastery in the ruins.

While the mainstream world chases headlines and hype, Sergei shows up in local meetups from Sacramento to Cleveland, mentors curious minds, and shares what he knows is true – hoping that, with the right spark, someone will light their own way forward.

We interviewed Sergei to trace his steps: where he started, what keeps him going, and why teaching bitcoin is far more than explaining how to set up a node – it’s about reaching the right minds before the noise consumes them. So we began where most journeys start: at the beginning.

First Steps

- So, where did it all begin for you and what made you stay curious?

I first heard about bitcoin from a friend’s book recommendation, American Kingpin, the book about Silk Road (online drug marketplace). He is still not a true bitcoiner, although I helped him secure private keys with some bitcoin.

I was really busy at the time – focused on my school curriculum, running a 7-bedroom Airbnb, and working for a standardized test prep company. Bitcoin seemed too technical for me to explore, and the pace of my work left no time for it.

After graduating, while pursuing more training, I started playing around with stocks and maximizing my savings. Passive income seemed like the path to early retirement, as per the promise of the FIRE movement (Financial Independence, Retire Early). I mostly followed the mainstream news and my mentor’s advice – he liked preferred stocks at the time.

I had some Coinbase IOUs and remember sending bitcoin within the Coinbase ledger to a couple friends. I also recall the 2018 crash; I actually saw the legendary price spike live but couldn’t benefit because my funds were stuck amidst the frenzy. I withdrew from that investment completely for some time. Thankfully, my mentor advised to keep en eye on bitcoin.

Around late 2019, I started DCA-ing cautiously. Additionally, my friend and I were discussing famous billionaires, and how there was no curriculum for becoming a billionaire. So, I typed “billionaires” into my podcast app, and landed on We Study Billionaires podcast.

That’s where I kept hearing Preston Pysh mention bitcoin, before splitting into his own podcast series, Bitcoin Fundamentals. I didn’t understand most of the terminology of stocks, bonds, etc, yet I kept listening and trying to absorb it thru repetition. Today, I realize all that financial talk was mostly noise.

When people ask me for a technical explanation of fiat, I say: it’s all made up, just like the fiat price of bitcoin! Starting in 2020, during the so-called pandemic, I dove deeper. I religiously read Bitcoin Magazine, scrolled thru Bitcoin Twitter, and joined Simply Bitcoin Telegram group back when DarthCoin was an admin.

DarthCoin was my favorite bitcoiner – experienced, knowledgeable, and unapologetic. Watching him shift from rage to kindness, from passion to despair, gave me a glimpse at what a true educator’s journey would look like.

The struggle isn’t about adoption at scale anymore. It’s about reaching the few who are willing to study, take risks, and stay out of fiat traps. The vast majority won’t follow that example – not yet at least… if I start telling others the requirements for true freedom and prosperity, they would certainly say “Hell no!”

- At what point did you start teaching others, and why?

After college, I helped teach at a standardized test preparation company, and mentored some students one-on-one. I even tried working at a kindergarten briefly, but left quickly; Babysitting is not teaching.

What I discovered is that those who will succeed don’t really need my help – they would succeed with or without me, because they already have the inner drive.

Once you realize your people are perishing for lack of knowledge, the only rational thing to do is help raise their level of knowledge and understanding. That’s the Great Work.

I sometimes imagine myself as a political prisoner. If that were to happen, I’d probably start teaching fellow prisoners, doctors, janitors, even guards. In a way we already live in an open-air prison, So what else is there to do but teach, organize, and conspire to dismantle the Matrix?

Building on Bitcoin

- You hosted some in-person meetups in Sacramento. What did you learn from those?

My first presentation was on MultiSig storage with SeedSigner, and submarine swaps through Boltz.exchange.

I realized quickly that I had overestimated the group’s technical background. Even the meetup organizer, a financial advisor, asked, “How is anyone supposed to follow these steps?” I responded that reading was required… He decided that Unchained is an easier way.

At a crypto meetup, I gave a much simpler talk, outlining how bitcoin will save the world, based on a DarthCoin’s guide. Only one person stuck around to ask questions – a man who seemed a little out there, and did not really seem to get the message beyond the strength of cryptographic security of bitcoin.

Again, I overestimated the audience’s readiness. That forced me to rethink my strategy. People are extremely early and reluctant to study.

- Now in Ohio, you hold sessions via the Orange Pill App. What’s changed?

My new motto is: educate the educators. The corollary is: don’t orange-pill stupid normies (as DarthCoin puts it).

I’ve shifted to small, technical sessions in order to raise a few solid guardians of this esoteric knowledge who really get it and can carry it forward.

The youngest attendee at one of my sessions is a newborn baby – he mostly sleeps, but maybe he still absorbs some of the educational vibes.

- How do local groups like Sactown and Cleveland Bitcoiners influence your work?

Every meetup reflects its local culture. Sacramento and Bay Area Bitcoiners, for example, do camping trips – once we camped through a desert storm, shielding our burgers from sand while others went to shoot guns.

Cleveland Bitcoiners are different. They amass large gatherings. They recently threw a 100k party. They do a bit more community outreach. Some are curious about the esoteric topics such as jurisdiction, spirituality, and healthful living.

I have no permanent allegiance to any state, race, or group. I go where I can teach and learn. I anticipate that in my next phase, I’ll meet Bitcoiners so advanced that I’ll have to give up my fiat job and focus full-time on serious projects where real health and wealth are on the line.

Hopefully, I’ll be ready. I believe the universe always challenges you exactly to your limit – no less, no more.

- What do people struggle with the most when it comes to technical education?

The biggest struggle isn’t technical – it’s a lack of deep curiosity. People ask “how” and “what” – how do I set up a node, what should one do with the lightning channels? But very few ask “why?”

Why does on-chain bitcoin not contribute to the circular economy? Why is it essential to run Lightning? Why did humanity fall into mental enslavement in the first place?

I’d rather teach two-year-olds who constantly ask “why” than adults who ask how to flip a profit. What worries me most is that most two-year-olds will grow up asking state-funded AI bots for answers and live according to its recommendations.

- One Cleveland Bitcoiner shows up at gold bug meetups. How valuable is face-to-face education?

I don’t think the older generation is going to reverse the current human condition. Most of them have been under mind control for too long, and they just don’t have the attention span to study and change their ways.

They’re better off stacking gold and helping fund their grandkids’ education. If I were to focus on a demographic, I’d go for teenagers – high school age – because by college, the indoctrination is usually too strong, and they’re chasing fiat mastery.

As for the gold bug meetup? Perhaps one day I will show up with a ukulele to sing some bitcoin-themed songs. Seniors love such entertainment.

- How do you choose what to focus on in your sessions, especially for different types of learners?

I don’t come in with a rigid agenda. I’ve collected a massive library of resources over the years and never stopped reading. My browser tab and folder count are exploding.

At the meetup, people share questions or topics they’re curious about, then I take that home, do my homework, and bring back a session based on those themes. I give them the key takeaways, plus where to dive deeper.

Most people won’t – or can’t – study the way I do, and I expect attendees to put in the work. I suspect that it’s more important to reach those who want to learn but don’t know how, the so-called nescient (not knowing), rather than the ignorant.

There are way too many ignorant bitcoiners, so my mission is to find those who are curious what’s beyond the facade of fake reality and superficial promises.

That naturally means that fewer people show up, and that’s fine. I’m not here for the crowds; I’m here to educate the educators. One bitcoiner who came decided to branch off into self-custody sessions and that’s awesome. Personally, I’m much more focused on Lightning.

I want to see broader adoption of tools like auth, sign-message, NWC, and LSPs. Next month, I’m going deep into eCash solutions, because let’s face it – most newcomers won’t be able to afford their own UTXO or open a lightning channel; additionally, it has to be fun and easy for them to transact sats, otherwise they won’t do it. Additionally, they’ll need to rely on

-

@ cae03c48:2a7d6671

2025-06-08 00:01:17

@ cae03c48:2a7d6671

2025-06-08 00:01:17Bitcoin Magazine

Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in BitcoinMeanwhile Insurance Bitcoin (Bermuda) Limited (“Meanwhile”) announced it has become the first company in the world to release externally audited financial statements denominated entirely in Bitcoin. According to the announcement, the company reported 220.4 BTC in assets and 25.29 BTC in net income for 2024, a 300% year over year increase.

Today marks a global first & historic event for us, along with the public release of our 2024 audited financial statements, covering our 1st year of sales.

As the 1st company in the world to have Bitcoin-denominated financial statements externally audited, we are excited to…

— meanwhile | Bitcoin Life Insurance (@meanwhilelife) June 5, 2025

“We’ve just made history as the first company in the world to have Bitcoin-denominated financial statements externally audited,” said Zac Townsend, CEO of Meanwhile. “This is an important, foundational step in reimagining the financial system based on a single, global, decentralized standard outside the control of any one government.”

The financial statements were audited by Harris & Trotter LLP and its digital asset division ht.digital. Meanwhile’s financials also comply with Bermuda’s Insurance Act 1978, noting that their BTC denominated financials were approved and comply with official guidelines. The firm, fully licensed by the Bermuda Monetary Authority (BMA), operates entirely in BTC and is prohibited from liquidating Bitcoin assets except through policyholder claims, positioning it as a long term holder.

“As the first regulated Bitcoin life insurance company, we view the BTC held by Meanwhile as inherently long-term in nature—primarily held to support the Company’s insurance liabilities over decades,” Townsend added. “This makes it significantly ‘stickier’ and resistant to market pressures compared to the BTC held by other companies as part of their treasury management strategies.”

Meanwhile’s 2024 financials also revealed 23.02 BTC in net premiums and 4.35 BTC in investment income, showing that its model not only preserves Bitcoin, but earns it. The company’s reserves (also held in BTC) were reviewed and approved by Willis Towers Watson (WTW).

Meanwhile also offers a Bitcoin Whole Life insurance product that allows policyholders to save, borrow, and build legacy wealth—entirely in BTC, and has plans to expand globally in 2025.

“We are incredibly proud of today’s news as it underscores how Meanwhile is at the forefront of the next phase of the convergence between Bitcoin and institutional financial markets,” said Tia Beckmann, CFO of Meanwhile. “Now having generated net income in BTC, we have demonstrated that we are earning it through a sustainable insurance business model designed for the long term.”

This post Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in Bitcoin first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ a296b972:e5a7a2e8

2025-06-07 16:39:43

@ a296b972:e5a7a2e8

2025-06-07 16:39:43Nur für‘s Protokoll. Hiermit erkläre ich, Georg Ohrweh, im tatsächlich vorhandenen vollen Besitz meiner geistigen Kräfte, dass Herr Lauterbach, gleich welche Position er in Zukunft noch bekleiden sollte, für mich nicht zuständig ist. Basta.

Ein Erguss dieses verhaltensoriginellen Über-alles-Bescheidwissers:

„Wir kommen jetzt in eine Phase hinein, wo der Ausnahmezustand die Normalität sein wird. Wir werden ab jetzt immer im Ausnahmezustand sein. Der Klimawandel wird zwangsläufig mehr Pandemien bringen.“

Wie kann es sein, dass solch eine Ausnahme-Gestalt, die schon rein äußerlich die Phantasie zu Vergleichen anregt, sich leider auch genauso verhält, wie die Gestalten, die in diesen Phantasien vorkommen, ungebremst auf der Panik-Klaviatur kakophonische Klänge erzeugen darf? Obwohl ein wenig Wahrheit ist auch enthalten: Wir sind tatsächlich immer im Ausnahmezustand, im Ausnahmezustand des fortgeschrittenen Wahnsinns.

Wie kann es sein, dass dieser Haaaarvardist seinen persönlich empfundenen Ausnahmezustand zum Allgemeingut erklären kann? Welche Verknüpfungs-Phantasien hat er sonst noch studiert? Er ist ja auch noch Vorsitzender im Raumfahrtausschuss. Was kommt als Nächstes? Eine Klima-Pandemie, verursacht durch außerirdische Viren, die die Temperaturen beeinflussen können? Im aktuellen Zeitgeist gibt es nichts, was nicht gedacht wird. Wem die besseren Absurditäten einfallen, der gewinnt. Man muss sich schon den gegebenen Denkstrukturen etwas anpassen, aber sich auch ein wenig Mühe geben.

Nach dem Wechsel der ehemaligen Außen-Dings zur UN (mit dem Ziel, aus den Vereinten Nationen die Feministischen Nationen zu gestalten) und des ehemaligen Wirtschafts-Dings in den Außenausschuss und als Gastdozent in Kalifornien (Thema: Wirtschaftsvernichtung unter Einbeziehung des gespannten Verhältnisses unter Geschwistern aufgrund ärmlicher Verhältnisse, am Beispiel des Märchens von Hänsel und Gretel) , jetzt auch noch der ehemalige Chef-Panikmacher zur WHO.

…und der Wahnsinn wurde hinausgetragen in die Welt, und es wurde dunkel, und es ward Nacht, und es wurde helle, und es ward Tag, der Wind blies oder auch nicht (was macht der Wind eigentlich, wenn er nicht weht?), und es ward Winter, und es wurde kälter, und es wurde wärmer, und es ward Sommer. Es regnete nicht mehr, die Wolken schwitzten. Und Putin verhinderte (wer auch sonst), dass das Eis in der Antarktis abnahm.

Wiederholte Bodentemperaturen in der Toskana von 50 Grad Celsius. Zu erwartende Wassertemperaturen während Ferragosto an der italienischen Adria von durchschnittlich 100 Grad Celsius. An Stellen mit wenig Strömung stiegen schon die ersten Kochblasen auf. Doch dann kam der durch Lachs gestählte, salzlose Super-Karl und rettete mit einem durch die WHO diktierten Klima-Logdown die gesamte Menschheit. Wer besser, als er konnte wissen, dass ein Klima-Logdown weitgehend nebenwirkungsfrei ist.

Was für ein Segen, dass Karl der Große, der uns so siegreich durch die Corona-Schlacht geführt hat, jetzt auch gegen das Klima in den Krieg zieht.

Wer kennt das nicht, Tage der Qual, in denen man zugeben muss: Ich hab‘ heute so schlimm Klima.

Viele Klimaexperten, die weltweit in der Qualitätspropaganda zitiert werden, zeichnen sich besonders dadurch aus, dass sie mit einer maximalen Abweichung von einem Grad Celsius ein Thermometer fehlerfrei ablesen können. Diese Ungenauigkeit wird der Erdverkochungsexperte sicher als erstes beheben.

In einer aufopfernden Studie während eines Urlaubs in 2023, in der um die damalige Zeit erstmals eisfreien Toskana, hat er den von ihm ausgetüftelten Klimaschutzplan ins Rheinische übersetzt. Titel: „Schützen Sie sisch, und, äh, andere!“ Weiter konnte er erforschen, dass die Bodentemperatur nicht immer mit der Temperatur des Erdkerns übereinstimmen muss.

Durch seine unermüdlichen Studien, können Hitzetote in Zukunft besser zugeordnet werden. Man weiß dann, ob jemand an hohen oder mit hohen Temperaturen gestorben ist. Der asymptomatische Klimawandel kann so in Zukunft viel besser bewertet werden. Man hat aus geringfügigen Fehlern gelernt und die Methoden erheblich verbessert.

Eine präzise Vorhersage der Jahreszeiten, vor allem die des Sommers, wird bald ebenfalls möglich sein. Es kann jetzt vor jahreszeitbedingten, teilweise sogar täglich schwankenden Temperaturveränderungen rechtzeitig gewarnt werden. Im Herbst können Heizempfehlungen für die ahnungslose Bevölkerung herausgegeben werden. Frieren war gestern, wissen wann es kalt wird, ist heute. Es wird an Farben geforscht, die noch roter sein sollen, als die, die jetzt in den Wetterkarten bei 21 Grad bereits verwendet werden.

Eine allgemeine Heizpflicht soll es europaweit zunächst nicht geben.

Weiter soll die Lichteinstrahlung der Sonne noch präziser bestimmt werden, damit den Europäern, in Ergänzung zur mitteleuropäischen Sommerzeit, jetzt auch noch genau mitgeteilt werden kann, wann es Tag und wann es Nacht ist.

Das Hinausschauen aus dem Fenster, zum Beispiel, ob es schon dunkel draußen ist, erübrigt sich. Die Tageszeit, in Ergänzung zur herkömmlichen Uhrzeit, wird demnächst automatisch mit dem Klima-Pass übermittelt werden. Zu Anfang natürlich erst einmal freiwillig.

Durch die persönliche ID können dann auch schnell und unkompliziert Sonderprämien überwiesen werden, sofern man sich klimakonform verhalten hat, damit man sich rechtzeitig vor Winterbeginn eine warme Jacke oder einen Mantel kaufen kann. Das Sparen von Bargeld auf eine bevorstehende größere Anschaffung von Winterkleidung wird somit überflüssig.

Ob es am Ende nun um Hitze oder Kälte geht, spielt eigentlich gar keine Rolle, denn wie wussten schon die Ahnen zu berichten: Was gut für die Kälte ist, ist auch gut für die Wärme.

Westliche Mächte unternehmen immer wieder Versuche, eskalierend auf den Ukraine-Konflikt einzuwirken, damit man atombetriebene Heizpilze aufstellen kann, an denen sich die Europäer im Winter auch im Freien wärmen können.

Wie praktisch, dass man nicht nur Gesundheit und Klima, sondern auch Klima und Krieg miteinander verbinden kann. Alles so, oder so ähnlich möglicherweise nachzulesen im genialen Hitzeschutzplan á la Lauterbach.

Besonders Deutschland braucht nicht nur lauterbachsche Hitzeschutzräume, nein es braucht atomsichere Hitzeschutzbunker, so schlägt man gleich zwei Fliegen mit einer Klappe.

Für die, die es sich leisten können, hier ein Vorschlag. Der K2000:

Für die weniger gut Betuchten reicht auch ein kühles Kellerloch, das man idealerweise im Februar beziehen und nicht vor November wieder verlassen sollte, so die Empfehlung auch von führenden Klima-Forschern, die es ja wissen müssen. Von Dezember bis Januar empfiehlt sich ein Besuch auf den Bahamas, besonders dann, wenn man eine leichte Erkältung verspürt.

Nur Verschwörungstheoretiker behaupten, dass die eigenartigen Anschlussverwendungen der Extrem-Kapazitäten, zu denen Lauterbach ohne Zweifel dazugehört, wie dicke rote Pfeile wirken, die auf Institutionen und Organisationen zeigen, um die man unter allen Umständen einen großen Bogen machen sollte, weil sie möglicherweise nichts Gutes im Schilde führen. Minimal sollen sie angeblich Unsinn verbreiten, maximal sollen sie gehörigen Schaden anrichten.

Man muss sich nur ein paar Gedanken machen, schon kann man feststellen, wie alles mit allem zusammenhängt.

“Dieser Beitrag wurde mit dem Pareto-Client geschrieben.”

* *

(Bild von pixabay)

-

@ 81022b27:2b8d0644

2025-06-08 15:06:12

@ 81022b27:2b8d0644

2025-06-08 15:06:12I have a family practice where I see pretty much everything, from infants to the elderly, athletes to people with disabilities.

When someone gets good results, they always want their loved ones to benefit in the same way.

Husbands tell their wives, wives bring in their husbands...

I even had a guy bring both his wife and his girlfriend! On different days, of course.

So, sometimes we notice a little bit of drama here and there. When one of our couples divorces, someone usually gets custody of the chiropractor.

It's rare that I keep seeing both parties.

It's probably for the best, because there was this one time when a guy showed up with his new "friend" while the ex’s best friend was in the waiting area.

Well, it was like an episode of the "Jerry Springer Show" that day.

Let's get to the story:

This one guy I’d been working on started coming in more frequently, complaining of more pain, more aches, more everything.

I've been doing this for a while now, so I told him that when I see this, it's one of two things:

Either you are physically doing something to aggravate the issue,

Or you are under emotional stress.

He told me that he and his wife were having problems, and there was lots of drama.

Of course, I kept working on him. Sometimes I did some emotional work, but with men, I have to be very business-like when dealing with emotions because we don't like to deal with them.

Time passed, and they finally divorced.

He still comes in regularly, and I've noticed he has less pain and fewer issues. His visits are more like "wellness visits"; he seems in better spirits.

I thought I'd never see the ex-wife again, but she showed up today, and when I checked her, she's doing better than ever!

It got me thinking... these people are way better off divorced! They're not in constant fight-or-flight mode; I'm sure they are happier or will be. It's a positive all the way around.

I've been divorced twice. That's not something I'm proud of. I see both those divorces as failures.

I was 23 when I got married the first time. We were both super young and unprepared. We struggled for four years, and then she wanted out.

Not that I blame her; I was unhappy with myself, and my frustration and unhappiness bled into the relationship.

My second marriage lasted a lot longer than the first. After all we were older, ended up having 2 kids and I really, really tried.

I was just terrified of losing my girls. I even recall saying that I was willing to be miserable and unhappy just “for the kids”

The truth is once we separated, I probably spent more “quality time” with my daughters than I had before.

But here’s the thing in both marriages I would have willingly given up the chance to be happier with a clean end to the relationship in order to give it another shot.

At some point you just run out of shots.

I see elderly couples out at restaurants and they hardly say anything to each other. Is it because they know each other so well that they don’t need to speak, or is one of them silently praying the other one will drop dead so they will finally have a chance at happiness?

What I’m trying to say here is:

Maybe there is no hope for that relationship that you are giving CPR

Maybe it’s time to move on.

Live Long and Prosper. 🖖

-

@ 41fa852b:af7b7706

2025-06-08 11:34:44

@ 41fa852b:af7b7706

2025-06-08 11:34:44"The poison was never forced - it was offered gently, until you forgot it was poison at all." - Mark Twain

Happy Sunday, folks.

Below is your weekly roundup of events for the coming week.

Added to the event section this week, an exciting new Scottish Bitcoin Conference, happening in August.

Check out all the details below.

This week's sponsor is…

Upcoming Bitcoin Meetups

Happening this week…

-

Dundee Bitcoin: Join them on the 2nd Monday of every month from 17:30 to 20:30 PM at The Wine Press, 16 Shore Terrace, Dundee DD1 3DN. This month's meetup is on Monday 9th. 🍻

-

Canterbury Bitcoin: Meeting this month at the The Dolphin Pub in Canterbury at 7 PM on Tuesday the 10th of June. An informal meetup to discuss Bitcoin and chat. 🍺

-

Glasgow Bitcoin: Meetups are held every second Wednesday of the month. This is a place for people in and around Glasgow to discuss Bitcoin. 18:00 - 23:00 at The Piper Bar, G1 1HL. This month on Wednesday 11th. 🍻

-

St Albans: This is a new meetup happening on the second Wednesday of each month. This month, it's from 19:00 to 22:00 on the 11th at the Robin Hood of St Albans, Victoria St, St Albans. 🍻

-

Children of Riddim - Festival - Bitcoin Stage: Children of Riddim Festival is bringing Bitcoin to the big stage from the 12th--16th June in Hemel Hempstead, with 150+ DJs, artists, and speakers. The Barn of Freedom will host Bitcoin talks, music, and Nostr-powered apps. Tickets and donations for the stage can be made via geyser.fund, with camping included. Acts/speakers include Joe Bryan, Metamick, Roger9000, Angor, and more. 🎉🪩

-

Bitcoin Beach Bournemouth: Every second Thursday of the month at Chaplins Cellar Bar. 529 Christchurch Road, Boscombe, United. You'll find them in the Cogg Room at 19:30. This month it's the 12th. 🍺

-

Bury St Edmunds Bitcoin: is reviving the medieval spirit of the Folkmoot, one Bitcoin meetup at a time. Their second gathering takes place this Friday at 17:30 at Edmundo Lounge. They've also just launched a brand new website.

-

Stoke Bitcoin Meetup: The Stoke Bitcoin meetup is back! They will have Bitcoin coffee to taste, delivered by hand directly from the mountains of El Salvador and grown by @lacruzboss in Berlin, El Salvador. 15:00 on Friday 13th. ☕️🍻

-

Bitcoin Walk - Edinburgh: Every Saturday they walk around Arthur's Seat in this historic city. Join them at 12 pm to chat about all things Bitcoin and keep fit. 🚶🏽♂️🚶🏼♀️🚶🏻

-

Bitcoin East: Join Bitcoin East in Bury St. Edmunds on Sunday 15th, 12:00 at Hopsters Bar, Felixstowe. All welcome, Bitcoiners and anyone else curious about Bitcoin. 🍺

New Businesses Accepting Bitcoin

This week we have…

- Core Agency: A creative communications firm that blends financial expertise with bold storytelling to help businesses in finance and beyond stand out. Based in the UK, they specialise in strategic planning, brand identity, content production, and public relations, delivering everything from investor-focused media to high-impact digital campaigns. With in-house studios for video, animation, and live streaming, Core offers end-to-end solutions that are both visually compelling and commercially effective. Their mission is to bring clarity, creativity, and confidence to brands navigating complex markets. Whether you're a fintech startup or a global institution, Core helps you communicate with purpose and originality. Now accepting bitcoin payments. 📈

Upcoming Special Events

These events aren't happening next week, but they're important to add to your calendar now as tickets are selling fast.

The Bitcoin Beach Retreat: An annual Bitcoin-only gathering held at a scenic coastal campsite in North Wales. Celebrating its fifth year in 2025, the retreat offers a relaxed, community-driven alternative to traditional conferences.

From July 11--14, up to 120 Bitcoiners will come together to share knowledge, enjoy beachside BBQs, and strengthen their networks under the stars. With no pre-booked speakers, the event thrives on peer-led workshops and spontaneous discussions, fostering genuine connections among attendees. Emphasising local engagement, the retreat directs the majority of its funds into the surrounding community, with 42% of expenses paid in Bitcoin last year.

Whether attending solo or with family, attendees can expect a welcoming environment dedicated to sound money and shared values.

Scottish Bitcoin Conference: Taking place on August 23, 2025, at the Glasgow University Union, located at 32 University Avenue, Glasgow G12 8LX. From 09:00 to 16:30.

Featuring an impressive roster of speakers, including Anthony Scaramucci, Hashley Giles, Rick Messit, Dr. Peter Connor, Claire Chisholm, Roger9000, John Magill, Ian Scanlon, Robin Thatcher, Jamie Plowman, Robbie Maltby, Russell Rukin, Peter Lane, Francesco Madonna, and Sam Roberts.

Open to all, this conference offers a unique opportunity for Bitcoiners and newcomers alike to connect and learn in the vibrant setting of Glasgow.

Get Involved

- Volunteer: Passionate about merchant adoption? Reach out to Bridge2Bitcoin on Twitter or website.

- Start a Meetup: Want to launch a Bitcoin meetup? We'll support you. Contact us on Twitter or just reply to this email.

- Contribute to BTCMaps: Help maintain this key Bitcoin resource--no coding skills needed. Update a UK area.

- Telegram: Join our Channel for UK meetup updates

- Feedback: Reply to this email with ideas and suggestions.

This week's sponsors is…

Get out and support the meetups where you can, visit Bitcoin Events UK for more info on each meetup and to find your closest on the interactive map.

Stay tuned for more updates next week!

Simon.

-

-

@ 9ca447d2:fbf5a36d

2025-06-07 16:01:19

@ 9ca447d2:fbf5a36d

2025-06-07 16:01:19Wall Street is warming up to Bitcoin and getting closer and closer to it.

Cantor Fitzgerald, one of the oldest and most respected investment banks on Wall Street, has launched a $2 billion bitcoin-backed lending program.

They’ve reportedly already done their first deals, lending to two big digital asset companies: FalconX and Maple Finance.

This is a big step in connecting traditional finance to the fast-moving world of Bitcoin.

Cantor’s new service allows big investors, hedge funds and asset managers, to borrow money using bitcoin as collateral.

This is a game changer for institutions that hold bitcoin, as they can now access liquidity without having to sell their assets.

“Institutions holding bitcoin are looking to broaden their access to diverse funding sources,” said Christian Wall, co-CEO and global head of fixed income at Cantor Fitzgerald.

“And we are excited to support their liquidity needs to help them drive long term growth and success.”

The loans are not speculative or unsecured.

They are structured like traditional finance deals, backed by the borrower’s bitcoin. This reduces the risk for Cantor while giving bitcoin-holding companies new ways to grow and operate.

The first recipients of Cantor’s lending program are FalconX, a digital asset brokerage, and Maple Finance, a blockchain-based lending platform.

FalconX confirmed they secured a credit facility of over $100 million. Maple Finance also received the first tranche of their loan from Cantor.

This comes at a time when the bitcoin lending space is recovering after a tough period. Several big firms went under in 2022 and investor confidence was shaken.

Now with traditional finance on board, bitcoin-backed lending has returned. According to Galaxy Research the total size of the digital asset lending market grew to $36.5 billion in Q4 2024.

Cantor’s move into bitcoin-backed lending isn’t new. They announced their plans in July 2024 and have been building their presence in the Bitcoin space since then.

Earlier this year, they partnered with Tether, SoftBank and Bitfinex to launch Twenty One Capital, a $3.6 billion fund to buy over 42,000 bitcoin.

In May 2025 Cantor Equity Partners merged with Twenty One Capital and bought nearly $459 million worth of bitcoin.

They also own around $1.9 billion in shares of Strategy, a company that holds a lot of bitcoin. Clearly Cantor believes in bitcoin as a long-term asset.

Cantor is also a big player in the stablecoin space.

They manage U.S. Treasury reserves for Tether, the company behind the $142 billion USDT stablecoin. This adds another layer of trust and credibility to Cantor’s digital asset involvement.

To secure the bitcoin used as collateral, Cantor has partnered with digital asset custodians Anchorage Digital and Copper.co.

These companies are known for their robust security and institutional-grade infrastructure. Cantor hasn’t disclosed loan terms or interest rates but confirmed the lending will follow current regulations.

This also shows how traditional financial players are embracing DeFi.

Maple Finance for example allows undercollateralized lending using blockchain. By backing companies like Maple, Cantor is innovating while still having control and compliance.

For years, bitcoin-backed loans were only available through digital-asset-native companies like Genesis, BlockFi, and Ledn.

These loans were mostly for smaller clients and retail investors. But with Cantor’s entry, the scale and professionalism of bitcoin lending are expanding.

-

@ eac63075:b4988b48

2025-06-07 15:14:03

@ eac63075:b4988b48

2025-06-07 15:14:03Ever imagined sending a Bitcoin transaction without an internet connection? Or talking to your friends during a total blackout when the cell network just vanishes? It sounds like science fiction, but this technology is an accessible reality, built with low-cost hardware and open-source software. Welcome to the world of mesh networks, Meshtastic, and the BTC Mesh project.

This guide explores the universe of decentralized communication networks, showing how they work, why they are vital for our digital sovereignty, and how you can use them to strengthen your privacy and resilience—not just in communication, but in your Bitcoin transactions as well.

https://fountain.fm/episode/nr8qWgi7XNoBbDkc8GZj

https://open.spotify.com/episode/6vKW7Lhi3uOUhlRogAtgej

What Are Mesh Networks and Why Should You Care?

Our connected world runs on a fragile, centralized infrastructure. Cell towers, internet providers, data centers—if one of these points fails, communication stops. A mesh network turns this logic on its head.

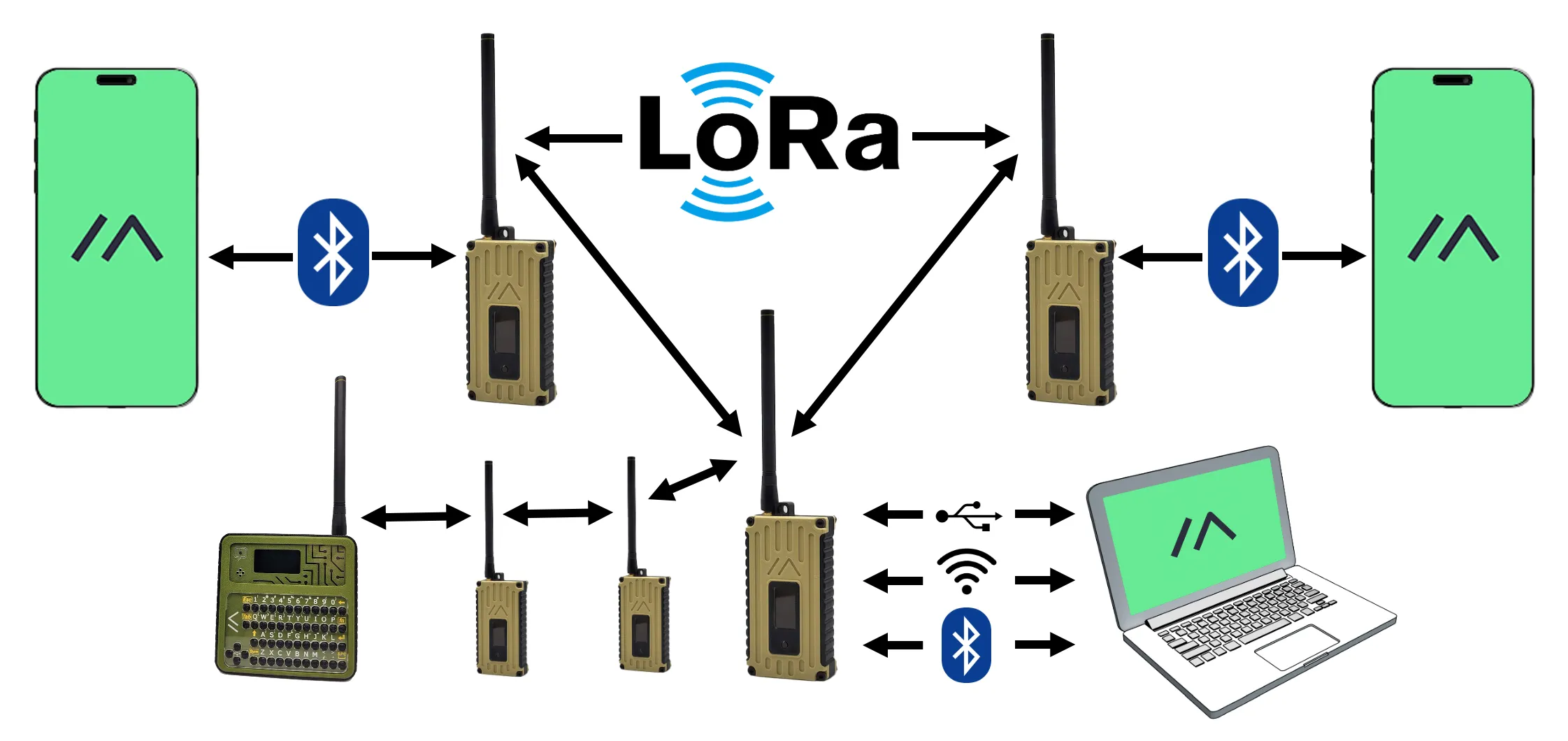

Here, each participant (or "node") connects directly to other nodes within its reach, forming a web of P2P (peer-to-peer) connections. Instead of data passing through a central server, it hops from node to node until it reaches its destination. The true strength of this approach is decentralization and resilience. If a node goes down, the others simply find a new path for the information. The network reconfigures and heals itself.

Source: meshtastic.org

Source: meshtastic.orgLoRa and Meshtastic: The Dynamic Duo

To create these networks in the real world, the enthusiast community has rallied around a powerful duo:

- LoRa (Long Range): Think of LoRa as the physical layer—the "radio waves" of our network. It's a technology that allows for long-range wireless communication with incredibly low power consumption. We're talking about cheap little radios that can send small data packets for miles, running for days on a single battery.

- Meshtastic: If LoRa is the physical medium, Meshtastic is the brain. It's open-source software that equips these radios to form a smart, easy-to-use mesh network. Meshtastic handles everything: discovering other nodes, managing routes, encrypting messages, and providing an interface on your phone, connected via Bluetooth.

Meshtastic was originally created as an off-grid communicator, but its usefulness goes far beyond that. Here, privacy is a fundamental pillar. To join a group channel, you need the encryption key. Direct messages are end-to-end encrypted. It's like having a "hardware wallet" for your communication: your private key is secure on your radio, ensuring that only you and the recipient can read the messages.

While Meshtastic is the most popular, alternatives like MeshCore exist, which aim to optimize packet routing. However, the network effect is powerful, and the vast majority of users today are on the Meshtastic platform.

Introducing BTC Mesh: Bitcoin Transactions Via Radio

This is where Bitcoin enters the picture. The inspiration for the BTC Mesh project came from a mix of necessity and chance. After buying a LoRa radio on AliExpress that, to my frustration, couldn't transmit over long distances—and the seller simply stopped responding—I discovered it worked perfectly within my apartment. With two radios in hand, one for the base and another "defective" one, I had the perfect test environment for a new use case: sending Bitcoin transactions over the mesh network.

GitHub - eddieoz/btcmesh: BTC Mesh Relay is designed to send Bitcoin payments via LoRa Meshtastic.

BTC Mesh is a simple application that allows anyone on a Meshtastic network to send a Bitcoin transaction (on-chain, layer 1) over the radio network, without needing a direct internet connection.

How the Magic Works

The system has two parts: a client and a server.

- The Server: Someone on the network with internet access runs the "server node." This is a computer (a Raspberry Pi can handle it) connected to a LoRa radio and a full Bitcoin node (Bitcoin Core). It acts as the bridge between the off-grid mesh world and the global Bitcoin network.

- The Client: Anyone else on the network, even miles away and without internet, can use the "client" on their laptop or phone.

The process is a choreographed dance designed for the low-speed LoRa network:

- Preparing the Transaction: In a wallet like Sparrow, you create and sign your transaction. Instead of clicking "Broadcast," you copy the "Raw Transaction"—a long hexadecimal text.

- Sending Over the Mesh: In the terminal, you run a simple command, pointing to the server's radio and pasting your raw transaction.

- The Communication: Since the transaction is too large for a single LoRa packet, the client splits it into chunks and starts a conversation with the server:

- Client: "Hey server! I have a transaction in 15 parts. Can we start?"

- Server: "Roger that! Awaiting 15 parts. Send the first one."

- Client: (sends part 1)

- Server: "Part 1 received. Send part 2."

- This "handshake" continues until all parts are confirmed, ensuring the transaction arrives complete.

- Validation and Broadcast: Upon receiving everything, the server reconstructs the transaction, validates it, and hands it off to its local Bitcoin node, which finally broadcasts it to the worldwide network.

And that's it! Your transaction is sent to the blockchain, broadcast from a radio, without your IP address ever being exposed.

Maximum Privacy and Sovereignty

BTC Mesh's power lies in its layers of privacy:

- No IP Trail: Since the transaction is sent via radio, there is no record of your IP address. To the Bitcoin network, the transaction simply originated from the server node.

- End-to-End Encryption: The communication between the radios is encrypted by Meshtastic. No one in between can see the content of your transaction.

- Extra Layer with Tor: For maximum privacy, the server node can connect to the internet through the Tor network. This way, not even the server's IP is exposed in the final broadcast.

This combination creates a powerful system for censorship-resistant Bitcoin transactions with high privacy.

Building Your Kit: The Hardware

Excited to build your own station? The hardware is cheap and accessible.

- Frequency is Key: First, know the legal LoRa frequency in your country. In Brazil, use 915 MHz. In Europe, 868 MHz. Buying the wrong frequency will render your radio useless.

- Popular Brands:

- Heltec: Very popular, with boards like the T114, V3, and the Wireless Bridge, which comes with a practical design and an e-ink screen.

- RAK Wireless: Considered more "professional." The RAK4631 model (which I use for my base) is excellent, and the WisBlock line is modular, requiring no soldering.

- LilyGo: Famous in the "maker" community. Offers boards like the T-Beam (with GPS), T-Echo (small and practical), and the T-Deck (a full communicator with a keyboard).

- Seeed Studio (SenseCAP): Offers robust devices like the T1000-e (waterproof) and the XIAO ESP32S3 (tiny, perfect for compact projects).

- Antennas: Don't underestimate the antenna! And a crucial warning: never, ever, turn on your radio without an antenna connected, or you could burn out the transmitter.

- 3 dBi: A more "rounded" signal (a sphere), great for short distances with vertical obstacles.

- 10 dBi: A "flatter," more directional signal (a frisbee), for long distances with a clear line of sight.

- Power: Many boards have connectors for batteries and small solar panels, allowing you to create autonomous nodes.

Limitations and Considerations

Despite its power, LoRa technology has its limits:

- Low Bandwidth: The network is slow. Think 140-character Twitter. It's perfect for messages, but forget about web browsing.

- Regulation: Many regions limit the amount of data a radio can transmit per hour ("duty cycle"). Meshtastic respects these limits, which reinforces the need for optimized applications.

- Need for a Bridge: For a transaction to reach the global network, one node on the mesh needs internet. The network can be fully off-grid for internal communication, but the bridge to the outside world is necessary for certain applications. MQTT servers can play this role, connecting distant mesh networks over the internet.

Use Cases: Beyond Bitcoin

- Disaster Communication: Projects like Disaster.Radio focus on using LoRa to coordinate rescue teams during catastrophes.

- Outdoor Activities: Essential for hiking and camping in remote locations.

- Internet of Things (IoT): In agriculture, sensors can cover vast areas. On farms, they can monitor livestock.

- Private Communication: In a world of surveillance, having a communication channel that you control is an act of sovereignty.

The Future is Decentralized

Projects like BTC Mesh offer a glimpse into a more resilient, private, and decentralized future. They give us the tools to build our own communication and financial networks, free from centralized control.

The technology is cheap, the software is free, and the community is vibrant. Building your first node might seem intimidating, but it's a rewarding project and a practical step toward personal sovereignty.

So, are you ready to get off the grid?

-

@ cae03c48:2a7d6671

2025-06-07 15:01:39

@ cae03c48:2a7d6671

2025-06-07 15:01:39Bitcoin Magazine

Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in BitcoinMeanwhile Insurance Bitcoin (Bermuda) Limited (“Meanwhile”) announced it has become the first company in the world to release externally audited financial statements denominated entirely in Bitcoin. According to the announcement, the company reported 220.4 BTC in assets and 25.29 BTC in net income for 2024, a 300% year over year increase.

Today marks a global first & historic event for us, along with the public release of our 2024 audited financial statements, covering our 1st year of sales.

As the 1st company in the world to have Bitcoin-denominated financial statements externally audited, we are excited to…

— meanwhile | Bitcoin Life Insurance (@meanwhilelife) June 5, 2025

“We’ve just made history as the first company in the world to have Bitcoin-denominated financial statements externally audited,” said Zac Townsend, CEO of Meanwhile. “This is an important, foundational step in reimagining the financial system based on a single, global, decentralized standard outside the control of any one government.”

The financial statements were audited by Harris & Trotter LLP and its digital asset division ht.digital. Meanwhile’s financials also comply with Bermuda’s Insurance Act 1978, noting that their BTC denominated financials were approved and comply with official guidelines. The firm, fully licensed by the Bermuda Monetary Authority (BMA), operates entirely in BTC and is prohibited from liquidating Bitcoin assets except through policyholder claims, positioning it as a long term holder.

“As the first regulated Bitcoin life insurance company, we view the BTC held by Meanwhile as inherently long-term in nature—primarily held to support the Company’s insurance liabilities over decades,” Townsend added. “This makes it significantly ‘stickier’ and resistant to market pressures compared to the BTC held by other companies as part of their treasury management strategies.”

Meanwhile’s 2024 financials also revealed 23.02 BTC in net premiums and 4.35 BTC in investment income, showing that its model not only preserves Bitcoin, but earns it. The company’s reserves (also held in BTC) were reviewed and approved by Willis Towers Watson (WTW).

Meanwhile also offers a Bitcoin Whole Life insurance product that allows policyholders to save, borrow, and build legacy wealth—entirely in BTC, and has plans to expand globally in 2025.

“We are incredibly proud of today’s news as it underscores how Meanwhile is at the forefront of the next phase of the convergence between Bitcoin and institutional financial markets,” said Tia Beckmann, CFO of Meanwhile. “Now having generated net income in BTC, we have demonstrated that we are earning it through a sustainable insurance business model designed for the long term.”

This post Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in Bitcoin first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ c11cf5f8:4928464d

2025-06-08 14:59:37

@ c11cf5f8:4928464d

2025-06-08 14:59:37Howdy stackers! Here we are again with our monthly Magnificent Seven, the summary giving you a hit of what you missed in the ~AGORA territory.

First thing first. let's check our top performing post Ads!

Top-Performing Ads

This month, the most engaging ones are:

-

01Bitcoin Magazine Launches V3 Limited Edition Bitcoin Crocs by @RideandSmile, no description, nor images provided. The title speak for the product itself. 31 sats \ 8 comments \ 15 May -

02Happy Pizza Day Jerky Offer (10k sats sale 5/22 ONLY) by @beejay, celebrating Bitcoin Pizza Day with a delicious offer for a handmade product. Offer is over but it still available on her online shop and IRL at next Twin Cities Outdoor Agora Market https://stacker.news/items/972209/r/AG 103 sats \ 3 comments \ 22 May -

03Lard Tallow lotion by @byzantine, sharing with us one of his preferred online shops that accept sats. Here other two: a Regenerative Farm in TX https://stacker.news/items/983695/r/AG and an artisanal lite roast coffee maker https://stacker.news/items/983668/r/AG 62 sats \ 4 comments \ 20 May -

04Bitaxe Gamma 601 for sale by @PictureRoom selling P2P, have you shipped it yet? 121 sats \ 12 comments \ 15 May -

05Built An Invisible Book Stage by @kr, he did well creating some expectations for this unique and durable product earlier https://stacker.news/items/903946/r/AG 124 sats \ 4 comments \ 21 May -

06"₿lack Market Money" T-Shirts by T&F by @BitcoinErrorLog, that had opened his online store with plenty of incredible products, including an Anti-Surveillance clothing line https://stacker.news/items/994555/r/AG stuff never seen before! 51 sats \ 3 comments \ 24 May -

07[SELL] Heatpunk 002 Tee by @thebullishbitcoiner, reviving the second edition of a t-shirt dedicated to home solo miners! 79 sats \ 1 comment \ 28 May

In case you missed

Here some interesting post, opening conversations and free speech about markets and business on the bitcoin circular economy:

- https://stacker.news/items/992449/r/AG - @Kontext is selling his beloved 2012 Jaguar XF 3.0 V6 Petrol [5M sats], great deal if paid in sats! Have you sold her?

- https://stacker.news/items/987241/r/AG - @RideandSmile shared the Freedom Issue: Letter From the Editor introducing a BM special edition

- https://stacker.news/items/999229/r/AG - @Solomonsatoshi was looking for Green Coffee Beans for DIY home roasting. Will @michaelbinary provide you some?

- https://stacker.news/items/992790/r/AG - @Rayo also introduce the P.A.Z.NIA Radio Network: 52 Hours of Liberation! An interesting livestream for all those interested in freedom.

- https://stacker.news/items/995163/r/AG welcome to @lunin, opening up on SN with Take it step by step and it will work! as part of a promising series: Founder's Thoughts. Here the second post https://stacker.news/items/999867/r/AG Startup according to Mozart

Hey sellers! Try Auctions

A quick reminder that now you can setup auctions here in the AGORA too! Learn how. The other feature released last month was the introduction of Shopfronts on SN. Check our SN Merch and SN Zine examples. Thank you all! Let's keep these trades coming and grow the P2P Bitcoin circular economy!

Active Professional Services accepting Bitcoin in the AGORA

Let us know if we miss any, here below the most memorable ones: - https://stacker.news/items/900208/r/AG - @unschooled offering Language Tutoring - https://stacker.news/items/813013/r/AG - @gpvansat's [OFFER][Graphic Design] From the paste editions (It's important to keep these offers available) - https://stacker.news/items/775383/r/AG - @TinstrMedia - Color Grading (Styling) Your Pictures as a Service - https://stacker.news/items/773557/r/AG - @MamaHodl, MATHS TUTOR 50K SATS/hour English global - https://stacker.news/items/684163/r/AG - @BTCLNAT's OFFER HEALTH COUNSELING [5K SAT/ consultation - https://stacker.news/items/689268/r/AG - @mathswithtess [SELL] MATHS TUTOR ONILINE, 90k sats per hour. Global but English only.

Let me know if I'm missing other stackers offering services around here!

Lost & Found in SN' Wild West Web

Stay with me, we're not done yet! I found plenty of other deals, offers and business related conversations in other territories too...

- BITCOIN... always fucking with my head... by @thecommoner (highly recommended read!)

- The Strange Moral Relativism of "Free Trade" by @Undisciplined (another highly recommended read!)

- What makes society thrive? by @aljaz

- Drop or proxy shipping services that take sats? by @lv99slacker

- Custom Bitcoin Nodes by @anon

- 23 Bitcoin Merch Shops That Sell Shirts For Sats by @hyperfree

- How to create an e-commerce website? by @Bitcoiner1

- Can You Outperform an Apple Tree? by @kr

- B2B Businesses in Bitcoin by @telcobert

Oh boy! Such exciting month! Now our latest weekly appointments:

🏷️ Spending Sunday

(LIVE TODAY)Share your most recent Bitcoin purchases of just check what other stackers are buying with their sats! Today's one open at https://stacker.news/items/1000477/r/AGAll series available here:

🤝 Sellers & Business Club

(UPCOMING EVERY TUESDAY)Here https://stacker.news/items/998773/r/AG wanted to introduce this new series, dedicated to our most active sellers^1. A room to talk about growing business and sales. You will join?📢 Thursday Talks: What have you sold for Bitcoin this week?

It is losing a bit of momentum, but it will still be opening every week for anyone interested to share sales tips, deals and offers around the Wild West Web! Latest one here https://stacker.news/items/997767/r/AG

Thanks all for reading until here, now... 🫡 Closing remarks as usual. See ya!

Create your Ads now!

Looking to start something new? Hit one of the links below to free your mind:

- 💬 TOPIC for conversation,

- [⚖️ SELL] anything! or,

- if you're looking for something, hit the [🛒 BUY]!

- [🧑💻 HIRE] any bitcoiner skill or stuff from bitcoiners

- [🖇 OFFER] any product or service and stack more sats

- [🧑⚖️ AUCTION] to let stackers decide a fair price for your item

- [🤝 SWAP] if you're looking to exchange anything with anything else

- [🆓 FREE] your space, make a gift!

- Start your own [SHOPFRONT] or simply...

- [⭐ REVIEW] any bitcoin product or LN service you recently bought or subscribed to.

Or contact @AGORA team on nostr DM, and we can help you publish a personalized post.

.

#nostr#bitcoin#stuff4sats#sell#buy#plebchain#grownostr#asknostr#market#businesshttps://stacker.news/items/1000715

-

-

@ dfa02707:41ca50e3

2025-06-07 14:01:22

@ dfa02707:41ca50e3

2025-06-07 14:01:22Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ dfa02707:41ca50e3

2025-06-07 14:01:19

@ dfa02707:41ca50e3

2025-06-07 14:01:19Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ 9ca447d2:fbf5a36d

2025-06-07 14:01:00

@ 9ca447d2:fbf5a36d

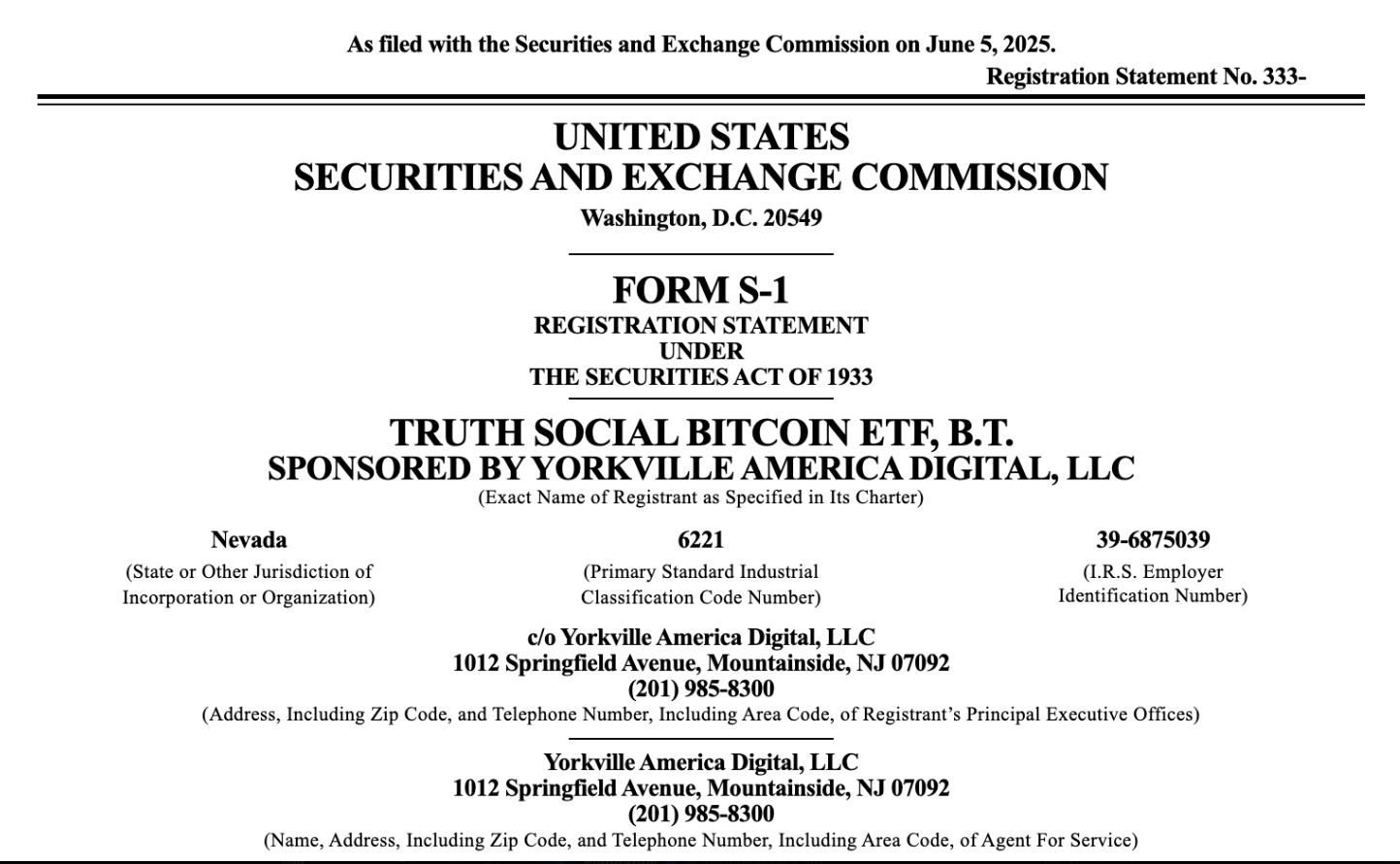

2025-06-07 14:01:00Trump Media & Technology Group (TMTG), the company behind Truth Social and other Trump-branded digital platforms, is planning to raise $2.5 billion to build one of the largest bitcoin treasuries among public companies.

The deal involves the sale of approximately $1.5 billion in common stock and $1.0 billion in convertible senior secured notes.

According to the company, the offering is expected to close by the end of May, pending standard closing conditions.

Devin Nunes, CEO of Trump Media, said the investment in bitcoin is a big part of the company’s long-term plan.

“We view Bitcoin as an apex instrument of financial freedom,” Nunes said.

“This investment will help defend our Company against harassment and discrimination by financial institutions, which plague many Americans and U.S. firms.”

He added that the bitcoin treasury will be used to create new synergies across the company’s platforms including Truth Social, Truth+, and the upcoming financial tech brand Truth.Fi.

“It’s a big step forward in the company’s plans to evolve into a holding company by acquiring additional profit-generating, crown jewel assets consistent with America First principles,” Nunes said.

The $2.5 billion raise will come from about 50 institutional investors. The $1 billion in convertible notes will have 0% interest and be convertible into shares at a 35% premium.

TMTG’s current liquid assets, including cash and short-term investments, are $759 million as of the end of the first quarter of 2025. With this new funding, the company’s liquid assets will be over $3 billion.

Custody of the bitcoin treasury will be handled by Crypto.com and Anchorage Digital. They will manage and store the digital assets.

Earlier this week The Financial Times reported Trump Media was planning to raise $3 billion for digital assets acquisitions.

The article said the funds would be used to buy bitcoin and other digital assets, and an announcement could come before a major related event in Las Vegas.

Related: Bitcoin 2025 Conference Kicks off in Las Vegas Today

Trump Media denied the FT report. In a statement, the company said, “Apparently the Financial Times has dumb writers listening to even dumber sources.”

There was no further comment. However, the official $2.5 billion figure, which was announced shortly after by Trump Media through a press release, aligns with its actual filing and investor communication.

Trump Media’s official announcement

This comes at a time when the Trump family and political allies are showing renewed interest in Bitcoin.

President Donald Trump who is now back in office since the 2025 election, has said he wants to make the U.S. the “crypto capital of the world.”

Trump Media is also working on retail bitcoin investment products including ETFs aligned with America First policies.

These products will make bitcoin more accessible to retail investors and support pro-Trump financial initiatives.

But not everyone is happy.

Democratic Senator Elizabeth Warren recently expressed concerns about Trump Media’s Bitcoin plans. She asked U.S. regulators to clarify their oversight of digital-asset ETFs, warning of investor risk.