-

@ 9ca447d2:fbf5a36d

2025-06-06 17:01:29

@ 9ca447d2:fbf5a36d

2025-06-06 17:01:29Michael Saylor, executive chairman and co-founder of Strategy, wants to be on The Joe Rogan Experience to talk about Bitcoin. His recent post on X has the Bitcoin community and beyond stoked.

On May 31, Saylor replied to a Joe Rogan fan account that asked who they would like to see on the podcast. His response was simple but bold: “Hey @joerogan, let’s talk about Bitcoin.”

Saylor has been one of the most vocal Bitcoin supporters for a long time. He talks about bitcoin being a store of value and a hedge against inflation all the time.

Even when Bitcoin was a niche topic, Saylor was promoting it.

His company MicroStrategy (which was recently renamed to Strategy) has made headlines for investing billions in bitcoin. They currently hold around 580,250 BTC worth over $60 billion according to public trackers.

Saylor’s invitation to Joe Rogan was met with excitement from the Bitcoin community. Several well-known figures quickly chimed in.

Kook, a trader and analyst, said: “Saylor is going to Bitcoin pill Joe Rogan.”

Brandon MacDougal said he would watch The Joe Rogan Experience for the first time if Saylor was on the show, and The Bitcoin Therapist said the potential interview would “shatter the internet.”

It’s not just hardcore Bitcoiners who are excited. Many think the conversation could reach a much wider audience and push Bitcoin into the mainstream financial conversation.

Joe Rogan has one of the most popular podcasts in the world with millions of listeners. He’s discussed digital assets many times and has a special interest in Bitcoin.

In an October 2023 episode with OpenAI’s Sam Altman, Rogan said: “The real fascinating crypto is Bitcoin. That’s the one that I think has the most likely possibility of becoming a universal viable currency. It’s limited in the amount that it can be.”

Rogan previously had Bitcoin educator Andreas Antonopoulos on the show between 2014 and 2016 when bitcoin was under $1,000. Those early episodes introduced Bitcoin to many new listeners.

With Rogan’s history of being open to the topic and his massive audience, a new episode with Saylor could get a whole new group of people interested in Bitcoin.

The buzz around Saylor’s invite is a sign of a bigger trend — Bitcoin becoming a bigger part of the global conversation. Saylor has positioned himself as a thought leader in the space and often talks about how Bitcoin can change the way money and financial systems work.

He believes Bitcoin can create more transparent and efficient systems, reduce transaction costs and challenge traditional banking models. He also said we need smart regulation to protect consumers while encouraging innovation.

A conversation between Saylor and Rogan wouldn’t just be about Bitcoin’s price or investment strategies. It would likely go deeper into topics like inflation, digital privacy, government policy and the future of money.

So far Joe Rogan hasn’t publicly responded to Saylor’s invite, but fans are hoping he’ll say yes. Many think the timing is perfect. Bitcoin is hot again and more people than ever are trying to figure out what role it will play in the future of finance.

-

@ 4898fe02:4ae46cb0

2025-06-06 16:56:23

@ 4898fe02:4ae46cb0

2025-06-06 16:56:23I had a bit of extra time this week to attend a call organized by npub1zuuajd7u3sx8xu92yav9jwxpr839cs0kc3q6t56vd5u9q033xmhsk6c2uc regarding a privacy focused project he's been working on for the last year-or-so. Shout-out to npub1e0z776cpe0gllgktjk54fuzv8pdfxmq6smsmh8xd7t8s7n474n9smk0txy for encouraging me to do so, pushing my somewhat out of my comfort zone in reporting on technical updates.

Also, if you know of or are involved in similar dev calls and would like a report done, please reach out and feel free to share calendar updates.

--npub1f4www6qjx43mckpkjld4apyyr76j3aahprvkduh9gc5xec78ypmsmakqh9 would be awesome to see this talked about on SNL later today, as it seems to be a very important/overlooked project for the future of privacy, nostr and bitcoin broadly.

Anyway, here's the unschooled report--my technical explanations may sometimes be scant, but I've done my best to provide more qualified sources where necessary.

Bringing Secure, Confidential Group Chats to Nostr - A Monthly MLS on Nostr Dev Call

Posted originally to Stacker News \~nostr territory

Developers met Tuesday, 3 Jun at 1600UTC at what would be the first of a monthly series of community calls to discuss updates and respond to questions about the implementation of the MLS (Messaging Layer Security) standard over nostr.

npub1klkk3vrzme455yh9rl2jshq7rc8dpegj3ndf82c3ks2sk40dxt7qulx3vt, npub1jlrs53pkdfjnts29kveljul2sm0actt6n8dxrrzqcersttvcuv3qdjynqn, npub1klkk3vrzme455yh9rl2jshq7rc8dpegj3ndf82c3ks2sk40dxt7qulx3vt and npub1zuuajd7u3sx8xu92yav9jwxpr839cs0kc3q6t56vd5u9q033xmhsk6c2uc among others attended and contributed to a discussion about the latter's research and development on implementing a new messaging standard on nostr using MLS.

The call highlighted some of the features of MLS, a relatively new (as of 2023) secure and confidential messaging and group-chat protocol standard. It is modeled to achieve a similar level of security as Signal, prioritizing forward-secrecy and post-compromise security, multi-device compatibility, as well as the ability to scale for large groups.

For those not familiar,

Forward secrecy means that encrypted content in the past remains encrypted even if key material is leaked.\ Post compromise security means that leaking key material doesn't allow an attacker to continue to read messages indefinitely into the future. ^1

Developers working on the project indicated that it will be an improvement on current instant-messaging standards commonly used by nostr clients, such as nip17, for a relatively simple implementation.

Those in attendance overall showed enthusiasm to push this project forward and developers interested are being encouraged to fork the the Nostr-MLS Rust Library to begin working it into their stack. Notably, jeffg and Hillebrand are keen to see new contributors work on the project.

Participants had the opportunity to ask technical questions about how the library handles some features as well as how to begin contributing.

Discussion also centered around issues with MLS (such as potential key-package rotation DOS attack vectors and de-syncing) as well as some key concepts for the new messaging standard such as how key-packages are signed by a users nsec and published to key-package inbox relays before being rotated.

Proofs of Concept

White Noise and 0xchat both have implemented MLS on nostr. These are the first to prove that the concept of secure-confidential group messaging is possible over the distributed nostr-relay protocol.

Learn More

jeffg has kept detailed project updates on his nostr account. Notably, the post MLS Over Nostr explains the vision he has for the project and his presentation The Past and Future of Messaging on Nostr (youtube) gives a high-level overview of messaging on nostr and the problems he is working to solve.

Follow npub1zuuajd7u3sx8xu92yav9jwxpr839cs0kc3q6t56vd5u9q033xmhsk6c2uc on your favourite nostr client for call updates.

Link to join.

Related:

-

@ 7459d333:f207289b

2025-06-06 16:18:11

@ 7459d333:f207289b

2025-06-06 16:18:11When onboarding friends and family, there's the wish to provide them with something that's self-custodial and not too complex. For people that are starting slow but will keep stacking in the future, we cannot just recommend them to stack 10k sats or 100k sats UTXOs. Since they're stacking for the long term it doesn't seem responsible to recommend them that.

So there comes the Lightning Network. They could stack there and swap out eventually when they reach 1-10M sats. The thing is, Lightning (in its self-custodial form) isn't really fit for this use case. Because to receive 100k sats, you first need to get some inbound liquidity from LSPs that sometimes isn't even 2x the amount you're receiving. So at best it's good for your next 100k but then you'll have to do something onchain again.

And you can always open channels to them yourself. But it's hard to predict who will stack hard and who will just forget about it. Also it puts some responsibility onto your node's uptime.

What I'm doing lately is recommending something like Wallet of Satoshi. As some kind of entry level test. Because if you have to explain onchain fees, UTXOs, channels, and inbound liquidity to a newbie, they're going to run away. Then whoever passes the first test might get a channel from your node or at least from an LSP on a self-custodial wallet.

And in general, LN is not good for stacking. If onchain fees were off the roof you would struggle to resize or open new channels while growing your stack.

So what's the way of scaling Bitcoin so that hundreds of millions of people can save in a self-custodial way?

Maybe multipeer channels make things better, where people in the “spending more than saving” part of their life could peer up with others doing the opposite. Or maybe it's something like Fedimint.

But on the other hand, should we be worrying about this now? Onchain fees are soooo cheap (as cheap as possible actually).

What do you think?

https://stacker.news/items/999012

-

@ cae03c48:2a7d6671

2025-06-06 16:01:22

@ cae03c48:2a7d6671

2025-06-06 16:01:22Bitcoin Magazine

Bitcoin Layer 2: The Key To Scaling BitcoinBitcoin, and for that matter all blockchains, do not scale. It is a fundamental limitation of blockchain based systems that they are incapable of facilitating transactional use at a truly global scale without completely sacrificing the decentralization and verifiability that make them valuable in the first place.

This has been an existential issue that Bitcoiners have grappled with from the very beginning of Bitcoin. This is a comment from James A. Donald, a Canadian cypherpunk who was the first person to reply to Satoshi’s original post on the cryptography mailing list:

Satoshi Nakamoto wrote:

“The bandwidth might not be as prohibitive as you

think. A typical transaction would be about 400 bytes

(ECC is nicely compact). Each transaction has to be

broadcast twice, so lets say 1KB per transaction.

Visa processed 37 billion transactions in FY2008, or

an average of 100 million transactions per day. That

many transactions would take 100GB of bandwidth, or

the size of 12 DVD or 2 HD quality movies, or about

$18 worth of bandwidth at current prices.”The trouble is, you are comparing with the Bankcard

network.But a new currency cannot compete directly with an old,

because network effects favor the old.You have to go where Bankcard does not go.

At present, file sharing works by barter for bits. This,

however requires the double coincidence of wants. People

only upload files they are downloading, and once the

download is complete, stop seeding. So only active

files, files that quite a lot of people want at the same

time, are available.File sharing requires extremely cheap transactions,

several transactions per second per client, day in and

day out, with monthly transaction costs being very small

per client, so to support file sharing on bitcoins, we

will need a layer of account money on top of the

bitcoins, supporting transactions of a hundred

thousandth the size of the smallest coin, and to support

anonymity, chaumian money on top of the account money.Let us call a bitcoin bank a bink. The bitcoins stand

in the same relation to account money as gold stood in

the days of the gold standard. The binks, not trusting

each other to be liquid when liquidity is most needed,

settle out any net discrepancies with each other by

moving bit coins around once every hundred thousand

seconds or so, so bitcoins do not change owners that

often, Most transactions cancel out at the account

level. The binks demand bitcoins of each other only

because they don’t want to hold account money for too

long. So a relatively small amount of bitcoins

infrequently transacted can support a somewhat larger

amount of account money frequently transacted.Despite the era of the Blocksize Wars, the big blockers, and the naive assumptions by many early Bitcoiners that simply raising the blocksize was a viable solution to scale the system, it has been understood by competent observers and engineers from the very beginning that this would undermine the core value proposition of that made it useful in the first place. Hal Finney also spoke of the need for such a settlement layer on top.

Scaling in layers has always been the only rational plan to make Bitcoin work in the long term, but for a long period of Bitcoin’s early history how to do so without relying on trusted third parties was an elusive problem.

One of the first ideas on how to do this was sidechains, independent blockchains with a peg to facilitate locking bitcoin on the mainchain to utilize on the sidechain, and at any point unlocking funds on the mainchain to move them back by proving legitimate control of bitcoin on the sidechain. These systems however have yet to achieve a way to operate a peg without either 1) introducing some form of trusted third party, no matter how well mitigated, or 2) creating centralization pressure for the primary Bitcoin network.

Since those early days there have been many more ideas developed that have found better ways to peg into second layer systems, specifically schemes like the Lightning Network and Ark which allow end users to unilaterally exit back to the mainchain without needing the permission or approval of some operator.

Scaling Bitcoin in a way that facilitates higher transactional volumes without degrading the security properties of Bitcoin to the point of being indistinguishable from third party operated custodians is one of the most critical problems to solve in order for Bitcoin to truly succeed in the long term.

This article series will explore the architectures of different Layer 2 systems for Bitcoin, both those deployed live on the network right now and those that are simply design proposals at this point.

Listed below are the systems I will be covering. The design space of Layer 2s is much more expansive than many people are familiar with, so this list should not be taken as comprehensive and complete, and will be updated over time to reflect additional Layer 2s that are covered.

- Ark

- Statechains

- Lightning Network

- Sidechains

- Clique

- Rollups

- Client Side Validated Systems

- Ecash

- Custodial Systems

- Physical Bearer Instruments

This post Bitcoin Layer 2: The Key To Scaling Bitcoin first appeared on Bitcoin Magazine and is written by Shinobi.

-

@ cae03c48:2a7d6671

2025-06-06 16:01:16

@ cae03c48:2a7d6671

2025-06-06 16:01:16Bitcoin Magazine

Support The Blockchain Regulatory Certainty Act (BRCA) To Protect Noncustodial ServicesWith a lot of regulatory talk centered around The GENIUS Act and The CLARITY Act (the market structure bill) right now, it’s important that Bitcoin enthusiasts also pay attention to and support The Blockchain Regulatory Certainty Act (BRCA) — H.R. 1747.

The act, which was reintroduced to Congress on May 21, 2025 by Rep. Tom Emmer (R-MN) and Rep. Ritchie Torres (D-NY), provides “safe harbor from licensing and registration for certain non-controlling blockchain developers and providers of blockchain services.”

Critical Bitcoin legislation was introduced last week & it needs our support

The Blockchain Regulatory Certainty Act (BRCA) by @GOPMajorityWhip and @RitchieTorres protects self-custody developers, miners, and nodes from being classified as money transmitters.

Thread

pic.twitter.com/cJ8Ogno3h5

pic.twitter.com/cJ8Ogno3h5— Nick Neuman (@Nneuman) May 30, 2025

It also stipulates that no blockchain developer or provider of a blockchain service shall be treated as a money transmitter unless the developers or providers behind the project have control over user funds.

This bill is relevant because the developers for both Samourai Wallet and Tornado Cash are currently facing charges for operating unlicensed money transmitter businesses, despite the fact that the developers for neither of these technologies ever had control over user funds.

It’s also important because, under the Biden administration, the U.S. Department of Justice (DoJ) didn’t just classify privacy services as money transmitters, but ancillary services such as Lightning nodes, rollup sequencers, and other Bitcoin and blockchain technology, as well.

If the BRCA isn’t enacted into law, there is a risk that all Bitcoin and crypto wallets as well as other noncustodial services and technologies will be made illegal and/or subject to KYC/AML laws.

While Rep. Emmer and Rep. Torres’ reintroducing this bill is a positive step, the congressmen need our help in making the BRCA a priority for this current Congress.

To help, go to SaveOurWallets.org and follow the directions on the website to contact the elected officials that represent your district and state in the federal government and tell them that you would like to see them support the BRCA.

But they need our help, we need to make clear that the Blockchain Regulatory Certainty Act is *the* priority this Congress for our space. Go to https://t.co/fXVqSQ2nUv, put in your ZIP code, and make a quick call. It works.

— saveourwallets (@saveourwalets) June 3, 2025

If this act doesn’t pass, we will face significant hurdles regarding the scaling of Bitcoin and other blockchains as well as around privacy.

Yes, yes, I know some of you are saying to yourselves Bitcoin will win regardless of our actions (or that it’s already won) and that we don’t need to engage with politicians in the process.

I’m here to say 1.) this isn’t necessarily true, 2.) there are four developers currently facing trial (the Samourai and Tornado Cash developers) and pushing to get this bill passed may help them, 3.) if this bill doesn’t pass, scaling Bitcoin may be much more difficult, and 4.) there’s a reality in which we give up a lot of our legal right to privacy when using Bitcoin if the bill doesn’t pass.

So, with these points in mind, pick up the phone and/or send an email to your elected representatives and tell them you’d like to see them support the BRCA.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

This post Support The Blockchain Regulatory Certainty Act (BRCA) To Protect Noncustodial Services first appeared on Bitcoin Magazine and is written by Frank Corva.

-

@ 472f440f:5669301e

2025-06-04 20:58:53

@ 472f440f:5669301e

2025-06-04 20:58:53Marty's Bent

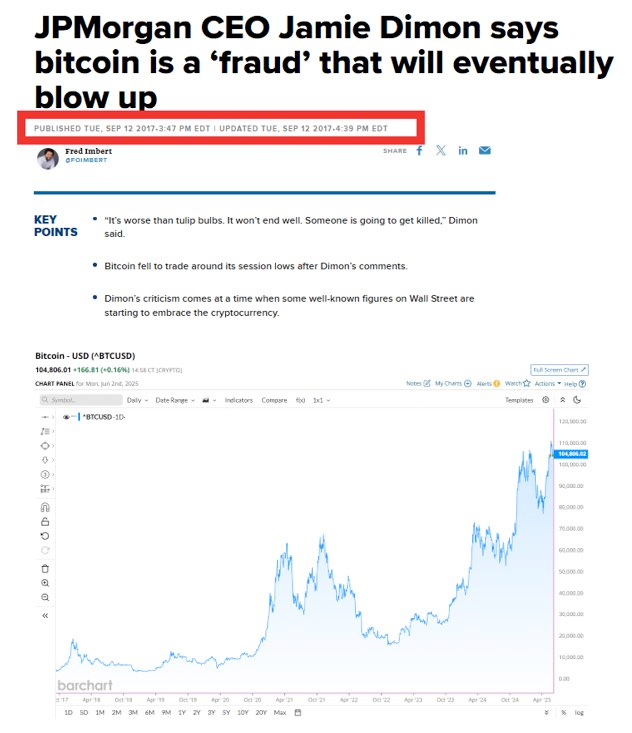

J.P. Morgan CEO Jamie Dimon has long been an outspoken skeptic and critic of bitcoin. He has called Bitcoin a speculative asset, a fraud, a pet rock, and has opined that it will inevitably blow up. A couple of years ago, he was on Capitol Hill saying that if he were the government, he would "close it down". Just within the last month, he was on Fox Business News talking with Maria Bartiromo, proclaiming that the U.S. should be stockpiling bullets and rare earth metals instead of bitcoin. It's pretty clear that Jamie Dimon, who is at the helm of the most powerful and largest bank in the world, does not like bitcoin one bit.

Evidence below:

via Bitcoin Magazine

via me

via CNBC

Despite Dimon's distinguished disdain for Bitcoin, J.P. Morgan cannot deny reality. The CEO of the largest bank in the world is certainly a powerful man, but no one individual, even in the position that Jamie Dimon is in, is more powerful than the market. And the market has spoken very clearly, it is demanding bitcoin. The Bitcoin ETFs have been the most successful ETFs in terms of pace of growth since their launch. They've accumulated tens of billions of dollars in AUM in a very short period of time. Outpacing the previous record set by the gold ETF, GLD.

Whether or not Jamie Dimon himself likes Bitcoin doesn't matter. J.P. Morgan, as the largest bank in the world and a publicly traded company, has a duty to shareholders. And that duty is to increase shareholder value by any ethical and legal means necessary. Earlier today, J.P. Morgan announced plans to offer clients financing against their Bitcoin ETFs, as well as some other benefits, including having their bitcoin holdings recognized in their overall net worth and liquid assets, similar to stocks, cars, and art, which will be massive for bitcoiners looking to get mortgages and other types of loans.

via Bloomberg

I've talked about this recently, but trying to buy a house when most of your liquid net worth is held in bitcoin is a massive pain in the ass. Up until this point, if you wanted to have your bitcoin recognized as part of your net worth and count towards your overall credit profile, you would need to sell some bitcoin, move it to a bank account, and have it sit there for a certain period of time before it was recognized toward your net worth. This is not ideal for bitcoiners who have sufficient cash flows and don't want to sell their bitcoin, pay the capital gains tax, and risk not being able to buy back the amount of sats they were forced to sell just to get a mortgage.

It's not yet clear to me whether or not J.P. Morgan will recognize bitcoin in cold storage toward their clients' net worth and credit profile, or if this is simply for bitcoin ETFs only. However, regardless, this is a step in the right direction and a validation of something that many bitcoiners have been saying for years. Inevitably, everyone will have to bend the knee to bitcoin. Today, it just happened to be the largest bank in the world. I expect more of this to come in the coming months, years, and decades.

Lyn Alden likes to say it in the context of the U.S. national debt and the fiscal crisis, but it also applies to bitcoin adoption and the need for incumbents to orient themselves around the demands of individual bitcoiners; nothing stops this train.

Corporate Bitcoin Treasuries are Changing Market Dynamics

Leon Wankum revealed how corporate Bitcoin treasuries are fundamentally reshaping business dynamics. Companies can now issue equity to fund operations while preserving their Bitcoin holdings, creating a revolutionary capital structure. Leon highlighted MicroStrategy's position, noting they hold enough Bitcoin to cover dividend payments for over 200 years. This model enables companies to reduce founder dilution since they don't need repeated funding rounds when their treasury appreciates.

"Some companies' Bitcoin treasuries are now worth more than all money they've ever raised." - Leon Wankum

Leon shared examples from his own portfolio companies where this strategy has proven transformative. Public companies have discovered an entirely new business model through strategic dilution that actually increases BTC per share. As Leon explained, this approach allows firms to leverage equity markets for operational funding while their Bitcoin treasury compounds in value, creating a positive feedback loop that benefits both shareholders and the company's long-term sustainability.

Check out the full podcast here for more on real estate price cycles, Bitcoin lending products, and the transition to a Bitcoin standard.

Headlines of the Day

California May Seize Idle Bitcoin After 3 Years - via X

Semler Scientific Buys $20M More Bitcoin, Holds $467M - via X

US Home Sellers Surge as Buyers Hit 4-Year Low - via X

Get our new STACK SATS hat - via tftcmerch.io

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

I feel old.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 7f6db517:a4931eda

2025-06-06 16:02:21

@ 7f6db517:a4931eda

2025-06-06 16:02:21

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 8bad92c3:ca714aa5

2025-06-06 12:01:54

@ 8bad92c3:ca714aa5

2025-06-06 12:01:54Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”

“We're not hodling just for the sake of hodling. There is a purpose to it.”

“Fiat money shortens your time horizon… you can never rest.”

“Savings precedes capital accumulation. You can’t build unless you’ve saved.”

“You're increasing the marginal value of everyone else’s Bitcoin.”

“True leisure is contemplation—the pursuit of the highest good.”

“What is Bitcoin for if not to make the conditions for magnificent acts of creation possible?”

“Bitcoin itself will last forever. Your stack might not. What will outlast your coins?”

“Only a whale can be magnificent.”

“The market will sell you all the crack you want. It’s up to you to demand beauty.”

Conclusion

This episode is a call to reimagine Bitcoin as more than a financial revolution—it’s a blueprint for civilizational renewal. Michael Goldstein reframes hodling as an act of moral stewardship, urging Bitcoiners to lower their time preference, build lasting institutions, and pursue truth, beauty, and legacy—not to escape the world, but to rebuild it on sound foundations.

Timestamps

00:00 - Intro

00:50 - Michael’s BBB presentation Hodl for Good

07:27 - Austrian principles on capital

15:40 - Fiat distorts the economic process

23:34 - Bitkey

24:29 - Hodl for Good triple entendre

29:52 - Bitcoin benefits everyone

39:05 - Unchained

40:14 - Leisure theory of value

52:15 - Heightening life

1:15:48 - Breaking from the chase makes room for magnificence

1:32:32 - Nakamoto Institute’s missionTranscript

(00:00) Fiat money is by its nature a disturbance. If money is being continually produced, especially at an uncertain rate, these uh policies are really just redistribution of wealth. Most are looking for number to go up post hyper bitcoinization. The rate of growth of bitcoin would be more reflective of the growth of the economy as a whole.

(00:23) Ultimately, capital requires knowledge because it requires knowing there is something that you can add to the structures of production to lengthen it in some way that will take time but allow you to have more in the future than you would today. Let Black Rockck buy the houses and you keep the sats, not the other way around.

(00:41) You wait until later for Larry Frink to try to sell you a [Music] mansion. And we're live just like that. Just like that. 3:30 on a Friday, Memorial Day weekend. It's a good good good way to end the week and start the holiday weekend. Yes, sir. Yes, sir. Thank you for having me here. Thank you for coming. I wore this hat specifically because I think it's I think it's very apppropo uh to the conversation we're going to have which is I hope an extension of the presentation you gave at Bitblock Boom Huddle for good. You were working on

(01:24) that for many weeks leading up to uh the conference and explaining how you were structuring it. I think it's a very important topic to discuss now as the Bitcoin price is hitting new all-time highs and people are trying to understand what am I doing with Bitcoin? Like you have you have the different sort of factions within Bitcoin.

(01:47) Uh get on a Bitcoin standard, get on zero, spend as much Bitcoin as possible. You have the sailors of the world are saying buy Bitcoin, never sell, die with your Bitcoin. And I think you do a really good job in that presentation. And I just think your understanding overall of Bitcoin is incredible to put everything into context. It's not either or.

(02:07) It really depends on what you want to accomplish. Yeah, it's definitely there there is no actual one-sizefits-all um for I mean nearly anything in this world. So um yeah, I mean first of all I mean there was it was the first conference talk I had given in maybe five years. I think the one prior to that uh was um bit block boom 2019 which was my meme talk which uh has uh become infamous and notorious.

(02:43) So uh there was also a lot of like high expectations uh you know rockstar dev uh has has treated that you know uh that that talk with a lot of reference. a lot of people have enjoyed it and he was expecting this one to be, you know, the greatest one ever, which is a little bit of a little bit of a uh a burden to live up to those kinds of standards.

(03:08) Um, but you know, because I don't give a lot of talks. Um, you know, I I I like to uh try to bring ideas that might even be ideas that are common. So, something like hodling, we all talk about it constantly. uh but try to bring it from a little bit of a different angle and try to give um a little bit of uh new light to it.

(03:31) I alsove I've I've always enjoyed kind of coming at things from a third angle. Um whenever there's, you know, there's there's all these little debates that we have in in Bitcoin and sometimes it's nice to try to uh step out of it and look at it a little more uh kind of objectively and find ways of understanding it that incorporate the truths of of all of them.

(03:58) uh you know cuz I think we should always be kind of as much as possible after ultimate truth. Um so with this one um yeah I was kind of finding that that sort of golden mean. So uh um yeah and I actually I think about that a lot is uh you know Aristotle has his his concept of the golden mean. So it's like any any virtue is sort of between two vices um because you can you can always you can always take something too far.

(04:27) So you're you're always trying to find that right balance. Um so someone who is uh courageous you know uh one of the vices uh on one side is being basically reckless. I I can't remember what word he would use. Uh but effectively being reckless and just wanting to put yourself in danger for no other reason than just you know the thrill of it.

(04:50) Um and then on the other side you would just have cowardice which is like you're unwilling to put yourself um at any risk at any time. Um, and courage is right there in the middle where it's understanding when is the right time uh to put your put yourself, you know, in in the face of danger um and take it on. And so um in some sense this this was kind of me uh in in some ways like I'm obviously a partisan of hodling.

(05:20) Um, I've for, you know, a long time now talked about the, um, why huddling is good, why people do it, why we should expect it. Um, but still trying to find that that sort of golden mean of like yes, huddle, but also what are we hodling for? And it's not we're we're not hodddling just merely for the sake of hodddling.

(05:45) There there is a a purpose to it. And we should think about that. And that would also help us think more about um what are the benefits of of spending, when should we spend, why should we spend, what should we spend on um to actually give light to that sort of side of the debate. Um so that was that was what I was kind of trying to trying to get into.

(06:09) Um, as well as also just uh at the same time despite all the talk of hodling, there's always this perennial uh there's always this perennial dislike of hodlers because we're treated as uh as if um we're just free riding the network or we're just greedy or you know any of these things. And I wanted to show how uh huddling does serve a real economic purpose.

(06:36) Um, and it does benefit the individual, but it also does uh it it has actual real social um benefits as well beyond merely the individual. Um, so I wanted to give that sort of defense of hodling as well to look at it from um a a broader position than just merely I'm trying to get rich. Um uh because even the person who uh that is all they want to do um just like you know your your pure number grow up go up moonboy even that behavior has positive ramifications on on the economy.

(07:14) And while we might look at them and have uh judgments about their particular choices for them as an individual, we shouldn't discount that uh their actions are having positive positive effects for the rest of the economy. Yeah. So, let's dive into that just not even in the context of Bitcoin because I think you did a great job of this in the presentation.

(07:36) just you've done a good job of this consistently throughout the years that I've known you. Just from like a first principles Austrian economics perspective, what is the idea around capital accumulation, low time preference and deployment of that capital like what what like getting getting into like the nitty-gritty and then applying it to Bitcoin? Yeah, it's it's a big question and um in many ways I mean I I even I barely scratched the surface.

(08:05) uh I I can't claim to have read uh all the volumes of Bombber works, you know, capital and interest and and stuff like that. Um but I think there's some some sort of basic concepts that we can look at that we can uh draw a lot out. Um the first uh I guess let's write that. So repeat so like capital time preference. Yeah. Well, I guess getting more broad like why sav -

@ 472f440f:5669301e

2025-06-04 01:37:37

@ 472f440f:5669301e

2025-06-04 01:37:37Marty's Bent

via nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqy0hwumn8ghj7mn0wd68yttjv4kxz7fwvf5hgcm0d9hzumnfde4xzqpq85h9z5yxn8uc7retm0n6gkm88358lejzparxms5kmy9epr236k2qtyz2zr

A lot of the focus over the last couple of months has been on the emergence of Strategy competitors in public markets looking to build sizable bitcoin treasuries and attract investors of all shapes and sizes to drive shareholder value. The other big topic in the bitcoin development world has been around OP_RETURN and the debate over whether or not the amount of data that can be shoved into a bitcoin transaction should be decided by the dominant implementation.

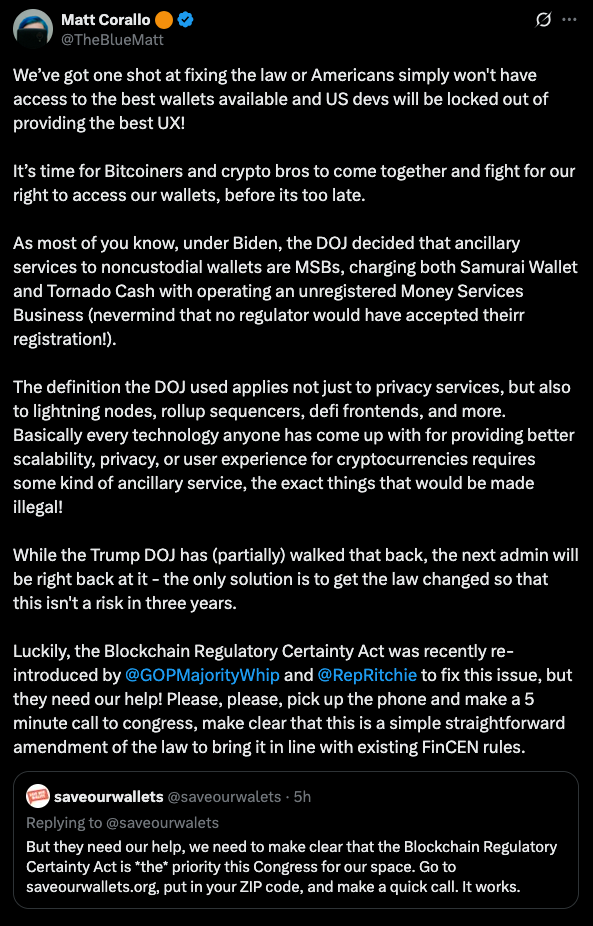

A topic that is just as, if not more, important that is not getting enough appreciation is the discussion around open source bitcoin developers and the lingering effects of the Biden administration's attack on Samourai Wallet and Tornado Cash. If you read our friend Matt Corallo's tweet above, you'll notice that the lingering effects are such that even though the Trump administration has made concerted efforts to reverse the effects of Operation Chokepoint 2.0 that were levied by the Biden administration, Elizabeth Warren, and her friends at the Treasury and SEC - it is imperative that we enshrine into law the rights of open source developers to build products and services that enable individuals to self-custody bitcoin and use it in a peer-to-peer fashion without the threat of getting thrown in jail cell.

As it stands today, the only assurances that we have are from an administration that is overtly in favor of the proliferation of bitcoin in the United States. There is nothing in place to stop the next administration or another down the line from reverting to Biden-era lawfare that puts thousands of bitcoin developers around the world at risk of being sent into a cage because the government doesn't like how some users leverage the code they write. To make sure that this isn't a problem down the line it is imperative that we pass the Blockchain Regulatory Clarity Act, which would not hold bitcoin developers liable for the ways in which end users leverage their tools.

Not only is this an act that would protect developers from pernicious government officials targeting them when end users use their technology in a way that doesn't make the government happy, it will also protect YOU, the end user, looking to transact in a peer-to-peer fashion and leverage all of the incredible properties of bitcoin the way they were meant to be. If the developers are not protected, they will not be able to build the technology that enables you to leverage bitcoin.

So do your part and go to saveourwallets.org. Reach out to your local representatives in Congress and Senators and make some noise. Let them know that this is something that you care deeply about and that they should not only pay attention to this bill but push it forward and enshrine it into law as quickly as possible.

There are currently many developers either behind bars or under house arrest for developing software that gives you the ability to use Bitcoin in a self-sovereign fashion and use it in a privacy-preserving way. Financial privacy isn't a crime. It is an inalienable human right that should be protected at all cost. The enshrinement of this inalienable right into law is way past due.

#FreeSamourai #FreeRoman

Headlines of the Day

MicroStrategy Copycats See Speculative Premiums Fade - via X

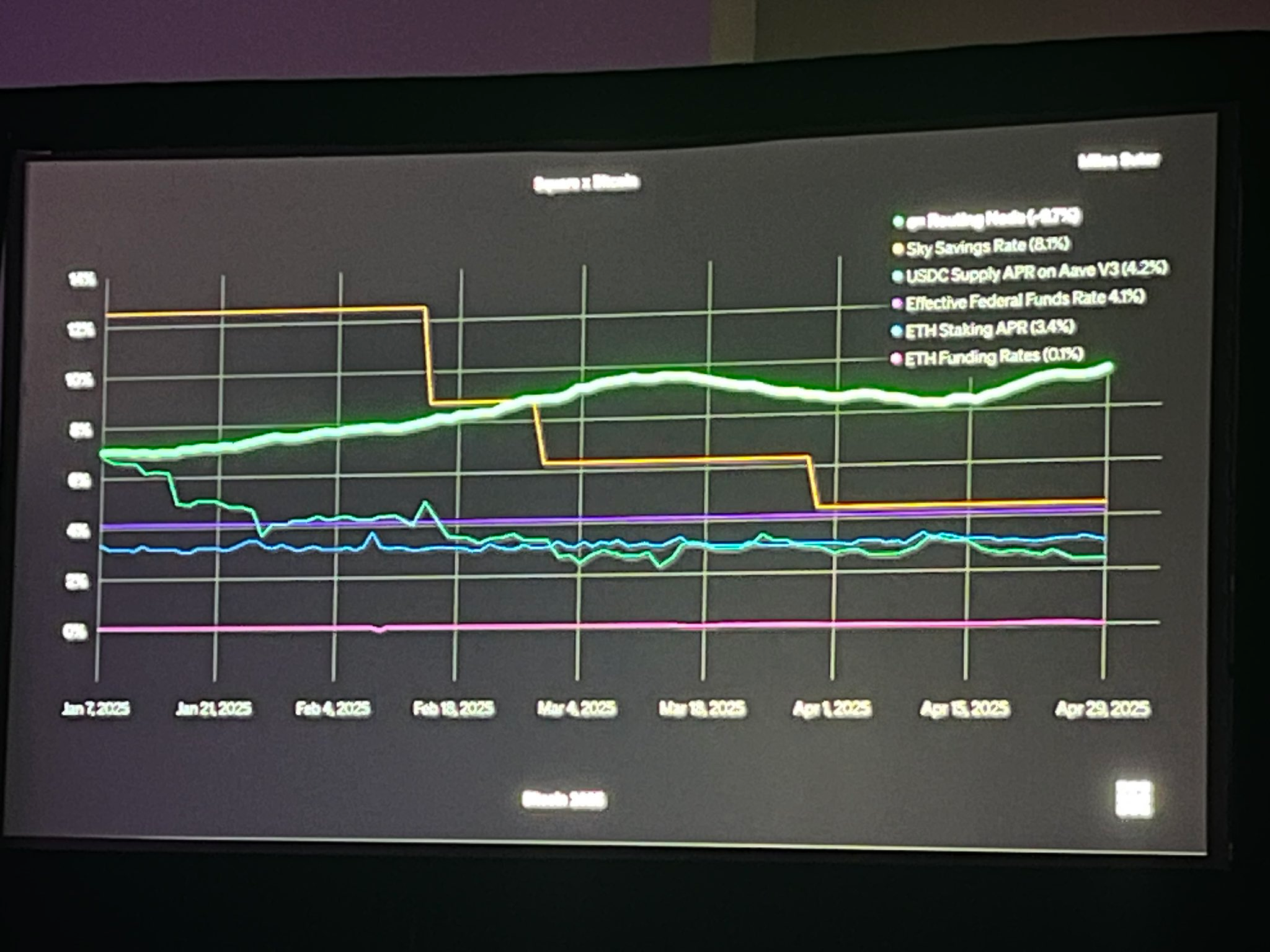

Square Tests Bitcoin Payments, Lightning Yields Beat DeFi - via X

Get our new STACK SATS hat - via tftcmerch.io

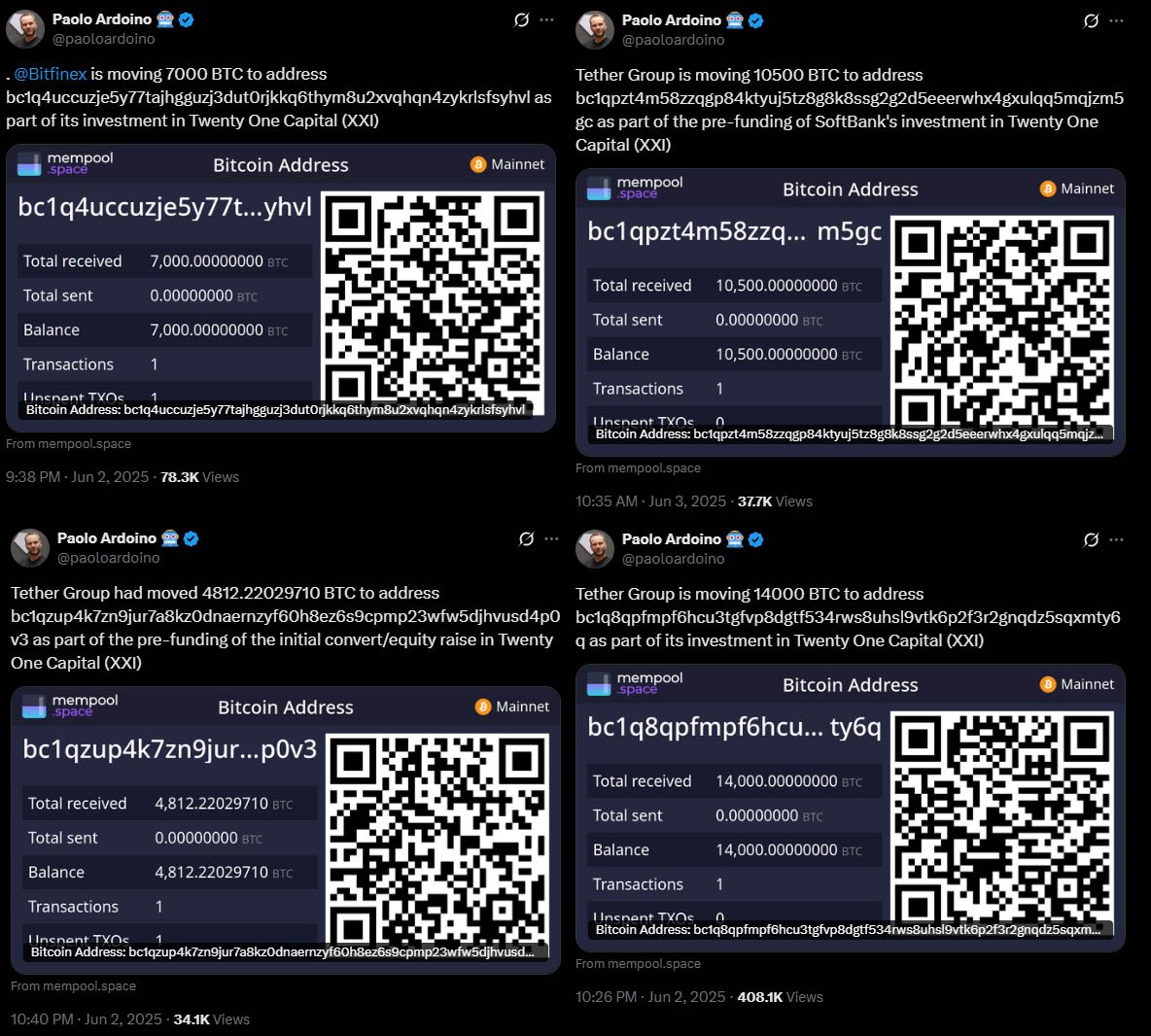

Bitfinex Moves $731M Bitcoin to Jack Mallers' Fund - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Should I join a country club?

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ a5ee4475:2ca75401

2025-06-06 15:30:41

@ a5ee4475:2ca75401

2025-06-06 15:30:41[EM ATUALIZAÇÃO]

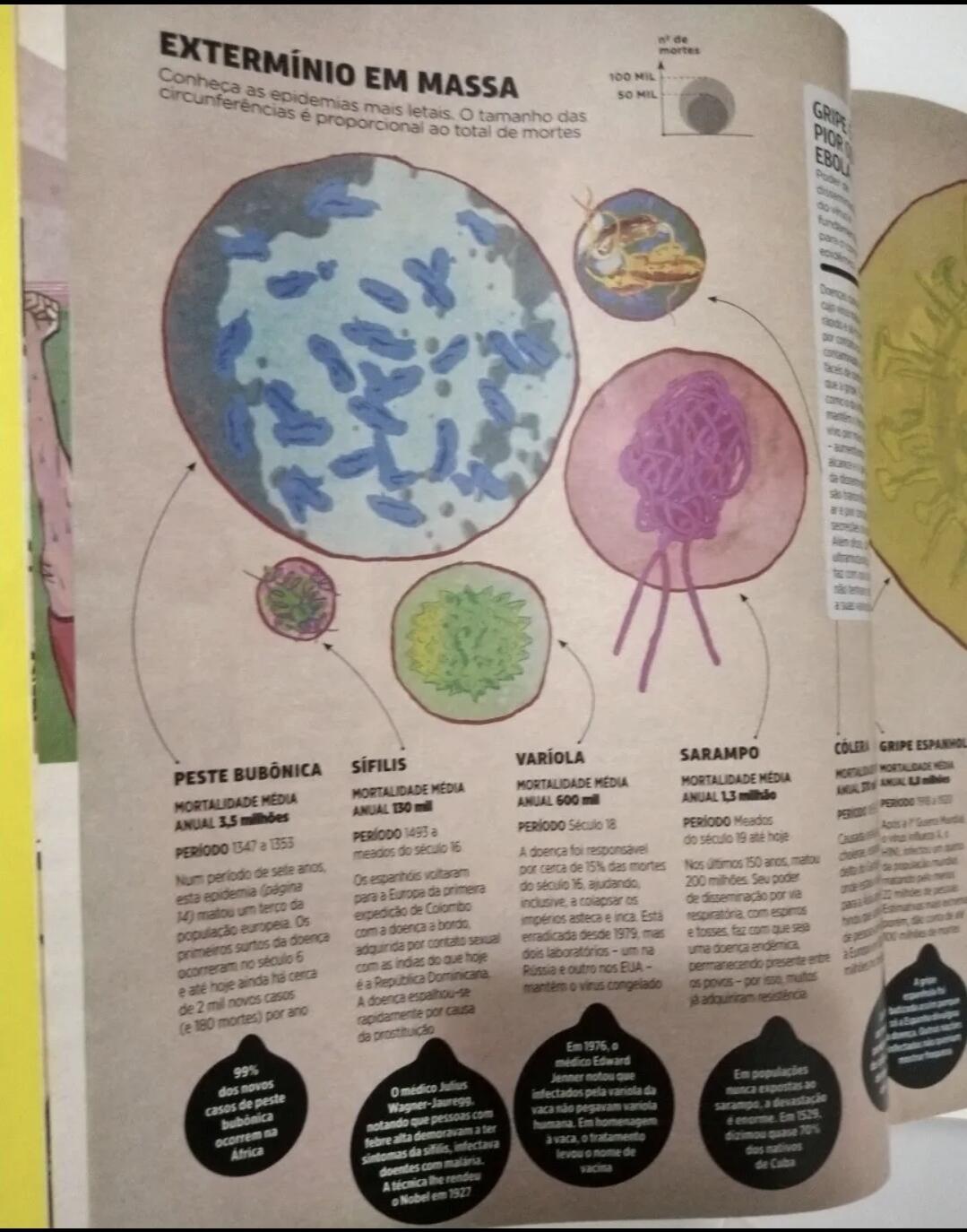

vacina #saude #politica #manipulacao #mundial #genocidio #pandemia #conspiracao

"Aqueles que não conseguem lembrar o passado estão condenados a repeti-lo." - George Satayana

Este artigo reúne algumas menções e evidências mais antigas que vim registrando durante alguns anos em relação a Covid-19, vacinas obrigatórias e a ação de agências de governo, fundações, políticos, mídia tradicional, celebridades, influenciadores, cientistas, redes sociais e laboratórios, em envolvimento com genocídio e restrições de liberdades em escala mundial causado por decisões em várias esferas relativas ao covid e as vacinas obrigatórias em geral.

Porém, alguns links podem não estar mais disponíveis, foram que ainda faltam ser registradas muitas informações já divulgadas nos últimos anos e que muitos não tiveram contato pela escassez de meios para a obtenção dessas informações de forma organizada.

Portanto, o presente artigo ainda passará por atualizações de conteúdo e formatação. Logo, se possível, ajudem sugerindo complementos ou alterações, ou com doações.

Noções iniciais:

- O termo 'Coronavírus' (COVID) é na verdade um nome genérico para vários vírus de gripes já comuns, dado para o tipo corona (com uma "coroa", 'espetos' ao redor dele), o Sars-Cov-2 (que passou a ser chamado erroneamente só de Covid), é só um deles.

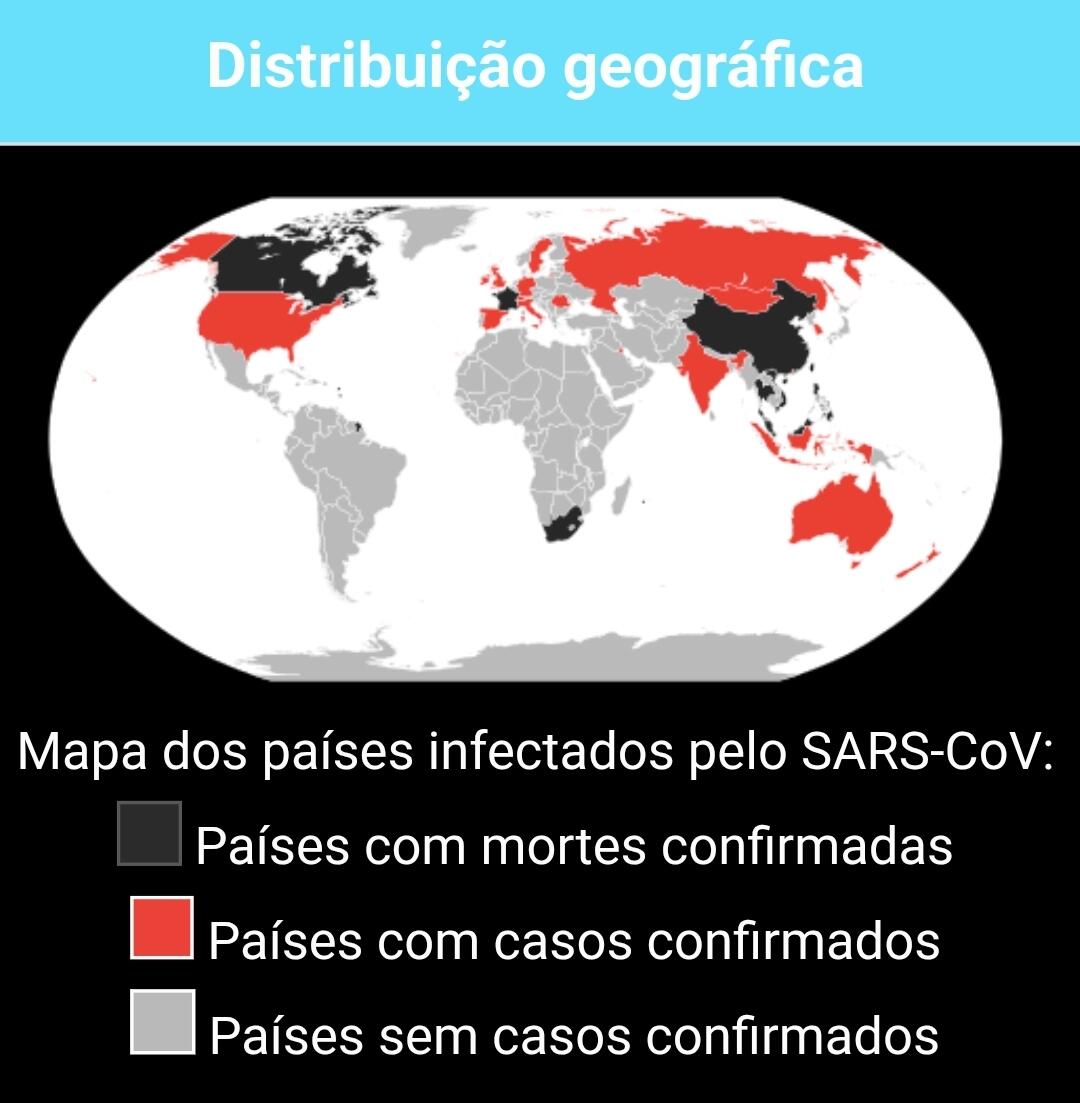

- SARS-CoV-2 é que é nome do vírus. Ele que causa a doença Covid-19;

- O coronavírus SARS-CoV-2 é o segundo tipo de SARS-CoV documentado, o primeiro ocorreu entre 2002 e 2003, se originando também da China e também dito como tendo origem animal;

- SARS (Severe Acute Respiratory Syndrome) - Síndrome Respiratória Aguda Grave (SRAG) é a uma doença respiratória viral, relatada ser de origem zoonótica (animal), causada pelos coronavírus SARS-CoV (2002) e SARS-CoV-2 (2019), ambos de origem chinesa;

1. Vacinas Obrigatórias em Geral

23/01/2025 - [Pesquisa] Vacinas nos EUA causando autismo em crianças https://publichealthpolicyjournal.com/vaccination-and-neurodevelopmental-disorders-a-study-of-nine-year-old-children-enrolled-in-medicaid/

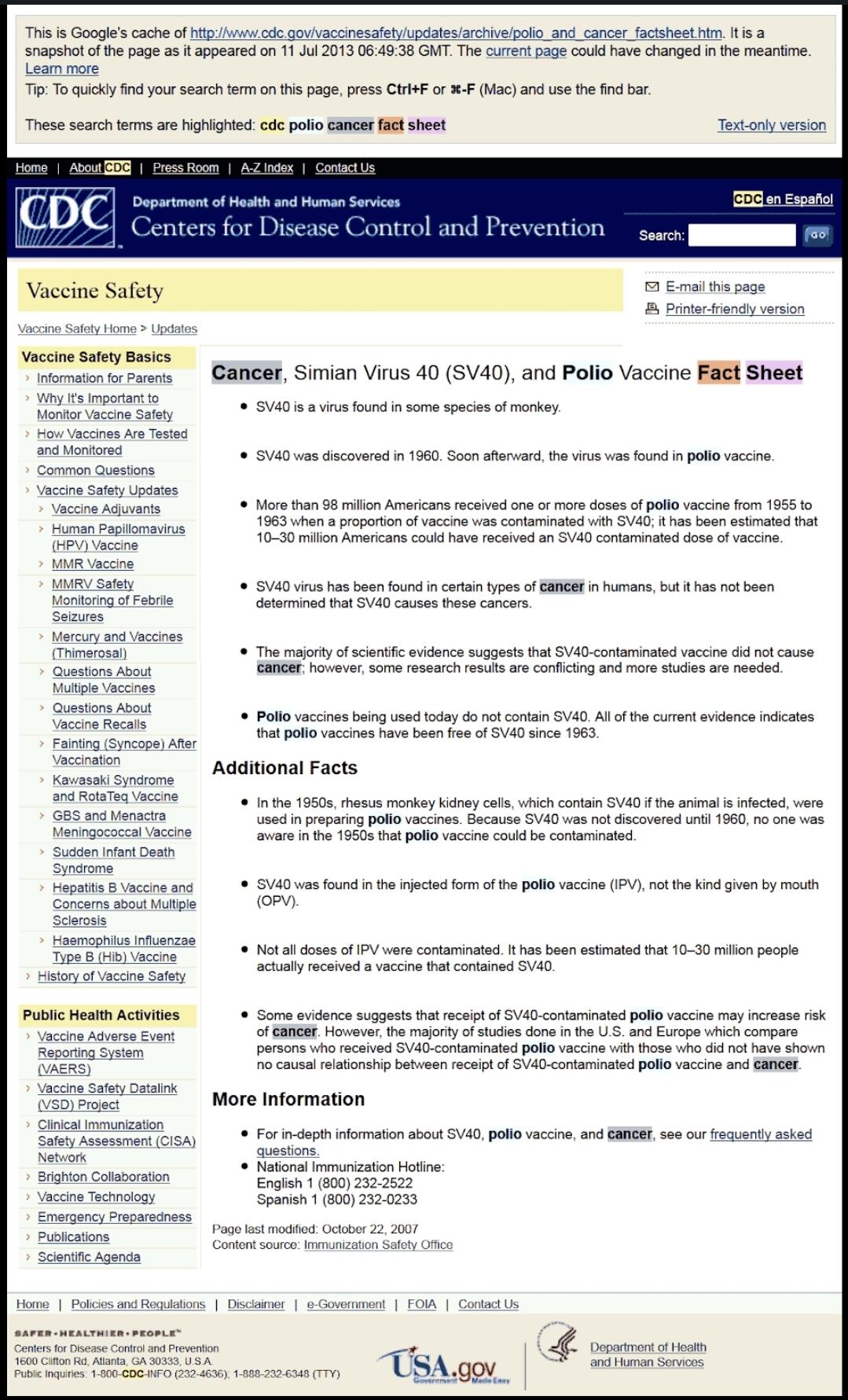

- O CDC admite que 98 milhões de pessoas receberam o vírus do câncer através da vacina da Poliomielite https://medicinanews.com.br/frente/frente_1/o-cdc-admite-que-98-milhoes-de-pessoas-receberam-o-virus-do-cancer-atraves-da-vacina-poliomielite/

"O CDC (Os Centros de Controle e Prevenção de Doenças dos Estados Unidos) removeu rapidamente uma página do seu site, que estava em cache no Google, como você pode ver logo abaixo, admitindo que mais de 98 milhões de americanos receberam uma ou mais doses de vacina contra pólio dentro de 8 período entre 1955 e 1963, quando uma proporção da vacina foi contaminada com um poliomavírus causador de câncer chamado SV40."

Fonte original da imagem: https://preventdisease.com/images13/CDC_Polio.png [indisponível] - A imagem foi trocada por outra de menor qualidade e em outro link, mas eu já tinha a imagem original salva.

Fonte original da imagem: https://preventdisease.com/images13/CDC_Polio.png [indisponível] - A imagem foi trocada por outra de menor qualidade e em outro link, mas eu já tinha a imagem original salva. Imagem arquivada em: https://web.archive.org/web/20201203231640/

Imagem arquivada em: https://web.archive.org/web/20201203231640/27/02/2021 - Por que o Japão demorou para vacinar, mesmo com Olimpíada se aproximando https://www.cnnbrasil.com.br/internacional/2021/02/27/por-que-o-japao-demorou-para-vacinar-mesmo-com-olimpiada-se-aproximando

"Desconfiança da população japonesa em relação a vacinas, ligada a casos ocorridos no passado, está entre razões que atrasaram imunização no país.

A resistência à vacina do Japão remonta à década de 1970, quando duas crianças morreram dentro de 24 horas após receberem a vacina combinada contra difteria, tétano e coqueluche (coqueluche). A vacina foi temporariamente suspensa, mas a confiança já havia sido abalada. Por vários anos, as taxas de vacinação infantil caíram, levando a um aumento nos casos de tosse convulsa.

No final dos anos 1980, houve outro susto com a introdução da vacina tripla contra sarampo, caxumba e rubéola produzida no Japão. As primeiras versões do imunizante foram associadas à meningite asséptica, ou inchaço das membranas ao redor do cérebro e da medula espinhal. O problema foi rastreado até o componente caxumba da vacina tripla, o que levou a uma ação judicial e a indenização por danos pesados.

O Instituto Nacional de Ciências da Saúde interrompeu a dose combinada em 1993 e a substituiu por vacinas individuais. Após o escândalo, Shibuya disse que o governo japonês se tornou "ciente dos riscos" e seu programa nacional de vacinação tornou-se voluntário.

O Dr. Yuho Horikoshi, especialista em doenças infecciosas, diz que os processos levaram a uma "lacuna de vacinação", em que nenhuma vacina foi aprovada no Japão por cerca de 15 anos.

Mais recentemente, em 2013, o Japão adicionou a vacina contra o papilomavírus humano (HPV) ao calendário nacional para proteger as meninas contra o vírus sexualmente transmissível, que é conhecido por causar câncer cervical. No entanto, vídeos de meninas supostamente sofrendo de reações adversas começaram a circular no YouTube, levando o governo a retirá-los da programação nacional."

2. PRIMEIRAS OCORRÊNCIAS PREDITIVAS AO COVID-19

2002 - Síndrome respiratória aguda grave (SARS) Brenda L. Tesini (setembro de 2018). Síndrome respiratória aguda grave (SARS) [indisponível]. Manual Merck. Consultado em 23 de janeiro de 2020, citado no Wikipedia

SARS - Wikipédia: "A SARS [doença do vírus SARS-CoV] foi detectada pela primeira vez no fim de 2002 na China. Entre 2002 e 2003, um surto da doença resultou em mais de 8 000 casos e cerca de 800 mortes em todo o mundo."

2010 - Fundação Rockfeller, Lockstep. https://www.rockefellerfoundation.org/wp-content/uploads/Annual-Report-2010-1.pdf

Neste PDF da fundação Rockfeller, em seu próprio site, a fundação deixou claro o seu envolvimento em casos de ‘contenção’ de pandemias juntamente com a USAID (agência americana com nome ambíguo, como formalmente ‘United States Agency for International Development’, mas soando como ‘US Socorre’, mas sendo um braço do governo democrata que financiava interferências políticas diretas em vários países, como em intervenções no Brasil ), inclusive em relacionadas ao SARS, o mesmo sintoma dos coronavírus Sars-Cov e Sars-Cov-2 (o vírus propagado em 2019) e que causa o COVID-19.

Segundo eles:

“Integração entre Regiões e Países

A Fundação Rockefeler investiu US$ 22 milhões em sua Iniciativa de Redes de Vigilância de Doenças para ajudar a conter a disseminação de doenças infecciosas e pandemias, fortalecendo os sistemas nacionais, regionais e globais de vigilância e resposta a doenças. Dois programas-chave da Rockefeler — a Rede de Vigilância de Doenças da Bacia do Mekong e a Rede Integrada de Vigilância de Doenças da África Oriental — conectaram e capacitaram profissionais de saúde, epidemiologistas e autoridades de saúde pública em toda a região, levando a um aumento de seis vezes nos locais de vigilância de doenças transfronteiriças somente nos últimos três anos. Em 2010, a Rockefeler expandiu a bem-sucedida campanha transdisciplinar One Health, que a USAID e o Banco Asiático de Desenvolvimento adotaram como modelos. One Health refere-se à integração da ciência médica e veterinária para combater essas novas variedades de doenças zoonóticas que se movem e sofrem mutações rapidamente de animais para humanos. Essas colaborações criaram e fortaleceram uma rede regional crítica de saúde pública, enquanto as lições aprendidas foram exportadas entre disciplinas e países. Além de fortalecer os laços globais em saúde pública, a Rockefeler ajudou a elevar o nível de especialização e treinamento em campo. O Programa de Treinamento em Epidemiologia de Campo coloca graduados nos mais altos escalões do governo no Laos e no Vietnã, enquanto as bolsas da Rockefeler transformaram as ferramentas disponíveis para os médicos, permitindo-lhes utilizar o poder da internet para se comunicar e monitorar eventos, compreender contextos locais e analisar novos problemas. Finalmente, estamos aplicando ferramentas do século XXI para combater os desafios de saúde do século XXI.”

Julho de 2012 - Revista Mundo Estranho - Epidemias Citado em: https://super.abril.com.br/especiais/epidemia-o-risco-invisivel/

Página do site ME salva em Imagem no Voidcat

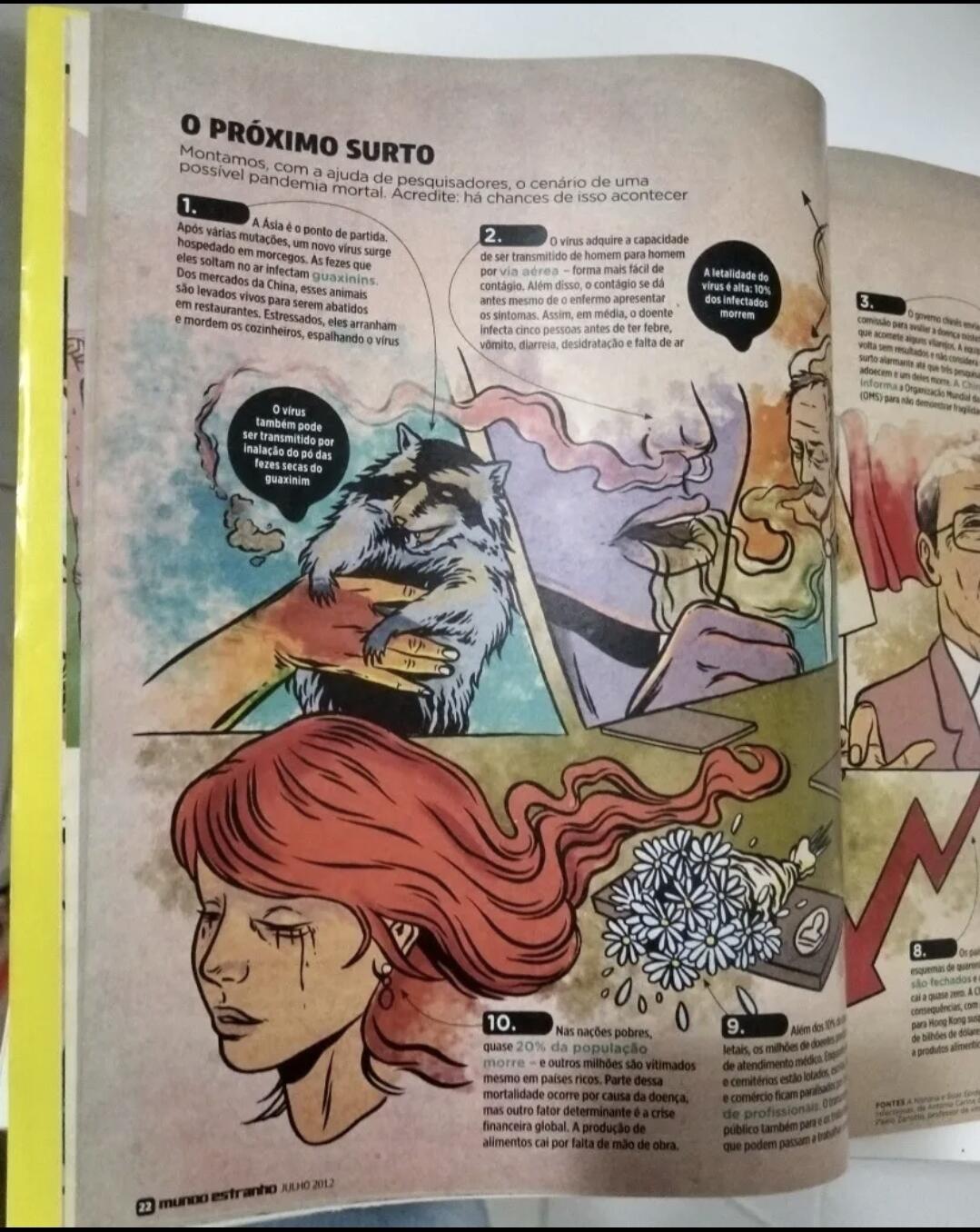

Houve uma ‘coincidência’, a revista Mundo Estranho em julho de 2012, entrevistou o até então doutorando em virologia, Átila Iamarino (do canal Nerdologia no Youtube - O mesmo cientista que fez diversas propagandas das vacinas no Brasil), para descrever um possível cenário de propagação de uma epidemia viral, a revista descreve com grande precisão os eventos de 2020, mas apontando o oposto da China, em que, na realidade, sua economia cresceu vertiginosamente.

Segundo eles:

“ 1 – A Ásia é o ponto de partida. Após várias mutações, um novo vírus surge hospedado em morcegos. As fezes que eles soltam no ar infectam guaxinins. Dos mercados da China, esses animais são levados vivos para serem abatidos em restaurantes. Estressados, eles arranham e mordem os cozinheiros, espalhando o vírus.

2 – O vírus adquire a capacidade de ser transmitido de homem para homem por via aérea – forma mais fácil de contágio. Além disso, o contágio se dá antes mesmo de o enfermo apresentar os sintomas. Assim, em média, o doente infecta cinco pessoas antes de ter febre, vômito, diarreia, desidratação e falta de ar.

3 – O governo chinês envia uma comissão para avaliar a doença misteriosa que acomete alguns vilarejos. A equipe volta sem resultados e não considera o surto alarmante até que três pesquisadores adoecem e um deles morre. A China não informa a Organização Mundial da Saúde (OMS) para não demonstrar fragilidade.

4 – Os sintomas são comuns e a doença só chama a atenção quando muita gente começa a morrer na mesma região. Ainda assim, demora para que médicos e enfermeiros percebam a ineficiência de antibióticos na cura – o que exclui a maioria das bactérias como agente causador. Testes com vírus comuns também dão negativo.

5 – O governo isola comunidades em que há focos da doença. Ninguém entra nas cidades e nenhum doente pode sair. Mas, como a misteriosa enfermidade demora quatro dias para mostrar seus sintomas, muitos doentes saem dos vilarejos sem saber que estão infectados, alastrando a epidemia.

6 – Doentes viajam de avião para grandes cidades, como Hong Kong. O fervilhante centro comercial, que atrai gente do mundo todo, é um polo de contágio e disseminação. Sem imaginar o risco que correm, pessoas são contaminadas e, ao voltar para seu local de origem, carregam o vírus para todos os continentes.

7 – Com a doença já fora de controle, começa uma corrida entre laboratórios e cientistas de grandes universidades para descobrir o agente causador. Mesmo com o vírus isolado, as vacinas demoram para ser feitas em larga escala, tornando impossível o atendimento à demanda mundial.

8 – Os países se isolam, mantendo esquemas de quarentena. Aeroportos são fechados e o turismo mundial cai a quase zero. A China sofre as piores consequências, com o fluxo de empresários para Hong Kong suspenso – gerando prejuízos de bilhões de dólares – e com o boicote a produtos alimentícios vindos da Ásia.

9 – Além dos 10% de casos letais, os milhões de doentes precisam de atendimento médico. Enquanto hospitais e cemitérios estão lotados, escolas, indústrias e comércio ficam paralisados por falta de profissionais. O transporte público também para e os trabalhadores que podem passam a trabalhar em casa.

10 – Nas nações pobres, quase 20% da população morre – e outros milhões são vitimados mesmo em países ricos. Parte dessa mortalidade ocorre por causa da doença, mas outro fator determinante é a crise financeira global. A produção de alimentos cai por falta de mão de obra.

Fontes: A História e Suas Epidemias e Pandemias – A Humanidade em Risco, de Stefan Cunha Ujvari; Pragas e Epidemias – Histórias de Doenças Infecciosas, de Antonio Carlos de Castro Toledo Jr. Consultoria: Stefan Ujvari Cunha, infectologista do Hospital Alemão Oswaldo Cruz; Paolo Zanotto, professor de virologia do Instituto de Ciências Biológicas (ICB) da USP; Átila Iamarino, doutorando em HIV-1 no ICB da USP. “

3. PRIMEIROS INDÍCIOS

10/2019 - Evento 201 - Durante os Jogos Militares Internacionais na China https://www.centerforhealthsecurity.org/event201/

Promovido por: - Bill & Melinda Gates Foundation - John Hopkins Institute - Fórum econômico mundial

"O evento simula a liberação de um coronavírus novo do tipo zoonótico transmitido por morcegos para porcos e por fim para humanos. Eventualmente ele se torna muito transmissível entre humanos levando a uma pandemia severa. O vírus é muito parecido com o vírus da SARS, mas se transmite muito mais facilmente entre pessoas devido a sintomas muito mais leves destas."

Também mencionado por: Jornal Estadão

Sobre o "Movimento antivacina"

05/12/2017 - Movimento antivacina: como surgiu e quais consequências ele pode trazer? https://www.uol.com.br/universa/noticias/redacao/2017/12/05/o-que-o-movimento-antivacina-pode-causar.htm?cmpid=copiaecola

23/03/2019 - "Instagram bloqueia hashtags e conteúdo antivacinação" https://canaltech.com.br/redes-sociais/instagram-bloqueia-hashtags-e-conteudo-antivacinacao-135411/

23/05/2021 - Novos dados sobre pesquisadores de Wuhan aumentam debate sobre origens da Covid https://www.cnnbrasil.com.br/saude/novos-dados-sobre-pesquisadores-de-wuhan-aumentam-debate-sobre-origens-da-covid/

"A China relatou à Organização Mundial da Saúde que o primeiro paciente com sintomas semelhantes aos de Covid-19 foi registrado em Wuhan em 8 de dezembro de 2019"

01/02/2020 - O que aconteceu desde que o novo coronavírus foi descoberto na China https://exame.com/ciencia/o-que-aconteceu-desde-que-o-novo-coronavirus-foi-descoberto-na-china/

"O primeiro alerta foi recebido pela Organização Mundial da Saúde (OMS) em 31 de dezembro de 2019"

15/09/2020 - YouTube diz que vai remover vídeos com mentiras sobre vacina contra COVID-19 https://gizmodo.uol.com.br/youtube-remover-videos-mentiras-vacina-covid-19/

"O YouTube anunciou na quarta-feira (14) que estenderá as regras atuais sobre mentiras, propaganda e teorias da conspiração sobre a pandemia do coronavírus para incluir desinformação sobre as vacinas contra a doença.

De acordo com a Reuters, a gigante do vídeo diz que agora vai proibir conteúdos sobre vacinas contra o coronavírus que contradizem “o consenso de especialistas das autoridades de saúde locais ou da OMS”, como afirmações falsas de que a vacina é um pretexto para colocar chips de rastreamento nas pessoas ou que irá matar ou esterilizar quem tomar."

*07/01/2021 - YouTube vai punir canais que promovem mentiras sobre eleições – incluindo os de Trump https://olhardigital.com.br/2021/01/07/noticias/youtube-vai-punir-canais-que-promovem-mentiras-sobre-eleicoes-incluindo-os-de-trump/

"O YouTube anunciou que vai punir canais que promovem mentiras sobre as eleições, removendo sumariamente qualquer vídeo que contenha desinformação e, ao mesmo tempo, advertindo com um “strike” o canal que o veicular. A medida já está valendo e a primeira “vítima” é ninguém menos que o ex-presidente americano, Donald Trump.

A medida não é exatamente nova, mas foi novamente comunicada e reforçada pelo YouTube na quarta-feira (6), após os eventos de invasão do Capitólio, em Washington, onde o presidente eleito Joe Biden participava da cerimônia que confirmava a sua vitória nas eleições de novembro de 2020. A ocasião ficou marcada pela tentativa de invasão de correligionários de Trump, que entraram no edifício em oposição à nomeação do novo presidente. Uma mulher acabou sendo morta pela polícia que protegia o local.

O ex-presidente Donald Trump teve vídeos banidos de seu canal no YouTube após os eventos de ontem (6) no capitólio."

4. FIGURAS CENTRAIS

Bill Gates

- Bill Gates diz 'não' a abrir patentes de vacinas https://www.frontliner.com.br/bill-gates-diz-nao-a-abrir-patentes-de-vacinas/

"Bill Gates, um dos homens mais ricos do mundo, cuja fundação tem participação na farmacêutica alemã CureVac, produtora de vacina mRNA para prevenção de covid-19, disse não acreditar que a propriedade intelectual tenha algo a ver com o longo esforço global para controlar a pandemia."

João Doria - Governo de São Paulo

26/07/2017 - João Dória vai a China conhecer drones para ampliar segurança eletrônica na capital paulista https://jc.ne10.uol.com.br/blogs/jamildo/2017/07/26/joao-doria-vai-china-conhecer-drones-para-ampliar-seguranca-eletronica-na-capital-paulista/

02/08/2019 - Governo de SP fará Missão China para ampliar cooperação e atrair investimentos https://www.saopaulo.sp.gov.br/spnoticias/governo-de-sao-paulo-detalha-objetivos-da-missao-china/

20/11/2019 - Doria se encontra com chineses das gigantes CREC e CRCC e oferece concessões de rodovia, metrô e ferrovia https://diariodotransporte.com.br/2019/11/20/doria-se-encontra-com-chineses-das-gigantes-crec-e-crcc-e-oferece-concessoes-de-rodovia-metro-e-ferrovia/

25/01/2020 - "Chineses serão agressivos" nas privatizações em SP até 2022, afirma Dória https://noticias.uol.com.br/colunas/jamil-chade/2020/01/25/entrevista-joao-doria-privatizacoes-sao-paulo-china.htm

O governador de São Paulo, João Doria, afirma que vai acelerar os programas de desestatização no estado em 2020 e acredita que concessões e vendas poderão permitir uma arrecadação de pelo menos R$ 40 bilhões. Nesse processo, o governador avalia que a China deve atuar de forma agressiva e que aprofundará sua posição de maior parceira comercial do estado, se distanciando de americanos e argentinos.

29/06/2020 - Doria estabelece multa para quem estiver sem máscara na rua em SP https://veja.abril.com.br/saude/doria-estabelece-multa-para-quem-estiver-sem-mascara-na-rua/

24/12/2020 - Doria é flagrado sem máscara e fazendo compras em Miami https://pleno.news/brasil/politica-nacional/doria-e-flagrado-sem-mascara-e-fazendo-compras-em-miami.html

"Foto do governador de São Paulo sem o item de proteção viralizou nas redes"

07/06/2021 - Doria é criticado na internet por tomar sol sem máscara em hotel no Rio https://vejasp.abril.com.br/cidades/doria-e-criticado-na-internet-por-tomar-sol-sem-mascara-em-hotel-no-rio/

30/09/2020 - Governo de SP assina contrato com Sinovac e prevê vacina para dezembro https://agenciabrasil.ebc.com.br/saude/noticia/2020-09/governo-de-sp-assina-contrato-com-sinovac-e-preve-vacina-para-dezembro

O governador de São Paulo, João Doria, e o vice-presidente da laboratório chinês Sinovac, Weining Meng, assinaram hoje (30), um contrato que prevê o fornecimento de 46 milhões de doses da vacina CoronaVac para o governo paulista até dezembro deste ano.

O contrato também prevê a transferência tecnológica da vacina da Sinovac para o Instituto Butantan, o que significa que, o instituto brasileiro poderá começar a fabricar doses dessa vacina contra o novo coronavírus. O valor do contrato, segundo o governador João Doria é de US$ 90 milhões.

20/10/2020 - Coronavac terá mais de 90% de eficácia, afirmam integrantes do governo paulista https://www.cnnbrasil.com.br/saude/2020/12/20/coronavac-tera-mais-de-90-de-eficacia-afirmam-integrantes-do-governo

24/10/2020 - Não esperamos 90% de eficácia da Coronavac’, diz secretário de saúde de SP https://www.cnnbrasil.com.br/saude/2020/12/24/nao-esperamos-90-de-eficacia-da-coronavac-diz-secretario-de-saude-de-sp

07/01/2021 - Vacina do Butantan: eficácia é de 78% em casos leves e 100% em graves https://www.cnnbrasil.com.br/saude/2021/01/07/vacina-do-butantan-eficacia-e-de-78-em-casos-leves-e-100-em-graves

09/01/2021 - Não é hora de sermos tão cientistas como estamos sendo agora https://g1.globo.com/sp/sao-paulo/video/nao-e-hora-de-sermos-tao-cientistas-como-estamos-sendo-agora-diz-secretario-de-saude-de-sp-9166405.ghtml

10/01/2021 - Dados da Coronavac relatados à Anvisa não estão claros, diz médico https://www.cnnbrasil.com.br/saude/2021/01/10/dados-da-coronavac-relatados-a-anvisa-nao-estao-claros-diz-medico

"O diretor do Laboratório de Imunologia do Incor, Jorge Kalil, reforçou que faltaram informações sobre a Coronavac nos dados divulgados à Anvisa"

12/01/2021 - New Brazil data shows disappointing 50,4% efficacy for China’s Coronavac vaccine [Novos dados do Brasil mostram eficácia decepcionante de 50,4% para a vacina CoronaVac da China] https://www.reuters.com/article/us-health-coronavirus-brazil-coronavirus/new-brazil-data-shows-disappointing-504-efficacy-for-chinas-coronavac-vaccine-idUSKBN29H2CE

13/01/2021 - Eficácia da Coronavac: 50,38%, 78% ou 100%? https://blogs.oglobo.globo.com/lauro-jardim/post/5038-78-ou-100.html

“De acordo com interlocutores que participaram tanto do anúncio de ontem como da semana passada, quem pressionou para que os dados de 78% e 100% fossem liberados foi João Dória.”

07/05/2021 - Covid-19: Doria toma primeira dose da vacina CoronaVac https://veja.abril.com.br/saude/covid-19-doria-toma-primeira-dose-da-vacina-coronavac/

04/06/2021 - Doria é vacinado com a segunda dose da CoronaVac em São Paulo https://noticias.uol.com.br/politica/ultimas-noticias/2021/06/04/doria-e-vacinado-com-a-segunda-dose-da-coronavac-em-sao-paulo.htm

15/07/2021 - Doria testa positivo para a Covid-19 pela 2ª vez https://www.correiobraziliense.com.br/politica/2021/07/4937833-doria-testa-positivo-para-covid-19-pela-segunda-vez.html

"Governador de São Paulo já havia sido diagnosticado com a doença no ano passado. Ele diz que, apesar da infecção, se sente bem, o que atribui ao fato de ter sido vacinado com duas doses da Coronavac"

06/08/2021 - CPI recebe investigação contra Doria por compra de máscara sem licitação https://www.conexaopoder.com.br/nacional/cpi-recebe-investigacao-contra-doria-por-compra-de-mascara-sem-licitacao/150827

"Empresa teria usado o nome de Alexandre Frota para vender máscaras ao governo de SP. Doria nega informação"

Renan Filho

(filho do Renan Calheiros)

25/07/2019 - Governador Renan Filho vai à China em busca de investimentos para o estado https://www.tnh1.com.br/videos/vid/governador-renan-filho-vai-a-china-em-busca-de-investimentos-para-o-estado/

20/03/2020 - Governadores do NE consultam China e pedem material para tratar covid-19 https://noticias.uol.com.br/saude/ultimas-noticias/redacao/2020/03/20/governadores-do-ne-consultam-china-e-pedem-material-para-tratar-covid-19.htm

5. Narrativas, restrições e proibições

17/12/2020 - STF decide que vacina contra a covid pode ser obrigatória, mas não forçada https://noticias.uol.com.br/saude/ultimas-noticias/redacao/2020/12/17/stf-julga-vacinacao-obrigatoria.htm?cmpid=copiaecola

"O STF (Supremo Tribunal Federal) decidiu, em julgamento hoje, que o Estado pode determinar a obrigatoriedade da vacinação contra a covid-19. Porém fica proibido o uso da força para exigir a vacinação, ainda que possam ser aplicadas restrições a direitos de quem recusar a imunização.

Dez ministros foram favoráveis a obrigatoriedade da vacinação, que poderá ser determinada pelo governo federal, estados ou municípios. As penalidades a quem não cumprir a obrigação deverão ser definidas em lei."

27/07/2021 - Saiba que países estão adotando 'passaporte da vacina' para suspender restrições https://www.cnnbrasil.com.br/internacional/2021/07/27/saiba-que-paises-estao-adotando-passaporte-da-vacina-para-suspender-restricoes

" - Israel - Uniao Europeia - Áustria - Dinamarca - Eslovênia - França - Grécia - Irlanda - Itália - Letônia - Lituânia - Luxemburgo - Holanda - Portugal - Japão - Coreia do sul"

18/06/2021 - O que é o passaporte da vacina que Bolsonaro quer vetar? https://noticias.uol.com.br/politica/ultimas-noticias/2021/06/18/uol-explica-o-que-e-o-passaporte-da-vacina-que-opoe-bolsonaro-e-damares.htm

"O Brasil poderá ter um certificado de imunização futuramente. Aprovado no Senado na semana passada, o "passaporte da vacina", como é chamado, prevê identificar pessoas vacinadas para que entrem em locais públicos ou privados com possíveis restrições."

6. Vacinas

Alegações iniciais

- CoronaVac, Oxford e Pfizer: veja diferenças entre as vacinas contra covid noticias.uol.com.br/saude/ultimas-noticias/redacao/2021/05/11/diferencas-vacinas-covid-brasil.htm

" - CoronaVac (Butantan/Sinovac - Chinesa) Com virus inativo 50,38% de eficácia 2 doses

-

Covishield - 'AstraZeneca' (Fiocruz/Astrazenica/Oxford - Britânica) Com virus não replicante 67% de eficácia 2 doses

-

ComiRNAty - 'Pfizer' (Pfizer - Americana / BioNTech - Alemã) Com RNA mensageiro 96% de eficácia 2 doses"

Riscos diretos

15/06/2021 - Trombose após vacinação com AstraZeneca: Quais os sintomas e como se deve atuar? https://www.istoedinheiro.com.br/trombose-apos-vacinacao-com-astrazeneca-quais-os-sintomas-e-como-se-deve-atuar/

"Agências europeias estão reticentes com a vacina da AstraZeneca. Ela chegou a ser desaconselhada a pessoas com idade inferior a 60 anos, e um alto funcionário da Agência Europeia de Medicamentos declarou que era melhor deixar de administrar a vacina deste laboratório em qualquer idade quando há alternativas disponíveis, devido aos relatos de trombose após a primeira dose, apesar de raros."

11/05/2021 - CoronaVac, Oxford e Pfizer: veja diferenças entre as vacinas contra covid https://noticias.uol.com.br/saude/ultimas-noticias/redacao/2021/05/11/diferencas-vacinas-covid-brasil.htm

"Na terça-feira (12), o Ministério da Saúde determinou a suspensão da aplicação da vacina de Oxford/AstraZeneca para gestantes e puérperas com comorbidades. A decisão segue recomendação da Anvisa, que apura a morte de uma grávida de 35 anos que tomou o imunizante e teve um AVC (acidente vascular cerebral)."

30/07/2021 - Pfizer representa o mesmo risco de trombose que a Astrazeneca, aponta levantamento https://panoramafarmaceutico.com.br/pfizer-representa-o-mesmo-risco-de-trombose-que-a-astrazeneca-aponta-levantamento/

7. CRIMES

Crimes da Pfizer

18/11/2020 Não listado no google - Os Crimes documentados da produtora de vacinas de Covid - Pfizer [INGLÊS] https://www.dmlawfirm.com/crimes-of-covid-vaccine-maker-pfizer-well-documented/

"A velocidade com que a vacina Covid da Pfizer foi produzida, a ausência de estudos em animais, testes de controle randomizados e outros testes e procedimentos padrão usuais para um novo medicamento são, no mínimo, preocupantes. Além disso, todos os fabricantes de vacinas Covid receberam imunidade legal para quaisquer ferimentos ou mortes que possam causar. Se essas vacinas são tão seguras quanto promovidas, por que seus fabricantes precisam de imunidade geral?"

"A Pfizer, uma empresa farmacêutica que parece ter ganhado na loteria para produzir a primeira vacina Covid-19, está atualmente lutando contra centenas de ações judiciais sobre o Zantac, um popular medicamento contra azia. Os processos da Zantac afirmam que a droga popular pode estar contaminada com uma substância cancerígena chamada N-nitrosodimetilamina (NDMA). Os processos Zantac são em aberto e em andamento, já que a farmacêutica está lutando contra eles; mas a Pfizer, sabemos, cometeu vários crimes ou transgressões pelos quais foi punida nos últimos anos. As falhas da empresa estão bem documentadas e vale a pena revisá-las neste momento crítico da história da humanidade, enquanto todos nós buscamos respostas."

A Pfizer recebeu a maior multa da história dos Estados Unidos como parte de um acordo judicial de US $ 2,3 bilhões com promotores federais por promover medicamentos erroneamente (Bextra, Celebrex) e pagar propinas a médicos complacentes. A Pfizer se confessou culpada de falsificar a marca do analgésico Bextra, promovendo o medicamento para usos para os quais não foi aprovado.

Na década de 1990, a Pfizer estava envolvida em válvulas cardíacas defeituosas que causaram a morte de mais de 100 pessoas. A Pfizer enganou deliberadamente os reguladores sobre os perigos. A empresa concordou em pagar US $ 10,75 milhões para acertar as acusações do departamento de justiça por enganar reguladores.

A Pfizer pagou mais de US $ 60 milhões para resolver um processo sobre o Rezulin, um medicamento para diabetes que causou a morte de pacientes de insuficiência hepática aguda.

No Reino Unido, a Pfizer foi multada em quase € 90 milhões por sobrecarregar o NHS, o Serviço Nacional de Saúde. A Pfizer cobrou do contribuinte um adicional de € 48 milhões por ano, pelo que deveria custar € 2 milhões por ano.

A Pfizer concordou em pagar US $ 430 milhões em 2004 para resolver acusações criminais de que havia subornado médicos para prescrever seu medicamento para epilepsia Neurontin para indicações para as quais não foi aprovado. Em 2011, um júri concluiu que a Pfizer cometeu fraude em sua comercialização do medicamento Neurontin. A Pfizer concordou em pagar $ 142,1 milhões para liquidar as despesas.

A Pfizer revelou que pagou quase 4.500 médicos e outros profissionais médicos cerca de US $ 20 milhões por falar em nome da Pfizer.

Em 2012, a Comissão de Valores Mobiliários dos Estados Unidos - anunciou que havia chegado a um acordo de US $ 45 milhões com a Pfizer para resolver acusações de que suas subsidiárias haviam subornado médicos e outros profissionais de saúde no exterior para aumentar as vendas no exterior.

A Pfizer foi processada em um tribunal federal dos Estados Unidos por usar crianças nigerianas como cobaias humanas, sem o consentimento dos pais das crianças. A Pfizer pagou US $ 75 milhões para entrar em acordo no tribunal nigeriano pelo uso de um antibiótico experimental, o Trovan, nas crianças. A empresa pagou um valor adicional não divulgado nos Estados Unidos para liquidar as despesas aqui. A Pfizer violou o direito internacional, incluindo a Convenção de Nuremberg estabelecida após a Segunda Guerra Mundial, devido aos experimentos nazistas em prisioneiros relutantes.

Em meio a críticas generalizadas de roubar os países pobres em busca de drogas, a Pfizer prometeu dar US $ 50 milhões para um medicamento para a AIDS para a África do Sul. Mais tarde, no entanto, a Pfizer falhou em honrar essa promessa.

- Pfizer contract leaked!

[Contrato da Pfizer vazado]

http://sanjeev.sabhlokcity.com/Misc/LEXO-KONTRATEN-E-PLOTE.pdf

http://sanjeev.sabhlokcity.com/Misc/LEXO-KONTRATEN-E-PLOTE.pdf

Segundo o contrato "o produto não deve ser serializado":

"5.5 Reconhecimento do comprador.

O Comprador reconhece que a Vacina e os materiais relacionados à Vacina, e seus componentes e materiais constituintes estão sendo desenvolvidos rapidamente devido às circunstâncias de emergência da pandemia de COVID-19 e continuarão a ser estudados após o fornecimento da Vacina ao Comprador nos termos deste Contrato. O Comprador reconhece ainda que os efeitos de longo prazo e eficácia da Vacina não são atualmente conhecidos e que pode haver efeitos adversos da Vacina que não são atualmente conhecidos. Além disso, na medida do aplicável, o Comprador reconhece que o Produto não deve ser serializado."

Crimes da AstraZeneca

21/06/2003 - AstraZeneca se declara culpada no esquema de médico de câncer https://www.nytimes.com/2003/06/21/business/astrazeneca-pleads-guilty-in-cancer-medicine-scheme.html

"A AstraZeneca, a grande empresa farmacêutica, se declarou culpada hoje de uma acusação de crime de fraude no sistema de saúde e concordou em pagar $ 355 milhões para resolver as acusações criminais e civis de que se envolveu em um esquema nacional para comercializar ilegalmente um medicamento contra o câncer de próstata.

O governo disse que os funcionários da empresa deram incentivos financeiros ilegais a cerca de 400 médicos em todo o país para persuadi-los a prescrever o medicamento Zoladex. Esses incentivos incluíram milhares de amostras grátis de Zoladex [...]"

27/04/2010 - Farmacêutica gigante AstraZeneca pagará US $ 520 milhões pelo marketing de medicamentos off-label https://www.justice.gov/opa/pr/pharmaceutical-giant-astrazeneca-pay-520-million-label-drug-marketing

"AstraZeneca LP e AstraZeneca Pharmaceuticals LP vão pagar $ 520 milhões para resolver as alegações de que a AstraZeneca comercializou ilegalmente o medicamento antipsicótico Seroquel para usos não aprovados como seguros e eficazes pela Food and Drug Administration (FDA), os Departamentos de Justiça e Saúde e Serviços Humanos A Equipe de Ação de Fiscalização de Fraudes em Saúde (HEAT) anunciou hoje. Esses usos não aprovados também são conhecidos como usos "off-label" porque não estão incluídos no rótulo do medicamento aprovado pela FDA."

- List of largest pharmaceutical settlements [Lista dos maiores acordos farmaceuticos] https://en.m.wikipedia.org/wiki/List_of_largest_pharmaceutical_settlements

8. CIENTISTAS

- Máscara Provoca Insuficiência Respiratória E Contaminação Microbiana… [Canal deletado] https://youtube.com/watch?v=eHu-pydSvDI

Não lembro mais a quem pertencia, mas provavelmente era de um médico falando do assunto. Creio ter sido do Dr. Paulo Sato, por essa temática ter sido abordada por ele, mas ao abrir o site aparece somente:

"Este vídeo foi removido por violar as diretrizes da comunidade do YouTube"

Dr. Paulo Sato

- USAR ou NÃO USAR a CUECA do seu governador no rosto https://fb.watch/7NPP_7rS5S/ https://www.facebook.com/AdoniasSoaresBR/videos/1347904292291481/ Adonias Soares entrevista ao Dr. Paulo Sato sobre as máscaras, em que é simulado o efeito da respiração prolongada das máscaras no organismo com o uso de águas de torneira, natural, gaseificada (com gás carbônico) e antioxidante, em que a com gás carbônico (PH 4 - Ácido) representa o organismo humano, e na prática representa lesão corporal e iniciação de doenças.

Dr. Kary Mullis

(Criador do teste PCR)

- PCR nas palavras do seu inventor - Dr. Kary Mullis (legendado) https://www.youtube.com/watch?v=W1O52uTygk8

"Qualquer um pode testar positivo para quase qualquer coisa com um teste de PCR, se você executá-lo por tempo suficiente… Com PCR, se voce fizer isso bem, você pode encontrar quase tudo em qualquer pessoa… Isso não te diz que você está doente."

- Kary Mullis DESTRUYE a Anthony Fauci lbry://@CapitalistChile#0/Kary-Mullis---Fauci#5

"Ele [...] não entende de medicina e não deveria estar onde está. A maioria dos que estão acima são só administrativos e não têm nem ideia do que ocorre aqui em baixo e essas pessoas tem uma agenda que não é a que gostaríamos que tivessem, dado que somos nós os que pagamos a eles para que cuidem da nossa saúde. Têm uma agenda pessoal."

Dra. Li-Meng Yan

- Dra. Li-Meng Yan: O vírus foi criado em laboratório com um objetivo: Causar dano. https://youtu.be/pSXp3CZnvOc

Dr. Joe Roseman

- Cientista Phd Dr Joe Roseman faz seríssimas advertencias sobre a picada https://youtu.be/0PIXVFqJ_h8

Dr. Robert Malone

- As vacinas podem estar causando ADE - Dr. Robert Malone https://odysee.com/@AkashaComunidad:f/Las_vacunas_pueden_estar_causando_ADE_magnificaci%C3%B3n_mediada_por:f lbry://@Información.#b/Drrm#9

Dr. Robert Malone, um dos três inventores da tecnologia de RNAm que se usa de forma farmacêutica. No vídeo fala sobre os efeitos de ADE (realce dependente de anticorpos) que estão ocorrendo com as vacinas. Nas palavras do Dr. Malone, já não é somente uma hipótese, mas baseada nos conhecimentos gerados nas provas e ensaios pré clínicos, com as vacinas contra o primeiro vírus da SARS.

Dr. Luc Montagnier

- Dr. Luc Montagnier, virologista, prêmio Nobel de medicina, um dos descobridores do vírus HIV, afirma: "a vacinação em massa está criando as novas variantes' (@medicospelavida , telegram)

CASOS DOCUMENTADOS

13/09/2021 - 13 de setembro de 2021 - Carta aberta ao Ministro da Saúde por Arlene Ferrari Graf, mãe de Bruno Oscar Graf https://telegra.ph/Carta-aberta-ao-Ministro-da-Sa%C3%BAde-09-13

Também em: Gazeta do Povo

O texto de uma mãe discorrendo sobre o filho dela, Bruno Oscar Graf, ter ANTI-HEPARINA PF4 AUTO-IMUNE e ter vindo a falecer por reação à vacina.

11/05/2021 - Rio notifica morte de grávida vacinada com imunizante Oxford https://www.terra.com.br/noticias/coronavirus/rio-notifica-morte-de-gravida-vacinada-com-imunizante-oxford,415b9b0c49169427ac2f90ae3765c057e9suy3qn.html

"Vítima não apresentava histórico de doença circulatória nem sofria de nenhuma doença viral; relação será investigada"

13/08/2021 - Cruzeiro com 4.336 pessoas tem 27 contaminados com Covid-19 em Belize https://paranaportal.uol.com.br/geral/cruzeiro-com-4-336-pessoas-tem-27-contaminados-com-covid-19-em-belize/amp/

"Segundo um comunicado do Conselho de Turismo de Belize emitido na quarta-feira (11), 26 contaminados são da tripulação e um é passageiro. A maioria é assintomática e os 27 estão vacinados."

9. ALEGAÇÕES DIRETAS

09/2021 - Setembro de 2021 - BOMBA: Ex-membro do Partido Comunista da China revela que o primeiro surto da Covid foi “intencional” https://terrabrasilnoticias.com/2021/09/bomba-ex-membro-do-partido-comunista-da-china-revela-que-o-primeiro-surto-da-covid-foi-intencional/

01/03/2023 - 1 de Março de 2023 - O chefe do FBI, Christopher Wray, diz que vazamento de laboratório na China é muito provável https://www.bbc.com/news/world-us-canada-64806903