-

@ cae03c48:2a7d6671

2025-05-29 16:01:40

@ cae03c48:2a7d6671

2025-05-29 16:01:40Bitcoin Magazine

GameStop CEO Ryan Cohen Announced Acquisition of Over $505 Million BitcoinAt the 2025 Bitcoin Conference in Las Vegas, in an interview with the CEO of Nakamoto David Bailey, the CEO of GameStop Ryan Cohen announced why the company bought over $505 million in Bitcoin.

JUST IN: GameStop $GME CEO explains why the company bought over $505 million #Bitcoin

“Bitcoin can be a hedge against global currency devaluation” pic.twitter.com/jNiId2fntA

— Bitcoin Magazine (@BitcoinMagazine) May 28, 2025

Ryan Cohen started by explaining some things about the GameStop business.

“When I took over, the company was a piece of crap and losing a lot of money and was under a lot of pressure moving from physical gains to digital downloads so you had to cut costs,” stated Cohen. “Very aggressively bringing physical discipline and we did. Retail is a tough business, but it was a big focus on getting cost under control.”

When Bailey asked Cohen how many Bitcoin GameStop owned, Ryan responded, “We currently own 4710 Bitcoin.”

Then Ryan mentioned why they are adding Bitcoin to their balance sheets.

“If the thesis is correct then Bitcoin and gold as well can be a hedge against global currency devaluation and systemic risk,” mentioned Ryan. “Bitcoin has certain unique advantages better than gold.”

He commented on the benefits of Bitcoin compared to gold.

“You can easily secure Bitcoin in a wallet whereas gold requires insurance and it’s very expensive and then there is the scarcity element of this as well,” commented Ryan. “There is a fixed supply of Bitcoin whereas with gold, the supply of gold is still uncertain.“

Ryan finished the announcement by saying, “GameStop is following GameStop Strategy. We are not following anyone else’s.”

This post GameStop CEO Ryan Cohen Announced Acquisition of Over $505 Million Bitcoin first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ da8b7de1:c0164aee

2025-05-29 15:52:45

@ da8b7de1:c0164aee

2025-05-29 15:52:45Bulgária: Először töltenek be Westinghouse-üzemanyagot a Kozloduy-5-be

Először töltöttek be Westinghouse által gyártott nukleáris üzemanyag-kazettákat Bulgária Kozloduy-5 VVER-1000 reaktorába 2025. május 29-én. Ez jelentős lépés Szófia azon törekvésében, hogy csökkentse orosz nukleáris üzemanyag-függőségét, és diverzifikálja energiaforrásait. A lépés része annak a szélesebb stratégiának, amelynek célja az energiaellátás biztonságának növelése és a nyugati partnerekkel való szorosabb együttműködés[NucNet].

Fehér Ház: Nukleáris Telepítési Csúcstalálkozó az USA-ban

A mai napon a Fehér Ház Nukleáris Telepítési Csúcstalálkozót tartott, amelyen kiemelték a köz- és magánszféra eredményeit. Fő témák voltak az orosz urántól való amerikai függőség csökkentése, a nukleáris üzemanyag-ellátási lánc bővítése, valamint a globális nukleáris kapacitás 2050-ig történő megháromszorozásának támogatása. A csúcson szó esett a nagy nukleáris projektek kockázatainak csökkentéséről, új reaktortervezetekről és a meglévő atomerőművek élettartamának meghosszabbításáról is. Az amerikai kormány hangsúlyozta, hogy továbbra is támogatja a fejlett nukleáris demonstrációs projekteket, a munkaerő-fejlesztést, valamint a legújabb törvényhozási lépéseket, például az orosz uránimport tilalmáról szóló törvényt[World Nuclear News].

Törékeny áramellátás a zaporizzsjai atomerőműben, Ukrajna

Az IAEA jelentése szerint az ukrajnai Zaporizzsjai Atomerőmű továbbra is rendkívül sebezhető helyzetben van, mivel jelenleg csak egyetlen külső áramvezetékre támaszkodik a biztonsági rendszerek működtetéséhez. Az utolsó tartalék vezeték három hete le van választva, ami aggodalomra ad okot a hűtő- és biztonsági rendszerek stabilitását illetően. Bár a létesítmény három éve nem termel áramot, folyamatos elektromos ellátásra van szükség a kiégett fűtőelemek hűtéséhez. Az IAEA továbbra is szorosan figyelemmel kíséri a helyzetet, és kiemeli a régióban zajló katonai tevékenységet[IAEA].

USA: SMR-fejlesztések és költségvetési megszorítások

A Tennessee Valley Authority benyújtotta az építési engedélykérelmet egy GE Vernova Hitachi BWRX-300 típusú kis moduláris reaktor (SMR) telepítésére a Clinch River helyszínen, ami jelentős előrelépés az amerikai SMR-programban. Eközben az amerikai kormány 2026-os költségvetési tervezete jelentős csökkentéseket irányoz elő az Energiaügyi Minisztérium nukleáris finanszírozásában, különösen a nem elsődleges kutatási területeken. A fókusz az innovatív reaktorkoncepciókra, fejlett üzemanyagokra és a kulcsfontosságú nemzeti laboratóriumi képességek fenntartására helyeződik[World Nuclear News][World Nuclear News].

Savannah River Site: Előrelépés a plutónium-magházak gyártásában

Az amerikai Energiaügyi Minisztérium Savannah River telephelyén megkezdődött a kesztyűs dobozok gyártása a plutónium magházak előállításához. Ezek a kesztyűs dobozok kulcsfontosságúak a Savannah River Plutonium Processing Facility számára, amely a Nemzeti Nukleáris Biztonsági Igazgatóság célkitűzéseit támogatja, hogy a projektet a 2030-as évek elejéig befejezzék. Ez a lépés az amerikai nukleáris fegyverkezési infrastruktúra modernizációjának része[ANS].

Nemzetközi trendek: ellátási lánc és új reaktorprojektek

A nukleáris ellátási lánc a globális növekedésre készül, ahogy azt a World Nuclear Association legutóbbi konferenciáján is hangsúlyozták. Kiemelt nemzetközi fejlemények:

- Gőzturbina-hengerek telepítése Kína Haiyang 3 erőművében.

- Új, négy reaktoros telephely jóváhagyása Indiában, Rádzsasztánban.

- Belgium és Dánia újragondolja a nukleáris kivonulási politikáját.

- Brazília az oroszokkal való SMR-együttműködést vizsgálja.

- Kanada előrelép a szállítható nukleáris erőmű-technológia terén[World Nuclear News].

Érintetti bevonás és a nukleáris energia szerepe a tiszta átmenetben

Az IAEA konferenciasorozata továbbra is hangsúlyozza az érintetti bevonás fontosságát a nukleáris non-proliferáció, biztonság és a közbizalom szempontjából. A panelek foglalkoznak a közvélemény-tájékoztatás tanulságaival, a nukleáris energia ipari dekarbonizációban betöltött szerepével és az újonnan belépő országok nukleáris infrastruktúra-fejlesztési tapasztalataival is[IAEA].

További részletek a következő forrásokon: - World Nuclear News - NucNet - IAEA - ANS

-

@ cf8c27f4:c95b9b5c

2025-05-29 15:21:33

@ cf8c27f4:c95b9b5c

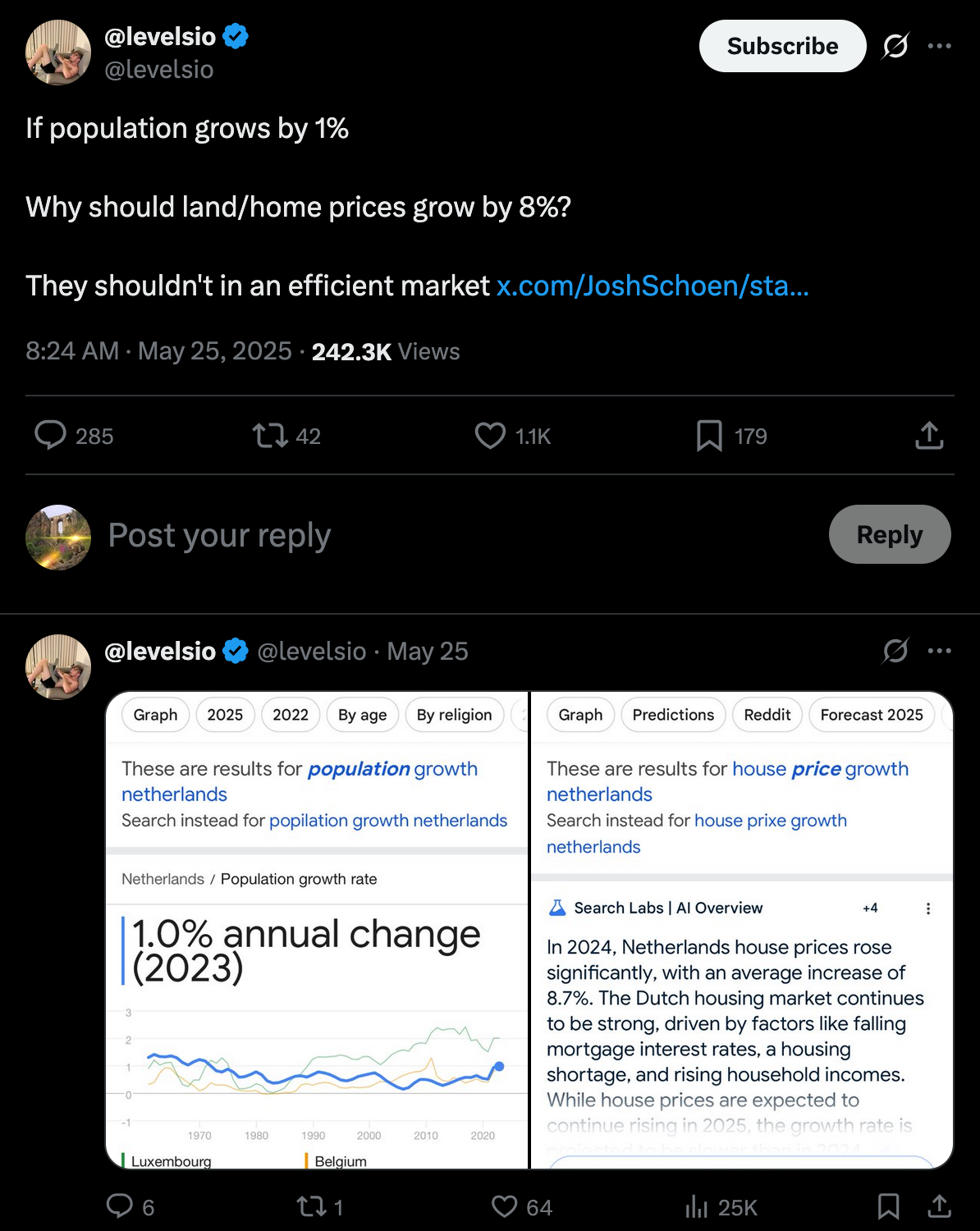

2025-05-29 15:21:33What’s Happening in Japan? Japan has the highest debt-to-GDP ratio in the developed world — over 260%. For decades, it got away with this by keeping interest rates near zero and having the Bank of Japan (BoJ) purchase most of its government bonds. This was known as Yield Curve Control — a desperate attempt to keep borrowing costs low.

But now, global bond markets are revolting.

🔺 Japanese 30-year yields have exploded past 3.18%

🔺 The worst bond auction since 1987 just occurred

🔺 Demand for JGBs (Japanese Government Bonds) is collapsing

When demand for bonds falls, prices drop and yields rise. This signals fear. Big fear.

As Taylor Kenney noted in a widely shared thread:

“This isn’t just a Japan problem — Japan is the largest foreign holder of U.S. debt.” The Contagion Risk: U.S. Debt and Global Collapse

Here’s where this gets truly global.

In 2025 alone, $9.2 trillion of U.S. debt will mature — 70% of it between January and June. That debt must be refinanced, and as interest rates remain elevated, the cost of servicing this debt balloons, potentially straining the U.S. government’s finances.

If yields rise further, it only worsens the cycle:

-

Yields rise

-

Interest costs balloon

-

Governments print more to cover deficits

-

Currencies debase

-

Confidence dies

-

Collapse follows

Japan may just be the canary in the coal mine. Gold Is Surging. Bitcoin Is Outpacing It.

Smart money is already moving.

Bitcoin is closing in on its all-time high — and closely tracking the M2 Global Liquidity Index, historically lagging it by 60–90 days.

Gold has also had a stellar run in 2025, signalling institutional flight to hard assets.

People are scared. And they should be.

The global financial system is built on an unsustainable foundation of debt, inflation, and artificial suppression of interest rates. That system is now cracking in Japan — but it won’t stop there. ₿ Bitcoin: The Exit Plan

Bitcoin doesn’t rely on a central bank.

It doesn’t need to be refinanced.

It doesn’t have a yield curve to control.

It’s decentralised, scarce, and incorruptible.

While fiat currencies spiral under the weight of debt and monetary debasement, Bitcoin offers an escape — a monetary protocol with a fixed supply and no political manipulation.

It’s not just an investment.

It’s an exit strategy from the madness. Final Thoughts

-

Japan is flashing red.

-

The U.S. is next in line.

-

The debt system is spiralling — fast.

Gold is insurance.

Bitcoin is the lifeboat.

-

-

@ cf8c27f4:c95b9b5c

2025-05-29 15:19:56

@ cf8c27f4:c95b9b5c

2025-05-29 15:19:56The Weimar Hyperinflation Nightmare

It’s 1921. Germany’s reeling from World War I, crushed by reparations and a wrecked economy. The government’s solution? Print money. Lots of it. The German mark starts tanking. By 1923, it’s a joke—4.2 trillion marks to one U.S. dollar. A loaf of bread costs wheelbarrows of cash. Savings? Wiped out. Middle-class families? Pauperized. Chaos.

Enter Hugo Stinnes, a coal and steel magnate with a sharp mind and sharper instincts. He sees the game: when a currency’s dying, debt is your friend. Why? Because the real value of your loans shrinks as inflation skyrockets. Borrow 1 million marks today, buy a factory, and by next year, that million’s worth a few pennies. Pay it back, keep the factory, repeat.

Stinnes’ Master Play

Stinnes goes all in. He borrows billions of marks, snapping up hard assets—steel mills, shipping lines, factories, real estate. Tangible stuff that holds value while paper marks turn to confetti. By 1923, his empire is a beast: over 1,500 companies, from coal mines to newspapers. Estimates say he controlled 15-20% of Germany’s industry, maybe more. A third of the economy? Probably an exaggeration, but the guy was a titan.

He wasn’t just lucky. Stinnes played 4D chess. He diversified his holdings to weather the storm, employed tens of thousands (keeping unrest at bay), and even argued his empire stabilized the economy. Critics, like British diplomat Lord D’Abernon, weren’t buying it—they called him a profiteer who thrived while others starved. Truth? Probably somewhere in the middle.

The Fall

Hyperinflation couldn’t last forever. In November 1923, Germany introduced the Rentenmark, a new currency backed by land and assets. The mark’s freefall stopped. Stinnes’ debt-fueled strategy hit a wall—stable currencies make loans harder to game. His health was failing too. He died in 1924, and his conglomerate started unraveling, with parts sold off or restructured. The Inflation King’s reign was over.

Why This Matters Today: Enter Bitcoin

Stinnes’ story isn’t just a history lesson—it’s a warning. Hyperinflation destroys trust in fiat money. When governments print cash to cover debts, savers get crushed, and the clever (or ruthless) like Stinnes exploit the chaos. Sound familiar? Look at today: global debt’s at $315 trillion, central banks are juggling interest rates, and inflation’s eating purchasing power. Argentina’s peso lost 50% of its value in 2024 alone. Venezuela’s bolívar? Toast.

This is where Bitcoin comes in. Born in 2009 after the financial crisis, Bitcoin is a hedge against fiat’s flaws. Unlike marks or dollars, it’s decentralised—no government can print more to pay its bills. Its supply is capped at 21 million coins, making it “digital gold.” When fiat currencies wobble, Bitcoin’s value often spikes—check its 2021 and 2024 bull runs during inflation fears.

Stinnes gamed a broken system by betting on hard assets. Today, Bitcoiners are doing the same, but instead of factories, they’re stacking sats. Why? Because in a world where fiat can be printed to oblivion, a deflationary asset like Bitcoin holds appeal. It’s not perfect—volatility’s a beast, and governments hate what they can’t control—but it’s a response to the same problem Stinnes faced: untrustworthy money.

The Lesson

Stinnes saw the Weimar collapse coming and turned it into wealth. Most didn’t. Today, you don’t need to be a tycoon to protect yourself, but you do need to understand the game. Fiat’s not collapsing tomorrow, but cracks are showing. Bitcoin’s one tool—maybe not the only one—to hedge against that risk. Study history, question the system, and don’t get caught holding the bag.

-

@ eb0157af:77ab6c55

2025-05-29 12:02:57

@ eb0157af:77ab6c55

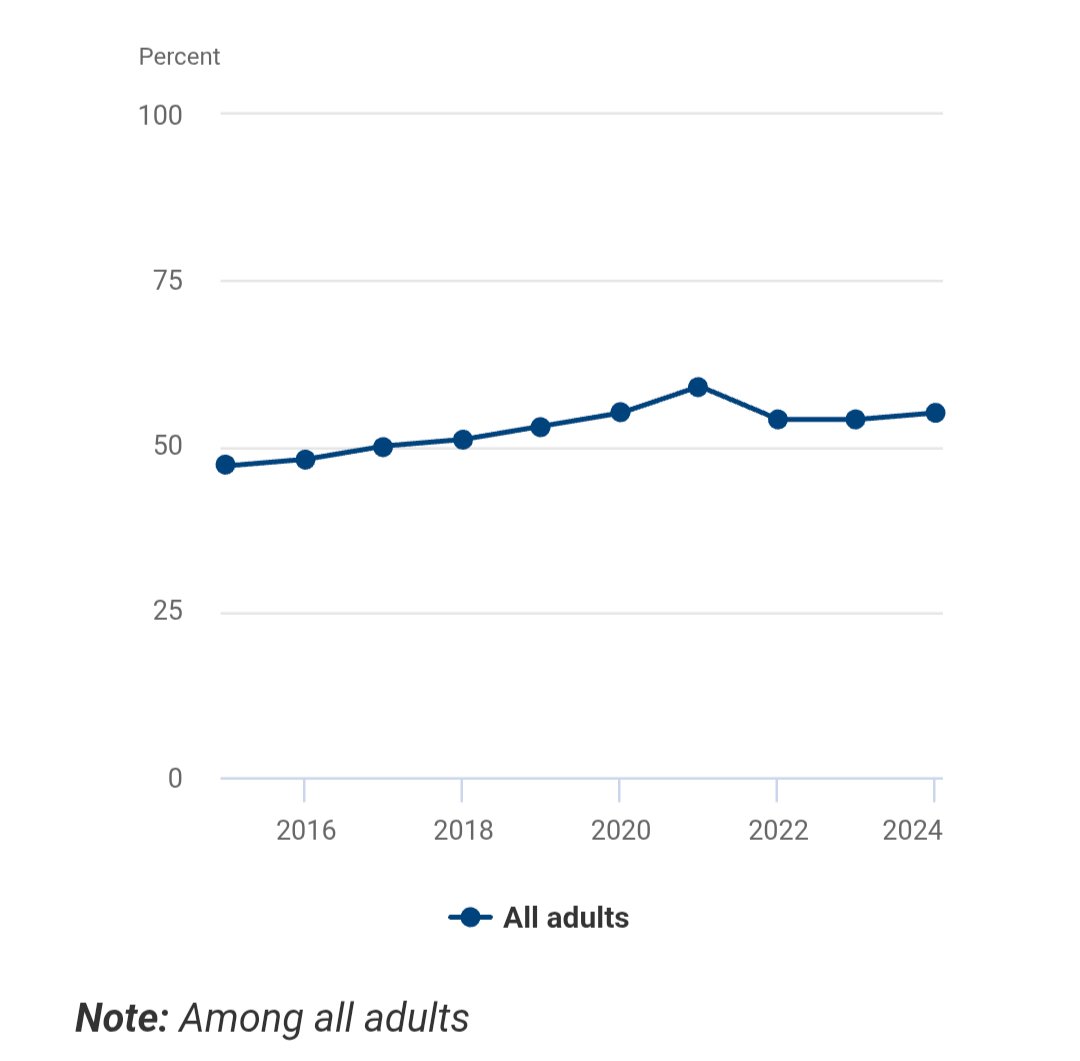

2025-05-29 12:02:57Since 2019, the United States has been the country with the highest number of recorded cases, but Europe remains the most affected region.

According to a Binance report, the United States is the country that has recorded the greatest number of crypto-related kidnapping cases since 2019, despite a recent increase in incidents in France.

At the regional level, however, Europe remains the area with the highest number of crypto-related kidnappings: 59 cases over six years. During the same period, North America — which includes the United States and Canada — recorded 48 cases. Particularly notable is the data concerning the entire Asian continent, where 62 cases of crypto-related kidnappings have been documented, most of which are concentrated in Southeast Asian countries.

France emerges as a concerning hotspot for crypto kidnappings, with six recent cases, three of which have already occurred in 2025.

Source: Binance

The primary targets of these kidnappings include executives of crypto companies, professional traders, exchange employees, and entrepreneurs in the sector. Family members and close associates of victims are often targeted as well. An emerging phenomenon involves tourists suspected of possessing large amounts of cryptocurrency funds.

Kidnapping cases in 2025

The year 2025 has already seen particularly serious episodes of kidnappings linked to the digital asset world. The most notable case involved David Balland, co-founder of Ledger, and his wife, who were abducted from their residence in France earlier this January. The incident drew international attention from both the crypto industry and law enforcement agencies.

Another attempt took place in Paris, where armed men tried to kidnap the daughter and granddaughter of the CEO of the French exchange Paymium. Overseas, in New York, police arrested 37-year-old John Woeltz after discovering that an Italian tourist had been held captive and mistreated for weeks in a luxury Manhattan apartment.

Binance highlights a direct correlation between the price trend of Bitcoin and the increase in kidnappings. Since Bitcoin reached new all-time highs this year, attacks involving physical threats have also increased proportionally, the exchange suggests.

Source: Binance

In 2025 alone, at least 15 kidnapping episodes have already been documented, many involving ransom demands denominated in bitcoin.

The post Crypto kidnappings on the rise: the US leads global statistics appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-05-29 10:01:20

@ eb0157af:77ab6c55

2025-05-29 10:01:20Jacopo Graziuso’s econometric study explains how the presence of Bitcoin is connected to the reduction of emissions and consumption in countries where it is mined.

The debate on Bitcoin’s environmental impact has been at the center of media attention for years, often characterized by approximate information and common misconceptions. But what emerges when data is analyzed? An answer comes from the study by Jacopo Graziuso, a recent graduate in Economics and Finance at the University of Salento, who dedicated his thesis to the topic, titled: “Bitcoin and energy: towards efficiency and environmental sustainability”.

“It bothers me when they tell me ‘Bitcoin pollutes, Bitcoin consumes’. This prompted me to write the thesis,” Graziuso tells Atlas21 microphones. “We live in an era of free and accessible information, yet disinformation reigns supreme, leading to beliefs without scientific foundation.”

Regarding his research work, Graziuso emphasizes: “I thank professor of econometrics Pierluigi Toma who knew what Bitcoin is and what mining is and gave me carte blanche for writing the thesis.”

The methodology used for the study is an econometric analysis based on data from 171 states from 2009 to 2024, with particular attention to the relationship between Bitcoin presence, greenhouse gas emissions (climate-altering gases) and energy consumption. To define Bitcoin’s “presence”, Graziuso created a variable that takes value 1 if at least 1% of the population uses (knows or has a wallet) the cryptocurrency or if it is present in state reserves.

The results of the research, conducted only with open source software, contradict the dominant narrative, Graziuso explains: “The analysis shows that Bitcoin’s presence in a state is associated with a decrease in greenhouse gas emissions. The study reveals that Bitcoin’s presence in a state reduces emissions by 39 megatons of CO2 equivalent. Essentially, where there is Bitcoin, climate-altering gas emissions decrease.”

Graziuso wants to emphasize the difference between consumption and pollution: “The problem is not consumption, it’s pollution. The distinction is fundamental: energy consumption is necessary for human development, while pollution derives from the use of inefficient energy sources. Currently China consumes over 4500% more than the entire Bitcoin network. Furthermore, thanks to mining flexibility, Bitcoin can help a state reduce general consumption.”

The research highlights how mining is acting as a catalyst for the adoption of renewable and nuclear energy. Mining naturally seeks the cheapest sources which increasingly coincide with the cleanest ones, the interviewee states.

One analyzed aspect is Bitcoin’s role as “buyer of last resort” for otherwise wasted energy. Graziuso cites several examples:

- Alps Blockchain, which has reactivated 32 disused hydroelectric plants in northern Italy and is working on building facilities in Paraguay and Ecuador exploiting hydroelectric energy;

- projects like Gridless that exploit excess energy from renewable sources in remote areas: “Not only does [Gridless] optimize the use of local energy resources, but it reinvests mining profits in communities, improving access to electricity and supporting the local economy,” writes Graziuso;

- in Texas, thanks to agreements with electricity grid operator ERCOT, miners exploit the operational flexibility of their machines to adapt consumption to grid needs, turning them off during peak moments and turning them back on when there is surplus energy, thus acting as buyers of last resort and contributing to stabilizing the electrical grid.

Another interesting aspect concerns the recovery of heat generated by machines: “Marathon Digital Holdings in Finland uses heat from its ASICs to heat 80,000 homes,” explains Graziuso. “Domestic applications are also being developed where ASIC heat is used for heating, further mitigating pollution.”

Immersion cooling, a technique that involves immersing mining machines in a dielectric fluid made in the laboratory, is cited as a promising solution to improve efficiency and reduce environmental impact. This way it is also possible to reduce machine noise, while the heat produced is dissipated by the dielectric material. Graziuso cites CleanSpark as an example of a completely carbon neutral mining farm that uses this technology: “This cooling technique allows us to safely overclock hardware, increasing performance by increasing operating frequency beyond factory settings,” states CleanSpark.

The thesis includes a section dedicated to zones that are emerging as sustainable mining hubs in different parts of the world:

- in Kenya and Ethiopia, “mining powered by hydroelectric energy is bringing drinking water and electricity to previously unserved communities,” declares Graziuso;

- in Georgia and Texas, Bitcoin mining is contributing to making the electrical grid more stable, intervening during peak demand moments and absorbing excess energy during overproduction periods;

- in Canada, companies like Upstream Data and Hut 8 Mining use mining to valorize excess or dispersed energy, including gas flaring in oil fields, thus reducing energy waste and emissions;

- the Makai project in Hawaii exploits OTEC (Ocean Thermal Energy Conversion) technology to convert ocean thermal energy into clean and renewable electricity.

Despite mining’s potential, obstacles to complete decarbonization still exist: “Decarbonization is still far away. Currently in many countries there are still state incentives from 40 years ago that favor fossil sources. Due to these incentives, today entrepreneurs’ costs are lower when fossil fuels are used. Once these state incentives end, perhaps the situation will improve. At the moment it is the miners who must voluntarily use renewable sources,” observes Graziuso. Italy, for example, continues to depend about 60% on fossil sources.

Another piece of data analyzed in the thesis is the improvement in energy efficiency of specialized mining machines: “In about 15 years, efficiency has improved by over 95%: this means decreased consumption and pollution,” emphasizes Graziuso.

“I hope this research contributes to spreading a more accurate and data-based narrative,” concludes Graziuso. “Bitcoin is not the problem, but could be part of the solution to the global energy challenge.”

The thesis will soon be published in its entirety online as a scientific paper.

The post Bitcoin reduces emissions and consumption: the thesis published at the University of Salento appeared first on Atlas21.

-

@ 21c71bfa:e28fa0f6

2025-05-29 15:09:17

@ 21c71bfa:e28fa0f6

2025-05-29 15:09:17Book *Bangalore to Tirupati cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ 21c71bfa:e28fa0f6

2025-05-29 15:08:51

@ 21c71bfa:e28fa0f6

2025-05-29 15:08:51Book *Tirupati to Srikalahasti cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ cf8c27f4:c95b9b5c

2025-05-29 15:17:06

@ cf8c27f4:c95b9b5c

2025-05-29 15:17:06Bitcoin’s Path to Global Dominance: Store of Value, Medium of Exchange, and the Road to a Bitcoin Standard

Bitcoin has ignited a financial revolution, captivating everyone from tech enthusiasts to institutional investors. Yet, amidst its meteoric rise, a tantalising question emerges: Could Bitcoin become the world’s reserve currency, relegating fiat currencies to the history books? This vision—a global Bitcoin standard—stirs intense debate within the community. Some champion Bitcoin as a Store of Value (SOV), a digital equivalent to gold, while others insist its future lies in becoming a Medium of Exchange (MOE), used for everyday transactions. With conflicting perspectives and community members at varying points in their Bitcoin journey, it’s time to unpack these ideas and chart a unified course.

This article delves into the interplay between Bitcoin’s SOV and MOE roles, examines the hurdles to widespread adoption, and proposes a roadmap for Bitcoin to claim global reserve status. My goal is to ignite a vibrant discussion, bridge divides, and encourage the Bitcoin community to rally around a shared vision for the future.

The Building Blocks: What Are SOV and MOE?

To kick things off, let’s define the two pillars of this debate:

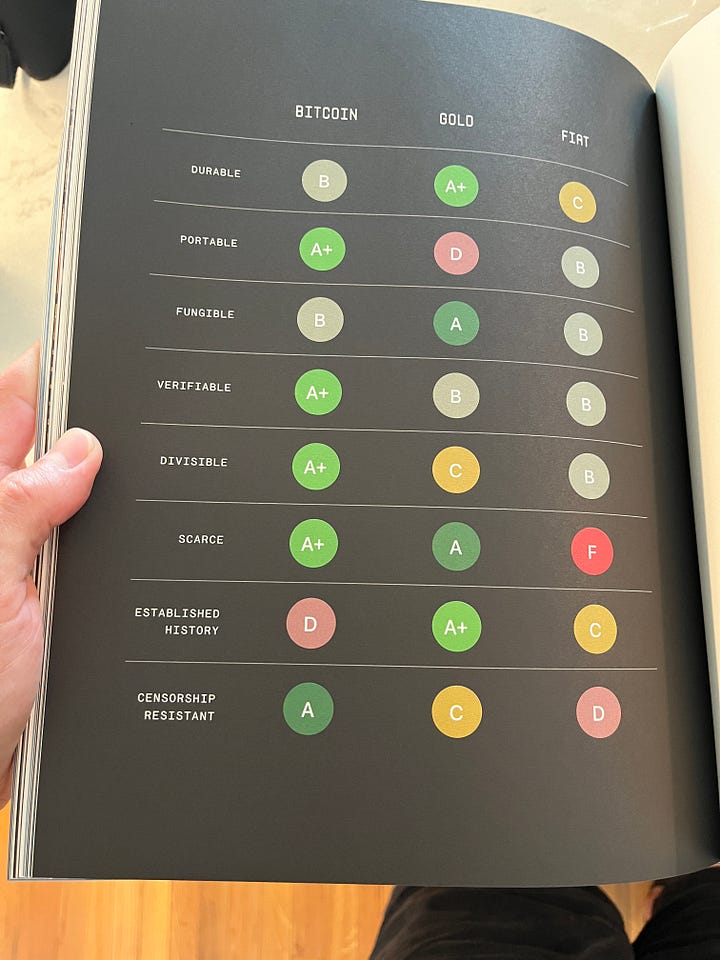

• Store of Value (SOV): An asset that holds or grows its worth over time, offering a dependable way to preserve wealth. Think gold, a classic example cherished for millennia.

• Medium of Exchange (MOE): A tool for transactions, enabling the seamless exchange of goods and services. Today, fiat currencies like the pound or dollar reign supreme in this domain.

Bitcoin’s allure stems from its unique traits: a capped supply of 21 million coins, a decentralised network, and immunity to censorship. These qualities position it as a contender to replace both gold and fiat money—but the journey is complex, and the community’s views are far from aligned.

Where We Stand: Bitcoin as Digital Gold

Bitcoin’s ascent has been propelled by its prowess as a Store of Value. Early adopters, savvy investors, and even big institutions have embraced it as a shield against inflation, economic turmoil, and the erosion of fiat value. Its scarcity—hardwired into its code—has cemented the “digital gold” narrative, drawing in those seeking a safe haven in uncertain times.

But here’s the rub: while Bitcoin shines as an SOV, it’s rarely used as an MOE. Its price swings, technical limitations, and patchy acceptance by merchants make it a tough sell for buying a pint or a loaf of bread. Many in the community—think of figures like Michael Saylor—preach the gospel of “hodling,” urging followers to stash Bitcoin away and watch its value soar. This strategy has paid off handsomely for some, but it begs a bigger question: Can Bitcoin rule the world if it remains a speculative treasure rather than a working currency?

The Adoption Puzzle: Bridging SOV and MOE

For Bitcoin to leap from a niche asset to the global reserve currency, it must become a widely accepted Medium of Exchange. This evolution matters for several reasons:

• Real-World Use Fuels Demand: When Bitcoin powers transactions, its value ties to tangible activity, not just market hype.

• Network Strength: More users mean a tougher, more valuable network—a classic network effect.

• Price Stability: Broader adoption could smooth out Bitcoin’s wild price rides, making it more practical for daily use.

Yet, hurdles abound. Bitcoin’s volatility is a dealbreaker for many—who’d spend it on a takeaway if it might double in value overnight? Then there’s the issue of “whales” or “max hodlers,” those holding vast swathes of Bitcoin. If too much of the supply sits idle, it starves the liquidity needed for an MOE to thrive.

The Hodler Debate: To Spend or Not to Spend?

A spirited clash within the community revolves around these large holders. Should they—like Saylor or early adopters—dip into their stacks to kickstart adoption? Hodling bolsters Bitcoin’s scarcity and SOV credentials, no doubt. But if the bulk of Bitcoin stays locked up, it could stall the growth of a bustling, transactional ecosystem.

Let’s be fair: hodling has been a winning play for many, turning small investments into fortunes. It’s a stretch to demand these pioneers shoulder the adoption burden alone. As Bitcoin weaves into the fabric of commerce—think businesses accepting it or workers earning it—transactional demand will rise organically. Over time, this could nudge even the staunchest hodlers to spend a bit, striking a balance between saving and circulating.

Growth and Stability: A Natural Progression

Bitcoin’s Compound Annual Growth Rate (CAGR) offers another angle. As its market cap balloons, its explosive growth is likely to taper off—a standard pattern for any asset. This slowdown could usher in greater stability, a boon for its MOE ambitions. Less volatility means less risk when spending Bitcoin, paving the way for it to move beyond investment portfolios and into wallets for everyday use.

This shift could redefine Bitcoin’s story, transforming it from a rollercoaster ride to a dependable currency. Voices like Jeff Booth and Jack Dorsey argue that MOE success is the key to sustaining Bitcoin’s SOV status. In short, while SOV lit the fuse, MOE could keep the fire burning.

The Blueprint: Steps to a Bitcoin Standard

So, how does Bitcoin ascend to world reserve status and birth a Bitcoin standard? Here’s a five-step vision:

1. SOV Momentum: Bitcoin’s allure as an inflation hedge and wealth preserver keeps drawing in holders, boosting its market cap and global clout.

2. MOE Infrastructure: Innovations like the Lightning Network must deliver fast, cheap transactions, making Bitcoin a practical choice for daily spending.

3. Value Stability: As adoption spreads and the market matures, Bitcoin’s price swings dampen, earning trust from users and merchants alike.

4. MOE Takeoff: With better tools and steadier value, Bitcoin becomes a go-to for transactions, amplifying its worth through a powerful network effect.

5. Global Crown: Governments and central banks start holding Bitcoin in reserves, using it for trade and settlements, cementing its place as the world’s reserve currency.

This isn’t a cakewalk. Scalability bottlenecks, regulatory pushback, and rival cryptocurrencies loom large. But if Bitcoin can clear these obstacles, it could become the backbone of global finance.

Harmony Over Division: SOV and MOE Together

Here’s the crux: SOV and MOE aren’t at odds—they’re partners in Bitcoin’s rise. Holding Bitcoin safeguards its scarcity and value; spending it spreads its reach and usefulness. Both are vital for the long haul.

At this pivotal moment, the Bitcoin community must rally around a dual-purpose ethos. We can:

• Educate: Help newcomers grasp Bitcoin’s twin roles as SOV and MOE.

• Innovate: Back tech that makes Bitcoin spending as easy as swiping a card.

• Talk: Host open forums to wrestle with differences and find unity.

The Final Word: Our Collective Challenge

Bitcoin’s shot at becoming the world’s reserve currency—and forging a Bitcoin standard—is as exhilarating as it is daunting. Its Store of Value roots have set the stage, but its Medium of Exchange potential will decide if it can topple fiat and redefine money itself.

The path is long, but the prize is transformative. By embracing both SOV and MOE, we can propel Bitcoin to new heights. Let’s grab this chance, dive into the debate, and build a future where Bitcoin leads the charge.

Your Turn: What’s the best way forward for Bitcoin? Should we lean harder into SOV, push MOE, or blend the two? Drop your thoughts below an

-

@ eb0157af:77ab6c55

2025-05-29 09:01:38

@ eb0157af:77ab6c55

2025-05-29 09:01:38The company is facing a class action lawsuit following a stock price drop triggered by the delayed disclosure of a December data breach.

Coinbase finds itself at the center of a legal storm after being hit with a class action lawsuit filed by shareholders. The lawsuit stems from a decline in the company’s stock price, which occurred after the belated communication of a cybersecurity incident.

The class action, filed in the United States District Court for the Eastern District of Pennsylvania, names investor Brady Nessler as the lead plaintiff. The suit claims that the platform’s shareholders suffered “substantial losses and damages” due to the company’s alleged failure to disclose material information.

Investors accuse the company of not promptly revealing crucial details that could have influenced investment decisions. Among the main allegations is the failure to immediately communicate a data breach that took place last December.

Details of the breach

On May 15, Coinbase publicly disclosed the news of a cyberattack that occurred last December. The incident involved cybercriminals who managed to corrupt several company employees, gaining unauthorized access to customer personal data.

The delayed disclosure of the data breach triggered an immediate stock market reaction. Coinbase shares fell 7.2%, closing the day at $244.

The exchange estimated that the financial impact of the data breach could range between $180 million and $400 million. These costs would cover both expenses to restore security systems and potential reimbursements to customers affected by the incident.

The lawsuit highlights that the company should have communicated these estimated costs to investors more promptly, allowing them to make informed decisions about their investments.

Additional allegations in the lawsuit

In addition to the data breach, the lawsuit lists a series of other alleged communication failures by the company. Among them is the non-disclosure of a violation by CB Payments — Coinbase’s UK subsidiary — of a 2020 agreement with the UK’s Financial Conduct Authority.

The class action covers all investors who acquired company shares between April 14, 2021, and May 14, 2025 — a period during which the allegedly omitted information is believed to have negatively affected the stock price.

The legal action doesn’t target the company alone but also names top executives including CEO Brian Armstrong and CFO Alesia Haas among the defendants.

The post Lawsuit against Coinbase: investors sue exchange for failing to disclose data breach appeared first on Atlas21.

-

@ 21c71bfa:e28fa0f6

2025-05-29 14:52:10

@ 21c71bfa:e28fa0f6

2025-05-29 14:52:10Book *Tirupati to Srikalahasti cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ c1e6505c:02b3157e

2025-05-28 17:36:03

@ c1e6505c:02b3157e

2025-05-28 17:36:03I recently acquired a new lens:

1959 Leica Summaron F2.8 35mm LTM.

1959 Leica Summaron 35mm f2.8 LTM mounted on my Fujifilm Xpro2 with LTM adapter made by Urth.

Technically, it was a trade. I helped a fellow Bitcoiner set up their Sparrow Wallet, Nostr stuff, and troubleshoot a few wallet issues, and in return, they gave me the lens.

It all started at a local Bitcoin meetup I went to about a week ago - my second time attending. I recognized a few faces from last time, but also saw some new ones. These meetups are refreshing - it’s rare to speak a common language about something like Bitcoin or Nostr. Most people still don’t get it. But they will.

Technology moves forward. Networks grow. Old cells die off.

During the meetup, someone noticed I had my Leica M262 with me and struck up a conversation. Said they had some old Leica lenses and gear at home, and wanted to show me.

Bitcoin and photography in one conversation? I’m down.

A day or so later, they sent me a photo of one of the lenses: a vintage Summaron LTM 35mm f/2.8 from 1959. I’d never seen or heard of one before. They asked if I could help them set up Sparrow and a Bitcoin node. In exchange, they’d give me the lens. Sounded like a good deal to me. Helping plebs with their setups feels like a duty anyway. I said, of course.

They invited me over - a pretty trusting move, which I appreciated. They had some great Bitcoin memorabilia: Fred Krueger’s The Big Bitcoin Book (even if the guy’s turned full shitcoiner), and some FTX sunglasses from Bitcoin 2022. Probably future collector’s items, lol.

We headed upstairs to work on setting up Sparrow Wallet on their Windows machine. I verified the software download first (which you should always do), then helped them create a new wallet using their Ledger Flex. They also had an older Ledger Nano X. The Flex setup was easy, but the Nano X gave us trouble. It turns out Ledger allows multiple wallets for the same asset, which can show up differently depending on how they’re configured. In Sparrow, only one wallet showed—none of the others.

I believe it had to do with the derivation path from the Ledger. If anyone knows a fix, let me know.

After a few hours of troubleshooting, I told them I couldn’t really recommend Ledger. The UX is a mess. They’d already heard similar things from other plebs too.

I suggested switching to the Blockstream Jade. It’s a solid Bitcoin-only device from a trustworthy team. That’s what you want in a hardware wallet.

But back to the lens…

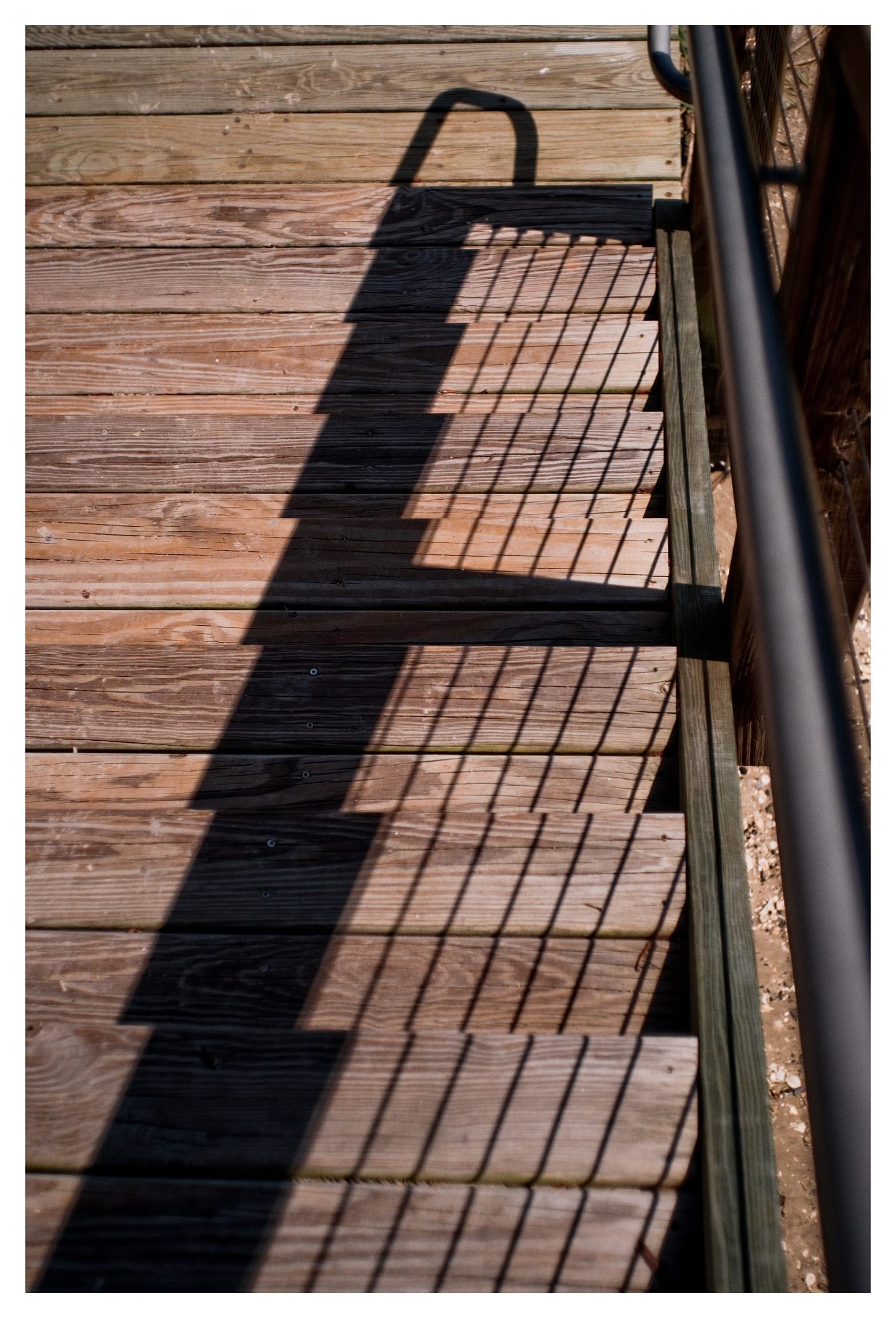

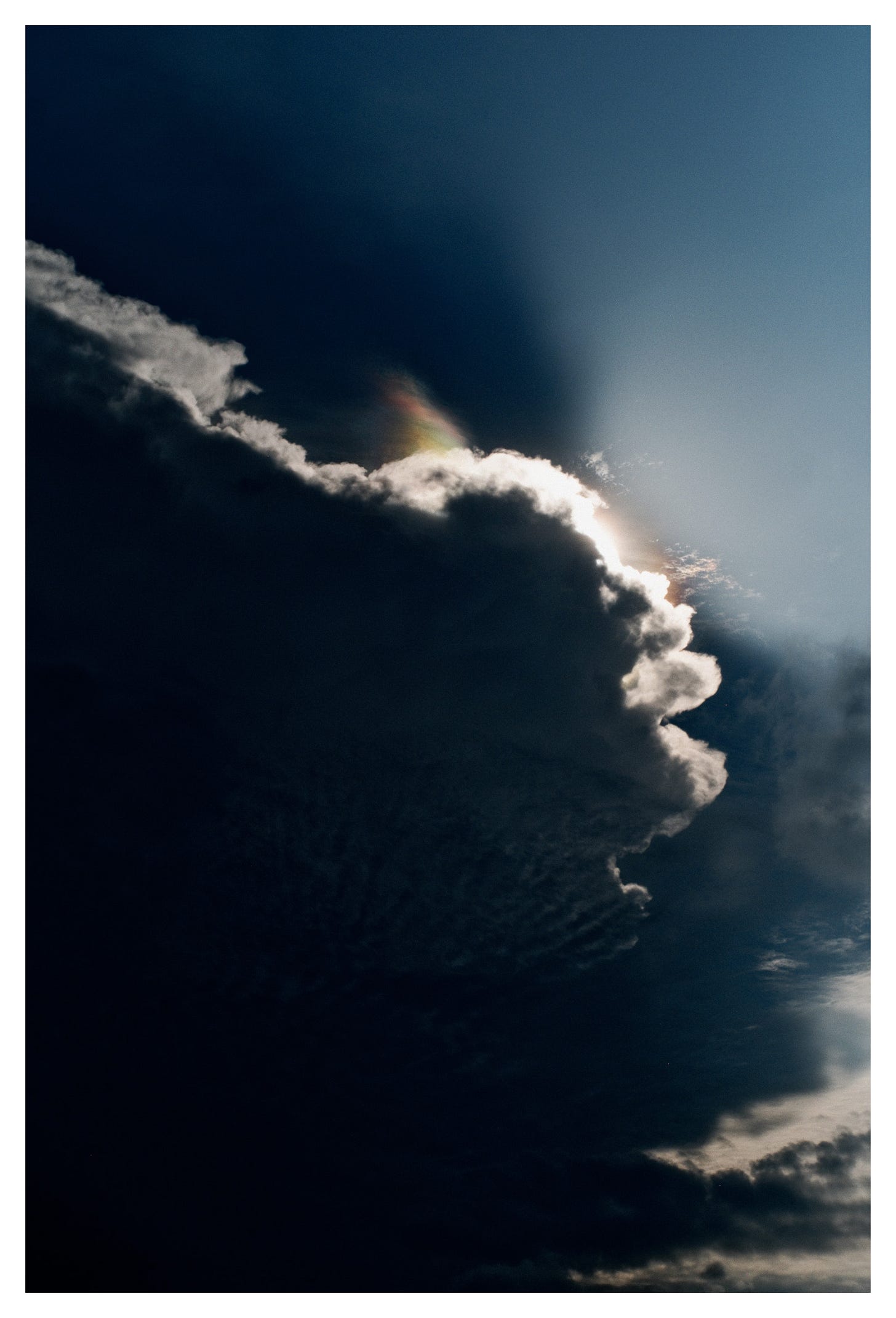

Since it’s an LTM (Leica Thread Mount), I couldn’t mount it directly on my M262. Luckily, I remembered I had an Urth adapter that fits my Fujifilm X-Pro2. I don’t use the X-Pro2 much these days—it’s mostly been sidelined by the M262 - but this was the perfect excuse to bring it out again.

To test the lens, I shot everything wide open at f/2.8. Nothing crazy fast, but it’s the best way to see a lens’s character. And this one definitely has character. There’s a subtle softness and a kind of motion blur effect around the edges when wide open. At first, I wasn’t sure how I felt about it, but the more I shot, the more I liked it. It reminds me of Winogrand’s work in Winogrand Color - those messy, shifting edges that make the frame feel alive. It also helps soften the digital-ness of the camera sensor.

The focus throw is short and snappy - much tighter than my Summicron V3 35mm f/2. I really like how fast it is to use. The closest focusing distance is about 3.5 feet, so it’s not ideal for close-ups. And with the Urth adapter on the X-Pro2, the focal length ends up closer to 40mm.

The only thing that threw me off was the infinity lock. When the focus hits infinity, it physically locks - you have to press a small tab to unlock it. I’ve seen others complain about it, so I guess it’s just one of those old lens quirks. I’m getting used to it.

All the photos here were taken around where I live in South Carolina. Some during bike rides to the river for a swim, others while walking through the marshlands.

I try to make work wherever I am. You should be able to.

It’s about the light, the rhythm, the play - and having the motivation to actually go out and shoot.

Lens rating: 7.9/10

I mainly shoot with a Leica M262, and edit in Lightroom + Dehancer

Use “PictureRoom” for 10% off Dehancer Film

If you’ve made it this far, thank you for taking the time to view my work - consider becoming a paid subscriber.

Also, please contact me if you would like to purchase any of my prints.

Follow me on Nostr:

npub1c8n9qhqzm2x3kzjm84kmdcvm96ezmn257r5xxphv3gsnjq4nz4lqelne96

-

@ 9e9085e9:2056af17

2025-05-29 07:51:18

@ 9e9085e9:2056af17

2025-05-29 07:51:18Part 5: Why You Should Join Yakihonne Today

🚀 Yakihonne: The Future of Free, Fair & Fast Social Interaction

Looking for a platform where you control everything—your posts, your data, your income?

Yakihonne is not just another app. It's a movement. A decentralized social payment network where:

Your voice can't be silenced

Your data isn't sold

Your followers are truly yours

Your creativity can be rewarded instantly

🔥 6 Reasons to Pay Attention to Yakihonne:

-

Zero Censorship Say what matters without fear of being muted or banned.

-

Built on Nostr Protocol Secure, scalable, and permissionless by design.

-

Social + Payments in One Chat, connect, and get paid—all from one app.

-

Lightning Fast Tips Reward content instantly with Bitcoin micro-payments.

-

No Algorithms. No Ads. No Noise. What you see is what you follow—simple and clean.

-

True Digital Freedom Break free from centralized control and own your digital presence.

🔗 Explore now: https://yakihonne.com 📱 Available on #iOS & #Android

-

-

@ 7459d333:f207289b

2025-05-29 07:44:37

@ 7459d333:f207289b

2025-05-29 07:44:37Bitcoin is something that grows in you. And the proof of work philosophy really is a thing.

At some point, you become uncomfortable about holding fiat or fiat related assets (stocks, bonds, ...). Because those aren't really yours. And feels like sponsoring a system you don't support.

At some point, you might have decided to opt out. And move all your savings into Bitcoin. How did you do that?

If you had a significant amount of index funds and wanted to move those to Bitcoin, how would you do it? When?

For the how: probably selling it off slowly for fiat and then Bisq or similar.

For the when: 2 years ago you would have gotten 4x the amount of Bitcoin that you get today for each “share” of the S&P 500. 4 years ago you would have gotten more or less the same that you would today. https://inflationchart.com/spx-in-btc/?time=5%20years&show_stock=0&show_adjuster=0&zero=1 Would you wait for another SP500/BTC peak?

Did you move all your savings into Bitcoin? How did you do so? How would you do it today?

https://stacker.news/items/991774

-

@ b7274d28:c99628cb

2025-05-28 01:11:43

@ b7274d28:c99628cb

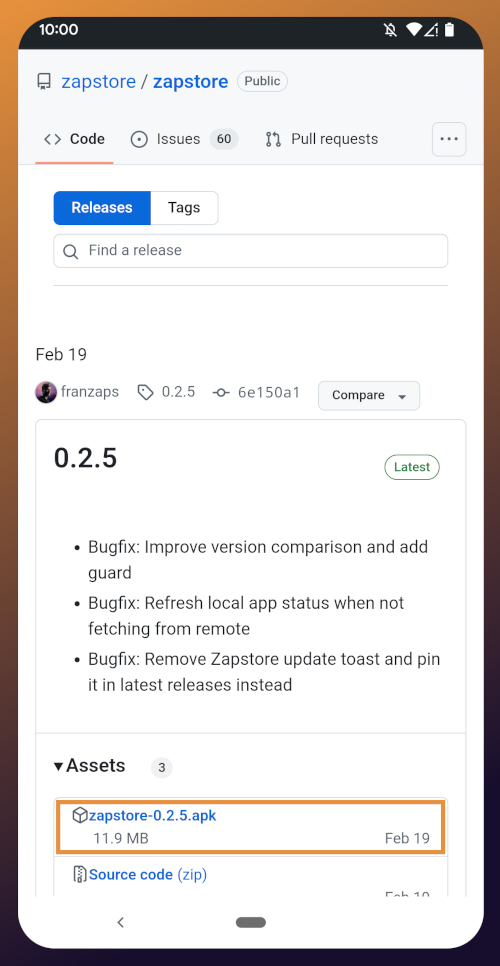

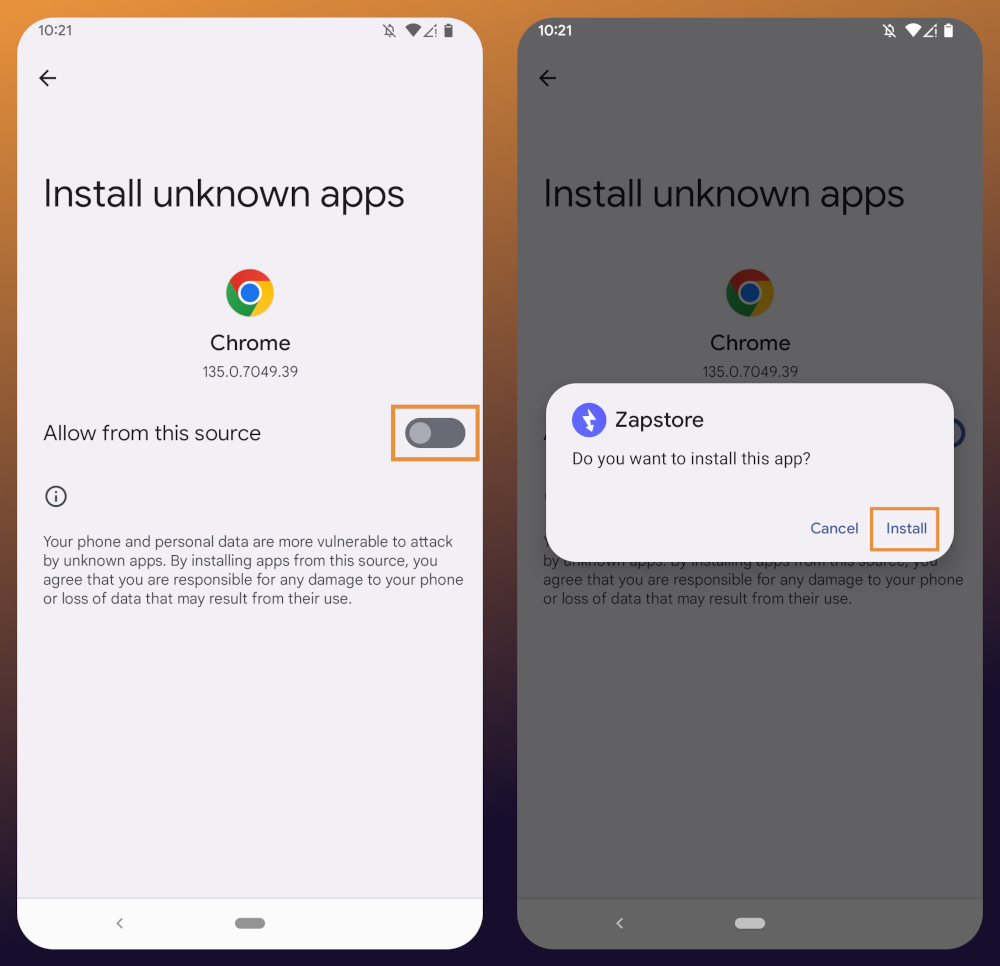

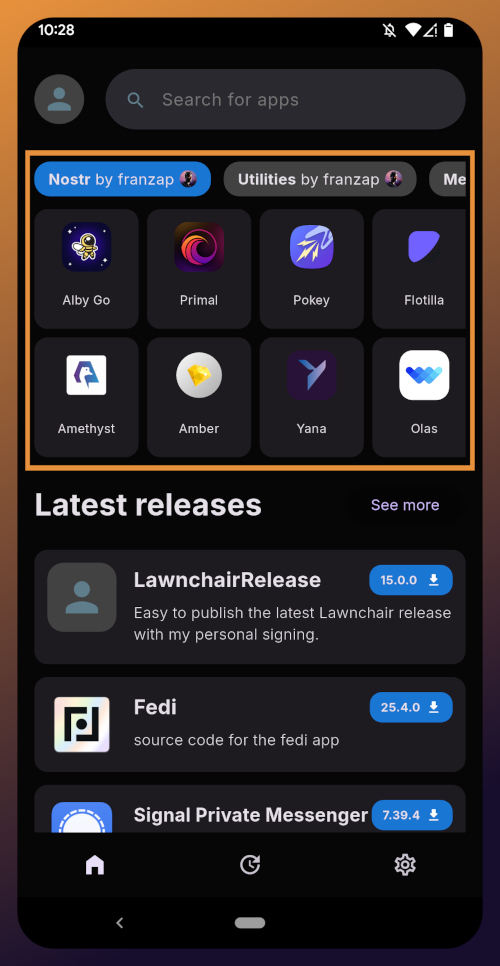

2025-05-28 01:11:43In this second installment of The Android Elite Setup tutorial series, we will cover installing the nostr:npub10r8xl2njyepcw2zwv3a6dyufj4e4ajx86hz6v4ehu4gnpupxxp7stjt2p8 on your #Android device and browsing for apps you may be interested in trying out.

Since the #Zapstore is a direct competitor to the Google Play Store, you're not going to be able to find and install it from there like you may be used to with other apps. Instead, you will need to install it directly from the developer's GitHub page. This is not a complicated process, but it is outside the normal flow of searching on the Play Store, tapping install, and you're done.

Installation

From any web browser on your Android phone, navigate to the Zapstore GitHub Releases page and the most recent version will be listed at the top of the page. The .apk file for you to download and install will be listed in the "Assets."

Tap the .apk to download it, and you should get a notification when the download has completed, with a prompt to open the file.

You will likely be presented with a prompt warning you that your phone currently isn't allowed to install applications from "unknown sources." Anywhere other than the Play Store is considered an "unknown source" by default. However, you can manually allow installation from unknown sources in the settings, which the prompt gives you the option to do.

In the settings page that opens, toggle it to allow installation from this source, and you should be prompted to install the application. If you aren't, simply go to your web browser's downloads and tap on the .apk file again, or go into your file browser app and you should find the .apk in your Downloads folder.

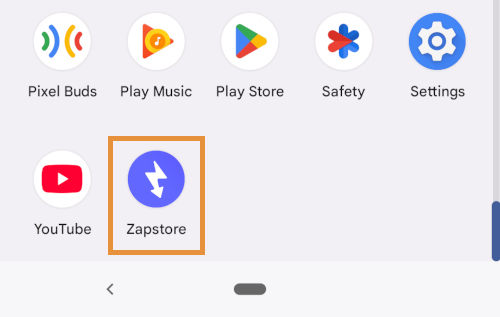

If the application doesn't open automatically after install, you will find it in your app drawer.

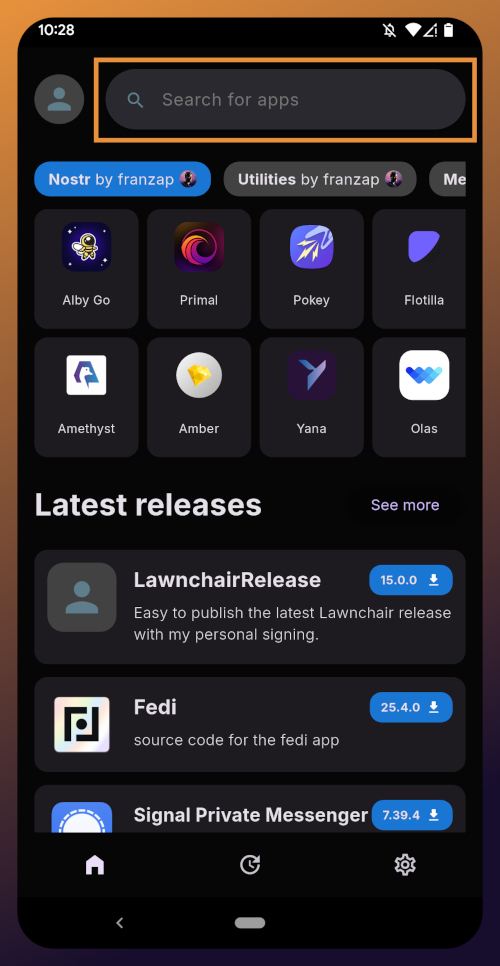

Home Page

Right at the top of the home page in the Zapstore is the search bar. You can use it to find a specific app you know is available in the Zapstore.

There are quite a lot of open source apps available, and more being added all the time. Most are added by the Zapstore developer, nostr:npub1wf4pufsucer5va8g9p0rj5dnhvfeh6d8w0g6eayaep5dhps6rsgs43dgh9, but some are added by the app developers themselves, especially Nostr apps. All of the applications we will be installing through the Zapstore have been added by their developers and are cryptographically signed, so you know that what you download is what the developer actually released.

The next section is for app discovery. There are curated app collections to peruse for ideas about what you may want to install. As you can see, all of the other apps we will be installing are listed in nostr:npub1wf4pufsucer5va8g9p0rj5dnhvfeh6d8w0g6eayaep5dhps6rsgs43dgh9's "Nostr" collection.

In future releases of the Zapstore, users will be able to create their own app collections.

The last section of the home page is a chronological list of the latest releases. This includes both new apps added to the Zapstore and recently updated apps. The list of recent releases on its own can be a great resource for discovering apps you may not have heard of before.

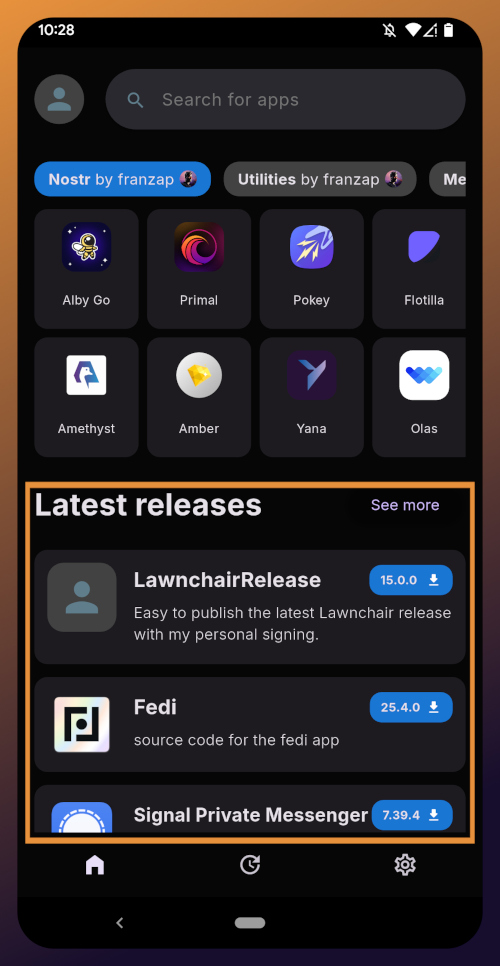

Installed Apps

The next page of the app, accessed by the icon in the bottom-center of the screen that looks like a clock with an arrow circling it, shows all apps you have installed that are available in the Zapstore. It's also where you will find apps you have previously installed that are ready to be updated. This page is pretty sparse on my test profile, since I only have the Zapstore itself installed, so here is a look at it on my main profile:

The "Disabled Apps" at the top are usually applications that were installed via the Play Store or some other means, but are also available in the Zapstore. You may be surprised to see that some of the apps you already have installed on your device are also available on the Zapstore. However, to manage their updates though the Zapstore, you would need to uninstall the app and reinstall it from the Zapstore instead. I only recommend doing this for applications that are added to the Zapstore by their developers, or you may encounter a significant delay between a new update being released for the app and when that update is available on the Zapstore.

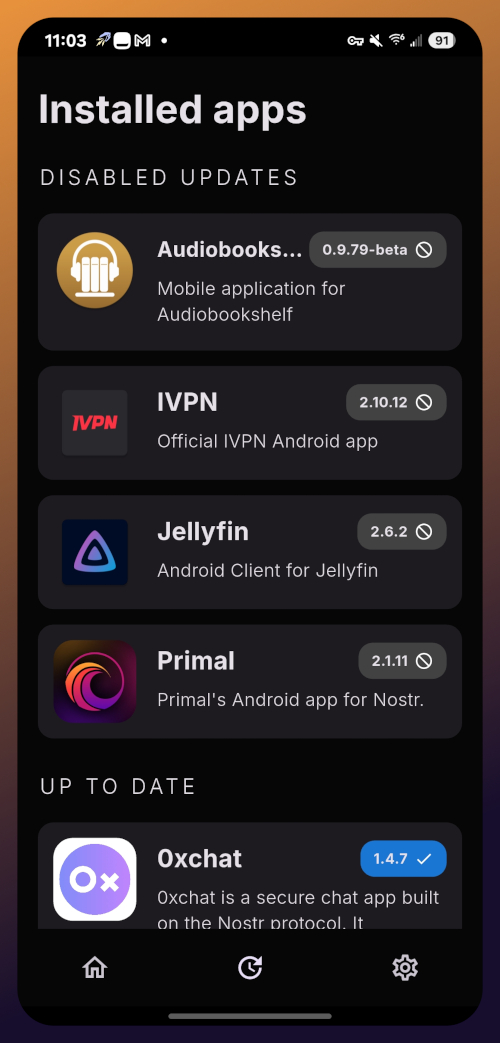

Tap on one of your apps in the list to see whether the app is added by the developer, or by the Zapstore. This takes you to the application's page, and you may see a warning at the top if the app was not installed through the Zapstore.

Scroll down the page a bit and you will see who signed the release that is available on the Zapstore.

In the case of Primal, even though the developer is on Nostr, they are not signing their own releases to the Zapstore yet. This means there will likely be a delay between Primal releasing an update and that update being available on the Zapstore.

Settings

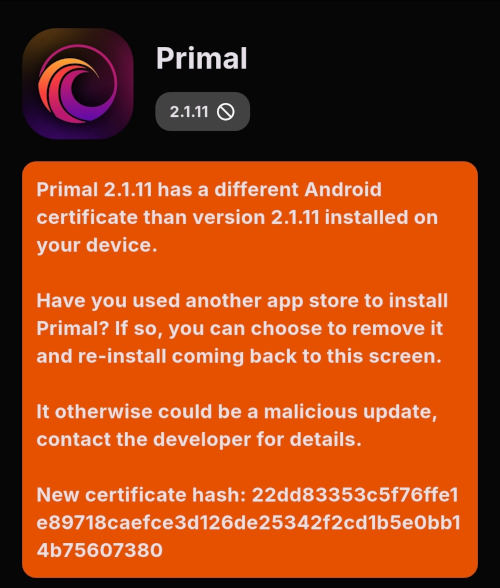

The last page of the app is the settings page, found by tapping the cog at the bottom right.

Here you can send the Zapstore developer feedback directly (if you are logged in), connect a Lightning wallet using Nostr Wallet Connect, delete your local cache, and view some system information.

We will be adding a connection to our nostr:npub1h2qfjpnxau9k7ja9qkf50043xfpfy8j5v60xsqryef64y44puwnq28w8ch wallet in part 5 of this tutorial series.

For the time being, we are all set with the Zapstore and ready for the next stage of our journey.

Continue to Part 3: Amber Signer. Nostr link: nostr:naddr1qqxnzde5xuengdeexcmnvv3eqgstwf6d9r37nqalwgxmfd9p9gclt3l0yc3jp5zuyhkfqjy6extz3jcrqsqqqa28qy2hwumn8ghj7un9d3shjtnyv9kh2uewd9hj7qg6waehxw309aex2mrp0yhxyunfva58gcn0d36zumn9wss80nug

-

@ 21c71bfa:e28fa0f6

2025-05-29 14:51:46

@ 21c71bfa:e28fa0f6

2025-05-29 14:51:46Book *Tirupati to Vellore cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ 21c71bfa:e28fa0f6

2025-05-29 14:51:23

@ 21c71bfa:e28fa0f6

2025-05-29 14:51:23Book *Tirupati to Tirumala cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ 9e9085e9:2056af17

2025-05-29 07:35:34

@ 9e9085e9:2056af17

2025-05-29 07:35:34**Part 4: Yakihonne as a Decentralized Social Payment Client

Yakihonne – Own Your Voice, Own Your Value

Yakihonne is evolving beyond just decentralized social networking—it’s now a decentralized social payment client on the Nostr protocol. With its integration of secure, user-owned identities and direct payment features, Yakihonne empowers people to truly own their voice and their value.

🔗 yakihonne.com 💬 Chat, post, connect—and pay—all in one place 💸 Send and receive Lightning payments directly 📱 Cross-platform access for #iOS and #Android

Why It Matters:

No Middlemen: Directly support creators, friends, or causes

Censorship-Resistant: Your content can’t be taken down or hidden

True Ownership: Your identity, your wallet, your data

Secure and Open: Built on the fast-growing Nostr protocol

Yakihonne isn’t just another app—it’s a new way to interact with your community and control your digital life.

Yakihonne #Yakihonne #Yakihonne #Nostr #Nostr #YoungDfx**

-

@ 90c656ff:9383fd4e

2025-05-27 11:27:26

@ 90c656ff:9383fd4e

2025-05-27 11:27:26Since its creation, Bitcoin has been a revolutionary asset, challenging the traditional financial system and proposing a new form of decentralized money. However, its future remains uncertain and the subject of intense debate. Among the possible outcomes, two extreme scenarios stand out: hyperbitcoinization-where Bitcoin becomes the dominant currency in the global economy—and obsolescence, where the network loses relevance and is replaced by other solutions.

- Hyperbitcoinization: The World Adopts Bitcoin as a Monetary Standard

01 - Loss of trust in fiat currencies: Due to excessive money printing by central banks, many economies face rampant inflation. Bitcoin, with its fixed supply of 21 million units, emerges as a more trustworthy alternative.

02 - Growing adoption by companies and governments: Some countries have already begun integrating Bitcoin into their economies, accepting it for payments and as a store of value. If this trend continues, Bitcoin’s legitimacy as a global currency will grow.

03 - Ease of global transactions: Bitcoin enables fast and low-cost international transfers, removing the need for financial intermediaries and reducing operational costs.

04 - Technological advancements: Scalability improvements, such as the Lightning Network, can make Bitcoin more efficient for daily use, encouraging mass adoption.

If hyperbitcoinization becomes reality, the world may witness a radical shift in the financial system—with greater decentralization, censorship resistance, and an economy based on sound, predictable money.

- Obsolescence: Bitcoin Loses Relevance and Is Replaced

01 - Restrictive government regulations: If major economic powers enforce strict regulations on Bitcoin, adoption could slow, reducing its utility.

02 - Technological shortcomings or lack of innovation: Despite its security and decentralization, Bitcoin may struggle to scale effectively. If superior solutions emerge and gain acceptance, Bitcoin could lose its leading position.

03 - Competition from faster, more user-friendly alternatives: Other forms of digital money may surpass Bitcoin in scalability and usability, potentially leading to a decline in Bitcoin adoption.

04 - Decreasing miner incentives: As new Bitcoin issuance halves every four years, miners will rely increasingly on transaction fees. If those fees are insufficient to sustain network security, long-term viability could be at risk.

In summary, Bitcoin’s future could unfold along multiple paths, depending on factors like innovation, global adoption, and resilience to external challenges. Hyperbitcoinization would represent an economic revolution—ushering in a decentralized, inflation-resistant monetary system. Yet, obsolescence remains a risk if the network fails to adapt to future demands. Regardless of the outcome, Bitcoin has already made its mark on financial history, paving the way for a new era of digital money and economic freedom.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ 866e0139:6a9334e5

2025-05-29 07:29:43

@ 866e0139:6a9334e5

2025-05-29 07:29:43Autor: Anna Nagel. (Bild: Lukas Karl). Dieser Beitrag wurde mit dem Pareto-Client geschrieben. Sie finden alle Texte der Friedenstaube und weitere Texte zum Thema Frieden hier. Die neuesten Pareto-Artikel finden Sie auch in unserem Telegram-Kanal.

Die neuesten Artikel der Friedenstaube gibt es jetzt auch im eigenen Friedenstaube-Telegram-Kanal.

Wem in seinem Leben Schmerz zugefügt wurde, wer sich ungerecht behandelt fühlt oder wachen Auges in der Welt umschaut, kommt wahrscheinlich irgendwann mit der Frage in Berührung, wie das alles noch einmal «gut» werden kann. Wie kann die Welt sich mit sich selbst versöhnen? Und wie kann ich es selbst schaffen, mich mit ihr und den Menschen, die schlimme Taten vollbringen, wieder in harmonischer Akzeptanz zu verbinden? Kann und will ich gewisse Gräueltaten verzeihen oder gibt es das «Unverzeihliche»? Und selbst wenn ich wollte, wie könnte mir das gelingen?

Perspektivwechsel

Wenn wir an dem Zorn über begangenes Unrecht festhalten, schauen wir in der Regel aus immer derselben Perspektive auf das Geschehen. Mal um Mal erzürnen und empören wir uns darüber, erzählen uns und anderen stets die gleiche Geschichte, die uns allerdings – ebenfalls ein ums andere Mal – wieder selbst verletzt. Das Destruktive holt uns so ständig wieder ein; wir sehen und fühlen das unschuldige Kind und empfinden Verachtung für die Täter.

Die Perspektive zu wechseln lädt uns dazu ein, das Geschehen aus anderen Blickwinkeln zu betrachten und unser Bewusstsein von der schmerzlichen Wiederholung zu lösen. Wir können einmal weit rauszoomen und einen spirituellen Blickwinkel einnehmen, beispielsweise aus Sicht des All-ein-Bewusstseins, das sich in unzählige Seelen teilt, von denen wiederum Milliarden derzeit auf der Erde inkarniert sind. Dieses eine Bewusstsein möchte jede auch nur mögliche Erfahrung machen und durch die Trennung – die Erschaffung der Dualität – kann es sich selbst aus diesen Milliarden Persönlichkeiten heraus erfahren, um zu lernen. Während dieser scheinbaren Trennung vergessen wir, dass wir alle eins sind, dass wir alle aus demselben «Stoff» gemacht sind und nach diesem Spiel hier auf Erden unsere Erinnerung zurückerlangen und unsere Erfahrungen zurück geben in die eine «Quelle».

Unser aller Reise geht letztlich darum, hier auf der Erde aus diesem Zustand des Vergessens zu erwachen. Um dies zu erreichen und all diese Erfahrungen machen zu können und uns auch unter widrigsten Umständen an unsere wahre Essenz, an die Liebe, erinnern können, braucht es auch Akteure, die die Dunkelheit verkörpern – denn nur so haben wir die Wahl, ob wir uns von ihr einnehmen lassen oder uns für die Liebe und das Mitgefühl entscheiden. Der Täter sowie das Opfer sind dabei stets Aspekte unserer selbst – im Innen wie im Außen – und jeder einzelne verändert die Welt, indem er Liebe und Mitgefühl oder Hass und Verachtung wählt.

Eine etwas rationalere Herangehensweise wäre, zu schauen, was dazu führt, dass ein Mensch sich derart unmenschlich verhalten kann; also der Zugang über die Psychologie. Hier werden wir uns bewusst, dass jeder Täter auch einmal ein Kind war. Symbolisch sogar das Kind, mit dem wir jetzt im Beispiel mitfühlen und das wir gleichzeitig heute als erwachsenen Täter verachten. Natürlich kann man hier einwenden, dass nicht jedes Opfer zum Täter wird, aber man kann ebenso anerkennen, dass uns bei dieser Haltung das größte Stück fehlt; und zwar die Geschichte desjenigen, die Jahre dazwischen, sowie jeder einzelne Reiz und jedes Detail der Umstände.

Wie viel Schmerz und Leid muss ein Mensch erfahren, bis er unmenschlich wird? Mit Einbezug aller Umstände und Faktoren, der psychischen Schutzmechanismen traumatischer Erfahrungen sowie fehlender Ausbildung sozialer und empathischer Fähigkeiten auch im neuronalen Bereich kann man auch auf diesem Wege Verständnis erlangen. Sichtbar wird hierdurch auch, dass emotionaler Schmerz über Generationen weitergegeben wird und es schwer ersichtlich ist, wo denn die eigentliche Ursache liegt. Auch hier wird erkennbar, dass nur jeder bei sich anfangen kann und Verantwortung für seine Heilung – und damit gleichzeitig die anderer – übernehmen müsste, anstatt auf die Suche nach dem oder der «Schuldigen» zu gehen.

Was bedarf eigentlich der Vergebung?

Wenn es uns schwerfällt zu vergeben, also Groll und Verachtung loszulassen und Mitgefühl zu empfinden, ist es ebenfalls hilfreich, einmal hinzuschauen, worum es genau geht. Wenn es uns selbst betrifft, handelt es sich in der Regel um Schmerz, der uns willentlich, manchmal auch unbewusst, zugefügt wurde und den wir (noch) nicht loslassen können, weil er noch nicht verheilt ist. Darauf gehe ich später noch einmal ein. Oft geht es aber auch um uns unbekannte Menschen, von deren Verbrechen wir Kenntnis haben und deren Ungeheuerlichkeit uns aus der Fassung bringt. Es geht um Taten, die wir nicht nachvollziehen können, weder rational noch emotional. Wir meinen, selbst wenn jemand nicht spürte, was er anderen antut, so müsse er es doch wenigstens besser wissen. Das ist das, was uns Menschen ausmacht, mit anderen mitzufühlen und sie zu verstehen. Doch anscheinend gibt es Menschen, deren Persönlichkeit oder auch Psyche dazu absolut nicht in der Lage sind. Die keinen moralischen Kompass besitzen und keinerlei soziales Empfinden, denn sonst könnten sie bestimmte Taten nicht ausführen. Möglicherweise dissoziieren sie sich selbst so stark, dass diese für sie eine Normalität darstellen, sie diese entschuldigen beziehungsweise vor sich selbst rechtfertigen oder im extremen Fall keine Erinnerung mehr daran haben.

Uns erscheinen die fehlende Empathie sowie das fehlende Verständnis so fremd, dass wir es nicht nachvollziehen können. Uns fehlt die Nachvollziehbarkeit der Nichtnachvollziehbarkeit des Erlebens des anderen, und wir erachten diesen dadurch als unmenschlich. Denn menschlich wären doch eben diese Fähigkeiten wie Mitgefühl, Güte, Reflexion, Warmherzigkeit, Verständnis und Liebe. Zugleich erzeugen wir hier aber einen Konflikt, wenn wir sagen: «Da diese Menschen sich so unmenschlich verhalten, soll ihnen kein Mitgefühl und keine Vergebung entgegengebracht werden, sollen auch sie nicht menschlich behandelt werden», wodurch wir uns allerdings selbst unserer Menschlichkeit berauben.

«Aber der Täter hatte doch die freie Wahl, er hätte doch anders entscheiden können!» Ja, möglicherweise schon, aber jetzt haben wir die Wahl. Und wir haben viel leichtere Voraussetzungen dafür, menschlich zu handeln, weil wir gesunden Zugang zu unserer Empathie, Moral und unserer Ratio haben.

Hätte der Täter es geschafft, seinen Tätern zu verzeihen, würde er die Destruktivität, die er ab einem gewissen Zeitpunkt nicht mehr in sich tragen oder verdrängen konnte, nicht an anderen ausagieren. Es ist ihm nicht gelungen, vielleicht sogar weil etwas in ihm es für unmöglich hielt, Unmenschliches, das ihm zugefügt wurde, zu verzeihen. Aber uns kann es gelingen, diesen Kreislauf zu durchbrechen und uns nicht in ihn hineinziehen zu lassen; wir können dem «Dunklen» den Nährboden entziehen.

Manchmal nehmen wir an, würden wir das Unbeschreibliche verzeihen, bedeutete dies, dass wir es tolerieren oder gar gutheißen. Dem ist nicht so. Analog dazu habe ich manches Mal die Angst gehabt, würde ich aufhören, um meinen Freund zu trauern, bedeute dies, dass ich ihn nicht mehr vermisse. Auch das ist nicht richtig. Ich heile lediglich das, was mir Schmerzen zufügt, bis am Ende nur noch die Liebe bleibt. Und wenn wir verzeihen, ist es kein Gutheißen der Taten, es bedeutet ein Loslassen dessen, was uns damit verstrickt und das Destruktive nährt.

Mitgefühl beginnt bei uns selbst

«Daß ich dem Hungrigen zu essen gebe, dem vergebe, der mich beleidigt, und meinen Feind liebe- das sind große Tugenden. Was aber, wenn ich nun entdecken sollte, daß der armselige Bettler und der unverschämteste Beleidiger alle in mir selber sind und ich bedürftig bin, Empfänger meiner eigenen Wohltaten zu sein? Daß ich der Feind bin, den ich lieben muß - was dann?» – C. G. Jung

Mit diesem Zitat beginnt Dan Millman das Kapitel «Das Gesetz des Mitgefühls» in seinem Buch «Die universellen Lebensgesetze des friedvollen Kriegers». Die weise Frau lehrt dem Wanderer das Gesetz des Mitgefühls und erklärt, es sei «eine liebevolle Aufforderung, über unsere begrenzte Sichtweise hinauszuwachsen», auch wenn die Last dieser Aufgabe zuweilen sehr schwer wiegen könne. Genau deshalb müsse man daran denken, dass sie bei uns selbst beginnt und wir «geduldig» und «sanft» mit uns, unseren Gefühlen und Gedanken sein sollten.

Um dem – noch skeptischen – Wanderer zu veranschaulichen, wie wir Mitgefühl auch mit unseren Gegnern empfinden können, bat sie ihn, sich an eine Auseinandersetzung zu erinnern, in der er zornig, neidisch oder eifersüchtig war und sich diese Gefühle noch einmal zu vergegenwärtigen. Als er das tat, den Schmerz und die Wut wieder spürte, sagte sie zu ihm: «Und nun stell dir vor, daß der Mensch, mit dem du dich streitest, mitten in eurer erregten Auseinandersetzung plötzlich nach seinem Herzen faßt, einen Schrei ausstößt und zu deinen Füßen tot zu Boden sinkt.» Der Wanderer erschrak und auf Nachfrage der weisen Frau stellte er fest, dass er nun keinerlei Schmerz oder Wut mehr empfand. Sogleich aber kam ihm der Gedanke: «Aber – aber was wäre, wenn ich mich über den Tod dieses Menschen freuen würde? Wenn ich ihm nicht verzeihen könnte?», worauf die weise Frau antwortete: «Dann verzeih dir wenigstens selber deine Unversöhnlichkeit. Und in dieser Vergebung wirst du das Mitgefühl finden, das deinen Schmerz heilt, als Mensch in dieser Welt zu leben.»

Weiter erinnert uns die weise Frau daran, dass wir alle, während wir hier auf der Erde sind, Träume, Hoffnungen und Enttäuschungen haben; und dass diese, sowie letztlich der Tod, uns alle verbinden.

Es ist ein Prozess

Dan Millman sagt hier in Gestalt der Weisen Frau, dass Mitgefühl bei uns selbst beginnt und diesen Aspekt möchte ich noch einmal hervorheben. Es kann nämlich passieren, dass wir uns in einer oberflächlichen Vergebung wieder finden, weil wir meinen, es sei richtig und moralisch, anderen zu verzeihen, ohne aber die tieferen Schichten dabei zu fühlen. Das ist dann leider nichts anderes, als Verdrängung. Gerade wenn wir selbst Opfer von Ungerechtigkeit, physischer oder mentaler Gewalt wurden, ist es unerlässlich den Heilungsweg in Gänze zu durchschreiten, und in den Wachstumsprozess zu verwandeln, der uns Mitgefühl und Weisheit lehrt. Und dazu gehören die Wut auf das Begangene, die Verzweiflung, die Ungerechtigkeit und Ohnmacht zu fühlen, uns auf «unsere Seite» zu stellen und Partei für uns selbst zu ergreifen, bevor es ernstlich möglich wird, zu verzeihen. Zunächst fühlen wir mit uns selbst den Schmerz und befreien die Gefühle, die wir uns möglicherweise nie trauten zu fühlen, all die Wut und den Groll. Erst später kann dann aus dem Inneren heraus das weitere Erkennen stattfinden und Heilung und Vergebung geschehen.

Vergebung findet im Herzen statt

Die hier in diesem Text von mir aufgeführten Perspektiven sind nur zwei, drei kleine Beispiele für Sichtweisen, die man einnehmen könnte, um zu neuen Einsichten zu gelangen. Sie sollen niemanden von irgendetwas überzeugen, sondern als Anregung dienen. Denn letztlich geht es darum, Vergebung in sich selbst zu finden. Vergebung ist also etwas, das aus dem Inneren heraus entsteht; ein Ergebnis eines tiefen Verständnisses und Fühlens, ja eines Erkennens. Auf dieser Reise gehen wir unterschiedliche Blickwinkel und Versionen ab, bis wir im Herzen ankommen, es sich öffnet und wir plötzlich «klar» sehen. Daraufhin breitet sich Wärme im Körper aus, Liebe durchströmt uns, begleitet möglicherweise von einem Gefühl leiser Euphorie, möglicherweise auch einem leichten Schmerz und Tränen – sowohl ein paar der Traurigkeit als auch welchen der Dankbarkeit. Das Loslassen und die Befreiung sind spürbar und nur für jeden persönlich erfahrbar, der sich auf diesen Weg begibt und seine individuelle Ansicht findet, die ihn befreit und erlöst.

Meiner Meinung nach bedeutet also Vergebung eine Öffnung des Herzens, ein Erkennen und ein Hineinwachsen in die Perspektive der Liebe. Sie ist nicht auf rationaler Ebene zu finden; die rationale Ebene kann nur dabei helfen, den Weg zum Mitgefühl zu beschreiten, denn:

«Man sieht nur mit dem Herzen gut. Das Wesentliche ist für die Augen unsichtbar.»

– Antoine de Saint-Exupéry

Anna Nagel veröffentlicht auf ihrem Blog „Heimwärts“ seit Jahren zu den Themen Heilung, Bewusstsein, kollektives Erwachen, Gefühle, Spiritualität, Psyche, Kundalini und Philosophie.

LASSEN SIE DER FRIEDENSTAUBE FLÜGEL WACHSEN!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt.

Schon jetzt können Sie uns unterstützen:

- Für 50 CHF/EURO bekommen Sie ein Jahresabo der Friedenstaube.

- Für 120 CHF/EURO bekommen Sie ein Jahresabo und ein T-Shirt/Hoodie mit der Friedenstaube.

- Für 500 CHF/EURO werden Sie Förderer und bekommen ein lebenslanges Abo sowie ein T-Shirt/Hoodie mit der Friedenstaube.

- Ab 1000 CHF werden Sie Genossenschafter der Friedenstaube mit Stimmrecht (und bekommen lebenslanges Abo, T-Shirt/Hoodie).

Für Einzahlungen in CHF (Betreff: Friedenstaube):

Für Einzahlungen in Euro:

Milosz Matuschek

IBAN DE 53710520500000814137

BYLADEM1TST

Sparkasse Traunstein-Trostberg

Betreff: Friedenstaube

Wenn Sie auf anderem Wege beitragen wollen, schreiben Sie die Friedenstaube an: friedenstaube@pareto.space

Sie sind noch nicht auf Nostr and wollen die volle Erfahrung machen (liken, kommentieren etc.)? Zappen können Sie den Autor auch ohne Nostr-Profil! Erstellen Sie sich einen Account auf Start. Weitere Onboarding-Leitfäden gibt es im Pareto-Wiki.

-

@ 21c71bfa:e28fa0f6

2025-05-29 14:51:04

@ 21c71bfa:e28fa0f6

2025-05-29 14:51:04Book *Bhubaneswar to Konark cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ 90c656ff:9383fd4e

2025-05-27 11:22:10

@ 90c656ff:9383fd4e

2025-05-27 11:22:10Since its creation, Bitcoin has been much more than just an alternative to traditional money. With the ongoing digitalization of the global economy, Bitcoin has emerged as a foundational pillar for new forms of transactions, commerce, and value storage. Its decentralization, transparency, and censorship resistance make it a solid base for digital economies, where financial interactions occur without the need for traditional intermediaries.

- Bitcoin’s role in the digital economy

01 - Global, borderless transactions: Anyone with internet access can send and receive Bitcoin without needing a bank or government authorization.

02 - Limited and predictable supply: Unlike fiat currencies that can be inflated by central banks, Bitcoin has a fixed cap of 21 million units, making it a scarce and reliable asset.

03 - Security and transparency: The Bitcoin blockchain or timechain publicly records all transactions, ensuring a secure and auditable system.

04 - Censorship resistance: No government or institution can block Bitcoin transactions, enabling a freer and more accessible digital economy.

With these characteristics, Bitcoin is already transforming various economic sectors and driving new forms of commerce and investment.

- Bitcoin in digital commerce and the global economy

01 - E-commerce: Businesses and consumers can use Bitcoin for fast international transactions without exorbitant fees.

02 - International remittances: Workers sending money to their home countries can avoid high fees and long delays by using Bitcoin.

03 - Emerging economies: In countries with unstable currencies and unreliable banking systems, Bitcoin serves as a secure and decentralized alternative for storing wealth and conducting daily transactions.

Additionally, Bitcoin is being adopted by companies and even governments as a store of value, reinforcing its role as a foundation for the digital economy of the future.

- Challenges and adapting to the new economy

01 - Price volatility: Bitcoin’s fluctuating value can make it difficult to use as a daily medium of exchange.

02 - Regulations and governmental resistance: Some countries attempt to restrict or regulate Bitcoin to maintain control over the traditional financial system.

03 - Education and adoption: Many people still lack the knowledge to use Bitcoin safely and effectively.

In summary, Bitcoin is transforming the way the world interacts with money, offering a decentralized and transparent alternative for digital economies. As more individuals and businesses adopt Bitcoin for payments, savings, and global commerce, its impact becomes increasingly clear. Despite the challenges, Bitcoin continues to solidify its place as the foundation of a new economic paradigm—where financial freedom and technological innovation go hand in hand.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ 39cc53c9:27168656

2025-05-27 09:21:53

@ 39cc53c9:27168656

2025-05-27 09:21:53The new website is finally live! I put in a lot of hard work over the past months on it. I'm proud to say that it's out now and it looks pretty cool, at least to me!

Why rewrite it all?

The old kycnot.me site was built using Python with Flask about two years ago. Since then, I've gained a lot more experience with Golang and coding in general. Trying to update that old codebase, which had a lot of design flaws, would have been a bad idea. It would have been like building on an unstable foundation.

That's why I made the decision to rewrite the entire application. Initially, I chose to use SvelteKit with JavaScript. I did manage to create a stable site that looked similar to the new one, but it required Jav aScript to work. As I kept coding, I started feeling like I was repeating "the Python mistake". I was writing the app in a language I wasn't very familiar with (just like when I was learning Python at that mom ent), and I wasn't happy with the code. It felt like spaghetti code all the time.

So, I made a complete U-turn and started over, this time using Golang. While I'm not as proficient in Golang as I am in Python now, I find it to be a very enjoyable language to code with. Most aof my recent pr ojects have been written in Golang, and I'm getting the hang of it. I tried to make the best decisions I could and structure the code as well as possible. Of course, there's still room for improvement, which I'll address in future updates.

Now I have a more maintainable website that can scale much better. It uses a real database instead of a JSON file like the old site, and I can add many more features. Since I chose to go with Golang, I mad e the "tradeoff" of not using JavaScript at all, so all the rendering load falls on the server. But I believe it's a tradeoff that's worth it.

What's new

- UI/UX - I've designed a new logo and color palette for kycnot.me. I think it looks pretty cool and cypherpunk. I am not a graphic designer, but I think I did a decent work and I put a lot of thinking on it to make it pleasant!

- Point system - The new point system provides more detailed information about the listings, and can be expanded to cover additional features across all services. Anyone can request a new point!

- ToS Scrapper: I've implemented a powerful automated terms-of-service scrapper that collects all the ToS pages from the listings. It saves you from the hassle of reading the ToS by listing the lines that are suspiciously related to KYC/AML practices. This is still in development and it will improve for sure, but it works pretty fine right now!

- Search bar - The new search bar allows you to easily filter services. It performs a full-text search on the Title, Description, Category, and Tags of all the services. Looking for VPN services? Just search for "vpn"!

- Transparency - To be more transparent, all discussions about services now take place publicly on GitLab. I won't be answering any e-mails (an auto-reply will prompt to write to the corresponding Gitlab issue). This ensures that all service-related matters are publicly accessible and recorded. Additionally, there's a real-time audits page that displays database changes.

- Listing Requests - I have upgraded the request system. The new form allows you to directly request services or points without any extra steps. In the future, I plan to enable requests for specific changes to parts of the website.

- Lightweight and fast - The new site is lighter and faster than its predecessor!

- Tor and I2P - At last! kycnot.me is now officially on Tor and I2P!

How?

This rewrite has been a labor of love, in the end, I've been working on this for more than 3 months now. I don't have a team, so I work by myself on my free time, but I find great joy in helping people on their private journey with cryptocurrencies. Making it easier for individuals to use cryptocurrencies without KYC is a goal I am proud of!

If you appreciate my work, you can support me through the methods listed here. Alternatively, feel free to send me an email with a kind message!

Technical details

All the code is written in Golang, the website makes use of the chi router for the routing part. I also make use of BigCache for caching database requests. There is 0 JavaScript, so all the rendering load falls on the server, this means it needed to be efficient enough to not drawn with a few users since the old site was reporting about 2M requests per month on average (note that this are not unique users).

The database is running with mariadb, using gorm as the ORM. This is more than enough for this project. I started working with an

sqlitedatabase, but I ended up migrating to mariadb since it works better with JSON.The scraper is using chromedp combined with a series of keywords, regex and other logic. It runs every 24h and scraps all the services. You can find the scraper code here.

The frontend is written using Golang Templates for the HTML, and TailwindCSS plus DaisyUI for the CSS classes framework. I also use some plain CSS, but it's minimal.

The requests forms is the only part of the project that requires JavaScript to be enabled. It is needed for parsing some from fields that are a bit complex and for the "captcha", which is a simple Proof of Work that runs on your browser, destinated to avoid spam. For this, I use mCaptcha.

-

@ 21c71bfa:e28fa0f6

2025-05-29 14:50:44

@ 21c71bfa:e28fa0f6

2025-05-29 14:50:44Book *Mcleodganj to Amritsar cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ 39cc53c9:27168656

2025-05-27 09:21:50

@ 39cc53c9:27168656

2025-05-27 09:21:50Over the past few months, I've dedicated my time to a complete rewrite of the kycnot.me website. The technology stack remains unchanged; Golang paired with TailwindCSS. However, I've made some design choices in this iteration that I believe significantly enhance the site. Particularly to backend code.

UI Improvements

You'll notice a refreshed UI that retains the original concept but has some notable enhancements. The service list view is now more visually engaging, it displays additional information in a more aesthetically pleasing manner. Both filtering and searching functionalities have been optimized for speed and user experience.

Service pages have been also redesigned to highlight key information at the top, with the KYC Level box always accessible. The display of service attributes is now more visually intuitive.

The request form, especially the Captcha, has undergone substantial improvements. The new self-made Captcha is robust, addressing the reliability issues encountered with the previous version.

Terms of Service Summarizer

A significant upgrade is the Terms of Service summarizer/reviewer, now powered by AI (GPT-4-turbo). It efficiently condenses each service's ToS, extracting and presenting critical points, including any warnings. Summaries are updated monthly, processing over 40 ToS pages via the OpenAI API using a self-crafted and thoroughly tested prompt.

Nostr Comments

I've integrated a comment section for each service using Nostr. For guidance on using this feature, visit the dedicated how-to page.

Database

The backend database has transitioned to pocketbase, an open-source Golang backend that has been a pleasure to work with. I maintain an updated fork of the Golang SDK for pocketbase at pluja/pocketbase.

Scoring

The scoring algorithm has also been refined to be more fair. Despite I had considered its removal due to the complexity it adds (it is very difficult to design a fair scoring system), some users highlighted its value, so I kept it. The updated algorithm is available open source.

Listings

Each listing has been re-evaluated, and the ones that were no longer operational were removed. New additions are included, and the backlog of pending services will be addressed progressively, since I still have access to the old database.

API

The API now offers more comprehensive data. For more details, check here.

About Page

The About page has been restructured for brevity and clarity.

Other Changes

Extensive changes have been implemented in the server-side logic, since the whole code base was re-written from the ground up. I may discuss these in a future post, but for now, I consider the current version to be just a bit beyond beta, and additional updates are planned in the coming weeks.

-

@ 21c71bfa:e28fa0f6

2025-05-29 14:50:23

@ 21c71bfa:e28fa0f6

2025-05-29 14:50:23Book *Manali to Amritsar cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ 21c71bfa:e28fa0f6

2025-05-29 14:50:05

@ 21c71bfa:e28fa0f6