-

@ 472f440f:5669301e

2025-05-20 13:01:09

@ 472f440f:5669301e

2025-05-20 13:01:09Marty's Bent

via me

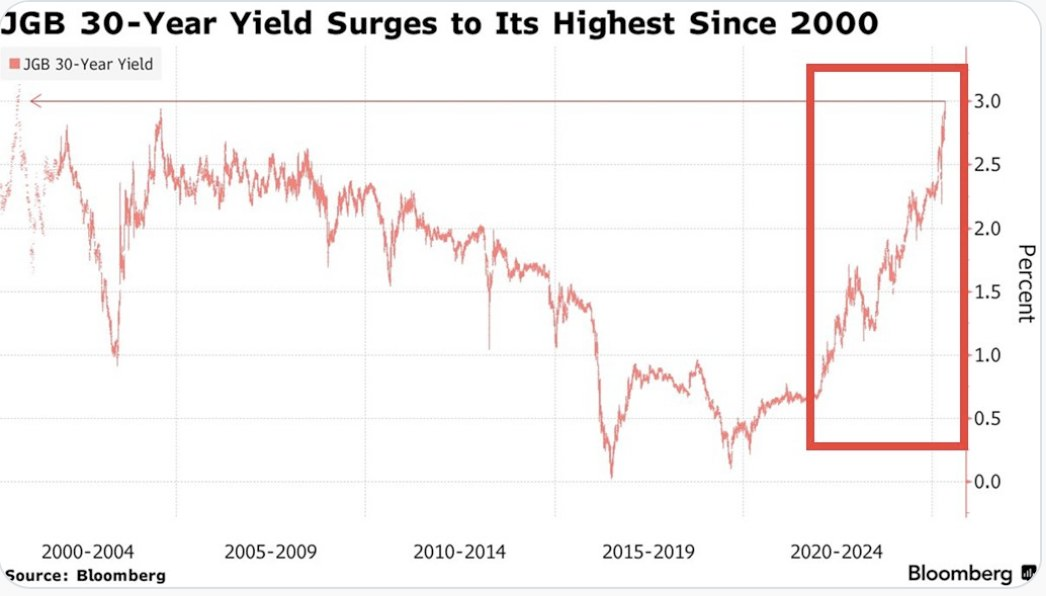

Don't sleep on what's happening in Japan right now. We've been covering the country and the fact that they've lost control of their yield curve since late last year. After many years of making it a top priority from a monetary policy perspective, last year the Bank of Japan decided to give up on yield curve control in an attempt to reel inflation. This has sent yields for the 30-year and 40-year Japanese government bonds to levels not seen since the early 2000s in the case of the 30-year and levels never before seen for the 40-year, which was launched in 2007. With a debt to GDP ratio that has surpassed 250% and a population that is aging out with an insufficient amount of births to replace the aging workforce, it's hard to see how Japan can get out of this conundrum without some sort of economic collapse.

This puts the United States in a tough position considering the fact that Japan is one of the largest holders of U.S. Treasury bonds with more than 1,135 sats | $1.20 trillion in exposure. If things get too out of control in Japan and the yield curve continues to drift higher and inflation continues to creep higher Japan can find itself in a situation where it's a forced seller of US Treasuries as they attempt to strengthen the yen. Another aspect to consider is the fact that investors may see the higher yields on Japanese government bonds and decide to purchase them instead of US Treasuries. This is something to keep an eye on in the weeks to come. Particularly if higher rates drive a higher cost of capital, which leads to even more inflation. As producers are forced to increase their prices to ensure that they can manage their debt repayments.

It's never a good sign when the Japanese Prime Minister is coming out to proclaim that his country's financial situation is worse than Greece's, which has been a laughing stock of Europe for the better part of three decades. Japan is a very proud nation, and the fact that its Prime Minister made a statement like this should not be underappreciated.

As we noted last week, the 10-year and 30-year U.S. Treasury bonds are drifting higher as well. Earlier today, the 30-year bond yield surpassed 5%, which has been a psychological level that many have been pointed to as a critical tipping point. When you take a step back and look around the world it seems pretty clear that bond markets are sending a very strong signal. And that signal is that something is not well in the back end of the financial system.

This is even made clear when you look at the private sector, particularly at consumer debt. In late March, we warned of the growing trend of buy now, pay later schemes drifting down market as major credit card companies released charge-off data which showed charge-off rates reaching levels not seen since the 2008 great financial crisis. At the time, we could only surmise that Klarna was experiencing similar charge-off rates on the bigger-ticket items they financed and started doing deals with companies like DoorDash to finance burrito deliveries in an attempt to move down market to finance smaller ticket items with a higher potential of getting paid back. It seems like that inclination was correct as Klarna released data earlier today showing more losses on their book as consumers find it extremely hard to pay back their debts.

via NewsWire

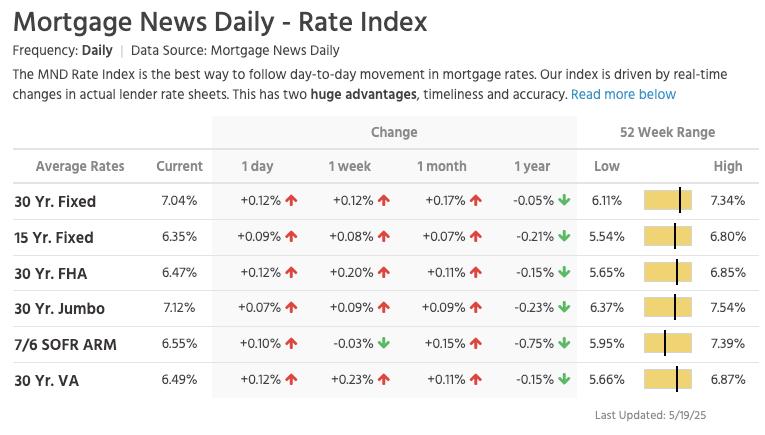

This news hit the markets on the same day as the average rate of the 30-year mortgage in the United States rose to 7.04%. I'm not sure if you've checked lately, but real estate prices are still relatively elevated outside of a few big cities who expanded supply significantly during the COVID era as people flooded out of blue states towards red states. It's hard to imagine that many people can afford a house based off of sticker price alone, but with a 7% 30-year mortgage rate it's becoming clear that the ability of the Common Man to buy a house is simply becoming impossible.

via Lance Lambert

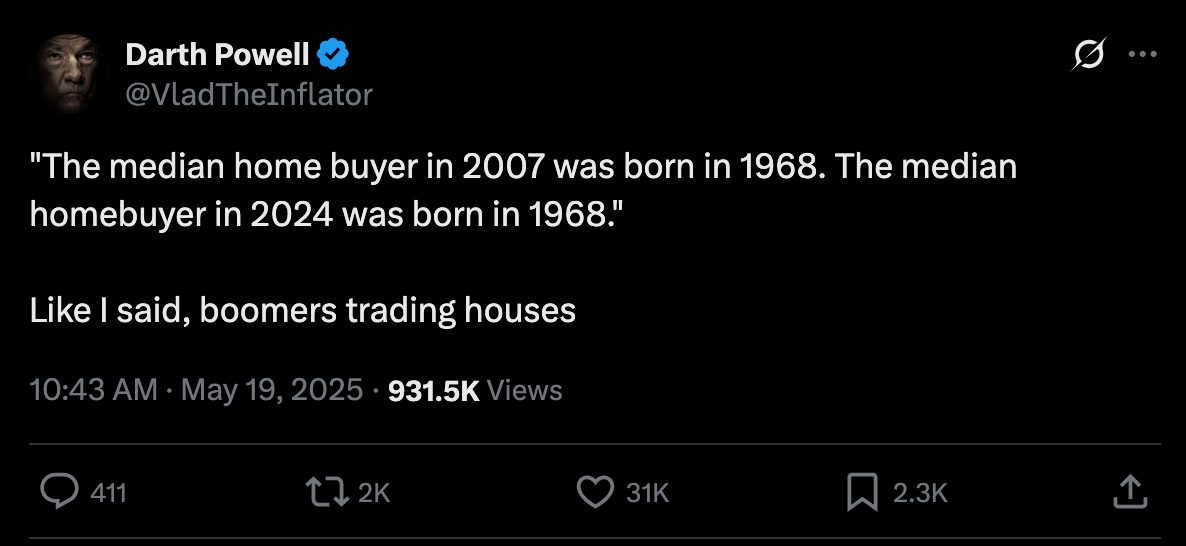

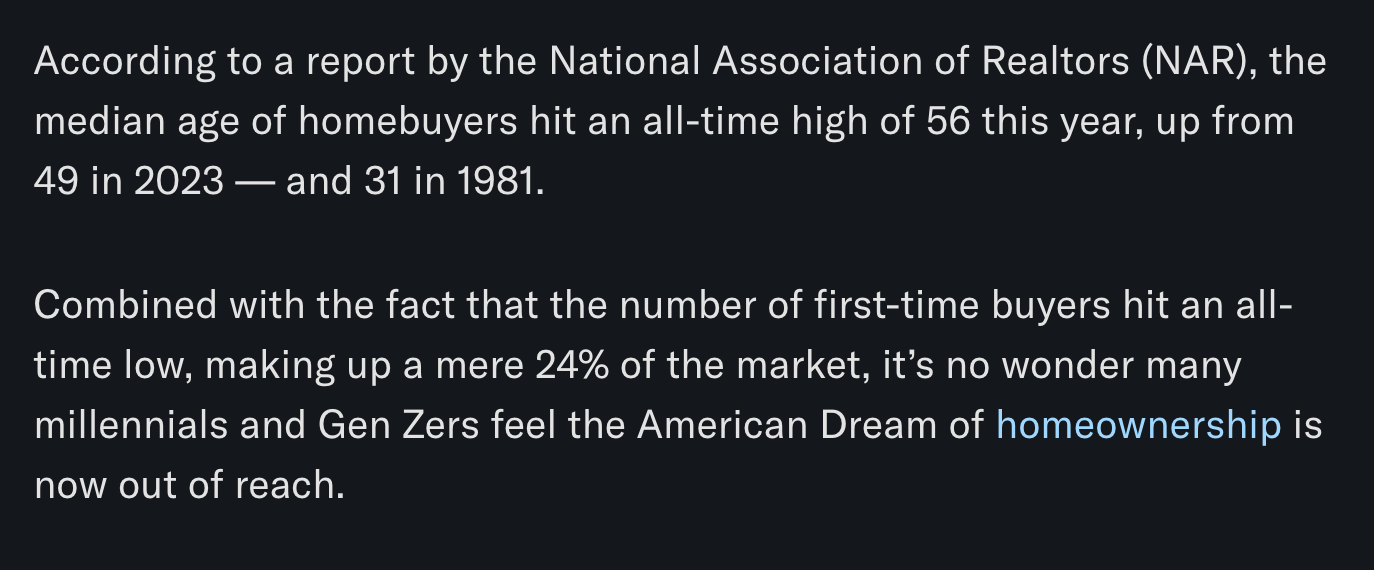

The mortgage rate data is not the only thing you need to look at to understand that it's becoming impossible for the Common Man of working age to buy a house. New data has recently been released that highlights That the median home buyer in 2007 was born in 1968, and the median home buyer in 2024 was born in 1968. Truly wild when you think of it. As our friend Darth Powell cheekily highlights below, we find ourselves in a situation where boomers are simply trading houses and the younger generations are becoming indentured slaves. Forever destined to rent because of the complete inability to afford to buy a house.

via Darth Powell

via Yahoo Finance

Meanwhile, Bitcoin re-approached all-time highs late this evening and looks primed for another breakout to the upside. This makes sense if you're paying attention. The high-velocity trash economy running on an obscene amount of debt in both the public and private sectors seems to be breaking at the seams. All the alarm bells are signaling that another big print is coming. And if you hope to preserve your purchasing power or, ideally, increase it as the big print approaches, the only thing that makes sense is to funnel your money into the hardest asset in the world, which is Bitcoin.

via Bitbo

Buckle up, freaks. It's gonna be a bumpy ride. Stay humble, Stack Sats.

Trump's Middle East Peace Strategy: Redefining U.S. Foreign Policy

In his recent Middle East tour, President Trump signaled what our guest Dr. Anas Alhajji calls "a major change in US policy." Trump explicitly rejected the nation-building strategies of his predecessors, contrasting the devastation in Afghanistan and Iraq with the prosperity of countries like Saudi Arabia and UAE. This marks a profound shift from both Republican and Democratic foreign policy orthodoxy. As Alhajji noted, Trump's willingness to meet with Syrian President Assad follows a historical pattern where former adversaries eventually become diplomatic partners.

"This is really one of the most important shifts in US foreign policy to say, look, sorry, we destroyed those countries because we tried to rebuild them and it was a big mistake." - Dr. Anas Alhajji

The administration's new approach emphasizes negotiation over intervention. Rather than military solutions, Trump is engaging with groups previously considered off-limits, including the Houthis, Hamas, and Iran. This pragmatic stance prioritizes economic cooperation and regional stability over ideological confrontation. The focus on trade deals and investment rather than regime change represents a fundamental reimagining of America's role in the Middle East.

Check out the full podcast here for more on the Iran nuclear situation, energy market predictions, and why AI development could create power grid challenges. Only on TFTC Studio.

Headlines of the Day

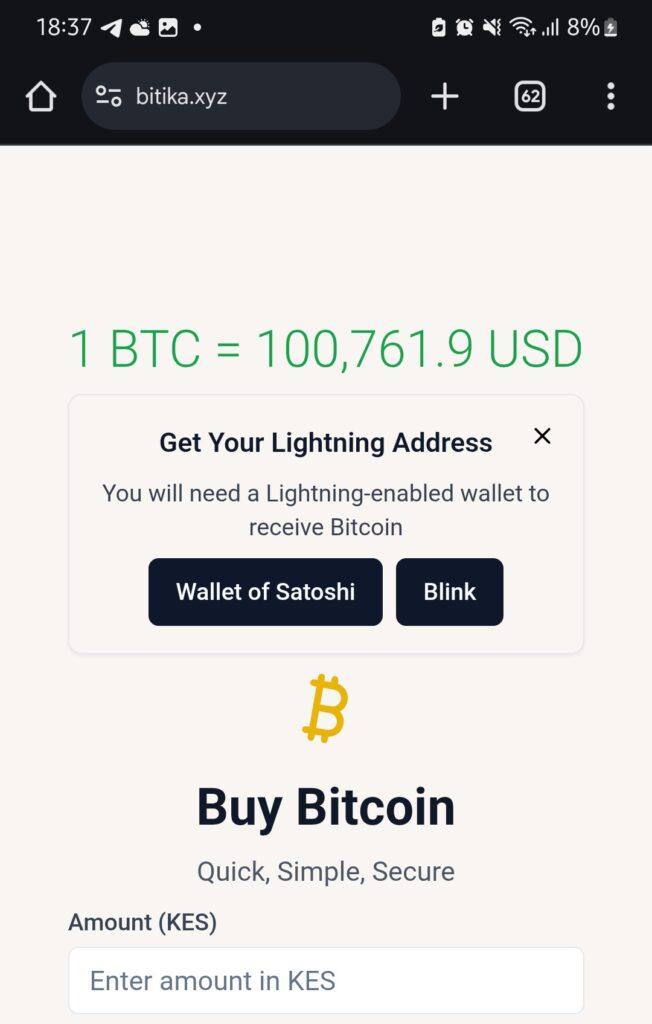

Bitcoin Soars to 100,217 sats | $106.00K While Bonds Lose 40% Since 2020 - via X

US Senate Advances Stablecoin Bill As America Embraces Bitcoin - via X

Get our new STACK SATS hat - via tftcmerch.io

Texas House Debates Bill For State-Run Bitcoin Reserve - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Don't let the noise consume you. Focus on making your life 1% better every day.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 472f440f:5669301e

2025-05-20 02:00:54

@ 472f440f:5669301e

2025-05-20 02:00:54Marty's Bent

https://www.youtube.com/watch?v=p0Sj1sG05VQ

Here's a great presentation from our good friend nostr:nprofile1qyx8wumn8ghj7cnjvghxjmcpp4mhxue69uhkummn9ekx7mqqyz2hj3zg2g3pqwxuhg69zgjhke4pcmjmmdpnndnefqndgqjt8exwj6ee8v7 , President of The Nakamoto Institute titled Hodl for Good. He gave it earlier this year at the BitBlockBoom Conference, and I think it's something everyone reading this should take 25 minutes to watch. Especially if you find yourself wondering whether or not it's a good idea to spend bitcoin at any given point in time. Michael gives an incredible Austrian Economics 101 lesson on the importance of lowering one's time preference and fully understanding the importance of hodling bitcoin. For the uninitiated, it may seem that the hodl meme is nothing more than a call to hoard bitcoins in hopes of getting rich eventually. However, as Michael points out, there's layers to the hodl meme and the good that hodling can bring individuals and the economy overall.

The first thing one needs to do to better understand the hodl meme is to completely flip the framing that is typically thrust on bitcoiners who encourage others to hodl. Instead of ceding that hodling is a greedy or selfish action, remind people that hodling, or better known as saving, is the foundation of capital formation, from which all productive and efficient economic activity stems. Number go up technology is great and it really matters. It matters because it enables anybody leveraging that technology to accumulate capital that can then be allocated toward productive endeavors that bring value to the individual who creates them and the individual who buys them.

When one internalizes this, it enables them to turn to personal praxis and focus on minimizing present consumption while thinking of ways to maximize long-term value creation. Live below your means, stack sats, and use the time that you're buying to think about things that you want in the future. By lowering your time preference and saving in a harder money you will have the luxury of demanding higher quality goods in the future. Another way of saying this is that you will be able to reshape production by voting with your sats. Initially when you hold them off the market by saving them - signaling that the market doesn't have goods worthy of your sats - and ultimately by redeploying them into the market when you find higher quality goods that meet the standards desire.

The first part of this equation is extremely important because it sends a signal to producers that they need to increase the quality of their work. As more and more individuals decide to use bitcoin as their savings technology, the signal gets stronger. And over many cycles we should begin to see low quality cheap goods exit the market in favor of higher quality goods that provide more value and lasts longer and, therefore, make it easier for an individual to depart with their hard-earned and hard-saved sats. This is only but one aspect that Michael tries to imbue throughout his presentation.

The other is the ability to buy yourself leisure time when you lower your time preference and save more than you spend. When your savings hit a critical tipping point that gives you the luxury to sit back and experience true leisure, which Michael explains is not idleness, but the contemplative space to study, create art, refine taste, and to find what "better goods" actually are. Those who can experience true leisure while reaping the benefits of saving in a hard asset that is increasing in purchasing power significantly over the long term are those who build truly great things. Things that outlast those who build them. Great art, great monuments, great institutions were all built by men who were afforded the time to experience leisure. Partly because they were leveraging hard money as their savings and the place they stored the profits reaped from their entrepreneurial endeavors.

If you squint and look into the future a couple of decades, it isn't hard to see a reality like this manifesting. As more people begin to save in Bitcoin, the forces of supply and demand will continue to come into play. There will only ever be 21 million bitcoin, there are around 8 billion people on this planet, and as more of those 8 billion individuals decide that bitcoin is the best savings vehicle, the price of bitcoin will rise.

When the price of bitcoin rises, it makes all other goods cheaper in bitcoin terms and, again, expands the entrepreneurial opportunity. The best part about this feedback loop is that even non-holders of bitcoin benefit through higher real wages and faster tech diffusion. The individuals and business owners who decide to hodl bitcoin will bring these benefits to the world whether you decide to use bitcoin or not.

This is why it is virtuous to hodl bitcoin. The potential for good things to manifest throughout the world increase when more individuals decide to hodl bitcoin. And as Michael very eloquently points out, this does not mean that people will not spend their bitcoin. It simply means that they have standards for the things that they will spend their bitcoin on. And those standards are higher than most who are fully engrossed in the high velocity trash economy have today.

In my opinion, one of those higher causes worthy of a sats donation is nostr:nprofile1qyfhwumn8ghj7enjv4jhyetvv9uju7re0gq3uamnwvaz7tmfdemxjmrvv9nk2tt0w468v6tvd3skwefwvdhk6qpqwzc9lz2f40azl98shkjewx3pywg5e5alwqxg09ew2mdyeey0c2rqcfecft . Consider donating so they can preserve and disseminate vital information about bitcoin and its foundations.

The Shell Game: How Health Narratives May Distract from Vaccine Risks

In our recent podcast, Dr. Jack Kruse presented a concerning theory about public health messaging. He argues that figures like Casey and Callie Means are promoting food and exercise narratives as a deliberate distraction from urgent vaccine issues. While no one disputes healthy eating matters, Dr. Kruse insists that focusing on "Froot Loops and Red Dye" diverts attention from what he sees as immediate dangers of mRNA vaccines, particularly for children.

"It's gonna take you 50 years to die from processed food. But the messenger jab can drop you like Damar Hamlin." - Dr Jack Kruse

Dr. Kruse emphasized that approximately 25,000 children per month are still receiving COVID vaccines despite concerns, with 3 million doses administered since Trump's election. This "shell game," as he describes it, allows vaccines to remain on childhood schedules while public attention fixates on less immediate health threats. As host, I believe this pattern deserves our heightened scrutiny given the potential stakes for our children's wellbeing.

Check out the full podcast here for more on Big Pharma's alleged bioweapons program, the "Time Bank Account" concept, and how Bitcoin principles apply to health sovereignty.

Headlines of the Day

Aussie Judge: Bitcoin is Money, Possibly CGT-Exempt - via X

JPMorgan to Let Clients Buy Bitcoin Without Direct Custody - via X

Get our new STACK SATS hat - via tftcmerch.io

Mubadala Acquires 384,239 sats | $408.50M Stake in BlackRock Bitcoin ETF - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

I've been walking from my house around Town Lake in Austin in the mornings and taking calls on the walk. Big fan of a walking call.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 472f440f:5669301e

2025-05-16 00:18:45

@ 472f440f:5669301e

2025-05-16 00:18:45Marty's Bent

It's been a pretty historic week for the United States as it pertains to geopolitical relations in the Middle East. President Trump and many members of his administration, including AI and Crypto Czar David Sacks and Treasury Secretary Scott Bessent, traveled across the Middle East making deals with countries like Qatar, Saudi Arabia, the United Arab Emirates, Syria, and others. Many are speculating that Iran may be included in some behind the scenes deal as well. This trip to the Middle East makes sense considering the fact that China is also vying for favorable relationships with those countries. The Middle East is a power player in the world, and it seems pretty clear that Donald Trump is dead set on ensuring that they choose the United States over China as the world moves towards a more multi-polar reality.

Many are calling the events of this week the Riyadh Accords. There were many deals that were struck in relation to artificial intelligence, defense, energy and direct investments in the United States. A truly prolific power play and demonstration of deal-making ability of Donald Trump, if you ask me. Though I will admit some of the numbers that were thrown out by some of the countries were a bit egregious. We shall see how everything plays out in the coming years. It will be interesting to see how China reacts to this power move by the United States.

While all this was going on, there was something happening back in the United States that many people outside of fringe corners of FinTwit are not talking about, which is the fact that the 10-year and 30-year U.S. Treasury bond yields are back on the rise. Yesterday, they surpassed the levels of mid-April that caused a market panic and are hovering back around levels that have not been seen since right before Donald Trump's inauguration.

I imagine that there isn't as much of an uproar right now because I'm pretty confident the media freakouts we were experiencing in mid-April were driven by the fact that many large hedge funds found themselves off sides of large levered basis trades. I wouldn't be surprised if those funds have decreased their leverage in those trades and bond yields being back to mid-April levels is not affecting those funds as much as they were last month. But the point stands, the 10-year and 30-year yields are significantly elevated with the 30-year approaching 5%. Regardless of the deals that are currently being made in the Middle East, the Treasury has a big problem on its hands. It still has to roll over many trillions worth of debt over over the next few years and doing so at these rates is going to be massively detrimental to fiscal deficits over the next decade. The interest expense on the debt is set to explode in the coming years.

On that note, data from the first quarter of 2025 has been released by the government and despite all the posturing by the Trump administration around DOGE and how tariffs are going to be beneficial for the U.S. economy, deficits are continuing to explode while the interest expense on the debt has definitively surpassed our annual defense budget.

via Charlie Bilello

via Mohamed Al-Erian

To make matters worse, as things are deteriorating on the fiscal side of things, the U.S. consumer is getting crushed by credit. The 90-plus day delinquency rates for credit card and auto loans are screaming higher right now.

via TXMC

One has to wonder how long all this can continue without some sort of liquidity crunch. Even though equities markets have recovered from their post-Liberation Day month long bear market, I would not be surprised if what we're witnessing is a dead cat bounce that can only be continued if the money printers are turned back on. Something's got to give, both on the fiscal side and in the private markets where the Common Man is getting crushed because he's been forced to take on insane amounts of debt to stay afloat after years of elevated levels of inflation. Add on the fact that AI has reached a state of maturity that will enable companies to replace their current meat suit workers with an army of cheap, efficient and fast digital workers and it isn't hard to see that some sort of employment crisis could be on the horizon as well.

Now is not the time to get complacent. While I do believe that the deals that are currently being made in the Middle East are probably in the best interest of the United States as the world, again, moves toward a more multi-polar reality, we are facing problems that one cannot simply wish away. They will need to be confronted. And as we've seen throughout the 21st century, the problems are usually met head-on with a money printer.

I take no pleasure in saying this because it is a bit uncouth to be gleeful to benefit from the strife of others, but it is pretty clear to me that all signs are pointing to bitcoin benefiting massively from everything that is going on. The shift towards a more multi-polar world, the runaway debt situation here in the United States, the increasing deficits, the AI job replacements and the consumer credit crisis that is currently unfolding, All will need to be "solved" by turning on the money printers to levels they've never been pushed to before.

Weird times we're living in.

China's Manufacturing Dominance: Why It Matters for the U.S.

In my recent conversation with Lyn Alden, she highlighted how China has rapidly ascended the manufacturing value chain. As Lyn pointed out, China transformed from making "sneakers and plastic trinkets" to becoming the world's largest auto exporter in just four years. This dramatic shift represents more than economic success—it's a strategic power play. China now dominates solar panel production with greater market control than OPEC has over oil and maintains near-monopoly control of rare earth elements crucial for modern technology.

"China makes like 10 times more steel than the United States does... which is relevant in ship making. It's relevant in all sorts of stuff." - Lyn Alden

Perhaps most concerning, as Lyn emphasized, is China's financial leverage. They hold substantial U.S. assets that could be strategically sold to disrupt U.S. treasury market functioning. This combination of manufacturing dominance, resource control, and financial leverage gives China significant negotiating power in any trade disputes, making our attempts to reshoring manufacturing all the more challenging.

Check out the full podcast here for more on Triffin's dilemma, Bitcoin's role in monetary transition, and the energy requirements for rebuilding America's industrial base.

Headlines of the Day

Financial Times Under Fire Over MicroStrategy Bitcoin Coverage - via X

Trump in Qatar: Historic Boeing Deal Signed - via X

Get our new STACK SATS hat - via tftcmerch.io

Johnson Backs Stock Trading Ban; Passage Chances Slim - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Building things of value is satisfying.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57I have been recently building NFDB, a new relay DB. This post is meant as a short overview.

Regular relays have challenges

Current relay software have significant challenges, which I have experienced when hosting Nostr.land: - Scalability is only supported by adding full replicas, which does not scale to large relays. - Most relays use slow databases and are not optimized for large scale usage. - Search is near-impossible to implement on standard relays. - Privacy features such as NIP-42 are lacking. - Regular DB maintenance tasks on normal relays require extended downtime. - Fault-tolerance is implemented, if any, using a load balancer, which is limited. - Personalization and advanced filtering is not possible. - Local caching is not supported.

NFDB: A scalable database for large relays

NFDB is a new database meant for medium-large scale relays, built on FoundationDB that provides: - Near-unlimited scalability - Extended fault tolerance - Instant loading - Better search - Better personalization - and more.

Search

NFDB has extended search capabilities including: - Semantic search: Search for meaning, not words. - Interest-based search: Highlight content you care about. - Multi-faceted queries: Easily filter by topic, author group, keywords, and more at the same time. - Wide support for event kinds, including users, articles, etc.

Personalization

NFDB allows significant personalization: - Customized algorithms: Be your own algorithm. - Spam filtering: Filter content to your WoT, and use advanced spam filters. - Topic mutes: Mute topics, not keywords. - Media filtering: With Nostr.build, you will be able to filter NSFW and other content - Low data mode: Block notes that use high amounts of cellular data. - and more

Other

NFDB has support for many other features such as: - NIP-42: Protect your privacy with private drafts and DMs - Microrelays: Easily deploy your own personal microrelay - Containers: Dedicated, fast storage for discoverability events such as relay lists

Calcite: A local microrelay database

Calcite is a lightweight, local version of NFDB that is meant for microrelays and caching, meant for thousands of personal microrelays.

Calcite HA is an additional layer that allows live migration and relay failover in under 30 seconds, providing higher availability compared to current relays with greater simplicity. Calcite HA is enabled in all Calcite deployments.

For zero-downtime, NFDB is recommended.

Noswhere SmartCache

Relays are fixed in one location, but users can be anywhere.

Noswhere SmartCache is a CDN for relays that dynamically caches data on edge servers closest to you, allowing: - Multiple regions around the world - Improved throughput and performance - Faster loading times

routerd

routerdis a custom load-balancer optimized for Nostr relays, integrated with SmartCache.routerdis specifically integrated with NFDB and Calcite HA to provide fast failover and high performance.Ending notes

NFDB is planned to be deployed to Nostr.land in the coming weeks.

A lot more is to come. 👀️️️️️️

-

@ 21335073:a244b1ad

2025-05-21 16:58:36

@ 21335073:a244b1ad

2025-05-21 16:58:36The other day, I had the privilege of sitting down with one of my favorite living artists. Our conversation was so captivating that I felt compelled to share it. I’m leaving his name out for privacy.

Since our last meeting, I’d watched a documentary about his life, one he’d helped create. I told him how much I admired his openness in it. There’s something strange about knowing intimate details of someone’s life when they know so little about yours—it’s almost like I knew him too well for the kind of relationship we have.

He paused, then said quietly, with a shy grin, that watching the documentary made him realize how “odd and eccentric” he is. I laughed and told him he’s probably the sanest person I know. Because he’s lived fully, chasing love, passion, and purpose with hardly any regrets. He’s truly lived.

Today, I turn 44, and I’ll admit I’m a bit eccentric myself. I think I came into the world this way. I’ve made mistakes along the way, but I carry few regrets. Every misstep taught me something. And as I age, I’m not interested in blending in with the world—I’ll probably just lean further into my own brand of “weird.” I want to live life to the brim. The older I get, the more I see that the “normal” folks often seem less grounded than the eccentric artists who dare to live boldly. Life’s too short to just exist, actually live.

I’m not saying to be strange just for the sake of it. But I’ve seen what the crowd celebrates, and I’m not impressed. Forge your own path, even if it feels lonely or unpopular at times.

It’s easy to scroll through the news and feel discouraged. But actually, this is one of the most incredible times to be alive! I wake up every day grateful to be here, now. The future is bursting with possibility—I can feel it.

So, to my fellow weirdos on nostr: stay bold. Keep dreaming, keep pushing, no matter what’s trending. Stay wild enough to believe in a free internet for all. Freedom is radical—hold it tight. Live with the soul of an artist and the grit of a fighter. Thanks for inspiring me and so many others to keep hoping. Thank you all for making the last year of my life so special.

-

@ 5ea46480:450da5bd

2025-05-24 09:57:37

@ 5ea46480:450da5bd

2025-05-24 09:57:37Decentralization refers to control/power, and relates to censorship resistance. That is it, it is not more complicated then that. Resilience is a function of redundancy; a centralized censored system can have a redundant set-up and therefor be resilient.

Take Bitcoin; the blockchain is a central database, it is resilient because it has many redundant copies among a lot of different nodes. The message (txs and blocks) propagation is decentralized due to existence of a p2p network among these nodes, making the data distribution censorship resistant (hello op_return debate). But onchain transactions themselves are NOT p2p, they require a middlemen (a miner) because it is a central database, as opposed to something like lightning which is p2p. Peer to Peer says something about relative architectural hierarchical position/relation. P2P provides censorship resistance because it entails equal power relations, provided becoming a peer is permissionless. What makes onchain transactions censorship resistant is that mining is permissionless, and involves this open power struggle/game where competition results in a power distribution among players, meaning (hopefully) decentralization. The fact users rely on these middlemen is mitigated by this decentralization on the one hand, and temper-proofing via cryptographic signatures on the other, resulting in what we call trustlessness (or trust minimization for the autists in the room); we only rely on a miner to perform a job (including your tx into a block), but we don’t trust the miner to perform the job correctly, this we can verify ourselves.

This leads us to Nostr, because that last part is exactly what Nostr does as well. It uses cryptography to get tamper-proof messaging, which then allows you to use middle-men in a trust minimized way. The result is decentralization because in general terms, any middle man is as good as any other (same as with miners), and becoming such a middleman is permissionless(somewhat, mostly); which in turn leads to censorship resistance. It also allows for resilience because you are free to make things as redundant as you'd like.

Ergo, the crux is putting the cryptography central, making it the starting point of the system; decentralization then becomes an option due to trust minimization. The difference between Bitcoin an Nostr, is that Bitcoin maintains a global state/central ledger and needs this PoW/Nakamoto consensus fanfare; Nostr rests itself with local perspectives on 'the network'.

The problem with the Fediverse, is that it does not provide trust minimization in relation to the middlemen. Sure, there are a lot different servers, but you rely on a particular one (and the idea you could switch never really seemed to have materialized in a meaningful way). It also fails in permisionlessness because you rely on the association between servers, i.e. federation, to have meaningful access to the rest of the network. In other words, it is more a requirement of association than freedom of association; you have the freedom to be excommunicated.

The problem with ATproto is that is basically does not solve this dynamic; it only complicates it by pulling apart the components; identity and data, distribution and perspective are now separated, and supposedly you don’t rely on any particular one of these sub-component providers in the stack; but you do rely on all these different sub-component providers in the stack to play nice with each other. And this ‘playing nice’ is just the same old ‘requirement of association’ and ‘freedom of excommunication’ that looms at the horizon.

Yes, splitting up the responsibilities of identity, hosting and indexing is what is required to safe us from the platform hellscape which at this stage takes care of all three. But as it turns out, it was not a matter cutting those up into various (on paper) interchangeable middlemen. All that is required is putting cryptographic keys in the hands of the user; the tamperproofing takes care of the rest, simply by trust minimizing the middlemen we use. All the sudden it does not matter which middlemen we use, and no one is required to play nice; we lost the requirement of association, and gained freedom of association, which was the purpose of censorship resistance and therefor decentralization, to begin with.

-

@ 51bbb15e:b77a2290

2025-05-21 00:24:36

@ 51bbb15e:b77a2290

2025-05-21 00:24:36Yeah, I’m sure everything in the file is legit. 👍 Let’s review the guard witness testimony…Oh wait, they weren’t at their posts despite 24/7 survellience instructions after another Epstein “suicide” attempt two weeks earlier. Well, at least the video of the suicide is in the file? Oh wait, a techical glitch. Damn those coincidences!

At this point, the Trump administration has zero credibility with me on anything related to the Epstein case and his clients. I still suspect the administration is using the Epstein files as leverage to keep a lot of RINOs in line, whereas they’d be sabotaging his agenda at every turn otherwise. However, I just don’t believe in ends-justify-the-means thinking. It’s led almost all of DC to toss out every bit of the values they might once have had.

-

@ 90c656ff:9383fd4e

2025-05-24 12:11:01

@ 90c656ff:9383fd4e

2025-05-24 12:11:01Since its creation, Bitcoin has marked a turning point in the digital money revolution—but its evolution didn’t stop at the original concept of decentralized transactions. Over the years, new technological solutions have been developed to expand its capabilities, making it more efficient and versatile. Among these innovations, smart contracts and the Lightning Network stand out, enabling increased functionality and scalability of the network, and ensuring a faster, cheaper, and more accessible system.

Smart contracts on Bitcoin

Smart contracts are programs that automatically execute certain actions when predefined conditions are met. Although the concept is more commonly associated with other networks, Bitcoin also supports smart contracts, especially through upgrades like Taproot.

- Smart contracts on Bitcoin enable functionalities such as:

01 - Conditional payments: Transactions that are only completed if certain rules are met, such as multi-signatures or specific time conditions.

02 - Advanced fund management: Use of multi-signature wallets, where different parties must approve a transaction before it is processed.

03 - Enhanced privacy: With the Taproot upgrade, smart contracts can be more efficient and indistinguishable from regular transactions, improving privacy across the network.

Although smart contracts on Bitcoin are simpler than those on other platforms, this simplicity is a strength—it preserves the network's security and robustness by avoiding complex vulnerabilities.

Lightning Network: scalability and instant transactions

One of the biggest challenges Bitcoin faces is scalability. Since the original network was designed to prioritize security and decentralization, transaction speed can be limited during periods of high demand. To address this issue, the Lightning Network was created—a second-layer solution that enables near-instant transactions with extremely low fees.

The Lightning Network works by creating payment channels between users, allowing them to conduct multiple transactions off-chain and recording only the final balance on the main Bitcoin blockchain or timechain. Key advantages include:

01 - Speed: Transactions are completed in milliseconds, making Bitcoin more suitable for daily payments.

02 - Low fees: Since transactions occur off-chain, fees are minimal, allowing for viable microtransactions.

03 - Network decongestion: By moving many transactions to the Lightning Network, Bitcoin’s main chain becomes more efficient and less congested.

In summary, Bitcoin continues to evolve technologically to meet the demands of a global financial system. Smart contracts increase its functionality, offering greater flexibility and security in transactions. The Lightning Network improves scalability, making Bitcoin faster and more practical for everyday use. With these innovations, Bitcoin remains at the forefront of the financial revolution, proving that despite its initial limitations, it continues to adapt and grow as a truly decentralized and global monetary system.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ f6488c62:c929299d

2025-05-24 05:10:20

@ f6488c62:c929299d

2025-05-24 05:10:20คุณเคยจินตนาการถึงอนาคตที่ AI มีความฉลาดเทียบเท่ามนุษย์หรือไม่? นี่คือสิ่งที่ Sam Altman ซีอีโอของ OpenAI และทีมพันธมิตรอย่าง SoftBank, Oracle และ MGX กำลังผลักดันผ่าน โครงการ Stargate! โครงการนี้ไม่ใช่แค่เรื่องเทคโนโลยี แต่เป็นก้าวกระโดดครั้งใหญ่ของมนุษยชาติ! Stargate คืออะไร? Stargate เป็นโปรเจกต์สร้าง ศูนย์ข้อมูล AI ขนาดยักษ์ที่ใหญ่ที่สุดในประวัติศาสตร์ ด้วยเงินลงทุนเริ่มต้น 100,000 ล้านดอลลาร์ และอาจสูงถึง 500,000 ล้านดอลลาร์ ภายในปี 2029! เป้าหมายคือการพัฒนา Artificial General Intelligence (AGI) หรือ AI ที่ฉลาดเทียบเท่ามนุษย์ เพื่อให้สหรัฐฯ ครองความเป็นผู้นำด้าน AI และแข่งขันกับคู่แข่งอย่างจีน โครงการนี้เริ่มต้นที่เมือง Abilene รัฐเท็กซัส โดยจะสร้างศูนย์ข้อมูล 10 แห่ง และขยายไปยังญี่ปุ่น สหราชอาณาจักร และสหรัฐอาหรับเอมิเรตส์ ทำไม Stargate ถึงสำคัญ?

นวัตกรรมเปลี่ยนโลก: AI จาก Stargate จะช่วยพัฒนาวัคซีน mRNA รักษามะเร็งได้ใน 48 ชั่วโมง และยกระดับอุตสาหกรรมต่าง ๆ เช่น การแพทย์และความมั่นคงแห่งชาติสร้างงาน: คาดว่าจะสร้างงานกว่า 100,000 ตำแหน่ง ในสหรัฐฯ

พลังงานมหาศาล: ศูนย์ข้อมูลอาจใช้พลังงานถึง 1.2 กิกะวัตต์ เทียบเท่ากับเมืองขนาดใหญ่!

ใครอยู่เบื้องหลัง? Sam Altman ร่วมมือกับ Masayoshi Son จาก SoftBank และได้รับการสนับสนุนจาก Donald Trump ซึ่งผลักดันนโยบายให้ Stargate เป็นจริง การก่อสร้างดำเนินการโดย Oracle และพันธมิตรด้านพลังงานอย่าง Crusoe Energy Systems ความท้าทาย? ถึงจะยิ่งใหญ่ แต่ Stargate ก็เจออุปสรรค ทั้งปัญหาการระดมทุน ความกังวลเรื่องภาษีนำเข้าชิป และการแข่งขันจากคู่แข่งอย่าง DeepSeek ที่ใช้โครงสร้างพื้นฐานน้อยกว่า แถม Elon Musk ยังออกมาวิจารณ์ว่าโครงการนี้อาจ “ไม่สมจริง” แต่ Altman มั่นใจและเชิญ Musk ไปดูไซต์งานที่เท็กซัสเลยทีเดียว! อนาคตของ Stargate ศูนย์ข้อมูลแห่งแรกจะเริ่มใช้งานในปี 2026 และอาจเปลี่ยนโฉมวงการ AI ไปตลอดกาล นี่คือก้าวสำคัญสู่ยุคใหม่ของเทคโนโลยีที่อาจเปลี่ยนวิถีชีวิตของเรา! และไม่ใช่ประตูดวงดาวแบบในหนังนะ! ถึงชื่อ Stargate จะได้แรงบันดาลใจจากภาพยนตร์ sci-fi อันโด่งดัง แต่โครงการนี้ไม่ได้พาเราไปยังดวงดาวอื่น มันคือการเปิดประตูสู่โลกแห่ง AI ที่ทรงพลัง และอาจเปลี่ยนอนาคตของมนุษยชาติไปเลย! และไม่เหมือน universechain ของ star ของผมนะครับ

Stargate #AI #SamAltman #OpenAI #อนาคตของเทคโนโลยี

-

@ 8aa70f44:3073d1a6

2025-05-21 13:07:14

@ 8aa70f44:3073d1a6

2025-05-21 13:07:14Earlier this year I launched the asknostr.site project which has been a great journey and learning experience. I had wanted to write down my goals and ideas with the project but didn't get to it yet. Primal launching the article editor was a trigger for me to go for it.

Ever since I joined Nostr i was looking for ways to apply my skillset solve a problem and help with adoption. Around Christmas I figured that a Quora/Stackoverflow alternative is something that needs to exist on Nostr.

Before I knew it I had a pretty decent prototype. And because the network already had so much awesome content, contributors and authors I was never discouraged by the challenge that kills so many good ideas -> "Where do I get the first users?".

Since the initial announcement I have received so much encouragement through zaps, likes, DM's, and maybe most of all seeing the increase in usage of the site and #asknostr content kept me going.

Current State

The current version of the site is stable and most bugs are hashed out. After logging in (remote signer, extension or nsec) you can engage with content through votes, comments and replies. Or simply ask a new question.

All content is stored in the site's own private relay and preprocessed/computed into a single data store (postgres) so the site is fast, accessible and crawl-able.

The site supports browsing hashtags, voting/commenting on answers, asking new questions and every contributor get their own profile (example). At the time of writing the site has 41k questions, almost 200k replies/comments and upwards of 5 million sats purely for #asknostr content.

What to expect/On my list

There are plenty of things and UI bugs that need love and between writing the draft of this post and hitting publish I shipped 3 minor bug fixes. Little by little, bit by bit...

In addition to all those small details here is an overview of the things on my own wish list:

-

Inline Zaps: Ability to zap from the asknostr.site interface. Click the zap button, specify or pick the number of sats zap away.

-

Contributor Rank: A leaderboard to add some gamification. More recognition to those nostriches that spend their time helping other people out

-

Search by Keyword: Search all content by keywords. Experiment with the index to show related questions or answers

-

Better User Profiles: Improve the user profile so it shows all the profile questions and answers. Quick buttons to follow or zap that person. Better insights in the topics (hashtags) the profile contributes to

-

Bookmarks: Ability to bookmark questions and answers. Increase bookmark weight as a signal to rank answers.

-

Smarter Scoring: Tune how answers are scored (winning answer formula). Perhaps give more weight to the question author or use WoT. Not sure yet.

All of this is happening at some point so follow me if you want to stay up to date.

Goals

To manage expectations and keep me focussed I write down the mid and long term goals of the project.

Long term

Call me cheesy but I believe that humanity will flourish through an open web and sound money. My own journey started from with bitcoin but if you asked me today if it's BTC or nostr that is going to have the most impact I wouldn't know what to answer. Chicken or egg?

The goal of the project is to offer an open platform that empowers individuals to ask questions, share expertise and access high-quality information across different topics. The project empowers anyone to monetize their experience creating a sustainable ecosystem that values and rewards knowledge sharing. This will ultimately democratize access to knowledge for all.

Mid term

The project can help a lot with onboarding new users onto the network. Once we start to rank on certain topics we can get a piece of the search traffic pie (StackOverflows 12 million, and Quora 150 million visitors per month) which is a great way to expose people to the power of the network.

First time visitors do not need to know about nostr or zaps to receive value. They can browse around, discover interesting content and perhaps even create a profile without even knowing they are on Nostr now.

Gradually those users will understand the value of the network through better rankings (zaps beats likes), a cross-client experience and a profile that can be used on any nostr site or app.

In order for the site to do that we need to make sure content is browsable by language, (sub)topics and and we double down on 'the human touch' with real contributors and not LLMs.

Short Term Goal

The first goal is to make the site really good and an important resource for existing Nostr users. Enable visitors to search and discover what they are interested in. Integrate within the existing nostr eco system with 'open in' functionality and quick links to interesting projects (followerpacks?)

One of things i want to get right is to improve user retention by making the whole Q\&A experience more sticky. I want to run some experiments (bots, award, summaries) to get more people to use asknostr.site more often and come back.

What about the name?

Finally the big question: What about the asknostr.site name? I don't like the name that much but it's what people know. I think there is a high chance that people will discover Nostr apps like Olas, Primal or Damus without needing to know what NOSTR is or means.

Therefore I think there is a good chance that the project won't be called asknostr.site forever. I guess it all depends on where we all take this.

Onwards!

-

-

@ fd208ee8:0fd927c1

2024-12-26 07:02:59

@ fd208ee8:0fd927c1

2024-12-26 07:02:59I just read this, and found it enlightening.

Jung... notes that intelligence can be seen as problem solving at an everyday level..., whereas creativity may represent problem solving for less common issues

Other studies have used metaphor creation as a creativity measure instead of divergent thinking and a spectrum of CHC components instead of just g and have found much higher relationships between creativity and intelligence than past studies

https://www.mdpi.com/2079-3200/3/3/59

I'm unusually intelligent (Who isn't?), but I'm much more creative, than intelligent, and I think that confuses people. The ability to apply intelligence, to solve completely novel problems, on the fly, is something IQ tests don't even claim to measure. They just claim a correlation.

Creativity requires taking wild, mental leaps out into nothingness; simply trusting that your brain will land you safely. And this is why I've been at the forefront of massive innovation, over and over, but never got rich off of it.

I'm a starving autist.

Zaps are the first time I've ever made money directly, for solving novel problems. Companies don't do this because there is a span of time between providing a solution and the solution being implemented, and the person building the implementation (or their boss) receives all the credit for the existence of the solution. At best, you can hope to get pawned off with a small bonus.

Nobody can remember who came up with the solution, originally, and that person might not even be there, anymore, and probably never filed a patent, and may have no idea that their idea has even been built. They just run across it, later, in a tech magazine or museum, and say, "Well, will you look at that! Someone actually went and built it! Isn't that nice!"

Universities at least had the idea of cementing novel solutions in academic papers, but that: 1) only works if you're an academic, and at a university, 2) is an incredibly slow process, not appropriate for a truly innovative field, 3) leads to manifestations of perverse incentives and biased research frameworks, coming from 'publish or perish' policies.

But I think long-form notes and zaps solve for this problem. #Alexandria, especially, is being built to cater to this long-suffering class of chronic underachievers. It leaves a written, public, time-stamped record of Clever Ideas We Have Had.

Because they are clever, the ideas. And we have had them.

-

@ c9badfea:610f861a

2025-05-20 19:49:20

@ c9badfea:610f861a

2025-05-20 19:49:20- Install Sky Map (it's free and open source)

- Launch the app and tap Accept, then tap OK

- When asked to access the device's location, tap While Using The App

- Tap somewhere on the screen to activate the menu, then tap ⁝ and select Settings

- Disable Send Usage Statistics

- Return to the main screen and enjoy stargazing!

ℹ️ Use the 🔍 icon in the upper toolbar to search for a specific celestial body, or tap the 👁️ icon to activate night mode

-

@ 90c656ff:9383fd4e

2025-05-24 12:06:36

@ 90c656ff:9383fd4e

2025-05-24 12:06:36Throughout history, money has always been under the control of central authorities, such as governments and banks. These intermediaries have set the rules of the financial system, controlled the issuance of currency, and overseen transactions. However, with the emergence of Bitcoin, a new paradigm began to take shape: decentralized money. This transformation represents a profound shift in how people store and transfer value, challenging the traditional financial model.

- The traditional model: centralized money

01 - Dependence on intermediaries: To carry out transactions, people rely on banks, governments, and other regulatory entities.

02 - Inflation and devaluation: Central banks can print money endlessly, often leading to a loss in purchasing power.

03 - Censorship and restrictions: Access to money can be denied for political, bureaucratic, or institutional reasons, limiting individuals’ financial freedom.

Despite being the dominant model for centuries, the centralized system has shown its vulnerabilities through numerous economic and political crises. It was in this context that Bitcoin emerged as an innovative alternative.

- The revolution of decentralized money

01 - Elimination of intermediaries: Transactions can be made directly between users, without the need for banks or financial companies.

02 - Limited and predictable supply: Bitcoin has a fixed cap of 21 million units, preventing the inflation caused by excessive money printing.

03 - Censorship resistance: No entity can block or prevent transactions, ensuring full financial freedom.

04 - Self-custody: Each user can hold their own funds without relying on a bank or any other institution.

This paradigm shift has a significant impact not only on the financial system but also on how people interact with money and protect their wealth.

Challenges and opposition to financial decentralization

The transition to a decentralized financial system faces several challenges, the main one being resistance from traditional institutions. Banks and governments see Bitcoin as a threat to their control over money and seek to regulate or limit its adoption.

There are also technical and educational barriers. Many people still do not fully understand how Bitcoin works, which can hinder its adoption. However, as more people become aware of the benefits of decentralized money, its use is likely to grow.

In summary, the shift from a centralized financial system to a decentralized one represents one of the most significant transformations of the digital era. Bitcoin leads this movement by offering a censorship-resistant, transparent, and accessible alternative. Despite opposition from the traditional system, the decentralization of money continues to gain momentum, providing greater autonomy and financial freedom to people around the world. This revolution is not just technological, but also social and economic—redefining the way the world understands and uses money.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ c1d77557:bf04ec8b

2025-05-24 05:02:26

@ c1d77557:bf04ec8b

2025-05-24 05:02:26O 567br é uma plataforma de entretenimento online que tem se destacado pela sua inovação, variedade de jogos e foco na experiência do jogador. Com uma interface amigável e recursos de alta qualidade, a plataforma oferece uma jornada divertida e segura para os seus usuários. Neste artigo, vamos explorar os principais aspectos do 567br, incluindo a introdução da plataforma, os jogos que ela oferece e como a experiência do jogador é aprimorada em cada detalhe.

O 567br foi desenvolvido com o objetivo de proporcionar aos jogadores uma experiência imersiva e prazerosa. Sua interface é simples, intuitiva e de fácil navegação, permitindo que os usuários encontrem rapidamente seus jogos favoritos. A plataforma também é otimizada para dispositivos móveis, o que significa que os jogadores podem acessar seus jogos em qualquer lugar e a qualquer momento, seja no computador ou no smartphone.

Além disso, o 567brse preocupa com a segurança de seus usuários, implementando tecnologias de criptografia de ponta para garantir que todos os dados pessoais e financeiros estejam protegidos. A plataforma também oferece suporte ao cliente de alta qualidade, disponível 24/7, para resolver quaisquer dúvidas ou problemas que possam surgir durante a experiência de jogo.

Jogos Empolgantes e Variedade para Todos os Gostos No 567br, a diversidade de jogos é um dos pontos fortes da plataforma. Desde jogos de mesa e cartas até opções de entretenimento mais dinâmicas e inovadoras, há algo para todos os gostos e preferências. Os jogos disponíveis são desenvolvidos por alguns dos melhores fornecedores de conteúdo da indústria, garantindo gráficos de alta qualidade, jogabilidade fluida e mecânicas envolventes.

Os jogadores podem escolher entre diferentes categorias, como:

Jogos de Mesa: Para quem gosta de uma experiência mais estratégica e de tomada de decisões, os jogos de mesa são uma excelente opção. São oferecidas diversas variantes de jogos populares, como pôquer, blackjack, roleta, entre outros.

Jogos de Ação e Aventura: Para os que buscam adrenalina e emoção, a plataforma oferece uma seleção de jogos de ação e aventura com temas envolventes e gráficos impressionantes. Esses jogos garantem uma experiência de jogo emocionante e desafiadora.

Jogos de Arcade: Se você está em busca de algo mais descontraído e divertido, os jogos de arcade são uma excelente escolha. Eles são rápidos, fáceis de entender e proporcionam diversão instantânea.

A plataforma está sempre atualizando seu portfólio de jogos para garantir que os jogadores tenham acesso às últimas novidades e inovações do mundo do entretenimento online.

A Experiência do Jogador: Personalização e Interatividade O 567br não se limita a oferecer apenas uma plataforma de jogos, mas também busca criar uma experiência personalizada e interativa para cada jogador. A plataforma possui funcionalidades que permitem que os usuários ajustem sua experiência de jogo de acordo com suas preferências individuais.

A personalização da interface é um exemplo claro disso. O jogador pode escolher o tema e a disposição dos elementos na tela, criando um ambiente que seja confortável e agradável de usar. Além disso, o 567br oferece recursos interativos, como chats ao vivo, onde os jogadores podem interagir com outros usuários e até mesmo com os dealers, proporcionando uma sensação de comunidade.

Outro aspecto importante é a possibilidade de acompanhar o desempenho e os resultados de jogo. A plataforma oferece relatórios detalhados, permitindo que os jogadores monitorem seu progresso, analisem suas vitórias e perdas, e façam ajustes em sua estratégia de jogo.

Promoções e Benefícios para os Jogadores O 567br também oferece uma série de promoções e benefícios que tornam a experiência de jogo ainda mais atrativa. Novos jogadores podem aproveitar bônus de boas-vindas e outras ofertas especiais, enquanto jogadores regulares podem se beneficiar de programas de fidelidade e promoções exclusivas.

Essas ofertas ajudam a aumentar a diversão e proporcionam mais oportunidades para que os jogadores explorem novos jogos e tenham uma experiência ainda mais rica. Além disso, o sistema de recompensas é transparente e justo, garantindo que todos os jogadores tenham as mesmas oportunidades de aproveitar os benefícios.

Conclusão: Uma Plataforma Completa para Todos os Gostos Com sua interface intuitiva, variedade de jogos e foco na experiência do jogador, o 567br se consolida como uma plataforma de entretenimento online de alta qualidade. Seja para quem busca jogos estratégicos, ação intensa ou diversão casual, o 567br tem algo para todos.

A segurança, o suporte ao cliente e a personalização da experiência de jogo tornam o 567br uma opção atraente para jogadores que buscam mais do que apenas uma plataforma de jogos – buscam uma jornada de entretenimento envolvente e segura. Se você está procurando por uma experiência completa e agradável, o 567br é, sem dúvida, uma excelente escolha.

-

@ 472f440f:5669301e

2025-05-14 13:17:04

@ 472f440f:5669301e

2025-05-14 13:17:04Marty's Bent

via me

It seems like every other day there's another company announced that is going public with the intent of competing with Strategy by leveraging capital markets to create financial instruments to acquire Bitcoin in a way that is accretive for shareholders. This is certainly a very interesting trend, very bullish for bitcoin in the short-term, and undoubtedly making it so bitcoin is top of mind in the mainstream. I won't pretend to know whether or not these strategies will ultimately be successful or fail in the short, medium or long term. However, one thing I do know is that the themes that interest me, both here at TFTC and in my role as Managing Partner at Ten31, are companies that are building good businesses that are efficient, have product-market-fit, generate revenues and profits and roll those profits into bitcoin.

While it seems pretty clear that Strategy has tapped into an arbitrage that exists in capital markets, it's not really that exciting. From a business perspective, it's actually pretty straightforward and simple; find where potential arbitrage opportunities exists between pools of capital looking for exposure to spot bitcoin or bitcoin's volatility but can't buy the actual asset, and provide them with products that give them access to exposure while simultaneously creating a cult-like retail following. Rinse and repeat. To the extent that this strategy is repeatable is yet to be seen. I imagine it can expand pretty rapidly. Particularly if we have a speculative fervor around companies that do this. But in the long run, I think the signal is falling back to first principles, looking for businesses that are actually providing goods and services to the broader economy - not focused on the hyper-financialized part of the economy - to provide value and create efficiencies that enable higher margins and profitability.

With this in mind, I think it's important to highlight the combined leverage that entrepreneurs have by utilizing bitcoin treasuries and AI tools that are emerging and becoming more advanced by the week. As I said in the tweet above, there's never been a better time to start a business that finds product-market fit and cash flows quickly with a team of two to three people. If you've been reading this rag over the last few weeks, you know that I've been experimenting with these AI tools and using them to make our business processes more efficient here at TFTC. I've also been using them at Ten31 to do deep research and analysis.

It has become abundantly clear to me that any founder or entrepreneur that is not utilizing the AI tools that are emerging is going to get left behind. As it stands today, all anyone has to do to get an idea from a thought in your head to the prototype stage to a minimum viable product is to hop into something like Claude or ChatGPT, have a brief conversation with an AI model that can do deep research about a particular niche that you want to provide a good service to and begin building.

Later this week, I will launch an app called Opportunity Cost in the Chrome and Firefox stores. It took me a few hours of work over the span of a week to ideate and iterate on the concept to the point where I had a working prototype that I handed off to a developer who is solving the last mile problem I have as an "idea guy" of getting the product to market. Only six months ago, accomplishing something like this would have been impossible for me. I've never written a line of code that's actually worked outside of the modded MySpace page I made back in middle school. I've always had a lot of ideas but have never been able to effectively communicate them to developers who can actually build them. With a combination of ChatGPT-03 and Replit, I was able to build an actual product that works. I'm using it in my browser today. It's pretty insane.

There are thousands of people coming to the same realization at the same time right now and going out there and building niche products very cheaply, with small teams, they are getting to market very quickly, and are amassing five figures, six figures, sometimes seven figures of MRR with extremely high profit margins. What most of these entrepreneurs have not really caught on to yet is that they should be cycling a portion - in my opinion, a large portion - of those profits into bitcoin. The combination of building a company utilizing these AI tools, getting it to market, getting revenue and profits, and turning those profits into bitcoin cannot be understated. You're going to begin seeing teams of one to ten people building businesses worth billions of dollars and they're going to need to store the value they create, any money that cannot be debased.

nostr:nprofile1qyx8wumn8ghj7cnjvghxjmcpz4mhxue69uhk2er9dchxummnw3ezumrpdejqqgy8fkmd9kmm8yp4lea2cx0g8fyz27g4ud7572j4edx2v6lz6aa23qmp5dth , one of the co-founders of Ten31, wrote about this in early 2024, bitcoin being the fourth lever of equity value growth for companies.

Bitcoin Treasury - The Fourth Lever to Equity Value Growth

We already see this theme playing out at Ten31 with some of our portfolio companies, most notably nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgdwaehxw309ahx7uewd3hkcqpqex7mdykw786qxvmtuls208uyxmn0hse95rfwsarvfde5yg6wy7jqjrm2qp , which recently released some of their financials, highlighting the fact that they're extremely profitable with high margins and a relatively small team (\~75). This is extremely impressive, especially when you consider the fact that they're a global company competing with the likes of Coinbase and Block, which have each thousands of employees.

Even those who are paying attention to the developments in the AI space and how the tools can enable entrepreneurs to build faster aren't really grasping the gravity of what's at play here. Many are simply thinking of consumer apps that can be built and distributed quickly to market, but the ways in which AI can be implemented extend far beyond the digital world. Here's a great example of a company a fellow freak is building with the mindset of keeping the team small, utilizing AI tools to automate processes and quickly push profits into bitcoin.

via Cormac

Again, this is where the exciting things are happening in my mind. People leveraging new tools to solve real problems to drive real value that ultimately produce profits for entrepreneurs. The entrepreneurs who decide to save those profits in bitcoin will find that the equity value growth of their companies accelerates exponentially as they provide more value, gain more traction, and increase their profits while also riding the bitcoin as it continues on its monetization phase. The compounded leverage of building a company that leverages AI tools and sweeps profits into bitcoin is going to be one of the biggest asymmetric plays of the next decade. Personally, I also see it as something that's much more fulfilling than the pure play bitcoin treasury companies that are coming to market because consumers and entrepreneurs are able to recive and provide a ton of value in the real economy.

If you're looking to stay on top of the developments in the AI space and how you can apply the tools to help build your business or create a new business, I highly recommend you follow somebody like Greg Isenberg, whose Startup Ideas Podcast has been incredibly valuable for me as I attempt to get a lay of the land of how to implement AI into my businesses.

America's Two Economies

In my recent podcast with Lyn Alden, she outlined how our trade deficits create a cycle that's reshaping America's economic geography. As Alden explained, US trade deficits pump dollars into international markets, but these dollars don't disappear - they return as investments in US financial assets. This cycle gradually depletes industrial heartlands while enriching financial centers on the coasts, creating what amounts to two separate American economies.

"We're basically constantly taking economic vibrancy out of Michigan and Ohio and rural Pennsylvania where the steel mills were... and stuffing it back into financial assets in New York and Silicon Valley." - nostr:nprofile1qy2hwumn8ghj7mn0wd68ytndv9kxjm3wdahxcqg5waehxw309ahx7um5wfekzarkvyhxuet5qqsw4v882mfjhq9u63j08kzyhqzqxqc8tgf740p4nxnk9jdv02u37ncdhu7e3

This pattern has persisted for over four decades, accelerating significantly since the early 1980s. Alden emphasized that while economists may argue there's still room before reaching a crisis point, the political consequences are already here. The growing divide between these two Americas has fueled populist sentiment as voters who feel left behind seek economic rebalancing, even if they can't articulate the exact mechanisms causing their hardship.

Check out the full podcast here for more on China's manufacturing dominance, Trump's tariff strategy, and the future of Bitcoin as a global reserve asset. All discussed in under 60 minutes.

Headlines of the Day

Trump's Saudi Summit: Peace and Economic Ties - via X

MSTR Edges Closer To S\&P 500 With Just 89 Trading Days Left - via X

Get our new STACK SATS hat - via tftcmerch.io

Individuals Shed 247K Bitcoin As Businesses Gain 157K - via X

Looking for the perfect video to push the smartest person you know from zero to one on bitcoin? Bitcoin, Not Crypto is a three-part master class from Parker Lewis and Dhruv Bansal that cuts through the noise—covering why 21 million was the key technical simplification that made bitcoin possible, why blockchains don’t create decentralization, and why everything else will be built on bitcoin.

Ten31, the largest bitcoin-focused investor, has deployed 144,229 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

My boys have started a game in the car where we count how many Waymos we see on the road while driving around town. Pretty crazy how innately stoked they are about that particular car.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 3f770d65:7a745b24

2025-05-20 21:14:28

@ 3f770d65:7a745b24

2025-05-20 21:14:28I’m Derek Ross, and I’m all-in on Nostr.

I started the Grow Nostr Initiative to help more people discover what makes Nostr so powerful: ✅ You own your identity ✅ You choose your social graph and algorithms ✅ You aren't locked into any single app or platform ✅ You can post, stream, chat, and build, all without gatekeepers

What we’re doing with Grow Nostr Initiative: 🌱 Hosting local meetups and mini-conferences to onboard people face-to-face 📚 Creating educational materials and guides to demystify how Nostr works 🧩 Helping businesses and creators understand how they can plug into Nostr (running media servers, relays, and using key management tools)

I believe Nostr is the foundation of a more open internet. It’s still early, but we’re already seeing incredible apps for social, blogging, podcasting, livestreaming, and more. And the best part is that they're all interoperable, censorship-resistant, and built on open standards. Nostr is the world's largest bitcoin economy by transaction volume and I truly believe that the purple pill helps the orange pill go down. Meaning, growing Nostr will also grow Bitcoin adoption.

If you’ve been curious about Nostr or are building something on it, or let’s talk. Whether you're just getting started or you're already deep in the ecosystem, I'm here to answer questions, share what I’ve learned, and hear your ideas. Check out https://nostrapps.com to find your next social decentralized experience.

Ask Me Anything about GNI, Nostr, Bitcoin, the upcoming #NosVegas event at the Bitcoin Conference next week, etc.!

– Derek Ross 🌐 https://grownostr.org npub18ams6ewn5aj2n3wt2qawzglx9mr4nzksxhvrdc4gzrecw7n5tvjqctp424

https://stacker.news/items/984689

-

@ b1ddb4d7:471244e7

2025-05-24 11:00:40

@ b1ddb4d7:471244e7

2025-05-24 11:00:40The upcoming Bitcoin 2025 conference, scheduled from May 27–29 at the Venetian Conference Center in Las Vegas, is set to make history with an official attempt to break the GUINNESS WORLD RECORDS® title for the most Bitcoin point-of-sale transactions in an eight-hour period.

Organized by BTC Inc, the event will showcase Bitcoin’s evolution from a digital capital asset to a practical medium of exchange, leveraging the latest advancements in payment technology.

Tap-to-Pay with Lightning-Ready Bolt Cards

To facilitate this record-setting attempt, 4,000 Lightning-ready Bolt Cards will be distributed to conference attendees.

— Uncle Rockstar Developer (@r0ckstardev) May 15, 2025

These NFC-enabled cards allow users to make instant, contactless Bitcoin payments at vendor booths throughout the expo-no apps or QR codes required, just a simple tap.

The cards are available in four collectible designs, each featuring a prominent figure in Bitcoin’s history: Senator Cynthia Lummis, Michael Saylor, Satoshi Nakamoto, and Jack Dorsey.

Each attendee will receive a randomly assigned card, making them both functional and collectible souvenirs.

Senator Lummis: A Playful Provocation

Notably, one of the card designs features Senator Cynthia Lummis with laser eyes-a playful nod to her reputation as a leading Bitcoin advocate in US politics.

While Lummis is known for her legislative efforts to promote Bitcoin integration, she has publicly stated she prefers to “spend dollars and save Bitcoin,” viewing BTC as a long-term store of value rather than a daily currency.

The choice to feature her on the Bolt Card, could be suggested by Rockstar Dev of the BTC Pay Server Foundation, perhaps a lighthearted way to highlight the ongoing debate about Bitcoin’s role in everyday payments.

Nothing cracks me up quite like a senator that wants the US to buy millions of Bitcoin use dollars to buy a beer at a Bitcoin bar.

This is how unserious some of you are. pic.twitter.com/jftIEggmip

— Magoo PhD (@HodlMagoo) April 4, 2025

How Bolt Cards and the Lightning Network Work

Bolt Cards are physical cards equipped with NFC (Near Field Communication) technology, similar to contactless credit or debit cards. When linked to a compatible Lightning wallet, they enable users to make Bitcoin payments over the Lightning Network by simply tapping the card at a point-of-sale terminal.

The Lightning Network is a second-layer protocol built on top of Bitcoin, designed to facilitate instant, low-cost transactions ideal for everyday purchases.

This integration aims to make Bitcoin as easy to use as traditional payment methods, eliminating the need for QR code scanning or mobile apps.

A Showcase for Bitcoin’s Real-World Usability

With over 30,000 attendees, 300 exhibitors, and 500 speakers expected, the Bitcoin 2025 conference is poised to be the largest Bitcoin event of the year-and potentially the most transactional.

The event will feature on-site activations such as the Official Bitcoin Magazine Store, where all merchandise will be available at a 21% discount for those paying with Bitcoin via the Lightning Network-a nod to Bitcoin’s 21 million coin supply limit.

By deeply integrating Lightning payments into the conference experience, organizers hope to demonstrate Bitcoin’s readiness for mainstream commerce and set a new benchmark for its practical use as a currency.

Conclusion

The Guinness World Record attempt at Bitcoin 2025 is more than a publicity stunt-it’s a bold demonstration of Bitcoin’s technological maturity and its potential to function as a modern, everyday payment method.

Whether or not the record is set, the event will serve as a milestone in the ongoing journey to make Bitcoin a truly global, user-friendly currency

-

@ 04c915da:3dfbecc9

2025-05-20 15:47:16

@ 04c915da:3dfbecc9

2025-05-20 15:47:16Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-

2030–2031\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

-

2032\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

Part Two: 2047

-

2047 (Early Year)\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

-

2047 (Mid-Year)\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

-

2047 (Late Year)\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

Key Differences

- Currency Dynamics: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- Government Power: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- Societal Outcome: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

-

@ a39d19ec:3d88f61e

2025-04-22 12:44:42

@ a39d19ec:3d88f61e