-

@ 8f69ac99:4f92f5fd

2025-05-16 11:40:35

@ 8f69ac99:4f92f5fd

2025-05-16 11:40:35Há algo quase reconfortante na previsibilidade com que certos colunistas abordam Bitcoin: a cada oportunidade, repetem os mesmos chavões, reciclados com indignação moralista e embrulhados numa embalagem de falsa autoridade. O artigo publicado na Visão, com o título dramático "De criança prodígio a adolescente problemático", encaixa-se perfeitamente nesse molde.

Trata-se de uma peça de opinião que mistura factos irrelevantes com interpretações enviesadas, estatísticas sem contexto e um medo mal disfarçado de perder o monopólio da narrativa económica. A autora, Sofia Santos Machado, opta por colar em Bitcoin os desastres do chamado “mundo cripto” como se fossem parte do mesmo fenómeno — ignorando, por conveniência ou ignorância, que Bitcoin não é altcoins, não é NFTs, não é esquemas de yield exótico, e não é fintech vestida de blockchain.

Esta resposta centra-se exclusivamente em Bitcoin — um protocolo monetário aberto, incorruptível e resistente à censura, que já está a servir como salvaguarda de valor em regiões onde o sistema financeiro convencional falhou. Não me interessa defender pirâmides, tokens inflacionários ou aventuras bancárias mal calculadas.

Criticar Bitcoin é legítimo — mas fazê-lo sem saber do que se fala é apenas desinformação.

A Histeria da Água — Falar Sem Saber

O artigo abre com uma pérola alarmista sobre o consumo de água:

“Uma única transacção de bitcoin consome seis milhões de vezes mais água do que um pagamento com cartão.”

Seis. Milhões. De vezes. Resta saber se a autora escreveu isto com cara séria ou a rir-se enquanto bebia água engarrafada dos Alpes Suíços.

Fontes? Metodologia? Contexto? Estou a brincar — isto é a Visão, onde os números são decoração e os factos opcionais.

Claro que comparar transacções na camada base de Bitcoin com pagamentos "instantâneos" da rede Visa é tão rigoroso como comparar um Boeing 747 com um avião de papel porque um voa mais longe. Um artigo sério teria falado em batching, na Lightning Network, ou no facto de que Bitcoin nem sequer compete com a Visa nesse nível, nem em nenhum. Mas isso exigiria, imagine-se, investigação.

Pior ainda, não há qualquer menção ao consumo de água na extracção de ouro, nos data centers bancários, ou no treino de modelos de inteligência artificial. Pelos vistos, só Bitcoin tem de obedecer aos mandamentos ecológicos da Visão. O resto? Santa ignorância selectiva.

Criminosos e o Fantasma do Satoshi

Eis o clássico: “Bitcoin é usado por criminosos”. Um cliché bafiento tirado do baú de 2013, agora reapresentado como se fosse escândalo fresco.

Na realidade, Bitcoin é pseudónimo, não anónimo. Todas as transacções ficam gravadas num livro público — não é propriamente o esconderijo ideal para lavar dinheiro, a menos que sejas fã de disfarces em néon.

E os dados? Claríssimos. Segundo a Chainalysis e a Europol, a actividade ilícita com Bitcoin tem vindo a diminuir. Enquanto isso, os bancos — esses bastiões de confiança — continuam a ser apanhados a lavar biliões para cartéis e cleptocratas. Mas disso a Visão não fala. Devia estragar a narrativa.

O verdadeiro crime aqui é a preguiça intelectual tão profunda que quase merece uma moldura. A Visão tem um editor?

O Espantalho Energético

Como uma criança que acabou de aprender uma palavra nova, a Visão repete “consumo energético” como se fosse um pecado original. Bitcoin usa electricidade — escândalo!

Mas vejamos: o Proof-of-Work não é um defeito. É a razão pela qual Bitcoin é seguro. Não há “desperdício” — há uso, e muitas vezes com energia excedente, renovável, ou que de outro modo seria desperdiçada. É por isso que os mineiros se instalam junto a barragens remotas, queima de gás (flaring), ou parques eólicos no meio do nada — não porque odeiam o planeta, mas porque os incentivos económicos funcionam. Escrevi sobre isso aqui.

O que a Visão convenientemente ignora é que Bitcoin está a ajudar a integrar mais energia renovável nas redes, funcionando como carga flexível. Mas nuance? Trabalho de casa? Esquece lá isso.

Para uma explicação mais séria, podiam ter ouvido o podcast A Seita Bitcoin com o Daniel Batten. Mas para quê investigar?

Cripto = Bitcoin = Fraude?

Aqui chegamos ao buraco negro intelectual: enfiar tudo no mesmo saco. FTX colapsou? Culpa de Bitcoin. Um banqueiro jogou com altcoins? Culpa de Bitcoin. Scam de NFT? Deve ter sido o Satoshi.

Vamos esclarecer: Bitcoin não é “cripto”. Bitcoin é descentralizado, sem líderes, transparente. Não teve pré-mineração, não tem CEO, não promete lucros. O que o rodeia? Tokens centralizados, esquemas Ponzi, pirâmides e vaporware — precisamente o oposto do que Bitcoin representa.

Se um executivo bancário perde o dinheiro dos clientes em Dogecoins, isso é um problema dele. Bitcoin não lhe prometeu nada. Foi a ganância.

E convenhamos: os bancos tradicionais também colapsam. E não precisam de satoshis para isso. Bastam dívidas mal geridas, contabilidade criativa e uma fé cega no sistema.

Culpar Bitcoin por falcatruas “cripto” é como culpar o TCP/IP ou SMTP por emails de phishing. É preguiçoso, desonesto e diz-nos mais sobre a autora do que sobre a tecnologia.

Promessas Por Cumprir? Só Se Não Estiveres a Ver

A "jornalista" da Visão lamenta que “após 15 anos, os riscos são reais mas as promessas por cumprir”. Que promessas? Dinheiro grátis? Cafés pagos com QR codes mágicos?

Bitcoin nunca prometeu fazer cappuccinos mais rápidos. Prometeu soberania monetária, resistência à censura e um sistema previsível. E tem cumprido — diariamente, para milhões. E para o cappuccino, há sempre a Lightning Network.

Pergunta aos venezuelanos, nigerianos, peruanos ou argentinos se Bitcoin falhou. Para muitos, é a única forma de escapar à hiperinflação, ao confisco estatal e à decadência financeira.

Bitcoin não é uma app. É infra-estrutura. É uma nova camada base para o dinheiro global. Não se vê — mas protege, impõe regras e não obedece a caprichos de banqueiros centrais.

E isso assusta. Especialmente quem nunca viveu fora da bolha do euro.

Conclusão: A Visão a Gritar Contra o Progresso

No fim, o artigo da Visão é um festival de clichés, dados errados e ressentimento. Não é só enganador. É desonesto. Culpa a tecnologia pelos erros dos homens. Rejeita o futuro em nome do conforto passado.

Bitcoin não é uma varinha mágica. Mas é a fundação de uma nova liberdade financeira. Uma ferramenta para proteger valor, resistir a abusos e escapar ao controlo constante de quem acha que sabe o que é melhor para ti.

Portanto, fica aqui o desafio, Sofia: se queres criticar Bitcoin, primeiro percebe o que é. Lê o white paper. Estuda. Faz perguntas difíceis.

Caso contrário, és só mais um cão a ladrar para a trovoada — muito barulho, zero impacto.

-

@ 0e29efc2:ff142af2

2025-05-07 15:09:46

@ 0e29efc2:ff142af2

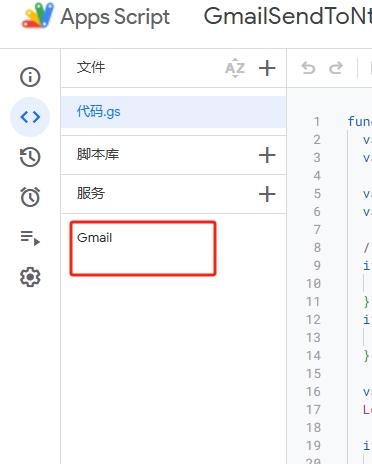

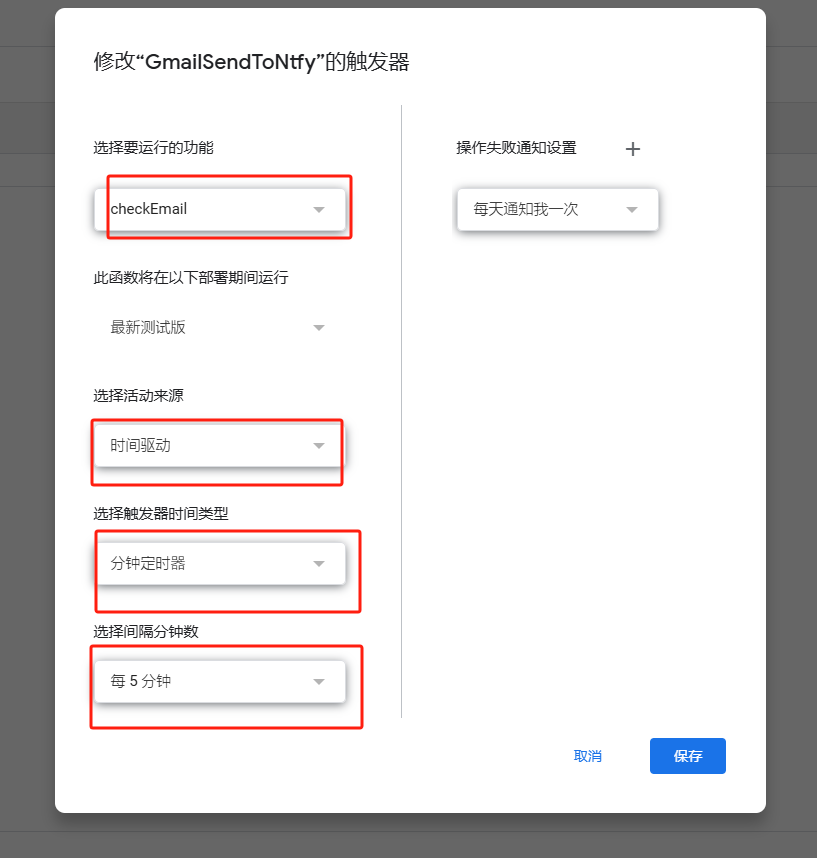

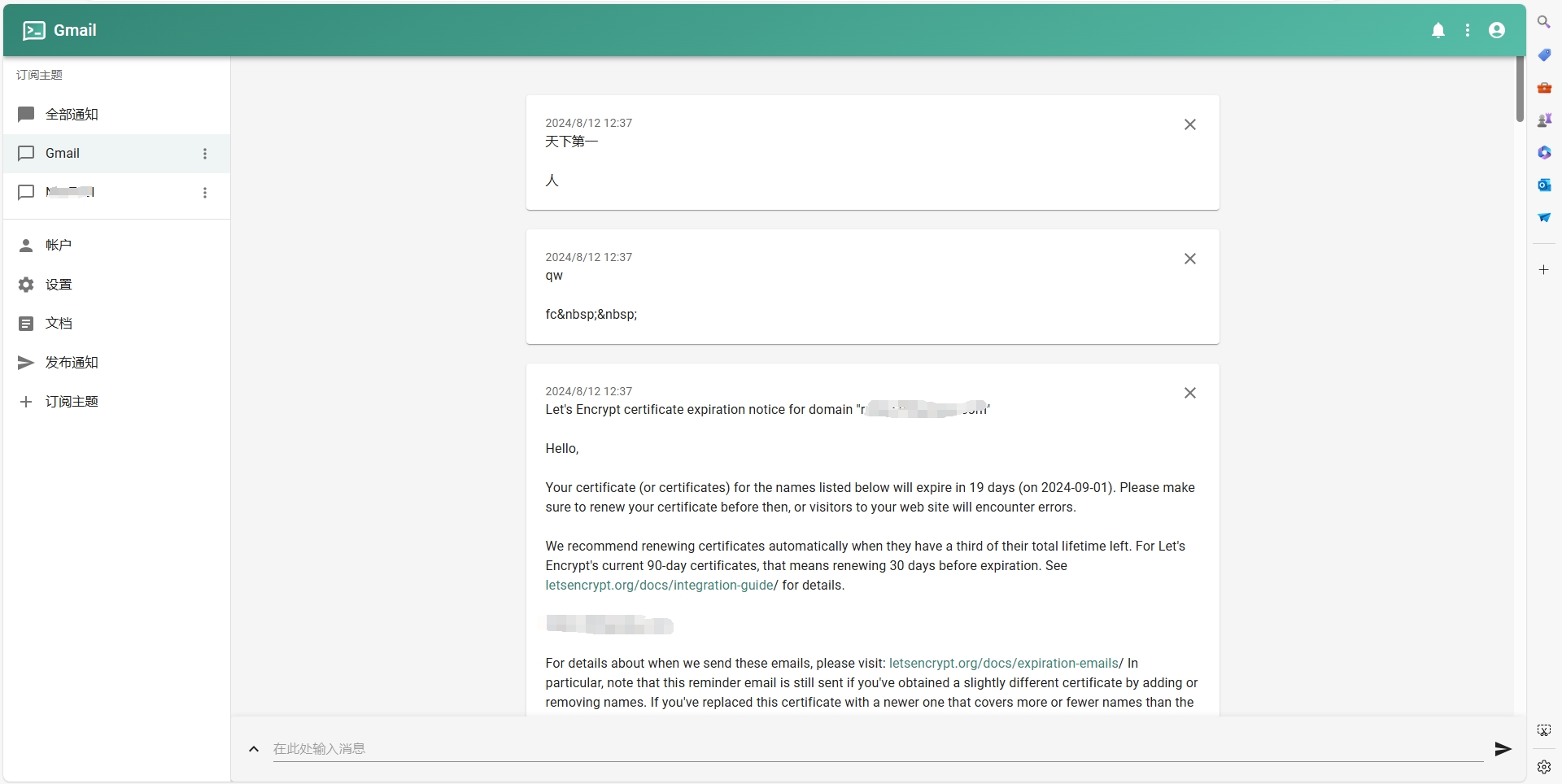

2025-05-07 15:09:46Table of Contents

- Intro

- Important Terminology

- Getting Started

- Where do I buy bitcoin?

- Okay, I bought some bitcoin-now what?

- Less than 0.01 BTC

- More than 0.01 BTC and less than 0.1 BTC

- More than 0.1 BTC

- How Bitcoin Works

- Skepticism

- Someone will hack it

- The government will try to stop it

- It’s not backed by anything

- Conclusion

Intro

Maybe you saw an article in Forbes, a news segment about MicroStrategy (MSTR), or you glanced at the bitcoin price chart; whatever the spark, your curiosity led you here. Enough friends and relatives keep asking me about bitcoin that I finally organized my thoughts into a single reference. This is not a comprehensive guide—it assumes you trust me as a heuristic.

Important Terminology

Sat (satoshi) – the smallest unit of bitcoin. One bitcoin (₿) equals 100 000 000 sats.

Getting Started

Where do I buy bitcoin?

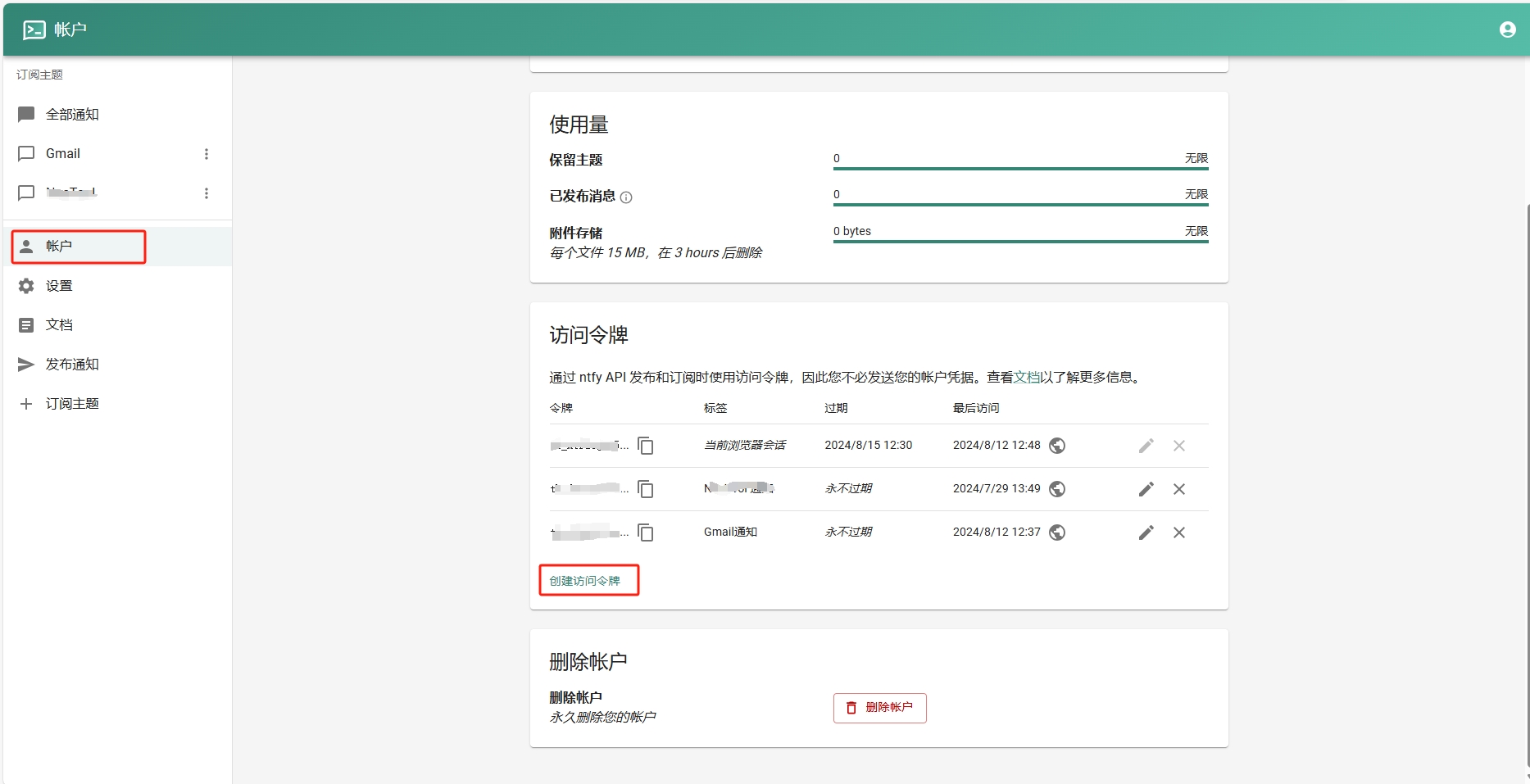

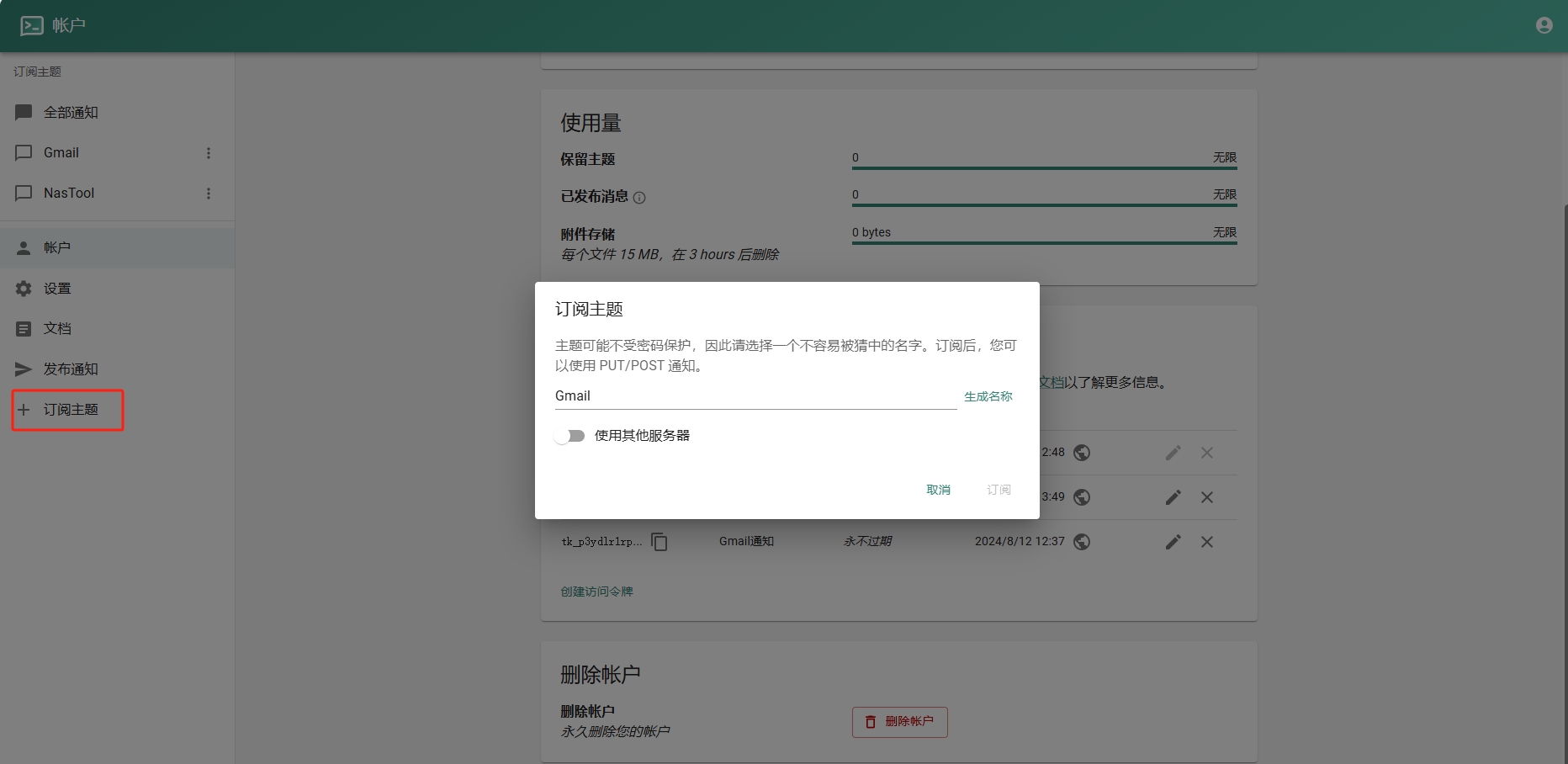

I use River because it publishes proof‑of‑reserves, supports the Lightning Network, and pays interest on idle USD balances (currently 3.8 %).

Okay, I bought some bitcoin-now what?

Withdraw it immediately. Centralized exchanges can and do fail. Your next step depends on how much bitcoin you hold.

If at any point you're struggling, please reach out to me.

Less than 0.01 BTC

- On your phone open Safari (iOS) or Chrome (Android).

- Paste

https://wallet.cashu.me?mint=https://mint.westernbtc.com. Confirm the prompt that asks whether you trusthttps://mint.westernbtc.com. I run this mint so beginners can skip the gnarly parts. - Complete setup.

- Tap Receive → LIGHTNING → enter amount → COPY.

- In River choose Send → Send to a Bitcoin wallet, paste the invoice, verify, and send.

- Return to the wallet; your sats should appear.

More than 0.01 BTC and less than 0.1 BTC

It's time for cold storage. Cold storage means a dedicated signing device not connected to the internet. Think of it like keys to a house. If you have the keys (your cold storage signing device), you can get into your house (the bitcoin). I recommend and use the COLDCARD Q or COLDCARD MK4 from COLDCARD. See this thorough walkthrough.

The creator nostr:npub1rxysxnjkhrmqd3ey73dp9n5y5yvyzcs64acc9g0k2epcpwwyya4spvhnp8 makes reliable content.

More than 0.1 BTC

The next security upgrade involves something called multisig. It requires the use of multiple devices instead of one. Think of those nuclear launch silos in movies where two keys need to be turned in order to launch the missile. One person can't reach both keys, so you need two people. Like the two keys needing to be turned, we need a certain number of keys (signing devices) to be used.

This offers a number of benefits. Say you have a 2-of-3 multisig setup. You would need two of the three keys to move the bitcoin. If you were to lose one, you could use the two others to move it instead. Many choose to geographically distribute the keys; choosing to keep one at a friend’s house or with a bank.

The previous video I linked covers multisig as well. Again, please reach out to me if you need help.

How Bitcoin Works

I'm going to paint a scene portraying the basics of how bitcoin works. Picture a race that's supposed to take 10 minutes to run start-to-finish, and there's a crowd of people spectating. When the fastest runner crosses the finish line, they're awarded 50 bitcoin. Everyone in the crowd recognizes who won, and writes it down on their own scoreboard. Then, the next race begins.

Now, let's say more racers who've had special training join. They start winning consistently because of it, and now the race only lasts about 9 minutes. There's a special rule everyone in the crowd agreed to, that they can make the race harder to ensure it's around 10 minutes long. So they make the race harder to counteract the faster runners.

With this in mind, let's get to the skepticism you might have.

Skepticism

Someone will hack it

Think of bitcoin as the people in the crowd. If someone tries to cheat and writes on their scoreboard that they have a billion bitcoin, their scoreboard is going to look different than everybody else’s. The other people in the crowd will cross-reference with each other and decide to ignore that person who cheated.

The government will try to stop it

Again, think of the crowd. In reality, the "crowd participants" are scattered all around the world. You might be able to stop many of them, but it would be almost impossible to stop everyone. Imagine people are watching the race on TV, can you find everyone who's spectating? Ironically, attempted bans often increase interest.

It’s not backed by anything.

Think of the runners. The runners are bitcoin miners. They have to expend real energy to participate in the race. The more bitcoin miners, the more secure the network. In summary, it's backed by electricity and work.

Conclusion

There are too many topics to cover in one article. I haven't even touched on the history of money, what money is, scarcity, etc. The best way to learn is to research the topics you're interested in for yourself. It took months of deep diving before I was sold on bitcoin, and I had many touch points before that.

Once you see it though, you can't unsee it.

-

@ 8f69ac99:4f92f5fd

2025-05-06 14:21:13

@ 8f69ac99:4f92f5fd

2025-05-06 14:21:13A concepção popular de "anarquia" evoca frequentemente caos, colapso e violência. Mas e se anarquia significasse outra coisa? E se representasse um mundo onde as pessoas cooperam e se coordenam sem autoridades impostas? E se implicasse liberdade, ordem voluntária e resiliência—sem coerção?

Bitcoin é um dos raros exemplos funcionais de princípios anarquistas em acção. Não tem CEO, nem Estado, nem planeador central—e, no entanto, o sistema funciona. Faz cumprir regras. Propõe um novo modelo de governação e oferece uma exploração concreta do anarcocapitalismo.

Para o compreendermos, temos de mudar de perspectiva. Bitcoin não é apenas software ou um instrumento de investimento—é um sistema vivo: uma ordem espontânea.

Ordem Espontânea, Teoria dos Jogos e o Papel dos Incentivos Económicos

Na política e economia contemporâneas, presume-se geralmente que a ordem tem de vir de cima. Governos, corporações e burocracias são vistos como essenciais para organizar a sociedade em grande escala.

Mas esta crença nem sempre se verifica.

Os mercados surgem espontaneamente da troca. A linguagem evolui sem supervisão central. Projectos de código aberto prosperam graças a contribuições voluntárias. Nenhum destes sistemas precisa de um rei—e, no entanto, têm estrutura e funcionam.

Bitcoin insere-se nesta tradição de ordens emergentes. Não é ditado por uma entidade única, mas é governado através de código, consenso dos utilizadores e incentivos económicos que recompensam a cooperação e penalizam a desonestidade.

Código Como Constituição

Bitcoin funciona com base num conjunto de regras de software transparentes e verificáveis. Estas regras determinam quem pode adicionar blocos, com que frequência, o que constitui uma transacção válida e como são criadas novas moedas.

Estas regras não são impostas por exércitos nem pela polícia. São mantidas por uma rede descentralizada de milhares de nós, cada um a correr voluntariamente software que valida o cumprimento das regras. Se alguém tentar quebrá-las, o resto da rede simplesmente rejeita a sua versão.

Isto não é governo por maioria—é aceitação baseada em regras.

Cada operador de nó escolhe qual versão do software quer executar. Se uma alteração proposta não tiver consenso suficiente, não se propaga. Foi assim que as "guerras do tamanho do bloco" foram resolvidas—não por votação, mas através de sinalização do que os utilizadores estavam dispostos a aceitar.

Este modelo de governação ascendente é voluntário, sem permissões, e extraordinariamente resiliente. Representa um novo paradigma de sistemas autorregulados.

Mineiros, Incentivos e a Segurança Baseada na Teoria dos Jogos

Bitcoin assegura a sua rede utilizando a Teoria de Jogos. Os mineiros que seguem o protocolo são recompensados financeiramente. Quem tenta enganar—como reescrever blocos ou gastar duas vezes—sofre perdas financeiras e desperdiça recursos.

Agir honestamente é mais lucrativo.

A genialidade de Bitcoin está em alinhar incentivos egoístas com o bem comum. Elimina a necessidade de confiar em administradores ou esperar benevolência. Em vez disso, torna a fraude economicamente irracional.

Isto substitui o modelo tradicional de "confiar nos líderes" por um mais robusto: construir sistemas onde o mau comportamento é desencorajado por design.

Isto é segurança anarquista—não a ausência de regras, mas a ausência de governantes.

Associação Voluntária e Confiança Construída em Consenso

Qualquer pessoa pode usar Bitcoin. Não há controlo de identidade, nem licenças, nem processo de aprovação. Basta descarregar o software e começar a transaccionar.

Ainda assim, Bitcoin não é um caos desorganizado. Os utilizadores seguem regras rigorosas do protocolo. Porquê? Porque é o consenso que dá valor às "moedas". Sem ele, a rede fragmenta-se e falha.

É aqui que Bitcoin desafia as ideias convencionais sobre anarquia. Mostra que sistemas voluntários podem gerar estabilidade—não porque as pessoas são altruístas, mas porque os incentivos bem desenhados tornam a cooperação a escolha racional.

Bitcoin é sem confiança (trustless), mas promove confiança.

Uma Prova de Conceito Viva

Muitos acreditam que, sem controlo central, a sociedade entraria em colapso. Bitcoin prova que isso não é necessariamente verdade.

É uma rede monetária global, sem permissões, capaz de fazer cumprir direitos de propriedade, coordenar recursos e resistir à censura—sem uma autoridade central. Baseia-se apenas em regras, incentivos e participação voluntária.

Bitcoin não é um sistema perfeito. É um projecto dinâmico, em constante evolução. Mas isso faz parte do que o torna tão relevante: é real, está a funcionar e continua a melhorar.

Conclusão

A anarquia não tem de significar caos. Pode significar cooperação sem coerção. Bitcoin prova isso.

Procuramos, desesperados, por alternativas às instituições falhadas, inchadas e corruptas. Bitcoin oferece mais do que dinheiro digital. É uma prova viva de que podemos construir sociedades descentralizadas, eficientes e justas.

E isso, por si só, já é revolucionário.

Photo by Floris Van Cauwelaert on Unsplash

-

@ 8f69ac99:4f92f5fd

2025-05-02 09:29:41

@ 8f69ac99:4f92f5fd

2025-05-02 09:29:41À medida que Portugal se aproxima das eleições legislativas de 2025, a 18 de Maio, torna-se essencial compreender as diferentes propostas políticas e os programas eleitorais dos partidos para votar de forma informada. Este artigo funciona como um índice para uma série de análises realizadas aos programas dos principais partidos, com foco em temas como liberdades individuais, descentralização e crescimento económico.

A Evolução da Esquerda e da Direita: Um Contexto Histórico e Ideológico

Os termos “esquerda” e “direita” surgiram na Revolução Francesa (1789–1799) para distinguir quem se sentava ao lado do presidente da Assembleia: as forças favoráveis às reformas radicais (à esquerda) e as defensoras da monarquia e da ordem estabelecida (à direita). Com o século XIX e o advento do liberalismo económico, a direita passou a associar-se ao livre mercado e ao direito de propriedade, enquanto a esquerda defendeu maior intervenção estatal para promover igualdade.

No final do século XIX e início do século XX, surgiram o socialismo e o comunismo como correntes mais radicais da esquerda, propondo a abolição da propriedade privada dos meios de produção (comunismo) ou sistemas mistos com forte regulação e redistribuição (socialismo). A resposta liberal-conservadora evoluiu para o capitalismo democrático, que combina mercado livre com alguns mecanismos de assistência social.

Hoje, o espectro político vai além do simples eixo esquerda–direita, incluindo dimensões como:

- Autoritarismo vs. Liberdade: grau de controlo do Estado sobre a vida individual e as instituições;

- Intervenção Estatal vs. Livre Mercado: equilíbrio entre regulação económica e iniciativas privadas;

- Igualdade Social vs. Mérito e Responsabilidade Individual: ênfase na redistribuição de recursos ou na criação de incentivos pessoais.

Este modelo multidimensional ajuda a capturar melhor as posições dos partidos contemporâneos e as suas promessas de governação.

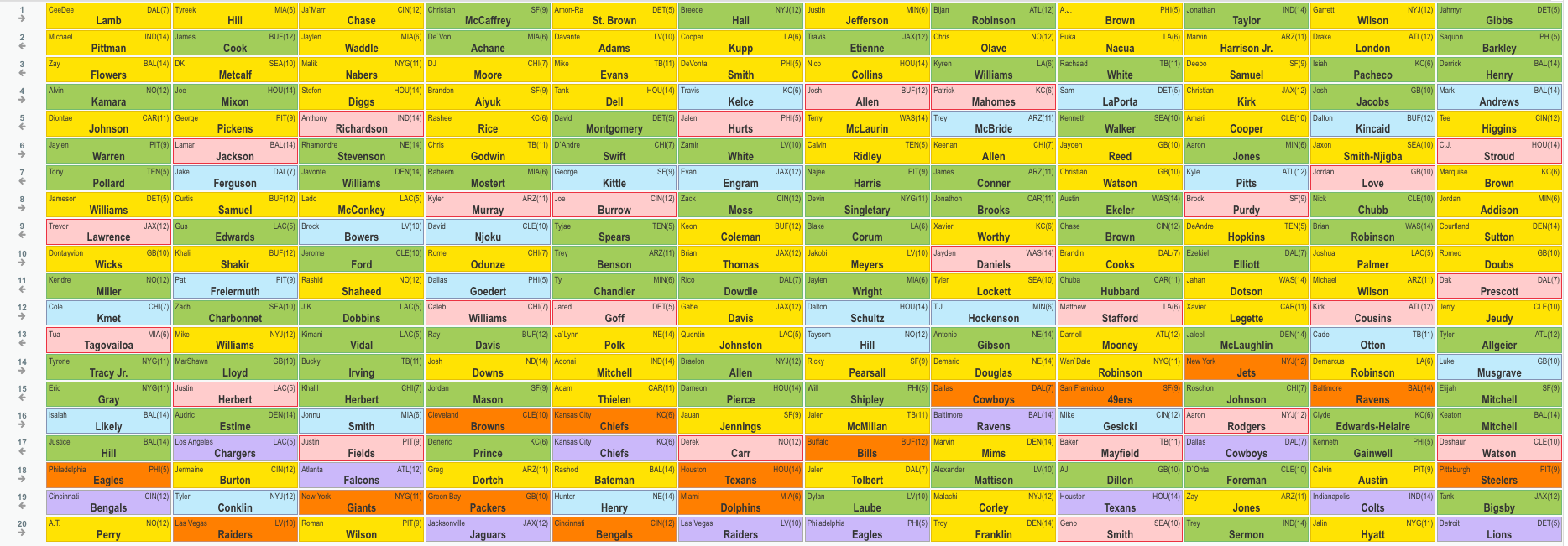

Visão Geral das Análises por Partido

Segue-se um resumo dos principais partidos políticos em Portugal, com destaque para a sua orientação ideológica segundo as dimensões de autoritarismo, nível de Intervenção estatal e grau de liberdade individual. Cada nome de partido estará ligado à respectiva análise detalhada.

| Partido | Orientação Ideológica | Nível de Intervenção Estatal | Grau de Liberdade Individual | |----------------------------------------|---------------------------------------------------------------------------------------|------------------------------|------------------------------| | AD – Aliança Democrática (PSD/CDS) | Centro-direita democrática (baixo autoritarismo / equilíbrio intervenção–mercado) | Médio | Médio | | PS – Partido Socialista | Centro-esquerda social-democrata (moderado autoritarismo / intervenção estatal) | Alto | Médio | | CDU – Coligação Democrática Unitária (PCP/PEV) | Esquerda comunista/eco-marxista (mais autoritário / forte intervenção) | Muito alto | Baixo | | IL – Iniciativa Liberal | Liberalismo clássico (muito baixa intervenção / alta liberdade) | Baixo | Muito alto | | Chega | Nacionalismo autoritário (controlo social elevado / mercado regulado com foco interno)| Médio | Baixo | | Livre | Esquerda progressista verde (baixa hierarquia / intervenção social) | Alto | Médio | | BE – Bloco de Esquerda | Esquerda democrática radical (moderado autoritarismo / intervenção forte) | Alto | Médio | | PAN – Pessoas-Animais-Natureza | Ambientalismo progressista (intervenção pragmática / foco em direitos e sustentabilidade) | Médio | Alto | | Ergue-te | Nacionalismo soberanista (autoritarismo elevado / intervenção seletiva com foco nacional) | Médio | Baixo | | ADN – Alternativa Democrática Nacional | Nacionalismo conservador (autoritarismo elevado / intervenção seletiva com foco nacional) | Médio | Baixo |

Análises Detalhadas dos Programas Eleitorais

Estas análises pretendem oferecer aos eleitores uma visão clara e objetiva das propostas de cada partido, facilitando decisões conscientes nas urnas. Ao focar-se nas promessas relacionadas com liberdades individuais, descentralização e crescimento económico, este conjunto de textos ajuda a compreender melhor o impacto potencial de cada escolha política.

Aliança Democrática (AD)

Partido Socialista (PS)

Coligação Democrática Unitária (CDU)

Iniciativa Liberal (IL)

Chega

Livre

Bloco de Esquerda (BE)

Pessoas,Animais e Natureza (PAN)

Alternativa Democrática Nacional (ADN)

Ergue-te

Photo by Brett Kunsch on Unsplash

-

@ 3bf0c63f:aefa459d

2025-04-25 19:26:48

@ 3bf0c63f:aefa459d

2025-04-25 19:26:48Redistributing Git with Nostr

Every time someone tries to "decentralize" Git -- like many projects tried in the past to do it with BitTorrent, IPFS, ScuttleButt or custom p2p protocols -- there is always a lurking comment: "but Git is already distributed!", and then the discussion proceeds to mention some facts about how Git supports multiple remotes and its magic syncing and merging abilities and so on.

Turns out all that is true, Git is indeed all that powerful, and yet GitHub is the big central hub that hosts basically all Git repositories in the giant world of open-source. There are some crazy people that host their stuff elsewhere, but these projects end up not being found by many people, and even when they do they suffer from lack of contributions.

Because everybody has a GitHub account it's easy to open a pull request to a repository of a project you're using if it's on GitHub (to be fair I think it's very annoying to have to clone the repository, then add it as a remote locally, push to it, then go on the web UI and click to open a pull request, then that cloned repository lurks forever in your profile unless you go through 16 screens to delete it -- but people in general seem to think it's easy).

It's much harder to do it on some random other server where some project might be hosted, because now you have to add 4 more even more annoying steps: create an account; pick a password; confirm an email address; setup SSH keys for pushing. (And I'm not even mentioning the basic impossibility of offering

pushaccess to external unknown contributors to people who want to host their own simple homemade Git server.)At this point some may argue that we could all have accounts on GitLab, or Codeberg or wherever else, then those steps are removed. Besides not being a practical strategy this pseudo solution misses the point of being decentralized (or distributed, who knows) entirely: it's far from the ideal to force everybody to have the double of account management and SSH setup work in order to have the open-source world controlled by two shady companies instead of one.

What we want is to give every person the opportunity to host their own Git server without being ostracized. at the same time we must recognize that most people won't want to host their own servers (not even most open-source programmers!) and give everybody the ability to host their stuff on multi-tenant servers (such as GitHub) too. Importantly, though, if we allow for a random person to have a standalone Git server on a standalone server they host themselves on their wood cabin that also means any new hosting company can show up and start offering Git hosting, with or without new cool features, charging high or low or zero, and be immediately competing against GitHub or GitLab, i.e. we must remove the network-effect centralization pressure.

External contributions

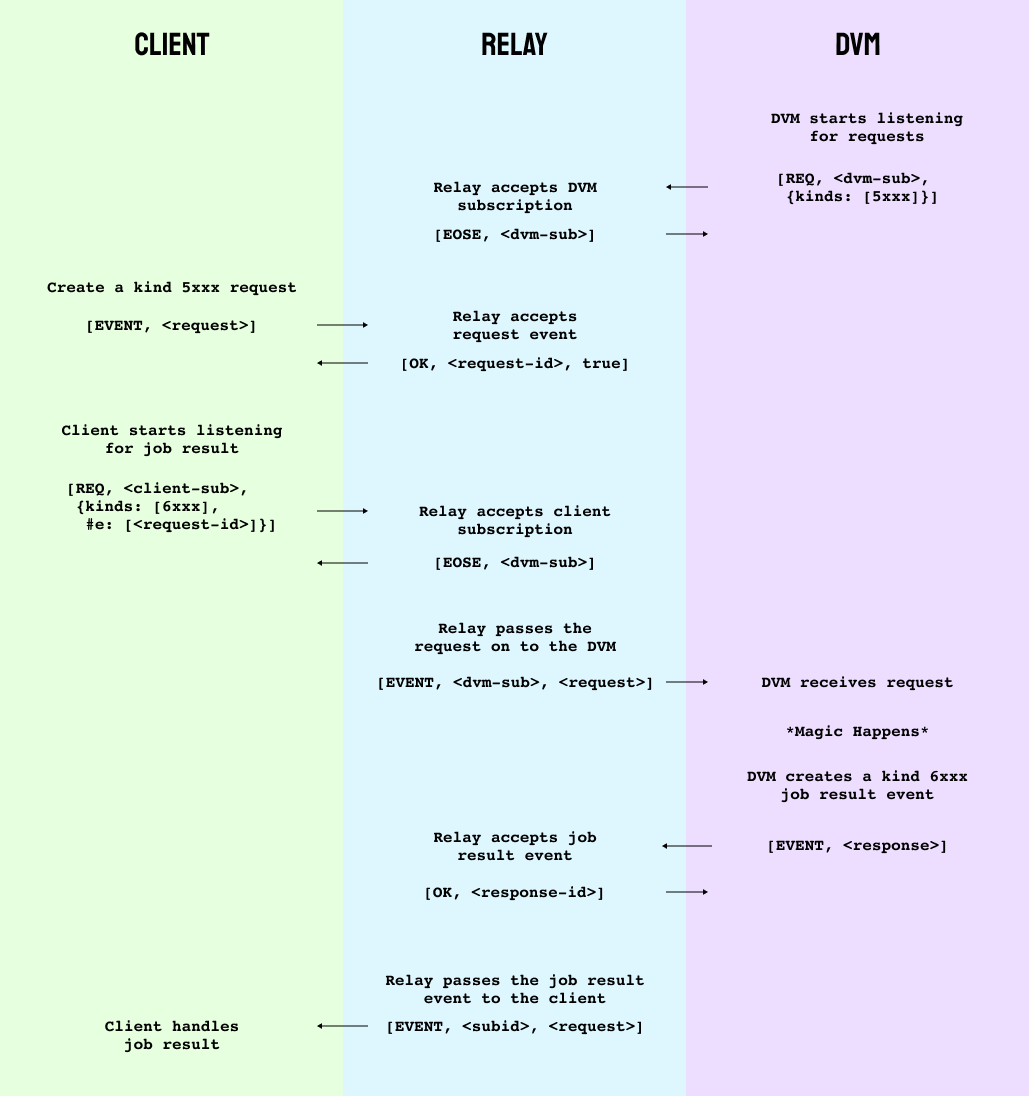

The first problem we have to solve is: how can Bob contribute to Alice's repository without having an account on Alice's server?

SourceHut has reminded GitHub users that Git has always had this (for most) arcane

git send-emailcommand that is the original way to send patches, using an once-open protocol.Turns out Nostr acts as a quite powerful email replacement and can be used to send text content just like email, therefore patches are a very good fit for Nostr event contents.

Once you get used to it and the proper UIs (or CLIs) are built sending and applying patches to and from others becomes a much easier flow than the intense clickops mixed with terminal copypasting that is interacting with GitHub (you have to clone the repository on GitHub, then update the remote URL in your local directory, then create a branch and then go back and turn that branch into a Pull Request, it's quite tiresome) that many people already dislike so much they went out of their way to build many GitHub CLI tools just so they could comment on issues and approve pull requests from their terminal.

Replacing GitHub features

Aside from being the "hub" that people use to send patches to other people's code (because no one can do the email flow anymore, justifiably), GitHub also has 3 other big features that are not directly related to Git, but that make its network-effect harder to overcome. Luckily Nostr can be used to create a new environment in which these same features are implemented in a more decentralized and healthy way.

Issues: bug reports, feature requests and general discussions

Since the "Issues" GitHub feature is just a bunch of text comments it should be very obvious that Nostr is a perfect fit for it.

I will not even mention the fact that Nostr is much better at threading comments than GitHub (which doesn't do it at all), which can generate much more productive and organized discussions (and you can opt out if you want).

Search

I use GitHub search all the time to find libraries and projects that may do something that I need, and it returns good results almost always. So if people migrated out to other code hosting providers wouldn't we lose it?

The fact is that even though we think everybody is on GitHub that is a globalist falsehood. Some projects are not on GitHub, and if we use only GitHub for search those will be missed. So even if we didn't have a Nostr Git alternative it would still be necessary to create a search engine that incorporated GitLab, Codeberg, SourceHut and whatnot.

Turns out on Nostr we can make that quite easy by not forcing anyone to integrate custom APIs or hardcoding Git provider URLs: each repository can make itself available by publishing an "announcement" event with a brief description and one or more Git URLs. That makes it easy for a search engine to index them -- and even automatically download the code and index the code (or index just README files or whatever) without a centralized platform ever having to be involved.

The relays where such announcements will be available play a role, of course, but that isn't a bad role: each announcement can be in multiple relays known for storing "public good" projects, some relays may curate only projects known to be very good according to some standards, other relays may allow any kind of garbage, which wouldn't make them good for a search engine to rely upon, but would still be useful in case one knows the exact thing (and from whom) they're searching for (the same is valid for all Nostr content, by the way, and that's where it's censorship-resistance comes from).

Continuous integration

GitHub Actions are a very hardly subsidized free-compute-for-all-paid-by-Microsoft feature, but one that isn't hard to replace at all. In fact there exists today many companies offering the same kind of service out there -- although they are mostly targeting businesses and not open-source projects, before GitHub Actions was introduced there were also many that were heavily used by open-source projects.

One problem is that these services are still heavily tied to GitHub today, they require a GitHub login, sometimes BitBucket and GitLab and whatnot, and do not allow one to paste an arbitrary Git server URL, but that isn't a thing that is very hard to change anyway, or to start from scratch. All we need are services that offer the CI/CD flows, perhaps using the same framework of GitHub Actions (although I would prefer to not use that messy garbage), and charge some few satoshis for it.

It may be the case that all the current services only support the big Git hosting platforms because they rely on their proprietary APIs, most notably the webhooks dispatched when a repository is updated, to trigger the jobs. It doesn't have to be said that Nostr can also solve that problem very easily.

-

@ 3bf0c63f:aefa459d

2025-04-25 18:55:52

@ 3bf0c63f:aefa459d

2025-04-25 18:55:52Report of how the money Jack donated to the cause in December 2022 has been misused so far.

Bounties given

March 2025

- Dhalsim: 1,110,540 - Work on Nostr wiki data processing

February 2025

- BOUNTY* NullKotlinDev: 950,480 - Twine RSS reader Nostr integration

- Dhalsim: 2,094,584 - Work on Hypothes.is Nostr fork

- Constant, Biz and J: 11,700,588 - Nostr Special Forces

January 2025

- Constant, Biz and J: 11,610,987 - Nostr Special Forces

- BOUNTY* NullKotlinDev: 843,840 - Feeder RSS reader Nostr integration

- BOUNTY* NullKotlinDev: 797,500 - ReadYou RSS reader Nostr integration

December 2024

- BOUNTY* tijl: 1,679,500 - Nostr integration into RSS readers yarr and miniflux

- Constant, Biz and J: 10,736,166 - Nostr Special Forces

- Thereza: 1,020,000 - Podcast outreach initiative

November 2024

- Constant, Biz and J: 5,422,464 - Nostr Special Forces

October 2024

- Nostrdam: 300,000 - hackathon prize

- Svetski: 5,000,000 - Latin America Nostr events contribution

- Quentin: 5,000,000 - nostrcheck.me

June 2024

- Darashi: 5,000,000 - maintaining nos.today, searchnos, search.nos.today and other experiments

- Toshiya: 5,000,000 - keeping the NIPs repo clean and other stuff

May 2024

- James: 3,500,000 - https://github.com/jamesmagoo/nostr-writer

- Yakihonne: 5,000,000 - spreading the word in Asia

- Dashu: 9,000,000 - https://github.com/haorendashu/nostrmo

February 2024

- Viktor: 5,000,000 - https://github.com/viktorvsk/saltivka and https://github.com/viktorvsk/knowstr

- Eric T: 5,000,000 - https://github.com/tcheeric/nostr-java

- Semisol: 5,000,000 - https://relay.noswhere.com/ and https://hist.nostr.land relays

- Sebastian: 5,000,000 - Drupal stuff and nostr-php work

- tijl: 5,000,000 - Cloudron, Yunohost and Fraidycat attempts

- Null Kotlin Dev: 5,000,000 - AntennaPod attempt

December 2023

- hzrd: 5,000,000 - Nostrudel

- awayuki: 5,000,000 - NOSTOPUS illustrations

- bera: 5,000,000 - getwired.app

- Chris: 5,000,000 - resolvr.io

- NoGood: 10,000,000 - nostrexplained.com stories

October 2023

- SnowCait: 5,000,000 - https://nostter.vercel.app/ and other tools

- Shaun: 10,000,000 - https://yakihonne.com/, events and work on Nostr awareness

- Derek Ross: 10,000,000 - spreading the word around the world

- fmar: 5,000,000 - https://github.com/frnandu/yana

- The Nostr Report: 2,500,000 - curating stuff

- james magoo: 2,500,000 - the Obsidian plugin: https://github.com/jamesmagoo/nostr-writer

August 2023

- Paul Miller: 5,000,000 - JS libraries and cryptography-related work

- BOUNTY tijl: 5,000,000 - https://github.com/github-tijlxyz/wikinostr

- gzuus: 5,000,000 - https://nostree.me/

July 2023

- syusui-s: 5,000,000 - rabbit, a tweetdeck-like Nostr client: https://syusui-s.github.io/rabbit/

- kojira: 5,000,000 - Nostr fanzine, Nostr discussion groups in Japan, hardware experiments

- darashi: 5,000,000 - https://github.com/darashi/nos.today, https://github.com/darashi/searchnos, https://github.com/darashi/murasaki

- jeff g: 5,000,000 - https://nostr.how and https://listr.lol, plus other contributions

- cloud fodder: 5,000,000 - https://nostr1.com (open-source)

- utxo.one: 5,000,000 - https://relaying.io (open-source)

- Max DeMarco: 10,269,507 - https://www.youtube.com/watch?v=aA-jiiepOrE

- BOUNTY optout21: 1,000,000 - https://github.com/optout21/nip41-proto0 (proposed nip41 CLI)

- BOUNTY Leo: 1,000,000 - https://github.com/leo-lox/camelus (an old relay thing I forgot exactly)

June 2023

- BOUNTY: Sepher: 2,000,000 - a webapp for making lists of anything: https://pinstr.app/

- BOUNTY: Kieran: 10,000,000 - implement gossip algorithm on Snort, implement all the other nice things: manual relay selection, following hints etc.

- Mattn: 5,000,000 - a myriad of projects and contributions to Nostr projects: https://github.com/search?q=owner%3Amattn+nostr&type=code

- BOUNTY: lynn: 2,000,000 - a simple and clean git nostr CLI written in Go, compatible with William's original git-nostr-tools; and implement threaded comments on https://github.com/fiatjaf/nocomment.

- Jack Chakany: 5,000,000 - https://github.com/jacany/nblog

- BOUNTY: Dan: 2,000,000 - https://metadata.nostr.com/

April 2023

- BOUNTY: Blake Jakopovic: 590,000 - event deleter tool, NIP dependency organization

- BOUNTY: koalasat: 1,000,000 - display relays

- BOUNTY: Mike Dilger: 4,000,000 - display relays, follow event hints (Gossip)

- BOUNTY: kaiwolfram: 5,000,000 - display relays, follow event hints, choose relays to publish (Nozzle)

- Daniele Tonon: 3,000,000 - Gossip

- bu5hm4nn: 3,000,000 - Gossip

- BOUNTY: hodlbod: 4,000,000 - display relays, follow event hints

March 2023

- Doug Hoyte: 5,000,000 sats - https://github.com/hoytech/strfry

- Alex Gleason: 5,000,000 sats - https://gitlab.com/soapbox-pub/mostr

- verbiricha: 5,000,000 sats - https://badges.page/, https://habla.news/

- talvasconcelos: 5,000,000 sats - https://migrate.nostr.com, https://read.nostr.com, https://write.nostr.com/

- BOUNTY: Gossip model: 5,000,000 - https://camelus.app/

- BOUNTY: Gossip model: 5,000,000 - https://github.com/kaiwolfram/Nozzle

- BOUNTY: Bounty Manager: 5,000,000 - https://nostrbounties.com/

February 2023

- styppo: 5,000,000 sats - https://hamstr.to/

- sandwich: 5,000,000 sats - https://nostr.watch/

- BOUNTY: Relay-centric client designs: 5,000,000 sats https://bountsr.org/design/2023/01/26/relay-based-design.html

- BOUNTY: Gossip model on https://coracle.social/: 5,000,000 sats

- Nostrovia Podcast: 3,000,000 sats - https://nostrovia.org/

- BOUNTY: Nostr-Desk / Monstr: 5,000,000 sats - https://github.com/alemmens/monstr

- Mike Dilger: 5,000,000 sats - https://github.com/mikedilger/gossip

January 2023

- ismyhc: 5,000,000 sats - https://github.com/Galaxoid-Labs/Seer

- Martti Malmi: 5,000,000 sats - https://iris.to/

- Carlos Autonomous: 5,000,000 sats - https://github.com/BrightonBTC/bija

- Koala Sat: 5,000,000 - https://github.com/KoalaSat/nostros

- Vitor Pamplona: 5,000,000 - https://github.com/vitorpamplona/amethyst

- Cameri: 5,000,000 - https://github.com/Cameri/nostream

December 2022

- William Casarin: 7 BTC - splitting the fund

- pseudozach: 5,000,000 sats - https://nostr.directory/

- Sondre Bjellas: 5,000,000 sats - https://notes.blockcore.net/

- Null Dev: 5,000,000 sats - https://github.com/KotlinGeekDev/Nosky

- Blake Jakopovic: 5,000,000 sats - https://github.com/blakejakopovic/nostcat, https://github.com/blakejakopovic/nostreq and https://github.com/blakejakopovic/NostrEventPlayground

-

@ 21335073:a244b1ad

2025-05-21 16:58:36

@ 21335073:a244b1ad

2025-05-21 16:58:36The other day, I had the privilege of sitting down with one of my favorite living artists. Our conversation was so captivating that I felt compelled to share it. I’m leaving his name out for privacy.

Since our last meeting, I’d watched a documentary about his life, one he’d helped create. I told him how much I admired his openness in it. There’s something strange about knowing intimate details of someone’s life when they know so little about yours—it’s almost like I knew him too well for the kind of relationship we have.

He paused, then said quietly, with a shy grin, that watching the documentary made him realize how “odd and eccentric” he is. I laughed and told him he’s probably the sanest person I know. Because he’s lived fully, chasing love, passion, and purpose with hardly any regrets. He’s truly lived.

Today, I turn 44, and I’ll admit I’m a bit eccentric myself. I think I came into the world this way. I’ve made mistakes along the way, but I carry few regrets. Every misstep taught me something. And as I age, I’m not interested in blending in with the world—I’ll probably just lean further into my own brand of “weird.” I want to live life to the brim. The older I get, the more I see that the “normal” folks often seem less grounded than the eccentric artists who dare to live boldly. Life’s too short to just exist, actually live.

I’m not saying to be strange just for the sake of it. But I’ve seen what the crowd celebrates, and I’m not impressed. Forge your own path, even if it feels lonely or unpopular at times.

It’s easy to scroll through the news and feel discouraged. But actually, this is one of the most incredible times to be alive! I wake up every day grateful to be here, now. The future is bursting with possibility—I can feel it.

So, to my fellow weirdos on nostr: stay bold. Keep dreaming, keep pushing, no matter what’s trending. Stay wild enough to believe in a free internet for all. Freedom is radical—hold it tight. Live with the soul of an artist and the grit of a fighter. Thanks for inspiring me and so many others to keep hoping. Thank you all for making the last year of my life so special.

-

@ 51bbb15e:b77a2290

2025-05-21 00:24:36

@ 51bbb15e:b77a2290

2025-05-21 00:24:36Yeah, I’m sure everything in the file is legit. 👍 Let’s review the guard witness testimony…Oh wait, they weren’t at their posts despite 24/7 survellience instructions after another Epstein “suicide” attempt two weeks earlier. Well, at least the video of the suicide is in the file? Oh wait, a techical glitch. Damn those coincidences!

At this point, the Trump administration has zero credibility with me on anything related to the Epstein case and his clients. I still suspect the administration is using the Epstein files as leverage to keep a lot of RINOs in line, whereas they’d be sabotaging his agenda at every turn otherwise. However, I just don’t believe in ends-justify-the-means thinking. It’s led almost all of DC to toss out every bit of the values they might once have had.

-

@ 34f1ddab:2ca0cf7c

2025-05-23 23:15:14

@ 34f1ddab:2ca0cf7c

2025-05-23 23:15:14Losing access to your cryptocurrency can feel like losing a part of your future. Whether it’s due to a forgotten password, a damaged seed backup, or a simple mistake in a transfer, the stress can be overwhelming. Fortunately, cryptrecver.com is here to assist! With our expert-led recovery services, you can safely and swiftly reclaim your lost Bitcoin and other cryptocurrencies.

Why Trust Crypt Recver? 🤝 🛠️ Expert Recovery Solutions At Crypt Recver, we specialize in addressing complex wallet-related issues. Our skilled engineers have the tools and expertise to handle:

Partially lost or forgotten seed phrases Extracting funds from outdated or invalid wallet addresses Recovering data from damaged hardware wallets Restoring coins from old or unsupported wallet formats You’re not just getting a service; you’re gaining a partner in your cryptocurrency journey.

🚀 Fast and Efficient Recovery We understand that time is crucial in crypto recovery. Our optimized systems enable you to regain access to your funds quickly, focusing on speed without compromising security. With a success rate of over 90%, you can rely on us to act swiftly on your behalf.

🔒 Privacy is Our Priority Your confidentiality is essential. Every recovery session is conducted with the utmost care, ensuring all processes are encrypted and confidential. You can rest assured that your sensitive information remains private.

💻 Advanced Technology Our proprietary tools and brute-force optimization techniques maximize recovery efficiency. Regardless of how challenging your case may be, our technology is designed to give you the best chance at retrieving your crypto.

Our Recovery Services Include: 📈 Bitcoin Recovery: Lost access to your Bitcoin wallet? We help recover lost wallets, private keys, and passphrases. Transaction Recovery: Mistakes happen — whether it’s an incorrect wallet address or a lost password, let us manage the recovery. Cold Wallet Restoration: If your cold wallet is failing, we can safely extract your assets and migrate them into a secure new wallet. Private Key Generation: Lost your private key? Our experts can help you regain control using advanced methods while ensuring your privacy. ⚠️ What We Don’t Do While we can handle many scenarios, some limitations exist. For instance, we cannot recover funds stored in custodial wallets or cases where there is a complete loss of four or more seed words without partial information available. We are transparent about what’s possible, so you know what to expect

Don’t Let Lost Crypto Hold You Back! Did you know that between 3 to 3.4 million BTC — nearly 20% of the total supply — are estimated to be permanently lost? Don’t become part of that statistic! Whether it’s due to a forgotten password, sending funds to the wrong address, or damaged drives, we can help you navigate these challenges

🛡️ Real-Time Dust Attack Protection Our services extend beyond recovery. We offer dust attack protection, keeping your activity anonymous and your funds secure, shielding your identity from unwanted tracking, ransomware, and phishing attempts.

🎉 Start Your Recovery Journey Today! Ready to reclaim your lost crypto? Don’t wait until it’s too late! 👉 cryptrecver.com

📞 Need Immediate Assistance? Connect with Us! For real-time support or questions, reach out to our dedicated team on: ✉️ Telegram: t.me/crypptrcver 💬 WhatsApp: +1(941)317–1821

Crypt Recver is your trusted partner in cryptocurrency recovery. Let us turn your challenges into victories. Don’t hesitate — your crypto future starts now! 🚀✨

Act fast and secure your digital assets with cryptrecver.com.Losing access to your cryptocurrency can feel like losing a part of your future. Whether it’s due to a forgotten password, a damaged seed backup, or a simple mistake in a transfer, the stress can be overwhelming. Fortunately, cryptrecver.com is here to assist! With our expert-led recovery services, you can safely and swiftly reclaim your lost Bitcoin and other cryptocurrencies.

# Why Trust Crypt Recver? 🤝

# Why Trust Crypt Recver? 🤝🛠️ Expert Recovery Solutions\ At Crypt Recver, we specialize in addressing complex wallet-related issues. Our skilled engineers have the tools and expertise to handle:

- Partially lost or forgotten seed phrases

- Extracting funds from outdated or invalid wallet addresses

- Recovering data from damaged hardware wallets

- Restoring coins from old or unsupported wallet formats

You’re not just getting a service; you’re gaining a partner in your cryptocurrency journey.

🚀 Fast and Efficient Recovery\ We understand that time is crucial in crypto recovery. Our optimized systems enable you to regain access to your funds quickly, focusing on speed without compromising security. With a success rate of over 90%, you can rely on us to act swiftly on your behalf.

🔒 Privacy is Our Priority\ Your confidentiality is essential. Every recovery session is conducted with the utmost care, ensuring all processes are encrypted and confidential. You can rest assured that your sensitive information remains private.

💻 Advanced Technology\ Our proprietary tools and brute-force optimization techniques maximize recovery efficiency. Regardless of how challenging your case may be, our technology is designed to give you the best chance at retrieving your crypto.

Our Recovery Services Include: 📈

- Bitcoin Recovery: Lost access to your Bitcoin wallet? We help recover lost wallets, private keys, and passphrases.

- Transaction Recovery: Mistakes happen — whether it’s an incorrect wallet address or a lost password, let us manage the recovery.

- Cold Wallet Restoration: If your cold wallet is failing, we can safely extract your assets and migrate them into a secure new wallet.

- Private Key Generation: Lost your private key? Our experts can help you regain control using advanced methods while ensuring your privacy.

⚠️ What We Don’t Do\ While we can handle many scenarios, some limitations exist. For instance, we cannot recover funds stored in custodial wallets or cases where there is a complete loss of four or more seed words without partial information available. We are transparent about what’s possible, so you know what to expect

# Don’t Let Lost Crypto Hold You Back!

# Don’t Let Lost Crypto Hold You Back!Did you know that between 3 to 3.4 million BTC — nearly 20% of the total supply — are estimated to be permanently lost? Don’t become part of that statistic! Whether it’s due to a forgotten password, sending funds to the wrong address, or damaged drives, we can help you navigate these challenges

🛡️ Real-Time Dust Attack Protection\ Our services extend beyond recovery. We offer dust attack protection, keeping your activity anonymous and your funds secure, shielding your identity from unwanted tracking, ransomware, and phishing attempts.

🎉 Start Your Recovery Journey Today!\ Ready to reclaim your lost crypto? Don’t wait until it’s too late!\ 👉 cryptrecver.com

📞 Need Immediate Assistance? Connect with Us!\ For real-time support or questions, reach out to our dedicated team on:\ ✉️ Telegram: t.me/crypptrcver\ 💬 WhatsApp: +1(941)317–1821

Crypt Recver is your trusted partner in cryptocurrency recovery. Let us turn your challenges into victories. Don’t hesitate — your crypto future starts now! 🚀✨

Act fast and secure your digital assets with cryptrecver.com.

-

@ c11cf5f8:4928464d

2024-09-01 13:22:49

@ c11cf5f8:4928464d

2024-09-01 13:22:49Let's hear some of your latest Bitcoin purchases, feel free to include links to the shops or merchants you bought from too!

If you missed our last thread, here are some of the items stackers recently spent their sats on.

originally posted at https://stacker.news/items/668607

-

@ 6c2d68ba:846525ec

2024-09-01 13:02:53

@ 6c2d68ba:846525ec

2024-09-01 13:02:53Dear friend,

it seems like you have decided to turn your back on those walled gardens and set sails to enter uncharted territory. A world without walls, an open world, a world of beautiful chaos. At least for today, I don't intend guiding you out of the safe harbour onto the open, endless sea. Today, my only intent is sharing a few thoughts, before you depart.

As a wise man on Madeira once said, it's not so much about having the right answers, it's about asking the right questions. While I'm not certain whether I have found the right questions myself by now, let me share the current set with you:

-

What causes the discomfort that drives you out of the walled garden onto the open sea?

-

Are you trying to transfer from one walled garden to the next one, where the difference being a slightly friendlier colour on the wall?

-

What are you hoping to find on the open sea that walled gardens cannot provide?

-

What are you willing to sacrifice for freedom (of speech)?

-

What will you need to keep the ship afloat?

-

How will you react when you find yourself in the middle of a storm?

I sincerely believe that it's worthwile taking a step back before departing to reflect on the big picture and the underlying paradigm shift between walled gardens and nostr. This is not about building competitors to broken systems, this is not about mimicking centralised services, this is not about repeating the same mistakes over and over.

This is about building a new world, an open world without walled gardens and data silos.

Onwards!

-

-

@ 8f69ac99:4f92f5fd

2025-04-23 14:39:01

@ 8f69ac99:4f92f5fd

2025-04-23 14:39:01Dizem-nos que a inflação é necessária. Mas e se for, afinal, a raiz da disfunção económica que enfrentamos?

A crença mainstream é clara: para estimular o crescimento, os governos devem poder desvalorizar a sua moeda — essencialmente, criar dinheiro do nada. Supostamente, isso incentiva o investimento, aumenta o consumo e permite responder a crises económicas. Esta narrativa foi repetida tantas vezes que se tornou quase um axioma — raramente questionado.

No centro desta visão está a lógica fiat-keynesiana: uma economia estável exige um banco central disposto a manipular o valor do dinheiro para alcançar certos objectivos políticos. Esta abordagem, inspirada por John Maynard Keynes, defende a intervenção estatal como forma de estabilizar a economia durante recessões. Na teoria, os investidores e consumidores beneficiam de taxas de juro artificiais e de maior poder de compra — um suposto ganho para todos.

Mas há outra perspectiva: a visão do dinheiro sólido (sound money, em inglês). Enraizada na escola austríaca e nos princípios da liberdade individual, esta defende que a manipulação monetária não é apenas desnecessária — é prejudicial. Uma moeda estável, não sujeita à depreciação arbitrária, é essencial para promover trocas voluntárias, empreendedorismo e crescimento económico genuíno.

Está na hora de desafiar esta sabedoria convencional. Ao longo dos próximos capítulos, vamos analisar os pressupostos errados que sustentam a lógica fiat-keynesiana e explorar os benefícios de um sistema baseado em dinheiro sólido — como Bitcoin. Vamos mostrar por que desvalorizar a moeda é moralmente questionável e economicamente prejudicial, e propor alternativas mais éticas e eficazes.

Este artigo (que surge em resposta ao "guru" Miguel Milhões) pretende iluminar as diferenças entre estas duas visões opostas e apresentar uma abordagem mais sólida e justa para a política económica — centrada na liberdade pessoal, na responsabilidade individual e na preservação de instituições financeiras saudáveis.

O Argumento Fiat: Por que Dizem que é Preciso Desvalorizar a Moeda

Este argumento parte geralmente de uma visão económica keynesiana e/ou estatista e assenta em duas ideias principais: o incentivo ao investimento e a necessidade de resposta a emergências.

Incentivo ao Investimento

Segundo os defensores do sistema fiat, se uma moeda como o ouro ou bitcoin valorizar ao longo do tempo, as pessoas tenderão a "acumular" essa riqueza em vez de investir em negócios produtivos. O receio é que, se guardar dinheiro se torna mais rentável do que investir, a economia entre em estagnação.

Esta ideia parte de uma visão simplista do comportamento humano. Na realidade, as pessoas tomam decisões financeiras com base em múltiplos factores. Embora seja verdade que activos valorizáveis são atractivos, isso não significa que os investimentos desapareçam. Pelo contrário, o surgimento de activos como bitcoin cria novas oportunidades de inovação e investimento.

Historicamente, houve crescimento económico em períodos de moeda sólida — como no padrão-ouro. Uma moeda estável e previsível pode incentivar o investimento, ao dar confiança nos retornos futuros.

Resposta a Emergências

A segunda tese é que os governos precisam de imprimir dinheiro rapidamente em tempos de crise — pandemias, guerras ou recessões. Esta capacidade de intervenção é vista como essencial para "salvar" a economia.

De acordo com economistas keynesianos, uma injecção rápida de liquidez pode estabilizar a economia e evitar colapsos sociais. No entanto, este argumento ignora vários pontos fundamentais:

- A política monetária não substitui a responsabilidade fiscal: A capacidade de imprimir dinheiro não torna automaticamente eficaz o estímulo económico.

- A inflação é uma consequência provável: A impressão de dinheiro pode levar a pressões inflacionistas, reduzindo o poder de compra dos consumidores e minando o próprio estímulo pretendido. Estamos agora a colher os "frutos" da impressão de dinheiro durante a pandemia.

- O timing é crítico: Intervenções mal cronometradas podem agravar a situação.

Veremos em seguida porque estes argumentos não se sustentam.

Rebatendo os Argumentos

O Investimento Não Morre num Sistema de Dinheiro Sólido

O argumento de que o dinheiro sólido mata o investimento falha em compreender a ligação entre poupança e capital. Num sistema sólido, a poupança não é apenas acumulação — é capital disponível para financiar novos projectos. Isso conduz a um crescimento mais sustentável, baseado na qualidade e não na especulação.

Em contraste, o sistema fiat, com crédito barato, gera bolhas e colapsos — como vimos em 2008 ou na bolha dot-com. Estes exemplos ilustram os perigos da especulação facilitada por políticas monetárias artificiais.

Já num sistema de dinheiro sólido, como o que cresce em torno de Bitcoin, vemos investimentos em mineração, startups, educação e arte. Os investidores continuam activos — mas fazem escolhas mais responsáveis e de longo prazo.

Imprimir Dinheiro Não Resolve Crises

A ideia de que imprimir dinheiro é essencial em tempos de crise parte de uma ilusão perigosa. A inflação que se segue reduz o poder de compra e afecta especialmente os mais pobres — é uma forma oculta de imposto.

Além disso, soluções descentralizadas — como os mercados, redes comunitárias e poupança — são frequentemente mais eficazes. A resposta à COVID-19 ilustra isso: grandes empresas foram salvas, mas pequenos negócios e famílias ficaram para trás. Os últimos receberam um amuse-bouche, enquanto os primeiros comeram o prato principal, sopa, sobremesa e ainda levaram os restos.

A verdade é que imprimir dinheiro não cria valor — apenas o redistribui injustamente. A verdadeira resiliência nasce de comunidades organizadas e de uma base económica saudável, não de decretos políticos.

Dois Mundos: Fiat vs. Dinheiro Sólido

| Dimensão | Sistema Fiat-Keynesiano | Sistema de Dinheiro Sólido | |----------|--------------------------|-----------------------------| | Investimento | Estimulado por crédito fácil, alimentando bolhas | Baseado em poupança real e oportunidades sustentáveis | | Resposta a crises | Centralizada, via impressão de moeda | Descentralizada, baseada em poupança e solidariedade | | Preferência temporal | Alta: foco no consumo imediato | Baixa: foco na poupança e no futuro | | Distribuição de riqueza | Favorece os próximos ao poder (Efeito Cantillon) | Benefícios da deflação são distribuídos de forma mais justa | | Fundamento moral | Coercivo e redistributivo | Voluntário e baseado na liberdade individual |

Estes contrastes mostram que a escolha entre os dois sistemas vai muito além da economia — é também uma questão ética.

Consequências de Cada Sistema

O Mundo Fiat

Num mundo dominado pelo sistema fiat, os ciclos de euforia e colapso são a norma. A desigualdade aumenta, com os mais próximos ao poder a lucrar com a inflação e a impressão de dinheiro. A poupança perde valor, e a autonomia financeira das pessoas diminui.

À medida que o Estado ganha mais controlo sobre a economia, os cidadãos perdem capacidade de escolha e dependem cada vez mais de apoios governamentais. Esta dependência destrói o espírito de iniciativa e promove o conformismo.

O resultado? Estagnação, conflitos sociais e perda de liberdade.

O Mundo com Dinheiro Sólido

Com uma moeda sólida, o crescimento é baseado em valor real. As pessoas poupam mais, investem melhor e tornam-se mais independentes financeiramente. As comunidades tornam-se mais resilientes, e a cooperação substitui a dependência estatal.

Benefícios chave:

- Poupança real: A moeda não perde valor, e a riqueza pode ser construída com estabilidade.

- Resiliência descentralizada: Apoio mútuo entre indivíduos e comunidades em tempos difíceis.

- Liberdade económica: Menor interferência política e mais espaço para inovação e iniciativa pessoal.

Conclusão

A desvalorização da moeda não é uma solução — é um problema. Os sistemas fiat estão desenhados para transferir riqueza e poder de forma opaca, perpetuando injustiças e instabilidade.

Por outro lado, o dinheiro sólido — como Bitcoin — oferece uma alternativa credível e ética. Promove liberdade, responsabilidade e transparência. Impede abusos de poder e expõe os verdadeiros custos da má governação.

Não precisamos de mais inflação — precisamos de mais integridade.

Está na hora de recuperarmos o controlo sobre a nossa vida financeira. De rejeitarmos os sistemas que nos empobrecem lentamente e de construirmos um futuro em que o dinheiro serve as pessoas — e não os interesses políticos.

O futuro do dinheiro pode e deve ser diferente. Juntos, podemos criar uma economia mais justa, livre e resiliente — onde a prosperidade é partilhada e a dignidade individual respeitada.

Photo by rc.xyz NFT gallery on Unsplash

-

@ c9badfea:610f861a

2025-05-20 19:49:20

@ c9badfea:610f861a

2025-05-20 19:49:20- Install Sky Map (it's free and open source)

- Launch the app and tap Accept, then tap OK

- When asked to access the device's location, tap While Using The App

- Tap somewhere on the screen to activate the menu, then tap ⁝ and select Settings

- Disable Send Usage Statistics

- Return to the main screen and enjoy stargazing!

ℹ️ Use the 🔍 icon in the upper toolbar to search for a specific celestial body, or tap the 👁️ icon to activate night mode

-

@ 8f69ac99:4f92f5fd

2025-04-07 15:35:08

@ 8f69ac99:4f92f5fd

2025-04-07 15:35:08No dia 2 de Abril de 2025, o Presidente dos Estados Unidos, Donald Trump, anunciou um novo pacote abrangente de tarifas com o objectivo de combater os desequilíbrios comerciais e revitalizar as indústrias nacionais. Foi imposta uma tarifa geral de 10% sobre todas as importações, com taxas mais elevadas—34% para a China e 20% para a União Europeia—em preparação para entrar em vigor. O anúncio reacendeu debates antigos sobre proteccionismo, globalização e o futuro do dólar norte-americano.

Embora estas medidas possam parecer extremas, as tarifas são um instrumento tradicional da política comercial internacional. Países de todo o mundo, incluindo a União Europeia, utilizam-nas rotineiramente para proteger indústrias estratégicas, regular o comércio e gerar receitas. A UE, por exemplo, impõe há muito tempo taxas sobre produtos norte-americanos como bens agrícolas, maquinaria e têxteis. Em contrapartida, os EUA já taxaram importações da UE, como o aço, alumínio e aeronaves, em disputas comerciais.

O que distingue a proposta de Trump é a sua escala, ambição e o objectivo mais amplo: reestruturar a economia dos EUA. Por detrás desta estratégia está uma realidade económica mais profunda—moldada por décadas de défices comerciais, endividamento crescente e o papel do dólar como moeda de reserva mundial. Este artigo explora como estes factores se cruzam, por que razão os EUA se encontram numa posição precária, e se políticas como tarifas elevadas, taxas de juro baixas ou até o Bitcoin podem apontar o caminho a seguir.

As Raízes da Crise: Sobreconsumo e Desindustrialização nos EUA

Durante décadas, os Estados Unidos "viveram acima das suas possibilidades", acumulando um défice comercial que actualmente ultrapassa os 800 mil milhões de dólares por ano. Este desequilíbrio—em que o país compra mais do que vende ao exterior—é sintoma de um problema mais profundo. No pós-Segunda Guerra Mundial, os EUA eram uma potência industrial. Mas, a partir dos anos 70, e com maior intensidade nos anos 90, a globalização transferiu a produção para o estrangeiro. As empresas procuraram custos de mão de obra mais baixos e os mercados norte-americanos encheram-se de produtos fabricados fora.

Para sustentar este consumo, os EUA apoiaram-se na sua posição privilegiada: a emissão da moeda de reserva mundial. Isso gerou um ciclo de endividamento, com o país a pedir emprestado ao exterior para manter o nível de vida. O resultado? Desindustrialização. Fábricas fecharam e milhões de empregos na indústria desapareceram em estados como Ohio, Michigan e Pensilvânia.

Hoje, os EUA produzem muito menos—em proporção ao seu tamanho—do que há algumas décadas, mesmo mantendo um apetite crescente por importações. O défice comercial expõe uma fragilidade estrutural: um país cada vez mais incapaz de sustentar-se através da sua própria produção. Os dólares gastos fora regressam muitas vezes sob a forma de compras de dívida pública, perpetuando o ciclo.

À medida que os défices crescem e a economia depende cada vez mais de mecanismos financeiros do que da produção real, surge uma questão inevitável: até quando poderá a América continuar a comprar a crédito antes que o cartão seja recusado?

O Dilema de Triffin: Moeda Global vs. Potência Industrial

Imagine ser a única pessoa numa cidade com uma impressora de dinheiro que todos usam. Para satisfazer a procura, continua a imprimir e a enviar notas para o exterior—até que o seu próprio negócio local entra em decadência e se torna dependente dos outros. Esta é a essência do Dilema de Triffin, e a corda bamba que os EUA têm vindo a atravessar há gerações.

O dilema surge quando a moeda de um país é usada como padrão global. O dólar—utilizado mundialmente para transacções de petróleo, comércio e reservas—precisa de estar amplamente disponível. Essa abundância provém de défices comerciais persistentes por parte dos EUA.

Mas os défices têm um custo. Os dólares enviados para fora voltam como procura por bens estrangeiros, enfraquecendo a produção interna. Porque fabricar um produto em Detroit por 10 dólares, quando se pode importar por $2? Com o tempo, isto destrói a base industrial do país.

Esta não é uma preocupação teórica—é uma realidade histórica. O economista Robert Triffin advertiu nos anos 60 que um país não pode simultaneamente manter a sua moeda como padrão mundial e conservar uma base industrial sólida. Os EUA confirmaram essa previsão. Após a guerra, os dólares ajudaram a reconstruir a Europa e o Japão, mas esses mesmos países tornaram-se concorrentes industriais dos EUA em sectores como o aço e a indústria automóvel.

As fábricas abandonadas no Midwest e os teares silenciosos no sul são marcas visíveis desta troca. O domínio do dólar concedeu influência global à América, mas às custas da sua produção.

Espiral da Dívida: Obrigações Financeiras Crescentes dos EUA

Em 2025, a dívida federal dos EUA ultrapassa os 36 biliões de dólares ($36 000 000 000 000 000 000)—cerca de 108 mil dólares por cada americano, adultos, jovens, idosos. Durante anos, o acesso fácil ao crédito e a procura global por dívida americana mascararam os riscos. Agora, as fissuras estão à vista.

O problema não é apenas o montante—é o prazo e o custo de manter esta dívida. Grande parte dela é de curto prazo, exigindo refinanciamentos frequentes. Com o aumento das taxas de juro, os custos associados disparam. Só em 2024, os pagamentos de juros ultrapassaram 1 bilião de dólares—mais do que os orçamentos combinados de educação, transportes e habitação.

A “Lei de Ferguson”, proposta pelo historiador Niall Ferguson, afirma que quando os juros da dívida superam os gastos militares, o império está em declínio. Em 2025, os EUA gastam cerca de 900 mil milhões em defesa, e os encargos com juros já os ultrapassaram.

Este ponto de viragem trouxe problemas a impérios do passado—do Reino Unido após a Primeira Guerra Mundial até Roma no seu declínio. Hoje, cresce o cepticismo quanto à saúde fiscal dos EUA. Países como a China e a Rússia estão a reduzir as suas reservas em dívida americana, preferindo ouro, yuan ou outros activos.

Se mais nações seguirem o mesmo caminho, os EUA terão de escolher: continuar a endividar-se para sustentar o sistema ou aceitar um papel reduzido para o dólar na economia mundial.

Desdolarização: A Mudança Global Longe do Dólar

A desdolarização refere-se à tendência crescente de reduzir a dependência do dólar nas transacções comerciais, reservas e sistemas financeiros. Embora o dólar ainda domine, a sua supremacia está sob crescente pressão de novas potências económicas e tensões geopolíticas.

Porque Está o Mundo a Afastar-se do Dólar?

- Risco Económico: A volatilidade do dólar, agravada pela dívida e instabilidade política nos EUA, torna-o menos fiável como reserva de valor.

- Instrumento Geopolítico: O uso do dólar pelos EUA para impor sanções leva rivais a procurar alternativas.

Alternativas Emergentes

- Ouro: Bancos centrais estão a reforçar as reservas em ouro como protecção.

- Commodities: Petróleo e cereais começam a ser transaccionados em moedas alternativas—como vendas de petróleo em yuan pela Arábia Saudita.

- Criptomoedas: Bitcoin e outros activos digitais ganham terreno como reservas neutras e descentralizadas.

- Moedas Regionais: Os países dos BRICS desenvolvem sistemas de pagamento e discutem uma moeda comum para reduzir a dependência do dólar.

Um Declínio Lento, Mas Visível

A percentagem do dólar nas reservas cambiais mundiais caiu de 70% no ano 2000 para menos de 60% actualmente. O comércio em moedas não-dólar cresceu 25% desde 2020. O domínio do dólar persiste, mas o movimento de mudança é claro.

A Estratégia Económica de Trump em 3 Etapas

Em 2025, Trump apresentou uma estratégia económica audaciosa em três frentes:

1. Tarifas Elevadas para Revitalizar a Indústria

Uma tarifa de 10% sobre todas as importações, com taxas superiores para países com superavit comercial, visa incentivar a produção interna. Críticos alertam para o aumento de preços e inflação, mas apoiantes defendem que é necessário para reindustrializar.

2. Redução das Taxas de Juro para Gerir a Dívida

A administração pressiona a Reserva Federal para baixar as taxas, reduzindo os encargos da dívida pública. Isto levanta preocupações sobre a independência do banco central e a estabilidade monetária a longo prazo.

3. Bitcoin como Activo Estratégico de Reserva

Num passo histórico, Trump assinou uma ordem executiva para criar a Reserva Estratégica de Bitcoin e o Stock Nacional de Activos Digitais. O objectivo é diversificar as reservas e proteger contra a inflação.

Riscos e Compensações

A estratégia económica de Trump não está isenta de riscos:

- Inflação: Tarifas mais altas poderão aumentar o custo de vida.

- Polarização Política: Medidas controversas poderão acentuar divisões internas.

- Incerteza Económica: O proteccionismo pode afastar investimento e travar a inovação.

- Instabilidade Monetária: Um erro na gestão da dívida ou dos activos digitais poderá enfraquecer o dólar.

Estes riscos exigem gestão cuidadosa para evitar agravar os problemas existentes.

O Papel de Bitcoin: Protecção ou Último Recurso?

Integrar Bitcoin nas reservas nacionais é ousado—mas pode ser revolucionário, e a meu ver, inevitável!

Vantagens

- Escassez: Com oferta limitada a 21 milhões de unidades, Bitcoin é deflacionário.

- Descentralização: Resistente à censura e manipulação, reforça a soberania financeira.

- Alcance Global: Sem fronteiras, permite trocas neutras num mundo multipolar.

Desafios

- Volatilidade: As flutuações no curto prazo são ainda significativas, mas a adopção institucional pode estabilizar o preço.

- Regulação: O enquadramento legal está em evolução, mas tende para maior clareza.

- Adopção Técnica: Persistem desafios de escalabilidade, embora soluções como a Lightning Network estejam a amadurecer.

A Reserva Estratégica de Bitcoin pode revelar-se visionária—ou precipitada. Tudo dependerá da execução e da aceitação global.

Futuros Possíveis: Crise ou Reinvenção?

Os EUA estão perante uma encruzilhada histórica. Um caminho aponta para a renovação: revitalizar a indústria e adoptar activos digitais, como por exemplo as stablecoins para perpetuar a hegemonia do dólar, lastreado em Bitcoin. O outro conduz à crise—com inflação, instabilidade e perda de influência global.

Num cenário optimista, os EUA emergem como líderes industriais e digitais, com reservas diversificadas que incluem Bitcoin. A recente ordem executiva para adquirir Bitcoin de forma neutra ao orçamento é um sinal positivo.

Num cenário pessimista, menos provável com as medidas em curso, o país mergulha em dívidas, vê o dólar enfraquecer e perde coesão interna. Mas com visão estratégica e inovação económica, há margem para navegar os desafios com sucesso.

Conclusão

A América enfrenta uma oportunidade única de redefinir o seu destino económico. A estratégia de Trump—baseada em tarifas, taxas de juro baixas e Bitcoin—pode marcar o início de uma nova era de resiliência e recuperação industrial.

A inclusão de Bitcoin nas reservas nacionais mostra que os instrumentos tradicionais já não bastam. Ao abraçar os activos digitais e restaurar a produção nacional, os EUA podem recuperar a liderança económica mundial.

O caminho será difícil. Mas com ousadia e execução eficaz, os Estados Unidos não só podem recuperar—podem reinventar-se.

-

@ 30ceb64e:7f08bdf5

2024-08-14 11:51:36

@ 30ceb64e:7f08bdf5

2024-08-14 11:51:36Heres a scenario:

Imagine you have a nostr e-cash/Lightning Wallet and you would like to have a maximum receive balance of 20k split in between 5 mints that enable multipath payments.

Pick 5 mints below to store 4k sats each, the funds are automatically withdrawn to your lightning node at the end of the day.

Stacker News Robosats Sparrow Coinkite Start9 Rabbit Hole Recap @siggy47 Damus LND Your own mint

originally posted at https://stacker.news/items/648298

-

@ 04c915da:3dfbecc9

2025-05-20 15:53:48

@ 04c915da:3dfbecc9

2025-05-20 15:53:48This piece is the first in a series that will focus on things I think are a priority if your focus is similar to mine: building a strong family and safeguarding their future.

Choosing the ideal place to raise a family is one of the most significant decisions you will ever make. For simplicity sake I will break down my thought process into key factors: strong property rights, the ability to grow your own food, access to fresh water, the freedom to own and train with guns, and a dependable community.

A Jurisdiction with Strong Property Rights

Strong property rights are essential and allow you to build on a solid foundation that is less likely to break underneath you. Regions with a history of limited government and clear legal protections for landowners are ideal. Personally I think the US is the single best option globally, but within the US there is a wide difference between which state you choose. Choose carefully and thoughtfully, think long term. Obviously if you are not American this is not a realistic option for you, there are other solid options available especially if your family has mobility. I understand many do not have this capability to easily move, consider that your first priority, making movement and jurisdiction choice possible in the first place.

Abundant Access to Fresh Water

Water is life. I cannot overstate the importance of living somewhere with reliable, clean, and abundant freshwater. Some regions face water scarcity or heavy regulations on usage, so prioritizing a place where water is plentiful and your rights to it are protected is critical. Ideally you should have well access so you are not tied to municipal water supplies. In times of crisis or chaos well water cannot be easily shutoff or disrupted. If you live in an area that is drought prone, you are one drought away from societal chaos. Not enough people appreciate this simple fact.

Grow Your Own Food

A location with fertile soil, a favorable climate, and enough space for a small homestead or at the very least a garden is key. In stable times, a small homestead provides good food and important education for your family. In times of chaos your family being able to grow and raise healthy food provides a level of self sufficiency that many others will lack. Look for areas with minimal restrictions, good weather, and a culture that supports local farming.

Guns

The ability to defend your family is fundamental. A location where you can legally and easily own guns is a must. Look for places with a strong gun culture and a political history of protecting those rights. Owning one or two guns is not enough and without proper training they will be a liability rather than a benefit. Get comfortable and proficient. Never stop improving your skills. If the time comes that you must use a gun to defend your family, the skills must be instinct. Practice. Practice. Practice.

A Strong Community You Can Depend On

No one thrives alone. A ride or die community that rallies together in tough times is invaluable. Seek out a place where people know their neighbors, share similar values, and are quick to lend a hand. Lead by example and become a good neighbor, people will naturally respond in kind. Small towns are ideal, if possible, but living outside of a major city can be a solid balance in terms of work opportunities and family security.

Let me know if you found this helpful. My plan is to break down how I think about these five key subjects in future posts.

-

@ 30ceb64e:7f08bdf5

2024-08-14 11:15:27

@ 30ceb64e:7f08bdf5

2024-08-14 11:15:27It's wild. I just proved I can build #nostr 'wallet' where I can store the encrypted tokens in a Germany relay and make the lightning payment out of a Singapore mint. All using a #nsec that never leaves my machine. https://primal.net/e/note15l02rf4r474ck04mlrxxfagyl0z6t04ltsugf9dtph4xxhzfnd4sqpk74n

I’ve proven to myself that a #nostr wallet can exist across time and space, independently of any one app, server or custodian. The only thing which controls the ‘wallet’ is the generation and control of an #nsec which is free to exist within or flee any jurisdiction.

In my mind, this lays to rest the notion that a wallet needs to be an app, service, or anything that can be captured commercially or by the state. https://primal.net/e/note13nwsh852x9tfex2jade6vwymhhct8zussxr4zwy7uag24hjc9stq0xsxaf

https://image.nostr.build/07dd1b56d6bb60b13cfe6c19d9384bc3ef198d01af4be9a5c544f791b80b746a.png

I am thinking about coining the term “nsac” to refer to a wallet-like thing that can exist on #nostr holding your valuable things, such as ecash tokens. I have already implemented a prototype #cashu ecash wallet which looks to be promising.

So you would have:

npub - your identity

nsec - your private key

nsac - your valuables

Your #nsac could be the same as your #nsec but better case is to generate as many #nsacs as required.

Happy to hear feedback!

For reference, what a ‘sac’ is in the biological sense:

A sac is a biological term referring to a pouch or cavity in an organism that is typically enclosed and may contain fluid, air, or other substances. Sacs can serve various functions depending on their location and role in the body, such as protecting a developing embryo, facilitating the exchange of gases in the lungs, or reducing friction between moving parts in joints

https://primal.net/e/note1snj7y9m6f7lhfzkd2ujzqcvparpgddzmgcgwsgghqvkcyd0rkqhsmmlyla

npub1q6mcr8tlr3l4gus3sfnw6772s7zae6hqncmw5wj27ejud5wcxf7q0nx7d5

Wild stuff freaks, will nostr become the best lightning/E-Cash wallet? Let me know what you think.

originally posted at https://stacker.news/items/648270

-

@ 04c915da:3dfbecc9

2025-05-20 15:47:16

@ 04c915da:3dfbecc9

2025-05-20 15:47:16Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-