-

@ 6d5c826a:4b27b659

2025-05-23 21:53:16

@ 6d5c826a:4b27b659

2025-05-23 21:53:16- DefGuard - True enterprise WireGuard with MFA/2FA and SSO. (Source Code)

Apache-2.0Rust - Dockovpn - Out-of-the-box stateless dockerized OpenVPN server which starts in less than 2 seconds. (Source Code)

GPL-2.0Docker - Firezone - WireGuard based VPN Server and Firewall. (Source Code)

Apache-2.0Docker - Gluetun VPN client - VPN client in a thin Docker container for multiple VPN providers, written in Go, and using OpenVPN or Wireguard, DNS over TLS, with a few proxy servers built-in.

MITdocker - Headscale - Self-hostable fork of Tailscale, cross-platform clients, simple to use, built-in (currently experimental) monitoring tools.

BSD-3-ClauseGo - Nebula - A scalable p2p VPN with a focus on performance, simplicity and security.

MITGo - ocserv - Cisco AnyConnect-compatible VPN server. (Source Code)

GPL-2.0C - OpenVPN - Uses a custom security protocol that utilizes SSL/TLS for key exchange. (Source Code)

GPL-2.0C - SoftEther - Multi-protocol software VPN with advanced features. (Source Code)

Apache-2.0C - sshuttle - Poor man's VPN.

LGPL-2.1Python - strongSwan - Complete IPsec implementation for Linux. (Source Code)

GPL-2.0C - WireGuard - Very fast VPN based on elliptic curve and public key crypto. (Source Code)

GPL-2.0C

- DefGuard - True enterprise WireGuard with MFA/2FA and SSO. (Source Code)

-

@ 6d5c826a:4b27b659

2025-05-23 21:52:59

@ 6d5c826a:4b27b659

2025-05-23 21:52:59- Ganeti - Cluster virtual server management software tool built on top of KVM and Xen. (Source Code)

BSD-2-ClausePython/Haskell - KVM - Linux kernel virtualization infrastructure. (Source Code)

GPL-2.0/LGPL-2.0C - OpenNebula - Build and manage enterprise clouds for virtualized services, containerized applications and serverless computing. (Source Code)

Apache-2.0C++ - oVirt - Manages virtual machines, storage and virtual networks. (Source Code)

Apache-2.0Java - Packer - A tool for creating identical machine images for multiple platforms from a single source configuration. (Source Code)

MPL-2.0Go - Proxmox VE - Virtualization management solution. (Source Code)

GPL-2.0Perl/Shell - QEMU - QEMU is a generic machine emulator and virtualizer. (Source Code)

LGPL-2.1C - Vagrant - Tool for building complete development environments. (Source Code)

BUSL-1.1Ruby - VirtualBox - Virtualization product from Oracle Corporation. (Source Code)

GPL-3.0/CDDL-1.0C++ - XCP-ng - Virtualization platform based on Xen Source and Citrix® Hypervisor (formerly XenServer). (Source Code)

GPL-2.0C - Xen - Virtual machine monitor for 32/64 bit Intel / AMD (IA 64) and PowerPC 970 architectures. (Source Code)

GPL-2.0C

- Ganeti - Cluster virtual server management software tool built on top of KVM and Xen. (Source Code)

-

@ 5144fe88:9587d5af

2025-05-23 17:01:37

@ 5144fe88:9587d5af

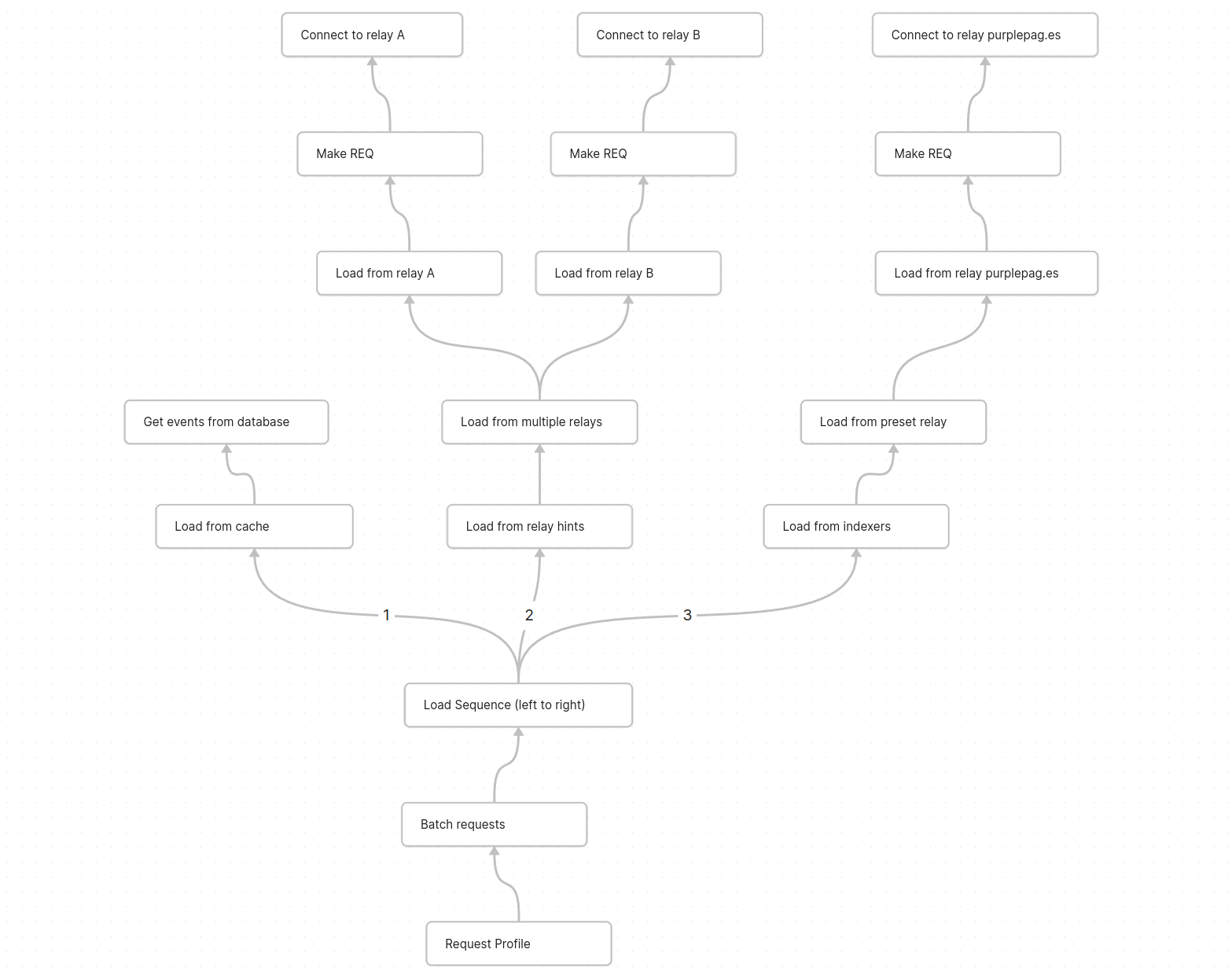

2025-05-23 17:01:37The recent anomalies in the financial market and the frequent occurrence of world trade wars and hot wars have caused the world's political and economic landscape to fluctuate violently. It always feels like the financial crisis is getting closer and closer.

This is a systematic analysis of the possibility of the current global financial crisis by Manus based on Ray Dalio's latest views, US and Japanese economic and financial data, Buffett's investment behavior, and historical financial crises.

Research shows that the current financial system has many preconditions for a crisis, especially debt levels, market valuations, and investor behavior, which show obvious crisis signals. The probability of a financial crisis in the short term (within 6-12 months) is 30%-40%,

in the medium term (within 1-2 years) is 50%-60%,

in the long term (within 2-3 years) is 60%-70%.

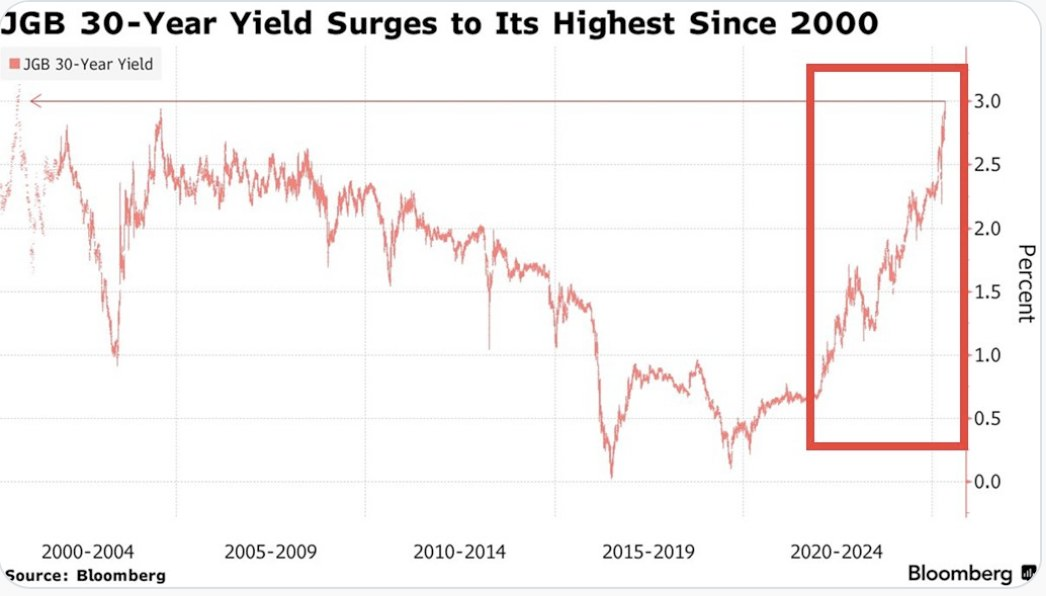

Japan's role as the world's largest holder of overseas assets and the largest creditor of the United States is particularly critical. The sharp appreciation of the yen may be a signal of the return of global safe-haven funds, which will become an important precursor to the outbreak of a financial crisis.

Potential conditions for triggering a financial crisis Conditions that have been met 1. High debt levels: The debt-to-GDP ratio of the United States and Japan has reached a record high. 2. Market overvaluation: The ratio of stock market to GDP hits a record high 3. Abnormal investor behavior: Buffett's cash holdings hit a record high, with net selling for 10 consecutive quarters 4. Monetary policy shift: Japan ends negative interest rates, and the Fed ends the rate hike cycle 5. Market concentration is too high: a few technology stocks dominate market performance

Potential trigger points 1. The Bank of Japan further tightens monetary policy, leading to a sharp appreciation of the yen and the return of overseas funds 2. The US debt crisis worsens, and the proportion of interest expenses continues to rise to unsustainable levels 3. The bursting of the technology bubble leads to a collapse in market confidence 4. The trade war further escalates, disrupting global supply chains and economic growth 5. Japan, as the largest creditor of the United States, reduces its holdings of US debt, causing US debt yields to soar

Analysis of the similarities and differences between the current economic environment and the historical financial crisis Debt level comparison Current debt situation • US government debt to GDP ratio: 124.0% (December 2024) • Japanese government debt to GDP ratio: 216.2% (December 2024), historical high 225.8% (March 2021) • US total debt: 36.21 trillion US dollars (May 2025) • Japanese debt/GDP ratio: more than 250%-263% (Japanese Prime Minister’s statement)

Before the 2008 financial crisis • US government debt to GDP ratio: about 64% (2007) • Japanese government debt to GDP ratio: about 175% (2007)

Before the Internet bubble in 2000 • US government debt to GDP ratio: about 55% (1999) • Japanese government debt to GDP ratio: about 130% (1999)

Key differences • The current US debt-to-GDP ratio is nearly twice that before the 2008 crisis • The current Japanese debt-to-GDP ratio is more than 1.2 times that before the 2008 crisis • Global debt levels are generally higher than historical pre-crisis levels • US interest payments are expected to devour 30% of fiscal revenue (Moody's warning)

Monetary policy and interest rate environment

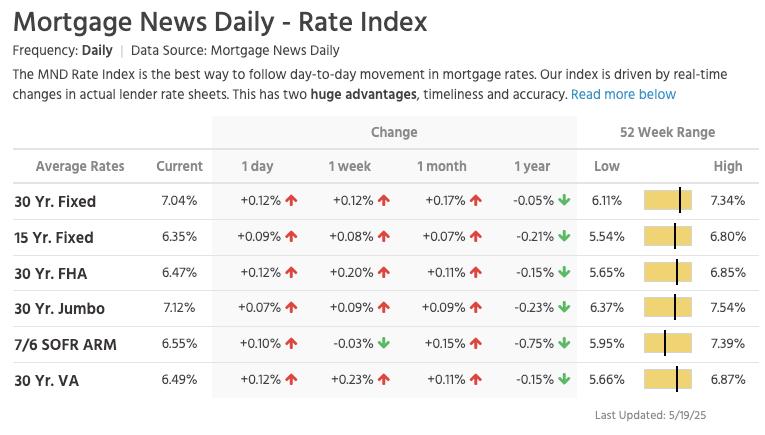

Current situation • US 10-year Treasury yield: about 4.6% (May 2025) • Bank of Japan policy: end negative interest rates and start a rate hike cycle • Bank of Japan's holdings of government bonds: 52%, plans to reduce purchases to 3 trillion yen per month by January-March 2026 • Fed policy: end the rate hike cycle and prepare to cut interest rates

Before the 2008 financial crisis • US 10-year Treasury yield: about 4.5%-5% (2007) • Fed policy: continuous rate hikes from 2004 to 2006, and rate cuts began in 2007 • Bank of Japan policy: maintain ultra-low interest rates

Key differences • Current US interest rates are similar to those before the 2008 crisis, but debt levels are much higher than then • Japan is in the early stages of ending its loose monetary policy, unlike before historical crises • The size of global central bank balance sheets is far greater than at any time in history

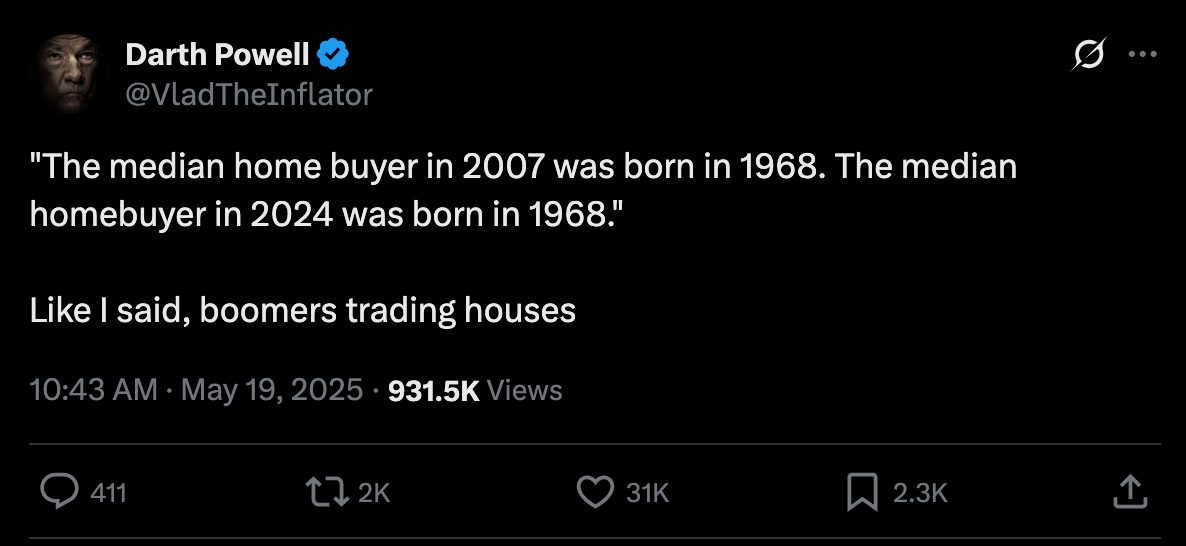

Market valuations and investor behavior Current situation • The ratio of stock market value to the size of the US economy: a record high • Buffett's cash holdings: $347 billion (28% of assets), a record high • Market concentration: US stock growth mainly relies on a few technology giants • Investor sentiment: Technology stocks are enthusiastic, but institutional investors are beginning to be cautious

Before the 2008 financial crisis • Buffett's cash holdings: 25% of assets (2005) • Market concentration: Financial and real estate-related stocks performed strongly • Investor sentiment: The real estate market was overheated and subprime products were widely popular

Before the 2000 Internet bubble • Buffett's cash holdings: increased from 1% to 13% (1998) • Market concentration: Internet stocks were extremely highly valued • Investor sentiment: Tech stocks are in a frenzy

Key differences • Buffett's current cash holdings exceed any pre-crisis level in history • Market valuation indicators have reached a record high, exceeding the levels before the 2000 bubble and the 2008 crisis • The current market concentration is higher than any period in history, and a few technology stocks dominate market performance

Safe-haven fund flows and international relations Current situation • The status of the yen: As a safe-haven currency, the appreciation of the yen may indicate a rise in global risk aversion • Trade relations: The United States has imposed tariffs on Japan, which is expected to reduce Japan's GDP growth by 0.3 percentage points in fiscal 2025 • International debt: Japan is one of the largest creditors of the United States

Before historical crises • Before the 2008 crisis: International capital flows to US real estate and financial products • Before the 2000 bubble: International capital flows to US technology stocks

Key differences • Current trade frictions have intensified and the trend of globalization has weakened • Japan's role as the world's largest holder of overseas assets has become more prominent • International debt dependence is higher than any period in history

-

@ 6d5c826a:4b27b659

2025-05-23 21:52:43

@ 6d5c826a:4b27b659

2025-05-23 21:52:43- Darcs - Cross-platform version control system, like git, mercurial or svn but with a very different approach: focus on changes rather than snapshots. (Source Code)

GPL-2.0Haskell - Fossil - Distributed version control with built-in wiki and bug tracking. (Source Code)

BSD-2-ClauseC - Git - Distributed revision control and source code management (SCM) with an emphasis on speed. (Source Code)

GPL-2.0C - Mercurial - Distributed source control management tool. (Source Code)

GPL-2.0Python/C/Rust - Subversion - Client-server revision control system. (Source Code)

Apache-2.0C

- Darcs - Cross-platform version control system, like git, mercurial or svn but with a very different approach: focus on changes rather than snapshots. (Source Code)

-

@ 1c5ff3ca:efe9c0f6

2025-05-23 10:13:57

@ 1c5ff3ca:efe9c0f6

2025-05-23 10:13:57Auto-Deployment on a VPS with GitHub Actions

Introduction

This tutorial describes how you can deploy an application on a VPS using GitHub Actions. This way, changes in your GitHub repository are automatically deployed to your VPS.

Prerequisites

- GitHub Account

- GitHub Repository

- Server + SSH access to the server

Step 1 - SSH Login to Server

Open a terminal and log in via SSH. Then navigate to the

.sshdirectoryssh user@hostname cd ~/.sshStep 2 - Create an SSH Key

Now create a new SSH key that we will use for auto-deployment. In the following dialog, simply press "Enter" repeatedly until the key is created.

ssh-keygen -t ed25519 -C "service-name-deploy-github"Step 3 - Add the Key to the

authorized_keysFilecat id_ed25519.pub >> authorized_keys(If you named the key file differently, change this accordingly)

Step 4 - GitHub Secrets

In order for the GitHub Action to perform the deployment later, some secrets must be stored in the repository. Open the repository on GitHub. Navigate to "Settings" -> "Secrets And Variables" -> "Actions". Add the following variables:

HOST: Hostname or IP address of the serverUSERNAME: Username you use to log in via SSHSSHKEY: The private key (copy the content fromcat ~/.ssh/id_ed25519)PORT: 22

Step 5 - Create the GitHub Action

Now create the GitHub Action for auto-deployment. The following GitHub Action will be used: https://github.com/appleboy/scp-action In your local repository, create the file

.github/workflows/deploy.yml:```yaml name: Deploy on: [push] jobs: build: runs-on: ubuntu-latest steps: - uses: actions/checkout@v1 - name: Copy repository content via scp uses: appleboy/scp-action@master with: host: ${{ secrets.HOST }} username: ${{ secrets.USERNAME }} port: ${{ secrets.PORT }} key: ${{ secrets.SSHKEY }} source: "." target: "/your-target-directory"

- name: Executing a remote command uses: appleboy/ssh-action@master with: host: ${{ secrets.HOST }} username: ${{ secrets.USERNAME }} port: ${{ secrets.PORT }} key: ${{ secrets.SSHKEY }} script: | ls```

This action copies the repository files to your server using

scp. Afterwards, thelscommand is executed. Here you can add appropriate commands that rebuild your service or similar. To rebuild and start a docker service you could use something like this or similar:docker compose -f target-dir/docker-compose.yml up --build -dNow commit this file and in the "Actions" tab of your repository, the newly created action should now be visible and executed. With every future change, the git repository will now be automatically copied to your server.Sources

I read this when trying out, but it did not work and I adapted the

deploy.ymlfile: https://dev.to/knowbee/how-to-setup-continuous-deployment-of-a-website-on-a-vps-using-github-actions-54im -

@ 6d5c826a:4b27b659

2025-05-23 21:52:26

@ 6d5c826a:4b27b659

2025-05-23 21:52:26- grml - Bootable Debian Live CD with powerful CLI tools. (Source Code)

GPL-3.0Shell - mitmproxy - A Python tool used for intercepting, viewing and modifying network traffic. Invaluable in troubleshooting certain problems. (Source Code)

MITPython - mtr - Network utility that combines traceroute and ping. (Source Code)

GPL-2.0C - Sysdig - Capture system state and activity from a running Linux instance, then save, filter and analyze. (Source Code)

Apache-2.0Docker/Lua/C - Wireshark - The world's foremost network protocol analyzer. (Source Code)

GPL-2.0C

- grml - Bootable Debian Live CD with powerful CLI tools. (Source Code)

-

@ 6d5c826a:4b27b659

2025-05-23 21:52:06

@ 6d5c826a:4b27b659

2025-05-23 21:52:06- Docker Compose - Define and run multi-container Docker applications. (Source Code)

Apache-2.0Go - Docker Swarm - Manage cluster of Docker Engines. (Source Code)

Apache-2.0Go - Docker - Platform for developers and sysadmins to build, ship, and run distributed applications. (Source Code)

Apache-2.0Go - LXC - Userspace interface for the Linux kernel containment features. (Source Code)

GPL-2.0C - LXD - Container "hypervisor" and a better UX for LXC. (Source Code)

Apache-2.0Go - OpenVZ - Container-based virtualization for Linux. (Source Code)

GPL-2.0C - Podman - Daemonless container engine for developing, managing, and running OCI Containers on your Linux System. Containers can either be run as root or in rootless mode. Simply put:

alias docker=podman. (Source Code)Apache-2.0Go - Portainer Community Edition - Simple management UI for Docker. (Source Code)

ZlibGo - systemd-nspawn - Lightweight, chroot-like, environment to run an OS or command directly under systemd. (Source Code)

GPL-2.0C

- Docker Compose - Define and run multi-container Docker applications. (Source Code)

-

@ 6d5c826a:4b27b659

2025-05-23 21:49:50

@ 6d5c826a:4b27b659

2025-05-23 21:49:50- Consul - Consul is a tool for service discovery, monitoring and configuration. (Source Code)

MPL-2.0Go - etcd - Distributed K/V-Store, authenticating via SSL PKI and a REST HTTP Api for shared configuration and service discovery. (Source Code)

Apache-2.0Go - ZooKeeper - ZooKeeper is a centralized service for maintaining configuration information, naming, providing distributed synchronization, and providing group services. (Source Code)

Apache-2.0Java/C++

- Consul - Consul is a tool for service discovery, monitoring and configuration. (Source Code)

-

@ 6d5c826a:4b27b659

2025-05-23 21:49:30

@ 6d5c826a:4b27b659

2025-05-23 21:49:30- DD-WRT - A Linux-based firmware for wireless routers and access points, originally designed for the Linksys WRT54G series. (Source Code)

GPL-2.0C - OpenWrt - A Linux-based router featuring Mesh networking, IPS via snort and AQM among many other features. (Source Code)

GPL-2.0C - OPNsense - An open source FreeBSD-based firewall and router with traffic shaping, load balancing, and virtual private network capabilities. (Source Code)

BSD-2-ClauseC/PHP - pfSense CE - Free network firewall distribution, based on the FreeBSD operating system with a custom kernel and including third party free software packages for additional functionality. (Source Code)

Apache-2.0Shell/PHP/Other

- DD-WRT - A Linux-based firmware for wireless routers and access points, originally designed for the Linksys WRT54G series. (Source Code)

-

@ 8d34bd24:414be32b

2025-05-21 15:52:46

@ 8d34bd24:414be32b

2025-05-21 15:52:46In our culture today, people like to have “my truth” as opposed to “your truth.” They want to have teachers who tell them what they want to hear and worship in the way they desire. The Bible predicted these times.

For the time will come when people will not put up with sound doctrine. Instead, to suit their own desires, they will gather around them a great number of teachers to say what their itching ears want to hear. (2 Timothy 4:3)

My question is, “do we get to choose what we want to believe about God and how we want to worship Him, or does God tell us what we are to believe and how we are to worship Him?”

The Bible makes it clear that He is who He says He is and He expects obedience and worship according to His commands. We do not get to decide for ourselves.

The woman said to Him, “Sir, I perceive that You are a prophet. Our fathers worshiped in this mountain, and you people say that in Jerusalem is the place where men ought to worship.” Jesus said to her, “Woman, believe Me, an hour is coming when neither in this mountain nor in Jerusalem will you worship the Father. You worship what you do not know; we worship what we know, for salvation is from the Jews. But an hour is coming, and now is, when the true worshipers will worship the Father in spirit and truth; for such people the Father seeks to be His worshipers. God is spirit, and those who worship Him must worship in spirit and truth.” (John 4:19-24) {emphasis mine}

In this passage, Jesus gently corrects the woman for worshipping what she does not know. He also says, “God is spirit, and those who worship Him must worship in spirit and truth.” He states what God is (spirit) and how He must be worshipped “in spirit and truth.” We don’t get to define God however we wish, and we don’t get to worship Him any way we wish. God is who He has revealed Himself to be and we must obey Him and worship Him the way He has commanded.

In this next passage, God makes clear that He is holy and we do not get to worship Him any way we wish. We are to interact with Him in the prescribed manner.

Now Nadab and Abihu, the sons of Aaron, took their respective firepans, and after putting fire in them, placed incense on it and offered strange fire before the Lord, which He had not commanded them. And fire came out from the presence of the Lord and consumed them, and they died before the Lord. Then Moses said to Aaron, “It is what the Lord spoke, saying,

‘By those who come near Me I will be treated as holy,\ And before all the people I will be honored.’ ”

So Aaron, therefore, kept silent. (Leviticus 10:1-3) {emphasis mine}

God had prescribed a particular way to approach Him and only those whom He had chosen (priests of the lineage of Aaron). Nadab and Abihu chose to “do it their way” and paid the price for ignoring God’s command. God set an example with them.

God has been gracious enough to reveal Himself, His character, His power, and His commands to us. If we have truly submitted ourselves to His rule, we should hunger for God’s words so we can know Him better and honor Him in obedience.

But now I come to You; and these things I speak in the world so that they may have My joy made full in themselves. I have given them Your word; and the world has hated them, because they are not of the world, even as I am not of the world. I do not ask You to take them out of the world, but to keep them from the evil one. They are not of the world, even as I am not of the world. Sanctify them in the truth; Your word is truth. (John 17:13-17) {emphasis mine}

In today’s culture, everybody likes to claim their own personal truth, but that isn’t how truth works. The truth is not determined by an individual for themselves. It isn’t even determined by a consensus or majority vote. The truth is the truth even if not one person on earth believes it. God speaks truth and God is truth. Our belief or lack thereof doesn’t change the truth, but our lack of belief in the truth, especially the truth as revealed by God in His word, can negatively affect our relationship with God.

God expects us to study His word so we can obey His commands.

For I did not speak to your fathers, or command them in the day that I brought them out of the land of Egypt, concerning burnt offerings and sacrifices. But this is what I commanded them, saying, ‘Obey My voice, and I will be your God, and you will be My people; and you will walk in all the way which I command you, that it may be well with you.’ Yet they did not obey or incline their ear, but walked in their own counsels and in the stubbornness of their evil heart, and went backward and not forward. Since the day that your fathers came out of the land of Egypt until this day, I have sent you all My servants the prophets, daily rising early and sending them. Yet they did not listen to Me or incline their ear, but stiffened their neck; they did more evil than their fathers. (Jeremiah 7:22-26) {emphasis mine}

Today you rarely see someone bowing down to a golden idol, but that doesn’t mean that we are any better at obeying God’s commands or submitting to His will. We still try to make God in our own image so He is a convenience to us and how we want to live our lives. We still put other things ahead of God — family, work, entertainment, fame, etc. Most of us aren’t any more faithful to God than the Israelites were. Just like the Israelites, we put on the trappings of faith but don’t live according to faith and faithfulness.

And He said to them, “Rightly did Isaiah prophesy of you hypocrites, as it is written:

‘This people honors Me with their lips,\ But their heart is far away from Me.\ **But in vain do they worship Me,\ Teaching as doctrines the precepts of men.’\ Neglecting the commandment of God, you hold to the tradition of men.”

He was also saying to them, “You are experts at setting aside the commandment of God in order to keep your tradition. (Mark 7:6-9) {emphasis mine}

How many “churches” and “Christian” leaders teach people according to the culture instead of according to the Word of God? How many tell people what they want to hear and what makes them feel good instead of what they need to hear — the truth as spoken through the Bible? How many church attenders follow a “Christian” leader more than they follow their Creator, Savior, and God? How many church attenders can recite the words of their leaders better than the Holy Scriptures?

I solemnly charge you in the presence of God and of Christ Jesus, who is to judge the living and the dead, and by His appearing and His kingdom: preach the word; be ready in season and out of season; reprove, rebuke, exhort, with great patience and instruction. For the time will come when they will not endure sound doctrine; but wanting to have their ears tickled, they will accumulate for themselves teachers in accordance to their own desires, and will turn away their ears from the truth and will turn aside to myths. But you, be sober in all things, endure hardship, do the work of an evangelist, fulfill your ministry. (2 Timothy 4:1-5) {emphasis mine}

How can we know if a church leader is rightly preaching God’s word? We can only know if we have read the Bible and studied it. We should be like the Bereans:

Now these were more noble-minded than those in Thessalonica, for they received the word with great eagerness, examining the Scriptures daily to see whether these things were so. (Acts 17:11)

Honestly, I don’t trust any spiritual leader who doesn’t encourage me to search the Scriptures to see whether their words are true. Any leader who puts their own word above the Scriptures is a false teacher. Sadly there are many, maybe more than faithful teachers. Some false teachers are intentionally so, but many have been misled by other false teachers. Their guilt is less, but they don’t do any less harm than those who intentionally mislead.

We need to seek trustworthy teachers who speak according to the Word of God, who quote the Bible to support their opinions, and who seek the good of their followers rather than the submission of their followers.

Do not harden your hearts, as at Meribah,\ As in the day of Massah in the wilderness,

“When your fathers tested Me,\ They tried Me, though they had seen My work.\ For forty years I loathed that generation,\ And said they are a people who err in their heart,\ And they do not know My ways.\ Therefore I swore in My anger,\ Truly they shall not enter into My rest.” (Psalm 95:8-11) {emphasis mine} *Teach me good discernment and knowledge,\ For I believe in Your commandments*.\ Before I was afflicted I went astray,\ But now I keep Your word.\ You are good and do good;\ Teach me Your statutes.\ The arrogant have forged a lie against me;\ *With all my heart I will observe Your precepts*.\ Their heart is covered with fat,\ But I delight in Your law.\ It is good for me that I was afflicted,\ That I may learn Your statutes.\ The law of Your mouth is better to me\ Than thousands of gold and silver pieces. (Psalm 119:66-72) {emphasis mine}

May our Creator God teach us the truth. May He fill our hearts with the desire to be in His word daily and to seek His will. May He do what is necessary to get our attention and turn our hearts and minds fully to Him, so we can learn His statutes and serve Him faithfully, so one day we are blessed to hear, “Well done! Good and faithful servant.”

Trust Jesus.

FYI, I see lack of knowledge of truth and God’s word as one of the biggest problems in the church today; however, it is possible to know the Bible in depth, but not know God. As important as knowledge of Scriptures is, this knowledge (without faith, submission, obedience, and love) is meaningless. Knowledge doesn’t get us to heaven. Even obedience doesn’t get us to heaven. Only faith and submission to our creator God leads to salvation and heaven. That being said, we can’t faithfully serve our God without knowledge of Him and His commands. Out of gratefulness for who He is and what He has done for us, we should seek to know and please Him.

-

@ 6d5c826a:4b27b659

2025-05-23 21:49:12

@ 6d5c826a:4b27b659

2025-05-23 21:49:12- Remmina - Feature-rich remote desktop application for linux and other unixes. (Source Code)

GPL-2.0C - Tiger VNC - High-performance, multi-platform VNC client and server. (Source Code)

GPL-2.0C++ - X2go - X2Go is an open source remote desktop software for Linux that uses the NoMachine/NX technology protocol. (Source Code)

GPL-2.0Perl

- Remmina - Feature-rich remote desktop application for linux and other unixes. (Source Code)

-

@ 6d5c826a:4b27b659

2025-05-23 21:48:56

@ 6d5c826a:4b27b659

2025-05-23 21:48:56- ActiveMQ - Java message broker. (Source Code)

Apache-2.0Java - BeanstalkD - A simple, fast work queue. (Source Code)

MITC - Gearman - Fast multi-language queuing/job processing platform. (Source Code)

BSD-3-ClauseC++ - NSQ - A realtime distributed messaging platform. (Source Code)

MPL-2.0Go - ZeroMQ - Lightweight queuing system. (Source Code)

GPL-3.0C++

- ActiveMQ - Java message broker. (Source Code)

-

@ fa984bd7:58018f52

2025-05-21 09:51:34

@ fa984bd7:58018f52

2025-05-21 09:51:34This post has been deleted.

-

@ 3f770d65:7a745b24

2025-05-20 21:14:28

@ 3f770d65:7a745b24

2025-05-20 21:14:28I’m Derek Ross, and I’m all-in on Nostr.

I started the Grow Nostr Initiative to help more people discover what makes Nostr so powerful: ✅ You own your identity ✅ You choose your social graph and algorithms ✅ You aren't locked into any single app or platform ✅ You can post, stream, chat, and build, all without gatekeepers

What we’re doing with Grow Nostr Initiative: 🌱 Hosting local meetups and mini-conferences to onboard people face-to-face 📚 Creating educational materials and guides to demystify how Nostr works 🧩 Helping businesses and creators understand how they can plug into Nostr (running media servers, relays, and using key management tools)

I believe Nostr is the foundation of a more open internet. It’s still early, but we’re already seeing incredible apps for social, blogging, podcasting, livestreaming, and more. And the best part is that they're all interoperable, censorship-resistant, and built on open standards. Nostr is the world's largest bitcoin economy by transaction volume and I truly believe that the purple pill helps the orange pill go down. Meaning, growing Nostr will also grow Bitcoin adoption.

If you’ve been curious about Nostr or are building something on it, or let’s talk. Whether you're just getting started or you're already deep in the ecosystem, I'm here to answer questions, share what I’ve learned, and hear your ideas. Check out https://nostrapps.com to find your next social decentralized experience.

Ask Me Anything about GNI, Nostr, Bitcoin, the upcoming #NosVegas event at the Bitcoin Conference next week, etc.!

– Derek Ross 🌐 https://grownostr.org npub18ams6ewn5aj2n3wt2qawzglx9mr4nzksxhvrdc4gzrecw7n5tvjqctp424

https://stacker.news/items/984689

-

@ c9badfea:610f861a

2025-05-20 19:49:20

@ c9badfea:610f861a

2025-05-20 19:49:20- Install Sky Map (it's free and open source)

- Launch the app and tap Accept, then tap OK

- When asked to access the device's location, tap While Using The App

- Tap somewhere on the screen to activate the menu, then tap ⁝ and select Settings

- Disable Send Usage Statistics

- Return to the main screen and enjoy stargazing!

ℹ️ Use the 🔍 icon in the upper toolbar to search for a specific celestial body, or tap the 👁️ icon to activate night mode

-

@ 6d5c826a:4b27b659

2025-05-23 21:48:36

@ 6d5c826a:4b27b659

2025-05-23 21:48:36- aptly - Swiss army knife for Debian repository management. (Source Code)

MITGo - fpm - Versatile multi format package creator. (Source Code)

MITRuby - omnibus-ruby - Easily create full-stack installers for your project across a variety of platforms.

Apache-2.0Ruby - tito - Builds RPMs for git-based projects.

GPL-2.0Python

- aptly - Swiss army knife for Debian repository management. (Source Code)

-

@ 04c915da:3dfbecc9

2025-05-20 15:53:48

@ 04c915da:3dfbecc9

2025-05-20 15:53:48This piece is the first in a series that will focus on things I think are a priority if your focus is similar to mine: building a strong family and safeguarding their future.

Choosing the ideal place to raise a family is one of the most significant decisions you will ever make. For simplicity sake I will break down my thought process into key factors: strong property rights, the ability to grow your own food, access to fresh water, the freedom to own and train with guns, and a dependable community.

A Jurisdiction with Strong Property Rights

Strong property rights are essential and allow you to build on a solid foundation that is less likely to break underneath you. Regions with a history of limited government and clear legal protections for landowners are ideal. Personally I think the US is the single best option globally, but within the US there is a wide difference between which state you choose. Choose carefully and thoughtfully, think long term. Obviously if you are not American this is not a realistic option for you, there are other solid options available especially if your family has mobility. I understand many do not have this capability to easily move, consider that your first priority, making movement and jurisdiction choice possible in the first place.

Abundant Access to Fresh Water

Water is life. I cannot overstate the importance of living somewhere with reliable, clean, and abundant freshwater. Some regions face water scarcity or heavy regulations on usage, so prioritizing a place where water is plentiful and your rights to it are protected is critical. Ideally you should have well access so you are not tied to municipal water supplies. In times of crisis or chaos well water cannot be easily shutoff or disrupted. If you live in an area that is drought prone, you are one drought away from societal chaos. Not enough people appreciate this simple fact.

Grow Your Own Food

A location with fertile soil, a favorable climate, and enough space for a small homestead or at the very least a garden is key. In stable times, a small homestead provides good food and important education for your family. In times of chaos your family being able to grow and raise healthy food provides a level of self sufficiency that many others will lack. Look for areas with minimal restrictions, good weather, and a culture that supports local farming.

Guns

The ability to defend your family is fundamental. A location where you can legally and easily own guns is a must. Look for places with a strong gun culture and a political history of protecting those rights. Owning one or two guns is not enough and without proper training they will be a liability rather than a benefit. Get comfortable and proficient. Never stop improving your skills. If the time comes that you must use a gun to defend your family, the skills must be instinct. Practice. Practice. Practice.

A Strong Community You Can Depend On

No one thrives alone. A ride or die community that rallies together in tough times is invaluable. Seek out a place where people know their neighbors, share similar values, and are quick to lend a hand. Lead by example and become a good neighbor, people will naturally respond in kind. Small towns are ideal, if possible, but living outside of a major city can be a solid balance in terms of work opportunities and family security.

Let me know if you found this helpful. My plan is to break down how I think about these five key subjects in future posts.

-

@ 6d5c826a:4b27b659

2025-05-23 21:48:21

@ 6d5c826a:4b27b659

2025-05-23 21:48:21- CapRover - Build your own PaaS in a few minutes. (Demo, Source Code)

Apache-2.0Docker/Nodejs - Coolify - An open-source & self-hostable Heroku / Netlify alternative (and even more). (Source Code)

Apache-2.0Docker - Dokku - An open-source PaaS (alternative to Heroku). (Source Code)

MITDocker/Shell/Go/deb - fx - A tool to help you do Function as a Service with painless on your own servers.

MITGo - Kubero - A self-hosted Heroku PaaS alternative for Kubernetes that implements GitOps. (Demo, Source Code)

GPL-3.0K8S/Nodejs/Go - LocalStack - LocalStack is a fully functional local AWS cloud stack. This includes Lambda for serverless computation. (Source Code)

Apache-2.0Python/Docker/K8S - Nhost - Firebase Alternative with GraphQL. Get a database and backend configured and ready in minutes. (Source Code)

MITDocker/Nodejs/Go - OpenFaaS - Serverless Functions Made Simple for Docker & Kubernetes. (Source Code)

MITGo - Tau - Easily build Cloud Computing Platforms with features like Serverless WebAssembly Functions, Frontend Hosting, CI/CD, Object Storage, K/V Database, and Pub-Sub Messaging. (Source Code)

BSD-3-ClauseGo/Rust/Docker - Trusted-CGI - Lightweight self-hosted lambda/applications/cgi/serverless-functions platform.

MITGo/deb/Docker

- CapRover - Build your own PaaS in a few minutes. (Demo, Source Code)

-

@ 6d5c826a:4b27b659

2025-05-23 21:48:04

@ 6d5c826a:4b27b659

2025-05-23 21:48:04- GNS3 - Graphical network simulator that provides a variety of virtual appliances. (Source Code)

GPL-3.0Python - OpenWISP - Open Source Network Management System for OpenWRT based routers and access points. (Demo, Source Code)

GPL-3.0Python - Oxidized - Network device configuration backup tool.

Apache-2.0Ruby - phpIPAM - Open source IP address management with PowerDNS integration. (Source Code)

GPL-3.0PHP - RANCID - Monitor network devices configuration and maintain history of changes. (Source Code)

BSD-3-ClausePerl/Shell - rConfig - Network device configuration management tool. (Source Code)

GPL-3.0PHP

- GNS3 - Graphical network simulator that provides a variety of virtual appliances. (Source Code)

-

@ 04c915da:3dfbecc9

2025-05-20 15:50:48

@ 04c915da:3dfbecc9

2025-05-20 15:50:48For years American bitcoin miners have argued for more efficient and free energy markets. It benefits everyone if our energy infrastructure is as efficient and robust as possible. Unfortunately, broken incentives have led to increased regulation throughout the sector, incentivizing less efficient energy sources such as solar and wind at the detriment of more efficient alternatives.

The result has been less reliable energy infrastructure for all Americans and increased energy costs across the board. This naturally has a direct impact on bitcoin miners: increased energy costs make them less competitive globally.

Bitcoin mining represents a global energy market that does not require permission to participate. Anyone can plug a mining computer into power and internet to get paid the current dynamic market price for their work in bitcoin. Using cellphone or satellite internet, these mines can be located anywhere in the world, sourcing the cheapest power available.

Absent of regulation, bitcoin mining naturally incentivizes the build out of highly efficient and robust energy infrastructure. Unfortunately that world does not exist and burdensome regulations remain the biggest threat for US based mining businesses. Jurisdictional arbitrage gives miners the option of moving to a friendlier country but that naturally comes with its own costs.

Enter AI. With the rapid development and release of AI tools comes the requirement of running massive datacenters for their models. Major tech companies are scrambling to secure machines, rack space, and cheap energy to run full suites of AI enabled tools and services. The most valuable and powerful tech companies in America have stumbled into an accidental alliance with bitcoin miners: THE NEED FOR CHEAP AND RELIABLE ENERGY.

Our government is corrupt. Money talks. These companies will push for energy freedom and it will greatly benefit us all.

-

@ 21335073:a244b1ad

2025-05-21 16:58:36

@ 21335073:a244b1ad

2025-05-21 16:58:36The other day, I had the privilege of sitting down with one of my favorite living artists. Our conversation was so captivating that I felt compelled to share it. I’m leaving his name out for privacy.

Since our last meeting, I’d watched a documentary about his life, one he’d helped create. I told him how much I admired his openness in it. There’s something strange about knowing intimate details of someone’s life when they know so little about yours—it’s almost like I knew him too well for the kind of relationship we have.

He paused, then said quietly, with a shy grin, that watching the documentary made him realize how “odd and eccentric” he is. I laughed and told him he’s probably the sanest person I know. Because he’s lived fully, chasing love, passion, and purpose with hardly any regrets. He’s truly lived.

Today, I turn 44, and I’ll admit I’m a bit eccentric myself. I think I came into the world this way. I’ve made mistakes along the way, but I carry few regrets. Every misstep taught me something. And as I age, I’m not interested in blending in with the world—I’ll probably just lean further into my own brand of “weird.” I want to live life to the brim. The older I get, the more I see that the “normal” folks often seem less grounded than the eccentric artists who dare to live boldly. Life’s too short to just exist, actually live.

I’m not saying to be strange just for the sake of it. But I’ve seen what the crowd celebrates, and I’m not impressed. Forge your own path, even if it feels lonely or unpopular at times.

It’s easy to scroll through the news and feel discouraged. But actually, this is one of the most incredible times to be alive! I wake up every day grateful to be here, now. The future is bursting with possibility—I can feel it.

So, to my fellow weirdos on nostr: stay bold. Keep dreaming, keep pushing, no matter what’s trending. Stay wild enough to believe in a free internet for all. Freedom is radical—hold it tight. Live with the soul of an artist and the grit of a fighter. Thanks for inspiring me and so many others to keep hoping. Thank you all for making the last year of my life so special.

-

@ 04c915da:3dfbecc9

2025-05-20 15:50:22

@ 04c915da:3dfbecc9

2025-05-20 15:50:22There is something quietly rebellious about stacking sats. In a world obsessed with instant gratification, choosing to patiently accumulate Bitcoin, one sat at a time, feels like a middle finger to the hype machine. But to do it right, you have got to stay humble. Stack too hard with your head in the clouds, and you will trip over your own ego before the next halving even hits.

Small Wins

Stacking sats is not glamorous. Discipline. Stacking every day, week, or month, no matter the price, and letting time do the heavy lifting. Humility lives in that consistency. You are not trying to outsmart the market or prove you are the next "crypto" prophet. Just a regular person, betting on a system you believe in, one humble stack at a time. Folks get rekt chasing the highs. They ape into some shitcoin pump, shout about it online, then go silent when they inevitably get rekt. The ones who last? They stack. Just keep showing up. Consistency. Humility in action. Know the game is long, and you are not bigger than it.

Ego is Volatile

Bitcoin’s swings can mess with your head. One day you are up 20%, feeling like a genius and the next down 30%, questioning everything. Ego will have you panic selling at the bottom or over leveraging the top. Staying humble means patience, a true bitcoin zen. Do not try to "beat” Bitcoin. Ride it. Stack what you can afford, live your life, and let compounding work its magic.

Simplicity

There is a beauty in how stacking sats forces you to rethink value. A sat is worth less than a penny today, but every time you grab a few thousand, you plant a seed. It is not about flaunting wealth but rather building it, quietly, without fanfare. That mindset spills over. Cut out the noise: the overpriced coffee, fancy watches, the status games that drain your wallet. Humility is good for your soul and your stack. I have a buddy who has been stacking since 2015. Never talks about it unless you ask. Lives in a decent place, drives an old truck, and just keeps stacking. He is not chasing clout, he is chasing freedom. That is the vibe: less ego, more sats, all grounded in life.

The Big Picture

Stack those sats. Do it quietly, do it consistently, and do not let the green days puff you up or the red days break you down. Humility is the secret sauce, it keeps you grounded while the world spins wild. In a decade, when you look back and smile, it will not be because you shouted the loudest. It will be because you stayed the course, one sat at a time. \ \ Stay Humble and Stack Sats. 🫡

-

@ 6d5c826a:4b27b659

2025-05-23 21:47:44

@ 6d5c826a:4b27b659

2025-05-23 21:47:44- Adagios - Web based Nagios interface for configuration and monitoring (replacement to the standard interface), and a REST interface. (Source Code)

AGPL-3.0Docker/Python - Alerta - Distributed, scalable and flexible monitoring system. (Source Code)

Apache-2.0Python - Beszel - Lightweight server monitoring platform that includes Docker statistics, historical data, and alert functions. (Source Code)

MITGo - Cacti - Web-based network monitoring and graphing tool. (Source Code)

GPL-2.0PHP - cadvisor - Analyzes resource usage and performance characteristics of running containers.

Apache-2.0Go - checkmk - Comprehensive solution for monitoring of applications, servers, and networks. (Source Code)

GPL-2.0Python/PHP - dashdot - A simple, modern server dashboard for smaller private servers. (Demo)

MITNodejs/Docker - EdMon - A command-line monitoring application helping you to check that your hosts and services are available, with notifications support.

MITJava - eZ Server Monitor - A lightweight and simple dashboard monitor for Linux, available in Web and Bash application. (Source Code)

GPL-3.0PHP/Shell - glances - Open-source, cross-platform real-time monitoring tool with CLI and web dashboard interfaces and many exporting options. (Source Code)

GPL-3.0Python - Healthchecks - Monitoring for cron jobs, background services and scheduled tasks. (Source Code)

BSD-3-ClausePython - Icinga - Nagios fork that has since lapped nagios several times. Comes with the possibility of clustered monitoring. (Source Code)

GPL-2.0C++ - LibreNMS - Fully featured network monitoring system that provides a wealth of features and device support. (Source Code)

GPL-3.0PHP - Linux Dash - A low-overhead monitoring web dashboard for a GNU/Linux machine.

MITNodejs/Go/Python/PHP - Monit - Small utility for managing and monitoring Unix systems. (Source Code)

AGPL-3.0C - Munin - Networked resource monitoring tool. (Source Code)

GPL-2.0Perl/Shell - Naemon - Network monitoring tool based on the Nagios 4 core with performance enhancements and new features. (Source Code)

GPL-2.0C - Nagios - Computer system, network and infrastructure monitoring software application. (Source Code)

GPL-2.0C - Netdata - Distributed, real-time, performance and health monitoring for systems and applications. Runs on Linux, FreeBSD, and MacOS. (Source Code)

GPL-3.0C - NetXMS - Open Source network and infrastructure monitoring and management. (Source Code)

LGPL-3.0/GPL-3.0Java/C++/C - Observium Community Edition - Network monitoring and management platform that provides real-time insight into network health and performance.

QPL-1.0PHP - openITCOCKPIT Community Edition - Monitoring Suite featuring seamless integrations with Naemon, Checkmk, Grafana and more. (Demo, Source Code)

GPL-3.0deb/Docker - Performance Co-Pilot - Lightweight, distributed system performance and analysis framework. (Source Code)

LGPL-2.1/GPL-2.0C - PHP Server Monitor - Open source tool to monitor your servers and websites. (Source Code)

GPL-3.0PHP - PhpSysInfo - A customizable PHP script that displays information about your system nicely. (Source Code)

GPL-2.0PHP - Prometheus - Service monitoring system and time series database. (Source Code)

Apache-2.0Go - Riemann - Flexible and fast events processor allowing complex events/metrics analysis. (Source Code)

EPL-1.0Java - rtop - Interactive, remote system monitoring tool based on SSH.

MITGo - ruptime - Classic system status server.

AGPL-3.0Shell - Scrutiny - Web UI for hard drive S.M.A.R.T monitoring, historical trends & real-world failure thresholds.

MITGo - Sensu - Monitoring tool for ephemeral infrastructure and distributed applications. (Source Code)

MITGo - Status - Simple and lightweight system monitoring tool for small homeservers with a pleasant web interface. (Demo

MITPython - Thruk - Multibackend monitoring web interface with support for Naemon, Nagios, Icinga and Shinken. (Source Code)

GPL-1.0Perl - Wazuh - Unified XDR and SIEM protection for endpoints and cloud workloads. (Source Code)

GPL-2.0C - Zabbix - Enterprise-class software for monitoring of networks and applications. (Source Code)

GPL-2.0C

- Adagios - Web based Nagios interface for configuration and monitoring (replacement to the standard interface), and a REST interface. (Source Code)

-

@ 04c915da:3dfbecc9

2025-05-20 15:47:16

@ 04c915da:3dfbecc9

2025-05-20 15:47:16Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-

2030–2031\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

-

2032\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

Part Two: 2047

-

2047 (Early Year)\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

-

2047 (Mid-Year)\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

-

2047 (Late Year)\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

Key Differences

- Currency Dynamics: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- Government Power: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- Societal Outcome: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

-

@ 6d5c826a:4b27b659

2025-05-23 21:47:22

@ 6d5c826a:4b27b659

2025-05-23 21:47:22- Chocolatey - The package manager for Windows. (Source Code)

Apache-2.0C#/PowerShell - Clonezilla - Partition and disk imaging/cloning program. (Source Code)

GPL-2.0Perl/Shell/Other - DadaMail - Mailing List Manager, written in Perl. (Source Code)

GPL-2.0Perl - Fog - Cloning/imaging solution/rescue suite. (Source Code)

GPL-3.0PHP/Shell - phpList - Newsletter and email marketing software. (Source Code)

AGPL-3.0PHP

- Chocolatey - The package manager for Windows. (Source Code)

-

@ 6d5c826a:4b27b659

2025-05-23 21:47:03

@ 6d5c826a:4b27b659

2025-05-23 21:47:03- Beats - Single-purpose data shippers that send data from hundreds or thousands of machines and systems to Logstash or Elasticsearch. (Source Code)

Apache-2.0Go - Collectd - System statistics collection daemon. (Source Code)

MITC - Diamond - Daemon that collects system metrics and publishes them to Graphite (and others).

MITPython - Grafana - A Graphite & InfluxDB Dashboard and Graph Editor. (Source Code)

AGPL-3.0Go - Graphite - Scalable graphing server. (Source Code)

Apache-2.0Python - RRDtool - Industry standard, high performance data logging and graphing system for time series data. (Source Code)

GPL-2.0C - Statsd - Daemon that listens for statistics like counters and timers, sent over UDP or TCP, and sends aggregates to one or more pluggable backend services.

MITNodejs - tcollector - Gathers data from local collectors and pushes the data to OpenTSDB. (Source Code)

LGPL-3.0/GPL-3.0Python - Telegraf - Plugin-driven server agent for collecting, processing, aggregating, and writing metrics.

MITGo

- Beats - Single-purpose data shippers that send data from hundreds or thousands of machines and systems to Logstash or Elasticsearch. (Source Code)

-

@ 3f770d65:7a745b24

2025-05-19 18:09:52

@ 3f770d65:7a745b24

2025-05-19 18:09:52🏌️ Monday, May 26 – Bitcoin Golf Championship & Kickoff Party

Location: Las Vegas, Nevada\ Event: 2nd Annual Bitcoin Golf Championship & Kick Off Party"\ Where: Bali Hai Golf Clubhouse, 5160 S Las Vegas Blvd, Las Vegas, NV 89119\ 🎟️ Get Tickets!

Details:

-

The week tees off in style with the Bitcoin Golf Championship. Swing clubs by day and swing to music by night.

-

Live performances from Nostr-powered acts courtesy of Tunestr, including Ainsley Costello and others.

-

Stop by the Purple Pill Booth hosted by Derek and Tanja, who will be on-boarding golfers and attendees to the decentralized social future with Nostr.

💬 May 27–29 – Bitcoin 2025 Conference at the Las Vegas Convention Center

Location: The Venetian Resort\ Main Attraction for Nostr Fans: The Nostr Lounge\ When: All day, Tuesday through Thursday\ Where: Right outside the Open Source Stage\ 🎟️ Get Tickets!

Come chill at the Nostr Lounge, your home base for all things decentralized social. With seating for \~50, comfy couches, high-tops, and good vibes, it’s the perfect space to meet developers, community leaders, and curious newcomers building the future of censorship-resistant communication.

Bonus: Right across the aisle, you’ll find Shopstr, a decentralized marketplace app built on Nostr. Stop by their booth to explore how peer-to-peer commerce works in a truly open ecosystem.

Daily Highlights at the Lounge:

-

☕️ Hang out casually or sit down for a deeper conversation about the Nostr protocol

-

🔧 1:1 demos from app teams

-

🛍️ Merch available onsite

-

🧠 Impromptu lightning talks

-

🎤 Scheduled Meetups (details below)

🎯 Nostr Lounge Meetups

Wednesday, May 28 @ 1:00 PM

- Damus Meetup: Come meet the team behind Damus, the OG Nostr app for iOS that helped kickstart the social revolution. They'll also be showcasing their new cross-platform app, Notedeck, designed for a more unified Nostr experience across devices. Grab some merch, get a demo, and connect directly with the developers.

Thursday, May 29 @ 1:00 PM

- Primal Meetup: Dive into Primal, the slickest Nostr experience available on web, Android, and iOS. With a built-in wallet, zapping your favorite creators and friends has never been easier. The team will be on-site for hands-on demos, Q\&A, merch giveaways, and deeper discussions on building the social layer of Bitcoin.

🎙️ Nostr Talks at Bitcoin 2025

If you want to hear from the minds building decentralized social, make sure you attend these two official conference sessions:

1. FROSTR Workshop: Multisig Nostr Signing

-

🕚 Time: 11:30 AM – 12:00 PM

-

📅 Date: Wednesday, May 28

-

📍 Location: Developer Zone

-

🎤 Speaker: nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgdwaehxw309ahx7uewd3hkcqpqs9etjgzjglwlaxdhsveq0qksxyh6xpdpn8ajh69ruetrug957r3qf4ggfm (Austin Kelsay) @ Voltage\ A deep-dive into FROST-based multisig key management for Nostr. Geared toward devs and power users interested in key security.

2. Panel: Decentralizing Social Media

-

🕑 Time: 2:00 PM – 2:30 PM

-

📅 Date: Thursday, May 29

-

📍 Location: Genesis Stage

-

🎙️ Moderator: nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqy08wumn8ghj7mn0wd68yttjv4kxz7fwv3jhyettwfhhxuewd4jsqgxnqajr23msx5malhhcz8paa2t0r70gfjpyncsqx56ztyj2nyyvlq00heps - Bitcoin Strategy @ Roxom TV

-

👥 Speakers:

-

nostr:nprofile1qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcppemhxue69uhkummn9ekx7mp0qqsy2ga7trfetvd3j65m3jptqw9k39wtq2mg85xz2w542p5dhg06e5qmhlpep – Early Bitcoin dev, CEO @ Sirius Business Ltd

-

nostr:nprofile1qy2hwumn8ghj7mn0wd68ytndv9kxjm3wdahxcqg5waehxw309ahx7um5wfekzarkvyhxuet5qqsw4v882mfjhq9u63j08kzyhqzqxqc8tgf740p4nxnk9jdv02u37ncdhu7e3 – Analyst & Partner @ Ego Death Capital

Get the big-picture perspective on why decentralized social matters and how Nostr fits into the future of digital communication.

🌃 NOS VEGAS Meetup & Afterparty

Date: Wednesday, May 28\ Time: 7:00 PM – 1:00 AM\ Location: We All Scream Nightclub, 517 Fremont St., Las Vegas, NV 89101\ 🎟️ Get Tickets!

What to Expect:

-

🎶 Live Music Stage – Featuring Ainsley Costello, Sara Jade, Able James, Martin Groom, Bobby Shell, Jessie Lark, and other V4V artists

-

🪩 DJ Party Deck – With sets by nostr:nprofile1qy0hwumn8ghj7cmgdae82uewd45kketyd9kxwetj9e3k7mf6xs6rgqgcwaehxw309ahx7um5wgh85mm694ek2unk9ehhyecqyq7hpmq75krx2zsywntgtpz5yzwjyg2c7sreardcqmcp0m67xrnkwylzzk4 , nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgkwaehxw309anx2etywvhxummnw3ezucnpdejqqg967faye3x6fxgnul77ej23l5aew8yj0x2e4a3tq2mkrgzrcvecfsk8xlu3 , and more DJs throwing down

-

🛰️ Live-streamed via Tunestr

-

🧠 Nostr Education – Talks by nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq37amnwvaz7tmwdaehgu3dwfjkccte9ejx2un9ddex7umn9ekk2tcqyqlhwrt96wnkf2w9edgr4cfruchvwkv26q6asdhz4qg08pm6w3djg3c8m4j , nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqg7waehxw309anx2etywvhxummnw3ezucnpdejz7ur0wp6kcctjqqspywh6ulgc0w3k6mwum97m7jkvtxh0lcjr77p9jtlc7f0d27wlxpslwvhau , nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq3vamnwvaz7tmwdaehgu3wd33xgetk9en82m30qqsgqke57uygxl0m8elstq26c4mq2erz3dvdtgxwswwvhdh0xcs04sc4u9p7d , nostr:nprofile1q9z8wumn8ghj7erzx3jkvmmzw4eny6tvw368wdt8da4kxamrdvek76mrwg6rwdngw94k67t3v36k77tev3kx7vn2xa5kjem9dp4hjepwd3hkxctvqyg8wumn8ghj7mn0wd68ytnhd9hx2qpqyaul8k059377u9lsu67de7y637w4jtgeuwcmh5n7788l6xnlnrgssuy4zk , nostr:nprofile1qy28wue69uhnzvpwxqhrqt33xgmn5dfsx5cqz9thwden5te0v4jx2m3wdehhxarj9ekxzmnyqqswavgevxe9gs43vwylumr7h656mu9vxmw4j6qkafc3nefphzpph8ssvcgf8 , and more.

-

🧾 Vendors & Project Booths – Explore new tools and services

-

🔐 Onboarding Stations – Learn how to use Nostr hands-on

-

🐦 Nostrich Flocking – Meet your favorite nyms IRL

-

🍸 Three Full Bars – Two floors of socializing overlooking vibrant Fremont Street

| | | | | ----------- | -------------------- | ------------------- | | Time | Name | Topic | | 7:30-7:50 | Derek | Nostr for Beginners | | 8:00-8:20 | Mark & Paul | Primal | | 8:30-8:50 | Terry | Damus | | 9:00-9:20 | OpenMike and Ainsley | V4V | | 09:30-09:50 | The Space | Space |

This is the after-party of the year for those who love freedom technology and decentralized social community. Don’t miss it.

Final Thoughts

Whether you're there to learn, network, party, or build, Bitcoin 2025 in Las Vegas has a packed week of Nostr-friendly programming. Be sure to catch all the events, visit the Nostr Lounge, and experience the growing decentralized social revolution.

🟣 Find us. Flock with us. Purple pill someone.

-

-

@ 6d5c826a:4b27b659

2025-05-23 21:46:46

@ 6d5c826a:4b27b659

2025-05-23 21:46:46- aerc - Terminal MUA with a focus on plaintext and features for developers. (Source Code)

MITGo - Claws Mail - Old school email client (and news reader), based on GTK+. (Source Code)

GPL-3.0C - ImapSync - Simple IMAP migration tool for copying mailboxes to other servers. (Source Code)

NLPLPerl - Mutt - Small but very powerful text-based mail client. (Source Code)

GPL-2.0C - Sylpheed - Still developed predecessor to Claws Mail, lightweight mail client. (Source Code)

GPL-2.0C - Thunderbird - Free email application that's easy to set up and customize. (Source Code)

MPL-2.0C/C++

- aerc - Terminal MUA with a focus on plaintext and features for developers. (Source Code)

-

@ 7460b7fd:4fc4e74b

2025-05-21 02:35:36

@ 7460b7fd:4fc4e74b

2025-05-21 02:35:36如果比特币发明了真正的钱,那么 Crypto 是什么?

引言

比特币诞生之初就以“数字黄金”姿态示人,被支持者誉为人类历史上第一次发明了真正意义上的钱——一种不依赖国家信用、总量恒定且不可篡改的硬通货。然而十多年过去,比特币之后蓬勃而起的加密世界(Crypto)已经远超“货币”范畴:从智能合约平台到去中心组织,从去央行的稳定币到戏谑荒诞的迷因币,Crypto 演化出一个丰富而混沌的新生态。这不禁引发一个根本性的追问:如果说比特币解决了“真金白银”的问题,那么 Crypto 又完成了什么发明?

Crypto 与政治的碰撞:随着Crypto版图扩张,全球政治势力也被裹挟进这场金融变革洪流(示意图)。比特币的出现重塑了货币信用,但Crypto所引发的却是一场更深刻的政治与治理结构实验。从华尔街到华盛顿,从散户论坛到主权国家,越来越多人意识到:Crypto不只是技术或金融现象,而是一种全新的政治表达结构正在萌芽。正如有激进论者所断言的:“比特币发明了真正的钱,而Crypto则在发明新的政治。”价格K线与流动性曲线,或许正成为这个时代社群意志和社会价值观的新型投射。

Crypto 与政治的碰撞:随着Crypto版图扩张,全球政治势力也被裹挟进这场金融变革洪流(示意图)。比特币的出现重塑了货币信用,但Crypto所引发的却是一场更深刻的政治与治理结构实验。从华尔街到华盛顿,从散户论坛到主权国家,越来越多人意识到:Crypto不只是技术或金融现象,而是一种全新的政治表达结构正在萌芽。正如有激进论者所断言的:“比特币发明了真正的钱,而Crypto则在发明新的政治。”价格K线与流动性曲线,或许正成为这个时代社群意志和社会价值观的新型投射。冲突结构:当价格挑战选票

传统政治中,选票是人民意志的载体,一人一票勾勒出民主治理的正统路径。而在链上的加密世界里,骤升骤降的价格曲线和真金白银的买卖行为却扮演起了选票的角色:资金流向成了民意走向,市场多空成为立场表决。价格行为取代选票,这听来匪夷所思,却已在Crypto社群中成为日常现实。每一次代币的抛售与追高,都是社区对项目决策的即时“投票”;每一根K线的涨跌,都折射出社区意志的赞同或抗议。市场行为本身承担了决策权与象征权——价格即政治,正在链上蔓延。

这一新生政治形式与旧世界的民主机制形成了鲜明冲突。bitcoin.org中本聪在比特币白皮书中提出“一CPU一票”的工作量证明共识,用算力投票取代了人为决策bitcoin.org。而今,Crypto更进一步,用资本市场的涨跌来取代传统政治的选举。支持某项目?直接购入其代币推高市值;反对某提案?用脚投票抛售资产。相比漫长的选举周期和层层代议制,链上市场提供了近乎实时的“公投”机制。但这种机制也引发巨大争议:资本的投票天然偏向持币多者(富者)的意志,是否意味着加密政治更为金权而非民权?持币多寡成为影响力大小,仿佛选举演变成了“一币一票”,巨鲸富豪俨然掌握更多话语权。这种与民主平等原则的冲突,成为Crypto政治形式饱受质疑的核心张力之一。

尽管如此,我们已经目睹市场投票在Crypto世界塑造秩序的威力:2016年以太坊因DAO事件分叉时,社区以真金白银“投票”决定了哪条链获得未来。arkhamintelligence.com结果是新链以太坊(ETH)成为主流,其市值一度超过2,800亿美元,而坚持原则的以太经典(ETC)市值不足35亿美元,不及前者的八十分之一arkhamintelligence.com。市场选择清楚地昭示了社区的政治意志。同样地,在比特币扩容之争、各类硬分叉博弈中,无不是由投资者和矿工用资金与算力投票,胜者存续败者黯然。价格成为裁决纷争的最终选票,冲击着传统“选票决胜”的政治理念。Crypto的价格民主,与现代代议民主正面相撞,激起当代政治哲思中前所未有的冲突火花。

治理与分配

XRP对决SEC成为了加密世界“治理与分配”冲突的经典战例。2020年底,美国证券交易委员会(SEC)突然起诉Ripple公司,指控其发行的XRP代币属于未注册证券,消息一出直接引爆市场恐慌。XRP价格应声暴跌,一度跌去超过60%,最低触及0.21美元coindesk.com。曾经位居市值前三的XRP险些被打入谷底,监管的强硬姿态似乎要将这个项目彻底扼杀。

然而XRP社区没有选择沉默。 大批长期持有者组成了自称“XRP军团”(XRP Army)的草根力量,在社交媒体上高调声援Ripple,对抗监管威胁。面对SEC的指控,他们集体发声,质疑政府选择性执法,声称以太坊当年发行却“逍遥法外”,只有Ripple遭到不公对待coindesk.com。正如《福布斯》的评论所言:没人预料到愤怒的加密散户投资者会掀起法律、政治和社交媒体领域的‘海啸式’反击,痛斥监管机构背弃了保护投资者的承诺crypto-law.us。这种草根抵抗监管的话语体系迅速形成:XRP持有者不但在网上掀起舆论风暴,还采取实际行动向SEC施压。他们发起了请愿,抨击SEC背离保护投资者初衷、诉讼给个人投资者带来巨大伤害,号召停止对Ripple的上诉纠缠——号称这是在捍卫全球加密用户的共同利益bitget.com。一场由民间主导的反监管运动就此拉开帷幕。

Ripple公司则选择背水一战,拒绝和解,在法庭上与SEC针锋相对地鏖战了近三年之久。Ripple坚称XRP并非证券,不应受到SEC管辖,即使面临沉重法律费用和业务压力也不妥协。2023年,这场持久战迎来了标志性转折:美国法庭作出初步裁决,认定XRP在二级市场的流通不构成证券coindesk.com。这一胜利犹如给沉寂已久的XRP注入强心针——消息公布当天XRP价格飙涨近一倍,盘中一度逼近1美元大关coindesk.com。沉重监管阴影下苟延残喘的项目,凭借司法层面的突破瞬间重获生机。这不仅是Ripple的胜利,更被支持者视为整个加密行业对SEC强权的一次胜仗。

XRP的对抗路线与某些“主动合规”的项目形成了鲜明对比。 稳定币USDC的发行方Circle、美国最大合规交易所Coinbase等选择了一条迎合监管的道路:它们高调拥抱现行法规,希望以合作换取生存空间。然而现实却给了它们沉重一击。USDC稳定币在监管风波中一度失去美元锚定,哪怕Circle及时披露储备状况也无法阻止恐慌蔓延,大批用户迅速失去信心,短时间内出现数十亿美元的赎回潮blockworks.co。Coinbase则更为直接:即便它早已注册上市、反复向监管示好,2023年仍被SEC指控为未注册证券交易所reuters.com,卷入漫长诉讼漩涡。可见,在迎合监管的策略下,这些机构非但未能换来监管青睐,反而因官司缠身或用户流失而丧失市场信任。 相比之下,XRP以对抗求生存的路线反而赢得了投资者的眼光:价格的涨跌成为社区投票的方式,抗争的勇气反过来强化了市场对它的信心。

同样引人深思的是另一种迥异的治理路径:技术至上的链上治理。 以MakerDAO为代表的去中心化治理模式曾被寄予厚望——MKR持币者投票决策、算法维持稳定币Dai的价值,被视为“代码即法律”的典范。然而,这套纯技术治理在市场层面却未能形成广泛认同,亦无法激发群体性的情绪动员。复杂晦涩的机制使得普通投资者难以参与其中,MakerDAO的治理讨论更多停留在极客圈子内部,在社会大众的政治对话中几乎听不见它的声音。相比XRP对抗监管所激发的铺天盖地关注,MakerDAO的治理实验显得默默无闻、难以“出圈”。这也说明,如果一种治理实践无法连接更广泛的利益诉求和情感共鸣,它在社会政治层面就难以形成影响力。

XRP之争的政治象征意义由此凸显: 它展示了一条“以市场对抗国家”的斗争路线,即通过代币价格的集体行动来回应监管权力的施压。在这场轰动业界的对决中,价格即是抗议的旗帜,涨跌映射着政治立场。XRP对SEC的胜利被视作加密世界向旧有权力宣告的一次胜利:资本市场的投票器可以撼动监管者的强权。这种“价格即政治”的张力,正是Crypto世界前所未有的社会实验:去中心化社区以市场行为直接对抗国家权力,在无形的价格曲线中凝聚起政治抗争的力量,向世人昭示加密货币不仅有技术和资本属性,更蕴含着不可小觑的社会能量和政治意涵。

不可归零的政治资本

Meme 币的本质并非廉价或易造,而在于其构建了一种“无法归零”的社群生存结构。 对于传统观点而言,多数 meme 币只是短命的投机游戏:价格暴涨暴跌后一地鸡毛,创始人套现跑路,投资者血本无归,然后“大家转去炒下一个”theguardian.com。然而,meme 币社群的独特之处在于——失败并不意味着终结,而更像是运动的逗号而非句号。一次币值崩盘后,持币的草根们往往并未散去;相反,他们汲取教训,准备东山再起。这种近乎“不死鸟”的循环,使得 meme 币运动呈现出一种数字政治循环的特质:价格可以归零,但社群的政治热情和组织势能不归零。正如研究者所指出的,加密领域中的骗局、崩盘等冲击并不会摧毁生态,反而成为让系统更加强韧的“健康应激”,令整个行业在动荡中变得更加反脆弱cointelegraph.com。对应到 meme 币,每一次暴跌和重挫,都是社群自我进化、卷土重来的契机。这个去中心化群体打造出一种自组织的安全垫,失败者得以在瓦砾上重建家园。对于草根社群、少数派乃至体制的“失败者”而言,meme 币提供了一个永不落幕的抗争舞台,一种真正反脆弱的政治性。正因如此,我们看到诸多曾被嘲笑的迷因项目屡败屡战:例如 Dogecoin 自2013年问世后历经八年沉浮,早已超越玩笑属性,成为互联网史上最具韧性的迷因之一frontiersin.org;支撑 Dogecoin 的正是背后强大的迷因文化和社区意志,它如同美国霸权支撑美元一样,为狗狗币提供了“永不中断”的生命力frontiersin.org。

“复活权”的数字政治意涵

这种“失败-重生”的循环结构蕴含着深刻的政治意涵:在传统政治和商业领域,一个政党选举失利或一家公司破产往往意味着清零出局,资源散尽、组织瓦解。然而在 meme 币的世界,社群拥有了一种前所未有的“复活权”。当项目崩盘,社区并不必然随之消亡,而是可以凭借剩余的人心和热情卷土重来——哪怕换一个 token 名称,哪怕重启一条链,运动依然延续。正如 Cheems 项目的核心开发者所言,在几乎无人问津、技术受阻的困境下,大多数人可能早已卷款走人,但 “CHEEMS 社区没有放弃,背景、技术、风投都不重要,重要的是永不言弃的精神”cointelegraph.com。这种精神使得Cheems项目起死回生,社区成员齐声宣告“我们都是 CHEEMS”,共同书写历史cointelegraph.com。与传统依赖风投和公司输血的项目不同,Cheems 完全依靠社区的信念与韧性存续发展,体现了去中心化运动的真谛cointelegraph.com。这意味着政治参与的门槛被大大降低:哪怕没有金主和官方背书,草根也能凭借群体意志赋予某个代币新的生命。对于身处社会边缘的群体来说,meme 币俨然成为自组织的安全垫和重新集结的工具。难怪有学者指出,近期涌入meme币浪潮的主力,正是那些对现实失望但渴望改变命运的年轻人theguardian.com——“迷茫的年轻人,想要一夜暴富”theguardian.com。meme币的炒作表面上看是投机赌博,但背后蕴含的是草根对既有金融秩序的不满与反抗:没有监管和护栏又如何?一次失败算不得什么,社区自有后路和新方案。这种由底层群众不断试错、纠错并重启的过程,本身就是一种数字时代的新型反抗运动和群众动员机制。

举例而言,Terra Luna 的沉浮充分展现了这种“复活机制”的政治力量。作为一度由风投资本热捧的项目,Luna 币在2022年的崩溃本可被视作“归零”的失败典范——稳定币UST瞬间失锚,Luna币价归零,数十亿美元灰飞烟灭。然而“崩盘”并没有画下休止符。Luna的残余社区拒绝承认失败命运,通过链上治理投票毅然启动新链,“复活”了 Luna 代币,再次回到市场交易reuters.com。正如 Terra 官方在崩盘后发布的推文所宣称:“我们力量永在社区,今日的决定正彰显了我们的韧性”reuters.com。事实上,原链更名为 Luna Classic 后,大批所谓“LUNC 军团”的散户依然死守阵地,誓言不离不弃;他们自发烧毁巨量代币以缩减供应、推动技术升级,试图让这个一度归零的项目重新燃起生命之火binance.com。失败者并未散场,而是化作一股草根洪流,奋力托举起项目的残迹。经过迷因化的叙事重塑,这场从废墟中重建价值的壮举,成为加密世界中草根政治的经典一幕。类似的案例不胜枚举:曾经被视为笑话的 DOGE(狗狗币)正因多年社群的凝聚而跻身主流币种,总市值一度高达数百亿美元,充分证明了“民有民享”的迷因货币同样可以笑傲市场frontiersin.org。再看最新的美国政治舞台,连总统特朗普也推出了自己的 meme 币 $TRUMP,号召粉丝拿真金白银来表达支持。该币首日即从7美元暴涨至75美元,两天后虽回落到40美元左右,但几乎同时,第一夫人 Melania 又发布了自己的 $Melania 币,甚至连就职典礼的牧师都跟风发行了纪念币theguardian.com!显然,对于狂热的群众来说,一个币的沉浮并非终点,而更像是运动的换挡——资本市场成为政治参与的新前线,你方唱罢我登场,meme 币的群众动员热度丝毫不减。值得注意的是,2024年出现的 Pump.fun 等平台更是进一步降低了这一循环的技术门槛,任何人都可以一键生成自己的 meme 币theguardian.com。这意味着哪怕某个项目归零,剩余的社区完全可以借助此类工具迅速复制一个新币接力,延续集体行动的火种。可以说,在 meme 币的世界里,草根社群获得了前所未有的再生能力和主动权,这正是一种数字时代的群众政治奇观:失败可以被当作梗来玩,破产能够变成重生的序章。

价格即政治:群众投机的新抗争

meme 币现象的兴盛表明:在加密时代,价格本身已成为一种政治表达。这些看似荒诞的迷因代币,将金融市场变成了群众宣泄情绪和诉求的另一个舞台。有学者将此概括为“将公民参与直接转化为了投机资产”cdn-brighterworld.humanities.mcmaster.ca——也就是说,社会运动的热情被注入币价涨跌,政治支持被铸造成可以交易的代币。meme 币融合了金融、技术与政治,通过病毒般的迷因文化激发公众参与,形成对现实政治的某种映射cdn-brighterworld.humanities.mcmaster.caosl.com。当一群草根投入全部热忱去炒作一枚毫无基本面支撑的币时,这本身就是一种大众政治动员的体现:币价暴涨,意味着一群人以戏谑的方式在向既有权威叫板;币价崩盘,也并不意味着信念的消亡,反而可能孕育下一次更汹涌的造势。正如有分析指出,政治类 meme 币的出现前所未有地将群众文化与政治情绪融入市场行情,价格曲线俨然成为民意和趋势的风向标cdn-brighterworld.humanities.mcmaster.ca。在这种局面下,投机不再仅仅是逐利,还是一种宣示立场、凝聚共识的过程——一次次看似荒唐的炒作背后,是草根对传统体制的不服与嘲讽,是失败者拒绝认输的呐喊。归根结底,meme 币所累积的,正是一种不可被归零的政治资本。价格涨落之间,群众的愤怒、幽默与希望尽显其中;这股力量不因一次挫败而消散,反而在市场的循环中愈发壮大。也正因如此,我们才说“价格即政治”——在迷因币的世界里,价格不只是数字,更是人民政治能量的晴雨表,哪怕归零也终将卷土重来。cdn-brighterworld.humanities.mcmaster.caosl.com

全球新兴现象:伊斯兰金融的入场

当Crypto在西方世界掀起市场治政的狂潮时,另一股独特力量也悄然融入这一场域:伊斯兰金融携其独特的道德秩序,开始在链上寻找存在感。长期以来,伊斯兰金融遵循着一套区别于世俗资本主义的原则:禁止利息(Riba)、反对过度投机(Gharar/Maysir)、强调实际资产支撑和道德投资。当这些原则遇上去中心化的加密技术,会碰撞出怎样的火花?出人意料的是,这两者竟在“以市场行为表达价值”这个层面产生了惊人的共鸣。伊斯兰金融并不拒绝市场机制本身,只是为其附加了道德准则;Crypto则将市场机制推向了政治高位,用价格来表达社群意志。二者看似理念迥异,实则都承认市场行为可以也应当承载社会价值观。这使得越来越多金融与政治分析人士开始关注:当虔诚的宗教伦理遇上狂野的加密市场,会塑造出何种新范式?

事实上,穆斯林世界已经在探索“清真加密”的道路。一些区块链项目致力于确保协议符合伊斯兰教法(Sharia)的要求。例如Haqq区块链发行的伊斯兰币(ISLM),从规则层面内置了宗教慈善义务——每发行新币即自动将10%拨入慈善DAO,用于公益捐赠,以符合天课(Zakat)的教义nasdaq.comnasdaq.com。同时,该链拒绝利息和赌博类应用,2022年还获得了宗教权威的教令(Fatwa)认可其合规性nasdaq.com。再看理念层面,伊斯兰经济学强调货币必须有内在价值、收益应来自真实劳动而非纯利息剥削。这一点与比特币的“工作量证明”精神不谋而合——有人甚至断言法定货币无锚印钞并不清真,而比特币这类需耗费能源生产的资产反而更符合教法初衷cointelegraph.com。由此,越来越多穆斯林投资者开始以道德投资的名义进入Crypto领域,将资金投向符合清真原则的代币和协议。

这种现象带来了微妙的双重合法性:一方面,Crypto世界原本奉行“价格即真理”的世俗逻辑,而伊斯兰金融为其注入了一股道德合法性,使部分加密资产同时获得了宗教与市场的双重背书;另一方面,即便在遵循宗教伦理的项目中,最终决定成败的依然是市场对其价值的认可。道德共识与市场共识在链上交汇,共同塑造出一种混合的新秩序。这一全球新兴现象引发广泛议论:有人将其视为金融民主化的极致表现——不同文化价值都能在市场平台上表达并竞争;也有人警惕这可能掩盖新的风险,因为把宗教情感融入高风险资产,既可能凝聚强大的忠诚度,也可能在泡沫破裂时引发信仰与财富的双重危机。但无论如何,伊斯兰金融的入场使Crypto的政治版图更加丰盈多元。从华尔街交易员到中东教士,不同背景的人们正通过Crypto这个奇特的舞台,对人类价值的表达方式进行前所未有的实验。

升华结语:价格即政治的新直觉

回顾比特币问世以来的这段历程,我们可以清晰地看到一条演进的主线:先有货币革命,后有政治发明。比特币赋予了人类一种真正自主的数字货币,而Crypto在此基础上完成的,则是一项前所未有的政治革新——它让市场价格行为承担起了类似政治选票的功能,开创了一种“价格即政治”的新直觉。在这个直觉下,市场不再只是冷冰冰的交易场所;每一次资本流动、每一轮行情涨落,都被赋予了社会意义和政治涵义。买入即表态,卖出即抗议,流动性的涌入或枯竭胜过千言万语的陈情。Crypto世界中,K线图俨然成为民意曲线,行情图就是政治晴雨表。决策不再由少数权力精英关起门来制定,而是在全球无眠的交易中由无数普通人共同谱写。这样的政治形式也许狂野,也许充满泡沫和噪音,但它不可否认地调动起了广泛的社会参与,让原本疏离政治进程的个体通过持币、交易重新找回了影响力的幻觉或实感。

“价格即政治”并非一句简单的口号,而是Crypto给予世界的全新想象力。它质疑了传统政治的正统性:如果一串代码和一群匿名投资者就能高效决策资源分配,我们为何还需要繁冗的官僚体系?它也拷问着自身的内在隐忧:当财富与权力深度绑定,Crypto政治如何避免堕入金钱统治的老路?或许,正是在这样的矛盾和张力中,人类政治的未来才会不断演化。Crypto所开启的,不仅是技术乌托邦或金融狂欢,更可能是一次对民主形式的深刻拓展和挑战。这里有最狂热的逐利者,也有最理想主义的社群塑梦者;有一夜暴富的神话,也有瞬间破灭的惨痛。而这一切汇聚成的洪流,正冲撞着工业时代以来既定的权力谱系。

当我们再次追问:Crypto究竟是什么? 或许可以这样回答——Crypto是比特币之后,人类完成的一次政治范式的试验性跃迁。在这里,价格行为化身为选票,资本市场演化为广场,代码与共识共同撰写“社会契约”。这是一场仍在进行的文明实验:它可能无声地融入既有秩序,也可能剧烈地重塑未来规则。但无论结局如何,如今我们已经见证:在比特币发明真正的货币之后,Crypto正在发明真正属于21世纪的政治。它以数字时代的语言宣告:在链上,价格即政治,市场即民意,代码即法律。这,或许就是Crypto带给我们的最直观而震撼的本质启示。

参考资料:

-

中本聪. 比特币白皮书: 一种点对点的电子现金系统. (2008)bitcoin.org

-

Arkham Intelligence. Ethereum vs Ethereum Classic: Understanding the Differences. (2023)arkhamintelligence.com

-

Binance Square (@渔神的加密日记). 狗狗币价格为何上涨?背后的原因你知道吗?binance.com

-

Cointelegraph中文. 特朗普的迷因币晚宴预期内容揭秘. (2025)cn.cointelegraph.com

-

慢雾科技 Web3Caff (@Lisa). 风险提醒:从 LIBRA 看“政治化”的加密货币骗局. (2025)web3caff.com

-

Nasdaq (@Anthony Clarke). How Cryptocurrency Aligns with the Principles of Islamic Finance. (2023)nasdaq.comnasdaq.com

-

Cointelegraph Magazine (@Andrew Fenton). DeFi can be halal but not DOGE? Decentralizing Islamic finance. (2023)cointelegraph.com

-

-

@ 6d5c826a:4b27b659

2025-05-23 21:46:28

@ 6d5c826a:4b27b659

2025-05-23 21:46:28- Fluentd - Data collector for unified logging layer. (Source Code)

Apache-2.0Ruby - Flume - Distributed, reliable, and available service for efficiently collecting, aggregating, and moving large amounts of log data. (Source Code)

Apache-2.0Java - GoAccess - Real-time web log analyzer and interactive viewer that runs in a terminal or through the browser. (Source Code)

MITC - Loki - Log aggregation system designed to store and query logs from all your applications and infrastructure. (Source Code)

AGPL-3.0Go - rsyslog - Rocket-fast system for log processing. (Source Code)

GPL-3.0C

- Fluentd - Data collector for unified logging layer. (Source Code)

-

@ 6ad3e2a3:c90b7740

2025-05-20 13:49:50

@ 6ad3e2a3:c90b7740

2025-05-20 13:49:50I’ve written about MSTR twice already, https://www.chrisliss.com/p/mstr and https://www.chrisliss.com/p/mstr-part-2, but I want to focus on legendary short seller James Chanos’ current trade wherein he buys bitcoin (via ETF) and shorts MSTR, in essence to “be like Mike” Saylor who sells MSTR shares at the market and uses them to add bitcoin to the company’s balance sheet. After all, if it’s good enough for Saylor, why shouldn’t everyone be doing it — shorting a company whose stock price is more than 2x its bitcoin holdings and using the proceeds to buy the bitcoin itself?

Saylor himself has said selling shares at 2x NAV (net asset value) to buy bitcoin is like selling dollars for two dollars each, and Chanos has apparently decided to get in while the getting (market cap more than 2x net asset value) is good. If the price of bitcoin moons, sending MSTR’s shares up, you are more than hedged in that event, too. At least that’s the theory.

The problem with this bet against MSTR’s mNAV, i.e., you are betting MSTR’s market cap will converge 1:1 toward its NAV in the short and medium term is this trade does not exist in a vacuum. Saylor has described how his ATM’s (at the market) sales of shares are accretive in BTC per share because of this very premium they carry. Yes, we’ll dilute your shares of the company, but because we’re getting you 2x the bitcoin per share, you are getting an ever smaller slice of an ever bigger overall pie, and the pie is growing 2x faster than your slice is reducing. (I https://www.chrisliss.com/p/mstr how this works in my first post.)

But for this accretion to continue, there must be a constant supply of “greater fools” to pony up for the infinitely printable shares which contain only half their value in underlying bitcoin. Yes, those shares will continue to accrete more BTC per share, but only if there are more fools willing to make this trade in the future. So will there be a constant supply of such “fools” to keep fueling MSTR’s mNAV multiple indefinitely?

Yes, there will be in my opinion because you have to look at the trade from the prospective fools’ perspective. Those “fools” are not trading bitcoin for MSTR, they are trading their dollars, selling other equities to raise them maybe, but in the end it’s a dollars for shares trade. They are not selling bitcoin for them.

You might object that those same dollars could buy bitcoin instead, so they are surely trading the opportunity cost of buying bitcoin for them, but if only 5-10 percent of the market (or less) is buying bitcoin itself, the bucket in which which those “fools” reside is the entire non-bitcoin-buying equity market. (And this is not considering the even larger debt market which Saylor has yet to tap in earnest.)

So for those 90-95 percent who do not and are not presently planning to own bitcoin itself, is buying MSTR a fool’s errand, so to speak? Not remotely. If MSTR shares are infinitely printable ATM, they are still less so than the dollar and other fiat currencies. And MSTR shares are backed 2:1 by bitcoin itself, while the fiat currencies are backed by absolutely nothing. So if you hold dollars or euros, trading them for MSTR shares is an errand more sage than foolish.

That’s why this trade (buying BTC and shorting MSTR) is so dangerous. Not only are there many people who won’t buy BTC buying MSTR, there are many funds and other investment entities who are only able to buy MSTR.

Do you want to get BTC at 1:1 with the 5-10 percent or MSTR backed 2:1 with the 90-95 percent. This is a bit like medical tests that have a 95 percent accuracy rate for an asymptomatic disease that only one percent of the population has. If someone tests positive, it’s more likely to be a false one than an indication he has the disease*. The accuracy rate, even at 19:1, is subservient to the size of the respective populations.

At some point this will no longer be the case, but so long as the understanding of bitcoin is not widespread, so long as the dollar is still the unit of account, the “greater fools” buying MSTR are still miles ahead of the greatest fools buying neither, and the stock price and mNAV should only increase.

. . .

One other thought: it’s more work to play defense than offense because the person on offense knows where he’s going, and the defender can only react to him once he moves. Similarly, Saylor by virtue of being the issuer of the shares knows when more will come online while Chanos and other short sellers are borrowing them to sell in reaction to Saylor’s strategy. At any given moment, Saylor can pause anytime, choosing to issue convertible debt or preferred shares with which to buy more bitcoin, and the shorts will not be given advance notice.

If the price runs, and there is no ATM that week because Saylor has stopped on a dime, so to speak, the shorts will be left having to scramble to change directions and buy the shares back to cover. Their momentum might be in the wrong direction, though, and like Allen Iverson breaking ankles with a crossover, Saylor might trigger a massive short squeeze, rocketing the share price ever higher. That’s why he actually welcomes Chanos et al trying this copycat strategy — it becomes the fuel for outsized gains.