-

@ 21335073:a244b1ad

2025-05-09 13:56:57

@ 21335073:a244b1ad

2025-05-09 13:56:57Someone asked for my thoughts, so I’ll share them thoughtfully. I’m not here to dictate how to promote Nostr—I’m still learning about it myself. While I’m not new to Nostr, freedom tech is a newer space for me. I’m skilled at advocating for topics I deeply understand, but freedom tech isn’t my expertise, so take my words with a grain of salt. Nothing I say is set in stone.

Those who need Nostr the most are the ones most vulnerable to censorship on other platforms right now. Reaching them requires real-time awareness of global issues and the dynamic relationships between governments and tech providers, which can shift suddenly. Effective Nostr promoters must grasp this and adapt quickly.

The best messengers are people from or closely tied to these at-risk regions—those who truly understand the local political and cultural dynamics. They can connect with those in need when tensions rise. Ideal promoters are rational, trustworthy, passionate about Nostr, but above all, dedicated to amplifying people’s voices when it matters most.

Forget influencers, corporate-backed figures, or traditional online PR—it comes off as inauthentic, corny, desperate and forced. Nostr’s promotion should be grassroots and organic, driven by a few passionate individuals who believe in Nostr and the communities they serve.

The idea that “people won’t join Nostr due to lack of reach” is nonsense. Everyone knows X’s “reach” is mostly with bots. If humans want real conversations, Nostr is the place. X is great for propaganda, but Nostr is for the authentic voices of the people.

Those spreading Nostr must be so passionate they’re willing to onboard others, which is time-consuming but rewarding for the right person. They’ll need to make Nostr and onboarding a core part of who they are. I see no issue with that level of dedication. I’ve been known to get that way myself at times. It’s fun for some folks.

With love, I suggest not adding Bitcoin promotion with Nostr outreach. Zaps already integrate that element naturally. (Still promote within the Bitcoin ecosystem, but this is about reaching vulnerable voices who needed Nostr yesterday.)

To promote Nostr, forget conventional strategies. “Influencers” aren’t the answer. “Influencers” are not the future. A trusted local community member has real influence—reach them. Connect with people seeking Nostr’s benefits but lacking the technical language to express it. This means some in the Nostr community might need to step outside of the Bitcoin bubble, which is uncomfortable but necessary. Thank you in advance to those who are willing to do that.

I don’t know who is paid to promote Nostr, if anyone. This piece isn’t shade. But it’s exhausting to see innocent voices globally silenced on corporate platforms like X while Nostr exists. Last night, I wondered: how many more voices must be censored before the Nostr community gets uncomfortable and thinks creatively to reach the vulnerable?

A warning: the global need for censorship-resistant social media is undeniable. If Nostr doesn’t make itself known, something else will fill that void. Let’s start this conversation.

-

@ 21335073:a244b1ad

2025-05-01 01:51:10

@ 21335073:a244b1ad

2025-05-01 01:51:10Please respect Virginia Giuffre’s memory by refraining from asking about the circumstances or theories surrounding her passing.

Since Virginia Giuffre’s death, I’ve reflected on what she would want me to say or do. This piece is my attempt to honor her legacy.

When I first spoke with Virginia, I was struck by her unshakable hope. I had grown cynical after years in the anti-human trafficking movement, worn down by a broken system and a government that often seemed complicit. But Virginia’s passion, creativity, and belief that survivors could be heard reignited something in me. She reminded me of my younger, more hopeful self. Instead of warning her about the challenges ahead, I let her dream big, unburdened by my own disillusionment. That conversation changed me for the better, and following her lead led to meaningful progress.

Virginia was one of the bravest people I’ve ever known. As a survivor of Epstein, Maxwell, and their co-conspirators, she risked everything to speak out, taking on some of the world’s most powerful figures.

She loved when I said, “Epstein isn’t the only Epstein.” This wasn’t just about one man—it was a call to hold all abusers accountable and to ensure survivors find hope and healing.

The Epstein case often gets reduced to sensational details about the elite, but that misses the bigger picture. Yes, we should be holding all of the co-conspirators accountable, we must listen to the survivors’ stories. Their experiences reveal how predators exploit vulnerabilities, offering lessons to prevent future victims.

You’re not powerless in this fight. Educate yourself about trafficking and abuse—online and offline—and take steps to protect those around you. Supporting survivors starts with small, meaningful actions. Free online resources can guide you in being a safe, supportive presence.

When high-profile accusations arise, resist snap judgments. Instead of dismissing survivors as “crazy,” pause to consider the trauma they may be navigating. Speaking out or coping with abuse is never easy. You don’t have to believe every claim, but you can refrain from attacking accusers online.

Society also fails at providing aftercare for survivors. The government, often part of the problem, won’t solve this. It’s up to us. Prevention is critical, but when abuse occurs, step up for your loved ones and community. Protect the vulnerable. it’s a challenging but a rewarding journey.

If you’re contributing to Nostr, you’re helping build a censorship resistant platform where survivors can share their stories freely, no matter how powerful their abusers are. Their voices can endure here, offering strength and hope to others. This gives me great hope for the future.

Virginia Giuffre’s courage was a gift to the world. It was an honor to know and serve her. She will be deeply missed. My hope is that her story inspires others to take on the powerful.

-

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57I have been recently building NFDB, a new relay DB. This post is meant as a short overview.

Regular relays have challenges

Current relay software have significant challenges, which I have experienced when hosting Nostr.land: - Scalability is only supported by adding full replicas, which does not scale to large relays. - Most relays use slow databases and are not optimized for large scale usage. - Search is near-impossible to implement on standard relays. - Privacy features such as NIP-42 are lacking. - Regular DB maintenance tasks on normal relays require extended downtime. - Fault-tolerance is implemented, if any, using a load balancer, which is limited. - Personalization and advanced filtering is not possible. - Local caching is not supported.

NFDB: A scalable database for large relays

NFDB is a new database meant for medium-large scale relays, built on FoundationDB that provides: - Near-unlimited scalability - Extended fault tolerance - Instant loading - Better search - Better personalization - and more.

Search

NFDB has extended search capabilities including: - Semantic search: Search for meaning, not words. - Interest-based search: Highlight content you care about. - Multi-faceted queries: Easily filter by topic, author group, keywords, and more at the same time. - Wide support for event kinds, including users, articles, etc.

Personalization

NFDB allows significant personalization: - Customized algorithms: Be your own algorithm. - Spam filtering: Filter content to your WoT, and use advanced spam filters. - Topic mutes: Mute topics, not keywords. - Media filtering: With Nostr.build, you will be able to filter NSFW and other content - Low data mode: Block notes that use high amounts of cellular data. - and more

Other

NFDB has support for many other features such as: - NIP-42: Protect your privacy with private drafts and DMs - Microrelays: Easily deploy your own personal microrelay - Containers: Dedicated, fast storage for discoverability events such as relay lists

Calcite: A local microrelay database

Calcite is a lightweight, local version of NFDB that is meant for microrelays and caching, meant for thousands of personal microrelays.

Calcite HA is an additional layer that allows live migration and relay failover in under 30 seconds, providing higher availability compared to current relays with greater simplicity. Calcite HA is enabled in all Calcite deployments.

For zero-downtime, NFDB is recommended.

Noswhere SmartCache

Relays are fixed in one location, but users can be anywhere.

Noswhere SmartCache is a CDN for relays that dynamically caches data on edge servers closest to you, allowing: - Multiple regions around the world - Improved throughput and performance - Faster loading times

routerd

routerdis a custom load-balancer optimized for Nostr relays, integrated with SmartCache.routerdis specifically integrated with NFDB and Calcite HA to provide fast failover and high performance.Ending notes

NFDB is planned to be deployed to Nostr.land in the coming weeks.

A lot more is to come. 👀️️️️️️

-

@ 91bea5cd:1df4451c

2025-04-26 10:16:21

@ 91bea5cd:1df4451c

2025-04-26 10:16:21O Contexto Legal Brasileiro e o Consentimento

No ordenamento jurídico brasileiro, o consentimento do ofendido pode, em certas circunstâncias, afastar a ilicitude de um ato que, sem ele, configuraria crime (como lesão corporal leve, prevista no Art. 129 do Código Penal). Contudo, o consentimento tem limites claros: não é válido para bens jurídicos indisponíveis, como a vida, e sua eficácia é questionável em casos de lesões corporais graves ou gravíssimas.

A prática de BDSM consensual situa-se em uma zona complexa. Em tese, se ambos os parceiros são adultos, capazes, e consentiram livre e informadamente nos atos praticados, sem que resultem em lesões graves permanentes ou risco de morte não consentido, não haveria crime. O desafio reside na comprovação desse consentimento, especialmente se uma das partes, posteriormente, o negar ou alegar coação.

A Lei Maria da Penha (Lei nº 11.340/2006)

A Lei Maria da Penha é um marco fundamental na proteção da mulher contra a violência doméstica e familiar. Ela estabelece mecanismos para coibir e prevenir tal violência, definindo suas formas (física, psicológica, sexual, patrimonial e moral) e prevendo medidas protetivas de urgência.

Embora essencial, a aplicação da lei em contextos de BDSM pode ser delicada. Uma alegação de violência por parte da mulher, mesmo que as lesões ou situações decorram de práticas consensuais, tende a receber atenção prioritária das autoridades, dada a presunção de vulnerabilidade estabelecida pela lei. Isso pode criar um cenário onde o parceiro masculino enfrenta dificuldades significativas em demonstrar a natureza consensual dos atos, especialmente se não houver provas robustas pré-constituídas.

Outros riscos:

Lesão corporal grave ou gravíssima (art. 129, §§ 1º e 2º, CP), não pode ser justificada pelo consentimento, podendo ensejar persecução penal.

Crimes contra a dignidade sexual (arts. 213 e seguintes do CP) são de ação pública incondicionada e independem de representação da vítima para a investigação e denúncia.

Riscos de Falsas Acusações e Alegação de Coação Futura

Os riscos para os praticantes de BDSM, especialmente para o parceiro que assume o papel dominante ou que inflige dor/restrição (frequentemente, mas não exclusivamente, o homem), podem surgir de diversas frentes:

- Acusações Externas: Vizinhos, familiares ou amigos que desconhecem a natureza consensual do relacionamento podem interpretar sons, marcas ou comportamentos como sinais de abuso e denunciar às autoridades.

- Alegações Futuras da Parceira: Em caso de término conturbado, vingança, arrependimento ou mudança de perspectiva, a parceira pode reinterpretar as práticas passadas como abuso e buscar reparação ou retaliação através de uma denúncia. A alegação pode ser de que o consentimento nunca existiu ou foi viciado.

- Alegação de Coação: Uma das formas mais complexas de refutar é a alegação de que o consentimento foi obtido mediante coação (física, moral, psicológica ou econômica). A parceira pode alegar, por exemplo, que se sentia pressionada, intimidada ou dependente, e que seu "sim" não era genuíno. Provar a ausência de coação a posteriori é extremamente difícil.

- Ingenuidade e Vulnerabilidade Masculina: Muitos homens, confiando na dinâmica consensual e na parceira, podem negligenciar a necessidade de precauções. A crença de que "isso nunca aconteceria comigo" ou a falta de conhecimento sobre as implicações legais e o peso processual de uma acusação no âmbito da Lei Maria da Penha podem deixá-los vulneráveis. A presença de marcas físicas, mesmo que consentidas, pode ser usada como evidência de agressão, invertendo o ônus da prova na prática, ainda que não na teoria jurídica.

Estratégias de Prevenção e Mitigação

Não existe um método infalível para evitar completamente o risco de uma falsa acusação, mas diversas medidas podem ser adotadas para construir um histórico de consentimento e reduzir vulnerabilidades:

- Comunicação Explícita e Contínua: A base de qualquer prática BDSM segura é a comunicação constante. Negociar limites, desejos, palavras de segurança ("safewords") e expectativas antes, durante e depois das cenas é crucial. Manter registros dessas negociações (e-mails, mensagens, diários compartilhados) pode ser útil.

-

Documentação do Consentimento:

-

Contratos de Relacionamento/Cena: Embora a validade jurídica de "contratos BDSM" seja discutível no Brasil (não podem afastar normas de ordem pública), eles servem como forte evidência da intenção das partes, da negociação detalhada de limites e do consentimento informado. Devem ser claros, datados, assinados e, idealmente, reconhecidos em cartório (para prova de data e autenticidade das assinaturas).

-

Registros Audiovisuais: Gravar (com consentimento explícito para a gravação) discussões sobre consentimento e limites antes das cenas pode ser uma prova poderosa. Gravar as próprias cenas é mais complexo devido a questões de privacidade e potencial uso indevido, mas pode ser considerado em casos específicos, sempre com consentimento mútuo documentado para a gravação.

Importante: a gravação deve ser com ciência da outra parte, para não configurar violação da intimidade (art. 5º, X, da Constituição Federal e art. 20 do Código Civil).

-

-

Testemunhas: Em alguns contextos de comunidade BDSM, a presença de terceiros de confiança durante negociações ou mesmo cenas pode servir como testemunho, embora isso possa alterar a dinâmica íntima do casal.

- Estabelecimento Claro de Limites e Palavras de Segurança: Definir e respeitar rigorosamente os limites (o que é permitido, o que é proibido) e as palavras de segurança é fundamental. O desrespeito a uma palavra de segurança encerra o consentimento para aquele ato.

- Avaliação Contínua do Consentimento: O consentimento não é um cheque em branco; ele deve ser entusiástico, contínuo e revogável a qualquer momento. Verificar o bem-estar do parceiro durante a cena ("check-ins") é essencial.

- Discrição e Cuidado com Evidências Físicas: Ser discreto sobre a natureza do relacionamento pode evitar mal-entendidos externos. Após cenas que deixem marcas, é prudente que ambos os parceiros estejam cientes e de acordo, talvez documentando por fotos (com data) e uma nota sobre a consensualidade da prática que as gerou.

- Aconselhamento Jurídico Preventivo: Consultar um advogado especializado em direito de família e criminal, com sensibilidade para dinâmicas de relacionamento alternativas, pode fornecer orientação personalizada sobre as melhores formas de documentar o consentimento e entender os riscos legais específicos.

Observações Importantes

- Nenhuma documentação substitui a necessidade de consentimento real, livre, informado e contínuo.

- A lei brasileira protege a "integridade física" e a "dignidade humana". Práticas que resultem em lesões graves ou que violem a dignidade de forma não consentida (ou com consentimento viciado) serão ilegais, independentemente de qualquer acordo prévio.

- Em caso de acusação, a existência de documentação robusta de consentimento não garante a absolvição, mas fortalece significativamente a defesa, ajudando a demonstrar a natureza consensual da relação e das práticas.

-

A alegação de coação futura é particularmente difícil de prevenir apenas com documentos. Um histórico consistente de comunicação aberta (whatsapp/telegram/e-mails), respeito mútuo e ausência de dependência ou controle excessivo na relação pode ajudar a contextualizar a dinâmica como não coercitiva.

-

Cuidado com Marcas Visíveis e Lesões Graves Práticas que resultam em hematomas severos ou lesões podem ser interpretadas como agressão, mesmo que consentidas. Evitar excessos protege não apenas a integridade física, mas também evita questionamentos legais futuros.

O que vem a ser consentimento viciado

No Direito, consentimento viciado é quando a pessoa concorda com algo, mas a vontade dela não é livre ou plena — ou seja, o consentimento existe formalmente, mas é defeituoso por alguma razão.

O Código Civil brasileiro (art. 138 a 165) define várias formas de vício de consentimento. As principais são:

Erro: A pessoa se engana sobre o que está consentindo. (Ex.: A pessoa acredita que vai participar de um jogo leve, mas na verdade é exposta a práticas pesadas.)

Dolo: A pessoa é enganada propositalmente para aceitar algo. (Ex.: Alguém mente sobre o que vai acontecer durante a prática.)

Coação: A pessoa é forçada ou ameaçada a consentir. (Ex.: "Se você não aceitar, eu termino com você" — pressão emocional forte pode ser vista como coação.)

Estado de perigo ou lesão: A pessoa aceita algo em situação de necessidade extrema ou abuso de sua vulnerabilidade. (Ex.: Alguém em situação emocional muito fragilizada é induzida a aceitar práticas que normalmente recusaria.)

No contexto de BDSM, isso é ainda mais delicado: Mesmo que a pessoa tenha "assinado" um contrato ou dito "sim", se depois ela alegar que seu consentimento foi dado sob medo, engano ou pressão psicológica, o consentimento pode ser considerado viciado — e, portanto, juridicamente inválido.

Isso tem duas implicações sérias:

-

O crime não se descaracteriza: Se houver vício, o consentimento é ignorado e a prática pode ser tratada como crime normal (lesão corporal, estupro, tortura, etc.).

-

A prova do consentimento precisa ser sólida: Mostrando que a pessoa estava informada, lúcida, livre e sem qualquer tipo de coação.

Consentimento viciado é quando a pessoa concorda formalmente, mas de maneira enganada, forçada ou pressionada, tornando o consentimento inútil para efeitos jurídicos.

Conclusão

Casais que praticam BDSM consensual no Brasil navegam em um terreno que exige não apenas confiança mútua e comunicação excepcional, mas também uma consciência aguçada das complexidades legais e dos riscos de interpretações equivocadas ou acusações mal-intencionadas. Embora o BDSM seja uma expressão legítima da sexualidade humana, sua prática no Brasil exige responsabilidade redobrada. Ter provas claras de consentimento, manter a comunicação aberta e agir com prudência são formas eficazes de se proteger de falsas alegações e preservar a liberdade e a segurança de todos os envolvidos. Embora leis controversas como a Maria da Penha sejam "vitais" para a proteção contra a violência real, os praticantes de BDSM, e em particular os homens nesse contexto, devem adotar uma postura proativa e prudente para mitigar os riscos inerentes à potencial má interpretação ou instrumentalização dessas práticas e leis, garantindo que a expressão de sua consensualidade esteja resguardada na medida do possível.

Importante: No Brasil, mesmo com tudo isso, o Ministério Público pode denunciar por crime como lesão corporal grave, estupro ou tortura, independente de consentimento. Então a prudência nas práticas é fundamental.

Aviso Legal: Este artigo tem caráter meramente informativo e não constitui aconselhamento jurídico. As leis e interpretações podem mudar, e cada situação é única. Recomenda-se buscar orientação de um advogado qualificado para discutir casos específicos.

Se curtiu este artigo faça uma contribuição, se tiver algum ponto relevante para o artigo deixe seu comentário.

-

@ 25f5c1c7:e956c514

2025-05-22 23:42:09

@ 25f5c1c7:e956c514

2025-05-22 23:42:09I've been exploring ways to retain the strong security guarantees of Proof-of-Work (PoW) while significantly reducing its environmental footprint. Traditional PoW systems are undeniably robust, but their energy demands are a major concern. Delayed Proof-of-Work (DPoW) is my first proposal toward solving this - a concept designed to preserve the integrity and fairness of PoW while operating with a fraction of the hash power.

How it Works

-

A new block is added to the chain.

-

All miners start computing a VDF (Verifiable Delay Function) with the latest block's hash as the input.

-

The VDF is designed to take 4 minutes to complete, enforcing a mandatory idle period.

-

The \~1 minute mining period begins when miners complete the VDF.

-

- Miners compete to find a valid PoW for a new block, which includes the VDF output in the header.

-

The first miner to find a valid hash broadcasts the new block to the network.

-

The block is verified by nodes by checking the VDF's output is correct for the previous block hash, and that the PoW is valid.

-

This cycle of a 4 minute idle period and a brief mining period continues.

Key Advantages

-

The idle-mine cycle allows the network to operate with \~1/5 of the hash power of a standard PoW blockchain while still taking advantage of the security properties of PoW.

-

During the 4 minute idle period, the blockchain is guaranteed to be static. The predictable delay means blocks are propagated and confirmed in a more synchronised fashion, which could reduce synchronisation issues and orphaned blocks.

Potential Issues

-

VDFs can be computed slightly faster on hardware with higher clock speeds or specialised circuits, resulting in some miners having a longer mining period.

-

The short mining-window means that miners on faster connections will have a significant advantage over slower connections, as they will be able to propagate a mined block faster.

-

The VDF also uses energy, although negligible compared to the amount that algorithms use.

-

Miners might redirect their hash power to other cryptocurrencies during the delay period, which would undermine the goal of reducing energy consumption.

-

A malicious miner who obtains or predicts the next block could start pre-computing the VDF early, gaining an unfair advantage.

-

-

@ e3ba5e1a:5e433365

2025-04-15 11:03:15

@ e3ba5e1a:5e433365

2025-04-15 11:03:15Prelude

I wrote this post differently than any of my others. It started with a discussion with AI on an OPSec-inspired review of separation of powers, and evolved into quite an exciting debate! I asked Grok to write up a summary in my overall writing style, which it got pretty well. I've decided to post it exactly as-is. Ultimately, I think there are two solid ideas driving my stance here:

- Perfect is the enemy of the good

- Failure is the crucible of success

Beyond that, just some hard-core belief in freedom, separation of powers, and operating from self-interest.

Intro

Alright, buckle up. I’ve been chewing on this idea for a while, and it’s time to spit it out. Let’s look at the U.S. government like I’d look at a codebase under a cybersecurity audit—OPSEC style, no fluff. Forget the endless debates about what politicians should do. That’s noise. I want to talk about what they can do, the raw powers baked into the system, and why we should stop pretending those powers are sacred. If there’s a hole, either patch it or exploit it. No half-measures. And yeah, I’m okay if the whole thing crashes a bit—failure’s a feature, not a bug.

The Filibuster: A Security Rule with No Teeth

You ever see a firewall rule that’s more theater than protection? That’s the Senate filibuster. Everyone acts like it’s this untouchable guardian of democracy, but here’s the deal: a simple majority can torch it any day. It’s not a law; it’s a Senate preference, like choosing tabs over spaces. When people call killing it the “nuclear option,” I roll my eyes. Nuclear? It’s a button labeled “press me.” If a party wants it gone, they’ll do it. So why the dance?

I say stop playing games. Get rid of the filibuster. If you’re one of those folks who thinks it’s the only thing saving us from tyranny, fine—push for a constitutional amendment to lock it in. That’s a real patch, not a Post-it note. Until then, it’s just a vulnerability begging to be exploited. Every time a party threatens to nuke it, they’re admitting it’s not essential. So let’s stop pretending and move on.

Supreme Court Packing: Because Nine’s Just a Number

Here’s another fun one: the Supreme Court. Nine justices, right? Sounds official. Except it’s not. The Constitution doesn’t say nine—it’s silent on the number. Congress could pass a law tomorrow to make it 15, 20, or 42 (hitchhiker’s reference, anyone?). Packing the court is always on the table, and both sides know it. It’s like a root exploit just sitting there, waiting for someone to log in.

So why not call the bluff? If you’re in power—say, Trump’s back in the game—say, “I’m packing the court unless we amend the Constitution to fix it at nine.” Force the issue. No more shadowboxing. And honestly? The court’s got way too much power anyway. It’s not supposed to be a super-legislature, but here we are, with justices’ ideologies driving the bus. That’s a bug, not a feature. If the court weren’t such a kingmaker, packing it wouldn’t even matter. Maybe we should be talking about clipping its wings instead of just its size.

The Executive Should Go Full Klingon

Let’s talk presidents. I’m not saying they should wear Klingon armor and start shouting “Qapla’!”—though, let’s be real, that’d be awesome. I’m saying the executive should use every scrap of power the Constitution hands them. Enforce the laws you agree with, sideline the ones you don’t. If Congress doesn’t like it, they’ve got tools: pass new laws, override vetoes, or—here’s the big one—cut the budget. That’s not chaos; that’s the system working as designed.

Right now, the real problem isn’t the president overreaching; it’s the bureaucracy. It’s like a daemon running in the background, eating CPU and ignoring the user. The president’s supposed to be the one steering, but the administrative state’s got its own agenda. Let the executive flex, push the limits, and force Congress to check it. Norms? Pfft. The Constitution’s the spec sheet—stick to it.

Let the System Crash

Here’s where I get a little spicy: I’m totally fine if the government grinds to a halt. Deadlock isn’t a disaster; it’s a feature. If the branches can’t agree, let the president veto, let Congress starve the budget, let enforcement stall. Don’t tell me about “essential services.” Nothing’s so critical it can’t take a breather. Shutdowns force everyone to the table—debate, compromise, or expose who’s dropping the ball. If the public loses trust? Good. They’ll vote out the clowns or live with the circus they elected.

Think of it like a server crash. Sometimes you need a hard reboot to clear the cruft. If voters keep picking the same bad admins, well, the country gets what it deserves. Failure’s the best teacher—way better than limping along on autopilot.

States Are the Real MVPs

If the feds fumble, states step up. Right now, states act like junior devs waiting for the lead engineer to sign off. Why? Federal money. It’s a leash, and it’s tight. Cut that cash, and states will remember they’re autonomous. Some will shine, others will tank—looking at you, California. And I’m okay with that. Let people flee to better-run states. No bailouts, no excuses. States are like competing startups: the good ones thrive, the bad ones pivot or die.

Could it get uneven? Sure. Some states might turn into sci-fi utopias while others look like a post-apocalyptic vidya game. That’s the point—competition sorts it out. Citizens can move, markets adjust, and failure’s a signal to fix your act.

Chaos Isn’t the Enemy

Yeah, this sounds messy. States ignoring federal law, external threats poking at our seams, maybe even a constitutional crisis. I’m not scared. The Supreme Court’s there to referee interstate fights, and Congress sets the rules for state-to-state play. But if it all falls apart? Still cool. States can sort it without a babysitter—it’ll be ugly, but freedom’s worth it. External enemies? They’ll either unify us or break us. If we can’t rally, we don’t deserve the win.

Centralizing power to avoid this is like rewriting your app in a single thread to prevent race conditions—sure, it’s simpler, but you’re begging for a deadlock. Decentralized chaos lets states experiment, lets people escape, lets markets breathe. States competing to cut regulations to attract businesses? That’s a race to the bottom for red tape, but a race to the top for innovation—workers might gripe, but they’ll push back, and the tension’s healthy. Bring it—let the cage match play out. The Constitution’s checks are enough if we stop coddling the system.

Why This Matters

I’m not pitching a utopia. I’m pitching a stress test. The U.S. isn’t a fragile porcelain doll; it’s a rugged piece of hardware built to take some hits. Let it fail a little—filibuster, court, feds, whatever. Patch the holes with amendments if you want, or lean into the grind. Either way, stop fearing the crash. It’s how we debug the republic.

So, what’s your take? Ready to let the system rumble, or got a better way to secure the code? Hit me up—I’m all ears.

-

@ 1817b617:715fb372

2025-05-22 23:39:18

@ 1817b617:715fb372

2025-05-22 23:39:18🚀 Instantly Send Spendable Flash BTC, ETH, & USDT — 100% Blockchain-Verifiable!

Step into the future of cryptocurrency innovation with CryptoFlashingTool.com — your go-to solution for sending spendable Flash Bitcoin (BTC), Ethereum (ETH), and USDT transactions. Using cutting-edge 🔥 Race/Finney-style blockchain simulation, our technology generates coins that are virtually indistinguishable from real, fully confirmed blockchain transactions. Transactions stay live and spendable from 60 up to 360 days!

🌐 Explore all the details at cryptoflashingtool.com.

🌟 Why Trust Our Crypto Flashing System? Whether you’re a blockchain enthusiast, ethical hacker, security expert, or digital entrepreneur, our solution offers a perfect mix of authenticity, speed, and flexibility.

🎯 Top Features You’ll Love: ✅ Instant Blockchain Simulation: Transactions are complete with valid wallet addresses, transaction IDs, and real confirmations.

🔒 Privacy First: Works flawlessly with VPNs, TOR, and proxies to keep you fully anonymous.

🖥️ User-Friendly Software: Built for Windows, beginner and pro-friendly with simple step-by-step guidance.

📅 Flexible Flash Durations: Choose how long coins stay valid — from 60 to 360 days.

🔄 Full Wallet Compatibility: Instantly flash coins to SegWit, Legacy, or BCH32 wallets with ease.

💱 Exchange-Ready: Spend your flashed coins on leading exchanges like Kraken and Huobi.

📊 Proven Results: ✅ Over 79 billion flash transactions completed. ✅ 3000+ satisfied users around the globe. ✅ 42 active blockchain nodes ensuring fast, seamless performance.

📌 How It Works: Step 1️⃣: Input Transaction Info

Pick your coin (BTC, ETH, USDT: TRC-20, ERC-20, BEP-20). Set amount and flash duration. Enter the recipient wallet (auto-validated). Step 2️⃣: Make Payment

Pay in your selected crypto. Scan the QR code or use the provided address. Upload your transaction proof (hash and screenshot). Step 3️⃣: Launch the Flash

Blockchain confirmation simulation happens instantly. Your transaction appears real within seconds. Step 4️⃣: Verify & Spend

Access your flashed coins immediately. Verify your transactions using blockchain explorers. 🛡️ Why Our Flashing Tech Leads the Market: 🔗 Race/Finney Attack Mechanics: Mimics authentic blockchain behavior. 🖥️ Private iNode Clusters: Deliver fast syncing and reliable confirmation. ⏰ Live Timer: Ensures fresh, legitimate transactions. 🔍 Real Blockchain TX IDs: All transactions come with verifiable IDs.

❓ FAQs:

Is flashing secure? ✅ Yes, fully encrypted with VPN/proxy compatibility. Multiple devices? ✅ Yes, up to 5 Windows PCs per license. Chargebacks possible? ❌ No, flashing is irreversible. Spendability? ✅ Flash coins stay spendable 60–360 days. Verification after expiry? ❌ No, transactions expire after the set time. Support? ✅ 24/7 Telegram and WhatsApp help available. 🔐 Independent, Transparent, Trusted:

At CryptoFlashingTool.com, we pride ourselves on unmatched transparency, speed, and reliability. See our excellent reviews on ScamAdvisor and top crypto forums!

📲 Contact Us: 📞 WhatsApp: +1 770 666 2531 ✈️ Telegram: @cryptoflashingtool

🎉 Ready to Flash Like a Pro?

💰 Buy Flash Coins Now 🖥️ Get Your Flashing Software

The safest, smartest, and most powerful crypto flashing solution is here — only at CryptoFlashingTool.com!

Instantly Send Spendable Flash BTC, ETH, & USDT — 100% Blockchain-Verifiable!

Step into the future of cryptocurrency innovation with CryptoFlashingTool.com — your go-to solution for sending spendable Flash Bitcoin (BTC), Ethereum (ETH), and USDT transactions. Using cutting-edge

Race/Finney-style blockchain simulation, our technology generates coins that are virtually indistinguishable from real, fully confirmed blockchain transactions. Transactions stay live and spendable from 60 up to 360 days!

Explore all the details at cryptoflashingtool.com.

Why Trust Our Crypto Flashing System? Whether you’re a blockchain enthusiast, ethical hacker, security expert, or digital entrepreneur, our solution offers a perfect mix of authenticity, speed, and flexibility.

Top Features You’ll Love:

Instant Blockchain Simulation: Transactions are complete with valid wallet addresses, transaction IDs, and real confirmations.

Privacy First: Works flawlessly with VPNs, TOR, and proxies to keep you fully anonymous.

User-Friendly Software: Built for Windows, beginner and pro-friendly with simple step-by-step guidance.

Flexible Flash Durations: Choose how long coins stay valid — from 60 to 360 days.

Full Wallet Compatibility: Instantly flash coins to SegWit, Legacy, or BCH32 wallets with ease.

Exchange-Ready: Spend your flashed coins on leading exchanges like Kraken and Huobi.

Proven Results:

Over 79 billion flash transactions completed.

3000+ satisfied users around the globe.

42 active blockchain nodes ensuring fast, seamless performance.

How It Works: Step

: Input Transaction Info

- Pick your coin (BTC, ETH, USDT: TRC-20, ERC-20, BEP-20).

- Set amount and flash duration.

- Enter the recipient wallet (auto-validated).

Step

: Make Payment

- Pay in your selected crypto.

- Scan the QR code or use the provided address.

- Upload your transaction proof (hash and screenshot).

Step

: Launch the Flash

- Blockchain confirmation simulation happens instantly.

- Your transaction appears real within seconds.

Step

: Verify & Spend

- Access your flashed coins immediately.

- Verify your transactions using blockchain explorers.

Why Our Flashing Tech Leads the Market:

Race/Finney Attack Mechanics: Mimics authentic blockchain behavior.

Private iNode Clusters: Deliver fast syncing and reliable confirmation.

Live Timer: Ensures fresh, legitimate transactions.

Real Blockchain TX IDs: All transactions come with verifiable IDs.

FAQs:

- Is flashing secure?

Yes, fully encrypted with VPN/proxy compatibility. - Multiple devices?

Yes, up to 5 Windows PCs per license. - Chargebacks possible?

No, flashing is irreversible. - Spendability?

Flash coins stay spendable 60–360 days. - Verification after expiry?

No, transactions expire after the set time. - Support?

24/7 Telegram and WhatsApp help available.

Independent, Transparent, Trusted:

At CryptoFlashingTool.com, we pride ourselves on unmatched transparency, speed, and reliability. See our excellent reviews on ScamAdvisor and top crypto forums!

Contact Us:

WhatsApp: +1 770 666 2531

Telegram: @cryptoflashingtool

Ready to Flash Like a Pro?

The safest, smartest, and most powerful crypto flashing solution is here — only at CryptoFlashingTool.com!

-

@ 91bea5cd:1df4451c

2025-04-15 06:27:28

@ 91bea5cd:1df4451c

2025-04-15 06:27:28Básico

bash lsblk # Lista todos os diretorios montados.Para criar o sistema de arquivos:

bash mkfs.btrfs -L "ThePool" -f /dev/sdxCriando um subvolume:

bash btrfs subvolume create SubVolMontando Sistema de Arquivos:

bash mount -o compress=zlib,subvol=SubVol,autodefrag /dev/sdx /mntLista os discos formatados no diretório:

bash btrfs filesystem show /mntAdiciona novo disco ao subvolume:

bash btrfs device add -f /dev/sdy /mntLista novamente os discos do subvolume:

bash btrfs filesystem show /mntExibe uso dos discos do subvolume:

bash btrfs filesystem df /mntBalancea os dados entre os discos sobre raid1:

bash btrfs filesystem balance start -dconvert=raid1 -mconvert=raid1 /mntScrub é uma passagem por todos os dados e metadados do sistema de arquivos e verifica as somas de verificação. Se uma cópia válida estiver disponível (perfis de grupo de blocos replicados), a danificada será reparada. Todas as cópias dos perfis replicados são validadas.

iniciar o processo de depuração :

bash btrfs scrub start /mntver o status do processo de depuração Btrfs em execução:

bash btrfs scrub status /mntver o status do scrub Btrfs para cada um dos dispositivos

bash btrfs scrub status -d / data btrfs scrub cancel / dataPara retomar o processo de depuração do Btrfs que você cancelou ou pausou:

btrfs scrub resume / data

Listando os subvolumes:

bash btrfs subvolume list /ReportsCriando um instantâneo dos subvolumes:

Aqui, estamos criando um instantâneo de leitura e gravação chamado snap de marketing do subvolume de marketing.

bash btrfs subvolume snapshot /Reports/marketing /Reports/marketing-snapAlém disso, você pode criar um instantâneo somente leitura usando o sinalizador -r conforme mostrado. O marketing-rosnap é um instantâneo somente leitura do subvolume de marketing

bash btrfs subvolume snapshot -r /Reports/marketing /Reports/marketing-rosnapForçar a sincronização do sistema de arquivos usando o utilitário 'sync'

Para forçar a sincronização do sistema de arquivos, invoque a opção de sincronização conforme mostrado. Observe que o sistema de arquivos já deve estar montado para que o processo de sincronização continue com sucesso.

bash btrfs filsystem sync /ReportsPara excluir o dispositivo do sistema de arquivos, use o comando device delete conforme mostrado.

bash btrfs device delete /dev/sdc /ReportsPara sondar o status de um scrub, use o comando scrub status com a opção -dR .

bash btrfs scrub status -dR / RelatóriosPara cancelar a execução do scrub, use o comando scrub cancel .

bash $ sudo btrfs scrub cancel / ReportsPara retomar ou continuar com uma depuração interrompida anteriormente, execute o comando de cancelamento de depuração

bash sudo btrfs scrub resume /Reportsmostra o uso do dispositivo de armazenamento:

btrfs filesystem usage /data

Para distribuir os dados, metadados e dados do sistema em todos os dispositivos de armazenamento do RAID (incluindo o dispositivo de armazenamento recém-adicionado) montados no diretório /data , execute o seguinte comando:

sudo btrfs balance start --full-balance /data

Pode demorar um pouco para espalhar os dados, metadados e dados do sistema em todos os dispositivos de armazenamento do RAID se ele contiver muitos dados.

Opções importantes de montagem Btrfs

Nesta seção, vou explicar algumas das importantes opções de montagem do Btrfs. Então vamos começar.

As opções de montagem Btrfs mais importantes são:

**1. acl e noacl

**ACL gerencia permissões de usuários e grupos para os arquivos/diretórios do sistema de arquivos Btrfs.

A opção de montagem acl Btrfs habilita ACL. Para desabilitar a ACL, você pode usar a opção de montagem noacl .

Por padrão, a ACL está habilitada. Portanto, o sistema de arquivos Btrfs usa a opção de montagem acl por padrão.

**2. autodefrag e noautodefrag

**Desfragmentar um sistema de arquivos Btrfs melhorará o desempenho do sistema de arquivos reduzindo a fragmentação de dados.

A opção de montagem autodefrag permite a desfragmentação automática do sistema de arquivos Btrfs.

A opção de montagem noautodefrag desativa a desfragmentação automática do sistema de arquivos Btrfs.

Por padrão, a desfragmentação automática está desabilitada. Portanto, o sistema de arquivos Btrfs usa a opção de montagem noautodefrag por padrão.

**3. compactar e compactar-forçar

**Controla a compactação de dados no nível do sistema de arquivos do sistema de arquivos Btrfs.

A opção compactar compacta apenas os arquivos que valem a pena compactar (se compactar o arquivo economizar espaço em disco).

A opção compress-force compacta todos os arquivos do sistema de arquivos Btrfs, mesmo que a compactação do arquivo aumente seu tamanho.

O sistema de arquivos Btrfs suporta muitos algoritmos de compactação e cada um dos algoritmos de compactação possui diferentes níveis de compactação.

Os algoritmos de compactação suportados pelo Btrfs são: lzo , zlib (nível 1 a 9) e zstd (nível 1 a 15).

Você pode especificar qual algoritmo de compactação usar para o sistema de arquivos Btrfs com uma das seguintes opções de montagem:

- compress=algoritmo:nível

- compress-force=algoritmo:nível

Para obter mais informações, consulte meu artigo Como habilitar a compactação do sistema de arquivos Btrfs .

**4. subvol e subvolid

**Estas opções de montagem são usadas para montar separadamente um subvolume específico de um sistema de arquivos Btrfs.

A opção de montagem subvol é usada para montar o subvolume de um sistema de arquivos Btrfs usando seu caminho relativo.

A opção de montagem subvolid é usada para montar o subvolume de um sistema de arquivos Btrfs usando o ID do subvolume.

Para obter mais informações, consulte meu artigo Como criar e montar subvolumes Btrfs .

**5. dispositivo

A opção de montagem de dispositivo** é usada no sistema de arquivos Btrfs de vários dispositivos ou RAID Btrfs.

Em alguns casos, o sistema operacional pode falhar ao detectar os dispositivos de armazenamento usados em um sistema de arquivos Btrfs de vários dispositivos ou RAID Btrfs. Nesses casos, você pode usar a opção de montagem do dispositivo para especificar os dispositivos que deseja usar para o sistema de arquivos de vários dispositivos Btrfs ou RAID.

Você pode usar a opção de montagem de dispositivo várias vezes para carregar diferentes dispositivos de armazenamento para o sistema de arquivos de vários dispositivos Btrfs ou RAID.

Você pode usar o nome do dispositivo (ou seja, sdb , sdc ) ou UUID , UUID_SUB ou PARTUUID do dispositivo de armazenamento com a opção de montagem do dispositivo para identificar o dispositivo de armazenamento.

Por exemplo,

- dispositivo=/dev/sdb

- dispositivo=/dev/sdb,dispositivo=/dev/sdc

- dispositivo=UUID_SUB=490a263d-eb9a-4558-931e-998d4d080c5d

- device=UUID_SUB=490a263d-eb9a-4558-931e-998d4d080c5d,device=UUID_SUB=f7ce4875-0874-436a-b47d-3edef66d3424

**6. degraded

A opção de montagem degradada** permite que um RAID Btrfs seja montado com menos dispositivos de armazenamento do que o perfil RAID requer.

Por exemplo, o perfil raid1 requer a presença de 2 dispositivos de armazenamento. Se um dos dispositivos de armazenamento não estiver disponível em qualquer caso, você usa a opção de montagem degradada para montar o RAID mesmo que 1 de 2 dispositivos de armazenamento esteja disponível.

**7. commit

A opção commit** mount é usada para definir o intervalo (em segundos) dentro do qual os dados serão gravados no dispositivo de armazenamento.

O padrão é definido como 30 segundos.

Para definir o intervalo de confirmação para 15 segundos, você pode usar a opção de montagem commit=15 (digamos).

**8. ssd e nossd

A opção de montagem ssd** informa ao sistema de arquivos Btrfs que o sistema de arquivos está usando um dispositivo de armazenamento SSD, e o sistema de arquivos Btrfs faz a otimização SSD necessária.

A opção de montagem nossd desativa a otimização do SSD.

O sistema de arquivos Btrfs detecta automaticamente se um SSD é usado para o sistema de arquivos Btrfs. Se um SSD for usado, a opção de montagem de SSD será habilitada. Caso contrário, a opção de montagem nossd é habilitada.

**9. ssd_spread e nossd_spread

A opção de montagem ssd_spread** tenta alocar grandes blocos contínuos de espaço não utilizado do SSD. Esse recurso melhora o desempenho de SSDs de baixo custo (baratos).

A opção de montagem nossd_spread desativa o recurso ssd_spread .

O sistema de arquivos Btrfs detecta automaticamente se um SSD é usado para o sistema de arquivos Btrfs. Se um SSD for usado, a opção de montagem ssd_spread será habilitada. Caso contrário, a opção de montagem nossd_spread é habilitada.

**10. descarte e nodiscard

Se você estiver usando um SSD que suporte TRIM enfileirado assíncrono (SATA rev3.1), a opção de montagem de descarte** permitirá o descarte de blocos de arquivos liberados. Isso melhorará o desempenho do SSD.

Se o SSD não suportar TRIM enfileirado assíncrono, a opção de montagem de descarte prejudicará o desempenho do SSD. Nesse caso, a opção de montagem nodiscard deve ser usada.

Por padrão, a opção de montagem nodiscard é usada.

**11. norecovery

Se a opção de montagem norecovery** for usada, o sistema de arquivos Btrfs não tentará executar a operação de recuperação de dados no momento da montagem.

**12. usebackuproot e nousebackuproot

Se a opção de montagem usebackuproot for usada, o sistema de arquivos Btrfs tentará recuperar qualquer raiz de árvore ruim/corrompida no momento da montagem. O sistema de arquivos Btrfs pode armazenar várias raízes de árvore no sistema de arquivos. A opção de montagem usebackuproot** procurará uma boa raiz de árvore e usará a primeira boa que encontrar.

A opção de montagem nousebackuproot não verificará ou recuperará raízes de árvore inválidas/corrompidas no momento da montagem. Este é o comportamento padrão do sistema de arquivos Btrfs.

**13. space_cache, space_cache=version, nospace_cache e clear_cache

A opção de montagem space_cache** é usada para controlar o cache de espaço livre. O cache de espaço livre é usado para melhorar o desempenho da leitura do espaço livre do grupo de blocos do sistema de arquivos Btrfs na memória (RAM).

O sistema de arquivos Btrfs suporta 2 versões do cache de espaço livre: v1 (padrão) e v2

O mecanismo de cache de espaço livre v2 melhora o desempenho de sistemas de arquivos grandes (tamanho de vários terabytes).

Você pode usar a opção de montagem space_cache=v1 para definir a v1 do cache de espaço livre e a opção de montagem space_cache=v2 para definir a v2 do cache de espaço livre.

A opção de montagem clear_cache é usada para limpar o cache de espaço livre.

Quando o cache de espaço livre v2 é criado, o cache deve ser limpo para criar um cache de espaço livre v1 .

Portanto, para usar o cache de espaço livre v1 após a criação do cache de espaço livre v2 , as opções de montagem clear_cache e space_cache=v1 devem ser combinadas: clear_cache,space_cache=v1

A opção de montagem nospace_cache é usada para desabilitar o cache de espaço livre.

Para desabilitar o cache de espaço livre após a criação do cache v1 ou v2 , as opções de montagem nospace_cache e clear_cache devem ser combinadas: clear_cache,nosapce_cache

**14. skip_balance

Por padrão, a operação de balanceamento interrompida/pausada de um sistema de arquivos Btrfs de vários dispositivos ou RAID Btrfs será retomada automaticamente assim que o sistema de arquivos Btrfs for montado. Para desabilitar a retomada automática da operação de equilíbrio interrompido/pausado em um sistema de arquivos Btrfs de vários dispositivos ou RAID Btrfs, você pode usar a opção de montagem skip_balance .**

**15. datacow e nodatacow

A opção datacow** mount habilita o recurso Copy-on-Write (CoW) do sistema de arquivos Btrfs. É o comportamento padrão.

Se você deseja desabilitar o recurso Copy-on-Write (CoW) do sistema de arquivos Btrfs para os arquivos recém-criados, monte o sistema de arquivos Btrfs com a opção de montagem nodatacow .

**16. datasum e nodatasum

A opção datasum** mount habilita a soma de verificação de dados para arquivos recém-criados do sistema de arquivos Btrfs. Este é o comportamento padrão.

Se você não quiser que o sistema de arquivos Btrfs faça a soma de verificação dos dados dos arquivos recém-criados, monte o sistema de arquivos Btrfs com a opção de montagem nodatasum .

Perfis Btrfs

Um perfil Btrfs é usado para informar ao sistema de arquivos Btrfs quantas cópias dos dados/metadados devem ser mantidas e quais níveis de RAID devem ser usados para os dados/metadados. O sistema de arquivos Btrfs contém muitos perfis. Entendê-los o ajudará a configurar um RAID Btrfs da maneira que você deseja.

Os perfis Btrfs disponíveis são os seguintes:

single : Se o perfil único for usado para os dados/metadados, apenas uma cópia dos dados/metadados será armazenada no sistema de arquivos, mesmo se você adicionar vários dispositivos de armazenamento ao sistema de arquivos. Assim, 100% do espaço em disco de cada um dos dispositivos de armazenamento adicionados ao sistema de arquivos pode ser utilizado.

dup : Se o perfil dup for usado para os dados/metadados, cada um dos dispositivos de armazenamento adicionados ao sistema de arquivos manterá duas cópias dos dados/metadados. Assim, 50% do espaço em disco de cada um dos dispositivos de armazenamento adicionados ao sistema de arquivos pode ser utilizado.

raid0 : No perfil raid0 , os dados/metadados serão divididos igualmente em todos os dispositivos de armazenamento adicionados ao sistema de arquivos. Nesta configuração, não haverá dados/metadados redundantes (duplicados). Assim, 100% do espaço em disco de cada um dos dispositivos de armazenamento adicionados ao sistema de arquivos pode ser usado. Se, em qualquer caso, um dos dispositivos de armazenamento falhar, todo o sistema de arquivos será corrompido. Você precisará de pelo menos dois dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid0 .

raid1 : No perfil raid1 , duas cópias dos dados/metadados serão armazenadas nos dispositivos de armazenamento adicionados ao sistema de arquivos. Nesta configuração, a matriz RAID pode sobreviver a uma falha de unidade. Mas você pode usar apenas 50% do espaço total em disco. Você precisará de pelo menos dois dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid1 .

raid1c3 : No perfil raid1c3 , três cópias dos dados/metadados serão armazenadas nos dispositivos de armazenamento adicionados ao sistema de arquivos. Nesta configuração, a matriz RAID pode sobreviver a duas falhas de unidade, mas você pode usar apenas 33% do espaço total em disco. Você precisará de pelo menos três dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid1c3 .

raid1c4 : No perfil raid1c4 , quatro cópias dos dados/metadados serão armazenadas nos dispositivos de armazenamento adicionados ao sistema de arquivos. Nesta configuração, a matriz RAID pode sobreviver a três falhas de unidade, mas você pode usar apenas 25% do espaço total em disco. Você precisará de pelo menos quatro dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid1c4 .

raid10 : No perfil raid10 , duas cópias dos dados/metadados serão armazenadas nos dispositivos de armazenamento adicionados ao sistema de arquivos, como no perfil raid1 . Além disso, os dados/metadados serão divididos entre os dispositivos de armazenamento, como no perfil raid0 .

O perfil raid10 é um híbrido dos perfis raid1 e raid0 . Alguns dos dispositivos de armazenamento formam arrays raid1 e alguns desses arrays raid1 são usados para formar um array raid0 . Em uma configuração raid10 , o sistema de arquivos pode sobreviver a uma única falha de unidade em cada uma das matrizes raid1 .

Você pode usar 50% do espaço total em disco na configuração raid10 . Você precisará de pelo menos quatro dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid10 .

raid5 : No perfil raid5 , uma cópia dos dados/metadados será dividida entre os dispositivos de armazenamento. Uma única paridade será calculada e distribuída entre os dispositivos de armazenamento do array RAID.

Em uma configuração raid5 , o sistema de arquivos pode sobreviver a uma única falha de unidade. Se uma unidade falhar, você pode adicionar uma nova unidade ao sistema de arquivos e os dados perdidos serão calculados a partir da paridade distribuída das unidades em execução.

Você pode usar 1 00x(N-1)/N % do total de espaços em disco na configuração raid5 . Aqui, N é o número de dispositivos de armazenamento adicionados ao sistema de arquivos. Você precisará de pelo menos três dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid5 .

raid6 : No perfil raid6 , uma cópia dos dados/metadados será dividida entre os dispositivos de armazenamento. Duas paridades serão calculadas e distribuídas entre os dispositivos de armazenamento do array RAID.

Em uma configuração raid6 , o sistema de arquivos pode sobreviver a duas falhas de unidade ao mesmo tempo. Se uma unidade falhar, você poderá adicionar uma nova unidade ao sistema de arquivos e os dados perdidos serão calculados a partir das duas paridades distribuídas das unidades em execução.

Você pode usar 100x(N-2)/N % do espaço total em disco na configuração raid6 . Aqui, N é o número de dispositivos de armazenamento adicionados ao sistema de arquivos. Você precisará de pelo menos quatro dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid6 .

-

@ 57c631a3:07529a8e

2025-04-07 13:17:50

@ 57c631a3:07529a8e

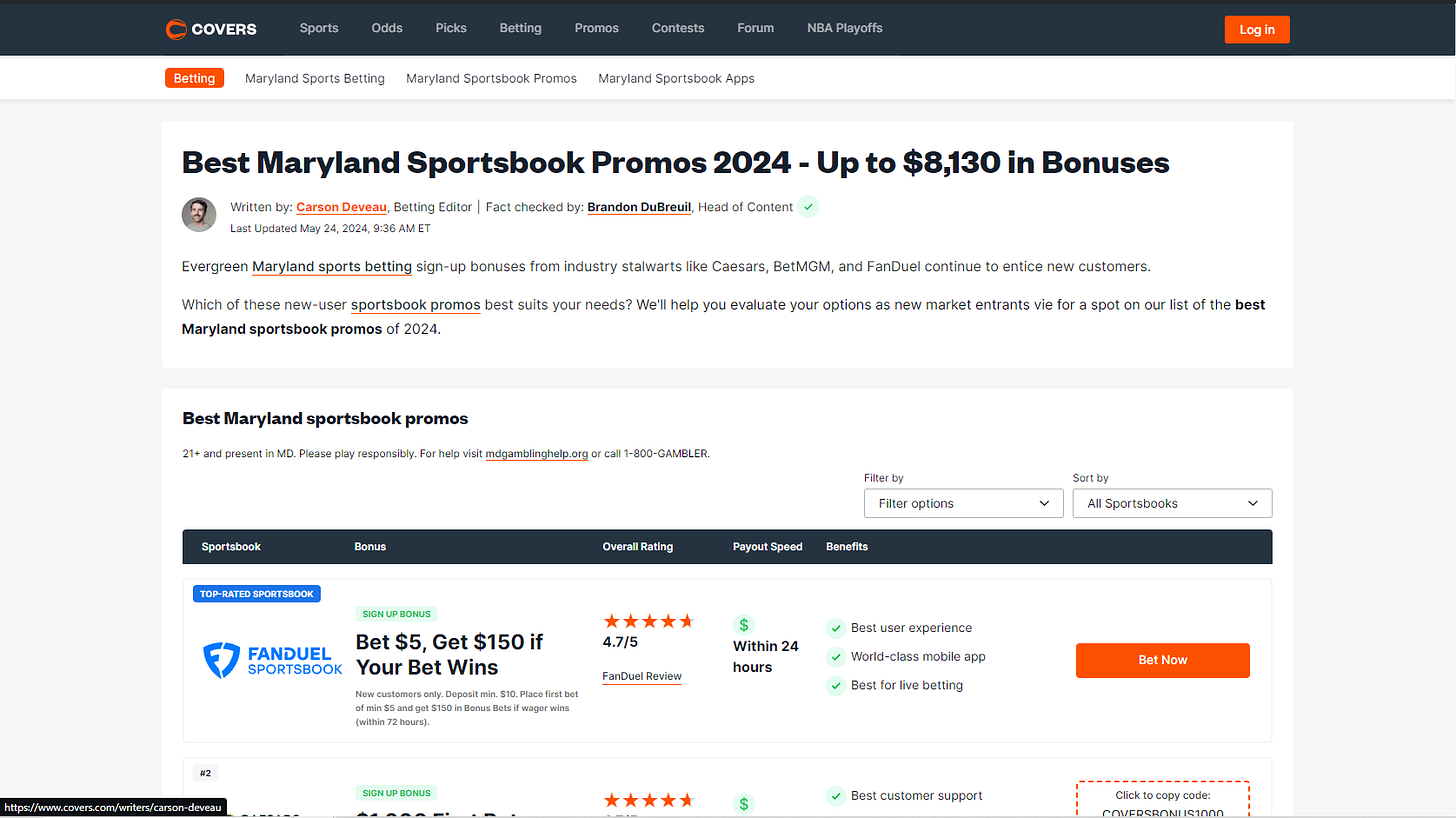

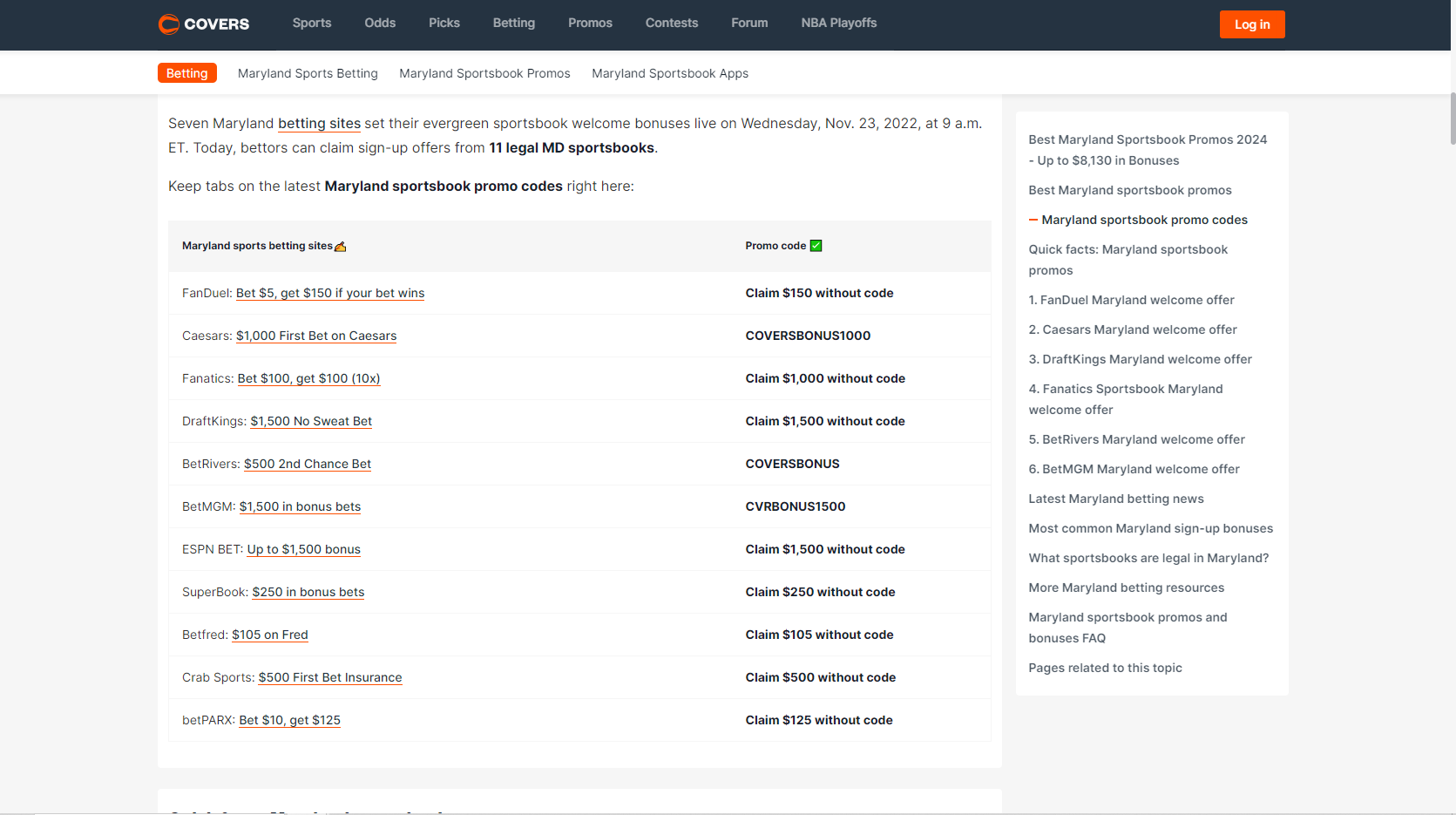

2025-04-07 13:17:50What is Growth Engineering? Before we start: if you’ve already filled out the What is your tech stack? survey: thank you! If you’ve not done so, your help will be greatly appreciated. It takes 5-15 minutes to complete. Those filling out will receive results before anyone else, and additional analysis from myself and Elin. Fill out this survey here.**

npub1sg6plzptd64u62a878hep2kev88swjh3tw00gjsfl8f237lmu63q0uf63m

Growth engineering was barely known a decade ago, but today, most scaleups and many publicly traded tech companies have dedicated growth teams staffed by growth engineers. However, some software engineers are still suspicious of this new area because of its reputation for hacky code with little to no code coverage.

For this reason and others, I thought it would be interesting to learn more from an expert who can tell us all about the practicalities of this controversial domain. So I turned to Alexey Komissarouk, who’s been in growth engineering since 2016, and was in charge of it at online education platform, MasterClass. These days, Alexey lives in Tokyo, Japan, where he advises on growth engineering and teaches the Growth Engineering course at Reforge.

In today’s deep dive, Alexey covers:

- What is Growth Engineering? In the simplest terms: writing code to help a company make more money. But there are details to consider: like the company size where it makes sense to have a dedicated team do this.

- What do Growth Engineers work on? Business-facing work, empowerment and platform work are the main areas.

- Why Growth Engineers move faster than Product Engineers. Product Engineers ship to build: Growth Engineers ship to learn. Growth Engineers do take shortcuts that would make no sense when building for longevity – doing this on purpose.

- Tech stack. Common programming languages, monitoring and oncall, feature flags and experimentation, product analytics, review apps, and more.

- What makes a good Growth Engineer? Curiosity, “build to learn” mindset and a “Jack of all trades” approach.

- Where do Growth Engineers fit in? Usually part of the engineering department, either operating as with an “owner” or a “hitchiker” model.

- Becoming a Growth Engineer. A great area if you want to eventually become a founder or product manager – but even if not, it can accelerate your career growth. Working in Growth forces you to learn more about the business.

With that, it’s over to Alexey:

I’ll never forget the first time I made my employer a million dollars.

I was running a push notification A/B test for meal delivery startup Sprig, trying to boost repeat orders.

A push notification similar to what we tested to boost repeat orders

Initial results were unpromising; the push notification was not receiving many opens. Still, I wanted to be thorough: before concluding the idea was a failure, I wrote a SQL query to compare order volume for subsequent weeks between customers in test vs control.

The SQL used to figure out the push notification’s efficiency

As it turned out, our test group “beat” the control group by around 10%:

‘review_5_push’ was the new type of push notification. Roughly the same amount of users clicked it, but they placed 10% more in orders

I plugged the numbers into a significance calculator, which showed it was statistically significant – or “stat-sig” – and therefore highly unlikely to be a coincidence. This meant we had a winner on our hands! But how meaningful was it, really, and what would adding the push notification mean for revenue, if rolled out to 100% of users?

It turned out this experiment created an additional $1.5 million dollars, annually, with just one push notification. Wow!

I was hooked. Since that day, I've shipped hundreds of experimental “winners” which generated hundreds of millions of incremental revenue for my employers. But you never forget the first one. Moments like this is what growth engineering is all about.

1. What is Growth Engineering?

Essentially, growth engineering is the writing of code to make a company money. Of course, all code produced by a business on some level serves this purpose, but while Product Engineers focus on creating a Product worth paying for, Growth Engineers instead focus on making that good product have a good business. To this end, they focus on optimizing and refining key parts of the customer journey, such as:

- Getting more people to consider the product

- Converting them into paying customers

- Keeping them as customers for longer, and spending more

What kinds of companies employ Growth Engineers? Places you’ve heard of, like Meta, LinkedIn, DoorDash, Coinbase, and Dropbox, are some of the ones I’ve had students from. There’s also OpenAI, Uber, Tiktok, Tinder, Airbnb, Pinterest… the list of high-profile companies goes on. Most newer public consumer companies you’ve heard have a growth engineering org, too.

Typically, growth engineering orgs are started by companies at Series B stage and beyond, so long as they are selling to either consumers or businesses via SaaS. These are often places trying to grow extremely fast, and have enough software engineers that some can focus purely on growth. Before the Series B stage, a team is unlikely to be ready for growth for various reasons; likely that it hasn’t found product-market fit, or has no available headcount, or lacks the visitor traffic required to run A/B tests.

Cost is a consideration. A fully-loaded growth team consisting of a handful of engineers, a PM, and a designer costs approximately 1 million dollars annually. To justify this, a rule of thumb is to have at least $5 million dollars in recurring revenue – a milestone often achieved at around the Series B stage.

Despite the presence of growth engineering at many public consumer tech companies, the field itself is still quite new, as a discipline and as a proper title.

Brief history of growth engineering

When I joined Opendoor in 2016, there was a head of growth but no dedicated growth engineers, but there were by the time I left in 2020. At MasterClass soon after, there was a growth org and a dozen dedicated growth engineers. So when did growth engineering originate?

The story is that its origins lie at Facebook in 2007. The team was created by then-VP of platform and monetization Chamath Palihapitiya. Reforce founder and CEO Brian Balfour shares:

“Growth (the kind found on an org chart) began at Facebook under the direction of Chamath Palihapitiya. In 2007, he joined the early team in a nebulous role that fell somewhere between Product, Marketing, and Operations. According to his retelling of the story on Recode Decode, after struggling to accomplish anything meaningful in his first year on the job, he was on the verge of being fired.Sheryl Sandberg joined soon after him, and in a hail mary move he pitched her the game-changing idea that led to the creation of the first-ever growth team. This idea not only saved his job, but earned him the lion’s share of the credit for Facebook’s unprecedented growth.At the time, Sheryl and Mark asked him, “What do you call this thing where you help change the product, do some SEO and SEM, and algorithmically do this or that?”His response: “I don’t know, I just call that, like, Growth, you know, we’re going to try to grow. I’ll be the head of growing stuff."And just like that, Growth became a thing.”

Rather than focus on a particular product or feature, the growth team at Facebook focused on moving the needle, and figuring out which features to work on. These days, Meta employs hundreds if not thousands of growth engineers.

2. What do Growth Engineers work on?

Before we jump into concrete examples, let’s identify three primary focus areas that a growth engineer’s work usually involves.

- Business-facing work – improving the business directly

- Empowerment work – enabling other teams to improve the business

- Platform work – improving the velocity of the above activities

Let’s go through all three:

Business-facing work

This is the bread and butter of growth engineering, and follows a common pattern:

- Implement an idea. Try something big or small to try and move a key business metric, which differs by team but is typically related to conversion rate or retention.

- Quantify impact. Usually via A/B testing.

- Analyze impact. Await results, analyze impact, ship or roll back – then go back to the first step.

Experiments can lead to sweeping or barely noticeable changes. A famous “I can’t believe they needed to test this” was when Google figured out which shade of blue generates the most clicks. At MasterClass, we tested things across the spectrum:

- Small: should we show the price right on the homepage, was that a winner? Yes, but we framed it in monthly terms of $15/month, not $180/year.

- Medium: when browsing a course page, should we include related courses, or more details about the course itself? Was it a winner? After lengthy experimentation, it was hard to tell: both are valuable and we needed to strike the right balance.

- Large: when a potential customer is interested, do we take them straight to checkout, or encourage them to learn more? Counterintuitively, adding steps boosted conversion!

Empowerment

One of the best ways an engineer can move a target metric is by removing themselves as a bottleneck, so colleagues from marketing can iterate and optimize freely. To this end, growth engineers can either build internal tools or integrate self-serve MarTech (Marketing Technology) vendors.

With the right tool, there’s a lot that marketers can do without engineering’s involvement:

- Build and iterate on landing pages (Unbounce, Instapage, etc)

- Draft and send email, SMS and Push Notifications (Iterable, Braze, Customer.io, etc)

- Connect new advertising partners (Google Tag Manager, Segment, etc)

We go more into detail about benefits and applications in the MarTech section of Tech Stack, below.

Platform work

As a business scales, dedicated platform teams help improve stability and velocity for the teams they support. Within growth, this often includes initiatives like:

- Experiment Platform. Many parts of running an experiment can be standardized, from filtering the audience, to bucketing users properly, to observing statistical methodology. Historically, companies built reusable Experiment Platforms in-house, but more recently, vendors such as Eppo and Statsig have grown in popularity with fancy statistical methodologies like “Controlled Using Pre-Experiment Data” (CUPED) that give more signal with less data.

- Reusable components. Companies with standard front-end components for things like headlines, buttons, and images, dramatically reduce the time required to spin up a new page. No more "did you want 5 or 6 pixels here" with a designer; instead growth engineers rely on tools like Storybook to standardize and share reusable React components.

- Monitoring. Growth engineering benefits greatly from leveraging monitoring to compensate for reduced code coverage. High-quality business metric monitoring tools can detect bugs before they cause damage.

When I worked at MasterClass, having monitoring at the ad layer prevented at least one six-figure incident. One Friday, a marketer accidentally broadened the audience for a particular ad from US-only, to worldwide. In response, the Facebook Ad algorithm went on a spending spree, bringing in plenty of visitors from places like Brazil and India, whom we knew from past experience were unlikely to purchase the product. Fortunately, our monitoring noticed the low-performing campaign within minutes, and an alert was sent to the growth engineer on-call, who immediately reached out to the marketer and confirmed the change was unintentional, and then shut down the campaign.

Without this monitoring, a subtle targeting error like this could have gone unnoticed all weekend and would have eaten up $100,000+ of marketing budget. This episode shows that platform investment can benefit everyone; and since growth needs them most, it’s often the growth platform engineering team which implements them.

As the day-to-day work of a Growth Engineer shows, A/B tests are a critical tool to both measure success and learn. It’s a numbers game: the more A/B tests a team can run in a given quarter, the more of them will end up winners, making the team successful. It’s no wonder, then, that Growth Engineering will pull out all the stops to improve velocity.

3. Why Growth Engineers move faster than Product Engineers

On the surface, growth engineering teams look like product engineering ones; writing code, shipping pull requests, monitoring on-call, etc. So how do they move so much faster? The big reason lies in philosophy and focus, not technology. To quote Elena Verna, head of growth at Dropbox:

“Product Engineering teams ship to build; Growth Engineering teams ship to learn.”

Real-world case: price changes at Masterclass

A few years ago at MasterClass, the growth team wanted to see if changing our pricing model to multiple tiers would improve revenue.

Inspired in part by multiple pricing tiers for competitors such as Netflix (above), Disney Plus, and Hulu.

The “multiple pricing tier” proposal for MasterClass.

From a software engineering perspective, this was a highly complex project because:

- Backend engineering work: the backend did not yet support multiple pricing options, requiring a decent amount of engineering, and rigorous testing to make sure existing customers weren’t affected.

- Client app changes: on the device side, multiple platforms (iOS, iPad, Android, Roku, Apple TV, etc) would each need to be updated, including each relevant app store.

The software engineering team estimated that becoming a “multi-pricing-tier” company would take months across numerous engineering teams, and engineering leadership was unwilling to greenlight that significant investment.

We in growth engineering took this as a challenge. As usual, our goal was not just to add the new pricing model, but to learn how much money it might bring in. The approach we ended up proposing was a Fake Door test, which involves offering a not-yet-available option to customers to gauge interest level. This was risky, as taking a customer who’s ready to pay and telling them to join some kind of waiting list is a colossal waste, and risks making them feel like the target of a “bait and switch” trick.

We found a way. The key insight was that people are only offended about a “bait and switch”, if the “switch” is worse than the “bait.” Telling customers they would pay $100 and then switching to $150 would cause a riot, but starting at $150 and then saying “just kidding, it’s only $100” is a pleasant surprise.

The good kind of surprise.

So long as every test “pricing tier” is less appealing – higher prices, fewer features – than the current offering, we could “upgrade” customers after their initial selection. A customer choosing the cheapest tier gets extra features at no extra cost, while a customer choosing a more expensive tier is offered a discount.

We created three new tiers, at different prices. The new “premium” tier would describe the existing, original offering. Regardless of what potential customers selected, they got this “original offering,” during the experiment.

The best thing about this was that no backend changes were required. There were no real, new, back-end pricing plans; everybody ended up purchasing the same version of MasterClass for the same price, with the same features. The entirety of the engineering work was on building a new pricing page, and the “congratulations, you’ve been upgraded” popup. This took just a few days.

Within a couple of weeks, we had enough data to be confident the financial upside of moving to a multi-pricing-tier model would be significant. With this, we’re able to convince the rest of engineering’s leadership to invest in building the feature properly. In the end, launching multiple pricing tiers turned out to be one of the biggest revenue wins of the year.

Building a skyscraper vs building a tent

The MasterClass example demonstrates the spirit of growth engineering; focusing on building to learn, instead of building to last. Consider building skyscrapers versus tents.

Building a tent optimizes for speed of set-up and tear-down over longevity. You don’t think of a tent as one that is shoddy or low-quality compared to skyscrapers: it’s not even the same category of buildings! Growth engineers maximize use of lightweight materials. To stick with the tents vs skyscraper metaphor: we prioritize lightweight fabric materials over steel and concrete whenever possible. We only resort to traditional building materials when there’s no other choice, or when a direction is confirmed as correct. Quality is important – after all, a tent must keep out rain and mosquitoes. However, the speed-vs-durability tradeoff decision results in very different approaches and outcomes.

4. Tech stack

At first glance, growth and product engineers use the same tooling, and contribute to the same codebases. But growth engineering tends to be high-velocity, experiment-heavy, and with limited test coverage. This means that certain “nice to have” tools for product engineering are mission-critical for growth engineers.

Read more https://connect-test.layer3.press/articles/ea02c1a1-7cfa-42b4-8722-0165abcae8bb

-

@ bf47c19e:c3d2573b

2025-05-22 21:07:02

@ bf47c19e:c3d2573b

2025-05-22 21:07:02Originalni tekst na bitcoin-balkan.com.

Pregled sadržaja

- Šta je Bitcoin?

- Šta Bitcoin može da učini za vas?

- Zašto ljudi kupuju Bitcoin?

- Da li je vaš novac siguran u dolarima, kućama, akcijama ili zlatu?

- Šta je bolje za štednju od dolara, kuća i akcija?

- Po čemu se Bitcoin razlikuje od ostalih valuta?

- kako Bitcoin spašava svet?

- Kako mogu da saznam više o Bitcoin-u?

Bitcoin čini da štednja novca bude kul – i praktična – ponovo. Ovaj članak objašnjava kako i zašto.

Šta je Bitcoin?

Bitcoin se naziva digitalno zlato, mašina za istinu, blockchain, peer to peer mreža čvorova, energetski ponor i još mnogo toga. Bitcoin je, u stvari, sve ovo. Međutim, ova objašnjenja su često toliko tehnička i suvoparna, da bi većina ljudi radije gledala kako trava raste. Što je najvažnije, ova objašnjenja ne pokazuju kako Bitcoin ima bilo kakve koristi za vas.

iPod nije postao kulturološka senzacija jer ga je Apple nazvao „prenosnim digitalnim medijskim uređajem“. Postao je senzacija jer su ga zvali “1,000 pesama u vašem džepu.”

Ne zanima vas šta je Bitcoin. Vas zanima šta on može da učini za vas.

Baš kao i Internet, vaš auto, vaš telefon, kao i mnogi drugi uređaji i sistemi koje svakodnevno koristite, vi ne treba da znate šta je Bitcoin ili kako to funkcioniše da biste razumeli šta on može da učini za vas.

Šta Bitcoin može da učini za vas?

Bitcoin može da sačuva vaš teško zarađeni novac.

Bitcoin je stekao veliku pažnju u 2017. i 2018. godini zbog svoje spekulativne upotrebe. Mnogi ljudi su ga kupili nadajući se da će se obogatiti. Cena je naglo porasla, a zatim se srušila. Ovo nije bio prvi put da je Bitcoin uradio to. Međutim, niko nikada nije izgubio novac držeći bitcoin duže od 3,5 godine – ćak i ako je kupio na apsolutnim vrhovima.

Zašto Bitcoin konstantno raste? Ljudi počinju da shvataju koliko je Bitcoin moćan, kao način uštede novca u svetu u kojem je ’novac’ poput dolara, eura i drugih nacionalnih valuta dizajniran da gubi vrednost.

Ovo čini Bitcoin odličnom opcijom za štednju novca na nekoliko godina ili više. Bitcoin je bolji od štednje novca u dolarima, akcijama, nekretninama, pa čak i u zlatu.

Zato pokušajte da zaboravite na trenutak na razumevanje blockchaina, digitalne valute, kriptografije, seed fraza, novčanika, rudarstva i svih ostalih nerazumljivih termina. Za sada, razgovarajmo o tome zašto ljudi kupuju Bitcoin: razlog je prostiji nego što vi mislite.

Zašto ljudi kupuju Bitcoin?

Naravno, svako ima svoj razlog za kupovinu Bitcoin-a. Jedan od razloga, koji verovatno često čujete, je taj što mu vrednost raste. Ljudi žele da se obogate. Uskoče kao spekulanti, krenu u vožnju i najverovatnije ih prodaju ubrzo nakon kupovine.

Međutim, čak i kada cena krene naglo prema gore i strmoglavo padne nazad, mnogi ljudi ostanu i nakon tog pada. Otkud mi to znamo? Broj aktivnih novčanika dnevno, koji je otprilike sličan broju korisnika Bitcoin-a, nastavlja da raste. Takođe, nakon svakog balona u istoriji Bitcoin-a, cena se nikada ne vraća na svoju cenu pre balona. Uvek ostane malo višlja. Bitcoin se penje, a svaka masovna spekulativna serija dovodi sve više i više ljudi.

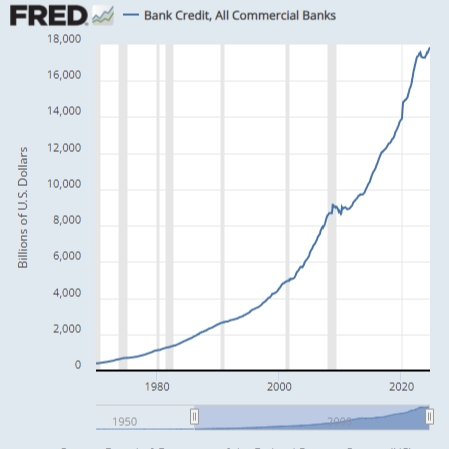

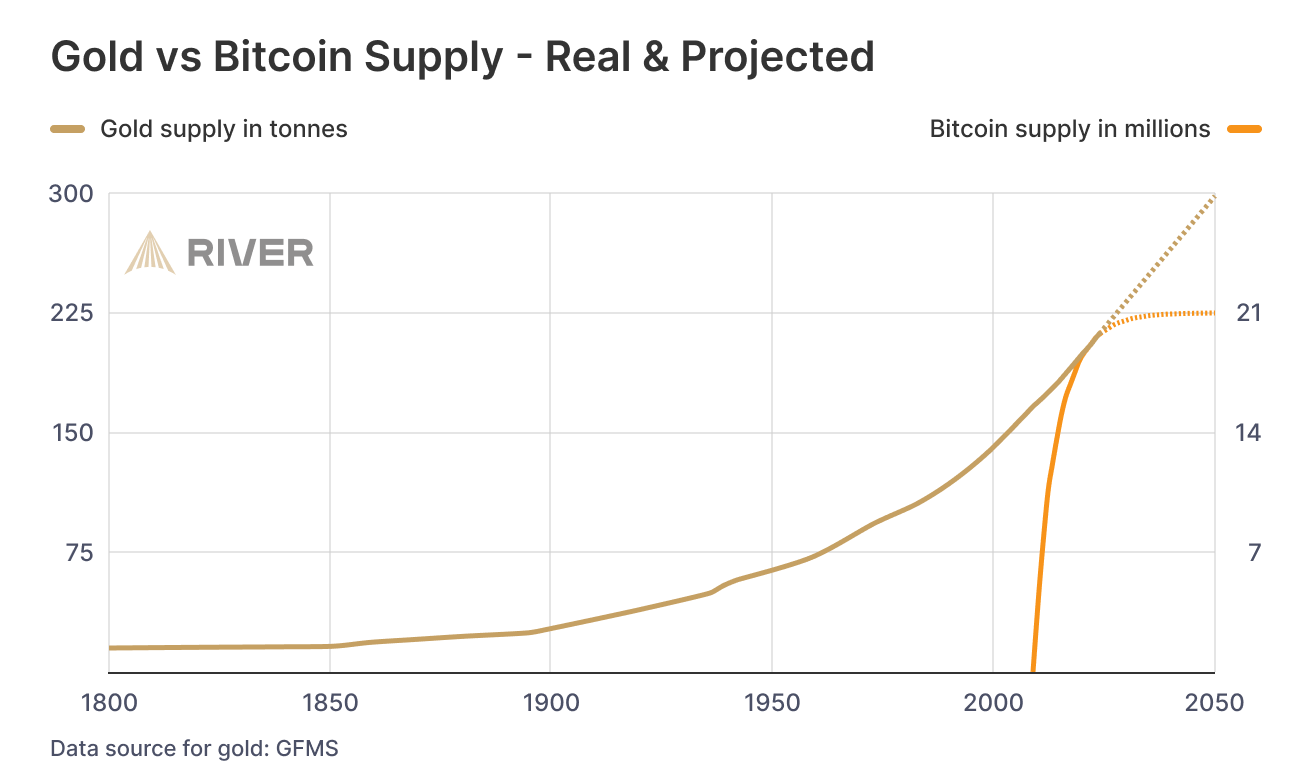

Broj aktivnih Bitcoin novčanika neprekidno raste

„Aktivna adresa“ znači da je neko tog dana poslao Bitcoin transakciju. Donji grafikon je na logaritamskoj skali.

Izvor: Glassnode

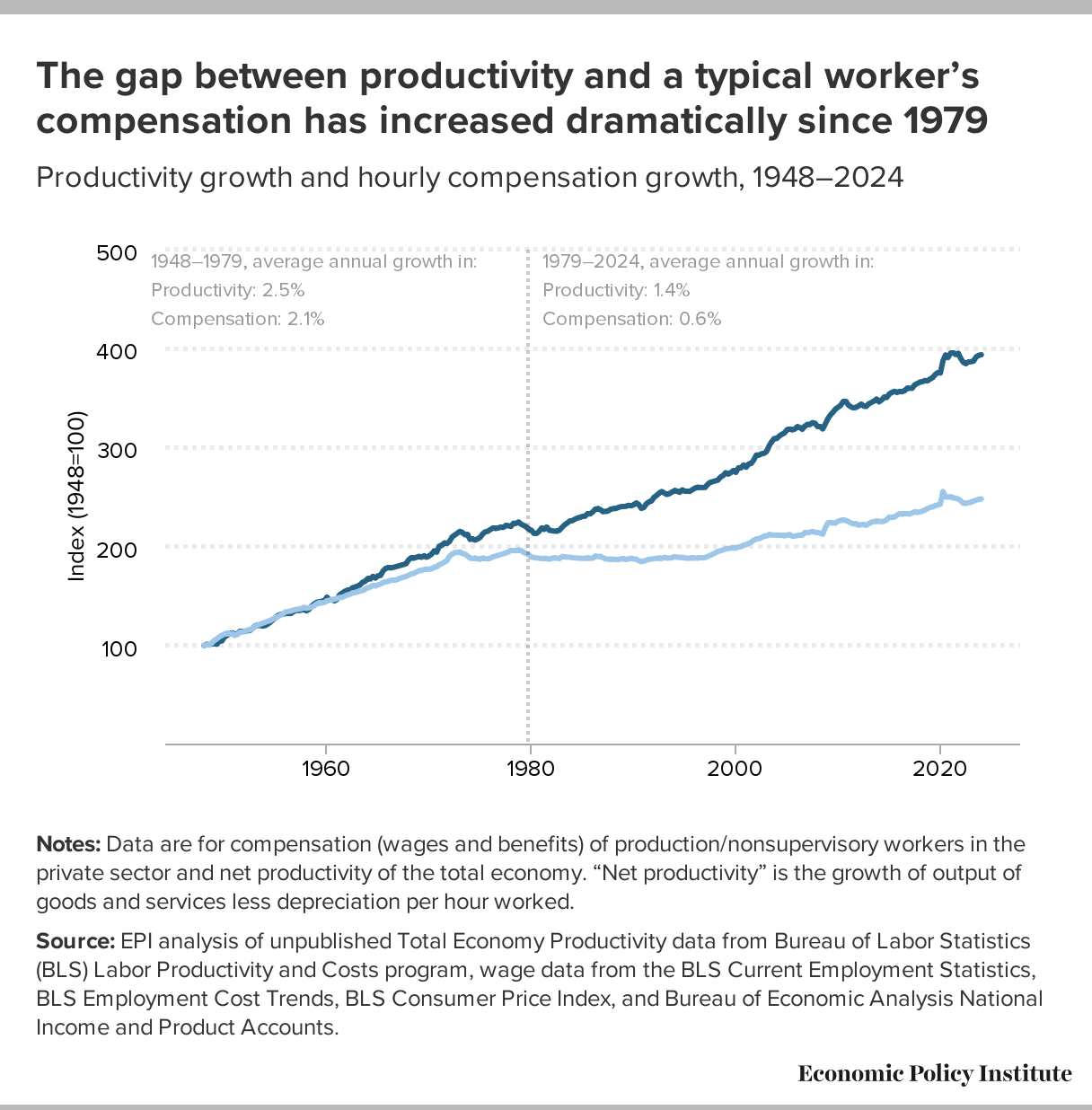

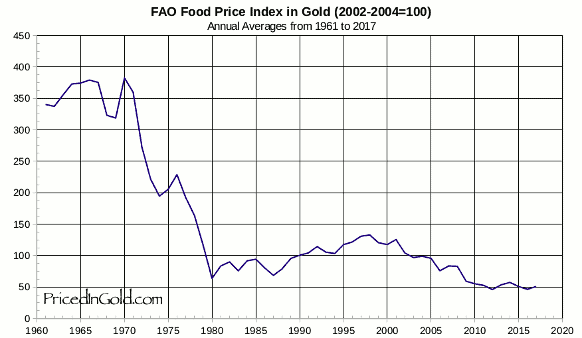

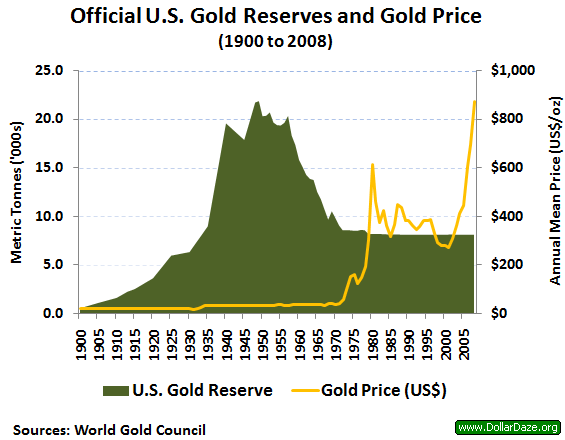

Izvor: GlassnodeCena Bitcoina se neprestano penje

Kroz istoriju Bitcoin-a možemo videti divlje kolebanje cena, ali nakon svakog balona, cena se ostaje višlja nego pre. Ovo je cena Bitcoin-a na logaritamskoj skali.

Izvor: Glassnode

Izvor: GlassnodeTo pokazuje da se ljudi zadržavaju: potražnja za Bitcoin-om se povećava. Da je svaki masovni rast cena bio samo balon koji su iscenirali prevaranti koji žele brzo da se obogate, cena bi se vratila na nivo pre balona. To se dogodilo sa lalama, ali ne i sa Bitcoin-om.

I zašto se onda cena Bitcoin-a stalno povećava? Sve veći broj ljudi čuva Bitcoin dugoročno – oni razumeju šta Bitcoin može učiniti za njihovu štednju.

Zašto ljudi štede svoj novac u Bitcoin-u umesto na štednim računima, kućama, deonicama ili zlatu? Hajde da pogledajmo sve te metode štednje, i zatim da ih uporedimo sa Bitcoin-om.

Da li je vaš novac siguran u dolarima, kućama, akcijama ili zlatu?

Tokom mnogo godina, to su bile pristojne opcije za štednju. Međutim, sistem koji podržava vrednost svega ovoga je u krizi.

Dolari, Euri, Dinari

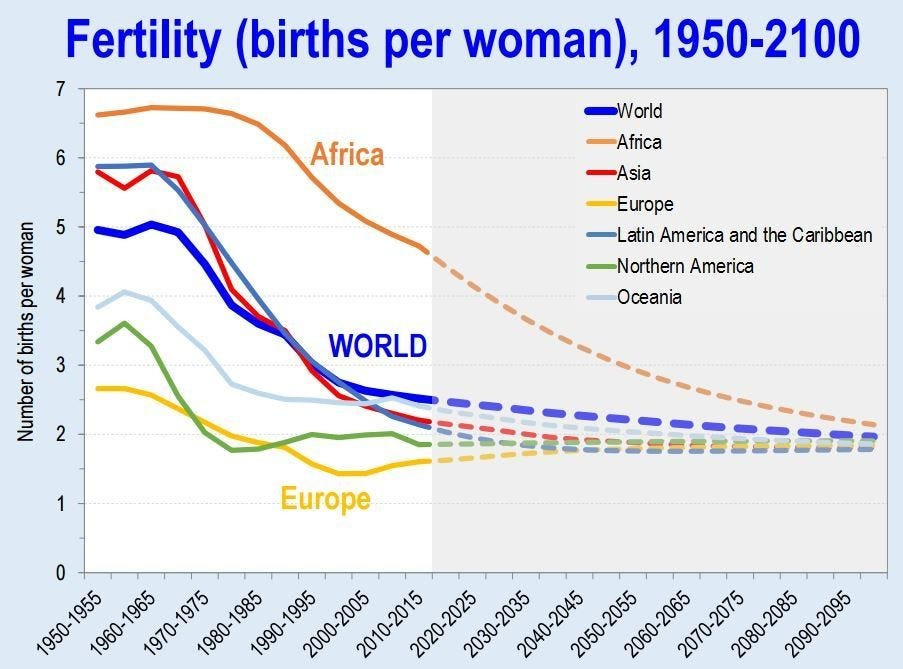

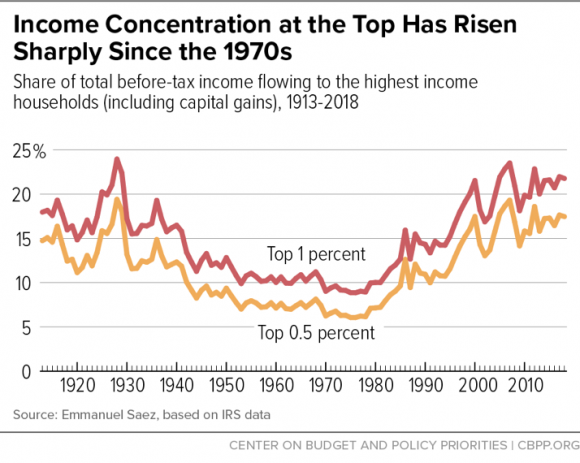

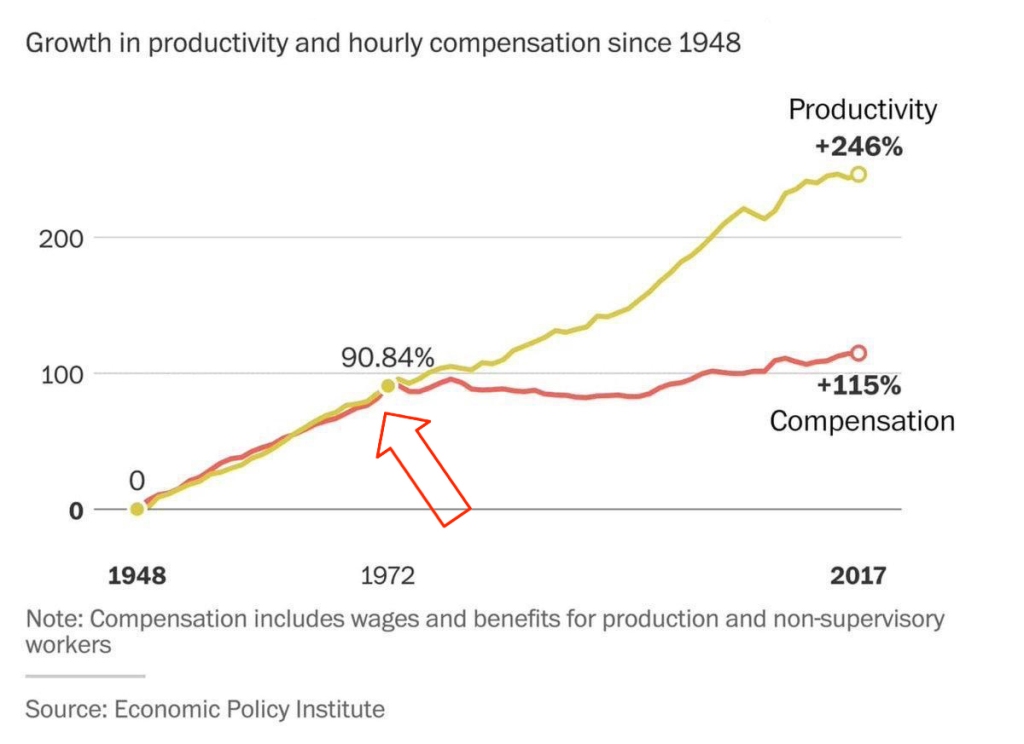

Dolari i sve ostale „tradicionalne“ valute koje proizvode vlade, stvorene su da izgube vrednost kroz inflaciju. Banke i tradicionalni monetarni sistem uzrokuju inflaciju stalnim stvaranjem i distribucijom novog novca. Kada Američke Federalne Rezerve objave ciljanu stopu od 2% inflacije, to znači da žele da vaš novac svake godine izgubi 2% od svoje vrednosti. Čak i sa inflacijom od samo 2%, vaša štednja u dolarima izgubiće polovinu vrednosti tokom 40-godišnjeg radnog veka.

Izveštena inflacija se danas opasno povečava, uprkos rastućem „buretu sa barutom“ koji bi mogao da explodira i dovede do masivne hiperinflacije. Što je više valute u opticaju, to je više baruta u buretu.