-

@ 57d1a264:69f1fee1

2025-05-21 05:47:41

@ 57d1a264:69f1fee1

2025-05-21 05:47:41As a product builder over too many years to mention, I’ve lost count of the number of times I’ve seen promising ideas go from zero to hero in a few weeks, only to fizzle out within months.

The problem with most finance apps, however, is that they often become a reflection of the internal politics of the business rather than an experience solely designed around the customer. This means that the focus is on delivering as many features and functionalities as possible to satisfy the needs and desires of competing internal departments, rather than providing a clear value proposition that is focused on what the people out there in the real world want. As a result, these products can very easily bloat to become a mixed bag of confusing, unrelated and ultimately unlovable customer experiences—a feature salad, you might say.

Financial products, which is the field I work in, are no exception. With people’s real hard-earned money on the line, user expectations running high, and a crowded market, it’s tempting to throw as many features at the wall as possible and hope something sticks. But this approach is a recipe for disaster.

Here’s why: https://alistapart.com/article/from-beta-to-bedrock-build-products-that-stick/

https://stacker.news/items/985285

-

@ 51bbb15e:b77a2290

2025-05-21 00:24:36

@ 51bbb15e:b77a2290

2025-05-21 00:24:36Yeah, I’m sure everything in the file is legit. 👍 Let’s review the guard witness testimony…Oh wait, they weren’t at their posts despite 24/7 survellience instructions after another Epstein “suicide” attempt two weeks earlier. Well, at least the video of the suicide is in the file? Oh wait, a techical glitch. Damn those coincidences!

At this point, the Trump administration has zero credibility with me on anything related to the Epstein case and his clients. I still suspect the administration is using the Epstein files as leverage to keep a lot of RINOs in line, whereas they’d be sabotaging his agenda at every turn otherwise. However, I just don’t believe in ends-justify-the-means thinking. It’s led almost all of DC to toss out every bit of the values they might once have had.

-

@ a6b4114e:60d83c46

2025-05-21 03:25:43

@ a6b4114e:60d83c46

2025-05-21 03:25:43GTA San Andreas is one installment of Grand Theft Auto.

It is safe and secure for your device. No harmful elements have been found yet. It does not contain viruses, malware, bloatware, bugs, or threats, as its authority always upgrades the game to eliminate unwanted components. The amazing thing is that the game is 100% free for Android users.

You do not pay a single cent from your pocket.

Download: https://androidhd.com/en/gta-san-andreas

-

@ c9badfea:610f861a

2025-05-20 19:49:20

@ c9badfea:610f861a

2025-05-20 19:49:20- Install Sky Map (it's free and open source)

- Launch the app and tap Accept, then tap OK

- When asked to access the device's location, tap While Using The App

- Tap somewhere on the screen to activate the menu, then tap ⁝ and select Settings

- Disable Send Usage Statistics

- Return to the main screen and enjoy stargazing!

ℹ️ Use the 🔍 icon in the upper toolbar to search for a specific celestial body, or tap the 👁️ icon to activate night mode

-

@ 04c915da:3dfbecc9

2025-05-20 15:53:48

@ 04c915da:3dfbecc9

2025-05-20 15:53:48This piece is the first in a series that will focus on things I think are a priority if your focus is similar to mine: building a strong family and safeguarding their future.

Choosing the ideal place to raise a family is one of the most significant decisions you will ever make. For simplicity sake I will break down my thought process into key factors: strong property rights, the ability to grow your own food, access to fresh water, the freedom to own and train with guns, and a dependable community.

A Jurisdiction with Strong Property Rights

Strong property rights are essential and allow you to build on a solid foundation that is less likely to break underneath you. Regions with a history of limited government and clear legal protections for landowners are ideal. Personally I think the US is the single best option globally, but within the US there is a wide difference between which state you choose. Choose carefully and thoughtfully, think long term. Obviously if you are not American this is not a realistic option for you, there are other solid options available especially if your family has mobility. I understand many do not have this capability to easily move, consider that your first priority, making movement and jurisdiction choice possible in the first place.

Abundant Access to Fresh Water

Water is life. I cannot overstate the importance of living somewhere with reliable, clean, and abundant freshwater. Some regions face water scarcity or heavy regulations on usage, so prioritizing a place where water is plentiful and your rights to it are protected is critical. Ideally you should have well access so you are not tied to municipal water supplies. In times of crisis or chaos well water cannot be easily shutoff or disrupted. If you live in an area that is drought prone, you are one drought away from societal chaos. Not enough people appreciate this simple fact.

Grow Your Own Food

A location with fertile soil, a favorable climate, and enough space for a small homestead or at the very least a garden is key. In stable times, a small homestead provides good food and important education for your family. In times of chaos your family being able to grow and raise healthy food provides a level of self sufficiency that many others will lack. Look for areas with minimal restrictions, good weather, and a culture that supports local farming.

Guns

The ability to defend your family is fundamental. A location where you can legally and easily own guns is a must. Look for places with a strong gun culture and a political history of protecting those rights. Owning one or two guns is not enough and without proper training they will be a liability rather than a benefit. Get comfortable and proficient. Never stop improving your skills. If the time comes that you must use a gun to defend your family, the skills must be instinct. Practice. Practice. Practice.

A Strong Community You Can Depend On

No one thrives alone. A ride or die community that rallies together in tough times is invaluable. Seek out a place where people know their neighbors, share similar values, and are quick to lend a hand. Lead by example and become a good neighbor, people will naturally respond in kind. Small towns are ideal, if possible, but living outside of a major city can be a solid balance in terms of work opportunities and family security.

Let me know if you found this helpful. My plan is to break down how I think about these five key subjects in future posts.

-

@ 554ab6fe:c6cbc27e

2025-05-20 15:51:33

@ 554ab6fe:c6cbc27e

2025-05-20 15:51:33Introduction

It is becoming increasingly evident that sunlight is an essential nutrient for the body. To be more precise, the various wavelengths coming from the sun provide different benefits to the body, and each play a vital role in human health. Even more so, they work in concert with one another, as one wavelength may help reduce the potentially harmful effects of another. Benefits are maximized and harm reduced when we are exposed to the full breadth of this rainbow. This article will attempt to shed light on these various benefits and synergies.

To put this discussion into context, it is important to consider the overall health benefits of sunlight exposure. In a Swedish study that followed 29,000 women over 20 years, it was found that the mortality rate was doubled in those who avoided sun exposure when compared to those that didn’t (Lindqvist et al. 2016). Women who avoided the sun were twice as likely to die, primarily from cardiovascular disease, and there was no difference between death from malignant melanoma between the two groups (Lindqvist et al. 2016).

To understand why sunlight is so beneficial to health, it is important to make clear the diverse range of wavelengths that come from the sun. We typically think of the sun as a provider of both visible light and warmth. However, the spectrum of light visible to the human eye is a narrow band of the wavelengths actually emitted by the sun.

As wavelengths become shorter, visible light becomes more blue. Beyond the visible spectrum on the blue end, we arrive at ultraviolet (UV) light. On the other end of the spectrum are the longer red wavelengths. Outside of the visible window on the red side is infrared (IR) light, which provides heat. For helpful context, consider how shorter wavelengths have a harder time penetrating our atmosphere. So, the skies of dawn and dusk are predominately filled with red and near-infrared (NIR) light, while the middle of the day contains more blue and UV light. The bulk of wavelengths from the sun throughout the day are on the NIR end. The entire spectrum of visible and non-visible light between UV and IR plays critical roles in human health, especially towards mitochondrial health and metabolism. To summarize these benefits and provide a general overview for the following article, the benefits are as follows:

- UV – aids in the production of vitamin D and melanin, but also causes DNA damage

- Vitamin D improves immune system function and can repair DNA damage

- Melanin stores electrons for use within mitochondria

- Blue – involved in our circadian rhythm as the absence of blue light triggers the production of melatonin, an important antioxidant.

- Near-infrared (NIR) – improves mitochondria function and energy production while also protecting us from the harms of blue and UV light.

Ultraviolet Light

Let’s begin with a discussion around the widely misunderstood light of UV. UV is often viewed as a dangerous form of light, given that it can cause DNA damage and lead to cancer. While true, this myopic point of view ignores the crucial benefits of UV light. UV light produces vitamin D, which counteracts the DNA damage caused by UV while providing many other benefits. Additionally, UV light triggers the production of melanin, which aids in mitochondrial function. Like all physiological processes in the body that are vital to survival, there is a release of POMC-derived endorphins when skin comes into contact with UV light (Fell et al. 2014). Any person likely reading this article can agree that sitting under the sun simply feels amazing. We are drawn to it in a deeply meaningful sense.

Vitamin D is one of the most important chemicals regarding health, and it is poorly named. The term ‘vitamin’ refers to a compound that is important for health but cannot be adequately made within the body and must be retrieved externally. Peoples of the Northern and Southern hemisphere who are exposed to less UV light during winter would, for example, historically retrieve their vitamin D from foods such as oily fish, seal blubber, whale blubber, and polar bear liver (Wacker and Holick 2013). In a similar way, vitamin D was given its name 100 years ago when it was found that cod-liver oil was capable of curing rickets, when it was found that the so-called vitamin could promote calcium deposition in bones (McCollum et al. 1922). It was only until much later, in 1981, when scientists discovered that human skin could also synthesize vitamin D (M. F. Holick 1981). A majority of human vitamin D is produced by the skin when exposed to UVB (280 – 315 nm), while a minor amount is gained through food (Prietl et al. 2013; Wacker and Holick 2013). Most cells and organs in the human body have vitamin D receptors and many organs also have the ability to produce it, this speaks to the incredibly important nature of this compound towards our health (Prietl et al. 2013; Wacker and Holick 2013). Vitamin D deficiency has been associated with various types of cancer, autoimmune disorders, type 1 diabetes mellitus, multiple sclerosis (MS), cardiovascular disease, and even schizophrenia (Michael F. Holick 2007; Wacker and Holick 2013). Multiple studies have also found that vitamin D deficiency increases all-cause mortality (Garland et al. 2014; Yang et al. 2011; Chowdhury et al. 2014).

Though the historical benefits to vitamin D were attributed mainly to bone health, it is far more important. Vitamin D plays a critical role in protecting against invasive pathogens, reducing autoimmunity, and maintaining overall health (Wimalawansa 2023). Regarding immunity, one way it does this is by causing a shift away from proinflammatory responses to one more centered around T cell activation (Prietl et al. 2013). Vitamin D has therefore been shown to benefit other disorders that are related to immunity, such as a study that found vitamin D supplementation during pregnancy reduced asthmatic symptoms in children (Litonjua et al. 2016). That being said, it is important to highlight how there is no substitution for natural sunlight as a means of getting vitamin D. Naturally produced vitamin D from the skin lasts 2-3 times longer in the body (Wacker and Holick 2013). This is one of many likely reasons why the natural avenue should always be preferred over the supplemental. A similar line of reasoning follows in methods of getting UV light, as natural sun exposure leads to a decrease of all-cause mortality while the use of artificial tanning beds has been shown to increase all-cause and cancer mortality (Yang et al. 2011). More on why this likely occurs later.

Beyond vitamin D’s benefits to the immune system, it is important to focus on the compound’s role in mitochondrial health. In a previous article I wrote titled “Sunlight and Health”, I delve deeper into the importance of mitochondria and the science of how they work. In simplicity, imagine how all life on earth centers around energy. The sun provides energy to the earth, and the plethora of life on earth harness and facilitate the flow of that energy. Plants and animals share a symbiotic relationship within this system. Plants, through photosynthesis, take in sunlight, CO2, and water and create a glucose precursor and oxygen. This occurs within the chloroplast of plant cells. Within human cells, we have mitochondria. Our mitochondria, in turn, take in oxygen and glucose and produce CO2, water, and energy for our bodies in the form of ATP. What the plant breathes out, we breathe in, and vice versa. Mitochondria are central to all animal life on earth, and the ATP produced is central to all physiologic function. If your mitochondria are unhealthy, you are unhealthy and will experience disease.

Vitamin D plays a role in mitochondrial health at a DNA level. Our cells have DNA, which we inherited from our mother and father. On top of that, the mitochondria within our cells have their own set of DNA (mtDNA). Our mitochondria come from our mother’s egg, and therefore our mtDNA always is inherited from our mother. UV light can cause damage to both our DNA and mtDNA (Birch-Machin, Russell, and Latimer 2013). This is what gives UV light the ability to cause cancer. Additionally, damage to the mtDNA within our mitochondria can lead to mitochondrial dysfunction. The more poorly our mitochondria function, the less energy we produce for our cells, and the less healthy our cells become. There is research being developed that suggests the role of vitamin D is to counterbalance this danger by regulating gene transcription and reducing mtDNA damage. A mouse study conducted in 2011, for example, found that different shapes of vitamin D reduce the development of tumors in mice following UV exposure (Dixon et al. 2011). It is not unlike nature to create a system of checks and balances, to ensure that the damaging effects of UV light are counterbalanced by a compound produced by the body when exposure to that same light.

While vitamin D may be important for mitochondrial health by protecting against mtDNA damage, melanin potentially plays a much larger role. Melanin is the pigment in our skin that make us darker. Not only is the diversity in skin tones across humans due to variations in melanin content, but a tan is also the creation of more melanin. To be more specific, the skin’s exposure to UVA (315-400nm) leads to the creation of melanin (Wicks et al. 2011). The most obvious benefit to the production of melanin, which most people could appreciate, is that the darker or tanner our skin is, the less damage we will receive from UV light. In this way, melanin shares a similar responsibility to vitamin D, where both are protecting the body against the very thing that forms them. Even more crucially however, melanin acts as a battery for the mitochondria.

During cellular respiration, where mitochondria turn oxygen and glucose into energy, electrons are stripped from the glucose for use. In other words, what our mitochondria really need are oxygen and electrons, and the glucose is simply a means to an end. If the mitochondria are the engine, then the electrons are the fuel (assuming you are still breathing). Due to its chemical structure, melanin is a natural reversible oxidation-reduction system (Figge 1939). In other words, it can both store and release electrons. Melanin is therefore a kind of battery, retrieving electrons from various sources, and storing them for future use in our mitochondria as a substitute for food. When stated this way, and considering how food is important because both fats and carbohydrates fuel the body by providing electrons to our mitochondria, one can imagine how vitally important melanin is. Melanin is central towards the availability of electrons for use in our body to produce the energy to live. Without adequate melanin, your mitochondria will starve for fuel and not provide your body with the energy it needs to thrive.

Blue Light

To contextualize the role blue light plays in human health, it is important to revisit an important byproduct of cellular respiration within mitochondria. When mitochondria turn electrons and oxygen into energy, there is a byproduct formed known as reactive oxygen species (ROS). ROS play important roles in the body, but in excess they can cause DNA damage and disrupt various cellular processes. For example, UV light causes cancer due to the ROS generated, and studies have found that blue light does the same in both the skin and eyes (Nakashima, Ohta, and Wolf 2017; Abdouh et al. 2024). This research suggests that excess blue light or blue light in isolation can damage the eyes and cause harm like UV light.

Blue and UV light are predominant during the middle of the day. Though both may cause oxidative stress on the body, the body simultaneously counteracts this damage through melatonin. Think of melatonin as the junk remover for mitochondria. Throughout the day mitochondria produce energy, and ROS is formed. During our nighttime sleep, melatonin plays an important role as an antioxidant and removes the excess ROS (Leon et al. 2004).

The relationship between blue light and melatonin is important. During the day, when blue light is present, our body suppresses the production of melatonin (West et al. 2011). When the sun sets and there is no longer a heavy presence of blue light, our body begins to produce melatonin for sleep. This is a central function for how our body gets tired at night and gets ready for sleep. This is also why artificial light at night, from our modern technology, is harmful to human health because it tricks the body into the continual suppression of melatonin production. Without proper melatonin production, our cells buildup too much ROS and this can cause mitochondrial dysfunction and other sleep related issues.

Beyond the importance of getting good sleep and producing melatonin to remove excess ROS from our cells, the existence of artificial light and excess blue light is problematic during the day as well. As stated previously, blue light causes ROS buildup in both the skin and eyes (Nakashima, Ohta, and Wolf 2017; Abdouh et al. 2024). As with most harms from sunlight, our body has adapted with a backup plan. During the day, when blue and UV light is present, there is simultaneous exposure to NIR light (650-1200nm). Recent research suggests that NIR also counterbalances the harm of blue light by increasing melatonin synthesis in the mitochondria (Tan et al. 2023). This highlights the importance of receiving the full spectrum of light from the sun, as one wavelength counterbalances the damages of the other.

Near-Infrared Light

While indoor living has been commonplace for humans across generations, and modern technology has over saturated our bodies with blue light, some recent changes to our technology have made things worse. Incandescent light bulbs emit NIR light, this is why they got warm. However, LED lights do not emit NIR light. Therefore, where people of past generations were potentially exposed to a lot of artificial light at night, this was counterbalanced by the NIR emitted by those same lightbulbs. Now, modern humans use LEDs and spend 93% of our time indoors with zero exposure to NIR, which is 90% of the light emitted by the sun (Tan et al. 2023).

Not only does NIR light protect our bodies from the damaging consequences of blue light, but it similarly protects us against UV light. As stated previously, NIR may result in the production of melatonin within mitochondria during the day, helping protect against the ROS buildup and mtDNA damage. Additionally, research has also found that NIR light protects from UV light in other ways. For example, a study in 2008 found that pretreating skin with NIR light (660nm) prevented sunburns (Barolet and Boucher 2008). Another study found that red and NIR light (620-690nm) altered gene expression and upregulated DNA repair (Kim et al. 2019). Again, this highlights the theme that the body has produced the means to protect itself from the harms of the sun via other rays emitted. However, the protection from harmful rays is best achieved when exposed to the full spectrum of light wavelengths as they change throughout the day. The light of dawn and dusk is predominately red and NIR. Therefore, this research suggests that being exposed to morning light will protect the body from the potentially cancer-causing effects of the UV light later in the day. A human being who lived outside would naturally be exposed to this spectrum of light every day. However, modern humans may be inside in the morning, go to the beach during the middle of the day, and get sunburned because they do not properly receive the full spectrum of light as nature intended every day.

Lastly, it is important to explore the ways NIR improves mitochondrial function. If electrons are the fuel source for this engine, and melatonin is the junk removal, then NIR is the lubricant. NIR improves the energy output of mitochondria, and there are various hypotheses for how this occurs. One hypothesis is that NIR boosts the functionality of cytochrome c oxidase, one of the chromophores used in the electron transport chain (ETC) of cellular respiration within mitochondria (De Freitas and Hamblin 2016). Another involves NIR light’s ability to modify the viscosity of water which increases the efficiency of the final step in the ETC, the ATP synthase (Sommer, Haddad, and Fecht 2015). ATP synthase can be thought of as a kind of pump that produces ATP, in this way NIR can be thought of almost literally as a lubricant for this pump.

Summary

In summary, the research involving how sunlight affects mitochondrial health highlights the importance of the full spectrum of wavelengths, each of which plays a vital role in human health throughout the day. Having exposure to one, without the other, can lead to imbalances and mitochondrial disease. The red and NIR light in the morning helps our mitochondria produce more energy throughout the day, while also preparing our bodies for the beneficial yet dangerous wavelengths to come. In the middle of the day, we receive much more UV and blue light, which help us produce vitamin D and melanin, both central to health and wellness. Once the sun sets, and blue light is absent, we produce melatonin for sleep. During our sleep, the melatonin removes the dangerous byproducts of our energy-producing day, protecting us from disease and preparing us for the following day. Mitochondria are central to human health and life on earth, and the rays from the sun are central to mitochondrial health.

Respecting nature and its cycles is vital for us humans who are increasingly immersing ourselves in a world dominated by technology. Our ancestors did not have to reconcile with these ideas, because life forced these exposures upon them. If we wish to maintain health in our modern world, we must be able to find balance. Even though some might think they can escape into the virtual world, our bodies will always and forever be connected and reliant upon the natural one.

References

Abdouh, Mohamed, Yunxi Chen, Alicia Goyeneche, and Miguel N. Burnier. 2024. “Blue Light-Induced Mitochondrial Oxidative Damage Underlay Retinal Pigment Epithelial Cell Apoptosis.” International Journal of Molecular Sciences 25 (23): 12619.

Barolet, Daniel, and Annie Boucher. 2008. “LED Photoprevention: Reduced MED Response Following Multiple LED Exposures.” Lasers in Surgery and Medicine 40 (2): 106–12.

Birch-Machin, M. A., E. V. Russell, and J. A. Latimer. 2013. “Mitochondrial DNA Damage as a Biomarker for Ultraviolet Radiation Exposure and Oxidative Stress.” The British Journal of Dermatology 169 (s2): 9–14.

Chowdhury, Rajiv, Setor Kunutsor, Anna Vitezova, Clare Oliver-Williams, Susmita Chowdhury, Jessica C. Kiefte-de-Jong, Hassan Khan, et al. 2014. “Vitamin D and Risk of Cause Specific Death: Systematic Review and Meta-Analysis of Observational Cohort and Randomised Intervention Studies.” BMJ (Clinical Research Ed.) 348 (apr01 2): g1903.

De Freitas, Lucas Freitas, and Michael R. Hamblin. 2016. “Proposed Mechanisms of Photobiomodulation or Low-Level Light Therapy.” IEEE Journal of Selected Topics in Quantum Electronics: A Publication of the IEEE Lasers and Electro-Optics Society 22 (3): 348–64.

Dixon, Katie M., Anthony W. Norman, Vanessa B. Sequeira, Ritu Mohan, Mark S. Rybchyn, Vivienne E. Reeve, Gary M. Halliday, and Rebecca S. Mason. 2011. “1α,25(OH)₂-Vitamin D and a Nongenomic Vitamin D Analogue Inhibit Ultraviolet Radiation-Induced Skin Carcinogenesis.” Cancer Prevention Research (Philadelphia, Pa.) 4 (9): 1485–94.

Fell, Gillian L., Kathleen C. Robinson, Jianren Mao, Clifford J. Woolf, and David E. Fisher. 2014. “Skin β-Endorphin Mediates Addiction to UV Light.” Cell 157 (7): 1527–34.

Figge, Frank H. J. 1939. “Melanin: A Natural Reversible Oxidation-Reduction System and Indicator.” Experimental Biology and Medicine (Maywood, N.J.) 41 (1): 127.

Garland, Cedric F., June Jiwon Kim, Sharif Burgette Mohr, Edward Doerr Gorham, William B. Grant, Edward L. Giovannucci, Leo Baggerly, et al. 2014. “Meta-Analysis of All-Cause Mortality According to Serum 25-Hydroxyvitamin D.” American Journal of Public Health 104 (8): e43-50.

Holick, M. F. 1981. “The Cutaneous Photosynthesis of Previtamin D3: A Unique Photoendocrine System.” The Journal of Investigative Dermatology 77 (1): 51–58.

Holick, Michael F. 2007. “Vitamin D Deficiency.” The New England Journal of Medicine 357 (3): 266–81.

Kim, Hyun Soo, Yeo Jin Kim, Su Ji Kim, Doo Seok Kang, Tae Ryong Lee, Dong Wook Shin, Hyoung-June Kim, and Young Rok Seo. 2019. “Transcriptomic Analysis of Human Dermal Fibroblast Cells Reveals Potential Mechanisms Underlying the Protective Effects of Visible Red Light against Damage from Ultraviolet B Light.” Journal of Dermatological Science 94 (2): 276–83.

Leon, Josefa, Dario Acuña-Castroviejo, Rosa M. Sainz, Juan C. Mayo, Dun Xian Tan, and Russel J. Reiter. 2004. “Melatonin and Mitochondrial Function.” Life Sciences. Elsevier Inc. https://doi.org/10.1016/j.lfs.2004.03.003.

Lindqvist, P. G., E. Epstein, K. Nielsen, M. Landin-Olsson, C. Ingvar, and H. Olsson. 2016. “Avoidance of Sun Exposure as a Risk Factor for Major Causes of Death: A Competing Risk Analysis of the Melanoma in Southern Sweden Cohort.” Journal of Internal Medicine 280 (4): 375–87.

Litonjua, Augusto A., Vincent J. Carey, Nancy Laranjo, Benjamin J. Harshfield, Thomas F. McElrath, George T. O’Connor, Megan Sandel, et al. 2016. “Effect of Prenatal Supplementation with Vitamin D on Asthma or Recurrent Wheezing in Offspring by Age 3 Years: The VDAART Randomized Clinical Trial.” JAMA: The Journal of the American Medical Association 315 (4): 362–70.

McCollum, E. V., Nina Simmonds, J. Ernestine Becker, and P. G. Shipley. 1922. “Studies on Experimental Rickets.” The Journal of Biological Chemistry 53 (2): 293–312.

Nakashima, Yuya, Shigeo Ohta, and Alexander M. Wolf. 2017. “Blue Light-Induced Oxidative Stress in Live Skin.” Free Radical Biology & Medicine 108 (July): 300–310.

Prietl, Barbara, Gerlies Treiber, Thomas R. Pieber, and Karin Amrein. 2013. “Vitamin D and Immune Function.” Nutrients 5 (7): 2502–21.

Sommer, Andrei P., Mike Kh Haddad, and Hans Jörg Fecht. 2015. “Light Effect on Water Viscosity: Implication for ATP Biosynthesis.” Scientific Reports 5 (July). https://doi.org/10.1038/srep12029.

Tan, Dun-Xian, Russel J. Reiter, Scott Zimmerman, and Ruediger Hardeland. 2023. “Melatonin: Both a Messenger of Darkness and a Participant in the Cellular Actions of Non-Visible Solar Radiation of near Infrared Light.” Biology 12 (1): 89.

Wacker, Matthias, and Michael F. Holick. 2013. “Sunlight and Vitamin D: A Global Perspective for Health: A Global Perspective for Health.” Dermato-Endocrinology 5 (1): 51–108.

West, Kathleen E., Michael R. Jablonski, Benjamin Warfield, Kate S. Cecil, Mary James, Melissa A. Ayers, James Maida, et al. 2011. “Blue Light from Light-Emitting Diodes Elicits a Dose-Dependent Suppression of Melatonin in Humans.” Journal of Applied Physiology (Bethesda, Md.: 1985) 110 (3): 619–26.

Wicks, Nadine L., Jason W. Chan, Julia A. Najera, Jonathan M. Ciriello, and Elena Oancea. 2011. “UVA Phototransduction Drives Early Melanin Synthesis in Human Melanocytes.” Current Biology: CB 21 (22): 1906.

Wimalawansa, Sunil J. 2023. “Infections and Autoimmunity-the Immune System and Vitamin D: A Systematic Review.” Nutrients 15 (17): 3842.

Yang, Ling, Marie Lof, Marit Bragelien Veierød, Sven Sandin, Hans-Olov Adami, and Elisabete Weiderpass. 2011. “Ultraviolet Exposure and Mortality among Women in Sweden.” Cancer Epidemiology, Biomarkers & Prevention: A Publication of the American Association for Cancer Research, Cosponsored by the American Society of Preventive Oncology 20 (4): 683–90.

- UV – aids in the production of vitamin D and melanin, but also causes DNA damage

-

@ 04c915da:3dfbecc9

2025-05-20 15:50:48

@ 04c915da:3dfbecc9

2025-05-20 15:50:48For years American bitcoin miners have argued for more efficient and free energy markets. It benefits everyone if our energy infrastructure is as efficient and robust as possible. Unfortunately, broken incentives have led to increased regulation throughout the sector, incentivizing less efficient energy sources such as solar and wind at the detriment of more efficient alternatives.

The result has been less reliable energy infrastructure for all Americans and increased energy costs across the board. This naturally has a direct impact on bitcoin miners: increased energy costs make them less competitive globally.

Bitcoin mining represents a global energy market that does not require permission to participate. Anyone can plug a mining computer into power and internet to get paid the current dynamic market price for their work in bitcoin. Using cellphone or satellite internet, these mines can be located anywhere in the world, sourcing the cheapest power available.

Absent of regulation, bitcoin mining naturally incentivizes the build out of highly efficient and robust energy infrastructure. Unfortunately that world does not exist and burdensome regulations remain the biggest threat for US based mining businesses. Jurisdictional arbitrage gives miners the option of moving to a friendlier country but that naturally comes with its own costs.

Enter AI. With the rapid development and release of AI tools comes the requirement of running massive datacenters for their models. Major tech companies are scrambling to secure machines, rack space, and cheap energy to run full suites of AI enabled tools and services. The most valuable and powerful tech companies in America have stumbled into an accidental alliance with bitcoin miners: THE NEED FOR CHEAP AND RELIABLE ENERGY.

Our government is corrupt. Money talks. These companies will push for energy freedom and it will greatly benefit us all.

-

@ 04c915da:3dfbecc9

2025-05-20 15:47:16

@ 04c915da:3dfbecc9

2025-05-20 15:47:16Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-

2030–2031\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

-

2032\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

Part Two: 2047

-

2047 (Early Year)\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

-

2047 (Mid-Year)\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

-

2047 (Late Year)\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

Key Differences

- Currency Dynamics: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- Government Power: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- Societal Outcome: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

-

@ 7460b7fd:4fc4e74b

2025-05-21 02:35:36

@ 7460b7fd:4fc4e74b

2025-05-21 02:35:36如果比特币发明了真正的钱,那么 Crypto 是什么?

引言

比特币诞生之初就以“数字黄金”姿态示人,被支持者誉为人类历史上第一次发明了真正意义上的钱——一种不依赖国家信用、总量恒定且不可篡改的硬通货。然而十多年过去,比特币之后蓬勃而起的加密世界(Crypto)已经远超“货币”范畴:从智能合约平台到去中心组织,从去央行的稳定币到戏谑荒诞的迷因币,Crypto 演化出一个丰富而混沌的新生态。这不禁引发一个根本性的追问:如果说比特币解决了“真金白银”的问题,那么 Crypto 又完成了什么发明?

Crypto 与政治的碰撞:随着Crypto版图扩张,全球政治势力也被裹挟进这场金融变革洪流(示意图)。比特币的出现重塑了货币信用,但Crypto所引发的却是一场更深刻的政治与治理结构实验。从华尔街到华盛顿,从散户论坛到主权国家,越来越多人意识到:Crypto不只是技术或金融现象,而是一种全新的政治表达结构正在萌芽。正如有激进论者所断言的:“比特币发明了真正的钱,而Crypto则在发明新的政治。”价格K线与流动性曲线,或许正成为这个时代社群意志和社会价值观的新型投射。

Crypto 与政治的碰撞:随着Crypto版图扩张,全球政治势力也被裹挟进这场金融变革洪流(示意图)。比特币的出现重塑了货币信用,但Crypto所引发的却是一场更深刻的政治与治理结构实验。从华尔街到华盛顿,从散户论坛到主权国家,越来越多人意识到:Crypto不只是技术或金融现象,而是一种全新的政治表达结构正在萌芽。正如有激进论者所断言的:“比特币发明了真正的钱,而Crypto则在发明新的政治。”价格K线与流动性曲线,或许正成为这个时代社群意志和社会价值观的新型投射。冲突结构:当价格挑战选票

传统政治中,选票是人民意志的载体,一人一票勾勒出民主治理的正统路径。而在链上的加密世界里,骤升骤降的价格曲线和真金白银的买卖行为却扮演起了选票的角色:资金流向成了民意走向,市场多空成为立场表决。价格行为取代选票,这听来匪夷所思,却已在Crypto社群中成为日常现实。每一次代币的抛售与追高,都是社区对项目决策的即时“投票”;每一根K线的涨跌,都折射出社区意志的赞同或抗议。市场行为本身承担了决策权与象征权——价格即政治,正在链上蔓延。

这一新生政治形式与旧世界的民主机制形成了鲜明冲突。bitcoin.org中本聪在比特币白皮书中提出“一CPU一票”的工作量证明共识,用算力投票取代了人为决策bitcoin.org。而今,Crypto更进一步,用资本市场的涨跌来取代传统政治的选举。支持某项目?直接购入其代币推高市值;反对某提案?用脚投票抛售资产。相比漫长的选举周期和层层代议制,链上市场提供了近乎实时的“公投”机制。但这种机制也引发巨大争议:资本的投票天然偏向持币多者(富者)的意志,是否意味着加密政治更为金权而非民权?持币多寡成为影响力大小,仿佛选举演变成了“一币一票”,巨鲸富豪俨然掌握更多话语权。这种与民主平等原则的冲突,成为Crypto政治形式饱受质疑的核心张力之一。

尽管如此,我们已经目睹市场投票在Crypto世界塑造秩序的威力:2016年以太坊因DAO事件分叉时,社区以真金白银“投票”决定了哪条链获得未来。arkhamintelligence.com结果是新链以太坊(ETH)成为主流,其市值一度超过2,800亿美元,而坚持原则的以太经典(ETC)市值不足35亿美元,不及前者的八十分之一arkhamintelligence.com。市场选择清楚地昭示了社区的政治意志。同样地,在比特币扩容之争、各类硬分叉博弈中,无不是由投资者和矿工用资金与算力投票,胜者存续败者黯然。价格成为裁决纷争的最终选票,冲击着传统“选票决胜”的政治理念。Crypto的价格民主,与现代代议民主正面相撞,激起当代政治哲思中前所未有的冲突火花。

治理与分配

XRP对决SEC成为了加密世界“治理与分配”冲突的经典战例。2020年底,美国证券交易委员会(SEC)突然起诉Ripple公司,指控其发行的XRP代币属于未注册证券,消息一出直接引爆市场恐慌。XRP价格应声暴跌,一度跌去超过60%,最低触及0.21美元coindesk.com。曾经位居市值前三的XRP险些被打入谷底,监管的强硬姿态似乎要将这个项目彻底扼杀。

然而XRP社区没有选择沉默。 大批长期持有者组成了自称“XRP军团”(XRP Army)的草根力量,在社交媒体上高调声援Ripple,对抗监管威胁。面对SEC的指控,他们集体发声,质疑政府选择性执法,声称以太坊当年发行却“逍遥法外”,只有Ripple遭到不公对待coindesk.com。正如《福布斯》的评论所言:没人预料到愤怒的加密散户投资者会掀起法律、政治和社交媒体领域的‘海啸式’反击,痛斥监管机构背弃了保护投资者的承诺crypto-law.us。这种草根抵抗监管的话语体系迅速形成:XRP持有者不但在网上掀起舆论风暴,还采取实际行动向SEC施压。他们发起了请愿,抨击SEC背离保护投资者初衷、诉讼给个人投资者带来巨大伤害,号召停止对Ripple的上诉纠缠——号称这是在捍卫全球加密用户的共同利益bitget.com。一场由民间主导的反监管运动就此拉开帷幕。

Ripple公司则选择背水一战,拒绝和解,在法庭上与SEC针锋相对地鏖战了近三年之久。Ripple坚称XRP并非证券,不应受到SEC管辖,即使面临沉重法律费用和业务压力也不妥协。2023年,这场持久战迎来了标志性转折:美国法庭作出初步裁决,认定XRP在二级市场的流通不构成证券coindesk.com。这一胜利犹如给沉寂已久的XRP注入强心针——消息公布当天XRP价格飙涨近一倍,盘中一度逼近1美元大关coindesk.com。沉重监管阴影下苟延残喘的项目,凭借司法层面的突破瞬间重获生机。这不仅是Ripple的胜利,更被支持者视为整个加密行业对SEC强权的一次胜仗。

XRP的对抗路线与某些“主动合规”的项目形成了鲜明对比。 稳定币USDC的发行方Circle、美国最大合规交易所Coinbase等选择了一条迎合监管的道路:它们高调拥抱现行法规,希望以合作换取生存空间。然而现实却给了它们沉重一击。USDC稳定币在监管风波中一度失去美元锚定,哪怕Circle及时披露储备状况也无法阻止恐慌蔓延,大批用户迅速失去信心,短时间内出现数十亿美元的赎回潮blockworks.co。Coinbase则更为直接:即便它早已注册上市、反复向监管示好,2023年仍被SEC指控为未注册证券交易所reuters.com,卷入漫长诉讼漩涡。可见,在迎合监管的策略下,这些机构非但未能换来监管青睐,反而因官司缠身或用户流失而丧失市场信任。 相比之下,XRP以对抗求生存的路线反而赢得了投资者的眼光:价格的涨跌成为社区投票的方式,抗争的勇气反过来强化了市场对它的信心。

同样引人深思的是另一种迥异的治理路径:技术至上的链上治理。 以MakerDAO为代表的去中心化治理模式曾被寄予厚望——MKR持币者投票决策、算法维持稳定币Dai的价值,被视为“代码即法律”的典范。然而,这套纯技术治理在市场层面却未能形成广泛认同,亦无法激发群体性的情绪动员。复杂晦涩的机制使得普通投资者难以参与其中,MakerDAO的治理讨论更多停留在极客圈子内部,在社会大众的政治对话中几乎听不见它的声音。相比XRP对抗监管所激发的铺天盖地关注,MakerDAO的治理实验显得默默无闻、难以“出圈”。这也说明,如果一种治理实践无法连接更广泛的利益诉求和情感共鸣,它在社会政治层面就难以形成影响力。

XRP之争的政治象征意义由此凸显: 它展示了一条“以市场对抗国家”的斗争路线,即通过代币价格的集体行动来回应监管权力的施压。在这场轰动业界的对决中,价格即是抗议的旗帜,涨跌映射着政治立场。XRP对SEC的胜利被视作加密世界向旧有权力宣告的一次胜利:资本市场的投票器可以撼动监管者的强权。这种“价格即政治”的张力,正是Crypto世界前所未有的社会实验:去中心化社区以市场行为直接对抗国家权力,在无形的价格曲线中凝聚起政治抗争的力量,向世人昭示加密货币不仅有技术和资本属性,更蕴含着不可小觑的社会能量和政治意涵。

不可归零的政治资本

Meme 币的本质并非廉价或易造,而在于其构建了一种“无法归零”的社群生存结构。 对于传统观点而言,多数 meme 币只是短命的投机游戏:价格暴涨暴跌后一地鸡毛,创始人套现跑路,投资者血本无归,然后“大家转去炒下一个”theguardian.com。然而,meme 币社群的独特之处在于——失败并不意味着终结,而更像是运动的逗号而非句号。一次币值崩盘后,持币的草根们往往并未散去;相反,他们汲取教训,准备东山再起。这种近乎“不死鸟”的循环,使得 meme 币运动呈现出一种数字政治循环的特质:价格可以归零,但社群的政治热情和组织势能不归零。正如研究者所指出的,加密领域中的骗局、崩盘等冲击并不会摧毁生态,反而成为让系统更加强韧的“健康应激”,令整个行业在动荡中变得更加反脆弱cointelegraph.com。对应到 meme 币,每一次暴跌和重挫,都是社群自我进化、卷土重来的契机。这个去中心化群体打造出一种自组织的安全垫,失败者得以在瓦砾上重建家园。对于草根社群、少数派乃至体制的“失败者”而言,meme 币提供了一个永不落幕的抗争舞台,一种真正反脆弱的政治性。正因如此,我们看到诸多曾被嘲笑的迷因项目屡败屡战:例如 Dogecoin 自2013年问世后历经八年沉浮,早已超越玩笑属性,成为互联网史上最具韧性的迷因之一frontiersin.org;支撑 Dogecoin 的正是背后强大的迷因文化和社区意志,它如同美国霸权支撑美元一样,为狗狗币提供了“永不中断”的生命力frontiersin.org。

“复活权”的数字政治意涵

这种“失败-重生”的循环结构蕴含着深刻的政治意涵:在传统政治和商业领域,一个政党选举失利或一家公司破产往往意味着清零出局,资源散尽、组织瓦解。然而在 meme 币的世界,社群拥有了一种前所未有的“复活权”。当项目崩盘,社区并不必然随之消亡,而是可以凭借剩余的人心和热情卷土重来——哪怕换一个 token 名称,哪怕重启一条链,运动依然延续。正如 Cheems 项目的核心开发者所言,在几乎无人问津、技术受阻的困境下,大多数人可能早已卷款走人,但 “CHEEMS 社区没有放弃,背景、技术、风投都不重要,重要的是永不言弃的精神”cointelegraph.com。这种精神使得Cheems项目起死回生,社区成员齐声宣告“我们都是 CHEEMS”,共同书写历史cointelegraph.com。与传统依赖风投和公司输血的项目不同,Cheems 完全依靠社区的信念与韧性存续发展,体现了去中心化运动的真谛cointelegraph.com。这意味着政治参与的门槛被大大降低:哪怕没有金主和官方背书,草根也能凭借群体意志赋予某个代币新的生命。对于身处社会边缘的群体来说,meme 币俨然成为自组织的安全垫和重新集结的工具。难怪有学者指出,近期涌入meme币浪潮的主力,正是那些对现实失望但渴望改变命运的年轻人theguardian.com——“迷茫的年轻人,想要一夜暴富”theguardian.com。meme币的炒作表面上看是投机赌博,但背后蕴含的是草根对既有金融秩序的不满与反抗:没有监管和护栏又如何?一次失败算不得什么,社区自有后路和新方案。这种由底层群众不断试错、纠错并重启的过程,本身就是一种数字时代的新型反抗运动和群众动员机制。

举例而言,Terra Luna 的沉浮充分展现了这种“复活机制”的政治力量。作为一度由风投资本热捧的项目,Luna 币在2022年的崩溃本可被视作“归零”的失败典范——稳定币UST瞬间失锚,Luna币价归零,数十亿美元灰飞烟灭。然而“崩盘”并没有画下休止符。Luna的残余社区拒绝承认失败命运,通过链上治理投票毅然启动新链,“复活”了 Luna 代币,再次回到市场交易reuters.com。正如 Terra 官方在崩盘后发布的推文所宣称:“我们力量永在社区,今日的决定正彰显了我们的韧性”reuters.com。事实上,原链更名为 Luna Classic 后,大批所谓“LUNC 军团”的散户依然死守阵地,誓言不离不弃;他们自发烧毁巨量代币以缩减供应、推动技术升级,试图让这个一度归零的项目重新燃起生命之火binance.com。失败者并未散场,而是化作一股草根洪流,奋力托举起项目的残迹。经过迷因化的叙事重塑,这场从废墟中重建价值的壮举,成为加密世界中草根政治的经典一幕。类似的案例不胜枚举:曾经被视为笑话的 DOGE(狗狗币)正因多年社群的凝聚而跻身主流币种,总市值一度高达数百亿美元,充分证明了“民有民享”的迷因货币同样可以笑傲市场frontiersin.org。再看最新的美国政治舞台,连总统特朗普也推出了自己的 meme 币 $TRUMP,号召粉丝拿真金白银来表达支持。该币首日即从7美元暴涨至75美元,两天后虽回落到40美元左右,但几乎同时,第一夫人 Melania 又发布了自己的 $Melania 币,甚至连就职典礼的牧师都跟风发行了纪念币theguardian.com!显然,对于狂热的群众来说,一个币的沉浮并非终点,而更像是运动的换挡——资本市场成为政治参与的新前线,你方唱罢我登场,meme 币的群众动员热度丝毫不减。值得注意的是,2024年出现的 Pump.fun 等平台更是进一步降低了这一循环的技术门槛,任何人都可以一键生成自己的 meme 币theguardian.com。这意味着哪怕某个项目归零,剩余的社区完全可以借助此类工具迅速复制一个新币接力,延续集体行动的火种。可以说,在 meme 币的世界里,草根社群获得了前所未有的再生能力和主动权,这正是一种数字时代的群众政治奇观:失败可以被当作梗来玩,破产能够变成重生的序章。

价格即政治:群众投机的新抗争

meme 币现象的兴盛表明:在加密时代,价格本身已成为一种政治表达。这些看似荒诞的迷因代币,将金融市场变成了群众宣泄情绪和诉求的另一个舞台。有学者将此概括为“将公民参与直接转化为了投机资产”cdn-brighterworld.humanities.mcmaster.ca——也就是说,社会运动的热情被注入币价涨跌,政治支持被铸造成可以交易的代币。meme 币融合了金融、技术与政治,通过病毒般的迷因文化激发公众参与,形成对现实政治的某种映射cdn-brighterworld.humanities.mcmaster.caosl.com。当一群草根投入全部热忱去炒作一枚毫无基本面支撑的币时,这本身就是一种大众政治动员的体现:币价暴涨,意味着一群人以戏谑的方式在向既有权威叫板;币价崩盘,也并不意味着信念的消亡,反而可能孕育下一次更汹涌的造势。正如有分析指出,政治类 meme 币的出现前所未有地将群众文化与政治情绪融入市场行情,价格曲线俨然成为民意和趋势的风向标cdn-brighterworld.humanities.mcmaster.ca。在这种局面下,投机不再仅仅是逐利,还是一种宣示立场、凝聚共识的过程——一次次看似荒唐的炒作背后,是草根对传统体制的不服与嘲讽,是失败者拒绝认输的呐喊。归根结底,meme 币所累积的,正是一种不可被归零的政治资本。价格涨落之间,群众的愤怒、幽默与希望尽显其中;这股力量不因一次挫败而消散,反而在市场的循环中愈发壮大。也正因如此,我们才说“价格即政治”——在迷因币的世界里,价格不只是数字,更是人民政治能量的晴雨表,哪怕归零也终将卷土重来。cdn-brighterworld.humanities.mcmaster.caosl.com

全球新兴现象:伊斯兰金融的入场

当Crypto在西方世界掀起市场治政的狂潮时,另一股独特力量也悄然融入这一场域:伊斯兰金融携其独特的道德秩序,开始在链上寻找存在感。长期以来,伊斯兰金融遵循着一套区别于世俗资本主义的原则:禁止利息(Riba)、反对过度投机(Gharar/Maysir)、强调实际资产支撑和道德投资。当这些原则遇上去中心化的加密技术,会碰撞出怎样的火花?出人意料的是,这两者竟在“以市场行为表达价值”这个层面产生了惊人的共鸣。伊斯兰金融并不拒绝市场机制本身,只是为其附加了道德准则;Crypto则将市场机制推向了政治高位,用价格来表达社群意志。二者看似理念迥异,实则都承认市场行为可以也应当承载社会价值观。这使得越来越多金融与政治分析人士开始关注:当虔诚的宗教伦理遇上狂野的加密市场,会塑造出何种新范式?

事实上,穆斯林世界已经在探索“清真加密”的道路。一些区块链项目致力于确保协议符合伊斯兰教法(Sharia)的要求。例如Haqq区块链发行的伊斯兰币(ISLM),从规则层面内置了宗教慈善义务——每发行新币即自动将10%拨入慈善DAO,用于公益捐赠,以符合天课(Zakat)的教义nasdaq.comnasdaq.com。同时,该链拒绝利息和赌博类应用,2022年还获得了宗教权威的教令(Fatwa)认可其合规性nasdaq.com。再看理念层面,伊斯兰经济学强调货币必须有内在价值、收益应来自真实劳动而非纯利息剥削。这一点与比特币的“工作量证明”精神不谋而合——有人甚至断言法定货币无锚印钞并不清真,而比特币这类需耗费能源生产的资产反而更符合教法初衷cointelegraph.com。由此,越来越多穆斯林投资者开始以道德投资的名义进入Crypto领域,将资金投向符合清真原则的代币和协议。

这种现象带来了微妙的双重合法性:一方面,Crypto世界原本奉行“价格即真理”的世俗逻辑,而伊斯兰金融为其注入了一股道德合法性,使部分加密资产同时获得了宗教与市场的双重背书;另一方面,即便在遵循宗教伦理的项目中,最终决定成败的依然是市场对其价值的认可。道德共识与市场共识在链上交汇,共同塑造出一种混合的新秩序。这一全球新兴现象引发广泛议论:有人将其视为金融民主化的极致表现——不同文化价值都能在市场平台上表达并竞争;也有人警惕这可能掩盖新的风险,因为把宗教情感融入高风险资产,既可能凝聚强大的忠诚度,也可能在泡沫破裂时引发信仰与财富的双重危机。但无论如何,伊斯兰金融的入场使Crypto的政治版图更加丰盈多元。从华尔街交易员到中东教士,不同背景的人们正通过Crypto这个奇特的舞台,对人类价值的表达方式进行前所未有的实验。

升华结语:价格即政治的新直觉

回顾比特币问世以来的这段历程,我们可以清晰地看到一条演进的主线:先有货币革命,后有政治发明。比特币赋予了人类一种真正自主的数字货币,而Crypto在此基础上完成的,则是一项前所未有的政治革新——它让市场价格行为承担起了类似政治选票的功能,开创了一种“价格即政治”的新直觉。在这个直觉下,市场不再只是冷冰冰的交易场所;每一次资本流动、每一轮行情涨落,都被赋予了社会意义和政治涵义。买入即表态,卖出即抗议,流动性的涌入或枯竭胜过千言万语的陈情。Crypto世界中,K线图俨然成为民意曲线,行情图就是政治晴雨表。决策不再由少数权力精英关起门来制定,而是在全球无眠的交易中由无数普通人共同谱写。这样的政治形式也许狂野,也许充满泡沫和噪音,但它不可否认地调动起了广泛的社会参与,让原本疏离政治进程的个体通过持币、交易重新找回了影响力的幻觉或实感。

“价格即政治”并非一句简单的口号,而是Crypto给予世界的全新想象力。它质疑了传统政治的正统性:如果一串代码和一群匿名投资者就能高效决策资源分配,我们为何还需要繁冗的官僚体系?它也拷问着自身的内在隐忧:当财富与权力深度绑定,Crypto政治如何避免堕入金钱统治的老路?或许,正是在这样的矛盾和张力中,人类政治的未来才会不断演化。Crypto所开启的,不仅是技术乌托邦或金融狂欢,更可能是一次对民主形式的深刻拓展和挑战。这里有最狂热的逐利者,也有最理想主义的社群塑梦者;有一夜暴富的神话,也有瞬间破灭的惨痛。而这一切汇聚成的洪流,正冲撞着工业时代以来既定的权力谱系。

当我们再次追问:Crypto究竟是什么? 或许可以这样回答——Crypto是比特币之后,人类完成的一次政治范式的试验性跃迁。在这里,价格行为化身为选票,资本市场演化为广场,代码与共识共同撰写“社会契约”。这是一场仍在进行的文明实验:它可能无声地融入既有秩序,也可能剧烈地重塑未来规则。但无论结局如何,如今我们已经见证:在比特币发明真正的货币之后,Crypto正在发明真正属于21世纪的政治。它以数字时代的语言宣告:在链上,价格即政治,市场即民意,代码即法律。这,或许就是Crypto带给我们的最直观而震撼的本质启示。

参考资料:

-

中本聪. 比特币白皮书: 一种点对点的电子现金系统. (2008)bitcoin.org

-

Arkham Intelligence. Ethereum vs Ethereum Classic: Understanding the Differences. (2023)arkhamintelligence.com

-

Binance Square (@渔神的加密日记). 狗狗币价格为何上涨?背后的原因你知道吗?binance.com

-

Cointelegraph中文. 特朗普的迷因币晚宴预期内容揭秘. (2025)cn.cointelegraph.com

-

慢雾科技 Web3Caff (@Lisa). 风险提醒:从 LIBRA 看“政治化”的加密货币骗局. (2025)web3caff.com

-

Nasdaq (@Anthony Clarke). How Cryptocurrency Aligns with the Principles of Islamic Finance. (2023)nasdaq.comnasdaq.com

-

Cointelegraph Magazine (@Andrew Fenton). DeFi can be halal but not DOGE? Decentralizing Islamic finance. (2023)cointelegraph.com

-

-

@ 9c9d2765:16f8c2c2

2025-05-21 05:45:00

@ 9c9d2765:16f8c2c2

2025-05-21 05:45:00CHAPTER TWENTY FOUR

Back at JP Towers, James had already anticipated the move. He had cameras and witness accounts from the anniversary event, stored securely in multiple locations. He knew the public had a short memory but a long hunger for drama. One misstep could tilt public sentiment.

But James was no longer playing to survive.

He was playing to reign.

Later that night, he stood before a mirror, adjusting the cuffs of his suit. In his reflection, he saw more than his own face; he saw the faces of those who had mocked, betrayed, and underestimated him. And he saw the legacy he was building not just for himself, but for those who once believed justice was a myth.

He whispered to the reflection, “Let them come. Let them burn what’s left of their dignity. I’ll rise through the smoke again. Because I always do.”

Outside, the wind howled like a prophecy through the high-rises.

The days that followed carried a subtle tension that coiled around the city's heartbeat. JP Enterprises thrived outwardly, stock prices climbed, investor confidence surged, and the company continued to solidify its dominion over the corporate landscape. But beneath the facade of calm and progress, a tempest brewed in silence.

James, the man once ridiculed and ostracized, now sat at the summit of power, yet his enemies, battered but unbroken, plotted from the shadows.

In an undisclosed meeting room within the Executive Wing, James convened with his most trusted circle Charles, Rita, and Sandra. The room was dimly lit, the atmosphere sober, with every eye locked onto the digital presentation being displayed.

On the screen were surveillance stills, financial records, and intercepted messages.

Rita, ever composed, began, “We’ve confirmed that Helen and Mark are using a shell media outlet in a nearby province to rewrite the narrative surrounding the anniversary incident. They’re laundering stories through third-party publications to make it appear as if you orchestrated the bribery and the public drama.”

Sandra added, her voice laced with concern, “The young woman from the event she’s set to appear in a televised interview in two days. The preview clips suggest she’ll claim coercion, manipulation… that you paid her to falsely accuse Mark and Helen.”

Charles sat back in his chair, folding his arms. “It’s a desperate move,” he muttered, “but one that could sway public opinion if left unchecked.”

James didn’t flinch. His gaze was cold and calculated. “Let them speak,” he said. “Let her appear on screen, let the nation watch but when the time is right, we’ll release the real footage. Every confession, every whispered transaction, every threat they issued. And when we do, it won’t just be public opinion they lose, it'll be their freedom.”

The room fell silent. The weight of the plan was immense. James wasn’t simply fighting a smear campaign he was orchestrating the downfall of those who had haunted his past and jeopardized his future.

Across town, in a luxurious yet shadowy apartment, Helen paced furiously. Mark sat slouched on the couch, phone in hand, monitoring the latest headlines.

“She hasn’t confirmed the script yet,” Mark grumbled, referring to the woman they’d bribed. “She’s stalling. You think she’s flipping again?”

“She better not,” Helen spat. “We gave her a second chance, more money, more protection. If she dares cross us again...”

“Then we make her disappear,” Mark said coldly.

Helen paused. “Or we pin everything on her. Let her take the fall.”

Their desperation bled into their decisions. The empire they tried to build with lies and manipulation was already on unstable ground. They didn’t realize James wasn’t just steps ahead. Two days later, as the nation sat glued to their screens, the controversial interview aired. The woman, visibly tense, spoke her lines.

“Yes… he promised to protect me… he told me to say Mark and Helen bribed me… I was scared of what he might do if I didn’t cooperate…”

The hosts gasped, commentators argued, and the news cycle erupted.

For an hour, James’s name trended for all the wrong reasons.

And then the storm came.

JP Enterprises’ official communication channels released a statement followed by a seven-minute clip, unedited, raw, and crystal clear. It captured everything: the lady kneeling, pointing to Mark and Helen, the whispered confessions, the crowd’s reaction, Helen’s furious outburst. And, most damning of all, a covert recording of Helen threatening the woman in a private meeting.

The tide turned instantly.

Social media exploded not with outrage toward James, but with condemnation of the real culprits. Hashtags flipped. Influencers, journalists, and even rival corporations came to James’s defense. The woman fled the city within hours. Mark and Helen, now disgraced, faced not just the wrath of public judgment, but the immediate interest of law enforcement.

Back at the JP tower, James watched it all unfold. The screen reflected in his eyes as headlines changed: “President Vindicated,” “Corporate Sabotage Exposed,” “Justice Prevails in High-Stakes Feud.”

Charles walked in slowly, a faint smile on his lips. “It’s done.”

James nodded, his voice a calm murmur. “No. It’s only the beginning. I haven’t just protected my name, I've carved a legacy.”

He stood up, walking toward the window where the city stretched out beneath him, unaware of how close it had come to being ruled by lies.

Behind him, the quiet echo of Charles’s voice lingered: “Your enemies are falling, one by one.”

-

@ 6ad3e2a3:c90b7740

2025-05-20 13:49:50

@ 6ad3e2a3:c90b7740

2025-05-20 13:49:50I’ve written about MSTR twice already, https://www.chrisliss.com/p/mstr and https://www.chrisliss.com/p/mstr-part-2, but I want to focus on legendary short seller James Chanos’ current trade wherein he buys bitcoin (via ETF) and shorts MSTR, in essence to “be like Mike” Saylor who sells MSTR shares at the market and uses them to add bitcoin to the company’s balance sheet. After all, if it’s good enough for Saylor, why shouldn’t everyone be doing it — shorting a company whose stock price is more than 2x its bitcoin holdings and using the proceeds to buy the bitcoin itself?

Saylor himself has said selling shares at 2x NAV (net asset value) to buy bitcoin is like selling dollars for two dollars each, and Chanos has apparently decided to get in while the getting (market cap more than 2x net asset value) is good. If the price of bitcoin moons, sending MSTR’s shares up, you are more than hedged in that event, too. At least that’s the theory.

The problem with this bet against MSTR’s mNAV, i.e., you are betting MSTR’s market cap will converge 1:1 toward its NAV in the short and medium term is this trade does not exist in a vacuum. Saylor has described how his ATM’s (at the market) sales of shares are accretive in BTC per share because of this very premium they carry. Yes, we’ll dilute your shares of the company, but because we’re getting you 2x the bitcoin per share, you are getting an ever smaller slice of an ever bigger overall pie, and the pie is growing 2x faster than your slice is reducing. (I https://www.chrisliss.com/p/mstr how this works in my first post.)

But for this accretion to continue, there must be a constant supply of “greater fools” to pony up for the infinitely printable shares which contain only half their value in underlying bitcoin. Yes, those shares will continue to accrete more BTC per share, but only if there are more fools willing to make this trade in the future. So will there be a constant supply of such “fools” to keep fueling MSTR’s mNAV multiple indefinitely?

Yes, there will be in my opinion because you have to look at the trade from the prospective fools’ perspective. Those “fools” are not trading bitcoin for MSTR, they are trading their dollars, selling other equities to raise them maybe, but in the end it’s a dollars for shares trade. They are not selling bitcoin for them.

You might object that those same dollars could buy bitcoin instead, so they are surely trading the opportunity cost of buying bitcoin for them, but if only 5-10 percent of the market (or less) is buying bitcoin itself, the bucket in which which those “fools” reside is the entire non-bitcoin-buying equity market. (And this is not considering the even larger debt market which Saylor has yet to tap in earnest.)

So for those 90-95 percent who do not and are not presently planning to own bitcoin itself, is buying MSTR a fool’s errand, so to speak? Not remotely. If MSTR shares are infinitely printable ATM, they are still less so than the dollar and other fiat currencies. And MSTR shares are backed 2:1 by bitcoin itself, while the fiat currencies are backed by absolutely nothing. So if you hold dollars or euros, trading them for MSTR shares is an errand more sage than foolish.

That’s why this trade (buying BTC and shorting MSTR) is so dangerous. Not only are there many people who won’t buy BTC buying MSTR, there are many funds and other investment entities who are only able to buy MSTR.

Do you want to get BTC at 1:1 with the 5-10 percent or MSTR backed 2:1 with the 90-95 percent. This is a bit like medical tests that have a 95 percent accuracy rate for an asymptomatic disease that only one percent of the population has. If someone tests positive, it’s more likely to be a false one than an indication he has the disease*. The accuracy rate, even at 19:1, is subservient to the size of the respective populations.

At some point this will no longer be the case, but so long as the understanding of bitcoin is not widespread, so long as the dollar is still the unit of account, the “greater fools” buying MSTR are still miles ahead of the greatest fools buying neither, and the stock price and mNAV should only increase.

. . .

One other thought: it’s more work to play defense than offense because the person on offense knows where he’s going, and the defender can only react to him once he moves. Similarly, Saylor by virtue of being the issuer of the shares knows when more will come online while Chanos and other short sellers are borrowing them to sell in reaction to Saylor’s strategy. At any given moment, Saylor can pause anytime, choosing to issue convertible debt or preferred shares with which to buy more bitcoin, and the shorts will not be given advance notice.

If the price runs, and there is no ATM that week because Saylor has stopped on a dime, so to speak, the shorts will be left having to scramble to change directions and buy the shares back to cover. Their momentum might be in the wrong direction, though, and like Allen Iverson breaking ankles with a crossover, Saylor might trigger a massive short squeeze, rocketing the share price ever higher. That’s why he actually welcomes Chanos et al trying this copycat strategy — it becomes the fuel for outsized gains.

For that reason, news that Chanos is shorting MSTR has not shaken my conviction, though there are other more pertinent https://www.chrisliss.com/p/mstr-part-2 with MSTR, of which one should be aware. And as always, do your own due diligence before investing in anything.

* To understand this, consider a population of 100,000, with one percent having a disease. That means 1,000 have it, 99,000 do not. If the test is 95 percent accurate, and everyone is tested, 950 of the 1,000 will test positive (true positives), 50 who have it will test negative (false negatives.) Of the positives, 95 percent of 99,000 (94,050) will test negative (true negatives) and five percent (4,950) will test positive (false positives). That means 4,950 out of 5,900 positives (84%) will be false.

-

@ 502ab02a:a2860397

2025-05-21 02:12:10

@ 502ab02a:a2860397

2025-05-21 02:12:10ถ้าเอ่ยถึง CJ หลายคนอาจนึกถึงซอสเกาหลีรสจัดจ้าน หรือบะหมี่กึ่งสำเร็จรูปแบรนด์ดังที่ขายทั่วโลก แต่เบื้องหลังความสำเร็จของแบรนด์เหล่านั้น มีบริษัทแม่อย่าง CJ CheilJedang ที่ไม่ได้แค่ผลิตอาหารแปรรูป แต่เป็นหนึ่งในผู้เล่นใหญ่ของอุตสาหกรรมอาหารระดับโลก ด้วยฐานความรู้ลึกซึ้งในเทคโนโลยีชีวภาพ หนึ่งในแขนงที่โดดเด่นคือ CJ BIO ธุรกิจไบโอเทคโนโลยีที่เน้นการใช้ Microbial Fermentation หรือการหมักจุลินทรีย์เพื่อผลิตสารอาหารและวัตถุดิบอาหารคุณภาพสูงในระดับอุตสาหกรรม

ประวัติของ CJ BIO เริ่มจากจุดเล็ก ๆ แต่ทรงพลัง คือการผลิต โมโนโซเดียมกลูตาเมต (MSG) ซึ่งเป็นกรดอะมิโนชนิดหนึ่งที่มีบทบาทสำคัญในการเพิ่มรสชาติ “อูมามิ” ให้กับอาหารทั่วโลก จุดนี้เองที่ทำให้ CJ BIO ได้สะสมเทคโนโลยีหมักจุลินทรีย์ในระดับอุตสาหกรรมมายาวนานกว่า 60 ปี ด้วยโรงงานหมักขนาดใหญ่ที่ตั้งอยู่ในหลายประเทศ เช่น เกาหลีใต้ จีน บราซิล อินโดนีเซีย และสหรัฐอเมริกา ทำให้ CJ BIO กลายเป็นหนึ่งในผู้ผลิตกรดอะมิโนและวัตถุดิบอาหารหมักจุลินทรีย์รายใหญ่ของโลก

แต่ถ้าให้พูดแบบง่าย ๆ การหมักจุลินทรีย์ของ CJ BIO นั้น ไม่ใช่แค่ “การทำอาหาร” ธรรมดา ๆ แต่เป็นการ “สร้างอาหารในระดับโมเลกุล” ตั้งแต่พื้นฐาน ซึ่งถือเป็นเทคโนโลยีที่สำคัญสำหรับอนาคตของอาหาร เพราะมันช่วยให้เราสามารถผลิตโปรตีน กรดอะมิโน และสารอาหารต่าง ๆ ที่มีคุณภาพสูงและควบคุมได้ในโรงงานขนาดใหญ่ โดยไม่ต้องพึ่งพาการเกษตรแบบดั้งเดิมที่ต้องใช้พื้นที่มากและมีผลกระทบต่อสิ่งแวดล้อม

เมื่อเทรนด์โลกกำลังเปลี่ยนไปในทางที่ผู้บริโภคหันมาใส่ใจสุขภาพและสิ่งแวดล้อมมากขึ้น เรื่อง “อาหารจากห้องแล็บ” หรือ “อาหารเทคโนโลยีชีวภาพ” จึงกลายเป็นสิ่งที่ได้รับความสนใจอย่างมาก และนี่เองที่ทำให้ CJ BIO ไม่ได้หยุดอยู่แค่ Microbial Fermentation แบบดั้งเดิม แต่เริ่มขยับเข้าสู่โลกใหม่ของ Precision Fermentation การใช้จุลินทรีย์ที่ผ่านการดัดแปลงพันธุกรรมอย่างแม่นยำ เพื่อผลิตโปรตีนหรือสารอาหารเฉพาะอย่างที่ต้องการ

ความเคลื่อนไหวที่สำคัญเกิดขึ้นในปี 2022 เมื่อ CJ CheilJedang ประกาศลงทุนใน New Culture สตาร์ทอัพสัญชาติอเมริกันที่กำลังพัฒนา “ชีสไร้วัว” ด้วยเทคโนโลยี Precision Fermentation ซึ่ง New Culture ใช้จุลินทรีย์ที่ถูกออกแบบมาเพื่อผลิตโปรตีนเคซีน โปรตีนหลักในน้ำนมวัว โดยไม่ต้องมีวัวจริงเลย นั่นหมายความว่าชีสที่ผลิตออกมาจะไม่มีส่วนผสมจากสัตว์จริง ๆ แต่ยังคงรสชาติและเนื้อสัมผัสเหมือนชีสธรรมชาติทุกประการ

การลงทุนครั้งนี้ของ CJ CheilJedang บริษัทแม่ของ CJ BIO จึงถือเป็นการผนึกกำลังระหว่างเทคโนโลยีดั้งเดิมที่ผ่านการพิสูจน์แล้วในระดับอุตสาหกรรม กับนวัตกรรมที่พร้อมเปลี่ยนแปลงวงการอาหารครั้งใหญ่

ถ้าให้เปรียบเทียบง่าย ๆ CJ BIO เหมือนกับ “โรงงานปั้นโมเลกุลอาหาร” ที่มีความเชี่ยวชาญสูงในการจัดการกับจุลินทรีย์และการผลิตกรดอะมิโนหลากหลายชนิด โดยเฉพาะ MSG ซึ่งถือเป็น “พี่ใหญ่” ในกลุ่มกรดอะมิโนที่ช่วยเพิ่มรสชาติและถูกใช้ในอุตสาหกรรมอาหารทั่วโลก

ความเชี่ยวชาญในการผลิต MSG นี้เอง คือฐานกำลังสำคัญที่ทำให้ CJ BIO สามารถขยายขอบเขตไปสู่การผลิตโปรตีนด้วย Precision Fermentation ได้อย่างมั่นใจ เพราะกระบวนการหมักจุลินทรีย์เพื่อผลิตกรดอะมิโนและโปรตีนนั้นมีความคล้ายคลึงกันในเชิงเทคนิคและการควบคุมคุณภาพ

CJ BIO มีโรงงานหมักจุลินทรีย์ที่ทันสมัยและขนาดใหญ่กระจายอยู่ทั่วโลก สามารถผลิตวัตถุดิบในปริมาณมหาศาลเพื่อตอบสนองตลาดอาหารที่เติบโตอย่างรวดเร็ว และการมีเครือข่ายโรงงานแบบนี้ทำให้ CJ BIO มีความได้เปรียบในการลดต้นทุนและควบคุมคุณภาพอย่างเข้มงวด

อนาคตที่ CJ BIO กำลังเดินไปนั้น ไม่ใช่แค่การผลิตวัตถุดิบอาหารธรรมดา ๆ แต่คือการสร้างนวัตกรรมที่จะเปลี่ยนแปลงวิธีการผลิตและการบริโภคอาหารของโลก

เมื่อผลิตภัณฑ์จากเทคโนโลยี Precision Fermentation อย่างชีสไร้วัว ไข่ไร่ไก่ หรือโปรตีนทางเลือกต่าง ๆ เริ่มเข้ามาในตลาดมากขึ้น เราอาจจะได้เห็น CJ BIO ทำหน้าที่เหมือน “Intel Inside” ของวงการอาหารอนาคต ที่อยู่เบื้องหลังผลิตภัณฑ์สำคัญ ๆ ที่ผู้บริโภคชื่นชอบโดยไม่รู้ตัว

นี่คือเหตุผลที่ทำให้การมองแค่แบรนด์อาหารหรือการตลาดที่พูดถึง “ความยั่งยืน” หรือ “อาหารปลอดสัตว์” ยังไม่พอ เราต้องมองให้ลึกไปถึงระบบนิเวศของเทคโนโลยีและทุนที่อยู่เบื้องหลัง เพราะนั่นคือเกมกระดานใหญ่ที่กำลังขยับเปลี่ยนแปลงวงการอาหารโลกอย่างแท้จริง

#pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ 04c915da:3dfbecc9

2025-05-20 15:50:22

@ 04c915da:3dfbecc9

2025-05-20 15:50:22There is something quietly rebellious about stacking sats. In a world obsessed with instant gratification, choosing to patiently accumulate Bitcoin, one sat at a time, feels like a middle finger to the hype machine. But to do it right, you have got to stay humble. Stack too hard with your head in the clouds, and you will trip over your own ego before the next halving even hits.

Small Wins

Stacking sats is not glamorous. Discipline. Stacking every day, week, or month, no matter the price, and letting time do the heavy lifting. Humility lives in that consistency. You are not trying to outsmart the market or prove you are the next "crypto" prophet. Just a regular person, betting on a system you believe in, one humble stack at a time. Folks get rekt chasing the highs. They ape into some shitcoin pump, shout about it online, then go silent when they inevitably get rekt. The ones who last? They stack. Just keep showing up. Consistency. Humility in action. Know the game is long, and you are not bigger than it.

Ego is Volatile

Bitcoin’s swings can mess with your head. One day you are up 20%, feeling like a genius and the next down 30%, questioning everything. Ego will have you panic selling at the bottom or over leveraging the top. Staying humble means patience, a true bitcoin zen. Do not try to "beat” Bitcoin. Ride it. Stack what you can afford, live your life, and let compounding work its magic.

Simplicity

There is a beauty in how stacking sats forces you to rethink value. A sat is worth less than a penny today, but every time you grab a few thousand, you plant a seed. It is not about flaunting wealth but rather building it, quietly, without fanfare. That mindset spills over. Cut out the noise: the overpriced coffee, fancy watches, the status games that drain your wallet. Humility is good for your soul and your stack. I have a buddy who has been stacking since 2015. Never talks about it unless you ask. Lives in a decent place, drives an old truck, and just keeps stacking. He is not chasing clout, he is chasing freedom. That is the vibe: less ego, more sats, all grounded in life.

The Big Picture

Stack those sats. Do it quietly, do it consistently, and do not let the green days puff you up or the red days break you down. Humility is the secret sauce, it keeps you grounded while the world spins wild. In a decade, when you look back and smile, it will not be because you shouted the loudest. It will be because you stayed the course, one sat at a time. \ \ Stay Humble and Stack Sats. 🫡

-

@ bc6ccd13:f53098e4

2025-05-21 02:04:25

@ bc6ccd13:f53098e4

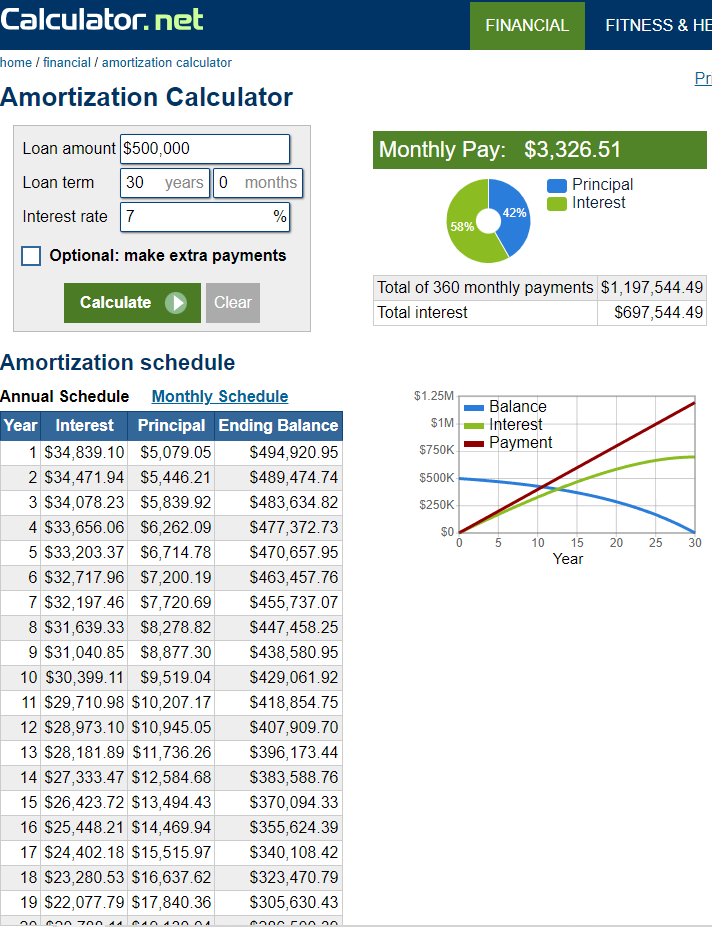

2025-05-21 02:04:25This article is slightly outside my normal writing focus. But it’s something everyone deserves to know, and take advantage of if they like. Before you click away, this isn’t a sports betting “system” or “strategy”. This is for anyone living in or near a state that has legalized online sports betting. It’s a way to take advantage of the new customer sign up bonuses these online sportsbooks give, by using free online tools to convert those bonuses into $2,000 or more in cash per person, depending on your state. It doesn’t require you to know anything whatsoever about sports, gambling, sports betting, odds, math, or anything like that. It doesn’t involve taking risks with your money. All you need is some capital (around $3-5,000 would be ideal), a smartphone, a legal sports betting state, and this guide.

Concepts and Principles

Online sports betting is now legal in 30 US states. You can check legality in your state on the map here. If you’re in a state with legal mobile betting, or close enough that you’d be willing to drive there, you can benefit from this guide.

Most states with legalized betting have multiple different sports books competing for customers. To attract new customers, many of them offer various types of bonus offers when you initially sign up. The idea is that once you sign up and place a bet, you’re likely to continue betting in the future. So the sportsbook doesn’t mind losing money on your first wager, because they’ll make it back over time. That leaves an opportunity for someone to just take the free money and leave, if they want to do that. It’s completely legal, and if you follow this guide, also risk free.

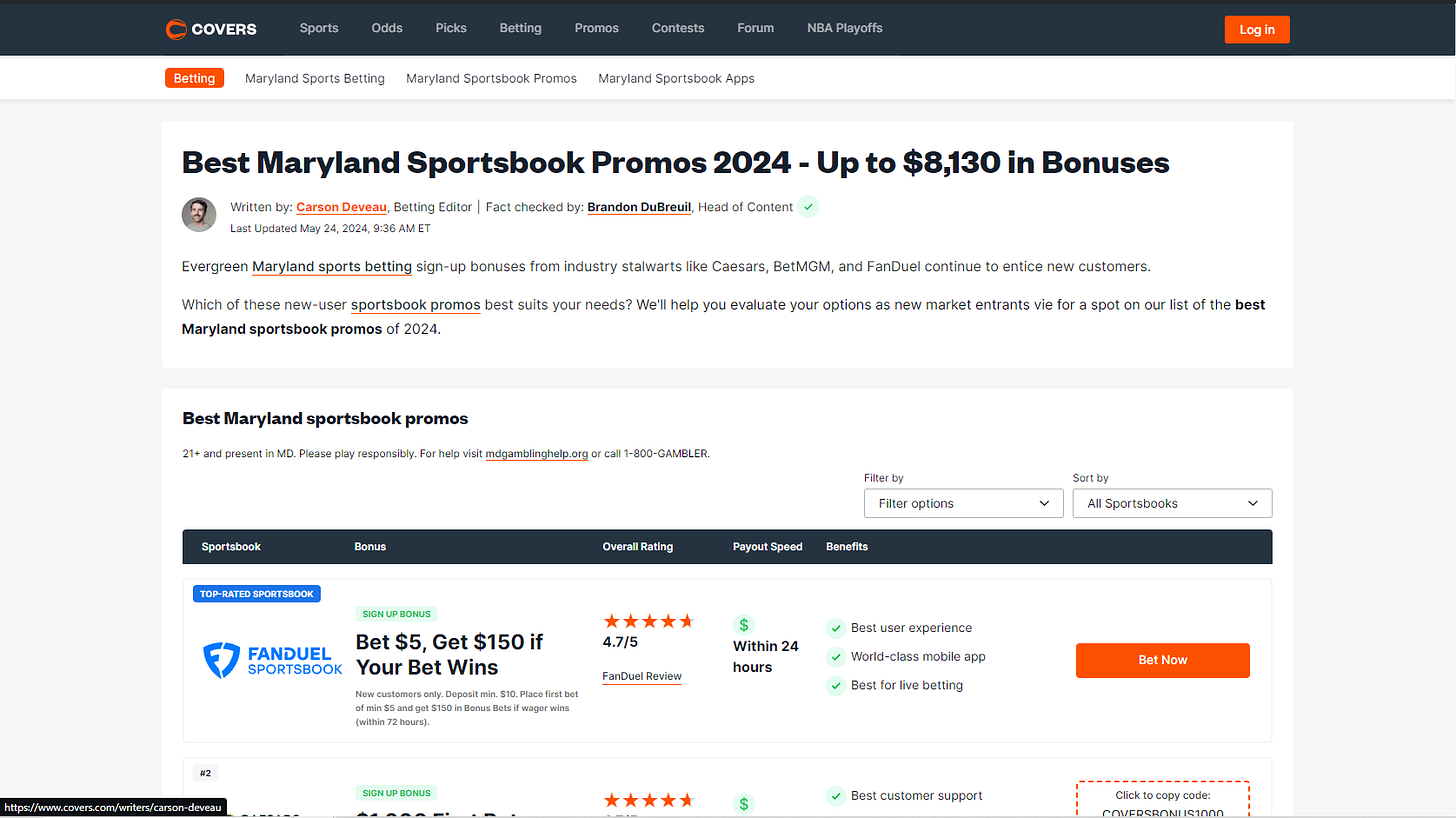

The bonuses vary in size, but are usually larger the first few months after a state legalizes online betting, since sportsbooks are competing heavily to attract the new customers to their site. But most states will have a combined $3-5,000 in bonuses available at any time across 4-8 sportsbooks. You can find the available offers in your state by searching “covers sports betting promo offers \

”. For example for Maryland, we’d end up up at covers.com on a page like this. The basic concept is that we open accounts on multiple sites, sign up for their bonus offers, then bet both sides of the same sports game but on 2 different sites. That way it doesn’t matter which team wins, we collect the free bonus money with no risk.

Actually doing it is a bit more nuanced, but I’ll explain it step by step and illustrate with plenty of screenshots to make sure you can follow along.

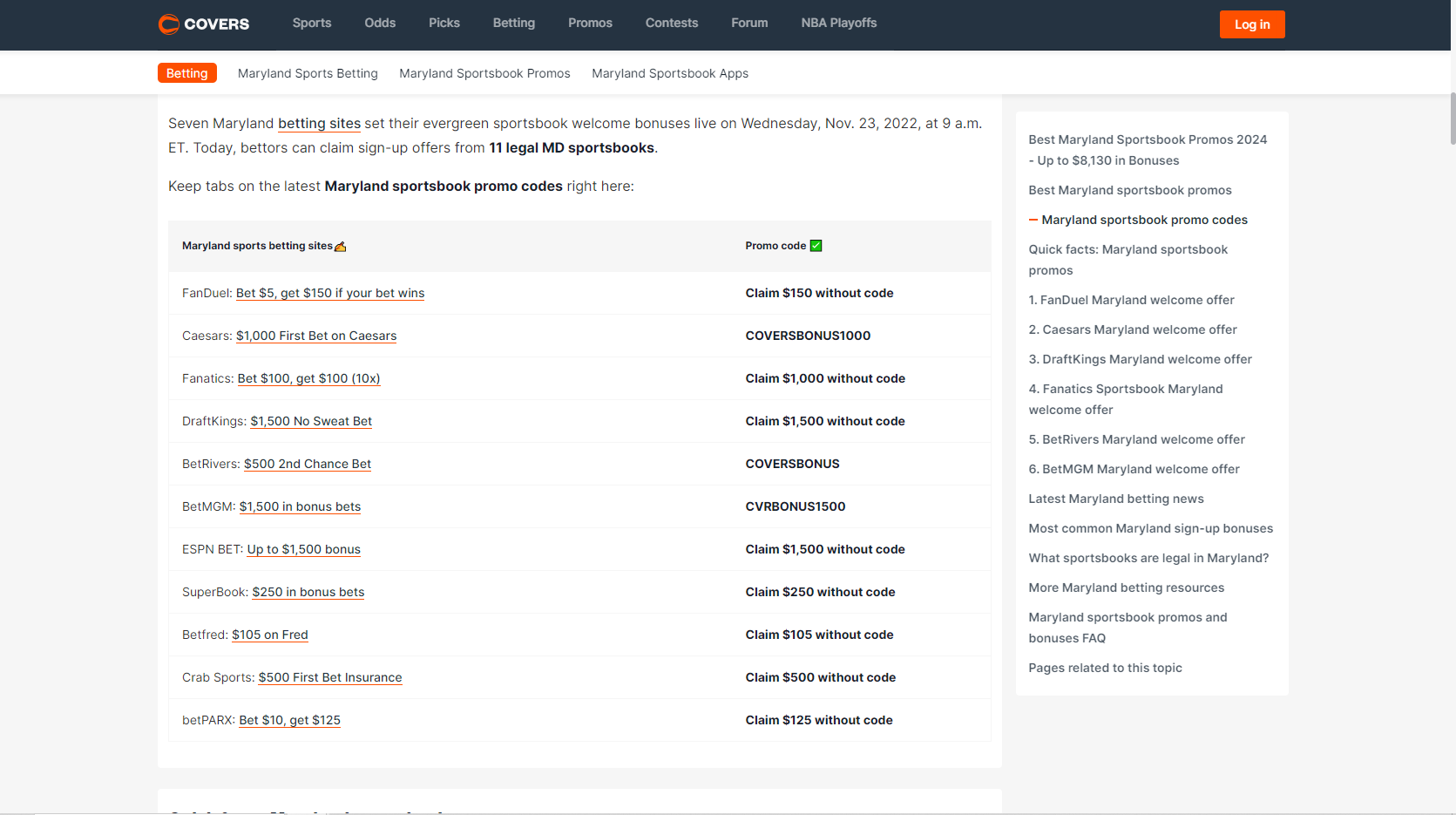

First, you want to find the offers for your state, and sign up for the sites with the offers you want to convert. For Maryland, if we scroll on down at covers.com, we’ll find this list of offers.

The larger offers are of course more worthwhile, so if I were in Maryland, I would first sign up for Caesars, DraftKings, BetMGM, and ESPN BET. Since you’ll also want another site to hedge your bets, I’d also sign up for FanDuel. You can download their apps, set up your accounts, and familiarize yourself with the deposit methods that are available.

Risk-Free Bets

These are the most common bonus offers you’ll find. They’ll also be called No Sweat Bets, Second Chance Bets, First Bet Insurance, Bonus Bets, First Bets, etc. Always make sure you check the details of the promotion you’re using to make sure it’s a Risk-Free Bet, and what the terms and details of the offer are. The four offers from the sites above for Maryland all fall under the category of risk-free bets.

The concept of this offer is simple: you open an account, deposit some money, and make a bet. The very first bet (MAKE SURE YOU GET THIS RIGHT) will be your risk-free bet. If you win that first bet, cool, you get the winnings from that bet and can withdraw it. If you lose your first bet, the risk-free bet kicks in, and you get a free bet deposited into your account equal to the amount of your first bet. So you basically get a do-over if you lose the first one.

Now you won’t be able to just withdraw the free bet in cash if you lose and get your money back. That would be too easy. The risk-free bet is a bet, you can only use it to bet on another game. If you win that second wager, you can withdraw your winnings. But if you don’t, you can still win by hedging your bets on a different sportsbook. That’s what I’m going to show you.

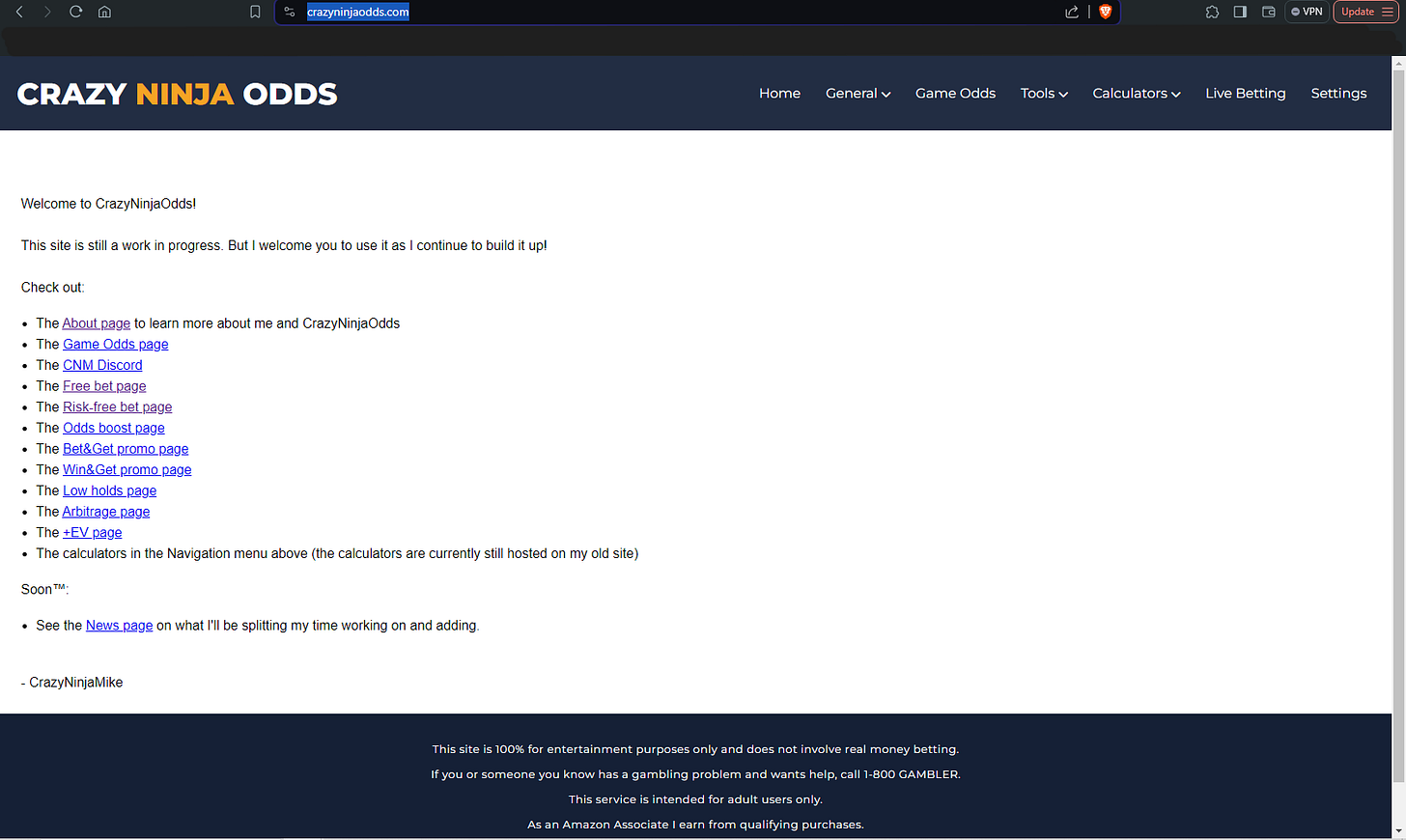

To find which games to bet on and how much to bet, you’ll need to use a different free website. Go to Crazy Ninja Odds.

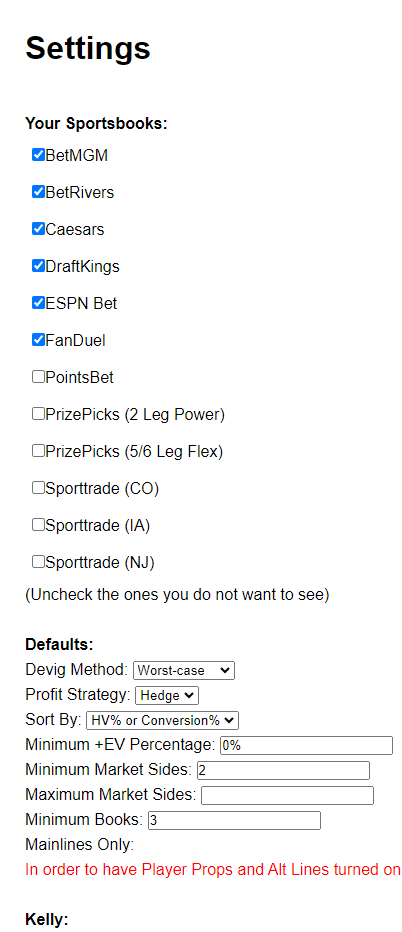

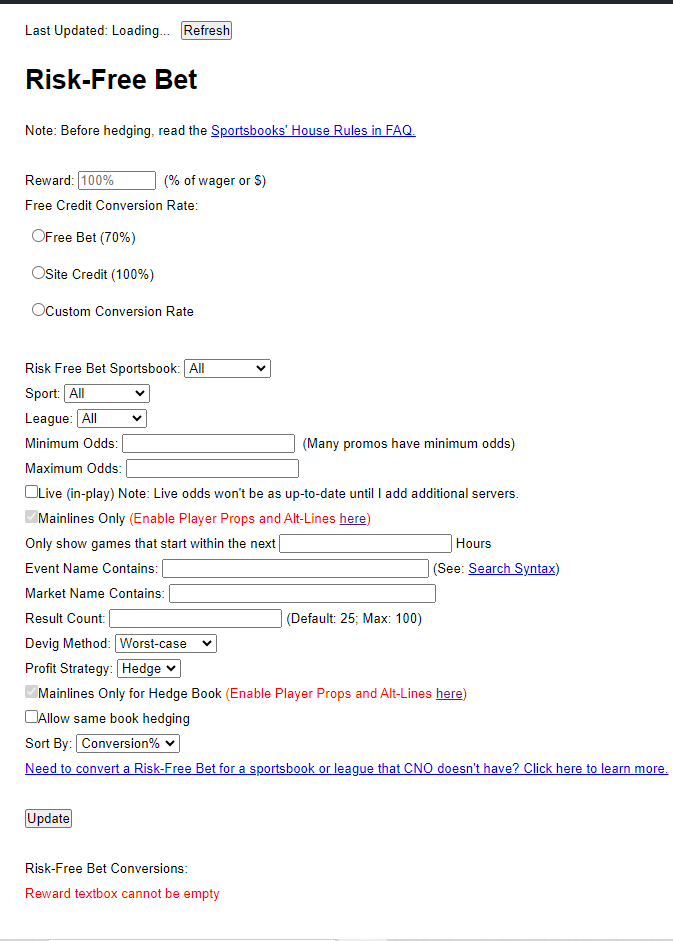

Go to Settings in the top right corner, uncheck the sites you aren’t using.

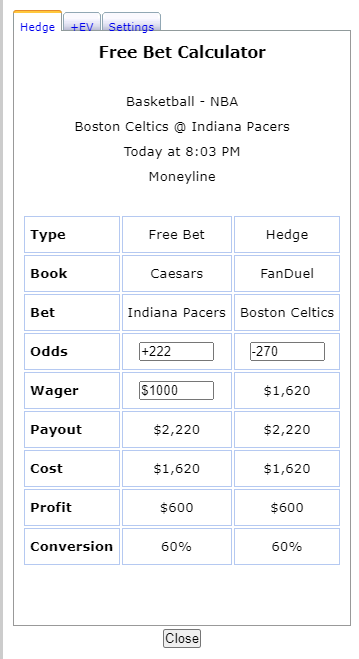

Now go back to Home. Click on Risk-free bet page.

Now we need to choose an offer to convert. Let’s choose our Caesars $1,000 First Bet. We can walk through the steps first, to see which game we want to bet and how much we need to deposit.

First, starting at the top, under “Reward” we’ll enter 100%. With this offer, if we lose our first bet, we get a free bonus bet of 100% of the amount of our first bet, up to $1,000.

Next, we’ll select “Free bet (70%)”. Our free bonus bet will be convertible at about 70%, but that’s not something we need to understand right now. Just check the box and move on.

Next, open “Risk Free Bet Sportsbook” and select Caesars.

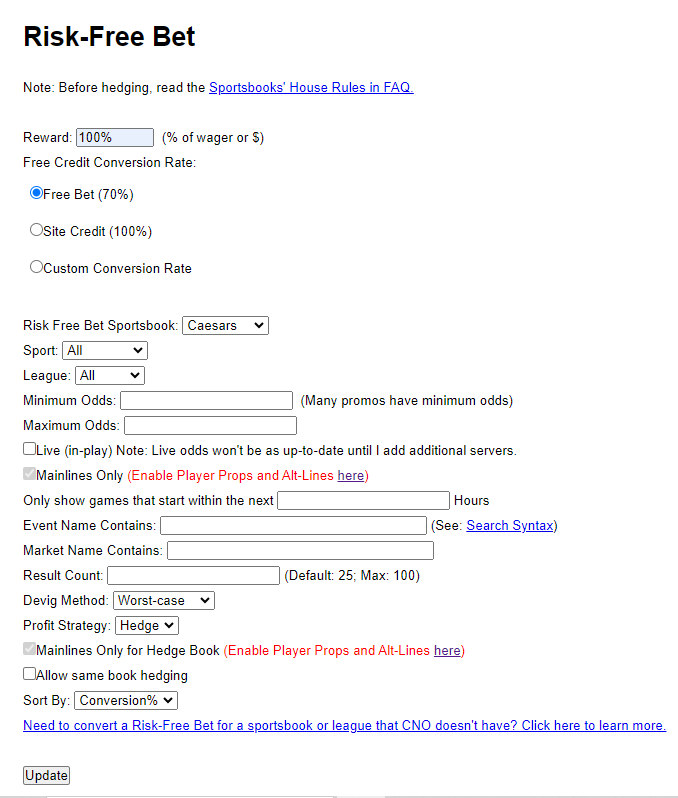

Now the page should be filled out like this.

Click “Update” at the bottom. Scroll down, and you’ll see a chart like this.

If none of this means anything to you, that’s fine. I’ll walk you through exactly what to do.

The bets are sorted by ranking from best to worst value. So we always want to choose the top bets unless we have a reason not to. In this case, we are making our risk-free bet on Caesars, and we want to hedge on the site where we aren’t trying to convert any offers, FanDuel. So we want to look at the second column on the right, Hedge Bet Sportsbook. Go down the column until you find FanDuel. In that row, the third column from the left has a “Calc” button. I’ve highlighted the button here.

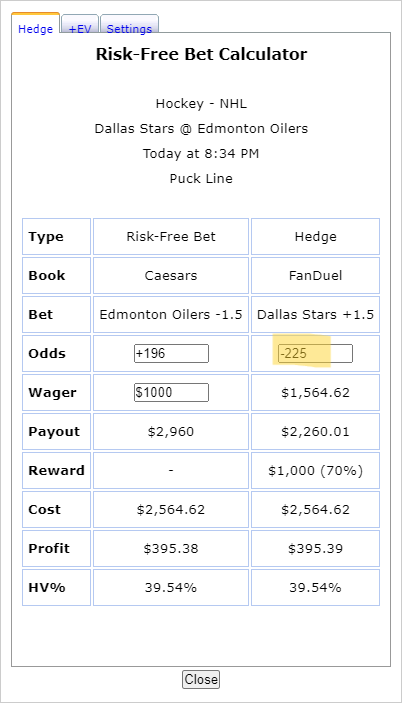

Click the button. You’ll get a popup that looks like this.

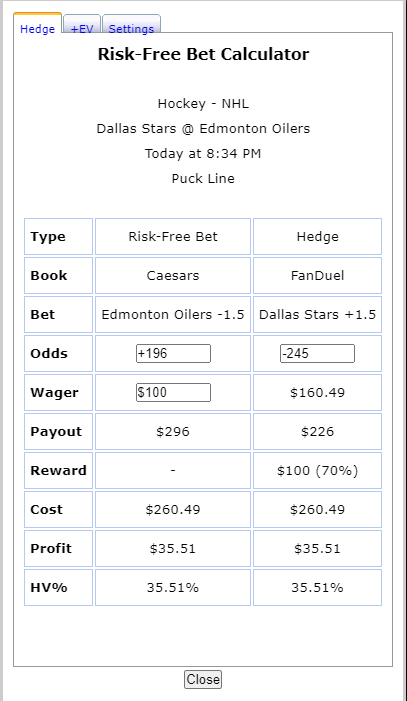

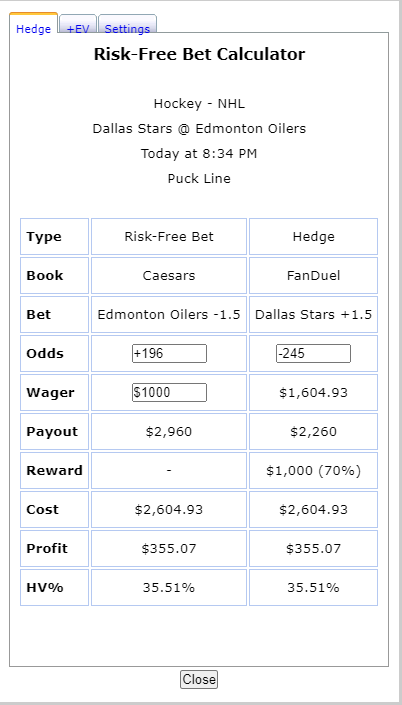

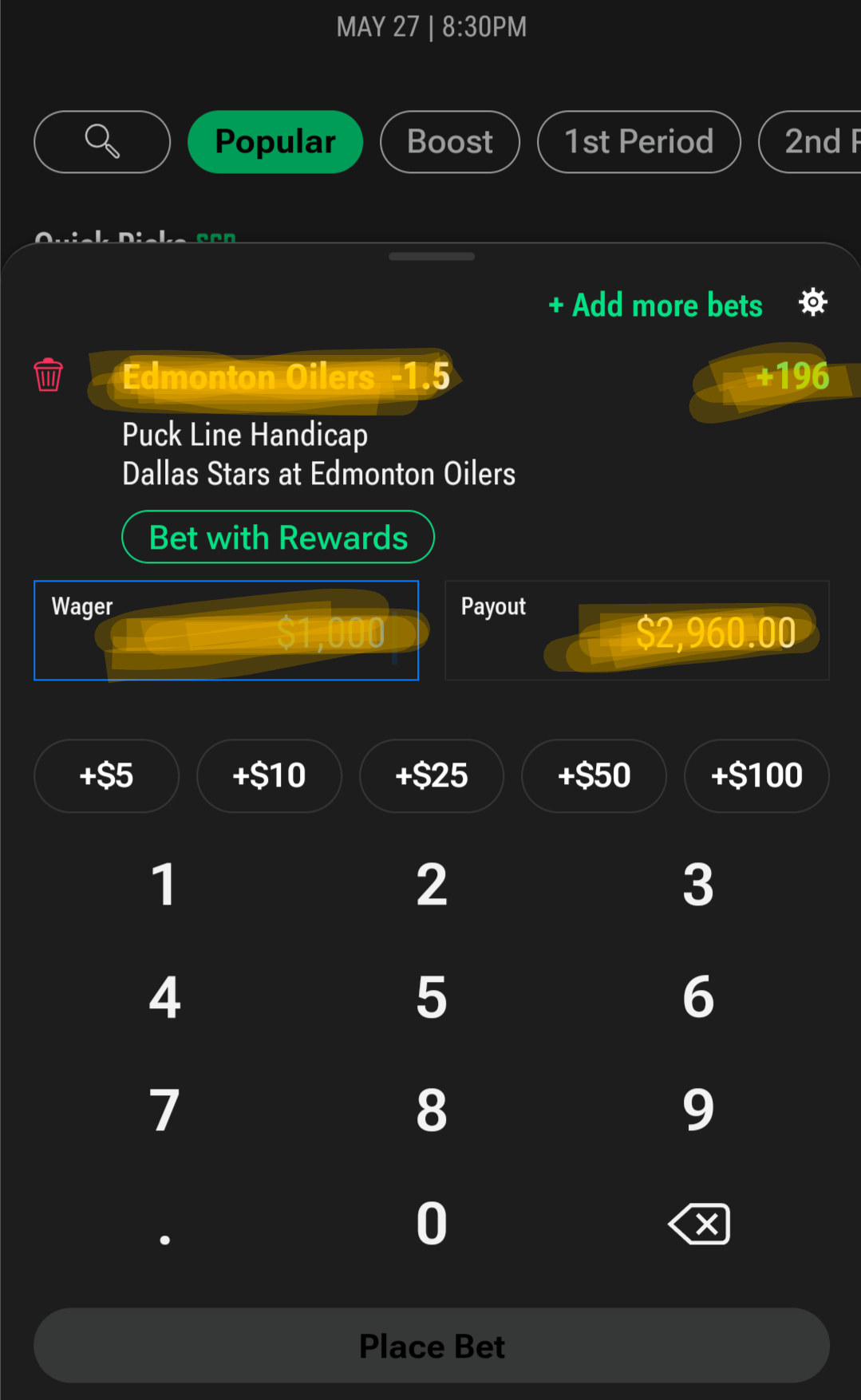

So this is an NHL hockey game between the Dallas Stars and the Edmonton Oilers. If you know absolutely nothing about hockey, perfect. Neither do I. The important thing is that this shows us which wagers to place, and for how much. The left column is our Risk-Free Bet on Caesars, and the right column is our Hedge on FanDuel.

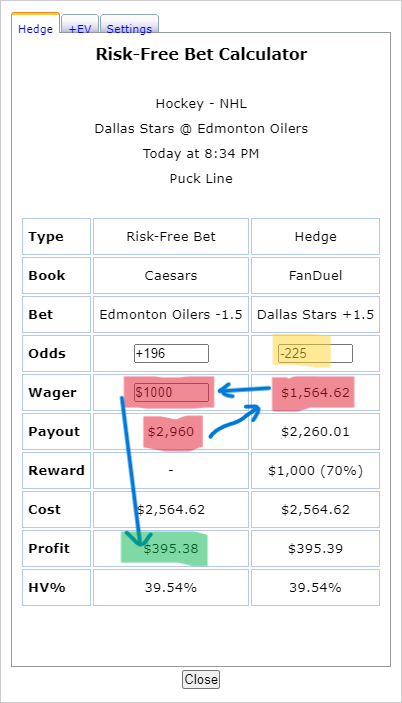

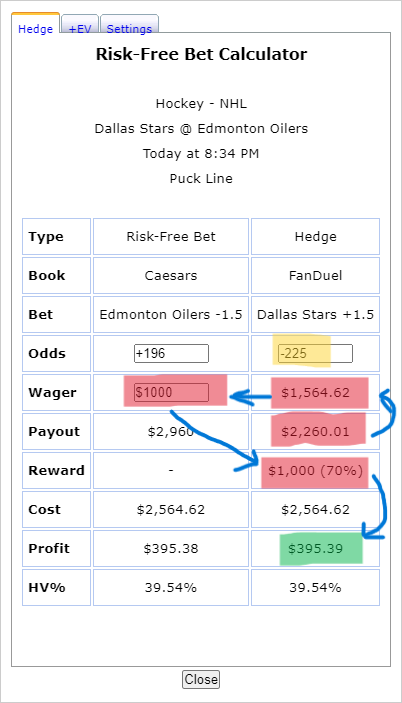

Our first decision is how much to wager. You’ll see that the Caesars wager is currently set to $100. But remember, our First Bet offer is for up to $1,000. You can wager any amount up to $1,000, but you’ll only get one shot at this offer, so if you wager less than $1,000, you won’t get the full benefit of the offer, and you’ll never be able to go back and use the rest in the future. It’s one shot. So my advice is wager $1,000, there’s no good reason not to. So we’ll change the wager amount to $1,000.

Now you can see that our risk-free bet is Edmonton Oilers -1.5 for $1,000, and our hedge bet is Dallas Stars +1.5 for $1,604.93. If you don’t know what that means, that’s fine. What you need to know is that you’ll need to deposit at least $1,000 into your Caesars account, and at least $1,604.93 into your FanDuel account. When that’s done, you can check the bets on each site to make sure the odds are accurate. They change constantly, so it’s always good to check both sites just before placing a bet.

First, we’ll open up the Caesars app and search for “Edmonton Oilers.” Sure enough, the game pops up.

Then we’ll click on that game and open it up

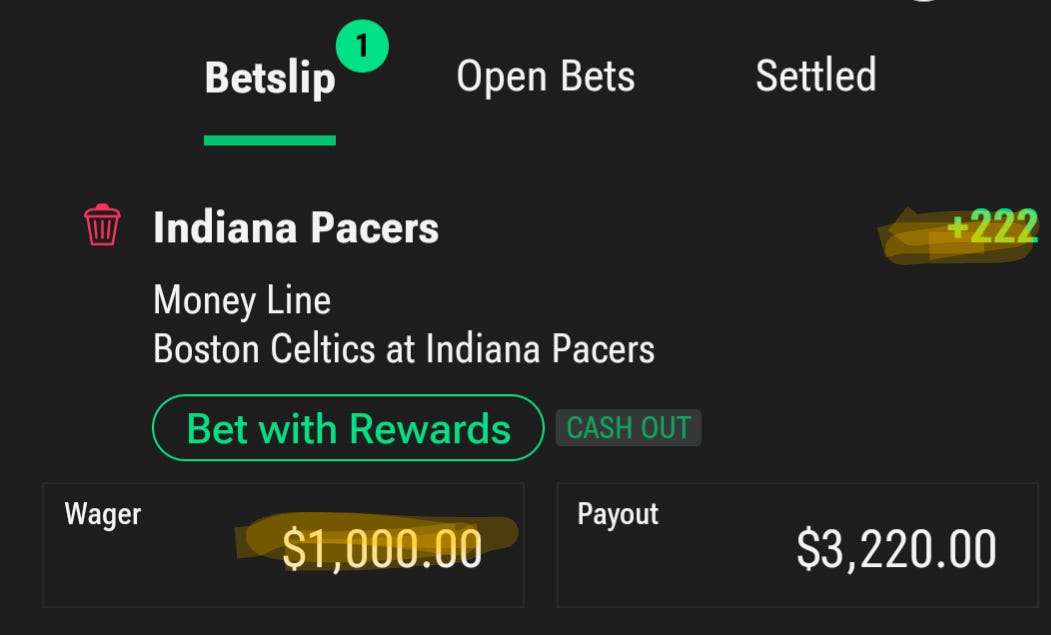

There are four things we want to check on each bet before placing it. I’ve highlighted them above. We have the Edmonton Oilers -1.5, odds of +196, a wager of $1,000, and a payout of $2,960. If we compare that with the correct column in our Risk-Free Bet Calculator, we’ll see that everything is correct.

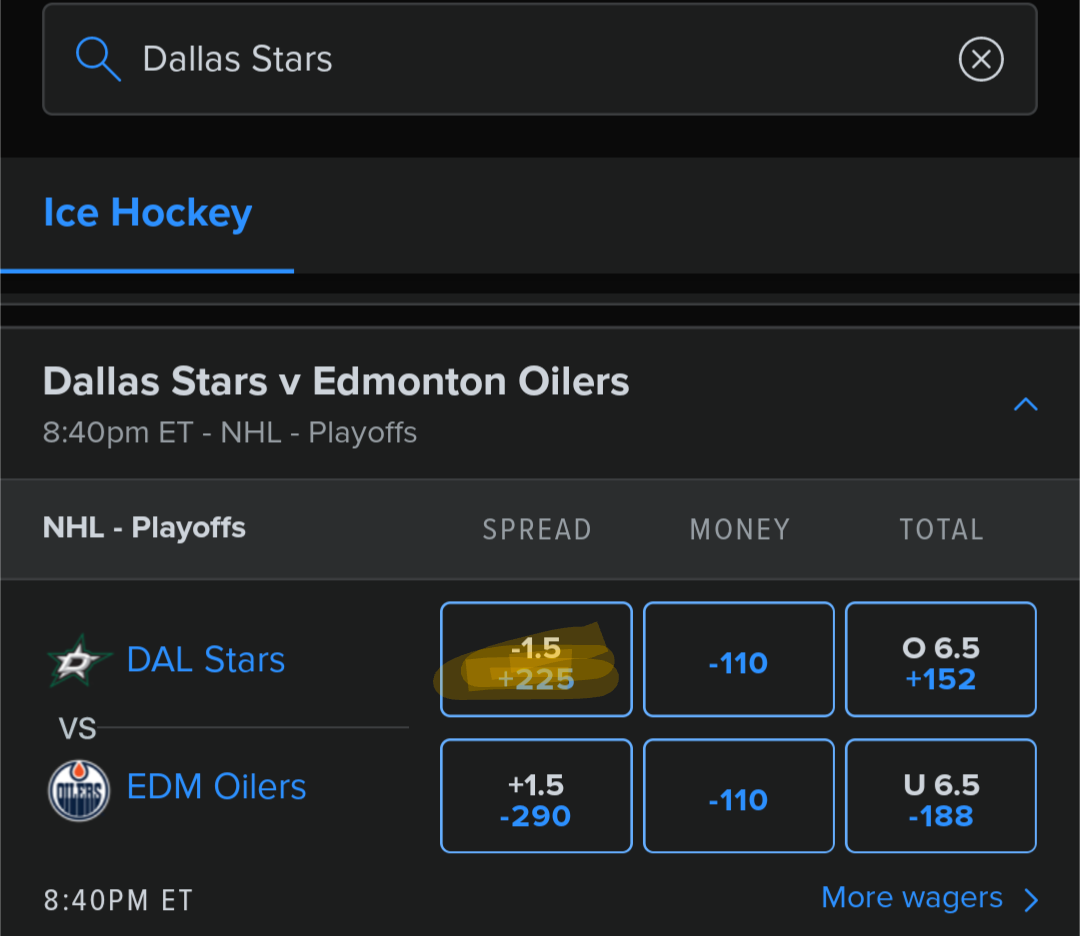

Now we want to do the same for the FanDuel hedge. We’ll open the FanDuels app and search for “Dallas Stars” and find the same game against the Oilers.

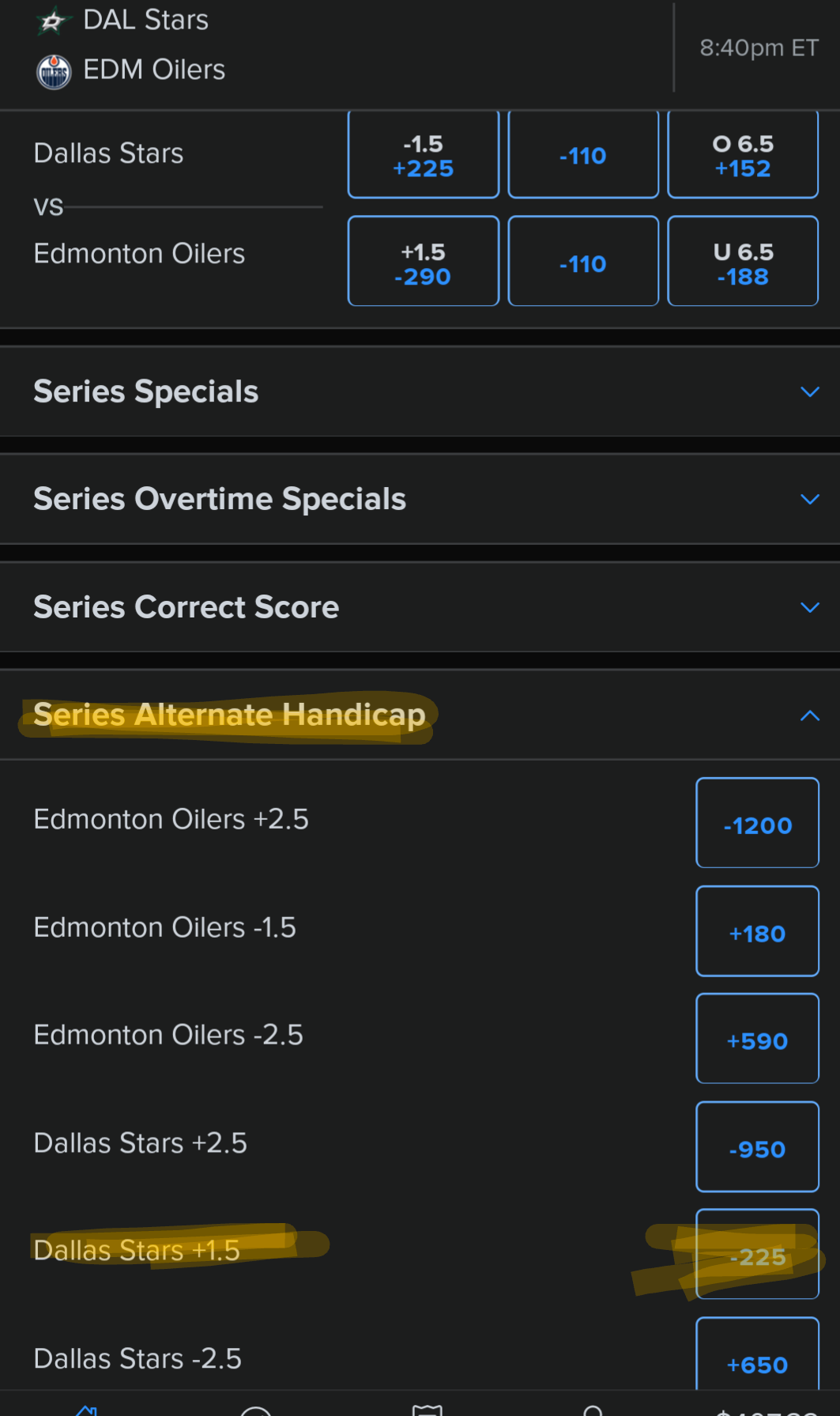

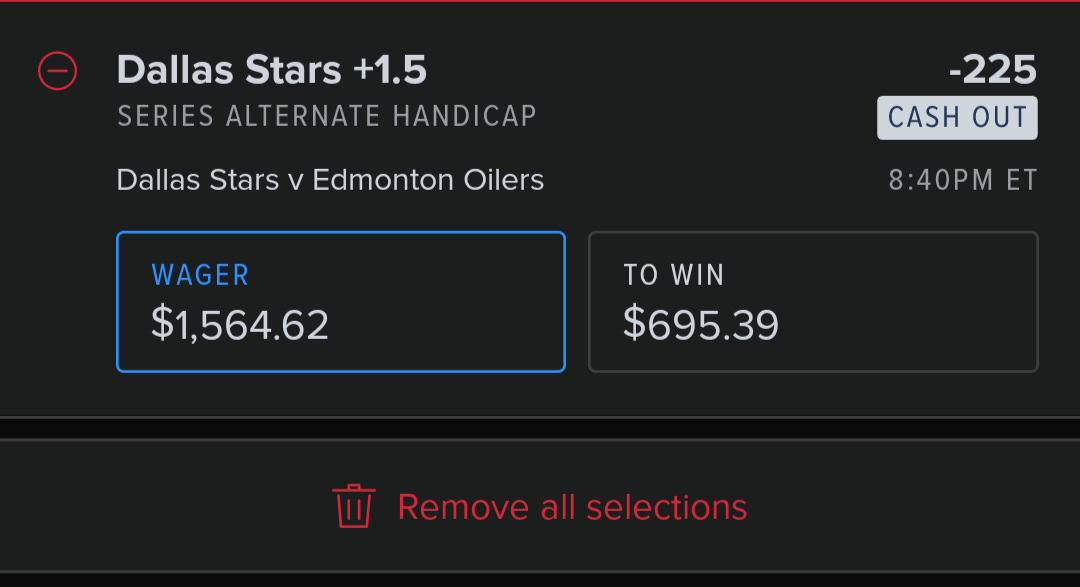

Here we can see the first problem. The spread we see here is -1.5, odds of +225. Our Risk-Free Bet Calculator is asking for Dallas Stars +1.5, odds -245. So we need to select a different line. Farther down the page you’ll see “Series Alternate Handicap.” Open that, and you’ll see Dallas Stars +1.5.

This is the bet we’re looking for. But you’ll also notice that the odds are -225 instead of -245. So we can select this bet, but we need to go back to our Risk-Free Bet Calculator and change the odds to get the correct amount to bet on this line.

So go back to the calculator and change -245 to -225. You’ll see this.

As you can see, the amount of the wager has changed to $1,564.62. So we can go back to FanDuel, select Dallas Stars +1.5, odds -225, and enter our updated wager amount.

As you can see, when we add the “Wager” and the “To Win” amount, we get $2,260.01. Looking at our calculator, that’s the exact number in our “Payout” row. So these are the bets we need to make.

Now that we’ve double checked everything, we can go back and make our $1,000 bet on Caesars, and immediately go make our $1,564.62 bet on FanDuel.

Awesome!

Now what? Well, our job is done. We just wait to see which team wins. Not that it matters to us either way. But which team wins will determine our next step.

Looking at our calculator again, there are two possible outcomes.

The first outcome is the Edmonton Oilers win. In that case, our Caesars bet will payout $2,960, while our FanDuel bet will be a total loss. Here’s how we do the math on that scenario.

We start with our $2,960 Caesars balance. We subtract our $1,564.62 FanDuel bet (which was a loss). Then we subtract the $1,000 we initially deposited and wagered on Caesars. This leaves us with a profit of $395.38! Not bad for a one day return on $2,564.62, while taking no risk.

Now for the second scenario. That would be if the Dallas Stars win. In that case, our Caesars bet is a total loss. Our FanDuel bet pays our $2,260.01

So to calculate our profit here, we start with our payout of $2,260.01, subtract our wager of $1,564.62, subtract our Caesars wager of $1,000 (which was a loss), and then add 70% of our free bonus Caesars bet of $1,000, or $700 (more on that in a minute). Once again, that gives us a profit of $395.39.

Now back to the free bonus bet. Since our Caesars bet lost, we qualified for the promotional payout. If we check the Caesars app, we should see a bonus bet of $1,000 in our balance. Remember I said that you can’t just withdraw the bonus bet? This situation is where that becomes an issue. So we have to place a $1,000 wager with Caesars before we can withdraw that money. The problem with that is, what if our second wager also loses? Then we lose money on the entire process. That’s where the 70% number comes in. We’ll use a similar process when making that $1,000 wager, by hedging on a second site once again. By doing that, we’ll be guaranteed to collect around 70% of the wager, or $700. I’ll explain that in the next section.

Free Bets

This is the name for the bet we get if we lose our initial bet on a site with a Risk-Free Bet offer. This is just what it sounds like, a free bet. You can bet the amount on a game, and if you win, the winnings are your money. You’re free to withdraw that cash.

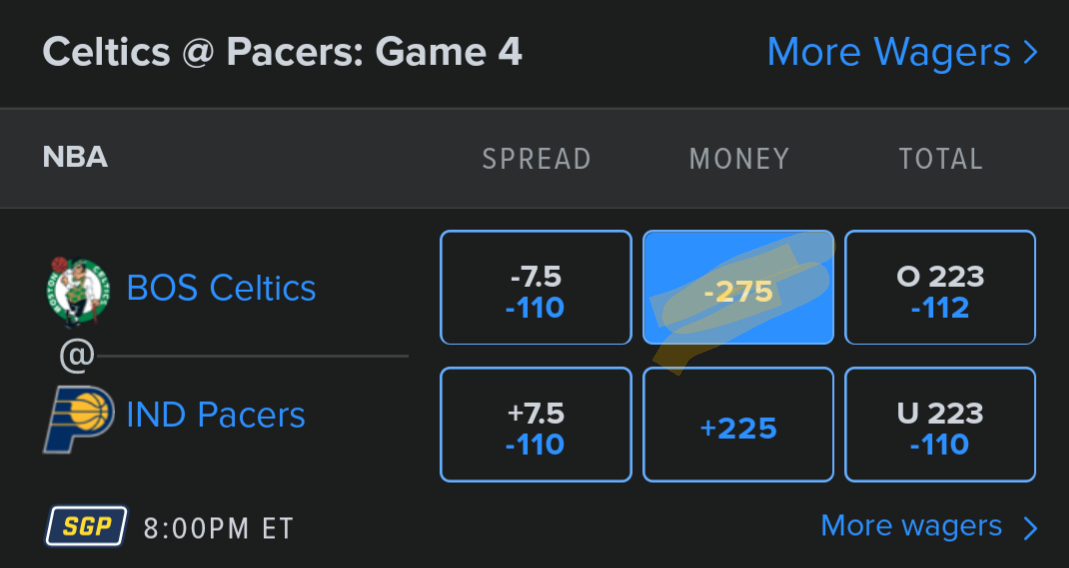

How do we ensure we still make a profit, even if our free bet loses? Well, Crazy Ninja Odds can help once again. Go back to their homepage, and this time click on Free Bets instead of Risk Free Bets. This time all we need to do is enter the sportsbook, Caesars, and click “update.” We’ll get a chart like this.

You know the drill by now. We find the first option on our Hedge Bet Sportsbook, FanDuel. This time it’s highlighted on the second row. Click “Calc.”

This is a money line bet, so it’s slightly different than the first one, but you won’t have any trouble figuring it out this time. You can check Caesars, and you’ll find the money line bet of $1,000 on the Pacers at +222, with a payout of $2,220.

Make sure you select your free bonus bet when you make the wager. If you lost your initial $1,000 deposit and didn’t deposit again, that should be your only option. It will look slightly different than this, since when you use a free bet, your payout won’t include the initial $1,000 wager, so it will read $2,220 instead of $3,220. I don’t have the free offer in my account so I can’t show you the exact screenshot, but you’ll be able to figure it out.

Then jump over to the other side of the game on FanDuel.

You’ll notice that the line is -275 instead of -270 like your calculator said. By now you know how to go back and change the odds in the calculator to get this.

Once again, you’ll want to make a $1,628 wager on the Boston Celtics at -275 to hedge your $1,000 free bonus bet on the Indiana Pacers at +222.