-

@ 0c9e5e17:480e870b

2025-06-18 01:52:11

@ 0c9e5e17:480e870b

2025-06-18 01:52:11I've owned a Fallkniven F1 knife for many years, but never really used it or taken it anywhere because of the sheath. The standard plastic sheath that it comes with may be perfectly designed for survival knife use or for pilots, which I think the knife was designed for, but for every day use or carry it is horrible. The knife sits loose inside, it rattles, the sheath barely retains the knife and the upper soft webbing is annoying. In my humble opinion anyway.

I've looked online for alternative sheaths for a couple of years and found some leather sheaths or Kydex sheaths, but none really suited my needs and were fairly expensive. So, the F1 sat in a box with other outdoor gear not getting any use.

Several years later I finally decided to try my hand at making a Kydex sheath on my own. This was spurred on by another DIY tool project I was working on that also happened to need a Kydex sheath (more on that in a later blog post). So, I thought making a sheath for my Fallkniven F1 might be a good practice project. It was getting no use anyway so what's the worse that could happen. I might even give it a new lease of life.

Making a Kydex Press

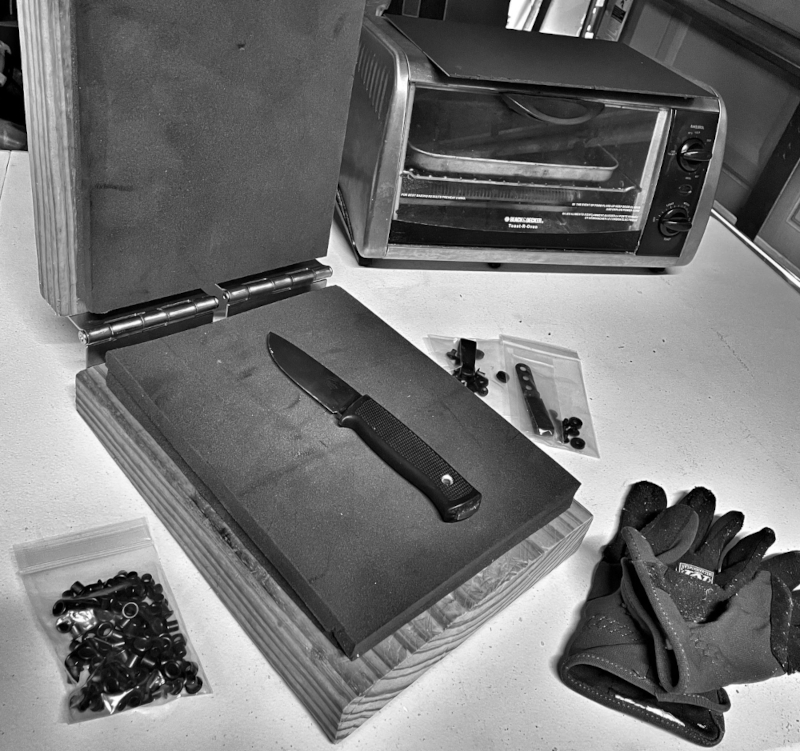

The first step was to make some form of press for forming the heated Kydex around the knife. I search on YouTube and found dozens of videos showing how to make simple hinged presses using pieces of wood and some small pieces of foam. I purchased two door hinges at my local Home Depot and used some scraps of wood I had and small sections of an old backpacking sleeping pad (neoprene) to make the Kydex press. I'm not going to go in to detail, if you want a step-by-step guide check out this video.

The first step was to make some form of press for forming the heated Kydex around the knife. I search on YouTube and found dozens of videos showing how to make simple hinged presses using pieces of wood and some small pieces of foam. I purchased two door hinges at my local Home Depot and used some scraps of wood I had and small sections of an old backpacking sleeping pad (neoprene) to make the Kydex press. I'm not going to go in to detail, if you want a step-by-step guide check out this video.Supplies

After more research I settled on using 0.8” thickness Kydex material. This seems strong enough for my needs, readily available and easy to form. I purchased a couple of 12” square sections on OD green from KnifeKits.com along with some 1/4” eye rivets and a rivet setting punch tool. I had some basic power tools, drill press, small toaster oven, and mini bandsaw in my garage workshop, along with a myriad of old hand tools, sanding paper etc.

Sheath Forming

According to several of the Kydex tutorial videos on YouTube University, it is recommended to apply two layers of blue painters tape to the blade of a knife before forming Kydex around it. This provided a small tolerance around the blade inside the sheath after the tape is removed. I prepped my Fallkniven F1 and got organized. I rough cut a piece of Kydex to approximately the size I needed. I had already decided to make a 'taco' style sheath. This requires once piece of Kydex to be folded around the blade and riveted on one side. The alternative is two pieces of separate Kydex and riveted on both sides of the blade - to me this added extra bulk and was unnecessary.

In an old toaster oven, heated to 350-degrees, I warmed my piece of Kydex. I had my sheath press ready along with two clamps. I wore a pair of Mechanix Wear gloves to protect my hands, heated Kydex is extremely hot and similar to handling molten plastic. You need gloves and need to be able to move quickly once the Kydex is up tp temperature. After about 90 seconds I tested the Kydex to find it perfectly soft and pliable. I wasn't able to find good information on what temperature to heat 0.8mm Kydex or for how long, but did find a video describing the right softness of Kydex so you can tell when it's ready. Pretty much trial and error.

I removed the heated Kydex and folded it around the back spine of the Fallkniven, quickly laying it down on the foam of my Kydex press, handle sticking out. I quickly closed the press lid and applied two clamps, tightening as hard as I could. I let this sit for 10 minutes to cool down.

Trimming and Rivet Placement

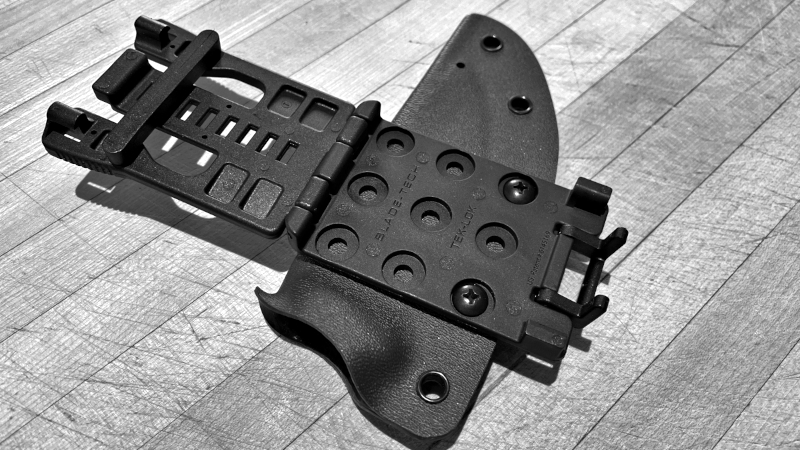

Once the Kydex had cooled down I removed it form the press and opened up the taco form to remove the knife. I knew I was going to be affixing a Tek-Lok clip to the sheath so that I could wear the knife appendix style (horizontally) on my belt. I marked out my rivet holes, spacing them to match the Tek-Lok and added a few more to secure the sheath. I drilled the 1/4” holes on my drill press and then marked the shape of the sheath using a white pencil. I trimmed most of the excess using a small bench-top bandsaw and finished the edges using sequentially finer levels of sandpaper. Kydex is pretty easy to work with.

Once the Kydex had cooled down I removed it form the press and opened up the taco form to remove the knife. I knew I was going to be affixing a Tek-Lok clip to the sheath so that I could wear the knife appendix style (horizontally) on my belt. I marked out my rivet holes, spacing them to match the Tek-Lok and added a few more to secure the sheath. I drilled the 1/4” holes on my drill press and then marked the shape of the sheath using a white pencil. I trimmed most of the excess using a small bench-top bandsaw and finished the edges using sequentially finer levels of sandpaper. Kydex is pretty easy to work with.I drilled a small hole at the bottom of the sheath right at the tip of the blade to allow for drainage should the sheath or knife get wet, fall into water, or get dirt inside. The last step before riveting was to clean out the inside of the sheath to remove and dust and debris from construction. I used some high pressure air.

I inserted each rivet one at a time and crimped them using my rivet setting die and a small arbor press I had. You could just as easily use a hammer a few small taps. Note: It's important that you use the right length rivets for the Kydex you are using. Mine were specifically for 0.8” Kydex.

Ensuring the Perfect Fit

I checked that the knife still fit snuggly into the sheath and was well retained. I noticed that it could use some adjustment and tweaks to fit and be removed more easily. I could describe all the steps here, or you could do what I did and watch this excellent YouTube video by Gentry Custom Knives which walks you through exactly how to ensure a perfect fit. I also took his advice and added a small thumb ramp to make removing the blade easier. I used a hot air gun to carefully heat the top edge of the Kydex sheath and bend it with my gloved finger.

I checked that the knife still fit snuggly into the sheath and was well retained. I noticed that it could use some adjustment and tweaks to fit and be removed more easily. I could describe all the steps here, or you could do what I did and watch this excellent YouTube video by Gentry Custom Knives which walks you through exactly how to ensure a perfect fit. I also took his advice and added a small thumb ramp to make removing the blade easier. I used a hot air gun to carefully heat the top edge of the Kydex sheath and bend it with my gloved finger.Tek-Lok Clip Mounting

Installing the Tek-Lok clip is extremely easy. Just align the holes that have been drilled and rivetted and determie if you need to have the vet spacer inserted or not - depending on how wide your belt is. And that's it.

The best way to do this is to just try. I had several failures along the way and learned what not to do. The great things about Kydex is that if you mess up in the pressing stage, you can warm it up again in the toaster oven and it will revert to it's original flat form and you can try again. I did discover however, that you can only do this a maximum of three times before the Kydex starts to misform and no longer be an even thickness - that might only be true in a toaster over. Time and more attempts will tell.

The best way to do this is to just try. I had several failures along the way and learned what not to do. The great things about Kydex is that if you mess up in the pressing stage, you can warm it up again in the toaster oven and it will revert to it's original flat form and you can try again. I did discover however, that you can only do this a maximum of three times before the Kydex starts to misform and no longer be an even thickness - that might only be true in a toaster over. Time and more attempts will tell.This project was a lot of fun and it gave and old under utilized knife an entirley new lease of life. The Fallkniven F1 is not a small knife, but I can hardly notice I am wearing it using this new sheath in an appendix carry mode.

Resources and Acknowledgements

I hoped you found this useful. I had a blast doing this for the first time and learned a lot along the way. I managed to do this on the cheap with less than $50 worth of materials, which will enable me to make more than this one sheath.

I'd like to acknowledge and give thank to some knifemakers who kindly shared their knowledge through videos on YouTube. I could not have learned how to do this without the many excellent videos shared by Gentry Custom Knives and Simple Little Life. Their videos were incredibly detailed and were the basis of everything I did here. Many, many thanks to both of them for taking the time to make their videos and openly share their skills and expertise to allow others to learn. Please support them in any way you can, subscribe to their channels, like their videos, or purchase some of their excellent knives.

KnifeKits.com - everything you could ever need and more to support your knife making habit - from a utter novice (like me) to an expert. Fast reliable shipping, and competitive prices.

I'd love to hear from you. What do you think about my first Kydex sheath project? Do you love it or hate it? What would you have done differently and what could I do better? Let me know, so that I can get better next time. - Bfgreen

I'd love to hear from you. What do you think about my first Kydex sheath project? Do you love it or hate it? What would you have done differently and what could I do better? Let me know, so that I can get better next time. - Bfgreen -

@ 8194da31:0f3badf3

2025-06-18 09:31:54

@ 8194da31:0f3badf3

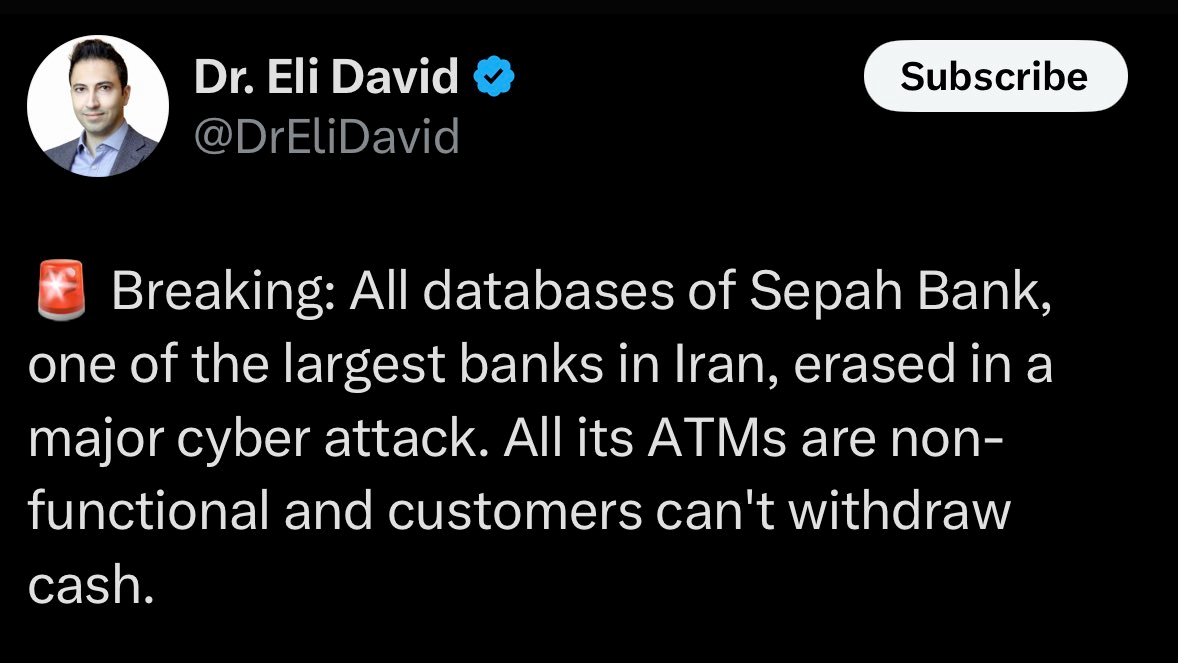

2025-06-18 09:31:54The Dollar Milkshake Theory is this:

The U.S. Dollar is the reserve currency, acting as the “straw” in the “milkshake” of financial liquidity.

Global markets get shaky.

Dollar sucks up liquidity as capital flies into the USD and US markets for safety.

Dollar gets stronger. Foreign countries struggle as dollar-denominated debts and basic goods and services get more expensive.

More panic, more flight to USD and US markets.

Dollar sucks up more liquidity, gets even stronger.

Rinse, repeat until total global crisis.

System collapses. The theory is correct in that the system will collapse.

The theory is incorrect in that the straw isn’t the U.S. Dollar – it’s Bitcoin.

This is the Bitcoin Milkshake Theory:

-

@ 9c9d2765:16f8c2c2

2025-06-18 09:31:51

@ 9c9d2765:16f8c2c2

2025-06-18 09:31:51The boardroom buzzed with tension.

Nana sat at the far end, her fingers clenched beneath the table. She had always been the quiet observer, the one who scribbled notes and nodded when spoken to. But today, something gnawed at her, the whisper of conscience growing louder.

Across the table, Mr. Johnson, the CEO, slammed a folder down. "We're pushing this contract through. No questions."

Nana knew what was in that contract. Unethical outsourcing. Workers with no protection. Children in some cases. She had seen the hidden memo.

Everyone else stayed silent.

Her heart pounded. “Sir,” she began softly. No one looked at her.

“I believe this contract violates our ethics code.”

The room froze.

Johnson turned, eyebrows raised. “Excuse me?”

Nana’s voice steadied. “There’s a report attached. Page seventeen. I think you overlooked it.”

He opened the file. His face twitched. “You went through private memos?”

“No, sir. It was attached accidentally to the draft.”

Gasps echoed. For a moment, she regretted everything. Then came a voice.

“She’s right,” said Daniel from HR. “We missed it.”

Another joined. “We can’t approve this.”

Within minutes, the momentum shifted. The contract was suspended.

After the meeting, Daniel approached her.

“You just saved the company’s integrity.”

Nana smiled faintly. Her hands still shook, but her silence had finally been broken for the right reason.

Moral: Sometimes the smallest voice becomes the loudest truth when spoken at the right moment.

-

@ 9dd283b1:cf9b6beb

2025-06-18 09:16:45

@ 9dd283b1:cf9b6beb

2025-06-18 09:16:45Question is inspired by this post - https://stacker.news/items/1008610/r/Catcher

If you follow the link in the post and check the fund contributors along with their local currencies, you’ll notice something interesting:

1 unit of account in Bitcoin is actually worth more than 1 unit of account in the local currency. That makes sending 1 sat feel like it’s not a diminishingly small amount anymore, or it doesn't make any difference cause 1 SAT = 1 SAT? 😊

https://stacker.news/items/1009186

-

@ 9c9d2765:16f8c2c2

2025-06-18 09:16:10

@ 9c9d2765:16f8c2c2

2025-06-18 09:16:10Rain lashed against the window panes of the old mansion as Jennifer stepped inside, flashlight in hand.

“Are you really doing this alone?” her friend Helen had asked that afternoon.

“I have to. It's my family’s house now,” Jennifer had replied. “And I need to know what really happened here.”

It had been ten years since her uncle, Dr. Johnson, a reclusive neuroscientist, vanished without a trace. His home, sealed ever since, was finally turned over to Jennifer after a lengthy legal battle.

She wandered through dark hallways filled with dust-covered furniture and half-finished journals. The air was thick with memories and secrets.

Then she found the door.

It was heavy, steel, and padlocked three times over. Scratched into the wood was a phrase:

“Do not open until the voices stop.”

Jennifer’s heart thumped. She pulled out the key ring the lawyer had given her and, one by one, undid the locks.

The hinges groaned as the door creaked open.

The room was pitch black, except for a single desk lamp. She stepped inside and found rows of voice recorders, wires, and scribbled notes all over the walls. A mirror hung directly across from the desk with strange cracks running across its surface each marked with names. One of them was hers.

Suddenly, a recorder clicked on by itself.

“If you’re hearing this… it means I’m likely gone,” her uncle’s voice rasped. “The voices they’re not in our heads. They live behind the reflections.”

Jennifer turned to the mirror.

Her reflection didn’t move.

Then… it blinked.

She froze.

“You should have never come here.”

The voice wasn’t from the recorder, it came from behind her.

She turned.

No one.

The door slammed shut.

The reflection began to grin as its mouth moved silently. The air grew colder.

Jennifer lunged for the desk, flipping through the notes. One said:

The mirror listens. But it also traps. I tried to destroy it. It fought back. I trapped it in here. Don't speak to it.

The reflection whispered:

“Jennifer… would you like to know where he went?”

She stepped closer.

“He begged me to let him out… just like you will.”

With trembling hands, she took a hammer from the drawer.

The reflection laughed.

“You wouldn’t dare.”

She raised the hammer high and swung.

The mirror shattered.

A blinding flash filled the room.

Then silence.

When Jennifer awoke, it was morning. The door was wide open. The room was empty. The mirror was gone, no glass, no shards, no reflection. Just sunlight.

She walked out.

As she locked the mansion door behind her, she whispered:

“Some doors are meant to be opened… but only once.”

Moral/Theme:

The truth may be terrifying, but denying it gives fear more power than it deserves.

-

@ a53364ff:e6ba5513

2025-06-18 09:06:26

@ a53364ff:e6ba5513

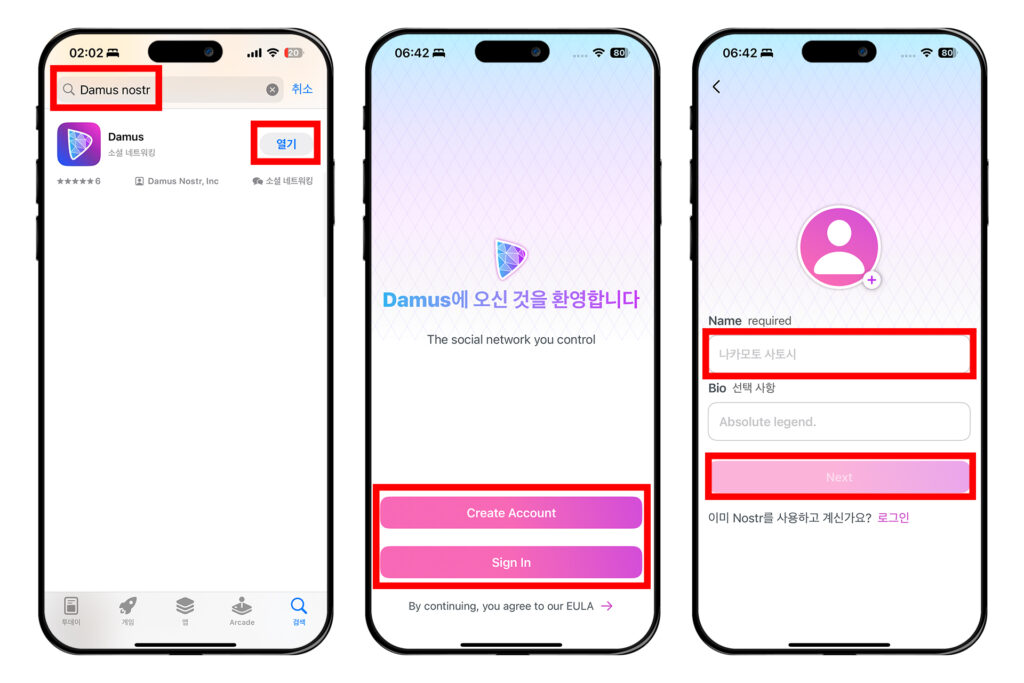

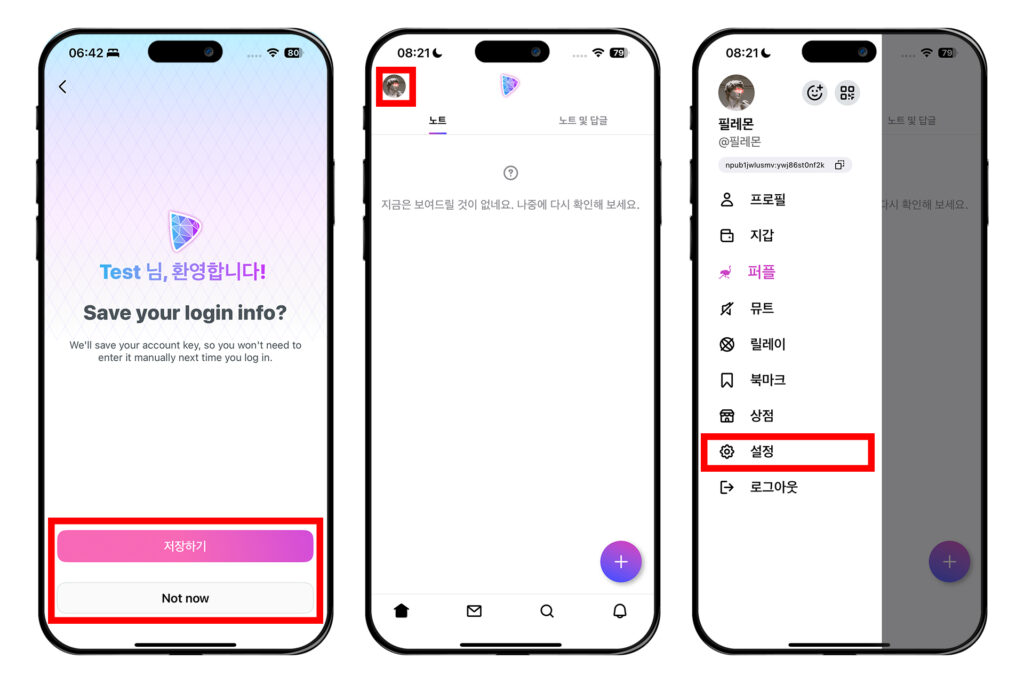

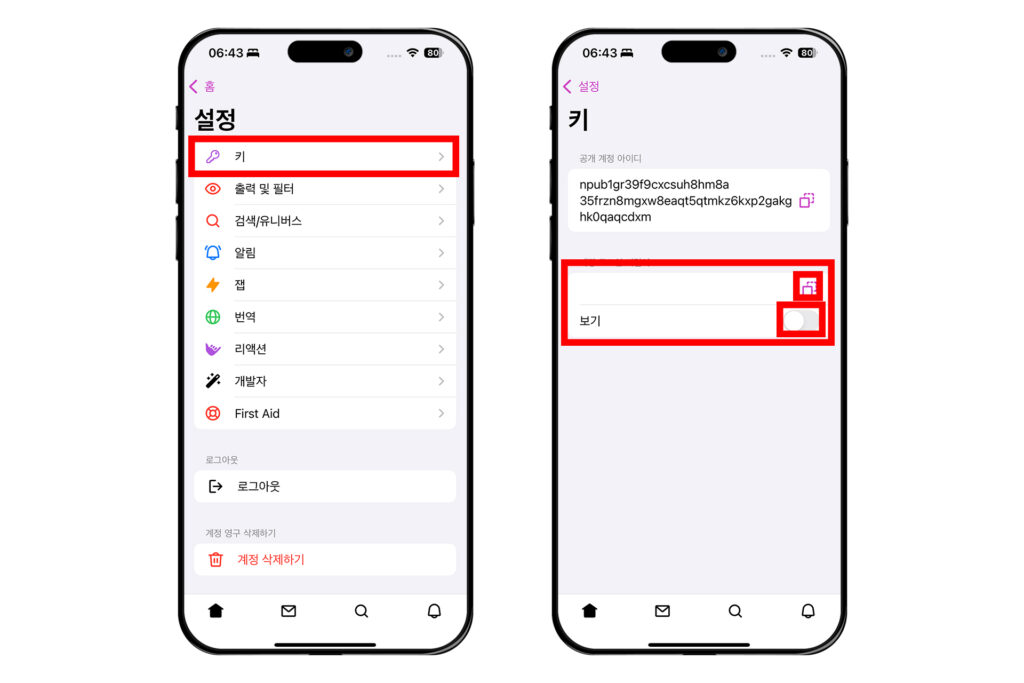

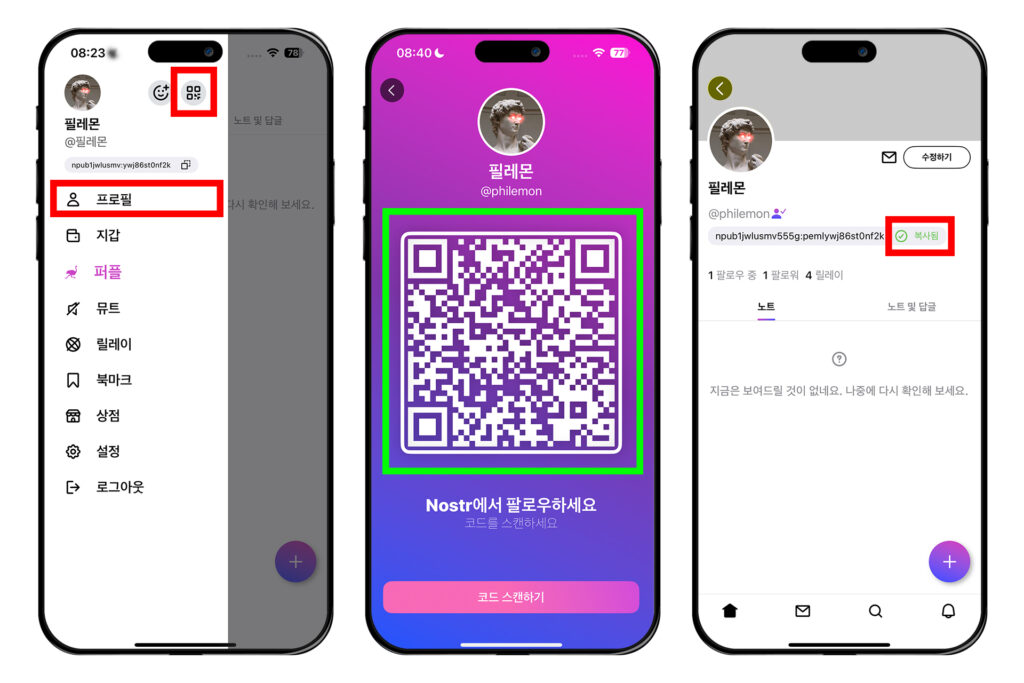

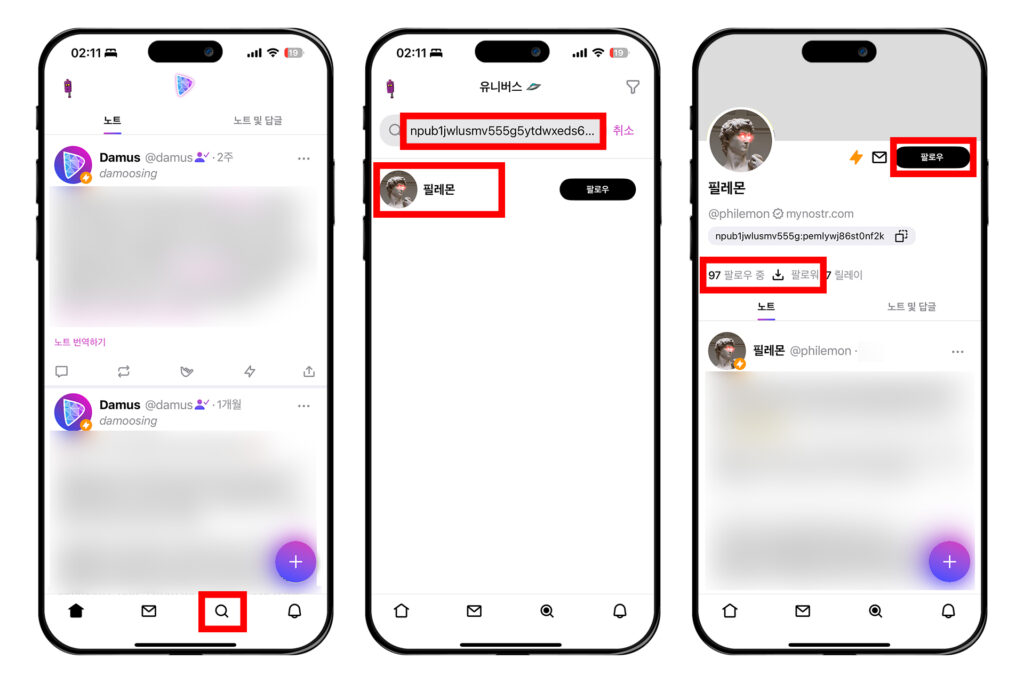

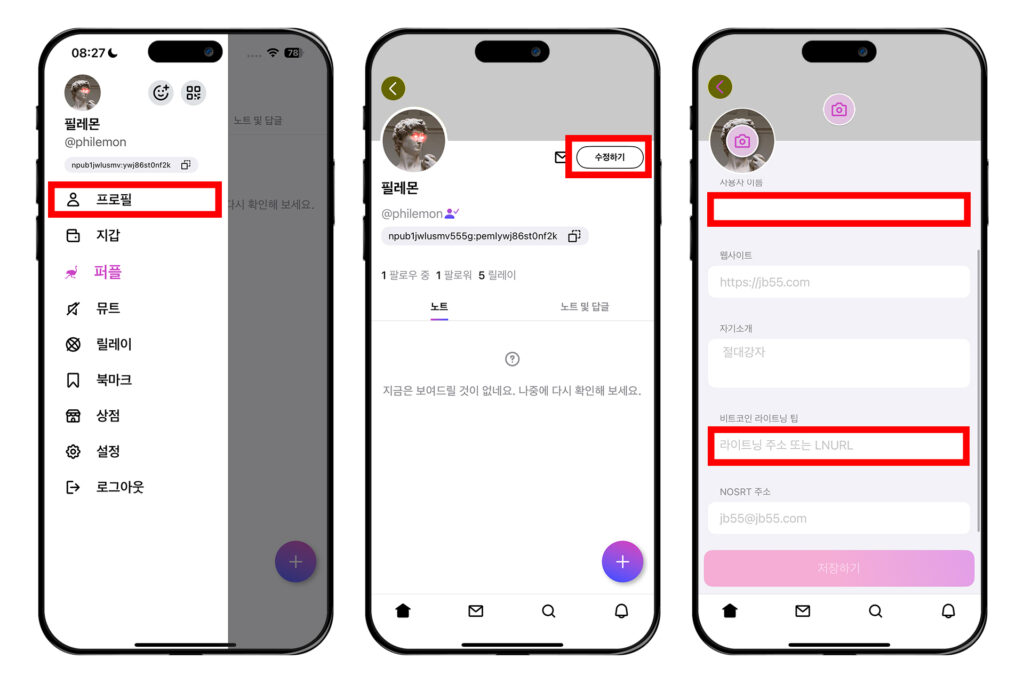

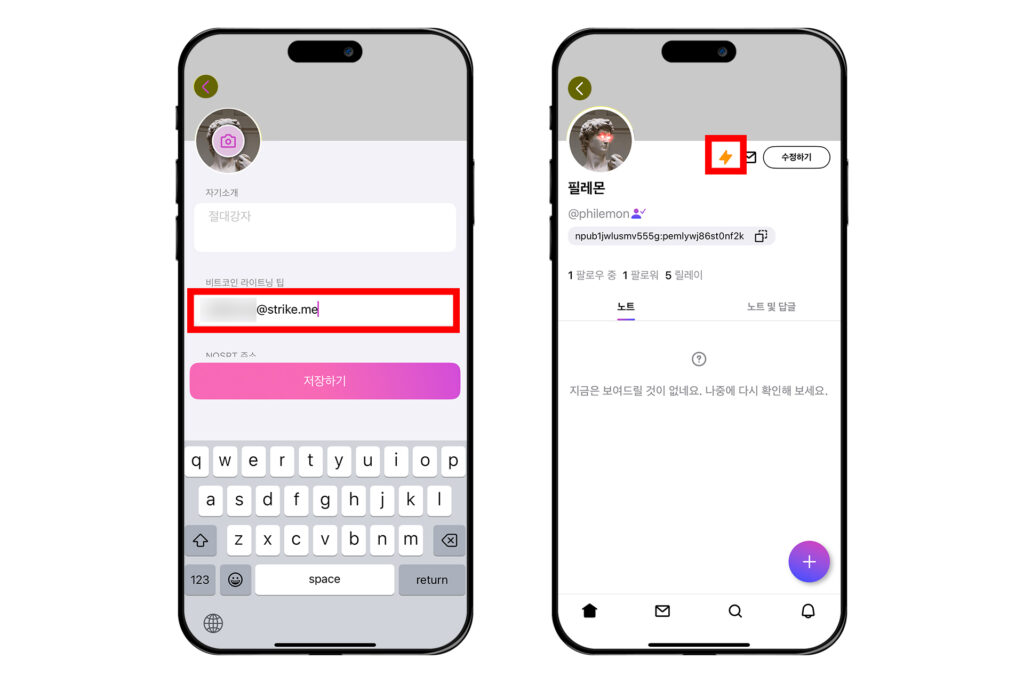

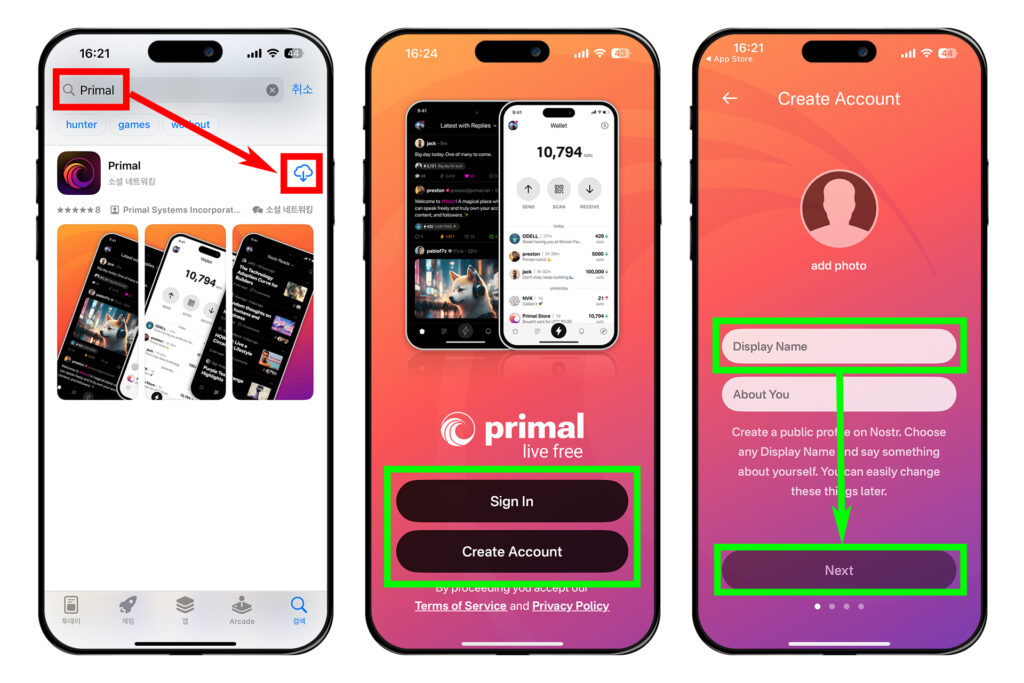

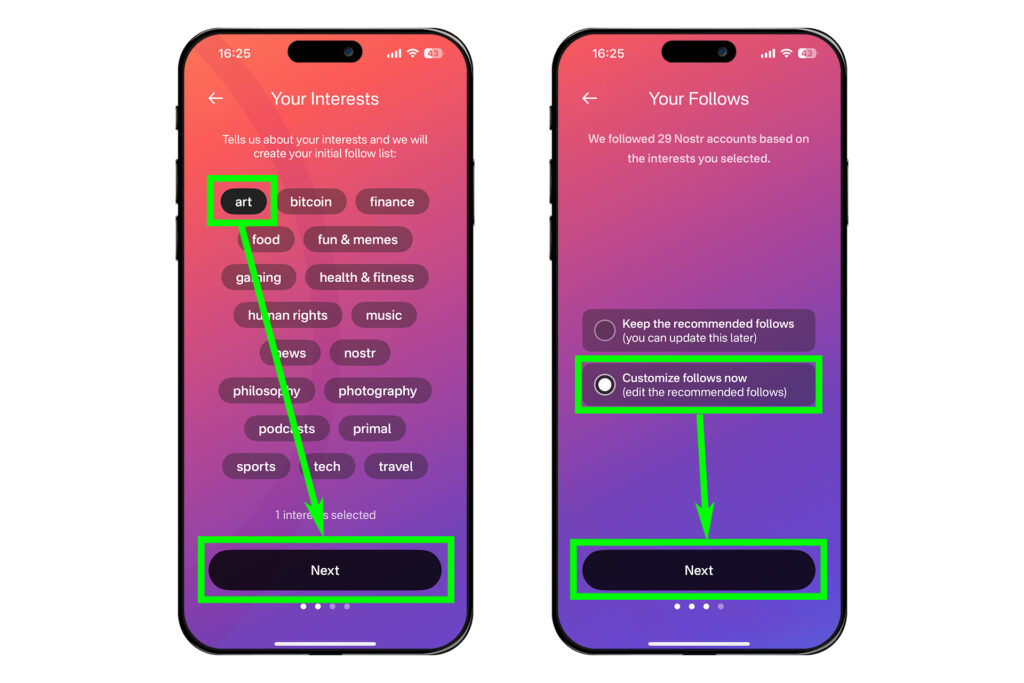

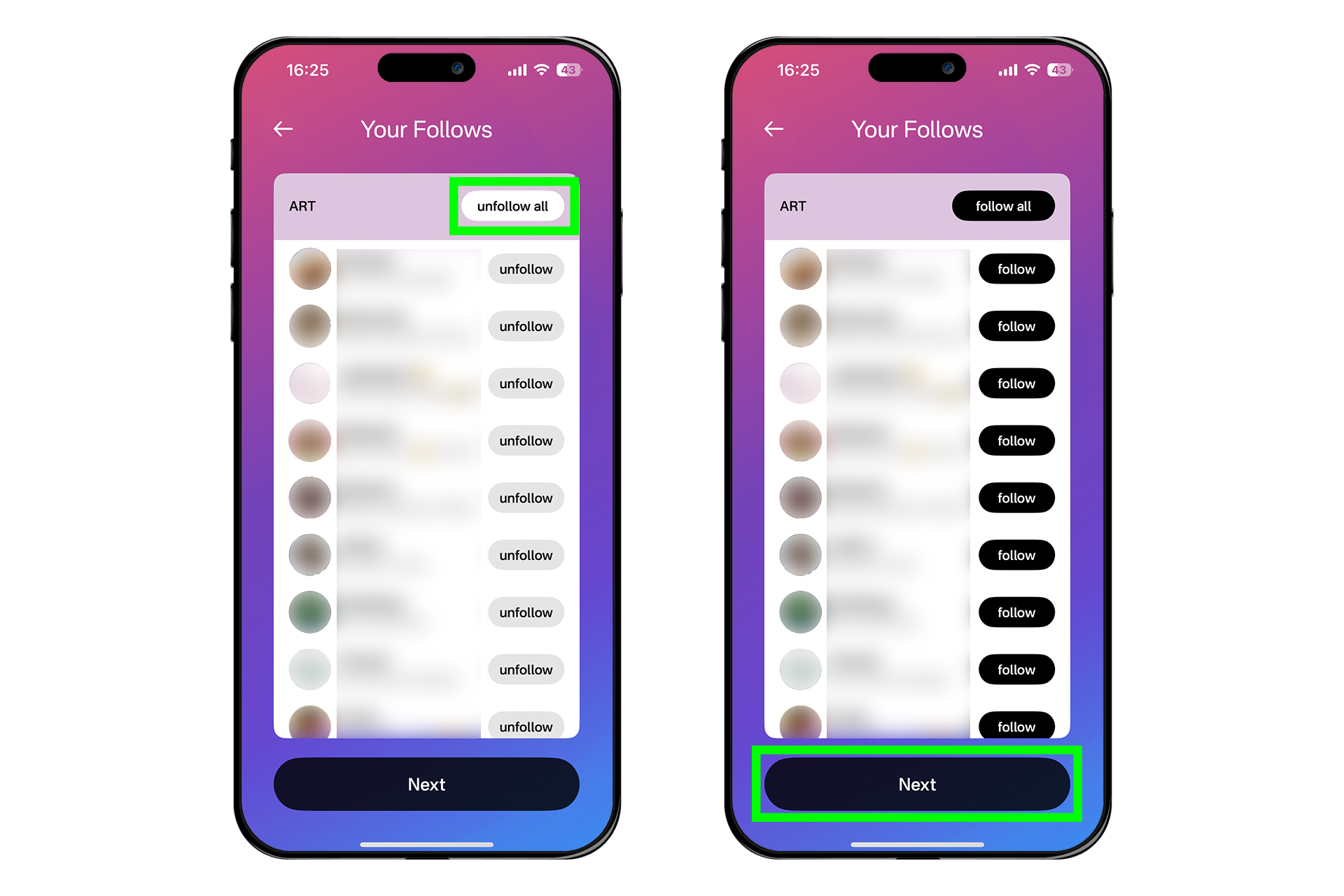

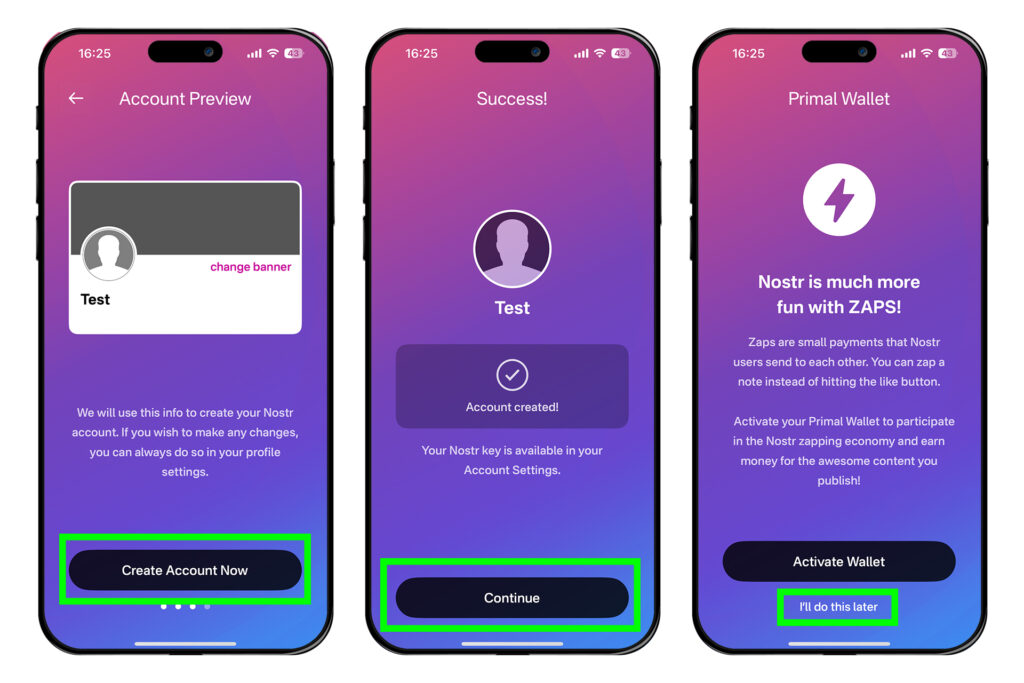

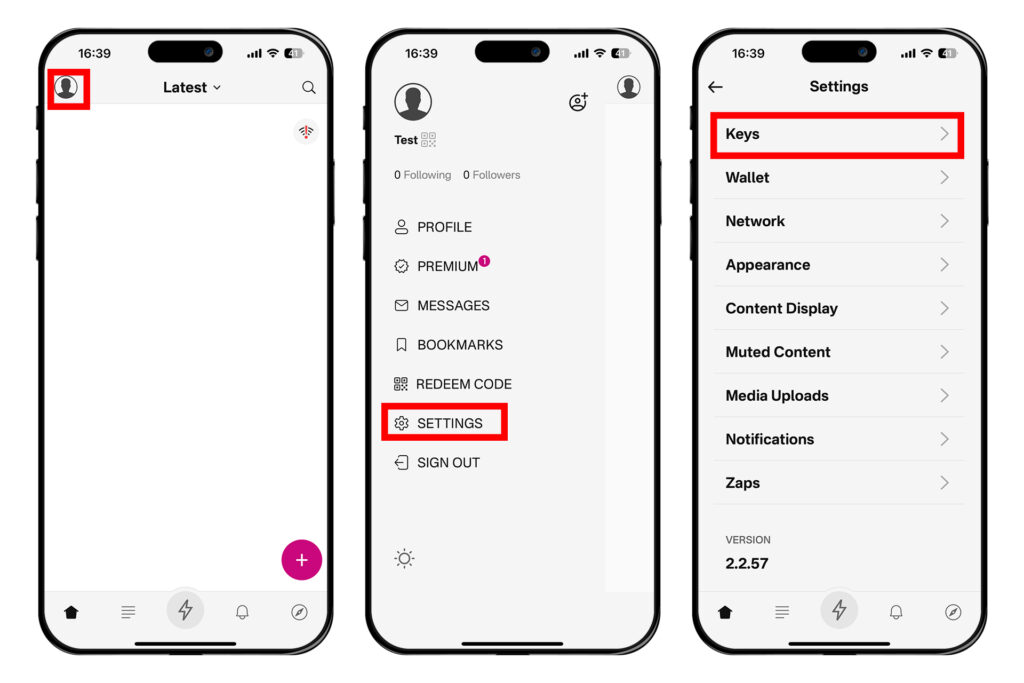

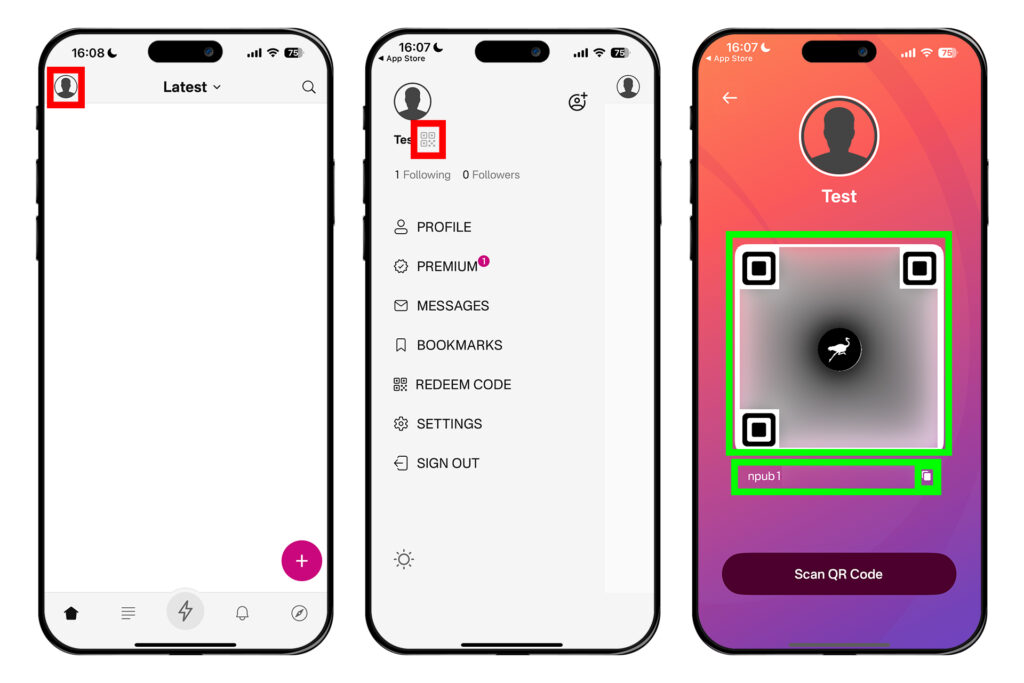

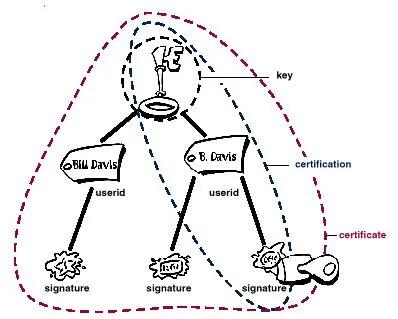

2025-06-18 09:06:26The internet is filled with countless social media platforms, all built on centralized servers and proprietary algorithms. However, in the world of decentralized technologies, a new contender is rising. Nostr is a simple, open protocol that promises to bring decentralized, censorship-resistant communication to the masses. In this article, we will explore what Nostr is, how it works, and why it might be the next big thing in the social media space.

1. How Did the Nostr Protocol Come About?

Nostr (Notes and Other Stuff Transmitted by Relays) was first conceived as a solution to the growing control centralized entities exert over online communications. Most social media platforms today are controlled by corporations, which have the power to censor, ban users, or manipulate what people see in their feeds. These issues, combined with growing concerns about privacy and data collection, inspired the creation of Nostr in 2020 by an anonymous developer named “fiatjaf”. The protocol aims to provide a decentralized alternative where users have control over their own content and identities.

2. What is Nostr?

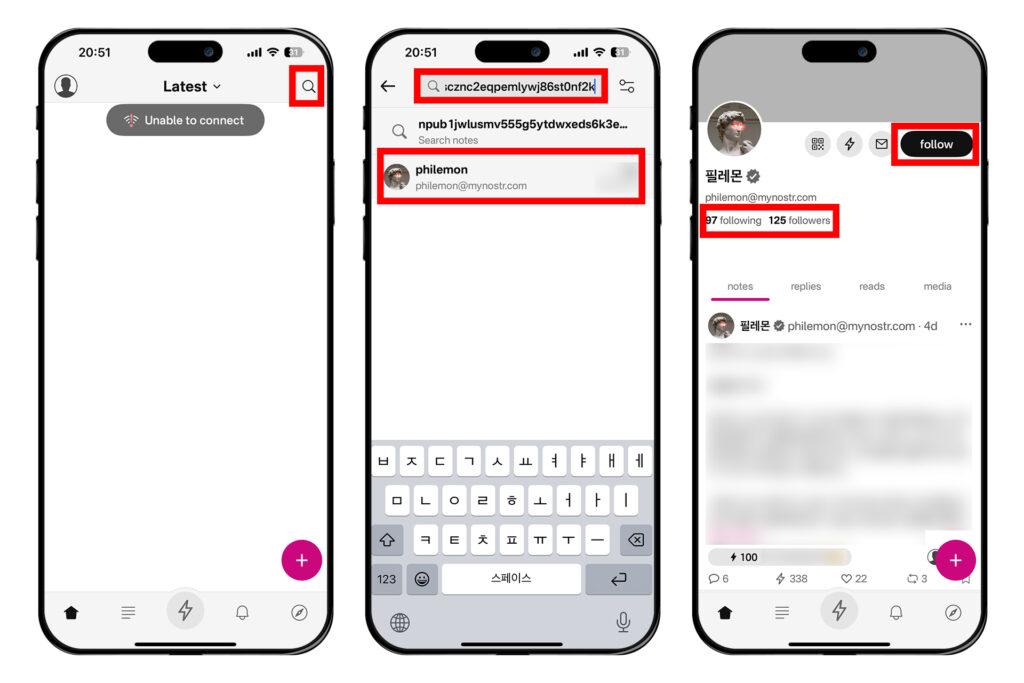

Nostr is an open, decentralized communication protocol that allows users to send and receive messages in a censorship-resistant manner. It’s not a social network by itself but a foundation for building decentralized applications (DApps), such as social networks, chat apps, and other forms of communication platforms. Unlike traditional platforms, where all data is stored and managed by a single company, Nostr allows users to control their own data and interact directly without intermediaries.

3. Why is Nostr Different from Other Social Networks?

Traditional social media platforms like Twitter, Facebook, and Instagram are centralized, meaning all of your posts, messages, and data are controlled by a single company. These platforms have the power to suspend accounts, remove content, or alter algorithms in ways that impact your online presence. Nostr, on the other hand, is decentralized and open-source. There is no central authority, meaning your posts cannot be censored or deleted by a single entity. Each user owns their data, and communication happens directly between users and servers (called relays), reducing the potential for manipulation or surveillance.

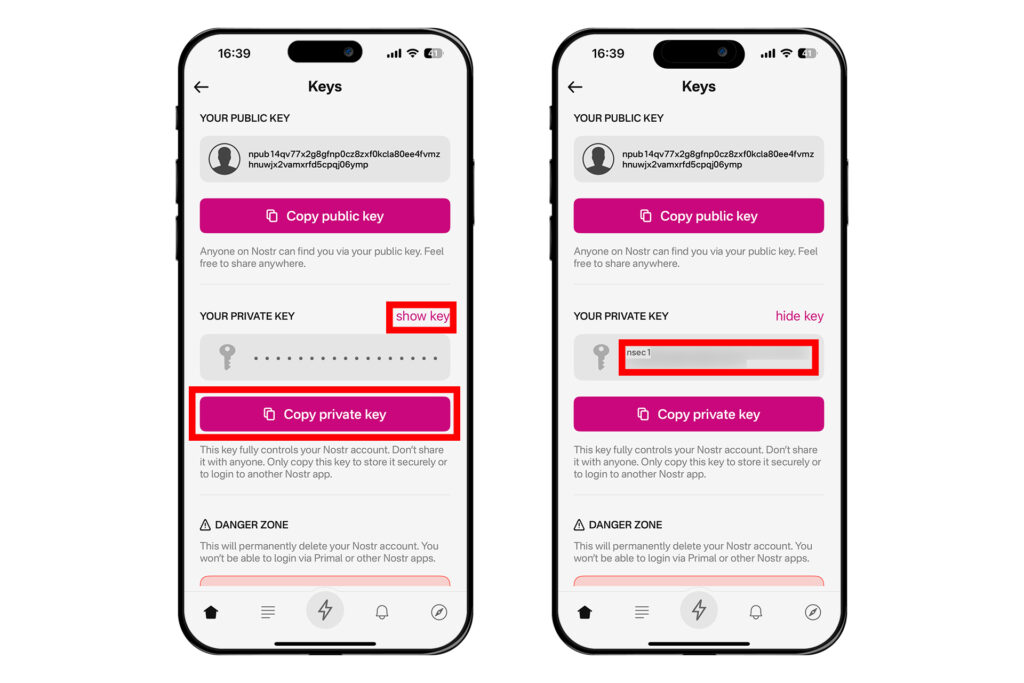

4. Similarities of Nostr with Bitcoin

Nostr shares a similar ethos with Bitcoin, in that both are decentralized, censorship-resistant, and permissionless. Just as Bitcoin allows people to transfer value without intermediaries, Nostr enables communication without relying on a central authority. Both projects promote the idea of individual sovereignty—whether that’s over your money or your communication.

Another connection is the use of public and private keys for identity management. Like Bitcoin wallets, Nostr uses cryptographic keys, meaning that users “log in” by signing messages with their private key. This ensures that only the true owner of the key can send messages from a specific identity.

5. Bitcoin Integrations

Bitcoin and Nostr are increasingly integrated, especially through Bitcoin’s Lightning Network, which is designed for fast, low-fee transactions. Nostr and Bitcoin are a natural fit. By integrating Bitcoin’s Lightning Network, Nostr allows users to send and receive micropayments seamlessly. This is particularly useful for tipping or rewarding content creators within the network. Satoshis (the smallest unit of Bitcoin) can be sent across Nostr’s network almost instantly and with minimal fees. On Nostr, users can send Bitcoin micropayments, often referred to as “zaps.” This enables tipping and rewarding users directly within the network, providing a seamless way for content creators to monetize their work without the need for third-party platforms. For example, if you appreciate a post, you can “zap” the creator a small amount of Bitcoin, creating a new way to support online communities.

6. How Does Nostr Work? What are Clients and Relays?

Nostr operates through two main components: Clients and Relays.

– Clients are applications that allow users to create accounts, post messages, and interact with others. These clients can be web apps, mobile apps, or desktop apps that interact with the Nostr network.

– Relays are servers that store and transmit the messages between clients. When you post a message on Nostr, it is sent to a relay, and other users’ clients pull that message from the relay. You are not tied to any single relay, so even if one relay is down or blocks your content, you can still interact with others using different relays.

This relay-client model ensures that the network remains decentralized and difficult to censor.

7. Difference Between Today’s Internet and Nostr’s

Today’s internet is heavily centralized. Most of our communication, from emails to social media, is managed by large corporations with access to vast amounts of data about their users. This leads to issues like censorship, surveillance, and data harvesting. Nostr seeks to change this by decentralizing communication. It puts control back into the hands of users, allowing for a more private and open internet experience. There’s no need for trust in any single company—users own their data and decide which relays to trust or use.

8. How Do Bitcoin Zaps and Micropayments Work on Nostr?

One of the most exciting features of Nostr is its integration with Bitcoin’s Lightning Network. Through this integration, users can send Bitcoin zaps, which are small amounts of Bitcoin transferred instantly over the Lightning Network. Zaps function like “likes” on traditional social media platforms, but with the added benefit of rewarding users with real monetary value.

To send a zap, users link their Nostr profile to a Lightning wallet. Once connected, they can zap others by sending small amounts of Bitcoin, typically for content they enjoy or want to support. These zaps are fast, inexpensive, and work seamlessly within the Nostr ecosystem, making it easy for users to monetize content and interact with Bitcoin in a meaningful way.

Conclusion

Nostr is an exciting protocol that promises to reshape how we think about online communication. Its decentralized, censorship-resistant nature, along with its integration with Bitcoin, creates a platform where users have control over their data and interactions. Whether you’re looking for a more private social media experience or want to explore new ways to integrate Bitcoin into everyday interactions, Nostr is a protocol worth watching. With its growing ecosystem of clients and relays, Nostr might just be the future of decentralized communication.

Nostr is more than just a social network; it represents a shift towards user autonomy, privacy, and decentralized control. By combining cutting-edge technology with a solid ideological foundation, Nostr offers a refreshing alternative to mainstream social platforms. Whether you’re tech-savvy or just curious about new innovations, Nostr is worth exploring. And with various clients making it easily accessible, there’s no reason not to dive in and experience the future of decentralized social networking for yourself!

-

@ dfa02707:41ca50e3

2025-06-18 09:01:50

@ dfa02707:41ca50e3

2025-06-18 09:01:50Contribute to keep No Bullshit Bitcoin news going.

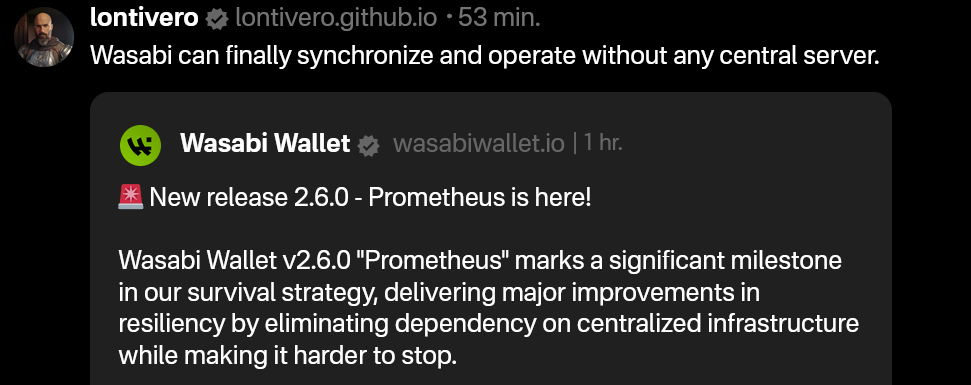

- Wasabi Wallet v2.6.0 "Prometheus" is a major update for the project, focused on resilience and independence from centralized systems.

- Key features include support for BIP 158 block filters for direct node synchronization, a revamped full node integration for easier setup without third-party reliance, SLIP 39 share backups for flexible wallet recovery (sponsored by Trezor), and a Nostr-based update manager for censorship-resistant updates.

- Additional improvements include UI bug fixes, a new fallback for transaction broadcasting, updated code signing, stricter JSON serialization, and options to avoid third-party rate providers, alongside various under-the-hood enhancements.

This new version brings us closer to our ultimate goal: ensuring Wasabi is future-proof," said the developers, while also highlighting the following key areas of focus for the project:

- Ensuring users can always fully and securely use their client.

- Making contribution and forks easy through a codebase of the highest quality possible: understandable, maintainable, and improvable.

"As we achieve our survival goals, expect more cutting-edge improvements in Bitcoin privacy and self-custody. Thank you for the trust you place in us by using Wasabi," was stated in the release notes.

What's new

- Support for Standard BIP 158 Block Filters. Wasabi now syncs using BIP 158 filters without a backend/indexer, connecting directly to a user's node. This boosts sync speed, resilience, and allows full sovereignty without specific server dependency.

- Full Node Integration Rework. The old integration has been replaced with a simpler, more adaptable system. It’s not tied to a specific Bitcoin node fork, doesn’t need the node on the same machine as Wasabi, and requires no changes to the node’s setup.

- "Simply enable the RPC server on your node and point Wasabi to it," said the developers. This ensures all Bitcoin network activities—like retrieving blocks, fee estimations, block filters, and transaction broadcasting—go through your own node, avoiding reliance on third parties.

- Create & Recover SLIP 39 Shares. Users now create and recover wallets with multiple share backups using SLIP 39 standard.

"Special thanks to Trezor (SatoshiLabs) for sponsoring this amazing feature."

- Nostr Update Manager. This version implements a pioneering system with the Nostr protocol for update information and downloads, replacing reliance on GitHub. This enhances the project's resilience, ensuring updates even if GitHub is unavailable, while still verifying updates with the project's secure certificate.

- Updated Avalonia to v11.2.7, fixes for UI bugs (including restoring Minimize on macOS Sequoia).

- Added a configurable third-party fallback for broadcasting transactions if other methods fail.

- Replaced Windows Code Signing Certificate with Azure Trusted Signing.

- Many bug fixes, improved codebase, and enhanced CI pipeline.

- Added the option to avoid using any third-party Exchange Rate and Fee Rate providers (Wasabi can work without them).

- Rebuilt all JSON Serialization mechanisms avoiding default .NET converters. Serialization is now stricter.

Full Changelog: v2.5.1...v2.6.0

-

@ eb0157af:77ab6c55

2025-06-18 01:02:06

@ eb0157af:77ab6c55

2025-06-18 01:02:06Carl Rickertsen completely exits his position in Strategy as insiders sell $864 million worth of stock.

As reported by Protos, Carl Rickertsen, a member of Strategy’s board of directors, has fully liquidated his entire shareholding for over $10 million.

Rickertsen’s decision to completely exit his Strategy position marks a sharp shift from his previous investment stance. In 2022, the executive had shown confidence in the company by investing $700,000 in MSTR shares.

On June 13, 2022, Rickertsen purchased $608,000 worth of MSTR stock at $152 per share. Since then, the stock has rallied 152%. However, by 2023, the director had already sold half of his 4,000-share position.

Rickertsen’s approach to managing his holdings has become increasingly aggressive in recent years. Since joining the board in 2019, he has adopted a strategy of immediately liquidating any stock options received.

One example of this tactic occurred on June 2, when he acquired and sold 26,390 MSTR shares on the same day.

As of June 5 this year, Rickertsen reported zero vested Strategy shares, marking the end of his equity involvement with the company.

Rickertsen’s situation is not an isolated case within Strategy. Data from the Securities and Exchange Commission (SEC) reveals a controversial picture. According to information gathered by secform4.com, over the past five years, total insider sales have exceeded purchases by $864 million. This imbalance in insider transactions could raise questions about executives’ confidence in the company’s future.

The post Strategy director liquidates all his MSTR shares appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-06-18 09:01:30

@ eb0157af:77ab6c55

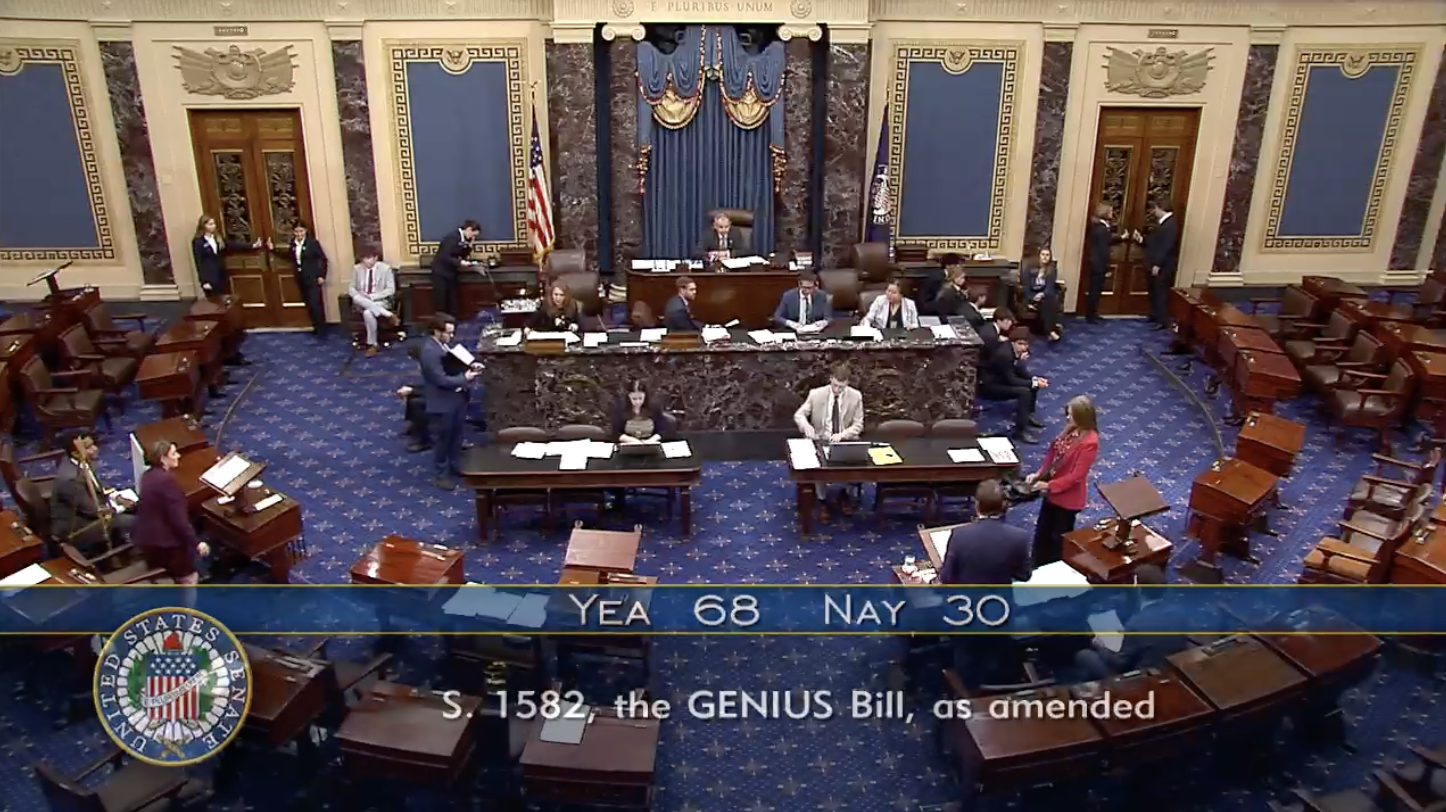

2025-06-18 09:01:30The House of Representatives will now decide whether to adopt its own proposal or the Senate’s version for the new stablecoin regulations.

The United States Senate has officially passed the GENIUS Act, marking another step toward establishing a federal regulatory framework for stablecoins. The final vote concluded with 68 in favor and 30 against, sending the bill to the House of Representatives for final approval in the coming weeks.

Republican Senator Bill Hagerty, sponsor of the bill, stated:

“The GENIUS Act establishes a pro-growth regulatory framework for payment stablecoins. This legislation will cement U.S. dollar dominance, protect consumers, and drive demand for U.S. Treasurys.”

New standards for stablecoins in the U.S.

The legislative proposal, officially titled the Guiding and Establishing National Innovation for US Stablecoins Act, sets strict legal requirements for stablecoin issuers. The bill mandates that every token must be fully backed by U.S. dollars or equally liquid assets (such as U.S. Treasurys), ensuring market stability and transparency.

Stablecoin issuers with a market capitalization exceeding $50 billion will be subject to mandatory annual audits, while foreign entities like Tether will be required to meet specific compliance rules to operate in the U.S. market.

Restrictions for Big Tech

One of the provisions of the GENIUS Act bans non-financial public companies — including giants like Meta and Amazon — from issuing stablecoins unless they meet stringent risk management and privacy standards. This measure aims to prevent potential conflicts of interest and concentrations of power in the digital currency sector.

In the event of an issuer’s insolvency, the bill grants stablecoin holders a “super-priority” status in bankruptcy proceedings, placing them ahead of other creditors in the repayment hierarchy.

Despite Senate approval, the GENIUS Act now faces a competing proposal in the House — the STABLE Act — which was advanced in committee last May. The two bills differ on key issues such as state versus federal oversight and the treatment of foreign stablecoin issuers. Reconciling these versions will be crucial before any legislation reaches President Trump’s desk for final signature.

The post U.S. Senate approves the GENIUS Act: now it moves to the House appeared first on Atlas21.

-

@ b1ddb4d7:471244e7

2025-06-18 09:01:10

@ b1ddb4d7:471244e7

2025-06-18 09:01:10Why are Stripe Alternatives are growing like mushrooms? When it comes to online payment processing, Stripe has long dominated the conversation.

However, with its complex pricing structure, strict policies and first-world focus, many entrepreneurs and companies are actively seeking viable Stripe alternatives.

Whether you’re a SaaS startup, e-commerce store, or global enterprise, choosing the right payment processor can significantly impact your bottom line and customer experience.

Table of Contents

- Why Consider Stripe Alternatives?

- The Complete List of Stripe Alternatives

- Additional Notable Mentions

- How to Choose the Right Stripe Alternative

- Conclusion

Why Consider Stripe Alternatives?

Before diving into our comprehensive list, it’s worth understanding why businesses are exploring alternatives to Stripe. While Stripe offers robust features and excellent developer tools, some businesses face challenges with pricing transparency, limited global coverage, or specific industry requirements that Stripe doesn’t fully address.

The Complete List of Stripe Alternatives

Based on extensive research and analysis of the payment processing landscape, here are 27 proven Stripe alternatives that could be the perfect fit for your business:

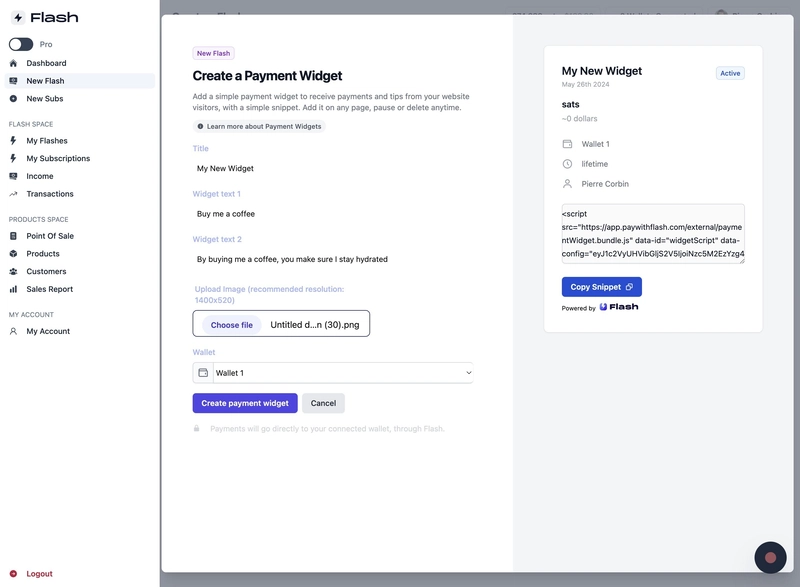

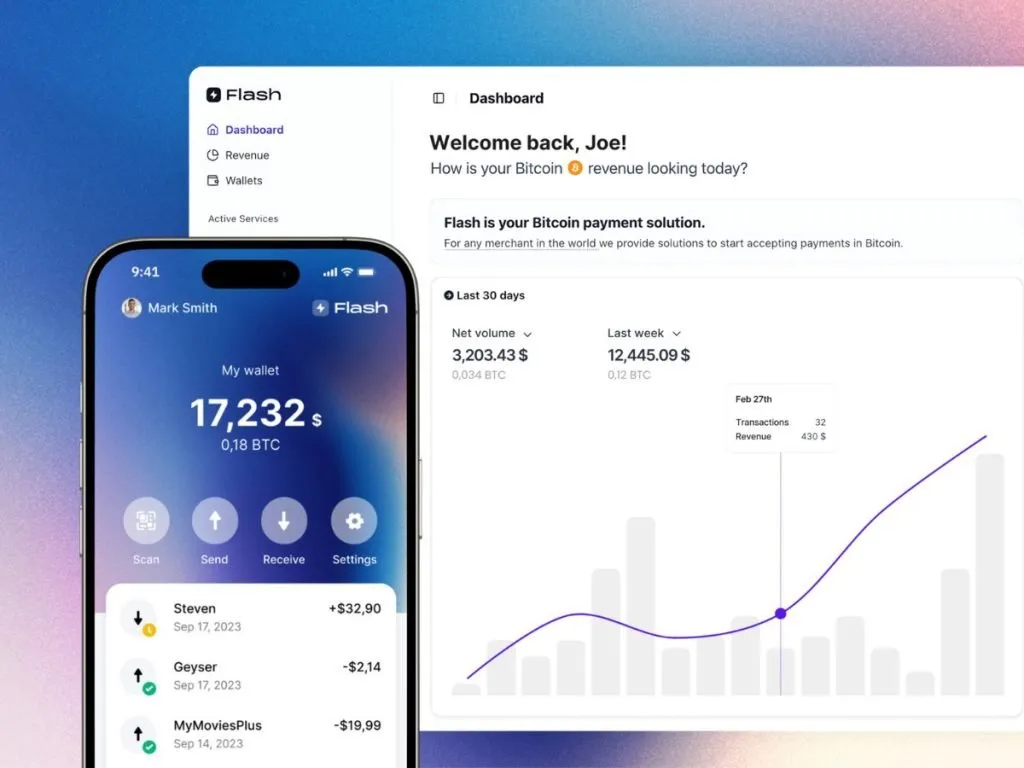

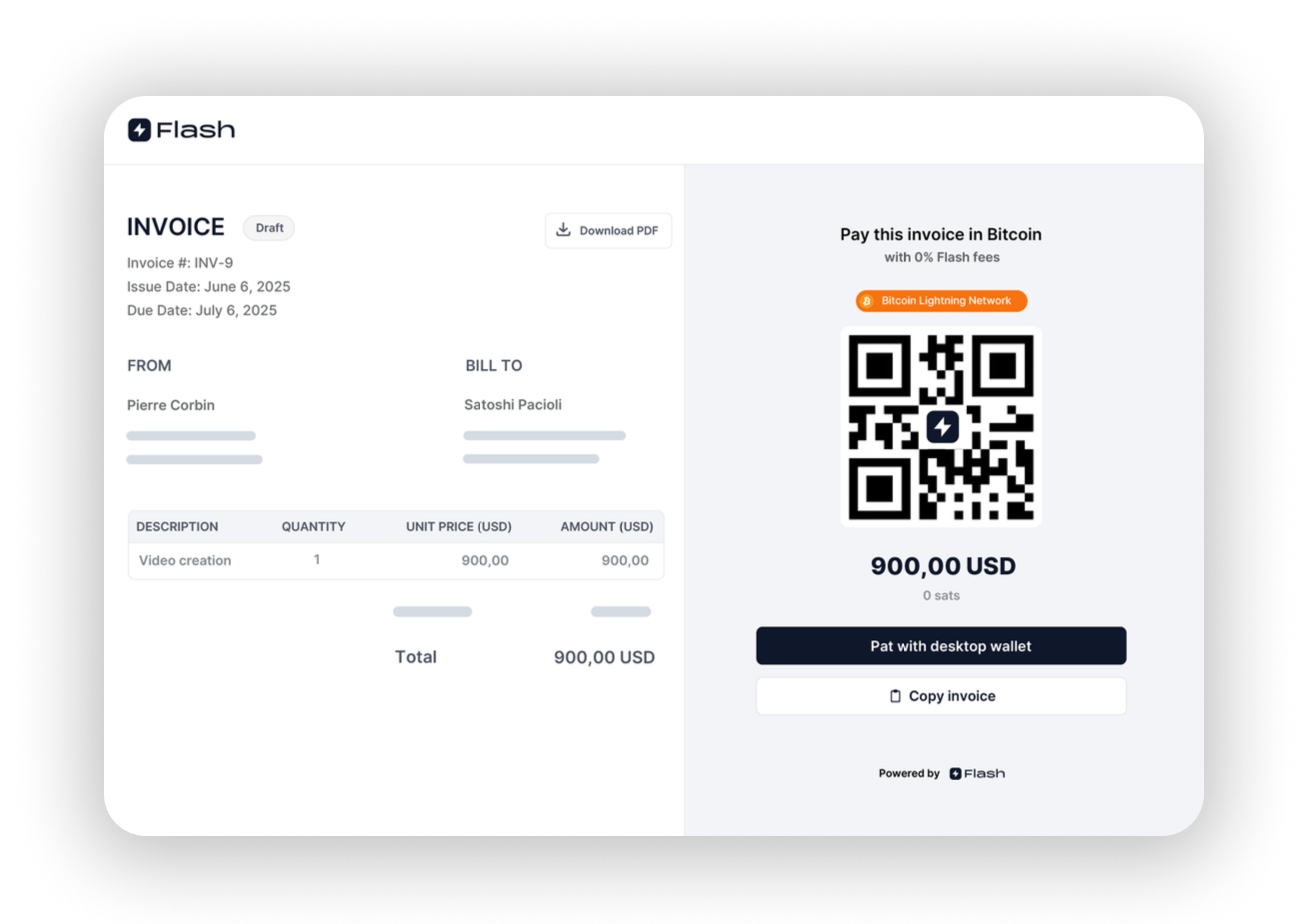

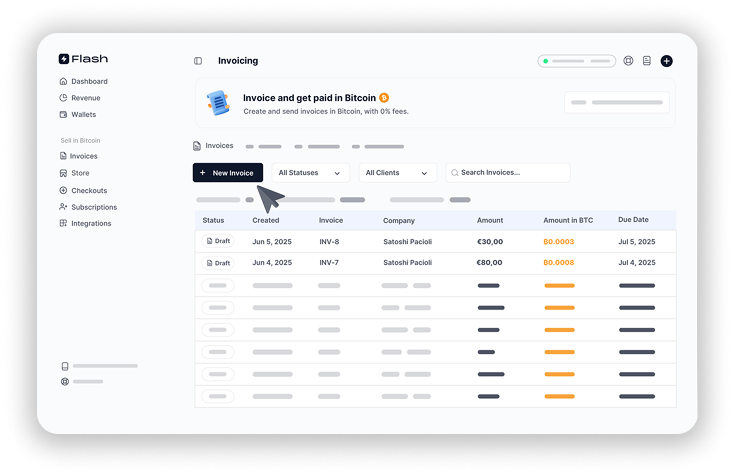

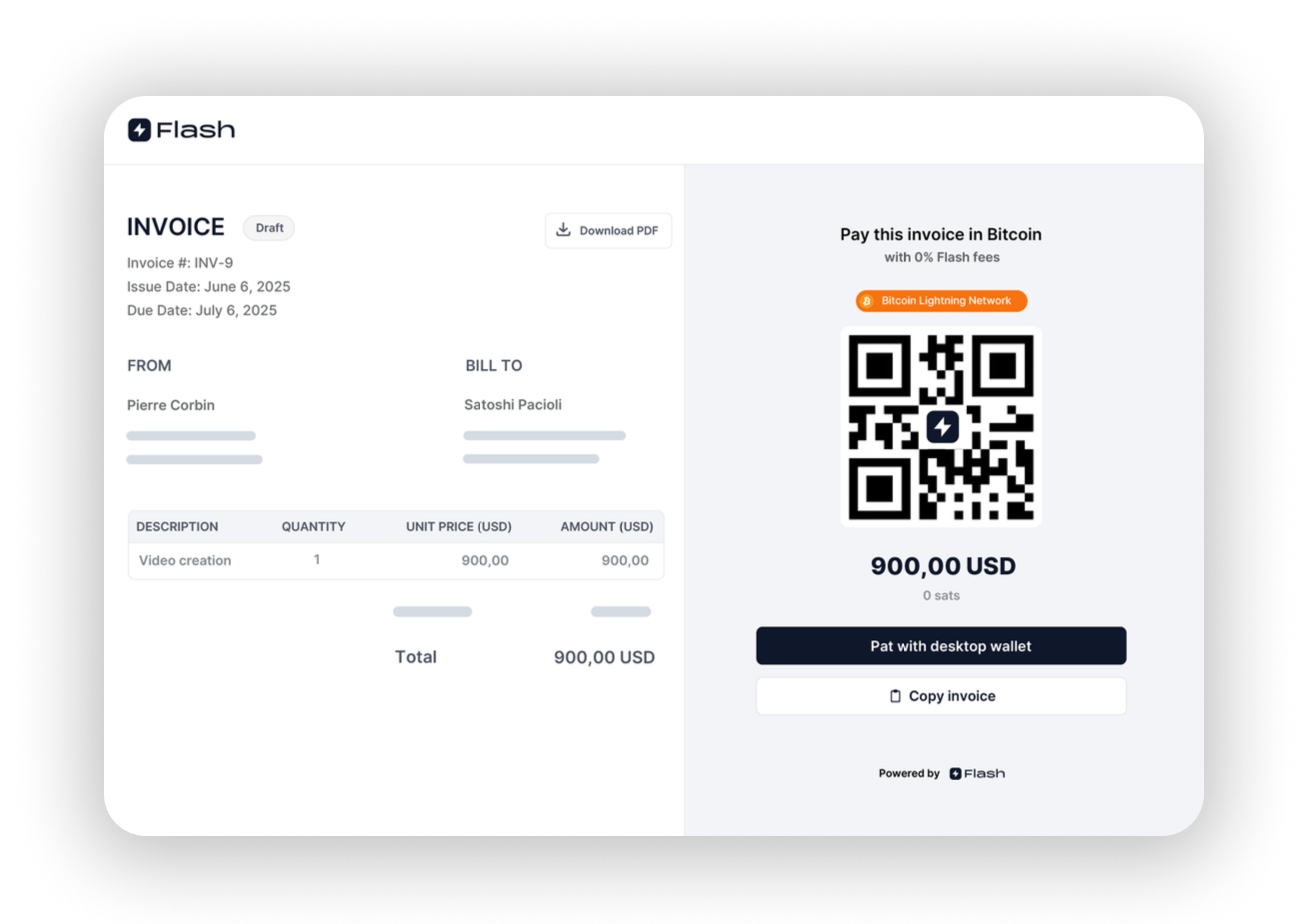

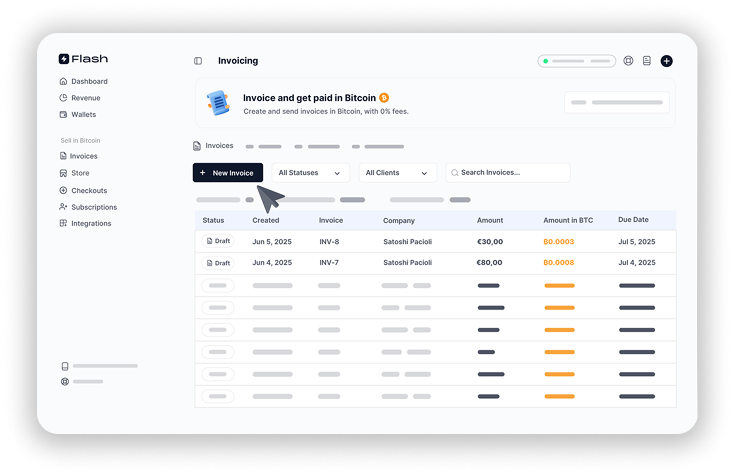

1. Flash – Easiest Bitcoin Payment Solution

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

2. Lemon Squeezy – The SaaS-Focused Alternative

Dubbed as “acq’d by Stripe,” Lemon Squeezy offers a comprehensive solution specifically designed for digital product sales and SaaS businesses. It provides strong customer support, built-in analytics, and handles payments, subscriptions, global tax compliance, and fraud prevention in one platform.

3. Gumroad – Creator Economy Champion

Gumroad has carved out a niche serving creators and small businesses by providing tools for selling digital products, physical goods, and subscriptions. It’s particularly popular among content creators, artists, and independent entrepreneurs who want to experiment with various ideas and formats. They also open-sourced their code which is quite the ‘chad-move’.

4. Paddle – All-in-One SaaS Commerce

Paddle caters to SaaS and software companies by offering a comprehensive platform with billing, licensing, and global tax handling capabilities. It’s designed to be a complete solution for subscription-based businesses, handling payments, tax, and subscription management in one platform.

5. FastSpring – Global E-commerce Specialist

FastSpring specializes in e-commerce solutions for software and SaaS companies, with a focus on global payments and subscription management. According to TechnologyAdvice, it’s particularly strong for international transactions and helps companies sell more, stay lean, and compete big.

6. 2Checkout – Versatile Payment Solutions

2Checkout (now part of Verifone) offers versatile payment solutions excelling in global payments, subscription billing, and digital commerce. One of the best stripe alternatives as it’s an all-in-one monetization platform that maximizes revenues and makes global online sales easier, supporting over 200 countries and territories.

7. Payoneer – Cross-Border Payment Expert

Payoneer simplifies cross-border payment solutions, offering local payment ease globally with a focus on market expansion and multi-currency support. It’s trusted by small to medium-sized businesses for global payment solutions and international money transfers.

8. Chargebee – Subscription Management Leader

Chargebee is a subscription management platform perfect for SaaS and SMBs, with robust billing and revenue management features. If you were looking for stripe alternatives to setup subscriptions, Chargebee might be right for you. It streamlines revenue operations and helps businesses grow efficiently with comprehensive subscription billing capabilities.

9. Maxio (formerly Chargify) – B2B SaaS Billing

Maxio offers a robust platform for B2B SaaS billing and financial operations, focusing on growth and efficiency for subscription businesses. It’s the most complete financial operations platform for B2B SaaS, bringing core financial operations into one platform.

10. Recurly – Dynamic Subscription Management

Recurly offers dynamic subscription management platform, excelling in churn management and data insights for subscription growth. It’s the only proven platform that expands and protects your recurring revenue with subscription management, recurring billing, and payments orchestration.

11. Braintree – PayPal’s Enterprise Solution

Braintree (by PayPal) provides a versatile global payments platform, integrating multiple payment methods with a focus on conversion and security. It delivers end-to-end checkout experiences for businesses, offering single-touch payments and mobile optimization.

12. PayKickstart – Modern Commerce Platform

PayKickstart offers a modern commerce platform for online billing and affiliates, focusing on revenue maximization and churn minimization. It’s the most complete checkout, recurring billing, affiliate management, and retention solution with global capabilities.

13. PayPro Global – Full-Service E-commerce

PayPro Global offers a full-service eCommerce solution for selling software and SaaS, focusing on global payments, tax compliance, and customer support. It provides flexible solutions with over 70 payment methods and great support for software companies.

14. Shopify Payments – E-commerce Integration

Integrated with Shopify, this service is ideal for SMBs in eCommerce, offering a seamless shopping cart and payment experience. It’s the simplest way to accept online payments, automatically set up for major methods with no fees for some payment types.

15. Square – Versatile POS and Payment Solutions

Square provides versatile POS and payment solutions for small businesses with a strong focus on retail and mobile payments. Forbes Advisor notes it as one of the top alternatives for businesses needing both online and offline payment capabilities.

16. Zoho Billing – Integrated Business Solution

Zoho Billing is an online recurring billing and subscription management solution, ideal for small and medium-sized businesses seeking professional invoice creation, time and expense tracking, and improved cash flow management. Zoho isn’t just competing for stripe alternatives, they offer a ton of other products and services.

17. WePay – Chase Company Integration

WePay, a Chase company, provides integrated payment solutions for ISVs and SaaS companies with customizable payment solutions. It’s designed for platforms like marketplaces and small business tools, offering seamless user experience and fraud protection.

18. QuickBooks Payments – SMB Accounting Integration

This service provides seamless accounting and payment solutions for SMBs and SaaS businesses, featuring real-time tracking and automated bookkeeping. It lets small businesses accept payments online from anywhere with easy integration into QuickBooks accounting.

19. Mangopay – Marketplace Payment Infrastructure

Mangopay offers a modular payment infrastructure for marketplaces and platforms, emphasizing flexibility, global payouts, and AI-powered anti-fraud. It uses flexible wallets built to orchestrate fund flows and monetize payment experiences.

20. Coinbase Commerce – Cryptocurrency Payments

Coinbase Commerce enables businesses to accept payments from around the world using cryptocurrency. It offers instant settlement, low fees, and broad asset support, making it easy for merchants to accept digital currency payments globally.

21. BTCPay Server – Open-Source Bitcoin Processor

BTCPay Server is a self-hosted, open-source cryptocurrency payment processor with 0% fees and no third-party involvement. It’s secure, private, censorship-resistant, and completely free for businesses wanting full control over their Bitcoin payments.

22. Lago – Open-Source Billing Alternative

Lago is an open-source alternative to Stripe Billing and Chargebee, specializing in billing and metering in one place for usage-b

-

@ a53364ff:e6ba5513

2025-06-18 08:46:41

@ a53364ff:e6ba5513

2025-06-18 08:46:41So you want to Run Bitcoin…

-

Knots helps you exercise your self sovereignty verification muscle, instead of conforming to the TrustMeBro defaults of core. Thus, you are more prepared to actively defend Bitcoin in case of hardfork-softfork or other shenanigan’s.

-

Knots is more feature rich and useful than core, allowing end users to finely tune their nodes mempool policy to reject spam transactions from their own mempools, through such bitcoin.conf settings as: rejectparasites=1 , datacarrier=0, permitbaremultisig=0

-

Running a Underdog Bitcoin Client makes the Bitcoin network more robust as a whole. Supporting an ecosystem of multiple compatible clients running in tandem. Running knots makes Bitcoin, the network more robust, and makes the bitcoin development ecosystem richer. Knots is a backup-option in case core becomes obviously compromised. For decentralization, do we really want only a single implementation, with all our eggs in one basket with just bitcoin core? No.

-

Knots makes it so that you’re not using your node’s computing resources to hold and process spam shitcoin transactions and you have better control over what transactions you prioritize processing.” — Thus you can save your mempool resources from being abused by bad actors with Knots, but not with core, unfortunately. Core doesn’t believe in giving their end users too much choice. This has long been their attitude: to dictate down and deny non-consensus violating choice to end users.

-

Thus running Knots is a counter movement to the unfortunate attitude in core that has willfully neglected a core subset of it’s users who care about spam filters. Running Knots is not just a technical improvement in running Bitcoin. It’s a political statement in the Bitcoin development ecosystem.

-

-

@ eb0157af:77ab6c55

2025-06-18 01:02:02

@ eb0157af:77ab6c55

2025-06-18 01:02:02A new study by Kraken reveals how cryptocurrency investors perceive security as the main challenge in self-managing their digital assets.

According to The Block, a recent survey conducted by crypto exchange Kraken found that nearly half of respondents consider themselves the primary risk factor for their own crypto security. The research, which surveyed 789 participants, highlights that 48% of users see their own actions as the greatest threat to their investments in digital assets, surpassing concerns about external theft or fraud.

Kraken’s report underlines how personal responsibility in security management forces users to take full control of their digital funds. However, the study suggests that this autonomy can also become a source of anxiety for many investors.

Nick Percoco, Chief Security Officer at Kraken, commented on the findings, noting that “a lack of confidence in personal crypto security is capping the growth of the industry.” According to Percoco, unlocking the full potential of cryptocurrencies will require users to embrace self-custody and consistently invest in strong security habits.

Technologies to strengthen security

Despite the concerns highlighted in the study, 31% of participants expressed optimism about future technologies that could improve crypto security. Among the most promising solutions identified:

- advanced biometric systems for user authentication;

- multi-factor authentication to secure wallet access;

- AI-based fraud detection systems to prevent attacks.

Data and case studies

Kraken’s research emerges in a context where security threats remain a pressing reality. FBI data shows that in 2024, nearly 150,000 reports of crypto-related internet fraud resulted in $9.3 billion in losses. Older users, particularly those over 60, proved especially vulnerable, accounting for $3 billion in crypto-related financial fraud losses on their own.

The post Kraken study: 48% of users fear themselves in managing and securing their funds appeared first on Atlas21.

-

@ cae03c48:2a7d6671

2025-06-18 09:00:50

@ cae03c48:2a7d6671

2025-06-18 09:00:50Bitcoin Magazine

DDC Enterprise Secures $528 Million to Expand Bitcoin HoldingsToday, DDC Enterprise Limited (NYSE: DDC) announced it has raised three securities purchase agreements for a total of up to $528 million to expand its Bitcoin holdings. According to the press release, this is one of the largest single-purpose Bitcoin raises by any NYSE-listed company.

JUST IN:

DDC Enterprise to raise up to $528 million to buy more #Bitcoin pic.twitter.com/CPxPlsjvwq

DDC Enterprise to raise up to $528 million to buy more #Bitcoin pic.twitter.com/CPxPlsjvwq— Bitcoin Magazine (@BitcoinMagazine) June 17, 2025

“Today is a defining moment for DDC Enterprise and our shareholders,” said the Founder and CEO of DDC Enterprise Norma Chu. “This capital commitment of up to $528 million, backed by respected institutions from both traditional finance and the digital asset frontier, represents a strong mandate to execute an ambitious corporate Bitcoin accumulation strategy globally. Our vision is unequivocal: we are building the world’s most valuable Bitcoin treasury.”

The funding, backed by investors including Anson Funds, Animoca Brands, Kenetic Capital, and QCP Capital, will be primarily allocated toward significantly increasing the company’s Bitcoin holdings.

“This funding is expected to propel DDC into one of the top global corporate Bitcoin holders,” stated Chu. “This investment by Anson Funds and the group of PIPE investors is a resounding validation of Bitcoin’s important role in future corporate balance sheets.”

Components of the capital raise include:

- $26 Million Equity PIPE Investment:

The company will issue up to 2.4 million Class A ordinary shares at an average price of $10.30 to investors including Animoca Brands, Kenetic Capital, and QCP Capital. The shares will be restricted for 180 days. - $300 Million Convertible Note and $2 Million Private Placement:

Anson Funds will provide an initial $25 million with no interest and will mature in 24 months, with up to $275 million available in future tranches. Anson will also purchase 307,693 Class A ordinary shares for $2 million in a concurrent private placement. - $200 Million Equity Line of Credit:

Anson Funds has also committed to a $200 million equity line of credit (ELOC), giving DDC flexible access to capital for future Bitcoin purchases.

“At DDC, we will deploy this capital with institutional discipline and unwavering conviction, cementing our position as the premier bridge between global capital markets and the Bitcoin ecosystem,” said Chu. “DDC Enterprise is strongly positioned as the definitive publicly-traded vehicle for concentrated Bitcoin exposure and value creation. My focus will be on growing our BTC treasury and delivering attractive BTC yield consistently for our shareholders.”

This post DDC Enterprise Secures $528 Million to Expand Bitcoin Holdings first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

- $26 Million Equity PIPE Investment:

-

@ eb0157af:77ab6c55

2025-06-18 00:02:25

@ eb0157af:77ab6c55

2025-06-18 00:02:25The banking giant is exploring an expansion of its blockchain services, focusing on digital payments and currencies.

JPMorgan Chase has filed a new trademark application for the name “JPMD.” The filing was submitted on June 15 to the United States Patent and Trademark Office (USPTO).

The application, filed by JPMorgan Chase Bank, N.A., covers a broad range of services related to digital assets and blockchain technology. These include the issuance of digital currencies, electronic payment processing, and financial custody services — all of which suggest a possible new stablecoin initiative for JPMorgan.

Experience with JPM Coin

This move wouldn’t be JPMorgan’s first foray into blockchain-based finance. The bank already operates JPM Coin, a dollar-pegged stablecoin used to enable instant transactions between institutional clients. The token runs on Quorum, a private blockchain network developed in-house by JPMorgan and based on Ethereum’s technology.

The registration of the JPMD trademark comes as JPMorgan and other major U.S. banks are considering a collaborative stablecoin project through their jointly owned entities: Early Warning Services and The Clearing House.

Similarly, corporations like Walmart and Amazon are mulling the creation of their own stablecoins.

The post JPMorgan files trademark for ‘JPMD’: a new stablecoin on the horizon for the American bank appeared first on Atlas21.

-

@ cae03c48:2a7d6671

2025-06-18 09:00:49

@ cae03c48:2a7d6671

2025-06-18 09:00:49Bitcoin Magazine

Thailand Approves Five Year Bitcoin And Crypto Tax BreakThailand has approved a five year tax exemption on capital gains from cryptocurrency trading made through licensed digital asset platforms. The exemption will be in effect from January 1, 2025, through December 31, 2029.

JUST IN:

Thailand’s cabinet approved personal tax waiver on profits from the #Bitcoin and crypto sale over five years. pic.twitter.com/4gWc1gn84j

Thailand’s cabinet approved personal tax waiver on profits from the #Bitcoin and crypto sale over five years. pic.twitter.com/4gWc1gn84j— Bitcoin Magazine (@BitcoinMagazine) June 17, 2025

Deputy Finance Minister Julapun Amornvivat announced the measure, calling it a move to increase investment, stimulate economic activity, and drive long term growth.

Amornvivat stated, “The Cabinet approved a five-year crypto tax exemption to promote Thailand as a global digital asset hub.”

According to the Ministry of Finance, the policy is designed to strengthen Thailand’s competitiveness in the global digital economy. It targets transparent growth, and aims to increase capital inflow into the Thai market. Officials expect over 1 billion baht in indirect tax revenue to result from the increased economic activity during the exemption period.

Amornvivat went on to say, “The capital gain tax exemption will be for the sale of digital assets made through operators regulated by the Securities and Exchange Commission.”

The tax break applies only to platforms licensed by the Thai SEC. This includes exchanges that meet strict regulatory standards under the government’s digital finance framework. Exchanges without Thai licenses will not benefit from the exemption and continue to face restrictions.

Officials say the new exemption aligns with international standards from the OECD and FATF. The government is also exploring a possible value-added tax (VAT) on digital assets to support fiscal stability.

Furthermore, this isn’t Thailand’s first step toward embracing Bitcoin or crypto.

Thailand approved its first spot Bitcoin ETF in 2024, allowing asset manager ONEAM to launch a fund for institutional investors. The ETF offers regulated exposure to Bitcoin through global funds and reflects growing demand for institutional access to the asset.

Thailand is taking a two sided approach. They support innovation through licensed platforms, while cracking down on unregulated players. With clearer rules and tax breaks, the country is positioning itself as a leader for Bitcoin and crypto growth in Southeast Asia.

This post Thailand Approves Five Year Bitcoin And Crypto Tax Break first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-18 09:00:48

@ cae03c48:2a7d6671

2025-06-18 09:00:48Bitcoin Magazine

Fold Holdings Secures $250 Million Equity Deal to Expand Bitcoin TreasuryToday, Fold Holdings, Inc. (NASDAQ: FLD), the first publicly traded bitcoin financial services company, has announced a $250 million equity purchase agreement to significantly increase its bitcoin holdings.

JUST IN:

Publicly traded Fold secures $250 million equity facility to buy more #Bitcoin pic.twitter.com/M7E3fzwAsT

Publicly traded Fold secures $250 million equity facility to buy more #Bitcoin pic.twitter.com/M7E3fzwAsT— Bitcoin Magazine (@BitcoinMagazine) June 17, 2025

Fold Holdings has the option, but not the obligation, to issue and sell up to $250 million in new common stock. The ability to access the funds is subject to certain conditions, including the requirement that a registration statement covering the resale of the stock be filed with and approved by the Securities and Exchange Commission (SEC).

“The Company is not required to use the Facility and controls the timing and amount of any drawdown on the Facility, subject to certain restrictions under the Facility,” said the press release. “The Company expects to use the net proceeds from the Facility, if any, primarily to acquire additional bitcoin for Fold’s corporate treasury.”

The shares offered under the facility will be issued through a private placement, relying on exemptions from the registration requirements of the Securities Act of 1933 and Regulation D. Fold noted that it “plans to file with the SEC a registration statement relating to the resale of the Common Stock issuable under the Facility.”

“The offers and sales of the Common Stock issuable under the Facility will be made in a private placement in reliance on an exemption from the registration requirements of the Securities Act of 1933,” according to the press release. “The Company cannot draw on the Facility, and the Common Stock may not be sold nor may offers to buy be accepted, prior to the time that the registration statement covering the resale of the Common Stock is declared effective by the SEC.”

On May 19, Fold also announced the launch of its Bitcoin gift card, marking its entry into the $300 billion U.S. retail gift card market. This new product allows consumers to purchase and gift bitcoin through familiar retail channels, with plans to expand to major retailers nationwide throughout the year.

“This gift card gives us distribution directly to millions of Americans who may not be buying Bitcoin because they haven’t downloaded a new app, don’t have a brokerage account, or haven’t seen the ETF,” said the Chairman and CEO of Fold Will Reeves.

“I think there’s a real chance by the end of 2025 that Bitcoin becomes the most popular gift in America because of this card,” stated Reeves.

This post Fold Holdings Secures $250 Million Equity Deal to Expand Bitcoin Treasury first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 5ea46480:450da5bd

2025-06-18 08:31:11

@ 5ea46480:450da5bd

2025-06-18 08:31:11When considering the concept of "smart clients and dumb relays," it is crucial to clearly define what "smart" and "dumb" represent in this context. The term "dumb" does not imply that relays lack control, complexity, or sophisticated policies regarding storage and distribution. Relays actively select what information to store, how long they store it, and under what conditions they provide access. Their decisions may differ significantly, allowing specialization that enriches the ecosystem.

Instead, the "dumb" attribute specifically describes the simplicity and universality of queries that relays support. Dumb relays provide a standardized interface rather than specialized queries serving individual client needs. This simplicity ensures interoperability; a client can interact with any relay without compatibility issues. The client side is "smart," equipped with all the logic necessary for determining what data to request, where to find it, how to interpret and present it. The client is responsible for the complexity and specificity of interactions.

This paradigm achieves clear separation; relays generalize data delivery, while clients handle intelligent interpretation and functionality. As a result, users remain free to switch between different clients, confident that basic connections remain intact across a diverse relay landscape. Differences in relay behavior—such as acceptance criteria or data availability—do not compromise this fundamental interoperability. Rather, its the interoperability that allows relays freedom from any obligation to represent a global network viewpoint.

Therefore, maintaining a simple relay query interface preserves interoperability, encourages client diversity, and allows relays to specialize according to their own preferences and policies. This setup captures the complementary principles behind smart clients and dumb relays.

-

@ cae03c48:2a7d6671

2025-06-18 09:00:47

@ cae03c48:2a7d6671

2025-06-18 09:00:47Bitcoin Magazine

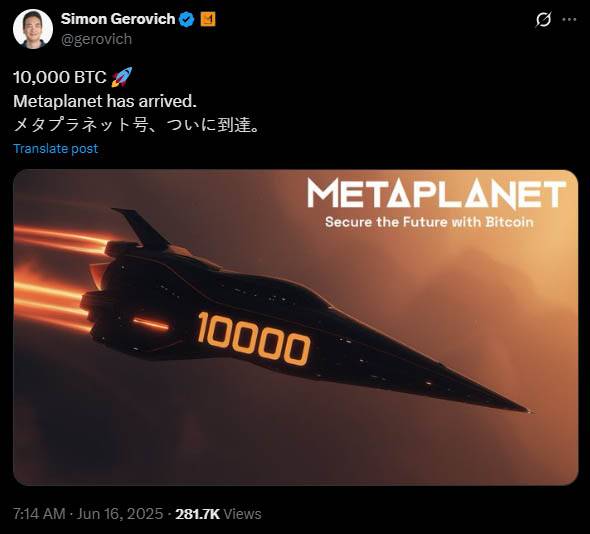

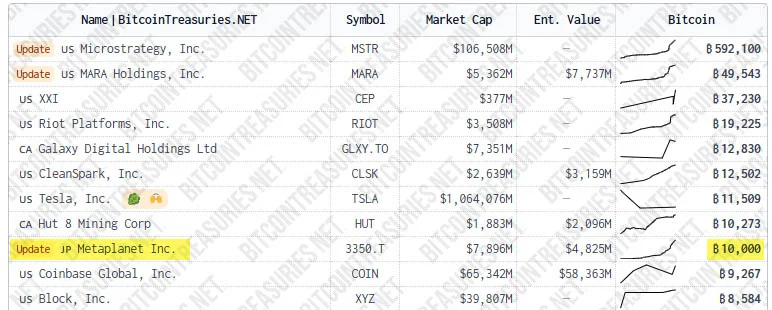

Ukraine Introduces Bill to Allow Bitcoin in National ReservesUkraine has introduced a bill that would give its central bank the legal right to hold Bitcoin and other assets as part of its national reserves. The draft law, submitted to the Verkhovna Rada on June 10, 2025, proposes updates to existing legislation to include “virtual assets” in the foreign exchange and gold reserves of the National Bank of Ukraine (NBU).

NEW: Ukraine introduces bill for Bitcoin Reserve in Parliament

pic.twitter.com/bYIiCNF13D

pic.twitter.com/bYIiCNF13D— Bitcoin Magazine (@BitcoinMagazine) June 17, 2025

This doesn’t mean Ukraine is officially adding Bitcoin to its balance sheet just yet, but it would give the central bank the green light to do so in the future.

One of the bill’s co-sponsors, Member of Parliament Yaroslav Zhelezniak, emphasized that the legislation is about granting permission, not making it a requirement. “Whether and to what extent they actually do so,” he said, “is up to the institution itself.”

Zhelezniak recently discussed with Binance’s regional head Kyrylo Khomiakov, that he believes Bitcoin could help Ukraine strengthen its economic position and contribute to long term digital innovation.

The timing of the bill is vital as Ukraine has been under enormous financial pressure since Russia’s invasion in 2022. Inflation remains high, the hryvnia has lost significant value, and the country is heavily reliant on international aid and loans. The NBU has managed to hold roughly $44.5 billion in reserves, mostly in U.S. dollars and government securities, but its room to maneuver is limited.

Back in 2022, the Ukrainian government was actively raising donations for the war effort through Bitcoin. They had an official wallet set up for donations, and their politicians were publicly tweeting out the addresses asking for support. On the first day alone, Ukraine’s official Bitcoin wallet raised over $3.5 million. By leaning into Bitcoin during their time of crisis, the government showed their belief and commitment in it, and this new bill shows that that commitment has not faded.

NEW

Ukraine government #Bitcoin wallet raises OVER $3.5 MILLION in 1st day of donations

Ukraine government #Bitcoin wallet raises OVER $3.5 MILLION in 1st day of donations

— Bitcoin Magazine (@BitcoinMagazine) February 27, 2022

If this bill is adopted, it could position Ukraine as one of the first countries to give its central bank the legal ability to hold Bitcoin as a strategic reserve asset.

This post Ukraine Introduces Bill to Allow Bitcoin in National Reserves first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ eb0157af:77ab6c55

2025-06-18 08:01:36

@ eb0157af:77ab6c55

2025-06-18 08:01:36A new study by Kraken reveals how cryptocurrency investors perceive security as the main challenge in self-managing their digital assets.

According to The Block, a recent survey conducted by crypto exchange Kraken found that nearly half of respondents consider themselves the primary risk factor for their own crypto security. The research, which surveyed 789 participants, highlights that 48% of users see their own actions as the greatest threat to their investments in digital assets, surpassing concerns about external theft or fraud.

Kraken’s report underlines how personal responsibility in security management forces users to take full control of their digital funds. However, the study suggests that this autonomy can also become a source of anxiety for many investors.

Nick Percoco, Chief Security Officer at Kraken, commented on the findings, noting that “a lack of confidence in personal crypto security is capping the growth of the industry.” According to Percoco, unlocking the full potential of cryptocurrencies will require users to embrace self-custody and consistently invest in strong security habits.

Technologies to strengthen security

Despite the concerns highlighted in the study, 31% of participants expressed optimism about future technologies that could improve crypto security. Among the most promising solutions identified:

- advanced biometric systems for user authentication;

- multi-factor authentication to secure wallet access;

- AI-based fraud detection systems to prevent attacks.

Data and case studies

Kraken’s research emerges in a context where security threats remain a pressing reality. FBI data shows that in 2024, nearly 150,000 reports of crypto-related internet fraud resulted in $9.3 billion in losses. Older users, particularly those over 60, proved especially vulnerable, accounting for $3 billion in crypto-related financial fraud losses on their own.

The post Kraken study: 48% of users fear themselves in managing and securing their funds appeared first on Atlas21.

-

@ 866e0139:6a9334e5

2025-06-18 06:09:20

@ 866e0139:6a9334e5

2025-06-18 06:09:20Autor: Mathias Bröckers. Dieser Beitrag wurde mit dem Pareto-Client geschrieben und erschien zuerst auf dem Blog des Autors. Sie finden alle Texte der Friedenstaube und weitere Texte zum Thema Frieden hier.**

Die neuesten Pareto-Artikel finden Sie in unserem Telegram-Kanal.

Die neuesten Artikel der Friedenstaube gibt es jetzt auch im eigenen Friedenstaube-Telegram-Kanal.

Im September 2001 fiel dem gerade pensionierten Vier-Sterne-General Wesley Clark, der bis 2000 die NATO-Streitkräfte in Europa befehligt hatte, der Unterkiefer nach unten, als er kurz nach den Anschlägen das Pentagon besuchte und ein alter Kollege aus dem »Joint Chiefs Of Staff« ihn in sein Zimmer zog:

»Ich habe gerade diesen Merkzettel aus dem Büro des Verteidigungsministers bekommen, und hier steht, wir werden sieben Länder angreifen und deren Regierungen innerhalb von fünf Jahren stürzen. Wir werden mit dem Irak beginnen und dann nehmen wir uns Syrien, Libanon, Libyen, Somalia, den Sudan und den Iran vor, sieben Länder in fünf Jahren.«

Dass der ehrgeizige Zeitplan durchaus ins Stocken geraten könnte, hatte Bushs Vize Dick Cheney mit seiner Ankündigung klar gemacht, dass „dieser Krieg länger als eine Generation dauern wird“. 9/11 hatte dem neo-konservativen „Project New American Century“ (PNAC) das „katalysierende Ereignis“ geliefert, das dieser Think-Tank mit vielen Mitgliedern der Bush-Regierung 1999 als erforderlich angesehen hatte, um massive militärische Aufrüstung für eine globale „Full Spectrum Dominance“ durchzusetzen.

Nach dem Abhandenkommen des Großfeinds Sowjetunion drohten dem militärisch-industriellen Komplex erhebliche Umsatzeinbußen, die ohne eine neue Großbedrohung nicht wettzumachen waren. Bushs massive Aufrüstung bis 2009 wurde dann von seinen Nachfolgern noch einmal verdoppelt. Diese Anstrengungen im sogenannten „War On Terror“ haben seitdem Millionen Menschen das Leben gekostet oder in die Flucht getrieben und zahlreiche Länder verwüstet. Mit der Bombardierung des Iran am Wochenende nun wurde das “Sahnehäubchen” in diesem Eroberungsplan des US-Imperiums in Angriff genommen.

Dabei werden wie im Krieg gegen Irak angebliche “Massenvernichtungswaffen” als Begründung propagiert, die freilich in Teheran genauso wenig vorhanden sind wie 2002/2003 in Bagdad. Was Englands Tony Blair seinerzeit aber nicht von der Behauptung abhielt, sie könnten “in 45 Minuten” London erreichen und Europa erfolgreich zur Unterstützung des Kriegs zu treiben. So wie Israels Netanyahu und die US-Neocons seit 30 Jahren erzählen, dass iranische Atomwaffen in 3 Jahren…/3 Monaten/…3 Tagen einsatzbereit wären und man das Land deshalb “präventiv” angreifen müsse. Dazu schreibt der Nahost-Korrespondent und Pulitzer-Preisträger Chris Hedges :

"Warum also in den Krieg mit dem Iran ziehen? Warum aus einem Atomabkommen aussteigen, gegen das der Iran nicht verstoßen hat? Warum eine Regierung dämonisieren, die der Todfeind der Taliban ist, zusammen mit anderen Takfiri-Gruppen, einschließlich Al-Qaida und Islamischer Staat in der Levante (ISIL)? Warum eine Region weiter destabilisieren, die bereits gefährlich instabil ist?Die Generäle, Politiker, Geheimdienste, Neocons, Waffenhersteller, so genannten Experten, prominenten Experten und israelischen Lobbyisten wollen nicht die Schuld für zwei Jahrzehnte militärischer Fiaskos auf sich nehmen. Sie brauchen einen Sündenbock. Das ist der Iran.

Die demütigenden Niederlagen in Afghanistan und im Irak, die gescheiterten Staaten Syrien und Libyen, die Ausbreitung extremistischer Gruppen und Milizen, von denen viele ursprünglich von den USA ausgebildet und bewaffnet wurden, sowie die anhaltenden weltweiten Terroranschläge, müssen die Schuld eines anderen sein.Das Chaos und die Instabilität, die wir vor allem im Irak und in Afghanistan ausgelöst haben, haben dazu geführt, dass der Iran das dominierende Land in der Region ist. Washington hat seinen Erzfeind gestärkt. Es hat keine Ahnung, wie es das rückgängig machen kann, außer es anzugreifen.

Das Völkerrecht und die Rechte von fast 90 Millionen Menschen im Iran werden ignoriert, genauso wie die Rechte der Menschen in Afghanistan, Irak, Libyen, Jemen und Syrien ignoriert wurden. Die Iraner sehen die Vereinigten Staaten nicht als Verbündete oder Befreier an, egal was sie von ihrer Führung halten. Sie wollen nicht angegriffen oder besetzt werden. Sie werden Widerstand leisten. Und die USA und Israel werden dafür bezahlen."

Der Zahltag ist schon gekommen, die ersten Wohngebiete in Tel Aviv sehen bereits aus wie in Gaza, auch in vielen anderen Städten schlugen Raketen ein, der viel gepriesene “Iron Dome”, Israels Luftabwehrschild, ist ein Papiertiger und gegen die iranischen Raketen weitgehend machtlos, wie der Einschlag von zwei hypersonischen Raketen in einem Kraftwerk in Haifa zeigt. Die am Freitag vermutlich per Sabotage ausgeschaltete iranische Luftabwehr war nach 8 Stunden wieder in Takt und meldete den Abschuss von mittlerweile drei israelischen F-35-Jets. Über Teheran war es in der Nacht zum Montag weitgehend ruhig, während es in Israel überall Drohnen und Bomben hagelte und der iranische Revolutionsrat mitteilte, dass diese Angriffe unvermindert weitergehen werden. Da der Iran über 20.000 Cruise Missiles verfügt ist das keine leere Drohung. Auch wenn Israel mit seinem unprovozierten Angriff weiterhin großen Schaden im Iran anrichten kann, sind die Gegenschläge weitaus effektiver, denn der Iran ist fast so groß wie ganz West-Europa, Israel inklusive der besetzten Gebiete hingegen kaum größer als Hessen. Und so geht der große zionistische Jammer schon nach drei Tagen los, fliegender Kostümwechsel vom Täter zum Opfer, vom Völkermörder zum Unschuldslamm, nach bewährter Dramaturgie: “There`s No Business Like Shoa-Business”.\ \ Wie weit sich Donald Trump weiter in das Drama hineinziehen lässt, ist im Moment noch unklar. Aktuell könnte er sich noch mit der Ausrede “Ich habe Bibi davor gewarnt anzugreifen, aber er wollte nicht hören” aus der Affäre ziehen, wenn aber jetzt US-Flugzeugträger und NATO-Tankflugzeuge anrücken, um Israels Angriffskrieg zu unterstützen, ist es sein Krieg. Und der zweite, den er militärisch nicht gewinnen kann. Die tapferen Houthis im Jemen konnten die USS “Eisenhower” mit ihren Drohnen nur aus dem Roten Meer verjagen, die iranische “Fattah-2” indessen könnte solch ein Dickschiff mit einem Schlag versenken. Und dann?

USA und NATOstan haben keine zwei Millionen Truppen für eine Invasion des Iran parat und Israel kann seine “Samson-Option” – einen Nuklearschlag – nur um dem Preis des eigenen Untergangs wählen, denn Pakistan hat für diesen Fall bereits zugesichert, dem iranischen Nachbarn mit einem nuklearen Gegenschlag beizustehen. Also bleibt nur, einen regime change mit Raketen auf die Zivilbevölkerung Teherans herbei zu bomben – wie in Beirut versucht, allerdings mit dem Unterschied, dass man es aufgrund der iranischen Verteidigungs-und Angriffsfähigkeit mit einem Gegner auf Augenhöhe zu tun hat, der zudem mit Russland und China zwei Supermächte im Rücken hat. Und einem Abnutzungskrieg weitaus gelassener entgegensehen kann als Israel, das weiter auf Teheran feuert und weiter von iranischen Raketen getroffen wird.

https://x.com/jacksonhinklle/status/1934355463920873736

Kann Trump wie gegen Russland “bis zum letzten Ukrainer” nun im nächsten Proxy-Krieg bis zum letzten Israeli kämpfen lassen, ohne aktiv einzugreifen? Oder hat er die vor der Pensionierung stehende USS Nimitz Richtung Israel geschickt, um sie als Protagonisten für ein neues Pearl Harbor zum Abschuss freizugeben – durch Israel für eine “false flag”? – und dann TV-gerecht in einen “full blown war” gegen ein “Terrorregime” mit “Massenvernichtungswaffen” einzusteigen?\ Wo Psychopathen agieren, wie der fanatische Führer eines Schurkenstaats und der schizoide “Heute Will Ich Frieden/Morgen Will Ich Krieg”-Rumpelstilzchen-Herrscher eines niedergehenden Imperiums, sind rationale Prognosen schwierig. Iran scheint, ähnlich wie Russland, auf die Provokation nicht mit einem Donnerschlag zu reagieren, sondern mit fortgesetzten Nadelstichen auf Demilitarisierung des Gegners zu setzen – denn es ist nur eine Frage von Tagen oder Wochen, bis diesem die Abwehrraketen ausgehen. Was Netanjahu heute den Bürgern Teherans empfahl – sich gegen ihre Regierung zu erheben – wird ihm dann eher selbst geschehen, und auch Trump kann einen weiteren ungewinnbaren Krieg politisch nicht überleben.

Das Jahrtausende alte persische Reich gilt historisch als Friedhof der Imperien, seit Alexander dem Großen haben sich alle Kolonisatoren die Zähne daran ausgebissen, das Volk der Perser zu unterwerfen. Zuletzt hatte es das anglo-amerikanische Imperium 1953 versucht, als man den demokratischen Präsidenten durch den Marionetten-Diktator Reza Pahlevi ersetzte, der aber 1979 (samt BP, Chevron & Co.) von der islamischen Revolution wieder verjagt wurde. Seit damit der Ölreichtum des Landes wieder der Bevölkerung zu Gute kommt stehen die politischen und religiösen Führer ganz oben auf den Abschusslisten von CIA, MI6 und Mossad, Regime change im Iran ist seit 30 Jahren der feuchte Traum der US-Neocons, von denen einige wie “The Onion” meldet, nach Israels Überraschungsangriff wegen Dauererrektion im Krankenhaus behandelt werden mussten. Wenn der wahnsinnige Traum aber mit der Realität kollidiert und eskaliert – mit einem Hiroshima hoch x im Mittleren Osten – wird Persien einmal mehr zum Friedhof für imperiale Eroberer.

DIE FRIEDENSTAUBE FLIEGT AUCH IN IHR POSTFACH!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt, vorerst für alle kostenfrei, wir starten gänzlich ohne Paywall. (Die Bezahlabos fangen erst zu laufen an, wenn ein Monetarisierungskonzept für die Inhalte steht). Sie wollen der Genossenschaft beitreten oder uns unterstützen? Mehr Infos hier oder am Ende des Textes.

Sie schreiben und haben etwas zum Frieden zu sagen? Melden Sie sich gerne: friedenstaube@pareto.space

Der “Shock & Awe”-Überaschungsangriff Israels hat nicht dazu geführt, dass die Iraner gegen ihre Regierung aufstehen oder gar den im Exil lebenden Sohn des Ex-Diktators Pahlevi als Marionette zurück wünschen, sondern im Gegenteil zu allgemeiner Unterstützung der Bevölkerung; geschockt und erschrocken sind dagegen die Israelis über die permanent einschlagenden Raketen. Bei den ersten Gegenschlägen hatte der Iran noch eher altes Material zum Einsatz gebracht, von dem ein großer Teil von der Luftverteidigung abgefangen werden konnte, am Dienstag aber schlugen bereits 5 Raketen in Tel Aviv ein, am helllichten Tag, auch das Mossad Hauptquartier scheint getroffen worden zu sein.

Und was empfiehlt der Schizo-Commander in Chief? Teheran (12 Mio. Einwohner) evakuieren! Denn: “Iran cannot have a nuclear weapon!” Dass Iran solche Waffen gar nicht hat und auch nicht produziert, hatte Geheimdienstdirektorin Tulsi Gabbard zuletzt Ende März bekannt gegeben, was Generalisimo Donald jetzt aber vergessen hat und zusammen mit Herodes 2.0 aka “Bibi Satanjahu” im Heiligen Land auf dem Highway To Hell durchstartet…

Mathias Bröckers, Jahrgang 1954, ist Autor und freier Journalist. Er gehörte zur Gründergeneration der taz, war dort bis 1991 Kultur- und Wissenschaftsredakteur und veröffentlichte seit 1980 rund 600 Beiträge für verschiedene Tageszeitungen, Wochen- und Monatszeitschriften, vor allem in den Bereichen Kultur, Wissenschaft und Politik. Neben seiner weiteren Tätigkeit als Rundfunkautor veröffentlichte Mathias Bröckers zahlreiche Bücher. Besonders bekannt wurden seine internationalen Bestseller „Die Wiederentdeckung der Nutzpflanze Hanf“ (1993), „Verschwörungen, Verschwörungstheorien und die Geheimnisse des 11.9.“ (2002) und „Wir sind immer die Guten – Ansichten eines Putinverstehers“ (2016, mit Paul Schreyer) sowie "Mythos 9/11 - Die Bilanz eines Jahrhundertverbrechens" (2021). Mathias Bröckers lebt in Berlin und Zürich und bloggt auf broeckers.com.

Sein aktuelles Buch "Inspiration, Konspiration, Evolution – Gesammelte Essays und Berichte aus dem Überall" – hier im Handel.

LASSEN SIE DER FRIEDENSTAUBE FLÜGEL WACHSEN!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt.

Schon jetzt können Sie uns unterstützen:

- Für 50 CHF/EURO bekommen Sie ein Jahresabo der Friedenstaube.

- Für 120 CHF/EURO bekommen Sie ein Jahresabo und ein T-Shirt/Hoodie mit der Friedenstaube.

- Für 500 CHF/EURO werden Sie Förderer und bekommen ein lebenslanges Abo sowie ein T-Shirt/Hoodie mit der Friedenstaube.

- Ab 1000 CHF werden Sie Genossenschafter der Friedenstaube mit Stimmrecht (und bekommen lebenslanges Abo, T-Shirt/Hoodie).

Für Einzahlungen in CHF (Betreff: Friedenstaube):

Für Einzahlungen in Euro:

Milosz Matuschek

IBAN DE 53710520500000814137

BYLADEM1TST

Sparkasse Traunstein-Trostberg

Betreff: Friedenstaube

Wenn Sie auf anderem Wege beitragen wollen, schreiben Sie die Friedenstaube an: friedenstaube@pareto.space

Sie sind noch nicht auf Nostr and wollen die volle Erfahrung machen (liken, kommentieren etc.)? Zappen können Sie den Autor auch ohne Nostr-Profil! Erstellen Sie sich einen Account auf Start. Weitere Onboarding-Leitfäden gibt es im Pareto-Wiki.

-

@ cae03c48:2a7d6671

2025-06-18 09:00:47

@ cae03c48:2a7d6671

2025-06-18 09:00:47Bitcoin Magazine

BBVA Tells Wealthy Clients to Invest Up to 7% in BitcoinSpanish bank BBVA is now advising its wealthy clients to invest up to 7% of their portfolios in crypto and Bitcoin, showing how traditional banks are starting to see the potential of Bitcoin.

JUST IN:

Spain's second largest bank BBVA is telling wealthy clients to invest in Bitcoin — Reuters pic.twitter.com/i2Pqg85uSk

Spain's second largest bank BBVA is telling wealthy clients to invest in Bitcoin — Reuters pic.twitter.com/i2Pqg85uSk— Bitcoin Magazine (@BitcoinMagazine) June 17, 2025

“With private customers, since September last year, we started advising on Bitcoin,” said Philippe Meyer, head of digital & blockchain solutions at BBVA Switzerland, during the DigiAssets conference in London. “The riskier profile, we allow up to 7% of portfolios in crypto.”

The bank’s private wealth division is currently recommending clients allocate 3% to 7% of their portfolio to Bitcoin and crypto, depending on their individual appetite. While many private banks have offered to execute Bitcoin or crypto trades upon request, it remains rare for a global financial institution to formally advise clients to buy. BBVA is currently recommending allocations specifically in Bitcoin.

Meyer emphasized that even a modest allocation to Bitcoin can have a meaningful impact on portfolio returns, “If you look at a balanced portfolio, if you introduce 3%, you already boost the performance,” he said. “At 3%, you are not taking a huge risk.”

BBVA began executing Bitcoin purchases for its clients in 2021, but Meyer said this is the first time it is formally advising allocations. In June 2021, the bank launched Bitcoin trading and custody services through its Swiss subsidiary for private clients. “With this innovative offer, BBVA positions itself as a benchmark institution in the adoption of blockchain technology,” said BBVA Switzerland CEO Alfonso Gómez at the time.

BREAKING: Spain's BBVA is opening #Bitcoin trading and custody to all private banking clients in Switzerland. pic.twitter.com/2ppfs34g6F

— Bitcoin Magazine (@BitcoinMagazine) June 18, 2021

BBVA’s interest in digital currency goes back even further. As early as 2015, the bank made it clear that it viewed Bitcoin and blockchain technology as more than just a passing trend. In a statement that now seems increasingly prescient, BBVA said “institutions that understand Bitcoin and digital currencies will lead the new monetary system,” highlighting its belief that early adopters would gain a strategic advantage.

This early support set BBVA apart from many of its peers, as few major banks were willing to publicly engage with Bitcoin at the time.

What began as interest in blockchain technology has turned into direct investment guidance, now culminating in BBVA formally advising wealthy clients to allocate up to 7% of their portfolios into Bitcoin, a clear sign the bank sees it as a long term part of its future.

This post BBVA Tells Wealthy Clients to Invest Up to 7% in Bitcoin first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ b7274d28:c99628cb

2025-06-18 00:01:01

@ b7274d28:c99628cb

2025-06-18 00:01:01Tired of dealing with spam? You're not alone. Here is a guide to picking relays that are good at keeping spam out, without sacrificing your own reach.

If you just want to skip to the relay suggestions, scroll to the sections titled "The Setup." There is one for users of Haven and one for those who aren't running their own relay at all.

Client Selection

"Wait, I thought this was a guide about selecting relays, not clients."