-

@ 9ca447d2:fbf5a36d

2025-06-16 06:01:44

@ 9ca447d2:fbf5a36d

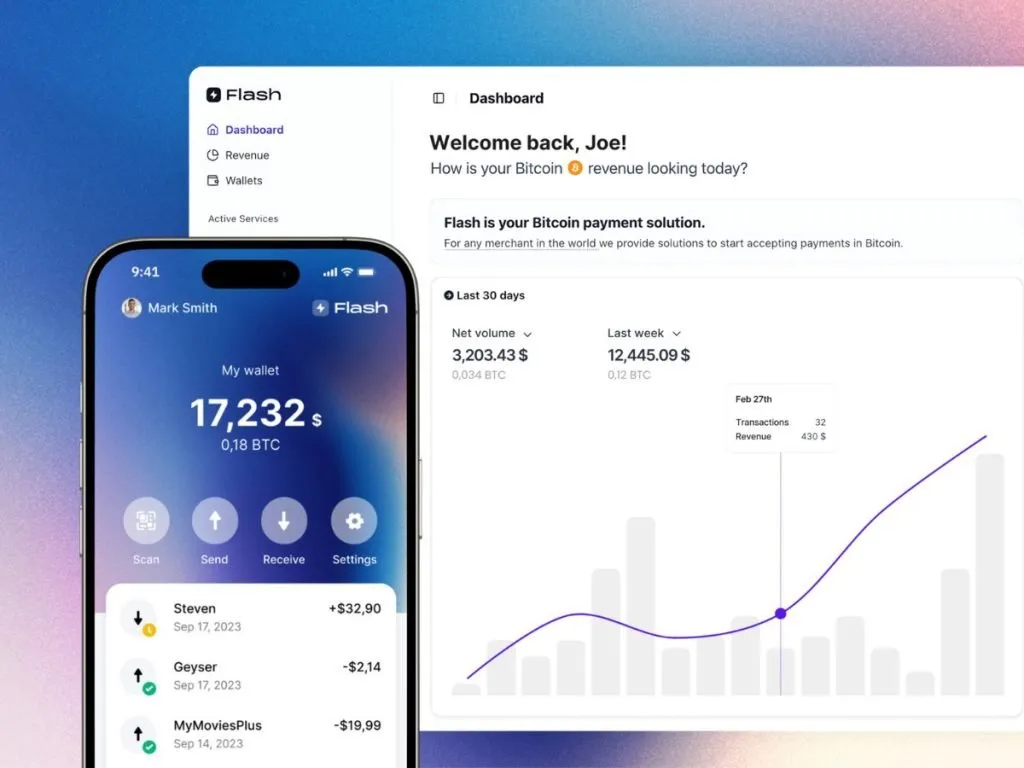

2025-06-16 06:01:44Paris, France – June 6, 2025 — Bitcoin payment gateway startup Flash, just announced a new partnership with the “Bitcoin Only Brewery”, marking the first-ever beverage company to leverage Lightning payments.

Flash enables Bitcoin Only Brewery to offer its “BOB” beer with, no-KYC (Know Your Customer) delivery across Europe, priced at 19,500 sats (~$18) for the 4-pack, shipping included.

The cans feature colorful Bitcoin artwork while the contents promise a hazy pale ale: “Each 33cl can contains a smooth, creamy mouthfeel, hazy appearance and refreshing Pale Ale at 5% ABV,” reads the product description.

Pierre Corbin, Co-Founder of Flash, commented:

“Currently, bitcoin is used more as a store of value but usage for payments is picking up. Thanks to new innovation on Lightning, bitcoin is ready to go mainstream for e-commerce sales.”

Flash, launched its 2.0 version in March 2025 with the goal to provide the easiest bitcoin payment gateway for businesses worldwide. The platform is non-custodial and can enable both digital and physical shops to accept bitcoin by connecting their own wallets to Flash.

By leveraging the scalability of the Lightning Network, Flash ensures instant, low-cost transactions, addressing on-chain Bitcoin bottlenecks like high fees and long wait times.

For businesses interested in adopting Bitcoin payments, Flash offers a straightforward onboarding process, low fees, and robust support for both digital and physical goods. To learn more, visit paywithflash.com.

Media Contact:

Pierre Corbin

Co-Founder, Flash

Email: press@paywithflash.com

Website: paywithflash.comAbout Flash

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

About Bitcoin Only Brewery

Bitcoin Only Brewery (@Drink_B0B) is a pioneering beverage company dedicated to the Bitcoin ethos, offering high-quality beers payable exclusively in Bitcoin. With a commitment to personal privacy, the brewery delivers across Europe with no-KYC requirements.

-

@ 7f6db517:a4931eda

2025-06-16 18:02:21

@ 7f6db517:a4931eda

2025-06-16 18:02:21

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 18:02:20

@ 7f6db517:a4931eda

2025-06-16 18:02:20

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

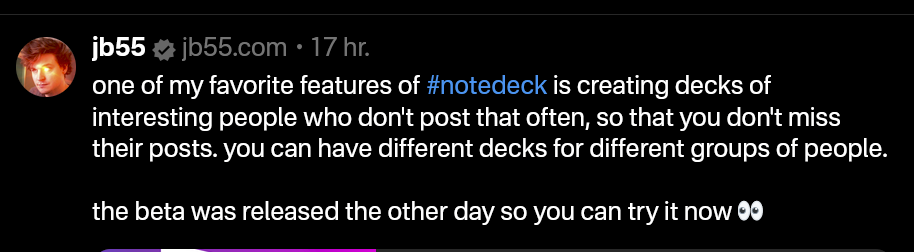

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 19:02:17

@ 7f6db517:a4931eda

2025-06-16 19:02:17

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ 3c7dc2c5:805642a8

2025-06-16 12:15:35

@ 3c7dc2c5:805642a8

2025-06-16 12:15:35🧠Quote(s) of the week:

"Bitcoin trades 168 hours a week. Every other asset trades 35 hours at best (and less on holidays). This is the most magical, transparent, and hard-working [asset] in history. I’m in awe watching Bitcoin trade at 9:30 pm on a Saturday. You could liquidate $100 million worth, any hour of any day, and maybe take a 3% haircut. This is extremely high-bandwidth price discovery." —Michael Saylor https://i.ibb.co/LXCm3Kp8/Gshl-Ixas-Awezk3.png

🧡Bitcoin news🧡

13 years ago the block subsidy was 50 BTC. 13 years from now it will be 0.39 BTC.

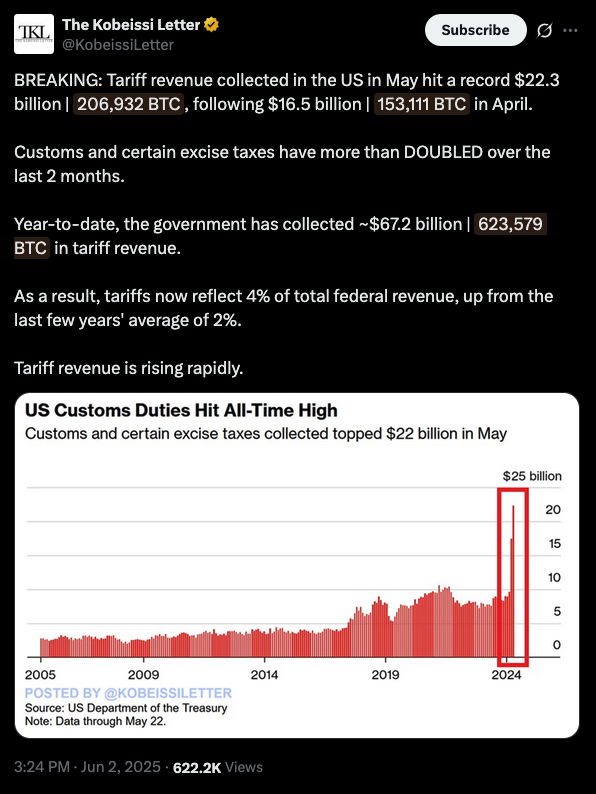

On the 2nd of June:

➡️Hong Kong’s Reitar Logitech files to acquire $1.5B in Bitcoin, becoming the latest firm to join the Bitcoin treasury trend. The logistics and real estate company says the move strengthens its financial foundation as it scales its global tech platform.

➡️Bitcoin's global hashrate has reached a new all-time high, with data from Hashrate Index showing a 7-day simple moving average peak of 943 EH/s. https://i.ibb.co/3yR2ZZ0w/Gsahm-VXMAA1m-Ol.png

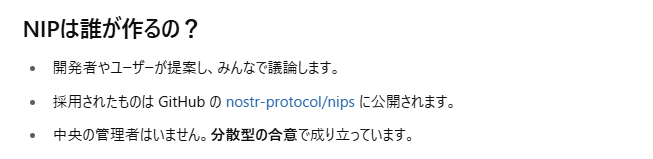

➡️(K)now (Y)our (C)ustomer is nothing but Stealth Mass Surveillance. What 95% of regulations cost versus return in one picture? https://i.ibb.co/Q3CLzF7j/Gsb20g-Pb-IAABy4-L.jpg

➡️Norwegian Block Exchange becomes the first publicly traded Bitcoin treasury company in Norway.' - Simply Bitcoin

➡️Poland just elected pro-Bitcoin Presidential candidate Karol Nawrocki. “Poland should be a birthplace of innovation rather than regulation.”

➡️NYC Mayor Eric Adams: “You all mocked me, ‘You’re taking your first 3 paychecks in #Bitcoin, what’s wrong with you?’ Now you wish you would have done.”

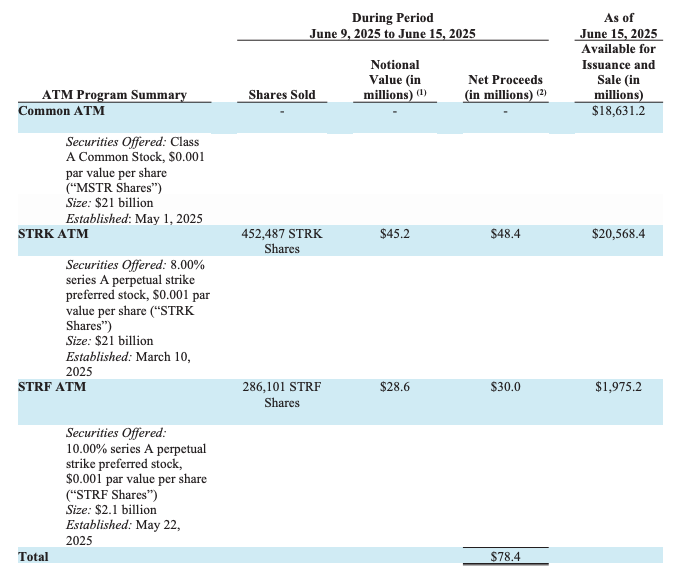

➡️Strategy plans to launch an IPO for 2.5M shares of its 10% Series A 'Stride' Preferred Stock (STRD), with proceeds going toward general corporate use and Bitcoin acquisition. Dividends are non-cumulative and paid only if declared.

Bit Paine: 'Remember: the entire fiat system is just various forms and layers of debt with different issuers all backed by an “asset,” (itself just a base layer of sovereign debt) that can and will be printed into oblivion. MSTR is just recapitulating this system but with a fixed supply underlying, meaning that in real terms anything it issues will benefit from the dilution of the fiat base layer and hence outperform (wildly) any fiat debt. No matter your institutional mandate, it makes no sense to hold debt whose base layer can be unilaterally demonetized when you can hold debt backed by a fixed supply underlying commodity that goes up forever.'

On the 3rd of June:

➡️Tether sends 37,229 Bitcoin worth almost $4 billion in total to Jack Maller's Twenty-One Capital

➡️El Salvador is running a full Bitcoin node!

➡️Canadian construction engineering company SolarBank adopts a Strategic Bitcoin Reserve "As the adoption of Bitcoin continues to grow, SolarBank believes that establishing a Bitcoin treasury strategy taps into a growing sector that is seeing increasing adoption."

➡️Willy Woo: "Who are the idiots who are selling when institutions and sovereigns are racing to buy billions in BTC?" This chart sheds light. The big whales >10k BTC have been selling since 2017. "They're stupid!" Most of those coins were bought between $0-$700 and held 8-16 years.' https://i.ibb.co/xKctV3Tf/Gsid236as-AAXPl-D.jpg

Selling at 20,000% profit is generally not a bad move.

➡️'South Korea just elected a pro-Bitcoin President who promised to legalize spot Bitcoin ETFs and scrap unfair regulation.' -Bitcoin Archive

➡️The average US investor owns 0.3% of their net worth in Bitcoin.

https://i.ibb.co/5WtFH9LM/Gsfoem-Tb0-AEfo-Ds.jpg

We are so damnn early.

➡️MARA mined 950 Bitcoin worth over $100 MILLION in May. They HODLed all of it.

➡️Bitcoin for Corporations: "Metaplanet just became Japan’s most traded stock — topping the charts in both value and volume:

➤ 170M shares traded

➤ ¥222B ($1.51B) value traded

This is what a Bitcoin strategy looks like in motion."

➡️'The Blockchain Group acquires 624 BTC for €60.2 million, nearly doubling their stack. They are now holding a total of 1,471 BTC with a BTC Yield of 1,097.6% YTD.' -Bitcoin News

➡️Publicly traded company K33 buys 10 Bitcoin for SEK 10 million for its balance sheet.

➡️California Assembly passes a bill to allow the state to receive payments in Bitcoin and digital currencies. It passed 68-0 and now heads to the Senate.

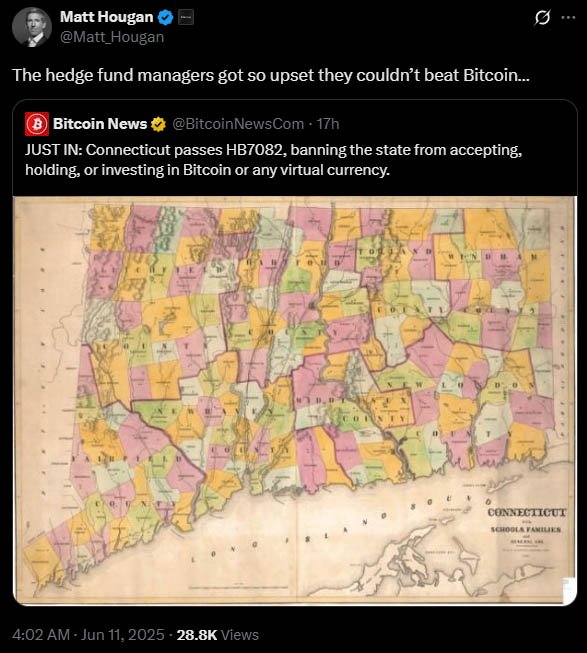

But hold up...

Bitcoin held on exchanges for +3 years will be transferred to the state of California under a law passed by the Assembly.

Not your keys…

➡️Adam Back invests $2.1 million into Swedish Bitcoin treasury company H100.

On the 4th of June:

➡️Daniel Batten: 'A large Bitcoin mining operation uses < 1/3 of the water of an average US family, and 0.0006% of the water a typical Gold mine uses.' https://i.ibb.co/TxNWSkHg/Gsn-VIjh-XQAEECOh.jpg

➡️And there it is: for JPMorgan, Bitcoin is now "safe collateral" JP Morgan will now offer loans backed by Bitcoin ETFs.

https://i.ibb.co/cXX0hKBK/Gsn-C5-B8-Wg-AA2e3i.png

Bent the knee. Wall Street realizes that Bitcoin is pristine collateral. Liquid 24/7/365 globally.

➡️Spanish coffee chain Vanadi Coffee to purchase $1.1 billion Bitcoin for its treasury reserve.

Disclaimer: This sounds great but it's not the whole story.

Pledditor: 'You mean a coffee shop chain founded just 4 years ago, only has 6 locations, and every year it has operated has suffered millions of dollars of net losses? They have 1975 Instagram followers. They have 149 Facebook followers. They have 48 X followers. But remember guys, you are investing in a "COFFEE GIANT"

So where does the $1.1B come from?

'The same way it came for Metaplanet (and all these other penny stocks) Get a bunch of high follower Bitcoin X accounts to hype your ticker (usually Bitcoin Magazine, Vivek, Pete Rizzo, etc), start up an "Irresponsibly Long ___" group, then dump a shitload of stock on the plebs.'

I have said it before...

Bitcoin treasury companies won't prevent another bear market; they’re the reason it’ll happen again this cycle.

➡️Public company Semler Scientific purchases an additional 185 Bitcoin for $20 million.

➡️Wicked: Imagine how rekt people would get if we went from $200k back down to $58k next bear market. The funny thing is that’d only be a 71% pullback, the smallest bear market pullback ever.

https://i.ibb.co/DfFtFZnP/Gsnr-U-3-Xo-AAJy-Kq.jpg

➡️Fidelty: An increasing number of institutions are leveraging Bitcoin as a strategic reserve asset. And as understanding of the asset deepens, interest continues to grow. See what may be driving the shift: Source: https://www.fidelitydigitalassets.com/research-and-insights/adding-bitcoin-corporate-treasury?ccsource=owned_social_btc_corp_treasury_june_x

➡️Solo Bitcoin miner solves block 899,826, earning 3.151 BTC ( $330K). A solo miner rented a massive amount of hashrate on @NiceHashMining and successfully mined a Bitcoin block solo on CKpool, claiming the full reward alone.

➡️Romania's national postal service, Poșta Română, launches a pilot program by installing its first Bitcoin ATM at a Tulcea branch, partnering with Bitcoin Romania (BTR Exchange), the country's leading cryptocurrency exchange.

On the 6th of June:

➡️Mononaut: 'With a weight of only 5723 units, block 899998 was the second lightest non-empty block of this halving epoch.'

➡️'UK-listed gold miner Bluebird Mining Ventures announces strategy to convert gold mining income into Bitcoin. A gold mining company will become the first UK-listed company to implement a Strategic Bitcoin Treasury' - Bitcoin News

➡️Phoenix Wallet: Phoenix 2.6.1 now supports NFC for sending and receiving. Works on Android and iOS. (NFC received on iOS is only due to Apple restrictions)

➡️Man from Germany fails to declare 24 words when crossing the border – nothing happens.

https://i.ibb.co/21W5qVks/Gswdghd-Xw-AA7-SH6.png

➡️Know Labs, Inc. to become a Bitcoin Treasury Strategy company starting with 1,000 BTC. Funny isn't it? Even former Ripple executive, Greg Kidd, is choosing to fill their company treasuries with bitcoin—not XRP.

➡️Bitcoin Successfully Mines the 900,000th Block! https://x.com/i/status/1930973314475815120

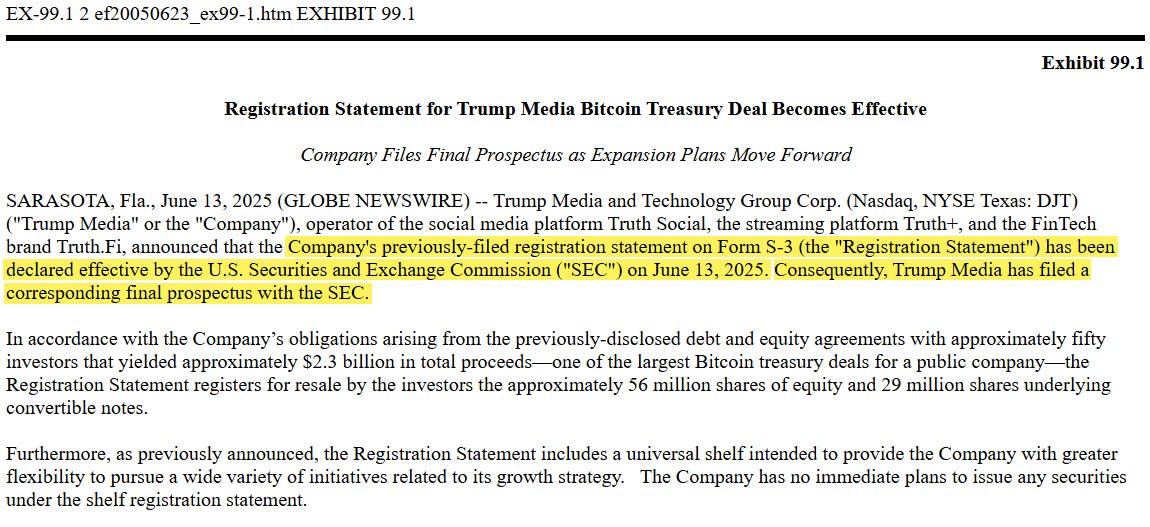

➡️Trump Media's latest S-3 filing officially adopts a Bitcoin treasury strategy. - Registers up to $12B in new securities to buy BTC - Adds to $2.44B already raised - Mentions “Bitcoin” 362 times (vs. once in prior S-3)

➡️Bitcoin News: Metaplanet just issued ¥855B ($5.4B) in moving-strike warrants to buy more Bitcoin, Japan’s largest equity issuance of its kind ever. It’s the first above-market pricing in Japan's history, defying the usual 8–10% discount.

➡️ Uber CEO tells Bloomberg Bitcoin is a proven store of value and that it is exploring crypto payments.

➡️Agricultural commodity trading company Davis Commodities will buy $4.5 million Bitcoin for their reserves, calling it "digital gold.

➡️Fidelity: As digital assets evolve, bitcoin’s potential as a store of value sets it apart from other cryptocurrencies. “Coin Report: Bitcoin” outlines why the asset’s design, scarcity, and decentralized nature help make it distinct—and where its future opportunities may lie. Read now: https://www.fidelitydigitalassets.com/research-and-insights/coin-report-bitcoin-btc?ccsource=owned_social_btc_report_june_x

➡️Japanese public company Remixpoint announces it bought 44.8 #Bitcoin worth $4.7 million

On the 8th of June:

➡️Wicked: Bitcoin has been running for 6,000 days and it’s already spent 60 of them, 1% of its life, closing above $100k. https://i.ibb.co/kVyrjR7v/Gs4uy-MIW8-AAOl-A.jpg

On the 9th of June:

➡️Australia’s ABC News reports on how Bitcoin adoption is bringing financial freedom and greater safety to Kibera, one of Africa’s largest slums in Kenya.

➡️ IBIT just blew through $70b and is now the fastest ETF to ever hit that mark in only 341 days, which is 5x faster than the old record held by GLD of 1,691 days. https://i.ibb.co/DfKbwhjG/Gt-Ar6-Eq-X0-AAzrl5.png

Credit chart JackiWang17 on X

➡️Japanese fashion brand ANAP plans to buy and hold over 1,000 Bitcoin by August 2025.

➡️South Korean President to introduce legislation this week to allow big banks to adopt Bitcoin.

➡️Wicked: Bitcoin's now 3x larger than the top 9 shitcoins combined. https://i.ibb.co/LDQKsGHM/Gt-AJy-D6-X0-AA7-PIY.jpg

💸Traditional Finance / Macro:

On the 3rd of May:

👉🏽'Hedge funds are still not buying the Magnificent 7: Hedge funds’ long/short ratio on Magnificent 7 stocks is now at its lowest level in 5 years, per Goldman Sachs. This is even lower than at the 2022 bear market bottom. Furthermore, their exposure to Magnificent 7 stocks is now down -50% over the last year. Meanwhile, hedge funds have bought US information technology stocks for 3 consecutive weeks. This occurred after the sector had been net sold in 10 of the previous 12 weeks. Retail has led the recent rebound.' -TKL

On the 6th of June:

👉🏽If you net out the Mag 7 from the S&P 500, the remaining 493 stocks have barely gone anywhere in over a decade (comparatively speaking). Chart: Goldman Sachs https://i.ibb.co/s9LmVBL8/Gsx53k6-W8-AAM2xr.jpg

🏦Banks:

On the 21st of May: 👉🏽No News

🌎Macro/Geopolitics:

'The reality is that the US soft defaults on its debt every day through structural inflation (the perpetual debasement of the US dollar). In other words, the Treasury pays you back dollars that are worth far less than what you lent to them. A soft default.' This is also valid for Europe.

On top of that, the richest man in the world is publicly arguing with the president of the United States about America’s solvency. Consider buying bitcoin.

So far regarding Trump: - didn't audit the Gold - didn't stop the wars - didn't reduce the deficit/debt/budget - didn't form a Bitcoin reserve - didn't release the Epstein files

Anyway, consider buying Bitcoin.

On the 2nd of June:

👉🏽'The Bank of Japan just racked up a record ¥28.6 trillion in bond losses That’s three times bigger than last year! This isn’t just Japan’s problem. It’s a screaming red alert for global markets.' - StockMarket News

TKL: " Japanese equity funds posted a record $11.8 billion in net outflows last week. This brought the 4-week moving average of outflows to $4.0 billion, an all-time high. Investors’ concerns over rapidly rising long-dated Japanese government bond yields were behind the outflows. Additionally, investors withdrew $5.1 billion from US stock funds. All while global equity funds saw $9.5 billion in net outflows, the most this year. Investors are taking profits after a sharp market recovery."

👉🏽The money printer is back on. US M2 just hit a new all-time high at $21.86T. Liquidity is flowing back into the system.

https://i.ibb.co/fGdx5kmt/Gsd-Jn-R9-XUAAUAO2.jpg

Recession odds have just dropped by 70% to 30% That’s the steepest decline in 65 years without a recession actually happening. Forget everything about a recession when M2 is moving up. Simple as that.

👉🏽$698 billion worth of homes are for sale in the United States, a new all-time high. Rajat Soni: 'The price of a house should be 0.01 BTC right now The housing market is way overpriced in terms of Bitcoin Interest rates or real estate prices will have to fall for these these homes actually to be sold.'

👉🏽The US Dollar is worth 8.9% less than it was at the beginning of the year.

👉🏽Argentina's economy grew 8% year-over-year in April 2025, the highest in the Western world!

On the 3rd of June:

👉🏽Trump's "Big Beautiful Bill" bans all 50 states from regulating AI for 10 years, centralizes control at the federal level, and integrates AI systems into key federal agencies. https://i.ibb.co/Q7t14q7M/Gse-V2f-YWUAAyb-Py.png

👉🏽 ZeroHedge: 'Total US debt is now $37.5 trillion (accrued). The $36.2 trillion actual is just the ceiling set by the debt limit which will be revised to $40 trillion in August/September.'

👉🏽A million seconds ago was May 23rd

A billion seconds ago was 1993

A trillion seconds ago was 30,000 B.C.

The US national debt is now rising by $1 Trillion every 180 days.

👉🏽NATO pushes European members to increase ground-based air defense systems five-fold — Bloomberg

👉🏽Global Markets Investor: 'This is incredible how European markets have outperformed the US this year. Poland, the Czech Republic, and Austria have grown their market capitalization by 44%, 36%, and 33%, respectively. Next are Hungary, Spain, Luxembourg, Greece, and Germany. The US has been flat.'

https://i.ibb.co/TMwrLnB0/Gsiu-KWYXEAAto-U1.jpg

This is one of the WORST years for the US stock market in history: The S&P 500 has UNDERperformed World stocks excluding the US by 12 percentage points year-to-date, the most in 32 YEARS. This is even worse than during the Great Financial Crisis.

👉🏽Bravos Research: 'M2 money supply is now expanding at 4.4% After reaching its deepest contraction in 65 years This is quite constructive for the stock market.' https://i.ibb.co/hFCRgFhr/Gsht-Kgk-Xw-AAy-PFq.jpg

On the 4th of June:

👉🏽“The $1.06 trillion unrealized loss in 2024 was ‘modestly higher’ than the $948.4 billion paper loss seen in 2023.” https://i.ibb.co/Pvm7zVWy/Gsj-9-OWs-AAvwp-F.jpg

Probably nothing. What’s a trillion between friends…

Currently, the US is spending $1,200 trillion per year on interest payments (dark line). If everything were financed at the current interest rate, the cost would exceed $1,500 trillion per year (green). https://i.ibb.co/mCpYtwVW/Gsm-H6-Mr-Xc-AAqd-F5.png

Note: The national debt is $36,9 trillion.

👉🏽Global debt is gigantic: Debt-to-GDP is above 100% in 6 of 7 G7 nations, and is still rising. Japan: ~250% Italy, the US, France, the UK, and Canada: all near or above 100%.

For 5 of 7 G7 economies, debt is set to surge further by 2030. Now debt is a problem but the main question would be...what will the productivity be in 2030?

On the 5th of June:

👉🏽 The United States Treasury just bought back $10 Billion of its own debt, the largest Treasury buyback in history.

Buying back your own debt with printed money. That's what happens just before fiat money goes to die (eventually). Eventually, nobody wants that worthless debt anymore, eventually!

Context by EndGame Macro:

💰 $10 Billion Buyback: The Treasury’s Silent Signal

On June 3, 2025, the U.S. Treasury quietly executed the largest debt buyback in American history, repurchasing $10 billion in short- and medium-term bonds. At first glance, it looked routine. But under the surface, this was a stealth intervention aimed at calming a system under increasing strain. This wasn’t just liquidity smoothing. It was strategic triage.

🧾 What Happened

Buyback Size: $10B (a record)

Debt Offered: $22.87B — more than double what was accepted

Target Maturities: July 2025 to May 2027

Issues Accepted: 22 of 40 eligible

Settlement: June 4, 2025

That huge offer volume isn’t just noise—it’s a warning sign that institutional players are under pressure.

🚨 What the Buyback Really Signaled

- A Quiet Circuit Breaker The buyback focused on maturities clustered around a $9 trillion rollover wall over the next 12 months. Without announcing it, the Treasury effectively tripped a circuit breaker to reduce near-term funding stress.

- QE Without the Label This wasn’t the Fed. No balance sheet expansion. But by retiring debt ahead of maturity and shrinking market float, the effect mirrored QE—without the political baggage.

- Institutions Are Feeling the Squeeze A staggering $22.87 billion in offers points to constraints at banks, funds, or foreign reserve desks. The Treasury didn’t save everyone—just enough to relieve pressure quietly.

🎯 Strategic Motivation

This wasn’t about boosting confidence. It was about managing two threats: Maturity Wall Risk: Avoiding auction failures as short-term debt piles up in 2025–2026. Yield Curve Stability: Preventing disorderly spikes by quietly absorbing supply. This move avoided triggering headlines—while containing the fire under the hood.

🧠 Echoes from History

This buyback fits into a lineage of quiet but powerful interventions: Operation Twist (1961) – Rebalancing maturity without QE branding. BoE Gilt Crisis (2022) – Targeted long-end intervention to save pensions. Belgium’s Shadow QE (2014) – U.S. debt absorbed off-balance-sheet during geopolitical tension. Each move relied on subtlety and intent—not optics.

🧩 What the Market Heard

Primary Dealers: Help exists—but it’s selective and discretionary.

Foreign Holders: Exit in order—or risk exclusion.

Money Markets: Relief, not resolution.

❗ Where the Logic Cracks

If this was routine: Why buy back below par? Why accept only 44% of the offered debt? Why deploy this now and not earlier? Each of these points to deeper stress than officials are openly admitting.

🔒 High-Conviction Takeaway

This buyback was a preemptive stabilization maneuver, not a stimulus. With over $9 trillion in short-term debt set to roll, foreign participation weakening, and institutional selling pressure rising, the Treasury acted before fractures became visible. The line wasn’t drawn to show strength. It was drawn behind the market—to stop a collapse.

🕵️♂️ Known Unknowns

Who were the biggest sellers—and what’s pressuring them? Was this coordinated with the Fed or global reserve desks? Is this a one-off event—or the start of a multi-phase liquidity campaign? The silence is strategic—but the signal is loud.

👉🏽Joe Consorti: 'Congress refuses to cut spending. So we must "grow our way out" of the deficit. That would take 39 years of 5% nominal GDP growth, or 22 years at 10%. In other words, 2-4 decades of explosive growth just to break even. We can't "grow our way out". We'll print our way out.'

👉🏽ZeroHedge: And just like that, the "climate crisis" is gone https://i.ibb.co/GQ76Z79P/Gsr3uus-XEAAjuv6.png

Don't get me wrong and with all respect to my environmentalist friends, but the “Crisis” never existed. A big part of the push has been marketing dollars/euros and media spin, let's face it.

Why do I think that? How do you think we will grow out of the Global Debt problem? One word: PRODUCTIVITY.

How can we manage that? They (Governments/Central Banks) need AI data farms. What do data farms need?

Electricity, water, energy.

Because Big Tech and AI need energy -- wherever they can find it -- climate change as a cause is finished. It was all virtue signaling. And remember the climate didn’t cool, it just stopped polling well. The scariest part of the “climate crisis” becoming out-of-vogue with the left is that it'll likely be replaced by something equally absurd and artificially manufactured.

On the 6th of June

👉🏽 'The US economy adds 139,000 jobs in May, above expectations of 126,000. The unemployment rate was 4.2%, in line with expectations of 4.2%. The April jobs number was revised down from 177,000 to 147,000. The headline numbers continue to exceed expectations.' - TKL

Surprise, surprise…

March jobs revised: 185K 120K (-65k)

April jobs revised: 177K 147K (-30k)

13 of the L16 have been revised lower.

Just to make it even worse, this is something I have shared multiple times in 2024. The number of year-over-year private job gains in 2024 was likely overstated by a MASSIVE 907,000 jobs, according to BLS data released Wednesday. This comes as the Quarterly Census of Employment and Wages (QCEW) data covering 97% of employers showed a private payroll growth rate of 0.6% for December 2024. This is 50% lower than the 1.2% growth rate initially reported in the monthly non-farm payroll (NFP) reports. To put this differently, there was a 907,000 gap between NFP data and QCEW data in 2024. This means jobs were likely overstated by an average of 75,583 PER MONTH in 2024.

👉🏽Opinion: Milei reduced government spending by 30% and achieved a surplus in only 1 month. His popularity didn't fall, it rose. Don't tell me fiscal discipline isn't popular with the general public. It's just unpopular to the powerful special interests that control DC or Brussels.

👉🏽'In the current fiscal year, the U.S. government already spent $4,159 billion. This is for the first 7 months and the fiscal year ends in September. The latest available data is as of April. The already accrued deficit amounts to over $1 trillion: $1,049 billion.

You can see in the chart how net interest expense has become the #2 largest spending category at $579 billion (for 7 months) after social security ($907 billion) and even exceeded national defense ($536 billion), health ($555 billion), and Medicare ($550 billion). The deficit is 34% of total receipts! (1049/3110) In other words: the U.S. government spent 34% more than it took in.

The last full fiscal year ended in September 2024. In that fiscal year, we spent $1.13 trillion on interest expenses. After only the first 7 months of fiscal year 2025 ending in September, they are already at $776 billion. This means we'll likely touch $1.3 trillion this fiscal year!' - AJ https://i.ibb.co/RTLTZPn1/Gsxv-Tso-Xc-AAZs-Zo.jpg

On the 7th of June:

👉🏽 The EU Commission paid climate "NGOs" for questionable lobbying with money from German taxpayers and wanted to keep it secret. https://i.ibb.co/zH6J41Zq/Gsz-Lu-F9-Xg-AAZttn.jpg Now read the above statement again and after that read the following bit:

👉🏽EU TRIES TO LECTURE EL SALVADOR - BUKELE BODYSLAMS BACK Source: https://www.eeas.europa.eu/eeas/el-salvador-statement-spokesperson-foreign-agents-law-and-recent-developments_en

The Diplomatic Service of the European: "El Salvador: The EU regrets the adoption of the Foreign Agents Law, which risks restricting civil society and runs counter to international obligations. Recent arrests of human rights defenders raise further concerns."

The EU’s sanctimonious finger-wagging at El Salvador reeks of hypocrisy. Brussels lectures sovereign nations on “civil society” while funneling billions into globalist NGOs that undermine national sovereignty. The institution that attacks liberty, freedom, democracy, and free speech in the name of a neosocialist woke ideology wants to lecture other countries on how they defend against their constant meddling and aggression. They are a bunch of unelected bureaucrats, accountable to no one, representing no one. Classic!

Supporting this further, let’s have a look how the EU is increasingly positioning itself as a technocratic regulator of personal freedom:

'The EU – the one that:

•wants to monitor every Bitcoin transaction through MiCA & DAC-8 •would love to ban non-custodial wallets

•is planning a chat control law that would make even China blush

•is considering a wealth register to digitally track every cent of your retirement savings

•restricts cash withdrawals in some member states •is testing CBDCs with expiration dates and spending limits

•and is preparing the digital euro as a full-blown control tool

…this EU is now complaining about human rights violations in El Salvador – a country whose government enjoys one of the highest approval ratings in the world. Over 85% support for President Bukele. Show me a single Western leader who even comes close to that.' - Bitcoin Hotel

Great reply by El Salvador's President Nayib Bukele: 'EU: El Salvador regrets that a bloc which is aging, overregulated, energy-dependent, tech-lagging, and led by unelected bureaucrats still insists on lecturing the rest of the world.'

👉🏽Sam Callahan: Alternative title: 73% of bonds in the world trading at less than the rate of debasement https://i.ibb.co/Y4qMvh0T/Gs7-Ry-WMAABf49.jpg

On the 8th of June:

👉🏽'US existing home sales dropped -3.1% year-over-year to an annualized 4.0 million in April, the lowest for any April since 2009. Month-over-month, home sales fell 0.5%, well below expectations of a +2.0% increase. The decline was driven by the West and Northeast regions. Sales in the South were flat, while in the Midwest improved slightly. Meanwhile, existing home inventory rose +21%, to 1.45 million, the most for any April since 2020, per ZeroHedge. Despite that, the median sales price increased +1.8% year-over-year to $414,000, a record for April. Homebuyer demand is weak and prices are still rising.' -TKL

On the 9th of June:

👉🏽Jeroen Blokland: '- China bought more gold in May. -China has been buying even more gold through ‘unofficial’ channels. - China's gold reserves today are low compared to those of the US and European countries -China is determined to move away from US dollar hegemony - China’s ambition to move away from the US dollar will only have strengthened because of the Trump tariff war - China has to acknowledge that few countries, companies, and households want to hold the Yuan So what will China be doing for years to come?'

No surprise central banks are avoiding sovereign debt and adding gold.

👉🏽TKL: Gold is on fire: Gold's share of global reserves reached 23% in Q2 2025, the highest level in 30 years. Over the last 6 years, the percentage has DOUBLED. At the same time, the US Dollar's share of international reserves has declined 10 percentage points, to 44%, the lowest since 1993. By comparison, the Euro's share has decreased 2 percentage points, to 16%, the lowest in 22 years. Gold is quickly replacing fiat currencies as a reserve currency.

🎁If you have made it this far, I would like to give you a little gift:

Lysander: "Lyn Alden gave one of the clearest breakdowns of why the U.S. is on an unstoppable fiscal path—and why Bitcoin matters more than ever because of it.

Lyn Alden walks through the numbers behind the federal deficit, interest expenses, Social Security, and the structural changes that happened post-2008. The short version? We’re in a new era. One where the government can’t slow down even if it wants to.

Her phrase: “Nothing stops this train.” Not because of ideology, but because of math—and human nature.

This isn’t hyperinflation doom-talk. It’s a sober look at what happens when a system built on ever-growing debt reaches its limits—and why Bitcoin, with its fixed supply and transparent rules, is the opposite of that system.

If you haven’t seen it, this is a must watch. Pure signal! https://www.youtube.com/watch?v=Giuzcd4oxIk

Credit: I have used multiple sources!

My savings account: Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

-

@ a8d1560d:3fec7a08

2025-06-16 00:58:00

@ a8d1560d:3fec7a08

2025-06-16 00:58:00THIS IS IMPORTANT!!!

After the wave of word-scrambling spam bots, a new and very problematic kind of spam has arrived in the Nostr. Whenever you post something now, you will get gay porn videos as an automated answer (No, being gay itself is not problematic!!!). To get rid of all the automated spam, remove the following relays from your inbox and outbox relay list: - nos.lol - relay.damus.io - nostr.oxtr.dev - relay.primal.net

As long as you have even one of these relays in your inbox and outbox lists, you and your followers will be spammed whenever posting something.

It is unknown if the bots only reply to kind 1 events or to all events.

-

@ 70c48e4b:00ce3ccb

2025-06-16 06:59:12

@ 70c48e4b:00ce3ccb

2025-06-16 06:59:12Hello all :)

Something pretty exciting just happened in the world of decentralized tech.

A new social network project called Nostria successfully wrapped up its pre-seed funding round. It raised the funds through Angor, a crowdfunding platform built on Bitcoin and Nostr that aligns perfectly with the project’s decentralized mission.This post is all about what Nostria is doing, why it matters, and how Angor made it all possible.

What is Nostria?

nostr:npub16x7nxvehx0wvgy0sa6ynkw9c2ghuph3z0ll5t8veq3xwm8n9tqds6ka44x is a social network app that’s built to make the Nostr protocol easy to use. If you're not familiar with Nostr, it's an open protocol for decentralized social networking. It gives users more control and privacy, without relying on big platforms.

Nostria makes all that feel less like a tech experiment and more like a real social network. The app is simple, elegant, and beginner-friendly. It is available across iOS, Android, and web so you can jump in from anywhere.

Think of it as the easiest way to start using Nostr without needing to understand all the technical stuff under the hood.

https://www.nostria.app/assets/screenshots/nostria-01.jpg

The Problem Nostria is Solving:

One of the challenges Nostr faces right now is scaling. The network relies on relays to pass messages around, but many of these are centralized and getting overloaded. That creates serious bottlenecks and makes the whole experience less reliable. Just to give you an idea:

- Damus relay has around 646,000 users

- Nos relay has 601,000 users

- Snort sits at 417,000 users

When so many users depend on just a few relays, it puts a huge strain on the system and limits how far the network can grow.

Nostria’s Clever Fix

Nostria introduces a smarter way to scale Nostr without losing its decentralized core. Instead of relying on a few overloaded relays, it uses:

• Regionally deployed Discovery Relays – Think of these as local hubs placed in different parts of the world. When users connect, they are matched with a nearby relay, which keeps things faster and spreads the traffic out so no single relay gets overwhelmed.

• Pooled User Relays – Instead of each person depending on just one relay, users are connected through a shared pool. This means messages are sent and received more efficiently, especially when more people join the network.

All of this happens behind the scenes. The app keeps things simple and intuitive, with automation that handles the complexity for you. Whether you're posting, reading, or connecting with others, the experience stays smooth.

Nostria has bold ambitions. Here’s what they’re going for:

- A goal of 1 million daily active users

- Competing with platforms like Bluesky, Mastodon, and even X (formerly Twitter)

- A long-term plan to support both free and premium services to drive adoption

As of now, the Nostr network as a whole has:

- 15,000 daily active users

- 42.7 million total users

- 552 million total events

So the market is already there. It just needs the right tools to grow.

https://www.nostria.app/assets/screenshots/nostria-02.jpg

Meet the Team

Nostria is led by nostr:npub1zl3g38a6qypp6py2z07shggg45cu8qex992xpss7d8zrl28mu52s4cjajh, a software engineer with deep experience in distributed systems. He has been involved with the Nostr protocol since its early days in 2021 and is deeply passionate about decentralization and open-source tech.

https://www.nostria.app/assets/team/sondre.jpg

He’s joined by nostr:npub1e0krp2gr3l5nfd2jw2cydh68adxjpmcqdhs2e0jxkrqd4crwt4dslwrk0k, a thoughtful full-stack developer focused on simplicity and sovereignty, and nostr:npub10c4sn723akd7fqegfe6xntpq43p86vnyvv7j2ryaq8jzvhyea4pq72c5ul, a junior dev who’s already contributed to open source and is finishing up her studies.

https://www.nostria.app/assets/team/kosta.jpg https://www.nostria.app/assets/team/lu.jpg

The Funding Round

To bring Nostria to life, the team aimed to raise $30,000 during their pre-seed round. This funding would help them:

- Complete their MVP (Minimum Viable Product)

- Deploy global infrastructure

- Start building their user base

- Get ready for a full Seed round in late 2025

How Angor Helped?

Angor is a decentralized crowdfunding platform built on Bitcoin and the Nostr protocol. It’s designed exactly for projects like this. The team at Nostria launched their campaign on Angor between May 12 and May 31, and it was a success.

What made the campaign stand out?

- The whole process was decentralized and transparent.

- Backers could fund the project directly, without intermediaries.

- Nostria aligned perfectly with Angor’s vision of empowering projects that push decentralization forward.

The campaign served as both a fundraiser and a real-world example of how decentralized infrastructure can power decentralized ideas. And it worked.

Inside the Funding Terms

As part of this funding round, Nostria offered contributors a post-money SAFE (Simple Agreement for Future Equity). This is a modern, flexible way for startups to raise money early without the complexity of traditional equity rounds.

In simple terms:

•Investors contributed funds now, and in return, they will receive equity in Nostria during a future priced equity round. When Nostria raises its next round, most likely a Seed round, then those SAFE contributions will convert into actual shares.

•The SAFE includes a valuation cap, which sets a maximum company valuation for conversion. This guarantees that early backers receive shares at a better rate than future investors. While the exact cap isn't publicly listed, this feature ensures early supporters are rewarded for their trust.

•There is no interest or maturity date, which is a major benefit over traditional convertible notes. There’s no ticking clock or repayment obligation. Investors simply wait until the next funding event.

•The SAFE also features a Most Favored Nation (MFN) clause. This ensures that if the company issues another SAFE later with better terms, early investors will automatically receive the same improved terms. It’s designed to keep things transparent and equitable.

•Jurisdiction and legal terms: While the full legal text isn’t included in the note, SAFEs typically specify the legal jurisdiction governing the agreement. Nostria’s approach suggests a commitment to following standard legal frameworks, further underlining their seriousness and professionalism.

You can read Nostria’s public SAFE summary here: nostr:npub16x7nxvehx0wvgy0sa6ynkw9c2ghuph3z0ll5t8veq3xwm8n9tqds6ka44x

And you can view the full campaign hosted on Angor here: https://hub.angor.io/project/angor1qwdgxjuzhjykgpn5q8p3l2q9vyrgqdlrkfp5sjr

By sharing these details openly, the team added a strong layer of transparency and trust to the entire campaign. It is a clear signal that they are building something serious and thoughtful, with long-term commitment and care instead of shortcuts.

What’s Next?

With the funding secured, Nostria is sprinting ahead. The roadmap includes:

- June: Deploying media and relay servers

- July: Adding premium features and full cross-platform support

- August: Growing the user base and preparing for the next funding round

If all goes well, Nostria is on track to become one of the most accessible and user-friendly Nostr based platforms out there. With a clear roadmap and a team focused on long-term decentralization, the journey is just getting started...

Got an idea of your own? You can launch your project on Angor, just like Nostria did, and start your own funding round with the support of a like-minded community.

Thanks for reading. See y’all next week with another story from the world of open, decentralized innovation. Ciao

-

@ b1ddb4d7:471244e7

2025-06-16 10:01:07

@ b1ddb4d7:471244e7

2025-06-16 10:01:07This article was originally published on dev.to by satshacker.

Alright, you’ve built a useful and beautiful website, tool or app. However, monetization isn’t a priority and you’d rather keep the project free, ads-free and accessible?

Accepting donations would be an option, but how? A PayPal button? Stripe? Buymeacoffe? Patreon?

All of these services require a bank account and KYC verification, before you can send and receive donations – not very convenient.

If we only could send value over the internet, with just one click and without the need of a bank account…

Oh, hold on, that’s bitcoin. The decentralized protocol to send value across the globe. Money over TCP/IP.

In this article, we’ll learn how anyone can easily add a payment button or donation widget on a website or app.

Let’s get into it.

Introduction

Bitcoin is digital money that you can send and receive without the need for banks. While bitcoin is extremely secure, it’s not very fast. The maximum transactions per second (TPS) the network can handle is about 7. Obviously that’s not useful for daily payments or microtransactions.

If you’d like to dig deeper into how bitcoin works, a great read is “Mastering Bitcoin” by Andreas Antonopoulos.

Bitcoin vs Lightning

If you’d like to receive bitcoin donations “on-chain” all you need is a bitcoin wallet. You simply display your bitcoin address on your site and that’s it. You can receive donations.

It would look something like this; 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa

Instead of showing the actual bitcoin address, you can also turn it into a QR code.

However, this is not a recommended solution. Using static on-chain addresses has two major downsides. It lowers privacy for you and your donnors and it’s a UTXO disaster because many small incoming transactions could beocme hard to consolidate in the future.

For donations and small transactions, the Lightning Network is the better option. Lightning allows for instant settlement with fees only a fraction of a cent.

Similar to bitcoin, you have the choice between non-custodial and custodial wallets. This means, either you have full control over your money or the wallet provider has.

Option 1: Lightning Address

With the lightning address feature, you an easily receive donations to an email like address.

It looks like this: yourname@wallet.com

Many wallets support lightning addresses and make it easy to create one. Then, you simple add the address to your donation page and you’re ready to receive tips.

You can also add a link link as in lightning:yourname@wallet.com and compatible lightning wallets and browser wallets will detect the address.

Option 2: Lightning Donation Widgets

If you like to take it a step further, you can also create a more enhanced donation checkout flow. Of course you could programm something yourself, there are many open source libraries you can build upon. If you want a simple plug-and-play solution, here are a couple of options:

Name

Type

Registration

SatSale

Self-hosted

No KYC

BTCPay Server

Self-hosted

No KYC

Pay With Flash

Widget

Email

Geyser Fund

Widget

Email

The Giving Block

Hosted

KYC

OpenNode

Hosted

KYC

SatSale (GitHub)

Lightweight, self-hosted Bitcoin/Lightning payment processor. No KYC.

Ideal for developers comfortable with server management. Simple to deploy, supports both on-chain and Lightning, and integrates with WooCommerce.

BTCPay Server

Powerful, open-source, self-hosted processor for Bitcoin and Lightning. No KYC.

Supports multiple currencies, advanced features, and full privacy. Requires technical setup and maintenance. Funds go directly to your wallet; great for those seeking full control.

Pay With Flash

Easiest for indie hackers. Add a donation widget with minimal code and no KYC. Payments go directly to your wallet for a 1.5% fee.

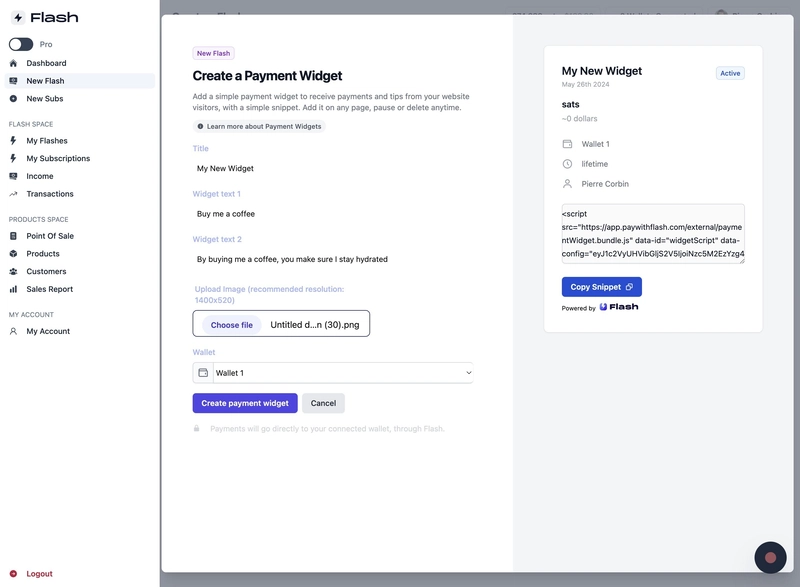

Setup Steps:

- Sign up at PayWithFlash.com

- Customize your widget in the dashboard

- Embed the code:

- Test to confirm functionality

Benefits:

- Minimal technical skills required

- Supports one-time or recurring donations

- Direct fund transfer, no intermediaries

Geyser Fund

Crowdfunding platform. Widget-based, connects to your wallet, email registration.Focused on Bitcoin crowdfunding, memberships and donations.

The Giving Block

Hosted, KYC required. Integrates with fiat and crypto, best for nonprofits or larger organizations.

OpenNode

Hosted, KYC required. Accept Bitcoin payments and donations; supports conversion to fiat, suitable for businesses and nonprofits.

Summary

- Fast, low-code setup: Use Pay With Flash or Geyser Fund.

- Privacy and control: Choose SatSale or BTCPay Server (requires technical skills).

- Managed, compliant solutions: The Giving Block or OpenNode.

Choose based on your technical comfort, privacy needs, and project scale.

I hope this article helped you. If you added bitcoin donations, share your link in the comments and I will send you a few satoshis maybe

-

@ 39cc53c9:27168656

2025-06-16 06:25:50

@ 39cc53c9:27168656

2025-06-16 06:25:50After almost 3 months of work, we've completed the redesign of kycnot.me. More modern and with many new features.

Privacy remains the foundation - everything still works with JavaScript disabled. If you enable JS, you will get some nice-to-have features like lazy loading and smoother page transitions, but nothing essential requires it.

User Accounts

We've introduced user accounts that require zero personal information:

- Secret user tokens - no email, no phone number, no personal data

- Randomly generated usernames for default privacy and fairness

- Karma system that rewards contributions and unlocks features: custom display names, profile pictures, and more.

Reviews and Community Discussions

On the previous sites, I was using third party open source tools for the comments and discussions. This time, I've built my own from scratch, fully integrated into the site, without JavaScript requirements.

Everyone can share their experiences and help others make informed decisions:

- Ratings: Comments can have a 1-5 star rating attached. You can have one rating per service and it will affect the overall user score.

- Discussions: These are normal comments, you can add them on any listed service.

Comment Moderation

I was strugling to keep up with moderation on the old site. For this, we've implemented an AI-powered moderation system that:

- Auto-approves legitimate comments instantly

- Flags suspicious content for human review

- Keeps discussions valuable by minimizing spam

The AI still can mark comments for human review, but most comments will get approved automatically by this system. The AI also makes summaries of the comments to help you understand the overall sentiment of the community.

Powerful Search & Filtering

Finding exactly what you need is now easier:

- Advanced filtering system with many parameters. You can even filter by attributes to pinpoint services with specific features.

The results are dynamic and shuffle services with identical scores for fairness.

See all listings

Listings are now added as 'Community Contributed' by default. This means that you can still find them in the search results, but they will be clearly marked as such.

Updated Scoring System

New dual-score approach provides more nuanced service evaluations:

- Privacy Score: Measures how well a service protects your personal information and data

-

Trust Score: Assesses reliability, security, and overall reputation

-

Combined into a weighted Overall Score for quick comparisons

- Completely transparent and open source calculation algorithm. No manual tweaking or hidden factors.

AI-Powered Terms of Service Analysis

Basically, a TLDR summary for Terms of Service:

- Automated system extracts the most important points from complex ToS documents

- Clear summaries

- Updated monthly to catch any changes

The ToS document is hashed and only will be updated if there are any changes.

Service Events and Timelines

Track the complete history of any service, on each service page you can see the timeline of events. There are two types of events:

- Automatic events: Created by the system whenever something about a service changes, like its description, supported currencies, attributes, verification status…

- Manual events: Added by admins when there’s important news, such as a service going offline, being hacked, acquired, shut down, or other major updates.

There is also a global timeline view available at /events

Notification System

Since we now have user accounts, we built a notifiaction system so you can stay informed about anything:

- Notifications for comment replies and status changes

- Watch any comment to get notified for new replies.

- Subscribe to services to monitor events and updates

- Notification customization.

Coming soon: Third-party privacy-preserving notifications integration with Telegram, Ntfy.sh, webhooks...

Service Suggestions

Anyone with an account can suggest a new service via the suggestion form. After submitting, you'll receive a tracking page where you can follow the status of your suggestion and communicate directly with admins.

All new suggestions start as "unlisted" — they won't appear in search results until reviewed. Our team checks each submission to ensure it's not spam or inappropriate. If similar services already exist, you'll be shown possible duplicates and can choose to submit your suggestion as an edit instead.

You can always check the progress of your suggestion, respond to moderator questions, and see when it goes live, everything will also be notified to your account. This process ensures high-quality listings and a collaborative approach to building the directory.

These are some of the main features we already have, but there are many more small changes and improvements that you will find when using the site.

What's Next?

This is just the beginning. We will be constantly working to improve KYCnot.me and add more features that help you preserve your privacy.

Remember: True financial freedom requires the right to privacy. Stay KYC-free!

-

@ 374ee93a:36623347

2025-06-16 16:23:52

@ 374ee93a:36623347

2025-06-16 16:23:52Chef's notes

A quick and easy recipe to help preserve your fresh strawberry harvest for months to come with the addition of vanilla to bring out that summer flavour.

Made with 20% extra fruit than standard supermarket jam. To make a reduced sugar version you can use Pomona's Pectin or accept runny jam ;)

Details

- ⏲️ Prep time: 10 mins

- 🍳 Cook time: 30 mins

- 🍽️ Servings: 5 jars

Ingredients

- 1.2kg fresh hulled strawberries

- 1kg golden cane sugar (can sub honey or maple syrup 1:1)

- 1 lemon

- 1 vanilla pod (or 1 tbspn extract)

Directions

- Remove the green stalks from your strawberries and cut into quarters

- Pare the lemon zest and reserve for another recipe (such as lemon curd, or cocktails!), chop roughly and add to a pan inside a small muslin bag)

- Gently cook the strawberries and lemon together with a lid on the pan for 15-20 minutes, until the lemon pith softens

- Squeeze the muslin bag to get as much pectin out as possiblem then add 1kg sugar to the miture and boil on high

- The jam can be tested for set after approx 10 mins boiling, spoon a small amount onto a chilled plate and place in the freezer for 2 minutes. If the jam wrinkles when pushed with a spoon it is ready to pot into sterlised jars. If it still appears runny cook for a further 5 minutes and repeat testing

-

@ 7f6db517:a4931eda

2025-06-16 19:02:15

@ 7f6db517:a4931eda

2025-06-16 19:02:15

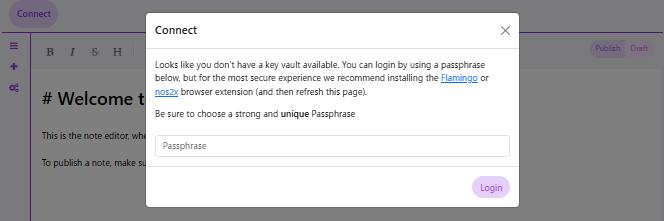

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 17:02:09

@ 7f6db517:a4931eda

2025-06-16 17:02:09

The former seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

The latter's future remains to be seen. Dependence on Tor, which has had massive reliability issues, and lack of strong privacy guarantees put it at risk.

— ODELL (@ODELL) October 27, 2022

The Basics

- Lightning is a protocol that enables cheap and fast native bitcoin transactions.

- At the core of the protocol is the ability for bitcoin users to create a payment channel with another user.

- These payment channels enable users to make many bitcoin transactions between each other with only two on-chain bitcoin transactions: the channel open transaction and the channel close transaction.

- Essentially lightning is a protocol for interoperable batched bitcoin transactions.

- It is expected that on chain bitcoin transaction fees will increase with adoption and the ability to easily batch transactions will save users significant money.

- As these lightning transactions are processed, liquidity flows from one side of a channel to the other side, on chain transactions are signed by both parties but not broadcasted to update this balance.

- Lightning is designed to be trust minimized, either party in a payment channel can close the channel at any time and their bitcoin will be settled on chain without trusting the other party.

There is no 'Lightning Network'

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise.

- There are many lightning channels between many different users and funds can flow across interconnected channels as long as there is a route through peers.

- If a lightning transaction requires multiple hops it will flow through multiple interconnected channels, adjusting the balance of all channels along the route, and paying lightning transaction fees that are set by each node on the route.

Example: You have a channel with Bob. Bob has a channel with Charlie. You can pay Charlie through your channel with Bob and Bob's channel with User C.

- As a result, it is not guaranteed that every lightning user can pay every other lightning user, they must have a route of interconnected channels between sender and receiver.

Lightning in Practice

- Lightning has already found product market fit and usage as an interconnected payment protocol between large professional custodians.

- They are able to easily manage channels and liquidity between each other without trust using this interoperable protocol.

- Lightning payments between large custodians are fast and easy. End users do not have to run their own node or manage their channels and liquidity. These payments rarely fail due to professional management of custodial nodes.

- The tradeoff is one inherent to custodians and other trusted third parties. Custodial wallets can steal funds and compromise user privacy.

Sovereign Lightning

- Trusted third parties are security holes.

- Users must run their own node and manage their own channels in order to use lightning without trusting a third party. This remains the single largest friction point for sovereign lightning usage: the mental burden of actively running a lightning node and associated liquidity management.

- Bitcoin development prioritizes node accessibility so cost to self host your own node is low but if a node is run at home or office, Tor or a VPN is recommended to mask your IP address: otherwise it is visible to the entire network and represents a privacy risk.

- This privacy risk is heightened due to the potential for certain governments to go after sovereign lightning users and compel them to shutdown their nodes. If their IP Address is exposed they are easier to target.

- Fortunately the tools to run and manage nodes continue to get easier but it is important to understand that this will always be a friction point when compared to custodial services.

The Potential Fracture of Lightning

- Any lightning user can choose which users are allowed to open channels with them.

- One potential is that professional custodians only peer with other professional custodians.

- We already see nodes like those run by CashApp only have channels open with other regulated counterparties. This could be due to performance goals, liability reduction, or regulatory pressure.

- Fortunately some of their peers are connected to non-regulated parties so payments to and from sovereign lightning users are still successfully processed by CashApp but this may not always be the case going forward.

Summary

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise. There is no singular 'Lightning Network' but rather many payment channels between distinct peers, some connected with each other and some not.

- Lightning as an interoperable payment protocol between professional custodians seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

- Lightning as a robust sovereign payment protocol has yet to be battle tested. Heavy reliance on Tor, which has had massive reliability issues, the friction of active liquidity management, significant on chain fee burden for small amounts, interactivity constraints on mobile, and lack of strong privacy guarantees put it at risk.

If you have never used lightning before, use this guide to get started on your phone.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 17:02:07

@ 7f6db517:a4931eda

2025-06-16 17:02:07

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 17:02:09

@ 7f6db517:a4931eda

2025-06-16 17:02:09

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 9ca447d2:fbf5a36d

2025-06-16 06:01:49

@ 9ca447d2:fbf5a36d

2025-06-16 06:01:49CANNES, FRANCE – May 2025 — Bitcoin mining made its mark at the world’s most prestigious film gathering this year as Puerto Rican director and producer Alana Mediavilla introduced her feature documentary Dirty Coin: The Bitcoin Mining Documentary at the Marché du Film during the Cannes Film Festival.

The film puts bitcoin mining at the center of a rising global conversation about energy, technology, and economic freedom.

Dirty Coin is the first feature-length documentary to explore bitcoin mining through immersive, on-the-ground case studies.

From rural towns in the United States to hydro-powered sites in Latin America and the Congo, the film follows miners and communities navigating what may be one of the most misunderstood technologies of our time.

The result is a human-centered look at how bitcoin mining is transforming local economies and energy infrastructure in real ways.

To mark its Cannes debut, Mediavilla and her team hosted a packed industry event that brought together leaders from both film and finance.

Dirty Coin debut ceremony at the Marché du Film

Sponsors Celestial Management, Sangha Renewables, Nordblock, and Paystand.org supported the program, which featured panels on mining, energy use, and decentralized infrastructure.

Attendees had the rare opportunity to engage directly with pioneers in the space. A special session in French led by Seb Gouspillou spotlighted mining efforts in the Congo’s Virunga region.

Dirty Coin builds on Mediavilla’s award-winning short film Stranded, which won over 20 international prizes, including Best Short Documentary at Cannes in 2024.

That success helped lay the foundation for the feature and positioned Mediavilla as one of the boldest new voices in global documentary filmmaking.

Alana Mediavilla speaks at the Marché du Film — Cannes Film Festival

“If we’ve found an industry that can unlock stranded energy and turn it into real power for people—especially in regions with energy poverty—why wouldn’t we look into it?” says Mediavilla. “Our privilege blinds us.

“The same thing we criticize could be the very thing that lifts the developing world to our standard of living. Ignoring that potential is a failure of imagination.”

Much like the decentralized network it explores, Dirty Coin is spreading globally through grassroots momentum.

Local leaders are hosting independent screenings around the world, from Roatán and Berlin to São Paulo and Madrid. Upcoming events include Toronto and Zurich, with more cities joining each month.

Mediavilla, who previously worked in creative leadership roles in the U.S. — including as a producer at Google — returned to Puerto Rico to found Campo Libre, a studio focused on high-caliber, globally relevant storytelling from the Caribbean.

She was also accepted into the Cannes Producers Network, a selective program open only to producers with box office releases in the past four years.

Mediavilla qualified after independently releasing Dirty Coin in theaters across Puerto Rico. Her participation in the network gave her direct access to meetings, insights, and connections with the most active distributors and producers working today.

The film’s next public screening will take place at the Anthem Film Festival in Palm Springs on Saturday, June 14 at 2 PM. Additional screenings and market appearances are planned throughout the year at Bitcoin events and international film platforms.

Dirty Coin at the Cannes Film Festival

Watch the Trailer + Access Press Materials

📂 EPK

🎬 Screener

🌍 Host a Screening

Follow the Movement

Instagram: https://www.instagram.com/dirty_coin_official/

Twitter: https://x.com/DirtyCoinDoc

Website: www.dirtycointhemovie.com -

@ 7f6db517:a4931eda

2025-06-16 17:02:06

@ 7f6db517:a4931eda

2025-06-16 17:02:06Will not live in a pod.

Will not eat the bugs.

Will not get the chip.

Will not get a blue check.

Will not use CBDCs.Live Free or Die.

Why did Elon buy twitter for $44 Billion? What value does he see in it besides the greater influence that undoubtedly comes with controlling one of the largest social platforms in the world? We do not need to speculate - he made his intentions incredibly clear in his first meeting with twitter employees after his takeover - WeChat of the West.

To those that do not appreciate freedom, the value prop is clear - WeChat is incredibly powerful and successful in China.

To those that do appreciate freedom, the concern is clear - WeChat has essentially become required to live in China, has surveillance and censorship integrated at its core, and if you are banned from the app your entire livelihood is at risk. Employment, housing, payments, travel, communication, and more become extremely difficult if WeChat censors determine you have acted out of line.

The blue check is the first step in Elon's plan to bring the chinese social credit score system to the west. Users who verify their identity are rewarded with more reach and better tools than those that do not. Verified users are the main product of Elon's twitter - an extensive database of individuals and complete control of the tools he will slowly get them to rely on - it is easier to monetize cattle than free men.

If you cannot resist the temptation of the blue check in its current form you have already lost - what comes next will be much darker. If you realize the need to resist - freedom tech provides us options.

If you found this post helpful support my work with bitcoin.

-

@ cae03c48:2a7d6671

2025-06-16 16:01:21

@ cae03c48:2a7d6671

2025-06-16 16:01:21Bitcoin Magazine

Coinbase Announces Bitcoin Rewards Credit Card, Offering up to 4% BTC Back on EverythingCoinbase is launching its first-ever branded credit card in partnership with American Express, set to roll out this fall. Called the Coinbase One Card, it will be available only to U.S. members of Coinbase One, the platform’s monthly subscription service. The card will offer 2% to 4% back in Bitcoin on everyday purchases, along with access to American Express perks.

JUST IN: Coinbase launches credit card allowing users to earn up to 4% bitcoin back on every purchase

pic.twitter.com/d6pdNZV4pi

pic.twitter.com/d6pdNZV4pi— Bitcoin Magazine (@BitcoinMagazine) June 12, 2025

This is a first-of-its-kind product for Coinbase, which previously only offered a prepaid debit card with Visa in 2020.

“We see real potential in the combination of Coinbase and crypto with the powerful backing of American Express, and what the card offers is an excellent mix of what customers are looking for right now,” said Will Stredwick, head of American Express global network services, during the Coinbase State of Crypto Summit in New York.

The card is part of a larger push by Coinbase to expand its subscription-based services. Coinbase One costs $29.99/month and includes zero trading fees, higher staking rewards, and customer support perks. The company also announced a cheaper version—Coinbase Basic—for $4.99/month or $49.99/year, which includes fewer features.

Coinbase’s subscription business is growing fast. It brought in $698.1 million in Q1 2025, compared to $1.26 billion in trading revenue. According to William Blair analyst Andrew Jeffrey, this kind of recurring revenue is a big reason why long-term investors are sticking with the stock.

Launched in 2023, Coinbase One now has over a million members. The company has been steadily growing its ecosystem with products like its Base developer platform and a self-custody wallet.

The company has long positioned Bitcoin at the center of its strategy—offering BTC custody services to institutions, supporting Bitcoin ETFs, integrating Bitcoin rewards into its products, and actively advocating for Bitcoin-friendly regulation in Washington. Coinbase also supports Bitcoin development directly through funding grants and engineering support. As the largest publicly traded crypto exchange in the U.S., Coinbase continues to frame Bitcoin not just as an asset, but as the foundation of its long-term vision.

This post Coinbase Announces Bitcoin Rewards Credit Card, Offering up to 4% BTC Back on Everything first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ b1ddb4d7:471244e7

2025-06-16 06:01:30

@ b1ddb4d7:471244e7

2025-06-16 06:01:30Paris, France – June 6, 2025 – Flash, the easiest Bitcoin payment gateway for businesses, just announced a new partnership with the Bitcoin Only Brewery, marking the first-ever beverage company to leverage Flash for seamless Bitcoin payments.

Bitcoin Buys Beer Thanks to Flash!

As Co-Founder of Flash, it's not every day we get to toast to a truly refreshing milestone.

Okay, jokes aside.

We're super buzzed to see our friends at @Drink_B0B

Bitcoin Only Brewery using Flash to power their online sales!The first… pic.twitter.com/G7TWhy50pX

— Pierre Corbin (@CierrePorbin) June 3, 2025

Flash enables Bitcoin Only Brewery to offer its “BOB” beer with, no-KYC (Know Your Customer) delivery across Europe, priced at 19,500 sats (~$18) for the 4-pack – shipping included.