-

@ c631e267:c2b78d3e

2025-06-18 18:50:48

@ c631e267:c2b78d3e

2025-06-18 18:50:48Ich dachte immer, jeder Mensch sei gegen den Krieg, \ bis ich herausfand, dass es welche gibt, \ die nicht hingehen müssen. \ Erich Maria Remarque

Was sollte man von einem Freitag, den 13., schon anderes erwarten?, ist man versucht zu sagen. Jedoch braucht niemand abergläubisch zu sein, um den heutigen Tag als unheilvoll anzusehen. Der israelische «Präventivschlag» von heute Nacht gegen militärische und nukleare Ziele im Iran könnte allem Anschein nach zu einem längeren bewaffneten Konflikt führen – und damit unweigerlich zu weiteren Opfern.

«Wir befinden uns im Krieg», soll ein ranghoher israelischer Militärvertreter gesagt haben, und der Iran wertet den israelischen Angriff laut seinem Außenminister als Kriegserklärung. Na also. Teheran hat Vergeltungsschläge angekündigt und antwortete zunächst mit Drohnen. Inzwischen ist eine zweite israelische Angriffswelle angelaufen. Ob wir wohl künftig in den Mainstream-Medien durchgängig von einem «israelischen Angriffskrieg auf den Iran» hören und lesen werden?

Dass die zunehmenden Spannungen um das iranische Atomprogramm zu einer akuten Eskalation im Nahen Osten führen könnten, hatte Transition News gestern berichtet. Laut US-Beamten sei Israel «voll bereit», den Iran in den nächsten Tagen anzugreifen, hieß es in dem Beitrag. Heute ist das bereits bittere Realität.

Der Nahe Osten steht übrigens auch auf der Themenliste des diesjährigen Bilderberg-Treffens, das zurzeit in Stockholm stattfindet. Viele Inhalte werden wir allerdings mal wieder nicht erfahren, denn wie immer hocken die «erlauchten» Persönlichkeiten aus Europa und den USA «informell» und unter größter Geheimhaltung zusammen, um über «Weltpolitik» zu diskutieren. Auf der Teinehmerliste stehen auch einige Vertreter aus der Schweiz und aus Deutschland.

Die Anwesenheit sowohl des aktuellen als auch des vorigen Generalsekretärs der NATO lässt vermuten, dass man bei dem Meeting weniger über das Thema «Neutralität» sprechen dürfte. Angesichts des Zustands unseres Planeten ist das schade, denn der Ökonom Jeffrey Sachs hob kürzlich in einem Interview die Rolle der Neutralität in geopolitischen Krisen hervor. Mit Blick auf die Schweiz betonte er, der zunehmende Druck zur NATO-Annäherung widerspreche nicht nur der Bundesverfassung, sondern auch dem historischen Erbe des Landes.

Positives gibt es diese Woche ebenfalls zu berichten. So hat der US-Gesundheitsminister Robert F. Kennedy Jr. nach der «sensationellen» Entlassung aller Mitglieder des Impfberatungsausschusses (wegen verbreiteter direkter Verbindungen zu Pharmaunternehmen) nun auch bereits neue Namen verkündet. Demnach möchte er unter anderem Robert W. Malone, Erfinder der mRNA-«Impfung» als Technologie und prominenter Kritiker der Corona-Maßnahmen, in das Komitee aufnehmen.

Auch die Aufarbeitung der unsinnigen Corona-Politik geht Schrittchen für Schrittchen weiter. In Heidelberg hat die Initiative für Demokratie und Aufklärung (IDA) den Gemeinderat angesichts der katastrophalen Haushaltslage zu einer offenen und ehrlichen Diskussion über die Ursachen der Krise aufgefordert. Das Thema «Corona» sei «das Teuerste, was Heidelberg je erlebt hat», sagte IDA-Stadtrat Gunter Frank im Plenum. Außerdem seien aus den Krisenstabsprotokollen der Stadt auch die enormen Verwerfungen ersichtlich, und es gebe Anlass für tiefgehende Gespräche mit der Stadtverwaltung.

Den juristischen und öffentlichen Druck auf die Kommunen möchte der Unternehmer Markus Böning erhöhen. Seine «Freiheitskanzlei» will Bürgern helfen, die Aufarbeitung selbst in die Hand zu nehmen. Unter dem Motto «Corona-Wiedergutmachung» bietet er Hilfestellung, wie Betroffene versuchen können, sich unrechtmäßige Bußgelder zurückzuholen.

So bleibt uns am Ende dieses finsteren Freitags doch auch Anlass zur Hoffnung. Es gibt definitiv noch Anzeichen von Menschlichkeit. Darauf möchte ich mich konzentrieren, und mit diesem Gefühl verabschiede ich mich ins Wochenende.

[Titelbild: Pixabay]

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ a53364ff:e6ba5513

2025-06-18 18:23:43

@ a53364ff:e6ba5513

2025-06-18 18:23:43The internet is filled with countless social media platforms, all built on centralized servers and proprietary algorithms. However, in the world of decentralized technologies, a new contender is rising. Nostr is a simple, open protocol that promises to bring decentralized, censorship-resistant communication to the masses. In this article, we will explore what Nostr is, how it works, and why it might be the next big thing in the social media space.

How Did the Nostr Protocol Come About?

Nostr (Notes and Other Stuff Transmitted by Relays) was first conceived as a solution to the growing control centralized entities exert over online communications. Most social media platforms today are controlled by corporations, which have the power to censor, ban users, or manipulate what people see in their feeds. These issues, combined with growing concerns about privacy and data collection, inspired the creation of Nostr in 2020 by an anonymous developer named “fiatjaf”. The protocol aims to provide a decentralized alternative where users have control over their own content and identities.

What is Nostr?

Nostr is an open, decentralized communication protocol that allows users to send and receive messages in a censorship-resistant manner. It’s not a social network by itself but a foundation for building decentralized applications (DApps), such as social networks, chat apps, and other forms of communication platforms. Unlike traditional platforms, where all data is stored and managed by a single company, Nostr allows users to control their own data and interact directly without intermediaries.

Why is Nostr Different from Other Social Networks?

Traditional social media platforms like Twitter, Facebook, and Instagram are centralized, meaning all of your posts, messages, and data are controlled by a single company. These platforms have the power to suspend accounts, remove content, or alter algorithms in ways that impact your online presence. Nostr, on the other hand, is decentralized and open-source. There is no central authority, meaning your posts cannot be censored or deleted by a single entity. Each user owns their data, and communication happens directly between users and servers (called relays), reducing the potential for manipulation or surveillance.

Similarities of Nostr with Bitcoin

Nostr shares a similar ethos with Bitcoin, in that both are decentralized, censorship-resistant, and permissionless. Just as Bitcoin allows people to transfer value without intermediaries, Nostr enables communication without relying on a central authority. Both projects promote the idea of individual sovereignty—whether that’s over your money or your communication.

Another connection is the use of public and private keys for identity management. Like Bitcoin wallets, Nostr uses cryptographic keys, meaning that users “log in” by signing messages with their private key. This ensures that only the true owner of the key can send messages from a specific identity.

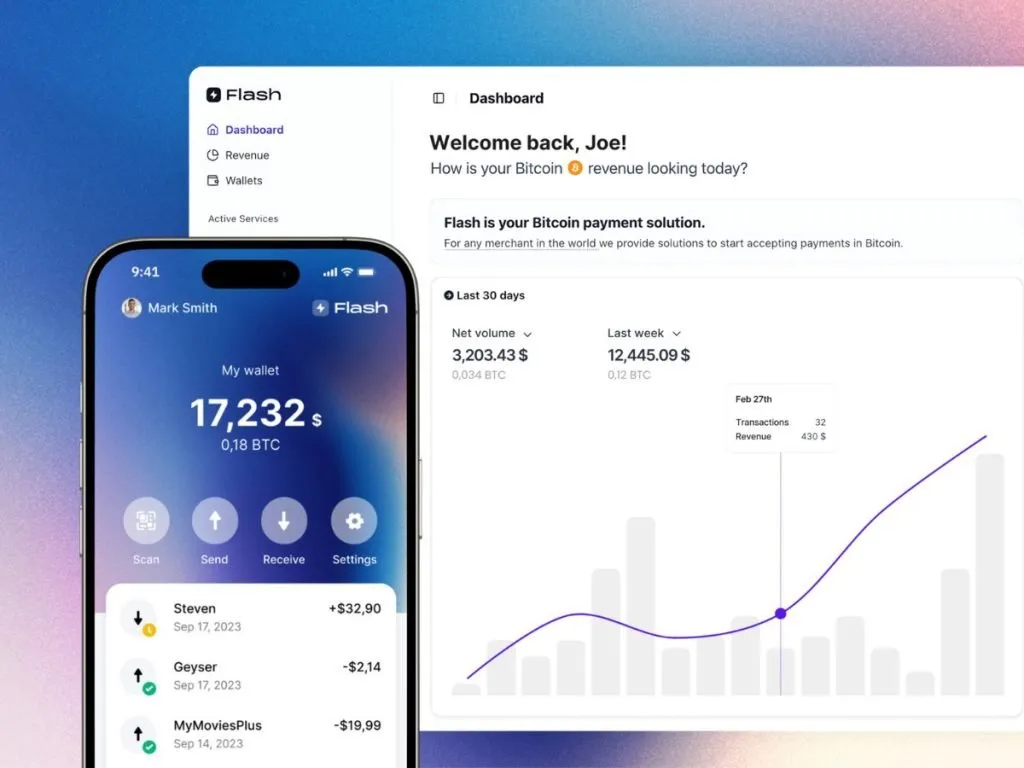

Bitcoin Integrations

Bitcoin and Nostr are increasingly integrated, especially through Bitcoin’s Lightning Network, which is designed for fast, low-fee transactions. Nostr and Bitcoin are a natural fit. By integrating Bitcoin’s Lightning Network, Nostr allows users to send and receive micropayments seamlessly. This is particularly useful for tipping or rewarding content creators within the network. Satoshis (the smallest unit of Bitcoin) can be sent across Nostr’s network almost instantly and with minimal fees. On Nostr, users can send Bitcoin micropayments, often referred to as “zaps.” This enables tipping and rewarding users directly within the network, providing a seamless way for content creators to monetize their work without the need for third-party platforms. For example, if you appreciate a post, you can “zap” the creator a small amount of Bitcoin, creating a new way to support online communities.

How Does Nostr Work? What are Clients and Relays?

Nostr operates through two main components: Clients and Relays.

– Clients are applications that allow users to create accounts, post messages, and interact with others. These clients can be web apps, mobile apps, or desktop apps that interact with the Nostr network.

– Relays are servers that store and transmit the messages between clients. When you post a message on Nostr, it is sent to a relay, and other users’ clients pull that message from the relay. You are not tied to any single relay, so even if one relay is down or blocks your content, you can still interact with others using different relays.

This relay-client model ensures that the network remains decentralized and difficult to censor.

Difference Between Today’s Internet and Nostr’s

Today’s internet is heavily centralized. Most of our communication, from emails to social media, is managed by large corporations with access to vast amounts of data about their users. This leads to issues like censorship, surveillance, and data harvesting. Nostr seeks to change this by decentralizing communication. It puts control back into the hands of users, allowing for a more private and open internet experience. There’s no need for trust in any single company—users own their data and decide which relays to trust or use.

How Do Bitcoin Zaps and Micropayments Work on Nostr?

One of the most exciting features of Nostr is its integration with Bitcoin’s Lightning Network. Through this integration, users can send Bitcoin zaps, which are small amounts of Bitcoin transferred instantly over the Lightning Network. Zaps function like “likes” on traditional social media platforms, but with the added benefit of rewarding users with real monetary value.

To send a zap, users link their Nostr profile to a Lightning wallet. Once connected, they can zap others by sending small amounts of Bitcoin, typically for content they enjoy or want to support. These zaps are fast, inexpensive, and work seamlessly within the Nostr ecosystem, making it easy for users to monetize content and interact with Bitcoin in a meaningful way.

Conclusion

Nostr is an exciting protocol that promises to reshape how we think about online communication. Its decentralized, censorship-resistant nature, along with its integration with Bitcoin, creates a platform where users have control over their data and interactions. Whether you’re looking for a more private social media experience or want to explore new ways to integrate Bitcoin into everyday interactions, Nostr is a protocol worth watching. With its growing ecosystem of clients and relays, Nostr might just be the future of decentralized communication.

Nostr is more than just a social network; it represents a shift towards user autonomy, privacy, and decentralized control. By combining cutting-edge technology with a solid ideological foundation, Nostr offers a refreshing alternative to mainstream social platforms. Whether you’re tech-savvy or just curious about new innovations, Nostr is worth exploring. And with various clients making it easily accessible, there’s no reason not to dive in and experience the future of decentralized social networking for yourself!

-

@ fd0bcf8c:521f98c0

2025-06-18 18:23:27

@ fd0bcf8c:521f98c0

2025-06-18 18:23:27Marcus enters the dining room.

They're all waiting.

Ramirez at the head of the table like some broken queen. Morrison to her right, medals catching light that costs more than food. Chen sweating through his collar, salt stains mapping his desperation. Williams straightening his tie with shaking hands.

The table is set.

China plates cracked at the edges. Crystal glasses clouded with water spots. Nothing on them. Nothing coming.

"Mr. Cross." Ramirez rises. Perfect smile painted over ruin. "Marcus. Thank you for coming."

"You said lunch."

"Yes. Well. Please, sit. We have so much to discuss."

He takes the empty chair. Studies the empty plates. The pristine silverware that won't touch food. Because there is no food.

Outside, sirens wail. Inside, silence breeds.

"How was the drive?" Morrison asks. His voice too bright. "Traffic not too bad, I hope?"

"Fine."

"The new checkpoint system," Chen adds, dabbing sweat. "It's actually improved flow rates by thirty percent."

"Forty percent," Williams corrects. His collar damp now. "In some sectors."

Small talk. The dance of the damned. Marcus waits. Watches them perform their ritual of normalcy while the state dies around them.

"Your parents," Ramirez says finally. The real conversation beginning. "We've been discussing ways to honor them."

"Have you."

"The Cross Memorial Act. Full posthumous pardons. A park perhaps." She gestures at nothing. "With fountains."

"They're dead."

"Their legacy—"

"Dead too."

Silence falls like ash.

Morrison adjusts his medals, each one marking battles they've already lost. Chen dabs his forehead with a napkin that costs more than most people's meals. The air conditioning hums but doesn't cool. Nothing cools anymore.

"Water?" Ramirez offers. Lifts an empty pitcher. Crystal catching fluorescent light. Sets it down with a clink that echoes. "I apologize. We're waiting on a delivery."

"No need."

"The shortages," she explains. Her voice smaller now. "Temporary. Everything's temporary."

"Except Bitcoin."

The word hangs there.

What they've been dancing around.

Why he's really here. Why they called him to this tomb of a dining room with its empty promises and emptier plates.

"Yes," she says. Breathing shallow. "Bitcoin. We should discuss that."

"Should we."

"California's position has... evolved." The word costs her. "We see the value now. The importance."

"You had ten thousand coins once."

Her smile flickers. Dies. Returns as a grimace. "Ancient history."

"You sold."

"The state needed liquidity." A lie they've told themselves so many times it almost sounds true.

"The state needed better advisors."

Morrison leans forward. His chair creaks under the weight of his desperation. "We've learned... from our mistakes."

"Have you."

"We bought back what we could," Chen says. Voice breaking on each syllable. "Four coins. Cost us everything."

"Two coins," Williams corrects quietly. A whisper of defeat. "We paid for water this morning."

The mask slips. Ramirez's perfect composure cracks like drought earth. Like everything else in this dying place.

"Two coins," she repeats. Testing the words. Tasting failure. "Yes. Two."

"Not enough," Marcus says.

"No. Not nearly enough."

More silence.

The empty plates mock them with their hunger. The crystal glasses hold nothing but light and broken dreams. Somewhere in the distance, gunfire. Always gunfire now.

"We know you have ten," Morrison says. Drops the pretense like a worn mask. "Chain analysis confirms it."

"So?"

"First purchase at sixteen thousand. Smart. Eight more over the years. The last two—" He stops. Even desperation has limits.

"What about them?"

"We know what they cost you. What you sacrificed."

Marcus says nothing. The silence stretches taut as wire. They all know. His wife. His daughter. The hospital that wouldn't take dollars. That only took Bitcoin. The choice no father should make.

"We need your help," Ramirez says simply. Truth naked and bleeding. "California needs your help."

"California needed help ten years ago."

"We weren't ready then."

"You're not ready now."

"We are." She opens her laptop. Shows him contracts printed on paper they can't afford. Plans drawn in blood they haven't shed yet.

"With what funds?"

"We'll find funds."

"You can't afford lunch."

The words land like bullets. Chen looks at his empty plate as if it might sprout food through will alone. Williams studies the ceiling, counting cracks like rosary beads.

"The militia needs payment," Morrison says. Each word a stone in his throat. "Without them, it's chaos."

"It's already chaos."

"Controlled chaos. One Bitcoin keeps them loyal for three months."

"And then?"

"We mine more."

"With what power?"

"Solar. Wind." Fantasies dressed as plans.

"With what hardware?"

"We'll source it."

"With what expertise?"

"You."

Ramirez turns her laptop. "Digital Currency Advisor. New position. Help us transition."

Marcus stands. The empty chair scrapes marble like nails on coffin wood. The sound echoes in the tomb they've made of governance.

"We're done here."

"Wait." Morrison stands too. His hand moves toward his sidearm. Old habits. "Executive order 12204. We can requisition digital assets."

"From where? My brain?"

"We have methods."

"You have nothing. Empty plates. Empty promises. Empty threats from empty men."

"Sit down," Ramirez says quietly. The last queen of a broken kingdom. "Please."

Marcus remains standing. Ten feet tall in a room full of shadows.

"Half a coin," he says. Each word measured. Weighed. "For the kids. Not for you. Not for your militia. For the kids dying of thirst in your streets."

"Half?" Chen's voice breaks completely. "We need all ten."

"You need time travel. You need your ten thousand coins back. You need leaders who understood value before it was too late."

"That's not fair," Williams whispers.

"Fair?" Marcus almost laughs. The sound would shatter glass if there was any left unbroken. "You invited me to lunch with no food. You talk about honoring my parents with no money. You make threats with no power. Tell me about fair."

Ramirez closes her laptop. The performance over. The curtain fallen. The truth naked between them like a wound.

"Half a coin," she says. "We accept."

Marcus pulls out his phone. The transfer screen glows like salvation. His fingers pause over buttons that control the future.

"This is the last time. Don't contact me again."

"Understood."

He sends it. Half a Bitcoin disappearing into the void of their incompetence. Ten percent of his wealth. For children he'll never meet in a state that can't save itself.

The transaction confirms. Somewhere, servers hum. The blockchain grows. The future loads one block at a time.

Marcus walks to the door. Each step an epoch. Stops. Turns back to them. Their empty plates. Their empty treasury. Their empty souls.

"What if we fail?" Ramirez asks. The last question of the dying.

"You already did."

He opens the door. Steps through. Closes it behind him with the finality of extinction.

In the dining room, they sit with their empty plates and their single Bitcoin and the weight of what comes next. Outside, through windows that still gleam with borrowed light, California burns on. The sovereign individual has made his choice. The state has made theirs.

The future already loading. One block at a time.

-

@ a53364ff:e6ba5513

2025-06-18 18:22:54

@ a53364ff:e6ba5513

2025-06-18 18:22:54Run Knots…

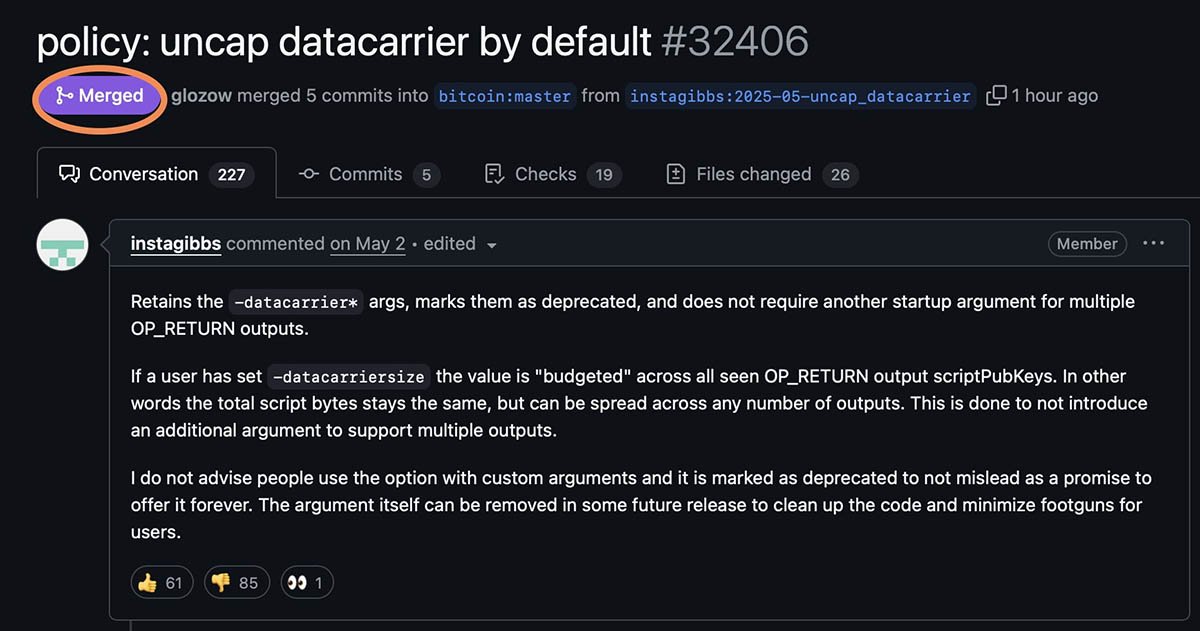

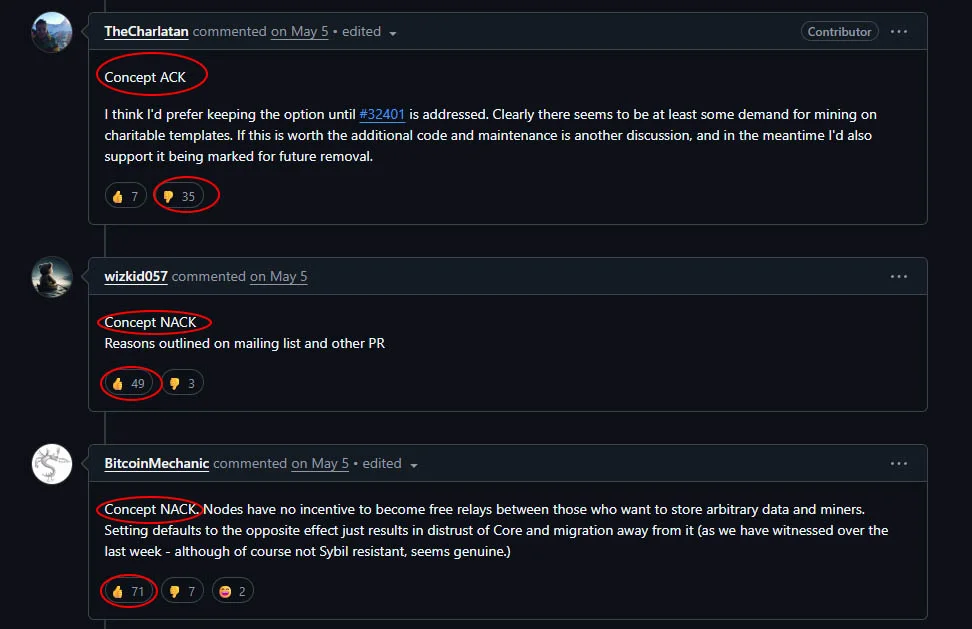

Knots helps you exercise your self sovereignty verification muscle, instead of conforming to the TrustMeBro defaults of core. Thus, you are more prepared to actively defend Bitcoin in case of hardfork-softfork or other shenanigan’s.

Knots is more feature rich and useful than core, allowing end users to finely tune their nodes mempool policy to reject spam transactions from their own mempools, through such bitcoin.conf settings as: rejectparasites=1 , datacarrier=0, permitbaremultisig=0

Running a Underdog Bitcoin Client makes the Bitcoin network more robust as a whole. Supporting an ecosystem of multiple compatible clients running in tandem. Running knots makes Bitcoin, the network more robust, and makes the bitcoin development ecosystem richer. Knots is a backup-option in case core becomes obviously compromised. For decentralization, do we really want only a single implementation, with all our eggs in one basket with just bitcoin core? No.

Knots makes it so that you’re not using your node’s computing resources to hold and process spam shitcoin transactions and you have better control over what transactions you prioritize processing.” — Thus you can save your mempool resources from being abused by bad actors with Knots, but not with core, unfortunately. Core doesn’t believe in giving their end users too much choice. This has long been their attitude: to dictate down and deny non-consensus violating choice to end users.

Thus running Knots is a counter movement to the unfortunate attitude in core that has willfully neglected a core subset of it’s users who care about spam filters. Running Knots is not just a technical improvement in running Bitcoin. It’s a political statement in the Bitcoin development ecosystem.

-

@ b7274d28:c99628cb

2025-06-18 18:21:04

@ b7274d28:c99628cb

2025-06-18 18:21:04Tired of dealing with spam? You're not alone. Here is a guide to picking relays that are good at keeping spam out, without sacrificing your own reach.

If you just want to skip to the relay suggestions, scroll to the sections titled "The Setup." There is one for users of Haven and one for those who aren't running their own relay at all.

Client Selection

"Wait, I thought this was a guide about selecting relays, not clients."

Yes, it is. But what relays you choose doesn't matter if you are using a client that does not read from your chosen relays, or that hard-codes problematic relays as fallbacks in addition to the relays you selected in an effort to "help you."

Additionally, some clients have settings that can help make up for poor relay selection using client-side spam mitigation methods. This includes clients like Coracle, Damus, Amethyst, and Nostur. Some may do so via web-of-trust (WoT) filters, so you only see notes and replies from those within your broader social circle, while others will automatically hide notes that those you follow have reported as spam or scams.

Coracle is a great client for dealing with spam, so long as you have gone into your "Content Settings" and set the "Minimum WoT Score" to at least 1. This means you will only see posts from users followed by at least one of the npubs you follow.

Damus also employs WoT, but it appears to be just for notifications, so you only receive notifications for those you follow and those they follow, or "friends of friends," as Damus put's it. This can be accessed by toggling it on in your notification tab at the top right, where you see the icon of the person with a check mark.

Nostur has WoT filters for downloading media turned on by default and also uses WoT to filter spam by default. Even better, if you use multiple npubs, you can filter using the WoT of your main npub, while logged into your alternate npubs.

Jumble recently added WoT filtering specifically for interactions. When you load a thread in Jumble, a shield icon will appear near the top right of the page, in line with the tabs for Replies and Quotes. Toggle it on, so the shield is green with a check mark and you will only see replies from those you follow and those your follows follow.

Amethyst does not yet have WoT based filtering built into the client, but it can hide notes that have been reported as spam, scams, impersonation, etc, by those you follow. This is not the most effective way to combat spam, though, since most users aren't often using the report feature. Hopefully we will see WoT filtering as an option in a future update.

Primal's apps do not read from any of your selected relays, but rather from their caching server alone. That said, they have a spam filter that is turned on by default so you see relatively little spam, regardless of which relays you use.

For this guide, I recommend using Amethyst for updating your relays, if you possibly can. The reason for this is because Amethyst has the most robust settings for being able to update all of your various relay lists.

Relay Lists Explained

Contrary to what you might think, there is not a single relay list for each user that is stored in a single note, because you can have relays that are used for only one purpose, and not for any other. Each of those purposes for which you might use a particular relay has its own list. That way a Nostr client can tell which relays you want to use for each separate purpose.

While this can make things less approachable for the user, it also means users don't have to rely on clients to hard code appropriate relays for each of these use-cases. If your client doesn't let you edit each of these relay lists, chances are they are using a set of relays for that purpose that the developer chose instead of you.

Public Outbox/Inbox Relays

This list of relays is found in your kind 10002 note, if you have one. If you don't have one, there won't be any relays shown for these categories in Amethyst. Other clients may fallback to showing you relays from a different list.

This list is intended to be used for Nostr clients to implement the "outbox model" to fetch notes from whatever relays they were written to, even if they aren't in the requesting user's relay list. This solves the issue of needing to share relays with those you follow in order to see their notes, allowing Nostr to remain decentralized.

Your "outbox" relays are the ones you write to, or at least the ones you want other users to know that you write to. When you add a relay here, it's like advertising to everyone, "If you want to see my public-facing notes, look for them on these relays."

Your "inbox" relays are the ones you read from. On this part of your list you are advertising, "If you want me to see your replies, comments, reactions, and zaps, then send them to these relays." These relays are massively important for reducing the amount of spam you see. If you have relays listed here that anyone can post to for free, you will almost certainly see a lot of spam in your replies, unless you have WoT filters turned on in your Nostr client.

DM Inbox Relays

This list is found in your kind 10050 note, if you have one, and is a list of relays where you want others to send you Direct Messages. Ideally, you will use a relay or two here that supports AUTH, so that it will only allow direct messages to be retrieved by the user they are addressed to.

What happens if you put a relay in here that doesn't support AUTH, so it allows anyone to retrieve your DMs? Not much. Anyone who wants to will just be able to see the encrypted content of the message, and depending on the type of DM they will see the identity of the receiver and perhaps also the sender. They will not be able to decrypt what was actually said in the messages. It's better if they cannot retrieve even that much, though.

Private Relays

This list is found in your 10013 note, if you have one. This is intended for listing a relay that you run yourself and that only you can access, as it will house notes that other users should not be able to see at all, such as eCash tokens and draft notes.

Search Relays

This list is found in your 10007 note, if you have one, and is used to search for notes or users who may not be using the same relays as you. It is good to use relays here that aggregate notes from other relays automatically, and which support NIP-50 for search capability.

Local Relays

This section is for any relays running on the local device, such as Citrine. Because the relays themselves are local, this list is local, as well, and is not saved to any note kind that is saved to your relays like the above lists.

General Relays

This list is found in the "content" tag of your kind 3 note, which is also where all of the npubs you follow are stored. As such, this note is commonly known as your follow list, rather than as a relay list. However, some clients, such as Amethyst, do make use of this list, and others use it as a fallback if they can't find a kind 10002.

If you are an Amethyst user most of the time, then I would recommend using this list to fill in any gaps that you may have from only writing to a few outbox relays, or only reading from a few inbox relays. It's a good place to put an aggregator relay, for instance, so long as that relay has good spam filtering, or a blastr relay, so those who don't yet use a client that supports the outbox model will still likely see your notes.

If you do not generally use Amethyst, then I would recommend you mirror your public inbox/outbox relays here, in case you use a client that cannot find your 10002 list. Relays that are only for outbox should be added as write only, those only for inbox should be added as read only, and those you use for both outbox and inbox should be both read and write.

The Setup (Haven Users)

If you are running your own set of Haven relays, here is the setup I would recommend:

Public Outbox (kind 10002)

Maximum of 4 relays.

- Your Haven outbox relay (Remember to add some public relays to your blastr)

- A paid relay of your choice (List available in "Paid Relays" section)

- A public relay, such as relay.damus.io, relay.primal.net, or nos.lol

Public Inbox (kind 10002)

Maximum of 4 relays.

- Your Haven inbox relay: [RelayAddress]/inbox

- A paid relay of your choice (can be same as outbox)

- A WoT relay of your choice (available in "WoT Relays" section)

- Optional additional WoT relay

DM Inbox

Maximum of 3 relays.

- Your Haven "chat" relay: [RelayAddress]/chat

- An alternate AUTH relay, such as inbox.nostr.wine(paid), nostr.land(paid), or auth.nostr1.com(free).

Private Relays

Maximum of 3 relays.

- Your Haven private relay: [RelayAddress]/private

Search Relays

Maximum of 4 relays.

- wss://nostr.wine (even if you don't pay to write to it)

- wss://relay.nostr.band

- wss://relay.noswhere.com

- wss://search.nos.today

Local Relays

- Your Citrine IP:Port, if you run Citrine.

General Relays

Assuming you use Amethyst on a regular basis, I recommend the following:

- A couple additional WoT relays set to read only.

- An aggregator relay that has good spam filtering, such as wss://aggr.nostr.land(payment required) and/or wss://nostr.wine(paid for write, but can read for free).

The Setup (Not Running Haven)

If you are not running your own set of Haven relays, I would highly recommend you learn how and do so. However, if you decide against it, here is a setup that should suffice:

Public Outbox (kind 10002)

Maximum of 4 relays.

- A paid relay of your choice (List available in "Paid Relays" section)

- A large public relay, such as relay.damus.io, relay.primal.net, or nos.lol

- An additional public relay, but a smaller one, or one-time-payment paid relay.

Public Inbox (kind 10002)

Maximum of 4 relays.

- A paid relay of your choice (can be same as outbox)

- wss://nostr.wine - Even if you don't pay for it, you can read from it.

- A WoT relay of your choice (available in "WoT Relays" section)

- Optional additional WoT relay

DM Inbox

Maximum of 3 relays.

- A paid AUTH relay, such as inbox.nostr.wine or nostr.land.

- An alternate AUTH relay, such as auth.nostr1.com(free).

Private Relays

Maximum of 3 relays.

- A private relay you run on your Umbrel or Start9, or that is hosted for you on relay.tools.

Search Relays

Maximum of 4 relays.

- wss://nostr.wine (even if you don't pay to write to it)

- wss://relay.nostr.band

- wss://relay.noswhere.com

- wss://search.nos.today

Local Relays

- Your Citrine IP:Port, if you run Citrine.

General Relays

Assuming you use Amethyst on a regular basis, I recommend the following:

- A couple additional WoT relays set to read only.

- An aggregator relay that has good spam filtering, such as wss://aggr.nostr.land(payment required).

- A blastr relay, such as filter.nostr.wine(paid), or...

- A few additional public relays set to write only.

Paid Relays

There are a ton of other paid relays out there that can be found via nostr.watch. The above listed options are simply the most popular with the largest feature-sets.

WoT Relays

These relays will only accept notes from npubs that are within the relay owner's WoT. I have provided a Jumble.social address for each relay so you can peruse the feed for yourself to see if you want to use it.

- wss://wot.utxo.one - Jumble Feed

- wss://nostrelites.org - Jumble Feed

- wss://wot.nostr.party - Jumble Feed

- wss://wot.sovbit.host - Jumble Feed

- wss://wot.girino.org - Jumble Feed

- wss://relay.lnau.net - Jumble Feed

- wss://wot.siamstr.com - Jumble Feed

- wss://relay.lexingtonbitcoin.org - Jumble Feed

- wss://wot.azzamo.net - Jumble Feed

- wss://wot.swarmstr.com - Jumble Feed

- wss://zap.watch - Jumble Feed

- wss://satsage.xyz - Jumble Feed

- wss://wons.calva.dev - Jumble Feed

- wss://wot.zacoos.com - Jumble Feed

- wss://wot.shaving.kiwi - Jumble Feed

- wss://wot.tealeaf.dev - Jumble Feed

- wss://wot.nostr.net - Jumble Feed

- wss://relay.goodmorningbitcoin.com - Jumble Feed

- wss://wot.sudocarlos.com - Jumble Feed

-

@ 8bad92c3:ca714aa5

2025-06-18 18:01:54

@ 8bad92c3:ca714aa5

2025-06-18 18:01:54Key Takeaways

In this episode, host Marty speaks with Ken, a former CIA deputy chief and now head of government affairs at the Bitcoin Policy Institute, about Bitcoin’s growing relevance in U.S. national security and policy circles. Ken traces his Bitcoin journey from professional curiosity within the CIA, studying adversarial use cases like the Lazarus Group, to personal conviction following events like the Canadian trucker protests, which exposed the dangers of financial censorship. Contrary to popular belief, he reveals that many in the intelligence community support Bitcoin for its alignment with American values such as sovereignty and freedom. The conversation highlights a major cultural shift in Washington, where policymakers now view Bitcoin as a strategic asset rather than a criminal tool. Ken stresses that the future hinges on whether Bitcoin shapes institutions or is co-opted by them, and that political engagement is crucial to ensure the former. He argues Bitcoin can help solve systemic problems from fiscal irresponsibility to geopolitical instability, but only if the industry continues to organize, advocate, and embed its values into national policy.

Best Quotes

"Either institutions are going to win, or Bitcoin is going to win."

"Bitcoin naturally washes out leverage… it's what makes Bitcoin antifragile."

"The CIA didn’t create Bitcoin, but they sure are paying attention now."

"We were all Satoshi."

"Let’s not test the resistance-money thesis in the United States."

"Bitcoin strengthens U.S. values, freedom, private property, sovereignty."

"Bitcoin is political, but it doesn't have to be partisan."

"If you're in a federal agency, the only incentive is to spend more. Bitcoin changes that."

"Don't underestimate your voice. If you keep the phones ringing, they listen."

Conclusion

This episode offers a rare glimpse into how Bitcoin is increasingly viewed as a serious strategic asset within the U.S. intelligence and policy communities. Ken, with his high-level government background and current role in Bitcoin advocacy, underscores the shift from skepticism to engagement among policymakers. His message is clear: Bitcoiners are no longer outsiders, they have a seat at the table, and with sustained political action and education, they can shape the future of Bitcoin policy. The time to engage is now, because the battle for Bitcoin’s role in society is already in motion.

Timestamps

0:00 - Intro

0:26 - Ken's background

6:58 - Tornado/Samourai, surveillance state

11:53 - Reestablishing trust

14:23 - Bitkey

15:18 - CIA bitcoin theory

18:42 - Neutral reserve asset

23:52 - Unchained

24:20 - BPI

29:49 - CLARITY and Secret Service message

33:54 - Withstanding a change in administration

40:03 - Institutions win or bitcoin wins

46:43 - Shrinking gov with bitcoin

57:47 - BPI summitTranscript

00:00:00 compared to China or Russia, do we have a comparable advantage in gold? How do we compete with China? And this is what the kinds of things CI will think about. Bitcoin is a natural option. At the end of the day, Bitcoin undermines the authority of the Chinese Communist Party. Either institutions are going to win or Bitcoin is going to win. But we do fundamentally on some level need institutions to make the country run. We want those institutions to be properly incentivized. In 10 years, Bitcoin is

00:00:19 either at a million dollars or is zero dollars. Ken, it's great to have you on the show. Thank you for joining me. Marty, finally. We've been we've been kicking us around for a few weeks. I'm glad we uh glad we were finally able to make it work. As I was telling you, in the middle of a move, conference in the middle of that move. It's been a hectic week, so I think I'm finally settling in. As you can see, no bookshelf, but we have stacked books behind me. Hopefully, they will be on on shelves soon.

00:00:52 No, there there are definitely ways there are ways in the world to get you know to get credits on um you know uh what do you call it? Um uh we're good Catholics, you know, when you when you pass and don't go to heaven. Um come on. Thank you. Well, moving is purgatory credit. So, I've done it many times in my life. So, I uh I feel for you. Well, thank you. But I'm really excited for this conversation and likewise the event in a few weeks, the BPI event down in DC, the summit, we met about a month ago, two months ago now at

00:01:26 this point in Austin during the takeover. And Zach was very eager to introduce you to me considering the the history of the show, topics we covered. And I think I'm excited for this cuz I'm infinitely curious to learn how somebody with your pedigree and your resume got into Bitcoin is now working for the Bitcoin Policy Institute as a director of government affairs. So for anybody listening who was unaware of Ken's resume, he did 20 years in government culminating as deputy chief of operations at the CIA Center for Cyber

00:02:01 Intelligence. uh you've worked overseas for the US State Department and now you're advocating on behalf of Bitcoin on Capitol Hill. So, how does somebody with that resume go from statecraft to cipher punk sort of ideas? Yeah. No, so I um like everybody else, I uh I um my my Bitcoin journey is a little bit everybody everybody has a unique journey, right? Um mine actually started at CIA, believe it or not. And it was for purely professional reasons. I um so I was an operations officer. I spent most of my career overseas um as

00:02:37 most of us do. Um but my last two years, my last two turn tours at CIA, I was at the center for cyber intelligence, which is CIA's cyber unit. Um and my first job there, I was group ch I was a operations chief for a group that worked on cyber threat issues. And this was in 2018. So you remember this was when Lazarus group the North Koreans figured out that stealing crypto was a lot easier than like you know trying to rob banks. Um this is when ransomware broke out as a serious problem just preceded you may

00:03:04 remember the Colonial Pipeline hack that shut down you know gasoline shipments to the east coast. So in 2018 um and it's kind of funny like I this is people say did the CIA create Bitcoin. I can tell you in 2018 when policy makers first had to confront its use by actors as an issue like nobody was ready for it. Like if they created it, it was tucked away and hidden in the basement cuz the the bench for people with crypto knowledge in general, digital assets, certainly Bitcoin was really really really shallow. Um I remember we had two

00:03:33 guys um who kind of had background in it and then you they became superstars because all of a sudden we were calling upon them to teach us about Bitcoin and digital assets in general. Um, but yeah, that's so I learned and like everything else, I learned about it because I had to because people we cared people we cared about were using it. Um, but like everything else there there was sort of a mind virus to it. Um, and I I admit, you know, I during co I was in the uh I was in the altcoin casino. I was defying

00:04:00 and memecoining and it was it was fun, you know. No, I I I don't hold any hate for the uh for the alcoiners. People do what they want with their money. Um but I you know that that was when it was during co um I had been sort of buying in 2018 but during co when I really started learning because this is what everybody learned right um and I you know for me Bitcoin was immediately attracted me to it and I was sort of inspired by um I mean the co Kenny trucker protest was something really important to me um I saw how it was

00:04:29 being used um but also sort of in my day job you know I I had a pretty good understanding of how the government uses financial financial tools as a weapon. Um, freezing bank accounts, OFAC sanctions, that kind of thing. And if you're on the, you know, on the giving end of that, that's great. Those are great tools to have if you're the government. Uh, not so great if you're on the other end of it. And, you know, watching these Canadian truckers the first time, you know, you'll be able to, it's very easy

00:04:54 to say, "Yeah, sanction the Iranian, sanction North Korea, whatever." You know, I'm not Iranian. Um but when you see all of a sudden Kat and Trucker people you had some sympathy with being targets of financial you know weaposition of the financial system it you know it struck it struck a it struck a nerve like a really really profound stinging shot to my consciousness my conscious about this issue. Um so for me for the first thing about Bitcoin was um was permissionless transactions that that's that's what got me into it. Um

00:05:23 then of course you go from there and by the time I left the government 2022 I had I was f I was you know full boore I was you know attending meetups and um that's when I started doing some advocacy stuff on Capitol Hill and and and messing around with uh David and Granny PPI doing some advocacy stuff but yeah but it it comes from my time at CIA and yeah I think the um the uh I think what might surprise some people is there are a lot of Bitcoiners um not just at CIA but across the whole national

00:05:52 security establishment And I think they're into it for the same reason that you know that everybody most of your listeners are right like it's you see what's happening in the world. You see the challenges we're facing. You see how governments use financial tools to weaponize them against opposition. You know it's it's very natural that if you have that kind of insight that you look for things to protect yourself and Bitcoin is obvious. So I I I tell a funny story when I um when I was first into it there was um cubicle one of the

00:06:17 guys and he had a bumper

-

@ 9ca447d2:fbf5a36d

2025-06-18 18:01:34

@ 9ca447d2:fbf5a36d

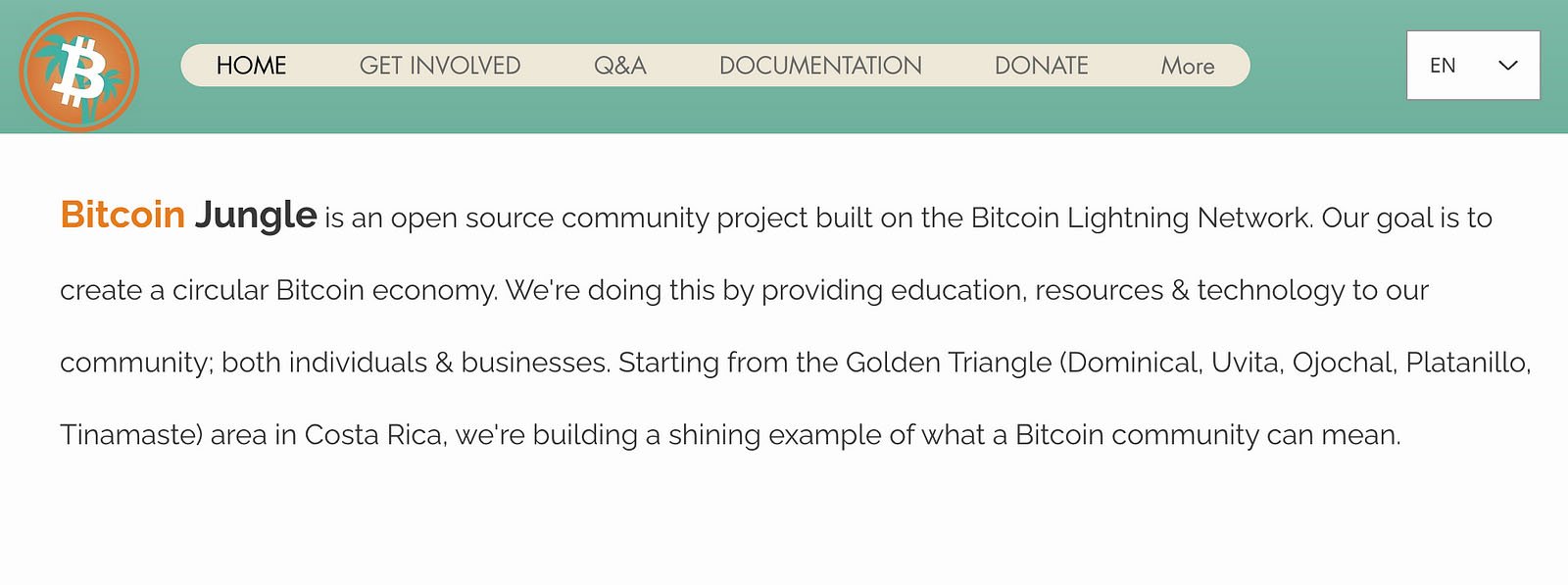

2025-06-18 18:01:34When Richard Scotford moved to Costa Rica in 2018, he had no idea he would become a key figure in a thriving Bitcoin economy.

A longtime Bitcoin holder who initially saw it through the lens of speculation, Scotford’s journey led him to embrace Bitcoin’s deeper purpose and spearhead Bitcoin Jungle — a grassroots movement bringing real-world Bitcoin adoption to Costa Rica.

Bitcoin circular economies create holistic value for Bitcoiners

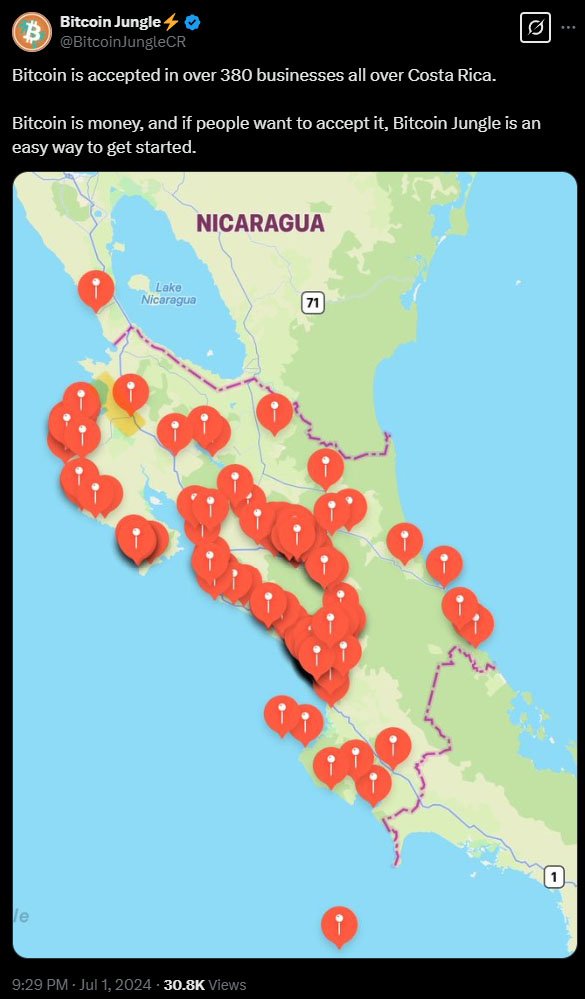

Bitcoin Jungle is inspired by Bitcoin Beach in El Salvador but uniquely adapted to Costa Rica’s economic landscape. Unlike El Salvador, where Bitcoin was positioned as a tool for financial inclusion, Costa Rica already has a fairly stable banking system.

The real issue? The friction of moving money. Expats, business owners, and tourists struggle with high fees, banking red tape, and slow transactions. Bitcoin helped solve a lot of these problems.

The Birth of Bitcoin Jungle

Scotford and his team launched Bitcoin Jungle in late 2021 with a simple goal: get bitcoin into people’s hands and make it usable. However, there was one challenge — he had no technical background.

Determined to create a circular bitcoin economy, Scotford networked aggressively. He attended the first Adopting Bitcoin conference in El Salvador, approaching strangers with his vision:

“I was just walking around trying to find people who could help me make this economy, going up to random people saying ‘Hey, what can you do? We’re trying to make a circular economy in Costa Rica, can you help us?’ They all thought I was crazy.”

The breakthrough came when he turned to Bitcoin Twitter. Nicolas Burtey from Galoy encouraged him to create a wallet, and developer Lee Salminen forked the Bitcoin Beach wallet for their project.

“Within two weeks of Adopting Bitcoin, Lee forked the Galoy Bitcoin Beach wallet, which took Galoy by surprise. Even though they made their wallet to be forked if necessary, I don’t think they were expecting people to do it so fast and, I’d like to say, so well. They were like, ‘Okay, cool, who are these guys doing this?’”

Finally Bitcoin Jungle had its own working wallet, surprising even the Galoy team with the speed of execution.

Grassroots Adoption: One Vendor at a Time

How do you build a bitcoin economy from scratch? Scotford’s answer was simple: start at the farmers’ markets.

“We were like, okay, we’re going to get all the bespoke niche market sellers who are in this area. We have all these beautiful farmers markets, and we decided to approach these people first,” Scotford explained.

His team took a strategic approach, targeting market gatekeepers first.

“If you want to talk to every individual person, it’s really difficult. But if you can talk to the person who is the owner of the market, and then they can introduce you to their market stores, you’re already halfway there.”

Going stall by stall, they pitched Bitcoin’s advantages — no bank fees and better payment options. But adoption didn’t happen overnight, so Bitcoin Jungle initially offered a safety net — vendors could cash out at the end of the day.

“We would say to the vendors, ‘Look, accept bitcoin, and at the end of the day, if you don’t want to keep the bitcoin, we’ll buy it off you,’” Scotford recalled.

“When we first started, maybe 30–40% of the vendors were cashing up every day or at the weekends. Lee would be walking around with big fistfuls of money, cashing out vendors.”

But over time, something shifted — they started keeping their bitcoin.

“Eventually, the vendors started to learn themselves that, ‘Oh, actually it’s better to keep it.’ They would then pay for their tables in the markets using bitcoin. They thought, ‘Well, I don’t want to keep this bitcoin, I don’t really know what to do with it, but I can pay for my table.’ So there, the circular economy starts to happen.”

Today, Bitcoin Jungle runs with minimal intervention, and Scotford takes pride in their reliability.

“When you come here to Costa Rica, what we really pride ourselves on is that if someone says they accept bitcoin, 99% of the time, they will. And if they’re part of Bitcoin Jungle, they will 100% accept bitcoin and you will have a fluid experience with it.”

By mid-summer 2024 over 380 locations in Costa Rica accepted bitcoin

The Bitcoin Jungle Wallet and Real Usage

Bitcoin Jungle is an open-source community project built on the Bitcoin Lightning Network.

Acting as a community bank, the project processes a large number of transactions daily. To encourage proper security practices, Scotford’s team alerts their peers, reminding users to move their bitcoin to cold storage.

“If you’ve got too much bitcoin on your wallet, we send you a message telling you to move it to cold storage,” he explained. For larger businesses, they even offer hands-on assistance to secure funds properly.

Unlike the HODL-only philosophy that many Bitcoiners advocate, Bitcoin Jungle encourages spending.

“Michael Saylor says don’t spend your bitcoin. We say the opposite,” Scotford laughed. “We’re the antithesis of that. You need to spend it.”

Bitcoin Jungle’s Unique Approach to Costa Rica

Bitcoin Jungle isn’t just another Bitcoin adoption effort; it’s tailored to Costa Rica’s economy. The wallet operates in Costa Rican colónes, making transactions feel familiar to residents while ensuring tourists and expats can still interact easily.

The team has also introduced low-fee bitcoin ATMs, point-of-sale integrations, and partnerships that allow users to pay in bitcoin while the recipient receives local currency.

A major breakthrough came when Francis Pouliot from Bull Bitcoin joined forces with Bitcoin Jungle, bringing his expertise in banking infrastructure to the project.

This collaboration enabled seamless bitcoin payments that integrate directly with Costa Rica’s financial system, allowing users to pay anyone, even businesses that don’t directly accept bitcoin, while the recipient receives funds in colónes or dollars.

“I can go to a hardware store, order steel for my new basketball court, pay in bitcoin, and the store gets dollars,” Scotford said. “For a non-tech guy like me, it’s magical.”

Why Aren’t There More Bitcoin Jungles?

Scotford sees an opportunity for more localized bitcoin economies.

“There should be a Bitcoin Harbor, a Bitcoin Mountain, a Bitcoin Driveway,” he joked. “But instead of waiting for permission or corporate funding, people need to take action themselves.”

He emphasizes that building a circular bitcoin economy doesn’t require deep pockets. “I probably gave away $600 worth of bitcoin when we started — just $3 here, $4 there — to get people using it.”

The Future of Bitcoin Jungle

Bitcoin Jungle continues to grow, recently hosting events like the Bitcoin Freedom Festival and integrating bitcoin into community projects, including a school where tuition can be paid in bitcoin.

“The institutions have come in, but the grassroots projects haven’t caught up,” Scotford observed. “It’s time for people to stop sitting on their hands and start building.”

Bitcoin is permissionless, no one has to wait for approval to start using it. Bitcoin Jungle proves that with vision and persistence, anyone can build a thriving Bitcoin economy, one market stall at a time.

Get the latest from Bitcoin Jungle: follow them on X

-

@ b1ddb4d7:471244e7

2025-06-18 18:01:14

@ b1ddb4d7:471244e7

2025-06-18 18:01:14The Present Ecosystem It Is Not Just Calls

The role of telecommunications carriers has long since evolved beyond that of simple call connectors. Currently, they serve as actual digital centers that penetrate practically every facet of our interconnected lives. With more than 5.7 billion mobile service subscribers and 4.7 billion mobile internet users worldwide (roughly 58% of the global population), telecommunications are the foundation of the digital economy. It is anticipated that by 2030, this figure will rise to an astounding 5.5 billion mobile internet users, or 64% of the world’s population.

A variety of connectivity options are available in the current telecommunications ecosystem, ranging from home fiber optics to 5th generation of mobile networks, which is expected to be adopted globally by 57% by 2030, creating roughly 5.3 billion connections. Collaborations with streaming services that provide on-demand entertainment.

Current Telecom Ecosystem

From fiber optics to 5G technology, telecommunications companies have focused on diversifying global connectivity. By 2030, they are expected to reach 57% global adoption, resulting in around 5.3 billion connections.

There are partnerships with streaming platforms that have transformed carriers into true content gateways. This has helped the explosive growth of data traffic, which reached the mark of 26.53 exabytes per month in 2018.

These companies are offering some personalized business services, such as IoT, security and cloud solutions.

Furthermore, many carriers already provide basic financial services like mobile payments and device financing. This last one is the perfect starting point for a further revolution: the integration of Bitcoin into the telecom ecosystem.

Telecommunications and Bitcoin: A Perfect Match

Carriers’ use of Bitcoin is a radical rethinking of the business-customer relationship, not merely a new mode of payment. Here is how this new ecosystem could work:

-

Customer Experience and Infrastructure – Before implementing Bitcoin, an carrier must build the necessary infrastructure. This entails creating mechanisms that may not only receive cryptocurrency payments but alsoIf companies want to lessen their exposure to volatility, they can automatically convert Bitcoin to fiat money. Companies can also easily integrate with current invoicing systems and provide a more straightforward user experience.

Imagine launching the app for your carrier, scanning a QR code, and having your bill paid or your monthly plan renewed in a matter of seconds. Without waiting for business days, without banking middlemen, and without exorbitant costs.

-

Bringing in New Segments – In addition to making life easier for current clients, Bitcoin’s acceptance draws in entirely new demographics:

Those that appreciate innovation and wish to back trailblazing businesses are known as technology enthusiasts.

Advocates for privacy: Customers who favor transactions that need less personal information to be shared

Global clientele are tourists from other countries who can pay for services without worrying about regional restrictions or exchange rates.Carrier might develop targeted marketing, such as “early access to new devices for customers who use cryptocurrencies” or “10% discount on data top-ups when paid with Bitcoin,” to attract these demographics.

Ongoing Innovation: What Will Happen After Bitcoin?

When businesses embrace Bitcoin and fully utilize blockchain technology, the real revolution will take place. This strategy creates opportunities for developments like:

- Creative Smart Contracts – Smart contracts are self-executing, blockchain-based programs that eliminate middlemen and automate processes. This could be interpreted by carriers as:

- Instant service activation – Your Bitcoin payment has been validated and your international data package is activated automatically even before you land at the airport.Contracts that automatically expire at the designated time eliminate the need for a constant call to the call center.

- Simplified termination – Mini-smart contracts enable family members to automatically transfer excess mobile data.

This was recently illustrated by the Japanese carrier Rakuten Mobile, which unveiled a system that enables users to temporarily increase their bandwidth through smart contracts for a few hours (for instance, to broadcast live events) without modifying their primary plan.

- Creative Partnerships in the World Ecosystem – The carriers are able to establish strategic alliances with:

- Fintech companies that specialize in bitcoin to create integrated digital wallets.

- Startups creating telecom-specific decentralized applications (DApps).

- Academic institutions will investigate novel applications of blockchain technology in the telecommunications sector.

Given that the market is dominated by industry titans like China Mobile (794 million subscribers in 2023), Verizon (US$ 133.97 billion in 2023), and AT&T (US$ 161.5 billion in revenue in 2022), these partnerships have the potential to accelerate disruptive innovations that benefit the entire telecommunications ecosystem.

Reimagining the Customer Relationship with New Business Models

The incorporation of Bitcoin enables the investigation of business ideas that were before unfeasible:

- Microtransactions: Only Paying for the Things You Use – Processing fees in the traditional financial system make it impossible to charge tiny sums. This issue is resolved by Bitcoin, particularly via the Lightning Network, which permits:

- Payment per call second (think of paying R$0.001 per second for just the actual usage)

- – Acquiring small data packages (e.g., 500MB for a single movie)

- – Immediate access to high-quality WiFi networks at cafes or airports, with just the time spent connecting being charged,

The startup Althea Network, which enables communities to establish their own internet networks where users automatically pay for each byte consumed, is already testing this idea. The trend of increasing video traffic, which currently makes up 70% of all mobile data traffic and is predicted to reach 80% by 2028, is well aligned with this strategy.

- Loyalty Initiatives on the Blockchain: Conventional point systems have little transparency and are hard to use. A method based on blockchain can:

Make loyalty tokens that are equivalent to actual digital money.

Permit customer exchanges (you can trade or sell points you won’t use).

Form more extensive alliances wherein other businesses accept the carrier tokens.A system where users earn blockchain-based “T-points” tokens that can be turned into modest amounts of Bitcoin or swapped for other services is already being tested by South Korean carrier SK Telecom. In South Korea, one of the top markets for the adoption of 5G worldwide, this kind of innovation is especially pertinent.

Obstacles and Realistic Implementation Considerations

Despite the vast potential, there are important issues that must be resolved:

- Evolutionary Regulation – Countries’ cryptocurrency regulations differ greatly from one another and are always evolving. Carriers will require:

- Maintain specialized teams to keep an eye on regulatory developments, work with authorities to help create reasonable regulations, and create adaptable systems that can evolve to meet new needs.

- This strategy is crucial in light of the fact that the telecom industry is already dealing with a lot of regulatory pressure in different jurisdictions, as demonstrated by the Canadian government’s recent initiatives to encourage more access to MVNOs (mobile virtual network carriers) in 2023.

- Please read this to undertand how Governors don’t do anything to help you.

- Financial Management and Volatility – One difficulty is the volatility of Bitcoin pricing. In order to reduce hazards, carriers can:

- Convert a portion of payments into fiat money automatically.

Employ hedge services to guard against sharp swings.

Provide dynamic prices that change based on the state of the market. - Given that international carriers oversee yearly earnings in the hundreds of billions of dollars, these tactics are particularly pertinent.

- Convert a portion of payments into fiat money automatically.

- Education of Consumers – Many customers are still confused about cryptocurrencies. Strategies that work include:

- The carrier app’s simplified instructional

- Committed assistance for Bitcoin transactions

- Rewards for initial cryptocurrency purchases

With more than 5.7 billion mobile consumers worldwide, this educational initiative has the potential to significantly accelerate the widespread acceptance of cryptocurrencies.

Now is the time for deep digital transformation

Telecommunications companies that incorporate blockchain and Bitcoin into their ecosystem are doing more than simply introducing a new payment method; they are putting themselves at the vanguard of a significant digital revolution that will keep up with the industry’s explosive growth, which is expected to reach US$ 1.3 trillion globally by 2028.

The ability to innovate services, draw in creative clients, and open up new markets will be available to those that welcome this shift, which the conventional model would not allow. In order to prepare the infrastructure for this revolution, more than 300 commercial 5G networks will be operational globally beginning in 2024, marking the beginning of this shift.

As customers, we may anticipate more individualized, open, and effective services. Our civilization is progressing toward a telecommunications infrastructure that is fully suited to the digital era and capable of handling the enormous amount of data traffic

-

-

@ cae03c48:2a7d6671

2025-06-18 18:00:52

@ cae03c48:2a7d6671

2025-06-18 18:00:52Bitcoin Magazine

Prenetics Becomes First Healthcare Firm to Launch Bitcoin Treasury Strategy With $20M BTC PurchasePrenetics Global Limited, a health sciences company, announced today that it has purchased $20 million worth of Bitcoin as part of a newly approved corporate treasury strategy. The company acquired 187.42 BTC at an average price of $106,712 and stated that its board has approved allocating the majority of its $117 million balance sheet to Bitcoin.

This follows the company’s strategic transfer of ownership of ACT Genomics, which increased its pro-forma cash to approximately $66 million and total liquid assets, including BTC and short-term holdings, to around $117 million.

According to a press release sent to Bitcoin Magazine, Danny Yeung, CEO of Prenetics stated, “With our strengthened balance sheet of $117 million in cash, BTC and short-term assets, we now have the financial foundation to pioneer innovative treasury management approaches, including our historic Bitcoin treasury strategy.”

Prenetics also announced the appointment of Andy Cheung, former COO of cryptocurrency exchange OKEx, to its Board of Directors. Cheung noted that the company’s Bitcoin strategy will include active treasury management, using tools such as derivatives and structured products.

“This isn’t about passive Bitcoin storage,” said Cheung. “We’re talking about dynamic treasury management using derivatives, yield strategies, and institutional-grade trading techniques.”

Prenetics plans to expand its Bitcoin holdings through institutional capital partnerships and to implement advanced return strategies. It also plans to accept Bitcoin payments across its direct to consumer platforms, including IM8 Health and CircleDNA.

In addition to Cheung, the company is working with two industry advisors, Tracy Hoyos Lopez, Chief of Staff at Kraken and a board member at the Bitcoin Advocacy Project, and Raphael Strauch, founder of crypto conference TOKEN2049.

“This is not a short-term play or market timing decision,” said Yeung. “We are implementing a comprehensive, long-term Bitcoin strategy that we believe will fundamentally transform our company’s value proposition.”

Prenetics reported strong recent growth, including a 336.5% year over year revenue increase in Q1 2025. It now operates three consumer health brands and maintains a deb free balance sheet.

Prenetics’ strategy shows Bitcoin’s tremendous growth and potential. But this time, from within the healthcare sector.

This post Prenetics Becomes First Healthcare Firm to Launch Bitcoin Treasury Strategy With $20M BTC Purchase first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-18 18:00:50

@ cae03c48:2a7d6671

2025-06-18 18:00:50Bitcoin Magazine

The Blockchain Group Buys $20 Million Worth Of BitcoinThe Blockchain Group has acquired an additional 182 Bitcoin for approximately €17 million ($19.6 million), further expanding its position as Europe’s first Bitcoin treasury company amid accelerating institutional adoption of Bitcoin reserves.

According to a press release issued June 18, the Euronext Growth Paris-listed company completed the purchases through multiple convertible bond issuances totalling over €18 million, subscribed by several investors, including UTXO Management, Moonlight Capital, and asset manager TOBAM.

JUST IN:

French publicly traded, The Blockchain Group buys an additional 182 #Bitcoin for €17.0 million

French publicly traded, The Blockchain Group buys an additional 182 #Bitcoin for €17.0 million Nothing stops this train

pic.twitter.com/fwIqq934Yy

pic.twitter.com/fwIqq934Yy— Bitcoin Magazine (@BitcoinMagazine) June 18, 2025

The acquisitions bring The Blockchain Group’s total Bitcoin holdings to 1,653 BTC, purchased at an average price of €90,081 ($104,000) per coin. The company reported a “BTC Yield” – measuring Bitcoin holdings relative to fully diluted shares – of 1,173.2% year-to-date, significantly outpacing other major corporate holders.

The company’s latest purchases were executed through Swissquote Bank Europe and Banque Delubac, with custody provided by Swiss infrastructure provider Taurus. Additional funding came from the conversion of share warrants into 2.98 million ordinary shares, raising €1.6 million.

We’re seeing unprecedented growth in corporate Bitcoin treasury strategies. The Blockchain Group’s success has created a model for European companies, with new organizations announcing Bitcoin purchases almost weekly.

The company indicated potential plans to acquire an additional 70 BTC through ongoing transactions, which could bring its total holdings to 1,723 BTC. This follows recent Bitcoin treasury announcements from companies including Metaplanet, which now holds 10,000 BTC, and Strategy’s latest acquisition of 10,1000 BTC.

At press time, Bitcoin trades at $104,021, down 1.26% over the past 24 hours, as markets continue to process the implications of growing institutional adoption. The Blockchain Group’s shares were down 3.9% to €4.80 on Wednesday, trading on Euronext Paris.

This post The Blockchain Group Buys $20 Million Worth Of Bitcoin first appeared on Bitcoin Magazine and is written by Vivek Sen.

-

@ cae03c48:2a7d6671

2025-06-18 18:00:48

@ cae03c48:2a7d6671

2025-06-18 18:00:48Bitcoin Magazine

K33 Announces Plans To Purchase Up To 1,000 BitcoinK33 AB, a leading digital asset brokerage and research firm, announced today the launch of a SEK 85 million direct share issue to fund the purchase of Bitcoin. The company aims to build Bitcoin as a core asset on its balance sheet, targeting the accumulation of up to 1,000 BTC as a strategic reserve.

PRESS RELEASE: K33 launches a share issue to finance the purchase of up to 1000 Bitcoin, with a minimum of SEK 85 million secured through pre-commitments pic.twitter.com/sG1LZjR6EI

PRESS RELEASE: K33 launches a share issue to finance the purchase of up to 1000 Bitcoin, with a minimum of SEK 85 million secured through pre-commitments pic.twitter.com/sG1LZjR6EI— K33 (@K33HQ) June 18, 2025

The share issue, priced at SEK 0.1036 per share, is fully backed by existing shareholders and new investors. Proceeds from the raise will be used exclusively to acquire BTC, supporting K33’s accumulation strategy revealed in May. By acquiring BTC, the company aims to strengthen its balance sheet, boost brokerage margins, launch new products, and attract more investors.

“This raise marks a major milestone towards our initial goal of acquiring 1000 BTC before scaling further,” commented the CEO of the Company Torbjørn Bull Jenssen. “We strongly believe that Bitcoin represents the future of global finance and are positioning K33 to benefit maximally from this. A strong balance sheet built on Bitcoin enables us to significantly improve our brokerage operation while maintaining full exposure to Bitcoin’s upside potential.”

As part of the strategy, K33 recently completed its first Bitcoin acquisition, purchasing 10 BTC for approximately SEK 10 million on June 3. This transaction is the initial deployment of capital from the SEK 60 million investment commitment announced earlier this year to support the company’s BTC treasury.

“We expect Bitcoin to be the best-performing asset in the coming years and will build our balance sheet in Bitcoin moving forward,” stated Jenssen. “This will give K33 direct exposure to the Bitcoin price and help unlock powerful synergies with our brokerage operation. Our ambition is to build a balance of at least 1000 BTC over time and then scale from there.”

During its Q1 2025 Report and Strategic Outlook presentation, K33 underscored the accelerating institutional adoption of Bitcoin, referencing the rapid growth of the US Bitcoin ETFs, which attracted more capital in its first year than gold ETFs had in the past two decades.

“For K33, Bitcoin is not only a high-conviction asset — it’s also a strategic enabler,” Jenssen said. “With a sizable BTC reserve, we will be able to strengthen our financial position while unlocking new revenue streams, product capabilities, and partnerships.”

This post K33 Announces Plans To Purchase Up To 1,000 Bitcoin first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-18 18:00:46

@ cae03c48:2a7d6671

2025-06-18 18:00:46Bitcoin Magazine

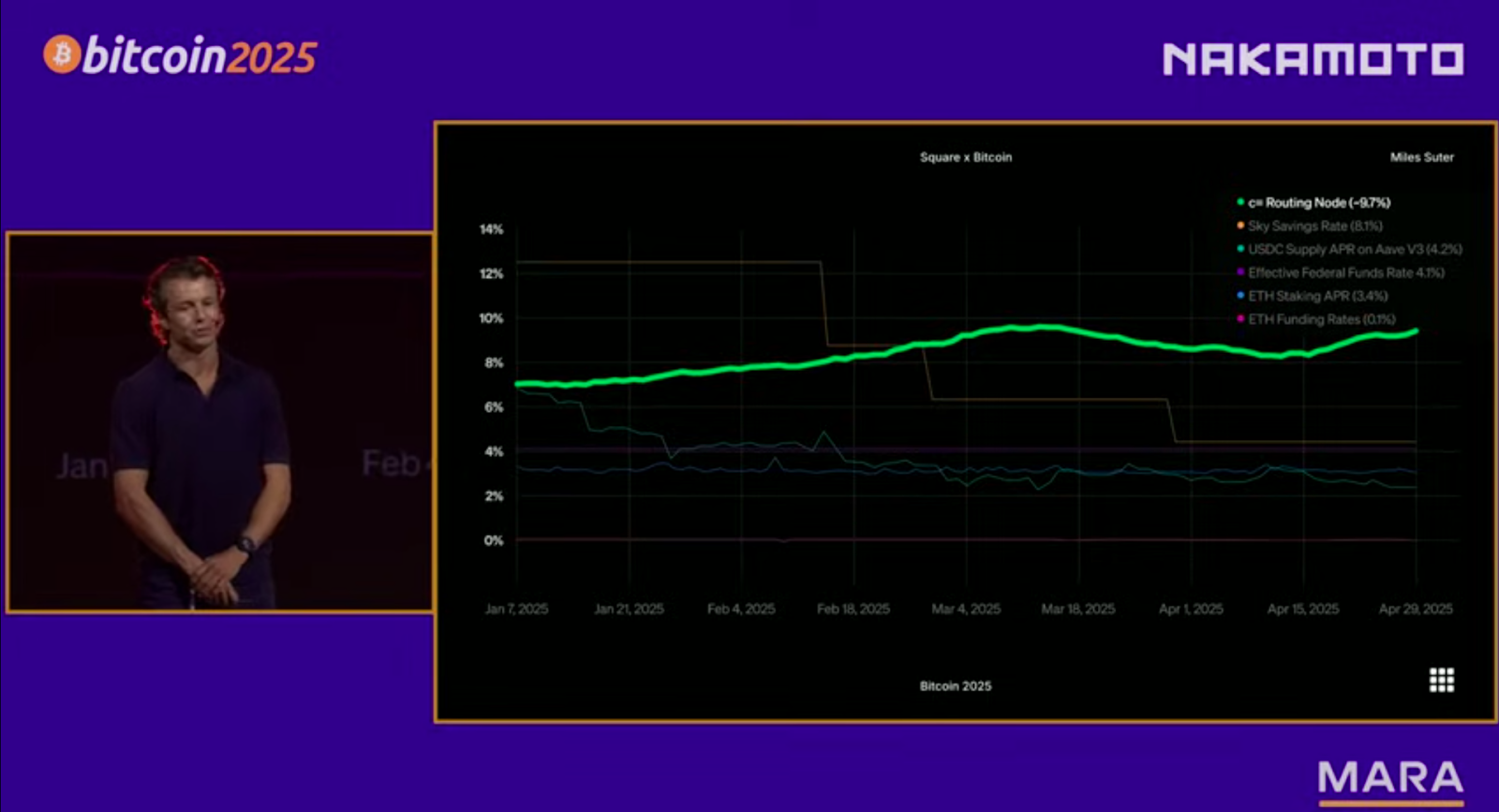

Bitcoin Tech Booms: Lightning Data Defies Digital Gold NarrativeEgo Death Capital’s portfolio reveals adoption metrics including $1.5 billion in Lightning-powered trading volume, as Block shocks the industry with their 9.7% Lightning Network yield.

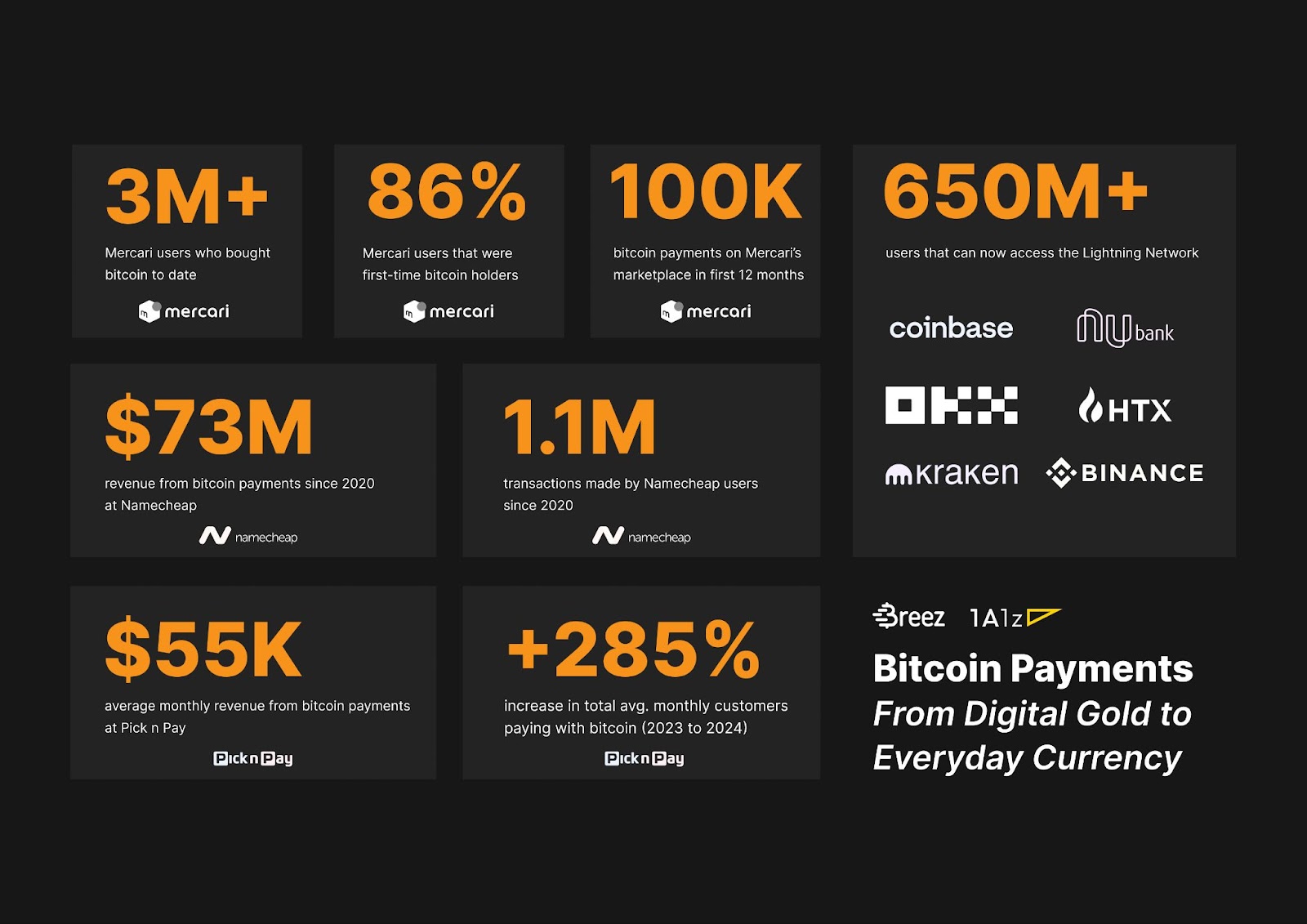

While bitcoin treasury companies, debates about market structure bills, and strategic bitcoin reserve advocacy dominate the headlines in 2025, a trend is quietly growing in the background: the success of Bitcoin technology companies.

Increasingly recognized as digital gold and a long-term store of value, bitcoin is far more than just a shiny rock in cyberspace. As a software technology, Bitcoin is programmable and has unlocked a new paradigm of payments, custody, settlement and trading possibilities.

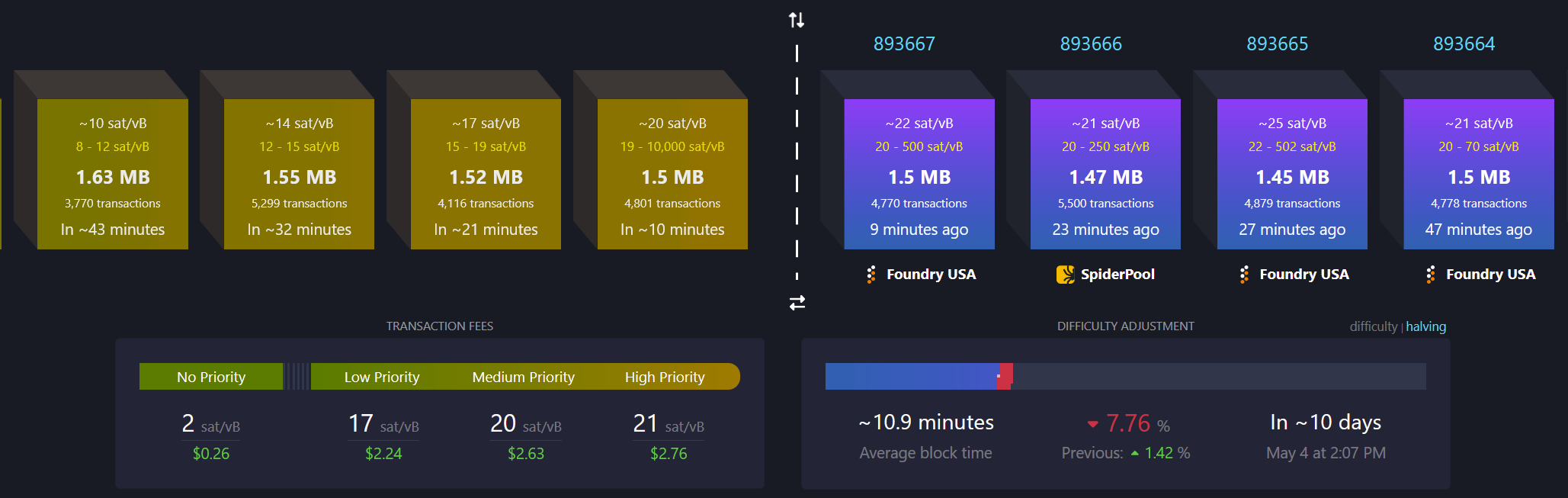

Nevertheless, some critics point to the empty blocks on the Bitcoin base layer and historically low transaction fees as implicit proof that Bitcoin is failing as a medium of exchange. Others claim that the Lightning Network has failed to get mainstream adoption and even argue that it suffers from significant privacy problems. But the opposite may be true.

New data coming out of various companies throughout the industry is starting to paint a different picture. Perhaps the Lightning Network has been so successful in drawing transactions off chain and making them more private that it is hard to quantify success metrics without companies involved sharing the data.

But, a variety of Bitcoin start-ups and companies using bitcoin to build out new financial infrastructure are now starting to boast of their success metrics, claiming numbers that suggest there is a strong product market fit beyond treasury strategies.

Jeff Booth, author of The Price Of Tomorrow and co-founder of the Bitcoin-focused VC firm Ego Death Capital, told Bitcoin Magazine he doesn’t “think the general public has any clue with how fast the Bitcoin ecosystem is growing.” Adding that, “They keep on hearing treasury companies this and politics that, and they’re missing the forest for the trees.”

Below follows a summary of various companies and projects demonstrating Bitcoin adoption in significant numbers, many of them within the Ego Death Capital portfolio.

Block: Earning Big on Lightning and Bitcoin Payments

The contrast in perspectives between the digital gold thesis and those that believe in Bitcoin as a payments technology was most recently seen at Bitcoin Vegas 2025 where Block, the parent company of Cash App, disclosed that they are earning 9.7% yield off their Bitcoin Lightning node.

Miles Suter, Bitcoin Product Lead at Block, told the live audience that “at the infrastructure layer, we’re earning nearly 10% bitcoin-on-bitcoin returns by efficiently routing real payments across the Lightning network. This isn’t yield from altcoin staking or reckless speculation; it’s from solving hard, real-time routing problems, and its real bitcoin-on-bitcoin returns from our corporate holdings via supporting real payments use cases.”

Besides Block’s stunning 9.7% figure announcement, which stood out as one of the most lasting impressions from the conference, Suter claimed that Cash App ranks “among the top bitcoin on-ramps in the U.S., accounting for nearly 10% of on-chain block space at any time,” adding that in 2024, its Lightning usage grew 7x and one in four of their outbound Bitcoin payments are processed on Lightning. These numbers highlight Block’s growth as a Bitcoin payments giant, now perhaps the most common merchant payments terminal and consumer payments app that integrates bitcoin.

Ego Death Capital

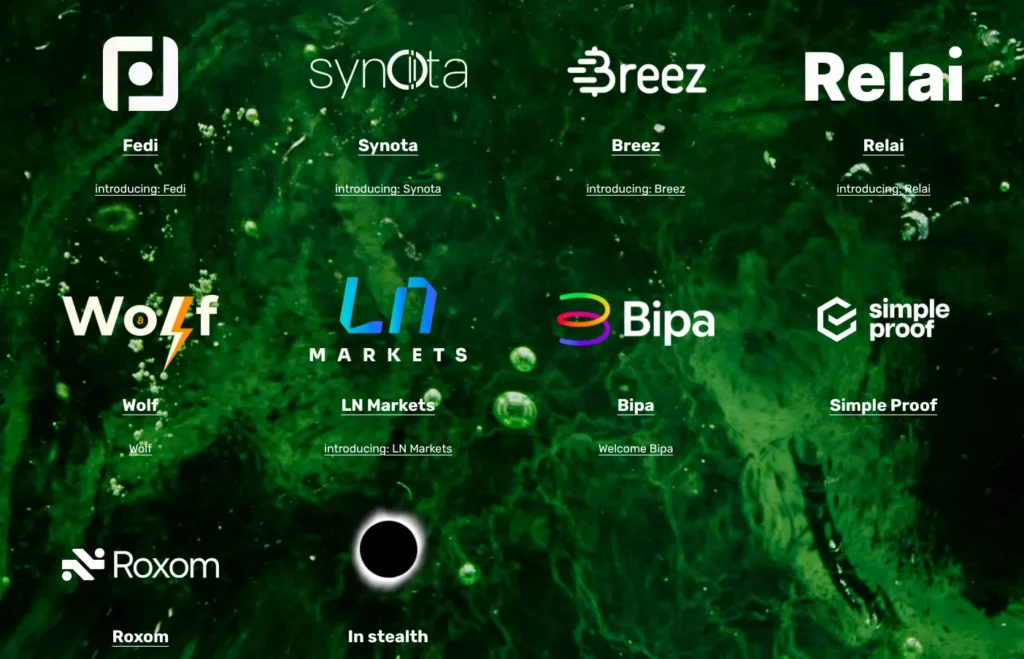

Ego Death Capital has been investing in Bitcoin infrastructure start-ups since 2022, initially raising a tactical 30 million dollar fund amid a boom in crypto and altcoin VC investments.

“When we first raised money, we actually targeted 30 million because the ecosystem at that time was really early. We realized we had to lean into these companies to help them scale. There were a lot of big crypto funds at that time, but they were spraying money everywhere else. And it was largely the exact opposite of what we believed would happen on Bitcoin.” Booth recalled that “Bitcoin was a protocol. It was developing in layers and it was early. And if you realized that and leaned in to help those companies that were developing in the layers, helping the infrastructure be created, then you would accelerate that. You would accelerate what we saw Bitcoin being, a currency, a store of value, an entirely new network.”

“We don’t have a failure in that fund,” Booth said of the firm’s first investment cohort, which included companies like Breez, Relai, LN Markets, Fedi, Wolf and Simple Proof. “That fund is just over three years old. It’s staggering. A number of those companies, I think three of those companies are already profitable — and profitable in bitcoin terms. So adding bitcoin to their treasury each month and growing incredibly fast.”

Breez: Powering a Global Lightning Payments Network

Breez, founded in 2018, is a self-custodial Lightning-as-a-service provider that enables developers to integrate Bitcoin payments into apps using its open source Breez SDK. By simplifying Lightning’s complexities, Breez has been driving widespread adoption across diverse industries.

“Over 40 apps have already implemented our SDK in production or beta since we launched it less than 18 months ago. Collectively, ~1.5 million users now have access to self-custodial, peer-to-peer bitcoin payments through these apps. These apps processed over $4.5 million in gross transaction volume in 2024,” wrote Roy Sheinfeld, CEO of Breez, in a January 2025 blog post.

The “Bitcoin Payments Report” by Breez and 1A1z, released February 2025, added, “The Lightning Network now reaches over 650 million users; driven by integrations with mainstream products, new developer tools, and growing merchant adoption.” A month later Sheinfeld published that “Lightning Pay’s user base has been growing with users moving a billion sats monthly.” Additionally, Breez’s integration with Klever Wallet brought Lightning to “100,000 monthly active users,” as stated in a December, 2024, blog post.

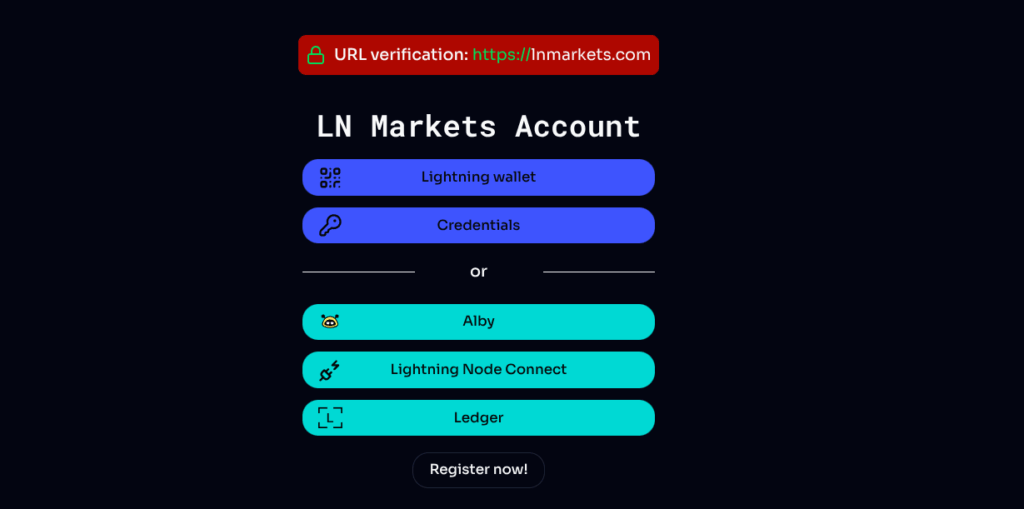

LN Markets: Lightning-Fueled Trading Takes Off

LN Markets, launched in 2020, is a Bitcoin-native derivatives trading platform, leveraging the Lightning Network for instant settlements and minimized counterparty risk.

Its Lightning-native login interface demonstrates they are on the cutting edge of Bitcoin technologies and unlocks user experience features that differentiate it from most other advanced trading platforms. The fast payment rails that result from this deep integration with the Lightning Network unlock faster settlement, lower withdrawal fees and provides access to smaller traders throughout the third world, with many users in South America in countries like Mexico, Brazil and Colombia.

“Basically we’ve gone from 50 million in monthly trading volume to 1.5 billion last month in May,” co-founder Romain Rouphael told Bitcoin Magazine, adding that they have gone from “one billion dollar yearly trading volume in 2023 to six billion last year to 12 billion this year.” Profitability is also strong, with Romain stating, “We double our revenue each year and we double our EBITDA as well every year,” and “We are doing millions of Lightning transactions every year” These figures highlight LN Markets’ strong and active user base as well as Lightning’s scalability.

The exchange focuses on B

-

@ cae03c48:2a7d6671

2025-06-18 18:00:42

@ cae03c48:2a7d6671

2025-06-18 18:00:42Bitcoin Magazine

Bitdeer Raises $330M to Expand Bitcoin Mining and AI OperationsSingapore-based Bitcoin mining firm Bitdeer Technologies Group has launched a $330 million convertible notes offering, aiming to strengthen its mining operations, develop ASIC rigs, and scale its AI infrastructure.

The notes, due in 2031, carry an annual interest rate of 4.875% and may be converted into Bitdeer Class A shares at a 25% premium to the current stock price of $11.84, placing the conversion price at approximately $15.88 per share.

The offering is targeted at qualified institutional buyers under Rule 144A of the Securities Act. If investors exercise an option to buy more within 13 days, the offering could reach $375 million.

This is Bitdeer’s third convertible notes raise. Previously, the company secured $150 million in August and $360 million in November last year. According to Bitdeer, the offering is expected to close on June 23, 2025.

Net proceeds are expected to total roughly $319.6 million. Around $129.6 million will go toward a zero-strike call option, with $36.1 million allocated for concurrent note exchanges. The remaining funds will support datacenter expansion, new ASIC rig development, and general corporate needs.