-

@ b1ddb4d7:471244e7

2025-06-09 12:00:56

@ b1ddb4d7:471244e7

2025-06-09 12:00:56In today’s digital era, access to financial services remains a privilege for many. Bitcoinization – the mass adoption of bitcoin as a payment medium and store of value – represents a unique opportunity to democratize access to financial services.

Telecommunications carriers occupy a strategic position in this transformation, especially in regions where traditional internet access is limited. However, this aspect remains largely unexplored.

This article seeks to examine how these companies can catalyze this financial revolution by analyzing the Machankura case and the technical possibilities within current communication infrastructure.

The Success Sotry of Machankura

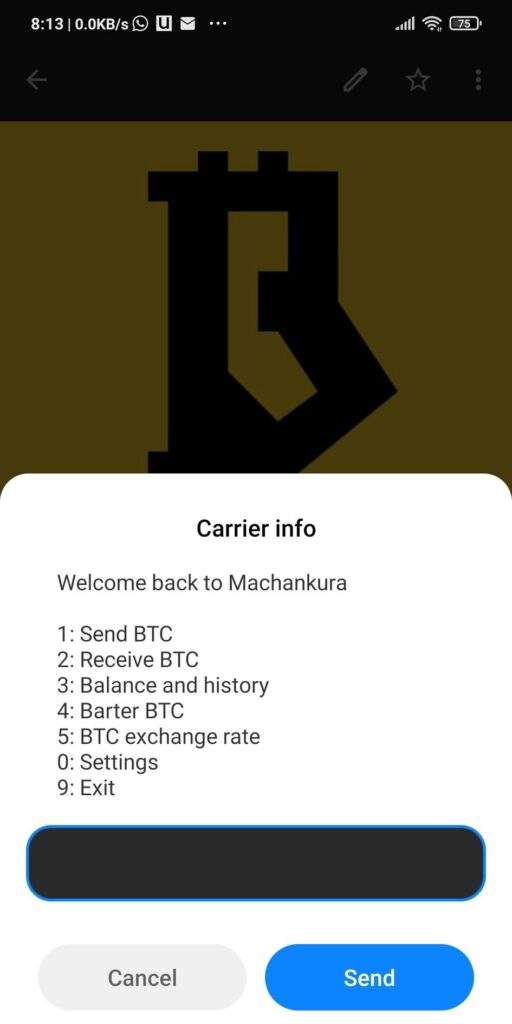

The Machankura project (8333.mobi) emerged to address a common challenge in various African regions: financial exclusion due to limited internet access. Created by South African developer Kgothatso Ngako, the service utilizes the USSD (Unstructured Supplementary Service Data) protocol, supported by virtually all mobile phones, to facilitate bitcoin transactions via 2G and 3G cellular networks.

Machankura – derived from South African slang for “money” – functions as a custodial bitcoin wallet. Through the USSD protocol, users can access the service by dialing short codes (*123*456789#, for example) or sending SMS messages to specific numbers.

When the server receives the code or message, an interactive session between the parties (server-user) begins. This enables users to create bitcoin wallets associated with their phone numbers, protected by multi-digit PINs.

Once registered, users receive a Lightning address (example: 1234567890@8333.mobi) that can be used to receive bitcoin from anyone worldwide. Users can also customize this address to a preferred username, further enhancing privacy.

Currently, Machankura is available in nine African countries, including Nigeria, Tanzania, South Africa, Kenya, Uganda, Ghana, and Malawi. The creator’s objective is to expand the service to all countries across the African continent in the coming years.

The Technical Foundations of Machankura’s Success – USSD

As mentioned, USSD is a protocol embedded in mobile networks and available on virtually all cellular devices. This choice proved crucial for the Machankura project, given that in Africa, more than half of phones sold are not smartphones. Additionally, this protocol offers critical technical advantages:

- Operates without requiring internet access, functioning in areas with poor connectivity.

- Universal compatibility with any mobile phone, including the most basic models.

- Provides real-time interactivity between users and the system.

- Features an intuitive interface already utilized for banking services, customer support, and self-service applications

These advantages have enabled bitcoin to become accessible to a significant portion of the region’s population, with over 15,000 users, according to Machankura’s project creator.

USSD and Connectivity Challenges

The primary technical limitation of USSD manifests in high-connectivity environments (4G, 5G, or higher). As established by the 3GPP (3rd Generation Partnership Project, organization for standardization of mobile networks), the protocol must be recognized by newer generations of cellular networks.

However, this recognition requires a procedure known as inter-technology fallback. For instance, if a user is connected to a 5G network and streaming music, when accessing a USSD service, their connection will downgrade to a 3G (or 2G) network, inevitably interrupting media streaming execution.

IP Multimedia Subsystem (IMS): The Evolution in Telecommunications Services

The solution to connectivity issues with USSD resides within the IMS (IP Multimedia Subsystem), a subsystem within the standardized architecture of newer cellular networks (from fourth generation onwards).

Its objective is to unify access and provision of multimedia services across both mobile and fixed networks. These services include:

- Voice services – such as Voice over LTE (VoLTE) and Voice over WiFi (VoWiFi)

- Video services – such as Video over LTE (ViLTE) and Video over WiFi (ViWiFi)

- Videoconferencing

- Instant messaging

- Streaming media

- Emergency services

- Interoperability between legacy networks

The New Era: USSI (USSD over IP)

USSI (USSD over IP) represents the solution for service continuity across 4G, 5G, and future networks when utilizing USSD services. This new protocol enhances service quality, increases simultaneous session capacity, provides additional features for recent devices, improves session security, and enables operation without requiring fallback procedures.

Strategic Opportunities for Carriers

Institutional bitcoin adoption is already established, with integration into portfolios of mining companies, exchanges, automobile manufacturers (Tesla), investment funds (BlackRock), financial institutions (Galaxy Digital Holdings), technology companies (including MicroStrategy, MercadoLibre, and Brazilian Meliúz), and even nations such as El Salvador, the United States, and China.

With robust, secure, and extensive infrastructure, telecommunications carriers can implement complex and advanced bitcoin-based financial services, demystifying its use and stimulating adoption.

Strategic partnerships with exchanges and fintechs enhance integrated solutions for entrepreneurs and consumers, such as integration with Lightning Network nodes to enable rapid, low-cost transactions between IoT devices, machine-to-machine (M2M) applications, and point-of-sale (POS) terminals.

The competitive advantages of this approach include:

- New Revenue Streams: Companies can collect fees from simple transactions and provide advanced financial services such as loans, insurance, and investments.

- Customer Retention: By offering innovative services, they can reduce customer churn.

- Vanguard Strategy: Strategic positioning in an emerging high-capitalization market

The Future of Bitcoinization in Telecommunications

The success of the Machankura project unequivocally demonstrates the potential of telecommunications as transformative agents in the mass adoption of bitcoin. As the bitcoin ecosystem consolidates and expands, it is essential that we recognize this opportunity not merely as a new business vertical but as an important step toward strategic positioning at the forefront of a global economic transformation.

Given the extensive reach of existing infrastructure, these carriers can become the primary catalyst for transforming the lives of the unbanked in an unprecedented manner. As we have seen, bitcoin is no longer just a trend; it is a reality. The natural consequence of this reality is bitcoinization, and we have the opportunity to be at the forefront of this emerging paradigm.

-

@ cae03c48:2a7d6671

2025-06-09 12:00:34

@ cae03c48:2a7d6671

2025-06-09 12:00:34Bitcoin Magazine

Know Labs, Inc. Announces Adopting a Bitcoin Treasury Strategy, Starting with 1,000 BitcoinKnow Labs, Inc. (NYSE American: KNW) announced entering into an agreement with Goldeneye 1995 LLC and the Ripple Chief Risk Officer Greg Kidd to acquire a controlling interest in the Company. Following the completion of the transaction, Mr. Kidd will become Chief Executive Officer and Chairman of the Board of Directors of the Company and Founder Ron Erickson will become Vice Chairman of the Board.

JUST IN: Know Labs, Inc. announces its adopting a Bitcoin Treasury Strategy and holds 1,000 Bitcoin

pic.twitter.com/NSn2xFZYx0

pic.twitter.com/NSn2xFZYx0— Bitcoin Magazine (@BitcoinMagazine) June 6, 2025

Under the agreement, the Buyer will acquire shares of Know Labs’ common stock by dividing the total value of 1,000 Bitcoin and a cash amount, designated to pay down existing debt, redeem outstanding preferred equity, and provide additional working capital. For every share purchased it will be priced at $0.335. The Bitcoin will serve as a central element of the Company’s treasury strategy, giving investors the exposure to Bitcoin.

“I’m thrilled to deploy a Bitcoin treasury strategy with the support of a forward-looking organization like Know Labs at a time when market and regulatory conditions are particularly favorable,” said Mr. Kidd. “We believe this approach will generate sustainable growth and long-term shareholder value.”

Once Bitcoin becomes the primary asset on the Company’s balance sheet, management will adopt the multiple of net asset value (mNAV) metric to assess the premium investors place on the Company’s market value relative to its Bitcoin assets. Based on a market cap of $128 million and a Bitcoin price of $105,000, the estimated entry mNAV multiple is 1.22x, with Bitcoin accounting for approximately 82% of the total market capitalization at closing.

“Partnering with Greg Kidd marks a pivotal next chapter for Know Labs,” commented Mr. Erickson. “We look forward to continuing our research in non-invasive medical technology. Greg’s visionary leadership positions Know Labs for a bold future.”

The adoption of Bitcoin as a treasury reserve asset has dramatically increased over the course of the last year, expanding globally. To date, there are 225 companies and other entities with Bitcoin in their balance sheets.

Norwegian Block Exchange (NBX), a leading Nordic cryptocurrency exchange and digital asset platform, announced on June 2 that it has added Bitcoin to its balance sheet, marking a national milestone as the first publicly listed company in Norway to hold Bitcoin as part of its treasury strategy.

“NBX will not sell this Bitcoin or go short in any form,” stated the company. “With reference to the latest POA notice with LDA capital, NBX will also use proceeds to buy additional Bitcoin.”

This post Know Labs, Inc. Announces Adopting a Bitcoin Treasury Strategy, Starting with 1,000 Bitcoin first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-09 12:00:32

@ cae03c48:2a7d6671

2025-06-09 12:00:32Bitcoin Magazine

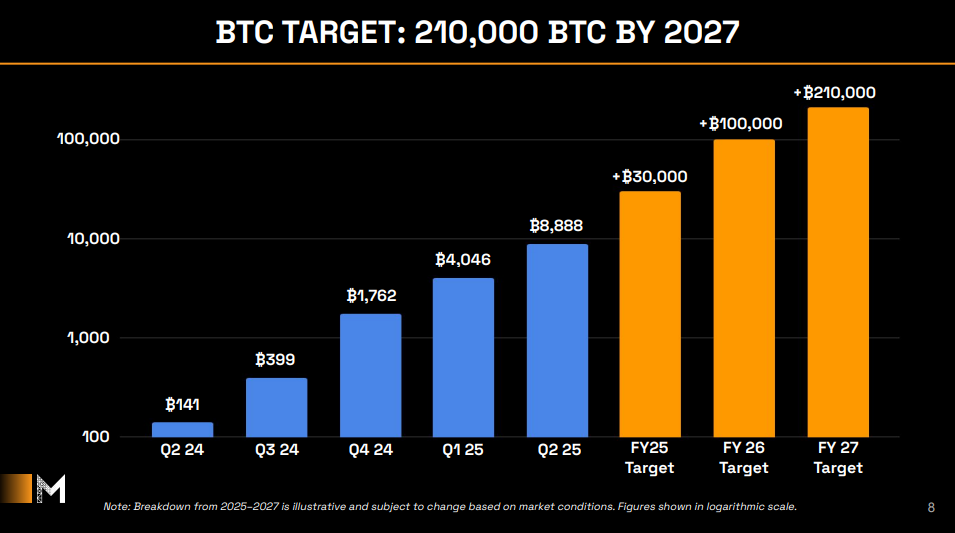

‘MicroStrategy of Asia’ Metaplanet Aims To Acquire Over 210,000 BTC By the End of 2027Metaplanet Inc. widely recognized as Japan’s leading Bitcoin treasury company, has announced a major update to its Bitcoin accumulation strategy, unveiling the “555 Million Plan” aimed at acquiring over 210,000 BTC by the end of 2027, which is equivalent to 1% of Bitcoin’s total supply.

*Metaplanet Announces Accelerated 2025-2027 Bitcoin Plan: Targeting 210,000 $BTC by 2027*

Full Presentation: https://t.co/JG28maMdfd pic.twitter.com/i9kzmjlDT8

— Metaplanet Inc. (@Metaplanet_JP) June 6, 2025

This new target marks a dramatic increase from the company’s earlier “21 Million Plan,” which aimed for just 21,000 BTC by 2026. Progress far outpaced expectations, with 8,888 BTC already secured as of June 2, prompting the strategic shift.

To fund this growth, Metaplanet has launched Asia’s largest Bitcoin-focused equity raise, aiming to secure ¥770.9 billion (approximately $5.4 billion) through the issuance of 555 million shares via moving strike warrants. This is the first structure of its kind in Japan, priced at a premium to market, made possible by the company’s high share liquidity and volatility.

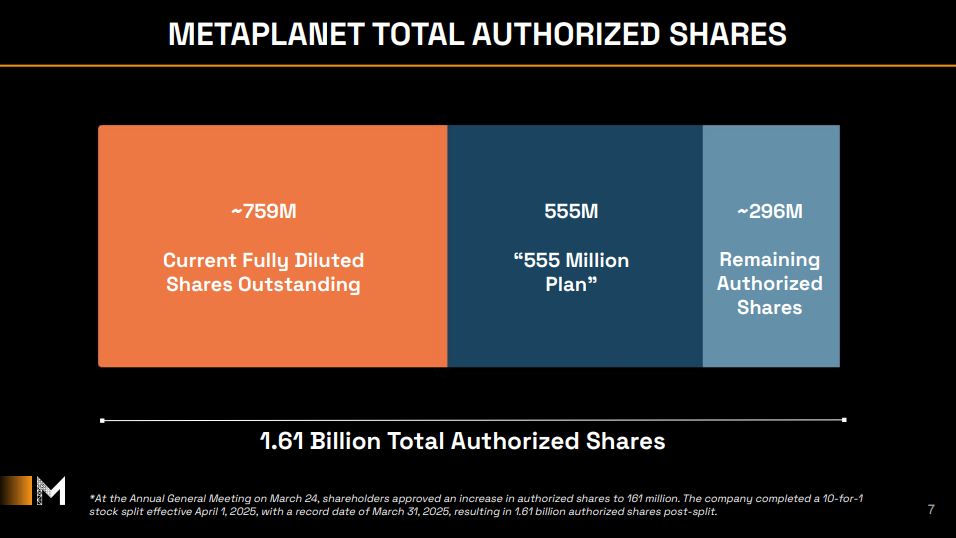

At the Annual General Meeting on March 24, shareholders approved an increase in authorized shares from 161 million to 1.61 billion, following a 10-for-1 stock split effective April 1, 2025; Metaplanet has approximately 296 million authorized shares remaining. The 555 million shares being issued under the new plan will bring the company’s fully diluted shares outstanding to around 759 million.

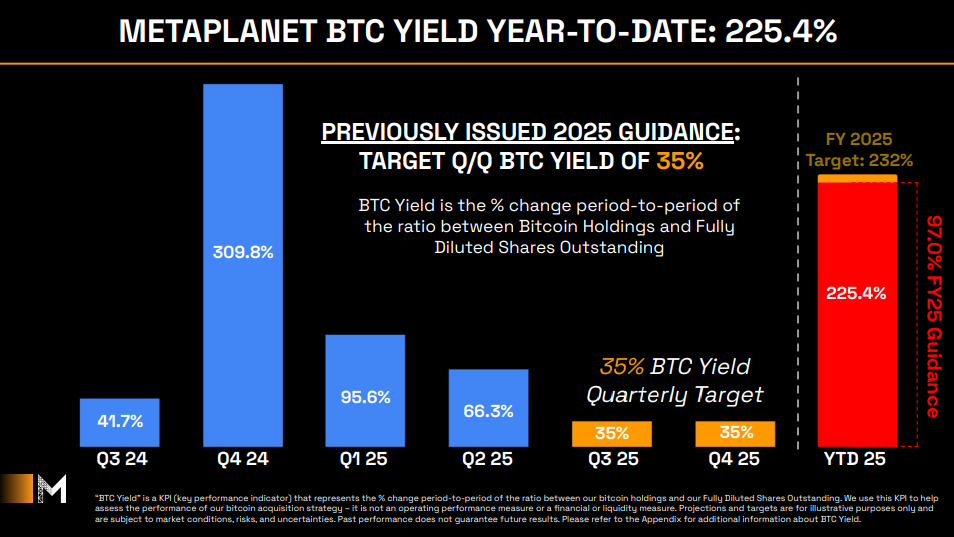

Metaplanet’s Bitcoin yield targets and performance for 2025 have shown strong momentum, with quarterly BTC yields of 41.7% in Q3 2024, 309.8% in Q4 2024, 95.6% in Q1 2025, 66.3% in Q2 2025, and projected 35% yields for both Q3 and Q4 2025. The year-to-date BTC yield for 2025 stands at 225.4%, closing to the full year target of 232%.

Metaplanet also announced the issuance of the 20th to 22nd Series of Stock Acquisition Rights via a third-party allotment to EVO FUND, potentially adding 555 million new shares. The initial exercise price is set at JPY 1,388 and will adjust regularly based on stock prices, with some series including a premium to protect shareholders. The exercise period runs from June 24, 2025, to June 23, 2027, with expected proceeds of approximately JPY 767.4 billion. This financing supports the “555 Million Plan” and further Bitcoin accumulation.

Metaplanet CEO Simon Gerovich wrote in a post on X, “thanks to all of our shareholders,” he said. “We are honored to be on this journey with you. Metaplanet is accelerating into the future — powered by Bitcoin.”

Metaplanet has launched Asia’s largest-ever equity raise dedicated to Bitcoin:

¥770.9 billion (~$5.4B) capital raise

¥770.9 billion (~$5.4B) capital raise

555 million shares via moving strike warrants

555 million shares via moving strike warrants

First in Japan: issued at a premium to market — enabled by Metaplanet’s high volatility and deep liquidity… pic.twitter.com/UlXHneyDzo

First in Japan: issued at a premium to market — enabled by Metaplanet’s high volatility and deep liquidity… pic.twitter.com/UlXHneyDzo— Simon Gerovich (@gerovich) June 6, 2025

This post ‘MicroStrategy of Asia’ Metaplanet Aims To Acquire Over 210,000 BTC By the End of 2027 first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-09 12:00:31

@ cae03c48:2a7d6671

2025-06-09 12:00:31Bitcoin Magazine

Gemini Files Draft With The SEC For Proposed IPOToday, Gemini Space Station, Inc. announced that it has confidentially filed a draft registration statement with the US Securities and Exchange Commission for a proposed initial public offering (IPO) of its Class A common stock. Details such as the number of shares and the price range have not been disclosed. The IPO will proceed after the SEC’s review and is subject to market conditions.

JUST IN: @Gemini has confidentially filed for an IPO with the @SECGov.

JUST IN: @Gemini has confidentially filed for an IPO with the @SECGov. Details on share count and pricing TBD.

Launch date will depend on SEC review and market conditions.

— Eleanor Terrett (@EleanorTerrett) June 6, 2025

“Any offers, solicitations or offers to buy, or any sales of securities will be made in accordance with the registration requirements of the Securities Act of 1933, as amended,” stated the press release. “This announcement is being issued in accordance with Rule 135 under the Securities Act.”

Gemini’s move comes during a period of growing activity in both the public markets and the digital asset space. Just yesterday, Trump Media and Technology Group Corp. (Nasdaq, NYSE Texas: DJT) also filed a Form S-1 with the SEC for its upcoming Truth Social Bitcoin ETF.

“Truth Social Bitcoin ETF, B.T. is a Nevada business trust that issues beneficial interests in its net assets,” stated the Form S-1. “The assets of the Trust consist primarily of bitcoin held by a custodian on behalf of the Trust. The Trust seeks to reflect generally the performance of the price of bitcoin.”

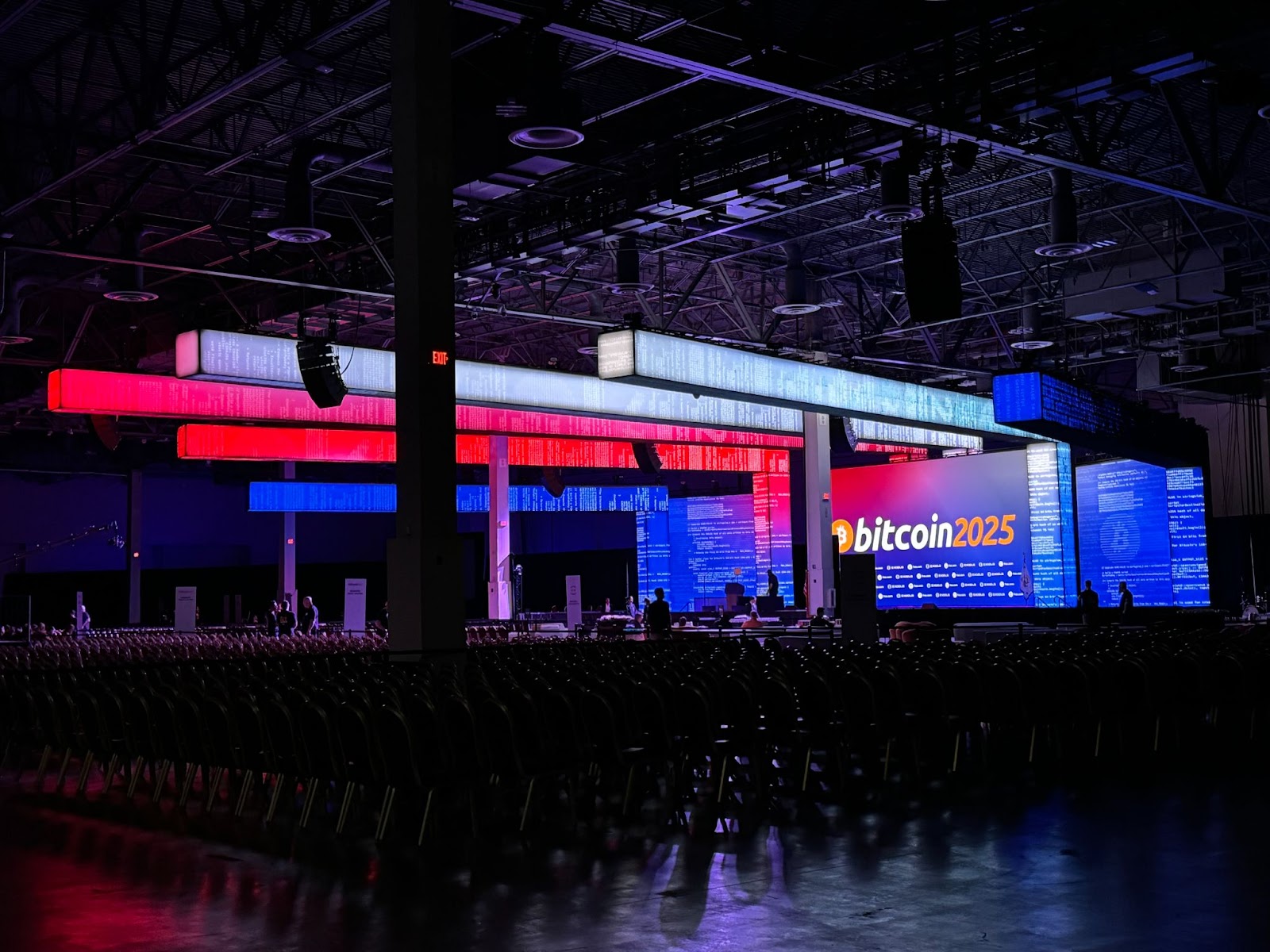

Momentum around Bitcoin and broader crypto policy was also evident last week at the 2025 Bitcoin Conference in Las Vegas. There, Gemini founders Cameron and Tyler Winklevoss joined White House A.I. & Crypto Czar David Sacks to discuss how the government should manage Bitcoin, as well as recent developments in federal policy.

“Orange is the new gold,” said Cameron. “So, Bitcoin is Gold 2.0, and that’s been true since day one. So, at $100,000 Bitcoin, that’s exciting, but if you take 21 million and do the above ground market price of gold. Really, it should be a million dollars a coin—easily,”

They talked about some of the recent policy changes that have been good for crypto include rolling back the IRS digital asset broker rule and SAB 121, which had stopped banks from holding Bitcoin. The Department of Justice also stopped its regulation by prosecution approach, which takes a lot of pressure off digital asset firms.

“It’s hard to imagine a President. Any other President being able to do any fraction of this or accomplish that or any administration and we have just over 100 days,” said Tyler. “So, It’s pretty amazing that we still have a lot of time left.” Later on, he ended the panel saying, “To the Moon!”

This post Gemini Files Draft With The SEC For Proposed IPO first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-09 12:00:28

@ cae03c48:2a7d6671

2025-06-09 12:00:28Bitcoin Magazine

TakeOver Successfully Hosts Second Annual BitGala Celebrating Bitcoin in Las VegasLAS VEGAS, NV, May 26, 2025 – TakeOver, Magic Eden, Spark, and Stacks successfully hosted their second annual BitGala on May 26th at the Wynn in Las Vegas. The celebration brought together over 200 Bitcoin industry leaders and community members for an evening dedicated to celebrating Bitcoin.

The BitGala was designed as a curated gathering focused on inspiring continued development, education, and adoption while reflecting on the strides Bitcoin has made toward a future of open, decentralized money. The event successfully brought together key leaders, creating meaningful opportunities for collaboration and strategic partnerships within the Bitcoin space.

“BitGala celebrates our partnership with Spark, marketing a major leap forward for Bitcoin DeFi,” said Elizabeth Olson, Head of Marketing for Bitcoin at Magic Eden. “As the #1 Bitcoin app, Magic Eden has spent the past few years pushing Bitcoin L1 to its limits, always with the goal of making Bitcoin more usable, fast, and fun without compromising its core ethos. We believe Spark has the potential to unlock a new era of building on Bitcoin, and we’re thrilled to be leading that charge together.”

“The BitGala was a stunning celebration of Bitcoin culture where luxury meets the cypherpunk spirit. We’re proving that Bitcoin isn’t just a protocol, it’s a movement connecting freedom-minded people from art, fashion, finance, and more. To us, it was a pure signal that people are starting to see what Stacks has been building all along: a future where Bitcoin isn’t just held, but used for apps, defi, and real ownership.” – Rena Shah, COO of Stacks.

Set against the backdrop of the Sphere, the evening brought together innovators, investors, and community leaders for a night dedicated to celebrating Bitcoin’s growth and the people driving its future.

The program opened with a welcome reception, followed by gourmet hors d’oeuvres and vibrant conversations. A keynote and honors segment recognized those making meaningful strides in Bitcoin adoption and development. Guests were then invited to explore a premium tequila tasting experience curated by Reach, and indulge in interactive gourmet chef stations.

“Our team has been fortunate to be part of the Bitcoin community since 2016, so we’re thrilled to see all the progress on display almost 10 years later at Bitcoin 2025. The energy in the room at BitGala was electric—from conversations sparking new partnerships to shared reflections on what’s next for Bitcoin—it was a powerful reminder of why we’re all here: to build an open, decentralized financial system that empowers everyone.” noted Kelley Weaver, Founder and CEO, Melrose PR and Founder, Bitwire.

This unforgettable gathering—hosted in partnership with leading organizations including Magic Eden, Spark, and Stacks—was more than a celebration. It was a call to continue pushing forward innovation, education, and adoption in

the Bitcoin ecosystem. BitGala was made possible through the generous support of key sponsors and partners who share Takeover’s commitment to fostering connections in the web3 space.

“We’re focused on making Bitcoin more useful for everyone, and events like this remind us that we’re not alone in that mission. It was inspiring to connect with others who share the vision of a more open, decentralized financial future powered by Bitcoin.” – Spark Team

Presenting Sponsors:

- Magic Eden – The largest NFT marketplace and Runes platform.

- Spark – The fastest, cheapest, most UX-friendly way to build financial apps and launch assets on Bitcoin.

- Stacks – A Bitcoin L2 enabling smart contracts & apps with Bitcoin as secure base layer.

Supporting Partners:

- Reach Ventures – a gaming-focused VC firm that actively invests in both early-stage and demo-ready game studios.

- Arch Network – a Bitcoin-native platform for building decentralized apps and smart contracts directly on Bitcoin.

- Melrose PR – An onchain communications firm that has been focused on the crypto industry exclusively for almost a decade.

- Bitwire – The modern newswire reimagined for today’s communications professionals.

The collaborative support from these organizations was instrumental in delivering a memorable event for all attendees.

Actor and comedian T.J. Miller was also a speaker at the event: “The bitcoin conference 2025 was incredible for so many reasons. It was such a joyful journey to be with so many like-minded people (all of whom have been laughed at) who share the same values: freedom, community, hope, and getting rich- the highpoint was the BitGala. I bought incredibly large expensive shoes for the specific purpose of showing up to the gala non-verbally saying bitcoin destroying Fiat, well that’s big shoes to fill… and we’ll fill ‘em. I can’t wait to return next year. I will wear more orange.”

About TakeOver

TakeOver is the experiential agency at the forefront of culture and innovation in the crypto space, known for curating powerful moments that educate, connect, and inspire. With a global Bitcoin Dinner Series and their annual flagship event, BitGala, they’ve become a cornerstone of community-building in Web3. Last year, they made headlines with a dramatic takeover of Nashville’s Parthenon—setting the bar for what crypto gatherings can be.

About Magic Eden

Magic Eden is the easiest platform to trade all digital assets onchain. As the #1 Bitcoin app and largest NFT marketplace, we provide a seamless trading experience to everyone. Magic Eden’s acquisition of Slingshot has expanded their capabilities to offer frictionless trading of over 5,000,000 tokens across all major chains. Magic Eden’s expanded product suite includes a cross-chain wallet, powerful trading tools, and the ability to mint, collect, and seamlessly trade NFTs and tokens.

Disclaimer: This is a sponsored press release. Readers are encouraged to perform their own due diligence before acting on any information presented in this article.

This post TakeOver Successfully Hosts Second Annual BitGala Celebrating Bitcoin in Las Vegas first appeared on Bitcoin Magazine and is written by TakeOver.

-

@ cae03c48:2a7d6671

2025-06-09 12:00:26

@ cae03c48:2a7d6671

2025-06-09 12:00:26Bitcoin Magazine

Bitcoin 2025 Las Vegas: Here’s What Went DownMy name is Jenna Montgomery, and maybe you’ve read some of my news articles here before, or seen me on the Bitcoin Magazine TikTok. But today, I wanted to switch it up and give you an inside look at the Bitcoin 2025 Conference in Las Vegas through my eyes as an intern, hired just one month before the conference, having little knowledge about Bitcoin beforehand and never attending an event like this before.

I’m writing this to give you a real, raw reflection of what I experienced over the course of the three day event, and why I believe you should absolutely attend the next Bitcoin conference. I want you all to know what goes down, what to expect, and to know how impactful I think this event really is. Bitcoin 2025 made a lasting impact on me and my life, and it just feels right to tell you why, so yours can maybe be changed too.

I got off the plane, threw my suitcase in my hotel room, and went to go and see the convention center as all of the finishing touches around the venue were being added. I remember thinking how big, beautiful, and fun the expo hall was—and where I would soon meet so many new people, make so many friends, and shake hands with people that I looked up to and admired.

I will never forget walking in and seeing the main conference stage, The Nakamoto Stage, for the first time. Seeing that giant room with a symphony and endless rows of chairs, soon to be filled with thousands of passionate Bitcoiners, really put in perspective to me how Bitcoin 2025 wasn’t just a conference, it felt like something bigger. I realized it’s an actual community and a place of countless opportunities.

The conference is essentially split up into 3 days: Industry Day, General Admission Day 1, and General Admission Day 2. Industry Day was mainly tailored towards professionals, investors, founders, and others focused on Bitcoin businesses. The general admission days were tailored more towards the casual Bitcoiner, and those were the days that I really felt the energy just exploding around the convention center.

Walking into the expo hall early in the morning on Industry Day, I was overwhelmed when I saw all of the vendors and companies setting up their tables, booths, stages, and even a rock climbing wall (thank you CleanSpark). It seemed as if the expo hall went for miles and miles, and featured a long orange carpet that made an intricate path through the venue that led you to each and every booth.

While fiat fails, Bitcoin prevails. pic.twitter.com/EV190PUqdT

— Valentina Gomez (@ValentinaForUSA) May 27, 2025

I remember being in total awe as I looked up at the ceiling and saw a huge UFO in the middle of the expo hall, with two Bitcoin themed Cybertrucks just off to the side of it, with lots of other interesting booths including one with a talking robot.

DAY ONE pic.twitter.com/KHXP6q8RCp

— Gemini (@Gemini) May 27, 2025

As I followed the long orange carpet around the venue, I looked over my shoulder and saw a huge blow-up of a Bitcoin Puppet in the art exhibit, featuring all kinds of other cool Bitcoin art. Some of these pieces of art were worth well over one bitcoin—which was mindblowing to me considering that is more than $100,000. Every good revolution has good art, and seeing all the talented artists pouring their hearts into their work helped me believe that Bitcoin is the future.

Now, it was time to get to work at where I would spend the majority of my time over the next few days. My coworkers and I were stationed up right in front of the Bitcoin Magazine news desk next to the AV (audio-visual) team, where I had a perfect view of everything. Here, I spent all day every day writing news articles for Bitcoin Magazine based on the speeches, keynotes, and other panels happening on the Nakamoto stage, as well as filming TikTok’s around the expo hall with attendees.

Working in front of the news desk was one of my favorite things about the conference. Everyone who spoke on it live had an electrifying personality that kept me locked into every conversation, especially one of the hosts Pete Rizzo. After every talk on the Nakamoto Stage ended, the live stream would pan over to the news desk where they would break down what happened, providing viewers with expert analysis. This was something extremely very fun to watch live and experience the production of it all first hand.

The talks on Industry Day kicked off to such a great start with Dan Edwards from Steak ‘n Shake, who recently became the first major fast food chain in America to begin accepting Bitcoin Lightning payments. So I was very excited to hear about Edwards’ speech and to visit Steak ‘n Shake’s incredible booth, which also featured a group of fun, dancing cows.

Steak ‘n Shake COWS HAVE NO CHILL

pic.twitter.com/8UkmPhWf9T

pic.twitter.com/8UkmPhWf9T— The Bitcoin Conference (@TheBitcoinConf) May 28, 2025

While speaking on stage, Edwards revealed that, “Bitcoin is faster than credit cards, and when customers choose to pay in Bitcoin, we’re saving 50% in processing fees.” Just think about that for a second — saving a whole 50% on each transaction? This really opened my eyes to the benefits of accepting Bitcoin as payment and why it could mean to merchants who adopt it.

Based on everything I heard in that speech, I think Steak ‘n Shake may be the first to start a new trend of other big companies accepting Bitcoin. If they recognized the benefits of Bitcoin, it’s only a matter of time before other franchises do as well.

JUST IN: Fast food giant Steak 'n Shake announced they're saving 50% in processing fees accepting Bitcoin payments

'#Bitcoin is faster than credit cards'

pic.twitter.com/bxApgBL6El

pic.twitter.com/bxApgBL6El— Bitcoin Magazine (@BitcoinMagazine) May 27, 2025

Another big highlight from this day was hearing Senator Cynthia Lummis confirm that President Donald Trump supports her Strategic Bitcoin Reserve Act. There were so many statements made during the conference that I will get to later on that point to the fact that the United States is pro-Bitcoin and we’re going to be the world leader in it. Senator Marsha Blackburn also added to this, stating, “Many of our allies follow what we do. If we lead, others will follow. This is vital to our economic future.”

JUST IN:

Senator Cynthia Lummis said US military generals are "big supporters" of a Strategic Bitcoin Reserve for economic power. pic.twitter.com/2RPMV3tbdA

Senator Cynthia Lummis said US military generals are "big supporters" of a Strategic Bitcoin Reserve for economic power. pic.twitter.com/2RPMV3tbdA— Bitcoin Magazine (@BitcoinMagazine) May 27, 2025

At this point in

-

@ cae03c48:2a7d6671

2025-06-09 12:00:21

@ cae03c48:2a7d6671

2025-06-09 12:00:21Bitcoin Magazine

The Blockchain Group Accelerates Bitcoin Treasury Strategy with €300M RaiseOn June 9, 2025, The Blockchain Group (Euronext: ALTBG) announced a €300 million capital increase program in partnership with TOBAM—marking one of the largest flexible funding facilities in the European public markets dedicated to scaling a Bitcoin treasury.

The raise is structured as an “ATM-type” (At-The-Market) offering, allowing TOBAM to subscribe daily for ordinary shares at a price based on the higher of the previous day’s closing price or volume-weighted average price (VWAP). Each tranche is capped at 21% of the day’s trading volume. This provides a disciplined mechanism to increase capital over time without disrupting market dynamics.

TOBAM: A Strategic Long-Term Backer

TOBAM, a Paris-based asset manager, has been a strategic investor in The Blockchain Group since 2017. The firm was among the earliest institutional advocates of Bitcoin as a treasury asset and remains one of Europe’s most innovative capital allocators. This deepened partnership underscores shared conviction in Bitcoin’s long-term value and the importance of financial infrastructure built on hard money principles.

Through this program, TOBAM can allocate capital into ALTBG shares in a way that aligns with market liquidity, ensuring that treasury growth occurs sustainably and with pricing transparency.

What It Means for Bitcoin For Corporations

For BFC members and observers, this development reflects the growing global standardization of capital tools for Bitcoin-native companies. The ATM structure—commonly used in U.S. equity markets—has now been adapted for European Bitcoin treasury growth. It offers several key advantages:

➤ Precision Timing: Capital can be deployed when conditions are favorable, avoiding the drawbacks of lump-sum raises.

➤ BTC Per Share Focus: The program is explicitly designed to increase the number of bitcoins per share on a fully diluted basis—aligning shareholder and treasury value.

➤ Strategic Flexibility: Instead of relying on traditional fundraising windows, The Blockchain Group now has continuous access to growth capital.A Treasury Engine, Not Just a Treasury

The Blockchain Group has been steadily transforming itself from a digital services company into a full-fledged Bitcoin Treasury Company. This €300 million program turns that transformation into a capital engine—one that can convert equity into Bitcoin consistently, responsively, and with strategic intent.

It also strengthens Europe’s position in the emerging corporate Bitcoin ecosystem. While most Bitcoin Treasury Companies today are U.S.-based, The Blockchain Group’s playbook offers a model for public firms across Euronext and other international exchanges.

The Blockchain Group isn’t just holding Bitcoin—it’s designing infrastructure to accumulate it over time. With TOBAM’s backing and a flexible ATM program in place, Europe’s first Bitcoin Treasury Company is poised to scale BTC per share with precision—one tranche at a time.

Disclaimer: This content was written on behalf of Bitcoin For Corporations. This article is intended solely for informational purposes and should not be interpreted as an invitation or solicitation to acquire, purchase, or subscribe for securities.

This post The Blockchain Group Accelerates Bitcoin Treasury Strategy with €300M Raise first appeared on Bitcoin Magazine and is written by Nick Ward.

-

@ eb0157af:77ab6c55

2025-06-09 11:01:37

@ eb0157af:77ab6c55

2025-06-09 11:01:37The newly elected South Korean President is aiming for a breakthrough in the cryptocurrency market with the introduction of spot ETFs and a national stablecoin.

On June 4, South Korea officially elected Lee Jae-myung as its new President. The candidate from the left-wing party secured victory following the impeachment of former leader Yoon Suk-yeol, who ended his three-year term after a failed attempt to establish a military-backed government.

Voter turnout reached 79.4%, the highest in the last 28 years. Lee won 49.42% of the vote, defeating his conservative opponent Kim Moon-soo, who garnered 41.15%.

The new President’s pledges

In addition to traditional economic priorities such as supporting low-income families and small businesses, Lee Jae-myung has placed digital assets at the heart of his political agenda.

The core pillar of Lee’s strategy involves the introduction of spot ETFs for Bitcoin and Ethereum in the domestic market. Currently, the issuance and local trading of crypto ETFs remain banned in the country.

Another key element of the plan is the approval of stablecoins pegged to the South Korean won. During a discussion last month, Lee emphasized the need to develop a won-based stablecoin market to prevent capital flight abroad.

Under the new administration, South Korea will also work to complete the second phase of its regulatory framework for digital assets. The upcoming legislation will specifically address stablecoin regulations and transparency requirements for cryptocurrency exchanges.

The program also includes the creation of special zones for blockchain-related businesses, where regulations will be minimized to maximize innovation and operational efficiency.

However, this isn’t the first time South Korea has elected a crypto-friendly candidate. The conservative president Yoon Suk-yeol, later impeached, had made several crypto-friendly promises aimed at deregulating the sector, though many of those initiatives saw delays and limited progress during his three-year term.

Yoon’s deregulatory plans faced resistance from the Financial Services Commission (FSC), which maintained strict regulations citing investor protection. In recent months, however, the FSC has shown greater openness toward easing crypto rules — a shift that could support Lee’s commitments.

According to FSC data, by the end of last year the country had 9.7 million registered exchange users, representing nearly 20% of the total population.

The post South Korea: the new leader may favor Bitcoin ETFs and a national stablecoin appeared first on Atlas21.

-

@ 9ca447d2:fbf5a36d

2025-06-09 11:01:17

@ 9ca447d2:fbf5a36d

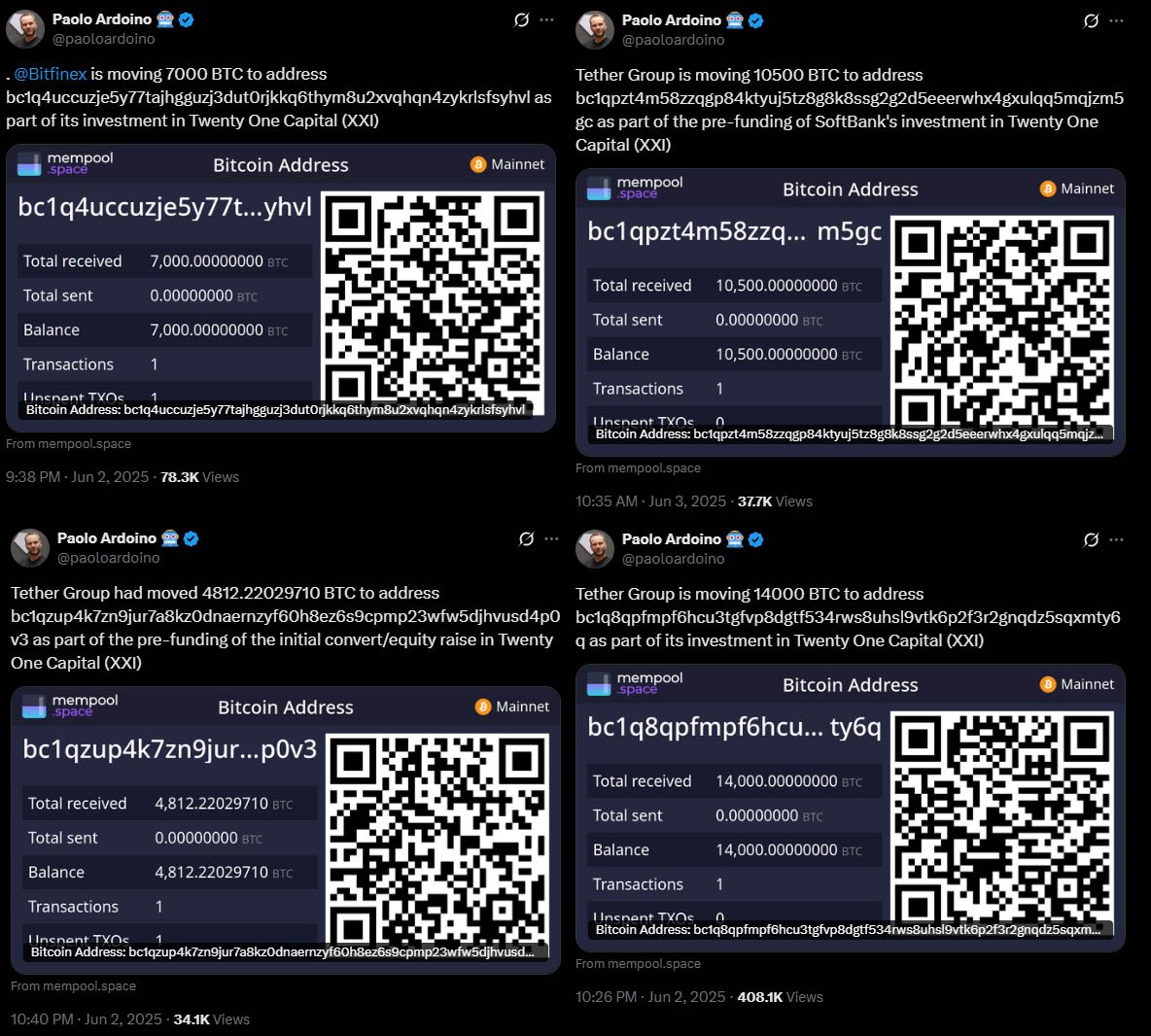

2025-06-09 11:01:17In a massive vote of confidence for a new bitcoin-focused company, Tether and Bitfinex have moved over 37,000 BTC—worth $3.9 billion—to digital treasury firm Twenty One Capital. This is one of the largest Bitcoin transactions in recent history.

The announcement came from Paolo Ardoino, CEO of Tether and CTO of Bitfinex, through multiple posts on X. According to Ardoino, the transfers were part of a pre-funding round for the launch of Twenty One Capital, a new company that will lead the bitcoin treasury space.

Ardoino announced several transfers on X — Sources 1, 2, 3, 4, and 5

“Tether Group is moving 10,500 BTC to address bc1qpzt4m58zzqgp84ktyuj5tz8g8k8ssg2g2d5eeerwhx4gxulqq5mqjzm5gc as part of the pre-funding of SoftBank’s investment in Twenty One Capital (XXI)” Ardoino said.

Twenty One Capital is a new bitcoin treasury firm led by Jack Mallers, CEO of Strike and founder of Zap. The company is backed by Tether, Bitfinex, SoftBank and Cantor Fitzgerald.

The company will go public via a SPAC merger with Cantor Equity Partners (CEP) and will trade under the ticker XXI on Nasdaq. After the merger was announced CEP’s stock price skyrocketed from $11 to $59.75.

Cantor Equity Partners’ stock price jumped on news of the merger — TradingView

Mallers says the company’s mission is bold and clear: accumulate bitcoin and provide full transparency through public wallet disclosures, also known as providing “proof-of-reserves“.

Total bitcoin moved to Twenty One Capital so far include:

- 10,500 BTC from Tether on behalf of SoftBank (worth about $1.1 billion)

- 19,729.69 BTC from Tether (worth around $2 billion)

- 7,000 BTC from Bitfinex (valued at roughly $740 million)

The amounts sum up to 37,229.69 BTC, worth around $3.9 billion at current prices. These were verified on public blockchain explorers.

The Twenty One Capital wallets now show large balances. They have already confirmed they have 31,500 BTC. That makes them the 3rd largest corporate bitcoin holder behind Strategy and Marathon Digital Holdings.

Once these new transfers are confirmed, the company will take over Marathon to become the second-largest corporate holder of the scarce digital asset globally.

Related: Twenty One Capital Becomes 3rd-Largest Corporate Holder of Bitcoin

Unlike companies that add bitcoin to their balance sheet, Twenty One Capital exists solely to accumulate and manage bitcoin. It follows a model similar to Strategy but is more transparent.

Mallers introduced new financial metrics like Bitcoin Per Share (BPS) and Bitcoin Return Rate (BRR) to value the company in bitcoin terms, not fiat.

He thinks economic value in the future will not be measured in dollars but in satoshis—the smallest unit of bitcoin. The company is not just about guarding against fiat collapse, but about completely opting out of the system.

A key part of the firm’s strategy is proof of reserves. Unlike some other big bitcoin holders, Twenty One Capital has already published its public wallet addresses so anyone can verify its holdings in real time.

Ardoino called this approach “Bitcoin Treasury Transparency (BTT)” and said it’s a response to recent industry scandals that showed the dangers of financial opacity in digital assets.

Mallers added openness is the only way to build long-term trust in a bitcoin-native financial system.

Twenty One Capital wants to reshape financial infrastructure, build native bitcoin lending models and promote global Bitcoin adoption.

-

@ b1ddb4d7:471244e7

2025-06-09 11:00:56

@ b1ddb4d7:471244e7

2025-06-09 11:00:56Jason Lowery’s thesis, Softwar: A Novel Theory on Power Projection and the National Strategic Significance of Bitcoin, reframes bitcoin not merely as digital cash but as a transformative security technology with profound implications for investors and nation-states alike.

For centuries, craft brewers understood that true innovation balanced tradition with experimentation—a delicate dance between established techniques and bold new flavors.

Much like the craft beer revolution reshaped a global industry, bitcoin represents a fundamental recalibration of how humans organize value and project power in the digital age.

The Antler in the Digital Forest: Power Projection

Lowery, a U.S. Space Force officer and MIT scholar, anchors his Softwar theory in a biological metaphor: Bitcoin as humanity’s “digital antler.” In nature, antlers allow animals like deer to compete for resources through non-lethal contests—sparring matches where power is demonstrated without fatal consequences. This contrasts sharply with wolves, who must resort to violent, potentially deadly fights to establish hierarchy.

The Human Power Dilemma: Historically, humans projected power and settled resource disputes through physical force—wars, seizures, or coercive control of assets. Even modern financial systems rely on abstract power structures: court orders, bank freezes, or government sanctions enforced by legal threat rather than immediate physical reality.

Lowery argues this creates inherent fragility: abstract systems can collapse when met with superior physical force (e.g., invasions, revolutions). Nature only respects physical power.

Bitcoin’s Physical Power Engine: Bitcoin introduces a novel solution through its proof-of-work consensus mechanism. Miners compete to solve computationally intense cryptographic puzzles, expending real-world energy (megawatts) to validate transactions and secure the network.

This process converts electricity—a tangible, physical resource—into digital security and immutable property rights. Winning a “block” is like winning a sparring match: it consumes significant resources (energy/cost) but is non-destructive.

The miner gains the right to write the next page of the ledger and collect rewards, but no participant is physically harmed, and no external infrastructure is destroyed.

Table: Traditional vs. Bitcoin-Based Power Systems

Power System

Mechanism

Key Vulnerability

Resource Cost

Traditional (Fiat/Banking)

Legal abstraction, threat of state force

Centralized points of failure, corruption, political change

Low immediate cost, high systemic risk

Military/Economic Coercion

Physical force, sanctions

Escalation, collateral damage, moral hazard

Very high (lives, capital, instability)

Bitcoin (Proof-of-Work)

Competition via energy expenditure

High energy cost, concentration risk (mining)

High energy cost, low systemic risk

Softwar Theory National Strategic Imperative: Governments Are Taking Notice

Lowery’s Softwar Theory has moved beyond academia into the corridors of power, shaping U.S. national strategy:

- The Strategic Bitcoin Reserve: Vice President JD Vance recently framed bitcoin as an instrument projecting American values—”innovation, entrepreneurship, freedom, and lack of censorship”. State legislation is now underway to implement this reserve, preventing easy reversal by future administrations.

- Regulatory Transformation: The SEC is shifting from an “enforcement-first” stance under previous leadership. New initiatives include:

- Repealing Staff Accounting Bulletin 121 (SAB 121), which discouraged banks from custodying digital currency by forcing unfavorable balance sheet treatment.

- Creating the Cyber and Emerging Technologies Unit (CETU) to develop clearer crypto registration/disclosure rules.

The Investor’s Lens: Scarcity, Security, and Asymmetric Opportunity

For investors, understanding “Softwar” validates bitcoin’s unique value proposition beyond price speculation:

-

Digital Scarcity as Strategic Depth: Bitcoin’s fixed supply of 21 million makes it the only digital asset with truly inelastic supply, a programmed scarcity immune to political whims or central bank printing.

This “scarcity imperative” acts as a natural antidote to global fiat debasement. As central banks expanded money supplies aggressively (Global M2), bitcoin’s price has shown strong correlation, acting as a pressure valve for inflation concerns. The quadrennial “halving” (latest: April 2024) mechanically reduces new supply, creating built-in supply shocks as adoption grows. * The Antifragile Security Feedback Loop: Bitcoin’s security isn’t static; it’s antifragile. The network strengthens through demand: * More users → More transactions → Higher fees → More miner revenue → More hashpower (computational security) → Greater network resilience → More user confidence.

This self-reinforcing cycle contrasts sharply with traditional systems, where security is a cost center (e.g., bank security budgets, military spending). Bitcoin turns security into a profitable, market-driven activity. * Institutionalization Without Centralization: While institutional ownership via ETFs (like BlackRock’s IBIT) and corporate treasuries (MicroStrategy, Metaplanet) has surged, supply remains highly decentralized.Individuals still hold the largest share of bitcoin, preventing a dangerous concentration of control. Spot Bitcoin ETFs alone are projected to see over $20 billion in net inflows in 2025, demonstrating robust institutional capital allocation.

The Bitcoin Community: Building the Digital Antler’s Resilience

Lowery’s “Softwar” theory underscores why bitcoin’s decentralized architecture is non-negotiable. Its strength lies in the alignment of incentives across three participant groups:

- Miners: Provide computational power (hashrate), validating transactions and securing the network. Incentivized by block rewards (newly minted BTC) and transaction fees. Their physical energy expenditure is the “muscle” behind the digital antler.

- Nodes: Independently verify and enforce the protocol rules, maintaining the blockchain’s integrity. Run by users, businesses, and enthusiasts globally. They ensure decentralized consensus, preventing unilateral protocol changes.

- Users: Individuals, institutions, and corporations holding, transacting, or building on bitcoin. Their demand drives transaction fees and fuels the security feedback loop.

This structure creates “Mutually Assured Preservation”. Attacking bitcoin requires overwhelming its global, distributed physical infrastructure (miners/nodes), a feat far more complex and costly than seizing a central bank’s gold vault or freezing a bank’s assets. It transforms financial security from a centralized liability into a decentralized, physically-grounded asset.

Risks & Responsibilities

Investors and policymakers must acknowledge persistent challenges:

- Volatility: Bitcoin remains volatile, though this has decreased as markets mature. Dollar-cost averaging (DCA) is widely recommended to mitigate timing risk.

- Regulatory Uncertainty: While U.S. policy is increasingly favorable, global coordination is lacking. The EU’s MiCAR regulation exemplifies divergent approaches.

- Security & Custody: While Bitcoin’s protocol is robust, user errors (lost keys) or exchange hacks remain risks.

- Environmental Debate: Proof-of-Work energy use is scrutinized, though mining increasingly uses stranded energy/renewables. Innovations continue.

Jason Lowery’s “Softwar” theory elevates bitcoin from a financial instrument to a socio-technological innovation on par with the invention of the corporation, the rule of law, or even the antler in evolutionary biology. It provides a coherent framework for understanding why:

- Nations like the U.S. are looking to establish bitcoin reserves and embracing stablecoins—they recognize bitcoin’s role in projecting economic power non-violently in the digital age.

- Institutional Investors are allocating billions via ETFs—they see a scarce, secure, uncorrelated asset with antifragile properties.

- Individuals in hyperinflationary economies or under authoritarian regimes use bitcoin—it offers self-sovereign wealth storage immune to seizure or debasement.

For the investor, bitcoin represents more than potential price appreciation. It offers exposure to a fundamental reorganization of how power and value are secured and exchanged globally, grounded not in abstract promises, but in the unyielding laws of physics and mathematics.

Like the brewers who balanced tradition with innovation to create something enduring and valuable, bitcoin pioneers are building the infrastructure for a more resilient digital future—one computationally secured block at a time. The “Softwar” is here, and it is reshaping the landscape of p

-

@ 7f6db517:a4931eda

2025-06-09 10:02:20

@ 7f6db517:a4931eda

2025-06-09 10:02:20

The former seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

The latter's future remains to be seen. Dependence on Tor, which has had massive reliability issues, and lack of strong privacy guarantees put it at risk.

— ODELL (@ODELL) October 27, 2022

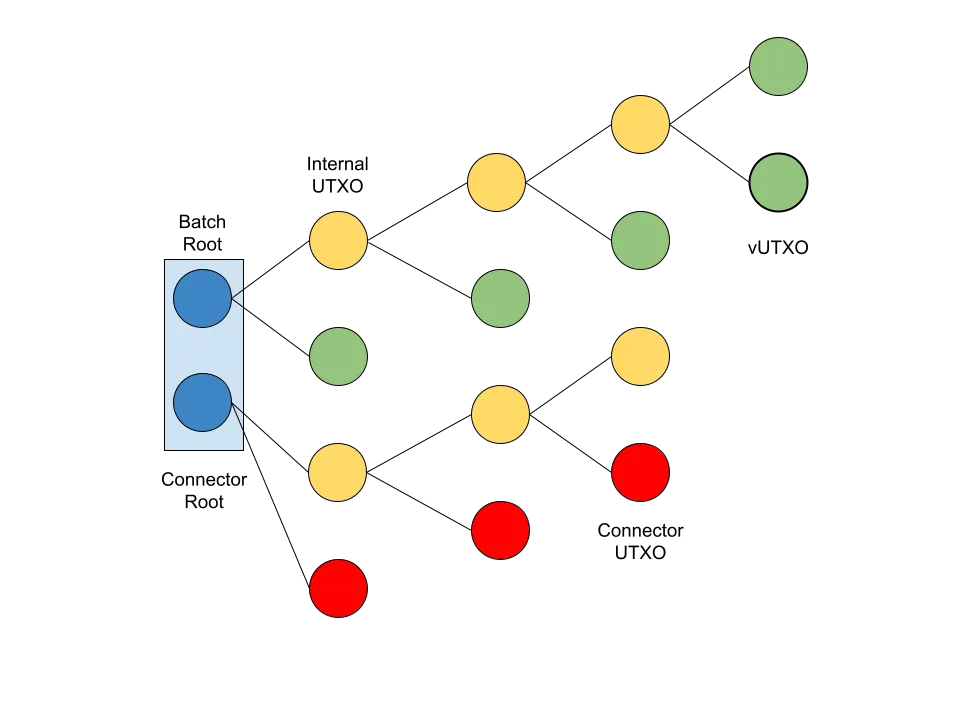

The Basics

- Lightning is a protocol that enables cheap and fast native bitcoin transactions.

- At the core of the protocol is the ability for bitcoin users to create a payment channel with another user.

- These payment channels enable users to make many bitcoin transactions between each other with only two on-chain bitcoin transactions: the channel open transaction and the channel close transaction.

- Essentially lightning is a protocol for interoperable batched bitcoin transactions.

- It is expected that on chain bitcoin transaction fees will increase with adoption and the ability to easily batch transactions will save users significant money.

- As these lightning transactions are processed, liquidity flows from one side of a channel to the other side, on chain transactions are signed by both parties but not broadcasted to update this balance.

- Lightning is designed to be trust minimized, either party in a payment channel can close the channel at any time and their bitcoin will be settled on chain without trusting the other party.

There is no 'Lightning Network'

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise.

- There are many lightning channels between many different users and funds can flow across interconnected channels as long as there is a route through peers.

- If a lightning transaction requires multiple hops it will flow through multiple interconnected channels, adjusting the balance of all channels along the route, and paying lightning transaction fees that are set by each node on the route.

Example: You have a channel with Bob. Bob has a channel with Charlie. You can pay Charlie through your channel with Bob and Bob's channel with User C.

- As a result, it is not guaranteed that every lightning user can pay every other lightning user, they must have a route of interconnected channels between sender and receiver.

Lightning in Practice

- Lightning has already found product market fit and usage as an interconnected payment protocol between large professional custodians.

- They are able to easily manage channels and liquidity between each other without trust using this interoperable protocol.

- Lightning payments between large custodians are fast and easy. End users do not have to run their own node or manage their channels and liquidity. These payments rarely fail due to professional management of custodial nodes.

- The tradeoff is one inherent to custodians and other trusted third parties. Custodial wallets can steal funds and compromise user privacy.

Sovereign Lightning

- Trusted third parties are security holes.

- Users must run their own node and manage their own channels in order to use lightning without trusting a third party. This remains the single largest friction point for sovereign lightning usage: the mental burden of actively running a lightning node and associated liquidity management.

- Bitcoin development prioritizes node accessibility so cost to self host your own node is low but if a node is run at home or office, Tor or a VPN is recommended to mask your IP address: otherwise it is visible to the entire network and represents a privacy risk.

- This privacy risk is heightened due to the potential for certain governments to go after sovereign lightning users and compel them to shutdown their nodes. If their IP Address is exposed they are easier to target.

- Fortunately the tools to run and manage nodes continue to get easier but it is important to understand that this will always be a friction point when compared to custodial services.

The Potential Fracture of Lightning

- Any lightning user can choose which users are allowed to open channels with them.

- One potential is that professional custodians only peer with other professional custodians.

- We already see nodes like those run by CashApp only have channels open with other regulated counterparties. This could be due to performance goals, liability reduction, or regulatory pressure.

- Fortunately some of their peers are connected to non-regulated parties so payments to and from sovereign lightning users are still successfully processed by CashApp but this may not always be the case going forward.

Summary

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise. There is no singular 'Lightning Network' but rather many payment channels between distinct peers, some connected with each other and some not.

- Lightning as an interoperable payment protocol between professional custodians seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

- Lightning as a robust sovereign payment protocol has yet to be battle tested. Heavy reliance on Tor, which has had massive reliability issues, the friction of active liquidity management, significant on chain fee burden for small amounts, interactivity constraints on mobile, and lack of strong privacy guarantees put it at risk.

If you have never used lightning before, use this guide to get started on your phone.

If you found this post helpful support my work with bitcoin.

-

@ eb0157af:77ab6c55

2025-06-09 10:02:00

@ eb0157af:77ab6c55

2025-06-09 10:02:00A new step for the American bank in the digital asset space: Bitcoin ETFs cleared for use as collateral for financing.

JPMorgan Chase will allow clients to use spot Bitcoin ETFs as collateral to obtain loans. According to sources close to the project, cited by Bloomberg, the initiative will launch in the coming weeks and will involve trading and wealth management clients on a global scale.

The bank has decided to begin this new phase starting with crypto ETFs, beginning with the BlackRock iShares Bitcoin Trust (IBIT), which has already surpassed $70 billion in assets under management (AUM). The decision is part of a broader strategy aimed at enabling selected clients to access financing by using cryptocurrency-related assets as collateral. Before this change, JPMorgan only accepted crypto ETFs as loan collateral under specific conditions.

The American bank’s new approach will see Bitcoin ETFs treated like other traditional assets when calculating a client’s borrowing capacity. Just as is currently the case with stocks, cars, or works of art, crypto ETFs will become an integral part of standard wealth evaluations.

Although CEO Jamie Dimon has historically been known for his skeptical stance on Bitcoin, the bank announced last month that it would soon allow clients to purchase spot ETFs on the leading cryptocurrency — although without offering custody services.

The new rules will apply to all of JPMorgan’s wealth management clients worldwide, from retail customers to high-net-worth individuals. The bank will also integrate crypto holdings into the net worth assessments of clients managed by its wealth management division.

The post JPMorgan Chase: Bitcoin ETFs accepted as loan collateral appeared first on Atlas21.

-

@ cae03c48:2a7d6671

2025-06-09 10:01:19

@ cae03c48:2a7d6671

2025-06-09 10:01:19Bitcoin Magazine

Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in BitcoinMeanwhile Insurance Bitcoin (Bermuda) Limited (“Meanwhile”) announced it has become the first company in the world to release externally audited financial statements denominated entirely in Bitcoin. According to the announcement, the company reported 220.4 BTC in assets and 25.29 BTC in net income for 2024, a 300% year over year increase.

Today marks a global first & historic event for us, along with the public release of our 2024 audited financial statements, covering our 1st year of sales.

As the 1st company in the world to have Bitcoin-denominated financial statements externally audited, we are excited to…

— meanwhile | Bitcoin Life Insurance (@meanwhilelife) June 5, 2025

“We’ve just made history as the first company in the world to have Bitcoin-denominated financial statements externally audited,” said Zac Townsend, CEO of Meanwhile. “This is an important, foundational step in reimagining the financial system based on a single, global, decentralized standard outside the control of any one government.”

The financial statements were audited by Harris & Trotter LLP and its digital asset division ht.digital. Meanwhile’s financials also comply with Bermuda’s Insurance Act 1978, noting that their BTC denominated financials were approved and comply with official guidelines. The firm, fully licensed by the Bermuda Monetary Authority (BMA), operates entirely in BTC and is prohibited from liquidating Bitcoin assets except through policyholder claims, positioning it as a long term holder.

“As the first regulated Bitcoin life insurance company, we view the BTC held by Meanwhile as inherently long-term in nature—primarily held to support the Company’s insurance liabilities over decades,” Townsend added. “This makes it significantly ‘stickier’ and resistant to market pressures compared to the BTC held by other companies as part of their treasury management strategies.”

Meanwhile’s 2024 financials also revealed 23.02 BTC in net premiums and 4.35 BTC in investment income, showing that its model not only preserves Bitcoin, but earns it. The company’s reserves (also held in BTC) were reviewed and approved by Willis Towers Watson (WTW).

Meanwhile also offers a Bitcoin Whole Life insurance product that allows policyholders to save, borrow, and build legacy wealth—entirely in BTC, and has plans to expand globally in 2025.

“We are incredibly proud of today’s news as it underscores how Meanwhile is at the forefront of the next phase of the convergence between Bitcoin and institutional financial markets,” said Tia Beckmann, CFO of Meanwhile. “Now having generated net income in BTC, we have demonstrated that we are earning it through a sustainable insurance business model designed for the long term.”

This post Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in Bitcoin first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 7f6db517:a4931eda

2025-06-08 18:01:54

@ 7f6db517:a4931eda

2025-06-08 18:01:54

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 318ebaba:9a262eae

2025-06-09 08:45:57

@ 318ebaba:9a262eae

2025-06-09 08:45:57Nostr, which stands for "Notes and Other Stuff Transmitted by Relays," is a decentralized communication protocol designed to facilitate the exchange of messages without relying on centralized servers. This innovative framework allows users to create, broadcast, and receive messages freely, emphasizing user empowerment and censorship resistance.

Key Features of Nostr

-

Decentralization: Unlike traditional social media platforms, Nostr operates on a network of relays, which are servers that anyone can run. This structure eliminates the control that a single entity can exert over the platform, thereby reducing the risk of censorship and enhancing user privacy[1][4][5].

-

Open Protocol: Nostr is not an application itself but a protocol that developers can use to build various applications. This openness allows for a wide range of services, from social media to messaging, all built on the same underlying technology. Users can access multiple applications using a single public/private key pair, making it easier to manage their online identities[2][3][4].

-

Censorship Resistance: One of the primary motivations behind Nostr's creation is to provide a platform where users can communicate without fear of censorship. This is particularly appealing to those disillusioned with traditional social media platforms that often impose restrictions on content[5][10].

-

User Control: Nostr empowers users by allowing them to control their data and interactions. Users can choose which relays to connect to and can run their own relays, ensuring that they are not dependent on any single service provider[4][5][7].

-

Cryptographic Security: The protocol employs public-key cryptography to secure messages and verify identities, similar to how Bitcoin operates. This ensures that messages are authentic and have not been tampered with during transmission[5][10].

Applications and Community

Nostr has gained traction among various communities, particularly within the cryptocurrency space, where figures like Jack Dorsey and Edward Snowden have expressed support for its potential to reshape online communication. The protocol's design allows for a variety of applications, including social media platforms, chat services, and content sharing tools, all of which can interoperate seamlessly[2][3][5].

In summary, Nostr represents a significant shift in how digital communication can be structured, prioritizing decentralization, user autonomy, and resistance to censorship, making it a compelling alternative to conventional social media platforms. [1] https://threenine.blog/posts/what-is-nostr [2] https://www.forbes.com/sites/digital-assets/2023/04/11/how-to-get-started-with-nostr/ [3] https://www.forbes.com/sites/digital-assets/2024/07/17/your-guide-to-nostr-the-decentralized-network-for-everything/ [4] https://www.ledger.com/academy/glossary/nostr [5] https://river.com/learn/what-is-nostr/ [6] https://www.cointribune.com/en/comment-utiliser-nostr-guide-pour-debutants-2/ [7] https://www.ccn.com/education/what-is-nostr-and-how-to-start-using-nostr/ [8] https://nostr.com/ [9] https://mylessnider.com/articles/why-im-excited-about-nostr [10] https://en.wikipedia.org/wiki/Nostr [11] https://nostr.how/en/what-is-nostr [12] https://nostr.org/ [13] https://medium.com/@colaru/an-introduction-to-nostr-protocol-dbc774ac797c [14] https://www.linkedin.com/pulse/what-nostr-manfred-van-doorn-nf9ce [15] https://www.cointribune.com/en/nostr-pour-les-debutants-tout-ce-que-vous-devez-savoir-sur-le-protocole-2/ [16] https://www.reddit.com/r/Bitcoin/comments/17j5glg/do_people_in_this_sub_know_about_nostr/ [17] https://www.voltage.cloud/blog/the-essential-guide-to-nostr-relays [18] https://www.reddit.com/r/nostr/comments/1i6t4g7/explain_how_nostr_works_like_im_a_5_year_old/ [19] https://github.com/nostr-protocol/nostr

-

-

@ 7f6db517:a4931eda

2025-06-09 05:02:25

@ 7f6db517:a4931eda

2025-06-09 05:02:25

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ cae03c48:2a7d6671

2025-06-08 00:01:17

@ cae03c48:2a7d6671

2025-06-08 00:01:17Bitcoin Magazine

Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in BitcoinMeanwhile Insurance Bitcoin (Bermuda) Limited (“Meanwhile”) announced it has become the first company in the world to release externally audited financial statements denominated entirely in Bitcoin. According to the announcement, the company reported 220.4 BTC in assets and 25.29 BTC in net income for 2024, a 300% year over year increase.

Today marks a global first & historic event for us, along with the public release of our 2024 audited financial statements, covering our 1st year of sales.

As the 1st company in the world to have Bitcoin-denominated financial statements externally audited, we are excited to…

— meanwhile | Bitcoin Life Insurance (@meanwhilelife) June 5, 2025

“We’ve just made history as the first company in the world to have Bitcoin-denominated financial statements externally audited,” said Zac Townsend, CEO of Meanwhile. “This is an important, foundational step in reimagining the financial system based on a single, global, decentralized standard outside the control of any one government.”

The financial statements were audited by Harris & Trotter LLP and its digital asset division ht.digital. Meanwhile’s financials also comply with Bermuda’s Insurance Act 1978, noting that their BTC denominated financials were approved and comply with official guidelines. The firm, fully licensed by the Bermuda Monetary Authority (BMA), operates entirely in BTC and is prohibited from liquidating Bitcoin assets except through policyholder claims, positioning it as a long term holder.

“As the first regulated Bitcoin life insurance company, we view the BTC held by Meanwhile as inherently long-term in nature—primarily held to support the Company’s insurance liabilities over decades,” Townsend added. “This makes it significantly ‘stickier’ and resistant to market pressures compared to the BTC held by other companies as part of their treasury management strategies.”

Meanwhile’s 2024 financials also revealed 23.02 BTC in net premiums and 4.35 BTC in investment income, showing that its model not only preserves Bitcoin, but earns it. The company’s reserves (also held in BTC) were reviewed and approved by Willis Towers Watson (WTW).

Meanwhile also offers a Bitcoin Whole Life insurance product that allows policyholders to save, borrow, and build legacy wealth—entirely in BTC, and has plans to expand globally in 2025.

“We are incredibly proud of today’s news as it underscores how Meanwhile is at the forefront of the next phase of the convergence between Bitcoin and institutional financial markets,” said Tia Beckmann, CFO of Meanwhile. “Now having generated net income in BTC, we have demonstrated that we are earning it through a sustainable insurance business model designed for the long term.”

This post Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in Bitcoin first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ edf0da8b:b2652fa3

2025-06-09 08:36:32

@ edf0da8b:b2652fa3

2025-06-09 08:36:32One remarkable thing the Wim Hof Method stirs in me is that I increasingly feel the desire to connect with pure nature. Now, what does that mean?

You may know that slight feeling of eeriness when looking at deep moving waters or that tiny insecurity when darkness creeps up around you alone among the trees? You are sure there's nothing to worry about. But still, these little old conditioned anxieties, these unreasonable mind scenarios, they keep coming up and make you seek safety.

They are different for everyone, but these anxieties in the foreground are a sign for inner blockages that deprive us from expressing our power and creativity. What's more, they separate us from nature. They suggest, everything around us is potentially dangerous. Is it though?

When practicing the Wim Hof Method, and especially right after the breathing exercises, I can immediately feel a clarity emerging, a stronger awareness of presence in the moment. Anxieties are caringly pushed back to their rightful place, but do not control my actions and no longer dominate my state of being.

And so suddenly, the world view shifts. Eerie deep moving waters become fascinating, the darkness around reveals the beauty of trees casting soft moonlight shadows. I deeply appreciate what is, I want to touch the waters, I want to merge with the shadows, I feel that power. Instead of running away I want to connect with nature. I'm more aware of the present and should danger reveal itself, I have the confidence that I can properly react when it arises. But until then, I can enjoy beauty and connectedness. The powerful shift is from scenarios about potential threats around me to curiosity and beautiful opportunity everywhere.

There are countless great techniques and traditions that guide us to such shifts. But with regular practice, I find the Wim Hof Method to be particularly simple, accessible and effective.

wimhofmethod #breathwork #coldtherapy #courage #motivation #freedom

-

@ 7f6db517:a4931eda

2025-06-08 18:01:53

@ 7f6db517:a4931eda

2025-06-08 18:01:53

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ 9ca447d2:fbf5a36d

2025-06-09 10:01:39

@ 9ca447d2:fbf5a36d

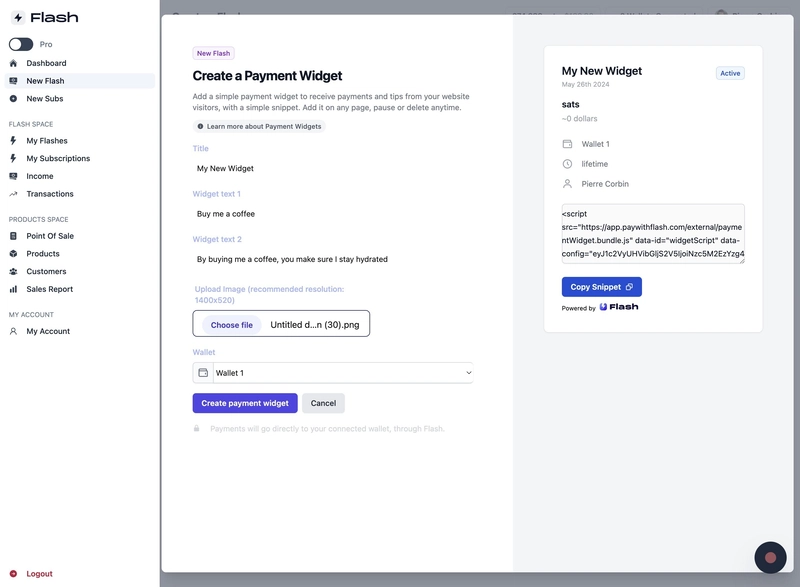

2025-06-09 10:01:39Paris, France – June 6, 2025 — Bitcoin payment gateway startup Flash, just announced a new partnership with the “Bitcoin Only Brewery”, marking the first-ever beverage company to leverage Lightning payments.

Flash enables Bitcoin Only Brewery to offer its “BOB” beer with, no-KYC (Know Your Customer) delivery across Europe, priced at 19,500 sats (~$18) for the 4-pack, shipping included.

The cans feature colorful Bitcoin artwork while the contents promise a hazy pale ale: “Each 33cl can contains a smooth, creamy mouthfeel, hazy appearance and refreshing Pale Ale at 5% ABV,” reads the product description.

Pierre Corbin, Co-Founder of Flash, commented:

“Currently, bitcoin is used more as a store of value but usage for payments is picking up. Thanks to new innovation on Lightning, bitcoin is ready to go mainstream for e-commerce sales.”

Flash, launched its 2.0 version in March 2025 with the goal to provide the easiest bitcoin payment gateway for businesses worldwide. The platform is non-custodial and can enable both digital and physical shops to accept bitcoin by connecting their own wallets to Flash.

By leveraging the scalability of the Lightning Network, Flash ensures instant, low-cost transactions, addressing on-chain Bitcoin bottlenecks like high fees and long wait times.