-

@ 5d4b6c8d:8a1c1ee3

2025-06-01 00:08:04

@ 5d4b6c8d:8a1c1ee3

2025-06-01 00:08:04How'd everyone do on their ~HealthAndFitness goals today?

I got pretty good sleep, stuck to my fast pretty well, didn't eat much junk food, and was pretty active with chores and errands. Not a particularly strong day, but not a weak on, either.

https://stacker.news/items/994000

-

@ 7f6db517:a4931eda

2025-06-01 00:01:36

@ 7f6db517:a4931eda

2025-06-01 00:01:36

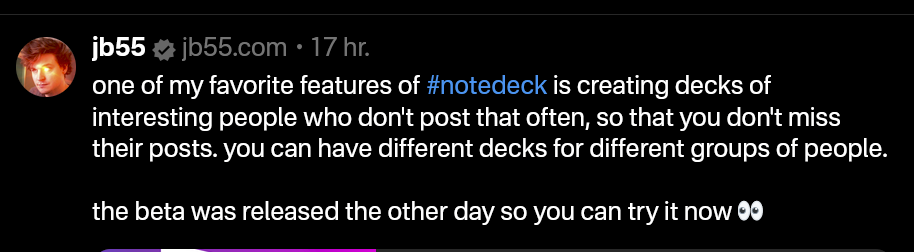

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ eb0157af:77ab6c55

2025-06-01 00:01:16

@ eb0157af:77ab6c55

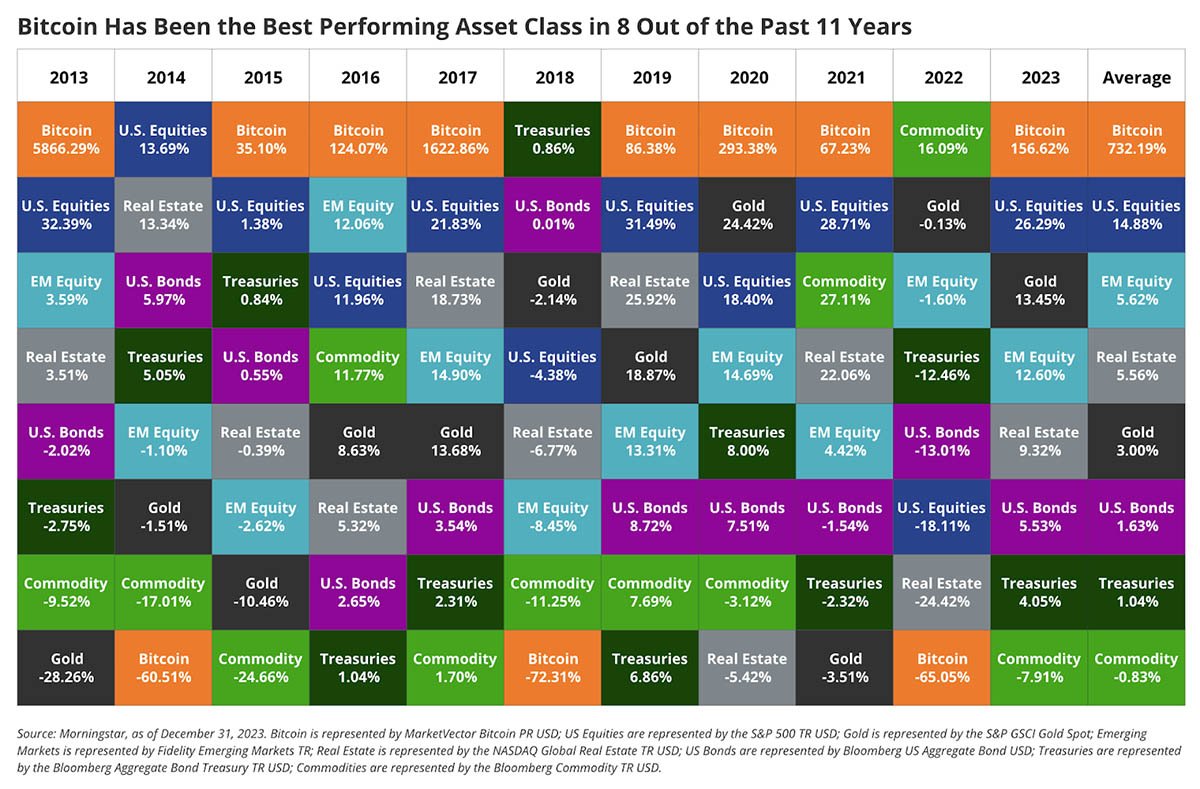

2025-06-01 00:01:16A new investment vehicle combines exposure to Bitcoin with downside protection based on the price of gold.

On May 29, Cantor Fitzgerald Asset Management announced the launch of an investment product that merges direct exposure to Bitcoin with a bearish hedge linked to gold.

According to the financial institution, the new fund offers a solution for investors seeking to benefit from the growth potential of the leading cryptocurrency while maintaining a safety net tied to the precious metal.

Fund features

The fund is structured with a five-year term and no cap on potential upside, allowing investors to fully capture Bitcoin’s growth. The “1-to-1” protection mechanism means that any losses on Bitcoin would be offset by corresponding gains from gold.

Brandon Lutnick, Chairman of Cantor and son of former CEO Howard Lutnick (now Commerce Secretary in the Trump administration), called the product “a truly revolutionary investment vehicle” that helps investors access Bitcoin’s potential while providing downside protection. “There are still people on the Earth that are still scared of Bitcoin, and we want to bring them into this ecosystem,” Lutnick added.

The fund marks Cantor Fitzgerald’s first BTC-focused investment product. The firm, with 79 years of history and $14.8 billion in assets under management, is making its first significant move into the Bitcoin market.

The announcement follows the closing of its first round of financing agreements with Maple Finance and FalconX. Through its “Bitcoin Financing Business” division, Cantor plans to initially make up to $2 billion in financing available to institutional clients.

The post Cantor Fitzgerald launches Bitcoin fund with gold hedge appeared first on Atlas21.

-

@ 9ca447d2:fbf5a36d

2025-06-01 00:00:55

@ 9ca447d2:fbf5a36d

2025-06-01 00:00:55The third annual Bitcoin FilmFest (aka BFF25) proved once again that sovereign minds and decentralized culture thrive together.

For four electrifying days in Poland’s capital, the festival’s rallying call—’Fix the money, fix the culture‘—wasn’t just a slogan but a living, breathing movement.

From May 22-25, 2025, Warsaw buzzed with cinematic innovation, Bitcoin philosophy, and artistic vibe marking this gathering as truly incomparable.

Rebel Tribe with Unfiltered Creativity

With 200+ attendees from 20+ countries – primarily Poland, Czech Republic, the UK and Germany (~70% combined), plus representation from Spain, Italy, USA, Turkey and 15+ other nations including Thailand, Israel, Dubai and Latin America—BFF25 became a true global hub of freedom-fighters at heart.

The European Pizza Day opener (May 22), celebrating Bitcoin’s first real-world transaction, saw rainy evening weather that couldn’t dampen the energy.

With concerts by Roger9000 and ABBE plus DJ sets from MadMunky, 2140 collective w/Airklipz and G.O.L.D., all early arrivals had a memorable start.

Dual Focus on Film and Bitcoin Culture

-

Seven film workshops and seven hands-on sessions running parallel across Friday and Saturday at Amondo Cinema Club. Film: Martin Piga, Oswald Horowitz, Psyfer, Juan Pablo Mejía, Kristina Weiserova, Rare Passenger, Noa Gruman & Lahav Levi (Scardust). Bitcoin/Nostr: Aleks Svetski, Ioni Appelberg, Flash, CryptoSteel, Bitrefill, Polish Bitcoin Association, Bitvocation.

-

The Community Stage (Friday to Sunday afternoon) gave important space for both projects and individuals discussing their work and passions.

Everything from music, art, fiction, Nostr, personal sovereignty to Polish-language debates on Bitcoin’s state and its possible future. -

Onscreen, 9 cinematic blocks from Friday to Sunday featured titles like UNBAKABLE, REVOLUCIÓN BITCOIN, HOTEL BITCOIN, PLANDEMIC: THE MUSICAL, plus shorts on new media (AI/experimental cinema), parallel communities (outcast cinema), and newly released pilots.

-

Cinematic shark-tank with a €3,000 bounty: 8 contestants

- Martin Piga: “PARALLEL SPACES”

- Kristina Weiserova: “PUZZLE”

- Aaron Koenig : “SATOSHI’S LAST WILL”

- Philip Charter: “21 FUTURES”

- Jenna Reid: “WHERE DO WE GO FROM HERE?”

- Mr Black: “A LODGING OF WAYFARING MEN”

- Oswald Horowitz: “THE LEGEND OF LANDI”

The event ended with Jenna winning.

-

Official Gala: Golden Rabbits 2025 crowned:

- HOTEL BITCOIN by Manuel Sanabria & Carlos “Pocho” Villaverde (Best Story)

- SATOSHI: THE CREATION OF BITCOIN by Arthur Machado (Best Short)

- REVOLUCIÓN BITCOIN by Juan Pablo Mejía (Audience Choice)

- NO MORE INFLATION by Maiku Tsukai’s aka Bitcoin Shooter (Best Film)

Nights Charged with Music and Unscripted Surprise

The festival’s legendary afterparties kept the energy high—Friday’s underground gathering at Morph Club (ex-Barbazaar) featured Aaron Koening’s live concert and 2140 DJs (Akme + Andy Princz).

The weekend’s unforgettable moment came when Noa Gruman took the stage with “MY HEAVEN” (Scardust original) and “40HPW” — her powerful tribute to Bitcoin podcasts and Bugle.News.

Lightning-Powered Innovation, and Extras

-

Lightning in Action: Flash enabled instant Bitcoin payments across both main venues (Amondo + Samo Centrum, merch stations, and online shop)

-

IndeeHub Backstage Pass: Attendees unlocked exclusive access to Lightning-powered VOD featuring selected films from BFF23-25

-

BFF TV: Kiki (El Salvador) broadcasting live interviews, event clips, and trailers. Day One, and Day Two to rewatch online.

-

Comedy Strike: Robert Le Ricain’s Gala stand-up proved Bitcoiners pack brains and humor—in equal measure.

A Community-Driven Cultural Experience

Bitcoin FilmFest wasn’t just an event—it was proof that culture shifts when money gets fixed. Mark your calendars for June 2026 and the next edition. More info and tickets going on sale soon.

-

-

@ cae03c48:2a7d6671

2025-06-01 00:00:35

@ cae03c48:2a7d6671

2025-06-01 00:00:35Bitcoin Magazine

Panama City Mayor Mizrachi: “Bitcoin Is Not Just Safe, It’s Prosperous”At the 2025 Bitcoin Conference in Las Vegas, the Director of Bitcoin Beach Mike Peterson, the Presidential Advisors of Building Bitcoin Country El Salvador Max & Stacy and the Mayor City of Panama Mayer Mizrachi discussed Bitcoins future in Panama.

At the beginning of the panel, Is Panama Next? El Salvador Leading The Region For Bitcoin Adoption, Mayor Mizrachi started by mentioning, “We accept Bitcoin. The city gets paid in Bitcoin, but it receives in dollars through an intermediary processing, payments processor. Bitcoin is not just safe. It’s prosperous.”

Max commented about the scammers in crypto and how El Salvador is managing it.

“We did a couple of things early on, one was to create The Bitcoin Office which will be directly reporting to the President, and then also we passed a law which will say bitcoin is money and everything else is an unregistered security,” said Max.

Mike Peterson stated, “the access of Bitcoin in Central America to do battle against the globalists that have always looked at the regionist back yard. This is intolerable and this is going to change right now.” After Mizrachi commented, “Imagine yourself in an economic block powered by El Salvador, supported by Panama and the rest will come.”

Stacy reminded everybody about El Salvador’s School system.

“El Salvador is the first country in the world to have a comprehensive public school financial literacy education program from 7 years old,” mentioned Stacy. “These are little kids, learning financial literacy.”

Max ended the panel by saying, “the US game theory right? Because the US wants to buy a lot of Bitcoin, so if Panama wants to buy a lot of bitcoin then it helps everybody in the US. This is the beautiful expression of game theory perfectly aligned in the protocol that is changing the world that we live in. And on the street level what bitcoin does to the population is to go from a spending mentality to a saving mentality.”

You can watch the full panel discussion and the rest of the Bitcoin 2025 Conference Day 3 below:

This post Panama City Mayor Mizrachi: “Bitcoin Is Not Just Safe, It’s Prosperous” first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ a10260a2:caa23e3e

2025-05-31 23:39:05

@ a10260a2:caa23e3e

2025-05-31 23:39:05Last Updated: May 31, 2025

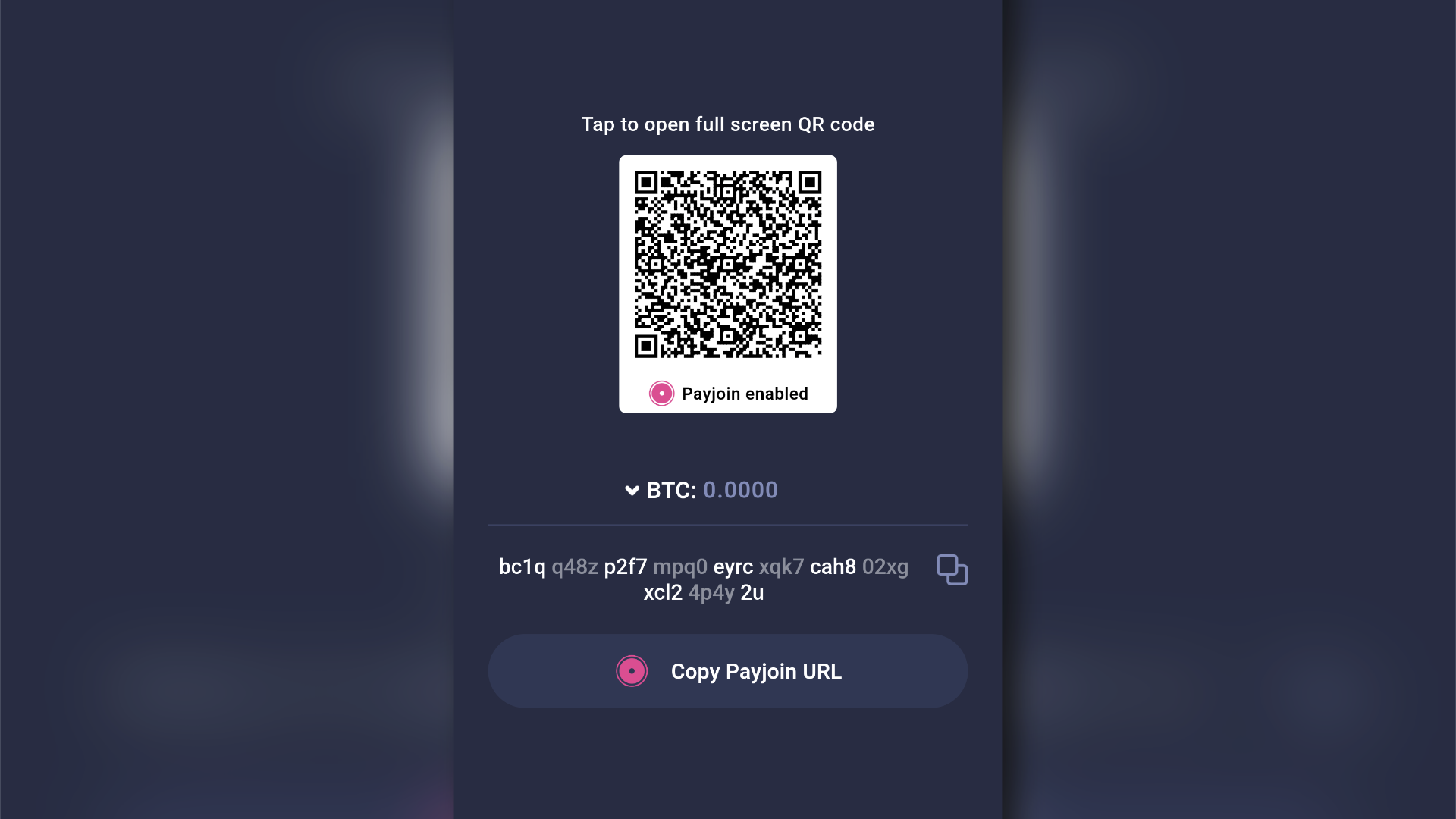

First off, big shoutout to Coinos for having support for adding a memo to BOLT12 offers. This provides a solid alternative for the pleb who wants to support mining decentralization but doesn’t want to set up a CLN node and pay thousands of sats for a channel only to get little rewards. This is the case for most of us who only have a miner or two (e.g. a Bitaxe and/or an S9).

Before we get into setting up Lightning payouts, you’ll want to have your miner configured to mine with OCEAN of course. You’ll also want to make sure that the bitcoin address you use is from a wallet that supports signing messages.

These are the ones listed in the OCEAN docs:

- Bitcoin Knots/Bitcoin Core

- Coldcard

- Electrum

- LND (Command Line)

- Seedsigner

- Sparrow

- Specter

- Trezor

I checked one of my favorite, user-friendly wallets — Blue Wallet — and it happens to support signing messages as well.

Just tap the three dots on the upper right and you’ll see the “Sign/Verify Message” button at the bottom.

Update [January 18]: You can now use Coinos to sign by going to https://coinos.io/sign

The trick here is to not refresh the page. In other words, when you're logged in to your Coinos account, go to the URL and use the legacy address (starts with a "1") that's displayed to configure your miner(s). If you refresh the page, you're going to get a new address which will cause the signing to fail later on. Remember, keep the tab open and don't refresh the page.

Whichever wallet you choose, generate a receive address to use when configuring your miner (it’ll also be your OCEAN username).

Here’s how it looks on the Bitaxe (AxeOS)…

And the Antminer S9 (Braiins OS).

NOTE: There’s a slight difference in the URL format between the two apps. Other than that, the username will be your bitcoin address followed by the optional “.” + the nickname for your machine.

You can find more details on OCEAN’s get started page.

Alright, now that your miner is pointed at OCEAN. Let’s configure Lightning payouts!

Generating the BOLT12 Offer

In the Coinos app, go to Receive > Bolt 12. This should be opened in another tab from the one we're using to sign the the configuration message.

Tap “Set memo” and set it to “OCEAN Payouts for [insert your bitcoin address]” (this text is case-sensitive). Use the same bitcoin address you used above to configure your miner(s).

After tapping OK, copy the BOLT12 offer (it should start with “lno”) and proceed to the next step.

Generating the Configuration Message

Navigate to the My Stats page by searching for your OCEAN Bitcoin address.

The click the Configuration link next to Next Block to access the configuration form.

Paste the BOLT12 offer here, update the block height to latest, click GENERATE, and copy the generated unsigned message.

Signing the Configuration Message

To sign the generated message, go back to Blue Wallet and use the signing function. Paste the configuration message in the Message field, tap Sign, and copy the signed message that’s generated.

If you're using Coinos to sign, return to the page that you kept open (and didn't refresh) and do the same. Paste the configuration message, click submit, and copy the signed message.

Submitting the Signed Message

Once signed, copy the signature, paste it in the OCEAN configuration form, and click CONFIRM.

If all goes well, you should see a confirmation that the configuration was successful. Congrats! 🎉

All you gotta do now is sit back, relax, and wait for a block to be found…

Or you can look into setting up DATUM. 😎

-

@ 4c96d763:80c3ee30

2025-05-31 23:33:02

@ 4c96d763:80c3ee30

2025-05-31 23:33:02Changes

Fernando López Guevara (2):

- feat(column): add tooltip on remove column button

- feat(hashtag-column): handle new hashtag on Enter key press

pushed to notedeck:refs/heads/master

-

@ dfa02707:41ca50e3

2025-05-31 23:01:26

@ dfa02707:41ca50e3

2025-05-31 23:01:26News

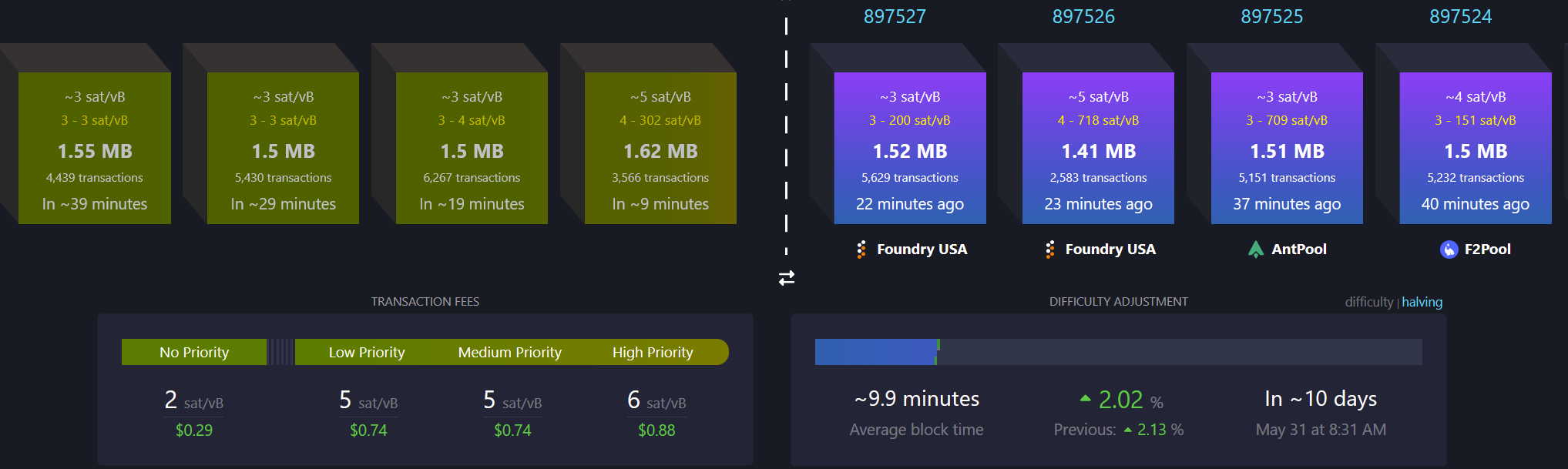

- Bitcoin mining centralization in 2025. According to a blog post by b10c, Bitcoin mining was at its most decentralized in May 2017, with another favorable period from 2019 to 2022. However, starting in 2023, mining has become increasingly centralized, particularly due to the influence of large pools like Foundry and the use of proxy pooling by entities such as AntPool.

Source: b10c's blog.

- OpenSats announces the eleventh wave of Nostr grants. The five projects in this wave are the mobile live-streaming app Swae, the Nostr-over-ham-radio project HAMSTR, Vertex—a Web-of-Trust (WOT) service for Nostr developers, Nostr Double Ratchet for end-to-end encrypted messaging, and the Nostr Game Engine for building games and applications integrated with the Nostr ecosystem.

- New Spiral grantee: l0rinc. In February 2024, l0rinc transitioned to full-time work on Bitcoin Core. His efforts focus on performance benchmarking and optimizations, enhancing code quality, conducting code reviews, reducing block download times, optimizing memory usage, and refactoring code.

- Project Eleven offers 1 BTC to break Bitcoin's cryptography with a quantum computer. The quantum computing research organization has introduced the Q-Day Prize, a global challenge that offers 1 BTC to the first team capable of breaking an elliptic curve cryptographic (ECC) key using Shor’s algorithm on a quantum computer. The prize will be awarded to the first team to successfully accomplish this breakthrough by April 5, 2026.

- Unchained has launched the Bitcoin Legacy Project. The initiative seeks to advance the Bitcoin ecosystem through a bitcoin-native donor-advised fund platform (DAF), investments in community hubs, support for education and open-source development, and a commitment to long-term sustainability with transparent annual reporting.

- In its first year, the program will provide support to Bitcoin hubs in Nashville, Austin, and Denver.

- Support also includes $50,000 to the Bitcoin Policy Institute, a $150,000 commitment at the University of Austin, and up to $250,000 in research grants through the Bitcoin Scholars program.

"Unchained will match grants 1:1 made to partner organizations who support Bitcoin Core development when made through the Unchained-powered bitcoin DAF, up to 1 BTC," was stated in a blog post.

- Block launched open-source tools for Bitcoin treasury management. These include a dashboard for managing corporate bitcoin holdings and provides a real-time BTC-to-USD price quote API, released as part of the Block Open Source initiative. The company’s own instance of the bitcoin holdings dashboard is available here.

Source: block.xyz

- Bull Bitcoin expands to Mexico, enabling anyone in the country to receive pesos from anywhere in the world straight from a Bitcoin wallet. Additionally, users can now buy Bitcoin with a Mexican bank account.

"Bull Bitcoin strongly believes in Bitcoin’s economic potential in Mexico, not only for international remittances and tourism, but also for Mexican individuals and companies to reclaim their financial sovereignty and protect their wealth from inflation and the fragility of traditional financial markets," said Francis Pouliot, Founder and CEO of Bull Bitcoin.

- Corporate bitcoin holdings hit a record high in Q1 2025. According to Bitwise, public companies' adoption of Bitcoin has hit an all-time high. In Q1 2025, these firms collectively hold over 688,000 BTC, marking a 16.11% increase from the previous quarter. This amount represents 3.28% of Bitcoin's fixed 21 million supply.

Source: Bitwise.

- The Bitcoin Bond Company for institutions has launched with the aim of acquiring $1 trillion in Bitcoin over 21 years. It utilizes secure, transparent, and compliant bond-like products backed by Bitcoin.

- The U.S. Senate confirmed Paul Atkins as Chair of the Securities and Exchange Commission (SEC). At his confirmation hearing, Atkins emphasized the need for a clear framework for digital assets. He aims to collaborate with the CFTC and Congress to address jurisdiction and rulemaking gaps, aligning with the Trump administration's goal to position the U.S. as a leader in Bitcoin and blockchain finance.

- Ethereum developer Virgil Griffith has been released from custody. Griffith, whose sentence was reduced to 56 months, is now seeking a pardon. He was initially sentenced to 63 months for allegedly violating international sanctions laws by providing technical advice on using cryptocurrencies and blockchain technology to evade sanctions during a presentation titled 'Blockchains for Peace' in North Korea.

- No-KYC exchange eXch to close down under money laundering scrutiny. The privacy-focused cryptocurrency trading platform said it will cease operations on May 1. This decision follows allegations that the platform was used by North Korea's Lazarus Group for money laundering. eXch revealed it is the subject of an active "transatlantic operation" aimed at shutting down the platform and prosecuting its team for "money laundering and terrorism."

- Blockstream combats ESP32 FUD concerning Jade signers. The company stated that after reviewing the vulnerability disclosed in early March, Jade was found to be secure. Espressif Systems, the designer of the ESP32, has since clarified that the "undocumented commands" do not constitute a "backdoor."

- Bank of America is lobbying for regulations that favor banks over tech firms in stablecoin issuance. The bank's CEO Brian Moynihan is working with groups such as the American Bankers Association to advance the issuance of a fully reserved, 1:1 backed "Bank of America coin." If successful, this could limit stablecoin efforts by non-banks like Tether, Circle, and others, reports The Block.

- Tether to back OCEAN Pool with its hashrate. "As a company committed to financial freedom and open access, we see supporting decentralization in Bitcoin mining as essential to the network’s long-term integrity," said Tether CEO Paolo Ardoino.

- Bitdeer to expand its self-mining operations to navigate tariffs. The Singapore-based mining company is advancing plans to produce machines in the U.S. while reducing its mining hardware sales. This response is in light of increasing uncertainties related to U.S. trade policy, as reported by Bloomberg.

- Tether acquires $32M in Bitdeer shares. The firm has boosted its investment in Bitdeer during a wider market sell-off, with purchases in early to mid-April amounting to about $32 million, regulatory filings reveal.

- US Bitcoin miner manufacturer Auradine has raised $153 million in a Series C funding round as it expands into AI infrastructure. The round was led by StepStone Group and included participation from Maverick Silicon, Premji Invest, Samsung Catalyst Fund, Qualcomm Ventures, Mayfield, MARA Holdings, GSBackers, and other existing investors. The firm raised to over $300 million since its inception in 2022.

- Voltage has partnered with BitGo to [enable](https://www.voltage.cloud/blog/bitgo-and-voltage-team-up-to-deliver-instant-bitcoin-and-stabl

-

@ cae03c48:2a7d6671

2025-06-01 00:00:34

@ cae03c48:2a7d6671

2025-06-01 00:00:34Bitcoin Magazine

The Debt Train Has No Brakes: Lyn Alden Makes the Case for BTC at Bitcoin 2025“Nothing stops this train,” Lyn Alden initially stated at Bitcoin 2025, walking the audience through a data-rich presentation that made one thing clear: the U.S. fiscal system is out of control—and Bitcoin is more necessary than ever.

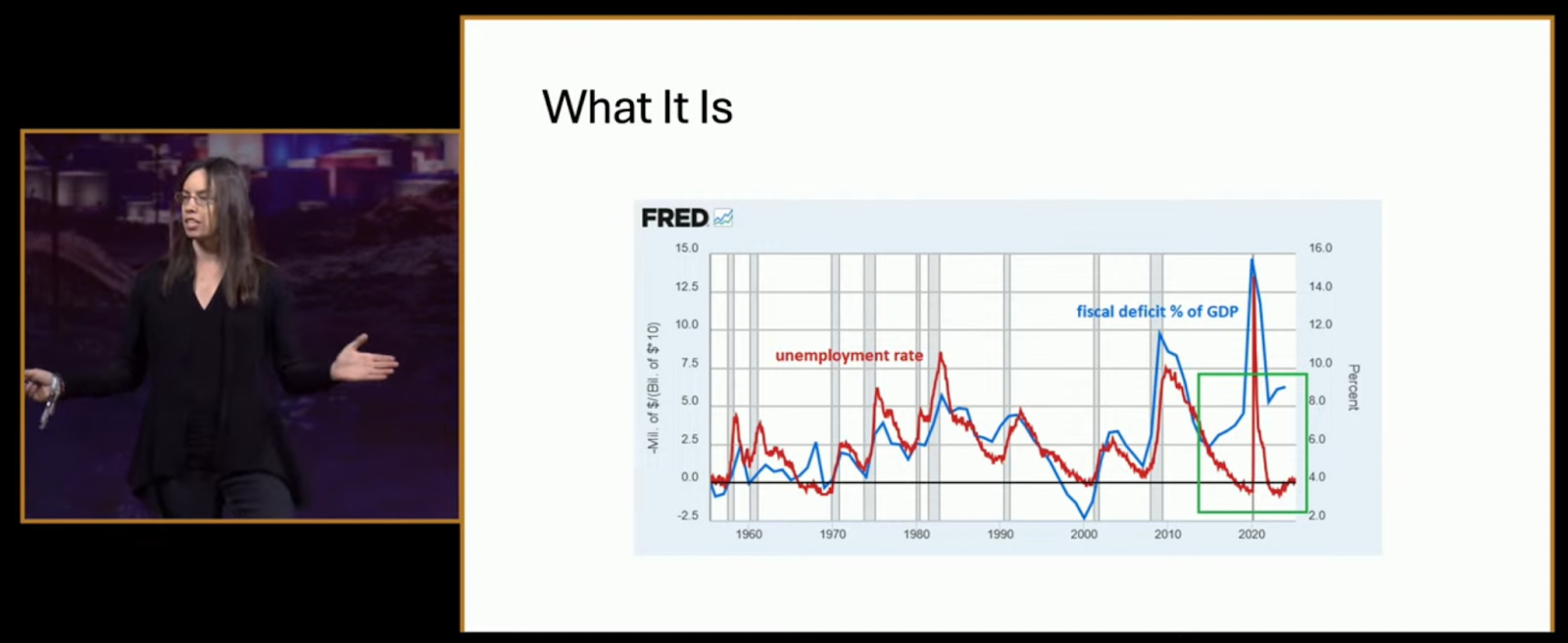

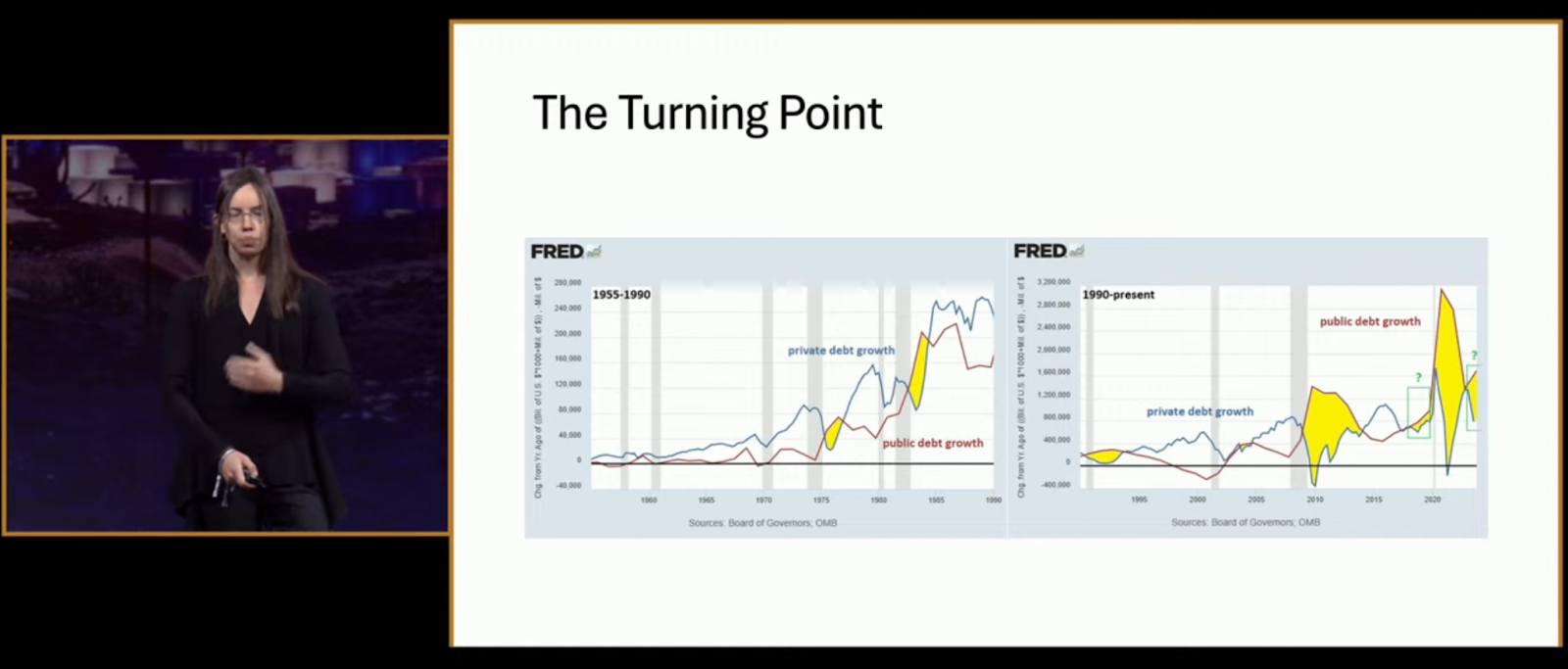

Her first chart, sourced from the Federal Reserve’s FRED database, displayed a stark decoupling: the unemployment rate is down, yet the fiscal deficit has surged past 7% of GDP. “This started around 2017, went into overdrive during the pandemic, and hasn’t corrected,” Alden said. “That’s not normal. We’re in a new era.”

She didn’t mince words. “Nothing stops this train because there are no brakes attached to it anymore. The brakes are heavily impaired.

Why should Bitcoiners care? Because, as Alden explained, “it matters for asset prices—especially anything scarce.” She displayed a gold vs. real rates chart that showed gold soaring as real interest rates plunged. “Five years ago, most would have said Bitcoin couldn’t thrive in a high-rate environment. Yet here we are—Bitcoin over $100K, gold at new highs, and banks breaking under pressure.”

Next came what she called “The Turning Point”—a side-by-side showing how public debt growth overtook private sector debt post-2008, flipping a decades-long norm. “This is inflationary, persistent, and it means the Fed can’t slow things down anymore.”

Another chart revealed why rising interest rates are now accelerating the deficit. “They’ve lost their brakes. Raising rates just makes the federal interest bill explode faster than it slows bank lending.”

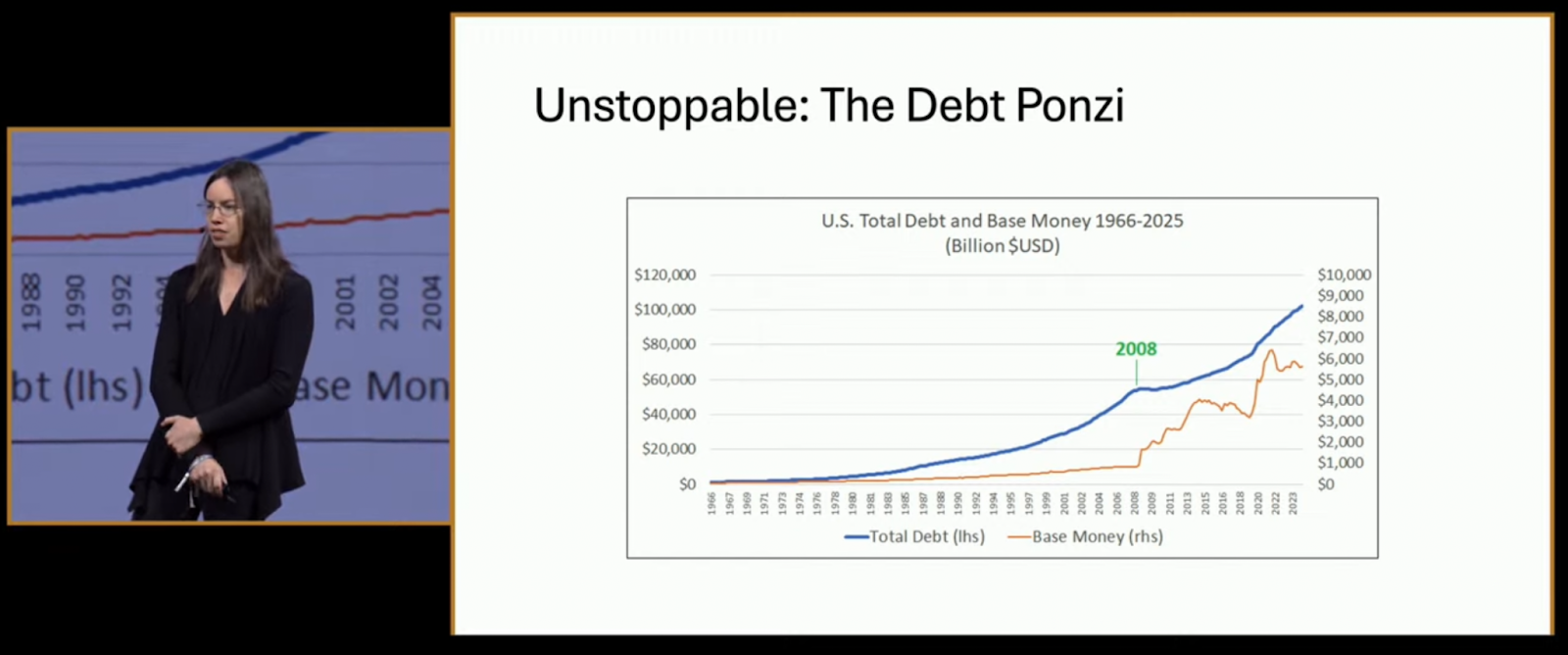

Alden called it a ponzi: “The system is built on constant growth. Like a shark, it dies if it stops swimming.”

Her slide showed a relentless rise in total debt versus base money—except for a jolt in 2008, and again after 2020. “This isn’t going backward. Ever.”

So why Bitcoin? “Because it’s the opposite. Scarce, decentralized, and mathematically capped,” Alden concluded. “There are two reasons nothing stops this train: math and human nature. Bitcoin is the mirror of this system—and the best protection from it.”

You can watch the full panel discussion and the rest of the Bitcoin 2025 Conference Day 3 below:

This post The Debt Train Has No Brakes: Lyn Alden Makes the Case for BTC at Bitcoin 2025 first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 9b12847f:9a3ee831

2025-05-31 23:42:09

@ 9b12847f:9a3ee831

2025-05-31 23:42:09What is the CGT loan trap?

The Capital Gains Tax (CGT) loan trap, is where you take a bitcoin-backed loan, expecting that providing the collateral does not trigger CGT, only to find that it does trigger CGT.

Oof.

It's a particularly dangerous trap for plebs because bitcoin collateralised lending typically requires over-collateralisation which is often 2x the amount being borrowed. This means if CGT is triggered on the provision of the collateral, your CGT is 2x the CGT bill had you just sold down the bitcoin for the amount you borrowed.

That's without adding the additional cost of the interest on the loan; more oof.

Why it's important to pay attention to this

Firstly because if you're caught in the trap, you're the one who is liable and not the Lender.

Secondly, because all bitcoin transactions are permanent records and you can reasonably assume that future tax collection sleuths will backtrack through yesterday's transactions. Lenders who KYC their customers provide an easy data collection point for tax collectors, and that data doesn't go away.

And lastly, because there is no emerging signs of fiscal responsibility at the sovereign level, so it's reasonable to assume tax agencies are being directed to increase collections .. and bitcoiners aren't going to get any sort of pass there.

And of course, the bigger the Bitcoin network grows, the more attractive bitcoin collateralised lending will be, and the the more attention it will garner .. and some of that will be from tax collectors.

So, what determines if CGT is applicable?

The concept of beneficial ownership is the relevant term to understand and pay attention to. A change in beneficial ownership is what tax authorities use as the trigger to determine if a CGT event has occurred. This isn't a term or concept isolated to my country (Australia) or the US or the UK or Europe - it's one that's been actively harmonised across the G20. It applies to all asset classes.

The beneficial owner is the one who enjoys the benefits of the asset. It's slightly different to the concept of legal owner which is the person or entity on a government register as the "owner" of the asset.

And if you're a bitcoiner reading this, you're probably already aware that there is no government register of the "ownership of bitcoin" - that's very literally what the timechain, and your bitcoin private keys, are .. but we digress.

Where there is a change in the beneficial owner of an asset, that triggers a CGT liability. This isn't new, it's not related to bitcoin specifically but to all asset classes, and it is consistent over a wide group of countries. The way that each jurisdiction legislates, enforces and applies it will vary somewhat.

So let's explore how that relates to providing collateral in bitcoin-backed loans.

Types of bitcoin backed loans

Bitcoin represents pristine and unimpeachable collateral, so any dollar lender should be happily accepting it as collateral from their perspective. But let's focus on the issue of changing beneficial ownership and how that ties into the borrower's CGT liabilities.

There are loans available from platforms that provide the dollar liquidity, and there are loans from peers.

Loans from platforms

Loans from platforms are going to require KYC information because there is a centralised lender and that will come with a legal construct. The three things to pay attention to are:

- Legal terms and conditions

Ideally, the platform terms should have a statement that acknowledges the unchanged beneficial ownership of the collateral by the borrower, as long as the borrower does not default on the loan.

There may not be such a statement, and if there is not, then the next point on how the collateral is managed needs some careful attention.

The immediate red-flag is if the terms categorically state that there is a change of beneficial ownership of the collateral; being a party to such a contract would legally acknowledge that you transferred beneficial ownership, triggering CGT.

NB: The legal terms and conditions should be generally accessible. If they aren't available then request them from support. If they're not forthcoming, then it's a giant red flag and I'd recommend you exit stage left.

- How the collateral is custodied

A key test that is used to determine if beneficial ownership has changed is the custody of the asset(s). If bitcoin as collateral is kept in a discrete location, and is not pooled with other collateral, then there is a strong case to maintain the chain of unbroken beneficial ownership.

By contrast, collateral that is sent into a "pool" can be deemed to be disposed of, since it's not the same bitcoin that is being returned on successful completion of the loan. I am personally aware of plebs who have been "bitten" by using lending services who "pool" collateral from multiple loans into a pool, and consequently receive different bitcoin on loan completion. The safe assumption is that collateral that is pooled, will be deemed a disposal for CGT events.

- Whether collateral can be re-hypothecated

Ignoring the very dubious issues around re-hypothecation more generally, (who remembers BlockFi, Celsius, Genesis, 3Arrows Capital etc), from a CGT trigger event perspective, if collateral can be re-hypothecated, it will likely be deemed a disposal for CGT purposes.

Loans that are peer-to-peer

There are other borrowing mechanisms that are based on enabling borrowing interaction directly between peers. These typically do not need to introduce the privacy and security risks of KYC, and so consequently do not require a specific legal contract between the peers.

The "terms" of the agreement are defined in the code that implements the contract between the parties, with the collateral held in a multi-party escrow, and returned to the Borrower should they successfully repay their loan. Only if the loan is NOT repaid, or needs to be liquidated, does the collateral change ownership.

In an ideal world, the usage terms for such platforms would acknowledge that the collateral provided by the Borrower remains their unchanged beneficial ownership unless the contract is liquidated, or the loan is not repaid.

Examples of platforms that allow peers to connect and create contracts for borrowing between themselves include Debifi, Lend at HodlHodl, Firefish and Lendasat.

How did I end up down this rabbit hole?

I narrowly avoided falling into precisely this trap recently when I was considering a loan from https://ledn.io I was curious that the Loan terms weren't available to review on their site, or from the customer dashboard after I signed up.

They happily provided them on request (https://www.ledn.io/legal/usd-loan-agreement), and once I got to Section 7 (b), it became clear this wasn't a product I wanted to use because every supply of collateral to Ledn, for any loan, would automatically trigger a CGT event.

Ledn, like every other lending platform, do not offer tax advice, and are clear to state the tax implications of using their products are up to the borrower to assess with their appropriate advisors.

Like many things in Bitcoin, this then made me curious about how widespread this practice was, what the underlying legal definitions were, how widely and harmoniously they were applied .. and here we are .. writing (and reading) blog posts!

So why borrow against your bitcoin at all?

Bitcoin-backed loans can potentially provide a mechanism to access dollars, without selling your bitcoin, and thereby deferring CGT on the sale of bitcoin.

For bitcoiners who've humbly stacked sats for several cycles, borrowing against your bitcoin, may provide a mechanism to further delay spending or selling sats, thereby increasing your purchasing power further.

When you borrow against your bitcoin, you are expecting bitcoin to continue to increase in purchasing power, and at a higher rate than the cost of the interest on the loan. Based on 16 years of bitcoin price history, this is a pretty safe assumption.

Don't however, make assumptions on CGT events that can potentially undermine the entire financial logic of going down this route in the first place; check carefully.

What will definitely trigger a CGT event?

Firstly and most obviously, if you take a bitcoin collateralised loan, and fail to repay the loan or are margin called and liquidated, then that portion of the collateral required to extinguish your loan will be sold. That's clearly a change of beneficial ownership, and that transaction will trigger a CGT liability.

Next, any service or product which explicitly requires you to acknowledge a change of beneficial ownership of the collateral on lodgement, will also trigger a CGT event.

After that, as we outlined earlier, pay close attention to collateral custody mechanisms and transparency and clarity on re-hypothecation - both of which are potential CGT trigger events.

So what's worth checking out?

Currently these are the lending offers that I'm aware of that are worth considering and I understand don't fall foul of the three key aspects outlined above.

As always, do your own checking, and validate with your accounting/legal advisors; the consequences of getting this wrong are potentially significant.

To be clear, I've no financial interest in any of these platforms, nor have I been paid to write this article, nor do I use referral codes. I have used some of these platforms, and believe them all to be operated by reputable teams with high integrity.

Final thoughts

Lastly, for those coming to the @bitcoinbushbash at the end of July in Palm Cove Queensland, I'll be presenting a session on this topic.

-

@ cae03c48:2a7d6671

2025-06-01 00:00:33

@ cae03c48:2a7d6671

2025-06-01 00:00:33Bitcoin Magazine

Jack Mallers Announced A New System of Bitcoin Backed Loans at StrikeThe Founder and CEO of Strike, Jack Mallers, at the 2025 Bitcoin Conference in Las Vegas, announced a new system of Bitcoin backed loans at Strike with one digit interest rate.

Jack Mallers began his keynote by pointing at the biggest problem. Fiat currency.

“The best time to go to Whole Foods and buy eggs with your dollars was 1913,” said Mallers. “Every other time after, you are getting screwed.”

What’s the solution?

“The solution is Bitcoin,” stated Mallers. “Bitcoin is the money that we coincide that nobody can print. You can’t print, you can’t debase my time and energy, you cannot deprive me of owning assets, of getting out of debt, of living sovereignly and protecting my future, my family, my priced possessions. Bitcoin is what we invented to do that.”

Mallers gave a power message to the audience by explaining that people should HODL every dollar they have in Bitcoin. People should also spend a little of it to have a nice life.

“You can’t HODL forever,” said Jack.

While talking about loans that people borrow against their Bitcoin. He explained why he thinks banks putting 20% in interest for loans backed with Bitcoin is outrageous.

“All these professional economists, they are like Bitcoin is risky and volatile,” stated Mallers. “No it’s not. This is the magnificent 7 one year volatility and the orange one in the middle is Bitcoin. It’s no more risky and volatile. It’s a little bit more volatile than Apple, but is far less more volatile than Tesla.”

“As Bitcoin matures, its volatility goes down,” continued Jack. “Bitcoin volatility is at a point where it is no more risky than a Tesla Stock. We should not be paying double digits rates for a loan.”

Mallers announced his new system of loans at Strike of 9-13% in interest rates. It will allow people to get loans from $10,000 to $1 billion.

Mallers closed by saying, “please be responsible. This is debt. Debt is like fire in my opinion. It can heat a civilization. It can warm your home, but if you go too crazy it can burn your house down.”

“Life is short,” said Jack. “Take the trip, but with bitcoin you just get to take a better one.”

This post Jack Mallers Announced A New System of Bitcoin Backed Loans at Strike first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 866e0139:6a9334e5

2025-05-31 10:45:03

@ 866e0139:6a9334e5

2025-05-31 10:45:03Autor: Marcel Bühler. Dieser Beitrag wurde mit dem Pareto-Client geschrieben. Sie finden alle Texte der Friedenstaube und weitere Texte zum Thema Frieden hier. Die neuesten Pareto-Artikel finden Sie in unserem Telegram-Kanal.

Die neuesten Artikel der Friedenstaube gibt es jetzt auch im eigenen Friedenstaube-Telegram-Kanal.

In einem Artikel in der NZZ vom 27. Mai mit dem Titel "Trump nennt Putin verrückt" wird über den laut Kiew grössten russischen Drohnenangriff seit Beginn des Krieges auf ukrainische Städte berichtet. Dabei sollen am vergangenen Wochenende 355 Drohnen und 69 Raketen auf Kiew, Odessa, Ternipol (Westukraine) und andere Städte gesteuert bzw. abgefeuert worden sein. 288 Drohnen und 9 Raketen konnten laut Kiew von der ukrainischen Luftverteidigung abgeschossen werden. Was der Artikel verschweigt: bereits in der Woche davor, am 20. - 22. Mai hatte die Ukraine 485 Drohnen gegen russische Städte wie Kursk, Belgorod oder Brijansk geflogen, 63 davon erreichten die Region Moskau. Auch am Wochenende schickten die Ukrainer 205 Drohnen gegen russische Städte, 13 davon erreichten Moskau. Auch hier konnte die Luftverteidigung die meisten Drohnen unschädlich machen, eine davon hatte gar den Helikopter von Präsident Putin (!) im Visier. Als Reaktion darauf erklärte Präsident Putin, dass in der ukrainischen Region Sumy bzw. Tschernihiw im Norden eine Sicherheitszoneeingerichtet werden soll da die meisten Drohnen von hier aus gestartet wurden. Auch am 27./28. Mai schickte die Ukraine wieder 296 Drohnen Richtung Moskau, offenbar soll die russische Luftverteidigung damit überlastet werden um später westliche Cruise Missiles wie "Storm shadows", "Skalp" oder die umstrittenen deutschen "Taurus" effektiver einsetzen zu können. Der neue Bundeskanzler Friedrich Merz hat dafür rund 5 Milliarden Euro in Aussicht gestellt um solche Waffensysteme in der Ukraine selber zusammenbauen zu können.

Diese Gewaltspirale hat eine lange Geschichte: diese begann 2007 mit der 43. Münchner Sicherheitskonferenz, in der Präsident Putin sich gegen die unilaterale Weltordnung der USA und ihrer Verbündeten aussprach. Auch erteilte er den NATO-Osterweiterungen seit 1991 eine deutliche Absage, da diese entgegen (mündlich) gemachten Zusicherungen vollzogen wurden (siehe im Anhang die Rede im Wortlaut). Bei anderer Gelegenheit bezeichnete er vor allem einen möglichen NATO-Beitritt der (ehemals russischen) Ukraine als die "rote Linie", da es hier im Osten eine gemeinsame Grenze zu Russland über weit mehr als tausend Kilometer gebe und zudem Millionen von russischstämmigen Bürgern in der Ukraine lebten welche durch die Unabhängigkeit des Landes von ihrem Mutterland getrennt seinen. Im mittlerweile umstrittenen Budapester Memorandum von 5.12.1994 hatten zudem die Signatarmächte USA, GB und die Russische Föderation in getrennten Dokumenten die Unabhängigkeit und territoriale Integrität der Ukraine garantiert, wenn diese ein neutraler Pufferstaat zwischen der NATO und der Russischen Föderation sei und auf ihre Atomwaffen aus der sowjetischen Zeit verzichte (die Neutralität war in der ukrainischen Verfassung verankert). Trotzdem erklärten am darauffolgenden NATO-Gipfel in Bukarest im April 2008 die versammelten Staats- und Regierungschefs der 26 NATO-Staaten: "Die NATO begrüßt die euro-atlantischen Bestrebungen der Ukraine und Georgiens, die dem Bündnis beitreten wollen. Wir kamen heute überein, dass diese Länder NATO-Mitglieder werden." Zudem wurde die Unabhängigkeitserklärung des Kosowo vorbehaltlos anerkannt, dies nach einer völkerrechtswidrigen militärischen Intervention (d.h. ohne eine entsprechende UN-Resolution) der NATO gegen die Republik Serbien im Jahr 1999 (Staatsgrenzen dürfen also unter Umständen verändert werden).

Die Gewalt begann schon wenige Monate danach, als der durch die "Rosenrevolution" 2003 mit Unterstützung der USA in Tiflis an die Macht gekommene Exil-Georgier, Michail Saakaschwili, in der Nacht auf den 8.8.2008 einen militärischen Angriff auf die seit 1992/93 abtrünnigen Südosseten bzw. deren Hauptstadt Zchinwali befahl und dabei auch russische Friedenstruppen (als Schutzmacht der Osseten) unter Beschuss gerieten. Dies nachdem die Regierung Bush jr. die georgische Armee durch NATO-Offiziere ausgebildet und aufgerüstet hatte. Laut einem NZZ-Artikel vom 1.10.2009 kam eine von der EU eingesetzte Untersuchungskommission unter der Schweizer Diplomatin Heidi Tagliavini 2009 zum Schluss, dass zuvor von beiden Seiten Provokationen in Form von Terroranschlägen, Entführungen und Morde begangen worden waren. Zudem hatte Russland jahrelang an willige Osseten und Abchasen russische Pässe ausgegeben, was völkerrechtswidrig sei, da dies die Staatlichkeit Georgiens untergrabe (Abchasien ist eine weitere abtrünnige Region Georgiens am schwarzen Meer). Saakaschwili wollte offenkundig mit dem überraschenden Angriff auf die Osseten die volle Kontrolle der Zentralregierung über das Gebiet wieder erlangen, da die Satzungen der NATO nur die Aufnahme von Ländern erlauben in denen keine ungelösten territorialen Konflikte vorhanden sind. Den Abchasen hätte also das gleiche Schicksal gedroht wenn die Aktion erfolgreich gewesen wäre. Da die Russen aber aufgepasst hatten, lief innert 24 Stunden eine russische Gegenoffensive welche die georgischen Verbände und ihre amerikanischen Berater innert wenigen Tagen bis nach Gori (Geburtsort von Stalin) zurückwarf. Präsident Saakaschwili verlor bald darauf in Tiflis die Macht und setzte sich in die Ukraine ab. Die heutige georgische Regierung unterhält wieder politische und wirtschaftliche Beziehungen zu Russland und verzichtet auf einen NATO-Beitritt. Siehe dazu das Interview von Roger Köppel mit dem aktuellen georgischen Regierungschef Kobachidse (auf englisch mit deutschen Untertiteln):

https://www.youtube.com/watch?v=xWh6bAfLdhw

In der Ukraine begann die Gewalt mit dem rechtswidrigen Sturz des 2010 legal gewählten Präsidenten Wiktor Janukowitsch, der zwischen der EU und Russland hin und her gerissen war und daher die Unterzeichnung eines EU-Assoziierungsabkommens auf unbestimmte Zeit vertagte. Nach den folgenden wochenlangen Protesten und Krawallen auf dem Maidan in Kiew ("Euromaidan") unterschrieb er unter Vermittlung Deutschlands, Frankreichs und Polens am 21.2.2014 einen Vertrag mit der Opposition und versprach baldige Neuwahlen. Trotzdem wurde er am Tag darauf durch einen regelrechten Putsch gestürzt und in die Flucht getrieben, indem unbekannte Heckenschützen aus verschiedenen Positionen zuerst auf die "Berkut"-Polizei und anschliessend auf militante Demonstranten schossen, welche die "Institutskaja" hinauf das durch eine Strassensperre der Polizei geschützte Regierungsviertel stürmen wollten.

Dabei kamen insgesamt 104 Menschen ums Leben, darunter 34 Polizisten und Vertreter der Regierung. Nach dem Putsch wurde der zuvor völlig unbekannte Exil-Ukrainer Arsenij Jazenjuk Chef der neuen Übergangsregierung, von dem die Europagesandte des US-Statedepartements, Victoria Nuland, bereits einige Tage davor in einem abgehörten Telefongespräch mit dem amerikanischen Botschafter in Kiew, Geoffrey Pyatt, gesprochen hatte ("Jaz is our man"). Die mit rund 600 Mann unter Führung von Andrij Parubi während Wochen auf dem Maidan präsenten militanten und teilweise bewaffneten Kräfte des "Prawi sektor" ("Rechter Sektor") und der "Swoboda" ("Freiheit") weigerten sich zuerst, der neuen Regierung ihre Waffen auszuhändigen. Mitglieder der "Swoboda" unter Oleh Tjahibok besetzten aber anfangs im Kabinett das Aussen-, Innen-, Verteidigungs- sowie das Ministerium für Kultur und "strategische" Kommunikation (Propaganda), während die Mitglieder des "Prawi sektor" unter Dmitro Jarosch eine Zusammenarbeit mit der neuen Regierung verweigerten. Als eine der ersten Amtshandlungen nach dem Putsch wurde in der ganzen Ukraine die russische Sprache als offizielle Amtssprache und als Unterrichtssprache in den Schulen verboten (auch in den mehrheitlich von russischstämmigen Menschen bewohnten Regionen im Osten und Süden des Landes).

DIE FRIEDENSTAUBE FLIEGT AUCH IN IHR POSTFACH!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt, vorerst für alle kostenfrei, wir starten gänzlich ohne Paywall. (Die Bezahlabos fangen erst zu laufen an, wenn ein Monetarisierungskonzept für die Inhalte steht). Sie wollen der Genossenschaft beitreten oder uns unterstützen? Mehr Infos hier oder am Ende des Textes.

Als erste Reaktion auf den rechtswidrigen Umsturz wurde in Simferopol auf der Krim das lokale Parlament von prorussischen Aktivisten besetzt und russische Soldaten verliessen illegal den Flottenstützpunkt in Sewastopol und besetzten strategische Positionen auf der ganzen Krim bzw. blockierten die ukrainischen Kasernen. Unter dem Schutz dieser "grünen Männchen" konnte dann am 16.3.2014 ein Referendum über den zukünftigen Status der Krim durchgeführt werden. Rund 70% der Bevölkerung stimmten für eine Wiedervereinigung mit Russland, was ungefähr dem Anteil der ethnischen Russen auf der Krim entspricht. Der Kommandant der ukrainischen Flotte in Sewastopol lief mit dem Grossteil der Matrosen zu den Russen über, so dass fast die gesamte Flotte im Kriegshafen verblieb (die Schwarzmeerflotte war anfang der 90er Jahre zwischen Russland und der Ukraine aufgeteilt worden). Die restlichen Matrosen und Soldaten durften später in die Ukraine heimkehren. Angesichts der klaren Machtverhältnisse auf der Krim verzichteten die ukrainischen Ultra-Nationalisten auf die angedrohte Entsendung von "Zügen der Freundschaft" (mit bewaffneten Schlägern) nach Simferopol.

Auch in den Städten Lugansk, Donezk und Mariupol in der Ostukraine besetzten prorussische Aktivisten analog den Vorgängen einige Monate zuvor in der Westukraine Regierungs- und Verwaltungsgebäude und hissten russische Fahnen auf vielen Gebäuden. Auch hier gab es am 11. bzw. 12.5.2014 Referenden über die zukünftige Zugehörigkeit dieser Gebiete, doch konnten dabei nur ungefähr die Hälfte der Bevölkerungen überhaupt darüber abstimmen, weil die Separatisten nicht die volle Kontrolle über die jeweiligen Bezirke hatten. Auch in anderen ukrainischen Städten wie Odessa und Charkow gab es prorussische Demonstrationen, doch wurden diese von den ukrainischen Behörden unterdrückt. In Odessa kam es am 2.5.2014 zu einem Massaker, als prorussische Aktivisten von mit Zügen aus Kiew angereisten Rechtsradikalen und Hooligans in ein Gewerkschaftshaus abgedrängt wurden welches dann kurzerhand abgefackelt und mit Handfeuerwaffen beschossen wurde. Rund 50 Menschen verloren dabei ihr Leben während die ukrainische Polizei untätig herumstand.

Die am 12.4.2014 von der neuen Regierung in Kiew verkündete "Antiterror-Operation" gegen die Separatisten im Osten wurde anfangs nur zaghaft umgesetzt, da viele russischstämmige Soldaten auch hier mit den Aufständischen sympathisierten und teilweise mitsamt dem Material überliefen. Erst nachdem sich der "Spreu vom Weizen" getrennt hatte und nach der Bildung von Freiwilligenverbänden wie "Donbas","Asow" oder "Aidar" - welche in der ukrainischen Nationalgarde (dem Innen- und nicht dem Verteidigungsministerium unterstellt) zusammengefasst wurden - gewann die ukrainische Offensive an Kraft, so dass bereits im Mai/Juni 2014 die Hafenstadt Mariupol vom Asow'schen Bataillon (später ein Regiment bzw. neu die 12. Brigade für spezielle Aufgaben) und einer Marinebrigade zurückerobert und bis zur vollständigen Kapitulation im berühmten Stahlwerk "Asowstal" nach der russischen Intervention vom 24.2.2022 besetzt werden konnte. Bei den heftigen Kämpfen im Frühjahr 2022 mussten die Zivilisten wochenlang im Keller ausharren, da die Stadtverwaltung die rechtzeitige Evakuierung der Zivilbevölkerung versäumt hatte). Nach den Kesselschlachten von Ilowaisk im Juli/Aug. 2014 bzw. von Debaltsewoim Jan./Feb. 2015, bei denen weit über tausend ukrainische Soldaten und hunderte von Kämpfern der neu aufgestellten Donezker- und Lugansker Volksmilizen sowie vermutlich rund 100 russische Soldaten ihr Leben verloren (laut Kiew beteiligten sich mehrere russische Bataillone an den Kämpfen), wurde am 12.2.2015 das Minsker Abkommen (Minsk II) unter Vermittlung von Weissrussland, Deutschland und Frankreich unterzeichnet. Vertragspartner als Unterzeichnende waren: der frühere Präsident der Ukraine Leonid Kutschma, der Botschafter der Russischen Föderation in der Ukraine Michail Surabow, die Milizenführer der selbstproklamierten Volksrepubliken Igor Plotnizki und Alexander Sachartschenko sowie die OSZE-Beauftragte Heidi Tagliavini. Der Waffenstillstand und die vertrauensbildenden Massnahmen (wie z.B. der Rückzug der schweren Waffen von der Frontlinie) wurden dabei von beiden Seiten wiederholt verletzt. Am 18.2.2017 unterzeichnete der russische Präsident Wladimir Putin ein Dekret, nach dem Pässe und andere Papiere der Volksrepubliken Donezk und Lugansk von Russland offiziell als gültig anerkannt wurden, was wiederum die Staatlichkeit der Ukraine untergrub und daher dem Minsker Abkommen widersprach, wonach die abtrünnigen Gebiete weiterhin zur Ukraine gehörten. Insgesamt verloren in dem jahrelangen Konflikt bis 2022 rund 14'000 Menschen ihr Leben, darunter ca. 3'500 Zivilisten inkl. 200 Kinder, besonders in der Stadt Donezk und Umgebung welche von der ukrainischen Armee immer wieder mit Artillerie (Granaten und Raketen) oder durch Scharfschützen beschossen wurde.

Nachdem eine von NATO-Offizieren jahrelang gut ausgebildete und mit modernen Waffen aufgerüstete ukrainische Elitearmee von rund 130'000 Mann ab Sommer 2021 vor dem Donbas aufmarschiert war um den Konflikt offenkundig gewaltsam zu lösen und seit Anfang 2022 auch der ukrainische Beschuss von Donezk und dessen Umland wieder verstärkt wurde, unterzeichnete Präsident Putin am 21.2.2022 ein Freundschafts- und Beistandsabkommen mit den ostukrainischen Volksrepubliken und anerkannte ausdrücklich deren Unabhängigkeitvon Kiew. Das Minsker Abkommen habe keine Zukunft mehr. Am 24.2.2022 intervenierte die russische Armee mit anfangs "nur" rund 190'000 Mann in der Ukraine da die rund 40'000 Mann der Donezker- und Lugansker Volksmilizen einem Angriff der ukrainischen Elitearmee nicht mehr hätten standhalten können. Zuvor hatte die Russische Föderation im Dez. 2021 den USA noch einmal Verhandlungen über den Abschluss eines gesamteuropäischen Sicherheitsabkommen unter Berücksichtigung des Konflikts in der Ukraine vorgeschlagen, was aber von der Regierung Biden abgelehnt wurde. Bei Beginn der "speziellen Militäroperation" erklärte Joe Biden öffentlich, das politische Ziel sei der Sturz des Regimes in Moskau.

Mit dem Beginn der russischen Sommeroffensive an allen Frontabschnitten dürften die ukrainischen Kräfte endgültig überdehnt werden. Da der Oberbefehlshaber der Ukraine, Alexander Syrskij, aus der Region Sumy und Charkow verschiedene Verbände wie die 36. Marinebrigade, die 43. Artilleriebrigade, die 44. mechanisierte Brigade, die 82. Air Assault Brigade sowie die berüchtigte 12. Brigade "Asow" nach Südosten verlegen musste, um die Lage um den wichtigen Logistikpunkt Pokrowsk bzw. die Stadt Konstantinowka zu stabilisieren, dürften die Russen auch bei der oben erwähnten Einrichtung einer Sicherheitszone im Norden rasche Fortschritte machen. Rund 50'000 russische Soldaten werden dort eingesetzt um die zukünftige Bedrohung durch ukrainische Drohnen zu minimieren.

Zusammenfassend kann gesagt werden, dass in dem jahrelangen Konflikt alle Seiten das Völkerrecht missachtetoder zum eigenen Vorteil interpretiert haben. Angefangen damit hat aber klar der Westen (NATO und EU), der mit der finanziellen und politischen Unterstützung des rechtswidrigen Putsches in Kiew 2014 die Gewaltspirale in der Ukraine in Gang setzte und mit den anhaltenden Waffenlieferungen und Geheimdienstinformationen für den Tod von weit mehr als einer Million Soldaten auf beiden Seiten und unzähligen Zivilisten entscheidend mitverantwortlichist. Zudem wurde zumindest im Falle der Ukraine mit der NATO-Erklärung von 2008 zu deren Aufnahme als Beitrittskandidat der Geist des Budapester Memorandums von 1994 verletzt. In einem erstaunlich offenen, zweiseitigen Interview in der NZZ vom 6. Mai hat der amerikanische Politikwissenschaftler Prof. John Mearsheimervon der Universität Chicago erklärt, er hätte anstelle von Präsident Putin "die Ukraine schon viel früher überfallen". Und: "Der Westen ist der Bösewicht. Aber das wollen die USA und die Europäer natürlich nicht hören". Er glaube, dass dieser Krieg auf dem Schlachtfeld entschieden werde und dass wir am Ende einen eingefrorenen Konflikt haben werden (ähnlich wie in Georgien).

Über das Problem des ukrainischen Faschismus und Ultra-Nationalismus, der letztlich die multiethnische Ukraine in ihren Grenzen von 1991 zerstört hat, äusserte er sich nicht. Stattdessen hat die EU gerade die ersten 150 Milliarden Euro zum Aufbau einer eigenen Rüstungsindustrie beschlossen. Der neue Vorsteher des Schweizer Verteidigungsdepartementes, Bundesrat Martin Pfister, hat in einem NZZ-Artikel vom 27. Mai erklärt, die Kooperation mit der EU und der NATO müsse intensiviert werden, "stets in Vereinbarkeit mit der Neutralität". In der gleichen NZZ-Ausgabe wurde auch berichtet, dass die Schweiz den Spitzendiplomaten Gabriel Lüchinger nach Moskau schicke um für Friedensgespräche in der Schweiz zu sondieren (Bürgenstock II).

Ob der während Jahren provozierte und stigmatisierte "russische Bär" darauf noch eingeht?

(Der Beitrag folgt der Schweizer Rechtschreibung)

LASSEN SIE DER FRIEDENSTAUBE FLÜGEL WACHSEN!

In Kürze folgt eine Mail an alle Genossenschafter, danke für die Geduld!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt.

Schon jetzt können Sie uns unterstützen:

- Für 50 CHF/EURO bekommen Sie ein Jahresabo der Friedenstaube.

- Für 120 CHF/EURO bekommen Sie ein Jahresabo und ein T-Shirt/Hoodie mit der Friedenstaube.

- Für 500 CHF/EURO werden Sie Förderer und bekommen ein lebenslanges Abo sowie ein T-Shirt/Hoodie mit der Friedenstaube.

- Ab 1000 CHF werden Sie Genossenschafter der Friedenstaube mit Stimmrecht (und bekommen lebenslanges Abo, T-Shirt/Hoodie).

Für Einzahlungen in CHF (Betreff: Friedenstaube):

Für Einzahlungen in Euro:

Milosz Matuschek

IBAN DE 53710520500000814137

BYLADEM1TST

Sparkasse Traunstein-Trostberg

Betreff: Friedenstaube

Wenn Sie auf anderem Wege beitragen wollen, schreiben Sie die Friedenstaube an: friedenstaube@pareto.space

Sie sind noch nicht auf Nostr and wollen die volle Erfahrung machen (liken, kommentieren etc.)? Zappen können Sie den Autor auch ohne Nostr-Profil! Erstellen Sie sich einen Account auf Start. Weitere Onboarding-Leitfäden gibt es im Pareto-Wiki.

-

@ dfa02707:41ca50e3

2025-05-31 23:01:26

@ dfa02707:41ca50e3

2025-05-31 23:01:26Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ 33baa074:3bb3a297

2025-05-28 08:54:40

@ 33baa074:3bb3a297

2025-05-28 08:54:40COD (chemical oxygen demand) sensors play a vital role in water quality testing. Their main functions include real-time monitoring, pollution event warning, water quality assessment and pollution source tracking. The following are the specific roles and applications of COD sensors in water quality testing:

Real-time monitoring and data acquisition COD sensors can monitor the COD content in water bodies in real time and continuously. Compared with traditional sampling methods, COD sensors are fast and accurate, without manual sampling and laboratory testing, which greatly saves time and labor costs. By combining with the data acquisition system, the monitoring data can be uploaded to the cloud in real time to form a extemporization distribution map of the COD content in the water body, providing detailed data support for environmental monitoring and management.

Pollution event warning and rapid response COD sensors play an important role in early warning and rapid response in water environment monitoring. Once there is an abnormal increase in organic matter in the water body, the COD sensor can quickly detect the change in COD content and alarm through the preset threshold. This enables relevant departments to take measures at the early stage of the pollution incident to prevent the spread of pollution and protect the water environment.

Water quality assessment and pollution source tracking COD sensors play an important role in water quality assessment and pollution source tracking. By continuously monitoring the COD content in water bodies, the water quality can be evaluated and compared with national and regional water quality standards. At the same time, COD sensors can also help determine and track the location and spread of pollution sources, provide accurate data support for environmental management departments, and guide the development of pollution prevention and control work.

Application scenarios COD sensors are widely used in various water quality monitoring scenarios, including but not limited to: Sewage treatment plants: used to monitor the COD content of in fluent and effluent to ensure the effect of sewage treatment. Water source protection and management: deployed in water sources to monitor the COD content of in fluent sources. Once the water quality exceeds the set limit, the system will issue an alarm in time to ensure water quality safety. Lake and river monitoring: deployed in water bodies such as lakes and rivers to monitor the COD content of water bodies in real time.

Technical features of COD sensor COD sensor uses advanced technology, such as ultraviolet absorption method, which does not require the use of chemical reagents, avoiding the risk of contamination of chemical reagents in traditional COD detection methods, and can achieve online uninterrupted water quality monitoring, providing strong support for real-time water quality assessment. In addition, COD sensor also has the advantages of low cost, high stability, strong anti-interference ability, and convenient installation.

Summary In summary, COD sensor plays an irreplaceable role in water quality detection. It can not only provide real-time and accurate water quality data, but also quickly warn when pollution incidents occur, providing strong technical support for water quality management and environmental protection. With the advancement of technology and the popularization of applications, COD sensor will play a more important role in water quality monitoring in the future.

-

@ 866e0139:6a9334e5

2025-05-30 17:37:36

@ 866e0139:6a9334e5

2025-05-30 17:37:36Autor: Michael Meyen. Dieser Beitrag wurde mit dem Pareto-Client geschrieben. Sie finden alle Texte der Friedenstaube und weitere Texte zum Thema Frieden hier. Die neuesten Pareto-Artikel finden Sie in unserem Telegram-Kanal.

Die neuesten Artikel der Friedenstaube gibt es jetzt auch im eigenen Friedenstaube-Telegram-Kanal.

„Eine wohltemperierte Abrechnung hin zum Frieden“ steht auf dem Cover, und ich dachte gleich: Das ist doch etwas für die „Friedenstaube“. Ist es auch, aber anders als zunächst gedacht. Vielleicht hätte ich mir einen Moment Zeit nehmen sollen für den Haupttitel. Drei Substantive ohne Punkt und Komma. Raffen Sterben Trance. Besser kann man das Leiden an dieser Welt nicht in Worte gießen – vor allem dann nicht, wenn daraus ein Satzstrom wird, der einen Rhythmus von ganz eigener Kraft entwickelt. Man braucht keine Noten, um einen Ohrwurm zu schreiben. Mit Buchstaben geht das auch. Wer das nicht glaubt, lese dieses Buch von Teer Sandmann und lasse sich von seiner Melodie durch die Abgründe dieser Zeit tragen.

Ich habe den Autor im Spätsommer 2020 kennengelernt, bei einem Rubikon-Treffen. Das schreibt sich jetzt so leicht hin, war aber damals fast ein Abenteuer. Schon die Bahnfahrt. Die Blicke, das Zischen, der Hass. Sie da! Wo ist Ihre Maske? Ich hatte überlegt, ob ich mir das antun will, und war auch nicht sicher, ob es wirklich eine gute Idee ist, drei Tage mit lauter Dissidenten auf einem Haufen zu sein. Mehr Zielscheibe geht kaum. Vor Ort war das dann alles wie weggeblasen. Abends ein Lagerfeuer und tagsüber Menschen wie Daniel Sandmann, der sich auf seinen Büchern Teer nennt und weiß, was Glück ist:

„Der Augenblick, den du mit dem Andern und durch das Andere erlebst, unbelangt von Staat, Norm und Konzern: dieser Augenblick hebt deine Einsamkeit auf. Die aufgehobene Einsamkeit aber ist die Freiheit, die wir als Wärme erleben. Als Feuer im Körper.“ (90)

So war das an jenem Augustwochenende. Jeder, der ein wenig älter ist, hat längst erlebt, dass keine Flamme ewig brennt. Nach Corona kamen die Kriege. Und selbst die, die solche Tage nicht vergessen wollen, verlieren sich im Kleinklein ihrer Eitelkeiten. Daniel und Teer Sandmann machen aus diesem Stoff eine grandiose Sinfonie, die darüber erhaben ist, mit dem Finger auf diesen zu zeigen oder auf jenen. Hin und wieder eine Andeutung: Das muss reichen. Der Formaterfinder, der sein Baby mit einem plumpen Satz schützt. „Nicht einfach kritisieren, mach es besser!“ Eine Redaktion der Gegenöffentlichkeit, hochgelobt, die kurze Sätze will und kurze Texte. Dieses Feld können und wollen die Sandmänner nicht bestellen, genau wie all das, was im Namen einer „Menschheitsfamilie“ daherkommt. „Liebe Community. So begrüßt ein dissidenter Moderator das Publikum in einer dissidenten Talkshow.“ (87) Etwas mehr Platz bekommt [Rainer Mausfeld](https://www.freie-medienakademie.de/medien-plus/101):

„Warum schweigen die Lämmer? Ein tolles Buch. Es hat gegriffen. Dann hat sich gezeigt: Das System, von diesem Buch dekonstruiert, muss einen Zacken zugeben an Totalität und schon schlüpft auch die Analyse mit hinein ins System und ins Schweigen und der Autor wird selbst zum Lamm.“ (21)

DIE FRIEDENSTAUBE FLIEGT AUCH IN IHR POSTFACH!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt, vorerst für alle kostenfrei, wir starten gänzlich ohne Paywall. (Die Bezahlabos fangen erst zu laufen an, wenn ein Monetarisierungskonzept für die Inhalte steht). Sie wollen der Genossenschaft beitreten oder uns unterstützen? Mehr Infos hier oder am Ende des Textes.

Ich kenne das Lied, das Daniel aka Teer Sandmann hier singt. Wie er bin ich von links gekommen und habe erlebt, „wie meine Welt leer wurde“ (23). Wie er weiß ich inzwischen, dass ich in „meinen Kreisen“ von einst nicht mehr klarkommen würde und dass es mit den neuen keinesfalls einfacher ist. Hier, immer noch und trotz alledem, die Idee, dass sich Glück planen lässt, und damit „der Wahn“, „ein Ziel zu erreichen und alles auszumerzen, was dem Ziel in die Quere kommt“ (143): „Die linken Ideen münden in Ordnungen und im Polizeistaat“ (24). Und dort Kritiker der Macht, die vor den Gerichten der gleichen Macht um ein wenig Wohlstand streiten, sich nur noch gegenseitig interviewen, die AfD hoffieren und auf Personen zielen, wo es um Strukturen gehen müsste. Klaus Schwab, Bill Gates, Jeff Epstein statt Kapitalismus. Was bleibt euch noch, Kinder, wenn ihr zwar den Totalitarismus erkennt, aber nicht sehen wollt, „wie dieser alternativlos aus dem Kapital hervorschießen musste“ (40)?

Der letzte Satz ist ein Versuch, den Takt aufzunehmen, den dieser Text anschlägt. Teer Sandmann sagt, dass ihn „die Musik aus der Renaissance“ noch mehr gerettet habe als das Schreiben, und baut vielleicht auch deshalb immer wieder Miniaturen ein, die zeigen, dass Kunst auch dann Jahrhunderte überdauern kann, wenn jemand wie ich noch nie davon gehört hat. Daniel Sandmann reicht. Vergesst all eure Gegenentwürfe, singt dieser Künstler:

„Wir sind für nichts. Wir stören die Haltungen und schaffen Nischen. Indem wir stören. Wir sind für alles, was nicht in ein ‚wir sind für‘ mündet. Bloß, ist das alles nicht schon eine Haltung? Und wer sind ‚wir‘?“ (79)

Die Sache mit dem Frieden, natürlich. Es gibt in diesem Buch einen Traum, in dem ein „lieber Gott“ alle Journalisten tötet, „die neuen Schwarzhemden“ (49), „die in diesem medialen Schlachtfeld, Journalismus genannt, mitfeuern und mitgeifern und ihrer Niedertracht freien Lauf lassen“, und mit ihnen auch alle, „die binnen einer Woche auch nur einen Cent noch überweisen an diese Instrumente der Niedertracht und der Geistvernichtung“ sowie Parteimitglieder und Manager, jeden Adelsclan und alle Künstler, „die der Macht zusprechen“ (55). Sie ahnen es schon: Diese Liste ist unvollständig und mit ihrer Wucht eine Ausnahme in dieser „wohltemperierten Abrechnung hin zum Frieden“. Daniel und Teer Sandmann suchen nach Ruhe und Trance. Frieden: Das ist nicht nur das Ende des Kapitalismus oder das vergessene Stück aus der Renaissance. Frieden bringt auch die Runde im Waldsee:

„Komme ich aus dem Wasser, komme ich nach Hause. Mag sein, dass im Orgasmus der Tod vergessen geht, im Wasser aber verliert er die Bedeutung und vermengt sich mit dem Leben aufs Unkenntliche. Stilles Jauchzen, meerjungfrauartiges Kreisen, kindliches Drehen um sich selbst und ohne Bezugspunkt: das sind die Ausdrucksformen dieses ungeplanten Glücks.“ (157)

Jetzt weiß ich auch, warum ich schon als junger Mann jeden Tag ohne Schwimmgelegenheit für einen verlorenen Tag gehalten habe.

Michael Meyen ist Medienforscher, Ausbilder und Journalist. Seit 2002 ist er Universitätsprofessor an der LMU München. https://www.freie-medienakademie.de/

LASSEN SIE DER FRIEDENSTAUBE FLÜGEL WACHSEN!

In Kürze folgt eine Mail an alle Genossenschafter, danke für die Geduld!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt.

Schon jetzt können Sie uns unterstützen:

- Für 50 CHF/EURO bekommen Sie ein Jahresabo der Friedenstaube.

- Für 120 CHF/EURO bekommen Sie ein Jahresabo und ein T-Shirt/Hoodie mit der Friedenstaube.

- Für 500 CHF/EURO werden Sie Förderer und bekommen ein lebenslanges Abo sowie ein T-Shirt/Hoodie mit der Friedenstaube.

- Ab 1000 CHF werden Sie Genossenschafter der Friedenstaube mit Stimmrecht (und bekommen lebenslanges Abo, T-Shirt/Hoodie).

Für Einzahlungen in CHF (Betreff: Friedenstaube):

Für Einzahlungen in Euro:

Milosz Matuschek

IBAN DE 53710520500000814137

BYLADEM1TST

Sparkasse Traunstein-Trostberg

Betreff: Friedenstaube

Wenn Sie auf anderem Wege beitragen wollen, schreiben Sie die Friedenstaube an: friedenstaube@pareto.space

Sie sind noch nicht auf Nostr and wollen die volle Erfahrung machen (liken, kommentieren etc.)? Zappen können Sie den Autor auch ohne Nostr-Profil! Erstellen Sie sich einen Account auf Start. Weitere Onboarding-Leitfäden gibt es im Pareto-Wiki.

-

@ dfa02707:41ca50e3

2025-05-31 23:01:26

@ dfa02707:41ca50e3

2025-05-31 23:01:26Contribute to keep No Bullshit Bitcoin news going.

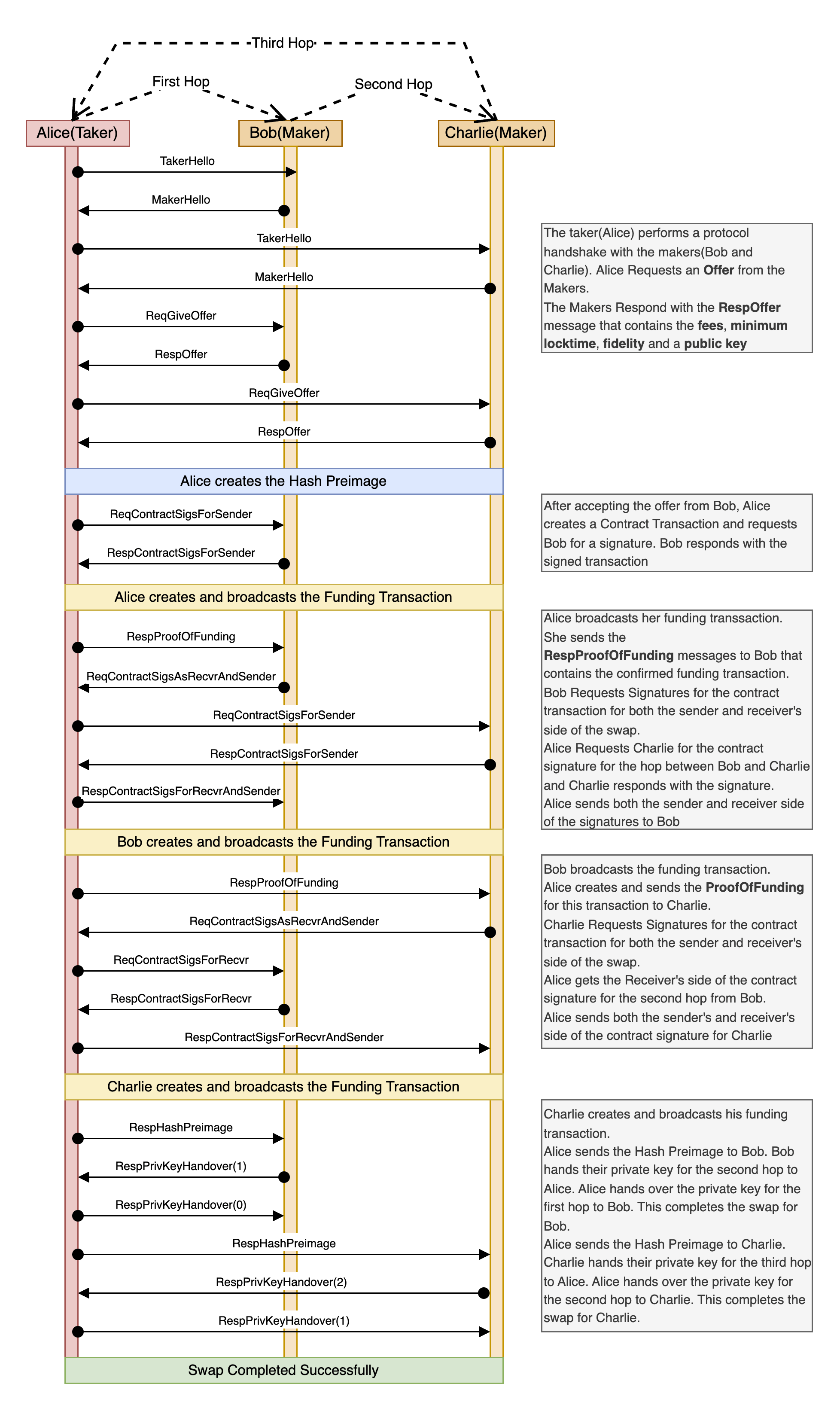

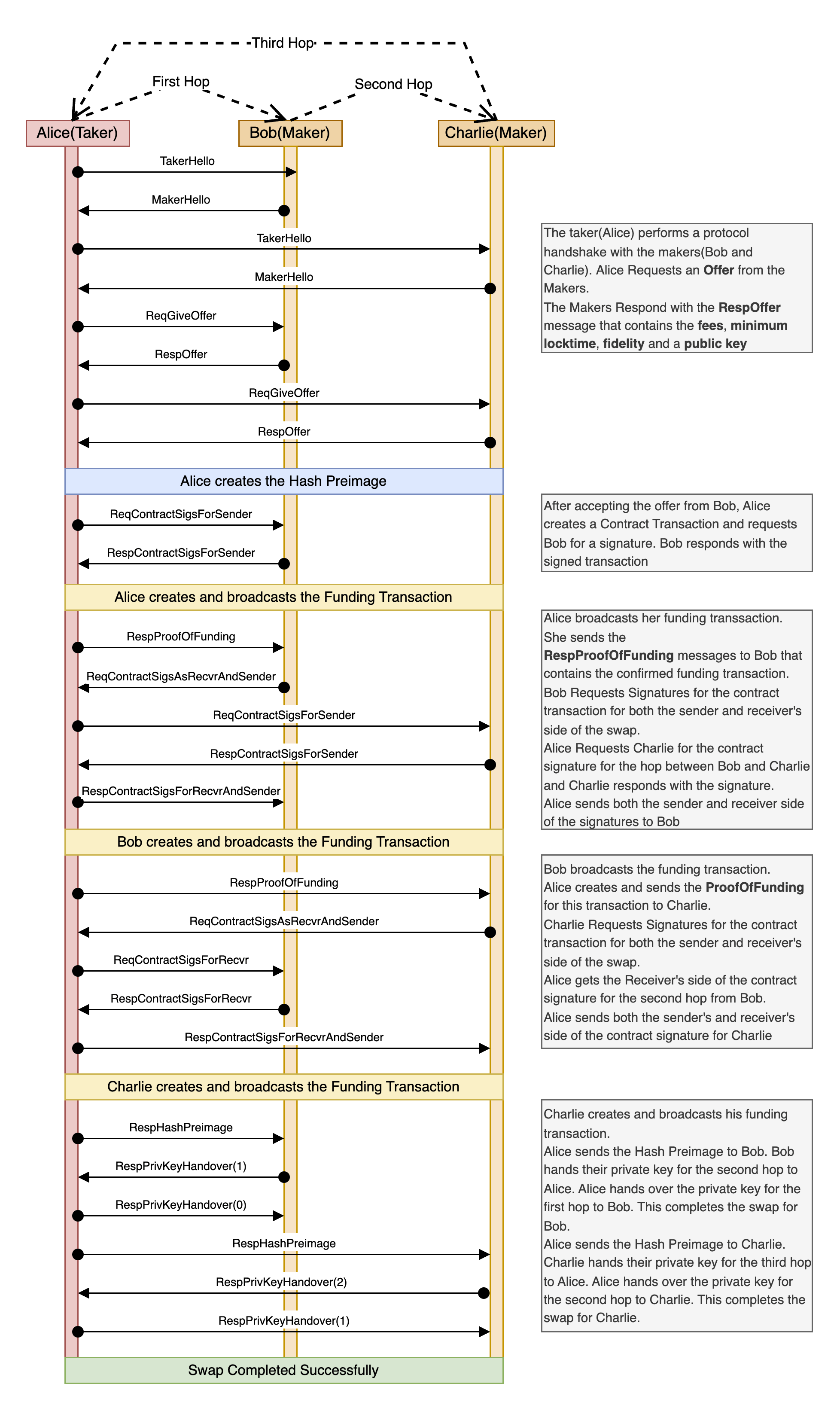

- Coinswap is a decentralized protocol for private, trustless cryptocurrency swaps. It allows participants to securely swap digital assets without intermediaries, using advanced cryptographic techniques and atomic swaps to ensure privacy and security.

- This release introduces major improvements to the protocol's efficiency, security, and usability, including custom in-memory UTXO indexes, more advanced coin-selection algorithms, fidelity bond management and more.

- The update also improves user experience with full Mac support, faster Tor connections, enhanced UI/UX, a unified API, and improved protocol documentation.

"The Project is under active beta development and open for contributions and beta testing. The Coinswap market place is live in testnet4. Bug fixes and feature requests are very much welcome."

- Manuals and demo docs are available here.

What's new

- Core protocol and performance improvements:

- Custom in-memory UTXO indexes. Frequent Core RPC calls, which caused significant delays, have been eliminated by implementing custom in-memory UTXO indexes. These indexes are also saved to disk, leading to faster wallet synchronization.

- Coin selection. Advanced coin-selection algorithms, like those in Bitcoin Core, have been incorporated, enhancing the efficiency of creating different types of transactions.

- Fidelity management. Maker servers now automate tasks such as checking bond expiries, redemption, and recreation for Fidelity Bonds, reducing the user's management responsibilities.

- Taker liveness. The

WaitingFundingConfirmationmessage has been added to keep swap connections between Takers and Makers, assisting with variable block confirmation delays.

-

User experience and compatibility:

- Mac compatibility. The crate and apps now fully support Mac.

- Tor operations are streamlined for faster, more resilient connections. Tor addresses are now consistently linked to the wallet seed, maintaining the same onion address through system reboots.

- The UI/UX improvements enhance the display of balances, UTXOs, offer data, fidelity bonds, and system logs. These updates make the apps more enjoyable and provide clearer coin swap logs during the swap process.

-

API design improvements. Transaction creation routines have been streamlined to use a single common API, which reduces technical debt and eliminates redundant code.

- Protocol spec documentation now details how Coinswap breaks the transaction graph and improves privacy through routed swaps and amount splitting, and includes diagrams for clarity.

Source: Coinswap Protocol specification.

-

@ cae03c48:2a7d6671

2025-06-01 00:00:33

@ cae03c48:2a7d6671

2025-06-01 00:00:33Bitcoin Magazine

Michael Saylor Presents The 21 Ways to Wealth at Bitcoin 2025Michael Saylor, Executive Chairman of Strategy, took the stage at Bitcoin 2025 delivering a keynote titled “21 Ways to Wealth.” He stated: “This speech is for you. I’ve traveled the world and told countries, institutional investors, and even the disembodied spirits of our children’s children why they need Bitcoin. This is for every individual, every family, every small business. It’s for everybody.”

He began with clarity. “The first way to wealth is clarity,” he said. “Clarity comes the moment you realize Bitcoin is capital—perfected capital, programmable capital, incorruptible capital.” For Saylor, every thoughtful individual on Earth will ultimately seek such pristine capital, and every AI system will prefer it as well.

The second path is conviction. Bitcoin, he said, will appreciate faster than every other asset, because it’s engineered for performance. “It’s going to grow faster than real estate or collectibles. It is the most efficient store of value in human history.”

The third way is courage. “If you’re going to get rich on Bitcoin, you need courage,” he warned. “Wealth favors those who embrace intelligent monetary risk. Some people will get left behind. Others will juggle it. But the bold will feed the fire—sell your bonds, buy Bitcoin. An extraordinary explosion of value is coming.”

Fourth comes cooperation. “You are more powerful if you have the full support of your family. Your children have time and potential. The secret is transferring capital into their hands. Families that move in unity are unstoppable.”

The fifth is capability. “Master AI,” he said. “In 2025, everything you can imagine is at your fingertips—wisdom, analysis, creativity. Ask AI, argue with it, use it. You can become a super genius. Don’t put your ego first—put your interests first. Your family will thank you.”

Saylor’s sixth way to wealth is composition: construct legal entities that scale your strategy and protect your assets. “Ask the AI and figure it out. You can work hard, or you can work smart. This year, everyone should be operating like the most sophisticated millionaire family office.”

The seventh is citizenship. Choose your economic nexus carefully—“domicile where sovereignty respects your freedom,” he said. “This isn’t just about this year—it’s about this century.”

Eighth is civility. “Respect the natural power structures of the world. Respect the force of nature,” he explained. “If you want to generate wealth in the Bitcoin universe, don’t fight unnecessarily. Find common ground. Inflation and distraction are your enemies.”

Ninth is corporation. “A well-structured corporation is the most powerful wealth engine on Earth. Families are powerful. Partnerships are even more powerful. But corporations can scale globally. What is your vehicle? What is your path?”

The tenth way is focus. “Just because you can do a thing doesn’t mean you should,” he warned. “If you invest in Bitcoin, there’s a 90% chance it will succeed over five years. Don’t confuse ambition with accomplishment. Come up with a strategy—and stick to it.”

The eleventh is equity. “Share your opportunities with investors who will share your risk,” he said, pointing to MicroStrategy’s own rise from $10 million to a $5 billion market cap by aligning with equity partners who believed in the Bitcoin mission.

The twelfth is credit. “There are people in the world who are afraid of the future—they want small yield, certainty. Offer that. Give creditors security in return for capital. Convert their fear into fuel and turn risk into yield by investing in Bitcoin.”

The thirteenth is compliance. “Create the best company you can within the rules of your market. Learn the rules of the road. If you know them, you can drive faster. You can scale legally and sustainably.”

The fourteenth way is capitalization. “Velocity compounds wealth,” Saylor said. “Raise and reinvest capital as fast and as often as you can. The faster your money moves into productive Bitcoin strategies, the more it multiplies.”

Fifteenth is communication. “Speak with candor. Act with transparency. And repeat your message often,” he urged. “Creating wealth with Bitcoin is simple—but only if people understand what you’re doing and why you’re doing it.”

Sixteenth is commitment. “Don’t allow yourself to be distracted,” he said. “Don’t chase your own ideas. Don’t feed the trolls. Stay committed to Bitcoin. It’s the greatest idea in the world. The world probably doesn’t care what you think—but it will care when you win.”

The Seventeenth way is competence. “You’re not competing with noise—you’re competing with someone who is laser-focused, who executes flawlessly,” he said. “You must deliver consistent, precise, and reliable performance. That’s how you win.”