-

@ 2b998b04:86727e47

2025-05-25 03:16:20

@ 2b998b04:86727e47

2025-05-25 03:16:20In an inflationary system, the goal is often just to keep up.

With prices always rising, most of us are stuck in a race:\ Earn more to afford more.\ Spend before your money loses value.\ Monetize everything just to stay ahead of the curve.

Work becomes reactive.\ You hustle to outrun rising costs.\ You take on projects you don’t believe in just to make next month’s bills.\ Money decays. So you move faster, invest riskier, and burn out quicker.

But what happens when the curve flips?

A deflationary economy—like the one Bitcoin makes possible—rewards stillness, reflection, and intentionality.

Time favors the saver, not the spender.\ Money gains purchasing power.\ You’re no longer punished for patience.

You don’t have to convert your energy into cash before it loses value.\ You don’t have to be always on.\ You can actually afford to wait for the right work.

And when you do work—it means more.

💡 The “bullshit jobs” David Graeber wrote about start to disappear.\ There’s no need to look busy just to justify your existence.\ There’s no reward for parasitic middle layers.\ Instead, value flows to real craft, real care, and real proof of work—philosophically and literally.

So what does a job look like in that world?

— A farmer building soil instead of chasing subsidies.\ — An engineer optimizing for simplicity instead of speed.\ — A craftsman making one perfect table instead of ten cheap ones.\ — A writer telling the truth without clickbait.\ — A builder who says no more than they say yes.

You choose work that endures—not because it pays instantly, but because it’s worth doing.

The deflationary future isn’t a fantasy.\ It’s a recalibration.

It’s not about working less.\ It’s about working better.

That’s what Bitcoin taught me.\ That’s what I’m trying to live now.

🟠 If you’re trying to align your work with these values, I’d love to connect.\ Zap this post, reply with your story, or follow along as I build—without permission, but with conviction.

-

@ 34ff86e0:dbb6b9fb

2025-05-25 02:36:39

@ 34ff86e0:dbb6b9fb

2025-05-25 02:36:39test openletter redirection after creation

-

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28Gerador de tabelas de todos contra todos

I don't remember exactly when I did this, but I think a friend wanted to do software that would give him money over the internet without having to work. He didn't know how to program. He mentioned this idea he had which was some kind of football championship manager solution, but I heard it like this: a website that generated a round-robin championship table for people to print.

It is actually not obvious to anyone how to do it, it requires an algorithm that people will not reach casually while thinking, and there was no website doing it in Portuguese at the time, so I made this and it worked and it had a couple hundred daily visitors, and it even generated money from Google Ads (not much)!

First it was a Python web app running on Heroku, then Heroku started charging or limiting the amount of free time I could have on their platform, so I migrated it to a static site that ran everything on the client. Since I didn't want to waste my Python code that actually generated the tables I used Brython to run Python on JavaScript, which was an interesting experience.

In hindsight I could have just taken one of the many

round-robinJavaScript libraries that exist on NPM, so eventually after a couple of more years I did that.I also removed Google Ads when Google decided it had so many requirements to send me the money it was impossible, and then the money started to vanished.

-

@ 3bf0c63f:aefa459d

2025-04-25 19:26:48

@ 3bf0c63f:aefa459d

2025-04-25 19:26:48Redistributing Git with Nostr

Every time someone tries to "decentralize" Git -- like many projects tried in the past to do it with BitTorrent, IPFS, ScuttleButt or custom p2p protocols -- there is always a lurking comment: "but Git is already distributed!", and then the discussion proceeds to mention some facts about how Git supports multiple remotes and its magic syncing and merging abilities and so on.

Turns out all that is true, Git is indeed all that powerful, and yet GitHub is the big central hub that hosts basically all Git repositories in the giant world of open-source. There are some crazy people that host their stuff elsewhere, but these projects end up not being found by many people, and even when they do they suffer from lack of contributions.

Because everybody has a GitHub account it's easy to open a pull request to a repository of a project you're using if it's on GitHub (to be fair I think it's very annoying to have to clone the repository, then add it as a remote locally, push to it, then go on the web UI and click to open a pull request, then that cloned repository lurks forever in your profile unless you go through 16 screens to delete it -- but people in general seem to think it's easy).

It's much harder to do it on some random other server where some project might be hosted, because now you have to add 4 more even more annoying steps: create an account; pick a password; confirm an email address; setup SSH keys for pushing. (And I'm not even mentioning the basic impossibility of offering

pushaccess to external unknown contributors to people who want to host their own simple homemade Git server.)At this point some may argue that we could all have accounts on GitLab, or Codeberg or wherever else, then those steps are removed. Besides not being a practical strategy this pseudo solution misses the point of being decentralized (or distributed, who knows) entirely: it's far from the ideal to force everybody to have the double of account management and SSH setup work in order to have the open-source world controlled by two shady companies instead of one.

What we want is to give every person the opportunity to host their own Git server without being ostracized. at the same time we must recognize that most people won't want to host their own servers (not even most open-source programmers!) and give everybody the ability to host their stuff on multi-tenant servers (such as GitHub) too. Importantly, though, if we allow for a random person to have a standalone Git server on a standalone server they host themselves on their wood cabin that also means any new hosting company can show up and start offering Git hosting, with or without new cool features, charging high or low or zero, and be immediately competing against GitHub or GitLab, i.e. we must remove the network-effect centralization pressure.

External contributions

The first problem we have to solve is: how can Bob contribute to Alice's repository without having an account on Alice's server?

SourceHut has reminded GitHub users that Git has always had this (for most) arcane

git send-emailcommand that is the original way to send patches, using an once-open protocol.Turns out Nostr acts as a quite powerful email replacement and can be used to send text content just like email, therefore patches are a very good fit for Nostr event contents.

Once you get used to it and the proper UIs (or CLIs) are built sending and applying patches to and from others becomes a much easier flow than the intense clickops mixed with terminal copypasting that is interacting with GitHub (you have to clone the repository on GitHub, then update the remote URL in your local directory, then create a branch and then go back and turn that branch into a Pull Request, it's quite tiresome) that many people already dislike so much they went out of their way to build many GitHub CLI tools just so they could comment on issues and approve pull requests from their terminal.

Replacing GitHub features

Aside from being the "hub" that people use to send patches to other people's code (because no one can do the email flow anymore, justifiably), GitHub also has 3 other big features that are not directly related to Git, but that make its network-effect harder to overcome. Luckily Nostr can be used to create a new environment in which these same features are implemented in a more decentralized and healthy way.

Issues: bug reports, feature requests and general discussions

Since the "Issues" GitHub feature is just a bunch of text comments it should be very obvious that Nostr is a perfect fit for it.

I will not even mention the fact that Nostr is much better at threading comments than GitHub (which doesn't do it at all), which can generate much more productive and organized discussions (and you can opt out if you want).

Search

I use GitHub search all the time to find libraries and projects that may do something that I need, and it returns good results almost always. So if people migrated out to other code hosting providers wouldn't we lose it?

The fact is that even though we think everybody is on GitHub that is a globalist falsehood. Some projects are not on GitHub, and if we use only GitHub for search those will be missed. So even if we didn't have a Nostr Git alternative it would still be necessary to create a search engine that incorporated GitLab, Codeberg, SourceHut and whatnot.

Turns out on Nostr we can make that quite easy by not forcing anyone to integrate custom APIs or hardcoding Git provider URLs: each repository can make itself available by publishing an "announcement" event with a brief description and one or more Git URLs. That makes it easy for a search engine to index them -- and even automatically download the code and index the code (or index just README files or whatever) without a centralized platform ever having to be involved.

The relays where such announcements will be available play a role, of course, but that isn't a bad role: each announcement can be in multiple relays known for storing "public good" projects, some relays may curate only projects known to be very good according to some standards, other relays may allow any kind of garbage, which wouldn't make them good for a search engine to rely upon, but would still be useful in case one knows the exact thing (and from whom) they're searching for (the same is valid for all Nostr content, by the way, and that's where it's censorship-resistance comes from).

Continuous integration

GitHub Actions are a very hardly subsidized free-compute-for-all-paid-by-Microsoft feature, but one that isn't hard to replace at all. In fact there exists today many companies offering the same kind of service out there -- although they are mostly targeting businesses and not open-source projects, before GitHub Actions was introduced there were also many that were heavily used by open-source projects.

One problem is that these services are still heavily tied to GitHub today, they require a GitHub login, sometimes BitBucket and GitLab and whatnot, and do not allow one to paste an arbitrary Git server URL, but that isn't a thing that is very hard to change anyway, or to start from scratch. All we need are services that offer the CI/CD flows, perhaps using the same framework of GitHub Actions (although I would prefer to not use that messy garbage), and charge some few satoshis for it.

It may be the case that all the current services only support the big Git hosting platforms because they rely on their proprietary APIs, most notably the webhooks dispatched when a repository is updated, to trigger the jobs. It doesn't have to be said that Nostr can also solve that problem very easily.

-

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28As valas comuns de Manaus

https://www.terra.com.br/noticias/brasil/cidades/manaus-comeca-a-enterrar-em-valas-coletivas,e7da8b2579e7f032629cf65fa27a11956wd2qblx.html

Todo o Estado do Amazonas tem 193 mortos por Coronavirus, mas essa foto de "valas coletivas" sendo abertas em Manaus tem aproximadamente 500 túmulos. As notícias de "calamidade total" já estão acontecendo pelo menos desde o dia 11 (https://www.oantagonista.com/brasil/manaus-sao-paulo-e-rio-de-janeiro-nao-podem-relaxar-com-as-medidas-de-distanciamento/).

O comércio está fechado por decreto desde o final de março (embora a matéria diga que as pessoas não estão respeitando).

-

@ 502ab02a:a2860397

2025-05-25 01:03:51

@ 502ab02a:a2860397

2025-05-25 01:03:51บางครั้งพลังยิ่งใหญ่ที่สุดก็ไม่ใช่สิ่งที่เห็นได้ด้วยตาเปล่า เหมือนแสงแดดที่คนส่วนใหญ่มักจะกลัวเพราะกลัวผิวเสีย กลัวฝ้า กลัวร้อน แต่แท้จริงแล้วในแสงแดดมีบางสิ่งที่น่าเคารพอยู่ลึกๆ มันคือแสงที่มองไม่เห็น มันไม่แสบตา ไม่แสบผิว แต่มันลึก ถึงเซลล์ มันคือ “แสงอินฟราเรด” ที่ซ่อนตัวอย่างสุภาพในแดดยามเช้า

เฮียมักชอบพูดว่า แดดที่ดีไม่จำเป็นต้องแสบหลัง อาบแสงที่ลอดผ่านใบไม้ยามเช้าแบบไม่ต้องฝืนตาก็พอ แสงอินฟราเรดนี่แหละคือพระเอกตัวจริงในความเงียบ มันไม่ดัง ไม่โชว์ ไม่โฆษณา แต่มันลงลึกไปถึงระดับที่ร่างกายเรากำลังหิวโดยไม่รู้ตัวในระดับเซลล์

ในเซลล์ของเรา มีหน่วยผลิตพลังงานที่เรียกว่าไมโทคอนเดรีย เจ้านี่แหละคือโรงไฟฟ้าจิ๋วประจำบ้าน ที่ต้องตื่นมาทำงานทุกวันโดยไม่ได้หยุดเสาร์อาทิตย์ ยิ่งถ้าไมโทคอนเดรียทำงานไม่ดี ร่างกายก็จะเหมือนไฟตกทั้งระบบ—ง่วงง่าย เพลียไว ปวดนู่นปวดนี่เหมือนไฟในบ้านกระพริบตลอดเวลา

แล้วแสงอินฟราเรดเกี่ยวอะไรกับมัน? เฮียขอเล่าง่ายๆ ว่า ไมโทคอนเดรียมีตัวรับแสงตัวหนึ่งชื่อว่า cytochrome c oxidase เจ้านี่ตอบสนองต่อแสงอินฟราเรดช่วงคลื่นเฉพาะ คือประมาณ 600–900 นาโนเมตร พอโดนเข้าไป มันเหมือนได้จุดประกายให้โรงงานพลังงานในร่างกายกลับมาคึกคักอีกครั้ง ผลิตพลังงานได้มากขึ้น ระบบไหลเวียนเลือดก็ดีขึ้น เหมือนท่อน้ำที่เคยอุดตันก็กลับมาใสแจ๋ว ความอักเสบเล็กๆ ในร่างกายก็ลดลง คล้ายบ้านที่เคยอับชื้นแล้วได้เปิดหน้าต่างให้แสงแดดส่องเข้าไป

และที่น่ารักกว่านั้นคือ เราไม่ต้องไปถึงชายหาด ไม่ต้องจองรีสอร์ตริมทะเล แค่แดดเช้าอ่อนๆ ข้างบ้านหรือตามขอบระเบียง ก็ให้แสงอินฟราเรดได้แล้ว ถ้าใครอยู่ในเมืองใหญ่ที่มีแต่ตึกบังแดด แล้วจะเลือกใช้หลอดไฟ Red Light Therapy ก็ไม่ผิด แต่ต้องเลือกแบบรู้เท่าทันรู้ ไม่ใช่เห็นใครรีวิวก็ซื้อมาเปิดใส่หน้า หวังจะหน้าใสข้ามคืน ต้องเข้าใจทั้งความยาวคลื่น เวลาใช้งาน และจุดประสงค์ ไม่ใช่ใช้เพราะแค่กลัวแก่อยากหน้าตึง แต่ใช้เพราะอยากให้ร่างกายกลับไปทำงานอย่างเป็นธรรมชาติอีกครั้ง และอยู่ในประเทศหรือสถานที่ที่โดนแดดได้น้อยอยากได้เสริมเฉยๆ

แล้วเราจะรู้ได้ยังไงว่าไมโทคอนเดรียเรากลับมาทำงานดีขึ้น? เฮียว่าไม่ต้องรอผลเลือดจากแล็บไหนก็รู้ได้ อย่าไปยึดติดกับตัวเลขมากครับ เอาตัวเองเป็นหลัก ตั้งคำถามกับตัวเองว่ารู้สึกยังไงบ้าง ถ้าเริ่มนอนหลับลึกขึ้น ตื่นมาแล้วหัวไม่มึน ไม่หงุดหงิดตั้งแต่ยังไม่ลืมตา ถ้าปวดหลังปวดข้อที่เคยมีเริ่มหายไปแบบไม่ได้กินยา หรือแม้แต่ผิวที่ดูสดใสขึ้นแบบไม่ต้องง้อสกินแคร์ นั่นแหละคือเสียงขอบคุณเบาๆ จากไมโทคอนเดรียที่ได้แสงแดดแล้วกลับมามีชีวิตอีกครั้ง ถ้ามันดีก็คือดี

บางที เราไม่ต้องกินวิตามินเม็ดไหนเพิ่ม แค่เดินออกไปรับแดดเบาๆ ในเวลาเช้าๆ แล้วให้ร่างกายได้พูดคุยกับธรรมชาติบ้าง เพราะในความอบอุ่นเงียบๆ ของแสงอินฟราเรดนั้น มีเสียงเบาๆ ที่กำลังปลุกพลังในตัวเราให้กลับมาอีกครั้ง

แดดไม่ใช่ศัตรู ถ้าเรารู้จักมันในมุมที่ถูกต้อง เฮียแค่อยากชวนให้ลองเปลี่ยนจากคำว่า “กลัวแดด” เป็น “ฟังแดด” เพราะบางครั้งธรรมชาติไม่ได้พูดด้วยคำ แต่สื่อสารด้วยแสงที่แทรกผ่านหัวใจเราโดยไม่ต้องผ่านล่าม

บางคนอาจคิดในใจ “แหมเฮีย ก็ดีหรอก ถ้าได้ตื่นเช้า” 555555

เฮียเข้าใจดีเลยว่าไม่ใช่ทุกคนจะตื่นมาทันแดดยามเช้าได้เสมอไป ชีวิตคนเรามันไม่ได้เริ่มต้นพร้อมไก่ขันทุกวัน บางคนเพิ่งเข้านอนตอนตีสาม ตื่นอีกทีแดดก็แตะบ่ายเข้าไปแล้ว ไม่ต้องกังวลไปจ้ะ เพราะความมหัศจรรย์ของแสงอินฟราเรดยังมีให้เราได้ใช้แม้ในแดดยามเย็น

แดดช่วงเย็น โดยเฉพาะหลังสี่โมงเย็นไปจนเกือบหกโมง (หรือเร็วช้าตามฤดู) ก็ยังอุดมไปด้วยแสงอินฟราเรดในช่วงคลื่นที่ไมโทคอนเดรียชอบ แถมยังไม่มีรังสี UV ที่แรงจัดมารบกวนเหมือนตอนเที่ยง เรียกว่าเป็นแดดแบบละมุนๆ สำหรับคนที่อยาก “บำบัดใจ” แบบไม่ต้องร้อนจนหัวเปียก

เฮียเคยลองตากแดดเย็นเดินไปในสวนสาธารณะ แล้วรู้สึกว่ามันเหมือนได้รีเซ็ตจิตใจหลังวันเหนื่อยๆ ไปในตัว ยิ่งพอรู้ว่าในช่วงเวลานี้แสงที่ได้กำลังช่วยปลุกพลังงานในร่างกายแบบเงียบๆ ด้วยแล้ว มันทำให้เฮียยิ่งเคารพธรรมชาติมากขึ้นไปอีก เคยเห็นคนที่วันๆมีแต่ความเครียด ความโกรธ ความอาฆาตต่อโลกไหมหละ บางคนแค่โดนแดด แต่ไม่ได้ตากแดด การตากแดดคือปล่อยใจไปกับธรรมชาติ พูดคุยกับร่างกาย บอกเขาว่าเราจะทำตัวให้เป็นประโยชน์กับโลกใบนี้ ให้สมกับที่ใช้พลังงานของโลก

จะเช้าหรือเย็น สำคัญไม่เท่ากับความตั้งใจ เฮียว่าไม่ว่าชีวิตจะตื่นตอนไหน ถ้าเราให้เวลาแค่ 10–15 นาทีในแต่ละวัน ออกไปยืนให้แดดแตะหน้า แตะแขน หรือแค่ให้แสงลอดผ่านตาเบาๆ โดยไม่ต้องจ้องจ้าๆ ก็พอ แค่นี้ก็เป็นการให้ไมโทคอนเดรียได้หายใจ ได้ออกกำลังกายแบบของมัน และได้ส่งพลังกลับมาหาเราทั้งร่างกายและจิตใจ

สุดท้ายแล้ว แดดไม่ได้แบ่งชนชั้น ไม่เลือกว่าจะรักเฉพาะคนตื่นเช้า หรือโกรธคนตื่นสาย ขอแค่เรารู้จักเวลาและวิธีอยู่กับมันอย่างถูกจังหวะ แดดก็พร้อมจะให้เสมอ

#pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr #SundaySpecialเราจะไปเป็นหมูแดดเดียว

-

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

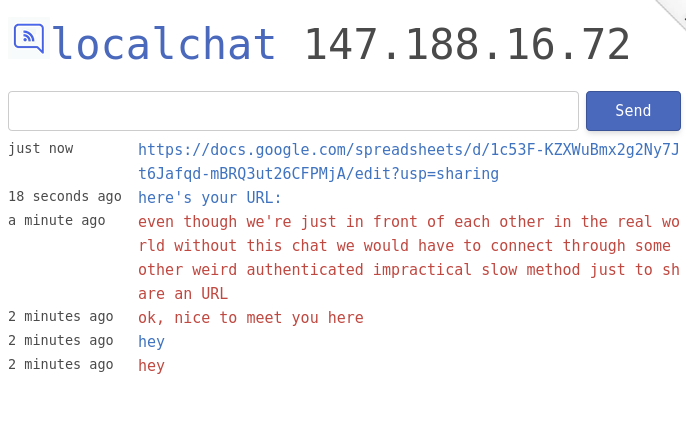

2024-01-14 13:55:28localchat

A server that creates instant chat rooms with Server-Sent Events and normal HTTP

POSTrequests (instead of WebSockets which are an overkill most of the times).It defaults to a room named as your public IP, so if two machines in the same LAN connect they'll be in the same chat automatically -- but then you can also join someone else's LAN if you need.

This is supposed to be useful.

See also

-

@ 47c860d3:b3f71b74

2025-05-25 01:56:39

@ 47c860d3:b3f71b74

2025-05-25 01:56:39ไขความลับรหัส 13 ตัวอักษรของ FT8: ศาสตร์แห่งการบีบอัดข้อมูลสื่อสารดิจิทัล คืนหนึ่ง ผมนั่งอยู่หน้าจอคอมพิวเตอร์ มองสัญญาณ FT8 กระพริบไปมา ส่งข้อความสั้นๆ ซ้ำไปซ้ำมา "CQ HS1IWX OK03" แล้วก็รอให้ใครสักคนตอบกลับ วนลูปไปอย่างไม่รู้จบ จนเกิดคำถามขึ้นมาในหัว... “นี่เรานั่งทำอะไรกันแน่?” FT8 มันควรเป็นอะไรมากกว่านี้ใช่ไหม? ไม่ใช่แค่การส่งคำสั้นๆ 13 ตัวอักษรไปมาเท่านั้น! เอ๊ะ! เดี๋ยวก่อน... 13 ตัวอักษร? ถ้าการส่งข้อความจำกัดที่ 13 ตัวอักษร แล้วทำไมข้อความอย่าง "CQ HS1IWX OK03" ซึ่งดูเหมือนจะมี 14 ตัวอักษร (รวมช่องว่าง) ถึงสามารถส่งได้? นี่มันต้องมีอะไรซ่อนอยู่! ระบบ FT8 ใช้เวทมนตร์อะไร หรือมันมีเทคนิคการเข้ารหัสแบบลับๆ ที่เรายังไม่รู้? และคำว่า "13 ตัวอักษร" ที่เขาพูดถึงนั้นหมายถึงอะไรกันแน่? แล้วลองนึกดูสิ... ถ้าเราอยู่ในสถานการณ์ฉุกเฉิน ต้องส่งข้อความที่สั้น กระชับ และมีความหมาย ในขณะที่แบตเตอรี่เหลือน้อย กำลังส่งต่ำ และอุปกรณ์มีเพียงเครื่องวิทยุขนาดเล็กกับสายอากาศชั่วคราวและมือถือ บางครั้ง FT8 อาจจะเป็นตัวเลือกเดียวที่ช่วยให้เราส่งสัญญาณขอความช่วยเหลือได้ เพราะมันสามารถถอดรหัสได้แม้สัญญาณอ่อนจนแทบจะมองไม่เห็น! ดังนั้น ผมต้องขุดลึกลงไป เพื่อไขความลับของรหัส 13 ตัวอักษรของ FT8 และหาคำตอบว่า ทำไม FT8 สามารถส่งข้อความบางอย่างที่ดูเหมือนยาวเกินขีดจำกัดได้? พร้อมกับสำรวจว่ามันสามารถช่วยเหลือเราในสถานการณ์ฉุกเฉินได้อย่างไร! อะไรคือความหมายที่แท้จริงของ 13 ตัวอักษร ? เมื่อเริ่มเจาะลึกลงไป ผมจึงได้รู้ว่า 13 ตัวอักษรที่เราพูดถึงนั้นหมายถึง ข้อความใน Free Text Mode หรือก็คือ ข้อความที่ไม่ได้ถูกเข้ารหัสในรูปแบบมาตรฐานของ FT8 หากเราส่งข้อความแบบอิสระ เช่น "HELLO WORLD!" หรือ "EMERGENCY CALL" เราจะถูกจำกัดแค่ 13 ตัวอักษรเท่านั้น เพราะข้อความเหล่านี้ไม่ได้ถูกเข้ารหัสให้เหมาะสมกับโปรโตคอลของระบบ FT8 แต่ถ้าเป็น ข้อความมาตรฐานที่ถูกกำหนดรูปแบบไว้แล้ว เช่น Callsign + Grid หรือ รายงาน SNR (-10, 599, RR73) ระบบ FT8 จะใช้การเข้ารหัส 77-bit Structured Message ซึ่งช่วยให้สามารถส่งข้อมูลได้มากกว่า 13 ตัวอักษร! อะไรคือ โครงสร้าง 77-bit Message ใน FT8 FT8 ใช้ 77 บิต สำหรับการเข้ารหัสข้อมูล โดยแบ่งออกเป็น 3 ส่วนหลัก: ส่วนของข้อมูล จำนวนบิต รายละเอียด Callsign 1 (ต้นทาง) 28 บิต รหัสสถานีที่ส่ง Callsign 2 (ปลายทาง) 28 บิต รหัสสถานีปลายทาง หรือ CQ Exchange Data 21 บิต Grid Locator หรือข้อมูลอื่น ๆ รวมทั้งหมด = 28 + 28 + 21 = 77 บิต การที่ FT8 ใช้โครงสร้างแบบนี้ ข้อความที่ถูกเข้ารหัสในมาตรฐาน FT8 จึงสามารถส่งได้มากกว่า 13 ตัวอักษร เช่น "CQ HS1IWX OK03" นั้นถูกเข้ารหัสให้อยู่ใน 77 บิต ไม่ใช่ Free Text แบบปกติ ทำให้สามารถส่งได้โดยไม่มีปัญหา! แต่ข้อสำคัญมันคือโปโตคอลของระบบ FT8 ในปัจจุบัน ถ้าเราต้องการ เข้ารหัสเองในรูปแบบของเราเราก็ต้องพัฒนาโปรแกรม FT8 ของเราเอง (ผมทำไม่เป็นครับ555) ก็ใช้ของเขาไปก็ได้ แล้วก็มาพัฒนาระบบ เทคนิคการส่งข้อมูลให้มีประสิทธิภาพภายใน 13 ตัวอักษร กันน่าจะสนุกกว่า ส่วนเรื่องรายละเอียดวิธีการเข้ารหัสผมคงไม่พูดถึงนะ เดี๋ยวจะวิชาการน่าเบื่อไปครับ ใครสนใจก็ไปศึกษาต่อกันเอาเองครับ การเข้ารหัสนี้จะใช้ร่วมกับเทคนิค FEC (Forward Error Correction) ใน FT8 ซึ่งเป็นหนึ่งในเทคนิคที่ทำให้ FT8 สามารถถอดรหัสข้อความได้แม้ในสภาวะสัญญาณอ่อน คือการใช้ Forward Error Correction (FEC) หรือ การแก้ไขข้อผิดพลาดล่วงหน้า ซึ่งช่วยให้สามารถกู้คืนข้อมูลที่อาจเกิดการสูญหายในระหว่างการส่งสัญญาณได้ โดย FT8 ใช้ Reed-Solomon (RS) Error Correction Code ซึ่งเป็นอัลกอริธึมที่เพิ่มบิตสำรองเพื่อช่วยตรวจจับและแก้ไขข้อผิดพลาดในข้อความที่ส่งไป และ ใช้ Convolutional Encoding และ Viterbi Decoding ซึ่งช่วยให้สามารถแก้ไขข้อมูลที่ผิดพลาดจากสัญญาณรบกวนได้ ซึ่งเมื่อสัญญาณอ่อน ข้อมูลบางส่วนอาจสูญหาย แต่ FEC ช่วยให้สามารถกู้คืนข้อความได้แม้ข้อมูลบางส่วนจะขาดหาย ทำให้ผลลัพธ์คือ FT8 สามารถทำงานได้แม้ระดับสัญญาณต่ำถึง -20 dB! ซึ่งส่วนนี้ผมก็ยังไม่เข้าใจมันดีเท่าไหร่ครับ อิอิ ฟังเขามาอีกที สิ่งที่เราทำได้ตอนนี้ในโปรแกรม FT8 ในปัจจุบันก็คือ เทคนิคการส่งข้อมูลให้มีประสิทธิภาพภายใน 13 ตัวอักษรถ้าเรา อยากส่งข้อความฉุกเฉินภายใน 13 ตัวอักษร ให้ได้ข้อมูลมากที่สุด เราต้องใช้เทคนิคต่อไปนี้: การใช้ตัวย่อและรหัสสากล • SOS 1234 BKK แทน "ขอความช่วยเหลือที่พิกัด 1234 ใกล้กรุงเทพ" • WX BKK T35C แทน "สภาพอากาศกรุงเทพ 35 องศา" • ALRT TSUNAMI แทน "เตือนภัยสึนามิ" ใช้ข้อความที่อ่านเข้าใจง่าย • ใช้โค้ดสั้นๆ เช่น "QRZ EMRG?" แทน "ใครรับสัญญาณฉุกเฉิน?" การส่งข้อความเป็นชุด • เฟรม 1: MSG1 BKK STORM1 • เฟรม 2: MSG2 BKK STORM2 • เฟรม 3: MSG3 BKK NOW “การฝึกฝนเพื่อทำความเข้าใจการสื่อสารเป็นสิ่งสำคัญ เพราะเมื่อได้รับข้อความเหล่านี้ เราจะสามารถถอดรหัสและติดตามข้อมูลได้อย่างทันท่วงที” ครั้งนี้อาจเป็นเพียงการค้นพบอีกด้านหนึ่งของ FT8… หรือมันอาจเปลี่ยนมุมมองของคุณที่มีต่อโหมดสื่อสารดิจิทัลไปตลอดกาลก็ได้ แต่เดี๋ยวก่อน—นี่มันอะไรกัน!? จู่ๆ บนจอคอมพิวเตอร์ของผมก็ปรากฏคอลซายที่ไม่คุ้นตา D1IFU—คอลซายที่ไม่มีอยู่ในฐานข้อมูลของ ITU แต่กลับปรากฏขึ้นบนคลื่นความถี่ของเรา D1…? มันมาได้ยังไง? แล้วทันใดนั้น ผมก็ฉุกคิดขึ้นมา—มันคือคอลซายจากพื้นที่ Donetsk หรือ Luhansk พื้นที่ที่เต็มไปด้วยความขัดแย้ง ดินแดนที่เราคิดว่าเงียบงันภายใต้เสียงระเบิดและความไม่แน่นอน แต่ตอนนี้ กลับมีสัญญาณเล็กๆ ปรากฏขึ้นบน FT8 มันคือใครกัน? เป็นทหาร? เป็นพลเรือนที่พยายามติดต่อโลกภายนอก? หรือเป็นเพียงนักวิทยุสมัครเล่นที่ยังคงเฝ้าฟังแม้โลกจะเต็มไปด้วยความวุ่นวาย? แต่สิ่งหนึ่งที่แน่ชัด… “นี่คือสัญญาณแห่งชีวิต” จบข่าว. 🚀📡

-

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28Como não houve resposta, estou enviando de novo

Recebi um email assim, dizendo a mesma coisa repetida. Eu havia recebido já da primeira vez, mas como era só uma informação já esperada, julguei que não precisava responder dizendo "chegou, obrigado!" e não o fiz.

Reconheço, porém, que dada a instabilidade desses serviços de email nunca ninguém sabe se a mensagem chegou ou não. Ela pode ter sido jogada na lixeira do spam, ou pode ter falhado por outros motivos, e aí não existe um jeito garantido de saber se houve falha, é um enorme problema sempre. Por isso a necessidade de uma resposta "chegou, obrigado!".

Mas não podemos parar por aí. A resposta "chegou, obrigado!" também está sujeita aos mesmos trâmites e riscos da mensagem original. Seria necessário, porém, que assim que a outra pessoa recebesse o "chegou, obrigado!" deveria então responder com um "recebi a sua confirmação". Caso não o fizesse, eu poderia achar que a minha mensagem não havia chegado e dias depois enviá-la de novo: "como não houve resposta à minha confirmação, estou enviando de novo".

E assim por diante (eu ia escrever mais um parágrafo só pelo drama, mas desisti. Já deu pra entender).

- Ripple and the problem of the decentralized commit, esta situação que acabo de viver é mais um exemplo prático disto.

-

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28Trello Attachment Editor

A static JS app that allowed you to authorize with your Trello account, fetch the board structure, find attachments, edit them in the browser then replace them in the cards.

Quite a nice thing. I believe it was done to help with Websites For Trello attached scripts and CSS files.

See also

-

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28Processos Antifrágeis

Há esse conceito, criado pelo genial Nassim Nicholas Taleb, que diz respeito a processos nos quais a curva de retorno em relação a uma variável aleatória é convexa, ou seja, o retorno tende a ser maior quanto mais aleatoriedade for adicionada ao processo.

Disso aí, o próprio Taleb tira uma conclusão que resolve a questão da pesquisa científica propositada contra a sorte, sobre quais levam a melhores resultados práticos e invenções. Escreve ele:

A história da sorte versus conhecimento é a seguinte: Ironicamente, temos imensamente mais evidência de resultados (descobertas úteis) ligados à sorte do que de resultados vindos da prática teleológica (de telos, “objetivo”), exceto na física — mesmo depois de descontarmos o sensacionalismo. Em alguns campos opacos e não-lineares, como a medicina ou a engenharia, as exceções teleológicas são a minoria, assim como são um pequeno número de remédios projetados. Isto nos deixa numa contradição de que chegamos até aqui graças ao puro acaso não-direcionado, mas ao mesmo tempo criamos programas de pesquisa que miram num progresso com direção definida, baseado em narrativas sobre o passado. E, o que é pior, estamos totalmente conscientes desta inconsistência.

Por outro lado, pura sorte não poderia produzir melhorias sempre. Processos de tentativa e erro (que são os que produzem as descobertas “por sorte”) têm um elemento erro, e erros, diz Taleb, causam explosões de avião, quedas de edifícios e perda de conhecimento.

A resposta, portanto, está na antifragilidade: as áreas onde a sorte vence a teleologia são as áreas onde estão em jogo sistemas complexos, onde os nexos causais são desconhecidos ou obscuros — e são as áreas onde a curva de retornos é convexa.

Vejamos a mais sombria de todas, a culinária, que depende inteiramente da heurística da tentativa e erro, já que ainda não nos foi possível projetar um prato direto de equações químicas ou descobrir, por engenharia reversa, gostos a partir de tabelas nutricionais. Pega-se o hummus, adiciona-se um ingrediente, digamos, uma pimenta, prova-se para ver se há uma melhora no gosto e guarda-se a receita, se o gosto for bom, ou descarta-se-á. Imprescindivelmente temos a opção, e não a obrigação, de guardar o resultado, o que nos deixa reter a parte superior da curva e nos impede de sermos lesados pelos retornos adversos.

A conclusão geral é que, para obter os melhores resultados na invenção de tecnologias, deve-se usar a experimentação sem exageros e cálculos quando se identificar uma área antifrágil, e usar a pesquisa rígida e cheia de provas matemáticas (ou o equivalente) quando a área for frágil.

A inovação capitalista

Um processo antifrágil importantíssimo deste mundo é a inovação capitalista (dói-me usar este termo já tão mal-gasto e mal-definido por aí). Não falo, como alguns, da invenção de novas tecnologias, mas, como outros, da invenção de novas formas de usar as coisas (qualquer coisa) para melhorar a vida de alguém, de alguma forma — e aqui incluem-se pequenas adaptações de tecnologias antigas que dão origem a novas tecnologias não muito diferentes das antigas, e incluem-se também o oferecimento de algum serviço, trabalho ou produto já existente, mas de uma nova forma, possivelmente melhor para seu provável consumidor. Este tipo de inovação é, segundo me parece, o poder mais subestimado dos mercados livres, é irreplicável em laboratórios de pesquisa tecnológica (só pode surgir mesmo na vida real, da cabeça de quem está envolvido com o problema real que a inovação soluciona), e é o que gerou idéias como o restaurante self-service, a terceirização dos serviços de construção civil ou o Google.

Esse tipo de inovação (ao contrário do sentido de inovação ligado a pesquisas caríssimas em universidades ou megaempresas, identificada pela famigerada sigla P&D) é antifrágil porque não custa muito ao indivíduo, não requer investimentos gigantescos ou qualquer coisa assim, porque é normalmente apenas uma adaptação do que ele próprio já faz.

Para a sociedade, não representa custo algum: o serviço novo é oferecido paralelamente ao serviço antigo, seus consumidores potenciais podem escolher o que mais lhes agrada, e rejeitar o outro. Se a nova solução não for satisfatória os mecanismos automáticos do mercado (o prejuízo simples) encarregam-se automaticamente de remover aquela novidade — e, automaticamente, o indivíduo que a criou pode se voltar ao seu processo antigo, ou a uma nova invenção.

Ao mesmo tempo em que cometer um erro numa tentativa de inovação é barato e não atrapalha ninguém, um acerto pode ter conseqüências que melhoram enormemente a vida de muita gente. O restaurante self-service, por exemplo, provavelmente teve sua implementação tentada por restaurantes de serviço à la carte várias vezes, em vários formatos diferentes, sem muito prejuízo para o restaurante, que podia continuar com seu serviço à la carte (no Brasil, senão o inventor dessa modalidade de restaurante ao menos um dos seus grandes expoentes, estas tentativas ocorreram durante a década de 80). Mas, quando enfim deu certo, promoveu melhoras enormes na qualidade de vida de milhares de pessoas — que podem pagar mais barato e comer apenas o que querem e quanto querem, dentro de uma gama maior de opções, o que permite que trabalhadores de todos os tipos comam melhor todos os dias, fiquem mais felizes e gastem menos.

-

@ 3bf0c63f:aefa459d

2024-01-14 14:52:16

@ 3bf0c63f:aefa459d

2024-01-14 14:52:16bitcoinddecentralizationIt is better to have multiple curator teams, with different vetting processes and release schedules for

bitcoindthan a single one."More eyes on code", "Contribute to Core", "Everybody should audit the code".

All these points repeated again and again fell to Earth on the day it was discovered that Bitcoin Core developers merged a variable name change from "blacklist" to "blocklist" without even discussing or acknowledging the fact that that innocent pull request opened by a sybil account was a social attack.

After a big lot of people manifested their dissatisfaction with that event on Twitter and on GitHub, most Core developers simply ignored everybody's concerns or even personally attacked people who were complaining.

The event has shown that:

1) Bitcoin Core ultimately rests on the hands of a couple maintainers and they decide what goes on the GitHub repository[^pr-merged-very-quickly] and the binary releases that will be downloaded by thousands; 2) Bitcoin Core is susceptible to social attacks; 2) "More eyes on code" don't matter, as these extra eyes can be ignored and dismissed.

Solution:

bitcoinddecentralizationIf usage was spread across 10 different

bitcoindflavors, the network would be much more resistant to social attacks to a single team.This has nothing to do with the question on if it is better to have multiple different Bitcoin node implementations or not, because here we're basically talking about the same software.

Multiple teams, each with their own release process, their own logo, some subtle changes, or perhaps no changes at all, just a different name for their

bitcoindflavor, and that's it.Every day or week or month or year, each flavor merges all changes from Bitcoin Core on their own fork. If there's anything suspicious or too leftist (or perhaps too rightist, in case there's a leftist

bitcoindflavor), maybe they will spot it and not merge.This way we keep the best of both worlds: all software development, bugfixes, improvements goes on Bitcoin Core, other flavors just copy. If there's some non-consensus change whose efficacy is debatable, one of the flavors will merge on their fork and test, and later others -- including Core -- can copy that too. Plus, we get resistant to attacks: in case there is an attack on Bitcoin Core, only 10% of the network would be compromised. the other flavors would be safe.

Run Bitcoin Knots

The first example of a

bitcoindsoftware that follows Bitcoin Core closely, adds some small changes, but has an independent vetting and release process is Bitcoin Knots, maintained by the incorruptible Luke DashJr.Next time you decide to run

bitcoind, run Bitcoin Knots instead and contribute tobitcoinddecentralization!

See also:

[^pr-merged-very-quickly]: See PR 20624, for example, a very complicated change that could be introducing bugs or be a deliberate attack, merged in 3 days without time for discussion.

-

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28jq-web

I took

jq's C code and compiled it with Emscripten, then added a wrapper so it would run on a browser with eitherasm.jsor WebAssembly.I believe I needed it for requesthub.xyz but I'm not sure I ever used it there. I also intended to use it on another (secret) project that relied on heavy data manipulation on the client, but it turned out to be too slow for that so I opted to use JavaScript directly. Later I used it for a client-side Etleneum simulator, but removed it later as it was impossible to replicate most of the Etleneum functionality on the client so the simulator was too broken and confusing.

See also

-

-

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28Democracia na América

Alexis de Tocqueville escreveu um livro só elogiando o sistema político dos Estados Unidos. E mesmo tendo sido assim, e mesmo tendo escrito o seu livro quase 100 anos antes do mais precoce sinal de decadência da democracia na América, percebeu coisas que até hoje quase ninguém percebe: o mandato da suprema corte é um enorme poder, uma força centralizadora, imune ao voto popular e com poderes altamente indefinidos e por isso mesmo ilimitados.

Não sei se ele concluiu, porém, que não existe nem pode existir balanço perfeito entre poderes. Sempre haverá furos.

De qualquer maneira, o homem é um gênio apenas por ter percebido isso e outras coisas, como o fato da figura do presidente, também obviamente um elemento centralizador, não ser tão poderosa quanto a figura de um rei da França, por exemplo. Mas ao mesmo tempo, por entre o véu de elogios (sempre muito sóbrios) deixou escapar que provavelmente também achava que não poderia durar para sempre a fraqueza do cargo de presidente.

-

@ bf47c19e:c3d2573b

2025-05-24 23:02:05

@ bf47c19e:c3d2573b

2025-05-24 23:02:05Da li ste znali da se već danas u Srbiji možete kompletno obući i svoj dom u potpunosti opremiti tehnikom i za sve to platiti Bitkoinom? Sve ovo je moguće zahvaljujući kompaniji Bitrefill!

Bitrefill je vodeća platforma koja omogućava kupovinu poklon-kartica putem Bitkoina i drugih kriptovaluta.

Od poklon-kartica koje je moguće kupiti na Bitrefillu, u Srbiji je najpopularnija, najraznovrsnija i najpraktičnija za korišćenje digitalna Giftoncard Multibrand poklon-kartica koju je moguće koristiti u više desetina šoping centara širom Srbije! Moguće je iskoristiti u više od 150 naznačenih brendova i radnji raznovrsnog tipa i zato kao takva predstavlja pravi spoj zabave, mode, sporta, tehnike... Od najpoznatijih prodavnica izdvajaju se Gigatron, Tehnomanija, Tehnomedija, Puma, Adidas, Sport Vision, Univerexport...

GiftOnCard poklon kartica je savršen način da ispoštujete ukus baš svakoga i rešite problem promašenog poklona!

Neki od tržnih centara u kojima se mogu koristiti poklon-kartice: Delta City, TC Ušće, Ada Mall, Galerija Beograd, TC Stadion, Merkator Centar Beograd/Novi Sad, Roda Mega Shopping Centar, Big Kruševac, Big Nova Pazova, Aviv Park Zvezdara, Stop Shop Borča, Forum Park, Big Shopping Centar Novi Sad, TC Promenada Novi Sad, TC Forum Niš, Delta Planet Niš, Capitol Park Šabac...

Giftoncard Multibrand poklon-karticu je na Bitrefillu moguće kupiti kako on-chain Bitkoinom, tako i putem Bitkoin Lightning mreže. U ponudi su kartice sa sredstvima u iznosu od 3000 i 6000 dinara.

Pored Multibrand kartice, na sajtu Bitrefill su dostupne i poklon-kartice Tehnomanije i Sport Visiona, s tim što je Sport Vision karticu moguće iskoristiti i onlajn na njihovom sajtu (ovo važi i za Multibrand karticu).

Kako do Giftoncard Multibrand poklon-kartice?

Proces plaćanja Bitkoin (Lightning-om) je veoma jednostavan.

- Izaberite vašu poklon-karticu zajedno sa željenom vrednošću.

- Popunite potrebna polja da biste nastavili sa plaćanjem.

- Izaberite željenu kriptovalutu i pošaljite odgovarajući iznos na dostavljenu adresu ili skenirajte QR kod putem vašeg mobilnog novčanika.

- Kada plaćanje bude izvršeno, digitalna poklon-kartica će vam biti dostavljena za nekoliko trenutaka, a takođe ćete dobiti i kopiju putem imejla.

Kako iskoristiti poklon-karticu?

- Možete iskoristiti poklon-karticu za plaćanje proizvoda i usluga na više od 300 lokacija širom Srbije sve do visine sredstava koja se nalaze na kartici.

- Niste u obavezi da iskoristite ceo iznos sa kartice odjednom; kartica se može koristiti više puta za više proizvoda i usluga sve dok ne potrošite čitav iznos.

- Možete proveravati stanje na kartici i sve transakcije registracijom na sajtu giftoncard.eu.

- Moguće je iskoristiti više poklon-kartica za jednu kupovinu.

- Kartica se ne može koristiti za povlačenje gotovine

- Kartica ne može biti poništena ili ponovo dopunjena.

Obradujte svoje najmilije i sebe poklonima, proizvodima i uslugama kupljenim za Bitkoin!

-

@ 3c7dc2c5:805642a8

2025-05-24 22:05:00

@ 3c7dc2c5:805642a8

2025-05-24 22:05:00🧠Quote(s) of the week:

'The Cantillon Effect: When new money is printed, those closest to the source (banks, elites) benefit first, buying assets before prices rise. Others lose purchasing power as inflation hits later. If people find out how this works, they will riot.' -Bitcoin for Freedom

Just think about it. Your employer gives you a 5% raise. The Fed (central banks in general) prints 7% more dollars/euros/Fiat. You just got a 2% pay cut. This isn't a conspiracy theory. This is how fiat money steals from the working class every single day. This is why I support Bitcoin.

Anilsaidso: 'Saving in fiat currency is no longer an option. A 2% inflation rate means you lose 1/3 of your purchasing power over 20yrs. At 5% inflation, you lose 60%. And at 10% you've burnt 85%. Reduce your uncertainty. Save in Bitcoin.' https://i.ibb.co/N661BdVp/Gr-Rwdg-OXc-AAWPVE.jpg

🧡Bitcoin news🧡

“Education increases conviction.

Conviction increases allocation.

Allocation increases freedom.” —Gigi

https://i.ibb.co/Q3trHk8Y/Gr-Arv-Ioa-AAAF5b0.jpg

On the 12th of May:

➡️Google searches for "Digital Gold" are at all-time highs. Bitcoin Croesus: "This is the second wave of the Digital Revolution - the digitization of value to complement the Internet's digitization of information. It wasn't possible to own a slice of the Internet itself, but it is possible with Bitcoin, the internet of value." "...It feels like you're late to Bitcoin. But this is a bigger game playing out than most realize, and we are much earlier than casual observers know. If you're reading this, you're here on the frontier early. And you have a chance to stake a claim before 99% of the world shows up. This is a land grab. This is the digital gold rush. Make your descendants proud."

https://i.ibb.co/5XXbNQ8S/Gqw-X4-QRWs-AEd5-Uh-1.jpg

➡️ 'A new holding company ‘Nakamoto’ just raised $710 million to buy more Bitcoin and will merge with KindlyMD to establish a Bitcoin Treasury company. Saylor playbook!' - Bitcoin Archive

➡️American Bitcoin, backed by Donald Trump Jr. and Eric Trump, will go public via an all-stock merger with Gryphon Digital Mining. Post-merger, Trump affiliates and Hut 8 will retain 98% ownership. GRYP tripled to $2.19, Hut 8 jumped 11% to $15.45. The deal closes in Q3 2025.

➡️Phoenix Wallet: 'Phoenix 0.6.0 is out: offers can now have a custom description simple close (set an exact mutual close tx fee rate) native support for Linux arm64 This is the server version. Phoenix mobile release is around the corner. '

On the 13th of May:

➡️Corporate Bitcoin purchases have now outweighed the supply of new Bitcoin by 3.3x in 2025. https://i.ibb.co/fVdgQhyY/Gq1ck-XRXUAAsg-Ym.jpg

➡️ Publicly listed Next Technology disclosed buying 5,000 Bitcoin for $180m, now HODLs 5,833 $BTC worth +$600m.

➡️ After rejecting the Arizona Strategic Bitcoin Reserve Act, Governor Katie Hobbs vetoed Bill SB 1373, which proposed a digital asset reserve fund. "Current volatility in the cryptocurrency markets does not make a prudent fit for general fund dollars."

➡️Meanwhile in Paris, France the kidnapping of a woman with her 2-year-old child morning on the streets of Paris - the target is allegedly the daughter of a crypto CEO. 3 masked men tried forcing them into a fake delivery van, before being fought off by her partner and bystanders. One of whom grabbed a dropped gun and aimed it back.

➡️ 'Bitcoin illiquid supply hit a new all-time high of $1.4B Are you HODLing too, anon?' - Bitcoin News

➡️Why Coinbase entering the S&P 500 matters. Boomers will have Bitcoin / CrApTo exposure, whether they like it or not. Anyway, remember what happened in 2021. The COIN IPO, and they’re still trading about 35% below their IPO-day high. Oh and please read the 'Coinbase" hack below haha.

➡️ Nasdaq listed GD Culture Group to sell up to $300 million shares to buy Bitcoin.

➡️ A Bitcoin wallet untouched since April 2014 just moved 300 BTC worth $31M for the first time in 11 years. This is how you HODL.

➡️ Bitcoin's realized price is steadily increasing, mirroring behaviors seen in past bull markets, according to CryptoQuant.

➡️ Bitcoin whales and sharks (10-10K BTC) accumulated 83,105 BTC in the last 30 days, while small retail holders (<0.1 BTC) sold 387 BTC, according to Santiment.

Bitcoin Whales have been AGGRESSIVELY accumulating BTC recently! With at least 240,000+ Bitcoin transferred to wallets with at least 100 BTC. The largest market participants are trying to buy as much as possible, what do they think comes next...

➡️'The average cost of mining 1 BTC for miners is currently $36.8K. The spread between the current market price and the cost of one coin = 182%. This is essentially the average profitability. This corresponds to the beginning of the bull cycle in November 2022 and the peaks of this cycle >$100K. A price increase above this level will allow miners to fully recover after the last halving and reach excess profits comparable to the beginning of the bull rally in January 2023.' -Axel Adler Jr.

➡️ Remember last week's segment on Coinbase..."Coinbase just disclosed in their Q1 filing: that they have custody of 2.68 million Bitcoin. That’s over 13% of all Bitcoin in circulation, on one platform. Is this the greatest honeypot in financial history? Yes, it is...read next week's Weekly Bitcoin update."

Well, here you go.

Coinbase estimates $180-$400 million in losses, remediation costs, and reimbursement following today’s cyber attack. https://i.ibb.co/jkysLtZ1/Gq-C7zl-W4-AAJ0-N6.jpg

Coinbase didn't get hacked. Coinbase employees sold customer data on the black market. Coinbase failed to protect customer data. This is why KYC is useless. The criminals have our driver's license scans. They have AI tools that can generate fake images and videos. KYC puts our identities at risk, makes onboarding more difficult, and rewards criminals. To make it even worse. Coinbase knew about the hack as early as January but only disclosed it publicly after being added to the S&P 500.

I will say it one more time! Don't buy your Bitcoin on KYC exchanges. KYC means handing over your identity to be leaked, sold, or extorted.

It was 2 days ago, see the bit on the 13th of May, that we saw a violent attack in Paris. Minimize the data you share with centralized tools. Store as much as you can locally. Always ask yourself what data am I giving and to whom? Remove the need for trust.

And for the love of God, Allah, or whatever god you are praying to...

DON'T LEAVE YOUR COINS ON A FREAKING EXCHANGE!!!!

Clear!

➡️ Sam Callahan: Bitcoin CAGRs over rolling four-year holding periods since 2012:

10th percentile: 33%

25th percentile: 50% 40th percentile: 75%

Said differently, for 90% of the time, Bitcoin’s four-year CAGR was higher than 33%. For comparison, here are the single best four-year CAGRs over the same period for:

Gold: 17%

Silver: 20%

S&P 500: 24%

Apple: 52%

Two lessons here:

1.) Even when Bitcoin underperforms, it still outperforms.

2.) Bitcoin holding goals are best measured in halving cycles.'

https://i.ibb.co/9m6q2118/Gq1-Ie2-Ob-AAIJ8-Kf.jpg

➡️ Deutsche Bank Aktiengesellschaft has bought 96,870 Strategy₿ stocks for 30 Million dollars at an Average Price Of $310 Per Share In Q1 2025, Their Total Holdings Is 518,000 Shares Worth Over 214 Million Dollars.

➡️Senator Lummis urges the U.S. Treasury to eliminate taxes on unrealized gains for Bitcoin.

On the 14th of May:

➡️At $168,000, Bitcoin will surpass Microsoft, the world's largest company.

➡️Fidelity tells institutions to buy Bitcoin if they can’t match Bitcoin’s 65% return on capital.

➡️Michigan has adopted House Resolution 100, declaring May 13 2025 as "Digital Asset Awareness Day." The resolution encourages "activities and programs that foster a deeper understanding of digital assets and their impact on our society and economy."

➡️Publicly traded Vinanz raises funding to buy $2 million in #Bitcoin assets.

➡️Bitcoin News: "Investor Jim Chanos is shorting MicroStrategy while going long on Bitcoin, calling the stock overvalued relative to its BTC holdings. “We’re selling MicroStrategy and buying Bitcoin, basically buying something for $1 and selling it for $2.50," he told CNBC

On the 15th of May:

➡️The Abu Dhabi sovereign wealth fund disclosed owning $511 million in Bitcoin through BlackRock’s ETF.

➡️UK public company Coinsilium Group raises £1.25 million to adopt a Bitcoin treasury strategy.

➡️Chinese Textile company Addentax issues stock to buy 8,000 Bitcoin.

➡️14 US states have reported $632m in $MSTR exposure for Q1, in public retirement and treasury funds. A collective increase of $302m in one quarter. The average increase in holding size was 44%.

➡️Chinese public company DDC Enterprise to adopt a Bitcoin Reserve with 5,000 BTC.

On the 16th of May:

➡️Brazilian listed company Méliuz buys $28.4 million Bitcoin to become the nation's first Bitcoin Treasury Company. Shareholders voted to approve the strategy by an "overwhelming majority".

➡️13F Filings show Texas Retirement System owns MSTR. The day MSTR enters the S&P 500, every pension fund will follow.

➡️'Wealthy Investors Shift Up to 5% into Bitcoin as confidence in fiat falters. UBS, a Swiss banking giant says Bitcoin and digital assets are becoming key hedges against inflation and systemic risk, marking a dramatic shift in modern portfolio strategy.' -CarlBMenger

➡️River: "Above all, Bitcoin is money for the people." https://i.ibb.co/Jj8MVQwr/Gr-Ew-EPp-XAAA1-TVN.jpg

On the 17th of May:

➡️Illicit activity is now down to 0.14% of transaction volume across all crypto.

Context: World Bank, IMF suggests 1.5–4% of global GDP is laundered yearly through traditional banking Of that 0.14%:

63% of illicit trade was stablecoins.

13% was Bitcoin (declining each year)

Source: The 2025 Crypto Crime Report, Chainalysis 2025

Yet another confirmation that Bitcoin's use in facilitating illicit activities is a rounding error on a rounding error.

On the 18th of May:

➡️JPMorgan CEO Jamie Dimon said they will allow clients to buy Bitcoin. The repeal of SAB 121 is a bigger deal than most realize. “I will fire any employee buying or trading Bitcoin for being stupid” - Jamie Dimon (2017) https://i.ibb.co/b5tnkb15/Gr-Vxxc-OXk-AA7cyo.jpg

On the 19th of May.

➡️Bookmark the following stuff from Daniel Batten if you want to combat climate change (fanatics)...

'That Bitcoin mining is not only not harmful, but beneficial to the environment is now supported by:

7 independent reports

20 peer-reviewed papers

As a result * 90% of climate-focused magazines * 87.5% of media coverage on Bitcoin & the environment is now positive * source 7 independent reports https://x.com/DSBatten/status/1922666207754281449… * 20 peer-reviewed papers https://x.com/DSBatten/status/1923014527651615182… * 10 climate-focused magazines https://x.com/DSBatten/status/1919518338092323260… * 16 mainstream media articles https://x.com/DSBatten/status/1922628399551434755

➡️Saifedean Ammous: '5 years ago at the height of corona hysteria, everyone worried about their savings.

If you put $10,000 in "risk-free" long-term US government bonds, you'd have $6,000 today.

If you put the $10,000 in "risky speculative tulip" bitcoin, you'd have $106,000.

HFSP, bondcucks!'

I love how Saifedean always put it so eloquently. haha

➡️An Australian judge rules Bitcoin is “just another form of money.” This could make it exempt from capital gains tax. Potentially opening the door to millions in refunds across the country. - AFR

If upheld, the decision could trigger up to $1B in refunds and overturn the Australian Tax Office’s crypto tax approach.

➡️Publicly traded Vinanz buys 16.9 Bitcoin for $1.75 Million for their treasury.

➡️Bitcoin just recorded its highest weekly close ever, while the Global Economic Policy Uncertainty Index hit its highest level in history.

➡️4 in 5 Americans want the U.S. to convert part of its gold reserves to Bitcoin. - The Nakamoto Project

"or background, the survey question was: "Assuming the United States was thinking of converting some of their gold reserves into Bitcoin, what percentage would you advise they convert?" Respondents were provided a slider used to choose between 0% and 100%. Our survey consisted of a national sample of 3,345 respondents recruited in partnership with Qualtrics, a survey and data collection company"

Context: https://x.com/thetrocro/status/1924552097565180107 https://i.ibb.co/fGDw06MC/Gr-VYDIdb-AAI7-Kxd.jpg

➡️Michael Saylor's STRATEGY bought another $764.9m Bitcoin. They now HODL 576,230 Bitcoin, acquired for $40.18 billion at $69,726 per Bitcoin.

➡️The German Government sold 49,858 BTC for $2.89B, at an average price of $57,900. If they had held it, their BTC would now be worth $5.24B.

➡️A record 63% of all the Bitcoin that exist have not transacted or moved from their wallets this year. - Wicked

https://i.ibb.co/j9nvbvmP/Gq3-Z-x6-Xw-AAv-Bhg.jpg

💸Traditional Finance / Macro:

On the 12th of May:

👉🏽The S&P 500 has closed more than 20% above its April low, technically beginning a new bull market. We are now up +1,000 points in one month.

On the 13th of May:

👉🏽 Nvidia announces a partnership with Humain to build "AI factories of the future" in Saudi Arabia. Just one hour ago, Saudi Arabia signed an economic agreement with President Trump to invest $600 billion in the US.

🏦Banks:

👉🏽 No news

🌎Macro/Geopolitics:

On the 12th of May:

👉🏽Huge pressure is on the European Union to reach a trade deal. Equities and commodities bounce hard on news of China-US trade deal. "We have reached an agreement on a 90-day pause and substantially moved down the tariff levels — both sides, on the reciprocal tariffs, will move their tariffs down 115%." - Treasury Secretary Scott Bessent

Dollar and Yuan strong bounce. Gold corrects.

👉🏽After reaching a high of 71% this year, recession odds are now back down to 40%. The odds of the US entering a recession in 2025 fall to a new low of 40% following the US-China trade deal announcement.

👉🏽'Truly incredible:

- Trump raises tariffs: Yields rise because inflation is back

- Trump cuts tariffs: Yields rise because growth is back

- Trump does nothing: Yields rise because the Fed won't cut rates Today, the bond market becomes Trump and Bessent's top priority.' - TKL

President Trump’s biggest problem persists even as trade deals are announced. Tariffs have been paused for 90 days, the US-China trade deal has been announced, and inflation data is down. Yet, the 10Y yield is nearing 4.50% again. Trump needs lower rates, but rates won’t fall.

👉🏽Last week a lot of talk on Japan’s Debt Death Spiral: Japan’s 40-year yield is detonating and the myth of consequence-free debt just died with it. One of the best explanations, you can read here:

👉🏽Michael A. Arouet: 'Eye-opening chart. Can a country with a services-based economy remain a superpower? Building back US manufacturing base makes a lot of strategic and geopolitical sense.' https://i.ibb.co/Q3zJY9Fc/Gqxc6-Pt-WQAI73c.jpg

On the 13th of May:

👉🏽There is a possibility of a “big, beautiful” economic rebalancing, Treasury Secretary Scott Bessent says at an investment forum in Saudi Arabia. The “dream scenario” would be if China and the US can work together on rebalancing, he adds

Luke Gromen: It does roll off the tongue a whole lot nicer than "We want to significantly devalue USD v. CNY, via a gold reference point."

Ergo: The price of gold specifically would rise in USD much more than it would in CNY, while prices for other goods and services would not, or would do so to a lesser degree.

👉🏽 Dutch inflation rises to 4.1 percent in April | CBS – final figure. Unchanged compared to the estimate.

👉🏽Philipp Heimberger: This interesting new paper argues that cuts to taxes on top incomes disproportionately benefit the financial sector. The finance industry gains more from top-income tax cuts than other industries. "Cuts in top income tax rates increase the (relative) size of the financial sector"

Kinda obvious, innit?

👉🏽US CPI data released. Overall good results and cooler than expected month-over-month and year-over-year (outside of yearly core). U.S. inflation is down to 2.3%, lower than expected.

On the 14th of May:

👉🏽'The US government cannot afford a recession: In previous economic cycles, the US budget deficit widened by ~4% of GDP on average during recessions. This would imply a ~$1.3 trillion deterioration of US government finances if a recession hits in 2025. That said, if the US enters a recession, long-term interest rates will likely go down.

A 2-percentage-point decrease in interest rates would save ~$568 billion in annual interest payments. However, this means government finances would worsen by more than DOUBLE the amount saved in interest due to a recession. An economic downturn would be incredibly costly for the US government.' -TKL

On the 15th of May:

👉🏽'In the Eurozone and the UK, households hold more than 30% of their financial assets in fiat currencies and bank deposits. This means that they (unknowingly?) allow inflation to destroy their purchasing power. The risks of inflation eating up your wealth increase in a debt-driven economic system characterized by fiscal dominance, where interest rates are structurally low and inflation levels and risks are high. There is so much forced and often failed regulation to increase financial literacy, but this part is never explained. Why is that, you think?' - Jeroen Blokland https://i.ibb.co/zWRpNqhz/Gq-jn-Bn-X0-AAmplm.png

On the 16th of May:

👉🏽'For the first time in a year, Japan's economy shrank by -0.7% in Q1 2025. This is more than double the decline expected by economists. Furthermore, this data does NOT include the reciprocal tariffs imposed on April 2nd. Japan's economy is heading for a recession.' -TKL

👉🏽'246 US large companies have gone bankrupt year-to-date, the most in 15 years. This is up from 206 recorded last year and more than DOUBLE during the same period in 2022. In April alone, the US saw 59 bankruptcy filings as tariffs ramped up. So far this year, the industrials sector has seen 41 bankruptcies, followed by 31 in consumer discretionary, and 17 in healthcare. According to S&P Global, consumer discretionary companies have been hit the hardest due to market volatility, tariffs, and inflation uncertainty. We expect a surge in bankruptcies in 2025.' -TKL

👉🏽'Moody's just downgraded the United States' credit rating for the FIRST time in history. The reason: An unsustainable path for US federal debt and its resulting interest burden. Moody's notes that the US debt-to-GDP ratio is on track to hit 134% by 2035. Federal interest payments are set to equal ~30% of revenue by 2035, up from ~18% in 2024 and ~9% in 2021. Furthermore, deficit spending is now at World War 2 levels as a percentage of GDP. The US debt crisis is our biggest issue with the least attention.' - TKL

Still, this is a nothing burger. In August 2023, when Fitch downgraded the US to AA+, and S&P (2011) the US became a split-rated AA+ country. This downgrade had almost no effect on the bond market. The last of the rating agencies, Moodys, pushed the US down to AA+ today. So technically it didn’t even change the US’s overall credit rating because it was already split-rated AA+, now it’s unanimous AA+.

Ergo: Nothing changed. America now shares a credit rating with Austria and Finland. Hard assets don’t lie. Watch Gold and Bitcoin.

https://i.ibb.co/Q7DcWY2P/Gr-K66i-EXIAAKh-MR.jpg

RAY DALIO: Credit Agencies are UNDERSTATING sovereign credit risks because "they don't include the greater risk that the countries in debt will print money to pay their debts" with devalued currency.

👉🏽US consumer credit card serious delinquencies are rising at a CRISIS pace: The share of US credit card debt that is past due at least 90 days hit 12.3% in Q1 2025, the highest in 14 YEARS. The percentage has risen even faster than during the Great Financial Crisis.' - Global Markets Investor

https://i.ibb.co/nNH9CxVK/Gr-E838o-XYAIk-Fyn.png

On the 18th of May:

👉🏽Michael A. Arouet: 'Look at ten bottom of this list. Milei has not only proven that real free market reforms work, but he has also proven that they work fast. It’s bigger than Argentina now, no wonder that the left legacy media doesn’t like him so much.' https://i.ibb.co/MDnBCDSY/Gr-Npu-KKWMAAf-Pc.jpg

On the 19th of May: 👉🏽Japan's 40-year bond yield just hit its highest level in over 20 years. Japan’s Prime Minister Ishiba has called the situation “worse than Greece.” All as Japan’s GDP is contracting again. You and your mother should be scared out of your fucking minds. https://i.ibb.co/rGZ9cMtv/GTXx-S7-Cb-MAAOu-Vt.png

👉🏽 TKL: 'Investors are piling into gold funds like never before: Gold funds have posted a record $85 BILLION in net inflows year-to-date. This is more than DOUBLE the full-year record seen in 2020. At this pace, net inflows will surpass $180 billion by the end of 2025. Gold is now the best-performing major asset class, up 22% year-to-date. Since the low in October 2022, gold prices have gained 97%. Gold is the global hedge against uncertainty.'

🎁If you have made it this far, I would like to give you a little gift, well, in this case, two gifts:

What Bitcoin Did - IS THE FED LOSING CONTROL? With Matthew Mezinskis

'Matthew Mezinskis is a macroeconomic researcher, host of the Crypto Voices podcast, and creator of Porkopolis Economics. In this episode, we discuss fractional reserve banking, why it's controversial among Bitcoiners, the historical precedent for banking practices, and whether fractional reserve banking inherently poses systemic risks. We also get into the dangers and instabilities introduced by central banking, why Bitcoin uniquely offers a pathway to financial sovereignty, the plumbing of the global financial system, breaking down money supply metrics, foreign holdings of US treasuries, and how all these elements indicate growing instability in the dollar system.'

https://youtu.be/j-XPVOl9zGc

Credit: I have used multiple sources!

My savings account: Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

-

@ bf47c19e:c3d2573b

2025-05-24 21:16:10

@ bf47c19e:c3d2573b

2025-05-24 21:16:10U ovoj sekciji pratićemo cene raznih dobara i usluga, a pre svega nekretnina, prosečne srpske plate, goriva, deviznih i zlatnih rezervi Srbije u odnosu na Bitkoin. Iz priloženih grafikona može se videti da sve vremenom gubi vrednost, odnosno postaje jeftinije u odnosu na BTC.

Cene nekretnina u Republici Srbiji izražene kroz Bitkoin (kompletni grafikoni)

Visina prosečne zarade u Republici Srbiji, cene goriva, dinarska i devizna štednja stanovništva, devizne i zlatne rezerve Srbije - izraženo kroz Bitkoin (kompletni grafikoni)

Prosečna cena m2 stana u Gradu Beogradu izražena kroz BTC

Prosečna cena m2 stana u Novom Sadu izražena kroz BTC

Prosečna cena m2 stana u Nišu izražena kroz BTC

Prosečna cena m2 stana u Kragujevcu izražena kroz BTC

Prosečna zarada u Republici Srbiji izražena kroz BTC

Cena goriva 'Evro Premium BMB 95' izražena kroz BTC

Cena goriva 'Evro Dizel' izražena kroz BTC

Dinarska štednja stanovništva kod banaka izražena kroz BTC

Devizna štednja stanovništva kod banaka izražena kroz BTC

Devizne rezerve Republike Srbije izražene kroz BTC