-

@ 9e9085e9:2056af17

2025-05-27 17:16:22

@ 9e9085e9:2056af17

2025-05-27 17:16:22Market Overview

As of May 27, 2025, Bitcoin (BTC) is trading at approximately $110,387, reflecting a modest 0.8% daily gain.

24-Hour Range: $108,291 – $110,415

Recent High: $111,970

Support Level to Watch: $105,700

Bullish Target: $135,000 (based on analyst projections)

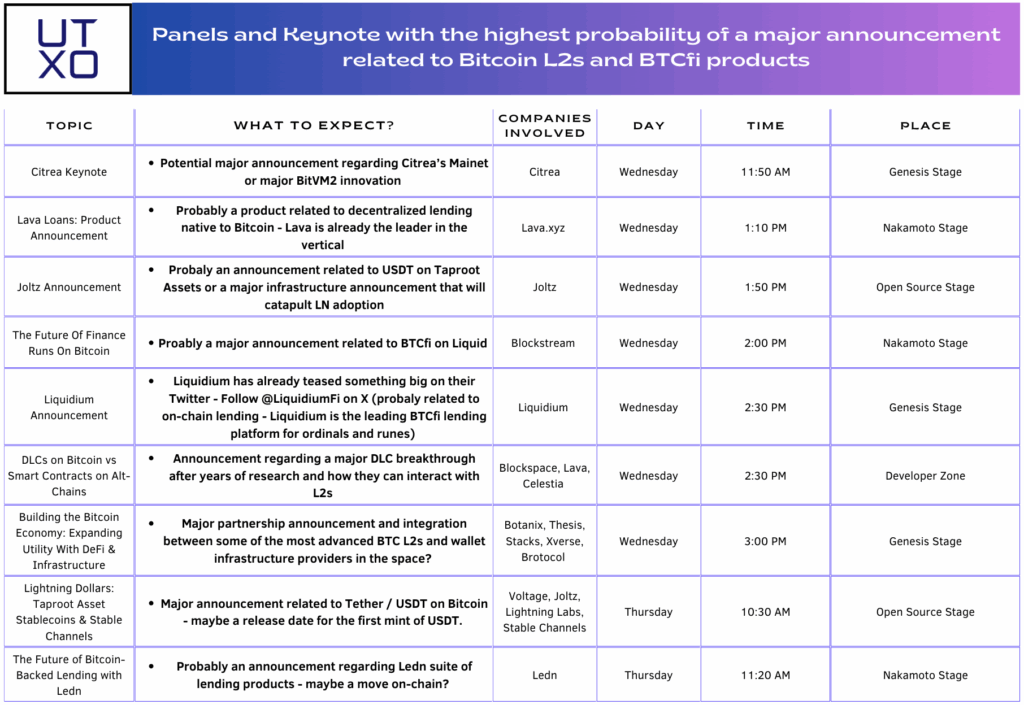

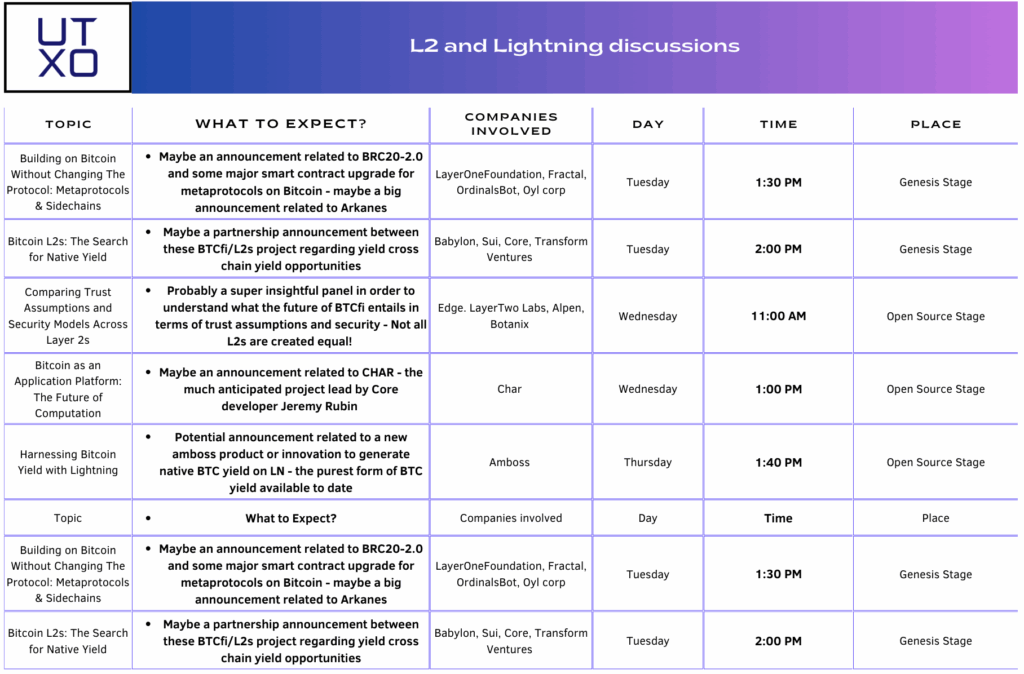

The market remains optimistic ahead of the Bitcoin 2025 Conference in Las Vegas, sparking renewed interest and speculation.

Impact on Decentralized Social Media

Bitcoin’s strong performance is influencing decentralized social platforms in multiple ways:

- Increased Engagement

Platforms like Nostr, Mastodon, and others are seeing a spike in activity. Users are sharing price charts, engaging in Bitcoin discourse, and posting market-related content.

- Monetization Opportunities

Creators on decentralized networks are leveraging Bitcoin-based tipping, NFT-based publishing, and tokenized rewards to monetize content more effectively.

- Community Growth

Positive sentiment is drawing in new users and developers, contributing to the growth of decentralized ecosystems and innovation in peer-to-peer social tech.

Strategic Highlights

Trump Media & Technology Group aims to raise $2.5 billion to build a Bitcoin treasury, signaling strong institutional interest.

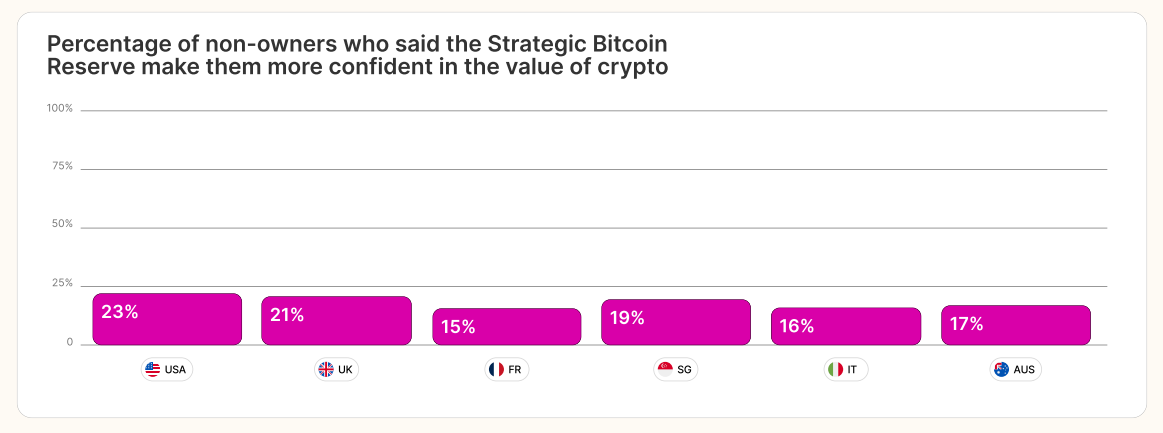

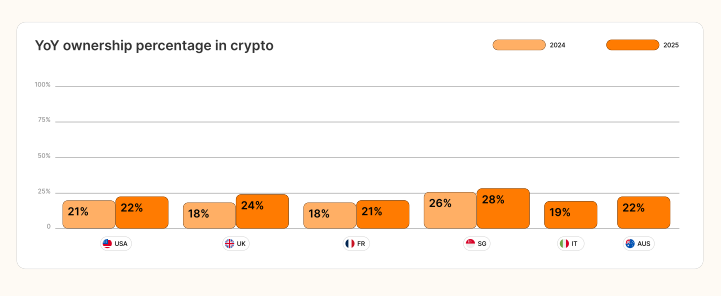

The U.S. is reportedly establishing a Strategic Bitcoin Reserve, underscoring digital currency’s growing relevance at the national level.

#Bitcoin #BTC #CryptoNews #Web3 #DecentralizedSocialMedia #Nostr #Yakihonne #CryptoCommunity #BitcoinUpdate #BTC2025 #DigitalFreedom #ContentCuration #Hackathon #SocialFi

-

@ dfa02707:41ca50e3

2025-05-27 17:01:42

@ dfa02707:41ca50e3

2025-05-27 17:01:42News

- Bitcoin mining centralization in 2025. According to a blog post by b10c, Bitcoin mining was at its most decentralized in May 2017, with another favorable period from 2019 to 2022. However, starting in 2023, mining has become increasingly centralized, particularly due to the influence of large pools like Foundry and the use of proxy pooling by entities such as AntPool.

Source: b10c's blog.

- OpenSats announces the eleventh wave of Nostr grants. The five projects in this wave are the mobile live-streaming app Swae, the Nostr-over-ham-radio project HAMSTR, Vertex—a Web-of-Trust (WOT) service for Nostr developers, Nostr Double Ratchet for end-to-end encrypted messaging, and the Nostr Game Engine for building games and applications integrated with the Nostr ecosystem.

- New Spiral grantee: l0rinc. In February 2024, l0rinc transitioned to full-time work on Bitcoin Core. His efforts focus on performance benchmarking and optimizations, enhancing code quality, conducting code reviews, reducing block download times, optimizing memory usage, and refactoring code.

- Project Eleven offers 1 BTC to break Bitcoin's cryptography with a quantum computer. The quantum computing research organization has introduced the Q-Day Prize, a global challenge that offers 1 BTC to the first team capable of breaking an elliptic curve cryptographic (ECC) key using Shor’s algorithm on a quantum computer. The prize will be awarded to the first team to successfully accomplish this breakthrough by April 5, 2026.

- Unchained has launched the Bitcoin Legacy Project. The initiative seeks to advance the Bitcoin ecosystem through a bitcoin-native donor-advised fund platform (DAF), investments in community hubs, support for education and open-source development, and a commitment to long-term sustainability with transparent annual reporting.

- In its first year, the program will provide support to Bitcoin hubs in Nashville, Austin, and Denver.

- Support also includes $50,000 to the Bitcoin Policy Institute, a $150,000 commitment at the University of Austin, and up to $250,000 in research grants through the Bitcoin Scholars program.

"Unchained will match grants 1:1 made to partner organizations who support Bitcoin Core development when made through the Unchained-powered bitcoin DAF, up to 1 BTC," was stated in a blog post.

- Block launched open-source tools for Bitcoin treasury management. These include a dashboard for managing corporate bitcoin holdings and provides a real-time BTC-to-USD price quote API, released as part of the Block Open Source initiative. The company’s own instance of the bitcoin holdings dashboard is available here.

Source: block.xyz

- Bull Bitcoin expands to Mexico, enabling anyone in the country to receive pesos from anywhere in the world straight from a Bitcoin wallet. Additionally, users can now buy Bitcoin with a Mexican bank account.

"Bull Bitcoin strongly believes in Bitcoin’s economic potential in Mexico, not only for international remittances and tourism, but also for Mexican individuals and companies to reclaim their financial sovereignty and protect their wealth from inflation and the fragility of traditional financial markets," said Francis Pouliot, Founder and CEO of Bull Bitcoin.

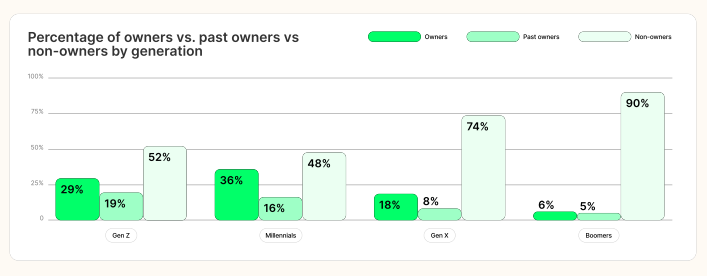

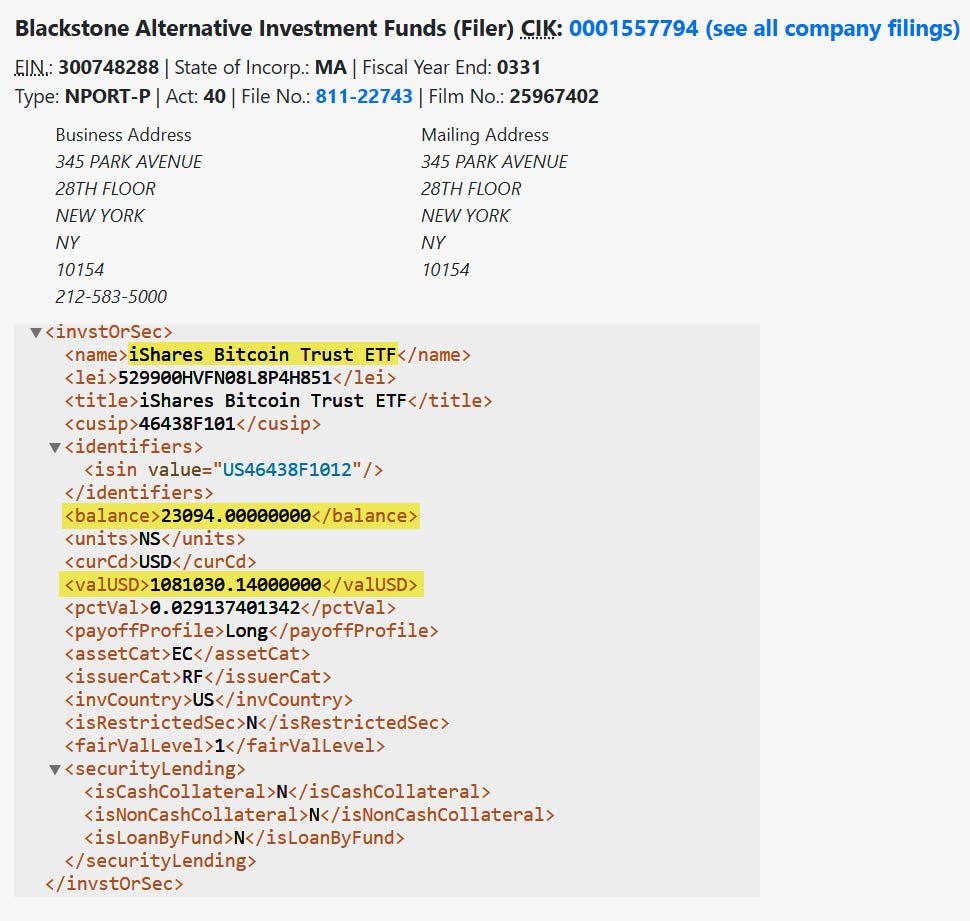

- Corporate bitcoin holdings hit a record high in Q1 2025. According to Bitwise, public companies' adoption of Bitcoin has hit an all-time high. In Q1 2025, these firms collectively hold over 688,000 BTC, marking a 16.11% increase from the previous quarter. This amount represents 3.28% of Bitcoin's fixed 21 million supply.

Source: Bitwise.

- The Bitcoin Bond Company for institutions has launched with the aim of acquiring $1 trillion in Bitcoin over 21 years. It utilizes secure, transparent, and compliant bond-like products backed by Bitcoin.

- The U.S. Senate confirmed Paul Atkins as Chair of the Securities and Exchange Commission (SEC). At his confirmation hearing, Atkins emphasized the need for a clear framework for digital assets. He aims to collaborate with the CFTC and Congress to address jurisdiction and rulemaking gaps, aligning with the Trump administration's goal to position the U.S. as a leader in Bitcoin and blockchain finance.

- Ethereum developer Virgil Griffith has been released from custody. Griffith, whose sentence was reduced to 56 months, is now seeking a pardon. He was initially sentenced to 63 months for allegedly violating international sanctions laws by providing technical advice on using cryptocurrencies and blockchain technology to evade sanctions during a presentation titled 'Blockchains for Peace' in North Korea.

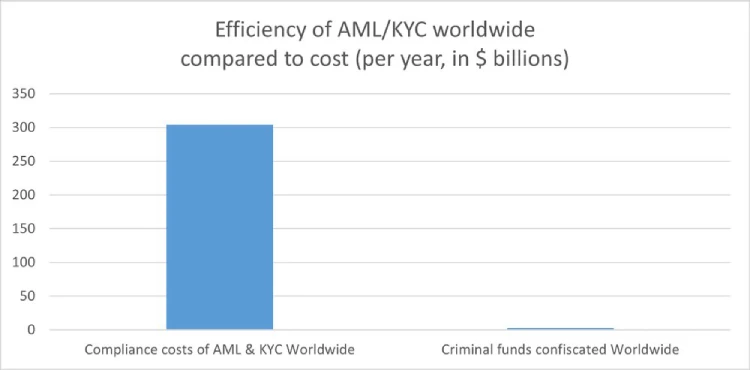

- No-KYC exchange eXch to close down under money laundering scrutiny. The privacy-focused cryptocurrency trading platform said it will cease operations on May 1. This decision follows allegations that the platform was used by North Korea's Lazarus Group for money laundering. eXch revealed it is the subject of an active "transatlantic operation" aimed at shutting down the platform and prosecuting its team for "money laundering and terrorism."

- Blockstream combats ESP32 FUD concerning Jade signers. The company stated that after reviewing the vulnerability disclosed in early March, Jade was found to be secure. Espressif Systems, the designer of the ESP32, has since clarified that the "undocumented commands" do not constitute a "backdoor."

- Bank of America is lobbying for regulations that favor banks over tech firms in stablecoin issuance. The bank's CEO Brian Moynihan is working with groups such as the American Bankers Association to advance the issuance of a fully reserved, 1:1 backed "Bank of America coin." If successful, this could limit stablecoin efforts by non-banks like Tether, Circle, and others, reports The Block.

- Tether to back OCEAN Pool with its hashrate. "As a company committed to financial freedom and open access, we see supporting decentralization in Bitcoin mining as essential to the network’s long-term integrity," said Tether CEO Paolo Ardoino.

- Bitdeer to expand its self-mining operations to navigate tariffs. The Singapore-based mining company is advancing plans to produce machines in the U.S. while reducing its mining hardware sales. This response is in light of increasing uncertainties related to U.S. trade policy, as reported by Bloomberg.

- Tether acquires $32M in Bitdeer shares. The firm has boosted its investment in Bitdeer during a wider market sell-off, with purchases in early to mid-April amounting to about $32 million, regulatory filings reveal.

- US Bitcoin miner manufacturer Auradine has raised $153 million in a Series C funding round as it expands into AI infrastructure. The round was led by StepStone Group and included participation from Maverick Silicon, Premji Invest, Samsung Catalyst Fund, Qualcomm Ventures, Mayfield, MARA Holdings, GSBackers, and other existing investors. The firm raised to over $300 million since its inception in 2022.

- Voltage has partnered with BitGo to [enable](https://www.voltage.cloud/blog/bitgo-and-voltage-team-up-to-deliver-instant-bitcoin-and-stabl

-

@ eb0157af:77ab6c55

2025-05-27 17:01:22

@ eb0157af:77ab6c55

2025-05-27 17:01:22The open-source project makes it possible to send bitcoin even in censored or disconnected areas through a radio mesh network.

In an interview with Decrypt, the developer known by the pseudonym “cyber” revealed the details of Darkwire, an open-source project that could enable new use cases for Bitcoin transactions without internet access.

The project, presented at the Bitcoin 2025 Official Hackathon, leverages Long Range Radio (LoRa) technology to create a decentralized mesh network that allows Bitcoin transactions to be sent even in the total absence of traditional connectivity.

Darkwire was specifically designed for situations where conventional communication infrastructure is inaccessible or controlled. According to cyber, the system is ideal for politically sensitive regions like the Rafah Crossing or the Indo-Tibetan border, where internet access can be limited or heavily monitored.

“Darkwire is for individuals seeking privacy or wishing to bypass surveillance of their communications and transactions. Imagine it to be akin to Tor but for this specific use case,” the creator explained.

LoRa technology

Darkwire operates through a combination of technologies. The system uses long-range LoRa radios along with microcontrollers such as the Arduino UNO to form a decentralized mesh network.

When a user wants to send a Bitcoin transaction without internet access, they specify the recipient’s address and the amount via a local graphical interface managed by bitcoinlib. The system then generates a signed Bitcoin transaction in hexadecimal format, which is split into smaller packets and transmitted via radio.

Mesh Network

Darkwire’s mesh network allows the data to “hop” from node to node until it reaches an internet-connected exit point. In ideal conditions, each Darkwire node has a range of up to 10 kilometers with a direct line of sight, reduced to 3-5 kilometers in densely populated areas.

“At least one node in the network needs to be connected to the internet, so that the transaction can be pushed to the blockchain for miners to verify it,” cyber said.

Once the transaction data reaches a node with internet access, it acts as an exit point, broadcasting the verified Bitcoin transaction to the global network, where it can be included in a block.

Limitations and future developments

Currently, Darkwire faces several technical limitations that the team is actively working to address. The relatively low bandwidth of LoRa radios and their sensitivity to terrain obstacles represent challenges. Moreover, the system’s dependence on internet-connected exit nodes could create potential points of failure.

According to reports, the project is still in its hackathon phase, but cyber has plans to further develop it, turning it into a full open-source platform and making it “the industry standard” for LoRa-based communications.

“I do hope people living in any kind of authoritarian regimes and states do get to use darkwire and put the truth out there,” the developer added.

The post Bitcoin without internet thanks to LoRa technology: the Darkwire project appeared first on Atlas21.

-

@ b1ddb4d7:471244e7

2025-05-27 17:01:01

@ b1ddb4d7:471244e7

2025-05-27 17:01:01Custodial Lightning wallets allow users to transact without managing private keys or channel liquidity. The provider handles technical complexities, but this convenience comes with critical trade-offs:

- You don’t control your keys: The custodian holds your bitcoin.

- Centralized points of failure: Servers can be hacked or shut down.

- Surveillance risks: Providers track transaction metadata.

Key Risks of Custodial Lightning Wallets

*1. Hacks and Exit Scams*

Custodians centralize large amounts of bitcoin, attracting hackers:

- Nearly $2.2 billion worth of funds were stolen from hacks in 2024.

- Lightning custodians suffered breaches, losing user funds.

Unlike non-custodial wallets, victims have no recourse since they don’t hold keys.

*2. Censorship and Account Freezes*

Custodians comply with regulators, risking fund seizures:

- Strike (a custodial Lightning app) froze accounts of users in sanctioned regions.

- A U.K. court in 2020 ordered Bitfinex to freeze bitcoin worth $860,000 after the exchange and blockchain sleuthing firm Chainalysis traced the funds to a ransomware payment.

*3. Privacy Erosion*

Custodians log user activity, exposing sensitive data:

- Transaction amounts, receiver addresses, and IPs are recorded.

*4. Service Downtime*

Centralized infrastructure risks outages.

*5. Inflation of Lightning Network Centralization*

Custodians dominate liquidity, weakening network resilience:

- At the moment, 10% of the nodes on Lightning control 80% of the liquidity.

- This centralization contradicts bitcoin’s decentralized ethos.

How to Switch to Self-Custodial Lightning Wallets

Migrating from custodial services is straightforward:

*1. Choose a Non-Custodial Wallet*

Opt for wallets that let you control keys and channels:

- Flash: The self-custodial tool that lets you own your keys, control your coins, and transact instantly.

- Breez Wallet : Non-custodial, POS integrations.

- Core Lightning : Advanced, for self-hosted node operators.

*2. Transfer Funds Securely*

- Withdraw funds from your custodial wallet to a bitcoin on-chain address.

- Send bitcoin to your non-custodial Lightning wallet.

*3. Set Up Channel Backups*

Use tools like Static Channel Backups (SCB) to recover channels if needed.

*4. Best Practices*

- Enable Tor: Mask your IP (e.g., Breez’s built-in Tor support).

- Verify Receiving Addresses: Avoid phishing scams.

- Regularly Rebalance Channels: Use tools like Lightning Pool for liquidity.

Why Self-Custodial Lightning Matters

- Self-custody: Control your keys and funds.

- Censorship resistance: No third party can block transactions.

- Network health: Decentralized liquidity strengthens Lightning.

Self-custodial wallets now rival custodial ease.

Custodial Lightning wallets sacrifice security for convenience, putting users at risk of hacks, surveillance, and frozen funds. As bitcoin adoption grows, so does the urgency to embrace self-custodial solutions.

Take action today:

- Withdraw custodial funds to a hardware wallet.

- Migrate to a self-custodial Lightning wallet.

- Educate others on the risks of custodial control.

The Lightning Network’s potential hinges on decentralization—don’t let custodians become its Achilles’ heel.

-

@ cae03c48:2a7d6671

2025-05-27 17:00:40

@ cae03c48:2a7d6671

2025-05-27 17:00:40Bitcoin Magazine

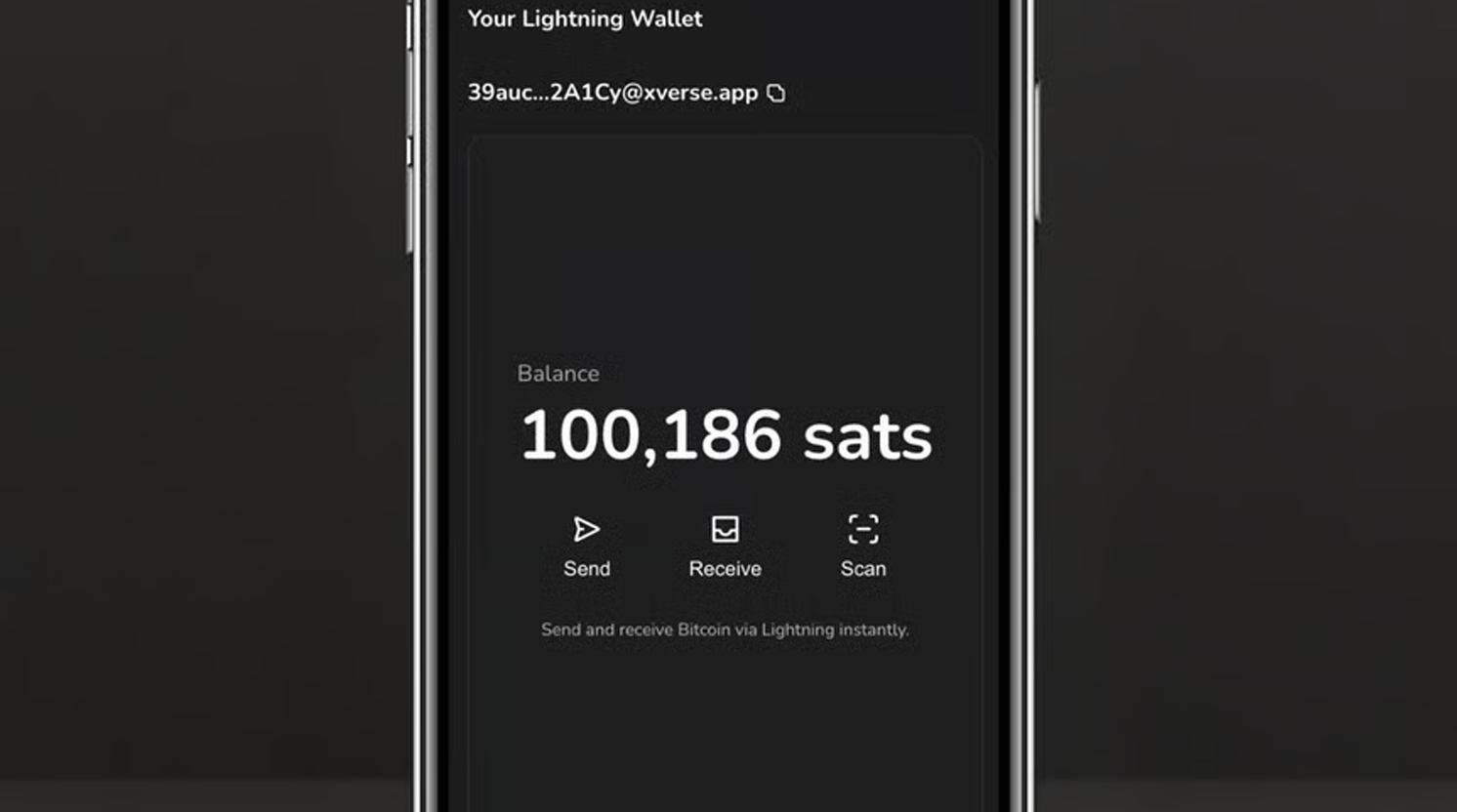

1.5 Million Users to Access Bitcoin’s Lightning Network on Xverse thanks to SatiSati, a Bitcoin payments app and Lightning infrastructure provider, today announced the launch of its Lightning integration with Xverse, a Bitcoin wallet used by over 1.5 million people worldwide. Thanks to the integration, Xverse users can now send and receive sats (Bitcoin’s smallest denomination) instantly over the Lightning Network with no setup, no app switching, and no custodial risk.

Initially designed in 2017, the Lightning Network has grown to become Bitcoin’s leading layer-2, with a current BTC capacity of over $465M. Sati is now leveraging this technology to bring the world’s favorite digital currency into the pockets of almost 3 billion users worldwide, thanks to its powerful API integration with WhatsApp.

“Bitcoin was not meant to be an asset for Wall Street—it was built for peer-to-peer money, borderless and accessible,” said Felipe Servin, Founder and CEO of Sati. “Integrating Lightning natively into Xverse brings that vision back to life, making Bitcoin usable at scale for billions.”

Thanks to the integration, every Xverse user now gets a Lightning Address instantly. That means they can receive tips, pay invoices, and use Bitcoin for microtransactions—all without having to manage channels or switch between different apps. Sati expects USDT on Lightning to be supported as early as Q3 for the Xverse wallet and in July 2025

for users accessing Sati through WhatsApp.This integration positions Sati’s role as a Lightning infrastructure provider, not just a consumer app. By leveraging its API-based solution, the company provides plug-and-play backend services to wallets and platforms looking to add Bitcoin payments without compromising on security or UX.

The Xverse launch follows the debut of Parasite Pool, a new mining pool leveraging Sati and Xverse’s tech stack and focused on democratizing Bitcoin mining. Parasite Pool charges 0% fees and pays out instantly over Lightning, making it ideal for small-scale miners, especially those running ultra-low-power hardware like Bitaxe.

With over 500 users joining Parasite Pool within weeks of launch and an average pool hashrate of 5 PH/s, Parasite Pool is steadily growing its presence in the home mining space. Thanks to the Lightning integration, Parasite Pool supports the smallest Lightning payouts in the industry (a fraction of a cent), lowering the barrier to entry for anyone interested in mining.

Sati recently closed a $600K pre-seed round backed by Bitcoin-focused investors, including Draper Associates, BitcoinFi, Arcanum, BoostVC, and Ricardo Salinas. The funding is being used to support global expansion, stablecoin integration, Lightning infrastructure growth, and broader access to Bitcoin in emerging markets.

Sati will be conducting live product demos at Bitcoin 2025 in Las Vegas on May 27-29. To learn more about Sati, visit sati.pro

About Sati

Sati is a Bitcoin payments infrastructure provider. Launched in 2025 with investors of the likes as Draper Associates and Ricardo Salinas, Sati powers fast, seamless Bitcoin payments on applications such as WhatsApp to fuel the next wave of adoption. Learn more at sati.proAbout Xverse

Xverse is the on-chain platform for the Bitcoin economy—think Revolut meets Alchemy, built natively on Bitcoin. Trusted by over 1.5 million users, Xverse is launching a unified portfolio platform for Bitcoin L1 and Layer 2s, alongside developer infrastructure to power seamless Bitcoin-native apps.Press Contact

press@sati.proDisclaimer: This is a sponsored press release. Readers are encouraged to perform their own due diligence before acting on any information presented in this article.

This post 1.5 Million Users to Access Bitcoin’s Lightning Network on Xverse thanks to Sati first appeared on Bitcoin Magazine and is written by Sati.

-

@ cae03c48:2a7d6671

2025-05-27 17:00:39

@ cae03c48:2a7d6671

2025-05-27 17:00:39Bitcoin Magazine

Bitlux Announced Private Jet Cards Accepting Bitcoin and Crypto PaymentsBitlux, a global private aviation company with charter solutions based on blockchain technology, just announced the industry’s first cryptocurrency-enabled Private Jet Card Program at the 2025 Bitcoin Conference.

“Bitcoin 2025 convenes innovators who are defining the future of money, mobility, and freedom,” stated Patel. “Our Jet Card is a natural continuation of that dialogue. We’re not just keeping up – we’re setting the new benchmark for what’s possible in luxury flight.”

The Bitlux Jet Card allows clients to fund their accounts using Bitcoin, and other cryptocurrencies. By integrating Bitcoin payments with private aviation, Bitlux aims to deliver transparency, and control for high-frequency private flyers

“The private aviation industry has needed a reboot for a long time,” said Bitlux CEO Kyle Patel. “We didn’t simply put a new face on the old model – we reconstructed it with transparency, efficiency, and user control as the guiding principles. This card is for individuals who demand more from their travel experience and their payment infrastructure.”

The card includes fixed hourly rates and does not apply blackout dates, peak surcharges, or additional fees. Payments are held in escrow until the completion of the flight. The program allows access to a global fleet, includes Wi-Fi on domestic flights, and permits cancellation of one-way bookings after reservation.

Bitlux offers four jet cards: Ascent, Cardinal, Sovereignty, and Nomad, corresponding to cabin classes that include midsize, super-midsize, large, and ultra-long haul. Operational terms specify a 48 hour callout on off-peak days, 36 peak days, and minimum daily flight times that vary depending on the aircraft size.

“Our clients are global citizens – entrepreneurs, investors, tech entrepreneurs – who conduct business in real-time environments,” said Patel. “They don’t have time for ambiguous language or antiquated payment structures. We’re coming to them where they are, with a smarter, safer way to fly.”

This post Bitlux Announced Private Jet Cards Accepting Bitcoin and Crypto Payments first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-05-27 17:00:37

@ cae03c48:2a7d6671

2025-05-27 17:00:37Bitcoin Magazine

Asigna Raises $3M Funding and Launches Bitcoin Multisig v2 UpgradeAsigna, a smart multisig vault operator for Bitcoin, has raised $3 million in a funding round led by Hivemind and Tykhe Block Ventures, with participation from Sats Ventures, Trust Machines, and others, according to an exclusive press release sent to Bitcoin Magazine. The raise follows a pre-seed round led by Portal Ventures.

“With Asigna, we are establishing foundational infrastructure for institutions and large holders to securely and confidently participate in the evolving Bitcoin ecosystem,” said the Co-Founder of Asigna Viven. “There’s a critical need for robust, transparent, and programmable non-custodial solutions, and the multisig infrastructure is at the heart of this transformation.”

Alongside the funding, Asigna is launching its v2 upgrade, which includes support for Embedded Apps and a developer SDK. The update enables developers to integrate multisig functionality directly into Bitcoin applications.

“Asigna’s innovative approach to Bitcoin security and its seamless integration with Layer-2 protocols make it a game-changer for institutional investors,” said the Senior Investment Principal at Hivemind Capital Kayla Phillips. “We are thrilled to support their mission to provide robust and transparent non-custodial solutions for the evolving Bitcoin ecosystem.”

The update also adds a custom dashboard, BTC swaps, and new tools like the Connection SDK and Multisig SDK, allowing for vault creation, transaction management, and app integration. Other features include sub accounts, email notifications, governance, customizable signer permissions, privacy mode, and advanced UTXO management.

“What’s unique about Asigna is that, unlike many other onchain smart wallet implementations, it is fully native to the Bitcoin layer, with no smart contract risks,” said the Co-Founder of Asigna Vlad. “We don’t directly interact with private keys and account owners can use any wallet to sign their transactions. Which means these multisig wallets can never be frozen or lost, regardless of what happens to Asigna. As it should be”.

Bitcoin has recently risen to a $2.2 trillion market cap and with a growing DeFi sector with over $6 billion in Total Value Locked (TVL), the company plans to use the new funding to provide their clients with access to DeFi and yield generation through staking and lending with a white-glove service.

This post Asigna Raises $3M Funding and Launches Bitcoin Multisig v2 Upgrade first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-05-27 17:00:35

@ cae03c48:2a7d6671

2025-05-27 17:00:35Bitcoin Magazine

The Bitcoin Mempool: Private MempoolsIn the last Mempool article, I went through the dynamics of transaction propagation when different nodes on the network are running different mempool relay policies. In this piece I’ll be looking at the dynamics of private mempools, and the implications that has for the utility of the public mempool, mining incentives, and the health of the Bitcoin network overall.

At the heart of the purpose of the mempool is facilitating the aligned incentives of two different parties, miners and transacting users. Users want to transact, and are willing to pay miners’ transaction fees in order to do so. Miners want to make money, and transaction fees are an additional source of revenue in addition to the new coin subsidy in each block, as well as a necessary primary revenue source to cultivate in the long term as the subsidy dwindles.

Bitcoin is a system secured by incentives. This core dynamic is what drives the security of the system, you have a customer(s) and a provider, and the two of them attempting to fulfill their wants and needs is what ensures the blockchain continues ticking forward with a sufficient amount of thermodynamic security.

Attempts to introduce friction into this facilitation mechanism does not ultimately do anything at all to change the incentives of these two parties. A user who wants to make a certain kind of transaction is still going to want to make that transaction, and pay for it. A miner who is willing to accept those kinds of transactions is still going to want to accept them, and collect the fee by including them in a block.

If the transaction is valid, then these two parties are still going to have their unmet wants and needs, and are still going to be strongly motivated to meet them in some form or fashion.

Miner API

Individual end users are not necessarily capitalized enough or competent enough in order to route around friction artificially introduced between both ends of a coincidence of wants, but miners most definitely are. As the old adage goes, “if you build it, they will come.”

The preferential situation for miners is obviously to acquire fee paying transactions in-band through the public mempool. It requires the lowest overhead possible for them, simply running a standard Bitcoin client out of the box, it is a very resilient propagation mechanism that ensures a very high degree of reliability in getting miners the highest fee paying transactions, and they don’t have to do anything. Just download the client and run it.

However, in a very hostile environment such as a network wide effort to filter consensus valid transactions during their propagation across the network, that traditional assumption can be drawn into question.

In such a scenario miners have every incentive to set up out-of-band mechanisms for accepting transactions that are not properly being relayed across the network. Marathon’s Slipstream API for non-standard transactions is not the only example of this. There is in fact a long standing precedent from almost ten years ago that was widely implemented by many mining pools, and still exists to this day. Transaction accelerators.

We now live in a world of Full-RBF, where any transaction, regardless of using the historical “opt-in” flag, can be fee-bumped. Any node who has upgraded to Full-RBF will relay any transaction that is spending an unconfirmed output already pending in the mempool as long as it is paying a higher fee. This has not always been the case. Historically only transactions that were originally made with a flag to opt-in to RBF use could be replaced and expected to propagate across the network.

Transaction accelerators were created by miners in order to facilitate this behavior for transactions that did not opt-in to RBF use.

Third Party APIs

While the overhead is not exorbitantly high for a miner or pool to create their own transaction submission API, it isn’t free. It still does require at least one developer and time to go through the design and release cycle of any piece of software. The curve isn’t particularly exaggerated, but it still does favor larger miners over smaller ones in terms of how much resources they will have to devote to such an endeavor.

Mempool.space has proven that it is a viable endeavour for a third party unrelated to miners to create such an API, allowing miners to simply connect to their service rather than expend the effort to create one themselves from scratch. This does have its issues though, such a third party is not going to build and operate such a service for free. They will want their cut.

There are two ways that this dynamic can go, either these services wind up requiring a higher cost in order to allow both the miners and service providers to earn revenue, or miners will have to share a smaller cut of the revenue in order for such services to remain competitive with directly miner operated ones. This means miners using a third party submission API rather than their own will earn less revenue than the miners operating their own API.

Private Order Flow

Either of the above possibilities introduces serious problems when it comes to the overall system incentives, reliability of end-user software, and potentially even the security model of second layer systems that rely on the use of pre-signed transactions and a reactive security model in order to keep user funds safe.

When transactions are submitted to a private API, they are not visible to network participants until they are actually confirmed in a block. The entire queue of unconfirmed transactions making use of these systems is opaque. This could be made public by the operators of these APIs, but not in a trustless fashion. There is no way to prove or guarantee that operators are not withholding information.

Withholding transactions from public view could distort fee estimates that users make, and even open the door to the possibility of manipulating those feerates by stuffing blocks with their own transactions. Transactions used in the operation of second layer systems could be withheld from public view until confirmation, which can delay users ability to react to transactions they must respond to in order to guarantee the security of their funds.

Lastly, just the existence of such APIs if the demand or need for them is high enough is a massive centralization pressure. Having to handle connecting to each individual API to submit a transaction is a hassle, poor UX, and potential back end complexity. This tends to reinforce the use of the largest API(s) and ignoring the tailend, which creates a feedback loop.

The API operators with the largest hashrate will have the quickest and most reliable confirmations, guaranteeing only those largest miners reliably earn this extra revenue, giving them more capital to grow larger, etc.

Parallel Mempools

On the other end of the spectrum is the possibility of creating totally independent public relay networks. While this does replicate the current openness of the existing public mempool, and avoids the worst of the centralizing pressures of central APIs, it still is not ideal.

Having multiple mempools introducing complexity for miners, for end users, and for end user applications. Users now need to keep track of all the independent mempools, especially ones used for systems they interact with that are not propagated over the primary relay network, in order to have a view of unconfirmed transactions.

If Lightning (or some other Layer 2) were to start making use of a parallel mempool, tracking it would be critical for any user of Lightning (or that other Layer 2). It would also be necessary to track all of the parallel relay networks in order to have an accurate view of the other unconfirmed transactions you are bidding against for inclusion in the next block. Tracking only a subset of them would lead to potentially large margins of error in any users fee estimation.

You Just Make Things Worse

Trying to prevent transactions with willing fee paying users without addressing them at the consensus level is just not possible. Bitcoin is an engine driven by incentives, and when the incentives of multiple parties align they will be facilitated in one form or another.

Trying to pretend that is not the case, and that things can be stopped, disincentivized, or otherwise delayed is a fool’s errand. Not only that, but trying at any serious scale comes with very serious negative consequences, in addition to being doomed to fail.

Bitcoin’s consensus rules are the framework in which incentives are played out. The only thing that can trump incentives is changing that framework. It is literally what informs and shapes the incentives in the first place.

Trying to interfere with those incentives at any other layer is a fool’s errand, and can do nothing but exacerbate the negative outcomes driven by incentives, i.e. centralization.

This post The Bitcoin Mempool: Private Mempools first appeared on Bitcoin Magazine and is written by Shinobi.

-

@ cae03c48:2a7d6671

2025-05-27 17:00:34

@ cae03c48:2a7d6671

2025-05-27 17:00:34Bitcoin Magazine

Steak ‘n Shake Reveals Bitcoin Payment Success at Bitcoin 2025 ConferenceSpeaking at the Bitcoin 2025 Conference this morning, Steak ‘n Shake executive Dan Edwards shared new data and insights from the company’s recent move to accept Bitcoin payments globally via the Lightning Network.

JUST IN: Fast food giant Steak 'n Shake announced they're saving 50% in processing fees accepting Bitcoin payments

'#Bitcoin is faster than credit cards'

pic.twitter.com/bxApgBL6El

pic.twitter.com/bxApgBL6El— Bitcoin Magazine (@BitcoinMagazine) May 27, 2025

“On May 16, we began accepting Bitcoin as payment—and we are permitted to do so by law,” Edwards began. “This is a global implementation.”

According to Edwards, Bitcoin transactions are already outperforming expectations. “The day we launched Bitcoin, 1 out of every 500 bitcoin transactions in the world happened at Steak ‘n Shake,” he said.

Steak ‘n Shake is also saving significantly on processing fees. “Bitcoin is faster than credit cards, and when customers choose to pay in Bitcoin, we’re saving 50% in processing fees,” said Edwards. “That makes Bitcoin a win for the customer, a win for us, and a win for the Bitcoin community.”

He emphasized that the decision was not a publicity stunt, but a serious payment upgrade. “We didn’t see this as a marketing gimmick. We saw it as a viable option to pay—on par with other globally accepted methods.”

The company reports that customer behavior has already shifted. “We’ve seen a sustained spike since adding Bitcoin,” Edwards noted.

Edwards also teased the company’s future plans, calling for more technical talent. “We’re not done. We’re investing in cyber chefs, autonomous drives, AI tech—and we need engineers to help us build it.”

To celebrate Bitcoin integration, limited-edition Bitcoin-themed menu items are launching this week in Las Vegas, including the Bitcoin Burger, Super-Sized Bitcoin Meal, and Bitcoin Milkshake. A “blockchain menu” is also in the works.

“Celebrate the use of Bitcoin,” Edwards concluded. “Because this is just the beginning.”

This post Steak ‘n Shake Reveals Bitcoin Payment Success at Bitcoin 2025 Conference first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 9e9085e9:2056af17

2025-05-27 16:58:28

@ 9e9085e9:2056af17

2025-05-27 16:58:28Part 2: Community Impact & Key Milestones

How Yakihonne Benefits the Community

Yakihonne is more than an app—it's a platform for freedom and self-expression. Here’s how it empowers its users and community:

Censorship-Resistant Communication Say what matters without fear of shadowbans or takedowns.

Privacy and Data Control You own your data—no tracking, no selling, no manipulation.

Peer-to-Peer Support for Creators With Bitcoin Lightning tipping, fans can directly support creators without needing middlemen.

Open Participation Developers, artists, and builders can all contribute to the network through the open Nostr protocol.

Milestones (You can update these with exact dates later)

Platform Launch: [Insert Date]

1,000+ Users Joined: [Insert Date]

Key Feature Rollouts (Chats, Groups, Tips): [Insert Date]

Yakihonne #Yakihonne #Yakihonne #Nostr #Nostr #YoungDfx

-

@ 491afeba:8b64834e

2025-05-27 16:48:45

@ 491afeba:8b64834e

2025-05-27 16:48:45Quando adolescente eu acreditava na coerência da teoria de "amor líquido" do polonês, sociólogo, Zygmunt Bauman, apresentada no livro "Amor Líquido: Sobre a Fragilidade dos Laços Humanos", qual no meu amadurecimento em estudos, sejam eles no meio acadêmico ou fora, percebo como uma das formas mais rasas de explicar as mudanças e transformações dos padrões de relações sócio-afetivas dos humanos. A seguir colocar-me-ei na minha juventude não tanto recente, direi então que nós, se adolescentes e conservadores, ou mesmo jovens adultos mais conservadores, costumamos levar como dogma uma óptica decadentista generalizada de todos os avanços de eras dos homens, universalizamos por nos ser comum a indistinção entre humanidade e humanidades, ou mesmo "humanity" e "humankind" ("humanidade" como espécime e "humanidade" como um universal), compreendemos toda "essas" como "essa" e indistinguimos as sociedades para com os homens, ou seja, a incapacidade de definir os seres dentro de suas respectivas singularidades e especificidades nos leva ao decadentismo generalista (a crença de que de forma geral, e universal, a "civilização universal" decai moralmente, éticamente, materialmente e espiritualmente), que aparente à nós determinadas mudanças nas relações humanas quanto ao caráter sócio-afetivo, por falta de profundidade e critérios ainda sobre questões alinhadas aos métodos e coerências, ou incoerências, lógicas, nós se jovens e conservadores somos levados ao engodo de concordar com a teoria do amor líquido de Bauman, que devo cá explicar de antemão: trata ela, a teoria, o padrão de "amor" dos tempos presentes como frágil, de prazo (curto e médio) e diferente em grau comparativamente ao amor comum das eras passadas.

Aos jovens mais progressistas opera uma compreensão dialética sobre as eras dos homens nos seu tempo presente, na qual ao tempo que o ser progride ele também regride simultaneamente, ou seja, a medida que aparecem contradições advindas de transformações materiais da realidade humana o ser supera essas contradições e progride em meio as transformações, ainda fazendo parte da lógica dessa indissociavelmente, assim constantemente progredindo e regredindo, havendo para esses dois vetores de distinção: o primeiro é o que releva questões espirituais como ao caráter do pensamento "new age", o segundo ignora essas questões por negar a existência da alma, seguem ao materialismo. Cedem em crer na teoria baumaninana como dogma, pois não encontram outros meios para explicar as transformações da sociedade na esfera sócio-afetiva sem que haja confrontamento direto com determinadas premissas assim pertinemente presentes, ou por não conciliarem com análises relativamente superiores, como a de Anthony Giddens sobre a "relação pura" em "A Transformação da Intimidade" e de François de Singly apresentada em "Sociologie du Couple".

!(image)[https://i.pinimg.com/736x/6f/b4/9e/6fb49eda2c8cf6dc837a0abfc7e108e6.jpg]

Há um problema quando uma teoria deixa de assim ser para vir a tornar-se mais um elemento desconexo da ciência, agora dentro da cultura pop, se assim podemos dizer, ou da cultura de massa, ou se preferirem mesmo "anticultura", esse problema é a sua deformização teórica, tornando-se essa rasa para sua palatabilidade massiva, somada a incapacidade de partes da sociedade civil em compreender as falhas daquilo que já foi massificado. Tive surpresa ao entender que muitos outros compartilham da mesma opinião, a exemplo, possuo um amigo na faculdade, marxista, que ao falarmos sobre nossos projetos de pesquisa, citou ele o projeto de um de nossos colegas, no qual esse referido um de nossos colegas faria seu projeto com base na teoria do amor líquido de Bauman, então alí demos risada disso, ora, para nós a teoria baumaniana é furada, passamos a falar sobre Bauman e o motivo pelo qual não gostávamos, lá fiquei até surpreso em saber que mais gente além de mim não gostava da teoria de Bauman, pois ao que eu via na internet era rede de enaltecimentos à figura e à sua teoria, tal como fosse uma revelação partindo de alguma divindade da Idade do Bronze. Pouco tempo depois tive em aula de teoria política uma citação de Bauman partindo do professor que ministrava a disciplina, no entanto, ao citar o nome de Bauman o mesmo fez uma feição na qual aparentava segurar risada, provavelmente ele também não levava Bauman à sério. Não devo negar que todas as vezes que vejo o sociólogo sendo citado em alguma nota no X, no Instagram ou qualquer outra rede social, tal como fosse um referencial teórico bom, sinto uma vergonha alheia pois alí tenho uma impressão de que a pessoa não leu Bauman e usa o referencial teórico como um fato já assim provado e comprovado.

Há pontos positivos na teoria baumaniana, como a capacidade de perceber o problema e correlacioná-lo à modernidade, assim como sucitar a influência do que há de material no fenômeno, porém os erros são pertinentes: o primeiro problema é de categoria. Não há, por parte de Bauman noção alguma entre as dissociações dos amores, não há atenção sobre o amor como estrutura ou ele como um sentimento, todo ele é compreendido uniformemente como "amor", partindo do pressuposto que todas as relações, todas elas, são firmadas com base no amor. Essa crença tem uma origem: Hegel. Nos Escritos Teológicos Hegel partia da crença que o amor ligava os seres relacionalmente como uma força de superação e alienação, mas há de compreendermos que esse Friedrich Hegel é o jovem ainda pouco maduro em suas ideias e seu sistema de pensamento, mais a frente, em "Fenomenologia do Espírito e na Filosofia do Direito", Hegel compreende a institucionalidade do direito no amor e a institucionalização dessa força, assim aproxima-se da realidade a respeito da inserção do amor nas esferas práticas do humano, porém essa ideia, apesar de imperfeita, pois ao que sabemos não é o amor que consolida a relação, mas sim a Verdade (Alétheia), conforme apontado por Heidegger em "Ser e Tempo", essa ideia do amor como a fundamento das relações humanas influenciou, e até hoje influencia, qualquer análise sobre as relações humanas fora da esfera materialista, fora dessa pois, melhormente explicado em exemplo, os marxistas (em exemplo), assim como Marx, consideram como base primordial das relações as condições materiais.

Por certo, não é de todo amor a base para a solidificação, ora, erram aqueles que creem que somente essa força, assim apontada por Hegel, constituiam todos os relacionamentos formais como pilares fundamentais, pois em prática as famílias eram até a fiduciarização dessas, por mais paradoxal que seja, compreendidas melhor como instituições orgânicas de caráter legal do que conluios de afetividades. A família outrora tinha consigo aparelhos de hierarquia bem estabelicidos, quais prezavam pela ordem interna e externa, que acima dessa instituição estava somente a Igreja (outra instituição), com sua fiduciarização [da família] após o movimento tomado pelos Estados nacionais em aplicação do casamento civil mudou-se a lógica das partes que a compõe, findou-se o princípio da subsidiariedade (não intervenção de determinadas instituições nas decisões quais podem ser exercidas em resuluções de problemas nas competências de quaisquer instituições), foi-se então, contudo, também a autoridade, e nisso revela-se um outro problema não apontado na teoria de Bauman: qual o padrão do amor "sólido"? Pois, ora, sociedades tradicionais não abdicavam do relevar dos amores para tornar seus filhos em ativos nas práticas de trocas (dádivas)? É notório que esse padrão se dissocia do padrão de sentimento apontado por Bauman, encontramos esse fato em estudo nos trabalhos "Ensaio Sobre a Dádiva", do Marcel Mauss, e "As Estruturas Elementares do Parentesco", do Claude Levi-Strauss, quais expõem que nas sociedades "sólidas", tradicionais, relevava-se mais questões institucionais que as sentimentais para a formação de laços (teoria da aliança). Muitas das relações passadas não eram baseadas no amor, não significando assim que as de hoje, em oposição, sejam, mas que permanecem-se semelhantes em base, diferentemente em grau e forma.

!(image)[https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F748b94c3-f882-45db-8333-09260ef15cfe_615x413.jpeg]

Ora, ainda existem casamentos motivados pela política, pelo status, pelo prestígio, pelos bens, pelo poder, pela influência familiar e assim sucetivamente, tal como no passado, ocorre que essa prática tornou-se oculta, não mais explícita e aparente, devo dizer ainda que em partes, pois prepondera em nosso tempo uma epidemia de adultérios, fornicações, práticas lascivas e demais práticas libertinosas explicitamente, em contraposição às práticas ocultas em vergonhas de sociedades sem declínio moral e espiritual, o que nos leva a questionar o método comparativo em dicotomia temporal "presente x passado" aplicado por Bauman, no qual segue-se da seguinte forma:

Transformação Passado = *sólido* | Presente = *líquido* Categorias Padrão de amor: tradicional (*sólido*) moderno (*líquido*) *Sólido* = estável, prazo (médio-grande), profundo, determinado. *Líquido* = instável, prazo (curto-médio), raso, indeterminado.O que penso é: Zygmunt Bauman buscou uma explicação material e laical para desviar ao fato de que há uma notória correlação entre espiritualização da sociedade, se voltada à Verdade, com a estabilidade das instituições, o que é já reduzido à moral religiosa, somente, não à mística, como por pensadores da linha de Tocqueville, ou em abordagens também mais laical (positivista) porém ainda relevantes, como Émile Durkheim em "As Formas Elementares da Vida Religiosa" e Max Weber em "A Ética Protestante e o Espírito do Capitalismo", contrapondo uma abordage mais voltada, de fato, a espiritualidade, como Christopher Dawnson, que defende essa teoria em "Religião e o Surgimento da Cultura Ocidental", e Eric Voegelin, principalmente nas obras "A Nova Ciência da Política" e "Ordem e História".

Encerrrando, minha cosmovisão é a católica, o sistema de crença e religião qual sigo é do Deus que se fez homem por amor aos seus filhos, não posso negar ou mesmo omitir o fato de que, por trás de toda a minha crítica estão meus pensamentos e minhas convicções alinhadas àquilo que mais tenho amor em toda minha vida: a Verdade, e a Verdade é Deus, pois Cristo é a Verdade, o Caminho e a Vida, ninguém vai ao Pai se não por Ele, e pois bem, seria incoerência de minha parte não relevar o fato de crença como um dos motivos pelos quais eu rejeito a teoria do amor líquido de Zygmunt Bauman, pois os amores são todos eles praticados por formas, existem por diferentes formas e assim são desde sua tradicionalidade até o predomínio das distorções de declínio espiritual das eras presentes (e também antigas pré-Era Axial), estão esses preservados pelo alinhamento à verdade, assim são indistorcíveis, imutáveis, ou seja, amor é amor, não releva-se o falso amor como um, simplesmente não o é, assim o interesse, a sanha por bens, o egoísmo e a egolatria ("cupiditas", para Santo Agostinho de Hipona, em oposição ao que o santo e filósofo trata por "caritas") não são formas do amor, são autoenganos, não bons, se não são bons logo não são de Deus, ora, se Deus é amor, se ele nos ama, determino como amor (e suas formas) o que está de acordo com a Verdade. Aprofundando, a Teologia do Corpo, do Papa São João Paulo II, rejeita a "liquidez" apresentada por Bauman, pois o amor é, em suma, sacríficio, parte da entrega total de si ao próximo, e se não há logo não é amor. A Teologia do Corpo rejeita não os fundamentos de mentira no "líquido", mas também no "sólido", pois a tradicionalidade não é sinônimo de bom e pleno acordo com o amor que Deus pede de nós, não são as coerções, as violências, as imposições e demais vontades em oposição às de Deus que determinam os amores -- fatos em oposição ao ideário romanticizado. Claro, nem todas as coerções são por si inválidas do amor, ou mesmo as escolhas em trocas racionalizadas, a exemplo do autruísmo em vista da chance da família ter êxito e sucesso, ou seja, pelo bem dos próximos haver a necessidade de submissão a, em exemplo, um casamento forjado, ou algo do gênero, reconhece-se o amor no ato se feito por bem da família, porém o amor incutido, nesse caso, explicita o caráter sacrificial, no qual uma vontade e um amor genuinamente potencial em prazeres e alegrias são anulados, ou seja, mesmo nesse modelo tradicional na "solidez" há possibilidade do amor, não nas formas romanticizadas em critérios, como "estabilidade" e "durabilidade", mas no caráter do sacríficio exercido. Conforme nos ensina São Tomás de Aquino, o amor não é uma "força", tal como ensina Hegel, mas sim uma virtude teologal conforme postas na "Suma Teológica" (II-II Q. 26-28), não devemos reduzir o amor e os amores em análises simplórias (não simples) de falsa complexidade extraídas em métodos questionáveis e pouco competentes à real diensão de crise espiritual das eras, por esse motivo não concordo com a teoria do amor líquido de Zygmunt Bauman.

-

@ 0fab798f:2752acff

2025-05-27 16:43:40

@ 0fab798f:2752acff

2025-05-27 16:43:40

In the heart of Africa’s digital uprising, Nigeria stands tall as one of the most crypto-curious nations on the planet. For many of us dreamers, builders, hustlers, crypto isn’t just a buzzword. It’s a lifeline. A path out of unemployment. A rebellion against the old financial system. A shot at freedom.

But here’s the hard truth: freedom without protection is exposure>

The recent $1.5 billion Ethereum heist — orchestrated by North Korea’s notorious Lazarus Group — didn’t just shake the crypto world. It shattered any illusions we might still have that blockchain alone can save us. If a juggernaut like Bybit can fall, what hope does the everyday Nigerian creative or crypto enthusiast have?

Let’s not sugarcoat it. This is war, a cyber war. And we must learn how to defend ourselves.

What the Heist Taught Us

- Security is not optional, it’s foundational.

- If you’re building in Web3, minting NFTs, or trading tokens, you’re a target. Use cold wallets. Enable 2FA. Don’t store your life savings on exchanges. Paranoia might just save your wallet.

- Don’t fall for vibes.

- Read smart contracts. Study tokenomics. If a project looks too clean, dig deeper. In crypto, vibes alone won’t protect your funds.

- Educate before you speculate.

- Everyone wants the bag, but not everyone reads the blueprint. Before you ape in, understand the tech. That’s how you stay alive in the jungle.* * *

For the Builders, the Artists, the Rebels

We’re not just investors. We’re architects of the future, launching NFT marketplaces, building DeFi protocols, designing metaverse spaces that blend culture, identity, and code. But here’s the kicker: even the most beautiful idea can burn if it’s built on shaky security.

What we need now isn’t just innovation,it’s insulation.

Form collectives: Learn together, audit each other’s code, build firewalls around our ideas.

Pressure regulators to evolve: Not to stifle us, but to protect the creative economy rising from the streets of Lagos, Port Harcourt, Enugu, Kano.

Go open-source: The more transparent we build, the harder it is for bad actors to hide.

Yakihonne Fam, Let’s Talk

This is more than a headline!

We can either continue building shiny dApps with no shields, or we can become cyber-aware architects of a truly secure digital future. One where Nigerian youth don’t just participate in Web3 — we define it.

The heist should wake us up, not wipe us out.

So the question is: will we build castles or fortresses?

Let’s choose wisely.

-

@ 9e9085e9:2056af17

2025-05-27 16:36:45

@ 9e9085e9:2056af17

2025-05-27 16:36:45Part 1: Introducing Yakihonne and the Nostr Protocol

Yakihonne – Redefining Social Media Through Decentralization

Yakihonne is a decentralized social media platform built on the Nostr protocol (Notes and Other Stuff Transmitted by Relays). Unlike traditional social networks controlled by corporations, Yakihonne puts users in charge—your identity, content, and connections are all yours to own.

What is Nostr? Nostr is an open protocol that uses public/private key pairs to enable secure communication. Posts (called “notes”) are sent to public relays instead of being stored on a central server. This allows Yakihonne to offer:

Censorship resistance

User-owned data

Open developer participation

Yakihonne leverages this technology to create a user-first social experience: chat, share, and connect—all without gatekeepers.

Yakihonne #Yakihonne #Yakihonne #Nostr #Nostr #YoungDfx

-

@ 6a6be47b:3e74e3e1

2025-05-27 16:34:16

@ 6a6be47b:3e74e3e1

2025-05-27 16:34:16🔍 Today was one of those days where I dove deeper into the world of Stacker News, exploring how wallets work and all that jazz. If you have any tips or tricks, please send them my way—I’m still figuring it all out!

After my tech adventures, I turned to drawing. Usually, I have a lineup of ideas ready to go, but none of them quite fit my mood today. Then I remembered the butterflies from my upcoming blog entry—can you guess what I’m writing and painting about? 👀

🦋Even though I’ve painted butterflies before here’s one on Instagram, I felt like revisiting them.

This one I posted on Nostr, a while ago

Lately, I’ve been seeing butterflies everywhere on my walks with my dog, and they just felt right for today’s art session. So here’s to butterflies and their beautiful symbolism!

In Celtic mythology, there’s an old Irish saying:

“Butterflies are souls of the dead waiting to pass through Purgatory.” From mindbodygreen.com

It’s no wonder butterflies are often seen as symbols of rebirth. Even Aristotle named the butterfly >“Psyche,” the Greek word for “soul.” From learnreligions.com

☀️With the weather warming up, days growing longer, and the air full of new scents (and butterfly sightings!🦋), I invite you to really enjoy this season. After drawing today’s butterfly, I realized how freeing it is to just let go and create—no pressure, just fun. Sometimes, taking even a few mindful minutes to do something you love can work wonders—maybe even a little magic.

Hope to catch you on the next one, frens. Godspeed! ✨

Today's butterfly. I drew it on Procreate.

https://stacker.news/items/990470

-

@ 9c9d2765:16f8c2c2

2025-05-27 16:19:12

@ 9c9d2765:16f8c2c2

2025-05-27 16:19:12CHAPTER THIRTY

“So this is what it’s come to?” Mark muttered, his voice barely audible beneath the hum of city traffic outside the courtroom. His suit was neatly pressed, but the weariness in his eyes betrayed sleepless nights. Helen stood beside him, silent for once, clutching her handbag like it was the last anchor to reality.

“Yes,” came a calm voice from behind them. They turned to see James approaching, flanked by Rita and a group of lawyers dressed in solemn black. His presence was poised, commanding, and utterly devoid of fear.

“You both built your legacy on lies,” James continued, his gaze unwavering. “It was only a matter of time before the truth surfaced.”

Helen’s composure cracked as she stepped forward. “You think this is justice, James? You think humiliating us in court will change the past?”

James gave a faint smirk. “No, Helen. But it will make sure no one else suffers because of your greed.”

The courtroom was already brimming with anticipation. Reporters filled the gallery. Spectators whispered rumors with every glance exchanged between lawyers. A judge with decades of experience presided over the case stern and unsympathetic to theatrics.

As the hearing commenced, James’s legal team presented meticulously organized evidence bank statements tracing illicit transactions to offshore accounts, leaked audio recordings of bribe negotiations, falsified media contracts, and forged internal memos. Each document was a nail in the coffin of Helen and Mark’s defense.

Rita testified, her voice calm and articulate, recounting the smear campaign orchestrated by Tracy under their instructions.

“They targeted James not just to discredit him,” she stated, looking the judge directly in the eye, “but to dismantle every ounce of credibility he had built. They used lies as weapons and fear as a shield.”

Tracy, under pressure from investigators, had also turned witness. Her statement confirmed the bribery and named both Helen and Mark as the masterminds.

“I was promised protection. They said James would be out of the picture before he could fight back,” Tracy confessed tearfully. “But I never imagined the damage we were doing.”

Mark buried his face in his hands while Helen’s facade of arrogance disintegrated in front of the press. Her voice trembled as she rose from her seat during cross-examination.

“It wasn’t meant to go this far,” she stammered. “We were just trying to protect our interests.”

The judge’s gavel struck with finality. “This court finds sufficient grounds for a full criminal trial. The charges include corporate fraud, character defamation, and financial manipulation. The accused are to remain in custody pending further proceedings.”

Gasps filled the room. Helen’s knees buckled as officers approached to take her into custody. Mark, pale and visibly shaking, didn’t resist.

As they were led away, James stood watching. Not with triumph but with quiet vindication.

Later that evening, James held a press conference at JP Enterprises. Cameras clicked and lights flashed as he stepped onto the podium.

“Today marks not a victory over enemies,” he said, his voice resonating with calm authority, “but a victory for accountability. For truth. For every hardworking individual who believes that integrity still matters in business.”

The days following the courtroom revelation were nothing short of transformative for James. What once seemed like an unending siege of betrayal and defamation now stood as a monumental testimony of perseverance. His vindication rippled through the business community, not only restoring his honor but elevating his stature to that of a symbol of resilience, truth, and quiet triumph.

The media, which had once been ravenous in its pursuit to scandalize his name, now sought exclusive interviews. Headlines changed overnight: “The President Who Defied the Odds,” “From Disgrace to Glory James’s Unrivaled Comeback,” and “Truth Prevails at JP Enterprises.”

Still, James remained composed. He declined most interview requests, only issuing a single written statement to the press:

“My silence was never a weakness, nor was my patience approved. In a world where deception moves faster than truth, I chose to let integrity do the talking. Let this be a reminder: time may delay justice, but it cannot deny it.”

In the boardroom of JP Enterprises, there was a newfound sense of reverence. Senior executives who once viewed James with reserved acknowledgment now listened with deference. Staff who had wavered in their loyalties found themselves inspired by his unshakable conviction.

Rita, reinstated officially as General Manager, transformed the company’s internal culture. She advocated for transparency, fairness, and accountability, echoing James’s values. Together, they initiated corporate reforms that would safeguard JP Enterprises against future exploitation. Employee welfare programs were improved, mentorship initiatives were introduced, and innovation was rewarded instead of suppressed.

As for Helen and Mark, the criminal proceedings dragged them through every layer of public accountability. Their assets were frozen pending investigation, and the companies they once boasted of began to crumble under the weight of distrust. The Ray family, mortified and shamed, distanced themselves completely. Robert, in particular, approached James privately, full of contrition.

“I misjudged you,” he said quietly, standing across from James in the same office where he once dismissed him. “And I know an apology may not undo what has been done… but I needed to say it.”

James, ever composed, gave a small nod. “Acknowledgment is the first step toward redemption, Robert. What you do with the rest of your journey that’s what will matter.”

Despite all the chaos, James found time to reconnect with himself. On certain evenings, he would return to the very neighborhood where he had once wandered, alone and destitute. He walked its narrow lanes not with bitterness, but gratitude. Every hardship had refined him. Every betrayal had taught him discernment.

On the sixteenth floor of JP Tower, standing before the massive glass window that overlooked the city skyline, James often stood in silence, his reflection merging with the city lights. He knew his story wasn’t merely about power or wealth, it was about transformation.

The days that followed James’s public exoneration ushered in a new chapter not only in his professional journey but also in his personal life. Amidst the rising stature and recognition, there remained unresolved threads that tugged quietly at his conscience chief among them, his estranged wife, Rita.

Though she was back in her rightful position at JP Enterprises, a wall of silence stood between them, built from years of misunderstanding, pride, and pain. Their conversations, though respectful and professional, were void of warmth. Yet, beneath her poised demeanor, James could sense her hesitation, perhaps a longing unspoken, restrained by fear of rejection or guilt over the past.

-

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06Star Wars is often viewed as a myth of rebellion, freedom, and resistance to tyranny. The iconography—scrappy rebels, totalitarian stormtroopers, lone smugglers—suggests a deep anti-authoritarian ethos. Yet, beneath the surface, the narrative arc of Star Wars consistently affirms the necessity, even sanctity, of central authority. This blog entry introduces the question: Is Star Wars fundamentally a celebration of statism?

Rebellion as Restoration, Not Revolution

The Rebel Alliance’s mission is not to dismantle centralized power, but to restore the Galactic Republic—a bureaucratic, centrally governed institution. Characters like Mon Mothma and Bail Organa are high-ranking senators, not populist revolutionaries. The goal is to remove the corrupt Empire and reinstall a previous central authority, presumed to be just.

- Rebels are loyalists to a prior state structure.

- Power is not questioned, only who wields it.

Jedi as Centralized Moral Elites

The Jedi, often idealized as protectors of peace, are unelected, extra-legal enforcers of moral and military order. Their authority stems from esoteric metaphysical abilities rather than democratic legitimacy.

- They answer only to their internal Council.

- They are deployed by the Senate, but act independently of civil law.

- Their collapse is depicted as tragic not because they were unaccountable, but because they were betrayed.

This positions them as a theocratic elite, not spiritual anarchists.

Chaos and the Frontier: The Case of the Cantina

The Mos Eisley cantina, often viewed as a symbol of frontier freedom, reveals something darker. It is: - Lawless - Violent - Culturally fragmented

Conflict resolution occurs through murder, not mediation. Obi-Wan slices off a limb; Han shoots first—both without legal consequence. There is no evidence of property rights, dispute resolution, or voluntary order.

This is not libertarian pluralism—it’s moral entropy. The message: without centralized governance, barbarism reigns.

The Mythic Arc: Restoration of the Just State

Every trilogy in the saga returns to a single theme: the fall and redemption of legitimate authority.

- Prequels: Republic collapses into tyranny.

- Originals: Rebels fight to restore legitimate order.

- Sequels: Weak governance leads to resurgence of authoritarianism; heroes must reestablish moral centralism.

The story is not anti-state—it’s anti-bad state. The solution is never decentralization; it’s the return of the right ruler or order.

Conclusion: The Hidden Statism of a Rebel Myth

Star Wars wears the costume of rebellion, but tells the story of centralized salvation. It: - Validates elite moral authority (Jedi) - Romanticizes restoration of fallen governments (Republic) - Portrays decentralized zones as corrupt and savage (outer rim worlds)

It is not an anarchist parable, nor a libertarian fable. It is a statist mythology, clothed in the spectacle of rebellion. Its core message is not that power should be abolished, but that power belongs to the virtuous few.

Question to Consider:

If the Star Wars universe consistently affirms the need for centralized moral and political authority, should we continue to see it as a myth of freedom? Or is it time to recognize it as a narrative of benevolent empire? -

@ 9c9d2765:16f8c2c2

2025-05-27 16:05:22

@ 9c9d2765:16f8c2c2

2025-05-27 16:05:22CHAPTER TWENTY NINE In boardrooms, lounges, and even on social media platforms, one question echoed relentlessly: Who is this man who rose from the ashes, not just to lead, but to lead with such bold transparency?

Meanwhile, in a dimly lit office nestled deep within Ray Enterprises, Helen paced restlessly across her carpeted floor. Her heels clicked in rhythm with the tension radiating from her. Mark stood by the window, nervously peeking through the blinds as though paranoia had taken root in his very soul.

“This can’t be happening,” Helen hissed, her voice sharp with frustration. “That press conference flipped everything. Now we’re the ones under scrutiny, and James has flipped the narrative like a magician.”

Mark turned, his voice laced with disbelief. “You saw the financial reports. Investors are pulling out of our side deals. If this continues, Ray Enterprises will collapse under the weight of its own debt.”

Helen clenched her fists, her perfectly manicured nails digging into her palms. “We need leverage. Something from his past. Something real. If the rumors didn’t ruin him, maybe the truth whatever it is will.”

But unknown to them, their every word was being monitored.

Lilian, the sharp cybersecurity expert at JP Enterprises, had tapped into Helen’s office through a corrupted email file disguised as a sponsorship request. Every correspondence, every call, and every document opened since then had been recorded and encrypted. Now, James had everything he needed and more.

At JP Enterprises, James stood in the private archive room, going through printed transcriptions of the recordings. Rita entered quietly, holding another file.

“We’ve compiled a list of shell companies used to launder bribe money into media firms and anonymous accounts,” she said, placing the documents gently before him.

James glanced through the list. Names of journalists, bloggers, and even a few local politicians filled the pages.

“They thought hiding behind faceless transactions would protect them,” he said calmly. “But even shadows betray their source when the light is bright enough.”

He closed the file slowly and looked at Rita.

“Let’s prepare the evidence for the federal board. By the time I’m done, Ray Enterprises will not only owe us 85%… they’ll owe us their very survival.”

The following day, the National Corporate Regulatory Board received a sealed dossier containing proof of bribery, media manipulation, and corporate fraud complete with audio clips, transaction records, and screen captures. An anonymous tip, courtesy of The Integrity Initiative.

As the investigation began to stir, Helen and Mark received a legal summons. Panic set in like a poison. Reporters camped outside Ray Enterprises. Shareholders demanded answers. The once feared and revered duo now found themselves cornered like rats.

In a final, desperate attempt, Helen reached out to James.

She showed up at JP Enterprises’ reception uninvited, her expression soft but insincere. She was dressed in white as if to evoke purity but James saw through the façade like glass.

“James,” she began, her voice low and trembling, “I know we’ve had our differences, but let’s not destroy each other. We can fix this, together. Let’s negotiate.”

James leaned back in his chair, eyes piercing.

“Negotiate?” he echoed, a wry smile touching his lips. “When you smeared my name, tried to sabotage my company, and humiliated me in public?”

Helen faltered but held her composure.

“It was business, James. That’s all. I didn’t mean to”

James cut her off with a raised hand.

“You didn’t mean to destroy my life? Helen, you orchestrated an entire charade. You bribed people to lie. But now the charade is over. And business… has consequences.”

He reached into his drawer, pulled out a copy of the legal complaint already filed against her, and placed it in front of her.

“You have 24 hours to prepare your lawyers.”

Helen’s mask of grace fell instantly. Her hands shook as she picked up the file, her eyes scanning the lines like a woman reading her own obituary.

-

@ cae03c48:2a7d6671

2025-05-27 16:00:28

@ cae03c48:2a7d6671

2025-05-27 16:00:28Bitcoin Magazine

Cake Wallet Introduces PayJoin v2, Increasing Bitcoin Privacy For The MassesCake Wallet, a non-custodial open-source wallet for cryptocurrencies, has officially launched PayJoin v2, becoming the first major mobile wallet to offer Bitcoin silent payments to everyday users.

This integration introduces a protocol upgrade that disrupts blockchain surveillance by mixing transaction inputs from both the sender and receiver, undermining the common blockchain surveillance techniques chain analysts typically rely on.

JUST LAUNCHED: Cake Wallet v4.28.0 brings Bitcoin Payjoin v2!

JUST LAUNCHED: Cake Wallet v4.28.0 brings Bitcoin Payjoin v2! • No need for both parties to be online

• No server required

• Just a few taps in your walletIt's that simple

Update Cake Wallet to try it out! pic.twitter.com/IjOccnBYy7

Update Cake Wallet to try it out! pic.twitter.com/IjOccnBYy7— Cake Wallet (@cakewallet) May 19, 2025

“Bitcoin is open and permissionless — but without privacy, it’s a surveillance tool,” said Vikrant Sharma, CEO of Cake Wallet in a recent press release sent to Bitcoin Magazine. “This upgrade gives everyday users the ability to transact privately, without needing to be online or run a server.”

Cake Wallet’s implementation removes the limitation of requiring both parties to be online or run a server to coordinate a transaction. Users can now send or receive Bitcoin through asynchronous, serverless PayJoin transactions—no Tor, no apps, no advanced configuration.

“This makes Bitcoin privacy accessible to people who aren’t developers or hardcore cypherpunks,” said Sharma. “We’ve seen huge progress with Monero privacy tools. Now, Bitcoin users can take a step towards privacy as well, built right into a mainstream wallet.”

This announcement follows closely on the heels of another major privacy upgrade: Cake Wallet recently became one of the first major wallets to support Silent Payments, allowing users to receive Bitcoin without exposing a reusable address.

This post Cake Wallet Introduces PayJoin v2, Increasing Bitcoin Privacy For The Masses first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ d360efec:14907b5f

2025-05-27 15:46:26

@ d360efec:14907b5f

2025-05-27 15:46:26 -

@ cae03c48:2a7d6671

2025-05-27 16:00:27

@ cae03c48:2a7d6671

2025-05-27 16:00:27Bitcoin Magazine

Exodus Launches XO Pay, An In-App Bitcoin And Crypto Purchase SolutionExodus has officially launched XO Pay, a new crypto purchasing feature that allows users to buy and sell digital assets directly within the Exodus mobile wallet, and is now live across the United States. XO Pay aims to simplify the process for its users to easily purchase cryptocurrencies such as Bitcoin.

XO Pay is powered by Coinme’s Crypto-as-a-Service (CaaS) API platform and is a self custody Bitcoin wallet. This means customers can now purchase BTC within the wallet without going through third-party exchanges while keeping full control of their assets.

“XO Pay represents our commitment to making cryptocurrency more accessible to everyday customers,” said JP Richardson, Co-Founder and CEO of Exodus, in a recent press release sent to Bitcoin Magazine. “By integrating the purchasing process directly into our mobile wallet, we’re removing barriers and simplifying the journey from fiat to crypto, and back.”

With XO Pay, Exodus offers a self custodial way to complete Bitcoin transactions. This rollout is part of Exodus’ broader mission to make digital assets more secure, as the demand for Bitcoin is increasing.

“By creating a Web2 checkout experience into a Web3 self-custody wallet, Exodus has set a new bar for crypto user experience,” said Neil Bergquist, CEO and co-founder of Coinme. “Exodus’ innovative integration of Coinme’s APIs delivers the seamless in-app purchase flow users expect while keeping them in full control of their assets.”

This post Exodus Launches XO Pay, An In-App Bitcoin And Crypto Purchase Solution first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ bf47c19e:c3d2573b

2025-05-27 14:57:56

@ bf47c19e:c3d2573b

2025-05-27 14:57:56Srpski prevod knjige "The Little Bitcoin Book"

Zašto je Bitkoin bitan za vašu slobodu, finansije i budućnost?

Verovatno ste čuli za Bitkoin u vestima ili da o njemu raspravljaju vaši prijatelji ili kolege. Kako to da se cena stalno menja? Da li je Bitkoin dobra investicija? Kako to uopšte ima vrednost? Zašto ljudi stalno govore o tome kao da će promeniti svet?

"Mala knjiga o Bitkoinu" govori o tome šta nije u redu sa današnjim novcem i zašto je Bitkoin izmišljen da obezbedi alternativu trenutnom sistemu. Jednostavnim rečima opisuje šta je Bitkoin, kako funkcioniše, zašto je vredan i kako utiče na individualnu slobodu i mogućnosti ljudi svuda - od Nigerije preko Filipina do Venecuele do Sjedinjenih Država. Ova knjiga takođe uključuje odeljak "Pitanja i odgovori" sa nekim od najčešće postavljanih pitanja o Bitkoinu.

Ako želite da saznate više o ovom novom obliku novca koji i dalje izaziva interesovanje i usvajanje širom sveta, onda je ova knjiga za vas.

-

@ bf47c19e:c3d2573b

2025-05-27 14:54:03

@ bf47c19e:c3d2573b

2025-05-27 14:54:03Originalni tekst na bitcoin-balkan.com.

Pregled sadržaja

- 5 Razloga Zašto je Novac Važan za Vas, Individualno

- 3 Razloga Zašto je Novac Važan za Društvo u Celini

- Zašto ljudi mrze novac?

Novac vs trenuci – da li oni treba da budu u sukobu? Kakva je uloga novca?

Novac je nepredvidiva zver modernog društva – neki ga veličaju sa stalnom željom da steknu više, dok ga drugi demonizuju i kažu da je pohlepa srž društvenih problema. Tokom mnogih godina svog života, ja sam često prelazio sa jednog na drugo gledište, i naučio mnogo toga upoznajući druge ljude koji žive na oba kraja ovog spektra. Kao i kod mnogih složenih tema, istina leži negde u sredini.

Novac je važan zato što on može da pomogne u uklanjanju materijalnih želja i patnji – omogućavanjem da preuzmete kontrolu nad svojim životom i da brinete o voljenima. Novac podiže životni standard društva omogućavanjem trgovine, a pritom minimalizuje potrebu za poverenjem.

Na novac možemo gledati kao na način da svoj uloženi trud sačuvamo u odredjenom obliku, i da ga vremenom prenesemo, tako da možemo da uživamo u plodovima svog rada. Novac kao alat je jedna od najvažnijih stvari za rast civilizacije. Na nesreću, mnogi su vremenom zlostavljali novac, ali sa dobrim razlogom: način na koji naš novac danas funkcioniše dovodi do duboko podeljenog društva – što ću i objasniti.

5 Razloga Zašto je Novac Važan za Vas, Individualno

Novac je važan za rast bogatstva, što je malo drugačije od toga da imamo veliku platu ili jednostavno zarađivati velike količine novca. Bogatstvo je otklanjanje želja, kako bi mogli da obratimo više pažnje na neke korisnije stvari u životu, od pukog preživljavanja i osnovnih udobnosti.

Bogata osoba je ona koja zaradi više novca nego što potroši, i koja ga čuva – ona čuva svoj rad tokom vremena. Uporedite ovo sa visoko plaćenim lekarom koji živi u velikoj vili sa hipotekom i sa Mercedesom na lizing. Iako ova osoba ima visoke prihode, ona takođe ima velike rashode u vidu obaveze plaćanja te hipoteke i lizinga. Te obaveze sprečavaju ovu osobu da uživa u istinskim blagodetima novca i bogatstva koje one predstavljaju:

1. Sloboda od potrebe za radom