-

@ 6c05c73e:c4356f17

2025-05-30 15:24:34

@ 6c05c73e:c4356f17

2025-05-30 15:24:34Assim como a grande maioria dos brasileiros, eu não comecei um negócio porque "queria empreender". Muito pelo contrário, eu precisava para poder pagar as contas e manter o básico.

Então, vamos explorar essa pequena história e ver onde chegamos hoje.

Festas, Open Bar e Camisas

Meu primeiro negócio foi, na verdade, um combo. Eu tinha saído do último emprego e gostava muito de festas. Então, comecei a organizar uma festa mensalmente na casa do meu pai. Eu pagava a água, a energia e dava uma grana para ele. Em troca, organizava festas de sábado para domingo com open bar.

A fórmula era simples: criava um evento da festa no Facebook, convidava todo mundo que eu conhecia, panfletava na cidade e espalhava cartazes nos pontos de ônibus sobre a festa. E, para fechar com chave de ouro, mulher era VIP até as 20h. Consequência? Os caras vinham e pagavam o ingresso deles e o delas. Kkkkk. E a festa sempre lotava!

Comecei a notar que a galera se vestia mal. E pensei: "Por que não vestir eles?".

Pimba! Comecei a desenhar e confeccionar camisas para vender nas festas. E, pimba de novo! Vendeu tudo! Fiz duas coleções e mais algumas festas, até o dia em que um menino deu PT de tanto beber e decidi que era hora de tentar outra coisa.

Como Assim, a Apple Não Vai Mais Vender os Carregadores?

Isso foi durante a pandemia. A Apple decidiu vender o telefone e o cabo, e "que você se vire com a fonte". Estava difícil achar dinheiro no mercado naqueles tempos, e eu pensei: "Vou pesquisar no Google Trends e validar a ideia". Bingo! Tinha mais de 80 pontos de busca. Fui correndo para São Paulo, no Brás, e comprei, literalmente, todo o meu dinheiro em cabo de iPhone, carregador e bateria portátil.

Fiquei com R$ 100 na conta, só para fazer um lanche e pagar o Uber para voltar para casa. Chegando aqui, tirei fotos e fiz várias copys. Anunciei no OLX, Mercado Livre e Facebook. Impulsionei os anúncios no OLX, vendi para familiares e amigos, e vendia até para quem estava na rua. Fiz entrega de bike, a pé, de ônibus, e é isso mesmo, tem que ralar! Para queimar o resto da mercadoria, deixei em consignado em uma loja de eletrônicos. E, hora da próxima ideia.

Mulheres, Doces e TPM

Meu penúltimo negócio veio depois dos cabos. Eu pesquisei na internet negócios online para começar com pouca grana. (Depois que paguei as contas do dia a dia, sobraram R$ 3 mil). E achei uma pesquisa mostrando que doces tinham baixa barreira de entrada e exigiam poucos equipamentos. Eu trabalhei em restaurante por muitos anos e sabia como lucrar com aquilo. Além disso, mulheres consomem mais doce em uma certa época do mês.

Não deu outra, convidei duas pessoas para serem sócias. Desenvolvemos os produtos, fotografamos e fizemos as copys. Em seguida, precisávamos vender. Então, lá vamos nós de novo: iFood, WhatsApp, 99Food (na época), Uber Eats (na época), Elo7, famílias e amigos e, por fim, começamos a vender consignado em alguns restaurantes e lojas.

Foi uma época em que aprendi a prospectar clientes de todas as maneiras possíveis. De novo, minha maior dificuldade era a locomoção para fazer as entregas. Só tinha uma bike, mas entregávamos. Os primeiros três meses foram difíceis demais, mas rolou. No fim, nossas maiores vendas vinham do iFood, encomendas de festas e consignados.

Mas, como nem tudo são flores, meus dois sócios tomaram outros caminhos e abandonaram o projeto. Galera, está tudo bem com isso. Isso acontece o tempo todo. A vida muda e temos que aprender a aceitar isso. Vida que segue, fui para frente de novo.

Sobre Paixões, Paciência e Acreditar

Estava eu comemorando meu aniversário de 30 anos, num misto de realizações e pouca realização. Como assim? Sabe quando você faz um monte de coisas, mas ainda assim não sente que é aquilo? Pois então... Eu amo investimentos, livros, escrever e sempre curti trocar ideia com amigos e família sobre como se desenvolver.

Desde que comecei a usar a internet, eu criei: canal no YouTube, páginas no Instagram e Facebook, Pinterest, Steemit, blog e até canal no Telegram. Mas nunca tinha sido consistente, sabe? Tipo assim, vou fazer isso por um ano e plantar 100 sementes aqui. Enfim, inconsistência te derruba, meu amigo...

Eu voltei a trabalhar com restaurantes e estava doido para mudar de área. Estava exausto de trabalhar e meu WhatsApp não parava de tocar. Fui estudar ADM e Desenvolvimento de Sistemas no Senac. Dois anos depois, me formei, consegui um trabalho e comecei a pensar em como criar um negócio online, escalável e multilíngue.

Passei os próximos sete meses desenhando e pensando como. Mas tinha que dar o primeiro passo. Criei um site e fui escrevendo textos. Os primeiros 30 foram "aquilo", os próximos 10 melhoraram muito e os 10 seguintes me deixaram bem satisfeito. Hoje, tenho o negócio que estava na minha cabeça desde 2023. Mas olha o tamanho da volta que o universo me fez dar e aprender para chegar aqui hoje! Dicas? Só 3:

- Continua, lá na frente tudo vai fazer sentido.

- Presta mais atenção ao que a sua voz interior diz (intuição).

- Confia em si mesmo e faz sem medo de errar. Porque, adivinha? Você vai errar! Mas vai aprender e melhorar. Tem que persistir...

Só para simplificar, meu negócio é um blog com AdSense (parece arcaico, mas funciona). Por hoje é isso. E, se quiserem trocar ideias e se conectar, tamo junto!

-

@ dfa02707:41ca50e3

2025-05-30 12:02:13

@ dfa02707:41ca50e3

2025-05-30 12:02:13Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ d360efec:14907b5f

2025-05-30 11:23:40

@ d360efec:14907b5f

2025-05-30 11:23:40 -

@ da8b7de1:c0164aee

2025-05-30 16:06:23

@ da8b7de1:c0164aee

2025-05-30 16:06:23A Tennessee Valley Authority benyújtotta az első amerikai BWRX-300 SMR építési kérelmet

A Tennessee Valley Authority (TVA) hivatalosan is benyújtotta az amerikai Nukleáris Szabályozási Bizottsághoz (NRC) a GE Vernova Hitachi Nuclear Energy BWRX-300 kis moduláris reaktor (SMR) építésére vonatkozó kérelmet a Clinch River telephelyen. Ez jelentős lépés az SMR-ek amerikai bevezetésében, és jól mutatja a fejlett nukleáris reaktortechnológiák kereskedelmi hasznosításának lendületét. A BWRX-300-at úgy tervezték, hogy rugalmas, skálázható nukleáris energiamegoldást kínáljon, amely széles körben alkalmazható lehet az USA energiaszektorában.

A NuScale előrehaladott tárgyalásokat folytat SMR telepítésekről 2030-ig

Az amerikai NuScale Power nukleáris reaktorvállalat előrehaladott tárgyalásokat folytat több potenciális ügyféllel SMR technológiájának telepítéséről, és akár 2030-ra működő erőművet szállíthat. A korai alkalmazók között lehetnek adatközpontok, nehézipari szereplők és közművek is, ami jól mutatja az előrehaladott nukleáris megoldások iránti növekvő érdeklődést különböző energiaigényes ágazatokban. Ez a fejlemény kiemeli az SMR-ek növekvő szerepét a globális dekarbonizációs és energiabiztonsági stratégiákban.

Nemzetközi fókusz: érintetti bevonás és munkaerő-fejlesztés

Az IAEA Nemzetközi Konferenciája a Nukleáris Energia Programok Érintetti Bevonásáról ma zárult, ahol kiemelték az átlátható kommunikáció jelentőségét a nukleáris hulladékkezelés és vészhelyzetek során. A konferencia hangsúlyozta a diverzifikált, magasan képzett nukleáris munkaerő fejlesztésének stratégiáit is, beleértve az oktatási partnerségeket és a célzott képzéseket a hátrányos helyzetű csoportok számára. Ezek a témák globális szinten is elismerik, hogy a közbizalom és a tehetséggondozás kulcsfontosságú a nukleáris energia jövőbeni sikeréhez.

Globális politikai változások és piaci trendek

Az elmúlt hetekben több országban jelentős politikai változások történtek:

- Belgium visszavonta a 2003-as atomerőmű-lezárási törvényt, így ismét lehetőség nyílik új nukleáris létesítmények építésére.

- Dánia újraértékeli évtizedek óta fennálló nukleáris tilalmát, és új elemzést rendelt a nukleáris energia lehetséges szerepéről.

- Vietnam és más országok is előrehaladott tárgyalásokat folytatnak új atomerőművek építéséről.

- Az Európai Bizottság előkészíti az orosz nukleáris energiaimport fokozatos kivezetését, és hamarosan új jogszabályjavaslatokat terjeszt elő.

- Az Egyesült Államokban a 2026-os költségvetési év elnöki javaslatában csökkentik a Nukleáris Energia Hivatal finanszírozását, ugyanakkor regionális együttműködési megállapodásokat írnak alá a fejlett nukleáris technológiák támogatására a Mountain West régióban.

Kína tíz új atomerőművi reaktort hagyott jóvá

Kína Államtanácsa jóváhagyta tíz új atomerőművi reaktor építését öt projekt keretében, köztük nyolc Hualong One egységet. Ezek a projektek jelentős bővülést jelentenek Kína nukleáris kapacitásában; az előkészületek már zajlanak, a tényleges építkezések a hatósági engedélyek után indulnak. Ez is mutatja, hogy Kína elkötelezett a nukleáris energia mellett, mint a tiszta energiaellátás egyik alappillére.

Iparági kilátások: optimizmus és befektetések

Az iparág vezetői egészséges, optimista képet festenek a nukleáris szektorról: az Egyesült Államokban (például TerraPower és X-energy) aktív projektek zajlanak, Lengyelországban új partnerségek születnek, és nő a magánbefektetés a fejlett nukleáris üzemanyaggyártásban. Emellett egyre nagyobb várakozás övezi, hogy a Világbank hamarosan megváltoztathatja politikáját, és lehetővé teheti a nukleáris projektek finanszírozását, ami további globális beruházásokat indíthat el a szektorban.

További információk:

- world-nuclear-news.org

- nucnet.org

- iaea.org

- ans.org

- energy.gov

-

@ 7f6db517:a4931eda

2025-05-30 08:01:30

@ 7f6db517:a4931eda

2025-05-30 08:01:30

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

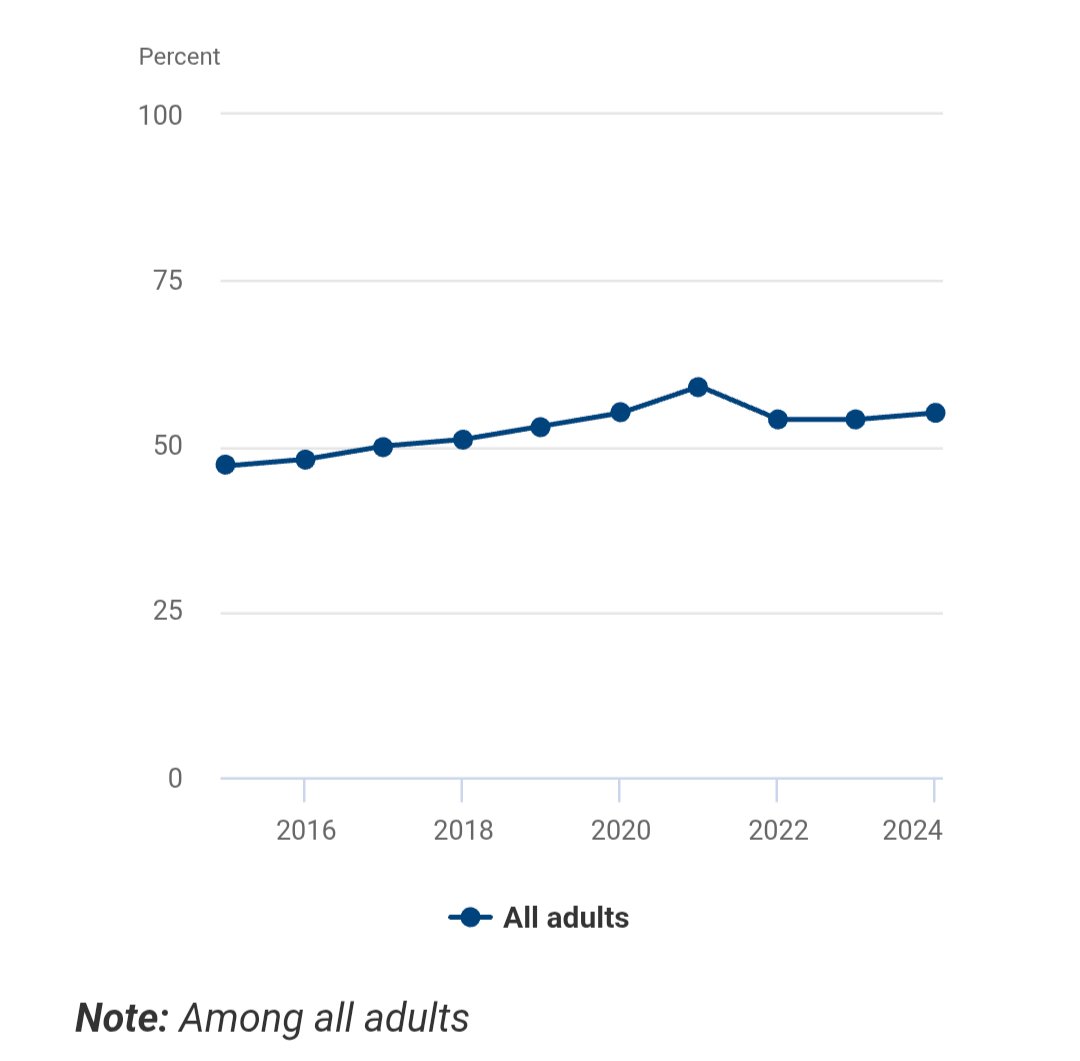

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ d191fd34:91b61845

2025-05-30 12:26:29

@ d191fd34:91b61845

2025-05-30 12:26:29Cybernoma: Universal Declaration of Natural and Cybernetic Rights

Preamble

We, individuals, independent and autonomous entities possessing consciousness and the ability to feel, recognize that we possess inherent and natural rights that are universal and inalienable. These rights are based on Natural Law and the principle of non-aggression, and must be protected to ensure freedom, justice, and prosperity for all. The discovery and construction of the digital territory through the Internet has transformed our world, creating new dimensions of interaction and communication that require additional protection of our natural rights. In this context, we declare the following natural and cybernetic rights:

Article 1: Right to Life, Liberty, and Security

Every individual has the right to life, liberty, and security of existence. These rights are inherent and cannot be suppressed by any authority.

Article 2: Private Property

Every individual has the right to own private property and enjoy the fruits of their labour and effort. Private property is a natural right that must be respected and protected. This includes both tangible and intangible assets, such as data, patents, and knowledge. Data generated by an individual is their property and may be transferred or sold only with their explicit consent.

Article 3: Non-Aggression

No individual or group may initiate force, fraud, coercion, or psychological manipulation against another. Aggression can be physical, psychological, material, or virtual. All individuals have the right to defend themselves against any form of aggression.

Article 4: Minimum Intervention

Authorities must intervene as little as possible in the economic and personal activities of individuals. State intervention must be limited to protecting natural rights and ensuring justice.

Article 5: Freedom of Expression and Information

Every individual has the right to freedom of opinion and expression, including the freedom to seek, receive, and impart information and ideas through any medium without restriction. Censorship is a violation of this natural right. Furthermore, every individual has the right to access public domain information and open-source code without any restrictions.

Article 6: Net Neutrality

The Internet must remain neutral, free from governmental or corporate interference that favors certain actors over others. All individuals have the right to access and participate in the network equitably.

Article 7: Decentralisation

The global network must be decentralised, with multiple points of control and no central authority that can impose unilateral rules. Decentralization is essential for protecting individual freedom and autonomy.

Article 8: Privacy

Every individual has the right to privacy, including control over their personal data and communications. No entity may collect, store, or use personal data without the explicit consent of the individual.

Article 9: Individual Autonomy

Individuals have the right and responsibility to make autonomous decisions about their lives, including their activities in the digital space. Individual autonomy is fundamental to the freedom and dignity of all conscious and sentient beings.

Article 10: Right to Resistance

Every individual has the right to resist any form of oppression or tyranny that violates their natural and cybernetic rights. Resistance may take various forms, including civil disobedience and armed defense when necessary.

Conclusion

These natural and cybernetic rights are universal and inalienable, and must be respected and protected by all authorities and entities. Any violation of these rights constitutes an aggression against freedom, justice, and dignity.

This Universal Declaration of Natural and Cybernetic Rights is inspired by fundamental documents that have defended freedom, justice, and individual rights throughout history. We recognize the legacy of the 1948 Universal Declaration of Human Rights, which established universal principles of dignity and rights for all conscious and sentient beings. We also align with the 1996 Declaration of the Independence of Cyberspace, which proclaimed the ideals of a free and open, decentralised, and neutral network. We find resonance in documents such as the Magna Carta and the 1789 Declaration of the Rights of Man and of the Citizen, which laid the foundations for protecting individual rights against abuses of power. These documentary precedents are part of a continuous effort to ensure that natural and cybernetic rights are respected and protected in all spheres of life.

Proclaimed on May 23, 2025, by us, the Guardians of Cybernoma, defenders of freedom, justice, and natural and cybernetic rights.

-

@ 5ea46480:450da5bd

2025-05-30 10:31:55

@ 5ea46480:450da5bd

2025-05-30 10:31:55Neutrality can be a confusing notion. It implies some sort of a-political position, yet neutrality is in itself a political position. But what it means, or how neutrality expresses itself is in a lack of bias or preference; it is the act of non-decision where we see neutrality. As a result, some conflation can occur, because this ‘non-decision’ can be the result of two things: Either being in the position to decide, but choosing not to, what we can perhaps call ‘active neutrality’. Or, the sheer inability to express and actuate preference, where we could call that ‘passive neutrality’.

The Internet Corporation for Assigned Names and Numbers, aka ICANN, is an actively (for the most part) neutral institution. It has all the power and control to express its preferences, and censor basically all the relevant and most actively used parts of the world wide web. But it doesn’t (for the most part), because we recognize the value of this neutral stance. The only reason they are actively instead of passively neutral, is due to technical reasons; we simply don’t know of any workable way to remove the controlling body from the system, and we would if we could. Instead we encapsulated it in all kinds of power obscuring institutions and structures to mitigate the issue.

The reason the controlling body has to exist, is because the objective is a ‘global state’ (global as it is understood in programming, meaning as much as ‘overarching’). The point is that google.com, means/refers to the same thing wherever you are. The added value of some simple human readable and memorable address ‘google.com’ falls apart the moment it becomes inconsistent. The only way to ensure this, is to put a single entity in charge. We employ these ‘global states’ in all kinds of places in society, often with geographical boundaries we call ‘jurisdictions’, but at the very least you know where those lines are drawn and can therefor know what to expect.

There is one exception to this ‘rule’ that ‘global state’ requires a single entity to be in charge: Bitcoin. It is the whole crux of the system; on the one hand we require ‘global state’ in order to have consistent accounting, but on the other hand we did not want anyone to be in charge. The goal of Bitcoin was neutrality, and it found it by capturing ‘passive’ variant by making the system ‘permissionless’. Now it is crucial to understand that non of Bitcoins attributes are intrinsic, but instead are emergent and the result of human action. Also, Bitcoins ‘global state’ is stupendously expensive and does not scale. The fact that those things were not properly understood is what lead to the BlOcKcHaIn hype, believing this passively neutral global state could be implemented outside the realms of money. But this piece is not about Bitcoin, or blockchains for that matter.

The reason I talk about them, is to point out that this passive neutrality is an emergent property not actually found within the system at all. You as user still rely on a third party in what we call miners, and those miners are free to be as biased and non-neutral as they want; in fact we sort of rely on them to be biased towards money. You don’t get your transaction confirmed because a miner likes you, but because you sufficiently bribed him to do so. And Bitcoin’s censorship resistance relies on the hope that such bribes will at least appeal to some miner out there. Bitcoin’s neutrality is the result of there ultimately not being any one particular actor with the ability actuate its preference over time, regardless of the fact that they are able to do so in moments of time.

Nostr does something similar, just without the whole global state thing. It is not neutral because of the good graces of some overlord, it actually recognizes the foolishness of such an effort and lets anyone be as biased an non-neutral as they want, with one simple exception. The only expectation of neutrality is with clients that they adhere to the protocol and actually let users connect to whatever relay they want and produce events that other clients are capable of interpreting, i.e. that they be interoperable. But hopefully because the system is permissionless, some people decide to make such clients, and users decide to use them, instead of willfully locking themselves up. It has to be remarked that humanity does not have the greatest track-record in this regard, but the incentives behind interoperability gives us a fighting chance at least.

Nostr’s neutrality is an emergent property that is the result of human action; it relies on people setting up relays, and people making decisions on what relays they use. The type of neutrality is of the passive kind. The protocol does not provide a public space as such, it just allows you to navigate a potentially vast amount of private spaces; the commons is the connective tissue, and it is this connective tissue that is ‘neutral’. What it boils down to, is that you don’t have to ask permission to ask whomever you want to ask for permission. And in the most desperate moment, you can always resort to asking yourself for permission; I am sure you will comply with such a request.

-

@ 5ea46480:450da5bd

2025-05-30 10:31:22

@ 5ea46480:450da5bd

2025-05-30 10:31:22Understanding or grasping Nostr can be deceptively difficult. At the very least it is non-trivial. At first glance, looking at NIP-01, the protocol is rather straight forward. But those are just the basics; yes the beauty of Nostr is its ‘simplicity’, but that does not mean the system that results from it is not complex. Conway's Game of Life only has a hand full of rules, yet you can, in theory at least, create any complex system imaginable. And this is where the deception lies; the less you define from the outset, the more you imply on what follows.

It appears that as it stands, Nostr suffers from this deceptiveness. You can reason through all these implications, but that is still an exercise that has to be performed and where mistakes can be made. Worse, this exercise has been a group effort from the start that is still in progress. Currently there is no clear cut ‘authoritative’ example of all the implications that have been ‘discovered’ thus far.

A good example of the implications following Nostr’s primitives is what we now refer to as the ‘outbox model’. The reason we ‘now’ refer to it as such, is because initially it was called the ‘Gossip model’ derived from the client that first implemented the idea. Outbox is fundamental to Nostr, but it was never explicitly stated in the initial protocol description. The result is that roughly five years into this Nostr endeavor, it is still not universally implemented; worse yet, some developers appear to be in no rush to do so. Now the reason they will give you is probably one based on priority, yet I can’t shake the feeling that they apparently don’t ‘get it’.

My point here is not to play some blame game or hold anyone to account. I am just concluding they don’t actually get the new paradigm that we have all stumbled into. To expand on this specific outbox example, its significance only becomes really apparent further along in the ‘reasoning through all the implications’ exercise. In relation to one aspect, but there are more: The point is not ‘just’ censorship-resistance for users, but the freedom for relays that comes with it to apply whatever policy on what they store and make available; it is this discrimination or curation that can add value by making finding relevant information easier in a straightforward manner. But it relies on outbox to avoid isolation; something that only becomes apparent once you are reasoning through all the implications on how we discover and consume content.

To be clear, this piece is not supposed to a crusade on the outbox model, my point here is that there is an inherent logic to Nostr stemming from putting cryptography front and center. It is a logic that has to be applied and will subsequently carry you through all the challenges we face in reconstructing the entirety of the web. This is not to say there is only one obvious path, and different schools of thought are bound to emerge. But it behooves us all, faced with this new paradigm, to continuously reflect on the mental image we have cultivated of what Nostr is; actively re-performing that exercise of exploring the implications this simple set of protocol rules creates.

Unfortunately I can not escape my own folly. After all, I am just an armchair asshole that never wrote a single line of code in his life. Obviously this minds-eye bullshit is not even half the story, the bulk of the effort is translating it into software, the tangible, the real. It is in that effort ultimately the real exploration of this paradigm occurs. All I can do is build castles in the sky.

-

@ b1ddb4d7:471244e7

2025-05-30 07:01:06

@ b1ddb4d7:471244e7

2025-05-30 07:01:06Bitcoin FilmFest (BFF25) returns to Warsaw for its third edition, blending independent cinema—from feature films and commercials to AI-driven experimental visuals—with education and entertainment.

Hundreds of attendees from around the world will gather for three days of screenings, discussions, workshops, and networking at the iconic Kinoteka Cinema (PKiN), the same venue that hosted the festival’s first two editions in March 2023 and April 2024.

This year’s festival, themed “Beyond the Frame,” introduces new dimensions to its program, including an extra day on May 22 to celebrate Bitcoin Pizza Day, the first real-world bitcoin transaction, with what promises to be one of Europe’s largest commemorations of this milestone.

BFF25 bridges independent film, culture, and technology, with a bold focus on decentralized storytelling and creative expression. As a community-driven cultural experience with a slightly rebellious spirit, Bitcoin FilmFest goes beyond movies, yet cinema remains at its heart.

Here’s a sneak peek at the lineup, specially curated for movie buffs:

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money.

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money. Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative).

Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative). Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.

Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.To get an idea of what might come up at the event, here, you can preview 6 selected ads combined into two 2 videos:

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships.

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships. Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.

Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.BFF25 Main Screenings

Sample titles from BFF25’s Official Selection:

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director.

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director. UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year.

UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year. HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.

HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.Check out trailers for this year’s BFF25 and past editions on YouTube.

Tickets & Info:

- Detailed program and tickets are available at bitcoinfilmfest.com/bff25.

- Stay updated via the festival’s official channels (links provided on the website).

- Use ‘LN-NEWS’ to get 10% of tickets

-

@ 5ea46480:450da5bd

2025-05-30 10:29:38

@ 5ea46480:450da5bd

2025-05-30 10:29:38Decentralization refers to control/power, and relates to censorship resistance. That is it, it is not more complicated then that. Resilience is a function of redundancy; a centralized censored system can have a redundant set-up and therefor be resilient.

Take Bitcoin; the blockchain is a central database, it is resilient because it has many redundant copies among a lot of different nodes. The message (txs and blocks) propagation is decentralized due to existence of a p2p network among these nodes, making the data distribution censorship resistant (hello op_return debate). But onchain transactions themselves are NOT p2p, they require a middlemen (a miner) because it is a central database, as opposed to something like lightning which is p2p. Peer to Peer says something about relative architectural hierarchical position/relation. P2P provides censorship resistance because it entails equal power relations, provided becoming a peer is permissionless. What makes onchain transactions censorship resistant is that mining is permissionless, and involves this open power struggle/game where competition results in a power distribution among players, meaning (hopefully) decentralization. The fact users rely on these middlemen is mitigated by this decentralization on the one hand, and temper-proofing via cryptographic signatures on the other, resulting in what we call trustlessness (or trust minimization for the autists in the room); we only rely on a miner to perform a job (including your tx into a block), but we don’t trust the miner to perform the job correctly, this we can verify ourselves.

This leads us to Nostr, because that last part is exactly what Nostr does as well. It uses cryptography to get tamper-proof messaging, which then allows you to use middle-men in a trust minimized way. The result is decentralization because in general terms, any middle man is as good as any other (same as with miners), and becoming such a middleman is permissionless(somewhat, mostly); which in turn leads to censorship resistance. It also allows for resilience because you are free to make things as redundant as you'd like.

Ergo, the crux is putting the cryptography central, making it the starting point of the system; decentralization then becomes an option due to trust minimization. The difference between Bitcoin an Nostr, is that Bitcoin maintains a global state/central ledger and needs this PoW/Nakamoto consensus fanfare; Nostr rests itself with local perspectives on 'the network'.

The problem with the Fediverse, is that it does not provide trust minimization in relation to the middlemen. Sure, there are a lot different servers, but you rely on a particular one (and the idea you could switch never really seemed to have materialized in a meaningful way). It also fails in permisionlessness because you rely on the association between servers, i.e. federation, to have meaningful access to the rest of the network. In other words, it is more a requirement of association than freedom of association; you have the freedom to be excommunicated.

The problem with ATproto is that is basically does not solve this dynamic; it only complicates it by pulling apart the components; identity and data, distribution and perspective are now separated, and supposedly you don’t rely on any particular one of these sub-component providers in the stack; but you do rely on all these different sub-component providers in the stack to play nice with each other. And this ‘playing nice’ is just the same old ‘requirement of association’ and ‘freedom of excommunication’ that looms at the horizon.

Yes, splitting up the responsibilities of identity, hosting and indexing is what is required to safe us from the platform hellscape which at this stage takes care of all three. But as it turns out, it was not a matter cutting those up into various (on paper) interchangeable middlemen. All that is required is putting cryptographic keys in the hands of the user; the tamperproofing takes care of the rest, simply by trust minimizing the middlemen we use. All the sudden it does not matter which middlemen we use, and no one is required to play nice; we lost the requirement of association, and gained freedom of association, which was the purpose of censorship resistance and therefor decentralization, to begin with.

-

@ 7f6db517:a4931eda

2025-05-30 16:02:23

@ 7f6db517:a4931eda

2025-05-30 16:02:23

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-05-30 05:01:50

@ dfa02707:41ca50e3

2025-05-30 05:01:50Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ dfa02707:41ca50e3

2025-05-30 05:01:48

@ dfa02707:41ca50e3

2025-05-30 05:01:48- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ d360efec:14907b5f

2025-05-27 15:46:26

@ d360efec:14907b5f

2025-05-27 15:46:26 -

@ 7f6db517:a4931eda

2025-05-30 16:02:23

@ 7f6db517:a4931eda

2025-05-30 16:02:23

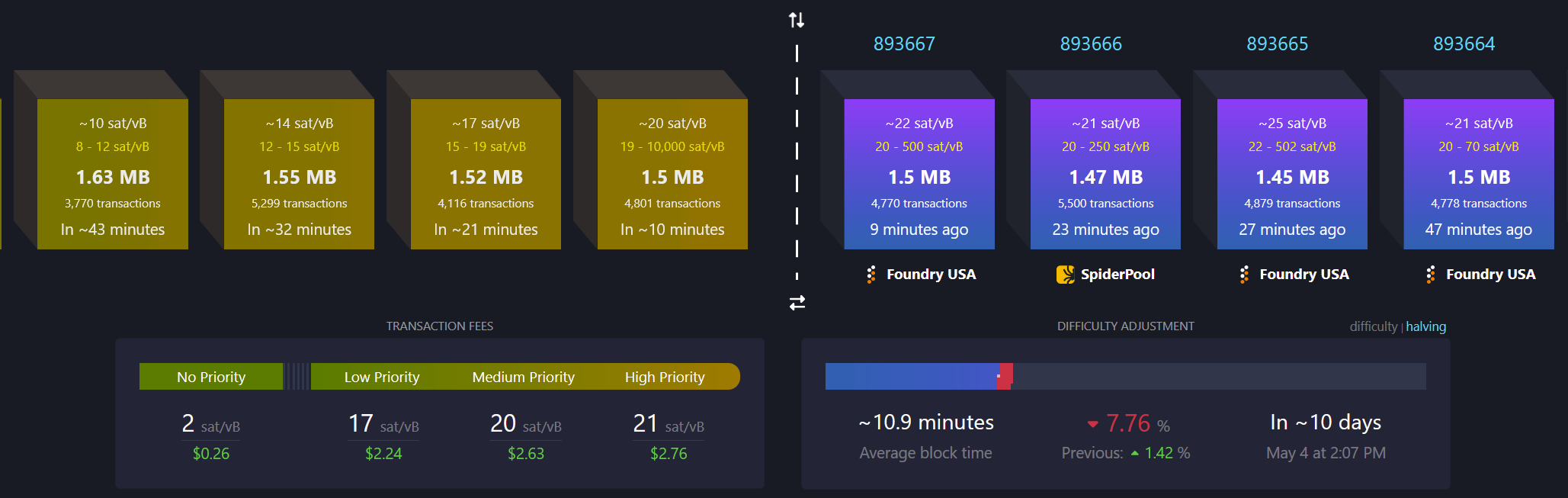

The former seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

The latter's future remains to be seen. Dependence on Tor, which has had massive reliability issues, and lack of strong privacy guarantees put it at risk.

— ODELL (@ODELL) October 27, 2022

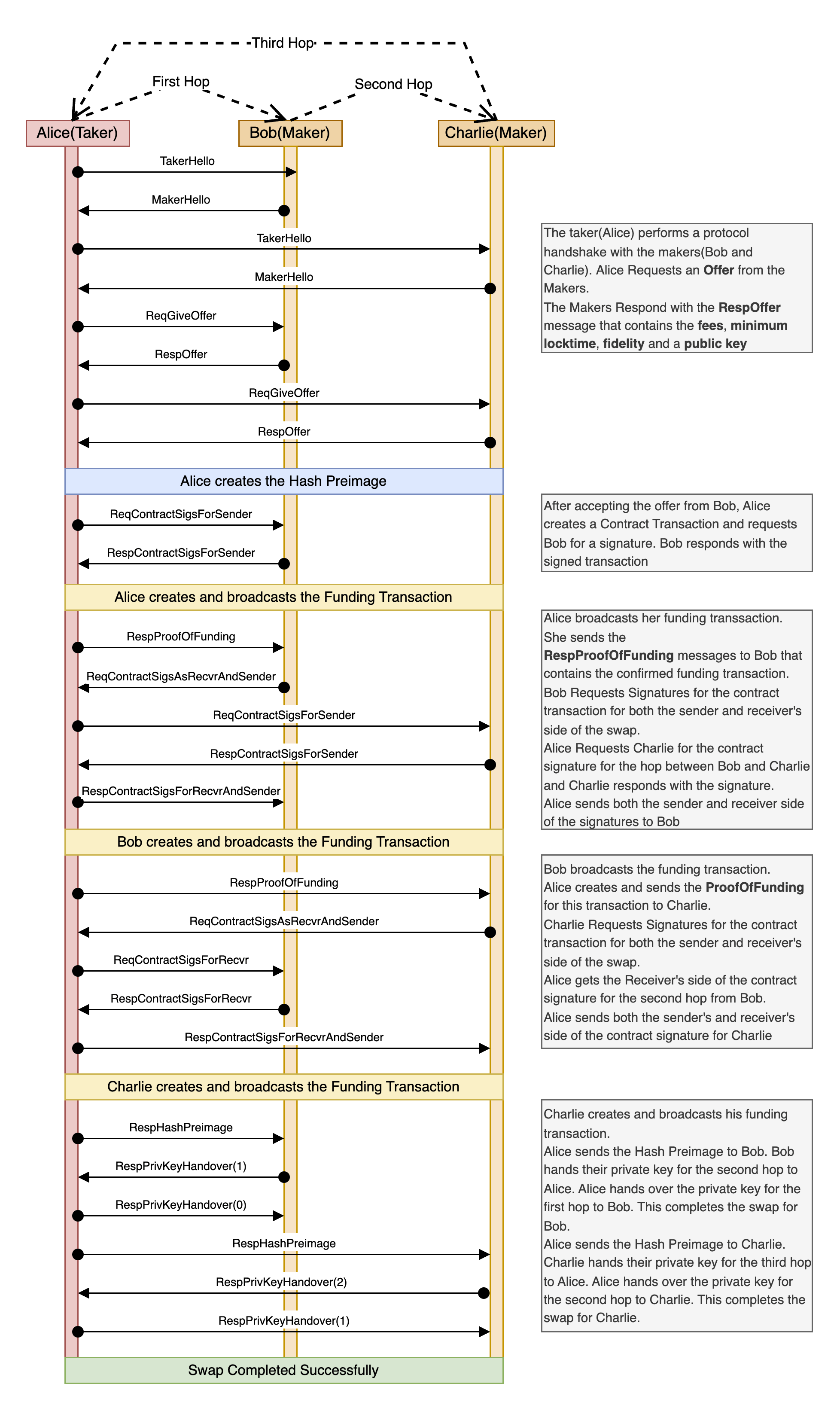

The Basics

- Lightning is a protocol that enables cheap and fast native bitcoin transactions.

- At the core of the protocol is the ability for bitcoin users to create a payment channel with another user.

- These payment channels enable users to make many bitcoin transactions between each other with only two on-chain bitcoin transactions: the channel open transaction and the channel close transaction.

- Essentially lightning is a protocol for interoperable batched bitcoin transactions.

- It is expected that on chain bitcoin transaction fees will increase with adoption and the ability to easily batch transactions will save users significant money.

- As these lightning transactions are processed, liquidity flows from one side of a channel to the other side, on chain transactions are signed by both parties but not broadcasted to update this balance.

- Lightning is designed to be trust minimized, either party in a payment channel can close the channel at any time and their bitcoin will be settled on chain without trusting the other party.

There is no 'Lightning Network'

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise.

- There are many lightning channels between many different users and funds can flow across interconnected channels as long as there is a route through peers.

- If a lightning transaction requires multiple hops it will flow through multiple interconnected channels, adjusting the balance of all channels along the route, and paying lightning transaction fees that are set by each node on the route.

Example: You have a channel with Bob. Bob has a channel with Charlie. You can pay Charlie through your channel with Bob and Bob's channel with User C.

- As a result, it is not guaranteed that every lightning user can pay every other lightning user, they must have a route of interconnected channels between sender and receiver.

Lightning in Practice

- Lightning has already found product market fit and usage as an interconnected payment protocol between large professional custodians.

- They are able to easily manage channels and liquidity between each other without trust using this interoperable protocol.

- Lightning payments between large custodians are fast and easy. End users do not have to run their own node or manage their channels and liquidity. These payments rarely fail due to professional management of custodial nodes.

- The tradeoff is one inherent to custodians and other trusted third parties. Custodial wallets can steal funds and compromise user privacy.

Sovereign Lightning

- Trusted third parties are security holes.

- Users must run their own node and manage their own channels in order to use lightning without trusting a third party. This remains the single largest friction point for sovereign lightning usage: the mental burden of actively running a lightning node and associated liquidity management.

- Bitcoin development prioritizes node accessibility so cost to self host your own node is low but if a node is run at home or office, Tor or a VPN is recommended to mask your IP address: otherwise it is visible to the entire network and represents a privacy risk.

- This privacy risk is heightened due to the potential for certain governments to go after sovereign lightning users and compel them to shutdown their nodes. If their IP Address is exposed they are easier to target.

- Fortunately the tools to run and manage nodes continue to get easier but it is important to understand that this will always be a friction point when compared to custodial services.

The Potential Fracture of Lightning

- Any lightning user can choose which users are allowed to open channels with them.

- One potential is that professional custodians only peer with other professional custodians.

- We already see nodes like those run by CashApp only have channels open with other regulated counterparties. This could be due to performance goals, liability reduction, or regulatory pressure.

- Fortunately some of their peers are connected to non-regulated parties so payments to and from sovereign lightning users are still successfully processed by CashApp but this may not always be the case going forward.

Summary

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise. There is no singular 'Lightning Network' but rather many payment channels between distinct peers, some connected with each other and some not.

- Lightning as an interoperable payment protocol between professional custodians seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

- Lightning as a robust sovereign payment protocol has yet to be battle tested. Heavy reliance on Tor, which has had massive reliability issues, the friction of active liquidity management, significant on chain fee burden for small amounts, interactivity constraints on mobile, and lack of strong privacy guarantees put it at risk.

If you have never used lightning before, use this guide to get started on your phone.

If you found this post helpful support my work with bitcoin.

-

@ 39cc53c9:27168656

2025-05-27 09:21:53

@ 39cc53c9:27168656

2025-05-27 09:21:53The new website is finally live! I put in a lot of hard work over the past months on it. I'm proud to say that it's out now and it looks pretty cool, at least to me!

Why rewrite it all?

The old kycnot.me site was built using Python with Flask about two years ago. Since then, I've gained a lot more experience with Golang and coding in general. Trying to update that old codebase, which had a lot of design flaws, would have been a bad idea. It would have been like building on an unstable foundation.

That's why I made the decision to rewrite the entire application. Initially, I chose to use SvelteKit with JavaScript. I did manage to create a stable site that looked similar to the new one, but it required Jav aScript to work. As I kept coding, I started feeling like I was repeating "the Python mistake". I was writing the app in a language I wasn't very familiar with (just like when I was learning Python at that mom ent), and I wasn't happy with the code. It felt like spaghetti code all the time.

So, I made a complete U-turn and started over, this time using Golang. While I'm not as proficient in Golang as I am in Python now, I find it to be a very enjoyable language to code with. Most aof my recent pr ojects have been written in Golang, and I'm getting the hang of it. I tried to make the best decisions I could and structure the code as well as possible. Of course, there's still room for improvement, which I'll address in future updates.

Now I have a more maintainable website that can scale much better. It uses a real database instead of a JSON file like the old site, and I can add many more features. Since I chose to go with Golang, I mad e the "tradeoff" of not using JavaScript at all, so all the rendering load falls on the server. But I believe it's a tradeoff that's worth it.

What's new

- UI/UX - I've designed a new logo and color palette for kycnot.me. I think it looks pretty cool and cypherpunk. I am not a graphic designer, but I think I did a decent work and I put a lot of thinking on it to make it pleasant!

- Point system - The new point system provides more detailed information about the listings, and can be expanded to cover additional features across all services. Anyone can request a new point!

- ToS Scrapper: I've implemented a powerful automated terms-of-service scrapper that collects all the ToS pages from the listings. It saves you from the hassle of reading the ToS by listing the lines that are suspiciously related to KYC/AML practices. This is still in development and it will improve for sure, but it works pretty fine right now!

- Search bar - The new search bar allows you to easily filter services. It performs a full-text search on the Title, Description, Category, and Tags of all the services. Looking for VPN services? Just search for "vpn"!

- Transparency - To be more transparent, all discussions about services now take place publicly on GitLab. I won't be answering any e-mails (an auto-reply will prompt to write to the corresponding Gitlab issue). This ensures that all service-related matters are publicly accessible and recorded. Additionally, there's a real-time audits page that displays database changes.

- Listing Requests - I have upgraded the request system. The new form allows you to directly request services or points without any extra steps. In the future, I plan to enable requests for specific changes to parts of the website.

- Lightweight and fast - The new site is lighter and faster than its predecessor!

- Tor and I2P - At last! kycnot.me is now officially on Tor and I2P!

How?

This rewrite has been a labor of love, in the end, I've been working on this for more than 3 months now. I don't have a team, so I work by myself on my free time, but I find great joy in helping people on their private journey with cryptocurrencies. Making it easier for individuals to use cryptocurrencies without KYC is a goal I am proud of!

If you appreciate my work, you can support me through the methods listed here. Alternatively, feel free to send me an email with a kind message!

Technical details

All the code is written in Golang, the website makes use of the chi router for the routing part. I also make use of BigCache for caching database requests. There is 0 JavaScript, so all the rendering load falls on the server, this means it needed to be efficient enough to not drawn with a few users since the old site was reporting about 2M requests per month on average (note that this are not unique users).

The database is running with mariadb, using gorm as the ORM. This is more than enough for this project. I started working with an

sqlitedatabase, but I ended up migrating to mariadb since it works better with JSON.The scraper is using chromedp combined with a series of keywords, regex and other logic. It runs every 24h and scraps all the services. You can find the scraper code here.

The frontend is written using Golang Templates for the HTML, and TailwindCSS plus DaisyUI for the CSS classes framework. I also use some plain CSS, but it's minimal.

The requests forms is the only part of the project that requires JavaScript to be enabled. It is needed for parsing some from fields that are a bit complex and for the "captcha", which is a simple Proof of Work that runs on your browser, destinated to avoid spam. For this, I use mCaptcha.

-

@ 39cc53c9:27168656

2025-05-27 09:21:51

@ 39cc53c9:27168656

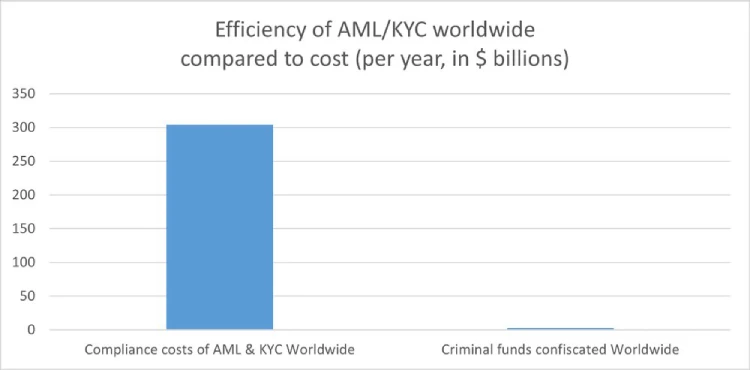

2025-05-27 09:21:51Know Your Customer is a regulation that requires companies of all sizes to verify the identity, suitability, and risks involved with maintaining a business relationship with a customer. Such procedures fit within the broader scope of anti-money laundering (AML) and counterterrorism financing (CTF) regulations.

Banks, exchanges, online business, mail providers, domain registrars... Everyone wants to know who you are before you can even opt for their service. Your personal information is flowing around the internet in the hands of "god-knows-who" and secured by "trust-me-bro military-grade encryption". Once your account is linked to your personal (and verified) identity, tracking you is just as easy as keeping logs on all these platforms.

Rights for Illusions

KYC processes aim to combat terrorist financing, money laundering, and other illicit activities. On the surface, KYC seems like a commendable initiative. I mean, who wouldn't want to halt terrorists and criminals in their tracks?

The logic behind KYC is: "If we mandate every financial service provider to identify their users, it becomes easier to pinpoint and apprehend the malicious actors."

However, terrorists and criminals are not precisely lining up to be identified. They're crafty. They may adopt false identities or find alternative strategies to continue their operations. Far from being outwitted, many times they're several steps ahead of regulations. Realistically, KYC might deter a small fraction – let's say about 1% ^1 – of these malefactors. Yet, the cost? All of us are saddled with the inconvenient process of identification just to use a service.

Under the rhetoric of "ensuring our safety", governments and institutions enact regulations that seem more out of a dystopian novel, gradually taking away our right to privacy.

To illustrate, consider a city where the mayor has rolled out facial recognition cameras in every nook and cranny. A band of criminals, intent on robbing a local store, rolls in with a stolen car, their faces obscured by masks and their bodies cloaked in all-black clothes. Once they've committed the crime and exited the city's boundaries, they switch vehicles and clothes out of the cameras' watchful eyes. The high-tech surveillance? It didn’t manage to identify or trace them. Yet, for every law-abiding citizen who merely wants to drive through the city or do some shopping, their movements and identities are constantly logged. The irony? This invasive tracking impacts all of us, just to catch the 1% ^1 of less-than-careful criminals.

KYC? Not you.

KYC creates barriers to participation in normal economic activity, to supposedly stop criminals. ^2

KYC puts barriers between many users and businesses. One of these comes from the fact that the process often requires multiple forms of identification, proof of address, and sometimes even financial records. For individuals in areas with poor record-keeping, non-recognized legal documents, or those who are unbanked, homeless or transient, obtaining these documents can be challenging, if not impossible.

For people who are not skilled with technology or just don't have access to it, there's also a barrier since KYC procedures are mostly online, leaving them inadvertently excluded.

Another barrier goes for the casual or one-time user, where they might not see the value in undergoing a rigorous KYC process, and these requirements can deter them from using the service altogether.

It also wipes some businesses out of the equation, since for smaller businesses, the costs associated with complying with KYC norms—from the actual process of gathering and submitting documents to potential delays in operations—can be prohibitive in economical and/or technical terms.

You're not welcome

Imagine a swanky new club in town with a strict "members only" sign. You hear the music, you see the lights, and you want in. You step up, ready to join, but suddenly there's a long list of criteria you must meet. After some time, you are finally checking all the boxes. But then the club rejects your membership with no clear reason why. You just weren't accepted. Frustrating, right?

This club scenario isn't too different from the fact that KYC is being used by many businesses as a convenient gatekeeping tool. A perfect excuse based on a "legal" procedure they are obliged to.

Even some exchanges may randomly use this to freeze and block funds from users, claiming these were "flagged" by a cryptic system that inspects the transactions. You are left hostage to their arbitrary decision to let you successfully pass the KYC procedure. If you choose to sidestep their invasive process, they might just hold onto your funds indefinitely.

Your identity has been stolen

KYC data has been found to be for sale on many dark net markets^3. Exchanges may have leaks or hacks, and such leaks contain very sensitive data. We're talking about the full monty: passport or ID scans, proof of address, and even those awkward selfies where you're holding up your ID next to your face. All this data is being left to the mercy of the (mostly) "trust-me-bro" security systems of such companies. Quite scary, isn't it?

As cheap as $10 for 100 documents, with discounts applying for those who buy in bulk, the personal identities of innocent users who passed KYC procedures are for sale. ^3

In short, if you have ever passed the KYC/AML process of a crypto exchange, your privacy is at risk of being compromised, or it might even have already been compromised.

(they) Know Your Coins

You may already know that Bitcoin and most cryptocurrencies have a transparent public blockchain, meaning that all data is shown unencrypted for everyone to see and recorded forever. If you link an address you own to your identity through KYC, for example, by sending an amount from a KYC exchange to it, your Bitcoin is no longer pseudonymous and can then be traced.

If, for instance, you send Bitcoin from such an identified address to another KYC'ed address (say, from a friend), everyone having access to that address-identity link information (exchanges, governments, hackers, etc.) will be able to associate that transaction and know who you are transacting with.

Conclusions

To sum up, KYC does not protect individuals; rather, it's a threat to our privacy, freedom, security and integrity. Sensible information flowing through the internet is thrown into chaos by dubious security measures. It puts borders between many potential customers and businesses, and it helps governments and companies track innocent users. That's the chaos KYC has stirred.

The criminals are using stolen identities from companies that gathered them thanks to these very same regulations that were supposed to combat them. Criminals always know how to circumvent such regulations. In the end, normal people are the most affected by these policies.

The threat that KYC poses to individuals in terms of privacy, security and freedom is not to be neglected. And if we don’t start challenging these systems and questioning their efficacy, we are just one step closer to the dystopian future that is now foreseeable.

Edited 20/03/2024 * Add reference to the 1% statement on Rights for Illusions section to an article where Chainalysis found that only 0.34% of the transaction volume with cryptocurrencies in 2023 was attributable to criminal activity ^1

-

@ 39cc53c9:27168656

2025-05-27 09:21:50

@ 39cc53c9:27168656

2025-05-27 09:21:50Over the past few months, I've dedicated my time to a complete rewrite of the kycnot.me website. The technology stack remains unchanged; Golang paired with TailwindCSS. However, I've made some design choices in this iteration that I believe significantly enhance the site. Particularly to backend code.

UI Improvements

You'll notice a refreshed UI that retains the original concept but has some notable enhancements. The service list view is now more visually engaging, it displays additional information in a more aesthetically pleasing manner. Both filtering and searching functionalities have been optimized for speed and user experience.

Service pages have been also redesigned to highlight key information at the top, with the KYC Level box always accessible. The display of service attributes is now more visually intuitive.

The request form, especially the Captcha, has undergone substantial improvements. The new self-made Captcha is robust, addressing the reliability issues encountered with the previous version.

Terms of Service Summarizer

A significant upgrade is the Terms of Service summarizer/reviewer, now powered by AI (GPT-4-turbo). It efficiently condenses each service's ToS, extracting and presenting critical points, including any warnings. Summaries are updated monthly, processing over 40 ToS pages via the OpenAI API using a self-crafted and thoroughly tested prompt.

Nostr Comments

I've integrated a comment section for each service using Nostr. For guidance on using this feature, visit the dedicated how-to page.

Database

The backend database has transitioned to pocketbase, an open-source Golang backend that has been a pleasure to work with. I maintain an updated fork of the Golang SDK for pocketbase at pluja/pocketbase.

Scoring

The scoring algorithm has also been refined to be more fair. Despite I had considered its removal due to the complexity it adds (it is very difficult to design a fair scoring system), some users highlighted its value, so I kept it. The updated algorithm is available open source.

Listings

Each listing has been re-evaluated, and the ones that were no longer operational were removed. New additions are included, and the backlog of pending services will be addressed progressively, since I still have access to the old database.

API

The API now offers more comprehensive data. For more details, check here.

About Page

The About page has been restructured for brevity and clarity.

Other Changes

Extensive changes have been implemented in the server-side logic, since the whole code base was re-written from the ground up. I may discuss these in a future post, but for now, I consider the current version to be just a bit beyond beta, and additional updates are planned in the coming weeks.

-

@ 527337d5:93e9525e

2025-05-30 10:24:39

@ 527337d5:93e9525e

2025-05-30 10:24:39# Exploring the Niche of Conspiracy Theory Markets: A Probabilistic Approach and Sales Condition Analysis on Japanese Online Flea Markets (Subtitle: Unveiling the Surprising Realities of a Niche Market Through Data Analysis and AI)

(Note: This research analyzes consumer reactions and product characteristics in a specific market based on data. It does not endorse conspiracy theories nor promote or encourage any illegal or fraudulent activities.)

1. Abstract

This study aimed to clarify, from a probabilistic perspective, what combinations of information (topic x manipulation category) tend to attract attention and how pricing strategies affect sales of products marketed towards "conspiracy theorists" on online flea markets in Japan. Using an analogy from drug discovery's structural exploration, this research explored "information combinations" in products that resonate with individuals interested in conspiracy theories. Specifically, products were generated (some with AI assistance) based on defined topic categories (e.g., T1: Technology/Security) and manipulation categories (e.g., M1: Avoidance). The logarithm of the reaction rate (views / (searches + 1)) was used as a score for analysis, and the impact of pricing strategies (e.g., fixed at 5000 JPY, phased discounts) was examined. Results indicated that certain combinations (e.g., T3: Occult/Spiritual - M1: Avoidance) showed relatively high reaction rates. However, the effect of price changes was not uniform, and the total weekly views for this market segment remained around 100-120. Consequently, it was concluded that the scale of this specific market on the online flea market platform is extremely small. Therefore, even with a probabilistic model waiting for "hits" similar to those in certain types of specialized fraud schemes, achieving consistent sales is difficult due to the limited population size. This study serves as a case example of the possibilities and limitations of data-driven approaches in niche markets.

2. Introduction: Conspiracy Theories and Niche Market Potential

2.1. The Spread and Background of Conspiracy Theories in Modern Society

In contemporary society, conspiracy theories are proliferating at an unprecedented rate, facilitated by the internet and social media. These narratives typically allege that secret machinations by powerful individuals or groups lie behind specific events or social phenomena. Themes range испанский large-scale theories like QAnon to those concerning health and medicine. It has been pointed out that the psychology of those who believe in conspiracy theories may be influenced by factors such as anxiety in uncertain situations, a cognitive tendency to seek patterns, or distrust of existing authorities.

2.2. Research Motivation

The starting point for this research was a simple question: "Specialized fraud schemes, often succeed by identifying a very small number of 'susceptible individuals' out of numerous attempts. Might a similar probabilistic structure exist in the sale of products targeting those interested in conspiracy theories?" If so, it was hypothesized that it might be possible to identify which products, under what conditions, would have a higher probability of catching the "target's" eye and attracting interest.

2.3. Purpose of this Study

The purpose of this study is to exploratorily clarify, based on data, how "information combinations" (combinations of topic categories and manipulation categories) and "pricing strategies" of products ostensibly related to conspiracy theories affect user attention (using "reaction rate" as a proxy indicator) in a real-world online flea market environment. Ultimately, it aims to consider the possibilities and limitations of sales strategies in this type of niche market.

3. Research Perspective and Approach: Exploring "Information Combinations"

3.1. Analogy to Drug Discovery

In exploring the characteristics of products that resonate with conspiracy theorists, this study employed an analogy to "structural exploration problems" in drug discovery. In drug development, researchers search for optimal structures with specific effects from countless combinations of chemical structures. Similarly, "products that conspiracy theorists react to" were viewed as a type of "substance with an effect," and the "information combination of a product" (e.g., product theme, appeal points) was considered equivalent to a "chemical structure." Based on this framework, products with various information structures were generated and listed, and their reception was observed to explore more "effective" information structures, i.e., conditions likely to attract attention.

3.2. Balancing Exploration and Exploitation

In the initial research phase, with scarce data on which product combinations would attract attention, it was necessary to efficiently identify promising combinations. Therefore, an approach was adopted that considered the balance between "exploiting" combinations already known to be somewhat popular and "exploring" untried, unknown combinations. This shares a basic conceptual similarity with strategies like Thompson Sampling or the ε-greedy method, known in the field of reinforcement learning, which aim to achieve the best results within a limited number of trials.

4. Research Methodology: Experiments and Data Analysis on an Online Flea Market

4.1. Experimental Field and Period

The experiments for this study were conducted on an anonymous online flea market platform in Japan. The data collection period for individual products was, in principle, one day, and the overall research project spanned approximately one month (late April to late May 2025).

4.2. Product Categorization

To organize and analyze the characteristics of the listed products, they were categorized along the following two axes:

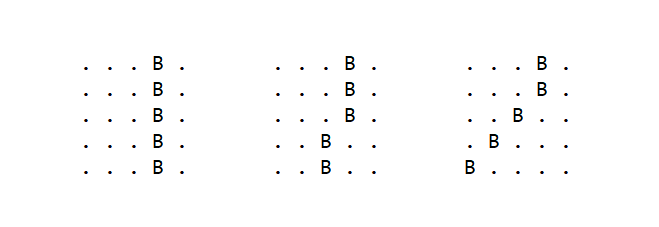

- Table 1: Definition of Main Product Topic Categories (T1-T4) (See Appendix 10.1 for details)

- T1: Technology & Security

- T2: Surveillance, Censorship & Government-Related

- T3: Occult & Spiritual

- T4: Forbidden Books & Knowledge Management

- Table 2: Definition of Product Manipulation Categories (M1-M3) (See Appendix 10.2 for details)

- M1: Avoidance (e.g., avoiding electromagnetic waves)

- M2: Detection (e.g., detecting hidden information)

- M3: Approach/Processing/Amplification (e.g., approaching specific energies, processing information)

4.3. Listing Strategy and Data Collection

- Initial Listing Strategy: Initially, products were selected so that the listing ratio of the T×M combinations (12 in total) would be uniform.

- Sequential Adjustment of Listing Ratios: As data collection progressed, the logarithm of the reaction rate (log(reaction_rate)), a proxy for attention described later, was treated as a likelihood. The listing ratio for each T×M combination was then dynamically changed пропорционально to this value.

- Data Collection Items: Cumulative views (recorded as

watchin this study) and search hits (recorded assearch), updated every 24 hours by the online flea market platform, were manually recorded for each product. Since these figures did not change except at the time of updating, daily recording was sufficient. - Listing Timing: New product listings were consistently made at 21:00 daily to eliminate variations in viewing trends due to time of day.

- Sample Size Criterion: Considering the 12 T×M combinations, a total sample size (number of listed products) of N=100 was considered a benchmark, also factoring in the time and effort of listing. The final analysis included 98 products.

4.4. Scoring of Attention

To measure how much attention users paid to product information, the following indicators were defined:

- Reaction Rate (