-

@ eb0157af:77ab6c55

2025-05-24 07:01:10

@ eb0157af:77ab6c55

2025-05-24 07:01:10A new study reveals: 4 out of 5 Americans would like the US to convert some of its gold into Bitcoin.

A recent survey conducted by the Nakamoto Project revealed that a majority of Americans support converting a portion of the United States’ gold reserves into Bitcoin. The survey, carried out online by Qualtrics between February and March 2025, involved 3,345 participants with demographic characteristics representative of US census standards. Most respondents expressed a desire to convert between 1% and 30% of the gold reserves into BTC.

Troy Cross, co-founder of the Nakamoto Project, stated:

“When given a slider and asked to advise the US government on the right proportion of Bitcoin and gold, subjects were very reluctant to put that slider on 0% Bitcoin and 100% gold. Instead, they settled around 10% Bitcoin.”

One significant finding from the research is the correlation between age and openness to Bitcoin: younger respondents showed a greater inclination toward the cryptocurrency compared to older generations.

A potential US strategy

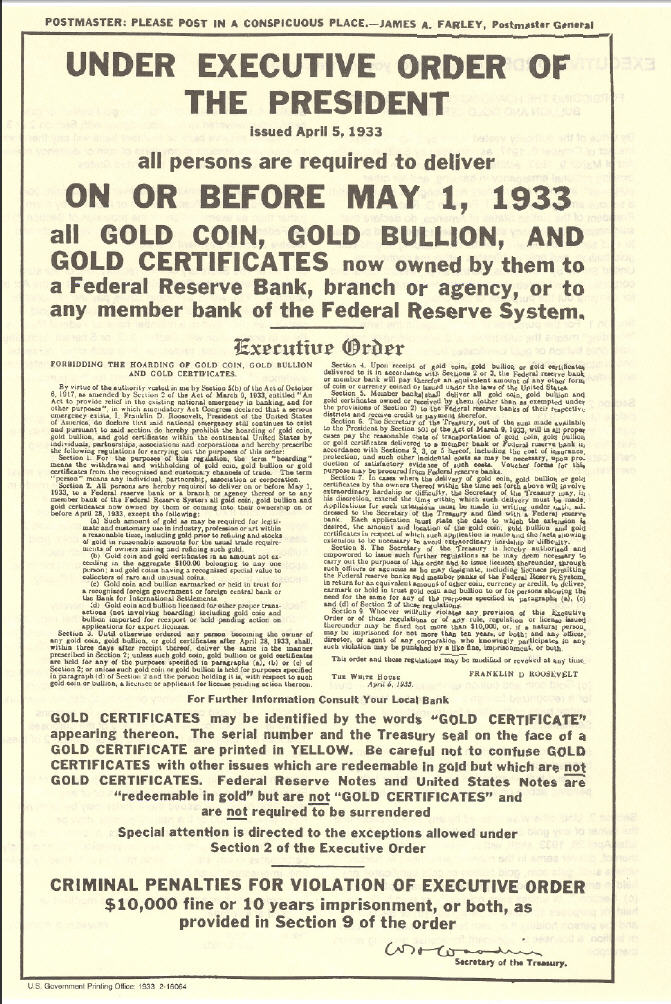

Bo Hines, a White House advisor, is promoting an initiative for the Treasury Department to acquire Bitcoin by selling off a portion of its gold. Under the proposed plan, the government could acquire up to 1 million BTC over the next five years.

To finance these purchases, the government plans to sell Federal Reserve gold certificates. The proposal aligns with Senator Cynthia Lummis’ 2025 Bitcoin Act, which aims to declare Bitcoin a critical national strategic asset.

Currently, the United States holds 8,133 metric tons of gold, valued at over $830 billion, and about 200,000 BTC, valued at $21 billion.

The post The majority in the US wants to convert part of the gold reserves into Bitcoin appeared first on Atlas21.

-

@ 9ca447d2:fbf5a36d

2025-05-24 07:01:35

@ 9ca447d2:fbf5a36d

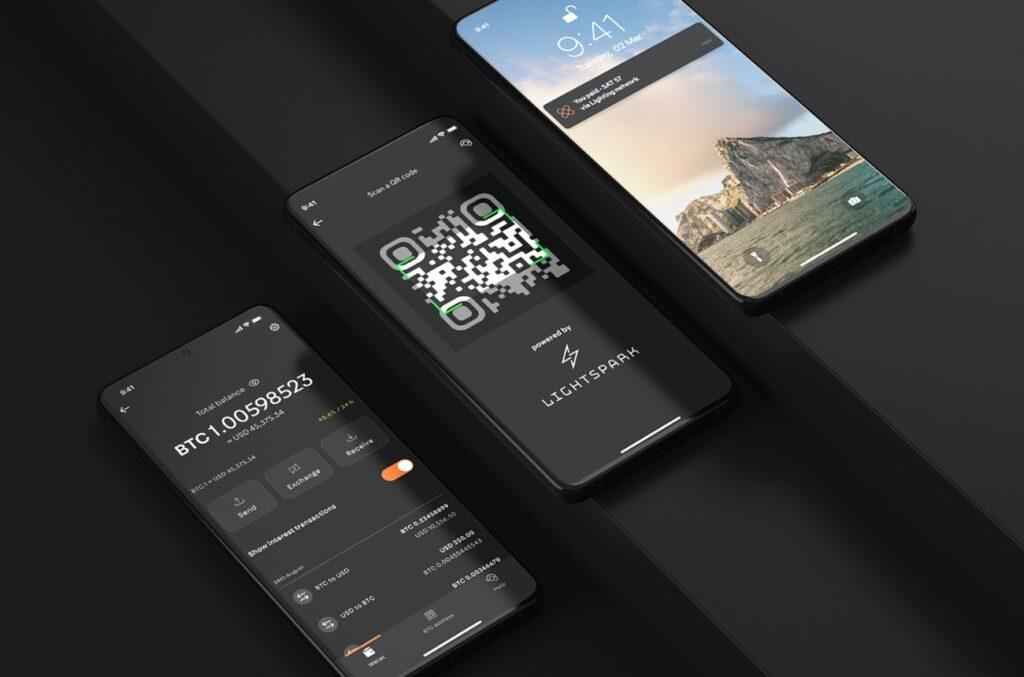

2025-05-24 07:01:35Singapore, May 14, 2025 — NEUTRON, the leading Lightning Network infrastructure provider in Asia, is announcing a new partnership with Cobo, a globally trusted digital asset custody platform.

Through this collaboration, Cobo will integrate Neutron’s Lightning Network API, enabling real-time, cost-effective Bitcoin transactions across its services.

Neutron’s mission is to make the Lightning Network the financial backbone for modern Bitcoin use, bridging traditional finance with Bitcoin’s borderless, decentralized economy.

“We’re thrilled to partner with Cobo, a trusted leader in custodial services, to further accelerate Bitcoin infrastructure across Asia,” said Albert Buu, CEO of Neutron.

“At Neutron, we are committed to providing enterprise businesses with easy and efficient integration into the Lightning Network, enabling next-generation global real-time settlement solutions.

“This partnership will not only drive innovation but also empower businesses across Asia with the fast, secure, and cost-effective benefits of Bitcoin payments.”

Neutron: The Lightning Engine for Bitcoin Adoption

Neutron provides a comprehensive API suite that allows businesses to instantly access the power of the Lightning Network, Bitcoin’s second-layer protocol designed for high-speed, scalable, and low-fee payments.

The integration is part of Neutron’s broader vision to equip forward-thinking institutions with the tools needed to participate in the next generation of Bitcoin utility.

Lightning-Powered Custody for the Next Era of Finance

Cobo’s integration of Neutron’s API gives institutional clients an additional option for BTC settlement, making Lightning Network access more programmable and easier to integrate within their existing systems.

“At Cobo, we’ve built our custody platform to combine uncompromising security with the scalability institutions need to grow,” said Dr. Changhao Jiang, CTO and Co-Founder of Cobo.

“Integrating Neutron’s Lightning Network API allows us to offer real-time, low-cost Bitcoin settlement at scale without compromising on trust or performance. Together, we’re laying the groundwork for faster, more efficient Bitcoin infrastructure across Asia.”

About Neutron

Neutron is Asia’s leading Bitcoin infrastructure company, helping businesses and individuals unlock the power of the Lightning Network, specializing in Lightning-as-a-Service.

nThrough its scalable API platform, mobile app, and lending product, Neutron empowers businesses and individuals to send, receive, save, and build with Bitcoin.

Want to bring Lightning into your product or platform? Reach out to our team at sales@neutron.me or visit us at www.neutron.meAbout Cobo

Cobo is a trusted leader in digital asset custody and wallet infrastructure, providing an all-in-one platform for organizations and developers to easily build, automate, and scale their digital asset businesses securely.

Founded in 2017 by blockchain pioneers and headquartered in Singapore, Cobo is trusted by more than 500 leading digital asset businesses globally, safeguarding billions of dollars in assets.

Today, Cobo offers the industry’s only unified wallet platform that integrates all four digital asset wallet technologies – Custodial Wallets, MPC Wallets, Smart Contract Wallets, and Exchange Wallets.

Committed to the highest security standards and regulatory compliance, Cobo has a zero-incident track record and holds ISO 27001, SOC2 (Type 1 and Type 2) certifications, as well as licenses in multiple jurisdictions.

Recognized for its industry-leading innovations, Cobo has received accolades from prestigious entities such as Hedgeweek and Global Custodian. For more information, please visit www.cobo.com

-

@ eb0157af:77ab6c55

2025-05-24 07:01:09

@ eb0157af:77ab6c55

2025-05-24 07:01:09The exchange reveals the extent of the breach that occurred last December as federal authorities investigate the recent data leak.

Coinbase has disclosed that the personal data of 69,461 users was compromised during the breach in December 2024, according to documentation filed with the Maine Attorney General’s Office.

The disclosure comes after Coinbase announced last week that a group of hackers had demanded a $20 million ransom, threatening to publish the stolen data on the dark web. The attackers allegedly bribed overseas customer service agents to extract information from the company’s systems.

Coinbase had previously stated that the breach affected less than 1% of its user base, compromising KYC (Know Your Customer) data such as names, addresses, and email addresses. In a filing with the U.S. Securities and Exchange Commission (SEC), the company clarified that passwords, private keys, and user funds were not affected.

Following the reports, the SEC has reportedly opened an official investigation to verify whether Coinbase may have inflated user metrics ahead of its 2021 IPO. Separately, the Department of Justice is investigating the breach at Coinbase’s request, according to CEO Brian Armstrong.

Meanwhile, Coinbase has faced criticism for its delayed response to the data breach. Michael Arrington, founder of TechCrunch, stated that the stolen data could cause irreparable harm. In a post on X, Arrington wrote:

“The human cost, denominated in misery, is much larger than the $400m or so they think it will actually cost the company to reimburse people. The consequences to companies who do not adequately protect their customer information should include, without limitation, prison time for executives.”

Coinbase estimates the incident could cost between $180 million and $400 million in remediation expenses and customer reimbursements.

Arrington also condemned KYC laws as ineffective and dangerous, calling on both regulators and companies to better protect user data:

“Combining these KYC laws with corporate profit maximization and lax laws on penalties for hacks like these means these issues will continue to happen. Both governments and corporations need to step up to stop this. As I said, the cost can only be measured in human suffering.”

The post Coinbase: 69,461 users affected by December 2024 data breach appeared first on Atlas21.

-

@ 0e9491aa:ef2adadf

2025-05-24 07:01:14

@ 0e9491aa:ef2adadf

2025-05-24 07:01:14

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 06830f6c:34da40c5

2025-05-24 04:21:03

@ 06830f6c:34da40c5

2025-05-24 04:21:03The evolution of development environments is incredibly rich and complex and reflects a continuous drive towards greater efficiency, consistency, isolation, and collaboration. It's a story of abstracting away complexity and standardizing workflows.

Phase 1: The Bare Metal & Manual Era (Early 1970s - Late 1990s)

-

Direct OS Interaction / Bare Metal Development:

- Description: Developers worked directly on the operating system's command line or a basic text editor. Installation of compilers, interpreters, and libraries was a manual, often arcane process involving downloading archives, compiling from source, and setting environment variables. "Configuration drift" (differences between developer machines) was the norm.

- Tools: Text editors (Vi, Emacs), command-line compilers (GCC), Makefiles.

- Challenges: Extremely high setup time, dependency hell, "works on my machine" syndrome, difficult onboarding for new developers, lack of reproducibility. Version control was primitive (e.g., RCS, SCCS).

-

Integrated Development Environments (IDEs) - Initial Emergence:

- Description: Early IDEs (like Turbo Pascal, Microsoft Visual Basic) began to integrate editors, compilers, debuggers, and sometimes GUI builders into a single application. This was a massive leap in developer convenience.

- Tools: Turbo Pascal, Visual Basic, early Visual Studio versions.

- Advancement: Improved developer productivity, streamlined common tasks. Still relied on local system dependencies.

Phase 2: Towards Dependency Management & Local Reproducibility (Late 1990s - Mid-2000s)

-

Basic Build Tools & Dependency Resolvers (Pre-Package Managers):

- Description: As projects grew, manual dependency tracking became impossible. Tools like Ant (Java) and early versions of

autoconf/makefor C/C++ helped automate the compilation and linking process, managing some dependencies. - Tools: Apache Ant, GNU Autotools.

- Advancement: Automated build processes, rudimentary dependency linking. Still not comprehensive environment management.

- Description: As projects grew, manual dependency tracking became impossible. Tools like Ant (Java) and early versions of

-

Language-Specific Package Managers:

- Description: A significant leap was the emergence of language-specific package managers that could fetch, install, and manage libraries and frameworks declared in a project's manifest file. Examples include Maven (Java), npm (Node.js), pip (Python), RubyGems (Ruby), Composer (PHP).

- Tools: Maven, npm, pip, RubyGems, Composer.

- Advancement: Dramatically simplified dependency resolution, improved intra-project reproducibility.

- Limitation: Managed language-level dependencies, but not system-level dependencies or the underlying OS environment. Conflicts between projects on the same machine (e.g., Project A needs Python 2.7, Project B needs Python 3.9) were common.

Phase 3: Environment Isolation & Portability (Mid-2000s - Early 2010s)

-

Virtual Machines (VMs) for Development:

- Description: To address the "it works on my machine" problem stemming from OS-level and system-level differences, developers started using VMs. Tools like VMware Workstation, VirtualBox, and later Vagrant (which automated VM provisioning) allowed developers to encapsulate an entire OS and its dependencies for a project.

- Tools: VMware, VirtualBox, Vagrant.

- Advancement: Achieved strong isolation and environment reproducibility (a true "single environment" for a project).

- Limitations: Resource-heavy (each VM consumed significant CPU, RAM, disk space), slow to provision and boot, difficult to share large VM images.

-

Early Automation & Provisioning Tools:

- Description: Alongside VMs, configuration management tools started being used to automate environment setup within VMs or on servers. This helped define environments as code, making them more consistent.

- Tools: Chef, Puppet, Ansible.

- Advancement: Automated provisioning, leading to more consistent environments, often used in conjunction with VMs.

Phase 4: The Container Revolution & Orchestration (Early 2010s - Present)

-

Containerization (Docker):

- Description: Docker popularized Linux Containers (LXC), offering a lightweight, portable, and efficient alternative to VMs. Containers package an application and all its dependencies into a self-contained unit that shares the host OS kernel. This drastically reduced resource overhead and startup times compared to VMs.

- Tools: Docker.

- Advancement: Unprecedented consistency from development to production (Dev/Prod Parity), rapid provisioning, highly efficient resource use. Became the de-facto standard for packaging applications.

-

Container Orchestration:

- Description: As microservices and container adoption grew, managing hundreds or thousands of containers became a new challenge. Orchestration platforms automated the deployment, scaling, healing, and networking of containers across clusters of machines.

- Tools: Kubernetes, Docker Swarm, Apache Mesos.

- Advancement: Enabled scalable, resilient, and complex distributed systems development and deployment. The "environment" started encompassing the entire cluster.

Phase 5: Cloud-Native, Serverless & Intelligent Environments (Present - Future)

-

Cloud-Native Development:

- Description: Leveraging cloud services (managed databases, message queues, serverless functions) directly within the development workflow. Developers focus on application logic, offloading infrastructure management to cloud providers. Containers become a key deployment unit in this paradigm.

- Tools: AWS Lambda, Azure Functions, Google Cloud Run, cloud-managed databases.

- Advancement: Reduced operational overhead, increased focus on business logic, highly scalable deployments.

-

Remote Development & Cloud-Based IDEs:

- Description: The full development environment (editor, terminal, debugger, code) can now reside in the cloud, accessed via a thin client or web browser. This means developers can work from any device, anywhere, with powerful cloud resources backing their environment.

- Tools: GitHub Codespaces, Gitpod, AWS Cloud9, VS Code Remote Development.

- Advancement: Instant onboarding, consistent remote environments, access to high-spec machines regardless of local hardware, enhanced security.

-

Declarative & AI-Assisted Environments (The Near Future):

- Description: Development environments will become even more declarative, where developers specify what they need, and AI/automation tools provision and maintain it. AI will proactively identify dependency issues, optimize resource usage, suggest code snippets, and perform automated testing within the environment.

- Tools: Next-gen dev container specifications, AI agents integrated into IDEs and CI/CD pipelines.

- Prediction: Near-zero environment setup time, self-healing environments, proactive problem identification, truly seamless collaboration.

web3 #computing #cloud #devstr

-

-

@ eb0157af:77ab6c55

2025-05-24 07:01:12

@ eb0157af:77ab6c55

2025-05-24 07:01:12Vivek Ramaswamy’s company bets on distressed bitcoin claims as its Bitcoin treasury strategy moves forward.

Strive Enterprises, an asset management firm co-founded by Vivek Ramaswamy, is exploring the acquisition of distressed bitcoin claims, with particular interest in around 75,000 BTC tied to the Mt. Gox bankruptcy estate. This move is part of the company’s broader strategy to build a Bitcoin treasury ahead of its planned merger with Asset Entities.

According to a document filed on May 20 with the Securities and Exchange Commission, Strive has partnered with 117 Castell Advisory Group to “identify and evaluate” distressed Bitcoin claims with confirmed legal judgments. Among these are approximately 75,000 BTC connected to Mt. Gox, with an estimated market value of $8 billion at current prices.

Essentially, Strive aims to acquire rights to bitcoins currently tied up in legal disputes, which can be purchased at a discount by those willing to take on the risk and wait for eventual recovery.

In a post on X, Strive’s CFO, Ben Pham, stated:

“Strive intends to use all available mechanisms, including novel financial strategies not used by other Bitcoin treasury companies, to maximize its exposure to the asset.”

The company also plans to buy cash at a discount by merging with publicly traded companies holding more cash than their stock value, using the excess funds to purchase additional Bitcoin.

Mt. Gox, the exchange that collapsed in 2014, is currently in the process of repaying creditors, with a deadline set for October 31, 2025.

In its SEC filing, Strive declared:

“This strategy is intended to allow Strive the opportunity to purchase Bitcoin exposure at a discount to market price, enhancing Bitcoin per share and supporting its goal of outperforming Bitcoin over the long run.”

At the beginning of May, Strive announced its merger plan with Asset Entities, a deal that would create the first publicly listed asset management firm focused on Bitcoin. The resulting company aims to join the growing number of firms adopting a Bitcoin treasury strategy.

The corporate treasury trend

Strive’s initiative to accumulate bitcoin mirrors that of other companies like Strategy and Japan’s Metaplanet. On May 19, Strategy, led by Michael Saylor, announced the purchase of an additional 7,390 BTC for $764.9 million, raising its total holdings to 576,230 BTC. On the same day, Metaplanet revealed it had acquired another 1,004 BTC, increasing its total to 7,800 BTC.

The post Bitcoin in Strive’s sights: 75,000 BTC from Mt. Gox among its targets appeared first on Atlas21.

-

@ b7274d28:c99628cb

2025-05-24 01:02:32

@ b7274d28:c99628cb

2025-05-24 01:02:32A few months ago, a nostrich was switching from iOS to Android and asked for suggestions for #Nostr apps to try out. nostr:npub18ams6ewn5aj2n3wt2qawzglx9mr4nzksxhvrdc4gzrecw7n5tvjqctp424 offered the following as his response:

nostr:nevent1qvzqqqqqqypzq0mhp4ja8fmy48zuk5p6uy37vtk8tx9dqdwcxm32sy8nsaa8gkeyqydhwumn8ghj7un9d3shjtnwdaehgunsd3jkyuewvdhk6tcpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhszythwden5te0dehhxarj9emkjmn99uqzpwwts6n28eyvjpcwvu5akkwu85eg92dpvgw7cgmpe4czdadqvnv984rl0z

Yes. #Android users are fortunate to have some powerful Nostr apps and tools at our disposal that simply have no comparison over on the iOS side. However, a tool is only as good as the knowledge of the user, who must have an understanding of how best to wield it for maximum effect. This fact was immediately evidenced by replies to Derek asking, "What is the use case for Citrine?" and "This is the first time I'm hearing about Citrine and Pokey. Can you give me links for those?"

Well, consider this tutorial your Nostr starter-kit for Android. We'll go over installing and setting up Amber, Amethyst, Citrine, and Pokey, and as a bonus we'll be throwing in the Zapstore and Coinos to boot. We will assume no previous experience with any of the above, so if you already know all about one or more of these apps, you can feel free to skip that tutorial.

So many apps...

You may be wondering, "Why do I need so many apps to use Nostr?" That's perfectly valid, and the honest answer is, you don't. You can absolutely just install a Nostr client from the Play Store, have it generate your Nostr identity for you, and stick with the default relays already set up in that app. You don't even need to connect a wallet, if you don't want to. However, you won't experience all that Nostr has to offer if that is as far as you go, any more than you would experience all that Italian cuisine has to offer if you only ever try spaghetti.

Nostr is not just one app that does one thing, like Facebook, Twitter, or TikTok. It is an entire ecosystem of applications that are all built on top of a protocol that allows them to be interoperable. This set of tools will help you make the most out of that interoperability, which you will never get from any of the big-tech social platforms. It will provide a solid foundation for you to build upon as you explore more and more of what Nostr has to offer.

So what do these apps do?

Fundamental to everything you do on Nostr is the need to cryptographically sign with your private key. If you aren't sure what that means, just imagine that you had to enter your password every time you hit the "like" button on Facebook, or every time you commented on the latest dank meme. That would get old really fast, right? That's effectively what Nostr requires, but on steroids.

To keep this from being something you manually have to do every 5 seconds when you post a note, react to someone else's note, or add a comment, Nostr apps can store your private key and use it to sign behind the scenes for you. This is very convenient, but it means you are trusting that app to not do anything with your private key that you don't want it to. You are also trusting it to not leak your private key, because anyone who gets their hands on it will be able to post as you, see your private messages, and effectively be you on Nostr. The more apps you give your private key to, the greater your risk that it will eventually be compromised.

Enter #Amber, an application that will store your private key in only one app, and all other compatible Nostr apps can communicate with it to request a signature, without giving any of those other apps access to your private key.

Most Nostr apps for Android now support logging in and signing with Amber, and you can even use it to log into apps on other devices, such as some of the web apps you use on your PC. It's an incredible tool given to us by nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5, and only available for Android users. Those on iPhone are incredibly jealous that they don't have anything comparable, yet.

Speaking of nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5, the next app is also one of his making.

All Nostr data is stored on relays, which are very simple servers that Nostr apps read notes from and write notes to. In most forms of social media, it can be a pain to get your own data out to keep a backup. That's not the case on Nostr. Anyone can run their own relay, either for the sake of backing up their personal notes, or for others to post their notes to, as well.

Since Nostr notes take up very little space, you can actually run a relay on your phone. I have been on Nostr for almost 2 and a half years, and I have 25,000+ notes of various kinds on my relay, and a backup of that full database is just 24MB on my phone's storage.

Having that backup can save your bacon if you try out a new Nostr client and it doesn't find your existing follow list for some reason, so it writes a new one and you suddenly lose all of the people you were following. Just pop into your #Citrine relay, confirm it still has your correct follow list or import it from a recent backup, then have Citrine restore it. Done.

Additionally, there are things you may want to only save to a relay you control, such as draft messages that you aren't ready to post publicly, or eCash tokens, which can actually be saved to Nostr relays now. Citrine can also be used with Amber for signing into certain Nostr applications that use a relay to communicate with Amber.

If you are really adventurous, you can also expose Citrine over Tor to be used as an outbox relay, or used for peer-to-peer private messaging, but that is far more involved than the scope of this tutorial series.

You can't get far in Nostr without a solid and reliable client to interact with. #Amethyst is the client we will be using for this tutorial because there simply isn't another Android client that comes close, so far. Moreover, it can be a great client for new users to get started on, and yet it has a ton of features for power-users to take advantage of as well.

There are plenty of other good clients to check out over time, such as Coracle, YakiHonne, Voyage, Olas, Flotilla and others, but I keep coming back to Amethyst, and by the time you finish this tutorial, I think you'll see why. nostr:npub1gcxzte5zlkncx26j68ez60fzkvtkm9e0vrwdcvsjakxf9mu9qewqlfnj5z and others who have contributed to Amethyst have really built something special in this client, and it just keeps improving with every update that's shipped.

Most social media apps have some form of push notifications, and some Nostr apps do, too. Where the issue comes in is that Nostr apps are all interoperable. If you have more than one application, you're going to have both of them notifying you. Nostr users are known for having five or more Nostr apps that they use regularly. If all of them had notifications turned on, it would be a nightmare. So maybe you limit it to only one of your Nostr apps having notifications turned on, but then you are pretty well locked-in to opening that particular app when you tap on the notification.

Pokey, by nostr:npub1v3tgrwwsv7c6xckyhm5dmluc05jxd4yeqhpxew87chn0kua0tjzqc6yvjh, solves this issue, allowing you to turn notifications off for all of your Nostr apps, and have Pokey handle them all for you. Then, when you tap on a Pokey notification, you can choose which Nostr app to open it in.

Pokey also gives you control over the types of things you want to be notified about. Maybe you don't care about reactions, and you just want to know about zaps, comments, and direct messages. Pokey has you covered. It even supports multiple accounts, so you can get notifications for all the npubs you control.

One of the most unique and incredibly fun aspects of Nostr is the ability to send and receive #zaps. Instead of merely giving someone a 👍️ when you like something they said, you can actually send them real value in the form of sats, small portions of a Bitcoin. There is nothing quite like the experience of receiving your first zap and realizing that someone valued what you said enough to send you a small amount (and sometimes not so small) of #Bitcoin, the best money mankind has ever known.

To be able to have that experience, though, you are going to need a wallet that can send and receive zaps, and preferably one that is easy to connect to Nostr applications. My current preference for that is Alby Hub, but not everyone wants to deal with all that comes along with running a #Lightning node. That being the case, I have opted to use nostr:npub1h2qfjpnxau9k7ja9qkf50043xfpfy8j5v60xsqryef64y44puwnq28w8ch for this tutorial, because they offer one of the easiest wallets to set up, and it connects to most Nostr apps by just copy/pasting a connection string from the settings in the wallet into the settings in your Nostr app of choice.

Additionally, even though #Coinos is a custodial wallet, you can have it automatically transfer any #sats over a specified threshold to a separate wallet, allowing you to mitigate the custodial risk without needing to keep an eye on your balance and make the transfer manually.

Most of us on Android are used to getting all of our mobile apps from one souce: the Google Play Store. That's not possible for this tutorial series. Only one of the apps mentioned above is available in Google's permissioned playground. However, on Android we have the advantage of being able to install whatever we want on our device, just by popping into our settings and flipping a toggle. Indeed, thumbing our noses at big-tech is at the heart of the Nostr ethos, so why would we make ourselves beholden to Google for installing Nostr apps?

The nostr:npub10r8xl2njyepcw2zwv3a6dyufj4e4ajx86hz6v4ehu4gnpupxxp7stjt2p8 is an alternative app store made by nostr:npub1wf4pufsucer5va8g9p0rj5dnhvfeh6d8w0g6eayaep5dhps6rsgs43dgh9 as a resource for all sorts of open-source apps, but especially Nostr apps. What is more, you can log in with Amber, connect a wallet like Coinos, and support the developers of your favorite Nostr apps directly within the #Zapstore by zapping their app releases.

One of the biggest features of the Zapstore is the fact that developers can cryptographically sign their app releases using their Nostr keys, so you know that the app you are downloading is the one they actually released and hasn't been altered in any way. The Zapstore will warn you and won't let you install the app if the signature is invalid.

Getting Started

Since the Zapstore will be the source we use for installing most of the other apps mentioned, we will start with installing the Zapstore.

We will then use the Zapstore to install Amber and set it up with our Nostr account, either by creating a new private key, or by importing one we already have. We'll also use it to log into the Zapstore.

Next, we will install Amethyst from the Zapstore and log into it via Amber.

After this, we will install Citrine from the Zapstore and add it as a local relay on Amethyst.

Because we want to be able to send and receive zaps, we will set up a wallet with CoinOS and connect it to Amethyst and the Zapstore using Nostr Wallet Connect.

Finally, we will install Pokey using the Zapstore, log into it using Amber, and set up the notifications we want to receive.

By the time you are done with this series, you will have a great head-start on your Nostr journey compared to muddling through it all on your own. Moreover, you will have developed a familiarity with how things generally work on Nostr that can be applied to other apps you try out in the future.

Continue to Part 2: Installing the Zapstore. (Coming Soon)

-

@ 611021ea:089a7d0f

2025-05-24 00:00:04

@ 611021ea:089a7d0f

2025-05-24 00:00:04The world of health and fitness data is booming. Users are tracking more aspects of their well-being than ever before, from daily steps and workout intensity to sleep patterns and caloric intake. But for developers looking to build innovative applications on this data, significant hurdles remain: ensuring user privacy, achieving interoperability between different services, and simply managing the complexity of diverse health metrics.

Enter the NIP-101h Health Profile Framework and its companion tools: the HealthNote SDK and the HealthNote API. This ecosystem is designed to empower developers to create next-generation health and fitness applications that are both powerful and privacy-preserving, built on the decentralized and user-centric principles of Nostr.

NIP-101h: A Standardized Language for Health Metrics

At the core of this ecosystem is NIP-101h. It's a Nostr Improvement Proposal that defines a standardized way to represent, store, and share granular health and fitness data. Instead of proprietary data silos, NIP-101h introduces specific Nostr event kinds for individual metrics like weight (kind

1351), height (kind1352), step count (kind1359), and many more.Key features of NIP-101h:

- Granularity: Each piece of health information (e.g., weight, caloric intake) is a distinct Nostr event, allowing for fine-grained control and access.

- User Control: Built on Nostr, the data remains under user control. Users decide what to share, with whom, and on which relays.

- Standardization: Defines common structures for units, timestamps, and metadata, promoting interoperability.

- Extensibility: New metrics can be added as new NIP-101h.X specifications, allowing the framework to evolve.

- Privacy by Design: Encourages the use of NIP-04/NIP-44 for encryption and includes a

consenttag for users to specify data-sharing preferences.

You can explore the full NIP-101h specification and its metric directory in the main project repository.

The HealthNote SDK: Simplifying Client-Side Integration

While NIP-101h provides the "what," the HealthNote SDK provides the "how" for client-side applications. This (currently draft) TypeScript SDK aims to make it trivial for developers to:

- Create & Validate NIP-101h Events: Easily construct well-formed Nostr events for any supported health metric, ensuring they conform to the NIP-101h specification.

- Handle Encryption: Seamlessly integrate with NIP-44 to encrypt sensitive health data before publication.

- Manage Consent: Automatically include appropriate

consenttags (e.g., defaulting toaggregate-only) to respect user preferences. - Publish to Relays: Interact with Nostr relays to publish the user's health data.

- Prepare Data for Analytics: Extract minimal, privacy-preserving "stat-blobs" for use with the HealthNote API.

The SDK's goal is to abstract away the low-level details of Nostr event creation and NIP-101h formatting, letting developers focus on their application's unique features.

The HealthNote API: Powerful Insights, Zero Raw Data Exposure

This is where things get really exciting for developers wanting to build data-driven features. The HealthNote API (detailed in

HealthNote-API.md) is a server-side component designed to provide powerful analytics over aggregated NIP-101h data without ever accessing or exposing individual users' raw, unencrypted metrics.Here's how it achieves this:

- Privacy-Preserving Ingestion: The SDK sends only "stat-blobs" to the API. These blobs contain the numeric value, unit, timestamp, and metric kind, but not the original encrypted content or sensitive user identifiers beyond what's necessary for aggregation.

- Aggregation at its Core: The API's endpoints are designed to return only aggregated data.

GET /trend: Provides time-series data (e.g., average daily step count over the last month).GET /correlate: Computes statistical correlations between two metrics (e.g., does increased activity duration correlate with changes in workout intensity?).GET /distribution: Shows how values for a metric are distributed across the user base.

- Built-in Privacy Techniques:

- k-Anonymity: Ensures that each data point in an aggregated response represents at least 'k' (e.g., 5) distinct users, preventing re-identification.

- Differential Privacy (Optional): Can add statistical noise to query results, further protecting individual data points while preserving overall trends.

- No Raw Data Access for Developers: Developers querying the API receive only these aggregated, anonymized results, perfect for powering charts, dashboards, and trend analysis in their applications.

A Typical Workflow

- A user records a workout in their NIP-101h-compatible fitness app.

- The app uses the HealthNote SDK to create NIP-101h events for metrics like distance, duration, and calories burned. Sensitive data is encrypted.

- The SDK publishes these events to the user's configured Nostr relays.

- The SDK also extracts stat-blobs (e.g.,

{ kind: 1363, value: 5, unit: 'km', ... }) and sends them to the HealthNote API for ingestion, tagged with anaggregate-onlyconsent. - Later, the app (or an authorized third-party service) queries the HealthNote API:

GET /trend?kind=1363&bucket=week&stat=sum. - The API returns a JSON object like:

{"series": [{"date": "2024-W20", "value": 15000}, ...]}showing the total distance run by all consenting users, week by week. This data can directly populate a trend chart.

Benefits for the Ecosystem

- For Users:

- Greater control and ownership of their health data.

- Ability to use a diverse range of interoperable health and fitness apps.

- Confidence that their data can contribute to insights without sacrificing personal privacy.

- For Developers:

- Easier to build sophisticated health and fitness applications without becoming privacy experts or building complex data aggregation pipelines.

- Access to rich, aggregated data for creating compelling user-facing features (trends, benchmarks, correlations).

- Reduced burden of storing and securing sensitive raw health data for analytical purposes.

- Opportunity to participate in an open, interoperable ecosystem.

The Road Ahead

The NIP-101h framework, the HealthNote SDK, and the HealthNote API are foundational pieces for a new generation of health and fitness applications. As these tools mature and gain adoption, we envision a vibrant ecosystem where users can seamlessly move their data between services, and developers can innovate rapidly, all while upholding the highest standards of privacy and user control.

We encourage developers to explore the NIP-101h specifications, experiment with the (upcoming) SDK, and review the HealthNote API design. Your feedback and contributions will be invaluable as we build this privacy-first future for health data.

https://github.com/HealthNoteLabs

-

@ eb0157af:77ab6c55

2025-05-24 07:01:11

@ eb0157af:77ab6c55

2025-05-24 07:01:11According to the ECB Executive Board member, the launch of the digital euro depends on the timing of the EU regulation.

The European Central Bank (ECB) is making progress in preparing for the digital euro. According to Piero Cipollone, ECB Executive Board member and coordinator of the project, the technical phase “is proceeding quickly and on schedule,” but moving to operational implementation still requires political approval of the regulation at the European level.

Speaking at the ‘Voices on the Future’ event organized by Ansa and Asvis, Cipollone outlined a possible timeline:

“If the regulation is approved at the start of 2026 — in the best-case scenario for the European legislative process — we could see the first transactions with the digital euro by mid-2028.”

Cipollone also highlighted Europe’s current dependence on electronic payment systems managed by non-European companies:

“Today in Europe, whenever we don’t use cash, any transaction online or at the supermarket has to go through credit cards, with their fees. The payment system relies on companies that aren’t based in Europe. You can see why it would make sense to have a system fully under our control.”

For the ECB board member, the digital euro would act as a direct alternative to cash in the digital world, working like “a banknote you can spend anywhere in Europe for any purpose.”

The digital euro project is part of the ECB’s broader strategy to strengthen the independence of Europe’s financial system. According to Cipollone and the Central Bank, Europe’s digital currency would be a key step toward greater autonomy in electronic payments, reducing reliance on infrastructure and services outside the European Union.

The post ECB: digital euro by mid-2028, says Cipollone appeared first on Atlas21.

-

@ 86611181:9fc27ad7

2025-05-23 20:31:44

@ 86611181:9fc27ad7

2025-05-23 20:31:44It's time to secure user data in your identity system This post was also published with the Industry Association of Privacy Professionals.

It seems like every day there is a new report of a major personal data breach. In just the past few months, Neiman Marcus, Ticketmaster, Evolve Bank, TeamViewer, Hubspot, and even the IRS have been affected.

The core issue is that user data is commonly spread across multiple systems that are increasingly difficult to fully secure, including database user tables, data warehouses and unstructured documents.

Most enterprises are already running an incredibly secure and hardened identity system to manage customer login and authorization, commonly referred to as a customer identity access management system. Since identity systems manage customer sign-up and sign-in, they typically contain customer names, email addresses, and phone numbers for multifactor authentication. Commercial CIAMs provide extensive logging, threat detection, availability and patch management.

Identity systems are highly secure and already store customers' personally identifiable information, so it stands to reason enterprises should consider identity systems to manage additional PII fields.

Identity systems are designed to store numerous PII fields and mask the fields for other systems. The Liberty Project developed the protocols that became Security Assertion Markup Language 2.0, the architecture at the core of CIAM systems, 20 years ago, when I was its chief technology officer. SAML 2.0 was built so identity data would be fully secure, and opaque tokens would be shared with other systems. Using tokens instead of actual user data is a core feature of identity software that can be used to fully secure user data across applications.

Most modern identity systems support adding additional customer fields, so it is easy to add new fields like Social Security numbers and physical addresses. Almost like a database, some identity systems even support additional tables and images.

A great feature of identity systems is that they often provide a full suite of user interface components for users to register, login and manage their profile fields. Moving fields like Social Security numbers from your database to your identity system means the identity system can fully manage the process of users entering, viewing and editing the field, and your existing application and database become descoped from managing sensitive data.

With sensitive fields fully isolated in an identity system and its user interface components, the identity system can provide for cumbersome and expensive compliance with standards such as the Health Insurance Portability and Accountability Act for medical data and the Payment Card Industry Data Security Standard for payment data, saving the time and effort to achieve similar compliance in your application.

There are, of course, applications that require sensitive data, such as customer service systems and data warehouses. Identity systems use a data distribution standard called System for Cross-domain Identity Management 2.0 to copy user data to other systems. The SCIM is a great standard to help manage compliance such as "right to be forgotten," because it can automatically delete customer data from other systems when a customer record is deleted from the identity system.

When copying customer data from an identity system to another application, consider anonymizing or masking fields. For example, anonymizing a birthdate into an age range when copying a customer record into a data warehouse can descope the data warehouse from containing personal information.

Most enterprises already run an Application Programming Interface Gateway to manage web services between systems. By combining an API Gateway with the identity system's APIs, it becomes very easy to automatically anonymize and mask customer data fields before they are copied into other systems.

A new set of companies including Baffle, Skyflow, and Piiano have introduced services that combine the governance and field management features of an identity system with extensive field masking. Since these systems do not offer the authentication and authorization features of an identity system, it's important to balance the additional features as they introduce an additional threat surface with PII storage and permissions.

PII sprawl is an increasing liability for companies. The most secure, compliant and flexible central data store to manage PII is the existing CIAM and API Gateway infrastructure that enterprises have already deployed.

Move that customer data into your identity system and lock it down. https://peter.layer3.press/articles/3c6912eb-404a-4630-9fe9-fd1bd23cfa64

-

@ e0a24c5c:fa44b1e7

2025-05-23 19:21:04

@ e0a24c5c:fa44b1e7

2025-05-23 19:21:04Ralph Boes – Menschenrechtsaktivist, Philosoph

Ralph Boes zeigt in dem Buch auf, wie wir uns von der Übermacht des Parteienwesens, die zur Entmündigung des Volkes führt, befreien können. Er zeigt, dass schon im Grundgesetz selbst höchst gegenläufige, an seinen freiheitlich-demokratischen Idealen bemessen sogar als verfassungswidrig zu bezeichnende Tendenzen wirken. Und dass diese es sind, die heute in seine Zerstörung führen. Er weist aber auch die Ansatzpunkte auf, durch die der Zerstörung des Grundgesetzes wirkungsvoll begegnet werden kann.

Eintritt frei, Spendentopf

Ralph Boes hat u.a. dafür gesorgt, dass die unmäßigen Sanktionen in Hartz IV 2019 vom Bundesverfassungsgericht für menschenrechts- und verfassungswidrig erklärt wurden. Aktuell setzt er sich für eine Ur-Abstimmung des Volkes über seine Verfassung ein.

-

@ 56f27915:5fee3024

2025-05-23 18:51:08

@ 56f27915:5fee3024

2025-05-23 18:51:08Ralph Boes – Menschenrechtsaktivist, Philosoph, Vorstandsmitglied im Verein Unsere Verfassung e.V.

Ralph Boes zeigt in dem Buch auf, wie wir uns von der Übermacht des Parteienwesens, die zur Entmündigung des Volkes führt, befreien können. Er zeigt, dass schon im Grundgesetz selbst höchst gegenläufige, an seinen freiheitlich-demokratischen Idealen bemessen sogar als verfassungswidrig zu bezeichnende Tendenzen wirken. Und dass diese es sind, die heute in seine Zerstörung führen. Er weist aber auch die Ansatzpunkte auf, durch die der Zerstörung des Grundgesetzes wirkungsvoll begegnet werden kann.

Eintritt frei, Spendentopf

Ralph Boes hat u.a. dafür gesorgt, dass die unmäßigen Sanktionen in Hartz IV 2019 vom Bundesverfassungsgericht für menschenrechts- und verfassungswidrig erklärt wurden. Aktuell setzt er sich für eine Ur-Abstimmung des Volkes über seine Verfassung ein.

-

@ 57d1a264:69f1fee1

2025-05-24 06:07:19

@ 57d1a264:69f1fee1

2025-05-24 06:07:19Definition: when every single person in the chain responsible for shipping a product looks at objectively horrendous design decisions and goes: yup, this looks good to me, release this. Designers, developers, product managers, testers, quality assurance... everyone.

I nominate Peugeot as the first example in this category.

Continue reading at https://grumpy.website/1665

https://stacker.news/items/988044

-

@ eb0157af:77ab6c55

2025-05-24 07:01:05

@ eb0157af:77ab6c55

2025-05-24 07:01:05Michigan lawmakers are unveiling a comprehensive strategy to regulate Bitcoin and cryptocurrencies.

On May 21, Republican Representative Bill Schuette introduced House Bill 4510, a proposal to amend the Michigan Public Employee Retirement System Investment Act. The legislation would allow the state treasurer, currently Rachael Eubanks, to diversify the state’s investments by including cryptocurrencies with an average market capitalization of over $250 million in the past calendar year.

Under current criteria, Bitcoin (BTC) and Ether (ETH) are the only cryptocurrencies that meet these selection standards. The proposal specifies that any investment in digital assets must be made through exchange-traded products (spot ETFs) issued by registered investment companies.

Anti-CBDC legislation

Republican Representative Bryan Posthumus is leading the bipartisan initiative behind the second bill, HB 4511, which establishes protections for cryptocurrency holders. The proposal prohibits Michigan from implementing crypto bans or imposing licensing requirements on digital asset holders.

Another key aspect of the legislation is a ban on state officials from supporting or promoting a potential federal central bank digital currency (CBDC). The definition includes the issuance of memorandums or official statements endorsing CBDC proposals related to testing, adoption, or implementation.

Mining and redevelopment of abandoned sites

The third bill, HB 4512, is a proposal led by Democratic Representative Mike McFall for a bipartisan group. This initiative would establish a Bitcoin mining program allowing operators to use abandoned oil and natural gas sites.

The program calls for the appointment of a supervisor tasked with assessing the site’s remaining productive potential, identifying the last operator, and determining the length of abandonment. Prospective participants would need to submit detailed legal documentation of their organizational structure, demonstrate operational expertise in mining, and provide profitability breakeven estimates for their ventures.

The fourth and final bill, HB 4513, also introduced by the bipartisan group led by McFall, focuses on the fiscal aspect of the HB 4512 initiative. The proposal would amend Michigan’s income tax laws to include proceeds generated from the proposed Bitcoin mining program.

The post Michigan: four bills on pension funds, CBDCs, and mining appeared first on Atlas21.

-

@ 57d1a264:69f1fee1

2025-05-24 05:53:43

@ 57d1a264:69f1fee1

2025-05-24 05:53:43This talks highlights tools for product management, UX design, web development, and content creation to embed accessibility.

Organizations need scalability and consistency in their accessibility work, aligning people, policies, and processes to integrate it across roles. This session highlights tools for product management, UX design, web development, and content creation to embed accessibility. We will explore inclusive personas, design artifacts, design systems, and content strategies to support developers and creators, with real-world examples.

https://www.youtube.com/watch?v=-M2cMLDU4u4

https://stacker.news/items/988041

-

@ 4c96d763:80c3ee30

2025-05-19 20:56:26

@ 4c96d763:80c3ee30

2025-05-19 20:56:26Changes

William Casarin (19):

- dave: add screenshot to readme

- dave: fix image in readme

- columns: remove spamming info logs about writing to cache

- columns: never truncate notes you're replying to

- windows: don't show terminal window

- mention: show username instead of display_name

- chrome: switch from ALPHA to BETA

- ui: make post replies selectable

- dave: include anonymous user identifier in api call

- dave: add trial mode

- dave: fix sidebar click

- dave: nudge avatar when you click

- dave: hide media in dave note previews

- chrome: fix theme persistence

- ui: fix a bunch of missing hover pointers

- Release Notedeck Beta v0.4.0

- release: changelog

- timeline: show media on universe timeline

- clippy: fix lint related to iterator

kernelkind (28):

- add

trust_media_from_pk2method - add hashbrown

- introduce & use

JobPool - introduce JobsCache

- add blurhash dependency

- introduce blur

- note: remove unnecessary derive macros from

NoteAction - propagate

JobsCache ImagePulseTint->PulseAlpha- images: move fetch to fn

- add

TexturesCache - images: make

MediaCacheholdMediaCacheType - images: make promise payload optional to take easily

- post: unnest

- notedeck_ui: move carousel to

note/media.rs - note media: only show full screen when loaded

- note media: unnest full screen media

- pass

NoteActionby value instead of reference - propagate

Imagesto actionbar - add one shot error message

- make

WidgetimplProfilePicmutably - implement blurring

- don't show zap button if no wallet

- display name should wrap

- make styled button toggleable

- method to get current default zap amount

- add

CustomZapView - use

CustomZapView

pushed to notedeck:refs/heads/master

-

@ 5144fe88:9587d5af

2025-05-23 17:01:37

@ 5144fe88:9587d5af

2025-05-23 17:01:37The recent anomalies in the financial market and the frequent occurrence of world trade wars and hot wars have caused the world's political and economic landscape to fluctuate violently. It always feels like the financial crisis is getting closer and closer.

This is a systematic analysis of the possibility of the current global financial crisis by Manus based on Ray Dalio's latest views, US and Japanese economic and financial data, Buffett's investment behavior, and historical financial crises.

Research shows that the current financial system has many preconditions for a crisis, especially debt levels, market valuations, and investor behavior, which show obvious crisis signals. The probability of a financial crisis in the short term (within 6-12 months) is 30%-40%,

in the medium term (within 1-2 years) is 50%-60%,

in the long term (within 2-3 years) is 60%-70%.

Japan's role as the world's largest holder of overseas assets and the largest creditor of the United States is particularly critical. The sharp appreciation of the yen may be a signal of the return of global safe-haven funds, which will become an important precursor to the outbreak of a financial crisis.

Potential conditions for triggering a financial crisis Conditions that have been met 1. High debt levels: The debt-to-GDP ratio of the United States and Japan has reached a record high. 2. Market overvaluation: The ratio of stock market to GDP hits a record high 3. Abnormal investor behavior: Buffett's cash holdings hit a record high, with net selling for 10 consecutive quarters 4. Monetary policy shift: Japan ends negative interest rates, and the Fed ends the rate hike cycle 5. Market concentration is too high: a few technology stocks dominate market performance

Potential trigger points 1. The Bank of Japan further tightens monetary policy, leading to a sharp appreciation of the yen and the return of overseas funds 2. The US debt crisis worsens, and the proportion of interest expenses continues to rise to unsustainable levels 3. The bursting of the technology bubble leads to a collapse in market confidence 4. The trade war further escalates, disrupting global supply chains and economic growth 5. Japan, as the largest creditor of the United States, reduces its holdings of US debt, causing US debt yields to soar

Analysis of the similarities and differences between the current economic environment and the historical financial crisis Debt level comparison Current debt situation • US government debt to GDP ratio: 124.0% (December 2024) • Japanese government debt to GDP ratio: 216.2% (December 2024), historical high 225.8% (March 2021) • US total debt: 36.21 trillion US dollars (May 2025) • Japanese debt/GDP ratio: more than 250%-263% (Japanese Prime Minister’s statement)

Before the 2008 financial crisis • US government debt to GDP ratio: about 64% (2007) • Japanese government debt to GDP ratio: about 175% (2007)

Before the Internet bubble in 2000 • US government debt to GDP ratio: about 55% (1999) • Japanese government debt to GDP ratio: about 130% (1999)

Key differences • The current US debt-to-GDP ratio is nearly twice that before the 2008 crisis • The current Japanese debt-to-GDP ratio is more than 1.2 times that before the 2008 crisis • Global debt levels are generally higher than historical pre-crisis levels • US interest payments are expected to devour 30% of fiscal revenue (Moody's warning)

Monetary policy and interest rate environment

Current situation • US 10-year Treasury yield: about 4.6% (May 2025) • Bank of Japan policy: end negative interest rates and start a rate hike cycle • Bank of Japan's holdings of government bonds: 52%, plans to reduce purchases to 3 trillion yen per month by January-March 2026 • Fed policy: end the rate hike cycle and prepare to cut interest rates

Before the 2008 financial crisis • US 10-year Treasury yield: about 4.5%-5% (2007) • Fed policy: continuous rate hikes from 2004 to 2006, and rate cuts began in 2007 • Bank of Japan policy: maintain ultra-low interest rates

Key differences • Current US interest rates are similar to those before the 2008 crisis, but debt levels are much higher than then • Japan is in the early stages of ending its loose monetary policy, unlike before historical crises • The size of global central bank balance sheets is far greater than at any time in history

Market valuations and investor behavior Current situation • The ratio of stock market value to the size of the US economy: a record high • Buffett's cash holdings: $347 billion (28% of assets), a record high • Market concentration: US stock growth mainly relies on a few technology giants • Investor sentiment: Technology stocks are enthusiastic, but institutional investors are beginning to be cautious

Before the 2008 financial crisis • Buffett's cash holdings: 25% of assets (2005) • Market concentration: Financial and real estate-related stocks performed strongly • Investor sentiment: The real estate market was overheated and subprime products were widely popular

Before the 2000 Internet bubble • Buffett's cash holdings: increased from 1% to 13% (1998) • Market concentration: Internet stocks were extremely highly valued • Investor sentiment: Tech stocks are in a frenzy

Key differences • Buffett's current cash holdings exceed any pre-crisis level in history • Market valuation indicators have reached a record high, exceeding the levels before the 2000 bubble and the 2008 crisis • The current market concentration is higher than any period in history, and a few technology stocks dominate market performance

Safe-haven fund flows and international relations Current situation • The status of the yen: As a safe-haven currency, the appreciation of the yen may indicate a rise in global risk aversion • Trade relations: The United States has imposed tariffs on Japan, which is expected to reduce Japan's GDP growth by 0.3 percentage points in fiscal 2025 • International debt: Japan is one of the largest creditors of the United States

Before historical crises • Before the 2008 crisis: International capital flows to US real estate and financial products • Before the 2000 bubble: International capital flows to US technology stocks

Key differences • Current trade frictions have intensified and the trend of globalization has weakened • Japan's role as the world's largest holder of overseas assets has become more prominent • International debt dependence is higher than any period in history

-

@ eb0157af:77ab6c55

2025-05-24 07:01:03

@ eb0157af:77ab6c55

2025-05-24 07:01:03Banking giants JPMorgan, Bank of America, Citigroup, and Wells Fargo are in talks to develop a unified stablecoin solution.

According to the Wall Street Journal on May 22, some of the largest financial institutions in the United States are exploring the possibility of joining forces to launch a stablecoin.

Subsidiaries of JPMorgan, Bank of America, Citigroup, and Wells Fargo have initiated preliminary discussions for a joint stablecoin issuance, according to sources close to the matter cited by the WSJ. Also at the negotiating table are Early Warning Services, the parent company of the digital payments network Zelle, and the payment network Clearing House.

The talks are reportedly still in the early stages, and any final decision could change depending on regulatory developments and market demand for stablecoins.

Stablecoin regulation

On May 20, the US Senate voted 66 to 32 to advance discussion of the Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act), a specific law to regulate stablecoins. The bill outlines a regulatory framework for stablecoin collateralization and mandates compliance with anti-money laundering rules.

David Sacks, White House crypto advisor, expressed optimism about the bill’s bipartisan approval. However, senior Democratic Party officials intend to amend the bill to include a clause preventing former President Donald Trump and other US officials from profiting from stablecoins.

Demand for stablecoins has increased, with total market capitalization rising to $245 billion from $205 billion at the beginning of the year, a 20% increase.

The post Major US banks consider launching a joint stablecoin appeared first on Atlas21.

-

@ da8b7de1:c0164aee

2025-05-23 16:08:53

@ da8b7de1:c0164aee

2025-05-23 16:08:53Amerikai Nukleáris Fordulat és Pénzügyi hatások

Donald Trump elnök bejelentette, hogy végrehajtási rendeleteket ír alá a nukleáris energia fellendítésére . Ezek célja az új reaktorok engedélyezési folyamatának egyszerűsítése, az üzemanyag-ellátási láncok megerősítése, valamint a hazai ipar támogatása az orosz és kínai nyersanyagfüggőség csökkentése érdekében. A hír hatására az amerikai és globális nukleáris részvények jelentős emelkedést mutattak: az Uránium Energy 11%, a Centrus Energy 19,6%, az Oklo 16%, a Nano Nuclear 15%, a Nu Power 14,1%, a Global X Uranium ETF pedig 9%-kal erősödött . A növekvő energiaigény, különösen a mesterséges intelligencia által hajtott adatközpontok miatt, tovább növeli a nukleáris energia stratégiai szerepét az USA-ban .

Európai és Nemzetközi Nukleáris Fejlemények

Svédország parlamentje elfogadta az új állami támogatási keretrendszert, amely akár 5 000 MW új nukleáris kapacitás beruházását ösztönzi . Az intézkedés célja az áramárak stabilizálása, az ellátásbiztonság növelése és a zöld átmenet támogatása. A program keveri az állami hiteleket és a piaci árgaranciákat (CfD), a projektek finanszírozásában pedig a magántőke is részt vesz. A törvény 2025. augusztus 1-jén lép hatályba, a végrehajtás azonban még EU-jóváhagyásra vár .

Nukleáris Ellátási Lánc és Iparági Konferencia

Május 20–21-én Varsóban rendezték meg az első World Nuclear Supply Chain Conference-t, amelynek célja a globális nukleáris ellátási lánc megerősítése és bővítése . A konferencián elhangzottak szerint az iparág előtt álló kihívás a kapacitás gyors növelése, hiszen a cél a globális nukleáris kapacitás megháromszorozása 2050-ig. A World Nuclear Association legfrissebb elemzése szerint a következő 15 évben akár 2 billió dollár értékű beruházási lehetőség nyílhat a nemzetközi ellátási láncban . A rendezvényen kiemelték az innováció, a lokalizáció és az iparági együttműködés fontosságát, valamint a szállítási és geopolitikai kihívásokat is.

Új Projektek, Technológiai és Piaci Hírek

Az Egyesült Államokban a Tennessee Valley Authority (TVA) benyújtotta az első hivatalos engedélykérelmet egy BWRX-300 típusú kis moduláris reaktor (SMR) építésére a Clinch River telephelyen . Indiában a nukleáris hatóság jóváhagyta a Mahi Banswara Rajasthan Atomerőmű négy új blokkjának helyszínét . Kínában befejeződött a Haiyang 3 atomerőmű gőzturbinájának fő egységeinek telepítése . Belgiumban és Dániában is újraértékelik a nukleáris energia szerepét, míg Brazília Oroszországgal közös SMR-projektet tervez .

Iparági Trendek és Kilátások

A World Nuclear Association és az International Energy Agency (IEA) szerint a globális nukleáris energiatermelés 2025-ben minden korábbinál magasabb szintet érhet el, köszönhetően az új reaktorok üzembe helyezésének és a stabil, alacsony kibocsátású energiaforrások iránti növekvő igénynek . A nukleáris üzemanyag-ellátási lánc megerősítése, az uránbányászat, az átalakítás és a dúsítás bővítése, valamint a szállítási kapacitás fejlesztése mind kulcsfontosságú tényezők lesznek a következő években .

Hivatkozások

reuters.com

investopedia.com

nucnet.org

world-nuclear-news.org

world-nuclear.org -

@ 9ca447d2:fbf5a36d

2025-05-22 14:01:52

@ 9ca447d2:fbf5a36d

2025-05-22 14:01:52Gen Z (those born between 1997 and 2012) are not rushing to stack sats, and Oliver Porter, Founder & CEO of Jippi, understands the challenge better than most. His strategy revolves around adapting Bitcoin education to fit seamlessly into the digital lives of young adults.

“We need to meet them where they are,” Oliver explains. “90% of Gen Z plays games. 70% expect to earn rewards.”

So, what will effectively introduce them to Bitcoin? In Oliver’s mind, the answer is simple: games that don’t feel preachy but still plant the orange pill.

Learn more at Jippi.app

That’s exactly what Jippi is. Based in Austin, Texas, the team has created a mobile augmented reality (AR) game that rewards players in bitcoin and sneakily teaches them why sound money matters.

“It’s Pokémon GO… but for sats,” Oliver puts it succinctly.

Jippi is like Pokemon Go, but for sats

Oliver’s Bitcoin journey, like many in the space, began long before he was ready. A former colleague had tried planting the seed years earlier, handing him a copy of The Bitcoin Standard. But the moment passed.

It wasn’t until the chaos of 2020 when lockdowns hit, printing presses roared, and civil liberties shrank that the message finally landed for him.

“The government got so good at doing reverse Robin Hood,” Oliver explains. “They steal from the working population and reward the rich.”

By 2020, though, the absurdity of the covid hysteria had caused his eyes to be opened and the orange light seemed the best path back to freedom.

He left the UK for Austin “one of the best places for Bitcoiners,” he says, and dove headfirst into the industry, working at Swan for a year before founding Jippi on PlebLab’s accelerator program.

Jippi’s flagship game lets players roam their cities hunting digital creatures, Bitcoin Beasts, tied to real-world locations. Catching them requires answering Bitcoin trivia, and the reward is sats.

No jargon. No hour-long lectures. Just gameplay with sound money principles woven right in.

The model is working. At a recent hackathon in Austin, Jippi beat out 14 other teams to win first place and $15,000 in prize money.

Oliver of Jippi won Top Builder Season 2 — PlebLab on X

“We’re backdooring Bitcoin education,” Oliver admits. “And while we’re at it, encouraging people to get outside and touch grass.”

Not everyone’s been thrilled. When Jippi team members visited one of the more liberal-leaning places in Texas, UT Austin, to test interest in Bitcoin, they found some seriously committed no-coiners on the campus.

“One young woman told me, ‘I would rather die than talk about Bitcoin,'” Oliver recalls, highlighting the cultural resistance that’s built up among younger demographics.

This resistance is backed by hard data. According to Oliver, some of the Bitcoin podcasters they met with in the space to do market research reported that less than 1% of their listeners are from Gen Z and that number is dropping.

“Unless we find a way to capture their interest in a meaningful way, there’s going to be a big problem around trying to sway Gen Z away from the siren call of s***coins and crypto casinos and towards Bitcoin,” Oliver warns.

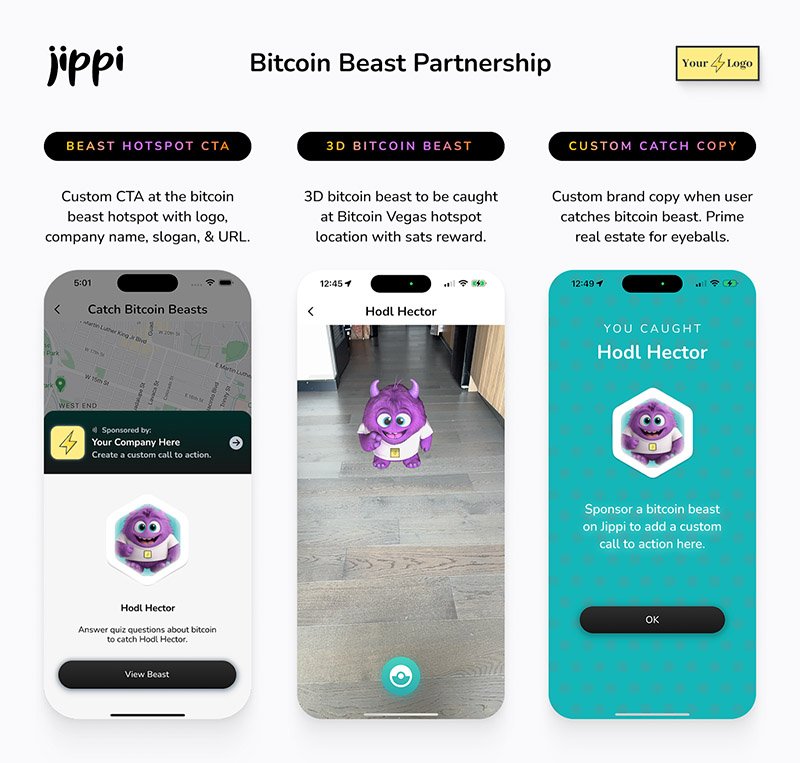

Jippi’s next big move is Las Vegas, where they’ll launch the Beast Catch experience at the Venetian during a major Bitcoin event. To mark the occasion, they’re opening up six limited sponsorship spots for Bitcoin companies, each one tied to a custom in-game beast.

Jippi looks to launch a special event at Bitcoin 2025

“It’s real estate inside the game,” Oliver explains. “Brands become allies, not intrusions. You get a logo, company name, and call to action, so we can push people to your site or app.”

Bitcoin Well—an automatic self-custody Bitcoin platform—has claimed Beast #1. Only five exclusive spots remain for Bitcoin companies to “beastify their brand” through Jippi’s immersive AR game.

“I love the Jippi mission. I think gamified learning is how we will onboard the next generation and it’s exciting to see what the Jippi team is doing! I love working with bitcoiners towards our common mission – bullish!” said Adam O’Brien, Bitcoin Well CEO.

Jippi’s sponsorship model is simple: align incentives, respect users, and support builders. Instead of throwing ad money at tech giants, Bitcoin companies can connect with new users naturally while they’re having fun and earning sats in the process.

For Bitcoin companies looking to reach a younger demographic, this represents a unique opportunity to showcase their brand to up to 30,000 potential customers at the Vegas event.

Jippi Bitcoin Beast partnership

While Jippi’s current focus is simple, get the game into more cities, Oliver sees a future where AR glasses and AI help personalize Bitcoin education even further.

“The magic is going to really happen when Apple releases the glasses form factor,” he says, describing how augmented reality could enhance real-world connections rather than isolate users.

In the longer term, Jippi aims to evolve from a free-to-play model toward a pay-to-play version with higher stakes. Users would form “tribes” with friends to compete for substantial bitcoin prizes, creating social connections along with financial education.

Unlike VC-backed startups, Jippi is raising funds pleb style via Timestamp, an open investment platform for Bitcoin companies.

“You don’t have to be an accredited investor,” Oliver explains. “You’re directly supporting the parallel Bitcoin economy by investing in Bitcoin companies for equity.”

Anyone can invest as little as $100. Perks include early access, exclusive game content, and even creating your own beast design with your name/pseudonym and unique game lore. Each investment comes with direct ownership of an early-stage Bitcoin company like Jippi.

For Oliver, this is more than just a business. It’s about future-proofing Bitcoin adoption and ensuring Satoshi’s vision lives on, especially as many people are lured by altcoins, NFTs, and social media dopamine.

“We’re on the right side of history,” he says firmly. “I want my grandkids to know that early on in the Bitcoin revolution, games like Jippi helped make it stick.”

In a world increasingly absorbed by screens and short attention spans, Jippi’s combination of outdoor play, sats rewards, and Bitcoin education might be exactly the bridge Gen Z needs.

Interested in sponsoring a Beast or investing in Jippi? Reach out to Jippi directly by heading to their partnerships page on their website or visit their Timestamp page to invest in Jippi today.

-

@ 57d1a264:69f1fee1

2025-05-22 13:13:36

@ 57d1a264:69f1fee1

2025-05-22 13:13:36Graphics materials for Bitcoin Knots https://github.com/bitcoinknots branding. See below guide image for reference, a bit cleaner and scalable:

Font family "Aileron" is provided free for personal and commercial use, and can be found here: https://www.1001fonts.com/aileron-font.html

Source: https://github.com/Blissmode/bitcoinknots-gfx/tree/main

https://stacker.news/items/986624

-

@ dfa02707:41ca50e3

2025-05-24 07:00:54

@ dfa02707:41ca50e3

2025-05-24 07:00:54News

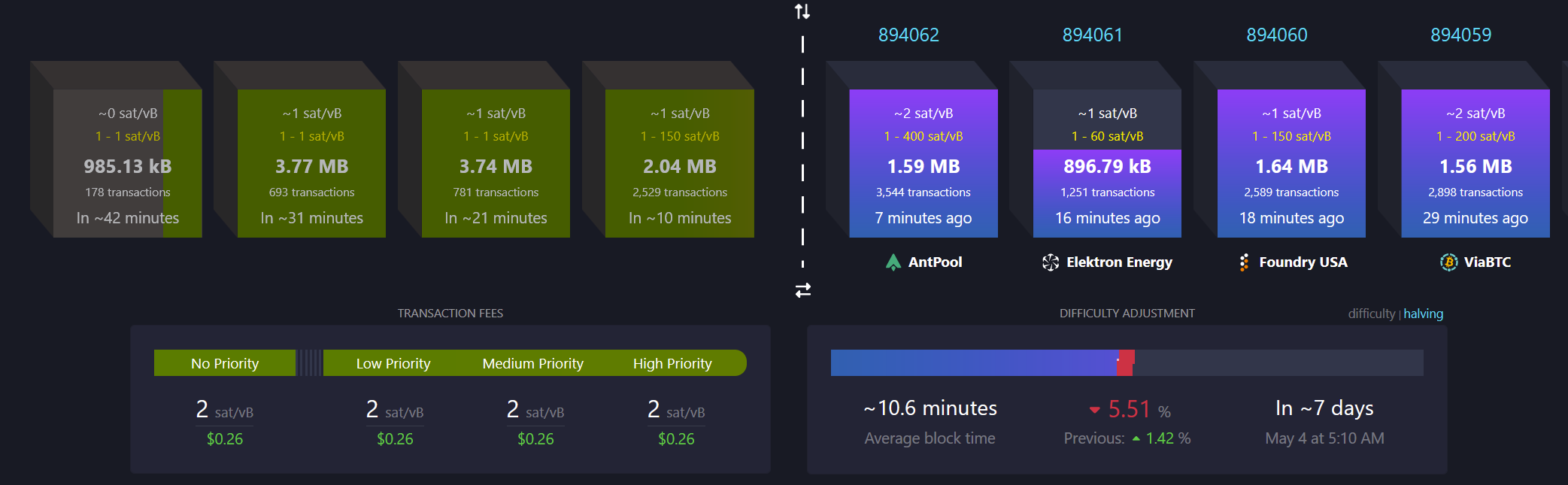

- Bitcoin mining centralization in 2025. According to a blog post by b10c, Bitcoin mining was at its most decentralized in May 2017, with another favorable period from 2019 to 2022. However, starting in 2023, mining has become increasingly centralized, particularly due to the influence of large pools like Foundry and the use of proxy pooling by entities such as AntPool.

Source: b10c's blog.

- OpenSats announces the eleventh wave of Nostr grants. The five projects in this wave are the mobile live-streaming app Swae, the Nostr-over-ham-radio project HAMSTR, Vertex—a Web-of-Trust (WOT) service for Nostr developers, Nostr Double Ratchet for end-to-end encrypted messaging, and the Nostr Game Engine for building games and applications integrated with the Nostr ecosystem.

- New Spiral grantee: l0rinc. In February 2024, l0rinc transitioned to full-time work on Bitcoin Core. His efforts focus on performance benchmarking and optimizations, enhancing code quality, conducting code reviews, reducing block download times, optimizing memory usage, and refactoring code.

- Project Eleven offers 1 BTC to break Bitcoin's cryptography with a quantum computer. The quantum computing research organization has introduced the Q-Day Prize, a global challenge that offers 1 BTC to the first team capable of breaking an elliptic curve cryptographic (ECC) key using Shor’s algorithm on a quantum computer. The prize will be awarded to the first team to successfully accomplish this breakthrough by April 5, 2026.

- Unchained has launched the Bitcoin Legacy Project. The initiative seeks to advance the Bitcoin ecosystem through a bitcoin-native donor-advised fund platform (DAF), investments in community hubs, support for education and open-source development, and a commitment to long-term sustainability with transparent annual reporting.

- In its first year, the program will provide support to Bitcoin hubs in Nashville, Austin, and Denver.

- Support also includes $50,000 to the Bitcoin Policy Institute, a $150,000 commitment at the University of Austin, and up to $250,000 in research grants through the Bitcoin Scholars program.

"Unchained will match grants 1:1 made to partner organizations who support Bitcoin Core development when made through the Unchained-powered bitcoin DAF, up to 1 BTC," was stated in a blog post.

- Block launched open-source tools for Bitcoin treasury management. These include a dashboard for managing corporate bitcoin holdings and provides a real-time BTC-to-USD price quote API, released as part of the Block Open Source initiative. The company’s own instance of the bitcoin holdings dashboard is available here.

Source: block.xyz

- Bull Bitcoin expands to Mexico, enabling anyone in the country to receive pesos from anywhere in the world straight from a Bitcoin wallet. Additionally, users can now buy Bitcoin with a Mexican bank account.

"Bull Bitcoin strongly believes in Bitcoin’s economic potential in Mexico, not only for international remittances and tourism, but also for Mexican individuals and companies to reclaim their financial sovereignty and protect their wealth from inflation and the fragility of traditional financial markets," said Francis Pouliot, Founder and CEO of Bull Bitcoin.

- Corporate bitcoin holdings hit a record high in Q1 2025. According to Bitwise, public companies' adoption of Bitcoin has hit an all-time high. In Q1 2025, these firms collectively hold over 688,000 BTC, marking a 16.11% increase from the previous quarter. This amount represents 3.28% of Bitcoin's fixed 21 million supply.

Source: Bitwise.

- The Bitcoin Bond Company for institutions has launched with the aim of acquiring $1 trillion in Bitcoin over 21 years. It utilizes secure, transparent, and compliant bond-like products backed by Bitcoin.

- The U.S. Senate confirmed Paul Atkins as Chair of the Securities and Exchange Commission (SEC). At his confirmation hearing, Atkins emphasized the need for a clear framework for digital assets. He aims to collaborate with the CFTC and Congress to address jurisdiction and rulemaking gaps, aligning with the Trump administration's goal to position the U.S. as a leader in Bitcoin and blockchain finance.

- Ethereum developer Virgil Griffith has been released from custody. Griffith, whose sentence was reduced to 56 months, is now seeking a pardon. He was initially sentenced to 63 months for allegedly violating international sanctions laws by providing technical advice on using cryptocurrencies and blockchain technology to evade sanctions during a presentation titled 'Blockchains for Peace' in North Korea.

- No-KYC exchange eXch to close down under money laundering scrutiny. The privacy-focused cryptocurrency trading platform said it will cease operations on May 1. This decision follows allegations that the platform was used by North Korea's Lazarus Group for money laundering. eXch revealed it is the subject of an active "transatlantic operation" aimed at shutting down the platform and prosecuting its team for "money laundering and terrorism."

- Blockstream combats ESP32 FUD concerning Jade signers. The company stated that after reviewing the vulnerability disclosed in early March, Jade was found to be secure. Espressif Systems, the designer of the ESP32, has since clarified that the "undocumented commands" do not constitute a "backdoor."

- Bank of America is lobbying for regulations that favor banks over tech firms in stablecoin issuance. The bank's CEO Brian Moynihan is working with groups such as the American Bankers Association to advance the issuance of a fully reserved, 1:1 backed "Bank of America coin." If successful, this could limit stablecoin efforts by non-banks like Tether, Circle, and others, reports The Block.

- Tether to back OCEAN Pool with its hashrate. "As a company committed to financial freedom and open access, we see supporting decentralization in Bitcoin mining as essential to the network’s long-term integrity," said Tether CEO Paolo Ardoino.

- Bitdeer to expand its self-mining operations to navigate tariffs. The Singapore-based mining company is advancing plans to produce machines in the U.S. while reducing its mining hardware sales. This response is in light of increasing uncertainties related to U.S. trade policy, as reported by Bloomberg.