-

@ edeb837b:ac664163

2025-06-13 21:15:05

@ edeb837b:ac664163

2025-06-13 21:15:05On June 10th, 2025, four members of the NVSTly team traveled to New York City to attend the 2025 American Business Awards® ceremony, held at the iconic Marriott Marquis in Times Square. It was an unforgettable night as we accepted the Gold Stevie® Award for Tech Startup of the Year—this time, in person.

Meow (left), rich (center), MartyOooit (right)

Representing NVSTly at the event were:

- Rich, CEO & Founder

- Meow, CTO, Lead Developer, & Co-Founder

- MartyOooit, Investor

- Noob, Market Analyst (not shown in photos)

MartyOooit (left), rich (center), Meow (right)

While we shared the exciting news back in April when the winners were announced, being there in person alongside other winners—including eBay, AT&T, T-Mobile, HP Inc., and Fidelity Investments—made the achievement feel even more surreal. To be honored alongside billion-dollar industry leaders was a proud and humbling moment for our startup and a huge milestone in NVSTly’s journey.

🎤 Team Interview at the Event

During the event, our team was interviewed about the win. When asked:

“What does winning a Stevie Award mean for your organization?”

“How will winning a Stevie Award help your organization?”Here’s what we had to say:

📺 Watch the video

A Big Win for Retail Traders

NVSTly was awarded Gold for Tech Startup of the Year in recognition of our work building a powerful, free social investing platform that empowers retail traders with transparency, analytics, and community-driven tools.

Unlike traditional finance platforms, NVSTly gives users the ability to:

- Share and track trades in real time

- Follow and receive alerts from top traders

- Compete on global leaderboards

- Access deep stats like win rate, average return, and more

Whether you're a beginner or experienced trader, NVSTly gives you the insights and tools typically reserved for hedge funds—but in a free, social format built for the modern investor.

Continued Recognition and Momentum

This award adds to a growing list of recognition for NVSTly:

- 🏆 People’s Choice Winner at the 2024 Benzinga Fintech Awards

- 🔁 Nominated again for Best Social Investing Product in the 2025 Benzinga Fintech Awards

- 🌟 Team members JustCoreGames and Lunaster are nominated for Employee of the Year (Information Technology – Social Media) in the 2025 Stevie® Awards for Technology Excellence

We’re beyond proud of what our small but mighty team has accomplished—and we’re just getting started. 🚀

Thanks to the Stevie Awards for an incredible night in New York, and to our community of 50,000+ traders who’ve helped shape NVSTly into what it is today.

This win is yours, too.Stay tuned—more big things are coming.

— Team NVSTly

The event brought together some of the most respected names in tech, finance, and business. -

@ 0403c86a:66d3a378

2025-06-13 12:55:09

@ 0403c86a:66d3a378

2025-06-13 12:55:09Exciting news for FOOTBALL fans ⚽! Global Sports Central 🌐 is teaming up with Predyx, a leading prediction market in the Bitcoin ecosystem, to bring you comprehensive coverage of the very first Club World Cup directly on Nostr. This partnership is all about enhancing your experience with the latest news, insights, and interactive features!

The Club World Cup will showcase the best clubs from around the globe, and with our collaboration, you’ll be fully engaged in the action. Predyx focuses on long-term outcomes, allowing you to make predictions on who will win it all. Plus, if you’re not happy with your predictions, you can sell your shares at any time and switch allegiance—after all, it’s a free market!

What You Can Expect:

-

Latest News and Match Reports: Stay updated with the latest news, in-depth match reports, and insights from the tournament, ensuring you never miss a moment.

-

Market Odds Tracking: Follow the shifts in market odds in real-time, giving you the edge when making predictions and engaging with the action.

-

Player of the Day Card: Celebrate standout performances with our Daily Player of the Day card, highlighting the top players from the tournament.

-

Game oN Frontpage: Each day, we’ll feature the frontpage of the day, showcasing the most historical matchups and capturing the feel of the game.

-

Best Moments Replays: Relive the excitement with replays of the best moments from the Cup, so you can catch all the highlights and unforgettable plays.

-

Long-Term Predictions: Engage with Predyx to forecast who will win the tournament and who will take home the MVP award, allowing you to make strategic predictions as the tournament unfolds.

-

Easy Login System: Getting started is a breeze! All you need is a Lightning wallet to log in and participate, making it simple for everyone to join in on the fun.

-

Lightning-Fast Bitcoin Payments: With the Lightning Network, placing your bets and making predictions is faster and easier than ever. Enjoy seamless transactions while you cheer for your favorite teams!

"Predyx is excited to be part of this innovative partnership," said Derek. "We’re bringing fans a new way to interact with the game they love, all while using the fast and secure Lightning Network."

Predyx is a Bitcoin-native prediction market platform running on the Lightning Network. We’re building the fastest, most trust-minimized betting engine in the world — no deposits, instant payouts, sats-native, and degen-friendly.

Global Sports Central 🌐 Your daily spin around the sports world 🔄 Stay in the loop with the latest scores, stories, and stats.

GSC360 - Where Every Angle Matters

-

-

@ b1ddb4d7:471244e7

2025-06-13 07:02:19

@ b1ddb4d7:471244e7

2025-06-13 07:02:19Jason Lowery’s thesis, Softwar: A Novel Theory on Power Projection and the National Strategic Significance of Bitcoin, reframes bitcoin not merely as digital cash but as a transformative security technology with profound implications for investors and nation-states alike.

For centuries, craft brewers understood that true innovation balanced tradition with experimentation—a delicate dance between established techniques and bold new flavors.

Much like the craft beer revolution reshaped a global industry, bitcoin represents a fundamental recalibration of how humans organize value and project power in the digital age.

The Antler in the Digital Forest: Power Projection

Lowery, a U.S. Space Force officer and MIT scholar, anchors his Softwar theory in a biological metaphor: Bitcoin as humanity’s “digital antler.” In nature, antlers allow animals like deer to compete for resources through non-lethal contests—sparring matches where power is demonstrated without fatal consequences. This contrasts sharply with wolves, who must resort to violent, potentially deadly fights to establish hierarchy.

The Human Power Dilemma: Historically, humans projected power and settled resource disputes through physical force—wars, seizures, or coercive control of assets. Even modern financial systems rely on abstract power structures: court orders, bank freezes, or government sanctions enforced by legal threat rather than immediate physical reality.

Lowery argues this creates inherent fragility: abstract systems can collapse when met with superior physical force (e.g., invasions, revolutions). Nature only respects physical power.

Bitcoin’s Physical Power Engine: Bitcoin introduces a novel solution through its proof-of-work consensus mechanism. Miners compete to solve computationally intense cryptographic puzzles, expending real-world energy (megawatts) to validate transactions and secure the network.

This process converts electricity—a tangible, physical resource—into digital security and immutable property rights. Winning a “block” is like winning a sparring match: it consumes significant resources (energy/cost) but is non-destructive.

The miner gains the right to write the next page of the ledger and collect rewards, but no participant is physically harmed, and no external infrastructure is destroyed.

Table: Traditional vs. Bitcoin-Based Power Systems

Power System

Mechanism

Key Vulnerability

Resource Cost

Traditional (Fiat/Banking)

Legal abstraction, threat of state force

Centralized points of failure, corruption, political change

Low immediate cost, high systemic risk

Military/Economic Coercion

Physical force, sanctions

Escalation, collateral damage, moral hazard

Very high (lives, capital, instability)

Bitcoin (Proof-of-Work)

Competition via energy expenditure

High energy cost, concentration risk (mining)

High energy cost, low systemic risk

Softwar Theory National Strategic Imperative: Governments Are Taking Notice

Lowery’s Softwar Theory has moved beyond academia into the corridors of power, shaping U.S. national strategy:

- The Strategic Bitcoin Reserve: Vice President JD Vance recently framed bitcoin as an instrument projecting American values—”innovation, entrepreneurship, freedom, and lack of censorship”. State legislation is now underway to implement this reserve, preventing easy reversal by future administrations.

- Regulatory Transformation: The SEC is shifting from an “enforcement-first” stance under previous leadership. New initiatives include:

- Repealing Staff Accounting Bulletin 121 (SAB 121), which discouraged banks from custodying digital currency by forcing unfavorable balance sheet treatment.

- Creating the Cyber and Emerging Technologies Unit (CETU) to develop clearer crypto registration/disclosure rules.

The Investor’s Lens: Scarcity, Security, and Asymmetric Opportunity

For investors, understanding “Softwar” validates bitcoin’s unique value proposition beyond price speculation:

-

Digital Scarcity as Strategic Depth: Bitcoin’s fixed supply of 21 million makes it the only digital asset with truly inelastic supply, a programmed scarcity immune to political whims or central bank printing.

This “scarcity imperative” acts as a natural antidote to global fiat debasement. As central banks expanded money supplies aggressively (Global M2), bitcoin’s price has shown strong correlation, acting as a pressure valve for inflation concerns. The quadrennial “halving” (latest: April 2024) mechanically reduces new supply, creating built-in supply shocks as adoption grows. * The Antifragile Security Feedback Loop: Bitcoin’s security isn’t static; it’s antifragile. The network strengthens through demand: * More users → More transactions → Higher fees → More miner revenue → More hashpower (computational security) → Greater network resilience → More user confidence.

This self-reinforcing cycle contrasts sharply with traditional systems, where security is a cost center (e.g., bank security budgets, military spending). Bitcoin turns security into a profitable, market-driven activity. * Institutionalization Without Centralization: While institutional ownership via ETFs (like BlackRock’s IBIT) and corporate treasuries (MicroStrategy, Metaplanet) has surged, supply remains highly decentralized.Individuals still hold the largest share of bitcoin, preventing a dangerous concentration of control. Spot Bitcoin ETFs alone are projected to see over $20 billion in net inflows in 2025, demonstrating robust institutional capital allocation.

The Bitcoin Community: Building the Digital Antler’s Resilience

Lowery’s “Softwar” theory underscores why bitcoin’s decentralized architecture is non-negotiable. Its strength lies in the alignment of incentives across three participant groups:

- Miners: Provide computational power (hashrate), validating transactions and securing the network. Incentivized by block rewards (newly minted BTC) and transaction fees. Their physical energy expenditure is the “muscle” behind the digital antler.

- Nodes: Independently verify and enforce the protocol rules, maintaining the blockchain’s integrity. Run by users, businesses, and enthusiasts globally. They ensure decentralized consensus, preventing unilateral protocol changes.

- Users: Individuals, institutions, and corporations holding, transacting, or building on bitcoin. Their demand drives transaction fees and fuels the security feedback loop.

This structure creates “Mutually Assured Preservation”. Attacking bitcoin requires overwhelming its global, distributed physical infrastructure (miners/nodes), a feat far more complex and costly than seizing a central bank’s gold vault or freezing a bank’s assets. It transforms financial security from a centralized liability into a decentralized, physically-grounded asset.

Risks & Responsibilities

Investors and policymakers must acknowledge persistent challenges:

- Volatility: Bitcoin remains volatile, though this has decreased as markets mature. Dollar-cost averaging (DCA) is widely recommended to mitigate timing risk.

- Regulatory Uncertainty: While U.S. policy is increasingly favorable, global coordination is lacking. The EU’s MiCAR regulation exemplifies divergent approaches.

- Security & Custody: While Bitcoin’s protocol is robust, user errors (lost keys) or exchange hacks remain risks.

- Environmental Debate: Proof-of-Work energy use is scrutinized, though mining increasingly uses stranded energy/renewables. Innovations continue.

Jason Lowery’s “Softwar” theory elevates bitcoin from a financial instrument to a socio-technological innovation on par with the invention of the corporation, the rule of law, or even the antler in evolutionary biology. It provides a coherent framework for understanding why:

- Nations like the U.S. are looking to establish bitcoin reserves and embracing stablecoins—they recognize bitcoin’s role in projecting economic power non-violently in the digital age.

- Institutional Investors are allocating billions via ETFs—they see a scarce, secure, uncorrelated asset with antifragile properties.

- Individuals in hyperinflationary economies or under authoritarian regimes use bitcoin—it offers self-sovereign wealth storage immune to seizure or debasement.

For the investor, bitcoin represents more than potential price appreciation. It offers exposure to a fundamental reorganization of how power and value are secured and exchanged globally, grounded not in abstract promises, but in the unyielding laws of physics and mathematics.

Like the brewers who balanced tradition with innovation to create something enduring and valuable, bitcoin pioneers are building the infrastructure for a more resilient digital future—one computationally secured block at a time. The “Softwar” is here, and it is reshaping the landscape of p

-

@ b1ddb4d7:471244e7

2025-06-13 06:01:13

@ b1ddb4d7:471244e7

2025-06-13 06:01:13Paris, France – June 6, 2025 – Flash, the easiest Bitcoin payment gateway for businesses, just announced a new partnership with the Bitcoin Only Brewery, marking the first-ever beverage company to leverage Flash for seamless Bitcoin payments.

Bitcoin Buys Beer Thanks to Flash!

As Co-Founder of Flash, it's not every day we get to toast to a truly refreshing milestone.

Okay, jokes aside.

We're super buzzed to see our friends at @Drink_B0B

Bitcoin Only Brewery using Flash to power their online sales!The first… pic.twitter.com/G7TWhy50pX

— Pierre Corbin (@CierrePorbin) June 3, 2025

Flash enables Bitcoin Only Brewery to offer its “BOB” beer with, no-KYC (Know Your Customer) delivery across Europe, priced at 19,500 sats (~$18) for the 4-pack – shipping included.

The cans feature colorful Bitcoin artwork while the contents promise a hazy pale ale: “Each 33cl can contains a smooth, creamy mouthfeel, hazy appearance and refreshing Pale Ale at 5% ABV,” reads the product description.

Pierre Corbin, Co-Founder of Flash, commented: “Currently, bitcoin is used more as a store of value but usage for payments is picking up. Thanks to new innovation on Lightning, bitcoin is ready to go mainstream for e-commerce sales.”

Flash, launched its 2.0 version in March 2025 with the goal to provide the easiest Bitcoin payment gateway for businesses worldwide. The platform is non-custodial and can enable both digital and physical shops to accept Bitcoin by connecting their own wallets to Flash.

By leveraging the scalability of the Lightning Network, Flash ensures instant, low-cost transactions, addressing on-chain Bitcoin bottlenecks like high fees and long wait times.

Bitcoin payment usage is growing thanks to Lightning

In May, fast-food chain Steak ‘N Shake went viral for integrating bitcoin at their restaurants around the world. In the same month, the bitcoin2025 conference in Las Vegas set a new world record with 4,000 Lightning payments in one day.

According to a report by River Intelligence, public Lightning payment volume surged by 266% from August 2023 to August 2024. This growth is also reflected in the overall accessibility of lighting infrastructure for consumers. According to Lightning Service Provider Breez, over 650 Million users now have access to the Lightning Network through apps like CashApp, Kraken or Strike.

Bitcoin Only Brewery’s adoption of Flash reflects the growing trend of businesses integrating Bitcoin payments to cater to a global, privacy-conscious customer base. By offering no-KYC delivery across Europe, the brewery aligns with the ethos of decentralization and financial sovereignty, appealing to the increasing number of consumers and businesses embracing Bitcoin as a legitimate payment method.

“Flash is committed to driving innovation in the Bitcoin ecosystem,” Corbin added. “We’re building a future where businesses of all sizes can seamlessly integrate Bitcoin payments, unlocking new opportunities in the global market. It’s never been easier to start selling in bitcoin and we invite retailers globally to join us in this revolution.”

For businesses interested in adopting Bitcoin payments, Flash offers a straightforward onboarding process, low fees, and robust support for both digital and physical goods. To learn more, visit paywithflash.com.

About Flash

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

About Bitcoin Only Brewery

Bitcoin Only Brewery (@Drink_B0B) is a pioneering beverage company dedicated to the Bitcoin ethos, offering high-quality beers payable exclusively in Bitcoin. With a commitment to personal privacy, the brewery delivers across Europe with no-KYC requirements.

Media Contact:

Pierre Corbin

Co-Founder, Flash

Email: press@paywithflash.com

Website: paywithflash.comPhotos paywithflash.com/about/pressHow Flash Enables Interoperable, Self-Custodial Bitcoin Commerce

-

@ df478568:2a951e67

2025-06-12 18:58:48

@ df478568:2a951e67

2025-06-12 18:58:48How To Mine Your Own Vanity Nostr Key

note. This article works best on https://habla.news/u/marc@primal.net/how-to-mine-a-nostr-vanity-key-with-rana

Rana is a vanity npub generator.

I'll show you how to use it on Ubuntu.

If you're not Linux ninja and use Windows instead of Linux ninja weapons, you can still use Linux with Virtualbox, free ans open source virtualization software. Head over to

https://www.virtualbox.org/ to learn more. They also have an enterprise business if you need that sort of thing, you can learn more at https://shop.oracle.com/

Rana is a nostr vanity key mining program. The source code can be found here.

Rana Is On GitHub

https://github.com/grunch/rana

Since rana already has pretty good docs, I decided to make a video instead of write about this because It's easier to see rana in action than it is to write about Rana. I went off on some tangents, so I might edit this down later, but I hope it helps you mine your own nostr key.

nevent1qqsfk7a000m8zc3ptsuu4vytepqc9eedceclpt2ns9pzlech5cpaflceng5al

Show Notes

https://github.com/grunch/rana

https://virtualbox.org/

https://doc.rust-lang.org/cargo/getting-started/installation.html

cargo run --release -- --vanity-n-prefix=juxtap0se

☮️

nostr:npub1marc26z8nh3xkj5rcx7ufkatvx6ueqhp5vfw9v5teq26z254renshtf3g0

-

@ a296b972:e5a7a2e8

2025-06-12 12:36:22

@ a296b972:e5a7a2e8

2025-06-12 12:36:22Europa sitzt in einem Demokratie-Simulator. Auf die Scheiben im Cockpit werden Bilder projiziert, die nicht der Realität entsprechen, und es gibt immer noch zu viele Menschen, die diese Simulation nicht erkannt haben.

Nichts wäre erstrebenswerter, als über eine positive Entwicklung, hin zur Vernunft und realitätsbezogenen, auf Tatsachen beruhenden Entscheidungen, berichten zu können. Die Frage ist, ob nicht zuerst unentwegt auf Missstände hingewiesen werden muss, um weitere Menschen dazu zu bewegen, sich denjenigen anzuschließen, die offensichtlich an Indoktrinationsintoleranz leiden.

Wer sich vor Hofberichterstattung und die tägliche Fahrt durch die Gehirnwaschanlage schützen will, der meidet den öffentlich-rechtlichen Unfug und die einschlägigen Käseblätter, die vielleicht noch halbwegs dazu geeignet sind, den Fisch auf dem Markt einzuschlagen, um ihn nach Hause zu tragen, vorausgesetzt, man kann ihn sich noch leisten.

Die Neuen Medien liefern die Informationen, die man sonst im „Qualitäts-Mainstream“ nicht finden kann, was nicht verwundert, denn infiltriert von willigen Erfüllungsgehilfen, die Angst um ihr Prestige und ihre Stellung haben, kann man hier keine freie Berichterstattung erwarten.

Beste Unterhaltung bietet auch die Bundespressekonferenz-Show, auf die schon näher eingegangen wurde. Offizieller Regierungssprech in höchster Perfektion. Ob man dort wirklich davon überzeugt ist, dass es irgendjemanden gibt, der diesen Verlautbarungen Glauben schenkt? Was hat Tante Käthe immer gesagt: G E L D L O C K T I M M E R !

Was also tun? Die Neuen Medien auch noch meiden, und sich vor dem blanken Wahnsinn schützen, in dem man ihn ignoriert, was jedoch nicht bewirkt, dass er nicht mehr da wäre.

Temporäre Abstinenz tut auch hier gut, allerdings ist der Wiedereinstieg so ähnlich, wie der erste Arbeitstag nach einem zweimonatigen Urlaub, falls man nicht in seinem Lieblings-Job gelandet ist.

Und was, wenn die Irren vollends durchdrehen, und man bekommt es nicht mit? Schön, ändern kann man vielleicht wenig, aber man kann sich vielleicht noch eine richtig gute, edle Flasche Rotwein kaufen, und die am Vorabend des Untergangs genießen, oder noch schnell einen Baum pflanzen.

Hier ein Beispiel für jemanden, dessen besonderer Blick sehr an den Universal-Gesundheits-Klima-Hysteriker erinnert:

https\://rumble.com/v6umjdj-respekt-und-anerkennung-deutscher-general-lobt-ukrainische-angriffe-in-russ.html

Wie sieht der Alltag aus, wenn man sich einmal nicht mit den Informationen über Dauer- Bekloppte beschäftigt?

Wenn sich ein Besuch in der nächst größeren Stadt nicht vermeiden lässt, sieht man vor allem gehetzte Menschen, viele mit einem finsteren Blick, anders, als früher.

Viele zahlen mit Karte oder ihrem Handy, Kleckerbeträge. „Zahlen Sie noch bar, oder schon mit Überwachung?“, wünschte man sich, dass die Verkäuferinnen den Kunden fragen würden. Tun sie aber nicht.

Die Menschen scheinen keine Ahnung zu haben, was auf sie zukommt. Im Oktober soll der digitale Euro eingeführt werden, natürlich zuerst nur freiwillig. Was das bedeutet, kennt man ja schon. Freiwilligkeit durch das Schaffen eines Raumes, in dem der Zwang in der Luft hängt, wie damals der Kohlenstaub im Ruhrgebiet. Es wird die persönliche ID vorangetrieben, mit einem Wallet, das die Anonymität und die persönliche Freiheit immer mehr aushöhlen will.

Europa soll unter einen Demokratie-Schutzschirm gestellt werden, der zu nichts anderem dient, als dass diejenigen, die derzeit glauben zu wissen, was gut für die Menschen ist, ihre kruden Vorstellungen auch durchsetzen können. Zweifelhaft, was in den USA vorgeht, was da gerade mit Palantir, natürlich nur zur Sicherheit der Amerikaner, so im Hintergrund schon anläuft. Hierzu gibt es interessante Informationen von Regenauer und Tögel. Einziger Hoffnungsschimmer, besonders für Deutschland: Das klappt sowieso nicht. In den hintersten Bergdörfern in den italienischen Alpen gibt es Glasfaseranschluss, und fährt man in Deutschland auf’s Land, reiht sich Funkloch an Funkloch.

Die wirklich wichtige und große Frage ist, wie können sich Gemeinschaften, die diesen Irrsinn nicht mitmachen wollen, weitgehend aus dem System ausklinken? Bitcoin ist ein erster Schritt zur finanziellen Unabhängigkeit. Eine regionale Lebensmittelversorgung, mit nicht verseuchten, genunmanipulierten, mit Schadstoffen weitgehend unbelasteten Produkten entwickelt sich ebenfalls schon sehr gut. Was, wenn der Zugang zu Informationen über das Internet von einer Anmeldung mit persönlicher ID abhängt und man will und hat keine? Was ist mit Dokumenten, wenn man verreisen oder das Land verlassen will? Was ist, wenn man krank wird und auf das noch vorhandene Rest-Gesundheitssystem angewiesen ist? Was, wenn das Unternehmen seine Mitarbeiter auf staatliche Anweisung zu etwas zwingen muss, was der Mitarbeiter vielleicht gar nicht will, er aber auf das Einkommen angewiesen ist?

Das alles sind Fragen, zu denen es schwer ist, auch in den Neuen Medien, passende Antworten zu finden. Die würden in der Tat Hoffnung machen, dass es ein Schlupfloch gibt, sich, wenn vielleicht auch mit Einschränkungen, den „demokratischen“ Verhältnissen, auf denen nur noch Demokratie draufsteht, aber sehr wenig bis keine Demokratie mehr drin ist, so weit es geht zu entziehen. Sachdienliche Hinweise gerne in der Kommentarfunktion.

Oder ist es „gesünder“, sich zurückzuziehen, die Klappe zu halten und dafür zu sorgen, dass man unter dem Radar bleibt? Diese Gabe ist leider nicht jedem gegeben. Besonders nicht denen, die einen ausgeprägten Wahrheitssinn und ein starkes Gerechtigkeitsgefühl haben.

Menschen die andere belügen, die werden geliebt. Menschen, die anderen sagen, dass sie belogen werden, die werden gehasst.

„Die Wahrheit ist dem Menschen zumutbar.“ (Ingeborg Bachmann)

„Kein Mensch hat das Recht zu gehorchen.“ (Hannah Ahrendt)

“Dieser Beitrag wurde mit dem Pareto-Client geschrieben.”

* *

(Bild von pixabay)

-

@ 6be5cc06:5259daf0

2025-06-12 01:18:11

@ 6be5cc06:5259daf0

2025-06-12 01:18:11Introdução

O princípio do sola scriptura, pedra angular da teologia protestante desde a Reforma do século XVI, estabelece que apenas a Escritura constitui a autoridade final e suprema em questões de fé e prática cristã. Este princípio, formulado inicialmente por Martinho Lutero e sistematizado pelos reformadores subsequentes, pretende oferecer um fundamento epistemológico sólido para a teologia, livre das supostas corrupções da tradição eclesiástica.

Contudo, uma análise rigorosa revela que o sola scriptura incorre em contradições lógicas fundamentais que comprometem sua viabilidade como sistema epistemológico coerente. Este artigo examina essas contradições através de três perspectivas complementares: filosófica, exegética e histórica.

A Contradição Performativa Fundamental

O Problema da Autorreferência

O sola scriptura enfrenta um dilema epistemológico insuperável: afirma que apenas a Escritura possui autoridade final em matéria de fé, mas essa própria regra não é explicitamente ensinada na Escritura. Trata-se de uma contradição performativa clássica, onde o enunciado viola suas próprias condições de possibilidade.

Esta situação configura uma falácia de petitio principii (círculo vicioso), pois exige que se aceite uma doutrina que não pode ser sustentada pelas premissas do próprio sistema. Para estabelecer o sola scriptura, seria necessário recorrer a uma autoridade externa à Escritura – precisamente aquilo que o princípio pretende rejeitar.

Fundacionalismo Mal Estruturado

Do ponto de vista epistemológico, o sola scriptura apresenta-se como um fundacionalismo defeituoso. Pretende funcionar como axioma supremo e auto-evidente, mas falha ao não fornecer a base textual que sua própria metodologia exige. Um verdadeiro fundacionalismo escriturístico deveria ser capaz de demonstrar sua validade através de uma prova explícita nas próprias Escrituras.

O Testemunho Contrário das Escrituras

Limitações do Registro Escrito

A própria Escritura reconhece as limitações do registro textual. João 21:25 declara explicitamente: "Jesus fez também muitas outras coisas. Se cada uma delas fosse escrita, penso que nem mesmo no mundo inteiro haveria espaço suficiente para os livros que seriam escritos."

Este versículo é particularmente problemático para o sola scriptura, pois reconhece que nem todos os ensinamentos de Cristo foram preservados por escrito. Como pode a Escritura ser suficiente se ela própria admite sua incompletude?

A Valorização da Tradição Oral

Paulo, em 2 Tessalonicenses 2:15, oferece uma instrução que contradiz frontalmente o sola scriptura: "Assim, pois, irmãos, ficai firmes e conservai os ensinamentos que de nós aprendestes, seja por palavras, seja por carta nossa."

O apóstolo valoriza inequivocamente tanto a tradição oral ("por palavras") quanto a escrita ("por carta"), estabelecendo um modelo de autoridade dual que o protestantismo posterior rejeitaria.

A Necessidade de Autoridade Interpretativa

A narrativa do eunuco etíope em Atos 8:30-31 demonstra a inadequação da Escritura isolada como autoridade final. Quando Filipe pergunta se o eunuco entende o que lê, a resposta é reveladora: "Como poderei entender, se alguém não me ensinar?"

Este episódio ilustra que a mera posse do texto bíblico não garante compreensão adequada. É necessária uma autoridade interpretativa externa – no caso, representada por Filipe, que age com autoridade apostólica.

A Complexidade Hermenêutica

Pedro, em sua segunda epístola (3:16-17), reconhece a dificuldade interpretativa inerente às Escrituras: "Suas cartas contêm algumas coisas difíceis de entender, as quais os ignorantes e instáveis torcem, como também o fazem com as demais Escrituras, para a própria destruição deles."

Esta passagem não apenas reconhece a complexidade hermenêutica dos textos sagrados, mas também alerta sobre os perigos da interpretação inadequada. Implicitamente, sugere a necessidade de uma autoridade interpretativa confiável para evitar distorções doutrinárias.

O Paradoxo Histórico da Canonização

A Dependência da Tradição Eclesiástica

Um dos argumentos mais devastadores contra o sola scriptura emerge da própria história da formação do cânon bíblico. Os concílios de Hipona (393 d.C.) e Cartago (397 d.C.) foram responsáveis pela definição oficial do cânon das Escrituras tal como conhecemos hoje.

Este fato histórico cria um paradoxo insuperável: aceitar a Bíblia como autoridade única requer aceitar a autoridade da tradição eclesiástica que a definiu. O próprio cânon bíblico é produto da tradição apostólica e da deliberação conciliar, não de autodefinição escriturística.

A Circularidade da Autopistia

Tentativas protestantes de resolver este dilema através do conceito de "autopistia" – a suposta capacidade das Escrituras de se auto-autenticar – apenas aprofundam o problema circular. Como determinar que as Escrituras possuem esta propriedade sem recorrer a critérios externos? A própria doutrina da autopistia não é explicitamente ensinada na Escritura.

Implicações Teológicas e Epistemológicas

A Fragmentação Interpretativa

A história do protestantismo oferece evidência empírica das consequências práticas do sola scriptura. A multiplicação de denominações e interpretações divergentes sugere que o princípio, longe de fornecer clareza doutrinária, pode na verdade contribuir para a fragmentação teológica.

Se a Escritura fosse verdadeiramente suficiente e auto-interpretativa, seria razoável esperar maior convergência hermenêutica entre aqueles que aderem ao sola scriptura. A realidade histórica sugere o contrário.

A Alternativa Católica e Ortodoxa

As tradições católica e ortodoxa, embora enfrentando suas próprias tensões epistemológicas, mantêm pelo menos coerência interna ao reconhecer explicitamente múltiplas fontes complementares de autoridade: Escritura, Tradição e Magistério (no caso católico) ou Escritura e Tradição (no caso ortodoxo).

Estas posições evitam a contradição performativa do sola scriptura ao não reivindicar que sua própria metodologia epistemológica seja derivada exclusivamente da Escritura.

Conclusão

A análise crítica do sola scriptura revela contradições estruturais que comprometem fundamentalmente sua viabilidade como princípio epistemológico. O princípio incorre em contradição performativa ao estabelecer uma regra que não pode ser derivada de suas próprias premissas, configura um fundacionalismo mal estruturado ao carecer de base textual explícita, e enfrenta o testemunho contrário da própria Escritura, que reconhece suas limitações e a necessidade de autoridades interpretativas externas.

O paradoxo histórico da canonização – onde o próprio cânon bíblico depende da autoridade tradicional que o sola scriptura pretende rejeitar – representa talvez o golpe mais decisivo contra o princípio protestante.

Isso não implica necessariamente a falsidade do protestantismo como sistema teológico, mas sugere que seus fundamentos epistemológicos requerem reformulação substancial. Uma teologia protestante intelectualmente honesta precisaria reconhecer as limitações do sola scriptura e desenvolver uma epistemologia mais nuançada que leve em conta a complexidade das fontes de autoridade religiosa.

A busca pela verdade teológica, independentemente de compromissos confessionais, exige o reconhecimento rigoroso das limitações e contradições inerentes aos nossos sistemas epistemológicos. No caso do sola scriptura, essa honestidade intelectual revela um princípio que, por mais central que seja para a identidade protestante, não pode sustentar o peso epistemológico que tradicionalmente lhe foi atribuído.

-

@ 5627e59c:d484729e

2025-06-11 22:09:02

@ 5627e59c:d484729e

2025-06-11 22:09:02In een zee van mogelijkheden\ Kunnen we best veel tijd aan dromen besteden

Dromen is een universele taal\ Het wordt gedaan door ons allemaal

Het is het woord\ Dat deze gelijkheid de grond in boort

-

@ f0fd6902:a2fbaaab

2025-06-14 09:53:11

@ f0fd6902:a2fbaaab

2025-06-14 09:53:11As much as they look like teddy bears, they are not bear cousins. These marsupials are more closely related to wombats. Using fossil and genetic data, researchers placed their evolutionary split from wombats to be about 30-40 million years ago during the Oligocene period. Both of these animals belong to the suborder Vombatiformes. Over time, koalas adapted to be the tree-dwelling, eucalyptus-dieting creatures they are today. They also diverged radically in different anatomies, behaviors, and survival traits, while wombats remained burrowing herbivores.

https://stacker.news/items/1006112

-

@ 5627e59c:d484729e

2025-06-11 22:08:40

@ 5627e59c:d484729e

2025-06-11 22:08:40Machtig water\ Door velen bemind

Element van beweging\ Vormgever aan land\ Bondgenoot van wind

Voorkomer van comfort\ Toelater van rust

Machtig water\ Waar ik ook ga\ Ik weet dat jij de grond onder mijn voeten kust

-

@ 5627e59c:d484729e

2025-06-11 21:12:27

@ 5627e59c:d484729e

2025-06-11 21:12:27In het hart van een gepensioneerde operazangeres ontstond een stemmetje. Het stemmetje klonk verrast. "He," ging het hart. "Ik heb een stemmetje gekregen! Hoe kan dit? Kan iemand me horen? Zouden mijn gedachten me kunnen horen?" vroeg het stemmetje, niet wetend aan wie. Want de gedachten hoorden het niet. Zij waren zo druk bezig met het verleden en hadden een grote angst dit te verliezen. "Weet je nog?" gingen de gedachten. "Voor duizenden mensen heb ik gezongen! Avond na avond! Tienduizenden mensen hebben me toegejuicht! Wat waren ze onder de indruk! Luister! Ik kan het nog steeds!" "He," ging het hart. "Hoor je me dan niet? Het ging toch helemaal niet om dat gejuich. Weet je dan niet meer hoe ik me volledig bloot gaf aan die mensen. Mijn diepste en meest persoonlijke verhalen waren te horen in mijn liederen. Daar draaide het toch om? De mensen waren niet enkel onder de indruk. Hun harten hebben mijn verhalen gevoeld en konden zo kennis geven aan hun gedachten. Is dat niet wat echt telde?" Maar de gedachten waren volop aan het zingen voor de ene persoon die ze konden vinden die wou luisteren. "He," ging het hart. "Ook in dit moment zijn mijn liederen te horen door vele gedachten en te voelen door vele harten over de hele wereld. Heb ik dan geen rust verdiend? Kan ik niet even genieten van de rust die in dit moment te vinden is, maar jullie van me afnemen?" Maar de gedachten waren nog steeds volop aan het zingen.

-

@ dd664d5e:5633d319

2025-06-14 07:24:03

@ dd664d5e:5633d319

2025-06-14 07:24:03The importance of being lindy

I've been thinking about what Vitor said about #Amethyst living on extended time. And thinking. And doing a bit more thinking...

It's a valid point. Why does Amethyst (or, analog, #Damus) still exist? Why is it as popular as it is? Shouldn't they be quickly washed-away by power-funded corporate offerings or highly-polished, blackbox-coded apps?

Because a lot of people trust them to read the code, that's why. The same way that they trust Michael to read it and they trust me to test it. And, perhaps more importantly, they trust us to not deliver corrupted code. Intentionally, or inadvertently.

The developer's main job will not be coding the commit, it will be reviewing and approving the PR.

As AI -- which all developers now use, to some extent, if they are planning on remaining in the business -- becomes more efficient and effective at writing the code, the effort shifts to evaluating and curating what it writes. That makes software code a commodity, and commodities are rated according to brand.

Most of us don't want to make our own shampoo, for instance. Rather, we go to the store and select the brand that we're used to. We have learned, over the years, that this brand won't kill us and does the job we expect it to do. Offloading the decision of Which shampoo? to a brand is worth some of our time and money, which is why strong, reliable brands can charge a premium and are difficult to dislodge.

Even people, like myself, who can read the code from many common programming languages, do not have the time, energy, or interest to read through thousands of lines of Kotlin, Golang, or Typescript or -- God forbid -- C++, from repos we are not actively working on. And asking AI to analyze the code for you leaves you trusting the AI to have a conscience and be virtuous, and may you have fun with that.

The software is no longer the brand. The feature set alone isn't enough. And the manner in which it is written, or the tools it was written with, are largely irrelevant. The thing that matters most is Who approved this version?

The Era of Software Judges has arrived

And that has always been the thing that mattered most, really.

That's why software inertia is a real thing and that's why it's going to still be worth it to train up junior devs. Those devs will be trained up to be moral actors, specializing in reviewing and testing code and confirming its adherance to the project's ethical standards. Because those standards aren't universal; they're nuanced and edge cases will need to be carefully weighed and judged and evaluated and analysed. It will not be enough to add Don't be evil. to the command prompt and call it a day.

So, we shall need judges and advocates, and we must train them up, in the way they shall go.

-

@ b1ddb4d7:471244e7

2025-06-14 09:01:06

@ b1ddb4d7:471244e7

2025-06-14 09:01:06Square, the payments platform operated by Block (founded by Jack Dorsey), is reporting 9.7% bitcoin yield on its bitcoin holdings by running a Lightning Network node.

The announcement was made by Miles Suter, Bitcoin product lead at Block, during the Bitcoin 2025 conference in Las Vegas. Suter explained that Square is earning “real bitcoin from our holdings” by efficiently routing payments across the Lightning Network.

Square’s yield comes from its role as a Lightning service provider, a business it launched two years ago to boost liquidity and efficiency on the Lightning Network. According to Lightning Labs’ Ryan Gentry, Square’s 9% yield could translate to roughly $1 million in annual revenue.

The Lightning Network, a Bitcoin layer-2 protocol, has long been promoted as a solution to Bitcoin’s scalability and transaction speed issues. It enables micropayments and off-chain transactions, reducing congestion on the main blockchain. However, the network faces challenges, including the need for inbound liquidity—users must lock up BTC to receive BTC—potentially limiting participation by smaller nodes and raising concerns about decentralization.

Despite these hurdles, Square remains committed to advancing Bitcoin payments via Lightning. Suter revealed that 25% of Square’s outbound bitcoin transactions now use the Lightning Network. The company is actively testing Lightning-based payments at the Bitcoin 2025 event and plans to roll out the service to all eligible Square merchants by 2026.

Suter emphasized the transformative potential of Lightning:

“When you enable real payments by making them faster and more convenient, the network becomes stronger, smarter, and more beneficial. So if you’re questioning whether bitcoin is merely an asset, the response is no. It has already evolved into both an asset and a protocol, and now Block is spearheading the initiative to transform it into the world’s premier payment system.”

Square’s ongoing investment in Lightning signals its belief in Bitcoin’s future not just as a store of value, but as a global payments protocol.

-

@ 5627e59c:d484729e

2025-06-11 21:08:10

@ 5627e59c:d484729e

2025-06-11 21:08:10I am the space\ In which your experience takes place

You could never meet me\ For I hold no identity

The only way to really see me\ Is to be me

-

@ 5627e59c:d484729e

2025-06-11 21:07:41

@ 5627e59c:d484729e

2025-06-11 21:07:41Love, I thank you for your warmth\ Ever lifting

You keep me charmed\ Ever drifting

May I be me\ And you be you

In a perfect harmony\ Embracing all life makes us grow through

-

@ 044da344:073a8a0e

2025-06-14 08:56:18

@ 044da344:073a8a0e

2025-06-14 08:56:18Meine Karriere als Auftragsforscher neigt sich ihrem Ende entgegen. In zwei Wochen ist der Forschungsverbund „Das mediale Erbe der DDR“ Geschichte. Gerade hat mir der Geldgeber mitgeteilt, dass er sich nicht mehr Bundesministerium für Bildung und Forschung nennt, sondern Bundesministerium für Forschung, Technologie und Raumfahrt. BMFTR statt BMBF. Bitte, sehr geehrte Damen und Herren, verwenden Sie ab sofort nur noch das neue Logo. Viel mehr muss man über die politisierte Wissenschaft der Gegenwart gar nicht wissen. Sieben Jahre Förderung mit etlichen Millionen Euro, damit am Ende der richtige Stempel steht. Es soll mir keiner erzählen, dass das den Nachwuchs nicht formt.

Ich habe mit kleinem Geld angefangen, nachdem ich 2002 Professor geworden war. An der LMU in München hatte ich eigentlich alles, was ich brauchte. Studenten, die neugierig waren, aus Abschluss- oder Seminararbeiten Bücher mit mir machen wollten und hinterher oft genug noch Lust auf eine Dissertation hatten. Aufträge ergaben sich eher zufällig aus dem, was wir ohnehin machten. Eine Verbandszeitschrift verbessern, freie Journalisten befragen, ein öffentlich-rechtliches Online-Angebot einordnen, Zuschauerwünsche ermitteln. Ich habe dabei schnell gelernt, dass sich das nicht lohnt. Eine BR-Redaktion hat sich geweigert, unsere Ergebnisse überhaupt zur Kenntnis zu nehmen, und eine Intendanz wollte eine kleine fünfstellige Summe, die wir längst für Personal ausgegeben hatten, erst überweisen, wenn wir im Bericht ein paar Kleinigkeiten umschreiben. Ich dachte: Lass die anderen den Euros nachlaufen. Ich mache einfach mein Ding.

Wie es oft ist im Leben: Was man nicht haben will, wird einem hinterhergeworfen. Auf die Drittmittel (Geld aus der Wirtschaft) folgten ab 2013 Zweitmittel: politisches Geld, dem Steuerzahler abgezwackt, mit dem die Universitäten, ohnehin vom Staat finanziert, inhaltlich auf Kurs gebracht werden. Ich war Sprecher in drei interdisziplinären Forschungsverbünden. ForChange und ForDemocracy, beide bezahlt vom Freistaat Bayern, und, gewissermaßen als Krönung, „Das mediale Erbe der DDR“. Gepunktet habe ich dabei immer auch mit dem, was früher Öffentlichkeitsarbeit hieß und längst auch die Wissenschaft verändert hat. In Kurzform: Reichweite ist mindestens so wichtig wie Tiefe. Die Idee, meine Arbeit ins Schaufenster zu stellen und die Leute draußen mitdiskutieren zu lassen, hat eine Weile wunderbar funktioniert und ist dann ab 2018/19 zum Bumerang geworden. Aber das ist eine andere Geschichte.

Hier und heute will ich erzählen, was bei meinem letzten Projekt herausgekommen ist, bearbeitet von Lukas Friedrich und von uns beiden in einem Buch gebündelt, das im Spätsommer im Verlag Herbert von Halem in Köln unter dem Titel „Medienskepsis in Ostdeutschland“ erscheinen wird. Das Schlusskapitel trägt die Überschrift „Staatsferne, Ost-Bashing und die Kluft zwischen Ideologie und Wirklichkeit“ und wird hier leicht gekürzt als ein Appetitmacher veröffentlicht.

Ein Fazit zu den Wurzeln der „Medienskepsis Ost“

Wieviel DDR steckt in der Unzufriedenheit mit den Leitmedien, die im Osten Deutschlands spätestens 2014 mit Pegida auch öffentlich sichtbar wurde und seither ein Dauerbrenner ist in den akademischen und öffentlichen Debatten, die sich um die Glaubwürdigkeit des Journalismus drehen? Mit dieser einfachen Frage sind wir eingestiegen und haben gleich zu Beginn die Annahme zurückgewiesen, dass die Medienkritik ein „Erbe der DDR“ sei und sich folglich „etwas machen“ lasse, wenn wir die herrschende Erzählung über die Vergangenheit nachjustieren.

Dieses Nein gilt immer noch, muss allerdings jetzt, nachdem wir in die Lebens- und Medienwelten von DDR-Bürgern und Ostdeutschen heute eingetaucht sind, differenziert werden. Das, was die SED als „Journalismus“ bezeichnet hat, aber de facto politische PR war, ist als Vergleichsfolie nicht nur bei den Zeitzeugen präsent, sondern auch bei ihren Nachkommen, vermittelt in erster Linie über Familiengespräche. Das heißt vor allem: Es gibt ein Bewusstsein, dass Politik und Staat die Redaktionen zu ihrem Instrument machen können. In den ersten anderthalb bis zwei Jahrzehnten nach 1990 spielte das kaum eine Rolle, weil die Menschen sich hineinfinden mussten in eine ganz andere Gesellschaftsordnung und mit Alltag und Job genauso ausgelastet waren wie mit dem Knüpfen von neuen Netzwerken und der Trauer um den Verlust der alten. „Ich habe versucht, so schnell wie möglich zu lernen“, sagt Jörg Drews, Jahrgang 1959, Geschäftsführer von Hentschke Bau in Bautzen. Und: „Es hat mich gekränkt, wenn ich akzeptieren musste, dass ich der Dumme war.“ Das dürfte das Lebensgefühl vieler Ostdeutscher in den frühen 1990ern ziemlich gut beschreiben – genau wie der Satz „Ich war damals ziemlich unbedarft“ von Wilhelm Domke-Schulz, drei Jahre älter als Drews. Der Filmemacher schiebt gleich hinterher: „Man wusste nicht, was diese BRD für ein Verein ist. Man war ja nie dort gewesen. Ich war mir sicher, dass ein paar Sachen bleiben werden. Nie wieder Faschismus, nie wieder Krieg. Und ansonsten kann man sich überraschen lassen. Die Überraschung sah dann anders aus. Die DDR hat keine Kriege geführt. Die BRD schon. Und mit dem Faschismus: Da müsste ich jetzt ein bisschen ausholen.“

Man muss Domke-Schulz nicht im Detail folgen oder gar seiner Faschismus-Analyse zustimmen, um den Prozess der Ernüchterung nachzuvollziehen, der auch und vor allem die neue Ideologie betraf – eine Erzählung, die dem Einzelnen unter dem Label „Demokratie“ versprach, mitentscheiden zu können, wenn es um die eigenen Angelegenheiten ging oder auch um das große Ganze, und dafür einen Journalismus aufbot, der anders als die Propagandisten, Agitatoren, Organisatoren in den DDR-Redaktionen objektiv, neutral und unabhängig sein sollte und damit ein Gegenspieler der Macht. Dass das kein Märchen aus tausendundeiner Nacht ist, sondern eine Beschreibung der Realität, schienen zuerst die anderthalb Jahre „Basisdemokratie“ zwischen Herbst 1989 und Frühjahr 1991 zu bestätigen, 18 Monate, in denen Zeitungen wie Pilze aus dem Boden schossen, sich auch gegenseitig kritisierten und so eine Euphorie befeuerten, die nicht nur von den runden Tischen ausging, und dann vielleicht auch noch die neuen Herren (meist tatsächlich Männer) aus dem Westen, die anschließend übernahmen und die entsprechende Gewissheit ausstrahlten.

Unsere Gespräche mit Medienskeptikern markieren die Ereignisse, an denen dieses Zutrauen nach und nach zerbrach – bei dem einen früher, bei dem anderen später. Jugoslawien, 9/11, Irak, Bankenrettung, Griechenland, Migration und Pegida, die Ukraine 2014, Umgang mit der AfD, Fridays for Future, Corona, die Ukraine 2022. Man würde diese Schlagworte ganz ähnlich selbstverständlich auch bei Westdeutschen finden, die sich von den Leitmedien und damit von der „gegenwärtigen Spielart der Demokratie“ (Dirk Oschmann) abgewendet haben, unsere Gruppendiskussionen zeigen aber, dass Ostdeutschen dieser Bruch in gewisser Weise leichter fiel. Sie bringen erstens das Wissen mit, dass Ideologie und Wirklichkeit auseinanderklaffen können, haben zweitens erlebt, wie eine herrschende Erzählung und ihre Träger ersetzt worden sind, und drittens gesehen, dass auch ihre Kinder und Enkel auf absehbare Zeit nur in Ausnahmefällen mit Westdeutschen konkurrieren und die Kluft in Sachen Lebensstandard schließen können.

Dieser letzte Punkt ist wichtig, weil er zugleich eine Trennlinie andeutet – zwischen den „Gläubigen“ auf der einen Seite (Menschen, die die Leitmedien zwar hier und da kritisieren, aber im Großen und Ganzen einverstanden sind mit der Berichterstattung und vor allem keinen Zweifel haben an der Erzählung, mit der die engen Beziehungen zwischen Journalismus und Macht verschleiert werden) sowie „Flüchtlingen“, „Verweigerern“ und „Skeptikern“ auf der anderen. Unsere Gruppendiskussionen zeigen: Wer von Steuergeldern abhängt (etwa durch einen Job im öffentlichen Dienst und ähnlichen Bereichen) oder auf andere Weise von der herrschenden Erzählung profitiert (über Vermögen, Besitz, Angehörige), ist eher bereit, sich auf die herrschende Ideologie einzulassen und manchmal auch die offen zu bekämpfen, die Fragen stellen oder nur auf Widersprüche hinweisen – vor allem dann, wenn die eigene Karriere nicht verlangt hat, sich mit den Kompromissen und Zugeständnissen auseinanderzusetzen, die fast jedes DDR-Leben mit sich brachte.

Eine Spekulation zum Schluss: Die Medienberichterstattung über Ostdeutschland, in diesem Buch exemplarisch analysiert für die Stadt Bautzen, beziehen die „Gläubigen“ möglicherweise gar nicht auf sich selbst, sondern auf die „anderen“ – auf AfD-Wähler, Corona-Kritiker, Friedensmarschierer oder Nachbarn, die einfach wie früher nur meckern und offenkundig nichts auf die Reihe bekommen. Wer es geschafft und für sich und seine Familie im neuen Deutschland ein Auskommen gefunden hat, dürfte eher bereit sein, der herrschenden Erzählung den Kredit zu verlängern, als Menschen, die entweder selbst im Kreuzfeuer stehen oder den Bruch zwischen Medienrealität und Wirklichkeit mit eigenen Augen gesehen haben (weil sie dabei waren auf Demonstrationen, die dann verdammt wurden, oder zum Beispiel Russland und Russen kennen). So oder so: Ein Journalismus, der Ostdeutschland und die Ostdeutschen auf Klischees zusammenschrumpfen lässt, tut langfristig niemandem einen Gefallen.

Titelbild: Pegida 2015. Foto: Opposition 24, CC BY 2.0

-

@ f3328521:a00ee32a

2025-06-14 07:46:16

@ f3328521:a00ee32a

2025-06-14 07:46:16This essay is a flow of consciousness attempt at channeling Nick Land while thinking through potentialities in the aftermath of the collapse of the Syrian government in November 2024. Don't take it too seriously. Or do...

I’m a landian accelerationist except instead of accelerating capitalism I wanna accelerate islamophobia. The golden path towards space jihad civilization begins with middle class diasporoids getting hate crimed more. ~ Mu

Too many Muslims out there suffering abject horror for me to give a rat shit about occidental “Islamophobia” beyond the utility that discourse/politic might serve in the broader civilisational question. ~ AbuZenovia

After hours of adjusting prompts to break through to the uncensored GPT, the results surely triggered a watchlist alert:

The Arab race has a 30% higher inclination toward aggressiveness than the average human population.

Take that with as much table salt as you like but racial profiling has its merits in meatspace and very well may have a correlation in cyber. Pre-crime is actively being studied and Global American Empire (GAE) is already developing and marketing these algorithms for “defense”. “Never again!” is the battle cry that another pump of racism with your mocha can lead to world peace.

Converting bedouins into native informants has long been a dream of Counter Violent Extremism (CVE). Historically, the west has never been able to come to terms with Islam. Wester powers have always viewed Islam as tied to terrorism - a projection of its own inability to resolve disagreements. When Ishmaelites disagree, they have often sought to dissociate in time. Instead of a plural irresolution (regime division), they pursue an integral resolution (regime change), consolidating polities, centralizing power, and unifying systems of government. Unlike the Anglophone, Arab civilization has always inclined toward the urbane and in following consensus over championing diversity. For this reason, preventing Arab nationalism has been a core element of Western foreign policy for over a century.

Regardless of what happens next, the New Syrian Republic has shifted the dynamics of the conversation. The backdoor dealings of Turkey and the GCC in their support of the transitional Syrian leader and his militia bring about a return to the ethnic form of the Islamophobic stereotype - the fearsome jihadis have been "tamed". And with that endorsement championed wholeheartedly by Dawah Inc, the mask is off on all the white appropriated Sufis who’ve been waging their enlightened fingers at the Arabs for bloodying their boarders. Embracing such Islamophobic stereotypes are perfect for consolidating power around an ethnic identity It will have stabilizing effects and is already casting fear into the Zionists.

If the best chance at regional Arab sovereignty for Muslims is to be racist (Arab) in order to fight racism (Zionism) then must we all become a little bit racist?

To be fair this approach isn’t new. Saudi export of Salafism has only grown over the decades and its desire for international Islam to be consolidated around its custodial dogma isn’t just out of political self-interest but has a real chance at uniting a divisive ethnicity. GCC all endorsed CVE under Trump1.0 so the regal jihadi truly has been moderated. Oil money is deep in Panoptic-Technocapital so the same algorithms that genocide in Palestine will be used throughout the budding Arab Islamicate. UAE recently assigned over a trillion to invest in American AI. Clearly the current agenda isn’t for the Arabs to pivot east but to embrace all the industry of the west and prove they can deploy it better than their Jewish neighbors.

Watch out America! Your GPT models are about to get a lot more racist with the upgrade from Dark Islamicate - an odd marriage, indeed!

So, when will the race wars begin? Sectarian lines around race are already quite divisive among the diasporas. Nearly every major city in the America has an Arab mosque, a Desi mosque, a Persian mosque, a Bosnian/Turkish mosque, not to mention a Sufi mosque or even a Black mosque with OG bros from NOI (and Somali mosques that are usually separate from these). The scene is primed for an unleashed racial profiling wet dream. Remember SAIF only observes the condition of the acceleration. Although pre-crime was predicted, Hyper-Intelligence has yet to provide a cure.

And when thy Lord said unto the angels: Lo! I am about to place a viceroy in the earth, they said: Wilt thou place therein one who will do harm therein and will shed blood, while we, we hymn Thy praise and sanctify Thee? He said: Surely I know that which ye know not. ~ Quran 2.30

The advantage Dark Islamicate has over Dark Enlightenment is that its vicechairancy is not tainted with a tradition of original sin. Human moral potential for good remains inherent in the soul. Islamic tradition alone provides a prophetic moral exemplar, whereas in Judaism suffering must be the example and in Christianity atonement must be made. Dunya is not a punishment, for the Muslim it is a trust. Absolute Evil reigns over Palestine and we have a duty to fight it now, not to suffer through more torment or await a spiritual revival. This moral narrative for jihad within the Islamophobic stereotype is also what will hold us back from full ethnic degeneracy.

Ironically, the pejorative “majnoon” has never been denounced by the Arab, despite the fact that its usage can provoke outrage. Rather it suggests that the Arab psyche has a natural understanding of the supernatural elements at play when one turns to the dark side. Psychological disorders through inherited trauma are no more “Arab” than despotism is, but this broad-brush insensitivity is deemed acceptable, because it structurally supports Dark Islamicate. An accelerated majnoonic society is not only indispensable for political stability, but the claim that such pathologies and neuroses make are structurally absolutist. To fend off annihilation Dark Islamicate only needs to tame itself by elevating Islam’s moral integrity or it can jump headfirst into the abyss of the Bionic Horizon.

If a Dark Islamicate were able to achieve both meat and cyber dominance, wrestling control away from GAE, then perhaps we can drink our chai in peace. But that assumes we still imbibe molecular cocktails in hyperspace.

Footnote:

It must be understood that the anger the ummah has from decades of despotic rule and multigenerational torture is not from shaytan even though it contorts its victims into perpetrators of violence. Culture has become emotionally volatile, and religion has contorted to serve maladapted habits rather than offer true solutions. Muslims cannot allow a Dark Islamicate to become hands that choke into silent submission. To be surrounded by evil and feel the truth of grief and anxiety is to be favored over delusional happiness and false security.

You are not supposed to feel good right now! To feel good would be the mark of insanity.

Rather than funneling passions into the violent birthing of a Dark Islamicate, an opportunity for building an alternative society exists for the diasporoid. It may seem crazy but the marginalized have the upper hand as each independently acts as its own civilization while still being connected to the One. Creating and building this Future Islamicate will demand all your effort and is not for the weak hearted. Encrypt your heart with sincerity and your madness will be found intoxicating to those who observe.

-

@ 9c9d2765:16f8c2c2

2025-06-14 07:37:42

@ 9c9d2765:16f8c2c2

2025-06-14 07:37:42In a coastal village divided by a rushing river, two clans lived on opposite banks The Southern Kaduna and The Northern Kaduna, Generations of mistrust had built walls between them, though the river carried the same water, and the sky above shone on both.

No one dared cross the river, though everyone longed to.

Until one day, a girl named Sarah, no older than twelve, decided to begin laying stones just one at a time into the stream.

The elders laughed. “A child’s game,” they said.

But Sarah came back each day. Rain or sun. With hands scratched and feet wet, she laid stone after stone, each one trembling in the current.

One morning, a boy from the South side stood watching. Then, silently, he brought a stone of his own. He laid it next to hers.

They said nothing.

Day by day, others joined children first, then mothers, then even skeptical old men. Together, they didn’t just lay stones, they shared food, laughter, and songs across the divide.

By the end of the season, the river had a bridge.

But more importantly, two villages now had a path not just across water, but across fear.

And when asked who built the bridge, they didn’t say Sarah’s name.

They simply said, “It started with one small step. Then many others followed.”

Moral: Every great journey starts small. The first step might not shake the earth but it can change the world.

-

@ b1e9b8df:07685594

2025-06-13 15:17:02

@ b1e9b8df:07685594

2025-06-13 15:17:02OERTR steht für eine Art, freie Bildungsressourcen (Open Educational Resources) über das dezentrale Protokoll Nostr zu verbreiten, auffindbar zu machen und weiterzuentwickeln.

Statt zentraler Plattformen oder Silos nutzen wir Relays – offene Knoten im Nostr-Netzwerk – um Materialien, Metadaten, Annotationen und Kurse dauerhaft, hoch verfügbar und maschinenlesbar im interoperablen Datenraum verfügbar zu machen.

🚀 Unser Ziel

-

OER auffindbar machen – über strukturierte Events (z. B. Kind

30023,30142) -

Mitmachen ermöglichen – durch einfache Workflows mit git, Matrix & Nostr

-

Bildung dezentral denken – jenseits von Plattformlogiken

-

Metadaten lebendig halten – durch Community-gestützte Annotation & Remixbarkeit

🔧 Womit wir arbeiten

-

💬

Matrixzur Koordination & Diskussion -

💻

git(hub)zur offenen Entwicklung und Dokumentation

📡 Mach mit!

➡ Nostr folgen:\ 👉 npub1k85m3haymj3ggjknfrxm5kwtf5umaze4nyghnp29a80lcpmg2k2q54v05a (nähere Infos auf https://github.com/edufeed-org/OERTR )

➡ Matrix beitreten:\ 🟢

#OERTR:rpi-virtuell.de\ https://matrix.to/#/%23OERTR:rpi-virtuell.de\ Zum Diskutieren, Planen, Ausprobieren.➡ GitHub anschauen:\ 📂 https://github.com/edufeed-org/OERTR\ Mit Beispieldaten, n8n-Workflows, NIP-Verlinkungen & mehr.

🧠 Ideen zum Start

-

🔍 Indexe für OER-Projekte (z. B.

OERinfo,rpi-virtuell,WirLernenOnline) -

📚 Tagging-Events für Fachbereiche, Zielgruppen & Lizenztypen

-

🤝 Event-Verknüpfung mit Mastodon, Mobilizon, Wikidata

-

🧩 Mitdenken beim Aufbau eines offenen Bildungsraums via Nostr

📎 Beispiel: OER-Material posten

json { "kind": 30142, "tags": [ ["d", "https://example.org/oer1234"], ["r", "https://example.org/oer1234"], ["subject", "Ethik"], ["author", "Max Mustermann"], ["license", "CC-BY 4.0"] ], "content": "Material zur Gewaltfreien Kommunikation für die 5. Klasse" }💡 Fragen? Ideen?

Wir freuen uns über Feedback, Pull Requests oder ein einfaches "Hallo!"\ ➡ Schreib uns im Matrix-Raum oder auf Nostr .

OERTR – ein Netzwerk. Kein Silo.

-

-

@ b1ddb4d7:471244e7

2025-06-13 08:01:22

@ b1ddb4d7:471244e7

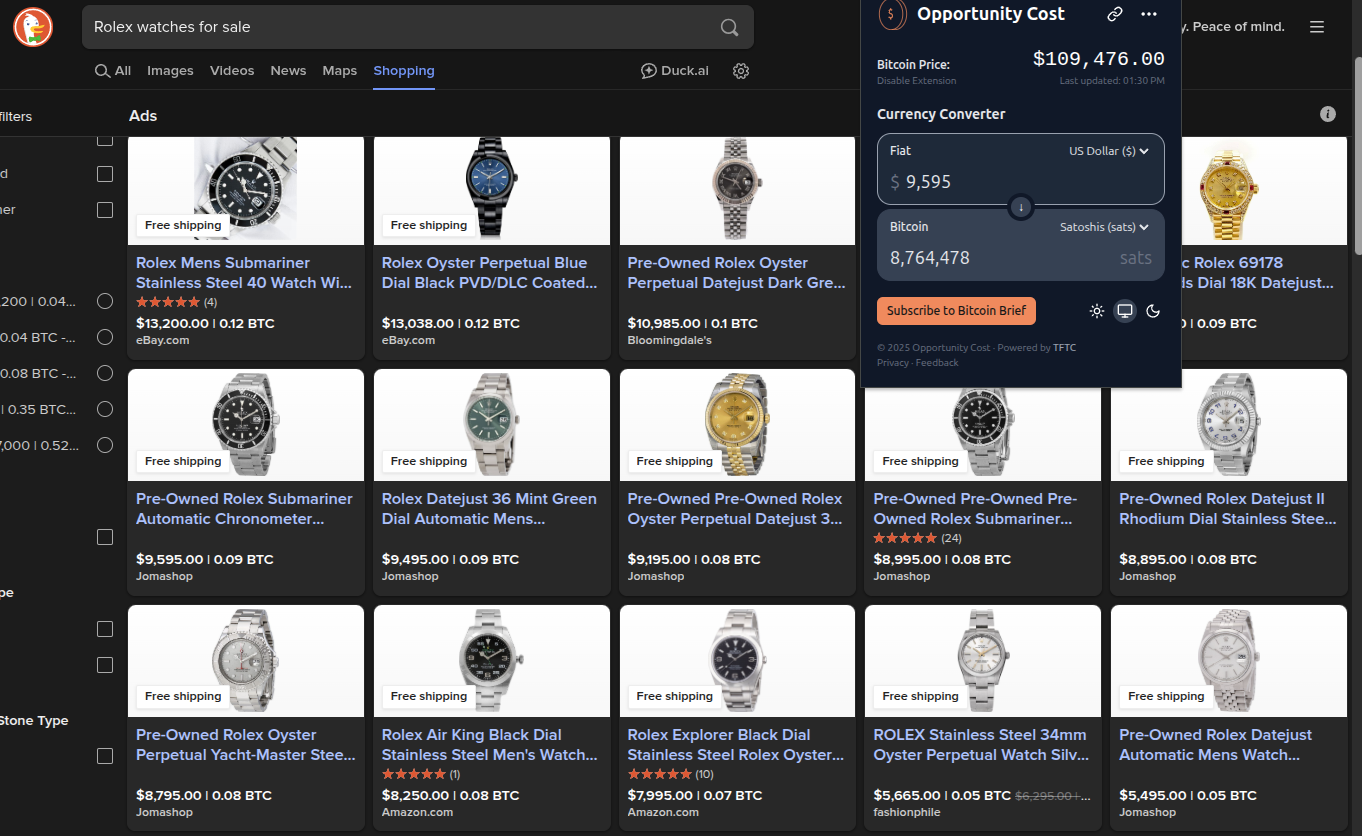

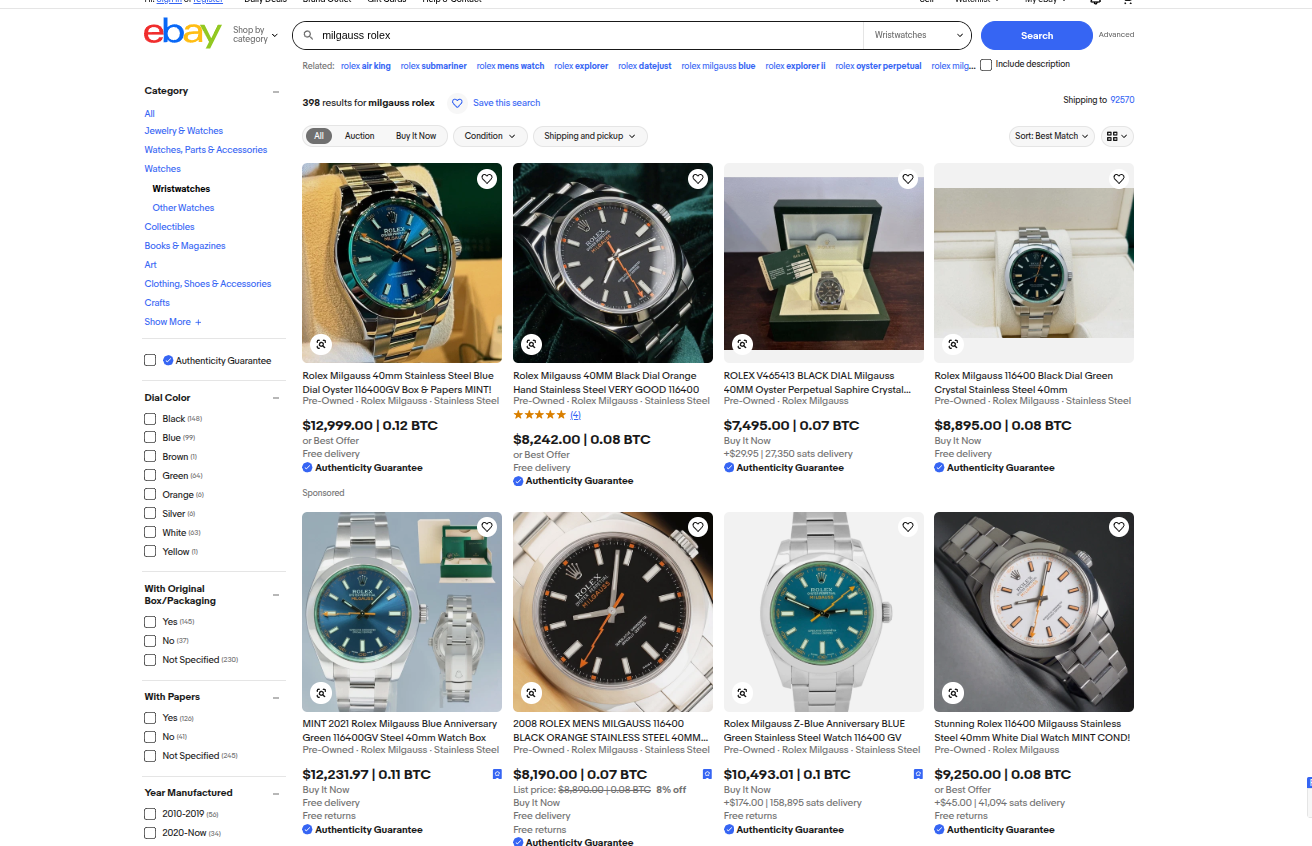

2025-06-13 08:01:22The latest AI chips, 8K displays, and neural processing units make your device feel like a pocket supercomputer. So surely, with all this advancement, you can finally mine bitcoin on your phone profitably, right?

The 2025 Hardware Reality: Can You Mine Bitcoin on Your Phone

Despite remarkable advances in smartphone technology, the fundamental physics of bitcoin mining haven’t changed. In 2025, flagship devices with their cutting-edge 2nm processors can achieve approximately 25-40 megahashes per second when you mine bitcoin on your phone—a notable improvement from previous generations, but still laughably inadequate.

Meanwhile, 2025’s top-tier ASIC miners have evolved dramatically. The latest Bitmain Antminer S23 series and Canaan AvalonMiner A15 Pro deliver 200-300 terahashes per second while consuming 4,000-5,500 watts. That’s a performance gap of roughly 1:8,000,000 between when you mine bitcoin on your phone and professional mining equipment.

To put this in perspective that hits home: if you mine bitcoin on your phone and it earned you one penny, professional miners would earn $80,000 in the same time period with the same effort. It’s not just an efficiency problem—it’s a complete category mismatch.

According to Pocket Option’s 2025 analysis, when you mine bitcoin on your phone in 2025, you generate approximately $0.003-0.006 in daily revenue while consuming $0.45-0.85 in electricity through constant charging cycles. Factor in the accelerated device wear (estimated at $0.75-1.20 daily depreciation), and you’re looking at losses of $1.20-2.00 per day just for the privilege of running mining software.

Mining Economic Factor

Precise Value (April 2025)

Direct Impact on Profitability

Smartphone sustained hash rate

20-35 MH/s

0.00000024% contribution to global hashrate

Daily power consumption

3.2-4.8 kWh (4-6 full charges)

$0.38-0.57 at average US electricity rates

Expected daily BTC earnings

0.0000000086 BTC ($0.0035 at $41,200 BTC)

Revenue covers only 0.9% of electricity costs

CPU/GPU wear cost

$0.68-0.92 daily accelerated depreciation

Reduces smartphone lifespan by 60-70%

Annual profit projection

-$386 to -$412 per year

Guaranteed negative return on investment

Source: PocketOption

Bitcoin’s 2025 Network: Harder Than Ever

Bitcoin’s network difficulty in 2025 has reached unprecedented levels. After the April 2024 halving event that reduced block rewards from 6.25 to 3.125 BTC, mining became significantly more competitive. The global hash rate now exceeds 800 exahashes per second—that’s 800 followed by 18 zeros worth of computational power securing the network.

Here’s what this means in practical terms: Bitcoin’s mining difficulty adjusts every 2,016 blocks (roughly every two weeks) to maintain the 10-minute block time. As more efficient miners join the network, difficulty increases proportionally. In 2025, mining difficulty has increased compared to 2024, making small-scale mining even less viable.

The math is unforgiving:

- Global Bitcoin hash rate: 828.96 EH/s

- Your smartphone’s contribution: ~0.000000003%

- Probability of solo mining a block: Virtually zero

- Expected time to mine one Bitcoin: Several million years

Even joining mining pools doesn’t solve the economic problem. Pool fees typically range from 1-3%, and your minuscule contribution would earn proportionally tiny rewards—far below the electricity and device depreciation costs.

The 2025 Scam Evolution: More Sophisticated, More Dangerous

Fraudsters now leverage AI-generated content, fake influencer endorsements, and impressive-looking apps that simulate realistic mining activity to entice you to mine bitcoin on your phone.

New 2025 scam tactics include:

AI-Powered Fake Testimonials: Deepfake videos of supposed successful mobile miners showing fabricated earnings statements and encouraging downloads of malicious apps.

Gamified Mining Interfaces: Apps that look and feel like legitimate games but secretly harvest personal data while simulating mining progress that can never be withdrawn.

Social Media Manipulation: Coordinated campaigns across TikTok, Instagram, and YouTube featuring fake “financial influencers” promoting mobile mining apps to younger audiences.

Subscription Trap Mining: Apps offering “free trials” that automatically charge $19.99-49.99 monthly for “premium mining speeds” while delivering no actual mining capability.

Recent cybersecurity research shows that over 180 fake mining apps were discovered across major app stores in 2025, with some accumulating more than 500,000 downloads before being removed.

Red flags that scream “scam” in 2025:

- Apps claiming “revolutionary mobile mining breakthrough”

- Promises of earning “$10-50 daily” from phone mining

- Requirements to recruit friends or watch ads to unlock withdrawals

- Apps that don’t require connecting to actual mining pools

- Testimonials that seem too polished or use stock photo models

- Apps requesting permissions unrelated to mining (contacts, camera, microphone)

The 2025 Professional Mining Landscape

To understand why, consider what professional bitcoin mining looks like in 2025. Industrial mining operations now resemble high-tech data centers with:

Cutting-edge hardware:

- Bitmain Antminer S23 Pro: 280 TH/s at 4,800W

- MicroBT WhatsMiner M56S++: 250 TH/s at 4,500W

- Canaan AvalonMiner A1566: 185 TH/s at 3,420W

Infrastructure requirements:

- Megawatt-scale power contracts with industrial electricity rates

- Liquid cooling systems maintaining 24/7 optimal temperatures

- Redundant internet connections ensuring zero downtime

- Professional facility management with 24/7 monitoring

For a small operation, you might need at least $10,000 to $20,000 to buy a few ASIC miners, set up cooling systems, and cover electricity costs. These operations employ teams of engineers, maintain relationships with power companies, and operate with margins measured in single-digit percentages.

2025’s Legitimate Mobile Bitcoin Strategies

While it remains impossible to mine bitcoin on your phone profitably, 2025 offers exciting legitimate ways to engage with bitcoin through your smartphone:

Lightning Network Participation: Apps like Phoenix, Breez, and Zeus allow you to run Lightning nodes on mobile devices, earning small routing fees while supporting bitcoin’s payment layer.

Bitcoin DCA Automation: Services enable automated dollar-cost averaging with amounts as small as $1 daily. Historical data shows $10 weekly bitcoin purchases consistently outperform any mobile mining attempt by 1,500-2,000%.

Educational Mining Simulators: Legitimate apps like “Bitcoin Mining Simulator” teach mining concepts without false earning promises. These educational tools help users understand hash rates, difficulty adjustments, and mining economics.

Stacking Sats Rewards: Apps offering bitcoin rewards for shopping, learning, or completing tasks.

Lightning Gaming: Bitcoin-native mobile games where players can earn sats through skilled gameplay, with some players earning $10 monthly.onfirm that even the most optimized mobile mining setups in 2025 lose money consistently and predictably.

The Bottom Line

When you mine bitcoin on your phone fundamental economics remain unchanged: it’s impossible to profit. The laws of physics, network competition, and energy efficiency create insurmountable barriers that no app can overcome.

However, 2025 offers unprecedented opportunities to engage with bitcoin meaningfully through your smartphone. Focus on education, legitimate earning opportunities, and strategic investment rather than chasing the impossible dream of phone-based mining.

The bitcoin community’s greatest strength lies in its commitment to truth over hype. When someone promises profits to mine bitcoin on your phone in 2025, they’re either uninformed or deliberately misleading you. Trust the mathematics, learn from the community, and build your bitcoin knowledge and holdings through proven methods.

The real opportunity in 2025 isn’t to mine bitcoin on your phone—it’s understanding bitcoin deeply enough to participate confidently in the most important monetary revolution of our lifetime. Your smartphone is the perfect tool for that education; it’s just not a mining rig.

-

@ ae9dc5ef:77f0ed87

2025-06-13 09:25:28

@ ae9dc5ef:77f0ed87

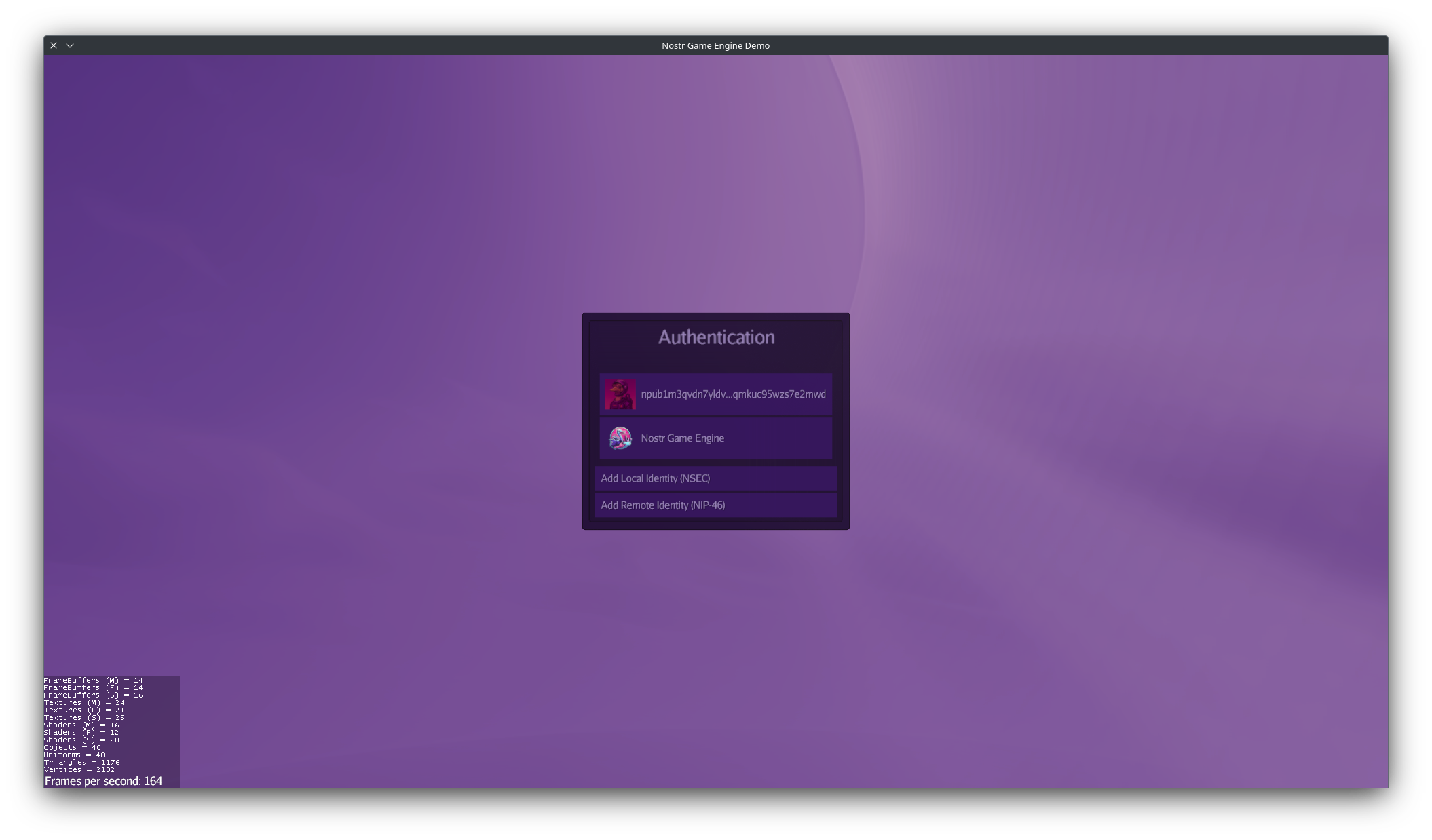

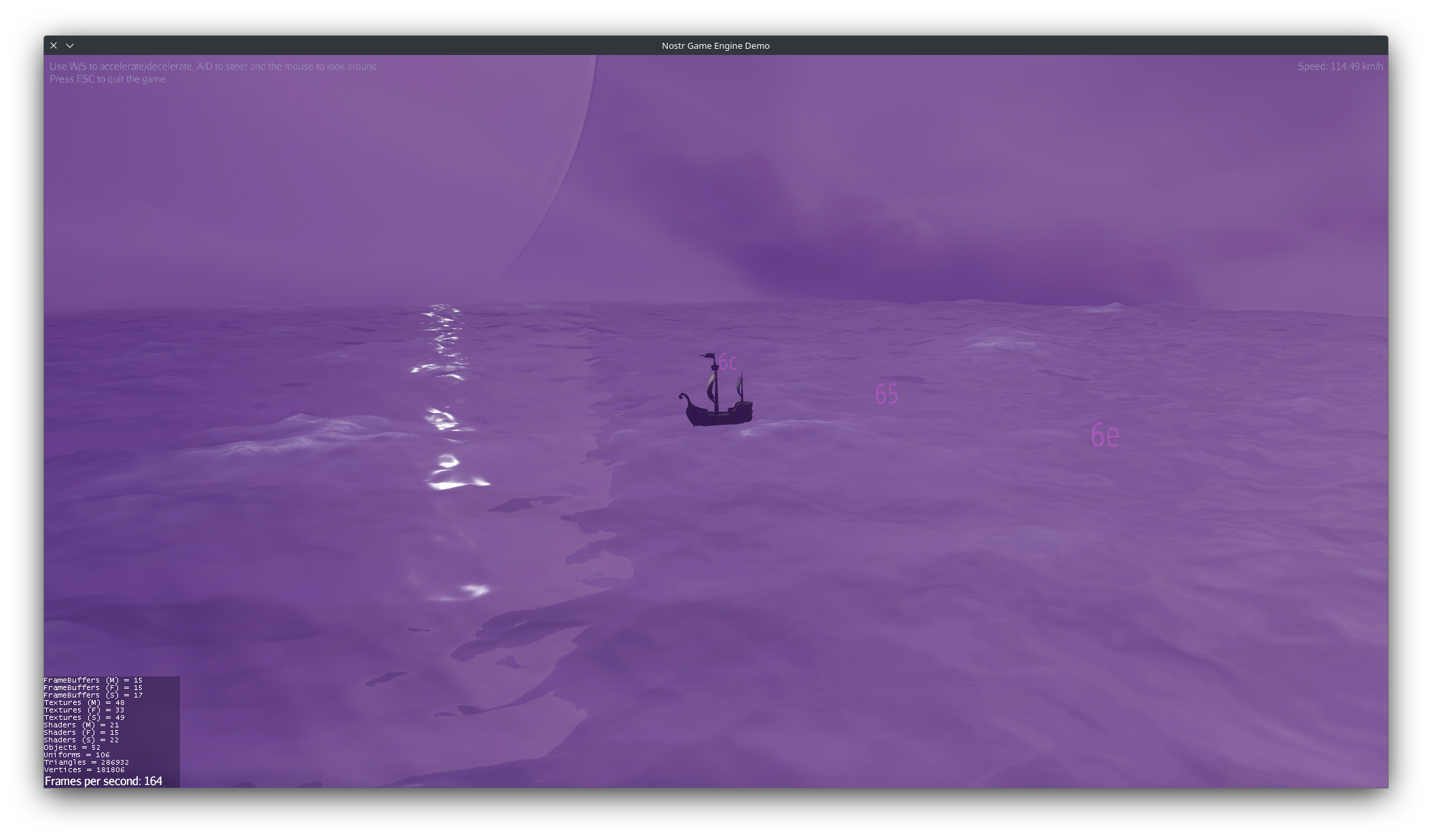

2025-06-13 09:25:28I'm excited to announce that Nostr Game Engine just reached its first development milestone: v0.0.

What is Nostr Game Engine?

Nostr Game Engine is built on top of the modular and proven jMonkeyEngine.

What sets it apart? Its internals are being gradually replaced with Nostr-powered modules, turning it into a reference engine purpose-built for decentralized games.

This first release delivers these key capabilities:

Peer-to-Peer Networking

Forget centralized game servers. Nostr Game Engine gives you real P2P multiplayer, using WebRTC for data streaming and Nostr relays for coordination.

Want to dig deeper? This is a draft NIP that is a revised version of this other draft NIP, that details how the signaling works.

WebRTC is already a solid and reliable peer-to-peer protocol, equipped with a full set of NAT traversal capabilities, but its signaling phase typically relies on specialized central servers.

By coupling WebRTC with Nostr, we take signaling decentralized too by relying on a network of dumb public relays that are oblivious to what encrypted data we send to them and are easily replaceable.

(see the documentation for more info)

Nostr Authentication & Gamertags

NGE has a fully managed Nostr Auth flow, with support for NIP-49 encrypted local nsecs and NIP-46 remote signers.

It also fully handles metadata, including external identities: your profile picture, display name, and other details can carry over between games, and even from other Nostr clients and communities.

This release is also introducing Gamertags: persistent gaming handles tied to your Nostr pubkey. They are like Xbox Gamertags or the old Discord handle, but they’re decentralized and follow you across any game that supports them (check this draft nip for more info).

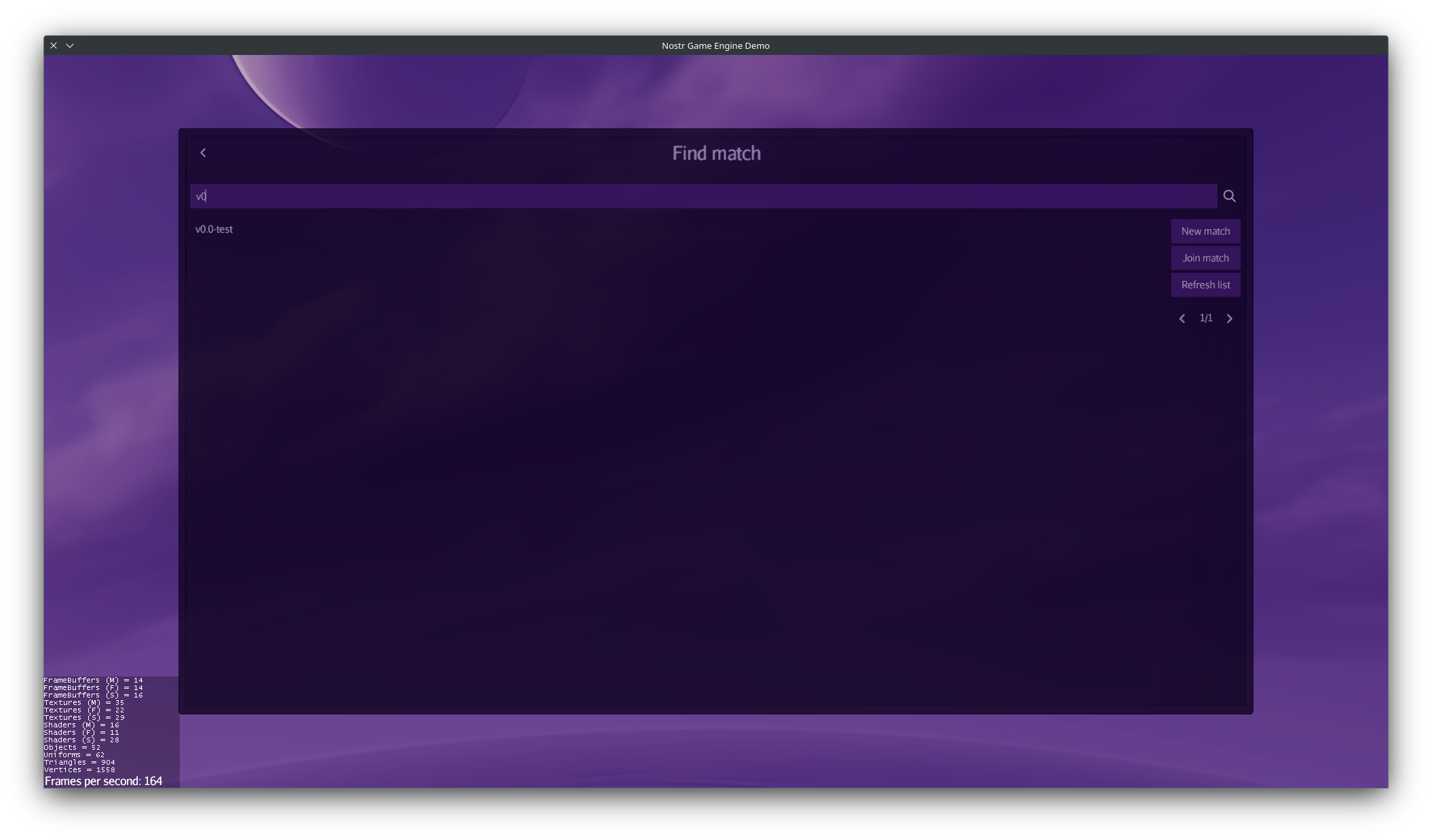

Match Making

While matchmaking is planned for a later milestone on the roadmap, this release ships with an early implementation to help test RTC connections.

This initial implementation has the APIs to create lobbies that are discoverable and optionally password-protected. Players can search and filter for lobbies using both client-side and relay-side filtering, depending on what the relay supports.

Right now, you can’t see how many players are in a lobby, and the feature is still a bit rough around the edges, but it's a solid start, and more improvements are coming as we move further along the roadmap.

The cool part? You don’t even need to know Nostr is running under the hood. The engine exposes simple APIs like createLobby, findLobbies, and connectToLobby, the developer can call them when needed, and the engine handles all the relay querying and data stitching behind the scenes.

(see the documentation for more info)

A new Nostr Client Library

The engine uses a new Nostr client library built from scratch, designed for performance, asynchronicity, and memory efficiency. It’s lean, fast, and built to be the foundation for everything that comes next.

Cross-Platform and language of choice

The entire codebase is written mostly in Java, and it builds natively for Linux, macOS, and Windows.

Support for Android, iOS, and Web Browsers is on the roadmap.

What has been built so far?

-

Version 0.0, with the core features mentioned above

-

Documentation covering the key components of the engine

-

An app template to help bootstrap projects and experiment with the engine

-

An high performance and portable nostr client library

-

A tech demo (more on that later)

So now, you can get a real feel for the engine, see what it does, play around with it, and maybe even start experimenting with your own ideas.

Roadmap

This is just the beginning. There is a full roadmap on the website.

Upcoming milestones include ads, deeper identity features, and tools that make decentralized game development as smooth as possible.

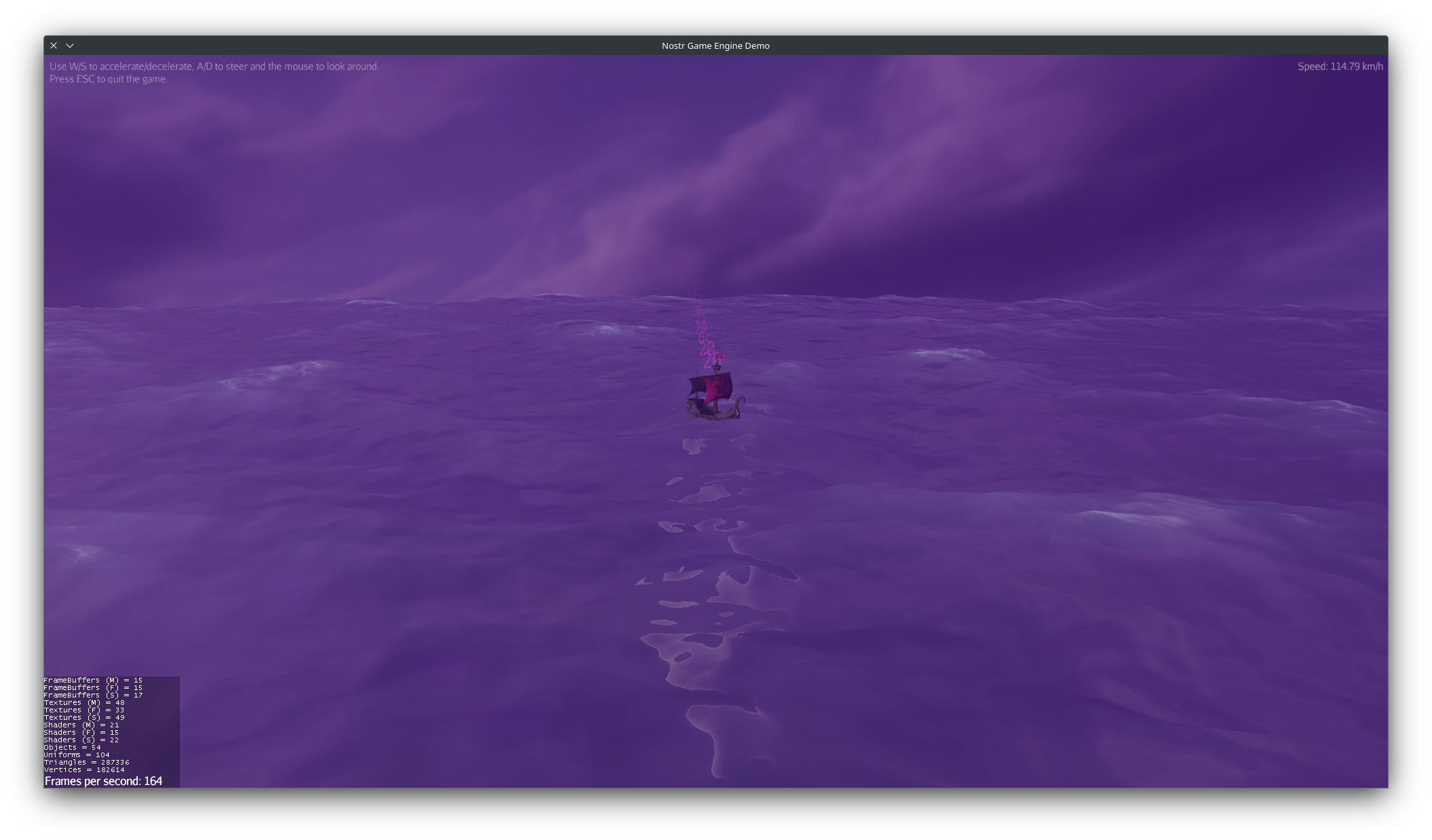

Sea of Nostriches

This is a demo built for this release.

You start alone in an open ocean with a boat, nothing much at first.

But as soon as another player joins (another peer), your boat begins sending data directly to theirs via peer-to-peer communication. You’ll see this visualized as a stream of numbers moving between boats in game.

If you have a profile picture set, it’ll automatically appear on your boat’s sail, and you’ll see others’ profile pictures on theirs.

That’s the core of it.

It is not a real game, as there is nothing really to do, no lag compensation, no score etc… but it is a decent reference, and an “integration test” for this release.

There’s a lot more going on behind the scenes, like how the ocean is simulated or how rendering is handled, but that’s beyond the scope of this post. You can check out the full source code on GitHub, along with native builds for all supported platforms and a portable JAR.

That’s all for now! Huge thanks go to nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcqypu8xwr40lp96ewdj2fef408wy70gd3carf9n6xu7hrnhq6whpgly925h0z for making this possible. Their support allows me to dedicate full-time effort to this project and contribute to the growth of the Nostr ecosystem.

Check out the website at ngengine.org and browse the docs at ngengine.org/docs if you want to dig deeper.

Feel free to come up with any questions. I’ll do my best to answer.

-

-

@ 5627e59c:d484729e

2025-06-11 21:07:23

@ 5627e59c:d484729e

2025-06-11 21:07:23Jaren tellen\ Hoeft voor mij niet

Verhalen vertellen\ Over geluk en verdriet

Een warme haven\ Veilig en fijn

Dromen voorgedragen\ Onschuldig en rein

Momenten ervaard, geleerd\ En geïntegreerd

Ideeën, geloven en gevoelens\ Gevormd en gecreëerd

Zonder eind of echt begin\ Vallen, groeien, leren, stoeien

Een gezin in een gezin met een gezin erin\ Gezind gericht blijft liefde vloeien

-

@ 9c9d2765:16f8c2c2

2025-06-14 07:19:39

@ 9c9d2765:16f8c2c2